UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07739

Harding, Loevner Funds, Inc.

(Exact name of registrant as specified in charter)

400 Crossing Boulevard

Fourth Floor

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip code)

Marcia Y. Lucas

The Northern Trust Company

50 South LaSalle Street

Chicago, IL 60603

With a copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2018

Item 1. Reports to Stockholders.

HARDING LOEVNER FUNDS

HARDING LOEVNER FUNDS

Global equity investing for institutions is Harding Loevner’s exclusive focus. Through Harding Loevner Funds it offers distinct global strategies based on its quality-and-growth investment philosophy. It seeks to purchase shares of growing, financially strong, well-managed companies at favorable prices. Harding Loevner manages each of the Funds’ Portfolios according to a disciplined, research-based investment process. It identifies companies with sustainable competitive advantages and assesses the durability of their earnings growth by conducting in-depth fundamental research into global industries. In constructing portfolios, Harding Loevner diversifies carefully to limit risk.

RECEIVE INVESTOR MATERIALS ELECTRONICALLY

RECEIVE INVESTOR MATERIALS ELECTRONICALLY

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| | 1. | Go to http://www.icsdelivery.com |

| | 2. | Select the first letter of your brokerage firm’s name. |

| | 3. | From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not be available. Please contact your brokerage firm. |

| | 4. | Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to http://www.icsdelivery.com, perform the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

Table of Contents

5 Letter to Our Shareholders

6 Global Equity Portfolio

10 International Equity Portfolio

14 International Small Companies Portfolio

18 Emerging Markets portfolios

22 Frontier Emerging Markets Portfolio

26 Global Equity Research Portfolio

30 International Equity Research Portfolio

34 Emerging Markets Research Portfolio

Contact

| | |

Harding, Loevner Funds, Inc. c/o Northern Trust Attn: Funds Center C5S 801 South Canal Street Chicago, IL 60607 Phone: (877) 435-8105 Fax: (312) 267-3657 www.hardingloevnerfunds.com | | Must be preceded or accompanied by a current Prospectus. Quasar Distributors, LLC, Distributor |

This page intentionally left blank.

| | |

| | DAVID LOEVNER, CFA, CIC CHAIRMAN OF THE FUNDS AND CEO OF THE ADVISER SIMON HALLETT, CFA CO-CIO OF THE ADVISER FERRILL ROLL, CFA CO-CIO OF THE ADVISER |

The decade since the global financial crisis has seen a very long run of generally rising share prices. But as we write this for our annual report to you for the period ended October 31, on the eve of its publication in December, share prices are falling hard—especially those of the highest growth companies, including the masters of the online economy. This development raises the question of why investor sentiment has soured. You probably can list the suspected causes as well as we: most prominently, the tariff wars instigated by the Trump administration, the eight hikes in short-term interest rates by the US Federal Reserve and the prospect for more as the labor market tightens, and the rising number of democratic countries in which unorthodox populist leaders from the right or the left are displacing or undermining the effectiveness of centrist governments or political voices.

We cannot predict whether the shift in sentiment will prove to be merely a corrective pause in an even more elongated bull market, or instead marks the beginning of a new, generally downward trend, a “secular” bear market. Those who have read or heard us over the years know that we are consistent in disclaiming any clairvoyance about the duration of economic or market cycles.

Our investment philosophy emerged from the premise that we cannot forecast the market’s future, but that we can identify companies that have navigated shifting tides well in the past, and—due to strong competitive advantages or benign competitive environments, along with sound finances and capable managements,—can be reasonably expected to weather capricious government policies or unforeseen economic downturns better than the average company in the future as well. Further that, so long as we don’t pay too much for the privilege of owning shares in such companies, we believe our investments in them will, on average, produce better-than-average returns for our Portfolios.

When asked about how much conviction we have in the prospects for the coming year of our current holdings, our resounding answer is, “Zero!” We recognize, for one thing, that if we discount our ability to forecast the market’s future, we equally cannot be confident in any near-term view of market-relative performance of individual stocks, since that, too, requires an ability to predict other investors’ behavior that we decidedly lack. Further, we recognize that, over our own long careers at Harding Loevner and prior, the future returns of individual holdings or, for that matter, of geographical or sectoral emphases, have never reliably shown a positive correlation with the respective degrees of our confidence in them ex ante.

Instead, and as we wrote in our Semi-Annual Commentary in 2017, we place our conviction, not in individual bets, but in the efficacy of our investment process, properly executed. That process helps us to avoid focusing on the ephemeral aspects of stocks and markets that we have little hope of getting consistently right, and instead maximize our efforts analyzing the more durable aspects of companies as potential investments: their ability to compete, the sustainability of their cash flows, and appropriate assumptions on which to make estimates of what those cash flows ought to be worth to an owner. That process, buttressed by findings from behavioral finance, prompts us to shift our clients’ capital incrementally away from the priciest of the best companies to their brethren that, while also growing and of high-quality, are, due to market fashion or investors’ shortsightedness in viewing temporary setbacks, currently less demanded.

Prosaic though it may be, that process, executed doggedly in strong markets and in weak ones, has helped us deliver good results over time. It is not a recipe for outperforming in every season, nor does it signal when periods of better or worse relative performance will arise. That uncertainty is the source of the challenge, both for us and for our clients: to retain conviction in the process and remain committed to its disciplined execution, because it has proven sound and we know no better alternative.

As ever, we are deeply grateful to you, our shareholders, for sharing our conviction.

Sincerely,

| | | | |

David R. Loevner, CFA, CIC | |

Simon Hallett, CFA | |

Ferrill D. Roll, CFA |

Opinions expressed are those of Harding Loevner and are not intended to be forecasts of future events, a guarantee of future results, nor investment advice. Please read the separate disclosure page for important information, including the risks of investing in the Portfolios. Past performance is not a guarantee of future results.

PORTFOLIO MANAGEMENT TEAM

| | |

|

PETER BAUGHAN, CFA CO-LEAD PORTFOLIO MANAGER FERRILL ROLL, CFA CO-LEAD PORTFOLIO MANAGER | | SCOTT CRAWSHAW PORTFOLIO MANAGER CHRISTOPHER MACK, CFA PORTFOLIO MANAGER RICHARD SCHMIDT, CFA PORTFOLIO MANAGER |

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

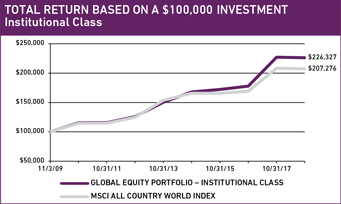

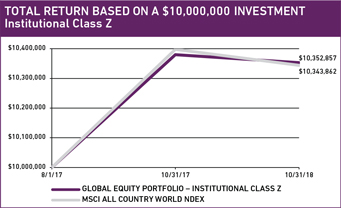

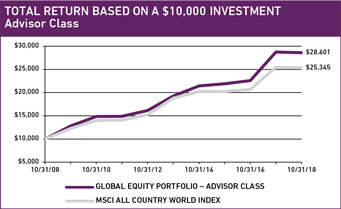

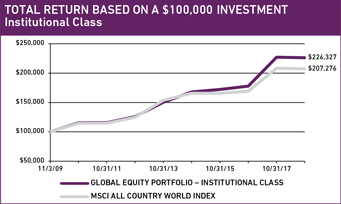

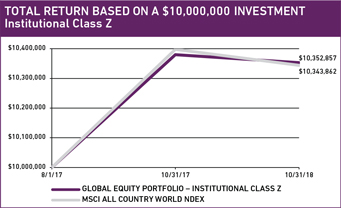

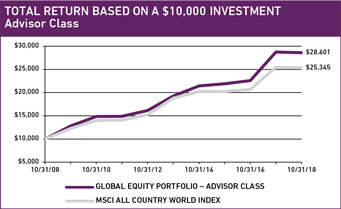

For the Global Equity Portfolio, the Institutional Class declined 0.35%, the Institutional Class Z declined 0.26%, and the Advisor Class declined 0.57% (net of fees and expenses) in the fiscal year ended October 31, 2018. The Portfolio’s benchmark, the MSCI All Country World Index (ACWI), declined 0.52% (net of source taxes).

MARKET REVIEW

MARKET REVIEW

Global stock markets had a volatile fiscal year. In 2017, synchronized global economic growth helped send stock markets soaring, but declines in January and February ended the MSCI ACWI’s 15-month streak of positive monthly returns. Emerging Markets (EMs) were hit particularly hard, weighed down by weakness in China and worries that rising US interest rates and trade frictions will combine to derail growth and investment in developing economies. Markets ended the fiscal year with a sharp sell-off in late September through October, led by Information Technology (IT) stocks.

Due to the substantial tax cuts enacted in November 2017, estimates of 2018’s earnings for US companies are indicating nearly twice as much profit growth as in the rest of the world. These estimates helped propel a broad-based US market rally, with most sectors in the US finishing the fiscal year in positive territory. IT, traditionally a high-beta sector, outperformed the US index. But, unusually for a non-cyclical sector, Health Care was also strong as investor worries about government intervention in drug pricing abated, boosting large-cap pharmaceutical stocks.

The Federal Reserve hiked overnight interest rates in late September, the eighth increase since late 2015. Short-term interest rates remain below the current inflation rate, doing little to dampen growth in the US economy or in US corporate earnings. These “normalizing” rate hikes have yet to deter investors in US equities more than temporarily so far; the same cannot be said of investors in US bonds or EM equities.

| | | | | | | | | | | | |

| | | |

| | FUND FACTS at October 31, 2018 | | | | | | |

| | | |

| | TOTAL NET ASSETS | | | $850.3M | | | |

| | | |

| | SALES CHARGE | | | NONE | | | |

| | | |

| | NUMBER OF HOLDINGS | | | 73 | | | |

| | | |

| | TURNOVER (5 YR. AVG.) | | | 36% | | | |

| | | |

| | REDEMPTION FEE | | | 2% FIRST 90 DAYS | | | |

| | | |

| | | DIVIDEND POLICY | | | ANNUAL | | | |

| | | | |

| | | | INSTITUTIONAL INVESTORS | | | INDIVIDUAL INVESTORS | | | |

| | | | | |

| | | | INSTL CLASS | | INSTL CLASS Z | | | ADVISOR CLASS | | | |

| | | | | |

| | TICKER | | HLMVX | | HLGZX | | | HLMGX | | | |

| | | | | |

| | CUSIP | | 412295602 | | 412295727 | | | 412295206 | | | |

| | | | | |

| | INCEPTION DATE | | 11/3/2009 | | 8/1/2017 | | | 12/1/1996 | | | |

| | | | | |

| | MINIMUM INVESTMENT1 | | $100,000 | | $10,000,000 | | | $5,000 | | | |

| | | | | |

| | NET EXPENSE RATIO | | 0.93% | | 0.90%2 | | | 1.14% | | | |

| | | | | |

| | GROSS EXPENSE RATIO | | 0.93% | | 1.21% | | | 1.14% | | | |

1Lower minimums available through certain brokerage firms; 2Shown net of Harding Loevner’s contractual agreement through February 28, 2019.

All Expense Ratios are as of the Prospectus dated February 28, 2018 unless otherwise noted.

EMs performed the worst in the year. Higher US short-term interest rates have been accompanied—led, even—by higher long-term rates (and lower bond prices). As these higher reference yields rippled through global markets, investors have punished markets in some of the developing economies most dependent on foreign capital, as borrowing costs and refinancing risks became more daunting. Severe economic crises in Turkey and Argentina raised the specter of EM contagion, the risk that investors retreat en masse from EMs.

The troubles that beset EM index heavyweight China this year were primarily domestic in origin. Government efforts to reduce leverage throughout the economy and bring transparency to the country’s unregulated lending (“shadow banking”) have, inevitably if unintentionally, slowed GDP growth. Chinese health care companies were hurt by a vaccine scandal and greater regulatory focus on decreasing the price of drugs. The escalating trade war with the US is beginning to have significant effects, as Chinese firms postpone capital investments to improve productivity or expand capacity in the face of uncertainty. Some of the biggest share price declines, not only in EMs, but also globally, were of Chinese internet search, e-commerce, and social media companies, predominantly domestic consumer businesses that rank among the world’s most valuable companies.

Elsewhere in the world, developed markets were mixed as investors continued to struggle with familiar problems. In Europe, investors are contemplating a worst-case “no-deal” Brexit, with negotiations between the UK and Europe still inconclusive as the deadline approaches. In Japan, US-instigated trade friction dampened Chinese demand for Japanese machine tools and led to lower manufacturing output. However, strong corporate profits,

PERFORMANCE (% TOTAL RETURN)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | for periods ended September 30, 2018 | | | for periods ended October 31, 2018 | |

| | | | | | | | | | | |

| | | | | 1

YEAR | | | 3

YEARS | | | 5

YEARS | | | 10

YEARS | | | SINCE

INCEPTION* Nov-09 Aug-17 Dec-96 | | | 1

YEAR | | | 3

YEARS | | | 5

YEARS | | | 10

YEARS | | | SINCE

INCEPTION* Nov-09 Aug-17 Dec-96 | |

| | | | | | | | | | | | | | | |

| | GLOBAL EQUITY PORTFOLIO – INST CLASS | | | 13.42 | | | | 16.65 | | | | 11.36 | | | | – | | | | 10.88 | | | | | | | | | | | | -0.35 | | | | 9.56 | | | | 8.50 | | | | – | | | | 9.51 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | GLOBAL EQUITY PORTFOLIO – INST CLASS Z | | | 13.43 | | | | – | | | | – | | | | – | | | | | | | | 12.48 | | | | | | | | -0.26 | | | | – | | | | – | | | | – | | | | | | | | 2.81 | | | | | |

| | | | | | | | | | | | | | | |

| | GLOBAL EQUITY PORTFOLIO - ADVISOR CLASS | | | 13.21 | | | | 16.36 | | | | 11.09 | | | | 9.94 | | | | | | | | | | | | 7.47 | | | | -0.57 | | | | 9.28 | | | | 8.22 | | | | 11.08 | | | | | | | | | | | | 6.94 | |

| | | | | | | | | | | | | | | |

| | MSCI ALL COUNTRY WORLD INDEX | | | 9.77 | | | | 13.40 | | | | 8.67 | | | | 8.19 | | | | 9.48 | | | | 10.07 | | | | – | | | | -0.52 | | | | 7.74 | | | | 6.15 | | | | 9.75 | | | | 8.44 | | | | 2.74 | | | | – | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, November 3, 2009. Inception of the Institutional Class Z, August 1, 2017. Inception of the Advisor Class, December 1, 1996. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. Performance data shown does not reflect the 2.00% redemption fee imposed on shares held 90 days or less; otherwise, total returns would be reduced.

along with the export-enhancing effects of a weaker yen and the continued strength of the Japanese labor market, and thus domestic spending, kept Japanese stocks relatively firm.

Style effects, once again, favored higher-quality, higher-growth, and more-expensive stocks. These effects were pronounced in the US, but not clear cut for non-US stocks. However, the preference for higher-growth (and more-expensive) stocks reversed sharply in October, both in and out of the US.

PERFORMANCE ATTRIBUTION

PERFORMANCE ATTRIBUTION

Stock selection was the most significant contributor to the Portfolio’s relative performance in the trailing 12 months. Our stocks and overweight in the top-performing Health Care sector were especially beneficial. Outsourced drug manufacturers Lonza Group (based in Switzerland) and Wuxi Biologics (based in China) both announced plans to expand capacity to meet burgeoning demand for biologic drugs. Japanese clinical-testing-equipment manufacturer Sysmex, Chinese drug manufacturer Sino Biopharmaceu-tical, and UK-based pharmaceutical company Shire also outperformed in the period.

Poor stocks within IT were the largest drag on relative returns. Shares of IPG Photonics, a US-based producer of industrial lasers, fell sharply after it reported a slowdown in orders. The company said Chinese manufacturers are reducing capital expenditures due to uncertainty over US tariffs. China-based AAC Technologies, already suffering from the poor uptake of Apple’s last iPhone models, raised concerns that its components for consumer electronics products would suffer from escalating trade measures even though, in September, Apple secured an exemption for its products from the US tariffs on Chinese goods.

Viewed geographically, stock selection in the eurozone contributed the most to our relative performance. German industrial-gas producer Linde rose as its planned merger with US industrial-gas producer Praxair won antitrust clearance in the US, and German flavors-and-fragrance maker Symrise forecasted continued steady growth in its second quarter results. Factory-materials supplier MonotaRO and Sysmex led stocks in Japan.

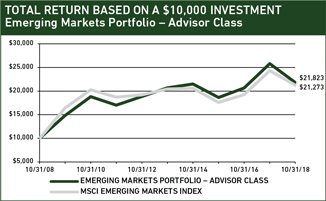

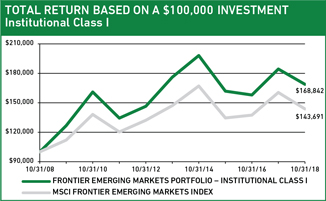

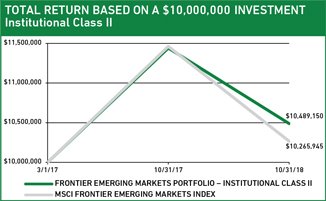

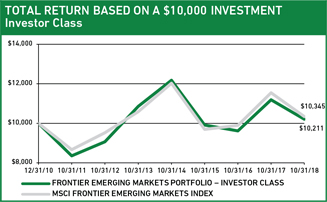

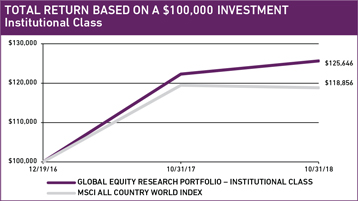

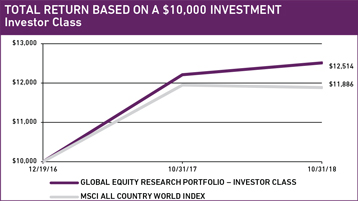

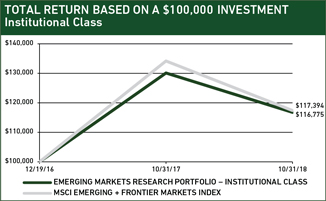

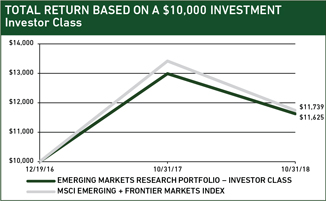

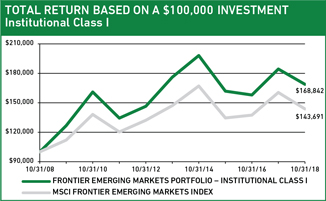

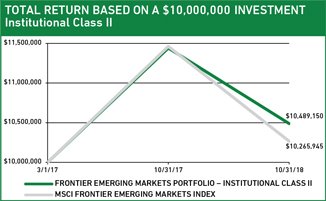

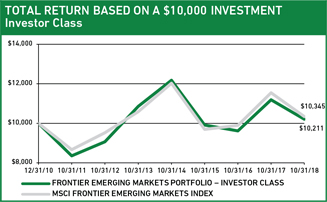

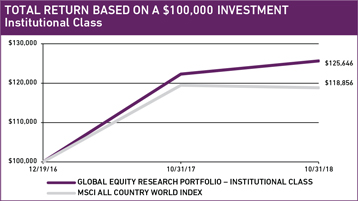

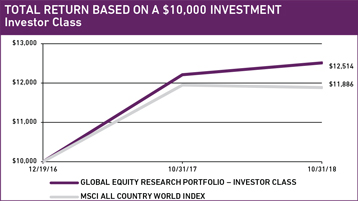

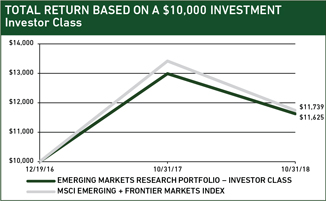

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

In the US, we were hurt by both poor stocks and the portfolio’s underweight in the strong US market. IPG Photonics was the biggest detractor, followed by biotech company Regeneron, oilfield services company Schlumberger, and Signature Bank.

PERSPECTIVE AND OUTLOOK

PERSPECTIVE AND OUTLOOK

Among the biggest contributors to China’s decline this year has been the fall in the shares of its internet giants—online retailer Alibaba, search engine Baidu, and social media and gaming company Tencent. The reasons for their decline are not so obvious. They serve domestic rather than foreign customers, so they have little direct exposure to the ongoing trade war. They have no need to borrow, generating very strong free cash flow, as do the largest US internet companies. Yet this year, the share prices of the counterparts have diverged, the Chinese IT sector falling sharply and US IT continuing upward. The share price divergence appears to be greater than warranted by the relative deterioration evident in the Chinese companies’ competitive situation.

Indeed, the business models of the largest internet companies in China and the US are remarkably similar, as are the competitive structures of their industries in their respective home markets. They have also achieved similar growth over the last decade. Their profitability arises from having achieved dominance with their core platforms, building on the network effects that accelerate once they reach a critical mass of users. Search results on either Google or Baidu are superior to less-used rivals because more user searches can be analyzed to improve the efficacy of the search engine. Socializing on Facebook or Tencent’s WeChat platforms becomes more appealing as more friends use the platforms. Once that self-reinforcing process is in place, the businesses can increase customer stickiness and bolster profits by pursuing additional value enhancements, such as reinvesting profits in service improvements created using machine learning to analyze users’ experience across billions of interactions. Other competitive strategies can include seeking to achieve economies of scale rapidly (i.e., spreading fixed costs over a larger revenue base) and employing product bundling strategies that increase customer loyalty, reflected in the manifold benefits of membership in Amazon.com’s Prime or Alibaba’s 88 VIP programs.

GEOGRAPHIC EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | COUNTRY/REGION | | PORTFOLIO | | BENCHMARK1 | | |

| | | | |

| | CANADA | | 0.0 | | 3.0 | | |

| | | | |

| | EMERGING MARKETS | | 15.4 | | 10.9 | | |

| | | | |

| | EUROPE EMU | | 12.3 | | 9.7 | | |

| | | | |

| | EUROPE EX-EMU | | 13.6 | | 9.6 | | |

| | | | |

| | FRONTIER MARKETS2 | | 0.0 | | – | | |

| | | | |

| | JAPAN | | 8.6 | | 7.5 | | |

| | | | |

| | MIDDLE EAST | | 1.0 | | 0.2 | | |

| | | | |

| | PACIFIC EX-JAPAN | | 2.3 | | 3.6 | | |

| | | | |

| | UNITED STATES | | 42.8 | | 55.5 | | |

| | | | |

| | CASH | | 4.0 | | – | | |

1MSCI All Country World Index; 2Includes countries with less-developed markets outside the Index.

SECTOR EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | SECTOR | | PORTFOLIO | | BENCHMARK1 | | |

| | | | |

| | CONSUMER DISCRETIONARY | | 12.0 | | 12.0 | | |

| | | | |

| | CONSUMER STAPLES | | 5.8 | | 8.4 | | |

| | | | |

| | ENERGY | | 3.2 | | 6.6 | | |

| | | | |

| | FINANCIALS | | 13.0 | | 17.4 | | |

| | | | |

| | HEALTH CARE | | 16.7 | | 12.0 | | |

| | | | |

| | INDUSTRIALS | | 15.5 | | 10.4 | | |

| | | | |

| | INFORMATION TECHNOLOGY | | 21.4 | | 19.6 | | |

| | | | |

| | MATERIALS | | 8.4 | | 4.7 | | |

| | | | |

| | REAL ESTATE | | 0.0 | | 2.9 | | |

| | | | |

| | TELECOM SERVICES | | 0.0 | | 2.9 | | |

| | | | |

| | UTILITIES | | 0.0 | | 3.1 | | |

| | | | |

| | CASH | | 4.0 | | – | | |

1MSCI All Country WorldIndex.

The US and Chinese internet companies also face similar challenges from increased scrutiny by regulators. The challenge, however, has been greater in China, where the government and Communist Party impose requirements to support their policies and restrict any material that may undercut their legitimacy. In August, for example, the General Administration of Press and Publication suspended approvals of new video games amid public officials’ concern about game addiction and eyesight impairment in young people. With games accounting for 35–40% of its revenues and an even larger percentage of profits, Tencent would be hurt if the license approval process becomes permanently contentious, curtailing its ability to keep its core constituency engaged with new products. This kind of regulatory intervention in China, which occurs without warning and for which there is no legal recourse, is more arbitrary and potentially more damaging than the fines levied on Google by the European Union, or the expensive content monitoring efforts that Facebook has been forced to adopt after public shaming.

Along with more-damaging regulatory actions, we have witnessed an intensification of rivalry among internet companies in China that has not been, so far, nearly as virulent in the US. We suspect (without hard evidence) that there is greater propensity among Chinese internet users to switch platforms to the “new, new thing” than in the US. (After all, half of the 800 million mobile internet users in China are under the age of 30.) This willingness to switch enables new entrants, making profitability hard to sustain. Weibo (a social network) and Tencent both have lost some user attention to an emergent short-video platform, Douyin, whose active users has swelled fourfold just since last December, to 225 million.

Another factor intensifying the rivalry among China’s online leaders is that after many years of rapid internet adoption, growth in new users is harder to come by, prompting greater competition for the attention of existing users. As a result, China’s internet companies have increased spending on new services that they

bundle with their existing products at no extra cost to users. They have also stepped up investments in additional areas of commerce, hoping not only to defend their existing market dominance but also to achieve new network effects. Alibaba, for example, has steadily invested in logistics and delivery, bringing its e-commerce services closer to the offline last mile in an effort to keep its customers happily tied to its platform by increasing convenience. Tencent, having declared 2018 a “year of investment,” has invested in major new games for its core platform, short-video and newsfeed platforms, expanded cloud services, its WeChat Pay mobile payment platform, and various e-commerce businesses that compete directly with Alibaba. These company strategies appear to be designed specifically to attract and lock in consumers through the convenience and economy of bundled services.

Offsetting this more-intense competition between the leading online players in China is an important difference that they enjoy relative to their US peers. The existing brick-and-mortar incumbents in China’s retailing, entertainment/media, and information/publishing industries are far less powerful than the incumbents in the US. Amazon must do battle with Walmart, whose revenues are three times as large and whose balance sheet resources match Amazon’s; Alibaba’s revenues are more than double those of its nearest offline competitor, while its operating cash flow is at least 10 times larger, generated from 17 times the gross merchandise value. Facebook and Netflix face off against Disney, Comcast, and Viacom, which have powerful content franchises. In China, these legacy industries were far more fragmented, if they even existed at all in private-sector form, as the mobile internet took hold over the past decade. Thus, the leading Chinese companies face a much smaller or weaker set of potential substitutes, leaving them greater firepower to direct at their online rivals or the ability to conform to government directives without irretrievably dashing profitability.

We have reduced our earnings and growth estimates for Alibaba, Tencent, and Baidu. Each of their share prices has fallen by 25% or more from its January highs. We have stuck with our investments in China’s internet businesses, pending any further developments. In contrast, we are viewing the US companies with even greater suspicion.

PORTFOLIO HIGHLIGHTS

PORTFOLIO HIGHLIGHTS

Many of our purchases this year, including three in the IT sector that we discuss below, were of stocks that experienced significant declines due to disappointing business results that we do not expect to persist. In each case, we are attempting to take advantage of the market’s myopia.

Shares of AAC Technologies suffered this year due to weaker-than-expected sales of Apple’s iPhone X. While other investors sold their shares, we did the opposite. Demand is rising for internet-connected devices that rely on voice commands to interact with users. AAC’s expertise in developing quality speakers and microphones in ever-smaller packages is unlikely to be matched by competitors anytime soon.

TEN LARGEST HOLDINGS at October 31, 2018

| | | | | | | | | | | | |

| | | | | |

| | | COMPANY | | SECTOR | | COUNTRY | | % | | | |

| | | | | |

| | PAYPAL | | INFO TECHNOLOGY | | US | | | 3.7 | | | |

| | | | | |

| | LONZA GROUP | | HEALTH CARE | | SWITZERLAND | | | 3.3 | | | |

| | | | | |

| | ROPER | | INDUSTRIALS | | US | | | 3.1 | | | |

| | | | | |

| | VERISK | | INDUSTRIALS | | US | | | 2.6 | | | |

| | | | | |

| | FIRST REPUBLIC BANK | | FINANCIALS | | US | | | 2.6 | | | |

| | | | | |

| | BOOKING HOLDINGS | | CONS DISCRETIONARY | | US | | | 2.5 | | | |

| | | | | |

| | SYMRISE | | MATERIALS | | GERMANY | | | 2.4 | | | |

| | | | | |

| | AIA GROUP | | FINANCIALS | | HONG KONG | | | 2.4 | | | |

| | | | | |

| | NASPERS | | CONS DISCRETIONARY | | SOUTH AFRICA | | | 2.0 | | | |

| | | | | |

| | APPLE | | INFO TECHNOLOGY | | US | | | 2.0 | | | |

Samsung Electronics, a leading South Korean manufacturer of computer memory chips, saw its share price drop significantly this year as investors worried about the potential impact of tariffs on goods made in EMs. Samsung’s customers are investing in artificial intelligence (AI) applications that require faster, more-expensive memory to run sophisticated algorithms. We do not know how the trade disputes will play out, but we are confident that AI is a long-term structural growth opportunity regardless.

We also purchased Cognex, a US-based provider of machine-vision software and equipment, which we had sold from the portfolio last year after its shares rose on a spike in iPhone X-related orders. Given the lumpiness of product orders, we felt the price didn’t adequately discount the risk of growth disappointment. As it turned out, investors quickly lost their enthusiasm for the stock. In April, we repurchased the shares, regarding that, at their lower price, short-term risk from order volatility was outweighed by the potential from rising long-term demand for industrial automation equipment.

In Financials, we sold Turkey’s Garanti Bank in April, ending an unsuccessful investment that saw a strong banking franchise deliver poor returns to foreign investors due to chronic currency weakness. Nevertheless, we avoided additional losses amid the distress that shook EMs later in the year. We re-established a position in UK-based Standard Chartered, a bank we held from 2003–15 and sold due to concerns with weak management and undisciplined investments. We believe Standard Chartered’s new management team, installed in 2015, has put the bank on a path back to healthy, sustainable returns on capital.

We made few new purchases or complete sales toward the end of the fiscal year. Our inactivity reflects a high degree of uncertainty about the potential outcomes of unfolding trade tensions and their impact on valuations. Our inability to forecast any outcome makes us leery of jettisoning investments in the strong businesses we hold whose share prices have underperformed—especially given our expectation that they have some ability to navigate successfully upcoming changes in the global trade order.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

PORTFOLIO MANAGEMENT TEAM

| | | | |

| |

| | FERRILL ROLL, CFA CO-LEAD PORTFOLIO MANAGER ALEXANDER WALSH, CFA CO-LEAD PORTFOLIO MANAGER SCOTT CRAWSHAW PORTFOLIO MANAGER BRYAN LLOYD, CFA PORTFOLIO MANAGER PATRICK TODD, CFA PORTFOLIO MANAGER ANDREW WEST, CFA PORTFOLIO MANAGER |

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

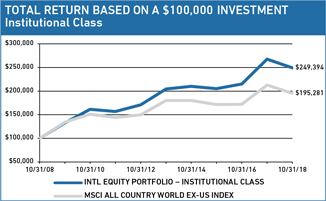

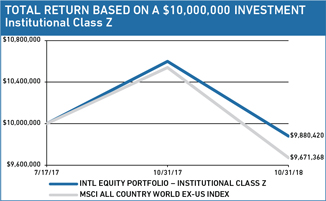

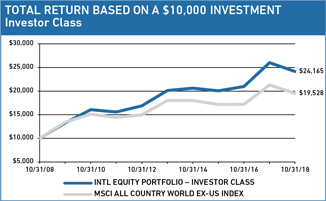

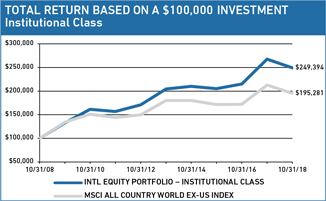

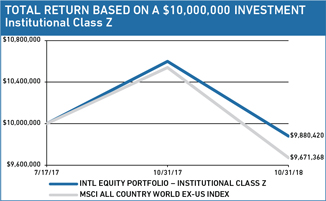

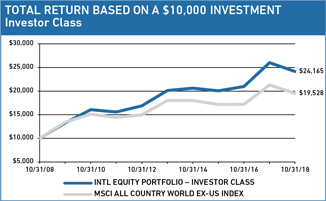

For the International Equity Portfolio, the Institutional Class declined 6.86%, the Institutional Class Z declined 6.79%, and the Investor Class declined 7.16% (net of fees and expenses) in the fiscal year ended October 31, 2018. The Portfolio’s benchmark, the MSCI All Country World (ACW) ex-US Index, declined 8.24% (net of source taxes).

MARKET REVIEW

MARKET REVIEW

International stock markets faced a volatile fiscal year. In 2017, synchronized global economic growth helped send stock markets soaring, but declines in January and February ended the MSCI ACW ex-US Index’s 14-month streak of positive monthly returns. Emerging Markets (EMs) were hit particularly hard, weighed down by weakness in China and worries that rising US interest rates and trade frictions will combine to derail growth and investment in developing economies. Markets ended the fiscal year with a sharp sell-off in late September through October, led by Information Technology (IT) stocks.

The Federal Reserve hiked overnight interest rates in late September, the eighth increase since late 2015. Short-term interest rates remain below the current inflation rate, doing little to dampen growth in the US economy or in US corporate earnings. These “normalizing” rate hikes have yet to deter investors in US equities more than temporarily so far; the same cannot be said of investors in US bonds or EM equities.

EMs performed the worst in the year. Higher US short-term interest rates have been accompanied—led, even—by higher long-term rates (and lower bond prices). As these higher reference yields rippled through global markets, investors have punished markets in some of the developing economies most dependent on

| | | | | | | | | | | | |

| | | |

| | FUND FACTS at October 31, 2018 | | | | | | |

| | | |

| | TOTAL NET ASSETS | | | $13,750.1M | | | |

| | | |

| | SALES CHARGE | | | NONE | | | |

| | | |

| | NUMBER OF HOLDINGS | | | 58 | | | |

| | | |

| | TURNOVER (5 YR. AVG.) | | | 14% | | | |

| | | |

| | REDEMPTION FEE | | | 2% FIRST 90 DAYS | | | |

| | | |

| | | DIVIDEND POLICY | | | ANNUAL | | | |

| | | | |

| | | | INSTITUTIONAL INVESTORS | | | INDIVIDUAL INVESTORS | | | |

| | | | | |

| | | | INSTL CLASS | | INSTL CLASS Z | | | INVESTOR CLASS | | | |

| | | | | |

| | TICKER | | HLMIX | | HLIZX | | | HLMNX | | | |

| | | | | |

| | CUSIP | | 412295107 | | 412295719 | | | 412295503 | | | |

| | | | | |

| | INCEPTION DATE | | 5/11/1994 | | 7/17/2017 | | | 9/30/2005 | | | |

| | | | | |

| | MINIMUM INVESTMENT1 | | $100,000 | | $10,000,000 | | | $5,000 | | | |

| | | | | |

| | NET EXPENSE RATIO | | 0.82% | | 0.74%2 | | | 1.14% | | | |

| | | | | |

| | GROSS EXPENSE RATIO | | 0.82% | | 0.99% | | | 1.14% | | | |

1Lower minimums available through certain brokerage firms; 2The Net Expense Ratio is as of October 31, 2018 as the Portfolio is operating below the contractual agreement, which is in effect until February 28, 2019.

All Expense Ratios are as of the Prospectus dated February 28, 2018 unless otherwise noted.

foreign capital, as borrowing costs and refinancing risks became more daunting. Severe economic crises in Turkey and Argentina raised the specter of EM contagion, the risk that investors retreat en masse from EMs.

The troubles that beset EM index heavyweight China this year were primarily domestic in origin. Government efforts to reduce leverage throughout the economy and bring transparency to the country’s unregulated lending (“shadow banking”) have, inevitably if unintentionally, slowed GDP growth. Chinese health care companies were hurt by a vaccine scandal and greater regulatory focus on decreasing the price of drugs. The escalating trade war with the US is beginning to have significant effects, as Chinese firms postpone capital investments to improve productivity or expand capacity in the face of uncertainty. Some of the biggest share price declines, not only in EMs, but also globally, were of Chinese internet search, e-commerce, and social media companies, predominantly domestic consumer businesses that rank among the world’s most valuable companies.

Elsewhere in the world, developed markets were mixed as investors continued to struggle with familiar problems. In Europe, investors are contemplating a worst-case “no-deal” Brexit, with negotiations between the UK and Europe still inconclusive as the deadline approaches. US-instigated trade friction dampened Chinese demand for Japanese machine tools and led to lower manufacturing output in Japan. However, strong corporate profits, along with the export-enhancing effects of a weaker yen and the continued strength of the Japanese labor market, and thus domestic spending, kept Japanese stocks relatively firm.

PERFORMANCE (% TOTAL RETURN)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | for periods ended September 30, 2018 | | | for periods ended October 31, 2018 | |

| | | | | | | | | | | |

| | | | | 1 | | | 3 | | | 5 | | | 10 | | | SINCE INCEPTION* | | | 1 | | | 3 | | | 5 | | | 10 | | | SINCE INCEPTION* | |

| | | | | YEAR | | | YEARS | | | YEARS | | | YEARS | | | May-94 | | | Jul-17 | | | Sep-05 | | | YEAR | | | YEARS | | | YEARS | | | YEARS | | | May-94 | | | Jul-17 | | | Sep-05 | |

| | | | | | | | | | | | | | | |

| | INTL EQUITY PORTFOLIO – INST CLASS | | | 5.85 | | | | 13.89 | | | | 7.00 | | | | 7.88 | | | | 6.45 | | | | | | | | | | | | -6.86 | | | | 6.74 | | | | 4.04 | | | | 9.57 | | | | 5.97 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | INTL EQUITY PORTFOLIO – INST CLASS Z | | | 5.88 | | | | – | | | | – | | | | – | | | | | | | | 8.15 | | | | | | | | -6.79 | | | | – | | | | – | | | | – | | | | | | | | -0.93 | | | | | |

| | | | | | | | | | | | | | | |

| | INTL EQUITY PORTFOLIO – INVESTOR CLASS | | | 5.48 | | | | 13.50 | | | | 6.66 | | | | 7.53 | | | | | | | | | | | | 6.68 | | | | -7.16 | | | | 6.41 | | | | 3.71 | | | | 9.22 | | | | | | | | | | | | 5.77 | |

| | | | | | | | | | | | | | | |

| | MSCI ALL COUNTRY WORLD EX-US INDEX | | | 1.76 | | | | 9.97 | | | | 4.12 | | | | 5.18 | | | | – | | | | 4.36 | | | | 4.62 | | | | -8.24 | | | | 4.37 | | | | 1.63 | | | | 6.92 | | | | – | | | | -2.56 | | | | 3.91 | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, May 11, 1994. Inception of the Institutional Class Z, July 17, 2017. Inception of the Investor Class, September 30, 2005. Index performance prior to January 1, 2001 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. Performance data shown does not reflect the 2.00% redemption fee imposed on shares held 90 days or less; otherwise, total returns would be reduced.

Style effects showed significant outperformance from high-growth stocks until late summer, but that effect reversed viciously in the final three months of the fiscal year. The most-expensive stocks also outperformed strongly, with a similar reversal. The highest-quality cohort performed the best, but there was not a clear preference for higher quality across the market.

PERFORMANCE ATTRIBUTION

PERFORMANCE ATTRIBUTION

The Portfolio’s relative outperformance in the trailing 12 months derived primarily from good stock selection. In IT, French software designer Dassault Systèmes rose alongside demand for its newest 3D-design products. Financials was boosted by Singapore commercial bank DBS Group, Hong Kong-based insurer AIA Group, and Brazil’s Itaú Unibanco. German industrial-gas producer Linde led Materials, as its planned merger with US industrial-gas producer Praxair won antitrust clearance in the US.

Our stocks in Health Care detracted the most from relative outperformance. In August, shares of German life-sciences firm Bayer declined after a California jury awarded US$290 million to a man who claimed his cancer was caused by glyphosate, an herbicide found in Monsanto’s Roundup weed killer. Bayer, which acquired Monsanto in June, is appealing the verdict. Shares of South Africa’s Aspen Pharmacare declined after the company provided weak revenue guidance for 2019. Our overweight relative the index in Health Care, the second-best-performing sector, however, was helpful.

Viewed geographically, the strongest relative returns were contributed by Europe (both within and outside of the eurozone) and Pacific ex-Japan. Leading stocks in Europe included Dassault, UK-based Royal Dutch Shell, Swiss pharmaceutical outsourcing company Lonza Group, and Nestlé.

In addition to Aspen Pharmacare, EM returns were hampered by South African media conglomerate Naspers, whose shares fell in tandem with its largest investment, China gaming and social media giant Tencent, as Chinese regulators halted approval of new video games in the country. Tencent’s profit margins also deteriorated in the latest quarter due to rising expenses associated with its many new digital ventures. Weibo and Baidu, a Chinese social media platform and search engine respectively, also declined.

The charts above illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

PERSPECTIVE AND OUTLOOK

PERSPECTIVE AND OUTLOOK

Among the biggest contributors to China’s decline this year has been the fall in the shares of its internet giants—Alibaba, Baidu, and Tencent. The reasons for their decline are not so obvious. They serve domestic rather than foreign customers, so they have little direct exposure to the ongoing trade war. They have no need to borrow, generating very strong free cash flow, as do the largest US internet companies. Yet this year, the share prices of the counterparts have diverged, the Chinese IT sector falling sharply and US IT continuing upward. The share price divergence appears to be greater than warranted by the relative deterioration evident in the Chinese companies’ competitive situation.

Indeed, the business models of the largest internet companies in China and the US are remarkably similar, as are the competitive structures of their industries in their respective home markets. They have also achieved similar growth over the last decade. Their profitability arises from having achieved dominance with their core platforms, building on the network effects that accelerate once they reach a critical mass of users. Search results on either Google or Baidu are superior to less-used rivals because more user searches can be analyzed to improve the efficacy of the search engine. Socializing on Facebook or Tencent’s WeChat platforms becomes more appealing as more friends use the platform. Likewise, Instagram or Weibo becomes more attractive to users as more opinion leaders choose it to establish their presence, and more valuable to advertisers as more followers join the audience. Once that self-reinforcing process is in place, the businesses can increase customer stickiness and bolster profits by pursuing additional value enhancements, such as reinvesting profits in service improvements created using machine learning to analyze users’ experience across billions of interactions. Other competitive strategies can include seeking to achieve economies of scale rapidly (i.e., spreading fixed costs over a larger revenue base) and employing product bundling strategies that increase customer loyalty, reflected in the manifold benefits of membership in Amazon’s Prime or Alibaba’s 88 VIP programs.

GEOGRAPHIC EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | COUNTRY/REGION | | PORTFOLIO | | BENCHMARK1 | | |

| | | | |

| | CANADA | | 2.4 | | 6.7 | | |

| | | | |

| | EMERGING MARKETS | | 19.5 | | 24.6 | | |

| | | | |

| | EUROPE EMU | | 27.5 | | 21.8 | | |

| | | | |

| | EUROPE EX-EMU | | 20.9 | | 21.6 | | |

| | | | |

| | FRONTIER MARKETS2 | | 0.0 | | – | | |

| | | | |

| | JAPAN | | 12.8 | | 16.9 | | |

| | | | |

| | MIDDLE EAST | | 2.8 | | 0.4 | | |

| | | | |

| | PACIFIC EX-JAPAN | | 7.9 | | 8.0 | | |

| | | | |

| | OTHER3 | | 3.1 | | – | | |

| | | | |

| | CASH | | 3.1 | | – | | |

1MSCI All Country World ex-US Index; 2Includes countries with less-developed markets outside the Index; 3Includes companies classified in countries outside the Index.

SECTOR EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | SECTOR | | PORTFOLIO | | BENCHMARK1

| | |

| | | | |

| | CONSUMER DISCRETIONARY | | 5.6 | | 10.7 | | |

| | | | |

| | CONSUMER STAPLES | | 8.9 | | 9.8 | | |

| | | | |

| | ENERGY | | 5.4 | | 7.8 | | |

| | | | |

| | FINANCIALS | | 18.1 | | 22.3 | | |

| | | | |

| | HEALTH CARE | | 15.6 | | 8.6 | | |

| | | | |

| | INDUSTRIALS | | 13.5 | | 11.8 | | |

| | | | |

| | INFORMATION TECHNOLOGY | | 21.4 | | 11.1 | | |

| | | | |

| | MATERIALS | | 8.4 | | 7.8 | | |

| | | | |

| | REAL ESTATE | | 0.0 | | 3.1 | | |

| | | | |

| | TELECOM SERVICES | | 0.0 | | 3.9 | | |

| | | | |

| | UTILITIES | | 0.0 | | 3.1 | | |

| | | | |

| | CASH | | 3.1 | | - | | |

1MSCI All Country World ex-US Index.

The US and Chinese internet companies also face similar challenges from regulators. The challenge, however, has been greater in China, where the government and Communist Party impose requirements to support their policies and restrict any material that may undercut their legitimacy. In August, for example, the General Administration of Press and Publication suspended approvals of new video games amid public officials’ concern about game addiction and eyesight impairment in young people. With games accounting for 35–40% of its revenues and an even larger percentage of profits, Tencent would be hurt if the license approval process becomes permanently contentious, curtailing its ability to keep its core constituency engaged with new products. The effect of such state intrusion may be to suppress content production and dull user engagement, degrading the platform’s vitality and its attractiveness to advertisers. This kind of regulatory intervention in China, which occurs without warning and for which there is no legal recourse, is more arbitrary and potentially more damaging than the fines levied on Google by the European Union, or the expensive content monitoring efforts that Facebook has been forced to adopt after public shaming.

Along with more-damaging regulatory actions, we have witnessed an intensification of rivalry among internet companies in China that has not been, so far, nearly as virulent in the US. We suspect (without hard evidence) that there is greater propensity among Chinese internet users to switch platforms to the “new, new thing” than in the US. (After all, half of the 800 million mobile internet users in China are under the age of 30.) This willingness to switch enables new entrants, making profitability hard to sustain. Weibo and Tencent both have lost some user attention to an emergent short video platform, Douyin, whose active users has swelled fourfold just since last December, to 225 million.

Another factor intensifying the rivalry among China’s online leaders is that after many years of rapid internet adoption, growth in new users is harder to come by, prompting greater competition for the attention of the existing users. As a result, China’s internet companies have increased spending on new services that they bundle with their existing products at no extra cost to users.

They have also stepped up investments in additional areas of commerce, hoping not only to defend their existing market dominance but also to achieve new network effects. Alibaba, for example, has steadily invested in logistics and delivery, bringing its e-commerce closer to the offline last mile, trying to keep its customers happily tied to its platform by increasing convenience. Tencent, having declared 2018 a “year of investment,” has invested in major new games for its core platform, short-video and newsfeed platforms, expanding cloud services, its WeChat Pay mobile payment platform, and in various e-commerce businesses that compete directly with Alibaba. These company strategies appear to be designed specifically to attract and lock in consumers through the convenience and economy of bundled services.

Offsetting this more-intense competition between the leading online players in China is an important difference that they enjoy relative to their US peers. The existing brick-and-mortar incumbents in China’s retailing, entertainment/media, and information/ publishing industries are far less powerful than the incumbents in the US. Amazon must do battle with Walmart, whose revenues are three times as large and whose balance sheet resources match Amazon’s; Alibaba’s revenues are more than double those of its nearest offline competitor, while its operating cash flow is at least 10 times larger, generated from 17 times the gross merchandise value. Facebook and Netflix face off against Disney, Comcast, and Viacom, which have powerful content franchises. In China, these legacy industries were far more fragmented, if they even existed at all in private-sector form, as the mobile internet took hold over the past decade. Thus, the leading Chinese companies face a much smaller or weaker set of potential substitutes, leaving them greater firepower to direct at their online rivals or the ability to conform to government directives without irretrievably dashing profitability.

We have reduced our earnings and growth estimates for Alibaba, Tencent, and Baidu. Each of their share prices has fallen by 25% or more from its January highs. We are sticking for now with our investments in these companies (Tencent through Naspers) as we watch business developments closely.

PORTFOLIO HIGHLIGHTS

PORTFOLIO HIGHLIGHTS

The lower prices of many EM stocks this year caused us to scrabble through the companies we follow, with an eye for bargains. In August, we purchased Brazil’s Ambev, one of the country’s largest brewers and the largest PepsiCo bottler outside the US. Brazil’s economy, hurt by falling commodities prices, has stagnated, and its unemployment rate has hovered at 12–14% since 2017. Still, Ambev’s revenues and earnings have continued to grow. After a sharp decline in its dollar-denominated stock, we took advantage of the opportunity to tap the company’s steady stream of profits at a reasonable price.

We also added a new holding in Health Care. Swiss pharmaceutical-outsourcing company Lonza Group is the premier contract manufacturer of biologics, enjoying long-standing relationships with customers like Bristol-Myers Squibb and Roche. Lonza recently opened the world’s largest development and manufacturing site for treatments involving gene editing and cell engineering.

TEN LARGEST HOLDINGS at October 31, 2018

| | | | | | | | | | | | | |

| | | | | |

| | | COMPANY | | SECTOR | | COUNTRY | | % | | |

| | | | | |

| | AIA GROUP | | FINANCIALS | | HONG KONG | | | | 4.0 | | | |

| | | | | |

| | NESTLÉ | | CONS STAPLES | | SWITZERLAND | | | | 3.6 | | | |

| | | | | |

| | ALLIANZ | | FINANCIALS | | GERMANY | | | | 3.5 | | | |

| | | | | |

| | ROYAL DUTCH SHELL | | ENERGY | | UNITED KINGDOM | | | | 3.3 | | | |

| | | | | |

| | SAMSUNG ELECTRONICS | | INFO TECHNOLOGY | | SOUTH KOREA | | | | 3.1 | | | |

| | | | | |

| | CHECK POINT | | INFO TECHNOLOGY | | ISRAEL | | | | 2.8 | | | |

| | | | | |

| | BAYER | | HEALTH CARE | | GERMANY | | | | 2.7 | | | |

| | | | | |

| | TSMC | | INFO TECHNOLOGY | | TAIWAN | | | | 2.7 | | | |

| | | | | |

| | DBS GROUP | | FINANCIALS | | SINGAPORE | | | | 2.7 | | | |

| | | | | |

| | FANUC | | INDUSTRIALS | | JAPAN | | | | 2.7 | | | |

The FDA approved the first of these types of therapies only in 2017, and we anticipate an accelerating pace of approvals in the coming years, which should underpin growth in demand for Lonza’s services.

In IT, we added to our position in Weibo, whose shares have fallen more than 50% since January. We are resisting the urge to conflate a weak share price with a weak business franchise. We expect Weibo’s revenues will continue to grow for the next several years even if online advertising spending growth slows, as the company now expects. Although we have lowered our growth expectations, we believe that Weibo’s system for cultivating key opinion leaders, who provide the content that Weibo’s users consume, remains a durable advantage.

Our complete sales in the fiscal year included UK-based pharmaceutical Shire, which received an acquisition offer from Japan’s Takeda Pharmaceutical, and Turkey’s Garanti Bank, a strong banking franchise that delivered poor returns to foreign investors due to chronic currency weakness.

Portfolio Management Team Update

Andrew West, portfolio manager on the International Equity strategy, will become a co-lead portfolio manager on January 2, 2019, replacing Alec Walsh. Ferrill Roll will continue as the other co-lead portfolio manager. Alec will remain on the International Equity strategy as a supporting member of the portfolio management team, along with Portfolio Managers Scott Crawshaw, Bryan Lloyd, and Patrick Todd. The assignment changes are being made in anticipation of Alec’s retirement, which is expected after the end of 2019.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

PORTFOLIO MANAGEMENT

| | |

JAFAR RIZVI, CFA CO-LEAD PORTFOLIO MANAGER ANIX VYAS, CFA CO-LEAD PORTFOLIO MANAGER | | |

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

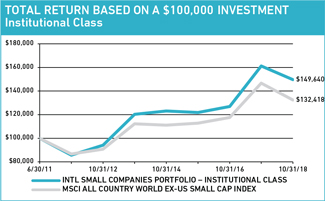

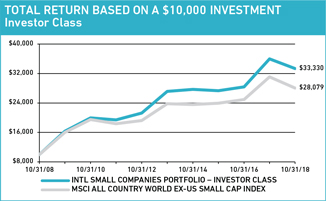

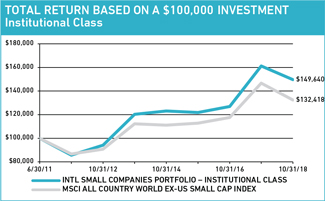

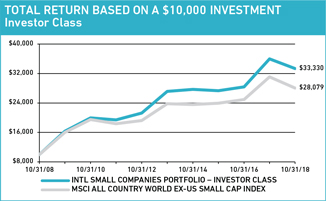

For the International Small Companies Portfolio, the Institutional Class declined 7.15% and the Investor Class declined 7.35% (net of fees and expenses) in the fiscal year ended October 31, 2018. The Portfolio’s benchmark, the MSCI All Country World ex-US Small Cap Index, declined 9.73% (net of source taxes).

MARKET REVIEW

MARKET REVIEW

This fiscal year, we have witnessed a return of market volatility. Following the sharp two week decline from late January to early February, the markets remained mostly flat until June, when volatility spiked again. Non-US stocks were dragged down by rising US interest rates, dollar strength, and an escalating trade war between the US and China.

The US economy is firing on all cylinders. In the second quarter, it grew at a 4.2% annual rate, the fastest in four years. Unemployment fell to 3.7%, the lowest since 1969, and inflation remains moderate. The Federal Reserve raised interest rates in September for the third time in 2018. The move contributed to dollar strength against most major currencies and detracted from international returns for US dollar-based investors.

The picture is less rosy outside the US. Small companies in Emerging Markets (EMs) fared worst. Escalating trade tensions between the US and China weighed on Taiwan, South Korea, Malaysia, and other developing countries that export to China. A prolonged trade war could further weaken China’s economy and demand for those countries’ products. Higher US interest rates and the strong dollar also took a toll on developing countries. Capital flowed to the US in pursuit of higher rates, while the strong dollar increased the cost of US-dollar denominated debt, which has risen to 16% of GDP in EMs, a level not reached since the late 1990s.1 The price of oil rose 21% in the fiscal year, further pressuring the economies of India, China, and other countries reliant on imported petroleum. India also faced a liquidity crunch after IL&FS, one of the country’s largest infrastructure lenders,

1BCA Research. Daily Insights. October 1, 2018.

| | | | | | | | |

| | |

| | FUND FACTS at October 31, 2018 | | |

| | | | |

| | TOTAL NET ASSETS | | | | $209.3M | | |

| | | | |

| | SALES CHARGE | | | | NONE | | |

| | | | |

| | NUMBER OF HOLDINGS | | | | 100 | | |

| | | | |

| | TURNOVER (5 YR. AVG.) | | | | 39% | | |

| | | | |

| | REDEMPTION FEE | | | | 2% FIRST 90 DAYS | | |

| | | | |

| | DIVIDEND POLICY | | | | ANNUAL | | |

| | | |

| | INSTITUTIONAL INVESTORS | | INDIVIDUAL INVESTORS | | |

| | | | |

| | | | INSTITUTIONAL CLASS | | INVESTOR CLASS | | |

| | | | |

| | TICKER | | HLMRX | | HLMSX | | |

| | | | |

| | CUSIP | | 412295875 | | 412295883 | | |

| | | | |

| | INCEPTION DATE | | 6/30/2011 | | 3/26/2007 | | |

| | | | |

| | MINIMUM INVESTMENT1 | | $100,000 | | $5,000 | | |

| | | | |

| | NET EXPENSE RATIO2 | | 1.15% | | 1.40% | | |

| | | | |

| | GROSS EXPENSE RATIO | | 1.41% | | 1.80% | | |

1Lower minimums available through certain brokerage firms; 2Shown net of Harding Loevner’s contractual agreement through February 28, 2019.

All Expense Ratios are as of the Prospectus dated February 28, 2018 unless otherwise noted.

defaulted on US$13 billion of debt, sending tremors through the Indian financial markets.

In Europe ex-European Monetary Union (EMU), small-cap stocks performed roughly in line with the index. In the UK, shares fell 9% as the March 29 deadline for its exit from the European Union (EU) nears. The “hard” Brexit scenario—one where the UK leaves the EU without retaining privileged access to its single market—appears increasingly likely. In late September, Prime Minister Theresa May said negotiations with the EU had stalled and her government was prepared to leave the EU without a deal.

Viewed by sector, Health Care—typically viewed as a “safe” sector—was the only sector to register a positive return. Energy was the next best, declining only slightly, as tightening global inventories and the pending US sanctions against Iran buoyed oil prices. Materials, Financials, and Information Technology (IT) performed the worst. The semiconductors and semiconductor equipment industry group fell 32% as reported book-to-bill ratios indicated orders may have peaked. Prices for memory chips and other semiconductors have begun to decline.

PERFORMANCE ATTRIBUTION

PERFORMANCE ATTRIBUTION

Our strong stock selection in IT contributed to the Portfolio’s outperformance over the trailing 12 months, especially within the software and services industry group. Shares of Infomart, a Japanese e-commerce company, were strong. The company reported a 13% increase in sales as more businesses eliminated paper invoices by adopting Infomart’s digital system. Shares of Bechtle, a German technology consultant, surged in August after the company reported a 17% increase in sales, in part due

PERFORMANCE (% TOTAL RETURN)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | for periods ended September 30, 2018 | | | for periods ended October 31, 2018 | |

| | | | | | | | | | | |

| | | | | 1 | | | 3 | | | 5 | | | 10 | | | SINCE INCEPTION* | | | 1 | | | 3 | | | 5 | | | 10 | | | SINCE INCEPTION* | |

| | | | | YEAR | | | YEARS | | | YEARS | | | YEARS | | | Jun-11 | | | Mar-07 | | | YEAR | | | YEARS | | | YEARS | | | YEARS | | | Jun-11 | | | Mar-07 | |

| | | | | | | | | | | | | |

| | INTL SMALL COMPANIES PORTFOLIO – INST CLASS | | | 4.23 | | | | 12.72 | | | | 7.32 | | | | – | | | | 7.29 | | | | | | | | -7.15 | | | | 7.08 | | | | 4.46 | | | | – | | | | 5.65 | | | | | |

| | | | | | | | | | | | | |

| | INTL SMALL COMPANIES PORTFOLIO – INVESTOR CLASS | | | 3.98 | | | | 12.44 | | | | 7.04 | | | | 10.96 | | | | | | | | 6.52 | | | | -7.35 | | | | 6.85 | | | | 4.19 | | | | 12.79 | | | | | | | | 5.50 | |

| | | | | | | | | | | | | |

| | MSCI ALL COUNTRY WORLD EX-US SMALL CAP INDEX | | | 1.86 | | | | 11.24 | | | | 6.14 | | | | 8.73 | | | | 5.42 | | | | – | | | | -9.73 | | | | 5.47 | | | | 3.36 | | | | 10.88 | | | | 3.90 | | | | – | |

Returns are annualized for periods greater than 1 year. *Inception of the Institutional Class, June 30, 2011. Inception of the Investor Class, March 26, 2007. Index performance prior to June 1, 2007 cannot be shown since it relies on back-filled data.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. Performance data shown does not reflect the 2.00% redemption fee imposed on shares held 90 days or less; otherwise, total returns would be reduced.

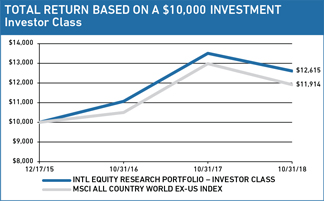

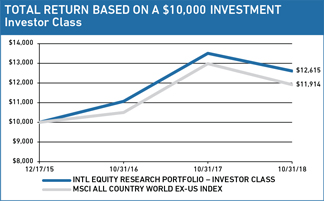

The charts below illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table and charts above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

to its successful expansion in Austria and Switzerland. Bechtle also revised upward its revenue and earnings estimates for the remainder of 2018.

Our stock selection in Health Care and our overweight to the sector also contributed. Dentistry tool manufacturer Nakanishi was a strong contributor. Japan’s Ministry of Health and Labor enacted stricter regulations requiring more frequent sterilization—in lieu of just cleaning—of dental equipment. Because sterilization takes more time, dentists bought additional instruments to use while others are sanitized. Nakanishi’s dental equipment sales in Japan surged 77% in the third quarter of 2018.

Poor selection in Financials hurt relative returns. Life insurance company Max Financial, which is discussed later in this report, detracted. Anadolu Hayat Emeklilik, Turkey’s oldest life insurer and our only holding in the country, also detracted. Investors expect that public participants will contribute less to government-subsidized savings plans as Turkey’s economy deteriorates. Returns for US dollar-based investors were also hurt by the lira’s decline against the greenback.

Our stock selection in Japan contributed more to our relative returns than in any other region, thanks to Nakanishi and Infomart. Our stocks in the eurozone also helped, especially medical technology provider Carl Zeiss and Bechtle in Germany. Italian IT consultant Reply also contributed.

Our poor stock selection in EMs, particularly India and China, detracted from our relative returns. In India, Max Financial and fragrance and flavors company SH Kelkar detracted. In China, shares of plastic injection-molding machines manufacturer Haitian fell, facing some investor concerns about trade wars. Chinese furniture company Suofeiya also declined after reporting slow second-quarter growth.

INVESTMENT PERSPECTIVES

INVESTMENT PERSPECTIVES

When supported by pro-growth public policies and political stability, emerging and frontier economies are capable of rapid expansion; the rise of China is the most salient example of this phenomenon. Investing in this growth, however, requires fortitude as developing countries—especially those dependent on external financing to fund their capital formation—are vulnerable to internal and external shocks that raise the cost of borrowing or undermine the confidence of foreign lenders. This year, many emerging and frontier markets (EMs and FMs) sold off as US interest rates rose, the dollar strengthened, and trade disputes escalated.

As small-cap investors, we are finding opportunities to invest in companies that are introducing the necessities and luxuries of modern life, from urban apartments to financial services, to millions of newly minted middle class consumers. Whereas our small developed market companies tend to be niche businesses serving

narrowly targeted customers, in EMs and FMs our small caps often are not limited to niche products and therefore enjoy greater potential. In these markets, industries that matured long ago in developed economies still offer growth opportunities.

One such example is the steel industry, where large caps tend to dominate. In developed countries, the steel industry has been contracting for decades. In Vietnam, it is booming. The country’s rapidly rising need for industrial plants, infrastructure, and urban residential construction creates enormous demand for the material. The country’s market leader is Hoa Phat Group, an integrated steel producer with the lowest production costs—a competitive advantage that will improve next year as the company increases its scale when a new plant with four million tons of additional capacity comes online.

In a small market like Peru, a small-cap company can operate nationwide. Alicorp makes a broad range of consumer packaged goods including pasta, cooking oil, flour, detergent, and soap. The Peruvian economy is strong, with low public debt, a stable currency, and accelerating growth. From 2001 to 2016, the percentage of Peruvians in poverty fell from 55% to 21%, lifting demand for Alicorp’s products. Alicorp tailors its goods to local tastes, unlike the multinationals that compete with it, including Unilever, Nestlé, and Kraft. The company has high brand recognition and one of Peru’s largest distribution networks, covering every major town in the country. The company has little debt and its management team has a good track record of capital allocation.

Urbanization and the other structural changes that accompany modernization disrupt traditional social networks and safety nets, creating demand for a more modern form of financial security. India’s Max Financial is a small company selling into a nascent market for life insurance. The Indian life insurance market was only privatized in 2001. Premium per capita lags significantly behind not only developed markets but also other EMs, pointing to a long runway for growth. Max has been growing quickly due to its strong agent network and its distribution partnership with Axis Bank. The recent troubles in the Indian banking sector are not expected to disrupt Max’s growth significantly, and the company is expanding its own agent network to hedge the risk that Axis does not renew the distribution partnership in 2021. The costs of this expansion will reduce Max’s margins in the short term, but ensure Max’s long-term growth prospects and strengthen its negotiating position vis-à-vis its partner. It is representative of the strategic foresight Max has demonstrated as it expanded its market share over the last decade.

For the reasons described, we are overweight in developing regions, when emerging and frontier markets are combined. Because our view of the long-term prospects for each of these high-quality, growing businesses has not changed, we see the recent sell-off in EMs and FMs as an opportunity to add to several existing holdings at more attractive prices, and to make new investments in emerging countries, such as Argentina and South Africa. Warren Buffett once said, “You pay a very high price in the stock market for a cheery consensus.” We think the inverse is true in emerging and frontier markets today: the overwhelmingly

SECTOR EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | SECTOR | | PORTFOLIO | | BENCHMARK1 | | |

| | | | |

| | CONSUMER DISCRETIONARY | | 7.8 | | 14.8 | | |

| | | | |

| | CONSUMER STAPLES | | 10.5 | | 6.7 | | |

| | | | |

| | ENERGY | | 4.3 | | 4.0 | | |

| | | | |

| | FINANCIALS | | 6.7 | | 11.1 | | |

| | | | |

| | HEALTH CARE | | 16.1 | | 7.6 | | |

| | | | |

| | INDUSTRIALS | | 20.6 | | 19.5 | | |

| | | | |

| | INFORMATION TECHNOLOGY | | 20.8 | | 11.3 | | |

| | | | |

| | MATERIALS | | 8.0 | | 10.2 | | |

| | | | |

| | REAL ESTATE | | 0.5 | | 10.6 | | |

| | | | |

| | TELECOM SERVICES | | 1.2 | | 1.3 | | |

| | | | |

| | UTILITIES | | 1.4 | | 2.9 | | |

| | | | |

| | CASH | | 2.1 | | – | | |

1MSCI All Country World ex-US Small Cap Index.

GEOGRAPHIC EXPOSURE (%) at October 31, 2018

| | | | | | | | |

| | | | |

| | | COUNTRY/REGION | | PORTFOLIO | | BENCHMARK1 | | |

| | | | |

| | CANADA | | 1.2 | | 7.2 | | |

| | | | |

| | EMERGING MARKETS | | 17.6 | | 19.0 | | |

| | | | |

| | EUROPE EMU | | 24.6 | | 17.3 | | |

| | | | |

| | EUROPE EX-EMU | | 24.9 | | 23.5 | | |

| | | | |

| | FRONTIER MARKETS2 | | 10.6 | | – | | |

| | | | |

| | JAPAN | | 13.6 | | 23.1 | | |

| | | | |

| | MIDDLE EAST | | 1.4 | | 1.5 | | |

| | | | |

| | PACIFIC EX-JAPAN | | 3.2 | | 8.4 | | |

| | | | |

| | OTHER3 | | 0.8 | | – | | |

| | | | |

| | CASH | | 2.1 | | – | | |

1MSCI All Country World ex-US Small Cap Index; 2Includes countries with less-developed markets outside the Index; 3Includes countries classified in countries outside the Index.

gloomy consensus offers the potential to acquire strong long-term growth at reasonable prices.

PORTFOLIO HIGHLIGHTS

PORTFOLIO HIGHLIGHTS

The addition of Anix Vyas, CFA as a co-lead portfolio manager on April 2 led to above-average activity in early 2018 as the Portfolio was adjusted to incorporate the investment decisions of each of the portfolio managers, taken independently. The number of holdings increased from 87 on October 31, 2017 to 100 on October 31, 2018.

Over the past 12 months, we added to several existing EM and FM holdings (including Hoa Phat, Moscow Exchange, Kernel, and Tower Bersama). We also initiated positions in Loma Negra, Argentina’s largest cement producer, Tiger Brands, South Africa’s dominant packaged goods company, Mabanee, Kuwait’s real estate developer, and Bharti Infratel, India’s largest wireless tower operator.

Stocks in Argentina were especially hard hit amid the country’s escalating currency crisis. The government responded by hiking interest rates to 60% (the world’s highest) and accelerating its plan to reduce the country’s fiscal deficit. Latin America’s third-largest economy will likely shrink this year and next. Construction activity and cement demand will decline. At the time of our purchase, Loma Negra’s shares had fallen 60% from their peak in January, and we believed its poor near-term outlook was more than fully reflected in its share price.

The Argentine cement industry has grown over the long term, despite the country’s frequent economic crises. In its 92 years in business, Loma has accumulated competitive advantages that should help it withstand the current crisis and eventually return to growth. Through one of its subsidiaries, Loma has indirect control of Ferrosur Roca, which operates a rail network that connects five of Loma’s eight factories to distribution centers. This enables Loma to move its cement faster and more cheaply than its competitors, and to shift production among factories based on regional demand. With its logistical advantages and lower production costs, Loma could comfortably match its rivals on price—but it doesn’t. On the strength of the company’s brand, it prices its cement at a 3% premium to peers. A new plant in Buenos Aires province, scheduled to be operational in 2020, will expand the company’s production capacity by 30% and produce at lower costs than existing plants, cementing Loma’s structural advantages over the competition.

In South Africa, shares of consumer-products maker Tiger Brands have fallen sharply this year due to a recession and a listeriosis outbreak traced to its meat-processing facilities. More than 200 people died and a thousand sickened this spring after eating polony sausage and other chilled meats. Scientists tied the outbreak to a strain of listeria that existing government and industry tests did not detect. Tiger recalled the tainted products and closed several factories, and is now leading efforts to improve national food-testing standards.

When we initiated our position in August, Tiger shares had fallen 25% from their highs reached before the listeria tragedy. Though it faces headwinds from South African economic weakness and litigation in the short term, the company’s competitive advantages remain strong. Most of Tiger’s food and personal-care brands lead the market in their categories. To capture share, Tiger packages its products in a variety of sizes and price points. The company, which primarily targets South Africa’s growing middle class, enjoys one of the largest distribution networks in Africa. At home, its distribution system extends across modern and traditional retail outlets, such as “spaza” shops (convenience stores run out of homes). About 10% of Tiger’s sales are in other African countries, including Nigeria, Kenya, and Cameroon.

We have difficulty identifying high-quality real estate businesses, but we found an exception in Kuwaiti developer Mabanee. The company owns and manages The Avenues, Kuwait’s largest shopping mall. The Avenues, which already accounts for more than 30% of the country’s total retail space, is undergoing an expansion project, which should provide a boost to Mabanee’s revenue and

TEN LARGEST HOLDINGS at October 31, 2018

| | | | | | | | | | | | |

| | | | | |

| | | COMPANY | | SECTOR | | COUNTRY | | % | | | |

| | | | | |

| | CARL ZEISS MEDITEC | | HEALTH CARE | | GERMANY | | | 3.2 | | | |

| | | | | |

| | NAKANISHI | | HEALTH CARE | | JAPAN | | | 2.9 | | | |

| | | | | |

| | ARIAKE | | CONS STAPLES | | JAPAN | | | 2.4 | | | |

| | | | | |

| | ABCAM | | HEALTH CARE | | UK | | | 2.4 | | | |

| | | | | |

| | BECHTLE | | INFO TECHNOLOGY | | GERMANY | | | 2.4 | | | |

| | | | | |

| | ALTEN | | INFO TECHNOLOGY | | FRANCE | | | 2.3 | | | |

| | | | | |

| | SENIOR | | INDUSTRIALS | | UK | | | 2.2 | | | |

| | | | | |

| | HOA PHAT GROUP | | MATERIALS | | VIETNAM | | | 2.1 | | | |

| | | | | |

| | REPLY | | INFO TECHNOLOGY | | ITALY | | | 2.0 | | | |

| | | | | |

| | DECHRA PHARMACEUTICALS | | HEALTH CARE | | UK | | | 1.7 | | | |

profits over the next three years. In a country with few large malls, Mabanee’s competitive advantage lies in the exclusive franchise agreement that its majority shareholder, Alshaya Group, has with nearly 90 international retail brands in Kuwait, which will also help it grow.

We also purchased India’s largest wireless tower operator, Bharti Infratel. In India, smartphone adoption lags much of the world, but that is changing rapidly as inexpensive models become available. With the number of smartphone users expected to double to 650 million in the next four years, more cell towers will be needed to meet burgeoning data demands. Infratel owns 92,000 towers across all of India’s 29 states and leases space for antennas and electronics to telecom operators, including Bharti Airtel, Vodafone Idea, and Jio Communications. Infratel’s 40% market share of towers is over twice as high as its closest competitor. Its scale allows it to negotiate lower prices than its rivals for steel, concrete, air conditioners, batteries, and other materials.

The recent merger of two of its customers, Vodafone and Idea, resulted in a consolidation of the antennas and wireless equipment on Infratel’s towers and, consequently, a decline in leases in the third quarter. We saw a sharp fall in its share price as an opportunity to establish a position at an attractive price because we think the set back is only short term. We expect Infratel to recover quickly as telecom operators lease more tower space to meet the demands of serving new smartphone users and implementing faster data networks. In fact, another 100,000 towers are needed just to meet current demand properly, according to the Tower and Infrastructure Providers Association of India.

Please read the separate disclosures page for important information, including the risks of investing in the Portfolio.

| | |

| PORTFOLIO MANAGEMENT TEAM |

|

| SCOTT CRAWSHAW | | PRADIPTA CHAKRABORTTY |

CO-LEAD PORTFOLIO MANAGER | | PORTFOLIO MANAGER |

| CRAIG SHAW, CFA | | G. RUSTY JOHNSON, CFA |

| CO-LEAD PORTFOLIO MANAGER | | PORTFOLIO MANAGER |

| | RICHARD SCHMIDT, CFA |

| | PORTFOLIO MANAGER |

The Institutional Emerging Markets Portfolio and the Emerging Markets Portfolio are generally closed to new investors.

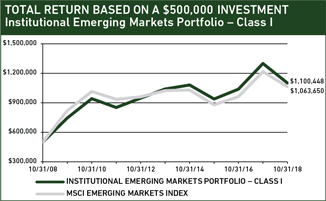

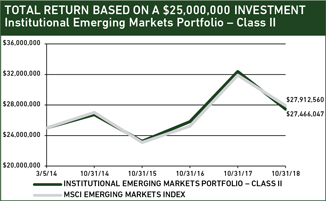

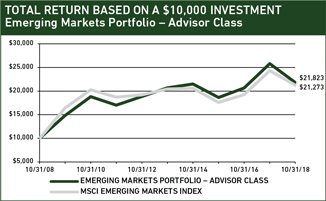

The Institutional Emerging Markets Portfolio – Class I and Class II – and the Emerging Markets Portfolio – Advisor Class (collectively, the “Portfolios”) are both managed in strict accordance with Harding Loevner’s Emerging Markets Equity strategy model portfolio. Therefore, the Portfolios have highly similar holdings and characteristics. We have provided a single commentary to cover both Portfolios. The specific performance and characteristics of each are presented separately in the tables that follow.

PERFORMANCE SUMMARY

PERFORMANCE SUMMARY

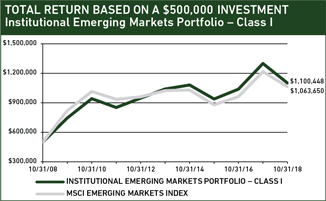

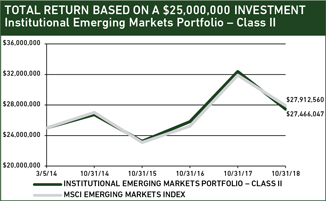

The Institutional Emerging Markets Portfolio – Class I fell 15.33%, the Institutional Emerging Markets Portfolio – Class II fell 15.21%, and the Emerging Markets Portfolio – Advisor Class fell 15.47% (all net of fees and expenses) in the fiscal year ended October 31, 2018. The Portfolios’ benchmark, the MSCI Emerging Markets Index, fell 12.52% (net of source taxes) in the fiscal year.

MARKET REVIEW

MARKET REVIEW