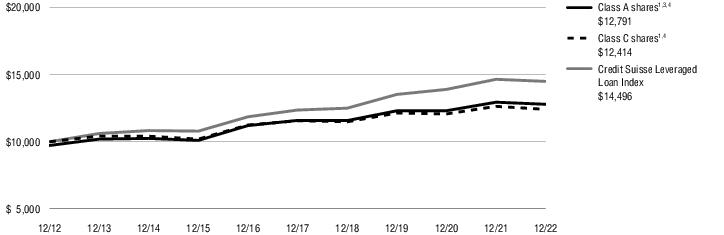

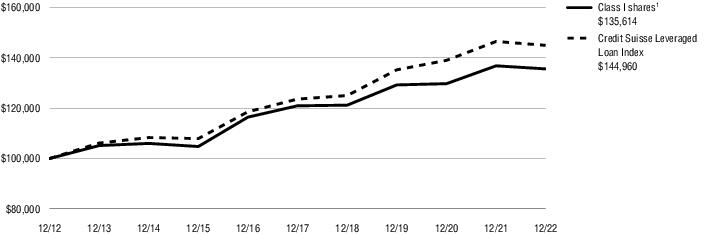

Credit Suisse Leveraged Loan Index

The Credit Suisse Leveraged Loan Index is a market-weighted index that tracks the investable universe of the U.S. dollar denominated leveraged loans. The index is calculated on a total return basis, is unmanaged and not available for direct investment. The unmanaged index returns do not reflect any fees, expenses, or sales charges.

Federal Reserve (the “Fed”)

The central Bank of the United States, responsible for controlling the money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches and all national and state banks that are part of the system.

ICE BofA 10+ Year U.S. Cash Pay High Yield Index

ICE BofA 10+ Year U.S. Cash Pay High Yield Index is a subset of ICE BofA U.S. Cash Pay High Yield Index including all securities with a remaining term to final maturity greater than or equal to 10 years. ICE BofA U.S. Cash Pay High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in the U.S. domestic market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

ICE BofA BB U.S. High Yield Index

ICE BofA BB U.S. High Yield Index is a subset of (H0A0) that includes all securities with a given investment grade rating BB. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

ICE BofA CCC & Lower U.S. High Yield Index

ICE BofA CCC & Lower U.S. High Yield Index is a subset of (H0A0) that includes all securities with a given investment grade rating CCC or below. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

ICE BofA Single-B U.S. High Yield Index

ICE BofA Single- B U.S. High Yield Index is a subset of (H0A0) that includes with a given investment grade rating B. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

ICE BofA U.S. Corporate Index

ICE BofA U.S. Corporate Index, which tracks the performance of U.S. dollar denominated investment grade rated corporate debt publicly issued in the U.S. domestic market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

ICE BofA U.S. Distressed High Yield Index

ICE BofAML U.S. Distressed High Yield Index is a subset of (H0A0) which includes any performing issues trading at an option-adjusted spread over 1000 basis points. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

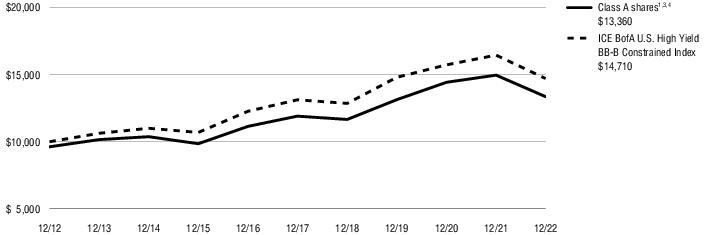

ICE BofA U.S. High Yield BB-B Constrained Index

The ICE BofA U.S. High Yield BB-B Constrained Index measures performance of BB/B U.S. dollar denominated corporate bonds publicly issued in the U.S. domestic market, and is restricted to a maximum of 2% per issuer. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

ICE BofA U.S. High Yield Index (“H0A0”)

The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt publicly issued in the US domestic market. To qualify for inclusion in the index, securities with a given investment grade rating BB. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Intercontinental Exchange (“ICE”)

An American Fortune 500 company formed in 2000 that operates global exchanges and clearing houses, and provides mortgage technology, data and listing services. The company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and over-the-counter energy, credit and equity markets.

J.P. Morgan Leveraged Loan Index

The J.P. Morgan Leveraged Loan Index is designed to mirror the investable universe of the USD institutional leveraged loan market. The index is comprised of issuers domiciled across the global markets. The international component of the index is comprised of developed market domiciled issuers only.

Leveraged Loan

Leveraged loans (also known as bank, senior or floating-rate loans) consists of below investment-grade credit quality loans that are arranged by banks and other financial institutions to help companies finance acquisitions, recapitalizations, or other highly leveraged