UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07831

FMI Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

(Registrant's telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2014

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2014

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| | | | |

| |  | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | FMI Funds | |

| | | |

| | Advised by Fiduciary Management, Inc. | |

| | www.fmifunds.com | |

| | | |

| | | | |

FMI Funds

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| Shareholder Letter | 3 |

| Schedule of Investments | 7 |

| Industry Sectors | 9 |

| | |

| FMI Common Stock Fund | |

| Shareholder Letter | 10 |

| Schedule of Investments | 14 |

| Industry Sectors | 16 |

| | |

| FMI International Fund | |

| Shareholder Letter | 17 |

| Schedule of Investments | 22 |

| Industry Sectors | 24 |

| | |

| Financial Statements | |

| Statements of Assets and Liabilities | 25 |

| Statements of Operations | 26 |

| Statements of Changes in Net Assets | 27 |

| Financial Highlights | 28 |

| Notes to Financial Statements | 29 |

| | |

| Additional Information | 34 |

| Expense Example | 35 |

| Advisory Agreements | 36 |

| Disclosure Information | 37 |

FMI

Large Cap

Fund

March 31, 2014

Dear Fellow Shareholders:

The FMI Large Cap Fund (FMIHX) returned 2.49% in the March quarter compared to 1.81% for the Standard & Poor’s 500 (“S&P 500”) Index. Sectors that aided results in the period included Energy Minerals, Process Industries, and Health Services. Devon Energy, Potash Corp., and UnitedHealth Group led these groups, respectively. On the downside, Transportation, Distribution Services, and Health Technology all detracted from the results. Expeditors International and AmerisourceBergen were the underperformers in the first two sectors, and the relative underweighting in Health Technology also played a role. While there were a few days and weeks of consternation, the market continued to show remarkable buoyancy as this bull run reached five years in duration. U.S. stock markets hit their low this cycle on March 9, 2009, with the S&P 500 closing at 676.5. Five years later it closed at 1878.0. With dividends, the total return was a remarkable 208.8%. The nearby table shows all of the Dow Jones Industrial Average’s bull markets since 1900 (the S&P 500 did not exist in its present form until 1957). This is the 22nd bull market of the modern era; the median price change was 83.5% and the median duration was 33 months. From the March 9, 2009 low through year-end 2013, the Dow Jones Industrials gained 153.2% in price (with dividends, the total return was 188.2%), making this bull market approximately 83% greater in price and 79% longer in duration than the median bull market over the past 114 years.

| | Bull Market Dates | | | Price | | | | | | | | | | | | |

| | Dow Jones Industrial | | | Return | | | # Days | | | ~ # Months |

| | Average | | | Only | | | | | | | | | | | | |

| | 9/24/1900 – 6/17/1901 | | | 47.8 | % | | | | 266 | | | | | 8.9 | | | |

| | 11/9/1903 – 1/19/1906 | | | 144.3 | % | | | | 802 | | | | | 26.7 | | | |

| | 11/18/1907 – 11/19/1909 | | | 89.6 | % | | | | 732 | | | | | 24.4 | | | |

| | 9/25/1911 – 9/30/1912 | | | 29.1 | % | | | | 371 | | | | | 12.4 | | | |

| | 12/24/1914 – 11/21/1916 | | | 110.5 | % | | | | 698 | | | | | 23.3 | | | |

| | 12/19/1917 – 11/3/1919 | | | 81.4 | % | | | | 684 | | | | | 22.8 | | | |

| | 8/24/1921 – 9/3/1929 | | | 495.2 | % | | | | 2926 | | | | | 97.5 | | | |

| | 7/8/1932 – 3/10/1937 | | | 371.6 | % | | | | 1706 | | | | | 56.9 | | | |

| | 3/31/1938 – 11/9/1938 | | | 60.1 | % | | | | 223 | | | | | 7.4 | | | |

| | 4/28/1942 – 5/29/1946 | | | 128.7 | % | | | | 1492 | | | | | 49.7 | | | |

| | 10/22/1957 – 12/13/1961 | | | 75.1 | % | | | | 1513 | | | | | 50.4 | | | |

| | 6/26/1962 – 2/9/1966 | | | 85.7 | % | | | | 1324 | | | | | 44.1 | | | |

| | 10/7/1966 – 12/3/1968 | | | 32.4 | % | | | | 788 | | | | | 26.3 | | | |

| | 5/26/1970 – 1/11/1973 | | | 66.6 | % | | | | 961 | | | | | 32.0 | | | |

| | 12/6/1974 – 9/21/1976 | | | 75.7 | % | | | | 655 | | | | | 21.8 | | | |

| | 2/28/1978 – 4/27/1981 | | | 38.0 | % | | | | 1154 | | | | | 38.5 | | | |

| | 8/12/1982 – 8/25/1987 | | | 250.4 | % | | | | 1839 | | | | | 61.3 | | | |

| | 10/19/1987 – 7/16/1990 | | | 72.5 | % | | | | 1001 | | | | | 33.4 | | | |

| | 10/11/1990 – 7/17/1998 | | | 294.8 | % | | | | 2835 | | | | | 94.5 | | | |

| | 8/31/1998 – 1/14/2000 | | | 55.5 | % | | | | 501 | | | | | 16.7 | | | |

| | 10/9/2002 – 10/9/2007 | | | 94.4 | % | | | | 1826 | | | | | 60.9 | | | |

| | 3/9/2009 – 12/31/2013 | | | 153.2 | % | | | | 1758 | | | | | 58.6 | | | |

| | Average | | | 129.7 | % | | | | 1184 | | | | | 39.5 | | | |

| | Median | | | 83.5 | % | | | | 981 | | | | | 32.7 | | | |

| | Source: Fiduciary Management, Inc./Bloomberg | | | | | | | | | | | |

This bull market reminds us of the old movie, Groundhog Day, with Bill Murray. Phil Connors (Murray) repeatedly wakes up to Sonny & Cher on the radio, and has to live the same day over and over no matter what he does. Similarly, this market seems to stay the same …expensive… despite a litany of less-than-appealing fundamentals: corporate revenue growth weakening, spotty job growth (actually falling when adjusted for the drop in average workweek hours), China slowing, emerging markets swooning, Syria and the Middle East aflame, Russia swiping Crimea and acting with hostility elsewhere, biotechnology stocks soaring on sketchy fundamentals, and classic signs of overexuberance (Whatsapp, Pandora, etc.). Of course, there are some positives, including improved bank lending and consumer sentiment, but so far precious little is being translated into sustainable economic growth. Valuations, as articulated ad nauseam in recent letters, remain extremely high from a historical perspective. Investor bullishness and the raft of low quality IPOs are additional signs of speculative excess. Added to this is the continuing fiscal crisis, a toxic political environment, and a monetary policy that all but ignores the potential ramifications of conjuring up $4 trillion of high-powered money out of thin air.

The developments in China deserve special mention. Chinese leaders have recently begun to admit what many, including us, have been saying for some time: credit extension has gotten out of control. Credit has grown at more than 20% per year for over five years ($14 trillion), much of which has been spent on real estate and infrastructure where there are clear signs of excess. On March 7, China allowed its first corporate bond default, the Chaori Solar Energy Science & Technology Co. On March 18, Zhejiang Xingrun Real Estate Co. defaulted on $567 million of debt. Will the authorities continue to let the air out of the bubble by not propping up zombie companies and state-owned enterprises? Heretofore that has not been their modus operandi but it is possible that a major change is afoot. How much pain will the authorities tolerate? We will monitor the developments closely.

Unlike Groundhog Day, we can’t stop the clock and make all the bad things turn out great. We own this set of shaky fundamentals, and we own them at high valuations. Most bull markets are impervious to fundamentals in the short run, but not over the long haul. The problem is that investors believe they can spot signs of trouble and “get out with their skin.” Unfortunately, this rarely happens. Simply look at the aforementioned list of real and anecdotal signs that might typically be tipping points for a stock market. So far each one proved false but instead of investors counting their lucky stars and derisking, they actually do the opposite, becoming more emboldened and aggressive. It’s why when markets turn, they rarely decline to an average or median level, but more commonly overshoot on the downside. The euphoria turns to panic and as the disillusionment deepens, the once overvalued becomes cheap. It’s also why most studies show that the average investor has achieved about a 3% return in the stock market while the S&P 500 has done close to 10%.

Human nature rarely changes from cycle to cycle. The crack marketing and client service team (all four of them!) at Fiduciary Management, Inc. (the adviser to FMIHX) tell prospective and existing shareholders to expect our approach to lag strong markets and outperform in more difficult markets. This has been the adviser’s general pattern for 30+ years of managing money, but of course there are no guarantees. Our philosophy and strategy is geared toward relative risk aversion and is focused on long-term rather than short-term performance. This has yielded fairly substantial outperformance over full market cycles but occasionally not over shorter periods. The FMI Large Cap Fund gained 194.77% from the March 9, 2009 bottom to the fifth anniversary of the current rally (3/7/2014), approximately 93% of the 208.75% return of the S&P 500. Of course the full story on this cycle has yet to be told, but if we go back to the previous peak on October 12, 2007 and measure the return through the 2008-09 bear market back to the five-year anniversary of the bull market (3/7/2014), FMIHX gained 54.96% compared to 38.54% for the S&P 500. Since the inception of FMIHX (12/31/2001), the total return through 3/31/2014 was 186.77% compared to 108.50% for the S&P 500. Despite the best efforts of our marketing people, we’ve seen the same phenomenon over the decades: some shareholders who acknowledge on the front end that our strategy will underperform in a strong up market don’t have the constitution to be patient and wait for the inevitable turn. Sometimes they go to the dark side (speculative growth or momentum) and other times they find a new value-oriented or “alternative” manager or mutual fund. There is always going to be another manager with a better near-term track record. The performance game is cutthroat and as Warren Buffett likes to say, “You never know who is swimming naked until the tide goes out.” The best approach is to ascertain whether the fund owns financially strong companies with good business models, and that have valuations that are reasonable, if not cheap.

On that note, we’d like to highlight a couple of investments.

Berkshire Hathaway Inc. – Cl B (BRK.B)

(Analyst: Karl Poehls)

Description

Berkshire Hathaway is a holding company owning subsidiaries that engage in a number of diverse business activities including property and casualty insurance and reinsurance (29% of 2013 EBIT [earnings before interest and taxes]); freight rail transportation (29%); utilities and energy (9%); finance (4%); and manufacturing, services and retailing (29%). Included in the group of subsidiaries that underwrite property and casualty insurance and reinsurance is GEICO, the third largest private passenger auto insurer in the U.S., and two of the largest reinsurers in the world, General Re and the Berkshire Hathaway Reinsurance Group. Other notable subsidiaries are: Burlington Northern Sante Fe (BNSF), MidAmerican Holdings, McLane, Iscar, The Marmon Group, Shaw Industries, Benjamin Moore, Lubrizol, NetJets, Forest River, and Johns Manville.

Good Business

| • | Most of Berkshire’s operating subsidiaries enjoy sustainable competitive advantages and hold leadership positions in their respective industries. |

| • | GEICO is one of the world’s most valuable insurance operations. It generates superior underwriting results and benefits from a low-cost structure. The reinsurance operations have the balance sheet capacity to write business that others cannot. |

| • | At year-end 2013, Berkshire’s insurance “float” exceeded $75 billion. Given the underwriting discipline of the company’s insurance operations, this float is effectively free capital that can be deployed into attractive investment opportunities. |

| • | The market value of Berkshire’s investment portfolio is approximately $220 billion. The underlying securities provide a recurring stream of investment income. |

| • | Over the past ten years, Berkshire’s book value per share has compounded at 11% per annum. |

| • | The company possesses a strong balance sheet. Berkshire’s long-term debt is rated Aa2 and AA by Moody’s and S&P, respectively. |

Valuation

| • | Berkshire’s current P/BV (price-to-book value) multiple is 1.38 times. This compares to its trailing 10-year average P/BV multiple of 1.42 times. CEO Warren Buffett has noted that he views a valuation below 1.20 times BV as attractive and plans to repurchase stock in the open market at valuations below this level. We estimate that 1.50-1.70 times BV is a more appropriate multiple. While highly unlikely, should Berkshire ever be broken up, the sum-of-the-parts valuation should be well in excess of the current market value. |

| • | In 2013, Berkshire’s non-insurance operations generated $15 billion in pretax earnings. Applying a 10 multiple to these earnings, we derive a value per Class B share of $63. In addition, the company’s cash and investments are worth $220 billion or $89 per Class B share. Thus, this valuation approach suggests Berkshire’s intrinsic value exceeds $150 per Class B share. |

Management

| • | CEO Warren Buffett is one of the world’s most successful investors. He owns a significant amount of Berkshire’s common stock and is an above-average steward of shareholder capital. |

| • | A key aspect of Buffett’s approach is to partner with outstanding operating managers. |

Investment Thesis

Warren Buffett is now 83 years old. Many investors are worried about succession planning and are skeptical about the company’s ability to grow book value at above market rates once Buffett steps down or dies. Buffett’s passing will undoubtedly hurt the stock but we believe that it will be a short-term hit and it won’t exactly come as a surprise. Further, investors are not giving the company credit for its increased earnings from non-insurance operations and are still valuing the enterprise like a financial institution. Given its fortress balance sheet and collection of above-average businesses, we estimate Berkshire’s common stock is trading at a meaningful discount to its intrinsic value.

UnitedHealth Group Inc. (UNH)

(Analyst: Dan Sievers)

Description

UnitedHealth Group is the largest and most diversified health benefits and managed care provider in the United States, with dominant competitive positioning in each of the core managed care business segments (commercial, Medicare, and Medicaid) as well as meaningful and improving competencies outside of the core managed care business (pharmacy benefit management, healthcare IT, and healthcare data). In terms of health benefits, the company serves 30 million consumers (individual, employer risk, and employer fee-based arrangements), 10 million Medicare beneficiaries (roughly 1 in 5), 4 million people through state Medicaid programs, 2.9 million veterans (a fee-based Department of Defense plan), and 4.8 million people through the acquired Amil business. Optum is a $37 billion growth business organized around health data.

Good Business

| • | UnitedHealth controls the number one or number two market share position in each health insurance end-market. The level of local, state, and federal regulations affecting this industry continue to raise complexity and thus barriers to entry. |

| • | Health benefits migration away from fee-for-service models and toward more sophisticated managed care arrangements (performance-based contracts, accountable care, shared savings, and data feedback) favors scale-advantaged technologically-capable players like UnitedHealth. |

| • | The company is expanding internationally (Amil is Brazil’s largest commercial insurer). |

| • | Optum is a collection of interesting higher-growth and higher-margin healthcare service, IT, and data businesses that have the potential to improve outcomes and healthcare efficiencies. |

| • | The 5-year average ROE (return on equity) has been 18.3%. |

Valuation

| • | UnitedHealth trades for 14.8 times earnings, in-line with its 10-year trailing average. |

| • | The stock trades at a discount to the median of its long-term enterprise value-to-sales multiple. |

| • | The company has a higher ROIC (return on invested capital) and long-term growth prospects that are greater than the average S&P 500 company, yet sells at a significant discount. |

Management

| • | CEO Steve Hemsley is highly regarded, and all of our research suggests that the company has a deep bench of executive talent. Management has purposefully diversified UnitedHealth in thoughtful ways and has invested in forward thinking (even reform-minded) businesses, especially in the construction of Optum. |

| • | Through dividends and repurchases, the company aims to return 65%-70% of free cash flow to shareholders. |

| • | ROE is a key compensation metric (2010-2012 target was 14.2% vs. 18.8% actual). |

| • | Optum’s performance target to advance from 8% ROIC in 2012 to 15% in 2015 looks achievable. |

Investment Thesis

By about 2017, UnitedHealth Group’s profit contribution should be roughly 1/3 Commercial, 1/3 Government programs, and 1/3 Optum. Following 2013’s Medicare Advantage reimbursement reset and 2014’s various Affordable Care Act (“ACA”) related changes (and challenges), the company will remain a powerful scale-advantaged player poised for substantial EPS (earnings per share) growth. As in any difficult reimbursement environment, the companies with the best scale and associated low operating cost structure gain market share. On the other side of ACA implementation, we believe that industry P/E (price-to-earnings) multiples could expand, at least on a relative basis. Given the company’s enviable track record and superior growth profile, we think it should trade at an expanded premium.

Thank you for your support of the FMI Large Cap Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 91.9% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 2.6% | | | | | | |

| | | Miscellaneous Commercial Services — 2.6% | | | | | | |

| | 3,895,000 | | Cintas Corp. | | $ | 104,178,514 | | | $ | 232,180,950 | |

| | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 10.5% | | | | | | | | |

| | | | Food: Major Diversified — 10.5% | | | | | | | | |

| | 27,475,000 | | Danone S.A. - SP-ADR | | | 388,621,919 | | | | 389,870,250 | |

| | 4,200,000 | | Nestlé S.A. - SP-ADR | | | 226,328,316 | | | | 315,924,000 | |

| | 5,287,000 | | Unilever PLC - SP-ADR | | | 212,079,561 | | | | 226,177,860 | |

| | | | | | | 827,029,796 | | | | 931,972,110 | |

| CONSUMER SERVICES SECTOR — 2.3% | | | | | | | | |

| | | | Media Conglomerates — 2.3% | | | | | | | | |

| | 3,175,000 | | Time Warner Inc. | | | 83,095,288 | | | | 207,422,750 | |

| | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 3.2% | | | | | | | | |

| | | | Medical Distributors — 3.2% | | | | | | | | |

| | 4,350,000 | | AmerisourceBergen Corp. | | | 131,156,744 | | | | 285,316,500 | |

| | | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 3.2% | | | | | | | | |

| | | | Electronic Components — 3.2% | | | | | | | | |

| | 4,755,000 | | TE Connectivity Ltd. | | | 109,032,092 | | | | 286,298,550 | |

| | | | | | | | | |

| ENERGY MINERALS SECTOR — 4.5% | | | | | | | | |

| | | | Oil & Gas Production — 4.5% | | | | | | | | |

| | 5,915,000 | | Devon Energy Corp. | | | 362,217,764 | | | | 395,890,950 | |

| | | | | | | | | |

| FINANCE SECTOR — 15.1% | | | | | | | | |

| | | | Financial Conglomerates — 4.1% | | | | | | | | |

| | 3,984,000 | | American Express Co. | | | 173,512,781 | | | | 358,679,520 | |

| | | | | | | | | | | | |

| | | | Insurance Brokers/Services — 2.1% | | | | | | | | |

| | 4,176,000 | | Willis Group Holdings PLC | | | 159,709,388 | | | | 184,286,880 | |

| | | | | | | | | | | | |

| | | | Major Banks — 8.9% | | | | | | | | |

| | 12,135,000 | | Bank of New York Mellon Corp. | | | 295,617,813 | | | | 428,244,150 | |

| | 7,010,000 | | Comerica Inc. | | | 216,460,410 | | | | 363,118,000 | |

| | | | | | | 512,078,223 | | | | 791,362,150 | |

| HEALTH SERVICES SECTOR — 5.0% | | | | | | | | |

| | | | Managed Health Care — 5.0% | | | | | | | | |

| | 5,421,000 | | UnitedHealth Group Inc. | | | 395,782,179 | | | | 444,467,790 | |

| | | | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 5.4% | | | | | | | | |

| | | | Medical Specialties — 3.5% | | | | | | | | |

| | 4,207,000 | | Covidien PLC | | | 182,529,340 | | | | 309,887,620 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals: Major — 1.9% | | | | | | | | |

| | 3,169,000 | | GlaxoSmithKline PLC - SP-ADR | | | 135,415,103 | | | | 169,319,670 | |

| | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 4.4% | | | | | | | | |

| | | | Oilfield Services/Equipment — 4.4% | | | | | | | | |

| | 4,000,000 | | Schlumberger | | | 264,608,708 | | | | 390,000,000 | |

| | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 6.3% | | | | | | | | |

| | | | Chemicals: Agricultural — 6.3% | | | | | | | | |

| | 15,392,000 | | Potash Corp. of Saskatchewan Inc. | | | 577,225,202 | | | | 557,498,240 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

| Shares or Principal Amount | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 91.9% (a) (Continued) | | | | | | |

| | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 15.1% | | | | | | |

| | | Industrial Conglomerates — 8.7% | | | | | | |

| | 2,500,000 | | 3M Co. | | $ | 178,166,900 | | | $ | 339,150,000 | |

| | 3,477,000 | | Berkshire Hathaway Inc. - Cl B* | | | 250,004,548 | | | | 434,520,690 | |

| | | | | | | 428,171,448 | | | | 773,670,690 | |

| | | | Industrial Machinery — 3.3% | | | | | | | | |

| | 3,633,000 | | Illinois Tool Works Inc. | | | 175,323,187 | | | | 295,471,890 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 3.1% | | | | | | | | |

| | 4,000,000 | | PACCAR Inc. | | | 170,974,477 | | | | 269,760,000 | |

| | | | | | | | | |

| RETAIL TRADE SECTOR — 3.4% | | | | | | | | |

| | | | Discount Stores — 3.4% | | | | | | | | |

| | 3,960,000 | | Wal-Mart Stores Inc. | | | 217,791,075 | | | | 302,662,800 | |

| | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 8.1% | | | | | | | | |

| | | | Information Technology Services — 4.8% | | | | | | | | |

| | 5,282,000 | | Accenture PLC | | | 260,748,277 | | | | 421,081,040 | |

| | | | | | | | | | | | |

| | | | Packaged Software — 3.3% | | | | | | | | |

| | 7,040,000 | | Microsoft Corp. | | | 206,917,184 | | | | 288,569,600 | |

| | | | | | | | | |

| TRANSPORTATION SECTOR — 2.8% | | | | | | | | |

| | | | Air Freight/Couriers — 2.8% | | | | | | | | |

| | 6,150,000 | | Expeditors International of Washington Inc. | | | 231,833,459 | | | | 243,724,500 | |

| | | | Total common stocks | | | 5,709,330,229 | | | | 8,139,524,200 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 7.9% (a) | | | | | | | | |

| | | | Commercial Paper — 4.0% | | | | | | | | |

| $ | 353,300,000 | | U.S. Bank N.A., 0.03%, due 04/01/14 | | | 353,300,000 | | | | 353,300,000 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 3.9% | | | | | | | | |

| | 350,000,000 | | U.S. Treasury Bills, 0.005%, due 04/17/14 | | | 349,992,222 | | | | 349,992,222 | |

| | | | Total short-term investments | | | 703,292,222 | | | | 703,292,222 | |

| | | | Total investments — 99.8% | | $ | 6,412,622,451 | | | | 8,842,816,422 | |

| | | | Other assets, less liabilities — 0.2% (a) | | | | | | | 14,546,351 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 8,857,362,773 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipt

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

INDUSTRY SECTORS

as of March 31, 2014 (Unaudited)

FMI

Common Stock

Fund

March 31, 2014

Dear Fellow Shareholders:

The FMI Common Stock Fund (FMIMX) returned 1.81% in the March quarter compared to 1.12% for the Russell 2000 Index. Sectors that aided results in the period included Distribution Services, Process Industries, and Energy. Anixter International, Innophos Holdings, and Cimarex Energy led these groups, respectively. On the downside, Producer Manufacturing, Commercial Services, and Electronic Technology all underperformed with Kennametal, Dun & Bradstreet, and MKS Instruments underperforming within these segments. While there were a few days and weeks of consternation, the market continued to show remarkable buoyancy as this bull run reached five years in duration. U.S. stock markets hit their low this cycle on March 9, 2009, with the Russell 2000 closing at 343.26. Five years later it closed at 1203.32. With dividends, the total return was a remarkable 275.22%. The table below shows all of the Dow Jones Industrial Average’s bull markets since 1900 (the Russell and Standard & Poor’s indices did not exist then). This is the 22nd bull market of the modern era; the median price change was 83.5% and the median duration was 33 months. From the March 9, 2009 low through year-end 2013, the Dow Jones Industrials gained 153.2% in price (with dividends, the total return was 188.2%), making this bull market approximately 83% greater in price and 79% longer in duration than the median bull market over the past 114 years.

| | Bull Market Dates | | | Price | | | | | | | | | | | | |

| | Dow Jones Industrial | | | Return | | | # Days | | | ~ # Months | | |

| | Average | | | Only | | | | | | | | | | | | |

| | 9/24/1900 – 6/17/1901 | | | 47.8 | % | | | | 266 | | | | | 8.9 | | | |

| | 11/9/1903 – 1/19/1906 | | | 144.3 | % | | | | 802 | | | | | 26.7 | | | |

| | 11/18/1907 – 11/19/1909 | | | 89.6 | % | | | | 732 | | | | | 24.4 | | | |

| | 9/25/1911 – 9/30/1912 | | | 29.1 | % | | | | 371 | | | | | 12.4 | | | |

| | 12/24/1914 – 11/21/1916 | | | 110.5 | % | | | | 698 | | | | | 23.3 | | | |

| | 12/19/1917 – 11/3/1919 | | | 81.4 | % | | | | 684 | | | | | 22.8 | | | |

| | 8/24/1921 – 9/3/1929 | | | 495.2 | % | | | | 2926 | | | | | 97.5 | | | |

| | 7/8/1932 – 3/10/1937 | | | 371.6 | % | | | | 1706 | | | | | 56.9 | | | |

| | 3/31/1938 – 11/9/1938 | | | 60.1 | % | | | | 223 | | | | | 7.4 | | | |

| | 4/28/1942 – 5/29/1946 | | | 128.7 | % | | | | 1492 | | | | | 49.7 | | | |

| | 10/22/1957 – 12/13/1961 | | | 75.1 | % | | | | 1513 | | | | | 50.4 | | | |

| | 6/26/1962 – 2/9/1966 | | | 85.7 | % | | | | 1324 | | | | | 44.1 | | | |

| | 10/7/1966 – 12/3/1968 | | | 32.4 | % | | | | 788 | | | | | 26.3 | | | |

| | 5/26/1970 – 1/11/1973 | | | 66.6 | % | | | | 961 | | | | | 32.0 | | | |

| | 12/6/1974 – 9/21/1976 | | | 75.7 | % | | | | 655 | | | | | 21.8 | | | |

| | 2/28/1978 – 4/27/1981 | | | 38.0 | % | | | | 1154 | | | | | 38.5 | | | |

| | 8/12/1982 – 8/25/1987 | | | 250.4 | % | | | | 1839 | | | | | 61.3 | | | |

| | 10/19/1987 – 7/16/1990 | | | 72.5 | % | | | | 1001 | | | | | 33.4 | | | |

| | 10/11/1990 – 7/17/1998 | | | 294.8 | % | | | | 2835 | | | | | 94.5 | | | |

| | 8/31/1998 – 1/14/2000 | | | 55.5 | % | | | | 501 | | | | | 16.7 | | | |

| | 10/9/2002 – 10/9/2007 | | | 94.4 | % | | | | 1826 | | | | | 60.9 | | | |

| | 3/9/2009 – 12/31/2013 | | | 153.2 | % | | | | 1758 | | | | | 58.6 | | | |

| | Average | | | 129.7 | % | | | | 1184 | | | | | 39.5 | | | |

| | Median | | | 83.5 | % | | | | 981 | | | | | 32.7 | | | |

| | Source: Fiduciary Management, Inc./Bloomberg | | | | | | | | | | | | |

This bull market reminds us of the old movie, Groundhog Day, with Bill Murray. Phil Connors (Murray) repeatedly wakes up to Sonny & Cher on the radio, and has to live the same day over and over no matter what he does. Similarly, this market seems to stay the same …expensive… despite a litany of less-than-appealing fundamentals: corporate revenue growth weakening, spotty job growth (actually falling when adjusted for the drop in average workweek hours), China slowing, emerging markets swooning, Syria and the Middle East aflame, Russia swiping Crimea and acting with hostility elsewhere, biotechnology stocks soaring on sketchy fundamentals, and classic signs of overexuberance (Whatsapp, Pandora, etc.). Of course, there are some positives, including improved bank lending and consumer sentiment, but so far precious little is being translated into sustainable economic growth. Valuations, as articulated ad nauseam in recent letters, remain extremely high from a historical perspective. Investor bullishness and the raft of low quality IPOs are additional signs of speculative excess. Added to this is the continuing fiscal crisis, a toxic political environment, and a monetary policy that all but ignores the potential ramifications of conjuring up $4 trillion of high-powered money out of thin air.

The developments in China deserve special mention. Chinese leaders have recently begun to admit what many, including us, have been saying for some time: credit extension has gotten out of control. Credit has grown at more than 20% per year for over five years ($14 trillion), much of which has been spent on real estate and infrastructure where there are clear signs of excess. On March 7, China allowed its first corporate bond default, the Chaori Solar Energy Science & Technology Co. On March 18, Zhejiang Xingrun Real Estate Co. defaulted on $567 million of debt. Will the authorities continue to let the air out of the bubble by not propping up zombie companies and state-owned enterprises? Heretofore that has not been their modus operandi but it is possible that a major change is afoot. How much pain will the authorities tolerate? We will monitor the developments closely.

Unlike Groundhog Day, we can’t stop the clock and make all the bad things turn out great. We own this set of shaky fundamentals and we own them at high valuations. Most bull markets are impervious to fundamentals in the short run, but not over the long haul. The problem is that investors believe they can spot signs of trouble and “get out with their skin.” Unfortunately, this rarely happens. Simply look at the aforementioned list of real and anecdotal signs that might typically be tipping points for a stock market. So far each one proved false but instead of investors counting their lucky stars and derisking, they actually do the opposite, becoming more emboldened and aggressive. It’s why when markets turn, they rarely decline to an average or median level, but more commonly overshoot on the downside. The euphoria turns to panic and as the disillusionment deepens, the once overvalued becomes cheap. It’s also why most studies show that the average investor has achieved about a 3% return in the stock market while the S&P 500 has done close to 10%.

Human nature rarely changes from cycle to cycle. The crack marketing and client service team (all four of them!) at Fiduciary Management, Inc. (the adviser to FMIMX) tell prospective and existing shareholders to expect our approach to lag strong markets and outperform in more difficult markets. This has been the adviser’s general pattern for over 30+ years of managing money, but of course there are no guarantees. Our philosophy and strategy is geared toward relative risk aversion and is focused on long-term rather than short-term performance. This has yielded fairly substantial outperformance over full market cycles but occasionally not over shorter periods. The FMI Common Stock Fund gained 243.33% from the March 9, 2009 bottom to the fifth anniversary of the current rally (3/7/2014), approximately 88% of the 274.97% return of the Russell 2000. Of course the full story on this cycle has yet to be told, but if we go back to the previous peak on July 13, 2007 and measure the return through the 2008-09 bear market back to the five-year anniversary of the bull market (3/7/2014), FMIMX gained 73.20% compared to 54.24% for the Russell 2000. Going back two peaks ago (3/10/2000) and measuring to March 7, 2014, the total return of FMIMX is 414.20% compared to 139.73% for the Russell 2000. Despite the best efforts of our marketing people, we’ve seen the same phenomenon over the decades: some shareholders who acknowledge on the front end that our strategy will underperform in a strong up market don’t have the constitution to be patient and wait for the inevitable turn. Sometimes they go to the dark side (speculative growth or momentum) and other times they find a new value-oriented or “alternative” manager or mutual fund. There is always going to be another fund with a better near-term track record. The performance game is cutthroat and as Warren Buffett likes to say, “You never know who is swimming naked until the tide goes out.” The best approach is to ascertain whether the fund owns financially strong companies with good business models, and that have valuations that are reasonable, if not cheap.

On that note, we’d like to highlight a couple of investments.

Valmont Industries Inc. (VMI)

(Analyst: Matt Sullivan)

Description

Valmont is a diversified global producer of fabricated metal infrastructure and irrigation products. The company has five reportable segments: Utility Support Structures (29% of revenue, 32% of profits), Irrigation (27%, 33%), Engineered Infrastructure Products (EIP) (27%, 16%), Coatings (9%, 14%), and Other (8%, 5%). The Utility segment produces steel and concrete pole structures that support electrical transmission and distribution lines. The Irrigation segment is a global producer of mechanized irrigation systems. The EIP segment produces steel lighting and traffic control poles, wireless communication towers, roadway safety products, and industrial access systems. The Coatings segment provides metal coating services, including galvanizing, painting, and anodizing. The company was founded in 1946, and is headquartered in Omaha, Nebraska.

Good Business

| • | ROIC (return on invested capital) has averaged 14% over the past five years and 13.3% over the past ten years, which comfortably exceeds the company’s cost of capital. |

| • | Valmont produces necessary products in industries with solid long-term demand drivers. |

| • | The company holds a leading market share position in each of its four main business segments. |

| • | Product quality and proximity to end customers differentiate industry competitors, giving well regarded, global incumbents with strong brand recognition a competitive advantage. |

| • | Valmont has a solid balance sheet with a debt-to-capital ratio of 24%, and cash equal to debt. |

| • | Management is experienced, well regarded, and known as a conservative team that emphasizes ROIC. |

Valuation

| • | Valmont is currently valued at 14.3 times earnings and 14.1 times forward EPS (earnings per share) estimates, both of which are approximately one standard deviation below the company’s respective 10-year averages. |

| • | Valmont’s price-to-book multiple is 2.6 times, which is in line with its 5- and 10-year averages. The company has compounded its book value at 19.3% over the past five and ten years. |

| • | The company is currently valued at 1.2 times sales, and 6.9 times EBITDA (earnings before interest, taxes, depreciation, and amortization). These metrics compare favorably to the general small- and mid-cap universe. |

Management

| • | The company’s CEO, Mogens Bay, has been with Valmont for 34 years. He has held the position of CEO since 1993, and Chairman of the Board since 1997. Bay owns 331,935, or 1.2%, of the outstanding shares. Valmont has a good track record under Bay’s leadership. |

| • | Long-term incentives are tied to return on invested capital and cumulative compound operating income growth. Conversations with Mogens Bay have revealed that he is intensely focused on ROIC and EVA (economic value added), which we believe is a very important managerial quality. |

Investment Thesis

Valmont is an above-average business with solid long-term growth prospects. Concerns over near-term demand for some of the company’s cyclical products have recently pressured the stock. Over time, these concerns should subside as the company continues to participate in domestic and international infrastructure build-outs. They are also well positioned to supply the increasing need for more sophisticated and efficient irrigation products. The irrigation market in the U.S. is dominated by Valmont and Lindsay Corp., another FMIMX holding. We feel Valmont is trading at an attractive absolute valuation, and is especially appealing relative to broader market indices. This is especially true when considering the company’s above-average historical growth and ROIC characteristics.

Varian Medical Systems Inc. (VAR)

(Analyst: Matthew Goetzinger)

Description

Varian Medical is the leading provider of instruments and technologies to treat and eradicate cancers. The Oncology segment generates 77% of total revenue, and 87% of profits. Varian’s industry leading X-RAY tubes and flat-panel image detector business accounts for 18% of total company revenues. Varian’s “Other” segment accounts for the residual 5% of company-wide revenue, and includes Security and Inspection Products (SIP) and the proton therapy business.

Good Business

| • | Varian’s industry-leading installed base, commitment to research and development, and time-tested product quality ensure a durable business model. |

| • | The company competes in a rational duopoly with the top two companies controlling 90% of the market. |

| • | As a byproduct of a sticky installed base, recurring service, software, and component parts drive over 55% of profits. Equipment replacement cycles average ten years. |

| • | Over the past five years, Varian has earned an average ROIC of 27%. |

| • | The company maintains net cash of $620 million, or $5.87 per share. Working capital is well controlled. |

| • | Government reimbursement is a risk, although the inherent profitability of radiation systems enables providers to earn a relatively short (12-24 month) payback. |

| • | Radiotherapy is one of the most effective and cost competitive treatment modalities. |

Valuation

| • | Excluding net cash on the balance sheet, Varian’s 2014 estimated P/E (price-to-earnings ratio) is 17.6 times. The company’s EV/Sales (enterprise value-to-sales) multiple is 2.6 times. Both valuation metrics are approximately in-line with the company’s historical 5-year mean. |

| • | At present, Varian trades at a 15% discount to the health technology sector, relative to the company’s 5-year average premium of 10%. |

| • | On an enterprise value-to-EBITDA basis, the stock trades at a meaningful discount to private transaction values and the stock market. |

Management

| • | Varian has a long-tenured management team with valuable industry experience. The company has been a good steward of shareholder capital. |

| • | Richard Levy, Ph.D. is Chairman of the Board, and previously led the company as CEO for seven years. |

| • | Dow Wilson was named President and CEO in 2012, having served as the head of the Oncology business for seven years. Wilson joined the company from the management ranks of GE Healthcare. |

Investment Thesis

Varian Medical is a high-quality business offered at a reasonable valuation in a generally expensive market. The company has matured gracefully, and now derives over 50% of profits from recurring revenue businesses. Management plans to continue to innovate, but not spend aggressively, in what has developed into a fairly rational duopoly. Occasional share repurchases, and perhaps eventually a dividend, await long-term shareholders. Under our conservative set of assumptions, we feel the company can grow EPS by at least 10% over the next several years. With the prospect for modest multiple expansion, the stock has solid long-term appeal.

Thank you for your support of the FMI Common Stock Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 84.1% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 8.8% | | | | | | |

| | | Financial Publishing/Services — 1.9% | | | | | | |

| | 272,000 | | The Dun & Bradstreet Corp. | | $ | 18,520,002 | | | $ | 27,023,200 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 5.6% | | | | | | | | |

| | 612,000 | | Cintas Corp. | | | 14,602,267 | | | | 36,481,320 | |

| | 1,200,000 | | Genpact Ltd* | | | 20,235,169 | | | | 20,904,000 | |

| | 1,333,850 | | RPX Corp.* | | | 22,619,330 | | | | 21,715,078 | |

| | | | | | | 57,456,766 | | | | 79,100,398 | |

| | | | Personnel Services — 1.3% | | | | | | | | |

| | 425,000 | | Robert Half International Inc. | | | 11,128,001 | | | | 17,828,750 | |

| | | | | | | | | |

| CONSUMER DURABLES SECTOR — 1.6% | | | | | | | | |

| | | | Homebuilding — 1.6% | | | | | | | | |

| | 20,000 | | NVR Inc.* | | | 19,680,129 | | | | 22,940,000 | |

| | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 0.5% | | | | | | | | |

| | | | Food: Specialty/Candy — 0.5% | | | | | | | | |

| | 116,725 | | Cal-Maine Foods Inc. | | | 5,836,773 | | | | 7,327,995 | |

| | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 15.6% | | | | | | | | |

| | | | Electronics Distributors — 10.0% | | | | | | | | |

| | 500,000 | | Anixter International Inc. | | | 32,972,379 | | | | 50,760,000 | |

| | 943,000 | | Arrow Electronics Inc.* | | | 14,950,905 | | | | 55,976,480 | |

| | 857,000 | | ScanSource Inc.* | | | 22,062,384 | | | | 34,939,890 | |

| | | | | | | 69,985,668 | | | | 141,676,370 | |

| | | | Medical Distributors — 3.2% | | | | | | | | |

| | 1,078,000 | | Patterson Cos. Inc. | | | 23,705,261 | | | | 45,017,280 | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 2.4% | | | | | | | | |

| | 244,000 | | MSC Industrial Direct Co. Inc. | | | 19,442,737 | | | | 21,110,880 | |

| | 300,000 | | World Fuel Services Corp. | | | 11,984,595 | | | | 13,230,000 | |

| | | | | | | 31,427,332 | | | | 34,340,880 | |

| ELECTRONIC TECHNOLOGY SECTOR — 3.4% | | | | | | | | |

| | | | Aerospace & Defense — 1.7% | | | | | | | | |

| | 673,000 | | FLIR Systems Inc. | | | 20,298,915 | | | | 24,228,000 | |

| | | | | | | | | | | | |

| | | | Electronic Production Equipment — 1.7% | | | | | | | | |

| | 793,000 | | MKS Instruments Inc. | | | 21,407,181 | | | | 23,702,770 | |

| | | | | | | | | |

| ENERGY MINERALS SECTOR — 3.4% | | | | | | | | |

| | | | Oil & Gas Production — 3.4% | | | | | | | | |

| | 402,000 | | Cimarex Energy Co. | | | 22,592,356 | | | | 47,882,220 | |

| | | | | | | | | |

| FINANCE SECTOR — 17.3% | | | | | | | | |

| | | | Finance/Rental/Leasing — 3.6% | | | | | | | | |

| | 630,000 | | Ryder System Inc. | | | 29,693,355 | | | | 50,349,600 | |

| | | | | | | | | | | | |

| | | | Insurance Brokers/Services — 1.4% | | | | | | | | |

| | 423,000 | | Arthur J. Gallagher & Co. | | | 8,259,786 | | | | 20,126,340 | |

| | | | | | | | | | | | |

| | | | Life/Health Insurance — 3.3% | | | | | | | | |

| | 897,000 | | Protective Life Corp. | | | 13,864,500 | | | | 47,173,230 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 4.3% | | | | | | | | |

| | 804,000 | | Greenlight Capital Re Ltd.* | | | 19,808,449 | | | | 26,371,200 | |

| | 840,000 | | W.R. Berkley Corp. | | | 20,975,570 | | | | 34,960,800 | |

| | | | | | | 40,784,019 | | | | 61,332,000 | |

| | | | Regional Banks — 4.7% | | | | | | | | |

| | 590,000 | | Cullen/Frost Bankers Inc. | | | 34,252,169 | | | | 45,742,700 | |

| | 680,000 | | Zions Bancorporation | | | 16,146,199 | | | | 21,066,400 | |

| | | | | | | 50,398,368 | | | | 66,809,100 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

| Shares or Principal Amount | | Cost | | | Value | |

| | | | | | | |

| COMMON STOCKS — 84.1% (a) (Continued) | | | | | | |

| | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 3.0% | | | | | | |

| | | Medical Specialties — 3.0% | | | | | | |

| | 512,000 | | Varian Medical Systems Inc.* | | $ | 38,084,589 | | | $ | 43,002,880 | |

| | | | | | | | | |

| PROCESS INDUSTRIES SECTOR — 11.7% | | | | | | | | |

| | | | Chemicals: Agricultural — 3.2% | | | | | | | | |

| | 1,400,000 | | Sociedad Quimica y Minera de Chile S.A. - SP-ADR | | | 42,141,813 | | | | 44,436,000 | |

| | | | | | | | | | | | |

| | | | Chemicals: Specialty — 4.0% | | | | | | | | |

| | 380,000 | | Compass Minerals International Inc. | | | 27,626,318 | | | | 31,357,600 | |

| | 446,000 | | Innophos Holdings Inc. | | | 22,106,901 | | | | 25,288,200 | |

| | | | | | | 49,733,219 | | | | 56,645,800 | |

| | | | Containers/Packaging — 2.7% | | | | | | | | |

| | 756,000 | | Avery Dennison Corp. | | | 21,521,769 | | | | 38,306,520 | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 1.8% | | | | | | | | |

| | 514,000 | | H.B. Fuller Co. | | | 13,814,305 | | | | 24,815,920 | |

| | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 9.7% | | | | | | | | |

| | | | Industrial Machinery — 3.8% | | | | | | | | |

| | 840,000 | | Kennametal Inc. | | | 33,600,357 | | | | 37,212,000 | |

| | 392,550 | | Woodward Inc. | | | 17,255,060 | | | | 16,302,602 | |

| | | | | | | 50,855,417 | | | | 53,514,602 | |

| | | | Miscellaneous Manufacturing — 3.9% | | | | | | | | |

| | 336,000 | | Carlisle Cos. Inc. | | | 7,508,321 | | | | 26,658,240 | |

| | 189,000 | | Valmont Industries Inc. | | | 28,314,014 | | | | 28,130,760 | |

| | | | | | | 35,822,335 | | | | 54,789,000 | |

| | | | Trucks/Construction/Farm Machinery — 2.0% | | | | | | | | |

| | 327,000 | | Lindsay Corp. | | | 26,203,090 | | | | 28,834,860 | |

| | | | | | | | | |

| RETAIL TRADE SECTOR — 1.3% | | | | | | | | |

| | | | Discount Stores — 1.3% | | | | | | | | |

| | 311,000 | | Family Dollar Stores Inc. | | | 8,376,626 | | | | 18,041,110 | |

| | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 4.1% | | | | | | | | |

| | | | Data Processing Services — 4.1% | | | | | | | | |

| | 1,558,000 | | Broadridge Financial Solutions Inc. | | | 34,988,238 | | | | 57,864,120 | |

| | | | | | | | | |

| TRANSPORTATION SECTOR — 3.7% | | | | | | | | |

| | | | Air Freight/Couriers — 1.2% | | | | | | | | |

| | 352,000 | | Forward Air Corp. | | | 11,267,415 | | | | 16,230,720 | |

| | | | | | | | | | | | |

| | | | Marine Shipping — 2.5% | | | | | | | | |

| | 343,000 | | Kirby Corp.* | | | 14,932,226 | | | | 34,728,750 | |

| | | | Total common stocks | | | 792,779,454 | | | | 1,188,068,415 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 16.3% (a) | | | | | | | | |

| | | | Commercial Paper — 9.2% | | | | | | | | |

| $ | 130,600,000 | | U.S. Bank N.A., 0.03%, due 04/01/14 | | | 130,600,000 | | | | 130,600,000 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 7.1% | | | | | | | | |

| | 100,000,000 | | U.S. Treasury Bills, 0.005%, due 04/17/14 | | | 99,997,778 | | | | 99,997,778 | |

| | | | Total short-term investments | | | 230,597,778 | | | | 230,597,778 | |

| | | | Total investments — 100.4% | | $ | 1,023,377,232 | | | | 1,418,666,193 | |

| | | | Liabilities, less other assets — (0.4%) (a) | | | | | | | (5,167,078 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,413,499,115 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |

SP-ADR – Sponsored American Depositary Receipt

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

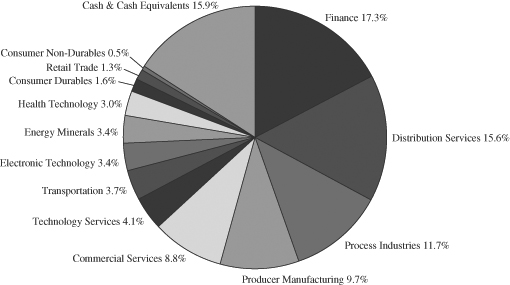

INDUSTRY SECTORS

as of March 31, 2014 (Unaudited)

FMI

International

Fund

March 31, 2014

Dear Fellow Shareholders:

The global macro picture was mixed in the March quarter. It featured a slowdown in growth in Japan, positive momentum in Europe, the first corporate debt default in China, economic turmoil across a number of emerging markets (Argentina, Turkey, Brazil, and South Africa to name a few), and Russia’s emboldened annexation of Crimea. Stock markets were volatile, with Japan taking a bit of a breather, declining by 6.84% after generating a 54.40% return in 2013. European stock markets bounced around, with the UK market posting a slight decline, while Germany, France, Italy and Spain returned varying gains.1 The FMI International Fund (FMIJX) held up reasonably well in the quarter with a gain of 1.82%, while the MSCI EAFE Index fell by 0.28% in local currency and rose by 0.66% in U.S. Dollars (USD). FMIJX sector outperformance was driven by Process Industries, Consumer Non-Durables, and Finance, while Commercial Services, Producer Manufacturing, and Consumer Services failed to keep pace. Top individual returns were generated by Amorepacific Corp., Sociedad Quimica y Minera de Chile, and Potash Corp., helping to offset declines by Rolls-Royce, Pirelli, and WPP. While we did not add any new names to the portfolio, we did trim and boost a number of our holdings over the course of the period.

Despite a few initial ripples through developed stock markets, great complacency still remains. The notion that central banks will continue to support (manipulate) asset prices and drive markets higher seems to be the prevailing view. We are often asked “how happy we must be” that stocks have been on a tear, with a belief that it “shows quantitative easing is working.” This cannot be further from the truth. Valuations are stretched, and there appears to be a wide disconnect between stock prices and business fundamentals. With interest rates near record lows, investors continue to stretch for yield and chase returns. Following the herd and playing the momentum game can work in the short run when greed is plentiful, but when fear creeps in, it’s a race for the exits. Company-wide, we are holding more cash now than typical over the Fund’s history. This is a result of a lack of viable investment candidates that meet our core criteria: a good business, strong management, and attractive valuation. We don’t expect everything to be perfect – we just want valuations on our side. If valuations were lower, we would be able to look through the abundance of geopolitical and economic risks across the globe. In our opinion, we are not being adequately compensated for the current risk/reward equation. At some point stock markets will overly discount, just as they are overpricing today. We will be ready to act.

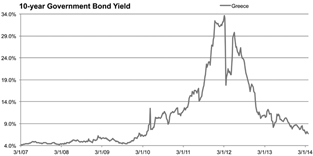

Europe: All Clear On The Western Front?

The eurozone continues to show some positive signs, stringing together three consecutive quarters of positive GDP growth (1.1% in the fourth quarter). The European Central Bank (ECB) is expecting growth of 1.2%, 1.5%, and 1.8% in 2014, 2015, and 2016, respectively, after a 0.4% decline in 2013. Manufacturing activity has expanded for nine straight months, and consumer confidence continues to improve. While these trends are certainly encouraging, the elephant in the room is that this level of growth will not be sufficient for the eurozone to “grow its way out” of the mess it has created, which includes an unemployment rate near record levels (11.9%), and debt burdens which are still dangerously high, far in excess of pre-crisis levels. Despite ECB President Mario Draghi’s headline-grabbing claims that he will “do whatever it takes” and that the ECB is “ready and willing to act,” it’s naive to believe that the eurozone is the “island of stability” that he proclaims. Just because European bonds are now priced near or below pre-crisis levels (see charts on the following page), and the ECB and IMF talking heads say the worst of the crisis is behind us, it doesn’t mean that we are out of the woods. As a reminder, for quite some time Ben Bernanke said he didn’t believe that there was a housing bubble in the U.S. and we all know that story ended badly. Wordsmiths can’t change reality.

The reality, from our perspective, is that it’s hard to make a case that European banks and sovereigns are structurally better today than they were before the crisis. The European banking system is still precarious. For example, Italy’s largest bank, Unicredit SpA, recently posted a record €15 billion ($20.8 billion) loss in the fourth quarter after having to set aside

| 1 | Japan TOPIX: 6.84%; FTSE All-Share (UK): -0.29%; Germany DAX: 0.04%; France CAC: 2.88%; Italy FTSE MIB: 14.38%; Spain IBEX: 5.42%. |

Source: Bloomberg

money for bad loans and writing down goodwill. In France, the national auditor recently described France’s debt level (which is set to top 95% of GDP this year) to be in a “danger zone,” with the country’s financial credibility facing a “serious blow” if it misses its deficit reduction target. In addition, German Chancellor Angela Merkel likes to highlight the fact that Europe accounts for 7% of the world’s population, 25% of its GDP, and 50% of its social spending. Europe has done little to address this imbalance, and like the U.S., continues to make social promises that are unlikely to be kept.

While European economies are showing some signs of life, unfortunately Europe’s publicly traded companies are recovering from the recession at the slowest pace during any business cycle since 1970, according to the Financial Times. They write that, “Not only is the recovery in earnings unusually lengthy, but the gap between Europe and the U.S. coming out of the recession is more than three times bigger than it has averaged at this stage in previous cycles. U.S. earnings are now 20% above their peak in 2007, while European earnings are 26% below.”2 At this rate, it may be 2017 (10 years) before European companies return to peak earnings. Despite Draghi’s best marketing efforts, it’s hard to buy into the notion that all is clear on the western (European) front.

Japan: Plight of “Abenomics”

After 4.5% and 4.1% annualized GDP growth in the first and second quarters of 2013, respectively, the “Abenomics” monetary experiment was quickly hailed as a great success. Japan was growing faster than both the U.S. and Europe, and the future suddenly looked bright again. Sentiment was improving, and Japan’s problems seemed to be magically disappearing. Fast forward just six short months, and as we expected, things are no longer as rosy as they once appeared. After 0.9% growth in the third quarter and 0.7% in the fourth quarter, expectations (and the Japanese stock market) have started to come back down to earth. The World Bank is forecasting just 1.4% and 1.2% growth in 2014 and 2015, respectively. As we have expressed in prior shareholder letters, printing money does not solve deep structural problems, and may lead to bigger issues down the road. Japan is no exception.

Despite more than a 35% depreciation of the yen, exports continue to be a drag. As described by the Financial Times, Japan “is the only major economic zone where the volume of exports is much lower than the pre-crisis peak.”3 While a weaker yen has done little to boost export volume growth, it has led to significantly higher energy import costs, especially with nuclear power plants shuttered. As a result, February’s trade accounts showed a trade deficit for the twentieth straight month, with January’s deficit being the largest on record. Trade is no longer the engine of growth that it once was, Japan is becoming increasingly dependent upon domestic consumption – a consumer who will soon be hit with a 3% sales tax hike (to 8%) in April. Demographics are also not on their side, as a shrinking and aging population would make the case for less, not more domestic consumption. Wage growth, which is a key ingredient to Prime Minister Abe’s master plan, has been virtually non-existent. January’s 0.1% base wage increase (excluding bonuses and overtime) was the first increase in 22 months. However, total pay still fell by 0.2%. While multinational companies such as Toyota, Honda, and Toshiba have announced relatively minor base wage increases, small and medium sized businesses, which employ most of the workers in Japan, are reluctant to raise salaries.4 This is not a recipe for success. If Abe eventually gets his elusive 2% inflation (or even more), and wages don’t follow suit, he will have an even bigger mess on his hands, with rising costs and falling real income.

| 2 | Gordon, Sarah. “European groups on slow path to profits.” Financial Times, February 24, 2014. |

| 3 | McLannahan, Ben. “Japanese manufacturers fail to reap benefit of weaker yen.” Financial Times, January 14, 2014. |

| 4 | Soble, Jonathan. “Pay rises likely to rev up Abenomics.” Financial Times, March 12, 2014. |

China: Credit Crunch Fears

For the last several quarters, we have been ringing the bell on China, with concerns that a credit and/or housing bubble could derail the world’s second largest economy. It appears China’s excess is starting to come home to roost, with visible signs of weakness in early 2014. According to “official” government data, January/February industrial output grew at the slowest pace (8.6%) since 2009, retail sales posted the weakest growth (11.8%) since February 2011, residential and commercial property sales fell by 3.7%, and exports declined by 1.6%. The HSBC Manufacturing Purchasing Managers’ Index (PMI) posted three consecutive readings below 50,5 which also implies contraction. We have long believed that China’s GDP growth rates were meaningfully lower than reported by the government, so we are not surprised to see more people starting to question the country’s ability to meet its official 2014 growth target of 7.5%, especially after a weak start to the year.

China is in the midst of an unprecedented period of debt-fueled fixed investment, as credit has grown at an annual rate of 20% over the last five years, more than twice that of GDP. During this time, $14-15 trillion of credit was extended, promoting investments in real estate, infrastructure, and manufacturing capacity.6 A significant amount of these investments are not economic. Ruchir Sharma, Morgan Stanley Investment Management’s head of emerging markets, writes: “The key to foretelling credit trouble is not the size but the pace of growth in debt, because during rapid credit booms more and more loans go to wasteful endeavors. That is China today. Five years ago it took just $1 of debt to generate $1 of economic growth in China. In 2013 it took nearly $4 – and one-third of the new debt goes to pay off the old debt.” He estimates China’s total debt to GDP is now 230%, up from 125% in 2008.7 Fitch Ratings predicts that at the current rate of credit growth, debt to GDP will exceed 270% by 2017, at which time China’s interest payments will account for 20% of GDP.6 As we have discussed in the past, we do not believe China’s growth model is sustainable.

To make matters worse, historically China has had a policy of bailing out companies with bad debt instead of allowing them to fail. This has created a moral hazard and helped facilitate a plethora of “zombie” companies, empty real estate buildings, roads and bridges to nowhere, manufacturing overcapacity, and potentially disastrous bank balance sheets. Importantly, this bailout mentality may be starting to change, at least to some degree, which could have important ramifications over time. At his annual news conference on March 13, Chinese Premier Li Keqiang commented that in the case of bonds and other financial products, “isolated cases of default will be unavoidable.” In fact, on March 6 the domestic Chinese bond market experienced its first public bond default since the central bank started regulating the market in 1997. Shanghai Chaori Solar Energy Science & Technology Co., a maker of solar cells, defaulted after failing to make a ¥89.8 million ($14.7 million) interest payment. Less than two weeks later, news surfaced of another pending default, as closely-held Zhejiang Xingrun Real Estate Co., a Chinese real estate developer with ¥3.5 billion ($566.6 million) of debt, was reported to have collapsed. The company was said not to have enough cash to repay creditors that included more than fifteen banks, with its largest shareholder being detained.8 If the credit rug continues to be pulled out from under businesses, they may die quickly. However, we suspect China will try to wade in slowly, allowing a select group of companies to default while continuing to bail out a number of others. Li Kequiang commented that the government would take steps to ensure that failures did not pose a threat to the financial system.9 Good luck with that! As recent history has shown (i.e. Lehman), a credit crisis can spin out of control in the blink of an eye.

This is a time to be cautious yet poised to move as conditions can change quickly. FMIJX has the preponderance of its exposure in powerful, financially strong global franchises such as Accenture, Danone, Henkel and Unilever. We’ve supplemented these holdings with some special situations, such as the two following highlighted securities:

| 5 | January reading of 49.5; February reading of 48.5; March reading of 48.0. |

| 6 | Pei, Minxin. “China admits its ills but faces an unpalatable cure.” Financial Times, March 18, 2014. |

| 7 | Sharma, Ruchir. “China’s deb-fuelled boom is in danger of turning to bust.” Financial Times, January 27, 2014. |

| 8 | Yang, Steven. “Chinese Developer With $567 million debt said to collapse.” Bloomberg News, March 17, 2014. |

| 9 | Hornby, Lucy & Anderlini, Jamil. “China warning on defaults sparks fears over growth.” Financial Times, March 14, 2014. |

Amorepacific Corp. Pfd. Shs. (090435-KS)

(Analyst: Jonathan Bloom)

Description

Amorepacific Corp. is South Korea’s leading cosmetics company, with a domestic market share of approximately 34%. The company generates 82% of sales domestically and 18% overseas with a presence in China (11% of sales), France (3%), Asia (3%), and the U.S. (1%). Approximately 85% of group sales are cosmetics, with 15% coming from household products and green tea. The company focuses on the high- and mid-end of the market, with 60% of domestic cosmetics sales in the “Luxury” category and 26% in the more reasonably priced “Premium” category. Domestic cosmetics sales channels include door-to-door (27% of segment sales), specialty store (18%), travel retail (17%), department store (14%), digital (13%), discount store (9%), direct sales (1%), and others (1%). Top selling domestic brands include Sulwhasoo, Iope, Hera, and Laneige.

Good Business

| • | Amorepacific’s return on invested capital (ROIC) has averaged over 16% during the last five years, which exceeds the company’s cost of capital, creating economic value. |

| • | As South Korea’s number one domestic cosmetics company, Amorepacific benefits from economies of scale. |

| • | Amorepacific’s brands are perceived to be among the highest quality in South Korea, with strong customer loyalty and brand equity. |

| • | The company has mid-to-high single-digit top line growth prospects, and potential for margin expansion overseas. |

| • | The business is easy to understand. |

| • | The company has a robust balance sheet with net cash. |

Valuation

| • | The preferred shares (090435-KS) trade at an implied enterprise value-to-sales multiple of 1.1 times, which compares favorably with low-to-mid double-digit operating margins. |

| • | The preferred shares (090435-KS) trade at a forward earnings per share multiple of 10.5 times. Global cosmetics peers typically trade at over 20 times. |

| • | The preferred shares trade at a 58% discount to the Amorepacific common shares (090430-KS), which is not economically justified. The preferred shares have the same economic interest, but lack voting rights. The preferred shares also pay a 1% higher dividend (non-cumulative) than the common shares. Voting rights are of little significance, so the discount is attributed to liquidity. |

| • | The valuation implies a deep discount to intrinsic value, offering a wide margin of safety. |

Management

| • | President & CEO, Mr. Kyung-bae Suh, received his MBA from Cornell University. Over $1.6 billion of his wealth is directly tied to the Amorepacific common shares, so he has significant skin in the game. |

| • | The founding Suh family collectively controls approximately 49.5% of voting rights via the common shares. |

| • | Management is known to be conservative, with a preference for organic growth vs. acquisitions. |

| • | Foreign ownership of the preferred shares is approximately 70%, helping to protect minority shareholder interests. |

| • | There is room for improvement with regard to returning cash to shareholders. The current dividend yield is only 1.2%. |

Investment Thesis

This is a rare opportunity to buy a growing, high-quality luxury cosmetics business at a deep discount to intrinsic value. The 58% preferred share discount is well above levels found in other developed stock markets. Potential catalysts for share price appreciation include earnings growth, multiple expansion, returning more cash to shareholders via the dividend or a highly accretive share buyback, and incremental interest from like-minded international investors. In a world of expensive stocks, we feel this opportunity is particularly compelling.

Electrocomponents PLC (ECM-LN)

(Analyst: Andy Ramer)

Description

Electrocomponents is a high service level distributor of tech products for design and maintenance engineers in Continental Europe (35% of sales), UK (29%), North America (23%), and Asia Pacific (13%). Product categories include electronics, automation & control, test & measurement, and electrical.

Good Business

| • | Electrocomponents’ service accuracy, product range and availability, partnerships with leading global suppliers, global customer reach, eCommerce capabilities, and multi-channel approach are competitive advantages. The company is gaining market share. |

| • | The average order size is only £150 ($250). Maintenance products account for 60% of sales. The business proved relatively resilient in the 2008 to 2009 downturn. |

| • | Return on invested capital was 12% in fiscal 2013 and has averaged 13% over the last five and ten years, respectively. ROIC troughed at 10% in fiscal 2010. Return on tangible capital was 18% in fiscal 2013. |

| • | This business is easy to understand. |

| • | The leverage ratio is 1.1 and interest expense is covered by approximately 22 times. Distribution businesses tend to become more cash generative in weaker times as receivables are collected and inventories are drawn down. |

Valuation

| • | Electrocomponents trades for 15.5 times the forward 12-month earnings per share estimate. |

| • | The enterprise value to last twelve-month sales multiple is 1.05 times and compares to a trailing operating margin of 8.5%, a five-year average margin of 9.5%, and a target range of 9% to 11%. |

| • | Price/book of 3.3 times is in the lower half of the five-year average range of 2.8 to 4.4 times. |

| • | The dividend yield is 4.4%. |

Management

| • | Ian Mason has been CEO since 2001. Simon Boddie joined as Finance Director in 2005. They know the company and industry well. |

| • | Management is focused on organic growth given their belief that there are significant opportunities to reinvest for growth at attractive returns. Excess capital is returned to shareholders via the dividend. |

| • | Executive compensation is modest. The Chairman and CEO roles are split, and directors stand for reelection annually. |

Investment Thesis

We feel Electrocomponents is poised to benefit from the secular growth in electronics, without having to take inventor’s risk. Moreover, structural trends favor larger, global distributors, thus enabling the company to continue taking share from smaller distributors who are unable to match Electrocomponents’ advantages. Systems are critical to success. The eCommerce channel represents 57% of sales and continues to move towards the medium-term target of 70%, and SAP has been implemented in over 90% of the business.

Thank you for your support of the FMI International Fund.

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

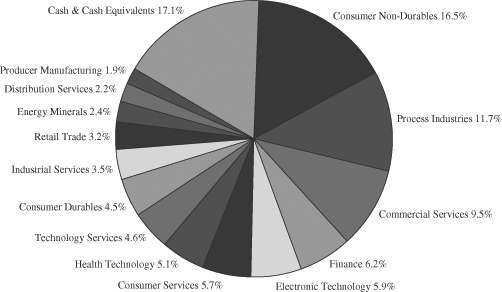

FMI International Fund

SCHEDULE OF INVESTMENTS

March 31, 2014 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | | | |

| LONG-TERM INVESTMENTS — 82.9% (a) | | | | | | |

| COMMON STOCKS — 77.8% (a) | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES SECTOR — 9.5% | | | | | | |

| | | Advertising/Marketing Services — 3.0% | | | | | | |

| | 297,000 | | WPP PLC (Jersey) (b) | | $ | 4,459,119 | | | $ | 6,136,608 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 4.3% | | | | | | | | |

| | 92,500 | | Secom Co. Ltd. (Japan) (b) | | | 4,851,835 | | | | 5,317,381 | |

| | 1,406,000 | | Taiwan Secom (Taiwan) (b) | | | 3,354,704 | | | | 3,606,130 | |

| | | | | | | 8,206,539 | | | | 8,923,511 | |

| | | | Personnel Services — 2.2% | | | | | | | | |

| | 54,500 | | Adecco S.A. (Switzerland) (b) | | | 2,555,471 | | | | 4,535,830 | |

| | | | | | | | | |

| CONSUMER DURABLES SECTOR — 3.1% | | | | | | | | |

| | | | Automotive Aftermarket — 3.1% | | | | | | | | |

| | 407,000 | | Pirelli & C. SpA (Italy) (b) | | | 4,668,792 | | | | 6,402,421 | |

| | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 12.8% | | | | | | | | |

| | | | Food: Major Diversified — 10.3% | | | | | | | | |

| | 124,500 | | Danone S.A. (France) (b) | | | 8,704,042 | | | | 8,795,643 | |

| | 67,000 | | Nestlé S.A. (Switzerland) (b) | | | 4,329,001 | | | | 5,043,067 | |

| | 172,500 | | Unilever PLC (Britain) (b) | | | 6,662,951 | | | | 7,377,708 | |

| | | | | | | 19,695,994 | | | | 21,216,418 | |

| | | | Household/Personal Care — 2.5% | | | | | | | | |

| | 50,500 | | Henkel AG & Co. KGaA (Germany) (b) | | | 2,850,203 | | | | 5,078,717 | |

| | | | | | | | | |

| CONSUMER SERVICES SECTOR — 5.7% | | | | | | | | |

| | | | Hotels/Resorts/Cruiselines — 3.6% | | | | | | | | |

| | 5,720,000 | | Genting Malaysia Berhad (Malaysia) (b) | | | 7,430,898 | | | | 7,359,732 | |

| | | | | | | | | | | | |

| | | | Restaurants — 2.1% | | | | | | | | |

| | 287,000 | | Compass Group PLC (Britain) (b) | | | 2,911,316 | | | | 4,382,119 | |

| | | | | | | | | |

| DISTRIBUTION SERVICES SECTOR — 2.2% | | | | | | | | |

| | | | Wholesale Distributors — 2.2% | | | | | | | | |

| | 974,000 | | Electrocomponents PLC (Britain) (b) | | | 3,711,388 | | | | 4,610,591 | |

| | | | | | | | |

| ELECTRONIC TECHNOLOGY SECTOR — 5.9% | | | | | | | |

| | | | Aerospace & Defense — 3.0% | | | | | | | | |

| | 342,000 | | Rolls-Royce Holdings PLC (Britain)*(b) | | | 5,025,504 | | | | 6,122,224 | |

| | | | | | | | | | | | |

| | | | Electronic Components — 2.9% | | | | | | | | |

| | 100,000 | | TE Connectivity Ltd. (Switzerland) | | | 3,731,179 | | | | 6,021,000 | |

| | | | | | | | | |

| ENERGY MINERALS SECTOR — 2.4% | | | | | | | | |

| | | | Integrated Oil — 2.4% | | | | | | | | |

| | 133,500 | | Royal Dutch Shell PLC (Britain) (b) | | | 4,613,838 | | | | 4,877,763 | |

| | | | | | | | | |

| FINANCE SECTOR — 6.2% | | | | | | | | |

| | | | Insurance Brokers/Services — 1.8% | | | | | | | | |

| | 83,500 | | Willis Group Holdings PLC (Ireland) | | | 3,232,258 | | | | 3,684,855 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 4.4% | | | | | | | | |

| | 21,000 | | Fairfax Financial Holdings Ltd. (Canada) | | | 8,272,292 | | | | 9,118,046 | |

| | | | | | | | | |

| HEALTH TECHNOLOGY SECTOR — 5.1% | | | | | | | | |

| | | | Medical Specialties — 3.6% | | | | | | | | |

| | 101,000 | | Covidien PLC (Ireland) | | | 5,610,633 | | | | 7,439,660 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals: Major — 1.5% | | | | | | | | |

| | 117,500 | | GlaxoSmithKline PLC (Britain) (b) | | | 2,684,849 | | | | 3,133,155 | |

| | | | | | | | | |

| INDUSTRIAL SERVICES SECTOR — 3.5% | | | | | | | | |

| | | | Oilfield Services/Equipment — 3.5% | | | | | | | | |

| | 74,500 | | Schlumberger (Curacao) | | | 5,499,236 | | | | 7,263,750 | |

FMI International Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

| Shares or Principal Amount | | Cost | | | Value | |

| | | | | | | |

| LONG-TERM INVESTMENTS — 82.9% (a) (Continued) | | | | | | |

| COMMON STOCKS — 77.8% (a) (Continued) | | | | | | |

| | | | | | | |

| PROCESS INDUSTRIES SECTOR — 11.7% | | | | | | |

| | | Chemicals: Agricultural — 7.9% | | | | | | |

| | 318,500 | | Potash Corp. of Saskatchewan Inc. (Canada) | | $ | 11,471,926 | | | $ | 11,536,070 | |

| | 149,000 | | Sociedad Quimica y Minera de Chile S.A. (Chile) | | | 3,951,162 | | | | 4,722,352 | |

| | | | | | | 15,423,088 | | | | 16,258,422 | |

| | | | Chemicals: Specialty — 1.1% | | | | | | | | |

| | 40,500 | | Shin-Etsu Chemical Co. Ltd. (Japan) (b) | | | 2,244,946 | | | | 2,308,742 | |

| | | | Industrial Specialties — 2.7% | | | | | | | | |

| | 68,000 | | Akzo Nobel N.V. (Netherlands) (b) | | | 4,059,369 | | | | 5,546,136 | |

| | | | | | | | | |

| PRODUCER MANUFACTURING SECTOR — 1.9% | | | | | | | | |

| | | | Industrial Machinery — 1.9% | | | | | | | | |

| | 12,000 | | Schindler Holding AG (Switzerland) (b) | | | 1,450,314 | | | | 1,769,076 | |

| | 8,500 | | SMC Corp. (Japan) (b) | | | 1,432,190 | | | | 2,241,731 | |

| | | | | | | 2,882,504 | | | | 4,010,807 | |

| RETAIL TRADE SECTOR — 3.2% | | | | | | | | |

| | | | Department Stores — 3.2% | | | | | | | | |

| | 415,000 | | Hyundai Green Food Co. Ltd. (South Korea) (b) | | | 6,451,206 | | | | 6,719,614 | |

| | | | | | | | | |

| TECHNOLOGY SERVICES SECTOR — 4.6% | | | | | | | | |

| | | | Information Technology Services — 4.6% | | | | | | | | |

| | 118,000 | | Accenture PLC (Ireland) | | | 8,158,078 | | | | 9,406,960 | |

| | | | Total common stocks | | | 134,378,700 | | | | 160,557,081 | |

| | | | | | | | | |

| PREFERRED STOCKS — 3.7% (a) | | | | | | | | |

| | | | | | | | | |

| CONSUMER NON-DURABLES SECTOR — 3.7% | | | | | | | | |

| | | | Household/Personal Care — 3.7% | | | | | | | | |

| | 8,500 | | Amorepacific Corp. (South Korea) (b) | | | 2,835,630 | | | | 4,222,373 | |

| | 16,000 | | LG Household & Health Care Ltd. (South Korea) (b) | | | 2,888,794 | | | | 3,471,266 | |

| | | | Total preferred stocks | | | 5,724,424 | | | | 7,693,639 | |

| | | | | | | | | |

| SAVINGS SHARES — 1.4% (a) | | | | | | | | |

| | | | | | | | | |

| CONSUMER DURABLES SECTOR — 1.4% | | | | | | | | |

| | | | Automotive Aftermarket — 1.4% | | | | | | | | |

| | 216,000 | | Pirelli & C. SpA - RSP (Italy) (b) | | | 2,287,047 | | | | 2,997,154 | |

| | | | Total savings shares | | | 2,287,047 | | | | 2,997,154 | |

| | | | Total long-term investments | | | 142,390,171 | | | | 171,247,874 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS — 17.9% (a) | | | | | | | | |

| | | | Commercial Paper — 10.6% | | | | | | | | |

| $ | 21,900,000 | | U.S. Bank N.A., 0.03%, due 04/01/14 | | | 21,900,000 | | | | 21,900,000 | |

| | | | US Treasury Securities — 7.3% | | | | | | | | |

| | 15,000,000 | | U.S. Treasury Bills, 0.005%, due 04/17/14 | | | 14,999,667 | | | | 14,999,667 | |

| | | | Total short-term investments | | | 36,899,667 | | | | 36,899,667 | |

| | | | Total investments — 100.8% | | $ | 179,289,838 | | | | 208,147,541 | |

| | | | Liabilities, less other assets — (0.8%) (a) | | | | | | | (1,666,523 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 206,481,018 | |

| * | | Non-income producing security. |

| (a) | | Percentages for the various classifications relate to net assets. |