SEMIANNUAL REPORT

March 31, 2017

FMI Large Cap Fund

Investor Class (FMIHX)

Institutional Class (FMIQX)

FMI Common Stock Fund

Investor Class (FMIMX)

Institutional Class (FMIUX)

FMI International Fund

Investor Class (FMIJX)

Institutional Class (FMIYX)

| |

|

|

|

FMI Funds, Inc. |

|

Advised by Fiduciary Management, Inc. |

| |

www.fmifunds.com |

|

| |

| |

| |

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| | Shareholder Letter | 1 |

| | Schedule of Investments | 7 |

| | Industry Sectors | 9 |

| | | |

| FMI Common Stock Fund | |

| | Shareholder Letter | 10 |

| | Schedule of Investments | 16 |

| | Industry Sectors | 18 |

| | | |

| FMI International Fund | |

| | Shareholder Letter | 19 |

| | Schedule of Investments | 27 |

| | Schedule of Forward Currency Contracts | 31 |

| | Industry Sectors | 32 |

| | | |

| Financial Statements | |

| | Statements of Assets and Liabilities | 33 |

| | Statements of Operations | 34 |

| | Statements of Changes in Net Assets | 35 |

| | Financial Highlights | 38 |

| | Notes to Financial Statements | 44 |

| | | |

| Additional Information | 55 |

| Expense Example | 56 |

| Advisory Agreements | 58 |

| Disclosure Information | 62 |

FMI

Large Cap

Fund

March 31, 2017

Dear Fellow Shareholders:

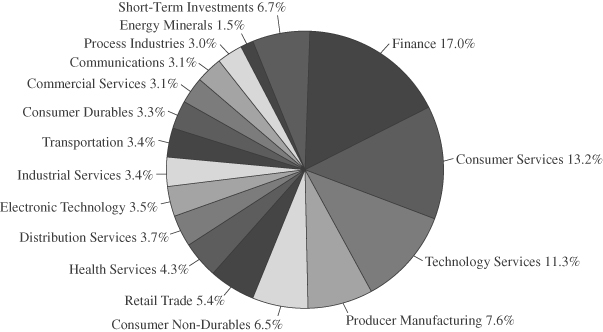

The FMI Large Cap Fund advanced 5.48%1 in the March quarter compared to 6.07% for the Standard & Poor’s 500 Index (S&P 500). Consumer Services, Consumer Non-Durables and Producer Manufacturing sectors outperformed in the quarter while Electronic Technology, Retail Trade and Process Industries lagged. Twenty-First Century Fox (“Fox”), Unilever and Rockwell Automation were the leaders in each of the outperforming groups. Media stocks in general had a good quarter and Fox also reported solid results; Unilever benefitted from a takeover bid by Kraft-Heinz (rebuffed); and a number of cyclical stocks, including Rockwell, moved higher on the expectations of better economic growth. Rockwell was sold due to a valuation that was nearly two standard deviations higher than its ten-year historical mean, based on enterprise value-to-sales data. The below-average results in Electronic Technology were due to our underweighted sector position. Dollar General hurt the Retail Trade sector as concerns about overall pricing pressure permeated the space. Potash Corp. also declined in the quarter, as the market continued to focus on near-term capacity additions.

We have to admit that it has been a struggle in recent years to keep these missives fresh. There are only so many ways to say the same thing! An enduring belief in the continuation of an environment that yields low interest rates, low inflation and no accidents seems to be the law of the land, even though a rational survey of history would lead to the opposite conclusion. The economy has been trapped in low growth, earnings gains have been meager, and valuations have continued to climb as stocks have outpaced fundamentals. Promises of more rapid economic growth and a normalization of interest rates have been “right around the corner” for five or six years. Of course there is no guarantee that stocks will continue to appreciate even if the economy snaps-to, but unless one believes in a perpetually rising price-to-earnings multiple machine, it’s the best chance. Recently there has been increased optimism that the economy is indeed gathering steam and that we are on the verge of an economic breakout. Let’s articulate some of these green shoots.

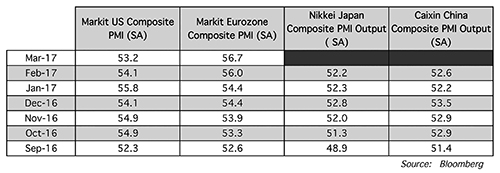

The Purchasing Managers Indices in the U.S., Asia and Europe have been steady or have improved over the past several months, as depicted in the nearby table (readings over 50 indicate expansion).

_______________

1 | Performance for the FMI Large Cap Fund Investor Class (FMIHX) for the first quarter of 2017 was 5.48%, and for the FMI Large Cap Fund Institutional Class (FMIQX), 5.53%. |

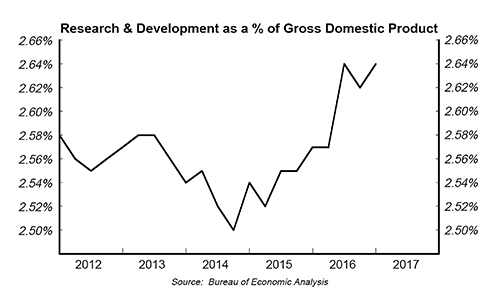

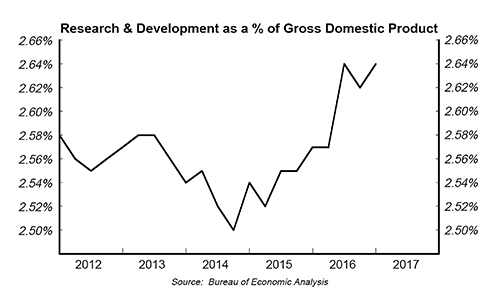

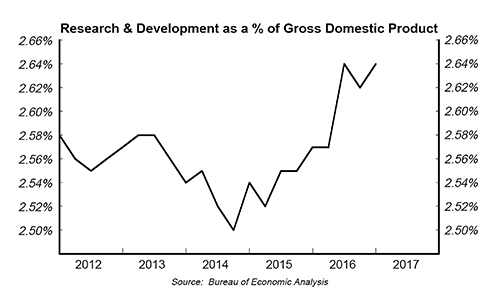

The Richmond Federal Reserve reported an exceptionally strong March Purchasing Managers’ Index (PMI) figure of 59.4. Export activity in a number of important trade centers has started to improve, according to The Economist. Research and development (R&D) spending has also begun to advance, based on Factset’s analysis of every company in the S&P 500 and broader measures provided by the Bureau of Economic Analysis (see nearby chart).

U.S. fixed business investment has recently edged higher. After being negative for the first three quarters last year, J.P. Morgan recently reported that worldwide equipment spending (excluding China) grew at a 4.1% annualized rate in the fourth quarter. Improved R&D and capital investment are two critical keys to attaining long-term economic growth. Additionally, U.S. nonfarm payrolls grew a relatively healthy 235,000 in February, and there was further evidence that European employment has gained ground. Both Germany and France showed an employment PMI above 50 and overall Eurozone unemployment continued to fall from the peak of 12.1% four years ago to a recent 9.5%. Producer prices have edged higher in the U.S. and a number of other developed economies. U.S. consumer sentiment indices are all flashing green.

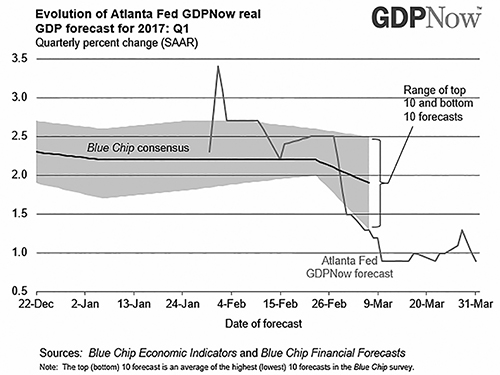

Main Street, if not Wall Street, will be thrilled if these budding positives manifest themselves into true and enduring economic growth. Counter to these positives, however, are some nagging figures. The GDPNow survey from the Atlanta Federal Reserve has been trending steadily down since late January, when estimates for first quarter Gross Domestic Product were over 3% compared to the latest data point of 1% (see nearby chart). The chart also shows the Blue Chip consensus forecast fading.

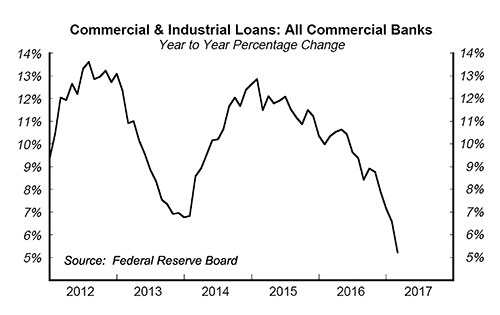

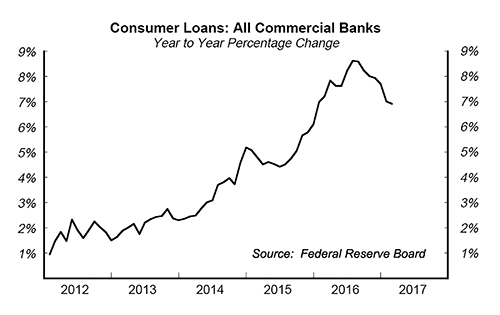

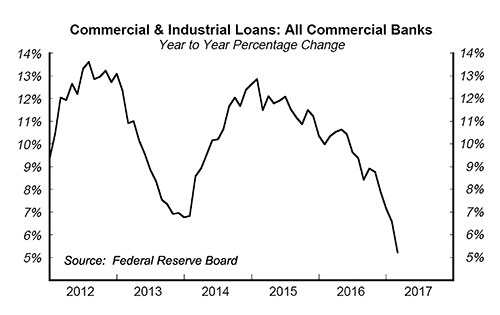

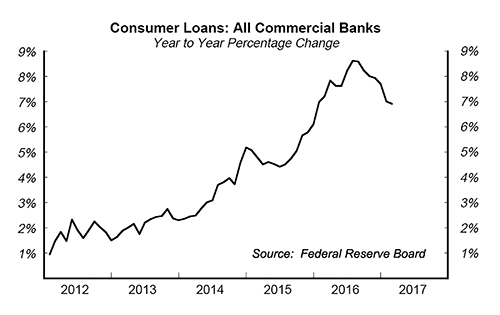

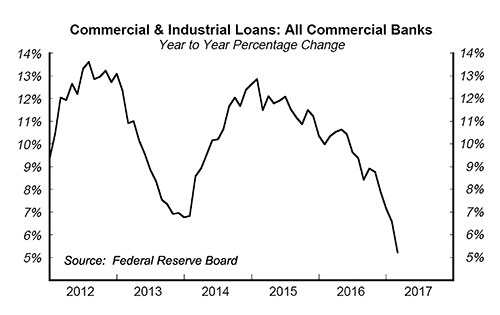

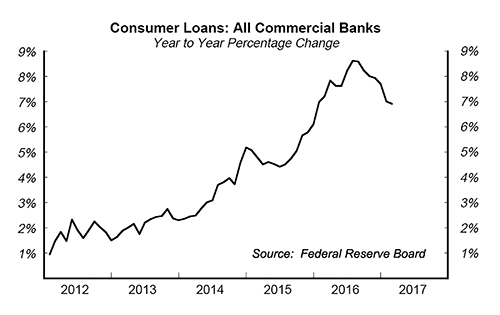

Additionally, lending activity has really begun to slow, which rarely happens when the economy is on the verge of stronger growth. David Rosenberg of Gluskin Sheff recently discussed this slowdown and we’ve included pictorials of a couple of the bigger categories (Commercial and Industrial loans and Consumer Loans). Auto loan growth has also begun to recede.

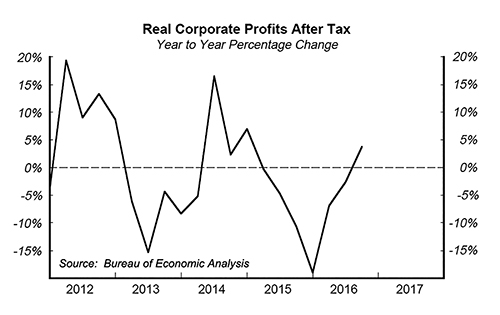

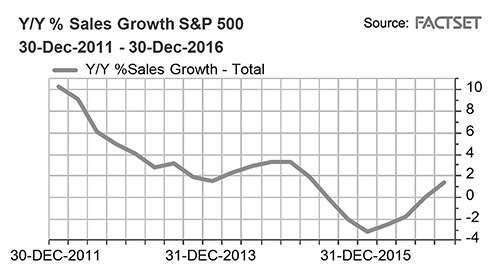

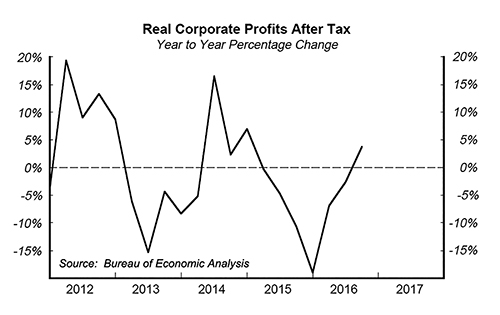

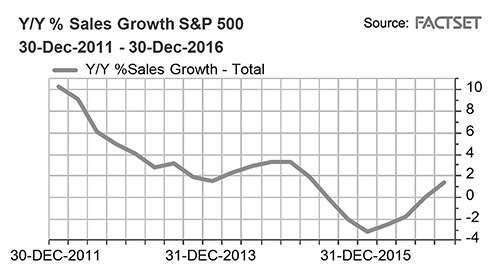

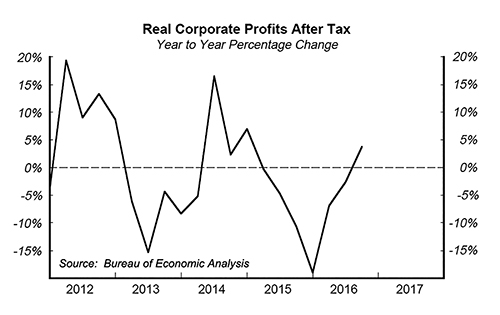

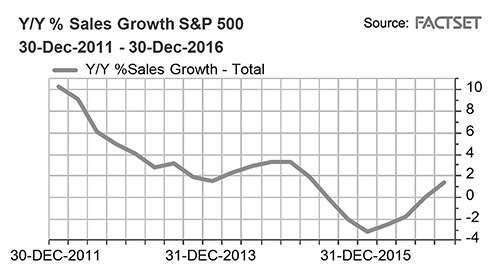

We read and listen to dozens of corporate calls each quarter, and while there is more optimism in the air, actual earnings growth overall remains somewhat stagnant, and is, at best, just inching ahead at a low single-digit rate, as the nearby chart indicates. Many of the cyclical companies are still seeing earnings declines. After years of cost cutting, our sense is that companies are nearing the limit in terms of margin expansion. For the next several years it will be difficult for businesses to grow earnings without experiencing better revenue growth, and we haven’t seen strong evidence of this yet — though it is improving, as the accompanying charts depict.

In last quarter’s letter we said the new administration had a number of things it wanted to accomplish in fairly short order. To quote ourselves, “Real reform of all of these elements will largely take place on Congress’ time table, not the president’s — and probably not Wall Street’s either.” The aborted attempt to repeal and replace the Affordable Care Act shows just how true this statement was, and how challenging it will be for the erstwhile opposition party to govern. As of the end of March, the bull market was still intact, so there hasn’t yet been a stock market price to pay for the lack of legislative progress. Tax reform appears to be next on the agenda, and we’ll reserve judgment until we see something more legislatively plausible than the first pass, which included a border tax (BAT) that uses suspect economic theory and is very unpopular with key constituents. Retailers, for example, will be severely damaged by the BAT and there are 15.9 million retail employees in the U.S. compared to 12.3 million manufacturing employees. This isn’t to suggest that retail is more important than manufacturing, but it does point out the political difficulty in favoring one industry over another. The Republicans seem too timid to offer a truly simplified tax policy… one that offers a relatively low flat rate in exchange for the elimination of deductions. The timing and character of the horse trading that plays out with tax reform will determine whether immigration, healthcare, entitlement reform or infrastructure investment initiatives reach the president’s desk within the next year or two. Given the recent healthcare legislative results, tax reform is likely to be the defining litmus test for the 115th Congress and the Trump administration.

One thing has remained constant over the past eight years despite historically anemic economic fundamentals: an unshakeable stock market. We won’t rehash the plethora of data that shows median valuations are greater than they have ever been, and weighted average measures are nearing the all-time highs of early 2000. Bullish sentiment by investment advisors is also very high, and as mentioned, consumer confidence is elevated. The Conference Board’s Consumer Confidence Index reached 125.6 in March, the highest it has been since December of 2000. Speculative sentiment and overconfidence combined with expensive valuations is not a recipe for good stock market returns. At some point confidence will be pricked and money will flow out rather than in for a period. From time eternal that is how markets have behaved. The market will give us the opportunity to deploy some cash and upgrade a handful of existing holdings to even better businesses. We have been working hard to build our idea inventory with high-quality businesses that are just too rich to own today; in the meantime, we are finding a few solid franchises with relatively attractive valuations. Two are highlighted below.

Cerner Corporation (CERN)

(Analyst: Matt Sullivan)

Description

Cerner is a leading supplier of healthcare information technology. The company offers a wide range of solutions and services that support the clinical, financial, and operational needs of healthcare organizations of all sizes. They have systems in more than 25,000 facilities worldwide, including hospitals, physician practices, laboratories, ambulatory centers, behavioral health centers, cardiac facilities, radiology clinics, surgery centers, extended care facilities, retail pharmacies, and employer sites. Cerner was founded by Neal Patterson, Cliff Illig, and Paul Gorup in 1979 and is headquartered in North Kansas City, Missouri.

Good Business

| | • | The business has a significant amount of recurring revenue. We estimate that somewhere around 70% of sales and over 80% of gross profits are recurring in nature. |

| | | |

| | • | Cerner’s software and services are mission critical for customers and have high switching costs. |

| | | |

| | • | Cerner is one of the dominant players in the healthcare IT industry. They are one of only a few industry players to have fully integrated clinical and financial software solutions across the continuum of care. |

| | | |

| | • | A large portion of Cerner’s future growth will come from selling existing customers additional software and services. We believe this is an attractive growth opportunity, as Cerner is already highly-entrenched within these customers’ operations, and customers are increasingly looking for integrated IT solutions. |

| | | |

| | • | The business generates solid free cash flow and high returns on invested capital (ROIC). Excluding cash on the balance sheet, the company has averaged a 19% ROIC over the past five years. |

| | | |

| | • | The balance sheet is in terrific shape with very little net debt. |

Valuation

| | • | The stock performance is down around 12% from its 52-week high and has underperformed the S&P 500 by 38% and 29% over the past two and three years, respectively, on a total return basis. |

| | | |

| | • | Cerner trades at 4.1 times sales, which is more than one standard deviation below the five-year historical average of 5.5 times sales. |

| | | |

| | • | The company trades at 13.5 times trailing earnings before interest, taxes, depreciation and amortization (EBITDA), and 12.0 times the 2017 estimated EBITDA, both of which are more than one standard deviation below the five-year historical average of 17.8 times EBITDA. |

| | | |

| | • | The valuation is very reasonable on a relative basis when compared to other healthcare stocks and the broader S&P 500, especially when considering Cerner’s entrenched market position, high returns on capital, and solid long-term growth prospects. |

Management

| | • | Cerner has a highly experienced management team; most high-level executives have been at the company for over a decade. |

| | | |

| | • | Neal Patterson is a co-founder of the company and has been a director since 1980. Patterson has been Chairman of the Board of Directors and Chief Executive Officer for more than five years. |

| | | |

| | • | Marc Naughton joined Cerner in 1992 and has served as Chief Financial Officer since 1996, and Executive Vice President since 2010. |

| | | |

| | • | Management prefers to grow organically rather than through acquisitions. Most excess free cash is used to repurchase the company’s own stock. We view this as an attractive capital allocation philosophy. |

Investment Thesis

Cerner is a terrific franchise with strong recurring revenue, high switching costs, a dominant market position, high returns on capital, and a pristine balance sheet. Following the election of Donald Trump, uncertainty regarding the replacement of the Affordable Care Act put pressure on a number of healthcare stocks, including many in the healthcare information technology industry. While we don’t know what may happen legislatively, we are confident that information technology will have an increasingly important role in delivering healthcare. We are willing to look past the near-term macro uncertainties to buy a leading bellwether health technology company at a reasonable valuation.

Oracle Corporation (ORCL)

(Analyst: Andy Ramer)

Description

Oracle is the number one database solutions company and the second largest software applications provider in the world. The company derived 78% of its $37 billion in revenues from software in fiscal 2016, followed by hardware at 13%, and services at 9%. The U.S. accounted for 47% of sales in the last fiscal year.

Good Business

| | • | The database business, as well as the applications, are difficult to displace given high switching costs, especially for large enterprises. Oracle invests a significant amount of money to support technology (with research and development approximating 15% of sales), and to maintain and grow customer relationships. |

| | | |

| | • | Approximately 80% of the company’s operating profit is derived from recurring sources of revenue like maintenance and cloud subscriptions. Renewal rates are high and rising. |

| | | |

| | • | Return on invested capital, net of cash, was approximately 30% in fiscal 2016. |

| | | |

| | • | Oracle has a strong balance sheet with net cash and marketable securities of $5.4 billion. |

Valuation

| | • | Shares have underperformed the market on a total return basis by approximately 25% over the last five years. |

| | | |

| | • | On a basis of enterprise value-to-forward twelve-month forecast earnings before interest and tax, the multiple is 12 times. |

| | | |

| | • | The free cash flow yield is 6%. |

Management

| | • | Lawrence Ellison is Chairman, Chief Technology Officer, and founder. He has driven Oracle’s transformation to the cloud, which began over a decade ago with the rewriting of their software. Ellison owns 27% of the company and thus brings an owner-operator perspective. |

| | | |

| | • | Oracle has returned a significant amount of free cash flow back to shareholders, with shares outstanding down by over 20% since fiscal 2011. |

| | | |

| | • | Co-CEO Mark Hurd is primarily responsible for sales and marketing, and Co-CEO Safra Catz manages the finances. Thomas Kurian is President of Product Development. |

Investment Thesis

Oracle’s transition to a cloud-based business model has been bumpy, with the shift from licenses to subscriptions pressuring profitability. However, we believe the strategy is on track, and that margins have troughed. Investor skepticism about the ultimate success of the transition has given us an opportunity to buy this high-quality and essential business at a relatively attractive price.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2017 (Unaudited)

| | | | | | | | | |

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 93.3% (a) | | | | |

| | |

COMMERCIAL SERVICES SECTOR — 3.1% | |

| | | Advertising/Marketing Services — 3.1% | | | | | | |

| | 2,429,000 | | Omnicom Group Inc. | | $ | 166,418,972 | | | $ | 209,404,090 | |

| | |

COMMUNICATIONS SECTOR — 3.1% | |

| | | | Specialty Telecommunications — 3.1% | | | | | | | | |

| | 3,585,000 | | Level 3 Communications Inc.* | | | 184,251,218 | | | | 205,133,700 | |

| | |

CONSUMER DURABLES SECTOR — 3.3% | |

| | | | Tools & Hardware — 3.3% | | | | | | | | |

| | 1,675,000 | | Stanley Black & Decker Inc. | | | 164,460,415 | | | | 222,557,250 | |

| | |

CONSUMER NON-DURABLES SECTOR — 6.5% | |

| | | | Food: Major Diversified — 2.9% | | | | | | | | |

| | 2,495,000 | | Nestle’ S.A. – SP-ADR | | | 135,981,028 | | | | 191,865,500 | |

| | | | Household/Personal Care — 3.6% | | | | | | | | |

| | 4,890,000 | | Unilever PLC – SP-ADR | | | 196,479,656 | | | | 241,272,600 | |

| | |

CONSUMER SERVICES SECTOR — 13.2% | |

| | | | Cable/Satellite TV — 5.0% | | | | | | | | |

| | 8,859,000 | | Comcast Corp. – Cl A | | | 242,054,254 | | | | 333,009,810 | |

| | | | Media Conglomerates — 4.5% | | | | | | | | |

| | 2,977,000 | | Twenty-First Century Fox Inc. – Cl A | | | 78,115,260 | | | | 96,425,030 | |

| | 6,536,000 | | Twenty-First Century Fox Inc. – Cl B | | | 179,837,219 | | | | 207,714,080 | |

| | | | | | | 257,952,479 | | | | 304,139,110 | |

| | | | Other Consumer Services — 3.7% | | | | | | | | |

| | 7,336,000 | | eBay Inc.* | | | 162,297,945 | | | | 246,269,520 | |

| | |

DISTRIBUTION SERVICES SECTOR — 3.7% | |

| | | | Medical Distributors — 3.7% | | | | | | | | |

| | 2,807,000 | | AmerisourceBergen Corp. | | | 155,295,094 | | | | 248,419,500 | |

| | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 3.5% | | | | | |

| | | | Electronic Components — 3.5% | | | | | | | | |

| | 3,183,000 | | TE Connectivity Ltd. | | | 62,840,975 | | | | 237,292,650 | |

| | | | | | | | | |

ENERGY MINERALS SECTOR — 1.5% | | | | | | | | |

| | | | Oil & Gas Production — 1.5% | | | | | | | | |

| | 2,363,000 | | Devon Energy Corp. | | | 79,527,815 | | | | 98,584,360 | |

| | | | | | | | | |

FINANCE SECTOR — 17.0% | | | | | | | | |

| | | | Financial Conglomerates — 10.7% | | | | | | | | |

| | 1,729,000 | | American Express Co. | | | 42,797,248 | | | | 136,781,190 | |

| | 1,962,000 | | Berkshire Hathaway Inc. – Cl B* | | | 126,948,738 | | | | 327,026,160 | |

| | 2,878,000 | | JPMorgan Chase & Co. | | | 185,960,119 | | | | 252,803,520 | |

| | | | | | | 355,706,105 | | | | 716,610,870 | |

| | | | Major Banks — 3.1% | | | | | | | | |

| | 4,345,000 | | Bank of New York Mellon Corp. | | | 92,229,325 | | | | 205,214,350 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 93.3% (a) (Continued) | | | | |

| | |

FINANCE SECTOR — 17.0% (Continued) | |

| | | Property/Casualty Insurance — 3.2% | | | | | | |

| | 5,447,000 | | Progressive Corp. | | $ | 133,055,587 | | | $ | 213,413,460 | |

| | |

HEALTH SERVICES SECTOR — 4.3% | |

| | | | Managed Health Care — 4.3% | | | | | | | | |

| | 1,745,000 | | UnitedHealth Group Inc. | | | 124,830,125 | | | | 286,197,450 | |

| | |

INDUSTRIAL SERVICES SECTOR — 3.4% | |

| | | | Oilfield Services/Equipment — 3.4% | | | | | | | | |

| | 2,952,000 | | Schlumberger Ltd. | | | 186,936,324 | | | | 230,551,200 | |

| | |

PROCESS INDUSTRIES SECTOR — 3.0% | |

| | | | Chemicals: Agricultural — 3.0% | | | | | | | | |

| | 11,547,000 | | Potash Corp. of Saskatchewan Inc. | | | 242,945,124 | | | | 197,222,760 | |

| | |

PRODUCER MANUFACTURING SECTOR — 7.6% | |

| | | | Industrial Conglomerates — 4.3% | | | | | | | | |

| | 2,275,000 | | Honeywell International Inc. | | | 224,827,180 | | | | 284,079,250 | |

| | | | Trucks/Construction/Farm Machinery — 3.3% | | | | | | | | |

| | 3,308,000 | | PACCAR Inc. | | | 136,197,904 | | | | 222,297,600 | |

| | |

RETAIL TRADE SECTOR — 5.4% | |

| | | | Apparel/Footwear Retail — 1.6% | | | | | | | | |

| | 1,315,000 | | The TJX Companies Inc. | | | 101,690,656 | | | | 103,990,200 | |

| | | | Discount Stores — 3.8% | | | | | | | | |

| | 3,653,000 | | Dollar General Corp. | | | 268,377,767 | | | | 254,723,690 | |

| | |

TECHNOLOGY SERVICES SECTOR — 11.3% | |

| | | | Information Technology Services — 7.1% | | | | | | | | |

| | 2,131,000 | | Accenture PLC | | | 68,775,156 | | | | 255,464,280 | |

| | 3,744,000 | | Cerner Corp.* | | | 198,370,781 | | | | 220,334,400 | |

| | | | | | | 267,145,937 | | | | 475,798,680 | |

| | | | Packaged Software — 4.2% | | | | | | | | |

| | 2,100,000 | | Microsoft Corp. | | | 56,910,667 | | | | 138,306,000 | |

| | 3,200,000 | | Oracle Corp. | | | 125,224,928 | | | | 142,752,000 | |

| | | | | | | 182,135,595 | | | | 281,058,000 | |

| | |

TRANSPORTATION SECTOR — 3.4% | |

| | | | Air Freight/Couriers — 3.4% | | | | | | | | |

| | 4,072,000 | | Expeditors International of Washington Inc. | | | 151,987,091 | | | | 230,027,280 | |

| | | | Total common stocks | | | 4,275,624,571 | | | | 6,239,132,880 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

| Principal Amount | | | | Cost | | | Value | |

| |

| SHORT-TERM INVESTMENTS — 6.1% (a) |

| | | Bank Deposit Account — 6.1% | | | | | | |

| $ | 406,317,249 | | U.S. Bank, N.A., 0.620% | | $ | 406,317,249 | | | $ | 406,317,249 | |

| | | | Total short-term investments | | | 406,317,249 | | | | 406,317,249 | |

| | | | Total investments — 99.4% | | $ | 4,681,941,820 | | | | 6,645,450,129 | |

| | | | Other assets, less liabilities — 0.6% (a) | | | | | | | 38,247,120 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 6,683,697,249 | |

| * | None-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

INDUSTRY SECTORS

as of March 31, 2017 (Unaudited)

FMI

Common Stock

Fund

March 31, 2017

Dear Fellow Shareholders:

The FMI Common Stock Fund advanced 3.52%1 in the March quarter compared to 2.47% for the Russell 2000 Index. Finance, Commercial Services and Distribution Services were among sectors that outperformed in the quarter while the Health Technology, Electronic Technology and Retail Trade sectors underperformed. W.R. Berkley, Manpower Group and MSC Industrial Direct were among the leading performers in each of the outperforming groups. W.R. Berkley continued to put up solid underwriting results, Manpower Group reported good results in most of their non-U.S. markets, and MSC Industrial Direct benefitted from a strong move in the industrial-related stocks. The below-average performance in Health Technology was due to our underweighted sector position. Esterline Technologies hurt relative performance in the period, although they reported a good quarter and the turnaround seems to be on track. Penske Automotive Group’s stock also declined modestly, perhaps on currency and Brexit concerns, as they have significant dealer exposure in the United Kingdom. We remain optimistic about both Esterline Technologies and Penske Automotive Group over the next few years.

We have to admit that it has been a struggle in recent years to keep these missives fresh. There are only so many ways to say the same thing! An enduring belief in the continuation of an environment that yields low interest rates, low inflation and no accidents seems to be the law of the land, even though a rational survey of history would lead to the opposite conclusion. The economy has been trapped in low growth, earnings gains have been meager, and valuations have continued to climb as stocks have outpaced fundamentals. Promises of more rapid economic growth and a normalization of interest rates have been “right around the corner” for five or six years. Of course there is no guarantee that stocks will continue to appreciate even if the economy snaps-to, but unless one believes in a perpetually rising price-to-earnings multiple machine, it’s the best chance. Recently there has been increased optimism that the economy is indeed gathering steam and that we are on the verge of an economic breakout. Let’s articulate some of these green shoots.

The Purchasing Managers Indices in the U.S., Asia and Europe have been steady or have improved over the past several months, as depicted in the nearby table (readings over 50 indicate expansion).

_______________

1 | Performance for both the FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) was 3.52% for the first quarter of 2017. |

The Richmond Federal Reserve reported an exceptionally strong March Purchasing Managers’ Index (PMI) figure of 59.4. Export activity in a number of important trade centers has started to improve, according to The Economist. Research and development (R&D) spending has also begun to advance, based on Factset’s analysis of every company in the S&P 500 and broader measures provided by the Bureau of Economic Analysis (see nearby chart).

U.S. fixed business investment has recently edged higher. After being negative for the first three quarters last year, J.P. Morgan recently reported that worldwide equipment spending (excluding China) grew at a 4.1% annualized rate in the fourth quarter. Improved R&D and capital investment are two critical keys to attaining long-term economic growth. Additionally, U.S. nonfarm payrolls grew a relatively healthy 235,000 in February, and there was further evidence that European employment has gained ground. Both Germany and France showed an employment PMI above 50 and overall Eurozone unemployment continued to fall from the peak of 12.1% four years ago to a recent 9.5%. Producer prices have edged higher in the U.S. and a number of other developed economies. U.S. consumer sentiment indices are all flashing green.

Main Street, if not Wall Street, will be thrilled if these budding positives manifest themselves into true and enduring economic growth. Counter to these positives, however, are some nagging figures. The GDPNow survey from the Atlanta Federal Reserve has been trending steadily down since late January, when estimates for first quarter Gross Domestic Product were over 3% compared to the latest data point of 1% (see nearby chart). The chart also shows the Blue Chip consensus forecast fading.

Additionally, lending activity has really begun to slow, which rarely happens when the economy is on the verge of stronger growth. David Rosenberg of Gluskin Sheff recently discussed this slowdown and we’ve included pictorials of a couple of the bigger categories (Commercial and Industrial loans and Consumer Loans). Auto loan growth has also begun to recede.

We read and listen to dozens of corporate calls each quarter, and while there is more optimism in the air, actual earnings growth overall remains somewhat stagnant, and is, at best, just inching ahead at a low single-digit rate, as the nearby chart indicates. Many of the cyclical companies are still seeing earnings declines. After years of cost cutting, our sense is that companies are nearing the limit in terms of margin expansion. For the next several years it will be difficult for businesses to grow earnings without experiencing better revenue growth, and we haven’t seen strong evidence of this yet — though it is improving, as the accompanying charts depict.

In last quarter’s letter we said the new administration had a number of things it wanted to accomplish in fairly short order. To quote ourselves, “Real reform of all of these elements will largely take place on Congress’ time table, not the president’s — and probably not Wall Street’s either.” The aborted attempt to repeal and replace the Affordable Care Act shows just how true this statement was, and how challenging it will be for the erstwhile opposition party to govern. As of the end of March, the bull market was still intact, so there hasn’t yet been a stock market price to pay for the lack of legislative progress. Tax reform appears to be next on the agenda, and we’ll reserve judgment until we see something more legislatively plausible than the first pass, which included a border tax (BAT) that uses suspect economic theory and is very unpopular with key constituents. Retailers, for example, will be severely damaged by the BAT and there are 15.9 million retail employees in the U.S. compared to 12.3 million manufacturing employees. This isn’t to suggest that retail is more important than manufacturing, but it does point out the political difficulty in favoring one industry over another. The Republicans seem too timid to offer a truly simplified tax policy… one that offers a relatively low flat rate in exchange for the elimination of deductions. The timing and character of the horse trading that plays out with tax reform will determine whether immigration, healthcare, entitlement reform or infrastructure investment initiatives reach the president’s desk within the next year or two. Given the recent healthcare legislative results, tax reform is likely to be the defining litmus test for the 115th Congress and the Trump administration.

One thing has remained constant over the past eight years despite historically anemic economic fundamentals: an unshakeable stock market. We won’t rehash the plethora of data that shows median valuations are greater than they have ever been, and weighted average measures are nearing the all-time highs of early 2000. Bullish sentiment by investment advisors is also very high, and as mentioned, consumer confidence is elevated. The Conference Board’s Consumer Confidence Index reached 125.6 in March, the highest it has been since December of 2000. Speculative sentiment and overconfidence combined with expensive valuations is not a recipe for good stock market returns. At some point confidence will be pricked and money will flow out rather than in for a period. From time eternal that is how markets have behaved. The market will give us the opportunity to deploy some cash and upgrade a handful of existing holdings to even better businesses. We have been working hard to build our idea inventory with high-quality businesses that are just too rich to own today; in the meantime, we are finding a few solid franchises with relatively attractive valuations. Two are highlighted below.

White Mountains Insurance Group Ltd. (WTM)

(Analyst: Matthew Goetzinger)

Description

White Mountains Insurance Group is a financial services holding company with primary business interests in specialty lines property and casualty insurance, municipal bond insurance, and various capital light insurance services companies. The company’s corporate headquarters are in Hanover, New Hampshire, while the registered offices are located in Hamilton, Bermuda.

Good Business

| | • | White Mountains’ goal is to become a premier group of property and casualty insurance and reinsurance underwriters that — with prudent operating and financial leverage — produces for its owners a long-term return equal to 700 basis points over the 10-Year Treasury yield. |

| | | |

| | • | The company’s insurance businesses sell a broad range of high value-added insurance protections against a variety of risks. |

| | | |

| | • | White Mountains functions as an intelligent allocator of capital and allows each member of the group to focus on prudent underwriting and a long-term focus. |

| | | |

| | • | Over long periods of time that include the 2009 financial crisis, the bear market of the early 2000’s for the S&P 500 Index, and a number of significant acquisitions and subsequent divestitures, the company’s long-term adjusted book value per share has grown at a 14% cumulative annual growth rate, outpacing the market (excluding dividends) by approximately 350 basis points. |

| | | |

| | • | The company’s operating businesses are well-capitalized. |

Valuation

| | • | White Mountains trades at a slight premium to stated book value per share, and approximately in line with a mark-to-market appraisal of the company’s net asset value. |

| | | |

| | • | White Mountains’ share price has closely tracked growth in the company’s book value per share over time. |

| | | |

| | • | Recent takeovers of primary and specialty lines property and casualty insurance companies have been at approximately two times book value. |

Management

| | • | White Mountains’ holding company is managed by a group of key decision makers that have been with the company for over ten years. |

| | | |

| | • | Management clearly understands economic returns on capital. |

| | | |

| | • | Absent an opportunity to acquire attractively valued new operating businesses, the company has used their capital to repurchase stock at a discount to book value per share. |

Investment Thesis

White Mountains’ long-term partnership model provides a means to gain exposure to a diversified portfolio of differentiated insurance business managed with a focus on long-term value creation. The company’s significant balance of holding company cash preserves optionality and should function as a portfolio ballast in a more challenging stock market environment.

Allscripts Healthcare Solutions, Inc. (MDRX)

(Analyst: Matt Sullivan)

Description

Allscripts is a leading supplier of information technology (IT) solutions and services to a wide range of healthcare providers, including physicians, hospitals, health plans, clinics, pharmacies, pharmacy benefit managers and post-acute care organizations. Allscripts has one of the largest client bases in the healthcare IT industry, as their products and services are used by over 180,000 physicians, 2,500 hospitals and 45,000 post-acute care facilities. The company was founded in 1986 and is headquartered in Chicago, Illinois.

Good Business

| | • | The business has a significant amount of recurring revenue; approximately 80% of the company’s revenue is now recurring in nature. |

| | | |

| | • | Allscripts’ software and services are mission-critical for customers and have high switching costs. |

| | | |

| | • | The company has a large, diverse customer base. |

| | | |

| | • | Allscripts’ software products can integrate and exchange data with most other healthcare IT providers; this is becoming increasingly important in the industry. |

| | | |

| | • | A large portion of Allscripts’ future growth will come from selling existing customers additional software and services. We believe this is an attractive growth opportunity as Allscripts is already highly entrenched within these customers’ operations. |

| | | |

| | • | The business generates solid free cash flow and high returns on invested capital. We estimate that Allscripts’ true return on invested capital is over 20%. |

Valuation

| | • | Allscripts’ performance is down around 11% from its 52-week high. It has underperformed the Russell 2000 by 30%, 7% and 52% over the past one, two and three years, respectively, on a total return basis. |

| | | |

| | • | Allscripts owns a 10% stake in NantHealth, a precision health IT company worth $57 million. Allscripts also owns 49% of a joint venture called NetSmart that we estimate is currently worth around $330 million to Allscripts. After taking these investments into account, we believe that Allscripts’ core business is trading at about 1.8 times sales, which is one standard deviation below the company’s five-year average, and well below where other comparable companies trade. |

| | | |

| | • | After considering the NantHealth and NetSmart investments, we believe that Allscripts’ core business has a 6 % free cash flow yield. We believe this is an attractive yield, given the company’s highly recurring revenue and solid growth prospects. |

| | | |

| | • | Take-out multiples for direct peers and a broader set of software companies indicate that Allscripts trades at an attractive valuation. We believe this provides us with some downside protection. |

Management

| | • | Paul Black has served as Chief Executive Officer and has been on the board of directors since 2012. Prior to joining the company, he was an Operating Executive of Genstar Capital, a private equity firm, and Senior Advisor at New Mountain Finance Corporation, an investment management company. From 1994 to 2007 Mr. Black served in various executive positions at Cerner Corp., including Chief Operating Officer from 2005 to 2007. |

| | | |

| | • | Mr. Black has brought a number of former Cerner executives to the company to run different divisions of Allscripts. |

Investment Thesis

Allscripts is a good business with a high level of recurring revenue, high switching costs, a diverse customer base, and attractive returns on invested capital; however, the business has gone through a significant amount of change over the past few years from both an operational and financial perspective, which has caused the stock to lag. This has been compounded by the election of Donald Trump, which created uncertainty about the future of the Affordable Care Act and put additional pressure on healthcare stocks.

It is our belief that changes to the business are now largely completed, and that top line growth is set to accelerate over the next few years. Furthermore, while we don’t know what will replace the Affordable Care Act, we are confident that IT will have an increasingly important role in delivering healthcare going forward. Therefore, we’re willing to look past the near-term macro uncertainty and own this above average business at a below-average valuation.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 81.6% (a) | |

| | |

COMMERCIAL SERVICES SECTOR — 12.9% | |

| | | Advertising/Marketing Services — 3.2% | | | | | | |

| | 1,338,000 | | Interpublic Group of Cos. Inc. | | $ | 23,960,538 | | | $ | 32,874,660 | |

| | | | Miscellaneous Commercial Services — 4.0% | | | | | | | | |

| | 1,650,000 | | Genpact Ltd. | | | 29,751,614 | | | | 40,854,000 | |

| | | | Personnel Services — 5.7% | | | | | | | | |

| | 250,000 | | ManpowerGroup Inc. | | | 16,116,295 | | | | 25,642,500 | |

| | 689,000 | | Robert Half International Inc. | | | 22,580,804 | | | | 33,643,870 | |

| | | | | | | 38,697,099 | | | | 59,286,370 | |

| | |

CONSUMER DURABLES SECTOR — 1.3% | |

| | | | Homebuilding — 1.3% | | | | | | | | |

| | 6,600 | | NVR Inc.* | | | 6,793,818 | | | | 13,905,408 | |

| | |

CONSUMER SERVICES SECTOR — 6.2% | |

| | | | Cable/Satellite TV — 2.3% | | | | | | | | |

| | 38,000 | | Cable One Inc. | | | 11,315,190 | | | | 23,729,860 | |

| | | | Other Consumer Services — 3.9% | | | | | | | | |

| | 68,000 | | Graham Holdings Co. | | | 32,353,868 | | | | 40,769,400 | |

| | |

DISTRIBUTION SERVICES SECTOR — 9.4% | |

| | | | Electronics Distributors — 3.6% | | | | | | | | |

| | 505,000 | | Arrow Electronics Inc.* | | | 11,671,655 | | | | 37,072,050 | |

| | | | Wholesale Distributors — 5.8% | | | | | | | | |

| | 373,000 | | nixter International Inc.* | | | 24,679,795 | | | | 29,578,900 | |

| | 240,000 | | Applied Industrial Technologies Inc. | | | 9,670,623 | | | | 14,844,000 | |

| | 150,000 | | MSC Industrial Direct Co. Inc. | | | 9,252,738 | | | | 15,414,000 | |

| | | | | | | 43,603,156 | | | | 59,836,900 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 3.9% | |

| | | | Aerospace & Defense — 2.4% | | | | | | | | |

| | 291,000 | | Esterline Technologies Corp.* | | | 27,046,113 | | | | 25,040,550 | |

| | | | Electronic Production Equipment — 1.5% | | | | | | | | |

| | 230,000 | | MKS Instruments Inc. | | | 6,024,501 | | | | 15,812,500 | |

| | |

FINANCE SECTOR — 18.4% | |

| | | | Finance/Rental/Leasing — 9.8% | | | | | | | | |

| | 180,000 | | ePlus Inc.* | | | 17,107,879 | | | | 24,309,000 | |

| | 1,025,000 | | FirstCash Inc. | | | 38,123,126 | | | | 50,378,750 | |

| | 356,000 | | Ryder System Inc. | | | 15,419,508 | | | | 26,856,640 | |

| | | | | | | 70,650,513 | | | | 101,544,390 | |

| | | | Property/Casualty Insurance — 5.1% | | | | | | | | |

| | 687,000 | | Greenlight Capital Re Ltd.* | | | 15,908,848 | | | | 15,182,700 | |

| | 327,000 | | W.R. Berkley Corp. | | | 7,992,588 | | | | 23,096,010 | |

| | 17,000 | | White Mountains Insurance Group Ltd. | | | 15,690,084 | | | | 14,957,960 | |

| | | | | | | 39,591,520 | | | | 53,236,670 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 81.6% (a) (Continued) | |

| | |

FINANCE SECTOR — 18.4% (Continued) | |

| | | Real Estate Development — 1.8% | | | | | | |

| | 835,000 | | Kennedy-Wilson Holdings Inc. | | $ | 18,293,698 | | | $ | 18,537,000 | |

| | | | Regional Banks — 1.7% | | | | | | | | |

| | 430,000 | | Zions Bancorporation | | | 9,376,971 | | | | 18,060,000 | |

| | |

HEALTH SERVICES SECTOR — 1.0% | |

| | | | Medical/Nursing Services — 1.0% | | | | | | | | |

| | 146,425 | | MEDNAX Inc.* | | | 9,614,667 | | | | 10,158,966 | |

| | |

HEALTH TECHNOLOGY SECTOR — 1.9% | |

| | | | Medical Specialties — 1.9% | | | | | | | | |

| | 215,000 | | Varian Medical Systems Inc.* | | | 13,696,887 | | | | 19,592,950 | |

| | |

PROCESS INDUSTRIES SECTOR — 6.5% | |

| | | | Chemicals: Specialty — 1.5% | | | | | | | | |

| | 225,000 | | Compass Minerals International Inc. | | | 16,042,584 | | | | 15,266,250 | |

| | | | Containers/Packaging — 2.4% | | | | | | | | |

| | 309,000 | | Avery Dennison Corp. | | | 10,064,340 | | | | 24,905,400 | |

| | | | Industrial Specialties — 2.6% | | | | | | | | |

| | 514,000 | | H.B. Fuller Co. | | | 13,814,305 | | | | 26,501,840 | |

| | |

PRODUCER MANUFACTURING SECTOR — 9.9% | |

| | | | Building Products — 2.8% | | | | | | | | |

| | 620,000 | | Armstrong World Industries Inc.* | | | 27,076,094 | | | | 28,551,000 | |

| | | | Industrial Machinery — 2.9% | | | | | | | | |

| | 441,000 | | Woodward Inc. | | | 18,138,890 | | | | 29,952,720 | |

| | | | Miscellaneous Manufacturing — 4.2% | | | | | | | | |

| | 129,000 | | Carlisle Cos. Inc. | | | 5,361,902 | | | | 13,726,890 | |

| | 921,000 | | TriMas Corp.* | | | 20,183,321 | | | | 19,110,750 | |

| | 65,000 | | Valmont Industries Inc. | | | 9,454,028 | | | | 10,107,500 | |

| | | | | | | 34,999,251 | | | | 42,945,140 | |

| | |

RETAIL TRADE SECTOR — 3.2% | |

| | | | Food Retail — 1.0% | | | | | | | | |

| | 90,000 | | Casey’s General Stores Inc. | | | 10,694,658 | | | | 10,102,500 | |

| | | | Specialty Stores — 2.2% | | | | | | | | |

| | 487,450 | | Penske Automotive Group Inc. | | | 17,709,307 | | | | 22,817,535 | |

| | |

TECHNOLOGY SERVICES SECTOR — 5.5% | |

| | | | Data Processing Services — 3.0% | | | | | | | | |

| | 455,000 | | Broadridge Financial Solutions Inc. | | | 9,493,259 | | | | 30,917,250 | |

| | | | Health Industry Services — 2.5% | | | | | | | | |

| | 2,045,000 | | Allscripts Healthcare Solutions Inc.* | | | 24,625,663 | | | | 25,930,600 | |

| | |

TRANSPORTATION SECTOR — 1.5% | |

| | | | Marine Shipping — 1.5% | | | | | | | | |

| | 221,000 | | Kirby Corp.* | | | 7,875,879 | | | | 15,591,550 | |

| | | | Total common stocks | | | 582,976,038 | | | | 843,793,459 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

Principal Amount | | Cost | | | Value | |

| | |

| SHORT-TERM INVESTMENTS — 18.5% (a) | |

| | | | | | | | | |

| | | Bank Deposit Account — 8.8% | | | | | | |

| $ | 90,992,583 | | U.S. Bank, N.A., 0.620% | | $ | 90,992,583 | | | $ | 90,992,583 | |

| | | | U.S. Treasury Securities — 9.7% | | | | | | | | |

| | 25,000,000 | | U.S. Treasury Bills, 0.557%, due 04/13/17^ | | | 24,994,583 | | | | 24,994,975 | |

| | 50,000,000 | | U.S. Treasury Bills, 0.652%, due 04/20/17^ | | | 49,984,299 | | | | 49,982,800 | |

| | 25,000,000 | | U.S. Treasury Bills, 0.649%, due 04/27/17^ | | | 24,986,819 | | | | 24,987,825 | |

| | | | Total U.S. Treasury Securities | | | 99,965,701 | | | | 99,965,600 | |

| | | | Total short-term investments | | | 190,958,284 | | | | 190,958,183 | |

| | | | Total investments — 100.1% | | $ | 773,934,322 | | | | 1,034,751,642 | |

| | | | Other assets, less liabilities — (0.1%) (a) | | | | | | | (824,471 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,033,927,171 | |

| * | None-income producing security. |

| ^ | The rate shown is the yield as of March 31, 2017. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

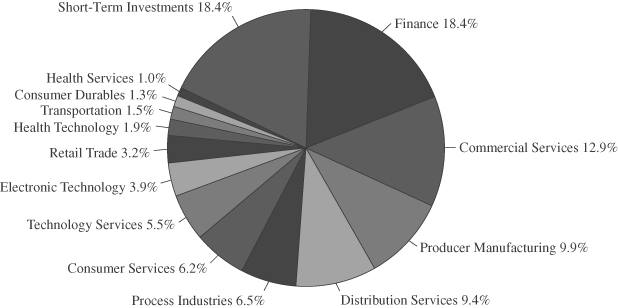

INDUSTRY SECTORS

as of March 31, 2017 (Unaudited)

FMI

International

Fund

March 31, 2017

Dear Fellow Shareholders:

Investor euphoria carried over from late 2016 as global stock markets continued to climb in the first quarter. A handful of positive economic data points added fuel to the fire, with market pundits citing the reawakening of investor “animal spirits” while momentum gathered pace. Unfortunately, a disregard for valuation was also on the rise, which has been amplified by an industry-wide shift to passive investing, where an appraisal of business value (vs. price) is irrelevant. From our vantage point, stock prices have run too far ahead of the fundamentals, and it is doubtful that the growth rates embedded in today’s equity valuations will come to fruition. We are hopeful that the global economy’s nascent recovery is here to stay and that Main Street will pick up enough steam to catch up with Wall Street’s lofty expectations, but view a smooth realignment as highly unlikely.

Despite taking a conservative approach, the FMI International Fund (the “Fund”) generated a 5.69%1 return in the first quarter of 2017, compared with the MSCI EAFE Index gain of 4.71% in local currency and 7.25% in U.S. Dollars (USD). The Producer Manufacturing, Electronic Technology, and Consumer Durables sectors were strong contributors, while Industrial Services, Finance, and Technology Services detracted. Akzo Nobel, Unilever and Jardine Strategic Holdings boosted the Fund’s relative performance, as Schlumberger, Potash Corp. and Fairfax Financial Holdings each weighed on the results. Currency hedging and an elevated cash balance were additional headwinds.

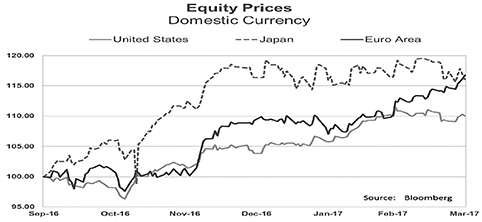

Up, Up and Away

Optimism, both for the global economy and the financial markets, is clearly rising. The Bank of Japan (BOJ) and European Central Bank (ECB) have each increased their domestic Gross Domestic Product (GDP) growth estimates in recent months, manufacturing purchasing-managers indexes are improving across geographies, business and consumer confidence is increasing, eurozone unemployment is falling, corporate profits are expected to rebound in 2017, and capital investment has finally shown some initial signs of life. Layer on enthusiasm for the Trump economic policy agenda, and public equity markets were off to the races, as can be seen in the nearby chart.

_______________

1 | Performance for both the FMI International Fund Investor Class (FMIJX) and the FMI International Fund Institutional Class (FMIYX) was 5.69% for the first quarter of 2017. |

While we acknowledge that there might be some “green shoots” in economic activity, we want to remind our readers that we are in the midst of an historic period of extreme (and experimental) monetary policy. Central banks are pulling out virtually all the stops, with unprecedented negative interest rates and massive quantitative easing initiatives. Potential long-term consequences (and risks) are likely to outweigh the short-term benefits we are seeing today. Unfortunately, printing money and suppressing interest rates will not solve the world’s problems.

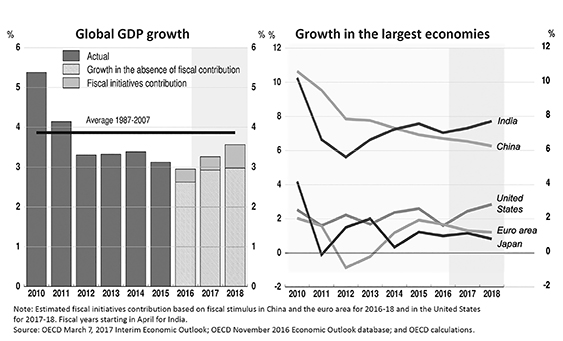

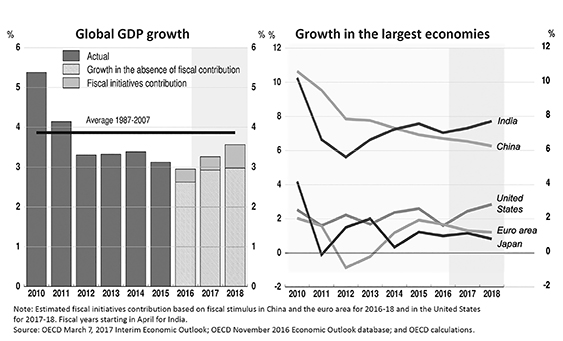

When we peel back the onion, the global economic “recovery” does not appear to be particularly robust, especially in light of all the levers being pulled. While the BOJ and ECB are raising GDP forecasts, growth rates are expected to plateau in 2017 (Eurozone: 1.8%, Japan: 1.5%), before falling in subsequent years. Global GDP is projected to grow at 3.2% in 2017 (up from 3.0% in 2016), which is well short of historical norms (see chart below). Eurozone unemployment has dropped from 12.1% to 9.5%, but remains quite high.2 Corporate profits in developed markets have started to tick up in the last few months, but are still below 2014 levels. Per J.P. Morgan, “global (excluding China) business equipment spending strengthened to 4.1% annualized last quarter [4Q16], a notable increase from the 1% contraction in the year through 3Q16.”3 However, we would caution extrapolating one quarter into the future; in aggregate, full-year capital investment was weak. While confidence is on the rise, consumption and investment have not kept pace. Productivity growth also remains sluggish, which is a key headwind for growth.

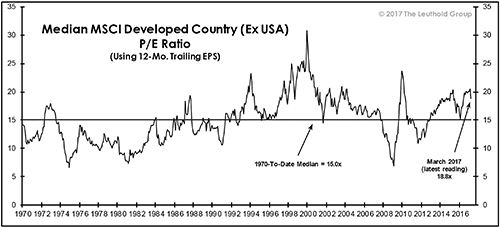

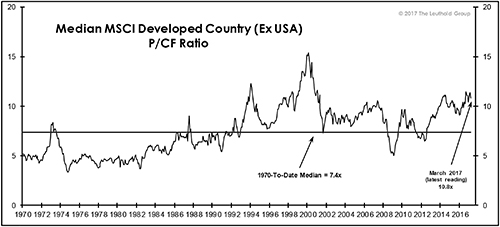

Meanwhile, the apparent disconnect between economic reality and financial markets is widening. Valuation multiples continue to climb, as illustrated by the charts nearby. In developed markets (excluding the USA), price-to-earnings and price-to-cash flow metrics have now reached 25% and 46% above historical medians, respectively. Absolute value is becoming harder to find.

_______________

2 | Source: Bloomberg |

3 | Joseph Lupton, Bruce Kasman and David Hensley. “Profits prime global liftoff.” J.P. Morgan, March 22, 2017. |

Ultimately, a combination of high asset prices (and expectations), slow growth, vast credit build-up, investor complacency, and ineffective central bank policies could leave investors vulnerable to a sizeable market correction. In addition, just as passive investment vehicles purchase equities with no regard for valuation, so too will they sell when asset flows reverse. As Warren Buffet is often quoted, “Only when the tide goes out do you discover who’s been swimming naked,” which we think will ring true. We believe it is a matter of when — and not if — stock markets will correct, and when the time comes, we will become more aggressive. Some of the best investments are made in periods of fear and distress. A value investing (contrarian) discipline in times of despair is essential to taking advantage of these rare opportunities.

Closer Than They Appear

While the eurozone debt crisis might “appear” to be in the rearview mirror (for now), according to Reuters the European Union has warned its banks that they might be facing higher bad loan risks when the ECB takes its foot off the gas and starts to tighten monetary policy. European banks are already lugging around more than €1 trillion of non-performing loans, with more than a quarter held by troubled Italian banks (discussed in the September 2016 letter). Greece, Cyprus, Slovenia and Portugal’s banks are also stressed.4 Per Reuters, “While banks are likely to benefit from higher interest rates, which improve the margin they make on their loans, this may be offset by the effects

_______________

4 | Martin Arnold and Jim Brunsden. “EU needs to create ‘bad bank’ for €1tn toxic loan pile, says EBA chief.” Financial Times, January 30, 2017. |

of another economic slowdown.”5 In addition, rising interest rates means increased borrowing costs for companies and households that are already struggling to keep up with their existing debt obligations, which could trigger rising defaults. The ECB will undoubtedly have its hands full once it starts to reverse course. There is no quick fix.

Not surprisingly, Greece has recently crept back into the headlines. In a new sustainability report issued by the International Monetary Fund (IMF), they describe Greece’s debt as “highly unsustainable” and on an “explosive” path. The IMF concludes that “Greece cannot be expected to grow out of its debt problem, even with full implementation of reforms” and “requires significant debt relief from its European partners to ensure debt sustainability,” something other creditors (European commission, ECB) have been reluctant to embrace. The IMF predicts that Greece’s debt as a percentage of GDP will reach about 184% once the 2016 figures are tallied.6 Per The Telegraph, “A fresh crisis over Greek debt could be triggered as soon as July when Greece is due to repay some €7 [billion] to its creditors – money the country cannot pay without a fresh injection of bailout cash.”7 While creditors appear optimistic, we have concerns that the worst is yet to come. Europe has continually kicked this can down the road, as the IMF study confirms. Absent a default or restructuring of their debt, Greek financial distress will continue to resurface again and again. How many other countries are one step behind Greece?

China: Keeping Our Distance

Fear of a real estate bubble in China continues to linger, despite the government’s attempts to cool the property market. According to the Financial Times, “Property investment grew at its fastest pace in two years in January and February at an annual rate of 8.9 per cent, while sales accelerated to 25.1 per cent growth in floor space terms.” During the same time, house prices were up around 12% nationally.8 Affordability also remains an issue. According to a People’s Bank of China survey, approximately 52.2% of urban households perceive housing prices as “unacceptably high.”9 Forbes reports that the average property price in Shanghai ($725,000), for example, is more than 50 times the city’s median salary ($13,620), which compares with New York, the U.S.’s most expensive city, at about 32 times. The author suggests that China’s housing market is “worth watching,” as China “consumes nearly half of the world’s steel and cement production” and accounts for “a third of global GDP growth.”10 We agree. Property investment remains an important driver of economic growth in China, and the government faces a daunting challenge of balancing internal growth objectives against the increasing risk of a property-induced credit crisis.

China’s astonishing accumulation of debt in recent years has been well documented. To further augment our concerns, recent data from China’s elaborate shadow banking system is increasingly worrisome. The Wall Street Journal pens that as banks retreat and credit markets face strains, Chinese companies have been stepping in to lend to one another. Per the report, “Company-to-company loans in China jumped by 20% last year to 13.2 trillion yuan ($1.92 trillion), according to research firm CEIC. That is roughly double the size of the loan book at Wells Fargo & Co., the U.S.’s biggest lender.” These “entrusted loans,” where banks serve as middlemen, can earn

_______________

5 | Francesco Guarascio. “EU warns banks may face higher bad loan risk when ECB tightens.” Reuters, July 17, 2015. |

6 | “Greece. IMF Country Report No. 17/40.” International Monetary Fund, February 2017. |

7 | Time Wallace. “EU faces crisis as IMF warns Greek debts are on ‘explosive’ path.” The Telegraph, February 7, 2017. |

8 | Gabriel Wildau. “Chinese cities revive crackdown on home loans as property bubble concerns grow.” Financial Times, March 20, 2017. |

9 | Huileng Tan. “China’s property bubble represents a social risk: Renowned Chinese economist.” Bloomberg, March 24, 2017. |

10 | Kenneth Rapoza. “Shanghai Housing Prices Completely Unsustainable.” Forbes, March 19, 2017. |

interest rates of up to 20%. The majority of these loans (about 60%) are being used to “prop up companies in sectors like mining and property where Beijing wants to reduce excess capacity.”11 The quality and pricing of entrusted loans is highly questionable, as “few Chinese companies have the personnel to adequately assess credit risk,”11 which is alarming. On a much smaller scale, but in a similar vein, China has also seen an explosion of peer-to-peer lending. Peer-to-peer loans have grown to 885.7 billion yuan, or $128 billion, up 8 times in only about 2 years. Lenders can expect yields of 8-12%, offering credit to high-risk consumers who are not able to get traditional bank financing.12 With wealth management ($3.8 trillion) and trust products ($2.2 trillion)13 also rapidly growing, shadow banking in China is becoming ever more popular and fraught with risk.

Speculation isn’t limited to China’s property and lending markets, however. The Financial Times reports that money has also started to flood into domestic private equity, as “overseas acquisitions become increasingly challenging amid Beijing’s clampdown on moving money offshore.” Nearly one-fifth of global early-stage private equity investments are made in China (approximately $15 billion). Valuations have sky-rocketed, with multiples coming in at around 30 times earnings before interest, tax, depreciation, and amortization (EBITDA), which compares with around 17 times in Asia-Pacific and 10 times in the U.S.14 It’s hard to earn your cost of capital at these nosebleed valuations. Overpaying, then trying to protect your intellectual property in China? Priceless.

Despite what may be an attractive long-term outlook for China, near-term risks continue to keep us at bay. Our indirect exposure to China (via existing holdings) is heavily weighted toward the Chinese consumer vs. fixed asset investment, which is not likely to change for the foreseeable future.

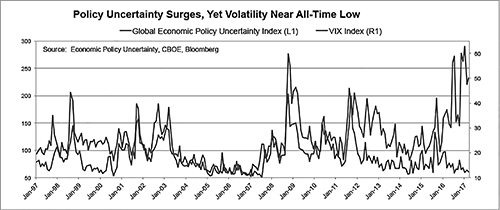

Calm Before The Storm?

The following Bloomberg chart illustrates the complacency we are seeing from today’s market participants. While global economic policy uncertainty is near multi-decade highs (e.g. Brexit, European elections, the Trump presidency, impeachments in Brazil and South Korea), stock market volatility (per the VIX Index) is approaching all-time lows. The recent divergence, compared with a more correlated historical relationship, is revealing. One would typically expect increased market volatility in periods of high economic policy uncertainty, yet we are seeing the exact opposite. Is this the calm before the storm?

_______________

11 | Rachel Rosenthal and Anjie Zheng. “Chinese Companies Rush In With Nearly $2 Trillion Where Bankers Fear to Lend.” The Wall Street Journal, February 9, 2017. |

12 | Yusho Cho. “China’s yield-strapped investors spark peer-to-peer explosion.” Nikkei Asian Review, March 17, 2017. |

13 | “China’s $9 Trillion Moral Hazard Is Now Too Big to Ignore.” Bloomberg News. February 21, 2017. |

14 | “Chinese private equity: look elsewhere.” Lex column, Financial Times, March 15, 2017. |

It’s certainly possible. When the masses start to brush aside risk factors (and valuation) and throw caution to the wind, one is better off doing the opposite. As “animal spirits” have taken hold and stock prices drift away from economic reality, finding suitable investments has become especially challenging. That said, we will continue to keep our heads down in search for the next attractive investment opportunity. We are eager to put our cash to work, but will remain disciplined in our approach, with a keen focus on downside protection. Highlighted below are a few examples where we’ve recently found value:

Whitbread PLC (WTB LN)

(Analyst: Jordan Teschendorf)

Description

Whitbread is the largest hospitality group in the United Kingdom, with over 730 hotels and 2,000 coffee shops, operating primarily under two strong brand names, Premier Inn and Costa. Premier Inn is the largest branded budget hotel chain in the U.K. and Costa is the largest branded coffee chain in the U.K. Whitbread also operates over 400 restaurants, nearly 95% of which are co-located with a Premier Inn. The group owns and operates the majority of its hotels, while it utilizes a number of channels to bring its Costa brand to market, including equity stores, franchised stores, wholesale arrangements, and express kiosks. The company is headquartered in Dunstable, U.K. and generates over 95% of its revenue in the U.K.

Good Business

| | • | Whitbread is the U.K. market leader in the economy hotel and branded coffee shop market with two strong and focused brands. Economies of scale are present in each business. |

| | | |

| | • | The company has successfully exited non-core businesses over the last ten years and focused on organic growth, driving improved margins and returns on capital. |

| | | |

| | • | Premier Inn derives a high and growing proportion of its bookings directly from its online bookings platform, PremierInn.com, which allows it to sell its inventory of rooms with very low distribution costs, invest at higher rates than competitors, and maintain a superior product. |

| | | |

| | • | The company’s lease-adjusted return on invested capital was 11.7% in fiscal year 2016. Returns have averaged 11.5%, 11.0%, and 10.0% over the last 3-, 5-, and 10- year periods, respectively, well in excess of the company’s cost of capital. |

| | | |

| | • | Whitbread maintains a solid balance sheet with net leverage of 1.3 times EBITDA at the end of the most recently completed period, earning a BBB credit rating from Fitch. Adjusted for off-balance sheet leases, net debt is a reasonable 3.3 times earnings before interest, taxes, depreciation, amortization, and rent costs (EBITDAR), and the company is committed to keeping it below 3.5 times. |

Valuation

| | • | The stock is down over 24% from its high in spring 2015, significantly underperforming the FTSE All-Share Index since that time. |

| | | |

| | • | The company’s 12-month forward price-to-earnings multiple is 15.0 times, which is below the 5-year and 10-year averages of 17.4 times and 15.7 times, respectively. |

| | | |

| | • | Shares currently yield 5.2% on our estimate of fiscal year 2017 underlying free cash flow. |

Management

| | • | Alison Brittain joined Whitbread as CEO Designate in September 2015 before taking over as CEO in December 2015. She previously served as Director of Retail at Lloyds Banking Group (2011–2015). |

| | • | Nicholas Cadbury has been Group Finance Director since November 2012, previously serving as CFO of Premier Farnell Plc. |

| | | |

| | • | The management team prioritizes returns on capital when considering growth and this measure is linked to the long term incentive plan. |

Investment Thesis

Premier Inn and Costa have proven to be relatively defensive businesses, capable of growing organically and taking market share in many economic environments. After a period of impressive growth, Whitbread’s shares have come under pressure over the past 18 months as investors have grown cautious on the U.K. hotel cycle and the general sentiment of the U.K. consumer. This has provided us with the opportunity to invest in a high-quality and steadily-growing company, at a relatively attractive valuation.

Vivendi SA (VIV FR)

(Analyst: Dan Sievers)

Description

Vivendi SA is a media holding company headquartered in Paris, France. Following a multi-year transition, Vivendi’s value lies principally in its two leading content-media businesses, Universal Music Group (UMG) and Canal+, followed by net cash and public equity investments worth about €7 billion. UMG (€5.2 billion in 2016 revenues) is #1 globally in recorded music and music publishing, and returned to growth in 2015 and 2016. Canal+ (€5.3 billion in 2016 revenues) contains the leading European film studio (StudioCanal) and is a leader in premium PayTV channels and packages in France and PayTV channels in Poland, Vietnam, and thirty French-speaking African countries.

Good Business

| | • | Global recorded music industry revenues fell by more than 50% between 1999 and 2014 but returned to growth in 2015, and accelerated in 2016. Absolute dollar decreases in physical sales have become smaller while digital streaming and subscription revenues continue to grow rapidly (Spotify, Apple Music, etc.), appealing to new customers and markets due to broad content libraries and attractive interfaces that are steering listeners away from piracy at the margin. In 2016, global recorded music industry revenue share was 29% for Vivendi’s UMG, 22% for Sony Music, and 17% for Warner Music Group. While the industry remains very competitive, these three players are unified in their pursuit of artists’ interests and copyright protections. |

| | | |

| | • | Canal+ has a French premium channels business that is generating significant losses (high sports rights costs and an irrational competitor), but “everything is on the table” to reach break-even by Fiscal Year 2018, and this is just one piece of Canal+. Canal+ also owns CanalSat (France), which is nicely profitable, and ongoing profit growth is expected from StudioCanal and the Canal+ International PayTV businesses, where subscriptions grew 14% to 6.2 million in 2016. |

| | | |

| | • | Both businesses have difficult-to-replicate content libraries, are leaders in their respective industries, and offer growth potential. Neither business requires significant incremental fixed capital investment, and both are capable of attractive returns on capital employed. |

Valuation

| | • | Vivendi trades for less than 1.2 times adjusted enterprise value to sales. This compares to UMG segment operating margins of 13% (and rising), and Canal+ segment operating margins of 6% including the aforementioned losses with potential well into the double digits as those losses are reduced. |

| | • | If the Canal+ French premium channels business were break-even today, we believe Vivendi would be trading at less than 8 times adjusted enterprise value-to-trailing EBITDA. The losses distort near-term valuation metrics. As Vivendi makes progress toward break-even in Fiscal Year 2018, we note that our adjusted enterprise value to estimated Fiscal Year 2019 EBITDA is 7.4 times. |

| | | |

| | • | Our sum of the parts value for Vivendi exceeds €22, offering more than 20% upside at present. |

Management

| | • | Vivendi is actively chaired by Vincent Bollore, an astute capital allocator whose controlled-company owns 20% of Vivendi’s shares (and about 29% of the voting rights). |

| | | |

| | • | Vivendi has excess cash and securities and CEO Arnaud de Puyfontaine has placed some emphasis on returning capital to shareholders through buybacks and both regular and special dividends. |

Investment Thesis

Despite lingering investor bias against recorded music, the value of UMG’s content library and UMG’s growth outlook look more positive now than at any time in the last 15 years. While Canal+ Group has a loss-making French premium channels business, it also has a valuable content library in StudioCanal, and an attractive growing International PayTV business (especially throughout French-speaking Africa). Net cash and public investment stakes of about €7 billion provide balance sheet safety, strategic optionality, and return potential. We view the current valuation as providing adequate downside protection and attractive upside, should management achieve break-even at Canal+ French premium channel in Fiscal Year 2018.

Thank you for your support of the FMI International Fund.

This shareholder letter is unaudited.

FMI International Fund

SCHEDULE OF INVESTMENTS

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | | | | |

| LONG-TERM INVESTMENTS — 78.2% | | | | |

| COMMON STOCKS — 71.9% (a) | | | | |

| | |

COMMERCIAL SERVICES SECTOR — 8.5% | |

| | | Advertising/Marketing Services — 2.0% | | | | | | |

| | 6,792,000 | | WPP PLC (Jersey) (b) | | $ | 147,481,785 | | | $ | 148,874,062 | |

| | | | Miscellaneous Commercial Services — 3.5% | | | | | | | | |

| | 1,074,966 | | DKSH Holding AG (Switzerland) (b) | | | 68,415,594 | | | | 83,266,799 | |

| | 2,460,000 | | Secom Co. Ltd. (Japan) (b) | | | 171,376,897 | | | | 176,769,246 | |

| | | | | | | 239,792,491 | | | | 260,036,045 | |

| | | | Personnel Services — 3.0% | | | | | | | | |

| | 3,100,000 | | Adecco Group AG (Switzerland) (b) | | | 190,781,180 | | | | 220,113,673 | |

| | |

COMMUNICATIONS SECTOR — 3.4% | |

| | | | Wireless Telecommunications — 3.4% | | | | | | | | |

| | 1,796,300 | | Millicom International Cellular S.A. | | | | | | | | |

| | | | (Sweden) (b) | | | 91,055,568 | | | | 100,163,158 | |

| | 7,740,000 | | Vivendi S.A. (France) (b) | | | 147,569,568 | | | | 150,145,984 | |

| | | | | | | 238,625,136 | | | | 250,309,142 | |

| | |

CONSUMER DURABLES SECTOR — 8.3% | |

| | | | Electronics/Appliances — 2.6% | | | | | | | | |

| | 6,845,000 | | Electrolux AB – Series B (Sweden) (b) | | | 176,513,141 | | | | 190,029,705 | |

| | | | Motor Vehicles — 1.6% | | | | | | | | |

| | 9,063,000 | | Isuzu Motors Ltd. (Japan) (b) | | | 104,954,217 | | | | 120,033,003 | |

| | | | Other Consumer Specialties — 1.2% | | | | | | | | |

| | 24,335,000 | | Samsonite International S.A. | | | | | | | | |

| | | | (Luxembourg) (b) | | | 73,871,338 | | | | 88,649,942 | |

| | | | Tools & Hardware — 2.9% | | | | | | | | |

| | 5,990,000 | | Makita Corp. (Japan) (b) | | | 177,682,828 | | | | 210,079,914 | |

| | |

CONSUMER NON-DURABLES SECTOR — 10.7% | |

| | | | Food: Major Diversified — 2.0% | | | | | | | | |

| | 1,945,000 | | Nestle’ S.A. (Switzerland) (b) | | | 145,015,822 | | | | 149,282,194 | |

| | | | Household/Personal Care — 8.7% | | | | | | | | |

| | 1,896,000 | | Henkel AG & Co. KGaA (Germany) (b) | | | 186,820,720 | | | | 210,851,161 | |

| | 5,322,000 | | Svenska Cellulosa AB | | | | | | | | |

| | | | (SCA Group) (Sweden) (b) | | | 153,810,623 | | | | 171,508,370 | |

| | 5,295,000 | | Unilever PLC (Britain) (b) | | | 229,418,933 | | | | 261,187,261 | |

| | | | | | | 570,050,276 | | | | 643,546,792 | |

| | |

CONSUMER SERVICES SECTOR — 7.0% | |

| | | | Cable/Satellite TV — 1.6% | | | | | | | | |

| | 1,807,200 | | Liberty Global PLC (Britain)* | | | 41,079,373 | | | | 41,637,888 | |

| | 3,600,000 | | Shaw Communications Inc. (Canada) | | | 69,012,383 | | | | 74,633,981 | |

| | | | | | | 110,091,756 | | | | 116,271,869 | |

| | | | Casinos/Gaming — 1.1% | | | | | | | | |

| | 67,280,000 | | Genting Malaysia Berhad (Malaysia) (b) | | | 74,616,562 | | | | 82,842,698 | |

FMI International Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | |

| LONG-TERM INVESTMENTS — 78.2% (Continued) | |

| COMMON STOCKS — 71.9% (a) (Continued) | |

| | |

CONSUMER SERVICES SECTOR — 7.0% (Continued) | |

| | | Restaurants — 4.3% | | | | | | |

| | 5,175,000 | | Compass Group PLC (Britain) (b) | | $ | 86,337,636 | | | $ | 97,704,869 | |

| | 4,350,000 | | Whitbread PLC (Britain) (b) | | | 199,988,909 | | | | 215,844,864 | |

| | | | | | | 286,326,545 | | | | 313,549,733 | |

| | |

DISTRIBUTION SERVICES SECTOR — 3.3% | |

| | | | Wholesale Distributors — 3.3% | | | | | | | | |

| | 1,761,800 | | Travis Perkins PLC (Britain) (b) | | | 33,342,308 | | | | 33,423,003 | |

| | 3,311,000 | | Wolseley PLC (Jersey) (b) | | | 180,765,788 | | | | 208,465,065 | |

| | | | | | | 214,108,096 | | | | 241,888,068 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 5.8% | |

| | | | Aerospace & Defense — 3.1% | | | | | | | | |

| | 24,121,000 | | Rolls-Royce Holdings PLC (Britain)* (b) | | | 257,659,555 | | | | 227,872,053 | |

| | | | Electronic Components — 2.7% | | | | | | | | |

| | 2,688,000 | | TE Connectivity Ltd. (Switzerland) | | | 173,325,892 | | | | 200,390,400 | |

| | |

FINANCE SECTOR — 3.4% | |

| | | | Property/Casualty Insurance — 3.4% | | | | | | | | |

| | 2,410,000 | | Admiral Group PLC (Britain) (b) | | | 53,581,849 | | | | 60,049,688 | |

| | 412,000 | | Fairfax Financial Holdings Ltd. (Canada) | | | 205,879,935 | | | | 187,496,635 | |

| | | | | | | 259,461,784 | | | | 247,546,323 | |

| | |

INDUSTRIAL SERVICES SECTOR — 3.4% | |

| | | | Oilfield Services/Equipment — 3.4% | | | | | | | | |

| | 3,242,000 | | Schlumberger Ltd. (Curacao) | | | 261,404,879 | | | | 253,200,200 | |

| | |

PROCESS INDUSTRIES SECTOR — 3.0% | |

| | | | Chemicals: Agricultural — 3.0% | | | | | | | | |

| | 12,733,000 | | Potash Corp. of Saskatchewan Inc. (Canada) | | | 281,085,092 | | | | 217,479,640 | |

| | |

PRODUCER MANUFACTURING SECTOR — 6.6% | |

| | | | Industrial Conglomerates — 6.6% | | | | | | | | |

| | 5,170,000 | | Jardine Strategic Holdings Ltd. (Bermuda) (b) | | | 167,571,084 | | | | 217,192,072 | |

| | 13,055,000 | | Smiths Group PLC (Britain) (b) | | | 226,870,788 | | | | 265,256,876 | |

| | | | | | | 394,441,872 | | | | 482,448,948 | |

| | |

RETAIL TRADE SECTOR — 2.3% | |

| | | | Department Stores — 0.6% | | | | | | | | |

| | 2,978,592 | | Hyundai GreenFood Co. Ltd. | | | | | | | | |

| | | | (South Korea) (b) | | | 46,769,395 | | | | 41,699,856 | |

| | | | Specialty Stores — 1.7% | | | | | | | | |

| | 830,000 | | Dufry AG (Switzerland)* (b) | | | 102,027,759 | | | | 126,375,727 | |

| | |

TECHNOLOGY SERVICES SECTOR — 3.8% | |

| | | | Information Technology Services — 3.8% | | | | | | | | |

| | 2,334,000 | | Accenture PLC (Ireland) | | | 238,746,330 | | | | 279,799,920 | |

FMI International Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

| Shares | | | | Cost | | | Value | |

| | |

| LONG-TERM INVESTMENTS — 78.2% (Continued) | |

| COMMON STOCKS — 71.9% (a) (Continued) | |

| | |

TRANSPORTATION SECTOR — 2.4% | |

| | | Other Transportation — 2.4% | | | | | | |

| | 44,544,000 | | Bolloré (France) (b) | | $ | 189,303,199 | | | $ | 172,415,331 | |

| | 219,509 | | Bolloré S.A. (France)* (b) | | | 731,567 | | | | 835,300 | |

| | | | | | | 190,034,766 | | | | 173,250,631 | |

| | Total common stocks | | | 4,954,868,497 | | | | 5,285,570,538 | |

| | |

| PREFERRED STOCKS — 6.3% (a) | |

| | |

CONSUMER DURABLES SECTOR — 1.5% | |

| | | | Motor Vehicles — 1.5% | | | | | | | | |

| | 1,165,000 | | Hyundai Motor Co. (South Korea) (b) | | | 100,902,924 | | | | 107,868,698 | |

| | |

CONSUMER NON-DURABLES SECTOR — 1.9% | |

| | | | Household/Personal Care — 1.9% | | | | | | | | |

| | 473,552 | | Amorepacific Corp. (South Korea) (b) | | | 61,536,904 | | | | 70,721,659 | |

| | 160,000 | | LG Household & Health Care Ltd. | | | | | | | | |

| | | | (South Korea) (b) | | | 57,514,856 | | | | 72,993,488 | |

| | | | | | | 119,051,760 | | | | 143,715,147 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 2.9% | |

| | | | Telecommunications Equipment — 2.9% | | | | | | | | |

| | 149,000 | | Samsung Electronics Co. Ltd. | | | | | | | | |

| | | | (South Korea) (b) | | | 158,851,538 | | | | 213,426,144 | |

| | | | Total preferred stocks | | | 378,806,222 | | | | 465,009,989 | |

| | | | Total long-term investments | | | 5,333,674,719 | | | | 5,750,580,527 | |

FMI International Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2017 (Unaudited)

Principal Amount | | Cost | | | Value | |

| | | | | |

| SHORT-TERM INVESTMENTS — 22.0% (a) | | | | |

| | | Bank Deposit Account — 8.4% | | | | | | |

| $ | 615,960,230 | | U.S. Bank, N.A., 0.620% | | $ | 615,960,230 | | | $ | 615,960,230 | |

| | | | U.S. Treasury Securities — 13.6% | | | | | | | | |

| | 300,000,000 | | U.S. Treasury Bills, 0.557%, due 04/13/17^ | | | 299,935,000 | | | | 299,939,700 | |

| | 400,000,000 | | U.S. Treasury Bills, 0.619%, due 04/20/17^ | | | 399,874,389 | | | | 399,862,400 | |

| | 300,000,000 | | U.S. Treasury Bills, 0.649%, due 04/27/17^ | | | 299,841,833 | | | | 299,853,900 | |

| | | | Total U.S. treasury securities | | | 999,651,222 | | | | 999,656,000 | |

| | | | Total short-term investments | | | 1,615,611,452 | | | | 1,615,616,230 | |

| | | | Total investments — 100.2% | | $ | 6,949,286,171 | | | | 7,366,196,757 | |

| | | | Other assets, less liabilities — (0.2%) (a) | | | | | | | (11,173,575 | ) |