SEMIANNUAL REPORTMarch 31, 2019

| FMI Large Cap Fund | FMI Common Stock Fund | FMI International Fund |

| Investor Class (FMIHX) | Investor Class (FMIMX) | Investor Class (FMIJX) |

| Institutional Class (FMIQX) | Institutional Class (FMIUX) | Institutional Class (FMIYX) |

| | |

| |

| |

| |

| |

| |

| FMI Funds, Inc. |

| |

| Advised by Fiduciary Management, Inc. |

| www.fmifunds.com |

| |

| |

| | |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.fmifunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-811-5311.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-811-5311 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| Shareholder Letter | 1 |

| Schedule of Investments | 8 |

| Industry Sectors | 10 |

| | |

| FMI Common Stock Fund | |

| Shareholder Letter | 11 |

| Schedule of Investments | 18 |

| Industry Sectors | 20 |

| | |

| FMI International Fund | |

| Shareholder Letter | 21 |

| Schedule of Investments | 29 |

| Schedule of Forward Currency Contracts | 33 |

| Industry Sectors | 34 |

| | |

| Financial Statements | |

| Statements of Assets and Liabilities | 35 |

| Statements of Operations | 36 |

| Statements of Changes in Net Assets | 37 |

| Financial Highlights | 40 |

| Notes to Financial Statements | 46 |

| | |

| Additional Information | 56 |

| Expense Example | 57 |

| Advisory Agreements | 59 |

| Disclosure Information | 63 |

FMI

Large Cap

Fund

March 31, 2019

Dear Fellow Shareholders:

The FMI Large Cap Fund returned 10.68%1 in the March quarter compared to 13.65% for the Standard & Poor’s 500 Index. From a sector perspective, Producer Manufacturing, Process Industries and Retail Trade helped during the quarter, while Finance, Electronic Technology and Communications lagged. Masco, eBay and Schlumberger added to results and Berkshire Hathaway, CenturyLink and UnitedHealth Group hurt results. After strong relative performance but difficult absolute results in the December quarter, stocks roared ahead in calendar quarter one. Fears that Fed Chief Powell would be different than former chairs Yellen and Bernanke proved ill-placed. Investors have been treated to more candy, i.e. easy money, or in this case, additional delays in returning to “normal rate policy” after more than a decade of “emergency rate actions.” Stocks and most other financial assets rebounded dramatically from only moderately depressed fourth quarter levels, leaving valuations back near all-time highs. Market participants have learned not to bet against central banks, regardless of the underlying fundamentals. Investors, after a one-quarter respite, have returned to growth stocks, continuing a decade-long love affair they believe will never end. Since 1900 (using the Dow Jones Industrial Average), there have been 21 bull markets, and excluding the present one, the median duration was 2.6 years and the cumulative price gain was 94.2%. The current bull market is 10 years old and has gained 296% on the same basis. Oddly, fundamental growth over this period has been below-average. As value-oriented investors, we often modestly lag growth stock-fueled markets, and this bull market has been no different. The real measure of performance, however, comes after a full market cycle, which few see coming but history says is inevitable. Since 1900, there have been 21 bear markets, with a median duration of 1.43 years and a price return of -37.2%. As investors increasingly abandon risk-sensitive investments chasing growth and index products, we remain steadfast in our belief that in the end, fundamentals win – not momentum or popularity.

Unemployment and inflation rates are low. Personal and corporate income tax rates have been cut. Stocks are higher. What’s not to like about today’s environment? While we are gratified to be near the government’s definition of full employment, we wonder why so many people are not working. The Federal Reserve Bank of St. Louis reports that in February of 2019, the employed-to-population ratio was 60.7%, compared to 64.6% in February of 2000. The labor participation rate is significantly lower than a decade ago. Ten years past the last recession, the number of people on SNAP, the Supplemental Nutrition Assistance Program (“food stamps”), remains approximately 38 million, which is significantly higher than the last recession. Additionally, 10 million individuals are categorized as disabled (almost double from 20 years ago).

Despite a return to fiscal stimulus and a dramatic rise in the budget deficit, the data suggests the United States economy has slowed considerably in recent months, and many economies around the globe are experiencing the same thing. At the beginning of the year, the Blue Chip consensus for first quarter U.S. GDP growth was over 2%. The estimate is less than 1.5% as of late March, while the Atlanta Fed’s GDPNow forecast (as of 3/10/19) for the first calendar quarter had fallen to just

_______________

1 | The FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of 10.68% and 10.70%, respectively, for the first quarter of 2019. |

0.4%. The yield spread between the 3-Month Treasury Bill and the 10-Year Treasury Bond recently inverted, which is often a precursor to recession. The Organisation for Economic Co-operation and Development (OECD) world growth estimate for first quarter real GDP is now 3.3%, down from 3.6% last year. Germany and China’s economies have experienced notable weakening, with Germany’s GDP growth barely above recession levels. The German 10-year bond yield is negative as of March 26th. China’s growth is expected to slow to 6.2% from 6.5%, according to the World Bank. While Chinese data is notoriously unreliable (a recent Brookings Institute study suggests China’s economy is 12% smaller than the official figures), anecdotal information such as electricity usage, equipment orders, and the resumption of stimulative monetary and fiscal actions suggest significant slowing. Early this March, just three months after ending the long-term quantitative easing program, the European Central Bank said it would hold interest rates at subzero levels at least through the end of 2019 and provide capital [from where?] to boost bank lending. Does anyone ever stop to wonder why, after years of artificially low interest rates and extraordinarily accommodative fiscal policies, economic growth is not higher?

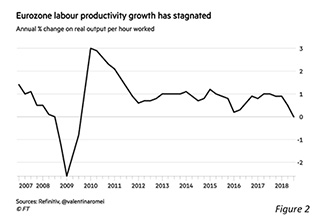

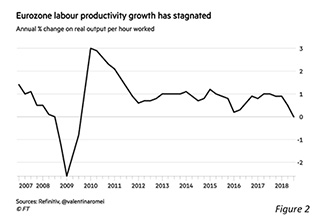

At some point, people will begin to understand that economic growth is a function of labor hours and productivity (Figure 1). With U.S. productivity growth, population growth, and labor hours growth relatively low from a historical perspective, it is not surprising that GDP growth has been significantly less than long-term averages. The Eurozone is in even tougher shape, as population growth and productivity growth are lower than in the United States, as the accompanying chart from the Financial Times attests (Figure 2).

In previous letters we have shown that over long periods of time, corporate sales and earnings growth essentially mirrors nominal GDP growth. Corporate performance is, in a sense, a proxy for GDP (most economic activity involves buying products and services from companies). Historically, growth in sales, earnings, and GDP has clustered around 5%, although recently it has been less than this. In March, The Leuthold Group published the sales and earnings growth of the S&P 500 from the 2007 cycle peak through March of 2019. The S&P 500 sales per share advanced at a 2.6% rate, and earnings per share grew at a 3.8% clip – both figures benefitting from strong stock repurchases. Most analysts find these figures shockingly low, especially juxtaposed to the earnings growth rates bandied about on CNBC or Bloomberg. The disconnect from the actual figures and “excellent earnings growth” one constantly hears from the media comes back to the phenomenon we have illuminated in recent missives: “adjusted earnings.” The massive write-offs at Kraft Heinz, General Electric, Teva and many others, along with the multitude of smaller, ever-recurring write-downs most companies are reporting, are really a true-up of formerly inflated earnings. And there is simply no explaining away 2.6% sales growth. We live in a slow-growth world, yet stocks seem to live on a different planet; in bull markets, realism is in short supply.

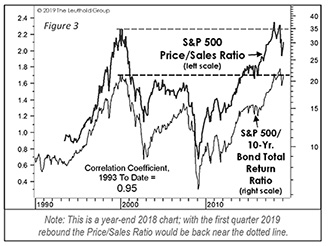

With equities advancing faster than underlying earnings, adjusted or otherwise, it leaves valuations back near historical highs (Figure 3). The late 2018 swoon was quickly wiped away by the “Powell

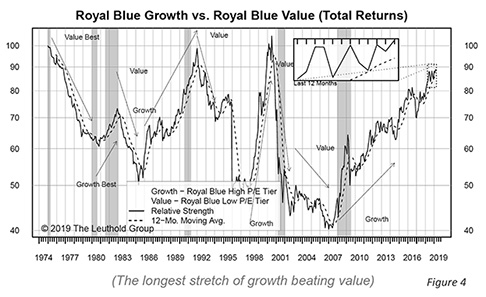

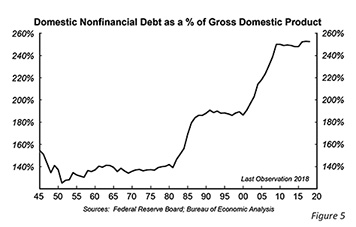

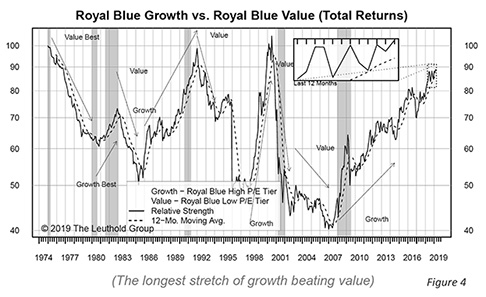

Put” further ingraining in investors’ minds that there is no real or lasting risk to owning financial assets. The length and magnitude of this stock market cycle seems to have dulled the senses of investors. They want the performance of growth stocks, or at least the index, regardless of the underlying fundamentals or valuations (Figure 4). Although Wall Street-adjusted earnings growth estimates (not to mention GAAP2 estimates) for the S&P 500 have slowed to zero or lower for the March quarter, it doesn’t seem to affect stock prices. Neither does a budget deficit again exceeding $1 trillion, federal debt surpassing $22 trillion, total debt-to-GDP of 250% (Figure 5), a venomous political climate, or a majority of young people – and even some high-profile politicians – favoring socialism over capitalism.

We are actually quite optimistic that the U.S. and the world will overcome most of the aforementioned negatives; there is a long history of problems being fixed. High valuations and the depth of some of the challenges, however, influence our opinion of what to expect out of stocks in the near-to-intermediate term, as well as the style that will win in the long run. Historically, value stocks have provided better protection on the downside, and have typically outperformed over a full market cycle; unless a hundred years of market history are no longer valid, we stand firm in this belief.

Before discussing a couple of investments that epitomize our approach, we’d like to take a moment to review the Fund’s sector weightings, with specific emphasis on areas we are avoiding.

_______________

2 | Generally Accepted Accounting Principles |

Since inception, the Fund has usually been underweight most technology-related sectors due to a few factors. First, the reward-to-risk ratio is not high enough; though there are periodic big winners in the Technology sector, there are also many losers. In portfolios where diversification doesn’t matter, one could let a winning stock overcome the bad ones; however, in professionally-managed portfolios or mutual funds, wherein there are either regulatory or self-imposed position size limits, the winning stock must usually be trimmed, mitigating some of the ability to cover the decliners. Next, when we study the return on invested capital (ROIC) for various Technology sectors, we don’t find the spread over the rest of the universe great enough to justify a large exposure. Finally, we are underweight Technology because the time required to stay on top of fast-moving and knowledge-intensive industries is tremendous; it is counterproductive to spend a disproportionate amount of time on something that won’t deliver a commensurate reward. So, in high-tech we tend to focus on service companies and downstream technology stocks, where the customer base is stickier and the information paper chase is less time-consuming.

The Utilities and the Energy sectors, specifically Exploration & Production (E&P), are two additional areas wherein we are perennially underweight. Even when multiples are cheap (which they are not), we generally find utilities unattractive. It is questionable whether most utility companies even earn their true cost of capital, but, being charitable, let’s just say that it is a very low return business; additionally, growth is almost non-existent or negative in many regions. Finally, utility companies are generally very levered businesses. The E&P space is also a low-returning sector over a full cycle. Discipline is in short supply, and illogical capital flows tend to ruin the economics of this business; E&P has wonderful “trading” moves from time to time, but it is a difficult place for long-term buy-and-hold type investors.

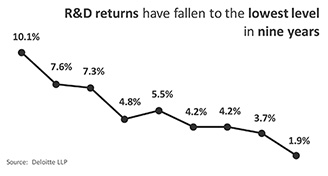

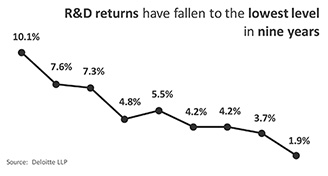

The last area where we have little exposure today is the “Big Pharma” sector. Since 2010, Deloitte has tracked the research and development (R&D) productivity for the top twelve global publicly-listed pharmaceutical companies: Amgen, AstraZeneca, Bristol-Myers Squibb, Eli Lilly, GlaxoSmithKline, Johnson & Johnson, Merck & Co., Novartis, Pfizer, Roche, Sanofi, and Takeda.3 R&D returns for the cohort have plunged, falling from 10.1% in 2010 to just 1.9% in 2018.

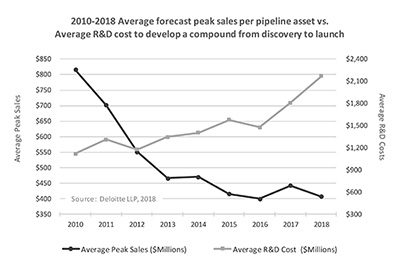

The reason that returns have deteriorated is twofold: costs are rising rapidly and forecast revenue is falling – a toxic combination. The cost to bring a compound to market has increased by over 80% the past eight years, from $1.188 billion in 2010 to $2.168 billion in 2018. At the same time, forecasted peak sales per compound have more than halved since 2010, falling from $816 million to $407 million. Even with record-low interest rates, it’s very difficult to make the case that Big Pharma has been earning its cost of capital in recent years. For years, Big Pharma has seen the writing on the wall and has opted to shoot their way out with expensive mergers and acquisitions (M&A). Informa Pharma Intelligence estimates that in 2018, biopharma M&A activity reached an astounding ~$265 billion, up 26% versus 2017. Takeda’s $64 billion acquisition of Shire led the charge. In early 2019, Bristol Myers Squibb announced a ~$95 billion acquisition of Celgene, in the largest pharmaceutical deal on record. While it might be easier to buy growth than to build it, acquisitions often fail to earn their cost of capital, especially at today’s lofty valuations.

Studying the long-term fundamentals of Big Pharma is instructive. For the cohort, total ROIC peaked at 29.8% in 2000. ROIC has since collapsed, averaging just 11.4% over the last five years, down by over 60%. To make matters worse, the 5-year average is overstated, as it fails to capture the tens of billions of dollars of impairments and write-downs that are ignored by Wall Street but help to inflate the ROIC calculation (i.e., lower invested capital, depreciation, and amortization in subsequent years). While some of our peers focus on relatively low “adjusted” price-to-earnings (P/E) multiples, we think the Big Pharma stocks are more expensive than they appear and the structural challenges are far deeper than commonly perceived.

_______________

3 | “Unlocking R&D productivity: Measuring the return from pharmaceutical innovation 2018.” Published electronically by Deloitte. |

The Fund typically does not have any major sectors that are always overweight. Today, some of our overweight contingent includes Producer Manufacturing, Industrial Services, Consumer Services, Consumer Non-Durables, Retail Trade and Process Industries. Our focus is on individual securities and the diversity that each company brings in terms of sales, earnings and geographic exposure. We strive for broadly diversified portfolios and often address industries through downstream exposure. For example, we get energy exposure by owning Schlumberger, who provides the proverbial picks and shovels to the energy producers. We get health care exposure by owning UnitedHealth Group, Cerner, Smith & Nephew, and Quest Diagnostics, which is a combination of claims management, insurance, service provider, software, product manufacturer and lab services. Our utility exposure is through the utilities owned within Berkshire Hathaway.

Today, the Fund is positioned relatively defensively. In the difficult fourth quarter of 2018, the Fund outperformed, and that has historically been the pattern in difficult markets. In the current environment we remain cautious and are prudently deploying capital to deliver both good absolute and risk-adjusted returns.

Below we highlight two Fund investments.

Fox Corp. (FOX/FOXA)

(Analyst: Dan Sievers)

Description

Following the sale of certain Twenty-First Century Fox assets to Disney, Fox Corp. is almost wholly focused on U.S. news and sports content that will continue to be watched live, unlike scripted comedies and dramas, which are increasingly watched “on-demand.” Fox will be organized into three primary operating segments: Television (Fox Broadcast Network + 28 owned and operated television stations), Cable News (Fox News + Fox Business), and Cable Sports (Fox Sports 1 & 2, and 51% of Big 10 Network). Fox’s three segments are a portfolio of networks for which carriage is collectively negotiated and contracted. For fiscal year 2019, Morgan Stanley estimates the following segment contributions: Television (51% of revenues), Cable News (28%), and Cable Sports (21%). Revenues will be comprised of 49% monthly fees (affiliate fees, retransmission fees, reverse-retransmission fees), 45% advertising, and 6% other.

Good Business

| | • | Fox is focused on U.S. news and sports, which will continue to be viewed live. |

| | | |

| | • | 49% of Fox revenues (and a higher percentage of profits) are generated by monthly fees from multi-year contracts with annual escalators that add some visibility to growth. |

| | | |

| | • | Fox News is both a cash cow and growth engine (Morgan Stanley and UBS expect a 6% and 9% compound annual growth rate, respectively, for revenue and profit growth) and functions as a strategic centerpiece: Fox News is too valuable for a pay TV operator to attempt to drop any Fox channels. Cable News is expected to generate a segment margin of 67% in the 2019 fiscal year. |

| | | |

| | • | While the Fox Broadcast network and its stations will remain important strategic portfolio assets, the combination is generating just a ~7% margin, which we think can increase with further gains in retransmission and reverse retransmission fees. Similarly, the Cable Sports segment is generating an 18% segment margin, which may increase as recent step-ups in sports content volumes have temporarily weighed on margins. The Cable Sports segment is expected to grow around 7%-8% over the foreseeable future. |

| | | |

| | • | The company’s balance sheet is sound; we expect net debt-to-EBITDA4 to be 1.6 times -1.9 times at fiscal year-end (June 30, 2019). |

| | | |

| | • | Fox will have limited capital requirements and likely a very high return on tangible assets. |

_______________

4 | Earnings before interest, taxes, depreciation and amortization. |

| | • | The estimated net present value of the Disney deal’s tax savings is $2.6 billion; other assets comprise Fox Studio Land (>$1 billion), 12% of Draft Kings ($65 million), Caffeine ($100 million) and Other Unconsolidated Assets ($300 million). |

Valuation

| | • | Fox currently trades at approximately 13.5 times fiscal 2020 estimates. GAAP earnings will be affected by the accounting treatment related to the Disney deal. We expect economic earnings to grow at a double-digit rate over the next several years. |

| | | |

| | • | Our best estimate of the sum-of-the-parts value for Fox is over 20% higher than the current stock price. Fox will have a variety of minority and non-earning assets that it may monetize (e.g., Fox Studio Land, Roku shares, and Draft Kings shares). |

Management

| | • | The Murdoch family presently controls nearly 40% of the voting interest in FOX. Lachlan Murdoch (47) will be CEO, although we expect Rupert, Lachlan and James Murdoch all to be involved in the company. |

| | | |

| | • | The Murdochs must be given credit for fully monetizing much of the value they created in Twenty-First Century Fox’s general entertainment and international assets. That said, we regard capital allocation as among the biggest risks at Fox. While copious free cash flow will go towards reinvestment, a small dividend, and share repurchases, we expect some modest M&A activity. |

Investment Thesis

The Murdoch clan can certainly be mercurial at times, but they should be given credit for creating and realizing value for outside shareholders at Twenty-First Century Fox. They have rebooted Fox Corp. as an enterprise focused on news and sports franchises, where live viewing is preferred. The market remains concerned about dependence on pay TV packages, but we believe this risk is manageable. The business should generate excellent cash flow growth in the coming years, and with a solid balance sheet and a low valuation, we think the reward-to-risk ratio is attractive.

PPG Industries Inc. (PPG)

(Analyst: Andy Ramer)

Description

PPG is one of the largest manufacturers of paints and coatings in the world, with sales of more than $15 billion. The company has a diversified portfolio of products across consumer and industrial end markets and two reportable business segments: Performance Coatings (59% of sales and 57% of earnings before interest and taxes [EBIT]), and Industrial Coatings (41% and 43%). Sales by subsegment break down as: Performance Coatings, which include Architectural Coatings (35%), Automotive Refinishing (11%), Aerospace (8%), and Protective & Marine (5%). Industrial Coatings comprise: Automotive OEM (17%), Industrial (15%), Packaging (5%), and Specialty Coatings & Materials (4%). The U.S. accounts for 40% of sales.

Good Business

| | • | PPG holds a top three global share in all major paints and coatings end markets. The intensifying technical specifications and performance qualifications of customers is benefiting large sophisticated companies like PPG. Industry consolidation is leading to an R&D critical mass that few can replicate. |

| | | |

| | • | The products are used by customers to protect their assets from corrosion (thus extending useful lives) and for aesthetic and functional purposes, such as managing reflection and absorption of various light wavelengths. |

| | | |

| | • | The industry has pricing power. Prices have generally kept up with cost inflation (albeit with a lag) and remain resilient in periods of cost deflation, thereby improving margins. |

| | | The cost of the product is typically small compared to either the labor or capital costs of the customer’s application process, but the product is critical to end customer satisfaction. |

| | | |

| | • | PPG generates half of its sales from the aftermarket (maintenance), which typically helps to provide some earnings and cash flow stability throughout the cycle. Almost everything gets painted. |

| | | |

| | • | The ROIC is in the mid-teens. Write-offs over the last decade have been de minimis. |

| | | |

| | • | PPG is focused on what is in its control, like costs and new product introductions, irrespective of the economic backdrop. The business is capital-light and labor-intensive, the supply chain is relatively short since paint is heavy to ship, and the company employs a batch manufacturing process, thus making it easier for PPG to react to business cycles. |

| | | |

| | • | This is an understandable business. |

| | | |

| | • | The company has an industry-leading balance sheet with a leverage ratio of 1.6 times and a solid investment-grade credit rating. Free cash flow is typically equal to, or greater than, net income. |

Valuation

| | • | Shares of PPG have underperformed the market for some time, as the company has been challenged by higher raw materials costs and mixed sales growth. |

| | | |

| | • | At the current share price, the stock is being valued at an enterprise value-to-last 12 months sales multiple of 1.9, which puts PPG at below its 5-year average of 2.0. |

| | | |

| | • | The P/E multiples on 2019 and 2020 estimates are 17.0 and 15.2, respectively. The enterprise value-to 2019 estimated EBIT multiple is equivalent to 12.6, on a tax-adjusted basis. |

Management

| | • | Michael McGarry has been CEO since September 2015, and Chairman since September 2016. He has been characterized as a strong operator who is focused on accelerating profitable organic volume growth through innovation. Vincent Morales has been CFO since March 2017. |

| | | |

| | • | Compensation for executive officers is tied in part to the company achieving a 12% cash flow return on capital. |

| | | |

| | • | With record levels of stock buy backs in the past three quarters, the year-end 2018 share count is expected to be down by approximately 10% from the time when PPG abandoned its bid for AkzoNobel. |

| | | |

| | • | Trian Partners announced its investment in PPG in October 2018. The prominent activist investor owned 4.1 million shares as of September 30, 2018, stating: “Coatings is one of the most attractive sub-segments within chemicals on account of its $140 billion addressable market, rapidly consolidating industry landscape, resilient margins and highly value-add product lines.” |

Investment Thesis

The investment case for PPG is predicated upon margin recovery through price increases, stabilization of raw material prices, renewed organic volume growth, and effective deployment of capital. If the company can deliver on these and return to earnings per share growth of at least 10%, investors will likely re-rate the stock. A recession or poor automotive cycle will temporarily hurt the story, and those fears are currently affecting the multiple. Trian will not challenge PPG’s board of directors at its 2019 shareholder meeting after the company met some of the activist’s demands, which include an exploration into separating architectural from industrial coatings, de-staggering the board, and removing supermajority voting.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2019 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 92.4% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 2.6% | | | | | | |

| | | Advertising/Marketing Services — 2.6% | | | | | | |

| | 1,860,000 | | Omnicom Group Inc. | | $ | 125,349,011 | | | $ | 135,761,400 | |

| | | | | | | | | |

COMMUNICATIONS SECTOR — 1.6% | | | | | | | | |

| | | | Specialty Telecommunications — 1.6% | | | | | | | | |

| | 6,730,000 | | CenturyLink Inc. | | | 132,434,340 | | | | 80,692,700 | |

| | | | | | | | | |

CONSUMER DURABLES SECTOR — 2.9% | | | | | | | | |

| | | | Tools & Hardware — 2.9% | | | | | | | | |

| | 1,095,000 | | Stanley Black & Decker Inc. | | | 106,646,597 | | | | 149,106,150 | |

| | | | | | | | | |

CONSUMER NON-DURABLES SECTOR — 10.3% | | | | | | | | |

| | | | Beverages: Non-Alcoholic — 3.5% | | | | | | | | |

| | 1,455,000 | | PepsiCo Inc. | | | 146,874,516 | | | | 178,310,250 | |

| | | | | | | | | | | | |

| | | | Food: Major Diversified — 3.5% | | | | | | | | |

| | 1,890,000 | | Nestlé S.A. — SP-ADR | | | 88,816,624 | | | | 180,154,800 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 3.3% | | | | | | | | |

| | 2,925,000 | | Unilever PLC — SP-ADR | | | 127,575,366 | | | | 168,831,000 | |

| | | | | | | | | |

CONSUMER SERVICES SECTOR — 6.1% | | | | | | | | |

| | | | Broadcasting — 2.4% | | | | | | | | |

| | 1,550,000 | | Fox Corp. — Cl A* | | | 62,268,615 | | | | 56,900,500 | |

| | 1,858,333 | | Fox Corp. — Cl B* | | | 43,563,973 | | | | 66,676,993 | |

| | | | | | | 105,832,588 | | | | 123,577,493 | |

| | | | Other Consumer Services — 3.7% | | | | | | | | |

| | 5,165,000 | | eBay Inc. | | | 106,389,207 | | | | 191,828,100 | |

| | | | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 2.1% | | | | | | | | |

| | | | Electronic Components — 2.1% | | | | | | | | |

| | 1,325,000 | | TE Connectivity Ltd. | | | 35,123,994 | | | | 106,993,750 | |

| | | | | | | | | |

FINANCE SECTOR — 15.5% | | | | | | | | |

| | | | Investment Managers — 1.2% | | | | | | | | |

| | 1,930,000 | | Franklin Resources Inc. | | | 62,018,367 | | | | 63,960,200 | |

| | | | | | | | | | | | |

| | | | Major Banks — 6.5% | | | | | | | | |

| | 2,900,000 | | Bank of New York Mellon Corp. | | | 58,571,246 | | | | 146,247,000 | |

| | 1,870,000 | | JPMorgan Chase & Co. | | | 119,946,365 | | | | 189,300,100 | |

| | | | | | | 178,517,611 | | | | 335,547,100 | |

| | | | Multi-Line Insurance — 5.0% | | | | | | | | |

| | 1,285,000 | | Berkshire Hathaway Inc. — Cl B* | | | 75,685,324 | | | | 258,143,650 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 2.8% | | | | | | | | |

| | 1,040,000 | | Chubb Ltd. | | | 139,835,797 | | | | 145,683,200 | |

| | | | | | | | | |

HEALTH SERVICES SECTOR — 7.5% | | | | | | | | |

| | | | Health Industry Services — 3.1% | | | | | | | | |

| | 1,770,000 | | Quest Diagnostics Inc. | | | 176,590,417 | | | | 159,158,400 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2019 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 92.4% (a) (Continued) | | | | | | |

| | | | | | | |

HEALTH SERVICES SECTOR — 7.5% (Continued) | | | | | | |

| | | Managed Health Care — 4.4% | | | | | | |

| | 915,000 | | UnitedHealth Group Inc. | | $ | 65,408,101 | | | $ | 226,242,900 | |

| | | | | | | | | |

HEALTH TECHNOLOGY SECTOR — 2.7% | | | | | | | | |

| | | | Medical Specialties — 2.7% | | | | | | | | |

| | 3,510,000 | | Smith & Nephew PLC — SP-ADR | | | 130,172,316 | | | | 140,786,100 | |

| | | | | | | | | |

INDUSTRIAL SERVICES SECTOR — 2.6% | | | | | | | | |

| | | | Oilfield Services/Equipment — 2.6% | | | | | | | | |

| | 3,055,000 | | Schlumberger Ltd. | | | 169,923,491 | | | | 133,106,350 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 5.0% | | | | | | | | |

| | | | Chemicals: Agricultural — 2.7% | | | | | | | | |

| | 2,650,000 | | Nutrien Ltd. | | | 107,477,565 | | | | 139,814,000 | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 2.3% | | | | | | | | |

| | 1,060,000 | | PPG Industries Inc. | | | 108,729,116 | | | | 119,642,200 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 10.7% | | | | | | | | |

| | | | Building Products — 3.9% | | | | | | | | |

| | 5,165,000 | | Masco Corp. | | | 185,816,365 | | | | 203,036,150 | |

| | | | | | | | | | | | |

| | | | Industrial Conglomerates — 4.5% | | | | | | | | |

| | 1,475,000 | | Honeywell International Inc. | | | 132,866,976 | | | | 234,407,000 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 2.3% | | | | | | | | |

| | 1,715,000 | | PACCAR Inc. | | | 69,004,635 | | | | 116,860,100 | |

| | | | | | | | | |

RETAIL TRADE SECTOR — 10.8% | | | | | | | | |

| | | | Apparel/Footwear Retail — 3.2% | | | | | | | | |

| | 3,125,000 | | The TJX Companies Inc. | | | 107,380,293 | | | | 166,281,250 | |

| | | | | | | | | | | | |

| | | | Discount Stores — 7.6% | | | | | | | | |

| | 1,700,000 | | Dollar General Corp. | | | 123,671,959 | | | | 202,810,000 | |

| | 1,830,000 | | Dollar Tree Inc.* | | | 165,643,321 | | | | 192,223,200 | |

| | | | | | | 289,315,280 | | | | 395,033,200 | |

TECHNOLOGY SERVICES SECTOR — 9.1% | | | | | | | | |

| | | | Information Technology Services — 6.7% | | | | | | | | |

| | 1,085,000 | | Accenture PLC | | | 31,200,058 | | | | 190,981,700 | |

| | 2,720,000 | | Cerner Corp.* | | | 142,015,413 | | | | 155,611,200 | |

| | | | | | | 173,215,471 | | | | 346,592,900 | |

| | | | Packaged Software — 2.4% | | | | | | | | |

| | 2,290,000 | | Oracle Corp. | | | 88,820,163 | | | | 122,995,900 | |

| | | | | | | | | |

TRANSPORTATION SECTOR — 2.9% | | | | | | | | |

| | | | Air Freight/Couriers — 2.9% | | | | | | | | |

| | 1,980,000 | | Expeditors International of Washington Inc. | | | 73,133,994 | | | | 150,282,000 | |

| | | | Total common stocks | | | 3,308,953,525 | | | | 4,772,828,243 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2019 (Unaudited)

| Principal Amount | | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 7.6% (a) | | | | | | |

| | | Bank Deposit Account — 7.6% | | | | | | |

| $ | 391,706,122 | | U.S. Bank N.A., 2.38%^ | | $ | 391,706,122 | | | $ | 391,706,122 | |

| | | | Total short-term investments | | | 391,706,122 | | | | 391,706,122 | |

| | | | Total investments — 100.0% | | $ | 3,700,659,647 | | | | 5,164,534,365 | |

| | | | Other assets, less liabilities — 0.0% (a) | | | | | | | 2,345,348 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 5,166,879,713 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of March 31, 2019. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

INDUSTRY SECTORS

as of March 31, 2019 (Unaudited)

FMI

Common Stock

Fund

March 31, 2019

Dear Fellow Shareholders:

The FMI Common Stock Fund returned 15.12%1 in the March quarter compared to 14.58% for the Russell 2000 Index. From a sector perspective, Producer Manufacturing, Finance and Commercial Services helped during the quarter, while Technology Services, Health Technology and Consumer Services lagged. Armstrong World Industries, Ryder System and Woodward added to results while Interpublic Group, MSC Industrial Direct and Cars.com were also positive contributors, but underperformed in relative terms. After strong relative performance but difficult absolute results in the December quarter, stocks roared ahead in calendar quarter one. Fears that Fed Chief Powell would be different than former chairs Yellen and Bernanke proved ill-placed. Investors have been treated to more candy, i.e. easy money, or in this case, additional delays in returning to “normal rate policy” after more than a decade of “emergency rate actions.” Stocks and most other financial assets rebounded dramatically from only moderately depressed fourth quarter levels, leaving valuations back near all-time highs. Market participants have learned not to bet against central banks, regardless of the underlying fundamentals. Investors, after a one-quarter respite, have returned to growth stocks, continuing a decade-long love affair they believe will never end. Since 1900 (using the Dow Jones Industrial Average), there have been 21 bull markets, and excluding the present one, the median duration was 2.6 years and the cumulative price gain was 94.2%. The current bull market is 10 years old and has gained 296% on the same basis. Oddly, fundamental growth over this period has been below-average. As value-oriented investors, we often modestly lag growth stock-fueled markets, and this bull market has been no different. The real measure of performance, however, comes after a full market cycle, which few see coming but history says is inevitable. Since 1900, there have been 21 bear markets, with a median duration of 1.43 years and a price return of -37.2%. As investors increasingly abandon risk-sensitive investments chasing growth and index products, we remain steadfast in our belief that in the end, fundamentals win – not momentum or popularity.

Unemployment and inflation rates are low. Personal and corporate income tax rates have been cut. Stocks are higher. What’s not to like about today’s environment? While we are gratified to be near the government’s definition of full employment, we wonder why so many people are not working. The Federal Reserve Bank of St. Louis reports that in February of 2019, the employed-to-population ratio was 60.7%, compared to 64.6% in February of 2000. The labor participation rate is significantly lower than a decade ago. Ten years past the last recession, the number of people on SNAP, the Supplemental Nutrition Assistance Program (“food stamps”), remains approximately 38 million, which is significantly higher than the last recession. Additionally, 10 million individuals are categorized as disabled (almost double from 20 years ago).

Despite a return to fiscal stimulus and a dramatic rise in the budget deficit, the data suggests the United States economy has slowed considerably in recent months, and many economies around the globe are experiencing the same thing. At the beginning of the year, the Blue Chip consensus for first quarter U.S. GDP growth was over 2%. The estimate is less than 1.5% as of late March, while the Atlanta Fed’s GDPNow forecast (as of 3/10/19) for the first calendar quarter had fallen to just

_______________

1 | The FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) had a return of 15.12% and 15.16%, respectively, for the first quarter of 2019. |

0.4%. The yield spread between the 3-Month Treasury Bill and the 10-Year Treasury Bond recently inverted, which is often a precursor to recession. The Organisation for Economic Co-operation and Development (OECD) world growth estimate for first quarter real GDP is now 3.3%, down from 3.6% last year. Germany and China’s economies have experienced notable weakening, with Germany’s GDP growth barely above recession levels. The German 10-year bond yield is negative as of March 26th. China’s growth is expected to slow to 6.2% from 6.5%, according to the World Bank. While Chinese data is notoriously unreliable (a recent Brookings Institute study suggests China’s economy is 12% smaller than the official figures), anecdotal information such as electricity usage, equipment orders, and the resumption of stimulative monetary and fiscal actions suggest significant slowing. Early this March, just three months after ending the long-term quantitative easing program, the European Central Bank said it would hold interest rates at subzero levels at least through the end of 2019 and provide capital [from where?] to boost bank lending. Does anyone ever stop to wonder why, after years of artificially low interest rates and extraordinarily accommodative fiscal policies, economic growth is not higher?

At some point, people will begin to understand that economic growth is a function of labor hours and productivity (Figure 1). With U.S. productivity growth, population growth, and labor hours growth relatively low from a historical perspective, it is not surprising that GDP growth has been significantly less than long-term averages. The Eurozone is in even tougher shape, as population growth and productivity growth are lower than in the United States, as the accompanying chart from the Financial Times attests (Figure 2).

In previous letters we have shown that over long periods of time, corporate sales and earnings growth essentially mirrors nominal GDP growth. Corporate performance is, in a sense, a proxy for GDP (most economic activity involves buying products and services from companies). Historically, growth in sales, earnings, and GDP has clustered around 5%, although recently it has been less than this. In March, The Leuthold Group published the sales and earnings growth of the Standard & Poor’s 500 Index from the 2007 cycle peak through March of 2019. The S&P 500 sales per share advanced at a 2.6% rate, and earnings per share grew at a 3.8% clip – both figures benefitting from strong stock repurchases. Most analysts find these figures shockingly low, especially juxtaposed to the earnings growth rates bandied about on CNBC or Bloomberg. The disconnect from the actual figures and “excellent earnings growth” one constantly hears from the media comes back to the phenomenon we have illuminated in recent missives: “adjusted earnings.” The massive write-offs at Kraft Heinz, General Electric, Teva and many others, along with the multitude of smaller, ever-recurring write-downs most companies are reporting, are really a true-up of formerly inflated earnings. And there is simply no explaining away 2.6% sales growth. We live in a slow-growth world, yet stocks seem to live on a different planet; in bull markets, realism is in short supply.

With equities advancing faster than underlying earnings, adjusted or otherwise, it leaves valuations back near historical highs (Figure 3). The late 2018 swoon was quickly wiped away by the “Powell

Put” further ingraining in investors’ minds that there is no real or lasting risk to owning financial assets. The length and magnitude of this stock market cycle seems to have dulled the senses of investors. They want the performance of growth stocks, or at least the index, regardless of the underlying fundamentals or valuations (Figure 4). Although Wall Street-adjusted earnings growth estimates (not to mention GAAP2 estimates) for the S&P 500 have slowed to zero or lower for the March quarter, it doesn’t seem to affect stock prices. Neither does a budget deficit again exceeding $1 trillion, federal debt surpassing $22 trillion, total debt-to-GDP of 250% (Figure 5), a venomous political climate, or a majority of young people – and even some high-profile politicians – favoring socialism over capitalism.

We are actually quite optimistic that the U.S. and the world will overcome most of the aforementioned negatives; there is a long history of problems being fixed. High valuations and the depth of some of the challenges, however, influence our opinion of what to expect out of stocks in the near-to-intermediate term, as well as the style that will win in the long run. Historically, value stocks have provided better protection on the downside, and have typically outperformed over a full market cycle; unless a hundred years of market history are no longer valid, we stand firm in this belief.

Before discussing a couple of investments that epitomize our approach, we’d like to take a moment to review the Fund’s sector weightings, with specific emphasis on areas we are avoiding.

_______________

2 | Generally Accepted Accounting Principles |

Since inception, the Fund has usually been underweight most technology-related sectors due to a few factors. First, the reward-to-risk ratio is not high enough; though there are periodic big winners in the Technology sector, there are also many losers. In portfolios where diversification doesn’t matter, one could let a winning stock overcome the bad ones; however, in professionally-managed portfolios or mutual funds, wherein there are either regulatory or self-imposed position size limits, the winning stock must usually be trimmed, mitigating some of the ability to cover the decliners. Next, when we study the return on invested capital (ROIC) for various Technology sectors, we don’t find the spread over the rest of the universe great enough to justify a large exposure. Finally, we are underweight Technology because the time required to stay on top of fast-moving and knowledge-intensive industries is tremendous; it is counterproductive to spend a disproportionate amount of time on something that won’t deliver a commensurate reward. So, in high-tech we tend to focus on service companies and downstream technology stocks, where the customer base is stickier and the information paper chase is less time-consuming.

The Utilities and the Energy sectors, specifically Exploration & Production (E&P), are two additional areas wherein we are perennially underweight. Even when multiples are cheap (which they are not), we generally find utilities unattractive. It is questionable whether most utility companies even earn their true cost of capital, but, being charitable, let’s just say that it is a very low return business; additionally, growth is almost non-existent or negative in many regions. Finally, utility companies are generally very levered businesses. The E&P space is also a low-returning sector over a full cycle. Discipline is in short supply, and illogical capital flows tend to ruin the economics of this business; E&P has wonderful “trading” moves from time to time, but it is a difficult place for long-term buy-and-hold type investors.

The last area where we have little exposure today is in Pharmaceuticals and Biotechnology. Since 2010, Deloitte has tracked the research and development (R&D) productivity for the top twelve global publicly-listed pharmaceutical companies: Amgen, AstraZeneca, Bristol-Myers Squibb, Eli Lilly, GlaxoSmithKline, Johnson & Johnson, Merck & Co., Novartis, Pfizer, Roche, Sanofi, and Takeda.3 R&D returns for the cohort have plunged, falling from 10.1% in 2010 to just 1.9% in 2018. The smaller cap biotechnology arena is even more bleak as the vast majority of companies lose money.

The reason that pharmaceutical investment returns have deteriorated is twofold: costs are rising rapidly and forecast revenue is falling – a toxic combination. The cost to bring a compound to market has increased by over 80% the past eight years, from $1.188 billion in 2010 to $2.168 billion in 2018. At the same time, forecasted peak sales per compound have more than halved since 2010, falling from $816 million to $407 million. Even with record-low interest rates, it’s very difficult to make the case that pharmaceutical companies have been earning the cost of incremental capital deployed. For years, the bigger pharmaceutical companies have seen the writing on the wall and have opted to shoot their way out with expensive mergers and acquisitions (M&A). Informa Pharma Intelligence estimates that in 2018, biopharma M&A activity reached an astounding ~$265 billion, up 26% versus 2017. Takeda’s $64 billion acquisition of Shire led the charge. In early 2019, Bristol Myers Squibb announced a ~$95 billion acquisition of Celgene, in the largest pharmaceutical deal on record. While it might be easier to buy growth than to build it, acquisitions often fail to earn their cost of capital, especially at today’s lofty valuations. Trying to pick the next lottery ticket for a takeout is not our bailiwick.

Studying the long-term fundamentals of the largest pharmaceutical companies is instructive. For the cohort, total ROIC peaked at 29.8% in 2000. ROIC has since collapsed, averaging just 11.4% over the last 5 years, down by over 60%. To make matters worse, the 5-year average is overstated, as it fails to capture the tens of billions of dollars of impairments and write-downs that are ignored by Wall Street but help to inflate the ROIC calculation (i.e., lower invested capital, depreciation, and amortization in subsequent years). We think the structural challenges are far deeper than commonly perceived.

_______________

3 | “Unlocking R&D productivity: Measuring the return from pharmaceutical innovation 2018.” Published electronically by Deloitte. |

The Fund typically does not have any major sectors that are always overweight. Today, some of our overweight contingent includes Producer Manufacturing, Commercial Services, Process Industries and Distribution Services. Our focus is on individual securities and the diversity each company brings in terms of sales, earnings and geographic exposure. We strive for broadly diversified portfolios but not at the expense of participating in overvalued segments.

Today, the Fund is positioned relatively defensively. In the difficult fourth quarter of 2018, the Fund outperformed, and that has historically been the pattern in difficult markets. In the current environment we remain cautious and are prudently deploying capital to deliver both good absolute and risk-adjusted returns.

Below we highlight two Fund investments.

Genpact Ltd. (G)

(Analyst: Jordan Teschendorf)

Business Description:

Genpact is a global leader in business process outsourcing (BPO) and information technology outsourcing (ITO) services; in 2017, BPO contributed 84% of sales, and ITO, 16%. The company executes its strategy according to its proprietary Smart Enterprise Processes (SEP) and Lean Digital frameworks. Genpact was spun off from General Electric (GE) in 2007 and continues to operate with an intense focus on Lean and Six Sigma business streamlining methodologies. The company has broad exposure across a number of industry verticals, employs over 77,000 professionals around the globe, delivers services to more than 700 clients from a network of more than 70 delivery centers, and competes in 16 countries, while supporting more than 30 languages.

Good Business:

| | • | Genpact derives a majority of its revenues from Fortune 1000 companies. |

| | | |

| | • | The company believes that more than 80% of its revenues can be considered recurring in nature, with average deal length around three years and annual client retention in the high-90% range. |

| | | |

| | • | Over the trailing 3, 5, and 10-year periods, Genpact’s organic growth has averaged 7%, 7%, and 9%, respectively. The company expects growth to be approximately 10% over the next several years, with two thirds of sales growth expected to come from existing clients. |

| | | |

| | • | Genpact’s solutions provide customers with a tangible return on investment and the company is gaining share in a secularly growing BPO market. We think the addressable market opportunity is approximately $500 billion, which is expected to grow 20% by the end of 2021. |

| | | |

| | • | Over the trailing 5 and 10-year periods, the company’s ROIC has averaged approximately 12%, which exceeds its cost of capital. |

| | | |

| | • | Genpact carries a prudent amount of debt. Its net debt-to-EBITDA4 and interest coverage ratios are 1.9 times and 6.5 times, respectively. |

Valuation:

| | • | The stock has underperformed the S&P 500 by 13% over the last 3 years, despite generating superior growth. |

| | | |

| | • | Genpact’s forward price-to-earnings multiple is 16.8 times, which is consistent with its trailing 5 and 10-year averages of 16.7 times, and a substantial discount to both the Russell 2000 and S&P 500 indices. |

| | | |

| | • | Consistently declining customer concentration (e.g., GE accounted for 9% of sales in 2018 compared to 20% in 2014 and 30% in 2011) and our expectation for accelerating organic growth and margin expansion over the next several years supports a valuation multiple above the company’s historical average. |

_______________

4 | Earnings before interest, tax, depreciation and amortization. |

Management:

| | • | Current CEO, N.V. “Tiger” Tyagarajan (57) has led the company since June 2011. He is considered a pioneer of the BPO industry and has a deep knowledge of Lean and Six Sigma. Mr. Tyagarajan beneficially owned 2.373 million shares as of the latest proxy filing (April 2018). |

| | | |

| | • | Bain Capital has approximately $1.1 billion invested in the company, which represents 17% of the outstanding shares. Further, representatives of Bain occupy two seats on Genpact’s board of directors. We believe this significant ownership interest will help to drive future shareholder value creation. |

Investment Thesis:

Over the last several years, areas within Genpact’s legacy information technology (IT) service and GE business lines have been a drag on the company’s top-line and earnings growth. Concurrently, management has invested significantly in the BPO franchise to add vertical expertise, enhance its brand image, and accelerate future top-line growth and margin potential. As a result, Genpact is increasingly being viewed as a partner in revenue generation rather than solely a provider of cost arbitrage. As these investments continue to mature and the headwinds abate, we see above-average return potential with a below-average risk profile driven by Genpact’s relatively high-growth business, with a sticky customer base and strong balance sheet.

Ryder System Inc. (R)

(Analyst: Jordan Teschendorf)

Business Description:

Ryder System Inc., a Florida corporation founded in 1933, is a global leader in transportation and supply chain management solutions. Ryder generated $8.4 billion of revenue in 2018 and its business is divided into three operating segments. Fleet Management Solutions (FMS) contributed 62% of 2017 earnings before tax (EBT), and provides full service leasing, contract maintenance, contract-related maintenance, and commercial rental of trucks, tractors and trailers to over 14,000 customers in a diverse set of industries in North America. Supply Chain Solutions (SCS), with 26% of 2017 EBT, provides comprehensive supply chain solutions including distribution, transportation, and IT solutions to over 500 customers throughout North America and Asia/Pacific. Dedicated Transportation Solutions (DTS), with 12% of 2017 EBT, provides vehicles and drivers as part of a dedicated transportation solution to over 200 customers throughout North America.

Good Business:

| | • | The company benefits from a reasonably high level of recurring revenue. We estimate that over 70% of total revenue is generated through multi-year contract agreements. |

| | | |

| | • | Ryder is one of only two nationwide full-service truck leasing companies, with roughly 20% market share. As one of the largest buyers of commercial trucks, and fleet maintenance, with its network of over 800 maintenance locations, the company benefits from economies of scale in purchasing. |

| | | |

| | • | Ryder is a beneficiary of secular trends favoring transportation outsourcing, including increasing cost and complexity of equipment ownership, driver recruitment and retention challenges, and regulatory pressures. |

| | | |

| | • | Despite headwinds from weak used vehicle pricing, Ryder has a good track record of earning a positive return on capital spread above its cost of capital, averaging over 50 basis points per annum over the last five years. The company is targeting an increase in the spread to a range of 100-150 basis points over the next several years. |

| | | |

| | • | The balance sheet is adequately capitalized, with net debt outstanding of $6.6 billion and a total debt-to-equity ratio of 2.28 times as of the fourth quarter of 2018. Ryder’s long-term corporate credit rating is investment grade by Standard & Poor’s (BBB+), Moody’s (Baa1), and Fitch (A-). |

Valuation:

| | • | Ryder is cyclical and out of favor, so the stock has badly lagged the Russell 2000 and S&P 500 indices over the past several years. With a positive ROIC spread relative to its cost of capital, we believe it has been treated too harshly. |

| | | |

| | • | Over the past five years, Ryder’s earnings per share (EPS) has averaged $5.48. The stock trades for 10.9 times this number. |

| | | |

| | • | The stock trades at 9.5 times forward EPS, and 24% and 30% below its 5 and 10-year averages of 12.6 times and 13.5 times, respectively. |

| | | |

| | • | We expect Ryder’s EPS to grow 10% over the long term without any meaningful tailwind from an improvement in used vehicle pricing. |

Management:

| | • | Bob Sanchez has been Chairman and CEO of Ryder since January 2013 and May 2013, respectively. He previously served as President and COO, CFO, President of FMS, CIO, and in other executive roles since joining the company over 25 years ago. |

| | | |

| | • | Management’s compensation has a meaningful performance-based component and long-term incentives are directly tied to return on capital. |

Investment Thesis:

The market is fixated on the prospects for near-term improvement in used vehicle pricing, which has been a headwind to Ryder’s profit growth over the last two to three years. Meanwhile, Ryder’s contractual businesses (~85% of sales) have delivered mid-single-digit organic growth at value-creating returns over this period. In fact, the company is seeing record demand in its core full service leasing product, which is the largest contributor to the company’s cash flow. We believe Ryder is nearing an inflection point where the core contractual business can generate double-digit consolidated earnings growth going forward, even considering incremental used vehicle sales headwinds (rental will be a key swing factor). The secular outsourcing trend to leasing appears to be accelerating, notwithstanding higher lease pricing (and lower residual risk for Ryder), which should set the stage for a reversal of used vehicle EPS headwinds at some point over the next few years, and an improvement in sentiment.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2019 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 84.3% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 12.9% | | | | | | |

| | | Advertising/Marketing Services — 3.1% | | | | | | |

| | 1,430,000 | | Interpublic Group of Cos. Inc. | | $ | 25,147,702 | | | $ | 30,044,300 | |

| | | | | | | | | | | | |

| | | | Financial Publishing/Services — 1.1% | | | | | | | | |

| | 44,000 | | FactSet Research Systems Inc. | | | 7,026,822 | | | | 10,923,880 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 5.0% | | | | | | | | |

| | 1,375,000 | | Genpact Ltd. | | | 23,466,073 | | | | 48,372,500 | |

| | | | | | | | | | | | |

| | | | Personnel Services — 3.7% | | | | | | | | |

| | 315,000 | | ManpowerGroup Inc. | | | 21,756,454 | | | | 26,047,350 | |

| | 145,000 | | Robert Half International Inc. | | | 3,739,318 | | | | 9,448,200 | |

| | | | | | | 25,495,772 | | | | 35,495,550 | |

CONSUMER NON-DURABLES SECTOR — 1.2% | | | | | | | | |

| | | | Food: Specialty/Candy — 1.2% | | | | | | | | |

| | 520,000 | | Hain Celestial Group Inc.* | | | 15,815,962 | | | | 12,022,400 | |

| | | | | | | | | |

CONSUMER SERVICES SECTOR — 6.4% | | | | | | | | |

| | | | Cable/Satellite TV — 1.4% | | | | | | | | |

| | 14,000 | | Cable One Inc. | | | 3,751,123 | | | | 13,739,320 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 5.0% | | | | | | | | |

| | 70,000 | | Graham Holdings Co. | | | 33,620,430 | | | | 47,822,600 | |

| | | | | | | | | |

DISTRIBUTION SERVICES SECTOR — 5.0% | | | | | | | | |

| | | | Electronics Distributors — 3.8% | | | | | | | | |

| | 188,000 | | Arrow Electronics Inc.* | | | 2,285,881 | | | | 14,487,280 | |

| | 245,000 | | ePlus Inc.* | | | 12,425,712 | | | | 21,692,300 | |

| | | | | | | 14,711,593 | | | | 36,179,580 | |

| | | | Wholesale Distributors — 1.2% | | | | | | | | |

| | 145,000 | | MSC Industrial Direct Co. Inc. | | | 9,336,406 | | | | 11,992,950 | |

| | | | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 2.5% | | | | | | | | |

| | | | Telecommunications Equipment — 2.5% | | | | | | | | |

| | 310,000 | | ViaSat Inc.* | | | 21,573,635 | | | | 24,025,000 | |

| | | | | | | | | |

FINANCE SECTOR — 21.5% | | | | | | | | |

| | | | Finance/Rental/Leasing — 6.3% | | | | | | | | |

| | 385,000 | | FirstCash Inc. | | | 11,902,936 | | | | 33,302,500 | |

| | 446,000 | | Ryder System Inc. | | | 20,693,612 | | | | 27,647,540 | |

| | | | | | | 32,596,548 | | | | 60,950,040 | |

| | | | Property/Casualty Insurance — 8.8% | | | | | | | | |

| | 275,000 | | Argo Group International Holdings Ltd. | | | 14,425,218 | | | | 19,431,500 | |

| | 377,000 | | W.R. Berkley Corp. | | | 12,617,614 | | | | 31,939,440 | |

| | 36,000 | | White Mountains Insurance Group Ltd. | | | 32,246,093 | | | | 33,317,280 | |

| | | | | | | 59,288,925 | | | | 84,688,220 | |

| | | | Real Estate Development — 5.2% | | | | | | | | |

| | 217,000 | | The Howard Hughes Corp.* | | | 26,622,730 | | | | 23,870,000 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2019 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 84.3% (a) (Continued) | | | | | | |

| | | | | | | |

FINANCE SECTOR — 21.5% (Continued) | | | | | | |

| | | Real Estate Development — 5.2% (Continued) | | | | | | |

| | 1,250,000 | | Kennedy-Wilson Holdings Inc. | | $ | 25,702,701 | | | $ | 26,737,500 | |

| | | | | | | 52,325,431 | | | | 50,607,500 | |

| | | | Regional Banks — 1.2% | | | | | | | | |

| | 263,000 | | Zions Bancorporation | | | 6,237,012 | | | | 11,942,830 | |

| | | | | | | | | |

HEALTH TECHNOLOGY SECTOR — 0.4% | | | | | | | | |

| | | | Pharmaceuticals: Major — 0.4% | | | | | | | | |

| | 102,370 | | Phibro Animal Health Corp. | | | 3,039,493 | | | | 3,378,210 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 7.2% | | | | | | | | |

| | | | Containers/Packaging — 5.7% | | | | | | | | |

| | 488,000 | | Avery Dennison Corp. | | | 34,703,594 | | | | 55,144,000 | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 1.5% | | | | | | | | |

| | 288,000 | | Donaldson Co. Inc. | | | 13,340,208 | | | | 14,417,280 | |

| | | | | | | | | |

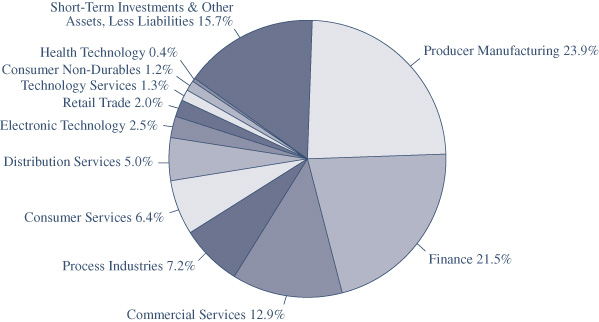

PRODUCER MANUFACTURING SECTOR — 23.9% | | | | | | | | |

| | | | Auto Parts: OEM — 1.4% | | | | | | | | |

| | 104,000 | | WABCO Holdings Inc.* | | | 12,624,528 | | | | 13,710,320 | |

| | | | | | | | | | | | |

| | | | Building Products — 5.4% | | | | | | | | |

| | 525,000 | | Armstrong World Industries Inc. | | | 22,577,688 | | | | 41,695,500 | |

| | 70,000 | | Watsco Inc. | | | 9,883,500 | | | | 10,024,700 | |

| | | | | | | 32,461,188 | | | | 51,720,200 | |

| | | | Industrial Machinery — 6.0% | | | | | | | | |

| | 228,000 | | EnPro Industries Inc. | | | 16,552,585 | | | | 14,694,600 | |

| | 345,000 | | Gardner Denver Holdings Inc.* | | | 9,636,080 | | | | 9,594,450 | |

| | 355,000 | | Woodward Inc. | | | 14,543,314 | | | | 33,685,950 | |

| | | | | | | 40,731,979 | | | | 57,975,000 | |

| | | | Metal Fabrication — 1.6% | | | | | | | | |

| | 120,000 | | Valmont Industries Inc. | | | 17,074,090 | | | | 15,612,000 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Manufacturing — 7.3% | | | | | | | | |

| | 365,000 | | Carlisle Cos. Inc. | | | 29,006,057 | | | | 44,756,300 | |

| | 840,000 | | TriMas Corp.* | | | 18,195,990 | | | | 25,393,200 | |

| | | | | | | 47,202,047 | | | | 70,149,500 | |

| | | | Trucks/Construction/Farm Machinery — 2.2% | | | | | | | | |

| | 970,000 | | Trinity Industries Inc. | | | 22,025,792 | | | | 21,078,100 | |

| | | | | | | | | |

RETAIL TRADE SECTOR — 2.0% | | | | | | | | |

| | | | Specialty Stores — 2.0% | | | | | | | | |

| | 440,000 | | Penske Automotive Group Inc. | | | 15,383,750 | | | | 19,646,000 | |

| | | | | | | | | |

TECHNOLOGY SERVICES SECTOR — 1.3% | | | | | | | | |

| | | | Internet Software/Services — 1.3% | | | | | | | | |

| | 560,000 | | Cars.com Inc.* | | | 15,143,247 | | | | 12,768,000 | |

| | | | Total common stocks | | | 584,123,350 | | | | 814,405,280 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2019 (Unaudited)

| Principal Amount | | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 15.5% (a) | | | | | | |

| | | Bank Deposit Account — 7.7% | | | | | | |

| $ | 74,453,919 | | U.S. Bank N.A., 2.38%^ | | $ | 74,453,919 | | | $ | 74,453,919 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 7.8% | | | | | | | | |

| | 25,000,000 | | U.S. Treasury Bills, 2.234%, due 04/18/19^ | | | 24,972,257 | | | | 24,972,079 | |

| | 25,000,000 | | U.S. Treasury Bills, 2.311%, due 05/16/19^ | | | 24,925,781 | | | | 24,926,167 | |

| | 25,000,000 | | U.S. Treasury Bills, 2.332%, due 06/13/19^ | | | 24,879,600 | | | | 24,880,171 | |

| | | | Total U.S. treasury securities | | | 74,777,638 | | | | 74,778,417 | |

| | | | Total short-term investments | | | 149,231,557 | | | | 149,232,336 | |

| | | | Total investments — 99.8% | | $ | 733,354,907 | | | | 963,637,616 | |

| | | | Other assets, less liabilities — 0.2% (a) | | | | | | | 2,107,747 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 965,745,363 | |

| * | | Non-income producing security. |

| ^ | | The rate shown is as of March 31, 2019. |

| (a) | | Percentages for the various classifications relate to total net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

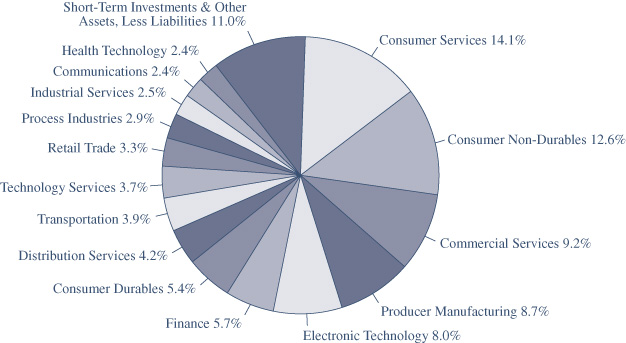

INDUSTRY SECTORS

as of March 31, 2019 (Unaudited)

FMI

International

Fund

March 31, 2019

Dear Fellow Shareholders:

Equities rebounded sharply in the March quarter despite global economic growth continuing to lose momentum, high policy uncertainty, and ongoing trade tensions. Central banks have performed a U-turn on raising interest rates, to the delight of market participants. After a brief reprieve in the fourth quarter, stock valuations are back on the rise and continue to be highly valued relative to historical measures.

The FMI International Fund (“Fund”) gained 8.38%1 in the period, which fell short of the MSCI EAFE Index advance of 10.59% in local currency and 9.98% in U.S. Dollars (USD). Sector underperformance was driven by Producer Manufacturing, Commercial Services and Consumer Non-Durables, with Retail Trade, Technology Services, and Finance picking up some of the slack. On an individual basis, Ferguson, DKSH and Jardine Strategic each detracted, while Accenture, B&M European Value Retail and Electrolux performed well. Growth outperformed value in the quarter, which didn’t help the Fund’s relative performance; neither did the residual cash position.

Over FMI’s 39-year track record, our mutual funds have tended to lag in market rallies while protecting better when times get tough – a winning equation through a full market cycle. Our underperformance in the quarter was consistent with this pattern, albeit disappointing on a relative basis.

Have No Fear: Central Bankers Are Here

How quickly times can change. In recent years, one of the most popular themes in the financial world was “synchronized global growth.” After years of money printing, quantitative easing (QE) and artificially low interest rates, the world’s 45 major economies were suddenly growing in harmony (in 2017).2 Did all these experimental central bank policies actually work? Were we on a new path toward prosperity? Not so fast. Despite extraordinary levels of central bank intervention, world economic growth over the last five years has averaged only ~3.4%, compared to the prior 20-year average of ~3.8%. Looking forward, in their latest economic outlook (March 2019), the Organisation for Economic Co-operation and Development (OECD) writes, “Growth has been revised downwards in almost all G20 economies, with particularly large revisions in the euro area.” World GDP is expected to grow at 3.3% in 2019, which is down from 3.6% in 2018, and 0.2% lower than the OECD’s November forecast. Eurozone growth is anticipated to decelerate from 1.8% last year to 1% in 2019 as industrial output has been weak, external demand has softened, and uncertainty around Brexit remains. Japan’s growth is projected at a measly 0.8%, weighed down by lackluster industrial production and export data. Growth in the U.S. and China is also expected to slow as trade tensions have persisted in addition to economic headwinds in the auto and housing sectors.3

_______________

1 | The FMI International Fund Investor Class (FMIJX) and the FMI International Fund Institutional Class (FMIYX) had a return of 8.38% and 8.41%, respectively, for the first quarter of 2019. |

2 | Josh Zumbrun. “The World’s Economies Are Growing in Rare Harmony.” The Wall Street Journal, January 22, 2018. |

3 | OECD Interim Economic Outlook. March 6, 2019. |

When we penned the December letter, it appeared central banks were taking a few imperative steps towards monetary policy normalization. No longer. The Federal Reserve (Fed) abruptly reversed course. Chairman Jerome Powell described interest rates as “a long way” from neutral in early October and remarkably back-tracked to “just below” neutral by late November. It’s amazing what a brief stock market correction can do to one’s psyche. Subsequently, plans for three interest rate hikes in 2019 are now down to zero and the unwinding of the Fed balance sheet will cease in September. At the European Central Bank (ECB), Mario Draghi decided to extend interest rates at record lows through at least the end of the year, likely ending his 8-year tenure without raising interest rates even once. He also offered up a new batch of cheap, long-term loans to eurozone banks, perhaps a sign that the ECB has concerns about the banking sector. Wait a minute – weren’t these TLTROs (Targeted Longer-Term Refinancing Operations) meant to be an emergency measure? Meanwhile, the Bank of Japan stands ready to ramp up stimulus, while China has introduced policy support through infrastructure spending, tax cuts, local government bond issuance, and cuts for banks’ reserve requirements.

These “synchronized” moves reek of desperation and call into question the true underlying health of economic and business fundamentals. In a world where $11 trillion of negative-yielding bonds and over $21 trillion in central bank balance sheets don’t do the trick, what comes next?4 We hope not more of the same, although central bankers claim to have more policy options up their collective sleeves.

China: Too Good to Be True?

According to their National Bureau of Statistics (NBS), China’s GDP growth decelerated to 6.6% in 2018, the lowest level in 28 years.5 Despite the slowdown, China continues to be the world’s biggest driver of growth. Using International Monetary Fund (IMF) projections, China’s share of global GDP growth is expected to rise from 27.2% in 2019 to 28.4% in 2023.6 This does not tell the full story, however. We have long been skeptical of the “official” numbers coming out of China. A recent study by the Brookings Institute confirms our doubts, calling into question the accuracy of the NBS data. The research suggests that the NBS is struggling to adjust inflated data from local officials, some of which they have openly admitted are “falsified.” Per the Financial Times, “The [Brookings Institute] economists used data on the collection of value added tax to adjust China’s historical GDP growth series. The tax data, which have been compiled through a computerized system since 2005, are highly resistant to fraud and tampering, they argue.” The analysis covers the years 2008-16 and it concludes that the official NBS data for nominal GDP has been overstated by 1.7 percentage points per year, which would make the size of the economy approximately 12% smaller in 2016 than officially reported.7 With global GDP growth below historical norms, even with an assist from inflated China statistics, perhaps the economic backdrop is indeed weaker than advertised.

_______________

4 | Daniel Kruger. “Negative Yields Mount Along With Europe’s Problems.” The Wall Street Journal, February 18, 2019. Bloomberg data. |

5 | Issaku Harada. “China’s GDP growth slows to 28-year low in 2018.” Nikkei, January 21, 2019. |

6 | By Alexandre Tanzi and Wei Lu. “Where Will Global GDP Growth Come From in the Next Five Years?” Bloomberg, October 28, 2018. |

7 | Gabriel Wildau. “China economy 12% smaller than claimed, report alleges.” Financial Times, March 6, 2019. |

Unfortunately, the accuracy of the NBS data is the least of our worries in China. A credit or housing crisis would be at the top of our list. As illustrated in the Institute of International Finance (IIF) chart below, China’s debt has exploded in the last decade and is fast approaching 300% of GDP. Total debt has sextupled (6x) since 2007, compounding at nearly 20%. Corporate sector debt accounts for 157% of GDP (the highest in the world) and compares with a developed market average of 91% in the U.S., Europe, and Japan.8 At the current debt level, Haibin Zhu, Chief China Economist at J.P. Morgan, estimates that 70% of new annual financing will be used to service the interest payment burden, leaving only 30% to support new economic activity. Zhu writes that this is a “key reason why credit policy transmission has been weakened in recent years.”9 It’s no wonder credit growth has dwarfed GDP growth over the last decade.

It is estimated that 30-35% of the corporate debt in China is associated with construction and real estate,10 and ~25% of China’s GDP has been driven by property-related industries. After a historic building boom, China now has approximately 65 million empty apartments across the country, according to estimates by Gan Li, a professor at Southwestern University of Finance and Economics in Chengdu. This accounts for 21.4% of the housing stock, up from 18.4% in 2011. As a frame of reference, 65 million would equate to nearly half of the total number of housing units in the U.S. (139 million). According to Xiang Songzuo, a professor at Renmin University in Beijing, “about 80% of a Chinese people’s wealth is in the form of real estate, totaling over $65 trillion in value – almost twice the size of all G-7 economies combined. A significant slowdown could, therefore, have a substantial impact on citizens’ financial health.” In addition, property developers are saddled with debt; Moody’s classifies 51 out of the 61 Chinese property companies as junk-rated. Meanwhile, the government has been cracking down on shadow banking, which had been an important source of financing for real estate developers.11 As China’s property market continues to show signs of a slowdown, the negative implications could start to have ripple effects.

What We Don’t Own

We believe that the FMI International Fund is a unique product when compared with the MSCI EAFE Index and our peers. In addition to running a concentrated Fund (25-40 holdings) of high-conviction ideas, our sector and geographic exposure differs significantly, given that we do not manage to a benchmark. We look to own high-quality businesses with sustainable competitive advantages, strong management teams, and attractive valuations. Value-oriented, bottom-up security analysis drives the path of the Fund, with an intense focus on downside protection. While we regularly feature descriptions of our holdings in our shareholder letters, we thought it would be informative to highlight a couple things that we don’t own. These active decisions are equally important to the long-term performance of the Fund.

_______________

8 | | “Global Debt Monitor.” Institute of International Finance. January 15, 2019 and May 2018. |

9 | | Haibin Zhu. “Through the looking glass: China in 2030.” J.P. Morgan. February 4, 2019. Pg. 7. |

10 | | “Rising Corporate Debt: Peril or Promise?” McKinsey Global Institute discussion paper. June 2018. “A decade after the Global Financial Crisis: What has (and hasn’t) changed?” McKinsey Global Institute briefing note. September 2018. |

11 | | Kenji Kawase. “China’s housing glut casts pall over the economy.” Nikkei Asian Review. February 13, 2019. |

Big Pharma: Despite pharmaceuticals having an 8.3% weighting in the MSCI EAFE Index, we are not invested in this segment. In short, we believe Big Pharma is a value trap and has become uneconomic. Since 2010, Deloitte has tracked the research and development (R&D) productivity for the top twelve global publicly-listed pharmaceutical companies: Amgen, AstraZeneca, Bristol-Myers Squibb, Eli Lilly, GlaxoSmithKline, Johnson & Johnson, Merck & Co., Novartis, Pfizer, Roche, Sanofi, and Takeda. As illustrated by the above chart, R&D returns for the cohort have plunged, falling from 10.1% in 2010 to just 1.9% in 2018.

The reason that returns have deteriorated is twofold: costs are rising rapidly and forecast revenue is falling – a toxic combination. The cost to bring a compound market has increased by over 80% the past eight years, from $1.188 billion in 2010 to $2.168 billion in 2018. At the same time, forecast peak sales per asset have more than halved since 2010, falling from $816 million to $407 million (see chart below). Even with record-low interest rates, it’s very difficult to make the case that Big Pharma has been earning its cost of capital in recent years. At the 1.9% return reported in 2018, they are unquestionably destroying value.12