SEMI-ANNUAL REPORT

March 31, 2021

FMI Large Cap Fund

Investor Class (Ticker Symbol: FMIHX)

Institutional Class (Ticker Symbol: FMIQX)

FMI Common Stock Fund

Investor Class (Ticker Symbol: FMIMX)

Institutional Class (Ticker Symbol: FMIUX)

FMI International Fund

Investor Class (Ticker Symbol: FMIJX)

Institutional Class (Ticker Symbol: FMIYX)

FMI International Fund II – Currency Unhedged

Investor Class (Not Available For Sale)

Institutional Class (Ticker Symbol: FMIFX)

| | |

| |

| |

| |

| FMI Funds, Inc. |

| |

| Advised by Fiduciary Management, Inc. |

| www.fmifunds.com |

| |

| |

| | |

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| Shareholder Letter | 1 |

| Schedule of Investments | 7 |

| Industry Sectors | 9 |

| | |

| FMI Common Stock Fund | |

| Shareholder Letter | 10 |

| Schedule of Investments | 15 |

| Industry Sectors | 17 |

| | |

| FMI International Fund and FMI International Fund II – Currency Unhedged | |

| Shareholder Letter | 18 |

| | |

| FMI International Fund | |

| Schedule of Investments | 25 |

| Schedule of Forward Currency Contracts | 29 |

| Industry Sectors | 30 |

| Concentration by Country | 30 |

| | |

| FMI International Fund II – Currency Unhedged | |

| Schedule of Investments | 31 |

| Industry Sectors | 35 |

| Concentration by Country | 35 |

| | |

| Financial Statements | |

| Statements of Assets and Liabilities | 36 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 40 |

| Financial Highlights | 44 |

| Notes to Financial Statements | 51 |

| | |

| Additional Information | 63 |

| Expense Example | 64 |

| Advisory Agreements | 66 |

| Disclosure Information | 73 |

FMI

Large Cap

Fund

(unaudited)

March 31, 2021

Dear Fellow Shareholders:

The FMI Large Cap Fund (“Fund”) returned 6.05%1 in the March quarter compared to 6.17% for the Standard & Poor’s 500 Index and 11.26% for the Russell 1000 Value Index. Relative to the S&P 500, sectors that outperformed included Electronic Technology, Finance, and Commercial Services. Underperforming areas included Energy Minerals, Consumer Non-Durables, and Health Services. From an individual stock perspective, Micron Technology Inc., The Charles Schwab Corp., and Omnicom Group Inc. were outstanding, while Unilever PLC, Dollar General Corp., and Nestlé S.A. lagged. Most stocks did reasonably well in the quarter; deeper-value names (many of suspect quality) and cyclical enterprises were standouts. Firms with a high probability of default, money-losing companies, and other highly-speculative stocks also continued to perform well. Recall that 2020 was a banner year for the most speculative stocks. Companies with over $1 billion in market value as of year-end 2020, who also lost money in 2019 (409 money-losing companies), gained on average 123% last year. When the other side of this stock market cycle has been completed, we believe most of these stocks will better reflect fundamental reality.

We lead this note with a reiteration of what we said in December. Vaccines are helping to drive COVID-19 into the background, economies are generally improving, and the outlook is brightening for revenue growth. This should favor value-oriented securities. The absence of generalized growth helped drive a high premium for those relatively few companies that were growing rapidly. There are still nearly ten million Americans out of work, and once the disincentive of a government check is removed, the expectation is that many people will rejoin the workforce. There is pent-up demand, and this should drive good GDP growth.

We also have to consider, however, the ramifications of unprecedented deficit spending. The U.S. government is set to borrow more money than it generates in tax receipts, pushing the deficit to likely exceed 20% of GDP this year, and the federal debt at least 30% greater than the total output of the economy. The U.S. has never had such a stretched balance sheet in non-war times. Someday the piper will have to be paid.

The “character” of the stock market is rambunctious, casino-like, and schizophrenic. Stocks rip up or down seemingly based on whether professional traders, CNBC, or the Reddit/Robinhood crowd deem it a “risk-on” or “risk-off” day. Social media-driven campaigns have perhaps mortally wounded short sellers. Short selling is a legitimate and useful endeavor as it helps with price discovery; however, if a loosely-organized mob can run up the stock of a low-quality, heavily-shorted business, it makes the profession untenable. At least one major hedge fund needed a multi-billion-dollar bailout after its short position in GameStop was attacked. Broken bets, at least so far, haven’t curbed the chaotic action in the retail investor camp. Recall last year’s head-scratching rally in the bankrupt rental car company, Hertz Corp. Trading around $20 per share in February of 2020, it filed for bankruptcy on May 22nd. The stock immediately went to $0.56. Retail

_______________

1 | The FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of 6.05% and 6.12%, respectively, for the first quarter of 2021. |

traders, taking cues from popular sites on Redditt like WallStreetBets, sent the stock up tenfold in a month. Today, trading in the pink sheets, Hertz is at $1.72 – still a highly-speculative price, considering the likelihood of equity investors getting zero in the restructuring.

Traders moving “baskets” of securities are causing stocks to lurch back-and-forth between various indices (growth or value) and subsectors (Special Purpose Acquisition Companies, or “SPACs,” shorts, rate-sensitive financials, high-beta reopening stories, non-profitable tech, oil, renewables, high beta coronavirus beneficiaries, infrastructure, etc.), furthering the disconnection between individual stocks and underlying fundamentals. Stocks are viewed by many as pieces of paper, not fractional ownership of businesses. There might be a whole generation of investors who simply do not consider valuation at all in the selection of their investments. It’s possible this multi-year phenomenon can continue. If so, investors can throw away the textbooks and simply follow momentum. Of course, we don’t believe it will persist; there is no historical precedent, and it just violates common sense.

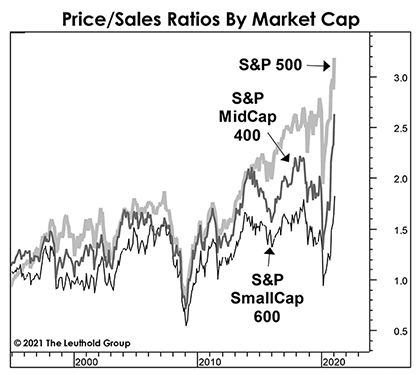

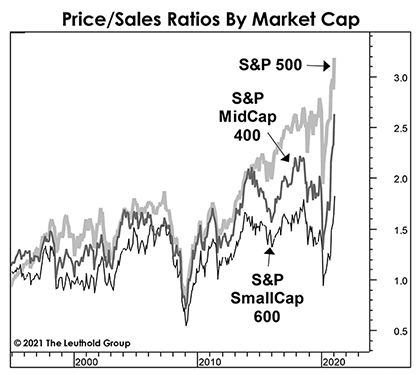

Most valuations are higher than at any time we have studied. Few would buy a company trading at 39.9 times trailing earnings (price-to-earnings), 27.7 times EBITDA (enterprise value-to-EBITDA), or 6.6 times revenue (price-to-sales), yet this is what index investors are paying for the S&P 500 today.2 It’s similar for other market caps. Below is a chart depicting the median price-to-sales ratio for three S&P indices. Lately, around our firm, we’ve marveled at some Wall Street research reports that literally do not mention a stock’s valuation. Many investors have a distorted view of how fast companies grow. Most would be surprised to learn that over the past decade, the median growth rates of the S&P 500 sales and earnings were 2.61% and 2.75%, respectively. Eventually, we expect that reality will be reflected in fundamental valuations.

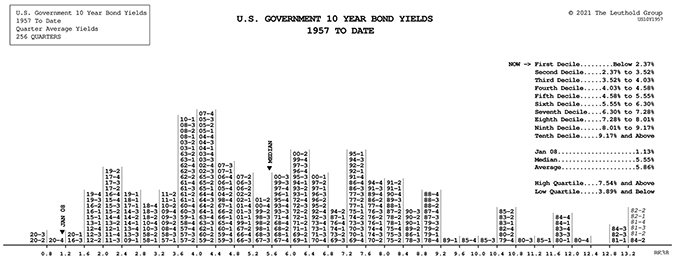

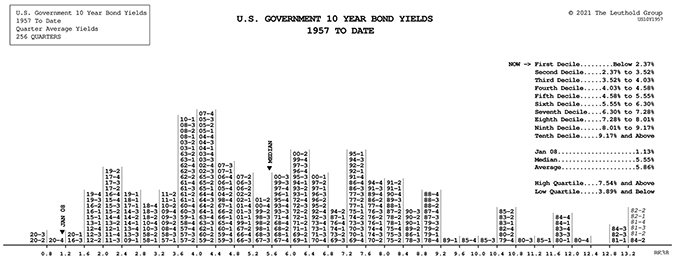

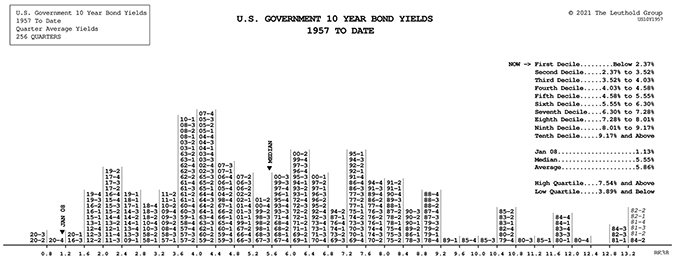

Growth stocks underperformed in the quarter. Higher interest rates are perhaps the culprit, although meeting elevated expectations may also be a factor. The 10-Year Treasury yield rose to 1.74% from 0.93% at the start of the year. As the economy gains speed coming out of coronavirus-induced shutdowns and dormant money starts to get deployed within the banking system, inflation concerns may surface. As mentioned, we are seeing anecdotal evidence of inflation in several places. Perhaps this sets the stage for the long-awaited “normalization” of interest rates. Since 1957, the median 10-Year Treasury yield is 5.55%. As the following histogram reveals, today’s level could rise 0.60% and still be in the first decile. We’ve reviewed Wall Street models for some growth companies that incorporate a cost of capital below 2%! Imagine what those long-term discount models would look like with a more normal 10% hurdle rate on equity capital and 5-6% on debt.

_______________

2 | Valuations are estimates based on the following scrubbing criteria: money losing companies are ascribed a 40 P/E ratio to them (which is probably conservative) and those with P/E ratios greater than 100 are capped at 100. For P/S, those with greater than a 30 multiple are capped at 30x. We assign the same multiple for no sales. The EV/EBITDA calculation excludes financials, and uses a cap of a 200 multiple, while those with a negative EV/EBITDA receive a 20 multiple in the calculation. |

Inflation is in almost nobody’s muscle memory. Very few investors were around in the early 1980s, the last time inflation was a real problem. Economies were much different back then. Natural resource dependency, labor mobility, supply chain efficiency, technology, and many other elements have fundamentally changed, making high inflation appear less likely than in the past. Nevertheless, warp speed increases in deficits and overall debt, low productivity, wanton Fed money printing, and complete political disfunction may help foster higher prices. Our companies are telling us their costs are rising. This could begin to change the interest rate environment. It is hard to believe, but the effort to bring inflation under control saw the Federal Funds Rate move from 5% in 1976 to 20% in 1980. Going from today’s street-level rates to something even remotely close to the lower end of this range would certainly change the character of what works, and what does not, in the stock market. Nobody has a crystal ball, but the Fund is not built with the notion that interest rates will stay low forever. Our approach is to buy all-weather vehicles, but with a dollop of contrarianism. We remain optimistic that good-quality, reasonably-valued businesses with solid balance sheets will prevail over the long run. Following are a couple of ideas that reflect this strategy.

Masco Corp. (MAS)

(Analyst: Jordan Teschendorf)

Description

Masco Corp., headquartered in Livonia, Michigan, is a global leader in the design, manufacture, and distribution of branded home improvement and building products. The company’s portfolio of well-recognized brands includes Behr paint, and Delta and Hansgrohe bath and shower fixtures. Operations are divided across two segments: Plumbing Products (58% sales, and 58% operating profit) and Decorative Architectural Products: (42%, and 42%). The company generated a 2020 sales profit of $7.2 billion, and operating profit of $1.3 billion. Sales are split between North America (81%), Europe (12%), China (3%), UK (2%), and Other (2%).

Good Business

| | • | Following several key portfolio actions in recent years (the 2015 spin-off of their installation business serving new construction, and the sale of their windows and cabinetry businesses in 2019 and 2020, respectively), the business has structurally increased its sustainable growth, margin, and return profile. |

| | | |

| | • | Masco is now comprised mostly of low-ticket and high-impact home improvement products in growing categories (paints, stains, faucets, etc.), with a sector-leading 89% of sales from the less cyclical and higher-margin repair and remodel (R&R) market. |

| | | |

| | • | The company generally holds number one or two positions in its major markets. Competitive advantages include its brand strength built over several decades, and close alignment with advantaged retail and distribution partners. |

| | • | Masco’s return on invested capital (ROIC) was 26% in 2020. The company’s ROIC has averaged around 20% over the last 3, 5, and 10-year periods. |

| | | |

| | • | The company has been a terrific generator of free cash flow, is conservatively financed, and is easy to understand. |

Valuation

| | • | The stock trades at a mid-teens forward earnings per share multiple (EPS), a discount to its 10-year average of 19.6 times. |

| | | |

| | • | It also trades at about a 20% discount to the median of its peers on a forward enterprise value-to-EBITDA. |

| | | |

| | • | Masco’s discount is particularly notable considering it leads its peer group in ROIC and long-term EPS growth, while also carrying well-below-average exposure to more cyclical new construction markets. |

Management

| | • | Keith Allman has been with Masco since 1998 and has served as Chief Executive Officer since February 2014. Under his leadership, the company has focused the business on higher-margin and less cyclical markets where it has competitive advantage and emphasized innovation and capital discipline. He beneficially owns over 1.1 million shares of the company as of the latest proxy. |

| | | |

| | • | Management demonstrates discipline in allocating free cash flow and has a clear understanding of ROIC (tied to compensation), steering clear of high-priced acquisitions, and accelerating share repurchase activity when the stock has traded below intrinsic value. |

Investment Thesis

Masco provides FMI exposure to the residential housing market through a best-in-class branded building products company with strong leverage to the attractive R&R segment. Although the stock has periodically reflected concerns over higher raw material costs, rising interest rates, and the outlook for new construction, we believe the company provides a good balance of offensive and defensive attributes. At a reasonable valuation, considering our expectation for mid-single-digit organic sales and double-digit EPS growth over the long-term, we continue to believe in Masco’s prospects.

Micron Technology Inc. (MU)

(Analyst: Dan Sievers)

Description

Micron Technology, founded in 1978 and headquartered in Boise, Idaho, is focused on the production of innovative memory and storage solutions. Approximately 70% of its revenue (85% of operating income) comes from dynamic random-access memory (DRAM) and 25% from “not and” (NAND) solid storage, and the balance from other emerging memory technologies. By broad market segment, 2020 sales were approximately 25% Mobile, 20% Client and Graphics, 20% Enterprise and Cloud Server, 20% Solid State Storage Devices, and 15% Automotive, Industrial, and Consumer.

Good Business

| | • | Following decades of consolidation culminating in the acquisition of Elpida Memory Inc. (out of bankruptcy) by Micron in 2013, DRAM entered a new paradigm, where none of the remaining three large players were seeking to win material market share. By 2019, nearly all of the global DRAM market was controlled by Samsung Electronics Co. Ltd. (46%), SK Hynix Inc. (30%), and Micron (21%) because migrating process technology to the next “node” has become increasingly difficult and costly. Barriers to entry have never been higher and the DRAM industry may soon be entering an extended period of structural undersupply. In the NAND market, where Micron is #4 of 7 (soon to be 6), a similar dynamic is gradually playing out. Industry leader Samsung still intends on near-term market share gains which may drive further consolidation. |

| | | |

| | • | Demand growth remains strong because almost anywhere there is a processing unit, dynamic memory and storage are needed, and as performance increases, memory demand increases. While industry demand growth may come in part from memory being added to new devices, the larger driver will continue to be growth in memory per device, or “content per box.” |

| | | |

| | • | PC DRAM and laptop NAND have been somewhat commoditized, but the end market demand for both is broadening. Micron is #1 in specialized DRAM for graphics, automotive, and networking. There are advantages to producing both DRAM and NAND, including shared research and development for other emerging and hybrid memory technologies. |

| | | |

| | • | Full cycle margins have been rising, and the memory industry appears to be becoming somewhat less cyclical because of predictable supply growth trends. With this, we expect Micron will have greater full cycle margin than historically. |

| | | |

| | • | As of 2019, Micron’s 5-year trailing ROIC was 18.3%. |

| | | |

| | • | Micron’s balance sheet tipped into a net cash position just nine quarters ago and had net cash and investments of $2.5 billion for the fourth quarter of 2020. Once carrying significant net debt, the company was upgraded to investment grade in recent years by both Moody’s and Standard & Poor’s. |

Valuation

| | • | Micron trades for a high single-digit 2022 EPS estimate. |

| | | |

| | • | While cyclicality remains a trait of Micron, we feel the multiple will be sustainably higher over the next five years due to the oligopolistic nature of the market and the strong secular demand. |

| | | |

| | • | Micron is likely to institute a dividend within a year or two. |

Management

| | • | Sanjay Mehrotra joined Micron as CEO in February 2017. On his watch, Micron has significantly closed the technology and cost gap versus Samsung. Mr. Mehrotra is focused on technological competitiveness, continuous cost reduction, capital expenditure discipline, and return on investment. He initiated the company’s first $10 billion buyback program in May 2018. He co-founded SanDisk Corp. in 1988 and was CEO when SanDisk was sold to Western Digital Corp. in 2016. |

Investment Thesis

The global memory industry has structurally improved since 2013 due to consolidation, higher barriers to supply growth, and the ongoing broadening of demand. While not recently evident, industry cyclicality is diminishing. Following an extraordinary demand-led increase, DRAM prices surged in fiscal year 2017 and 2018 (hyperscale cloud data center buying), but receded drastically in 2019 and 2020 ended September 30. Prior to COVID, Micron was anticipating a fairly smooth calendar year 2020, but demand was pulled forward from datacenter buyers (work-from-home trends) and Chinese smartphone manufacturers, building inventory anticipating trade frictions. Though smartphone demand rebounded in the second half of 2020, these two factors created a demand hole for a few quarters. Looking forward, the DRAM industry appears headed for structural undersupply, which supports firming prices, rising margins, and significant earnings growth ahead.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 97.7% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 2.7% | | | | | | |

| | | | | | | | | |

| | | Advertising/Marketing Services — 2.7% | | | | | | |

| | 1,250,000 | | Omnicom Group Inc. | | $ | 83,142,288 | | | $ | 92,687,500 | |

| | | | | | | | | |

CONSUMER DURABLES SECTOR — 4.5% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Electronics/Appliances — 4.5% | | | | | | | | |

| | 1,425,000 | | Sony Group Corp. — SP-ADR* | | | 89,894,994 | | | | 151,064,250 | |

| | | | | | | | | |

CONSUMER NON-DURABLES SECTOR — 7.5% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Beverages: Non-Alcoholic — 2.1% | | | | | | | | |

| | 495,000 | | PepsiCo Inc. | | | 49,489,098 | | | | 70,017,750 | |

| | | | | | | | | | | | |

| | | | Food: Major Diversified — 1.8% | | | | | | | | |

| | 555,000 | | Nestlé S.A. — SP-ADR | | | 22,838,608 | | | | 61,888,050 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 3.6% | | | | | | | | |

| | 2,150,000 | | Unilever PLC — SP-ADR | | | 88,689,949 | | | | 120,034,500 | |

| | | | | | | | | |

CONSUMER SERVICES SECTOR — 8.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Cable/Satellite TV — 4.7% | | | | | | | | |

| | 2,900,000 | | Comcast Corp. — Cl A | | | 128,277,020 | | | | 156,919,000 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 3.5% | | | | | | | | |

| | 50,000 | | Booking Holdings Inc.* | | | 86,729,684 | | | | 116,492,000 | |

| | | | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 2.9% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Semiconductors — 2.9% | | | | | | | | |

| | 1,115,000 | | Micron Technology Inc.* | | | 55,149,596 | | | | 98,354,150 | |

| | | | | | | | | |

FINANCE SECTOR — 23.8% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Investment Banks/Brokers — 4.1% | | | | | | | | |

| | 2,135,000 | | The Charles Schwab Corp. | | | 77,583,151 | | | | 139,159,300 | |

| | | | | | | | | | | | |

| | | | Major Banks — 3.9% | | | | | | | | |

| | 855,000 | | JPMorgan Chase & Co. | | | 54,460,960 | | | | 130,156,650 | |

| | | | | | | | | | | | |

| | | | Multi-Line Insurance — 7.7% | | | | | | | | |

| | 1,038,437 | | Arch Capital Group Ltd.* | | | 37,856,480 | | | | 39,844,828 | |

| | 865,000 | | Berkshire Hathaway Inc. — Cl B* | | | 47,098,294 | | | | 220,981,550 | |

| | | | | | | 84,954,774 | | | | 260,826,378 | |

| | | | Property/Casualty Insurance — 5.2% | | | | | | | | |

| | 543,559 | | Chubb Ltd. | | | 71,924,228 | | | | 85,866,015 | |

| | 925,000 | | Progressive Corp. | | | 71,985,977 | | | | 88,439,250 | |

| | | | | | | 143,910,205 | | | | 174,305,265 | |

| | | | Regional Banks — 2.9% | | | | | | | | |

| | 930,000 | | Northern Trust Corp. | | | 79,842,526 | | | | 97,752,300 | |

| | | | | | | | | |

HEALTH SERVICES SECTOR — 10.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Health Industry Services — 4.2% | | | | | | | | |

| | 1,115,000 | | Quest Diagnostics Inc. | | | 109,158,654 | | | | 143,099,100 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 97.7% (a) (Continued) | | | | | | |

| | | | | | | |

HEALTH SERVICES SECTOR — 10.2% (Continued) | | | | | | |

| | | | | | | | | |

| | | Managed Health Care — 3.7% | | | | | | |

| | 335,000 | | UnitedHealth Group Inc. | | $ | 23,921,781 | | | $ | 124,643,450 | |

| | | | | | | | | | | | |

| | | | Medical/Nursing Services — 2.3% | | | | | | | | |

| | 2,100,000 | | Fresenius Medical Care AG & Co. KGaA | | | 84,929,501 | | | | 77,448,000 | |

| | | | | | | | | |

HEALTH TECHNOLOGY SECTOR — 6.0% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Medical Specialties — 6.0% | | | | | | | | |

| | 2,100,000 | | Koninklijke Philips N.V. — SP-ADR* | | | 98,186,296 | | | | 119,763,000 | |

| | 2,200,000 | | Smith & Nephew PLC — SP-ADR | | | 81,768,368 | | | | 83,380,000 | |

| | | | | | | 179,954,664 | | | | 203,143,000 | |

INDUSTRIAL SERVICES SECTOR — 1.6% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Oilfield Services/Equipment — 1.6% | | | | | | | | |

| | 1,995,000 | | Schlumberger Ltd. | | | 38,502,804 | | | | 54,244,050 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 2.9% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 2.9% | | | | | | | | |

| | 640,000 | | PPG Industries Inc. | | | 63,061,315 | | | | 96,166,400 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 14.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Building Products — 5.2% | | | | | | | | |

| | 2,930,000 | | Masco Corp. | | | 100,827,714 | | | | 175,507,000 | |

| | | | | | | | | | | | |

| | | | Electrical Products — 4.7% | | | | | | | | |

| | 780,000 | | Eaton Corp. PLC | | | 71,502,214 | | | | 107,858,400 | |

| | 555,000 | | Emerson Electric Co. | | | 25,997,940 | | | | 50,072,100 | |

| | | | | | | 97,500,154 | | | | 157,930,500 | |

| | | | Industrial Machinery — 2.0% | | | | | | | | |

| | 500,000 | | Dover Corp. | | | 67,511,523 | | | | 68,565,000 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 2.2% | | | | | | | | |

| | 790,000 | | PACCAR Inc. | | | 31,557,064 | | | | 73,406,800 | |

| | | | | | | | | |

RETAIL TRADE SECTOR — 11.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Apparel/Footwear Retail — 2.4% | | | | | | | | |

| | 1,215,000 | | The TJX Companies Inc. | | | 41,480,803 | | | | 80,372,250 | |

| | | | | | | | | | | | |

| | | | Discount Stores — 8.7% | | | | | | | | |

| | 750,000 | | Dollar General Corp. | | | 61,785,760 | | | | 151,965,000 | |

| | 1,250,000 | | Dollar Tree Inc.* | | | 110,348,944 | | | | 143,075,000 | |

| | | | | | | 172,134,704 | | | | 295,040,000 | |

TRANSPORTATION SECTOR — 2.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Air Freight/Couriers — 2.2% | | | | | | | | |

| | 685,000 | | Expeditors International of Washington Inc. | | | 25,076,809 | | | | 73,767,650 | |

| | | | Total common stocks | | | 2,080,580,343 | | | | 3,292,990,293 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2021 (Unaudited)

Principal Amount | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 2.5% (a) | | | | | | |

| | | | | | | | | |

| | | Bank Deposit Account — 2.5% | | | | | | |

| $ | 85,038,114 | | U.S. Bank N.A., 0.01%^ | | $ | 85,038,114 | | | $ | 85,038,114 | |

| | | | Total short-term investments | | | 85,038,114 | | | | 85,038,114 | |

| | | | Total investments — 100.2% | | $ | 2,165,618,457 | | | | 3,378,028,407 | |

| | | | Other liabilities, less assets — (0.2%) (a) | | | | | | | (5,895,772 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 3,372,132,635 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of March 31, 2021. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

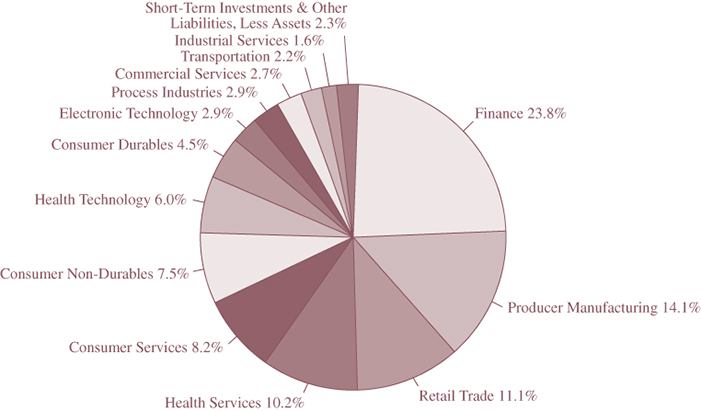

INDUSTRY SECTORS as a percentage of net assets

as of March 31, 2021 (Unaudited)

FMI

Common Stock

Fund

(unaudited)

March 31, 2021

Dear Fellow Shareholders:

The FMI Common Stock Fund (“Fund”) returned 12.51%1 in the March quarter compared to 12.70% for the Russell 2000 Index (“Russell 2000”) and 21.17% for the Russell 2000 Value Index. Relative to the Russell 2000, sectors that outperformed included Health Technology, Technology Services, and Electronic Technology. Underperforming areas included Producer Manufacturing, Finance, and Retail Trade. From an individual stock perspective, Robert Half International Inc., Insight Enterprises Inc., and Interpublic Group of Cos. Inc. were outstanding, while FirstCash Inc., TriMas Corp., and Houlihan Lokey Inc. lagged. Most stocks did reasonably well in the quarter; deeper-value names (many of suspect quality) and cyclical enterprises were standouts. Firms with a high probability of default, money-losing companies, and other highly-speculative stocks also continued to perform well. Recall that 2020 was a banner year for the most speculative stocks. Companies with over $1 billion in market value as of year-end 2020, who also lost money in 2019 (409 money-losing companies), gained on average 123% last year. When the other side of this stock market cycle has been completed, we believe most of these stocks will better reflect fundamental reality.

We lead this note with a reiteration of what we said in December. Vaccines are helping to drive COVID-19 into the background, economies are generally improving, and the outlook is brightening for revenue growth. This should favor value-oriented securities. The absence of generalized growth helped drive a high premium for those relatively few companies that were growing rapidly. There are still nearly ten million Americans out of work, and once the disincentive of a government check is removed, the expectation is that many people will rejoin the workforce. There is pent-up demand, and this should drive good GDP growth.

We also have to consider, however, the ramifications of unprecedented deficit spending. The U.S. government is set to borrow more money than it generates in tax receipts, pushing the deficit to likely exceed 20% of GDP this year, and the federal debt at least 30% greater than the total output of the economy. The U.S. has never had such a stretched balance sheet in non-war times. Someday the piper will have to be paid.

The “character” of the stock market is rambunctious, casino-like, and schizophrenic. Stocks rip up or down seemingly based on whether professional traders, CNBC, or the Reddit/Robinhood crowd deem it a “risk-on” or “risk-off” day. Social media-driven campaigns have perhaps mortally wounded short sellers. Short selling is a legitimate and useful endeavor as it helps with price discovery; however, if a loosely-organized mob can run up the stock of a low-quality, heavily-shorted business, it makes the profession untenable. At least one major hedge fund needed a multi-billion-dollar bailout after its short position in GameStop was attacked. Broken bets, at least so far, haven’t curbed the chaotic action in the retail investor camp. Recall last year’s head-scratching rally in the bankrupt rental car company, Hertz Corp. Trading around $20 per share in February of 2020, it filed for bankruptcy on May 22nd. The stock immediately went to $0.56. Retail

_______________

1 | The FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) had a return of 12.51% and 12.50%, respectively, for the first quarter of 2021. |

traders, taking cues from popular sites on Redditt like WallStreetBets, sent the stock up tenfold in a month. Today, trading in the pink sheets, Hertz is at $1.72 – still a highly-speculative price, considering the likelihood of equity investors getting zero in the restructuring.

Traders moving “baskets” of securities are causing stocks to lurch back-and-forth between various indices (growth or value) and subsectors (Special Purpose Acquisition Companies, or “SPACs,” shorts, rate-sensitive financials, high-beta reopening stories, non-profitable tech, oil, renewables, high beta coronavirus beneficiaries, infrastructure, etc.), furthering the disconnection between individual stocks and underlying fundamentals. Stocks are viewed by many as pieces of paper, not fractional ownership of businesses. There might be a whole generation of investors who simply do not consider valuation at all in the selection of their investments. It’s possible this multi-year phenomenon can continue. If so, investors can throw away the textbooks and simply follow momentum. Of course, we don’t believe it will persist; there is no historical precedent, and it just violates common sense.

Most valuations are higher than at any time we have studied. Few would buy a company trading at 39.9 times trailing earnings (price-to-earnings), 27.7 times EBITDA (enterprise value-to-EBITDA), or 6.6 times revenue (price-to-sales), yet this is what index investors are paying for the S&P 500 today.2 It’s similar for other market caps. Below is a chart depicting the median price-to-sales ratio for three S&P indices. Lately, around our firm, we’ve marveled at some Wall Street research reports that literally do not mention a stock’s valuation. Many investors have a distorted view of how fast companies grow. Most would be surprised to learn that over the past decade, the median growth rates of the S&P 500 sales and earnings were 2.61% and 2.75%, respectively. Eventually, we expect that reality will be reflected in fundamental valuations.

Growth stocks underperformed in the quarter. Higher interest rates are perhaps the culprit, although meeting elevated expectations may also be a factor. The 10-Year Treasury yield rose to 1.74% from 0.93% at the start of the year. As the economy gains speed coming out of coronavirus-induced shutdowns and dormant money starts to get deployed within the banking system, inflation concerns may surface. As mentioned, we are seeing anecdotal evidence of inflation in several places. Perhaps this sets the stage for the long-awaited “normalization” of interest rates. Since 1957, the median 10-Year Treasury yield is 5.55%. As the following histogram reveals, today’s level could rise 0.60% and still be in the first decile. We’ve reviewed Wall Street models for some growth companies that incorporate a cost of capital below 2%! Imagine what those long-term discount models would look like with a more normal 10% hurdle rate on equity capital and 5-6% on debt.

_______________

2 | Valuations are estimates based on the following scrubbing criteria: money losing companies are ascribed a 40 price-to-earnings (P/E) ratio to them (which is probably conservative) and those with P/E ratios greater than 100 are capped at 100. For P/S, those with greater than a 30 multiple are capped at 30x. We assign the same multiple for no sales. The EV/EBITDA calculation excludes financials, and uses a cap of a 200 multiple, while those with a negative EV/EBITDA receive a 20 multiple in the calculation. |

Inflation is in almost nobody’s muscle memory. Very few investors were around in the early 1980s, the last time inflation was a real problem. Economies were much different back then. Natural resource dependency, labor mobility, supply chain efficiency, technology, and many other elements have fundamentally changed, making high inflation appear less likely than in the past. Nevertheless, warp speed increases in deficits and overall debt, low productivity, wanton Fed money printing, and complete political disfunction may help foster higher prices. Our companies are telling us their costs are rising. This could begin to change the interest rate environment. It is hard to believe, but the effort to bring inflation under control saw the Federal Funds Rate move from 5% in 1976 to 20% in 1980. Going from today’s street-level rates to something even remotely close to the lower end of this range would certainly change the character of what works, and what does not, in the stock market. Nobody has a crystal ball, but the Fund is not built with the notion that interest rates will stay low forever. Our approach is to buy all-weather vehicles, but with a dollop of contrarianism. We remain optimistic that good-quality, reasonably-valued businesses with solid balance sheets will prevail over the long run. Following are a couple of ideas that reflect this strategy.

Insight Enterprises Inc. (NSIT)

(Analyst: Matt Sullivan)

Description

Insight specializes in digital innovation, cloud/data center modernization, and connected workforce and supply chain optimization. The company designs and implements an array of solutions from over 6,000 information technology (IT) vendors for more than 150,000 end customers including government organizations, businesses, and healthcare and education institutions. Insight derives 78% of sales from North America, 19% from Europe, the Middle East and Africa, and 3% from Asia-Pacific. In total, the company operates across 19 countries.

Good Business

| | • | As one of the largest value-added resellers of necessary technology product and service solutions, Insight benefits from scale and global growth in technology without being exposed to the same obsolescence risk as technology manufacturers. |

| | | |

| | • | Insight helps customers manage a complex IT environment in a cost-efficient manner. |

| | | |

| | • | The company is focused on services and integrated solutions to customers, which should benefit margins and returns over time. |

| | | |

| | • | Over the past five years the company has averaged a 12% return on invested capital (ROIC), exceeding its cost of capital. |

| | | |

| | • | Its balance sheet leverage is low, and the business is easy to understand. |

Valuation

| | • | The stock trades at a significant discount to the Russell 2000 despite it being a better-than-average business. |

| | | |

| | • | Insight is being valued at a low double-digit enterprise value-to-EBITDA multiple and, using our estimate for next year’s earnings, a mid-teens forward price-to-earnings multiple. |

Management

| | • | Ken Lamneck was appointed President and Chief Executive Officer and a director in January 2010. From 2004 through 2009, he was President of the Americas at Tech Data Corp., and from 1996 to 2003, held various executive management positions at Arrow Electronics Inc. He currently owns around $29.4 million of Insight stock. |

| | | |

| | • | Glynis Bryan joined Insight in December 2007 as Chief Financial Officer. Prior to joining Insight, Ms. Bryan served as Executive Vice President and CFO at Swift Transportation Co., Inc. from April 2005 to May 2007. Prior to joining Swift, she served as CFO at APL Logistics Ltd. in Oakland, California and in various finance roles at Ryder System Inc., including CFO of Ryder’s largest business unit. She currently owns approximately $7.2 million worth of Insight stock. |

Investment Thesis

As a reseller of IT solutions, the company gives investors exposure to technology growth without subjecting them to the short product cycles, cut-throat competition, and poor capital allocation decisions that are typically inherent in technology investments. We believe Insight has solid long-term growth prospects, and that it will continue to expand its margins over time by selling more services and solutions to end customers. Given the earnings growth potential and the company’s ROIC profile, we view the current valuation as attractive.

Flowserve Corp. (FLS)

(Analyst: Andy Ramer)

Description

Flowserve is a leading manufacturer and aftermarket service provider of flow control systems, with sales of $3.7 billion. The company has two divisions: Flowserve Pump Division (pumps), with 72% of sales, and Flowserve Control Division (valves), with 28% of sales. Flowserve serves more than 10,000 customers in over 50 countries. End markets served include Oil & Gas (35%), Chemical (29%), General Industries (18%), Power (14%), and Water (4%). North America accounts for 37% of sales, followed by Asia Pacific (23%), Europe (22%), Middle East & Africa (12%), and Latin America (6%). The company’s market cap is $5.2 billion.

Good Business

| | • | Flowserve has respected brands and technical expertise across broad industry process applications, and a history of strong customer relationships with end users, engineering and construction companies, and distributors. |

| | | |

| | • | A significant installed base with more than five million assets provides recurring aftermarket opportunities. The aftermarket accounts for one-half of sales. The products and services are used in mission-critical applications. |

| | | |

| | • | As restructuring expenses have declined, operating margins have improved. Flowserve has become less working capital-intensive as it has grown. |

| | | |

| | • | Net debt is at the lowest level since 2012. The leverage ratio is a relatively modest 1.35 times. Free cash flow (FCF) is abundant. |

Valuation

| | • | Flowserve trades for around 20 times depressed 2021 estimates and 10 times prior peak earnings. After the company completes a multi-year restructuring process, it is expected to be a better business than historically, and therefore, should garner a higher multiple. |

| | | |

| | • | The company is being valued at a low-teens enterprise value-to-EBITDA multiples on 2021 and 2022 estimates. |

| | | |

| | • | Flowserve converts approximately 100% of its net income into FCF. There should be ample room for share repurchases and dividends in the future. |

Management

| | • | Scott Rowe has been President and CEO since April 2017. Although the turnaround may take a little more time to complete, we have been impressed by his progress to date. |

| | | |

| | • | There has been a much-needed wholesale upgrade of leadership directly reporting to Mr. Rowe, and multiple changeouts from the board. |

| | | |

| | • | A large number of senior leaders now have FCF and working capital metrics as part of their incentive compensation benchmarks, which will be measured quarterly, rather than simply a year-end target. |

Investment Thesis

Flowserve is in a far better place than it was just four years ago, aided by the implementation of self-help initiatives under new management which has taken, or is taking action to optimize its manufacturing footprint, improve (standardize) processes, invest in systems, reinvigorate innovation, and improve the capture rate of its large installed base. The company’s long-term targets include revenue growth of 2% above the industry growth rate and achieving an operating margin of mid-teens, up from 10% in 2020. Flowserve is a higher-quality way to gain exposure to the out-of-favor energy space.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 96.1% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 18.3% | | | | | | |

| | | | | | | | | |

| | | Advertising/Marketing Services — 4.1% | | | | | | |

| | 1,275,000 | | Interpublic Group of Cos. Inc. | | $ | 22,046,035 | | | $ | 37,230,000 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 9.0% | | | | | | | | |

| | 315,000 | | CDK Global Inc. | | | 15,824,113 | | | | 17,028,900 | |

| | 174,000 | | FTI Consulting Inc.* | | | 19,681,508 | | | | 24,379,140 | |

| | 940,000 | | Genpact Ltd. | | | 17,185,315 | | | | 40,250,800 | |

| | | | | | | 52,690,936 | | | | 81,658,840 | |

| | | | Personnel Services — 5.2% | | | | | | | | |

| | 160,000 | | ManpowerGroup Inc. | | | 10,005,094 | | | | 15,824,000 | |

| | 400,000 | | Robert Half International Inc. | | | 16,456,716 | | | | 31,228,000 | |

| | | | | | | 26,461,810 | | | | 47,052,000 | |

CONSUMER DURABLES SECTOR — 1.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Homebuilding — 1.1% | | | | | | | | |

| | 65,000 | | LGI Homes Inc.* | | | 9,150,625 | | | | 9,705,150 | |

| | | | | | | | | |

CONSUMER SERVICES SECTOR — 2.3% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 2.3% | | | | | | | | |

| | 37,000 | | Graham Holdings Co. | | | 16,690,194 | | | | 20,810,280 | |

| | | | | | | | | |

DISTRIBUTION SERVICES SECTOR — 8.9% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Electronics Distributors — 3.7% | | | | | | | | |

| | 300,000 | | Arrow Electronics Inc.* | | | 9,893,291 | | | | 33,246,000 | |

| | | | | | | | | | | | |

| | | | Medical Distributors — 2.9% | | | | | | | | |

| | 386,000 | | Henry Schein Inc.* | | | 21,459,047 | | | | 26,726,640 | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 2.3% | | | | | | | | |

| | 225,000 | | Applied Industrial Technologies Inc. | | | 13,908,440 | | | | 20,513,250 | |

| | | | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 7.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Aerospace & Defense — 1.5% | | | | | | | | |

| | 67,000 | | Huntington Ingalls Industries Inc. | | | 11,054,904 | | | | 13,791,950 | |

| | | | | | | | | | | | |

| | | | Electronic Components — 5.7% | | | | | | | | |

| | 910,000 | | nVent Electric PLC | | | 18,334,725 | | | | 25,398,100 | |

| | 285,000 | | Plexus Corp.* | | | 20,719,925 | | | | 26,174,400 | |

| | | | | | | 39,054,650 | | | | 51,572,500 | |

FINANCE SECTOR — 24.4% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Finance/Rental/Leasing — 6.5% | | | | | | | | |

| | 578,000 | | FirstCash Inc. | | | 28,793,574 | | | | 37,957,260 | |

| | 275,000 | | Ryder System Inc. | | | 11,426,250 | | | | 20,803,750 | |

| | | | | | | 40,219,824 | | | | 58,761,010 | |

| | | | Investment Banks/Brokers — 3.1% | | | | | | | | |

| | 420,000 | | Houlihan Lokey Inc. | | | 21,230,306 | | | | 27,934,200 | |

| | | | | | | | | | | | |

| | | | Life/Health Insurance — 1.5% | | | | | | | | |

| | 95,000 | | Primerica Inc. | | | 11,278,740 | | | | 14,042,900 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 96.1% (a) (Continued) | | | | | | |

| | | | | | | |

FINANCE SECTOR — 24.4% (Continued) | | | | | | |

| | | | | | | | | |

| | | Multi-Line Insurance — 1.4% | | | | | | |

| | 11,000 | | White Mountains Insurance Group Ltd. | | $ | 9,528,437 | | | $ | 12,263,900 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 2.7% | | | | | | | | |

| | 320,000 | | W.R. Berkley Corp. | | | 5,439,248 | | | | 24,112,000 | |

| | | | | | | | | | | | |

| | | | Real Estate Development — 5.1% | | | | | | | | |

| | 240,000 | | The Howard Hughes Corp.* | | | 24,086,139 | | | | 22,831,200 | |

| | 1,150,000 | | Kennedy-Wilson Holdings Inc. | | | 21,156,377 | | | | 23,241,500 | |

| | | | | | | 45,242,516 | | | | 46,072,700 | |

| | | | Regional Banks — 4.1% | | | | | | | | |

| | 670,000 | | Zions Bancorporation N.A. | | | 20,922,754 | | | | 36,823,200 | |

| | | | | | | | | |

HEALTH TECHNOLOGY SECTOR — 4.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Medical Specialties — 3.1% | | | | | | | | |

| | 440,000 | | Dentsply Sirona Inc. | | | 14,747,639 | | | | 28,076,400 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals: Major — 1.0% | | | | | | | | |

| | 380,000 | | Phibro Animal Health Corp. | | | 10,167,044 | | | | 9,272,000 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 7.3% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Containers/Packaging — 5.1% | | | | | | | | |

| | 253,000 | | Avery Dennison Corp. | | | 10,258,363 | | | | 46,463,450 | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 2.2% | | | | | | | | |

| | 350,000 | | Donaldson Co. Inc. | | | 14,991,016 | | | | 20,356,000 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 19.4% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Building Products — 2.5% | | | | | | | | |

| | 150,000 | | A.O. Smith Corp. | | | 5,616,286 | | | | 10,141,500 | |

| | 144,000 | | Armstrong World Industries Inc. | | | 5,892,139 | | | | 12,972,960 | |

| | | | | | | 11,508,425 | | | | 23,114,460 | |

| | | | Industrial Machinery — 5.7% | | | | | | | | |

| | 170,000 | | EnPro Industries Inc. | | | 12,166,948 | | | | 14,495,900 | |

| | 530,000 | | Flowserve Corp. | | | 13,162,928 | | | | 20,569,300 | |

| | 140,000 | | Woodward Inc. | | | 5,679,554 | | | | 16,888,200 | |

| | | | | | | 31,009,430 | | | | 51,953,400 | |

| | | | Miscellaneous Manufacturing — 9.5% | | | | | | | | |

| | 170,000 | | Brady Corp. — Cl A | | | 8,474,567 | | | | 9,086,500 | |

| | 287,000 | | Carlisle Cos. Inc. | | | 21,469,984 | | | | 47,234,460 | |

| | 990,000 | | TriMas Corp.* | | | 21,908,123 | | | | 30,016,800 | |

| | | | | | | 51,852,674 | | | | 86,337,760 | |

| | | | Trucks/Construction/Farm Machinery — 1.7% | | | | | | | | |

| | 530,000 | | Trinity Industries Inc. | | | 10,096,736 | | | | 15,099,700 | |

| | | | | | | | | |

TECHNOLOGY SERVICES SECTOR — 3.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Information Technology Services — 3.1% | | | | | | | | |

| | 292,000 | | Insight Enterprises Inc.* | | | 17,101,647 | | | | 27,862,640 | |

| | | | Total common stocks | | | 548,004,731 | | | | 870,852,330 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2021 (Unaudited)

Principal Amount | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 4.0% (a) | | | | | | |

| | | | | | | | | |

| | | Bank Deposit Account — 4.0% | | | | | | |

| $ | 36,404,090 | | U.S. Bank N.A., 0.01%^ | | $ | 36,404,090 | | | $ | 36,404,090 | |

| | | | Total short-term investments | | | 36,404,090 | | | | 36,404,090 | |

| | | | Total investments — 100.1% | | $ | 584,408,821 | | | | 907,256,420 | |

| | | | Other liabilities, less assets — (0.1%) (a) | | | | | | | (501,067 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 906,755,353 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of March 31, 2021. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

The accompanying notes to financial statements are an integral part of this schedule.

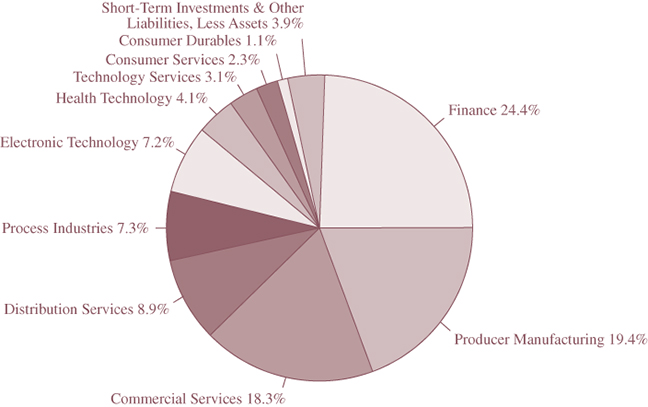

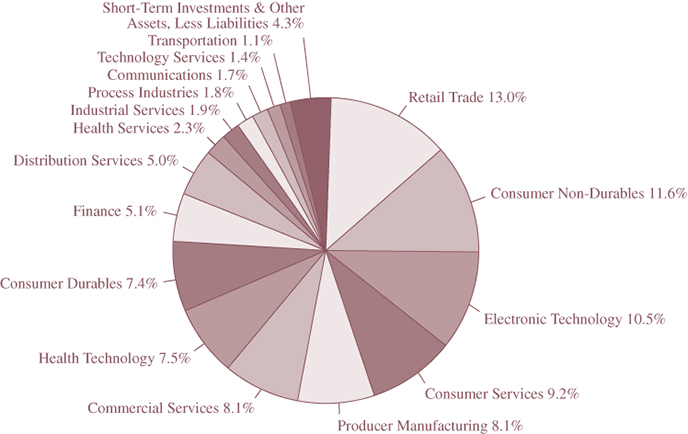

INDUSTRY SECTORS as a percentage of net assets

as of March 31, 2021 (Unaudited)

FMI International Fund

and

FMI International Fund II – Currency Unhedged

(unaudited)

March 31, 2021

Dear Fellow Shareholders:

Value investing’s resurgence continued in the March quarter, marking the second consecutive period of outperformance. Growth stocks had been the primary beneficiary of low inflation, unprecedented interest rates, and coronavirus lockdowns, but the tide finally appears to be turning. Improving global economic growth prospects are now working in favor of the value trade, driven by increased vaccine production and roll-outs, the gradual re-opening of hard-hit sectors of the economy, rebounding industrial production and global trade, and continued fiscal and monetary support (helping fuel concerns over higher inflation and interest rates). With the world economy on the mend and value stocks trading at a significant discount to their growth counterparts, the relative outlook from here looks attractive.

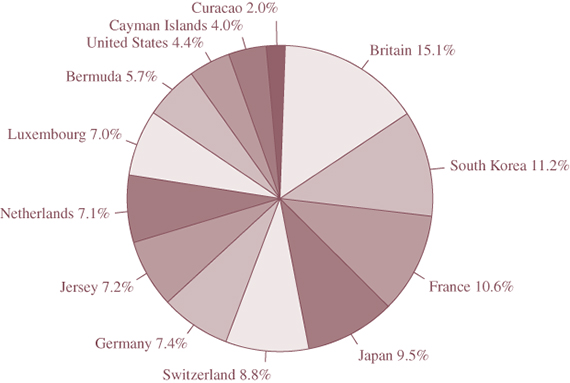

In the first quarter, the FMI International portfolios gained 7.07% (currency hedged)1 and 4.95% (currency unhedged),2 respectively, which compares with an MSCI EAFE Index gain of 7.59% in local currency (LOC) and 3.48% in U.S. Dollars (USD). The MSCI EAFE Value Index advanced 11.32% in LOC and 7.44% in USD, outpacing the MSCI EAFE Growth Indices by over 8%. “Deep” value stocks (e.g., lower-quality, significantly out-of-favor, having poor balance sheets), including the financial and energy sectors, led the charge. FMI’s focus on business quality and conservative balance sheets weighed on the relative comparison. The FMI International portfolios generated strong results from the Retail Trade, Consumer Services, and Consumer Non-Durables sectors, but lagged in Electronic Technology, Distribution Services, and Finance. Individual stock performance was driven by Shaw Communications Inc., Jardine Strategic Holdings Ltd., and CNH Industrial N.V., while Samsung Electronics Co. Ltd., Ferguson PLC, and Smith & Nephew PLC came up short. FMI’s currency hedged performance benefited from a strong USD in the period.

Diverging Paths

Despite an encouraging global economic outlook, it’s been a challenging period for continental Europe. As of late March, the European Union (EU) had fallen behind on the vaccine front, having administered only 12 doses per 100 people, compared with 34.1 in the U.S. and 40.5 in the UK. Infections and deaths have fallen significantly in the U.S. and UK, while cases and hospitalizations in the EU are on the rise.3 New COVID-19 variants are spreading and the EU retreated to tighter restrictions and lockdowns amid concern that Europe could be headed toward another disappointing summer tourism season. Economists are cutting growth expectations, as reported by the Financial Times:

“From the outset, the pandemic inflicted deeper economic scars on Europe than the US. Now, their responses to the crisis mean the economies are about to drift further apart. The EU’s ‘output gap’ – the shortfall in what the bloc was producing compared with its full potential at the start of this year – was double the equivalent in the US, meaning the EU was creating fewer jobs, yielding weaker demand and generating lower inflation.”

_______________

1 | The FMI International Fund [currency hedged] Investor Class (FMIJX) and the FMI International Fund [currency hedged] Institutional Class (FMIYX) had a return of 7.07% and 7.12%, respectively, for the first quarter of 2021. |

2 | The FMI International Fund [unhedged] Institutional Class (FMIFX) had a return of 4.95% for the first quarter of 2021. |

3 | Ben Hall, Michael Peel, Sam Fleming, Leila Abboud and Guy Chazan. “Europe’s vaccine disarray.” Financial Times, March 19, 2021. |

The U.S. is expected to catch up with its pre-crisis growth trajectory by 2021, while it may be 2023 before Europe can say the same.4

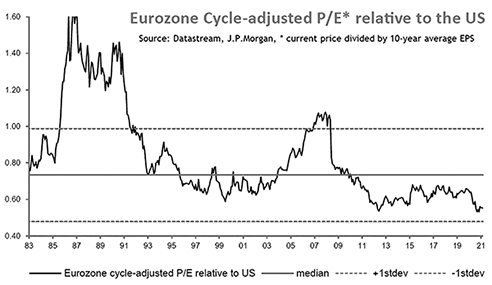

While it may sound bleak, it is not all gloom and doom for Europe. The EU will eventually arrest the spread of the virus and re-open its economies, however many months behind the U.S. and UK. Having a 3 to 5-year investment time horizon works to FMI’s advantage in this scenario, with most investors focused on the here and now. As we wait for the business activity in Europe to resume, cheaper relative valuations abound. The eurozone now trades at a historic discount to the U.S. (see chart),5 boding well for future returns.

Onward and Upward

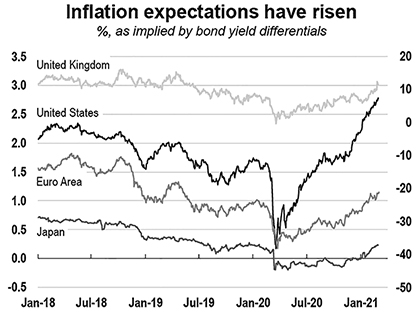

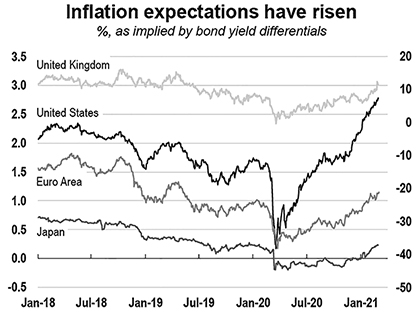

After an extraordinary (and worrisome) period of ultra-low interest rates, inflation expectations have started to rise in the U.S., Europe and Japan, with the eurozone Consumer Price Index jumping the most in over a decade.6 Yields for U.S. Treasuries, German Bunds, UK Gilts, and Japanese Government Bonds have all started to move upward, but with $13.4 trillion of negative-yielding bonds globally (from December’s peak of $18.4 trillion), there is still plenty of room to run.7 Apparently $28 trillion of money printing (a.k.a. fiscal and monetary stimulus) over the past 12 months,8 combined with vaccine relief and an improving economic outlook, has finally started to spark concerns about a long-overdue increase in the cost of capital.

On that topic, BofA Global Research opined about the “mother-of-all policy bubbles” in February, calculating that global central banks had purchased “$1.1 billion of financial assets every hour since March.” This profligacy helped inflate the “mother-of-all-asset bubbles,” as global market capitalizations increased by “$6.2 billion per hour,” or over “$50 trillion in 11 months.”9 No, these are not figures taken from an article in The Onion. Central banks have taken market manipulation to unthinkable levels.

_______________

4 | Martin Arnold and James Politi. “US to leave EU trailing in race for recovery after pandemic.” Financial Times, March 16, 2021. |

5 | Mislav Matejka, Prabhav Bhadani and Nitya Saldanha. “Equity Strategy.” J.P. Morgan Cazenove, March 1, 2021. |

6 | Martin Arnold. “Eurozone inflation in biggest jump for decade.” Financial Times, February 3, 2021. |

7 | Source: Bloomberg. |

8 | Michael Hartnett, David Jones, Shirley Wu. “The Flow Show.” BofA Global Research, March 11, 2021. |

9 | Michael Hartnett, David Jones, Shirley Wu. “The Flow Show.” BofA Global Research, February 18, 2021. |

Print money, buy assets, drive up asset prices, rinse, and repeat. This has been the central bank playbook. However, money printing is a dangerous game with serious negative consequences (just ask Venezuela or Argentina). Rising interest rates seem inevitable over the long run, and are most detrimental for growth stocks, which have a far greater proportion of their value derived from earnings many years into the future, and thus are more sensitive to higher discount rates. The days of speculative fervor being rewarded may be numbered, as justifying sky-high valuations with aggressively low discount rates can only go on for so long.

Portfolio Positioning

Most financial stocks fall into the value camp, and as such, financials make up a significant portion of the MSCI EAFE (~20% of sector weight) and MSCI EAFE Value (~31%) indices. The sector, and the banking industry in particular, has significantly outperformed to start the year. The FMI International portfolios are underweight financials, because we have struggled to find higher-quality companies with solid balance sheets. Many of the businesses are commoditized in nature. We think a good measure of the strong upward move in the second-tier players will not last.

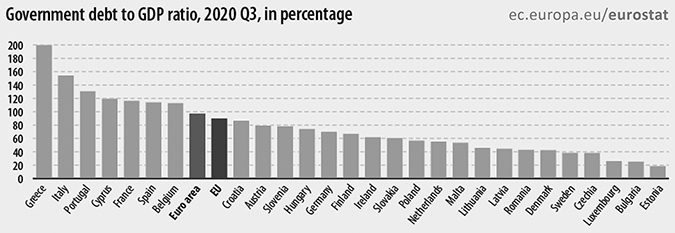

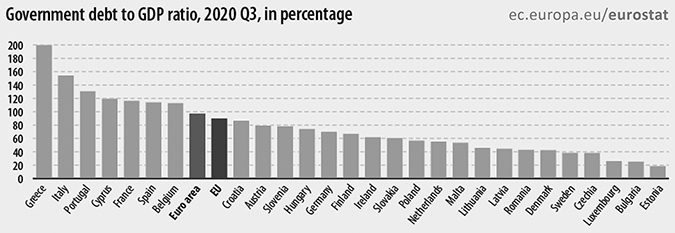

In the first quarter of 2020, we purchased Lloyds Banking Group PLC, which is the market leader in the homogenous and consolidated UK market. With Lloyds we were able to buy a well-capitalized, low-cost, high-quality bank that traded down to around half of tangible book value. The loan book is roughly two-thirds residential mortgages with an average loan-to-value of under 45%, allowing us to sleep at night. In the eurozone, however, it has been much more challenging to find suitable investments in the banking industry that meet our quality standards and also have transparency. To start, capital controls vary by regions, making underlying economic viability and returns more difficult to assess. In addition, eurozone banks have been piling on government debt, raising their holdings by 19% to €1.2 trillion in late 2020. Banks have set aside little-to-no capital to account for sovereign debt because regulators consider these to be “risk-free” assets.10 This is where we part ways. We believe European sovereign debt carries tremendous risk, especially at the current price levels. The European debt crisis, which took place less than a decade ago, is a case in point. Given that these same eurozone countries are starting from a place of weakness today (huge fiscal deficits and record debt-to-GDP), caution appears warranted.

Eurozone banks could also be facing significant bad debt problems from their corporate loan books. As noted by The Wall Street Journal (WSJ), “The region’s generous lockdown-support programs and patchwork of insolvency laws could create [more] so-called zombie firms,”11 or companies whose interest expense exceeds their earnings before interest and taxes. Support from eurozone governments has included significant loan guarantees, subsidies for millions of employee

_______________

10 | Patricia Kowsmann. “Banks Pile Into Government Debt, Setting Up ‘Doom Loop’ Sequel in Europe.” The Wall Street Journal, December 30, 2020. |

11 | Rochelle Toplensky. “Zombies Could Stunt the Bank Recovery.” The Wall Street Journal, January 12, 2021. |

wages, and bailouts for large numbers of companies. What happens when the money fountain runs dry? Per the Financial Times, French bank Natixis “estimates that the proportion of [European] companies that are ‘zombies’ has risen from 3.5 per cent at the beginning of the 1990s, to close to 11 per cent in 2008, to 21 per cent in 2019.”12 And that was before a once-in-a-lifetime global pandemic! Unproductive zombie companies have been kept on life support for years with low interest rates and accommodative policies, which may spell trouble down the road. While we continue to assess eurozone banks because they are statistically cheap, in most cases we believe the risks outweigh the potential rewards.

An additional contributor for the MSCI EAFE indices was the Energy Minerals sector (another FMI underweight), driven in large part by Integrated Oil. These exploration and production (E&P) companies have rarely aligned well with our investment principles. The E&P space is generally a low-returning sector over a full cycle. Discipline is in short supply, and illogical capital flows tend to ruin the economics of this business; E&P can have wonderful ‘trading’ moves from time to time, but it is a difficult place for long-term buy-and-hold type investors. E&P is a commodity business where differentiation is next to impossible and companies don’t control their own destiny. FMI has opted for energy exposure through the likes of Schlumberger Ltd., among other tangential exposure through Yokogawa Electric Corp. and Smiths Group PLC. Schlumberger supplies the “picks and shovels” to a broad array of producers. Among service providers, Schlumberger is the gold standard, given the breadth and value-added nature of their products, technology and services, exposure to the entire lifecycle of the well, and broad geographic exposure. They are also a leader in emerging carbon-neutral technologies, which is becoming an increasing area of focus for the industry. While the company has disappointed in recent years, we believe the outlook is bright.

Our largest sector overweight is in Retail Trade, where we own B&M European Value Retail S.A., the largest general merchandise discounter in the UK. The company’s competitive positioning was strengthened during the pandemic, as more affluent shoppers traded down to the concept, expanding their addressable market. This quarter, we also purchased Greggs PLC, the UK’s leading convenience food-to-go store operator, which closed stores for nearly 15 weeks during the pandemic, culminating in the first loss in the company’s history. We believe Greggs is poised for a swift recovery as the UK economy reopens. We have also found opportunities in Consumer Services (our second-largest sector overweight), where corporate action has been plentiful. A spinoff of Universal Music Group (#1 in global recorded music) is unlocking significant value at both our Vivendi and Bolloré holdings, while Shaw Communications Inc. is being acquired by Rogers Communications Inc. (we sold our shares following the March announcement). Our exposure to Electronic Technology also exceeds that of the MSCI EAFE, led by Samsung Electronics Co. Ltd. Samsung dominates the world’s semiconductor memory business (#1 in DRAM & NAND storage technologies) as it has become a much more consolidated industry in recent years. Based on exchange classification, our greatest country overweight continues to be the UK, where a cocktail of Brexit and COVID-19 sent investors running for the exits. We have taken a contrarian approach, as we believe Brexit will be a long-term positive for the UK as they further distance themselves from the dysfunction of the EU. With COVID cases down over 90%, as soon as restrictions and lockdowns ease, it should only be a matter of time before the economy starts to regain its footing.

Valuation Discipline

Even great companies can get too expensive. In early January, we sold our long-standing position in Accenture PLC after the company’s valuation exceeded 30 times next 12 months (NTM) earnings per share (EPS). We originally invested in Accenture at the launch of the FMI International strategy at a valuation below 15 times NTM EPS and held the stock for over ten years. We added to the holding numerous times in the early years, growing the position size to as high as 5.5% in

_______________

12 | Claire Jones. “European Zombification becomes even scarier.” Financial Times, December 2, 2021. |

late 2014, before dialing it back in recent years as the valuation became less compelling. It is one of the world’s largest information technology services firms, specializing in helping complex, global businesses navigate disruption, and focusing on next-generation services like digital, cloud, and security. For years, the investment allowed FMI to capture the inherently higher growth of technology-related industries (GDP+) without investing directly in pure “invention-oriented” technology companies. Through Accenture we were able to avoid some of the shortfalls of tech investing: technology obsolescence, short product cycles, and subpar return on invested capital (ROIC). It grew steadily, was solidly profitable, capital-light, and generated high returns, all while maintaining a rock-solid balance sheet. It compounded its business value for many years, outperforming the MSCI EAFE indices by over 450% during our holding period. Unfortunately, the market increasingly recognized the company’s positive attributes, and the stock’s discount to intrinsic value slowly evaporated. Despite our admiration for the business, it exceeded our valuation threshold. We will continue to follow the company closely for future opportunities. Outlined below are a couple of out-of-favor investments that soaked up the Accenture proceeds.

Fresenius Medical Care AG & Co. KGaA (FME GR)

(Analyst: Dan Sievers)

Description

Fresenius Medical Care is the #1 global provider of products and services for patients with chronic kidney failure and end stage renal disease (ESRD), providing over 53 million dialysis treatments to about 350,000 patients annually. Fresenius equipment (with more than 11,000 patents) and related products are used to treat more than half of worldwide dialysis patients. The company operates a global network of about 4,100 outpatient dialysis clinics in the U.S. (2,600) and about 50 other countries (1,500). In 2020, Fresenius revenue was €17.9 billion with €14.1 billion (79%) from Services and €3.7 billion (21%) from Products. This understates the size of its razor and blade-type products business, as Fresenius eliminates intercompany revenue.

Good Business

| | • | In 2019, the number of worldwide dialysis patients grew to 3.5 million, up 6% year-over-year, in line with the long-term average. In 2020, COVID-related excess mortality contributed to slower-than-expected worldwide patient growth of just 3%. |

| | | |

| | • | Fresenius Medical and DaVita, Inc. are the low-cost providers in the U.S., accounting for just over 80% of treatments in the $25 billion U.S. dialysis services industry ($30-$40 lower cost per treatment). |

| | | |

| | • | While Fresenius and DaVita have historically had significant influence over pricing from private insurers, they are mostly price-takers from Medicare. |

| | | |

| | • | Treatment is necessary several times a week and clinic utilization is high, with limited excess capacity nationwide. |

| | | |

| | • | About 88% of patients receive in-center treatment with 12% receiving treatment at home (increasing). |

| | | |

| | • | The U.S. market is shifting toward home treatment (more profitable and less capital intensive) and coordinated care models (value-based care), which will sometimes entail broader patient healthcare cost risk in exchange for greater oversight. In 2021, Medicare Advantage is newly mandated to provide broad access to care for ESRD and these negotiated rates are often 10 percentage points higher than traditional Medicare. |

| | | |

| | • | The company’s internal ROIC was 6% for 2020, with one-third of long-term executive compensation tied to increasing this ROIC level 100-150 basis points by 2025. If adjusting for goodwill (because industry consolidation is mostly behind us), the underlying tangible ROIC is in the mid-to-upper teens. |

| | | |

| | • | 2020 Net debt-to-EBITDA finished at 2.7 times, with a 2.3% weighted average cost of debt. |

Valuation

| | • | Fresenius shares trade for a mid-teens multiple of 2020, and of 2021 EPS estimates. The roll-off of COVID-related costs and a return to something like conventional patient growth during 2022 should result in a meaningful earnings rebound (making the stock attractive in absolute terms) and represents a large discount to medical technology sector averages. |

| | | |

| | • | Fresenius’ shares are more than 30% below their early 2018 highs, and its enterprise value-to-sales ratio is 1.5 times, versus the 5-year average of 1.8 times. Despite advantages from larger scale, vertical integration, and a stronger international footprint, the stock’s historical premium to DiVita has recently become a discount. |

Management

| | • | Chief Executive Officer Rice Powell has been with Fresenius for 24 years. During his tenure, patient outcomes have improved. With U.S. dialysis service consolidation via mergers and acquisitions largely in the rearview mirror, Mr. Powell has made several investments in home dialysis, related chronic kidney disease treatments, and care coordination that should advantage the company in the future. ROIC was added to the compensation plan in 2016 and a €1 billion buyback was announced in 2019. |

Investment Thesis

Fresenius Medical is a dependable top-line grower with low exposure to the typical business cycle. Despite the pandemic, it grew in 2020 and increased its dividend more than 10%. That said, unlike medical technology peers who saw their most severe COVID-related business impact from deferred procedures in the middle of 2020, the company will see the greatest business impact throughout 2021 from excess mortality in its patient population. A difficult 2021 outlook has resulted in an interesting multi-year investment opportunity, as COVID-related costs begin to roll off later this year, the dialysis services patient population resumes growth in 2022, and the company begins to adjust its clinic and cost base as necessary. While investments in Care Coordination and Home Dialysis contributed to recent margin compression, these same investments, along with expanded Medicare Advantage coverage, should contribute toward improving financial metrics and multiple expansion back towards historical averages.

Henkel AG & Co. KGaA (HEN GR)

(Analyst: Dain Tofson)

Description

Henkel is the global leader in adhesives and has strong regional market positions in laundry, home care, and beauty care products. Henkel reports three segments: Adhesives (45% of sales and 49% of operating profit), Laundry & Home Care (35% and 37%), and Beauty Care (20% and 14%). Key brands for Henkel include Loctite, Persil, all, Bref, Schwarzkopf, Dial, and Syoss. Sales by geography are split Western Europe (30%), North America (27%), Asia-Pacific (16%), Eastern Europe (15%), Africa/Middle East (6%), and Latin America (6%). Emerging markets represent approximately 40% of sales.

Good Business

| | • | As the global leader in Adhesives and a top three player in key Laundry & Home Care and Beauty Care categories, Henkel benefits from economies of scale compared with smaller competitors. |

| | | |

| | • | Henkel earns a mid-teens return on capital over a market cycle. |

| | | |

| | • | The Adhesives segment benefits from the secular trends of electrification, connectivity, and sustainability, and represents a low share of total product/project cost, but high cost of failure. |

| | | |

| | • | Adhesives and consumer staple products (laundry detergent, cleaning products, hair care, etc.) are recurring in nature; trust and brand loyalty tend to foster repeat consumption. |

| | • | Henkel’s products are necessary, and the business is easy to understand. |

| | | |

| | • | The balance sheet is strong, with net debt-to-EBITDA at only 0.3 times. |

Valuation

| | • | Henkel trades at an upper-teens price-to-earnings (P/E) multiple on estimates that are depressed due to COVID; this valuation is attractive given the growth prospects of the business and mid-teens return on capital profile. |

| | | |

| | • | The current P/E is around a 20% discount to peers, a level last seen in the Global Financial Crisis. |

| | | |

| | • | The ordinary shares, which we own, trade at a 12% discount to the preferred shares. |

Management

| | • | Carsten Knobel, CEO, is executing a strategic plan to improve the business through reinvesting in innovation, sustainability, and digital initiatives, disposing of or fixing underperforming businesses, reorganizing closer to the customer, and transforming the culture. |

| | | |

| | • | The Henkel family controls the business through their majority ownership of the ordinary shares, which we believe allows management to take a long-term view. |

| | | |

| | • | Management compensation is tied to return on capital. |

Investment Thesis

Henkel is the global leader in Adhesives and a top three player in key Laundry & Home Care and Beauty Care categories. Henkel is currently performing below its potential due to COVID impacts in Adhesives and Beauty Care, challenges related to North American laundry, and two years of elevated reinvestment costs in Laundry & Home Care and Beauty Care to correct previous underinvestment in innovation. While these challenges have weighed on past performance, the outlook is attractive as growth is accelerating in Adhesives, and Laundry & Home Care and Beauty Care are set to benefit from the reinvestments and continued execution of the strategic plan. Given this setup, we are confident management can meet its target for mid-to-high single-digit EPS growth (compound annual growth rate) over the medium term. The valuation is undemanding for this growth potential, and the balance sheet is very strong.

Thank you for your support of the FMI International Funds.

This shareholder letter is unaudited.

FMI International Fund

SCHEDULE OF INVESTMENTS

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 96.3% (a) | | | | | | |

| | | | | | | |

| COMMON STOCKS — 85.7% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 8.2% | | | | | | |

| | | | | | | | | |

| | | Advertising/Marketing Services — 2.1% | | | | | | |

| | 5,975,000 | | WPP PLC (Jersey) (b) | | $ | 78,739,956 | | | $ | 76,142,655 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 6.1% | | | | | | | | |

| | 2,400,000 | | Bureau Veritas S.A. (France) (b) | | | 58,172,890 | | | | 68,296,230 | |

| | 1,265,000 | | DKSH Holding AG (Switzerland) (b) | | | 69,346,588 | | | | 97,131,534 | |

| | 595,000 | | Secom Co. Ltd. (Japan) (b) | | | 34,985,221 | | | | 50,159,509 | |

| | | | | | | 162,504,699 | | | | 215,587,273 | |

COMMUNICATIONS SECTOR — 1.8% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Wireless Telecommunications — 1.8% | | | | | | | | |

| | 1,675,000 | | Millicom International | | | | | | | | |

| | | | Cellular S.A. (Luxembourg)* | | | 80,004,555 | | | | 64,001,750 | |

| | | | | | | | | |

CONSUMER DURABLES SECTOR — 6.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Electronics/Appliances — 4.9% | | | | | | | | |

| | 1,640,000 | | Sony Group Corp. (Japan) (b) | | | 88,971,699 | | | | 173,566,897 | |

| | | | | | | | | | | | |

| | | | Home Furnishings — 1.3% | | | | | | | | |

| | 4,500,000 | | Howden Joinery Group PLC (Britain) (b) | | | 33,633,224 | | | | 45,471,062 | |

| | | | | | | | | |

CONSUMER NON-DURABLES SECTOR — 7.8% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Food: Major Diversified — 1.1% | | | | | | | | |

| | 365,000 | | Nestlé S.A. (Switzerland) (b) | | | 25,240,035 | | | | 40,688,883 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 6.7% | | | | | | | | |

| | 1,240,000 | | Henkel AG & Co. KGaA (Germany) (b) | | | 115,868,760 | | | | 122,850,130 | |

| | 2,050,000 | | Unilever PLC (Britain) (b) | | | 87,177,197 | | | | 114,390,175 | |

| | | | | | | 203,045,957 | | | | 237,240,305 | |

CONSUMER SERVICES SECTOR — 9.5% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Media Conglomerates — 2.5% | | | | | | | | |

| | 2,675,000 | | Vivendi (France) (b) | | | 49,298,777 | | | | 87,803,568 | |

| | | | | | | | | | | | |

| | | | Movies/Entertainment — 2.6% | | | | | | | | |

| | 19,500,000 | | Bolloré (France) (b) | | | 71,365,315 | | | | 94,105,148 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 3.3% | | | | | | | | |

| | 50,000 | | Booking Holdings Inc. (United States)* | | | 86,486,789 | | | | 116,492,000 | |

| | | | | | | | | | | | |

| | | | Restaurants — 1.1% | | | | | | | | |

| | 1,845,000 | | Compass Group PLC (Britain) (b)* | | | 27,085,868 | | | | 37,276,160 | |

| | | | | | | | | |

DISTRIBUTION SERVICES SECTOR — 5.0% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 5.0% | | | | | | | | |

| | 1,410,000 | | Ferguson PLC (Jersey) (b) | | | 73,582,547 | | | | 168,432,459 | |

| | 517,771 | | Rexel S.A. (France) (b) | | | 9,908,680 | | | | 10,248,865 | |

| | | | | | | 83,491,227 | | | | 178,681,324 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI International Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2021 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 96.3% (a) (Continued) | | | | | | |

| | | | | | | |

| COMMON STOCKS — 85.7% (a) (Continued) | | | | | | |

| | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 4.8% | | | | | | |

| | | | | | | | | |

| | | Aerospace & Defense — 3.0% | | | | | | |

| | 785,000 | | Safran S.A. (France) (b)* | | $ | 84,840,811 | | | $ | 106,781,979 | |

| | | | | | | | | | | | |

| | | | Electronic Equipment/Instruments — 1.8% | | | | | | | | |

| | 3,515,000 | | Yokogawa Electric Corp. (Japan) (b) | | | 62,344,220 | | | | 64,931,808 | |

| | | | | | | | | |

FINANCE SECTOR — 5.1% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Major Banks — 2.1% | | | | | | | | |

| | 129,200,000 | | Lloyds Banking Group PLC (Britain) (b) | | | 65,790,017 | | | | 75,792,275 | |

| | | | | | | | | | | | |

| | | | Multi-Line Insurance — 0.3% | | | | | | | | |