UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07831

FMI Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

John S. Brandser

Fiduciary Management, Inc.

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2018

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2018

FMI Large Cap Fund

Investor Class (FMIHX)

Institutional Class (FMIQX)

FMI Common Stock Fund

Investor Class (FMIMX)

Institutional Class (FMIUX)

FMI International Fund

Investor Class (FMIJX)

Institutional Class (FMIYX)

| |

| |

| |

| |

| |

| FMI Funds, Inc. |

| |

| Advised by Fiduciary Management, Inc. |

| www.fmifunds.com |

| |

| |

| |

| |

| |

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| Shareholder Letter | 1 |

| Schedule of Investments | 7 |

| Industry Sectors | 9 |

| | |

| FMI Common Stock Fund | |

| Shareholder Letter | 10 |

| Schedule of Investments | 16 |

| Industry Sectors | 18 |

| | |

| FMI International Fund | |

| Shareholder Letter | 19 |

| Schedule of Investments | 26 |

| Schedule of Forward Currency Contracts | 30 |

| Industry Sectors | 31 |

| | |

| Financial Statements | |

| Statements of Assets and Liabilities | 32 |

| Statements of Operations | 33 |

| Statements of Changes in Net Assets | 34 |

| Financial Highlights | 37 |

| Notes to Financial Statements | 43 |

| | |

| Additional Information | 53 |

| Expense Example | 54 |

| Advisory Agreements | 56 |

| Disclosure Information | 60 |

FMI

Large Cap

Fund

March 31, 2018

Dear Fellow Shareholders:

The FMI Large Cap Fund returned -1.16%1 in the March quarter compared to -0.76% for the S&P 500 Index. Finance, Retail Trade and Energy Minerals were positive sector contributors, while Consumer Services, Electronic Technology and Technology Services all detracted. Stocks that helped during the period included Progressive Corp., JPMorgan Chase, and TJX Companies. On the flipside, Comcast Corp., Cerner Corp., Oracle Corp. and Nutrien Ltd. all hurt. Our zero exposure to the so-called FAANG stocks (Facebook, Amazon, Apple, Netflix and Google [Alphabet]) hurt the quarter’s performance by over 40 basis points.

There were a few new elements to contend with in the investment world this quarter that we haven’t seen in a while. An almost complete lack of volatility over recent years was interrupted for twenty trading days, beginning January 27th. Over nine sessions, the S&P 500 dropped 10.10%, followed immediately by a gain of 7.84% during eleven trading days, leaving it down just 3.05% for this period. Interestingly, the average of the FAANG stocks actually outperformed in the down-and-up part of this mini-cycle, reinforcing both the “buy-the-dip” and the “value doesn’t matter” notions. It is going to take more than a few bad days to shake people’s faith in these exceedingly expensive stocks. Amazon and Netflix were up 23.8% and 53.9%, respectively, in the quarter, and trade at multiples that would make the big cap tech darlings of 1999 blush. Amazon and Netflix both have trailing GAAP (Generally Accepted Accounting Principles) price-to-earnings ratios north of 180. Facebook, a phenomenal stock over the past five years, did wobble a bit in March, marking this as an unusual occurrence. Stocks suffered a rare few bad days near the end of the quarter, with most pundits tying this to tariff concerns. The last few sessions also saw more volatility in the FAANG group, Tesla and a few other tech high fliers. Perhaps change is on the horizon. Additional wrinkles from the quarter include the 3-month Libor (London Interbank Offered Rate, a key number tied to $200 trillion in financial contracts) gaining roughly 60 basis points to 2.3% — a level not seen since 2008 — and an inflation rate hitting 2.2% in February, which, if it holds for the year, would be the highest annual figure since 2011. For the first time in years, companies were talking about higher raw material and transportation costs pinching margins. Oddly, given the widespread view that lower taxes were expected to propel the economy into overdrive, real GDP forecasts for the first quarter from the Atlanta Fed (GDPNow) have dropped from 5% in early February to 2.4% at the end of March. We find corporate revenue growth to be a more reliable indicator and it still appears solid, but the precipitous drop in GDPNow is noteworthy. One more significant change in today’s investment landscape was the defenestration of the price of Bitcoin, as foreshadowed in our last letter. It was down 52.7% in the quarter and is off 72.4% from its peak on December 18th of 2017.

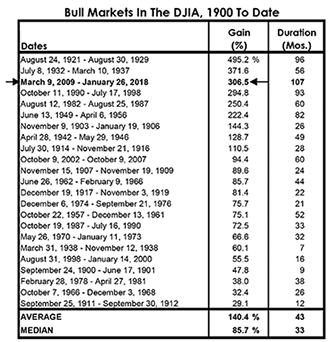

Most things about this market, however, haven’t changed much over the past several years. March 9th marked the ninth year without a bear market in the large cap indices, making this the longest bull

_______________

1 | For the quarter ended 03/31/18, the FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) were down -1.16% and -1.12%, respectively. |

market (using the Dow Jones Industrial Average) in measured history and the third most powerful (see table to the right).

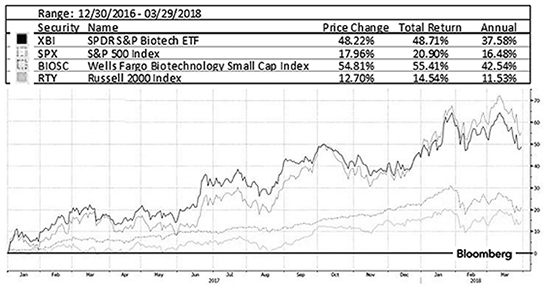

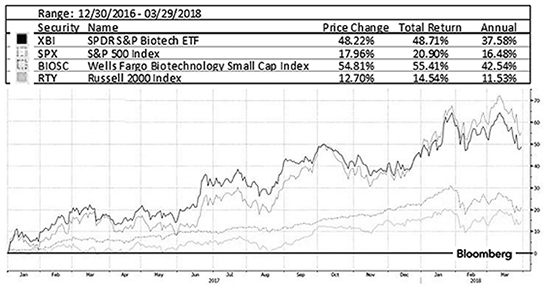

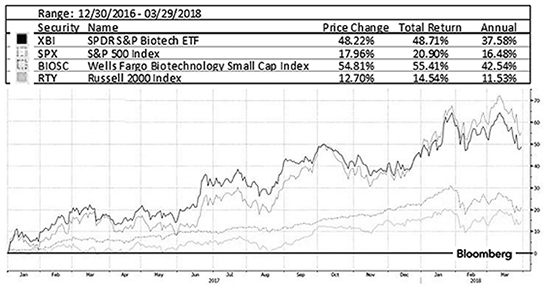

We aren’t going to conduct a lengthy rehash of what we have been articulating for some time. Despite a slightly improved valuation environment from the December quarter, stocks, on a median basis, remain near the most expensive we have ever experienced or studied. Many stock indices have become quite narrow again, reflecting a strong funneling effect from passive flows to the most popular names. Eight of the ten largest companies in the S&P 500 outperformed the index in 2017. The median stock once more underperformed the S&P 500 Index in the March quarter. Speculative biotech stocks have again been on a roll, as seen in the chart below showing performance compared to the benchmarks since the beginning of last year. Like some of the popular tech names, however, they also had a few tough days right at the end of March.

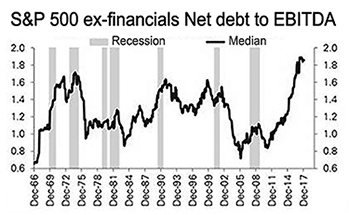

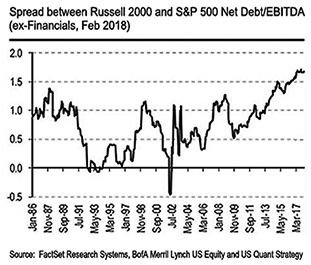

Investor confidence, which was near record-high territory three months ago, has started to fall. Still, there appears to be widespread belief that the S&P 500 is a safe investment over any time horizon. The losses that S&P 500 Index investors sustained in the past two bear markets (47.4% in 2000-2002 and 55.3% in 2007-2009) apparently are forgotten. People have been conditioned not to fear, yet ironically, risk elements are on the rise. Debt continues to pile up, as we have noted numerous times previously. The S&P 500’s debt-to-earnings before interest, taxes, depreciation and amortization (EBITDA) is at a 50-year high. (see chart above).

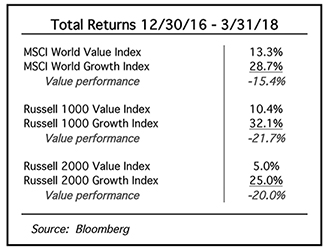

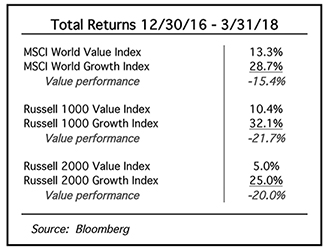

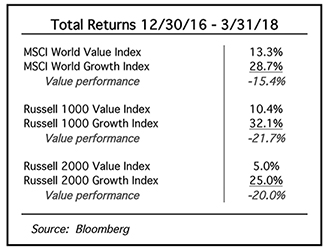

Growth stocks have bested value stocks over the last ten years, causing investors to question the premise that value beats growth over long time frames. More recently, since the beginning of 2017, growth stocks have seemingly gone into overdrive, as shown in the table to the right.

Despite the great outperformance of growth compared to value during most of the past decade, over longer periods, value has still significantly outperformed growth. Using the Russell 1000 growth and value indices as far back as the Bloomberg data goes (12/31/1979-12/31/2017), value has outperformed growth (7,346% versus 5,333% — or 12.0% versus 11.1% compounded annually). We are confident value will win in the long run because it takes advantage of human nature and behavior. People tend to be overly optimistic in bull markets, paying up for projected growth. When reality strikes and stocks fall, some panic. In a true bear market, many lose faith, become overly pessimistic, and sometimes even vacate the market completely. These investors typically do not come back until “the situation stabilizes,” which is usually well into the next up cycle. Since 1994, DALBAR, Inc. has published studies of the “Quantitative Analysis of Investor Behavior,” where they attempt to measure the “effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long-term timeframes.” Not surprisingly, “The results consistently show that the average investor earns less – in many cases, much less – than mutual fund performance reports would suggest.”2 For example, in their 2016 study, over the last 30 years, DALBAR estimates that the average equity investor generated an annual return of 3.98% versus the S&P 500 at 10.16%.3 Buying near the top and selling near the bottom are all too common. Similarly, in Spencer Jakab’s book, Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor, he examines the track record of Fidelity Magellan’s renowned portfolio manager Peter Lynch: “During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent annualized return. But Lynch himself pointed out a fly in the ointment. He calculated that the average investor in his fund made only around 7 percent during the same period. When he would have a setback, for example, the money would flow out of the fund through redemptions. Then when he got back on track it would flow back in, having missed the recovery.”4

In our view, human nature will never change. Emotion, fear, and greed will continue to play a role in investor behavior. In its simplest form, value investing looks to appraise the value of a business, invest when the business is undervalued by the market (out of favor), and sell when the discount has narrowed. It is inherently contrarian in nature – buying when the masses are running for the exits, and selling during periods of irrational exuberance. Conversely, growth, momentum, and technical investing are far more speculative in nature. A disciplined value-oriented approach is well-positioned to outperform over the long run, as it is rooted in fundamental analysis with valuation as its guidepost. We firmly believe that value investing’s recent lull is the exception, not the rule. A confluence of factors — including large-scale central bank asset purchases, suppressed

_______________

2 | “DALBAR’S 22nd Annual Quantitative Analysis of Investor Behavior: Period Ended 12/31/15.” www.dalbar.com. |

3 | “DALBAR 2017: Investors Suck At Investing & Tips For Advisors,” by Lance Roberts. Realinvestmentadvice.com. September 25, 2017. Performance period ending December 30, 2016. |

4 | Spencer Jakab. “Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor.” July 12, 2016. |

interest rates (i.e., negative yields), a lack of volatility, a disconnect from valuation, and a massive shift from active to passive investing — have obscured markets since the great financial crisis of 2008-09. Today, high-quality, well-run businesses often trade at one or two standard deviations above their historical averages. It’s likely just a matter of time before history repeats itself, fear rears its head, and value investing returns to the top.

Below we highlight a couple of investments:

Omnicom Group (OMC)

(Analyst: Rob Helf)

Description

Omnicom Group is a strategic holding company comprised of advertising, marketing and corporate communication service firms. The company’s agency networks include: BBDO, DDB and Omnicom Media Group. In 2017, 57% of overall revenue was generated in North America, 9% in the UK, 18% in Europe, 11% in Asia Pacific, 3% in Latin America and 2% in the Middle East/Africa. Omnicom’s global branded networks provide a comprehensive range of services in four disciplines: advertising (including creative and media planning/buying), which makes up 54% of revenue; customer relationship management, 31%; public relations, 9%; and healthcare, 6%.

Good Business

| | • | Omnicom is one of the world’s largest advertising and marketing services companies. |

| | | |

| | • | The company offers a comprehensive roster of fee-based services to a diverse mix of clients. |

| | | |

| | • | Omnicom should be able to grow as fast as general advertising. The company has significant exposure to developing markets and higher growth marketing services. |

| | | |

| | • | The company’s largest client represents less than 4% of overall revenues. |

| | | |

| | • | The integrated relationship between client and agency results in high switching costs. |

| | | |

| | • | Over the past decade, Omnicom has generated a return on invested capital (ROIC) greater than its cost of capital. On average, its ROIC has been approximately 13%. |

| | | |

| | • | The company’s balance sheet is in excellent shape, with net debt less than EBITDA. |

| | | |

| | • | Omnicom pays a $2.36 per share annual dividend to yield 3.2%. The dividend has grown at over 13% per annum over the past five years. |

| | | |

| | • | Over the past ten years, the company has repurchased an average of over $750 million worth of its equity per year. |

Valuation

| | • | Omnicom trades at approximately 1.2 times enterprise value (EV)-to-sales, 8 times EBITDA and 13 times forward earnings per share (EPS) estimates. The business generates a 13.5% operating margin. |

| | | |

| | • | Over the past fifteen years, the stock has traded, on average, at 1.5 times EV/sales, 10 times EBITDA and 17 times EPS. |

| | | |

| | • | Currently, we estimate that Omnicom trades at a 40-50% discount to the S&P 500 on many statistical measures vs. a conventional discount of 10-20%. |

Management

| | • | John Wren, 65, has been President and CEO since 1997. He has been in advertising since 1984, joined Omnicom in 1986, and owns over $100 million worth of OMC shares. |

| | | |

| | • | Phil Angelastro, 53, has been CFO and Executive VP since 2014, and has been with Omnicom over 20 years in various accounting and finance executive positions. |

Investment Thesis

Omnicom fell short of expectations in 2017. Revenues and profits have been impacted by fee compression and lower spending by the advertising-heavy consumer goods, retail and auto sectors as a residual of softer top-line, zero-based budgeting and activist shareholders. There are some near-term challenges for the industry, however, we believe that these pressures are more cyclical than secular in nature and will ease in the medium term. Importantly, Omnicom is one of the leaders in the advertising and marketing service industry, which has historically been able to adapt with changes in technology and media. The business continues to offer an outsourced solution to clients, has demonstrated a flexible cost structure, and is managed by entrepreneurial individuals. Additionally, the business provides an important function in helping clients establish brands and grow revenues. At just over 9 times EBIT and 13 times EPS, shares of Omnicom are attractive on an absolute and relative basis.

Quest Diagnostics (DGX)

(Analyst: Matthew Goetzinger)

Description

Quest Diagnostics is the largest independent clinical laboratory testing company, with 24% market share. The company’s Diagnostic Information Services (DIS) business (96% of total company revenues) provides clinical laboratory testing, focusing on routine tests (66% of DIS revenues), esoteric tests (25% of DIS revenues), and anatomic pathology tests (9% of DIS revenues). The Diagnostic Solutions business (4% of total company revenues) focuses on risk assessment services for life insurance customers. Quest’s clinical trials business is now included within the Q2 Solutions joint venture with Quintiles (IQV), of which the company owns 40%. Q2 is the industry’s second largest central lab.

Good Business

| | • | Quest Diagnostics is the market leader in the clinical lab sector, controlling roughly a quarter of the $27 billion independent U.S. lab industry. |

| | | |

| | • | The scale and scope of Quest’s lab network result in the company consistently operating as the industry’s low-cost provider. |

| | | |

| | • | The company’s testing revenues are reasonably predictable and recurring in nature. |

| | | |

| | • | The broader lab industry is a $79 billion market accounting for only 2% of total healthcare spending, and yet influencing over 70% of medical decisions. Quest’s value-add is further supported by a very modest average cost per requisition of approximately $46. |

| | | |

| | • | The company’s established network business model requires minimal incremental capital, with the stock earning a 30% return on tangible capital over the past five years. |

| | | |

| | • | The stock is currently levered at 2.3 times net debt-to-EBITDA. In 2017, Quest generated $1.2 billion of operating cash flow. |

Valuation

| | • | Over the past five years, the stock has traded at an average price-to-free cash flow multiple of 16 times. This valuation metric is a slight premium to the company’s 5-year average price-to-earnings (P/E) ratio. Presently, the stock trades at 15 times free cash flow. |

| | | |

| | • | With conservative growth, margin, and capital allocation assumptions, the company’s earnings power exceeds $8.50 per share. |

| | | |

| | • | The stock presently trades at a modest discount to other healthcare service companies, despite maintaining a stronger fundamental outlook. |

Management

| | • | Steve Rusckowski has been President and CEO since May 2012, and Chairman of the Board since January 1, 2017. |

| | | |

| | • | Since the beginning of CEO Rusckowski’s tenure, the company has used ROIC as a key long-term performance metric. |

| | | |

| | • | Over the past five years, 75% of free cash flow generation has been returned to shareholders through share repurchases. |

Investment Thesis

As the largest independent clinical lab testing company, Quest operates the industry’s most expansive and lowest cost network. Over the past five years management has been building upon a focused strategy to improve the organic growth rate of the business, and harvest additional cost efficiencies. The company’s strategy to address each facet of the hospital testing market is beginning to yield growing market share. Government pricing pressures from PAMA (Protecting Access to Medicare Act) are manageable and contained to a small subset of their business. Presently, Quest shares represent a reasonable value and an opportunity to invest in a business with the enduring value-add of providing quantifiable data used to guide treatment protocols at a small fractional expense.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

March 31, 2018 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 90.2% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 2.8% | | | | | | |

| | | Advertising/Marketing Services — 2.8% | | | | | | |

| | 2,345,000 | | Omnicom Group Inc. | | $ | 159,622,634 | | | $ | 170,411,150 | |

| | | | | | | | | |

COMMUNICATIONS SECTOR — 2.3% | | | | | | | | |

| | | | Specialty Telecommunications — 2.3% | | | | | | | | |

| | 8,512,000 | | CenturyLink Inc. | | | 178,413,247 | | | | 139,852,160 | |

| | | | | | | | | |

CONSUMER DURABLES SECTOR — 3.4% | | | | | | | | |

| | | | Tools & Hardware — 3.4% | | | | | | | | |

| | 1,385,000 | | Stanley Black & Decker Inc. | | | 135,503,537 | | | | 212,182,000 | |

| | | | | | | | | |

CONSUMER NON-DURABLES SECTOR — 4.6% | | | | | | | | |

| | | | Food: Major Diversified — 2.7% | | | | | | | | |

| | 2,110,000 | | Nestlé S.A. — SP-ADR | | | 105,949,410 | | | | 166,795,500 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 1.9% | | | | | | | | |

| | 2,155,000 | | Unilever PLC — SP-ADR | | | 85,442,690 | | | | 119,731,800 | |

| | | | | | | | | |

CONSUMER SERVICES SECTOR — 10.5% | | | | | | | | |

| | | | Cable/Satellite TV — 3.4% | | | | | | | | |

| | 6,200,000 | | Comcast Corp. — Cl A | | | 168,871,791 | | | | 211,854,000 | |

| | | | | | | | | | | | |

| | | | Movies/Entertainment — 3.1% | | | | | | | | |

| | 5,326,000 | | Twenty-First Century Fox Inc. — Cl B | | | 145,560,481 | | | | 193,706,620 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 4.0% | | | | | | | | |

| | 6,101,000 | | eBay Inc.* | | | 128,455,979 | | | | 245,504,240 | |

| | | | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 3.6% | | | | | | | | |

| | | | Electronic Components — 3.6% | | | | | | | | |

| | 2,225,000 | | TE Connectivity Ltd. | | | 38,155,162 | | | | 222,277,500 | |

| | | | | | | | | |

FINANCE SECTOR — 16.5% | | | | | | | | |

| | | | Financial Conglomerates — 4.2% | | | | | | | | |

| | 2,348,000 | | JPMorgan Chase & Co. | | | 150,911,219 | | | | 258,209,560 | |

| | | | | | | | | | | | |

| | | | Major Banks — 3.1% | | | | | | | | |

| | 3,650,000 | | Bank of New York Mellon Corp. | | | 75,454,457 | | | | 188,084,500 | |

| | | | | | | | | | | | |

| | | | Multi-Line Insurance — 5.2% | | | | | | | | |

| | 1,605,000 | | Berkshire Hathaway Inc. — Cl B* | | | 99,249,490 | | | | 320,165,400 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 4.0% | | | | | | | | |

| | 4,045,000 | | Progressive Corp. | | | 98,338,696 | | | | 246,461,850 | |

| | | | | | | | | |

HEALTH SERVICES SECTOR — 7.7% | | | | | | | | |

| | | | Health Industry Services — 2.7% | | | | | | | | |

| | 1,670,000 | | Quest Diagnostics Inc. | | | 166,294,828 | | | | 167,501,000 | |

| | | | | | | | | | | | |

| | | | Managed Health Care — 5.0% | | | | | | | | |

| | 1,454,000 | | UnitedHealth Group Inc. | | | 103,996,620 | | | | 311,156,000 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2018 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 90.2% (a) (Continued) | | | | | | |

| | | | | | | |

HEALTH TECHNOLOGY SECTOR — 2.0% | | | | | | |

| | | Medical Specialties — 2.0% | | | | | | |

| | 3,159,750 | | Smith & Nephew PLC — SP-ADR | | $ | 117,764,285 | | | $ | 120,544,462 | |

| | | | | | | | | |

INDUSTRIAL SERVICES SECTOR — 3.1% | | | | | | | | |

| | | | Oilfield Services/Equipment — 3.1% | | | | | | | | |

| | 2,910,000 | | Schlumberger Ltd. | | | 182,431,922 | | | | 188,509,800 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 2.9% | | | | | | | | |

| | | | Chemicals: Agricultural — 2.9% | | | | | | | | |

| | 3,846,800 | | Nutrien Ltd. | | | 184,133,280 | | | | 181,799,768 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 6.7% | | | | | | | | |

| | | | Industrial Conglomerates — 4.4% | | | | | | | | |

| | 1,875,000 | | Honeywell International Inc. | | | 181,120,470 | | | | 270,956,250 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 2.3% | | | | | | | | |

| | 2,165,000 | | PACCAR Inc. | | | 87,403,978 | | | | 143,258,050 | |

| | | | | | | | | |

RETAIL TRADE SECTOR — 9.3% | | | | | | | | |

| | | | Apparel/Footwear Retail — 4.7% | | | | | | | | |

| | 3,550,000 | | The TJX Companies Inc. | | | 258,487,522 | | | | 289,538,000 | |

| | | | | | | | | | | | |

| | | | Discount Stores — 4.6% | | | | | | | | |

| | 3,008,000 | | Dollar General Corp. | | | 220,464,487 | | | | 281,398,400 | |

| | | | | | | | | |

TECHNOLOGY SERVICES SECTOR — 12.2% | | | | | | | | |

| | | | Information Technology Services — 7.2% | | | | | | | | |

| | 1,680,000 | | Accenture PLC | | | 51,809,410 | | | | 257,880,000 | |

| | 3,174,000 | | Cerner Corp.* | | | 165,717,581 | | | | 184,092,000 | |

| | | | | | | 217,526,991 | | | | 441,972,000 | |

| | | | Packaged Software — 5.0% | | | | | | | | |

| | 1,527,000 | | Microsoft Corp. | | | 40,721,239 | | | | 139,369,290 | |

| | 3,639,000 | | Oracle Corp. | | | 149,826,047 | | | | 166,484,250 | |

| | | | | | | 190,547,286 | | | | 305,853,540 | |

TRANSPORTATION SECTOR — 2.6% | | | | | | | | |

| | | | Air Freight/Couriers — 2.6% | | | | | | | | |

| | 2,500,000 | | Expeditors International of Washington Inc. | | | 92,611,377 | | | | 158,250,000 | |

| | | | Total common stocks | | | 3,572,711,839 | | | | 5,555,973,550 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2018 (Unaudited)

| Principal Amount | | | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 9.9% (a) | | | | | | |

| | | Bank Deposit Account — 4.3% | | | | | | |

| $ | 263,083,738 | | U.S. Bank N.A., 1.50%^ | | $ | 263,083,738 | | | $ | 263,083,738 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 5.6% | | | | | | | | |

| | 150,000,000 | | U.S. Treasury Bills, 0.976%, due 04/05/18^ | | | 149,978,041 | | | | 149,979,676 | |

| | 50,000,000 | | U.S. Treasury Bills, 1.614%, due 05/31/18^ | | | 49,864,583 | | | | 49,863,291 | |

| | 150,000,000 | | U.S. Treasury Bills, 1.614%, due 06/14/18^ | | | 149,477,375 | | | | 149,495,760 | |

| | | | Total U.S. treasury securities | | | 349,319,999 | | | | 349,338,727 | |

| | | | Total short-term investments | | | 612,403,737 | | | | 612,422,465 | |

| | | | Total investments — 100.1% | | $ | 4,185,115,576 | | | | 6,168,396,015 | |

| | | | Other assets, less liabilities — (0.1%) (a) | | | | | | | (6,008,449 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 6,162,387,566 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of March 31, 2018. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

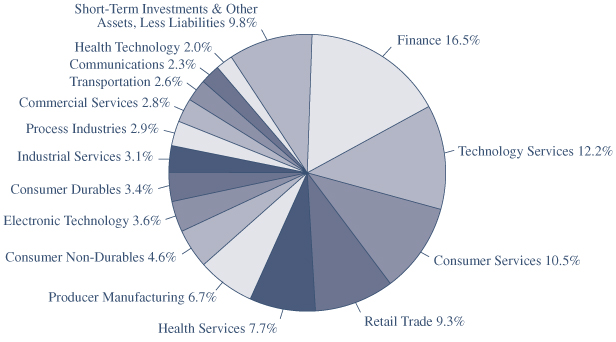

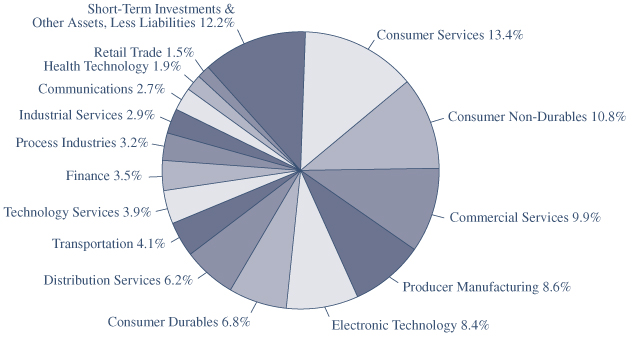

INDUSTRY SECTORS (% of net assets)

as of March 31, 2018 (Unaudited)

FMI

Common Stock

Fund

March 31, 2018

Dear Fellow Shareholders:

The FMI Common Stock Fund returned -0.26%1 in the March quarter compared to -0.08% for the Russell 2000 Index. Finance, Utilities, and Consumer Services were three notable positive sector contributors, while Technology Services, Health Technology and Producer Manufacturing detracted. Our zero exposure to the Utilities sector explained the positive relative performance, while our intentional lack of exposure to high flying, and almost entirely money losing, biotechnology shares caused substantial relative underperformance. Stocks that helped during the period included FirstCash, Interpublic Group, and Broadridge Financial Solutions. On the flipside, Allscripts Healthcare Solutions, Carlisle Companies and ManpowerGroup all lagged.

There were a few new elements to contend with in the investment world this quarter that we haven’t seen in a while. An almost complete lack of volatility over recent years was interrupted for twenty trading days, beginning January 27th. Over nine sessions, the S&P 500 dropped 10.10%, followed immediately by a gain of 7.84% during eleven trading days, leaving it down just 3.05% for this period. Interestingly, the average of the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google [Alphabet]) actually outperformed in the down-and-up part of this mini-cycle, reinforcing both the “buy-the-dip” and the “value doesn’t matter” notions. It is going to take more than a few bad days to shake people’s faith in these exceedingly expensive stocks. Amazon and Netflix were up 23.8% and 53.9%, respectively, in the quarter, and trade at multiples that would make the big cap tech darlings of 1999 blush. Amazon and Netflix both have trailing GAAP (Generally Accepted Accounting Principles) price-to-earnings ratios north of 180. Facebook, a phenomenal stock over the past five years, did wobble a bit in March, marking this as an unusual occurrence. Stocks suffered a rare few bad days near the end of the quarter, with most pundits tying this to tariff concerns. The last few sessions also saw more volatility in the FAANG group, Tesla and a few other tech high fliers. Perhaps change is on the horizon. Additional wrinkles from the quarter include the 3-month Libor (London Interbank Offered Rate, a key number tied to $200 trillion in financial contracts) gaining roughly 60 basis points to 2.3% — a level not seen since 2008 — and an inflation rate hitting 2.2% in February, which, if it holds for the year, would be the highest annual figure since 2011. For the first time in years, companies were talking about higher raw material and transportation costs pinching margins. Oddly, given the widespread view that lower taxes were expected to propel the economy into overdrive, real GDP forecasts for the first quarter from the Atlanta Fed (GDPNow) have dropped from 5% in early February to 2.4% at the end of March. We find corporate revenue growth to be a more reliable indicator and it still appears solid, but the precipitous drop in GDPNow is noteworthy. One more significant change in today’s investment landscape was the defenestration of the price of Bitcoin, as foreshadowed in our last letter. It was down 52.7% in the quarter and is off 72.4% from its peak on December 18th of 2017.

Most things about this market, however, haven’t changed much over the past several years. March 9th marked the ninth year without a bear market in the large cap indices, making this the longest bull

_______________

1 | For the quarter ended 03/31/18, the FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) were down -0.26% and -0.23%, respectively. |

market (using the Dow Jones Industrial Average) in measured history and the third most powerful (see table to the right).

We aren’t going to conduct a lengthy rehash of what we have been articulating for some time. Despite a slightly improved valuation environment from the December quarter, stocks, on a median basis, remain near the most expensive we have ever experienced or studied. Many stock indices have become quite narrow again, reflecting a strong funneling effect from passive flows to the most popular names. The median stock once more underperformed the S&P 500 Index in the March quarter. Speculative biotech stocks have again been on a roll, as seen in the chart below showing performance compared to the benchmarks since the beginning of last year. Like some of the popular tech names, however, they also had a few tough days right at the end of March.

Investor confidence, which was near record-high territory three months ago, has started to fall. Still, there appears to be widespread belief that the S&P 500 is a safe investment over any time horizon. The losses that S&P 500 Index investors sustained in the past two bear markets (47.4% in 2000-2002 and 55.3% in 2007-2009) apparently are forgotten. People have been conditioned not to fear, yet ironically, risk elements are on the rise. Debt continues to pile up, as we have noted numerous times previously. The S&P 500’s debt-to-earnings before interest, taxes, depreciation and amortization (EBITDA) is at a 50-year high. (See chart above).

Smaller capitalization companies are even more extreme, as can be seen in the chart to the right.

Growth stocks have bested value stocks over the last ten years, causing investors to question the premise that value beats growth over long time frames. More recently, since the beginning of 2017, growth stocks have seemingly gone into overdrive, as shown in the table below.

Despite the great outperformance of growth compared to value during most of the past decade, over longer periods, value has still significantly outperformed growth. Using the Russell 2000 growth and value indices as far back as the Bloomberg data goes (12/31/1979-12/31/2017), value has outperformed growth (9,048% versus 2,577% — or 12.6% versus 9.0% compounded annually). We are confident value will win in the long run because it takes advantage of human nature and behavior. People tend to be overly optimistic in bull markets, paying up for projected growth. When reality strikes and stocks fall, some panic. In a true bear market, many lose faith, become overly pessimistic, and sometimes even vacate the market completely. These investors typically do not come back until “the situation stabilizes,” which is usually well into the next up cycle. Since 1994, DALBAR, Inc. has published studies of the “Quantitative Analysis of Investor Behavior,” where they attempt to measure the “effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long-term timeframes.” Not surprisingly, “The results consistently show that the average investor earns less – in many cases, much less – than mutual fund performance reports would suggest.”2 For example, in their 2016 study, over the last 30 years, DALBAR estimates that the average equity investor generated an annual return of 3.98% versus the S&P 500 at 10.16%.3 Buying near the top and selling near the bottom are all too common. Similarly, in Spencer Jakab’s book, Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor, he examines the track record of Fidelity Magellan’s renowned portfolio manager Peter Lynch: “During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent annualized return. But Lynch himself pointed out a fly in the ointment. He calculated that the average investor in his fund made only around 7 percent during the same period. When he would have a setback, for example, the money would flow out of the fund through redemptions. Then when he got back on track it would flow back in, having missed the recovery.”4

_______________

2 | “DALBAR’S 22nd Annual Quantitative Analysis of Investor Behavior: Period Ended 12/31/15.” www.dalbar.com |

3 | “DALBAR 2017: Investors Suck At Investing & Tips For Advisors,” by Lance Roberts. Realinvestmentadvice.com. September 25, 2017. Performance period ending December 30, 2016. |

4 | Spencer Jakab. “Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor.” July 12, 2016. |

In our view, human nature will never change. Emotion, fear, and greed will continue to play a role in investor behavior. In its simplest form, value investing looks to appraise the value of a business, invest when the business is undervalued by the market (out of favor), and sell when the discount has narrowed. It is inherently contrarian in nature – buying when the masses are running for the exits, and selling during periods of irrational exuberance. Conversely, growth, momentum, and technical investing are far more speculative in nature. A disciplined value-oriented approach is well-positioned to outperform over the long run, as it is rooted in fundamental analysis with valuation as its guidepost. We firmly believe that value investing’s recent lull is the exception, not the rule. A confluence of factors — including large-scale central bank asset purchases, suppressed interest rates (i.e., negative yields), a lack of volatility, a disconnect from valuation, and a massive shift from active to passive investing — have obscured markets since the great financial crisis of 2008-09. Today, high-quality, well-run businesses often trade at one or two standard deviations above their historical averages. It’s likely just a matter of time before history repeats itself, fear rears its head, and value investing returns to the top.

Below we highlight a couple of investments:

Carlisle Companies, Inc. (CSL)

(Analyst: Ben Karek)

Description

Carlisle is a diversified manufacturer of a broad range of products selling into industries such as commercial roofing, aerospace, construction, transports, heavy equipment and general industrial. Carlisle operates in four segments: Carlisle Construction Materials (CCM — 62% of sales, and 79% of earnings before interest and taxes [EBIT]), Carlisle Interconnect Technologies (CIT — 22%, and 17%), Carlisle Fluid Technologies (CFT — 8%, and 3%), and Carlisle Brake and Friction (CBF — 8%, and 1%). Carlisle’s operating companies are given significant autonomy and responsibility for the performance of their businesses. This instills an entrepreneurial spirit that is central to the Carlisle Operating System, a LEAN/six sigma program.

Good Business

| | • | The majority of Carlisle’s sales are in markets where they maintain a #1 or #2 position. |

| | | |

| | • | Carlisle’s largest segment, CCM, derives 70% of its sales from the aftermarket. Commercial roofs are replaced roughly every 25 years. |

| | | |

| | • | The company’s products are specialized, highly engineered and recurring in nature. |

| | | |

| | • | Carlisle’s businesses are necessary and easy to understand. |

| | | |

| | • | The company is conservatively financed at 1.7 times net debt/EBITDA. |

| | | |

| | • | Carlisle’s business is cash generative, with free cash flow averaging greater than 100% of net income. |

| | | |

| | • | Return on invested capital (ROIC) has averaged 12% over the last 5 years. |

Valuation

| | • | The stock trades at a reasonable 17 times 2018 estimates, which approximates its 10-year average. |

| | | |

| | • | Carlisle’s enterprise value-to-sales multiple is 1.8 times, as compared to a long-term margin target of 20%. |

Management

| | • | The company has a strong track record of value creation. Carlisle’s ROIC is above its cost of capital in spite of completing numerous small and mid-size acquisitions. |

| | • | Chris Koch, who took over from former CEO and current Chairman Dave Roberts in 2016, has demonstrated a continuity with the Carlisle model and a willingness to shrink the portfolio of businesses if doing so creates value. |

| | | |

| | • | Carlisle’s variable compensation includes metrics on EBIT margin, ROIC, and working capital. |

Investment Thesis

Carlisle’s shares have recently come under pressure due to raw material-driven margin compression in its largest segment, Carlisle Construction Materials. Carlisle has historically proven the ability to pass through raw material inflation, albeit on a lag, as evidenced by the decade-long margin expansion that this segment has experienced through multiple cycles. The company has increasingly exited low margin, less differentiated businesses while re-investing in their better businesses both organically and through tuck-in acquisitions. We believe Carlisle continues to be a best-in-class operator, and this hiccup has given us a chance to own the shares at a discounted valuation relative to an expensive small cap market.

The Howard Hughes Corporation (HHC)

(Analyst: Andy Ramer)

Description

Howard Hughes specializes in the development of master planned communities (MPCs); in the ownership, management, and redevelopment of revenue-generating real estate assets (Operating Assets); and in the development of other real estate assets in the form of entitled and unentitled land and residential condominium developments (Strategic Developments). Howard Hughes emerged as a public company in November of 2010 following its spinoff from General Growth Properties.

Good Business

| | • | The company owns attractive real estate in some of the country’s best markets. |

| | | |

| | • | Howard Hughes is growing its sources of recurring revenue. |

| | | |

| | • | Since inception, the company has completed $1.6 billion of development that is expected to deliver a 9.9% yield on cost, or a 29.7% return on the $283 million of cash equity invested, assuming a 5.5% cost of debt. |

| | | |

| | • | Howard Hughes owns all the development rights to its land, and is therefore able to control supply, and thus pricing, in markets with high barriers to entry. |

| | | |

| | • | The company maintains a conservatively funded balance sheet. The net debt-to-capital ratio is 38.5%, and a majority of the debt is non-recourse to the parent. |

Valuation

| | • | Howard Hughes is underfollowed and misunderstood due to its relative complexity and lack of current profitability. |

| | | |

| | • | At the 3/15/18 closing share price of $136.54, the company traded at a 9% discount to our conservative Net Asset Value estimate of $150.00 per share. Howard Hughes repurchased stock at $120.33 per share on 2/21/18 because this represented a meaningful discount to their estimate of NAV ($165+). |

| | | |

| | • | Short interest is only 2.5% of the float and passive strategies own just 13.0% of the shares. |

Management

| | • | There is strong alignment between insiders and shareholders as the board of directors and management have a combined ownership in the company of approximately 20%. |

| | • | There is an average of 25 years of commercial real estate experience throughout the company’s senior management and board. |

| | | |

| | • | In September of 2017, CEO David Weinreb entered into a 10-year employment agreement and purchased a new warrant for $50 million at market value. |

| | | |

| | • | That same month, President Grant Herlitz also entered into an employment agreement through 2027 and purchased a new warrant for $2 million. CFO David O’Reilly acquired a warrant for $1 million upon joining the company in October of 2016. |

Investment Thesis

Howard Hughes is on the cusp of transitioning from a real estate company with dormant assets and lack of cash flow to one that is producing cash flow from difficult-to-replicate assets. The company has a presence in markets that have prospects for above-average growth – Houston; Las Vegas; and Columbia, Maryland – and owns unique irreplaceable land in Manhattan and Honolulu. Howard Hughes is managed by owner-operators who have demonstrated their ability to deploy capital and earn attractive returns.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

March 31, 2018 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 81.3% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 15.1% | | | | | | |

| | | Advertising/Marketing Services — 3.4% | | | | | | |

| | 1,550,000 | | Interpublic Group of Cos. Inc. | | $ | 27,837,296 | | | $ | 35,696,500 | |

| | | | | | | | | | | | |

| | | | Financial Publishing/Services — 1.5% | | | | | | | | |

| | 78,000 | | FactSet Research Systems Inc. | | | 12,516,471 | | | | 15,554,760 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 4.1% | | | | | | | | |

| | 1,340,000 | | Genpact Ltd. | | | 22,409,227 | | | | 42,866,600 | |

| | | | | | | | | | | | |

| | | | Personnel Services — 6.1% | | | | | | | | |

| | 236,000 | | ManpowerGroup Inc. | | | 15,161,560 | | | | 27,163,600 | |

| | 639,000 | | Robert Half International Inc. | | | 20,170,724 | | | | 36,991,710 | |

| | | | | | | 35,332,284 | | | | 64,155,310 | |

CONSUMER SERVICES SECTOR — 5.6% | | | | | | | | |

| | | | Cable/Satellite TV — 1.4% | | | | | | | | |

| | 21,000 | | Cable One Inc. | | | 5,654,176 | | | | 14,429,310 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 4.2% | | | | | | | | |

| | 73,000 | | Graham Holdings Co. | | | 35,482,299 | | | | 43,964,250 | |

| | | | | | | | | |

DISTRIBUTION SERVICES SECTOR — 6.5% | | | | | | | | |

| | | | Electronics Distributors — 1.9% | | | | | | | | |

| | 260,000 | | Arrow Electronics Inc.* | | | 3,239,047 | | | | 20,025,200 | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 4.6% | | | | | | | | |

| | 348,000 | | Anixter International Inc.* | | | 22,551,135 | | | | 26,361,000 | |

| | 160,000 | | Applied Industrial Technologies Inc. | | | 6,407,530 | | | | 11,664,000 | |

| | 117,000 | | MSC Industrial Direct Co. Inc. | | | 7,003,921 | | | | 10,730,070 | |

| | | | | | | 35,962,586 | | | | 48,755,070 | |

ELECTRONIC TECHNOLOGY SECTOR — 2.2% | | | | | | | | |

| | | | Telecommunications Equipment — 2.2% | | | | | | | | |

| | 355,000 | | ViaSat Inc.* | | | 24,867,862 | | | | 23,330,600 | |

| | | | | | | | | |

FINANCE SECTOR — 21.4% | | | | | | | | |

| | | | Finance/Rental/Leasing — 9.3% | | | | | | | | |

| | 280,000 | | ePlus Inc.* | | | 15,102,514 | | | | 21,756,000 | |

| | 597,675 | | FirstCash Inc. | | | 19,852,810 | | | | 48,561,094 | |

| | 383,000 | | Ryder System Inc. | | | 17,201,060 | | | | 27,878,570 | |

| | | | | | | 52,156,384 | | | | 98,195,664 | |

| | | | Property/Casualty Insurance — 6.9% | | | | | | | | |

| | 304,750 | | Argo Group International Holdings Ltd. | | | 16,023,541 | | | | 17,492,650 | |

| | 365,000 | | W.R. Berkley Corp. | | | 11,515,238 | | | | 26,535,500 | |

| | 35,000 | | White Mountains Insurance Group Ltd. | | | 31,410,325 | | | | 28,788,200 | |

| | | | | | | 58,949,104 | | | | 72,816,350 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2018 (Unaudited)

| Shares | | | | Cost | | | Value | |

| COMMON STOCKS — 81.3% (a) (Continued) | | | | | | |

| | | | | | | |

FINANCE SECTOR — 21.4% (Continued) | | | | | | |

| | | Real Estate Development — 3.7% | | | | | | |

| | 125,000 | | The Howard Hughes Corp.* | | $ | 15,622,950 | | | $ | 17,391,250 | |

| | 1,220,000 | | Kennedy-Wilson Holdings Inc. | | | 25,274,389 | | | | 21,228,000 | |

| | | | | | | 40,897,339 | | | | 38,619,250 | |

| | | | Regional Banks — 1.5% | | | | | | | | |

| | 293,000 | | Zions Bancorporation | | | 7,891,512 | | | | 15,449,890 | |

| | | | | | | | | |

HEALTH SERVICES SECTOR — 3.2% | | | | | | | | |

| | | | Medical/Nursing Services — 3.2% | | | | | | | | |

| | 605,000 | | MEDNAX Inc.* | | | 32,324,216 | | | | 33,656,150 | |

| | | | | | | | | |

PROCESS INDUSTRIES SECTOR — 2.0% | | | | | | | | |

| | | | Containers/Packaging — 2.0% | | | | | | | | |

| | 197,000 | | Avery Dennison Corp. | | | 5,127,102 | | | | 20,931,250 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 14.3% | | | | | | | | |

| | | | Building Products — 3.2% | | | | | | | | |

| | 600,000 | | Armstrong World Industries Inc.* | | | 26,113,541 | | | | 33,780,000 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery — 2.8% | | | | | | | | |

| | 414,000 | | Woodward Inc. | | | 17,005,585 | | | | 29,667,240 | |

| | | | | | | | | | | | |

| | | | Metal Fabrication — 1.4% | | | | | | | | |

| | 102,000 | | Valmont Industries Inc. | | | 14,934,787 | | | | 14,922,600 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Manufacturing — 5.9% | | | | | | | | |

| | 350,000 | | Carlisle Cos. Inc. | | | 27,516,535 | | | | 36,543,500 | |

| | 965,000 | | TriMas Corp.* | | | 21,230,669 | | | | 25,331,250 | |

| | | | | | | 48,747,204 | | | | 61,874,750 | |

| | | | Trucks/Construction/Farm Machinery — 1.0% | | | | | | | | |

| | 335,000 | | Trinity Industries Inc. | | | 10,981,711 | | | | 10,931,050 | |

| | | | | | | | | |

RETAIL TRADE SECTOR — 2.5% | | | | | | | | |

| | | | Specialty Stores — 2.5% | | | | | | | | |

| | 587,000 | | Penske Automotive Group Inc. | | | 21,837,392 | | | | 26,021,710 | |

| | | | | | | | | |

TECHNOLOGY SERVICES SECTOR — 8.5% | | | | | | | | |

| | | | Data Processing Services — 3.0% | | | | | | | | |

| | 287,000 | | Broadridge Financial Solutions Inc. | | | 5,904,062 | | | | 31,481,030 | |

| | | | | | | | | | | | |

| | | | Information Technology Services — 2.6% | | | | | | | | |

| | 2,260,000 | | Allscripts Healthcare Solutions Inc.* | | | 27,585,535 | | | | 27,911,000 | |

| | | | | | | | | | | | |

| | | | Internet Software/Services — 1.7% | | | | | | | | |

| | 615,000 | | Cars.com Inc.* | | | 16,797,883 | | | | 17,422,950 | |

| | | | | | | | | | | | |

| | | | Packaged Software — 1.2% | | | | | | | | |

| | 920,000 | | TiVo Corp. | | | 12,608,763 | | | | 12,466,000 | |

| | | | Total common stocks | | | 603,163,368 | | | | 854,924,484 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2018 (Unaudited)

| Principal Amount | | | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 18.6% (a) | | | | | | |

| | | Bank Deposit Account — 6.7% | | | | | | |

| $ | 70,401,025 | | U.S. Bank N.A., 1.50%^ | | $ | 70,401,025 | | | $ | 70,401,025 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 11.9% | | | | | | | | |

| | 25,000,000 | | U.S. Treasury Bills, 0.976%, due 04/05/18^ | | | 24,996,340 | | | | 24,996,613 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.472%, due 04/26/18^ | | | 24,975,694 | | | | 24,973,417 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.614%, due 05/31/18^ | | | 24,932,292 | | | | 24,931,645 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.614%, due 06/14/18^ | | | 24,912,896 | | | | 24,915,960 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.645%, due 06/28/18 ^ | | | 24,893,514 | | | | 24,898,349 | |

| | | | Total U.S. treasury securities | | | 124,710,736 | | | | 124,715,984 | |

| | | | Total short-term investments | | | 195,111,761 | | | | 195,117,009 | |

| | | | Total investments — 99.9% | | $ | 798,275,129 | | | | 1,050,041,493 | |

| | | | Other assets, less liabilities — 0.1% (a) | | | | | | | 883,250 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,050,924,743 | |

| * | | Non-income producing security. |

| ^ | | The rate shown is as of March 31, 2018. |

| (a) | | Percentages for the various classifications relate to total net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

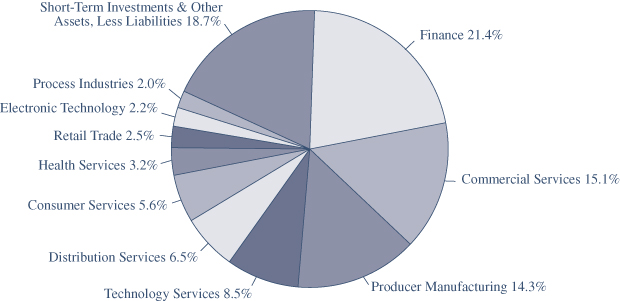

INDUSTRY SECTORS (% of net assets)

as of March 31, 2018 (Unaudited)

FMI

International

Fund

March 31, 2018

Dear Fellow Shareholders:

Fear made a rare appearance in the first quarter, with developed equity markets printing a quarterly decline for the first time since June of 2016.1 Rising interest rates, a spike in volatility, and talk of a potential trade war shook investor confidence. The FMI International Fund (“Fund”) fell by 3.30%2 in the quarter, compared with an MSCI EAFE Index drop of 4.28% in local currency and 1.53% in U.S. Dollars (USD). The Fund’s top performing sectors included Consumer Non-Durables, Communications and Technology Services, while Commercial Services, Consumer Services, and Consumer Durables weighed on the results. TE Connectivity, Henkel, and Smiths Group outperformed on a relative basis, as Travis Perkins, WPP and Isuzu Motors fell short of expectations. Currency hedging and a weakening USD continues to be a significant headwind. Over the past five quarters, the MSCI EAFE Index’s return in local currency has underperformed the USD equivalent by 12.82%, making for a tough comparison versus the USD index. Of course, the recent USD weakness could reverse at any time.

As we look out at the global opportunity set, not much has changed from our vantage point. Stocks are still expensive, risks are plenty, and global economic growth continues to be boosted by artificially low interest rates, rising debt, stimulus and quantitative easing (QE). As central bankers start to take their feet off the gas, the reversal of unprecedented experimental policies and asset purchases (which helped fuel a rapid rise in financial markets) might finally take a toll. Interest rate normalization poses a risk to asset valuations, and keeping a lid on inflation may prove to be easier said than done. Central bankers will have their work cut out for them, as taking away the proverbial “punch bowl” may not be well received. Given the precarious backdrop, we will continue to proceed with caution, as downside protection is paramount.

Tried and True

As we’ve discussed in previous shareholder letters, it’s been a challenging time to be a value investor. Despite a long history of success, with academic studies and empirical evidence supporting the case for value investing, some critics argue that the value investment strategy simply no longer works. The last 10+ years certainly fits the narrative, as value has meaningfully underperformed. Let’s take a closer look…

To frame the most recent period in a historical context, we examined the rolling 5-year returns of the MSCI EAFE Value vs. MSCI EAFE Growth indexes3 at the end of each calendar year, as far back as the Bloomberg dataset would take us (December 31, 1974). How did value do? As the following table illustrates, out of 39 periods, value underperformed growth only 10 times, or 26% of the time. Interestingly, value fell short in each of the last nine periods, so had the analysis been done a decade earlier, value would have prevailed in all but one of the 5-year rolling periods

_______________

1 | In local currency, per the MSCI EAFE Index. |

2 | For the quarter ended 03/31/18, the FMI International Fund Investor Class (FMIJX) and the FMI International Fund Institutional Class (FMIYX) were down -3.30% and -3.27%, respectively. |

3 | MSCI EAFE Value Net Total Return Index (Bloomberg Ticker: M1EA00V), MSCI EAFE Growth Net Total Return Index (Bloomberg Ticker: M1EA000G). |

(97% of the time). How times have changed! Even with the recent hiccup, value’s outperformance since inception is striking and undeniable: the MSCI EAFE Value has generated a cumulative return of 9,533% (11.2% annualized), far outpacing the MSCI EAFE Growth’s return of 3,429% (8.6%). The power of compounding is apparent.

Are value investing’s recent struggles the exception or the (new) rule? To address the question, it’s important to understand why value investing has worked so well, historically. The answer is relatively simple: human nature. Inevitably fear and greed play a huge role in investor psyche and behavior. On the way up, investors become overly optimistic, gain comfort in numbers (the herd), and chase the best performing stocks to valuations well above fair value, with little regard for underlying business fundamentals. Greed, and a fear of missing out, can lead to periods where a stock or the market can become significantly overpriced. Conversely, on the way down, investors can be overly pessimistic and overwhelmed with the fear of losing money. Risk aversion takes hold, selling begets selling, and the end result is a mass exodus in a stock or the market. Again, the underlying business fundamentals are disregarded, this time leading to depressed valuations that are well below intrinsic value. Eventually investors come to their senses, as markets tend to be relatively efficient over longer periods of time, with valuation ultimately settling in around the vicinity of fair value. That said, dislocation in the near term, especially at the extremes, creates some of the market’s most rewarding investment opportunities.

Since 1994, DALBAR, Inc. has published studies of the “Quantitative Analysis of Investor Behavior,” where they attempt to measure the “effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long-term timeframes.” Not surprisingly, “The results consistently show that the average investor earns less – in many cases, much less – than mutual fund performance reports would suggest.”4 For example, in their 2016 study, over the last 30 years, DALBAR estimates that the average equity investor generated an annual return of 3.98% versus the S&P 500 at 10.16%.5 Buying near the top and selling near the bottom are all too common. Similarly, in Spencer Jakab’s book, Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor, he examines the track record of Fidelity Magellan’s renowned portfolio manager Peter Lynch: “During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent annualized return. But Lynch himself pointed out a fly in the ointment. He calculated that the average investor in his fund made only around 7 percent during the same period. When he

_______________

4 | “DALBAR’S 22nd Annual Quantitative Analysis of Investor Behavior: Period Ended 12/31/15.” www.dalbar.com |

5 | “DALBAR 2017: Investors Suck At Investing & Tips For Advisors,” by Lance Roberts. Realinvestmentadvice.com. September 25, 2017. Performance period ending December 30, 2016. |

would have a setback, for example, the money would flow out of the fund through redemptions. Then when he got back on track it would flow back in, having missed the recovery.”6

In our view, human nature will never change. Emotion, fear, and greed will continue to play a role in investor behavior. In its simplest form, value investing looks to appraise the value of a business, invest when the business is undervalued by the market (out of favor), and sell when the discount has narrowed. It is inherently contrarian in nature – buying when the masses are running for the exits, and selling during periods of irrational exuberance. Conversely, growth, momentum, and technical investing are far more speculative in nature. A disciplined value-oriented approach is well-positioned to outperform over the long run, as it is rooted in fundamental analysis with valuation as its guidepost. We firmly believe that value investing’s recent lull is the exception, not the rule. A confluence of factors — including large-scale central bank asset purchases, suppressed interest rates (i.e., negative yields), a lack of volatility, a disconnect from valuation, and a massive shift from active to passive investing — have obscured markets since the great financial crisis of 2008-09. Today, high-quality, well-run businesses often trade at one or two standard deviations above their historical averages. It’s likely just a matter of time before history repeats itself, fear rears its head, and value investing returns to the top.

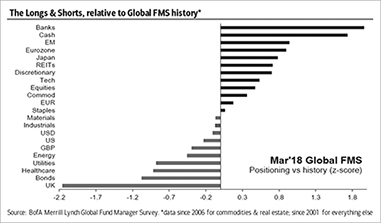

Against the Grain

Being contrarian can be defined as “opposing or rejecting popular opinion; going against current practice.”7 In other words, zigging when everyone else is zagging. In equity investing, in order to beat the market (or your peers), you have to do something different than the market. In constructing the portfolio, we strive to have industry diversification with exposure to most, but not all major economic sectors. Geographic exposure is a consideration, but it does not drive the investment decisions, as bottom-up security analysis takes priority. While we include mention of the MSCI EAFE Index in our letters, it is only insofar as international investors have grown accustomed to seeing this benchmark. We do not consider the benchmark in the management of the Fund and we expect to see significant divergence in performance over quarterly or annual periods. It’s also worth noting that currencies in the Fund are passively hedged, with a goal of ensuring that our returns are a reflection of FMI’s stock selection, and not the volatile swings of foreign exchange rates. As a result, the MSCI EAFE’s local index is the more comparable benchmark (vs. the USD equivalent) as we strive to capture the local return of our investments. Unlike some of our international peers, we run concentrated portfolios with a limited number of holdings (30-40). Our focus is predominantly on large-cap developed market companies, though we have occasionally found a few mid-cap and emerging market opportunities that met our investment criteria.

As value investors who embrace leaning into the wind, we were encouraged to see the recent Bank of America Merrill Lynch Global Fund Manager Survey chart to the right,8 where our peers are currently shifting heavily into banks and Japan, while reducing exposure to the UK. We’ve moved in the opposite direction.

_______________

6 | Spencer Jakab. “Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor.” July 12, 2016. |

7 | Google dictionary. |

8 | BofA Merrill Lynch Global Fund Manager Survey. March 20, 2018. |

In FMI’s 38-year history, we have consistently been underweight financials, especially banks. We generally view banking as a commodity business, and are not keen on balance sheets that are opaque and highly levered. As such, historically we have gotten more of our financial exposure through insurance companies, insurance brokerages, financial processors, and asset managers. As it relates to international banks in particular, we do have additional concerns. Capital standards vary meaningfully across regions, resulting in an incomplete accounting of underlying economic viability and returns. Regions also vary considerably as it pertains to the underlying rules and ownership rights on assets securing debt financing. This makes it difficult to recognize and resolve problem asset issues, further tying up capital, and creating zombie loans. In addition, we have always operated by the axiom suggesting that investors approach a fast-growing loan category with extreme caution. Paradoxically, global banks are attracted to developing markets principally because they believe that new loans can expand at a rate exceeding underlying GDP. Lastly, entry barriers are generally low, while exit barriers are fairly high (banks aren’t allowed to fail). This is problematic as banks are heavily influenced by the weakest competitor in each of their markets. When you are competing with a commodity (money), an undisciplined player can temporarily create an artificial price (loan yield, loan-to-value, terms and conditions, etc.) that will upset the returns (losses) in a particular market. Given the aforementioned, it makes sense why European banks have racked up $1.17 trillion of bad debt on their balance sheets.9 While many of our international peers are piling into “inexpensive” banks, we’ll err on the side of caution and watch this game from the sidelines.

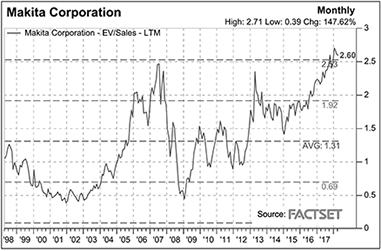

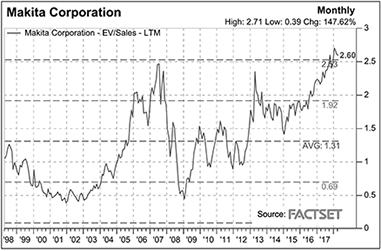

Similarly, we’ve long documented our concerns about Japan in prior shareholder letters, which include excessive government debt levels, unsustainably low interest rates, an aging and shrinking population, and relatively weak economic growth prospects (despite an uptick in recent years). In addition, the Bank of Japan’s (BOJ) QE program has been the most aggressive in the developed world, and by a wide margin. In the recently completed March fiscal year, the BOJ purchased around 75% of all the government bonds that were issued. They now own more than 40% of the country’s sovereign debt and 70% of the ETF market.10,11 As reported by Almost Daily Grant’s, the BOJ has been printing money at an astonishing pace: “In the five years ended Feb. 28, Japan’s monetary base (comprised of money in circulation as well as bank reserves) has increased by 281% to ¥475 trillion ($4.4 trillion), or just under 31% annualized growth. By comparison, the European Central Bank has increased its monetary base by 63% over the past five years (10% annualized growth), while the Federal Reserve has overseen a 34% uptick in the U.S. monetary base, or 6% annualized.”12 Desperate to drive inflation, the BOJ should be careful what it wishes for as it is playing a dangerous game. Meanwhile, the Japanese stock market has been on fire since November of 2012, up 158% in less than 5.5 years (19.2% annualized), more than doubling the MSCI EAFE Index’s local return of 75% (10.9% annualized). We’ve participated to some extent, but have been selling investments in Japan in recent years due to concerns about valuation. For example, in November 2017 we sold our position in Makita Corporation (6586 JT), as the discount to fair value

_______________

9 | | Nicholas Comfort, Giovanni Salzano and Sonia Sirletti. “Five Charts That Explain How European Banks Are Dealing With Their Bad-Loan Problem.” Bloomberg, February 13, 2018. |

10 | | Hidenori Yamanaka. “Not a Single Japan 10-Year Bond Traded Tuesday: Death by BOJ.” Bloomberg, March 14, 2018. |

11 | | Min Jeong Lee and Emi Urabe. “Bank of Japan’s $150 Billion ETF Binge Looks Likely to Slow Next Year.” Bloomberg, December 10, 2017. |

12 | | “QE chronicles.” Almost Daily Grant’s. Wednesday, March 14, 2018. |

all but evaporated. As illustrated to the right, the stock now trades at more than two standard deviations above its long-term historical average. Unfortunately, many charts look like this in Japan, with great businesses commanding healthy premiums. After a massive run in the stock market, we find it telling that the herd continues to pile into Japan unabated.

Conversely, in the UK, concerns around Brexit, slowing growth and rising inflation have weighed on investor sentiment. The stock market has lagged over the past five years, and predictably, global managers are now positioning themselves to avoid the market. In June of 2016 we wrote, “At a high level, we view [Brexit] as more of an opportunity than a risk. There is likely to be significant uncertainty in the near-term regarding economic growth, trade deal negotiations, currency fluctuations, political posturing, and potential call for similar referendums (with Eurosceptic parties in Italy, France, Netherlands, Denmark and Sweden already piping up), et al. Stock prices may continue to come under pressure. However, if this means that great businesses will be offered up at value prices (including some of our own holdings), then we will look to capitalize as people throw out the baby with the bath water.” Our long-term view hasn’t changed, and as expected we have added high-quality businesses such as Whitbread (WTB LN), Travis Perkins (TPK LN), Merlin Entertainments (MERL LN), and Smith & Nephew (SN/ LN) to the Fund, after each of the stocks had come under pressure. With strong, durable business models that are built to withstand adversity, we think that these undervalued investments will serve us well in the years to come.

Even though taking the road less traveled can be lonely, as it is today, our investors can rest assured that we will stay the course. Value investing will endure. Below are two examples of where we are finding attractive opportunities:

WPP PLC (WPP LN)

(Analyst: Rob Helf)

Description

WPP is a strategic holding company made up of leading advertising, media buying, market research, direct and digital marketing, branding and public relations firms. WPP owns four global ad networks: J. Walter Thompson (JWT), Ogilvy & Mather, Young & Rubicam and Grey. In 2017, 37% of overall revenue was generated in North America, 20% in Western Europe, 13% in the UK and 30% from the rest of the world. The company’s core business is advertising and media investment, which makes up almost 50% of revenues and includes media planning/buying and analysis as well as creative services.

Good Business

| | • | WPP is the largest advertising and marketing service company in the world. |

| | | |

| | • | The company offers a comprehensive roster of fee-based services to a diverse mix of clients. |

| | | |

| | • | WPP should be able to grow as fast as general advertising, as the company has significant exposure to more rapidly growing areas, including emerging markets, marketing services and digital advertising. |

| | | |

| | • | Its largest client represents less than 4% of overall revenues. |

| | • | Agencies develop integrated relationships with clients, resulting in high switching costs. |

| | | |

| | • | WPP should benefit from increased spending on advertising/marketing in a healthier economy. |

| | | |

| | • | Over the past decade, WPP has generated a return on capital above its cost of capital. |

| | | |

| | • | The balance sheet is in reasonable shape with net debt slightly less than 2 times earnings before interest, taxes, depreciation and amortization (EBITDA). |

| | | |

| | • | WPP’s annual dividend is £0.60/year (2017), which yields over 5% currently. |

Valuation

| | • | WPP currently trades at approximately 1.4 times enterprise value-to-sales (EV/S), 7.7 times enterprise value-to-EBITDA (EV/EBITDA) and 10.5 times forward earnings per share (EPS) estimates. WPP should generate 17%+ earnings before interest and taxes (EBIT) margins on net revenues in 2018. |

| | | |

| | • | Historically, the company has been valued at 1.6 times sales, 10 times EBITDA and 15 times EPS. |

| | | |

| | • | The free cash flow (£1.5 billion) yield on the enterprise value is 7.8%. |

| | | |

| | • | Currently, we estimate WPP trades at a 40-50% discount to the MSCI EAFE Index on many statistical measures vs. a conventional discount of 10-20%. |

Management

| | • | Sir Martin Sorrell, 74, is director and CEO. He joined the company in 1986 as director and later the same year became group CEO. He owns over £200 million worth of the company’s equity, so he has significant skin in the game. |

| | | |

| | • | Paul Richardson, 61, is Finance director. Mr. Richardson has held this title since 1996 following four years with WPP as director of Treasury. |

| | | |

| | • | Mark Read, 51, is Strategy director and CEO, Wunderman/WPP Digital. Mr. Read was appointed a director in March 2005. Prior to joining WPP, he was a principal at Booz-Allen & Hamilton, and founder of WebRewards. |

| | | |

| | • | Operating companies are each run by capable executives. |

Investment Thesis

WPP fell short of expectations in 2017 and hurt the Fund’s overall performance last year. Revenue and profit have been impacted by fee compression and lower spending by the advertising-heavy consumer goods, retail and auto clients as a residual of softer top-line, zero-based budgeting and activist shareholders. There are some near-term challenges for the industry; however, we believe that these pressures are more cyclical than secular in nature and will ease in the medium term. Importantly, WPP is one of the leaders in the advertising and marketing service industry that has historically been able to adapt with changes in technology and media. The business continues to offer an outsourced solution to clients, has demonstrated a flexible cost structure and is managed by entrepreneurial individuals. Additionally, the business provides an important function in helping clients establish brands and grow revenue. At just over 8.5 times EBIT and 10 times EPS, the shares of WPP are attractive.

Bureau Veritas (BVI FP)

(Analyst: Matthew Goetzinger)

Description

Bureau Veritas (BV) is the world’s second largest testing, inspection and certification company. Across the company’s six reportable business segments, BV provides recognized independent

inspection services leveraging over 3,500 global accreditation standards within a diverse set of end markets. Geographically, Western Europe represents 32% of total revenues. Eastern Europe, the Middle East and Africa together represent 12% of total revenues. The Americas accounts for 27% of total revenues, while Asia Pacific is 29% of total revenues.

Good Business

| | • | As a large global trusted third party, BV offers independently verified testing, inspection and certification services across a diversified set of products, systems and physical assets. |

| | | |

| | • | The company’s verification services and recognized authoritative certification results in significant incremental end-product value that meaningfully outweighs the cost of the service. |

| | | |

| | • | The company’s scale is leveraged across a diversified balance of end markets and geographies. |

| | | |

| | • | Recurring monitoring businesses represent approximately 70% of firm revenues. |

| | | |

| | • | Over the past five years BV has generated an average return on invested capital (ROIC) of 12%. |

| | | |

| | • | BV’s balance sheet is stable with net debt-to-EBITDA ratio of 2 times. Interest coverage is over 8 times. |

Valuation

| | • | Bureau Veritas’ stock price has been flat for approximately five years. During this time period the company’s forward earnings multiple has come down from 26 times next 12 months earnings to a near market median. |

| | | |

| | • | Across several important valuation metrics BV trades at a 25% average discount to peers. |

| | | |

| | • | BV trades at its 5-year average forward earnings multiple of approximately 20 times. |

| | | |

| | • | Relative to normalized growth and profit margins, BV trades at approximately 17 times earnings. |

Management

| | • | Several new management appointments and changes in reporting structure suggest that BV is working to improve the efficiency and diversity of the organization. |

| | | |

| | • | In 2012 BV appointed an outsider from Otis (UTX) as the company’s new CEO. In March, a new Chairman was named, also from outside the organization. |

| | | |

| | • | In 2016 the company’s short-term incentive compensation plan moved to reward organic growth, margin expansion and cash flow. |

Investment Thesis

Over the past several years Bureau Veritas has worked through cyclical weakness in capital expenditure-related businesses that are now nearing cyclical troughs. During this time period BV has transitioned its business model to focus on recurring inspection-related testing businesses that are more immune to end market cycles. The company’s value-add will grow as regulation and verification services increase in an expanding global economy. In addition to driving improvements in organic growth, BV management has begun to emphasize a more balanced approach to capital deployment and returns. Near term tariff worries are nettlesome, but BV’s franchise is strong and likely to prove defensive in a tougher economic and stock market cycle.

Thank you for your support of the FMI International Fund.

This shareholder letter is unaudited.

FMI International Fund

SCHEDULE OF INVESTMENTS

March 31, 2018 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 87.8% (a) | | | | | | |

| COMMON STOCKS — 79.8% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 9.9% | | | | | | |

| | | Advertising/Marketing Services — 1.8% | | | | | | |

| | 8,500,000 | | WPP PLC (Jersey) (b) | | $ | 176,136,027 | | | $ | 135,078,590 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 5.2% | | | | | | | | |

| | 2,986,000 | | Bureau Veritas S.A. (France) (b) | | | 75,523,369 | | | | 77,618,372 | |

| | 1,069,000 | | DKSH Holding AG (Switzerland) (b) | | | 67,975,646 | | | | 86,929,842 | |

| | 2,928,000 | | Secom Co. Ltd. (Japan) (b) | | | 205,998,981 | | | | 218,092,653 | |

| | | | | | | 349,497,996 | | | | 382,640,867 | |

| | | | Personnel Services — 2.9% | | | | | | | | |

| | 2,995,000 | | Adecco Group AG (Switzerland) (b) | | | 183,262,960 | | | | 213,333,978 | |

| | | | | | | | | |

COMMUNICATIONS SECTOR — 2.7% | | | | | | | | |

| | | | Wireless Telecommunications — 2.7% | | | | | | | | |

| | 2,904,000 | | Millicom International | | | | | | | | |

| | | | Cellular S.A. (Luxembourg) (b) | | | 155,269,162 | | | | 198,734,318 | |

| | | | | | | | | |

CONSUMER DURABLES SECTOR — 5.4% | | | | | | | | |

| | | | Electronics/Appliances — 2.5% | | | | | | | | |

| | 5,823,000 | | Electrolux AB — Series B (Sweden) (b) | | | 148,967,651 | | | | 183,887,520 | |

| | | | | | | | | | | | |

| | | | Motor Vehicles — 1.8% | | | | | | | | |

| | 8,828,000 | | Isuzu Motors Ltd. (Japan) (b) | | | 101,081,448 | | | | 135,258,026 | |

| | | | | | | | | | | | |

| | | | Other Consumer Specialties — 1.1% | | | | | | | | |

| | 18,040,000 | | Samsonite International S.A. | | | | | | | | |

| | | | (Luxembourg) (b) | | | 52,897,050 | | | | 82,511,606 | |

| | | | | | | | | |

CONSUMER NON-DURABLES SECTOR — 7.9% | | | | | | | | |

| | | | Food: Major Diversified — 2.0% | | | | | | | | |

| | 1,885,000 | | Nestlé S.A. (Switzerland) (b) | | | 139,955,881 | | | | 148,993,281 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 5.9% | | | | | | | | |

| | 2,275,000 | | Henkel AG & Co. KGaA (Germany) (b) | | | 233,077,117 | | | | 286,613,176 | |

| | 2,700,000 | | Unilever PLC (Britain) (b) | | | 110,949,123 | | | | 149,748,547 | |

| | | | | | | 344,026,240 | | | | 436,361,723 | |

CONSUMER SERVICES SECTOR — 13.4% | | | | | | | | |

| | | | Broadcasting — 0.7% | | | | | | | | |

| | 2,980,300 | | Grupo Televisa S.A.B. — SP-ADR (Mexico) | | | 45,810,555 | | | | 47,565,588 | |

| | | | | | | | | | | | |

| | | | Cable/Satellite TV — 1.9% | | | | | | | | |

| | 3,900,000 | | Liberty Latin America Ltd. Cl C (Bermuda)* | | | 86,812,940 | | | | 74,451,000 | |

| | 3,560,000 | | Shaw Communications Inc. (Canada) | | | 68,198,492 | | | | 68,583,227 | |

| | | | | | | 155,011,432 | | | | 143,034,227 | |

| | | | Casinos/Gaming — 0.0% | | | | | | | | |

| | 1,686,000 | | Genting Malaysia Berhad (Malaysia) (b) | | | 1,564,936 | | | | 2,118,922 | |