UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07831

FMI Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue

Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

(Registrant's telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Item 1. Reports to Stockholders.

ANNUAL REPORT

September 30, 2015

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| |

|

|

|

| Advised by Fiduciary Management, Inc. |

| www.fmifunds.com |

| |

| | |

FMI Funds

TABLE OF CONTENTS

| FMI Large Cap Fund | |

| | | |

| | Shareholder Letter | 2 |

| | | |

| | Management’s Discussion of Fund Performance | 6 |

| | | |

| | Schedule of Investments | 7 |

| | | |

| | Industry Sectors | 9 |

| | | |

| | | |

| FMI Common Stock Fund | |

| | | |

| | Shareholder Letter | 10 |

| | | |

| | Management’s Discussion of Fund Performance | 16 |

| | | |

| | Schedule of Investments | 17 |

| | | |

| | Industry Sectors | 19 |

| | | |

| | | |

| FMI International Fund | |

| | | |

| | Shareholder Letter | 20 |

| | | |

| | Management’s Discussion of Fund Performance | 26 |

| | | |

| | Schedule of Investments | 28 |

| | | |

| | Schedule of Forward Currency Contracts | 30 |

| | | |

| | Industry Sectors | 30 |

| | | |

| | |

| Financial Statements | |

| | | |

| | Statements of Assets and Liabilities | 31 |

| | | |

| | Statements of Operations | 32 |

| | | |

| | Statements of Changes in Net Assets | 33 |

| | | |

| | Financial Highlights | 34 |

| | | |

| | Notes to Financial Statements | 36 |

| | | |

| | |

| Report of Independent Registered Public Accounting Firm | 40 |

| | |

| Expense Example | 41 |

| | |

| Directors and Officers | 42 |

| | |

| Disclosure Information | 43 |

| | |

| Additional Information | 45 |

| | |

| Tax Notice | 45 |

| | |

| Notice of Privacy Policy | 45 |

| | |

| Householding Notice | 45 |

FMI

Large Cap

Fund

September 30, 2015

Dear Fellow Shareholders:

The FMI Large Cap Fund declined 7.58% in the September quarter compared to a drop of 6.44% for the Standard & Poor’s 500 Index. Sectors that outperformed included Finance and Transportation, while sectors that underperformed included Process Industries and Energy Minerals. Progressive Corp. and Expeditors were relatively strong in the September quarter, while Potash Corp. and Devon Energy meaningfully declined.

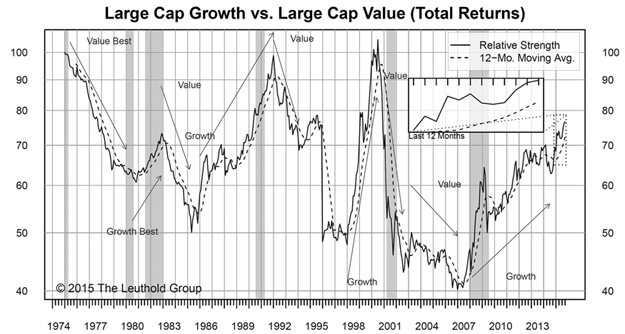

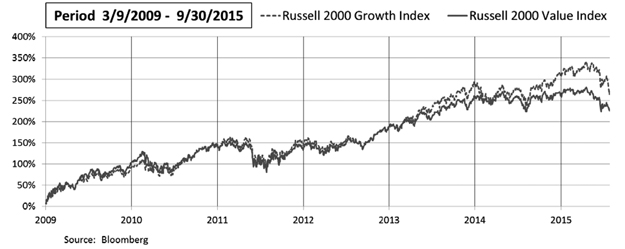

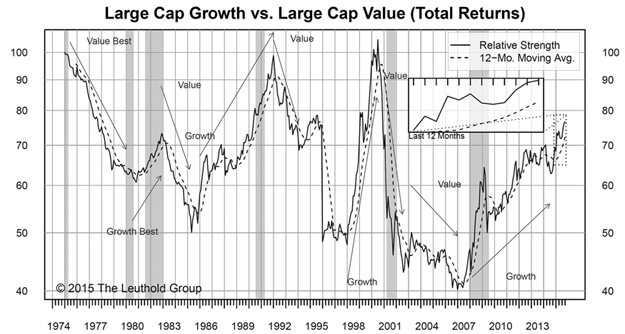

Worries about global growth, particularly in emerging markets, have dampened demand for most commodities and industrial machinery. Nearly all commodity-oriented stocks have been hit, with energy and agriculture related stocks both suffering significant losses. Many industrial stocks have also buckled as global gross domestic product (GDP) has slowed. The first market pullback, which began in late May and ended in late August for most stocks, was the third 10% correction the market has seen since March of 2009. It is interesting that some of the most speculative sectors like Health Care and Biotechnology, which have been huge winners over the past several years, declined less than the market during this downturn. A quick recovery of about half the decline seemed to put the market back into the same pattern of the past several years. There is an old stock market bromide that says, “In a real bear market they get them all.” We think Biotechnology is a good bellwether group for this market; unless and until this group gets its comeuppance, we probably haven’t broken the pattern. Biotechnology stocks did come under significant selling pressure when the market had a second rough spell beginning September 17 and continuing until the last day of the quarter. The action in Biotechnology and other highly speculative groups will be closely monitored for signs that the fever has finally broken. The relative cheapness of our stocks has yet to pay significant dividends in this cycle. The market has not been focused on valuations, and continues to favor so-called growth and momentum stocks relative to value-oriented equities. Below is a chart illustrating this phenomenon.

As we pointed out in a previous letter, over very long periods of time value has historically beaten growth by a significant margin, but it is obviously very cyclical and growth has been relatively strong for quite some time. We anticipate this dynamic to change but cannot predict the timing.

Poor fundamental and anecdotal data coming out of China, Brazil and Japan, including expected negative GDP in the latter two countries; an energy-wounded and increasingly belligerent Russia; an escalating Middle East crisis creating approximately four million refugees; and a United States economy that quarterly bobs back and forth between poor and moderate growth, haven’t delivered a nasty market in six and a half years despite high valuations (the Leuthold statistics of roughly 50 different valuation measures that we cite frequently was in the ninth decile at the start of the September quarter). The Fed recently lapped the ninth year since rates have been raised and nearly seven years of essentially zero percent Fed Funds rates, continuing what we believe is a dangerous and destructive policy that misallocates investment and engenders low, rather than high growth. As long as the Fed sees the world through a single prism – that low growth, seemingly slack labor conditions and low investment means interest rates need to be suppressed — no one will know what normal policies could achieve.

Since China concerns seemed to be at the root of the recent market correction, it is important to both remind ourselves just how extended China has become, but also that these worries need to be kept in perspective. Yes, as we have discussed for the past several years in these letters, China has undergone a massive credit buildup on the order of $26 trillion over the previous fifteen years, and has overbuilt a number of areas including steel and cement. Yes, China has likely built infrastructure that is far in excess of what is needed. Yes, China has too many apartments and too many malls. Yes, the Chinese banking system is fraught with risk. Yes, it will be very painful as China retrenches. It is important to remember, however, that most of the infrastructure (roads, bridges, rails, airports, marine terminals, etc.) has a long useful life. It is also critical to realize that what we know loosely as the private sector in China (businesses other than the State Owned Enterprises, or SOEs) has grown much more rapidly than the SOEs, and today account for an estimated two-thirds of all economic output, according to The Economist. The Chinese, generally speaking, are highly entrepreneurial and the largely private firms that have been allowed to operate have generated hundreds of millions of jobs over the past few decades. Chinese companies are increasingly known for their innovation, and we’ve seen glimpses of that with companies such as Alibaba, Xiaomi and Huawei. There is little doubt that China’s GDP growth rate is less than the official number of 7%, and there will likely be very significant digestion problems over the near term, including perhaps negative GDP growth. This will continue to have a deleterious impact on a number of companies across the globe, but longer-term, we remain optimistic about the growth in China and for many other emerging markets.

The producer side of the U.S. economy is clearly slowing, if not retracting. The strong dollar and the weakness in big economies like China, Brazil, Japan and Russia, along with the collateral damage from plunging commodity prices, is clearly affecting U.S. companies. Bellwether companies such as Grainger, Praxair and GE are seeing a broad-based industrial slowdown. However, some of the consumer facing industries such as retail, home and multi-family housing, automobiles and health care, are still growing significantly. Real personal spending on categories like food service, hotels, recreation and communications are all growing at a mid-single-digit rate. Overall real GDP growth in the first two quarters of 2015 was 0.6% and 3.9%, respectively, and recently the Atlanta Federal Reserve Bank lowered their third quater GDP estimate from 1.8% to 0.9%. Unfortunately, corporate sales and earnings growth, as measured by the S&P 500 and Russell 2000 Indices, respectively, continue to be mired in the minus 1%-to-plus 1% range.

So, in summary, we see an uneven domestic economy, generally difficult world economies, little corporate sales or earnings growth, and equity valuations that remain quite expensive from a historical perspective. They are particularly expensive in the so-called defensive sectors. Investors have a tough choice: own really expensive stocks in the sectors that are “holding up,” or own less expensive stocks in the areas where fundamentals are deteriorating. The good news is that

increased volatility is giving long-term investors at least a glimpse of better risk/rewards. Over the past few years as stocks have seemingly levitated at unattractive levels, the portfolio management team has been actively researching dozens and dozens of good businesses whose valuations are not quite acceptable. We are excited about the potential opportunities to deploy capital at more attractive levels and reorient the Fund to even better values as the market is pressured. As is our custom in the September letter, below we have highlighted a few investments:

Dollar General Corp. (DG)

(Analyst: Matt Sullivan)

Description

Dollar General is one of the largest discount retailers in the United States. The company operates over 12,000 small box stores located throughout 43 states, primarily in the southern, southwestern, midwestern and eastern U.S. They offer a broad selection of both branded and private label merchandise, including consumables (75%), seasonal products (13%), home products (6.5%), and apparel (5.5%). The company utilizes an “everyday low prices” strategy, with most merchandise priced at less than $10. Average selling space per store is approximately 7,400 square feet.

Good Business

| • | Dollar General’s 5-year average return on invested capital (ROIC) is somewhere between 10.8% (including capitalized leases) and 25% (excluding capitalized leases). Given the fungible nature of the real estate, the true 5-year average ROIC greatly exceeds the company’s cost of capital. |

| | |

| • | Dollar General has grown its same store sales for 25 consecutive years, proving that the business model is more successful and less volatile than most other retail concepts. |

| | |

| • | The low cost of real estate and concentrated SKUs (stock keeping units) allows Dollar General to sell merchandise at very competitive prices. |

| | |

| • | The core customer makes less than $50,000 per year and the low average ticket price provides the business with some protection from online competition. |

| | |

| • | Dollar General has a solid balance sheet with debt-to-capital of 35%, adjusted debt-to-EBITDAR of 3.0 times, and a fixed charge coverage ratio of 3.1 times. Management has stated that they would like to remain investment grade, and keep debt levels close to 3.0 times adjusted debt/EBITDAR. |

| | |

| • | The business is easy to understand. |

Valuation

| • | Dollar General trades for 16.4 times the next 12-month earnings per share forecasts, which is a discount to the S&P 500. However, this is a better-than-average company. |

| | |

| • | The enterprise value-to-2015 (estimate) sales multiple is 1.15 times, which is below the company’s 5-year average enterprise value-to-sales multiple of 1.2 times. |

Management

| • | Todd Vasos was recently appointed CEO. Vasos has been with Dollar General since 2008, and was COO from 2013-2015. |

| | |

| • | Rick Dreiling joined Dollar General in January 2008 as CEO and Board member. He was appointed Chairman of the Board on December 2, 2008. Dreiling recently retired from the CEO position but is still the company’s Chairman of the Board. |

Investment Thesis

Dollar General is a defensive business that performs well in most economic environments. For example, the company has grown its same store sales for 25 consecutive years. We expect that over the next few years, same store sales will continue to grow, and the company will also expand its store base. This should drive steady and reliable sales growth over our investment time horizon. When including stock buybacks, earnings per share are expected to grow at a double-digit compound annual rate. The company’s stock is reasonably valued, trading at 16.4 times the next twelve month earnings per share estimates in an expensive market.

Stanley Black & Decker Inc. (SWK)

(Analyst: Matthew Goetzinger)

Description

Stanley Black & Decker is a leading global manufacturer of power and hand tools, engineered fasteners, and mechanical and electronic security solutions. The Tools & Storage business is the company’s largest profit center, accounting for two-thirds of net income. In aggregate, 49% of the company’s annual revenues are generated in the United States, with the remainder from Europe (25%), various emerging markets (17%), Canada (5%) and elsewhere.

Good Business

| • | Stanley Black & Decker is a leading consumer and professional tools franchise complimented by a growing market position in the value-added Engineered Fasteners business. Across each of the company’s businesses, it is recognized for its innovation and product quality. |

| | |

| • | The company’s industry-leading branded tools business operates within a rational oligopoly. The Engineered Fasteners business participates within attractive niche applications that carry good entry barriers and high switching costs. Security Solutions also commands a leading market share within a more fragmented global market. |

| | |

| • | Approximately 78% of the company’s business can be considered recurring, replacement or platform-based. |

| | |

| • | Excluding balance sheet goodwill, the 5-year average ROIC is 17.2% (2014: 20.4%). |

| | |

| • | The company maintains a strong Standard & Poors A rated balance sheet, with net debt-to-EBITDA of 1.9 times. |

| | |

| • | The business is easy to understand. The company controls its own destiny. |

Valuation

| • | On an absolute basis, Stanley Black & Decker trades at reasonable multiples to revenues of 1.6 times, and EBITDA of 9 times, given the company’s market position, margin structure, incremental return profile, and balance sheet characteristics. |

| | |

| • | The stock trades at 16.7 times the calendar 2015 earnings estimate, which is a discount to the weighted average multiple of the S&P 500. |

| | |

| • | Over the last decade, the company has returned approximately 50% of normalized free cash flow to its shareowners. Further, the company has raised its shareholder dividend for 47 consecutive years. Equally impressive is the fact that it has reduced the outstanding share count by 8% since 2011. |

Management

| • | John Lundgren has been CEO since 2004 and Chairman since 2013. A reasonable acquisition track record has been hurt by a recent disappointment. |

| | |

| • | Across the business, Stanley Black & Decker’s management team carries years of industry experience and has performed well in terms of operational excellence. |

| | |

| • | Management is incentivized to achieve an appropriate balance between cash flow return on investment, EPS growth and total shareholder return. |

Investment Thesis

Management credibility and stock valuation have been hurt by underperformance within the company’s small acquired security business. This temporary setback has resulted in the company refocusing on organic growth and repurchasing shares, as opposed to deal making. Over time this should allow the company’s strong underlying market positions, brands, and reputation of innovation and product quality to grow intrinsic value and the stock price. Additionally, this company provides desired exposure to construction markets.

Thank you for your support of the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2015, the FMI Large Cap Fund (the “Fund”) had a total return of -0.54%. The benchmark S&P 500 returned -0.61% in the same period. Sectors that aided relative performance included Health Services, Distribution Services, and Technology Services. UnitedHealth Group had strong performance within the Health Services sector as they managed through lower reimbursement and reestablished solid growth. AmerisouceBergen Corp. drove the performance of the Distribution Services sector, as the initiatives they undertook over the past few years bore fruit. Accenture continued to win new business and expand margins, helping the Technology Services sector outperform. On the negative side, Process Industries, Consumer Non-Durables and Finance all pulled down performance. The Fund’s lack of exposure to Health Technology also detracted from performance as this sector was relatively good for the market. Potash Corp. declined significantly in the period, hurting the Process Industries sector. Low crop prices and worries about excess capacity hurt Potash’s stock. The Fund’s adviser continues to believe that Potash is significantly undervalued. A strong dollar hurt the performance of Consumer Non-Durable stocks. In local currency, these stocks outperformed the return of the benchmark sector. Comerica and American Express depressed the performance of the Finance sector. Comerica continues to suffer from low interest rates and the collapse of hydrocarbon prices also affected the stock, given that they are significant lender in the energy field. American Express’ business has become more competitive and this has hurt its growth rate. We think both of these financial franchises remain sound and the stocks undervalued. Stocks sold in the period included Cintas and PayPal. New additions to the Fund over the past twelve months included Stanley Black & Decker, Dollar General and Rockwell. At September 30, 2015, the Fund was significantly overweighted in Producer Manufacturing, Process Industries and Distribution Services and meaningfully underweighted in Health Technology, Utilities and Electronic Technology.

Good performance across mostly the so-called “defensive” sectors and some speculative groups like biotechnology helped drive the results for the S&P 500. While the market corrected over 9% from May 21 through September 30, the “character” of the market hasn’t seemed to change yet. Growth and momentum oriented stocks have outperformed value oriented stocks over the past several years and only late in the September quarter did these types of stocks lag the market. It has been over six and a half years since the last bear market (that is to say a market decline of 20% or greater). Valuations remain near the upper end of historical parameters. Easy monetary policy appears to have been a significant driver of stock market performance in recent years. Many economies around the world have weakened and while the U.S. economy has had positive real GDP growth, the rate over the past year has been below average. The unemployment rate has also improved, but the labor participation rate remains at a very low level and an extraordinarily high number of citizens are dependent on government support. Companies have been restrained with respect to investing in both capital equipment and labor, which has resulted in less than satisfactory internal growth rates. Geopolitical problems have seemingly escalated over the past year. This, combined with less than average growth and high valuations makes us cautious on the stock market in the short run. The Fund continues to believe, however, that stocks have the best chance to adjust to a dynamic environment over the long run. The Fund sells at a discount to the S&P 500 on most valuation measures.

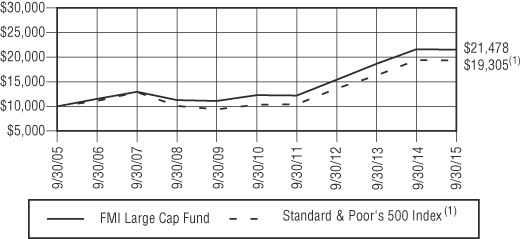

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI LARGE CAP FUND AND STANDARD & POOR’S 500 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/31/01 |

| FMI Large Cap Fund | (0.54%) | 11.91% | 7.94% | 8.22% |

| S&P 500 Index | (0.61%) | 13.34% | 6.80% | 5.92% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

An investment cannot be made directly into an index.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

September 30, 2015

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 93.8% (a) | |

| | |

COMMERCIAL SERVICES SECTOR — 3.7% | |

| | | | | | | | | |

| | Advertising/Marketing Services — 3.7% | | | | | | |

| | 4,745,000 | | Omnicom Group Inc. | | $ | 335,107,960 | | | $ | 312,695,500 | |

| | |

CONSUMER DURABLES SECTOR — 2.7% | |

| | | | Tools & Hardware — 2.7% | | | | | | | | |

| | 2,330,000 | | Stanley Black & Decker Inc. | | | 231,860,536 | | | | 225,963,400 | |

| | |

CONSUMER NON-DURABLES SECTOR — 9.6% | |

| | | | Food: Major Diversified — 7.2% | | | | | | | | |

| | 25,618,000 | | Danone S.A. - SP-ADR | | | 358,928,587 | | | | 322,786,800 | |

| | 3,786,000 | | Nestle’ S.A. - SP-ADR | | | 195,888,557 | | | | 284,858,640 | |

| | | | | | | 554,817,144 | | | | 607,645,440 | |

| | | | Household/Personal Care — 2.4% | | | | | | | | |

| | 4,917,000 | | Unilever PLC - SP-ADR | | | 196,952,599 | | | | 200,515,260 | |

| | |

CONSUMER SERVICES SECTOR — 7.5% | |

| | | | Cable/Satellite TV — 4.7% | | | | | | | | |

| | 7,072,000 | | Comcast Corp. - Cl A | | | 392,538,821 | | | | 402,255,360 | |

| | | | Other Consumer Services — 2.8% | | | | | | | | |

| | 9,751,000 | | eBay Inc.* | | | 240,526,258 | | | | 238,314,440 | |

| | |

DISTRIBUTION SERVICES SECTOR — 1.8% | |

| | | | Medical Distributors — 1.8% | | | | | | | | |

| | 1,630,000 | | AmerisourceBergen Corp. | | | 45,545,395 | | | | 154,833,700 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 3.6% | |

| | | | Electronic Components — 3.6% | | | | | | | | |

| | 5,098,000 | | TE Connectivity Ltd. | | | 144,222,118 | | | | 305,319,220 | |

| | |

ENERGY MINERALS SECTOR — 2.8% | |

| | | | Oil & Gas Production — 2.8% | | | | | | | | |

| | 6,485,000 | | Devon Energy Corp. | | | 372,529,941 | | | | 240,528,650 | |

| | |

FINANCE SECTOR — 14.5% | |

| | | | Financial Conglomerates — 3.1% | | | | | | | | |

| | 3,594,000 | | American Express Co. | | | 141,724,656 | | | | 266,423,220 | |

| | | | Major Banks — 7.1% | | | | | | | | |

| | 8,746,350 | | Bank of New York Mellon Corp. | | | 197,956,486 | | | | 342,419,603 | |

| | 6,375,000 | | Comerica Inc. | | | 192,182,537 | | | | 262,012,500 | |

| | | | | | | 390,139,023 | | | | 604,432,103 | |

| | | | Property/Casualty Insurance — 4.3% | | | | | | | | |

| | 12,025,000 | | Progressive Corp. | | | 301,438,224 | | | | 368,446,000 | |

| | |

HEALTH SERVICES SECTOR — 4.8% | |

| | | | Managed Health Care — 4.8% | | | | | | | | |

| | 3,480,000 | | UnitedHealth Group Inc. | | | 250,086,949 | | | | 403,714,800 | |

| | |

INDUSTRIAL SERVICES SECTOR — 3.8% | |

| | | | Oilfield Services/Equipment — 3.8% | | | | | | | | |

| | 4,662,000 | | Schlumberger Ltd. | | | 315,022,307 | | | | 321,538,140 | |

| | |

PROCESS INDUSTRIES SECTOR — 3.7% | |

| | | | Chemicals: Agricultural — 3.7% | | | | | | | | |

| | 15,444,000 | | Potash Corp. of Saskatchewan Inc. | | | 561,550,273 | | | | 317,374,200 | |

| | | | | | | | | | | | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2015

Shares or Principal Amount | | Cost | | | Value | |

| | |

| COMMON STOCKS — 93.8% (a) (Continued) | |

| | |

PRODUCER MANUFACTURING SECTOR — 15.4% | |

| | Industrial Conglomerates — 11.2% | | | | | | |

| | 1,115,000 | | 3M Co. | | $ | 66,981,194 | | | $ | 158,073,550 | |

| | 3,092,000 | | Berkshire Hathaway Inc. - Cl B* | | | 217,596,176 | | | | 403,196,800 | |

| | 4,148,000 | | Honeywell International Inc. | | | 398,409,351 | | | | 392,774,120 | |

| | | | | | | 682,986,721 | | | | 954,044,470 | |

| | | | Industrial Machinery — 1.0% | | | | | | | | |

| | 825,000 | | Rockwell Automation Inc. | | | 86,973,529 | | | | 83,712,750 | |

| | | | Trucks/Construction/Farm Machinery — 3.2% | | | | | | | | |

| | 5,243,000 | | PACCAR Inc. | | | 250,061,398 | | | | 273,527,310 | |

| | |

RETAIL TRADE SECTOR — 7.8% | |

| | | | Apparel/Footwear Retail — 3.7% | | | | | | | | |

| | 6,405,000 | | Ross Stores Inc. | | | 217,184,140 | | | | 310,450,350 | |

| | | | Discount Stores — 4.1% | | | | | | | | |

| | 4,769,000 | | Dollar General Corp. | | | 353,364,792 | | | | 345,466,360 | |

| | |

TECHNOLOGY SERVICES SECTOR — 9.0% | |

| | | | Information Technology Services — 5.4% | | | | | | | | |

| | 4,706,000 | | Accenture PLC | | | 217,530,631 | | | | 462,411,560 | |

| | | | Packaged Software — 3.6% | | | | | | | | |

| | 6,985,000 | | Microsoft Corp. | | | 204,913,875 | | | | 309,156,100 | |

| | |

TRANSPORTATION SECTOR — 3.1% | |

| | | | Air Freight/Couriers — 3.1% | | | | | | | | |

| | 5,625,000 | | Expeditors International of Washington Inc. | | | 211,408,061 | | | | 264,656,250 | |

| | | | Total common stocks | | | 6,698,485,351 | | | | 7,973,424,583 | |

| | | | | | | | | | | | |

| | |

| SHORT-TERM INVESTMENTS — 6.1% (a) | |

| | | | Commercial Paper — 6.1% | | | | | | | | |

| $ | 519,800,000 | | U.S. Bank N.A., 0.03%, due 10/01/15 | | | 519,800,000 | | | | 519,800,000 | |

| | | | Total investments — 99.9% | | $ | 7,218,285,351 | | | | 8,493,224,583 | |

| | | | Other assets, less liabilities — 0.1% (a) | | | | | | | 5,999,050 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 8,499,223,633 | |

* Non-income producing security.

(a) Percentages for the various classifications relate to net assets.

PLC – Public Limited Company

SP-ADR – Sponsored American Depositary Receipt

The accompanying notes to financial statements are an integral part of this schedule.

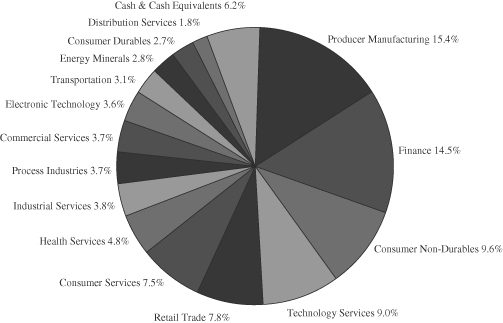

FMI Large Cap Fund

INDUSTRY SECTORS

as of September 30, 2015 (Unaudited)

FMI

Common Stock

Fund

September 30, 2015

Dear Fellow Shareholders:

The FMI Common Stock Fund declined 8.44% in the September quarter compared to a drop of 11.92% for the Russell 2000 Index. Sectors that outperformed included Commercial Services and Consumer Durables, while sectors that underperformed included Producer Manufacturing and Finance. Genpact Ltd. and NVR Inc. were relatively strong in the September quarter, while Woodward and Cullen/Frost meaningfully declined.

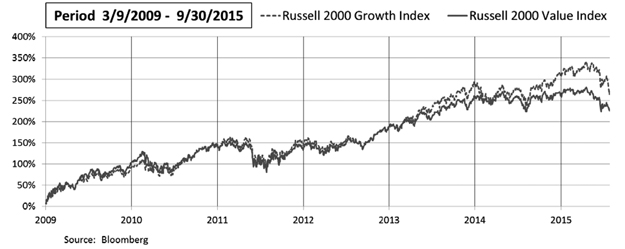

Worries about global growth, particularly in emerging markets, have dampened demand for most commodities and industrial machinery. Nearly all commodity-oriented stocks have been hit, with energy and agriculture related stocks both suffering significant losses. Many industrial stocks have also buckled as global gross domestic product (GDP) has slowed. The first market pullback, which began in late May and ended in late August for most stocks, was the third 10% correction the market has seen since March of 2009. It is interesting that some of the most speculative sectors like Health Care and Biotechnology, which have been huge winners over the past several years, declined less than the market during this downturn. A quick recovery of about half the decline seemed to put the market back into the same pattern of the past several years. There is an old stock market bromide that says, “In a real bear market they get them all.” We think Biotechnology is a good bellwether group for this market; unless and until this group gets its comeuppance, we probably haven’t broken the pattern. Biotechnology stocks did come under significant selling pressure when the market had a second rough spell beginning September 17 and continuing until the last day of the quarter. The action in Biotechnology and other highly speculative groups will be closely monitored for signs that the fever has finally broken. The relative cheapness of our stocks has yet to pay significant dividends in this cycle. The market has not been focused on valuations, and continues to favor so-called growth and momentum stocks relative to value-oriented equities. Below is a chart of the Russell 2000 Growth Index compared to the Russell 2000 Value Index since the bottom of the last bear market.

As we pointed out in a previous letter, over very long periods of time value has historically beaten growth by a significant margin, but it is obviously very cyclical and growth has been relatively strong for quite some time. We anticipate this dynamic to change but cannot predict the timing.

Poor fundamental and anecdotal data coming out of China, Brazil and Japan, including expected negative GDP in the latter two countries; an energy-wounded and increasingly belligerent Russia; an escalating Middle-East crisis creating approximately four million refugees; and a United States economy that quarterly bobs back and forth between poor and moderate growth, haven’t delivered a nasty market in six and a half years, despite high valuations (the Leuthold statistics of

roughly 50 different valuation measures that we cite frequently was in the ninth decile at the start of the September quarter). The Fed recently lapped the ninth year since rates have been raised and nearly seven years of essentially zero percent Fed Funds rates, continuing what we believe is a dangerous and destructive policy that misallocates investment and engenders low, rather than high growth. As long as the Fed sees the world through a single prism – that low growth, seemingly slack labor conditions and low investment means interest rates need to be suppressed – no one will know what normal policies could achieve.

Since China concerns seemed to be at the root of the recent market correction, it is important to both remind ourselves just how extended China has become, but also that these worries need to be kept in perspective. Yes, as we have discussed for the past several years in these letters, China has undergone a massive credit buildup on the order of $26 trillion over the previous fifteen years, and has overbuilt a number of areas including steel and cement. Yes, China has likely built infrastructure that is far in excess of what is needed. Yes, China has too many apartments and too many malls. Yes, the Chinese banking system is fraught with risk. Yes, it will be very painful as China retrenches. It is important to remember, however, that most of the infrastructure (roads, bridges, rails, airports, marine terminals, etc.) has a long useful life. It is also critical to realize that what we know loosely as the private sector in China (businesses other than the State Owned Enterprises, or SOEs) has grown much more rapidly than the SOEs, and today account for an estimated two-thirds of all economic output, according to The Economist. The Chinese, generally speaking, are highly entrepreneurial and the largely private firms that have been allowed to operate have generated hundreds of millions of jobs over the past few decades. Chinese companies are increasingly known for their innovation, and we’ve seen glimpses of that with companies such as Alibaba, Xiaomi and Huawei. There is little doubt that China’s GDP growth rate is less than the official number of 7%, and there will likely be very significant digestion problems over the near term, including perhaps negative GDP growth. This will continue to have a deleterious impact on a number of companies across the globe, but longer term we remain optimistic about the growth in China and for many other emerging markets.

The producer side of the U.S. economy is clearly slowing, if not retracting. The strong dollar and the weakness in big economies like China, Brazil, Japan and Russia, along with the collateral damage from plunging commodity prices, is clearly affecting U.S. companies. Bellwether companies such as Grainger, Praxair and GE are seeing a broad-based industrial slowdown. However, some of the consumer facing industries such as retail, home and multi-family housing, automobiles and health care, are still growing significantly. Real personal spending on categories like food service, hotels, recreation and communications are all growing at a mid-single-digit rate. Overall real GDP growth in the first two quarters of 2015 was 0.6% and 3.9%, respectively, and recently the Atlanta Federal Reserve Bank lowered their third quater GDP estimate from 1.8% to 0.9%. Unfortunately, corporate sales and earnings growth, as measured by the S&P 500 and Russell 2000 Indices, respectively, continue to be mired in the minus 1%-to-plus 1% range.

So, in summary, we see an uneven domestic economy, generally difficult world economies, little corporate sales or earnings growth, and equity valuations that remain quite expensive from a historical perspective. They are particularly expensive in the so-called defensive sectors. Investors have a tough choice: own really expensive stocks in the sectors that are “holding up,” or own less expensive stocks in the areas where fundamentals are deteriorating. The good news is that increased volatility is giving long-term investors at least a glimpse of better risk/rewards. Over the past few years as stocks have seemingly levitated at unattractive levels, the portfolio management team has been actively researching dozens and dozens of good businesses whose valuations are not quite acceptable. We are excited about the potential opportunities to deploy capital at more attractive levels and reorient the Fund to even better values as the market is pressured. As is our custom in the September letter, below we have highlighted a few investments:

First Cash Financial Services Inc. (FCFS) and Cash America International Inc. (CSH)

(Analyst: Matt Sullivan)

Industry Description

First Cash Financial Services and Cash America are two of the largest pawn operators in North America. While we don’t often buy two companies in the same industry, in this instance we felt it was appropriate. Generally speaking, we were attracted to the pawn industry because many states have adopted regulations that make it difficult to open new pawn stores, which insulates incumbent players from new competition. Further, other forms of lending to the pawn industry’s core, low income customer base are under intense regulatory scrutiny, which we believe will create a tailwind for the pawn industry over the next several years. Finally, the pawn industry gives investors exposure to gold, as pawn store fundamentals improve when gold prices rise. Given the experimental monetary policies around the world, we believe this exposure is attractive. We also believe that pawn stores are a much better way to get exposure to gold than buying gold miners, which are notoriously bad businesses with dismal return on invested capital (ROIC) profiles.

The reason we decided to buy both companies is that First Cash derives over 50% of its business from Mexico, whereas Cash America only does business in the United States. The Mexico market has different demographics and growth prospects than the U.S. market; therefore, we felt that we were getting significantly different exposures from the two businesses, despite the fact that they are close competitors in the same industry.

First Cash Financial Services Inc. (FCFS)

Description

First Cash Financial Services is one of the largest pawn operators in the world by market cap and by number of stores. The company operates a total of 1,011 stores, 686 of which are in Mexico (68%), and 325 of which are in the United States (32%). Stores are typically 5,000-6,000 square feet in size. Pawn services account for 93% of the company’s net revenue, while uncollateralized consumer loan fees account for the other 7%. The company was founded in 1988 and is headquartered in Arlington, Texas.

Good Business

| • | First Cash’s ROIC was 16.5% last year, and has averaged 22.2% and 20.2% over the past five and ten years, respectively, which greatly exceeds the company’s cost of capital. |

| | |

| • | Loans are typically based on need, making revenue relatively stable and providing some insulation from economic cycles. |

| | |

| • | According to the company, a high percentage of customers are repeat customers. Customers redeem collateral for 70-75% of their loans and often use the same piece of collateral for multiple loans. This gives the business some recurring revenue characteristics. |

| | |

| • | Loans are small in size and have short maturities, which helps to keep regulatory bodies out of the industry, and helps customers to repay loans frequently. |

| | |

| • | All loans are collateralized by merchandise at attractive loan-to-value ratios. When a customer “defaults,” First Cash is still able to earn a yield on the loan by selling the merchandise through its retail stores. |

| | |

| • | Regulatory barriers to entry keep new competitors at bay. |

| | |

| • | The company has worked to reduce uncollateralized consumer loans as a percentage of the overall business in order to decrease regulatory risk. |

| | |

| • | The company has a strong balance sheet and solid free cash flow. |

| | |

| • | This is a simple business that is easy to understand. |

Valuation

| • | First Cash trades at an enterprise value-to-sales multiple of 1.8 times, which is well below the company’s 5- and 10-year averages. The company’s 5-year average earnings before interest and taxes (EBIT) margin is approximately 20%. |

| | |

| • | The stock trades at 14 times the next 12-month earnings per share estimate, which is below the company’s 5- and 10-year averages, and is a significant discount to small cap market indices. |

Management

| • | Rick Wessel has been with the company since 1992 and has served in a number of positions, including CEO since November 2006, and CFO from May 1992 to December 2002. He has also been Chairman of the Board since October 2010, and previously served as Vice Chairman of the Board from November 2004 to October 2010. |

| | |

| • | Doug Orr joined the company in 2002, and became CFO in 2003. |

| | |

| • | Management and executives own 4% of the company. Rick Wessel personally owns a $30 million dollar stake. |

Investment Thesis

First Cash Financial Services is one of the leading pawn operators in the world. The company is known as the best operator in its industry, as their growth, margins, and returns are better than their peers. Over the past few years, declining gold prices and the depreciation of the Mexican peso relative to the U.S. dollar have caused the stock to meaningfully underperform. This has given us the opportunity to buy an industry leader with strong long-term growth and return prospects at an undemanding valuation. First Cash also gives investors exposure to gold, which we believe is a prudent hedge given the experimental monetary policies around the world.

Cash America International Inc. (CSH)

Description

Cash America is the largest pawn operator in the United States by number of stores. The company operates 859 lending locations in 21 states. Pawn services account for approximately 90% of the company’s net revenue. The company also offers other financial services such as uncollateralized consumer loan services, check cashing, and a few other ancillary financial services that account for the remaining 10% of the company’s net revenue. Cash America was founded in 1983 and is headquartered in Fort Worth, Texas.

Good Business

| • | Returns on capital are adequate. Incremental returns on capital appear to be attractive. The company should be able to narrow the gap between their ROIC and that of their closest competitor, First Cash, over time. |

| | |

| • | Loans are typically based on need, making revenue relatively stable and providing some insulation from economic cycles. |

| | |

| • | According to the company, a high percentage of customers are repeat customers. Customers redeem collateral for 70%-75% of their loans and often use the same piece of collateral for multiple loans. This gives the business some recurring revenue characteristics. |

| | |

| • | Loans are small in size and have short maturities, which helps to keep regulatory bodies out of the industry, and helps customers to repay loans frequently. |

| | |

| • | All loans are collateralized by merchandise at attractive loan-to-value ratios. When a customer “defaults,” Cash America is still able to earn a yield on the loan by selling the merchandise through its retail stores. |

| | |

| • | The business was recently simplified with the spinoff of Enova, an online unsecured lending business. The company is also working to reduce unsecured consumer lending in its retail outlets in order to decrease regulatory risk. |

| | |

| • | Regulatory barriers to entry keep new competitors at bay. |

| | |

| • | The company has a strong balance sheet and solid free cash flow. |

| | |

| • | This is a simple business that is easy to understand. |

Valuation

| • | Cash America trades at an adjusted enterprise-value-to-sales multiple of 0.8 times, relative to an 8% operating margin. Margins are significantly below the company’s closest peers. We believe Cash America should be able to improve margins and narrow the gap with peers over time. |

| | |

| • | Cash America trades at 11.9 times this year’s cash earnings per share forecasts, which is a significant discount to its closest peer and to the broader small cap market indices. |

Management

| • | CEO Dan Feehan has been with the company since 1988. Feehan is stepping down from the CEO position in October of this year, but will move into an Executive Chairman position. He has also agreed to remain on the company’s board through 2020 if shareholders approve his nomination each year. |

| | |

| • | Brent Stuart was promoted to the CEO position. Stuart has been at Cash America since 2008, and most recently served as the company’s COO. |

| | |

| • | CFO Tom Bessant has been with the company since 1993, and has been CFO since 1997. |

| | |

| • | Each board member has been with the company for over nine years. Most have been with the company for 20 years or more. |

| | |

| • | Executives and managers own 2.1% of the shares outstanding. |

Investment Thesis

Cash America is a simple business that operates in a large, fragmented market with stable competitive dynamics. They provide necessary services to a growing number of people. Management recently simplified and de-risked the business by spinning off the online unsecured consumer loan business, and by reducing its storefront unsecured consumer loan revenue. The U.S. pawn business now contributes almost all of the company’s revenue and profits. We believe that the long-term outlook for the U.S. pawn industry is attractive, and that Cash America is undervalued relative to competitors and broader small cap market indices. Additionally, Cash America gives investors some exposure to gold, which we believe is a prudent hedge given the experimental monetary policies around the world.

Applied Industrial Technologies Inc. (AIT)

(Analyst: Andy Ramer)

Description

Applied Industrial is a leading North American distributor of motion control technologies including bearings (29%), fluid power products (29%), and power transmission components (27%), which combined account for 85% of the portfolio. The company serves customers in virtually every industry.

Good Business

| • | Applied’s scale, technical expertise, and longstanding relationships with both customers and suppliers support its competitive position. |

| | |

| • | Distributors play a crucial role in connecting many suppliers and customers with one another, as it would be inefficient for the two parties to contract with each other directly. |

| | |

| • | The aftermarket accounts for 75% of sales, where the company sells replacement parts to factories to fix machines on assembly lines when they break down. |

| | |

| • | ROIC is 11.5% and has averaged 13.5% over the last five fiscal years; it has remained in the double digits during the most recent recession. |

| | |

| • | This is an easy business to understand. |

| | |

| • | The balance sheet is solid and cash flow generation has been strong. |

Valuation

| • | At a price-to-fiscal 2016 (June) forecast earnings multiple of 13.8 times, the stock trades at a significant discount to the Russell 2000. |

| | |

| • | Shares trade for 0.67 times trailing 12-month sales relative to an operating margin of 6.7%, or 10 times EBIT. |

| | |

| • | At a price-to-book ratio of 2.11 times, the stock trades below its 5- and 10-year average multiples of 2.44 and 2.33 times, respectively. |

| | |

| • | The dividend yields 2.8%. |

| | |

| • | Only two of the eight Wall Street analysts who cover the stock have rated AIT a Buy. |

| | |

Management

| • | Neil Schrimsher, 51, joined Applied as CEO in October 2011. He was previously Executive Vice President of Cooper Industries, where he led Cooper’s Electrical Products Group, and also served as President of Cooper Lighting. |

| | |

| • | Mark Eisele, 58, has been CFO since January 2004. |

| | |

| • | The company successfully completed a multi-year phased-in implementation of a new enterprise resource planning (ERP) system to replace multiple legacy applications. |

| | |

| • | Applied does not grant stock options, and compensation is, in part, tied to return on asset performance over a 3-year time horizon. |

Investment Thesis

Applied has an opportunity to accelerate growth and boost profitability after having greatly enhanced its operating capabilities via the new ERP system, which standardizes and simplifies processes and enables continuous improvement throughout operations for years to come. The current weakness in the industrial sector has negatively impacted the stock and provided an opportunity for long-term investors.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2015, the FMI Common Stock Fund (the “Fund”) had a total return of -3.38%. The benchmark Russell 2000 returned 1.25% in the same period. Sectors that aided relative performance included Commercial Services, Energy Minerals and Consumer Durables. Genpact Ltd. had strong performance during the fiscal year as the company continued to gain market share while slightly improving margins and was a meaningful part of the outperformance of Commercial Services. Energy Minerals outperformed due to the Fund’s underweighted position in what has been a very difficult hydrocarbon environment and this sector also benefited from relatively good performance from Cimarex, which was sold during the year due to valuation. An improved home building environment helped NVR Inc., which drove the outperformance of Consumer Durables. On the negative side, Health Technology, Finance, Producer Manufacturing and Distribution Services all pulled down performance. Health Technology was a strong performer for the market, as exceptionally high multiple stocks became even more expensive during the year. The Fund’s significant underweighted position in Health Technology hurt performance. The Fund’s underweighted position and stock selection harmed relative performance in the Finance sector. Greenlight Capital and Cullen/Frost were the primary detractors in this sector. Kennametal and Valmont Industries were down significantly during the year, as the metal processing and agricultural industries suffered disproportionately in the Producer Manufacturing sector. In the Distribution sector, MSC Industrial and Anixter International detracted from performance as the industrial economy continued to slow and multiples contracted. Stocks sold in the period included Innophos, Cintas, Hanger, Forward Air, Patterson, Cimarex and SQM. A number of new additions were made over the past twelve months, including ManpowerGroup, Allscripts, Donaldson, Cash America, Esterline, Applied Industrial Technologies, TriMas, Cable One and First Cash Financial. At September 30, 2015, the Fund was significantly overweighted in Distribution Services, Commercial Services and Process Industries and meaningfully underweighted in Health Technology, Finance and Electronic Technology.

Good performance across mostly the so-called “defensive” sectors and some speculative groups like biotechnology helped drive positive results for the Russell 2000. While the market corrected nearly 12% from May 21 through September 30, the “character” of the market hasn’t seemed to change yet. Growth and momentum oriented stocks have outperformed value oriented stocks over the past several years and only late in the September quarter did these types of stocks lag the market. It has been over six and a half years since the last bear market (that is to say a market decline of 20% or greater). Valuations remain near the upper end of historical parameters. Easy monetary policy appears to have been a significant driver of stock market performance in recent years. Many economies around the world have weakened and while the U.S. economy has had positive real GDP growth, the rate over the past year has been below average. The unemployment rate has also improved, but the labor participation rate remains at a very low level and an extraordinarily high number of citizens are dependent on government support. Companies have been restrained with respect to investing in both capital equipment and labor, which has resulted in less than satisfactory internal growth rates. Geopolitical problems have seemingly escalated over the past year. This, combined with less than average growth and high valuations makes the Fund cautious on the stock market in the short run. The Fund continues to believe, however, that stocks have the best chance to adjust to a dynamic environment over the long run. The Fund sells at a discount to the Russell 2000 on most valuation measures.

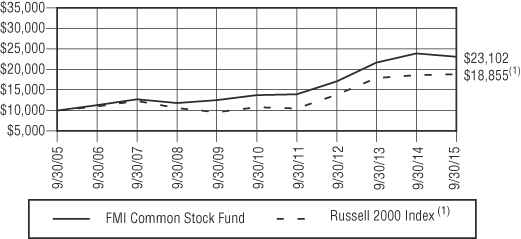

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND AND THE RUSSELL 2000 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN |

| | | | | Since |

| | | | | Inception |

| | 1-Year | 5-Year | 10-Year | 12/18/81 |

| FMI Common | | | | |

| Stock Fund | (3.38%) | 11.03% | 8.73% | 11.84% |

| Russell 2000 Index | 1.25% | 11.73% | 6.55% | 10.11% |

| | | | | |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. |

An investment cannot be made directly into an index.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

September 30, 2015

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 88.9% (a) | |

| | |

COMMERCIAL SERVICES SECTOR — 15.5% | |

| | Advertising/Marketing Services — 3.4% | | | | | | |

| | 2,190,000 | | Interpublic Group of Cos. Inc. | | $ | 38,949,020 | | | $ | 41,894,700 | |

| | | | Financial Publishing/Services — 1.3% | | | | | | | | |

| | 154,000 | | Dun & Bradstreet Corp. | | | 10,220,652 | | | | 16,170,000 | |

| | | | Miscellaneous Commercial Services — 6.3% | | | | | | | | |

| | 2,237,000 | | Genpact Ltd.* | | | 37,851,285 | | | | 52,815,570 | |

| | 1,860,000 | | RPX Corp.* | | | 30,160,282 | | | | 25,519,200 | |

| | | | | | | 68,011,567 | | | | 78,334,770 | |

| | | | Personnel Services — 4.5% | | | | | | | | |

| | 436,000 | | ManpowerGroup Inc. | | | 30,959,951 | | | | 35,704,040 | |

| | 398,000 | | Robert Half International Inc. | | | 11,272,233 | | | | 20,361,680 | |

| | | | | | | 42,232,184 | | | | 56,065,720 | |

| | |

CONSUMER DURABLES SECTOR — 4.0% | |

| | | | Homebuilding — 2.7% | | | | | | | | |

| | 22,000 | | NVR Inc.* | | | 21,947,485 | | | | 33,554,840 | |

| | | | Recreational Products — 1.3% | | | | | | | | |

| | 270,000 | | Sturm, Ruger & Co. Inc. | | | 13,441,137 | | | | 15,846,300 | |

| | |

CONSUMER SERVICES SECTOR — 5.2% | |

| | | | Cable/Satellite TV — 1.9% | | | | | | | | |

| | 56,000 | | Cable One Inc.* | | | 18,472,025 | | | | 23,487,520 | |

| | | | Other Consumer Services — 3.3% | | | | | | | | |

| | 37,080 | | Graham Holdings Co. | | | 17,900,197 | | | | 21,395,160 | |

| | 185,000 | | UniFirst Corp. | | | 19,388,458 | | | | 19,759,850 | |

| | | | | | | 37,288,655 | | | | 41,155,010 | |

| | |

DISTRIBUTION SERVICES SECTOR — 11.6% | |

| | | | Electronics Distributors — 6.9% | | | | | | | | |

| | 502,000 | | Anixter International Inc.* | | | 33,270,391 | | | | 29,005,560 | |

| | 581,000 | | Arrow Electronics Inc.* | | | 7,950,028 | | | | 32,117,680 | |

| | 697,000 | | ScanSource Inc.* | | | 17,169,319 | | | | 24,715,620 | |

| | | | | | | 58,389,738 | | | | 85,838,860 | |

| | | | Wholesale Distributors — 4.7% | | | | | | | | |

| | 742,000 | | Applied Industrial Technologies Inc. | | | 31,115,767 | | | | 28,307,300 | |

| | 490,000 | | MSC Industrial Direct Co. Inc. | | | 38,560,412 | | | | 29,904,700 | |

| | | | | | | 69,676,179 | | | | 58,212,000 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 6.0% | |

| | | | Aerospace & Defense — 4.6% | | | | | | | | |

| | 357,000 | | Esterline Technologies Corp.* | | | 36,447,420 | | | | 25,664,730 | |

| | 1,139,000 | | FLIR Systems Inc. | | | 34,069,095 | | | | 31,880,610 | |

| | | | | | | 70,516,515 | | | | 57,545,340 | |

| | | | Electronic Production Equipment — 1.4% | | | | | | | | |

| | 538,000 | | MKS Instruments Inc. | | | 14,376,868 | | | | 18,039,140 | |

| | |

FINANCE SECTOR — 13.3% | |

| | | | Finance/Rental/Leasing — 4.8% | | | | | | | | |

| | 775,000 | | Cash America International Inc. | | | 20,532,720 | | | | 21,676,750 | |

| | 403,350 | | First Cash Financial Services Inc.* | | | 16,712,989 | | | | 16,158,201 | |

| | 302,000 | | Ryder System Inc. | | | 12,558,006 | | | | 22,360,080 | |

| | | | | | | 49,803,715 | | | | 60,195,031 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2015

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 88.9% (a) (Continued) | |

| | |

FINANCE SECTOR — 13.3% (Continued) | |

| | Property/Casualty Insurance — 4.4% | | | | | | |

| | 694,000 | | Greenlight Capital Re Ltd.* | | $ | 17,029,788 | | | $ | 15,462,320 | |

| | 730,000 | | W.R. Berkley Corp. | | | 18,021,531 | | | | 39,690,100 | |

| | | | | | | 35,051,319 | | | | 55,152,420 | |

| | | | Regional Banks — 4.1% | | | | | | | | |

| | 531,000 | | Cullen/Frost Bankers Inc. | | | 30,719,040 | | | | 33,760,980 | |

| | 645,000 | | Zions Bancorporation | | | 15,175,180 | | | | 17,763,300 | |

| | | | | | | 45,894,220 | | | | 51,524,280 | |

| | |

HEALTH SERVICES SECTOR — 1.1% | |

| | | | Health Industry Services — 1.1% | | | | | | | | |

| | 1,140,000 | | Allscripts Healthcare Solutions Inc.* | | | 14,008,183 | | | | 14,136,000 | |

| | |

HEALTH TECHNOLOGY SECTOR — 1.9% | |

| | | | Medical Specialties — 1.9% | | | | | | | | |

| | 320,000 | | Varian Medical Systems Inc.* | | | 23,217,512 | | | | 23,609,600 | |

| | |

PROCESS INDUSTRIES SECTOR — 9.9% | |

| | | | Chemicals: Specialty — 2.1% | | | | | | | | |

| | 330,000 | | Compass Minerals International Inc. | | | 23,839,571 | | | | 25,862,100 | |

| | | | Containers/Packaging — 3.1% | | | | | | | | |

| | 691,000 | | Avery Dennison Corp. | | | 19,196,226 | | | | 39,089,870 | |

| | | | Industrial Specialties — 4.7% | | | | | | | | |

| | 724,000 | | Donaldson Co. Inc. | | | 26,078,894 | | | | 20,329,920 | |

| | 1,124,000 | | H.B. Fuller Co. | | | 41,441,034 | | | | 38,148,560 | |

| | | | | | | 67,519,928 | | | | 58,478,480 | |

| | |

PRODUCER MANUFACTURING SECTOR — 11.6% | |

| | | | Building Products — 2.1% | | | | | | | | |

| | 535,000 | | Armstrong World Industries Inc.* | | | 28,224,974 | | | | 25,540,900 | |

| | | | Industrial Machinery — 4.3% | | | | | | | | |

| | 469,300 | | Kennametal Inc. | | | 17,658,018 | | | | 11,680,877 | |

| | 1,021,000 | | Woodward Inc. | | | 44,740,804 | | | | 41,554,700 | |

| | | | | | | 62,398,822 | | | | 53,235,577 | |

| | | | Miscellaneous Manufacturing — 3.6% | | | | | | | | |

| | 150,000 | | Carlisle Cos. Inc. | | | 3,096,679 | | | | 13,107,000 | |

| | 847,000 | | TriMas Corp.* | | | 20,546,657 | | | | 13,848,450 | |

| | 192,000 | | Valmont Industries Inc. | | | 28,530,189 | | | | 18,218,880 | |

| | | | | | | 52,173,525 | | | | 45,174,330 | |

| | | | Trucks/Construction/Farm Machinery — 1.6% | | | | | | | | |

| | 297,000 | | Lindsay Corp. | | | 23,623,211 | | | | 20,133,630 | |

| | |

TECHNOLOGY SERVICES SECTOR — 7.1% | |

| | | | Data Processing Services — 5.3% | | | | | | | | |

| | 1,185,000 | | Broadridge Financial Solutions Inc. | | | 25,331,685 | | | | 65,589,750 | |

| | | | Internet Software/Services — 1.8% | | | | | | | | |

| | 845,000 | | Progress Software Corp.* | | | 18,718,874 | | | | 21,826,350 | |

| | |

TRANSPORTATION SECTOR — 1.7% | |

| | | | Marine Shipping — 1.7% | | | | | | | | |

| | 335,000 | | Kirby Corp.* | | | 18,771,202 | | | | 20,753,250 | |

| | | | Total common stocks | | | 971,294,992 | | | | 1,106,445,768 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2015

Principal Amount | | Cost | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENTS — 11.1% (a) | | | | | | |

| | Commercial Paper — 11.1% | | | | | | |

| $ | 137,700,000 | | U.S. Bank N.A., 0.03%, due 10/01/15 | | $ | 137,700,000 | | | $ | 137,700,000 | |

| | | | Total investments — 100.0% | | $ | 1,108,994,992 | | | | 1,244,145,768 | |

| | | | Liabilities, less other assets — 0.0% (a) | | | | | | | (368,302 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 1,243,777,466 | |

* Non-income producing security.

(a) Percentages for the various classifications relate to net assets.

The accompanying notes to financial statements are an integral part of this schedule.

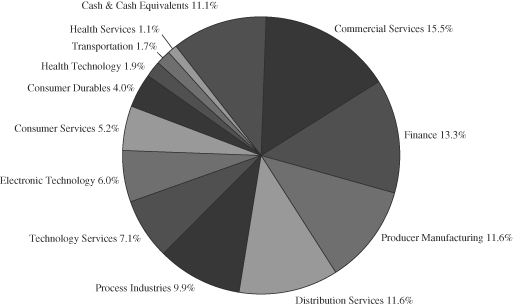

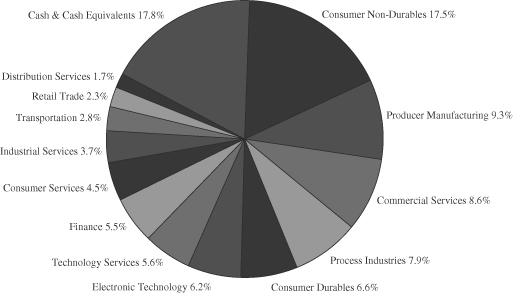

INDUSTRY SECTORS

as of September 30, 2015 (Unaudited)

FMI

International

Fund

September 30, 2015

Dear Fellow Shareholders:

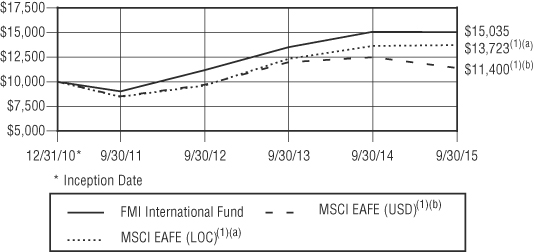

Fear and volatility have crept back into view after an extended period of investor complacency. International equities came under pressure in the September quarter as China’s overheated stock market collapsed, the People’s Bank of China (PBOC) unexpectedly devalued the renminbi (RMB), commodity prices continued to tumble, and growth slowed across a number of emerging and developed economies. Stock markets in Japan (-12.88%), Germany (-11.74%), the UK (-5.64%), and France (-6.79%) all retreated sharply in the quarter.1 All else considered, the FMI International Fund (FMIJX) held up well on a relative basis, falling by 6.08% in the September quarter, compared with an MSCI EAFE Index decline of 8.98% in local currency and 10.23% in U.S. dollars (USD). The Finance, Consumer Durables and Technology Services sectors have supported performance, while Electronic Technology, Industrial Services and Process Industries weighed on the results. Accenture, Admiral Group and LG Household & Health Care were among the top individual gainers in the quarter, while Potash Corp., Rolls-Royce and Schlumberger lagged the market.

As valuations became more palatable, we put some cash to work, boosting a number of our existing holdings and adding two new positions to the portfolio: SCA Group and Samsonite International. SCA is a leading global supplier of tissue, personal care and forest products, as well as Europe’s largest private forest owner. It’s a self-help story with an opportunity for both margin and multiple (valuation) expansion, as profitability lags global peers (more on this later). Samsonite is the world’s largest travel luggage company, at over four times the size of the next closest competitor. Economies of scale and brand equity solidify the company’s competitive advantage, and secular tailwinds in global travel make for an attractive runway of growth. We previously owned Samsonite in 2012 and 2013 before selling the stock due to valuation. Since then, earnings have improved but the stock has barely budged, creating an attractive re-entry point. Lastly, we exited our holding in Sociedad Química y Minera de Chile (SQM), as we underestimated the political risk of our investment. Despite our efforts to improve the company’s corporate governance (e.g., board letter, votes for independent director), improprieties within the leadership ranks have heightened this risk and threatens a valuable lease agreement in the Salar de Atacama, which could permanently impair SQM’s asset value.

The global macro environment remains challenging. World debt has grown by $57 trillion since 2007, and astonishingly, no major economy has decreased its debt-to-Gross Domestic Product (GDP) ratio over this time.2 This is during an economic “recovery.” Central bankers have injected roughly $8 trillion into the global economy since the financial crisis, yet the International Monetary Fund (IMF), World Bank and Organisation for Economic Co-operation and Development (OECD) routinely cut global growth forecasts.3 We are on track for a record level of global mergers and acquisitions (M&A) this year, but in countries such as France, Germany, Italy and Japan, real investment has not even recovered to pre-recession levels (which does not bode well for future growth).4,5 Stock markets and valuations have soared in recent years, but business fundamentals and management commentary have remained weak. A forced suppression of interest rates and fiscal stimulus has not worked. While we are hopeful that world leaders and central bankers will eventually get that memo (and get out of the way), for the time being we expect misguided Keynesian policies and choppy economic waters to persist. In the interim, we will remain diligent in our hunt for strong businesses, value prices and downside protection.

_______________

1 | The following market indexes are being referred to above: Japan TOPIX, Germany DAX, UK FTSE All-Share, France CAC. |

2 | Richard Dobbs, Susan Lund, Jonathan Woetzel, and Mina Mutafchieva. “Debt and (not much) deleveraging.” McKinsey Global Institute Report, February 2015. |

3 | Ian Talley. “Central Banks’ Lesson: Easy Money Alone Isn’t a Growth Salve.” Wall Street Journal, September 17, 2015. |

4 | Dana Mattioli and Dan Strumpf. “M&A Deal Activity on Pace for Record Year.” Wall Street Journal, August 10, 2015. |

5 | Ryan Banerjee, Jonathan Kearns, and Marco Lombardi. “(Why) Is investment weak?” BIS Quarterly Review, March 2015. |

Crisis: Made In China

Even with unprecedented intervention to prop up stock prices, the Shanghai and Shenzen Composite indexes still fell by around 28% in the quarter. It’s not for a lack of effort, as China has pulled out virtually all the stops: cutting interest rates five times, reducing the required reserve ratio, lowering securities transaction fees (by 30%), relaxing rules on margin trading, suspending accounts from short selling, financing a broker-led stabilization fund ($42 billion), allowing more than half of the companies on the stock exchange to halt trading in their shares, suspending initial public offering (IPO) issuances, ordering State Owned Enterprises (SOEs) not to sell shares, creating a team to investigate illegal market “manipulation,” banning officers, directors and listed company shareholders with stakes of 5% or more from selling any shares for six months, publicly prosecuting brokerages and individuals through state media outlets, announcing new stimulus ($40 billion) and government spending initiatives, devaluing the RMB, and directing the purchase of $236 billion of equities, or 9.2% of the free float6,7,8,9. Sound a bit ridiculous? We sure think so, and we’re not surprised these acts of desperation failed. If anyone should be called out for market manipulation it’s the Chinese government! We have never felt comfortable investing directly in China, and our prior reservations have been fully reinforced.

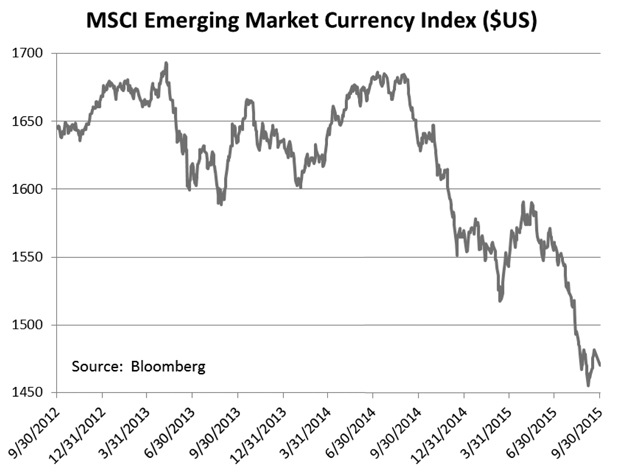

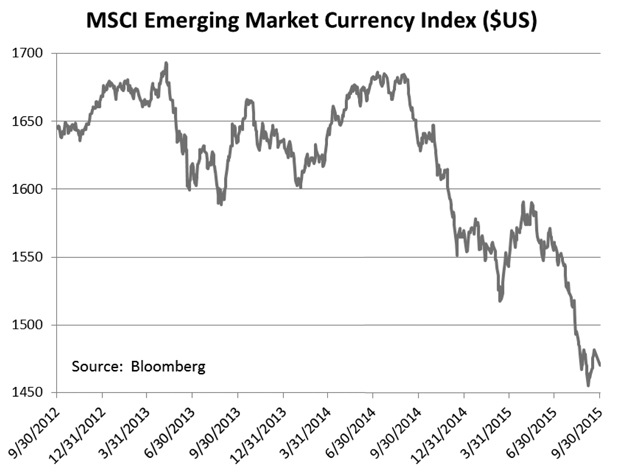

Meanwhile, China’s economic growth continues to decelerate. Imports and exports have sharply declined, manufacturing in September hit a 6-year low, and property investment through the first eight months of the year fell to 3.5% (the slowest rate since 2009).10,11 Official GDP was reported at 7%, but actual GDP is believed to be far lower and deteriorating. To combat the slowdown, the PBOC moved to devalue the RMB, which had previously been pegged (soft) to the U.S. dollar since 2005. This unexpected move took many by surprise, and evoked fears of currency wars and emerging market (EM) capital flight. As illustrated below, EM currencies have been under steady pressure over the past 12 months. China’s currency devaluation may create further instability. Similarly, capital flight from EMs has intensified. It had reached nearly $1 trillion in the 13 months through July, nearly double the $480 billion that flowed out during the 2008-09 financial crisis.12 With EMs making up roughly 35% of global GDP, heightened investor concern is clearly warranted.13

_______________

6 | “China’s Share Market Intervention.” State Street Global Advisors, July 2015. |

7 | “Timeline of decline: Key dates in China’s stock market slide.” Associated Press, August 27, 2015. |

8 | Heather Long. “China is taking 10 huge actions to save its stock market.” CNN Money, July 8, 2015. |

9 | “China’s Stock-Rescue Tab Surges to $236 Billion”, Goldman Sachs, September 7, 2015. |

10 | “Home Prices Rise in China for Fourth Consecutive Month.” Reuters, September 18, 2015. |

11 | Jamil Anderlini. “China manufacturing contracts at fastest pace in more than 6 years.” Financial Times, September 23, 2015. |

12 | James Kynge and Roger Blitz. “Surge in emerging market capital outflows hits growth and currencies.” Financial Times, August 18, 2015. |

13 | Jonathan Wheatley and James Kynge. “Emerging markets: Trading blow.” Financial Times, June 10, 2015. |

Despite the aforementioned matters, we do not believe China’s stock market or currency manipulation is the biggest risk to the global economy (and equity markets). A financial crisis stemming from a real estate or credit market collapse is of far greater concern. We have voiced our distrust of China’s excess numerous times. For example, in September 2013 we wrote: “The risk of a housing and/or credit bubble remains […] credit is growing over two times faster than the economy […] it is widely perceived that [China’s banks] are understating the true extent of their underperforming loans, hiding significant off-balance-sheet risk […] All bets are off if the housing bubble bursts, as it could potentially make the U.S. housing collapse look like a walk in the park.” Not much has improved in recent years to change our opinion. Property speculation continues to grow as prices have increased by 60%+ in 40 Chinese cities since 2008, and even more so in Shanghai and Shenzhen.14 However, as real estate transaction volumes have slowed, inventory has grown, creating significant oversupply. The plethora of empty apartment and office buildings persists. Smaller cities (Tier 3 and 4) now have roughly three years of unsold inventory.15 In a best-case scenario (no crisis), a sustained slowdown in property investment would still meaningfully weigh on employment (construction jobs) and GDP growth.

China’s economic “miracle” over the past 15+ years has been both astounding and alarming. China has moved from 3.6% of global GDP in 2000, to 6.1% in 2007, and to 13.3% in 2014. It has accounted for as much as half of global GDP growth in recent years.16 Credit has exploded, far outpacing growth in economic output. In 2000, for example, China had total debt of $2.1 trillion and GDP of $1.2 trillion, a debt-to-GDP ratio of 175%. By 2007, total debt of $7.4 trillion compared with $3.5 trillion in GDP (211%). In mid-2014, debt reached $28.2 trillion vs. GDP of approximately $10 trillion(282%). McKinsey & Company estimates that around $9 trillion of the total debt is related to real estate,17,18 and “With real estate markets overbuilt, this [debt-to-GDP] ratio is one reason that the return on fixed-asset investment in China is declining. The incremental capital output ratio (ICOR), which shows how much capital is needed to generate a unit of GDP, was 3.4 on average from 1990 to 2010, but it has since risen to 5.4, meaning that it takes 60 percent more capital to generate a unit of GDP.”19 Clearly China is getting a lot less bang for their buck.

The sheer magnitude of China’s fixed investment boom is hard to fathom. Historian Vaclav Smil, in his book Making the Modern World: Materials and Dematerialization, writes that China has used more cement in three years from 2011-13 (6.6 gigatons) than the U.S. has in the entire 20th century (4.5 gigatons).20 Mining statistics tell a similar story: In 2002

_______________

14 | Richard Dobbs, Susan Lund, Jonathan Woetzel, and Mina Mutafchieva. “Debt and (not much) deleveraging.” McKinsey Global Institute Report, February 2015. Page 9. |

15 | “People’s Republic of China, 2015 Article IV Consultation.” IMF Country Report No. 15/234. August 2015. Page 9. |

16 | World Bank national accounts data, and OECD National Accounts data files. |

17 | Richard Dobbs, Susan Lund, Jonathan Woetzel, and Mina Mutafchieva. “Debt and (not much) deleveraging.” McKinsey Global Institute Report, February 2015. Pages 10, 78. |

18 | Bloomberg data. |

19 | McKinsey & Company. “The China Effect on Global Innovation.” McKinsey Global Institute Research Bulletin, August, 2015. Page 2. |

20 | Bill Gates. “Have You Hugged a Concrete Pillar Today?” http://www.gatesnotes.com/Books/Making-the-Modern-World, June 12, 2014. |

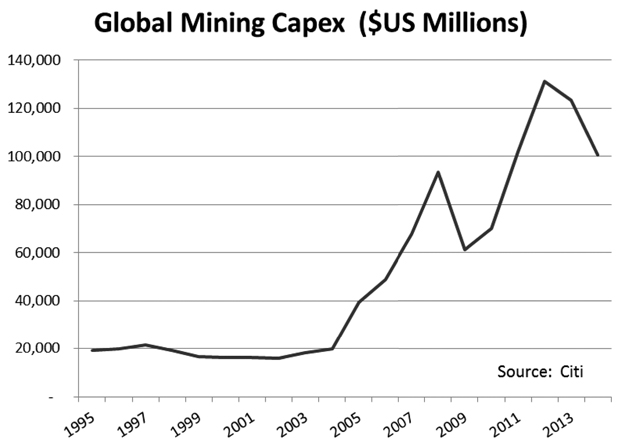

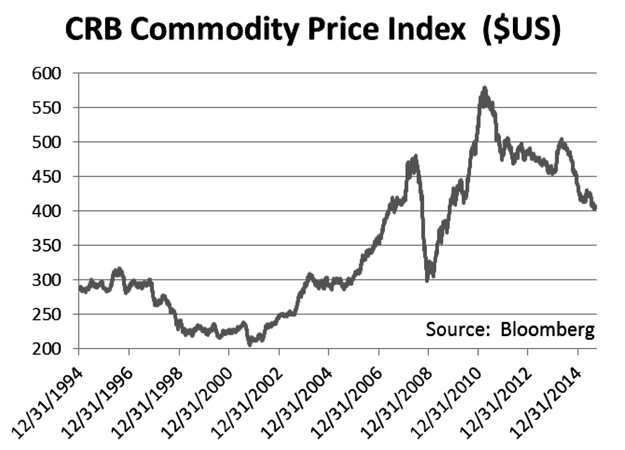

global mining capital expenditure was $16.1 billion; by 2012 it had grown to a massive $131 billion.21 The commodities super cycle was born, and China was the driving force. The problem we are left with today is that a number of countries (and companies) invested heavily to meet China’s surging demand, and are now suffering from widespread overcapacity as China’s economy has slowed and commodity prices have plummeted. It’s no surprise that Brazil, Canada, and Russia are all in a recession, and Australia is not far off. Unfortunately, the pain felt by commodity-dependent countries (and companies) is not likely to end anytime soon. An extended adjustment period is underway.

While we’ve presented a pretty dreary view of China, it’s important to bear in mind that it is less than 14% of the world economy, and it isn’t disappearing. Throwing out the official 7% GDP growth figure and plugging in 3% would still imply that the Chinese economy is not losing share. China is making some progress, moving their economy from one dominated by fixed investment to one driven more by consumption. In 2015, 44% of China’s GDP is expected to come from fixed investment, down from 47% five years ago.22 While they haven’t said what they would like the split to be, the U.S. economy is around 20% fixed investment, and our guess is that China would at least like to move toward 30%.23 A transition of this magnitude will take time and there will be some dislocations, but we feel the rest of the world will be able to weather the storm.

Euro-phoria

While policymakers are hopeful that the European Central Bank’s (ECB) aggressive asset-purchasing program will improve the eurozone’s economic outlook, we believe such optimism is foolhardy. Growth in the eurozone slowed in the second quarter, as GDP fell to 0.3% (1.3% on an annualized basis) from 0.4% growth in the first quarter. Growth in France stagnated, while Germany’s output fell short of expectations.24 The ECB has cut its growth forecast to 1.4% in 2015 (from 1.5%) and 1.7% in 2016 (from 1.9%).25 Unemployment (10.9%) remains stubbornly high and deep structural challenges have still not been addressed (discussed at length in prior shareholder letters). The eurozone economy has been running in place, with GDP yet to recover to its pre-crisis peak.24 Eurozone companies have not fared much better. In July the Leuthold Group wrote, “The current forward [earnings per share (EPS)] estimate for the MSCI Euro area composite matches the forecast made in December 2004. We have no way of knowing what the ten-year EPS forecasts of those analysts were at the time, but we doubt they were for zero growth.”26

Elsewhere in Europe, after all the drama, Greece has been forced to sign yet another set of extend-and-pretend bailout terms. Per the IMF’s preliminary public debt sustainability analysis, however, “Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider […] If Europe prefers to again provide debt relief through maturity extension, there would have to be a very dramatic extension with grace periods of, say, 30 years on the entire stock of European debt, including new assistance […] Other options include explicit annual transfers to the Greek budget or deep upfront haircuts.” Europe (i.e. Germany) appears reluctant to take the necessary steps to ensure Greek sustainability, so it’s likely just a matter of time before Greece is back in the headlines.

Land Of The Falling Sun

To avoid sounding like a broken record, we’ll keep our Japan discussion to a minimum. The stock market is up over 102% in the last three years and 8% in the last year. However, recent economic developments show a lack of progress. Inflation is near zero, debt is on the rise (debt-to-GDP is expected to reach 247% next year), real wages are falling, consumer spending and net trade is weak, inventory is building, and GDP is contracting (at an annualized rate of 1.2% in the second quarter).27,28 As we anticipated, Abenomics (AKA quantitative easing on steroids) is not working. Why? Because printing money does not solve structural economic problems. This bears repeating (in case central bankers are listening). If printing money was all that was needed to fix the world’s problems, we’d be in nirvana by now.

_______________