Ted D. Kellner

Fiduciary Management, Inc.

ANNUAL REPORT

September 30, 2016

FMI Large Cap Fund

(FMIHX)

FMI Common Stock Fund

(FMIMX)

FMI International Fund

(FMIJX)

| |

| |

|

| |

| |

| FMI Funds, Inc. |

| |

| Advised by Fiduciary Management, Inc. |

| |

| www.fmifunds.com |

| |

| |

| |

| | |

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund |

| Shareholder Letter | | | 1 |

| Management’s Discussion of Fund Performance | | | 7 |

| Schedule of Investments | | | 9 |

| Industry Sectors | | | 12 |

| | | | |

| FMI Common Stock Fund |

| Shareholder Letter | | | 13 |

| Management’s Discussion of Fund Performance | | | 19 |

| Schedule of Investments | | | 21 |

| Industry Sectors | | | 24 |

| | | | |

| FMI International Fund |

| Shareholder Letter | | | 25 |

| Management’s Discussion of Fund Performance | | | 32 |

| Schedule of Investments | | | 34 |

| Schedule of Forward Currency Contracts | | | 37 |

| Industry Sectors | | | 38 |

| | | | |

| Financial Statements |

| Statements of Assets and Liabilities | | | 39 |

| Statements of Operations | | | 40 |

| Statements of Changes in Net Assets | | | 41 |

| Financial Highlights | | | 44 |

| Notes to Financial Statements | | | 47 |

| | | | |

| Report of Independent Registered Public Accounting Firm | | | 54 |

| Expense Example | | | 55 |

| Directors and Officers | | | 57 |

| Disclosure Information | | | 59 |

| Matters Submitted for Shareholder Vote | | | 62 |

| Additional Information | | | 62 |

| New Share Class Announcement | | | 63 |

| Tax Notice | | | 63 |

| Notice of Privacy Policy | | | 64 |

| Householding Notice | | | 64 |

FMI

Large Cap

Fund

September 30, 2016

Dear Fellow Shareholders:

The FMI Large Cap Fund (Fund) returned 3.06% in the September quarter compared to 3.85% for the Standard & Poor’s 500 Index (S&P 500). Sectors that aided performance included Energy Minerals, Consumer Services and Consumer Non-Durables. Those that hurt performance included Retail Trade, Electronic Technology and Finance. Stocks that aided results in the period included Devon Energy, eBay and Comerica. We took advantage of the move in Comerica to swap it with JPMorgan, which we believe is a superior franchise trading at a similar multiple. Underperformers included Dollar General, Progressive Corp. and Twenty-First Century Fox. The market worries of January and February, which were bringing some sanity back to equity valuations, ameliorated through the second and third calendar quarters, keeping the bull alive. Our underweighted positions in financial, technology and health care related industries were a drag in the quarter. We are comfortable being underweighted these sectors given the levered, opaque nature of most financials, and the high valuations in technology and health care. The top five, and eight of the top ten contributors to the S&P 500 this quarter were technology-related companies, which gives some insight into the speculative hue of this market. Rumors that Twitter was in play caused its stock to surge over 35% in the quarter. Twitter carries a $17 billion market cap, has never turned a profit (and has lost over $400 million in the last twelve months), and trades for over 5 times revenue. Further evidence comes from a corner of the private equity world with the impending offering of Yeti (coolers, coffee mugs, etc.) rumored at a $5 billion valuation, which is over 10 times 2015 revenue, and 36 times 2015 earnings before interest, taxes, depreciation and amortization (EBITDA).

There is somewhat of a surreal nature to the economic and stock market dialogue today. If one listens to the administration, the economy is a well-oiled jobs machine that delivers steady growth without inflation. Janet Yellen and other Federal Reserve (Fed) board members tell us the economy

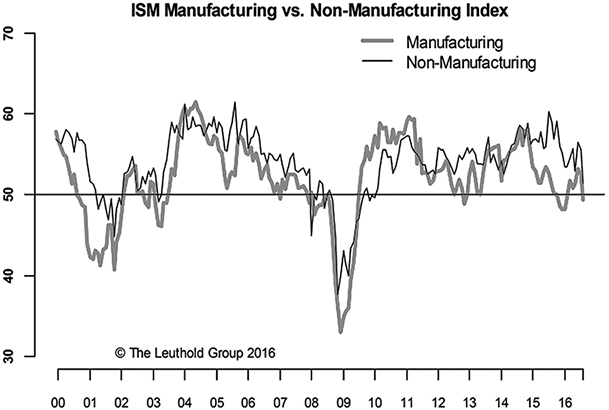

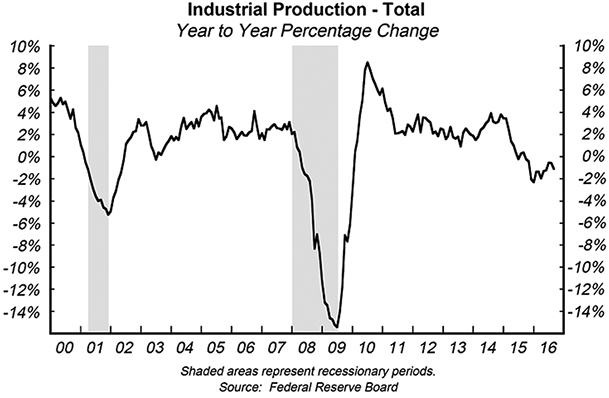

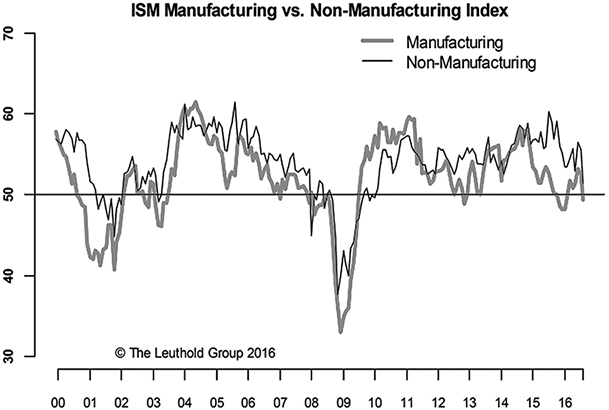

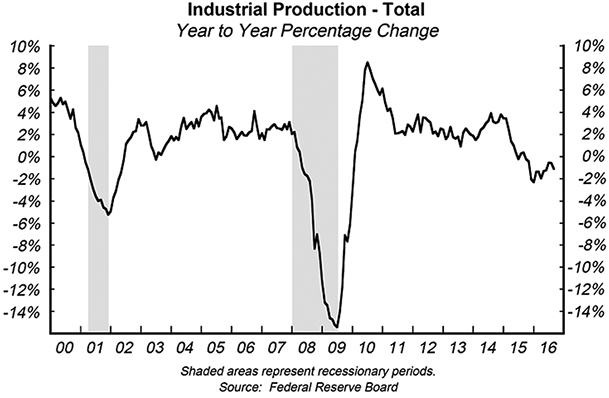

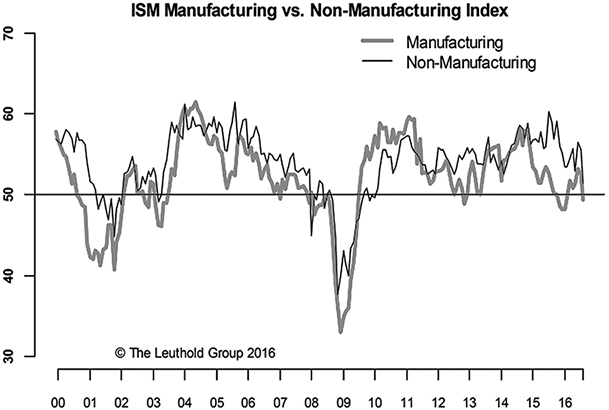

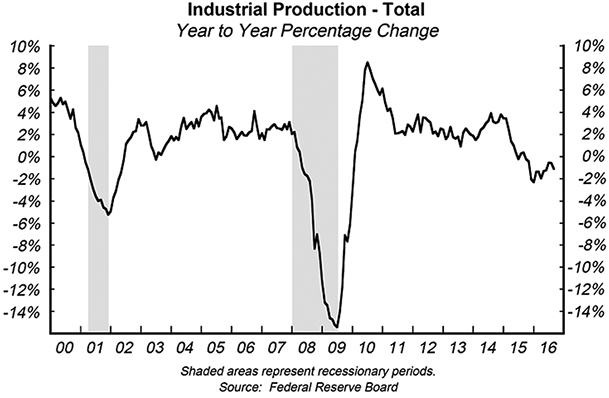

is sound, and that interest rates will soon be normalized (although year after year goes by with little action). The bull market recently passed 7½ years, and people with financial assets — essentially the top 5% — seem pleased. It’s hard to reconcile this against the backdrop of persistently weak gross domestic product (GDP) growth of roughly 1.0-1.5%, and corporate sales and earnings growth that has been negative for five quarters (with a sixth decline expected in the September quarter). If the market reflected just the decline in earnings so far, according to David Rosenberg of Gluskin Sheff, the S&P 500 would be down 20%. The combined Manufacturing and Non-Manufacturing ISM Composite Index (see graph on previous page) recently dropped to 51.2% (the weakest in over six years), industrial production remains soft, retail sales have sputtered, and the Fed’s own broad Labor Market Conditions Index dropped 0.7% in August. The employment-to-population ratio for the U.S. remains mired below 60% and real incomes are lower today than a decade ago, although they rose last year for the first time in years. The average American is running in place, at best.

Consumer health care, rent/housing, and educational expenses are swamping the small increases or declines in other consumer items. Perhaps someone should tell the Fed that the Consumer Price Index (excluding food and energy) was up 2.3% year-over-year in August. Health care and entitlement spending are out of control and are being funded with unsustainable increases in debt. Most people believe the real damage to balance sheets took place in 2008-09, yet over just the past five years the federal government has added $4.8 trillion of debt (bringing the total debt to $19.5 trillion), the Federal Reserve pumped up its balance sheet by $1.7 trillion to $4.5 trillion, and corporations have layered on an estimated $2.2 trillion of new borrowings. The most dangerous aspect is that debt is growing faster than GDP.

These stories, however, are old news. We’ve lost the ability to be surprised or moved by quarter after quarter of the same combination of runaway government spending, easy money and relatively weak economic growth. On the corporate side, financial engineering remains the go-to strategy, but this has proven to be no substitute for organic investment in people and projects. The Fed seems to think one more quarter, or one more year, of extremely low rates is all that is needed to jump-start the economy. If low rates induce capital formation, however, wouldn’t we have seen explosive business investment after eight years of a nearly zero percent Fed Funds rate? Instead, it has been one of the weakest periods of fixed business investment on record.

Moreover, despite a curious but enduring belief in Keynesian economic theories, government spending doesn’t seem likely to cure the growth problem. If deficit spending was the answer, wouldn’t the economy be screaming after more than a decade of nonstop stimulus? It is astonishing

that some pundits are calling for even more fiscal stimulus today. Few consider that there is a wide body of evidence showing that government debt accumulation (deficit spending) steals from overall economic growth. That government spending has a negative multiplier effect on the economy should not come as a startling revelation. Just look around and see where governments spend money and compare that to private capital projects and research and development expansion, and it is easy to see why the economy has underperformed.

Stocks remain elevated by just about all traditional valuation measures. Asset inflation and high valuations are also not confined to the equity markets. Bonds, private equity, real estate and other alternatives are all expensive by historical standards. Paul Singer, the highly regarded leader of Elliott Management, recently called long-term bonds the “biggest bond bubble in world history,” although the 10-Year Treasury has recently backed up a bit. A relatively weak economy, negative earnings growth and high valuations wouldn’t seem to be the ticket to higher stock prices. As we asked in our last letter, what are investors supposed to do? The best option is to take the long view and own quality franchises trading at relative discounts, and recognize that while nobody will be immune to a stock market downturn, this strategy offers the best chance to preserve, and eventually grow, capital. The public continues to pour money into index funds, which have beaten approximately 90% of active U.S. equity managers over the past five years. The money flows are a self-fulfilling feedback loop in the short run that will eventually collapse, as they have in the past. The last time index funds outperformed like this was in the five years ending in early 2000. The S&P 500 proceeded to drop nearly 50% and it took over seven years to recover to the prior peak.

While speculation is alive and well in the stock market, there may be a few markets beginning to crack. The high end of the Canadian and New York City real estate bubbles may be beginning to deflate. Additionally, recall our discussion in the June of 2014 letter of the tremendous excesses in the contemporary art market. In recent months the bottom has begun to fall out of this market, with a number of pieces dropping over 90% or failing to sell at auction. In a recent Bloomberg story, the author mentioned the work of one Lucien Smith: “Smith saw a painting he made while an undergraduate at New York’s Cooper Union fetch $389,000 at Phillips in 2013, two years after it was purchased for $10,000. This week, estimates for three Smith pieces are as low as $7,000. One (to the right), from the series he made by spraying more than 200 canvases with paint from a fire extinguisher, is estimated at $12,000 to $18,000. A bigger spray work sold for $372,120 two years ago.” To each his own, but we know some third graders with ball point pens who would take a dollar and an ice cream cone for similar work.

It takes fortitude to avoid playing someone else’s game, i.e., chasing after what is currently working even though these investments may lack true value. Using professional golf as an analogy, the best players focus not on the results, but the process. They do everything in their power to choose the right club, envision the right shot shape and put themselves in a mental mindset that will deliver a positive swing. If they can execute the process consistently, most, but not all shots will come off well. If they let their minds race after a bad shot or a bad hole and fret about the

results, they are likely to compound their difficulties. You can’t wish the ball into the hole, but instead, must keep your discipline and process. It is strikingly similar with investing. Fortunately, the Fund’s adviser has a great culture that places a lot of faith in being intellectually honest and in staying true to the process. We can’t control the fact that over the past few years, investors have been willing, for example, to buy utility stocks that barely earn their cost of capital, have little to no growth, are highly regulated, and are heavily indebted and expensive. Our process would not translate into a purchase decision in this sector even though, looking in the rear view mirror, it has been rewarding. We are highly confident that in the fullness of time, this group will reflect its underlying fundamentals. Over the years, we have seen this same dynamic in many popular stocks; with few exceptions, these equities ultimately reflected the intrinsic value of their respective businesses. As Ben Graham famously said over eighty years ago, “…the market is a voting machine [popularity contest] in the short run but a weighing machine in the long run.”

Below are a couple of investments we think will eventually register well on the weighing machine.

Bank of New York Mellon Corp. (BK)

(Analyst: Matthew Goetzinger)

Description

The Bank of New York Mellon (BK) is the world’s largest custodian bank, with over $29.5 trillion in assets under custody. The company has the most diverse service offering within the trust bank industry. Asset-based fee businesses drive 80% of the firm’s revenue. 20% comes from net interest income. The company’s Investment Services business accounts for 70% of the fee-based revenue and includes core custody, back and middle office outsourcing, securities clearing, execution, debt issuance and trust services. The company’s multi-manager boutique Investment Management business generates the remaining 30% of fee revenues.

Good Business

| • | BK operates within a rational oligopoly industry structure. The company commands a leading market share in each of its diversified businesses. |

| | |

| • | Scale, long-standing client relationships, deeply intertwined technology platforms, and a global resource base all represent significant durable competitive advantages. |

| | |

| • | Recurring fee-based businesses contribute 80% of the company’s total revenues. |

| | |

| • | The company’s long-term average return on equity exceeds its cost of equity capital; the last twelve months’ return on tangible equity is 20.4%. |

| | |

| • | BK is securely financed with a Basel III capital ratio of 10.2%. Management remains committed to returning substantially all of net income to shareholders through dividends and share repurchases. |

Valuation

| • | Trust banks have historically traded in line with the S&P 500 on a price-to-earnings (P/E) basis. Presently BK trades at a several multiple point discount to the market’s long-term median P/E ratio. |

| | |

| • | Giving effect to a normalization in interest rates, BK’s earnings power is in excess of $4.00 per share. At a P/E multiple of 17, BK’s fair value is approximately 50-75% higher. |

| | |

| • | A sum-of-the-parts valuation places an alternative market value far in excess of the current market price of the stock. |

Management

| • | Gerald Hassell has been the company’s Chief Executive Officer since September 2011. Since joining BK over 30 years ago, Hassell has had direct management responsibility for a broad range of the company’s Investment Services businesses, including asset servicing and issuer, broker-dealer, treasury and clearing services. Hassel owns roughly 0.8 million shares outright. |

| | |

| • | Todd Gibbons is the company’s current Chief Financial Officer. Previously Gibbons served as the company’s Chief Risk Officer. |

| | |

| • | Management is focused on driving organic growth, improving margins, and returns on capital, while at the same time returning excess capital to shareholders. |

Investment Thesis

Bank of New York Mellon’s numerous capital light financial processor franchises are underappreciated by the market. Despite operating with significant scale as the market leader in many recurring fee-based businesses, BK’s valuation is comparable to that of a conventional bank. Over the next three to five years, BK’s earnings growth rate and valuation multiple will improve due to stronger organic revenue growth, further operating leverage, movements toward a more normal interest rate environment, and growth in the global capital markets.

Omnicom Group Inc. (OMC)

(Analyst: Rob Helf)

Description

Omnicom Group is a strategic holding company of advertising and marketing firms that operate in more than 100 countries with more than 5,000 clients. Its business emphasizes traditional media advertising as well as more than 30 marketing services, including customer relationship management, public relations and specialty communications. Additionally, the company provides strategic media planning, buying and digital and interactive marketing.

Good Business

| • | Omnicom is one of the world’s largest advertising and marketing services companies. Approximately 60% of its revenue comes from the U.S., while the balance comes from Europe and the rest of world. |

| | |

| • | The company offers a diversified mix of fee-based services. Omnicom should benefit from the current and anticipated growth in digital advertising expenditures. |

| | |

| • | Agencies have taken on a consultative role in the age of new media, as changes are rapid. |

| | |

| • | Omnicom’s largest client represents less than 4% of overall revenues. |

| | |

| • | The integrated relationship between client and agency results in high switching costs. |

| | |

| • | Over the past decade, the stock has generated a return on invested capital greater than its cost of capital every year, and has averaged 13%. |

| | |

| • | The company’s balance sheet is in excellent shape, with net debt about 1.0 times EBITDA. |

| | |

| • | Omnicom recently increased its quarterly dividend to $0.55 per share, which implies an annual yield of 2.6%. The dividend has grown at over 20% per annum over the past five years as the company has focused on returning cash to shareholders. |

| | |

| • | On average, the company has repurchased over $850 million worth of its equity annually over the past decade. |

Valuation

| • | The stock trades at approximately 1.4 times enterprise value-to-revenues, 9.6 times EBITDA, and 16 times 2017 earnings per share (EPS) estimates. |

| | |

| • | Over the past 10 years, Omnicom has traded at 1.1-1.7 times enterprise value-to-revenues, 8-11.5 times EBITDA, and 13-21 times EPS. The shares trade at their long-term (15 year) averages on most valuation measures, compared to the stock market, which is trading near the peak of its long-term average. |

Management

| • | Bruce Crawford, 87, is Chairman of Omnicom. He began his career in advertising in 1956 and joined BBDO in 1963. He has previously held the positions of President and CEO at Omnicom. |

| | |

| • | John Wren has been President and CEO since 1997. He has been in advertising since 1984, and joined Omnicom in 1986. |

| | |

| • | Phil Angelastro is Executive Vice President and CFO. He has been in this position for two years, and has been with Omnicom since 1997. Previously, he was a partner with Coopers & Lybrand. |

Investment Thesis

Omnicom is attractively valued in a generally expensive market. The company should deliver organic growth at or above GDP with stable margins, strong returns and cash flow. As marketing dollars rapidly move to digital/mobile, corporate marketers should continue to utilize the agencies due to their consultative and non-biased role in the changing landscape. Management has proven to be disciplined since the failed merger with Publicis, and should continue to return a significant amount of capital to shareholders via hefty share repurchases and a healthy dividend.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2016, the FMI Large Cap Fund (Fund) had a total return of 12.36%. The benchmark S&P 500 Index returned 15.43% in the same period. Sectors that aided relative performance included Health Services, Commercial Services, and Consumer Durables. UnitedHealth Group had good performance within the Health Services sector as they reestablished solid growth and announced they were getting out of the exchanges. Omnicom drove the performance of the Commercial Services sector, as they continued to demonstrate steady mid-single digit growth in revenue with improved margins. In the Consumer Durables arena, Stanley Black & Decker gained significantly. On the negative side of sector performance, Process Industries, Electronic Technology and Finance all detracted. The Fund’s relatively high Cash level was also a drag on performance. Potash Corporation declined again this fiscal year, hurting the Process Industries sector. Continued low crop prices, adverse currency impacts and ongoing worries about excess capacity hurt Potash’s stock. Late in the fiscal year Potash and Agrium announced intentions to merge. The Fund’s adviser feels this is a good strategic move, and continues to believe that Potash is significantly undervalued. The Fund’s underweighted position in Electronic Technology detracted from relative results and TE Connectivity, while up in the period, underperformed the sector. The Fund’s adviser believes this sector is significantly overvalued. In the Finance group, Bank of New York and American Express both underperformed. American Express continues to battle increased competition and is taking steps to lower its cost structure.

Other stocks that helped performance included Ross Stores, Honeywell and Accenture. AmerisourceBergen, Dollar General and Twenty-First Century Fox detracted from relative results.

New additions to the Fund over the past twelve months included Twenty-First Century Fox, JPMorgan and Level 3 Communications. 3M and Comerica were sold during the fiscal year. At September 30, 2016, the Fund was significantly overweighted in Producer Manufacturing, Consumer Services and Distribution Services and meaningfully underweighted in Health Technology, Utilities and Electronic Technology.

Good performance across many so-called “defensive” sectors and some speculative groups like Electronic Technology and Health Technology helped drive the results for the S&P 500 Index. While the market corrected about 10% in December, January and into early February, it rallied through the rest of the fiscal year. The “character” of the market hasn’t seemed to change a great deal yet. The bull market is seven and a half years old and valuations remain near the upper end of historical parameters. Easy monetary policy appears to have been a significant driver of stock market performance in recent years. Many economies around the world have weakened and while the U.S. economy has had positive real GDP growth, the rate over the past year has been below average. The unemployment rate has also improved, but the labor participation rate remains at a very low level and an extraordinarily high number of citizens are dependent on government support. Companies have been restrained with respect to investing in both capital equipment and labor, which has resulted in less than satisfactory internal growth rates. Geopolitical problems have seemingly escalated over the past year. This, combined with less than average growth and high valuations makes us cautious on the stock market in the short run. The Fund’s adviser continues to believe, however, that stocks have the best chance to adjust to a dynamic environment over the long run. The Fund sells at discount to the S&P 500 Index on most valuation measures.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

(Continued)

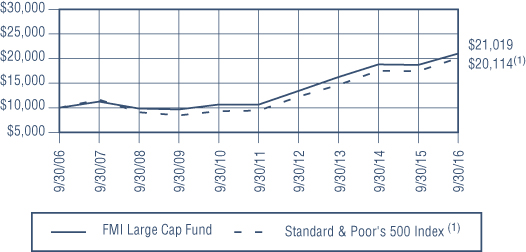

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI LARGE CAP FUND AND STANDARD & POOR’S 500 INDEX(1)

AVERAGE ANNUALIZED TOTAL RETURN

| | | | | Since Inception |

| | 1-Year | 5-Year | 10-Year | 12/31/01 |

| FMI Large Cap Fund | 12.36% | 14.57% | 7.71% | 8.50% |

| Standard & Poor’s 500 Index | 15.43% | 16.37% | 7.24% | 6.54% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

An investment cannot be made directly into an index.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

September 30, 2016

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 90.6% (a) | | | | |

| | | | | |

COMMERCIAL SERVICES SECTOR — 3.5% | | | | |

| | | | | | | | | |

| | | Advertising/Marketing Services — 3.5% | | | | | | |

| | 2,669,000 | | Omnicom Group Inc. | | $ | 183,505,224 | | | $ | 226,865,000 | |

| | | | | | |

COMMUNICATIONS SECTOR — 1.9% | | | | | |

| | | | | | | | | | | | |

| | | | Specialty Telecommunications — 1.9% | | | | | | | | |

| | 2,650,000 | | Level 3 Communications Inc.* | | | 129,768,754 | | | | 122,907,000 | |

| | |

CONSUMER DURABLES SECTOR — 3.4% | |

| | | | | | | | | | | | |

| | | | Tools & Hardware — 3.4% | | | | | | | | |

| | 1,835,000 | | Stanley Black & Decker Inc. | | | 180,437,919 | | | | 225,668,300 | |

| | | | | | |

CONSUMER NON-DURABLES SECTOR — 7.2% | | | | | |

| | | | | | | | | | | | |

| | | | Food: Major Diversified — 4.7% | | | | | | | | |

| | 6,966,000 | | Danone S.A. – SP-ADR | | | 92,079,728 | | | | 103,445,100 | |

| | 2,616,000 | | Nestle’ S.A. – SP-ADR | | | 114,853,710 | | | | 206,716,320 | |

| | | | | | | 206,933,438 | | | | 310,161,420 | |

| | | | | | | | | | | | |

| | | | Household/Personal Care — 2.5% | | | | | | | | |

| | 3,407,000 | | Unilever PLC – SP-ADR | | | 135,625,648 | | | | 161,491,800 | |

| | | | | | |

CONSUMER SERVICES SECTOR — 12.8% | | | | | |

| | | | | | | | | | | | |

| | | | Cable/Satellite TV — 4.9% | | | | | | | | |

| | 4,842,000 | | Comcast Corp. – Cl A | | | 264,787,583 | | | | 321,218,280 | |

| | | | | | | | | | | | |

| | | | Media Conglomerates — 3.9% | | | | | | | | |

| | 3,352,000 | | Twenty-First Century Fox Inc. – Cl A | | | 88,134,377 | | | | 81,185,440 | |

| | 7,106,000 | | Twenty-First Century Fox Inc. – Cl B | | | 196,387,661 | | | | 175,802,440 | |

| | | | | | | 284,522,038 | | | | 256,987,880 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 4.0% | | | | | | | | |

| | 7,986,000 | | eBay Inc.* | | | 180,752,341 | | | | 262,739,400 | |

| | | | | | |

DISTRIBUTION SERVICES SECTOR — 3.3% | | | | | |

| | | | | | | | | | | | |

| | | | Medical Distributors — 3.3% | | | | | | | | |

| | 2,718,000 | | AmerisourceBergen Corp. | | | 147,394,531 | | | | 219,560,040 | |

| | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 3.4% | | | | | |

| | | | | | | | | | | | |

| | | | Electronic Components — 3.4% | | | | | | | | |

| | 3,478,000 | | TE Connectivity Ltd. | | | 71,101,826 | | | | 223,913,640 | |

| | | | | | |

ENERGY MINERALS SECTOR — 3.0% | | | | | |

| | | | | | | | | | | | |

| | | | Oil & Gas Production — 3.0% | | | | | | | | |

| | 4,525,000 | | Devon Energy Corp. | | | 152,819,047 | | | | 199,597,750 | |

| | | | | | |

FINANCE SECTOR — 11.7% | | | | | |

| | | | | | | | | | | | |

| | | | Financial Conglomerates — 5.6% | | | | | | | | |

| | 2,474,000 | | American Express Co. | | | 75,195,045 | | | | 158,434,960 | |

| | 3,168,000 | | JPMorgan Chase & Co. | | | 205,137,819 | | | | 210,957,120 | |

| | | | | | | 280,332,864 | | | | 369,392,080 | |

| | | | | | | | | | | | |

| | | | Major Banks — 3.2% | | | | | | | | |

| | 5,180,000 | | Bank of New York Mellon Corp. | | | 111,145,244 | | | | 206,578,400 | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2016

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 90.6% (a) (Continued) | | | | |

| | | | | |

FINANCE SECTOR — 11.7% (Continued) | | | | |

| | | | | | | | | |

| | | Property/Casualty Insurance — 2.9% | | | | | | |

| | 5,962,000 | | Progressive Corp. | | $ | 145,870,519 | | | $ | 187,803,000 | |

| | | | | | |

HEALTH SERVICES SECTOR — 4.1% | | | | | |

| | | | | | | | | | | | |

| | | | Managed Health Care — 4.1% | | | | | | | | |

| | 1,920,000 | | UnitedHealth Group Inc. | | | 137,390,385 | | | | 268,800,000 | |

| | | | | | |

INDUSTRIAL SERVICES SECTOR — 3.9% | | | | | |

| | | | | | | | | | | | |

| | | | Oilfield Services/Equipment — 3.9% | | | | | | | | |

| | 3,247,000 | | Schlumberger Ltd. | | | 208,615,346 | | | | 255,344,080 | |

| | | | | | |

PROCESS INDUSTRIES SECTOR — 3.1% | | | | | |

| | | | | | | | | | | | |

| | | | Chemicals: Agricultural — 3.1% | | | | | | | | |

| | 12,622,000 | | Potash Corp. of Saskatchewan Inc. | | | 276,283,416 | | | | 205,991,040 | |

| | | | | | |

PRODUCER MANUFACTURING SECTOR — 11.6% | | | | | |

| | | | | | | | | | | | |

| | | | Industrial Conglomerates — 7.2% | | | | | | | | |

| | 2,132,000 | | Berkshire Hathaway Inc. – Cl B* | | | 140,389,265 | | | | 308,010,040 | |

| | 1,439,000 | | Honeywell International Inc. | | | 135,736,875 | | | | 167,773,010 | |

| | | | | | | 276,126,140 | | | | 475,783,050 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery — 1.2% | | | | | | | | |

| | 650,000 | | Rockwell Automation Inc. | | | 68,167,231 | | | | 79,521,000 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 3.2% | | | | | | | | |

| | 3,583,000 | | PACCAR Inc. | | | 149,663,302 | | | | 210,608,740 | |

| | | | | | |

RETAIL TRADE SECTOR — 7.3% | | | | | |

| | | | | | | | | | | | |

| | | | Apparel/Footwear Retail — 3.1% | | | | | | | | |

| | 3,204,000 | | Ross Stores Inc. | | | 108,159,538 | | | | 206,017,200 | |

| | | | | | | | | | | | |

| | | | Discount Stores — 4.2% | | | | | | | | |

| | 3,983,000 | | Dollar General Corp. | | | 292,985,290 | | | | 278,770,170 | |

| | | | | | |

TECHNOLOGY SERVICES SECTOR — 6.9% | | | | | |

| | | | | | | | | | | | |

| | | | Information Technology Services — 4.4% | | | | | | | | |

| | 2,341,000 | | Accenture PLC | | | 76,791,507 | | | | 285,999,970 | |

| | | | | | | | | | | | |

| | | | Packaged Software — 2.5% | | | | | | | | |

| | 2,888,000 | | Microsoft Corp. | | | 79,174,786 | | | | 166,348,800 | |

| | | | | | |

TRANSPORTATION SECTOR — 3.5% | | | | | |

| | | | | | | | | | | | |

| | | | Air Freight/Couriers — 3.5% | | | | | | | | |

| | 4,477,000 | | Expeditors International of Washington Inc. | | | 167,338,527 | | | | 230,655,040 | |

| | | | Total common stocks | | | 4,315,692,444 | | | | 5,958,723,080 | |

| | | | | | | | | | | | |

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2016

| Principal Amount | | | | Cost | | | Value | |

| | |

| SHORT-TERM INVESTMENTS — 9.8% (a) | |

| | | | | | | | | |

| | | Money Market Deposit Account — 7.5% | | | | | | |

| $ | 494,668,761 | | U.S. Bank, N.A., 0.25% | | $ | 494,668,761 | | | $ | 494,668,761 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 2.3% | | | | | | | | |

| | 150,000,000 | | U.S. Treasury Bills, 0.115%, due 10/20/16 | | | 149,990,896 | | | | 149,990,400 | |

| | | | Total short-term investments | | | 644,659,657 | | | | 644,659,161 | |

| | | | Total investments — 100.4% | | $ | 4,960,352,101 | | | | 6,603,382,241 | |

| | | | Other assets, less liabilities — (0.4%) (a) | | | | | | | (27,273,252 | ) |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 6,576,108,989 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

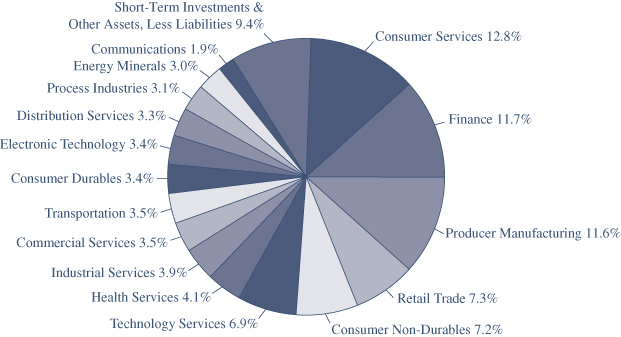

FMI Large Cap Fund

INDUSTRY SECTORS

as of September 30, 2016 (Unaudited)

FMI

Common Stock

Fund

September 30, 2016

Dear Fellow Shareholders:

The FMI Common Stock Fund (Fund) returned 4.95% in the September quarter compared to 9.05% for the Russell 2000 Index (Russell 2000). Sectors that aided performance included Retail Trade, Consumer Services and Health Services. Those that hurt performance included Commercial Services, Producer Manufacturing and Health Technology. Stocks that aided results included Penske Automotive, Anixter International and Zions Bancorporation. Underperformers included Genpact Ltd., Interpublic Group and Valmont Industries. The market worries of January and February, which were bringing some sanity back to equity valuations, ameliorated through the second and the third calendar quarters, keeping the bull alive. The Fund had a tough relative quarter, with some of the more economically sensitive stocks taking it on the chin and the elevated cash position hurting as well. Being underweighted Health Technology and Electronic Technology also hurt relative performance. Investors seemed more emboldened as the quarter unfolded. Health Technology and Electronic Technology sectors are both very expensive. Additionally, we are underweight Finance, which generally performs poorly in difficult markets. To give some color on the degree to which speculative fervor drove the Russell 2000 this quarter, nine of the top ten contributors to that Index were biotech or technology companies. For example, Sarepta Therapeutics gained 222%, Exelixis advanced 64%, and Cepheid appreciated 71%; all three generate huge losses. Rumors that Twitter was in play caused its stock to surge over 35% in the quarter. Twitter carries a $17 billion market cap, has never turned a profit (and has lost over $400 million in the last twelve months), and trades for over 5 times revenue. Further evidence comes from a corner of the private equity world with the impending offering of Yeti (coolers, coffee mugs, etc.) rumored at a $5 billion valuation, which is over 10 times 2015 revenue, and 36 times 2015 earnings before interest, taxes, depreciation and amortization (EBITDA).

There is somewhat of a surreal nature to the economic and stock market dialogue today. If one listens to the administration, the economy is a well-oiled jobs machine that delivers steady growth

without inflation. Janet Yellen and other Federal Reserve (Fed) board members tell us the economy is sound, and that interest rates will soon be normalized (although year after year goes by with little action). The bull market recently passed 7½ years, and people with financial assets — essentially the top 5% — seem pleased. It’s hard to reconcile this against the backdrop of persistently weak gross domestic product (GDP) growth of roughly 1.0-1.5%, and corporate sales and earnings growth that has been negative for five quarters (with a sixth decline expected in the September quarter). If the market reflected just the decline in earnings so far, according to David Rosenberg of Gluskin Sheff, the S&P 500 would be down 20%. The combined Manufacturing and Non-Manufacturing ISM Composite Index (see graph on previous page) recently dropped to 51.2% (the weakest in over six years), industrial production remains soft, retail sales have sputtered, and the Fed’s own broad Labor Market Conditions Index dropped 0.7% in August. The employment-to-population ratio for the U.S. remains mired below 60% and real incomes are lower today than a decade ago, although they rose last year for the first time in years. The average American is running in place, at best.

Consumer health care, rent/housing, and educational expenses are swamping the small increases or declines in other consumer items. Perhaps someone should tell the Fed that the Consumer Price Index (excluding food and energy) was up 2.3% year-over-year in August. Health care and entitlement spending are out of control and are being funded with unsustainable increases in debt. Most people believe the real damage to balance sheets took place in 2008-09, yet over just the past five years the federal government has added $4.8 trillion of debt (bringing the total debt to $19.5 trillion), the Federal Reserve pumped up its balance sheet by $1.7 trillion to $4.5 trillion, and corporations have layered on an estimated $2.2 trillion of new borrowings. The most dangerous aspect is that debt is growing faster than GDP.

These stories, however, are old news. We’ve lost the ability to be surprised or moved by quarter after quarter of the same combination of runaway government spending, easy money and relatively weak economic growth. On the corporate side, financial engineering remains the go-to strategy, but this has proven to be no substitute for organic investment in people and projects. The Fed seems to think one more quarter, or one more year, of extremely low rates is all that is needed to jump-start the economy. If low rates induce capital formation, however, wouldn’t we have seen explosive business investment after eight years of a nearly zero percent Fed Funds rate? Instead, it has been one of the weakest periods of fixed business investment on record.

Moreover, despite a curious but enduring belief in Keynesian economic theories, government spending doesn’t seem likely to cure the growth problem. If deficit spending was the answer,

wouldn’t the economy be screaming after more than a decade of nonstop stimulus? It is astonishing that some pundits are calling for even more fiscal stimulus today. Few consider that there is a wide body of evidence showing that government debt accumulation (deficit spending) steals from overall economic growth. That government spending has a negative multiplier effect on the economy should not come as a startling revelation. Just look around and see where governments spend money and compare that to private capital projects and research and development expansion, and it is easy to see why the economy has underperformed.

Stocks remain elevated by just about all traditional valuation measures. Asset inflation and high valuations are also not confined to the equity markets. Bonds, private equity, real estate and other alternatives are all expensive by historical standards. Paul Singer, the highly regarded leader of Elliott Management, recently called long-term bonds the “biggest bond bubble in world history,” although the 10-Year Treasury has recently backed up a bit. A relatively weak economy, negative earnings growth and high valuations wouldn’t seem to be the ticket to higher stock prices. As we asked in our last letter, what are investors supposed to do? The best option is to take the long view and own quality franchises trading at relative discounts, and recognize that while nobody will be immune to a stock market downturn, this strategy offers the best chance to preserve, and eventually grow, capital. The public continues to pour money into index funds, which have beaten approximately 90% of active U.S. equity managers over the past five years. The money flows are a self-fulfilling feedback loop in the short run that will eventually collapse, as they have in the past. The last time index funds outperformed like this was in the five years ending in early 2000. The S&P 500 proceeded to drop nearly 50% and it took over seven years to recover to the prior peak.

While speculation is alive and well in the stock market, there may be a few markets beginning to crack. The high end of the Canadian and New York City real estate bubbles may be beginning to deflate. Additionally, recall our discussion in the June of 2014 letter of the tremendous excesses in the contemporary art market. In recent months the bottom has begun to fall out of this market, with a number of pieces dropping over 90% or failing to sell at auction. In a recent Bloomberg story, the author mentioned the work of one Lucien Smith: “Smith saw a painting he made while an undergraduate at New York’s Cooper Union fetch $389,000 at Phillips in 2013, two years after it was purchased for $10,000. This week, estimates for three Smith pieces are as low as $7,000. One (to the right), from the series he made by spraying more than 200 canvases with paint from a fire extinguisher, is estimated at $12,000 to $18,000. A bigger spray work sold for $372,120 two years ago.” To each his own, but we know some third graders with ball point pens who would take a dollar and an ice cream cone for similar work.

It takes fortitude to avoid playing someone else’s game, i.e., chasing after what is currently working even though these investments may lack true value. Using professional golf as an analogy, the best players focus not on the results, but the process. They do everything in their power to choose the right club, envision the right shot shape and put themselves in a mental mindset that will deliver a positive swing. If they can execute the process consistently, most, but not all shots

will come off well. If they let their minds race after a bad shot or a bad hole and fret about the results, they are likely to compound their difficulties. You can’t wish the ball into the hole, but instead, must keep your discipline and process. It is strikingly similar with investing. Fortunately, the Fund’s adviser has a great culture that places a lot of faith in being intellectually honest and in staying true to the process. We can’t control the fact that over the past few years, investors have been willing, for example, to buy utility stocks that barely earn their cost of capital, have little to no growth, are highly regulated, and are heavily indebted and expensive. Our process would not translate into a purchase decision in this sector even though, looking in the rear view mirror, it has been rewarding. We are highly confident that in the fullness of time, this group will reflect its underlying fundamentals. Over the years, we have seen this same dynamic in many popular stocks; with few exceptions, these equities ultimately reflected the intrinsic value of their respective businesses. As Ben Graham famously said over eighty years ago, “…the market is a voting machine [popularity contest] in the short run but a weighing machine in the long run.”

Below are a couple of investments we think will eventually register well on the weighing machine.

Arrow Electronics Inc. (ARW)

(Analyst: Matt Sullivan)

Description

Arrow Electronics is a leading global distributor of semiconductors, passive and other electronic components, and enterprise computing solutions. The company also offers a variety of value-added services including programming, system training and certification, solutions testing, and inventory and supply chain management. Arrow distributes these products and services to over 100,000 industrial and commercial customers spanning across 85 different countries.

Good Business

| • | As a distributor of electronics and technology systems, Arrow benefits from global growth in high technology without being exposed to the same obsolescence risk as technology manufacturers. |

| | |

| • | Arrow is one of the world’s largest global information technology distributors, and controls a large market share position in the industry. It has stood the test of time, having incorporated in 1946. |

| | |

| • | The company has a diversified set of vendors, customers, and end markets. Arrow serves over 100,000 customers in 85 countries, including 12,000 value-added resellers. No single supplier accounts for more than 7% of overall revenues, and no single customer accounts for more than 2% of overall revenues. |

| | |

| • | Arrow’s size and expertise in its product offerings create a competitive advantage that translates into better margins than most of its smaller competitors. |

| | |

| • | Over time, the company has proven its ability to consistently earn a return on capital that exceeds its cost of capital. |

| | |

| • | The balance sheet is modestly levered with a debt-to-total capital ratio of approximately 37%. |

Valuation

| • | Arrow is valued at 9.7 times the 2016 consensus earnings per share (EPS) estimate, and 0.34 times enterprise value-to-sales (EV/Sales). This is a significant discount to most market indices, including the Russell 2000. |

| | |

| • | While Arrow has historically traded at a discount to most market indices, the valuation gap has widened significantly in recent years. |

| • | Based on a sum-of-the-parts analysis, we believe Arrow should be trading at least 50% higher. Our confidence in this analysis grew recently when Arrow’s closest competitor, Avnet, sold part of its business at an attractive multiple. |

Management

| • | Michael Long is Chairman, President, and Chief Executive Officer. He has been CEO since 2009, and has been with the company since 1991. Prior to working at Arrow Electronics, Long worked at Schweber Electronics from 1983 until Schweber merged with Arrow in 1991. |

| | |

| • | Management has become more focused on return on invested capital (ROIC) over time. ROIC is one of the key performance metrics used to evaluate and compensate management. |

Investment Thesis

Arrow Electronics is one of the world’s largest distributors of electronic components and enterprise computing solutions. As a distributor of electronics, the company is in the advantageous position of benefitting from global technology growth without being directly exposed to the short product cycles and cutthroat competition that exist for the innovators of technology. Arrow trades at a significant discount to most market indices, despite having a solid track record of earnings per share growth and an above-average ROIC profile. Concerns about Arrow’s role as cloud computing grows have also impacted the multiple. We feel Arrow will continue to thrive in the environment we see existing over the next decade, which, for the vast majority of companies, will be a combination of pure cloud services, traditional networks and hybrid public/private deployments. The large discount in Arrow’s multiple is unwarranted.

Robert Half International Inc. (RHI)

(Analyst: Rob Helf)

Description

Headquartered in Menlo Park, California, Robert Half is the world’s largest specialized staffing company. The company’s revenues are generated in the fields of accounting and finance (Accountemps), Robert Half Technology, Legal and Protiviti, a well-regarded business consulting and internal audit operation.

Good Business

| • | Robert Half is the world’s largest specialized staffing company, with a particular strength in the field of finance/accounting. The company has successfully levered its powerful brand name into other specialty staffing services, including information technology. |

| | |

| • | The increased regulatory burden on permanent employment provides a tailwind for the company. |

| | |

| • | Robert Half has a diverse set of small to mid-size customers, which have traditionally been less price-sensitive and stickier than larger, national account clients. |

| | |

| • | Flexible staffing has strong secular appeal, given the changes in how work is conducted. |

| | |

| • | The company has been expanding its international presence. |

| | |

| • | The company has generated a low double-digit ROIC, on average, over the last decade. |

| | |

| • | Robert Half’s balance sheet is in excellent shape with approximately $2 per share in net cash. |

| | |

| • | The company has consistently generated strong free cash flow and has returned over 100% of this to shareholders via dividends and repurchases. |

| | |

| • | The company currently pays a $0.88 annual dividend, yielding 2.4%. |

Valuation

| • | On a cash-adjusted basis, Robert Half trades at 12.8 times EPS, 8.0 times earnings before interest and taxes (EBIT) and 0.85 times sales. |

| | |

| • | Over the past ten years, the stock, on average, has traded for over 25 times EPS, 15 times EBIT and 1.1 times sales. |

| | |

| • | The shares are approaching one standard deviation below its 10-year EV/Sales average. |

Management

| • | Harold Messmer, 70, is Chairman and CEO; he has served in these roles for over 20 years. From 1985-2004, he served as President. Mr. Messmer beneficially owns more than 1.2 million shares at a value of $68 million. |

| | |

| • | Keith Waddell, 59, is Vice Chairman (since 1999), President (since 2004) and Chief Financial Officer (since 1988). He owns over 1.3 million shares. |

| | |

| • | Paul Gentzkow, 60, is President and Chief Operating Officer-Staffing Services. |

| | |

| • | Management has created an enterprise that has among the highest margins and returns in the staffing industry, and they have been good capital allocators. |

Investment Thesis

The shares of Robert Half have underperformed the overall market in 2016, as growth has slowed for this growing/cyclical leader in specialized staffing. In the most recent quarter, organic growth was a very healthy +8%, and this compared to 15% in the prior year. The shares are discounting an economic recession with an EV/Sales ratio approaching one standard deviation below their 10-year average in the context of an overall stock market that is just the opposite, trading near the upper end of its historical range. The stock appears to be largely discounting a recession and a severe earnings decline. We believe any additional decline in the stock will be temporary. The long-term outlook for Robert Half appears to be strong.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2016, the FMI Common Stock Fund (Fund) had a total return of 12.61%. The benchmark Russell 2000 Index (Russell 2000) returned 15.47% in the same period. Sectors that aided relative performance included Health Technology, Retail Trade and Process Industries. Varian Medical Systems gained in the period as new products began to sell better and they announced plans to spin off a division. The Retail Trade sector was weak for the market but the Fund’s investment in Penske Automotive Group gained. Both H.B. Fuller and Avery Dennison aided performance in the Process Industries sector. On the flipside, Commercial Services, Finance, Electronic Technology and Cash all pulled down performance. Robert Half and ManpowerGroup, both temporary help companies, significantly lagged the market as economic growth continued to disappoint. Finance was a strong sector for the benchmark and the Fund’s underweighted position hurt. Additionally, Greenlight Capital and Ryder System had negative contributions. Similarly, a strong move for the market in Electronic Technology hurt the Fund on a relative basis because of its underweighting. The Fund also underperformed because of its lack of exposure to the Utilities sector, which the Fund’s adviser believes is highly overvalued.

Stocks sold in the period included Kennametal, Armstrong World, Cullen/Frost and Lindsay Corp. Stocks added included ePlus, Penske Automotive Group, and Kennedy-Wilson. At September 30, 2016, the Fund was significantly overweighted in Distribution Services, Process Industries and Producer Manufacturing and meaningfully underweighted in Finance, Electronic Technology and Utilities.

Performance was very mixed by sector over the fiscal year. Oddly, some aggressive groups like Electronic Technology and traditionally defensive groups like Utilities both outperformed the benchmark return. Speculation appears to be solidly in vogue again but so does so-called “yield chasing.” With a few exceptions, both of these themes generally look unattractive. The Russell 2000 dropped approximately 20% from early December of 2015 to mid-February of 2016, technically ending a seven year bull market (<20%> being the widely recognized definition of a bear market) in the small cap arena, although large caps remain in a bull market. Valuations began to get more interesting in this period but still remained well above historical averages. The market then quickly rebounded, bringing valuations back to the upper end of their long-term historical ranges.

Easy monetary policy appears to have been a significant driver of stock market performance in recent years. Many economies around the world have weakened and while the U.S. economy has had positive real GDP growth, the rate over the past year has been below average. The unemployment rate has also improved, but the labor participation rate remains at a very low level and an extraordinarily high number of citizens are dependent on government support. Companies have been restrained with respect to investing in both capital equipment and labor, which has resulted in less than satisfactory internal growth rates. Geopolitical problems have seemingly escalated over the past year. This, combined with less than average growth and high valuations makes the Fund’s adviser cautious on the stock market in the short run. The Fund’s adviser continues to believe, however, that stocks have the best chance to adjust to a dynamic environment over the long run. The Fund sells at discount to the Russell 2000 on most valuation measures.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

(Continued)

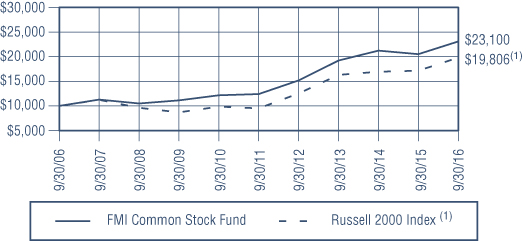

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND AND THE RUSSELL 2000 INDEX(1)

AVERAGE ANNUALIZED TOTAL RETURN

| | | | | Since Inception |

| | 1-Year | 5-Year | 10-Year | 12/18/81 |

| FMI Common Stock Fund | 12.61% | 13.24% | 8.73% | 11.86% |

| Russell 2000 Index | 15.47% | 15.82% | 7.07% | 10.26% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. |

An investment cannot be made directly into an index.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

September 30, 2016

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 88.4% (a) | | | | |

| | | | | |

COMMERCIAL SERVICES SECTOR — 13.8% | | | | |

| | | | | | | | | |

| | | Advertising/Marketing Services — 2.7% | | | | | | |

| | 1,150,000 | | Interpublic Group of Cos. Inc. | | $ | 19,666,148 | | | $ | 25,702,500 | |

| | | | | | | | | | | | |

| | | | Financial Publishing/Services — 1.4% | | | | | | | | |

| | 100,000 | | Dun & Bradstreet Corp. | | | 6,577,926 | | | | 13,662,000 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Commercial Services — 4.5% | | | | | | | | |

| | 1,375,000 | | Genpact Ltd.* | | | 23,005,945 | | | | 32,931,250 | |

| | 883,000 | | RPX Corp.* | | | 13,508,006 | | | | 9,439,270 | |

| | | | | | | 36,513,951 | | | | 42,370,520 | |

| | | | Personnel Services — 5.2% | | | | | | | | |

| | 408,000 | | ManpowerGroup Inc. | | | 27,182,240 | | | | 29,482,080 | |

| | 516,000 | | Robert Half International Inc. | | | 15,719,859 | | | | 19,535,760 | |

| | | | | | | 42,902,099 | | | | 49,017,840 | |

| | | | | | |

CONSUMER DURABLES SECTOR — 1.0% | | | | | |

| | | | | | | | | | | | |

| | | | Homebuilding — 1.0% | | | | | | | | |

| | 6,000 | | NVR Inc.* | | | 5,780,230 | | | | 9,839,220 | |

| | | | | | |

CONSUMER SERVICES SECTOR — 7.0% | | | | | |

| | | | | | | | | | | | |

| | | | Cable/Satellite TV — 2.3% | | | | | | | | |

| | 38,000 | | Cable One Inc. | | | 11,315,190 | | | | 22,192,000 | |

| | | | | | | | | | | | |

| | | | Other Consumer Services — 4.7% | | | | | | | | |

| | 51,000 | | Graham Holdings Co. | | | 23,883,902 | | | | 24,549,870 | |

| | 147,000 | | UniFirst Corp. | | | 14,887,732 | | | | 19,383,420 | |

| | | | | | | 38,771,634 | | | | 43,933,290 | |

| | | | | | |

DISTRIBUTION SERVICES SECTOR — 11.7% | | | | | |

| | | | | | | | | | | | |

| | | | Electronics Distributors — 4.1% | | | | | | | | |

| | 475,000 | | Arrow Electronics Inc.* | | | 9,683,372 | | | | 30,385,750 | |

| | 236,000 | | ScanSource Inc.* | | | 5,005,446 | | | | 8,614,000 | |

| | | | | | | 14,688,818 | | | | 38,999,750 | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 7.6% | | | | | | | | |

| | 342,000 | | Anixter International Inc.* | | | 22,052,994 | | | | 22,059,000 | |

| | 507,000 | | Applied Industrial Technologies Inc. | | | 20,998,745 | | | | 23,697,180 | |

| | 361,000 | | MSC Industrial Direct Co. Inc. | | | 25,065,457 | | | | 26,501,010 | |

| | | | | | | 68,117,196 | | | | 72,257,190 | |

| | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 6.0% | | | | | |

| | | | | | | | | | | | |

| | | | Aerospace & Defense — 4.1% | | | | | | | | |

| | 265,000 | | Esterline Technologies Corp.* | | | 24,727,951 | | | | 20,150,600 | |

| | 581,000 | | FLIR Systems Inc. | | | 16,615,792 | | | | 18,255,020 | |

| | | | | | | 41,343,743 | | | | 38,405,620 | |

| | | | | | | | | | | | |

| | | | Electronic Production Equipment — 1.9% | | | | | | | | |

| | 368,000 | | MKS Instruments Inc. | | | 9,738,799 | | | | 18,300,640 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2016

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 88.4% (a) (Continued) | | | | |

| | |

FINANCE SECTOR — 13.9% | |

| | | | | | | | | |

| | | Finance/Rental/Leasing — 7.9% | | | | | | |

| | 156,000 | | ePlus Inc.* | | $ | 14,009,047 | | | $ | 14,727,960 | |

| | 781,800 | | FirstCash Inc. | | | 27,477,148 | | | | 36,807,144 | |

| | 356,000 | | Ryder System Inc. | | | 15,419,508 | | | | 23,478,200 | |

| | | | | | | 56,905,703 | | | | 75,013,304 | |

| | | | | | | | | | | | |

| | | | Property/Casualty Insurance — 3.5% | | | | | | | | |

| | 687,000 | | Greenlight Capital Re Ltd.* | | | 15,908,848 | | | | 14,042,280 | |

| | 327,000 | | W.R. Berkley Corp. | | | 7,992,588 | | | | 18,887,520 | |

| | | | | | | 23,901,436 | | | | 32,929,800 | |

| | | | | | | | | | | | |

| | | | Real Estate Development — 1.1% | | | | | | | | |

| | 465,750 | | Kennedy-Wilson Holdings Inc. | | | 10,212,395 | | | | 10,502,662 | |

| | | | | | | | | | | | |

| | | | Regional Banks — 1.4% | | | | | | | | |

| | 430,000 | | Zions Bancorporation | | | 9,376,971 | | | | 13,338,600 | |

| | | | | | |

HEALTH SERVICES SECTOR — 1.9% | | | | | |

| | | | | | | | | | | | |

| | | | Health Industry Services — 1.9% | | | | | | | | |

| | 1,349,000 | | Allscripts Healthcare Solutions Inc.* | | | 16,774,790 | | | | 17,766,330 | |

| | | | | | |

HEALTH TECHNOLOGY SECTOR — 2.3% | | | | | |

| | | | | | | | | | | | |

| | | | Medical Specialties — 2.3% | | | | | | | | |

| | 215,000 | | Varian Medical Systems Inc.* | | | 15,467,253 | | | | 21,398,950 | |

| | | | | | |

PROCESS INDUSTRIES SECTOR — 9.1% | | | | | |

| | | | | | | | | | | | |

| | | | Chemicals: Specialty — 1.8% | | | | | | | | |

| | 225,000 | | Compass Minerals International Inc. | | | 16,042,584 | | | | 16,582,500 | |

| | | | | | | | | | | | |

| | | | Containers/Packaging — 2.2% | | | | | | | | |

| | 272,000 | | Avery Dennison Corp. | | | 7,082,809 | | | | 21,158,880 | |

| | | | | | | | | | | | |

| | | | Industrial Specialties — 5.1% | | | | | | | | |

| | 336,400 | | Donaldson Co. Inc. | | | 9,688,204 | | | | 12,557,812 | |

| | 759,000 | | H.B. Fuller Co. | | | 23,536,650 | | | | 35,270,730 | |

| | | | | | | 33,224,854 | | | | 47,828,542 | |

| | | | | | |

PRODUCER MANUFACTURING SECTOR — 11.6% | | | | | |

| | | | | | | | | | | | |

| | | | Building Products — 2.5% | | | | | | | | |

| | 569,000 | | Armstrong World Industries Inc.* | | | 25,004,632 | | | | 23,511,080 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery — 4.5% | | | | | | | | |

| | 681,000 | | Woodward Inc. | | | 28,725,484 | | | | 42,548,880 | |

| | | | | | | | | | | | |

| | | | Miscellaneous Manufacturing — 4.6% | | | | | | | | |

| | 97,000 | | Carlisle Cos. Inc. | | | 1,986,225 | | | | 9,949,290 | |

| | 836,000 | | TriMas Corp.* | | | 18,249,897 | | | | 15,557,960 | |

| | 130,000 | | Valmont Industries Inc. | | | 19,120,992 | | | | 17,494,100 | |

| | | | | | | 39,357,114 | | | | 43,001,350 | |

| | | | | | |

RETAIL TRADE SECTOR — 2.3% | | | | | |

| | | | | | | | | | | | |

| | | | Specialty Stores — 2.3% | | | | | | | | |

| | 448,450 | | Penske Automotive Group Inc. | | | 15,709,458 | | | | 21,606,321 | |

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2016

Shares or Principal Amount | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 88.4% (a) (Continued) | | | | |

| | | | | |

TECHNOLOGY SERVICES SECTOR — 4.9% | | | | |

| | | | | | | | | |

| | | Data Processing Services — 3.3% | | | | | | |

| | 455,000 | | Broadridge Financial Solutions Inc. | | $ | 9,493,259 | | | $ | 30,844,450 | |

| | | | | | | | | | | | |

| | | | Packaged Software — 1.6% | | | | | | | | |

| | 570,000 | | Progress Software Corp.* | | | 12,368,726 | | | | 15,504,000 | |

| | | | | | |

TRANSPORTATION SECTOR — 2.9% | | | | | |

| | | | | | | | | | | | |

| | | | Marine Shipping — 2.9% | | | | | | | | |

| | 436,000 | | Kirby Corp.* | | | 20,866,866 | | | | 27,101,760 | |

| | | | Total common stocks | | | 635,930,068 | | | | 835,317,979 | |

| | | | | | |

| SHORT-TERM INVESTMENTS — 11.1% (a) | | | | | |

| | | | | | | | | | | | |

| | | | Money Market Deposit Account — 8.5% | | | | | | | | |

| $ | 79,947,556 | | U.S. Bank, N.A., 0.25% | | | 79,947,556 | | | | 79,947,556 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 2.6% | | | | | | | | |

| | 25,000,000 | | U.S. Treasury Bills, 0.115%, due 10/20/16 | | | 24,998,483 | | | | 24,998,400 | |

| | | | Total short-term investments | | | 104,946,039 | | | | 104,945,956 | |

| | | | Total investments — 99.5% | | $ | 740,876,107 | | | | 940,263,935 | |

| | | | Other assets, less liabilities — 0.5% (a) | | | | | | | 4,389,599 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 944,653,534 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

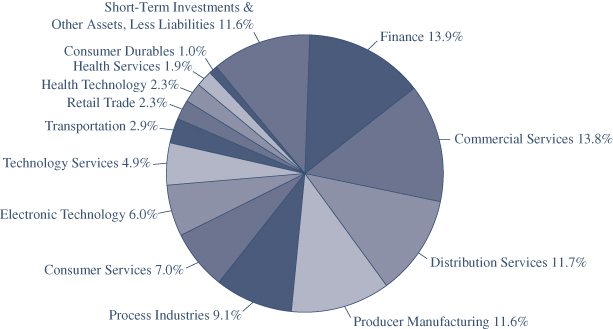

FMI Common Stock Fund

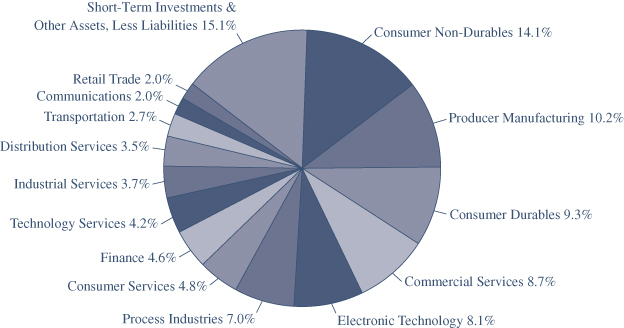

INDUSTRY SECTORS

as of September 30, 2016 (Unaudited)

FMI

International

Fund

September 30, 2016

Dear Fellow Shareholders:

Global stock markets rallied in the third quarter as Brexit fears eased. Fortunately, the sky didn’t fall as some economists had predicted. The FMI International Fund (FMIJX) captured most of the upside, advancing 5.40% in the quarter, while the MSCI EAFE Index gained 6.04% in local currency and 6.43% in U.S. Dollars (USD). Strong relative performance by Producer Manufacturing, Distribution Services, and Commercial Services sectors was partially offset by weaker results in Finance, Consumer Durables, and Consumer Non-Durables. Top performing stocks were Smiths Group, Electrocomponents, and SMC Corp., while LG Household & Health Care, SCA Group, Hyundai GreenFood each declined in value.

With each passing quarter, we do our best to avoid sounding like a broken record. Unfortunately, the story hasn’t changed a whole lot, and if anything, risk has increased. Experimental central bank monetary policies are dangerous (and ineffective), economic and business growth continues to falter, debt is high and on the rise, and stock valuations remain elevated. While negative interest rates and quantitative easing (QE) have pumped up financial asset prices, to believe that printing money out of thin air and artificially suppressing rates will solve the world’s problems is beyond our comprehension. In our view, markets are upside down, and with each passing day we venture further into uncharted territory. At some point there will be a day of reckoning, at which time we will be eagerly waiting to sift through the bargain bin. In the meantime, we remain cautious and highly skeptical, with a continued focus on downside protection.

Return-Free Risk

The negative interest rate frenzy is reaching new heights. In Europe, Henkel and Sanofi were added to the list of corporations to issue bonds at a negative yield. The Wall Street Journal reports that “Roughly €706 billion of eurozone investment-grade corporate bonds traded at negative yields as of Sept. 5, or over 30% of the entire market, according to trading platform Tradeweb, up from roughly 5% of the market in early January.”1 The global figure for negative-yielding debt (primarily government bonds in Europe and Japan) is staggering, topping $13.4 trillion in the period (from close to zero at the start of 2014).2 It is remarkable (and quite alarming) that we’ve gone from a world where sovereign debt once provided a supposed “risk-free return,” to today, when investors are lining up in droves for corporate bonds offering “return-free risk.” According to Richard Sylla (co-author of A History of Interest Rates in 2005), there is no such precedent (for negative interest rates) in at least 5,000 years of banking history.3 For good reason.

To make matters worse, central banks are running out of things to buy. In Europe, despite expanding the €1.6 trillion QE program into corporate bonds, some analysts believe the European Central Bank (ECB) could run out of bonds by year end.4 Reports are surfacing that companies

_______________

1 | Christopher Whittall. “Now Companies Are Getting Paid to Borrow.” The Wall Street Journal, September 6, 2016. |

2 | Robin Wigglesworth and Eric Platt. “Value of negative-yielding bonds hits $13.4tn.” Financial Times, August 12, 2016. |

3 | James Grant. “Hostage to a Bull Market.” The Wall Street Journal, September 9, 2016. |

4 | Elaine Moore. “When will the ECB run out of bonds to buy?” Financial Times, September 8, 2016. |

are creating bonds to sell to the ECB through private placement, which is troubling.5 While the ECB has yet to buy equities, we wouldn’t be surprised if it happens. In Japan, the Bank of Japan (BOJ) holds around a third of Japan’s government bonds, and analysts estimate that it could reach 60% by the end of 2018. They are currently buying bonds at roughly twice the pace at which the government is issuing them.6 The BOJ is also well down the path of acquiring equities, as it is already a top ten shareholder in around 90% of the Nikkei 225 index,7 and is on course to become the number one shareholder in 55 of those companies by the end of 2017.8 This is not normal.

Since the 2008 financial crisis, central banks have printed more than $12 trillion and cut interest rates more than 650 times,9 yet, “global economic output growth is about to enter a sixth year below the average rate since 1990, marking one of the longest eras of weak output in decades,” per The Wall Street Journal.10 In addition, McKinsey Global Institute writes, “Between 65 and 70 percent of households in 25 advanced economies, the equivalent of 540 million to 580 million people, were in segments of the income distribution whose real market incomes—their wages and income from capital—were flat or had fallen in 2014 compared with 2005. This compared with less than 2 percent, or fewer than ten million people, who experienced this phenomenon between 1993 and 2005.”11 The conventional wisdom was that low interest rates and inflated asset prices would help spur demand, with an increase in business and household spending. But the reverse has transpired, as business investment has been anemic and households have padded their savings. Despite a plethora of evidence suggesting that monetary policies have failed, central bankers continue to plow

_______________

5 | Christopher Whittall. “Seller’s Paradise: Companies Build Bonds for European Central Bank to Buy.” The Wall Street Journal, August 21, 2016. |

6 | Rachel Rosenthal and Suryatapa Bhattacharya. “Bank of Japan Risk: Running Out of Bonds to Buy.” The Wall Street Journal, September 9, 2016. |

7 | Yuji Nakamura, Anna Kitanaka and Nao Sano. “The Tokyo Whale Is Quietly Buying Up Huge Stakes in Japan Inc.” Bloomberg, April 24, 2016. |

8 | Anna Kitanaka, Yuji Nakamura and Toshiro Hasegawa. “The Bank of Japan’s Unstoppable Rise to Shareholder No. 1.” Bloomberg, August 14, 2016. |

9 | Jeff Cox. “$12 trillion of QE and the lowest rates in 5,000 years...for this?” CNBC, June 13, 2016. |

10 | Ian Talley. “IMF Signals Another Downgrade to Global Growth.” The Wall Street Journal, September 1, 2016. |

11 | “Poorer Than Their Parents?” McKinsey Global Institute, July 2016. |

ahead with more of the same. This is very unlikely to create a path to prosperity, in our view. Money is not supposed to be free. Our children and grandchildren will likely look back at this period with bewilderment as the economic textbooks are re-written. When policies and valuations get stretched to the extreme, so too will the inevitable consequences.

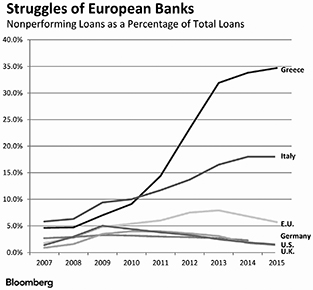

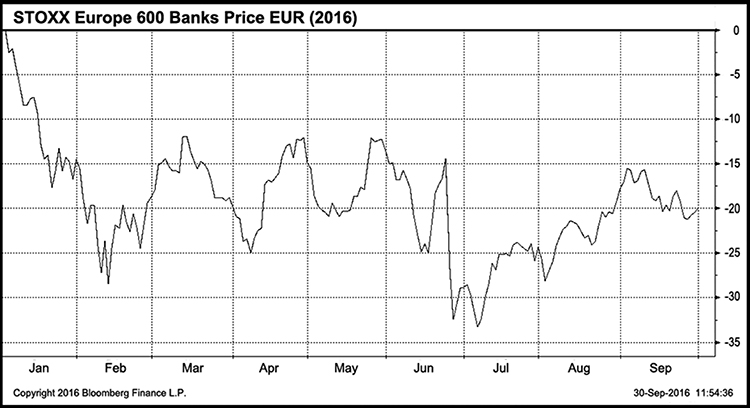

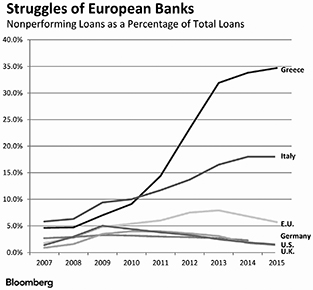

In Banks We Trust

In doing “whatever it takes” to preserve the eurozone and resurrect growth, ECB President Mario Draghi has put a major squeeze on one of his most troubled sectors: European banks. Negative interest rates are debilitating to bank margins and profitability, and earnings have suffered as a result. Furthermore, European banks are lugging around approximately €900 billion ($1 trillion) of bad debt, with Southern Europe being the most heavily weighted to these distressed loans12 (which is not a big surprise). Meanwhile, banks have recently been increasing their exposure to sovereign debt, as it is treated as “risk-free” and does not incur capital charges. As the European sovereign debt crisis should have demonstrated, Europe’s government bonds are hardly “risk-free.” Regulators have (rightly) expressed an interest in introducing capital charges on these holdings, but Fitch Ratings has warned that a policy shift could result in banks having to raise as much as €170 billion in extra capital, or sell €500 billion in debt.13 In reality, European bank balance sheets are likely far worse than meets the eye, and regulators’ softball “stress tests” do little to create comfort.

Absent Greece, the Italian banks are clearly in the worst shape, as 17% of total loans have gone sour. This equates to over €360 billion, quadruple the level reached in 2008.14 As articulated by Mauldin Economics, “Italian GDP [gross domestic product] is around $2 trillion. At today’s exchange rate, Italy’s nonperforming bank loans total roughly 25% of GDP. Compare Italy to the U.S., where nonperforming loans amount to only 1.2% of GDP, or $128 billion. If nonperforming loans in the U.S. were 25% of U.S. GDP, they would amount to an astronomical $4.5 trillion. Italy is one good global recession away from a major crisis.”15 While the eurozone was barely able to manage through the contagion risks associated with the Greece debacle, a bank and/or sovereign debt crisis in Italy, at ten times the size of the Greek economy, would be a whole different animal. Needless to say, time is of the essence in terms of putting forth a credible path to sustainability.

_______________

12 | Tom Fairless and Todd Buell. “ECB Proposals Aim to Clear Europe’s Bad Debt Mountain.” The Wall Street Journal, September 12, 2016. |

13 | “European banks raise government debt holdings.” Financial Times, June 21, 2016. |

14 | Giovanni Legorano. “Bad Debt Piled in Italian Banks Looms as Next Crisis.” The Wall Street Journal, July 4, 2016. |

15 | John Mauldin. “Brexit Doesn’t Change the Sad Reality of Europe.” Mauldin Economics, July 8, 2016. |

Despite the stock price decline in European banks earlier this year, we will continue to keep our distance and watch from the sidelines. The black box nature of the businesses, highly-levered balance sheets, and concerns around solvency keep us at bay. Permanent impairment of capital is a material risk.

Fiscal Stimulus To Save The Day?

With monetary policy failing to deliver, some are hoping fiscal stimulus will come to the rescue. In the U.S., Japan and United Kingdom, budget deficits are set to be larger this year than last year, or larger than originally planned.16 As a reminder, with rising deficits comes rising debt. When interest rates inevitably start to normalize (increase), perhaps the cost of debt will come back into focus. Like monetary policy, fiscal stimulus is no magic bullet. If that was the case, Japan’s economy would be on top of the world. Since 1990, Japan has delivered 25 economic stimulus packages,17 and what do they have to show for it? Lackluster growth and the world’s largest accumulation of government debt (as a percentage of GDP).

Mind The Gap

Speaking of profligate spending, the Chinese government continues to prop up its economy as the private sector wanes. Fixed-asset investment, the key driver of China’s growth engine in recent years, hit a 17-year low (8.1%) through August. Investments made by state-run companies were up a massive 21.4%, but investment by private companies, which account for 60% of the total, rose by only 2.1%.18,19 In June, private investment fell for the first time since China started tracking the data in 2004. This is quite a slowdown, considering that it had grown by nearly 30% on average over the prior decade (10.1% in 2015).20 While fixed investment has driven exceptional headline GDP growth, a significant portion of capital appears to have been poorly allocated. A recent Oxford Review of Economic Policy study writes, “Evidence suggests that over half the infrastructure investments in China made in the last three decades have been NPV [net present value] negative.

_______________

16 | Greg Ip. “Fiscal Policy Makes a Quiet Turn Toward Stimulus.” The Wall Street Journal, September 15, 2016. |

17 | Issaku Harada. “Japan Strategy Views.” Goldman Sachs, July 26, 2016. |

18 | “China’s fixed-asset investment hits 17-year low through July.” Nikkei News, August 12, 2016. |

19 | “China retail, industrial production beat expectations in August.” Financial Times, September 12, 2016. |

20 | Mark Magnier. “The Private Pain of China’s Economy.” The Wall Street Journal, August 9, 2016. |

Far from being an engine of economic growth, a typical infrastructure investment has destroyed economic value in China due to poor management of risks that impact cost, time, and benefits.” They also note that “The majority of the investments China has made since 2000 have been debt-fueled,”21 which further compounds the problem.

As we have highlighted in a number of our prior letters, China’s debt levels are of great concern. New data from the Bank for International Settlements (BIS) and Standard & Poor’s (S&P) Global Ratings further reinforce our trepidation. The BIS publishes a quarterly “Credit-to-GDP gap,” which tracks the buildup of excessive credit and is defined as “the difference between the credit-to-GDP ratio and its long-run trend.” It has “been found to be a useful early warning indicator of financial crises.” Typically, a reading over 10% is a cause for concern, indicating an elevated risk to the country’s banking sector. In March, China logged in at 30.1%, the highest level of any nation on record (from 1995).22,23 In addition, S&P reports that China’s total outstanding corporate debt has reached $17.8 trillion, or 171% of GDP. Per the Financial Times, this makes “China’s corporate debt mountain by far the world’s largest in both absolute and relative terms. Not only is the ratio of Chinese company debt-to-GDP more than double that in the U.S. and eurozone, it is projected to grow far more quickly as an increasing number of heavily-indebted corporations ramp up their borrowing simply to repay debts that are coming due. By 2020, China’s outstanding corporate debt will be $32.6 trillion, while its share of global company borrowings will have risen to 43 per cent from 35 per cent last year, according to S&P estimates.”24 Buyers beware. A credit crisis in China would have significant global ramifications.

As we attempt to navigate through some of the potential landmines in the world economy, below are a couple stocks where we see an attractive risk versus reward. In the months ahead, our clients can expect us to remain defensively postured, as we continue to search for high-quality, durable businesses trading at a discount to their intrinsic values.

TE Connectivity Ltd. (TEL)