ANNUAL REPORT

September 30, 2019

| FMI Large Cap Fund | FMI Common Stock Fund | FMI International Fund |

| Investor Class (FMIHX) | Investor Class (FMIMX) | Investor Class (FMIJX) |

| Institutional Class (FMIQX) | Institutional Class (FMIUX) | Institutional Class (FMIYX) |

| |

|

|

|

| FMI Funds, Inc. |

| |

| Advised by Fiduciary Management, Inc. |

| |

| www.fmifunds.com |

| |

| |

| |

| |

| |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.fmifunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-811-5311.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-811-5311 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

FMI Funds, Inc.

TABLE OF CONTENTS

| FMI Large Cap Fund | | |

| Shareholder Letter | | | 1 |

| Management’s Discussion of Fund Performance | | | 7 |

| Schedule of Investments | | | 9 |

| Industry Sectors | | | 11 |

| | | | |

| FMI Common Stock Fund | | | |

| Shareholder Letter | | | 12 |

| Management’s Discussion of Fund Performance | | | 18 |

| Schedule of Investments | | | 20 |

| Industry Sectors | | | 22 |

| | | | |

| FMI International Fund | | | |

| Shareholder Letter | | | 23 |

| Management’s Discussion of Fund Performance | | | 31 |

| Schedule of Investments | | | 34 |

| Schedule of Forward Currency Contracts | | | 38 |

| Industry Sectors | | | 39 |

| | | | |

| Financial Statements | | | |

| Statements of Assets and Liabilities | | | 40 |

| Statements of Operations | | | 41 |

| Statements of Changes in Net Assets | | | 42 |

| Financial Highlights | | | 45 |

| Notes to Financial Statements | | | 51 |

| | | | |

| Report of Independent Registered Public Accounting Firm | | | 61 |

| Expense Example | | | 62 |

| Directors and Officers | | | 64 |

| Liquidity Risk Management Program | | | 66 |

| Disclosure Information | | | 67 |

| Additional Information | | | 70 |

| Tax Notice | | | 70 |

| Notice of Privacy Policy | | | 71 |

| Householding Notice | | | 71 |

FMI

Large Cap

Fund

September 30, 2019

Dear Fellow Shareholders:

The FMI Large Cap Fund gained 0.25%1 in the September quarter compared to 1.70% for the Standard & Poor’s 500 Index (“S&P 500”). Retail Trade, Health Technology (underweight) and Energy Minerals (underweight) drove sector performance on the positive side this quarter. On the flipside, Electronic Technology (underweight), Technology Services and Commercial Services all hurt. Stocks boosting quarterly performance included Dollar General and TJX Companies in the Retail Trade area, Smith & Nephew in the Health Technology sector, and Quest Diagnostics in the Health Services arena. On the negative side, Omnicom hurt the Commercial Services sector, Cerner detracted from Technology Services, and Franklin Resources negatively impacted the Finance sector. Franklin Resources and Bank of New York were replaced in the quarter by Charles Schwab and Northern Trust. The pullback in financials gave us the opportunity to upgrade the quality of this exposure. Despite a few high-flying money-losing tech stocks coming down to earth, investors, year-to-date, continued to favor growth styles over value ones. The difference has been remarkable, with the Russell 1000 Growth Index outperforming the Russell 1000 Value Index by about 550 basis points (5.5 percentage points) year-to-date, and by an astonishing 4,200 basis points (42 percentage points cumulative) over the past five years. The charm of today’s market was captured by Jim Grant, in a recent edition of Grant’s Interest Rate Observer: “The quest for value comes instinctively to shoppers but only cyclically to investors. The same individual who trundles home grocery bags filled with store-brand bargains may think nothing of logging on to Charles Schwab to buy shares of Netflix.”

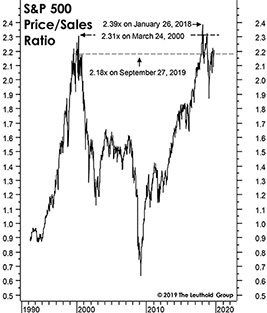

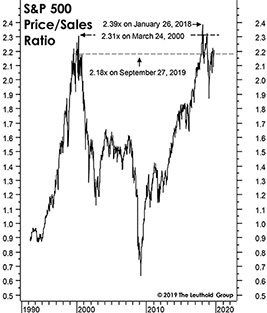

From an investment landscape perspective, not much has changed over the past three months. Stocks remain near the high end of historical valuation ranges. The long list of valuation statistics compiled by The Leuthold Group, which we frequently reference, reveals that the median valuation metric returned to the most expensive decile (10), which is not surprising considering the strong market move this year. To the right is a chart of the cap-weighted average price-to-sales ratio of the S&P 500, showing a ratio that is near the tech bubble highs of early 2000. What seems to get little airtime is the fact that earnings growth has been flat-to-negative this year!

_______________

1 | The FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of 0.25% and 0.30%, respectively, for the third quarter of 2019. |

For most of the year, stocks perceived as safe have done well, despite very high valuations. Deep cyclicals have underperformed, setting up a difficult investor decision: hold on to overvalued but historically defensive names, or take a chance with relatively more attractive deep cyclicals that may already be discounting a recession. We find ourselves leaning toward the latter, but do so with some trepidation. The pullback in the fourth quarter of last year favored traditional defensive names, despite their high valuations. At some point the valuation spread will be too wide, but of course a gnome isn’t going to magically appear to steer our Bloombergs. It is a judgment call whose correctness will only be apparent in the fullness of time. Mergers and acquisitions (M&A) activity continues unabated, apparently driven by a belief that low interest rates are here to stay, along with the idea that this deal is going to work out better than the prior ones! While just a guess, we’d estimate that the typical CEO spends twice as much of their time on deals versus 25 years ago. This would include evaluating, consummating, integrating, fixing or selling prior acquisitions. Return on invested capital (ROIC) is hardly more than a talking point for many CEOs. Instead, “proforma adjusted EBITDA2” three years in the future, which typically depends on speculative growth assumptions, is seemingly what drives many transactions today. We admit to some cynicism regarding today’s deal culture, but numerous academic and consultancy studies show that most acquisitions are value-destructive to the buyer.

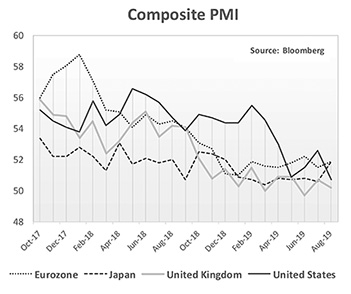

Despite significant weakening in many Purchasing Managers Index (PMI) figures and other recession indicators, economic growth has continued at around a 2% rate (the Atlanta Federal Reserve’s GDPNow third quarter estimate is 1.9% as of September 25th). We have been stuck in a low-growth world for nearly twelve years (U.S. real GDP growth since the end of 2007 has averaged just 1.6%), and continued tepid growth seems to be the consensus opinion for the future. We are more optimistic about future growth, as long as people begin to realize that rate suppression, high government borrowing, and unbridled M&A are not pathways to prosperity. Academics and economists have promulgated these policies for a very long time with the same results (low growth and dangerously levered balance sheets). As Friedrich Hegel famously said, “The only thing we learn from history is that we learn nothing from history.”

Growth-friendly conditions, in our opinion, involve having a normal risk premium reflected in interest rates, engendering organic rather than inorganic investment, having free and fair trade, growing our population and reducing government borrowing, leaving more money for private investment. Profit-seeking enterprises are almost always better asset allocators than governments, although in recent years corporations have been levering up to do deals and to buy back stock. The Federal Reserve reports that corporate debt has grown by approximately $1.2 trillion in the last two years alone and now is nearly $10 trillion, which is a record high percentage of GDP (47%), according to The Wall Street Journal. Ginning up debt to such a high level doesn’t have a great historical track record of success. Morgan Stanley recently documented a notable drop in the price of loans within collateralized loan obligations. While corporate credit problems remain mostly anecdotal at this point, we will be closely monitoring the situation.

_______________

2 | Earnings before interest, taxes, depreciation and amortization. |

Before our customary discussion of two portfolio holdings, we want to briefly review our background and philosophy as advisor to the FMI Large Cap Fund. Fiduciary Management, Inc. (FMI) is independently owned and has managed money for over 39 years in the same disciplined, fundamentally-driven and value-oriented way. FMI operates from a single office in Milwaukee, Wisconsin, away from the bustle and groupthink sometimes prevalent in big cities. We are not a “product shop”; we have one investment team, one philosophy and one process. We do not manage any hedge funds. We’re not like many large investment managers who constantly open new funds and strategies, and close underperforming ones. Approximately 5,300 mutual funds have been closed or merged since 2009; it certainly makes peer group statistics suspect! Instead, we stick to our knitting, and our team invests right alongside our shareholders and clients. FMI has a focused approach to investing, with high active share. We are the antithesis of an index fund. While not popular today, this approach has been both a winning one, and a less volatile one, over the long run. As the small print always says, past results may not repeat but rest assured, we have not changed our stripes.

FMI’s investment philosophy can be summarized as follows:

| • | We seek undervalued stocks. That typically occurs when there is a cloud over the business. |

| | |

| • | We make our research count by focusing on a limited number of companies for the portfolio. |

| | |

| • | We invest in businesses that are likely to earn above their cost of capital over the business cycle. |

| | |

| • | We invest in management teams who we believe will act like shareholders. |

| | |

| • | We are highly attuned to avoiding value traps, i.e., secularly challenged businesses. |

| | |

| • | We want to minimize financial risk by sticking to companies with good balance sheets. |

| | |

| • | We focus on the downside risk before the upside opportunity. |

In addition, all of our investments have to pass a common-sense test. Recall, last quarter we expressed astonishment with a number of so-called unicorns, including WeWork (recently changed to The We Company). It had a valuation of $47 billion. In three short months that value has collapsed to an estimated $10 billion and the initial public offering is currently on ice. As we said in the June letter, the business has few barriers to entry and operates what is essentially a mismatched loan book. Corporate governance was a disaster, although the board is now scrambling to improve it. The We Company cleverly tried to pass themselves off as a technology company and it worked for a while, but to us, it never passed the common-sense test. Similarly, Uber and Lyft also seem to fail a common-sense test. Their respective business models depend on drivers underestimating the true cost of operating automobiles. These companies can’t charge enough to make money and grow rapidly. They whipped investors into a frenzy by underpricing their service to drive rapid top line growth. Economies of scale have yet to surface, as evidenced by the escalating losses, even as the revenues grow. Ride-sharing economics will be further damaged if regulatory bodies treat independent drivers as employees. Perhaps as a premium service they will thrive; meanwhile, they are eating capital like crazy. These kinds of stories play poorly when markets are risk-averse. The common-sense litmus test applies to all our investments, as well as company strategies and acquisitions.

Today it is more important than ever to have an experienced and steady team behind your investments. Using the Dow Jones Industrial Average as a proxy, the current cycle (through September 30th) has returned approximately three times (438%) the bull market average since 1900 (145%) and has also lasted three times longer (roughly 126 months versus 42 months). Characterizing this phase of the market cycle as long in the tooth would be an understatement. Anecdotally, it seems many of today’s investors implicitly believe at least two things: one, that

stock market returns will continue to be much higher than underlying economic or earnings growth; and two, that investing in index funds is a risk-mitigating maneuver. We simply don’t believe the first, since there is little historical evidence of it over long periods of time, and regarding the second, we recognize that fund flows have driven outperformance in many index products, but those who think an index fund is less risky than a carefully-constructed and risk-sensitive approach may be in for a rude awakening.

Below we discuss two portfolio holdings.

Northern Trust Corp. (NTRS)

(Analyst: Dain Tofson)

Description

Northern Trust is a provider of asset servicing, wealth management, investment management, and banking solutions. The company reports three segments: Corporate & Institutional Services (C&IS); Wealth Management; and Treasury and Other. C&IS provides services such as custody, fund administration, investment operations outsourcing, investment management and securities lending, to pension funds, insurance companies, foundations, fund managers, and other institutional investors. Wealth Management provides such things as advisory services, investment management and custody, to high-net-worth individuals and family offices. Other includes corporate items not allocated to C&IS and Wealth Management. In 2018, net income was split, 58% C&IS, 51% Wealth Management, and -9% Other.

Good Business

| • | Organic, fee-based revenue growth has averaged 4-5% over the last 15-20 years. |

| | |

| • | Return on equity was 16.2% last year and exceeds the cost of capital through a cycle. |

| | |

| • | The balance sheet is strong with relatively low-risk earning assets, largely a deposit-based funding structure, and industry-leading capital ratios. |

| | |

| • | The company has paid a dividend for over 120 consecutive years and was one of only two large banks that didn’t cut their dividend during the global financial crisis. |

| | |

| • | We believe the company is best-in-class, as highlighted by recent accolades including Private Equity Fund Administrator of the Year, and Outstanding Fund Technology Innovation Award in C&IS; and Best Private Bank for Family Offices and Technology in Wealth Management. |

Valuation

| • | The company trades at 14.3 times 2019 earnings per share (EPS), versus its 10-year average of greater than 17.0 times. |

| | |

| • | Historically, the company has traded at a premium to the S&P 500 on a price-to-earnings (P/E) basis. Today, the company trades at a discount to the S&P 500 long-term average. |

| | |

| • | The dividend yield plus the company’s gross share buyback authorization combine to produce a shareholder yield of almost 10%. |

| | |

| • | The intrinsic value of the business is greater than the current equity value when you consider private market transactions, particularly in the Wealth Management segment. |

Management

| • | The management team led by Michael O’Grady is shareholder-oriented with a focus on achieving revenue growth, improving productivity, and increasing shareholder returns. |

| | |

| • | The company is managed for the long term; it has had only ten chief executive officers since 1889, and the founding Smith family continues to own shares and sit on the board. |

| | |

| • | The company was largely built through organic investment, and capital allocation priorities remain sensible today, with a focus on maintaining superior capital ratios. |

Investment Thesis

Northern Trust is a high-quality compounder with an attractive business mix that is trading at a discount to its history, the market, and intrinsic value largely due to macro concerns, most notably the challenging interest rate environment. While we acknowledge these concerns, we believe that the company’s strong value proposition – outstanding customer service and financial stability – and shareholder-oriented management team, will enable it to navigate this more challenging environment and ultimately create shareholder value over time.

HD Supply Holdings Inc. (HDS)

(Analyst: Jordan Teschendorf)

Description

Headquartered in Atlanta, Georgia, HD Supply is one of the largest industrial distributors in North America, with leading market positions in two distribution businesses: Facilities Maintenance, Repair & Operations (51% of fiscal 2018 sales, and 66% of EBIT3) and Specialty Construction & Industrial (49%, and 34%). The company serves 500,000 professional customers through a network of approximately 310 locations in the U.S. & Canada (44 distribution centers and 266 branches) and has 11,500 employees. Its sales exposure to facilities maintenance, restoration and overhaul, non-residential construction, and residential construction markets is approximately 57%, 32%, and 11%, respectively.

Good Business

| • | HD Supply has become a more focused and disciplined entity since it came public in June 2013, selling non-core businesses in power, electrical, water, and hardware markets, while paying down a significant amount of debt. This has significantly raised the company’s full cycle growth rate, margins, and ROIC. |

| | |

| • | Adjusting for the sale of non-core assets, the company has grown sales at nearly a 10% compound annual growth rate (CAGR) over the last eight years, outperforming its end markets by an estimated 5-7% per annum on average. Further, operating margins have improved five percentage points over the last five years to 12.0%, and return on tangible capital has more than tripled to 39%. |

| | |

| • | HD Supply occupies the number one market position in each of the specialized distribution markets in which it competes. National scale, local density, and knowledgeable associates provide it with competitive advantages in terms of purchasing, fulfillment, and contractor relationships vs. generally fragmented competition. |

| | |

| • | The company’s largest business, Facilities Maintenance, has proven to be defensive in down markets, growing 5% organically in 2008 while declining a modest 3% in 2009. Most sales are driven by replacement demand for products that break and need to be fixed quickly, with customers often requiring products same-day or next-day. |

| | |

| • | The most important volume driver is the installed base of occupied renter housing units, which has grown at a 2% CAGR over the last decade, and the business is also able to pass through cost inflation over long time periods. |

| | |

| • | Across both businesses, we expect the majority of future growth to be achieved through deeper penetration of existing accounts as the company widens its service advantage and adds more value to clients over time. |

| | |

| • | HD Supply carries a reasonable amount of net debt (2.4 times EBITDA) and generates very healthy free cash flow. |

_______________

3 | Earnings before interest and taxes. |

Valuation

| • | The company’s forward P/E multiple is at a 13% discount to its long-term average of 13.7 times. |

| | |

| • | The shares trade at a significant discount to leading industrial and specialty distribution peers. Ascribing peer multiples to the company’s two businesses yields an upside of around 26%. |

| | |

| • | The company should generate approximately $500 million of free cash flow this year, which equates to a 7.5% yield for shareowners. |

Management

| • | Joseph DeAngelo has been Chief Executive Officer and Chairman since January 2005 and March 2015, respectively. He also served as Executive Vice President and Chief Operating Officer of The Home Depot in 2007, prior to its sale of HD Supply to private equity sponsors. |

| | |

| • | Evan Levitt has served as Senior Vice President and Chief Financial Officer since December 2013. Prior to his appointment as CFO, he served as VP and Corporate Controller since 2007, when he joined the company from The Home Depot. |

| | |

| • | Under this leadership team, the company has pruned its portfolio of businesses and transformed into a faster-growing, more profitable and higher-returning enterprise. Net disposal proceeds of $3.15 billion since 2013, along with strong growth in the core businesses, have doubled return on total assets and tripled return on tangible capital. |

Investment Thesis

HD Supply Holdings is a high quality, durable business that occupies the leading market position in each of the specialized and growing markets in which it competes. Recent concerns, including slower end market growth, unfavorable weather, tariffs, and a temporary service interruption at one of its distribution centers, have provided an opportunity to invest at an attractive valuation. Through the cycle, we expect the business to generate mid-single-digit organic sales and double-digit organic EPS growth, which compare conservatively to the company’s historical performance. An increasingly focused, defensive, and high ROIC business mix, combined with a strengthened balance sheet, have simplified the investment case and should lead to a higher earnings multiple over time.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2019, the FMI Large Cap Fund Investor Class (FMIHX, or the “Fund”) had a total return of 5.72%.* The benchmark Standard & Poor’s 500 Index (“S&P 500”) returned 4.25% in the same period. Sectors that aided relative performance included Retail Trade, Health Technology and Energy Minerals. Dollar General drove the performance within the Retail Trade sector, based on the continuation of solid same store sales and the perception that the earnings stream is defensive in nature. Smith & Nephew strongly appreciated during the year because of solid earnings results and a favorable industry view. Our lack of investments in Energy Minerals also helped during the year as oil-related stocks declined. On the negative side of sector performance, Communications, Industrial Services and Finance all detracted. The Fund’s cash level also hurt results. Within the Communications sector, CenturyLink was the sole detractor and declined significantly during the year due to disappointing sales and earnings growth. The lines of business we thought would markedly grow only advanced modestly and products we thought would decline slowly fell more rapidly. Not seeing a likely turnaround in these results, mostly due to increased competition, moved us to sell CenturyLink. In the Industrial Services arena, Schlumberger fell substantially in the fiscal year, mirroring most oil-related stocks. Rapid consolidation in the oil service area gives us confidence that Schlumberger’s competitive position is improving. In the Finance sector, Bank of New York declined modestly. The company’s inability to address its growth and margin challenges was behind the decision to sell the stock.

Other stocks that helped performance included Dollar Tree, Nestlé and PepsiCo. These stocks all benefitted from the market’s desire to own defensive companies. UnitedHealth Group, Nutrien and Berkshire Hathaway all detracted from relative results. UnitedHealth Group suffered from political talk about government taking over the provisioning of health care services, Nutrien was a victim to lower farm incomes and extremely wet weather, and Berkshire Hathaway was hurt by poor results within a few large portfolio holdings.

Some new additions to the Fund over the past twelve months include HD Supply, Booking Holdings, Charles Schwab, PPG Industries and Northern Trust. Stocks sold during the year include CenturyLink, Oracle, Franklin Resources and Bank of New York. As of September 30, 2019, the Fund was overweight in Producer Manufacturing, Health Services and Retail Trade, and underweight in Health Technology, Utilities and Energy Minerals.

Solid performance across several defensive areas, including Consumer Non-Durables, Consumer Services and Commercial Services, characterized the S&P 500 over the past year. Sectors and stocks perceived to be deep cyclicals performed poorly on a relative basis. So-called growth stocks were very strong in fiscal 2018 yet cooled off slightly in fiscal 2019. Passive investment strategies continued to see heavy inflows of money, at the expense of active strategies. Many stocks appear overvalued and the S&P 500, on most valuation measures, is even more expensive than it was in the late 1990s. The growing use of “adjusted earnings,” rather than GAAP earnings, by Wall Street and corporate management gives a misleading price-to-earnings ratio. The current bull market is over ten years old and is one of the longest on record.

The Federal Reserve reversed course and began lowering interest rates in July. The price of money remains unusually cheap by historical standards. Economic growth has weakened over the past twelve months. Trade activity has slowed in response to tariff policies and lower investment. Debt at both the corporate and government levels has grown substantially. Total government debt relative to U.S. GDP is near 100% and the deficit to GDP is approximately 4%. Corporate leverage, by some measures, is at a 50-year high. The unemployment rate remains low, but the labor force participation rate continues to be depressed. Wage rates increased during the fiscal year. Domestic and international political risks remain elevated.

While conventional wisdom is that stocks will continue to rise because interest rates and inflation are low, we believe extraordinarily high valuations and spotty earnings are unappreciated risks. We remain cautious on the stock market’s prospects over the near term. The Fund continues to sell at a large discount to the S&P 500 on most valuation measures.

_______________

| * | The FMI Large Cap Fund Institutional Class (FMIQX) returned 5.89% for the fiscal year ended 9/30/19. |

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

(Continued)

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI LARGE CAP FUND – INVESTOR CLASS AND STANDARD & POOR’S 500 INDEX(1)

AVERAGE ANNUALIZED TOTAL RETURN

| | | | | | Inception |

| | | | | | through |

| | Inception Date | 1-Year | 5-Year | 10-Year | 9/30/2019 |

| FMI Large Cap Fund – Investor Class | 12/31/01 | 5.72% | 9.43% | 11.81% | 9.08% |

| FMI Large Cap Fund – Institutional Class | 10/31/16 | 5.89% | N/A | N/A | 13.40% |

Standard & Poor’s 500 Index(1)* | | 4.25% | 10.84% | 13.24% | 7.67% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

| * | The benchmark since inception returns are calculated since inception of the Investor Class, December 31, 2001 to September 30, 2019. |

An investment cannot be made directly into an index.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS

September 30, 2019

| Shares | | | | Cost | | | Value | |

| |

| COMMON STOCKS — 92.9% (a) |

| | | | | |

COMMERCIAL SERVICES SECTOR — 3.4% | | | | |

| | | Advertising/Marketing Services — 3.4% | | | | | | |

| | 2,190,000 | | Omnicom Group Inc. | | $ | 152,205,917 | | | $ | 171,477,000 | |

| | | | | | |

CONSUMER DURABLES SECTOR — 1.0% | | | | | |

| | | | Tools & Hardware — 1.0% | | | | | | | | |

| | 345,000 | | Stanley Black & Decker Inc. | | | 33,110,087 | | | | 49,821,450 | |

| | | | | | |

CONSUMER NON-DURABLES SECTOR — 9.8% | | | | | |

| | | | Beverages: Non-Alcoholic — 3.2% | | | | | | | | |

| | 1,170,000 | | PepsiCo Inc. | | | 117,186,507 | | | | 160,407,000 | |

| | | | Food: Major Diversified — 3.4% | | | | | | | | |

| | 1,575,000 | | Nestlé S.A. — SP-ADR | | | 66,118,744 | | | | 170,730,000 | |

| | | | Household/Personal Care — 3.2% | | | | | | | | |

| | 2,700,000 | | Unilever PLC — SP-ADR | | | 115,147,008 | | | | 162,270,000 | |

| | | | | | |

CONSUMER SERVICES SECTOR — 6.1% | | | | | |

| | | | Broadcasting — 2.0% | | | | | | | | |

| | 1,550,000 | | Fox Corp. — Cl A | | | 62,268,615 | | | | 48,879,250 | |

| | 1,658,333 | | Fox Corp. — Cl B | | | 66,706,445 | | | | 52,303,823 | |

| | | | | | | 128,975,060 | | | | 101,183,073 | |

| | | | Other Consumer Services — 4.1% | | | | | | | | |

| | 33,722 | | Booking Holdings Inc.* | | | 59,237,769 | | | | 66,183,134 | |

| | 3,600,000 | | eBay Inc. | | | 72,481,075 | | | | 140,328,000 | |

| | | | | | | 131,718,844 | | | | 206,511,134 | |

| | | | | | |

DISTRIBUTION SERVICES SECTOR — 2.4% | | | | | |

| | | | Wholesale Distributors — 2.4% | | | | | | | | |

| | 3,030,000 | | HD Supply Holdings Inc.* | | | 123,289,972 | | | | 118,700,250 | |

| | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 2.4% | | | | | |

| | | | Electronic Components — 2.4% | | | | | | | | |

| | 1,275,000 | | TE Connectivity Ltd. | | | 30,929,161 | | | | 118,804,500 | |

| | | | | | |

FINANCE SECTOR — 16.4% | | | | | |

| | | | Investment Banks/Brokers — 1.6% | | | | | | | | |

| | 1,900,000 | | The Charles Schwab Corp. | | | 70,296,344 | | | | 79,477,000 | |

| | | | Major Banks — 4.3% | | | | | | | | |

| | 1,830,000 | | JPMorgan Chase & Co. | | | 117,795,552 | | | | 215,372,700 | |

| | | | Multi-Line Insurance — 5.2% | | | | | | | | |

| | 1,240,000 | | Berkshire Hathaway Inc. — Cl B* | | | 72,463,950 | | | | 257,944,800 | |

| | | | Property/Casualty Insurance — 3.7% | | | | | | | | |

| | 1,160,000 | | Chubb Ltd. | | | 157,826,339 | | | | 187,270,400 | |

| | | | Regional Banks — 1.6% | | | | | | | | |

| | 845,000 | | Northern Trust Corp. | | | 74,045,622 | | | | 78,855,400 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2019

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 92.9% (a) (Continued) | |

| | |

HEALTH SERVICES SECTOR — 8.2% | |

| | | Health Industry Services — 4.1% | | | | | | |

| | 1,895,000 | | Quest Diagnostics Inc. | | $ | 189,042,835 | | | $ | 202,821,850 | |

| | | | Managed Health Care — 4.1% | | | | | | | | |

| | 940,000 | | UnitedHealth Group Inc. | | | 73,666,875 | | | | 204,280,800 | |

| | |

HEALTH TECHNOLOGY SECTOR — 3.3% | |

| | | | Medical Specialties — 3.3% | | | | | | | | |

| | 3,390,000 | | Smith & Nephew PLC — SP-ADR | | | 125,646,394 | | | | 163,160,700 | |

| | |

INDUSTRIAL SERVICES SECTOR — 2.5% | |

| | | | Oilfield Services/Equipment — 2.5% | | | | | | | | |

| | 3,610,000 | | Schlumberger Ltd. | | | 153,687,691 | | | | 123,353,700 | |

| | |

PROCESS INDUSTRIES SECTOR — 4.5% | |

| | | | Chemicals: Agricultural — 2.1% | | | | | | | | |

| | 2,100,000 | | Nutrien Ltd. | | | 84,540,560 | | | | 104,748,000 | |

| | | | Industrial Specialties — 2.4% | | | | | | | | |

| | 1,010,000 | | PPG Industries Inc. | | | 103,156,371 | | | | 119,695,100 | |

| | |

PRODUCER MANUFACTURING SECTOR — 10.9% | |

| | | | Building Products — 4.3% | | | | | | | | |

| | 5,165,000 | | Masco Corp. | | | 185,816,365 | | | | 215,277,200 | |

| | | | Industrial Conglomerates — 4.2% | | | | | | | | |

| | 1,250,000 | | Honeywell International Inc. | | | 112,218,385 | | | | 211,500,000 | |

| | | | Trucks/Construction/Farm Machinery — 2.4% | | | | | | | | |

| | 1,750,000 | | PACCAR Inc. | | | 71,935,014 | | | | 122,517,500 | |

| | |

RETAIL TRADE SECTOR — 12.4% | |

| | | | Apparel/Footwear Retail — 3.2% | | | | | | | | |

| | 2,825,000 | | The TJX Companies Inc. | | | 96,956,729 | | | | 157,465,500 | |

| | | | Discount Stores — 9.2% | | | | | | | | |

| | 1,560,000 | | Dollar General Corp. | | | 113,357,519 | | | | 247,946,400 | |

| | 1,830,000 | | Dollar Tree Inc.* | | | 165,643,321 | | | | 208,912,800 | |

| | | | | | | 279,000,840 | | | | 456,859,200 | |

TECHNOLOGY SERVICES SECTOR — 5.7% | |

| | | | Information Technology Services — 5.7% | | | | | | | | |

| | 855,000 | | Accenture PLC | | | 23,914,836 | | | | 164,459,250 | |

| | 1,760,000 | | Cerner Corp. | | | 89,744,996 | | | | 119,979,200 | |

| | | | | | | 113,659,832 | | | | 284,438,450 | |

| | |

TRANSPORTATION SECTOR — 3.9% | |

| | | | Air Freight/Couriers — 2.7% | | | | | | | | |

| | 1,790,000 | | Expeditors International of Washington Inc. | | | 66,048,514 | | | | 132,979,100 | |

| | | | Airlines — 1.2% | | | | | | | | |

| | 1,100,000 | | Southwest Airlines Co. | | | 60,701,030 | | | | 59,411,000 | |

| | | | Total common stocks | | | 3,107,186,542 | | | | 4,637,332,807 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2019

| Principal Amount | | | | Cost | | | Value | |

| | |

| SHORT-TERM INVESTMENTS — 7.0% (a) | |

| | | Bank Deposit Account — 7.0% | | | | | | |

| $ | 349,839,754 | | U.S. Bank N.A., 1.91%^ | | $ | 349,839,754 | | | $ | 349,839,754 | |

| �� | | | Total short-term investments | | | 349,839,754 | | | | 349,839,754 | |

| | | | Total investments — 99.9% | | $ | 3,457,026,296 | | | | 4,987,172,561 | |

| | | | Other assets, less liabilities — 0.1% (a) | | | | | | | 2,728,483 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 4,989,901,044 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of September 30, 2019. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

INDUSTRY SECTORS as a percentage of net assetsas of September 30, 2019 (Unaudited)

FMI

Common Stock

Fund

September 30, 2019

Dear Fellow Shareholders:

The FMI Common Stock Fund retreated 1.01%1 in the September quarter compared to a decline of 2.40% for the Russell 2000 Index. Health Technology (underweight), Producer Manufacturing, and Energy Minerals (underweight) drove sector performance on the positive side this quarter. On the flipside, Electronic Technology (underweight), Commercial Services and Finance all hurt. Stocks boosting quarterly performance included W.R. Berkley, Carlisle Companies and Valmont Industries. Cars.com, ManpowerGroup and Phibro Animal Health detracted from performance in the period. Two stocks were sold in the quarter: Cars.com for fundamental reasons, and Cable One due to valuation. The Russell 2000 Value Index outperformed the Russell 2000 Growth Index in the quarter, but still lagged year-to-date and over a 5-year perspective. Value-oriented investors have been on the outside looking in for quite a while, but we are optimistic that this will change. The charm of today’s market was captured by Jim Grant, in a recent edition of Grant’s Interest Rate Observer: “The quest for value comes instinctively to shoppers but only cyclically to investors. The same individual who trundles home grocery bags filled with store-brand bargains may think nothing of logging on to Charles Schwab to buy shares of Netflix.”

From an investment landscape perspective, not much has changed over the past three months. Stocks remain near the high end of historical valuation ranges. The long list of valuation statistics compiled by The Leuthold Group, which we frequently reference, reveals that the median valuation metric returned to the most expensive decile (10), which is not surprising considering the strong market move this year. To the right is a chart of the cap-weighted average price-to-sales ratio of the S&P 500, showing a ratio that is near the tech bubble highs of early 2000. What seems to get little airtime is the fact that earnings growth has been flat-to-negative this year!

For most of the year, stocks perceived as safe have done well, despite very high valuations. Deep cyclicals have underperformed, setting up a difficult investor decision: hold on to overvalued but historically defensive names, or take a chance with relatively more attractive deep cyclicals that may already be discounting a recession. We find ourselves leaning toward the latter, but do so with some trepidation. The pullback in the fourth quarter of last year favored traditional defensive names,

_______________

1 | The FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) had a return of -1.01% and -0.97%, respectively, for the third quarter of 2019. |

despite their high valuations. At some point the valuation spread will be too wide, but of course a gnome isn’t going to magically appear to steer our Bloombergs. It is a judgment call whose correctness will only be apparent in the fullness of time. Mergers and acquisitions (M&A) activity continues unabated, apparently driven by a belief that low interest rates are here to stay, along with the idea that this deal is going to work out better than the prior ones! While just a guess, we’d estimate that the typical CEO spends twice as much of their time on deals versus 25 years ago. This would include evaluating, consummating, integrating, fixing or selling prior acquisitions. Return on invested capital (ROIC) is hardly more than a talking point for many CEOs. Instead, “proforma adjusted EBITDA2” three years in the future, which typically depends on speculative growth assumptions, is seemingly what drives many transactions today. We admit to some cynicism regarding today’s deal culture, but numerous academic and consultancy studies show that most acquisitions are value-destructive to the buyer.

Despite significant weakening in many Purchasing Managers Index (PMI) figures and other recession indicators, economic growth has continued at around a 2% rate (the Atlanta Fed’s GDPNow third quarter estimate is 1.9% as of September 25th). We have been stuck in a low-growth world for nearly twelve years (U.S. real GDP growth since the end of 2007 has averaged just 1.6%), and continued tepid growth seems to be the consensus opinion for the future. We are more optimistic about future growth, as long as people begin to realize that rate suppression, high government borrowing, and unbridled M&A are not pathways to prosperity. Academics and economists have promulgated these policies for a very long time with the same results (low growth and dangerously levered balance sheets). As Friedrich Hegel famously said, “The only thing we learn from history is that we learn nothing from history.”

Growth-friendly conditions, in our opinion, involve having a normal risk premium reflected in interest rates, engendering organic rather than inorganic investment, having free and fair trade, growing our population and reducing government borrowing, leaving more money for private investment. Profit-seeking enterprises are almost always better asset allocators than governments, although in recent years corporations have been levering up to do deals and to buy back stock. The Federal Reserve reports that corporate debt has grown by approximately $1.2 trillion in the last two years alone and now is nearly $10 trillion, which is a record high percentage of GDP (47%), according to The Wall Street Journal. Ginning up debt to such a high level doesn’t have a great historical track record of success. Morgan Stanley recently documented a notable drop in the price of loans within collateralized loan obligations. While corporate credit problems remain mostly anecdotal at this point, we will be closely monitoring the situation.

Before our customary discussion of two portfolio holdings, we want to briefly review our background and philosophy as advisor to the FMI Common Stock Fund. Fiduciary Management, Inc. (FMI) is independently owned and has managed money for over 39 years in the same disciplined, fundamentally-driven and value-oriented way. FMI operates from a single office in

_______________

2 | Earnings before interest, taxes, depreciation and amortization. |

Milwaukee, Wisconsin, away from the bustle and groupthink sometimes prevalent in big cities. We are not a “product shop”; we have one investment team, one philosophy and one process. We do not manage any hedge funds. We’re not like many large investment managers who constantly open new funds and strategies, and close underperforming ones. Approximately 5,300 mutual funds have been closed or merged since 2009; it certainly makes peer group statistics suspect! Instead, we stick to our knitting, and our team invests right alongside our shareholders and clients. FMI has a focused approach to investing, with high active share. We are the antithesis of an index fund. While not popular today, this approach has been both a winning one, and a less volatile one, over the long run. As the small print always says, past results may not repeat but rest assured, we have not changed our stripes.

FMI’s investment philosophy can be summarized as follows:

| • | We seek undervalued stocks. That typically occurs when there is a cloud over the business. |

| | |

| • | We make our research count by focusing on a limited number of companies for the portfolio. |

| | |

| • | We invest in businesses that are likely to earn above their cost of capital over the business cycle. |

| | |

| • | We invest in management teams who we believe will act like shareholders. |

| | |

| • | We are highly attuned to avoiding value traps, i.e., secularly challenged businesses. |

| | |

| • | We want to minimize financial risk by sticking to companies with good balance sheets. |

| | |

| • | We focus on the downside risk before the upside opportunity. |

In addition, all of our investments have to pass a common-sense test. Recall, last quarter we expressed astonishment with a number of so-called unicorns, including WeWork (recently changed to The We Company). It had a valuation of $47 billion. In three short months that value has collapsed to an estimated $10 billion and the initial public offering is currently on ice. As we said in the June letter, the business has few barriers to entry and operates what is essentially a mismatched loan book. Corporate governance was a disaster, although the board is now scrambling to improve it. The We Company cleverly tried to pass themselves off as a technology company and it worked for a while, but to us, it never passed the common-sense test. Similarly, Uber and Lyft also seem to fail a common-sense test. Their respective business models depend on drivers underestimating the true cost of operating automobiles. These companies can’t charge enough to make money and grow rapidly. They whipped investors into a frenzy by underpricing their service to drive rapid top line growth. Economies of scale have yet to surface, as evidenced by the escalating losses, even as the revenues grow. Ride-sharing economics will be further damaged if regulatory bodies treat independent drivers as employees. Perhaps as a premium service they will thrive; meanwhile, they are eating capital like crazy. These kinds of stories play poorly when markets are risk-averse. The common-sense litmus test applies to all our investments, as well as company strategies and acquisitions.

Today it is more important than ever to have an experienced and steady team behind your investments. Using the Dow Jones Industrial Average as a proxy, the current cycle (through September 30th) has returned approximately three times (438%) the bull market average since 1900 (145%) and has also lasted three times longer (roughly 126 months versus 42 months). Characterizing this phase of the market cycle as long in the tooth would be an understatement. Anecdotally, it seems many of today’s investors implicitly believe at least two things: one, that stock market returns will continue to be much higher than underlying economic or earnings growth; and two, that investing in index funds is a risk-mitigating maneuver. We simply don’t believe the first, since there is little historical evidence of it over long periods of time, and regarding the second, we recognize that fund flows have driven outperformance in many index products, but those who think an index fund is less risky than a carefully-constructed and risk-sensitive approach may be in for a rude awakening.

Below we discuss two portfolio holdings.

Kennedy-Wilson Holdings Inc. (KW)

(Analyst: Jordan Teschendorf)

Description

Kennedy-Wilson is an integrated real estate investment company employing 336 professionals and operating out of 16 global offices. Its core business is sourcing, acquiring, managing, and disposing of real estate properties and related investments. The company invests predominantly in multifamily and commercial properties, as well as loans backed by real estate, with a focus on the Western U.S., the UK and Ireland. At the end of June 2019, the carrying value of Kennedy-Wilson’s real estate was $5.8 billion with the portfolio generating $410 million of annual estimated net operating income (NOI) split as follows: Western U.S. (48%), UK (24%), Ireland (23%), and Italy & Spain (5%).

Good Business

| • | Kennedy-Wilson has generated impressive returns from its real estate investments, realizing over a 25% gross internal rate of return on its U.S. investments since 1999. |

| | |

| • | Many of the company’s investment properties are located in markets with above-average employment growth rates and prospects (i.e., the Pacific Northwest) — a dynamic we expect to benefit the rental rate growth. |

| | |

| • | The company’s integrated acquisition, asset management, and disposal functions generate superior investment performance relative to public real estate investment trusts (REITs), evident in its multifamily same property revenue and NOI growth. |

| | |

| • | The assets are simple to understand and most of them generate predictable cash flow. |

| | |

| • | Kennedy-Wilson continues to increase its recurring revenue through the growth of third-party assets it manages, and through its ownership interest in expanding property level income. |

| | |

| • | The balance sheet is in good health, with $854 million of liquidity ($404 million of cash), a weighted average interest rate on debt of 3.9%, and a weighted average maturity of 5.3 years. 94% of total debt has a fixed rate, or is hedged against rising interest rates. |

Valuation

| • | The stock trades at a meaningful discount to our net asset value per share (NAV) estimate, a value which assigns zero value to the company’s development and re-development projects (which we believe could conservatively contribute an additional 40% in NAV through 2023). |

| | |

| • | The company is underfollowed by the sell-side, contributing to its undervaluation. |

| | |

| • | Kennedy-Wilson pays an annual dividend yielding 3.8%. |

Management

| • | Management and directors own nearly 15% of the company, aligning their interests with ours. |

| | |

| • | William McMorrow has been Chairman and Chief Executive Officer since 1988 and as of the latest proxy, owned 9.3% (13.2 million shares) of the company. |

| | |

| • | Mary Ricks was named President in August 2018. She served as CEO of Kennedy Wilson Europe starting in 2011, and has been an important contributor to the International investment platform. She’s been with the organization since 1990 and owns over 2.1 million shares. |

Investment Thesis

Kennedy-Wilson has produced an impressive track record of investment returns across multiple geographies and investment environments, often providing liquidity when it has been scarce. In the current environment, the company has been a net seller of assets, preferring to deploy capital to internal NOI growth initiatives and opportunistic share repurchases. As a result of significant development and redevelopment projects underway, along with its strong record of investment performance and capital raising, the company should be able to capitalize on market volatility and continue to grow its recurring property NOI and services cash flow. We feel that the downside is well-protected by the stock’s discount to NAV and the company’s strong internal growth prospects.

Trinity Industries Inc. (TRN)

(Analyst: Andy Ramer)

Description

Trinity Industries is a leading provider of rail transportation products and services in North America, servicing its customers through an integrated rail platform. Trinity’s rail platform combines railcar leasing and management services (about 80% of 2018 economic profit) and railcar manufacturing (about 20%) to provide customers with a single source for comprehensive rail transportation solutions.

Good Business

| • | Trinity has leading positions in the railcar market, which plays a key role in the economy as 25% of U.S. freight ton miles is moved via rail (essential-use equipment). The company is the largest manufacturer (40% share) and fifth largest lessor (12% share) of railcars in North America. |

| | |

| • | Although railcar manufacturing is cyclical, the operations generate substantial earnings over a business cycle. The company has also tripled the size of its high-quality portfolio of leased railcars during the past decade, which has built a base of stable, recurring revenues through long-term leases (high utilization throughout rail cycles). |

| | |

| • | Trinity aspires to mid-teens return on equity for the leasing business, and a similar return on capital for the manufacturing business over the railcar cycle. |

| | |

| • | The company is conservatively financed. The balance sheet is under-levered versus peers and the leasing business is capitalized through non-recourse debt. |

Valuation

| • | At the current share price, we are getting the leasing business for approximately book value, and the manufacturing business for free. Both the public and private markets are valuing railcar leasing businesses at 1.5-2.0 times book value. Trinity’s railcar manufacturing business should generate north of $250 million in mid-cycle EBITDA. |

| | |

| • | At 1.5 times book value and 10 times mid-cycle EBITDA, the stock would be valued at nearly two times the current share price. |

Management

| • | With the recent corporate transformation (non-rail manufacturing businesses were spun-off in November 2018) and ValueAct partner Brandon Boze joining the board, the company is working to unlock significant earnings potential for the business. After having recently bought additional shares on the open market, ValueAct is Trinity’s largest shareholder, with an ownership stake of 17.6%. |

| | |

| • | The company has taken advantage of the attractive valuation and aggressively repurchased stock. The share count is down in excess of 12% year over year, and Trinity is also returning capital to shareholders though an upsized dividend that currently yields 3.5%. |

Investment Thesis

The market is undervaluing Trinity due to fears about the economy and because its integrated leasing and manufacturing business model is perceived to be complex; however, the company is taking steps to improve the investment community’s understanding of the business. The combination of operational improvement potential, organic and inorganic growth opportunities for the fleet, and improving fundamentals in rail equipment demand, sets up well for both near- and long-term value creation. Railcars have the added benefit of serving as an inflationary hedge, given their positive yield relationship to inflation.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2019, the FMI Common Stock Fund Investor Class (FMIMX, or the “Fund”) had a total return of 5.28%.* The benchmark Russell 2000 Index declined 8.89% in the same period. Sectors that aided relative performance included Producer Manufacturing, Health Technology and Commercial Services. Driven by fundamental results being somewhat better than the market anticipated, Armstrong World Industries, Carlisle Companies and Woodward were notable positive contributors within the Producer Manufacturing sector. Our underweighting in Health Technology drove the relative performance there, while in the Commercial Services sector, Genpact appreciated strongly because of solid sales and earnings growth. On the negative side of the ledger, Technology Services, Utilities and Electronic Technology, along with an elevated Cash level pulled down performance. Allscripts and Cars.com declined markedly in the period, hurting the Technology Services sector. Utilities were strong in the period and the Fund had no exposure there, and despite good stock selection, our underweighting in Electronic Technology hurt relative performance.

Other stocks that helped performance during the fiscal year include TriMas, W.R. Berkley and FirstCash. The good relative performance of these stocks was driven by better-than-expected earnings growth. Owing to revised earnings targets, additional stock-specific detractors in the period include Ryder, ePlus and MSC Industrial.

Stocks sold in the period include TiVo, Allscripts, Broadridge, Cars.com, FactSet Research Systems, Anixter and Hain Celestial. Stocks added include Donaldson, Watsco, HD Supply and Phibro Animal Health. As of September 30, 2019, the Fund was overweight in Producer Manufacturing, Commercial Services and Process Industries, and underweight in Technology Services, Electronic Technology and Industrial Services.

The benchmark Russell 2000 struggled over the past year. In the December quarter many of the most speculative stocks declined sharply, significantly helping the Fund’s relative performance. It was a complete reversal compared to the past few years. Still, the benchmark remains loaded with money-losing companies (over one-third) and continues to sell at a very high valuation. The Fund is well-positioned, in our opinion, to take advantage of the shortcomings of the benchmark on a relative basis. Passive investment strategies continued to see heavy inflows of money, at the expense of active strategies.

The Federal Reserve reversed course and began lowering interest rates in July. The price of money remains unusually cheap by historical standards. Economic growth has weakened over the past twelve months. Trade activity has slowed in response to tariff policies and lower investment. Debt at both the corporate and government levels has grown substantially. Total government debt relative to U.S. GDP is near 100% and the deficit to GDP is approximately 4%. Corporate leverage, by some measures, is at a 50-year high. The unemployment rate remains low, but the labor force participation rate continues to be depressed. Wage rates increased during the fiscal year. Domestic and international political risks remain elevated.

While conventional wisdom is that stocks will continue to rise because interest rates and inflation are low, we believe extraordinarily high valuations and spotty earnings are unappreciated risks. We remain cautious on the stock market’s prospects over the near term. The Fund continues to sell at a large discount to the Russell 2000 on most valuation measures.

_______________

| * | The FMI Common Stock Fund Institutional Class (FMIUX) returned 5.40% for the fiscal year ending 9/30/19. |

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

(Continued)

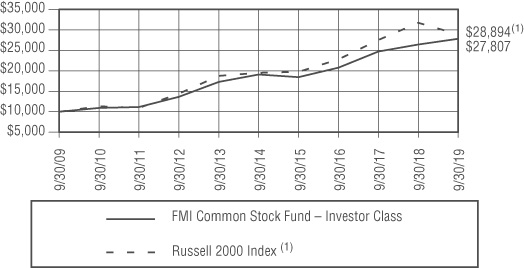

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND – INVESTOR CLASS AND THE RUSSELL 2000 INDEX(1)

AVERAGE ANNUALIZED TOTAL RETURN

| | | | | | Inception |

| | | | | | through |

| | Inception Date | 1-Year | 5-Year | 10-Year | 9/30/2019 |

| FMI Common Stock Fund – | | | | | |

| Investor Class | 12/18/81 | 5.28% | 7.82% | 10.77% | 11.73% |

| FMI Common Stock Fund – | | | | | |

| Institutional Class | 10/31/16 | 5.40% | N/A | N/A | 11.71% |

Russell 2000 Index(1)* | | -8.89% | 8.19% | 11.19% | 10.10% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. |

| * | The benchmark since inception returns are calculated since inception of the Investor Class, December 18, 1981 to September 30, 2019. |

An investment cannot be made directly into an index.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS

September 30, 2019

| Shares | | | | Cost | | | Value | |

| | |

| COMMON STOCKS — 82.6% (a) | |

| | |

COMMERCIAL SERVICES SECTOR — 12.4% | |

| | | Advertising/Marketing Services — 3.4% | | | | | | |

| | 1,535,000 | | Interpublic Group of Cos. Inc. | | $ | 27,569,569 | | | $ | 33,094,600 | |

| | | | Miscellaneous Commercial Services — 4.4% | | | | | | | | |

| | 1,095,000 | | Genpact Ltd. | | | 18,233,342 | | | | 42,431,250 | |

| | | | Personnel Services — 4.6% | | | | | | | | |

| | 315,000 | | ManpowerGroup Inc. | | | 21,756,454 | | | | 26,535,600 | |

| | 338,000 | | Robert Half International Inc. | | | 14,348,150 | | | | 18,813,080 | |

| | | | | | | 36,104,604 | | | | 45,348,680 | |

| | |

CONSUMER SERVICES SECTOR — 4.4% | |

| | | | Other Consumer Services — 4.4% | | | | | | | | |

| | 65,000 | | Graham Holdings Co. | | | 30,731,969 | | | | 43,124,250 | |

| | |

DISTRIBUTION SERVICES SECTOR — 8.9% | |

| | | | Electronics Distributors — 4.4% | | | | | | | | |

| | 305,000 | | Arrow Electronics Inc.* | | | 10,452,428 | | | | 22,746,900 | |

| | 270,000 | | ePlus Inc.* | | | 14,689,759 | | | | 20,544,300 | |

| | | | | | | 25,142,187 | | | | 43,291,200 | |

| | | | Wholesale Distributors — 4.5% | | | | | | | | |

| | 741,000 | | HD Supply Holdings Inc.* | | | 30,591,761 | | | | 29,028,675 | |

| | 210,000 | | MSC Industrial Direct Co. Inc. | | | 14,743,335 | | | | 15,231,300 | |

| | | | | | | 45,335,096 | | | | 44,259,975 | |

| | |

ELECTRONIC TECHNOLOGY SECTOR — 2.4% | |

| | | | Telecommunications Equipment — 2.4% | | | | | | | | |

| | 310,000 | | ViaSat Inc.* | | | 21,573,634 | | | | 23,349,200 | |

| | |

FINANCE SECTOR — 22.4% | |

| | | | Finance/Rental/Leasing — 5.2% | | | | | | | | |

| | 287,000 | | FirstCash Inc. | | | 8,834,047 | | | | 26,309,290 | |

| | 480,000 | | Ryder System Inc. | | | 22,450,484 | | | | 24,849,600 | |

| | | | | | | 31,284,531 | | | | 51,158,890 | |

| | | | Multi-Line Insurance — 2.0% | | | | | | | | |

| | 275,000 | | Argo Group International Holdings Ltd. | | | 14,425,218 | | | | 19,316,000 | |

| | | | Property/Casualty Insurance — 6.8% | | | | | | | | |

| | 382,000 | | W.R. Berkley Corp. | | | 6,214,850 | | | | 27,591,860 | |

| | 36,000 | | White Mountains Insurance Group Ltd. | | | 32,246,093 | | | | 38,880,000 | |

| | | | | | | 38,460,943 | | | | 66,471,860 | |

| | | | Real Estate Development — 5.7% | | | | | | | | |

| | 217,000 | | The Howard Hughes Corp.* | | | 26,622,730 | | | | 28,123,200 | |

| | 1,250,000 | | Kennedy-Wilson Holdings Inc. | | | 25,702,701 | | | | 27,400,000 | |

| | | | | | | 52,325,431 | | | | 55,523,200 | |

| | | | Regional Banks — 2.7% | | | | | | | | |

| | 595,000 | | Zions Bancorporation | | | 21,137,353 | | | | 26,489,400 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2019

| Shares | | | | Cost | | | Value | |

| | | | | |

| COMMON STOCKS — 82.6% (a) (Continued) | | | | |

| | |

HEALTH TECHNOLOGY SECTOR — 0.4% | |

| | | Pharmaceuticals: Major — 0.4% | | | | | | |

| | 180,000 | | Phibro Animal Health Corp. | | $ | 5,271,616 | | | $ | 3,839,400 | |

| | |

PROCESS INDUSTRIES SECTOR — 6.2% | |

| | | | Containers/Packaging — 4.7% | | | | | | | | |

| | 405,000 | | Avery Dennison Corp. | | | 25,623,308 | | | | 45,995,850 | |

| | | | Industrial Specialties — 1.5% | | | | | | | | |

| | 288,000 | | Donaldson Co. Inc. | | | 13,340,208 | | | | 14,999,040 | |

| | |

PRODUCER MANUFACTURING SECTOR — 23.4% | |

| | | | Auto Parts: OEM — 2.5% | | | | | | | | |

| | 183,000 | | WABCO Holdings Inc.* | | | 23,046,456 | | | | 24,476,250 | |

| | | | Building Products — 3.5% | | | | | | | | |

| | 200,000 | | Armstrong World Industries Inc. | | | 8,259,202 | | | | 19,340,000 | |

| | 85,000 | | Watsco Inc. | | | 12,066,967 | | | | 14,380,300 | |

| | | | | | | 20,326,169 | | | | 33,720,300 | |

| | | | Industrial Machinery — 4.5% | | | | | | | | |

| | 228,000 | | EnPro Industries Inc. | | | 16,552,585 | | | | 15,652,200 | |

| | 265,000 | | Woodward Inc. | | | 10,808,862 | | | | 28,574,950 | |

| | | | | | | 27,361,447 | | | | 44,227,150 | |

| | | | Metal Fabrication — 2.1% | | | | | | | | |

| | 147,000 | | Valmont Industries Inc. | | | 20,685,525 | | | | 20,350,680 | |

| | | | Miscellaneous Manufacturing — 8.6% | | | | | | | | |

| | 365,000 | | Carlisle Cos. Inc. | | | 29,006,057 | | | | 53,122,100 | |

| | 1,010,000 | | TriMas Corp.* | | | 23,466,478 | | | | 30,956,500 | |

| | | | | | | 52,472,535 | | | | 84,078,600 | |

| | | | Trucks/Construction/Farm Machinery — 2.2% | | | | | | | | |

| | 1,085,000 | | Trinity Industries Inc. | | | 21,332,059 | | | | 21,352,800 | |

| | |

RETAIL TRADE SECTOR — 2.1% | |

| | | | Specialty Stores — 2.1% | | | | | | | | |

| | 440,000 | | Penske Automotive Group Inc. | | | 15,383,750 | | | | 20,803,200 | |

| | | | Total common stocks | | | 587,166,950 | | | | 807,701,775 | |

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2019

| Principal Amount | | | | Cost | | | Value | |

| | |

| SHORT-TERM INVESTMENTS — 17.4% (a) | |

| | | Bank Deposit Account — 7.2% | | | | | | |

| $ | 69,816,891 | | U.S. Bank N.A., 1.91%^ | | $ | 69,816,891 | | | $ | 69,816,891 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 10.2% | | | | | | | | |

| | 25,000,000 | | U.S. Treasury Bills, 1.718%, due 10/24/19^ | | | 24,967,576 | | | | 24,971,370 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.741%, due 11/14/19^ | | | 24,941,792 | | | | 24,945,603 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.704%, due 12/19/19^ | | | 24,897,739 | | | | 24,905,351 | |

| | 25,000,000 | | U.S. Treasury Bills, 1.778%, due 01/23/20^ | | | 24,854,333 | | | | 24,858,015 | |

| | | | Total U.S. treasury securities | | | 99,661,440 | | | | 99,680,339 | |

| | | | Total short-term investments | | | 169,478,331 | | | | 169,497,230 | |

| | | | Total investments — 100.0% | | $ | 756,645,281 | | | | 977,199,005 | |

| | | | Other assets, less liabilities — 0.0% (a) | | | | | | | 297,351 | |

| | | | TOTAL NET ASSETS — 100.0% | | | | | | $ | 977,496,356 | |

| * | Non-income producing security. |

| ^ | The rate shown is as of September 30, 2019. |

| (a) | Percentages for the various classifications relate to total net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

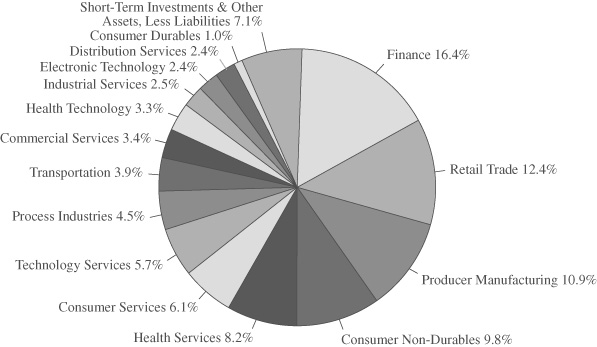

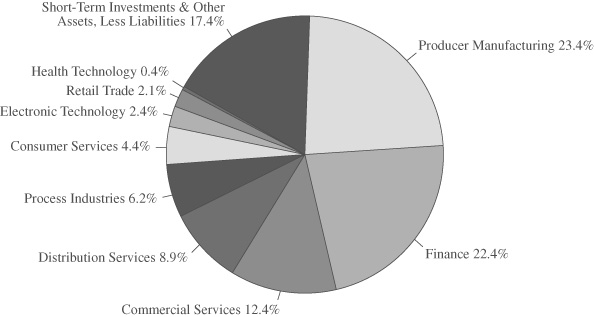

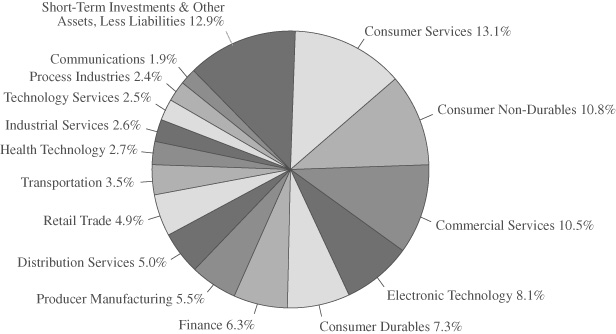

INDUSTRY SECTORS as a percentage of net assetsas of September 30, 2019 (Unaudited)

FMI

International

Fund

September 30, 2019

Dear Fellow Shareholders:

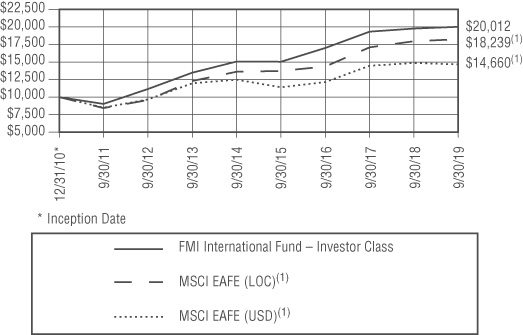

In the face of deteriorating economic and business fundamentals, international stock markets continued to advance in the third quarter (in local currencies), thanks to yet another round of support from global central banks. The FMI International Fund (“Fund”) gained 0.03%1 in the period, compared with the MSCI EAFE Index’s return of 1.75% in local currency and a decline of 1.07% in U.S. Dollars (USD). The Technology Services, Distribution Services and Finance sectors aided the Fund’s relative performance, while Producer Manufacturing, Industrial Services, and Consumer Non-Durables weighed on the results. The top individual contributors were Smith & Nephew, B&M European Value Retail and Chubb Ltd., as Jardine Strategic, Schlumberger and Fairfax Financial Holdings underperformed. Growth continued to outperform value in the quarter, adding to the challenging backdrop.

Dark & Stormy

There are no shortages of geopolitical risks in today’s macro environment, with the U.S. & China and Japan & Korea engulfed in escalating trade wars, extreme unrest and protests in Hong Kong, lingering Brexit uncertainty, and a drone bombing of Saudi Arabia’s oil interests, to name a few. As a result, economic growth continues to decelerate, with the Organisation for Economic Co-operation and Development (OECD) cutting its September forecast for global GDP growth to 2.9% in 2019 (from a 3.2% estimate in May) and 3.0% in 2020 (from 3.4%), the weakest annual growth since the 2009 financial crisis. GDP has now been revised downward in almost all G20 economies, as trade growth has collapsed, industrial production is falling, investment and productivity are weak, and employment growth has slowed. According to the OECD, “The global outlook continues to darken” as “trade and political tensions fuel risks of persistent low growth.”2

In the second quarter, economic growth in Europe’s two biggest economies, Germany and the United Kingdom (UK), each turned negative and may be on the verge of a recession. China is feeling the pain of the trade war as its growth fell to 6.2%, the slowest pace since 1992. Not surprisingly, China’s “official” government statistics are being questioned, with The Wall Street Journal reporting, “Some economists who dissected China’s GDP numbers say more accurate figures could be up to 3 percentage points lower, based on their analysis of corporate profits, tax revenue, rail freight, property sales and other measures of activity that they believe are harder for the government to fudge […] government efforts to keep the economy from cratering, such as infrastructure spending, lending and other stimulus, can obscure areas of weakness or smooth headline growth numbers.”3 At the same time, U.S. growth is also losing momentum, with a new forecast of 2.0% in 2020, down from 2.9% in 2018. Japan is expected to fall to 0.6% from 0.8%.4

_______________

1 | The FMI International Fund Investor Class (FMIJX) and the FMI International Fund Institutional Class (FMIYX) had a return of 0.03% and 0.06%, respectively, for the third quarter of 2019. |

2 | Laurence Boone, OECD Chief Economist. “OECD Interim Economic Outlook. Warning: low growth ahead.” Presentation slide deck and press release. September 19, 2019. |

3 | Mike Bird and Lucy Craymer. “China Says Growth Is Fine. Private Data Show a Sharper Slowdown.” The Wall Street Journal. September 8, 2019. |

4 | Boone (n 2) |

In response to an increasingly fragile and uncertain economic outlook, world central bankers are resorting to the same old playbook. Through early September, global central banks had delivered 32 interest rate cuts in 2019, according to data from the Bank of International Settlements (BIS). Additionally, Bloomberg reports that, “Over the next 12 months, interest-rate swap markets have priced in around 58 more rate cuts, assuming central banks maintain their current trajectories in easing.”5 Notably, the European Central Bank (ECB) is back in the money-printing business, cutting interest rates further into negative territory and restarting its €2.6 trillion Quantitative Easing (QE) program with €20 billion per month of bond purchases.6 While markets regard easy money as a bullish signal, we view it far more skeptically – as a sign of desperation.

The recent flurry of central bank activity has led to a massive spike in negative-yielding bonds, reaching a record $17 trillion in late August, an astounding 30% of global investment-grade bonds.7 Negative yields hit several eye-opening new milestones, including 10-year mortgages in Denmark8 (you get paid to buy a house!), “high-yield” junk bonds in Europe,9 and 30-year German government debt.10 We continue to believe that owning risk-bearing assets at a guaranteed loss defies logic and does not pass the common-sense test. As mentioned last quarter, manipulating interest rates is a dangerous game with significant long-term ramifications. These experimental policies are ill-advised and will likely do more harm than good. At some point investors will lose faith in the all-encompassing power of central banks, realizing that these institutions can’t solve the world’s problems with the swipe of a pen. When that day comes, financial markets will come under pressure.

Fundamental Disconnect

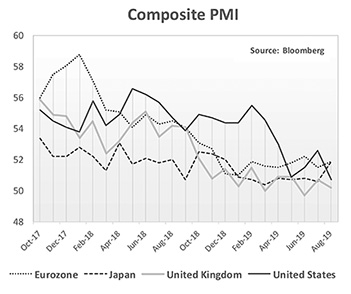

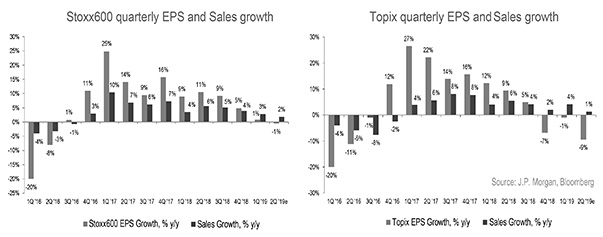

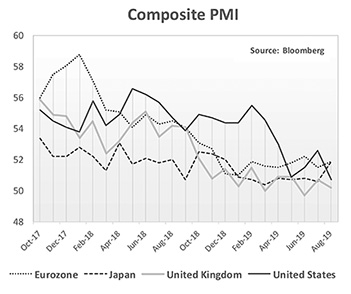

Given the precarious economic landscape, we would not have been surprised to see equity markets decline in 2019, yet the opposite has transpired, as a seemingly never-ending flow of monetary and fiscal stimulus has rejuvenated investor euphoria. Year-to-date, the Stoxx600 and Topix indexes, proxies for Europe and Japan, have gained a robust 20.32% and 8.66%, respectively. Meanwhile, earnings growth has come to a screeching halt, declining by 1% and 9%, respectively, in the second quarter (see charts below).11 Clearly there is a growing disconnect between stock prices and the unraveling of business fundamentals.

_______________

5 | Stephen Spratt. “After 32 Rate Cuts in 2019, Traders Say Many More Are Coming.” Bloomberg. September 5, 2019. |

6 | Martin Arnold. “Over to you, Draghi tells eurozone.” Financial Times. September 12, 2019. |

7 | John Ainger. “The Unstoppable Surge in Negative Yields Reaches $17 Trillion.” Bloomberg. August 30, 2019. |

8 | Oliver Telling. “Negative Mortgages Set Another Milestone in No-Rate World.” Bloomberg. August 18, 2019. |

9 | Paul J. Davies. “Oxymoron Alert: Some ‘High Yield’ Bonds Go Negative.” The Wall Street Journal. July 14, 2019. |

10 | Dhara Ranasinghe, Michelle Martin. “Germany sells new 30-year bond with negative yield, a first.” Reuters. August 21, 2019. |

11 | Mislav Matejka, Prabhav Bhadani, and Nitya Saldanha. “Equity Strategy: Q2 Earnings Season Tracker.” J.P. Morgan Cazenove. August 9, 2019. |

As we have highlighted in prior letters, equity valuations are elevated by historical standards. To justify today’s lofty valuations, investors must believe that ultra-low interest rates are here to stay. With hundreds of years of financial market history on our side, we take the other side of that bet. Excessive money printing should eventually lead to inflation. We have already seen it on the asset side (i.e., stocks, bonds, real estate, art, and private equity), and it is likely just a matter of time before it makes its way to the consumer. We view the current environment as the exception, not the rule. In the long run, we expect to see a reversion to the mean, not only for interest rates and asset valuations, but for value versus growth.

Over the past decade, equity markets have been driven by growth and momentum stocks. The MSCI EAFE Growth Index has outpaced the Value Index by ~10% this year alone, and by ~50% cumulatively over the past ten years. As market participants are willing to ascribe higher and higher prices to their beloved growth stocks, the valuation premium for growth versus value has ballooned. Compared with a 10-year average premium on a price-to-earnings (P/E) basis of ~42%, today investors are paying an ~80% premium for growth stocks, per the Bloomberg chart below. In the fullness of time, we have great confidence that value will outperform (as it has done historically), because human nature never changes. Fear and greed will forever hinder investor objectivity.

Given the macro concerns, the valuation spread between defensive and cyclical stocks has also become extended. Unfortunately, perceived “safety” stocks come with a high price tag today. As cyclical and deeper-value stocks have continued to underperform, we’ve looked to take advantage. In the quarter we trimmed several of our stalwart defensive holdings such as Nestlé, Compass Group, and Smith & Nephew, rotating equity exposure into out-of-favor stories such as Amorepacific, Schlumberger, and B&M European Value Retail, which trade at meaningfully lower valuations. More of the same is likely to follow.

A Lonely Road

As we wrote in our March 2018 shareholder letter, “Being contrarian can be defined as ‘opposing or rejecting popular opinion; going against current practice.’ In other words, zigging when everyone else is zagging. In equity investing, in order to beat the market (or your peers), you have to do something different from the market.” With a relatively concentrated portfolio of 25-40 companies, we expect that we will typically look quite a bit different than our peers and benchmarks. While we strive to have industry and geographic diversification, we do not have predefined weightings, and let the bottom-up stock-picking and opportunity set dictate the direction of the portfolio. The portfolio may look very different today than it will in five or ten years, depending on where we are finding value at a given point in time.

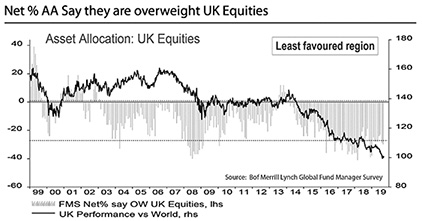

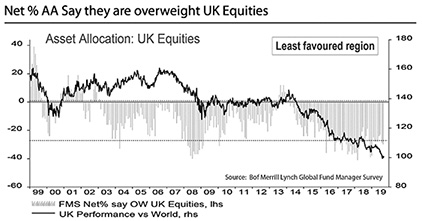

Today, one of our biggest country overweights is the UK, where a Brexit cloud has enabled us to invest in a collection of world-class businesses at discount valuations. Except for Whitbread and B&M, which are domestically-focused, the rest of our UK holdings are multinational companies with a vast majority of their revenue outside the UK. Ultimately, we think Brexit will be a long-term positive for the UK, even if there is near-term pain, as the British will finally rid themselves of the