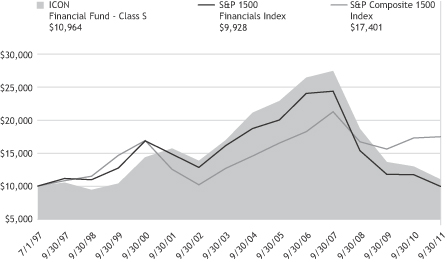

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07883

ICON Funds

(Exact name of registrant as specified in charter)

5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Address of principal executive offices) (Zip code)

Erik L. Jonson 5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-790-1600

Date of fiscal year end: September 30, 2011

Date of reporting period: September 30, 2011

TABLE OF CONTENTS

Item 1. Reports to Stockholders.

2011 ANNUAL REPORT

ICON DIVERSIFIED FUNDS

INVESTMENT UPDATE

ICON Bond Fund

ICON Core Equity Fund

ICON Equity Income Fund

ICON Long/Short Fund

ICON Risk-Managed Equity Fund

1-800-764-0442 | www.iconfunds.com

AR-DIV-11 K21585

You can now sign up for electronic delivery of ICON Fund shareholder reports, including prospectuses, annual reports, semiannual reports and proxy statements.

When these materials are available, you will receive an email from ICON with instructions on how to view the documents. Statements, transaction confirmations and other documents that are not available online will continue to be sent to you by U.S. mail.

Visit ICON’s website at www.iconfunds.com to learn more and sign up.

You may change or cancel your participation in eDelivery by visiting www.iconfunds.com, or you can request a hard copy of any of the materials free of charge by calling ICON Funds at 1-800-764-0442.

1-800-764-0442 • www.iconfunds.com

TABLEOF CONTENTS

ABOUT THIS REPORT (UNAUDITED)

Historical Returns

All total returns mentioned in this Report account for the change in a Fund’s per-share price and the reinvestment of any dividends, capital gain distributions and adjustments for financial statement purposes. If your account is set up to receive Fund distributions in cash rather than to reinvest them, your actual return may differ from these figures. The Funds’ performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Adviser may have reimbursed certain fees or expenses of some of the Funds. If not for these reimbursements, performance would have been lower. Fund results shown, unless otherwise indicated, are at net asset value. If a sales charge (maximum 5.75%) had been deducted, results would have been lower.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results represent past performance, and current performance may be higher or lower. Please call 1-800-764-0442 or visit www.iconfunds.com for performance results current to the most recent month-end.

Portfolio Data

This Report reflects ICON’s views, opinions and portfolio holdings as of September 30, 2011, the end of the reporting period. The information is not a complete analysis of every aspect of any sector, industry, security or the Funds.

Opinions and forecasts regarding industries, companies and/or themes, and portfolio composition and holdings are subject to change at any time based on market and other conditions, and should not be construed as a recommendation of any specific security, industry or sector. Each Fund’s holdings as of September 30, 2011 are included in each Fund’s Schedule of Investments.

According to ICON, value investing is an analytical approach to investing that employs various factors, including projecting earnings growth estimates, in an effort to determine whether securities are over- or underpriced relative to ICON’s estimates of their intrinsic value. Value investing involves risks and uncertainties and does not guarantee better performance or lower costs than other investment methodologies. ICON’s value-to-price ratio (“V/P”) is a ratio of intrinsic value, as calculated using ICON’s proprietary valuation methodology, of a broad range of domestic and international securities within ICON’s system as compared to the current market price of those securities. The ICON system relies on the integrity of financial statements released to the market as part of our analysis.

This Report contains statements regarding industry or sector themes, new market themes, investment outlook, relative strength, value-to-price ratios, and investment team expectations, beliefs, goals and the like that are based on current expectations, recent individual stock performance relative to current market prices, estimates of company values and other information supplied to the market by the companies we follow. Words such as “expects,” “suggests,” “anticipates,” “targets,” “goals,” “value,” “intrinsic value,” “indicates,” “believes,” “considers,” “estimates,” variations of such words and similar expressions are intended to identify forward looking statements, which are not statements of historical fact. Forward looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. These risks and uncertainties are based on a number of important factors, including, among others: stock price fluctuations; the integrity and accuracy of historical and projected financial and other information supplied by companies to the public or assumptions based on such information supplied; interest rates; bond yields; future earnings growth rates; the risks noted in this Report and other factors beyond the control of our investment team but used by the investment team to influence their assumptions. Therefore, actual outcome may differ materially from what is expressed in such forward looking statements.

There are risks associated with mutual fund investing, including the loss of principal. The likelihood of loss may be greater if you invest for a shorter period of time. There is no assurance that the investment process will consistently lead to successful results.

There are risks associated with selling short, including the risk that the ICON Long/Short Fund may have to cover its short position at a higher price than the short price, resulting in a loss. The ICON Long/Short Fund’s loss on a short sale is potentially unlimited as a loss occurs when the value of a security sold short increases. Call options involve certain risks, such as limited gains and lack of liquidity in the underlying securities, and are not suitable for all investors.

Investing in fixed income securities such as bonds involves interest rate risk. When interest rates rise, the value of fixed income securities generally decreases. The ICON Bond Fund may invest up to 25% of its assets in high-yield bonds that are below investment grade. High-yield bonds involve a greater risk of default and price volatility than U.S. Government and other higher-quality bonds.

An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

Investments in foreign securities may entail unique risks, including political, market, and currency risks. Financial statements of foreign companies are governed by different accounting, auditing, and financial standards than U.S. companies and may be less transparent and uniform than in the United States. Many corporate governance standards, which help ensure the integrity of public information in the United States, do not exist in foreign countries. In general, there may be less governmental supervision of foreign stock exchanges and securities brokers and issuers. The ICON system relies on the integrity of financial statements released to the market as part of our analysis.

The prospectus and statement of additional information contain this and other information about the Funds and are available by visiting www.iconfunds.com or calling 1-800-764-0442. Please read the prospectus and statement of additional information carefully.

Comparative Indexes

The comparative indexes discussed in this Report are meant to provide a basis for judging a Fund’s performance against specific securities indexes. Each index shown accounts for both change in the security price and reinvestment of dividends and distributions (except as noted), but does not reflect the costs of managing a mutual fund. The Funds’ portfolios may significantly differ in holdings and composition from the index. Individuals cannot invest directly in an index.

| • | | The unmanaged Standard & Poor’s (“S&P”) Composite 1500 Index (“S&P Composite 1500 Index”) is a broad-based capitalization-weighted index comprising 1,500 stocks of large-cap, mid-cap, and small-cap U.S. companies. |

| • | | The unmanaged Barclays Capital U.S. Universal Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-ERISA portion of the Commercial Mortgage-Backed Securities (“CMBS”) Index and the CMBS High-Yield Index. All securities in this market-value weighted index have at least one year remaining to maturity and meet certain minimum issue size criteria. |

| • | | The unmanaged Barclays Capital U.S. Universal Index (ex-MBS) represents the Barclays Capital U.S. Universal Index without including the CMBS Index and the CMBS High-Yield Index. |

Index returns and statistical data included in this Report are provided by FactSet Research Systems.

Financial Intermediary

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may influence the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

MESSAGE FROM ICON FUNDS

Dear Shareholder,

As valuation investors, we look for quality companies priced below our estimate of intrinsic value. We will buy stocks we believe are “on sale” when investors get distracted by a particular news story or headline and worry about its potential impact on the economy in general and the markets in particular. When this happens, stocks are temporarily priced based on worst-case scenario projections, not on their fundamentals. As concerns subside, prices often move up toward the stock’s intrinsic value and may even exceed ICON’s estimate of value when excessive worry is replaced with excessive optimism. Implementing our valuation strategy does not require an information edge; it simply requires discipline. Our system needs discipline to filter out news headlines, concentrate on value, and, frequently, buy when most are selling and sell when most are buying. ICON’s discipline requires also the willingness to take strong industry and sector tilts. We see industries and sectors becoming overpriced and underpriced through cycles as investors change their views of the economy and migrate around the universe of stocks.

In spite of a volatile 12 months, we believe the stock market is in a multi-year recovery from the financial crisis and recession of 2008-2009. Stocks were generally priced far below our estimate of their fair value when the market hit its recent low in March 2009, but their ascent toward fair value has been choppy and severely interrupted at least twice; first in the summer of 2010 and then again during the summer of 2011. Both times, sharp drops in stock prices were precipitated by concerns over the European sovereign debt crisis. Investors were especially wary of the situation in Greece, but also, to a lesser extent, investors worried about the economies of Ireland, Spain and Italy. We thought these concerns were excessive in 2010 and we continue to believe the concern is unwarranted. We expect fears to subside and, when that happens, we believe stocks will resume their recovery path.

The interruptions experienced during the summers of 2010 and 2011 have been frustrating for value investors like ICON, as we see a very different world than many other investors. Where others see a negative macroeconomic outlook, we see positive earnings and solid company fundamentals. When 2011 second quarter earnings were announced, companies in the S&P 500 Index reported earnings that were, on average, 16.24% higher than a year earlier. In fact, 75% of those companies reported earnings that exceeded analysts’ estimates by 4.67% on average. This growth in earnings is more robust than the earnings we saw coming out of any of the previous four recessions (that is, 1974, 1982, 1992 and 2001 recessions). Strong earnings and a low interest rate environment contribute to what we

| | |

| 6 | | MESSAGE FROM ICON FUNDS |

believe are attractive valuations, but skittish investors, concerned with debt problems in Europe, continue to shy away from equities.

We have seen investors turn their backs on solid fundamentals many times before. Historically, however, investors have come to gradually embrace these fundamentals and stock prices generally rise again to meet intrinsic value. In 1990, 1998 and 2010, for example, the market experienced a decline similar in magnitude and duration to that seen during the summer of 2011. Each market bottom led to anxiety over a worsening recession, but, months later, these fears proved unfounded. Stock prices rebounded and resumed their prior upward path. As we head into a new fiscal year, we are anticipating a similar rebound. Having two major market interruptions in two consecutive summers is unusual, unsettling and has admittedly made it difficult for investors to stay the course to recovery. The volatile environment also presented problems for money managers like ICON who struggled with abrupt and extreme industry and sector theme reversals.

As fiscal year 2011 comes to an end, we still believe cyclical, economically sensitive industries are the long term leaders for this multi-year recovery. Unfortunately, these same industries can be subject to dramatic market swings when investors, worried about the economy, panic and jump out of the market. We believe the old Wall Street adage still applies: “Stocks climb a wall of worry.” The climb back from the recession and financial crisis of 2008 and 2009 has been and will continue to be riddled with worry.

As always, we remain focused on value and company fundamentals as we try to filter out the conjecture and emotions that typically contribute to market volatility. Experienced sailors will tell someone who is seasick: “Don’t look at the waves; look at the horizon.” Lately, it seems, most investors have been focused on the waves. At ICON, we like to focus on a horizon that includes quality companies, with growing earnings, priced far below our estimate of their fair value. We will continue to stay this course.

Yours truly,

Craig T Callahan, DBA

Chairman of the Board of Trustees and President of the Adviser

| | | | |

| MESSAGE FROM ICON FUNDS | | | 7 | |

| | | | |

MANAGEMENT OVERVIEW ICON BOND FUND | | Class I Class C Class Z Class A | | IOBIX IOBCX IOBZX IOBAX |

| Q. | How did the Fund perform relative to its benchmark? |

| A. | For the Fund’s fiscal year ended September 30, 2011, the ICON Bond Fund underperformed its benchmark, the Barclays Capital US Universal ex MBS Index. For the fiscal year the Fund returned -0.19% for the Class I shares, -0.68% for the Class C shares (and -1.53% with maximum sales charge), -0.02% for the Class A shares (and -4.77% with maximum sales charge) and 0.15% for the Class Z shares, while the Barclays Capital US Universal ex MBS Index returned 4.47% and the Barclays Capital US Universal Index returned 4.77%.1 Total returns for other periods as of September 30, 2011 appear in the subsequent pages of this Fund’s Management Overview. |

| 1 | The Fund changed its benchmark to the Barclays Capital US Universal ex MBS Index on January 24, 2011 because the Fund has not significantly invested in asset-backed securities in the past and has no present intent to do so in the immediate future. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | While the majority of headline news has been focused on volatility in the equity market, the fixed income market experienced similar movement, creating a challenging environment for the ICON Bond Fund. The fiscal year can be broken down into two distinct time periods based on the differences in performance between corporate bonds and the “risk free” safe haven of Treasury securities. Utilizing ICON’s valuation system, which is quantitatively based on comparing historical relationships across the credit curve to current relationships, the Fund began the fiscal year with an overweight position in corporate bonds and underweight position in Treasury securities as historical risk-return relationships pointed to a continuation of corporate credit spread tightening amidst an environment of rising interest rates. Because of the Fund’s overweight position in corporate bonds, the Fund did well during the first half of the fiscal year as investors sold off Treasury securities, increasing the yield on the 10-Year Treasury from 2.51% on 09/30/10 to 3.47% on 03/31/11. At the same time corporate credit spreads, as measured by comparing Moody’s Baa Index Yields to the US 10-year Constant Maturity Treasury yield, tightened from 307 bps. to 258 bps. During the first half of the fiscal year, corporate bonds with lower credit quality also fared well with the Barclays Capital US High Yield Corporate Index posting gains in excess of 7%. |

The second half of the fiscal year saw investors shift their focus away from improving corporate fundamentals and towards European sovereign debt concerns and slowing domestic economic growth. Initially, safe haven buying of Treasury securities was relatively muted as 10-year yields fell by 47 bps. to 3% from 03/31/11 to 06/30/11. However, increasing fears surrounding European debt combined with additional monetary stimulus from the Federal Reserve, in the form of “Operation Twist,” caused Treasury yields to collapse, finishing the fiscal year at 1.92%. Inversely, corporate bond spreads, again measured by comparing Moody’s Baa Index Yields to the US 10-year Constant Maturity Treasury yield, widened significantly from 258 bps on 03/31/11 to finish the year at 330 bps on 09/30/11. This reversal resulted in the Fund underperforming as our valuation methodology indicated that corporate bonds were undervalued while Treasuries were overvalued throughout the entire fiscal year.

| Q. | How did the Fund’s composition affect performance? |

| A. | As stated above, the Fund’s overweight position in corporate bonds during the fiscal year affected performance negatively. Further, although the Fund’s significant underweight position in perceived “risk free” Treasuries benefitted the Fund’s performance relative to the benchmark during the first half of the fiscal year, the strong reversal during the second half of the year resulted in negative overall allocation effect. The Fund’s corporate bond allocation also resulted in underperformance relative to the benchmark as our methodology pointed us towards both the Financial sector and the high yield segment of the market. Both of these areas underperformed during the fiscal year. Finally, while the Fund’s exposure to floating rate notes aided relative performance in the face of rising yields at the outset of the fiscal year, this overweight exposure negatively impacted relative performance in the second half of the year as the Federal Reserve’s announcement that it intended to maintain low interest rates into 2013 made variable rate investments unattractive. |

| Q. | What is your investment outlook for the bond market? |

| A. | ICON’s valuation system continues to see significant value in intermediate to long term corporate bonds. On the Treasury side, continued purchases by the Federal Reserve should provide enough support to aid further economic expansion. However, this action has lowered interest rates to a level that makes investment in these securities unattractive from a valuation perspective. On the corporate side, credit spreads widened over the fiscal year due to a barrage of economic concerns. However, default rates continue to decline across all |

| | credit qualities. This environment of declining default rates coupled with widening credit spreads creates very attractive valuation disconnects which have historically resulted in positive returns for patient investors. We believe once economic concerns subside, corporate bond spreads will resume the tightening trend that began in 2009. |

ICON Bond Fund

Credit Diversification

September 30, 2011

| | | | |

A1 | | | 1.7% | |

A2 | | | 4.7% | |

A3 | | | 12.6% | |

Aa2 | | | 2.6% | |

Aa3 | | | 2.5% | |

B1 | | | 6.0% | |

B2 | | | 1.2% | |

B3 | | | 1.6% | |

Ba1 | | | 4.6% | |

Ba2 | | | 4.4% | |

| | | | |

Baa1 | | | 9.1% | |

Baa2 | | | 14.1% | |

Baa3 | | | 22.8% | |

| | | | |

| | | 87.9% | |

| | | | |

Percentages are based upon corporate and foreign corporate bond investments as a percentage of net assets.

Ratings based on Moody’s Investors Service, Inc.

ICON Bond Fund

Average Annual Total Return

as of September 30, 2011

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | 1 Year | | | 5 Years | | | Since

Inception | | | Gross

Expense

Ratio* | | | Net

Expense

Ratio* | |

ICON Bond Fund - Class I | | | 9/30/02 | | | | -0.19% | | | | 5.21% | | | | 4.80% | | | | 1.13% | | | | 1.00% | |

Barclays Capital U.S. Universal Index | | | | | | | 4.77% | | | | 6.40% | | | | 5.66% | | | | N/A | | | | N/A | |

Barclays Capital U.S. Universal Index (ex-MBS) | | | | | | | 4.47% | | | | 6.17% | | | | 5.72% | | | | N/A | | | | N/A | |

ICON Bond Fund - Class C | | | 10/21/02 | | | | -0.68% | | | | 4.59% | | | | 4.48% | | | | 2.46% | | | | 1.60% | |

Barclays Capital U.S. Universal Index | | | | | | | 4.77% | | | | 6.40% | | | | 5.92% | | | | N/A | | | | N/A | |

Barclays Capital U.S. Universal Index (ex-MBS) | | | | | | | 4.47% | | | | 6.17% | | | | 6.06% | | | | N/A | | | | N/A | |

ICON Bond Fund - Class Z | | | 5/6/04 | | | | 0.15% | | | | 5.46% | | | | 4.84% | | | | 1.39% | | | | 0.75% | |

Barclays Capital U.S. Universal Index | | | | | | | 4.77% | | | | 6.40% | | | | 5.91% | | | | N/A | | | | N/A | |

Barclays Capital U.S. Universal Index (ex-MBS) | | | | | | | 4.47% | | | | 6.17% | | | | 5.78% | | | | N/A | | | | N/A | |

ICON Bond Fund - Class A | | | 9/30/10 | | | | -0.02% | | | | N/A | | | | -0.02% | | | | 1.13% | | | | 1.00% | |

ICON Bond Fund - Class A (including maximum sales charge of 4.75%) | | | 9/30/10 | | | | -4.77% | | | | N/A | | | | -4.76% | | | | 1.13% | | | | 1.00% | |

Barclays Capital U.S. Universal Index | | | | | | | 4.77% | | | | N/A | | | | 4.77% | | | | N/A | | | | N/A | |

Barclays Capital U.S. Universal Index (ex-MBS) | | | | | | | 4.47% | | | | N/A | | | | 4.47% | | | | N/A | | | | N/A | |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future. Class Z shares are available only to institutional investors.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

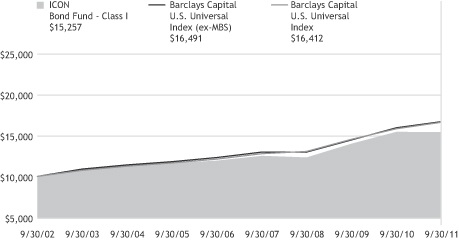

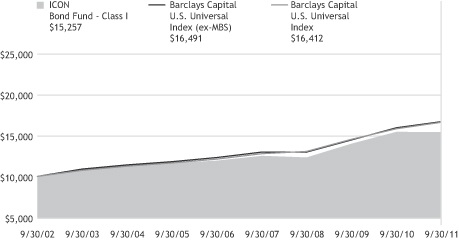

ICON Bond Fund

Value of a $10,000 Investment

through September 30, 2011

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Fund’s Class I shares on the Class’ inception date of 9/30/02 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Fund’s other share classes will vary due to differences in charges and expenses. The Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

ICON BOND FUND

SCHEDULEOF INVESTMENTS

SEPTEMBER 30, 2011

| | | | | | | | | | | | | | | | |

| Shares or Principal Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| | | | | | | | | | | | | | | | |

| | Corporate Bonds (80.2%) | |

| $ | 220,000 | | | ACE INA Holdings, Inc. | | | 8.88 | % | | | 08/15/29 | | | $ | 308,157 | |

| | 800,000 | | | AES Corp. | | | 7.75 | % | | | 10/15/15 | | | | 812,000 | |

| | 1,000,000 | | | Alcoa, Inc. | | | 6.75 | % | | | 07/15/18 | | | | 1,071,104 | |

| | 950,000 | | | Alcoa, Inc. | | | 5.72 | % | | | 02/23/19 | | | | 953,448 | |

| | 1,000,000 | | | Alcoa, Inc. | | | 6.75 | % | | | 01/15/28 | | | | 1,034,944 | |

| | 1,000,000 | | | Allied Waste North America, Inc. | | | 6.88 | % | | | 06/01/17 | | | | 1,068,750 | |

| | 2,000,000 | | | Ally Financial, Inc. | | | 6.75 | % | | | 12/01/14 | | | | 1,938,732 | |

| | 1,000,000 | | | Ameren Energy Generating Co.(a) | | | 7.00 | % | | | 04/15/18 | | | | 1,012,500 | |

| | 1,440,000 | | | American Express Bank FSB(b) | | | 0.53 | % | | | 06/12/17 | | | | 1,323,238 | |

| | 1,000,000 | | | American Express Co. | | | 7.00 | % | | | 03/19/18 | | | | 1,183,027 | |

| | 400,000 | | | American International Group, Inc. | | | 5.38 | % | | | 10/18/11 | | | | 399,500 | |

| | 900,000 | | | American International Group, Inc. | | | 4.25 | % | | | 05/15/13 | | | | 897,831 | |

| | 900,000 | | | American International Group, Inc. | | | 8.25 | % | | | 08/15/18 | | | | 997,602 | |

| | 800,000 | | | Avnet, Inc. | | | 6.00 | % | | | 09/01/15 | | | | 864,858 | |

| | 250,000 | | | Bank of America Corp. | | | 5.42 | % | | | 03/15/17 | | | | 217,191 | |

| | 900,000 | | | Bank of America Corp. | | | 5.63 | % | | | 07/01/20 | | | | 828,956 | |

| | 1,000,000 | | | Bank of America Corp. | | | 6.80 | % | | | 03/15/28 | | | | 975,829 | |

| | 950,000 | | | Bank of America NA(b) | | | 0.65 | % | | | 06/15/17 | | | | 698,668 | |

| | 1,000,000 | | | BB&T Corp. | | | 5.25 | % | | | 11/01/19 | | | | 1,089,943 | |

| | 850,000 | | | Best Buy Co., Inc. | | | 5.50 | % | | | 03/15/21 | | | | 772,330 | |

| | 401,000 | | | Bill Barrett Corp. | | | 9.88 | % | | | 07/15/16 | | | | 437,090 | |

| | 950,000 | | | Citigroup, Inc. | | | 6.00 | % | | | 08/15/17 | | | | 1,008,173 | |

| | 1,000,000 | | | Citigroup, Inc. | | | 6.13 | % | | | 05/15/18 | | | | 1,072,604 | |

| | 500,000 | | | Comcast Cable Holdings LLC | | | 9.80 | % | | | 02/01/12 | | | | 513,491 | |

| | 1,000,000 | | | Commercial Metals Co. | | | 7.35 | % | | | 08/15/18 | | | | 1,017,166 | |

| | 1,000,000 | | | Computer Sciences Corp. | | | 6.50 | % | | | 03/15/18 | | | | 1,080,137 | |

| | 900,000 | | | Cooper Tire & Rubber Co. | | | 7.63 | % | | | 03/15/27 | | | | 792,000 | |

| | 114,000 | | | Cox Communications, Inc. | | | 7.63 | % | | | 06/15/25 | | | | 149,041 | |

| | 450,000 | | | Dean Foods Co. | | | 6.90 | % | | | 10/15/17 | | | | 420,750 | |

| | 950,000 | | | Delphi Financial Group, Inc. | | | 7.88 | % | | | 01/31/20 | | | | 1,090,151 | |

| | 500,000 | | | Denbury Resources, Inc. | | | 9.75 | % | | | 03/01/16 | | | | 540,000 | |

| | 450,000 | | | Exelon Generation Co. LLC | | | 5.35 | % | | | 01/15/14 | | | | 481,640 | |

| | 750,000 | | | Exelon Generation Co. LLC | | | 6.20 | % | | | 10/01/17 | | | | 845,688 | |

| | 900,000 | | | Exelon Generation Co. LLC | | | 4.00 | % | | | 10/01/20 | | | | 894,757 | |

| | 23,000 | | | FirstEnergy Corp., Series B | | | 6.45 | % | | | 11/15/11 | | | | 23,125 | |

| | | | |

| SCHEDULEOF INVESTMENTS | | | 13 | |

| | | | | | | | | | | | | | | | |

| Shares or Principal Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| | | | | | | | | | | | | | | | |

| $ | 1,000,000 | | | Ford Motor Credit Co. LLC | | | 5.63 | % | | | 09/15/15 | | | $ | 1,005,915 | |

| | 600,000 | | | Freeport-McMoRan Copper & Gold, Inc. | | | 8.38 | % | | | 04/01/17 | | | | 643,500 | |

| | 1,000,000 | | | Frontier Communications Corp. | | | 8.13 | % | | | 10/01/18 | | | | 980,000 | |

| | 900,000 | | | Gap, Inc. | | | 5.95 | % | | | 04/12/21 | | | | 846,528 | |

| | 500,000 | | | General Electric Capital Corp. | | | 4.75 | % | | | 09/15/14 | | | | 535,444 | |

| | 1,000,000 | | | General Electric Capital Corp.(a)(b) | | | 0.48 | % | | | 05/11/16 | | | | 922,515 | |

| | 397,000 | | | Genworth Financial, Inc. | | | 5.65 | % | | | 06/15/12 | | | | 401,410 | |

| | 1,000,000 | | | Goldman Sachs Group, Inc.(b) | | | 0.81 | % | | | 03/22/16 | | | | 857,593 | |

| | 1,000,000 | | | Goldman Sachs Group, Inc. | | | 5.95 | % | | | 01/15/27 | | | | 974,468 | |

| | 900,000 | | | Goodyear Tire & Rubber Co.(a) | | | 8.25 | % | | | 08/15/20 | | | | 915,750 | |

| | 1,000,000 | | | Hartford Financial Services Group, Inc. | | | 6.30 | % | | | 03/15/18 | | | | 1,033,682 | |

| | 1,000,000 | | | HCP, Inc. | | | 5.65 | % | | | 12/15/13 | | | | 1,050,297 | |

| | 1,500,000 | | | HCP, Inc. | | | 6.30 | % | | | 09/15/16 | | | | 1,604,880 | |

| | 500,000 | | | HCP, Inc. | | | 6.70 | % | | | 01/30/18 | | | | 540,245 | |

| | 1,000,000 | | | Horace Mann Educators Corp. | | | 6.85 | % | | | 04/15/16 | | | | 1,086,839 | |

| | 500,000 | | | HSBC Finance Corp. | | | 4.75 | % | | | 07/15/13 | | | | 516,915 | |

| | 474,700 | | | JC Penney Corp., Inc. | | | 7.95 | % | | | 04/01/17 | | | | 505,556 | |

| | 450,000 | | | John Hancock Life Insurance Co.(c)(d) | | | 7.38 | % | | | 02/15/24 | | | | 528,110 | |

| | 1,000,000 | | | JPMorgan Chase Bank NA(b) | | | 0.67 | % | | | 06/13/16 | | | | 917,509 | |

| | 1,000,000 | | | Lincoln National Corp. | | | 7.00 | % | | | 03/15/18 | | | | 1,145,875 | |

| | 1,000,000 | | | Lincoln National Corp. | | | 8.75 | % | | | 07/01/19 | | | | 1,185,269 | |

| | 1,400,000 | | | Lorillard Tobacco Co.(a) | | | 6.88 | % | | | 05/01/20 | | | | 1,552,499 | |

| | 1,000,000 | | | Masco Corp. | | | 6.13 | % | | | 10/03/16 | | | | 975,183 | |

| | 350,000 | | | Merrill Lynch & Co., Inc. | | | 5.45 | % | | | 02/05/13 | | | | 346,859 | |

| | 1,500,000 | | | Morgan Stanley(a) | | | 4.75 | % | | | 04/01/14 | | | | 1,425,478 | |

| | 900,000 | | | Morgan Stanley(b) | | | 0.73 | % | | | 10/15/15 | | | | 760,029 | |

| | 950,000 | | | Morgan Stanley | | | 3.50 | % | | | 10/15/20 | | | | 866,875 | |

| | 1,000,000 | | | National City Bank(b) | | | 0.70 | % | | | 06/07/17 | | | | 915,629 | |

| | 1,000,000 | | | National City Corp. | | | 6.88 | % | | | 05/15/19 | | | | 1,148,928 | |

| | 500,000 | | | Newfield Exploration Co. | | | 7.13 | % | | | 05/15/18 | | | | 517,500 | |

| | 122,000 | | | NLV Financial Corp.(c)(d) | | | 6.50 | % | | | 03/15/35 | | | | 109,236 | |

| | 1,000,000 | | | NRG Energy, Inc. | | | 7.38 | % | | | 01/15/17 | | | | 1,031,250 | |

| | 600,000 | | | Pitney Bowes, Inc. | | | 4.75 | % | | | 05/15/18 | | | | 601,389 | |

| | 750,000 | | | PPL Energy Supply LLC | | | 6.50 | % | | | 05/01/18 | | | | 877,314 | |

| | 180,000 | | | Provident Cos., Inc. | | | 7.00 | % | | | 07/15/18 | | | | 202,908 | |

| | 1,000,000 | | | Reynolds American, Inc. | | | 7.25 | % | | | 06/01/12 | | | | 1,039,499 | |

| | 900,000 | | | Reynolds American, Inc. | | | 7.25 | % | | | 06/01/13 | | | | 981,886 | |

| | 1,000,000 | | | Rowan Cos., Inc. | | | 7.88 | % | | | 08/01/19 | | | | 1,180,730 | |

| | 500,000 | | | RR Donnelley & Sons Co. | | | 4.95 | % | | | 04/01/14 | | | | 472,500 | |

| | 1,350,000 | | | RR Donnelley & Sons Co. | | | 6.13 | % | | | 01/15/17 | | | | 1,171,125 | |

| | 900,000 | | | RR Donnelley & Sons Co.(a) | | | 6.63 | % | | | 04/15/29 | | | | 722,250 | |

| | |

| 14 | | SCHEDULEOF INVESTMENTS |

| | | | | | | | | | | | | | | | |

| Shares or Principal Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| | | | | | | | | | | | | | | | |

| $ | 500,000 | | | Ryder System, Inc. | | | 5.85 | % | | | 03/01/14 | | | $ | 546,577 | |

| | 1,350,000 | | | Southern Copper Corp. | | | 5.38 | % | | | 04/16/20 | | | | 1,377,000 | |

| | 500,000 | | | State Street Bank & Trust Co.(b) | | | 0.54 | % | | | 12/08/15 | | | | 479,969 | |

| | 1,000,000 | | | Suntrust Banks, Inc.(b) | | | 0.55 | % | | | 04/01/15 | | | | 926,260 | |

| | 500,000 | | | Tennessee Gas Pipeline Co. | | | 7.00 | % | | | 10/15/28 | | | | 585,269 | |

| | 500,000 | | | Tesoro Corp.(a) | | | 6.63 | % | | | 11/01/15 | | | | 503,125 | |

| | 1,000,000 | | | Torchmark Corp. | | | 6.38 | % | | | 06/15/16 | | | | 1,092,700 | |

| | 1,800,000 | | | Toys R Us, Inc. | | | 7.38 | % | | | 10/15/18 | | | | 1,530,000 | |

| | 1,000,000 | | | UIL Holdings Corp. | | | 4.63 | % | | | 10/01/20 | | | | 1,033,207 | |

| | 1,000,000 | | | United States Steel Corp.(a) | | | 6.05 | % | | | 06/01/17 | | | | 910,000 | |

| | 850,000 | | | Valmont Industries, Inc. | | | 6.63 | % | | | 04/20/20 | | | | 988,162 | |

| | 500,000 | | | Wachovia Corp. | | | 5.25 | % | | | 08/01/14 | | | | 524,558 | |

| | 900,000 | | | Wells Fargo Bank NA(b) | | | 0.50 | % | | | 05/16/16 | | | | 797,677 | |

| | 1,000,000 | | | Whirlpool Corp. | | | 7.75 | % | | | 07/15/16 | | | | 1,205,879 | |

| | 1,000,000 | | | Willis North America, Inc. | | | 6.20 | % | | | 03/28/17 | | | | 1,091,987 | |

| | | | | | | | | | | | | | | | |

| Total Corporate Bonds

(Cost $75,795,150) |

| | | 77,504,158 | |

| | U.S. Treasury Obligations (5.7%) | |

| | 2,000,000 | | | U.S. Treasury Note | | | 2.38 | % | | | 07/31/17 | | | | 2,136,250 | |

| | 1,000,000 | | | U.S. Treasury Note | | | 1.88 | % | | | 08/31/17 | | | | 1,038,750 | |

| | 2,000,000 | | | U.S. Treasury Note | | | 3.63 | % | | | 02/15/20 | | | | 2,308,750 | |

| | | | | | | | | | | | | | | | |

| Total U.S. Treasury Obligations

(Cost $5,031,283) |

| | | 5,483,750 | |

| | Foreign Corporate Bonds (7.7%) | |

| | 900,000 | | | AngloGold Holdings PLC | | | 5.38 | % | | | 04/15/20 | | | | 881,749 | |

| | 900,000 | | | ArcelorMittal(a) | | | 5.50 | % | | | 03/01/21 | | | | 806,445 | |

| | 900,000 | | | Aspen Insurance Holdings, Ltd.(a) | | | 6.00 | % | | | 12/15/20 | | | | 920,447 | |

| | 1,000,000 | | | Gold Fields Orogen Holding BVI, Ltd.(d) | | | 4.88 | % | | | 10/07/20 | | | | 920,672 | |

| | 900,000 | | | Petrobras International Finance Co. | | | 5.38 | % | | | 01/27/21 | | | | 909,900 | |

| | 1,900,000 | | | UBS AG | | | 5.88 | % | | | 12/20/17 | | | | 1,955,161 | |

| | 900,000 | | | Vale Overseas, Ltd. | | | 8.25 | % | | | 01/17/34 | | | | 1,096,200 | |

| | | | | | | | | | | | | | | | |

| Total Foreign Corporate Bonds

(Cost $7,748,949) |

| | | 7,490,574 | |

| | Foreign Government Bond (0.6%) | |

| | 500,000 | | | Republic of South Africa, YD | | | 6.50 | % | | | 06/02/14 | | | | 553,750 | |

| | | | | | | | | | | | | | | | |

| Total Foreign Government Bonds

(Cost $508,558) |

| | | 553,750 | |

| | Collateral for Securities on Loan (6.8%) | |

| | 6,560,230 | | | State Street Navigator Prime Portfolio | | | | | | | | | | | 6,560,230 | |

| | | | | | | | | | | | | | | | |

| Total Collateral for Securities on Loan

(Cost $6,560,230) |

| | | 6,560,230 | |

| | | | |

| SCHEDULEOF INVESTMENTS | | | 15 | |

| | | | | | | | | | | | |

| Shares or Principal Amount | | Interest

Rate | | Maturity

Date | | Value | |

| | | | | | | | | | | | |

| | Short-Term Investment (4.5%) | |

| $ | 4,326,005 | | | State Street Euro Dollar Time Deposit (USD), 0.01%, 10/03/11 | | | | | | $ | 4,326,005 | |

| | | | | | | | | | | | |

| Total Short-Term Investments

(Cost $4,326,005) | | | 4,326,005 | |

| Total Investments 105.5%

(Cost $99,970,175) | | | 101,918,467 | |

| | Liabilities Less Other Assets (5.5)% | | | (5,350,682 | ) |

| | | | | | | | | | | | |

| | Net Assets 100.0% | | $ | 96,567,785 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| (a) | All or a portion of the security was on loan as of September 30, 2011. |

| (b) | Floating Rate Security. Rate disclosed is as of September 30, 2011. |

| (c) | These securities are considered to be illiquid. The aggregate value of these securities at September 30, 2011 was $637,346, which represent 0.7% of the Fund’s Net Assets. |

| (d) | Security was acquired pursuant to Rule 144A of the Securities Act of 1933 and may be deemed to be restricted for resale. |

| | |

| 16 | | SCHEDULEOF INVESTMENTS |

| | | | |

MANAGEMENT OVERVIEW ICON CORE EQUITY FUND | | Class I Class C Class Z Class A | | ICNIX ICNCX ICNZX ICNAX |

| Q. | How did the Fund perform relative to its benchmark? |

| A. | The ICON Core Equity Fund lost -1.33% for the Class I shares, -2.27% for the Class C shares (-3.27% with maximum sales charge), -2.43% for the Class Z shares, and -2.42% for the Class A shares (-8.04% with maximum sales charge) for the fiscal year ended September 30, 2011. The Fund’s benchmark, the S&P Composite 1500 Index, gained 0.92% over the fiscal year. Total returns for other periods as of September 30, 2011 appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors influenced the Fund’s relative performance during the period? |

| A. | During fiscal year 2011, the stock market exhibited two extreme behaviors. Stock prices surged higher for the first seven months of the fiscal year. Between May and September 2011, however, prices dropped over European sovereign debt concerns and the potential fallout on the economy in general and European banks in particular. While the Fund rose 24.83% through April 2011, outperforming its benchmark, those gains were offset by the Fund’s declining 20.95% versus benchmark losses of 17.02% between May and September. As we did not see overpriced valuation readings typical of market peaks in April, we remained largely invested and had too much exposure during the ensuing five-month retreat. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The Fund is heavily weighted in economically sensitive, cyclical stocks - the very stocks investors worried about recessions or economic slowdowns tend to avoid. We continued to hold on to many of these stocks even through the market downturn in the last half of the fiscal year because they had attractive valuation readings under the ICON system. |

In that regard, the Fund was adversely affected by its holdings in the industrial conglomerates, industrial machinery, coal & consumable fuels, electronic components and steel industries. Nonetheless, we continue to hold positions in these last five industries at fiscal year end, believing them to be good values, and anticipating that these laggards will emerge as leaders in the next market upturn.

The top five industries that contributed positively to Fund performance are retail apparel, diversified metals & mining, computer hardware, consumer finance, and life & health insurance.

| Q. | What is your investment outlook for the overall market? |

| A. | As the fiscal year closes, we estimate the overall market has a value-to-price ratio of 1.48, giving us confidence about the prospect for future opportunities. We believe the fears that drove the market lower will prove to be unwarranted and that the market will resume its recovery off the March 2009 low. As one fiscal year closes and another begins, we will continue to rely upon our disciplined methodology to guide us through these challenging times. |

ICON Core Equity Fund

Sector Composition

September 30, 2011

| | | | |

Industrials | | | 25.8% | |

Consumer Discretionary | | | 25.2% | |

Information Technology | | | 13.6% | |

Energy | | | 12.2% | |

Materials | | | 8.5% | |

Financial | | | 7.4% | |

Health Care | | | 7.3% | |

| | | | |

| | | 100.0% | |

| | | | |

Percentages are based upon common stocks as a percentage of net assets.

ICON Core Equity Fund

Industry Composition

September 30, 2011

| | | | |

Integrated Oil & Gas | | | 7.4% | |

IT Consulting & Other Services | | | 7.2% | |

Cable & Satellite | | | 7.1% | |

Apparel Retail | | | 6.8% | |

Industrial Conglomerates | | | 6.0% | |

Footwear | | | 5.5% | |

Electrical Components & Equipment | | | 5.2% | |

Industrial Machinery | | | 5.0% | |

Computer Hardware | | | 4.5% | |

Steel | | | 4.4% | |

Industrial Gases | | | 4.1% | |

Movies & Entertainment | | | 3.8% | |

Railroads | | | 3.5% | |

Construction & Farm Machinery & Heavy Trucks | | | 3.5% | |

Biotechnology | | | 2.9% | |

Consumer Finance | | | 2.9% | |

| | | | |

Health Care Equipment | | | 2.3% | |

Specialized Finance | | | 2.1% | |

Health Care Services | | | 2.1% | |

General Merchandise Stores | | | 2.1% | |

Oil & Gas Drilling | | | 2.0% | |

Electronic Components | | | 1.8% | |

Other Diversified Financial Services | | | 1.8% | |

Trading Companies & Distributors | | | 1.7% | |

Coal & Consumable Fuels | | | 1.4% | |

Oil & Gas Refining & Marketing | | | 1.4% | |

Other Industries (each less

than 1%) | | | 1.5% | |

| | | | |

| | | 100.0% | |

| | | | |

Percentages are based upon common stocks as a percentage of net assets.

ICON Core Equity Fund

Average Annual Total Return

as of September 30, 2011

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | | | Gross

Expense

Ratio* | | | Net

Expense

Ratio* | |

ICON Core Equity Fund - Class I | | | 10/12/00 | | | | -1.33% | | | | -6.82% | | | | 1.23% | | | | 1.16% | | | | 1.35% | | | | 1.35% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 3.34% | | | | 1.01% | | | | N/A | | | | N/A | |

ICON Core Equity Fund - Class C | | | 11/28/00 | | | | -2.27% | | | | -7.62% | | | | 0.40% | | | | -0.20% | | | | 2.25% | | | | 2.25% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 3.34% | | | | 0.96% | | | | N/A | | | | N/A | |

ICON Core Equity Fund - Class Z | | | 5/6/04 | | | | -2.43% | | | | -7.17% | | | | N/A | | | | -1.37% | | | | 1.90% | | | | 1.90% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | N/A | | | | 2.62% | | | | N/A | | | | N/A | |

ICON Core Equity Fund - Class A | | | 5/31/06 | | | | -2.42% | | | | -7.82% | | | | N/A | | | | -8.14% | | | | 2.68% | | | | 2.68% | |

ICON Core Equity Fund - Class A (including maximum sales charge of 5.75%) | | | 5/31/06 | | | | -8.04% | | | | -8.90% | | | | N/A | | | | -9.15% | | | | 2.68% | | | | 2.68% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | N/A | | | | 0.10% | | | | N/A | | | | N/A | |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Since Inception performance results for Class C shares include returns for certain time periods that were restarted as of June 8, 2004. Class Z shares are available only to institutional investors.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

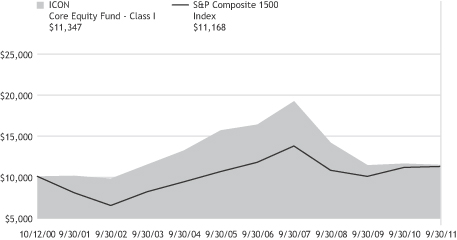

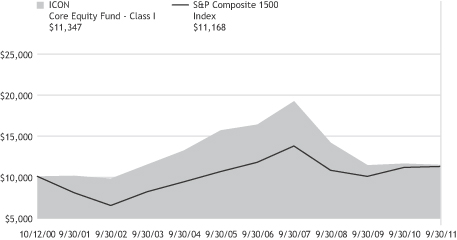

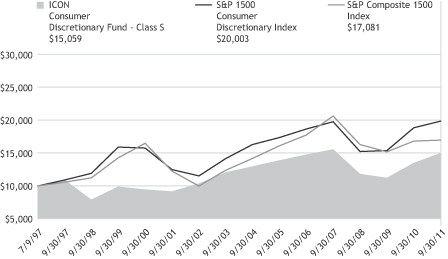

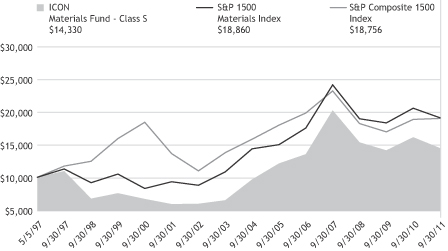

ICON Core Equity Fund

Value of a $10,000 Investment

through September 30, 2011

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Fund’s Class I shares on the Class’ inception date of 10/12/00 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Fund’s other share classes will vary due to differences in charges and expenses. The Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

ICON CORE EQUITY FUND

SCHEDULEOF INVESTMENTS

SEPTEMBER 30, 2011

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | Common Stocks (100.0%) | |

| | 22,100 | | | Accenture PLC, Class A | | $ | 1,164,228 | |

| | 53,800 | | | Alpha Natural Resources, Inc.† | | | 951,722 | |

| | 7,900 | | | Apple, Inc.† | | | 3,011,322 | |

| | 75,100 | | | Bio-Reference Labs, Inc.†(a) | | | 1,382,591 | |

| | 29,000 | | | CACI International, Inc., Class A† | | | 1,448,260 | |

| | 15,800 | | | Cash America International, Inc. | | | 808,328 | |

| | 31,000 | | | Caterpillar, Inc. | | | 2,289,040 | |

| | 31,400 | | | Celgene Corp.† | | | 1,944,288 | |

| | 27,100 | | | Chevron Corp. | | | 2,507,292 | |

| | 13,500 | | | Cliffs Natural Resources, Inc. | | | 690,795 | |

| | 5,700 | | | CME Group, Inc. | | | 1,404,480 | |

| | 114,700 | | | Comcast Corp., Class A | | | 2,397,230 | |

| | 31,800 | | | Cooper Industries PLC | | | 1,466,616 | |

| | 98,400 | | | Corning, Inc. | | | 1,216,224 | |

| | 61,800 | | | CSX Corp. | | | 1,153,806 | |

| | 18,200 | | | Dollar Tree, Inc.† | | | 1,367,002 | |

| | 18,400 | | | Dover Corp. | | | 857,440 | |

| | 21,600 | | | Eaton Corp. | | | 766,800 | |

| | 48,100 | | | Emerson Electric Co. | | | 1,987,011 | |

| | 33,200 | | | Exxon Mobil Corp. | | | 2,411,316 | |

| | 38,700 | | | Ezcorp, Inc., Class A† | | | 1,104,498 | |

| | 11,800 | | | General Dynamics Corp. | | | 671,302 | |

| | 126,400 | | | General Electric Co. | | | 1,926,336 | |

| | 31,000 | | | Illinois Tool Works, Inc. | | | 1,289,600 | |

| | 12,500 | | | International Business Machines Corp. | | | 2,187,875 | |

| | 39,000 | | | JPMorgan Chase & Co. | | | 1,174,680 | |

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | 35,500 | | | Nike, Inc., Class B | | $ | 3,035,605 | |

| | 44,100 | | | Noble Corp.† | | | 1,294,335 | |

| | 26,400 | | | Nucor Corp. | | | 835,296 | |

| | 6,300 | | | Parker Hannifin Corp. | | | 397,719 | |

| | 29,200 | | | Praxair, Inc. | | | 2,729,616 | |

| | 52,500 | | | ResMed, Inc.†(a) | | | 1,511,475 | |

| | 22,600 | | | Ross Stores, Inc. | | | 1,778,394 | |

| | 22,900 | | | Siemens AG, ADR | | | 2,056,191 | |

| | 137,900 | | | Steel Dynamics, Inc. | | | 1,367,968 | |

| | 37,300 | | | Time Warner Cable, Inc. | | | 2,337,591 | |

| | 48,600 | | | TJX Cos., Inc. | | | 2,695,842 | |

| | 14,500 | | | Union Pacific Corp. | | | 1,184,215 | |

| | 50,900 | | | Valero Energy Corp. | | | 905,002 | |

| | 30,200 | | | Viacom, Inc., Class B | | | 1,169,948 | |

| | 44,100 | | | Walt Disney Co. | | | 1,330,056 | |

| | 17,100 | | | Wells Fargo & Co. | | | 412,452 | |

| | 18,500 | | | Wolverine World Wide, Inc. | | | 615,125 | |

| | 7,700 | | | WW Grainger, Inc. | | | 1,151,458 | |

| | | | | | | | |

| Total Common Stocks

(Cost $67,135,739) | | | 66,388,370 | |

| Collateral for Securities on

Loan (2.8%) | | | | |

| | 1,841,798 | | | State Street Navigator Prime Portfolio | | | 1,841,798 | |

| | | | | | | | |

| Total Collateral for Securities

on Loan

(Cost $1,841,798) | | | 1,841,798 | |

| Total Investments 102.8%

(Cost $68,977,537) | | | 68,230,168 | |

| Liabilities Less Other Assets

(2.8)% | | | (1,875,937 | ) |

| | | | | | | | |

| | Net Assets 100.0% | | $ | 66,354,231 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| † | Non-income producing security. |

| (a) | All or a portion of the security was on loan as of September 30, 2011. |

| ADR | American Depository Receipt |

| | | | |

| SCHEDULEOF INVESTMENTS | | | 21 | |

| | | | |

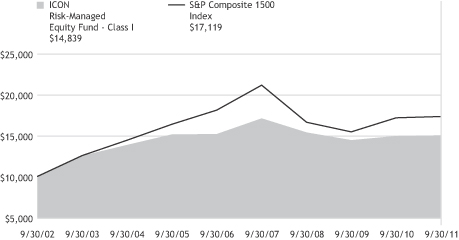

MANAGEMENT OVERVIEW ICON EQUITY INCOME FUND | | Class I Class C Class Z Class A | | IOEIX IOECX IOEZX IEQAX |

| Q. | How did the Fund perform relative to its benchmark? |

| A. | The ICON Equity Income Fund, Class I, returned -2.73% for the fiscal year ending September 30, 2011, underperforming the Fund’s benchmark, the S&P Composite 1500 Index, which returned 0.92% during the same period. Class A shares of the Fund returned -2.66% (and -8.22% with maximum sales charge) during the same period. Class C shares of the Fund returned -3.47% (and –4.47% with maximum sales charge) for the fiscal year, while Class Z shares returned -2.40%. Total returns for other periods as of September 30, 2011 appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | In the first half of the fiscal year, the S&P 1500 rose over 18% while the ICON Equity Income Fund returned approximately 14%. The Fund’s cash and non-equity holdings, as well as weak performance from the Fund’s dividend paying stocks in general, help account for the Fund’s underperforming the benchmark by 4% during this period. For the 12-months ended September 30, 2011, the Fund’s composition, on average, included an allocation of approximately 15% cash, preferred stock, convertible bonds, and other fixed income instruments. In a six-month period marked by an 18% return in the benchmark, the Fund’s cash and fixed income holdings proved detrimental to performance. The Fund’s dividend-paying stocks likewise dragged on performance. Within the S&P 1500, stocks that pay a dividend yield of less than 2% gained over 20% during the first half of the fiscal year while stocks that pay more than 2% returned about 15% for the same time period. Over the course of the fiscal year, 78% of the stocks in the ICON Equity Income Fund, on average, had a dividend of 2% or more. |

In the last half of the fiscal year, however, the market reversed course, and both the market and the Fund experienced significant losses that offset earlier gains. Although the Fund’s equity positions lagged the benchmark, this time the Fund’s non-equity exposure benefitted Fund performance during the market downturn.

| Q. | How did the Fund’s composition affect performance? |

| A. | The fund was overweight Energy and Industrials stocks with a dividend yield of 2% or more. These higher yielding stocks returned considerably |

| | less during the fiscal year than stocks that paid a dividend yield of less than 2%. Moreover, the Fund’s Energy and Industrials holdings had losses of 20% or more compared to an overall 6.5% loss for similar yielding stocks in the S&P 1500. |

The Fund’s overweight position in the Industrials sector was the biggest detractor from performance, with the Fund’s railroads holdings in particular contributing significantly to those losses. Over the course of the fiscal year, Industrials made up on average around 13.8% of the Fund compared to 11.5% of the benchmark. On the other hand, the Fund’s overweight Utilities holdings were up approximately 19.5% over the fiscal year, outperforming the 11.9% return by the Utilities stocks held by the S&P 1500. Still, the Fund’s Utilities returns could not overcome losses by the Fund’s Industrials and other cyclical holdings.

| Q. | What is your investment outlook for the market? |

| A. | As the fiscal year ends, we estimate the overall domestic market has a V/P of approximately 1.48 under the ICON system, suggesting many opportunities exist for investors. We believe also that investors will seek out high dividend securities as they look to generate income in the coming year. Guided by our valuation and relative strength metrics, we will continue to try to take advantage of changing market conditions so as to benefit the Fund. |

ICON Equity Income Fund

Sector Composition

September 30, 2011

| | | | |

Industrials | | | 17.8% | |

Financial | | | 15.3% | |

Information Technology | | | 14.7% | |

Consumer Discretionary | | | 11.6% | |

Energy | | | 10.9% | |

Materials | | | 7.4% | |

Health Care | | | 6.7% | |

Telecommunication & Utilities | | | 4.7% | |

Consumer Staples | | | 2.7% | |

| | | | |

| | | 91.8% | |

| | | | |

Percentages are based upon common, preferred and convertible preferred stocks as a percentage of net assets.

ICON Equity Income Fund

Industry Composition

September 30, 2011

| | | | |

Integrated Oil & Gas | | | 7.9% | |

Industrial Conglomerates | | | 3.9% | |

Pharmaceuticals | | | 3.7% | |

IT Consulting & Other Services | | | 3.0% | |

Apparel Retail | | | 2.9% | |

Railroads | | | 2.9% | |

Systems Software | | | 2.8% | |

Industrial Machinery | | | 2.6% | |

Office Services & Supplies | | | 2.4% | |

Semiconductors | | | 2.3% | |

Regional Banks | | | 2.3% | |

Diversified Chemicals | | | 2.3% | |

Aerospace & Defense | | | 2.1% | |

Diversified Banks | | | 2.0% | |

Oil & Gas Drilling | | | 1.8% | |

Specialty Chemicals | | | 1.8% | |

Restaurants | | | 1.8% | |

Asset Management & Custody Banks | | | 1.8% | |

Mortgage REIT’s | | | 1.7% | |

Data Processing & Outsourced Services | | | 1.7% | |

Other Diversified Financial Services | | | 1.7% | |

Life & Health Insurance | | | 1.6% | |

| | | | |

Construction & Farm Machinery & Heavy Trucks | | | 1.6% | |

Industrial Gases | | | 1.5% | |

Health Care Equipment | | | 1.3% | |

Computer Hardware | | | 1.3% | |

Home Improvement Retail | | | 1.3% | |

Coal & Consumable Fuels | | | 1.2% | |

Specialized Consumer Services | | | 1.2% | |

Specialized Finance | | | 1.1% | |

General Merchandise Stores | | | 1.1% | |

Semiconductor Equipment | | | 1.1% | |

Internet Software & Services | | | 1.1% | |

Cable & Satellite | | | 1.1% | |

Movies & Entertainment | | | 1.0% | |

Consumer Finance | | | 1.0% | |

Thrifts & Mortgage Finance | | | 1.0% | |

Multi-Utilities | | | 1.0% | |

Commercial Printing | | | 1.0% | |

Steel | | | 1.0% | |

Property & Casualty Insurance | | | 1.0% | |

Other Industries (each less

than 1%) | | | 12.9% | |

| | | | |

| | | 91.8% | |

| | | | |

Percentages are based upon common, preferred and convertible preferred stocks as a percentage of net assets.

ICON Equity Income Fund

Average Annual Total Return

as of September 30, 2011

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | 1 Year | | | 5 Years | | | Since

Inception | | | Gross

Expense

Ratio* | | | Net

Expense

Ratio* | |

ICON Equity Income Fund - Class I | | | 9/30/02 | | | | -2.73% | | | | -1.12% | | | | 5.75% | | | | 1.55% | | | | 1.47% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 6.16% | | | | N/A | | | | N/A | |

ICON Equity Income Fund - Class C | | | 11/8/02 | | | | -3.47% | | | | -1.98% | | | | 4.18% | | | | 2.99% | | | | 2.22% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 5.18% | | | | N/A | | | | N/A | |

ICON Equity Income Fund - Class Z | | | 5/10/04 | | | | -2.40% | | | | -0.97% | | | | 2.60% | | | | 7.68% | | | | 1.22% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 2.99% | | | | N/A | | | | N/A | |

ICON Equity Income Fund - Class A | | | 5/31/06 | | | | -2.66% | | | | -1.25% | | | | -1.09% | | | | 4.61% | | | | 1.47% | |

ICON Equity Income Fund - Class A (including maximum sales charge of 5.75%) | | | 5/31/06 | | | | -8.22% | | | | -2.41% | | | | -2.18% | | | | 4.61% | | | | 1.47% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 0.10% | | | | N/A | | | | N/A | |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future. Class Z shares are available only to institutional investors.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

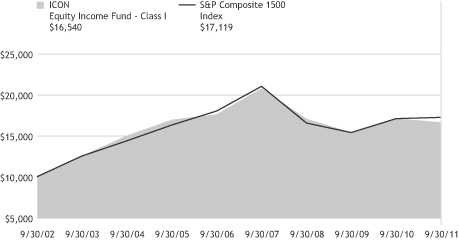

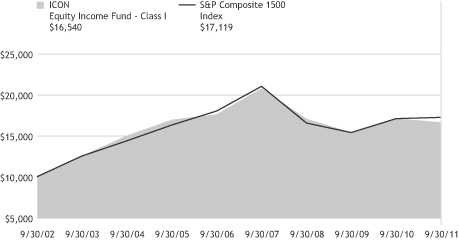

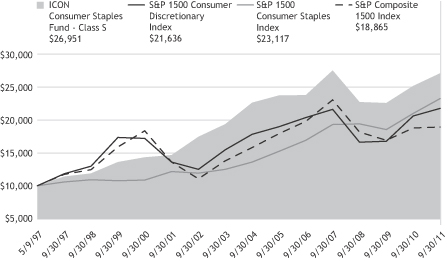

ICON Equity Income Fund

Value of a $10,000 Investment

through September 30, 2011

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Fund’s Class I shares on the Class’ inception date of 9/30/02 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Fund’s other share classes will vary due to differences in charges and expenses. The Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

ICON EQUITY INCOME FUND

SCHEDULEOF INVESTMENTS

SEPTEMBER 30, 2011

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | Common Stocks (88.0%) | |

| | 8,500 | | | 3M Co. | | $ | 610,215 | |

| | 15,500 | | | A Schulman, Inc. | | | 263,345 | |

| | 6,500 | | | Air Products & Chemicals, Inc. | | | 496,405 | |

| | 5,900 | | | Alliance Resource Partners L.P. | | | 386,804 | |

| | 31,700 | | | American Eagle Outfitters, Inc. | | | 371,524 | |

| | 8,500 | | | American States Water Co. | | | 288,405 | |

| | 19,500 | | | Annaly Capital Management, Inc., REIT | | | 324,285 | |

| | 42,800 | | | Apollo Investment Corp. | | | 321,856 | |

| | 6,400 | | | Automatic Data Processing, Inc. | | | 301,760 | |

| | 5,200 | | | Avery Dennison Corp. | | | 130,416 | |

| | 7,000 | | | Bank of Montreal(a) | | | 390,950 | |

| | 7,800 | | | Baxter International, Inc. | | | 437,892 | |

| | 19,300 | | | BB&T Corp. | | | 411,669 | |

| | 11,400 | | | Best Buy Co., Inc. | | | 265,620 | |

| | 1,700 | | | BlackRock, Inc. | | | 251,617 | |

| | 8,000 | | | Buckle, Inc.(a) | | | 307,680 | |

| | 6,900 | | | Caterpillar, Inc. | | | 509,496 | |

| | 11,100 | | | CEC Entertainment, Inc. | | | 316,017 | |

| | 7,400 | | | Chevron Corp. | | | 684,648 | |

| | 1,500 | | | CME Group, Inc. | | | 369,600 | |

| | 9,700 | | | Computer Sciences Corp. | | | 260,445 | |

| | 13,000 | | | ConocoPhillips | | | 823,160 | |

| | 17,700 | | | CSX Corp. | | | 330,459 | |

| | 3,900 | | | Cullen/Frost Bankers, Inc. | | | 178,854 | |

| | 15,400 | | | Diebold, Inc. | | | 423,654 | |

| | 14,100 | | | Dow Chemical Co. | | | 316,686 | |

| | 10,700 | | | E.I. du Pont de Nemours & Co. | | | 427,679 | |

| | 8,000 | | | Eaton Corp. | | | 284,000 | |

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | 7,100 | | | Eli Lilly & Co. | | $ | 262,487 | |

| | 9,300 | | | ENI SpA, ADR(a) | | | 326,709 | |

| | 7,900 | | | Ensco PLC, ADR | | | 319,397 | |

| | 10,300 | | | Exxon Mobil Corp. | | | 748,089 | |

| | 36,800 | | | First Niagara Financial Group, Inc. | | | 336,720 | |

| | 43,900 | | | General Electric Co. | | | 669,036 | |

| | 9,100 | | | Guess?, Inc. | | | 259,259 | |

| | 28,600 | | | H&R Block, Inc. | | | 380,666 | |

| | 6,900 | | | Harris Corp. | | | 235,773 | |

| | 13,500 | | | Harsco Corp. | | | 261,765 | |

| | 12,800 | | | Home Depot, Inc. | | | 420,736 | |

| | 7,400 | | | Illinois Tool Works, Inc. | | | 307,840 | |

| | 21,800 | | | Intel Corp. | | | 464,994 | |

| | 5,600 | | | International Business Machines Corp. | | | 980,168 | |

| | 4,300 | | | Johnson & Johnson | | | 273,953 | |

| | 18,500 | | | JPMorgan Chase & Co. | | | 557,220 | |

| | 3,600 | | | Kimberly-Clark Corp. | | | 255,636 | |

| | 9,300 | | | KLA-Tencor Corp. | | | 356,004 | |

| | 13,400 | | | Leggett & Platt, Inc. | | | 265,186 | |

| | 10,800 | | | Linear Technology Corp. | | | 298,620 | |

| | 3,600 | | | Lockheed Martin Corp. | | | 261,504 | |

| | 21,300 | | | Manulife Financial Corp. | | | 241,329 | |

| | 11,900 | | | Merck & Co., Inc. | | | 389,249 | |

| | 8,400 | | | Mercury General Corp. | | | 322,140 | |

| | 36,600 | | | Microsoft Corp. | | | 910,974 | |

| | 7,000 | | | Norfolk Southern Corp. | | | 427,140 | |

| | 4,400 | | | Northrop Grumman Corp. | | | 229,504 | |

| | 10,200 | | | Nucor Corp. | | | 322,728 | |

| | 7,100 | | | Omnicom Group, Inc. | | | 261,564 | |

| | 55,300 | | | PDL BioPharma, Inc. | | | 306,915 | |

| | 5,000 | | | PepsiCo, Inc. | | | 309,500 | |

| | 15,900 | | | Pfizer, Inc. | | | 281,112 | |

| | 34,200 | | | Pitney Bowes, Inc.(a) | | | 642,960 | |

| | 11,800 | | | Pool Corp. | | | 308,924 | |

| | | | |

| SCHEDULEOF INVESTMENTS | | | 27 | |

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | 22,000 | | | Redwood Trust, Inc., REIT(a) | | $ | 245,740 | |

| | 23,300 | | | RR Donnelley & Sons Co. | | | 328,996 | |

| | 5,800 | | | Ryder System, Inc. | | | 217,558 | |

| | 8,300 | | | SCANA Corp. | | | 335,735 | |

| | 20,600 | | | Seagate Technology PLC | | | 211,768 | |

| | 10,400 | | | Southern Copper Corp. | | | 259,896 | |

| | 12,100 | | | Sun Life Financial, Inc. | | | 287,859 | |

| | 46,000 | | | SUPERVALU, Inc.(a) | | | 306,360 | |

| | 7,500 | | | Target Corp. | | | 367,800 | |

| | 19,800 | | | Texas Roadhouse, Inc. | | | 261,756 | |

| | 5,600 | | | Transocean, Ltd. | | | 267,344 | |

| | 9,300 | | | UGI Corp. | | | 244,311 | |

| | 2,200 | | | Union Pacific Corp. | | | 179,674 | |

| | 67,200 | | | United Online, Inc. | | | 351,456 | |

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | 3,900 | | | United Parcel Service, Inc., Class B | | $ | 246,285 | |

| | 2,800 | | | United Technologies Corp. | | | 197,008 | |

| | 15,700 | | | Valley National Bancorp | | | 166,263 | |

| | 10,200 | | | Valspar Corp. | | | 318,342 | |

| | 11,000 | | | Wells Fargo & Co. | | | 265,320 | |

| | | | | | | | |

| Total Common Stocks

(Cost $31,605,601) | | | 28,740,413 | |

| | Preferred Stocks (3.1%) | | | | |

| | 13,400 | | | Capital One Capital II(a) | | | 338,350 | |

| | 13,400 | | | Comcast Corp. | | | 343,308 | |

| | 13,400 | | | Viacom, Inc. | | | 341,834 | |

| | | | | | | | |

| Total Preferred Stocks

(Cost $1,034,833) | | | 1,023,492 | |

| | | | | | | | | | | | | | | | |

| Shares or Principal Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

| | Corporate Bonds (6.2%) | | | | | | | | | | | | |

| $ | 240,000 | | | Archer-Daniels-Midland Co. | | | 6.63 | % | | | 05/01/29 | | | $ | 314,287 | |

| | 600,000 | | | Bank of America Corp. | | | 5.42 | % | | | 03/15/17 | | | | 521,258 | |

| | 350,000 | | | Commercial Metals Co. | | | 7.35 | % | | | 08/15/18 | | | | 356,008 | |

| | 300,000 | | | Delphi Financial Group, Inc. | | | 7.88 | % | | | 01/31/20 | | | | 344,258 | |

| | 500,000 | | | Goldman Sachs Group, Inc. | | | 5.38 | % | | | 03/15/20 | | | | 496,538 | |

| | | | | | | | | | | | | | | | |

| Total Corporate Bonds

(Cost $2,081,063) | | | | | | | | | | | 2,032,349 | |

| | Convertible Corporate Bonds (0.8%) | | | | | | | | | | | | |

| | 350,000 | | | Central European Distribution Corp. | | | 3.00 | % | | | 03/15/13 | | | | 239,750 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Corporate Bonds

(Cost $323,507) | | | | | | | | | | | 239,750 | |

| | Convertible Preferred Stock (0.7%) | | | | | | | | | | | | |

| | 6,100 | | | Omnicare Capital Trust II, Series B | | | 4.00 | % | | | 06/15/33 | | | | 231,800 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Preferred Stocks

(Cost $265,165) | | | | | | | | | | | 231,800 | |

| | | | |

| | 28 | | | SCHEDULEOF INVESTMENTS |

| | | | | | | | |

Underlying Security/ Expiration Date/

Exercise Price | | Contracts* | | | Value | |

| Call Options Purchased (0.1%) | |

Archer-Daniels-Midland Co., January 2013, $35.00 | | | 69 | | | $ | 7,141 | |

Bank Of America Corp., January 2012, $17.50 | | | 343 | | | | 343 | |

Bank Of America Corp., January 2012, $9.00 | | | 667 | | | | 15,341 | |

Commercial Metals Co., March 2012, $14.00 | | | 250 | | | | 6,250 | |

Computer Sciences Corp., January 2012, $60.00 | | | 58 | | | | 290 | |

Delphi Financial Group, Inc., January 2012, $30.00 | | | 100 | | | | 2,500 | |

Goldman Sachs Group, Inc., January 2012, $185.00 | | | 27 | | | | 135 | |

Hewlett Packard Co., January 2012, $50.00 | | | 50 | | | | 125 | |

Valero Energy Corp., January 2012, $30.00 | | | 117 | | | | 1,287 | |

| | | | | | | | |

Total Call Options Purchased (Cost $228,380) | | | | 33,412 | |

| | | | | | | | |

Shares or Principal Amount | | Value | |

| | Collateral for Securities on Loan (6.6%) | |

| | 2,154,862 | | | State Street Navigator Prime Portfolio | | $ | 2,154,862 | |

| | | | | | | | |

| Total Collateral for Securities

on Loan

(Cost $2,154,862) | | | 2,154,862 | |

| Total Investments 105.5%

(Cost $37,693,411) | | | 34,456,078 | |

| Liabilities Less Other Assets

(5.5)% | | | (1,794,482 | ) |

| | | | | | | | |

| | Net Assets 100.0% | | $ | 32,661,596 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| * | All Options have 100 shares per contract. |

| (a) | All or a portion of the security was on loan as of September 30, 2011. |

| ADR | American Depository Receipt |

| REIT | Real Estate Investment Trust |

| | | | |

| SCHEDULEOF INVESTMENTS | | | 29 | |

| | | | |

MANAGEMENT OVERVIEW ICON LONG/SHORT FUND | | Class I Class C Class Z Class A | | IOLIX IOLCX IOLZX ISTAX |

| Q. | How did the Fund perform relative to its benchmark? |

| A. | For the 12-months ended September 30, 2011, the ICON Long/Short Fund returned -2.78% for Class I shares, -3.54% for Class C shares (-4.54% with maximum sales charge), -2.44% for Class Z shares, and -2.80% for Class A shares (-8.41% with maximum sales charge), underperforming the 0.92% return for the Fund’s stated benchmark, the S&P 1500 Composite Index. The Fund underperformed the 0.27% return for the Bank of America/Merrill Lynch US Dollar 3 month Constant Maturity benchmark which is often traditionally used with long/short funds. Total returns and other performance statistics for other periods as of September 30, 2011 appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors influenced the Fund’s relative performance during the period? |

| A. | Between September 30, 2010 and September 30, 2011, the stock market exhibited two very different behaviors. The market rallied from the beginning of the fiscal year, surging higher through the end of April 2011. From May through the end of September, however, the S&P 1500 fell 16.22%, as investors grew concerned over Europe’s sovereign debt crisis and its impact on Europe’s banks in particular and the economy in general. The Fund did not keep pace with its benchmark as the market rallied through April, but, by design, the Fund declined less than the market during the May-September retreat. |

The ICON system did not uncover many overvalued companies during the fiscal year, making it difficult to find stocks we believed were overpriced to sell short. In fact, on September 22, 2011, we calculated an overall market V/P of 1.59 – one of the highest V/Ps we’ve ever recorded. Negative investor sentiment and high valuations make for attractive bargains under the ICON system, and we saw few places to profit from short selling in this environment.

| Q. | How did the Fund’s composition affect performance? |

| A. | The Fund had a heavy, long position tilt in economically sensitive, cyclical stocks during the fiscal year. In spite of our high valuation readings, investors avoided these shares as they became wary of an economic slowdown or recession. The Fund’s exposure to cyclical industries and sectors, combined with what we believed to be a dearth of short opportunities, negatively impacted performance. |

The industries that benefitted Fund performance during the fiscal year included IT consulting, life & health Insurance, diversified metals & mining, apparel retail and homefurnishing retail. By contrast, the Fund’s holdings in railroads, industrial machinery, steel, electronic components and coal & consumable fuels adversely affected Fund performance. Nonetheless, at fiscal year-end the Fund continued to hold positions in these five industries, as we believe these laggards may well become this fiscal year’s leaders.

| Q. | What is your investment outlook for the overall market? |

| A. | As the fiscal year ends, we estimate the overall market has a V/P of 1.48, giving us confidence about the prospect for future opportunities. We believe the fears that drove the market lower will prove to be unwarranted and that the market will resume its recovery off the March 2009 low. As one fiscal year closes and another begins, we will continue to rely upon our disciplined methodology to guide us through these challenging times. |

ICON Long/Short Fund

Sector Composition

September 30, 2011

| | | | |

Industrials | | | 24.6% | |

Information Technology | | | 21.0% | |

Consumer Discretionary | | | 18.8% | |

Financial | | | 11.1% | |

Energy | | | 9.6% | |

Health Care | | | 7.8% | |

Materials | | | 7.2% | |

| | | | |

| | | 100.1% | |

| | | | |

Percentages are based upon long positions as a percentage of net assets.

ICON Long/Short Fund

Industry Composition

September 30, 2011

| | | | |

IT Consulting & Other Services | | | 12.7% | |

Integrated Oil & Gas | | | 8.7% | |

Industrial Machinery | | | 7.6% | |

Apparel Retail | | | 7.0% | |

Cable & Satellite | | | 5.7% | |

Computer Hardware | | | 4.6% | |

Industrial Conglomerates | | | 4.3% | |

Consumer Finance | | | 4.2% | |

| | | | |

Railroads | | | 3.5% | |

Construction & Farm Machinery & Heavy Trucks | | | 3.4% | |

Health Care Equipment | | | 3.2% | |

Industrial Gases | | | 3.0% | |

Footwear | | | 3.0% | |

Biotechnology | | | 2.9% | |

ICON Long/Short Fund

Industry Composition (continued)

September 30, 2011

| | | | |

Electrical Components & Equipment | | | 2.8% | |

Diversified Banks | | | 2.1% | |

Specialty Chemicals | | | 2.1% | |

Specialized Finance | | | 2.1% | |

Steel | | | 2.0% | |

Electronic Components | | | 2.0% | |

Aerospace & Defense | | | 2.0% | |

Other Diversified Financial Services | | | 1.8% | |

Health Care Services | | | 1.8% | |

| | | | |

Data Processing & Outsourced Services | | | 1.7% | |

General Merchandise Stores | | | 1.6% | |

Home Improvement Retail | | | 1.5% | |

Trading Companies & Distributors | | | 1.0% | |

Other Industries (each less

than 1%) | | | 1.8% | |

| | | | |

| | | 100.1% | |

| | | | |

Percentages are based upon long positions as a percentage of net assets.

ICON Long/Short Fund

Average Annual Total Return

as of September 30, 2011

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | 1 Year | | | 5 Years | | | Since

Inception | | | Gross

Expense

Ratio* | | | Net

Expense

Ratio* | |

ICON Long/Short Fund - Class I | | | 9/30/02 | | | | -2.78% | | | | -5.65% | | | | 3.34% | | | | 2.90% | | | | 2.45% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 6.16% | | | | N/A | | | | N/A | |

ICON Long/Short Fund - Class C | | | 10/17/02 | | | | -3.54% | | | | -6.40% | | | | 1.88% | | | | 3.60% | | | | 3.19% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 5.35% | | | | N/A | | | | N/A | |

ICON Long/Short Fund - Class Z | | | 5/6/04 | | | | -2.44% | | | | -5.51% | | | | -0.52% | | | | 5.80% | | | | 2.15% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 2.62% | | | | N/A | | | | N/A | |

ICON Long/Short Fund - Class A | | | 5/31/06 | | | | -2.80% | | | | -5.72% | | | | -5.71% | | | | 3.65% | | | | 2.45% | |

ICON Long/Short Fund - Class A (including maximum sales charge of 5.75%) | | | 5/31/06 | | | | -8.41% | | | | -6.83% | | | | -6.75% | | | | 3.65% | | | | 2.45% | |

S&P Composite 1500 Index | | | | | | | 0.92% | | | | -0.86% | | | | 0.10% | | | | N/A | | | | N/A | |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future. Class Z shares are available only to institutional investors.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

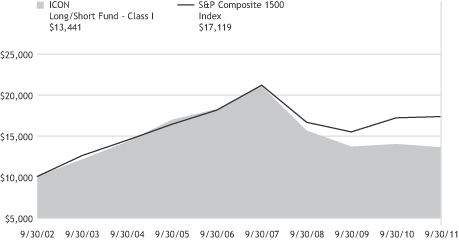

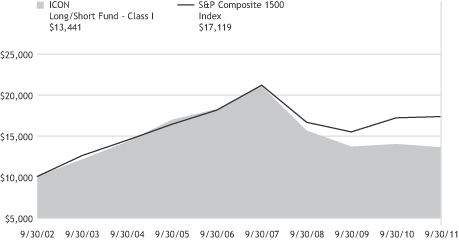

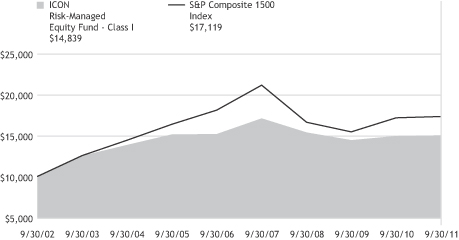

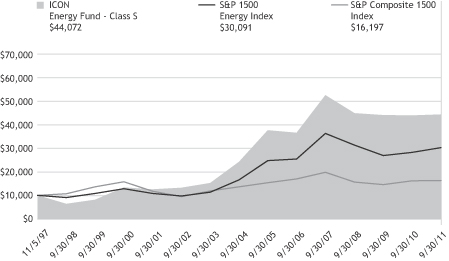

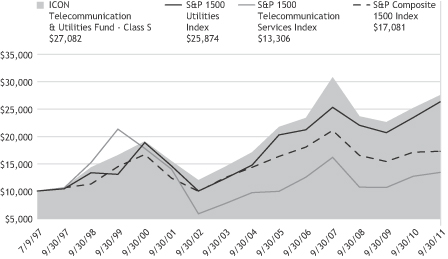

ICON Long/Short Fund

Value of a $10,000 Investment

through September 30, 2011

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Fund’s Class I shares on the Class’ inception date of 9/30/02 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Fund’s other share classes will vary due to differences in charges and expenses. The Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

ICON LONG/SHORT FUND

SCHEDULEOF INVESTMENTS

SEPTEMBER 30, 2011

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | Common Stocks (100.1%) | |

| | 9,500 | | | Accenture PLC, Class Ax | | $ | 500,460 | |

| | 7,300 | | | Alpha Natural Resources, Inc.†x | | | 129,137 | |

| | 1,700 | | | Apple, Inc.†x | | | 648,006 | |

| | 4,400 | | | Automatic Data Processing, Inc.x | | | 207,460 | |

| | 13,700 | | | Bio-Reference Labs, Inc.†(a) | | | 252,217 | |

| | 6,400 | | | CACI International, Inc., Class A† | | | 319,616 | |

| | 4,700 | | | Capital One Financial Corp.x | | | 186,261 | |

| | 5,500 | | | Caterpillar, Inc.x | | | 406,120 | |

| | 6,600 | | | Celgene Corp.†x | | | 408,672 | |

| | 3,200 | | | Chevron Corp.x | | | 296,064 | |

| | 2,700 | | | Cliffs Natural Resources, Inc. | | | 138,159 | |

| | 1,200 | | | CME Group, Inc. | | | 295,680 | |

| | 5,800 | | | Cognizant Technology Solutions Corp., Class A† | | | 363,660 | |

| | 21,500 | | | Comcast Corp., Class Ax | | | 449,350 | |

| | 1,300 | | | Computer Sciences Corp. | | | 34,905 | |

| | 3,500 | | | Cooper Industries PLC | | | 161,420 | |

| | 22,900 | | | Corning, Inc. | | | 283,044 | |

| | 1,300 | | | Covidien PLCx | | | 57,330 | |

| | 18,600 | | | CSX Corp.x | | | 347,262 | |

| | 10,500 | | | Danaher Corp.x | | | 440,370 | |

| | 1,300 | | | Deere & Co. | | | 83,941 | |

| | 3,100 | | | Dollar Tree, Inc.† | | | 232,841 | |

| | 8,600 | | | Dover Corp. | | | 400,760 | |

| | 6,100 | | | Ecolab, Inc. | | | 298,229 | |

| | 5,600 | | | Emerson Electric Co. | | | 231,336 | |

| | | | | | | | |

| Shares or Principal Amount | | Value | |

| | | | | | | | |

| | 10,000 | | | Exxon Mobil Corp.x | | $ | 726,300 | |

| | 14,300 | | | Ezcorp, Inc., Class A† | | | 408,122 | |

| | 2,500 | | | General Dynamics Corp. | | | 142,225 | |

| | 40,400 | | | General Electric Co.x | | | 615,696 | |

| | 4,800 | | | Guess?, Inc. | | | 136,752 | |

| | 4,600 | | | HCC Insurance Holdings, Inc. | | | 124,430 | |

| | 3,600 | | | Home Depot, Inc. | | | 118,332 | |

| | 5,700 | | | Illinois Tool Works, Inc. | | | 237,120 | |

| | 3,600 | | | International Business Machines Corp.x | | | 630,108 | |

| | 8,500 | | | JPMorgan Chase & Co. | | | 256,020 | |

| | 5,100 | | | Lowe’s Cos., Inc. | | | 98,634 | |

| | 10,200 | | | Marathon Oil Corp.x | | | 220,116 | |