UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08061

Diamond Hill Funds

(Exact name of registrant as specified in charter)

325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Address of principal executive offices) (Zip code)

Thomas E. Line, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Name and address of agent for service)

Registrant’s telephone number, including area code: 614-255-3333

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Item 1. Reports to Stockholders.

Annual Report

December 31, 2014

| | |

| Small Cap Fund | | Long-Short Fund |

| Small-Mid Cap Fund | | Research Opportunities Fund |

| Mid Cap Fund | | Financial Long-Short Fund |

| Large Cap Fund | | Strategic Income Fund |

| Select Fund | | |

This material must be preceded or accompanied by a current prospectus.

Not FDIC Insured. May Lose Value. No Bank Guarantee.

Table of Contents

Cautionary Statement: At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Investors should consider the investment objectives, risks, charges, and expenses of the Diamond Hill Funds carefully before investing. The prospectus or summary prospectus contain this and other important information about the Fund(s) and are available at diamond-hill.com or by calling 888.226.5595. Please read the prospectus or summary prospectus carefully before investing. The Diamond Hill Funds are distributed by BHIL Distributors, Inc. (Member FINRA), an affiliated company. Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

Letter to Shareholders

Dear Fellow Shareholders:

We are pleased to provide you with this year-end update for the Diamond Hill Funds. All of our Funds posted positive absolute returns in 2014; however, on a relative basis, most trailed their respective benchmark returns. 2014 was a difficult year for active managers in large part due to lower volatility and lower dispersion. Volatility provides opportunities for active managers to identify mispricings in the market and take advantage of those mispricings. When volatility is low, there are fewer opportunities. Similarly, when dispersion is low, the spread between winners and losers is narrow, making it more difficult to stand out from the crowd. More importantly, as of December 31, 2014, the since inception returns for nearly all of our Funds exceeded their respective benchmark returns. The exceptions were the Diamond Hill Research Opportunities Fund and the Diamond Hill Mid Cap Fund. The Mid Cap Fund has been in existence for less than five years, which is the minimum time period that we use to evaluate our results, and the Research Opportunities Fund completed its first five-year period of existence at March 31, 2014.

2014 Financial Markets

Driven by an expanding economy, growing corporate profits, and persistently low interest rates, the broad U.S. equity market posted its sixth consecutive annual gain in 2014. The S&P 500 Index finished the year with a 13.7% total return (including dividends), and the Federal Reserve signaled its belief in the economy’s ability to grow without assistance by concluding its bond purchasing program known as Quantitative Easing, or QE, in October 2014. Although investors expect the Fed to raise interest rates sometime in 2015, its overall monetary policy remains accommodative, encouraging equity investors.

In the U.S., unemployment fell as a result of the best hiring stretch since the late 1990s. The U.S. consumer benefitted from a steep decline in gasoline prices to the lowest levels in five years. The sharp decline in the price of oil over the past few months is likely to improve household budgets. Globally, central banks remained extraordinarily accommodative in an attempt to provide a backdrop for increased economic growth. Europe, which has been a clear economic laggard over the past few years, was still only showing modest signs of improvement. Meanwhile, China and India continued to grow at healthy mid-single digit rates, but many other emerging economies around the world are seeing decelerating growth rates. The U.S. dollar ended the year strong relative to other currencies as investors were confident that stronger economic growth in the U.S. will lead the Fed to raise rates in 2015 for the first time since before the financial crisis.

Outlook

Despite the end of the Federal Reserve’s Quantitative Easing, we continue to believe the Fed is likely to maintain a very accommodative overall monetary stance well into next year as the domestic economy is lacking signs of robust growth, while inflation expectations have again turned lower. The recent strength of the U.S. dollar is now playing a key role in these

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 1 | |

Letter to Shareholders

developments as its relative appreciation has created a new headwind for growth while also pushing down commodity prices. The modest deleveraging of the U.S. household sector over the past few years continues to be a positive story. These lower debt levels combined with very low interest rates have allowed consumer debt-service burdens to improve to very low levels by historical standards. This healthy debt service picture remains very much tied to historically low interest/mortgage rates, and any sharp, meaningful increase in those rates is likely to present an important headwind for growth.

Although the U.S. economy appears to be healing at a steady pace and set to maintain its 2% - 3% growth heading into next year, we continue to expect positive but below average equity market returns over the next five years. Our conclusion is primarily based on above average price/earnings multiples applied to already very strong corporate profit margins, which in combination, likely tempers prospective returns. This outlook also seems consistent with the current interest rate environment. We believe that we can achieve better than market returns over the next five years through active portfolio management and stock selection independent of benchmark weights.

Diamond Hill Capital Management, Inc.

| | |

| |  |

| |

Chris Welch, CFA Co-Chief Investment Officer | | Austin Hawley, CFA Co-Chief Investment Officer |

The views expressed are those of the portfolio managers as of December 31, 2014, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The S&P 500 Index is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard and Poor’s selects the companies for the index to widely represent the stock market based on market size, liquidity, and industry group representation. Indexes are unmanaged, do not incur fees, and cannot be invested in directly.

| | | | | | | | | | | | | | |

| 2 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Our Mission

At Diamond Hill, we serve our clients by providing investment strategies that deliver lasting value through a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach and alignment with our clients’ interests.

VALUE

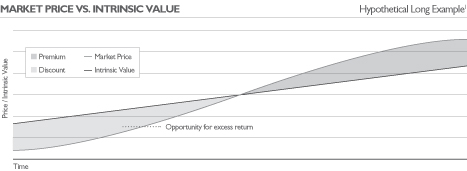

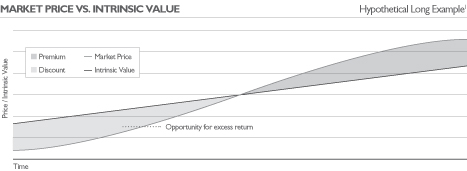

We believe market price and intrinsic value are independent in the short-term but tend to converge over time.

LONG-TERM

We maintain a long-term focus both in investment analysis and management of our business.

DISCIPLINE

We invest with discipline to increase potential return and protect capital.

PARTNERSHIP

We align our interests with those of our clients through significant personal investment in our strategies.

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 3 | |

Fundamental Principles

The Importance of Valuation

We believe that a company’s intrinsic value is independent of its stock price and that intrinsic value can be reasonably estimated using a discounted cash flow methodology. Our entire investment team shares the same investment philosophy, which drives our investment process.

We focus on the fundamentals of intrinsic value, which are far less volatile than market price, and our actions are ultimately dictated by the price to intrinsic value relationship.

| | There is no guarantee that a discount to intrinsic value will be achieved or that market price and/or intrinsic value will increase over time. |

| 1 | The inverse is true for short position |

| | | | | | | | | | | | | | |

| 4 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Fundamental Principles

Equity Investment Principles

Valuation

| Ÿ | | We believe that every share of stock has an intrinsic value that is independent of its current market price, and at any point in time, the market price may be higher or lower than intrinsic value. |

| Ÿ | | Over short periods of time, the market price is heavily influenced by the emotions of market participants, which are far more difficult to predict than intrinsic value. While market prices may experience extreme fluctuations on a particular day, we believe intrinsic value is far less volatile. |

| Ÿ | | Over sufficiently long periods of time, five years or longer, the market price tends to converge with intrinsic value. |

Intrinsic Value Estimate

| Ÿ | | We believe that we can determine a reasonable approximation of intrinsic value if we are confident in projecting the future cash flows of a business and use an appropriate discount rate. |

Suitable Investments

| Ÿ | | We only invest when the market price is lower than our conservative assessment of per share intrinsic value (or at a premium for short positions). |

| Ÿ | | We concentrate our investments in businesses whose per share intrinsic value is likely to increase. We invest in businesses that possess a competitive advantage, conservative balance sheet, and outstanding managers and employees. For short positions, the inverse is often true, and a growing intrinsic value is a detriment to the performance of the position. |

Risk & Return

| Ÿ | | We intend to achieve our return from both the closing of the gap between our purchase price and intrinsic value and the increase in per share intrinsic value. For short positions, an increasing intrinsic value may shorten the holding period. |

| Ÿ | | We define risk as the permanent loss of capital rather than price volatility. We manage risk by investing in companies selling at a discount (premium for short positions) to our estimate of intrinsic value. |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 5 | |

Fundamental Principles

Fixed Income Investment Principles

Business Analysis

| Ÿ | | We believe we can leverage our research team’s industry analysis of the fundamental economic drivers of the business to identify attractive corporate bonds and other senior corporate securities. |

| Ÿ | | We evaluate the quality of a firm’s management and their treatment of bondholders and stockholders. We believe managements that focus on growth, without regard to return on invested capital or long-term cost of capital, are more likely to destroy value for bondholders and stockholders. In contrast, managements that understand the competitive dynamics of their business and prudent capital allocation often produce value for both bondholders and stockholders. |

Valuation

| Ÿ | | We focus on the intrinsic value of the business in relation to the amount of debt in the capital structure. We also evaluate the sources and uses of cash for the business. |

| Ÿ | | The liquidity and expected volatility of a corporate bond are also important factors in valuation. Because of our long-term time horizon, we will invest in less liquid or more volatile securities; however, we require a higher yield as compensation. |

Suitable Investments

| Ÿ | | We generally invest in corporate bonds of companies with improving competitive positions and return on invested capital. |

| Ÿ | | Our core competency is the evaluation of credit risk. We typically favor lower duration, shorter maturity corporate bonds. We focus almost entirely on the secondary market for corporate bonds rather than the primary (new issue) market. We primarily invest in investment grade and below-investment grade (high yield) corporate bonds, including a significant allocation to defensive high yield corporate bonds (due to low duration and higher credit quality). |

Risk & Return

| Ÿ | | We define risk as the permanent loss of capital. We seek to avoid a permanent loss of capital and to earn a sufficient return on capital to grow our purchasing power. |

| Ÿ | | We expect to achieve our return objective by investing in corporate bonds when we believe the market price discounts a greater risk of default or a greater loss upon default than is warranted. An additional source of return exists when the market price provides attractive compensation for short-term illiquidity or volatility, both of which are of less concern to a long-term investor. |

| Ÿ | | We focus on credit risk, interest rate risk, liquidity risk, call risk, reinvestment risk, and other risks when evaluating corporate bonds. |

| | | | | | | | | | | | | | |

| 6 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund

2014 Portfolio Commentary

The Diamond Hill Small Cap Fund returned 4.86% (Class I) in 2014 compared to a 4.89% return for the Russell 2000 Index. In 2014, the small cap market’s best performing sectors were healthcare, utilities, and consumer staples. These sectors tend to be seen as relatively defensive and associated with “safe havens.” Utilities, in particular, also tend to do well when interest rates fall as many view regulated utilities as the most bond-like of equity investments. Government interest rates declined during the year, with the 10-year Treasury finishing below 2.2%, down from levels around 3% at the beginning of the year. Energy was by far the worst performing sector in 2014, as crude oil prices declined nearly 50%. The Fund’s underperformance can largely be attributed to having a larger allocation to energy stocks and a smaller allocation to healthcare stocks than the Index. In addition, while stock selection was generally good, the consumer staples sector was an exception.

The Fund’s financial holdings were the largest contributors in 2014. The Fund averaged roughly 27% of net assets invested in this sector, with nearly half of that amount in insurance companies. Banks and real estate investment trusts (REITs) each comprised about a fifth of the financial sector holdings. Winthrop Realty Trust, Inc. announced a liquidation plan to sell all its assets and distribute the proceeds to shareholders within a two-year period. Thus far, asset sales have come in a bit above the mid-point of ranges that the company has used in its internal estimate of net asset value. In total, these developments led to a 65% total return for the stock in the year. Insurance or reinsurance companies including HCC Insurance Holdings, Inc., Navigators Group, Inc., Alleghany Corp., Enstar Group Ltd., American Equity Investment Life Holding Co., and Reinsurance Group of America all experienced total returns between 10% and 18.5%. The largest detractors within financials were First Niagara Financial Group, Inc. and Nationstar Mortgage Holdings, Inc. Nationstar is a non-bank mortgage servicer whose primary competitor, Ocwen Financial Corp., has encountered great regulatory scrutiny. We believe Nationstar may ultimately benefit from Ocwen’s problems, while thus far the market is skeptical.

Industrials were the second largest contributor to Fund performance during the year. Avis Budget Group, Inc. was the Fund’s largest holding at year-end and produced a 64% total return for the year. While fleet costs face some headwinds on lower residual values, there are signs that this will be more than offset by positive pricing action within the industry in 2015. Alaska Air Group, Inc. has benefitted from favorable fundamentals for airlines, bolstered further by falling jet fuel prices. Aircastle Ltd., an aircraft lessor, and Corrections Corp of America also appreciated more than 20% for the year. Hyster-Yale Materials Handling, Inc., Brink’s Co., TriMas Corp., and Kennametal, Inc. all declined for the year on lower earnings than the previous year. Finally, Trinity Industries, Inc. soared during the first part of the year on continued strong fundamentals in railcar manufacturing and leasing. However, as the price of oil fell in the second half of the year, concerns about the future orders for tank cars to transport oil and a product liability lawsuit concerning the company’s highway guardrail product weighed heavily on the stock, leading to only a marginally positive return.

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 7 | |

Diamond Hill Small Cap Fund

In energy, crude oil prices declined about 46% for the year. Natural gas prices also declined in the U.S., closing at $2.88/mcf, down from the $4.23/mcf close in 2013. Oil supply continued to grow from U.S. shales and higher production from Libya and Iraq following previous declines tied to unrest in those countries. Demand growth weakened with slower growth in China and some European economies experiencing contraction. Developed economies also continue to make efficiency gains. The result has been an oversupplied market that in previous times was balanced by OPEC, but Saudi Arabia expressed its comfort with allowing market forces to balance supply and demand and the lower oil prices that has ushered in. The fundamentals of individual companies were generally within our expectations, but the estimated intrinsic values have all been diminished by lower commodity price curves.

Historically, the Fund generally has had far less invested in health care than the Russell 2000 Index. This continues to be the case, and while stock selection was good, including Natus Medical, Inc., Lifepoint Hospitals, Inc., and health insurer Universal American Financial Corp., the lower overall exposure meant a lesser contribution from this sector than the Index. Utility holdings, UGI Corp., Cleco Corp., and ITC Holdings Corp. performed well but totaled only about 3% of the Fund. Cleco has announced a deal to be acquired with the expected close to come in 2015.

Our consumer staples companies performed relatively poorly for the year. The largest positive contributor to the Fund in this area was Energizer Holdings, Inc. Flowers Foods, Inc. and B&G Foods, Inc. both had mediocre years fundamentally but have been well run companies and successful investments over longer periods. We anticipate better business results from both in the future.

Thank you for your continued interest in the Fund as we move into 2015.

| | |

| | |

| |

Tom Schindler, CFA Portfolio Manager | | |

| | | | | | | | | | | | | | |

| 8 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Expense

Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/29/2000 | | | | 4.60 | % | | | 18.15 | % | | | 13.50 | % | | | 7.65 | % | | | 1.32 | % |

| Class C Shares | | | 2/20/2001 | | | | 3.86 | | | | 17.28 | | | | 12.65 | | | | 6.84 | | | | 2.07 | |

| Class I Shares | | | 4/29/2005 | | | | 4.86 | | | | 18.46 | | | | 13.81 | | | | 8.00 | | | | 1.07 | |

| Class Y Shares | | | 12/30/2011 | | | | 5.06 | | | | 18.64 | | | | 13.78 | | | | 7.78 | | | | 0.93 | |

| BENCHMARK | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000 Index | | | | | | | 4.89 | | | | 19.21 | | | | 15.55 | | | | 7.77 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/29/2000 | | | | -0.62 | | | | 16.16 | | | | 12.34 | | | | 7.09 | | | | 1.32 | |

| Class C Shares | | | 2/20/2001 | | | | 2.87 | | | | 17.28 | | | | 12.65 | | | | 6.84 | | | | 2.07 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

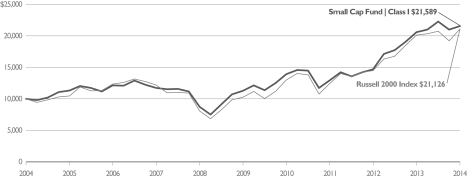

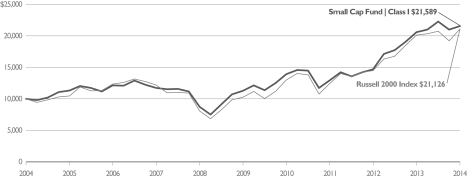

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small Cap Fund Class I(A) and the Russell 2000 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Historical performance for Class I and Class Y shares prior to their inception is based on the performance of Class A shares. Class I and Class Y performance has been adjusted to reflect differences in sales charges. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 9 | |

Diamond Hill Small-Mid Cap Fund

2014 Portfolio Commentary

The Diamond Hill Small-Mid Cap Fund gained 7.36% (Class I) in 2014 compared to a 7.07% increase in the benchmark Russell 2500 Index. For the five-year period ended December 31, 2014, the Fund’s return was 15.87% annually while the Russell 2500 Index returned 16.36% over the same period. In the nine years since inception, the Fund’s annual return of 9.56% outpaced the 8.78% benchmark return. The 2014 performance was driven by favorable stock selection in the consumer discretionary sector offset by unfavorable stock selection in financials.

The large market capitalization segment of the stock market delivered significantly better results in 2014 than smaller size stocks. The Russell 1000 Index (large cap domestic stocks) rose 13.24% during the year, while the Russell 2500 Index, which is widely used to measure the performance of small to mid-cap domestic stocks, gained just 7.07%. We were well-positioned for that trend, as the weighted market capitalization of stocks in the Diamond Hill Small-Mid Cap Fund was well above that of the benchmark throughout the year.

Our returns this year benefited from stock selection in the consumer discretionary sector. Longer-term holdings Whirlpool Corp., Staples, Inc., and Jarden Corp. all gained more than 15% for the year, while new purchases Gannett Co., Inc. and Goodyear Tire & Rubber Co. achieved the same feat during the period we owned them. While declining energy prices and the slow but steady improvement in the U.S. labor market helped boost consumer spending, our investments all had company-specific drivers that assisted in generating the favorable returns.

The energy sector was a negative contributor to return, but surprisingly it had less of a negative impact on the Small-Mid Cap Fund portfolio return than it did for the benchmark Russell 2500 Index, despite our overweight relative to the benchmark in energy stocks. The reason for that was our very favorable stock selection in the sector. In particular, Cimarex Energy Co., our largest energy position, generated a slightly positive total return for the full year, compared to a greater than 30% decline for the energy sector of the benchmark. Cimarex has strong assets in the Permian Basin of west Texas, and the company’s excellent management team has effectively used the new hydraulic fracturing and horizontal drilling technologies to increase production and reduce costs. Cimarex has also maintained very little leverage on its balance sheet. These characteristics leave us comfortable holding a large position in Cimarex stock even in the face of the significant decline in the price of oil.

The biggest negative contributor to return relative to the benchmark was unfavorable stock selection in the financials sector. The primary reason for this was our sparse investment in Real Estate Investment Trust (REIT) stocks. REITs in general benefited significantly from the decline in long-term interest rates, as they are used by many investors as a way to increase a portfolio’s income generation. We own a couple of REITs, but we own them due to our belief that the companies are valued at a discount to our estimates of the firms’ intrinsic values, rather than as a way to increase exposure to higher-yielding stocks. We

| | | | | | | | | | | | | | |

| 10 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund

continue to find numerous attractive opportunities in the financials sector, and at year-end, it was our largest sector weight at nearly 30% of the portfolio.

Another area that was challenging during 2014 was stocks in the food industry. While some food stocks benefited from consolidation, we did not participate in that trend, and our investments faced deep challenges in revenue growth and profitability. We sold ConAgra Foods, Inc. during the year as we lost confidence in the company’s outlook, but we maintained investments in our other food stocks.

I’d like to once again recognize our excellent research team of 16 equity research analysts and 9 research associates who work hard to generate ideas and deliver strong returns to clients. They are the force behind the favorable returns we’ve been able to generate on your behalf over the past nine years.

Our outlook remains little changed from last year. Small- and mid-cap stock valuations are above historical averages, and it remains challenging to find many new ideas. Given the concentration of our portfolios, however, we remain confident in our ability to find 60 or so attractive investment ideas for the portfolio. The most important aspects of our approach remain our insistence on an attractive discount to intrinsic value with any investment we make and our strict focus on a long-term investment time horizon.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

|

.. ..

|

|

Chris Welch, CFA Portfolio Manager |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 11 | |

Diamond Hill Small-Mid Cap Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

Year | | | Three

Years | | | Five

Years | | | Since Inception

(12/30/05) | | | Expense

Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/30/2005 | | | | 7.17 | % | | | 20.45 | % | | | 15.55 | % | | | 9.20 | % | | | 1.25 | % |

| Class C Shares | | | 12/30/2005 | | | | 6.33 | | | | 19.54 | | | | 14.69 | | | | 8.41 | | | | 2.00 | |

| Class I Shares | | | 12/30/2005 | | | | 7.36 | | | | 20.74 | | | | 15.87 | | | | 9.56 | | | | 1.00 | |

| Class Y Shares | | | 12/30/2011 | | | | 7.60 | | | | 20.93 | | | | 15.83 | | | | 9.35 | | | | 0.86 | |

| BENCHMARK | | | | | | | | | | | | | | | | | |

| Russell 2500 Index | | | | | | | 7.07 | | | | 19.97 | | | | 16.36 | | | | 8.78 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/30/2005 | | | | 1.83 | | | | 18.39 | | | | 14.36 | | | | 8.58 | | | | 1.25 | |

| Class C Shares | | | 12/30/2005 | | | | 5.33 | | | | 19.54 | | | | 14.69 | | | | 8.41 | | | | 2.00 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

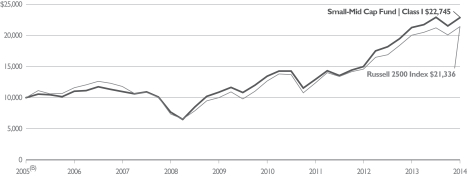

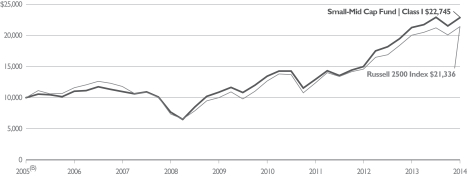

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small-Mid Cap Fund Class I(A) and the Russell 2500 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| (B) | Class I shares commenced operations on December 30, 2005. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2500 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,500 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | |

| 12 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund

2014 Portfolio Commentary

The Diamond Hill Mid Cap Fund gained 7.91% (Class I) in 2014. While this figure represents an adequate absolute return for investing in mid cap equities in this low interest rate environment, it trailed the 13.22% return of the Russell Mid Cap Index. At Diamond Hill, we constantly emphasize that we believe the most appropriate time frame over which to measure our performance is five years. However, we recognize that, by definition, to achieve above-average long-term returns, we must have a subset of above-average returns over shorter time horizons, despite our long-term focus. As such, we are disappointed in our 2014 results relative to the benchmark but continue to work toward delivering strong results over a five-year horizon.

The large market capitalization segment of the stock market delivered significantly better results in 2014 than smaller size stocks. The Russell 1000 Index (large cap domestic stocks) rose 13.24% during the year, while the Russell 2000 Index, which is widely used to measure the performance of small cap domestic stocks, gained just 4.89%. We were poorly positioned for that trend, as the weighted market capitalization of stocks in the Diamond Hill Mid Cap Fund fell below that of the benchmark throughout the year.

Our returns this year benefited from stock selection in the consumer discretionary sector. We owned numerous stocks in the sector which returned more than 20% for us during the year, including Ross Stores, Inc., Whirlpool Corp., Staples, Inc., Gannett Co., Inc., and V.F. Corp. While declining energy prices and the slow but steady improvement in the U.S. labor market helped boost consumer spending, our investments all had company-specific drivers that assisted in generating the favorable returns. These gains were partially offset by losses in Mattel, Inc., which struggled with weak sales in its Barbie division as well as other areas. Toy companies face increasing competition from digital entertainment for children, but Mattel’s history of innovation and prudent management suggest it will be able to retain a valuable role in the industry.

The energy sector was a negative contributor to return, but our favorable stock selection partially offset that decline. We were overweight energy stocks relative to the benchmark throughout the year, and we made only modest changes to the portfolio as oil prices declined during the 2014 fourth quarter. Cimarex Energy Co., our largest energy position, generated a slightly positive total return for the full year, compared to a negative 25% return for the energy sector of the benchmark. Cimarex has strong assets in the Permian Basin of west Texas, and the company’s excellent management team has effectively used the new hydraulic fracturing and horizontal drilling technologies to increase production and reduce costs. Cimarex has also maintained very little leverage on its balance sheet. These characteristics leave us comfortable holding a large position in Cimarex stock even in the face of the significant decline in the price of oil.

The biggest negative contributor to return relative to the benchmark was unfavorable stock selection in the financials sector. The primary reason for this was our sparse investment in Real Estate Investment Trust (REIT) stocks. REITs in general benefited significantly from

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 13 | |

Diamond Hill Mid Cap Fund

the decline in long-term interest rates, as they are used by many investors as a way to increase a portfolio’s income generation. We continue to find numerous attractive opportunities in the financials sector, and at year end, it was our largest sector weight at nearly 30% of the portfolio.

Another area that was challenging during 2014 was stocks in the food industry. While some food stocks benefited from consolidation, we did not participate in that trend, and our investments faced deep challenges in revenue growth and profitability. We sold ConAgra Foods, Inc. during the year as we lost confidence in the company’s outlook, but we maintained investments in our other food stocks.

I’d like to recognize our excellent research team of 16 equity research analysts and 9 research associates who work hard to generate ideas and deliver strong returns to clients. The team has a great deal of experience, and it has also benefited from a significant amount of stability over time.

Mid-cap stock valuations are above historical averages, and it is somewhat challenging to find many new ideas. Given the concentration of our portfolio, however, we remain confident in our ability to find 50 or so attractive investment ideas for the portfolio. The most important aspects of our approach are our insistence on an attractive discount to intrinsic value with any investment we make and our strict focus on a long-term investment time horizon.

We appreciate your support and look forward to continuing to work with you in the coming years.

|

.. ..

|

|

Chris Welch, CFA Portfolio Manager |

| | | | | | | | | | | | | | |

| 14 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

Year | | | Since

Inception | | | Expense

Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | |

| Class A Shares | | | 12/31/2013 | | | | 7.57 | % | | | 7.57 | % | | | 1.15 | % |

| Class C Shares | | | 12/31/2013 | | | | 6.80 | | | | 6.80 | | | | 1.90 | |

| Class I Shares | | | 12/31/2013 | | | | 7.91 | | | | 7.91 | | | | 0.90 | |

| Class Y Shares | | | 12/31/2013 | | | | 8.02 | | | | 8.02 | | | | 0.76 | |

| BENCHMARK | | | | | | | | | |

| Russell Midcap Index | | | | | | | 13.22 | | | | 13.22 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | |

| Class A Shares | | | 12/31/2013 | | | | 2.16 | | | | 2.16 | | | | 1.15 | |

| Class C Shares | | | 12/31/2013 | | | | 5.80 | | | | 5.80 | | | | 1.90 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

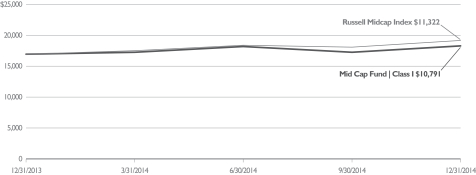

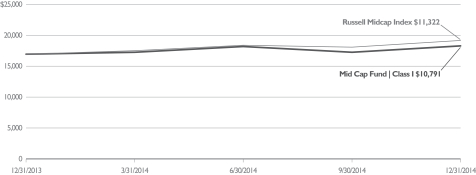

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Mid Cap Fund Class I(A) and the Russell Midcap Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| | The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell Midcap Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 15 | |

Diamond Hill Large Cap Fund

2014 Portfolio Commentary

The Diamond Hill Large Cap Fund returned 10.74% (Class I) in 2014 compared to 13.24% for the Russell 1000 Index. I was disappointed the Fund lagged the Russell 1000 Index but pleased that 2014 was another strong year in the equity markets. The continued strong returns following the 2008-2009 bear market led to new record highs in the large cap indices for 2014. The best performing sectors of the market were the interest sensitive utilities and the health care sectors.

The health care sector was the top performing sector for the Fund as well as the Index in 2014, but our holdings lagged the performance of the health care sector in the Index. Medtronic, Inc., Abbott Laboratories, and Express Scripts Holding, Inc. all returned in excess of 20%. Medtronic announced the planned acquisition of Covidien PLC in the second quarter of the year. Top line growth for Medtronic has been challenged in recent years, but we believe this acquisition should help drive growth for the entire company and improve the shares’ valuation. Medtronic’s 28% return was the largest for any health care holding in the portfolio. Abbott Laboratories has continued to adjust its business portfolio to improve the long-term growth of the company. The improved performance of Abbott reflects its superior growth portfolio. Express Scripts has continued the integration of the Medco acquisition of a couple years ago, which has led to improving margins in its core pharmaceutical benefit management business. Stryker Corp. is a surgical products company with an outstanding long-term record. The shares were added to the portfolio at attractive prices during the autumn market sell-off. This holding returned more than 15% in the brief time it has been held.

The consumer discretionary sector was the best performing sector of the portfolio relative to the Index. Several holdings, including Whirlpool Corp., Walt Disney Co., and V.F. Corp., returned in excess of 20% in 2014. Whirlpool continued to benefit from improving margins driven by strong end-market growth and the integration of previous acquisitions. Walt Disney continued to benefit from its strong positioning in the broadcasting and entertainment industries. Disney’s unique competitive position has allowed the company to grow earnings in a variety of economic environments. V.F. Corp. is a very well managed consumer branded apparel company, and the company continued to take market share as its products are highly valued by consumers. This has driven consistent strong revenue and earnings growth, leading to the strong performance of the shares.

Energy was a controversial sector in 2014 as the strong performance in the first half of the year was overshadowed by the severe decline in oil prices in the fourth quarter. EOG Resources, Inc. and Cimarex Energy Co. provided small positive returns during the year, but the returns were down meaningfully from the large gains earlier in the year. One of the largest disappointments in the portfolio was Noble Energy, Inc. which was down approximately 37%. We eliminated the shares from the portfolio as we believe a more challenging energy market could prove especially difficult for Noble. Overall, our energy holdings outperformed the energy sector of the market, which was the worst performing sector of 2014.

| | | | | | | | | | | | | | |

| 16 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund

The financial sector was by far the largest sector concentration in the portfolio. Large bank holding companies such as Morgan Stanley, PNC Financial Services Group, Inc., and Wells Fargo & Co. returned in excess of 20% for the year. PNC and Wells Fargo were helped by improvements in loan demand which drove better earnings. Morgan Stanley benefited from a strong asset management environment as well as improved investment banking activity. Prudential Financial, Inc., a large life insurance company, was disappointing. Low interest rates threatened to slow earnings growth and caused investors to remain cautious toward the life insurance industry in general. Capital One Financial Corp. was a new financial services holding in the portfolio. We believe the company will benefit from improved consumer loan demand as well as stable asset quality. The shares remain inexpensive due to investor concerns regarding the potential for deteriorating loan quality. While asset quality has been unusually good, there is no indication of a meaningful deterioration in consumer lending.

The technology sector was the source of biggest disappointment in 2014. IBM, a large portfolio holding, declined approximately 12%. I am particularly concerned with the negative growth IBM has recently experienced in its software business. This is a concern we will monitor closely, but the shares remain very inexpensive so there could be meaningful opportunity if the business experiences a cyclical recovery. The key for IBM will be a return to positive top line growth once the company has completed the divestitures of its hardware businesses.

Several new names were added to the portfolio in 2014. Shares of Goodyear Tire & Rubber Co., Gannett Co., Inc., MetLife, Inc., Twenty-First Century Fox, Inc., and Eastman Chemical Co. were all purchased during the year to take advantage of attractive investment opportunities. All were positive contributors to performance.

As 2014 draws to a close, I am disappointed the Fund did not keep pace with the Russell 1000 Index. For the most part, the companies in the portfolio met our expectations. However, there was an absence of large gainers in the portfolio, which has often driven performance in past years. We will continue to focus on long-term opportunities in our search for new investments, and I look forward to the continued challenge of managing the portfolio. This concludes my 12th year of managing the Diamond Hill Large Cap Fund, and I remain grateful for the opportunity. Thank you for your continued support.

| | |

| | |

| |

Chuck Bath, CFA Portfolio Manager | | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 17 | |

Diamond Hill Large Cap Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Expense

Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 6/29/2001 | | | | 10.42 | % | | | 19.12 | % | | | 13.59 | % | | | 8.63 | % | | | 1.04 | % |

| Class C Shares | | | 9/25/2001 | | | | 9.60 | | | | 18.26 | | | | 12.74 | | | | 7.81 | | | | 1.79 | |

| Class I Shares | | | 1/31/2005 | | | | 10.74 | | | | 19.43 | | | | 13.91 | | | | 8.99 | | | | 0.79 | |

| Class Y Shares | | | 12/30/2011 | | | | 10.89 | | | | 19.63 | | | | 13.88 | | | | 8.77 | | | | 0.65 | |

| BENCHMARK | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 1000 Index | | | | | | | 13.24 | | | | 20.62 | | | | 15.64 | | | | 7.96 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 6/29/2001 | | | | 4.91 | | | | 17.10 | | | | 12.42 | | | | 8.07 | | | | 1.04 | |

| Class C Shares | | | 9/25/2001 | | | | 8.60 | | | | 18.26 | | | | 12.74 | | | | 7.81 | | | | 1.79 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

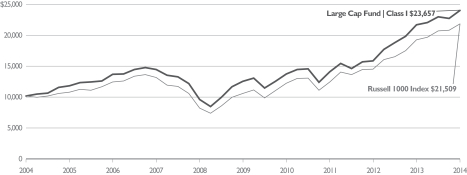

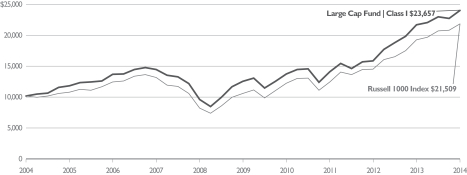

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Large Cap Fund Class I(A) and the Russell 1000 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Historical performance for Class I and Class Y shares prior to their inception is based on the performance of Class A shares. Class I and Class Y performance has been adjusted to reflect differences in sales charges. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | |

| 18 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Select Fund

2014 Portfolio Commentary

The Diamond Hill Select Fund gained 11.57% (Class I) in 2014 compared to our benchmark, the Russell 3000 Index, which returned 12.56%.

Underperformance relative to the benchmark was primarily driven by stock selection in financials, health care, and information technology. This was somewhat offset by favorable stock selection in the consumer discretionary and energy sectors.

Our largest sector weighting continued to be in financials. Whereas this sector was a source of significant outperformance for the fund in 2013, financials detracted somewhat from relative performance in 2014. The best performing financial holding was Popular, Inc., the Puerto Rican bank which gained regulatory approval in 2014 to repay Troubled Asset Relief Program (TARP). The worst performing financial holding was Fortress Investment Group LLC which we exited in the first quarter of 2014 due to concerns over the quality of earnings and the valuation multiple that those earnings might receive.

The health care sector remains a large weight in the Fund. Within health care, Teva Pharmaceutical Industries, Ltd. was the best performer, returning 47% over the course of the year in response to signs that the company is making good progress on both its cost reduction plan and in protecting the valuable Copaxone franchise. The worst health care performer was GlaxoSmithlKline PLC, which we exited after signs that its very profitable respiratory franchise was coming under pricing pressure from a consolidating payer base. Valeant Pharmaceuticals International, Inc. was a new health care position. Valeant’s management team has assembled an impressive collection of assets in the most attractive segments of health care while exhibiting great discipline in the prices paid and in harvesting anticipated acquisition synergies.

Information technology continues to be a significant weight in the portfolio, and three of our top performers came from this sector. Apple, Inc. benefited from improved capital allocation, successful uptake of the iPhone in China, and robust sales of larger iPhone form factors. Cisco Systems, Inc. shares rose on the stabilization of switching margins and the realization that reported revenue weakness would be short lived. Microsoft Corp. benefited from continued strength in enterprise software, strong conversion to the Office 365 subscription model, and stabilization in PC volumes. IBM, however, has been a disappointment, reporting weak 2014 third quarter earnings and backing away from a long-stated 2015 earnings goal.

We added two new holdings in the consumer discretionary sector, Whirlpool Corp. and Twenty-First Century Fox, Inc. Whirlpool replaced Aaron’s, Inc. in the portfolio after we became concerned that the lower-end consumer was not participating in the economic recovery. This was a fortuitous change to the portfolio, as Whirlpool became our best performer for the year, returning 48% from the time it was purchased in January. The shares benefited from investors’ recognition of strong cyclical tailwinds and associated operating leverage in North America, further penetration in places such as Latin America, Asia and India, and significant margin expansion opportunities in Europe owing to scale synergies yet to be realized from the Indesit acquisition.

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 19 | |

Diamond Hill Select Fund

By early 2014, we had repositioned our energy holdings by trimming overall exposure and focusing our investments in Cimarex Energy Co. and EOG Resources, Inc., both major disruptors in the domestic shale boom with conservative balance sheets. Despite performing well through mid-year, these two holdings finished the year flat to slightly negative, respectively, after a precipitous decline in oil prices caused by the confluence of faltering world demand in the face of steady domestic shale production growth, mitigation of certain OPEC supply disruptions, and Saudi Arabia signaling an unwillingness to continue balancing the market. When factoring in the new forward curve for oil, and the lower cash flows and ability to reinvest implied by the forward curve for the next 12 to 24 months, our estimate of intrinsic value for EOG fell to a point that we found other opportunities, outside of energy, more attractive, and we exited the position. We continue to hold Cimarex due to its very attractive asset base and opportunities to capture further drilling and production efficiencies.

All portfolio decisions are made from a bottom up perspective, evaluating individual holdings against the opportunities presented by others; however, it is still interesting to pause periodically to observe, from the top down, how the portfolio has evolved. During 2014, concentration increased as the total number of holdings decreased roughly 10% (from 35 to 32). On a net basis, we added one mega cap position and one small cap position, while eliminating five positions from within the $5 billion to $50 billion market capitalization range. In terms of sector weights, consumer discretionary, and to a lesser extent, financials both increased and were funded by reductions in energy and industrials.

As the market price of individual holdings approach our estimates of intrinsic value, we continue to find attractive replacements. In fact, three of the holdings added in 2014 (Valeant, Whirlpool, and Twenty-First Century Fox) are compelling enough that we have made them top five holdings.

We appreciate your support and look forward to 2015.

| | |

| |

|

| |

Austin Hawley, CFA Portfolio Manager | | Rick Snowdon, CFA Portfolio Manager |

| | | | | | | | | | | | | | |

| 20 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Select Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception | | | Expense

Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/30/2005 | | | | 11.30 | % | | | 21.28 | % | | | 14.02 | % | | | 8.36 | % | | | 1.19 | % |

| Class C Shares | | | 12/30/2005 | | | | 10.46 | | | | 20.40 | | | | 13.17 | | | | 7.58 | | | | 1.94 | |

| Class I Shares | | | 12/30/2005 | | | | 11.57 | | | | 21.56 | | | | 14.32 | | | | 8.71 | | | | 0.94 | |

| Class Y Shares | | | 12/30/2011 | | | | 11.74 | | | | 21.78 | | | | 14.30 | | | | 8.51 | | | | 0.80 | |

| BENCHMARK | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 3000 Index | | | | | | | 12.56 | | | | 20.51 | | | | 15.63 | | | | 8.15 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 12/30/2005 | | | | 5.77 | | | | 19.23 | | | | 12.87 | | | | 7.74 | | | | 1.19 | |

| Class C Shares | | | 12/30/2005 | | | | 9.47 | | | | 20.40 | | | | 13.17 | | | | 7.58 | | | | 1.94 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

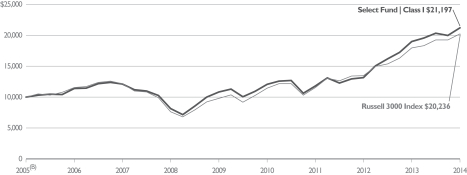

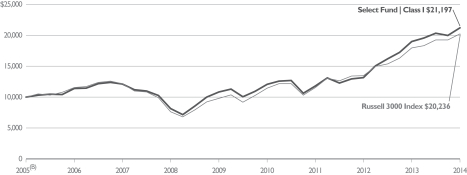

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Select Fund Class I(A) and the Russell 3000 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| (B) | Class I shares commenced operations on December 30, 2005. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 3000 Index (“Index”). The Index is a widely recognized market capitalization-weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 21 | |

Diamond Hill Long-Short Fund

2014 Portfolio Commentary

The Diamond Hill Long-Short Fund returned 7.55% (Class I) in 2014 compared to 13.24% for the long-only Russell 1000 Index and a 7.86% return for the blended benchmark (60% Russell 1000 Index/40% BofA Merrill Lynch U.S. T-Bill 0-3 Month Index). While the portfolio lagged the long-only Russell 1000 Index, we were more disappointed that the Fund slightly lagged the blended benchmark, which takes into account the portfolio’s 60% net long bias. It is very difficult for a long/short strategy to keep pace with a strong equity market like 2014. However, we strive to outperform the blended benchmark in all market environments. The source of disappointment was mostly in the long portfolio, which meaningfully lagged the long-only indexes. While the short portfolio was up, the increase was meaningfully less than the market’s appreciation. We were encouraged that our long portfolio outperformed our short portfolio; however, it was not enough to allow us to outperform the blended benchmark.

During 2014, the bias for the portfolio was to remain slightly longer than our blended benchmark with the net long exposure between 60% and 65% during most of the year. This reflected our generally positive view on the market throughout the year. At year-end, the net long exposure was slightly in excess of 61%.

The consumer staples and consumer discretionary sectors provided the biggest positive contribution to return in the long portfolio. Kimberly-Clark Corp. was the biggest gainer in the consumer staples sector, producing solid earnings in 2014 as competitive pressures eased and market share improved. Procter & Gamble Co., Kimberly-Clark’s biggest competitor, was up in excess of 15%. Restructuring initiatives combined with a stable competitive environment allowed earnings growth to improve. Whirlpool Corp. showed the biggest gain in the consumer discretionary sector. Whirlpool returned in excess of 33% as strong margin improvements and a stable housing recovery allowed the company to deliver continued profitability growth. Walt Disney Co. returned in excess of 24%. Continued strong park attendance combined with the success of Disney’s broadcasting and entertainment businesses demonstrated the strength of this unique consumer franchise.

Technology was also a strong sector in the long portfolio. Apple, Inc. has been a very successful investment since we added it to the portfolio in 2013. New product successes, particularly the recently introduced new smart phone, helped to drive revenue and profit growth. Profit growth, combined with the shares’ inexpensive valuation, continues to make this an attractive investment even after the 40% total return for Apple shares in 2014. Cisco Systems, Inc. and Microsoft Corp. both returned in excess of 27%. These companies are large, dominant technology companies with good balance sheets, but the success of these investments was driven by the inexpensive valuation of the shares. Both continue to remain attractive and were still held in the portfolio at year-end.

The biggest disappointment in the long portfolio was in the health care sector. While our returns in this sector were strong, they lagged the overall market returns earned in the sector, which was the strongest market sector in 2014. Medtronic, Inc. and Abbott Laboratories both returned in excess of 20%. Medtronic announced the planned acquisition

| | | | | | | | | | | | | | |

| 22 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund

of Covidien PLC in the 2014 second quarter. Top line growth for Medtronic has been challenged in recent years, but we believe this acquisition should help drive growth for the entire company and improve the shares’ valuation. Abbott Laboratories continued to adjust its business portfolio to improve the long-term performance of the company. The performance of the shares reflected the improved outlook for Abbott Laboratories. The biggest disappointment was Quest Diagnostics, Inc., a name we eliminated from the portfolio during the year. Continued anemic revenue growth reflected its weak competitive position.

Energy was a controversial sector as strong performance in the first half of 2014 was overshadowed by the severe decline in oil prices in the fourth quarter. EOG Resources, Inc. and Cimarex Energy Co. provided small positive returns for the year, but the overall return for our holdings in the sector was slightly negative. However, this slight negative performance was better than the performance of the energy sector in the overall market. One of the largest disappointments in the portfolio was Noble Energy, Inc., which was down more than 37%. We eliminated the shares from the portfolio due to concerns surrounding the challenging energy market, but as we entered 2015, the portfolio maintained most of its long energy holdings.

The short portfolio detracted from performance in 2014. This was not surprising in a year of strong equity markets. However, while our short portfolio appreciated, it was up meaningfully less than our long portfolio or the market as a whole. Several of our short positions were down, helping the portfolio return. Financial short positions such as BancorpSouth, Inc., Rouse Properties, Inc., and Principal Financial Group, Inc. were all down in excess of 10%. Technology company Ubiquiti Networks, Inc. was the biggest gainer in the short portfolio as the shares declined in excess of 30%. Other successful short positions included Advent Software, Inc., Intrepid Potash, Inc., Navistar International Corp., and Kansas City Southern. In several cases, we covered these short positions as the shares achieved our price objective. The biggest disappointment in the short portfolio was Celgene Corp., which returned in excess of 30%. As of year-end, this short position remained in the portfolio.

We introduced shorting to this Fund more than a decade ago to provide clients with a long/short strategy to meet the needs of their investment portfolios. We have been gratified by the growing acceptance of long/short strategies in general and the Diamond Hill Long-Short Fund in particular. We are grateful for your continued support and appreciate the opportunity to continue to earn your trust in 2015.

| | | | |

| |  | |

|

| | |

Ric Dillon, CFA Portfolio Manager | | Chris Bingaman, CFA Portfolio Manager | | Chuck Bath, CFA Portfolio Manager |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 23 | |

Diamond Hill Long-Short Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Expense Ratio* | |

| PERFORMANCE AT NAV WITHOUT SALES CHARGES | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 6/30/2000 | | | | 7.23 | % | | | 12.65 | % | | | 7.98 | % | | | 6.83 | % | | | 1.84 | % |

| Class C Shares | | | 2/13/2001 | | | | 6.44 | | | | 11.82 | | | | 7.18 | | | | 6.03 | | | | 2.59 | |

| Class I Shares | | | 1/31/2005 | | | | 7.55 | | | | 12.95 | | | | 8.29 | | | | 7.19 | | | | 1.59 | |

| Class Y Shares | | | 12/30/2011 | | | | 7.68 | | | | 13.12 | | | | 8.25 | | | | 6.96 | | | | 1.45 | |

| BENCHMARK | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 1000 Index | | | | | | | 13.24 | | | | 20.62 | | | | 15.64 | | | | 7.96 | | | | — | |

60% Russell 1000 Index/40%

BofA Merrill Lynch U.S. T-Bill 0-3 Month Index | | | | | | | 7.86 | | | | 12.08 | | | | 9.39 | | | | 5.61 | | | | — | |

| PERFORMANCE AT POP INCLUDES SALES CHARGES** | | | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | 6/30/2000 | | | | 1.88 | | | | 10.74 | | | | 6.88 | | | | 6.28 | | | | 1.84 | |

| Class C Shares | | | 2/13/2001 | | | | 5.44 | | | | 11.82 | | | | 7.18 | | | | 6.03 | | | | 2.59 | |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2015. |

| ** | The maximum sales charge for Class A shares on purchases and Class C shares on certain redemptions are 5.00% and 1.00% respectively. |

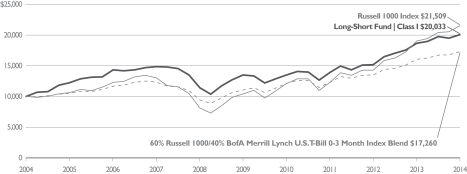

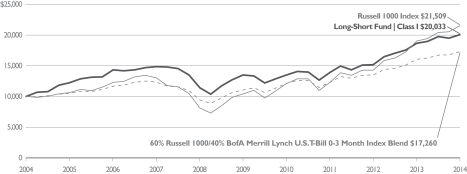

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Long-Short Fund Class I(A), the Russell 1000 Index and the Blended Index (60% Russell 1000 Index and 40% BofA Merrill Lynch U.S. T-Bill 0-3 Month Index)

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| | The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index and the blended index. The Russell 1000 Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies on a market capitalization basis, in the Russell 3000 Index. The blended index represents a 60% weighting of the Russell 1000 Index as described above and a 40% weighting of the BofA Merrill Lynch U.S. T-Bill 0-3 Month Index. The BofA Merrill Lynch U.S. T-Bill 0-3 Month Index tracks the performance of U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Both indices are unmanaged, and do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| | Historical performance for Class I and Class Y shares prior to their inception is based on the performance of Class A shares. Class I and Class Y performance has been adjusted to reflect differences in sales charges. |

| | Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

| | | | | | | | | | | | | | |

| 24 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Research Opportunities Fund

2014 Portfolio Commentary

The Diamond Hill Research Opportunities Fund increased 7.21% (Class I) during 2014 compared to a 12.56% increase in the long-only benchmark Russell 3000 Index. At Diamond Hill, we have a long-term investment horizon and therefore evaluate our performance over rolling five-year periods. At the end of 2014, our five-year compound annual return was 12.62% versus 15.63% for the Russell 3000 Index. While pleased with the absolute return of the Fund, we are disappointed with our relative results. Another year of strong broad equity market returns made it difficult to keep pace with our long-only benchmark. In addition to negative contributions from the short portfolio, our willingness to hold cash in the absence of sufficiently attractive opportunities partially offset the strong performance of our long positions. We continue to believe our disciplined approach to capital allocation will deliver satisfactory absolute and relative results over most rolling five-year periods.

During 2014, the long portfolio contributed to the Fund’s return with an average long exposure of 85%, while the positions in the short portfolio detracted modestly with average short exposure of (11)%. The largest contributors to performance were long investments in Microsoft Corp., Whirlpool Corp., Winthrop Realty Trust, Inc., and Popular, Inc.

Microsoft made several favorable moves in 2014. Following the appointment of Satya Nadella to the CEO role in February, Microsoft shifted from a Windows-centric view of the world to an emphasis on the usage of Microsoft products and services regardless of the user’s operating system. Enterprise business was strong throughout the year, and the company began to regain momentum in its Consumer business as consumers increasingly embraced the subscription-based Office 365. Additionally, Microsoft took measures to control costs in both its phone and online search businesses. We have been pleased by the shifts at Microsoft under Nadella, and we continue to view Microsoft shares as priced below their intrinsic value.

Whirlpool’s fundamentals benefited from a continuation of the domestic appliance recovery in 2014. The company also completed two significant acquisitions, the largest being Indesit which more than doubles the size of the company’s European business. The second was a majority stake in Hefei Sanyo, offering a platform to grow the company’s Chinese business. With domestic demand remaining strong and profitable opportunities internationally, Whirlpool’s future looks promising, and the company’s goal of doubling earnings per share by 2018 seems very attainable.

Winthrop Realty Trust adopted a plan of liquidation after a prolonged disconnect between the stock price and management’s estimate of net asset value. Under the plan, management will liquidate the assets of the company in the most efficient way possible and pay out the proceeds to shareholders. Winthrop has been a long-term holding of the Fund, and the quality and track record of its management team were two driving forces behind our investment. The liquidation plan demonstrates management’s willingness to act like owners and in the best interest of shareholders, even if it means liquidating themselves out of a job. That is rare in today’s business climate.

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM | | | 25 | |

Diamond Hill Research Opportunities Fund

Our long-term holding in Puerto Rico-based bank Popular, Inc. appreciated as the company executed additional key steps in its recovery from the financial crisis, including continuing the cleanup of problem credits, simplifying operations by divesting some of its North American operations, and exiting the U.S. Treasury’s crisis era government funding program without issuing new common equity. Though the economy in Puerto Rico remains sluggish, the valuation on Popular’s shares remains undemanding, and we are hopeful that the company will announce meaningful capital return in 2015.

Long positions in International Business Machines Corp. (IBM), Tesco PLC, and Kennametal, Inc. were the largest detractors from performance during 2014.

IBM had a difficult 2014 as the company struggled to grow its revenue base. Along with a disappointing third quarter earnings report, management acknowledged that the company will fail to achieve the $20 per share in calendar-year 2015 (non-GAAP) operating earnings that was the cornerstone of its much-publicized 2015 Roadmap. While we have been dissatisfied with the company’s short-term execution, we continue to believe that IBM possesses a set of businesses that are both fundamentally attractive and resilient, and the stock currently trades at a meaningful discount to our estimate of intrinsic value.

Tesco’s key challenge in 2014 was the rise of discount grocers who offer a simple range and value pricing, while accounting misstatements and a change in management added complexity to meeting this challenge. Despite these challenges, we remain confident in the intrinsic value of Tesco, given the company’s market leading position and high quality asset base.

Kennametal, Inc. was able to generate positive revenue growth in fiscal 2014 despite continued weakness in its Infrastructure segment (largely due to mining and road construction exposure). However, in anticipation of even better sales management, the company expanded costs, thus forfeiting any leverage to the bottom line from increased sales. By the end of the year, it became apparent that not only were sales not going to grow as quickly as anticipated, but also would actually renew their deterioration largely due to weakness in Europe and softening sales to the energy sector. This, coupled with a more leveraged balance sheet from the acquisition of Allegheny Technologies’ tungsten material business earlier in Kennametal’s fiscal year, weighed heavily on the stock price.

As of December 31, 2014, the Fund held 60 long and 19 short positions with the top ten positions representing 38% of net assets.

We want to thank shareholders for their support, and we look forward to working with you in the years ahead.

Diamond Hill Research Analysts

| | | | | | | | | | | | | | |

| 26 | | DIAMOND HILL FUNDS | | | | | ANNUAL REPORT | | | | | DECEMBER 31, 2014 | | | | | DIAMOND-HILL.COM |

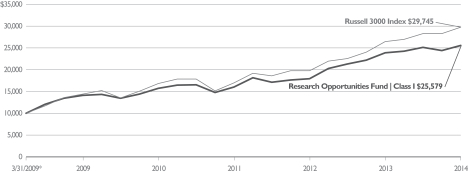

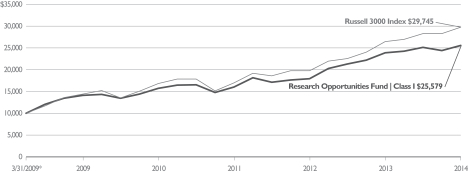

Diamond Hill Research Opportunities Fund

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | One

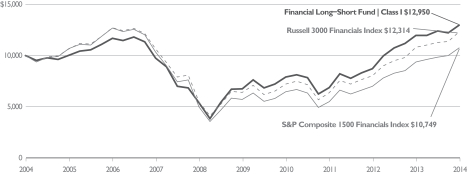

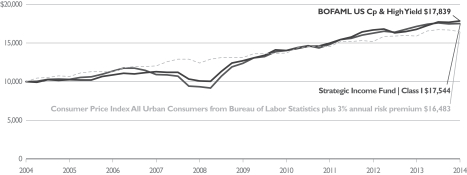

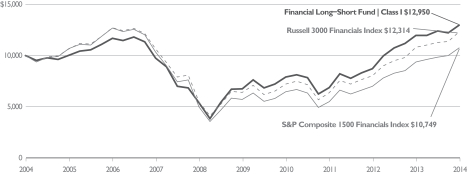

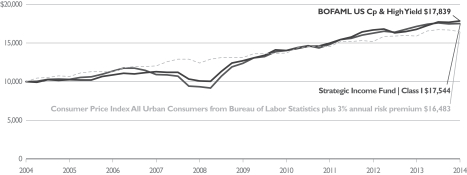

Year | | | Three