OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2007

Estimated average burden hours per response: 19.3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8319

ING Partners, Inc.

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | January 1, 2006 to December 31, 2006 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Funds

Annual Report

December 31, 2006

Classes I, S and ADV

ING Partners, Inc.

n ING American Century Large Company Value Portfolio

n ING American Century Select Portfolio

n ING American Century Small-Mid Cap Value Portfolio (formerly, ING American Century Small Cap Value Portfolio)

n ING Baron Asset Portfolio

n ING Baron Small Cap Growth Portfolio

n ING Columbia Small Cap Value II Portfolio

n ING Davis Venture Value Portfolio

n ING Fundamental Research Portfolio

n ING Goldman Sachs® Capital Growth Portfolio

n ING Goldman Sachs® Structured Equity Portfolio (formerly, ING Goldman Sachs® Core Equity Portfolio)

n ING JPMorgan International Portfolio

n ING JPMorgan Mid Cap Value Portfolio

n ING Legg Mason Partners Aggressive Growth Portfolio (formerly, ING Salomon Brothers Aggressive Growth Portfolio)

n ING Legg Mason Partners Large Cap Growth Portfolio (formerly, ING Salomon Brothers Large Cap Growth Portfolio)

n ING Lord Abbett U.S. Government Securities Portfolio

n ING Neuberger Berman Partners Portfolio

n ING Neuberger Berman Regency Portfolio

n ING OpCap Balanced Value Portfolio

n ING Oppenheimer Global Portfolio

n ING Oppenheimer Strategic Income Portfolio

n ING PIMCO Total Return Portfolio

n ING Pioneer High Yield Portfolio

n ING T. Rowe Price Diversified Mid Cap Growth Portfolio

n ING T. Rowe Price Growth Equity Portfolio

n ING Templeton Foreign Equity Portfolio

n ING Thornburg Value Portfolio

(formerly, ING MFS Capital Opportunities Portfolio)

n ING UBS U.S. Large Cap Equity Portfolio

n ING UBS U.S. Small Cap Growth Portfolio

n ING Van Kampen Comstock Portfolio

n ING Van Kampen Equity and Income Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 2 | | |

|

| Portfolio Managers' Reports | | | 4 | | |

|

| Shareholder Expense Examples | | | 64 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 73 | | |

|

| Statements of Assets and Liabilities | | | 74 | | |

|

| Statements of Operations | | | 84 | | |

|

| Statements of Changes in Net Assets | | | 92 | | |

|

| Financial Highlights | | | 107 | | |

|

| Notes to Financial Statements | | | 158 | | |

|

| Portfolios of Investments | | | 186 | | |

|

| Tax Information | | | 297 | | |

|

| Director and Officer Information | | | 300 | | |

|

| Shareholder Meeting Information | | | 304 | | |

|

| Advisory Contract Approval Discussion | | | 305 | | |

|

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available (1) without charge, upon request, by calling Shareholder Services toll-free at 1-800-992-0180; (2) on the ING Funds' website at www.ingfunds.com; and (3) on the SEC's website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.ingfunds.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at 1-800-992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

PRESIDENT'S LETTER

Dear Shareholder,

In its recent meetings, the U.S. Federal Reserve Board (the "Fed") ceased what was a two-year trend. That trend — a string of 17 consecutive interest rate hikes that ended last fall — was seen by many analysts as a sign that the Fed was concerned about containing inflation.

Now, the Fed is neither raising nor lowering interest rates, which puts us in the midst of what economists refer to as a "plateau." Historically, there have been six similar plateaus since 1982 and during four of those periods the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index") rose significantly.

Of course, the Fed's actions impact economies and market performance around the world. For instance, the current interest rate climate has been cited as one reason for a decline in the value of the dollar. Last year, that drop in the dollar meant that international stocks — which are often determined in foreign currencies — generally experienced strong performance as foreign currencies climbed and world stock markets continued to produce strong results.

Meanwhile, here at home, 2006 was an interesting year for equity investors. In May of 2006, the S&P 500® Index hit a five-year high followed by a market correction and several months of non-directional returns. A strong rally occurred in the second half of the year driven in part by the aforementioned dollar decline and the interest rate plateau. The good news is many economists believe that these conditions may continue in the months to come.

At ING Funds, we are committed to providing you, the investor, with an array of investment choices that enables you to build a diversified portfolio across a variety of asset classes. We do so, with a view that the globalization of markets is an initial consideration in the products we offer.

We take the confidence you place in us with your investments very seriously — everyone in our firm is committed to renewing this trust each and every day.

Shaun Mathews

President

ING Funds

January 31, 2007

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

(1) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2006

In our semi-annual report, we described how the feast of the first quarter had turned to famine in the second quarter for global equity markets on concerns that rising interest rates would freeze out global growth. Indeed as late as June 27, 2006, the year-to-date return on the Morgan Stanley Capital International ("MSCI") World IndexSM(1) measured in local currencies, including net reinvested dividends had been precisely 0%. However, the second half of the year ended December 31, 2006, was much healthier and the same index powered ahead 12.3% and for the year ended December 31, 2006, returned 20.07%. The return to dollar based in vestors was a little better at 13.2%, as late in the year a slowing economy and hints that central banks would be diversifying out of dollars weighed on that currency. For the six months ended December 31, 2006, the dollar fell 3.1% against the euro and 5.6% against the pound, but gained 4.1% on the yen due to stumbling growth and miniscule interest rates in Japan. For the year ended December 31, 2006, the dollar fell 10.6% against the euro and 12.4% against the pound, but gained 1.3% against the yen.

As the first half of 2006 ended, the Federal Open Market Committee ("FOMC") had just raised the federal funds rate for the seventeenth time since June 2004, to 5.25%. The relatively mild accompanying language led many in the fixed income market to hope that the tightening cycle was now over. Not everyone believed it, especially when new Middle East conflict pushed the price of oil to another record on July 14, 2006. But data, especially on housing, had mostly pointed to cooling demand and a tame employment report on August 4, 2006 probably decided the matter. Four days later the FOMC met and left rates unchanged. The booming housing market had been a powerful driver of growth in recent years through new construction and demand created by mortgage loan refinancing. This boom was deteriorating a ppreciably with housing prices and the key new building permits measure falling sharply. Only in the last few days of 2006 did the slump show some signs of bottoming out with unexpectedly good new and existing home sales figures reported, along with rebounding consumer confidence. For the six months ended December 31, 2006, the Lehman Brothers® Aggregate Bond ("LBAB") Index(2) of investment grade bonds gained 5.09% and for the year ended December 31, 2006 it gained 4.33%. The most important dynamic was the broad yield curve inversion, suggestive of an expected fall in interest rates and a further economic slow down. The ten-year Treasury yield fell 43 basis points (0.43%) to 4.71%, while the yield on the three-month Bill rose by 3 basis points (0.03%) to 4.89%. Since mid-August, with the exception of two days, bond investors had been prepare d to lend money to the government for ten years at a lower interest rate than for three months.

Faced with fading business activity, as the key housing engine seized up, and a yield curve inverted to the point of recession according to some commentators, investors in U.S. equities must have been in the mood to sell. Not so fast. Those investors saw things differently and indeed the apparent "disagreement" between the bond market and global stock markets was a well discussed feature of the second half of the year. For one thing, the oil price, having hit its record, fell back, as surly calm returned to the Middle East, as the summer driving and hurricane seasons came and went and as winter got off to a mild start in the key North East region. The price of oil averaged 22% less in the fourth quarter than at its peak, boosting consumers' spending power and confidence. And if longer-term int erest rates were falling then stocks looked more attractive as bonds provided less competition and the present value of future corporate profits rose. Speaking of which, Standard & Poor's 500® Composite Stock Price ("S&P 500®") Index(3) companies duly reported their 13th straight double-digit quarterly percentage earnings gain. Gross domestic product ("GDP") growth may have slowed, but the share of corporate profits, reported at 12.4%, was the highest since the 1950's. The next merger or acquisition to get investors in the mood never seemed far away. Five of them were even announced in one day on November 6, 2006, sending markets up about 1%. For the six months ended December 31, 2006, the S&P 500® Index, including dividends, rose 12.7% and for the year ended December 31, 2006, the S&P 500&r eg; Index, including dividends, rose 15.8%. All but 30 basis points (0.30%) of the gain came after August 8, 2006, making six-year highs as the year ended.

International markets, based on MSCI local currency indices, as in the U.S., finished near their best levels for the year. In Japan the market advanced 8.7%, in 2006, after a late surge. The long awaited increase in interest rates from 0.0% to 0.25% took place in July just as the economic recovery was losing impetus. Third quarter growth was estimated at only 0.8% and generated by exports and capital spending alone. Consumer spending was lagging despite low

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2006

unemployment and almost flat prices, yet business confidence remained high and profit growth healthy. Elsewhere, Asian markets ex Japan rose 28.2% in 2006, but with wide disparities, ranging from –2.0% in Thailand to 83.4% in China. In Thailand the uncertainty caused by a military coup was compounded when the junta imposed exchange controls to hold back the strong baht, only to rescind them the next day. China's market soared in surely speculative excess, and in the absence of attractive alternatives, as investors sought a piece of the world's fourth largest economy. By the end of 2006 the Chinese market had become the third biggest emerging market after South Korea and Taiwan. European ex UK markets surged 16.1%, in 2006. The Eurozone's GDP growth had recorded its best first half of a year since 2000, 1.7%, and the lowest unemployment rate, 7.8%, since the start of the Eurozone itself. But as the second half of 2006, wore on there were signs that the best news was behind it and the third quarter's annualized growth fell to 2.0%. Business confidence, however, stayed buoyant and cheered by extensive merger and acquisition activity despite headwinds in the form of a strengthening euro, a hawkish European Central Bank that raised rates three times and the looming rise in German sales tax. UK equities added 8.6% in the six months ended December 31, 2006. The Bank of England raised rates twice as GDP growth accelerated to 2.9% year over year, inflation climbed above target and house prices, an import ant demand generator, continued their recovery with average prices up more than 10% in 2006. Again, however, it was widespread, large scale mergers and acquisitions energizing the market.

(1) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The LBAB Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of the Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

ING AMERICAN CENTURY LARGE COMPANY VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING American Century Large Company Value Portfolio (the "Portfolio") seeks long-term capital growth. Income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Charles A. Ritter, Vice President and Senior Portfolio Manager and Brendan Healy, Vice President and Portfolio Manager*, American Century Investment Management, Inc. — the Sub-Adviser.

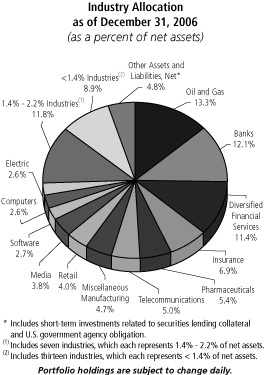

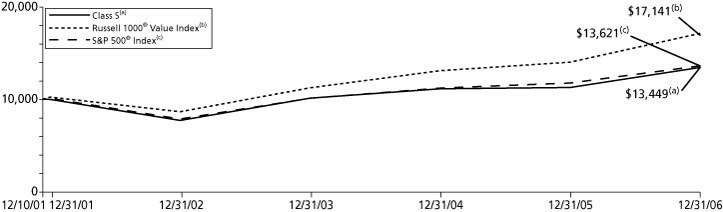

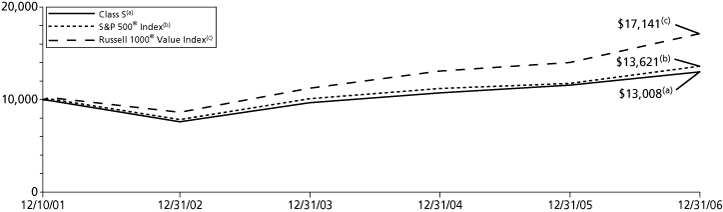

Performance: For the year ended December 31, 2006, the Portfolio's Class S shares provided a total return of 19.30% compared to the Russell 1000® Value Index(1) and the Standard & Poor's 500 Composite Stock Price® Index(2) ("S&P 500 Index"), which returned 22.25% and 15.79%, respectively, for the same period.

Portfolio Specifics: Economic growth surged early in the 12-month period ended December 31, 2006. This in turn drove commodity prices, short-term interest rates, and inflation higher. But growth and inflation moderated in the period's second half, during which the U.S Federal Reserve Board ("Fed") halted its two-year string of interest rate hikes. The Fed's pause and expectations for lower interest rates and mild inflation going forward helped produce double-digit stock index returns for the 12-month fiscal period ended December 31.

In that environment, we received positive absolute contributions from each of the ten sectors in which we were invested, and all of our sector positions delivered double-digit returns. Nevertheless, for the fiscal year, security selection modestly slowed relative performance, causing the Portfolio to trail its benchmark by a slight margin.

Our investments in the financials sector, on average our largest single position, contributed the most to absolute performance during 2006. In a period marked by strong market performance, companies involved with the capital markets fared well overall. That was especially true for mega-cap commercial banks and for companies involved in investment banking such as Merrill Lynch & Co., Inc. and Morgan Stanley. However our zero weighting in Real Estate held back relative returns against the financials sector of the benchmark.

The energy sector also made a significant contribution to total return. We maintained a focus on international integrated oil and gas companies, which sport better valuations and are considered more defensive than their higher-beta, more aggressive cousins in the exploration and production industry. Earlier in the year, the latter group excelled, but in the second half, our patience was rewarded when oil and gas companies like the ones we own came to the market forefront. Major, integrated oil and gas companies, including ExxonMobil Corp. and Chevron Corp., were top performers.

The telecom sector was the market's best-performing area. After years of underperformance, stabilizing fundamentals among companies in the sector drove a strong reversal that made the group a rich source of absolute contribution. AT&T, Inc. and BellSouth Corp. were both top stocks. The acquisition of BellSouth Corp. by AT&T, Inc., a deal valued at $85 billion that will create the largest phone company in the United States, kept both stocks aloft.

While no sector detracted from absolute performance, we still encountered some individual challenges along the way. Chipmaker Intel Corp., saw its shares fall sharply early in the year after announcing robust earnings and revenue growth that nevertheless fell short of heightened expectations.

Elsewhere in the information technology sector, our stake in the computers & peripherals industry was rewarding. We held only one stock, and it was a top contributor. Hewlett Packard Co. is a good example of our price-sensitive discipline. It has long been a top performer, and as it has appreciated, we've gradually reduced our position.

From a relative perspective, stock selection in the consumer discretionary sector turned out to be a liability, and that group slowed performance against the benchmark the most. That was particularly true in the media industry, where a number of names performed well but did not meet our valuation criteria. Consequently, the Portfolio missed some of that performance. Unfavorable selection among multi-line retail firms also generated drag.

The top-detracting stock for the year on a relative basis was mortgage lender Freddie Mac. For much of the period, the stock struggled as delays in implementing new accounting systems raised regulatory scrutiny. The managers continue to have confidence in this firm's long-term prospects and have maintained the position.

Current Strategy & Outlook: The Portfolio is designed for investors seeking long-term capital growth who can tolerate relatively moderate share price fluctuation compared with volatility from more aggressive, growth-oriented investments. The Portfolio can serve as a solid core holding in a diversified portfolio, with the capability to outperform growth-oriented investments when the value discipline is more in favor, as it was for much of the reporting period.

As fundamental, bottom-up managers, we evaluate each company individually on its own merits, and build the Portfolio from the ground up, one stock at a time. In our search for companies that are undervalued, we will structure exposure to stocks and market segments as warranted based on the strength of individual companies.

Top Ten Holdings*

as of December 31, 2006

(as a percent of net assets)

| Citigroup, Inc. | | | 4.8 | % | |

| ExxonMobil Corp. | | | 4.7 | % | |

| Bank of America Corp. | | | 3.8 | % | |

| Chevron Corp. | | | 3.0 | % | |

| Freddie Mac | | | 2.8 | % | |

| Wells Fargo & Co. | | | 2.7 | % | |

| Royal Dutch Shell PLC ADR | | | 2.7 | % | |

| ConocoPhillips | | | 2.1 | % | |

| Pfizer, Inc. | | | 1.9 | % | |

| Morgan Stanley | | | 1.9 | % | |

* Excludes short-term investments related to securities lending collateral and U.S. government agency obligation.

Portfolio holdings are subject to change daily.

* Effective December 31, 2006, Mark Mallon retired as the portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

PORTFOLIO MANAGERS' REPORT

ING AMERICAN CENTURY LARGE COMPANY VALUE PORTFOLIO

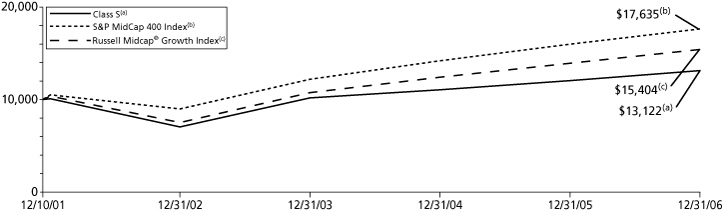

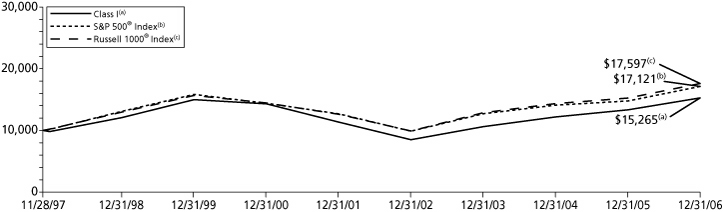

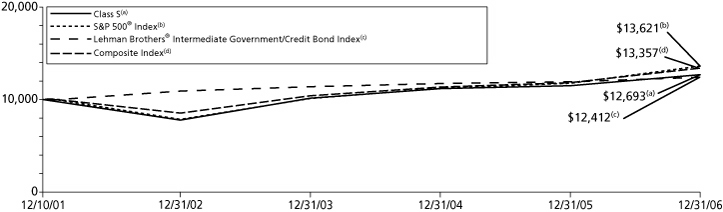

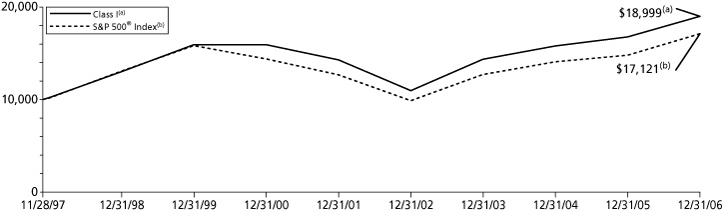

| Average Annual Total Returns for the Periods Ended December 31, 2006 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes I, S and ADV

December 10, 2001 | |

| Class I | | | 19.58 | % | | | 6.41 | % | | | 6.30 | % | |

| Class S | | | 19.30 | % | | | 6.14 | % | | | 6.03 | % | |

| Class ADV | | | 18.89 | % | | | 5.87 | % | | | 5.75 | % | |

| Russell 1000® Value Index(1) | | | 22.25 | % | | | 10.86 | % | | | 11.18 | %(3) | |

| S&P 500® Index(2) | | | 15.79 | % | | | 6.19 | % | | | 6.27 | %(3) | |

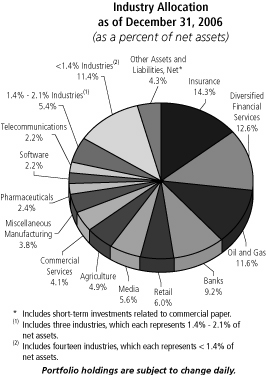

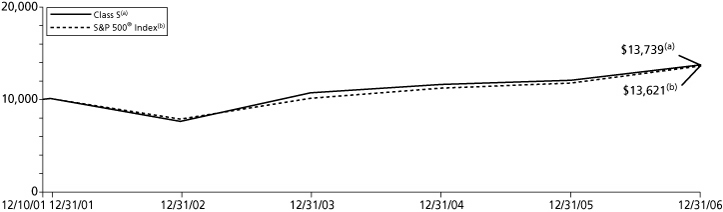

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING American Century Large Company Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Value Index is an unmanaged index that measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower than forecasted growth values.

(2) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

(3) Since inception performance of the index is shown as of December 1, 2001.

5

ING AMERICAN CENTURY SELECT PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING American Century Select Portfolio (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Keith Lee and Michael Li, Portfolio Managers of American Century Investment Management, Inc. — the Sub-Adviser.

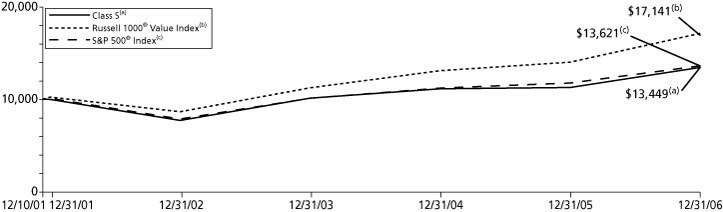

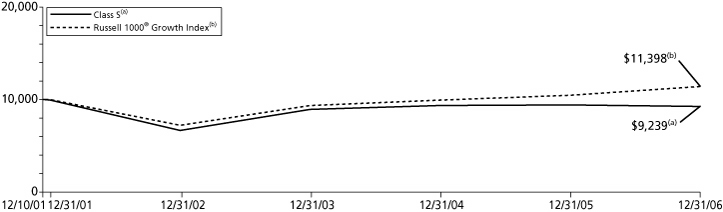

Performance: For the year ended Dec. 31, 2006, the Portfolio's Class S shares provided a total return of (1.75)%, compared with the Russell 1000® Growth Index(1), which returned 9.07% for the same period.

Portfolio Specifics: U.S. stock markets surged in 2006 as the U.S. Federal Reserve Board halted its two-year string of interest rate hikes. Rising stock prices early in the year gave way to a mid-year slump amid fears that rising inflation would accompany a recession. Inflation moderated late in the year and the economy remained relatively strong. As a result, markets began rebounding in July and rallied through the end of the year.

In April 2006, Harold Bradley took over as lead portfolio manager of the Portfolio and enhanced the Portfolio's investment process to focus more heavily on stocks exhibiting classic growth and price momentum features. The timing of the process change proved poor.

Prior to the change, the market favored sectors — energy, industrials and materials — that the Portfolio generally avoided because those sectors, particularly energy, have a spotty record in producing returns on capital. While a focus on return on capital remains important in the Portfolio's process, Mr. Bradley steered the portfolio toward more growth and momentum-oriented stocks, enabling the Portfolio to better take advantage of hot areas of the market.

However, investors tended to avoid stocks with growth and momentum features after the mid-year market selloff, which sent the S&P 500 down 5.68% between the end of April and July 15. Even as the market rebounded in the third quarter of 2006, adverse conditions for growth and momentum investment factors persisted. With the new process, the portfolio likely will perform best when the market rewards growth and momentum factors. But it typically will not generate excess returns during market cycles when both factors rotate out of favor.

The Portfolio recovered in the fourth quarter of 2006, as its 6.90% return outpaced its benchmark by 20 basis points. But for the year as a whole, overweight stakes and poor security selection in both health care and energy accounted for the bulk of the Portfolio's significant relative underperformance, and nine of the Portfolio's 10 leading individual detractors came from those two sectors. Poor security selection in financials and consumer-oriented stocks further reduced relative returns.

Current Strategy and Outlook: The Portfolio's investment team will continue seeking companies with attractive valuations and risk/reward characteristics that also appear capable of sustaining long-term growth in earnings and revenue. Growth and momentum factors returned to favor somewhat in the fourth quarter of 2006, and the Portfolio's performance improved as a result. If that environment remains in place in early 2007, we believe the Portfolio should stand to benefit, particularly if the market rally intact at the end of 2006 also continues.

Effective January 5, 2007, Mr. Bradley was removed as portfolio manager as he has left American Century after 19 years with the firm to take over as chief investment officer of the Kansas City, Mo.-based Kauffman Foundation. Co-portfolio managers Keith Lee and Michael Li will remain in their current roles.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

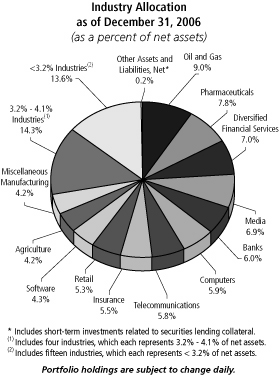

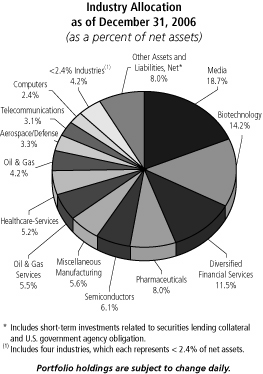

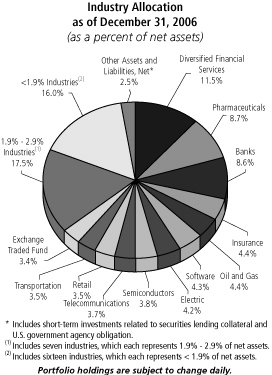

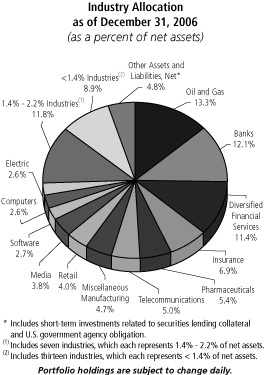

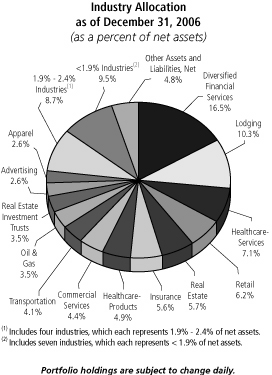

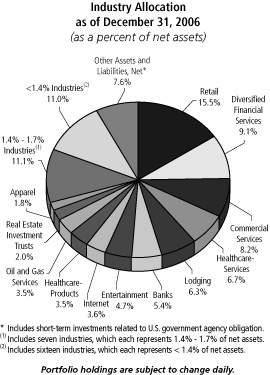

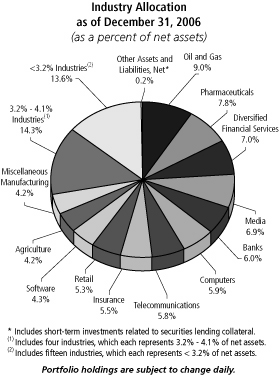

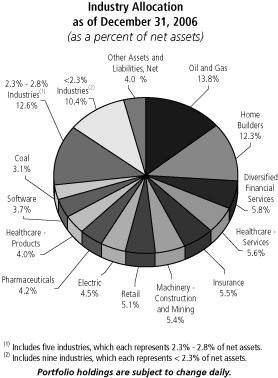

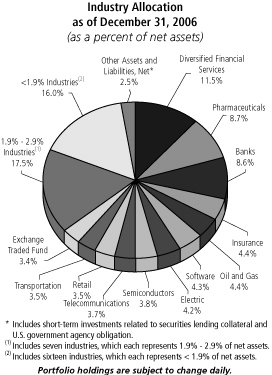

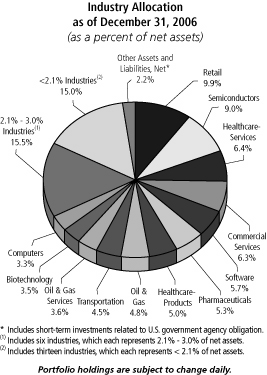

Industry Allocation

as of December 31, 2006

(as a percent of net assets) | |

| Software | | | 7.7 | % | |

| Healthcare-Products | | | 7.2 | % | |

| Insurance | | | 7.0 | % | |

| Diversified Financial Services | | | 5.5 | % | |

| Aerospace/Defense | | | 5.3 | % | |

| Semiconductors | | | 4.9 | % | |

| Lodging | | | 4.4 | % | |

| Oil & Gas | | | 4.4 | % | |

| Telecommunications | | | 4.1 | % | |

| Engineering & Construction | | | 4.0 | % | |

| Retail | | | 4.0 | % | |

| Media | | | 3.8 | % | |

| Industries between 2.6%-3.3%(1) | | | 17.5 | % | |

| Industries between 1.1%-2.4%(2) | | | 16.6 | % | |

| Industries less than 1.0%(3) | | | 3.6 | % | |

| Other Assets and Liabilities, Net* | | | 0.0 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to securities lending collateral and U.S. government agency obligation.

(1) Includes six industries, which each represents 2.6% - 3.3% of net assets.

(2) Includes nine industries, which each represents 1.1% - 2.4% of net assets.

(3) Includes five industries, which each represents less than 1.0% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2006

(as a percent of net assets)

| MEMC Electronic Materials, Inc. | | | 3.1 | % | |

| ABB Ltd. ADR | | | 2.9 | % | |

| Loews Corp. | | | 2.8 | % | |

| Las Vegas Sands Corp. | | | 2.8 | % | |

| Baxter International, Inc. | | | 2.8 | % | |

| Diageo PLC | | | 2.6 | % | |

| Omnicom Group | | | 2.6 | % | |

| Cisco Systems, Inc. | | | 2.5 | % | |

| Infosys Technologies Ltd. ADR | | | 2.5 | % | |

| Microsoft Corp. | | | 2.4 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

6

PORTFOLIO MANAGERS' REPORT

ING AMERICAN CENTURY SELECT PORTFOLIO

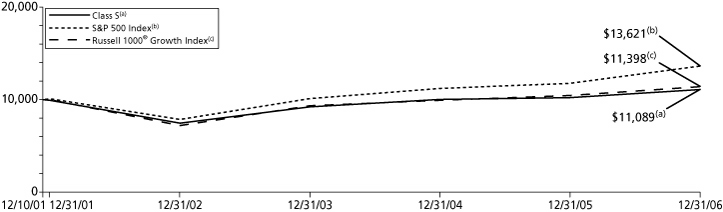

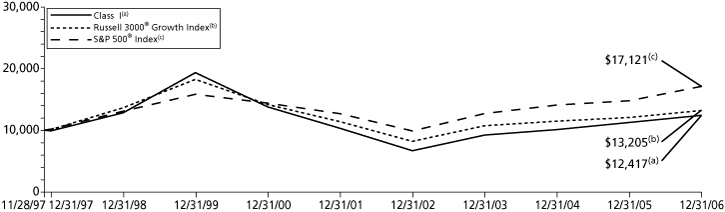

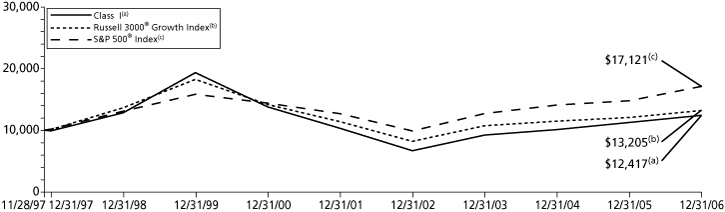

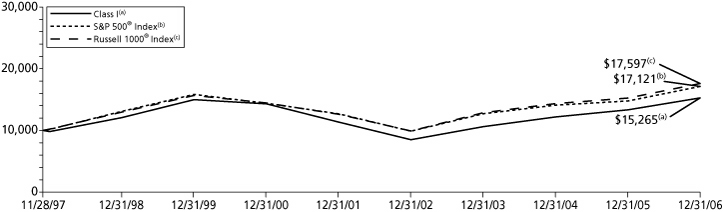

| Average Annual Total Returns for the Periods Ended December 31, 2006 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes I, S and ADV

December 10, 2001 | |

| Class I | | | (1.61 | )% | | | (1.17 | )% | | | (1.29 | )% | |

| Class S | | | (1.75 | )% | | | (1.43 | )% | | | (1.55 | )% | |

| Class ADV | | | (2.01 | )% | | | (1.67 | )% | | | (1.79 | )% | |

| Russell 1000® Growth Index(1) | | | 9.07 | % | | | 2.69 | % | | | 2.61 | %(2) | |

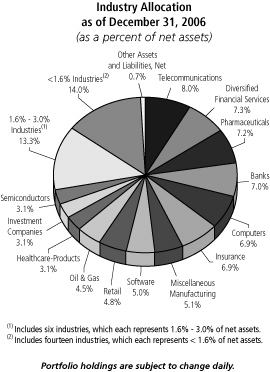

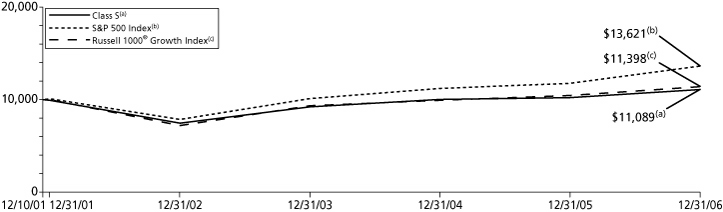

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING American Century Select Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Growth Index is an index of common stocks designed to track performance of large capitalization companies with greater than average growth orientation.

(2) Since inception performance of the index is shown from December 1, 2001.

7

ING AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING American Century Small-Mid Cap Value Portfolio (the "Portfolio") seeks long-term capital growth, income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Benjamin Z. Giele, Steve Roth, Phillip N. Davidson, Scott A. Moore, and Michael Liss, Portfolio Managers* of American Century Investment Management, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2006, the Portfolio's Class S shares provided a total return of 15.43% compared to the Russell 2500TM Value Index(1), Standard & Poor's ("S&P") SmallCap 600/CitigroupValue Index(2) and S&P Small Cap 600 Index(3) ("S&P 600 Index"), which returned 20.18%, 19.57% and 15.12%, respectively, for the same period.

Portfolio Specifics: Small-Cap Value- The Portfolio's small-cap value investment sleeve received positive absolute contributions from all ten of the sectors in which it was invested but fell short of the S&P SmallCap 600/Citigroup Value Index, results attributable primarily to unfavorable security selection in the consumer discretionary and the materials sectors.

Investments in the financials sector, on average our largest sector weighting, contributed the most to total return during the period. Real estate investment trusts ("REITs"), were the strongest performers, followed by capital markets firms. In the latter group, we held several names that advanced and were not represented in the benchmark, including Lazard Ltd., a top-contributing stock. However, a significant underweight overall in REITs proved costly to performance against the benchmark.

Finally, effective security selection made the information technology sector another rich source of contribution and yielded the top-contributing stock. During the year, long-time holding Sybase, an infrastructure and mobile applications software company, raised its profit outlook for 2007 and announced plans to buy Mobile 365, which will make Sybase the leader in mobile messaging and content delivery.

Despite these successes, we encountered some difficulties along the way. Stock selection proved unfavorable in the consumer discretionary sector, which weighed the most on relative performance. One holding from that group that fell short was specialty retailer Pier 1 Imports. Despite aggressive pricing and advertising campaigns, the company reported disappointing sales, recording losses amid tepid consumer response to new merchandising initiatives.

In addition, we also maintained an underweight position in the metals & mining industry, a momentum-driven area where a number of companies did not meet our valuation criteria and therefore did not merit inclusion in the Portfolio. Our relatively smaller exposure slowed performance relative to the benchmark in this area.

Mid-Cap Value — The Portfolio's mid-cap value investment sleeve received positive contributions from all ten sectors in which it was invested. A strategic weighting and stock selection among companies involved in consumer staples (particularly providers of food products), plus an effective mix of information technology businesses, contributed the most to the Portfolio's relative performance.

In consumer staples, the investment team was rewarded for its decision to own Diamond Foods Inc., a holding not found in the benchmark. Diamond is a specialty food company that focuses on culinary and snack nuts, such as walnuts, pine nuts, and peanuts. The leader in its category with a nearly 40% market share, Diamond is expanding its product line, with an emphasis on higher-margin products.

While the information technology sector was up as a whole for the period, communications equipment companies were down for the period. The investment team avoided that part of the sector entirely, which weighed on the benchmark's return. Similarly, an effective mix of semiconductor companies added to the Portfolio's progress; the industry turned in negative results for the Russell Midcap® Value Index.

On the down side, investments in the consumer discretionary sector represented the largest drag on performance against the Russell Midcap® Value Index. A case in point was the Portfolio's larger position in Dollar General Corp. Over much of the period, the discount retailer found its profits squeezed by markdowns, higher shrink (loss from theft) and gasoline prices that both raised transportation costs and slowed spending by consumers.

Elsewhere, in financials, an underweight position in REITs, which were up strongly during the period, restrained the Portfolio. Shares of REITs have surged during the past few years, and continued their march in 2006. As a result of their sustained upswing, few REITs fell within the Portfolio's valuation criteria.

Current Strategy & Outlook: As fundamental, bottom-up managers, we evaluate each company individually on its own merits, and build the Portfolio from the ground up, one stock at a time. In our search for companies that are undervalued, we will structure exposure to stocks and market segments as warranted based on the strength of individual companies.

Top Ten Holdings*

as of December 31, 2006

(as a percent of net assets) | |

| iShares Russell 2000 Value Index Fund | | | 2.5 | % | |

| iShares Russell 2000 Index Fund | | | 2.1 | % | |

| Sybase, Inc. | | | 1.6 | % | |

| Puget Energy, Inc. | | | 1.2 | % | |

| Minerals Technologies, Inc. | | | 1.2 | % | |

| WGL Holdings, Inc. | | | 1.1 | % | |

| Washington Federal, Inc. | | | 1.1 | % | |

| Platinum Underwriters Holdings Ltd. | | | 1.0 | % | |

| South Financial Group, Inc. | | | 1.0 | % | |

| Parametric Technology Corp. | | | 1.0 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

* Effective November 1, 2006, Steve Roth replaced Kevin Laub as portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

8

PORTFOLIO MANAGERS' REPORT

ING AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

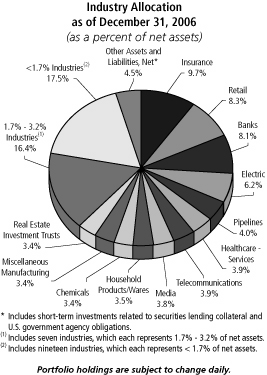

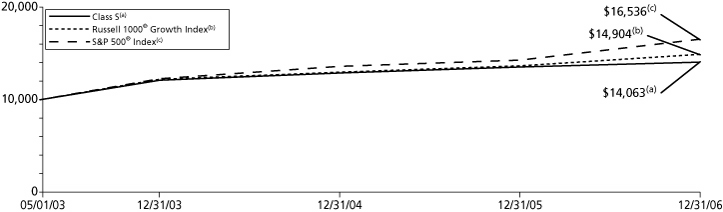

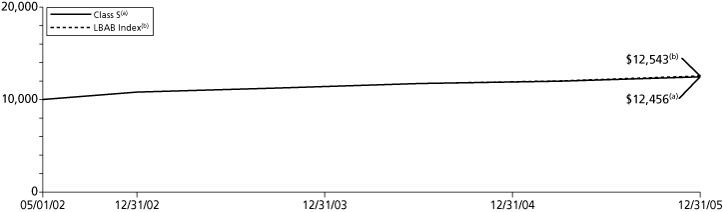

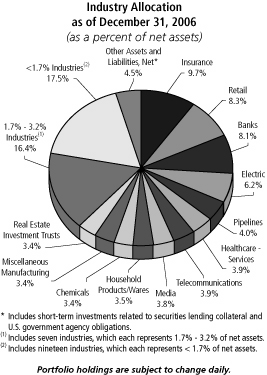

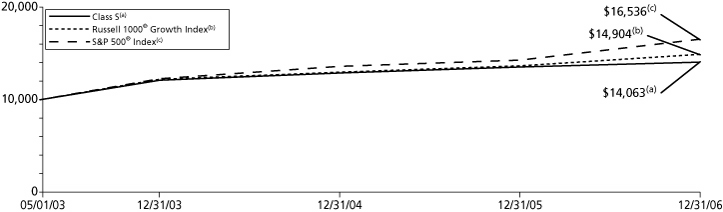

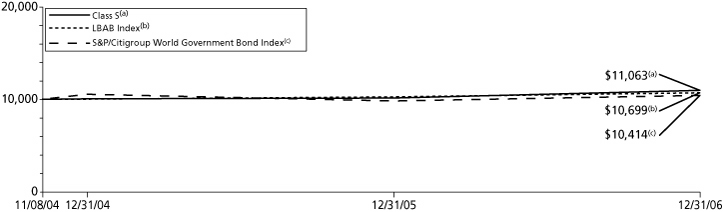

| Average Annual Total Returns for the Periods Ended December 31, 2006 | |

| | | 1 Year | | Since Inception

of Classes I, S and ADV

May 1, 2002 | |

| Class I | | | 15.75 | % | | | 11.87 | % | |

| Class S | | | 15.43 | % | | | 11.58 | % | |

| Class ADV | | | 15.14 | % | | | 11.30 | % | |

| Russell 2500TM Value Index(1) | | | 20.18 | % | | | 14.26 | % | |

| S&P SmallCap 600/Citigroup Value Index(2) | | | 19.57 | % | | | 11.83 | % | |

| S&P SmallCap 600 Index(3) | | | 15.12 | % | | | 11.15 | % | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING American Century Small-Mid Cap Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 2500TM Value Index measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

(2) The S&P SmallCap 600/Citigroup Value Index measures the performance of those S&P 600 Index companies with lower price-to-book ratios.

(3) The S&P SmallCap 600 Index is a market-weighted index of 600 small-sized domestic stocks.

9

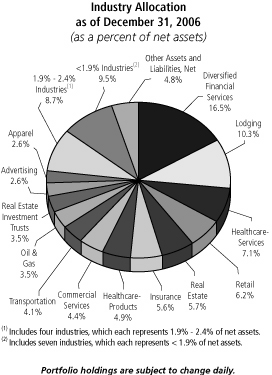

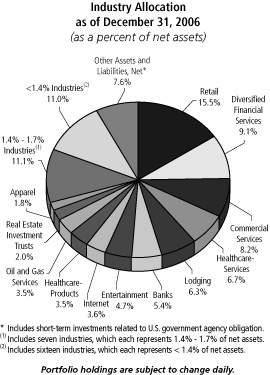

ING BARON ASSET PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING Baron Asset Portfolio (the "Portfolio") seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman and Andrew Peck, Vice President, Portfolio Managers of BAMCO, Inc. ("BAMCO") — the Sub-Adviser.

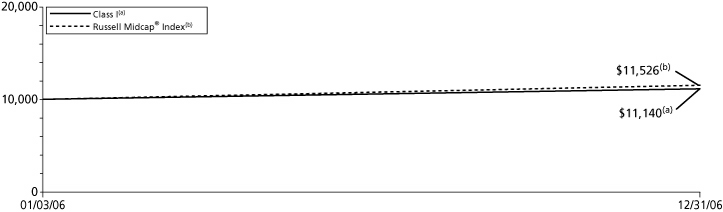

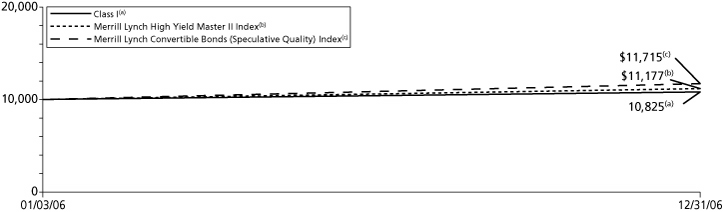

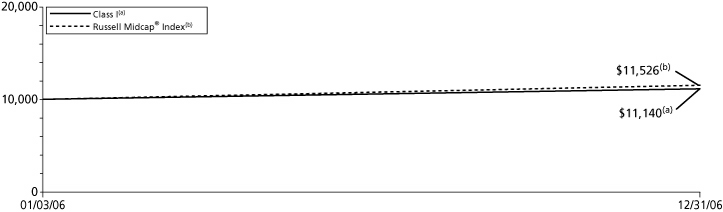

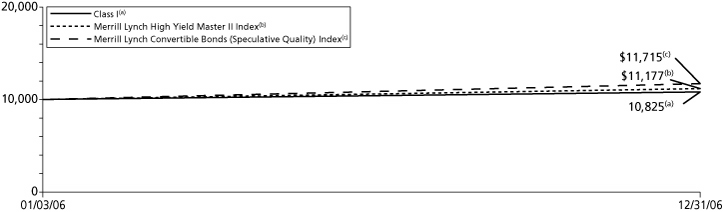

Performance: Since Portfolio's inception on January 3, 2006 through December 31, 2006, the Portfolio's Class I shares provided a total return of 11.40% compared to the Russell Midcap® Index(1), which returned 15.26% for the year ended December 31, 2006.

Portfolio Specifics: The recreation and resorts industry had the most positive impact on the Portfolio's performance during 2006, led by Las Vegas Sands Corp. ("LVS"). The company's stock increased 130% last year as investors started to see value in its Macau China development plans for Henquin Island, an island about a five minute drive from the Cotai Strip that is expected to contain all non-gaming amenities to complement the gaming area of the Strip. The company plans to sell up to $20,000 condos, develop three golf courses as well as a marina and have other entertainment options for the Island including tennis and water sports activities. Strong results from Wynn Resorts Ltd. also helped LVS as it appeared Wynn Resorts Ltd. was growing the market and was not taking share away from LVS's Sands Macau property. In addition, investors became excited as the company's chief operating officer announced that it should be able to sell its Macau mall space for total proceeds between $6 billion and $12 billion, which could completely finance its Cotai Strip land developments. Finally, the company won a license to open a $3.6-billion casino in Singapore on the Marina Bay Waterfront that is expected to open in 2009. We believe this is a strong positive for the company as it will now be able to cross market the Chinese high rollers between both its Macau and Singapore properties. We think this cross marketing should be an even greater benefit for LVS as it will be able to take advantage of the gaming tax disparity, as the gaming tax in Macau is 39% while it is just 15% in Singapore. We believe the company's future projects on the Cotai Strip, as well as the opening of its Palazzo casino on the Las Vegas Strip in June 2007, should continue to drive the stock and the company's growth over the next few years.

The financial services-brokerages & exchanges industry also had a positive impact on performance for 2006 as all four of the Portfolio's holdings in this industry were up during the year. International Security Exchange had the most positive impact as the stock price increased in response to its impressive 50% earnings per share growth during the first three quarters. This earnings growth was driven by an increase in the exchange's average daily trading volume of approximately 40% during this period. Given the company's largely fixed cost structure, earnings generally grow at a faster rate than revenues. Options trading volume was helped by the growing institutional adoption of equity and index options as an attractive security class to both hedge risk and to make leveraged bets on the movement of underlying stock prices.

Advertising services and distribution industries had the most negative impact on performance during 2006. Stock photo provider Getty Images, Inc. was the Portfolio's poorest performer during the period. Getty Images, Inc. lowered guidance several times this year, as its creative images growth rates have slowed due to customers beginning to purchase images at lower effective prices from micro-payment sites and under subscription plans, as well as due to increased competition from traditional players. We have reduced our Getty position during the past several months, and now have a smaller investment in Getty Images, Inc. Shares of air conditioning equipment and parts distributor Watsco, Inc. were down in 2006 as investors digested the company's earnings which came in mostly in-line with expectations and were highlighted by double digit organic revenue and earnings growth. However, we think investors have sold the stock for two reasons: 1) con cerns that the company can not maintain its reported record revenue growth from price inflation and 2) the industry's transition to higher priced, more energy efficient air conditioning units known as SEER 13, where significant inventory dollars have been committed. Despite what we think is a highly predictable replacement business, Wall Street has been unkind to building materials distributors of late, choosing to value them as cyclical stocks tied to new construction housing. In reality, only 25% of Watsco Inc.'s business is connected to residential new construction. The fundamentals of its primary repair and maintenance business remain healthy in our estimation. In the beginning of the winter, the majority of the U.S. experienced unusually warm temperatures making its higher efficiency, higher quality air-conditioning units as relevant as ever.

Current Strategy and Outlook: BAMCO invests for the long-term in what we believe to be forward-looking, well-managed, fast-growing businesses. We believe the companies we own will continue to grow at healthy and sustainable rates.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings

as of December 31, 2006

(as a percent of net assets) | |

| Las Vegas Sands Corp. | | | 3.9 | % | |

| CB Richard Ellis Group, Inc. | | | 3.6 | % | |

| Wynn Resorts Ltd. | | | 3.6 | % | |

| Boyd Gaming Corp. | | | 2.7 | % | |

| Polo Ralph Lauren Corp. | | | 2.6 | % | |

| Iron Mountain, Inc. | | | 2.6 | % | |

| AllianceBernstein Holding LP | | | 2.4 | % | |

| Lamar Advertising Co. | | | 2.4 | % | |

| Charles Schwab Corp. | | | 2.3 | % | |

| International Securities Exchange, Inc. | | | 2.3 | % | |

Portfolio holdings are subject to change daily.

10

PORTFOLIO MANAGERS' REPORT

ING BARON ASSET PORTFOLIO

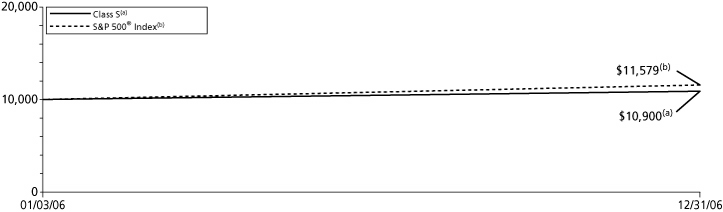

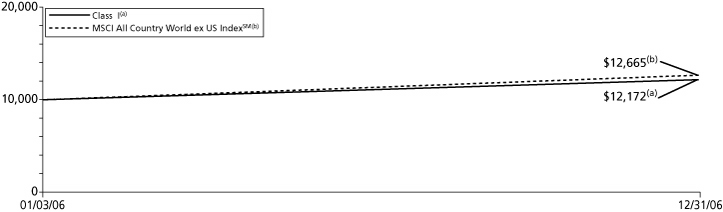

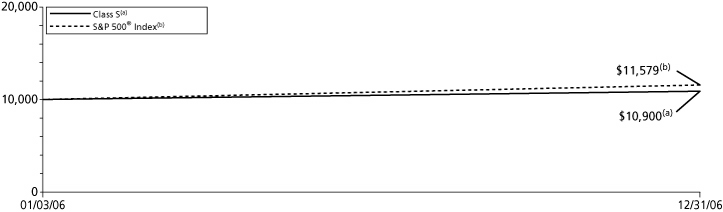

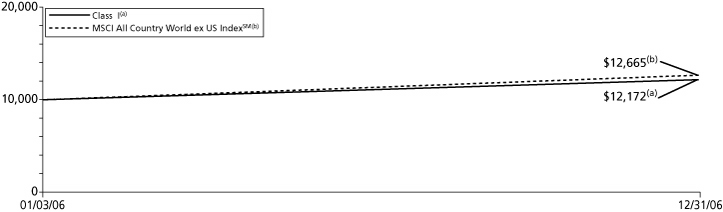

| Cumulative Total Returns for the Periods Ended December 31, 2006 | |

| | | Since Inception

of Class I

January 3, 2006 | | Since Inception

of Class S

May 3, 2006 | | Since Inception

of Class ADV

January 18, 2006 | |

| Class I | | | 11.40 | % | | | — | | | | — | | |

| Class S | | | — | | | | 3.45 | % | | | — | | |

| Class ADV | | | — | | | | — | | | | 10.46 | % | |

| Russell Midcap® Index(1) | | | 15.26 | %(2) | | | 6.36 | %(3) | | | 9.63 | %(4) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Baron Asset Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell Midcap® Index is an unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000® Index, which represents approximately 26% of the total market capitalization of the Russell 1000® Index.

(2) Since inception performance of the index is shown from January 1, 2006.

(3) Since inception performance of the index is shown from May 1, 2006.

(4) Since inception performance of the index is shown from February 1, 2006.

11

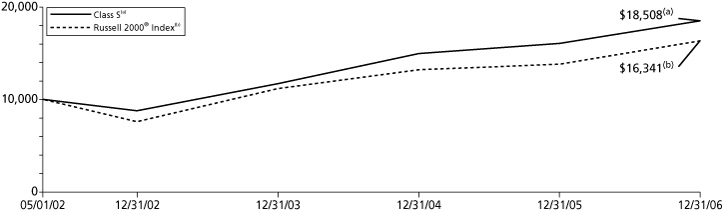

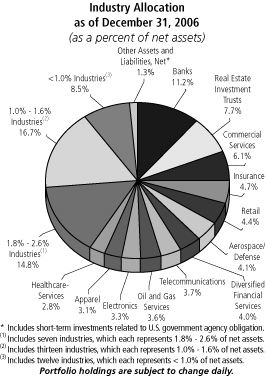

ING BARON SMALL CAP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING Baron Small Cap Growth Portfolio (the "Portfolio") seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman, and Portfolio Manager of BAMCO, Inc. ("BAMCO") — the Sub-Adviser.

Performance: For the year ended December 31, 2006, the Portfolio's Class S shares provided a total return of 15.24% compared to the Russell 2000® Index(1), which returned 18.37% for the same period.

Portfolio Specifics: Industries that had the most positive contribution over the one-year period included retail-specialty stores, recreation & resorts and health services-insurance.

The retail-specialty stores industry made the largest contribution to the Portfolio's gain, with Dick's Sporting Goods, Inc. leading the way. The retail industry has attracted a lot of attention from private equity firms due to the stable cash flows, high free cash generation and real estate assets. Dick's Sporting Goods share price performed very well in 2006 posting a gain of 41%. In mid November, the company reported very strong third quarter sales and net income which the company attributed to cold weather. Increasing same store sales, strong performance from new stores, and improvements in private labels has allowed for gross margins to increase and for selling, general and administrative costs to be lowered. We believe new store returns should increase as Dick's Sporting Goods, Inc. has opened stores in, we think, the best trade locations and as competition among sporting goods retailers has dissipated following Dick's Sporting Goods acquisition of Galyan's and The Sports Authority privatization.

The recreation & resorts industry also made a significant contribution, led by Wynn Resorts Ltd. Wynn Resorts Ltd. was up 72% last year mainly due to investor excitement over the company's sale of its Macau subconcession for $900 million and the opening of the first phase of its $1.2 billion Macau casino in September. The proceeds from the sale of the subconcession helped Wynn Resorts Ltd. almost completely finance its Macau casino and significantly improved the company's leverage. Wynn Resorts Ltd. was also up on the announcement that it is paying out a special $6 per share dividend or $660 million to shareholders as a result of selling its Macau subconcession, a sign the company is confident about its prospects in Macau and feels well financed for its future developments in Macau on the Cotai Strip. Further helping the stock was Wynn Resorts Ltd.'s ability to increase its Macau market share from 9% in October to 16% in November. In addition, the stock continued to trade up as Las Vegas Sands Corp. continued to report strong Macau earnings and continued to maintain its 20% Macau market share even in the face of new capacity coming online.

Restaurants and distribution were the worst performing industries for the Portfolio in 2006. The decline in the restaurant industry was led by Red Robin Gourmet Burgers, Inc. which lowered guidance in November causing the shares to plummet. The company's new stores are more heavily weighted to new markets (60% of new stores are in new markets vs. 40% in 2005). These new stores in new markets did not regain a large portion of their honeymoon period sales and therefore had much lower sales than new stores in existing markets. At this time the percent of new stores in new markets cannot be scaled back to the prior 40% level because strong existing markets are either nearing capacity or have been sold to franchisees. The company now plans to scale back total growth and will attempt to grow new markets' average unit volume to a respectable level through experimenting with outdoor marketing, increased radio and potentially TV ads. We question how long it will take the company to succeed. The Portfolio no longer has a position in Red Robin Gourmet Burgers, Inc.

Current Strategy and Outlook: BAMCO invests for the long-term in what we believe to be forward-looking, well-managed, fast-growing businesses. We believe the companies we own will continue to grow at healthy and sustainable rates.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2006

(as a percent of net assets) | |

| Cohen & Steers, Inc. | | | 2.4 | % | |

| WellCare Health Plans, Inc. | | | 2.2 | % | |

| Dick's Sporting Goods, Inc. | | | 2.1 | % | |

| International Securities Exchange, Inc. | | | 2.0 | % | |

| DeVry, Inc. | | | 1.9 | % | |

| Equinix, Inc. | | | 1.9 | % | |

| CB Richard Ellis Group, Inc. | | | 1.7 | % | |

| Carter's, Inc. | | | 1.6 | % | |

| Amerigroup Corp. | | | 1.5 | % | |

| Eagle Materials, Inc. | | | 1.5 | % | |

* Excludes short-term investments related to U.S. government agency obligation.

Portfolio holdings are subject to change daily.

12

PORTFOLIO MANAGERS' REPORT

ING BARON SMALL CAP GROWTH PORTFOLIO

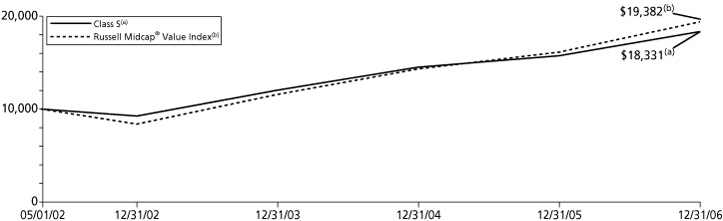

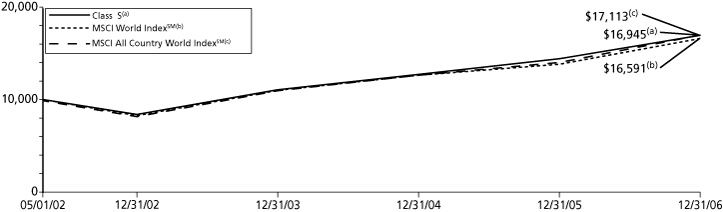

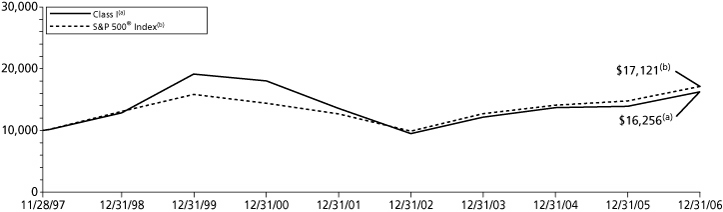

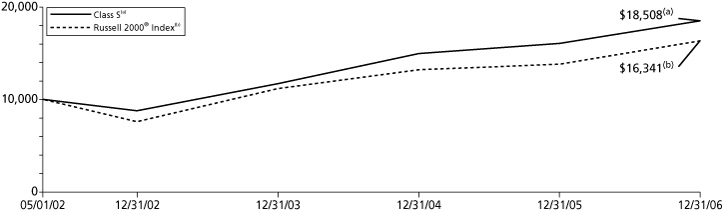

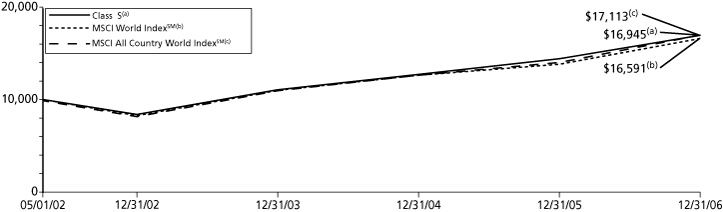

| Average Annual Total Returns for the Periods Ended December 31, 2006 | |

| | | 1 Year | | Since Inception

of Classes I, S and ADV

May 1, 2002 | |

| Class I | | | 15.54 | % | | | 14.38 | % | |

| Class S | | | 15.24 | % | | | 14.09 | % | |

| Class ADV | | | 15.02 | % | | | 13.80 | % | |

| Russell 2000® Index(1) | | | 18.37 | % | | | 11.10 | % | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Baron Small Cap Growth Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 2000® Index is a broad-based unmanaged capitalization weighted index of small capitalization companies.

13

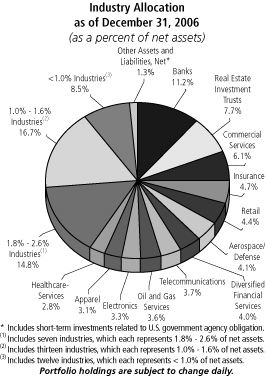

ING COLUMBIA SMALL CAP VALUE II PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING Columbia Small Cap Value II Portfolio (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Christian Stadlinger and Jarl Ginsberg, Portfolio Managers, Columbia Management Advisors, LLC — the Sub-Adviser.

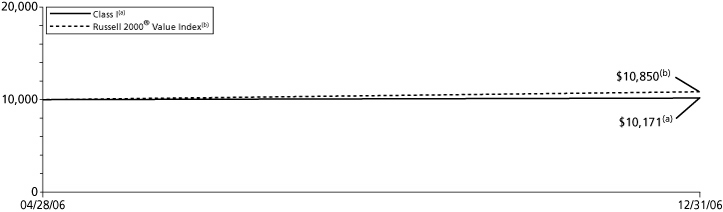

Performance: Since the Portfolio inception on April 28, 2006 through December 31, 2006, the Portfolio's Class I shares provided a total return of 1.70% compared to the Russell 2000® Value Index(1), which returned 8.50% for the period beginning May 1, 2006 through December 1, 2006.

Portfolio Specifics: Detracting from the relative performance were areas of the Portfolio that experienced weak stock performance versus the corresponding Russell 2000® Value Index sectors. For example, the Portfolio's industrial holdings (down 3.3%) underperformed those in the Russell 2000® Value Index (up 5.6%). The Portfolio's consumer discretionary and information technology investments were down 3.0% and 8% respectively, which lagged the benchmark's 9.2% consumer discretionary sector return and 0.6% loss in the information technology sector..

On the plus side, the Portfolio's investments in the consumer staples sector gained 28.9%, compared to 17.4% for the Russell 2000® Value Index, while the Portfolio's financial investments (up 12.4%) outperformed those in the Russell 2000® Value Index (up 11.3%) due to strong stock picking in the capital markets and insurance industries.

The third and fourth quarters were studies in contrasts as fears of a weakening economy hurt many cyclicals and helped more defensive sectors during the third quarter, despite company-specific fundamentals that signaled continued expansion and revenue growth. However, in the fourth quarter, investors realized that fears of a dramatic slowdown were unwarranted which spurred a rebound in many cyclical sectors. As a result, the Portfolio's industrial holdings declined 9.3% during the third quarter yet, rebounded by 13.7% in the fourth quarter.

Not convinced that fears of a wholesale economic slowdown were warranted, we continued to focus on strong company fundamentals rather than the prospects for a given sector. At the same time, we increased exposure to areas where improvement occurred, such as the textile and clothing goods companies within the consumer discretionary sector. Many of these companies may benefit from declining fuel costs, stabilizing in interest rates and resurgent consumer spending.

Current Strategy and Outlook: We employ a disciplined, bottom-up approach that incorporates quantitative screens, fundamental analysis and sophisticated risk management techniques. The investment process is designed to separate value opportunities — companies with solid top-line growth prospects and good cash flow fundamentals — from "value traps," those at a competitive disadvantage due to poor management, a weak product line or a hostile business environment.

We believe that the key to converting opportunity into performance is to purchase stocks that are at an "inflection point," i.e., companies likely to achieve improved earnings because of a change in business strategy, the introduction of new product or a change in the business environment, to list a few possible performance catalysts.

The Portfolio is positioned to avoid rate-sensitive financial companies, which may have difficulty expanding their margins due to pressure from an inverted yield curve, tight credit spreads, potentially deteriorating credit quality and slowing economic growth. We see opportunities within the capital markets area, where companies are more engaged in fee-based activities and where continued industry consolidation and heightened merger and acquisition activity bodes well for performance next year.

Additionally, we see opportunity in the industrials area, specifically those companies serving the aerospace and defense market. Within that group, some of the more promising prospects, which are likely to benefit from strong military spending trends, are in the original equipment and aftermarket space.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings

as of December 31, 2006

(as a percent of net assets) | |

| Barnes Group, Inc. | | | 1.1 | % | |

| Warnaco Group, Inc. | | | 1.1 | % | |

| LaSalle Hotel Properties | | | 1.1 | % | |

| Brown Shoe Co., Inc. | | | 1.1 | % | |

| Lazard Ltd. | | | 1.1 | % | |

| Atmos Energy Corp. | | | 1.1 | % | |

| Genesco, Inc. | | | 1.1 | % | |

| Magellan Health Services, Inc. | | | 1.1 | % | |

| AAR Corp. | | | 1.1 | % | |

| DRS Technologies, Inc. | | | 1.1 | % | |

Portfolio holdings are subject to change daily.

14

PORTFOLIO MANAGERS' REPORT

ING COLUMBIA SMALL CAP VALUE II PORTFOLIO

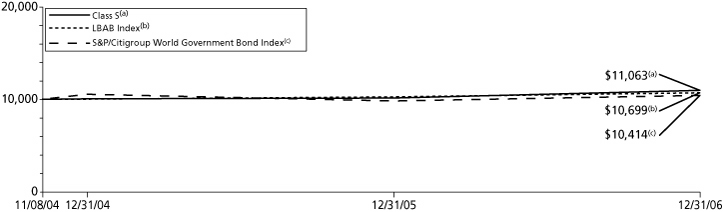

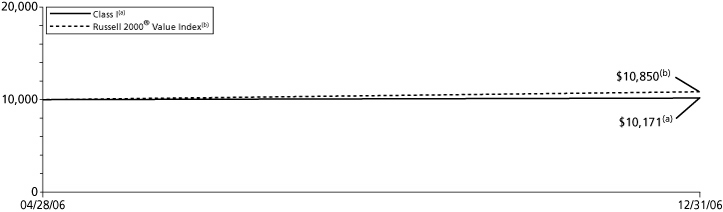

| Cumulative Total Returns for the Periods Ended December 31, 2006* | |

| | | Since Inception

of Class I

April 28, 2006 | | Since Inception

of Class S

May 1, 2006 | |

| Class I | | | 1.70 | % | | | — | | |

| Class S | | | — | | | | 2.01 | % | |

| Russell 2000® Value Index(1) | | | 8.50 | %(2) | | | 8.50 | % | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Columbia Small Cap Value II Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

* Class ADV commenced operations on December 29, 2006, therefore, there is no performance information for the period ended December 31, 2006.

(1) The Russell 2000® Value Index is an unmanaged index measures the performance of those Russell 2000 securities with lower price-to-book ratios and lower forecasted growth values.

(2) Since inception performance of the index is shown from May 1, 2006.

15

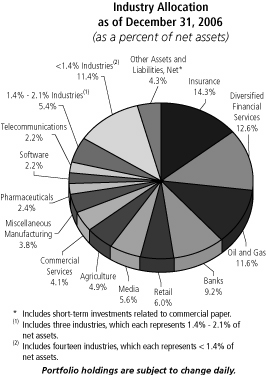

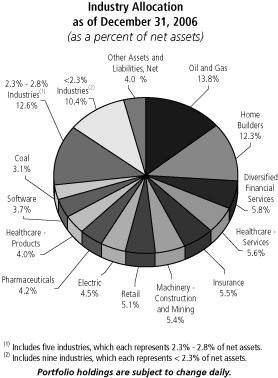

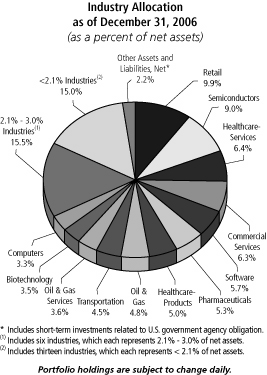

ING DAVIS VENTURE VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

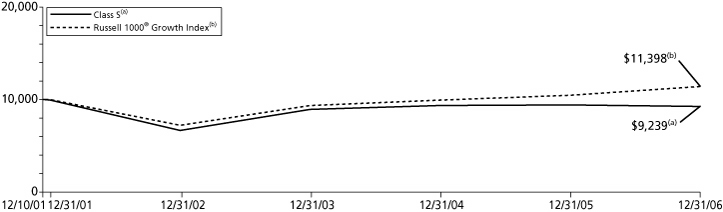

The ING Davis Venture Value Portfolio (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Christopher C. Davis and Kenneth C. Feinberg, Portfolio Managers, with Davis Selected Advisers, L.P. — the Sub-Adviser.

Performance: For the year ended December 31, 2006, the Portfolio's Class S shares provided a total return of 13.85% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), which returned 15.79% for the same period.

Portfolio Specifics: Diversified financial companies were the most important contributors to the Portfolio's performance over the twelve-month period. The Portfolio benefited from its substantial investment in this sector, which out-performed the S&P 500® Index. Three diversified financial companies, JPMorgan Chase, Citigroup, and American Express, were among the top contributors to performance.

Consumer discretionary and consumer staple companies also made important contributions to performance. One consumer discretionary company, Comcast Corp., and two consumer staple companies, Altria Group, Inc. and Diageo PLC ADR, were among the top contributors to performance. Two consumer discretionary companies, Apollo Group (purchased in March 2006) and H&R Block, and one consumer staples company, Hershey Foods, were among the top detractors from performance.

The Portfolio's largest investment was in insurance companies. While insurance companies made a positive contribution to performance, they under performed the S&P 500® Index. Berkshire Hathaway, Inc and Loews Corp. were among the top contributors to performance. Progressive Corp., Transatlantic Holdings, Inc. and Marsh & McLennan were among the top detractors from performance.

Our stock selections in the industry groups within the energy sector under-performed the corresponding stocks in the S&P 500® Index and this is the main reason why the Portfolio underperformed over all.

The Portfolio's investments in telecommunication service and energy companies also contributed to the Portfolio under-performing the S&P 500® Index over the twelve-month period. Telecommunication service companies were the strongest performing sector of the S&P 500® Index, but the telecommunication service companies owned by the Portfolio did not perform as well. While energy companies made positive contributions to performance, they also under performed the S&P 500® Index. One energy company, ConocoPhillips, was among the top contributors to performance. One telecommunication services company, Sprint Nextel (purchased in March 2006), and one energy company, EOG Resources, were among the top detractors from performance.

The Portfolio had approximately 10% of its assets invested in foreign companies at December 31, 2006. As a group, the foreign companies owned by the Portfolio out-performed the S&P 500® Index over the twelve-month period.

Current Strategy and Outlook: We believe that a twelve-month period is too short to provide meaningful insight into a Portfolio's future long-term performance. We are building a portfolio which is quite different in composition from the S&P 500® Index. The Portfolio's investment strategy is to perform extensive research to buy durable companies at a discount to their intrinsic values and hold them for the long term.

Consistent with our low-turnover strategy, only two companies dropped out of the Portfolio's top 10 holdings, Progressive Corp. and Golden West Financial. Progressive remains among the Portfolio's top 20 holdings at year-end and Golden West Financial was acquired by Wachovia. Two new additions to the Portfolio's top 10 holdings at year-end were ConocoPhillips and Comcast, both of which had already been top 20 holdings at the beginning of the year.

Top Ten Holdings*

as of December 31, 2006

(as a percent of net assets) | |

| Altria Group, Inc. | | | 4.9 | % | |

| American Express Co. | | | 4.9 | % | |

| ConocoPhillips | | | 4.3 | % | |

| American International Group, Inc. | | | 4.3 | % | |

| Tyco International Ltd. | | | 3.8 | % | |

| JPMorgan Chase & Co. | | | 3.5 | % | |

| Costco Wholesale Corp. | | | 3.0 | % | |

| Berkshire Hathaway, Inc.-Class A | | | 2.7 | % | |

| Wells Fargo & Co. | | | 2.7 | % | |

| Comcast Corp. | | | 2.6 | % | |

* Excludes short-term investments related to commercial paper.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

16

PORTFOLIO MANAGERS' REPORT

ING DAVIS VENTURE VALUE PORTFOLIO

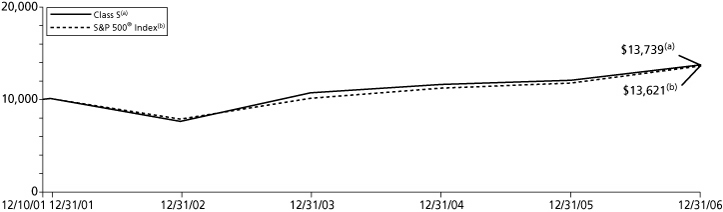

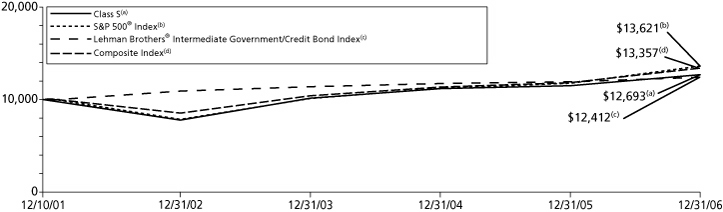

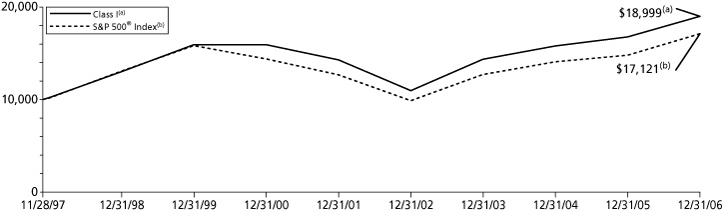

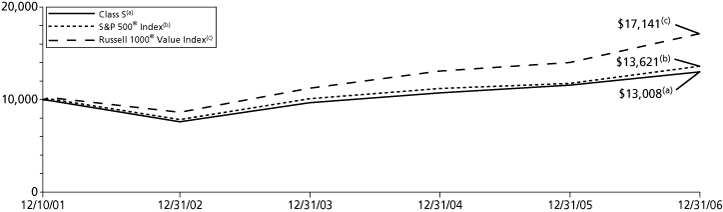

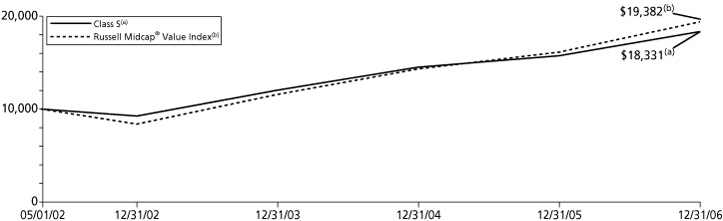

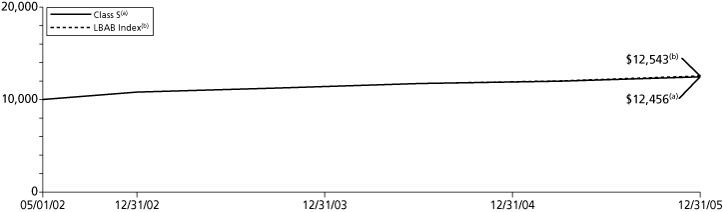

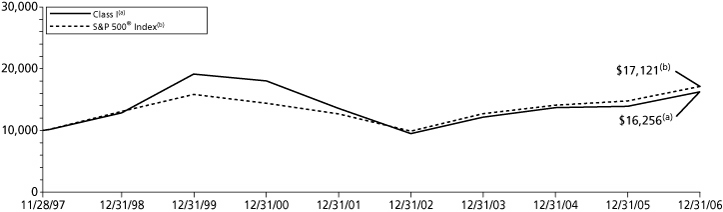

| Average Annual Total Returns for the Periods Ended December 31, 2006 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes I, S and ADV

December 10, 2001 | |

| Class I | | | 14.19 | % | | | 6.62 | % | | | 6.74 | % | |

| Class S | | | 13.85 | % | | | 6.34 | % | | | 6.47 | % | |

| Class ADV | | | 13.58 | % | | | 6.09 | % | | | 6.21 | % | |

| S&P 500® Index(1) | | | 15.79 | % | | | 6.19 | % | | | 6.27 | %(2) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Davis Venture Value Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

(2) Since inception performance of the index is shown as of December 1, 2001.

17

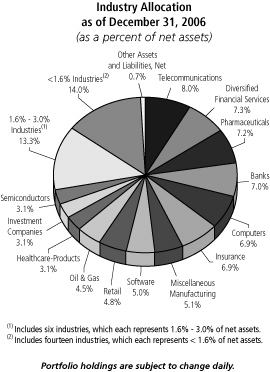

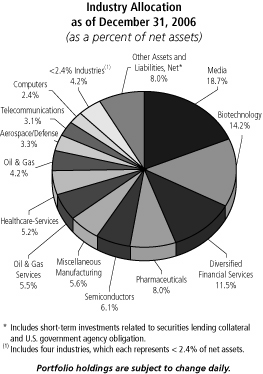

ING FUNDAMENTAL RESEARCH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

The ING Fundamental Research Portfolio (the "Portfolio") seeks to maximize total return through investments in a diversified portfolio of common stocks and securities convertible into common stock. The Portfolio is managed by Christopher F. Corapi, Portfolio Manager and Director of Fundamental Equity Research of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2006, the Portfolio's Class S shares provided a total return of 12.14% compared to the Standard & Poor's 500® Composite Stock Index(1) ("S&P 500® Index"), which returned 15.79% for the same period.

Portfolio Specifics: The Portfolio benefited from favorable stock selection within industrials and, to a lesser extent, telecommunications. Underperformance can partially be attributed to weak stock selection in energy and health care. Our decision to underweight integrated oils and gas companies in favor of exploration and production companies also detracted from performance. This sector experienced a flight to quality in the second half of this year, caused partly by a sharp and unanticipated decline in natural gas prices as cooler weather allowed inventories to build. Within technology, the Portfolio was hurt by weak stock selection in the hardware and equipment industry group as well as our decision to overweight the sector.

WESCO International, Inc. and ABB Ltd. were the greatest contributors to relative performance. Strength in WESCO International, Inc.'s commercial construction end markets, as well as utility company spending on the upgrading of electricity transmission and distribution (i.e., the power grid) helped fuel strong organic growth and margin performance. Like WESCO International, Inc., ABB Ltd. delivered excellent margin improvement and robust sales growth from utility spending on energy infrastructure. We believe ABB Ltd. still has significant upside potential going forward given strong demand and pricing in transmission and distribution and continued capital spending in the global energy markets. The Portfolio also benefited from investments in Verizon Communications, Inc. and AT&T, Inc. AT&T, Inc. benefited this year from improved wireline performance and margin recovery at Cingular Wireless. Verizon Communications, Inc. saw strong perf ormance in the second half of this year due to solid organic growth.