OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2014

Estimated average burden hours per response: 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8319

ING Partners, Inc.

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | January 1, 2011 to December 31, 2011 |

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2011

Classes ADV, I, S and S2

ING Partners, Inc.

n ING American Century Small-Mid Cap Value Portfolio

n ING Baron Small Cap Growth Portfolio

n ING Columbia Small Cap Value II Portfolio

n ING Davis New York Venture Portfolio

n ING Global Bond Portfolio

n ING Invesco Van Kampen Comstock Portfolio

n ING Invesco Van Kampen Equity and Income Portfolio

n ING JPMorgan Mid Cap Value Portfolio

n ING Oppenheimer Global Portfolio

n ING PIMCO Total Return Portfolio

n ING Pioneer High Yield Portfolio

n ING T. Rowe Price Diversified Mid Cap Growth Portfolio

n ING T. Rowe Price Growth Equity Portfolio

n ING Templeton Foreign Equity Portfolio

n ING Thornburg Value Portfolio

n ING UBS U.S. Large Cap Equity Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 3 | | |

|

| Portfolio Managers' Reports | | | 6 | | |

|

| Shareholder Expense Examples | | | 38 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 41 | | |

|

| Statements of Assets and Liabilities | | | 42 | | |

|

| Statements of Operations | | | 50 | | |

|

| Statements of Changes in Net Assets | | | 54 | | |

|

| Financial Highlights | | | 62 | | |

|

| Notes to Financial Statements | | | 69 | | |

|

| Summary Portfolios of Investments | | | 93 | | |

|

| Tax Information | | | 178 | | |

|

| Director and Officer Information | | | 180 | | |

|

| Shareholder Meeting Information | | | 184 | | |

|

| Advisory Contract Approval Discussion | | | 185 | | |

|

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds' website at www.inginvestment.com; and (3) on the U.S. Securities and Exchange Commission's ("SEC's") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.inginvestment.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for certain Portfolios. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios' Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT'S LETTER

Euro zone — continued uncertainty

Dear Shareholder,

Recent months have seen headlines and financial markets continue to focus on the ongoing euro zone debt crisis. Acknowledging that the status quo was untenable, in early December, Europe opted to move closer together rather than be torn apart. All 17 nations that use the euro and nine other European Union members agreed to a new fiscal compact that would invite closer scrutiny of individual country budgets. Ratings agencies were mostly unimpressed by these machinations; ultimately, Standard & Poor's downgraded nine countries in the region, including formerly AAA-rated France.

With the stability of Italy and Spain now in question, the need for an effective policy response has become even more acute. The new governments in both countries will have but a short grace period in which to demonstrate their resolve; both have been forced to pay yields at euro-era highs for newly issued bonds.

Across the Atlantic, the chasm between the two major political parties in the United States is as wide as ever, most recently evidenced by the failure of the Congressional "supercommittee" on deficit reduction. Notwithstanding the ongoing paralysis in Washington, the U.S. economy is showing new signs of momentum.

We expect the global economy to deliver positive, if uninspiring, growth into 2012 despite the euro zone's debt problems. We believe interest rates should remain low in major advanced countries. Markets — and risk assets in general — are likely to remain vulnerable to uncertainty until there is confidence that Europe has adequately addressed its issues.

In times of uncertainty investors historically have turned to sovereign credits, especially U.S. Treasury securities. This spotlights the critical role that governments play in defining the parameters of the financial markets and serving as foundations for generating value within economies. The current trend toward fiscal austerity downplays this important function and may prolong the global economic doldrums.

How should you respond to uncertainty in your own investment program? Don't try to time the markets. Keep your portfolio well diversified, and pay careful attention to the risks you are assuming. Talk to your financial advisor before you make any changes that might detour your portfolio from your long-term goals.

We appreciate your continued confidence in ING Funds, and we look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

ING Funds

January 3, 2012

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. Consider the fund's investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

(THIS PAGE INTENTIONALLY LEFT BLANK)

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2011

In our semi-annual report we described how investor sentiment was generally positive through April. Many of the developed world's economies including the U.S., seemed to be returning to health, boosted by heavy, ongoing doses of stimulative and monetary medicine. This was despite natural disasters in Japan, the violent uncertainties of the "Arab Spring" in North Africa and the Middle East, not to mention a European sovereign debt crisis.

But the mood darkened in early May 2011. Global equities in the form of the MSCI World IndexSM measured in local currencies, including net reinvested dividends, slid from May through September, losing over 17%, before a remarkable October rally clawed back about half of this. For the whole fiscal year the Index lost 5.49%. (The MSCI World IndexSM returned (5.54)% for the year ended December 31, 2011, measured in U.S. dollars.)

A confluence of factors caused the deterioration in outlook after April. That month the latest unemployment rate was reported at 8.8%, the lowest in 24 months. New private sector jobs, well above 200,000, were added in each of January, February and March. But in May the unemployment rate rebounded to 9.1%. By September the employment report showed zero new jobs created in August. But more upbeat releases in later months revised this up, and by year end the three-month average of jobs created was back to 143,000 from just 35,000 in September.

In the housing market, home prices (based on the S&P/Case-Shiller 20-City Composite Home Price Index) fell every month in the year. Sales were depressed, despite improved affordability and record low mortgage interest rates, by tight credit with many homeowners in negative equity on their properties.

Gross Domestic Product ("GDP") growth had been reported at 3.1% (quarter-over-quarter, annualized) for the fourth quarter of 2010. On July 29, this was scaled down to 2.3%, among other revisions that showed the recession had been deeper and started earlier than previously thought. Worse, growth in the first quarter of 2011 was a barely perceptible 0.4%. When the second quarter's figure was finalized at just 1.3%, the common assessment was that the economy was operating at "stall-speed". There was relief in October when the first estimate of third quarter GDP growth was a much-improved 2.5%, although this was subsequently revised down to 1.8%.

Political deadlock weighed on sentiment throughout. A stopgap agreement to raise the debt ceiling did not stop Standard & Poors from downgrading the country's credit rating. A bipartisan "Debt Super Committee" appointed to negotiate a more lasting set of budget control measures, admitted defeat on November 21.

Other keenly watched figures like retail sales and wages & salaries were stagnant in the months up to October, improved in that month and were mixed thereafter. Purchasing managers' indices indicated expansion but not by much. Taken together, the data were inconclusive as the year ended but the consensus was that the once-feared return to recession now looked unlikely.

The euro zone's sovereign debt crisis continued to move markets. By early August it seemed to be veering out of control. When attention turned from Greece to the much bigger bond markets of Spain and especially Italy, the European Central Bank ("ECB") stepped in, uneasily, to buy their bonds — and some time. The threat to the euro zone banking system, where vast quantities of Italian and Spanish bonds are held, was clear.

Finally, a baby step towards closer fiscal union among euro zone countries was agreed in December, including restrictions on budget deficits with near automatic disciplinary procedures for violators. Bilateral loans of up to €200 billion would be made to the International Monetary Fund, presumably to fund rescue packages for individual nations. But it provided no lender of last resort with unlimited firepower, nor measures to promote growth and liberalize markets. Investors were under no illusions as the year ended that the crisis had been solved.

In U.S. fixed income markets, the Barclays Capital U.S. Aggregate Bond Index of investment grade bonds rose 7.84% in the fiscal year, while the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index gained 4.96%. Most notable within the Barclays Capital U.S. Aggregate Bond Index was the remarkable 29.93% return on long-dated Treasuries, reflecting both the overall decline in risk appetite and quantitative easing.

U.S. equities, represented by the S&P 500® Index, including dividends, returned 2.11% for 2011, almost identical to the dividend yield. Sector returns ranged from (17.06)% for financials to 19.91% for utilities. The operating earnings per share of S&P 500® companies made new records in the second and third quarters of 2011, but estimates for future quarters were coming down as December ended.

In currency markets, the euro zone's problems finally took their toll, as the dollar gained 2.34% on the euro in 2011, which dropped sharply after October. The pound was barely changed despite late weakness: the dollar gained 0.10%. But the dollar fell back against the yen by 5.35% despite Bank of Japan intervention as that currency repeatedly breached post-war high levels.

In international markets, the MSCI Japan® Index slumped 18.73% in 2011. The economy contracted for three straight quarters before finally recovering, as it struggled to recover from the earthquake and tsunami of March as well as a strong yen. The MSCI Europe ex UK® Index sank 12.87%, weighed down by the recessionary threat of the sovereign debt crisis. Euro zone growth shrunk to 0.2% in the second and third quarters and unemployment stood at 10.3%, a euro-era high. The MSCI UK® Index slipped just 1.83%. Weak euro zone demand and fiscal austerity at home depressed stocks, within which, however, the well-represented energy, staples and telecoms sectors managed positive average returns.

Parentheses denote a negative number.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower of higher than the performance data shown. Please call (800) 262-3862 or log on to www.inginvestment.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

BENCHMARK DESCRIPTIONS

| Index | | Description | |

| Bank of America/Merrill Lynch All U.S. Convertibles (Speculative Grade) Index | | An unmanaged index that includes about 270 convertible securities and represents the

non-investment-grade convertible market. | |

|

| Bank of America/Merrill Lynch High Yield Master II Index | | A broad-based index consisting of all U.S. dollar-denominated high-yield bonds with a minimum outstanding amount of $100 million and with a maturity of greater than one year period. The quality rating is less than BBB by Standard & Poor's. | |

|

| Barclays Capital Global Aggregate Index | | provides a broad-based measure of the global investment-grade fixed-rate debt markets. | |

|

| Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index | | An unmanaged index that includes all fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | |

|

| Barclays Capital U.S. Aggregate Bond Index | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. | |

|

| Barclays Capital U.S. Government/Credit Bond Index | | An index made up of the Barclays Capital Government and Credit indices, including securities issued by the U.S. government and its agencies and publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. | |

|

| MSCI All Country World ex U.S. IndexSM | | A free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. | |

|

| MSCI All Country World IndexSM | | A broad-based unmanaged index comprised of equity securities in countries around the world, including the United States, other developed countries and emerging markets. | |

|

| MSCI EAFE® Index | | an unmanaged index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. | |

|

| MSCI Europe ex UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | |

|

| MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market market equity performance in Japan. | |

|

| MSCI UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | |

|

| MSCI World IndexSM | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | |

|

| Russell 1000® Value Index | | An unmanaged index that measures the performance of those Russell 1000® securities with lower price-to-book ratios and lower forecasted growth values. | |

|

| Russell 1000® Index | | An unmanaged, comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies. | |

|

| Russell 2000® Growth Index | | An unmanaged index that measures the performance of securities of smaller U.S. companies with greater than average growth orientation. | |

|

| Russell 2000® Index | | An unmanaged index that measures the performance of securities of small U.S. companies. | |

|

| Russell 2000® Value Index | | An unmanaged index that measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower than forecasted growth values. | |

|

| Russell 2500TM Value Index | | Measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. | |

|

| Russell 3000® Growth Index | | An unmanaged index that measures performance of broad growth segment of the U.S. Equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values. | |

|

| Russell Midcap® Growth Index | | An unmanaged index that measures the performance of those companies included in the Russell Midcap® Index with relatively higher price-to-book ratios and higher forecasted growth values. | |

|

| Russell Midcap® Value Index | | Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. | |

|

4

BENCHMARK DESCRIPTIONS (CONTINUED)

| Index | | Description | |

| S&P 500® Index | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | |

|

| S&P MidCap 400 Index | | A broad-based unmanaged capitalization weighted index of mid-capitalization companies. | |

|

| S&P Small Cap 600/CitigroupValue Index | | Measures the performance of those S&P 600 Index companies with lower price-to-book ratios. | |

|

| S&P/Case-Shiller 20-City Composite Home Price Index | | A composite index of the home price index for the top 20 Metropolitan Statistical Areas in the United States. The index is published monthly by Standard & Poor's. | |

|

| S&P/Citigroup World Government Bond Index | | S&P/Citigroup World Government Bond Index is an unmanaged index of bonds from 14 world government bond markets with maturities of at least one year. | |

|

5

ING AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

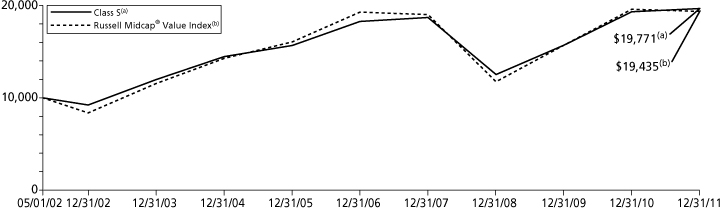

ING American Century Small-Mid Cap Value Portfolio (the "Portfolio") seeks long-term capital growth. Income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Benjamin Z. Giele and James Pitman (responsible for the management of the Small Cap Value portion of the Portfolio) and Kevin Toney, Phillip N. Davidson, and Michael Liss (responsible for the Mid Cap Value portion of the Portfolio), Portfolio Managers of American Century Investment Management, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2011, the Portfolio's Class S shares provided a total return of (3.16)% compared to the Russell 2500TM Value Index and the S&P Small Cap 600/CitigroupValue Index, which returned (3.36)% and (1.38)%, respectively, for the same period.

Portfolio Specifics: Stocks recorded mixed results in 2011 as some indices eked out small gains and others posted modest losses. Market volatility was high as investors confronted political turmoil in the Middle East; Japan's earthquake, tsunami, and nuclear accident; the European debt crisis; and a political stalemate in the U.S. over the raising of the debt ceiling. Lackluster U.S. growth also dampened investor sentiment, though conditions improved in the final months of the year. Corporate earnings remained solid and employers began to add jobs. Investors generally favored higher-yielding securities. Large cap growth stocks outperformed their value counterparts and small cap value stocks beat their growth counterparts, but mid cap value stocks narrowly outperformed mid cap growth stocks.

Small Cap Value* — The portfolio's return for the year was quite close to that of the Russell 2000® Value Index before deduction of expenses. Investments in the information technology and industrials sectors contributed to relative performance versus the Russell 2000® Value Index. In information technology, the portfolio benefitted from holdings among semiconductor stocks and IT services names. Notable contributors were semiconductor maker National Semiconductor Corp.; Total System Services, Inc., an electronic payment processor; and communications clearinghouse NeuStar, Inc. In industrials, an underweight in commercial services and supplies added value. Stock selection among electrical equipment companies and professional services stocks also enhanced results. A key contributor was Mistras Group, Inc., which provides non-destructive testing and inspection services and software for analyzing energy, industrial and public infrastructure. The energy and financials sectors detracted from performance. In energy, the portfolio was hampered by its investments in the oil, gas and consumable fuels industry. Detractors included independent oil and gas exploration company Penn Virginia Corp.; oil tanker company Overseas Shipholding Group; and coal producer Patriot Coal Corp. In financials, commercial banking was a source of weakness. A notable detractor was regional bank First Horizon National Corp.

Mid Cap Value* — The portfolio outperformed relative to the Russell Mid Cap Value Index. The portfolio benefited from positions in the financials, consumer staples, and energy sectors. In financials, an underweight and effective security selection contributed to relative results. Within the insurance industry, the portfolio benefited from owning TransAtlantic Holdings, Inc., a global reinsurance company. An investment in American Tower Corp. ("American Tower"), which is not represented in the benchmark, was also advantageous. American Tower announced it was planning to convert itself into a real estate investment trust ("REIT") at the end of 2011, attracting more investors to the stock. (The conversion led to American Tower's reclassification from a telecommunications stock to a REIT.) The financials sector was also the source of two top detractors, Northern Trust Corp. and Hudson City Bancorp., Inc. In consumer staples, an overweight added to relative performance as did the portfolio's focus on high-quality names such as Kimberly-Clark Corp. and General Mills, Inc. The energy sector supplied two notable contributors: EQT Corp., a low-cost producer of unconventional tight-shale natural gas, and Imperial Oil Ltd., a Canadian energy company. Detracting from relative performance were positions in the consumer discretionary and utilities sectors. In consumer discretionary, an underweight in the media industry slowed relative performance. The household durables and specialty retailing industries provided key detractors, appliance manufacturer Whirlpool Corp. and office supply retailer Staples. An underweight in utilities dampened relative results. Utilities stocks, which are generally viewed as defensive instruments in difficult economic times, outperformed. The portfolio management team considers many utilities stocks overvalued.

Current Strategy and Outlook: Small Cap Value* — The portfolio management team takes a fundamental, bottom-up approach, evaluating each company individually on its own merits and building the portfolio from the ground up, one stock at a time. As of December 31, 2011, the portfolio was broadly diversified, with overweight positions relative to the benchmark in information technology, industrials and health care and underweights in financials and utilities.

Mid Cap Value* — The portfolio management team takes a fundamental, bottom-up approach, evaluating each company individually on its own merits and building the portfolio from the ground up, one stock at a time. As of December 31, 2011, the portfolio was broadly diversified, with overweight positions relative to the benchmark in industrials and health care, and underweights in financials, utilities, information technology, and consumer discretionary stocks.

Sector Diversification

as of December 31, 2011

(as a percentage of net assets)

| Financials | | | 27.1 | % | |

| Industrials | | | 16.7 | % | |

| Consumer Discretionary | | | 9.6 | % | |

| Utilities | | | 9.4 | % | |

| Health Care | | | 9.0 | % | |

| Information Technology | | | 8.2 | % | |

| Consumer Staples | | | 6.3 | % | |

| Energy | | | 5.8 | % | |

| Materials | | | 4.4 | % | |

| Telecommunications | | | 2.3 | % | |

| Assets in Excess of Other Liabilities* | | | 1.2 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011*

(as a percentage of net assets)

| Republic Services, Inc. | | | 2.0 | % | |

| Northern Trust Corp. | | | 1.6 | % | |

| iShares Russell Midcap Value Index Fund | | | 1.5 | % | |

| HCC Insurance Holdings, Inc. | | | 1.4 | % | |

| Zimmer Holdings, Inc. | | | 1.3 | % | |

| Ralcorp Holdings, Inc. | | | 1.3 | % | |

| Lowe's Cos., Inc. | | | 1.3 | % | |

| Imperial Oil Ltd. | | | 1.3 | % | |

| Bemis Co., Inc. | | | 1.2 | % | |

| Great Plains Energy, Inc. | | | 1.2 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

* For purposes of these discussions, "the portfolio" refers to each respectively managed portion of ING American Century Small-Mid Cap Value Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

6

PORTFOLIO MANAGERS' REPORT

ING AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

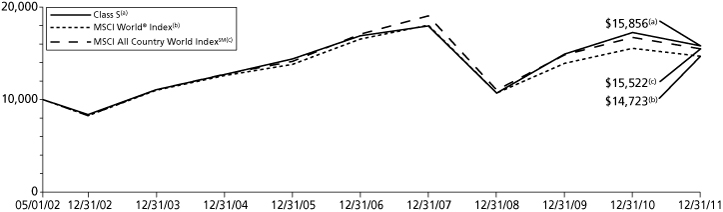

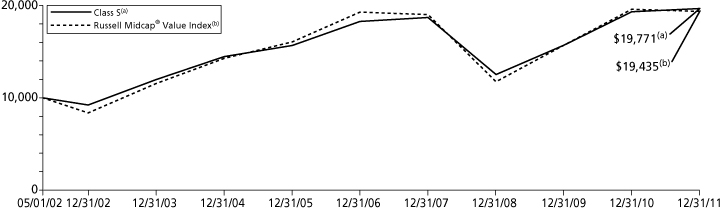

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes ADV, I and S

May 1, 2002 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | (3.47 | )% | | | 2.44 | % | | | 6.63 | % | | | — | | |

| Class I | | | (2.97 | )% | | | 2.96 | % | | | 7.17 | % | | | — | | |

| Class S | | | (3.16 | )% | | | 2.71 | % | | | 6.90 | % | | | — | | |

| Class S2 | | | (3.33 | )% | | | — | | | | — | | | | 27.06 | % | |

| Russell 2500TM Value Index | | | (3.36 | )% | | | (0.58 | )% | | | 6.33 | % | | | 27.74 | %(1) | |

| S&P Small Cap 600/Citigroup Value Index | | | (1.38 | )% | | | 0.12 | % | | | 5.61 | % | | | 28.06 | %(1) | |

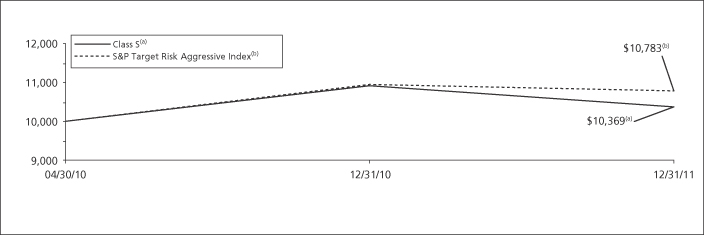

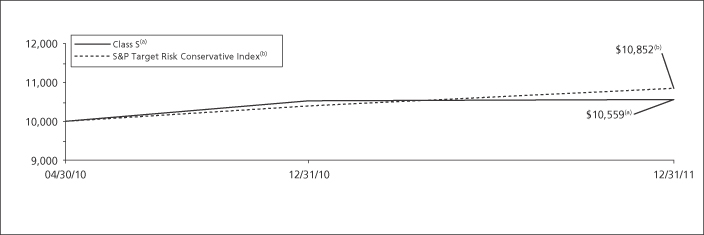

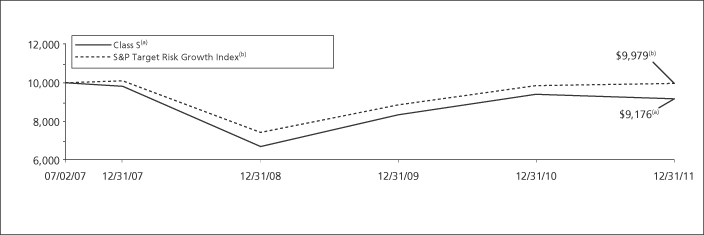

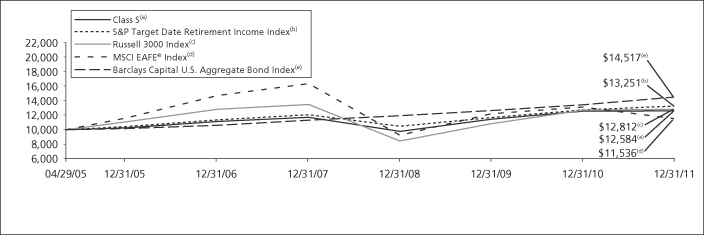

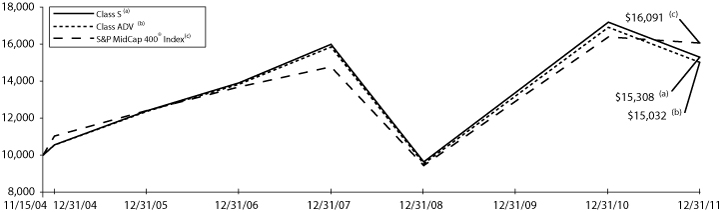

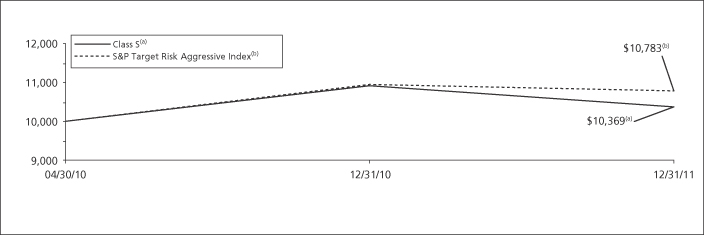

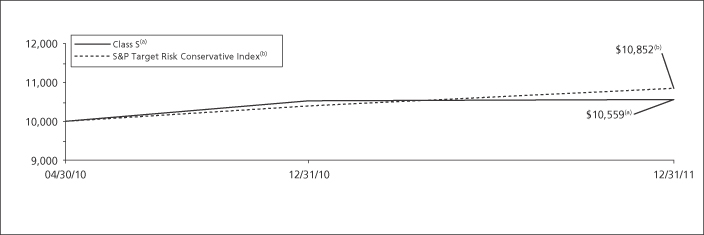

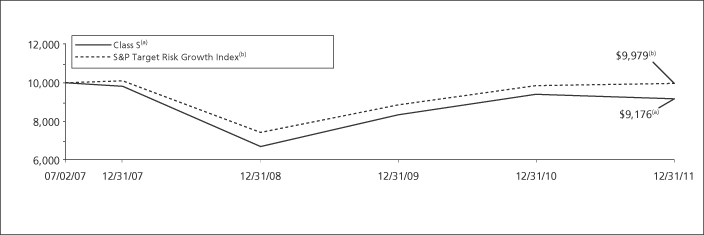

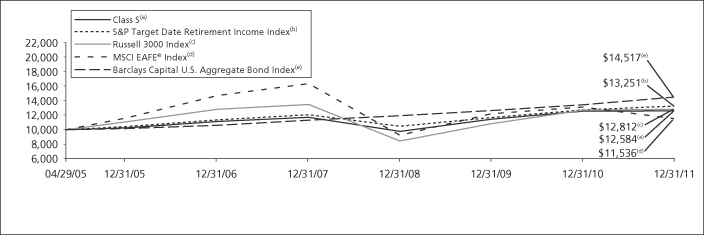

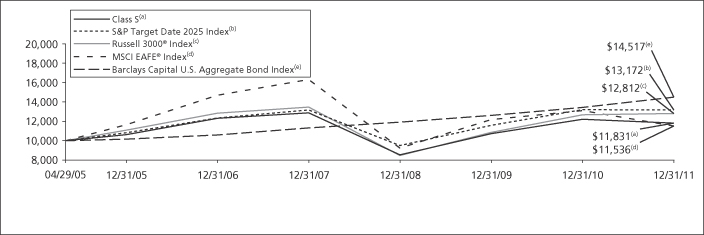

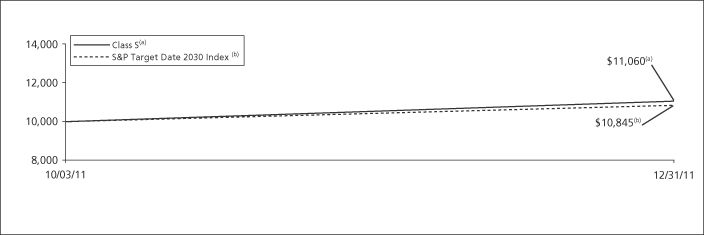

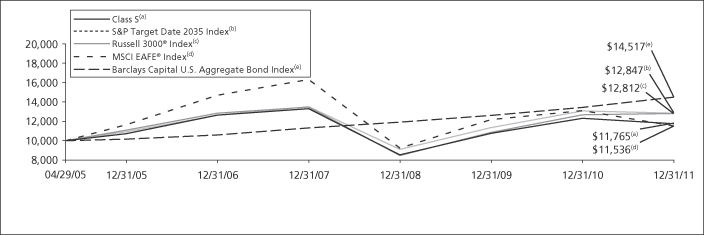

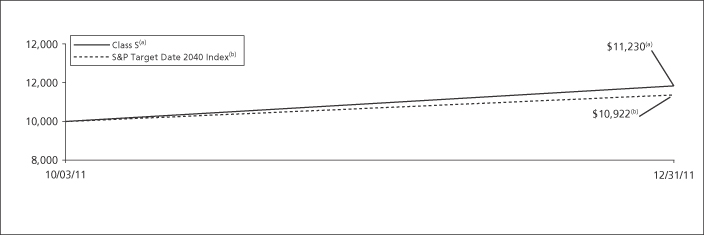

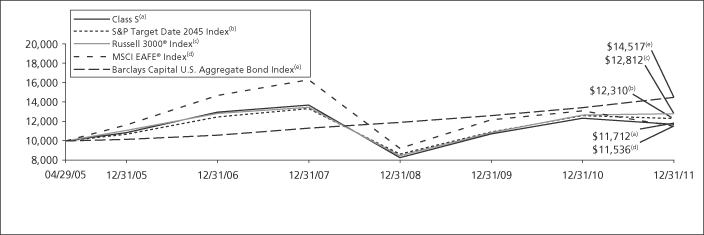

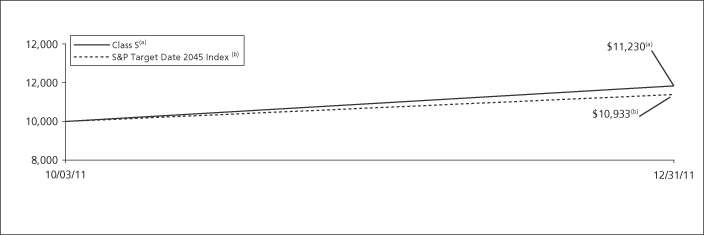

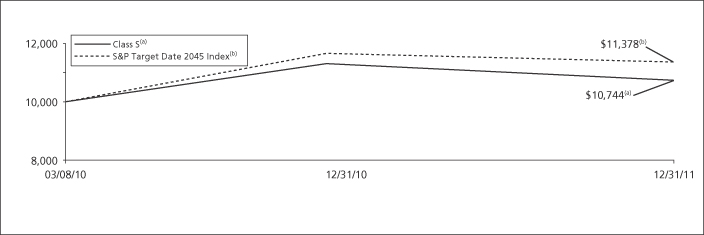

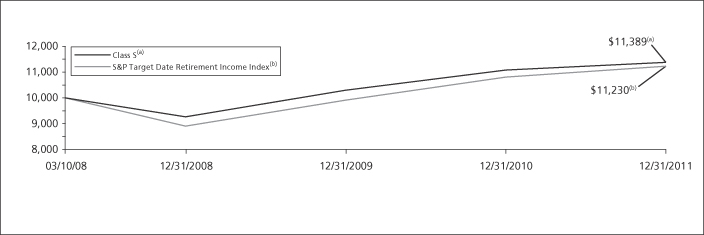

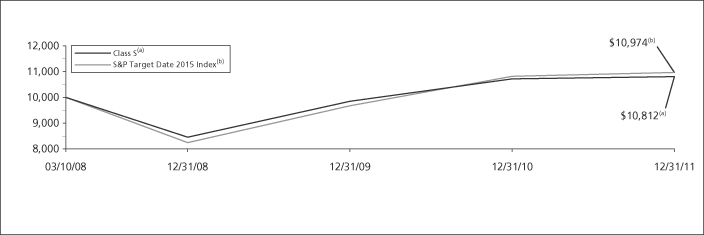

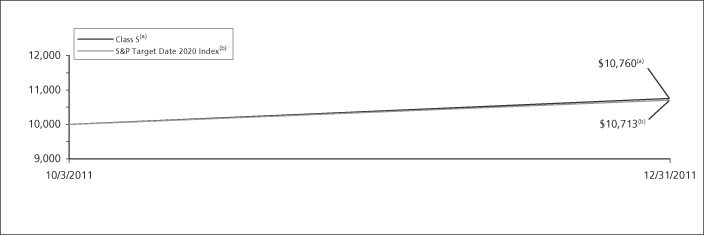

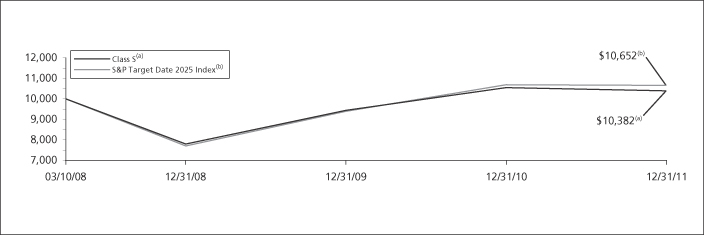

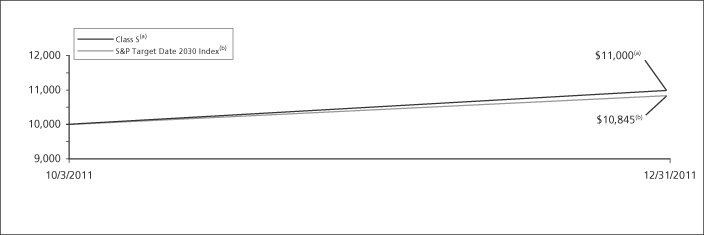

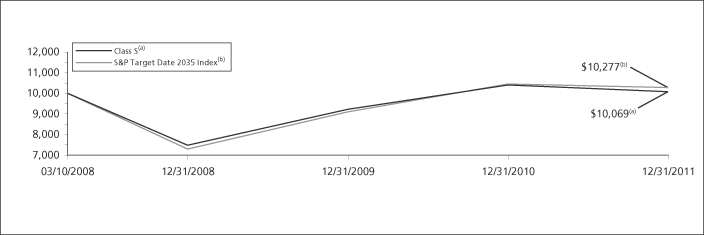

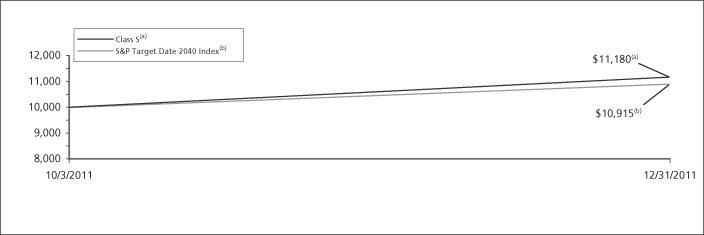

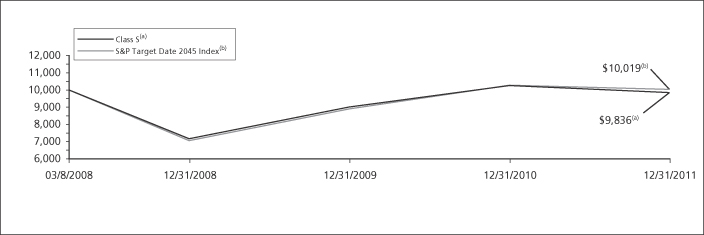

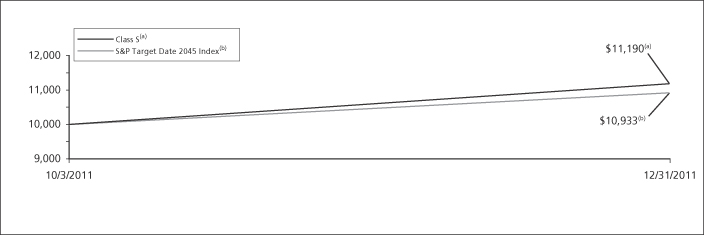

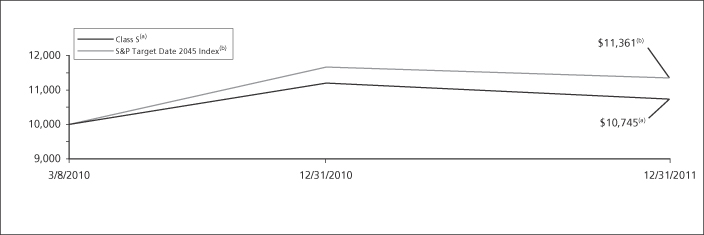

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING American Century Small-Mid Cap Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance of the indices is shown from March 1, 2009.

7

ING BARON SMALL CAP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Baron Small Cap Growth Portfolio (the "Portfolio") seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman, and Portfolio Manager of BAMCO, Inc. ("BAMCO") — the Sub-Adviser.

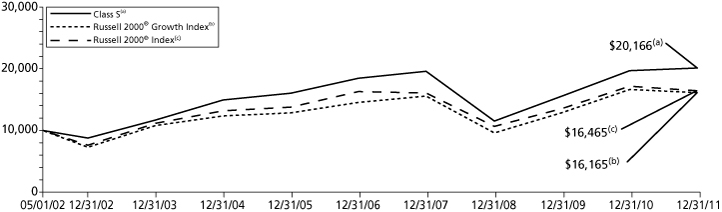

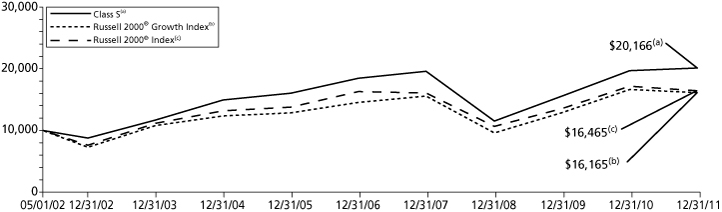

Performance: For the year ended December 31, 2011, the Portfolio's Class S shares provided a total return of 2.22% compared to the Russell 2000® Growth Index and the Russell 2000® Index, which returned (2.91)% and (4.18)%, respectively, for the same period.

Portfolio Specifics: The U.S. stock markets rebounded in the fourth quarter of 2011 following a sharp correction in the third quarter. The markets benefited from generally positive economic data and strong reported business results. We believe the primary reason for the rebound was that a number of economic indicators provided reassurance that a recession was not imminent, as had been feared in the fall. The markets, however, remain dominated by macro concerns. Daily headlines concerning developments in Europe have led to continued volatility.

The two sectors that contributed the most to absolute performance were energy and industrials.

Energy stocks finally showed some life in the fourth quarter. While the near-term macro backdrop is uncertain, over the long-term we believe that global economic growth will generate higher demand in energy. Southern Union Co., one of the nation's leading diversified natural gas companies, was the largest absolute contributor to performance. The company gained for the year as it was subject to a takeover battle between The Williams Companies, Inc. and Energy Transfer Equity, L.P. ("ETE"). ETE emerged as the winner, ultimately paying 33% more than its original offer. We exited our position.

Industrial stocks rallied in the fourth quarter after pulling back sharply in the third quarter. Industrial stock prices are highly sensitive to the macro outlook, yet not always indicative of the fundamentals of each company. For example, Generac Holdings, Inc. a leading manufacturer of standby and portable generators for the residential, industrial, and commercial markets, performed well for the year as the company had strong second half sales driven by severe power outages caused by seasonal storms.

Healthcare performance has been weak due to continued high unemployment and low consumer confidence. For people with health insurance, employers are shifting more of the cost burden to employees, resulting in higher deductibles, co-payments and co-insurance. As a result, people are consuming less healthcare. We believe the winners will be healthcare companies that can reduce costs and enhance efficiency while improving patient outcomes and benefiting from the aging of the population. In our view, examples are Edwards Lifesciences Corp. a leading manufacturer of heart valves used in surgical and transcatheter heart-valve replacement, and Community Health Systems, Inc. ("Community") a leading operator of hospitals, the majority of which are sole providers in mostly rural and suburban U.S. markets. Community's shares dropped sharply after acquisition target Tenet Healthcare accused the company of improper Medicare billing. Hospital stocks, including Community, ended the year trading at historically low multiples due to budget concerns and uncertainty about health care reform. We think Community's stock is oversold, trading at a steep discount to per-bed replacement costs while overlooking the potential for margin improvement from recently acquired facilities.

The individual stock that detracted the most from absolute performance was Anhanguera Educacional Participacoes S/A ("Anhanguera") (consumer discretionary). Anhangerua is the leading private, post-secondary education company in Brazil. We thought that Anhanguera would be the main beneficiary of Brazil's need for skilled workers and an emerging middle class seeking private post-secondary degrees to gain credentials. This year, our investment thesis was overshadowed by multiple headwinds including postponement of government civil service exams that adversely affected enrollment and margin dilution from the largest merger and acquisition in its history. The Portfolio's investments within the energy, industrials, and consumer discretionary sectors were the largest contributors to relative results for the year. Within energy, strength in crude prices coupled with opportunistic acquisitions, led to outperformance of the majority of the energy holdings and translated to positive stock selection effect. The Portfolio's holdings in the oil and gas exploration and production segment also performed well during the year. In industrials, positive stock selection effect was mostly driven by outperformance of Generac Holdings, Inc. and Genesee & Wyoming, Inc. Within consumer discretionary, positive stock selection effect was largely the result of outperformance of Panera Bread Co. and Peet's Coffee & Tea, Inc.

The Portfolio's investments in healthcare and financials were the largest detractors from relative performance. Within healthcare, weakness was mainly attributable to underperformance of the Portfolio's healthcare facilities holdings, led by Community. Within financials, the Portfolio's holdings in consumer and specialized finance were the largest detractors from relative results. Unfavorable stock selection in financials was partially offset by the Fund's larger exposure to the sector, one of the better performing sectors in the benchmark, which positively impacted relative results.

Current Strategy and Outlook: Although there are still U.S. fiscal issues and a somewhat dysfunctional government, we think the U.S. consumer has remained resilient and corporate America has remained strong. We think the balance sheets for the companies we own are mostly solid, and we believe businesses are equipped with ample capital to fund growth opportunities, make acquisitions, or return capital to shareholders. And though there is momentum at present, we think we are in for a period of modest general economic growth. Even in this environment, we believe the businesses in which we have invested can grow earnings and accrete value. We do not believe this growth is reflected in the trading multiples, so we expect multiple expansions in the future when the focus of the markets returns to fundamentals. We believe that current stock market valuations are compelling. U.S. interest rates remain near historically low levels, and the fixed income markets offer limited inflation-adjusted returns. There are important trends occurring in several industries that we believe offer growth opportunities over the next few years independent of normal business cycles. In our search for new companies, we seek businesses with what we believe are visionary leaders that are separating themselves from competitors through efficient operations, strong balance sheets, unique assets or properties and, in many cases, innovative and game changing technology.

Sector Diversification

as of December 31, 2011

(as a percentage of net assets)

| Consumer Discretionary | | | 24.4 | % | |

| Industrials | | | 17.0 | % | |

| Information Technology | | | 14.2 | % | |

| Health Care | | | 12.9 | % | |

| Financials | | | 11.4 | % | |

| Energy | | | 11.0 | % | |

| Consumer Staples | | | 4.6 | % | |

| Utilities | | | 1.6 | % | |

| Telecommunications | | | 0.6 | % | |

| Materials | | | 0.4 | % | |

| Assets in Excess of Other Liabilities* | | | 1.9 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011

(as a percentage of net assets)

| AMERIGROUP Corp. | | | 2.9 | % | |

| Dick's Sporting Goods, Inc. | | | 2.9 | % | |

| Genesee & Wyoming, Inc. | | | 2.9 | % | |

| Choice Hotels International, Inc. | | | 2.8 | % | |

| Vail Resorts, Inc. | | | 2.7 | % | |

| Core Laboratories NV | | | 2.7 | % | |

| Mettler Toledo International, Inc. | | | 2.3 | % | |

| LKQ Corp. | | | 2.3 | % | |

| MSCI, Inc. — Class A | | | 2.2 | % | |

| Panera Bread Co. | | | 2.2 | % | |

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

8

PORTFOLIO MANAGERS' REPORT

ING BARON SMALL CAP GROWTH PORTFOLIO

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes ADV, I and S

May 1, 2002 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 1.89 | % | | | 1.46 | % | | | 7.24 | % | | | — | | |

| Class I | | | 2.43 | % | | | 1.97 | % | | | 7.78 | % | | | — | | |

| Class S | | | 2.22 | % | | | 1.73 | % | | | 7.52 | % | | | — | | |

| Class S2 | | | 2.05 | % | | | — | | | | — | | | | 28.37 | % | |

| Russell 2000® Growth Index | | | (2.91 | )% | | | 2.09 | % | | | 5.09 | % | | | 28.50 | %(1) | |

| Russell 2000® Index | | | (4.18 | )% | | | 0.15 | % | | | 5.29 | % | | | 27.26 | %(1) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Baron Small Cap Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance of the index is shown from March 1, 2009.

9

ING COLUMBIA SMALL CAP VALUE II PORTFOLIO

PORTFOLIO MANAGERS' REPORT

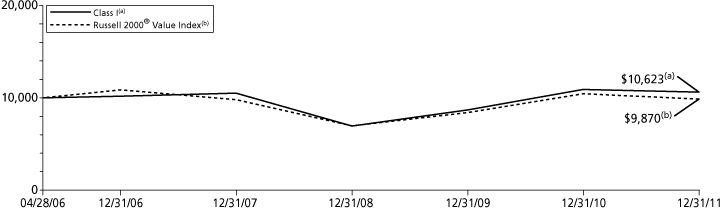

ING Columbia Small Cap Value Portfolio II (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Christian Stadlinger and Jarl Ginsberg, Portfolio Managers, of Columbia Investment Management Advisors, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2011, the Portfolio's Class I shares provided a total return of (2.48)% compared to the Russell 2000® Value Index, which returned (5.50)% for the same period.

Portfolio Specifics: The year 2011 was marked by volatility and reversals. The year began with several macro issues such as the unrest in the Middle East and North Africa and subsequent regime changes in the region followed by natural disasters and a nuclear crisis in Japan, the ongoing European debt crisis, Standard & Poor's historic downgrade of U.S. sovereign debt, stunted global economic growth and a persistently high unemployment rate in the U.S. On the upside, all this was mitigated by slow underlying improvement in U.S. economic data. Next, while equity markets experienced record highs and lows, in the end equity returns were lackluster. Third quarter indices experienced one of their worst losses in history, while fourth quarter indices posted one of their strongest gains helping to make 2011 a year of reversals.

The small cap market's overall performance in 2011 was negative as the Russell 2000® Value Index posted a (5.50)% return. The Portfolio fared better, outperforming the benchmark.

As a result of the aforementioned volatility, markets were risk averse leading to outperformance by the defensive sectors (utilities, healthcare and consumer staples) and underperformance by the cyclical sectors (information technology, materials and industrials). This was reflected in the Portfolio's sector returns as utilities, consumer staples and healthcare outperformed with double digit performances while materials suffered the most with a double digit loss followed by information technology. The Portfolio was overweight information technology, consumer staples and industrials and underweight financials, utilities and consumer discretionary. However, the impact of sector weights was small. The underweight to utilities and to a much lesser extent, the overweight to information technology, detracted from sector performance.

Stock selection was positive in virtually all of the sectors with materials being the only sector to detract from results. Stock selection drove performance and was most positive in consumer discretionary and industrials, bolstering returns considerably. These were followed by healthcare, energy, consumer staples and information technology.

Stock selection in consumer discretionary was the most positive contributor to returns. Strong performances by Domino's Pizza, Inc. ("Domino's") and specialty retailer GNC Holdings, Inc. ("GNC") benefited returns. Domino's advanced on several fronts during the year as they benefited from better-than-expected results in their domestic and international same store sales, robust international store growth, and generally higher traffic following a well-advertised upgrade of their pizza recipe. Meanwhile, shares of nutritional products company GNC continued to rise as investors became more confident that higher sales and improving merchandising margins may lead to upside. Selection in household durables also benefited returns as the Portfolio avoided many benchmark underperformers.

Stock selection was also positive in industrials led by United Rentals, Inc. The company benefited as economic signs improved and on a trend towards renting rather than owning equipment in an uncertain environment. Stock selection in the healthcare industry was positive driven by the Portfolio's emphasis on managed healthcare companies such as Centene Corp, Wellcare Health Plans and other solid portfolio performers. Late in the year managed healthcare company HealthSpring, Inc. was acquired by a competitor confirming the strategic value of Medicare and Medicaid managed care companies. Stock selection was also positive in the personal products industry within consumer staples as Nu Skin Enterprises, Inc. advanced. Throughout the year, the company's earnings benefited from increased global sales of its new products. Holdings within food products also aided returns. In energy, several holdings in the equipment and services industry were positives for the year.

On the downside, the Portfolio's underweight to utilities, based on high valuation for many of these companies, hampered returns in a strong performing year for that sector.

Current Strategy and Outlook: Our investment process is to focus our research on those companies which we find attractively valued and where we believe the valuation gap is likely to shrink in the near term. We accomplish this by focusing on what we call an "upward inflection point," which essentially means we want stocks that we believe are both inexpensive and are showing improving operating performance metrics. In thinking about the types of situations that are attractive to us, our opportunities typically encompass one or more of the following: 1) "out-of-the-limelight" companies missed by the Wall Street research community; 2) cyclically-driven opportunities in industries that have been out of favor and show signs of resurgence; and, 3) companies with compressed operating margins that we believe are poised to expand within a reasonable timeframe. That said, moving into 2012 the Portfolio begins the year with an overweight to information technology, consumer staples and Industrials. The Portfolio remains underweight the interest rate sensitive sectors of financials (driven by real estate investment trusts and specialty finance companies) and utilities.

Sector Diversification

as of December 31, 2011

(as a percentage of net assets)

| Financials | | | 31.4 | % | |

| Industrials | | | 15.8 | % | |

| Information Technology | | | 14.7 | % | |

| Consumer Discretionary | | | 9.5 | % | |

| Health Care | | | 6.6 | % | |

| Utilities | | | 5.0 | % | |

| Materials | | | 4.8 | % | |

| Energy | | | 4.4 | % | |

| Consumer Staples | | | 4.3 | % | |

| Assets in Excess of Other Liabilities* | | | 3.5 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011*

(as a percentage of net assets)

| South Jersey Industries, Inc. | | | 1.4 | % | |

| New Jersey Resources Corp. | | | 1.4 | % | |

| NeuStar, Inc. | | | 1.3 | % | |

| UIL Holdings Corp. | | | 1.2 | % | |

| Delphi Financial Group | | | 1.2 | % | |

| CubeSmart | | | 1.2 | % | |

| Community Bank System, Inc. | | | 1.2 | % | |

| Domino's Pizza, Inc. | | | 1.2 | % | |

| Independent Bank Corp. | | | 1.2 | % | |

| Helen of Troy Ltd. | | | 1.2 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

The Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

10

PORTFOLIO MANAGERS' REPORT

ING COLUMBIA SMALL CAP VALUE II PORTFOLIO

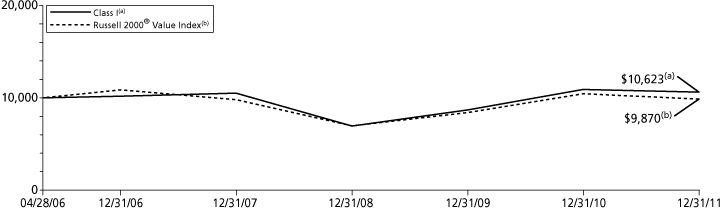

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class I

April 28, 2006 | | Since Inception

of Class S

May 1, 2006 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | (2.96 | )% | | | 0.37 | % | | | 0.37 | % | | | — | | | | — | | | | — | | |

| Class I | | | (2.48 | )% | | | 0.88 | % | | | — | | | | 1.07 | % | | | — | | | | — | | |

| Class S | | | (2.69 | )% | | | 0.63 | % | | | — | | | | — | | | | 0.91 | % | | | — | | |

| Class S2 | | | (2.88 | )% | | | — | | | | — | | | | — | | | | — | | | | 27.01 | % | |

| Russell 2000® Value Index | | | (5.50 | )% | | | (1.87 | )% | | | (1.87 | )%(1) | | | (0.23 | )%(2) | | | (0.23 | )% | | | 25.94 | %(3) | |

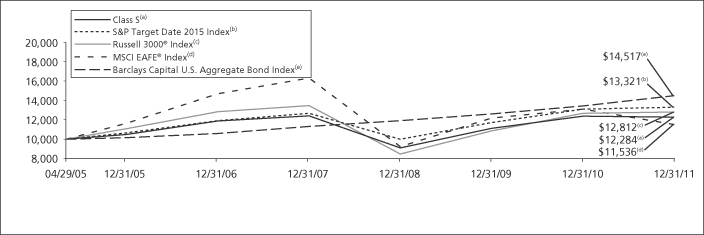

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Columbia Small Cap Value II Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance of the index is shown from January 1, 2007.

(2) Since inception performance of the index is shown from May 1, 2006.

(3) Since inception performance of the index is shown from March 1, 2009.

11

ING DAVIS NEW YORK VENTURE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Davis New York Venture Portfolio (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Christopher C. Davis and Kenneth C. Feinberg, Portfolio Managers, with Davis Selected Advisers, L.P. ("Davis Advisers") — the Sub-Adviser.

Performance: For the year ended December 31, 2011, the Portfolio's Class S shares provided a total return of (4.63)% compared to the S&P 500® Index, which returned 2.11% for the same period.

Portfolio Specifics: The sectors within the S&P 500® Index that turned in the strongest performance over the year were utilities, consumer staples, and healthcare. The sectorsthat turned in the weakest performance over the year were financials, materials, and industrials.

Material companies were the most important detractor from performance on an absolute basis and were the second most important detractor from performance relative to the index. The Portfolio's material companies underperformed the corresponding sector within the index and had a higher relative average weighting in this weaker performing sector. Sino-Forest Corp. and Sealed Air Corp. were among the most important detractors from performance.

The Portfolio had more invested in financial companies than in any other sector and they were the second most important detractor from absolute performance. The Portfolio's financial companies outperformed the corresponding sector within the index, but relative performance was harmed by a higher relative average weighting in this weaker performing sector. American Express Co. was among the most important contributors to performance. Bank of New York Mellon Corp. and Wells Fargo & Co. were among the most important detractors from performance.

Energy companies were important detractors from performance on both an absolute basis and relative to the index. The Portfolio's energy companies significantly under-performed the corresponding sector within the Index and had a higher relative average weighting. EOG Resources, Inc. was among the most important contributors to performance. Devon Energy Corp., Canadian Natural Resources Ltd., and Transocean Ltd. were among the most important detractors from performance.

Consumer staple companies made important contributions to performance on both an absolute basis and relative to the index. The Portfolio's consumer staple companies outperformed the corresponding sector within the index and also benefited by having a higher relative average weighting in this stronger performing sector. CVS Caremark Corp., Costco Wholesale Corp., andPhilip Morris International, Inc. were among the most important contributors to performance.

The Portfolio held approximately 17% of its assets in foreign companies (including American depositary receipts) at December 31, 2011. As a whole these companies underperformed the domestic companies held by the Portfolio.

Current Strategy and Outlook: Our long-term focus usually results in low portfolio turnover. We try not to overreact to past short-term performance from individual holdings on either the upside or the downside. The Portfolio's investment strategy is to perform extensive research to buy durable companies at what we believe is a discount to their intrinsic values and to hold them for the long term. We focus deliberately on the future, considering each company's long-term business fundamentals.

As of December 31, 2011, only one company had dropped out of the Portfolio's top 10 holdings from the end of 2010. This is consistent with our low-turnover strategy. Devon Energy Corp. was replaced among the top 10 holdings by Google, Inc.

Sector Diversification

as of December 31, 2011

(as a percentage of net assets)

| Financials | | | 29.8 | % | |

| Consumer Staples | | | 16.9 | % | |

| Energy | | | 12.8 | % | |

| Health Care | | | 9.5 | % | |

| Information Technology | | | 8.0 | % | |

| Consumer Discretionary | | | 7.4 | % | |

| Materials | | | 6.2 | % | |

| Industrials | | | 5.5 | % | |

| Telecommunications | | | 0.4 | % | |

| Assets in Excess of Other Liabilities* | | | 3.5 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011*

(as a percentage of net assets)

| CVS Caremark Corp. | | | 5.0 | % | |

| American Express Co. | | | 5.0 | % | |

| Costco Wholesale Corp. | | | 5.0 | % | |

| Wells Fargo & Co. | | | 4.7 | % | |

| Bank of New York Mellon Corp. | | | 4.2 | % | |

| EOG Resources, Inc. | | | 3.6 | % | |

| Occidental Petroleum Corp. | | | 3.3 | % | |

| Google, Inc. — Class A | | | 3.1 | % | |

| Canadian Natural Resources Ltd. | | | 3.1 | % | |

| Loews Corp. | | | 2.9 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

12

PORTFOLIO MANAGERS' REPORT

ING DAVIS NEW YORK VENTURE PORTFOLIO

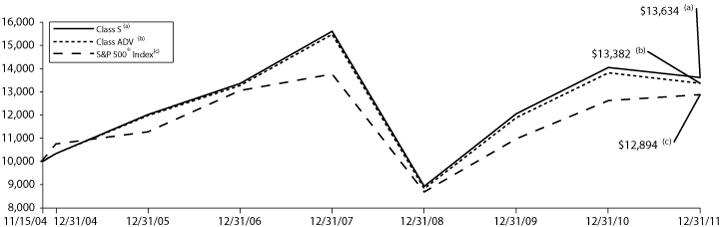

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | 10 Year | |

| Class ADV | | | (4.92 | )% | | | (2.55 | )% | | | 1.68 | % | |

| Class I | | | (4.52 | )% | | | (2.07 | )% | | | 2.18 | % | |

| Class S | | | (4.63 | )% | | | (2.30 | )% | | | 1.93 | % | |

| S&P 500® Index | | | 2.11 | % | | | (0.25 | )% | | | 2.92 | % | |

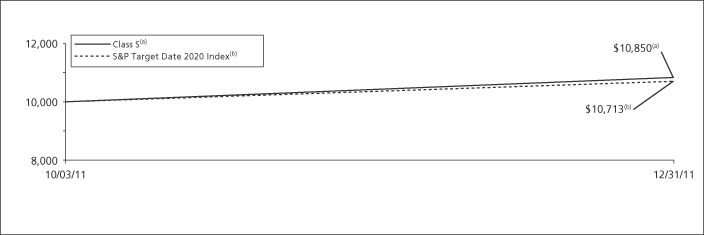

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Davis New York Venture Portfolio against the index indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

Prior to October 31, 2005, the Portfolio was sub-advised by Salomon Brothers Asset Management Inc. Effective October 31, 2005, the Portfolio's principal investment strategies and name changed.

13

ING GLOBAL BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

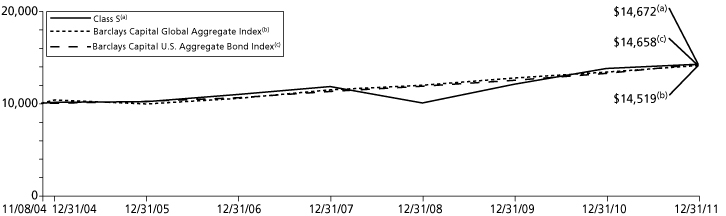

ING Global Bond Portfolio (the "Portfolio") seeks to maximize total return through a combination of current income and capital appreciation. The Portfolio is managed by Christine Hurtsellers, Michael Mata, and Robert Robis, Portfolio Managers of ING Investment Management Co. LLC — the Sub-Adviser.*

Performance: For the year ended December 31, 2011, the Portfolio's Class S shares provided a total return of 3.51% compared to the Barclays Capital Global Aggregate Index, which returned 5.64% for the same period.

Portfolio Specifics: Volatility reigned supreme in the financial markets for most of the period, prompting a "risk-on/risk-off" mentality — buying risky assets such as stocks, then quickly turning to safer investments such as U.S. Treasury securities when uncertainty reared up. Conflict in the Middle East, natural disasters in Japan, political gridlock in the United States and a deepening sense of crisis in the euro zone pushed and pulled markets around the world. During the latter part of the period interest rates declined across the globe.

The Portfolio lagged its benchmark for the reporting period due to detraction, in aggregate, from security selection. Both investment grade and high yield corporate bond spreads widened in the latter part of the period, in sympathy with global risk aversion stemming from the European sovereign debt problems. We believe fundamentals for these sectors remain sound, but we expect these and other sectors of the market to be subject to downside risk while uncertainties persist around a European solution and Its potential impact on the global economy.

Our interest rate positioning for the period was additive as interest rates ultimately declined. This benefited the Portfolio because we extended duration in a number of key markets where we had forecast softer global economic conditions with expectations of lower inflationary pressures. We continued to actively manage currency allocations seeking to protect against downside risk during the volatile second half of the year. We cut exposures to emerging market currencies that exhibited strong correlations to the downdraft in Europe.

The Portfolio came under severe pressure and underperformed its benchmark in the month of August. Fears of a European credit crisis and global economic slowdown surged, leading many investors to reduce risk by retreating to the relative safety of U.S. government bonds. Despite our decision to reduce credit exposure throughout the summer months due to the deteriorating macro outlook, spread sectors across the board underperformed for the month of August.

Over the summer months and through September, we steadily trimmed risk in the portfolio in response to the headwinds gusting out of the European periphery, and the early warning signs of what might be a more pronounced global economic slowdown. Notable shifts included replacing the Portfolio's emerging market currency overweights with added duration across a number of bond markets to protect the Portfolio from the effects of heightened risk aversion. Towards the end of the period we increased allocations to investment grade credit and high yield, and lowered our exposure to agency mortgage-backed securities (MBS) because of the political headwinds associated with increased prepayment risk due to a broad-based, government-sponsored refinancing wave. We have been avoiding debt of peripheral countries along with corporate credits located throughout the region. We have cautiously increased exposure to the more fundamentally sound emerging markets (EM) in Latin America and Asia, which in our view have far less exposure to the European economy, but whose markets have sold off excessively in sympathy with the euro zone crisis.

Derivative instruments such as currency forwards continue to be important tools for us to manage risk and gain exposure across broad key markets. During the period, derivatives in aggregate added to Portfolio results.

Current Strategy and Outlook: With Europe and Japan likely in or near recession, we are forecasting a more sanguine economic outlook for the global economy. While there are still some bright spots such as Latin America and Asia, our base case is for global interest rates to remain somewhat range-bound for the developed world. This is accentuated by what we would expect to be continued central bank action to help provide stimulus and balance sheet support to offset the pressures of debt-burdened economies. Further, we believe we will see additional interest rate easing by a number of emerging markets central banks this year as inflation considerations continue to abate. Given this outlook and the volatile environment we think likely to persist in 2012, we believe it important to continue to manage risk in the Portfolio, with a focus on quality and liquidity. At the overall Portfolio level we are currently underweight in duration relative to the benchmark. Most of this duration underweight stems from Europe and Japan, where we believe interest rate levels are unattractive given the higher debt burdens. We do favor select duration overweights in emerging markets including Brazil, Mexico, Colombia and South Africa. We continue to like U.S. high yield and investment grade corporate bonds given their attractive valuations and strong fundamentals. We also favor a number of emerging market sovereign and corporate bonds, with preference for Latin American and Asian bonds. We have a modest underweight to residential mortgages. In currencies, we remain underweight the euro based on the significant structural resolution and economic drain eventually facing the euro zone. We remain neutral to a small tactical overweight to the U.S. dollar and Canadian dollar. We favor small overweights to emerging market currencies, particularly in Latin America and Asia. Specific currencies we like include the Brazilian real, the Mexican peso, the Korean won, the Colombian peso and the Indonesian rupiah. These overweights are set against underweights of the euro, the Japanese yen and Australian dollar, the latter of which is partially being used to protect the Portfolio in the event of further economic slowdown. Looking forward into 2012 and beyond, we remain optimistic for investment opportunities in global bonds and currencies given the many forces at play in the global economy.

Country Allocation

as of December 31, 2011

(as a percentage of net assets)

| United States | | | 50.0 | % | |

| Brazil | | | 7.1 | % | |

| Mexico | | | 6.8 | % | |

| South Africa | | | 5.6 | % | |

| France | | | 4.2 | % | |

| Colombia | | | 2.5 | % | |

| Peru | | | 1.9 | % | |

| Canada | | | 0.7 | % | |

| Australia | | | 0.2 | % | |

| Countries between 0.0%-1.6%^ | | | 13.5 | % | |

| Assets in Excess of Other Liabilities* | | | 7.5 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

^ Includes 29 countries, which each represents 0.0%-1.6% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011*

(as a percentage of net assets)

United States Treasury Note,

0.250%, 11/30/13 | | | 4.3 | % | |

South Africa Government Bond,

7.250%, 01/15/20 | | | 4.0 | % | |

French Treasury Note BTAN,

2.500%, 07/25/16 | | | 2.8 | % | |

United States Treasury Note,

0.375%, 11/15/14 | | | 2.3 | % | |

Brazil Notas do Tesouro Nacional Series F,

10.000%, 01/01/21 | | | 2.2 | % | |

United States Treasury Note,

0.875%, 11/30/16 | | | 2.0 | % | |

Mex Bonos De Desarrollo,

10.000%, 11/20/36 | | | 1.8 | % | |

Citigroup Funding, Inc.,

11.000%, 07/27/20 | | | 1.7 | % | |

Citigroup Funding, Inc.,

11.000%, 07/27/20 | | | 1.7 | % | |

Brazil Notas do Tesouro Nacional Series B,

6.000%, 08/15/16 | | | 1.7 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

* Effective January 21, 2011, the Portfolio's name, Sub-Adviser, investment objective and principal investment strategies were changed. Effective July 18, 2011, Robert Robis was added as a portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

14

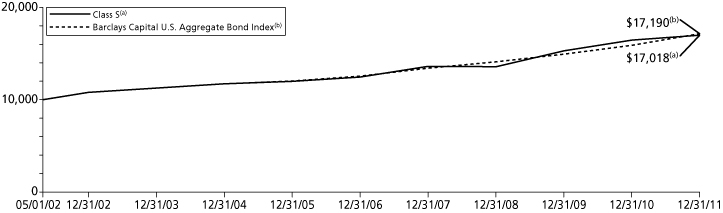

PORTFOLIO MANAGERS' REPORT

ING GLOBAL BOND PORTFOLIO

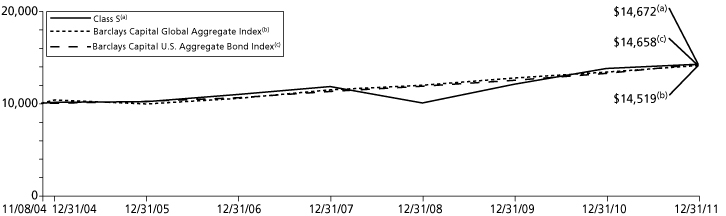

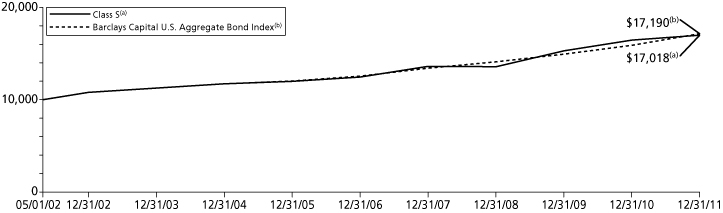

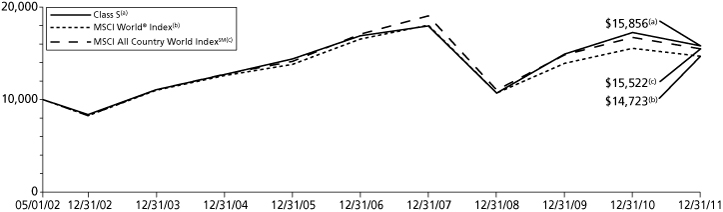

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes ADV, I and S

November 8, 2004 | |

| Class ADV | | | 3.26 | % | | | 5.56 | % | | | 5.25 | % | |

| Class I | | | 3.70 | % | | | 6.06 | % | | | 5.76 | % | |

| Class S | | | 3.51 | % | | | 5.81 | % | | | 5.51 | % | |

| Barclays Capital Global Aggregate Index | | | 5.64 | % | | | 6.46 | % | | | 5.34 | %(1) | |

| Barclays Capital U.S. Aggregate Bond Index | | | 7.84 | % | | | 6.50 | % | | | 5.48 | %(1) | |

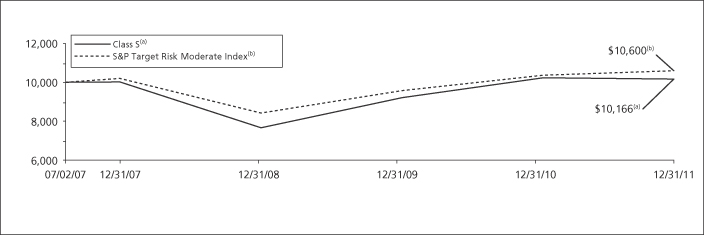

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Bond Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.inginvestment.com or call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on marked and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance for the indices is shown from November 1, 2004.

Prior to January 21, 2011, the Portfolio was sub-advised by Oppenheimer Funds, Inc. Effective January 21, 2011, the Portfolio's name and investment strategies changed.

15

ING INVESCO VAN KAMPEN COMSTOCK PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Invesco Van Kampen Comstock Portfolio (the "Portfolio") seeks capital growth and income. The Portfolio is managed by Kevin Holt, Managing Director, Jason Leder, Managing Director, Devin E. Armstrong, CFA, Vice President, James N. Warwick, Executive Director, and Matthew Seinsheimer of Invesco Advisers, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2011, the Portfolio's Class S shares, provided a total return of (2.09)% compared to the Russell 1000® Value Index and the S&P 500® Index, which returned 0.39% and 2.11%, respectively, for the same period.

Portfolio Specifics: The fiscal year began with equity markets fueled on the second round of "quantitative easing" by the U.S. Federal Reserve and on an upward trend through the first quarter of 2011. However, with the spring came increased volatility due to civil unrest in Egypt and Libya and a devastating earthquake and tsunami in Japan. Although markets stabilized and were generally in positive territory through the summer, major equity indexes sold off precipitously in August as the U.S. received its first ever credit downgrade by Standard and Poor's. Even with the increased volatility, equity markets ended with a slightly positive return.

Results were mixed among the sectors of the Russell 1000® Value Index, with cyclical industries such as financials, materials and information technology posting negative returns, while defensive sectors such as healthcare and consumer staples fared better, posting double digit positive returns.

On the positive side, strong stock selection in the healthcare sector was the largest contributor to Portfolio performance. Specifically, a healthcare service provider and holdings within large pharmaceuticals benefited relative performance. A significant overweight position in the consumer discretionary sector, contributed to relative returns, as did stock selection in telecommunications.

Unfavorable stock selection and a slight underweight position in the energy sector were the largest detractors from Portfolio performance. Specifically, the Portfolio had exposure to oil equipment and services companies, which were the main detractors in this sector due to decreasing profit margins from international drilling efforts that fell through during the economic slow-down in Europe and overseas. Also, stock selection within, and an overweight to, information technology companies dampened performance relative to the index. Finally, stock selection in the financials sector acted as a detractor from relative performance for the period. Notably, exposure to diversified financials detracted from both absolute and relative performance as investors fled bank stocks beginning in the summer of 2011 on concerns of European debt crisis contagion.

Current Strategy and Outlook: Toward the end of the reporting period, at the margins, we reduced positions in media, pharmaceuticals and insurance companies due to rising valuations and used the proceeds to increase exposure to select diversified financial, banking, property and casualty insurance and integrated oil companies as they came under pressure.

We remain overweight in media within the consumer discretionary sector, but continue to pare down holdings as valuations approach what we believe to befair value. The Portfolio is also overweight information technology, and materials. We are materially underweight to financials and utilities, and underweight within industrials.

We believe our contrarian philosophy and deep value approach of buying what we believe are extremely undervalued companies can allow us to capitalize on market volatility and periods of down markets as value is created for new investment opportunities.

Sector Diversification

as of December 31, 2011

(as a percentage of net assets)

| Financials | | | 19.2 | % | |

| Consumer Discretionary | | | 15.6 | % | |

| Health Care | | | 13.4 | % | |

| Energy | | | 11.9 | % | |

| Information Technology | | | 11.0 | % | |

| Consumer Staples | | | 7.7 | % | |

| Industrials | | | 6.1 | % | |

| Materials | | | 4.0 | % | |

| Telecommunications | | | 3.7 | % | |

| Utilities | | | 2.8 | % | |

| Assets in Excess of Other Liabilities* | | | 4.6 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2011*

(as a percentage of net assets)

| Comcast Corp. — Class A | | | 3.9 | % | |

| International Paper Co. | | | 3.1 | % | |

| Pfizer, Inc. | | | 2.7 | % | |

| JPMorgan Chase & Co. | | | 2.5 | % | |

| Viacom — Class B | | | 2.5 | % | |

| Microsoft Corp. | | | 2.3 | % | |

| Citigroup, Inc. | | | 2.3 | % | |

| Bristol-Myers Squibb Co. | | | 2.2 | % | |

| Allstate Corp. | | | 2.1 | % | |

| Royal Dutch Shell PLC — Class A ADR | | | 2.1 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

16

PORTFOLIO MANAGERS' REPORT

ING INVESCO VAN KAMPEN COMSTOCK PORTFOLIO

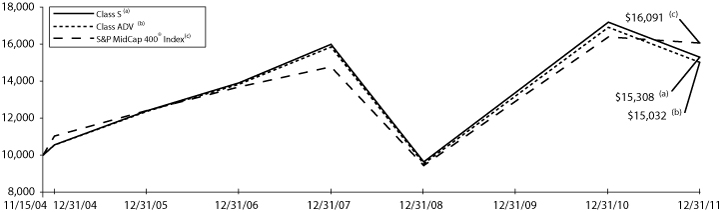

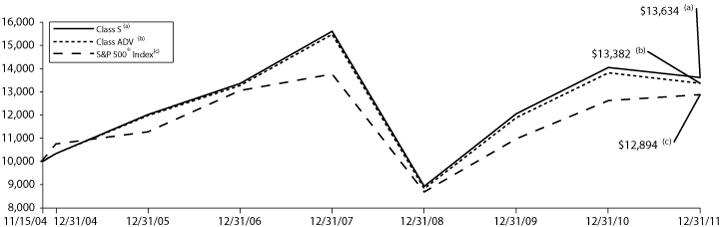

| Average Annual Total Returns for the Periods Ended December 31, 2011 | |

| | | 1 Year | | 5 Year | | Since Inception

of Classes ADV, I and S

May 1, 2002 | |

| Class ADV | | | (2.32 | )% | | | (2.34 | )% | | | 3.02 | % | |

| Class I | | | (1.81 | )% | | | (1.86 | )% | | | 3.54 | % | |

| Class S | | | (2.09 | )% | | | (2.10 | )% | | | 3.29 | % | |