OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2017

Estimated average burden hours per response: 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8319

Voya Partners, Inc.

(Exact name of registrant as specified in charter)

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

| Date of fiscal year end: | December 31 |

| | |

| Date of reporting period: | January 1, 2014 to December 31, 2014 |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2014

Classes ADV, I, S and S2

Voya Partners, Inc.

| | ■ | Voya Aggregate Bond Portfolio (formerly, VY® PIMCO Bond Portfolio) |

| | ■ | Voya Global Bond Portfolio |

| | ■ | VY® American Century Small-Mid Cap Value Portfolio |

| | ■ | VY® Baron Growth Portfolio |

| | ■ | VY® Columbia Contrarian Core Portfolio |

| | ■ | VY® Columbia Small Cap Value II Portfolio |

| | ■ | VY® Invesco Comstock Portfolio |

| | ■ | VY® Invesco Equity and Income Portfolio |

| | ■ | VY® JPMorgan Mid Cap Value Portfolio |

| | ■ | VY® Oppenheimer Global Portfolio |

| | ■ | VY® Pioneer High Yield Portfolio |

| | ■ | VY® T. Rowe Price Diversified Mid Cap Growth Portfolio |

| | ■ | VY® T. Rowe Price Growth Equity Portfolio |

| | ■ | VY® Templeton Foreign Equity Portfolio |

| | | This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | | |

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for the Portfolios. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios’ Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

New Year, Hopeful View

Dear Shareholder,

As 2014 came to a close, U.S. economic growth accelerated, Japan and Europe were struggling and volatility re-emerged in markets around the world. Though periods of volatility may challenge investor resolve over the course of the year, we believe resilience will prevail thanks to continued improvements in global consumer and business spending and ample global liquidity.

Resilience has been a defining characteristic of markets for some time now, as we have seen them shake off such potentially destabilizing events as Europe’s chronic economic malaise, China’s growth slowdown and Japan’s sharp and surprising return to recession. And that’s not to mention the various geopolitical hotspots — Ukraine, the Middle East and elsewhere — that have flared up from time to time. Along the way markets have been fortified by all-time high U.S. corporate earnings; renewed monetary stimulus from central banks in Japan, Europe and China; and plummeting oil prices that have provided a positive supply shock to consumers and businesses. This confluence of events has bolstered markets worldwide and has raised investor confidence that such trends can be sustained into 2015.

Despite our optimism, we — as always — advocate a well-balanced, globally diversified portfolio. We believe such an approach is the best way to potentially benefit from whatever opportunities may arise, while limiting the potential for over-exposure to as-yet-unidentified risks. Also as always, be sure to review your investment strategy and portfolio with your financial advisor to ensure they continue to reflect your goals and needs. Thoroughly discuss any potential portfolio changes with your advisor before taking action.

We appreciate your continued confidence in us, and we look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

Executive Vice President

Voya Family of Funds

January 28, 2015

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and the Voya mutual funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for a Voya mutual fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any Voya mutual fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

Market Perspective: Year Ended December 31, 2014

Global equities, in the form of the MSCI World IndexSM (the “Index”) measured in local currencies, including net reinvested dividends ended 2013 at a record high. Investor sentiment had evidently reconciled itself to the tapering of the U.S. Federal Reserve Board’s (“Fed’s”) $85 billion of monthly Treasury and mortgage-backed securities purchases. The Fed’s December 18 announcement of a reduction in purchases to $75 billion per month with more to come was taken in stride. There was still plenty to worry about however and the Index endured an early slump and wide swings late in 2014 before ending up 9.81% for the year. (The Index returned 4.94% for the one year ended December 31, 2014, measured in U.S. dollars.)

It did not take long for worries about a flagging U.S. economy to resurface. A disappointingly weak employment report on January 10 showed only 74,000 jobs created in December, the lowest in nearly three years. A cold and snowy winter was thought to be depressing hiring and other key statistics like durable goods orders and home sales.

The Index reached its low point on February 3, down almost exactly 5% in 2014. Yet it took only 18 days to erase the loss despite new political turmoil that flared in Eastern Europe as Russia annexed Crimea after the president of Ukraine was deposed.

With the improvement in the season came a pick-up in U.S. economic data. Employment reports were looking better and the unemployment rate fell below 6%. The December bulletin marked the eighth consecutive month in which more than 200,000 jobs were created. National purchasing managers’ activity indices signaled healthy expansion. While the housing market was cooling, the annualized rate of existing home sales exceeded 5 million for five straight months. Consumer confidence touched seven-year high levels. Growth in gross domestic product (“GDP”) was -2.1% (annualized) in the first quarter but bounced back to 5.0% in the third.

Yet concerns remained about the sustainability of the recovery in the U.S. and worldwide. The improving U.S. employment situation was accompanied by labor force participation rates at or near the lowest since 1978. Wage growth was sluggish near 2% annually. The Fed’s monthly Treasury and mortgage-backed securities purchases ended in October.

Outside of the U.S., growth in China was decelerating, which also weighed on global commodity supplying countries. Japan re-entered recession in the third quarter after an April rise in consumption tax. But it was the euro zone that was the most problematic. Growth almost ground to a halt in the second and third quarters. Unemployment seemed stuck at 11.5%, while deflation was perilously close. Markets became increasingly skeptical that the European Central Bank (“ECB”) could attempt U.S., UK and Japan-style quantitative easing with Germany unequivocally opposed. Oil prices had been steadily falling since late June and would halve by year-end. Increased shale oil production notwithstanding, was this also a signal that global economic activity was weaker than anyone had imagined?

Securities prices mirrored investors’ mood swings in the last few months. The Index actually reached a new peak on September 19, but by October 16 fell 8.2%. From there the Index rebounded 12% to December 5, fell 5% to December 16 then rose 4% to end the year 1.3% below its all-time high.

In U.S. fixed income markets, the Barclays Long-Term U.S. Treasury sub-index returned a remarkable 25.07% in 2014; the Barclays Short-Term U.S. Treasury sub-index just 0.09% as the Treasury yield curve flattened. The Barclays U.S. Aggregate Bond Index (“Barclays Aggregate”) added 5.97%, while the Barclays U.S. Corporate Investment Grade Bond sub-index gained 7.46%. Both outperformed the Barclays High Yield Bond — 2% Issuer Constrained Composite Index (not a part of the Barclays Aggregate), which gained only 2.46%, perhaps reflecting growing disillusionment with the risk/reward profile of high yield bonds after strong returns in recent years.

U.S. equities, represented by the S&P 500® Index including dividends, returned 13.69% in the fiscal year, about 1.5% below its all-time high. The utilities sector was the top performer, returning 28.98%; not surprisingly, the only loser was energy, which dropped 7.78% as oil prices sagged. Record operating earnings per share for S&P 500® companies in the second and third quarters were supported by low interest rates, slow wage growth and historically high share buy-back volumes. Operating margins breached 10% for the first time.

In currencies, the dollar advanced against most other currencies over the year. The dollar surged 13.60% against the euro, on the U.S.’s much better growth and interest rate increase prospects, and 13.74% against the yen, on the likelihood of further monetary easing in Japan and an announced partial re-allocation into non-yen securities for the giant Government Pension Investment Fund (“GPIF”). The dollar gained less, 6.29%, on the pound. The UK had a better growth story than the euro zone, which however is the destination for about 40% of the UK’s exports.

In international markets, the MSCI Japan® Index rose 9.48% in 2014, boosted in the case of Japan’s large exporters by the falling yen and in general by the GPIF’s announcement described above. The MSCI Europe ex UK® Index added 6.63%. The poor economic data referred to above and the lingering conflict in Ukraine dampened markets, which were spasmodically supported by the possibility of quantitative easing. The strong health care sector contributed about one third of the total. Despite superior economic results, the MSCI UK® Index was much weaker, edging up 0.50%. UK stock indices are not particularly representative of the UK economy: the largest 14 names account for half of the index and comprise mostly global banking, energy, pharmaceuticals and materials companies. As a group, they held back returns by about 1.80%.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 262-3862 or log on to www.voyainvestments.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of Voya Investment Management’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

Benchmark Descriptions

| | | Index | | | | Description | | |

| | | Bank of America/Merrill Lynch All Convertibles (Speculative Grade) Index | | | | An unmanaged index that includes about 270 convertible securities and represents the

non-investment-grade convertible market. | | |

| | | Bank of America/Merrill Lynch High Yield Master II Index | | | | A broad-based index consisting of all U.S. dollar-denominated high-yield bonds with a minimum outstanding amount of $100 million and with a maturity of greater than one year period. The quality rating is less than BBB by Standard & Poor’s. | | |

| | | Barclays Global Aggregate Index | | | | Provides a broad-based measure of the global investment-grade fixed-rate debt markets. | | |

| | | Barclays High Yield Bond — 2% Issuer Constrained Composite Index | | | | An unmanaged index that includes all fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | | |

| | | Barclays Long-Term U.S. Treasury Index | | | | The Index includes all publicly issued, U.S. Treasury securities that have a remaining maturity of 10 or more years, are rated investment grade, and have $250 million or more of outstanding face value. | | |

| | | Barclays Short-Term U.S. Treasury Index | | | | A market capitalization-weighted index that is composed of fixed-rate, non-convertible U.S. Treasury securities that have a remaining maturity of between one and 12 months and have $250 million or more of outstanding face value. | | |

| | | Barclays U.S. Aggregate Bond Index | | | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. | | |

| | | Barclays U.S. Corporate Investment Grade Bond Index | | | | An unmanaged index consisting of publicly issued, fixed rate, nonconvertible, investment grade debt securities. | | |

| | | Barclays U.S. Government/Credit Bond Index | | | | An index made up of the Barclays Government and Credit indices, including securities issued by the U.S. government and its agencies and publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. | | |

| | | MSCI All Country World IndexSM | | | | A broad-based unmanaged index comprised of equity securities in countries around the world, including the United States, other developed countries and emerging markets. | | |

| | | MSCI All Country World ex-U.S. IndexSM | | | | A free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. | | |

| | | MSCI EAFE® Index | | | | An unmanaged index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. | | |

| | | MSCI Europe ex UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | | |

| | | MSCI Japan® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. | | |

| | | MSCI UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | | |

| | | MSCI World IndexSM | | | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | | |

| | | Russell 1000® Index | | | | An unmanaged, comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies. | | |

| | | Russell 1000 Growth® Index | | | | Measures the performance of the 1,000 largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth. | | |

| | | Russell 1000® Value Index | | | | An unmanaged index that measures the performance of those Russell 1000® securities with lower price-to-book ratios and lower forecasted growth values. | | |

| | | Russell 2000® Growth Index | | | | An unmanaged index that measures the performance of securities of smaller U.S. companies with greater than average growth orientation. | | |

Benchmark Descriptions (continued)

| | | Index | | | | Description | | |

| | | Russell 2000® Value Index | | | | An unmanaged index that measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower than forecasted growth values. | | |

| | | Russell 2500™ Growth Index | | | | Measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500™ Index companies with higher price-to-book ratios and higher forecasted growth values. | | |

| | | Russell 2500™ Value Index | | | | Measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. | | |

| | | Russell Midcap® Growth Index | | | | An unmanaged index that measures the performance of those companies included in the Russell Midcap® Index with relatively higher price-to-book ratios and higher forecasted growth values. | | |

| | | Russell Midcap® Value Index | | | | Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. | | |

| | | S&P 500® Index | | | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | | |

| | | S&P MidCap 400 Index | | | | A broad-based unmanaged capitalization weighted index of midcapitalization companies. | | |

| | | S&P Small Cap 600/Citigroup Value Index | | | | Measures the performance of those S&P 600 Index companies with lower price-to-book ratios. | | |

| Portfolio Managers’ Report | Voya Aggregate Bond Portfolio |

| | Investment Type Allocation

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Corporate Bonds/Notes | | | 28.1% | |

| | U.S. Treasury Obligations | | | 20.2% | |

| | U.S. Government Agency Obligations | | | 16.1% | |

| | Asset-Backed Securities | | | 12.6% | |

| | Collateralized Mortgage Obligations | | | 10.8% | |

| | Municipal Bonds | | | 4.6% | |

| | Foreign Government Bonds | | | 2.1% | |

| | Preferred Stock | | | 0.6% | |

| | Certificates of Deposit | | | 0.5% | |

| | Assets in Excess of Other Liabilities* | | | 4.4% | |

| | Net Assets | | | 100.0% | |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Voya Aggregate Bond Portfolio(1) (the “Portfolio”) seeks to provide maximum total return, consistent with capital preservation and prudent investment management. The Portfolio is managed by Christine Hurtsellers, CFA, and Matthew Toms, CFA, Portfolio Managers of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.(2)

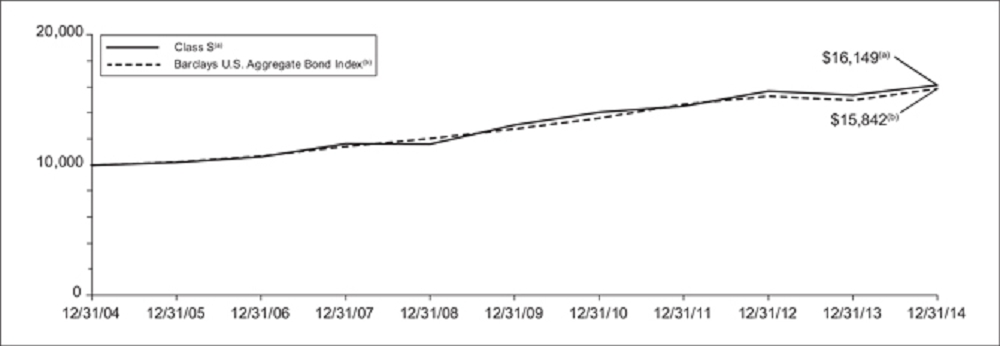

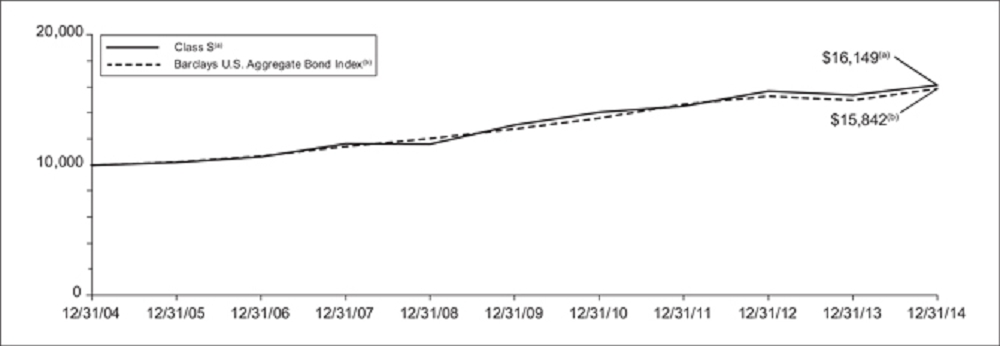

Performance: For the one-year period ended December 31, 2014, the Portfolio’s Class S shares provided a total return of 5.19%, compared to its benchmark the Barclays U.S. Aggregate Bond Index, which returned 5.97% for the same period.

Portfolio Specifics: PIMCO: The Portfolio underperformed the Barclays U.S. Aggregate Bond Index by approximately 88 basis points (0.88%) for the period from January 1, 2014 through December 11, 2014.

Both uncertainty and volatility increased in the first quarter of 2014. Equity markets initially suffered from geopolitical tensions and weather-weakened data before rebounding strongly. Bond markets rallied early in the quarter due to the somewhat uncertain pace of economic expansion and mostly held on to gains as the crisis in Ukraine led a general flight to quality. European economies continued to stabilize but concerns rose in Asia, especially over China’s economic health.

The second quarter of 2014 saw the return of risk appetite and an easing of global political risks. Bond markets rallied as central banks remained accommodative. Global equity markets posted sizeable gains overall as the S&P 500® Index rose to an all-time high and emerging market stocks rebounded on reduced political risks.

The third quarter was marked by geopolitical tension and diverging markets. Most developed market government yields moved lower, while credit markets backed up. Equity markets had modest gains in the U.S., but were flat or slightly negative in many other regions as economic data varied. Given this improvement in the outlook for growth, the U.S. Federal Reserve Board policy rate projections increased modestly and the U.S. dollar surged more than 7.5% versus its major trading partners. Further east, growth concerns developed in China and Japan, and in emerging markets tensions over Ukraine pushed the U.S. and European Union to expand sanctions on Russia.

| | Top Ten Holdings

as of December 31, 2014*

(as a percentage of net assets) | |

| | | | | | |

| | United States Treasury Note, 1.500%,

11/30/19 | | | 11.3% | |

| | United States Treasury Note, 2.250%,

11/15/24 | | | 5.0% | |

| | Freddie Mac, 3.500%, 01/01/45 | | | 4.2% | |

| | Fannie Mae, 4.000%, 12/01/44 | | | 3.5% | |

| | United States Treasury Bond, 3.125%,

08/15/44 | | | 3.3% | |

| | Citibank Credit Card Issuance Trust, 4.850%, 03/10/17 | | | 1.3% | |

| | Accredited Mortgage Loan Trust 2006-1, 0.435%, 04/25/36 | | | 1.1% | |

| | Southern California Public Power Authority, 5.943%, 07/01/40 | | | 0.9% | |

| | Rockies Express Pipeline LLC, 3.900%,

04/15/15 | | | 0.9% | |

| | International Lease Finance Corp., 8.625%, 09/15/15 | | | 0.8% | |

| | * Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

Evidence of global growth divergence was further borne out in the final quarter of 2014, but the most defining event of the quarter was the sharp decline in oil prices and accompanying market volatility. Growth in the U.S. exceeded expectations and handily outpaced its peers in the developed world, especially Japan and Europe, which continued to struggle. The uneven growth and drop in oil led to bouts of market volatility that dissipated quickly but still managed to leave certain risk sectors bruised.

The following strategies were positive for returns: A defensive position against the euro and the yen, implemented using currency forwards, was positive for performance as these currencies depreciated versus the U.S. dollar. Holdings of non-Agency mortgage backed securities contributed to returns as the sector continued to benefit from limited supply and the ongoing housing recovery. An underweight to investment grade corporate securities was positive for performance as spreads generally widened. Tactical exposure to Italian and Spanish duration contributed to returns for the year as rates fell across the curve in these countries. Exposure to Mexican interest rates, which was partially implemented using interest rates swaps, was positive for performance as rates broadly fell.

The following strategies were negative or neutral for returns: An underweight to the long end of the yield curve, partially implemented through pay fixed interest rate swaps, detracted from returns as long-end rates fell over the year. A focus on the front end of the yield curve also detracted from returns as rates for shorter maturity Treasuries increased. An allocation to U.S. Treasury Inflation-Protected Securities was negative for performance as breakeven inflation levels (the difference between nominal and real yields) fell during the period.

Voya IM: The Portfolio outperformed the Barclays U.S. Aggregate Bond Index by approximately 9 basis points (0.09%) for the period from December 12, 2014 through December 31, 2014.

Current Strategy and Outlook: Going into the New Year, our base case is that the U.S. will maintain a modest pace of growth, while global central banks continue to aggressively fight to improve their own near-term outlooks. We believe the U.S. economy continues to be the bright spot globally with unemployment numbers improving and third quarter gross domestic product surpassing expectations. As oil prices begin to find their footing, we expect better behavior by U.S. spread sectors in 2015. We believe that the contrast in monetary policy between the U.S. and the other major economies is likely to become increasingly stark in 2015. In our view, the ECB appears likely to soon announce a new quantitative easing program that includes euro-denominated corporate or sovereign bonds.

| | (1) | On November 20, 2014, the Board approved a change with respect to the Portfolio’s sub-adviser from Pacific Investment Management Company LLC to Voya IM with related changes to the Portfolio’s name and principal investment strategies. Effective December 12, 2014, the Portfolio’s investment strategies were changed and the Portfolio changed its name from VY® PIMCO Bond Portfolio to Voya Aggregate Bond Portfolio. |

| | (2) | Effective December 12, 2014, Voya IM began managing the Portfolio. Additionally, Mark Kiesel, Scott A. Mather and Mihir Worah were removed as portfolio managers and Christine Hurtsellers and Matthew Toms were added as portfolio managers of the Portfolio. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya Aggregate Bond Portfolio | Portfolio Managers’ Report |

| | Average Annual Total Returns for the Periods Ended December 31, 2014 | |

| | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S2

February 27, 2009 | | |

| | | | | | | | | | | | | | | |

| | Class ADV | | | 4.85 | % | | | 4.07 | % | | | 4.63 | % | | | — | | |

| | Class I | | | 5.39 | % | | | 4.59 | % | | | 5.16 | % | | | — | | |

| | Class S | | | 5.19 | % | | | 4.34 | % | | | 4.91 | % | | | — | | |

| | Class S2 | | | 5.01 | % | | | 4.18 | % | | | — | | | | 6.29 | % | |

| | Barclays U.S. Aggregate Bond Index | | | 5.97 | % | | | 4.45 | % | | | 4.71 | % | | | 5.06 | % | |

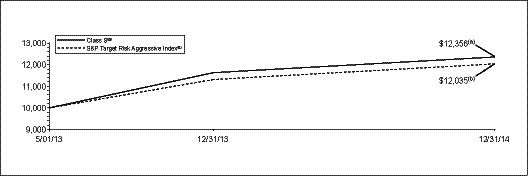

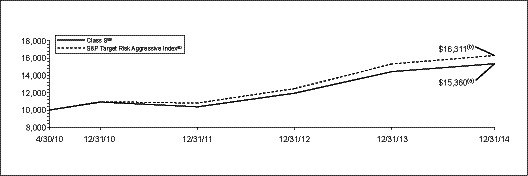

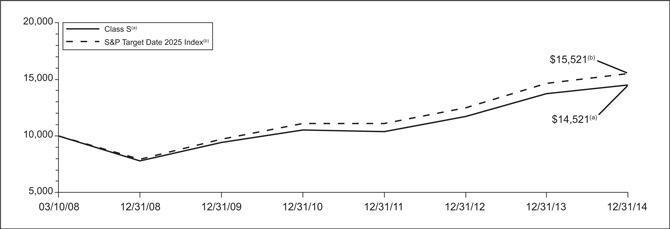

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Aggregate Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable

contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to close of business on December 12, 2014, the Portfolio was advised by a different sub-adviser.

| Portfolio Managers’ Report | Voya Global Bond Portfolio |

| | Geographic Diversification

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | United States(1) | | | 91.1% | |

| | Germany | | | 5.3% | |

| | Cayman Islands | | | 5.0% | |

| | Brazil | | | 0.6% | |

| | Russia | | | 0.6% | |

| | France | | | 0.5% | |

| | Netherlands | | | 0.5% | |

| | Australia | | | 0.4% | |

| | United Kingdom | | | 0.4% | |

| | Switzerland | | | 0.3% | |

| | Countries between 0.0%-0.2%^ | | | 1.0% | |

| | Liabilities in Excess of Other Assets* | | | (5.7)% | |

| | Net Assets | | | 100.0% | |

| | * Includes short-term investments. | |

| | ^ Includes 8 countries, which each represents 0.0%-0.2% of net assets. | |

| | (1) Includes 32.1% total investment in Voya Emerging Markets Hard Currency Debt Fund, Voya Emerging Markets Local Currency Debt Fund, Voya Emerging Markets Corporate Debt Fund, and Voya High Yield Bond Fund. | |

| | Portfolio holdings are subject to change daily. | |

Voya Global Bond Portfolio (the “Portfolio”) seeks to maximize total return through a combination of current income and capital appreciation. The Portfolio is managed by Christine Hurtsellers, CFA, and Brian Timberlake, CFA, Portfolio Managers of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.*

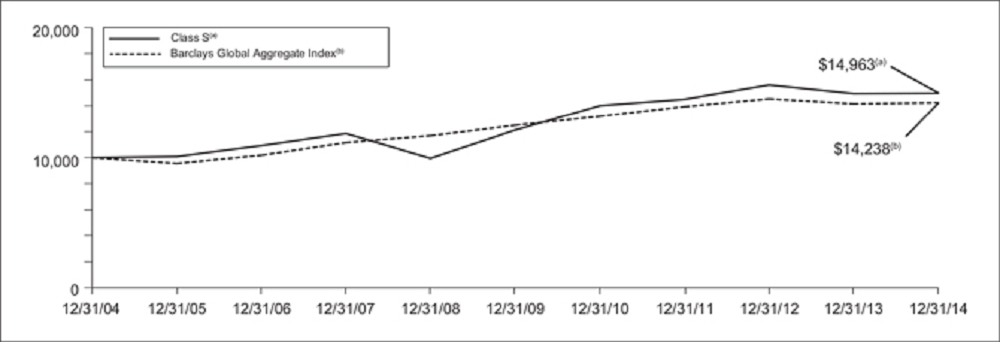

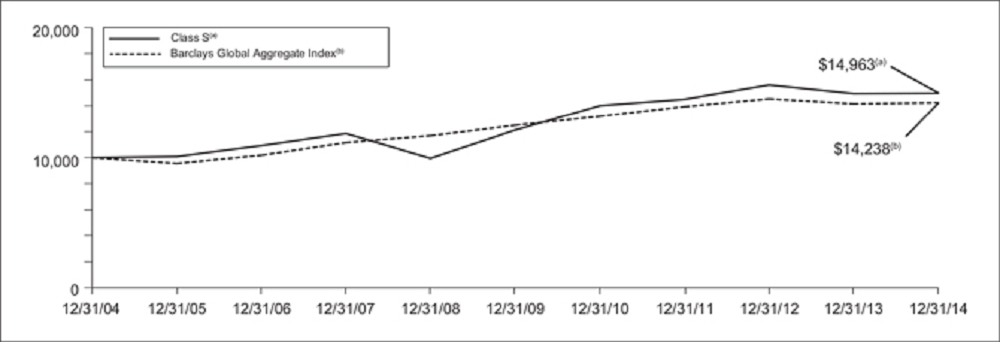

Performance: For the year ended December 31, 2014, the Portfolio’s Class S shares provided a total return of 0.15% compared to the Barclays Global Aggregate Index, which returned 0.59% for the same period.

Portfolio Specifics: A brutal winter obscured an otherwise positive forecast for United States economic growth in the first half of 2014. Meanwhile, in December 2013 the U.S. Federal Reserve Board (the “Fed”) announced it would reduce the scope of its quantitative easing effort by $10 billion per month. However, the Fed continued to reinforce its intention to provide ample liquidity and maintain the federal funds rate at near-zero levels for the foreseeable future, given slack in the labor markets and a benign inflation outlook. Gross domestic product expectations in the U.S. for the second half of the year began to increase after shaking off the chill of winter and the Fed continued its “measured pace” of tapering asset purchases and policy normalization. Elsewhere, conditions outside U.S. borders remained tenuous.

| | Top Ten Holdings

as of December 31, 2014*

(as a percentage of net assets) | |

| | | | | | |

| | Voya Emerging Markets Hard Currency Debt Fund - Class P | | | 11.0% | |

| | Voya Emerging Markets Local Currency Debt Fund - Class P | | | 10.9% | |

| | Voya High Yield Bond Fund - Class P | | | 5.5% | |

| | Bundesrepublik Deutsche Inflation Linked Bond, 0.100%, 04/15/23 | | | 5.2% | |

| | Voya Emerging Markets Corporate Debt Fund - Class P | | | 4.7% | |

| | Fannie Mae, 3.000%, 11/25/42 | | | 2.2% | |

| | Fannie Mae, 3.500%, 07/25/41 | | | 1.5% | |

| | Fannie Mae, 4.000%, 08/25/40 | | | 1.5% | |

| | Fannie Mae, 4.500%, 01/25/39 | | | 1.4% | |

| | United States Treasury Note, 2.250%,

11/ 15/24 | | | 1.3% | |

| | * Excludes short-term investments. | | |

| | Portfolio holdings are subject to change daily. | |

The European Central Bank (“ECB”) grew more accommodative throughout the reporting period by cutting rates and implementing targeted longer-term refinancing operations in the face of a sluggish economy, troubling unemployment levels and persistent deflationary pressures. Tensions between Russia and Ukraine intensified and Iraq descended into internal chaos, while the long-running Israeli/Palestinian conflict flared up. Portugal found itself a source of global panic only two months after it emerged from its international bailout program, as one of its largest lenders missed some debt payments. With the U.S. now leading the charge to unwind its extraordinary accommodation, emerging markets became relatively less attractive. Several central banks were quick to action in defense of their currencies, but the tighter financial conditions necessary to bolster local currencies had a dampening effect on growth. Economic expansion in the emerging markets proved challenging in 2014, particularly in light of weak developed market demand, deflationary fears in Europe, falling commodity prices and China’s economic cooling.

Market concern regarding the end of quantitative easing and the timing of interest rate hikes in the U.S. resulted in heightened volatility in “spread” markets (securities such as corporate bonds or mortgage-backed securities, whose yields are measured by their differences from equivalent-maturity U.S. Treasury securities). Volatility was particularly heightened in the fourth quarter of 2014 in response to the precipitous drop in oil prices. Nonetheless, global interest rates and U.S. dollar-denominated assets were bolstered throughout the period by the expectation of a prolonged period of accommodation from global central banks. For example, the Bank of Japan (“BoJ”) significantly expanded its version of quantitative easing at the end of October and the ECB promised more sizable action in 2015.

| | * | Effective March 1, 2015, Mustafa Chowdhury will be added as a portfolio manager of the Portfolio. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Voya Global Bond Portfolio | Portfolio Managers’ Report |

The Portfolio maintained a U.S.-centric bias throughout the reporting period. This was expressed through overweights in a variety of spread sectors, most notably U.S. high yield corporate bonds and commercial mortgage-backed securities (“CMBS”), as well as mostly dollar-denominated emerging market (EM) sovereign and corporate bonds. These asset classes were not immune to the volatility that occurred later in the reporting period. The most acute spread widening occurred during the fourth quarter as lower Treasury yields and risks from the energy sector drove credit spreads significantly wider. While supported by strong corporate fundamentals and low default expectations, combined with a supportive technical backdrop (i.e., low new issuance), high yield corporate bond exposures suffered from the fall in oil prices toward the end of the reporting period. CMBS proved fairly resilient, buoyed by strong underlying fundamentals, the housing recovery and a supply/demand balance tilted strongly in favor of sellers. Exposure to EM hard currency sovereign and corporate debt was additive in May, as positions with exposure to Russian and Ukrainian turmoil rebounded from distressed prices. Still, these and other commodity-sensitive exposures suffered from the fall in oil prices later in the period. We were generally positioned, however, in more conservative, lower market-risk issues, avoiding Brazil, South Africa and India. All told, spread sector overweight positioning weighed on relative returns for the reporting period.

The Portfolio was generally overweight the U.S. dollar versus other G10 developed market currencies, including the euro and Japanese yen, with minimal exposure to EM currencies. Being underweight the euro was a detractor earlier in the reporting period. However, this positioning proved beneficial when the euro began to fall versus the dollar in September, as deflation threats in the euro zone pushed the ECB to announce extreme easing measures such as negative interest rates and an asset-backed purchase program. The decision to be underweight the yen also proved beneficial, particularly at the very end of the period in light of the BoJ’s surprise announcement to significantly expand its version of quantitative easing. The decision to be overweight the U.S. dollar relative to underweights in the yen and euro proved to be particularly beneficial during the fourth quarter of 2014, as the euro depreciated more than 4% and the yen more than 8%.

The Portfolio’s interest rate posture detracted from results for the reporting period. Portfolio duration (i.e., interest rate sensitivity) was shorter than the benchmark through the first half of the reporting period, which was followed by an overweight in New Zealand, Australia and the UK during the second half of the year. The Portfolio was short duration in European sovereign and peripheral debt. This detracted from results as the European core and periphery rallied due to easing actions by the ECB. Being overweight in Australia and New Zealand, however, contributed to results. We thought the expectations of rate hikes were too aggressive and were ultimately proven right as the outlook for global economic growth weakened and commodity prices declined. As the reporting period progressed, we moved to a short duration position relative to the benchmark, concentrated in U.S. duration and sought out opportunities to buy protection against significantly higher U.S. rates through option positions. These positions have little impact on the portfolio’s duration, but potentially would work to naturally shorten portfolio duration in the event of a significant interest rate sell-off. Being underweight interest rate risk later in the period (e.g. short U.S. and Canada) detracted from results, as rates rallied to 18-month lows in the U.S. and all-time lows in some other global markets. In particular, lower yields in long-term U.S. Treasuries and in peripheral euro zone sovereigns detracted from returns.

To manage interest rate risk during the period, the Portfolio used government bond futures and interest rate swaps. To manage currency risk, we employed currency forwards, occasionally using currency options to limit risk in adverse scenarios. Occasionally, we used index credit default swaps to manage exposure to spread sectors.

Current Strategy and Outlook: Given the continuing potential for a global economic slowdown and prolonged central bank accommodation, we maintain a bias for U.S. dollar-denominated assets tied to stable corporate fundamentals, the housing recovery and the U.S. consumer. The Portfolio remains overweight a variety of spread sectors, including EM sovereigns, U.S. investment grade corporates and U.S. high yield corporates. Risks to these sectors were highlighted during the fourth quarter, as oil prices plummeted and global growth expectations, particularly in Europe and some emerging markets were revised downward. However, despite low overall yields, we believe spread widening in these sectors leaves valuations compelling for selected holdings. As we still do not anticipate a new default cycle in the near term, particularly in credits most exposed to the U.S. economy, we feel that default-adjusted returns are likely to be attractive in 2015.

The Portfolio remains overweight the U.S. dollar and underweight the euro and Japanese yen. In our view, the yen may have already experienced most of its weakening move, as the BoJ’s surprise announcement of faster bond buying is well past. In the first quarter of 2015, we expect the ECB to announce its own sovereign bond purchase program. As that event approaches, we expect to be increasingly underweight euros versus the U.S. dollar and other currencies, including the British pound and Swiss franc.

The Portfolio is underweight interest rate risk in the U.S., but has closed its underweights in interest rate risk denominated in other currencies. In our opinion, valuations are generally rich in rates, but with new central bank purchase programs being announced, flooding the market with liquidity at a time of economic uncertainty, we see no near-term catalyst for a global rate sell-off. Our underweights are concentrated in the front end of the U.S. curve, where Fed policy may provide a possible cue for a sell-off. We are also positioning in options strategies to gain from less rapid changes in the slope of the U.S. interest rate curve in the near future.

| Portfolio Managers’ Report | Voya Global Bond Portfolio |

| | Average Annual Total Returns for the Periods Ended December 31, 2014 | |

| | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | Class ADV | | | -0.06 | % | | | 4.04 | % | | | 3.85 | % | |

| | Class I | | | 0.42 | % | | | 4.56 | % | | | 4.35 | % | |

| | Class S | | | 0.15 | % | | | 4.30 | % | | | 4.11 | % | |

| | Barclays Global Aggregate Index | | | 0.59 | % | | | 2.65 | % | | | 3.60 | % | |

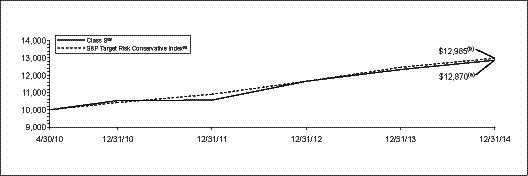

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Global Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past

performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to January 21, 2011, the Portfolio was advised by a different sub-adviser.

| VY® American Century Small-Mid Cap Value Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 28.3% | |

| | Industrials | | | 12.8% | |

| | Information Technology | | | 10.1% | |

| | Utilities | | | 9.9% | |

| | Health Care | | | 9.3% | |

| | Consumer Discretionary | | | 8.6% | |

| | Consumer Staples | | | 5.5% | |

| | Energy | | | 5.4% | |

| | Materials | | | 5.1% | |

| | Exchange-Traded Funds | | | 2.2% | |

| | Telecommunication Services | | | 1.0% | |

| | Assets in Excess of Other Liabilities* | | | 1.8% | |

| | Net Assets | | | 100.0% | |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY® American Century Small-Mid Cap Value Portfolio (the “Portfolio”) seeks long-term capital growth. Income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Miles Lewis and Jeff John (responsible for the management of the Small Cap Value portion of the Portfolio) and Kevin Toney, Phillip N. Davidson, Michael Liss and Brian Woglom (responsible for the Mid Cap Value portion of the Portfolio) (each a “Sleeve”), Portfolio Managers of American Century Investment Management, Inc. — the Sub-Adviser.*

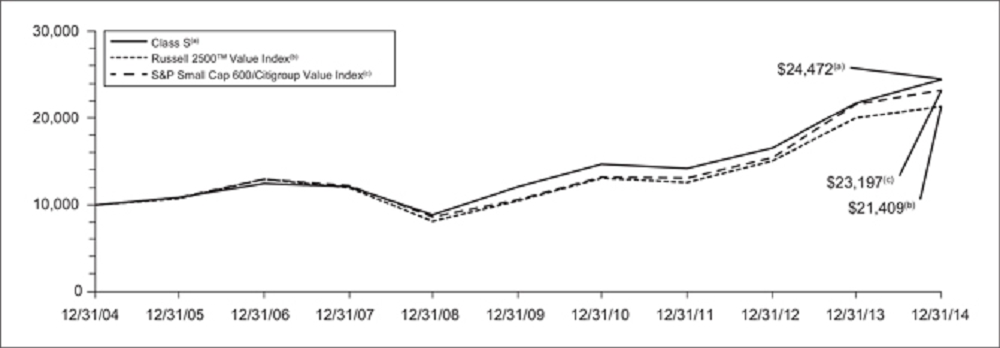

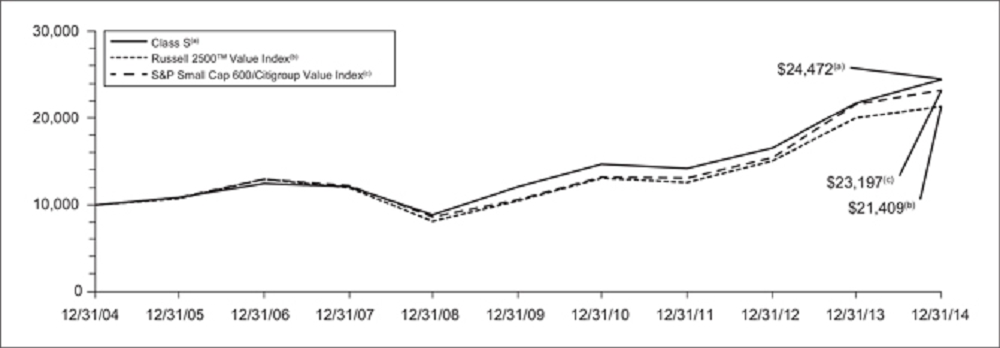

Performance: For the year ended December 31, 2014, the Portfolio’s Class S shares provided a total return 12.47% compared to the Russell 2500TM Value Index and the S&P Small Cap 600/Citigroup Value Index, which returned 7.11% and 7.54%, respectively, for the same period.

Portfolio Specifics: Small Cap Value Sleeve — investments in the materials, energy, and industrials sectors added significantly to performance, while positions in the financials, consumer discretionary, and utilities sectors detracted from returns.

The Small Cap Value Sleeve outperformed its benchmark due to security selection. Sector weightings were detractive on balance.

In materials, the Sleeve benefited from stock selection, particularly in the containers and packaging industry. Berry Plastics benefited from the dramatic drop in crude oil prices during the second half of the year, as the resin it uses in many of its products is a petroleum product that dropped in price. While the consumer discretionary sector detracted, individual names in the sector were among the top contributors. Entravision, the largest Spanish-language broadcaster in the U.S., recovered from previous weakness across the media industry. The company also benefited from news that the federal government is assessing interest among television broadcasters in auctioning off excess broadcast spectrum. If completed, the auction would likely bring in significant capital for the company, and it has indicated it would use the income to deleverage debt. The Portfolio was also helped by its position in Red Robin Gourmet Burgers. The team established the position during the third quarter when the stock dipped as a result of poor marketing execution. The company recovered from the stumble and performed well during the fourth quarter, as restaurants are some of the first places consumers begin spending when discretionary income increases.

Security selection and a significant underweight to the financials sector detracted from relative performance, particularly among real estate investment trusts (“REITs”). BankUnited, which operates in Miami and New York, declined after issuing fourth-quarter guidance that was lower than anticipated. The bank is still experiencing solid growth and the team believes it is a high quality name with attractive valuation. In consumer discretionary, electronics and appliance retailer Conn’s detracted, and the Sleeve exited its position. Watch maker Movado also weighed on relative results as growth in the business segment is slowing. An underweight to the utilities sector further hampered performance.

Mid Cap Value Sleeve – Positions in the information technology, industrials, and energy sectors contributed the most to performance, while positions in the financials and materials sectors detracted from returns.

| | Top Ten Holdings

as of December 31, 2014*

(as a percentage of net assets) | |

| | | | | | |

| | Republic Services, Inc. | | | 2.1% | |

| | Northern Trust Corp. | | | 2.0% | |

| | iShares Russell Midcap Value Index Fund | | | 1.9% | |

| | Laclede Group, Inc. | | | 1.4% | |

| | Sysco Corp. | | | 1.1% | |

| | Koninklijke Philips NV | | | 1.1% | |

| | LifePoint Hospitals, Inc. | | | 1.1% | |

| | Imperial Oil Ltd. | | | 1.1% | |

| | Westar Energy, Inc. | | | 1.1% | |

| | Edison International | | | 1.0% | |

| | * Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

The Mid Cap Value Sleeve outperformed its benchmark due to security selection. Sector allocations detracted slightly from relative performance.

Security selection among information technology names contributed to relative results. In the information technology sector, Applied Materials enhanced returns. The semiconductor equipment maker saw fundamentals improve across the industry in the wake of technology changes in semiconductor and memory manufacturing. The company continues to focus on improving its margins, market share, and research and development productivity. Additionally, the firm is working toward closing an acquisition that would be highly accretive. In the industrials sector, security selection enhanced relative performance, though some of the gain was offset by a detrimental overweight in the sector. Security selection and an underweight in the machinery segment drove contribution from the sector.

Security selection in the financials sector was the greatest detractor from relative performance. The Portfolio remained significantly underweight in REITs, as the team finds valuations unattractive amid continued low interest rates. In the materials sector, security selection weighed on relative returns, though some of the detraction was offset by the portfolio’s underweight to the sector. Global aluminum fabricator Constellium NV detracted as an acquisition increased its debt burden. Additionally, the company announced its intent to increase capacity over the next three years, which could limit its free cash flow generation.

Current Strategy and Outlook: We continue to be bottom-up investment managers, building our portfolios one stock at a time, a process that results in exposure to market segments based on the attractiveness of individual companies in terms of their valuation and fundamentals. As of December 31, 2014, the Mid Cap Value Sleeve was overweight in industrials, consumer staples, and energy, relative to the benchmark. Fundamental analysis and valuation work have led to smaller relative weightings in financials, consumer discretionary, and materials stocks. The Small Cap Value Sleeve, as of December 31, 2014, maintained an overall underweight in the energy sector, eliminating several oil and gas exploration and production names but retaining, in our opinion, high quality refining companies, which held better than other energy names. The Portfolio is also overweight names that store and transport oil and gas products. The Portfolio is overweight the consumer discretionary sector. The Portfolio is still underweight banks, but has been adding, in our opinion, some high quality names in anticipation of an eventual rise in interest rates and improved earning power. While banks have underperformed recently, the team believes it has seen improving fundamentals and profit growth, while valuations remain attractive.

| | * | Effective December 31, 2014, Benjamin Z. Giele was removed as a portfolio manager and Miles Lewis was added as a portfolio manager of the Portfolio. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® American Century Small-Mid Cap Value Portfolio |

| | Average Annual Total Returns for the Periods Ended December 31, 2014 | |

| | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S2

February 27, 2009 | | |

| | Class ADV | | | 12.15 | % | | | 14.95 | % | | | 9.09 | % | | | — | | |

| | Class I | | | 12.76 | % | | | 15.52 | % | | | 9.64 | % | | | — | | |

| | Class S | | | 12.47 | % | | | 15.23 | % | | | 9.36 | % | | | — | | |

| | Class S2 | | | 12.33 | % | | | 15.07 | % | | | — | | | | 23.21 | % | |

| | Russell 2500TM Value Index | | | 7.11 | % | | | 15.48 | % | | | 7.91 | % | | | 23.38 | % | |

| | S&P Small Cap 600/Citigroup Value Index | | | 7.54 | % | | | 16.96 | % | | | 8.78 | % | | | 24.47 | % | |

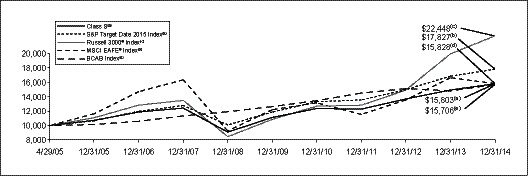

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® American Century Small-Mid Cap Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Baron Growth Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Consumer Discretionary | | | 27.3% | |

| | Industrials | | | 16.7% | |

| | Financials | | | 15.2% | |

| | Information Technology | | | 14.9% | |

| | Health Care | | | 8.5% | |

| | Consumer Staples | | | 8.3% | |

| | Energy | | | 3.4% | |

| | Materials | | | 2.4% | |

| | Utilities | | | 1.8% | |

| | Telecommunication Services | | | 0.8% | |

| | Assets in Excess of Other Liabilities* | | | 0.7% | |

| | Net Assets | | | 100.0% | |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY® Baron Growth Portfolio (the “Portfolio”) seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman, and Portfolio Manager of BAMCO, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2014, the Portfolio’s Class S shares provided a total return of 4.34% compared to the Russell 2000® Growth Index and the Russell 2500TM Growth Index, which returned 5.60% and 7.05%, respectively, for the same period.

Portfolio Specifics: The Portfolio underperformed the Russell 2000® Growth Index. The positive effect of stock selection was more than offset by the negative effect of relative sector weights.

Results for U.S. stock markets were volatile in 2014, as investors rotated among sub-asset classes and sectors in reaction to geopolitical events, the pace of global economic growth, interest rates, and, in the second half of the year, plummeting oil prices. After outperforming by about 1,000 basis points (10%) in 2013, small cap stocks underperformed their large cap counterparts by roughly 800 basis points (8%) in 2014. This cyclical behavior is a well-established pattern. We are confident that stocks of smaller, faster growing companies once again may return to favor, although we cannot predict exactly when, or how, it will happen.

Health care, information technology (“IT”), and consumer staples were the Portfolio’s top contributing sectors in 2014. Health care’s contribution was driven primarily by the strong performance of holdings in health care equipment and health care facilities, including the Portfolio’s fourth largest contributor, U.S. hospital operator Community Health Systems, Inc. The Portfolio’s sole pharmaceuticals investment, Latin American generic drug company CFR Pharmaceuticals S.A., was the third biggest contributor to Portfolio performance. Its stock rose significantly on news that it was being acquired by Abbott Laboratories. IT contributed on gains in holdings in IT consulting & other services and data processing and outsourced services. Several application software companies also performed well in 2014, including SS&C Technologies, Inc., Concur Technologies, Inc., and FactSet Research Systems Inc. In consumer staples, private label food company TreeHouse Foods, Inc. and leading craft brewer Boston Beer Company, Inc. led sector performance. While performance of the Portfolio’s Consumer Discretionary investments was mixed, the sector included the Portfolio’s top two contributors, athletic apparel company Under Armour, Inc. and ski resort operator Vail Resorts, Inc.

| | Top Ten Holdings

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Vail Resorts, Inc. | | | 4.1% | |

| | Under Armour, Inc. | | | 3.2% | |

| | Gartner, Inc. | | | 3.2% | |

| | Choice Hotels International, Inc. | | | 3.1% | |

| | Middleby Corp. | | | 3.0% | |

| | Genesee & Wyoming, Inc. | | | 2.9% | |

| | TreeHouse Foods, Inc. | | | 2.8% | |

| | CoStar Group, Inc. | | | 2.7% | |

| | Dick’s Sporting Goods, Inc. | | | 2.5% | |

| | Caesar Stone Sdot Yam Ltd. | | | 2.4% | |

| | Portfolio holdings are subject to change daily. | |

Energy and industrials detracted from Portfolio performance. Investors fled the energy sector in the second half of the year in reaction to the steep drop in oil prices, which fell by approximately 50%. Oil & gas equipment & services company Core Laboratories NV led the decline in the Portfolio. With mixed performance among its holdings, Industrials lost ground in part due to poor performances by standby generator company Generac Holdings Inc. and industrial machinery company Colfax Corporation. Portfolio performance was also hurt by the sagging stock prices of two consumer discretionary stocks, automotive parts distributor LKQ Corporation and Lumber Liquidators Holdings, Inc., the second and third biggest individual detractors, respectively.

Energy, materials, and utilities contributed the most to relative results. With the Portfolio’s Energy holdings primarily in storage & transportation, which are less sensitive to oil price fluctuations, the sector outperformed its index counterpart. In addition, the outperformance of, and lower exposure to, exploration and production companies helped relative performance. Strong performance of the Portfolio’s only materials holding, CaesarStone Sdot-Yam Ltd., combined with its lower exposure to this underperforming sector, contributed to relative results. The sole utilities investment, ITC Holdings Corp., also outperformed, but this was partly offset by larger exposure to this lagging sector.

Lower exposure to health care and underperformance of industrials and financials detracted the most from relative performance. Gains in health care holdings CFR Pharmaceuticals SA, Community Health Systems, Inc., and IDEXX Laboratories, Inc. were more than offset by lower exposure to biotechnology and pharmaceuticals stocks. Industrials trailed its index counterpart, led by declines in Colfax Corp., Genesee & Wyoming, Inc., and Generac Holdings, Inc. Larger exposure to the lagging asset management & custody banks sub-industry and underperformance of Gaming and Leisure Properties, Inc. detracted the most from relative results of the Portfolio’s financials investments.

Current Strategy and Outlook: Generally positive domestic economic reports over the year support the view that the U.S. economy is accelerating, outpacing much of the rest of the developed world. 2014 was the best year for job creation since 1999, average hourly earnings ticked up, consumer confidence rose, and third quarter GDP of 5% represented the fastest pace of expansion in 11 years. We think the economy will continue to improve in 2015.

We consider the decline in oil prices to be a positive for the U.S. economy and non-energy-related U.S. stocks. While we are not making significant changes to our overall investment approach, we view the low price of oil as an opportunity to explore new and additional investments in companies affected by the price of oil. We are studying companies in energy-intensive industries, such as airlines, cruise lines, and automotive companies, as well as businesses that benefit from increased activity in those industries, such as travel-related businesses. We are also studying consumer discretionary businesses – historically a major focus for us – building on the increase in disposable income produced by lower oil prices and the improving economy.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® Baron Growth Portfolio |

| | Average Annual Total Returns for the Periods Ended December 31, 2014 | |

| | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S2

February 27, 2009 | | |

| | Class ADV | | | 4.06 | % | | | 17.22 | % | | | 8.58 | % | | | — | | |

| | Class I | | | 4.55 | % | | | 17.80 | % | | | 9.12 | % | | | — | | |

| | Class S | | | 4.34 | % | | | 17.52 | % | | | 8.86 | % | | | — | | |

| | Class S2 | | | 4.17 | % | | | 17.34 | % | | | — | | | | 24.00 | % | |

| | Russell 2000® Growth Index | | | 5.60 | % | | | 16.80 | % | | | 8.54 | % | | | 24.13 | % | |

| | Russell 2500TM Growth Index | | | 7.05 | % | | | 17.27 | % | | | 9.37 | % | | | 24.91 | % | |

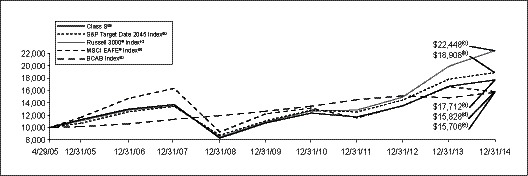

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Baron Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Columbia Contrarian Core Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 20.2% | |

| | Information Technology | | | 19.1% | |

| | Health Care | | | 15.6% | |

| | Consumer Discretionary | | | 13.2% | |

| | Industrials | | | 11.3% | |

| | Consumer Staples | | | 8.4% | |

| | Energy | | | 6.6% | |

| | Materials | | | 3.2% | |

| | Telecommunication Services | | | 2.4% | |

| | Assets in Excess of Other Liabilities | | | –% | |

| | Net Assets | | | 100.0% | |

| | Portfolio holdings are subject to change daily. | |

VY® Columbia Contrarian Core Portfolio (the “Portfolio”) seeks total return, consisting of long-term capital appreciation and current income. The Portfolio is managed by Guy W. Pope, CFA, Portfolio Manager with Columbia Management Investment Advisers, LLC (“CMIA”) — the Sub-Adviser.

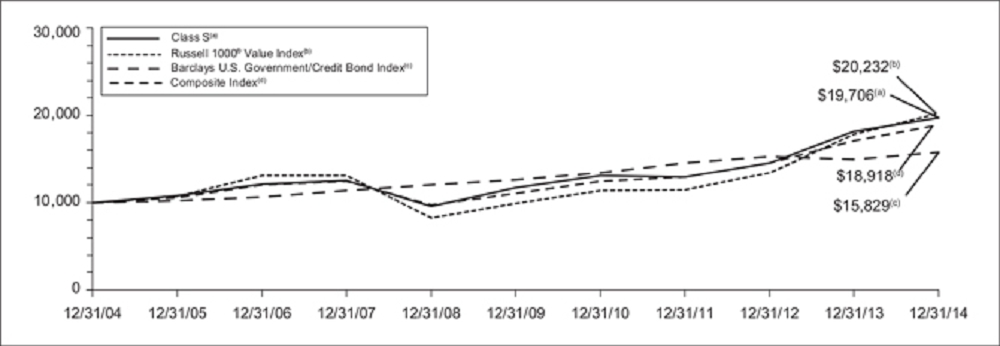

Performance: For the year ended December 31, 2014, the Portfolio’s Class S shares provided a total return of 12.81% compared to the Russell 1000® Index, which returned 13.24% for the same period.

Portfolio Specifics: Stock selection was the primary driver of performance for the period, with stocks in the information technology, health care, and consumer staples sectors leading the way. Stock selection in the industrials, consumer discretionary and financials sectors detracted. An underweight to the utilities sector also detracted from relative performance.

In information technology, software and gaming company Electronic Arts, Inc. (“EA”) continued its strong and steady performance, posting more than 100% gain in the period. The world’s second largest video game publisher has built a diversified array of gaming titles, including its sports series (Madden NFL, FIFA), Sims series, and Battlefield. This year EA has taken market share in the mobile and online gaming segments. The company is extremely cost conscious and is gaining a competitive advantage in these higher profit margin areas.

| | Top Ten Holdings

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Apple, Inc. | | | 4.6% | |

| | JPMorgan Chase & Co. | | | 3.5% | |

| | Citigroup, Inc. | | | 3.5% | |

| | Comcast Corp. – Class A | | | 2.9% | |

| | CVS Caremark Corp. | | | 2.8% | |

| | Honeywell International, Inc. | | | 2.6% | |

| | Berkshire Hathaway, Inc. | | | 2.6% | |

| | Goldman Sachs Group, Inc. | | | 2.5% | |

| | Microsoft Corp. | | | 2.5% | |

| | Blackrock, Inc. | | | 2.4% | |

| | Portfolio holdings are subject to change daily. | |

Apple, Inc. (“Apple”) was once again a top contributor in the portfolio, gaining approximately 40% in the period. Apple reported some of its best earnings in recent memory and focus shifted to possible catalysts for the stock in the months and quarters ahead. There appears to be increased bullishness surrounding Apple’s product launches, which included the highly anticipated iPhone 6, and the iWatch, which Apple will introduce in 2015.

Many of our energy sector names were detractors in the period, especially Halliburton Company, Noble Energy, Inc. and Chevron Corporation. A strengthening U.S. dollar, increasing supply and lower demand driven by fears of a global economic slowdown gripped the energy markets and resulted in a drastic decline in oil prices which left the energy sector down more than 8% for the period.

Current Strategy and Outlook: We expect higher volatility in the short term, and we expect that to continue until there is clarity around a few fundamental factors. In our view, these factors include: the path of the U.S. Federal Reserve Board’s monetary policy, Greece and its position in the Euro, and general earnings growth, which appears to be facing stiffer headwinds in 2015, which marks the 6th year of this maturing earnings and economic cycle. As we have discussed in the past, we believe volatility can create opportunities to pick up good companies at compelling valuations. As such, we will continue to adhere to our process and look for contrarian investments in this environment.

| Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. Performance for the different classes of shares will vary based on differences in fees associated with each class. |

| Portfolio Managers’ Report | VY® Columbia Contrarian Core Portfolio |

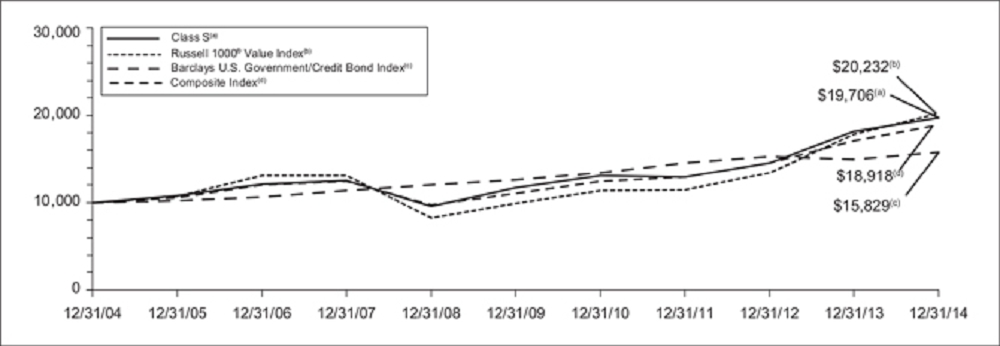

| | Average Annual Total Returns for the Periods Ended December 31, 2014 | |

| | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | Class ADV | | | 12.50 | % | | | 12.47 | % | | | 5.77 | % | |

| | Class I | | | 13.09 | % | | | 13.04 | % | | | 6.30 | % | |

| | Class S | | | 12.81 | % | | | 12.76 | % | | | 6.03 | % | |

| | Russell 1000® Index | | | 13.24 | % | | | 15.64 | % | | | 7.96 | % | |

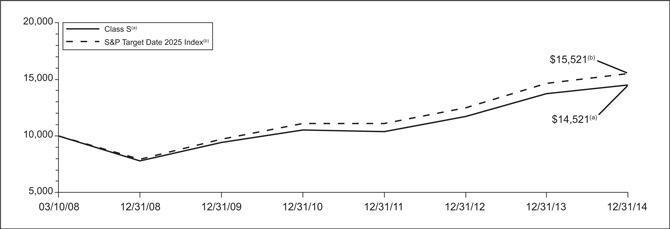

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Columbia Contrarian Core Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable

contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to October 31, 2005, the Portfolio was advised by a different sub-adviser. Prior to April 15, 2013, the Portfolio was advised by a different sub-adviser.

| VY® Columbia Small Cap Value II Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2014

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 35.8% | |

| | Consumer Discretionary | | | 12.7% | |

| | Industrials | | | 11.4% | |

| | Information Technology | | | 10.3% | |

| | Health Care | | | 8.2% | |

| | Materials | | | 7.6% | |

| | Utilities | | | 5.5% | |

| | Energy | | | 4.0% | |

| | Consumer Staples | | | 1.2% | |

| | Assets in Excess of Other Liabilities* | | | 3.3% | |

| | Net Assets | | | 100.0% | |

| | * Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY® Columbia Small Cap Value II Portfolio (the “Portfolio”) seeks long-term growth of capital. The Portfolio is managed by Christian K. Stadlinger, CFA, and Jarl Ginsberg, CFA, Portfolio Managers, of Columbia Management Investment Advisors, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2014, the Portfolio’s Class I shares provided a total return of 4.68% compared to the Russell 2000® Value Index, which returned 4.22% for the same period.

Portfolio Specifics: Despite many challenges, U.S. equity markets generally posted solid performance during 2014. The year began with a harsh winter that brought many parts of the U.S. economy to a near-halt, followed by growing concerns that included slowing global growth, mounting tensions between Russia and Ukraine, and the end of quantitative easing in the U.S. Deflation was an additional threat in many economies worldwide, as was the adverse effects of plunging oil prices. Positive economic data eased much of the anxiety, however, and equity markets charged ahead. By year-end the S&P 500 had hit more than 50 record highs — almost half of which were reached during the fourth quarter.

During 2014, the Portfolio’s relative performance benefited substantially from its strategy of buying undervalued securities where the companies’ fortunes are improving, particularly in the industrials sector. Within the sector, while most industries were strong contributors, the greatest contributions came from two of the Portfolio’s airline holdings. In the beginning of 2014, the stock of American Airlines Group, Inc. reaped the rewards of the long-awaited closure of the merger with US Airways Group that came to fruition. Alaska Air Group, Inc. advanced later in the period on lower gas prices as well as on increased demand for airline seats. The Portfolio also benefited from strong stock selection and continued M&A activity in both industrials and energy.

| | Top Ten Holdings

as of December 31, 2014*

(as a percentage of net assets) | |

| | | | | | |

| | American Assets Trust, Inc. | | | 1.3% | |

| | Amerisafe, Inc. | | | 1.3% | |

| | Western Alliance Bancorp. | | | 1.2% | |

| | Sterling Bancorp/DE | | | 1.2% | |

| | VCA, Inc. | | | 1.2% | |

| | Deluxe Corp. | | | 1.2% | |

| | American Equity Investment Life Holding Co. | | | 1.2% | |

| | Avista Corp. | | | 1.2% | |

| | TreeHouse Foods, Inc. | | | 1.2% | |

| | Integrated Device Technology, Inc. | | | 1.2% | |

| | * Excludes short-term investments. | | |

| | Portfolio holdings are subject to change daily. | |

Stock selection was negative within consumer staples and detracted from the Portfolio’s relative performance. Nu Skin Enterprises, Inc., a personal care company, declined on concerns over sales in China. The continued decline ran contrary to our thesis and we exited the name. In addition, the oil price decline that benefited consumers in many ways hurt energy holdings, most notably Goodrich Petroleum Corporation, Basic Energy Services Inc. and Parsely Energy, Inc. Offsetting these disappointments was our investment in E&P company Athlon Energy. The stock advanced during the period initially as there was more evidence of successful exploration in the Permian Basin. It received another boost later in the period on news that it was being acquired by Canadian based Encana Corp. During the period, we reduced our net exposure to the sector based on overall declining cash flow expectations due to weakness in oil prices.

Current Strategy and Outlook: We continue to believe that our focus on small cap value companies with strong underlying earnings prospects and attractively priced shares have the potential to reward investors. We remain focused on our research of those companies where we believe the valuation gap is likely to shrink in the near term and look for a company’s upward inflection point — we seek out stocks that are both inexpensive and show improving operating performance/metrics. As we do this, three types of opportunities typically come to light: Companies with compressed near term operating fundamentals that the managers believe are poised to expand within a reasonable timeframe; Opportunities in industries that may be out of favor; and “Out-of-the-limelight” companies missed by the Wall Street research community.