UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08319

Voya Partners, Inc.

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-262-3862

| Date of fiscal year end: | December 31 |

| | |

| Date of reporting period: | December 31, 2015 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2015

Classes ADV, I, S and S2

Voya Partners, Inc.

■

Voya Global Bond Portfolio

■

VY® American Century Small-Mid Cap Value Portfolio

■

VY® Baron Growth Portfolio

■

VY® Columbia Contrarian Core Portfolio

■

VY® Columbia Small Cap Value II Portfolio

■

VY® Invesco Comstock Portfolio

■

VY® Invesco Equity and Income Portfolio

■

VY® JPMorgan Mid Cap Value Portfolio

■

VY® Oppenheimer Global Portfolio

■

VY® Pioneer High Yield Portfolio

■

VY® T. Rowe Price Diversified Mid Cap Growth Portfolio

■

VY® T. Rowe Price Growth Equity Portfolio

■

VY® Templeton Foreign Equity Portfolio

| | | This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for certain Portfolios. The Portfolios’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios’ Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

Fed action — global reaction

Dear Shareholder,

One of the most anticipated events of 2015 came to pass with only a few weeks left on the calendar. Following the mid-December gathering of its policy-making Federal Open Market Committee, the Federal Reserve Board (“Fed”) announced the first increase of the federal funds target rate in nearly a decade, hiking its key policy interest rate 0.25% to a range of 0.25% – 0.50%. In its announcement, the central bank cited considerable improvement in labor-market conditions and a reasonable confidence that inflation will approach its 2% objective over the medium term. The widely expected interest rate hike already had been priced into most asset classes and thus had minimal immediate impact on the direction of financial markets.

Worth noting is that the Fed’s decision to begin raising short-term interest rates comes at a time when other major central banks — notably, in Europe, China and Japan — continue to provide massive amounts of support to their economies and are biased more toward further accommodation. The disruptions that potentially may emerge from this divergence in central bank policies will demand close attention in the year ahead. Witness January stock market performance.

Though the Fed believes the U.S. economy is strong enough to bear a fed funds interest rate increase, many of the same risks and opportunities persist in the markets. The global economic backdrop and geopolitical stresses continue to induce uncertainty, which could lead to periods of intense volatility, in our view. How can investors keep their perspective in such times? Don’t let today’s uncertainties distract you from focusing on your long-term goals, and don’t risk compromising your goals for the sake of avoiding volatility now. Keep your portfolio well-diversified and thoroughly discuss any prospective changes with your investment advisor before you take action.

At Voya Investment Management, we seek to be a reliable partner committed to reliable investing, helping you and your investment advisor achieve your goals. We appreciate your continued confidence in us, and we look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

January 12, 2016

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and the Voya mutual funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for a Voya mutual fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any Voya mutual fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

Market Perspective: Year Ended December 31, 2015

In our semi-annual report, we described how equity market interest had recently moved from the U.S. to Europe with the advent of the European Central Bank’s (“ECB”) quantitative easing program. But from there, attention moved east and in August an unexpected announcement from China re-awakened other concerns, sending global equities, in the form of the MSCI World IndexSM (the “Index”) measured in local currencies, including net reinvested dividends, on a roller-coaster ride. Having been up 4.14% for the half-year, the Index finally ended 2015 with a gain of 2.08%. (The Index returned -0.87% for the one year ended December 31, 2015, measured in U.S. dollars.)

U.S. economic data was mixed in what was still a rather pedestrian recovery. A disappointing October employment report was followed by a very strong one in November showing that 271,000 jobs had been created the previous month. Sluggish annual wage growth improved to 2.5%, which doesn’t sound like much, but it was the best since 2009. The unemployment rate fell to 5.0%. The December report was a little weaker. Gross domestic product (“GDP”), initially held back by another harsh winter, rebounded to 3.9% in the second quarter of 2015, before an inventory downturn pegged it back to 2.0% in the third. Industrial production was uneven, while retail sales were still showing no acceleration despite lower gasoline prices.

Superimposed on this was the prospect of rising U.S. interest rates. The Federal Open Market Committee (“FOMC”) had not increased the federal funds interest rate for nine years and many feared that it would feel pressed to act before the economy was really ready. But when on September 17 the FOMC left rates unchanged, citing weakness overseas, investors seemed unnerved at this new narrative rather than relieved. Perhaps sensing a credibility problem, the FOMC tried to re-set expectations, signaling in October the December increase of 0.25% that eventually took place, to a range of 0.25% – 0.50%.

Internationally, as noted, the ECB at last implemented a program of quantitative easing in March. Before long the economic data started to look a little less weak: the unemployment rate ticked down to 10.7% and GDP rose 1.6% year-over-year in the third quarter of 2015. Core inflation edged above 1.0% before slipping back. In December, ECB President Draghi’s much anticipated intensification of the program disappointed markets. Sentiment also suffered in mid-year when the integrity of the euro zone itself was threatened, as Greece wrangled over the terms of its bailout. Creditors stood firm and facing ejection, Greece finally accepted even stricter terms.

Annual GDP growth in China decelerated to 7.0% in the first and second quarters of 2015, the slowest in six years, then to 6.9% in the third. But to many commentators 7.0% was suspiciously close to government targets and perhaps overstated. They watched nervously as the Shanghai Stock Exchange Composite Index (“Shanghai Composite”) soared 64% in 2015 by June 12, fueled by retail savings and margin debt. The Shanghai Composite was already in retreat when on August 11, global commodities and equity markets were shaken as China announced a 2% devaluation of the yuan, suggesting that the Chinese economy, the largest single contributor to global growth in recent years, was indeed weaker than had previously been admitted. By August 26 the Shanghai Composite was down 43% from its peak. But gradually the feeling grew that concerns had been overdone. The

Bank of China lowered interest rates, eased bank reserve requirements and by the end of December, with the yuan gradually depreciating, the Shanghai Composite had regained over a quarter of its losses.

In U.S. fixed income markets, the Barclays U.S. Aggregate Bond Index (“Barclays Aggregate”) gained 0.55% in 2015, while the Barclays U.S. Treasury Bond sub-index added 0.84%. Indices of riskier classes fared worse: the Barclays U.S. Corporate Investment Grade Bond sub-index lost 0.68%, while the Barclays High Yield Bond — 2% Issuer Constrained Composite Index (not a part of the Barclays Aggregate) sagged 4.43%. Reflecting another kind of risk, the Barclays Global Inflation Linked U.S. TIPS Index dipped 1.44% as inflationary expectations receded.

U.S. equities, represented by the S&P 500® Index including dividends, crept up 1.38% over the year, within which August represented the worst month since September 2011, while October was the strongest since October 2011. The consumer discretionary sector did best, rising 10.11%. The most challenged sector was understandably energy, slumping 21.12%. S&P 500® earnings per share, dragged down by the energy sector, recorded their first year-over-year decline since 2012 in the second quarter of 2015, despite continuing high levels of share buybacks, and declined again in the third. Shares of companies with smaller market capitalizations lagged: the Russell Midcap® Index fell 2.44% and the Russell 2000® Index fell 4.41%.

In currencies, “divergence” became the word on the experts’ lips to describe the prospect of the U.S. starting to raise interest rates just as the ECB ratcheted up its quantitative easing program. Unsurprisingly the dollar rose 11.47% against the euro over the year. It rose less, 5.75%, against the pound, as the UK is much closer to raising rates than the euro zone. The dollar’s gains against the yen had been made before the period started and it barely moved, rising just 0.40%.

International markets fell sharply after the events in August, with a partial recovery which was faltering by year-end. The MSCI Japan® Index held on to a gain of 9.93% for the year, amid renewed optimism about the yen-denominated profitability and better governance of Japanese corporations. The MSCI Europe ex UK® Index was cushioned by the introduction of quantitative easing, plus the declining euro that went with it and advanced 8.30%. The MSCI UK® Index, burdened by its large, losing holdings in the energy, materials and banking sectors, dropped 2.21%.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 262-3862 or log on to www.voyainvestments.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of Voya Investment Management’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

| | | Index | | | | Description | | |

| | | Bank of America/Merrill Lynch All Convertibles (Speculative Grade) Index | | | | An unmanaged index that includes about 270 convertible securities and represents the non-investment-grade convertible market. | | |

| | | Bank of America/Merrill Lynch High Yield Master II Index | | | | A broad-based index consisting of all U.S. dollar-denominated high-yield bonds with a minimum outstanding amount of $100 million and with a maturity of greater than one year period. The quality rating is less than BBB by Standard & Poor’s. | | |

| | | Barclays Global Aggregate Index | | | | Provides a broad-based measure of the global investment-grade fixed-rate debt markets. | | |

| | | Barclays Global Inflation Linked U.S. TIPS Index | | | | The index measures the performance of the US Treasury Inflation Protected Securities (TIPS) market. | | |

| | | Barclays High Yield Bond — 2% Issuer Constrained Composite Index | | | | An unmanaged index that includes all fixed-income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | | |

| | | Barclays U.S. Aggregate Bond Index | | | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. | | |

| | | Barclays U.S. Corporate Investment Grade Bond Index | | | | An unmanaged index consisting of publicly issued, fixed rate, nonconvertible, investment grade debt securities. | | |

| | | Barclays U.S. Government/Credit Bond Index | | | | An index made up of the Barclays Government and Credit indices, including securities issued by the U.S. government and its agencies and publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. | | |

| | | Barclays U.S. Treasury Bond Index | | | | A market capitalization-weighted index that measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of one year or more. | | |

| | | MSCI All Country World IndexSM | | | | A broad-based unmanaged index comprised of equity securities in countries around the world, including the United States, other developed countries and emerging markets. | | |

| | | MSCI All Country World ex-U.S. IndexSM | | | | A free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. | | |

| | | MSCI EAFE® Index | | | | An unmanaged index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. | | |

| | | MSCI Europe ex UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | | |

| | | MSCI Japan® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. | | |

| | | MSCI UK® Index | | | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | | |

| | | MSCI World IndexSM | | | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | | |

| | | Russell 1000® Index | | | | An unmanaged, comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies. | | |

| | | Russell 1000® Growth Index | | | | Measures the performance of the 1,000 largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth. | | |

| | | Russell 1000® Value Index | | | | An unmanaged index that measures the performance of those Russell 1000® securities with lower price-to-book ratios and lower forecasted growth values. | | |

| | | Russell 2000® Index | | | | An unmanaged index that measures the performance of securities of small U.S. companies. | | |

| | | Russell 2000® Growth Index | | | | An unmanaged index that measures the performance of securities of smaller U.S. companies with greater than average growth orientation. | | |

Benchmark Descriptions (continued)

| | | Index | | | | Description | | |

| | | Russell 2000® Value Index | | | | An unmanaged index that measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower than forecasted growth values. | | |

| | | Russell 2500™ Growth Index | | | | Measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500™ Index companies with higher price-to-book ratios and higher forecasted growth values. | | |

| | | Russell 2500™ Value Index | | | | Measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. | | |

| | | Russell Midcap® Index | | | | An unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000® Index, which represents approximately 26% of the total market capitalization of the Russell 1000® Index. | | |

| | | Russell Midcap® Growth Index | | | | An unmanaged index that measures the performance of those companies included in the Russell Midcap® Index with relatively higher price-to-book ratios and higher forecasted growth values. | | |

| | | Russell Midcap® Value Index | | | | Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. | | |

| | | S&P 500® Index | | | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | | |

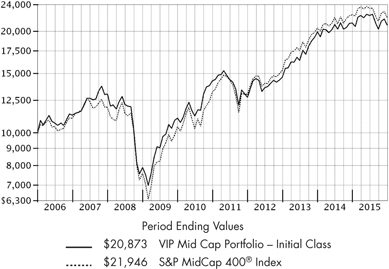

| | | S&P MidCap 400 Index | | | | A broad-based unmanaged capitalization weighted index of midcapitalization companies. | | |

| | | S&P Small Cap 600/Citigroup Value Index | | | | Measures the performance of those S&P 600 Index companies with lower price-to-book ratios. | | |

| | | Shanghai Stock Exchange Composite Index | | | | A capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was developed on December 19, 1990 with a base value of 100. | | |

| Portfolio Managers’ Report | Voya Global Bond Portfolio |

| | Geographic Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | United States(1) | | | 83.3% | |

| | Spain | | | 4.5% | |

| | Cayman Islands | | | 2.7% | |

| | Austria | | | 1.5% | |

| | France | | | 1.0% | |

| | Netherlands | | | 1.0% | |

| | United Kingdom | | | 0.8% | |

| | Germany | | | 0.7% | |

| | Japan | | | 0.4% | |

| | Sweden | | | 0.4% | |

| | Countries between 0.0% – 0.3%^ | | | 2.1% | |

| | Assets in Excess of Other Liabilities* | | | 1.6% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | ^

Includes 12 countries, which each represents 0.0% – 0.3% of net assets. | |

| | (1)

Includes 22.6% total investment in Voya Emerging Markets Corporate Debt Fund, Voya Emerging Markets Hard Currency Debt Fund, Voya Emerging Markets Local Currency Debt Fund, and Voya High Yield Bond Fund. | |

| | Portfolio holdings are subject to change daily. | |

Voya Global Bond Portfolio (the “Portfolio”) seeks to maximize total return through a combination of current income and capital appreciation. The Portfolio is managed by Christine Hurtsellers, CFA, Mustafa Chowdhury and Brian Timberlake, Ph.D., CFA, Portfolio Managers of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.*

Performance: For the year ended December 31, 2015, the Portfolio’s Class S shares provided a total return of -4.50% compared to the Barclays Global Aggregate Index, which returned -3.15% for the same period.

Portfolio Specifics: The main event of the fourth quarter — at least the most anticipated — was the first increase of interest rates in nearly a decade. The U.S. Federal Reserve Board (“Fed”) announced a 0.25% hike in the federal funds rate following the gathering of its policy-making Federal Open Market Committee (“FOMC”) in December; the increase brought the rate target to 0.25–0.50%. In its announcement, the FOMC cited considerable improvement in labor market conditions and a reasonable confidence that inflation will approach its 2% objective over the medium term.

The interest rate hike had already been priced into most asset classes, so it did not change the direction of the markets for the quarter. U.S. stocks posted high, single-digit gains despite reduced expectations of fourth quarter 2015 earnings; possibly due to early indications of a positive holiday shopping season. Though somewhat below U.S. equities, international stocks also posted gains. Oil prices continued to drop, sustaining losses for the quarter and for the full year. Bond prices generally declined, particularly among high-yield issues; the main exceptions were mortgage-backed securities. Bond yields, which

| | Top Ten Holdings

as of December 31, 2015*

(as a percentage of net assets) | |

| | | | | | |

| | Voya Emerging Markets Local Currency Debt Fund – Class P | | | 8.4% | |

| | Voya Emerging Markets Hard Currency Debt Fund – Class P | | | 6.4% | |

| | Voya Emerging Markets Corporate Debt Fund – Class P | | | 4.2% | |

| | Voya High Yield Bond Fund – Class P | | | 3.6% | |

| | Spain Government Bond, 1.600%, 04/30/25 | | | 3.3% | |

| | United States Treasury Note, 0.875%, 11/30/17 | | | 2.6% | |

| | Fannie Mae, 4.500%, 05/01/44 | | | 1.6% | |

| | Fannie Mae, 3.000%, 07/01/43 | | | 1.6% | |

| | Austria Government Bond, 1.650%, 10/21/24 | | | 1.5% | |

| | Spain Government Bond, 2.750%, 10/31/24 | | | 1.2% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

move in the opposite direction of bond prices, generally increased. The yield on the widely watched ten-year U.S. Treasury note began the year just below 2.2% and finished close to 2.3%.

The Fed’s decision to begin raising short-term interest rates comes at a time when other major central banks — notably, in Europe, China and Japan — continue to provide massive amounts of support to their economies and are biased more toward further accommodation. The disruptions that potentially may emerge from this divergence in central bank policies will demand close attention from investors this year.

The Portfolio’s allocation to spread assets was the largest positive contributor to performance for the period. We remained generally overweight to corporate credit, both high yield and investment grade within the U.S. and emerging markets (“EM”). Since declining oil prices resulted in spread widening within high yield early in the year, the Portfolio moved more defensive in its allocation to the sector. Volatility within commodities resulted in a shift away from credits more sensitive to these price moves to a focus in higher quality, more consumer-related names that could take advantage of a resurgent consumer both in the U.S. and Europe. Additionally, the Portfolio favored mortgages as the U.S. housing market continued to gain steam throughout the year.

The overall foreign exchange allocation in the Portfolio added to performance for the period. EM currencies struggled for the year as growth across EM economies slowed. Positions such as the Mexican peso detracted from performance in response to the collapse of global commodities and slowing economic growth; however, developed market currency positioning more than offset negative performance from EM currencies. Overweight positioning during the first half of the year to the Swiss franc versus an underweight to the Euro resulted in solid returns. During the second and third quarters, the Portfolio maintained an overweight to the Euro and was underweight the dollar as we held a stronger view than the market on a

| Voya Global Bond Portfolio | Portfolio Managers’ Report |

European economic recovery. The Portfolio was also long the Japanese Yen (“JPY”) relative to USD at the end of the third quarter and fourth quarter resulting in negative performance for the Portfolio. We held a view that Abe and Kuroda lacked the joint will to stimulate growth further; however JPY performance was overwhelmed by risk on sentiment early in the fourth quarter. In the fourth quarter, our expectations of increased quantitative easing and rate cuts from the European Central Bank (“ECB”) led us to be short EUR. This position ultimately resulted in losses as the magnitude of ECB easing was less than half of market expectations. These losses were partly offset with gains in a short GBP position that expressed our view of a slowing economy with lower inflation expectations.

For the year, interest rate positioning detracted in all four quarters, including quarters 1, 2, and 4 in the U.S. as well as quarters 2, 3, and 4 in Europe. The Portfolio’s allocation to interest rate risk was the main detractor from performance as sovereign debt yields shifted dramatically as a result of negative macro headlines. The Portfolio’s allocation to developed market sovereigns underperformed the allocation to EM sovereigns for the period. The Portfolio’s short duration posture when rates rose in the U.S. and long duration positioning when rates fell in Germany provided nice returns early on in the year. During second and third quarters of the year, the Portfolio increased its duration as anticipation of an interest rate hike by the Fed declined, but decreased duration in the fourth quarter when a rate hike became more imminent. The Portfolio also capitalized on lower Italian 10-year interest rates relative to German 10-year interest rates. Carry in the portfolio arising from US and Euro interest rate derivatives further enhanced returns.

To manage interest rate risk during the period, the portfolio used government bond futures and interest rate swaps. To manage currency risk we employed currency forwards, occasionally using currency options to limit risk in adverse scenarios. Occasionally, we used index credit default swaps to manage exposure to spread sectors. The use of derivatives contributed to performance.

Current Strategy and Outlook: Our view is that U.S. growth is poised to stay closely tethered to a frustratingly low potential rate. We believe momentum in the household formation rate is likely to continue and is a sign of the continued resilience of the U.S. consumer. However, a continued cautious stance towards leverage, particularly within the millennial generation, is subduing the upside to growth. While U.S. dollar strength will continue to weigh on near term growth prospects, we believe this headwind will wane throughout 2016.

The Fed’s decision to begin raising short-term interest rates comes at a time when other major central banks — notably, in Europe, China and Japan — continue to provide massive amounts of support to their economies and are biased more toward further accommodation. The disruptions that potentially may emerge from this divergence in central bank policies will demand close attention from investors this year. We believe G-3 central banks will be progressively less effective in either calibrating monetary policy to economic conditions or achieving desired growth or inflation outcomes. Central Banks are addressing only the demand side of the economy while there is significant supply side weakness arising from historically low productivity growth and low labor force participation. Central bank policy deployment is now more likely to cause market confusion and volatility, in contrast to generally positive influence to markets over prior years.

The speed of the Fed’s normalization actions will be driven by supply-side and/or productivity improvements or lack thereof. We believe a continuation of the relatively muted growth in supply side factors would be received negatively by the market and would pressure the Fed to accelerate the near term pace of tightening while also lowering the terminal funds rate. Additionally, the lack of top-line revenue growth, paired with continued pressure for a larger share of income for labor, will pressure corporate margins from their historically high levels. We believe that higher levels of nominal growth will ultimately prove necessary for more leveraged entities.

*

Effective January 1, 2015, Mustafa Chowdhury was added as a portfolio manager of the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | Voya Global Bond Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Class ADV | | | | | -4.85% | | | | | | 0.13% | | | | | | 3.27% | | | |

| | | Class I | | | | | -4.32% | | | | | | 0.64% | | | | | | 3.78% | | | |

| | | Class S | | | | | -4.50% | | | | | | 0.40% | | | | | | 3.54% | | | |

| | | Barclays Global Aggregate Index | | | | | -3.15% | | | | | | 0.90% | | | | | | 3.74% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Global Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable

annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to January 21, 2011, the Portfolio was advised by a different sub-adviser.

| VY® American Century Small-Mid Cap Value Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 29.2% | |

| | Industrials | | | 13.2% | |

| | Information Technology | | | 10.2% | |

| | Energy | | | 9.6% | |

| | Consumer Discretionary | | | 8.3% | |

| | Utilities | | | 7.5% | |

| | Health Care | | | 7.2% | |

| | Consumer Staples | | | 6.2% | |

| | Materials | | | 5.1% | |

| | Telecommunication Services | | | 0.8% | |

| | Exchange-Traded Funds | | | 0.7% | |

| | Assets in Excess of Other Liabilities* | | | 2.0% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY

® American Century Small-Mid Cap Value Portfolio (the “Portfolio”) seeks long-term capital growth. Income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Miles Lewis, CFA, and Jeff John, CFA, Vice President (responsible for the management of the Small Cap Value portion of the Portfolio) and Kevin Toney, CFA, Vice President, Phillip N. Davidson, CFA, Chief Investment Officer — Value Equity and Senior Vice President, Michael Liss, CFA, CPA, and Brian Woglom, CFA, Vice President (responsible for the Mid Cap Value portion of the Portfolio) (each a “Sleeve”), Portfolio Managers of American Century Investment Management, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2015, the Portfolio’s Class S shares provided a total return -1.74% compared to the Russell 2500™ Value Index and the S&P SmallCap 600®/Citigroup Value Index, which returned -5.49% and -6.67%, respectively, for the same period.

Portfolio Specifics: Overall Portfolio — The portfolio outperformed the Russell 2500 Value benchmark due to security selection. Although the Russell 2500 Value is the overall portfolio benchmark, the Small Cap Value and Mid Cap Value sleeves are managed against the Russell 2000 Value and Russell Mid Cap Value benchmarks, respectively.

Small Cap Value Sleeve — Investments in the energy, consumer discretionary, and financials sectors added significantly to performance, while positions in the information technology, utilities, and consumer staples sectors detracted from returns. The Small Cap Value Sleeve outperformed the Russell 2000 Value Index due to security selection. Sector weightings were detractive on balance.

Two banking positions, Bank of the Ozarks and BankUnited, led contributors for the Sleeve. Bank of the Ozarks sold off early in the period but bounced back in the second quarter on solid loan growth and announced three acquisitions later in the year. BankUnited exhibited solid loan growth throughout the year. In the media space, Entravision, the largest Spanish-language broadcaster in the U.S., continued to benefit from news that television broadcasters may be able to auction off the excess broadcast spectrum they gained by switching from analog to digital. Additionally, the company should benefit from the 2016 U.S. presidential election cycle, as Latinos are a significant demographic for candidates.

Cumulus Media detracted from relative returns as core advertising trends weakened across the industry. The company’s integration of its acquisition of the Westwood One network was slower and more expensive than hoped, as it worked to unlock the considerable value in Westwood

| | Top Ten Holdings

as of December 31, 2015*

(as a percentage of net assets) | |

| | | | | | |

| | Sysco Corp. | | | 2.3% | |

| | Northern Trust Corp. | | | 2.1% | |

| | Republic Services, Inc. | | | 1.7% | |

| | Zimmer Biomet Holdings, Inc. | | | 1.4% | |

| | Imperial Oil Ltd. | | | 1.3% | |

| | LifePoint Hospitals, Inc. | | | 1.3% | |

| | Applied Materials, Inc. | | | 1.2% | |

| | Weyerhaeuser Co. | | | 1.2% | |

| | Tyco International Plc | | | 1.2% | |

| | Cameron International Corp. | | | 1.2% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

One’s content. In the materials sector, Horsehead Holdings Corporation added new, low-cost capacity but experienced cost overruns at a new plant. The team felt the company’s balance sheet was deteriorating and exited the portfolio’s position.

Mid Cap Value Sleeve — Positions in the consumer staples, utilities, and energy sectors contributed the most to performance, while positions in the information technology and financials sectors detracted from returns. The Mid Cap Value Sleeve outperformed the Russell Mid Cap Value Index due to security selection. Sector allocations detracted slightly from relative performance.

Waste management company Republic Services contributed as the company continued to execute well and has minimal exposure to emerging markets and foreign currency issues. The team trimmed its position on outperformance. A lack of exposure to Freeport-McMoRan was helpful when the company sold shares in a secondary offering in the third quarter and the stock sold off.

A non-index position in Devon Energy detracted after the company announced a $2 billion acquisition of Felix Energy. Shares of natural gas producer EQT Corp. underperformed as warm weather caused weak natural gas consumption and drove commodity prices to decade lows.

Current Strategy and Outlook: We continue to be bottom-up investment managers, building our portfolios one stock at a time, a process that seeks exposure to market segments based on the attractiveness of individual companies in terms of their valuation and fundamentals. As of December 31, 2015, the Mid Cap Value Sleeve is notably overweight the consumer staples sector and also has a significant overweight in energy stocks. The Portfolio has smaller overweights in the industrials and health care sector. The Small Cap Value Sleeve, as of December 31, 2015, maintained substantial overweights in the materials and industrials sectors and a smaller overweight to consumer discretionary companies. The Portfolio’s greatest underweights are in the financials and utilities sectors.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® American Century Small-Mid Cap Value Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S2

February 27, 2009 | | |

| | | Class ADV | | | | | -1.97% | | | | | | 10.06% | | | | | | 8.08% | | | | | | — | | | |

| | | Class I | | | | | -1.54% | | | | | | 10.61% | | | | | | 8.61% | | | | | | — | | | |

| | | Class S | | | | | -1.74% | | | | | | 10.34% | | | | | | 8.35% | | | | | | — | | | |

| | | Class S2 | | | | | -1.91% | | | | | | 10.18% | | | | | | — | | | | | | 19.17% | | | |

| | | Russell 2500TM Value Index | | | | | -5.49% | | | | | | 9.23% | | | | | | 6.51% | | | | | | 18.66% | | | |

| | | S&P SmallCap 600®/Citigroup Value Index | | | | | -6.67% | | | | | | 10.37% | | | | | | 7.17% | | | | | | 19.34% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® American Century Small-Mid Cap Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Baron Growth Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Consumer Discretionary | | | 30.9% | |

| | Information Technology | | | 18.1% | |

| | Financials | | | 17.3% | |

| | Industrials | | | 10.5% | |

| | Health Care | | | 9.7% | |

| | Consumer Staples | | | 7.5% | |

| | Utilities | | | 2.2% | |

| | Materials | | | 2.1% | |

| | Telecommunication Services | | | 0.9% | |

| | Assets in Excess of Other Liabilities* | | | 0.8% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY

® Baron Growth Portfolio (the “Portfolio”) seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman, and Portfolio Manager of BAMCO, Inc. — the Sub-Adviser.

Performance: For the year ended December 31, 2015, the Portfolio’s Class S shares provided a total return of -5.03% compared to the Russell 2000® Growth Index and the Russell 2500™ Growth Index, which returned -1.38% and -0.19%, respectively, for the same period.

Portfolio Specifics: Many sectors and capitalization ranges experienced significant volatility in 2015, in reaction to geopolitical events, global monetary policies, sagging oil and commodity prices, and a strengthening U.S. dollar. For the first seven and a half months of 2015, the markets generally increased. In late August, and again in late September, however, stocks plunged sharply, largely as a reaction to the collapse of China’s A-shares stock market and concerns around a slowing Chinese economy. In October, the markets again reversed course, boosted by signals from central banks that they would extend the global trend of easy monetary policy. Toward the end of the year, the Federal Reserve Board (“Fed”) raised interest rates for the first time since 2006. After an initial rally, the markets sold off over concerns about the implications of Fed tightening in the face of lingering concerns around employment trends, soft commodity prices, slowing overseas growth, and weakness in corporate earnings.

Information technology (“IT”) and consumer discretionary were the top contributors to performance in 2015. IT had a solid year, with gains in 12 of 13 sector holdings, led by application software. Consumer discretionary investments had a mixed year, although contributors outweighed detractors. The sector included ski resort company Vail Resorts, Inc. and corporate-sponsored childcare company Bright Horizons Family Solutions, Inc., the top and second largest contributors to performance.

Industrials, consumer staples, and health care were the top sector detractors. Industrials holdings were pressured by foreign exchange headwinds. The sector included the portfolio’s third biggest detractor, shortline railroad Genesee & Wyoming, Inc. Consumer staples was hurt by poor performance of the second biggest detractor, United Natural Foods, Inc. Health care was pressured by weakness in the stock of top detractor Community Health Systems, Inc.

Outperformance of consumer discretionary and IT investments and lower exposure to the poor performing materials sector contributed the most to relative results. Within consumer discretionary, outperformance of Vail Resorts, Inc., Bright Horizons Family Solutions, Inc., and Under Armour,

| | Top Ten Holdings

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Vail Resorts, Inc. | | | 7.2% | |

| | Under Armour, Inc. | | | 4.6% | |

| | Gartner, Inc. | | | 4.1% | |

| | Middleby Corp. | | | 4.1% | |

| | CoStar Group, Inc. | | | 3.8% | |

| | Choice Hotels International, Inc. | | | 3.4% | |

| | Bright Horizons Family Solutions, Inc. | | | 3.4% | |

| | SS&C Technologies Holdings, Inc. | | | 3.1% | |

| | Mettler Toledo International, Inc. | | | 2.7% | |

| | MAXIMUS, Inc. | | | 2.7% | |

| | Portfolio holdings are subject to change daily. | |

Inc. added value and overshadowed the negative effect of larger exposure to this lagging sector. Strength in IT was partly attributable to outperformance of application software investments and larger exposure to this strong performing sub-industry. Larger exposure to the outperforming IT consulting & other services sub-industry also aided relative results. These positive effects were somewhat offset by lack of exposure to semiconductor stocks, which rose 8.3% within the Russell 2000

® Growth index.

Health care, industrials, consumer staples, and financials investments were the primary detractors from relative performance. Within health care, underperformance of Community Health Systems, Inc. and lower exposure to outperforming biotechnology and health care equipment stocks detracted the most from relative results. Weakness in industrials was mainly due to the underperformance of Genesee & Wyoming, Inc., CaesarStone Sdot-Yam Ltd., Colfax Corp., and Generac Holdings, Inc. Consumer staples holdings trailed their counterparts in the Russell 2000® Growth index after falling 18.1%, with United Natural Foods, Inc. and The Boston Beer Company, Inc. leading the decline. Within financials, underperformance of asset management & custody bank holdings, led by Cohen & Steers, Inc., The Carlyle Group, and Artisan Partners Asset Management, Inc., and larger exposure to this lagging sub-industry hurt relative results.

Current Strategy and Outlook: As long-term, fundamental, bottom-up investors, we are continuing to position the Portfolio to benefit from what we believe to be growth opportunities over the long term. We think the U.S. economy will continue on its path to recovery, which is good news for the types of companies in which we invest. At the same time, we think the process of deleveraging from historical highs could take years, during which interest rates will remain relatively low, in our view. We also believe that low oil prices, which have dampened economic growth in the past year due to the negative impact on the energy sector and its suppliers, will be offset by faster growth in the rest of the economy in part spurred by the lower cost of energy.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® Baron Growth Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception

of Class S2

February 27, 2009 | | |

| | | Class ADV | | | | | -5.27% | | | | | | 10.68% | | | | | | 7.26% | | | | | | — | | | |

| | | Class I | | | | | -4.75% | | | | | | 11.24% | | | | | | 7.80% | | | | | | — | | | |

| | | Class S | | | | | -5.03% | | | | | | 10.97% | | | | | | 7.54% | | | | | | — | | | |

| | | Class S2 | | | | | -5.17% | | | | | | 10.81% | | | | | | — | | | | | | 19.23% | | | |

| | | Russell 2000® Growth Index | | | | | -1.38% | | | | | | 10.67% | | | | | | 7.95% | | | | | | 20.02% | | | |

| | | Russell 2500TM Growth Index | | | | | -0.19% | | | | | | 11.43% | | | | | | 8.49% | | | | | | 20.87% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Baron Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Columbia Contrarian Core Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Information Technology | | | 21.2% | |

| | Financials | | | 18.5% | |

| | Health Care | | | 18.4% | |

| | Consumer Discretionary | | | 12.0% | |

| | Industrials | | | 9.6% | |

| | Consumer Staples | | | 7.9% | |

| | Energy | | | 5.5% | |

| | Telecommunication Services | | | 2.7% | |

| | Materials | | | 1.5% | |

| | Utilities | | | 1.4% | |

| | Assets in Excess of Other Liabilities | | | 1.3% | |

| | Net Assets | | | 100.0% | |

| | Portfolio holdings are subject to change daily. | |

VY

® Columbia Contrarian Core Portfolio (the “Portfolio”) seeks total return, consisting of long-term capital appreciation and current income. The Portfolio is managed by Guy W. Pope, CFA, Portfolio Manager and Head of Contrarian Core Strategy with Columbia Management Investment Advisers, LLC (“CMIA”) — the Sub-Adviser.

Performance: For the year ended December 31, 2015, the Portfolio’s Class S shares provided a total return of 2.98% compared to the Russell 1000® Index, which returned 0.92% for the same period.

Portfolio Specifics: During the reporting period, stock selection was the primary driver of performance, with strong stock selection in the information technology sector, while the detractors were driven primarily from stock selection in the financials and consumer discretionary sectors. An underweight to the poor performing energy sector also contributed positively.

In the tech sector, the top contributor in the Portfolio for the period was Activision Blizzard. The video game maker finished a strong year with its “Call of Duty” franchise dominating holiday sales within the industry and its massive active user base leaving room for additional cross sell and monetization opportunities as its highly profitable franchises, including “World of Warcraft,” “Call of Duty” and “Destiny,” will be leveraged on other platforms and media (online, mobile, social networking, film and video). During the period, the company also announced it was acquiring King Digital Entertainment, maker of the popular “Candy Crush Saga” game, which will further enable Activision Blizzard to extend its presence across the fast-growing mobile gaming category.

Alphabet Inc. was also a top contributor as the company delivered strong results driven primarily by Google mobile search and YouTube. YouTube’s revenue continues to grow rapidly as a result of hours watched and demand for TrueView ads by advertisers. TrueView ads allow viewers to skip ads after five seconds or select which ads they want to view. Sponsors pay

| | Top Ten Holdings

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Apple, Inc. | | | 3.4% | |

| | Citigroup, Inc. | | | 2.9% | |

| | JPMorgan Chase & Co. | | | 2.8% | |

| | Microsoft Corp. | | | 2.7% | |

| | Verizon Communications, Inc. | | | 2.7% | |

| | Berkshire Hathaway, Inc. – Class B | | | 2.6% | |

| | CVS Health Corp. | | | 2.6% | |

| | Medtronic PLC | | | 2.6% | |

| | Alphabet, Inc. - Class C | | | 2.4% | |

| | Johnson & Johnson | | | 2.4% | |

| | Portfolio holdings are subject to change daily. | |

only for ads that are viewed in their entirety. Google is well-positioned to continue to capture an increasing percentage of advertisers’ wallet share with unified ad campaigns that optimize spending across channels and products, and new measurement tools that ensure better understanding of their online to offline conversions.

Range Resources Inc., an independent oil and natural gas company that was added to the Portfolio in March of this year, was the top detractor in the Portfolio for the period. The stock dropped approximately 54%, driven by earnings and revenue misses. We sold the stock before the end of the period.

Current Strategy and Outlook: In 2016, we expect continued slow earnings growth and a more volatile stock market. Earnings growth ended 2015 essentially flat, which was a let-down given estimates at the start of the year targeting high single digits. At this time, we feel the market will take its cue from the global macroeconomic outlook. The perception that there will be a recovery of global growth would be welcomed and the opposite would have a negative impact on markets. From a long term standpoint, we believe equities remain an attractive asset class even though the short-term market backdrop is less certain.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® Columbia Contrarian Core Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Class ADV | | | | | 2.75% | | | | | | 10.59% | | | | | | 5.68% | | | |

| | | Class I | | | | | 3.25% | | | | | | 11.15% | | | | | | 6.21% | | | |

| | | Class S | | | | | 2.98% | | | | | | 10.88% | | | | | | 5.94% | | | |

| | | Russell 1000® Index | | | | | 0.92% | | | | | | 12.44% | | | | | | 7.40% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Columbia Contrarian Core Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The

performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

Prior to October 31, 2005, the Portfolio was advised by a different sub-adviser. Prior to April 30, 2013, the Portfolio was advised by a different sub-adviser.

| VY® Columbia Small Cap Value II Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 38.2% | |

| | Industrials | | | 13.4% | |

| | Consumer Discretionary | | | 11.6% | |

| | Information Technology | | | 10.8% | |

| | Health Care | | | 6.3% | |

| | Energy | | | 4.9% | |

| | Materials | | | 4.6% | |

| | Utilities | | | 4.5% | |

| | Consumer Staples | | | 3.4% | |

| | Assets in Excess of Other Liabilities* | | | 2.3% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY

® Columbia Small Cap Value II Portfolio (the “Portfolio”) seeks long-term growth of capital. The Portfolio is managed by Christian K. Stadlinger, Ph. D., CFA, and Jarl Ginsberg, CFA, CAIA, Portfolio Managers, of Columbia Management Investment Advisors, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2015, the Portfolio’s Class I shares provided a total return of -2.74% compared to the Russell 2000® Value Index, which returned -7.47% for the same period.

Portfolio Specifics: During the reporting period, stock selection accounted for the overwhelming majority of outperformance, with strongest stock selection in the financials sector, followed by energy, consumer discretionary and industrials. This was slightly offset by poorer stock selection in the consumer staples sector. An overweight to health care stocks helped, and an overweight to the poor performing consumer discretionary sector detracted.

The Portfolio’s holdings in life insurer Symetra Financial benefitted from news of an acquisition agreement with a Japanese insurance company, sending the company’s stock price higher.

In consumer discretionary, signs of improving consumer spending aided the sector. Stock selection was favorable in apparel (Skechers U.S.A, Inc.) and household durables (Helen of Troy Limited). These two holdings contributed strongly to the Portfolio’s relative outperformance. Skechers continued to advance strongly on robust athletic and apparel trends in the U.S., product innovation combined with a sound marketing strategy and broad expansion internationally. Helen of Troy also continued its incremental rise through solid product positioning of its hair care appliances, accessories and related consumer products.

In the health care sector, PharMerica Corporation advanced on general merger and acquisition activity in the service area

| | Top Ten Holdings

as of December 31, 2015*

(as a percentage of net assets) | |

| | | | | | |

| | Sterling Bancorp/DE | | | 1.5% | |

| | Amerisafe, Inc. | | | 1.5% | |

| | Argo Group International Holdings Ltd. | | | 1.4% | |

| | Independent Bank Corp. | | | 1.4% | |

| | CubeSmart | | | 1.4% | |

| | PharMerica Corp. | | | 1.4% | |

| | Renasant Corp. | | | 1.4% | |

| | Community Bank System, Inc. | | | 1.3% | |

| | Avista Corp. | | | 1.3% | |

| | Fairchild Semiconductor International, Inc. | | | 1.3% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

highlighting the company’s franchise value as well as pharmacy sales to long term care facilities.

Swift Transportation Company, the largest truckload carrier in North America, was the top detractor in the Portfolio for the period. The company earnings came in below estimates and guidance, and in the face of the current headwinds - no fleet growth, lowered pricing expectations, and the absence of any material utilization improvement - we sold the stock.

Current Strategy and Outlook: In 2016, we expect continued slow earnings growth and a more volatile stock market. Earnings growth ended 2015 essentially flat, which was a let-down given estimates at the start of the year targeting high single digits. At this time we feel the market will take its cue from the global macroeconomic outlook. We continue to believe that our focus on small-cap value companies with strong underlying earnings prospects and attractively priced shares has the potential to reward investors. We remain focused on our research of those companies where we believe the valuation gap is likely to shrink in the near term and look for a company’s upward inflection point. We seek out stocks that are both inexpensive and show improving operating performance/metrics.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® Columbia Small Cap Value II Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | Since Inception

of Class ADV

December 29, 2006 | | | Since Inception

of Class I

April 28, 2006 | | | Since Inception

of Class S

May 1, 2006 | | | Since Inception

of Class S2

February 27, 2009 | | |

| | | Class ADV | | | | | -3.21% | | | | | | 9.25% | | | | | | 5.60% | | | | | | — | | | | | | — | | | | | | — | | | |

| | | Class I | | | | | -2.74% | | | | | | 9.80% | | | | | | — | | | | | | 5.88% | | | | | | — | | | | | | — | | | |

| | | Class S | | | | | -2.95% | | | | | | 9.51% | | | | | | — | | | | | | — | | | | | | 5.67% | | | | | | — | | | |

| | | Class S2 | | | | | -3.19% | | | | | | 9.33% | | | | | | — | | | | | | — | | | | | | — | | | | | | 18.40% | | | |

| | | Russell 2000® Value Index | | | | | -7.47% | | | | | | 7.67% | | | | | | 3.75% | | | | | | 4.37% | | | | | | 4.41% | | | | | | 17.12% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Columbia Small Cap Value II Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Invesco Comstock Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 28.3% | |

| | Consumer Discretionary | | | 14.7% | |

| | Energy | | | 13.0% | |

| | Information Technology | | | 12.8% | |

| | Health Care | | | 11.0% | |

| | Industrials | | | 6.9% | |

| | Consumer Staples | | | 4.7% | |

| | Materials | | | 1.7% | |

| | Utilities | | | 1.1% | |

| | Telecommunication Services | | | 0.7% | |

| | Assets in Excess of Other Liabilities* | | | 5.1% | |

| | Net Assets | | | 100.0% | |

| | *

Includes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

VY

® Invesco Comstock Portfolio (the “Portfolio”) seeks capital growth and income. The Portfolio is managed by Kevin Holt, Lead Portfolio Manager, Devin E. Armstrong, James N. Warwick, and Charles DyReyes, Product Managers, of Invesco Advisers, Inc. — the Sub-Adviser.*

Performance: For the year ended December 31, 2015, the Portfolio’s Class S shares, provided a total return of -5.97% compared to the Russell 1000® Value Index and the S&P 500® Index, which returned -3.83% and 1.38%, respectively, for the same period.

Portfolio Specifics: On the positive side of sector performance, we used currency forward contracts during the reporting period for the purpose of hedging currency exposure of non-US based companies held in the Portfolio. Derivatives were used solely for the purpose of hedging and not for speculative purposes or leverage. The use of currency forward contracts had a large positive impact on the Portfolio’s performance relative to the Russell 1000® Value Index for the reporting period.

Stock selection within consumer staples also contributed to relative performance. ConAgra Foods shares benefited after the packaged foods maker reported earnings that exceeded analysts’ estimates towards the end of the reporting period, causing the stock to post double digit returns. Also, not owning Proctor & Gamble, which is a large benchmark holding that posted negative performance for the period helped relative performance.

A material underweight in utilities also helped relative performance, as utilities stocks posted negative returns for the period. We continue to believe utilities remain overvalued, as a sector.

On the negative side, weak stock selection and an underweight to healthcare stocks was a large detractor to relative performance. Specifically, being underweight within the healthcare equipment and services industry hurt performance. Also, not owning select names within pharmaceuticals, like Eli Lilly and Company, hurt performance as that stock posted a return of over 20% for the period.

Stock selection and an underweight in financials also acted as a large detractor to performance. Within diversified financials, Morgan Stanley and State Street underperformed the sector and benchmark, posting double digit negative returns. Although Morgan Stanley

| | Top Ten Holdings

as of December 31, 2015*

(as a percentage of net assets) | |

| | | | | | |

| | Citigroup, Inc. | | | 4.8% | |

| | JPMorgan Chase & Co. | | | 3.8% | |

| | Bank of America Corp. | | | 3.0% | |

| | Carnival Corp. | | | 2.9% | |

| | Cisco Systems, Inc. | | | 2.4% | |

| | General Electric Co. | | | 2.3% | |

| | Suncor Energy, Inc. | | | 2.1% | |

| | Wells Fargo & Co. | | | 2.1% | |

| | Merck & Co., Inc. | | | 2.0% | |

| | General Motors Co. | | | 1.9% | |

| | *

Excludes short-term investments. | |

| | Portfolio holdings are subject to change daily. | |

reported profits and revenues that beat estimates, financial stocks in general declined in the latter part of the period due to concerns about a prolonged low interest rate environment. Not owning real estate also hurt performance.

Stock selection and an overweight within the energy sector also hurt performance, mainly due to the declining prices of oil. Notably, Royal Dutch Shell and Murphy Oil Corp. were two of the largest relative detractors within the sector. Despite having a strong balance sheet and maintaining an attractive dividend, Royal Dutch Shell, a non-benchmark and top holding within the portfolio, underperformed the sector and benchmark for the period.

Current Strategy and Outlook: Although the Portfolio is underweight financials and overweight in energy compared to the Russell 1000® Value Index, we have a favorable view of large diversified financials companies and have been taking advantage of what we perceive to be weakness in the energy sector to add to the Portfolio’s energy position. The Portfolio’s exposure in each sector has a higher volatility than the Russell 1000® Value Index. Therefore, we believe the Portfolio should be more sensitive to broad moves within these sectors for the foreseeable future.

*

Effective November 9, 2015, Matthew Seinsheimer was removed as a portfolio manager of the Portfolio and Charles DyReyes was added as a portfolio manager of the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Portfolio Managers’ Report | VY® Invesco Comstock Portfolio |

| | | Average Annual Total Returns for the Periods Ended December 31, 2015 | | |

| | | | | | 1 Year | | | 5 Year | | | 10 Year | | |

| | | Class ADV | | | | | -6.19% | | | | | | 9.72% | | | | | | 5.27% | | | |

| | | Class I | | | | | -5.76% | | | | | | 10.26% | | | | | | 5.79% | | | |

| | | Class S | | | | | -5.97% | | | | | | 9.99% | | | | | | 5.53% | | | |

| | | Russell 1000® Value Index | | | | | -3.83% | | | | | | 11.27% | | | | | | 6.16% | | | |

| | | S&P 500® Index | | | | | 1.38% | | | | | | 12.57% | | | | | | 7.31% | | | |

| | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Invesco Comstock Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 262-3862 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

| VY® Invesco Equity and Income Portfolio | Portfolio Managers’ Report |

| | Sector Diversification

as of December 31, 2015

(as a percentage of net assets) | |

| | | | | | |

| | Financials | | | 26.5% | |

| | Health Care | | | 9.1% | |

| | Energy | | | 8.5% | |

| | Information Technology | | | 8.3% | |

| | U.S. Treasury Notes | | | 8.2% | |

| | Industrials | | | 6.4% | |

| | Consumer Discretionary | | | 5.8% | |

| | Consumer Staples | | | 5.0% | |

| | Consumer, Non-cyclical | | | 4.7% | |

| | Technology | | | 3.3% | |