UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-08319

Voya Partners, Inc.

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-800-262-3862

Date of fiscal year end:December 31

Date of reporting period:December 31, 2019

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Voya Investment Management

Annual Report

December 31, 2019

Classes ADV, I, R6, S and S2

Voya Partners, Inc.

n Voya Global Bond Portfolio

n Voya International High Dividend Low Volatility Portfolio

n VY® American Century Small-Mid Cap Value Portfolio

n VY® Baron Growth Portfolio

n VY® Columbia Contrarian Core Portfolio

n VY® Columbia Small Cap Value II Portfolio

n VY® Invesco Comstock Portfolio

n VY® Invesco Equity and Income Portfolio

n VY® Invesco Oppenheimer Global Portfolio

n VY® JPMorgan Mid Cap Value Portfolio

n VY® T. Rowe Price Diversified Mid Cap Growth Portfolio

n VY® T. Rowe Price Growth Equity Portfolio

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of each Portfolio's annual and semi-annual shareholder reports, like this annual report, will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from your insurance carrier electronically by contacting them directly.

You may elect to receive all future reports in paper free of charge. If you received this document in the mail, please follow the instructions provided to elect to continue receiving paper copies of your shareholder reports. You can inform us that you wish to continue receiving paper copies by calling 1-800-283-3427. Your election to receive reports in paper will apply to all the funds in which you invest.

This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

INVESTMENT MANAGEMENT

voyainvestments.com

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios' website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission's ("SEC's") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Portfolios' website at www.voyainvestments.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Form N-PORT, available for filings after March 31, 2019. This report contains a summary portfolio of investments for the Portfolios. The Portfolios' Form N-Q or Form N-PORT is available on the SEC's website at www.sec.gov. The Portfolios' complete schedule of portfolio holdings, as filed on Form N-Q or Form N-PORT, are available: on www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180.

TABLE OF CONTENTS

New season, last year's plot

Dear Shareholder,

The financial markets delivered strong performance in 2019, and at this juncture, in our view, the outlook for 2020 seems upbeat. Thanks to supportive central bank policies around the world, global economic growth is reaccelerating; manufacturing activity, a key metric for setting market expectations, appears to be strengthening. Recent progress in the trade negotiations between China and the U.S. also helps brighten the outlook as 2020 gets underway.

So expect smooth sailing, right? Maybe. Barely into the first week of the new year, the world faced the prospect of escalating conflict in the Middle East, though tensions appear to have eased since then. Markets initially pulled back in response to heightened uncertainty but regrouped quickly. Follow-on events, if they occur, may not impact markets that much: during 2019, investors generally did well by downplaying geopolitical concerns, and we could see the same behavior in 2020.

Still, we believe that turbulence seems to be the world's modus operandi: economic and market uncertainty are still with us, trade issues remain unresolved and the upcoming U.S. presidential election adds another dimension of political uncertainty. Even though market participants have become more comfortable accepting risk, we have observed persistent preferences for higher-quality, lower-volatility assets. This tells us that investors perceive significant risks they wish to avoid, and points to the potential for volatile reactions to adverse news.

With potential surprises from anywhere, we believe investors should continue to diversify their portfolios as broadly as practicable, and not attempt to time the markets. At the start of 2019, in our opinion, many investors did not believe U.S. equities offered attractive return potential — acting on that belief would have resulted in missed opportunities. Remember that your portfolio is structured to meet your long-term objectives; changing it in response to short-term market conditions may put your long-term goals at risk. If your goals have changed, please discuss them thoroughly with your investment advisor before making any changes to your portfolio.

Voya seeks to remain a reliable partner committed to reliable investing, helping you and your investment advisor achieve your goals. We appreciate your continued confidence in us, and we look forward to serving your investment actualneeds in the future.

Sincerely,

Dina Santoro

President

Voya Family of Funds

January 21, 2020

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and the Voya mutual funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for a Voya mutual fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any Voya mutual fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

2

TABLE OF CONTENTS

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2019

In our semi-annual report, we described how global equities, in the form of the MSCI World IndexSM (the "Index") measured in local currencies, including net reinvested dividends, rose 16.69% for the half-year after a nervous start.

A trade war between the U.S. and China had been ongoing for more than a year, with U.S. tariffs on some $250 billion of Chinese goods in place together with Chinese tariffs on $110 billion of U.S. goods. The war was being waged against a backdrop of slowing global growth, in part the result of uncertainties caused by the trade war itself.

Fears on both fronts: the trade war and slowing global growth, would ebb and flow in the second half; yet the Index rose five months out of six, ending the year up 27.34%, just below the record set a few days earlier. (The Index returned 27.67% for the year ended December 31, 2019, measured in U.S. dollars.)

Entering May, trade talks had appeared to be going reasonably well and the path of least resistance for the Index still seemed upwards. This all changed when the President tweeted his intention to raise the existing 10% tariff on $200 billion of the $250 billion to 25% of Chinese goods. Trade negotiations had evidently broken down. Later he unexpectedly threatened tariffs on Mexican goods for reasons unrelated to trade.

On perceived slowing global growth, there was still plenty to worry about.

In Europe, manufacturing was in contraction. The euro zone's annual growth in gross domestic product ("GDP") in the second and third quarters of 2019 was just 1.2%. In the U.K., chronic disagreement about whether and how to leave the European Union ("Brexit") culminated in a general election called for December.

Japan, with manufacturing also in contraction, managed GDP growth of 2.0% annualized in the second quarter, slipping to 1.8% in the third. Exports and imports were both falling and core inflation languished at 0.8%, with a demand-dampening sales tax increase effective on October 1.

China's GDP grew at 6.0% in the third quarter, the smallest advance in 27 years. Industrial production was expanding near the slowest pace in 17 years, retail sales in 16 years.

In the U.S., manufacturing fell into contraction in September. Corporate profits were flat to falling year-over-year. While annualized first quarter growth had surprised to the upside at 3.1%, it fell to 2.0% and 2.1% in the second and third quarters, respectively. Growth was heavily dependent on consumer spending, supported by the lowest unemployment rate since 1969.

Back in the markets, after May's slump, central banks came to the rescue in June. On June 19 the Federal Open Market Committee ("FOMC") left rates unchanged, but markets heard Chairman Powell signal a cut in July. The European Central Bank announced its willingness to cut its already negative deposit rate and resume bond purchases. The Japanese government also promised increased stimulus. Plans for tariffs on Mexican imports were "indefinitely suspended", and investors were finally left to cheer a truce in the U.S.-China trade conflict, agreed on June 29.

July was a comparatively quiet month. The FOMC duly cut the federal funds rate by 25 basis points (0.25%), but disappointed some, including the President, by referring to it as only a "mid-cycle adjustment". And it was back to trade-war angst in August, as first the President announced 10% tariffs on the approximately $300 billion of Chinese imports as yet

unaffected, and then increased existing and planned tariffs by 5% when China retaliated.

The market rollercoaster lurched back up in September and October, when high-level trade talks between the U.S. and China resumed. Both sides expressed confidence that "Phase 1" of a deal was possible by year-end. The FOMC cut rates again in both months.

And as year-end approached, a more positive narrative was increasingly heard. Markets were rising despite trade tensions, sluggish global growth, declining profits and political uncertainties in the U.S. and elsewhere. Perhaps, some commentators ventured, this was a signal that the worst was over. The Phase 1 trade deal was announced, amid some skepticism on the details, as was agreement on USMCA, the replacement for NAFTA. The U.K. government's emphatic election victory might offer more clarity on Brexit. Central banks were all supportive and some of the economic data were starting to improve.

In U.S. fixed income markets, the Treasury yield curve fell. For the year, the Bloomberg Barclays U.S. Aggregate Bond Index rose 8.72%. The Bloomberg Barclays Long-Term U.S. Treasury sub-index returned 14.83%, the 30-year yield briefly dipping below 2% in August. The 10-year yield on Japanese and some euro zone government bonds ended below zero.

U.S. equities, represented by the S&P 500® Index, including dividends, surged 31.49%. Technology was by far the top performer, up 50.29%, led by Apple and Microsoft. Energy, exposed to slowing global economic activity, was the weakest, but still rose 11.81%.

In currencies, the dollar rose 2.04% against the euro, but lost 3.80% against the pound and 0.97% against the yen. On a trade-weighted basis, according to Reuters, the dollar had the smallest annual move ever in 2019.

In international markets, the MSCI Japan® Index ended up 18.48% for the year, supported by the Bank of Japan's purchases of exchange-traded funds, but pressured by Japan's own vulnerability to a trade war. The MSCI Europe ex U.K.® Index advanced 26.43%, powered by capital goods and pharmaceuticals companies. The MSCI U.K.® Index rose 16.37%, dampened by Brexit concerns, but also affected by the company-specific fortunes of MSCI U.K.'s market heavyweights. Among the largest contributors were pharmaceuticals, AstraZeneca and GlaxoSmithKline; the biggest detractors were miner Glencore and HSBC.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance.

Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Each Portfolio's performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 262-3862 or log on to www.voyainvestments.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of Voya Investment Management's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

TABLE OF CONTENTS

Index | | Description | |

Bloomberg Barclays Global Aggregate Index | | Provides a broad-based measure of the global investment-grade fixed-rate debt markets. | |

Bloomberg Barclays U.S. Aggregate Bond Index | | An index of publicly issued investment grade U.S. government, mortgage-backed, asset-backed and corporate debt securities. | |

Bloomberg Barclays U.S. Government/Credit Index | | An index made up of the Barclays Government and Credit indices, including securities issued by the U.S. government and its agencies and publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements. | |

Bloomberg Barclays Long-Term U.S. Treasury Index | | This index measures the performance of U.S. Treasury bills with long-term maturity. The credit level for this index is investment grade. The rebalance scheme is monthly. | |

MSCI All Country World IndexSM | | A free-float adjusted market capitalization index that is designed to measure equity performance in the global developed and emerging markets. | |

MSCI All Country World ex-U.S. IndexSM | | A free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. | |

MSCI Europe, Australasia and Far East® ("MSCI EAFE") Index | | An index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. It includes the reinvestment of dividends net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. | |

MSCI Europe ex U.K.® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | |

MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. | |

MSCI U.K.® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | |

MSCI World IndexSM | | An index that measures the performance of over 1,600 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | |

Russell 1000® Index | | A comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies. | |

Russell 1000® Growth Index | | Measures the performance of the 1,000 largest companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth. | |

Russell 1000® Value Index | | An index that measures the performance of those Russell 1000® securities with lower price-to-book ratios and lower forecasted growth values. | |

Russell 2000® Growth Index | | An index that measures the performance of securities of smaller U.S. companies with greater than average growth orientation. | |

Russell 2000® Value Index | | An index that measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower than forecasted growth values. | |

Russell 2500TM Growth Index | | Measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500TM Index companies with higher price-to-book ratios and higher forecasted growth values. | |

Russell 2500TM Value Index | | Measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. | |

Russell Midcap® Growth Index | | An index that measures the performance of those companies included in the Russell Midcap® Index with relatively higher price-to-book ratios and higher forecasted growth values. | |

Russell Midcap® Value Index | | Measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. | |

4

TABLE OF CONTENTS

BENCHMARK DESCRIPTIONS (CONTINUED)

Index | | Description | |

S&P 500® Index | | An index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | |

S&P MidCap 400® Index | | An index that measures the performance of the mid-size company segment of the U.S. market. | |

S&P SmallCap 600® Value Index | | Measures the performance of those S&P SmallCap 600® Index companies with lower price-to-book ratios. | |

5

TABLE OF CONTENTS

VOYA GLOBAL BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

Voya Global Bond Portfolio (the "Portfolio") seeks to maximize total return through a combination of current income and capital appreciation. The Portfolio is managed by Mustafa Chowdhury, Sean Banai, CFA, and Brian Timberlake, Ph.D., CFA, Portfolio Managers* of Voya Investment Management Co. LLC ("Voya IM") — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio's Class S shares provided a total return of 7.64% compared to the Bloomberg Barclays Global Aggregate Index, which returned 6.84% for the same period.

Portfolio Specifics: The Portfolio's outperformance versus the Bloomberg Barclays Global Aggregate Index was due primarily to sector allocation, whereas currency positioning did not meaningfully impact results over the period. On the downside, duration/yield curve positioning that was defensive earlier in the year, detracted from performance.

Fixed income markets witnessed an about face, as the U.S. Federal Reserve Board ("Fed") pivoted from raising rates four times in 2018 to instituting the first of three 2019 rate cuts in July. Elevated tensions between the U.S. and China drove concerns on the risk of recession in the U.S., which saw the 10-year Treasury yield go below 1.5% in the summer months. The European Central Bank ("ECB") continued its dovish tone, as leadership transitioned to Christine LaGarde and the ECB cut rates, pushing official rates into further negative territory. Economic data in the fourth quarter alleviated many of those fears and global Treasury yields rose. Non-government sectors outperformed over the reporting period, supported by accommodative central banks and steady demand for higher yielding sectors as the global economy posted positive growth.

Sector allocation, which included overweights to spread sectors and underweights to global Treasury securities, was the dominant driver of outperformance for the year. Favorable security selection within corporate bonds was the largest contributor, as the Fund capitalized on weakness in corporate markets early in the year and benefited throughout 2019. The Portfolio also benefited from an overweight to and favorable security selection within commercial mortgage-backed securities. Securitized sector allocations were less pronounced. Positive contributions from security selection within agency mortgages were offset by detractions from positioning in agency residential mortgage-backed securities.

Duration/yield curve positioning in emerging markets contributed to performance, while the Portfolio's positioning in developed markets detracted from results. In particular, defensive strategies implemented in the first quarter of 2019 were a headwind for returns as rates declined. Finally, currency positioning did not meaningfully impact performance during the reporting period.

The Portfolio used derivatives, such as futures, swaps, options and forward contracts, for hedging and overall risk management. The use of derivatives positively impacted performance for the period.

Current Strategy and Outlook: Entering 2020, we believe that there are signs of steadying economic growth, especially outside the U.S. However, while we believe this positive outlook for growth will prove supportive to spread sectors, we also believe geopolitical and monetary policy uncertainty, coupled with somewhat rich valuations across many sectors, will limit potential upside. Meanwhile, the lack of inflationary pressures will permit global developed central banks to remain accommodative, in our view.

Emerging markets, while supported by the macroeconomic environment, are no stranger to political upheaval that can cause disruption and create opportunities. Heading into 2020, we believe fiscal responsiveness to social unrest needs to be closely monitored. From our perspective, separating winners from losers in emerging markets requires identifying countries that will use fiscal stimulus that is investment-oriented rather than implementing consumption-based government programs. In addition, in our opinion, the degree of stimulus must be monitored and cannot threaten a country's debt sustainability, as well as the sovereign's credit profile.

We continue to believe corporate credit risk is idiosyncratic, not systemic. We believe the path to future investment success will be paved by security selection, as this backdrop favors idiosyncratic opportunities over broad market risk taking. We expect that, when volatility does strike, perceived "losers" will be excessively punished and avoiding these investments will be critical. As we have over the past year, we will continue to view episodes of volatility in credit markets as fertile ground for identifying oversold individual credits with strong fundamentals.

Based on current valuations, we continue to favor securitized credit over corporate credit on a relative basis. Fundamentally, we believe agency mortgage-backed securities ("MBS") are attractive relative to Treasuries and other high-grade assets. In addition, we see opportunities in non-agency residential MBS, commercial mortgage-backed securities and asset-backed securities as an attractive source of durable yield to capture while we diligently surveil markets for new opportunities.

With regard to currencies, we believe the U.S. dollar is likely to decline versus major developed currencies, as the Fed has indicated it is on hold for the foreseeable future. In addition, we will look to capitalize on emerging market currency opportunities, while being mindful of volatility connected to geopolitical risks.

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets)

United States | | | 81.8 | % | |

Germany | | | 4.8 | % | |

Spain | | | 1.2 | % | |

United Kingdom | | | 1.1 | % | |

Cayman Islands | | | 1.1 | % | |

Brazil | | | 1.0 | % | |

Peru | | | 1.0 | % | |

Japan | | | 0.9 | % | |

Netherlands | | | 0.8 | % | |

Portugal | | | 0.7 | % | |

Countries between 0.0%-0.7%^ | | | 4.6 | % | |

Assets in Excess of Other Liabilities*,** | | | 1.0 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments.

** Includes purchased options.

^ Includes 13 countries, which each represents 0.0%-0.7% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets)

Voya Emerging Markets Local Currency Debt

Fund — Class P | | | 6.9 | % | |

Voya Emerging Markets Hard Currency Debt

Fund — Class P | | | 5.5 | % | |

Voya High Yield Bond Fund — Class P | | | 3.6 | % | |

Bundesrepublik Deutschland, 0.500%, 02/15/25 | | | 3.4 | % | |

Voya Emerging Markets Corporate Debt

Fund — Class P | | | 3.3 | % | |

United States Treasury Inflation Indexed Bonds,

0.250%, 07/15/29 | | | 3.1 | % | |

Uniform Mortgage-Backed Securities,

3.500%, 08/01/49 | | | 2.1 | % | |

Ginnie Mae, 3.000%, 01/20/50 | | | 2.1 | % | |

United States Treasury Note, 1.750%, 11/15/29 | | | 2.0 | % | |

United States Treasury Bond, 2.250%, 08/15/49 | | | 1.7 | % | |

Portfolio holdings are subject to change daily.

* Effective March 1, 2019, Sean Banai was added as a portfolio manager for the Portfolio. Effective August 31, 2019, Mustafa Chowdhury was removed as a portfolio manager for the Portfolio.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

6

TABLE OF CONTENTS

PORTFOLIO MANAGERS' REPORT

VOYA GLOBAL BOND PORTFOLIO

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 7.36 | % | | | 2.84 | % | | | 3.44 | % | |

Class I | | | 7.90 | % | | | 3.36 | % | | | 3.96 | % | |

Class S | | | 7.64 | % | | | 3.11 | % | | | 3.70 | % | |

Blooomberg Barclays Global Aggregate Index | | | 6.84 | % | | | 2.31 | % | | | 2.48 | % | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Global Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the

effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

Prior to January 21, 2011, the Portfolio was managed by a different sub-adviser.

7

TABLE OF CONTENTS

VOYA INTERNATIONAL HIGH DIVIDEND LOW VOLATILITY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

Voya International High Dividend Low Volatility Portfolio (the "Portfolio") seeks maximum total return. The Portfolio is managed by Vincent Costa, CFA, Kai Yee Wong, Peg DiOrio, CFA, and Steve Wetter, Portfolio Managers of Voya Investment Management Co. LLC ("VIM") — the Sub-Adviser*.

Performance: For the year ended December 31, 2019, the Portfolio's Class I shares provided a total return of 16.75% compared to the MSCI EAFE® Index** and the MSCI All Country World ex-U.S. IndexSM ("MSCI ACWI ex-U.S."), which returned 22.01% and 21.51%, respectively, for the same period.

Portfolio Specifics — Templeton Investment Counsel LLC ("Templeton") January 1, 2019 — April 16, 2019: During the period in which Templeton managed the Portfolio, the Portfolio underperformed the MSCI ACWI ex-U.S.) by approximately 329 basis points (-3.29%). Stock selection and an unfavorable overweight allocation in the communication services sector detracted from relative performance. Shares of SES, a Luxembourg-based satellite operator, declined due to regulatory challenges facing the company's efforts to monetize its potentially valuable spectrum. While the best procedure for reallocating spectrum has yet to be decided, we believe the firm will ultimately recognize significant value from these important assets.

Stock selection and an unfavorable overweight allocation in the health care sector detracted from relative results. Israeli generic pharmaceuticals firm Teva was a significant detractor in the sector.

Stock selection among underweight consumer staples holdings also detracted from relative results. Shares of Japanese convenience store owner Seven & I declined after analysts downgraded the stock following a disappointing profit forecast.

In contrast, stock selection in the materials sector contributed to relative returns. Irish building materials firm CRH was a significant contributor to relative returns in the sector.

Stock selection in overweight utilities and underweight information technology and industrials holdings also contributed to relative performance.

From a regional standpoint, stock selection in underweight Asian holdings detracted from relative performance, pressured by Japanese and Chinese holdings. In Europe, stock selection detracted from relative results, offsetting a favorable overweight allocation.

Portfolio Specifics*** — VIM — May 1, 2019 — December 31, 2019: During the period in which VIM managed the Portfolio, the Portfolio underperformed the MSCI EAFE® Index by approximately 203 basis points (-2.03%). In terms of the Portfolio's performance, both low beta and dividend yield outperformed for the period while the stock ranking model underperformed. The Portfolio's stock specific exposures and smaller size further drove relative underperformance. On the regional level, stock selection within Japan, and to a lesser extent Asia/Pacific ex Japan, had the largest negative impact on relative performance. On the sector level, Portfolio holdings within the real estate and financial sectors had the largest positive impact on performance. On an individual stock level basis, an overweight position in Sekisui House, Ltd., an underweight position in BP plc and not owning HSBC Holdings Plc were among the key contributors. By contrast, stock selection within the health care and materials sectors had the largest negative impact on returns. Key detractors for the period include overweight positions in Evraz plc and Konica Minolta, Inc. as well as not owning benchmark holding ASML Holding NV.

Current Strategy and Outlook: This is an actively managed international quantitative equity strategy that seeks to generate higher dividend income and total returns, with lower volatility and better downside capture, than the benchmark. The investment process seeks to create a universe of sustainable dividend-paying stocks and utilizes fundamentally driven sector-specific alpha models to identify the most attractive stocks within each region-sector. The Portfolio is then optimized to achieve its dividend, alpha, and volatility objectives.

Geographic Diversification

as of December 31, 2019

(as a percentage of net assets)

Japan | | | 25.2 | % | |

United Kingdom | | | 13.5 | % | |

Switzerland | | | 9.3 | % | |

France | | | 8.3 | % | |

Australia | | | 7.8 | % | |

Netherlands | | | 6.1 | % | |

Germany | | | 5.6 | % | |

Italy | | | 4.1 | % | |

Denmark | | | 3.5 | % | |

Finland | | | 3.1 | % | |

Countries between 0.2%-3.1%^ | | | 12.2 | % | |

Assets in Excess of Other Liabilities* | | | 1.3 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments and exchange-traded funds.

^ Includes 9 countries, which each represents 0.2%-3.1% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets)

Nestle SA | | | 2.7 | % | |

Royal Dutch Shell PLC — Class A | | | 2.1 | % | |

Roche Holding AG | | | 2.1 | % | |

Novartis AG | | | 1.6 | % | |

GlaxoSmithKline PLC | | | 1.4 | % | |

| BP PLC | | | 1.4 | % | |

Sanofi | | | 1.4 | % | |

Novo Nordisk A/S | | | 1.3 | % | |

Rio Tinto Ltd. | | | 1.2 | % | |

Unilever NV | | | 1.1 | % | |

Portfolio holdings are subject to change daily.

* The Board of Trustees of the Portfolio approved an investment objective change, strategy change and sub-adviser replacement of Templeton, with VIM effective May 1, 2019.

In conjunction with the investment objective change, strategy change and sub-adviser replacement, effective May 1, 2019, Vincent Costa, Kai Yee Wong, Peg DiOrio, and Steve Wetter were added as portfolio managers to the Portfolio and Antonio T. Docal, Peter A. Nori, and Matthew R. Nagle were removed as portfolio managers to the Portfolio.

In conjunction with the sub-adviser change, the Portfolio's name changed to "Voya International High Dividend Low Volatility Portfolio".

** Effective May 1, 2019, the sub-adviser changed the primary benchmark from the MSCI ACWI Ex-U.S. to the MSCI EAFE® Index because the MSCI EAFE® Index is considered by the sub-adviser to be a more appropriate benchmark reflecting the type of securities in which the Portfolio invests.

*** Beginning April 16, 2019, through the close of business on April 30, 2019, the Portfolio was in a transition period and may have held a large portion of the Portfolio's assets in temporary investments.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

8

TABLE OF CONTENTS

PORTFOLIO MANAGERS' REPORT

VOYA INTERNATIONAL HIGH DIVIDEND LOW VOLATILITY PORTFOLIO

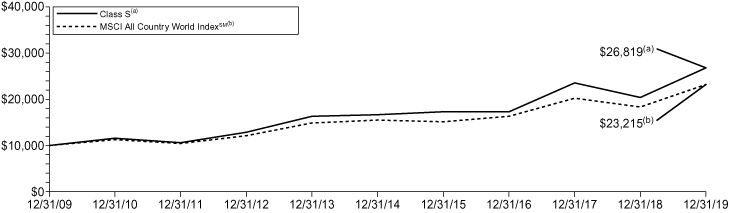

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 16.13 | % | | | 3.11 | % | | | 3.82 | % | |

Class I | | | 16.75 | % | | | 3.64 | % | | | 4.35 | % | |

Class S | | | 16.40 | % | | | 3.38 | % | | | 4.08 | % | |

Class S2 | | | 16.28 | % | | | 3.23 | % | | | 3.95 | % | |

MSCI EAFE® Index | | | 22.01 | % | | | 5.67 | % | | | 5.50 | % | |

MSCI ACWI ex-U.S. | | | 21.51 | % | | | 5.51 | % | | | 4.97 | % | |

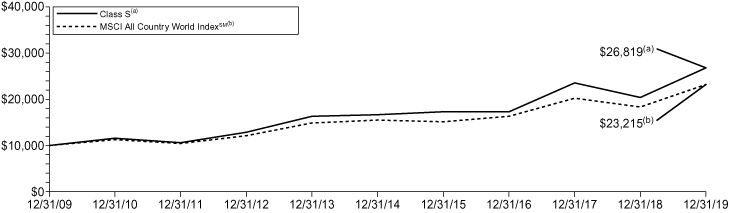

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya International High Dividend Low Volatility Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

Effective May 1, 2019, the Adviser changed the primary benchmark from the MSCI ACWI Ex-U.S. to the MSCI EAFE® Index because the MSCI EAFE® Index is considered by the Sub-Adviser to be a more appropriate benchmark reflecting the type of securities in which the Portfolio invests.

Prior to May 1, 2019, the Portfolio was managed by a different sub-adviser.

9

TABLE OF CONTENTS

VY® AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VY® American Century Small-Mid Cap Value Portfolio (the "Portfolio") seeks long-term capital growth. Income is a secondary objective. The Portfolio is managed by a team of portfolio managers comprised of Miles Lewis, CFA and Vice President, and Jeff John, CFA, Vice President (responsible for the management of the Small Cap Value portion of the Portfolio) and Kevin Toney, CFA, Chief Investment Officer — Global Value Equity and Senior Vice President, Phillip N. Davidson, CFA, Senior Vice President and Executive Portfolio Manager — Global Value Equity and Senior Vice President, Michael Liss, CFA, CPA and Vice President, and Brian Woglom, CFA, Vice President (responsible for the Mid Cap Value portion of the Portfolio) (each a "Sleeve"), Portfolio Managers of American Century Investment Management, Inc. — the Sub-Adviser.

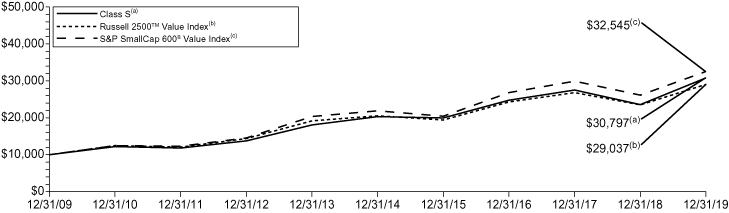

Performance: For the year ended December 31, 2019, the Portfolio's Class S shares provided a total return of 30.67% compared to the Russell 2500TM Value Index and the S&P SmallCap 600® Value Index, which returned 23.56% and 24.54%, respectively, for the same period.

Portfolio Specifics: Resilient U.S. economic growth and positive earnings fueled strong stock market performance for 2019, despite periods of volatility sparked by trade tensions and global economic uncertainty. The U.S. Federal Reserve Board cut interest rates three times in response to global economic risks, but central bank policymakers signaled a pause in the fourth quarter as economic data improved. Stocks ended the year on a strong note as news of a potential U.S.-China trade deal helped ease trade-related uncertainty. According to the FTSE Russell indices, large-cap stocks outperformed both mid and small caps for the year. Generally, value stocks underperformed growth.

The Portfolio outperformed the Russell 2500TM Value Index. Although the Russell 2500TM Value Index is the overall portfolio benchmark, the Small Cap Value and Mid Cap Value sleeves are managed against the Russell 2000® Value and Russell Midcap Value® indices, respectively.

The Mid Cap Value sleeve outperformed its benchmark, the Russell Midcap® Value Index, for the year. Stock selection in health care lifted relative performance. Stock selection in consumer staples also contributed positively to relative performance. Stock selection in financials detracted.

The Small Cap Value sleeve also outperformed its benchmark, the Russell 2000® Value Index. Stock selection in financials was a strong contributor to relative performance. Stock selection and an overweight in the materials sector also aided relative results. Stock selection in information technology detracted from relative performance.

The overall Portfolio's performance for the year exceeded that of its benchmark, the Russell 2500TM Value Index. Stock selection drove relative outperformance, especially in the financials sector where Compass Diversified Holdings was a top relative contributor. This publicly traded private equity firm reported solid revenue and profitability from its branded consumer businesses. In addition, Compass sold some businesses from its Portfolio, resulting in a strong balance sheet with significantly less leverage. Elsewhere in the Portfolio, Applied Materials was a top contributor. This semiconductor company was a strong performer, as it delivered solid financial results despite an uncertain global economic environment. We believe this semiconductor company remains well positioned, supported by greenfield investments and share gain from its new tool offering.

Despite the strength in Applied Materials, stock selection in the overall information technology sector detracted from relative performance. Sector detractors included data warehousing company Teradata, which suffered earnings volatility. The stock fell further in the fourth quarter after the company lowered earnings guidance due to the trade war, and its CEO was fired. Despite these events, we believe Teradata continues to make progress in transitioning to a subscription business. Communications equipment company Casa Systems, another sector detractor, lagged after some of its customers reduced spending early in the year. It also made a large acquisition that we believe may not have been beneficial to the business. The stock declined further in the fourth quarter after the company reported poor quarterly results.

Current Strategy and Outlook: We follow a stock-specific, valuation-driven strategy. The Portfolio's sector allocation is a result of our bottom-up investment process.

We continue to hold a considerable overweight in financials. According to our metrics, our bank holdings remain, in our view, attractive as valuations have been pressured by low interest rates and a relatively flat interest rate curve. Our Portfolio also has a notable overweight to health care. We have found what we believe to be attractive opportunities in the sector due to increased political rhetoric as well as company-specific issues. The vast majority of our holdings are in two industries: 1) health care equipment and supplies and 2) health care providers and services.

Real estate is a prominent underweight. According to our metrics, we believe that real estate stocks remain expensive relative to their historical valuation and to other areas of the equity market. Therefore, we hold a limited number of higher-quality real estate stocks that offer compelling valuations. Consumer discretionary is also a sector underweight. Most companies in the consumer discretionary sector do not meet our quality criteria. Our metrics also show that valuations throughout the communication services sector are unattractive, and the sector is also a portfolio underweight. Additionally, many stocks in the sector have volatile business models, leading to a wider range of potential outcomes.

Sector Diversification

as of December 31, 2019

(as a percentage of net assets)

Financials | | | 26.4 | % | |

Industrials | | | 15.7 | % | |

Health Care | | | 9.0 | % | |

Information Technology | | | 8.0 | % | |

Consumer Discretionary | | | 7.5 | % | |

Real Estate | | | 7.1 | % | |

Utilities | | | 6.9 | % | |

Consumer Staples | | | 5.8 | % | |

Materials | | | 4.9 | % | |

Energy | | | 4.5 | % | |

Exchange-Traded Funds | | | 2.1 | % | |

Communication Services | | | 0.8 | % | |

Assets in Excess of Other Liabilities* | | | 1.3 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments and exchange-traded funds.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019*

(as a percentage of net assets)

iShares Russell Mid-Cap Value ETF | | | 2.1 | % | |

Zimmer Biomet Holdings, Inc. | | | 2.0 | % | |

Truist Financial Corp. | | | 1.7 | % | |

Northern Trust Corp. | | | 1.7 | % | |

First Hawaiian, Inc. | | | 1.5 | % | |

ProAssurance Corp. | | | 1.4 | % | |

Xcel Energy, Inc. | | | 1.4 | % | |

Weyerhaeuser Co. | | | 1.3 | % | |

Emerson Electric Co. | | | 1.3 | % | |

Hubbell, Inc. | | | 1.1 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

10

TABLE OF CONTENTS

VY® AMERICAN CENTURY SMALL-MID CAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 30.17 | % | | | 8.40 | % | | | 11.63 | % | |

Class I | | | 30.96 | % | | | 8.94 | % | | | 12.18 | % | |

Class S | | | 30.67 | % | | | 8.68 | % | | | 11.91 | % | |

Class S2 | | | 30.42 | % | | | 8.51 | % | | | 11.74 | % | |

Russell 2500TM Value Index | | | 23.56 | % | | | 7.18 | % | | | 11.25 | % | |

S&P SmallCap 600® Value Index | | | 24.54 | % | | | 8.26 | % | | | 12.52 | % | |

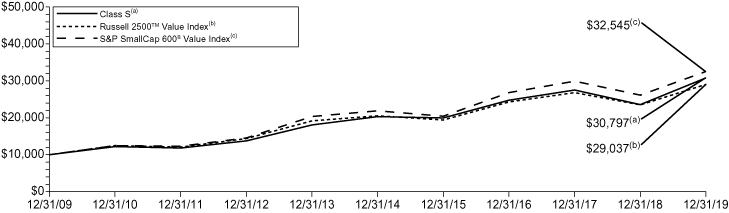

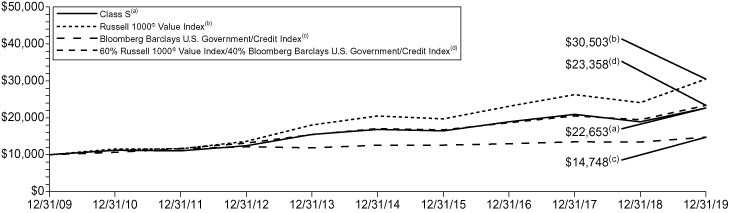

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® American Century Small-Mid Cap Value Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment

Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

11

TABLE OF CONTENTS

VY® BARON GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VY® Baron Growth Portfolio (the "Portfolio") seeks capital appreciation. The Portfolio is managed by Ronald Baron, Founder, Chief Executive Officer, Chief Investment Officer, Chairman, and Portfolio Manager and Neal Rosenberg, Portfolio Manager of BAMCO, Inc. — the Sub-Adviser.

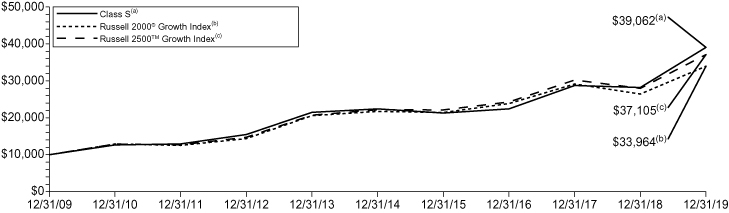

Performance: For the year ended December 31, 2019, the Portfolio's Class S shares provided a total return of 38.52% compared to the Russell 2000® Growth Index and the Russell 2500TM Growth Index, which returned 28.48% and 32.65%, respectively, for the same period.

Portfolio Specifics: After a steep sell-off in December 2018, the U.S. stock market rebounded in 2019. The rally was fueled in large part by a policy shift at the U.S. Federal Reserve Board, which lowered rates three times in 2019. Better-than-expected corporate earnings also helped buoy investor sentiment. We believe that these headwinds outweighed uncertainty surrounding ongoing trade wars, turmoil in Washington, and fears of a global economic slowdown.

Absolute Performance: Top contributors within the Portfolio included real estate information and marketing services company CoStar Group, Inc., driven by excellent business results. Additionally, shares of MSCI Inc., a leading provider of investment decision support tools, rose in response to positive earnings momentum, an upbeat investor day presentation, and the announcement of a new ten-year contract extension with BlackRock. Shares of simulation software company ANSYS, Inc. rose steadily throughout the year on healthy sales growth. An analyst event held mid-year also boosted investor confidence in the company's growth prospects.

Top detractors within the Portfolio included shares of benefits enrollment platform Benefitfocus, Inc. which were down sharply after revenue growth fell short of Street expectations. We retain conviction, as we believe this is a short-term issue. Additionally, shares of Covetrus, Inc., a newly formed global animal health technology and services company, fell sharply as investors reacted to a first quarter revenue and EBITDA miss and guidance reset. We exited our position.

Relative Performance: The Portfolio was up sharply for the year and outperformed the Russell 2000® Growth Index primarily due to stock selection. Style biases also added value, driven by overexposure to strong performing mid-cap stocks and underexposure to the weak performing earnings variation factor.

Outperformance of investments in financials, industrials, and real estate added the most value. Stock selection in financials contributed almost 675 basis points (6.75%) to relative results, driven by the outperformance of financial exchanges & data companies MSCI, Inc. and Morningstar, Inc. Asset managers Cohen & Steers, Inc. and The Carlyle Group as well as insurers Arch Capital Group Ltd., Kinsale Capital Group, Inc. and Primerica, Inc. also boosted relative results. Strength in industrials came from CoStar Group, Inc. Real Estate holdings outperformed after appreciating more than 36% as group, led by specialized REITs Gaming and Leisure Properties, Inc. and Alexandria Real Estate Equities, Inc.

Information technology investments were the only detractors from relative performance with most of the weakness coming from Benefitfocus, Inc. and syndicated research provider Gartner, Inc.

Current Strategy and Outlook: As long-term investors in what we view as high quality growth stocks, we are always actively looking for what we believe to be good investment ideas. We continue to position the Portfolio to benefit from what we believe to be strong, long-term growth opportunities.

Sector Diversification

as of December 31, 2019

(as a percentage of net assets)

Financials | | | 26.1 | % | |

Consumer Discretionary | | | 23.6 | % | |

Information Technology | | | 17.1 | % | |

Health Care | | | 10.2 | % | |

Industrials | | | 9.4 | % | |

Real Estate | | | 8.6 | % | |

Communication Services | | | 3.9 | % | |

Consumer Staples | | | 0.7 | % | |

Assets in Excess of Other Liabilities* | | | 0.4 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019

(as a percentage of net assets)

Vail Resorts, Inc. | | | 7.8 | % | |

CoStar Group, Inc. | | | 6.6 | % | |

Choice Hotels International, Inc. | | | 6.6 | % | |

MSCI, Inc. — Class A | | | 6.4 | % | |

ANSYS, Inc. | | | 5.0 | % | |

Gartner, Inc. | | | 4.7 | % | |

Factset Research Systems, Inc. | | | 4.3 | % | |

Idexx Laboratories, Inc. | | | 3.8 | % | |

Bright Horizons Family Solutions, Inc. | | | 3.6 | % | |

Arch Capital Group Ltd. | | | 3.5 | % | |

Portfolio holdings are subject to change daily.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

12

TABLE OF CONTENTS

PORTFOLIO MANAGERS' REPORT

VY® BARON GROWTH PORTFOLIO

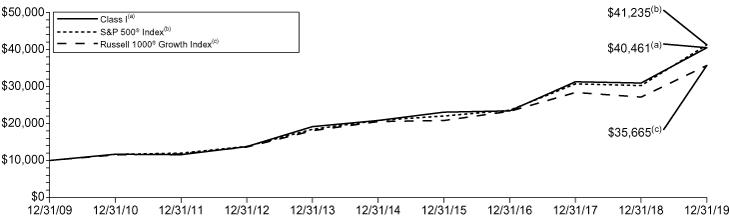

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 38.24 | % | | | 11.47 | % | | | 14.31 | % | |

Class I | | | 38.97 | % | | | 12.04 | % | | | 14.89 | % | |

Class R6(1) | | | 38.94 | % | | | 12.04 | % | | | 14.89 | % | |

Class S | | | 38.52 | % | | | 11.75 | % | | | 14.60 | % | |

Class S2 | | | 38.37 | % | | | 11.59 | % | | | 14.43 | % | |

Russell 2000® Growth Index | | | 28.48 | % | | | 9.34 | % | | | 13.01 | % | |

Russell 2500TM Growth Index | | | 32.65 | % | | | 10.84 | % | | | 14.01 | % | |

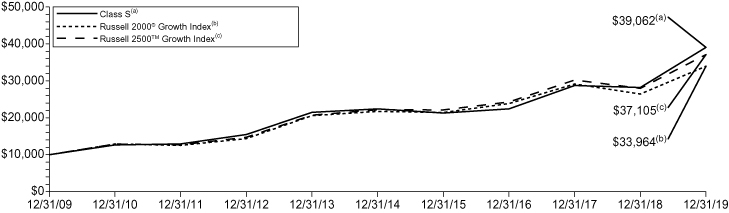

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Baron Growth Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

(1) Class R6 incepted on May 3, 2016. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

13

TABLE OF CONTENTS

VY® COLUMBIA CONTRARIAN CORE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VY® Columbia Contrarian Core Portfolio (the "Portfolio") seeks total return consisting of long-term capital appreciation and current income. The Portfolio is managed by Guy W. Pope, CFA, Senior Portfolio Manager and Head of Contrarian Core Strategy with Columbia Management Investment Advisers, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2019, the Portfolio's Class S shares provided a total return of 33.06% compared to the Russell 1000® Index, which returned 31.43% for the same period.

Portfolio Specifics: The Portfolio's relative outperformance for the year was largely attributable to strong stock selection in all but a few sectors and positive sector allocation in eight out of 11 sectors as well. Stock selection was most notably positive in information technology, communication services and consumer staples, followed by real estate, energy and financials. The Portfolio's stock selection detracted most in health care and detracted to a much lesser degree in materials and consumer discretionary. While sector allocation is, for the most part, a result of the Portfolio's bottom-up stock selection process, it was nonetheless positive in 2019, with longstanding underweights to utilities and industrials having a positive impact. Underweights to consumer staples and real estate and the overweight to information technology also helped relative performance.

Several of the Portfolio's holdings in information technology performed well in 2019, including our stocks in the payments and financial software industry where consolidation paid off handsomely for First Data Corporation, Fidelity National Information Services, Fiserv and Total System Services. A wide range of other technology holdings performed well throughout the year. Microsoft continues to benefit from all facets of its businesses, but primarily from businesses moving to the cloud. A number of the Portfolio's companies in the very eclectic communications services sector also did well in 2019. Facebook did very well, AT&T was up approximately 45% for the year and Comcast was up approximately 34%.

Energy was the worst performing sector in 2019, up only approximately 11%, and EOG Resources simply lagged with the sector and the general exploration and production area for much of the year. Health care was the most difficult sector for the Portfolio in 2019 — a tough sector from the standpoint of stock selection throughout the year, and Pfizer was down 6.%. Materials was the only other negative sector for the Portfolio overall, and DuPont was the Portfolio's worst-performing stock in the sector, down approximately 14%.

Current Strategy and Outlook: Throughout 2019 we saw slowing economic and earnings growth, increased geopolitical uncertainty, and increased domestic political uncertainty. Factors offsetting slowing growth and political uncertainty included lower interest rates and a strong U.S. consumer. Going into 2020, it would not surprise us to see more volatility in the months ahead as investors grapple with these issues as well as a presidential election now only months away with key primaries coming early in the year. As always, we will look to take advantage of this potential volatility as we deploy our contrarian process that has served us well over the long term.

Sector Diversification

as of December 31, 2019

(as a percentage of net assets)

Information Technology | | | 25.8 | % | |

Financials | | | 14.9 | % | |

Communication Services | | | 14.2 | % | |

Health Care | | | 12.3 | % | |

Consumer Discretionary | | | 7.7 | % | |

Industrials | | | 7.5 | % | |

Energy | | | 5.5 | % | |

Consumer Staples | | | 4.5 | % | |

Materials | | | 3.2 | % | |

Real Estate | | | 1.1 | % | |

Utilities | | | 0.8 | % | |

Assets in Excess of Other Liabilities* | | | 2.5 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019*

(as a percentage of net assets)

Microsoft Corp. | | | 5.7 | % | |

Apple, Inc. | | | 4.9 | % | |

Berkshire Hathaway, Inc. — Class B | | | 4.0 | % | |

JPMorgan Chase & Co. | | | 3.3 | % | |

Citigroup, Inc. | | | 3.0 | % | |

Amazon.com, Inc. | | | 2.9 | % | |

Medtronic PLC | | | 2.9 | % | |

Comcast Corp. — Class A | | | 2.5 | % | |

Facebook, Inc. — Class A | | | 2.5 | % | |

Mastercard, Inc. — Class A | | | 2.3 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

14

TABLE OF CONTENTS

VY® COLUMBIA CONTRARIAN CORE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

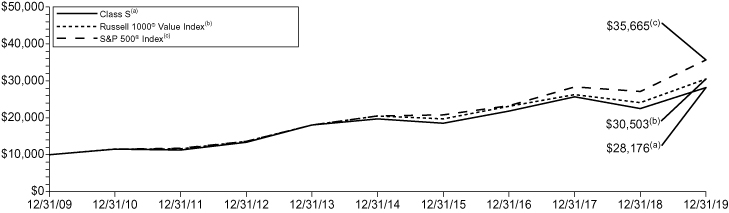

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 32.41 | % | | | 10.13 | % | | | 11.29 | % | |

Class I | | | 33.05 | % | | | 10.68 | % | | | 11.85 | % | |

Class S | | | 33.06 | % | | | 10.45 | % | | | 11.60 | % | |

Russell 1000® Index | | | 31.43 | % | | | 11.48 | % | | | 13.54 | % | |

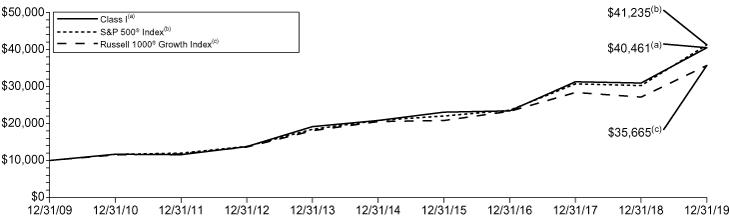

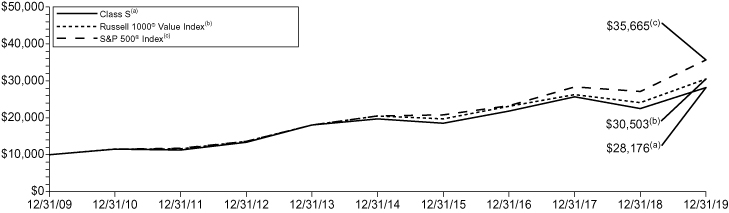

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Columbia Contrarian Core Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the

effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

Prior to April 30, 2013, the Portfolio was managed by a different sub-adviser.

15

TABLE OF CONTENTS

VY® COLUMBIA SMALL CAP VALUE II PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VY® Columbia Small Cap Value II Portfolio (the "Portfolio") seeks long-term growth of capital. The Portfolio is managed by Christian K. Stadlinger, Ph.D., CFA, and Jarl Ginsberg, CFA, CAIA, Portfolio Managers, of Columbia Management Investment Advisers, LLC — the Sub-Adviser.

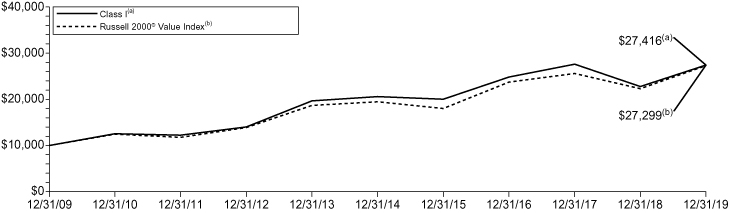

Performance: For the year ended December 31, 2019, the Portfolio's Class I shares provided a total return of 20.42% compared to the Russell 2000® Value Index, which returned 22.39% for the same period.

Portfolio Specifics: For the year, the Portfolio underperformed the Russell 2000® Value Index. Underperformance was primarily driven by stock selection. Stock selection was strong within healthcare, communication services, and information technology, however selection within materials, financials, real estate, and industrials offset these relative results. Sector allocation modestly added to relative results, helped along by our overweight to information technology (which was the best performing sector in the benchmark by a significant margin), and our underweight to energy.

In general, much of the relative underperformance came during the month of September. During the beginning of September yields rose and there was a sharp spike in the small cap value market. During this time, smaller and more volatile names outperformed. Through our process, we have historically benefited over the long term from avoiding these types of names — even if it meant giving up some upside in the short term.

In terms of specific securities, one of the top contributors to relative performance was our position in industrials company Armstrong World Industries. The company, which designs and manufacturers ceilings and walls, saw its shares rise steadily over the first half of the year as investors rewarded their continued growth and healthy margins.

The biggest detractor from relative performance was our position in Merit Medical Systems. The company, which manufacturers and markets disposable medical devices, reported earnings over the summer that underwhelmed. Results were driven by lower than expected sales from two recent acquisitions by the company. The company had been a steady performer over the past few years and we expect the current earnings dislocation to be rectified by the company.

Current Strategy and Outlook: Our outlook continues to remain cautiously positive. Chief among our concerns continue to be the potential for a prolonged trade conflict, levels of debt, and political dysfunction that could derail pro-growth policy.

Regardless of what transpires, we will continue our longstanding philosophy of bottom-up, fundamental analysis. We continue to look for what we believe to be undervalued companies with strong underlying earnings prospects that are exhibiting evidence of upward inflection. In doing so, we believe we will be able to avoid value traps and deliver strong returns for our clients. As of the end of the quarter, we continue to be overweight technology, materials, and industrials while remaining underweight real estate and financials.

Sector Diversification

as of December 31, 2019

(as a percentage of net assets)

Financials | | | 28.1 | % | |

Information Technology | | | 14.0 | % | |

Industrials | | | 13.5 | % | |

Consumer Discretionary | | | 8.6 | % | |

Real Estate | | | 8.2 | % | |

Materials | | | 5.6 | % | |

Utilities | | | 5.2 | % | |

Health Care | | | 5.1 | % | |

Energy | | | 4.8 | % | |

Consumer Staples | | | 2.9 | % | |

Communication Services | | | 2.2 | % | |

Assets in Excess of Other Liabilities* | | | 1.8 | % | |

Net Assets | | | 100.0 | % | |

* Includes short-term investments.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2019*

(as a percentage of net assets)

TCF Financial Corp. | | | 1.7 | % | |

Community Bank System, Inc. | | | 1.7 | % | |

First Industrial Realty Trust, Inc. | | | 1.6 | % | |

Atlantic Union Bankshares Corp. | | | 1.6 | % | |

Independent Bank Corp. | | | 1.5 | % | |

Nexstar Media Group, Inc. | | | 1.5 | % | |

SYNNEX Corp. | | | 1.4 | % | |

MGIC Investment Corp. | | | 1.4 | % | |

Sandy Spring Bancorp, Inc. | | | 1.3 | % | |

LHC Group, Inc. | | | 1.3 | % | |

* Excludes short-term investments.

Portfolio holdings are subject to change daily.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements. The Portfolio's performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

16

TABLE OF CONTENTS

PORTFOLIO MANAGERS' REPORT

VY® COLUMBIA SMALL CAP VALUE II PORTFOLIO

Average Annual Total Returns for the Periods Ended December 31, 2019 | |

| | 1 Year | | 5 Year | | 10 Year | |

Class ADV | | | 19.88 | % | | | 5.39 | % | | | 10.08 | % | |

Class I | | | 20.42 | % | | | 5.90 | % | | | 10.61 | % | |

Class R6(1) | | | 20.48 | % | | | 5.90 | % | | | 10.61 | % | |

Class S | | | 20.21 | % | | | 5.65 | % | | | 10.35 | % | |

Class S2 | | | 19.95 | % | | | 5.48 | % | | | 10.17 | % | |

Russell 2000® Value Index | | | 22.39 | % | | | 6.99 | % | | | 10.56 | % | |

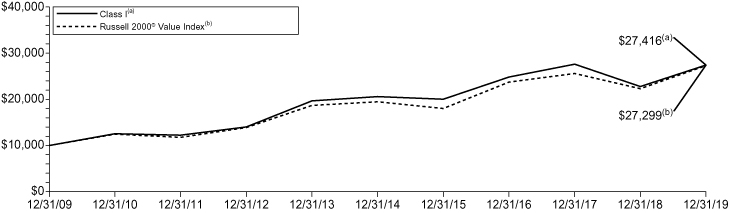

Based on a $10,000 initial investment, the graph and table above illustrate the total return of VY® Columbia Small Cap Value II Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 262-3862 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

(1) Class R6 incepted on May 3, 2016. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different.

17

TABLE OF CONTENTS

VY® INVESCO COMSTOCK PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VY® Invesco Comstock Portfolio (the "Portfolio") seeks capital growth and income. The Portfolio is managed by Kevin Holt, Lead Portfolio Manager, and Devin Armstrong, James Warwick, and Charles DyReyes, each a Portfolio Manager of Invesco Advisers, Inc. — the Sub-Adviser.

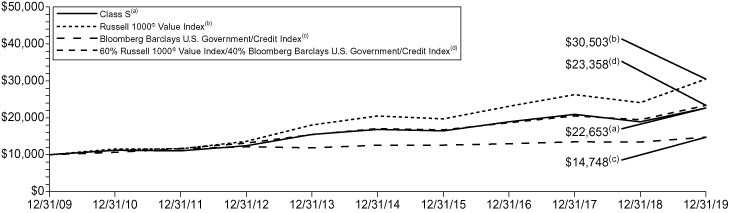

Performance: For the year ended December 31, 2019, the Portfolio's Class S shares provided a total return of 25.24% compared to the Russell 1000® Value Index and the S&P 500® Index, which returned 26.54% and 31.49%, respectively, for the same period.

Portfolio Specifics: For the year ended December 31, 2019, the Portfolio underperformed the Russell 1000® Value Index, the Portfolio's style-specific benchmark. All sectors posted positive returns within the Russell 1000® Value Index. Information technology, industrials and financials were the strongest performing sectors, with energy being the worst performing sector.

Strong stock selection within financials was a large contributor to relative performance within the Portfolio. Citigroup, Bank of America and not owning Berkshire Hathaway were the top relative contributors in the sector. Large banks performed well during the period, as interest rates have stabilized, and investors have benefited from return of capital back to shareholders. Stock selection within industrials also boosted relative performance for the year. Johnson Controls International was a notable contributor as the company beat earnings estimates in the first half of the period. Stock selection within communication services also enhanced relative performance.