UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08361

Goldman Sachs Variable Insurance Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606-6303

(Address of principal executive offices) (Zip code)

Caroline Kraus

Goldman, Sachs & Co.

200 West Street

New York, NY 10282

Copies to:

Geoffrey R.T. Kenyon, Esq.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, MA 02110-2605

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Reports to Shareholders are filed herewith. |

Goldman

Sachs Variable Insurance Trust

Goldman Sachs

Global Trends

Allocation Fund*

| * | Effective April 29, 2015, the Goldman Sachs Global Markets Navigator Fund was renamed the Goldman Sachs Global Trends Allocation Fund. |

Annual Report

December 31, 2015

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Principal Investment Strategies and Risks

This is not a complete list of the risks that may affect the Fund. For additional information concerning the risks applicable to the Fund, please see the Fund’s Prospectuses.

Shares of the Goldman Sachs Variable Insurance Trust — Goldman Sachs Global Trends Allocation Fund are offered to separate accounts of participating life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies. Shares of the Fund are not offered directly to the general public. The variable annuity contracts and variable life insurance policies are described in the separate prospectuses issued by participating insurance companies. You should refer to those prospectuses for information about surrender charges, mortality and expense risk fees and other charges that may be assessed by participating insurance companies under the variable annuity contracts or variable life insurance policies. Such fees or charges, if any, may affect the return you realize with respect to your investments. Ask your representative for more complete information. Please consider the Fund’s objective, risks and charges and expenses, and read the Prospectus carefully before investing. The Prospectus contains this and other information about the Fund.

The Goldman Sachs Global Trends Allocation Fund (formerly, Goldman Sachs Global Markets Navigator Fund) seeks total return while seeking to provide volatility management. Derivative instruments (including swaps) may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. The Fund’s use of derivatives may result in leverage, which can make the Fund more volatile. Over-the-counter transactions are subject to less government regulation and supervision. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The Fund’s fixed income investments are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. The Fund is also subject to the risk that the issuers of sovereign debt or the government authorities that control the payment of debt may be unable or unwilling to repay principal or interest when due. High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. Any guarantee on U.S. government securities applies only to the underlying securities of the Fund if held to maturity and not to the value of the Fund’s shares. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its portfolio securities without a substantial drop in price, if at all. The Fund’s investments in other investment companies (including ETFs) subject it to additional expenses. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

1

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

INVESTMENT OBJECTIVE

The Fund seeks total return while seeking to provide volatility management.

Portfolio Management Discussion and Analysis

Effective on April 29, 2015, the Goldman Sachs Variable Insurance Trust — Goldman Sachs Global Markets Navigator Fund was renamed and repositioned as the Goldman Sachs Variable Insurance Trust — Goldman Sachs Global Trends Allocation Fund (the “Fund”). At the same time, the Fund’s performance benchmark was changed from the Goldman Sachs Global Markets Navigator IndexTM to the Global Trends Allocation Composite Index, which is composed of the Morgan Stanley Capital International (MSCI) World Index (60%) and the Barclays U.S. Aggregate Bond Index (40%). The performance information reported below is the combined performance of the Fund, reflecting current and prior investment objectives, strategies and policies.

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Fund’s performance and positioning for the 12-month period ended December 31, 2015 (the “Reporting Period”).

How did the Fund perform during the Reporting Period?

During the Reporting Period, the Fund’s Institutional and Service Shares generated average annual total returns of -5.52% and -5.82%, respectively. These returns compare to the 0.26% average annual total return of the Fund’s new benchmark, the Global Trends Allocation Composite Index (the “Index”), during the same time period. The components of the Fund’s benchmark, the MSCI World Index and the Barclays U.S. Aggregate Bond Index, generated average annual total returns of -0.32% and 0.55%, respectively, during the same time period.

Importantly, during the Reporting Period, the Fund’s overall annualized volatility (which is measured versus the S&P 500® Index) was 7.75%, less than the S&P 500® Index’s annualized volatility of 15.15% during the same time period.

How did the Fund’s investment strategy change as a result of its renaming and repositioning on April 29, 2015?

On April 29, 2015, the Fund’s investment objective changed from seeking “to achieve investment results that approximate the performance of the GS Global Markets Navigator IndexTM” to seeking “total return while seeking to provide volatility management.” The Fund continues to have exposure to a broad spectrum of asset classes and geographic regions by investing in equity and fixed income securities of U.S. and non-U.S. issuers, pooled investment vehicles and certain types of derivatives. However, rather than passively investing in such instruments to seek to track an index, the Fund employs, as of April 29, 2015, active investment management techniques, which may involve buying and selling securities and other instruments potentially based upon analysis of economic and market factors. In addition, the Fund now seeks to manage volatility and losses by allocating its assets away from risky investments in distressed market environments.

Under normal market conditions, the Fund expects to invest at least 40% of its assets in equity investments and at least 20% of its assets in fixed income investments. The Investment Adviser makes investment decisions based upon its analysis of market factors around the world and may allocate more of the Fund’s assets to investments with strong recent performance and allocate assets away from investments with poor recent performance. The percentage of the Fund’s portfolio exposed to any asset class or geographic region will vary from time to time as the weightings of the Fund change, and the Fund may not be invested in each asset class at all times.

What economic and market factors most influenced the Fund during the Reporting Period?

Central bank policy, geopolitical tensions, concerns about Chinese and global economic growth and a selloff in commodity prices were the key themes affecting the financial markets during the Reporting Period.

As evidence of a U.S. economic and labor market recovery mounted, market expectations of a Federal Reserve (“Fed”) interest rate hike increased. Meanwhile, other global central banks, including the European Central Bank and the Bank of Japan, eased monetary policy during the Reporting Period. The monetary policy divergence resulted in relative U.S. dollar strength, which benefited equity markets in several major developed market regions outside the U.S. but detracted from their returns in U.S. dollar terms. In December 2015, the Fed voted unanimously for a 25 basis point hike. (A basis point is 1/100th of a percentage point.)

2

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Geopolitical tensions intensified during the summer of 2015, as negotiations between Greece and its creditors unraveled, and the probability of a Greek exit, popularly known in the media as “Grexit,” from the euro increased. “Grexit” risk subsequently declined with an agreement in July 2015. However, concerns then escalated around China’s economic weakness, exacerbated by a surprise devaluation of its renminbi in August 2015, which further shook market confidence.

Oil and commodity prices were “lower for longer” in 2015, as the supply glut took longer than expected to correct and demand concerns arose. Brent crude oil and West Texas Intermediate (“WTI”) crude oil prices began 2015 at $57 and $53 per barrel, respectively, already well below 2014 highs of more than $100 per barrel. Both Brent and WTI crude oil prices ended 2015 still lower at approximately $37 per barrel.

What key factors were responsible for the Fund’s performance between January 1, 2015 and April 28, 2015 (“the initial part of the Reporting Period”)?

During the initial part of the Reporting Period, the Fund sought to achieve its former investment objective by investing in financial instruments that provide exposure to the various underlying global equity and fixed income indices that composed the GS Global Markets Navigator IndexTM. By dynamically allocating across global asset classes, using a momentum-based methodology, the Fund sought to manage risk and enhance long-term returns in changing market environments. Momentum investing seeks growth of capital by gaining exposure to asset classes that have exhibited trends in price performance over selected time periods. In managing the Fund, we used a methodology that evaluated historical returns, volatilities and correlations across a range of nine global asset classes. Represented by indices, these asset classes included, within the equities category, U.S. large-cap, U.S. small-cap, Europe, Japan, emerging markets and U.K. stocks. Within the fixed income category, the Fund might allocate assets to U.S., European and Japanese fixed income securities. The analysis of these asset classes drove the aggregate allocations of the Fund over time. We believe market price momentum — either positive or negative — has significant predictive power.

During the initial part of the Reporting Period, the Fund benefited from its allocation to Japanese equities, which performed well on improving economic data. Japan came out of recession, with 0.6% growth in its fourth quarter 2014 Gross Domestic Product (“GDP”). The Fund’s allocation to European equities also helped performance, as Europe’s stock markets advanced.

Conversely, the Fund’s allocation to U.S. equities detracted from returns, as slower than expected U.S. economic growth muted U.S. stock market performance.

What key factors were responsible for the Fund’s performance between April 29, 2015 and December 31, 2015 (“the latter part of the Reporting Period”)?

During the latter part of the Reporting Period, the Fund continued dynamically allocating across global asset classes, using a momentum-based methodology, as it sought total return while also seeking to provide volatility management. In addition, as we sought to achieve the Fund’s new investment objective, we employed active investment management techniques to buy and sell based upon analysis of economic and market conditions. We sought to manage volatility and losses by allocating the assets away from risky investments in distressed market environments.

During the latter part of the Reporting Period, the Fund’s allocations to U.S. and European stocks broadly detracted from performance, as U.S. and European equity markets retreated due to international concerns, including the potential exit of Greece from the euro and Chinese economic weakness. Allocations to Japanese stocks, emerging markets equities, U.K. stocks and U.S. small-cap equities also hurt Fund returns, though to a lesser extent. Allocations to German government bonds detracted from results as the perceived riskiness of Eurozone fixed income increased amid the resurgent Greek debt crisis, causing German government yields to broadly increase. Exposure to U.S. Treasury securities added slightly to performance during the latter part of the Reporting Period in spite of the Fed raising the benchmark federal funds rate by 0.25% in December 2015, the first rate hike since 2006.

What was the Fund’s volatility during the Reporting Period?

As part of our investment approach, we seek to mitigate the Fund’s volatility. As mentioned earlier, for the Reporting Period overall, the Fund’s actual volatility (annualized, using daily returns) was 7.75% versus the S&P 500® Index’s annualized volatility of 15.15%. In the latter half of the year, as a result of heightened volatility across global equity markets and the Fund’s volatility management strategy, the Fund allocated a significant portion of assets to cash beginning in September and throughout the remainder of the year. This cash allocation helped to reduce the Fund’s exposure to down-trending global equities, as well as dampen the overall volatility of the Fund.

3

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

How was the Fund positioned during the Reporting Period?

During the Reporting Period, we tactically managed the Fund’s allocations across equity and fixed income markets based on the momentum and volatility of these asset classes. At the beginning of the Reporting Period, the Fund’s total assets were allocated 73% to equities, 27% to fixed income and 0% to cash. The Fund had no exposure to Japanese government bonds or to U.K., European and emerging market equities. It had significant weights in U.S. large-cap and small-cap stocks, Japanese equities, U.S. Treasury securities and German government bonds. Near the middle of the Reporting Period, we added a modest allocation to European and U.K. equities and a small allocation to emerging markets equities, while trimming the Fund’s allocations to Japanese stocks, U.S. Treasury securities and German government bonds. At the same time, we also added a modest allocation to Japanese government bonds. In September 2015, we increased the Fund’s allocation to cash as a means of volatility control after a sharp selloff in Chinese equities in August 2015 rattled global stock markets. The selloff had been triggered by weakening Chinese economic data and a devaluation of the renminbi. Toward the end of the Reporting Period, as the global equity market environment improved slightly, we pared back the Fund’s allocation to cash.

How did the Fund use derivatives and similar instruments during the Reporting Period?

During the Reporting Period, the Fund used exchange-traded index futures contracts to gain exposure to U.S. small-cap equities and non-U.S. developed market equities, including those in Europe, Japan and the U.K., as well as to gain exposure to Japanese government bonds. The use of exchange-traded index futures had a positive impact on the Fund’s performance during the Reporting Period.

What is the Fund’s tactical asset allocation view and strategy for the months ahead?

At the end of the Reporting Period, the Fund had a moderate allocation to cash. Within equities, we slightly trimmed the Fund’s allocation to U.S. large-cap stocks and European equities. We maintained the Fund’s small allocations to Japanese and U.K. stocks. In addition, at the end of the Reporting Period, the Fund was neutral relative to the Index in U.S. small-cap equities and emerging markets stocks. Within fixed income, we slightly reduced the Fund’s allocations to Japanese government bonds, U.S. Treasury securities and German government bonds. Overall, at the end of the Reporting Period, the Fund’s total assets were allocated 46% to equities, 27% to fixed income and 26% to cash.

Going forward, we intend to position the Fund to provide exposure to price momentum from among nine underlying asset classes, while seeking to manage the volatility, or risk, of the overall portfolio. In general, the Fund seeks to maintain a strategic allocation of 60% of its assets in equity investments and 40% of its assets in fixed income investments. The Fund may deviate from these strategic allocations in order to allocate a greater percentage to asset classes with strong momentum and to reduce its allocation to assets with weak momentum. When volatility increases, our goal is to preserve capital by proportionally increasing the Fund’s cash exposure and reducing its exposure to riskier asset classes. There is no guarantee the Fund’s dynamic management strategy will cause it to achieve its investment objective.

4

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Index Definitions

Goldman Sachs Global Markets Navigator IndexTM is composed of, and allocates exposure to, a set of underlying indices representing various global asset classes including, but not limited to, global equity, fixed income and commodity assets. It is constructed using a proprietary methodology developed by the index provider and is rebalanced at least monthly.

Global Trends Allocation Composite Index is composed 60% of MSCI World Index and 40% of Barclays U.S. Aggregate Bond Index. It is a composite representation prepared by the Investment Adviser of the performance of the Fund’s asset classes, weighted according to their respective weightings in the Fund’s target range.

MSCI World Index (Net, USD, unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed markets.

Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment grade corporate bonds, and mortgage-backed and asset-backed securities.

5

FUND BASICS

Global Trends Allocation Fund

as of December 31, 2015

STANDARDIZED TOTAL RETURNS1

| | | | | | | | | | | | | | |

| For the year ended 12/31/15 | | One Year | | | Three Year | | | Since Inception | | | Inception Date |

| Institutional | | | -5.52 | % | | | 3.82 | % | | | 0.72 | % | | 10/16/13 |

| Service | | | -5.82 | | | | 3.60 | | | | 3.92 | | | 4/16/12 |

| 1 | Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value (“NAV”). Because Institutional Shares and Service Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

Total return figures in the above chart represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the total return figures in the above chart. Please visit www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced.

EXPENSE RATIOS2

| | | | | | | | |

| | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| Institutional | | | 0.88 | % | | | 1.12 | % |

| Service | | | 1.14 | | | | 1.35 | |

| 2 | The expense ratios of the Fund, both current (net of any fee waivers or expense limitations) and before waivers (gross of any fee waivers or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least April 30, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

6

FUND BASICS

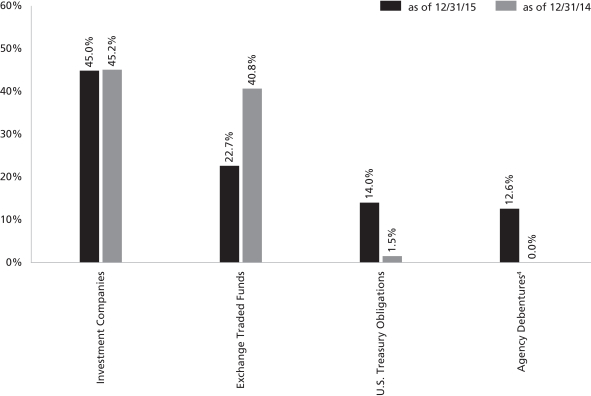

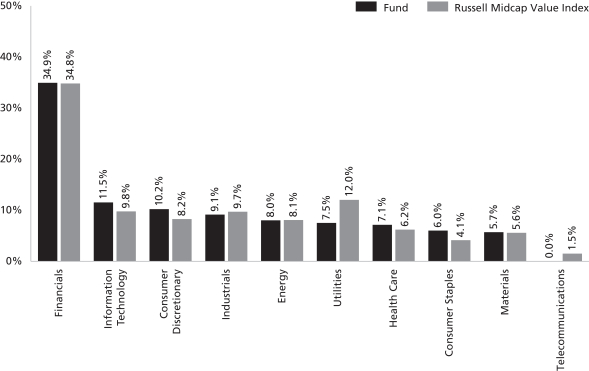

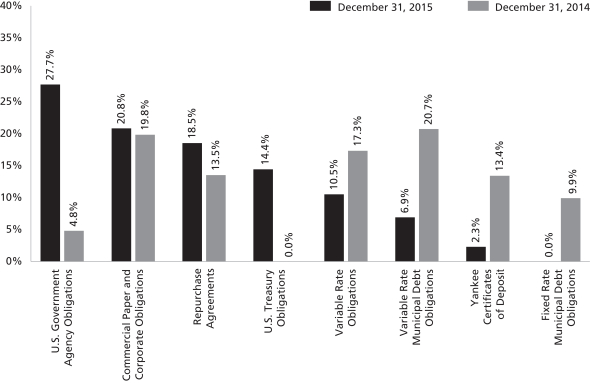

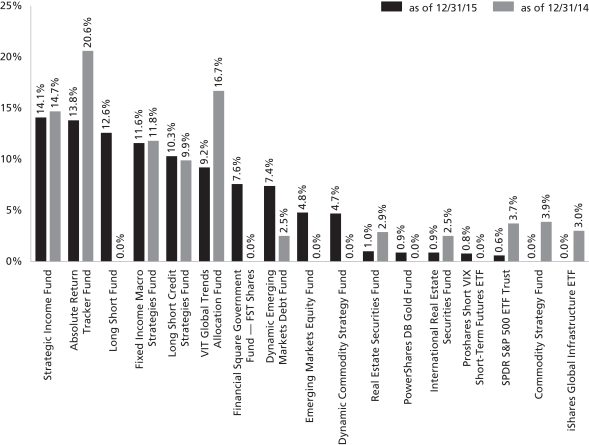

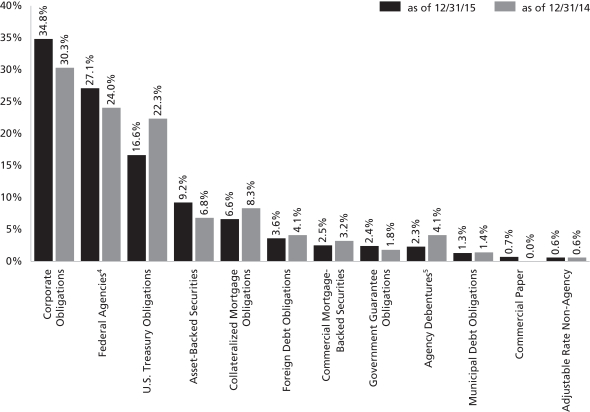

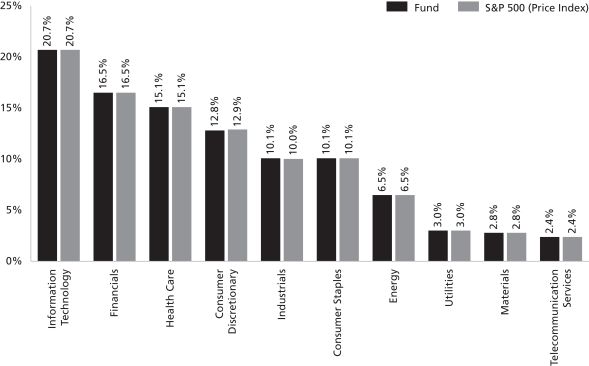

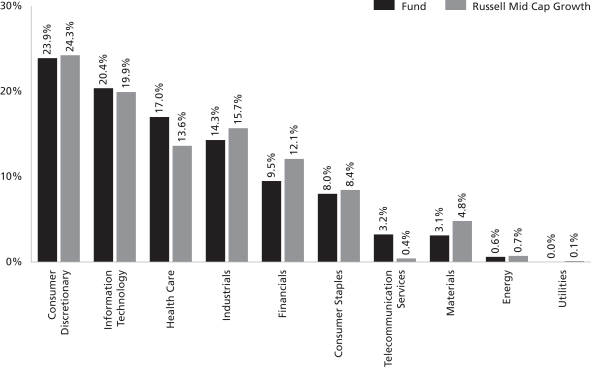

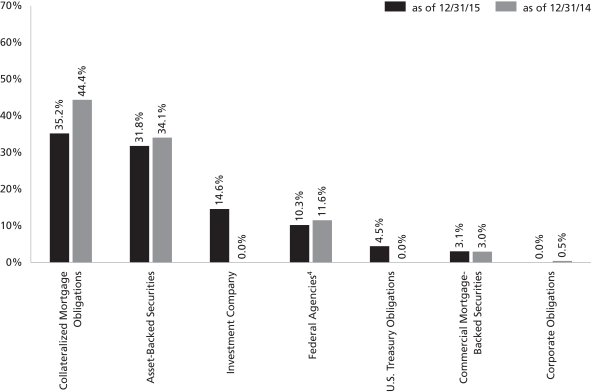

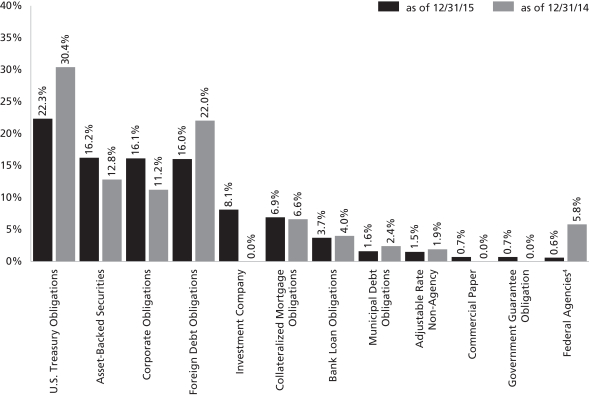

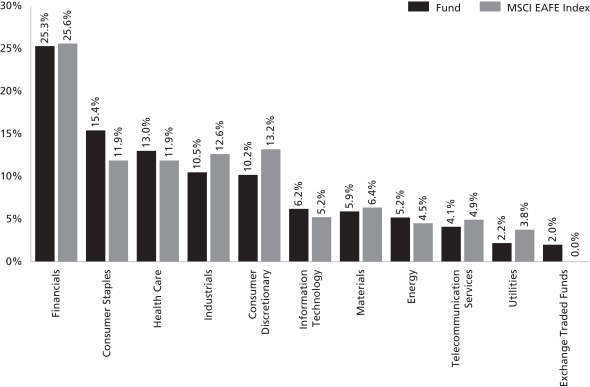

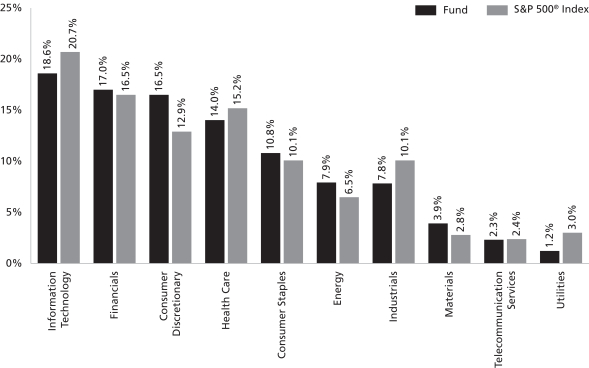

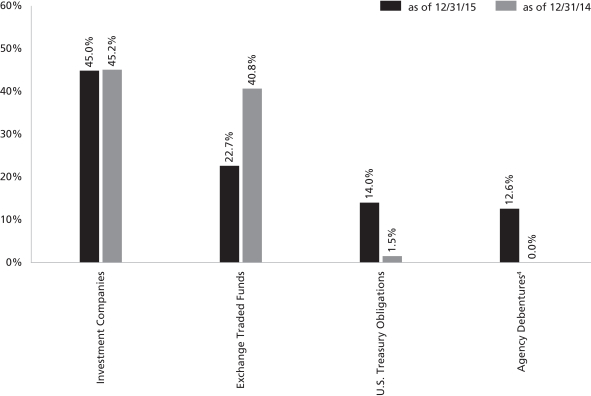

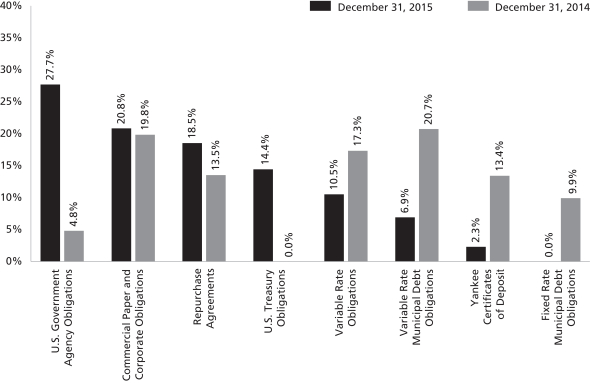

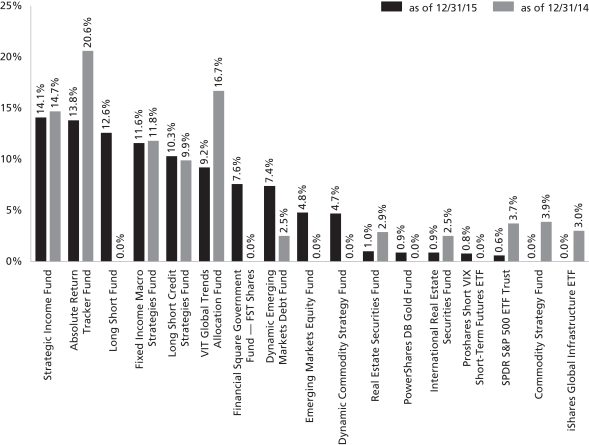

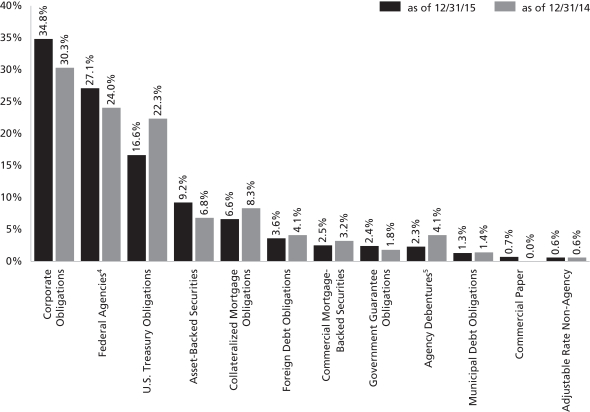

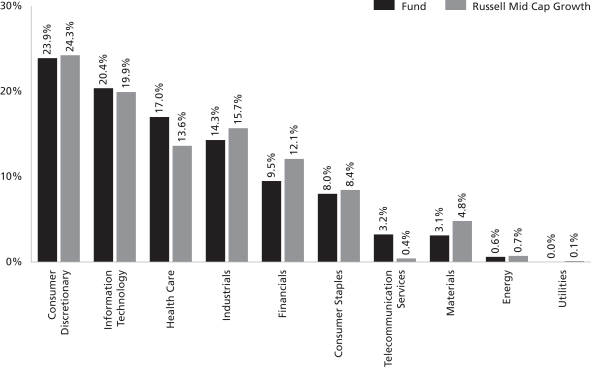

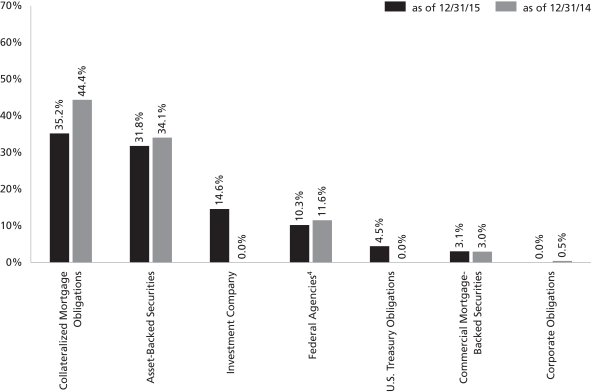

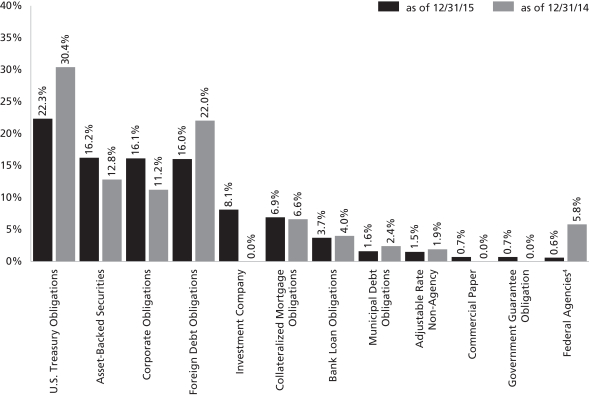

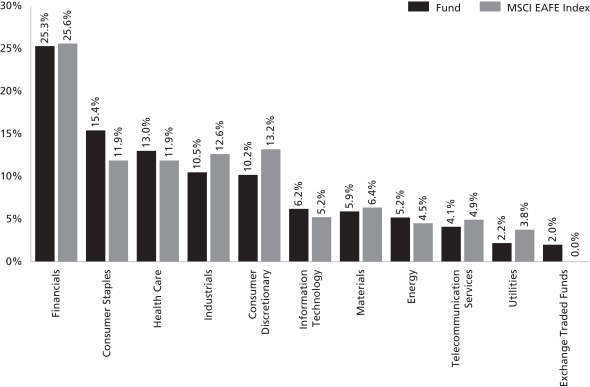

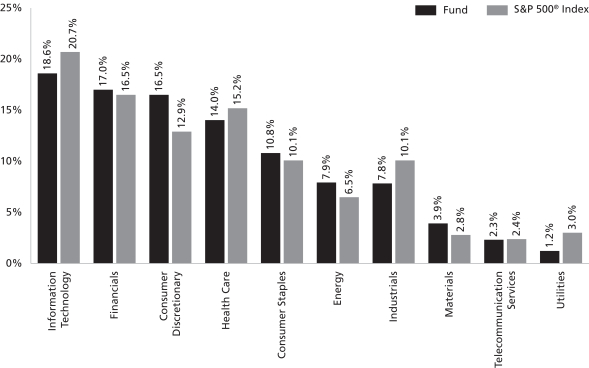

FUND COMPOSITION3

| 3 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets (excluding investments in the securities lending reinvestment vehicle, if any). Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. Underlying sector allocations of exchange traded funds held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| 4 | “Agency Debentures” include agency securities offered by companies such as Federal Home Loan Bank and Federal Home Loan Mortgage Corporation, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

7

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Performance Summary

December 31, 2015

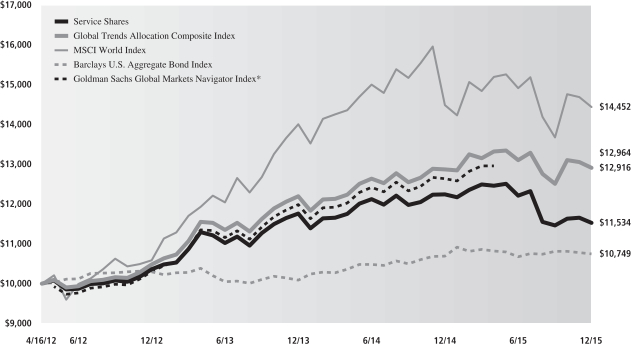

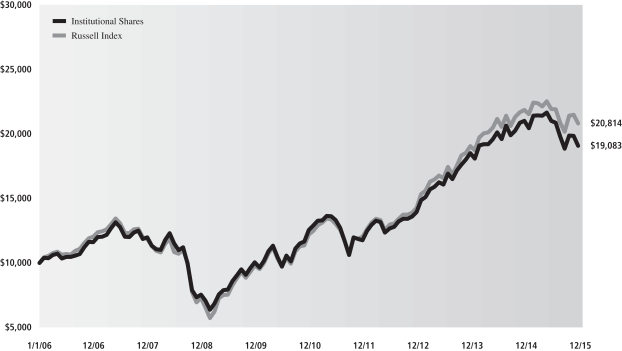

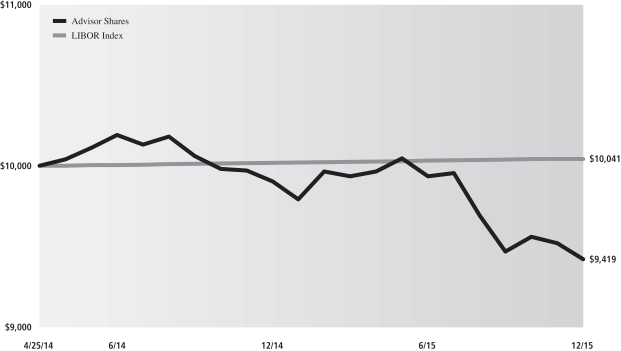

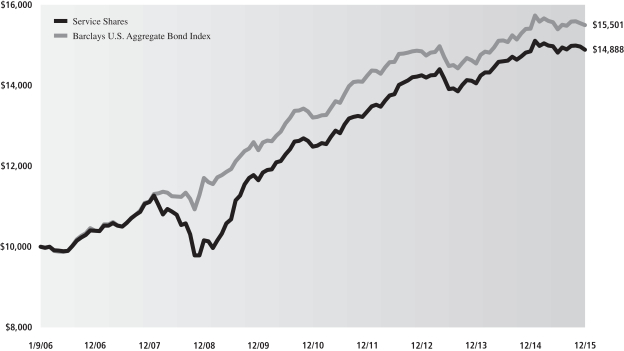

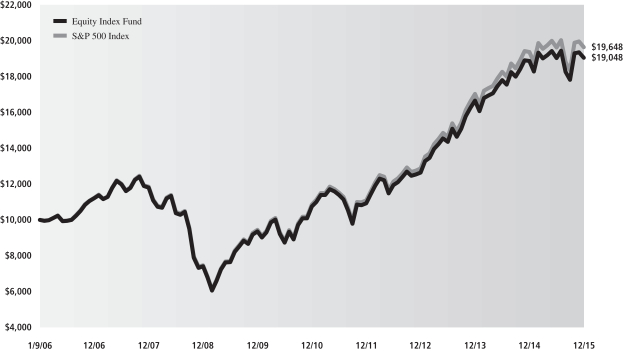

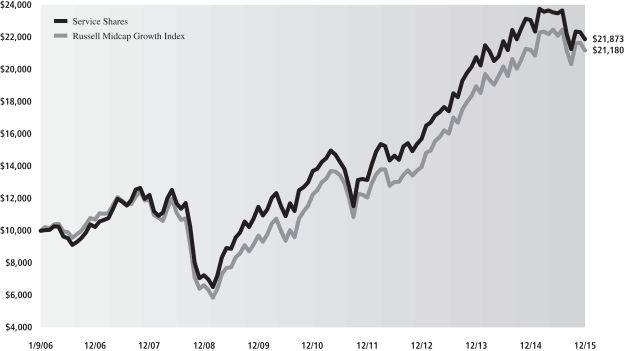

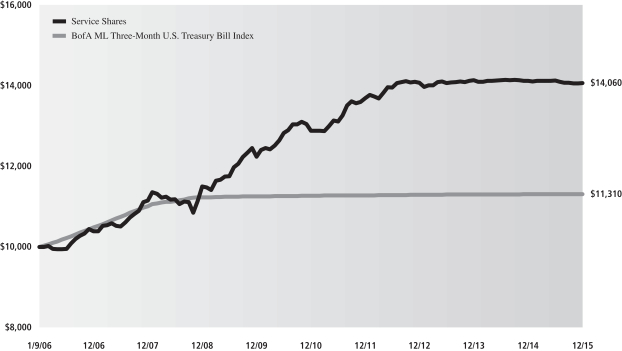

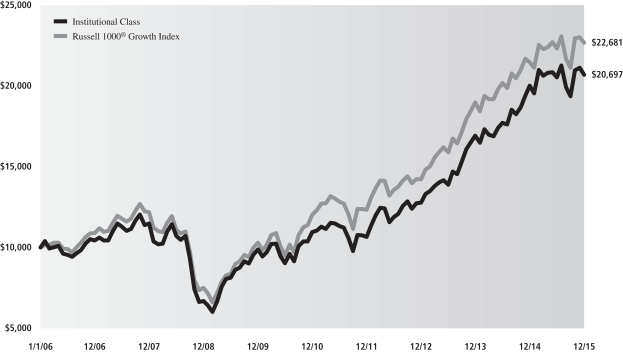

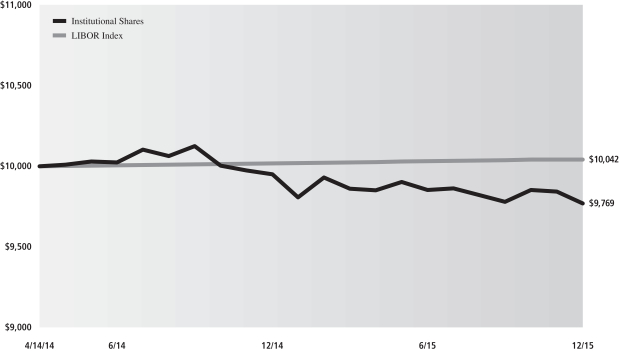

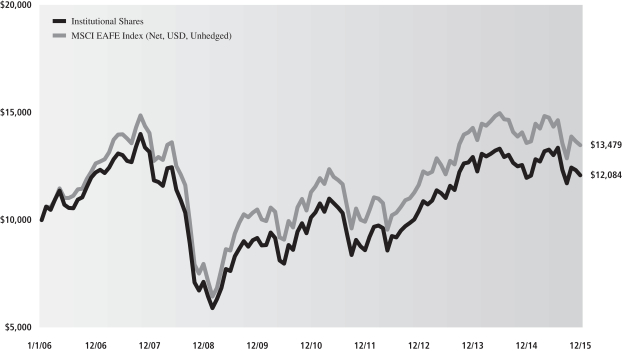

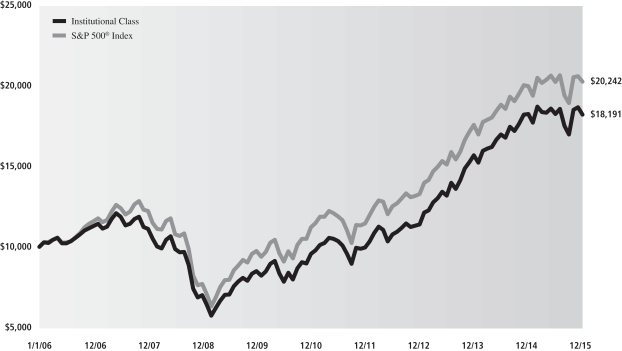

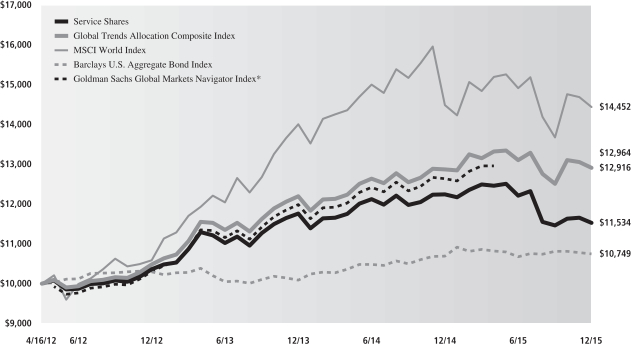

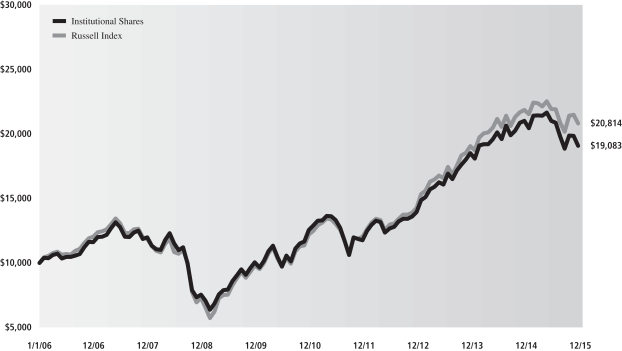

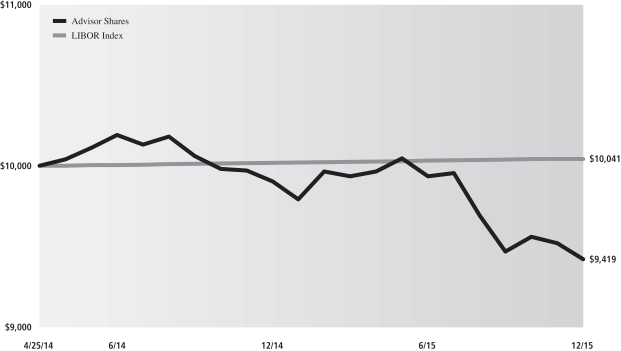

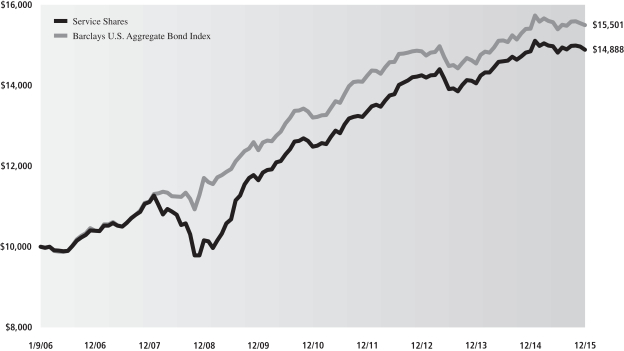

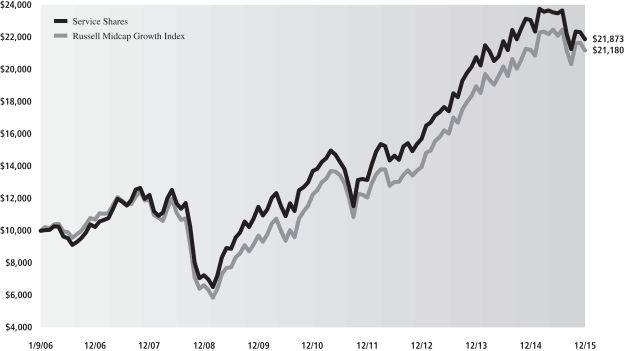

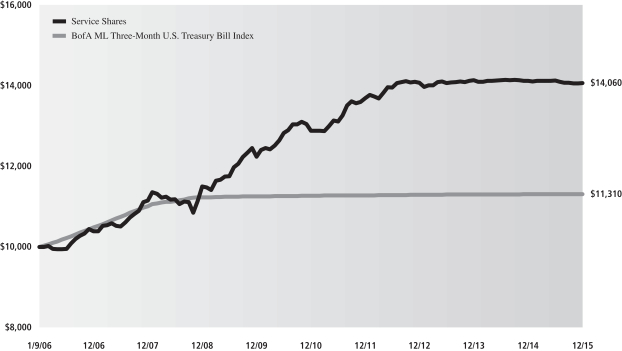

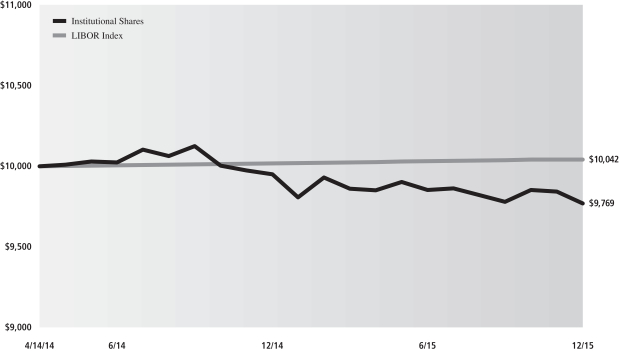

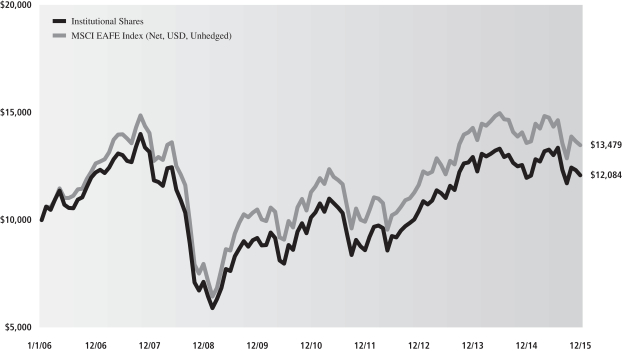

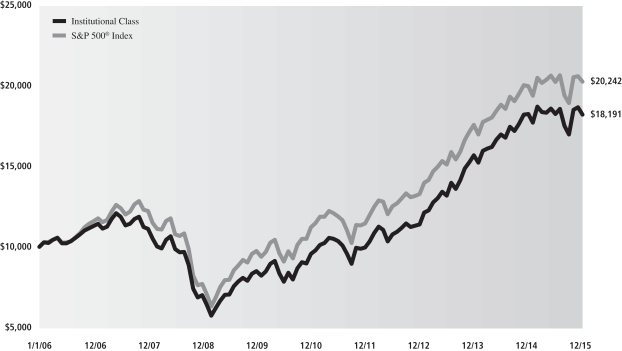

The following graph shows the value, as of December 31, 2015, of a $10,000 investment made on April 16, 2012 (commencement of the Fund’s operations) in Service Shares at NAV. For comparative purposes, the performance of the Fund’s current benchmark (effective April 30, 2015), the Global Trends Allocation Composite Index, (comprised of the Morgan Stanley Capital International (MSCI) World Index (60%) and the Barclays U.S. Aggregate Bond Index (40%)) and the Fund’s former benchmark, the Goldman Sachs Global Markets Navigator Index, is shown. The Investment Adviser believes that the Global Trends Allocation Composite Index is a more appropriate index against which to measure performance. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects Fund level expenses but does not reflect fees and expenses associated with any variable annuity contract or variable life insurance policy that uses the Fund as an investment option for any contract or policy. Had performance reflected all of those fees and expenses, performance would have been reduced. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown, and in their absence, performance would be reduced. Performance of Institutional Shares will vary from Service Shares due to differences in class specific fees. In addition to the Investment Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund.

Global Trends Allocation Fund’s Lifetime Performance

Performance of a $10,000 investment, with distributions reinvested, from April 16, 2012 through December 31, 2015.

| | | | |

| Average Annual Total Return through December 31, 2015 | | One Year | | Since Inception |

Institutional (Commenced October 16, 2013) | | -5.52% | | 0.72% |

Service (Commenced April 16, 2012) | | -5.82% | | 3.92% |

| * | Index was discontinued effective April 30, 2015. |

8

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Schedule of Investments

December 31, 2015

| | | | | | | | | | | | | | |

Principal Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | Agency Debentures(a) – 12.6% | |

| FHLMC Discount Notes | |

| $ | 29,958,000 | | | | 0.000 | % | | | 01/22/16 | | | $ | 29,955,753 | |

| FNMA Discount Notes | |

| | 14,950,000 | | | | 0.000 | | | | 01/14/16 | | | | 14,949,372 | |

| | |

| | TOTAL AGENCY DEBENTURES | | | | | |

| | (Cost $44,903,323) | | | $ | 44,905,125 | |

| | |

| | | | | | | | | | | | | | |

| | U.S. Treasury Obligation – 14.0% | |

| United States Treasury Note | |

| $ | 47,566,000 | | | | 2.750 | % | | | 11/15/23 | | | $ | 49,648,439 | |

| | (Cost $49,968,538) | | | | | |

| | |

| | | | | | | | |

| Shares | | | Description | | Value | |

| | Exchange Traded Funds – 22.7% | |

| | 252,909 | | | iShares Core S&P 500 ETF | | $ | 51,813,467 | |

| | 153,562 | | | Vanguard S&P 500 ETF | | | 28,705,344 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | | | | |

| | (Cost $80,701,539) | | $ | 80,518,811 | |

| | |

| | | | | | | | |

| Shares | | Distribution

Rate | | | Value | |

| Investment Company(b)(c) – 45.0% | |

Goldman Sachs Financial Square Government Fund —

FST Shares | |

| 160,199,048 | | | 0.185 | % | | $ | 160,199,048 | |

| (Cost $160,199,048) | | | | | |

| |

| TOTAL INVESTMENTS – 94.3% | |

| (Cost $335,772,448) | | | $ | 335,271,423 | |

| |

| OTHER ASSETS IN EXCESS OF LIABILITIES – 5.7% | | | | 20,442,770 | |

| |

| NET ASSETS – 100.0% | | | $ | 355,714,193 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| (a) | | Issued with a zero coupon. Income is recognized through the accretion of discount. |

| (b) | | Represents an affiliated issuer. |

| (c) | | Variable rate security. Interest rate or distribution rate disclosed is that which is in effect on December 31, 2015. |

| | |

| Investment Abbreviations: |

| FHLMC | | —Federal Home Loan Mortgage Corp. |

| FNMA | | —Federal National Mortgage Association |

ADDITIONAL INVESTMENT INFORMATION

FUTURES CONTRACTS — At December 31, 2015, the Fund had the following futures contracts:

| | | | | | | | | | | | |

| Type | | Number of

Contracts

Long (Short) | | Expiration

Date | | Current

Value | | | Unrealized

Gain (Loss) | |

| EURO STOXX 50 Index | | 263 | | March 2016 | | $ | 9,380,456 | | | $ | 183,348 | |

| Euro-Bund | | 171 | | March 2016 | | | 29,346,944 | | | | (463,070 | ) |

| FTSE 100 Index | | 141 | | March 2016 | | | 12,883,299 | | | | 571,816 | |

| TSE TOPIX Index | | 130 | | March 2016 | | | 16,737,385 | | | | (221,001 | ) |

10 Year Japanese Government Bonds | | 48 | | March 2016 | | | 59,519,281 | | | | 181,244 | |

| TOTAL | | | | | | | | | | $ | 252,337 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statement of Assets and Liabilities

December 31, 2015

| | | | |

| | | | |

| Assets: | |

Investments in unaffiliated issuers, at value (cost $175,573,400) | | $ | 175,072,375 | |

Investments in affiliated Underlying Funds, at value (cost $160,199,048) | | | 160,199,048 | |

Cash | | | 16,869,351 | |

Receivables: | | | | |

Collateral on certain derivative contracts | | | 2,884,275 | |

Fund shares sold | | | 917,897 | |

Dividends and interest | | | 231,185 | |

Reimbursement from investment adviser | | | 46,295 | |

| Total assets | | | 356,220,426 | |

| | | | |

| | | | |

| Liabilities: | | | |

Variation margin on certain derivative contracts | | | 56,668 | |

Payables: | | | | |

Management fees | | | 217,221 | |

Distribution and Service fees and Transfer Agency fees | | | 80,673 | |

Fund shares redeemed | | | 62,496 | |

Accrued expenses | | | 89,175 | |

| Total liabilities | | | 506,233 | |

| | | | |

| | | | |

| Net Assets: | | | |

Paid-in capital | | | 372,194,137 | |

Undistributed net investment income | | | — | |

Accumulated net realized loss | | | (16,246,866 | ) |

Net unrealized loss | | | (233,078 | ) |

| NET ASSETS | | $ | 355,714,193 | |

Net Assets: | | | | |

Institutional | | $ | 1,007,763 | |

Service | | | 354,706,430 | |

Total Net Assets | | $ | 355,714,193 | |

Shares of beneficial interest outstanding $0.001 par value (unlimited shares authorized): | | | | |

Institutional | | | 92,556 | |

Service | | | 32,588,556 | |

Net asset value, offering and redemption price per share: | | | | |

Institutional | | | $10.89 | |

Service | | | 10.88 | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statement of Operations

For the Fiscal Year Ended December 31, 2015

| | | | |

| | | | |

| Investment income: | |

Dividends — unaffiliated issuers | | $ | 1,435,209 | |

Interest | | | 1,168,072 | |

Dividends — affiliated issuers | | | 29,785 | |

Securities lending income — affiliated issuer | | | 29,254 | |

| Total investment income | | | 2,662,320 | |

| | | | |

| | | | |

| Expenses: | | | |

Management fees | | | 2,490,068 | |

Distribution and Service fees — Service Class | | | 785,916 | |

Professional fees | | | 157,675 | |

Printing and mailing costs | | | 70,769 | |

Transfer Agency fees(a) | | | 63,035 | |

Custody, accounting and administrative services | | | 57,817 | |

Trustee fees | | | 24,761 | |

Other | | | 30,301 | |

| Total expenses | | | 3,680,342 | |

Less — expense reductions | | | (531,185 | ) |

| Net expenses | | | 3,149,157 | |

| NET INVESTMENT LOSS | | | (486,837 | ) |

| | | | |

| | | | |

| Realized and unrealized gain (loss): | | | |

Net realized gain (loss) from: | | | | |

Investments | | | (14,302,475 | ) |

Futures contracts | | | 114,312 | |

Foreign currency transactions | | | (199,939 | ) |

Net change in unrealized gain (loss) on: | | | | |

Investments | | | (6,777,901 | ) |

Futures contracts | | | 1,630,330 | |

Foreign currency translation | | | (39,665 | ) |

| Net realized and unrealized loss | | | (19,575,338 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (20,062,175 | ) |

(a) Institutional and Service Shares incurred Transfer Agency fees of $167 and $62,868, respectively.

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Fiscal Year Ended

December 31, 2015 | | | For the

Fiscal Year Ended

December 31, 2014 | |

| | | | | | | | |

| From operations: | |

Net investment income (loss) | | $ | (486,837 | ) | | $ | 68,289 | |

Net realized gain (loss) | | | (14,388,102 | ) | | | 8,685,740 | |

Net change in unrealized loss | | | (5,187,236 | ) | | | (1,129,700 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (20,062,175 | ) | | | 7,624,329 | |

| | | | | | | | |

| | | | | | | | |

| Distributions to shareholders: | | | | | | |

From net investment income | | | | | | | | |

Institutional Shares | | | (3,063 | ) | | | (1,539 | ) |

Service Shares | | | (309,376 | ) | | | (95,487 | ) |

From net realized gains | | | | | | | | |

Institutional Shares | | | (21,380 | ) | | | (5,716 | ) |

Service Shares | | | (7,668,103 | ) | | | (2,127,353 | ) |

| Total distributions to shareholders | | | (8,001,922 | ) | | | (2,230,095 | ) |

| | | | | | | | |

| | | | | | | | |

| From share transactions: | | | | | | |

Proceeds from sales of shares | | | 141,160,161 | | | | 143,896,829 | |

Reinvestment of distributions | | | 8,001,922 | | | | 2,230,095 | |

Cost of shares redeemed | | | (33,842,796 | ) | | | (19,203,651 | ) |

| Net increase in net assets resulting from share transactions | | | 115,319,287 | | | | 126,923,273 | |

| TOTAL INCREASE | | | 87,255,190 | | | | 132,317,507 | |

| | | | | | | | |

| | | | | | | | |

| Net assets: | | | | | | |

| | |

Beginning of year | | | 268,459,003 | | | | 136,141,496 | |

End of year | | $ | 355,714,193 | | | $ | 268,459,003 | |

| Undistributed net investment income | | $ | — | | | $ | 311,386 | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (loss) from

investment operations | | | Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | | |

| Year - Share Class | | Net asset

value,

beginning

of period | | | Net

investment

income

(loss)(a) | | | Net

realized

and

unrealized

gain (loss) | | | Total from

investment

operations | | | From net

investment

income | | | From

net

realized

gains | | | Total

distributions | | | Net asset

value,

end of

period | | | Total

return(b) | | | Net assets,

end of

period

(in 000s) | | | Ratio of

net expenses

to average

net assets | | | Ratio of

total

expenses

to average

net assets | | | Ratio of

net investment

income (loss)

to average

net assets | | | Portfolio

turnover

rate(c) | |

FOR THE FISCAL YEARS ENDED DECEMBER 31, | |

2015 - Institutional | | $ | 11.82 | | | $ | 0.01 | | | $ | (0.67 | ) | | $ | (0.66 | ) | | $ | (0.03 | ) | | $ | (0.24 | ) | | $ | (0.27 | ) | | $ | 10.89 | | | | (5.52 | )% | | $ | 1,008 | | | | 0.75 | % | | | 0.92 | % | | | 0.12 | % | | | 504 | % |

2015 - Service | | | 11.82 | | | | (0.02 | ) | | | (0.67 | ) | | | (0.69 | ) | | | (0.01 | ) | | | (0.24 | ) | | | (0.25 | ) | | | 10.88 | | | | (5.82 | ) | | | 354,706 | | | | 1.00 | | | | 1.17 | | | | (0.16 | ) | | | 504 | |

2014 - Institutional | | | 11.46 | | | | 0.08 | | | | 0.41 | | | | 0.49 | | | | (0.03 | ) | | | (0.10 | ) | | | (0.13 | ) | | | 11.82 | | | | 4.23 | | | | 739 | | | | 0.77 | | | | 1.01 | | | | 0.68 | | | | 304 | |

2014 - Service | | | 11.47 | | | | — | (d) | | | 0.45 | | | | 0.45 | | | | — | (d) | | | (0.10 | ) | | | (0.10 | ) | | | 11.82 | | | | 3.95 | | | | 267,720 | | | | 1.03 | | | | 1.24 | | | | 0.04 | | | | 304 | |

2013 - Institutional (Commenced October 16, 2013) | | | 11.41 | | | | 0.01 | | | | 0.34 | | | | 0.35 | | | | (0.02 | ) | | | (0.28 | ) | | | (0.30 | ) | | | 11.46 | | | | 3.17 | | | | 26 | | | | 0.81 | (e) | | | 1.09 | (e) | | | 0.33 | (e) | | | 195 | |

2013 - Service | | | 10.36 | | | | (0.02 | ) | | | 1.42 | | | | 1.40 | | | | (0.01 | ) | | | (0.28 | ) | | | (0.29 | ) | | | 11.47 | | | | 13.57 | | | | 136,116 | | | | 1.04 | | | | 1.51 | | | | (0.21 | ) | | | 195 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FOR THE PERIOD ENDED DECEMBER 31, | |

2012 (Commenced April 16, 2012) | | | 10.00 | | | | 0.02 | | | | 0.35 | | | | 0.37 | | | | — | | | | (0.01 | ) | | | (0.01 | ) | | | 10.36 | | | | 3.74 | | | | 25,990 | | | | 1.04 | (e) | | | 4.21 | (e) | | | 0.27 | (e) | | | 300 | |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the net asset value at the beginning of the period, reinvestment of all distributions, and a complete redemption of the investment at the net asset value at the end of the period. |

| (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| (d) | Amount is less than $0.005 per share. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | 13 | | |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements

December 31, 2015

1. ORGANIZATION

Goldman Sachs Variable Insurance Trust (the “Trust” or “VIT”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust includes the Goldman Sachs Global Trends Allocation Fund (the “Fund”) (Formerly the Goldman Sachs Global Markets Navigator Fund). The Fund is a non-diversified portfolio under the Act offering two classes of shares — Institutional and Service Shares. Shares of the Trust are offered to separate accounts of participating life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman, Sachs & Co. (“Goldman Sachs”), serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income and dividend income, net of any foreign withholding taxes, less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Any foreign capital gains tax is accrued daily based upon net unrealized gains, and is payable upon sale of such investments.

For derivative contracts, realized gains and losses are recorded upon settlement of the contract.

C. Class Allocations and Expenses — Investment income, realized and unrealized gain (loss), and non-class specific expenses of the Fund are allocated daily based upon the proportion of net assets of each class. Non-class specific expenses directly incurred by a Fund are charged to that Fund, while such expenses incurred by the Trust are allocated across the applicable Funds on a straight-line and/or pro-rata basis depending upon the nature of the expenses. Class specific expenses, where applicable, are borne by the respective share classes and include Distribution and Service and Transfer Agency fees.

D. Federal Taxes and Distributions to Shareholders — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies (mutual funds) and to distribute each year substantially all of its investment company taxable income and capital gains to its shareholders. Accordingly, the Fund is not required to make any provisions for the payment of federal income tax. Distributions to shareholders are recorded on the ex-dividend date. Income and capital gains distributions, if any, are declared and paid annually.

Net capital losses are carried forward to future fiscal years and may be used to the extent allowed by the Code to offset any future capital gains. Losses that are carried forward will retain their character as either short-term or long-term capital losses. Utilization of capital loss carryforwards will reduce the requirement of future capital gains distributions.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. The source of the Fund’s distributions may be shown in the accompanying financial statements as either from net investment income, net realized gain or capital. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/tax differences based on the appropriate tax character.

E. Foreign Currency Translation — The accounting records and reporting currency of the Fund are maintained in United States (“U.S.”) dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within

14

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

net realized and unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Statement of Operations within net change in unrealized gain (loss) on foreign currency translations. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

Changes in valuation techniques may result in transfers into or out of an assigned level within the hierarchy. In accordance with the Funds’ policy, transfers between different levels of the fair value hierarchy resulting from such changes are deemed to have occurred as of the beginning of the reporting period.

The Board of Trustees (“Trustees”) has approved Valuation Procedures that govern the valuation of the portfolio investments held by the Fund, including investments for which market quotations are not readily available. The Trustees have delegated to GSAM day-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Fund’s portfolio investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments — The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Equity Securities — Equity securities traded on a U.S. securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price or such price is believed by GSAM to not represent fair value, equity securities are valued at the last bid price for long positions and at the last ask price for short positions. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign currency exchange rates

15

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements (continued)

December 31, 2015

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued)

that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Underlying Funds (including Money Market Funds) — Underlying Funds (“Underlying Funds”) include other investment companies and exchange-traded funds (“ETFs”). Investments in the Underlying Funds (except ETFs) are valued at the NAV per share of the Institutional Share class (the FST class for Money Market Funds) on the day of valuation. ETFs are valued daily at the last sale price or official closing price on the principal exchange or system on which the investment is traded. Because the Fund invests in Underlying Funds that fluctuate in value, the Fund’s shares will correspondingly fluctuate in value. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2. For information regarding an Underlying Fund’s accounting policies and investment holdings, please see the Underlying Fund’s shareholder report.

Debt Securities — Debt securities for which market quotations are readily available are valued daily on the basis of quotations supplied by dealers or an independent pricing service approved by the Trustees. The pricing services may use valuation models or matrix pricing, which consider: (i) yield or price with respect to bonds that are considered comparable in characteristics such as rating, interest rate and maturity date or (ii) quotations from securities dealers to determine current value. Short-term debt obligations that mature in sixty days or less and that do not exhibit signs of credit deterioration are valued at amortized cost, which approximates fair value. With the exception of treasury securities of G8 countries (not held in money market funds), which are generally classified as Level 1, these investments are generally classified as Level 2 of the fair value hierarchy.

Derivative Contracts — A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. The Fund enters into derivative transactions to hedge against changes in interest rates, securities prices, and/or currency exchange rates, to increase total return, or to gain access to certain markets or attain exposure to other underliers.

Exchange-traded derivatives, including futures and options contracts, are valued at the last sale or settlement price and typically fall within Level 1 of the fair value hierarchy. Over-the-counter (“OTC”) and centrally cleared derivatives are valued using market transactions and other market evidence, including market-based inputs to models, calibration to market-clearing transactions, broker or dealer quotations, or other alternative pricing sources. Where models are used, the selection of a particular model to value OTC and centrally cleared derivatives depends upon the contractual terms of, and specific risks inherent in, the instrument, as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, yield curves, credit curves, measures of volatility, voluntary and involuntary prepayment rates, loss severity rates and correlations of such inputs. For OTC and centrally cleared derivatives that trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. OTC and centrally cleared derivatives are classified within Level 2 of the fair value hierarchy when significant inputs are corroborated by market evidence.

i. Futures Contracts — Futures contracts are contracts to buy or sell a standardized quantity of a specified commodity or security and are valued based on exchanged settlement prices or independent market quotes. Futures contracts are valued at the last settlement price, or in the absence of a sale, the last bid price for long positions and at the last ask price for short positions, at the end of each day on the board of trade or exchange upon which they are traded. Upon entering into a futures contract, a Fund deposits cash or securities in an account on behalf of the broker in an amount sufficient to meet the initial margin requirement. Subsequent payments are made or received by a Fund equal to the daily change in the contract value and are recorded as variation margin receivable or payable with a corresponding offset to unrealized gains or losses.

B. Level 3 Fair Value Investments — To the extent that significant inputs to valuation models and other alternative pricing sources are unobservable, or if quotations are not readily available, or if GSAM believes that such quotations do not accurately reflect fair value, the fair value of the Fund’s investments may be determined under Valuation Procedures approved by the Trustees. GSAM, consistent with its procedures and applicable regulatory guidance, may make an adjustment to the most recent valuation prices of either domestic or foreign securities in light of significant events to reflect what it believes to be the fair value of

16

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued)

the securities at the time of determining a Fund’s NAV. Significant events which could affect a large number of securities in a particular market may include, but are not limited to: significant fluctuations in U.S. or foreign markets; market dislocations; market disruptions; or unscheduled market closings. Significant events which could also affect a single issuer may include, but are not limited to: corporate actions such as reorganizations, mergers and buy-outs; ratings downgrades; and bankruptcies.

C. Fair Value Hierarchy — The following is a summary of the Fund’s investments and derivatives classified in the fair value hierarchy as of December 31, 2015:

| | | | | | | | | | | | |

| Investment Type | | Level 1 | | | Level 2 | | | Level 3 | |

| Assets | | | | | | | | | | | | |

| Fixed Income | | | | | | | | | | | | |

Agency Debentures | | $ | — | | | $ | 44,905,125 | | | $ | — | |

U.S. Treasury Obligations and/or Other U.S. Government Agencies | | | 49,648,439 | | | | — | | | | — | |

| Exchange Traded Funds | | | 80,518,811 | | | | — | | | | — | |

| Investment Company | | | 160,199,048 | | | | — | | | | — | |

| Total | | $ | 290,366,298 | | | $ | 44,905,125 | | | $ | — | |

| | | |

| Derivative Type | | | | | | | | | |

| Assets(a) | | | | | | | | | | | | |

| Futures Contracts | | $ | 936,408 | | | $ | — | | | $ | — | |

| Liabilities(a) | | | | | | | | | | | | |

| Futures Contracts | | $ | (684,071 | ) | | $ | — | | | $ | — | |

| (a) | Amount shown represents unrealized gain (loss) at fiscal year end. |

For further information regarding security characteristics, see the Schedule of Investments.

4. INVESTMENTS IN DERIVATIVES

The following table sets forth, by certain risk types, the gross value of derivative contracts as of December 31, 2015. These instruments were used as part of the Fund’s investment strategies and to obtain and/or manage exposure related to the risks below. The values in the table below exclude the effects of cash collateral received or posted pursuant to these derivative contracts, and therefore are not representative of the Fund’s net exposure.

| | | | | | | | | | | | | | |

| Risk | | | | Statement of Assets and Liabilities | | Assets(a) | | | Statement of Assets and Liabilities | | Liabilities(a) | |

| Equity | | | | Variation margin on certain derivative contracts | | $ | 755,164 | | | Variation margin on certain derivative contracts | | $ | (221,001 | ) |

| Interest Rate | | | | Variation margin on certain derivative contracts | | | 181,244 | | | Variation margin on certain derivative contracts | | | (463,070 | ) |

| Total | | | | | | $ | 936,408 | | | | | $ | (684,071 | ) |

| (a) | Includes unrealized gain (loss) on futures contracts described in the Additional Investment Information section of the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

The following table sets forth, by certain risk types, the Fund’s gains (losses) related to these derivatives and their indicative volumes for the fiscal year ended December 31, 2015. These gains (losses) should be considered in the context that these derivative contracts may have been executed to create investment opportunities and/or economically hedge certain investments, and

17

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements (continued)

December 31, 2015

4. INVESTMENTS IN DERIVATIVES (continued)

accordingly, certain gains (losses) on such derivative contracts may offset certain (losses) gains attributable to investments. These gains (losses) are included in “Net realized gain (loss)” or “Net change in unrealized gain (loss)” on the Statement of Operations:

| | | | | | | | | | | | | | | | |

| Risk | | Statement of Operations | | | | Net

Realized

Gain (Loss) | | | Net Change in

Unrealized

Gain (Loss) | | | Average

Number of

Contracts(a) | |

Equity | | Net realized gain (loss) from futures contracts/Net change in unrealized gain (loss) on futures contracts | | | | $ | (1,601,064 | ) | | $ | 2,952,806 | | | | 1,065 | |

Interest Rate | | Net realized gain (loss) from futures contracts/Net change in unrealized gain (loss) on futures contracts | | | | | 1,715,376 | | | | (1,322,476 | ) | | | 177 | |

| Total | | | | | | $ | 114,312 | | | $ | 1,630,330 | | | | 1,242 | |

| (a) | Average number of contracts is based on the average of month end balances for the fiscal year ended December 31, 2015. |

5. AGREEMENTS AND AFFILIATED TRANSACTIONS

A. Management Agreement — Under the Agreement, GSAM manages the Fund, subject to the general supervision of the Trustees.

As compensation for the services rendered pursuant to the Agreement, the assumption of the expenses related thereto and administration of the Fund’s business affairs, including providing facilities, GSAM is entitled to a management fee, accrued daily and paid monthly, equal to an annual percentage rate of the Fund’s average daily net assets.

For the fiscal year ended December 31, 2015, contractual and effective net management fees with GSAM were at the following rates:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contractual Management Rate | | | | |

First

$1 billion | | | Next

$1 billion | | | Next

$3 billion | | | Next

$3 billion | | | Over

$8 billion | | | Effective

Rate | | | Effective Net

Management Rate^ | |

| | 0.79% | | | | 0.71 | % | | | 0.68 | % | | | 0.66 | % | | | 0.65 | % | | | 0.79 | % | | | 0.73 | % |

| ^ | Effective Net Management Rate includes the impact of management fee waivers of affiliated underlying funds, if any. |

The Fund invests in FST Shares of the Goldman Sachs Financial Square Government Fund, which is an affiliated Underlying Fund. GSAM has agreed to waive a portion of its management fee payable by the Fund in an amount equal to the management fee it earns as an investment adviser to any of the affiliated Underlying Funds in which the Fund invests. For the fiscal year ended December 31, 2015, GSAM waived $184,455 of the Fund’s management fee.

B. Distribution and Service Plan — The Trust, on behalf of the Service Shares of the Fund, has adopted a Distribution and Service Plan (the “Plan”). Under the Plans, Goldman Sachs, which serves as distributor (the “Distributor”), is entitled to a fee accrued daily and paid monthly, for distribution services and personal and account maintenance services, which may then be paid by Goldman Sachs to authorized dealers, equal to, on an annual basis, 0.25% of the Fund’s average daily net assets attributable to Service Shares.

C. Transfer Agency Agreement — Goldman Sachs also serves as the transfer agent of the Fund for a fee pursuant to the Transfer Agency Agreement. The fees charged for such transfer agency services are accrued daily and paid monthly at an annual rate of 0.02% of the average daily net assets of Institutional and Service Shares.

D. Other Expense Agreements and Affiliated Transactions — GSAM has agreed to limit certain “Other Expenses” of the Fund (excluding acquired fund fees and expenses, transfer agency fees and expenses, taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification and extraordinary expenses) to the extent such expenses exceed, on an annual basis, a

18

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

5. AGREEMENTS AND AFFILIATED TRANSACTIONS (continued)

percentage rate of the average daily net assets of the Fund. Such Other Expense reimbursements, if any, are accrued daily and paid monthly. In addition, the Fund is not obligated to reimburse GSAM for prior fiscal year expense reimbursements, if any. The Other Expense limitation as an annual percentage rate of average daily net assets for the Fund is 0.004%. The Other Expense limitation will remain in place through at least April 30, 2016, and prior to such date GSAM may not terminate the arrangement without the approval of the Trustees. For the fiscal year ended December 31, 2015, GSAM reimbursed $328,717 to the Fund. In addition, the Fund has entered into certain offset arrangements with the custodian and the transfer agent, which may result in a reduction of the Fund’s expenses and are received irrespective of the application of the “Other Expense” limitation described above. For the fiscal year ended December 31, 2015, custody fee credits were $18,013.

E. Line of Credit Facility — As of December 31, 2015, the Fund participated in a $1,205,000,000 committed, unsecured revolving line of credit facility (the “facility”) together with other funds of the Trust and certain registered investment companies having management agreements with GSAM or its affiliates (“Other Borrowers”). Pursuant to the terms of the facility, the Fund and Other Borrowers could increase the credit amount by up to an additional $115,000,000, for a total of up to $1,320,000,000. This facility is to be used for temporary emergency purposes, or to allow for an orderly liquidation of securities to meet redemption requests. The interest rate on borrowings is based on the federal funds rate. The facility also requires a fee to be paid by the Fund based on the amount of the commitment that has not been utilized. For the fiscal year ended December 31, 2015, the Fund did not have any borrowings under the facility.

F. Other Transactions with Affiliates — For the fiscal year ended December 31, 2015, Goldman Sachs earned $55 in brokerage commissions from portfolio transactions, including futures transactions executed with Goldman Sachs as the Futures Commission Merchant, on behalf of the Fund.

The following table provides information about the Fund’s investment in the Goldman Sachs Financial Square Government Fund as of and for the fiscal year ended December 31, 2015:

| | | | | | | | | | | | | | | | | | |

Market

Value

12/31/2014 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Market

Value

12/31/2015 | | | Dividend

Income | |

| $ | 121,367,084 | | | $ | 402,093,126 | | | $ | (363,261,162 | ) | | $ | 160,199,048 | | | $ | 29,785 | |

6. PORTFOLIO SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales and maturities of long-term securities for the fiscal year ended December 31, 2015, were as follows:

| | | | | | | | | | | | | | |

Purchases of

U.S. Government and

Agency Obligations | | | Purchases (Excluding

U.S. Government and

Agency Obligations) | | | Sales and

Maturities of

U.S. Government and

Agency Obligations | | | Sales and

Maturities (Excluding

U.S. Government and

Agency Obligations) | |

| $ | 349,570,497 | | | $ | 352,261,535 | | | $ | 299,541,902 | | | $ | 364,454,773 | |

19

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements (continued)

December 31, 2015

7. SECURITIES LENDING

Pursuant to exemptive relief granted by the Securities and Exchange Commission (“SEC”) and the terms and conditions contained therein, the Fund may lend its securities through a securities lending agent, Goldman Sachs Agency Lending (“GSAL”), a wholly-owned subsidiary of Goldman Sachs, to certain qualified borrowers including Goldman Sachs and affiliates. In accordance with the Fund’s securities lending procedures, the Fund receives cash collateral at least equal to the market value of the securities on loan. The market value of the loaned securities is determined at the close of business of the Fund, at their last sale price or official closing price on the principal exchange or system on which they are traded, and any additional required collateral is delivered to the Fund on the next business day. As with other extensions of credit, the Fund may experience delay in the recovery of its securities or incur a loss should the borrower of the securities breach its agreement with the Fund or become insolvent at a time when the collateral is insufficient to cover the cost of repurchasing securities on loan. Dividend income received from securities on loan may not be subject to withholding taxes and therefore withholding taxes paid may differ from the amounts listed in the Statement of Operations. Loans of securities are terminable at any time and as such 1) the remaining contractual maturities of the outstanding securities lending transactions are considered to be overnight and continuous and 2) the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

The Fund invests the cash collateral received in connection with securities lending transactions in the Goldman Sachs Financial Square Money Market Fund (“Money Market Fund”), an affiliated series of the Trust. The Money Market Fund is registered under the Act as an open end investment company, is subject to Rule 2a-7 under the Act, and is managed by GSAM, for which GSAM may receive an investment advisory fee of up to 0.205% on an annualized basis of the average daily net assets of the Money Market Fund.

In the event of a default by a borrower with respect to any loan, GSAL will exercise any and all remedies provided under the applicable borrower agreement to make the Fund whole. These remedies include purchasing replacement securities by applying the collateral held from the defaulting broker against the purchase cost of the replacement securities. If, despite such efforts by GSAL to exercise these remedies, the Fund sustains losses as a result of a borrower’s default, GSAL indemnifies the Fund by purchasing replacement securities at GSAL’s expense, or paying the Fund an amount equal to the market value of the replacement securities, subject to an exclusion for any shortfalls resulting from a loss of value in the cash collateral pool due to reinvestment risk and a requirement that the Fund agrees to assign rights to the collateral to GSAL for purpose of using the collateral to cover purchase of replacement securities as more fully described in the Securities Lending Agency Agreement. The Fund’s loaned securities were all subject to enforceable Securities Lending Agreements and the value of the collateral is at least equal to the value of the cash received. The value of loaned securities and cash collateral at period end are disclosed in the Fund’s Statement of Assets and Liabilities.

Both the Fund and GSAL received compensation relating to the lending of the Fund’s securities. The amount earned by the Fund for the fiscal year ended December 31, 2015, is reported under Investment Income on the Statement of Operations. For the fiscal year ended December 31, 2015, GSAL earned $3,238 in fees as securities lending agent.

The following table provides information about the Fund’s investment in the Money Market Fund for the fiscal year ended December 31, 2015:

| | | | | | | | | | | | | | |

Market

Value

12/31/14 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Market

Value

12/31/15 | |

| | $11,955,850 | | | $ | 228,850,350 | | | $ | (240,806,200 | ) | | $ | — | |

20

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

8. TAX INFORMATION

The tax character of distributions paid during the fiscal years ended December 31, 2014 and December 31, 2015, was as follows:

| | | | | | | | |

| | | 2014 | | | 2015 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 1,035,132 | | | $ | 6,728,201 | |

| Net long-term capital gains | | | 1,194,963 | | | | 1,273,993 | |

| Total taxable distributions | | $ | 2,230,095 | | | $ | 8,002,194 | |

As of December 31, 2015, the components of accumulated earnings (losses) on a tax-basis were as follows:

| | | | |

| Capital loss carryforwards: | | $ | (13,375,529 | ) |

| Timing differences (Qualified Late Year Loss Deferral/Post October Loss Deferral) | | | (218,043 | ) |

| Unrealized losses — net | | | (2,886,372 | ) |

| Total accumulated losses — net | | $ | (16,479,944 | ) |

As of December 31, 2015, the Funds’ aggregate security unrealized gains and losses based on cost for U.S. federal income tax purposes were as follows:

| | | | |

| Tax cost | | $ | 338,133,648 | |

| Gross unrealized gain | | | 452,314 | |

| Gross unrealized loss | | | (3,314,539 | ) |

| Net unrealized security loss | | $ | (2,862,225 | ) |

| Net unrealized security gain (loss) in other investments | | | (24,147 | ) |

| Net unrealized loss | | $ | (2,886,372 | ) |

The difference between GAAP-basis and tax-basis unrealized gains (losses) is attributable primarily to wash sales and net mark to market gains (losses) on regulated futures contracts.

In order to present certain components of the Fund’s capital accounts on a tax-basis, the Fund has reclassified $100,095 of paid-in capital and $387,795 of accumulated net realized gain to undistributed net investment income. These reclassifications have no impact on the NAV of the Fund and result primarily from dividend redesignations and differences in the tax treatment of foreign currency transactions.

GSAM has reviewed the Fund’s tax positions for all open tax years (the current and prior three years, as applicable) and has concluded that no provision for income tax is required in the Fund’s financial statements. Such open tax years remain subject to examination and adjustment by tax authorities.

9. OTHER RISKS

The Fund’s risks include, but are not limited to, the following:

Foreign Custody Risk — A Fund that invests in foreign securities may hold such securities and cash with foreign banks, agents, and securities depositories appointed by the Fund’s custodian (each a “Foreign Custodian”). Some foreign custodians may be recently organized or new to the foreign custody business. In some countries, Foreign Custodians may be subject to little or no regulatory oversight over, or independent evaluation of, their operations. Further, the laws of certain countries may place limitations on a Fund’s ability to recover its assets if a Foreign Custodian enters bankruptcy. Investments in emerging markets may be subject to greater custody risks than investments in more developed markets. Custody services in emerging market countries are

21

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements (continued)

December 31, 2015

9. OTHER RISKS (continued)

very often undeveloped and may be considerably less well regulated than in more developed countries, and thus may not afford the same level of investor protection as would apply in developed countries.

Industry Concentration Risk — The Fund will not invest more than 25% of the value of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry, except that, to the extent that an industry represents 20% or more of the Fund’s index at the time of investment, the Fund may invest up to 35% of its assets in that industry. Concentrating Fund investments in issuers conducting business in the same industry will subject the Fund to a greater risk of loss as a result of adverse economic, business or other developments affecting that industry than if its investments were not so concentrated.

Interest Rate Risk — When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments.

Investments in Other Investment Companies — As a shareholder of another investment company, including an ETF, a Fund will indirectly bear its proportionate share of any net management fees and other expenses paid by such other investment companies, in addition to the fees and expenses regularly borne by the Fund. ETFs are subject to risks that do not apply to conventional mutual funds, including but not limited to the following: (i) the market price of the ETF’s shares may trade at a premium or a discount to their NAV; and (ii) an active trading market for an ETF’s shares may not develop or be maintained.

Large Shareholder Transactions Risk — The Fund may experience adverse effects when certain large shareholders, such as other funds, participating insurance companies, accounts and Goldman Sachs affiliates, purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would.

Liquidity Risk — The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell investments at an unfavorable time and/or under unfavorable conditions. Liquidity risk may be the result of, among other things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity.

Market and Credit Risks — In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk). Additionally, the Fund may also be exposed to credit risk in the event that an issuer or guarantor fails to perform or that an institution or entity with which the Fund has unsettled or open transactions defaults.

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from the imposition of exchange controls, confiscations and other government restrictions by the U.S. or other governments, or from problems in registration, settlement or custody. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to

22

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

9. OTHER RISKS (continued)

foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. To the extent that the Fund also invests in securities of issuers located in emerging markets, these risks may be more pronounced.

Non-Diversification Risk — The Fund is non-diversified, meaning that it is permitted to invest a larger percentage of its assets in fewer issuers than diversified mutual funds. Thus, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio, and may be more susceptible to greater losses because of these developments.

10. INDEMNIFICATIONS

Under the Trust’s organizational documents, its Trustees, officers, employees and agents are indemnified, to the extent permitted by the Act and state law, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, GSAM believes the risk of loss under these arrangements to be remote.

11. SUBSEQUENT EVENTS