UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08361

Goldman Sachs Variable Insurance Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606-6303

(Address of principal executive offices) (Zip code)

Caroline Kraus

Goldman Sachs & Co. LLC

200 West Street

New York, NY 10282

Copies to:

Geoffrey R.T. Kenyon, Esq.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, MA 02110-2605

(Name and address of agents for service)

Registrant’s telephone number, including area code:(312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Reports to Shareholders are filed herewith. |

Goldman

SachsVariable Insurance Trust

Goldman Sachs

Global Trends

Allocation Fund

Annual Report

December 31, 2018

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

INVESTMENT OBJECTIVE

The Fund seeks total return while seeking to provide volatility management.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Variable Insurance Trust — Goldman Sachs Global Trends Allocation Fund’s (the “Fund”) performance and positioning for the12-month period ended December 31, 2018 (the “Reporting Period”).

How did the Fund perform during the Reporting Period?

During the Reporting Period, the Fund’s Institutional and Service Shares generated average annual total returns of –4.08% and –4.34%, respectively. These returns compare to the –5.07% average annual total return of the Fund’s benchmark, the Global Trends Allocation Composite Index (the “Index”), during the same time period. The components of the Fund’s benchmark, the MSCI World Index (Net, USD, Unhedged) and the Bloomberg Barclays U.S. Aggregate Bond Index, generated average annual total returns of –8.71% and 0.01%, respectively, during the same time period.

Importantly, during the Reporting Period, the Fund’s overall annualized volatility (which is measured versus the S&P 500® Index) was 8.53%, less than the S&P 500® Index’s annualized volatility of 14.70% during the same time period.

What economic and market factors most influenced the Fund during the Reporting Period?

During the Reporting Period, the performance of the capital markets was influenced most by economic data, central bank monetary policy and geopolitical events.

Global equities saw a strong start to the Reporting Period in January 2018, peaking during the final week of the month. They then sold off during February 2018 on market speculation of a faster pace of Federal Reserve (“Fed”) short-term interest rate hikes, which stoked a sharp rise in bond yields and an increase in equity market volatility. Concerns about Fed monetary policy tightening were further exacerbated by solid U.S. labor and inflation data. In March 2018, escalating trade tensions and potential tariffs weighed on investor sentiment. Meanwhile, the Fed delivered on a widely expected interest rate increase, with its “dot plot” pointing to a total of three interest rate hikes in the 2018 calendar year and potentially two in 2019. (The “dot plot” shows rate projections of the members of the Fed’s Open Market Committee.) During the first calendar quarter overall, macroeconomic data moderated in the developed markets, particularly in Europe and Japan. Emerging markets equities generally outperformed their developed markets peers because of what many considered to be attractive valuations, because of the comparatively stronger economic data within emerging markets countries and because of higher commodity prices.

During the second quarter of 2018, developed markets equities generated positive returns, while emerging markets equities experienced broad-based weakness. In the developed markets, U.S., U.K., European and Japanese equities advanced, with U.K. export-driven stocks, in particular, benefiting from the depreciation of the British pound versus other major currencies. Emerging markets equities lagged developed markets stocks, as emerging markets’ economic growth slowed and disputes between the U.S. and China about trade tariffs dampened investor appetite for emerging markets assets in general.

Volatility was high for global equities during the third quarter of 2018, driven by trade-related headlines and strong U.S. macroeconomic data relative to other markets. Developed markets equities generally posted gains, though a number of factors weighed on investor sentiment, including trade and protectionism worries, uncertainty about Italy’s 2019 budget, the risk of ano-deal Brexit and concerns that Turkey’s financial crisis could spread to other markets. (Brexit refers to the U.K.’s efforts to leave the European Union.) As for emerging markets equities, they advanced in July 2018 after five consecutive months of declines but resumed their descent in August and September. They closed the third quarter of 2018 with rather flat returns overall, as heightened risk aversion, escalating trade tensions and tightening global liquidity dominated headlines.

In October 2018, global equities fell sharply, as investor sentiment rapidly deteriorated on heightened trade and political uncertainty and in a delayed reaction to rising interest rates. Market conditions eased in November, and developed markets stocks recorded modest gains, led by U.S. and Japanese stocks. Emerging markets equities also moved higher. The recovery, however, was short-lived, as global equities plunged in December 2018 on softer global economic data, which led to downward consensus expectations for corporate earnings growth, and on the Fed’s ongoing interest rate hikes. A partial U.S. federal government shutdown and the U.S. President’s criticism of Fed Chair Jerome Powell also weighed on U.S. stocks, while European equities fell on continued

1

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

uncertainty surrounding ano-deal Brexit scenario. Although emerging markets equities also retreated during the fourth quarter overall, they generally outperformed developed markets equities, due largely to rallies in Brazilian and Indian stocks.

Regarding fixed income, spread, ornon-government bond, sectors were challenged during the first quarter of 2018 by a surge in market volatility and“risk-off” sentiment, or reduced risk appetite, amid equity market declines in February and March. Catalysts included firmer than consensus expected U.S. wage and price inflation data at the beginning of February 2018 and rising concerns about trade tensions during March. At their March policy meeting, Fed officials raised short-term interest rates, much as the market had expected, and continued to point to a total of three interest rate increases in 2018. However, Fed policymakers revised their economic growth forecast higher and their employment forecast lower.

During the second calendar quarter, spread sectors broadly weakened amid protectionist trade measures and political events in emerging markets countries and Italy as well as on higher U.S. interest rates and a stronger U.S. dollar. U.S. high yield corporate bonds, however, generated a small positive return. Rising oil prices were a tailwind for the broader high yield corporate bond sector, as many energy bonds are high yield rated. In June 2018, the Fed raised short-term interest rates, and its dot plot pointed to two more rate increases in 2018, implying a total of four rate hikes in the calendar year. U.S. economic growth strengthened, with the Gross Domestic Product expanding at an annualized rate of 4.2% in the second calendar quarter. In contrast, economic growth softened in the Eurozone, Japan and China.

Spread sectors performed well during the third quarter of 2018, as the global economy — led by particularly strong economic growth in the U.S. — expanded. However, some major economies, including those of the Eurozone, the U.K. and China, continued to exhibit a gradual weakening trend. Emerging markets debt broadly posted gains, with strength in July and September 2018 outweighing pronounced August weakness. High yield corporate bonds also advanced, recording their best quarterly performance since the first quarter of 2017. In September 2018, the Fed delivered the eighth interest rate hike of its current tightening cycle, with its dot plot pointing to another increase by calendaryear-end and three more during 2019. Fed Chair Powell delivered an upbeat assessment of the U.S. economy, which supported market expectations for these additional Fed rate hikes in 2019. U.S. Treasury rates rose in response, followed, in turn, by the interest rates of other developed markets countries.

During the fourth quarter of 2018, investor concerns about slowing global economic growth momentum as well as tighter financial conditions, mainly in the U.S., weighed on spread sector performance. In particular, U.S. corporate bonds experienced notable weakness, as credit spreads, or yield differentials versus U.S. Treasury securities, widened significantly. U.S. Treasury rates fell as investors grew fearful about the possible end of the global economic cycle and their expectations for Fed rate hikes diminished. In December 2018, Fed policymakers raised short-term interest rates, much as the market had expected, but lowered their projection for 2019 monetary policy tightening from three rate hikes to two. U.S. economic activity data remained in expansionary territory during the fourth calendar quarter but moderated from cycle highs. Headline inflation pressures eased as crude oil prices declined.

What key factors were responsible for the Fund’s performance during the Reporting Period?

The Fund primarily seeks to achieve its investment objective by investing in a global portfolio of equity and fixed income asset classes. Under normal market conditions, the Fund expects to invest at least 40% of its assets in equity investments and at least 20% of its assets in fixed income investments. The percentage of the Fund’s portfolio exposed to any asset class or geographic region will vary from time to time as the weightings of the Fund change, and the Fund may not be invested in each asset class at all times.

As part of the Fund’s investment strategy, the Investment Adviser seeks to manage volatility and limit losses by allocating the Fund’s assets away from risky investments in distressed or volatile market environments. Volatility is a statistical measurement of the magnitude of up and down fluctuations in the value of a financial instrument or index. In distressed or volatile market environments, the Fund may also hold significant amounts of U.S. Treasury, short-term or other fixed income investments, including money market funds and repurchase agreements or cash, and at times may invest up to 100% of its assets in such investments.

During the Reporting Period, the Fund continued dynamically allocating across global asset classes, using a momentum-based methodology, as it sought total return while also seeking to provide volatility management. Momentum investing seeks growth of capital by gaining exposure to asset classes that have exhibited trends in price performance over selected time periods. In managing the Fund, we use a methodology that evaluates historical three-,six- and nine-month returns, volatilities and correlations across a range of nine global asset classes. Represented by indices, these asset classes include, within the equities category, U.S.large-cap andsmall-cap, European, Asian, emerging markets and U.K. stocks. Within the fixed income category, the Fund may allocate assets to the U.S., Europe and Japan. The analysis of these asset classes drives the aggregate allocations of the Fund over time. We believe market price momentum — either positive or negative — has significant predictive power.

2

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

During the Reporting Period, the Fund was hurt overall by our efforts to reduce risk in response to the market volatility in February 2018 and during the last three months of 2018. Allocations to U.S.large-cap stocks and Japanese equities detracted most from the Fund’s performance. The Fund’s allocations to European, U.K. and emerging markets equities also diminished returns. On the positive side, the Fund benefited from its allocations to U.S. Treasury securities and German and Japanese government bonds. An allocation to U.S.small-cap equities did not have a meaningful impact on the Fund’s performance during the Reporting Period.

What was the Fund’s volatility during the Reporting Period?

As part of our investment approach, we seek to mitigate the Fund’s volatility. As mentioned earlier, for the Reporting Period overall, the Fund’s actual volatility (annualized, using daily returns) was 8.53%, less than the S&P 500® Index’s annualized volatility of 14.70%.

How was the Fund positioned during the Reporting Period?

During the Reporting Period, we tactically managed the Fund’s allocations across equity and fixed income markets based on the momentum and volatility of these asset classes. At the beginning of the Reporting Period, the Fund’s total assets were allocated 80% to equities, 20% to fixed income and 0% to cash. (Many of these positions were implemented through the use of exchanged-traded index future contracts.) Within the equity category, the Fund had allocations to five of six global equity asset classes. It did not have an allocation to U.S.small-cap equities at the beginning of the Reporting Period. As for fixed income, the Fund had an allocation to Japanese government bonds. It had no exposure to U.S. Treasuries or German government bonds at the start of the Reporting Period.

In January 2018, we made no changes to the Fund’s allocations. During February, we reduced the Fund’s allocation to Japanese equities and added an allocation to U.S. small-cap equities. We also added a small position in cash as we sought to reduce risk in the portfolio. Overall, from early February through the end of April 2018, we actively sought to manage volatility within the Fund’s allocations to Japanese equities and U.S. large-cap equities.

During March 2018, we modestly increased the Fund’s position in cash as we continued in our efforts to reduce risk in the portfolio. We reduced the Fund’s allocations to Japanese and U.S. large-cap stocks. We increased its allocation to U.S. small-cap equities. Overall, from the end of March through the end of April, we actively sought to manage volatility within the Fund’s allocation to U.S. small-cap equities. Within fixed income during March, we added an allocation to German government bonds.

In April 2018, we reduced the Fund’s allocation to emerging markets equities and U.S. large-cap equities. We increased its allocations to Japanese, U.K., and European equities. Within fixed income, we increased the Fund’s allocations to German government bonds. By the end of the month, we had eliminated the Fund’s position in cash.

During May 2018, we eliminated the Fund’s allocation to emerging markets equities. We reduced its allocation to European equities and increased its allocations to U.K. and U.S. small-cap and large-cap equities. Within fixed income, we added an allocation to U.S. Treasury securities and decreased its allocation to German government bonds.

During June 2018, within the equity allocation, we increased the Fund’s exposure to Japanese equities and reduced its exposure to U.K. and U.S. large-cap equities. Within fixed income, we increased the Fund’s allocation to German government bonds and eliminated its allocation to U.S. Treasuries.

In July 2018, we increased the Fund’s allocations to U.S.large-cap equities and European equities. We moderated its allocations to Japanese equities and U.K. equities. Within fixed income, we lowered the Fund’s allocations to Japanese and German government bonds.

During August 2018, we increased the Fund’s allocations to U.S.large-cap equities and Japanese equities. We moderated its allocation to European equities. Within fixed income, we greatly reduced the Fund’s allocation to Japanese government bonds, while adding slightly to its allocation to German government bonds. We also established a small allocation to U.S. Treasuries.

During September 2018, we increased the Fund’s allocations to European and Japanese equities. We moderated its allocation to U.S.small-cap equities. Within fixed income, we greatly reduced the Fund’s allocation to German government bonds, while significantly increasing its allocation to Japanese government bonds. In addition, we eliminated the Fund’s small allocation to U.S. Treasuries.

In October 2018, we increased the Fund’s cash position and its allocation to fixed income. Were-established an allocation to U.S. Treasuries. We also decreased the Fund’s allocations to U.S.large-cap, European, U.K. and Japanese equities. During November, we gradually reduced the Fund’s cash position, reallocating the capital to equities and fixed income. In December, as we sought to

3

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

reduce risk due to increased market stress, we significantly increased the Fund’s cash position and decreased its allocations to equities and fixed income overall.

How did the Fund use derivatives and similar instruments during the Reporting Period?

During the Reporting Period, the Fund employed exchange-traded index futures contracts to gain exposure to U.S.large-cap andsmall-cap stocks; the European, Japanese and U.K. equity markets; and U.S., Japanese and German government bonds. On an absolute basis, the use of these instruments had a negative impact on the Fund’s performance, as the majority of these allocations detracted from returns.

Were there any changes to the Fund’s portfolio management team during the Reporting Period?

Effective April 20, 2018, Amna Qaiser no longer served as a portfolio manager of the Fund. As of the same date, Federico Gilly and Oliver Bunn became portfolio managers of the Fund. By design, all investment decisions for the Fund are performed within aco-lead or team structure, with multiple subject matter experts. This strategic decision making has been the cornerstone of our approach and ensures continuity in the Fund. At the end of the Reporting Period, the portfolio managers for the Fund were Gary Chropuvka, Federico Gilly and Oliver Bunn.

What is the Fund’s tactical asset allocation view and strategy for the months ahead?

At the end of the Reporting Period, the Fund’s total assets were allocated 19.3% to equities, 38.3% to fixed income and 42.4% to cash. (Many of these positions were implemented through the use of exchanged-traded index future contracts.) We prepared for 2019 by maintaining a significant cash position in the Fund. Within the equity allocation, which we had decreased overall, the Fund continued to have exposure to U.S.large-cap stocks and Japanese equities and, to a lesser extent, to U.K. and European equities. Within the fixed income allocation, we had decreased the Fund’s exposure to Japanese and German government bonds as well as U.S. Treasury securities. At the end of the Reporting Period, the Fund had no exposure to emerging markets equities and U.S.small-cap stocks.

Going forward, we intend to position the Fund to provide exposure to price momentum from among nine underlying asset classes, while dynamically managing the volatility, or risk, of the overall portfolio. In general, the Fund seeks to maintain a strategic allocation of 60% of its assets in equity investments and 40% of its assets in fixed income investments. The Fund may deviate from these strategic allocations in order to allocate a greater percentage to asset classes with strong momentum and to reduce its allocation to assets with weak momentum. When volatility increases, our goal is to preserve capital by proportionally increasing the Fund’s cash exposure and reducing its exposure to riskier asset classes. There is no guarantee the Fund’s dynamic management strategy will cause it to achieve its investment objective.

4

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Index Definitions

Global Trends Allocation Composite Index is composed 60% of MSCI World Index (Net, USD, Unhedged) and 40% of Bloomberg Barclays U.S. Aggregate Bond Index. It is a composite representation prepared by the Investment Adviser of the performance of the Fund’s asset classes, weighted according to their respective weightings in the Fund’s target range.

MSCI World Index (Net, USD, Unhedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed markets.

Bloomberg Barclays U.S. Aggregate Bond Indexrepresents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment grade corporate bonds, and mortgage-backed and asset-backed securities.

S&P 500® Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S.

It is not possible to invest directly in an unmanaged index.

5

FUND BASICS

Global Trends Allocation Fund

as of December 31, 2018

STANDARDIZED TOTAL RETURNS1

| | | | | | | | | | | | | | |

| | | | |

| For the year ended 12/31/18 | | One Year | | | Five Years | | | Since Inception | | | Inception Date |

| Institutional | | | -4.08 | % | | | 2.27 | % | | | 2.79 | % | | 10/16/13 |

| Service | | | -4.34 | | | | 2.02 | | | | 4.01 | | | 4/16/12 |

| 1 | Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at net asset value (“NAV”). Because Institutional Shares and Service Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

Total return figures in the above chart represent past performance and do not indicate future results, which will vary. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the total return figures in the above chart. Please visit www.GSAMFUNDS.com to obtain the most recent month-end returns.Performance reflects fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced.

EXPENSE RATIOS2

| | | | | | | | |

| | |

| | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| Institutional | | | 0.75 | % | | | 1.00 | % |

| Service | | | 1.00 | | | | 1.25 | |

| 2 | The expense ratios of the Fund, both current (net of any fee waivers and/or expense limitations) and before waivers (gross of any fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s fee waivers and/or expense limitations will remain in place through at least April 30, 2019, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

6

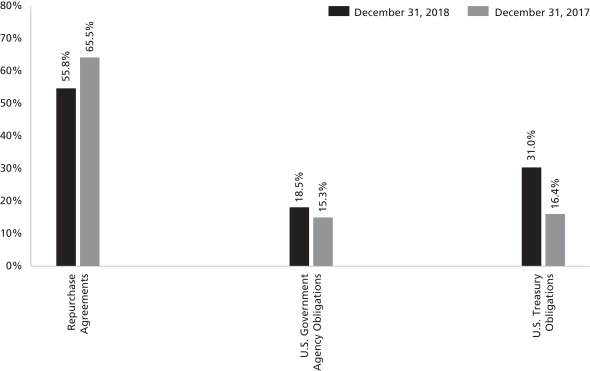

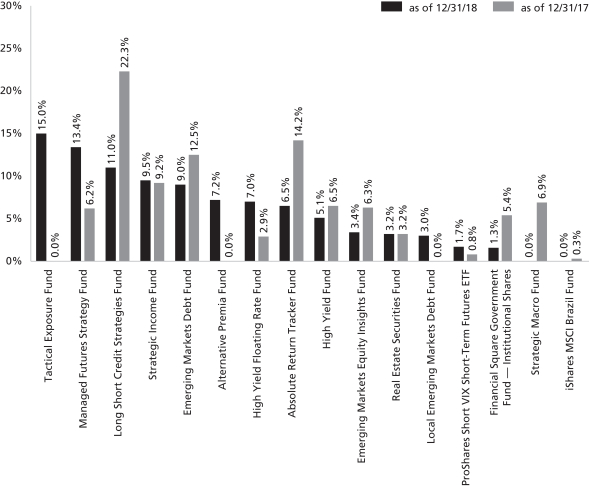

FUND BASICS

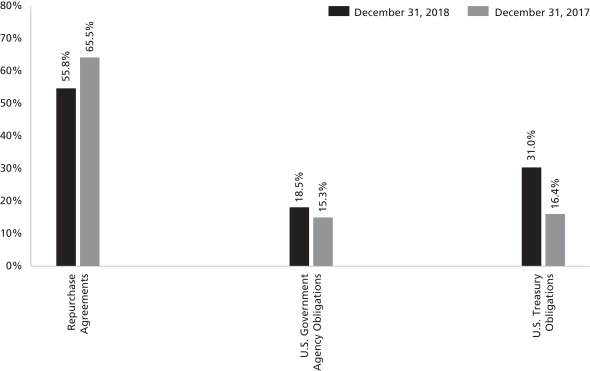

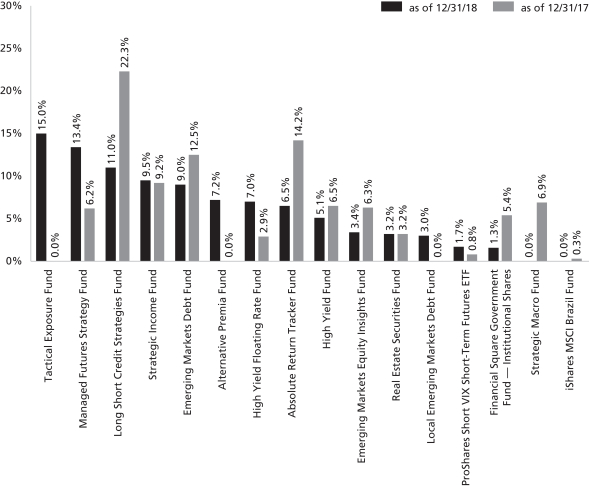

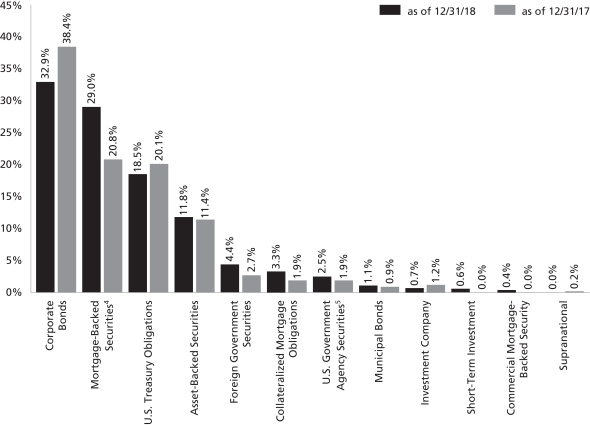

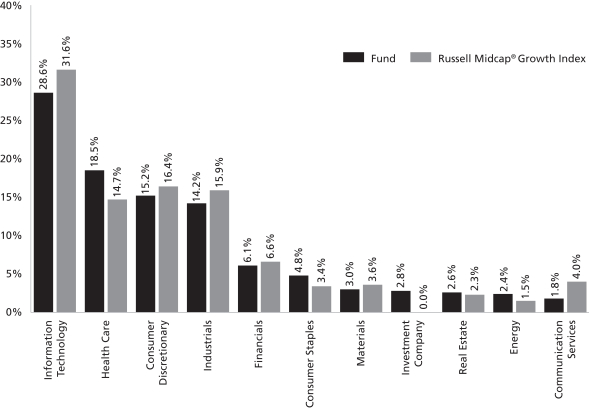

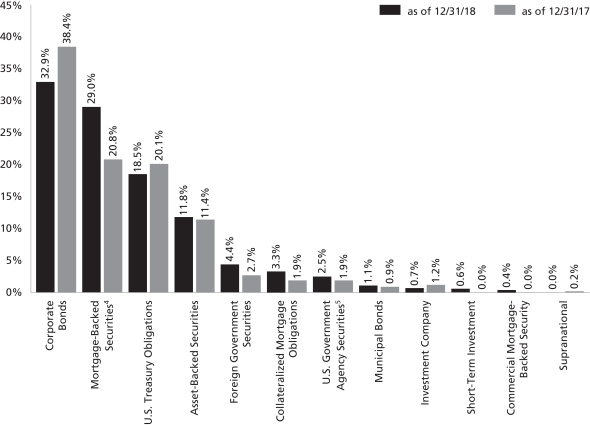

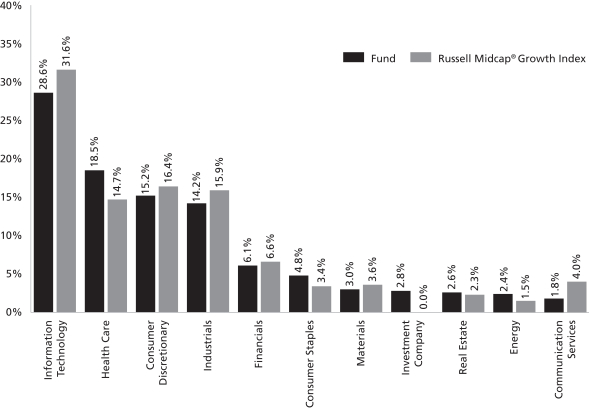

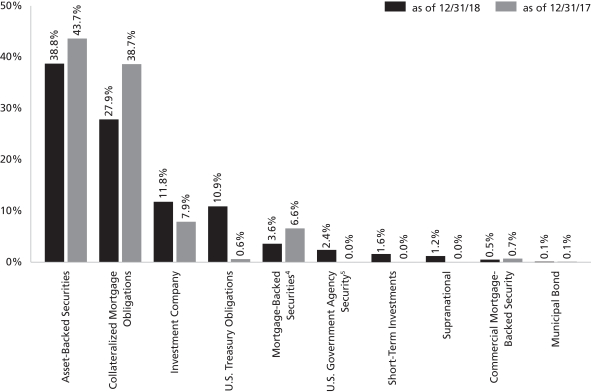

FUND COMPOSITION3

| 3 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The underlying composition of exchange traded funds and investment companies held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall composition may differ from the percentages contained in the graph above. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

7

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Performance Summary

December 31, 2018

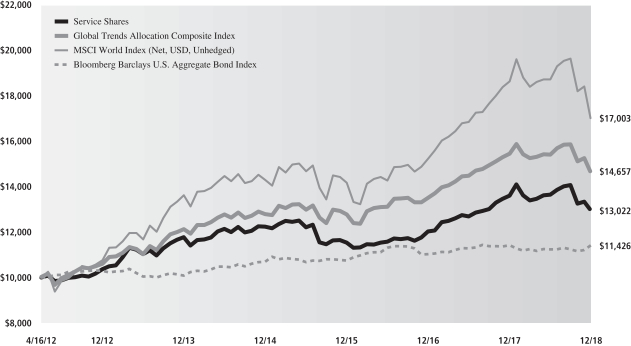

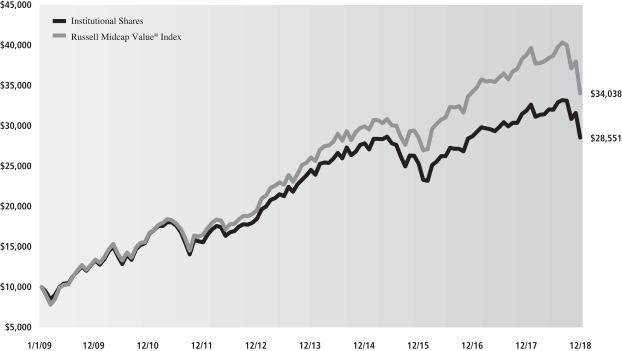

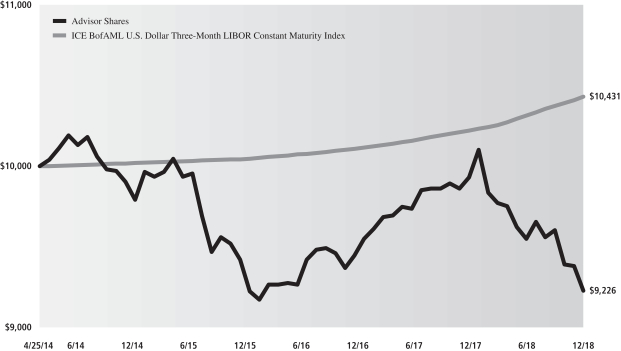

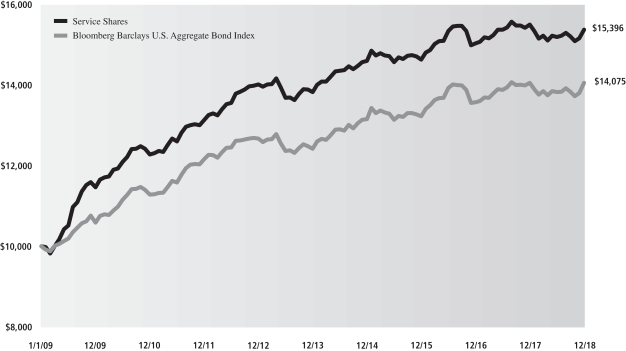

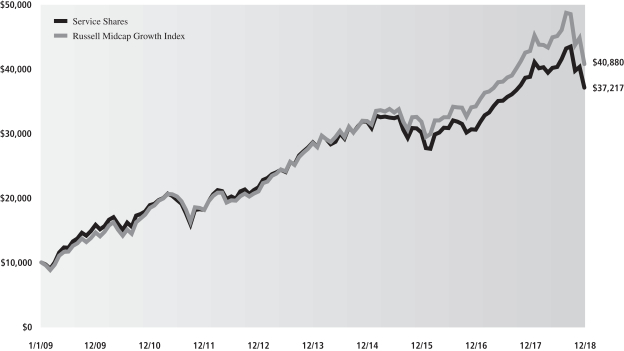

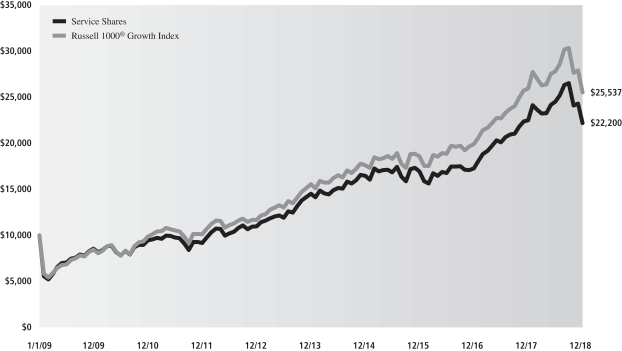

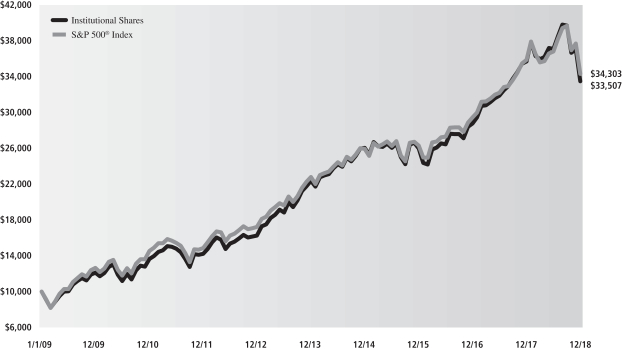

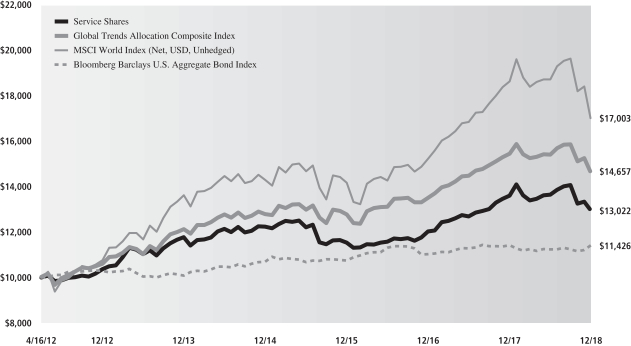

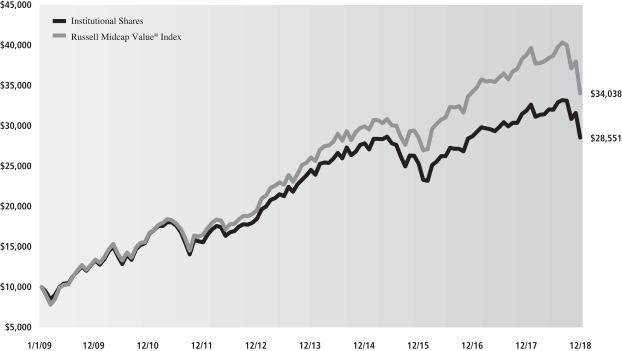

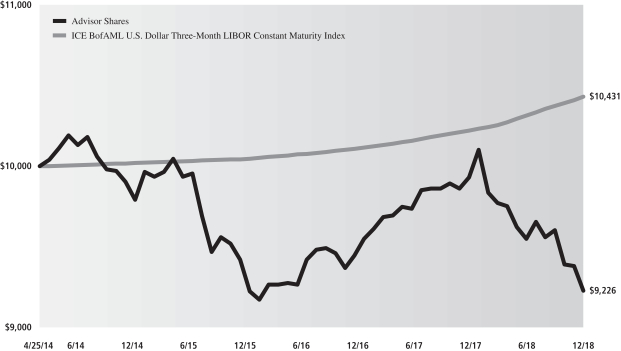

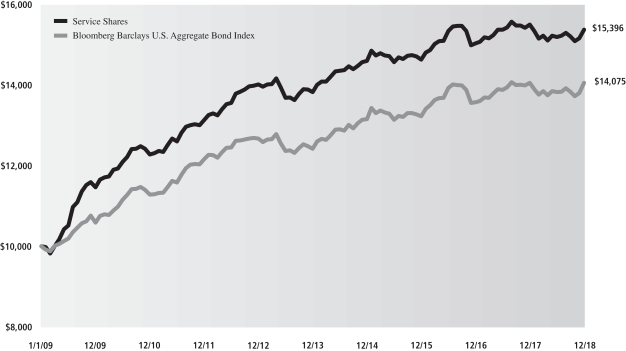

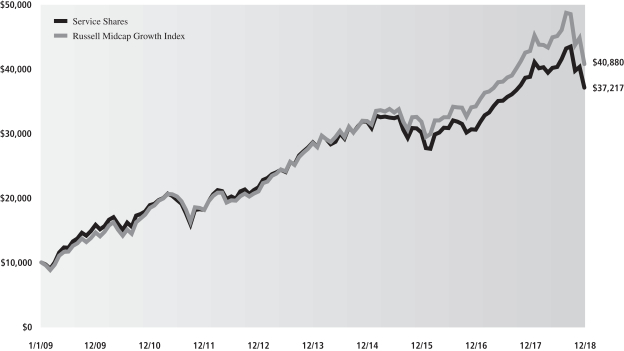

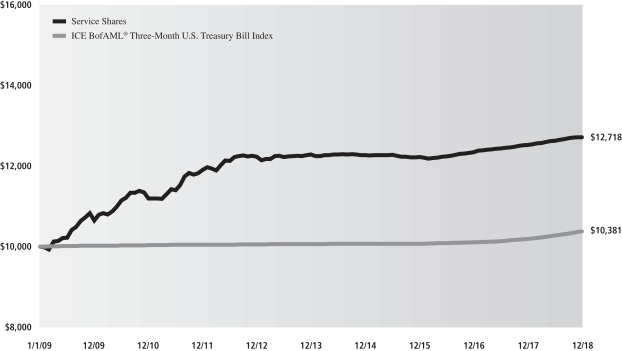

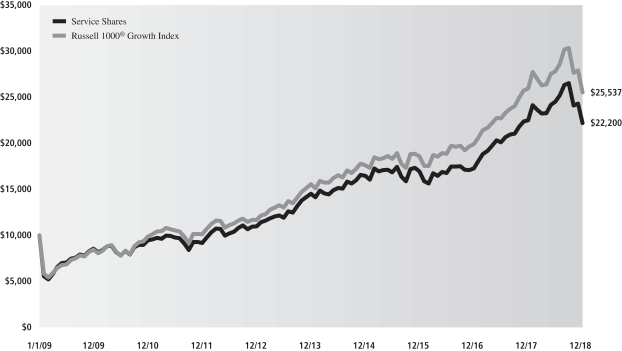

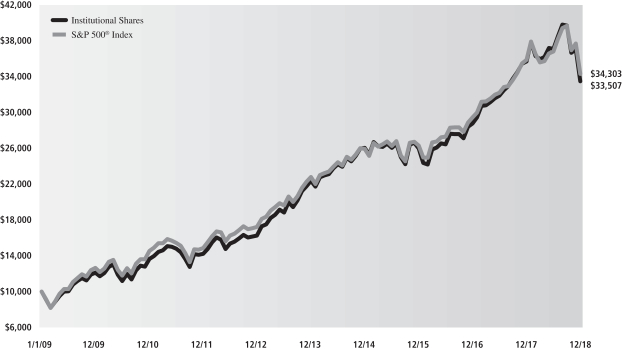

The following graph shows the value, as of December 31, 2018, of a $10,000 investment made on April 16, 2012 (commencement of the Fund’s operations) in Service Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Global Trends Allocation Composite Index, (comprised of the Morgan Stanley Capital International (MSCI) World Index (Net, USD, Unhedged) (60%) and the Bloomberg Barclays U.S. Aggregate Bond Index (40%)) is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects Fund level expenses but does not reflect fees and expenses associated with any variable annuity contract or variable life insurance policy that uses the Fund as an investment option for any contract or policy. Had performance reflected all of those fees and expenses, performance would have been reduced. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown, and in their absence, performance would be reduced. Performance of Institutional Shares will vary from Service Shares due to differences in class specific fees. In addition to the Investment Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Fund.

Global Trends Allocation Fund’s Lifetime Performance

Performance of a $10,000 investment, with distributions reinvested, from April 16, 2012 through December 31, 2018.

| | | | | | |

| Average Annual Total Return through December 31, 2018 | | One Year | | Five Years | | Since Inception |

Institutional (Commenced October 16, 2013) | | -4.08% | | 2.27% | | 2.79% |

Service (Commenced April 16, 2012) | | -4.34% | | 2.02% | | 4.01% |

8

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Schedule of Investments

December 31, 2018

| | | | | | |

| Shares | | Description | | Value | |

|

| Exchange Traded Fund –13.3% | |

| 208,444 | | iShares Core S&P 500 ETF | | | | |

| (Cost $42,482,984) | | $ | 52,446,595 | |

| |

| | | | | | | | |

| Shares | | Dividend Rate | | | Value | |

|

| Investment Companies(a) – 56.4% | |

Goldman Sachs Financial Square Government Fund — Institutional Shares | |

| 119,104,588 | | | 2.521 | % | | $ | 119,104,588 | |

Goldman Sachs Financial Square Treasury Obligations Fund —Institutional Shares | |

| 52,179,797 | | | 2.611 | | | | 52,179,797 | |

Goldman Sachs Financial Square Treasury Solutions Fund —Institutional Shares | |

| 52,179,797 | | | 2.235 | | | | 52,179,797 | |

| |

TOTAL INVESTMENT COMPANIES

| |

| (Cost $223,464,182) | | | $ | 223,464,182 | |

| |

TOTAL INVESTMENTS – 69.7%

| |

| (Cost $265,947,166) | | | $ | 275,910,777 | |

| |

OTHER ASSETS IN EXCESS OF LIABILITIES – 30.3% | | | | 120,177,668 | |

| |

| NET ASSETS – 100.0% | | | $ | 396,088,445 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| (a) | | Represents an affiliated issuer. |

ADDITIONAL INVESTMENT INFORMATION

FUTURES CONTRACTS — At December 31, 2018, the Fund had the following futures contracts:

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | |

| |

Long position contracts: | | | | | |

| EURO STOXX 50 Index | | | 358 | | | | 03/15/2019 | | | $ | 12,198,709 | | | $ | (218,062 | ) |

| Euro-Bund | | | 257 | | | | 03/07/2019 | | | | 48,155,620 | | | | 286,692 | |

| FTSE 100 Index | | | 146 | | | | 03/15/2019 | | | | 12,391,839 | | | | 25,554 | |

| Japan 10 Year Bond | | | 31 | | | | 03/13/2019 | | | | 43,140,641 | | | | 197,500 | |

| TOPIX Index | | | 60 | | | | 03/07/2019 | | | | 8,175,722 | | | | (413,465 | ) |

U.S. Treasury 10 Year Note | | | 416 | | | | 03/20/2019 | | | | 50,771,500 | | | | 963,034 | |

| | | | |

| Total | | | | | | | | | | | | | | $ | 841,253 | |

| |

Short position contracts: | | | | | |

S&P 500E-Mini Index | | | (57 | ) | | | 03/15/2019 | | | $ | (7,139,820 | ) | | $ | (53,298 | ) |

| |

| Total Futures Contracts | | | $ | 787,955 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statement of Assets and Liabilities

December 31, 2018

| | | | |

| | | | |

| Assets: | | | |

Investments in unaffiliated issuers, at value (cost $42,482,984) | | $ | 52,446,595 | |

Investments in affiliated issuers, at value (cost $223,464,182) | | | 223,464,182 | |

Cash | | | 117,094,121 | |

Receivables: | | | | |

Collateral on certain derivative contracts | | | 3,520,288 | |

Dividends | | | 260,873 | |

Fund shares sold | | | 26,699 | |

Reimbursement from investment adviser | | | 16,887 | |

| Variation margin on futures | | | 37,817 | |

Other assets | | | 38 | |

| |

| Total assets | | | 396,867,500 | |

| | | | |

| | | | |

| Liabilities: | |

Payables: | | | | |

Fund shares redeemed | | | 395,210 | |

Management fees | | | 193,507 | |

Distribution and Service fees and Transfer Agency fees | | | 91,778 | |

Accrued expenses and other liabilities | | | 98,560 | |

| |

| Total liabilities | | | 779,055 | |

| | | | |

| | | | |

| Net Assets: | |

Paid-in capital | | | 389,978,969 | |

Total distributable earnings | | | 6,109,476 | |

| |

| NET ASSETS | | $ | 396,088,445 | |

Net Assets: | | | | |

Institutional | | $ | 246,688 | |

Service | | | 395,841,757 | |

| |

Total Net Assets | | $ | 396,088,445 | |

Shares outstanding $0.001 par value (unlimited shares authorized): | | | | |

Institutional | | | 21,171 | |

Service | | | 34,013,609 | |

Net asset value, offering and redemption price per share: | | | | |

Institutional | | | $11.65 | |

Service | | | 11.64 | |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statement of Operations

For the Fiscal Year Ended December 31, 2018

| | | | |

| | | | |

| Investment income: | |

Dividends — affiliated issuers | | $ | 3,911,639 | |

Dividends — unaffiliated issuers | | | 2,035,809 | |

| |

| Total investment income | | | 5,947,448 | |

| | | | |

| | | | |

| Expenses: | |

Management fees | | | 3,262,432 | |

Distribution and Service fees — Service Shares | | | 1,032,044 | |

Professional fees | | | 98,208 | |

Transfer Agency fees(a) | | | 82,587 | |

Printing and mailing costs | | | 42,237 | |

Custody, accounting and administrative services | | | 34,784 | |

Trustee fees | | | 16,885 | |

Other | | | 19,583 | |

| |

| Total expenses | | | 4,588,760 | |

| |

Less — expense reductions | | | (1,227,100 | ) |

| |

| Net expenses | | | 3,361,660 | |

| |

| NET INVESTMENT INCOME | | | 2,585,788 | |

| | | | |

| | | | |

| Realized and unrealized gain (loss): | |

Net realized gain (loss) from: | | | | |

Investments — unaffiliated issuers | | | 12,177,593 | |

Futures contracts | | | (14,279,935 | ) |

Foreign currency transactions | | | 210,883 | |

Net change in unrealized loss on: | |

Investments — unaffiliated issuers | | | (18,150,267 | ) |

Futures contracts | | | (301,063 | ) |

Foreign currency translation | | | (91,634 | ) |

| |

| Net realized and unrealized loss | | | (20,434,423 | ) |

| |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (17,848,635 | ) |

(a) Institutional and Service Shares incurred Transfer Agency fees of $30 and $82,557, respectively.

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Fiscal Year Ended

December 31, 2018 | | | For the

Fiscal Year Ended

December 31, 2017 | |

| | | | | | | | |

| From operations: | |

Net investment income | | $ | 2,585,788 | | | $ | 812,849 | |

Net realized gain (loss) | | | (1,891,459 | ) | | | 30,615,788 | |

Net change in unrealized gain (loss) | | | (18,542,964 | ) | | | 15,102,236 | |

| | |

| Net increase (decrease) in net assets resulting from operations | | | (17,848,635 | ) | | | 46,530,873 | |

| | | | | | | | |

| | | | | | | | |

| Distributions to shareholders: | |

From distributable earnings: | | | | | | | | |

Institutional Shares | | | (6,273 | ) | | | (901 | )(a) |

Service Shares | | | (9,086,313 | ) | | | (11,254,056 | )(a) |

| | |

| Total distributions to shareholders | | | (9,092,586 | ) | | | (11,254,957 | ) |

| | | | | | | | |

| | | | | | | | |

| From share transactions: | |

Proceeds from sales of shares | | | 42,650,408 | | | | 38,959,444 | |

Reinvestment of distributions | | | 9,092,586 | | | | 11,254,957 | |

Cost of shares redeemed | | | (35,610,360 | ) | | | (32,234,857 | ) |

| | |

| Net increase in net assets resulting from share transactions | | | 16,132,634 | | | | 17,979,544 | |

| | |

| TOTAL INCREASE (DECREASE) | | | (10,808,587 | ) | | | 53,255,460 | |

| | | | | | | | |

| | | | | | | | |

| Net assets:(b) | |

| | |

Beginning of year | | | 406,897,032 | | | | 353,641,572 | |

| | |

End of year | | $ | 396,088,445 | | | $ | 406,897,032 | |

(a) Prior year information has been revised to conform to current year presentation, see prior year presentation below:

| | | | | | | | |

| | | Institutional | | | Service | |

Distribution from net investment income: | | $ | (157 | ) | | $ | (1,185,638 | ) |

| | |

Distributions from net realized gains: | | $ | (744 | ) | | $ | (10,068,418 | ) |

| (b) | Prior fiscal year information has been revised to conform with current year presentation. Undistributed net investment income was $888,720 for the Fund, as of December 31, 2017. |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Global Trends Allocation Fund | |

| | | Institutional Shares | |

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 12.46 | | | $ | 11.33 | | | $ | 10.89 | | | $ | 11.82 | | | $ | 11.46 | |

| | | | | |

Net investment income (loss)(a) | | | 0.14 | | | | 0.06 | | | | (0.03 | ) | | | 0.01 | | | | 0.08 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (0.64 | ) | | | 1.46 | | | | 0.52 | | | | (0.67 | ) | | | 0.41 | |

| | | | | |

Total from investment operations | | | (0.50 | ) | | | 1.52 | | | | 0.49 | | | | (0.66 | ) | | | 0.49 | |

| | | | | |

Distributions to shareholders from net investment income | | | (0.12 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.03 | ) |

| | | | | |

Distributions to shareholders from net realized gains | | | (0.19 | ) | | | (0.32 | ) | | | — | | | | (0.24 | ) | | | (0.10 | ) |

| | | | | |

Total distributions | | | (0.31 | ) | | | (0.39 | ) | | | (0.05 | ) | | | (0.27 | ) | | | (0.13 | ) |

| | | | | |

Net asset value, end of year | | $ | 11.65 | | | $ | 12.46 | | | $ | 11.33 | | | $ | 10.89 | | | $ | 11.82 | |

| | | | | |

Total return(b) | | | (4.08 | )% | | | 13.36 | % | | | 4.49 | % | | | (5.52 | )% | | | 4.23 | % |

| | | | | |

Net assets, end of year (in 000s) | | $ | 247 | | | $ | 30 | | | $ | 27 | | | $ | 1,008 | | | $ | 739 | |

| | | | | |

Ratio of net expenses to average net assets | | | 0.51 | % | | | 0.68 | % | | | 0.74 | % | | | 0.75 | % | | | 0.77 | % |

| | | | | |

Ratio of total expenses to average net assets | | | 0.86 | % | | | 0.86 | % | | | 0.89 | % | | | 0.92 | % | | | 1.01 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 1.13 | % | | | 0.46 | % | | | (0.25 | )% | | | 0.12 | % | | | 0.68 | % |

| | | | | |

Portfolio turnover rate(c) | | | 60 | % | | | 64 | % | | | 260 | % | | | 504 | % | | | 304 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the net asset value at the beginning of the year, reinvestment of all distributions, and a complete redemption of the investment at the net asset value at the end of the year. |

| (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Financial Highlights(continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Global Trends Allocation Fund | |

| | | Service Shares | |

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 12.45 | | | $ | 11.32 | | | $ | 10.88 | | | $ | 11.82 | | | $ | 11.47 | |

| | | | | |

Net investment income (loss)(a) | | | 0.08 | | | | 0.03 | | | | 0.02 | | | | (0.02 | ) | | | — | (b) |

| | | | | | |

Net realized and unrealized gain (loss) | | | (0.62 | ) | | | 1.46 | | | | 0.45 | | | | (0.67 | ) | | | 0.45 | |

| | | | | |

Total from investment operations | | | (0.54 | ) | | | 1.49 | | | | 0.47 | | | | (0.69 | ) | | | 0.45 | |

| | | | | |

Distributions to shareholders from net investment income | | | (0.08 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.01 | ) | | | — | (b) |

| | | | | | |

Distributions to shareholders from net realized gains | | | (0.19 | ) | | | (0.32 | ) | | | — | | | | (0.24 | ) | | | (0.10 | ) |

| | | | | |

Total distributions | | | (0.27 | ) | | | (0.36 | ) | | | (0.03 | ) | | | (0.25 | ) | | | (0.10 | ) |

| | | | | |

Net asset value, end of year | | $ | 11.64 | | | $ | 12.45 | | | $ | 11.32 | | | $ | 10.88 | | | $ | 11.82 | |

| | | | | |

Total return(c) | | | (4.34 | )% | | | 13.11 | % | | | 4.33 | % | | | (5.82 | )% | | | 3.95 | % |

| | | | | |

Net assets, end of year (in 000s) | | $ | 395,842 | | | $ | 406,867 | | | $ | 353,615 | | | $ | 354,706 | | | $ | 267,720 | |

| | | | | |

Ratio of net expenses to average net assets | | | 0.81 | % | | | 0.93 | % | | | 1.00 | % | | | 1.00 | % | | | 1.03 | % |

| | | | | |

Ratio of total expenses to average net assets | | | 1.11 | % | | | 1.11 | % | | | 1.13 | % | | | 1.17 | % | | | 1.24 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.63 | % | | | 0.21 | % | | | 0.20 | % | | | (0.16 | )% | | | (0.04 | )% |

| | | | | |

Portfolio turnover rate(d) | | | 60 | % | | | 64 | % | | | 260 | % | | | 504 | % | | | 304 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Amount is less than $0.005 per share. |

| (c) | Assumes investment at the net asset value at the beginning of the year, reinvestment of all distributions, and a complete redemption of the investment at the net asset value at the end of the year. |

| (d) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements

December 31, 2018

1. ORGANIZATION

Goldman Sachs Variable Insurance Trust (the “Trust” or “VIT”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as anopen-end management investment company. The Trust includes the Goldman Sachs Global Trends Allocation Fund (the “Fund”). The Fund is a diversified portfolio under the Act offering two classes of shares — Institutional and Service Shares. Shares of the Trust are offered to separate accounts of participating life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC (“Goldman Sachs”), serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions.

A. Investment Valuation —The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments —Investment income includes interest income, dividend income, and securities lending income, if any. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized onex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to theex-dividend date. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Investment income is recorded net of any foreign withholding taxes, less any amounts reclaimable. The Fund may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any foreign capital gains tax is accrued daily based upon net unrealized gains, and is payable upon sale of such investments.

For derivative contracts, realized gains and losses are recorded upon settlement of the contract.

C. Class Allocations and Expenses —Investment income, realized and unrealized gain (loss), if any, andnon-class specific expenses of the Fund are allocated daily based upon the proportion of net assets of each class.Non-class specific expenses directly incurred by the Fund are charged to the Fund, while such expenses incurred by the Trust are allocated across the Fund on a straight-line and/orpro-rata basis depending upon the nature of the expenses. Class-specific expenses, where applicable, are borne by the respective share classes and include Distribution and Service and Transfer Agency fees.

D. Federal Taxes and Distributions to Shareholders —It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute each year substantially all of its investment company taxable income and capital gains to its shareholders. Accordingly, the Fund is not required to make any provisions for the payment of federal income tax. Distributions to shareholders are recorded on theex-dividend date. Income and capital gains distributions, if any, are declared and paid annually.

Net capital losses, if any, are carried forward to future fiscal years and may be used to the extent allowed by the Code to offset any future capital gains. Losses that are carried forward will retain their character as either short-term or long-term capital losses. Utilization of capital loss carryforwards will reduce the requirement of future capital gains distributions.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. The source of the Fund’s distributions may be shown in the accompanying financial statements as either from distributable earnings or capital. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/tax differences based on the appropriate tax character.

E. Foreign Currency Translation —The accounting records and reporting currency of the Fund are maintained in United States (“U.S.”) dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within

15

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements(continued)

December 31, 2018

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

net realized and unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Statement of Operations within net change in unrealized gain (loss) on foreign currency translation. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS

U.S. GAAP defines the fair value of a financial instrument as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price); the Fund’s policy is to use the market approach. GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

Changes in valuation techniques may result in transfers into or out of an assigned level within the hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value hierarchy resulting from such changes are deemed to have occurred as of the beginning of the reporting period.

The Board of Trustees (“Trustees”) has approved Valuation Procedures that govern the valuation of the portfolio investments held by the Fund, including investments for which market quotations are not readily available. The Trustees have delegated to GSAMday-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Fund’s investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments —The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Equity Securities —Equity securities traded on a U.S. securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price or such price is believed by GSAM to not represent fair value, equity securities are valued at the last bid price for long positions and at the last ask price for short positions. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price, and are generally classified as Level 2. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign

16

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued)

currency exchange rates that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Underlying Funds (including Money Market Funds) —Underlying funds (“Underlying Funds”) include other investment companies and exchange-traded funds (“ETFs”). Investments in the Underlying Funds (except ETFs) are valued at the NAV per share of the Institutional share class on the day of valuation. ETFs are valued daily at the last sale price or official closing price on the principal exchange or system on which the investment is traded. Because the Fund invests in Underlying Funds that fluctuate in value, the Fund’s shares will correspondingly fluctuate in value. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2. For information regarding an Underlying Fund’s accounting policies and investment holdings, please see the Underlying Fund’s shareholder report.

Derivative Contracts —A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. The Fund enters into derivative transactions to hedge against changes in interest rates, securities prices, and/or currency exchange rates, to increase total return, or to gain access to certain markets or attain exposure to other underliers.

Exchange-traded derivatives, including futures and options contracts, are generally valued at the last sale or settlement price on the exchange where they are principally traded. Exchange-traded options without settlement prices are generally valued at the midpoint of the bid and ask prices on the exchange where they are principally traded (or, in the absence oftwo-way trading, at the last bid price for long positions and the last ask price for short positions). Exchange-traded derivatives typically fall within Level 1 of the fair value hierarchy.Over-the-counter (“OTC”) and centrally cleared derivatives are valued using market transactions and other market evidence, including market-based inputs to models, calibration to market-clearing transactions, broker or dealer quotations, or other alternative pricing sources. Where models are used, the selection of a particular model to value OTC and centrally cleared derivatives depends upon the contractual terms of, and specific risks inherent in, the instrument, as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, yield curves, credit curves, measures of volatility, voluntary and involuntary prepayment rates, loss severity rates and correlations of such inputs. For OTC and centrally cleared derivatives that trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. OTC and centrally cleared derivatives are classified within Level 2 of the fair value hierarchy when significant inputs are corroborated by market evidence.

i. Futures Contracts —Futures contracts are contracts to buy or sell a standardized quantity of a specified commodity or security. Upon entering into a futures contract, the Fund deposits cash or securities in an account on behalf of the broker in an amount sufficient to meet the initial margin requirement. Subsequent payments are made or received by the Fund equal to the daily change in the contract value and are recorded as variation margin receivable or payable with a corresponding offset to unrealized gains or losses. For financial reporting purposes, cash collateral that has been pledged to cover obligations of the Fund and cash collateral received, if any, is reported separately on the Statement of Assets and Liabilities as receivables/payables for collateral on certain derivative contracts.Non-cash collateral pledged by the Fund, if any, is noted in the Schedule of Investments.

B. Level 3 Fair Value Investments —To the extent that significant inputs to valuation models and other alternative pricing sources are unobservable, or if quotations are not readily available, or if GSAM believes that such quotations do not accurately reflect fair value, the fair value of the Fund’s investments may be determined under Valuation Procedures approved by the Trustees. GSAM, consistent with its procedures and applicable regulatory guidance, may make an adjustment to the most recent valuation prices of either domestic or foreign securities in light of significant events to reflect what it believes to be the fair value of the securities at the time of determining the Fund’s NAV. Significant events which could affect a large number of securities in a particular market may include, but are not limited to: significant fluctuations in U.S. or foreign markets; market dislocations; market disruptions; or unscheduled market closings. Significant events which could also affect a single issuer may include, but are not limited to: corporate actions such as reorganizations, mergers andbuy-outs; ratings downgrades; and bankruptcies.

17

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements(continued)

December 31, 2018

3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued)

C. Fair Value Hierarchy —The following is a summary of the Fund’s investments and derivatives classified in the fair value hierarchy as of December 31, 2018:

| | | | | | | | | | | | |

| Investment Type | | Level 1 | | | Level 2 | | | Level 3 | |

| | | |

| Assets | | | | | | | | | | | | |

| Exchange Traded Fund | | $ | 52,446,595 | | | $ | — | | | $ | — | |

Investment Companies | | | 223,464,182 | | | | — | | | | — | |

| | | |

| Total | | $ | 275,910,777 | | | $ | — | | | $ | — | |

| | | |

| Derivative Type | | | | | | | | | |

| | | |

| Assets(a) | | | | | | | | | | | | |

| Futures Contracts | | $ | 1,472,780 | | | $ | — | | | $ | — | |

| | | |

| Liabilities(a) | | | | | | | | | | | | |

| Futures Contracts | | $ | (684,825 | ) | | $ | — | | | $ | — | |

| (a) | Amount shown represents unrealized gain (loss) at fiscal year end. |

For further information regarding security characteristics, see the Schedule of Investments.

4. INVESTMENTS IN DERIVATIVES

The following table sets forth, by certain risk types, the gross value of derivative contracts (not considered to be hedging instruments for accounting disclosure purposes) as of December 31, 2018. These instruments were used as part of the Fund’s investment strategies and to obtain and/or manage exposure related to the risks below. The values in the table below exclude the effects of cash collateral received or posted pursuant to these derivative contracts, and therefore are not representative of the Fund’s net exposure.

| | | | | | | | | | | | | | |

| Risk | | | | Statement of Assets and Liabilities | | Assets(a) | | | Statement of Assets and Liabilities | | Liabilities(a) | |

| Equity | | | | Variation margin on futures contracts | | $ | 25,554 | | | Variation margin on futures contracts | | $ | (684,825 | ) |

| Interest Rate | | | | Variation margin on futures contracts | | | 1,447,226 | | | — | | | — | |

| | | | | |

| Total | | | | | | $ | 1,472,780 | | | | | $ | (684,825 | ) |

| (a) | Includes unrealized gain (loss) on futures contracts described in the Additional Investment Information section of the Schedule of Investments. Only the variation margin as of December 31, 2018 is reported within the Statement of Assets and Liabilities. |

The following table sets forth, by certain risk types, the Fund’s gains (losses) related to these derivatives and their indicative volumes for the fiscal year ended December 31, 2018. These gains (losses) should be considered in the context that these derivative contracts may have been executed to create investment opportunities and/or economically hedge certain investments, and

18

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

4. INVESTMENTS IN DERIVATIVES (continued)

accordingly, certain gains (losses) on such derivative contracts may offset certain (losses) gains attributable to investments. These gains (losses) are included in “Net realized gain (loss)” or “Net change in unrealized gain (loss)” on the Statement of Operations:

| | | | | | | | | | | | | | |

| Risk | | Statement of Operations | | Net

Realized

Gain (Loss) | | | Net Change in

Unrealized

Gain (Loss) | | | Average

Number of

Contracts(a) | |

| Equity | | Net realized gain (loss) from futures contracts/Net change in unrealized gain (loss) on futures contracts | | $ | (17,520,874 | ) | | $ | (1,783,976 | ) | | | 1,467 | |

| Interest Rate | | Net realized gain (loss) from futures contracts/Net change in unrealized gain (loss) on futures contracts | | | 3,240,939 | | | | 1,482,913 | | | | 412 | |

| Total | | | | $ | (14,279,935 | ) | | $ | (301,063 | ) | | | 1,879 | |

| (a) | Average number of contracts is based on the average of month end balances for the fiscal year ended December 31, 2018. |

5. AGREEMENTS AND AFFILIATED TRANSACTIONS

A. Management Agreement —Under the Agreement, GSAM manages the Fund, subject to the general supervision of the Trustees.

As compensation for the services rendered pursuant to the Agreement, the assumption of the expenses related thereto and administration of the Fund’s business affairs, including providing facilities, GSAM is entitled to a management fee, accrued daily and paid monthly, equal to an annual percentage rate of the Fund’s average daily net assets.

As of December 31, 2018, the contractual management fees with GSAM were as stated below. The effective contractual management rates and effective net management rates represent the rates for the fiscal year ended December 31, 2018.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contractual Management Rate | | | | | | | |

First

$1 billion | | | Next

$1 billion | | | Next

$3 billion | | | Next

$3 billion | | | Over

$8 billion | | | Effective

Rate | | | Effective Net

Management Rate^ | |

| | 0.79% | | | | 0.71 | % | | | 0.68 | % | | | 0.66 | % | | | 0.65 | % | | | 0.79 | % | | | 0.55 | %* |

| ^ | Effective Net Management Rate includes the impact of management fee waivers of affiliated Underlying Funds, if any. |

| * | GSAM agreed to waive a portion of its management fee in order to achieve a net management rate, as defined in the Fund’s most recent prospectus. This waiver will be effective through at least April 30, 2019, and prior to such date GSAM may not terminate the arrangement without approval of the Trustees. For the fiscal year ended December 31, 2018, GSAM waived $495,564 of its management fee. |

The Fund invests in Institutional Shares of the Goldman Sachs Financial Square Government, Goldman Sachs Financial Square Treasury Obligations, and Goldman Sachs Financial Square Treasury Solutions Funds, which are affiliated Underlying Funds. GSAM has agreed to waive a portion of its management fee payable by the Fund in an amount equal to the management fee it earns as an investment adviser to the affiliated Underlying Funds in which the Fund invests, except those management fees it earns from the Fund’s investments of cash collateral received in connection with securities lending transactions in the Goldman Sachs Financial Square Government, Goldman Sachs Financial Square Treasury Obligations, and Goldman Sachs Financial Square Treasury Solutions Funds. For the fiscal year ended December 31, 2018, GSAM waived $513,308 of the Fund’s management fee.

B. Distribution and Service(12b-1) Plan —The Trust, on behalf of Service Shares of the Fund, has adopted a Distribution and Service Plan subject to Rule12b-1 under the Act. Under the Distribution and Service Plan, Goldman Sachs, which serves as distributor, is entitled to a fee accrued daily and paid monthly, for distribution services and personal and account maintenance services, which may then be paid by Goldman Sachs to authorized dealers, equal to, on an annual basis, 0.25% of the Fund’s average daily net assets attributable to Service Shares.

19

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements(continued)

December 31, 2018

5. AGREEMENTS AND AFFILIATED TRANSACTIONS (continued)

C. Transfer Agency Agreement —Goldman Sachs also serves as the transfer agent of the Fund for a fee pursuant to the Transfer Agency Agreement. The fees charged for such transfer agency services are accrued daily and paid monthly at an annual rate of 0.02% of the average daily net assets of Institutional and Service Shares.

D. Other Expense Agreements and Affiliated Transactions —GSAM has agreed to limit certain “Other Expenses” of the Fund (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees and shareholder administration fees (as applicable), taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to the extent such expenses exceed, on an annual basis, a percentage rate of the average daily net assets of the Fund. Such Other Expense reimbursements, if any, are accrued daily and paid monthly. In addition, the Fund is not obligated to reimburse GSAM for prior fiscal year expense reimbursements, if any. The Other Expense limitation as an annual percentage rate of average daily net assets for the Fund is 0.004%. The Other Expense limitation will remain in place through at least April 30, 2019, and prior to such date GSAM may not terminate the arrangement without the approval of the Trustees. In addition, the Fund has entered into certain offset arrangements with the custodian and the transfer agent, which may result in a reduction of the Fund’s expenses and are received irrespective of the application of the “Other Expense” limitation described above.

For the fiscal year ended December 31, 2018, these expense reductions, including any fee waivers and Other Expense reimbursements, were as follows:

| | | | | | | | | | | | | | |

Management Fee

Waiver | | | Custody Fee

Credits | | | Other Expense

Reimbursement | | | Total Expense

Reductions | |

| | | |

| | $1,008,872 | | | $ | 23,047 | | | $ | 195,181 | | | $ | 1,227,100 | |

E. Line of Credit Facility —As of December 31, 2018, the Fund participated in a $770,000,000 committed, unsecured revolving line of credit facility (the “facility”) together with other funds of the Trust and certain registered investment companies having management agreements with GSAM or its affiliates. This facility is to be used for temporary emergency purposes, or to allow for an orderly liquidation of securities to meet redemption requests. The interest rate on borrowings is based on the federal funds rate. The facility also requires a fee to be paid by the Fund based on the amount of the commitment that has not been utilized. For the fiscal year ended December 31, 2018, the Fund did not have any borrowings under the facility.

F. Other Transactions with Affiliates —The following table provides information about the Fund’s investments in the Goldman Sachs Financial Square Government, Goldman Sachs Financial Square Treasury Obligations, and Goldman Sachs Financial Square Treasury Solutions Funds as of and for the fiscal year ended December 31, 2018:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Companies | | Beginning

Value as of

December 31, 2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Ending

Value as of

December 31, 2018 | | | Shares as of

December 31, 2018 | | | Dividend

Income | |

Goldman Sachs Financial Square Government Fund | | $ | 122,370,204 | | | $ | 59,786,246 | | | $ | (63,051,862 | ) | | $ | 119,104,588 | | | | 119,104,588 | | | $ | 2,144,905 | |

Goldman Sachs Financial Square Treasury Obligations Fund | | | 50,802,535 | | | | 1,377,262 | | | | — | | | | 52,179,797 | | | | 52,179,797 | | | | 888,397 | |

Goldman Sachs Financial Square Treasury Solutions Fund | | | 50,802,535 | | | | 1,377,262 | | | | — | | | | 52,179,797 | | | | 52,179,797 | | | | 878,337 | |

| | | | | | |

| Total | | $ | 223,975,274 | | | $ | 62,540,770 | | | $ | (63,051,862 | ) | | $ | 223,464,182 | | | | 223,464,182 | | | $ | 3,911,639 | |

As of December 31, 2018, The Goldman Sachs Group, Inc. was the beneficial owner of approximately 12% of the Institutional Shares of the Fund.

20

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

6. PORTFOLIO SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales and maturities of long-term securities for the fiscal year ended December 31, 2018, were $68,252,836 and $152,561,616, respectively.

7. TAX INFORMATION

The tax character of distributions paid during the fiscal years ended December 31, 2017 and December 31, 2018 was as follows:

| | | | | | | | |

| | | 2017 | | | 2018 | |

| Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 4,343,505 | | | $ | 7,135,108 | |

Net long-term capital gains | | | 6,911,452 | | | | 1,957,478 | |

| Total taxable distributions | | $ | 11,254,957 | | | $ | 9,092,586 | |

As of December 31, 2018, the components of accumulated earnings (losses) on atax-basis were as follows:

| | | | |

| Undistributed ordinary income — net | | $ | 3,104,633 | |

| Timing differences (Post October Loss Deferral) | | | (2,279,017 | ) |

| Unrealized gains — net | | | 5,283,860 | |

| Total accumulated earnings — net | | $ | 6,109,476 | |

As of December 31, 2018, the Fund’s aggregate security unrealized gains and losses based on cost for U.S. federal income tax purposes were as follows:

| | | | |

| Tax cost | | $ | 271,309,340 | |

| Gross unrealized gain | | | 11,436,391 | |

| Gross unrealized loss | | | (6,152,531 | ) |

| Net unrealized gain | | $ | 5,283,860 | |

The difference between GAAP-basis andtax-basis unrealized gains (losses) is attributable primarily to wash sales and net mark to market gains (losses) on regulated futures contracts.

GSAM has reviewed the Fund’s tax positions for all open tax years (the current and prior three years, as applicable) and has concluded that no provision for income tax is required in the Fund’s financial statements. Such open tax years remain subject to examination and adjustment by tax authorities.

8. OTHER RISKS

The Fund’s risks include, but are not limited to, the following:

Derivatives Risk —The Fund’s use of derivatives may result in loss. Derivative instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. Losses from

21

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

Notes to Financial Statements(continued)

December 31, 2018

8. OTHER RISKS (continued)

derivatives can also result from a lack of correlation between changes in the value of derivative instruments and the portfolio assets (if any) being hedged.

Foreign and Emerging Countries Risk —Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls (including repatriation restrictions), confiscations, trade restrictions (including tariffs) and other government restrictions by the U.S. or other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. To the extent that the Fund also invests in securities of issuers located in emerging markets, these risks may be more pronounced.

Foreign Custody Risk —If the Fund invests in foreign securities, the Fund may hold such securities and cash with foreign banks, agents, and securities depositories appointed by the Fund’s custodian (each a “Foreign Custodian”). Some foreign custodians may be recently organized or new to the foreign custody business. In some countries, Foreign Custodians may be subject to little or no regulatory oversight over, or independent evaluation of, their operations. Further, the laws of certain countries may place limitations on the Fund’s ability to recover its assets if a Foreign Custodian enters bankruptcy. Investments in emerging markets may be subject to even greater custody risks than investments in more developed markets. Custody services in emerging market countries are very often undeveloped and may be considerably less well regulated than in more developed countries, and thus may not afford the same level of investor protection as would apply in developed countries.

Interest Rate Risk —When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund’s investments. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund.

Investments in Other Investment Companies Risk —As a shareholder of another investment company, including an ETF, the Fund will indirectly bear its proportionate share of any net management fees and other expenses paid by such other investment companies, in addition to the fees and expenses regularly borne by the Fund. ETFs are subject to risks that do not apply to conventional mutual funds, including but not limited to the following: (i) the market price of the ETF’s shares may trade at a premium or a discount to their NAV; and (ii) an active trading market for an ETF’s shares may not develop or be maintained.

Large Shareholder Transactions Risk —The Fund may experience adverse effects when certain large shareholders, such as other funds, participating insurance companies, accounts and Goldman Sachs affiliates, purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would.

Liquidity Risk —The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period or without significant dilution to remaining investors’ interests because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell investments at an unfavorable time and/or under unfavorable

22

GOLDMAN SACHS VARIABLE INSURANCE TRUST GLOBAL TRENDS ALLOCATION FUND

8. OTHER RISKS (continued)

conditions. If a Fund is forced to sell securities at an unfavorable time and/or under unfavorable conditions, such sales may adversely affect the Fund’s NAV and dilute remaining investors’ interests. Liquidity risk may be the result of, among other things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging market countries.

Market and Credit Risks —In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to changes in the market (market risk). Additionally, the Fund may also be exposed to credit risk in the event that an issuer or guarantor fails to perform or that an institution or entity with which the Fund has unsettled or open transactions defaults.

9. INDEMNIFICATIONS