UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08361

Goldman Sachs Variable Insurance Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606-6303

(Address of principal executive offices) (Zip code)

Caroline Kraus

Goldman Sachs & Co. LLC

200 West Street

New York, NY 10282

Copies to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman

Sachs Variable Insurance Trust

Goldman Sachs Multi-Strategy Alternatives Portfolio

Goldman Sachs Trend Driven Allocation Fund

Annual Report

December 31, 2022

Goldman Sachs Variable Insurance Trust

| ∎ | | GOLDMAN SACHS VIT MULTI-STRATEGY ALTERNATIVES PORTFOLIO |

| ∎ | | GOLDMAN SACHS VIT TREND DRIVEN ALLOCATION FUND |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Goldman Sachs Variable Insurance Trust Funds — Goldman Sachs VIT Multi Asset Strategies Funds

Market Review

Ongoing macroeconomic and geopolitical uncertainty created a challenging backdrop for the capital markets during the 12-month period ended December 31, 2022 (the “Reporting Period”). The Russia-Ukraine conflict and its impact on energy prices, COVID-19 flare-ups in China and pressure from rising wages in the U.S. led to sustained high inflation and hawkish, synchronized monetary policy responses from global central banks. (Hawkish suggests higher interest rates; opposite of dovish.)

During the first quarter of 2022, when the Reporting Period began, inflationary pressures intensified, with many developed nations experiencing their fastest price increases in decades. In February, geopolitical tensions added uncertainty to an already complex investment backdrop as energy and commodity prices spiked in response to Russia’s invasion of Ukraine late in the month. In response, global central banks, including the U.S. Federal Reserve (the “Fed”), took policy action. In March, the Fed raised interest rates, by 25 basis points, for the first time since 2018. (A basis point is 1/100th of a percentage point.) Fed Chair Jerome Powell provided guidance that policymakers were prepared to act even more aggressively to tackle inflation. In addition, a number of Fed governors indicated their openness to 50-basis-point rate hikes at the next meeting or two with the possibility of getting to neutral rate levels by the end of 2022. (The neutral rate is the theoretical federal funds rate at which the stance of Fed monetary policy is neither accommodative nor restrictive. It is the short-term real interest rate consistent with the economy maintaining full employment with associated price stability.) Global equities broadly declined during the first calendar quarter. Within fixed income, credit spreads (or, yield differentials) widened, as bond yields rose in response to inflationary pressures.

Global economic activity moderated noticeably in the second quarter of 2022 amid tighter financial conditions and COVID-19 outbreaks in China. Inflation accelerated, as food and energy prices continued to rise in the wake of Russia’s attack on Ukraine. Major central banks focused on taming inflation, signaling they would continue to tighten monetary policy until inflation came down toward their respective target levels. In the U.S., the Fed raised interest rates twice during the second calendar quarter, by 50 basis points in May and then by 75 basis points in June, and indicated there would be more rate increases into the end of 2022. Investor concerns around slower economic growth deepened, with worries about a potential policy miscalculation by the Fed increasing. As a result, global equities continued to sell off, led by a steep decline in the U.S. equity market. Emerging market equities also fell, though Chinese equities broadly recorded gains. Fixed income markets were mostly negative, as central bank interest rate hikes overall came faster than investors had previously anticipated. Rising short-term interest rates and expectations for further monetary policy tightening hurt duration-sensitive assets, while concerns about the economic outlook led to further credit spread widening. (Duration is a measure of a security’s sensitivity to changes in interest rates.)

The themes that had dominated the capital markets during the first half of 2022 persisted into the third calendar quarter. Higher-than-expected inflation data prompted the Fed to make two additional rate hikes, totaling 150 basis points, during the third quarter, increasing investor concern that Fed tightening might ultimately tip the U.S. economy into recession. In this environment, global equities and the fixed income market posted further losses. In the U.S., the S&P 500® Index recorded a third consecutive quarter of declines for the first time since the 2008 recession. Within fixed income, the Fed’s short-term rate hikes and rising longer-term yields weighed heavily on duration-sensitive assets. Higher perceived recession risk pushed credit spreads wider.

The fourth quarter of 2022 saw modest relief for risk assets, which recouped some of the losses suffered during the previous three calendar quarters. Although U.S. inflation surprised to the downside in October and November, helping to drive up equity markets, major central banks generally maintained their tightening stance and signaled additional tightening, though at a slower pace. The Fed hiked interest rates twice during the fourth quarter, with a 75-basis-point hike in November and a 50-basis-point hike in December, in line with market expectations. Meanwhile, China began reopening its economy as the government ended COVID-19 restrictions. In Europe, energy prices dropped, thanks to a warmer than usual winter.

Looking Ahead

At the end of the Reporting Period, we had a cautious outlook on the capital markets. In our view, the Fed was likely to continue tightening monetary policy until officials saw clear and consistent evidence of a sufficient and sustained decline in inflation. Although we acknowledged a growing investor narrative about the potential for a soft landing, we believed the Fed might find that difficult to achieve. (A soft landing, in economics, is a cyclical downturn that avoids recession. It typically describes attempts by central banks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a significant increase in unemployment, or a hard landing.) Furthermore, we thought that global central bank tightening cycles might diverge in terms of direction and speed based on each region’s household vulnerabilities, with some regions having more encumbered households than others.

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

INVESTMENT OBJECTIVE

The Portfolio seeks long-term growth of capital.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Multi-Asset Solutions (“MAS”) Group discusses the Goldman Sachs Variable Insurance Trust — Goldman Sachs Multi-Strategy Alternatives Portfolio’s (the “Portfolio”) performance and positioning for the 12-month period ended December 31, 2022 (the “Reporting Period”).

How did the Portfolio perform during the Reporting Period?

During the Reporting Period, the Portfolio’s Institutional, Service and Advisor Shares generated average annual total returns of -6.24%, -6.54% and -6.61%, respectively. These returns compare to the 1.47% average annual total return of the Portfolio’s benchmark, the ICE BofA 3-Month U.S. Treasury Bill Index during the same period.

Please note that the Portfolio’s benchmark being the ICE BofA 3-Month U.S. Treasury Bill Index is a means of emphasizing that the Portfolio has an unconstrained strategy. That said, this Portfolio employs a benchmark agnostic strategy and thus comparisons to a benchmark index are not particularly relevant.

What key factors were responsible for the Portfolio’s performance during the Reporting Period?

The Portfolio’s performance is driven by three sources of return: long-term strategic asset allocation to market exposures, medium-term and short-term dynamic allocations, and excess returns from investments in Underlying Funds. Long-term strategic asset allocation is the process by which the Portfolio’s assets are allocated across underlying asset classes and strategies in a way that considers the risks of each underlying asset class and strategy. Medium-term dynamic allocation is the process by which we adjust the portfolio for changes in the business or economic cycle, while short-term dynamic allocation is the implementation of tactical market views with the goal of improving the Portfolio’s risk-adjusted return. The risk-adjusted return on an investment takes into account the risk associated with that investment relative to other potential investments. Excess returns from investments in Underlying Funds is by how much the Underlying Funds outperform or underperform their respective benchmark indices.

During the Reporting Period, the Portfolio generated negative absolute returns, largely because of long-term strategic asset allocation. Security selection within the Underlying Funds overall also had a negative impact on performance. Conversely, short-term dynamic allocations contributed positively to the Portfolio’s returns, while medium-term dynamic allocations added modestly.

Long-term strategic asset allocation hampered the Portfolio’s performance during the Reporting Period. Within fixed income, the Portfolio’s strategic allocation to emerging markets debt detracted from results. Additionally, the Portfolio’s U.S. interest rate options strategy, which seeks to profit if interest rates fall, remain constant or rise less than anticipated, had a negative impact on performance as U.S. Treasury yields rose during the Reporting Period. (Our long U.S. interest rate options strategy is a macroeconomic hedge that buys options on short-term interest rates, including call options. A call option is an option that gives the holder the right to buy a certain quantity of an underlying security at an agreed-upon price at any time up to an agreed-upon date.) Within equities, the Portfolio’s strategic allocation to emerging markets equities detracted from performance. On the positive side, among liquid alternatives strategies, the Portfolio benefited from a strategic allocation to managed futures.

Medium-term dynamic allocation added modestly to the Portfolio’s performance during the Reporting Period. Specifically, the Portfolio benefited from its significant cash position and our decision to reduce its exposure to emerging markets equities.

Short-term dynamic allocations bolstered the Portfolio’s performance during the Reporting Period overall. From the beginning of the Reporting Period until January 17, 2022, the MAS Group expressed its short-term dynamic views through an allocation to the Goldman Sachs Tactical Tilt Overlay Fund (the “Underlying Tactical Fund”), which generated positive returns during that time period. Starting on January 17, 2022 through the end of the Reporting Period, the MAS Group implemented its short-term dynamic views directly, primarily through the use of derivatives and exchange-traded funds (“ETFs”). During that period, the Portfolio benefited most from its short-term dynamic allocations to the energy and health care sectors.

Overall, security selection within the Underlying Funds detracted from the Portfolio’s returns during the Reporting Period, with many fixed income and equity Underlying Funds underperforming their benchmark indices. The Goldman Sachs Strategic Income Fund and Goldman Sachs Emerging Markets Debt Fund underperformed their respective benchmark indices the most. Although the

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

performance of liquid alternative Underlying Funds was mixed, the Portfolio benefited from its investment in the Goldman Sachs Managed Futures Fund, which significantly outperformed its cash benchmark.

How was the Portfolio positioned at the beginning of the Reporting Period?

At the beginning of the Reporting Period, the Portfolio was positioned, in terms of its total net assets, with 56.6% in liquid alternative strategies, 32.4% in real assets/satellite asset classes, 13.8% in directional views and the balance in cash. Liquid alternatives strategies generally include, but are not limited to, momentum or trend trading strategies (investment decisions based on trends in asset prices over time), hedge fund beta (long term total returns consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds), managed risk investment strategies (which seek to manage extreme risk scenarios by implementing daily and monthly risk targets across a diversified mix of asset classes) and unconstrained fixed income strategies (which have the ability to move across various fixed income sectors). Real assets/satellite asset classes generally include, but are not limited to, commodities, global real estate securities, global infrastructure securities, master limited partnerships, emerging markets equities and emerging markets debt. Directional views include more traditional beta investments, such as U.S. equities and non-U.S. developed markets equities. This above sector breakout is inclusive of derivative exposure across all asset classes.

How did you manage the Portfolio’s allocations during the Reporting Period?

No changes were made to the Portfolio’s long-term strategic asset allocations during the Reporting Period.

Within medium-term dynamic allocations, we decreased the Portfolio’s exposure to U.S. equities during March. In April, we reduced the Portfolio’s investments in 10-year U.S. Treasury futures and added investments in two-year U.S. Treasury futures. We also slightly increased the Portfolio’s medium-term dynamic allocation to the long U.S. interest rate options strategy. During May, we increased the Portfolio’s exposure to core fixed income, and we reduced its overall fixed income risk by decreasing exposure to high yield corporate bonds and high yield loans. In June, we reduced the Portfolio’s medium-term dynamic allocation to global infrastructure. During July, we decreased its exposure to emerging markets debt and increased its exposure to core fixed income. In August, we reduced the Portfolio’s medium-term dynamic exposure to emerging markets equities in favor of adding exposure to developed markets equities. During December, we increased the Portfolio’s exposure to emerging markets equities.

Regarding short-term dynamic allocations, we removed the Portfolio’s allocation to the Underlying Tactical Fund during January 2022 and began implementing our views directly, primarily through ETFs and derivatives. Using these instruments, we added tactical exposures to U.S. equities, non-U.S. developed markets equities, fixed income and currencies. In May, we slightly increased the Portfolio’s overall equity risk by increasing its exposure to U.S. large-cap equities. During July, we slightly increased the Portfolio’s tactical exposures to equities and fixed income. We reversed this short-term dynamic view in August, reducing the Portfolio’s allocations to equities and fixed income. In September, we increased the Portfolio’s overall equity risk by increasing its short-term dynamic allocations to U.S. large-cap equities. In December, we partially reduced the Portfolio’s short-term dynamic exposure to U.S. large-cap equities.

Regarding Underlying Funds, we removed the Goldman Sachs Absolute Return Tracker Fund as an Underlying Fund for the Portfolio during January 2022, reallocating the capital to other Underlying Funds with multi-strategy investment approaches. Also in January, we removed the Goldman Sachs Dynamic Global Equity Fund as an Underlying Fund for the Portfolio, reallocating the assets to other equity Underlying Funds. In February, in advance of its liquidation, we removed the Goldman Sachs Alternative Premia Fund as an Underlying Fund for the Portfolio. We reallocated the capital to the Goldman Sachs Long Short Credit Strategies Fund.

How was the Portfolio positioned at the end of the Reporting Period?

At the end of the Reporting Period, the Portfolio was positioned, in terms of its total net assets, with 35.7% in liquid alternative strategies, 29.5% in real assets/satellite asset classes, 16.19% in directional views and the balance in cash. This above sector breakout is inclusive of derivative exposure across all asset classes.

How did the Portfolio use derivatives and similar instruments during the Reporting Period?

During the Reporting Period, derivatives were used primarily to express views across developed and emerging markets equities as well as on U.S. interest rates. The Portfolio employed equity index futures to effect long exposures in U.S. large-cap equities, U.S. small-cap equities and emerging markets equities (each having a negative impact on performance). Within fixed income during the Reporting Period, the Portfolio used interest rate futures, specifically U.S. Treasury futures, to express views on the U.S. Treasury yield curve (negative impact). The Portfolio also used interest rate options in a macroeconomic hedge that seeks to profit if interest rates fall, remain constant or rise less than anticipated (negative impact). Finally, within short-term tactical views on currencies, the Portfolio employed forward foreign currency exchange contracts (neutral impact).

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Additionally, some of the Underlying Funds used derivatives during the Reporting Period to apply their active investment views with greater versatility and potentially to afford greater risk management precision. As market conditions warranted during the Reporting Period, some of these Underlying Funds engaged in forward foreign currency exchange contracts, financial futures contracts, options, swap contracts and structured securities to attempt to enhance portfolio return and for hedging purposes.

Were there any changes to the Portfolio’s portfolio management team during the Reporting Period?

Effective January 3, 2022, Alexandra Wilson-Elizondo became a portfolio manager for the Portfolio, joining Neill Nuttall. By design, all investment decisions for the Portfolios are performed within a team structure, with multiple subject matter experts. This strategic decision making has been the cornerstone of our approach and ensures continuity in the Portfolio.

What is the Portfolio’s tactical view and strategy for the months ahead?

At the end of the Reporting Period, we remained cautious about the potential risk-reward of adding risk to the Portfolio. In addition, with short-term interest rates near 5%, we believed investors were not being adequately compensated for being pro-risk amid the prevailing uncertainty around earnings growth, geopolitical developments and global monetary policy. Until we saw more clarity in the inflation/economic growth mix, we expected to favor higher-yielding, high-quality fixed income over equities. Going forward, we continued to believe that a dynamic investment approach and careful risk management should help us identify attractive opportunities, both regionally and across asset classes.

FUND BASICS

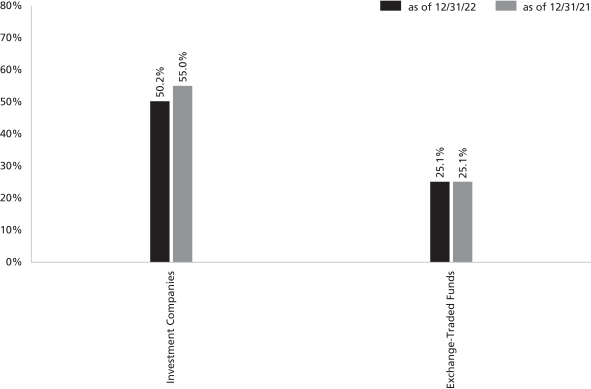

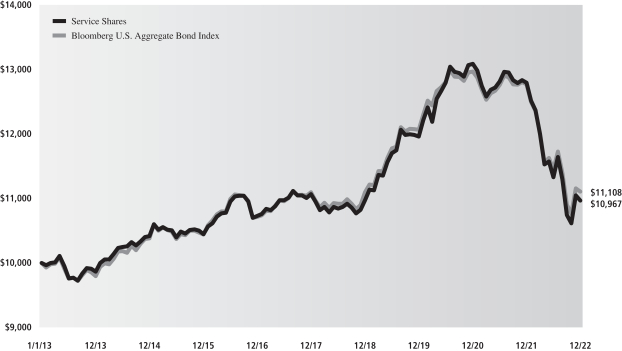

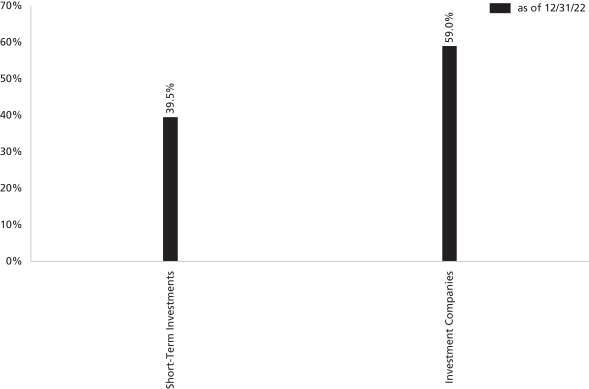

OVERALL UNDERLYING FUND AND ETF WEIGHTINGS1

Percentage of Net Assets

| 1 | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each Underlying Fund and ETF reflects the value of that Underlying Fund or ETF as a percentage of net assets of the Portfolio. Figures in the graph above may not sum to 100% due to rounding and/or exclusion of other assets and liabilities. Underlying sector allocations of exchange traded funds and investment companies held by the Portfolio are not reflected in the graph above. The graph depicts the Portfolio’s investments but may not represent the Portfolio’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Performance Summary

December 31, 2022

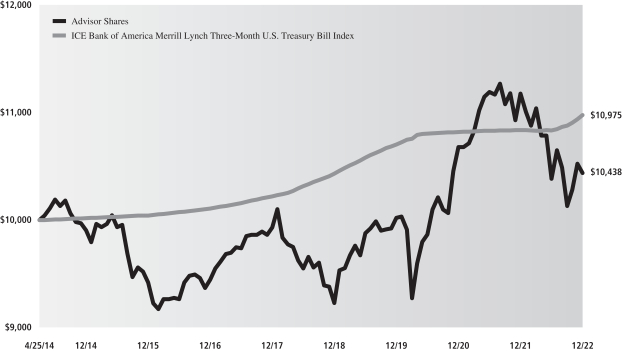

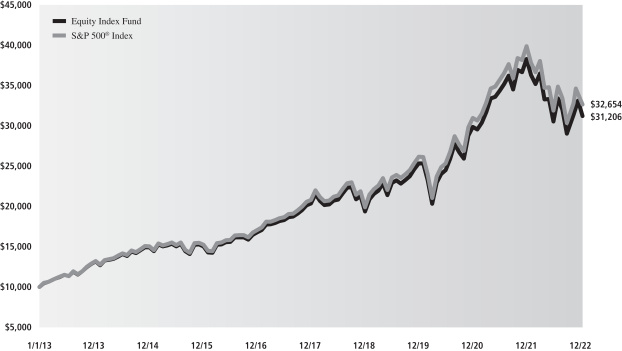

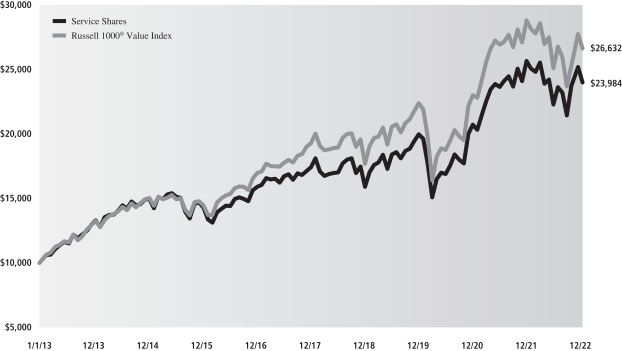

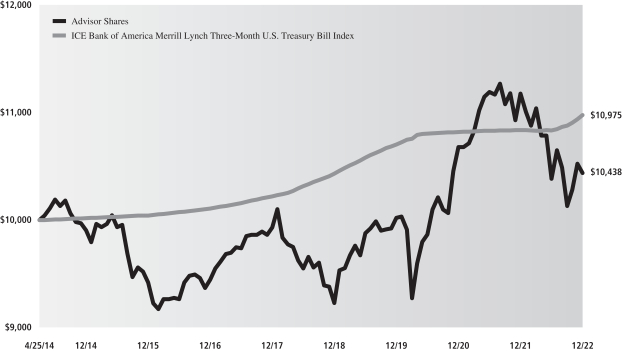

The following graph shows the value, as of December 31, 2022, of a $10,000 investment made on April 25, 2014 (commencement of the Fund’s operations) in Advisor Shares at NAV. For comparative purposes, the performance of the Portfolio’s benchmark, the ICE Bank of America Merrill Lynch Three-Month U.S. Treasury Bill Index, is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and, in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

Multi-Strategy Alternatives Portfolio’s Lifetime Performance

Performance of a $10,000 investment, with distributions reinvested, from April 25, 2014 through December 31, 2022.

| | | | | | |

| Average Annual Total Return through December 31, 2022 | | One Year | | Five Years | | Since Inception |

Institutional (Commenced April 25, 2014) | | -6.24% | | 1.41% | | 0.89% |

Service (Commenced April 25, 2014) | | -6.54% | | 1.15% | | 0.64% |

Advisor (Commenced April 25, 2014) | | -6.61% | | 1.00% | | 0.49% |

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

INVESTMENT OBJECTIVE

The Fund seeks total return while seeking to provide volatility management.

Portfolio Management Discussion and Analysis

Effective after the close of business on January 31, 2022, the Goldman Sachs Variable Insurance Trust — Goldman Sachs Trend Driven Allocation Fund’s (the “Fund”) principal investment strategy changed. The Fund’s investment objective and benchmark indices remained the same. Below, the Goldman Sachs Quantitative Investment Strategies (“QIS”) Team discusses the Fund’s performance and positioning for the 12-month period ended December 31, 2022 (the “Reporting Period”).

How did the Fund perform during the Reporting Period?

During the Reporting Period, the Fund’s Institutional and Service Shares generated average annual total returns of -19.00% and -19.16%, respectively. These returns compare to the -13.93% average annual total return of the Fund’s blended benchmark during the same time period. The components of the Fund’s blended benchmark, which is comprised 60% of the MSCI World Index (Net, USD, Hedged) and 40% of the Bloomberg U.S. Treasury Index (Total Return, Unhedged, USD), generated average annual total returns of -15.38% and -12.46%, respectively, during the same time period.

Importantly, during the Reporting Period, the Fund’s overall annualized volatility was 10.66%, less than the Fund’s blended benchmark’s annualized volatility of 12.17% during the same time period. By way of comparison, the S&P 500® Index’s annualized volatility was 24.13% during the Reporting Period.

How did the Fund’s investment strategy change after the close of business on January 31, 2022?

Before the close of business on January 31, 2022, the Fund primarily sought to achieve its investment objective by investing in a global portfolio of equity and fixed income asset classes, with at least 40% of its assets invested in equities and at least 20% of its assets invested in fixed income, assuming normal market conditions. Goldman Sachs Asset Management, L.P. (the “Investment Adviser”) made investment decisions based upon its analysis of the recent performance of market factors around the world, and might then allocate more of the Fund’s assets to investments with strong recent performance and allocate assets away from investments with poor recent performance.

Effective after the close of business on January 31, 2022, the Fund primarily seeks to achieve its investment objective by investing in a portfolio of equity and fixed income asset classes, with the expectation of investing at least 50% of its assets in equities and a minimum of 30% of its assets in fixed income, assuming normal market conditions. The Investment Adviser makes investment decisions based upon its analysis of macro factors, most notably “trends” from around the world. The trends analyzed by the Investment Adviser are based on, but are not limited to, relative considerations around the prices and volatility of the underlying markets. If recent prices are higher than measures of historical prices for an asset, the Investment Adviser generally considers there to be a positive (strong) trend for these assets, whereas recent prices below such measures generally indicate negative (poor) trends. If the current measure of volatility is elevated relative to historic realizations of this volatility measure for an asset, the Investment Adviser generally considers there to be a negative (poor) trend for this asset, whereas volatility that is less elevated indicates positive (strong) trends. As a result of the trends analysis, the Investment Adviser may allocate more of the Fund’s assets to investments with relatively strong recent trends and allocate assets away from investments with relatively poor recent trends.

In addition, as a continuing part of the Fund’s investment strategy, the Investment Adviser seeks to manage volatility and limit losses by allocating the Fund’s assets away from risky investments in distressed or volatile market environments. In this context, volatility is a statistical measurement of the magnitude of up and/or down fluctuations in the value of a financial instrument or index. While the Investment Adviser attempts to manage the Fund’s volatility, there can be no guarantee that the Fund will be successful.

What key factors were responsible for the Fund’s performance during the Reporting Period?

Because of heightened equity market volatility during the Reporting Period, the Fund’s drawdown control and volatility management mechanisms were activated multiple times, actively de-risking the Fund into cash, especially in early March, May/June, and September/October 2022. (A drawdown is a peak-to-trough decline during a specific time period and is a measure of downside volatility.)

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

During the first and fourth quarters of 2022, the Fund underperformed its blended benchmark due to the Fund’s sizeable cash allocation, which kept the Fund from fully participating in the equity market rebound in the March and during a period from October into November. This was offset somewhat by the Fund’s cash allocation in the second and third calendar quarters, which bolstered relative performance amid the equity drawdown during that period.

From an absolute return perspective, the Fund benefited from its allocation to cash during the Reporting Period, as interest rates rose. Conversely, the Fund’s allocations to U.S. large-cap equities, European equities and Japanese equities, each of which posted negative returns, detracted from its absolute performance during the Reporting Period. The largest detractor was the Fund’s allocation to U.S. large-cap equities.

What was the Fund’s volatility during the Reporting Period?

As part of our investment approach, we seek to mitigate the Fund’s volatility. As mentioned earlier, for the Reporting Period overall, the Fund’s overall annualized volatility was 10.66%, less than its blended benchmark’s annualized volatility of 12.17%. By way of comparison, the S&P 500® Index’s annualized volatility was 24.13% during the Reporting Period.

How was the Fund positioned during the Reporting Period?

During the Reporting Period, we managed the Fund’s allocations across equity and fixed income markets based upon an analysis of market factors and, after the close of business on January 31, 2022, upon an analysis of trends from around the world. At the beginning of the Reporting Period, the Fund’s total assets were allocated 80.0% to equities, 20.0% to fixed income and 0% to cash. (Many of these positions were implemented through the use of exchanged-traded index future contracts.) Within the equity category, the Fund had allocations to U.S. large-cap equities, European equities, U.K. equities and Japanese equities. It did not have allocations to U.S. small-cap equities or emerging markets equities. As for fixed income, the Fund had allocations to Japanese and German government bonds at the start of the Reporting Period. It did not have an allocation to U.S. Treasury securities.

During the first quarter of 2022, as market equity volatility increased, we trimmed the Fund’s allocations to U.S. large-cap equities, European equities, U.K. equities and Japanese equities, while increasing its allocations to U.S. Treasury securities and cash. We reversed this positioning somewhat near quarter-end as equity markets rebounded. At the end of the first quarter, the Fund did not hold any German and Japanese government bonds. The equity market rebound at the end of the first quarter proved to be short-lived, and equity markets resumed their declines during the second quarter and into the summer months, though they experienced occasional brief rallies. In May 2022, we increased the Fund’s allocation to equities, most notably U.S. equities, and then trimmed it during June following a spike in volatility, which had reversed the previous trend. As markets stabilized somewhat in July and August, we steadily reduced the Fund’s cash position to almost zero and increased its allocations to equities and U.S. Treasury securities. In September, during a time of risk-off, or heightened risk aversion, sentiment, we significantly increased the Fund’s cash position. We started the fourth quarter of 2022 by increasing the Fund’s allocations to equities and U.S. Treasuries, reducing its cash position back to zero.

Overall, the Fund was dynamically positioned in equities, U.S. Treasury securities and cash during the first half of the Reporting Period. During the second half of the Reporting Period, there were distinct periods when the Fund held a nearly zero cash position. Throughout the Reporting Period, U.S. equities and U.S. Treasury securities were the Fund’s largest allocations.

How did the Fund use derivatives and similar instruments during the Reporting Period?

During the Reporting Period, the Fund employed exchange-traded equity index futures to gain exposure to U.S. large-cap stocks and to European, Japanese and U.K. equities. The use of these instruments had a negative impact overall on absolute returns. In addition, the Fund used bond futures to gain exposure to U.S. Treasury securities and to Japanese and German government bonds. On an absolute basis, the use of these instruments had a negative impact overall on the Fund’s performance.

Were there any changes to the Fund’s portfolio management team during the Reporting Period?

Effective at the close of business on June 23, 2022, Federico Gilly no longer served as a portfolio manager for the Fund, and James Park became a portfolio manager for the Fund. As of September 22, 2022, James Park no longer served as a portfolio manager for the Fund, and Momoko Ono and Jay Seo became portfolio managers for the Fund. At the end of the Reporting Period, Oliver Bunn, Momoko Ono and Jay Seo served as portfolio managers of the Fund. By design, all investment decisions for the Fund are performed within a team structure, with multiple subject matter experts. This strategic decision making has been a cornerstone of our approach and helps ensure continuity in the Fund.

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

What is the Fund’s tactical asset allocation view and strategy for the months ahead?

At the end of the Reporting Period, the Fund’s total assets were allocated 69.5% to equities, 30.5% to fixed income and 0% to cash. (Many of these positions were implemented through the use of exchanged-traded index future contracts.) Within the equity allocation, the Fund had significant exposure to U.S. large-cap equities and, to a lesser extent, to European, Japanese and U.K. equities. It had no exposure to emerging markets equities or U.S. small-cap stocks at the end of the Reporting Period. Within the fixed income allocation, the Fund had exposure to U.S. Treasury securities at the end of the Reporting Period and no exposure to Japanese and German government bonds.

Going forward, we intend to position the Fund based on analyses of trends from around the world, while dynamically managing the volatility, or risk, of the overall portfolio. In general, the Fund will seek to invest at least 50% of its assets in equity investments and at least 30% of its assets in fixed income investments. The Fund may deviate from these strategic allocations in order to allocate more of the Fund’s assets to investments with relatively strong recent trends and allocate assets away from investments with relatively poor recent trends. When volatility increases, our goal is to preserve capital by proportionally increasing the Fund’s cash exposure and reducing its exposure to riskier asset classes. There is no guarantee the Fund’s dynamic management strategy will cause it to achieve its investment objective.

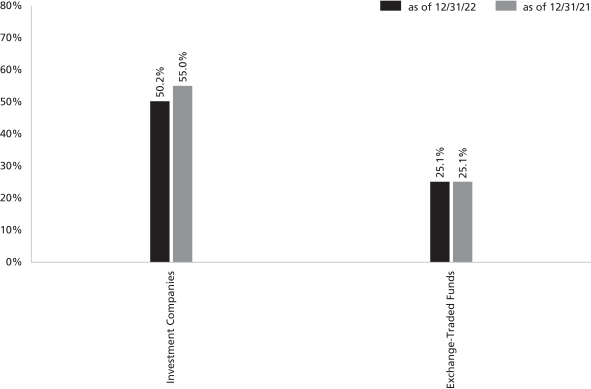

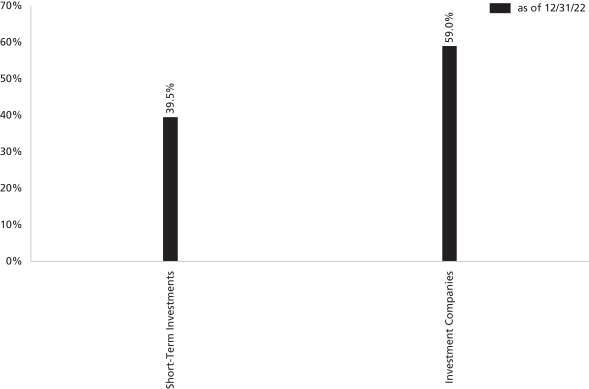

FUND BASICS

Trend Driven Allocation Fund

as of December 31, 2022

FUND COMPOSITION1

| 1 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The underlying composition of exchange traded funds and investment companies held by the Fund are not reflected in the graph above. Consequently, the Fund’s overall composition may differ from the percentages contained in the graph above. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

Performance Summary

December 31, 2022

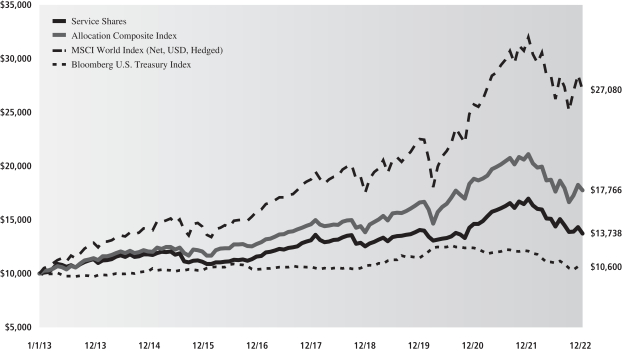

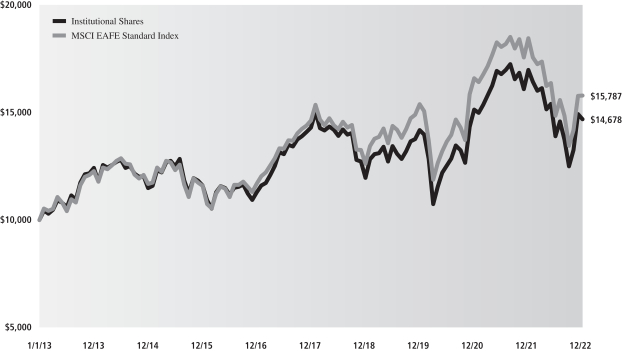

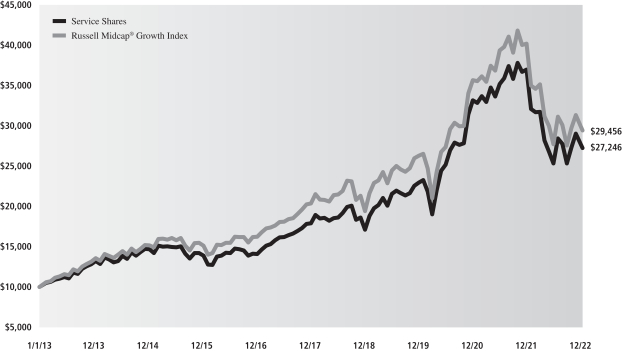

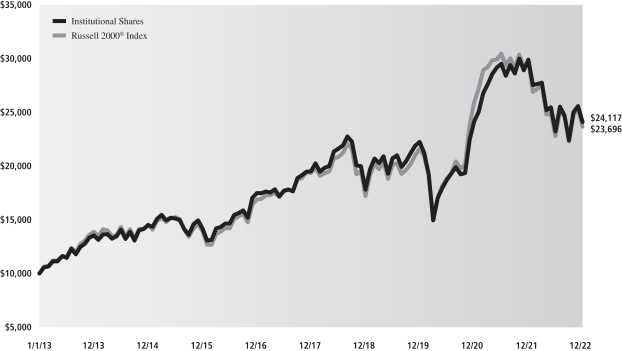

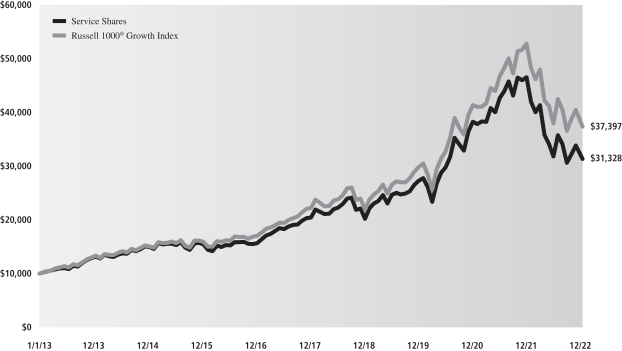

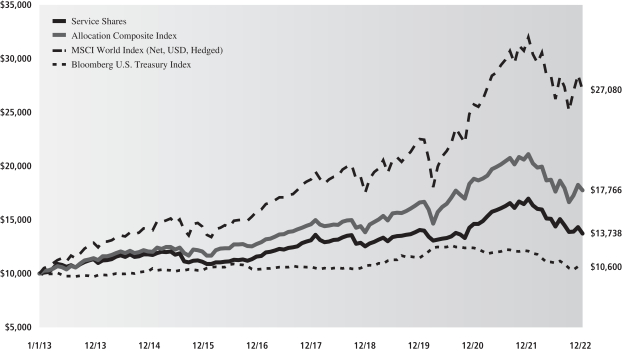

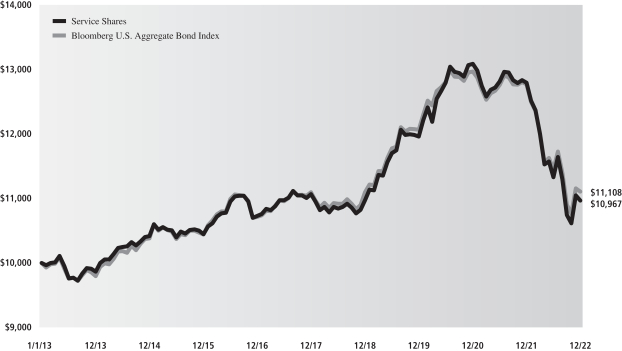

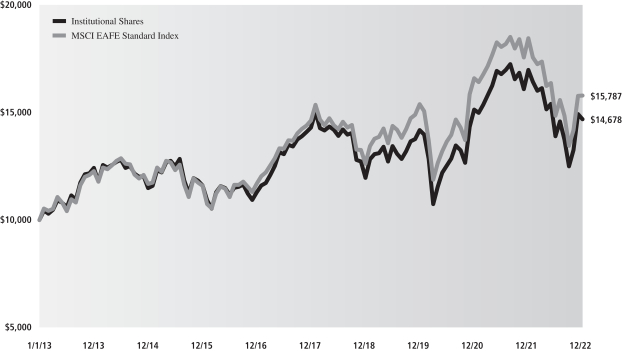

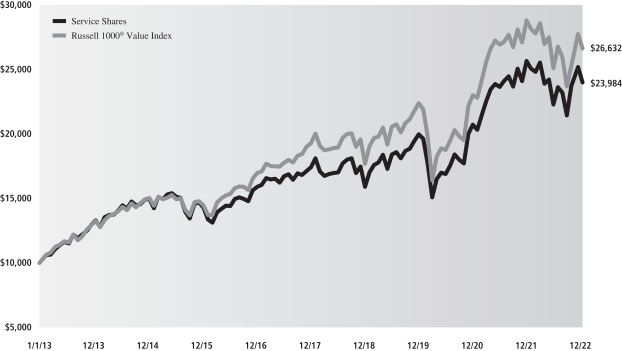

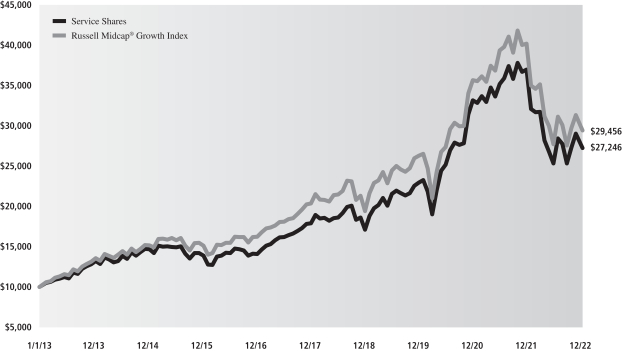

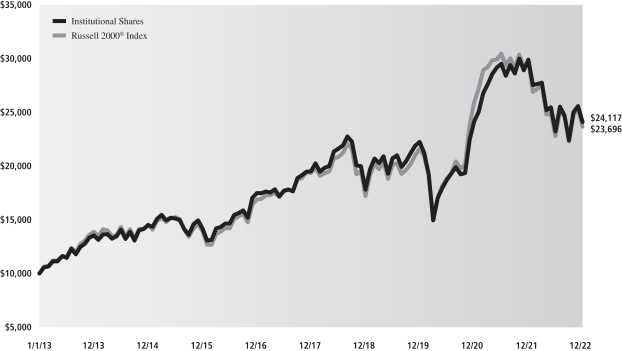

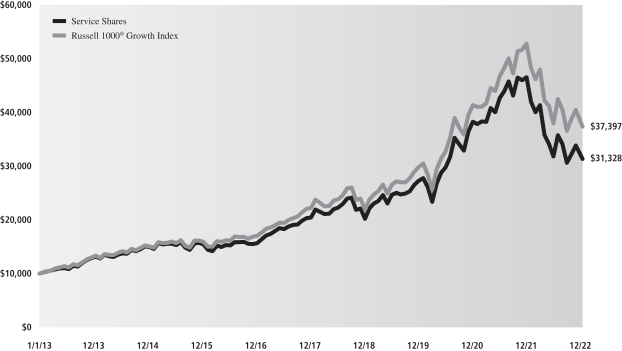

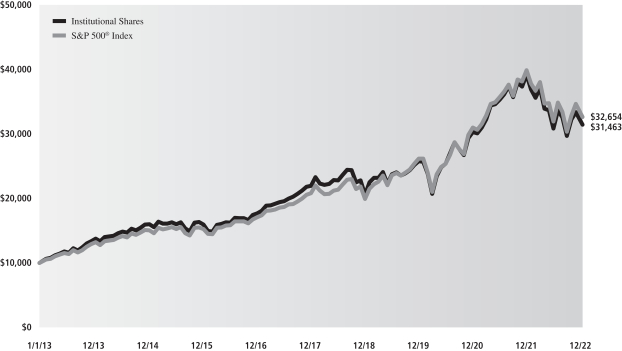

The following graph shows the value, as of December 31, 2022, of a $10,000 investment made on January 1, 2013 in Service Shares at NAV. For comparative purposes, the performance of the Fund’s blended benchmark, the Allocation Composite Index, (comprised of the Morgan Stanley Capital International (MSCI) World Index (Net, USD, Hedged) (60%) and the Bloomberg U.S. Treasury Index (Total Return, USD, Unhedged) (40%)) is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and, in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

Trend Driven Allocation Fund’s 10 Year Performance

Performance of a $10,000 investment, with distributions reinvested, from January 1, 2013 through December 31, 2022.

| | | | | | | | |

| Average Annual Total Return through December 31, 2022 | | One Year | | Five Years | | Ten Years | | Since Inception |

Institutional (Commenced October 16, 2013) | | -19.00% | | 1.18% | | N/A | | 2.68% |

Service | | -19.16% | | 0.92% | | 3.22% | | — |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-ASSET STRATEGIES FUNDS

Index Definitions

ICE BofAML Three-Month T-Bill Index measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by Bank of America Merrill Lynch.

MSCI ACWI Investable Market Index captures large, mid and small cap representation across 23 developed markets and 27 emerging markets countries.

MSCI Emerging Markets Index captures large-cap and mid-cap representation across 26 emerging markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Bloomberg U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Treasury bills are excluded by the maturity constraint.

MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country.

S&P 500® Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices.

It is not possible to invest directly in an unmanaged index.

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Underlying Funds (Class R6 Shares)(a) – 63.7% | |

| Equity – 11.2% | |

| | 208,599 | | | Goldman Sachs Global Infrastructure Fund | | $ | 2,544,911 | |

| | 187,878 | | | Goldman Sachs Emerging Markets Equity Insights Fund | | | 1,401,569 | |

| | 15,680 | | | Goldman Sachs Energy Infrastructure Fund | | | 166,361 | |

| | | | | | | | |

| | | | | | | 4,112,841 | |

| | |

| Fixed Income – 52.5% | |

| | 931,023 | | | Goldman Sachs Long Short Credit Strategies Fund | | | 7,094,397 | |

| | 482,432 | | | Goldman Sachs Managed Futures Strategy Fund | | | 4,930,459 | |

| | 287,214 | | | Goldman Sachs Emerging Markets Debt Fund | | | 2,550,458 | |

| | 386,754 | | | Goldman Sachs High Yield Fund | | | 2,057,530 | |

| | 177,750 | | | Goldman Sachs High Yield Floating Rate Fund | | | 1,539,318 | |

| | 129,972 | | | Goldman Sachs Strategic Income Fund | | | 1,146,354 | |

| | | | | | | | |

| | | | | | | 19,318,516 | |

| | |

| | TOTAL UNDERLYING FUNDS (CLASS R6 SHARES) | |

| | (Cost $24,144,238) | | $ | 23,431,357 | |

| | |

| | | | | | | | |

|

| Exchange Traded Funds – 8.5% | |

| | 42,308 | | | Goldman Sachs MarketBeta US Equity ETF | | $ | 2,196,208 | |

| | 19,779 | | | Goldman Sachs MarketBeta International Equity ETF(b) | | | 928,624 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | |

| | (Cost $3,181,225) | | $ | 3,124,832 | |

| | |

| Shares | | Dividend

Rate | | | Value | |

|

| Investment Companies (Institutional Shares)(a) – 26.0% | |

Goldman Sachs Financial Square Government Fund | |

| 3,276,259 | | | 4.159 | % | | $ | 3,276,259 | |

Goldman Sachs VIT Government Money Market Fund | |

| 6,285,567 | | | 4.183 | % | | $ | 6,285,567 | |

| |

| TOTAL INVESTMENT COMPANIES | |

| (Cost $9,561,826) | | | | 9,561,826 | |

| |

| TOTAL INVESTMENTS BEFORE SECURITIES LENDING REINVESTMENT VEHICLE | |

| (Cost $36,887,289) | | | $ | 36,118,015 | |

| |

| | | | | | | | |

|

| Securities Lending Reinvestment Vehicle(a) – 2.5% | |

Goldman Sachs Financial Square Government Fund — Institutional Shares | |

| 911,315 | | | 4.159 | % | | $ | 911,315 | |

(Cost $911,315) | |

| |

| TOTAL INVESTMENTS – 100.7% | |

| (Cost $37,798,604) | | | $ | 37,029,330 | |

| |

LIABILITIES IN EXCESS OF OTHER ASSETS – (0.7)% | | | | (270,140 | ) |

| |

| NET ASSETS – 100.0% | | | $ | 36,759,190 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| (a) | | Represents an affiliated issuer. |

| |

| (b) | | All or a portion of security is on loan. |

| | |

| |

| Currency Abbreviations: |

| CHF | | —Swiss Franc |

| EUR | | —Euro |

| USD | | —United States Dollar |

ADDITIONAL INVESTMENT INFORMATION

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — As of December 31, 2022, the Portfolio had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Settlement

Date | | | Unrealized

Gain | |

| UBS Financial Services | | | CHF 30,000 | | | | USD 32,319 | | | | 3/15/2023 | | | $ | 383 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Schedule of Investments

December 31, 2022

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Schedule of Investments (continued)

December 31, 2022

ADDITIONAL INVESTMENT INFORMATION (continued)

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Settlement

Date | | | Unrealized

Loss | |

| UBS Financial Services | | | USD 31,741 | | | | EUR 30,000 | | | | 3/15/2023 | | | $ | (533 | ) |

FUTURES CONTRACTS — As of December 31, 2022, the Portfolio had the following futures contracts:

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | |

| | | | |

Long position contracts: | | | | | | | | | | | | | | | | |

| EURO STOXX Bank Index | | | 35 | | | | 03/17/23 | | | $ | 180,304 | | | $ | 5,229 | |

| MSCI Emerging Markets E-Mini Index | | | 7 | | | | 03/17/23 | | | | 335,790 | | | | (3,794 | ) |

| U.S. Treasury 10 Year Note | | | 10 | | | | 03/22/23 | | | | 1,121,406 | | | | (7,494 | ) |

U.S. Treasury 2 Year Note | | | 8 | | | | 03/31/23 | | | | 1,640,000 | | | | (162 | ) |

| | | | |

| Total Futures Contracts | | | | | | | | | | | | | | $ | (6,221 | ) |

PURCHASED OPTIONS CONTRACTS — As of December 31, 2022, the Portfolio had the following purchased option contracts:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Exercise

Price | | | Expiration

Date | | | Number of

Contracts | | | Notional

Amount | | | Value | | | Premiums

Paid

(Received)

by the

Portfolio | | | Unrealized

Appreciation/

(Depreciation) | |

|

Purchased options contracts: | |

| | | | | | | |

Calls | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3 Month Eurodollar | | | 95.00 USD | | | | 09/18/2023 | | | | 3 | | | $ | 711,938 | | | $ | 2,569 | | | $ | 6,982 | | | $ | (4,413 | ) |

3 Month Eurodollar | | | 94.75 USD | | | | 12/18/2023 | | | | 8 | | | | 1,904,200 | | | | 14,900 | | | | 16,194 | | | | (1,294 | ) |

3 Month Eurodollar | | | 95.00 USD | | | | 12/18/2023 | | | | 4 | | | | 952,100 | | | | 5,975 | | | | 11,559 | | | | (5,584 | ) |

3 Month Eurodollar | | | 97.25 USD | | | | 12/19/2023 | | | | 18 | | | | 4,284,450 | | | | 3,600 | | | | 20,533 | | | | (16,933 | ) |

3 Month Eurodollar | | | 94.75 USD | | | | 03/18/2024 | | | | 8 | | | | 1,912,000 | | | | 21,850 | | | | 23,250 | | | | (1,400 | ) |

3 Month Eurodollar | | | 97.50 USD | | | | 03/19/2024 | | | | 46 | | | | 10,994,000 | | | | 15,525 | | | | 54,257 | | | | (38,732 | ) |

3 Month Eurodollar | | | 97.00 USD | | | | 06/17/2024 | | | | 8 | | | | 1,919,400 | | | | 6,650 | | | | 7,603 | | | | (953 | ) |

3 Month Eurodollar | | | 97.50 USD | | | | 06/17/2024 | | | | 40 | | | | 9,597,000 | | | | 22,750 | | | | 53,230 | | | | (30,480 | ) |

3 Month Eurodollar | | | 97.00 USD | | | | 09/16/2024 | | | | 12 | | | | 2,887,200 | | | | 13,275 | | | | 15,853 | | | | (2,578 | ) |

3 Month Eurodollar | | | 95.00 USD | | | | 09/16/2024 | | | | 4 | | | | 962,400 | | | | 15,100 | | | | 15,909 | | | | (809 | ) |

3 Month Eurodollar | | | 97.00 USD | | | | 12/16/2024 | | | | 21 | | | | 5,061,000 | | | | 28,481 | | | | 33,277 | | | | (4,796 | ) |

3 Month Eurodollar | | | 97.00 USD | | | | 03/17/2025 | | | | 18 | | | | 4,341,825 | | | | 27,563 | | | | 32,449 | | | | (4,886 | ) |

3 Month Eurodollar | | | 95.88 USD | | | | 09/18/2023 | | | | 12 | | | | 2,847,750 | | | | 3,525 | | | | 30,603 | | | | (27,078 | ) |

3 Month Eurodollar | | | 95.88 USD | | | | 06/20/2023 | | | | 12 | | | | 2,845,050 | | | | 1,275 | | | | 24,853 | | | | (23,578 | ) |

3 Month Eurodollar | | | 95.88 USD | | | | 03/13/2023 | | | | 8 | | | | 1,898,500 | | | | 300 | | | | 14,244 | | | | (13,944 | ) |

3 Month Eurodollar | | | 95.13 USD | | | | 03/18/2024 | | | | 5 | | | | 1,195,000 | | | | 10,719 | | | | 15,824 | | | | (5,105 | ) |

3 Month Eurodollar | | | 95.13 USD | | | | 06/17/2024 | | | | 5 | | | | 1,199,625 | | | | 14,812 | | | | 18,261 | | | | (3,449 | ) |

3 Month Eurodollar | | | 95.13 USD | | | | 09/16/2024 | | | | 5 | | | | 1,203,000 | | | | 17,750 | | | | 20,262 | | | | (2,512 | ) |

3 Month Eurodollar | | | 94.88 USD | | | | 06/17/2024 | | | | 4 | | | | 959,700 | | | | 13,500 | | | | 14,034 | | | | (534 | ) |

3 Month Eurodollar | | | 97.75 USD | | | | 03/13/2023 | | | | 7 | | | | 1,661,188 | | | | 44 | | | | 19,248 | | | | (19,204 | ) |

3 Month Eurodollar | | | 97.75 USD | | | | 06/19/2023 | | | | 4 | | | | 948,350 | | | | 125 | | | | 16,312 | | | | (16,187 | ) |

| | | | | | | |

| TOTAL | | | | | | | | | | | | | | $ | 60,285,676 | | | $ | 240,288 | | | $ | 464,737 | | | $ | (224,449 | ) |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

Schedule of Investments

December 31, 2022

| | | | | | | | |

| Shares | | |

Description | | Value | |

|

| Exchange Traded Funds – 25.1% | |

| | 90,765 | | | iShares Core S&P 500 ETF | | $ | 34,872,821 | |

| | 91,600 | | | Vanguard S&P 500 ETF | | | 32,182,744 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | |

| | (Cost $50,719,973) | | $ | 67,055,565 | |

| | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Dividend

Rate | | | Value | |

|

| Investment Companies (Institutional Shares)(a) – 50.2% | |

Goldman Sachs Financial Square Government Fund | |

| 53,931,471 | | | 4.138 | % | | $ | 53,931,471 | |

Goldman Sachs Financial Square Treasury Instruments Fund | |

| 26,776,391 | | | 3.932 | | | | 26,776,391 | |

Goldman Sachs Financial Square Treasury Obligations Fund | |

| 26,777,206 | | | 4.144 | | | | 26,777,206 | |

Goldman Sachs Financial Square Treasury Solutions Fund | |

| 26,776,391 | | | 4.127 | | | | 26,776,391 | |

| |

| TOTAL INVESTMENT COMPANIES | |

| (Cost $134,261,459) | | | $ | 134,261,459 | |

| |

| TOTAL INVESTMENTS – 75.3% | |

| (Cost $184,981,432) | | | $ | 201,317,024 | |

| |

OTHER ASSETS IN EXCESS OF LIABILITIES – 24.7% | | | | 66,122,451 | |

| |

| NET ASSETS – 100.0% | | | $ | 267,439,475 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| (a) | | Represents an affiliated issuer. |

ADDITIONAL INVESTMENT INFORMATION

FUTURES CONTRACTS — As of December 31, 2022, the Fund had the following futures contracts:

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Unrealized

Appreciation/

(Depreciation) | |

| | | | |

Long position contracts: | | | | | | | | | | | | | | | | |

| EURO STOXX 50 Index | | | 461 | | | | 03/17/23 | | | $ | 18,678,133 | | | $ | (945,697 | ) |

| FTSE 100 Index | | | 101 | | | | 03/17/23 | | | | 9,116,282 | | | | (42,644 | ) |

| S&P 500 E-Mini Index | | | 407 | | | | 03/17/23 | | | | 78,571,350 | | | | (3,064,189 | ) |

| TOPIX Index | | | 85 | | | | 03/09/23 | | | | 12,250,648 | | | | (307,791 | ) |

U.S. Treasury 10 Year Note | | | 728 | | | | 03/22/23 | | | | 81,638,375 | | | | (882,879 | ) |

| | | | |

| Total Futures Contracts | | | | | | | | | | | | | | $ | (5,243,200 | ) |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-ASSET STRATEGIES FUNDS

Statements of Assets and Liabilities

December 31, 2022

| | | | | | | | |

| | | Multi-Strategy

Alternatives Portfolio | | | Trend Driven

Allocation Fund | |

| | | | | | | | |

| Assets: | | | | | | |

Investments in unaffiliated issuers, at value (cost $— and $50,719,973, respectively) | | $ | — | | | $ | 67,055,565 | |

Investments in affiliated issuers, at value (cost $36,887,289 and $134,261,459, respectively)(a) | | | 36,118,015 | | | | 134,261,459 | |

Investments in affiliated securities lending reinvestment vehicle, at value which equals cost | | | 911,315 | | | | — | |

Purchased Options, at value (premiums paid $464,737 and $—, respectively) | | | 240,288 | | | | — | |

Cash | | | 559,127 | | | | 57,473,870 | |

Foreign currency, at value (cost $— and $201,779, respectively) | | | — | | | | 205,391 | |

Receivables: | | | | | | | | |

Collateral on future contracts | | | 41,600 | | | | — | |

Dividends | | | 13,152 | | | | 260,244 | |

Fund shares sold | | | 13,070 | | | | 30,372 | |

Securities lending income | | | 551 | | | | — | |

Due from broker | | | — | | | | 9,474,089 | |

Reimbursement from investment adviser | | | 17,042 | | | | 22,459 | |

Unrealized gain on forward foreign currency exchange contracts | | | 383 | | | | — | |

Other assets | | | 67 | | | | 96 | |

| | |

| Total assets | | | 37,914,610 | | | | 268,783,545 | |

| | | | | | | | |

| | | | | | | | |

| Liabilities: | | | | | | |

Variation margin on futures contracts | | | 9,008 | | | | 957,607 | |

Unrealized loss on forward foreign currency exchange contracts | | | 533 | | | | — | |

Payables: | | | | | | | | |

Payable upon return of securities loaned | | | 911,315 | | | | — | |

Fund shares redeemed | | | 73,669 | | | | 74,511 | |

Distribution and Service fees and Transfer Agency fees | | | 67,313 | | | | 69,505 | |

Management fees | | | 4,708 | | | | 147,680 | |

Accrued expenses | | | 88,874 | | | | 94,767 | |

| | |

| Total liabilities | | | 1,155,420 | | | | 1,344,070 | |

| | | | | | | | |

| | | | | | | | |

| Net Assets: | | | | | | |

Paid-in capital | | | 41,049,722 | | | | 299,892,684 | |

Total distributable earnings (loss) | | | (4,290,532 | ) | | | (32,453,209 | ) |

| | |

| NET ASSETS | | $ | 36,759,190 | | | $ | 267,439,475 | |

Net Assets: | | | | | | | | |

Advisor | | $ | 23,200,142 | | | $ | — | |

Institutional | | | 2,203,322 | | | | 505,791 | |

Service | | | 11,355,726 | | | | 266,933,684 | |

| | |

Total Net Assets | | $ | 36,759,190 | | | $ | 267,439,475 | |

Shares outstanding $0.001 par value (unlimited number of shares authorized): | | | | | | | | |

Advisor | | | 2,646,539 | | | | — | |

Institutional | | | 250,158 | | | | 50,281 | |

Service | | | 1,288,333 | | | | 26,726,720 | |

Net asset value, offering and redemption price per share: | | | | | | | | |

Advisor | | | $8.77 | | | | $— | |

Institutional | | | 8.81 | | | | 10.06 | |

Service | | | 8.81 | | | | 9.99 | |

(a) Includes loaned securities having a market value of $882,191 and $–, respectively.

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-ASSET STRATEGIES FUNDS

Statements of Operations

For the Fiscal Year Ended December 31, 2022

| | | | | | | | |

| | | Multi-Strategy

Alternatives Portfolio | | | Trend Driven

Allocation Fund | |

| | | | | | | | |

| Investment income: | | | | | | |

Dividends — affiliated Underlying Funds | | $ | 1,752,128 | | | $ | 2,206,619 | |

Dividends — unaffiliated issuers | | | 21,433 | | | | 931,651 | |

Securities lending income — affiliated issuer | | | 1,127 | | | | 6,390 | |

| | |

| Total investment income | | | 1,774,688 | | | | 3,144,660 | |

| | | | | | | | |

| | | | | | | | |

| Expenses: | | | | | | |

Distribution and/or Service (12b-1) fees(a) | | | 131,264 | | | | 752,332 | |

Professional fees | | | 94,179 | | | | 181,377 | |

Custody, accounting and administrative services | | | 71,454 | | | | 64,360 | |

Management fees | | | 63,034 | | | | 2,381,158 | |

Trustee fees | | | 27,295 | | | | 35,263 | |

Printing and mailing costs | | | 13,053 | | | | 37,779 | |

Transfer Agency fees(a) | | | 8,405 | | | | 60,282 | |

Other | | | 1,509 | | | | 5,884 | |

| | |

| Total expenses | | | 410,193 | | | | 3,518,435 | |

| | |

Less — expense reductions | | | (194,634 | ) | | | (778,094 | ) |

| | |

| Net expenses | | | 215,559 | | | | 2,740,341 | |

| | |

| NET INVESTMENT INCOME | | | 1,559,129 | | | | 404,319 | |

| | | | | | | | |

| | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | |

Net realized gain (loss) from: | | | | | | | | |

Investments — unaffiliated issuers | | | 430,726 | | | | 4,646,782 | |

Investments — affiliated Underlying Funds | | | (3,366,417 | ) | | | — | |

Futures contracts | | | (552,257 | ) | | | (37,545,427 | ) |

Purchased options | | | (267,112 | ) | | �� | — | |

Foreign currency transactions | | | 11,413 | | | | (1,072,748 | ) |

Net change in unrealized gain (loss) on: | | | | | | | | |

Investments — unaffiliated issuers | | | — | | | | (25,809,077 | ) |

Investments — affiliated Underlying Funds | | | (1,125,104 | ) | | | — | |

Futures contracts | | | (27,832 | ) | | | (8,086,440 | ) |

Purchased Options | | | (168,602 | ) | | | — | |

Forward foreign currency exchange contracts | | | (150 | ) | | | — | |

Foreign currency translations | | | 6,564 | | | | 1,180,323 | |

| | |

| Net realized and unrealized loss | | | (5,058,772 | ) | | | (66,686,587 | ) |

| | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (3,499,642 | ) | | $ | (66,282,268 | ) |

(a) Class specific Distribution and/or Service and Transfer Agency fees were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Distribution and/or

Service (12b-1) Fees | | | Transfer Agency Fees | |

Fund | | Advisor | | | Service | | | Advisor | | | Institutional | | | Service | |

Multi-Strategy Alternatives Portfolio | | $ | 85,620 | | | $ | 45,644 | | | $ | 4,281 | | | $ | 472 | | | $ | 3,652 | |

Trend Driven Allocation Fund | | | — | | | | 752,332 | | | | — | | | | 96 | | | | 60,186 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-ASSET STRATEGIES FUNDS

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Multi-Strategy Alternatives Portfolio | | | Trend Driven Allocation Fund | |

| | | For the

Fiscal Year Ended

December 31, 2022 | | | For the

Fiscal Year Ended

December 31, 2021 | | | For the

Fiscal Year Ended

December 31, 2022 | | | For the

Fiscal Year Ended

December 31, 2021 | |

| | | | | | | | | | | | | | | | |

| From operations: | | | | | | | | | | | | |

Net investment income (loss) | | $ | 1,559,129 | | | $ | 519,664 | | | $ | 404,319 | | | $ | (2,029,491 | ) |

Net realized gain (loss) | | | (3,743,647 | ) | | | 460,329 | | | | (33,971,393 | ) | | | 44,004,366 | |

Net change in unrealized gain (loss) | | | (1,315,124 | ) | | | 137,496 | | | | (32,715,194 | ) | | | 10,247,601 | |

| | | | |

| Net increase (decrease) in net assets resulting from operations | | | (3,499,642 | ) | | | 1,117,489 | | | | (66,282,268 | ) | | | 52,222,476 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Distributions to shareholders: | | | | | | | | | | | | |

From distributable earnings: | | | | | | | | | | | | | | | | |

Advisor Shares | | | (806,855 | ) | | | (268,995 | ) | | | — | | | | — | |

Institutional Shares | | | (84,430 | ) | | | (41,966 | ) | | | (20,604 | ) | | | (40,198 | ) |

Service Shares | | | (388,859 | ) | | | (96,854 | ) | | | (10,871,371 | ) | | | (43,019,719 | ) |

| | | | |

| Total distributions to shareholders | | | (1,280,144 | ) | | | (407,815 | ) | | | (10,891,975 | ) | | | (43,059,917 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| From share transactions: | | | | | | | | | | | | |

Proceeds from sales of shares | | | 76,038,713 | | | | 9,602,512 | | | | 25,924,207 | | | | 16,311,964 | |

Reinvestment of distributions | | | 1,280,144 | | | | 407,815 | | | | 10,891,975 | | | | 43,059,917 | |

Cost of shares redeemed | | | (65,417,529 | ) | | | (3,772,014 | ) | | | (49,855,165 | ) | | | (46,955,103 | ) |

| | | | |

| Net increase (decrease) in net assets resulting from share transactions | | | 11,901,328 | | | | 6,238,313 | | | | (13,038,983 | ) | | | 12,416,778 | |

| | | | |

| TOTAL INCREASE (DECREASE) | | | 7,121,542 | | | | 6,947,987 | | | | (90,213,226 | ) | | | 21,579,337 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| | | | |

Beginning of year | | | 29,637,648 | | | | 22,689,661 | | | | 357,652,701 | | | | 336,073,364 | |

| | | | |

End of year | | $ | 36,759,190 | | | $ | 29,637,648 | | | $ | 267,439,475 | | | $ | 357,652,701 | |

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Multi-Strategy Alternatives Portfolio | |

| | | Institutional Shares | |

| | | Year Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 9.77 | | | $ | 9.46 | | | $ | 9.02 | | | $ | 8.51 | | | $ | 9.39 | |

| | | | | |

Net investment income(a)(b) | | | 0.38 | | | | 0.23 | | | | 0.25 | | | | 0.30 | | | | 0.24 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (0.99 | ) | | | 0.25 | | | | 0.39 | | | | 0.48 | | | | (0.87 | ) |

| | | | | |

Total from investment operations | | | (0.61 | ) | | | 0.48 | | | | 0.64 | | | | 0.78 | | | | (0.63 | ) |

| | | | | |

Distributions to shareholders from net investment income | | | (0.35 | ) | | | (0.17 | ) | | | (0.20 | ) | | | (0.27 | ) | | | (0.25 | ) |

| | | | | |

Net asset value, end of year | | $ | 8.81 | | | $ | 9.77 | | | $ | 9.46 | | | $ | 9.02 | | | $ | 8.51 | |

| | | | | |

Total Return(c) | | | (6.24 | )% | | | 5.03 | % | | | 7.05 | % | | | 9.11 | % | | | (6.74 | )% |

| | | | | |

Net assets, end of year (in 000’s) | | $ | 2,203 | | | $ | 2,515 | | | $ | 1,520 | | | $ | 1,309 | | | $ | 745 | |

| | | | | |

Ratio of net expenses to average net assets(d) | | | 0.20 | % | | | 0.22 | % | | | 0.21 | % | | | 0.25 | % | | | 0.22 | % |

| | | | | |

Ratio of total expenses to average net assets(d) | | | 0.69 | % | | | 1.02 | % | | | 1.39 | % | | | 1.60 | % | | | 1.57 | % |

| | | | | |

Ratio of net investment income to average net assets | | | 4.08 | % | | | 2.29 | % | | | 2.73 | % | | | 3.30 | % | | | 2.62 | % |

| | | | | |

Portfolio turnover rate(e) | | | 199 | % | | | 25 | % | | | 5 | % | | | 26 | % | | | 61 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Recognition of net investment income by the Portfolio is affected by the timing of declaration of dividends by the Underlying Funds in which the Portfolio invests. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Expense ratios exclude the expenses of the Underlying Funds in which the Portfolio invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Multi-Strategy Alternatives Portfolio | |

| | | Service Shares | |

| | | Year Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 9.76 | | | $ | 9.45 | | | $ | 9.02 | | | $ | 8.52 | | | $ | 9.41 | |

| | | | | |

Net investment income(a)(b) | | | 0.31 | | | | 0.20 | | | | 0.23 | | | | 0.32 | | | | 0.28 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (0.95 | ) | | | 0.26 | | | | 0.38 | | | | 0.43 | | | | (0.93 | ) |

| | | | | |

Total from investment operations | | | (0.64 | ) | | | 0.46 | | | | 0.61 | | | | 0.75 | | | | (0.65 | ) |

| | | | | |

Distributions to shareholders from net investment income | | | (0.31 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.25 | ) | | | (0.24 | ) |

| | | | | |

Net asset value, end of year | | $ | 8.81 | | | $ | 9.76 | | | $ | 9.45 | | | $ | 9.02 | | | $ | 8.52 | |

| | | | | |

Total Return(c) | | | (6.54 | )% | | | 4.84 | % | | | 6.70 | % | | | 8.82 | % | | | (6.93 | )% |

| | | | | |

Net assets, end of year (in 000’s) | | $ | 11,356 | | | $ | 6,538 | | | $ | 3,472 | | | $ | 2,857 | | | $ | 811 | |

| | | | | |

Ratio of net expenses to average net assets(d) | | | 0.45 | % | | | 0.47 | % | | | 0.46 | % | | | 0.51 | % | | | 0.47 | % |

| | | | | |

Ratio of total expenses to average net assets(d) | | | 0.88 | % | | | 1.28 | % | | | 1.65 | % | | | 1.86 | % | | | 1.95 | % |

| | | | | |

Ratio of net investment income to average net assets | | | 3.34 | % | | | 2.04 | % | | | 2.51 | % | | | 3.54 | % | | | 3.08 | % |

| | | | | |

Portfolio turnover rate(e) | | | 199 | % | | | 25 | % | | | 5 | % | | | 26 | % | | | 61 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Recognition of net investment income by the Portfolio is affected by the timing of declaration of dividends by the Underlying Funds in which the Portfolio invests. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Expense ratios exclude the expenses of the Underlying Funds in which the Portfolio invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-STRATEGY ALTERNATIVES PORTFOLIO

Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Multi-Strategy Alternatives Portfolio | |

| | | Advisor Shares | |

| | | Year Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 9.73 | | | $ | 9.42 | | | $ | 8.99 | | | $ | 8.49 | | | $ | 9.36 | |

| | | | | |

Net investment income(a)(b) | | | 0.37 | | | | 0.18 | | | | 0.20 | | | | 0.24 | | | | 0.17 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (1.01 | ) | | | 0.26 | | | | 0.39 | | | | 0.49 | | | | (0.83 | ) |

| | | | | |

Total from investment operations | | | (0.64 | ) | | | 0.44 | | | | 0.59 | | | | 0.73 | | | | (0.66 | ) |

| | | | | |

Distributions to shareholders from net investment income | | | (0.32 | ) | | | (0.13 | ) | | | (0.16 | ) | | | (0.23 | ) | | | (0.21 | ) |

| | | | | |

Net asset value, end of year | | $ | 8.77 | | | $ | 9.73 | | | $ | 9.42 | | | $ | 8.99 | | | $ | 8.49 | |

| | | | | |

Total Return(c) | | | (6.61 | )% | | | 4.66 | % | | | 6.56 | % | | | 8.60 | % | | | (7.09 | )% |

| | | | | |

Net assets, end of year (in 000’s) | | $ | 23,200 | | | $ | 20,585 | | | $ | 17,698 | | | $ | 15,410 | | | $ | 13,460 | |

| | | | | |

Ratio of net expenses to average net assets(d) | | | 0.60 | % | | | 0.62 | % | | | 0.61 | % | | | 0.64 | % | | | 0.62 | % |

| | | | | |

Ratio of total expenses to average net assets(d) | | | 1.09 | % | | | 1.44 | % | | | 1.79 | % | | | 2.01 | % | | | 1.93 | % |

| | | | | |

Ratio of net investment income to average net assets | | | 3.99 | % | | | 1.89 | % | | | 2.28 | % | | | 2.61 | % | | | 1.92 | % |

| | | | | |

Portfolio turnover rate(e) | | | 199 | % | | | 25 | % | | | 5 | % | | | 26 | % | | | 61 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Recognition of net investment income by the Portfolio is affected by the timing of declaration of dividends by the Underlying Funds in which the Portfolio invests. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Expense ratios exclude the expenses of the Underlying Funds in which the Portfolio invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Trend Driven Allocation Fund | |

| | | Institutional Shares | |

| | | Year Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 12.92 | | | $ | 12.61 | | | $ | 12.32 | | | $ | 11.65 | | | $ | 12.46 | |

| | | | | |

Net investment income (loss)(a) | | | 0.07 | | | | (0.04 | ) | | | 0.02 | | | | 0.15 | | | | 0.14 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (2.51 | ) | | | 2.10 | | | | 0.52 | | | | 1.28 | | | | (0.64 | ) |

| | | | | |

Total from investment operations | | | (2.44 | ) | | | 2.06 | | | | 0.54 | | | | 1.43 | | | | (0.50 | ) |

| | | | | |

Distributions to shareholders from net investment income | | | — | | | | — | | | | (0.07 | ) | | | (0.22 | ) | | | (0.12 | ) |

| | | | | |

Distributions to shareholders from net realized gains | | | (0.42 | ) | | | (1.75 | ) | | | (0.18 | ) | | | (0.54 | ) | | | (0.19 | ) |

| | | | | |

Total distributions | | | (0.42 | ) | | | (1.75 | ) | | | (0.25 | ) | | | (0.76 | ) | | | (0.31 | ) |

| | | | | |

Net asset value, end of year | | $ | 10.06 | | | $ | 12.92 | | | $ | 12.61 | | | $ | 12.32 | | | $ | 11.65 | |

| | | | | |

Total Return(b) | | | (19.00 | )% | | | 16.46 | % | | | 4.35 | % | | | 12.29 | % | | | (4.08 | )% |

| | | | | |

Net assets, end of year (in 000’s) | | $ | 506 | | | $ | 337 | | | $ | 289 | | | $ | 277 | | | $ | 247 | |

| | | | | |

Ratio of net expenses to average net assets | | | 0.66 | % | | | 0.65 | % | | | 0.60 | % | | | 0.59 | % | | | 0.51 | % |

| | | | | |

Ratio of total expenses to average net assets | | | 0.92 | % | | | 0.87 | % | | | 0.90 | % | | | 0.89 | % | | | 0.86 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.63 | % | | | (0.32 | )% | | | 0.13 | % | | | 1.18 | % | | | 1.13 | % |

| | | | | |

Portfolio turnover rate(c) | | | 344 | % | | | 12 | % | | | 168 | % | | | 61 | % | | | 60 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS VARIABLE INSURANCE TRUST TREND DRIVEN ALLOCATION FUND

Financial Highlights (continued)

Selected Data for a Share Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | |

| | | Goldman Sachs Trend Driven Allocation Fund | |

| | | Service Shares | |

| | | Year Ended December 31, | |

| | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | $ | 12.86 | | | $ | 12.59 | | | $ | 12.30 | | | $ | 11.64 | | | $ | 12.45 | |

| | | | | |

Net investment income (loss)(a) | | | 0.02 | | | | (0.08 | ) | | | (0.01 | ) | | | 0.11 | | | | 0.08 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (2.47 | ) | | | 2.10 | | | | 0.51 | | | | 1.28 | | | | (0.62 | ) |

| | | | | |

Total from investment operations | | | (2.45 | ) | | | 2.02 | | | | 0.50 | | | | 1.39 | | | | (0.54 | ) |

| | | | | |

Distributions to shareholders from net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.19 | ) | | | (0.08 | ) |

| | | | | |

Distributions to shareholders from net realized gains | | | (0.42 | ) | | | (1.75 | ) | | | (0.18 | ) | | | (0.54 | ) | | | (0.19 | ) |

| | | | | |

Total distributions | | | (0.42 | ) | | | (1.75 | ) | | | (0.21 | ) | | | (0.73 | ) | | | (0.27 | ) |

| | | | | |

Net asset value, end of year | | $ | 9.99 | | | $ | 12.86 | | | $ | 12.59 | | | $ | 12.30 | | | $ | 11.64 | |

| | | | | |

Total Return(b) | | | (19.16 | )% | | | 16.17 | % | | | 4.10 | % | | | 11.94 | % | | | (4.34 | )% |

| | | | | |

Net assets, end of year (in 000’s) | | $ | 266,934 | | | $ | 357,316 | | | $ | 335,784 | | | $ | 345,219 | | | $ | 395,842 | |

| | | | | |

Ratio of net expenses to average net assets | | | 0.91 | % | | | 0.92 | % | | | 0.85 | % | | | 0.84 | % | | | 0.81 | % |

| | | | | |

Ratio of total expenses to average net assets | | | 1.17 | % | | | 1.14 | % | | | 1.15 | % | | | 1.14 | % | | | 1.11 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.13 | % | | | (0.58 | )% | | | (0.12 | )% | | | 0.91 | % | | | 0.63 | % |

| | | | | |

Portfolio turnover rate(c) | | | 344 | % | | | 12 | % | | | 168 | % | | | 61 | % | | | 60 | % |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (c) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

GOLDMAN SACHS VARIABLE INSURANCE TRUST MULTI-ASSET STRATEGIES FUNDS

Notes to Financial Statements

December 31, 2022

1. ORGANIZATION

Goldman Sachs Variable Insurance Trust (the “Trust” or “VIT”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The following table lists those series of the Trust that are included in this report (collectively, the “Funds” or individually a “Fund”), along with their corresponding share classes and respective diversification status under the Act:

| | | | |

| Fund | | Share Classes Offered | | Diversified/ Non-diversified |

Multi-Strategy Alternatives | | Institutional, Service and Advisor | | Diversified |

Trend Driven Allocation | | Institutional and Service | | Diversified |

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC (“Goldman Sachs”), serves as investment adviser to the Funds pursuant to management agreements (the “Agreements”) with the Trust.