UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08397

THE MARSICO INVESTMENT FUND

(Exact Name of Registrant as Specified in Charter)

1200 17th Street, Suite 1700

Denver, CO 80202

(Address of Principal Executive Offices) (Zip Code)

The Corporation Trust Company

The Marsico Investment Fund

Corporation Trust Center 1209 Orange Street

Wilmington, Delaware 19802

(Name and address of Agent for Service of Process)

Copies to:

Anthony H. Zacharski

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Registrant’s Telephone Number, including Area Code: 1-888-860-8686

Date of fiscal year end: September 30

Date of Reporting Period: March 31, 2023

| Item 1. | Reports to Stockholders |

DEAR SHAREHOLDER:

Enclosed is your semi-annual report for each portfolio of The Marsico Investment Fund (the “Marsico Funds”) encompassing the six-month fiscal period from October 1, 2022, to March 31, 2023.

The purpose of this report is to provide a review of the Marsico Funds’ six-month investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indices.

For updated information regarding each Fund’s overall investment positioning and performance, please refer to the Funds’ website at marsicofunds.com.(1)

NOTE REGARDING CHANGES TO THE MARSICO INTERNATIONAL OPPORTUNITIES FUND AND THE MARSICO GLOBAL FUND TEAMS

Effective April 17, 2023, Robert G. Susman no longer serves as a co-portfolio manager of the Marsico International Opportunities Fund and the Marsico Global Fund and Peter C. Marsico and James D. Marsico have been added as co-portfolio managers of those Funds. Thomas F. Marsico continues to serve as a portfolio manager to both the Marsico International Opportunities Fund and the Marsico Global Fund.

| (1) | The references to the Marsico Funds website (marsicofunds.com) included throughout this semi-annual report do not incorporate the website’s contents into this report. |

| KEY FUND STATISTICS | 2 |

| MARKET ENVIRONMENT | 5 |

| MARSICO FOCUS FUND | |

| Investment Review | 6 |

| Fund Overview | 8 |

| Schedule of Investments | 9 |

| MARSICO GROWTH FUND | |

| Investment Review | 10 |

| Fund Overview | 12 |

| Schedule of Investments | 13 |

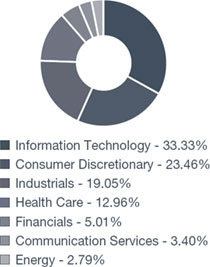

| MARSICO MIDCAP GROWTH FOCUS FUND | |

| Investment Review | 14 |

| Fund Overview | 16 |

| Schedule of Investments | 17 |

| MARSICO INTERNATIONAL OPPORTUNITIES FUND | |

| Investment Review | 18 |

| Fund Overview | 20 |

| Schedule of Investments | 21 |

| MARSICO GLOBAL FUND | |

| Investment Review | 23 |

| Fund Overview | 25 |

| Schedule of Investments | 26 |

| FINANCIAL STATEMENTS | 28 |

| NOTES TO FINANCIAL STATEMENTS | 38 |

| EXPENSE EXAMPLE | 45 |

| CONSIDERATION OF INVESTMENT ADVISORY AGREEMENTS | 47 |

| OTHER INFORMATION | 50 |

| KEY FUND STATISTICS (UNAUDITED) |

Marsico Focus Fund | Marsico Growth Fund | Marsico Midcap Growth

Focus Fund |

| For additional disclosures, please see page 8. | For additional disclosures, please see page 12. | For additional disclosures, please see page 16. |

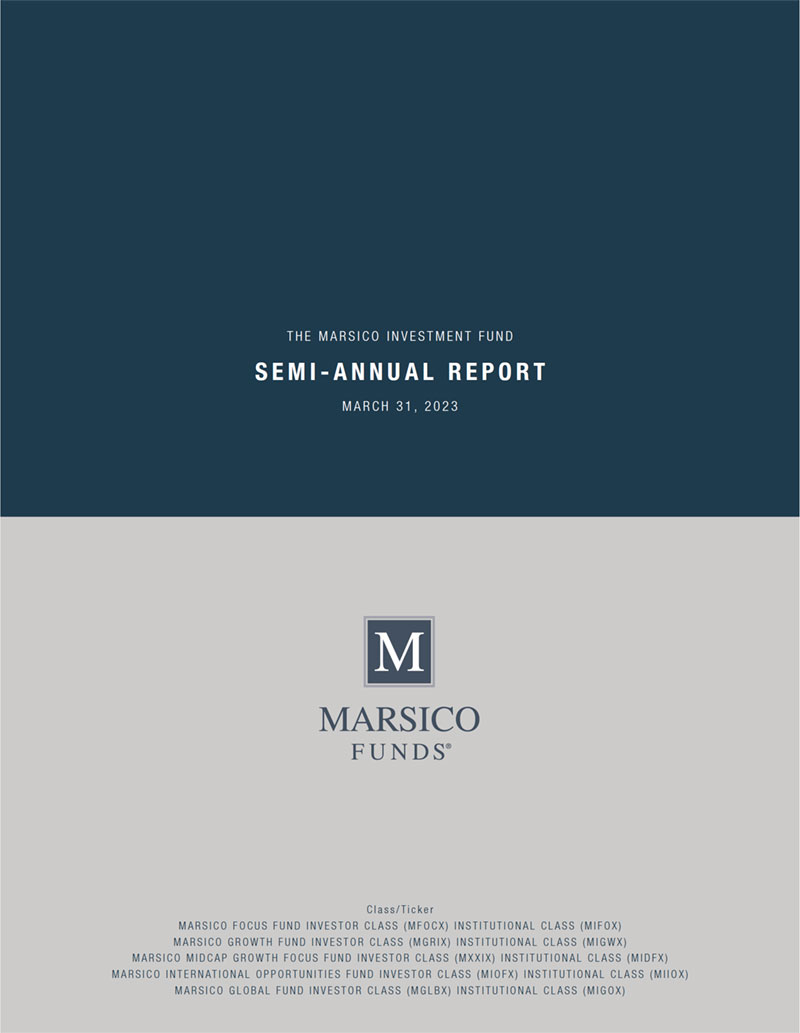

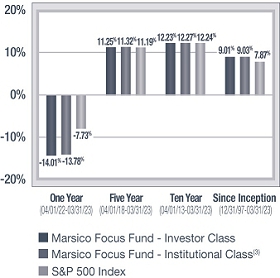

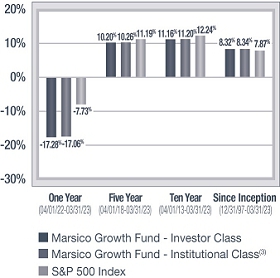

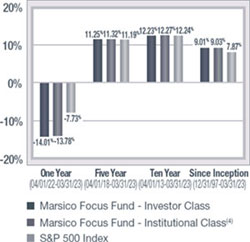

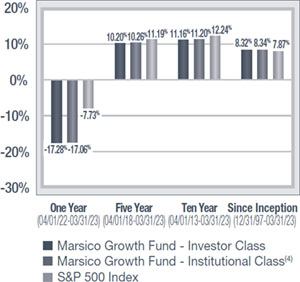

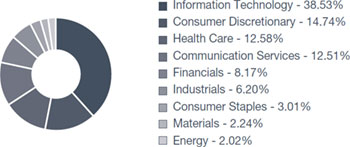

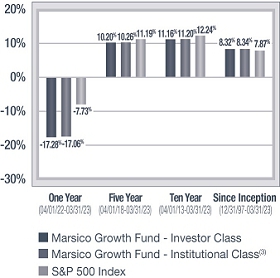

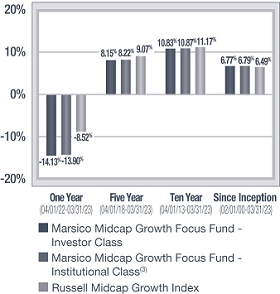

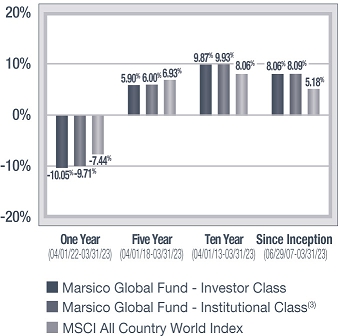

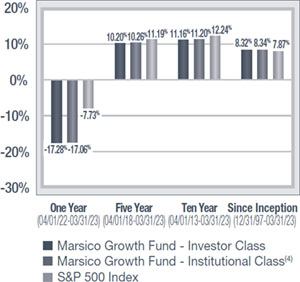

| PERFORMANCE COMPARISON(1)(2) | PERFORMANCE COMPARISON(1)(2) | PERFORMANCE COMPARISON(1)(2) |

| Average Annualized Returns | Average Annualized Returns | Average Annualized Returns |

|  |  |

INVESTOR CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.03% INSTITUTIONAL CLASS

TOTAL ANNUAL OPERATING EXPENSES* 0.66% | INVESTOR CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.20% INSTITUTIONAL CLASS

TOTAL ANNUAL OPERATING EXPENSES* 0.93% | INVESTOR CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.35% INSTITUTIONAL CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.12% |

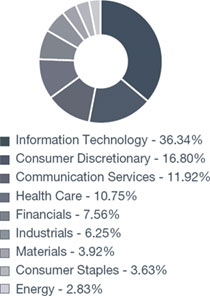

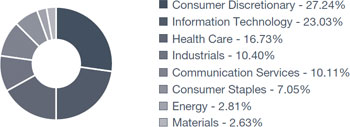

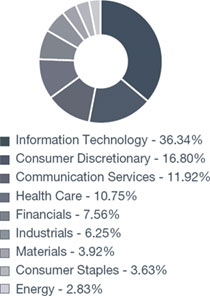

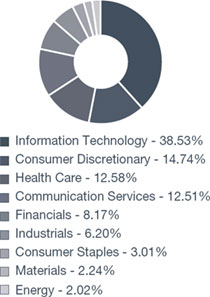

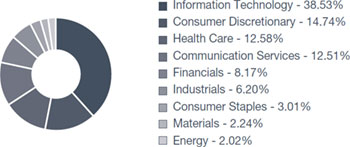

| SECTOR ALLOCATION(4) | SECTOR ALLOCATION(4) | SECTOR ALLOCATION(4) |

|  |  |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| | | | | | | | | | | | |

| | MICROSOFT CORP. | 8.57% | | | MICROSOFT CORP. | 8.18% | | | SYNOPSYS, INC. | 5.23% | |

| | APPLE, INC. | 8.22% | | | NVIDIA CORP. | 6.40% | | | CHIPOTLE MEXICAN GRILL, INC. | 4.64% | |

| | NVIDIA CORP. | 6.43% | | | APPLE, INC. | 5.60% | | | AMPHENOL CORP. - CL. A | 4.46% | |

| | META PLATFORMS, INC. - CL. A | 6.03% | | | AMAZON.COM, INC. | 5.15% | | | CINTAS CORP. | 4.23% | |

| | AMAZON.COM, INC. | 5.40% | | | META PLATFORMS, INC. - CL. A | 5.12% | | | HEICO CORP. | 4.02% | |

| | | | | | | | | | | | |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

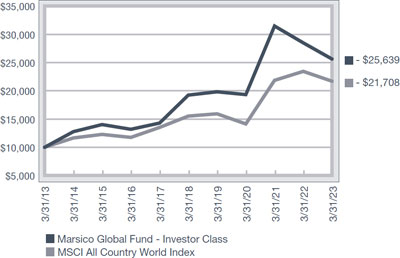

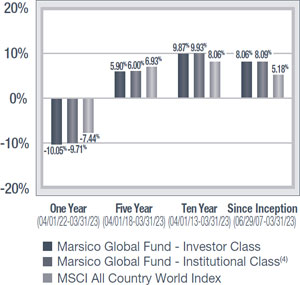

| KEY FUND STATISTICS (UNAUDITED) |

Marsico International

Opportunities Fund | Marsico Global Fund |

| For additional disclosures, please see page 20. | For additional disclosures, please see page 25. |

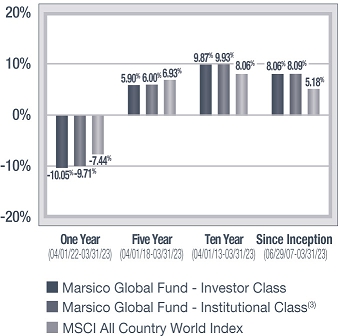

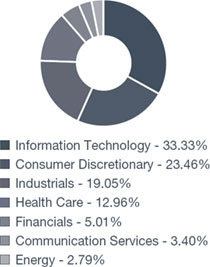

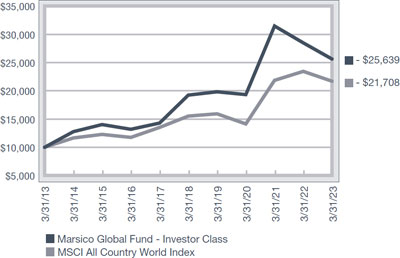

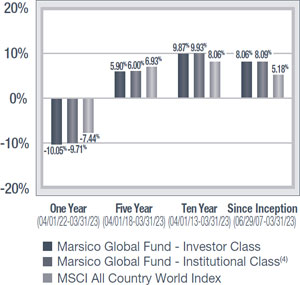

| PERFORMANCE COMPARISON(1)(2) | PERFORMANCE COMPARISON(1)(2) |

| Average Annualized Returns | Average Annualized Returns |

|  |

INVESTOR CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.71%

NET EXPENSES* † 1.50% INSTITUTIONAL CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.81%

NET EXPENSES* † 1.25% | INVESTOR CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.38%

NET EXPENSES* † 1.46% INSTITUTIONAL CLASS

TOTAL ANNUAL OPERATING EXPENSES* 1.07% |

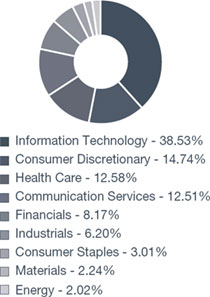

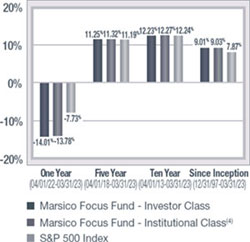

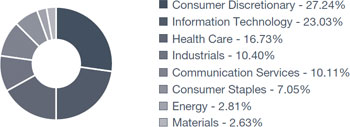

| SECTOR ALLOCATION(4) | SECTOR ALLOCATION(4) |

|  |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| | |

| | AIRBUS S.E. | 4.19% | | | HERMES INTERNATIONAL | 8.40% | |

| | NESTLÉ S.A. | 3.76% | | | DEUTSCHE TELEKOM A.G. | 5.11% | |

| | ASTRAZENECA PLC | 3.72% | | | META PLATFORMS, INC. - CL. A | 5.00% | |

| | ASML HOLDING N.V. | 3.64% | | | ASML HOLDING N.V. - NY REG. SHS. | 4.77% | |

| | NOVO NORDISK A/S - CL. B | 3.27% | | | MICROSOFT CORP. | 4.69% | |

| | | | | | | | |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.

| KEY FUND STATISTICS (UNAUDITED) |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2023, as supplemented. The information may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed (i) to limit the total expenses of the Investor Class of each Fund (excluding taxes, interest, acquired fund fees and expenses, litigation, extraordinary expenses, and brokerage and other transaction expenses relating to the purchase or sale of portfolio investments) to an annual rate of 1.50% of the average net assets attributable to Investor Class shares of the International Opportunities Fund and Global Fund, and (ii) to limit the total expenses of the Institutional Class of each Fund (excluding taxes, interest, acquired fund fees and expenses, litigation, extraordinary expenses, and brokerage and other transaction expenses relating to the purchase or sale of portfolio investments) to an annual rate of 1.25% of the average net assets attributable to Institutional Class shares of the International Opportunities Fund and Global Fund, until January 31, 2024. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2024, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from a Fund (or share class as applicable) any fees previously waived and/or expenses previously reimbursed by the Adviser with respect to that Fund or share class, as applicable, including any applicable waivers which may apply to a specific share class, pursuant to this agreement (including waivers or reimbursements under previous expense limitations), if (1) such recoupment by the Adviser does not cause the Fund’s share class, at the time of recoupment, to exceed the lesser of (a) the expense limitation in effect at the time the relevant amount was waived and/or reimbursed, or (b) the expense limitation in effect at the time of the proposed recoupment, and (2) the recoupment is made within three years after the fiscal year end date as of which the amount to be waived or reimbursed was determined and the waiver or reimbursement occurred. In accordance with the Funds’ Multi-Class Plan, amounts eligible for recoupment from periods prior to the addition of the Institutional Class will continue to be eligible for recoupment from the Investor Class. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| | The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| (2) | Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the Funds. In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the Growth Fund, Midcap Growth Focus Fund, International Opportunities Fund, and Global Fund, resulting in a lower performance return. |

| (3) | Institutional Class shares commenced operations on December 6, 2021. The performance attributed to the Institutional Class shares prior to that date is that of the Investor Class shares. Performance prior to December 6, 2021 has not been adjusted to reflect the lower expenses of the Institutional Class shares. During this period, Institutional Class shares would have had returns similar to, but potentially higher than, Investor Class shares due to the fact that Institutional Class shares represent interests in the same portfolio as Investor Class shares but are typically subject to lower expenses than the Investor Class shares. |

| (4) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARKET ENVIRONMENT: OCTOBER 2022 – MARCH 2023 (UNAUDITED)

The financial markets have undergone a significant relief rally over the past six months. Fears of an impending global recession and a corresponding equity market correction proved to be exaggerated, at least in the near term. We attribute the improvement in investor sentiment to the notable resilience of the US economy and strong corporate earnings during this period. A marked improvement in labor and goods supply has contributed to stabilizing the magnitude of increases in wages and goods prices. Consequently, earnings outlooks and economic forecasts provided by many corporations and economists have become more optimistic for the remainder of the calendar year, in contrast to the bleak scenarios previously anticipated by the market in the middle of the 2022 calendar year. In the sections below, we further discuss our view on the resilience of the US economy and the normalization of supply chains.

The US economy demonstrated remarkable resilience in early 2023, bouncing back from a lackluster end to the 2022 calendar year, as both the labor market and retail sales rebounded in January despite tighter financial conditions. In the first two months of the year alone, the US economy added over 800,000 jobs, driving the unemployment rate to historically low levels. The services sector saw the most significant job gains during this period, with hospitality and restaurants accounting for nearly +50% of the increase, signaling a recovery of the service economy from pandemic-induced disruptions in consumption patterns. Encouragingly, unit labor costs are stabilizing alongside the job rebound, suggesting a more favorable labor environment for businesses. This development contributed to better than expected earnings guidance for the first quarter of 2023 for many corporations, as both revenue and profit margins remained strong. Bolstered by these positive results and outlooks, many economic forecasters have pushed their US recession predictions to late 2023 or even 2024, if any.

Over the past six months, the global supply chain has undergone a fundamental transformation, aligning supply more effectively with demand compared to the pandemic-induced disruptions that led to severe price distortions. Key developments, such as the reopening of the Chinese economy following the abandonment of its restrictive “zero-COVID” policy, have contributed to reduced disruptions in manufacturing and trade. Furthermore, despite the ongoing conflict in Ukraine, the flow of grains to and from the region has been reestablished. Consequently, the S&P Goldman Sachs Commodity Index (GSCI), a widely used indicator of commodity prices, has experienced a correction of nearly -33% from its June 2022 highs. As these lower commodity prices are reflected in retail goods, we anticipate a decline in price increases at the point of sale, which would lead to a significant deceleration in goods inflation and providing much-needed relief to consumers, especially those with lower incomes.

We are encouraged by the prospects of easing inflation, a weakening US dollar, and the resilience of the US consumer. Given the slowing economic activity and disinflationary trends, we expect the Federal Open Market Committee to adopt a less hawkish stance, potentially pausing or cutting interest rates in the latter half of the year. The companies held by the Funds have tended to be less sensitive to economic cycles, and we believe these companies are positioned to perform well amidst the current economic uncertainty caused in part by tightening financial conditions.

It is important to acknowledge the presence of external factors that could impact the economy, and we remain diligent in monitoring economic trends and adjusting our investment outlook accordingly. For instance, the recent regional banking crisis was unanticipated and has the potential to materially alter our economic outlook. However, we view the protections extended to depositors in some regional banks by the U.S. Federal Reserve and the U.S. Department of the Treasury as prudent measures, and we are hopeful that these protections will prevent any negative spillover into the broader economy. The ongoing conflict in Ukraine is also unpredictable and presents potentially significant implications for commodity markets and overall inflation expectations. Amidst this uncertainty, we believe our top-down, bottom-up investment approach is well-suited to navigate the challenges ahead. We are deeply appreciative of your trust and continued support during these turbulent times.

The performance of global markets during the six-month fiscal period ended March 31, 2023, is depicted below. Both US and global markets posted positive returns during the period. In general, small-capitalization stocks underperformed compared to large- and mid-capitalization equities, and emerging market equities underperformed compared to developed international equity markets.

| Index Name(1) | Universe of

Equities Represented | Six-Month

Total Return (as of

March 31, 2023) |

| US |

| S&P 500 | US large-capitalization equities | +15.62% |

| Russell 3000 | US publicly-traded equities of all capitalizations | +14.88% |

| Russell 2000 | US small-capitalization equities | +9.14% |

| Russell Midcap Growth | US medium-capitalization equities that exhibit growth characteristics | +16.67% |

| Index Name(1) | Universe of

Equities Represented | Six-Month

Total Return (as of

March 31, 2023) |

| INTERNATIONAL |

| MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | +27.27% |

| MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | +14.04% |

| MSCI ACWI (US$) | Equities in the global developed and emerging markets | +17.78% |

Sincerely,

THE MARSICO INVESTMENT TEAM

| (1) | All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. |

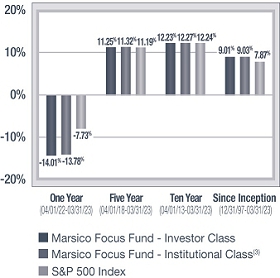

INVESTMENT REVIEW BY TOM MARSICO, PETER MARSICO, AND JIMMY MARSICO (UNAUDITED)

The Marsico Focus Fund’s Investor Class shares and Institutional Class shares posted total returns of +13.22% and +13.37%, respectively, for the six-month fiscal period ended March 31, 2023. The Fund underperformed its benchmark index, the S&P 500 Index, which had a total return of +15.62% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2023.

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today due to the active management of the Fund. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of issuers. Holding securities of fewer issuers increases the risk that the value of the Fund could go down because of the poor performance of a single investment or may be more volatile than its benchmark. The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and those investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track its benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. The Fund may be subject to risks associated with a particular sector or other area in which it is overweight, including the risk that the stocks of companies within one area could simultaneously decline in price because of an event that affects the entire area. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The Focus Fund’s underperformance during the six-month fiscal period ended March 31, 2023, as compared to the S&P 500 Index, can primarily be attributed to stock selection and an overweight allocation to the weakest-performing sector of the benchmark index, Consumer Discretionary, as defined in the Global Industry Classification Standard (“GICS”)(2). Stock selection in the Health Care and Energy sectors was also weak. The Fund’s performance was further dampened relative to its benchmark index by maintaining an underweight allocation to the Industrials sector, which was one of the strongest-performing sectors of the benchmark index. Additionally, as the Fund’s benchmark index returned +15.62% during the period, the Fund’s cash position (4% on average) created a drag on the relative Fund performance.

In the Consumer Discretionary sector, Amazon.com, Inc. (“Amazon”) (-13%) detracted from the Fund’s performance during the period as the company’s fourth quarter results and forward outlook underwhelmed many investors. Despite its underperformance, we remain confident that Amazon is well positioned to drive outsized returns over the long run. The company is currently grappling with slowing demand in its cloud computing business (Amazon Web Services) and overcapacity in its retail distribution business. While the slowdown could persist for the next couple of quarters, we believe the long-term trends remain positive. In particular, we believe the emergence of artificial intelligence (“AI”) solutions should accelerate the demand for Amazon’s cloud services as corporations look to drive productivity across their workforces, while introducing innovative products and services to the marketplace.

Health Care sector holding UnitedHealth Group, Inc. (“UnitedHealth”) (-6%) detracted from the Fund’s performance for the period due in part to the Medicare Advantage preliminary rates being listed below street expectations. The Centers for Medicare & Medicaid Services (“CMS”) issues rate payment decisions for their fiscal year end at the beginning of the calendar year and then receives industry concern/feedback, before issuing a final rate in April. The preliminary rates published by CMS would require a step down in payments for the HMO sector for Medicare Advantage enrollees. HMOs received positive rate decisions for multiple years prior to 2023, bolstering many investors’ expectations that the preliminary rates would be more favorable to the industry. This rate ruling, along with CMS’s decision on prior period payment audits, contributed to underperformance for UnitedHealth. We believe that the final CMS payment rates are likely to be adjusted more favorably given the industry’s concerns with the preliminary rates. In addition, we believe that the financial impact of the CMS audits appears manageable for the HMO industry. For these reasons, we remain positive on the outlook for UnitedHealth.

On the positive end of the spectrum, the Fund’s performance was bolstered by stock selection and an overweight allocation to the strongest-performing sector of the benchmark index, Information Technology. Stock selection in the Communication Services sector was also strong. A lack of exposure to the Utilities and Real Estate sectors, two of the weaker-performing areas of the benchmark index, created an additional tailwind for relative Fund performance.

Information Technology sector holding NVIDIA Corp. (“NVIDIA”) (+129%) was a top contributor to Fund performance over the period after reporting a much stronger than expected fourth quarter ending in January. Many investors are very focused on ChatGPT and other generative artificial intelligence (“AI”) initiatives from Alphabet Inc., Meta Platforms, Inc., and other companies. NVIDIA is one of the most direct beneficiaries of these new AI tools, as their graphics processing units are the workhorses of these technological innovations. In late March, NVIDIA hosted its annual GTC conference for the developer community, which showcased NVIDIA’s CUDA computer framework for AI. During this conference, NVIDIA announced numerous new hardware, software, and other service products that strengthen the company’s offerings to companies that are bringing AI to the masses. This contributed further to its strong stock performance.

In the Communication Services sector Meta Platforms, Inc. – Cl. A (“Meta”) (+110%) bolstered the Fund’s performance over the period due in part to its increased focus on profitability and efficiency. We believe this shift in strategy has resulted in greater visibility for margin improvement and higher levels of free cash flow generation, which has been well received by the market. The company’s ability to raise earnings despite facing higher levels of inflation and an unpredictable macroeconomic environment is also contributing to its growing popularity among investors. Overall, Meta’s improved performance and focus on profitability appear to be paying off in terms of investor confidence and financial results.

During the reporting period, the Fund increased its exposure to the Industrials, Financials, and Energy sectors, and decreased its allocation to the Consumer Discretionary, Health Care, Communication Services, and Information Technology sectors. There were no significant changes to the Fund’s allocation to the Consumer Staples or Materials sectors. The Fund’s lack of exposure to the Real Estate and Utilities sectors remained unchanged.

The Focus Fund experienced elevated portfolio turnover during the period, which was primarily related to the Fund changing its portfolio composition to reinvest in other positions or attempt to preserve capital based on market conditions. Increased portfolio turnover increases transaction-related expenses, which could reduce Fund returns.

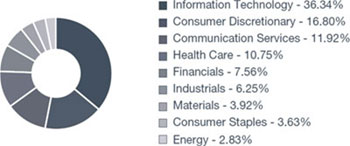

Fiscal Period-End Investment Posture

As of March 31, 2023, the Fund’s largest economic sector allocations included Information Technology, Consumer Discretionary, Communication Services, and Health Care. As of that date, the Fund had no investments in the Real Estate or Utilities sectors.

Sincerely,

THOMAS F. MARSICO

PETER C. MARSICO

JAMES D. MARSICO

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Please see the Prospectus for more information. |

| (2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by the Adviser. Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

March 31, 2023 (Unaudited)

The Focus Fund is a non-diversified portfolio and invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Fund will normally hold a core position of between 20 and 35 common stocks.

| | | INVESTOR CLASS | | | | INSTITUTIONAL CLASS | |

| | TOTAL ANNUAL OPERATING EXPENSES* | 1.03% | | | TOTAL ANNUAL OPERATING EXPENSES* | 0.66% | |

| | | | | | | | |

| GROWTH OF $10,000(1)(2)(3) | PERFORMANCE COMPARISON(1)(2) |

| | Average Annualized Returns |

|  |

| SECTOR ALLOCATION(5) | TOP FIVE HOLDINGS |

| | | | |

| | MICROSOFT CORP. | 8.57% | |

| | APPLE, INC. | 8.22% | |

| | NVIDIA CORP. | 6.43% | |

| | META PLATFORMS, INC. - CL. A | 6.03% | |

| | AMAZON.COM, INC. | 5.40% | |

| | | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2023, as supplemented, and may differ from the expense ratios disclosed in this report. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| (2) | Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. |

| (3) | This chart assumes an initial investment of $10,000 made on March 31, 2013 in the Investor Class shares of the Fund. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (4) | Institutional Class shares commenced operations on December 6, 2021. The performance attributed to the Institutional Class shares prior to that date is that of the Investor Class shares. Performance prior to December 6, 2021 has not been adjusted to reflect the lower expenses of the Institutional Class shares. During this period, Institutional Class shares would have had returns similar to, but potentially higher than, Investor Class shares due to the fact that Institutional Class shares represent interests in the same portfolio as Investor Class shares but are typically subject to lower expenses than the Investor Class shares. |

| (5) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

| COMMON STOCKS | | | | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | | | | |

| The Boeing Company* | | | 83,971 | | | $ | 17,837,959 | | | | 2.89 | % |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | | | | | | | | |

| lululemon athletica, inc.* | | | 54,585 | | | | 19,879,311 | | | | 3.22 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Synopsys, Inc.* | | | 53,584 | | | | 20,696,820 | | | | 3.35 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla, Inc.* | | | 97,169 | | | | 20,158,681 | | | | 3.27 | |

| | | | | | | | | | | | | |

| Broadline Retail | | | | | | | | | | | | |

| Amazon.com, Inc.* | | | 322,395 | | | | 33,300,179 | | | | 5.40 | |

| | | | | | | | | | | | | |

| Consumer Staples Merchandise Retail | | | | | | | | | | | | |

| Costco Wholesale Corp. | | | 43,148 | | | | 21,438,947 | | | | 3.47 | |

| | | | | | | | | | | | | |

| Financial Exchanges & Data | | | | | | | | | | | | |

| S&P Global, Inc. | | | 51,518 | | | | 17,761,861 | | | | 2.88 | |

| | | | | | | | | | | | | |

| Interactive Media & Services | | | | | | | | | | | | |

| Alphabet, Inc. - Cl. A* | | | 86,526 | | | | 8,975,342 | | | | 1.46 | |

| Meta Platforms, Inc. - Cl. A* | | | 175,738 | | | | 37,245,912 | | | | 6.03 | |

| | | | | | | | 46,221,254 | | | | 7.49 | |

| Life Sciences Tools & Services | | | | | | | | | | | | |

| Danaher Corp. | | | 67,752 | | | | 17,076,214 | | | | 2.77 | |

| | | | | | | | | | | | | |

| Managed Health Care | | | | | | | | | | | | |

| UnitedHealth Group, Inc. | | | 48,264 | | | | 22,809,084 | | | | 3.70 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| Pioneer Natural Resources Company | | | 81,711 | | | | 16,688,655 | | | | 2.70 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Eli Lilly & Company | | | 68,722 | | | | 23,600,509 | | | | 3.82 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 15,132 | | | | 25,849,844 | | | | 4.19 | |

| | | | | | | | | | | | | |

| Semiconductor Materials & Equipment | | | | | | | | | | | | |

| ASML Holding N.V. - NY Reg. Shs. | | | 44,480 | | | | 30,277,981 | | | | 4.91 | |

| | | | | | | | | | | | | |

| Semiconductors | | | | | | | | | | | | |

| NVIDIA Corp. | | | 142,959 | | | | 39,709,721 | | | | 6.43 | |

| | | | | | | | | | | | | |

| Specialty Chemicals | | | | | | | | | | | | |

| The Sherwin-Williams Company | | | 102,810 | | | | 23,108,604 | | | | 3.74 | |

| | | | | | | | | | | | | |

| Systems Software | | | | | | | | | | | | |

| Microsoft Corp. | | | 183,581 | | | | 52,926,402 | | | | 8.57 | |

| ServiceNow, Inc.* | | | 43,390 | | | | 20,164,201 | | | | 3.27 | |

| | | | | | | | 73,090,603 | | | | 11.84 | |

| Technology Hardware, Storage & Peripherals | | | | | | | | | | | | |

| Apple, Inc. | | | 307,645 | | | | 50,730,660 | | | | 8.22 | |

| | | | | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | | | | |

| United Rentals, Inc. | | | 48,081 | | | | 19,028,537 | | | | 3.08 | |

| | | | | | | | | | | | | |

| Transaction & Payment Processing Services | | | | | | | | | | | | |

| Visa, Inc. - Cl. A | | | 119,111 | | | | 26,854,766 | | | | 4.35 | |

| | | | | | | | | | | | | |

| Wireless Telecommunication Services | | | | | | | | | | | | |

| T-Mobile US, Inc.* | | | 166,793 | | | | 24,158,298 | | | | 3.91 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $388,949,492) | | | | | | | 590,278,488 | | | | 95.63 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund - Premier Class, 4.53%# | | | 29,561,881 | | | | 29,561,881 | | | | 4.79 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $29,561,881) | | | | | | | 29,561,881 | | | | 4.79 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $418,511,373) | | | | | | | 619,840,369 | | | | 100.42 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (2,569,441 | ) | | | (0.42 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 617,270,928 | | | | 100.00 | % |

| # | Rate shown is the 7-day yield as of March 31, 2023. |

| | See notes to financial statements. |

INVESTMENT REVIEW BY TOM MARSICO, PETER MARSICO, AND JIMMY MARSICO (UNAUDITED)

The Marsico Growth Fund’s Investor Class shares and Institutional Class shares posted total returns of +14.16% and +14.28%, respectively, for the six-month fiscal period ended March 31, 2023. The Fund underperformed its benchmark index, the S&P 500 Index, which had a total return of +15.62% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2023.

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today due to the active management of the Fund. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and those investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track its benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. The Fund may be subject to risks associated with a particular sector or other area in which it is overweight, including the risk that the stocks of companies within one area could simultaneously decline in price because of an event that affects the entire area. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The Growth Fund’s underperformance during the six-month fiscal period ended March 31, 2023, as compared to the S&P 500 Index, can primarily be attributed to stock selection and an overweight allocation to the weakest-performing sector of the benchmark index, Consumer Discretionary, as defined in the Global Industry Classification Standard (“GICS”)(2). Similarly, stock selection and an underweight allocation to two strong-performing sectors of the benchmark index, Energy and Industrials, hindered results. The Fund’s performance was also dampened, relative to its benchmark index, by maintaining an average cash position of approximately 5% as the benchmark index returned +15.62% during the period.

Consumer Discretionary holding Tesla, Inc. (“Tesla”) (-28%) detracted from the Fund’s performance during the period. The Fund’s holding in Tesla was sold early in the fiscal period due in part to concerns that Elon Musk’s purchase of Twitter, Inc. and service as its CEO could result in increased executional and reputational risk for Tesla. However, as those concerns abated, we reinitiated a position near the end of the period.

Energy holding Pioneer Natural Resources Company (“Pioneer”) (-2%) negatively impacted the Fund’s performance during the period as the prospect of a deteriorating macroeconomic environment posed a threat to oil demand, contributing to falling oil prices. We remain positive on the company as Pioneer holds a competitive edge with low-cost operations due to its strong assets in the Permian Basin.

On the positive end of the spectrum, the Fund’s performance was bolstered relative to its benchmark index by an overweight allocation and stock selection in the strongest-performing sector of the benchmark index, Information Technology. The Fund also benefitted from strong stock selection in the Health Care and Communication Services sectors. From a sector allocation perspective, the Fund benefitted by an underweighted posture in the Financials and Utilities sectors, two of the weaker-performing areas of the benchmark index.

In the Information Technology sector, NVIDIA Corp. (“NVIDIA”) (+129%) was a top contributor to the Fund’s performance over the period after reporting a much stronger than expected quarter ending in January. Many investors are very focused on ChatGPT and other generative artificial intelligence (“AI”) initiatives from Alphabet Inc, Meta Platforms, Inc., and other companies. NVIDIA is one of the most direct beneficiaries of these new AI tools, as their graphics processing units are the workhorses of these technological innovations. In late March, NVIDIA hosted its annual GTC conference for the developer community, which showcased NVIDIA’s CUDA computer framework for AI. During this conference, NVIDIA announced numerous new hardware, software, and other service products that strengthen the company’s offerings to companies that are bringing AI to the masses. This contributed further to its strong stock performance.

Health Care holding IDEXX Laboratories, Inc. (“IDEXX”) (+53%) was a strong contributor to the Fund’s performance for the period as the company’s Companion Animal Diagnostics division benefitted from continued increases in both the utilization of diagnostic services in the Companion Animal market and the average price per pet visit. This momentum contributed to the company outpacing the industry growth rate for the veterinary market despite facing industry wide challenges with staffing shortages. IDEXX continues to focus on instrumentation and diagnostics, which help deliver a higher standard of care, support customer workflow, and increase staff productivity.

There were several sector adjustments made to the Fund during the reporting period. The Fund decreased its exposure to the Consumer Discretionary and Consumer Staples sectors, and sold its sole position in the Real Estate sector. Meanwhile, the Fund increased its allocation to the Financials and Health Care sectors. There were no significant changes to the Fund’s allocations to the Energy, Industrials, Communication Services, Materials, or Information Technology sectors. Additionally, the Fund’s lack of exposure to the Utilities sector remained unchanged.

The Growth Fund experienced elevated portfolio turnover during the period, which was primarily related to the Fund changing its portfolio composition to reinvest in other positions or attempt to preserve capital based on market conditions. Increased portfolio turnover increases transaction-related expenses, which could reduce Fund returns.

Fiscal Period-End Investment Posture

As of March 31, 2023, the Fund’s largest economic sector allocations included Information Technology, Consumer Discretionary, Health Care, and Communication Services. As of that date, the Fund had no investments in the Real Estate or Utilities sectors.

Sincerely,

THOMAS F. MARSICO

PETER C. MARSICO

JAMES D. MARSICO

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses, resulting in a lower performance return. Please see the Prospectus for more information. |

| (2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by the Adviser. Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

March 31, 2023 (Unaudited)

The Growth Fund is a diversified portfolio and invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of up to 50 common stocks.

| | | INVESTOR CLASS | | | INSTITUTIONAL CLASS | |

| | TOTAL ANNUAL OPERATING EXPENSES* | 1.20% | | TOTAL ANNUAL OPERATING EXPENSES* | 0.93% | |

| | | | | | | |

| GROWTH OF $10,000(1)(2)(3) | PERFORMANCE COMPARISON(1)(2) |

| | Average Annualized Returns |

|  |

| SECTOR ALLOCATION(5) | TOP FIVE HOLDINGS |

| | | | |

| | Microsoft Corp. | 8.18% | |

| | NVIDIA CORP. | 6.40% | |

| | Apple, Inc. | 5.60% | |

| | Amazon.com, Inc. | 5.15% | |

| | META PLATFORMS, INC. - CL. A | 5.12% | |

| | | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2023, as supplemented, and may differ from the expense ratios disclosed in this report. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

| (2) | Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses, resulting in a lower performance return. |

| (3) | This chart assumes an initial investment of $10,000 made on March 31, 2013 in the Investor Class shares of the Fund. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (4) | Institutional Class shares commenced operations on December 6, 2021. The performance attributed to the Institutional Class shares prior to that date is that of the Investor Class shares. Performance prior to December 6, 2021 has not been adjusted to reflect the lower expenses of the Institutional Class shares. During this period, Institutional Class shares would have had returns similar to, but potentially higher than, Investor Class shares due to the fact that Institutional Class shares represent interests in the same portfolio as Investor Class shares but are typically subject to lower expenses than the Investor Class shares. |

| (5) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

| COMMON STOCKS | | | | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | | | | |

| HEICO Corp. | | | 15,313 | | | $ | 2,619,135 | | | | 1.03 | % |

| The Boeing Company* | | | 23,869 | | | | 5,070,492 | | | | 1.99 | |

| | | | | | | | 7,689,627 | | | | 3.02 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | | | | | | | | |

| lululemon athletica, inc.* | | | 8,127 | | | | 2,959,772 | | | | 1.16 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Synopsys, Inc.* | | | 25,315 | | | | 9,777,919 | | | | 3.83 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla, Inc.* | | | 31,765 | | | | 6,589,967 | | | | 2.58 | |

| | | | | | | | | | | | | |

| Broadline Retail | | | | | | | | | | | | |

| Amazon.com, Inc.* | | | 127,113 | | | | 13,129,502 | | | | 5.15 | |

| | | | | | | | | | | | | |

| Consumer Staples Merchandise Retail | | | | | | | | | | | | |

| Costco Wholesale Corp. | | | 14,519 | | | | 7,214,056 | | | | 2.83 | |

| | | | | | | | | | | | | |

| Diversified Support Services | | | | | | | | | | | | |

| Cintas Corp. | | | 10,309 | | | | 4,769,768 | | | | 1.87 | |

| | | | | | | | | | | | | |

| Electronic Components | | | | | | | | | | | | |

| Amphenol Corp. - Cl. A | | | 74,774 | | | | 6,110,531 | | | | 2.40 | |

| | | | | | | | | | | | | |

| Financial Exchanges & Data | | | | | | | | | | | | |

| MSCI, Inc. | | | 9,234 | | | | 5,168,178 | | | | 2.03 | |

| S&P Global, Inc. | | | 15,504 | | | | 5,345,314 | | | | 2.09 | |

| | | | | | | | 10,513,492 | | | | 4.12 | |

| Health Care Equipment | | | | | | | | | | | | |

| IDEXX Laboratories, Inc.* | | | 15,977 | | | | 7,989,778 | | | | 3.13 | |

| | | | | | | | | | | | | |

| Interactive Media & Services | | | | | | | | | | | | |

| Alphabet, Inc. - Cl. A* | | | 59,752 | | | | 6,198,075 | | | | 2.43 | |

| Meta Platforms, Inc. - Cl. A* | | | 61,641 | | | | 13,064,193 | | | | 5.12 | |

| | | | | | | | 19,262,268 | | | | 7.55 | |

| Life Sciences Tools & Services | | | | | | | | | | | | |

| Danaher Corp. | | | 23,889 | | | | 6,020,984 | | | | 2.36 | |

| Mettler-Toledo International, Inc.* | | | 3,306 | | | | 5,058,874 | | | | 1.98 | |

| | | | | | | | 11,079,858 | | | | 4.34 | |

| Managed Health Care | | | | | | | | | | | | |

| UnitedHealth Group, Inc. | | | 15,673 | | | | 7,406,903 | | | | 2.90 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| Spotify Technology S.A.* | | | 28,898 | | | | 3,861,351 | | | | 1.51 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| Pioneer Natural Resources Company | | | 23,679 | | | | 4,836,199 | | | | 1.90 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Eli Lilly & Company | | | 10,557 | | | | 3,625,485 | | | | 1.42 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 5,191 | | | | 8,867,733 | | | | 3.48 | |

| Starbucks Corp. | | | 35,736 | | | | 3,721,190 | | | | 1.46 | |

| | | | | | | | 12,588,923 | | | | 4.94 | |

| Semiconductor Materials & Equipment | | | | | | | | | | | | |

| ASML Holding N.V. - NY Reg. Shs. | | | 9,999 | | | | 6,806,419 | | | | 2.67 | |

| KLA Corp. | | | 8,643 | | | | 3,450,027 | | | | 1.35 | |

| | | | | | | | 10,256,446 | | | | 4.02 | |

| Semiconductors | | | | | | | | | | | | |

| Advanced Micro Devices, Inc.* | | | 56,658 | | | | 5,553,051 | | | | 2.18 | |

| NVIDIA Corp. | | | 58,769 | | | | 16,324,265 | | | | 6.40 | |

| | | | | | | | 21,877,316 | | | | 8.58 | |

| Specialty Chemicals | | | | | | | | | | | | |

| The Sherwin-Williams Company | | | 23,885 | | | | 5,368,631 | | | | 2.10 | |

| | | | | | | | | | | | | |

| Systems Software | | | | | | | | | | | | |

| Microsoft Corp. | | | 72,379 | | | | 20,866,866 | | | | 8.18 | |

| ServiceNow, Inc.* | | | 19,409 | | | | 9,019,750 | | | | 3.54 | |

| | | | | | | | 29,886,616 | | | | 11.72 | |

| Technology Hardware, Storage & Peripherals | | | | | | | | | | | | |

| Apple, Inc. | | | 86,555 | | | | 14,272,919 | | | | 5.60 | |

| | | | | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | | | | |

| United Rentals, Inc. | | | 6,017 | | | | 2,381,288 | | | | 0.93 | |

| | | | | | | | | | | | | |

| Transaction & Payment Processing Services | | | | | | | | | | | | |

| Mastercard, Inc. - Cl. A | | | 24,838 | | | | 9,026,378 | | | | 3.54 | |

| | | | | | | | | | | | | |

| Wireless Telecommunication Services | | | | | | | | | | | | |

| T-Mobile US, Inc.* | | | 46,938 | | | | 6,798,500 | | | | 2.67 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $169,220,149) | | | | | | | 239,273,493 | | | | 93.81 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund - Premier Class, 4.53%# | | | 17,813,719 | | | | 17,813,719 | | | | 6.99 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $17,813,719) | | | | | | | 17,813,719 | | | | 6.99 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $187,033,868) | | | | | | | 257,087,212 | | | | 100.80 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (2,032,713 | ) | | | (0.80 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 255,054,499 | | | | 100.00 | % |

| # | Rate shown is the 7-day yield as of March 31, 2023. |

| | See notes to financial statements. |

INVESTMENT REVIEW BY TOM MARSICO, PETER MARSICO, AND JIMMY MARSICO (UNAUDITED)

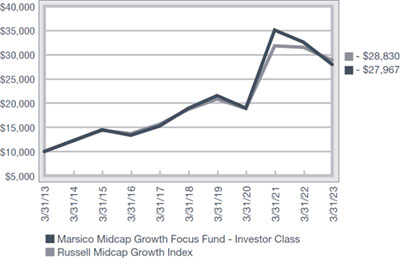

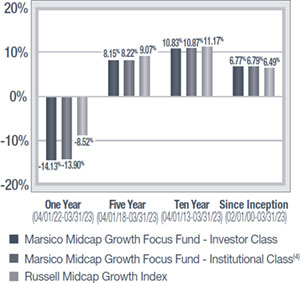

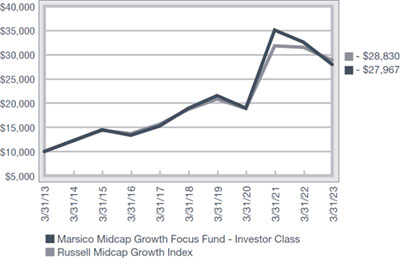

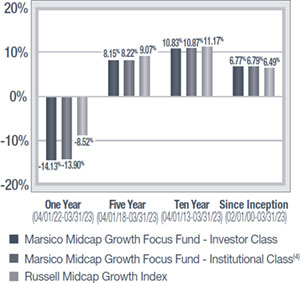

The Marsico Midcap Growth Focus Fund’s Investor Class shares and Institutional Class shares posted total returns of +14.29% and +14.39%, respectively, for the six-month fiscal period ended March 31, 2023. The Fund underperformed its benchmark index, the Russell Midcap Growth Index, which had a total return of +16.67% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2023.

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today due to the active management of the Fund. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and those investments may not perform as anticipated.

The Fund’s investments in medium-capitalization or midcap companies, as well as any investments in small-cap companies, can involve more risk than investments in larger companies because medium-capitalization and smaller companies have potentially greater sensitivity to adverse business or economic conditions. Medium-capitalization and smaller companies may have more limited financial resources, markets or product lines, less access to capital markets, and more limited trading in their stocks. This can cause the prices of equity securities of these companies to be more volatile than those of larger companies, or to decline more significantly during market downturns than the market as a whole. Please see the Prospectus for more information.

The Fund is not managed to track its benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. The Fund may be subject to risks associated with a particular sector or other area in which it is overweight, including the risk that the stocks of companies within one area could simultaneously decline in price because of an event that affects the entire area. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The Midcap Growth Focus Fund’s underperformance during the six-month fiscal period ended March 31, 2023, as compared to the Russell Midcap Growth Index, can be primarily attributed to stock selection in the Financials, Industrials, and Heath Care sectors, as defined in the Global Industry Classification Standard (“GICS”)(2). The Fund’s relative performance was also adversely impacted by having an underweight allocation to one of the stronger-performing sectors of the benchmark index, Health Care. Additionally, the Fund’s performance was dampened, relative to its benchmark index, by maintaining an average cash position of approximately 5% as the benchmark index returned +16.67% during the period.

Financials position First Republic Bank (“First Republic”) (-80% prior to being sold) detracted from the Fund’s performance over the period. With the failure of Silicon Valley Bank, many depositors grew nervous that First Republic would be seized by the Federal Deposit Insurance Corporation and withdrew their money causing a bank run. The bank run was stopped once several large banks stepped in to add deposits to First Republic and stabilize the balance sheet. First Republic is a high-quality, high-service bank that primarily provides home loans to low risk borrowers on the east and west coasts. Unfortunately, as the stock price fell, depositors continued withdrawing funds which contributed to the further devaluing of the company in an accelerating cycle. As a result, we exited the position.

Uber Technologies, Inc. (“Uber”) (-18% prior to being sold) detracted from the performance of the portfolio during the period partly as a result of the company still being in the early stages of generating significant operating profit margins. In addition, the regulatory overhang in certain US states regarding whether to classify Uber’s drivers as independent contractors or employees has hampered the performance of Uber’s stock. Given these issues, we chose to exit the position in favor of allocating assets in the portfolio to stocks that we believe have a higher likelihood of maintaining long-term sustainable margins.

The Fund had some bright spots during the period, including stock selection in the Information Technology and Consumer Discretionary sectors. The Fund’s results in Consumer Discretionary were further bolstered by the Fund’s overweight allocation to the sector, which was the strongest-performing sector of the benchmark index during the period. An underweight allocation to two weaker-performing areas of the benchmark index, Communication Services and Materials, aided the Fund’s results on a relative performance basis.

In the Information Technology sector, Constellation Software, Inc. (“Constellation”) (+38%) was a positive contributor to the Fund’s performance over the period for several reasons. First, technology companies generally benefited as interest rate increases diminished in magnitude during February and March of 2023, partially reversing the industry’s weak performance in 2022. In addition, Constellation announced the spin-off of Lumine Group Inc. (“Lumine”) (the shares of which the Fund received through the spin-off were sold during the period), which helped to unlock value and focus Constellation’s attention on fewer offerings. Last, semi-annual results were stronger than expected with an uptick in organic growth.

Consumer Discretionary holding NVR, Inc. (+35%), one of the largest homebuilders in the United States, operating in 34 metropolitan areas, was a contributor to the Fund’s performance for the period as the company continued to outperform expectations for new homes sales, price per home sold, and overall profitability. Due to over a decade of underinvestment in the homebuilding market, there is a long-term industry shortfall for new construction, and it is estimated that this underinvestment has led to an approximate shortfall of 4 million homes in the US housing industry. Although the US housing industry is considered cyclical and has been negatively impacted by tighter financial conditions, the fundamentals for household formation, including the cumulative housing shortfall, overall migration away from cities, and greater representation of millennials in the work force, should remain strong for multiple years.

During the reporting period, the Fund reduced its exposure to the Energy and Financials sectors and sold its sole position in the Real Estate sector. The Fund increased its allocation to the Health Care, Communication Services, and Consumer Discretionary sectors. There were no significant changes to the Fund’s allocations to the Information Technology or Industrials sectors. Additionally, the Fund’s lack of exposure to the Consumer Staples, Materials, and Utilities sectors remained unchanged.

Fiscal Period-End Investment Posture

As of March 31, 2023, the Fund’s primary economic sector allocations included Information Technology, Consumer Discretionary, Industrials, and Health Care. At period end, the Fund had no investments in the Consumer Staples, Materials, Real Estate, or Utilities sectors.

Sincerely,

THOMAS F. MARSICO

PETER C. MARSICO

JAMES D. MARSICO

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses, resulting in a lower performance return. Please see the Prospectus for more information. |

| (2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by the Adviser. Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

MIDCAP GROWTH FOCUS FUND OVERVIEW |

March 31, 2023 (Unaudited)

The Midcap Growth Focus Fund is a diversified portfolio and invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size. Under normal circumstances, the Fund will invest at least 80% of the value of its assets in medium-capitalization (or “midcap”) growth companies. The Fund will normally hold a core position of between 35 and 50 common stocks.

| | | INVESTOR CLASS | | | INSTITUTIONAL CLASS | |

| | TOTAL ANNUAL OPERATING EXPENSES* | 1.35% | | TOTAL ANNUAL OPERATING EXPENSES* | 1.12% | |

| | | | | | | |

| GROWTH OF $10,000(1)(2)(3) | PERFORMANCE COMPARISON(1)(2) |

| | Average Annualized Returns |

|  |

| SECTOR ALLOCATION(5) | TOP FIVE HOLDINGS |

| | | | |

| | SYNOPSYS, INC. | 5.23% | |

| | CHIPOTLE MEXICAN GRILL, INC. | 4.64% | |

| | AMPHENOL CORP. - CL. A | 4.46% | |

| | CINTAS CORP. | 4.23% | |

| | HEICO CORP. | 4.02% | |

| | | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2023, as supplemented, and may differ from the expense ratios disclosed in this report. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| | The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| | The Russell Midcap Growth Index (the “Underlying Index”) measures the performance of the mid-capitalization growth sector of the US equity market, and is composed of mid-capitalization US equities that exhibit growth characteristics. It is a subset of the Russell Midcap® Index, which measures the performance of the mid-capitalization sector of the US equity market. The Underlying Index measures the performance of equity securities of Russell Midcap Index issuers with higher price-to-book ratios and higher forecasted growth. |

| (2) | Periodically, certain fees and expenses have been waived or reimbursed by Marsico Capital Management, LLC (the “Adviser”). In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses, resulting in a lower performance return. |

| (3) | This chart assumes an initial investment of $10,000 made on March 31, 2013 in the Investor Class shares of the Fund. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (4) | Institutional Class shares commenced operations on December 6, 2021. The performance attributed to the Institutional Class shares prior to that date is that of the Investor Class shares. Performance prior to December 6, 2021 has not been adjusted to reflect the lower expenses of the Institutional Class shares. During this period, Institutional Class shares would have had returns similar to, but potentially higher than, Investor Class shares due to the fact that Institutional Class shares represent interests in the same portfolio as Investor Class shares but are typically subject to lower expenses than the Investor Class shares. |

| (5) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO MIDCAP GROWTH FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

| COMMON STOCKS |

| Aerospace & Defense | | | | | | | | | | | | |

| HEICO Corp. | | | 57,011 | | | $ | 9,751,161 | | | | 4.02 | % |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | | | | | | | | |

| lululemon athletica, inc.* | | | 22,155 | | | | 8,068,630 | | | | 3.33 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Constellation Software, Inc. | | | 5,185 | | | | 9,748,145 | | | | 4.02 | |

| Synopsys, Inc.* | | | 32,816 | | | | 12,675,180 | | | | 5.23 | |

| | | | | | | | 22,423,325 | | | | 9.25 | |

| Automotive Parts & Equipment | | | | | | | | | | | | |

| Mobileye Global, Inc. - Cl. A* | | | 56,975 | | | | 2,465,308 | | | | 1.02 | |

| | | | | | | | | | | | | |

| Automotive Retail | | | | | | | | | | | | |

| O’Reilly Automotive, Inc.* | | | 9,076 | | | | 7,705,343 | | | | 3.18 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Neurocrine Biosciences, Inc.* | | | 64,223 | | | | 6,500,652 | | | | 2.68 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Las Vegas Sands Corp.* | | | 102,075 | | | | 5,864,209 | | | | 2.42 | |

| | | | | | | | | | | | | |

| Diversified Support Services | | | | | | | | | | | | |

| Cintas Corp. | | | 22,184 | | | | 10,264,093 | | | | 4.23 | |

| | | | | | | | | | | | | |

| Electrical Components & Equipment | | | | | | | | | | | | |

| AMETEK, Inc. | | | 48,635 | | | | 7,068,125 | | | | 2.92 | |

| | | | | | | | | | | | | |

| Electronic Components | | | | | | | | | | | | |

| Amphenol Corp. - Cl. A | | | 132,175 | | | | 10,801,341 | | | | 4.46 | |

| | | | | | | | | | | | | |

| Electronic Equipment & Instruments | | | | | | | | | | | | |

| Novanta, Inc.* | | | 42,470 | | | | 6,756,552 | | | | 2.79 | |

| | | | | | | | | | | | | |

| Financial Exchanges & Data | | | | | | | | | | | | |

| MSCI, Inc. | | | 14,888 | | | | 8,332,665 | | | | 3.44 | |

| | | | | | | | | | | | | |

| Health Care Equipment | | | | | | | | | | | | |

| GE HealthCare Technologies, Inc.* | | | 30,576 | | | | 2,508,149 | | | | 1.04 | |

| IDEXX Laboratories, Inc.* | | | 14,839 | | | | 7,420,687 | | | | 3.06 | |

| | | | | | | | 9,928,836 | | | | 4.10 | |

| Home Improvement Retail | | | | | | | | | | | | |

| Floor & Decor Holdings, Inc. - Cl. A* | | | 24,837 | | | | 2,439,490 | | | | 1.01 | |

| | | | | | | | | | | | | |

| Homebuilding | | | | | | | | | | | | |

| NVR, Inc.* | | | 1,287 | | | | 7,171,409 | | | | 2.96 | |

| | | | | | | | | | | | | |

| Interactive Home Entertainment | | | | | | | | | | | | |

| Take-Two Interactive Software, Inc.* | | | 20,647 | | | | 2,463,187 | | | | 1.02 | |

| | | | | | | | | | | | | |

| IT Consulting & Other Services | | | | | | | | | | | | |

| Gartner, Inc.* | | | 7,425 | | | | 2,418,842 | | | | 1.00 | |

| | | | | | | | | | | | | |

| Leisure Products | | | | | | | | | | | | |

| Acushnet Holdings Corp. | | | 145,062 | | | | 7,389,458 | | | | 3.05 | |

| | | | | | | | | | | | | |

| Life Sciences Tools & Services | | | | | | | | | | | | |

| Mettler-Toledo International, Inc.* | | | 5,734 | | | | 8,774,224 | | | | 3.62 | |

| Repligen Corp.* | | | 29,824 | | | | 5,021,169 | | | | 2.07 | |

| | | | | | | | 13,795,393 | | | | 5.69 | |

| Movies & Entertainment | | | | | | | | | | | | |

| Spotify Technology S.A.* | | | 40,983 | | | | 5,476,149 | | | | 2.26 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | | | | |

| Pioneer Natural Resources Company | | | 31,846 | | | | 6,504,227 | | | | 2.68 | |

| | | | | | | | | | | | | |

| Other Specialty Retail | | | | | | | | | | | | |

| Five Below, Inc.* | | | 11,557 | | | | 2,380,395 | | | | 0.98 | |

| | | | | | | | | | | | | |

| Passenger Airlines | | | | | | | | | | | | |

| United Airlines Holdings, Inc.* | | | 126,178 | | | | 5,583,377 | | | | 2.30 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 6,582 | | | | 11,243,965 | | | | 4.64 | |

| | | | | | | | | | | | | |

| Semiconductor Materials & Equipment | | | | | | | | | | | | |

| Enphase Energy, Inc.* | | | 34,236 | | | | 7,199,146 | | | | 2.97 | |

| KLA Corp. | | | 21,400 | | | | 8,542,238 | | | | 3.52 | |

| | | | | | | | 15,741,384 | | | | 6.49 | |

| Semiconductors | | | | | | | | | | | | |

| Marvell Technology, Inc. | | | 56,386 | | | | 2,441,514 | | | | 1.01 | |

| Microchip Technology, Inc. | | | 109,468 | | | | 9,171,229 | | | | 3.78 | |

| | | | | | | | 11,612,743 | | | | 4.79 | |

| Systems Software | | | | | | | | | | | | |

| Palo Alto Networks, Inc.* | | | 39,964 | | | | 7,982,409 | | | | 3.29 | |

| | | | | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | | | | |

| United Rentals, Inc. | | | 23,516 | | | | 9,306,692 | | | | 3.84 | |

| Watsco, Inc. | | | 7,720 | | | | 2,456,195 | | | | 1.01 | |

| | | | | | | | 11,762,887 | | | | 4.85 | |

| Transaction & Payment Processing Services | | | | | | | | | | | | |

| Toast, Inc. - Cl. A* | | | 189,531 | | | | 3,364,175 | | | | 1.39 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $173,740,084) | | | | | | | 233,259,730 | | | | 96.24 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund - Premier Class, 4.53%# | | | 10,157,116 | | | | 10,157,116 | | | | 4.19 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $10,157,116) | | | | | | | 10,157,116 | | | | 4.19 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $183,897,200) | | | | | | | 243,416,846 | | | | 100.43 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (1,053,965 | ) | | | (0.43 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 242,362,881 | | | | 100.00 | % |

| # | Rate shown is the 7-day yield as of March 31, 2023. |

See notes to financial statements.

INTERNATIONAL OPPORTUNITIES FUND |

INVESTMENT REVIEW BY TOM MARSICO, PETER MARSICO, AND JIMMY MARSICO (UNAUDITED)

The Marsico International Opportunities Fund’s Investor Class shares and Institutional Class shares posted total returns of (US$) +26.88% and +27.10%, respectively, for the six-month fiscal period ended March 31, 2023. The Fund underperformed its benchmark index, the MSCI Europe Australasia Far East Index (“MSCI EAFE Index”), which had a total return of (US$) +27.27% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2023.

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.(1)