UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08565 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 12 |

|

| (This Form N-CSR relates solely to the Registrant’s: Prudential QMA Long-Short Equity Fund, Prudential Short Duration Muni High Income Fund and Prudential US Real Estate Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 3/31/2017 |

| |

| Date of reporting period: | | 3/31/2017 |

| Item 1 – | Reports to Stockholders |

PRUDENTIAL US REAL ESTATE FUND

ANNUAL REPORT

MARCH 31, 2017

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

| Objective: Capital appreciation and income |

Highlights

PRUDENTIAL US REAL ESTATE FUND

| • | | Stock selection in, and an underweight allocation to, the specialty sector against the FTSE NAREIT Equity REITs Index (the Index) was the most beneficial contributor to the Fund’s relative performance. A specialty real estate security invests in non-traditional properties such as cell phone towers, cold storage warehouses, transportation and energy infrastructure, or other types of properties. |

| • | | Hotel securities also performed well, while an underweight allocation to the health care sector and overweight allocation to the residential sector slightly boosted relative performance. |

| • | | Stock selection among office stocks was notably unfavorable and an overweight allocation to the sector had a negative impact on relative results. While stock selection and asset allocation both had negative impacts on performance in the office sector, stock selection’s impact was much larger. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Real Estate is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2017 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the Prudential US Real Estate Fund informative and useful. The report covers performance for the 12-month period ended March 31, 2017. We are proud to announce that Prudential Investments became PGIM® Investments, effective April 3, 2017. Why PGIM? This new name was chosen to further align with the global investment management businesses of Prudential Financial, which rebranded from Prudential Investment Management in January 2016. This new name allows for one brand and reflects our ability and commitment to delivering investment solutions to clients around the globe. Please keep in mind that only the Fund adviser’s name was changed: The name of your Fund and its management and operation did not change.

The reporting period was dominated by headline events. Most prominent was the surprising end to a dramatic US election season, as Donald Trump was elected 45th president of the US. In the wake of the election, investor sentiment was positive for both the economy and the markets in anticipation of a more pro-business environment under a Trump-led administration. Another major headline event was Brexit—the term used to represent Britain’s decision to leave the European Union. This referendum raised further economic and political uncertainty over the future of existing trade and commerce agreements. Meanwhile, the US economy’s recovery strengthened as labor markets tightened.

Equity markets in the US reached new highs as stocks experienced powerful gains after the US election, as equity investors appeared to believe that the new administration would quickly implement measures to boost growth. European stocks generally advanced as the eurozone economy continued to experience slow growth. Most Asian markets gained. In aggregate, emerging markets turned in very strong results.

In a move widely anticipated by the markets, the Federal Reserve raised its federal funds rate by 0.25% during its December 2016 policy meeting. On March 15, the Federal Reserve decided to hike rates by 0.25%. Additional rate hikes are planned for 2017. Overall, fixed income markets experienced mixed returns, as rising interest rates and concerns over potential inflation jolted bond markets later in the period.

Given the uncertainty in today’s investment environment, we believe that active professional portfolio management offers a potential advantage. Active managers often have the knowledge and flexibility to find the best investment opportunities in the most challenging markets.

Even so, it’s best if investment decisions are based on your long-term goals rather than on short-term market and economic developments. We also encourage you to work with an experienced financial advisor who can help you set goals, determine your tolerance for risk, build a diversified plan that’s right for you, and make adjustments when necessary.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. We’re part of PGIM, the 9th-largest global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart Parker, President

Prudential US Real Estate Fund

May 15, 2017

| | | | |

| Prudential US Real Estate Fund | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| | | | | | | | | | |

| | | Average Annual Total Returns as of 3/31/17 (with Sales Charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | –4.55 | | | 6.92 | | | | 8.41 (12/21/10) | |

| Class B | | –4.11 | | | 7.17 | | | | 8.60 (12/21/10) | |

| Class C | | –0.61 | | | 7.33 | | | | 8.58 (12/21/10) | |

| Class Z | | 1.26 | | | 8.41 | | | | 9.66 (12/21/10) | |

| | | | | | | | | | |

| | | Average Annual Total Returns as of 3/31/17 (without Sales Charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | 1.01 | | | 8.13 | | | | 9.39 (12/21/10) | |

| Class B | | 0.26 | | | 7.32 | | | | 8.60 (12/21/10) | |

| Class C | | 0.26 | | | 7.33 | | | | 8.58 (12/21/10) | |

| Class Z | | 1.26 | | | 8.41 | | | | 9.66 (12/21/10) | |

| FTSE NAREIT Equity REITs Index | | 3.56 | | | 9.99 | | | | 11.11 | |

| S&P 500 Index | | 17.15 | | | 13.29 | | | | 12.98 | |

| Lipper Equity Real Estate Funds Average | | 3.29 | | | 8.84 | | | | 10.01 | |

| | |

| 4 | | Visit our website at pgiminvestments.com |

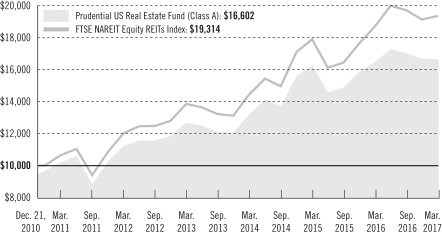

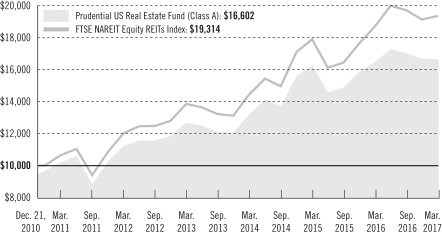

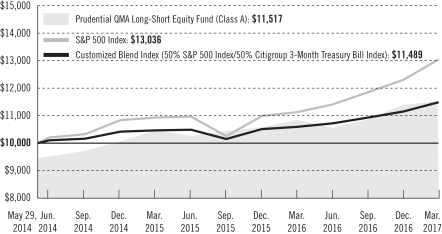

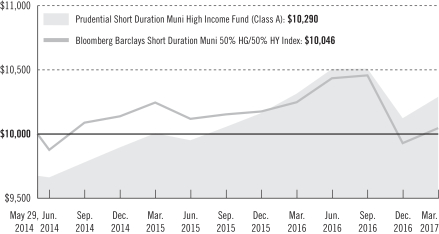

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential US Real Estate Fund (Class A shares) with a similar investment in the FTSE NAREIT Equity REITs Index, by portraying the initial account values at the commencement of operations for Class A shares (December 21, 2010) and the account values at the end of the current fiscal year (March 31, 2017) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as explained in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years.

| | | | |

| Prudential US Real Estate Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | Class A | | Class B* | | Class C | | Class Z |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | | 1% on sales of $1 million or more made within 12 months of purchase | | 5% (Yr.1) 4% (Yr.2) 3% (Yr.3) 2% (Yr.4) 1% (Yr.5&6) 0% (Yr.7) | | 1% on sales made within 12 months of purchase | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .30% (.25% currently) | | 1% | | 1% | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

FTSE NAREIT Equity REITs Index—The Financial Times Stock Exchange National Association of Real Estate Investment Trusts (FTSE NAREIT) Equity REITs Index is an unmanaged index which measures the performance of all REITs listed on the New York Stock Exchange, the NASDAQ National Market, and the NYSE MKT LLC. The Index is designed to reflect the performance of all publicly-traded equity REITs as a whole.

S&P 500 Index—The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

Lipper Equity Real Estate Funds Average—The Lipper Equity Real Estate Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Equity Real Estate Funds category for the periods noted. Funds in the Lipper Average invest their portfolios primarily in shares of domestic companies engaged in the real estate industry.

Investors cannot invest directly in an index or average. The securities in the Indexes may be very different from those in the Fund. Index returns do not include the effect of sales charges and operating expenses of a mutual fund or taxes and would be lower if they did. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes. The Since Inception returns for the Indexes and the Lipper Average are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

| | |

| 6 | | Visit our website at pgiminvestments.com |

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 3/31/17 (%) | |

| Ventas, Inc., Health Care REITs | | | 5.3 | |

| Simon Property Group, Inc., Retail REITs | | | 4.9 | |

| Equity Residential, Residential REITs | | | 4.4 | |

| Equinix, Inc., Specialized REITs | | | 3.6 | |

| Digital Realty Trust, Inc., Specialized REITs | | | 3.0 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 3/31/17 (%) | |

| Retail REITs | | | 19.9 | |

| Residential REITs | | | 17.5 | |

| Specialized REITs | | | 15.2 | |

| Office REITs | | | 13.1 | |

| Health Care REITs | | | 10.6 | |

Industry weightings reflect only long-term investments and are subject to change.

| | | | |

| Prudential US Real Estate Fund | | | 7 | |

Strategy and Performance Overview

How did the Fund perform?

The Prudential US Real Estate Fund’s Class A shares gained 1.01% over the 12-month period ended March 31, 2017. Over the same period, the FTSE NAREIT Equity REITs Index (the Index) returned 3.56% and the Lipper Equity Real Estate Funds Average returned 3.29%. The S&P 500 Index returned 17.15%.

What were conditions like in the US real estate securities market?

Real estate investment trust (REIT) returns were primarily driven by the potential for reflation and new government policy, interest rate movements, and continued strong real estate fundamentals. The economic backdrop remained favorable for REIT fundamentals. The level of jobs growth continued to create ample real estate demand to absorb vacancies and create pricing power in most property types and markets.

However, it did not create much in the form of material supply additions, except for apartments and certain hotel markets. New supply remains well below historical averages and near historical lows at 1.2% of existing supply. Supply additions for long lease duration properties remain well below long-term averages. Supply additions for shorter lease duration properties like apartments, hotels and self-storage are more in line with long-term historical averages. Most importantly though, new construction is down 20% from the post-crisis peak in early 2016.

From a relative valuation perspective, REITs ended the quarter trading at an attractive 5% discount to NAV (net asset value), compared to a 2.8% premium historically.1 As of March 30, 2017, core real estate traded at an 11% discount to NAV. This means the true value of the real estate is important and investors will realize there are discounts and will take advantage of them. Core real estate is considered to be the least risky because they often target stabilized, fully leased, secure investments in major core markets. These include properties with long-term leases in place to high credit tenants and Class A buildings in highly desirable locations. These buildings are often well kept and require little to no improvements on behalf of the new owner.

Certain sectors are trading at very wide discounts relative to their historical levels. A capital (cap) rate is the rate of return on a property based on the expected income that the property will generate. The implied cap rate spreads (yield differentials) of REITs relative to a 10-year Treasury remain wide at roughly 360 basis points (bps), in line with the long term historical average of 360 bps.2 (A basis point is one hundredth of one percent.) When cap rates contract, REITs are more attractive to investors, because they are perceived as less risky. Therefore, that 360 bps spread level provides REITs with a cushion if interest rates increase, as spreads could contract without any deterioration in real estate value.

| 1 | Evercore ISI. As of 30-Mar-2017 |

| 2 | Citigroup. As of 30-Mar-2017 |

| | |

| 8 | | Visit our website at pgiminvestments.com |

What worked?

| • | | Stock selection in, and an underweight allocation to, the specialty sector was the most beneficial contributor to the Fund’s relative performance. A specialty REIT invests in non-traditional properties such as cell phone towers, cold storage warehouses, transportation and energy infrastructure, or other types of properties. |

| • | | Hotel securities also performed well, while an underweight allocation to the health care sector and overweight allocation to the residential sector slightly boosted relative performance. |

What didn’t work?

| • | | The office sector was the largest detractor of performance. |

| • | | Stock selection among office stocks was notably unfavorable and an overweight allocation to the sector had a negative impact on relative results. While stock selection and asset allocation both had negative impacts on performance in the office sector, stock selection’s impact was much larger. |

| • | | The data center sector was also a primary detractor, mainly due to the Fund’s underweight allocation, relative to the Index; security selection also had a slight drag on results. |

| • | | Other underperforming sectors included storage and triple net. A triple net refers to a type of lease agreement in which the tenant is responsible for paying the building’s property taxes, insurance, and maintenance. |

The percentage points shown in the tables identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| Top Contributors (%) | | Top Detractors (%) |

| Equinix, Inc. | | 0.72 | | DDR Corp. | | –0.24 |

| Public Storage | | 0.65 | | Federal Realty Investment Trust | | –0.25 |

| Hudson Pacific Properties, Inc. | | 0.52 | | Extra Space Storage Inc. | | –0.29 |

| Community Healthcare Trust, Inc. | | 0.50 | | Life Storage, Inc. | | –0.46 |

| First Potomac Realty Trust | | 0.47 | | Prologis, Inc. | | –0.50 |

Current outlook

REIT rental rates are expected to continue to improve for the remainder of 2017. At this point in the cycle, PGIM Real Estate would expect most revenue growth to come from rental growth versus occupancy gains. Supply is expected to remain muted in most markets and property types, except for apartments, self-storage and certain hotel markets. Employment centers that focus on technology, healthcare, and media/entertainment are expected to

| | | | |

| Prudential US Real Estate Fund | | | 9 | |

Strategy and Performance Overview (continued)

deliver relatively strong jobs growth. PGIM Real Estate will continue to monitor technology-dependent markets for any signs of decelerating demand growth, and is more constructive on energy-related markets, as oil prices show stability and job growth in markets like Houston are stabilizing.

A slow growth, lower rates for a longer time, environment bodes well for US REITs, and offers a valuable combination of income and growth in a volatile market. The wall of capital to be invested in US real estate remains high. PGIM Real Estate is positioned to focus on companies with strong relative internal cash flow growth and strong balance sheets that trade at reasonable valuations relative to their private market value.

| | |

| 10 | | Visit our website at pgiminvestments.com |

Comments on Largest Holdings

| 5.3% | Ventas, Inc., Health Care REITs |

The Trust owns seniors housing communities, skilled nursing facilities, hospitals, and medical office buildings in the United States and Canada.

| 4.9% | Simon Property Group, Inc., Retail REITs |

Simon Property Group, Inc. is a self-administered and self-managed REIT. The Company owns, develops, and manages retail real estate properties including regional malls, outlet centers, community/lifestyle centers, and international properties.

| 4.4% | Equity Residential, Residential REITs |

The Trust acquires, develops, and manages apartment complexes in the United States.

| 3.6% | Equinix, Inc., Specialized REITs |

Equinix, Inc. operates as a REIT. The Company invests in interconnected data centers. Equinix focuses on developing network and cloud-neutral data center platforms for cloud and information technology, enterprises, network and mobile services providers, as well as for financial companies.

| 3.0% | Digital Realty Trust, Inc., Specialized REITs |

Digital Realty Trust, Inc. owns, acquires, repositions, and manages technology-related real estate. The Company’s properties contain applications and operations critical to the day-to-day operations of technology industry tenants and corporate enterprise data center tenants. Digital’s property portfolio is located throughout the United States and in England.

| | | | |

| Prudential US Real Estate Fund | | | 11 | |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended March 31, 2017. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses

| | |

| 12 | | Visit our website at pgiminvestments.com |

paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential US

Real Estate Fund | | Beginning Account

Value

October 1, 2016 | | | Ending Account

Value

March 31, 2017 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 978.30 | | | | 1.25 | % | | $ | 6.17 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.25 | % | | $ | 6.29 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 974.40 | | | | 2.00 | % | | $ | 9.84 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00 | % | | $ | 10.05 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 974.30 | | | | 2.00 | % | | $ | 9.84 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00 | % | | $ | 10.05 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 979.50 | | | | 1.00 | % | | $ | 4.94 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00 | % | | $ | 5.04 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2017, and divided by the 365 days in the Fund’s fiscal year ended March 31, 2017 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| Prudential US Real Estate Fund | | | 13 | |

Portfolio of Investments

as of March 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 98.7% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Diversified REITs 7.4% | | | | | | | | |

Empire State Realty Trust, Inc. (Class A Stock) | | | 791 | | | $ | 16,326 | |

First Potomac Realty Trust | | | 23,179 | | | | 238,280 | |

Forest City Realty Trust, Inc. (Class A Stock) | | | 27,957 | | | | 608,904 | |

Spirit Realty Capital, Inc. | | | 40,754 | | | | 412,838 | |

STORE Capital Corp. | | | 20,197 | | | | 482,304 | |

| | | | | | | | |

| | | | | | | 1,758,652 | |

| | |

Health Care REITs 10.6% | | | | | | | | |

Community Healthcare Trust, Inc. | | | 13,197 | | | | 315,408 | |

MedEquities Realty Trust, Inc. | | | 22,247 | | | | 249,389 | |

Omega Healthcare Investors, Inc. | | | 4,526 | | | | 149,313 | |

Physicians Realty Trust | | | 18,595 | | | | 369,483 | |

Ventas, Inc. | | | 19,609 | | | | 1,275,369 | |

Welltower, Inc. | | | 2,517 | | | | 178,254 | |

| | | | | | | | |

| | | | | | | 2,537,216 | |

| | |

Hotel & Resort REITs 7.6% | | | | | | | | |

Chesapeake Lodging Trust | | | 5,803 | | | | 139,040 | |

DiamondRock Hospitality Co. | | | 46,799 | | | | 521,809 | |

MGM Growth Properties LLC (Class A Stock) | | | 17,406 | | | | 470,832 | |

Park Hotels & Resorts, Inc. | | | 14,815 | | | | 380,301 | |

Sunstone Hotel Investors, Inc. | | | 19,876 | | | | 304,699 | |

| | | | | | | | |

| | | | | | | 1,816,681 | |

| | |

Industrial REITs 7.4% | | | | | | | | |

Duke Realty Corp. | | | 23,320 | | | | 612,616 | |

First Industrial Realty Trust, Inc. | | | 12,122 | | | | 322,809 | |

Prologis, Inc. | | | 8,112 | | | | 420,851 | |

Rexford Industrial Realty, Inc. | | | 18,572 | | | | 418,241 | |

| | | | | | | | |

| | | | | | | 1,774,517 | |

| | |

Office REITs 13.1% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 5,152 | | | | 569,399 | |

Boston Properties, Inc. | | | 3,393 | | | | 449,267 | |

Columbia Property Trust, Inc. | | | 14,638 | | | | 325,696 | |

Hudson Pacific Properties, Inc. | | | 20,065 | | | | 695,052 | |

SL Green Realty Corp. | | | 5,926 | | | | 631,830 | |

Vornado Realty Trust | | | 4,659 | | | | 467,344 | |

| | | | | | | | |

| | | | | | | 3,138,588 | |

See Notes to Financial Statements.

| | | | |

| Prudential US Real Estate Fund | | | 15 | |

Portfolio of Investments continued

as of March 31, 2017

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Residential REITs 17.5% | | | | | | | | |

American Campus Communities, Inc. | | | 6,720 | | | $ | 319,805 | |

Camden Property Trust | | | 8,940 | | | | 719,312 | |

Equity LifeStyle Properties, Inc. | | | 7,286 | | | | 561,459 | |

Equity Residential | | | 17,043 | | | | 1,060,416 | |

Essex Property Trust, Inc. | | | 2,855 | | | | 661,018 | |

Mid-America Apartment Communities, Inc. | | | 2,645 | | | | 269,102 | |

Monogram Residential Trust, Inc. | | | 31,650 | | | | 315,551 | |

Sun Communities, Inc. | | | 3,358 | | | | 269,748 | |

| | | | | | | | |

| | | | | | | 4,176,411 | |

| | |

Retail REITs 19.9% | | | | | | | | |

DDR Corp. | | | 39,987 | | | | 501,037 | |

Federal Realty Investment Trust | | | 5,213 | | | | 695,935 | |

GGP, Inc. | | | 4,524 | | | | 104,866 | |

Macerich Co. (The) | | | 11,117 | | | | 715,935 | |

National Retail Properties, Inc. | | | 10,030 | | | | 437,509 | |

Retail Properties of America, Inc. (Class A Stock) | | | 45,596 | | | | 657,494 | |

Simon Property Group, Inc. | | | 6,772 | | | | 1,164,987 | |

Taubman Centers, Inc. | | | 7,237 | | | | 477,787 | |

| | | | | | | | |

| | | | | | | 4,755,550 | |

| | |

Specialized REITs 15.2% | | | | | | | | |

CoreSite Realty Corp. | | | 1,669 | | | | 150,294 | |

CubeSmart | | | 22,269 | | | | 578,103 | |

Digital Realty Trust, Inc. | | | 6,793 | | | | 722,707 | |

Equinix, Inc. | | | 2,128 | | | | 851,987 | |

Extra Space Storage, Inc. | | | 8,242 | | | | 613,123 | |

Four Corners Property Trust, Inc. | | | 17,599 | | | | 401,785 | |

Public Storage | | | 1,411 | | | | 308,882 | |

| | | | | | | | |

| | | | | | | 3,626,881 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $21,350,396) | | | | | | | 23,584,496 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value | |

SHORT-TERM INVESTMENTS 0.9% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

Prudential Investment Portfolios 2 - Prudential Core Ultra Short Bond Fund(a) | | | 211,656 | | | $ | 211,656 | |

Prudential Investment Portfolios 2 - Prudential Institutional Money Market Fund(a) | | | 1 | | | | 1 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $211,657) | | | | | | | 211,657 | |

| | | | | | | | |

TOTAL INVESTMENTS 99.6%

(cost $21,562,053) | | | | | | | 23,796,153 | |

Other assets in excess of liabilities 0.4% | | | | | | | 90,314 | |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 23,886,467 | |

| | | | | | | | |

The following abbreviations are used in the annual report:

LIBOR—London Interbank Offered Rate

REIT—Real Estate Investment Trust

| (a) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the Prudential Investment Portfolios 2—Prudential Core Ultra Short Bond Fund and Prudential Institutional Money Market Fund. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of March 31, 2017 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Diversified REITs | | $ | 1,758,652 | | | $ | — | | | $ | — | |

Health Care REITs | | | 2,537,216 | | | | — | | | | — | |

Hotel & Resort REITs | | | 1,816,681 | | | | — | | | | — | |

Industrial REITs | | | 1,774,517 | | | | — | | | | — | |

Office REITs | | | 3,138,588 | | | | — | | | | — | |

Residential REITs | | | 4,176,411 | | | | — | | | | — | |

Retail REITs | | | 4,755,550 | | | | — | | | | — | |

Specialized REITs | | | 3,626,881 | | | | — | | | | — | |

Affiliated Mutual Funds | | | 211,657 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 23,796,153 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential US Real Estate Fund | | | 17 | |

Portfolio of Investments (continued)

as of March 31, 2017

During the period, there were no transfers between Level 1, Level 2 and Level 3 to report.

Industry Classification:

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of March 31, 2017 were as follows (unaudited):

| | | | |

Retail REITs | | | 19.9 | % |

Residential REITs | | | 17.5 | |

Specialized REITs | | | 15.2 | |

Office REITs | | | 13.1 | |

Health Care REITs | | | 10.6 | |

Hotel & Resort REITs | | | 7.6 | |

Industrial REITs | | | 7.4 | |

Diversified REITs | | | 7.4 | % |

Affiliated Mutual Funds | | | 0.9 | |

| | | | |

| | | 99.6 | |

Other assets in excess of liabilities | | | 0.4 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

This Page Intentionally Left Blank

Statement of Assets & Liabilities

as of March 31, 2017

| | | | |

Assets | | | | |

Investments at value: | | | | |

Unaffiliated investments (cost $21,350,396) | | $ | 23,584,496 | |

Affiliated investments (cost $211,657) | | | 211,657 | |

Receivable for investments sold | | | 275,269 | |

Dividends receivable | | | 112,303 | |

Receivable for Fund shares sold | | | 34,228 | |

Prepaid expenses | | | 385 | |

| | | | |

Total assets | | | 24,218,338 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 256,377 | |

Payable for Fund shares reacquired | | | 33,837 | |

Accrued expenses | | | 33,741 | |

Distribution fee payable | | | 3,297 | |

Management fee payable | | | 2,404 | |

Affiliated transfer agent fee payable | | | 2,215 | |

| | | | |

Total liabilities | | | 331,871 | |

| | | | |

| |

Net Assets | | $ | 23,886,467 | |

| | | | |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 1,992 | |

Paid-in capital in excess of par | | | 21,199,560 | |

| | | | |

| | | 21,201,552 | |

Accumulated net realized gain on investment and foreign currency transactions | | | 450,815 | |

Net unrealized appreciation on investments | | | 2,234,100 | |

| | | | |

Net assets, March 31, 2017 | | $ | 23,886,467 | |

| | | | |

See Notes to Financial Statements.

| | | | |

Class A | | | | |

Net asset value and redemption price per share,

($4,863,231 ÷ 405,042 shares of beneficial interest issued and outstanding) | | $ | 12.01 | |

Maximum sales charge (5.50% of offering price) | | | 0.70 | |

| | | | |

Maximum offering price to public | | $ | 12.71 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share,

($1,089,343 ÷ 92,248 shares of beneficial interest issued and outstanding) | | $ | 11.81 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share,

($1,536,434 ÷ 130,354 shares of beneficial interest issued and outstanding) | | $ | 11.79 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share,

($16,397,459 ÷ 1,364,612 shares of beneficial interest issued and outstanding) | | $ | 12.02 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential US Real Estate Fund | | | 21 | |

Statement of Operations

Year Ended March 31, 2017

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $3,258) | | $ | 535,203 | |

Affiliated dividend income | | | 1,478 | |

Income from securities lending, net (including affiliated income of $11) | | | 17 | |

| | | | |

Total income | | | 536,698 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 244,142 | |

Distribution fee—Class A | | | 16,666 | |

Distribution fee—Class B | | | 12,399 | |

Distribution fee—Class C | | | 16,692 | |

Registration fees | | | 63,000 | |

Custodian and accounting fees | | | 60,000 | |

Audit fee | | | 26,000 | |

Transfer agent’s fees and expenses (including affiliated expense of $11,600) | | | 20,000 | |

Legal fees and expenses | | | 20,000 | |

Shareholders’ reports | | | 19,000 | |

Trustees’ fees | | | 10,000 | |

Loan interest expense | | | 1,453 | |

Miscellaneous | | | 18,257 | |

| | | | |

Total expenses | | | 527,609 | |

Less: Management fee waiver and/or expense reimbursement | | | (140,365 | ) |

Distribution fee waiver—Class A | | | (2,778 | ) |

| | | | |

Net expenses | | | 384,466 | |

| | | | |

Net investment income (loss) | | | 152,232 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 3,410,960 | |

In-kind redemptions | | | 1,467,232 | |

Foreign currency transactions | | | 199 | |

| | | | |

| | | 4,878,391 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (4,182,455 | ) |

Foreign currencies | | | (23 | ) |

| | | | |

| | | (4,182,478 | ) |

| | | | |

Net gain (loss) on investment and foreign currency transactions | | | 695,913 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 848,145 | |

| | | | |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended March 31, | |

| | | 2017 | | | 2016 | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 152,232 | | | $ | 799,018 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 4,878,391 | | | | 1,807,738 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (4,182,478 | ) | | | (1,878,307 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 848,145 | | | | 728,449 | |

| | | | | | | | |

| | |

Dividends and Distributions | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (110,959 | ) | | | (47,609 | ) |

Class B | | | (16,856 | ) | | | (5,802 | ) |

Class C | | | (22,161 | ) | | | (6,507 | ) |

Class Z | | | (560,715 | ) | | | (454,720 | ) |

| | | | | | | | |

| | | (710,691 | ) | | | (514,638 | ) |

| | | | | | | | |

Distributions from net realized gains | | | | | | | | |

Class A | | | (651,917 | ) | | | (360,255 | ) |

Class B | | | (145,776 | ) | | | (105,714 | ) |

Class C | | | (200,183 | ) | | | (116,114 | ) |

Class Z | | | (2,153,241 | ) | | | (2,830,149 | ) |

| | | | | | | | |

| | | (3,151,117 | ) | | | (3,412,232 | ) |

| | | | | | | | |

| | |

Fund share transactions (Net of share conversions) | | | | | | | | |

Net proceeds from shares sold | | | 6,896,382 | | | | 16,984,936 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 3,832,323 | | | | 3,903,922 | |

Cost of shares reacquired | | | (27,548,452 | ) | | | (19,274,633 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | (16,819,747 | ) | | | 1,614,225 | |

| | | | | | | | |

Total increase (decrease) | | | (19,833,410 | ) | | | (1,584,196 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 43,719,877 | | | | 45,304,073 | |

| | | | | | | | |

End of year(a) | | $ | 23,886,467 | | | $ | 43,719,877 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | — | | | $ | 381,730 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential US Real Estate Fund | | | 23 | |

Notes to Financial Statements

Prudential Investment Portfolios 12 (the “Trust”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The Trust was established as a Delaware business trust on October 24, 1997. The Trust currently consists of the following four series: Prudential Global Real Estate Fund, Prudential US Real Estate Fund, Prudential QMA Long-Short Equity Fund and Prudential Short Duration Muni High Income Fund. These financial statements relate only to Prudential US Real Estate Fund (the “Fund”). The Fund is a non-diversified series of the Trust. The financial statements of the other series of the Trust are not presented herein.

The investment objective of the Fund is capital appreciation and income.

Note 1. Accounting Policies

The Fund follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Trust and the Fund consistently follow such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Trustees (the “Board”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or “the Manager”) (formerly known as Prudential Investments LLC). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the table following the Portfolio of Investments.

Common and preferred stocks, exchange-traded funds, and derivative instruments such as futures or options that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security

principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy.

In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Common and preferred stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stocks discussed above.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current daily rates of exchange;

| | | | |

| Prudential US Real Estate Fund | | | 25 | |

Notes to Financial Statements (continued)

(ii) purchases and sales of investment securities, income and expenses—at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions.

Additionally, net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from holdings of foreign currencies, forward currency contracts, disposition of foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Master Netting Arrangements: The Fund is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may have negotiated and entered into on behalf of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law. During the reporting period, there was no intention to settle on a net basis and all amounts are presented on a gross basis on the Statement of Assets and Liabilities.

Securities Lending: The Fund may lend its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in an affiliated money market fund

and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the Fund securities identical to the loaned securities. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities in the open market using the collateral. The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The borrower receives all interest and dividends from the securities loaned and such payments are passed back to the lender in amounts equivalent thereto. The Fund also continues to recognize any unrealized gain (loss) in the market price of the securities loaned and on the change in the value of the collateral invested that may occur during the term of the loan. In addition, realized gain (loss) is recognized on changes in the value of the collateral invested upon liquidation of the collateral. Net earnings from securities lending are disclosed on the Statement of Operations as “Income from securities lending, net”.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-date. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on an accrual basis. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day.

Real Estate Investment Trusts (REITs): The Fund invests in REITs which report information on the source of their distributions annually. Based on current and historical information, a portion of distributions received from REITs during the period is estimated to be dividend income, capital gain or a return of capital and recorded accordingly. These estimates are adjusted periodically when the actual source of distributions is disclosed by the REITs.

Concentration of Risk: An investment in the Fund will be closely linked to the performance of the real estate markets. Real estate securities are subject to the same risks as direct investments in real estate and mortgages, and their value will depend on the value of the underlying properties or the underlying loans or interests. The underlying loans may be subject to the risks of default or of prepayments that occur earlier or later than expected, and such loans may also include so-called “subprime” mortgages. The value of these securities will rise and fall in response to many factors, including economic conditions, the demand for rental property and interest rates. In particular, the value of these securities may decline when interest rates rise and will also be affected by the real estate market and by the management of the underlying properties.

| | | | |

| Prudential US Real Estate Fund | | | 27 | |

Notes to Financial Statements (continued)

In addition, investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, may not be diversified geographically or by property/mortgage asset type, and are subject to heavy cash flow dependency, default by borrowers and self-liquidation. REITs may be more volatile and/or more illiquid than other types of equity securities. REITs (especially mortgage REITs) are subject to interest rate risks. REITs may incur significant amounts of leverage. The Fund will indirectly bear a portion of the expenses, including management fees, paid by each REIT in which it invests, in addition to the expenses of the Fund.

Dividends and Distributions: The Fund expects to pay dividends from net investment income quarterly and distributions from net realized capital and currency gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified amongst undistributed net investment income, accumulated net realized gain (loss) and paid in capital in excess of par, as appropriate.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign interest and dividends are recorded, net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Trust, on behalf of the Fund, has a management agreement with PGIM Investments. Pursuant to this agreement, PGIM Investments has responsibility for all the investment advisory services and supervises the subadviser’s performance of such services. PGIM Investments has entered into a subadvisory agreement with PGIM, Inc., which provides subadvisory services to the Fund through its PGIM Real Estate unit. The subadvisory agreement provides that PGIM Real Estate will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PGIM Real Estate is obligated to keep certain books and records of the Fund. PGIM Investments pays for the services of PGIM Real Estate, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

Effective July 1, 2016, the management fee paid to PGIM Investments is accrued daily and payable monthly at an annual rate of .75% of the Fund’s average daily net assets up to and including $1 billion, .73% on the next $2 billion of average daily net assets, .71% on the next $2 billion of average daily net assets, .70% on the next $5 billion of average daily net assets and .69% on the average daily net assets in excess of $10 billion. Prior to July 1, 2016, the management fee paid to PGIM Investments was accrued daily and payable monthly at an annual rate of .90% of the Fund’s average daily net assets up to and including $1 billion, .88% on the next $2 billion of average daily net assets, .86% on the next $2 billion of average daily net assets, .85% on the next $5 billion of average daily net assets and .84% on the average daily net assets in excess of $10 billion. The effective management fee rate, before any waivers and/or expense reimbursement was .80% for the year ended March 31, 2017. The effective management fee rate, net of waivers and/or expense reimbursement was .34%.

Effective July 1, 2016, PGIM Investments has contractually agreed through July 31, 2018, to limit net annual Fund operating expenses (exclusive of distribution and service (12b-1) fees, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses), interest, underlying funds, brokerage, extraordinary and certain other expenses such as dividend, broker charges and interest expense on short sales) of each class of shares to 1.00% of the Fund’s average daily net assets. Prior to July 1, 2016, PGIM Investments had contractually agreed to limit the net annual operating expenses (exclusive of distribution and service (12b-1) fees, taxes (such as income and foreign withholdings taxes, stamp duty and deferred tax expenses), interest, underlying funds, brokerage, extraordinary and certain other expenses such as dividend, broker charges and interest expense on short sales) of each class of shares of the Fund to 1.35% of the Fund’s average daily net assets. Expenses waived/reimbursed by the Manager in accordance with this agreement may be recouped by the Manager within the same fiscal year during which such waver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year.

The Trust, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”) which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A, Class B and Class C shares, pursuant to plans of distribution (the “Distribution Plans”) regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor for Class Z shares of the Fund.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution related activities at an annual rate of up to .30%, 1% and 1% of the average daily net assets of the Class A, Class B and Class C shares, respectively. PIMS has contractually agreed through July 31, 2018, to limit such fees to .25% of the average daily net assets of the Class A shares.

PIMS has advised the Fund that it has received $30,706 in front-end sales charges resulting from sales of Class A shares during the year ended March 31, 2017. From these

| | | | |

| Prudential US Real Estate Fund | | | 29 | |

Notes to Financial Statements (continued)

fees, PIMS paid such sales charges to broker-dealers which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Fund that for the year ended March 31, 2017, it received $2,214 and $129 in contingent deferred sales charges imposed upon certain redemptions by Class B and Class C shareholders, respectively.

PGIM Investments, PIMS, and PGIM, Inc. are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common trustees, and/or common officers. Such transactions are subject to ratification by the Board.

The Fund may invest its overnight sweep cash in the Prudential Core Ultra Short Bond Fund (the “Core Fund) and its securities lending cash collateral in the Prudential Institutional Money Market Fund (the “Money Market Fund”), each a series of Prudential Investment Portfolios 2, registered under the 1940 Act and managed by PGIM Investments. For the period ended March 31, 2017, PGIM, Inc., was compensated $4 by PGIM Investments for managing the Fund’s securities lending cash collateral as subadviser to the Money Market Fund. Earnings from the Core Fund and the Money Market Fund are disclosed on the Statement of Operations as “Affiliated dividend income” and “Income from securities lending, net”, respectively.

Note 4. Portfolio Securities

The aggregate cost of purchases and proceeds from sales of portfolio securities, (excluding short-term investments and U.S. Treasuries), for the year ended March 31, 2017, were $37,118,882 and $40,653,117, respectively.

Note 5. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. In order to present overdistributed net investment income, accumulated net realized gain on investment and foreign currency transactions and paid-in capital in excess of par on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to overdistributed net investment income, accumulated net realized gain on investment and foreign currency transactions and paid-in capital in excess of par. For the year ended March 31, 2017, the adjustments were to decrease overdistributed net investment income by $176,729, decrease accumulated net realized gain on investment and foreign currency transactions by $1,487,209 and increase paid-in capital in excess of par by $1,310,480, due to differences in the treatment for book and tax purposes of certain transactions involving foreign securities and currencies, investments in passive foreign investment companies, reclassification of dividends, in-kind distributions for shareholder redemptions and other book to tax differences. Net investment income, net realized gain (loss) on investment and foreign currency transactions and net assets were not affected by this change.

For the year ended March 31, 2017, the tax character of dividends paid by the Fund were $1,571,120 from ordinary income and $2,290,688 from long-term capital gains. For the year ended March 31, 2016, the tax character of dividends paid by the Fund were $852,226 from ordinary income and $3,074,644 from long-term capital gains.

As of March 31, 2017, the accumulated undistributed earnings on a tax basis were $4,713 of ordinary income and $839,296 of long-term capital gains. This differs from the amount shown on the Statement of Assets and Liabilities primarily due to cumulative timing differences between financial and tax reporting.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of March 31, 2017 were as follows:

| | | | | | |

Tax Basis | | Appreciation | | Depreciation | | Net

Unrealized

Appreciation |

| $21,955,247 | | $2,647,285 | | $(806,379) | | $1,840,906 |

The difference between book basis and tax basis was primarily attributable to deferred losses on wash sales.

Management has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. The Fund’s federal, state and local income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

| | | | |

| Prudential US Real Estate Fund | | | 31 | |

Notes to Financial Statements (continued)

Note 6. Capital

The Fund offers Class A, Class B, Class C and Class Z shares. Class A shares are sold with front-end sales charge of up to 5.50%. All investors who purchase Class A shares in an amount of $1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (“CDSC”) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential. Class B shares are sold with a CDSC which declines from 5% to zero depending on the period of time the shares are held. Class B shares automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. Class B shares are closed to new purchases. Class C shares are sold with a CDSC of 1% on shares redeemed within the first 12 months of purchase. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class Z shares are not subject to any sales or redemption charge and are available exclusively for sale to a limited group of investors.

Under certain circumstances, an exchange may be made from specified share classes of the Fund to one or more other share classes of the Fund as presented in the table of transactions in shares of beneficial interest.

The Trust has authorized an unlimited number of shares of beneficial interest at $.001 par value divided into four classes, designated Class A, Class B, Class C and Class Z.

As of March 31, 2017, Prudential owned 1,263,122 Class Z shares of the Fund. At reporting period end, three shareholders of record held 76% of the Fund’s outstanding shares on behalf of multiple beneficial owners.

Transactions in shares of beneficial interest were as follows:

| | | | | | | | |

Class A | | Shares | | | Amount | |

Year ended March 31, 2017: | | | | | | | | |

Shares sold | | | 240,777 | | | $ | 3,125,192 | |

Shares issued in reinvestment of dividends and distributions | | | 60,264 | | | | 740,909 | |

Shares reacquired | | | (231,518 | ) | | | (2,981,968 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 69,523 | | | | 884,133 | |

Shares issued upon conversion from other share class(es) | | | 9,235 | | | | 120,751 | |

Shares reacquired upon conversion into other share class(es) | | | (39,225 | ) | | | (478,117 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 39,533 | | | $ | 526,767 | |

| | | | | | | | |

Year ended March 31, 2016: | | | | | | | | |

Shares sold | | | 111,510 | | | $ | 1,549,638 | |

Shares issued in reinvestment of dividends and distributions | | | 30,657 | | | | 392,234 | |

Shares reacquired | | | (204,549 | ) | | | (2,836,189 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (62,382 | ) | | | (894,317 | ) |

Shares issued upon conversion from other share class(es) | | | 2,524 | | | | 32,658 | |

Shares reacquired upon conversion into other share class(es) | | | (13,913 | ) | | | (194,677 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (73,771 | ) | | $ | (1,056,336 | ) |

| | | | | | | | |

| | | | | | | | |

Class B | | Shares | | | Amount | |

Year ended March 31, 2017: | | | | | | | | |

Shares sold | | | 13,597 | | | $ | 185,880 | |

Shares issued in reinvestment of dividends and distributions | | | 13,185 | | | | 159,841 | |

Shares reacquired | | | (24,618 | ) | | | (311,930 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 2,164 | | | | 33,791 | |

Shares reacquired upon conversion into other share class(es) | | | (4,312 | ) | | | (55,371 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (2,148 | ) | | $ | (21,580 | ) |

| | | | | | | | |

Year ended March 31, 2016: | | | | | | | | |

Shares sold | | | 1,207 | | | $ | 16,701 | |

Shares issued in reinvestment of dividends and distributions | | | 8,792 | | | | 110,699 | |

Shares reacquired | | | (37,118 | ) | | | (497,117 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (27,119 | ) | | | (369,717 | ) |

Shares reacquired upon conversion into other share class(es) | | | (2,557 | ) | | | (32,658 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (29,676 | ) | | $ | (402,375 | ) |

| | | | | | | | |

Class C | | | | | | |

Year ended March 31, 2017: | | | | | | | | |

Shares sold | | | 45,835 | | | $ | 611,002 | |

Shares issued in reinvestment of dividends and distributions | | | 18,301 | | | | 220,410 | |

Shares reacquired | | | (39,224 | ) | | | (484,354 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 24,912 | | | | 347,058 | |

Shares reacquired upon conversion into other share class(es) | | | (5,061 | ) | | | (65,380 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 19,851 | | | $ | 281,678 | |

| | | | | | | | |

Year ended March 31, 2016: | | | | | | | | |

Shares sold | | | 15,384 | | | $ | 206,851 | |

Shares issued in reinvestment of dividends and distributions | | | 9,313 | | | | 117,096 | |

Shares reacquired | | | (35,360 | ) | | | (465,604 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (10,663 | ) | | $ | (141,657 | ) |

| | | | | | | | |

Class Z | | | | | | |

Year ended March 31, 2017: | | | | | | | | |

Shares sold | | | 211,906 | | | $ | 2,974,308 | |

Shares issued in reinvestment of dividends and distributions | | | 215,187 | | | | 2,711,163 | |

Shares reacquired | | | (1,720,388 | ) | | | (23,770,200 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (1,293,295 | ) | | | (18,084,729 | ) |

Shares issued upon conversion from other share class(es) | | | 39,195 | | | | 478,117 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (1,254,100 | ) | | $ | (17,606,612 | ) |

| | | | | | | | |

Year ended March 31, 2016: | | | | | | | | |

Shares sold | | | 1,116,124 | | | $ | 15,211,746 | |

Shares issued in reinvestment of dividends and distributions | | | 256,269 | | | | 3,283,893 | |

Shares reacquired | | | (1,146,552 | ) | | | (15,475,723 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 225,841 | | | | 3,019,916 | |

Shares issued upon conversion from other share class(es) | | | 13,906 | | | | 194,677 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 239,747 | | | $ | 3,214,593 | |

| | | | | | | | |

| | | | |

| Prudential US Real Estate Fund | | | 33 | |

Notes to Financial Statements (continued)

Note 7. Borrowings

The Fund, along with other affiliated registered investment companies (the “Funds”), is a party to a Syndicated Credit Agreement (“SCA”) with a group of banks. The purpose of the SCA is to provide an alternative source of temporary funding for capital share redemptions. The SCA provides for a commitment of $900 million for the period October 6, 2016 through October 5, 2017. The Funds pay an annualized commitment fee of .15% of the unused portion of the SCA. Prior to October 6, 2016, the Funds had a prior SCA that provided a commitment of $900 million in which the Funds paid an annualized commitment fee of .11% of the unused portion of the prior SCA. For the SCA and the prior SCA, the Fund’s portion of the commitment fee for the unused amount, allocated based upon a method approved by the Board, is accrued daily and paid quarterly. The interest on borrowings under each SCA is paid monthly and at a per annum interest rate based upon a contractual spread plus the higher of (1) the effective federal funds rate, (2) the 1-month LIBOR rate or (3) zero percent.

The Fund utilized the SCA during the year ended March 31, 2017. The average balance for the 58 days that the Fund had loans outstanding was $520,310, borrowed at a weighted average interest rate of 1.73%. The maximum loan balance outstanding during the period was $1,803,000. At March 31, 2017, the Fund did not have an outstanding loan balance.

Note 8. In-Kind Redemption

During the year ended March 31, 2017, the Fund settled the redemption of certain fund shares by delivery of certain portfolio securities in lieu of cash. The value of such securities was $15,365,333. Additionally, cash of $236,538 was transferred in-kind. In-kind redemption gains and losses are excluded from the calculation of the Fund’s taxable gain (loss) for federal income tax purposes.

Note 9. Recent Accounting Pronouncements and Reporting Updates

On October 13, 2016, the Securities and Exchange Commission (the “SEC”) adopted new rules and forms and amended existing rules and forms which are intended to modernize and enhance the reporting and disclosure of information by registered investment companies and to improve the quality of information that funds provide to investors, including modifications to Regulation S-X which would require standardized, enhanced disclosure about derivatives in investment company financial statements. The new rules also enhance disclosure regarding fund liquidity and redemption practices. Also under the new rules, the SEC will permit open-end funds, with the exception of money market funds, to offer swing pricing, subject to board approval and review. The compliance dates of the modifications to Regulation S-X are August 1, 2017 and other amendments and rules are

generally June 1, 2018 and December 1, 2018. Management is currently evaluating the impacts to the financial statement disclosures, if any.

Note 10. Other

At the Fund’s Board meeting in March, 2017, the Board of Trustees approved a change in the methodology of allocating certain expenses, like Transfer Agency (including sub-transfer agency and networking) and Blue Sky fees. The impact to the net assets of the Fund and individual share classes is not ascertainable at the present time. Management expects to implement the changes by December 31, 2017.

| | | | |

| Prudential US Real Estate Fund | | | 35 | |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | |