UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08565 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 12 |

|

| (This Form N-CSR relates solely to the Registrant’s PGIM QMA Long-Short Equity Fund, PGIM Short Duration Muni High Income Fund, PGIM US Real Estate Fund and PGIM QMA Large Cap Core Equity PLUS Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 3/31/2019 |

| |

| Date of reporting period: | | 3/31/2019 |

Item 1 – Reports to Stockholders

PGIM US REAL ESTATE FUND

(Formerly known as Prudential US Real Estate Fund)

ANNUAL REPORT

MARCH 31, 2019

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgiminvestments.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary or follow instructions included with this notice to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

| Objective:Capital appreciation and income |

Highlights(unaudited)

| • | | The Fund’s stock selection contributed to performance, while asset allocation had only a small positive impact relative to the FTSE NAREIT Equity REITs Index (the Index). |

| • | | Performance versus the Index in the health care, industrial, and office sectors was strong, driven by favorable security selection. Relative performance was also strong among the shopping center, residential, and storage stocks held in the Fund. |

| • | | Malls and triple net stocks underperformed due to weak stock selection. The Fund’s underweight position to triple net securities, on average, also detracted from results. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Real Estate is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies.© 2019 Prudential Financial, Inc. and its related entities. PGIM Real Estate, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Table of Contents

| | | | |

| PGIM US Real Estate Fund | | | 3 | |

This Page Intentionally Left Blank

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM US Real Estate Fund informative and useful. The report covers performance for the 12-month period that ended March 31, 2019.

We have important information to share with you. Effective June 11, 2018, Prudential Mutual Funds were renamed PGIM Funds. This renaming was part of our ongoing effort to further build our reputation and establish our global brand, which began when our firm adopted PGIM Investments as its name in April 2017. Please note that only the Fund’s name has changed. Your Fund’s management and operation, along with its symbols, remained the same.*

Global economic performance diverged during the reporting period. In the US, growth remained healthy with strong corporate profits and rising employment. The Federal Reserve hiked interest rate targets three times during the period, based on a strengthening labor market and rising economic activity. Growth in many other regions weakened. China showed signs of slowing amid trade tensions with the US, and turmoil grew in Great Britain as it negotiated an exit from the European Union. Sharp declines in crude oil prices during the latter half of the period provided economic support for many oil-importing countries.

Despite the growing US economy, volatility returned to the equity markets during the period. After corporate tax cuts and regulatory reforms helped boost US stocks early in the period, equities declined significantly at the end of 2018 on concerns about China’s economy, a potential global trade war, higher interest rates, and worries that profit growth might slow. Stocks reversed course early in 2019, rising sharply after the Fed moderated its position on additional rate hikes for the remainder of the year. For the period overall, equities rose in US markets but fell in both developed foreign markets and emerging markets.

The overall US bond market posted healthy returns during the period, led by high yield corporate, municipal, and investment-grade corporate bonds. Globally, bonds in developed markets fell slightly, but emerging markets debt denominated in hard currencies delivered solid gains. A major trend during the period was the flattening of the US Treasury yield curve, as the yield on fixed income investments with shorter maturities rose and made them more attractive to investors.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart Parker, President

PGIM US Real Estate Fund

May 15, 2019

*The Prudential Day One Funds did not change their names.

| | | | |

| PGIM US Real Estate Fund | | | 5 | |

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | | | |

| |

| | | Average Annual Total Returns as of 3/31/19

(with sales charges) |

| | | One Year (%) | | Five Years (%) | | Since Inception (%) |

| Class A | | 17.89 | | 7.70 | | 8.88 (12/21/10) |

| Class B | | 18.85 | | 7.95 | | 8.83 (12/21/10) |

| Class C | | 22.81 | | 8.10 | | 8.81 (12/21/10) |

| Class Z | | 25.03 | | 9.19 | | 9.90 (12/21/10) |

| Class R6* | | 25.14 | | N/A | | 10.85 (5/25/17) |

| FTSE NAREIT Equity REITs Index | | | | |

| | 20.86 | | 9.12 | | — |

| S&P 500 Index | | | | |

| | 9.49 | | 10.90 | | — |

| Lipper Equity Real Estate Funds Average | | |

| | | 16.40 | | 8.14 | | — |

| | | | | | |

| |

| | | Average Annual Total Returns as of 3/31/19

(without Sales Charges) |

| | | One Year (%) | | Five Years (%) | | Since Inception (%) |

| Class A | | 24.76 | | 8.93 | | 9.63 (12/21/10) |

| Class B | | 23.85 | | 8.10 | | 8.83 (12/21/10) |

| Class C | | 23.81 | | 8.10 | | 8.81 (12/21/10) |

| Class Z | | 25.03 | | 9.19 | | 9.90 (12/21/10) |

| Class R6* | | 25.14 | | N/A | | 10.85 (5/25/17) |

| FTSE NAREIT Equity REITs Index | | | | | | |

| | 20.86 | | 9.12 | | — |

| S&P 500 Index | | | | | | |

| | 9.49 | | 10.90 | | — |

| Lipper Equity Real Estate Funds Average | | | | | | |

| | | 16.40 | | 8.14 | | — |

| | |

| 6 | | Visit our website at pgiminvestments.com |

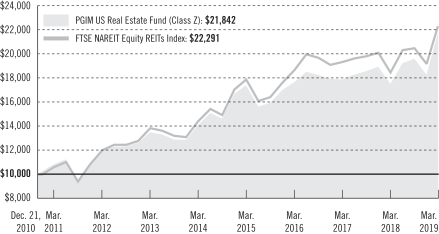

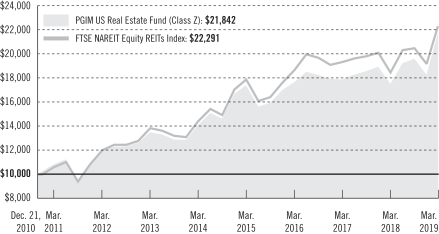

Growth of a $10,000 Investment(unaudited)

The graph compares a $10,000 investment in the PGIM US Real Estate Fund (Class Z shares) with a similar investment in the FTSE NAREIT Equity REITs Index, by portraying the initial account values at the commencement of operations for Class Z shares (December 21, 2010) and the account values at the end of the current fiscal year (March 31, 2019) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as explained in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

*Formerly known as Class Q shares.

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes and the Lipper Average are measured from the closest month-end to the class’ inception date.

| | | | |

| PGIM US Real Estate Fund | | | 7 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | |

| | | | | | |

| | | Class A | | Class B* | | Class C | | Class Z | | Class R6** |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 5.00% (Yr.1) 4.00% (Yr.2) 3.00% (Yr.3) 2.00% (Yr.4) 1.00% (Yr.5&6) 0.00% (Yr.7) | | 1.00% on sales made within 12 months of purchase | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% (0.25% currently) | | 1.00% | | 1.00% | | None | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

**Formerly known as Class Q

Benchmark Definitions

FTSE NAREIT Equity REITs Index—The Financial Times Stock Exchange National Association of Real Estate Investment Trusts (FTSE NAREIT) Equity REITs Index is an unmanaged index which measures the performance of all equity real estate investment trusts (REITs) listed on the New York Stock Exchange, the NASDAQ National Market, and the NYSE MKT LLC. The Index is designed to reflect the performance of all publicly traded equity REITs as a whole. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class A, B, C, and Z shares is 10.20% and 8.52% for Class R6 shares.

S&P 500 Index—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed. The average annual total return for the Index measured from the month-end closest to the inception date of the Fund’s Class A, B, C, and Z shares is 12.67% and 11.37% for Class R6 shares.

Lipper Equity Real Estate Funds Average—The Lipper Equity Real Estate Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Equity Real Estate Funds universe for the periods noted. Funds in the Lipper Average invest their portfolios primarily in shares of domestic companies engaged in the real estate industry. The average annual total return for the Average measured from the month-end closest to the inception date of the Fund’s Class A, B, C, and Z shares is 9.27% and 7.46% for Class R6 shares.

| | |

| 8 | | Visit our website at pgiminvestments.com |

Investors cannot invest directly in an index or average. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

Presentation of Fund Holdings

| | | | |

|

Five Largest Holdings expressed as a

percentage of net assets as of 3/31/19 (%) | |

| Welltower, Inc.,HealthCareREITs | | | 7.6 | |

| Americold Realty Trust,IndustrialREITs | | | 7.2 | |

| AvalonBay Communities, Inc.,Residential REITs | | | 6.2 | |

| Prologis, Inc.,IndustrialREITs | | | 5.1 | |

| Equity LifeStyle Properties, Inc.,Residential REITs | | | 4.8 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

|

Five Largest Sectors expressed as a percentage

of net assets as of 3/31/19 (%) | |

| Industrial REITs | | | 20.1 | |

| Residential REITs | | | 17.3 | |

| Office REITs | | | 14.6 | |

| Specialized REITs | | | 14.3 | |

| Health Care REITs | | | 11.4 | |

Industry weightings reflect only long-term investments and are subject to change.

| | | | |

| PGIM US Real Estate Fund | | | 9 | |

Strategy and Performance Overview(unaudited)

How did the Fund perform?

ThePGIM US Real Estate Fund’s Class Z shares rose 25.03% in the12-month reporting period that ended March 31, 2019, outperforming the 20.86% return of the FTSE NAREIT Equity REITs Index (the Index), the 16.40% return of the Lipper Equity Real Estate Funds Average, and the 9.49% return of the S&P 500 Index.

What were conditions like in the US real estate securities market?

| • | | The reporting period was favorable for the US real estate investment trust (REIT) market, as indicated above by the Index’s 20.86% return. This represented more than 1,000 basis points of relative outperformance to the S&P 500 Index’s return during the same time. One basis point equals 0.01%. The S&P 500 tracks the performance of 500 large-capitalization US stocks. |

| • | | The combination of the Federal Reserve’s more accommodative stance on short-term interest rate hikes early in 2019 along with stable economic growth has created an ideal environment for the US REIT market, in PGIM Real Estate’s view. In addition, the recent drop in long-term interest rates has tempered concerns regardingcap-rate expansion, providing further support to current real estate valuations. |

| • | | On average, REITs trade at a 2% premium to net asset value (NAV), roughly in line with the historical average. However, valuations vary dramatically across sectors and companies, presenting plenty of opportunity for good returns, in PGIM Real Estate’s view. |

What worked?

| • | | The Fund’s stock selection contributed to performance, while asset allocation had only a small positive impact relative to the Index. |

| • | | Performance versus the Index in the health care, industrial, and office sectors was strong, driven by favorable security selection. Relative performance was also strong among the shopping center, residential, and storage stocks held in the Fund. |

What didn’t work?

| • | | Malls and triple net stocks underperformed due to weak stock selection. Triple net stocks specialize in leases that require tenants to pay for property taxes, building insurance, and maintenance costs. The Fund’s underweight position to triple net securities, on average, also detracted from results. |

| | |

| 10 | | Visit our website at pgiminvestments.com |

The percentage points shown in the tables identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| |

| Top Contributors (%) | | Top Detractors (%) |

| Welltower, Inc. | | 3.20 | | Sunstone Hotel Investors, Inc. | | –0.07 |

| Americold Realty Trust | | 1.61 | | Host Hotels & Resorts, Inc. | | –0.12 |

| AvalonBay Communities, Inc. | | 1.55 | | Easterly Government Properties, Inc. | | –0.13 |

| Equity LifeStyle Properties, Inc. | | 1.33 | | Empire State Realty Trust, Inc. Class A | | –0.22 |

| American Assets Trust, Inc. | | 1.17 | | Macerich Co. | | –0.84 |

Current outlook

| • | | PGIM Real Estate expects the remainder of 2019 to be a favorable year for the US REIT market, which historically has outperformed during periods of stable rates and subdued economic growth. Increased concerns about the duration of the economic cycle and persistent equity market volatility could potentially lead to more REIT mergers and acquisitions (M&A) and privatizations. 2018 was a record-setting year for M&A activity, with nine transactions representing over $50 billion in deal volume. That said, there have already been two REIT M&A deals so far in 2019, and private equity investors had approximately $330 billion in committed capital on the sidelines at the end of the period, up 20% from the previous year. |

| • | | This environment is well-suited for PGIM Real Estate’s value-based investment approach. The Fund held overweight positions in both acquisition targets—MedEquities Realty Trust Inc. and Tier REIT Inc.—in this year’s M&A transactions, providing a nice boost to outperformance. REITs should continue to post stable operating fundamentals, with 2% to 3% same-store net operating income (NOI) growth resulting in 5% to 7% cash flow and dividend growth over the next 12 months. That said, performance will vary among property types, with industrial REITs likely to see the best NOI growth at over 4% while retail and storage REITs likely to be on the lower side at 1% to 2%. |

| • | | PGIM Real Estate remains overweight to the industrial sector, which continues to benefit from the secular demand shift towarde-commerce, and also favors the manufactured housing sector based on its leading cash flow growth and limited supply additions. PGIM Real Estate has increased its overweight position to gaming REITs, given their stable fundamentals and attractive external growth opportunities, and has added to its investments in selectnet-lease stocks that it views as best-positioned to take advantage of their low cost of capital to boost earnings growth and create value. PGIM Real Estate remains cautious on the retail industry, specifically the mall sector, and has further increased its underweight position. It also maintains underweight positions in the storage, health care, and shopping center sectors. |

| | | | |

| PGIM US Real Estate Fund | | | 11 | |

Comments on Largest Holdings

| 7.6% | Welltower,Health Care |

Welltower invests in senior living and health care properties, primarily skilled nursing and assisted-living facilities designed for older people needing help with everyday living. It also has investments in independent living facilities, medical office buildings, and specialty care facilities. Its portfolio includes approximately 1,700 properties leased to health care operators in more than 45 states in the US, its largest market.

| 7.2% | Americold Realty Trust,Industrial |

Americold provides temperature-controlled food distribution services, including warehousing, consolidation programs, shipment management, multi-vendor consolidation, and logistics solutions. It serves food producers, processors, distributors, wholesalers, retailers, and restaurants worldwide.

| 6.3% | AvalonBay Communities,Residential |

AvalonBay buys, develops, renovates, and operates multifamily properties in the US, specializing in upscale properties in markets with high barriers to entry such as Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC. By providing luxury living in high-demand areas where apartment-zoned land is in low supply, AvalonBay can also charge premium rent. It owns about 180 apartment communities with more than 53,000 units. It also has more than 30 properties under construction or redevelopment, and owns rights to develop more than 30 additional properties.

Prologis is an owner, operator, and developer of industrial real estate, focused on global and regional markets across the Americas, Europe, and Asia. It also leases modern distribution facilities to customers, including manufacturers, retailers, transportation companies, third-party logistics providers, and other enterprises.

| 4.8% | Equity LifeStyle Properties,Specialty Housing |

Equity LifeStyle Properties owns an interest in communities in the US and western Canada, acquiring properties such as campgrounds and seasonal resort communities.

| | |

| 12 | | Visit our website at pgiminvestments.com |

Fees and Expenses(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended March 31, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | | | |

| PGIM US Real Estate Fund | | | 13 | |

Fees and Expenses(continued)

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM US Real

Estate Fund | | Beginning Account

Value

October 1, 2018 | | | Ending Account

Value

March 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,115.10 | | | | 1.25 | % | | $ | 6.59 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.25 | % | | $ | 6.29 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 1,110.90 | | | | 2.00 | % | | $ | 10.53 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00 | % | | $ | 10.05 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,111.20 | | | | 2.00 | % | | $ | 10.53 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00 | % | | $ | 10.05 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,116.20 | | | | 1.00 | % | | $ | 5.28 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00 | % | | $ | 5.04 | |

| Class R6** | | Actual | | $ | 1,000.00 | | | $ | 1,117.10 | | | | 1.00 | % | | $ | 5.28 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00 | % | | $ | 5.04 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2019, and divided by the 365 days in the Fund’s fiscal year ended March 31, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**Formerly known as Class Q shares.

| | |

| 14 | | Visit our website at pgiminvestments.com |

Schedule of Investments

as of March 31, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 99.4% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Diversified REITs 8.0% | | | | | | | | |

American Assets Trust, Inc. | | | 17,592 | | | $ | 806,769 | |

Essential Properties Realty Trust, Inc. | | | 27,204 | | | | 531,022 | |

STORE Capital Corp. | | | 25,442 | | | | 852,307 | |

| | | | | | | | |

| | | | | | | 2,190,098 | |

| | |

Health Care REITs 11.4% | | | | | | | | |

CareTrust REIT, Inc. | | | 28,900 | | | | 677,994 | |

Medical Properties Trust, Inc. | | | 19,329 | | | | 357,780 | |

Welltower, Inc. | | | 26,870 | | | | 2,085,112 | |

| | | | | | | | |

| | | | | | | 3,120,886 | |

| | |

Hotel & Resort REITs 8.3% | | | | | | | | |

Apple Hospitality REIT, Inc. | | | 24,425 | | | | 398,128 | |

DiamondRock Hospitality Co. | | | 55,129 | | | | 597,047 | |

Host Hotels & Resorts, Inc. | | | 18,521 | | | | 350,047 | |

MGM Growth Properties LLC (Class A Stock) | | | 28,770 | | | | 927,832 | |

| | | | | | | | |

| | | | | | | 2,273,054 | |

| | |

Industrial REITs 20.1% | | | | | | | | |

Americold Realty Trust | | | 64,574 | | | | 1,970,153 | |

Duke Realty Corp. | | | 20,992 | | | | 641,935 | |

Prologis, Inc. | | | 19,602 | | | | 1,410,364 | |

Rexford Industrial Realty, Inc. | | | 21,973 | | | | 786,853 | |

STAG Industrial, Inc. | | | 23,886 | | | | 708,220 | |

| | | | | | | | |

| | | | | | | 5,517,525 | |

| | |

Office REITs 14.6% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 6,045 | | | | 861,775 | |

Hudson Pacific Properties, Inc. | | | 27,913 | | | | 960,766 | |

JBG SMITH Properties | | | 17,771 | | | | 734,831 | |

Kilroy Realty Corp. | | | 7,978 | | | | 606,009 | |

Tier REIT, Inc. | | | 29,158 | | | | 835,668 | |

| | | | | | | | |

| | | | | | | 3,999,049 | |

| | |

Residential REITs 17.3% | | | | | | | | |

AvalonBay Communities, Inc. | | | 8,488 | | | | 1,703,796 | |

Camden Property Trust | | | 9,673 | | | | 981,810 | |

See Notes to Financial Statements.

| | | | |

| PGIM US Real Estate Fund | | | 15 | |

Schedule of Investments(continued)

as of March 31, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Residential REITs (cont’d.) | | | | | | | | |

Equity LifeStyle Properties, Inc. | | | 11,507 | | | $ | 1,315,250 | |

Essex Property Trust, Inc. | | | 2,596 | | | | 750,867 | |

| | | | | | | | |

| | | | | | | 4,751,723 | |

| | |

Retail REITs 5.4% | | | | | | | | |

Regency Centers Corp. | | | 3,982 | | | | 268,745 | |

Simon Property Group, Inc. | | | 6,673 | | | | 1,215,887 | |

| | | | | | | | |

| | | | | | | 1,484,632 | |

| | |

Specialized REITs 14.3% | | | | | | | | |

Digital Realty Trust, Inc. | | | 4,078 | | | | 485,282 | |

Equinix, Inc. | | | 2,508 | | | | 1,136,525 | |

Extra Space Storage, Inc. | | | 5,897 | | | | 600,963 | |

Four Corners Property Trust, Inc. | | | 16,701 | | | | 494,350 | |

Public Storage | | | 1,333 | | | | 290,301 | |

QTS Realty Trust, Inc. (Class A Stock) | | | 9,305 | | | | 418,632 | |

VICI Properties, Inc. | | | 23,133 | | | | 506,150 | |

| | | | | | | | |

| | | | | | | 3,932,203 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $22,371,179) | | | | | | | 27,269,170 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT 1.1% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUND | | | | | | | | |

PGIM Core Ultra Short Bond Fund

(cost $289,096)(w) | | | 289,096 | | | | 289,096 | |

| | | | | | | | |

TOTAL INVESTMENTS 100.5%

(cost $22,660,275) | | | | | | | 27,558,266 | |

Liabilities in excess of other assets (0.5)% | | | | | | | (126,068 | ) |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 27,432,198 | |

| | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

LIBOR—London Interbank Offered Rate

REIT(s)—Real Estate Investment Trust(s)

| (w) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Core Ultra Short Bond Fund. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

See Notes to Financial Statements.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of March 31, 2019 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Diversified REITs | | $ | 2,190,098 | | | $ | — | | | $ | — | |

Health Care REITs | | | 3,120,886 | | | | — | | | | — | |

Hotel & Resort REITs | | | 2,273,054 | | | | — | | | | — | |

Industrial REITs | | | 5,517,525 | | | | — | | | | — | |

Office REITs | | | 3,999,049 | | | | — | | | | — | |

Residential REITs | | | 4,751,723 | | | | — | | | | — | |

Retail REITs | | | 1,484,632 | | | | — | | | | — | |

Specialized REITs | | | 3,932,203 | | | | — | | | | — | |

Affiliated Mutual Fund | | | 289,096 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 27,558,266 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

Sector Classification:

The sector classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of March 31, 2019 were as follows (unaudited):

| | | | |

Industrial REITs | | | 20.1 | % |

Residential REITs | | | 17.3 | |

Office REITs | | | 14.6 | |

Specialized REITs | | | 14.3 | |

Health Care REITs | | | 11.4 | |

Hotel & Resort REITs | | | 8.3 | |

Diversified REITs | | | 8.0 | |

Retail REITs | | | 5.4 | % |

Affiliated Mutual Fund | | | 1.1 | |

| | | | |

| | | 100.5 | |

Liabilities in excess of other assets | | | (0.5 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

| | | | |

| PGIM US Real Estate Fund | | | 17 | |

Statement of Assets & Liabilities

as of March 31, 2019

| | | | |

Assets | | | | |

Investments at value: | | | | |

Unaffiliated investments (cost $22,371,179) | | $ | 27,269,170 | |

Affiliated investments (cost $289,096) | | | 289,096 | |

Dividends receivable | | | 126,583 | |

Receivable for Fund shares sold | | | 5,197 | |

Due from Manager | | | 368 | |

Prepaid expenses | | | 377 | |

| | | | |

Total Assets | | | 27,690,791 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 205,037 | |

Custodian and accounting fees payable | | | 20,082 | |

Registration fee payable | | | 16,750 | |

Accrued expenses and other liabilities | | | 10,917 | |

Affiliated transfer agent fee payable | | | 2,608 | |

Distribution fee payable | | | 2,394 | |

Payable for Fund shares reacquired | | | 805 | |

| | | | |

Total Liabilities | | | 258,593 | |

| | | | |

| |

Net Assets | | $ | 27,432,198 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 2,088 | |

Paid-in capital in excess of par | | | 22,431,721 | |

Total distributable earnings (loss) | | | 4,998,389 | |

| | | | |

Net assets, March 31, 2019 | | $ | 27,432,198 | |

| | | | |

See Notes to Financial Statements.

| | | | |

Class A | | | | |

Net asset value and redemption price per share,

($4,735,302 ÷ 360,383 shares of beneficial interest issued and outstanding) | | $ | 13.14 | |

Maximum sales charge (5.50% of offering price) | | | 0.76 | |

| | | | |

Maximum offering price to public | | $ | 13.90 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share, | | | | |

($571,781 ÷ 44,430 shares of beneficial interest issued and outstanding) | | $ | 12.87 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share, | | | | |

($1,135,381 ÷ 88,398 shares of beneficial interest issued and outstanding) | | $ | 12.84 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share, | | | | |

($20,977,637 ÷ 1,593,929 shares of beneficial interest issued and outstanding) | | $ | 13.16 | |

| | | | |

| |

Class R6 | | | | |

Net asset value, offering price and redemption price per share, | | | | |

($12,097 ÷ 919 shares of beneficial interest issued and outstanding) | | $ | 13.16 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| PGIM US Real Estate Fund | | | 19 | |

Statement of Operations

Year Ended March 31, 2019

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income | | $ | 659,580 | |

Affiliated dividend income | | | 5,545 | |

| | | | |

Total income | | | 665,125 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 172,446 | |

Distribution fee(a) | | | 28,589 | |

Registration fees(a) | | | 70,925 | |

Custodian and accounting fees | | | 61,828 | |

Audit fee | | | 25,688 | |

Shareholders’ reports | | | 24,428 | |

Transfer agent’s fees and expenses (including affiliated expense of $12,345)(a) | | | 18,662 | |

Legal fees and expenses | | | 17,522 | |

Trustees’ fees | | | 12,430 | |

Miscellaneous | | | 17,317 | |

| | | | |

Total expenses | | | 449,835 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (191,265 | ) |

Distribution fee waiver(a) | | | (2,115 | ) |

| | | | |

Net expenses | | | 256,455 | |

| | | | |

Net investment income (loss) | | | 408,670 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 1,228,528 | |

Foreign currency transactions | | | (518 | ) |

| | | | |

| | | 1,228,010 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 3,591,535 | |

Foreign currencies | | | (5 | ) |

| | | | |

| | | 3,591,530 | |

| | | | |

Net gain (loss) on investment and foreign currency transactions | | | 4,819,540 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 5,228,210 | |

| | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | | | Class B | | | Class C | | | Class Z | | | Class R6 | |

Distribution fee | | | 12,691 | | | | 6,424 | | | | 9,474 | | | | — | | | | — | |

Registration fees | | | 14,185 | | | | 14,185 | | | | 14,185 | | | | 14,185 | | | | 14,185 | |

Transfer agent’s fees and expenses | | | 12,110 | | | | 2,233 | | | | 2,211 | | | | 2,042 | | | | 66 | |

Fee waiver and/or expense reimbursement | | | (44,965 | ) | | | (19,268 | ) | | | (20,594 | ) | | | (92,142 | ) | | | (14,296 | ) |

Distribution fee waiver | | | (2,115 | ) | | | — | | | | — | | | | — | | | | — | |

See Notes to Financial Statements.

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended March 31, | |

| | |

| | | 2019 | | | 2018 | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 408,670 | | | $ | 371,802 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 1,228,010 | | | | 123,022 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 3,591,530 | | | | (927,639 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 5,228,210 | | | | (432,815 | ) |

| | | | | | | | |

| | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings* | | | | | | | | |

Class A | | | (195,526 | ) | | | — | |

Class B | | | (24,630 | ) | | | — | |

Class C | | | (38,028 | ) | | | — | |

Class Z | | | (839,636 | ) | | | — | |

Class R6 | | | (526 | ) | | | — | |

| | | | | | | | |

| | | (1,098,346 | ) | | | — | |

| | | | | | | | |

Dividends from net investment income* | | | | | | | | |

Class A | | | | | | | (49,977 | ) |

Class B | | | | | | | (5,635 | ) |

Class C | | | | | | | (7,078 | ) |

Class Z | | | | | | | (215,378 | ) |

Class R6 | | | | | | | (133 | ) |

| | | | | | | | |

| | | * | | | | (278,201 | ) |

| | | | | | | | |

Distributions from net realized gains* | | | | | | | | |

Class A | | | | | | | (210,157 | ) |

Class B | | | | | | | (45,310 | ) |

Class C | | | | | | | (55,167 | ) |

Class Z | | | | | | | (794,247 | ) |

Class R6 | | | | | | | (493 | ) |

| | | | | | | | |

| | | * | | | | (1,105,374 | ) |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| PGIM US Real Estate Fund | | | 21 | |

Statements of Changes in Net Assets(continued)

| | | | | | | | |

| |

| | | Year Ended March 31, | |

| | |

| | | 2019 | | | 2018 | |

Fund share transactions (Net of share conversions) | | | | | | | | |

Net proceeds from shares sold | | $ | 3,095,291 | | | $ | 640,396 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 1,097,576 | | | | 1,378,664 | |

Cost of shares reacquired | | | (1,978,612 | ) | | | (3,001,058 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | 2,214,255 | | | | (981,998 | ) |

| | | | | | | | |

Total increase (decrease) | | | 6,344,119 | | | | (2,798,388 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 21,088,079 | | | | 23,886,467 | |

| | | | | | | | |

End of year(a) | | $ | 27,432,198 | | | $ | 21,088,079 | |

| | | | | | | | |

(a) Includes undistributed/(distributions in excess of) net investment income of: | | $ | * | | | $ | 93,559 | |

| | | | | | | | |

| * | For the year ended March 31, 2019, the disclosures have been revised to reflect revisions to RegulationS-X adopted by the SEC in 2018 (refer to Note 9). |

See Notes to Financial Statements.

Notes to Financial Statements

Prudential Investment Portfolios 12 (the “Trust”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as anopen-end management investment company. The Trust was established as a Delaware business trust on October 24, 1997. The Trust currently consists of the following six series: PGIM QMALarge-Cap Core Equity PLUS Fund, PGIM QMA Long-Short Equity Fund and PGIM Short Duration Muni High Income Fund, each of which are diversified funds and PGIM Global Real Estate Fund, PGIM Jennison Technology Fund and PGIM US Real Estate Fund, each of which arenon-diversified funds for purposes of the 1940 Act. These financial statements relate only to the PGIM US Real Estate Fund (the “Fund”). Effective June 11, 2018, the names of the Fund and the other funds which comprise the Trust were changed by replacing “Prudential” with “PGIM” in each fund’s name and each fund’s Class Q shares were renamed Class R6 shares.

The investment objective of the Fund is capital appreciation and income.

1. Accounting Policies

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services—Investment Companies.The following accounting policies conform to U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation:The Fund holds securities and other assets and liabilities that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Trust’s Board of Trustees (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly scheduled quarterly meeting.

For the fiscal reportingyear-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities

| | | | |

| PGIM US Real Estate Fund | | | 23 | |

Notes to Financial Statements(continued)

trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820—Fair Value Measurements and Disclosures.

Common and preferred stocks, exchange-traded funds, and derivative instruments, such as futures or options, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Fund is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments inopen-end,non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Illiquid Securities:Pursuant to Rule22e-4 under the 1940 Act, the Fund has adopted a Board approved Liquidity Risk Management Program (“LRMP”) that requires, among other things, that the Fund limit its illiquid investments that are assets to no more than 15% of net assets. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. The Fund may find it difficult to sell illiquid securities at the time considered most advantageous by its Subadviser and may incur transaction costs that would not be incurred in the sale of securities that were freely marketable.

Restricted Securities:Securities acquired in unregistered, private sales from the issuing company or from an affiliate of the issuer are considered restricted as to disposition under federal securities law (“restricted securities”). Such restricted securities are valued pursuant to the valuation procedures noted above. Restricted securities that would otherwise be considered illiquid investments pursuant to the Fund’s LRMP because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. Therefore, these Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(2) of the Securities Act of 1933, may be classified higher than “illiquid” under the LRMP (i.e. “moderately liquid” or “less liquid” investments). However, the liquidity of the Fund’s investments in restricted securities could be impaired if trading does not develop or declines.

Foreign Currency Translation:The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses—at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the

| | | | |

| PGIM US Real Estate Fund | | | 25 | |

Notes to Financial Statements(continued)

results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from the disposition of holdings of foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) arise from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates.

Equity and Mortgage Real Estate Investment Trusts (collectively equity REITs):The Fund invests in equity REITs, which report information on the source of their distributions annually. Based on current and historical information, a portion of distributions received from equity REITs during the period is estimated to be dividend income, capital gain or return of capital and recorded accordingly. When material, these estimates are adjusted periodically when the actual source of distributions is disclosed by the equity REITs.

Securities Transactions and Net Investment Income:Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on theex-date, or for certain foreign securities, when the Fund becomes aware of such dividends. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual. Net investment income or loss (other than class specific expenses and waivers, which are allocated as noted below) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day. Class specific expenses and waivers, where applicable, are charged to the respective share classes. Class specific expenses include distribution fees and distribution fee waivers, shareholder servicing fees, transfer agent’s fees and expenses, registration fees and fee waivers and/or expense reimbursements, as applicable.

Taxes:It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal

income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Tax reform legislation commonly referred to as the Tax Cuts and Jobs Act permits a direct REIT shareholder to claim a 20% “qualified business income” deduction for ordinary REIT dividends, but did not permit regulated investment companies (“RICs”) paying dividends attributable to such income to pass through this special treatment to its shareholders. On January��18, 2019, the Internal Revenue Service issued regulations that permit RICs to pass through “qualified REIT dividends” to their shareholders.

Dividends and Distributions:The Fund expects to pay dividends from net investment income quarterly. Distributions from net realized capital and currency gains, if any, are declared and paid annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on theex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified amongst total distributable earnings (loss) andpaid-in capital in excess of par, as appropriate.

Estimates:The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

2. Agreements

The Trust, on behalf of the Fund, has a management agreement with PGIM Investments. Pursuant to this agreement, PGIM Investments has responsibility for all investment advisory services and supervises the Subadviser’s performance of such services. In addition, under the management agreement, PGIM Investments provides all of the administrative functions necessary for the organization, operation and management of the Fund. PGIM Investments administers the corporate affairs of the Fund and, in connection therewith, furnishes the Fund with office facilities, together with those ordinary clerical and bookkeeping services which are not being furnished by the Fund’s custodian and the Fund’s transfer agent. PGIM Investments is also responsible for the staffing and management of dedicated groups of legal, marketing, compliance and related personnel necessary for the operation of the Fund. The legal, marketing, compliance and related personnel are also responsible for the management and oversight of the various service providers to the Fund, including, but not limited to, the custodian, transfer agent, and accounting agent.

PGIM Investments has entered into a subadvisory agreement with PGIM, Inc., which provides subadvisory services to the Fund through its PGIM Real Estate unit. The subadvisory agreement provides that PGIM Real Estate will furnish investment advisory services in connection with the management of the Fund. In connection therewith, PGIM Real Estate is obligated to keep certain books and records of the Fund. PGIM Investments pays for the services of PGIM Real Estate, the cost of compensation of officers of the Fund,

| | | | |

| PGIM US Real Estate Fund | | | 27 | |

Notes to Financial Statements(continued)

occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to the Manager is accrued daily and payable monthly at an annual rate of 0.75% of the Fund’s average daily net assets up to and including $1 billion, 0.73% on the next $2 billion of average daily net assets, 0.71% on the next $2 billion of average daily net assets, 0.70% on the next $5 billion of average daily net assets and 0.69% on the average daily net assets in excess of $10 billion. The effective management fee rate before any waivers and/or expense reimbursements was 0.75% for the year ended March 31, 2019.

The Manager has contractually agreed, through July 31, 2019, to limit total annual operating expenses after fee waivers and/or expense reimbursements to 1.25% of average daily net assets for Class A shares, 2.00% of average daily net assets for Class B shares 2.00% of average daily net assets for Class C shares, 1.00% of average daily net assets for Class Z shares, and 1.00% of average daily net assets for Class R6 shares. This contractual waiver excludes interest, brokerage, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses), acquired fund fees and expenses, extraordinary expenses, and certain other Fund expenses such as dividend and interest expense and broker charges on short sales. Expenses waived/reimbursed by the Manager in accordance with this agreement may be recouped by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. Effective April 1, 2019 this waiver agreement was extended through July 31, 2020.

Where applicable, the Manager voluntarily agreed through March 31, 2019, to waive management fees or shared operating expenses on any share class to the same extent that it waives similar expenses on any other share class and, in addition, total annual operating expenses for Class R6 shares will not exceed total annual operating expenses for Class Z shares. Effective April 1, 2019 this voluntary agreement became part of the Fund’s contractual waiver agreement through July 31, 2020 and is subject to recoupment by the Manager within the same fiscal year during which such waiver/reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year.

The Trust, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C, Class Z and Class R6 shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A, Class B and Class C shares, pursuant to the plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by

PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Z or Class R6 shares of the Fund.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution related activities at an annual rate of up to 0.30%, 1% and 1% of the average daily net assets of the Class A, Class B and Class C shares, respectively. PIMS has contractually agreed through July 31, 2020 to limit such fees to 0.25% of the average daily net assets of the Class A shares.

For the year ended March 31, 2019, PIMS received $5,718 infront-end sales charges resulting from sales of Class A shares. Additionally, for the year ended March 31, 2019, PIMS received $1,024 and $36 in contingent deferred sales charges imposed upon redemptions by certain Class B and Class C shareholders, respectively. From these fees, PIMS paid such sales charges to broker-dealers, who in turn paid commissions to salespersons and incurred other distribution costs.

PGIM Investments, PGIM, Inc. and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certainout-of-pocket expenses paid tonon-affiliates, where applicable.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule17a-7 procedures. Rule17a-7 is an exemptive rule under the 1940 Act, that subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. Pursuant to the Rule17a-7 procedures and consistent with guidance issued by the SEC, the Trust’s Chief Compliance Officer (“CCO”) prepares a quarterly summary of all such transactions for submission to the Board, together with the CCO’s written representation that all such17a-7 transactions were effected in accordance with the Fund’s Rule17a-7 procedures. Any17a-7 transactions for the reporting period are disclosed in the “Portfolio Securities” note, below.

The Fund may invest its overnight sweep cash in the PGIM Core Ultra Short Bond Fund (the “Core Fund”), a series of Prudential Investment Portfolios 2, registered under the 1940 Act and managed by PGIM Investments. Through the Fund’s investments in the mentioned underlying fund, PGIM Investments and/or its affiliates are paid fees or reimbursed for providing their services. Earnings from the Core Fund are disclosed on the Statement of Operations as “Affiliated dividend income”.

| | | | |

| PGIM US Real Estate Fund | | | 29 | |

Notes to Financial Statements(continued)

4. Portfolio Securities

The aggregate cost of purchases and proceeds from sales of portfolio securities (excluding short-term investments and U.S. Government securities) for the year ended March 31, 2019, were $37,220,443 and $35,459,098, respectively.

A summary of the cost of purchases and proceeds from sales of shares of affiliated investments for the year ended March 31, 2019, is presented as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value,

Beginning

of Year | | | Cost of

Purchases | | | Proceeds

from

Sales | | | Change in

Unrealized

Gain

(Loss) | | | Realized

Gain

(Loss) | | | Value,

End of

Year | | | Shares,

End of

Year | | | Income | |

| | PGIM Core Ultra Short Bond Fund | |

| $ | 390,119 | | | $ | 8,957,856 | | | $ | 9,058,879 | | | $ | — | | | $ | — | | | $ | 289,096 | | | | 289,096 | | | $ | 5,545 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the year ended March 31, 2019, no17a-7 transactions were entered into by the Fund.

5. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on theex-date.

For the year ended March 31, 2019, the tax character of dividends paid by the Fund were $664,697 of ordinary income and $433,649 of long-term capital gains. For the year ended March 31, 2018, the tax character of dividends paid by the Fund were $282,994 of ordinary income and $1,100,581 of long-term capital gains.

As of March 31, 2019, the accumulated undistributed earnings on a tax basis were $165,108 of ordinary income and $16,579 of long-term capital gains.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of March 31, 2019 were as follows:

| | | | | | |

Tax Basis | | Gross Unrealized Appreciation | | Gross Unrealized Depreciation | | Net Unrealized Appreciation |

| $22,741,564 | | $4,914,414 | | $(97,712) | | $4,816,702 |

The differences between book basis and tax basis were primarily attributable to deferred losses on wash sales.

The Manager has analyzed the Fund’s tax positions taken on federal, state and local income tax returns for all open tax years and has concluded that no provision for income tax is required in the Fund’s financial statements for the current reporting period. The Fund’s federal, state and local income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

6. Capital and Ownership

The Fund offers Class A, Class B, Class C, Class Z and Class R6 shares. Class A shares are sold with a maximumfront-end sales charge of 5.50%. Investors who purchase $1 million or more of Class A shares and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (“CDSC”) of 1%, although they are not subject to an initial sales charge. The Class A CDSC is waived for certain retirement and/or benefit plans. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class B shares are sold with a CDSC which declines from 5% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. Class B shares are closed to new purchases. Class C shares are sold with a CDSC of 1% on sales made within 12 months of purchase. Class C shares will automatically convert to Class A shares on a monthly basis approximately 10 years after purchase. Class Z and Class R6 shares are not subject to any sales or redemption charge and are available exclusively for sale to a limited group of investors.

Under certain circumstances, an exchange may be made from specified share classes of the Fund to one or more other share classes of the Fund as presented in the table of transactions in shares of beneficial interest.

The Trust has authorized an unlimited number of shares of beneficial interest at $0.001 par value per share.

As of March 31, 2019, Prudential, through its affiliated entities, including affiliated funds (if applicable), owned 1,412,228 Class Z shares and 919 Class R6 shares of the Fund. At reporting period end, two shareholders of record, each holding greater than 5% of the Fund, held 74% of the Fund’s outstanding shares, of which 68% were held by an affiliate of Prudential.

| | | | |

| PGIM US Real Estate Fund | | | 31 | |

Notes to Financial Statements(continued)

Transactions in shares of beneficial interest were as follows:

| | | | | | | | |

Class A | | Shares | | | Amount | |

Year ended March 31, 2019: | | | | | | | | |

Shares sold | | | 70,301 | | | $ | 862,796 | |

Shares issued in reinvestment of dividends and distributions | | | 16,740 | | | | 194,981 | |

Shares reacquired | | | (60,405 | ) | | | (718,202 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 26,636 | | | | 339,575 | |

Shares issued upon conversion from other share class(es) | | | 8,642 | | | | 105,884 | |

Shares reacquired upon conversion into other share class(es) | | | (31,385 | ) | | | (363,821 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 3,893 | | | $ | 81,638 | |

| | | | | | | | |

Year ended March 31, 2018: | | | | | | | | |

Shares sold | | | 31,313 | | | $ | 377,933 | |

Shares issued in reinvestment of dividends and distributions | | | 21,380 | | | | 257,483 | |

Shares reacquired | | | (100,575 | ) | | | (1,218,634 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (47,882 | ) | | | (583,218 | ) |

Shares issued upon conversion from other share class(es) | | | 1,086 | | | | 12,656 | |

Shares reacquired upon conversion into other share class(es) | | | (1,756 | ) | | | (20,301 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (48,552 | ) | | $ | (590,863 | ) |

| | | | | | | | |

Class B | | | | | | |

Year ended March 31, 2019: | | | | | | | | |

Shares sold | | | 466 | | | $ | 5,500 | |

Shares issued in reinvestment of dividends and distributions | | | 2,151 | | | | 24,624 | |

Shares reacquired | | | (20,315 | ) | | | (234,544 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (17,698 | ) | | | (204,420 | ) |

Shares reacquired upon conversion into other share class(es) | | | (8,813 | ) | | | (105,884 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (26,511 | ) | | $ | (310,304 | ) |

| | | | | | | | |

Year ended March 31, 2018: | | | | | | | | |

Shares sold | | | 854 | | | $ | 10,394 | |

Shares issued in reinvestment of dividends and distributions | | | 4,216 | | | | 49,811 | |

Shares reacquired | | | (25,271 | ) | | | (298,628 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (20,201 | ) | | | (238,423 | ) |

Shares reacquired upon conversion into other share class(es) | | | (1,106 | ) | | | (12,656 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (21,307 | ) | | $ | (251,079 | ) |

| | | | | | | | |

Class C | | | | | | |

Year ended March 31, 2019: | | | | | | | | |

Shares sold | | | 19,100 | | | $ | 229,251 | |

Shares issued in reinvestment of dividends and distributions | | | 3,327 | | | | 38,000 | |

Shares reacquired | | | (21,841 | ) | | | (251,878 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 586 | | | $ | 15,373 | |

| | | | | | | | |

Year ended March 31, 2018: | | | | | | | | |

Shares sold | | | 6,558 | | | $ | 78,894 | |

Shares issued in reinvestment of dividends and distributions | | | 5,236 | | | | 61,754 | |

Shares reacquired | | | (51,214 | ) | | | (608,394 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | (39,420 | ) | | | (467,746 | ) |

Shares reacquired upon conversion into other share class(es) | | | (3,122 | ) | | | (38,594 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (42,542 | ) | | $ | (506,340 | ) |

| | | | | | | | |

| | | | | | | | |

Class Z | | Shares | | | Amount | |

Year ended March 31, 2019: | | | | | | | | |

Shares sold | | | 162,454 | | | $ | 1,997,744 | |

Shares issued in reinvestment of dividends and distributions | | | 72,024 | | | | 839,444 | |

Shares reacquired | | | (65,531 | ) | | | (773,988 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 168,947 | | | | 2,063,200 | |

Shares issued upon conversion from other share class(es) | | | 31,332 | | | | 363,821 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 200,279 | | | $ | 2,427,021 | |

| | | | | | | | |

Year ended March 31, 2018: | | | | | | | | |

Shares sold | | | 13,610 | | | $ | 163,175 | |

Shares issued in reinvestment of dividends and distributions | | | 83,673 | | | | 1,008,990 | |

Shares reacquired | | | (73,051 | ) | | | (875,402 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | | 24,232 | | | | 296,763 | |

Shares issued upon conversion from other share class(es) | | | 4,806 | | | | 58,895 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 29,038 | | | $ | 355,658 | |

| | | | | | | | |

Class R6 | | | | | | |

Year ended March 31, 2019: | | | | | | | | |

Shares issued in reinvestment of dividends and distributions | | | 45 | | | $ | 527 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 45 | | | $ | 527 | |

| | | | | | | | |

Period ended March 31, 2018*: | | | | | | | | |

Shares sold | | | 822 | | | $ | 10,000 | |

Shares issued in reinvestment of dividends and distributions | | | 52 | | | | 626 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 874 | | | $ | 10,626 | |

| | | | | | | | |

| * | Commencement of offering was May 25, 2017. |

7. Borrowings

The Trust, on behalf of the Fund, along with other affiliated registered investment companies (the “Funds”), is a party to a Syndicated Credit Agreement (“SCA”) with a group of banks. The purpose of the SCA is to provide an alternative source of temporary funding for capital share redemptions. The SCA provides for a commitment of $900 million for the period October 4, 2018 through October 3, 2019. The Funds pay an annualized commitment fee of 0.15% of the unused portion of the SCA. The Fund’s portion of the commitment fee for the unused amount, allocated based upon a method approved by the Board, is accrued daily and paid quarterly. Prior to October 4, 2018, the Funds had another SCA that provided a commitment of $900 million and the Funds paid an annualized commitment fee of 0.15% of the unused portion of the SCA. The interest on borrowings under both SCAs is paid monthly and at a per annum interest rate based upon a contractual spread plus the higher of (1) the effective federal funds rate, (2) the1-month LIBOR rate or (3) zero percent.