UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08629

HARTFORD SERIES FUND, INC.

(Exact name of registrant as specified in charter)

P. O. Box 2999, Hartford, Connecticut 06104-2999

(Address of Principal Executive Offices)

Edward P. Macdonald, Esquire

Life Law Unit

The Hartford Financial Services Group, Inc.

200 Hopmeadow Street

Simsbury, Connecticut 06089

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (860) 843-9934

Date of fiscal year end: December 31, 2010

Date of reporting period: January 1, 2010 – December 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholder s under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | | |

| | Hartford Advisers HLS Fund | |

| | | |

| | | |

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

As 2011 begins, I’d like to thank you for investing with the Hartford HLS Funds.

One word aptly summarizes the performance of the stock market in 2010: volatility. In May, the S&P 500 Total Return Index dropped 7.99%, the worst performance for that month since 1962. In September, the S&P 500 Total Return Index rose 8.92%, the best performance for that month since 1939.

Looking at it another way, the S&P 500 Total Return Index had six months with gains or losses of 5% or more in 2010 (gains of 6.03%, 7.01%, 8.92%, and 6.68% in March, July, September, and December, respectively, and losses of -7.99% and -5.23% in May and June, respectively). Despite all the volatility, the S&P 500 Total Return Index finished 2010 with a gain of 15.06%, a positive follow-up to the gain of 26.46% in 2009.

On the domestic front, unemployment remained stubbornly high, demand for mortgages and refinancings began to increase due to historically low interest rates, corporate earnings remained robust, and the Federal Reserve initiated a policy of Quantitative Easing II ("QE II"), with the goal of providing business owners easier access to credit.

Overall, the economy has continued its path to recovery. After contracting in the final two quarters of 2008 and the first two quarters of 2009, Gross Domestic Product (a commonly used measure of economic growth) has remained positive for six consecutive quarters. The recovery is progressing, but not at a pace that’s fast enough for most Americans.

When you meet with your trusted financial professional for your next portfolio review, here are some topics you can discuss with him or her:

| • | Diversification: Is your portfolio diversified not only among stocks, bonds, and cash, but also among foreign and domestic stocks to capture potential growth in international markets? |

| • | Risk: Investors in recent years have been pouring money into bond funds at a record pace, but not all bonds are created equal. Make sure you’re investing in bonds for the right reasons, and not just because you think they’re “safe.” |

| • | Strategy: A year-end review is a great time to assess your overall portfolio strategy. You may want to talk to your advisor about flexible strategies that can adjust based on changing market conditions, position your portfolio for the economic recovery, and discuss strategies to deal with rising interest rates. |

Thank you for your continued confidence in the Hartford HLS Funds.

Jim Davey

President

Hartford HLS Funds

Jim Davey became president of the Hartford HLS Funds effective November 4, 2010.

Hartford Advisers HLS Fund

| |

| Manager Discussion (Unaudited) | 2 |

| Financial Statements | |

| 5 |

| 12 |

| 13 |

| 14 |

| 15 |

| 16 |

| 28 |

| 30 |

| 31 |

| 33 |

| 33 |

| 34 |

| 35 |

This report is prepared for the general information of contract owners and qualified retirement plan participants. It is not an offer of contracts or of qualified retirement plans. It should not be used in connection with any offer, except in conjunction with the appropriate product prospectus which contains all pertinent information including the applicable sales, administrative and other charges.

The views expressed in the Fund’s Manager Discussion under “Why did the Fund perform this way?” and “What is the outlook?” are views of the Fund’s subadviser and portfolio management team through the end of the reporting period and are subject to change based on market and other conditions.

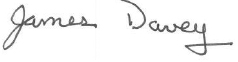

Hartford Advisers HLS Fund inception 03/31/1983

(subadvised by Wellington Management Company, LLP)

Investment objective – Seeks long-term total return.

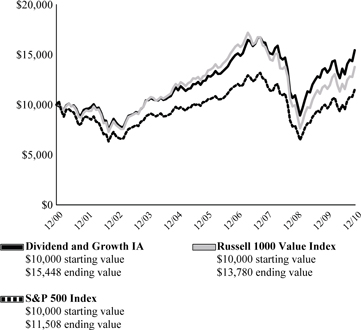

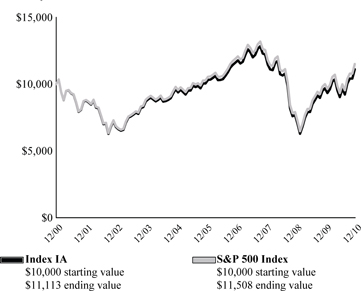

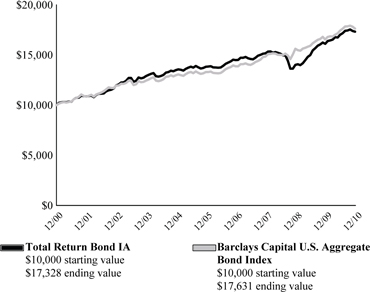

Performance Overview(1) 12/31/00 - 12/31/10

Growth of $10,000 investment

Advisers HLS Fund Blended Index is a blended index comprised of the following indices: S&P 500 Index (60%), Barclays Capital U.S. Government/ Credit Bond Index (35%) and 90 day Treasury Bill Index (5%).

Barclays Capital Government/Credit Bond Index is an unmanaged, market-value-weighted index of all debt obligations of the U.S. Treasury and U.S. Government agencies (excluding mortgage-backed securities) and of all publicly-issued fixed-rate, nonconvertible, investment grade domestic corporate debt.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

The chart represents a hypothetical investment in the Fund. Performance data represents past performance and current performance could be higher or lower.

Average Annual Returns (as of 12/31/10)

| | | 1 | | 5 | | 10 | |

| | | Year | | Year | | Year | |

| Advisers IA | | 12.14% | | 3.35% | | 2.48% | |

| Advisers IB | | 11.86% | | 3.09% | | 2.23% | |

| Advisers HLS Fund Blended Index | | 11.82% | | 3.82% | | 3.43% | |

| Barclays Capital Government/ | | | | | | | |

| Credit Bond Index | | 6.59% | | 5.56% | | 5.83% | |

| S&P 500 Index | | 15.08% | | 2.29% | | 1.41% | |

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

| (1) | Growth of a $10,000 investment in Class IB shares will vary from the results seen on this page due to differences in the expenses charged to this share class. |

Performance information may reflect historical or current expense waivers from the investment adviser, without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

The value of the contract will fluctuate so that when redeemed, it may be worth more or less than the original investment. The chart and table do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. The figures do not include sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees would lower the Fund’s performance.

| Portfolio Managers | | |

| Steve T. Irons, CFA | John C. Keogh | Peter I. Higgins, CFA |

| Senior Vice President | Senior Vice President | Senior Vice President |

| | | |

How did the Fund perform?

The Class IA shares of The Hartford Advisers HLS Fund returned 12.14% for the twelve-month period ended December 31, 2010, outperforming its blended benchmark (60% S&P 500 Index, 35% Barclays Capital Government/Credit, and 5% Treasury Bills), which returned 11.82% as well as the Barclays Capital Government/Credit Bond Index, which returned 6.59% for the same period. The Fund underperformed the S&P 500 which returned 15.08% and the 13.14% return of the average fund in the Lipper Mixed-Asset Target Allocation Growth Funds VP-UF peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

Equity markets were volatile during the period due, we believe, to significant macroeconomic concerns which included the European sovereign debt crisis and fears of a double-dip recession in the U.S. Investors regained some confidence in the second half of 2010 with two consecutive quarters of strong gains. The implementation of further

quantitative easing in the U.S., strong corporate earnings, and improving economic news out of Germany and the U.S. all served to support stocks. Equity markets as measured by the S&P 500 Index returned (15.1)% during the period. Consumer Discretionary (+28%), Industrials (+27%), and Materials (+22%) posted the largest gains while Health Care (+3%) and Utilities (+6%) gained the least.

The bond market, as measured by the Barclays Capital Government/Credit Bond Index, returned (6.6%) during the period. All risk segments of the fixed income market outperformed duration-equivalent U.S Treasuries for the period.

The Fund has three primary levers to generate investment performance: equity investments, fixed income investments, and asset allocation among stocks, bonds, and cash. During the period, the equity portion and the fixed income portions of the Fund both outperformed their respective benchmarks. Asset allocation also contributed positively to benchmark-relative (i.e. performance of the Fund as measured against the benchmark) results as the Fund was generally overweight (i.e. the Fund’s sector position was greater than the benchmark position) equities and underweight (i.e. the Fund’s sector position was less than the benchmark position) fixed income and cash relative to the benchmark.

Equity outperformance versus the benchmark was driven in part by security selection, which was strongest in Financials and Industrials. This was partially offset by weaker selection in Consumer Staples and Health Care. Sector positioning, which is a result of bottom-up (i.e. stock by stock fundamental research) security selection, also contributed positively to relative performance due to an underweight to Utilities and overweight exposures to Industrials and Consumer Discretionary.

Top contributors to benchmark relative performance of the equity portion of the Fund during the period were PACCAR (Industrials), Comcast (Consumer Discretionary), and Ford (Consumer Discretionary). PACCAR, a U.S.-based truck manufacturer, saw its shares rise after reporting improved revenue and earnings for the third quarter of 2010 which were driven by accelerating sales of trucks globally. U.S. cable communications company Comcast saw its shares rise after announcing third quarter earnings that exceeded expectations and prospects for closing the NBC deal grew clearer. Shares of automobile and truck manufacturer Ford rose after the company released strong year-over-year monthly sales increases and continued to make progress strengthening its balance sheet. The Fund’s holdings in Apple (Information Technology) and Exxon Mobil (Energy) also contributed positively to the Fund’s returns on an absolute performance (i.e. total return) basis.

Stocks that detracted the most from benchmark-relative returns in the equity portion of the Fund during the period were UCB (Health Care), Cisco Systems (Information Technology), and Medtronic (Heath Care). UCB, a U.S. biopharmaceutical company, was notified by the Food and Drug Administration that the patch version of its Parkinson's disease drug Neupro would not be approved for sale in the U.S. soon. With the company facing a delay in sales of roughly two years, shares fell. Shares of Cisco Systems, a leading supplier of networking equipment, fell on weaker than expected revenue guidance as state and local government spending slowed sharply due to budget concerns. Diversified medical device manufacturer Medtronic saw its shares fall due to a broad-based slowdown in surgical procedure volumes impacting its prospects for revenue growth. Our holdings of Microsoft (Information Technology) also detracted from absolute performance returns.

The fixed income portion of the Fund outperformed its benchmark during the period. The Fund’s overweight to and security selection within the Investment Grade corporate bond sector were the primary drivers of the outperformance. Allocations to U.S. agencies, agency mortgage-backed securities (MBS) and consumer asset-backed securities (ABS) were also additive, while yield curve and duration positioning detracted. Corporate bonds posted strong performance for the period as corporate earnings improved and demand for corporate bonds remained strong. The sector experienced large inflows as investors sought higher-yielding alternatives to low cash rates. Within the sector, improved earnings and declining loan and investment losses benefited issuers within the Financial sector where we held an overweight. During 2010, MBS was one of the best-performing investment-grade sectors. Agency MBS rallied during the last quarter of the year, boosted by slowing prepayment speeds, and higher rates, which reduced concerns of a pick-up in refinancing activity. Consumer ABS, including credit card deals, were buoyed by improving economic conditions. Limited supply and positive developments in consumer fundamentals also supported the sector.

What is the outlook?

We expect a solid year in terms of global economic growth. While much of the inventory replacement manufacturing cycle has played out, demand has steadily recovered in the developed world which, we believe will help support continued global growth. We feel that growth in the U.S. should accelerate as confidence brings job growth and we see a steadily improving consumer. We do believe the current run-up in food and energy prices is likely to slow economic growth in many emerging markets as these two items compose a significantly higher percentage of the emerging market consumers’ consumption basket than in the developed world. Global inflation and sovereign debt risks continue to be at the top of our list of concerns, but we do not see either being severe enough to throw us back into a global recession. The continuation of quantitative easing, through which the government attempts to lower interest rates by buying bonds on the open market, should help keep rates low in the near term. We believe that macroeconomic fundamentals should continue to see some improvement in 2011, although persistent high unemployment and a sluggish housing market remain headwinds.

Within the equity portion of the Fund we continue to focus our efforts on stock-by-stock fundamental research to construct a diversified large-cap core portfolio. We screen for companies on specific valuation, return on capital, and earnings characteristics and we focus on understanding how returns on capital are being created, employing a disciplined valuation methodology for both purchases and sales. At the end of the period, our bottom-up investment approach resulted in overweight exposures in Health Care, Information Technology, Consumer Discretionary, Financials, and Materials. The largest underweights of the equity portion of the Fund to the S&P 500 were in Utilities, Consumer Staples, and Telecommunication Services.

We believe that fixed income volatility in the current environment is likely to remain elevated for the foreseeable future. We believe that the Federal Reserve will keep the policy rate low and that inflation pressures within the U.S. will continue to be subdued. U.S. Treasury yields are likely to remain range bound in this scenario and, as a result, within the fixed income sleeve we are tactically managing the Fund’s duration

around neutral. Overall, we maintain a constructive view on risk assets amid an improving economic backdrop and attractive valuations.

In the fixed income portion of the Fund we ended the period with an underweight to the government sector, as we believe that there are more compelling opportunities in other sectors. Within the credit sector, we believe that valuations are relatively attractive. Corporate earnings are improving and demand for the sector remains strong. We maintained our overweight posture to the sector at the end of the period, favoring financial and BBB-rated issuers. We continue to hold Agency pass-through securities. Lastly, we believe that fundamentals for consumer ABS are stabilizing and hold exposure to the senior tranches of select credit card-backed deals.

The equity and fixed income managers will continue to work collaboratively to make decisions regarding portfolio weights in stocks, bonds, and cash. As of December 31, 2010, the Fund’s equity exposure was at 68% compared to 60% in its blended benchmark and at the upper end of the Fund’s 50-70% range.

Diversification by Industry

as of December 31, 2010

| | | Percentage of | |

| Industry (Sector) | | Net Assets | |

| Equity Securities | | | |

| Automobiles & Components (Consumer Discretionary) | | | 1.8 | % |

| Banks (Financials) | | | 3.4 | |

| Capital Goods (Industrials) | | | 4.9 | |

| Consumer Durables & Apparel (Consumer Discretionary) | | | 0.4 | |

| Consumer Services (Consumer Discretionary) | | | 0.4 | |

| Diversified Financials (Financials) | | | 6.3 | |

| Energy (Energy) | | | 7.0 | |

| Food & Staples Retailing (Consumer Staples) | | | 1.6 | |

| Food, Beverage & Tobacco (Consumer Staples) | | | 3.1 | |

| Health Care Equipment & Services (Health Care) | | | 3.0 | |

| Household & Personal Products (Consumer Staples) | | | 0.7 | |

| Insurance (Financials) | | | 1.4 | |

| Materials (Materials) | | | 2.7 | |

| Media (Consumer Discretionary) | | | 1.6 | |

| Other Investment Pools and Funds (Financials) | | | 0.7 | |

| Pharmaceuticals, Biotechnology & Life Sciences (Health Care) | | | 7.5 | |

| Retailing (Consumer Discretionary) | | | 3.9 | |

| Semiconductors & Semiconductor Equipment (Information Technology) | | | 2.5 | |

| Software & Services (Information Technology) | | | 6.5 | |

| Technology Hardware & Equipment (Information Technology) | | | 5.3 | |

| Telecommunication Services (Services) | | | 0.7 | |

| Transportation (Industrials) | | | 1.7 | |

| Utilities (Utilities) | | | 0.4 | |

| Total | | | 67.5 | % |

| Fixed Income Securities | | | | |

| Air Transportation (Transportation) | | | 0.2 | % |

| Arts, Entertainment and Recreation (Services) | | | 0.3 | |

| Beverage and Tobacco Product Manufacturing | | | | |

| (Consumer Staples) | | | 0.2 | |

| Chemical Manufacturing (Basic Materials) | | | 0.0 | |

| Finance and Insurance (Finance) | | | 8.2 | |

| Food Manufacturing (Consumer Staples) | | | 0.3 | |

| General Obligations (General Obligations) | | | 0.3 | |

| Health Care and Social Assistance (Health Care) | | | 0.5 | |

| Higher Education (Univ., Dorms, etc.) (Higher Education (Univ., Dorms, etc.)) | | | 0.2 | |

| Housing (HFA'S, etc.) (Housing (HFA'S, etc.)) | | | 0.0 | |

| Information (Technology) | | | 0.9 | |

| Machinery Manufacturing (Capital Goods) | | | 0.2 | |

| Motor Vehicle & Parts Manufacturing (Consumer Cyclical) | | | 0.3 | |

| Petroleum and Coal Products Manufacturing (Energy) | | | 0.4 | |

| Pipeline Transportation (Utilities) | | | 0.1 | |

| Retail Trade (Consumer Cyclical) | | | 0.2 | |

| Soap, Cleaning Compound and Toilet Manufacturing (Consumer Staples) | | | 0.3 | |

| Tax Allocation (Tax Allocation) | | | 0.1 | |

| Transportation (Transportation) | | | 0.3 | |

| U.S. Government Agencies (U.S. Government Agencies) | | | 1.4 | |

| U.S. Government Securities (U.S. Government Agencies) | | | 14.1 | |

| Utilities (Utilities) | | | 0.8 | |

| Utilities - Water and Sewer (Utilities - Water and Sewer) | | | 0.1 | |

| Total | | | 29.7 | % |

| Short-Term Investments | | | 2.6 | % |

| Other Assets and Liabilities | | | 0.2 | |

| Total | | | 100.0 | % |

Diversification by Security Type

as of December 31, 2010

| | | Percentage of | |

| Category | | Net Assets | |

| Equity Securities | | | |

| Common Stocks | | | 66.8 | % |

| Exchange Traded Funds | | | 0.7 | |

| Total | | | 67.5 | % |

| Fixed Income Securities | | | | |

| Asset & Commercial Mortgage Backed Securities | | | 0.8 | % |

| Corporate Bonds: Investment Grade | | | 11.8 | |

| Corporate Bonds: Non-Investment Grade | | | 0.6 | |

| Municipal Bonds | | | 1.0 | |

| U.S. Government Agencies | | | 1.4 | |

| U.S. Government Securities | | | 14.1 | |

| Total | | | 29.7 | % |

| Short-Term Investments | | | 2.6 | % |

| Other Assets and Liabilities | | | 0.2 | |

| Total | | | 100.0 | % |

Schedule of Investments

December 31, 2010

| Shares or Principal Amount | | Market Value ╪ | |

| COMMON STOCKS - 66.8% | | | |

| | | Automobiles & Components - 1.8% | | | |

| | 687 | | General Motors Co. ● | | $ | 25,319 | |

| | 896 | | Harley-Davidson, Inc. | | | 31,078 | |

| | 459 | | Johnson Controls, Inc. | | | 17,541 | |

| | | | | | | 73,938 | |

| | | | Banks - 3.4% | | | | |

| | 727 | | BB&T Corp. | | | 19,100 | |

| | 4,077 | | Mitsubishi UFJ Financial Group, Inc. † | | | 21,983 | |

| | 322 | | PNC Financial Services Group, Inc. | | | 19,522 | |

| | 2,495 | | Wells Fargo & Co. | | | 77,328 | |

| | | | | | | 137,933 | |

| | | | Capital Goods - 4.9% | | | | |

| | 361 | | 3M Co. | | | 31,129 | |

| | 546 | | European Aeronautic Defence and Space Co. N.V. † | | | 12,746 | |

| | 1,676 | | General Electric Co. | | | 30,654 | |

| | 726 | | Ingersoll-Rand plc | | | 34,206 | |

| | 947 | | Masco Corp. | | | 11,989 | |

| | 633 | | PACCAR, Inc. | | | 36,364 | |

| | 265 | | Rockwell Collins, Inc. | | | 15,450 | |

| | 1,213 | | Textron, Inc. | | | 28,685 | |

| | | | | | | 201,223 | |

| | | | Consumer Durables & Apparel - 0.4% | | | | |

| | 248 | | Stanley Black & Decker, Inc. | | | 16,557 | |

| | | | | | | | |

| | | | Consumer Services - 0.4% | | | | |

| | 359 | | DeVry, Inc. | | | 17,244 | |

| | | | | | | | |

| | | | Diversified Financials - 6.3% | | | | |

| | 1,193 | | Bank of America Corp. | | | 15,914 | |

| | 119 | | BlackRock, Inc. | | | 22,660 | |

| | 1,703 | | Citigroup, Inc. ● | | | 8,056 | |

| | 263 | | Goldman Sachs Group, Inc. | | | 44,176 | |

| | 1,103 | | Invesco Ltd. | | | 26,545 | |

| | 1,666 | | JP Morgan Chase & Co. | | | 70,659 | |

| | 737 | | SEI Investments Co. | | | 17,524 | |

| | 251 | | T. Rowe Price Group, Inc. | | | 16,180 | |

| | 111 | | UBS AG † | | | 1,814 | |

| | 2,096 | | UBS AG ADR | | | 34,529 | |

| | | | | | | 258,057 | |

| | | | Energy - 7.0% | | | | |

| | 414 | | Anadarko Petroleum Corp. | | | 31,561 | |

| | 232 | | Baker Hughes, Inc. | | | 13,275 | |

| | 237 | | BG Group plc † | | | 4,803 | |

| | 490 | | Chevron Corp. | | | 44,740 | |

| | 1,362 | | Exxon Mobil Corp. | | | 99,589 | |

| | 341 | | Occidental Petroleum Corp. | | | 33,472 | |

| | 525 | | Southwestern Energy Co. ● | | | 19,654 | |

| | 613 | | Statoilhydro ASA ADR | | | 14,559 | |

| | 299 | | Suncor Energy, Inc. | | | 11,459 | |

| | 292 | | Ultra Petroleum Corp. ● | | | 13,930 | |

| | | | | | | 287,042 | |

| | | | Food & Staples Retailing - 1.6% | | | | |

| | 1,036 | | CVS/Caremark Corp. | | | 36,022 | |

| | 1,049 | | Sysco Corp. | | | 30,837 | |

| | | | | | | 66,859 | |

| | | | Food, Beverage & Tobacco - 3.1% | | | | |

| | 101 | | Fomento Economico Mexicano S.A.B. de | | | | |

| | | | C.V. ADR | | | 5,665 | |

| | 849 | | General Mills, Inc. | | | 30,198 | |

| | 1,264 | | Kraft Foods, Inc. | | | 39,826 | |

| | 768 | | PepsiCo, Inc. | | | 50,154 | |

| | | | | | | 125,843 | |

| | | | Health Care Equipment & Services - 3.0% | | | | |

| | 2,065 | | Boston Scientific Corp. ● | | | 15,635 | |

| | 1,070 | | Medtronic, Inc. | | | 39,686 | |

| | 387 | | St. Jude Medical, Inc. ● | | | 16,540 | |

| | 859 | | UnitedHealth Group, Inc. | | | 31,022 | |

| | 334 | | Zimmer Holdings, Inc. ● | | | 17,935 | |

| | | | | | | 120,818 | |

| | | | Household & Personal Products - 0.7% | | | | |

| | 416 | | Procter & Gamble Co. | | | 26,755 | |

| | | | | | | | |

| | | | Insurance - 1.4% | | | | |

| | 234 | | ACE Ltd. | | | 14,545 | |

| | 3,007 | | Ageas † | | | 6,872 | |

| | 804 | | Marsh & McLennan Cos., Inc. | | | 21,976 | |

| | 628 | | Unum Group | | | 15,220 | |

| | | | | | | 58,613 | |

| | | | Materials - 2.7% | | | | |

| | 226 | | Airgas, Inc. | | | 14,135 | |

| | 101 | | CF Industries Holdings, Inc. | | | 13,623 | |

| | 257 | | Dow Chemical Co. | | | 8,784 | |

| | 613 | | Monsanto Co. | | | 42,668 | |

| | 119 | | Mosaic Co. | | | 9,110 | |

| | 310 | | Nucor Corp. | | | 13,567 | |

| | 69 | | Potash Corp. of Saskatchewan, Inc. | | | 10,606 | |

| | | | | | | 112,493 | |

| | | | Media - 1.6% | | | | |

| | 2,919 | | Comcast Corp. Class A | | | 64,135 | |

| | | | | | | | |

| | | | Pharmaceuticals, Biotechnology & Life Sciences - 7.5% | | | | |

| | 407 | | Amgen, Inc. ● | | | 22,339 | |

| | 388 | | Celgene Corp. ● | | | 22,952 | |

| | 1,271 | | Daiichi Sankyo Co., Ltd. † | | | 27,769 | |

| | 110 | | Forest Laboratories, Inc. ● | | | 3,531 | |

| | 214 | | Gilead Sciences, Inc. ● | | | 7,748 | |

| | 325 | | Life Technologies Corp. ● | | | 18,015 | |

| | 1,059 | | Merck & Co., Inc. | | | 38,159 | |

| | 4,191 | | Pfizer, Inc. | | | 73,376 | |

| | 135 | | Roche Holding AG † | | | 19,743 | |

| | 1,135 | | Shionogi & Co., Ltd. † | | | 22,369 | |

| | 895 | | UCB S.A. † | | | 30,748 | |

| | 541 | | Vertex Pharmaceuticals, Inc. ● | | | 18,948 | |

| | | | | | | 305,697 | |

| | | | Retailing - 3.9% | | | | |

| | 11,241 | | Buck Holdings L.P. ⌂●† | | | 25,248 | |

| | 654 | | Kohl's Corp. ● | | | 35,544 | |

| | 2,251 | | Lowe's Co., Inc. | | | 56,460 | |

| | 620 | | Nordstrom, Inc. | | | 26,292 | |

| | 741 | | Staples, Inc. | | | 16,868 | |

| | | | | | | 160,412 | |

| | | | Semiconductors & Semiconductor Equipment - 2.5% | | | | |

| | 401 | | Analog Devices, Inc. | | | 15,109 | |

| | 300 | | Broadcom Corp. Class A | | | 13,074 | |

| | 1,024 | | Intel Corp. | | | 21,537 | |

| | 1,186 | | Maxim Integrated Products, Inc. | | | 28,011 | |

The accompanying notes are an integral part of these financial statements.

| Hartford Advisers HLS Fund |

Schedule of Investments – (continued)

December 31, 2010

| Shares or Principal Amount | | Market Value ╪ | |

| COMMON STOCKS - 66.8% - (continued) | | | |

| | | Semiconductors & Semiconductor Equipment - 2.5% - (continued) | | | |

| | 685 | | Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | $ | 8,584 | |

| | 502 | | Xilinx, Inc. | | | 14,539 | |

| | | | | | | 100,854 | |

| | | | Software & Services - 6.5% | | | | |

| | 725 | | Accenture plc | | | 35,150 | |

| | 760 | | Automatic Data Processing, Inc. | | | 35,168 | |

| | 517 | | Check Point Software Technologies Ltd. ADR ● | | | 23,894 | |

| | 778 | | eBay, Inc. ● | | | 21,641 | |

| | 90 | | Google, Inc. ● | | | 53,576 | |

| | 500 | | Lender Processing Services | | | 14,757 | |

| | 1,039 | | Microsoft Corp. | | | 29,017 | |

| | 2,957 | | Western Union Co. | | | 54,910 | |

| | | | | | | 268,113 | |

| | | | Technology Hardware & Equipment - 5.3% | | | | |

| | 237 | | Apple, Inc. ● | | | 76,318 | |

| | 3,275 | | Cisco Systems, Inc. ● | | | 66,261 | |

| | 859 | | EMC Corp. ● | | | 19,664 | |

| | 1,149 | | Qualcomm, Inc. | | | 56,869 | |

| | | | | | | 219,112 | |

| | | | Telecommunication Services - 0.7% | | | | |

| | 1,108 | | Vodafone Group plc ADR | | | 29,277 | |

| | | | | | | | |

| | | | Transportation - 1.7% | | | | |

| | 149 | | FedEx Corp. | | | 13,861 | |

| | 464 | | Kansas City Southern ● | | | 22,226 | |

| | 491 | | United Parcel Service, Inc. Class B | | | 35,644 | |

| | | | | | | 71,731 | |

| | | | Utilities - 0.4% | | | | |

| | 271 | | NextEra Energy, Inc. | | | 14,074 | |

| | | | | | | | |

| | | | Total common stocks | | | | |

| | | | (cost $2,337,509) | | $ | 2,736,780 | |

| | | | | | | | |

| EXCHANGE TRADED FUNDS - 0.7% | | | | |

| | | | Other Investment Pools and Funds - 0.7% | | | | |

| | 236 | | S&P 500 Depositary Receipt | | | 29,634 | |

| | | | | | | | |

| | | | Total exchange traded funds | | | | |

| | | | (cost $27,290) | | $ | 29,634 | |

| | | | | | | | |

| ASSET & COMMERCIAL MORTGAGE BACKED SECURITIES - 0.8 % | | | | |

| | | | Finance and Insurance - 0.8% | | | | |

| | | | Bear Stearns Commercial Mortgage Securities, Inc. | | | | |

| $ | 423 | | 5.61%, 11/15/2033 | | $ | 430 | |

| | | | Citibank Credit Card Issuance Trust | | | | |

| | 11,945 | | 5.65%, 09/20/2019 | | | 13,584 | |

| | | | Commercial Mortgage Asset Trust | | | | |

| | 84 | | 6.64%, 01/17/2032 | | | 84 | |

| | | | CS First Boston Mortgage Securities Corp. | | | | |

| | 450 | | 3.94%, 05/15/2038 | | | 467 | |

| | | | Goldman Sachs Mortgage Securities Corp. II | | | | |

| | 110 | | 0.79%, 03/06/2020 ■Δ | | | 100 | |

| | | | Harley-Davidson Motorcycle Trust | | | | |

| | 6,565 | | 5.21%, 06/17/2013 | | | 6,701 | |

| | | | Marriott Vacation Club Owner Trust | | | | |

| | 626 | | 5.36%, 10/20/2028 ■ | | | 653 | |

| | | | New Century Home Equity Loan Trust | | | | |

| | 8 | | 0.55%, 03/25/2035 Δ | | | 7 | |

| | | | Prudential Commercial Mortgage Trust | | | | |

| | 570 | | 4.49%, 02/11/2036 | | | 597 | |

| | | | USAA Automotive Owner Trust | | | | |

| | 10,275 | | 4.50%, 10/15/2013 | | | 10,509 | |

| | | | | | | 33,132 | |

| | | | Total asset & commercial mortgage backed securities | | | | |

| | | | (cost $30,992) | | $ | 33,132 | |

| | | | | | | | |

| CORPORATE BONDS: INVESTMENT GRADE - 11.8% | | | | |

| | | | Air Transportation - 0.2% | | | | |

| | | | Continental Airlines, Inc. | | | | |

| $ | 3,994 | | 5.98%, 04/19/2022 | | $ | 4,213 | |

| | | | Southwest Airlines Co. | | | | |

| | 2,700 | | 5.75%, 12/15/2016 | | | 2,859 | |

| | 3,106 | | 6.15%, 08/01/2022 | | | 3,417 | |

| | | | | | | 10,489 | |

| | | | Arts, Entertainment and Recreation - 0.3% | | | | |

| | | | CBS Corp. | | | | |

| | 575 | | 5.75%, 04/15/2020 | | | 611 | |

| | | | Comcast Corp. | | | | |

| | 8,000 | | 5.90%, 03/15/2016 | | | 8,956 | |

| | | | News America Holdings, Inc. | | | | |

| | 1,275 | | 5.65%, 08/15/2020 | | | 1,430 | |

| | | | | | | 10,997 | |

| | | | Beverage and Tobacco Product Manufacturing - 0.2% | | | | |

| | | | Anheuser-Busch InBev N.V. | | | | |

| | 4,200 | | 7.75%, 01/15/2019 ■ | | | 5,226 | |

| | | | Cia Brasileira de Bebidas | | | | |

| | 300 | | 10.50%, 12/15/2011 | | | 323 | |

| | | | Coca-Cola Enterprises, Inc. | | | | |

| | 500 | | 8.50%, 02/01/2022 | | | 689 | |

| | | | Diageo Capital plc | | | | |

| | 430 | | 5.20%, 01/30/2013 | | | 464 | |

| | | | Philip Morris International, Inc. | | | | |

| | 270 | | 5.65%, 05/16/2018 | | | 304 | |

| | | | | | | 7,006 | |

| | | | Chemical Manufacturing - 0.0% | | | | |

| | | | Agrium, Inc. | | | | |

| | 660 | | 6.13%, 01/15/2041 | | | 699 | |

| | | | | | | | |

| | | | Computer and Electronic Product Manufacturing - 0.1% | | | | |

| | | | Dell, Inc. | | | | |

| | 2,735 | | 5.88%, 06/15/2019 | | | 2,993 | |

| | | | Thermo Fisher Scientific, Inc. | | | | |

| | 845 | | 3.20%, 05/01/2015 | | | 864 | |

| | | | | | | 3,857 | |

The accompanying notes are an integral part of these financial statements.

| Shares or Principal Amount | | Market Value ╪ | |

| CORPORATE BONDS: INVESTMENT GRADE - 11.8% - (continued) | | | |

| | | Electrical Equipment, Appliance Manufacturing - 0.2% | | | |

| | | General Electric Co. | | | |

| $ | 6,925 | | 5.00%, 02/01/2013 | | $ | 7,403 | |

| | | | | | | | |

| | | | Finance and Insurance - 6.8% | | | | |

| | | | Ace INA Holdings, Inc. | | | | |

| | 700 | | 5.88%, 06/15/2014 | | | 785 | |

| | | | American Express Centurion Bank | | | | |

| | 6,350 | | 6.00%, 09/13/2017 | | | 7,076 | |

| | | | ANZ National Ltd. | | | | |

| | 1,360 | | 2.38%, 12/21/2012 ■ | | | 1,381 | |

| | | | Bank of America Corp. | | | | |

| | 200 | | 7.38%, 05/15/2014 | | | 222 | |

| | | | Berkshire Hathaway Finance Corp. | | | | |

| | 5,500 | | 4.85%, 01/15/2015 | | | 6,015 | |

| | | | BP Capital Markets plc | | | | |

| | 2,850 | | 4.75%, 03/10/2019 | | | 2,938 | |

| | | | Brandywine Operating Partnership | | | | |

| | 3,210 | | 6.00%, 04/01/2016 | | | 3,316 | |

| | | | CDP Financial, Inc. | | | | |

| | 3,475 | | 4.40%, 11/25/2019 ■ | | | 3,533 | |

| | | | Citibank NA | | | | |

| | 26,000 | | 1.88%, 06/04/2012 | | | 26,456 | |

| | | | Citigroup, Inc. | | | | |

| | 8,800 | | 6.00%, 10/31/2033 | | | 8,238 | |

| | 2,700 | | 6.13%, 05/15/2018 | | | 2,958 | |

| | 1,700 | | 6.88%, 03/05/2038 | | | 1,886 | |

| | 520 | | 8.13%, 07/15/2039 | | | 661 | |

| | | | COX Communications, Inc. | | | | |

| | 440 | | 4.63%, 06/01/2013 | | | 471 | |

| | 9,000 | | 5.45%, 12/15/2014 | | | 9,908 | |

| | | | Credit Agricole | | | | |

| | 3,950 | | 3.50%, 04/13/2015 ■ | | | 3,976 | |

| | | | Eaton Vance Corp. | | | | |

| | 3,305 | | 6.50%, 10/02/2017 | | | 3,747 | |

| | | | Everest Reinsurance Holdings, Inc. | | | | |

| | 4,525 | | 5.40%, 10/15/2014 | | | 4,772 | |

| | | | General Electric Capital Corp. | | | | |

| | 4,300 | | 4.38%, 09/16/2020 | | | 4,232 | |

| | 5,000 | | 5.88%, 01/14/2038 | | | 5,190 | |

| | | | Goldman Sachs Group, Inc. | | | | |

| | 20,000 | | 1.63%, 07/15/2011 | | | 20,143 | |

| | 6,000 | | 5.63%, 01/15/2017 | | | 6,345 | |

| | 5,500 | | 6.00%, 05/01/2014 | | | 6,059 | |

| | 1,700 | | 6.15%, 04/01/2018 | | | 1,872 | |

| | | | Health Care Properties | | | | |

| | 4,230 | | 6.00%, 01/30/2017 | | | 4,424 | |

| | | | HSBC Holdings plc | | | | |

| | 240 | | 0.49%, 10/06/2016 Δ | | | 230 | |

| | | | Jackson National Life Insurance Co. | | | | |

| | 6,250 | | 8.15%, 03/15/2027 ■ | | | 6,717 | |

| | | | JP Morgan Chase & Co. | | | | |

| | 3,500 | | 3.70%, 01/20/2015 | | | 3,622 | |

| | 2,000 | | 4.95%, 03/25/2020 | | | 2,053 | |

| | 10,375 | | 5.13%, 09/15/2014 | | | 11,040 | |

| | | | Kimco Realty Corp. | | | | |

| | 4,380 | | 5.78%, 03/15/2016 | | | 4,766 | |

| | | | Liberty Mutual Group, Inc. | | | | |

| | 6,050 | | 5.75%, 03/15/2014 ■ | | | 6,293 | |

| | | | Liberty Property L.P. | | | | |

| | 1,725 | | 6.63%, 10/01/2017 | | | 1,954 | |

| | | | Merrill Lynch & Co., Inc. | | | | |

| | 11,000 | | 5.00%, 02/03/2014 | | | 11,384 | |

| | 1,000 | | 6.40%, 08/28/2017 | | | 1,057 | |

| | 6,000 | | 6.88%, 04/25/2018 | | | 6,566 | |

| | | | Morgan Stanley | | | | |

| | 13,000 | | 5.38%, 10/15/2015 | | | 13,655 | |

| | 250 | | 5.63%, 09/23/2019 | | | 255 | |

| | | | National City Corp. | | | | |

| | 4,250 | | 6.88%, 05/15/2019 | | | 4,772 | |

| | | | New England Mutual Life Insurance Co. | | | | |

| | 6,000 | | 7.88%, 02/15/2024 ■ | | | 6,921 | |

| | | | Nordea Bank Ab | | | | |

| | 1,790 | | 3.70%, 11/13/2014 ■ | | | 1,845 | |

| | | | Prudential Financial, Inc. | | | | |

| | 8,000 | | 5.50%, 03/15/2016 | | | 8,562 | |

| | | | Rabobank Nederland N.V. NY | | | | |

| | 3,900 | | 3.20%, 03/11/2015 ■ | | | 3,970 | |

| | | | Realty Income Corp. | | | | |

| | 2,830 | | 6.75%, 08/15/2019 | | | 3,198 | |

| | | | Republic New York Capital I | | | | |

| | 500 | | 7.75%, 11/15/2026 | | | 511 | |

| | | | Royal Bank of Scotland plc | | | | |

| | 2,600 | | 4.88%, 03/16/2015 | | | 2,660 | |

| | | | Simon Property Group L.P. | | | | |

| | 4,565 | | 6.10%, 05/01/2016 | | | 5,117 | |

| | | | Sovereign Bancorp, Inc. | | | | |

| | 4,795 | | 8.75%, 05/30/2018 | | | 5,229 | |

| | | | Sovereign Capital Trust IV | | | | |

| | 7,250 | | 7.91%, 06/13/2036 | | | 7,465 | |

| | | | Svenska Handelsbanken Ab | | | | |

| | 2,900 | | 4.88%, 06/10/2014 ■ | | | 3,083 | |

| | | | UBS AG Stamford | | | | |

| | 235 | | 5.88%, 12/20/2017 | | | 259 | |

| | | | UnitedHealth Group, Inc. | | | | |

| | 1,891 | | 5.50%, 11/15/2012 | | | 2,027 | |

| | | | Wachovia Corp. | | | | |

| | 10,000 | | 5.25%, 08/01/2014 | | | 10,665 | |

| | 2,000 | | 5.75%, 06/15/2017 | | | 2,214 | |

| | | | WEA Finance LLC | | | | |

| | 2,850 | | 7.13%, 04/15/2018 ■ | | | 3,279 | |

| | | | | | | 277,973 | |

| | | | Food Manufacturing - 0.3% | | | | |

| | | | Kellogg Co. | | | | |

| | 3,900 | | 4.00%, 12/15/2020 | | | 3,846 | |

| | 430 | | 4.25%, 03/06/2013 | | | 457 | |

| | 325 | | 5.13%, 12/03/2012 | | | 348 | |

| | | | Kraft Foods, Inc. | | | | |

| | 3,800 | | 4.13%, 02/09/2016 | | | 3,989 | |

| | 285 | | 5.38%, 02/10/2020 | | | 307 | |

| | | | Wrigley Jr., William Co. | | | | |

| | 3,900 | | 3.70%, 06/30/2014 ■ | | | 4,017 | |

| | | | | | | 12,964 | |

| | | | Health Care and Social Assistance - 0.5% | | | | |

| | | | CVS Corp. | | | | |

| | 7,725 | | 6.13%, 08/15/2016 | | | 8,765 | |

| | | | Express Scripts, Inc. | | | | |

| | 1,020 | | 6.25%, 06/15/2014 | | | 1,140 | |

The accompanying notes are an integral part of these financial statements.

| Hartford Advisers HLS Fund |

Schedule of Investments – (continued)

December 31, 2010

| Shares or Principal Amount | | Market Value ╪ | |

| CORPORATE BONDS: INVESTMENT GRADE - 11.8% - (continued) | | | |

| | | Health Care and Social Assistance - 0.5% - (continued) | | | |

| | | Merck & Co., Inc. | | | |

| $ | 2,100 | | 4.00%, 06/30/2015 | | $ | 2,253 | |

| | | | Schering-Plough Corp. | | | | |

| | 9,000 | | 5.30%, 12/01/2013 | | | 9,997 | |

| | | | | | | 22,155 | |

| | | | Information - 0.9% | | | | |

| | | | AT&T, Inc. | | | | |

| | 2,300 | | 2.50%, 08/15/2015 | | | 2,292 | |

| | 2,510 | | 6.80%, 05/15/2036 ‡ | | | 2,780 | |

| | | | BellSouth Telecommunications | | | | |

| | 650 | | 7.00%, 12/01/2095 | | | 664 | |

| | | | Cellco Partnership - Verizon Wireless Capital | | | | |

| | 395 | | 5.55%, 02/01/2014 | | | 435 | |

| | | | Fiserv, Inc. | | | | |

| | 3,510 | | 6.13%, 11/20/2012 | | | 3,796 | |

| | | | France Telecom S.A. | | | | |

| | 1,300 | | 4.38%, 07/08/2014 | | | 1,389 | |

| | | | Intuit, Inc. | | | | |

| | 7,900 | | 5.40%, 03/15/2012 | | | 8,273 | |

| | | | Oracle Corp. | | | | |

| | 2,850 | | 6.13%, 07/08/2039 | | | 3,198 | |

| | | | SBA Tower Trust | | | | |

| | 2,035 | | 4.25%, 04/15/2015 ■ | | | 2,106 | |

| | | | Telecom Italia Capital | | | | |

| | 2,900 | | 7.00%, 06/04/2018 | | | 3,071 | |

| | | | Time Warner Cable, Inc. | | | | |

| | 4,870 | | 5.85%, 05/01/2017 | | | 5,434 | |

| | | | Verizon Communications, Inc. | | | | |

| | 240 | | 4.35%, 02/15/2013 | | | 255 | |

| | 5,000 | | 5.35%, 02/15/2011 | | | 5,028 | |

| | | | Verizon New England, Inc. | | | | |

| | 375 | | 6.50%, 09/15/2011 | | | 390 | |

| | | | | | | 39,111 | |

| | | | Machinery Manufacturing - 0.2% | | | | |

| | | | Xerox Corp. | | | | |

| | 6,000 | | 8.25%, 05/15/2014 | | | 7,004 | |

| | | | | | | | |

| | | | Motor Vehicle & Parts Manufacturing - 0.3% | | | | |

| | | | DaimlerChrysler NA Holdings Corp. | | | | |

| | 9,550 | | 6.50%, 11/15/2013 | | | 10,811 | |

| | | | | | | | |

| | | | Petroleum and Coal Products Manufacturing - 0.4% | | | | |

| | | | Atmos Energy Corp. | | | | |

| | 5,875 | | 6.35%, 06/15/2017 | | | 6,476 | |

| | | | EnCana Corp. | | | | |

| | 305 | | 5.90%, 12/01/2017 | | | 347 | |

| | | | Motiva Enterprises LLC | | | | |

| | 420 | | 5.75%, 01/15/2020 ■ | | | 471 | |

| | | | Ras Laffan Liquefied Natural Gas Co., Ltd. | | | | |

| | 1,200 | | 5.50%, 09/30/2014 ■ | | | 1,292 | |

| | | | Shell International Finance B.V. | | | | |

| | 6,400 | | 4.38%, 03/25/2020 | | | 6,713 | |

| | | | | | | 15,299 | |

| | | | Pipeline Transportation - 0.1% | | | | |

| | | | Kinder Morgan Energy Partners L.P. | | | | |

| | 5,000 | | 6.95%, 01/15/2038 | | | 5,433 | |

| | | | | | | | |

| | | | Retail Trade - 0.2% | | | | |

| | | | Lowe's Co., Inc. | | | | |

| | 3,400 | | 4.63%, 04/15/2020 | | | 3,584 | |

| | | | Staples, Inc. | | | | |

| | 2,525 | | 9.75%, 01/15/2014 | | | 3,060 | |

| | | | | | | 6,644 | |

| | | | Soap, Cleaning Compound and Toilet Manufacturing - 0.3 % | | | | |

| | | | Procter & Gamble Co. | | | | |

| | 10,641 | | 9.36%, 01/01/2021 | | | 13,360 | |

| | | | | | | | |

| | | | Utilities - 0.8% | | | | |

| | | | Consolidated Edison Co. of NY | | | | |

| | 4,605 | | 5.30%, 12/01/2016 | | | 5,171 | |

| | | | Enel Finance International S.A. | | | | |

| | 300 | | 3.88%, 10/07/2014 ■ | | | 305 | |

| | | | Indianapolis Power and Light | | | | |

| | 8,000 | | 6.60%, 06/01/2037 ■ | | | 8,743 | |

| | | | MidAmerican Energy Co. | | | | |

| | 6,000 | | 5.65%, 07/15/2012 | | | 6,411 | |

| | | | Niagara Mohawk Power Corp. | | | | |

| | 2,510 | | 3.55%, 10/01/2014 ■ | | | 2,608 | |

| | | | Southern California Edison Co. | | | | |

| | 8,000 | | 5.55%, 01/15/2037 | | | 8,337 | |

| | | | Wisconsin Electirc Power Co. | | | | |

| | 1,960 | | 4.25%, 12/15/2019 | | | 2,019 | |

| | | | | | | 33,594 | |

| | | | Total corporate bonds: investment grade | | | | |

| | | | (cost $455,263) | | $ | 484,799 | |

| | | | | | | | |

| CORPORATE BONDS: NON-INVESTMENT GRADE - 0.6% | | | | |

| | | | Finance and Insurance - 0.6% | | | | |

| | | | Capital One Capital IV | | | | |

| $ | 1,625 | | 6.75%, 02/17/2037 | | $ | 1,605 | |

| | | | Discover Financial Services, Inc. | | | | |

| | 3,620 | | 6.45%, 06/12/2017 | | | 3,769 | |

| | | | Postal Square L.P. | | | | |

| | 14,885 | | 8.95%, 06/15/2022 | | | 19,265 | |

| | | | Southern Capital Corp. | | | | |

| | 58 | | 5.70%, 06/30/2022 ■ | | | 51 | |

| | | | | | | 24,690 | |

| | | | Total corporate bonds: non-investment grade | | | | |

| | | | (cost $21,946) | | $ | 24,690 | |

| | | | | | | | |

| MUNICIPAL BONDS - 1.0% | | | | |

| | | | General Obligations - 0.3% | | | | |

| | | | Chicago Metropolitan Water Reclamation Dist, | | | | |

| $ | 685 | | 5.72%, 12/01/2038 | | $ | 681 | |

| | | | Los Angeles USD, | | | | |

| | 4,300 | | 5.75%, 07/01/2034 | | | 4,016 | |

| | | | Oregon School Boards Association, Taxable Pension, | | | | |

| | 10,000 | | 4.76%, 06/30/2028 | | | 8,894 | |

| | | | | | | 13,591 | |

| | | | Higher Education (Univ., Dorms, etc.) - 0.2% | | | | |

| | | | Curators University, MO, Taxable System Facs Rev, | | | | |

| | 2,170 | | 5.96%, 11/01/2039 | | | 2,237 | |

The accompanying notes are an integral part of these financial statements.

| Shares or Principal Amount | | Market Value ╪ | |

| MUNICIPAL BONDS - 1.0% - (continued) | | | |

| | | Higher Education (Univ., Dorms, etc.) - 0.2% - (continued) | | | |

| | | Massachusetts School Building Auth, | | | |

| $ | 2,500 | | 5.72%, 08/15/2039 | | $ | 2,594 | |

| | | | University of California, | | | | |

| | 1,960 | | 5.77%, 05/15/2043 | | | 1,846 | |

| | | | | | | 6,677 | |

| | | | Housing (HFA'S, etc.) - 0.0% | | | | |

| | | | University of California, | | | | |

| | 1,935 | | 6.58%, 05/15/2049 | | | 1,891 | |

| | | | | | | | |

| | | | Tax Allocation - 0.1% | | | | |

| | | | Dallas, TX, Area Rapid Transit Taxable Sales Tax Rev, | | | | |

| | 2,200 | | 6.00%, 12/01/2044 | | | 2,282 | |

| | | | | | | | |

| | | | Transportation - 0.3% | | | | |

| | | | Bay Area Toll Auth, | | | | |

| | 3,100 | | 6.26%, 04/01/2049 | | | 3,063 | |

| | | | Illinois State Toll Highway Auth, Taxable Rev, | | | | |

| | 1,875 | | 6.18%, 01/01/2034 | | | 1,836 | |

| | | | Maryland State Transit Auth, | | | | |

| | 1,350 | | 5.89%, 07/01/2043 | | | 1,400 | |

| | | | New York and New Jersey PA, Taxable Rev, | | | | |

| | 975 | | 5.86%, 12/01/2024 | | | 991 | |

| | 570 | | 6.04%, 12/01/2029 | | | 566 | |

| | | | North Texas Tollway Auth Rev, | | | | |

| | 3,400 | | 6.72%, 01/01/2049 | | | 3,329 | |

| | | | | | | 11,185 | |

| | | | Utilities - Water and Sewer - 0.1% | | | | |

| | | | Irvine Ranch, CA, Water Dist, | | | | |

| | 2,870 | | 2.61%, 03/15/2014 | | | 2,914 | |

| | | | | | | | |

| | | | Total municipal bonds | | | | |

| | | | (cost $39,999) | | $ | 38,540 | |

| | | | | | | | |

| U.S. GOVERNMENT AGENCIES - 1.4% | | | | |

| | | | Federal Home Loan Mortgage Corporation - 1.0% | | | | |

| $ | 36,000 | | 0.05%, 01/15/2040 ☼ | | $ | 35,736 | |

| | 1,232 | | 0.61%, 11/15/2036 Δ | | | 1,234 | |

| | 197 | | 2.46%, 04/01/2029 Δ | | | 203 | |

| | | | | | | 37,173 | |

| | | | Federal National Mortgage Association - 0.2% | | | | |

| | 255 | | 0.66%, 06/25/2036 Δ | | | 256 | |

| | 525 | | 2.75%, 02/05/2014 | | | 549 | |

| | 898 | | 4.78%, 02/01/2014 | | | 963 | |

| | 1,438 | | 4.97%, 12/01/2013 Δ | | | 1,546 | |

| | 335 | | 5.00%, 02/01/2019 - 04/01/2019 | | | 359 | |

| | 28 | | 6.50%, 11/01/2013 | | | 31 | |

| | 3 | | 7.00%, 02/01/2029 | | | 4 | |

| | | | | | | 3,708 | |

| | | | Government National Mortgage Association - 0.2% | | | | |

| | 4,978 | | 6.00%, 06/15/2024 - 06/15/2035 | | | 5,502 | |

| | 1,592 | | 6.50%, 03/15/2026 - 02/15/2035 | | | 1,810 | |

| | 6,553 | | 7.00%, 11/15/2031 - 11/15/2033 | | | 7,480 | |

| | 306 | | 7.50%, 09/16/2035 | | | 351 | |

| | 1,159 | | 8.00%, 09/15/2026 - 02/15/2031 | | | 1,327 | |

| | 78 | | 9.00%, 06/20/2016 - 06/15/2022 | | | 84 | |

| | | | | | | 16,554 | |

| | | | Total U.S. government agencies | | | | |

| | | | (cost $55,315) | | $ | 57,435 | |

| | | | | | | | |

| U.S. GOVERNMENT SECURITIES - 14.1% | | | | |

| | | | Other Direct Federal Obligations - 3.2% | | | | |

| | | | Federal Financing Corporation - 0.4% | | | | |

| $ | 6,500 | | 5.24%, 12/06/2013 ○ | | $ | 6,232 | |

| | 11,117 | | 5.25%, 12/27/2013 ○ | | | 10,639 | |

| | | | | | | 16,871 | |

| | | | Tennessee Valley Authority - 2.8% | | | | |

| | 54,300 | | 4.38%, 06/15/2015 | | | 59,609 | |

| | 50,000 | | 6.00%, 03/15/2013 | | | 55,600 | |

| | | | | | | 115,209 | |

| | | | | | | 132,080 | |

| | | | U.S. Treasury Securities - 10.9% | | | | |

| | | | U.S. Treasury Bonds - 2.7% | | | | |

| | 22,000 | | 4.38%, 02/15/2038 | | | 22,234 | |

| | 32,853 | | 4.38%, 11/15/2039 - 05/15/2040 | | | 33,024 | |

| | 1,100 | | 4.50%, 05/15/2038 □ | | | 1,133 | |

| | 100 | | 5.38%, 02/15/2031 | | | 117 | |

| | 18,000 | | 6.00%, 02/15/2026 | | | 22,255 | |

| | 25,650 | | 6.25%, 08/15/2023 ‡ | | | 32,239 | |

| | | | | | | 111,002 | |

| | | | U.S. Treasury Notes - 8.2% | | | | |

| | 15,000 | | 1.00%, 09/30/2011 | | | 15,081 | |

| | 18,000 | | 1.13%, 12/15/2012 | | | 18,185 | |

| | 119,000 | | 1.25%, 10/31/2015 | | | 115,170 | |

| | 40,900 | | 1.38%, 05/15/2012 - 01/15/2013 | | | 41,464 | |

| | 23,000 | | 2.75%, 02/15/2019 | | | 22,704 | |

| | 75 | | 3.13%, 04/30/2013 | | | 79 | |

| | 68,090 | | 3.50%, 05/15/2020 | | | 69,750 | |

| | 25,000 | | 3.88%, 05/15/2018 ‡ | | | 26,898 | |

| | 13,000 | | 4.25%, 08/15/2013 | | | 14,154 | |

| | 9,950 | | 4.75%, 05/31/2012 ‡ | | | 10,557 | |

| | | | | | | 334,042 | |

| | | | | | | 445,044 | |

| | | | Total U.S. government securities | | | | |

| | | | (cost $560,963) | | $ | 577,124 | |

| | | | | | | | |

| | | | Total long-term investments | | | | |

| | | | (cost $3,529,277) | | $ | 3,982,134 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS - 2.6% | | | | |

| | | | Repurchase Agreements - 2.6% | | | | |

| | | | Bank of America Merrill Lynch TriParty | | | | |

| | | | Joint Repurchase Agreement (maturing on | | | | |

| | | | 01/03/2011 in the amount of $8,050, | | | | |

| | | | collateralized by FNMA 5.50%, 2038, | | | | |

| | | | value of $8,211) | | | | |

| $ | 8,050 | | 0.20%, 12/31/2010 | | $ | 8,050 | |

The accompanying notes are an integral part of these financial statements.

| Hartford Advisers HLS Fund |

Schedule of Investments – (continued)

December 31, 2010

| Shares or Principal Amount | | | | | Market Value ╪ | |

| SHORT-TERM INVESTMENTS - 2.6% - (continued) | | | | | | | |

| | | Repurchase Agreements - 2.6% - (continued) | | | | | | | |

| | | Barclays Capital TriParty Joint Repurchase | | | | | | | |

| | | Agreement (maturing on 01/03/2011 in the | | | | | | | |

| | | amount of $66,318, collateralized by U.S. | | | | | | | |

| | | Treasury Note 0.88% - 2.13%, 2012 - | | | | | | | |

| | | 2015, value of $67,644) | | | | | | | |

| $ | 66,318 | | 0.20%, 12/31/2010 | | | | | | $ | 66,318 | |

| | | | Deutsche Bank Securities TriParty Joint | | | | | | | | |

| | | | Repurchase Agreement (maturing on | | | | | | | | |

| | | | 01/03/2011 in the amount of $30,284, | | | | | | | | |

| | | | collateralized by GNMA 4.00% - 6.00%, | | | | | | | | |

| | | | 2035 - 2040, value of $30,889) | | | | | | | | |

| | 30,284 | | 0.28%, 12/31/2010 | | | | | | | 30,284 | |

| | | | UBS Securities, Inc. Joint Repurchase | | | | | | | | |

| | | | Agreement (maturing on 01/03/2011 in the | | | | | | | | |

| | | | amount of $287, collateralized by U.S. | | | | | | | | |

| | | | Treasury Note 2.75%, 2019, value of | | | | | | | | |

| | | | $ 294 ) | | | | | | | | |

| | 287 | | 0.20%, 12/31/2010 | | | | | | | 287 | |

| | | | | | | | | | | 104,939 | |

| | | | Total short-term investments | | | | | | | | |

| | | | (cost $104,939) | | | | | | $ | 104,939 | |

| | | | | | | | | | | | |

| | | | Total investments | | | | | | | | |

| | | | (cost $3,634,216) ▲ | | | 99.8 | % | | $ | 4,087,073 | |

| | | | Other assets and liabilities | | | 0.2 | % | | | 9,079 | |

| | | | Total net assets | | | 100.0 | % | | $ | 4,096,152 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. Market value of investments in foreign securities represents 7.8% of total net assets at December 31, 2010. |

| | Prices of foreign equities that are principally traded on certain foreign markets are adjusted daily pursuant to a fair value pricing service approved by the Board of Directors in order to reflect an adjustment for factors occurring after the close of certain foreign markets but before the close of the New York Stock Exchange. |

| ▲ | At December 31, 2010, the cost of securities for federal income tax purposes was $3,683,408 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 490,030 | |

| Unrealized Depreciation | | | (86,365 | ) |

| Net Unrealized Appreciation | | $ | 403,665 | |

| † | The aggregate value of securities valued in good faith at fair value as determined under policies and procedures established by and under the supervision of the Fund's Board of Directors at December 31, 2010, was $174,095, which represents 4.25% of total net assets. This amount excludes securities that are principally traded in certain foreign markets and whose prices are adjusted pursuant to a third party pricing service methodology approved by the Board of Directors. |

| ● | Currently non-income producing. |

| ‡ | This security, or a portion of this security, has been segregated to cover funding requirements on investment transactions settling in the future. |

| Δ | Variable rate securities; the rate reported is the coupon rate in effect at December 31, 2010. |

| ■ | Securities issued within terms of a private placement memorandum, exempt from registration under Rule 144A under the Securities Act of 1933, as amended, and may be sold only to qualified institutional buyers. Pursuant to guidelines adopted by the Board of Directors, these issues are determined to be liquid. At December 31, 2010, the aggregate value of these securities was $66,570, which represents 1.63% of total net assets. |

The accompanying notes are an integral part of these financial statements.

☼ | The cost of securities purchased on a when-issued, delayed delivery or delayed draw basis at December 31, 2010 was $35,452. |

| ○ | The interest rate disclosed for these securities represents the effective yield on the date of the acquisition. |

| □ | Security pledged as initial margin deposit for open futures contracts at December 31, 2010 as follows: |

| | | | | | | | | | | | | | | Unrealized | |

| | | Number of | | | | Expiration | | | | | Notional | | | Appreciation/ | |

| Description | | Contracts* | | Position | | Date | | Market Value ╪ | | | Amount | | | (Depreciation) | |

| 10 Year U.S. Treasury Note | | | 300 | | Short | | 03/22/2011 | | $ | 36,131 | | | $ | 36,767 | | | $ | 636 | |

| | * | The number of contracts does not omit 000's. |

| ⌂ | The following securities are considered illiquid. Illiquid securities are often purchased in private placement transactions, are often not registered under the Securities Act of 1933 and may have contractual restrictions on resale. A security may also be considered illiquid if the security lacks a readily available market or if its valuation has not changed for a certain period of time. |

| Period Acquired | | | Shares/ Par | | Security | | Cost Basis | |

| 06/2007 | | | | 11,241 | | Buck Holdings L.P. | | $ | 8,617 | |

The aggregate value of these securities at December 31, 2010, was $25,248, which represents 0.62% of total net assets.

| | USD | – United School District |

Foreign Currency Contracts Outstanding at December 31, 2010

| | | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | Contract | | | | Appreciation/ | |

| Description | | Counterparty | | Buy / Sell | | Market Value ╪ | | | Amount | | Delivery Date | | (Depreciation) | |

| British Pound | | CS First Boston | | Sell | | $ | 56 | | | $ | 56 | | 01/04/2011 | | $ | – | |

| Euro | | State Street Global Markets LLC | | Sell | | | 324 | | | | 321 | | 01/04/2011 | | | (3 | ) |

| Japanese Yen | | BNP Paribas Securities | | Buy | | | 21,724 | | | | 20,605 | | 09/02/2011 | | | 1,119 | |

| Japanese Yen | | Citibank | | Sell | | | 25,510 | | | | 25,422 | | 10/21/2011 | | | (88 | ) |

| Japanese Yen | | CS First Boston | | Sell | | | 340 | | | | 336 | | 01/05/2011 | | | (4 | ) |

| Japanese Yen | | CS First Boston | | Sell | | | 92 | | | | 91 | | 01/06/2011 | | | (1 | ) |

| Japanese Yen | | Goldman Sachs | | Buy | | | 25,502 | | | | 24,185 | | 09/02/2011 | | | 1,317 | |

| Japanese Yen | | Goldman Sachs | | Sell | | | 47,225 | | | | 45,498 | | 09/02/2011 | | | (1,727 | ) |

| Japanese Yen | | Goldman Sachs | | Sell | | | 26,551 | | | | 26,457 | | 10/21/2011 | | | (94 | ) |

| Japanese Yen | | UBS AG | | Sell | | | 24 | | | | 24 | | 01/04/2011 | | | – | |

| Swiss Franc | | CS First Boston | | Sell | | | 224 | | | | 224 | | 01/04/2011 | | | – | |

| | | | | | | | | | | | | | | | $ | 519 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

The accompanying notes are an integral part of these financial statements.

Investment Valuation Hierarchy Level Summary

December 31, 2010

| | | Total | | | Level 1 ♦ | | | Level 2 ♦ | | | Level 3 | |

| Assets: | | | | | | | | | | | | |

| Asset & Commercial Mortgage Backed Securities | | $ | 33,132 | | | $ | – | | | $ | 33,125 | | | $ | 7 | |

| Common Stocks ‡ | | | 2,736,780 | | | | 2,562,685 | | | | 148,847 | | | | 25,248 | |

| Corporate Bonds: Investment Grade | | | 484,799 | | | | – | | | | 477,169 | | | | 7,630 | |

| Corporate Bonds: Non-Investment Grade | | | 24,690 | | | | – | | | | 24,639 | | | | 51 | |

| Exchange Traded Funds | | | 29,634 | | | | 29,634 | | | | – | | | | – | |

| Municipal Bonds | | | 38,540 | | | | – | | | | 38,540 | | | | – | |

| U.S. Government Agencies | | | 57,435 | | | | – | | | | 57,435 | | | | – | |

| U.S. Government Securities | | | 577,124 | | | | – | | | | 577,124 | | | | – | |

| Short-Term Investments | | | 104,939 | | | | – | | | | 104,939 | | | | – | |

| Total | | $ | 4,087,073 | | | $ | 2,592,319 | | | $ | 1,461,818 | | | $ | 32,936 | |

| Foreign Currency Contracts * | | | 2,436 | | | | – | | | | 2,436 | | | | – | |

| Futures * | | | 636 | | | | 636 | | | | – | | | | – | |

| Total | | $ | 3,072 | | | $ | 636 | | | $ | 2,436 | | | $ | – | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Foreign Currency Contracts * | | | 1,917 | | | | – | | | | 1,917 | | | | – | |

| Total | | $ | 1,917 | | | $ | – | | | $ | 1,917 | | | $ | – | |

| ♦ | For the year ended December 31, 2010, there were no significant transfers between Level 1 and Level 2. |

| ‡ | The Fund has all or primarily all of the equity securities categorized in a particular level. Refer to the Schedule of Investments for further industry breakout. |

| * | Derivative instruments not reflected in the Schedule of Investments are valued at the unrealized appreciation/depreciation on the investments. |

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | Balance | | | | | | Change in | | | | | | | | | | | | | | | | | | Balance | |

| | | as of | | | Realized | | | Unrealized | | | | | | | | | | | | Transfers | | | Transfers | | | as of | |

| | | December | | | Gain | | | Appreciation | | | Net | | | | | | | | | Into | | | Out of | | | December | |

| | | 31, 2009 | | | (Loss) | | | (Depreciation) | | | Amortization | | | Purchases* | | | Sales | | | Level 3 | | | Level 3 | | | 31, 2010 | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset & Commercial Mortgage Backed Securities | | $ | — | | | $ | — | | | $ | (1 | )† | | $ | — | | | $ | 8 | | | $ | — | | | $ | — | | | $ | — | | | $ | 7 | |

| Common Stocks | | | 23,561 | | | | (31,325 | ) | | | 39,768 | ‡ | | | — | | | | — | | | | (6,756 | ) | | | — | | | | — | | | | 25,248 | |

| Corporate Bonds | | | 7,244 | | | | — | | | 726 | § | | | — | | | | 47 | | | | (336 | ) | | | — | | | | — | | | | 7,681 | |

| Warrants | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total | | $ | 30,805 | | | $ | (31,325 | ) | | $ | 40,493 | | | $ | — | | | $ | 55 | | | $ | (7,092 | ) | | $ | — | | | $ | — | | | $ | 32,936 | |

| * | Cost of securities totaling $80 were acquired through fund merger. The market value of these securities on merger date was $55. |

| † | Change in unrealized appreciation or depreciation in the current period relating to assets still held at December 31, 2010 was $(1). |

| ‡ | Change in unrealized appreciation or depreciation in the current period relating to assets still held at December 31, 2010 was $3,595. |

| § | Change in unrealized appreciation or depreciation in the current period relating to assets still held at December 31, 2010 was $727. |

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

December 31, 2010

| Assets: | | | |

| Investments in securities, at market value (cost $3,634,216) | | $ | 4,087,073 | |

| Cash | | | 59 | |

| Unrealized appreciation on foreign currency contracts | | | 2,436 | |

| Receivables: | | | | |

| Investment securities sold | | | 68,396 | |

| Fund shares sold | | | 349 | |

| Dividends and interest | | | 14,343 | |

| Total assets | | | 4,172,656 | |

| Liabilities: | | | | |

| Unrealized depreciation on foreign currency contracts | | | 1,917 | |

| Payables: | | | | |

| Investment securities purchased | | | 71,140 | |

| Fund shares redeemed | | | 2,356 | |

| Variation margin | | | 136 | |

| Investment management fees | | | 547 | |

| Distribution fees | | | 31 | |

| Accrued expenses | | | 377 | |

| Total liabilities | | | 76,504 | |

| Net assets | | $ | 4,096,152 | |

| Summary of Net Assets: | | | | |

| Capital stock and paid-in-capital | | $ | 4,916,145 | |

| Accumulated undistributed net investment income | | | 17,505 | |

| Accumulated net realized loss on investments and foreign currency transactions | | | (1,291,532 | ) |

| Unrealized appreciation of investments and the translations of assets and liabilities denominated in foreign currency | | | 454,034 | |

| Net assets | | $ | 4,096,152 | |

| Shares authorized | | | 9,500,000 | |

| Par value | | $ | 0.001 | |

Class IA: Net asset value per share | | $ | 19.32 | |

| Shares outstanding | | | 183,210 | |

| Net assets | | $ | 3,539,983 | |

Class IB: Net asset value per share | | $ | 19.55 | |

| Shares outstanding | | | 28,445 | |

| Net assets | | $ | 556,169 | |

The accompanying notes are an integral part of these financial statements.

Statement of Operations

For the Year Ended December 31, 2010

| Investment Income: | | | |

| Dividends | | $ | 43,756 | |

| Interest | | | 52,370 | |

| Less: Foreign tax withheld | | | (476 | ) |

| Total investment income, net | | | 95,650 | |

| | | | | |

| Expenses: | | | | |

| Investment management fees | | | 23,699 | |

| Administrative service fees | | | 1,337 | |

| Distribution fees - Class IB | | | 1,412 | |

| Custodian fees | | | 19 | |

| Accounting services fees | | | 657 | |

| Board of Directors' fees | | | 85 | |

| Audit fees | | | 65 | |

| Other expenses | | | 740 | |

| Total expenses (before fees paid indirectly) | | | 28,014 | |

| Commission recapture | | | (88 | ) |

| Total fees paid indirectly | | | (88 | ) |

| Total expenses, net | | | 27,926 | |

| Net investment income | | | 67,724 | |

| | | | | |

| Net Realized Gain on Investments, Other Financial Instruments and Foreign Currency Transactions: | | | | |

| Net realized gain on investments | | | 291,858 | |

| Net realized loss on futures | | | (21 | ) |

| Net realized loss on swap contracts | | | (184 | ) |

| Net realized gain on foreign currency contracts | | | 1,352 | |

| Net realized loss on other foreign currency transactions | | | (1,236 | ) |

| Net Realized Gain on Investments, Other Financial Instruments and Foreign Currency Transactions | | | 291,769 | |

| | | | | |

| Net Changes in Unrealized Appreciation of Investments, Other Financial Instruments and Foreign Currency Transactions: | | | | |

| Net unrealized appreciation of investments | | | 96,402 | |

| Net unrealized appreciation of futures | | | 636 | |

| Net unrealized depreciation of swap contracts | | | (115 | ) |

| Net unrealized appreciation of foreign currency contracts | | | 519 | |

| Net unrealized appreciation on translation of other assets and liabilities in foreign currencies | | | 28 | |

| Net Changes in Unrealized Appreciation of Investments, Other Financial Instruments and Foreign Currency Transactions | | | 97,470 | |

| Net Gain on Investments, Other Financial Instruments and Foreign Currency Transactions | | | 389,239 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 456,963 | |

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2010 | | | 2009 | |

| Operations: | | | | | | |

| Net investment income | | $ | 67,724 | | | $ | 82,989 | |

| Net realized gain (loss) on investments, other financial instruments and foreign currency transactions | | | 291,769 | | | | (720,503 | ) |

| Net unrealized appreciation of investments, other financial instruments and foreign currency transactions | | | 97,470 | | | | 1,668,328 | |

| Net Increase In Net Assets Resulting From Operations | | | 456,963 | | | | 1,030,814 | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | | | | | | |

| Class IA | | | (48,804 | ) | | | (73,154 | ) |

| Class IB | | | (6,196 | ) | | | (10,271 | ) |

| Total distributions | | | (55,000 | ) | | | (83,425 | ) |

| Capital Share Transactions: | | | | | | | | |

| Class IA | | | | | | | | |

| Sold | | | 57,957 | | | | 62,103 | |

| Issued in merger | | | 188,305 | | | | — | |

| Issued on reinvestment of distributions | | | 48,804 | | | | 73,154 | |

| Redeemed | | | (710,101 | ) | | | (749,298 | ) |

| Total capital share transactions | | | (415,035 | ) | | | (614,041 | ) |

| Class IB | | | | | | | | |

| Sold | | | 28,941 | | | | 19,980 | |

| Issued in merger | | | 36,319 | | | | — | |

| Issued on reinvestment of distributions | | | 6,196 | | | | 10,271 | |

| Redeemed | | | (148,646 | ) | | | (130,857 | ) |

| Total capital share transactions | | | (77,190 | ) | | | (100,606 | ) |

| Net decrease from capital share transactions | | | (492,225 | ) | | | (714,647 | ) |

| Proceeds from regulatory settlements | | | 147 | | | | — | |

| Net Increase (Decrease) In Net Assets | | | (90,115 | ) | | | 232,742 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 4,186,267 | | | | 3,953,525 | |

| End of period | | $ | 4,096,152 | | | $ | 4,186,267 | |

| Accumulated undistributed (distribution in excess of) net investment income | | $ | 17,505 | | | $ | 4,894 | |

| Shares: | | | | | | | | |

| Class IA | | | | | | | | |

| Sold | | | 3,219 | | | | 4,010 | |

| Issued in merger | | | 10,373 | | | | — | |

| Issued on reinvestment of distributions | | | 2,575 | | | | 4,239 | |

| Redeemed | | | (39,434 | ) | | | (50,470 | ) |

| Total share activity | | | (23,267 | ) | | | (42,221 | ) |

| Class IB | | | | | | | | |

| Sold | | | 1,579 | | | | 1,260 | |

| Issued in merger | | | 1,979 | | | | — | |

| Issued on reinvestment of distributions | | | 324 | | | | 589 | |

| Redeemed | | | (8,152 | ) | | | (8,768 | ) |

| Total share activity | | | (4,270 | ) | | | (6,919 | ) |

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

December 31, 2010

Hartford Advisers HLS Fund (the "Fund") serves as an underlying investment option for certain variable annuity and variable life insurance separate accounts of Hartford Life Insurance Company (“HLIC”) and its affiliates and certain qualified retirement plans. The Fund may also serve as an underlying investment option for certain variable annuity and variable life separate accounts of other insurance companies. Owners of variable annuity contracts and policyholders of variable life insurance contracts may choose the funds permitted in the variable insurance contract prospectus. In addition, participants in certain qualified retirement plans may choose the fund if permitted by their plans.

Hartford Series Fund, Inc. (the “Company”) is an open-end registered management investment company comprised of twenty-nine portfolios. Financial Statements for the Fund, a series of the Company, are included in this report.

The Company is organized under the laws of the State of Maryland and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (“1940 Act”). The Fund is a diversified open-end management investment company.

The Fund is divided into Class IA and Class IB shares. Each class is offered at the per share net asset value (“NAV”) without a sales charge and is subject to the same expenses, except that the Class IB shares are subject to distribution and service fees charged pursuant to a Distribution and Service Plan adopted in accordance with Rule 12b-1 under the 1940 Act.

| 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies of the Fund, which are in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).

| | a) | Security Transactions and Investment Income – Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Security gains and losses are determined on the basis of identified cost. |

| | Dividend income is accrued as of the ex-dividend date, except that certain dividends for foreign securities where the ex-dividend date may have passed are recorded as soon as the Fund is informed of the dividend in the exercise of reasonable diligence. Interest income, including amortization of premium and accretion of discounts, is accrued on a daily basis. |

| | b) | Security Valuation – The Fund generally uses market prices in valuing portfolio securities. If market prices are not readily available or are deemed unreliable, the Fund will use the fair value of the security as determined in good faith under policies and procedures established by and under the supervision of the Fund’s Board of Directors. Market prices may be deemed unreliable, for example, if a security is thinly traded or if an event has occurred after the close of the security’s primary market, but before the close of the New York Stock Exchange (the “Exchange”) (generally 4:00 p.m. Eastern Time, referred to as the “Valuation Time”) that is expected to affect the value of the portfolio security. The circumstances in which the Fund may use fair value pricing include, among others: (i) the occurrence of events that are significant to a particular issuer, such as mergers, restructuring or defaults; (ii) the occurrence of events that are significant to an entire market, such as natural disasters in a particular region or governmental actions; (iii) trading restrictions on securities; (iv) thinly traded securities and (v) market events such as trading halts and early market closings. In addition, with respect to the valuation of stocks primarily traded on certain foreign markets, the Fund uses a fair value pricing service approved by the Fund’s Board of Directors, which employs quantitative models that evaluate changes in the value of foreign market proxies (e.g., futures contracts, American Depositary Receipts, exchange traded funds (“ETFs”)) after the close of certain foreign markets but before the Valuation Time. Securities that are primarily traded on foreign markets may trade on days that are not business days of the Fund. The value of the foreign securities in which the Fund invests may change on days when a shareholder will not be able to purchase or redeem shares of the Fund. Fair value pricing is subjective in nature and the use of fair value pricing by the Fund may cause the NAV of its |

shares to differ significantly from the NAV that would have been calculated using market prices at the close of the exchange on which a portfolio security is primarily traded but before the Valuation Time. There can be no assurance that the Fund could obtain the fair value assigned to a security if the Fund were to sell the security at approximately the time at which the Fund determines its NAV.

Exchange-traded equity securities are valued at the last reported sale price or official close price on the exchange or market on which the security is primarily traded (the “Primary Market”) at the Valuation Time. If the security did not trade on the Primary Market, it may be valued at the Valuation Time at the last reported sale price on another exchange where it trades. The value of an equity security not traded on any exchange but traded on the Nasdaq Stock Market, Inc. or another over-the-counter market shall be valued at the last reported sale price or official closing price on the exchange or market on which the security is traded as of the Valuation Time.

Debt securities (other than short-term obligations) held by the Fund are valued using bid prices or using valuations based on a matrix system (which considers factors such as security prices, yield, maturity and ratings) as provided by independent pricing services. Securities for which prices are not available from an independent pricing service may be valued using market quotations obtained from one or more dealers that make markets in the securities in accordance with procedures established by the Fund’s Board of Directors. Generally, the Fund may use fair valuation in regard to debt securities when the Fund holds defaulted or distressed securities or securities in a company in which a reorganization is pending. Short-term investments with a maturity of more than 60 days when purchased are valued based on market quotations until the remaining days to maturity become less than 61 days. Investments that mature in 60 days or less are generally valued at amortized cost, which approximates market value.

Foreign-denominated assets, including investments in securities, and liabilities are translated from the local currency into U.S. dollars using exchange rates obtained from an independent third party as of the Fund’s Valuation Time.

Financial instruments for which prices are not available from an independent pricing service may be valued using market quotations obtained from one or more dealers that make markets in the respective financial instrument in accordance with procedures established by the Fund’s Board of Directors.

Futures contracts are valued at the most recent settlement price reported by an exchange on which, over time, they are traded most extensively. If a settlement price is not available, futures contracts will be valued at the most recent trade price as of the Valuation Time. If there were no trades, the contract shall be valued at the mean of the closing bid and asked prices as of the Valuation Time.

Foreign currency contracts represent agreements to exchange currencies on specific future dates at predetermined rates. Foreign currency contracts are valued using foreign currency exchange rates and forward rates on the Valuation Date from an independent pricing service.

Swaps are valued based on custom valuations furnished by an independent pricing service. Swaps for which prices are not available from an independent pricing service are valued in accordance with procedures established by the Fund’s Board of Directors.

Other derivative or contractual type instruments are valued using market prices if such instruments trade on an exchange or market. If such instruments do not trade on an exchange or market, such instruments are valued at a price at which the counterparty to such contract would repurchase the instrument. In the event that the counterparty cannot provide a price, such valuation may be determined in accordance with procedures established by the Fund’s Board of Directors.

| Hartford Advisers HLS Fund |

Notes to Financial Statements – (continued)

December 31, 2010

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized into three broad hierarchy levels. This hierarchy is based on whether the valuation inputs are observable or unobservable. These levels are: