UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-08629

HARTFORD SERIES FUND, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Edward P. Macdonald, Esquire

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F. Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HARTFORDFUNDS

| | HARTFORD SERIES FUND, INC. 2014 Semi Annual Report |

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

Thank you for investing in Hartford HLS Funds.

Market Review

U.S. equities (as represented by the S&P 500 Index) started 2014 on a shaky note after posting a strong 32.39% gain in 2013. However, stocks managed to maintain modest gains throughout the first quarter and returned to a generally steady climb in the second quarter. Through June 30, 2014, the S&P 500 Index advanced 7.14%. It appears that much of the market volatility during the year can be attributed to heightened international tensions. In particular, the Russian annexation of Ukraine’s Crimean Peninsula and increased tensions in Iraq were cause for concern.

On the domestic front, subdued economic and employment reports slowed stocks’ progress early in the new year, although much of the weakness seemed to dissipate as the year’s unusually harsh winter subsided. And despite initial reactions to the idea, when the U.S. Federal Reserve began tapering its quantitative-easing program in January by reducing its bond purchases by $10 billion a month, the markets took the policy change in stride.

Despite a rough start to the year for financial markets, the global economy seems to be settling into a slow-but-steady recovery. While first-quarter U.S. gross domestic product (GDP) growth was disappointing at -2.9%, U.S. consumer spending, which is a significant contributor toward economic growth, rose by 3% during the quarter. It appears that Europe is also maintaining its own recovery: The International Monetary Fund projects that Europe’s full-year GDP growth may breach positive territory for the first time since 2011.

The impact of international affairs on stocks so far this year is an important reminder to stay informed about both domestic and international economic developments, and any effects they may have on your individual investment goals. If you have not already had a mid-year review of your portfolio, it may be a good time to meet with your financial advisor to review your progress and make certain your investments are prepared for all market environments:

| • | Is your portfolio properly diversified with an appropriate mix of stocks and bonds? |

| • | Is your portfolio positioned to take advantage of the global economic recovery, with investments in both domestic and international holdings? |

| • | Are your investments still in line with your risk tolerance and investment time horizon? |

Your financial professional can help you choose options within our fund family to help you reach your investment goals with confidence.

Thank you again for investing with Hartford HLS Funds.

James Davey

President

Hartford HLS Funds

1 The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

2The Dow Jones Industrial Average is an unmanaged, price-weighted index of 30 of the largest, most widely held stocks traded on the New York Stock Exchange.

Hartford Series Fund, Inc.

Table of Contents

This report is prepared for the general information of contract owners and is not an offer of contracts. It should not be used in connection with any offer, except in conjunction with the appropriate product prospectus which contains all pertinent product information including the applicable sales, administrative and other charges.

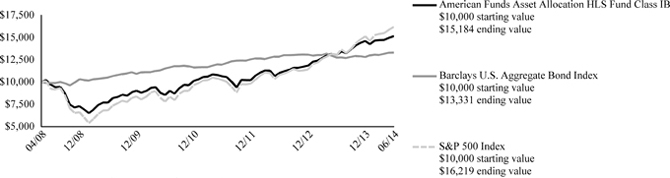

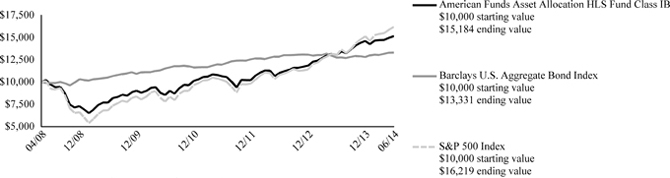

American Funds Asset Allocation HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks high total return (including income and capital gains) consistent with preservation of capital over the long term. |

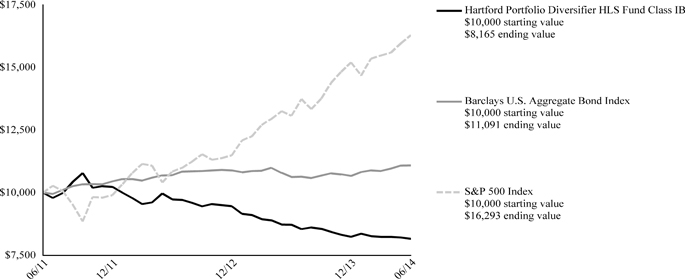

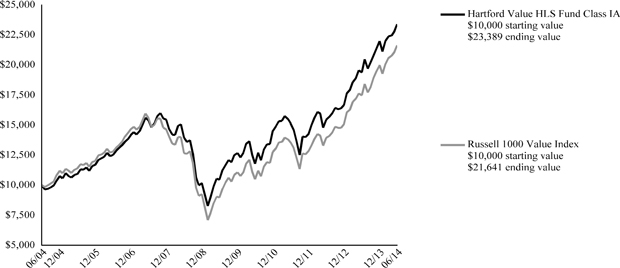

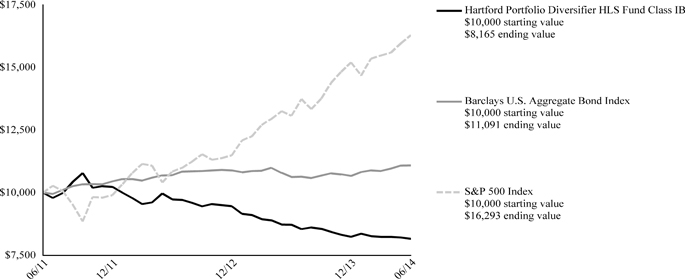

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Asset Allocation HLS Fund IB | 3.80% | 16.33% | 14.51% | 7.01% |

| Barclays U.S. Aggregate Bond Index | 3.93% | 4.37% | 4.85% | 4.77% |

| S&P 500 Index | 7.14% | 24.61% | 18.83% | 8.16% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Barclays U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 0.86% and the gross total annual operating expense ratio for Class IB shares was 1.26%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Asset Allocation HLS Fund returned 3.80% for the six-month period ended June 30, 2014, versus the returns of 7.14% for the S&P 500 Index and 3.93% for the Barclays U.S. Aggregate Bond Index. The Fund underperformed the 5.35% average return of the Variable Products-Underlying Funds Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Asset Allocation HLS Fund is directly related to the performance of the American Funds Insurance Series – Asset Allocation Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Asset Allocation Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Asset Allocation HLS Fund’s financial statements.

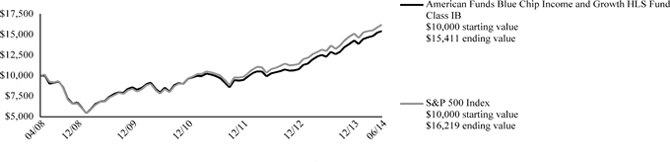

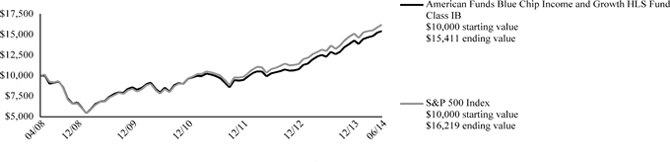

American Funds Blue Chip Income and Growth HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks to produce income exceeding the average yield on U.S. stocks generally and to provide an opportunity for growth of principal consistent with sound common stock investing. |

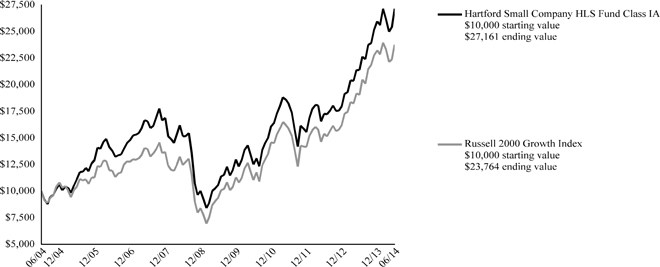

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Blue Chip Income and Growth HLS Fund IB | 7.80% | 25.02% | 17.38% | 7.26% |

| S&P 500 Index | 7.14% | 24.61% | 18.83% | 8.16% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 0.99% and the gross total annual operating expense ratio for Class IB shares was 1.49%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Blue Chip Income and Growth HLS Fund returned 7.80% for the six-month period ended June 30, 2014, versus the return of 7.14% for the S&P 500 Index. The Fund outperformed the 6.54% average return of the Variable Products-Underlying Funds Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Blue Chip Income and Growth HLS Fund is directly related to the performance of the American Funds Insurance Series – Blue Chip Income and Growth Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Blue Chip Income and Growth Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Blue Chip Income and Growth HLS Fund’s financial statements.

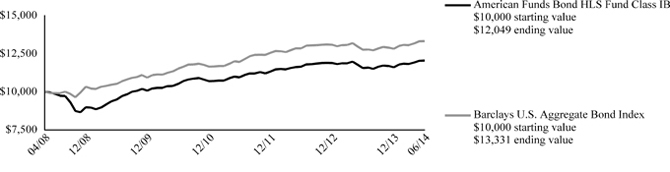

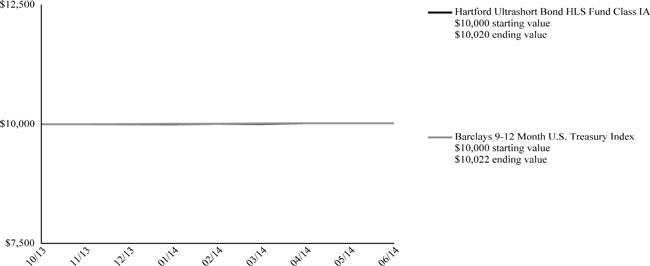

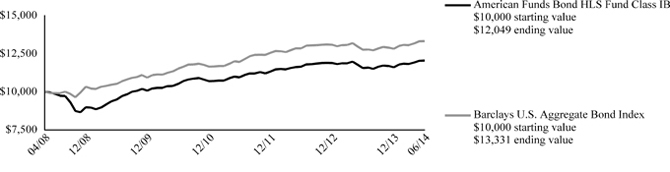

American Funds Bond HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks as high a level of current income as is consistent with the preservation of capital. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Bond HLS Fund IB | 3.79% | 4.19% | 4.87% | 3.07% |

| Barclays U.S. Aggregate Bond Index | 3.93% | 4.37% | 4.85% | 4.77% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Barclays U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 0.93% and the gross total annual operating expense ratio for Class IB shares was 1.18%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Bond HLS Fund returned 3.79% for the six-month period ended June 30, 2014, versus the return of 3.93% for the Barclays U.S. Aggregate Bond Index. The Fund underperformed the 4.05% average return of the Variable Products-Underlying Funds Lipper Intermediate Investment Grade Debt Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Bond HLS Fund is directly related to the performance of the American Funds Insurance Series – Bond Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Bond Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Bond HLS Fund’s financial statements.

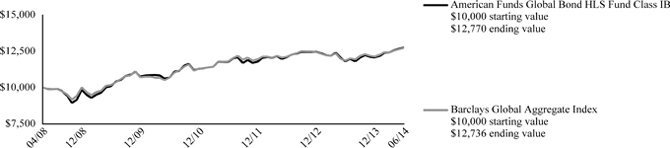

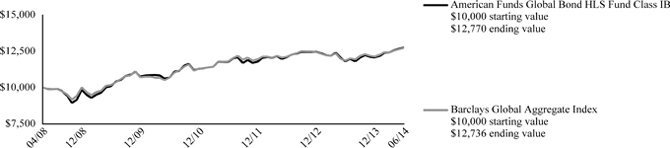

American Funds Global Bond HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks to provide you, over the long-term, with a high level of total return consistent with prudent investment management. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

| Average Annual Total Returns (as of 6/30/14) |

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Global Bond HLS Fund IB | 5.59% | 8.03% | 4.81% | 4.04% |

| Barclays Global Aggregate Index | 4.94% | 7.39% | 4.60% | 4.00% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Barclays Global Aggregate Index represents the global investment-grade fixed-income markets.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.15% and the gross total annual operating expense ratio for Class IB shares was 1.65%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Global Bond HLS Fund returned 5.59% for the six-month period ended June 30, 2014, versus the return of 4.94% for the Barclays Global Aggregate Index. The Fund outperformed the 4.73% average return of the Variable Products-Underlying Funds Lipper Global Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Global Bond HLS Fund is directly related to the performance of the American Funds Insurance Series – Global Bond Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Global Bond Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Global Bond HLS Fund’s financial statements.

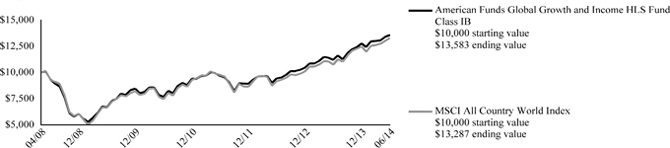

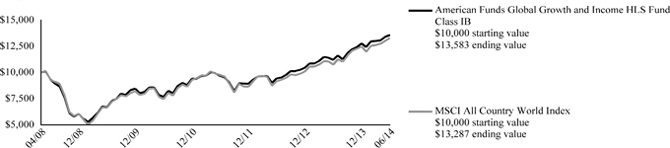

American Funds Global Growth and Income HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term growth of capital while providing current income. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Global Growth and Income HLS Fund IB | 6.32% | 21.15% | 15.22% | 5.09% |

| MSCI All Country World Index | 6.50% | 23.58% | 14.88% | 4.72% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indices.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.18% and the gross total annual operating expense ratio for Class IB shares was 1.73%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Global Growth and Income HLS Fund returned 6.32% for the six-month period ended June 30, 2014, versus the return of 6.50% for the MSCI All Country World Index. The Fund outperformed the 3.87% average return of the Variable Products-Underlying Funds Lipper Global Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Global Growth and Income HLS Fund is directly related to the performance of the American Funds Insurance Series – Global Growth and Income Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Global Growth and Income Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Global Growth and Income HLS Fund’s financial statements.

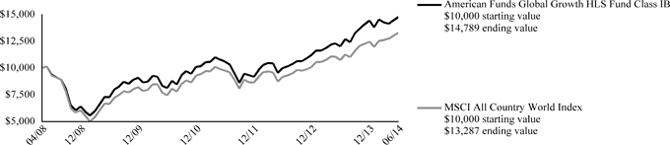

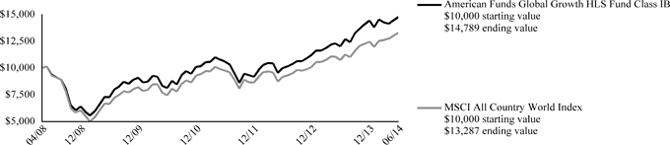

American Funds Global Growth HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term growth of capital. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Global Growth HLS Fund IB | 2.31% | 22.79% | 15.20% | 6.55% |

| MSCI All Country World Index | 6.50% | 23.58% | 14.88% | 4.72% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indices.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.14% and the gross total annual operating expense ratio for Class IB shares was 1.89%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Global Growth HLS Fund returned 2.31% for the six-month period ended June 30, 2014, versus the return of 6.50% for the MSCI All Country World Index. The Fund underperformed the 5.08% average return of the Variable Products-Underlying Funds Lipper Global Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Global Growth HLS Fund is directly related to the performance of the American Funds Insurance Series – Global Growth Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Global Growth Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Global Growth HLS Fund’s financial statements.

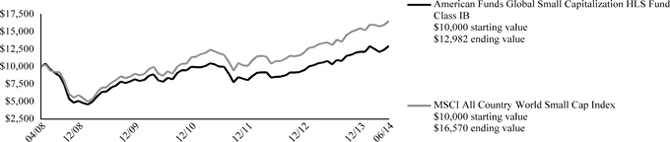

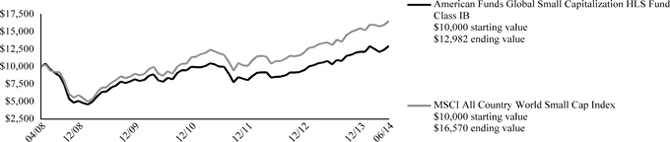

American Funds Global Small Capitalization HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term growth of capital. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Global Small Capitalization HLS Fund IB | 6.86% | 25.63% | 14.96% | 4.32% |

| MSCI All Country World Small Cap Index | 6.74% | 26.47% | 18.63% | 8.53% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI All Country World Small Cap Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of smaller capitalization companies in both developed and emerging markets.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.32% and the gross total annual operating expense ratio for Class IB shares was 1.87%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Global Small Capitalization HLS Fund returned 6.86% for the six-month period ended June 30, 2014, versus the return of 6.74% for the MSCI All Country World Small Cap Index. The Fund outperformed the 4.89% average return of the Variable Products-Underlying Funds Lipper Global Small/Mid-Cap Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Global Small Capitalization HLS Fund is directly related to the performance of the American Funds Insurance Series – Global Small Capitalization Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Global Small Capitalization Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Global Small Capitalization HLS Fund’s financial statements.

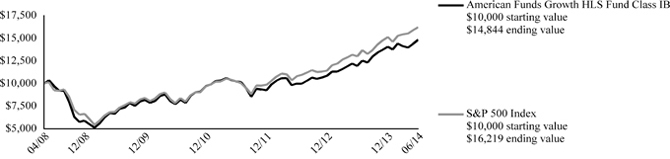

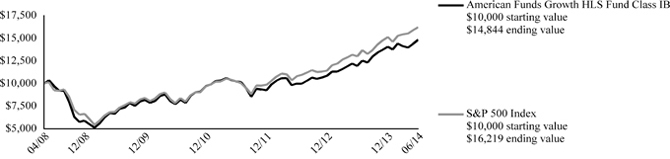

American Funds Growth HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks growth of capital. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Growth HLS Fund IB | 5.35% | 24.25% | 17.48% | 6.62% |

| S&P 500 Index | 7.14% | 24.61% | 18.83% | 8.16% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 0.89% and the gross total annual operating expense ratio for Class IB shares was 1.39%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Growth HLS Fund returned 5.35% for the six-month period ended June 30, 2014, versus the return of 7.14% for the S&P 500 Index. The Fund outperformed the 4.58% average return of the Variable Products-Underlying Funds Lipper Large-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Growth HLS Fund is directly related to the performance of the American Funds Insurance Series – Growth Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Growth Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Growth HLS Fund’s financial statements.

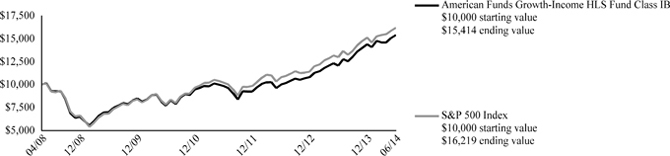

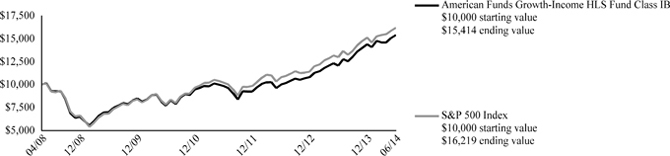

American Funds Growth-Income HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term growth of capital and income. |

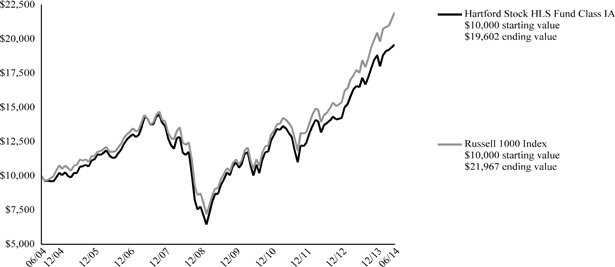

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds Growth-Income HLS Fund IB | 6.79% | 27.42% | 17.10% | 7.27% |

| S&P 500 Index | 7.14% | 24.61% | 18.83% | 8.16% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 0.83% and the gross total annual operating expense ratio for Class IB shares was 1.28%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds Growth-Income HLS Fund returned 6.79% for the six-month period ended June 30, 2014, versus the return of 7.14% for the S&P 500 Index. The Fund outperformed the 6.54% average return of the Variable Products-Underlying Funds Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds Growth-Income HLS Fund is directly related to the performance of the American Funds Insurance Series – Growth-Income Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – Growth-Income Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds Growth-Income HLS Fund’s financial statements.

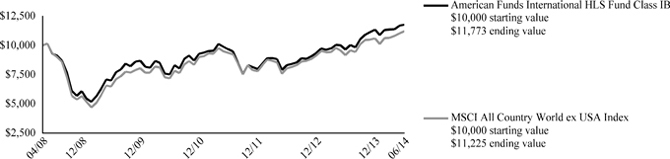

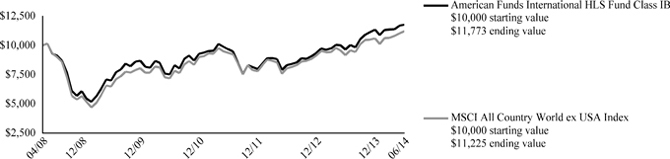

American Funds International HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term growth of capital. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds International HLS Fund IB | 3.60% | 21.77% | 10.94% | 2.68% |

| MSCI All Country World ex USA Index | 5.89% | 22.27% | 11.59% | 1.89% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI All Country World ex USA Index is a broad-based, unmanaged, market capitalization weighted, total return index that measures the performance of both developed and emerging stock markets, excluding the U.S. The index is calculated to exclude companies and share classes which cannot be freely purchased by foreigners.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.09% and the gross total annual operating expense ratio for Class IB shares was 1.69%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds International HLS Fund returned 3.60% for the six-month period ended June 30, 2014, versus the return of 5.89% for the MSCI All Country World ex USA Index. The Fund underperformed the 4.48% average return of the Variable Products-Underlying Funds Lipper International Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds International HLS Fund is directly related to the performance of the American Funds Insurance Series – International Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – International Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds International HLS Fund’s financial statements.

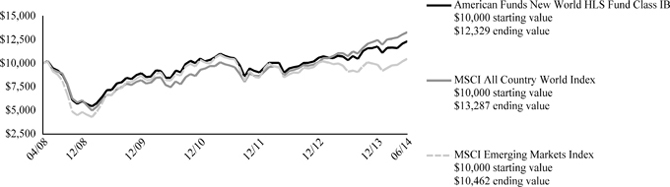

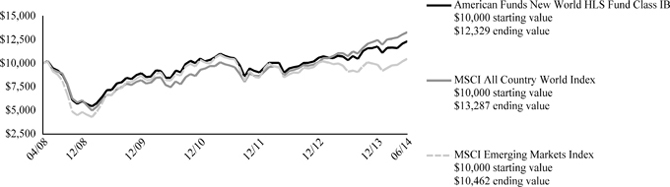

American Funds New World HLS Fund inception 4/30/2008

(advised by Hartford Funds Management Company, LLC)

| Investment Goal: Seeks long-term capital appreciation. |

Performance Overview 4/30/08 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IB.

Average Annual Total Returns (as of 6/30/14)

| | 6 Month† | 1 Year | 5 Years | Since

Inception▲ |

| American Funds New World HLS Fund IB | 4.69% | 19.30% | 11.39% | 3.45% |

| MSCI All Country World Index | 6.50% | 23.58% | 14.88% | 4.72% |

| MSCI Emerging Markets Index | 6.32% | 14.68% | 9.58% | 0.73% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI All Country World Index consists of 44 country indices comprising 23 developed and 21 emerging market country indices.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the net total annual operating expense ratio for Class IB shares was 1.36% and the gross total annual operating expense ratio for Class IB shares was 2.21%. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

Net operating expenses are the expenses paid to own the Fund. If the net operating expenses shown are lower than the gross operating expenses, then the net operating expenses reflect contractual fee waivers and expense reimbursements that may not be renewed. Contractual waivers or reimbursements remain in effect for as long as the Fund is a part of a master-feeder fund structure unless terminated or changed by the Fund or its Board of Directors if the fund structure changes. For more information about the fee arrangement and expiration dates, please see the expense table in the prospectus.

Gross operating expenses shown are before management fee waivers or expense caps. Performance information may reflect historical or current expense waivers or reimbursements, without which, performance would have been lower. For more information on fee waivers and/or expense reimbursements, please see the expense table in the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

How did the Fund perform?

The Class IB shares of the American Funds New World HLS Fund returned 4.69% for the six-month period ended June 30, 2014, versus the returns of 6.50% for the MSCI All Country World Index and 6.32% for the MSCI Emerging Markets Index. The Fund underperformed the 5.90% average return of the Variable Products-Underlying Funds Lipper Emerging Markets Funds peer group, a group of funds with investment strategies similar to those of the Fund.

The performance of the American Funds New World HLS Fund is directly related to the performance of the American Funds Insurance Series – New World Fund Class 1, in which the Fund invests. The financial statements of the American Funds Insurance Series – New World Fund Class 1, including the Schedule of Investments, are provided in the accompanying report and should be read in conjunction with the American Funds New World HLS Fund’s financial statements.

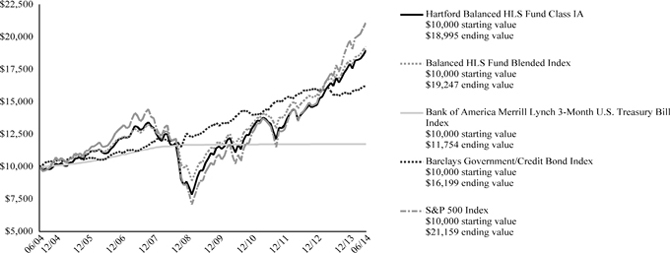

| American Funds Asset Allocation HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 2,629 | | | American Funds Insurance Series - Asset Allocation Fund Class 1 | | | | | | $ | 58,442 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $48,621) | | | | | | $ | 58,442 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $48,621) ▲ | | | 100.0 | % | | $ | 58,442 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (16 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 58,426 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $48,942 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 9,500 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 9,500 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 58,442 | |

| | Total | | $ | 58,442 | |

| American Funds Blue Chip Income and Growth HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 3,150 | | | American Funds Insurance Series - Blue Chip Income and Growth Fund Class 1 | | | | | | $ | 44,510 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $31,243) | | | | | | $ | 44,510 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $31,243) ▲ | | | 100.0 | % | | $ | 44,510 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (15 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 44,495 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $31,837 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 12,673 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 12,673 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 44,510 | |

| | Total | | $ | 44,510 | |

The accompanying notes are an integral part of these financial statements.

| American Funds Bond HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 19,968 | | | American Funds Insurance Series - Bond Fund Class 1 | | | | | | $ | 222,239 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $216,917) | | | | | | $ | 222,239 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $216,917) ▲ | | | 100.0 | % | | $ | 222,239 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (44 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 222,195 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $217,656 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 4,583 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 4,583 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 222,239 | |

| | Total | | $ | 222,239 | |

| American Funds Global Bond HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.1% |

| | 1,416 | | | American Funds Insurance Series - Global Bond Fund Class 1 | | | | | | $ | 17,603 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $17,355) | | | | | | $ | 17,603 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $17,355) ▲ | | | 100.1 | % | | $ | 17,603 | |

| | | | | Other Assets and Liabilities | | | (0.1 | )% | | | (12 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 17,591 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $17,366 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 237 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 237 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 17,603 | |

| | Total | | $ | 17,603 | |

The accompanying notes are an integral part of these financial statements.

| American Funds Global Growth and Income HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 3,923 | | | American Funds Insurance Series - Global Growth and Income Fund Class 1 | | | | | | $ | 52,131 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $34,350) | | | | | | $ | 52,131 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $34,350) ▲ | | | 100.0 | % | | $ | 52,131 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (18 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 52,113 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $36,023 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 16,108 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 16,108 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 52,131 | |

| | Total | | $ | 52,131 | |

| American Funds Global Growth HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.1% |

| | 817 | | | American Funds Insurance Series - Global Growth Fund Class 1 | | | | | | $ | 22,724 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $17,437) | | | | | | $ | 22,724 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $17,437) ▲ | | | 100.1 | % | | $ | 22,724 | |

| | | | | Other Assets and Liabilities | | | (0.1 | )% | | | (12 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 22,712 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $18,632 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 4,092 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 4,092 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 22,724 | |

| | Total | | $ | 22,724 | |

The accompanying notes are an integral part of these financial statements.

| American Funds Global Small Capitalization HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 2,152 | | | American Funds Insurance Series - Global Small Capitalization Fund Class 1 | | | | | | $ | 58,993 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $40,570) | | | | | | $ | 58,993 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $40,570) ▲ | | | 100.0 | % | | $ | 58,993 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (22 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 58,971 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $42,604 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 16,389 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 16,389 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 58,993 | |

| | Total | | $ | 58,993 | |

| American Funds Growth HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 4,272 | | | American Funds Insurance Series - Growth Fund Class 1 | | | | | | $ | 335,833 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $191,013) | | | | | | $ | 335,833 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $191,013) ▲ | | | 100.0 | % | | $ | 335,833 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (73 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 335,760 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $200,157 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 135,676 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 135,676 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 335,833 | |

| | Total | | $ | 335,833 | |

The accompanying notes are an integral part of these financial statements.

| American Funds Growth-Income HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 3,667 | | | American Funds Insurance Series - Growth-Income Fund Class 1 | | | | | | $ | 189,117 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $113,876) | | | | | | $ | 189,117 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $113,876) ▲ | | | 100.0 | % | | $ | 189,117 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (40 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 189,077 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $117,746 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 71,371 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 71,371 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 189,117 | |

| | Total | | $ | 189,117 | |

| American Funds International HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% | | | | | | | | |

| | 9,644 | | | American Funds Insurance Series - International Fund Class 1 | | | | | | $ | 212,468 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $154,875) | | | | | | $ | 212,468 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $154,875) ▲ | | | 100.0 | % | | $ | 212,468 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (58 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 212,410 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $160,721 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 51,747 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 51,747 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 212,468 | |

| | Total | | $ | 212,468 | |

The accompanying notes are an integral part of these financial statements.

| American Funds New World HLS Fund |

| Schedule of Investments |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| Shares | | | | | | Market Value ╪ | |

| Investment Companies - 100.0% |

| | 1,395 | | | American Funds Insurance Series - New World Fund Class 1 | | | | | | $ | 33,249 | |

| | | | | | | | | | | | | |

| | | | | Total Investment Companies | | | | | | | | |

| | | | | (Cost $30,499) | | | | | | $ | 33,249 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $30,499) ▲ | | | 100.0 | % | | $ | 33,249 | |

| | | | | Other Assets and Liabilities | | | — | % | | | (16 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 33,233 | |

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $31,044 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 2,205 | |

| Unrealized Depreciation | | | — | |

| Net Unrealized Appreciation | | $ | 2,205 | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

At June 30, 2014, the investment valuation hierarchy levels were:

| | Assets: | | | | |

| | Investment in Securities - Level 1 | | $ | 33,249 | |

| | Total | | $ | 33,249 | |

The accompanying notes are an integral part of these financial statements.

[This page is intentionally left blank]

| Hartford Series Fund, Inc. |

| Statements of Assets and Liabilities |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

| | | American Funds

Asset Allocation

HLS Fund | | | American Funds

Blue Chip Income

and Growth

HLS Fund | | | American Funds

Bond

HLS Fund | |

| Assets: | | | | | | | | | | | | |

| Investments in underlying funds, at market value @ | | $ | 58,442 | | | $ | 44,510 | | | $ | 222,239 | |

| Cash | | | 242 | | | | 150 | | | | 1,361 | |

| Receivables: | | | | | | | | | | | | |

| Fund shares sold | | | — | | | | — | | | | — | |

| Other assets | | | 3 | | | | 3 | | | | 8 | |

| Total assets | | | 58,687 | | | | 44,663 | | | | 223,608 | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Fund shares redeemed | | | 242 | | | | 150 | | | | 1,361 | |

| Investment management fees | | | 5 | | | | 5 | | | | 15 | |

| Distribution fees | | | 2 | | | | 1 | | | | 8 | |

| Accrued expenses | | | 12 | | | | 12 | | | | 29 | |

| Total liabilities | | | 261 | | | | 168 | | | | 1,413 | |

| Net assets | | $ | 58,426 | | | $ | 44,495 | | | $ | 222,195 | |

| Summary of Net Assets: | | | | | | | | | | | | |

| Capital stock and paid-in-capital | | $ | 30,637 | | | $ | 22,789 | | | $ | 206,367 | |

| Undistributed net investment income | | | 677 | | | | 719 | | | | 3,719 | |

| Accumulated net realized gain | | | 17,291 | | | | 7,720 | | | | 6,787 | |

| Unrealized appreciation of investments | | | 9,821 | | | | 13,267 | | | | 5,322 | |

| Net assets | | $ | 58,426 | | | $ | 44,495 | | | $ | 222,195 | |

| Shares authorized | | | 200,000 | | | | 200,000 | | | | 200,000 | |

| Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |

| Class IB: Net asset value per share | | $ | 13.11 | | | $ | 13.27 | | | $ | 10.12 | |

| Shares outstanding | | | 4,455 | | | | 3,352 | | | | 21,950 | |

| Net assets | | $ | 58,426 | | | $ | 44,495 | | | $ | 222,195 | |

| @ Cost of investments in underlying funds | | $ | 48,621 | | | $ | 31,243 | | | $ | 216,917 | |

The accompanying notes are an integral part of these financial statements.

| Hartford Series Fund, Inc. |

| Statements of Assets and Liabilities – (continued) |

| June 30, 2014 (Unaudited) |

| (000’s Omitted) |

American Funds

Global Bond

HLS Fund | | | American Funds

Global Growth

and Income

HLS Fund | | | American Funds

Global Growth

HLS Fund | | | American Funds

Global Small

Capitalization

HLS Fund | | | American Funds

Growth

HLS Fund | | | American Funds

Growth-Income

HLS Fund | | | American Funds

International

HLS Fund | | | American Funds

New World

HLS Fund | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 17,603 | | | $ | 52,131 | | | $ | 22,724 | | | $ | 58,993 | | | $ | 335,833 | | | $ | 189,117 | | | $ | 212,468 | | | $ | 33,249 | |

| | 7 | | | | 128 | | | | 119 | | | | 214 | | | | 1,285 | | | | 363 | | | | 950 | | | | 123 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | 35 | | | | — | | | | — | |

| | 1 | | | | 4 | | | | 2 | | | | 4 | | | | 23 | | | | 11 | | | | 17 | | | | 5 | |

| | 17,611 | | | | 52,263 | | | | 22,845 | | | | 59,211 | | | | 337,141 | | | | 189,526 | | | | 213,435 | | | | 33,377 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 7 | | | | 128 | | | | 119 | | | | 214 | | | | 1,285 | | | | 398 | | | | 950 | | | | 123 | |

| | 2 | | | | 5 | | | | 3 | | | | 6 | | | | 35 | | | | 18 | | | | 25 | | | | 5 | |

| | 1 | | | | 2 | | | | 1 | | | | 2 | | | | 11 | | | | 7 | | | | 7 | | | | 1 | |

| | 10 | | | | 15 | | | | 10 | | | | 18 | | | | 50 | | | | 26 | | | | 43 | | | | 15 | |

| | 20 | | | | 150 | | | | 133 | | | | 240 | | | | 1,381 | | | | 449 | | | | 1,025 | | | | 144 | |

| $ | 17,591 | | | $ | 52,113 | | | $ | 22,712 | | | $ | 58,971 | | | $ | 335,760 | | | $ | 189,077 | | | $ | 212,410 | | | $ | 33,233 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 15,962 | | | $ | 15,817 | | | $ | 8,896 | | | $ | 32,812 | | | $ | 115,748 | | | $ | 70,848 | | | $ | 127,780 | | | $ | 20,338 | |

| | 13 | | | | 1,646 | | | | 215 | | | | — | | | | 2,811 | | | | 1,954 | | | | 1,851 | | | | 286 | |

| | 1,368 | | | | 16,869 | | | | 8,314 | | | | 7,736 | | | | 72,381 | | | | 41,034 | | | | 25,186 | | | | 9,859 | |

| | 248 | | | | 17,781 | | | | 5,287 | | | | 18,423 | | | | 144,820 | | | | 75,241 | | | | 57,593 | | | | 2,750 | |

| $ | 17,591 | | | $ | 52,113 | | | $ | 22,712 | | | $ | 58,971 | | | $ | 335,760 | | | $ | 189,077 | | | $ | 212,410 | | | $ | 33,233 | |

| | 200,000 | | | | 200,000 | | | | 200,000 | | | | 200,000 | | | | 200,000 | | | | 200,000 | | | | 200,000 | | | | 200,000 | |

| $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | | | $ | 0.001 | |