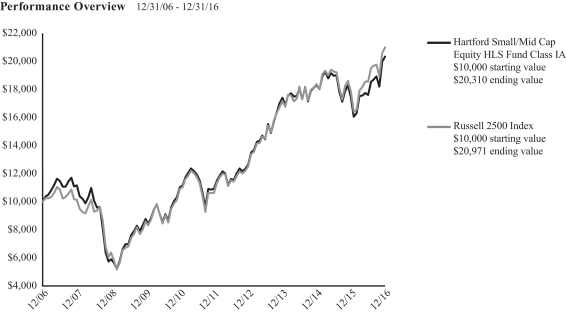

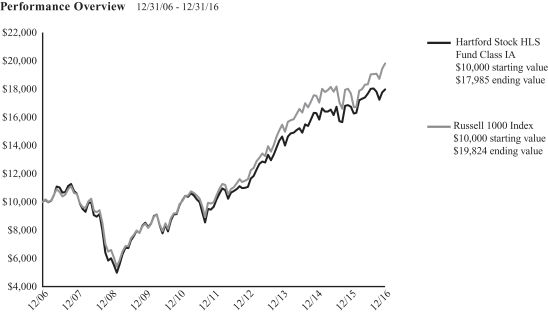

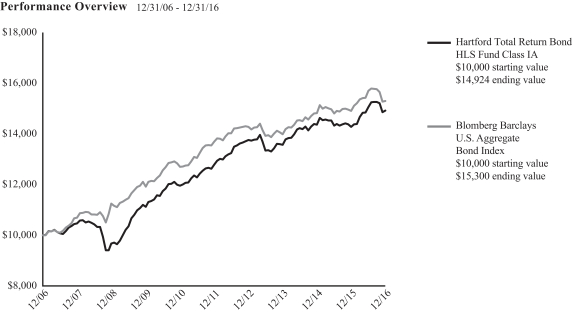

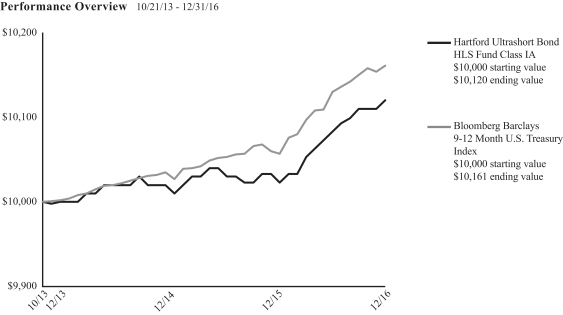

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-08629

HARTFORD SERIES FUND, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Alice A. Pellegrino

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-1844

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F. Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

Thank you for investing in Hartford HLS Funds.

Market Review

During the year ended December 31, 2016, the period of this report, stocks, as measured by the S&P 500 Index,1 endured a correction then recovered and,

despite periodic gyrations, managed to remain generally in positive territory for the remainder of the period. Even with the bouts of uncertainty the market experienced, the current bull market continued into its seventh year, making it the second-longest bull market on record for the S&P 500 Index. From January 1, 2016 through December 31, 2016, the S&P 500 Index generated an 11.96% total return.

The market reacted to a handful of concerns during the course of the year, including worries about low oil prices, weakness in the Chinese economy, a surprise vote for the U.K. to leave the European Union (dubbed Brexit), the beginning of a rate increase cycle by the U.S. Federal Reserve (Fed), and a contentious U.S. presidential election cycle with an unexpected outcome.

There were also more positive influences, including generally positive jobs reports over the course of the period, which helped the unemployment rate fall to pre-recession levels. In addition, growth of the domestic economy, while slow, has remained steady. This has helped limit the Fed’s actions; it has kept rate increases very gradual, which helps markets better digest and account for such changes.

Going forward, President Trump’s potential policy changes are likely to play a key role in market movements for the new year and beyond. While it is difficult to assess the full potential impact of changing political policies, markets seem to consider his positions pro-growth, which could bode well for investors. However, change to the status quo can often result in volatility in the markets.

As we enter 2017, we encourage you to maintain a strong relationship with a financial advisor who can help guide you through shifting markets with confidence. If there’s one certain thing about markets, it’s that movements can be hard to anticipate, especially in the short term. So it’s important to proactively build a portfolio that takes that unknown into account along with your unique investment goals and risk tolerances. Your financial advisor can help you find a fit within our family of mutual funds as you work toward those goals.

Thank you again for investing with Hartford HLS Funds.

James Davey

President

Hartford HLS Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

Hartford HLS Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion under “Why did the Fund perform this way?” and “What is the outlook?” are views of that Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

Hartford Balanced HLS Fund inception 03/31/1983

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks long-term total return. |

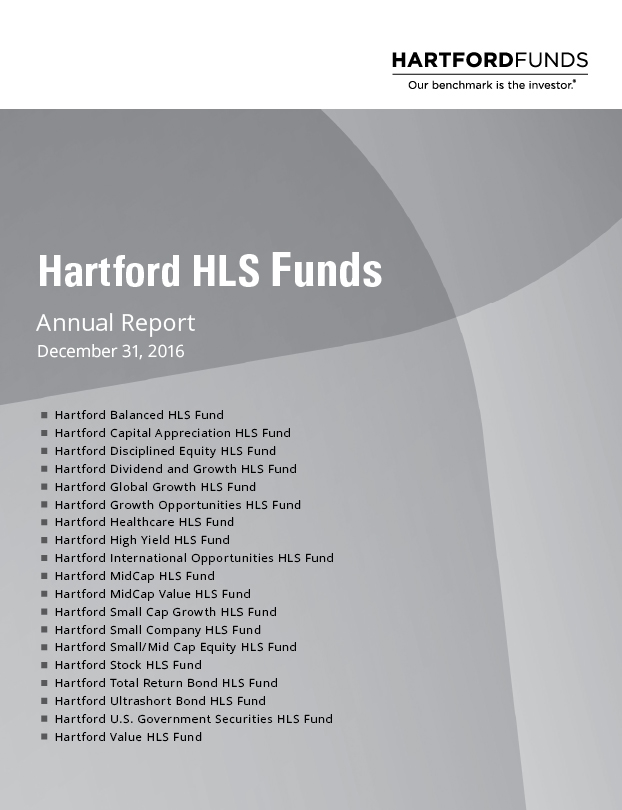

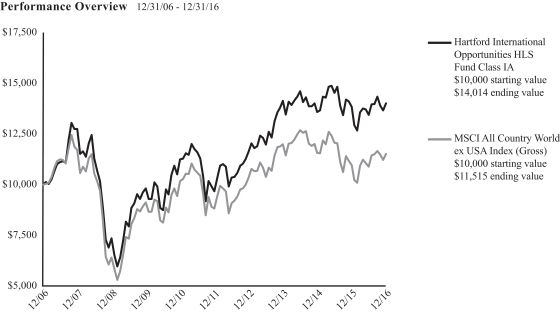

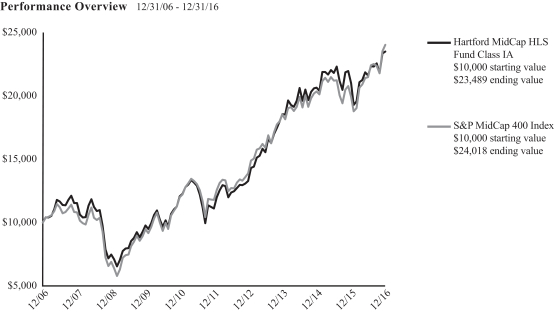

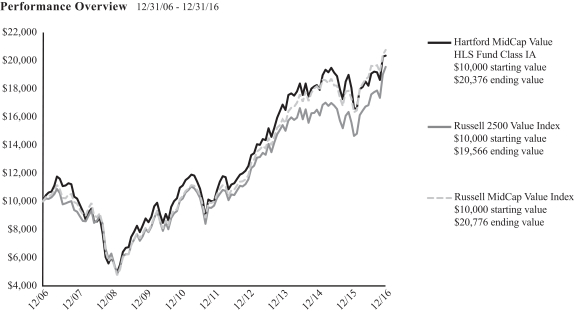

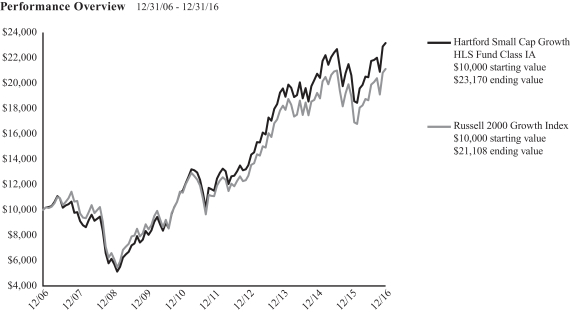

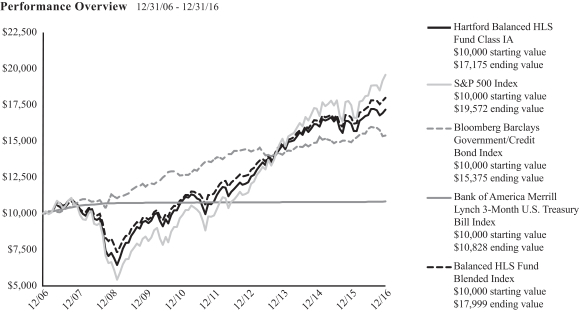

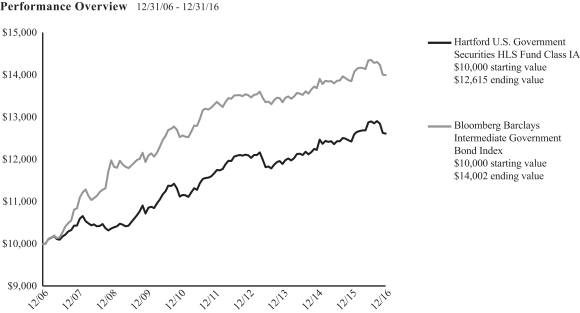

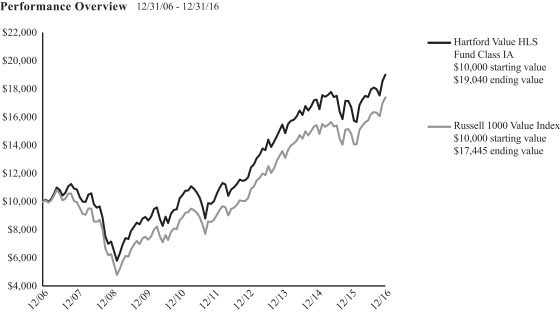

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 12/31/16)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Balanced IA | | | 6.04% | | | | 9.63% | | | | 5.56% | |

Balanced IB | | | 5.79% | | | | 9.35% | | | | 5.30% | |

S&P 500 Index | | | 11.96% | | | | 14.66% | | | | 6.95% | |

Bloomberg Barclays Government/Credit Bond Index | | | 3.05% | | | | 2.29% | | | | 4.40% | |

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.33% | | | | 0.12% | | | | 0.80% | |

Balanced HLS Fund Blended Index | | | 8.33% | | | | 9.60% | | | | 6.05% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2016, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Bloomberg Barclays Government/Credit Bond Index is an unmanaged, market-value-weighted index of all debt obligations of the U.S. Treasury and U.S. Government agencies (excluding mortgaged-backed securities) and of all publicly-issued fixed-rate, nonconvertible, investment grade domestic corporate debt.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar denominated U.S. Treasury bills publicly issued in the U.S. domestic markets with maturities of 90 days or less that assumes reinvestment of all income.

Balanced HLS Fund Blended Index is calculated by Hartford Funds Management Company, LLC (“HFMC”) and represents the weighted return of 60% S&P 500 Index, 35% Bloomberg Barclays Government/Credit Bond Index and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index.

On August 24, 2016, Bloomberg L.P. acquired Barclays Risk Analytics and Index Solutions Ltd. from Barclays PLC. As a result of this acquisition, the Barclays indices have been rebranded as Bloomberg Barclays indices.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or

taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2016, the total annual fund operating expense ratios for Class IA and Class IB were 0.65% and 0.90%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2016.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see “A Word about Risk” section in the “Manager Discussion” section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Balanced HLS Fund |

Manager Discussion

December 31, 2016 (Unaudited)

Portfolio Managers

Karen H. Grimes, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Michael E. Stack, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

How did the Fund perform during the period?

The Class IA shares of Hartford Balanced HLS Fund returned 6.04% for the twelve-month period ended December 31, 2016, underperforming the Fund’s blended benchmark, 60% S&P 500 Index, 35% Bloomberg Barclays Government/Credit Index, and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index, which returned 8.33% for the same period. The S&P 500, Bloomberg Barclays Government/Credit Bond, and Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Indices returned 11.96%, 3.05% and 0.33%, respectively. The Fund also underperformed the 7.17% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

U.S. equities rose over the period, as measured by the S&P 500 Index, notwithstanding significant volatility during the year. Early in the first quarter of 2016, equities plunged and moved in virtual lockstep with the price of oil as fears of a recession and weakness in China weighed on investors’ minds. However, equity markets surged in late February and March as solid economic data, a stabilization in oil prices, and accommodative commentary from the Federal Reserve (Fed) helped to calm the market’s early year jitters. A better-than-feared U.S. corporate earnings season in the second quarter and an encouraging economic backdrop helped sustain the rally. At its June meeting, the Fed left rates unchanged and reduced its U.S. growth and long-run policy rate forecasts, citing mixed U.S. economic data and uncertainty about global economic and financial developments. After plunging in the two trading days following the approval of the U.K.’s exit from the E.U. (Brexit), U.S. equities staged an impressive comeback in the days following.

U.S. equities continued to climb in July, following a solid start to the corporate earnings season and encouraging housing and employment data releases. Stocks were essentially flat in August and September as investors remained focused on the Fed’s actions, specifically on the timing of the next rate increase. A confluence of worries contributed to increased volatility during September, including

uncertainty surrounding the U.S. presidential election, tepid economic data, and valuation concerns. Stocks surged following Donald Trump’s victory in the U.S. Presidential election on hopes of increased fiscal stimulus, reduced regulatory restrictions, and lower corporate taxes. Economic data released during the fourth quarter was generally encouraging, as third quarter gross domestic product (GDP) growth was revised slightly higher and the U.S. housing market continued to display healthy trends. In December, the Fed raised rates by 0.25%, a move that was anticipated by most of the market. It was only the second increase in the last decade. During the twelve-month period, nine of the eleven sectors1 within the S&P 500 Index posted positive returns, led by Energy (+27%), Telecommunication Services (+23%), and Financials (+23%), while Real Estate (-6%) and Healthcare (-3%) fell.

Over the period, global fixed income markets were influenced by global economic growth concerns, central bank monetary policy expectations, and oil prices. Early in 2016, falling oil prices, concerns over slowing growth in China, and questions about the efficacy of central bank monetary policies sparked a broad sell-off in credit markets, while government bond prices benefited from their safe-haven status. Markets reversed course in mid-February as the major central banks adopted more cautious monetary policies in an effort to ease market risk. A rebound in crude oil prices, accommodative global central bank monetary policy and signs of near-term stabilization in China further supported global financial markets through the second quarter. The U.K.’s momentous vote in June to leave the E.U. led to a spike in global financial market volatility and a flight to safety, with U.K. and European equity and credit markets bearing the brunt of the sell-off. Policy paths of major central banks appeared to diverge in the third quarter as the Bank of England unveiled a stimulus package designed to prevent a recession following the Brexit vote while the European Central Bank (ECB) kept its stimulus program unchanged and avoided making a firm commitment to further expand its bond-buying program. In the U.S., Fed rhetoric turned more focused on interest rate increases, setting up for a December rate increase. Global government bond yields moved sharply higher in the fourth quarter, particularly following the U.S. presidential election results as President-elect Trump’s

| 1 | Effective September 1, 2016, a new Real Estate sector was created under the Global Industry Classification Standard (GICS); holdings in this sector were previously classified as Financials. The attribution analysis of the Financials sector includes Real Estate for the period starting January 1, 2016 through August 31, 2016. The attribution analysis of the Real Estate sector is only for the period starting September 1, 2016 through December 31, 2016. |

|

| Hartford Balanced HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

proposed expansionary fiscal policy lifted inflation expectations. In December, the Fed increased rates for only the second time in ten years. While markets had largely anticipated the decision, the Fed’s post-meeting statement and press conference leaned more toward an aggressive interest rate policy than expected.

Developed markets’ government bond prices largely gained outside the U.S. over the period, as global uncertainties kept central banks in easing mode for most of the year. In the U.S., the yield curve flattened; front-end yields, which were heavily influenced by Fed monetary policy expectations, rose more than intermediate- and long-term yields. The U.S. dollar ended higher against a broad basket of currencies over the period, particularly following the U.S. presidential election results and Fed rate increase decision. Emerging market currencies also weakened significantly against the dollar following Trump’s election victory over concerns about potential U.S. trade protectionism. Meanwhile, the U.K. pound depreciated in the aftermath of Brexit.

Absolute returns in the major fixed income credit risk sectors were positive during the twelve-month period, aided by the decline in government bond yields outside the U.S. In the U.S., interest income helped offset the impact of higher Treasury yields. On an excess return basis, most credit risk sectors posted positive returns over the period, including high yield, emerging markets debt, and investment grade corporates, as credit spreads tightened during the year. However, this masked considerable volatility in credit risk sector returns, including a drawdown in many credit risk sectors in the first part of 2016 and immediately following the Brexit referendum.

During the period, the equity portion of the Fund underperformed the S&P 500 Index while the fixed income portion of the Fund outperformed the Bloomberg Barclays U.S. Government/Credit Index. Asset allocation decisions slightly contributed positively to benchmark-relative performance during the period. The Fund was generally overweight equities and fixed income and underweight cash relative to the blended benchmark.

Equity underperformance versus the S&P 500 Index was driven primarily by security selection. In particular, weak security selection in Healthcare, Financials, and Consumer Staples detracted from relative performance, which was partially offset by stronger selection in Energy and Materials. Sector allocation, which is a residual of the Fund’s bottom-up security selection process, also detracted during the period primarily due to the Fund’s overweight to Healthcare and underweight to Telecommunication Services, which was slightly offset by positive performance from an underweight to Real Estate.

Stocks that detracted the most from relative returns in the equity portion of the Fund during the period were Vertex (Healthcare), Norwegian Cruise Line (Consumer Discretionary), and UCB SA (Healthcare). Vertex, a U.S.-based pharmaceutical company, saw its shares drop after the company received notice from the FDA that it

could not approve the company’s label expansion claim for Kalydeco, a cystic fibrosis drug, based on the current application. The company also reported a higher-than-expected discontinuation rate for Orkambi, another cystic fibrosis drug. Shares of Norwegian Cruise Lines, a U.S.-based international cruise operator, fell due to uncertainty regarding how Brexit will affect the travel and leisure industry, in addition to reporting weaker than expected quarterly earnings report that cited terror attacks in Paris, Brussels, and Istanbul as a drag on European cruise revenue. UCB SA, a Belgium-based biopharmaceutical company specializing in central nervous system and immunology therapies sold off during the year, particularly during the first half of 2016, partly due to a modest disappointment in their Romosozumab osteoporosis clinical trial. Allergan (Healthcare) detracted the most on an absolute basis.

Top contributors to relative performance in the equity portion of the Fund during the period were Halliburton (Energy), UnitedHealth Group (Healthcare), and Ingersoll-Rand (Industrials). Halliburton is a U.S. energy services provider. The stock price of the company rose over the year, benefiting from the recovery in oil prices. Furthermore, the market welcomed the abandonment of the merger with Baker Hughes, which was blocked by regulators over concerns for the competitive environment. Shares of UnitedHealth Group, a U.S.-based health care benefits and services provider, rose during the period as the company continued to execute well and exceed consensus revenue and earnings expectations. Ingersoll-Rand, an Irish-based provider of industrial machinery, climate control systems, and security products, saw its shares rise over the year after announcing strong quarterly earnings and revenues and raising its dividend payout by 25% in the fourth quarter. The Fund’s holdings in JPMorgan Chase (Financials) and Microsoft (Information Technology) also contributed positively on an absolute basis.

Outperformance of the fixed income portion of the Fund relative to the Bloomberg Barclays Government/Credit Bond Index during the period was driven by security selection in investment grade (IG) corporate credit, particularly within Industrials, and an overweight allocation to taxable municipals. An out-of-benchmark allocation to asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) also modestly contributed positively to relative returns during the period. The Fund’s allocation to high yield detracted from relative returns during this period. The Fund’s duration and yield curve positioning also detracted from results relative to the Bloomberg Barclays Government/Credit Bond Index. Though rates rose in the fourth quarter, rates had been falling for most of the year. During this time, the fixed income portion of the Fund was shorter duration than its benchmark.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

|

| Hartford Balanced HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

What is the outlook?

We expect the U.S. economy to maintain steady growth in 2017, supported by continued growth in consumer spending and an increase in investment levels, but the range of outcomes is wider than normal given policy uncertainty with respect to the new, incoming administration. Additionally, elevated fiscal/trade policy uncertainty in the U.S. and the rise of nationalist, populist movements in Western democracies pose longer-term risks. Inventories, which have been a headwind to growth over the last 5 quarters, appear to be in better balance heading into 2017, and should no longer be a meaningful drag on the economy. We believe decreased regulation, lower tax rates, and the potential for increased infrastructure spending should also support the economy in the coming year. On the negative side, the strong U.S. dollar and uncertainty surrounding foreign policy and global trade may weigh on growth. We expect the Fed to continue its gradual tightening trajectory, but with an awareness to both the potential inflationary impact of fiscal stimulus when the U.S. is at full employment and the risks to global growth from protectionist policies.

Financials and Consumer Discretionary represented the Fund’s largest sector overweight and underweight, respectively, in the equity portion of the Fund at the end of the period. On the fixed income side the Fund ended the period with a moderately pro-cyclical risk posture, continuing to favor financial issuers within IG credit. The Fund continued to hold out-of-benchmark allocations to high yield, agency mortgage-backed securities (MBS), commercial mortgage-backed securities (CMBS), and asset-backed securities (ABS).

At the end of the period, the Fund’s equity exposure was at 63% compared to 60% in its benchmark.

A Word about Risk

All investments are subject to risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. If the Fund’s strategy for allocating assets among different asset classes and/or portfolio management teams does not work as intended, the Fund may not achieve its objective or may underperform other funds with similar investment strategies. Foreign investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as political and economic developments in foreign countries and regions. Fixed income risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall; these risks are currently heightened due to the historically low interest rate environment. Mortgage- and asset-backed securities’ risks include credit, interest-rate, prepayment, and extension risk. Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government.

Composition by Security Type

as of December 31, 2016

| | | | |

| Category | | Percentage of

Net Assets | |

Equity Securities | | | | |

Common Stocks | | | 62.8 | % |

| | | | |

Total | | | 62.8 | % |

| | | | |

Fixed Income Securities | | | | |

Asset & Commercial Mortgage Backed Securities | | | 3.0 | % |

Corporate Bonds | | | 19.6 | |

Foreign Government Obligations | | | 0.3 | |

Municipal Bonds | | | 1.3 | |

U.S. Government Agencies | | | 0.5 | |

U.S. Government Securities | | | 11.4 | |

| | | | |

Total | | | 36.1 | % |

| | | | |

Short-Term Investments | | | 0.9 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

Hartford Capital Appreciation HLS Fund inception 04/02/1984

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

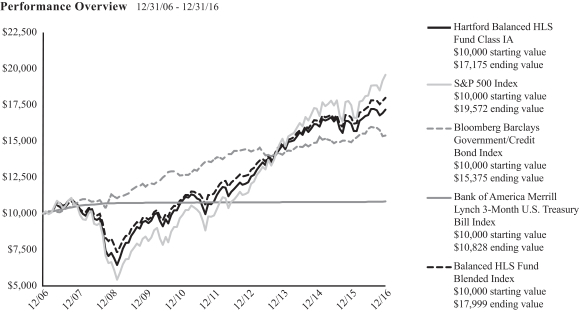

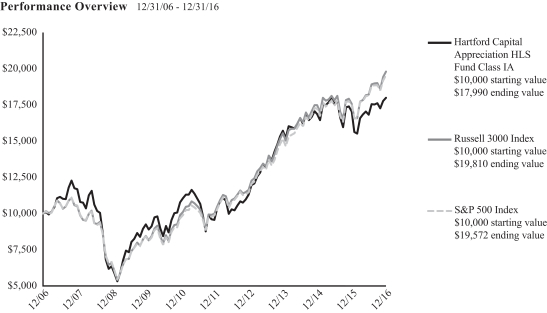

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 12/31/16)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Capital Appreciation IA | | | 5.52% | | | | 13.49% | | | | 6.05% | |

Capital Appreciation IB | | | 5.24% | | | | 13.20% | | | | 5.78% | |

Capital Appreciation IC | | | 4.99% | | | | 12.93% | | | | 5.52% | |

Russell 3000 Index | | | 12.74% | | | | 14.67% | | | | 7.07% | |

S&P 500 Index | | | 11.96% | | | | 14.66% | | | | 6.95% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2016, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

Russell 3000 Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2016, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.67%, 0.92% and 1.17%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2016.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see “A Word about Risk” section in the “Manager Discussion” section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Capital Appreciation HLS Fund |

Manager Discussion

December 31, 2016 (Unaudited)

Portfolio Managers

Saul J. Pannell, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Gregg R. Thomas, CFA

Senior Managing Director and Associate Director of Investment Strategy & Risk

Wellington Management Company LLP

Kent M. Stahl, CFA

Senior Managing Director and Director of Investment Strategy & Risk

Wellington Management Company LLP

How did the Fund perform during the period?

The Class IA shares of Hartford Capital Appreciation HLS Fund returned 5.52% for the twelve-month period ended December 31, 2016, underperforming the Fund’s benchmark, the Russell 3000 Index, which returned 12.74% for the same period, and the Fund’s other benchmark, the S&P 500 Index, which returned 11.96% for the same period. The Fund also underperformed the 10.98% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities rose over the period, as measured by the S&P 500 Index, notwithstanding volatility during the year. Early in the first quarter of 2016, equities plunged and moved in virtual lockstep with the price of oil as fears of a recession and weakness in China weighed on investors’ minds. However, equity markets surged in late February and March as solid economic data, a stabilization in oil prices, and accommodative commentary from the Federal Reserve (Fed) helped to calm the market’s early year jitters. A better-than-feared U.S. corporate earnings season in the second quarter and an encouraging economic backdrop helped sustain the rally. At its June meeting, the Fed left rates unchanged and reduced its U.S. growth and long-run policy rate forecasts, citing mixed U.S. economic data and uncertainty about global economic and financial developments. After plunging in the two trading days following the approval of the U.K.’s exit from the E.U. (Brexit), U.S. equities staged an impressive comeback in the days following.

U.S. equities continued to climb in July, following a solid start to the corporate earnings season and encouraging housing and employment data releases. Stocks were essentially flat in August and September as investors remained focused on the Fed’s actions, specifically on the timing of the next rate increase. A confluence of worries contributed to increased volatility during September, including uncertainty surrounding the U.S. presidential election, tepid economic

data, and valuation concerns. Stocks surged following Donald Trump’s victory in the U.S. Presidential election on hopes of increased fiscal stimulus, reduced regulatory restrictions, and lower corporate taxes. Economic data released during the fourth quarter was generally encouraging, as third quarter gross domestic product (GDP) growth was revised slightly higher and the U.S. housing market continued to display healthy trends. In December, the Fed raised rates by 0.25%, a move that was anticipated by most of the market. It was only the second increase in the last decade.

Equity returns varied by market-cap during the period, as small- and mid-cap equities, as measured by the Russell 2000 and S&P MidCap 400 Indices, outperformed large-cap equities, as measured by the S&P 500 Index. Nine of the eleven sectors1 in the Russell 3000 Index had positive returns during the period. Energy (+27%), Financials (+25%), and Telecommunication Services (+24%) performed best, while Real Estate (-4%) and Healthcare (-3%) lagged the broader index.

Security selection was the primary detractor from performance relative to the Russell 3000 Index during the period. Selection was weakest within the Information Technology, Healthcare, and Consumer Discretionary sectors. Sector allocation, a result of our bottom-up security selection process, also detracted from performance relative to the Russell 3000 Index during the period. An overweight to the Healthcare sector and an underweight to Energy detracted most from benchmark-relative returns. This was only partially offset by an underweight to Financials in the early part of the year and an underweight to Real Estate, which contributed positively to relative performance. From a factor perspective, low volatility and yield outperformed in the first half of the year, which was a headwind for the Fund. The trend in low volatility reversed in the second half of the year and risk-seeking factors outperformed following the election. An overweight to beta (stocks that are more sensitive to market movements) and small cap, as well as an underweight to momentum

| 1 | Effective September 1, 2016, a new Real Estate sector was created under the Global Industry Classification Standard (GICS); holdings in this sector were previously classified as Financials. The attribution analysis of the Financials sector includes Real Estate for the period starting January 1, 2016 through August 31, 2016. The attribution analysis of the Real Estate sector is only for the period starting September 1, 2016 through December 31, 2016. |

|

| Hartford Capital Appreciation HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

(stocks with persistent positive price movements), were tailwinds for the Fund during the year, while underweight exposure to dividend yield detracted from performance.

The largest absolute and relative detractors over the period were SunPower (Information Technology), Bristol-Myers Squibb (Healthcare), and Regeneron Pharmaceuticals (Healthcare). Shares of SunPower, a U.S.-based energy company that designs and manufactures crystalline silicon photovoltaic cells, roof tiles, and solar panels, fell during the period on concerns that 2017 earnings will decline as the renewal of investment tax credits in late 2015 has elongated project demand into future years. The stock price of Bristol-Myers Squibb, a U.S.-based biopharmaceutical company, fell as the company’s trial for immuno-oncology drug Opdivo failed during the third quarter of 2016. Shares of Regeneron Pharmaceuticals, a U.S.-based biotech company, fell during the period. In February, the company announced poor quarterly earnings and conservative guidance for 2016 which adversely affected the stock price. Additionally, a verdict was reached during the period that Regeneron violated Amgen’s patent on an injectable cholesterol drug. This headline news also weighed on the stock price. Allergan (Healthcare) was a top absolute detractor during the period.

The top contributors to performance relative to the Russell 3000 Index during the period included Sberbank (Financials), Ivanhoe Mines (Materials), and Samsung (Information Technology). Shares of Sberbank, a Russian banking and financial services company, rose during the period. In May, the company reported a record profit for the first quarter of 2016, largely driven by lower borrowing costs and a decline in loan-loss provisions. The stock was additionally supported by geopolitical developments in the latter part of the year. Ivanhoe Mines, a Canadian mineral exploration and development company, saw its stock price rise after announcing a copper discovery early in 2016 and receiving unsolicited interest in the company. The share price of Samsung, a Korean-based manufacturer of consumer electronic products, rose over the period as it announced quarterly results that beat market expectations from strong mobile phone demand. Though shares pulled back slightly in September due to the recall of its Galaxy Note 7 phone, the stock price later recovered. Merck (Healthcare), JPMorgan Chase (Financials), and PNC Financial (Financials) were the top absolute contributors during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

The election of Donald Trump could prove to be a transformative event for the economy as emphasis on fiscal policies, de-regulation, and a more efficient tax code support an improved growth outlook. However, there currently are many unknowns and this leads to a broader range of potential outcomes. Additional policy detail out of

the U.S., the ability of China to extend its current economic cycle, and political developments in Germany and France are key events to watch, in our opinion. From a factor perspective, we have seen strong performance from value in the U.S. We believe we are still relatively early in the value cycle compared to past cycles. However, it’s important to note that value is normally an early cycle factor, and in our opinion, we are not in the early stages. Quality has been more correlated with low volatility recently, so we remain cautious on this exposure.

At the end of the period, the Fund’s largest overweights were to the Financials and Information Technology sectors, while the Fund’s largest underweights were to the Consumer Staples, Real Estate, and Energy sectors, relative to the Russell 3000 Index.

A Word about Risk

All investments are subject to risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. If the Fund’s strategy for allocating assets among different asset classes and/or portfolio management teams does not work as intended, the Fund may not achieve its objective or may underperform other funds with similar investment strategies. Small- and mid-cap securities can have greater risk and volatility than large-cap securities. Foreign investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as political and economic developments in foreign countries and regions. The Fund may have high portfolio turnover, which could increase the Fund’s transaction costs.

Composition by Sector

as of December 31, 2016

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | |

Consumer Discretionary | | | 13.4 | % |

Consumer Staples | | | 5.6 | |

Energy | | | 5.1 | |

Financials | | | 19.0 | |

Health Care | | | 13.9 | |

Industrials | | | 9.3 | |

Information Technology | | | 21.8 | |

Materials | | | 3.7 | |

Real Estate | | | 2.2 | |

Telecommunication Services | | | 1.4 | |

Utilities | | | 2.4 | |

| | | | |

Total | | | 97.8 | % |

| | | | |

Short-Term Investments | | | 2.2 | |

Other Assets & Liabilities | | | 0.0 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for financial reporting purposes.

Hartford Disciplined Equity HLS Fund inception 05/29/1998

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

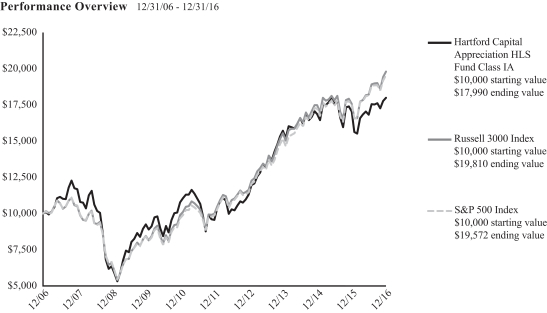

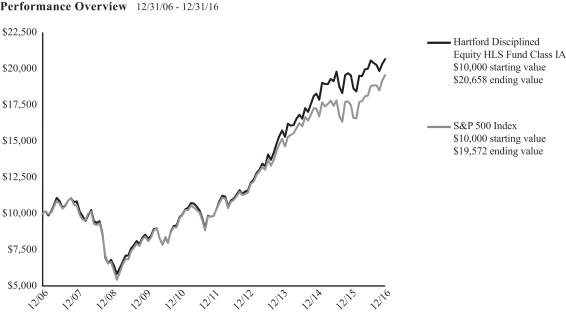

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 12/31/16)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Disciplined Equity IA | | | 5.76 | % | | | 15.96 | % | | | 7.52 | % |

Disciplined Equity IB | | | 5.49 | % | | | 15.67 | % | | | 7.25 | % |

S&P 500 Index | | | 11.96 | % | | | 14.66 | % | | | 6.95 | % |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2016, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2016, the total annual fund operating expense ratios for Class IA and Class IB were 0.76% and 1.01%,

respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2016.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see “A Word about Risk” section in the

“Manager Discussion” section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Disciplined Equity HLS Fund |

Manager Discussion

December 31, 2016 (Unaudited)

Portfolio Manager

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform during the period?

The Class IA shares of Hartford Disciplined Equity HLS Fund returned 5.76% for the twelve-month period ended December 31, 2016, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 11.96% for the same period. The Fund also underperformed the 10.33% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities rose over the period, as measured by the S&P 500 Index, notwithstanding significant volatility during the year. Early in the first quarter of 2016, equities plunged and moved in virtual lockstep with the price of oil as fears of a recession and weakness in China weighed on investors’ minds. However, equity markets surged in late February and March as solid economic data, a stabilization in oil prices, and accommodative commentary from the Federal Reserve (Fed) helped to calm the market’s early year jitters. A better-than-feared U.S. corporate earnings season in the second quarter and an encouraging economic backdrop helped sustain the rally. At its June meeting, the Fed left rates unchanged and reduced its U.S. growth and long-run policy rate forecasts, citing mixed U.S. economic data and uncertainty about global economic and financial developments. After plunging in the two trading days following the approval of the U.K.’s exit from the E.U. (Brexit), U.S. equities staged an impressive comeback in the days following.

U.S. equities continued to climb in July, following a solid start to the corporate earnings season and encouraging housing and employment data releases. Stocks were essentially flat in August and September as investors remained focused on the Fed’s actions, specifically on the timing of the next rate increase. A confluence of worries contributed to increased volatility during September, including uncertainty surrounding the U.S. presidential election, tepid economic data, and valuation concerns. Stocks surged following Donald Trump’s victory in the U.S. Presidential election on hopes of increased fiscal stimulus, reduced regulatory restrictions, and lower corporate taxes. Economic data released during the fourth quarter was generally encouraging, as third quarter gross domestic product (GDP) growth was revised slightly higher and the U.S. housing market continued to display healthy trends. In December, the Fed raised rates by 0.25%, a move that was anticipated by most of the market. It was only the second increase in the last decade.

Equity returns varied by market-cap, during the period, as small- and mid-cap equities, as measured by the Russell 2000 and S&P MidCap 400 Indices, outperformed large-cap equities, as measured by the S&P 500 Index. During the twelve-month period, nine of the eleven sectors1 within the Russell 1000 Index rose, led by Energy (+27%), Telecommunication Services (+24%), and Financials (+23%). Real Estate (+6%) and Healthcare (-3%) lagged on a relative basis.

The Fund underperformed the S&P 500 Index during the period primarily due to weak security selection, primarily within Information Technology, Consumer Staples, and Consumer Discretionary, which more than offset stronger selection within the Energy and Financial sectors. Sector allocation, which is a residual of the Fund’s bottom-up security selection process, also detracted from benchmark-relative returns during the period. Underweight allocations to the Energy and Telecommunication Services sectors more than offset the positive impact from an underweight to the Real Estate sector.

The largest detractors from performance relative to the S&P 500 Index over the period were Allergan (Healthcare), McKesson (Healthcare), and Signet Jewelers (Consumer Discretionary). Shares of Allergan, a U.S.-based specialty pharmaceutical company, fell during the period as Pfizer walked away from a proposed merger due to changes in the Treasury Department’s tax inversion rules. Shares of McKesson, a U.S.-based pharmaceutical distributor and health care information company, fell over the period as drug distributors generally have been under pressure due to weak generic pricing. We exited the position during the period. Shares of Signet Jewelers, a U.S.-based retailer of jewelry, fell over the period as a result of fears over the quality of their credit business and increased scrutiny around service issues. We exited the position during the period.

The largest contributors to benchmark-relative performance over the period were Bank of America (Financials), JPMorgan Chase (Financials), and UnitedHealth Group (Healthcare). Shares of Bank of America, a U.S.-based global financial services company, rose during the period as the bank has made what many investors consider to be impressive improvements to its business model. It has streamlined operations and right-sized the business so that interest rate increases can be expected to provide an increase to earnings. Shares of JPMorgan Chase, a U.S.-based global financial services company, rose during the period benefiting from the anticipation that the incoming U.S. administration would roll back some post-financial

| 1 | Effective September 1, 2016, a new Real Estate sector was created under the Global Industry Classification Standard (GICS); holdings in this sector were previously classified as Financials. The attribution analysis of the Financials sector includes Real Estate for the period starting January 1, 2016 through August 31, 2016. The attribution analysis of the Real Estate sector is only for the period starting September 1, 2016 through December 31, 2016. |

|

| Hartford Disciplined Equity HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

crisis regulations. Shares of UnitedHealth Group, a U.S.-based health care benefits and services provider, rose over the period as its traditional benefits business is expected to post organic enrollment growth across each of its three main business lines. Optum, the firm’s health care IT and consulting services division, may also benefit from growth of Optum Rx, OptumInsight, and OptumHealth.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

As we enter 2017, we believe the global trend toward a return of inflation remains intact as we expect stronger global growth and higher inflation in 2017. Under a Trump administration, there is a reasonable likelihood of corporate and individual tax reform, both of which we believe would be good for reinvestment and consumption. Trump’s policies are likely to be inflationary and induce a stronger U.S. dollar. We expect that tax cuts will be a centerpiece of the new administration. We believe that corporate tax cuts, including the return of foreign earnings to the U.S. at lower tax rates, may mean a boost for corporate earnings. Several questions remain on implementation and cost. Another boost to the U.S. economy may come from deregulation in areas such as health care, financial services, and energy drilling, which would increase business confidence, lower the cost of doing business, and increase incentives to hire more workers.

However, we think a risk under a Trump presidency is that the U.S. may end up with trade tensions, which would be a hindrance for the U.S. economy, as well as the global economy. We believe there is also the risk of increased geopolitical uncertainty. The reaction of the rest of the world to Trump’s policies regarding trade and other relationships remains a wild card until we see his policies unfold.

Globally, we are encouraged by data coming out of Europe and believe nominal GDP growth and earnings will pick up given the positive economic data surprises in recent months and weakness of the euro. However, we view the French election as a near-term risk, as well as the negotiations surrounding Brexit, which will likely heat up in the first half of the year.

A Word about Risk

All investments are subject to risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. Foreign investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as political and economic developments in foreign countries and regions.

Composition by Sector

as of December 31, 2016

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 13.5 | % |

Consumer Staples | | | 13.8 | |

Energy | | | 3.5 | |

Financials | | | 17.5 | |

Health Care | | | 12.4 | |

Industrials | | | 10.7 | |

Information Technology | | | 19.4 | |

Materials | | | 3.7 | |

Utilities | | | 5.0 | |

| | | | |

Total | | | 99.5 | % |

| | | | |

Short-Term Investments | | | 0.8 | |

Other Assets & Liabilities | | | (0.3 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for financial reporting purposes.

Hartford Dividend and Growth HLS Fund inception 03/09/1994

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 12/31/16)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Dividend and Growth IA | | | 14.89% | | | | 13.96% | | | | 7.23% | |

Dividend and Growth IB | | | 14.58% | | | | 13.67% | | | | 6.96% | |

S&P 500 Index | | | 11.96% | | | | 14.66% | | | | 6.95% | |

Russell 1000 Value Index | | | 17.34% | | | | 14.80% | | | | 5.72% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2016, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Russell 1000 Value Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies, based on total market capitalizations.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2016, the total annual fund operating expense ratios for Class IA and Class IB were 0.67% and 0.92%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2016.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see “A Word about Risk” section in the “Manager Discussion” section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Dividend and Growth HLS Fund |

Manager Discussion

December 31, 2016 (Unaudited)

Portfolio Managers

Edward P. Bousa, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Donald J. Kilbride

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform during the period?

The Class IA shares of Hartford Dividend and Growth HLS Fund returned 14.89% for the twelve-month period ended December 31, 2016, outperforming the Fund’s benchmark, the S&P 500 Index, which returned 11.96% for the same period. The Fund underperformed the Russell 1000 Value Index, its other benchmark, which returned 17.34% for the same period. The Fund outperformed the 14.68% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities rose over the period, as measured by the S&P 500 Index, notwithstanding significant volatility during the year. Early in the first quarter of 2016, equities plunged and moved in virtual lockstep with the price of oil as fears of a recession and weakness in China weighed on investors’ minds. However, equity markets surged in late February and March as solid economic data, a stabilization in oil prices, and accommodative commentary from the Federal Reserve (Fed) helped to calm the market’s early year jitters. A better-than-feared U.S. corporate earnings season in the second quarter and an encouraging economic backdrop helped sustain the rally. At its June meeting, the Fed left rates unchanged and reduced its U.S. growth and long-run policy rate forecasts, citing mixed U.S. economic data and uncertainty about global economic and financial developments. After plunging in the two trading days following the approval of the U.K.’s exit from the E.U. (Brexit), U.S. equities staged an impressive comeback in the days following.

U.S. equities continued to climb in July, following a solid start to the corporate earnings season and encouraging housing and employment data releases. Stocks were essentially flat in August and September as investors remained focused on the Fed’s actions, specifically on the timing of the next rate increase. A confluence of worries contributed to increased volatility during September, including

uncertainty surrounding the U.S. presidential election, tepid economic data, and valuation concerns. Stocks surged following Donald Trump’s victory in the U.S. Presidential election on hopes of increased fiscal stimulus, reduced regulatory restrictions, and lower corporate taxes. Economic data released during the fourth quarter was generally encouraging, as third quarter gross domestic product (GDP) growth was revised slightly higher and the U.S. housing market continued to display healthy trends. In December, the Fed raised rates by 0.25%, a move that was anticipated by most of the market. It was only the second increase in the last decade.

Equity returns varied by market-cap during the period, as small- and mid-cap equities, as measured by the Russell 2000 and S&P MidCap 400 Indices, outperformed large-cap equities, as measured by the S&P 500 Index. During the twelve-month period, nine of the eleven sectors1 within the S&P 500 Index posted positive returns, led by Energy (+27%), Telecommunication Services (+24%), and Financials (+23%), while Real Estate (-6%) and Healthcare (-3%) fell.

Sector allocation, a result of the Fund’s bottom up stock selection process, was the primary contributor to performance relative to the S&P 500 Index during the period. Overweights to the Financials and Energy sectors and an underweight to the Consumer Discretionary sector more than offset the negative impact of an overweight to Healthcare and an underweight to the Information Technology sector. Security selection also contributed positively to returns relative to the S&P 500 Index during the period. Strong selection within Healthcare, Consumer Discretionary, and Industrials was only partially offset by weaker selection within Consumer Staples and Information Technology.

The Fund’s top contributors to performance relative to the S&P 500 Index during the period were Bank of America (Financials), Prudential Financial (Financials), and JPMorgan Chase (Financials). Bank of America, a U.S.-based bank holding and financial holding company,

| 1 | Effective September 1, 2016, a new Real Estate sector was created under the Global Industry Classification Standard (GICS); holdings in this sector were previously classified as Financials. The attribution analysis of the Financials sector includes Real Estate for the period starting January 1, 2016 through August 31, 2016. The attribution analysis of the Real Estate sector is only for the period starting September 1, 2016 through December 31, 2016. |

|

| Hartford Dividend and Growth HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

saw its stock price rise on expectations of rising interest rates and hope that the Republican sweep of the White House and Congress might relieve regulatory pressures the banking sector has faced since the financial crisis. Prudential Financial, a U.S.-based financial services company, rose for the period after it announced strong operating results and a positive outlook. Profitability of the company was also better than expected given the low interest rate environment. JPMorgan Chase, a U.S.-based financial holding company, was another company whose share price rose following the U.S. presidential election and expectations of reduced regulations in the Financials sector. Top absolute performers during the period included Chevron (Energy).

The Fund’s top detractors from returns relative to the S&P 500 Index were AstraZeneca (Healthcare), Wells Fargo (Financials) and Bristol-Myers Squibb (Healthcare). The stock price of AstraZeneca, a U.K.-based manufacturer of pharmaceutical products, fell over the period after it reported results that disappointed investors and lowered its 2016 guidance. Shares of Wells Fargo, a U.S.-based financial services company, fell during the period, as investors became increasingly concerned that interest rates would not move higher quickly enough to support near-term profitability for the bank, and following allegations that bank employees opened more than 2 million unauthorized accounts to hit sales targets. The stock price of Bristol-Myers Squibb, a U.S.-based biopharmaceutical company, fell following the release of their Opdivo lung cancer drug trial results, which did not achieve the primary endpoint. Citigroup (Financials) and Cardinal Health (Healthcare) were also top absolute detractors during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

At the start of the year, the outlook that interest rates would remain lower for a longer than expected period led to declines in oil prices and increased pressure on bank earnings. A rising probability of Clinton being elected as president also contributed to skepticism about bank earnings as investors anticipated higher regulatory hurdles with a Democratic administration. This challenging environment reversed in November with the surprising result in which Donald Trump won over Hillary Clinton, and Republicans swept both houses of Congress.

We believe rates will rise incrementally and will at least be higher in 2017 than they were in 2016. Oil prices have gotten a boost following the Organization of the Petroleum Exporting Countries’ (OPEC) decision to cut supply. Although we do not believe that economic growth will necessarily be exceptionally robust, we do believe that these marginal improvements should lead to more rational market behavior. For example, higher rates should allow capital to be allocated in a more “normal” fashion. We believe distortions to capital

allocation were introduced when rates were so far below normal. Internationally, we expect Europe should benefit from growth in the U.S. Likewise, China should also share in positive momentum in the U.S. though debt issues could dampen the effect of tailwinds.

We are finding valuation across sectors to be compelling for a smaller group of sectors as equity markets appear to be discounting robust economic growth. As a result, we have been taking profits, selling higher multiple energy companies, and adding to companies with more compelling relative valuations and solid fundamentals. We also added to the Fund’s position in Apple, which has not participated in the “Trump rally” following the U.S. presidential election.

We continue to focus on valuations and company fundamentals. During the year, we gained confidence in this approach to company analysis as the Fund’s positioning with overweight allocations to Financials and Energy has been rewarded. Although we did not anticipate the Brexit result or the Trump victory in the U.S. presidential election, which were key events driving market performance this year, we had established downside protection prior to those events by investing in companies that had lowered their breakeven profit levels by lowering their cost bases. These companies performed best when markets rose rapidly following the U.S. elections, and the result was the strongest relative performance quarter in the recent history of the approach. The majority of the full year performance was generated in the final quarter of the year.

At the end of the period, the Fund’s largest overweights relative to the S&P 500 Index were to the Financials, Energy, and Utilities sectors, while the Fund’s largest underweights were to Information Technology and Consumer Discretionary.

A Word about Risk

All investments are subject to risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. The Fund’s share price may fluctuate due to market risk and/or security selections that may underperform the market or relevant benchmarks. For dividend-paying stocks, dividends are not guaranteed and may decrease without notice. Foreign investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as political and economic developments in foreign countries and regions.

|

| Hartford Dividend and Growth HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

Composition by Sector

as of December 31, 2016

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 7.1 | % |

Consumer Staples | | | 6.3 | |

Energy | | | 10.1 | |

Financials | | | 24.7 | |

Health Care | | | 13.8 | |

Industrials | | | 10.5 | |

Information Technology | | | 14.0 | |

Materials | | | 3.6 | |

Real Estate | | | 0.5 | |

Telecommunication Services | | | 2.2 | |

Utilities | | | 4.7 | |

| | | | |

Total | | | 97.5 | % |

| | | | |

Short-Term Investments | | | 2.3 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for financial reporting purposes.

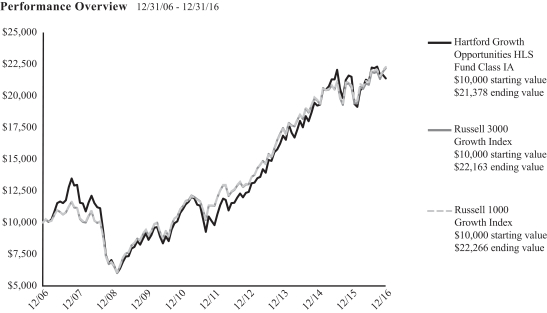

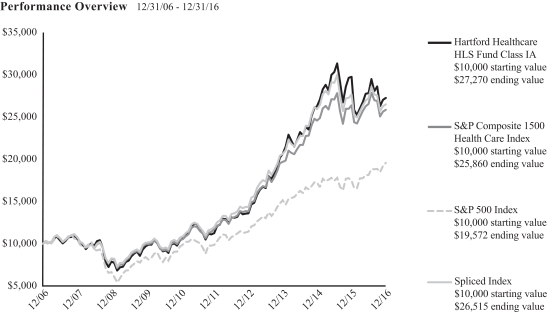

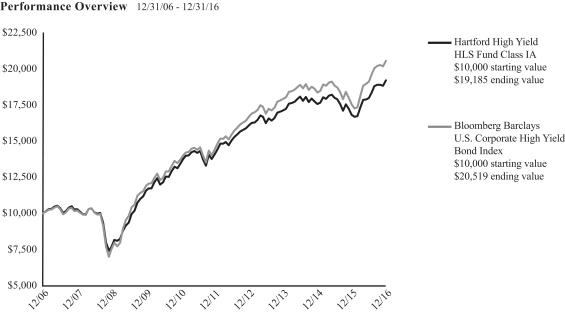

Hartford Global Growth HLS Fund inception 09/30/1998

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

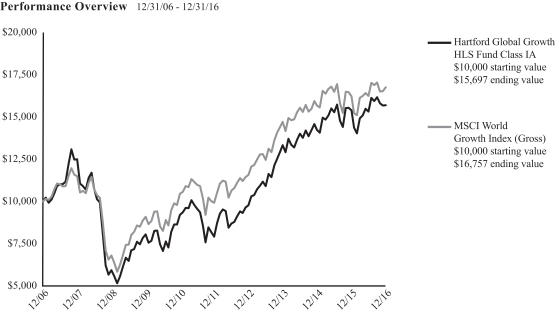

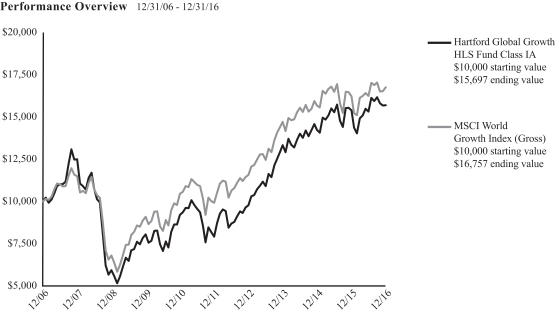

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 12/31/16)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Global Growth IA | | | 1.95 | % | | | 14.62 | % | | | 4.61 | % |

Global Growth IB | | | 1.71 | % | | | 14.34 | % | | | 4.35 | % |

MSCI World Growth Index (Gross) | | | 3.21 | % | | | 11.04 | % | | | 5.30 | % |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2016, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI World Growth Index (Gross) is a broad-based unmanaged market capitalization-weighted total return index which measures the performance of growth securities in 23 developed-country global equity markets including the United States, Canada, Europe, Australia, New Zealand and the Far East.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2016, the total annual fund operating expense ratios for Class IA and Class IB were 0.81% and 1.06%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2016.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see “A Word about Risk” section in the

“Manager Discussion” section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Global Growth HLS Fund |

Manager Discussion

December 31, 2016 (Unaudited)

Portfolio Managers

Matthew D. Hudson, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

John Boselli, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform during the period?

The Class IA shares of Hartford Global Growth HLS Fund returned 1.95% for the twelve-month period ended December 31, 2016, underperforming the Fund’s benchmark, the MSCI World Growth Index (Gross), which returned 3.21% for the same period. The Fund also underperformed the 2.60% average return of the Lipper Global Large-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

Global equities rose over the twelve-month period, as measured by the MSCI All Country World Index (Gross). 2016 got off to a volatile start as Chinese equities plunged in early January, sparking a global flight to quality trade. Along with ongoing worries about a hard landing in China, fears that yuan weakness could unleash a wave of global deflationary pressure resurfaced. Once again, extended monetary policy accommodation by major central banks helped support risk assets, such as equities. First, the Bank of Japan (BOJ) cut its benchmark rate to negative territory in January. Next, the People’s Bank of China (PBOC) lowered the reserve-requirement ratio in an effort to boost growth. Finally, European Central Bank (ECB) President Mario Draghi announced more-than-expected stimulus in March. Emerging market equities participated strongly in the market rebound. In June, the British electorate voted to leave the European Union (Brexit). The Brexit vote overshadowed a promising European economic backdrop and the ECB’s reaffirmation of its policy stance of maintaining low to near zero interest rates. In the U.S., solid economic data helped investors shrug off the Federal Reserve’s (Fed) ramped-up statements suggesting plans to further raise rates during May.

During the third quarter, expectations for continued accommodative monetary policy from central banks around the globe helped to stoke investors’ risk appetites. The Bank of England delivered a hefty stimulus package, which helped counteract the Brexit shock. Stocks rallied following Donald Trump’s victory in the U.S. Presidential election in November on expectations that Trump would reduce regulatory restrictions and increase fiscal stimulus, including corporate and individual tax cuts and a boost in infrastructure

spending. However, there was pronounced dispersion among sectors and regions. For instance, emerging market equities fell on concerns that a Trump administration would lead to trade protectionism, higher inflation, and a stronger U.S. dollar. In December, the Fed raised rates by 0.25%, a move that was anticipated by most of the market. It was only the second increase in the last decade.

During the period, U.S. equities outperformed non-U.S. equities, as measured by the S&P 500 Index and MSCI EAFE Index, respectively, and emerging market equities outperformed their developed market counterparts, as measured by the MSCI Emerging Markets Index and MSCI World Index, respectively. Within the MSCI World Growth Index (Gross), seven of eleven sectors1 posted positive returns during the period. Energy (+28%), Materials (+12%), and Industrials (+11%) gained the most, while the Healthcare (-10%), Real Estate (-6%), and Telecommunication Services (-3%) sectors lagged the most on a relative basis.

The Fund’s underperformance versus the MSCI World Growth Index (Gross) was driven by sector allocation, a result of the Fund’s bottom-up security selection process. The Fund’s underweights to Industrials and Materials and an overweight to Healthcare detracted the most from relative performance. This was partially offset by positive contribution from an overweight to Information Technology. Security selection slightly detracted from benchmark-relative results over the period. Selection within Industrials, Consumer Discretionary and Healthcare detracted the most, which was partially offset by stronger selection within Information Technology and Energy.

The top detractors from the Fund’s performance relative to the MSCI World Growth Index (Gross) were Allergan (Healthcare), Bristol-Myers Squibb (Healthcare), and Apple (Information Technology). Allergan, a U.S.-based high quality specialty pharmaceutical company, underperformed analysts’ expectations; after having announced a merger with Pfizer in the fourth quarter, the Treasury’s recent changes to tax inversion rules caused Pfizer to walk away from the deal, which led to a slump in Allergan’s stock price. The stock price of Bristol-Myers Squibb, a U.S.-based biopharmaceutical company, fell as the company’s trial for immuno-oncology drug

| 1 | Effective September 1, 2016, a new Real Estate sector was created under the Global Industry Classification Standard (GICS); holdings in this sector were previously classified as Financials. The attribution analysis of the Financials sector includes Real Estate for the period starting January 1, 2016 through August 31, 2016. The attribution analysis of the Real Estate sector is only for the period starting September 1, 2016 through December 31, 2016. |

|

| Hartford Global Growth HLS Fund |

Manager Discussion – (continued)

December 31, 2016 (Unaudited)

Opdivo failed during the third quarter of 2016. Shares of Apple, a U.S.-based mobile communication and media devices company, rose during the period after the company announced better than expected sales of its new iPhone 7 in the fourth quarter. Not owning this benchmark-constituent detracted from relative performance. Top absolute detractors also included Unione Di Banche (Financials).

Top contributors to performance relative to the MSCI World Growth Index (Gross) included Nintendo (Information Technology), Pioneer (Energy), and Assured Guaranty (Financials). Nintendo, a Japan-based gaming device and software company, saw its stock price rise during the period due to the release of its Pokemon GO game and announcing the release of Super Mario Run on the iPhone. Shares of Pioneer, a U.S.-based oil and gas exploration and production company, rose during the period as the company benefited from the recovery in commodity prices and after it raised its production growth outlook. The stock price of Assured Guaranty, a U.S.-based insurance company, rose for the year after it announced earnings results in November that beat market expectations. Comcast (Consumer Discretionary) was a top absolute contributor during the period.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

Looking ahead, we believe that the global economy seems poised for moderate growth in 2017. Economic conditions are broadly improving. A combination of monetary and fiscal policies in the United States, Japan, and Europe should have a positive influence while policy reforms in India and a rising middle class in China are driving growth in those countries. If President-elect Trump can deliver on his promises for lower corporate taxes, less regulation, and further fiscal stimuli, we feel this should contribute to growth in the United States in particular. We believe, however, that these potential positives must be balanced with the risks associated with the possibilities of increased protectionism, the threat of trade wars, the impact of a stronger U.S. dollar, higher interest rates, and heightened geopolitical risk.

At the end of the period, the Fund’s largest sector overweights were to the Information Technology and Financials sectors while the Fund was most underweight Consumer Staples, Industrials, and Healthcare, relative to the MSCI World Growth Index (Gross).

A Word about Risk