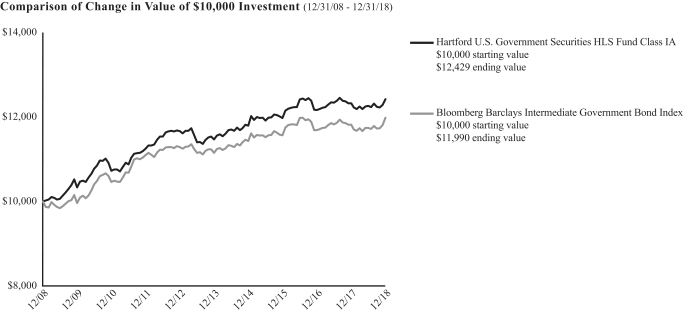

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-08629

HARTFORD SERIES FUND, INC.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610)386-4068

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford HLS Funds. The following is the Funds’ Annual Report covering the period from January 1, 2018 through December 31, 2018.

Market Review

The market was volatile in 2018, particularly at the end of the year. For the first time since 2008, the S&P 500 Index1 closed the year with a negative return,-4.38%.

Rising interest rates, inflation anxiety, slowing global growth, and concerns surrounding U.S. tariffs and foreign policy have all contributed to increased volatility.

Throughout 2018, the U.S. Federal Reserve (Fed) continued its cycle of interest-rate increases. At the end of December 2018, short-term rates had risen to 2.5%. At the time of this writing, expectations were for two additional raises in 2019. Central banks overseas also began to unwind their accommodative policies by raising interest rates.

Domestic and foreign politics are likely to play a key role in market movements in 2019. For example, potential gridlock due to divided government and ongoing trade tensions with China could impact U.S. markets significantly. Abroad, uncertainties surrounding the future of the “Brexit” undertaking for the United Kingdom to leave the European Union may impact global markets.

Despite increased volatility, unemployment is low in the U.S. and the U.S. economy is supported by a strong job market, higher wages, and healthy consumer confidence.

We encourage you to maintain a strong relationship with your financial advisor, who can help guide you through shifting markets confidently. He or she can help you proactively build a portfolio that takes market uncertainty into account, along with your unique investment goals and risk tolerances. Your financial advisor can help you find a fit within our family of funds as you work toward those goals.

Thank you again for investing in Hartford HLS Funds. For the mostup-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford HLS Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. The index is unmanaged and not available for direct investment. Past performance is not indicative of future results. |

Hartford HLS Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

|

| Hartford Balanced HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 3/31/1983 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks long-term total return. |

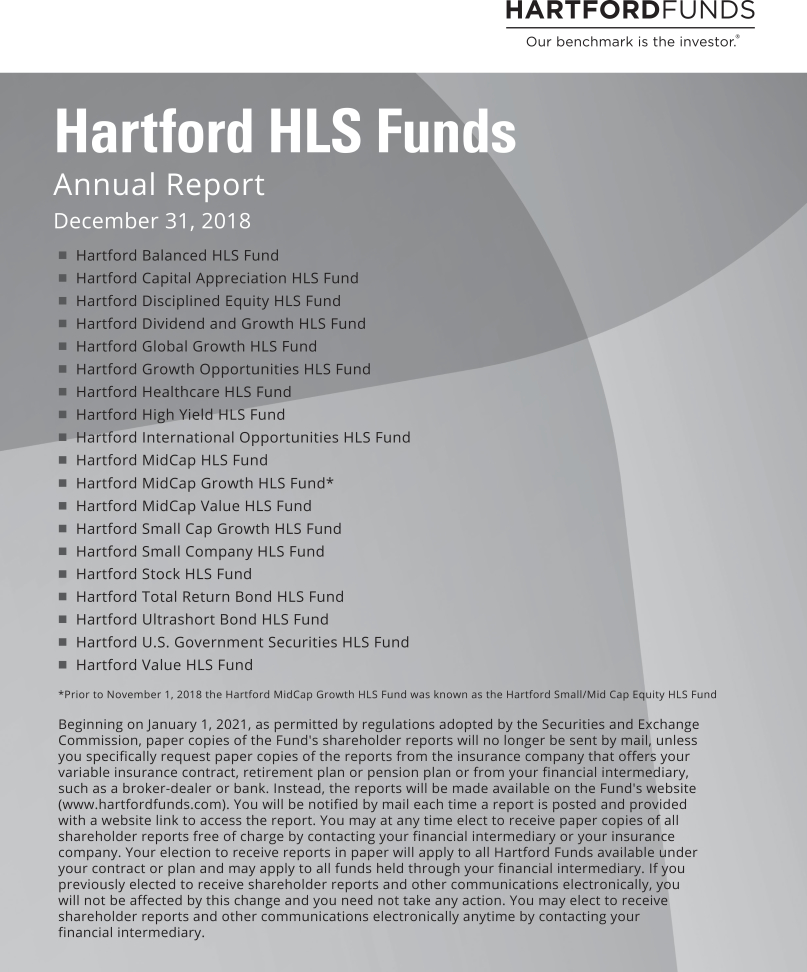

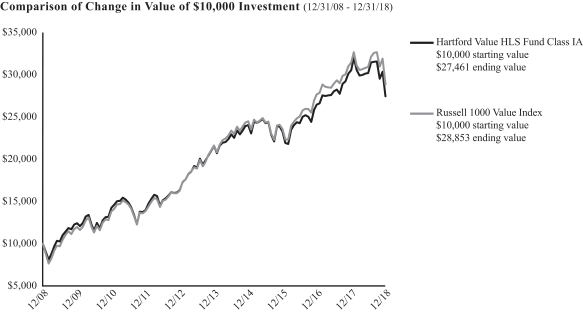

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | -5.24% | | | | 5.02% | | | | 9.94% | |

Class IB | | | -5.50% | | | | 4.75% | | | | 9.67% | |

60% S&P 500 Index/ 35% Bloomberg Barclays Government/Credit Bond Index/ 5% ICE BofAML US 3-Month Treasury Bill Index | | | -2.41% | | | | 6.14% | | | | 9.25% | |

S&P 500 Index | | | -4.38% | | | | 8.49% | | | | 13.12% | |

Bloomberg Barclays Government/Credit Bond Index | | | -0.42% | | | | 2.53% | | | | 3.46% | |

ICE BofAML US 3-Month Treasury Bill Index | | | 1.88% | | | | 0.63% | | | | 0.37% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

60% S&P 500 Index/ 35% Bloomberg Barclays Government/Credit Bond Index/ 5% ICE BofAML US 3-Month Treasury Bill Index is calculated by Hartford Funds Management Company, LLC.

S&P 500 Index(reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

Bloomberg Barclays Government/Credit Bond Index(reflects no deduction for fees, expenses or taxes) is designed to measure the non-securitized component of the U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities.

ICE BofAML US 3-Month Treasury Bill Index (reflects no deduction for fees, expenses or taxes) is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

You cannot invest directly in an index.

Performance information may reflect historical or current waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

As shown in the Fund’s prospectus dated May 1, 2018, the total annual fund operating expense ratios for Class IA and Class IB were 0.66% and 0.91%, respectively. The Fund filed a supplement to its prospectus, dated November 19, 2018, with the U.S. Securities and Exchange Commission that updated the Fund’s total annual fund operating expense table effective January 1, 2019. However, the information in this annual report is as of December 31, 2018 and does not reflect any changes made to the total annual fund operating expense table in the prospectus, as supplemented. The net expense ratios shown in the supplement are as follows: 0.63% (Class IA) and 0.88% (Class IB). The gross expense ratios shown in the supplement are as follows: 0.66% (Class IA) and 0.91% (Class IB). This contractual waiver will remain in effect through April 30, 2020 unless the Board of Directors of the Fund approves its earlier termination. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2018.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Portfolio Managers

Adam H. Illfelder, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Michael E. Stack, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Loren L. Moran, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Balanced HLS Fund returned-5.24% for the twelve-month period ended December 31, 2018, underperforming the Fund’s custom benchmark (60% S&P 500 Index, 35% Bloomberg Barclays Government/Credit Bond Index, and 5% ICE BofAML US3-Month Treasury Bill Index), which returned-2.41% for the same period. The S&P 500, Bloomberg Barclays Government/Credit Bond, and ICE BofAML US3-Month Treasury Bill Indices returned-4.38%,-0.42% and 1.88%, respectively for the same period. During the same period, the Class IA shares of the Fund outperformed the-6.64% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted negative results over the trailing twelve month period ending December 31, 2018. Bullish sentiment was exceptionally strong to start the year, as better-than-expected corporate profits helped drive U.S. equities higher. Returns in October and December were sharply negative, with the latter representing the largest U.S. equity market monthly decline seen this decade, culminating the first year of negative U.S. equity returns since 2008.

During the twelve-month period, three of the eleven sectors within the S&P 500 Index posted positive returns, led by Healthcare (+6%), Utilities (+4%), and Consumer Discretionary (+1%), while Energy(-18%) and Communication Services(-15%) fell the most.

U.S. fixed income markets largely generated negative total returns during the year, driven by corporate spread widening and higher yields as measured by the Bloomberg Barclays Global Aggregate Index. Geopolitical uncertainty remained elevated despite some seemingly positive developments, including a temporary U.S. and China trade truce, survived confidence vote by U.K. Prime Minister May, and compromised budget plan between Italy and the European Union (EU).

Global monetary policy continued along a less accommodative path during the period. The Federal Reserve (Fed) increased rates four times and projected additional increases, but set expectations that the pace of tightening may slow. The European Central Bank (ECB) concluded its asset purchase program but announced it would continue reinvestments for an extended period after the first rate increase, slated for the second half of 2019.

Early in the period, U.S. yields generally moved higher, driven by continued global growth momentum and rising inflation expectations. However, late in the year, yields declined amid a spike in equity market volatility and increasing concerns about slowing global growth. The prospect of fewer Fed rate increases in 2019 amid a deteriorating global economic outlook contributed to a decline in U.S. yields late in the period but they still finished higher for the year. The yield curve flattened substantially during the year as Fed rate increases propelledfront-end rates higher.

During the period, asset allocation decisions detracted from the custom benchmark-relative performance during the period. The Fund was generally overweight equities and underweight fixed income and cash relative to the custom benchmark. The equity portion of the Fund underperformed the S&P 500 Index while the fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index.

Equity underperformance versus the S&P 500 Index was driven primarily by security selection. In particular, weak security selection in the Consumer Discretionary, Consumer Staples, and Finance sectors detracted from performance relative to the S&P 500 Index, which was partially offset by stronger selection in the Information Technology and Communication Services sector. Sector allocation, which is a residual of ourbottom-up security selection process, contributed positively to relative performance during the period primarily due to the Fund’s overweight to the Healthcare sector and underweight to the Consumer Staples sector, which was slightly offset by an overweight to Energy and Materials sectors.

Stocks that detracted the most from returns relative to the S&P 500 Index and absolute returns in the equity portion of the Fund during the period were Invesco (Financials), British-American Tobacco (Consumer Staples), and Fortune Brands Home (Consumer Discretionary). Shares of the Invesco, a U.S.-based investment management company, fell over 52% as a result of broad market weakness, weak fund flows, and uncertainty about the impact of their recent acquisition of Oppenheimer. We maintained a position in the stock as of the end of the period. British-American Tobacco, aUK-based tobacco company, shares were impacted by concerns about the long-term trajectory of the U.S. cigarette business, due to increased Federal Drug Administration (FDA) regulation and the significant growth of the JUULe-vapor product. The FDA is seeking to ban menthol in U.S. tobacco products, which would have a meaningful impact on the company’s U.S. business and their important Newport brand. We exited the position during the fourth quarter on concerns about greater FDA regulation and added risk from their

|

| Hartford Balanced HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

balance sheet leverage. Shares of Fortune Brands Home, a U.S.-based manufacturer of home fixtures and hardware, declined due to softer-than-expected demand during the fourth quarter of 2018. In addition, underwhelming new construction end market shipments in the fourth quarter of 2018 and lower starts expectations in 2019 may limit organic growth for the company. We maintain a position in the stock at the end of the period. Invesco (Financials), Citigroup (Financials), and Philip Morris International (Consumer Staples) were the top detractors from absolute returns during the period.

Top contributors to performance relative to the S&P 500 Index in the equity portion of the Fund during the period included Eli Lilly (Healthcare), XL Group (Financials), and NextEra Energy (Energy). Eli Lilly, a U.S.-based global pharmaceutical company, returned more than 50% during the period, as the company reported strong third quarter results and released positive data on their diabetes franchise. Shares of XL Group, a global insurance and reinsurance company, rose sharply after the company agreed to be acquired by France-based insurer AXA. We eliminated the Fund’s position during the period. Shares of NextEra Energy, a U.S.-based clean energy company, rose during the period as the company reported strong second quarter earnings. The year-over-year earnings growth was led by solid contribution from both Florida Power & Light Company and NextEra Energy Resources segments. The enhanced growth was primarily due to new investments made at both the segments. Microsoft (Information Technology), Eli Lilly (Healthcare), and XL Group (Financials) were the top contributors to absolute returns during the period.

The fixed income portion of the Fund outperformed the Bloomberg Barclays Government/Credit Bond Index during the period. Short duration/yield curve positioning was the primary contributor to relative performance. Investment grade credit positioning contributed positively overall, as positive impacts from an overweight to and security selection within the Industrials, Sovereigns and Taxable Municipals sectors more than offset a negative impact from an overweight to Financials and Utilities sectors.Out-of-benchmark allocation to Treasury Inflation-Protected Securities (TIPS) detracted from performance relative to the Bloomberg Barclays Government/Credit Bond Index, particularly in the last quarter of 2018 as TIPS underperformed duration-equivalent nominal U.S. Treasuries. An out of benchmark allocation to agency Mortgage-Backed Securities (MBS) pass-throughs and Collateralized Loan Obligations (CLOs) detracted modestly from relative performance.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Economic updates remained solid during the period, but rising uncertainty on a range of issues contributed to a deterioration in investor sentiment. Job growth remained steady through the period and the unemployment rate remained below 4%. Consumer confidence and retail sales have remained strong throughout the year, and initial reports from the holiday season have been solid. Inflation remains benign, partly thanks to lower oil prices, which we believe may benefit the consumer in 2019. The Fed highlighted in December that wages have started to increase which we believe may also help the U.S. consumer, but may also serve as a source of margin pressure in several domestic industries.

On the fixed income side, we have a cautious view of risk assets and as a result, the Fund has reduced exposure to corporate bonds. With better interest rate valuations, and as we expect the Fed to be more data dependent as we approach the terminal policy rate, and with much of the

rise in short- term rates behind us, we have chosen to seek to limit the Fund’s interest rate risk relative to the benchmark and have reduced the Fund’s short duration positioning. Credit remains a main investment focus of the portfolio. While the Fund is positioned with an overweight to corporate credit, we favor higher quality and less cyclical sectors. We believe that the market should benefit from continued tailwinds of tax reform, deregulation, and fiscal stimulus. Despite the prolonged economic cycle and persistently strong earnings from the corporate sector, we are viewing the credit cycle as mature with most of the narrowing of spreads (corporate compared to Treasury) behind us.

Within equities, the Fund ended the period most overweight to the Healthcare sector and most underweight to the Consumer Discretionary sector. Within fixed income, the Fund ended the period with a moderatelypro-cyclical risk posture, continuing to favor investment grade credit, particularly in the U.S. Financials sector. As of the end of the period, the Fund is positioned with an overweight to taxable municipal bonds for the diversification benefit we believe they provide and maintained long inflation break evens via an allocation to TIPS. The Fund ownsout-of-benchmark allocations to securitized sectors MBS, Commercial Mortgage Backed Securities (CMBS), and Asset Backed Securities (ABS) as of the end of the period.

At the end of the period, the Fund’s equity exposure was at 67% compared to 60% in its custom benchmark.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.• Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.• Fixed income security risks include credit, liquidity, call, duration, and interest-rate risk. As interest rates rise, bond prices generally fall.• Mortgage related- and asset-backed securities’ risks include credit, interest-rate, prepayment, and extension risk.• Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government.

Composition by Security Type(1)

as of December 31, 2018

| | | | |

| Category | | Percentage of

Net Assets | |

Equity Securities | | | | |

Common Stocks | | | 65.1 | % |

| | | | |

Total | | | 65.1 | % |

| | | | |

Fixed Income Securities | | | | |

Asset & Commercial Mortgage Backed Securities | | | 3.7 | % |

Corporate Bonds | | | 18.4 | |

Foreign Government Obligations | | | 0.6 | |

Municipal Bonds | | | 1.1 | |

U.S. Government Agencies | | | 0.9 | |

U.S. Government Securities | | | 8.4 | |

| | | | |

Total | | | 33.1 | % |

| | | | |

Short-Term Investments | | | 1.6 | |

Other Assets & Liabilities | | | 0.2 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 4/02/1984 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

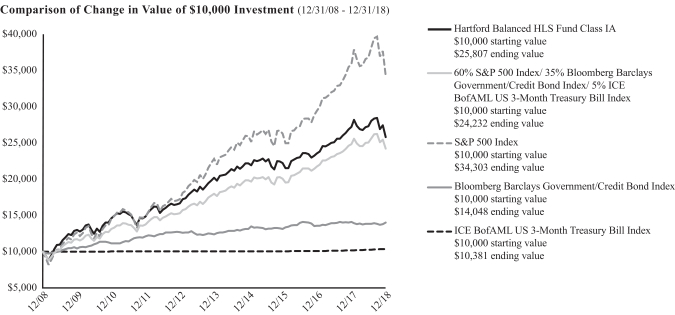

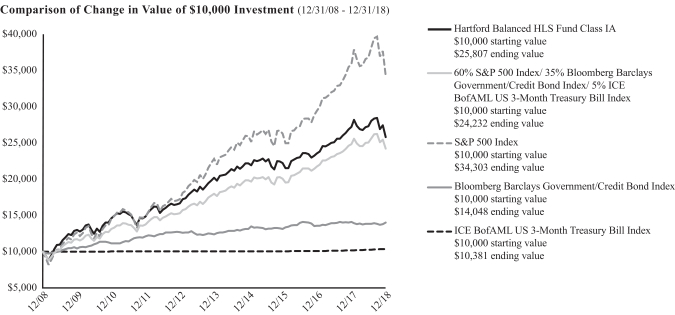

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | -6.96% | | | | 5.39% | | | | 12.39% | |

Class IB | | | -7.18% | | | | 5.12% | | | | 12.11% | |

Class IC | | | -7.41% | | | | 4.86% | | | | 11.83% | |

Russell 3000 Index | | | -5.24% | | | | 7.91% | | | | 13.18% | |

S&P 500 Index | | | -4.38% | | | | 8.49% | | | | 13.12% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

Russell 3000 Index(reflects no deduction for fees, expenses or taxes) is designed to measure the performance of the 3,000 largest U.S. companies based on total market capitalization.

S&P 500 Index(reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.68%, 0.93% and 1.18%, respectively. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2018.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Portfolio Managers

Gregg R. Thomas, CFA

Senior Managing Director and Director of Investment Strategy

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Capital Appreciation HLS Fund returned-6.96% for the twelve-month period ended December 31, 2018, underperforming the Fund’s benchmarks, the Russell 3000 Index and the S&P 500 Index, which returned-5.24% and-4.38%, respectively, for the same period. For the same period, Class IA shares of the Fund outperformed the-7.87% average return of the LipperMulti-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted negative results over the trailing twelve-month period ending December 31, 2018. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the year, in line with expectations, although they signaled a more dovish path heading into 2019. (“Dovish” describes a monetary policy that favors lower interest rates to encourage economic growth.) Bullish sentiment was exceptionally strong to start the year, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February of 2018 which led to heightened levels of volatility, a theme that continued for the remainder of the year. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This changed in the final months of 2018, when concerns surrounding slowing global growth, rich valuations, rising central bank benchmark interest rates, and capricious U.S. and China trade tensions were at the forefront of investors’ minds. Returns in October and December were sharply negative, with the latter representing the largest U.S. equity market monthly decline seen this decade, culminating the first year of negative U.S. equity returns since 2008.

Returns varied bymarket-cap during the period, aslarge-cap equities, as measured by the S&P 500 Index, outperformed both small- andmid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, eight of the eleven sectors in the Russell 3000 Index had negative returns. Energy(-20.0%), Materials(-16.4%), and Industrials(-14.1%) were the worst performers, while Healthcare (+5.3), Utilities (+4.6%), and Information Technology (+0.5%) performed best.

Security selection was the primary detractor from performance relative to the Russell 3000 Index during the period. Weak stock selection in the Healthcare, Consumer Discretionary, and Information Technology sectors was only partially offset by positive selection in the Industrials and Real Estate sectors. Sector allocation, a result of the Fund’sbottom-up security selection process, contributed positively to

performance relative to the Russell 3000 Index during the period. An overweight to the Consumer Staples sector and an underweight to the Financials and Energy sectors contributed positively to returns relative to the Russell 3000 Index. This was only partially offset by an overweight to the Materials and Industrials sectors, which detracted from benchmark-relative performance. Factor impact on the Fund was neutral. Exposure to volatility factors was positive but was offset by exposure to dividend yield. International exposure (country and currency) also detracted from relative performance, in particular due to the Fund’s exposure within Europe (Switzerland, France, and the United Kingdom) and Emerging Markets (China and South Korea).

The largest detractors to performance relative to the Russell 3000 Index over the period were Amazon (Consumer Discretionary), Microsoft (Information Technology), and Halliburton (Energy). Underweight exposure to U.S.-based globale-commerce retailer Amazon detracted from performance relative to the Russell 3000 Index. The stock price rose after the company posted strong earnings during the period as investors continued to be bullish on the prospects of continued strong growth. We believe the fundamentals across Amazon’s three key business units remain robust and the company continues to expand its categories, many of which have a high likelihood of success. While we have added to the position over the period, we remained underweight relative to the Russell 3000 Index. Underweight exposure to Microsoft, a U.S.-based developer of software products and services, detracted from performance relative to the Russell 3000 Index. Microsoft’s stock price rose during the period as the company released strong quarterly and fiscal 2018 financial results driven by robust performance across all business segments (productivity and business processes, intelligent cloud, and personal computing). Halliburton is a U.S.-based oil service company. The stock price declined during the period with falling oil prices. Bank OZK (Financials) and Citigroup (Financials) were among the top absolute detractors during the period.

The largest contributors to performance relative to the Russell 3000 Index over the period were ServiceNow (Information Technology), Facebook (Communications Services), and General Electric (Industrials). ServiceNow is a U.S.-based provider of cloud-based services that automate enterprise IT operations. The stock price rose as underlying results and guidance were better than the market expected during each quarterly earnings report. The market continued to have confidence in the company’s strong fundamentals momentum, as it has been successful at selling their products more broadly. The Fund continued to have an overweight to ServiceNow at the end of the period. Facebook is a U.S.-based company that engages in the development of social media applications. Shares declined sharply after lower than expected second quarter results as Facebook’s privacy data issues have had more of an impact on users, usage, and advertising revenue than anticipated. The company provided a softer outlook for the second half of 2018 and given the increased near-term uncertainty on revenue growth, slowing user growth, and lower margin forecast we have eliminated the Fund’s position. Our decision not to own General Electric

|

| Hartford Capital Appreciation HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

contributed positively to performance relative to the Russell 3000 Index during the period. GE is a U.S.-based multi-segment company that develops and manufactures products for the generation, transmission, distribution, control and utilization of electricity. The company is facing a number of controversies, including those relating to the company’s accounting practices. The stock price fell significantly in 2018 in the face of high leverage, poor power and gas business, and continued restructuring efforts. We continued to avoid the stock at the end of the period and remained unconvinced that the company’s turnaround plan will work. Atlassian (Information Technology) and Nike (Consumer Discretionary) were among the top contributors to absolute returns over the period.

The Fund, at times, uses derivative instruments such as currency forwards to hedge currency risk and equity index futures to hedge the market risk. During the period, the use of currency forwards did not have a significant impact on performance while the use of equity index futures slightly detracted from relative performance.

What is the outlook as of the end of the period?

Economic growth in the U.S. was tracking above the long-term average in the fourth quarter of 2018; however, we see signs of slowing growth ahead as durable goods orders remain sluggish and input costs are increasing on the back of higher tariffs. With inflationin-line with Fed’s forecasts and the Fed’s reiteration of a data-dependent monetary policy agenda, we could see further tightening in 2019. However, we expect to see a pause in this policy approach if macro fundamentals deteriorate.

In addition to the considerable uncertainty regarding the pace of tightening, we believe continued uncertainty stemming from ongoing trade tensions persists. Furthermore, the risk of an abrupt economic slowdown in China and political risk in Europe could have ramifications for the U.S. We expect the net impact of these uncertainties to lead to continued market volatility in 2019.

From a factor perspective, while we maintained the Fund’s exposure to value and growth factors for capital appreciation potential, we are increasingly looking to quality and low volatility to mitigate downside risk.

At the end of the period, the Fund’s largest overweights were to Consumer Discretionary and Consumer Staples sectors, while the Fund’s largest underweights were to Information Technology and Communications Services sectors, relative to the Russell 3000 Index.

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes and/or portfolio management teams. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.• Small- and mid-cap securities can have greater risk and volatility than large-cap securities.• Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks are generally greater for investments in emerging markets.• The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Sector(1)

as of December 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 6.0 | % |

Consumer Discretionary | | | 12.7 | |

Consumer Staples | | | 8.6 | |

Energy | | | 3.9 | |

Financials | | | 11.9 | |

Health Care | | | 16.7 | |

Industrials | | | 11.9 | |

Information Technology | | | 15.2 | |

Materials | | | 3.6 | |

Real Estate | | | 5.6 | |

Utilities | | | 2.2 | |

| | | | |

Total | | | 98.3 | % |

| | | | |

Short-Term Investments | | | 1.8 | |

Other Assets & Liabilities | | | (0.1 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 5/29/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

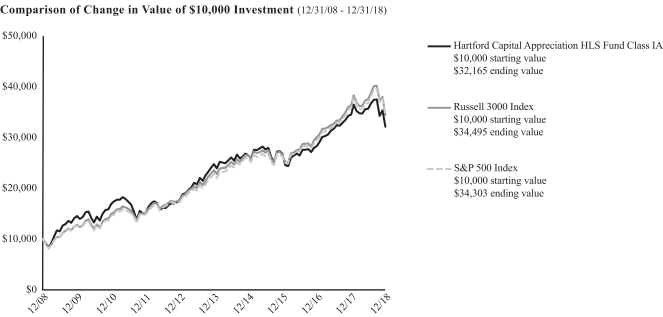

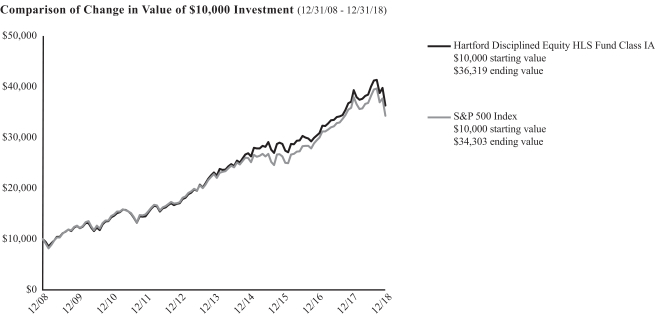

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | -1.99% | | | | 9.42% | | | | 13.77% | |

Class IB | | | -2.23% | | | | 9.15% | | | | 13.48% | |

S&P 500 Index | | | -4.38% | | | | 8.49% | | | | 13.12% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index(reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.78% and 1.03%, respectively. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2018.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Portfolio Managers

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

David A. Siegle, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Douglas W. McLane, CFA

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of the Hartford Disciplined Equity HLS Fund returned-1.99% for the twelve-month period ended December 31, 2018, outperforming the Fund’s benchmark, the S&P 500 Index, which returned-4.38% for the same period. During the same period, the Class IA shares of the Fund also outperformed the-5.43% average return of the LipperLarge-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted negative results over the trailing twelve-month period ending December 31, 2018. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period ending December 31, 2018, in line with expectations, although they signaled a more dovish path heading into 2019. (“Dovish” describes a monetary policy that favors lower interest rates to encourage economic growth.) Bullish sentiment was exceptionally strong to start the year, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February which led to heightened levels of volatility, a theme that continued for the remainder of the year. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This changed in the final months of 2018, when concerns surrounding slowing global growth, rich valuations, rising central bank benchmark interest rates, and capricious U.S. and China trade tensions were at the forefront of investors’ minds. Returns in October and December were sharply negative, with the latter representing the largest U.S. equity market monthly decline seen this decade, culminating the first year of negative U.S. equity returns since 2008.

Returns varied bymarket-cap during the period, aslarge-cap equities, as measured by the S&P 500 Index, outperformed both small- andmid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, three of the eleven sectors within the S&P 500 Index rose, led by Healthcare (+6%), Utilities (+4%), and Consumer Discretionary (+1%). Energy(-18%), Communication Services(-15%) and Materials(-15%) lagged on a relative basis.

Security selection was the primary contributor to returns relative to the S&P 500 Index during the period, primarily within Healthcare, Information Technology, and Communication Services sectors, which more than offset weaker selection within the Consumer Discretionary and Energy sectors, which detracted from performance relative to the S&P 500 Index. Sector allocation, which is a residual of ourbottom-up security selection process, contributed positively to results relative to the S&P 500 Index driven by the Fund’s underweight to the Energy sector and overweight to Healthcare and Utilities sectors. This more than offset the negative impact from an overweight to the Industrials sector and an underweight to the Consumer Discretionary sector.

The top contributors to performance relative to the S&P 500 Index and absolute performance over the period were Mastercard (Information Technology), XL Group (Financials), and Eli Lilly (Healthcare). The top contributor to performance relative to the S&P 500 Index during the period was Mastercard, a U.S.-based electronic transactions company. The stock price of the company rose as the company continued to benefit from the ongoing secular shift away from cash and checks and towards electronic payments. XL Group, a U.S.-based global commercial Property & Casualty insurer was among the top contributors during the period. The company’s share price rose after the company agreed to be acquired by France-based insurer AXA. Eli Lilly, a global pharmaceutical company, contributed positively to performance relative to the S&P 500 Index during the period. Its shares traded higher on positive news from the company, including the U.S. Food and Drug Administration granting Breakthrough Therapy Designation to the company’s headache drug candidate Emgality.

The largest detractors from performance relative to the S&P 500 Index over the period were Amazon (Consumer Discretionary), Micron (Information Technology), and Fortune Brands (Industrials). An underweight position in Amazon, a U.S.-based globale-commerce retailer, detracted from performance relative to the S&P 500 Index as the company saw its share price rise; the company continued to expand its categories, such as its purchase of Whole Foods, to which the market reacted positively. Micron, a U.S.-based semiconductor company was among the top detractors from performance relative to the S&P 500 Index during the period. Share prices of the company came under pressure amid market concerns over global trade tensions and price weakness in the DRAM memory chip market. Fortune Brands, a U.S.-based home and security company, saw its share price decline during the period over concerns around rising interest rates and slowing housing starts. FedEx (Industrials) was a top absolute detractor from performance during the period.

|

| Hartford Disciplined Equity HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

We believe the U.S. economy remains healthy, although leading indicators are suggesting some moderation in growth into next year. With unemployment levels low and trending lower, we see risks of higher U.S. inflation. Many companies are facing higher labor and material costs, creating some uncertainty around profitability. While we were concerned about the possibility of higher oil prices during the period given the prospect of Iran sanctions, the waivers granted by the U.S. government actually resulted in oversupply and declining crude prices. However, we believe the subsequent cuts should restore supply demand balance and allow oil prices to find a firmer footing in 2019.

Trade continues to dominate the narrative. We are hopeful that a satisfactory agreement with China will be arrived at, however some supply chain disruption and temporary pauses in capital investment cannot be ruled out. The U.K.’s exit from the E.U. hasre-emerged as another near term uncertainty that we have to monitor. On the flip side, we believe the strong employment situation bodes well for the consumer and so far the government shutdown has had little economic impact. Also credit remains benign and does not appear to be a near term headwind to profitability.

We will be watching profitability trends in 2019, particularly in areas seeing inflationary pressures, to evaluate the ability for companies to pass on prices and still grow. Given the uncertainty of some of the aforementioned macroeconomic issues, we do expect volatility to remain somewhat elevated despite recent declines in the market.

At the end of the period, the Fund’s largest overweights were to the Healthcare, Consumer Staples, and Utilities sectors, while the Fund’s largest underweights were to the Communication Services, Energy, and Information Technology sectors, relative to the S&P 500 Index.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.

Composition by Sector(1)

as of December 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 6.6 | % |

Consumer Discretionary | | | 10.5 | |

Consumer Staples | | | 9.2 | |

Energy | | | 2.1 | |

Financials | | | 14.0 | |

Health Care | | | 19.3 | |

Industrials | | | 10.4 | |

Information Technology | | | 18.0 | |

Materials | | | 2.3 | |

Real Estate | | | 1.1 | |

Utilities | | | 5.2 | |

| | | | |

Total | | | 98.7 | % |

| | | | |

Short-Term Investments | | | 1.2 | |

Other Assets & Liabilities | | | 0.1 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 3/09/1994 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

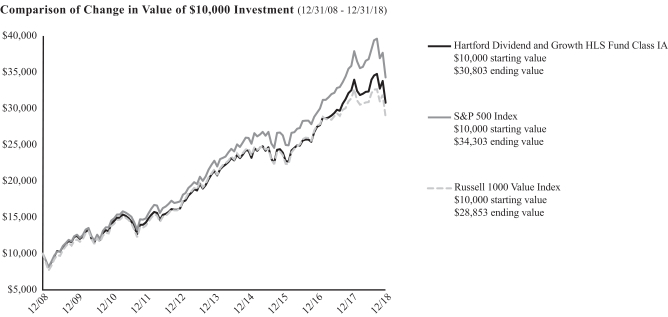

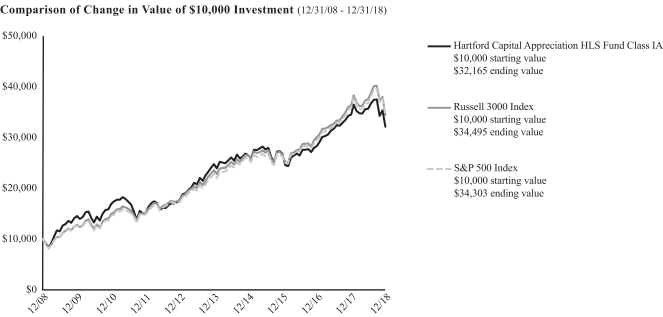

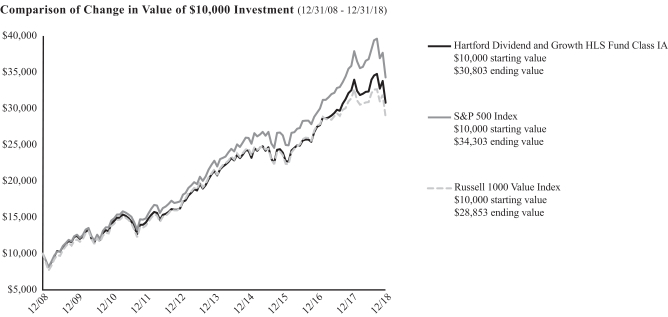

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | -5.32% | | | | 7.53% | | | | 11.91% | |

Class IB | | | -5.56% | | | | 7.26% | | | | 11.63% | |

S&P 500 Index | | | -4.38% | | | | 8.49% | | | | 13.12% | |

Russell 1000 Value Index | | | -8.27% | | | | 5.95% | | | | 11.18% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index(reflects no deduction for fees, expenses or taxes) is a float-adjusted market capitalization-weighted price index composed of 500 widely held common stocks.

Russell 1000 Value Index(reflects no deduction for fees, expenses or taxes) is designed to measure the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index is designed to measure the performance of the 1,000 largest companies in the Russell 3000 Index based on their market capitalization and current index membership.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.68% and 0.93%, respectively. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2018.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Portfolio Managers

Edward P. Bousa, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mark E. Vincent

Managing Director and Equity Research Analyst

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Dividend and Growth HLS Fund returned-5.32% for the twelve-month period ended December 31, 2018, underperforming one of the Fund’s benchmarks, the S&P 500 Index, which returned-4.38% for the same period. Class IA shares of the Fund outperformed the Russell 1000 Value Index, its other benchmark, which returned-8.27% for the same period. During the same period, the Class IA shares of the Fund outperformed the-7.08% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, posted negative results over the trailing twelve-month period ending December 31, 2018. The Federal Reserve (Fed) raised its benchmark interest rate by 0.25% four times during the twelve-month period, in line with expectations, although they signaled a more dovish path heading into 2019. (“Dovish” describes a monetary policy that favors lower interest rates to encourage economic growth.) Bullish sentiment was exceptionally strong to start the year, as better-than-expected corporate profits helped drive U.S. equities higher. Signs of inflation entered the market in February which led to heightened levels of volatility, a theme that continued for the remainder of the period. By the summer of 2018, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. Nonetheless, positive sentiment persisted, fueled by robust earnings growth, fiscal stimulus, the announcement of a preliminary trade deal between the U.S. and Mexico, and expectations for stronger U.S. economic growth relative to other regions of the world. This changed in the final months of 2018, when concerns surrounding slowing global growth, rich valuations, rising central bank benchmark interest rates, and capricious U.S. and China trade tensions were at the forefront of investors’ minds. Returns in October and December were sharply negative, with the latter representing the largest U.S. equity market monthly decline seen this decade, culminating the first year of negative U.S. equity returns since 2008.

Returns varied bymarket-cap during the period, aslarge-cap equities, as measured by the S&P 500 Index, outperformed both small- andmid-cap equities, as measured by the Russell 2000 Index and S&P MidCap 400 Index, respectively. During the twelve-month period, three of the eleven sectors within the S&P 500 Index posted positive returns, led by Healthcare (+6%), Utilities (+4%), and Consumer Discretionary

(+1%). Energy(-18%), Communication Services(-15%) and Materials(-15%) lagged on a relative basis.

Sector allocation, a result of our bottom up stock selection process, was the primary detractor from performance relative to the S&P 500 Index during the period. An overweight to the Financials and Energy sectors more than offset the positive impact of an overweight to the Utilities sector and an underweight to Consumer Staples sector. Security selection contributed positively to performance relative to the S&P 500 Index during the period. Strong selection within Communication Services, Healthcare, and Energy sectors was only partially offset by weaker selection within Consumer Discretionary and Financials sectors.

The Fund’s top detractors from performance relative to the S&P 500 Index were Amazon (Consumer Discretionary), Prudential Financial (Financials), and Principal Financial Group (Financials). Not owning Amazon, a constituent in the S&P 500 Index, a U.S.-based globale-commerce retailer, detracted from performance relative to the S&P 500 Index as the company reported strong organic growth and rising profit, along with increasing net sales year over year. Shares of U.S.-based life insurance and Financial Services company, Prudential, detracted from performance relative to the S&P 500 Index despite rising earnings expectations during the year. The stock fell along with those of many other insurers on concerns over potential charges associated with long-term care insurance and the fear of economic recession. Principal Financial Group, faltered during the period amid widespread weakness in the sector and earnings results that slightly lagged street estimates. Top absolute detractors during the period included Bank of America (Financials) and DXC Technology (Information Technology).

The Fund’s top contributors to performance relative to the S&P 500 Index during the period were Facebook (Communication Services), Verizon (Communication Services), and General Electric (Industrials). Not holding Facebook, a constituent in the S&P 500 Index, U.S.-based social media provider, contributed positively to benchmark-relative performance as the company faced ongoing concerns surrounding slowing growth and the potential for increased regulatory attention. Verizon, a U.S.-based communications technology company, saw its share price rise as the company reported strong quarterly results above street estimates and reduced its capital expenditure guidance. General Electric, a U.S.-based multinational conglomerate operating in the technology infrastructure, capital finance, and consumer and industrial products industries, underperformed as the company reported earnings results that were weaker than consensus estimates primarily driven by

|

| Hartford Dividend and Growth HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

another miss in the GE Power division. The Fund’s modest position in GE was eliminated at the beginning of the period. Top absolute performers during the period included Microsoft (Information Technology) and Merck (Healthcare).

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

The economic outlook has weakened in the last six months, and we are now seeing the slowdown in China reverberating across Europe and the U.S. While we generally see the U.S. on the tail end of the slowdown, we believe that the wealth effect of weak equity market performance should impact consumer confidence. As of the end of the period, we remained optimistic about the Fund’s overweight to the Financials sector given the moderate valuations. We are cautious on more cyclical sectors of the economy and would not want to overexpose the portfolio to highly leveraged businesses at this stage of the cycle. However, as equities in the Industrials sector underperformed the broad market by the end of the period, we became interested in select opportunities. Many of the traditionally safe equities in the Consumers Staples sector appeared overly expensive in our valuation framework as of the end of the period.

We continue to rely on our process and philosophy as we construct the Fund.

At the end of the period, the Fund’s largest overweights relative to the to the S&P 500 Index were to the Financials, Energy, and Utilities sectors, while the Fund’s largest underweights were to Information Technology and Consumer Discretionary sectors.

Important Risks

Investing involves risk, including the possible loss of principal. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.• For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.• Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments.

Composition by Sector(1)

as of December 31, 2018

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Communication Services | | | 9.2 | % |

Consumer Discretionary | | | 4.8 | |

Consumer Staples | | | 5.4 | |

Energy | | | 8.6 | |

Financials | | | 20.4 | |

Health Care | | | 16.2 | |

Industrials | | | 8.4 | |

Information Technology | | | 13.1 | |

Materials | | | 4.3 | |

Real Estate | | | 2.6 | |

Utilities | | | 5.1 | |

| | | | |

Total | | | 98.1 | % |

| | | | |

Short-Term Investments | | | 1.9 | |

Other Assets & Liabilities | | | 0.0 | * |

| | | | |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to zero. |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

|

| Hartford Global Growth HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 9/30/1998 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks growth of capital. |

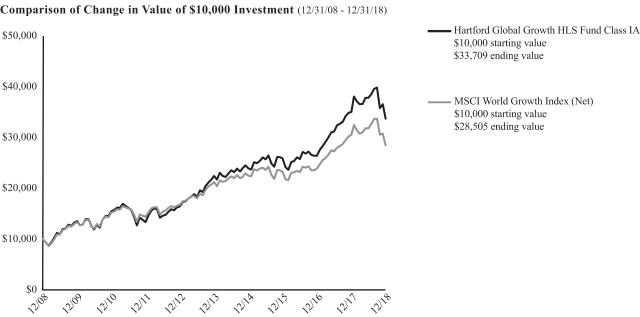

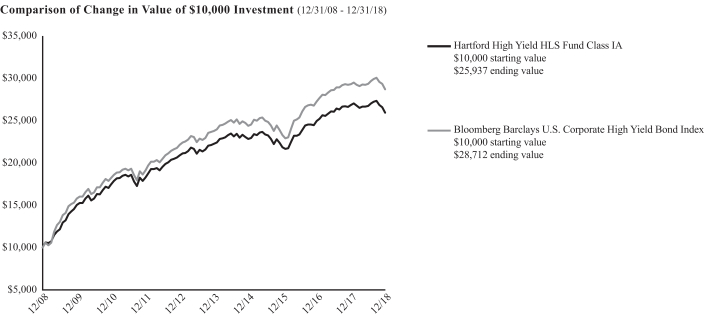

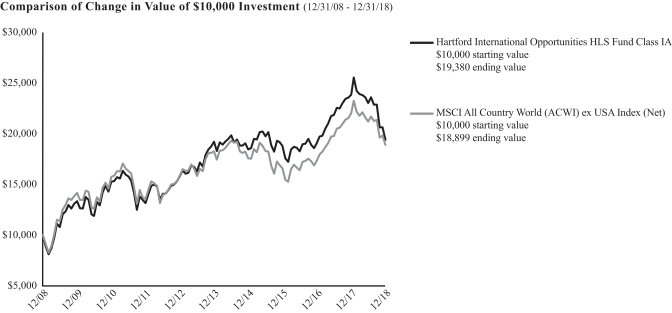

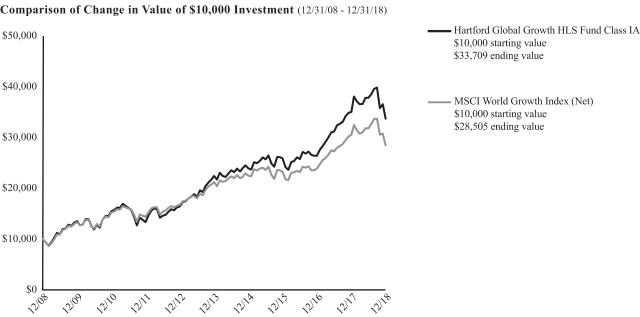

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | -3.81% | | | | 8.47% | | | | 12.92% | |

Class IB | | | -4.07% | | | | 8.21% | | | | 12.64% | |

MSCI World Growth Index (Net) | | | -6.74% | | | | 6.08% | | | | 11.04% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI World Growth Index (Net)(reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or other taxes) is designed to capture large and mid cap securities exhibiting overall growth style characteristics across developed markets.

You cannot invest directly in an index.

Performance information may reflect historical waivers/reimbursements without which performance would have been lower.

As shown in the Fund’s current prospectus, the total annual fund operating expense ratios for Class IA and Class IB were 0.81% and 1.06%, respectively. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended December 31, 2018.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

The Fund is closed to certain qualified pension and retirement plans. For more information, please see the Fund’s statutory prospectus.

|

| Hartford Global Growth HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

Portfolio Managers

Matthew D. Hudson, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

John A. Boselli, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Manager Discussion

How did the Fund perform during the period?

The Class IA shares of Hartford Global Growth HLS Fund returned-3.81% for the twelve-month period ended December 31, 2018, outperforming the Fund’s benchmark, the MSCI World Growth Index (Net), which returned-6.74% for the same period. For the same period, Class IA shares of the Fund also outperformed the-7.94% average return of the Lipper GlobalMulti-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

Global equity markets lost ground over the twelve-month period ended December 31, 2018, as measured by the MSCI All Country World Index (Net), finishing the year in negative territory. Escalating inflation risks knocked the rallying market off course, leading to a sharp correction and a large spike in volatility at the onset of February of 2018. Through the late spring and summer of 2018, an intensification of trade war rhetoric, strong U.S. economic data, and a strengthening dollar formed a divergence between markets as the U.S. broadly outperformed international markets, most notably China and other developing economies. Global equities, U.S.-included, finished the year in a turbulent downtrend, weighed down by the cumulating stress of higher rates, tariff uncertainty, and shifts in political power.

The U.S. government saw a shift in power when Democrats gained control of the U.S. House of Representatives following November’smid-term elections. U.S.-China trade relations remained especially volatile. By early July, talk of tariffs and trade wars had progressed to implementation, raising concerns in an otherwise strong economy. In Europe, the U.K.’s exit from the E.U. (“Brexit”) negotiations progressed after the European Union (EU) and the U.K. reached a deal that set the terms of the U.K.’s exit from the bloc. In Latin America, Brazil was a notable bright spot in the fourth quarter of 2018, as markets rallied on the news that Jair Bolsonaro was elected president.

On the monetary front, the U.S. Federal Reserve (Fed), the Bank of England, and the Bank of Canada raised interest rates. In the U.S., Fed Chairman Jerome Powell raised interest rates four times, bringing the Fed Funds rate to a range of2.25-2.5%. The European Central Bank (ECB) announced that quantitative easing will not continue into 2019, but offered a dovish undertone pledging to keep policy rates unchanged at least through the summer of 2019. (“Dovish” describes a monetary policy that favors lower interest rates to encourage economic growth.) Central banks globally are concluding multifaceted economic support programs. However, on several occasions through the year the People’s Bank of China lowered the reserve-requirement ratio (RRR), the amount of cash banks must keep on reserve, in an effort to boost growth.

Global Manufacturing Purchasing Managers’ Index (PMI) fell through the course of the year, signaling moderated growth rates. In the U.S., unemployment continued to trend downward over the period, ending the year at a historically low 3.7%. Oil approached a four-year high amidst global supply uncertainties and strong global growth before plummeting over 25% through the end of the year as increased production was paired with tepid demand. China’s Gross Domestic Product (GDP) growth slowed; in the third quarter economic growth fell to its lowest level since the first quarter of 2009.

During the period, U.S. equities outperformednon-U.S. equities, as measured by the S&P 500 Index and MSCI EAFE Index (Net), respectively, and emerging market equities underperformed their developed market counterparts, as measured by the MSCI Emerging Markets Index (Net) and MSCI World Index (Net), respectively. Within the MSCI World Growth Index (Net), all sectors posted negative returns. Energy(-24%), Materials(-17%), and Industrials(-14%) fell by the most during the period.

The Fund’s outperformance versus the Fund’s benchmark, was driven by security selection and sector allocation. In particular, selection in the Healthcare, Information Technology, and Consumer Discretionary sectors contributed positively to relative performance, which was partially offset by weaker selection in the Energy and Financials sectors, which detracted from performance. Sector allocation, a result of the Fund’sbottom-up security selection process, also contributed positively to relative performance. The Fund’s overweight to the Information Technology sector and underweights to the Materials and Energy sectors contributed positively to performance relative to the MSCI World Growth Index (Net). This was partially offset by an overweight to the Financials sector, which detracted from performance relative to the MSCI World Growth Index (Net).

Top contributors to performance relative to the MSCI World Growth Index (Net) were Adobe (Information Technology), ServiceNow (Information Technology), and salesforce.com (Information Technology). Shares of Adobe, a U.S. based multinational computer software company, outperformed driven by strong earnings, as the company has been able to transition to a subscription based model with sticky, recurring revenues, while raising prices. The Fund’s position in ServiceNow, a U.S. based provider of cloud-based services that automate enterprise IT operations, rose during the period as the market gained confidence in the company’s strong fundamental momentum, which continues to show impressive success with new products and market penetration. The stock price of salesforce.com, a U.S.-based developer ofon-demand customer relationship management (CRM) software, posted positive results after the company reported strong revenue growth and provided next year’s guidance ahead of expectations. Amazon (Consumer Discretionary) was a top absolute contributor during the period.

|

| Hartford Global Growth HLS Fund |

Fund Overview – (continued)

December 31, 2018 (Unaudited)

The top detractors from the Fund’s performance relative to the MSCI World Growth Index (Net) were EnCana (Energy), Flex (Information Technology), and Julius Baer Group (Financials). Shares of EnCana, a Canada based energy company, underperformed amid broader energy weakness. Additionally, at the beginning of November, EnCana announced it would acquire Newfield Exploration in anall-stock transaction further hindering EnCana’s performance. Given the Fund held both companies and the share price of Newfield Exploration increased following news of the acquisition, the Fund eliminated its Newfield Exploration holdings. Flex, a U.S.-based company that designs, manufactures, and services consumer electronics for original equipment manufacturers, announced the retirement of its CEO at the end of 2018, the cancellation of a strategic partnership with Nike, and lowered guidance for the quarter and 2019 during their third period’s earnings release. The Fund sold its position in order to seek to fund more attractive opportunities. The shares of Julius Baer Group, a Switzerland-based multinational private bank, underperformed primarily due to negative market sentiment in Europe and European financials, poor performance in Asia where transaction volumes were lower than expected, and a minor money laundering scandal in Panama. Top absolute detractors included Electronic Arts (Communication Services) and Schlumberger (Energy).

Derivatives were not used in a significant manner in this Fund during the period and did not have a material impact on performance during the period.

What is the outlook as of the end of the period?

Looking ahead, our focus remains on stock selection driven bybottom-up, fundamental research, regular meetings with the managements of leading companies globally, and leveraging the deep research capabilities of our firm. As of the end of the period, we believe risks remain on the horizon, including political risk in Europe, trade negotiations between the U.S. and China, and the potential ramifications of a sharp slowdown in economic growth in China. We remain focused on selecting companies with improving fundamentals and catalysts that we think should lead to accelerating earnings growth above consensus expectations.

At the end of the period, the Fund’s largest sector overweights were to the Healthcare, Consumer Discretionary, and Financials sectors, while the Fund’s largest underweights were to the Consumer Staples, Materials, and Industrials sectors, relative to the MSCI World Growth Index (Net).

Important Risks

Investing involves risk, including the possible loss of principal. The Fund seeks to achieve its investment objective by allocating assets among different asset classes and/or portfolio management teams. There is no guarantee the Fund will achieve its stated objective. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies.• Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political and economic developments. These risks may be greater for investments in emerging markets.• Mid-cap securities can have greater risk and volatility than large-cap securities.• Different investment styles may go in and out of favor, which may cause the Fund to underperform the broader stock market.• The Fund’s focus on investments in particular sectors may increase its volatility and risk of loss if adverse developments occur.

Composition by Country(1)

as of December 31, 2018

| | | | |

| Country | | Percentage of

Net Assets | |

Canada | | | 1.6 | % |

China | | | 2.9 | |

France | | | 2.5 | |

Germany | | | 1.3 | |

Hong Kong | | | 1.5 | |

India | | | 0.6 | |

Ireland | | | 1.3 | |

Italy | | | 1.2 | |

Japan | | | 4.3 | |

Luxembourg | | | 0.6 | |

Portugal | | | 0.5 | |

Russia | | | 0.6 | |

Sweden | | | 1.0 | |

Switzerland | | | 3.6 | |

Taiwan | | | 0.5 | |

United Kingdom | | | 6.9 | |

United States | | | 68.2 | |

Short-Term Investments | | | 1.1 | |

Other Assets & Liabilities | | | (0.2 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | The table above is based on Bloomberg’s country of risk classifications. For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

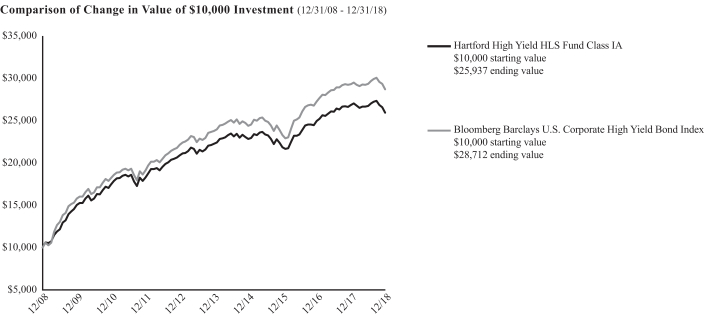

| Hartford Growth Opportunities HLS Fund |

Fund Overview

December 31, 2018 (Unaudited)

| | |

Inception 3/24/1987 Sub-advised by Wellington Management Company LLP | | Investment objective – The Fund seeks capital appreciation. |

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns

for the Periods Ending 12/31/18

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class IA | | | 0.53% | | | | 10.72% | | | | 14.81% | |

Class IB | | | 0.29% | | | | 10.44% | | | | 14.52% | |

Class IC | | | 0.04% | | | | 10.18% | | | | 14.24% | |

Russell 3000 Growth Index | | | -2.12% | | | | 9.99% | | | | 15.15% | |

Russell 1000 Growth Index | | | -1.51% | | | | 10.40% | | | | 15.29% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on December 31, 2018, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

Russell 3000 Growth Index(reflects no deduction for fees, expenses or taxes) is designed to measure the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index is designed to measure the performance of the 3,000 largest U.S. companies based on total market capitalization.

Russell 1000 Growth Index(reflects no deduction for fees, expenses or taxes) is designed to measure the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is