UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-08673 |

| |

| BNY Mellon Investment Portfolios | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 240 Greenwich Street New York, New York 10286 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 12/31 | |

Date of reporting period: | 12/31/2020 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Investment Portfolios, MidCap Stock Portfolio

| |

ANNUAL REPORT December 31, 2020 |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from January 1, 2020 through December 31, 2020, as provided by Peter D. Goslin, CFA, Adam Logan, CFA, Chris Yao, CFA and Syed A. Zamil, CFA, Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended December 31, 2020, BNY Mellon Investment Portfolios, MidCap Stock Portfolio’s Initial shares produced a total return of 8.11%, and its Service shares produced a total return of 7.85%.1 In comparison, the fund’s benchmark, the S&P MidCap 400® Index (the “Index”), produced a total return of 13.66% for the same period.2

Mid-cap stocks posted gains over the reporting period, bolstered by supportive central bank policies during the COVID-19 pandemic. The fund lagged the Index, primarily due to security selection shortfalls in the industrials, information technology and consumer discretionary sectors.

The Fund’s Investment Approach

The fund seeks investment results that are greater than the total return performance of publicly traded, common stocks of medium-sized, domestic companies in the aggregate, as represented by the Index. To pursue this goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks of mid-cap companies.

The fund invests in growth and value stocks, which are chosen through a disciplined investment process that combines quantitative-modeling techniques, fundamental analysis and risk management. Consistency of returns compared to the Index is a primary goal of the investment process.

The portfolio managers select stocks through a “bottom-up” structured approach that seeks to identify undervalued securities using a quantitative ranking process. The process is driven by a proprietary stock selection model that measures a diverse set of corporate characteristics to identify and rank stocks based on valuation, momentum, sentiment and earnings quality measures.

Next, the fund’s portfolio managers construct the portfolio through a risk-controlled process, focusing on stock selection, as opposed to making proactive decisions as to industry and sector exposure. The portfolio managers seek to maintain a portfolio that has exposure to industries and market capitalizations that are generally similar to the fund’s benchmark. Finally, within each sector and style subset, the fund will seek to overweight the most attractive stocks and underweight or not hold the stocks that have been ranked least attractive.

Central Bank Policy and COVID-19 Influence Markets

After an optimistic end to 2019, markets gave way to extreme risk aversion in early 2020, as the global scope of the COVID-19 pandemic became apparent. Equity valuations in the U.S. remained robust throughout January and February 2020, while markets in areas that experienced the virus earlier, such as China, began to experience volatility closer to the start of the calendar year. Financial markets also had to contend with a second major shock in the form of an oil-price war between Saudi Arabia and Russia, which caused oil prices to fall precipitously in March 2020. Worldwide, governments and central banks launched an

2

unprecedented array of fiscal initiatives that sought to offset the economic impact of widespread lockdown measures and bolster asset prices. The intervention provided comfort to investors, and indices began to rally towards the end of March 2020. Supported by the intervention, equities generally went on to stage a recovery that lasted through August 2020. However, the recovery was company and sector specific, as several industries that remained affected by COVID-19 prevention procedures did not fully participate.

In September 2020, volatility crept back into equity markets, as increasing COVID-19 infection rates began to concern investors. By October, several countries had begun to reinstitute some degree of behavioral restriction among residents in order to stem the spread of the virus. In addition, mounting political rhetoric in the U.S. due to the election, renewed trade difficulties between the U.S. and China, and other geopolitical events stoked investor anxiety. However, resolution in the U.S. presidential election and promising progress towards a COVID-19 vaccine during the month of November 2020 helped stocks resurrect their upward momentum. December 2020 brought vaccine approvals and passage of another U.S. fiscal stimulus package, both of which helped to support the rally which lasted through the end of the year.

According to the S&P family of indices, large-cap stocks generally outperformed their mid- and small-cap counterparts during the period.

Security Selections Drove Fund Performance

The fund’s performance compared to the Index was constrained by stock selection shortfalls across the industrials, information technology and consumer discretionary sectors. The industrials sector, particularly within the aerospace and defense and construction and engineering industries, was the primary driver of underperformance. The spread of COVID-19 drastically reduced demand for products and services from these market segments, negatively affecting stock prices. Negative security selection within the semiconductor and semiconductor equipment industry in the information technology sector also weighed on relative results. Within the consumer discretionary sector, the hotels, restaurants and leisure industry was the hardest hit. Valuations in this market segment were also harmed by the pandemic, as a widespread lockdown canceled the majority of consumer demand for these businesses’ products. From an individual issuer perspective, food company Domino’s Pizza was among one of the top detractors for the period. A lack of exposure during the early part of the year to the well-performing pizza delivery company caused underperformance. The position was purchased later in the period, although sold prior to the end of the year after it graduated from the index. A position in office equipment company Xerox Holdings was among the leading detractors. Due to office closures and the trend toward working from home, investors became concerned that corporate clients would use Xerox Holdings’ products less. We have exited the position. Elsewhere in the markets, a position in real estate company Weingarten Realty Investors also provided a headwind. The stock came under pressure, as concerns mounted over tenants’ ability to pay rent amid widespread lockdowns and growing unemployment. A position in Brandywine Realty Trust also weighed on results.

The fund achieved better results in several other areas. Positioning within the financials and health care sectors was positive for results. An underweight to the underperforming financials sector benefited returns. An underweight exposure to bank stocks, which were hit particularly hard, due in part to the low rate environment during the year, was particularly

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

additive. Within health care, security selections within the health care technology industry provided a tailwind. From an individual issuer perspective, life science research company Bio-Rad Laboratories beat earnings expectations several times throughout the year, leading to substantial earnings momentum and gains during the period. Veeva Systems, which provides computing solutions for life sciences companies, was a top contributor to positive results as well. The company beat earnings expectations and raised guidance repeatedly during the 12 months. We have closed the position. Elsewhere in the markets, outdoor shoe and apparel company Deckers Outdoor was also among the leading performers. The company beat earnings several times throughout the year. The stock moved higher on positive financial results.

A Disciplined Approach to Stock Picking

As of the reporting period’s end, our quantitative models have continued to identify what we believe are attractive investment opportunities across a broad spectrum of mid-cap companies and industry groups. Investor preference for top line growth is a theme we observed in 2020. We had exposure to this theme and found the opportunity during the fourth quarter to add to this exposure. Stock market volatility experienced during the period may have provided opportunities to purchase the stocks of companies ranked highly by our process. When the fund’s holdings reach what we perceive to be fuller valuations, we expect to replace them with high-quality companies that display then-currently-attractive valuations in our model. In addition, we continue to maintain a broadly diversified portfolio.

January 15, 2021

1 Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts, which will reduce returns. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through May 1, 2021, at which time it may be extended, modified or terminated. Had these expenses not been absorbed, returns would have been lower.

2 Source: Lipper Inc. — The S&P MidCap 400® Index provides investors with a benchmark for mid-sized companies. The index measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund's exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

Stocks of mid-cap companies often experience sharper price fluctuations than stocks of large-cap companies.

The fund is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies. Individuals may not purchase shares of the fund directly. A variable annuity is an insurance contract issued by an insurance company that enables investors to accumulate assets on a tax-deferred basis for retirement or other long-term goals. The investment objective and policies of BNY Mellon Investment Portfolios, MidCap Stock Portfolio made available through insurance products may be similar to those of other funds managed by BNY Mellon Investment Adviser, Inc. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other BNY Mellon Investment Adviser, Inc. fund.

The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor stock performance.

4

FUND PERFORMANCE (Unaudited)

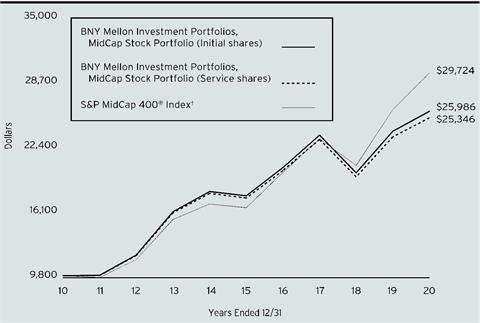

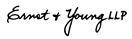

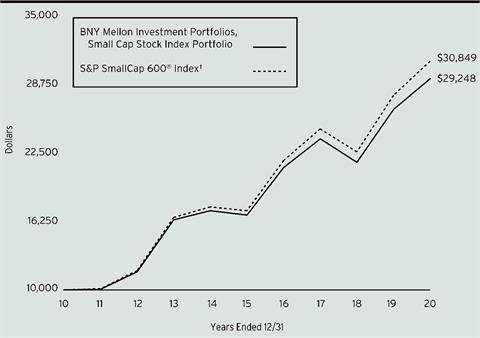

Comparison of change in value of a $10,000 investment in Initial shares and Service shares of BNY Mellon Investment Portfolios, MidCap Stock Portfolio with a hypothetical investment of $10,000 in the S&P MidCap 400® Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance. The fund’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in variable insurance contracts which will reduce returns.

The above graph compares a hypothetical investment of $10,000 investment made in each of the Initial shares and Service shares of BNY Mellon Investment Portfolios, MidCap Stock Portfolio on 12/31/10 to a hypothetical investment of $10,000 made in the Index on that date.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses. The Index provides investors with a benchmark for midsized companies. The Index measures the performance of midsized companies, reflecting the distinctive risk and return characteristics of this market segment. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

| | | | |

Average Annual Total Returns as of 12/31/2020 |

| 1 Year | 5 Years | 10 Years |

Initial shares | 8.11% | 7.90% | 10.02% |

Service shares | 7.85% | 7.63% | 9.75% |

S&P MidCap 400® Index | 13.66% | 12.35% | 11.51% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s Initial shares are not subject to a Rule 12b-1 fee. The fund’s Service shares are subject to a 0.25% annual Rule 12b-1 fee. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads), redemption fees and expenses associated with variable annuity or insurance contracts, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Investment Portfolios, MidCap Stock Portfolio from July 1, 2020 to December 31, 2020. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended December 31, 2020 | |

| | | | |

| | Initial Shares | Service Shares | |

Expense paid per $1,000† | $5.01 | $6.45 | |

Ending value (after expenses) | $1,292.50 | $1,290.80 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended December 31, 2020 | |

| | | | |

| | Initial Shares | Service Shares | |

Expense paid per $1,000† | $4.42 | $5.69 | |

Ending value (after expenses) | $1,020.76 | $1,019.51 | |

† Expenses are equal to the fund’s annualized expense ratio of .87% for Initial Shares and 1.12% for Service Shares, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

6

STATEMENT OF INVESTMENTS

December 31, 2020

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% | | | | | |

Automobiles & Components - 2.1% | | | | | |

Adient | | | | 12,190 | a | 423,846 | |

Dana | | | | 28,750 | | 561,200 | |

Gentex | | | | 35,640 | | 1,209,265 | |

Harley-Davidson | | | | 9,360 | | 343,512 | |

Thor Industries | | | | 4,880 | | 453,791 | |

Visteon | | | | 1,580 | a | 198,322 | |

| | | | | 3,189,936 | |

Banks - 6.7% | | | | | |

Associated Banc-Corp | | | | 46,810 | | 798,110 | |

Bank OZK | | | | 6,450 | | 201,692 | |

BOK Financial | | | | 5,150 | | 352,672 | |

Cathay General Bancorp | | | | 49,625 | | 1,597,429 | |

CIT Group | | | | 13,170 | | 472,803 | |

Comerica | | | | 8,510 | | 475,369 | |

East West Bancorp | | | | 9,960 | | 505,072 | |

Essent Group | | | | 15,470 | | 668,304 | |

First Citizens Bancshares, Cl. A | | | | 780 | | 447,931 | |

First Financial Bankshares | | | | 8,260 | | 298,806 | |

Glacier Bancorp | | | | 11,200 | | 515,312 | |

International Bancshares | | | | 17,530 | | 656,323 | |

KeyCorp | | | | 34,460 | | 565,489 | |

MGIC Investment | | | | 28,120 | | 352,906 | |

New York Community Bancorp | | | | 59,790 | | 630,784 | |

Prosperity Bancshares | | | | 5,080 | | 352,349 | |

Regions Financial | | | | 38,600 | | 622,232 | |

Western Alliance Bancorp | | | | 11,920 | | 714,604 | |

| | | | | 10,228,187 | |

Capital Goods - 11.3% | | | | | |

Acuity Brands | | | | 9,240 | | 1,118,872 | |

AGCO | | | | 5,340 | | 550,501 | |

Axon Enterprise | | | | 2,370 | a | 290,396 | |

Carlisle | | | | 2,780 | | 434,180 | |

Colfax | | | | 8,720 | a,b | 333,453 | |

Crane | | | | 8,860 | | 688,068 | |

Curtiss-Wright | | | | 8,980 | | 1,044,823 | |

Donaldson | | | | 16,980 | | 948,842 | |

Dycom Industries | | | | 3,850 | a | 290,752 | |

EMCOR Group | | | | 13,130 | | 1,200,870 | |

EnerSys | | | | 3,330 | | 276,590 | |

Fortune Brands Home & Security | | | | 4,100 | | 351,452 | |

GATX | | | | 1,630 | | 135,583 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Capital Goods - 11.3% (continued) | | | | | |

Generac Holdings | | | | 4,950 | a | 1,125,679 | |

Hubbell | | | | 2,740 | | 429,605 | |

ITT | | | | 12,680 | | 976,614 | |

Lennox International | | | | 690 | | 189,039 | |

Lincoln Electric Holdings | | | | 3,400 | | 395,250 | |

MasTec | | | | 9,630 | a,b | 656,573 | |

Nordson | | | | 3,110 | | 624,954 | |

Owens Corning | | | | 5,360 | | 406,074 | |

Regal Beloit | | | | 6,580 | | 808,090 | |

Simpson Manufacturing | | | | 5,730 | | 535,468 | |

Sunrun | | | | 5,740 | a | 398,241 | |

Teledyne Technologies | | | | 890 | a | 348,862 | |

The Middleby | | | | 2,800 | a | 360,976 | |

The Timken Company | | | | 15,950 | | 1,233,892 | |

Trex | | | | 5,240 | a,b | 438,693 | |

Trinity Industries | | | | 7,420 | b | 195,814 | |

Univar Solutions | | | | 13,430 | a | 255,304 | |

Watsco | | | | 1,300 | | 294,515 | |

| | | | | 17,338,025 | |

Commercial & Professional Services - 2.5% | | | | | |

Clean Harbors | | | | 7,330 | a | 557,813 | |

CoreLogic | | | | 5,120 | | 395,878 | |

FTI Consulting | | | | 3,020 | a | 337,394 | |

Healthcare Services Group | | | | 7,940 | | 223,114 | |

Herman Miller | | | | 6,000 | | 202,800 | |

HNI | | | | 16,600 | | 572,036 | |

IAA | | | | 6,070 | a | 394,429 | |

Insperity | | | | 4,230 | | 344,407 | |

ManpowerGroup | | | | 4,610 | | 415,730 | |

Tetra Tech | | | | 3,110 | | 360,076 | |

| | | | | 3,803,677 | |

Consumer Durables & Apparel - 4.5% | | | | | |

Brunswick | | | | 7,940 | | 605,346 | |

Carter's | | | | 4,860 | | 457,180 | |

Deckers Outdoor | | | | 4,630 | a | 1,327,791 | |

Helen of Troy | | | | 1,720 | a,b | 382,167 | |

Peloton Interactive, Cl. A | | | | 3,910 | a | 593,225 | |

Polaris | | | | 7,960 | | 758,429 | |

PulteGroup | | | | 4,420 | | 190,590 | |

PVH | | | | 2,990 | | 280,731 | |

Tempur Sealy International | | | | 29,310 | a | 791,370 | |

Toll Brothers | | | | 4,410 | | 191,703 | |

TopBuild | | | | 3,510 | a | 646,121 | |

8

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Consumer Durables & Apparel - 4.5% (continued) | | | | | |

TRI Pointe Group | | | | 33,840 | a,b | 583,740 | |

Whirlpool | | | | 690 | | 124,538 | |

| | | | | 6,932,931 | |

Consumer Services - 4.9% | | | | | |

Adtalem Global Education | | | | 6,620 | a | 224,749 | |

Boyd Gaming | | | | 17,960 | | 770,843 | |

Caesars Entertainment | | | | 13,320 | a | 989,276 | |

Chipotle Mexican Grill | | | | 340 | a | 471,481 | |

Churchill Downs | | | | 930 | b | 181,155 | |

Graham Holdings, Cl. B | | | | 960 | | 512,045 | |

Grand Canyon Education | | | | 4,070 | a | 378,958 | |

Jack in the Box | | | | 6,470 | | 600,416 | |

Marriott Vacations Worldwide | | | | 1,680 | | 230,530 | |

Papa John's International | | | | 4,270 | | 362,309 | |

Penn National Gaming | | | | 10,190 | a,b | 880,110 | |

Planet Fitness, Cl. A | | | | 5,960 | a | 462,675 | |

Scientific Games | | | | 4,490 | a | 186,290 | |

Service Corp. International | | | | 15,770 | | 774,307 | |

Strategic Education | | | | 1,180 | | 112,489 | |

WW International | | | | 4,020 | a | 98,088 | |

Wyndham Destinations | | | | 7,930 | | 355,740 | |

| | | | | 7,591,461 | |

Diversified Financials - 3.5% | | | | | |

Eaton Vance | | | | 8,110 | | 550,912 | |

Evercore, Cl. A | | | | 1,740 | | 190,774 | |

FactSet Research Systems | | | | 1,110 | | 369,075 | |

Federated Hermes | | | | 16,330 | | 471,774 | |

Interactive Brokers Group, Cl. A | | | | 4,770 | | 290,588 | |

Janus Henderson Group | | | | 10,300 | | 334,853 | |

Jefferies Financial Group | | | | 21,560 | | 530,376 | |

OneMain Holdings | | | | 8,520 | | 410,323 | |

PROG Holdings | | | | 4,950 | | 266,657 | |

SEI Investments | | | | 24,380 | | 1,401,119 | |

Stifel Financial | | | | 10,845 | | 547,239 | |

| | | | | 5,363,690 | |

Energy - 2.1% | | | | | |

Antero Midstream | | | | 40,710 | | 313,874 | |

ChampionX | | | | 15,940 | a | 243,882 | |

CNX Resources | | | | 15,010 | a | 162,108 | |

EQT | | | | 12,340 | | 156,841 | |

Equitrans Midstream | | | | 34,090 | | 274,084 | |

Halliburton | | | | 14,770 | | 279,153 | |

Marathon Oil | | | | 47,470 | | 316,625 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Energy - 2.1% (continued) | | | | | |

Murphy Oil | | | | 43,670 | | 528,407 | |

NOV | | | | 21,360 | a | 293,273 | |

World Fuel Services | | | | 10,600 | | 330,296 | |

WPX Energy | | | | 44,690 | a | 364,223 | |

| | | | | 3,262,766 | |

Food & Staples Retailing - .9% | | | | | |

BJ's Wholesale Club Holdings | | | | 11,020 | a | 410,826 | |

Casey's General Stores | | | | 3,510 | | 626,956 | |

Sprouts Farmers Market | | | | 16,880 | a | 339,288 | |

| | | | | 1,377,070 | |

Food, Beverage & Tobacco - 1.5% | | | | | |

Campbell Soup | | | | 4,340 | | 209,839 | |

Conagra Brands | | | | 3,750 | | 135,975 | |

Darling Ingredients | | | | 8,540 | a | 492,587 | |

Flowers Foods | | | | 30,740 | | 695,646 | |

The Boston Beer Company, Cl. A | | | | 380 | a | 377,830 | |

The Hain Celestial Group | | | | 5,810 | a | 233,272 | |

TreeHouse Foods | | | | 4,520 | a | 192,055 | |

| | | | | 2,337,204 | |

Health Care Equipment & Services - 6.2% | | | | | |

Acadia Healthcare | | | | 5,340 | a | 268,389 | |

Align Technology | | | | 970 | a | 518,349 | |

Amedisys | | | | 2,730 | a | 800,791 | |

AmerisourceBergen | | | | 2,180 | | 213,117 | |

Cantel Medical | | | | 3,430 | | 270,490 | |

Chemed | | | | 2,070 | | 1,102,503 | |

DaVita | | | | 1,500 | a | 176,100 | |

Globus Medical, Cl. A | | | | 5,060 | a | 330,013 | |

Haemonetics | | | | 1,280 | a | 152,000 | |

HealthEquity | | | | 2,760 | a | 192,400 | |

Hill-Rom Holdings | | | | 8,220 | | 805,313 | |

ICU Medical | | | | 830 | a | 178,027 | |

LHC Group | | | | 2,010 | a | 428,773 | |

McKesson | | | | 860 | | 149,571 | |

Molina Healthcare | | | | 3,310 | a | 703,971 | |

Neogen | | | | 4,250 | a | 337,025 | |

NuVasive | | | | 4,660 | a | 262,498 | |

Patterson Companies | | | | 6,580 | | 194,965 | |

Quidel | | | | 1,140 | a | 204,801 | |

Steris | | | | 7,170 | | 1,359,002 | |

Teladoc Health | | | | 2,220 | a,b | 443,911 | |

Tenet Healthcare | | | | 10,100 | a | 403,293 | |

| | | | | 9,495,302 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Household & Personal Products - .6% | | | | | |

Nu Skin Enterprises, Cl. A | | | | 12,770 | | 697,625 | |

The Clorox Company | | | | 840 | | 169,613 | |

| | | | | 867,238 | |

Insurance - 4.2% | | | | | |

First American Financial | | | | 12,020 | | 620,593 | |

Globe Life | | | | 7,850 | | 745,436 | |

Kemper | | | | 9,700 | | 745,251 | |

Mercury General | | | | 4,080 | | 213,017 | |

Primerica | | | | 15,195 | | 2,035,066 | |

Reinsurance Group of America | | | | 4,070 | | 471,713 | |

RenaissanceRe Holdings | | | | 1,680 | | 278,578 | |

Selective Insurance Group | | | | 6,030 | | 403,889 | |

The Hanover Insurance Group | | | | 5,770 | | 674,628 | |

White Mountains Insurance Group | | | | 210 | | 210,139 | |

| | | | | 6,398,310 | |

Materials - 5.1% | | | | | |

Avient | | | | 10,320 | | 415,690 | |

Compass Minerals International | | | | 2,750 | | 169,730 | |

Eagle Materials | | | | 7,430 | | 753,030 | |

Element Solutions | | | | 10,410 | | 184,569 | |

FMC | | | | 980 | | 112,631 | |

Graphic Packaging Holding | | | | 26,360 | | 446,538 | |

Ingevity | | | | 1,720 | a | 130,256 | |

Louisiana-Pacific | | | | 11,470 | | 426,340 | |

Minerals Technologies | | | | 8,250 | | 512,490 | |

NewMarket | | | | 840 | | 334,564 | |

Reliance Steel & Aluminum | | | | 10,600 | | 1,269,350 | |

RPM International | | | | 10,020 | | 909,616 | |

Silgan Holdings | | | | 11,280 | | 418,262 | |

The Chemours Company | | | | 14,670 | | 363,669 | |

The Scotts Miracle-Gro Company | | | | 3,180 | | 633,265 | |

Valvoline | | | | 17,750 | | 410,735 | |

Worthington Industries | | | | 6,000 | | 308,040 | |

| | | | | 7,798,775 | |

Media & Entertainment - 2.2% | | | | | |

Cable One | | | | 300 | | 668,316 | |

Cinemark Holdings | | | | 13,690 | b | 238,343 | |

DISH Network, Cl. A | | | | 6,220 | a | 201,155 | |

Lions Gate Entertainment, Cl. A | | | | 18,050 | a,b | 205,229 | |

Take-Two Interactive Software | | | | 770 | a | 159,998 | |

The Interpublic Group of Companies | | | | 6,390 | | 150,293 | |

The New York Times Company, Cl. A | | | | 16,440 | | 851,099 | |

World Wrestling Entertainment, Cl. A | | | | 2,980 | | 143,189 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Media & Entertainment - 2.2% (continued) | | | | | |

Yelp | | | | 17,560 | a | 573,685 | |

Zillow Group, Cl. C | | | | 1,200 | a | 155,760 | |

| | | | | 3,347,067 | |

Pharmaceuticals Biotechnology & Life Sciences - 5.4% | | | | | |

Bio-Rad Laboratories, Cl. A | | | | 1,440 | a | 839,434 | |

Bio-Techne | | | | 870 | | 276,269 | |

Catalent | | | | 7,000 | a | 728,490 | |

Charles River Laboratories International | | | | 6,780 | a | 1,694,051 | |

Emergent BioSolutions | | | | 3,650 | a | 327,040 | |

Exelixis | | | | 23,510 | a | 471,846 | |

Halozyme Therapeutics | | | | 5,090 | a,b | 217,394 | |

Jazz Pharmaceuticals | | | | 3,450 | a | 569,422 | |

Medpace Holdings | | | | 1,680 | a | 233,856 | |

PRA Health Sciences | | | | 5,220 | a | 654,797 | |

Prestige Consumer Healthcare | | | | 6,300 | a | 219,681 | |

Repligen | | | | 6,060 | a | 1,161,278 | |

Seagen | | | | 2,510 | a | 439,601 | |

Syneos Health | | | | 5,500 | a | 374,715 | |

United Therapeutics | | | | 1,110 | a | 168,487 | |

| | | | | 8,376,361 | |

Real Estate - 8.8% | | | | | |

Brandywine Realty Trust | | | | 91,300 | c | 1,087,383 | |

Camden Property Trust | | | | 4,920 | c | 491,606 | |

CoreSite Realty | | | | 1,250 | c | 156,600 | |

Corporate Office Properties Trust | | | | 46,760 | c | 1,219,501 | |

Cousins Properties | | | | 18,540 | c | 621,090 | |

CyrusOne | | | | 1,960 | c | 143,374 | |

EastGroup Properties | | | | 4,940 | c | 682,016 | |

First Industrial Realty Trust | | | | 46,870 | c | 1,974,633 | |

Gaming & Leisure Properties | | | | 26 | c | 1,102 | |

Healthcare Realty Trust | | | | 20,130 | c | 595,848 | |

Highwoods Properties | | | | 17,200 | c | 681,636 | |

Lamar Advertising, Cl. A | | | | 16,875 | c | 1,404,337 | |

Life Storage | | | | 5,050 | c | 602,919 | |

Omega Healthcare Investors | | | | 17,800 | c | 646,496 | |

Physicians Realty Trust | | | | 20,030 | c | 356,534 | |

PS Business Parks | | | | 9,850 | c | 1,308,769 | |

Sabra Health Care REIT | | | | 22,550 | c | 391,693 | |

Service Properties Trust | | | | 27,895 | c | 320,514 | |

Weingarten Realty Investors | | | | 37,580 | c | 814,359 | |

| | | | | 13,500,410 | |

Retailing - 3.6% | | | | | |

AutoNation | | | | 5,750 | a | 401,292 | |

12

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Retailing - 3.6% (continued) | | | | | |

Dick's Sporting Goods | | | | 7,420 | | 417,078 | |

Foot Locker | | | | 8,290 | | 335,248 | |

Kohl's | | | | 14,380 | | 585,122 | |

Lithia Motors, Cl. A | | | | 1,990 | | 582,413 | |

Murphy USA | | | | 2,320 | | 303,618 | |

Nordstrom | | | | 9,410 | b | 293,686 | |

Ollie's Bargain Outlet Holdings | | | | 5,010 | a,b | 409,668 | |

Pool | | | | 900 | | 335,250 | |

RH | | | | 1,690 | a | 756,309 | |

Wayfair, Cl. A | | | | 1,880 | a,b | 424,523 | |

Williams-Sonoma | | | | 6,870 | | 699,641 | |

| | | | | 5,543,848 | |

Semiconductors & Semiconductor Equipment - 5.6% | | | | | |

Cirrus Logic | | | | 9,890 | a | 812,958 | |

Enphase Energy | | | | 8,380 | a | 1,470,439 | |

First Solar | | | | 6,080 | a | 601,434 | |

MKS Instruments | | | | 2,180 | | 327,981 | |

Monolithic Power Systems | | | | 3,420 | | 1,252,507 | |

Qorvo | | | | 1,370 | a | 227,790 | |

Semtech | | | | 8,660 | a | 624,299 | |

Silicon Laboratories | | | | 4,240 | a | 539,922 | |

SolarEdge Technologies | | | | 1,200 | a | 382,944 | |

Synaptics | | | | 3,570 | a,b | 344,148 | |

Teradyne | | | | 15,800 | | 1,894,262 | |

Universal Display | | | | 870 | | 199,926 | |

| | | | | 8,678,610 | |

Software & Services - 8.0% | | | | | |

Alliance Data Systems | | | | 6,950 | | 514,995 | |

CACI International, Cl. A | | | | 3,330 | a | 830,269 | |

CDK Global | | | | 4,340 | | 224,942 | |

Ceridian HCM Holding | | | | 4,570 | a | 486,979 | |

Concentrix | | | | 3,260 | a | 321,762 | |

DocuSign | | | | 1,860 | a | 413,478 | |

Fair Isaac | | | | 2,250 | a | 1,149,840 | |

Fortinet | | | | 1,360 | a | 202,001 | |

HubSpot | | | | 1,160 | a | 459,870 | |

J2 Global | | | | 10,640 | a,b | 1,039,422 | |

KBR | | | | 19,230 | | 594,784 | |

Leidos Holdings | | | | 3,590 | | 377,381 | |

Manhattan Associates | | | | 4,740 | a | 498,553 | |

Medallia | | | | 14,690 | a,b | 488,002 | |

Nuance Communications | | | | 10,650 | a,b | 469,558 | |

Palo Alto Networks | | | | 1,470 | a | 522,423 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.2% (continued) | | | | | |

Software & Services - 8.0% (continued) | | | | | |

Paylocity Holding | | | | 1,620 | a | 333,574 | |

PTC | | | | 4,350 | a | 520,303 | |

Qualys | | | | 3,760 | a | 458,231 | |

Splunk | | | | 2,780 | a | 472,294 | |

Teradata | | | | 7,580 | a | 170,323 | |

Twilio, Cl. A | | | | 1,410 | a | 477,285 | |

WEX | | | | 5,920 | a | 1,204,898 | |

| | | | | 12,231,167 | |

Technology Hardware & Equipment - 4.6% | | | | | |

Arrow Electronics | | | | 5,470 | a | 532,231 | |

Avnet | | | | 19,150 | | 672,356 | |

Ciena | | | | 18,200 | a | 961,870 | |

Cognex | | | | 9,870 | | 792,413 | |

II-VI | | | | 7,350 | a,b | 558,306 | |

InterDigital | | | | 5,780 | | 350,730 | |

Jabil | | | | 4,410 | | 187,557 | |

Lumentum Holdings | | | | 6,240 | a | 591,552 | |

NCR | | | | 19,180 | a | 720,593 | |

NETSCOUT Systems | | | | 8,270 | a | 226,763 | |

SYNNEX | | | | 3,260 | | 265,494 | |

Trimble | | | | 14,360 | a | 958,817 | |

Zebra Technologies, Cl. A | | | | 570 | a | 219,068 | |

| | | | | 7,037,750 | |

Telecommunication Services - .1% | | | | | |

Telephone & Data Systems | | | | 8,490 | | 157,659 | |

Transportation - 1.4% | | | | | |

Avis Budget Group | | | | 10,340 | a | 385,682 | |

Kansas City Southern | | | | 660 | | 134,726 | |

Old Dominion Freight Line | | | | 1,775 | | 346,445 | |

Werner Enterprises | | | | 6,750 | | 264,735 | |

XPO Logistics | | | | 8,250 | a | 983,400 | |

| | | | | 2,114,988 | |

Utilities - 3.4% | | | | | |

Black Hills | | | | 4,760 | | 292,502 | |

Hawaiian Electric Industries | | | | 15,240 | | 539,344 | |

IDACORP | | | | 11,750 | | 1,128,352 | |

MDU Resources Group | | | | 26,510 | | 698,273 | |

NorthWestern | | | | 4,050 | | 236,156 | |

OGE Energy | | | | 36,770 | | 1,171,492 | |

ONE Gas | | | | 9,010 | | 691,698 | |

Spire | | | | 8,270 | | 529,611 | |

| | | | | 5,287,428 | |

Total Common Stocks (cost $120,591,713) | | | | 152,259,860 | |

14

| | | | | | | | |

| |

Description | | 1-Day

Yield (%) | | Shares | | Value ($) | |

Investment Companies - .8% | | | | | |

Registered Investment Companies - .8% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $1,225,389) | | 0.09 | | 1,225,389 | d | 1,225,389 | |

| | | | | | | | |

Investment of Cash Collateral for Securities Loaned - .5% | | | | | |

Registered Investment Companies - .5% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares

(cost $827,423) | | 0.05 | | 827,423 | d | 827,423 | |

Total Investments (cost $122,644,525) | | 100.5% | | 154,312,672 | |

Liabilities, Less Cash and Receivables | | (.5%) | | (802,242) | |

Net Assets | | 100.0% | | 153,510,430 | |

REIT—Real Estate Investment Trust

aNon-income producing security.

bSecurity, or portion thereof, on loan. At December 31, 2020, the value of the fund’s securities on loan was $7,655,641 and the value of the collateral was $7,864,881, consisting of cash collateral of $827,423 and U.S. Government & Agency securities valued at $7,037,458.

cInvestment in real estate investment trust within the United States.

dInvestment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Information Technology | 18.2 |

Consumer Discretionary | 15.2 |

Industrials | 15.2 |

Financials | 14.3 |

Health Care | 11.6 |

Real Estate | 8.8 |

Materials | 5.1 |

Utilities | 3.4 |

Consumer Staples | 3.0 |

Communication Services | 2.3 |

Energy | 2.1 |

Investment Companies | 1.3 |

| | 100.5 |

† Based on net assets.

See notes to financial statements.

15

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | | | | |

Investment Companies | Value

12/31/19 ($) | Purchases ($)† | Sales ($) | Value

12/31/20 ($) | Net

Assets(%) | Dividends/

Distributions ($) |

Registered Investment Companies; |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 1,003,692 | 23,740,514 | (23,518,817) | 1,225,389 | .8 | 4,986 |

Investment of Cash Collateral for Securities Loaned:†† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 386,235 | 9,797,325 | (10,183,560) | - | - | 21,650††† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares | - | 2,516,219 | (1,688,796) | 827,423 | .5 | 3,139††† |

Total | 1,389,927 | 36,054,058 | (35,391,173) | 2,052,812 | 1.3 | 29,775 |

† Included reinvested dividends/distributions.

†† Effective November 9, 2020, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares.

††† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

16

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2020

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $7,655,641)—Note 1(c): | | | |

Unaffiliated issuers | 120,591,713 | | 152,259,860 | |

Affiliated issuers | | 2,052,812 | | 2,052,812 | |

Receivable for shares of Beneficial Interest subscribed | | 123,317 | |

Dividends and securities lending income receivable | | 99,945 | |

Prepaid expenses | | | | | 2,831 | |

| | | | | 154,538,765 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(b) | | 119,224 | |

Liability for securities on loan—Note 1(c) | | 827,423 | |

Payable for shares of Beneficial Interest redeemed | | 13,052 | |

Trustees’ fees and expenses payable | | 1,464 | |

Other accrued expenses | | | | | 67,172 | |

| | | | | 1,028,335 | |

Net Assets ($) | | | 153,510,430 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 120,057,772 | |

Total distributable earnings (loss) | | | | | 33,452,658 | |

Net Assets ($) | | | 153,510,430 | |

| | | | |

Net Asset Value Per Share | Initial Shares | Service Shares | |

Net Assets ($) | 75,648,823 | 77,861,607 | |

Shares Outstanding | 3,795,707 | 3,923,755 | |

Net Asset Value Per Share ($) | 19.93 | 19.84 | |

| | | |

See notes to financial statements. | | | |

17

STATEMENT OF OPERATIONS

Year Ended December 31, 2020

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $1,491 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 2,166,876 | |

Affiliated issuers | | | 4,863 | |

Income from securities lending—Note 1(c) | | | 24,789 | |

Interest | | | 180 | |

Total Income | | | 2,196,708 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 979,797 | |

Distribution fees—Note 3(b) | | | 161,947 | |

Professional fees | | | 84,325 | |

Prospectus and shareholders’ reports | | | 18,533 | |

Chief Compliance Officer fees—Note 3(b) | | | 13,982 | |

Custodian fees—Note 3(b) | | | 10,326 | |

Trustees’ fees and expenses—Note 3(c) | | | 8,708 | |

Loan commitment fees—Note 2 | | | 4,944 | |

Shareholder servicing costs—Note 3(b) | | | 1,413 | |

Miscellaneous | | | 17,872 | |

Total Expenses | | | 1,301,847 | |

Investment Income—Net | | | 894,861 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 3,458,899 | |

Capital gain distributions from affiliated issuers | 123 | |

Net Realized Gain (Loss) | | | 3,459,022 | |

Net change in unrealized appreciation (depreciation) on investments | 6,471,918 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 9,930,940 | |

Net Increase in Net Assets Resulting from Operations | | 10,825,801 | |

| | | | | | |

See notes to financial statements. | | | | | |

18

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2020 | | 2019 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 894,861 | | | | 921,708 | |

Net realized gain (loss) on investments | | 3,459,022 | | | | (2,572,437) | |

Net change in unrealized appreciation

(depreciation) on investments | | 6,471,918 | | | | 28,415,232 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 10,825,801 | | | | 26,764,503 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Initial Shares | | | (552,702) | | | | (6,099,962) | |

Service Shares | | | (343,563) | | | | (5,546,134) | |

Total Distributions | | | (896,265) | | | | (11,646,096) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Initial Shares | | | 7,458,751 | | | | 3,870,606 | |

Service Shares | | | 14,678,777 | | | | 10,588,703 | |

Distributions reinvested: | | | | | | | | |

Initial Shares | | | 552,702 | | | | 6,099,962 | |

Service Shares | | | 343,563 | | | | 5,546,134 | |

Cost of shares redeemed: | | | | | | | | |

Initial Shares | | | (13,780,638) | | | | (13,408,861) | |

Service Shares | | | (16,960,443) | | | | (12,102,125) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | (7,707,288) | | | | 594,419 | |

Total Increase (Decrease) in Net Assets | 2,222,248 | | | | 15,712,826 | |

Net Assets ($): | |

Beginning of Period | | | 151,288,182 | | | | 135,575,356 | |

End of Period | | | 153,510,430 | | | | 151,288,182 | |

Capital Share Transactions (Shares): | |

Initial Shares | | | | | | | | |

Shares sold | | | 456,232 | | | | 216,730 | |

Shares issued for distributions reinvested | | | 45,155 | | | | 351,583 | |

Shares redeemed | | | (828,281) | | | | (752,804) | |

Net Increase (Decrease) in Shares Outstanding | (326,894) | | | | (184,491) | |

Service Shares | | | | | | | | |

Shares sold | | | 938,110 | | | | 600,304 | |

Shares issued for distributions reinvested | | | 28,138 | | | | 320,957 | |

Shares redeemed | | | (1,060,385) | | | | (685,012) | |

Net Increase (Decrease) in Shares Outstanding | (94,137) | | | | 236,249 | |

| | | | | | | | | |

See notes to financial statements. | | | | | | | | |

19

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. The fund’s total returns do not reflect expenses associated with variable annuity or insurance contracts. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | |

| | | |

| | | Year Ended December 31, |

Initial Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 18.64 | 16.80 | 22.56 | 20.09 | 18.95 |

Investment Operations: | | | | | | |

Investment income—neta | | .13 | .13 | .12 | .10 | .21 |

Net realized and unrealized

gain (loss) on investments | | 1.30 | 3.15 | (3.19) | 2.92 | 2.50 |

Total from Investment Operations | | 1.43 | 3.28 | (3.07) | 3.02 | 2.71 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.14) | (.12) | (.13) | (.22) | (.21) |

Dividends from

net realized gain on investments | | - | (1.32) | (2.56) | (.33) | (1.36) |

Total Distributions | | (.14) | (1.44) | (2.69) | (.55) | (1.57) |

Net asset value, end of period | | 19.93 | 18.64 | 16.80 | 22.56 | 20.09 |

Total Return (%) | | 8.11 | 20.18 | (15.49) | 15.38 | 15.47 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .87 | .86 | .86 | .87 | .85 |

Ratio of net investment income

to average net assets | | .81 | .73 | .59 | .50 | 1.16 |

Portfolio Turnover Rate | | 92.40 | 82.88 | 68.02 | 64.86 | 65.52 |

Net Assets, end of period ($ x 1,000) | | 75,649 | 76,835 | 72,374 | 92,776 | 123,226 |

a Based on average shares outstanding.

See notes to financial statements.

20

| | | | | | | |

| | | |

| | | |

| | | Year Ended December 31, |

Service Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 18.53 | 16.71 | 22.45 | 20.00 | 18.88 |

Investment Operations: | | | | | | |

Investment income—neta | | .09 | .09 | .07 | .06 | .17 |

Net realized and unrealized

gain (loss) on investments | | 1.31 | 3.12 | (3.18) | 2.90 | 2.47 |

Total from Investment Operations | | 1.40 | 3.21 | (3.11) | 2.96 | 2.64 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.09) | (.07) | (.07) | (.18) | (.16) |

Dividends from

net realized gain on investments | | - | (1.32) | (2.56) | (.33) | (1.36) |

Total Distributions | | (.09) | (1.39) | (2.63) | (.51) | (1.52) |

Net asset value, end of period | | 19.84 | 18.53 | 16.71 | 22.45 | 20.00 |

Total Return (%) | | 7.85 | 19.85 | (15.69) | 15.04 | 15.20 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.12 | 1.11 | 1.11 | 1.12 | 1.10 |

Ratio of net investment income

to average net assets | | .56 | .48 | .34 | .28 | .94 |

Portfolio Turnover Rate | | 92.40 | 82.88 | 68.02 | 64.86 | 65.52 |

Net Assets, end of period ($ x 1,000) | | 77,862 | 74,454 | 63,202 | 76,948 | 63,972 |

a Based on average shares outstanding.

See notes to financial statements.

21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

MidCap Stock Portfolio (the “fund”) is a separate diversified series of BNY Mellon Investment Portfolios (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering three series, including the fund. The fund is only offered to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. The fund’s investment objective is to seek investment results that are greater than the total return performance of publicly traded common stocks of medium-size domestic companies in the aggregate, as represented by the Standard & Poor’s MidCap 400® Index. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares, which are sold without a sales charge. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Initial and Service. Each class of shares has identical rights and privileges, except with respect to the Distribution Plan, and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management

22

estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing

23

NOTES TO FINANCIAL STATEMENTS (continued)

price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of December 31, 2020 in valuing the fund’s investments:

24

| | | | | |

| | Level 1 -

Unadjusted

Quoted Prices | Level 2 – Other

Significant

Observable

Inputs | Level 3 -

Significant

Unobservable

Inputs | Total |

Assets ($) | | | | |

Investments in Securities:† | | | | |

Equity Securities-

Common Stocks | 152,259,860 | - | - | 152,259,860 |

Investment Companies | 2,052,812 | - | - | 2,052,812 |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign Taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of December 31, 2020, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual

25

NOTES TO FINANCIAL STATEMENTS (continued)

maturity of security lending transactions are on an overnight and continuous basis. During the period ended December 31, 2020, The Bank of New York Mellon earned $4,961 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Risk: Certain events particular to the industries in which the fund’s investments conduct their operations, as well as general economic, political and public health conditions, may have a significant negative impact on the investee’s operations and profitability. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and

26

net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended December 31, 2020, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended December 31, 2020, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended December 31, 2020 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At December 31, 2020, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $922,462, undistributed capital gains $1,096,701 and unrealized appreciation $31,433,495.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2020 and December 31, 2019 were as follows: ordinary income $896,265 and $799,710, and long-term capital gains $0 and $10,846,386, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $823.5 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by The Bank of New York Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $688.5 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $135 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. Prior to September 30, 2020, the Citibank Credit Facility was $927 million with Tranche A available in an amount equal to $747 million and Tranche B available in an amount equal to $180 million. Prior to March 11, 2020, the Citibank Credit Facility was $1.030 billion with Tranche A available in an amount equal to $830 million and Tranche B available in an amount equal to $200 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility

27

NOTES TO FINANCIAL STATEMENTS (continued)

at the time of borrowing. During the period ended December 31, 2020, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Adviser, the management fee is computed at the annual rate of .75% of the value of the fund's average daily net assets and is payable monthly. The Adviser has contractually agreed, from May 1, 2020 through May 1, 2021, to waive receipt of its fees and/or assume the expenses of the fund, so that the direct expenses of the fund (excluding Rule 12b-1 Distribution Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed 1.00%. On or after May 1, 2021, the Adviser may terminate this expense limitation at any time. During the period ended December 31, 2020, there were no reduction in expense pursuant to undertaking.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Service shares pay the Distributor for distributing its shares, for servicing and/or maintaining Service shares’ shareholder accounts and for advertising and marketing for Service shares. The Distribution Plan provides for payments to be made at an annual rate of .25% of the value of the Service shares’ average daily net assets. The Distributor may make payments to Participating Insurance Companies and to brokers and dealers acting as principal underwriter for their variable insurance products. The fees payable under the Distribution Plan are payable without regard to actual expenses incurred. During the period ended December 31, 2020, Service shares were charged $161,947 pursuant to the Distribution Plan.

The fund has an arrangement with the transfer agent whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency fees. For financial reporting purposes, the fund includes net earnings credits, if any, as shareholder servicing costs in the Statement of Operations.

The fund has an arrangement with the custodian whereby the fund will receive interest income or be charged an overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates BNY Mellon Transfer, Inc., a wholly-owned subsidiary of the Adviser, under a transfer agency agreement for providing transfer agency and cash management services inclusive of earnings credits, if any, for the fund. The majority of transfer agency fees are comprised of

28

amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended December 31, 2020, the fund was charged $1,237 for transfer agency services, inclusive of earnings credit, if any. These fees are included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended December 31, 2020, the fund was charged $10,326 pursuant to the custody agreement.

During the period ended December 31, 2020, the fund was charged $13,982 for services performed by the Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fees of $95,942, Distribution Plan fees of $16,089, custodian fees of $4,056, Chief Compliance Officer fees of $2,903 and transfer agency fees of $234.

(c) Each Board member also serves as a Board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2020, amounted to $120,427,615 and $128,364,915, respectively.

At December 31, 2020, the cost of investments for federal income tax purposes was $122,879,177; accordingly, accumulated net unrealized appreciation on investments was $31,433,495, consisting of $34,746,746 gross unrealized appreciation and $3,313,251 gross unrealized depreciation.

29

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of MidCap Stock Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of MidCap Stock Portfolio (the “Fund”) (one of the funds constituting BNY Mellon Investment Portfolios), including the statements of investments and investments in affiliated issuers, as of December 31, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting BNY Mellon Investment Portfolios) at December 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies in the BNY Mellon Family of Funds since at least 1957, but we are unable to determine the specific year.

New York, New York

February 9, 2021

30

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the portfolio hereby reports 100% of the ordinary dividends paid during the fiscal year ended December 31, 2020 as qualifying for the corporate dividends received deduction. Shareholders will receive notification in early 2021 of the percentage applicable to the preparation of their 2020 income tax returns.

31

INFORMATION ABOUT THE RENEWAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT (Unaudited)

At a meeting of the fund’s Board of Trustees held on July 20-21, 2020, the Board considered the renewal of the fund’s Management Agreement pursuant to which the Adviser provides the fund with investment advisory and administrative services (the “Agreement”). The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Adviser. In considering the renewal of the Agreement, the Board considered several factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to it at the meeting and in previous presentations from representatives of the Adviser regarding the nature, extent, and quality of the services provided to funds in the BNY Mellon fund complex, including the fund. The Adviser provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. The Adviser also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the BNY Mellon fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or the Adviser) and the Adviser’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that the Adviser also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board also considered the Adviser’s extensive administrative, accounting and compliance infrastructures. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of investment company data based on classifications provided by Thomson Reuters Lipper, which included information comparing (1) the performance of the fund’s Initial shares with the performance of a group of small-cap core funds underlying variable insurance products (“VIPs”) selected by Broadridge as comparable to the fund (the “Performance Group”) and with a broader group of funds consisting of all small-cap core funds underlying VIPs (the “Performance Universe”), all for various periods ended May 31, 2020, and (2) the fund’s actual and contractual management fees and total expenses with those of the same

32