UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08789

VALIC Company II

(Exact name of registrant as specified in charter)

2929 Allen Parkway, Houston, TX 77019

(Address of principal executive offices) (Zip code)

John T. Genoy

President

The Variable Annuity Life Insurance Company

2929 Allen Parkway

Houston, TX 77019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (201) 324-6414

Date of fiscal year end: August 31

Date of reporting period: August 31, 2016

Item 1. Reports to Stockholders

VALIC Company II

Annual Report, August 31, 2016

SAVING :INVESTING :PLANNING

VALIC Company II

ANNUAL REPORT AUGUST 31, 2016

TABLE OF CONTENTS

VALIC Company II

PRESIDENT’S LETTER

Dear Valued Investor:

We are pleased to provide you with the following Annual Report for VALIC Company II. The report contains the investment portfolio information and the financial statements of VALIC Company II for the twelve-month period ended August 31, 2016. We encourage you to carefully read this report and hope you find it informative and helpful.

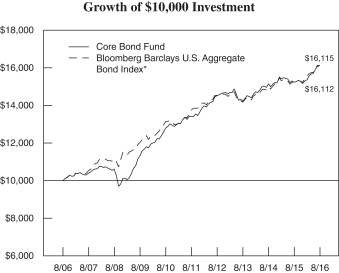

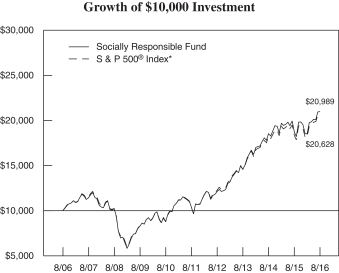

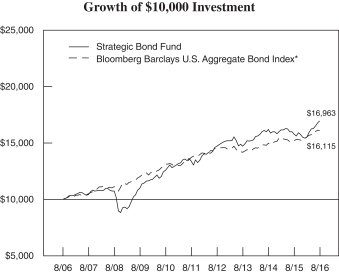

Domestically, the total return for the S&P 500® Index*, widely regarded as the best single gauge of the U.S. equity market, ended up 12.55%. The MSCI EAFE Index (net)**, designed to measure the equity market performance of developed foreign markets (Europe, Australasia, Far East), excluding the U.S. and Canada, declined -0.12%. The domestic bond market experienced respectable returns, with the Bloomberg Barclays U.S. Aggregate Bond Index***, a broad measure of the bond market, rising 5.97%.

Global growth continued to slow during the period which weighed heavily on international markets. Market volatility increased during the reporting period amid signs of a steeper than expected economic slowdown in China shortly after the unexpected decision by the Chinese government to devalue the Renminbi (RMB), which triggered a major market sell-off. In response, the Chinese government utilized fiscal and monetary measures in an effort to stimulate the economy. Following these measures, the Chinese economy began to show signs of stabilization towards the end of the period. Further compounding global pressures was the shadow that was cast over the Eurozone amidst the fallout and potential ramifications from the United Kingdom’s vote to leave the European Union, dubbed “Brexit” (British Exit).

Domestically, the U.S. Federal Reserve (“Fed”) began its much anticipated monetary tightening in December 2015. While Fed officials said they expect to make further adjustments with respect to monetary policy, they intend to do so gradually, watching the global economy closely. In August 2016, Fed comments from the Jackson Hole, WY, meeting continued the discussion about the need for and timing of a rate hike, citing continued “solid performance of the labor market and the outlook for economic activity and inflation.” The U.S. dollar remains strong as compared to the major international currencies, which has some Fed policy makers concerned that this strength could translate to a drag on exports.

Oil prices fell dramatically during the period, reaching lows not seen for almost seven years. Oil prices have been affected by a myriad of issues, most notable among them was the major oil producers’ refusal to curtail production (which has created a supply glut), exacerbated by a weak global economy. In August 2016, oil prices began to climb off their lows amid speculation that oil producing nations would take necessary measures amidst the supply glut.

Planning for your financial future in such an uncertain world should be a top priority. We believe your investment with VALIC Company II is an important step to help you potentially reach your long-term financial goals. Another important step, we further believe, is to meet with your financial advisor periodically to ensure that you maintain a diversified portfolio appropriate for your goals and risk tolerance.

We appreciate being part of your investment program and thank you for your ongoing confidence in us. We look forward to serving your investment needs in the years ahead.

Sincerely,

John T. Genoy, President

VALIC Company II

Past performance is no guarantee of future results.

| * | The S&P 500® Index is an index of the stocks of 500 major large-cap U.S. corporations, chosen for market size, liquidity, and industry group representation. It is a market-value weighted index, with each stock’s percentage in the Index in proportion to its market value. |

| ** | The MSCI EAFE Index (net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. |

| *** | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage- and asset-backed securities and commercial mortgage-backed securities. Effective August 24, 2016, the name of the Barclays U.S. Aggregate Bond Index was changed to Bloomberg Barclays U.S. Aggregate Bond Index. |

Indices are not managed and an investor cannot invest directly into an index. Past performance of an index does not guarantee the future performance of any investment.

1

VALIC Company II

EXPENSE EXAMPLE — August 31, 2016 (unaudited)

Disclosure of Fund Expenses in Shareholder Reports

As a shareholder of a Fund in VALIC Company II (“VC II”), you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at March 1, 2016 and held until August 31, 2016. Shares of VC II are currently issued and redeemed only in connection with investments in and payments under variable annuity contracts and variable life insurance policies (“Variable Contracts”), qualified retirement plans (the “Plans”) and Individual Retirement Plan Accounts (“IRA”) offered by The Variable Annuity Life Insurance Company (“VALIC”), the investment adviser to VC II and other life insurance companies affiliated with VALIC. The fees and expenses associated with the Variable Contracts, Plans and IRA’s are not included in these Examples, and had such fees and expenses been included, your costs would have been higher. Please see your Variable Contract prospectus or Plan/IRA documents for more details on the fees associated with the Variable Contract, Plans or IRA’s.

Actual Expenses

The “Actual” section of the table provides information about your actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled “Expenses Paid During the Six Months Ended August 31, 2016” to estimate the expenses you paid on your account during this period. The “Expenses Paid During the Six Months Ended August 31, 2016” column and the “Annualized Expense Ratio” column do not include fees and expenses that may be charged by the Variable Contracts, Plans and IRA’s, in which the Funds are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended August 31, 2016” column would have been higher and the “Ending Account Value” column would have been lower.

Hypothetical Example for Comparison Purposes

The “Hypothetical” section of the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The “Expenses Paid During the Six Months Ended August 31, 2016” column and the “Annualized Expense Ratio” column do not include fees and expenses that may be charged by the Variable Contracts, Plans or IRA’s in which the Funds are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended August 31, 2016” column would have been higher and the “Ending Account Value” column would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the Variable Contracts, Plans or IRA’s. Please refer to your Variable Contract prospectus or Plan/IRA document for more information. Therefore, the “hypothetical” example is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses were included, your costs would have been higher.

2

VALIC Company II

EXPENSE EXAMPLE — August 31, 2016 (unaudited) — (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual

| | | Hypothetical

| |

Fund

| | Beginning

Account Value

at March 1,

2016

| | | Ending

Account Value

Using Actual

Return at

August 31,

2016

| | | Expenses Paid

During the Six

Months Ended

August 31,

2016*

| | | Beginning

Account Value

at March 1,

2016

| | | Ending

Account Value

Using a

Hypothetical

5% Annual

Return at

August 31,

2016

| | | Expenses Paid

During the

Six Months Ended

August 31,

2016*

| | | Annualized

Expense

Ratio

| |

Aggressive Growth Lifestyle# | | $ | 1,000.00 | | | $ | 1,133.78 | | | $ | 0.54 | | | $ | 1,000.00 | | | $ | 1,024.63 | | | $ | 0.51 | | | | 0.10 | % |

Capital Appreciation# | | $ | 1,000.00 | | | $ | 1,117.45 | | | $ | 4.52 | | | $ | 1,000.00 | | | $ | 1,020.86 | | | $ | 4.32 | | | | 0.85 | % |

Conservative Growth Lifestyle# | | $ | 1,000.00 | | | $ | 1,094.93 | | | $ | 0.53 | | | $ | 1,000.00 | | | $ | 1,024.63 | | | $ | 0.51 | | | | 0.10 | % |

Core Bond# | | $ | 1,000.00 | | | $ | 1,049.12 | | | $ | 3.97 | | | $ | 1,000.00 | | | $ | 1,021.27 | | | $ | 3.91 | | | | 0.77 | % |

High Yield Bond# | | $ | 1,000.00 | | | $ | 1,115.90 | | | $ | 5.11 | | | $ | 1,000.00 | | | $ | 1,020.31 | | | $ | 4.88 | | | | 0.96 | % |

International Opportunities# | | $ | 1,000.00 | | | $ | 1,121.38 | | | $ | 5.33 | | | $ | 1,000.00 | | | $ | 1,020.11 | | | $ | 5.08 | | | | 1.00 | % |

Large Cap Value# | | $ | 1,000.00 | | | $ | 1,151.57 | | | $ | 4.38 | | | $ | 1,000.00 | | | $ | 1,021.06 | | | $ | 4.12 | | | | 0.81 | % |

Mid Cap Growth# | | $ | 1,000.00 | | | $ | 1,171.03 | | | $ | 4.64 | | | $ | 1,000.00 | | | $ | 1,020.86 | | | $ | 4.32 | | | | 0.85 | % |

Mid Cap Value# | | $ | 1,000.00 | | | $ | 1,176.55 | | | $ | 5.74 | | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.33 | | | | 1.05 | % |

Moderate Growth Lifestyle# | | $ | 1,000.00 | | | $ | 1,119.29 | | | $ | 0.53 | | | $ | 1,000.00 | | | $ | 1,024.63 | | | $ | 0.51 | | | | 0.10 | % |

Money Market II# | | $ | 1,000.00 | | | $ | 1,000.05 | | | $ | 2.06 | | | $ | 1,000.00 | | | $ | 1,023.08 | | | $ | 2.08 | | | | 0.41 | % |

Small Cap Growth# | | $ | 1,000.00 | | | $ | 1,270.52 | | | $ | 6.62 | | | $ | 1,000.00 | | | $ | 1,019.30 | | | $ | 5.89 | | | | 1.16 | % |

Small Cap Value# | | $ | 1,000.00 | | | $ | 1,204.76 | | | $ | 5.26 | | | $ | 1,000.00 | | | $ | 1,020.36 | | | $ | 4.82 | | | | 0.95 | % |

Socially Responsible# | | $ | 1,000.00 | | | $ | 1,133.85 | | | $ | 3.00 | | | $ | 1,000.00 | | | $ | 1,022.32 | | | $ | 2.85 | | | | 0.56 | % |

Strategic Bond | | $ | 1,000.00 | | | $ | 1,092.34 | | | $ | 4.63 | | | $ | 1,000.00 | | | $ | 1,020.71 | | | $ | 4.47 | | | | 0.88 | % |

| * | Expenses are equal to each Fund‘s annualized expense ratio multiplied by the average account value over the period, multiplied by 184 days then divided by 366 days (to reflect the one-half year period) . These ratios do not reflect fees and expenses associated with the Variable Contracts, Plans or IRA‘s. If such fees and expenses had been included, the expenses would have been higher. Please refer to your Variable Contract prospectus for details on the expenses that apply to the Variable Contracts or your Plan/IRA document for details on the administration fees charged by your Plan sponsor. |

| # | During the stated period, the investment adviser waived a portion of or all fees and assumed a portion of or all expenses for the Fund. As a result, if these fees and expenses had not been waived or assumed, the “Actual/Hypothetical Ending Account Value” would have been lower and the “Actual/Hypothetical Expenses Paid During the Six Months Ended August 31, 2016” and the “Annualized Expense Ratio” would have been higher. |

3

VALIC Company II Aggressive Growth Lifestyle Fund

PORTFOLIO PROFILE — August 31, 2016 (unaudited)

Industry Allocation*

| | | | |

Domestic Equity Investment Companies | | | 46.9 | % |

Domestic Fixed Income Investment Companies | | | 23.2 | |

International Equity Investment Companies | | | 19.7 | |

Real Estate Investment Companies | | | 10.1 | |

International Fixed Income Investment Companies | | | 0.1 | |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

| * | Calculated as a percentage of net assets |

VALIC Company II Aggressive Growth Lifestyle Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

AFFILIATED REGISTERED INVESTMENT COMPANIES#(1) — 100.0% | |

Domestic Equity Investment Companies — 46.9% | | | | | | | | |

VALIC Co. I Blue Chip Growth Fund | | | 959,989 | | | $ | 15,321,422 | |

VALIC Co. I Dividend Value Fund | | | 1,422,778 | | | | 17,130,245 | |

VALIC Co. I Mid Cap Index Fund | | | 1,014,686 | | | | 26,564,486 | |

VALIC Co. I Mid Cap Strategic Growth Fund | | | 454,675 | | | | 5,997,163 | |

VALIC Co. I Nasdaq-100 Index Fund | | | 1,178,005 | | | | 12,357,276 | |

VALIC Co. I Science & Technology Fund | | | 348,130 | | | | 7,961,730 | |

VALIC Co. I Small Cap Index Fund | | | 1,534,625 | | | | 29,618,264 | |

VALIC Co. I Small Cap Special Values Fund | | | 1,096,229 | | | | 14,152,320 | |

VALIC Co. I Stock Index Fund | | | 580,775 | | | | 20,019,331 | |

VALIC Co. I Value Fund | | | 219,625 | | | | 3,395,396 | |

VALIC Co. II Capital Appreciation Fund | | | 1,052,411 | | | | 16,828,047 | |

VALIC Co. II Large Cap Value Fund | | | 534,897 | | | | 9,847,452 | |

VALIC Co. II Mid Cap Growth Fund | | | 830,878 | | | | 6,995,995 | |

VALIC Co. II Mid Cap Value Fund | | | 1,620,949 | | | | 33,148,398 | |

VALIC Co. II Small Cap Growth Fund | | | 738,128 | | | | 10,481,418 | |

VALIC Co. II Small Cap Value Fund | | | 1,557,958 | | | | 21,141,495 | |

| | | | | | |

|

|

|

Total Domestic Equity Investment Companies | | | | | | | | |

(cost $232,158,408) | | | | | | | 250,960,438 | |

| | | | | | |

|

|

|

Domestic Fixed Income Investment Companies — 23.2% | |

VALIC Co. I Capital Conservation Fund | | | 587,379 | | | | 5,985,390 | |

VALIC Co. I Government Securities Fund | | | 670,444 | | | | 7,401,700 | |

VALIC Co. I Inflation Protected Fund | | | 294,976 | | | | 3,256,539 | |

VALIC Co. II Core Bond Fund | | | 2,800,944 | | | | 31,650,665 | |

VALIC Co. II High Yield Bond Fund | | | 5,524,842 | | | | 41,823,055 | |

VALIC Co. II Strategic Bond Fund | | | 2,998,097 | | | | 33,848,518 | |

| | | | | | |

|

|

|

Total Domestic Fixed Income Investment Companies | | | | | | | | |

(cost $123,416,553) | | | | | | | 123,965,867 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

| | | | | | | | | |

International Equity Investment Companies — 19.7% | |

VALIC Co. I Emerging Economies Fund | | | 1,433,416 | | | $ | 9,933,574 | |

VALIC Co. I Foreign Value Fund | | | 2,859,542 | | | | 26,622,335 | |

VALIC Co. I International Equities Index Fund | �� | | 5,307,805 | | | | 33,545,328 | |

VALIC Co. I International Growth Fund | | | 1,490,477 | | | | 17,423,681 | |

VALIC Co. II International Opportunities Fund | | | 1,127,731 | | | | 18,032,426 | |

| | | | | | |

|

|

|

Total International Equity Investment Companies | | | | | | | | |

(cost $113,301,169) | | | | | | | 105,557,344 | |

| | | | | | |

|

|

|

International Fixed Income Investment Companies — 0.1% | |

VALIC Co. I International Government Bond Fund | | | | | | | | |

(cost $520,178) | | | 44,612 | | | | 531,777 | |

| | | | | | |

|

|

|

Real Estate Investment Trusts — 10.1% | | | | | | | | |

VALIC Co. I Global Real Estate Fund | | | | | | | | |

(cost $53,162,466) | | | 6,440,311 | | | | 54,356,225 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS | | | | | | | | |

(cost $522,558,774)(2) | | | 100.0 | % | | | 535,371,651 | |

Liabilities in excess of other assets | | | (0.0 | ) | | | (126,452 | ) |

| | |

|

|

| |

|

|

|

NET ASSETS | | | 100.0 | % | | $ | 535,245,199 | |

| | |

|

|

| |

|

|

|

| # | The Aggressive Growth Lifestyle Fund invests in various VALIC Company I or VALIC Company II Funds, some of which are not presented in this report. Additional information on the underlying funds including such fund’s prospectuses and shareholder reports is available at our website, www.valic.com. |

| (2) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2016 (see Note 2):

| | | | | | | | | | | | | | | | |

| | | Level 1 - Unadjusted

Quoted Prices

| | | Level 2 - Other

Observable Inputs

| | | Level 3 - Significant

Unobservable Inputs

| | | Total

| |

ASSETS: | | | | | | | | | | | | | | | | |

Investments at Value:* | | | | | | | | | | | | | | | | |

Affiliated Registered Investment Companies | | $ | 535,371,651 | | | $ | — | | | $ | — | | | $ | 535,371,651 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Fund’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

VALIC Company II Capital Appreciation Fund

PORTFOLIO PROFILE — August 31, 2016 (unaudited)

Industry Allocation*

| | | | |

Web Portals/ISP | | | 5.8 | % |

Medical — Drugs | | | 4.8 | |

Applications Software | | | 4.7 | |

Electronic Components — Semiconductors | | | 4.5 | |

Internet Content — Entertainment | | | 4.4 | |

E-Commerce/Products | | | 4.2 | |

Cable/Satellite TV | | | 3.6 | |

Medical — Biomedical/Gene | | | 3.6 | |

Medical — HMO | | | 3.3 | |

Finance — Credit Card | | | 3.1 | |

Enterprise Software/Service | | | 2.9 | |

Medical Instruments | | | 2.8 | |

Instruments — Controls | | | 2.6 | |

Beverages — Non-alcoholic | | | 2.6 | |

Retail — Building Products | | | 2.6 | |

Transport — Rail | | | 2.5 | |

Food — Misc./Diversified | | | 2.3 | |

Retail — Discount | | | 2.0 | |

Retail — Major Department Stores | | | 1.9 | |

E-Commerce/Services | | | 1.9 | |

Finance — Other Services | | | 1.8 | |

Aerospace/Defense | | | 1.7 | |

Brewery | | | 1.6 | |

Computer Services | | | 1.6 | |

Networking Products | | | 1.5 | |

Investment Management/Advisor Services | | | 1.5 | |

Retail — Perfume & Cosmetics | | | 1.5 | |

Data Processing/Management | | | 1.5 | |

Cosmetics & Toiletries | | | 1.5 | |

Apparel Manufacturers | | | 1.5 | |

Diagnostic Equipment | | | 1.5 | |

Chemicals — Diversified | | | 1.3 | |

Aerospace/Defense — Equipment | | | 1.3 | |

Television | | | 1.3 | |

Coatings/Paint | | | 1.2 | |

Insurance — Property/Casualty | | | 1.2 | |

Dental Supplies & Equipment | | | 1.1 | |

Medical — Wholesale Drug Distribution | | | 1.1 | |

Finance — Consumer Loans | | | 1.1 | |

Oil — Field Services | | | 1.0 | |

Building Products — Cement | | | 1.0 | |

Auto/Truck Parts & Equipment — Original | | | 0.9 | |

Auto — Cars/Light Trucks | | | 0.8 | |

Oil Companies — Exploration & Production | | | 0.8 | |

Electronic Measurement Instruments | | | 0.8 | |

Advertising Agencies | | | 0.7 | |

Time Deposits | | | 0.6 | |

Internet Application Software | | | 0.5 | |

Registered Investment Companies | | | 0.5 | |

| | |

|

|

|

| | | | 100.5 | % |

| | |

|

|

|

| * | Calculated as a percentage of net assets |

VALIC Company II Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

COMMON STOCKS — 99.4% | | | | | | | | |

Advertising Agencies — 0.7% | | | | | | | | |

Interpublic Group of Cos., Inc. | | | 24,664 | | | $ | 570,725 | |

| | | | | | |

|

|

|

Aerospace/Defense — 1.7% | | | | | | | | |

Raytheon Co. | | | 10,447 | | | | 1,463,938 | |

| | | | | | |

|

|

|

Aerospace/Defense - Equipment — 1.3% | | | | | | | | |

United Technologies Corp. | | | 10,206 | | | | 1,086,225 | |

| | | | | | |

|

|

|

Apparel Manufacturers — 1.5% | | | | | | | | |

Hanesbrands, Inc. | | | 47,583 | | | | 1,262,853 | |

| | | | | | |

|

|

|

Applications Software — 4.7% | | | | | | | | |

Citrix Systems, Inc.† | | | 14,186 | | | | 1,237,019 | |

Intuit, Inc. | | | 11,131 | | | | 1,240,550 | |

Salesforce.com, Inc.† | | | 18,822 | | | | 1,494,843 | |

| | | | | | |

|

|

|

| | | | | 3,972,412 | |

| | | | | | |

|

|

|

Auto - Cars/Light Trucks — 0.8% | | | | | | | | |

Tesla Motors, Inc.†# | | | 3,280 | | | | 695,393 | |

| | | | | | |

|

|

|

Auto/Truck Parts & Equipment - Original — 0.9% | | | | | | | | |

Delphi Automotive PLC | | | 10,974 | | | | 775,423 | |

| | | | | | |

|

|

|

Beverages - Non-alcoholic — 2.6% | | | | | | | | |

Coca-Cola Co. | | | 51,008 | | | | 2,215,277 | |

| | | | | | |

|

|

|

Brewery — 1.6% | | | | | | | | |

Molson Coors Brewing Co., Class B | | | 13,633 | | | | 1,394,929 | |

| | | | | | |

|

|

|

Building Products - Cement — 1.0% | | | | | | | | |

Vulcan Materials Co. | | | 7,212 | | | | 821,230 | |

| | | | | | |

|

|

|

Cable/Satellite TV — 3.6% | | | | | | | | |

Charter Communications, Inc. Class A† | | | 4,457 | | | | 1,146,385 | |

Comcast Corp., Class A | | | 29,262 | | | | 1,909,638 | |

| | | | | | |

|

|

|

| | | | | 3,056,023 | |

| | | | | | |

|

|

|

Chemicals - Diversified — 1.3% | | | | | | | | |

Dow Chemical Co. | | | 21,231 | | | | 1,138,831 | |

| | | | | | |

|

|

|

Coatings/Paint — 1.2% | | | | | | | | |

Sherwin-Williams Co. | | | 3,588 | | | | 1,017,952 | |

| | | | | | |

|

|

|

Computer Services — 1.6% | | | | | | | | |

Cognizant Technology Solutions Corp., Class A† | | | 15,920 | | | | 914,445 | |

Teradata Corp.† | | | 14,583 | | | | 462,718 | |

| | | | | | |

|

|

|

| | | | | 1,377,163 | |

| | | | | | |

|

|

|

Cosmetics & Toiletries — 1.5% | | | | | | | | |

Estee Lauder Cos., Inc., Class A | | | 14,188 | | | | 1,265,995 | |

| | | | | | |

|

|

|

Data Processing/Management — 1.5% | | | | | | | | |

Paychex, Inc. | | | 20,910 | | | | 1,268,610 | |

| | | | | | |

|

|

|

Dental Supplies & Equipment — 1.1% | | | | | | | | |

DENTSPLY SIRONA, Inc. | | | 15,827 | | | | 972,727 | |

| | | | | | |

|

|

|

Diagnostic Equipment — 1.5% | | | | | | | | |

Danaher Corp. | | | 15,421 | | | | 1,255,424 | |

| | | | | | |

|

|

|

E-Commerce/Products — 4.2% | | | | | | | | |

Amazon.com, Inc.† | | | 4,596 | | | | 3,535,059 | |

| | | | | | |

|

|

|

E-Commerce/Services — 1.9% | | | | | | | | |

Priceline Group, Inc.† | | | 1,125 | | | | 1,593,821 | |

| | | | | | |

|

|

|

Electronic Components - Semiconductors — 4.5% | | | | | | | | |

Broadcom, Ltd. | | | 10,781 | | | | 1,901,984 | |

Texas Instruments, Inc. | | | 27,470 | | | | 1,910,264 | |

| | | | | | |

|

|

|

| | | | | 3,812,248 | |

| | | | | | |

|

|

|

Electronic Measurement Instruments — 0.8% | | | | | | | | |

Fortive Corp. | | | 12,639 | | | | 665,696 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Enterprise Software/Service — 2.9% | | | | | | | | |

Oracle Corp. | | | 47,554 | | | $ | 1,960,176 | |

Workday, Inc., Class A† | | | 5,744 | | | | 487,034 | |

| | | | | | |

|

|

|

| | | | | 2,447,210 | |

| | | | | | |

|

|

|

Finance - Consumer Loans — 1.1% | | | | | | | | |

Synchrony Financial | | | 33,402 | | | | 929,578 | |

| | | | | | |

|

|

|

Finance - Credit Card — 3.1% | | | | | | | | |

Visa, Inc., Class A | | | 32,466 | | | | 2,626,499 | |

| | | | | | |

|

|

|

Finance - Other Services — 1.8% | | | | | | | | |

Intercontinental Exchange, Inc. | | | 5,263 | | | | 1,484,271 | |

| | | | | | |

|

|

|

Food - Misc./Diversified — 2.3% | | | | | | | | |

ConAgra Foods, Inc. | | | 20,011 | | | | 932,713 | |

Kellogg Co. | | | 12,445 | | | | 1,023,103 | |

| | | | | | |

|

|

|

| | | | | 1,955,816 | |

| | | | | | |

|

|

|

Instruments - Controls — 2.6% | | | | | | | | |

Honeywell International, Inc. | | | 18,990 | | | | 2,216,323 | |

| | | | | | |

|

|

|

Insurance - Property/Casualty — 1.2% | | | | | | | | |

Progressive Corp. | | | 30,637 | | | | 997,541 | |

| | | | | | |

|

|

|

Internet Application Software — 0.5% | | | | | | | | |

Splunk, Inc.† | | | 7,789 | | | | 453,631 | |

| | | | | | |

|

|

|

Internet Content - Entertainment — 4.4% | | | | | | | | |

Facebook, Inc., Class A† | | | 29,708 | | | | 3,746,773 | |

| | | | | | |

|

|

|

Investment Management/Advisor Services — 1.5% | | | | | | | | |

BlackRock, Inc. | | | 3,472 | | | | 1,294,396 | |

| | | | | | |

|

|

|

Medical Instruments — 2.8% | | | | | | | | |

Boston Scientific Corp.† | | | 45,488 | | | | 1,083,524 | |

Medtronic PLC | | | 15,048 | | | | 1,309,628 | |

| | | | | | |

|

|

|

| | | | | 2,393,152 | |

| | | | | | |

|

|

|

Medical - Biomedical/Gene — 3.6% | | | | | | | | |

BioMarin Pharmaceutical, Inc.† | | | 10,044 | | | | 943,031 | |

Celgene Corp.† | | | 9,144 | | | | 976,031 | |

Vertex Pharmaceuticals, Inc.† | | | 11,990 | | | | 1,133,175 | |

| | | | | | |

|

|

|

| | | | | 3,052,237 | |

| | | | | | |

|

|

|

Medical - Drugs — 4.8% | | | | | | | | |

AbbVie, Inc. | | | 29,800 | | | | 1,910,180 | |

Allergan PLC† | | | 3,522 | | | | 826,050 | |

Eli Lilly & Co. | | | 17,386 | | | | 1,351,761 | |

| | | | | | |

|

|

|

| | | | | 4,087,991 | |

| | | | | | |

|

|

|

Medical - HMO — 3.3% | | | | | | | | |

Centene Corp.† | | | 16,431 | | | | 1,122,073 | |

UnitedHealth Group, Inc. | | | 12,560 | | | | 1,708,788 | |

| | | | | | |

|

|

|

| | | | | 2,830,861 | |

| | | | | | |

|

|

|

Medical - Wholesale Drug Distribution — 1.1% | | | | | | | | |

Cardinal Health, Inc. | | | 11,952 | | | | 952,216 | |

| | | | | | |

|

|

|

Networking Products — 1.5% | | | | | | | | |

Cisco Systems, Inc. | | | 41,691 | | | | 1,310,765 | |

| | | | | | |

|

|

|

Oil Companies - Exploration & Production — 0.8% | |

Pioneer Natural Resources Co. | | | 3,880 | | | | 694,714 | |

| | | | | | |

|

|

|

Oil - Field Services — 1.0% | | | | | | | | |

Schlumberger, Ltd. | | | 6,060 | | | | 478,740 | |

Superior Energy Services, Inc. | | | 23,316 | | | | 392,408 | |

| | | | | | |

|

|

|

| | | | | 871,148 | |

| | | | | | |

|

|

|

Retail - Building Products — 2.6% | |

Home Depot, Inc. | | | 16,332 | | | | 2,190,448 | |

| | | | | | |

|

|

|

VALIC Company II Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016 — (continued)

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

COMMON STOCKS (continued) | |

Retail - Discount — 2.0% | |

Costco Wholesale Corp. | | | 10,253 | | | $ | 1,661,909 | |

| | | | | | |

|

|

|

Retail - Major Department Stores — 1.9% | |

TJX Cos., Inc. | | | 21,000 | | | | 1,626,240 | |

| | | | | | |

|

|

|

Retail - Perfume & Cosmetics — 1.5% | |

Ulta Salon Cosmetics & Fragrance, Inc.† | | | 5,191 | | | | 1,283,267 | |

| | | | | | |

|

|

|

Television — 1.3% | |

CBS Corp., Class B | | | 20,925 | | | | 1,067,803 | |

| | | | | | |

|

|

|

Transport - Rail — 2.5% | |

Union Pacific Corp. | | | 22,182 | | | | 2,119,046 | |

| | | | | | |

|

|

|

Web Portals/ISP — 5.8% | |

Alphabet, Inc., Class A† | | | 2,652 | | | | 2,094,682 | |

Alphabet, Inc., Class C† | | | 3,692 | | | | 2,831,949 | |

| | | | | | |

|

|

|

| | | | | | | | 4,926,631 | |

| | | | | | |

|

|

|

Total Long-Term Investment Securities | | | | | | | | |

(cost $68,809,936) | | | | | | | 84,438,420 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Shares/

Principal

Amount | | | Value

(Note 2) | |

| |

SHORT-TERM INVESTMENT SECURITIES — 1.1% | | | | | | | | |

Registered Investment Companies — 0.5% | | | | | | | | |

State Street Navigator Securities Lending Prime Portfolio 0.43%(1)(2) | | | 392,881 | | | $ | 392,881 | |

| | | | | | |

|

|

|

Time Deposits — 0.6% | |

Euro Time Deposit with State Street Bank and Trust Co. 0.01% due 09/01/2016 | | $ | 498,000 | | | | 498,000 | |

| | | | | | |

|

|

|

Total Short-Term Investment Securities | | | | | | | | |

(cost $890,881) | | | | | | | 890,881 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS | | | | | | | | |

(cost $69,700,817)(3) | | | 100.5 | % | | | 85,329,301 | |

Liabilities in excess of other assets | | | (0.5 | ) | | | (383,639 | ) |

| | |

|

|

| |

|

|

|

NET ASSETS | | | 100.0 | % | | $ | 84,945,662 | |

| | |

|

|

| |

|

|

|

| † | Non-income producing security |

| # | The security or a portion thereof is out on loan (see Note 2). |

| (1) | At August 31, 2016, the Fund had loaned securities with a total value of $386,070. This was secured by collateral of $392,881, which was received in cash and subsequently invested in short-term investments currently valued at $392,881 as reported in the Portfolio of Investments. |

| (2) | The rate shown is the 7-day yield as of August 31, 2016. |

| (3) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2016 (see Note 2):

| | | | | | | | | | | | | | | | |

| | | Level 1 - Unadjusted

Quoted Prices

| | | Level 2 - Other

Observable Inputs

| | | Level 3 - Significant

Unobservable Inputs

| | | Total

| |

ASSETS: | | | | | | | | | | | | | | | | |

Investments at Value:* | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 84,438,420 | | | $ | — | | | $ | — | | | $ | 84,438,420 | |

Short-Term Investment Securities: | | | | | | | | | | | | | | | | |

Registered Investment Companies | | | 392,881 | | | | — | | | | — | | | | 392,881 | |

Time Deposits | | | — | | | | 498,000 | | | | — | | | | 498,000 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Investments at Value | | $ | 84,831,301 | | | $ | 498,000 | | | $ | — | | | $ | 85,329,301 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Fund’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

VALIC Company II Conservative Growth Lifestyle Fund

PORTFOLIO PROFILE — August 31, 2016 (unaudited)

Industry Allocation*

| | | | |

Domestic Fixed Income Investment Companies | | | 65.8 | % |

Domestic Equity Investment Companies | | | 15.5 | |

International Equity Investment Companies | | | 12.7 | |

Real Estate Investment Companies | | | 5.9 | |

International Fixed Income Investment Companies | | | 0.1 | |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

| * | Calculated as a percentage of net assets |

VALIC Company II Conservative Growth Lifestyle Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

AFFILIATED REGISTERED INVESTMENT COMPANIES#(1) — 100.0% | |

Domestic Equity Investment Companies — 15.5% | |

VALIC Co. I Blue Chip Growth Fund | | | 145,794 | | | $ | 2,326,865 | |

VALIC Co. I Dividend Value Fund | | | 590,475 | | | | 7,109,322 | |

VALIC Co. I Mid Cap Index Fund | | | 91,162 | | | | 2,386,633 | |

VALIC Co. I Mid Cap Strategic Growth Fund | | | 50,942 | | | | 671,931 | |

VALIC Co. I Nasdaq-100 Index Fund | | | 64,822 | | | | 679,983 | |

VALIC Co. I Science & Technology Fund | | | 30,139 | | | | 689,268 | |

VALIC Co. I Small Cap Index Fund | | | 283,716 | | | | 5,475,724 | |

VALIC Co. I Small Cap Special Values Fund | | | 443,949 | | | | 5,731,386 | |

VALIC Co. I Stock Index Fund | | | 59,387 | | | | 2,047,065 | |

VALIC Co. I Value Fund | | | 55,046 | | | | 851,011 | |

VALIC Co. II Capital Appreciation Fund | | | 222,675 | | | | 3,560,571 | |

VALIC Co. II Large Cap Value Fund | | | 184,803 | | | | 3,402,227 | |

VALIC Co. II Mid Cap Growth Fund | | | 79,022 | | | | 665,361 | |

VALIC Co. II Mid Cap Value Fund | | | 380,404 | | | | 7,779,257 | |

VALIC Co. II Small Cap Growth Fund | | | 38,228 | | | | 542,833 | |

VALIC Co. II Small Cap Value Fund | | | 520,695 | | | | 7,065,831 | |

| | | | | | |

|

|

|

Total Domestic Equity Investment Companies | | | | | | | | |

(cost $47,716,157) | | | | | | | 50,985,268 | |

| | | | | | |

|

|

|

Domestic Fixed Income Investment Companies — 65.8% | |

VALIC Co. I Capital Conservation Fund | | | 1,320,993 | | | | 13,460,918 | |

VALIC Co. I Government Securities Fund | | | 1,037,390 | | | | 11,452,787 | |

VALIC Co. I Inflation Protected Fund | | | 903,825 | | | | 9,978,232 | |

VALIC Co. II Core Bond Fund | | | 5,873,358 | | | | 66,368,944 | |

VALIC Co. II High Yield Bond Fund | | | 6,055,486 | | | | 45,840,032 | |

VALIC Co. II Strategic Bond Fund | | | 6,116,949 | | | | 69,060,359 | |

| | | | | | |

|

|

|

Total Domestic Fixed Income Investment Companies | | | | | | | | |

(cost $215,876,551) | | | | | | | 216,161,272 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Shares | | | Value

(Note 2) | |

| |

| | | | | | | | | |

International Equity Investment Companies — 12.7% | |

VALIC Co. I Emerging Economies Fund | | | 222,336 | | | $ | 1,540,790 | |

VALIC Co. I Foreign Value Fund | | | 1,209,431 | | | | 11,259,806 | |

VALIC Co. I International Equities Index Fund | | | 2,395,939 | | | | 15,142,320 | |

VALIC Co. I International Growth Fund | | | 542,139 | | | | 6,337,605 | |

VALIC Co. II International Opportunities Fund | | | 453,191 | | | | 7,246,530 | |

| | | | | | |

|

|

|

Total International Equity Investment Companies | | | | | | | | |

(cost $44,619,037) | | | | | | | 41,527,051 | |

| | | | | | |

|

|

|

International Fixed Income Investment Companies — 0.1% | |

VALIC Co. I International Government Bond Fund | | | | | | | | |

(cost $322,326) | | | 27,657 | | | | 329,674 | |

| | | | | | |

|

|

|

Real Estate Investment Companies — 5.9% | |

VALIC Co. I Global Real Estate Fund | | | | | | | | |

(cost $19,400,116) | | | 2,303,377 | | | | 19,440,502 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS | | | | | | | | |

(cost $327,934,187)(2) | | | 100.0 | % | | | 328,443,767 | |

Liabilities in excess of other assets | | | (0.0 | ) | | | (54,135 | ) |

| | |

|

|

| |

|

|

|

NET ASSETS | | | 100.0 | % | | $ | 328,389,632 | |

| | |

|

|

| |

|

|

|

| # | The Conservative Growth Lifestyle Fund invests in various VALIC Company I or VALIC Company II Funds, some of which are not presented in this report. Additional information on the underlying funds including such fund’s prospectuses and shareholder reports is available at our website, www.valic.com. |

| (2) | See Note 5 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Fund’s net assets as of August 31, 2016 (see Note 2):

| | | | | | | | | | | | | | | | |

| | | Level 1 - Unadjusted

Quoted Prices

| | | Level 2 - Other

Observable Inputs

| | | Level 3 - Significant

Unobservable Inputs

| | | Total

| |

ASSETS: | | | | | | | | | | | | | | | | |

Investments at Value:* | | | | | | | | | | | | | | | | |

Affiliated Registered Investment Companies | | $ | 328,443,767 | | | $ | — | | | $ | — | | | $ | 328,443,767 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Fund’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

VALIC Company II Core Bond Fund

PORTFOLIO PROFILE — August 31, 2016 (unaudited)

Industry Allocation*

| | | | |

Federal National Mtg. Assoc. | | | 19.1 | % |

Federal Home Loan Mtg. Corp. | | | 15.3 | |

United States Treasury Notes | | | 11.5 | |

United States Treasury Bonds | | | 7.0 | |

Time Deposits | | | 6.2 | |

Diversified Banking Institutions | | | 3.8 | |

Diversified Financial Services | | | 2.7 | |

Banks — Commercial | | | 2.6 | |

Government National Mtg. Assoc. | | | 2.5 | |

Electric — Integrated | | | 1.6 | |

Telephone — Integrated | | | 1.4 | |

Pipelines | | | 1.3 | |

Registered Investment Companies | | | 1.3 | |

Auto — Cars/Light Trucks | | | 1.3 | |

Oil Companies — Exploration & Production | | | 1.1 | |

Cable/Satellite TV | | | 1.0 | |

Oil Companies — Integrated | | | 0.9 | |

Paper & Related Products | | | 0.8 | |

Insurance — Life/Health | | | 0.8 | |

Computers | | | 0.8 | |

Savings & Loans/Thrifts | | | 0.7 | |

Brewery | | | 0.7 | |

Insurance — Multi-line | | | 0.7 | |

Diversified Manufacturing Operations | | | 0.6 | |

Sovereign | | | 0.6 | |

Medical — Drugs | | | 0.6 | |

Medical Labs & Testing Services | | | 0.5 | |

Electric — Generation | | | 0.5 | |

Finance — Other Services | | | 0.5 | |

Banks — Super Regional | | | 0.4 | |

Cellular Telecom | | | 0.4 | |

Aerospace/Defense | | | 0.4 | |

Real Estate Investment Trusts | | | 0.4 | |

Networking Products | | | 0.4 | |

Aerospace/Defense — Equipment | | | 0.4 | |

Retail — Drug Store | | | 0.4 | |

Applications Software | | | 0.4 | |

Medical — Hospitals | | | 0.3 | |

Enterprise Software/Service | | | 0.3 | |

Machinery — Farming | | | 0.3 | |

Medical — HMO | | | 0.3 | |

Electric — Distribution | | | 0.3 | |

Insurance — Mutual | | | 0.3 | |

Satellite Telecom | | | 0.3 | |

Steel — Producers | | | 0.2 | |

Computer Services | | | 0.2 | |

Pharmacy Services | | | 0.2 | |

Finance — Auto Loans | | | 0.2 | |

Finance — Credit Card | | | 0.2 | |

Finance — Leasing Companies | | | 0.2 | |

Beverages — Wine/Spirits | | | 0.2 | |

Finance — Consumer Loans | | | 0.2 | |

Chemicals — Diversified | | | 0.2 | |

Containers — Paper/Plastic | | | 0.2 | |

Retail — Discount | | | 0.2 | |

Medical — Generic Drugs | | | 0.2 | |

Oil Refining & Marketing | | | 0.2 | |

Auto — Heavy Duty Trucks | | | 0.2 | |

Casino Hotels | | | 0.2 | |

Multimedia | | | 0.2 | |

Building Products — Wood | | | 0.2 | |

Printing — Commercial | | | 0.2 | |

Food — Misc./Diversified | | | 0.2 | |

Beverages — Non-alcoholic | | | 0.2 | |

Tools — Hand Held | | | 0.2 | |

Building — Residential/Commercial | | | 0.2 | |

| | | | |

Electronic Components — Semiconductors | | | 0.1 | |

Coatings/Paint | | | 0.1 | |

Telecom Services | | | 0.1 | |

Advertising Agencies | | | 0.1 | |

Airlines | | | 0.1 | |

Banks — Fiduciary | | | 0.1 | |

Containers — Metal/Glass | | | 0.1 | |

Chemicals — Plastics | | | 0.1 | |

Consumer Products — Misc. | | | 0.1 | |

Independent Power Producers | | | 0.1 | |

Retail — Restaurants | | | 0.1 | |

Steel Pipe & Tube | | | 0.1 | |

Transport — Rail | | | 0.1 | |

Electronic Measurement Instruments | | | 0.1 | |

Oil — Field Services | | | 0.1 | |

Coal | | | 0.1 | |

Medical Products | | | 0.1 | |

Internet Connectivity Services | | | 0.1 | |

Municipal Bonds & Notes | | | 0.1 | |

Gambling (Non-Hotel) | | | 0.1 | |

Rental Auto/Equipment | | | 0.1 | |

Data Processing/Management | | | 0.1 | |

Wire & Cable Products | | | 0.1 | |

Home Decoration Products | | | 0.1 | |

SupraNational Banks | | | 0.1 | |

Real Estate Management/Services | | | 0.1 | |

Machinery — General Industrial | | | 0.1 | |

Financial Guarantee Insurance | | | 0.1 | |

Telecommunication Equipment | | | 0.1 | |

Chemicals — Specialty | | | 0.1 | |

Insurance — Reinsurance | | | 0.1 | |

Real Estate Operations & Development | | | 0.1 | |

Food — Dairy Products | | | 0.1 | |

Computers — Integrated Systems | | | 0.1 | |

Broadcast Services/Program | | | 0.1 | |

Food — Retail | | | 0.1 | |

Power Converter/Supply Equipment | | | 0.1 | |

Internet Content — Entertainment | | | 0.1 | |

Publishing — Periodicals | | | 0.1 | |

Finance — Mortgage Loan/Banker | | | 0.1 | |

Metal — Copper | | | 0.1 | |

Finance — Investment Banker/Broker | | | 0.1 | |

Energy — Alternate Sources | | | 0.1 | |

Publishing — Newspapers | | | 0.1 | |

Transport — Services | | | 0.1 | |

Cruise Lines | | | 0.1 | |

Metal — Aluminum | | | 0.1 | |

Marine Services | | | 0.1 | |

Travel Services | | | 0.1 | |

Retail — Appliances | | | 0.1 | |

Agricultural Operations | | | 0.1 | |

Appliances | | | 0.1 | |

Building & Construction Products — Misc. | | | 0.1 | |

Electronic Components — Misc. | | | 0.1 | |

Computer Software | | | 0.1 | |

Diversified Minerals | | | 0.1 | |

Rubber/Plastic Products | | | 0.1 | |

Hotels/Motels | | | 0.1 | |

Retail — Computer Equipment | | | 0.1 | |

Metal Processors & Fabrication | | | 0.1 | |

Footwear & Related Apparel | | | 0.1 | |

Gas — Distribution | | | 0.1 | |

Food — Meat Products | | | 0.1 | |

Batteries/Battery Systems | | | 0.1 | |

Agricultural Chemicals | | | 0.1 | |

| | |

|

|

|

| | | | 104.6 | % |

| | |

|

|

|

| * | Calculated as a percentage of net assets |

VALIC Company II Core Bond Fund

PORTFOLIO PROFILE — August 31, 2016 (unaudited) — (continued)

Credit Quality†#

| | | | |

Aaa | | | 59.3 | % |

Aa | | | 2.7 | |

A | | | 10.8 | |

Baa | | | 14.0 | |

Ba | | | 4.7 | |

B | | | 4.7 | |

Caa | | | 1.7 | |

Not Rated@ | | | 2.1 | |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

| # | Calculated as a percentage of total debt issues, excluding short-term securities. |

| @ | Represents debt issues that either have no rating, or the rating is unavailable from the data source. |

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

ASSET BACKED SECURITIES — 2.5% | | | | | | | | |

Diversified Financial Services — 2.5% | | | | | | | | |

American Express Credit Account Master Trust FRS

Series 2014-1, Class A

0.88% due 12/15/2021 | | $ | 760,000 | | | $ | 762,263 | |

AmeriCredit Automobile Receivables Trust

Series 2013-3, Class D

3.00% due 07/08/2019 | | | 525,000 | | | | 532,838 | |

Asset Backed Securities Corp. Home Equity Loan Trust FRS

Series 2004-HE7, Class M2

2.06% due 10/25/2034 | | | 923,526 | | | | 872,555 | |

BA Credit Card Trust

Series 2015-A2,Class A

1.36% due 09/15/2020 | | | 1,217,000 | | | | 1,220,125 | |

Capital One Multi-Asset Execution Trust

Series 2016-A4, Class A4

1.33% due 06/15/2022 | | | 725,000 | | | | 724,825 | |

CGGS Commercial Mtg. Trust

Series 2016-RNDA, Class AFX

2.76% due 02/10/2033*(1) | | | 2,800,000 | | | | 2,842,746 | |

Chase Issuance Trust FRS

Series 2014-A5, Class A5

0.89% due 04/15/2021 | | | 446,000 | | | | 446,802 | |

Chase Issuance Trust

Series 2016-A2, Class A

1.37% due 06/15/2021 | | | 420,000 | | | | 420,336 | |

Chase Mtg. Trust VRS

Series 2016-2, Class M2

3.75% due 12/25/2045*(3) | | | 492,864 | | | | 508,834 | |

Citigroup Commercial Mtg. Trust

Series 2014-GC19, Class A2

2.79% due 03/10/2047(1) | | | 1,478,000 | | | | 1,508,934 | |

Citigroup Commercial Mtg. Trust

Series 2014-GC23, Class A2

2.85% due 07/10/2047(1) | | | 1,460,000 | | | | 1,502,192 | |

Commercial Mtg. Trust

Series 2015-DC1, Class A2

2.87% due 02/10/2048(1) | | | 1,778,000 | | | | 1,836,346 | |

Commercial Mtg. Trust

Series 2015-CR24, Class A2

3.02% due 08/10/2048(1) | | | 145,390 | | | | 152,241 | |

Commercial Mtg. Trust VRS

Series 2016-787S, Class A

3.55% due 02/10/2036*(1) | | | 1,786,000 | | | | 1,946,939 | |

Commercial Mtg. Trust VRS

Series 2016-787S, Class B

3.96% due 02/10/2036*(1) | | | 754,000 | | | | 831,043 | |

Core Industrial Trust

Series 2015-CALW, Class A

3.04% due 02/10/2034*(1) | | | 6,000 | | | | 6,325 | |

CSAIL Commercial Mtg. Trust

Series 2015-C1, Class A2

2.97% due 04/15/2050(1) | | | 86,800 | | | | 90,375 | |

CSMC Trust

Series 2015-GLPA, Class A

3.88% due 11/15/2037*(1) | | | 1,500,000 | | | | 1,671,233 | |

Discover Card Execution Note Trust

Series 2015-A4, Class A4

2.19% due 04/17/2023 | | | 1,556,000 | | | | 1,599,007 | |

Ford Credit Auto Owner Trust

Series 2014-C,Class B

1.97% due 04/15/2020 | | | 1,001,000 | | | | 1,008,381 | |

GS Mtg. Securities Corp. II

Series GC30, Class A2

2.73% due 05/10/2050(1) | | | 162,750 | | | | 167,611 | |

GS Mtg. Securities Trust

Series 2015-GC28, Class A2

2.90% due 02/10/2048(1) | | | 61,000 | | | | 62,943 | |

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Diversified Financial Services (continued) | | | | | | | | |

GS Mtg. Securities Trust

Series 2013-GC14, Class A2

3.00% due 08/10/2046(1) | | $ | 3,200,000 | | | $ | 3,261,063 | |

Honda Auto Receivables Owner Trust

Series 2016-2, Class A4

1.62% due 08/15/2022 | | | 512,000 | | | | 515,266 | |

LB-UBS Commercial Mtg. Trust

Series 2007-C1, Class A4

5.42% due 02/15/2040(1) | | | 416,693 | | | | 419,262 | |

Morgan Stanley Bank of America Merrill Lynch Trust

Series 2015-C23, Class A2

2.98% due 07/15/2050(1) | | | 1,000,000 | | | | 1,044,856 | |

NRP Mtg. Trust VRS

Series 2013-1, Class A1

3.25% due 07/25/2043*(3) | | | 1,838,212 | | | | 1,843,845 | |

Santander Drive Auto Receivables Trust

Series 2014-5, Class C

2.46% due 06/15/2020 | | | 620,000 | | | | 623,182 | |

Synchrony Credit Card Master Note Trust

Series 2016-1, Class A

2.04% due 03/15/2022 | | | 350,000 | | | | 354,689 | |

Synchrony Credit Card Master Note Trust

Series 2016-2, Class A

2.21% due 05/15/2024 | | | 277,000 | | | | 282,174 | |

Taco Bell Funding LLC

Series 2016-1A, Class A2I

3.83% due 05/25/2046* | | | 524,000 | | | | 531,148 | |

Taco Bell Funding LLC

Series 2016-1A, Class A2II

4.38% due 05/25/2046* | | | 524,000 | | | | 538,218 | |

Wells Fargo Mtg. Backed Securities Trust FRS

Series 2004-X, Class 1A3

2.79% due 11/25/2034(3) | | | 321,899 | | | | 321,659 | |

| | | | | | |

|

|

|

Total Asset Backed Securities | | | | | | | | |

(cost $30,027,619) | | | | | | | 30,450,256 | |

| | | | | | |

|

|

|

U.S. CORPORATE BONDS & NOTES — 30.7% | | | | | | | | |

Advertising Agencies — 0.1% | | | | | | | | |

Interpublic Group of Cos., Inc.

Senior Notes

4.20% due 04/15/2024 | | | 611,000 | | | | 661,469 | |

Omnicom Group, Inc.

Company Guar. Notes

3.60% due 04/15/2026 | | | 942,000 | | | | 1,003,493 | |

| | | | | | |

|

|

|

| | | | | | | | 1,664,962 | |

| | | | | | |

|

|

|

Aerospace/Defense — 0.4% | |

BAE Systems Holdings, Inc.

Company Guar. Notes

3.80% due 10/07/2024* | | | 1,143,000 | | | | 1,209,100 | |

BAE Systems Holdings, Inc.

Company Guar. Notes

4.75% due 10/07/2044* | | | 532,000 | | | | 595,869 | |

Boeing Co.

Senior Notes

0.95% due 05/15/2018 | | | 1,547,000 | | | | 1,545,126 | |

Boeing Co.

Senior Notes

2.20% due 10/30/2022 | | | 857,000 | | | | 876,403 | |

General Dynamics Corp.

Company Guar. Notes

2.13% due 08/15/2026 | | | 786,000 | | | | 776,821 | |

| | | | | | |

|

|

|

| | | | | | | | 5,003,319 | |

| | | | | | |

|

|

|

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016 — (continued)

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

U.S. CORPORATE BONDS & NOTES (continued) | | | | | | | | |

Aerospace/Defense-Equipment — 0.4% | | | | | | | | |

Harris Corp.

Senior Notes

4.85% due 04/27/2035 | | $ | 1,054,000 | | | $ | 1,178,995 | |

Harris Corp.

Senior Notes

5.05% due 04/27/2045 | | | 1,000,000 | | | | 1,168,822 | |

Moog, Inc.

Company Guar. Notes

5.25% due 12/01/2022* | | | 609,000 | | | | 627,270 | |

Orbital ATK, Inc.

Company Guar. Notes

5.50% due 10/01/2023 | | | 710,000 | | | | 747,275 | |

Spirit AeroSystems, Inc.

Company Guar. Notes

3.85% due 06/15/2026 | | | 166,000 | | | | 172,451 | |

Triumph Group, Inc.

Company Guar. Notes

5.25% due 06/01/2022 | | | 470,000 | | | | 450,025 | |

| | | | | | |

|

|

|

| | | | | | | | 4,344,838 | |

| | | | | | |

|

|

|

Agricultural Operations — 0.1% | | | | | | | | |

Archer-Daniels-Midland Co.

Senior Notes

2.50% due 08/11/2026 | | | 718,000 | | | | 723,058 | |

| | | | | | |

|

|

|

Airlines — 0.1% | | | | | | | | |

Allegiant Travel Co.

Company Guar. Notes

5.50% due 07/15/2019 | | | 693,000 | | | | 722,452 | |

Atlas Air, Inc.

Pass-Through Certs.

Series 1999-1, Class B

7.63% due 01/02/2018(4) | | | 45,115 | | | | 45,277 | |

United Airlines Pass-Through Trust

Pass-Through Certs.

Series 2014-2, Class B

4.63% due 03/03/2024 | | | 874,871 | | | | 883,620 | |

| | | | | | |

|

|

|

| | | | | | | | 1,651,349 | |

| | | | | | |

|

|

|

Appliances — 0.1% | | | | | | | | |

Whirlpool Corp.

Senior Notes

4.50% due 06/01/2046 | | | 634,000 | | | | 695,099 | |

| | | | | | |

|

|

|

Applications Software — 0.4% | | | | | | | | |

Microsoft Corp.

Senior Notes

1.30% due 11/03/2018 | | | 936,000 | | | | 941,803 | |

Microsoft Corp.

Senior Notes

2.40% due 08/08/2026 | | | 1,069,000 | | | | 1,074,669 | |

Microsoft Corp.

Senior Notes

3.45% due 08/08/2036 | | | 1,114,000 | | | | 1,145,287 | |

Microsoft Corp.

Senior Notes

3.70% due 08/08/2046 | | | 1,107,000 | | | | 1,150,241 | |

| | | | | | |

|

|

|

| | | | | | | | 4,312,000 | |

| | | | | | |

|

|

|

Auto - Cars/Light Trucks — 1.3% | | | | | | | | |

American Honda Finance Corp.

Senior Notes

1.20% due 07/14/2017 | | | 1,451,000 | | | | 1,454,021 | |

American Honda Finance Corp.

Senior Notes

1.20% due 07/12/2019 | | | 1,383,000 | | | | 1,380,075 | |

BMW US Capital LLC

Company Guar. Notes

1.50% due 04/11/2019* | | | 1,015,000 | | | | 1,019,945 | |

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Auto - Cars/Light Trucks (continued) | | | | | | | | |

Daimler Finance North America LLC

Company Guar. Notes

1.38% due 08/01/2017* | | $ | 1,461,000 | | | $ | 1,464,175 | |

Daimler Finance North America LLC

Company Guar. Notes

2.00% due 07/06/2021* | | | 911,000 | | | | 915,491 | |

Daimler Finance North America LLC

Company Guar. Notes

2.45% due 05/18/2020* | | | 1,839,000 | | | | 1,888,464 | |

Daimler Finance North America LLC

Company Guar. Notes

2.63% due 09/15/2016* | | | 587,000 | | | | 587,275 | |

Ford Motor Credit Co. LLC

Senior Notes

1.50% due 01/17/2017 | | | 698,000 | | | | 699,046 | |

Ford Motor Credit Co. LLC

Senior Notes

2.02% due 05/03/2019 | | | 1,314,000 | | | | 1,321,424 | |

Ford Motor Credit Co. LLC

Senior Notes

3.10% due 05/04/2023 | | | 1,309,000 | | | | 1,324,921 | |

Hyundai Capital America

Senior Notes

2.40% due 10/30/2018* | | | 2,238,000 | | | | 2,271,234 | |

Toyota Motor Credit Corp.

Senior Notes

2.00% due 10/24/2018 | | | 738,000 | | | | 749,959 | |

| | | | | | |

|

|

|

| | | | | | | | 15,076,030 | |

| | | | | | |

|

|

|

Auto - Heavy Duty Trucks — 0.2% | | | | | | | | |

JB Poindexter & Co., Inc.

Senior Notes

9.00% due 04/01/2022* | | | 318,000 | | | | 341,850 | |

PACCAR Financial Corp.

Senior Notes

1.65% due 02/25/2019 | | | 324,000 | | | | 327,117 | |

PACCAR Financial Corp.

Senior Notes

2.20% due 09/15/2019 | | | 1,620,000 | | | | 1,656,936 | |

| | | | | | |

|

|

|

| | | | | | | | 2,325,903 | |

| | | | | | |

|

|

|

Banks - Commercial — 1.2% | | | | | | | | |

BankUnited, Inc.

Senior Notes

4.88% due 11/17/2025 | | | 2,256,000 | | | | 2,346,522 | |

Citizens Bank NA

Senior Notes

2.55% due 05/13/2021 | | | 514,000 | | | | 523,462 | |

Discover Bank

Senior Notes

3.45% due 07/27/2026 | | | 757,000 | | | | 761,721 | |

Fifth Third Bank

Senior Notes

2.30% due 03/15/2019 | | | 450,000 | | | | 458,244 | |

Fifth Third Bank

Senior Notes

2.88% due 10/01/2021 | | | 1,423,000 | | | | 1,486,967 | |

First Horizon National Corp.

Senior Notes

3.50% due 12/15/2020 | | | 3,712,000 | | | | 3,784,406 | |

First Tennessee Bank NA

Senior Notes

2.95% due 12/01/2019 | | | 979,000 | | | | 982,607 | |

Regions Financial Corp.

Senior Notes

3.20% due 02/08/2021 | | | 1,098,000 | | | | 1,139,131 | |

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016 — (continued)

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

U.S. CORPORATE BONDS & NOTES (continued) | | | | | | | | |

Banks - Commercial (continued) | | | | | | | | |

Regions Financial Corp.

Sub. Notes

7.38% due 12/10/2037 | | $ | 1,907,000 | | | $ | 2,478,408 | |

| | | | | | |

|

|

|

| | | | | | | | 13,961,468 | |

| | | | | | |

|

|

|

Banks - Fiduciary — 0.1% | | | | | | | | |

Citizens Financial Group, Inc.

Sub. Notes

4.15% due 09/28/2022* | | | 1,570,000 | | | | 1,624,341 | |

| | | | | | |

|

|

|

Banks - Super Regional — 0.3% | | | | | | | | |

Capital One Financial Corp.

Sub. Notes

3.75% due 07/28/2026 | | | 536,000 | | | | 538,558 | |

Wells Fargo & Co.

Sub. Notes

4.10% due 06/03/2026 | | | 1,033,000 | | | | 1,122,309 | |

Wells Fargo & Co.

Sub. Notes

4.30% due 07/22/2027 | | | 1,775,000 | | | | 1,961,210 | |

Wells Fargo & Co.

Sub. Notes

4.40% due 06/14/2046 | | | 133,000 | | | | 141,989 | |

Wells Fargo & Co.

Sub. Notes

4.90% due 11/17/2045 | | | 194,000 | | | | 221,580 | |

| | | | | | |

|

|

|

| | | | | | | | 3,985,646 | |

| | | | | | |

|

|

|

Batteries/Battery Systems — 0.1% | | | | | | | | |

EnerSys

Company Guar. Notes

5.00% due 04/30/2023* | | | 605,000 | | | | 603,488 | |

| | | | | | |

|

|

|

Brewery — 0.7% | | | | | | | | |

Anheuser-Busch InBev Finance, Inc.

Company Guar. Notes

1.90% due 02/01/2019 | | | 753,000 | | | | 760,772 | |

Anheuser-Busch InBev Finance, Inc.

Company Guar. Notes

2.65% due 02/01/2021 | | | 1,408,000 | | | | 1,451,961 | |

Anheuser-Busch InBev Finance, Inc.

Company Guar. Notes

3.30% due 02/01/2023 | | | 617,000 | | | | 647,925 | |

Anheuser-Busch InBev Finance, Inc.

Company Guar. Notes

4.70% due 02/01/2036 | | | 1,027,000 | | | | 1,191,789 | |

Anheuser-Busch InBev Finance, Inc.

Company Guar. Notes

4.90% due 02/01/2046 | | | 447,000 | | | | 542,177 | |

Anheuser-Busch InBev Worldwide, Inc.

Company Guar. Notes

1.38% due 07/15/2017 | | | 2,222,000 | | | | 2,226,831 | |

Molson Coors Brewing Co.

Company Guar. Notes

3.00% due 07/15/2026 | | | 379,000 | | | | 383,833 | |

Molson Coors Brewing Co.

Company Guar. Notes

4.20% due 07/15/2046 | | | 600,000 | | | | 633,811 | |

| | | | | | |

|

|

|

| | | | | | | | 7,839,099 | |

| | | | | | |

|

|

|

Broadcast Services/Program — 0.1% | | | | | | | | |

Clear Channel Worldwide Holdings, Inc.

Company Guar. Notes

Series A

6.50% due 11/15/2022 | | | 911,000 | | | | 921,249 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Building & Construction Products - Misc. — 0.1% | | | | | | | | |

Standard Industries, Inc.

Senior Notes

6.00% due 10/15/2025* | | $ | 610,000 | | | $ | 668,712 | |

| | | | | | |

|

|

|

Building & Construction - Misc. — 0.0% | | | | | | | | |

Weekley Homes LLC/Weekley Finance Corp.

Senior Notes

6.00% due 02/01/2023 | | | 650,000 | | | | 598,000 | |

| | | | | | |

|

|

|

Building Products - Doors & Windows — 0.0% | | | | | | | | |

Griffon Corp.

Company Guar. Notes

5.25% due 03/01/2022 | | | 539,000 | | | | 541,695 | |

| | | | | | |

|

|

|

| Building Products - Wood — 0.2% | |

Boise Cascade Co.

Company Guar. Notes

5.63% due 09/01/2024* | | | 600,000 | | | | 612,000 | |

Masco Corp.

Senior Notes

4.45% due 04/01/2025 | | | 1,336,000 | | | | 1,426,180 | |

| | | | | | |

|

|

|

| | | | | | | | 2,038,180 | |

| | | | | | |

|

|

|

Building - Residential/Commercial — 0.1% | |

K. Hovnanian Enterprises, Inc.

Senior Sec. Notes

7.25% due 10/15/2020* | | | 794,000 | | | | 710,630 | |

Meritage Homes Corp.

Company Guar. Notes

7.00% due 04/01/2022 | | | 500,000 | | | | 557,500 | |

| | | | | | |

|

|

|

| | | | | | | | 1,268,130 | |

| | | | | | |

|

|

|

Cable/Satellite TV — 0.7% | |

Block Communications, Inc.

Senior Notes

7.25% due 02/01/2020* | | | 533,000 | | | | 548,990 | |

Cable One, Inc.

Company Guar. Notes

5.75% due 06/15/2022* | | | 877,000 | | | | 923,042 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

Senior Notes

5.75% due 02/15/2026* | | | 590,000 | | | | 631,300 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

Senior Notes

5.88% due 04/01/2024* | | | 390,000 | | | | 420,225 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

Senior Sec. Notes

3.58% due 07/23/2020* | | | 692,000 | | | | 724,128 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

Senior Sec. Notes

6.38% due 10/23/2035* | | | 599,000 | | | | 716,226 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

Senior Sec. Notes

6.48% due 10/23/2045* | | | 398,000 | | | | 489,120 | |

Comcast Corp.

Company Guar. Notes

2.35% due 01/15/2027 | | | 693,000 | | | | 686,867 | |

Comcast Corp.

Company Guar. Notes

3.20% due 07/15/2036 | | | 720,000 | | | | 718,708 | |

Comcast Corp.

Company Guar. Notes

3.40% due 07/15/2046 | | | 720,000 | | | | 706,967 | |

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016 — (continued)

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

U.S. CORPORATE BONDS & NOTES (continued) | | | | | | | | |

Cable/Satellite TV — (continued) | | | | | | | | |

CSC Holdings LLC

Company Guar. Notes

6.63% due 10/15/2025* | | $ | 545,000 | | | $ | 592,006 | |

DISH DBS Corp.

Company Guar. Notes

7.75% due 07/01/2026* | | | 834,000 | | | | 889,870 | |

| | | | | | |

|

|

|

| | | | | | | | 8,047,449 | |

| | | | | | |

|

|

|

Casino Hotels — 0.2% | |

Caesars Entertainment Resort Properties LLC

Senior Sec. Notes

8.00% due 10/01/2020 | | | 582,000 | | | | 590,730 | |

Caesars Entertainment Resort Properties LLC

Sec. Notes

11.00% due 10/01/2021# | | | 383,000 | | | | 394,969 | |

Downstream Development Authority of the Quapaw Tribe of Oklahoma

Senior Sec. Notes

10.50% due 07/01/2019* | | | 656,000 | | | | 674,040 | |

Golden Nugget Escrow, Inc.

Senior Notes

8.50% due 12/01/2021* | | | 568,000 | | | | 593,560 | |

| | | | | | |

|

|

|

| | | | | | | | 2,253,299 | |

| | | | | | |

|

|

|

Cellular Telecom — 0.4% | |

Sprint Communications, Inc.

Senior Notes

7.00% due 08/15/2020 | | | 495,000 | | | | 487,575 | |

Sprint Communications, Inc.

Company Guar. Notes

9.00% due 11/15/2018* | | | 545,000 | | | | 600,181 | |

Sprint Corp.

Company Guar. Notes

7.25% due 09/15/2021 | | | 3,095,000 | | | | 3,060,181 | |

T-Mobile USA, Inc.

Company Guar. Notes

6.54% due 04/28/2020 | | | 1,164,000 | | | | 1,201,830 | |

| | | | | | |

|

|

|

| | | | | | | | 5,349,767 | |

| | | | | | |

|

|

|

Chemicals - Diversified — 0.2% | |

Westlake Chemical Corp.

Company Guar. Notes

3.60% due 08/15/2026* | | | 874,000 | | | | 874,228 | |

Westlake Chemical Corp.

Company Guar. Notes

5.00% due 08/15/2046* | | | 1,174,000 | | | | 1,204,947 | |

| | | | | | |

|

|

|

| | | | | | | | 2,079,175 | |

| | | | | | |

|

|

|

Chemicals - Plastics — 0.0% | |

A. Schulman, Inc.

Company Guar. Notes

6.88% due 06/01/2023*# | | | 554,000 | | | | 556,770 | |

| | | | | | |

|

|

|

Chemicals - Specialty — 0.1% | |

Lubrizol Corp.

Company Guar. Notes

6.50% due 10/01/2034 | | | 550,000 | | | | 750,719 | |

Unifrax I LLC/Unifrax Holding Co.

Company Guar. Notes

7.50% due 02/15/2019* | | | 253,000 | | | | 227,700 | |

| | | | | | |

|

|

|

| | | | | | | | 978,419 | |

| | | | | | |

|

|

|

Coal — 0.1% | |

SunCoke Energy Partners LP/SunCoke Energy Partners Finance Corp.

Company Guar. Notes

7.38% due 02/01/2020 | | | 1,334,000 | | | | 1,223,945 | |

| | | | | | |

|

|

|

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Coatings/Paint — 0.1% | |

RPM International, Inc.

Senior Notes

5.25% due 06/01/2045 | | $ | 1,691,000 | | | $ | 1,804,339 | |

| | | | | | |

|

|

|

Commercial Services - Finance — 0.0% | |

Automatic Data Processing, Inc.

Senior Notes

2.25% due 09/15/2020 | | | 547,000 | | | | 565,839 | |

| | | | | | |

|

|

|

Computer Services — 0.2% | |

Harland Clarke Holdings Corp.

Senior Sec. Notes

6.88% due 03/01/2020* | | | 600,000 | | | | 577,500 | |

Harland Clarke Holdings Corp.

Senior Notes

9.25% due 03/01/2021* | | | 652,000 | | | | 557,460 | |

Hewlett Packard Enterprise Co.

Senior Bonds

4.90% due 10/15/2025* | | | 554,000 | | | | 592,202 | |

Hewlett Packard Enterprise Co.

Senior Bonds

6.20% due 10/15/2035* | | | 1,017,000 | | | | 1,067,261 | |

| | | | | | |

|

|

|

| | | | | | | | 2,794,423 | |

| | | | | | |

|

|

|

Computer Software — 0.1% | |

Rackspace Hosting, Inc.

Company Guar. Notes

6.50% due 01/15/2024* | | | 630,000 | | | | 661,563 | |

| | | | | | |

|

|

|

Computers — 0.8% | |

Apple, Inc.

Senior Notes

2.45% due 08/04/2026 | | | 815,000 | | | | 817,170 | |

Apple, Inc.

Senior Notes

2.85% due 05/06/2021 | | | 1,080,000 | | | | 1,139,928 | |

Apple, Inc.

Senior Notes

2.85% due 02/23/2023 | | | 1,130,000 | | | | 1,187,239 | |

Apple, Inc.

Senior Notes

3.85% due 08/04/2046 | | | 595,000 | | | | 620,927 | |

Apple, Inc.

Senior Notes

4.50% due 02/23/2036 | | | 461,000 | | | | 532,722 | |

Diamond 1 Finance Corp./Diamond 2 Finance Corp.

Senior Sec.

Notes 6.02% due 06/15/2026* | | | 1,483,000 | | | | 1,586,700 | |

Diamond 1 Finance Corp./Diamond 2 Finance Corp.

Company Guar. Notes

7.13% due 06/15/2024* | | | 780,000 | | | | 845,017 | |

Diamond 1 Finance Corp./Diamond 2 Finance Corp.

Senior Sec. Notes

8.10% due 07/15/2036* | | | 1,240,000 | | | | 1,440,441 | |

Diamond 1 Finance Corp./Diamond 2 Finance Corp.

Senior Sec. Notes

8.35% due 07/15/2046* | | | 825,000 | | | | 961,423 | |

| | | | | | |

|

|

|

| | | | | | | | 9,131,567 | |

| | | | | | |

|

|

|

Computers - Integrated Systems — 0.1% | |

Diebold, Inc.

Company Guar. Notes

8.50% due 04/15/2024* | | | 919,000 | | | | 935,082 | |

| | | | | | |

|

|

|

Computers - Memory Devices — 0.0% | |

Western Digital Corp.

Company Guar. Notes

10.50% due 04/01/2024* | | | 518,000 | | | | 585,340 | |

| | | | | | |

|

|

|

VALIC Company II Core Bond Fund

PORTFOLIO OF INVESTMENTS — August 31, 2016 — (continued)

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

U.S. CORPORATE BONDS & NOTES (continued) | | | | | | | | |

Consumer Products - Misc. — 0.0% | |

Kimberly-Clark Corp.

Senior Notes

1.85% due 03/01/2020 | | $ | 367,000 | | | $ | 373,632 | |

| | | | | | |

|

|

|

Containers - Metal/Glass — 0.1% | |

Crown Cork & Seal Co., Inc.

Company Guar. Notes

7.38% due 12/15/2026 | | | 483,000 | | | | 543,375 | |

Owens-Brockway Glass Container, Inc.

Company Guar. Notes

5.38% due 01/15/2025* | | | 700,000 | | | | 733,250 | |

| | | | | | |

|

|

|

| | | | | | | | 1,276,625 | |

| | | | | | |

|

|

|

Containers - Paper/Plastic — 0.2% | |

Amcor Finance USA, Inc.

Company Guar. Notes

3.63% due 04/28/2026* | | | 1,287,000 | | | | 1,331,398 | |

Brambles USA, Inc.

Company Guar. Notes

4.13% due 10/23/2025* | | | 446,000 | | | | 481,326 | |

Multi-Color Corp.

Company Guar. Notes

6.13% due 12/01/2022* | | | 650,000 | | | | 678,437 | |

| | | | | | |

|

|

|

| | | | | | | | 2,491,161 | |

| | | | | | |

|

|

|

Cosmetics & Toiletries — 0.0% | |

Estee Lauder Cos., Inc.

Senior Notes

4.38% due 06/15/2045 | | | 326,000 | | | | 381,363 | |

| | | | | | |

|

|

|

Data Processing/Management — 0.1% | |

Fidelity National Information Services, Inc.

Senior Notes

4.50% due 08/15/2046 | | | 541,000 | | | | 551,843 | |

Fidelity National Information Services, Inc.

Company Guar. Notes

5.00% due 10/15/2025 | | | 453,000 | | | | 519,950 | |

| | | | | | |

|

|

|

| | | | | | | | 1,071,793 | |

| | | | | | |

|

|

|

Diagnostic Equipment — 0.0% | | | | | | | | |

Danaher Corp.

Senior Notes

4.38% due 09/15/2045 | | | 430,000 | | | | 521,260 | |

| | | | | | |

|

|

|

Distribution/Wholesale — 0.0% | | | | | | | | |

WW Grainger, Inc.

Senior Notes

3.75% due 05/15/2046 | | | 504,000 | | | | 533,577 | |

| | | | | | |

|

|

|

Diversified Banking Institutions — 3.0% | | | | | | | | |

Bank of America Corp.

Senior Notes

2.60% due 01/15/2019 | | | 1,286,000 | | | | 1,314,823 | |

Bank of America Corp.

Senior Notes

2.63% due 10/19/2020 | | | 655,000 | | | | 670,734 | |

Bank of America Corp.

Sub. Notes

3.95% due 04/21/2025 | | | 543,000 | | | | 565,596 | |

Bank of America Corp.

Sub. Notes

4.25% due 10/22/2026 | | | 2,167,000 | | | | 2,297,174 | |

Bank of America Corp.

Sub. Notes

6.11% due 01/29/2037 | | | 1,681,000 | | | | 2,092,248 | |

Bank of America Corp.

Sub. Notes

7.25% due 10/15/2025 | | | 75,000 | | | | 91,342 | |

| | | | | | | | |

| | |

| Security Description | | Principal

Amount | | | Value

(Note 2) | |

| |

| | | | | | | | | |

Diversified Banking Institutions (continued) | | | | | | | | |

Citigroup, Inc.

Sub. Notes

3.88% due 03/26/2025 | | $ | 183,000 | | | $ | 188,898 | |

Citigroup, Inc.

Sub. Notes

4.40% due 06/10/2025 | | | 2,229,000 | | | | 2,364,273 | |

Citigroup, Inc.

Sub. Notes

4.45% due 09/29/2027 | | | 2,866,000 | | | | 3,023,412 | |

Citigroup, Inc.

Sub. Notes

6.00% due 10/31/2033 | | | 622,000 | | | | 745,032 | |

Goldman Sachs Group, Inc.

Senior Notes

3.63% due 01/22/2023 | | | 1,286,000 | | | | 1,363,874 | |

Goldman Sachs Group, Inc.

Sub. Notes

4.25% due 10/21/2025 | | | 693,000 | | | | 735,692 | |

Goldman Sachs Group, Inc.

Senior Notes

4.75% due 10/21/2045 | | | 395,000 | | | | 451,998 | |

Goldman Sachs Group, Inc.

Sub. Notes

5.15% due 05/22/2045 | | | 851,000 | | | | 936,912 | |

Goldman Sachs Group, Inc.

Senior Notes

6.13% due 02/15/2033 | | | 1,627,000 | | | | 2,048,779 | |

Goldman Sachs Group, Inc.

Sub. Notes

6.75% due 10/01/2037 | | | 1,174,000 | | | | 1,497,267 | |

JPMorgan Chase & Co.

Senior Notes

2.20% due 10/22/2019 | | | 1,856,000 | | | | 1,888,298 | |

JPMorgan Chase & Co.

Senior Notes

2.30% due 08/15/2021 | | | 745,000 | | | | 749,533 | |

JPMorgan Chase & Co.

Senior Notes

2.55% due 03/01/2021 | | | 1,250,000 | | | | 1,276,894 | |

JPMorgan Chase & Co.

Senior Notes

2.70% due 05/18/2023 | | | 1,632,000 | | | | 1,658,473 | |

JPMorgan Chase & Co.

Sub. Notes