UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02554

Name of Registrant: Vanguard Money Market Reserves

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: August 31

Date of reporting period: September 1, 2012 – August 31, 2013

Item 1: Reports to Shareholders

|

|

| Annual Report | August 31, 2013 |

| Vanguard Money Market Funds |

| |

|

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 9 |

| Prime Money Market Fund. | 11 |

| Federal Money Market Fund. | 35 |

| Admiral Treasury Money Market Fund. | 47 |

| About Your Fund’s Expenses. | 59 |

| Trustees Approve Advisory Arrangement. | 61 |

| Glossary. | 62 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas. This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| | |

| Fiscal Year Ended August 31, 2013 | | |

| |

| | 7-Day SEC | Total |

| | Yield | Returns |

| Vanguard Prime Money Market Fund | | |

| Investor Shares | 0.01% | 0.02% |

| Institutional Shares | 0.04 | 0.07 |

| Money Market Funds Average | | 0.00 |

| Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| Vanguard Federal Money Market Fund | 0.02% | 0.01% |

| Government Money Market Funds Average | | 0.00 |

| Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| Vanguard Admiral Treasury Money Market Fund | 0.01% | 0.02% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | | 0.00 |

iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The 7-day SEC yield of a money market fund more closely reflects the current earnings of the fund than its total return.

Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

1

Chairman’s Letter

Dear Shareholder,

While longer-term interest rates jumped during the 12 months ended August 31, 2013, because of uncertainty about when the Federal Reserve might start scaling back its stimulus efforts, shorter-term bond yields remained exceptionally low. Consequently, money market returns remained paper thin. Vanguard Prime Money Market Fund returned 0.02% for Investor Shares and 0.07% for Institutional Shares, which have a lower expense ratio. Vanguard Federal Money Market Fund returned 0.01% and Vanguard Admiral Treasury Money Market Fund returned 0.02%. Although it’s of little comfort, the funds managed to do better than the average return of their peer groups, which in each case was 0.00%.

As of August 31, the Prime Money Market Fund’s 7-day SEC yield had slipped to 0.01% from 0.04% a year earlier for Investor Shares and to 0.04% from 0.11% for Institutional Shares. At the end of the period, the 7-day SEC yield was 0.02% for the Federal Money Market Fund and 0.01% for the Admiral Treasury Money Market Fund. (These two funds have been closed to new investors since 2009.)

On a separate note, the Securities and Exchange Commission proposed a number of regulatory changes for money market funds in June. Vanguard has been active in working with the SEC and other

2

agencies to preserve these funds’ time-tested benefits. We will continue to take the lead in advocating for the value we see in these funds for our shareholders and their portfolios.

Bond returns turned negative amid worry about the Fed’s next move

Bonds, which maintained slightly positive returns overall through the first eight months of the period, reversed course in May and then continued to retreat as investors anticipated reductions in the Fed’s bond-buying program.

The broad U.S. taxable bond market returned –2.47% for the 12 months. The yield of the 10-year Treasury note finished at 2.76%, up from 1.56% at the end of August 2012. Municipal bonds suffered more, returning –3.70% for the fiscal year.

Stocks posted robust results despite setbacks at the finish

U.S. stocks advanced about 20% in the 12 months ended August 31 despite slipping in June and August. Through most of the fiscal year, stocks surged as the economy continued to show modest growth and investors appeared more receptive to risk.

Much of the market’s recent weakness was linked to concerns over monetary policy. Heightened strife in the Middle East also contributed to anxiety in the global markets.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended August 31, 2013 |

| | One | Three | Five |

| | Year | Years | Years |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | -2.47% | 2.58% | 4.93% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -3.70 | 2.45 | 4.52 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.07 | 0.08 | 0.17 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 19.84% | 18.74% | 7.59% |

| Russell 2000 Index (Small-caps) | 26.27 | 20.50 | 7.98 |

| Russell 3000 Index (Broad U.S. market) | 20.32 | 18.87 | 7.63 |

| MSCI All Country World Index ex USA (International) | 12.98 | 6.93 | 1.48 |

| |

| CPI | | | |

| Consumer Price Index | 1.52% | 2.32% | 1.32% |

3

International stocks in aggregate finished with a return of about 13%. Developed markets in the Pacific region and Europe posted results closer to those of the United States. Returns for emerging-market stocks were virtually flat as economic growth slowed in China and Brazil.

Although global economic worries and tensions over conflicts abroad have unsettled markets, Jonathan Lemco, a senior sovereign debt analyst in Vanguard’s Taxable Credit Research Group, pointed out that investors can still manage risks amid international instability. “Vanguard believes a diversified portfolio is the best way to spread the risk of geopolitical uncertainty,” he said.

Longer-term rates driven higher, while shorter-term rates stayed low

With growth remaining sluggish and unemployment high, the Federal Reserve continued to provide unprecedented stimulus to the economy throughout the period. Its efforts included buying $40 billion per month of mortgage bonds to support the housing market and $45 billion per month of Treasuries to hold borrowing costs down for households and businesses. The Fed also kept its federal funds target rate—the rate banks charge one another for overnight loans—anchored at 0.00%–0.25% to keep short-term interest rates low.

Given the magnitude of this support, it was not surprising that the financial markets were rattled when Fed officials began

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Institutional | Peer Group |

| | Shares | Shares | Average |

| Prime Money Market Fund | 0.16% | 0.09% | 0.23% |

| Federal Money Market Fund | 0.16 | — | 0.12 |

| Admiral Treasury Money Market Fund | 0.10 | — | 0.08 |

The fund expense ratios shown are from the prospectus dated December 28, 2012, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2013, the funds’ expense ratios were: for the Prime Money Market Fund, 0.16% for Investor Shares and 0.10% for Institutional Shares; for the Federal Money Market Fund, 0.13%; for the Admiral Treasury Money Market Fund, 0.08%. The expense ratios for the Prime Money Market Fund Investor Shares, the Federal Money Market Fund, and the Admiral Treasury Money Market Fund reflect a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before the reduction, the expense ratios were: for the Prime Money Market Fund Investor Shares, 0.17%; for the Federal Money Market Fund, 0.14%; for the Admiral Treasury Money Market Fund, 0.09%.

Peer groups: For the Prime Money Market Fund, Money Market Funds; for the Federal Money Market Fund, Government Money Market Funds; and for the Admiral Treasury Money Market Fund, U.S. Treasury Money Market Funds. In most, if not all, cases, the expense ratios for funds in the peer groups are based on net operating expenses after reimbursement and/or fee waivers by fund sponsors. In contrast, the Vanguard money market funds’ expense ratios in the table above do not reflect expense reductions.

4

signaling in May that further improvements in the housing and labor markets might warrant “letting up a bit on the gas pedal,” as the Fed chairman put it, before the end of the year. The prospect of the central bank beginning to taper its efforts sooner than the market had been anticipating drove the yields of longer-term bonds substantially higher and their prices lower. (Bond yields and prices move in opposite directions.)

Short-term bond yields were affected much less, however, as they more closely track the federal funds target rate, which the Fed expects to keep near zero for some time. Its latest guidance was that the rate will stay exceptionally low at least as long as inflation remains contained and the unemployment rate stays above 6.5% (the rate stood at 7.3% in August).

While money market yields were meager, the funds’ advisor, Vanguard Fixed Income Group, was able to add value by keeping costs low and by seeking out relative value opportunities among securities with high credit quality.

A source of liquidity and safety for all three funds was their “risk-free” holdings in U.S. Treasury bills. During the period, the advisor found more relative value for the Federal and Prime Money Market Funds among U.S. government obligations—primarily notes issued by Fannie Mae and

| |

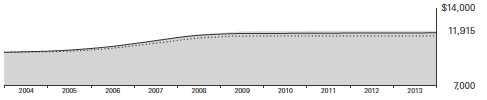

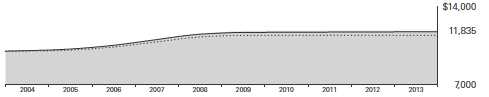

| Total Returns | |

| Ten Years Ended August 31, 2013 | |

| | Average |

| | Annual Return |

| Prime Money Market Fund Investor Shares | 1.77% |

| Money Market Funds Average | 1.38 |

| Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

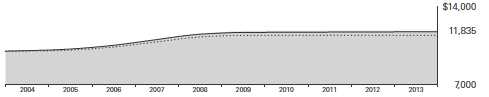

| |

| Federal Money Market Fund | 1.70% |

| Government Money Market Funds Average | 1.35 |

| Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| Admiral Treasury Money Market Fund | 1.61% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | 1.20 |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by iMoneyNet, Inc. | |

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the funds. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in such a fund.

5

Freddie Mac that are not backed by the full faith and credit of the U.S. government but are nonetheless of very high credit quality.

Within the Prime Money Market Fund, which has a broader investment mandate, the advisor also took advantage of opportunities to invest in high-quality foreign debt denominated in U.S. dollars. The yields on offer and the advantage of greater diversification led the advisor to invest in securities of Canadian and Australian banks in particular, while avoiding their European counterparts during the period under review.

Money market returns haven’t always been so low

While short-term interest rates have been negligible for several years now, the annualized return of the funds over the last ten years reflects the higher rates that existed before the financial crisis. The average annual return for the Prime Money Market Fund over the past ten years was 1.77% for Investor Shares and 1.91% for Institutional Shares. The Federal Money Market Fund returned 1.70% and the Admiral Treasury Money Market Fund returned 1.61% for the same period. It’s pleasing to note that the returns of all three funds were well ahead of the average returns of their peer groups, thanks in part to the experienced and

| | |

| Changes in Yields | | |

| | | 7-Day SEC Yield |

| | August 31, | August 31, |

| Money Market Fund | 2013 | 2012 |

| Prime | | |

| Investor Shares | 0.01% | 0.04% |

| Institutional Shares | 0.04 | 0.11 |

| Federal | 0.02 | 0.01 |

| Admiral Treasury | 0.01 | 0.02 |

6

astute management team that oversees the funds as well as our low-cost structure for running them.

In pursuing investment goals, your long-term asset mix is key

As I mentioned earlier, financial markets were rattled by the prospect that the Fed might begin scaling back its massive bond-buying program. Bond yields jumped (and so prices fell), and the stock market experienced some turmoil.

Volatility and increased uncertainty can tempt investors to deviate from their investment plan. In the mutual fund industry, for example, the recent rise in bond yields has led to net redemptions from bond funds as investors try to sidestep losses that might arise from a sustained climb in interest rates.

Keep in mind, however, that although interest rates remain low, nobody is certain what their next move will be—much less how financial markets will react to the change.

In fact, it’s precisely because short-term market movements are unpredictable that trying to time the markets often fails, as Vanguard and other researchers have found. A recent Vanguard research paper notes that although many investors alter their portfolios based on emotional reactions to market movements,

|

| Your fund distributed a small capital gain |

| Shortly after the close of the fiscal year, your money market fund made a small |

| distribution of short-term capital gains. You can view the amount per share on |

| Vanguard’s website by visiting the “Distributions” section of your fund’s profile. |

| |

| Although uncommon for money market funds, capital gains distributions have |

| become more common in recent years because of the unusual interest rate |

| environment. Declining rates drive up the prices of securities, which then may |

| generate a gain if they are sold. These short-term capital gains are taxed as |

| ordinary income. |

| |

| Consistent with their investment objectives, all three funds maintained their |

| share price of $1, as is expected but not guaranteed. |

7

investment success actually is “largely determined by the long-term mixture of assets in a portfolio.” (You can find the full report, Vanguard’s Framework for Constructing Diversified Portfolios, at vanguard.com/research.)

We continue to believe that sticking to a well-diversified portfolio of stocks, bonds, and money market instruments over the long haul—rather than making impulsive changes to try to avoid potential losses or capitalize on perceived opportunities—gives you the best chance of meeting your investment goals.

As always, thank you for your confidence in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

September 13, 2013

8

Advisor’s Report

For the 12 months ended August 31, 2013, returns for the three Vanguard Money Market Funds in this report were negligible, ranging from 0.01% for the Federal Money Market Fund to 0.07% for Institutional Shares of the Prime Money Market Fund. The average return for each fund’s peer group was 0%.

The Federal Reserve has continued to keep short-term rates at extremely low levels since December 2008, extending what has been a challenging environment for money market investors. Moreover, while economic conditions have shown steady improvement, the pace remains subdued, leading us to conclude that we are headed for another year of exceptionally low returns for money market funds.

Portfolio adjustments

Given our outlook for interest rates, we kept the weighted average maturity of the portfolio at the upper end of the permitted range. This allowed us to capture more of the higher yields offered by longer-dated securities.

We continue to manage our investments with an eye toward maintaining a high degree of liquidity and safety in the portfolios. Our allocation to U.S. Treasury and agency securities in the Prime Money Market Fund, our flagship fund, is crucial to achieving this goal. During critical periods throughout the financial crisis, U.S. Treasury and agency securities outperformed other money market assets while remaining highly liquid. Their yields may be lower because of their superior quality and liquidity, but Vanguard’s expense ratio advantage helps balance that out.

That said, the Admiral Treasury Money Market Fund and the Prime Money Market Fund had both lightened their allocation a little to Treasuries by the end of the period in favor of the slightly better yields available from agency securities. In addition, we shifted the asset mix of the Prime Money Market Fund to take advantage of relative value opportunities, primarily in Canadian government debt issued in U.S. dollars and commercial paper issued by U.S. industrial corporations.

The outlook

We have continued to monitor conditions in Europe, but refrained from investing in European banks during the period. While we still believe a number of countries in the southern periphery of Europe remain vulnerable to external shocks and counterproductive domestic policy choices, the conditions that led us to avoid all European bank debt have subsided. As of this writing, we have begun to diversify our holdings, primarily by adding securities issued by a limited number of U.K. and Northern European banks. These institutions were insulated from the conditions that plagued their southern counterparts.

9

The Securities and Exchange Commission (SEC) recently proposed money market fund reforms that go beyond the changes the commission adopted in 2010 in the wake of the financial crisis to enhance the funds’ stability and safety. We appreciate the commission’s efforts in moving this debate forward and have welcomed the opportunity to review and comment on its latest proposal to ensure that your interests are represented.

While the regulatory environment is going to continue to evolve, we remain confident in the stability and safety of our money market funds, in part because we manage our funds conservatively, keep costs low, and invest only in securities that our skilled and experienced credit analysts identify as being of the highest quality.

David R. Glocke, Principal

Vanguard Fixed Income Group

September 19, 2013

10

Prime Money Market Fund

Fund Profile

As of August 31, 2013

| | |

| Financial Attributes | | |

| | Investor | Institutional |

| | Shares | Shares |

| Ticker Symbol | VMMXX | VMRXX |

| Expense Ratio1 | 0.16% | 0.09% |

| 7-Day SEC Yield | 0.01% | 0.04% |

| Average Weighted | | |

| Maturity | 59 days | 59 days |

| |

| Sector Diversification (% of portfolio) | |

| Certificates of Deposit | 10.6% |

| Corporate Bonds | 0.2 |

| Repurchase Agreements | 0.1 |

| U.S. Commercial Paper | 11.2 |

| U.S. Government Agency Obligations | 35.4 |

| U.S. Treasury Bills | 14.4 |

| Yankee/Foreign | 25.0 |

| Other | 3.1 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

| |

| Distribution by Credit Quality (% of portfolio) |

| First Tier | 100.0% |

For information about these ratings, see the Glossary entry for Credit Quality.

1 The expense ratios shown are from the prospectus dated December 28, 2012, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2013, the expense ratios were 0.16% for Investor Shares and 0.10% for Institutional Shares. The expense ratio for the Prime Money Market Fund Investor Shares reflects a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the expense ratio for the Prime Money Market Fund Investor Shares was 0.17%.

11

Prime Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

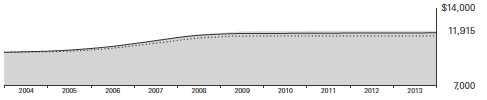

Cumulative Performance: August 31, 2003, Through August 31, 2013

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | |

| | Periods Ended August 31, 2013 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Prime Money Market Fund Investor | | | | |

| Shares | 0.02% | 0.30% | 1.77% | $11,915 |

| Money Market Funds Average | 0.00 | 0.13 | 1.38 | 11,474 |

| Citigroup Three-Month U.S. Treasury | | | | |

| Bill Index | 0.07 | 0.17 | 1.62 | 11,739 |

Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $5,000,000 |

| | Year | Years | Years | Investment |

| Prime Money Market Fund Institutional | | | | |

| Shares | 0.07% | 0.41% | 1.91% | $6,044,202 |

| Institutional Money Market Funds Average | 0.01 | 0.22 | 1.66 | 5,893,100 |

| Citigroup Three-Month U.S. Treasury Bill | | | | |

| Index | 0.07 | 0.17 | 1.62 | 5,877,371 |

See Financial Highlights for dividend information.

12

Prime Money Market Fund

| | |

| Fiscal-Year Total Returns (%): August 31, 2003, Through August 31, 2013 | |

| | | Money |

| | | Market |

| | | Funds |

| | Investor Shares | Average |

| Fiscal Year | Total Returns | Total Returns |

| 2004 | 0.83% | 0.39% |

| 2005 | 2.31 | 1.68 |

| 2006 | 4.38 | 3.69 |

| 2007 | 5.23 | 4.55 |

| 2008 | 3.60 | 3.02 |

| 2009 | 1.31 | 0.62 |

| 2010 | 0.08 | 0.02 |

| 2011 | 0.06 | 0.00 |

| 2012 | 0.04 | 0.00 |

| 2013 | 0.02 | 0.00 |

| 7-day SEC yield (8/31/2013): 0.01% |

| Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

Average Annual Total Returns: Periods Ended June 30, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 6/4/1975 | 0.02% | 0.38% | 1.78% |

| Institutional Shares | 10/3/1989 | 0.09 | 0.49 | 1.93 |

13

Prime Money Market Fund

Financial Statements

Statement of Net Assets

As of August 31, 2013

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec. gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| U.S. Government and Agency Obligations (50.7%) | | | |

| 2 | Fannie Mae Discount Notes | 0.150% | 9/3/13 | 1,000,000 | 999,992 |

| 2 | Fannie Mae Discount Notes | 0.135%–0.140% | 9/11/13 | 125,486 | 125,481 |

| 2 | Fannie Mae Discount Notes | 0.140% | 12/26/13 | 175,000 | 174,921 |

| 2 | Fannie Mae Discount Notes | 0.110% | 1/8/14 | 250,000 | 249,901 |

| 3 | Federal Home Loan Bank Discount Notes | 0.075%–0.078% | 9/6/13 | 667,766 | 667,759 |

| 3 | Federal Home Loan Bank Discount Notes | 0.078%–0.137% | 9/11/13 | 899,195 | 899,171 |

| 3 | Federal Home Loan Bank Discount Notes | 0.090%–0.140% | 9/13/13 | 812,600 | 812,571 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100% | 9/18/13 | 23,175 | 23,174 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100%–0.130% | 9/20/13 | 1,105,706 | 1,105,644 |

| 3 | Federal Home Loan Bank Discount Notes | 0.120% | 10/9/13 | 42,500 | 42,495 |

| 3 | Federal Home Loan Bank Discount Notes | 0.105%–0.110% | 10/16/13 | 191,039 | 191,014 |

| 3 | Federal Home Loan Bank Discount Notes | 0.105% | 10/18/13 | 781,800 | 781,693 |

| 3 | Federal Home Loan Bank Discount Notes | 0.103% | 10/25/13 | 350,000 | 349,946 |

| 3 | Federal Home Loan Bank Discount Notes | 0.105% | 10/30/13 | 1,303,000 | 1,302,776 |

| 3 | Federal Home Loan Bank Discount Notes | 0.105%–0.108% | 11/1/13 | 128,172 | 128,149 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100% | 11/13/13 | 308,000 | 307,938 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100% | 11/15/13 | 593,770 | 593,646 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100% | 11/19/13 | 44,000 | 43,990 |

| 3 | Federal Home Loan Bank Discount Notes | 0.050%–0.105% | 11/22/13 | 458,000 | 457,926 |

| 3 | Federal Home Loan Bank Discount Notes | 0.100%–0.105% | 11/27/13 | 805,000 | 804,803 |

| 3 | Federal Home Loan Bank Discount Notes | 0.055% | 11/29/13 | 51,000 | 50,993 |

| 3 | Federal Home Loan Bank Discount Notes | 0.098% | 2/12/14 | 42,000 | 41,981 |

| 3 | Federal Home Loan Bank Discount Notes | 0.098%–0.100% | 2/14/14 | 80,842 | 80,805 |

| 3 | Federal Home Loan Bank Discount Notes | 0.095%–0.100% | 2/19/14 | 534,500 | 534,249 |

| 3,4 | Federal Home Loan Banks | 0.133% | 11/22/13 | 150,000 | 149,993 |

| 3,4 | Federal Home Loan Banks | 0.156% | 12/6/13 | 50,000 | 49,999 |

| 3,4 | Federal Home Loan Banks | 0.159% | 12/26/13 | 1,525,000 | 1,525,000 |

| 3,4 | Federal Home Loan Banks | 0.104% | 1/15/14 | 135,000 | 134,998 |

| 3,4 | Federal Home Loan Banks | 0.136% | 4/3/14 | 1,465,000 | 1,465,000 |

| 3,4 | Federal Home Loan Banks | 0.124% | 4/25/14 | 388,000 | 388,000 |

| 3,4 | Federal Home Loan Banks | 0.126% | 6/5/14 | 400,000 | 400,000 |

| 3,4 | Federal Home Loan Banks | 0.126% | 6/5/14 | 150,000 | 150,000 |

| 3,4 | Federal Home Loan Banks | 0.126% | 6/6/14 | 1,400,000 | 1,400,000 |

| 3,4 | Federal Home Loan Banks | 0.126% | 6/6/14 | 931,500 | 931,500 |

| 3,4 | Federal Home Loan Banks | 0.126% | 7/3/14 | 482,000 | 482,000 |

| 3,4 | Federal Home Loan Banks | 0.167% | 10/1/14 | 150,000 | 149,967 |

14

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| 3,4 | Federal Home Loan Banks | 0.139% | 2/27/15 | 496,000 | 495,925 |

| 2,4 | Federal Home Loan Mortgage Corp. | 0.156% | 11/4/13 | 64,780 | 64,780 |

| 2,4 | Federal National Mortgage Assn. | 0.155% | 11/8/13 | 1,365,500 | 1,365,428 |

| 2,4 | Federal National Mortgage Assn. | 0.155% | 11/14/13 | 1,000,000 | 999,940 |

| 2,4 | Federal National Mortgage Assn. | 0.165% | 9/11/14 | 2,350,000 | 2,349,512 |

| 2,4 | Federal National Mortgage Assn. | 0.154% | 2/27/15 | 3,350,000 | 3,348,748 |

| 2,4 | Federal National Mortgage Assn. | 0.156% | 8/5/15 | 1,775,000 | 1,774,305 |

| 2 | Freddie Mac Discount Notes | 0.140% | 9/3/13 | 307,000 | 306,998 |

| 2 | Freddie Mac Discount Notes | 0.133%–0.135% | 9/9/13 | 351,667 | 351,657 |

| 2 | Freddie Mac Discount Notes | 0.128% | 9/16/13 | 58,528 | 58,525 |

| 2 | Freddie Mac Discount Notes | 0.125% | 9/23/13 | 50,000 | 49,996 |

| 2 | Freddie Mac Discount Notes | 0.125% | 9/30/13 | 840,000 | 839,915 |

| 2 | Freddie Mac Discount Notes | 0.090% | 10/22/13 | 50,000 | 49,994 |

| 2 | Freddie Mac Discount Notes | 0.100% | 11/4/13 | 613,484 | 613,375 |

| 2 | Freddie Mac Discount Notes | 0.075%–0.100% | 11/12/13 | 297,995 | 297,940 |

| 2 | Freddie Mac Discount Notes | 0.075%–0.100% | 11/18/13 | 578,467 | 578,364 |

| 2 | Freddie Mac Discount Notes | 0.100% | 11/25/13 | 325,000 | 324,923 |

| 2 | Freddie Mac Discount Notes | 0.100%–0.140% | 12/3/13 | 286,750 | 286,667 |

| 2 | Freddie Mac Discount Notes | 0.150% | 12/16/13 | 121,630 | 121,576 |

| 2 | Freddie Mac Discount Notes | 0.150% | 12/23/13 | 1,040,625 | 1,040,135 |

| 2 | Freddie Mac Discount Notes | 0.138% | 12/30/13 | 520,000 | 519,761 |

| 2 | Freddie Mac Discount Notes | 0.098% | 1/13/14 | 300,000 | 299,891 |

| 2 | Freddie Mac Discount Notes | 0.095%–0.100% | 2/18/14 | 248,500 | 248,384 |

| | United States Treasury Bill | 0.120% | 9/5/13 | 850,000 | 849,989 |

| | United States Treasury Bill | 0.113% | 9/12/13 | 1,000,000 | 999,966 |

| | United States Treasury Bill | 0.038%–0.040% | 9/26/13 | 2,500,000 | 2,499,938 |

| | United States Treasury Bill | 0.108%–0.111% | 10/3/13 | 1,710,000 | 1,709,834 |

| | United States Treasury Bill | 0.101% | 10/10/13 | 500,000 | 499,946 |

| | United States Treasury Bill | 0.085% | 11/7/13 | 725,000 | 724,885 |

| | United States Treasury Bill | 0.056%–0.057% | 11/14/13 | 1,500,000 | 1,499,826 |

| | United States Treasury Bill | 0.038%–0.041% | 11/29/13 | 3,600,000 | 3,599,642 |

| | United States Treasury Bill | 0.073% | 1/23/14 | 500,000 | 499,854 |

| | United States Treasury Bill | 0.073%–0.077% | 2/6/14 | 2,828,834 | 2,827,909 |

| | United States Treasury Bill | 0.077% | 2/13/14 | 1,000,000 | 999,647 |

| | United States Treasury Bill | 0.078% | 2/20/14 | 2,190,000 | 2,189,187 |

| | United States Treasury Note/Bond | 3.125% | 9/30/13 | 594,000 | 595,439 |

| | United States Treasury Note/Bond | 0.500% | 10/15/13 | 447,000 | 447,215 |

| | United States Treasury Note/Bond | 2.750% | 10/31/13 | 415,000 | 416,809 |

| | United States Treasury Note/Bond | 0.500% | 11/15/13 | 517,800 | 518,207 |

| | United States Treasury Note/Bond | 4.250% | 11/15/13 | 481,000 | 485,051 |

| | United States Treasury Note/Bond | 0.250% | 11/30/13 | 40,000 | 40,015 |

| | United States Treasury Note/Bond | 2.000% | 11/30/13 | 568,000 | 570,656 |

| | United States Treasury Note/Bond | 0.750% | 12/15/13 | 1,234,000 | 1,236,294 |

| | United States Treasury Note/Bond | 0.125% | 12/31/13 | 148,500 | 148,514 |

| | United States Treasury Note/Bond | 1.000% | 1/15/14 | 1,681,000 | 1,686,553 |

| | United States Treasury Note/Bond | 1.250% | 2/15/14 | 1,304,000 | 1,310,650 |

| | United States Treasury Note/Bond | 4.000% | 2/15/14 | 700,000 | 712,374 |

| | United States Treasury Note/Bond | 0.250% | 2/28/14 | 764,000 | 764,414 |

| | United States Treasury Note/Bond | 1.875% | 2/28/14 | 267,000 | 269,341 |

| | United States Treasury Note/Bond | 1.250% | 3/15/14 | 1,225,000 | 1,232,480 |

| | United States Treasury Note/Bond | 0.250% | 3/31/14 | 357,000 | 357,282 |

| | United States Treasury Note/Bond | 1.750% | 3/31/14 | 746,000 | 752,953 |

| | United States Treasury Note/Bond | 1.250% | 4/15/14 | 599,000 | 603,198 |

| Total U. S. Government and Agency Obligations (Cost $65,432,282) | | | 65,432,282 |

15

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Commercial Paper (28.0%) | | | | |

| Finance—Auto (2.4%) | | | | |

| American Honda Finance Corp. | 0.130% | 9/18/13 | 65,000 | 64,996 |

| American Honda Finance Corp. | 0.130% | 9/19/13 | 165,750 | 165,739 |

| American Honda Finance Corp. | 0.150% | 9/23/13 | 10,000 | 9,999 |

| American Honda Finance Corp. | 0.135%–0.150% | 9/24/13 | 81,100 | 81,093 |

| American Honda Finance Corp. | 0.135%–0.180% | 9/25/13 | 65,000 | 64,994 |

| American Honda Finance Corp. | 0.130%–0.160% | 10/4/13 | 125,500 | 125,484 |

| American Honda Finance Corp. | 0.120%–0.150% | 10/21/13 | 248,500 | 248,450 |

| American Honda Finance Corp. | 0.120%–0.130% | 10/22/13 | 36,000 | 35,994 |

| American Honda Finance Corp. | 0.120% | 10/28/13 | 77,700 | 77,685 |

| American Honda Finance Corp. | 0.120% | 10/29/13 | 27,750 | 27,745 |

| American Honda Finance Corp. | 0.120% | 11/6/13 | 55,500 | 55,488 |

| American Honda Finance Corp. | 0.110% | 11/12/13 | 69,250 | 69,235 |

| American Honda Finance Corp. | 0.120% | 11/13/13 | 142,000 | 141,965 |

| 5 BMW US Capital LLC | 0.120% | 9/3/13 | 24,500 | 24,500 |

| 5 BMW US Capital LLC | 0.120% | 9/4/13 | 24,000 | 24,000 |

| 5 BMW US Capital LLC | 0.120% | 9/5/13 | 49,500 | 49,499 |

| 5 BMW US Capital LLC | 0.120% | 9/11/13 | 39,500 | 39,499 |

| 5 BMW US Capital LLC | 0.120% | 9/12/13 | 22,000 | 21,999 |

| 5 BMW US Capital LLC | 0.120% | 9/23/13 | 67,000 | 66,995 |

| 5 BMW US Capital LLC | 0.130% | 10/7/13 | 22,000 | 21,997 |

| 5 BMW US Capital LLC | 0.130% | 10/8/13 | 18,000 | 17,998 |

| 5 BMW US Capital LLC | 0.130% | 10/9/13 | 35,250 | 35,245 |

| 5 BMW US Capital LLC | 0.130% | 10/11/13 | 30,000 | 29,996 |

| 5 BMW US Capital LLC | 0.130% | 10/15/13 | 66,000 | 65,990 |

| 5 BMW US Capital LLC | 0.130% | 10/16/13 | 89,500 | 89,485 |

| 5 BMW US Capital LLC | 0.130% | 10/17/13 | 34,250 | 34,244 |

| 5 BMW US Capital LLC | 0.130% | 10/18/13 | 52,000 | 51,991 |

| 5 BMW US Capital LLC | 0.110% | 10/21/13 | 29,750 | 29,745 |

| 5 BMW US Capital LLC | 0.110% | 10/28/13 | 117,800 | 117,780 |

| 5 BMW US Capital LLC | 0.120% | 11/4/13 | 50,000 | 49,989 |

| 5 BMW US Capital LLC | 0.120% | 11/5/13 | 22,500 | 22,495 |

| Toyota Motor Credit Corp. | 0.210% | 9/11/13 | 32,670 | 32,668 |

| Toyota Motor Credit Corp. | 0.240% | 10/1/13 | 26,250 | 26,245 |

| Toyota Motor Credit Corp. | 0.230% | 10/2/13 | 168,000 | 167,967 |

| Toyota Motor Credit Corp. | 0.220% | 10/15/13 | 32,000 | 31,991 |

| Toyota Motor Credit Corp. | 0.210% | 11/8/13 | 189,000 | 188,925 |

| 4 Toyota Motor Credit Corp. | 0.175% | 12/10/13 | 221,000 | 221,000 |

| 4 Toyota Motor Credit Corp. | 0.175% | 12/11/13 | 194,000 | 194,000 |

| Toyota Motor Credit Corp. | 0.240% | 1/6/14 | 74,000 | 73,937 |

| Toyota Motor Credit Corp. | 0.230% | 2/3/14 | 157,750 | 157,594 |

| | | | | 3,056,641 |

| Finance—Other (3.0%) | | | | |

| General Electric Capital Corp. | 0.150% | 10/2/13 | 297,000 | 296,962 |

| General Electric Capital Corp. | 0.150% | 10/4/13 | 248,000 | 247,966 |

| General Electric Capital Corp. | 0.150% | 10/8/13 | 198,000 | 197,969 |

| General Electric Capital Corp. | 0.130% | 10/11/13 | 157,000 | 156,977 |

| General Electric Capital Corp. | 0.190% | 10/15/13 | 99,000 | 98,977 |

| General Electric Capital Corp. | 0.130% | 10/18/13 | 150,000 | 149,974 |

| General Electric Capital Corp. | 0.130% | 10/23/13 | 80,000 | 79,985 |

| General Electric Capital Corp. | 0.150% | 10/25/13 | 248,000 | 247,944 |

| General Electric Capital Corp. | 0.150% | 11/1/13 | 196,000 | 195,950 |

| General Electric Capital Corp. | 0.150% | 11/4/13 | 196,000 | 195,948 |

16

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| | General Electric Capital Corp. | 0.150% | 11/7/13 | 33,000 | 32,991 |

| | General Electric Capital Corp. | 0.150% | 11/22/13 | 250,000 | 249,915 |

| | General Electric Capital Corp. | 0.150% | 12/5/13 | 175,000 | 174,931 |

| 5 | Jupiter Securitization Co. LLC | 0.130% | 9/27/13 | 25,000 | 24,998 |

| 5 | Old Line Funding LLC | 0.160% | 9/17/13 | 49,500 | 49,496 |

| 5 | Old Line Funding LLC | 0.120%–0.130% | 9/23/13 | 67,685 | 67,680 |

| 5 | Old Line Funding LLC | 0.170% | 9/25/13 | 134,000 | 133,985 |

| 5 | Old Line Funding LLC | 0.150%–0.200% | 10/17/13 | 260,127 | 260,062 |

| 5 | Old Line Funding LLC | 0.200% | 10/18/13 | 222,000 | 221,942 |

| 5 | Old Line Funding LLC | 0.200% | 10/22/13 | 38,000 | 37,989 |

| 5 | Old Line Funding LLC | 0.200% | 10/23/13 | 14,098 | 14,094 |

| 5 | Old Line Funding LLC | 0.200% | 10/24/13 | 50,000 | 49,985 |

| 5 | Old Line Funding LLC | 0.200% | 10/25/13 | 24,500 | 24,493 |

| 5 | Old Line Funding LLC | 0.200% | 10/29/13 | 40,500 | 40,487 |

| 5 | Old Line Funding LLC | 0.200% | 11/1/13 | 78,000 | 77,974 |

| 5 | Old Line Funding LLC | 0.200% | 11/8/13 | 39,500 | 39,485 |

| 5 | Old Line Funding LLC | 0.200% | 11/12/13 | 222,000 | 221,911 |

| 5 | Old Line Funding LLC | 0.190%–0.200% | 11/18/13 | 133,500 | 133,442 |

| 5 | Old Line Funding LLC | 0.200% | 12/9/13 | 83,500 | 83,454 |

| 5 | Old Line Funding LLC | 0.200% | 12/18/13 | 76,000 | 75,954 |

| 5 | Old Line Funding LLC | 0.200% | 12/23/13 | 40,000 | 39,975 |

| 5 | Old Line Funding LLC | 0.200% | 1/6/14 | 26,000 | 25,982 |

| | | | | | 3,949,877 |

| Foreign Banks (3.5%) | | | | |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.185% | 10/8/13 | 466,500 | 466,500 |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.185% | 10/9/13 | 298,000 | 298,000 |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.185% | 11/8/13 | 240,000 | 240,000 |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.184% | 11/25/13 | 37,000 | 37,000 |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.183% | 12/23/13 | 123,000 | 123,000 |

| 4,5 | Australia & New Zealand Banking Group, Ltd. | 0.174% | 1/24/14 | 264,000 | 264,000 |

| 5 | Commonwealth Bank of Australia | 0.230% | 10/22/13 | 43,000 | 42,986 |

| 5 | Commonwealth Bank of Australia | 0.220% | 10/29/13 | 28,143 | 28,133 |

| 4,5 | Commonwealth Bank of Australia | 0.316% | 11/1/13 | 46,500 | 46,508 |

| 5 | Commonwealth Bank of Australia | 0.225% | 11/12/13 | 100,000 | 99,955 |

| 5 | Commonwealth Bank of Australia | 0.220% | 12/2/13 | 40,000 | 39,978 |

| 5 | Commonwealth Bank of Australia | 0.215% | 12/5/13 | 30,905 | 30,888 |

| 5 | Commonwealth Bank of Australia | 0.215%–0.230% | 12/16/13 | 205,015 | 204,881 |

| 4,5 | Westpac Banking Corp. | 0.184% | 9/25/13 | 185,000 | 185,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 9/26/13 | 185,000 | 185,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 9/27/13 | 185,000 | 185,000 |

| 4,5 | Westpac Banking Corp. | 0.182% | 9/30/13 | 670,000 | 670,000 |

| 4,5 | Westpac Banking Corp. | 0.182% | 9/30/13 | 450,000 | 450,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 10/16/13 | 150,000 | 150,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 10/21/13 | 150,000 | 150,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 10/25/13 | 73,000 | 73,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 10/28/13 | 100,000 | 100,000 |

| 4,5 | Westpac Banking Corp. | 0.186% | 11/7/13 | 218,000 | 218,000 |

| 4,5 | Westpac Banking Corp. | 0.184% | 11/20/13 | 73,000 | 73,000 |

| 4,5 | Westpac Banking Corp. | 0.318% | 1/13/14 | 118,000 | 118,049 |

| 4,5 | Westpac Banking Corp. | 0.315% | 1/24/14 | 39,500 | 39,518 |

| | | | | | 4,518,396 |

| Foreign Governments (7.1%) | | | | |

| | Canada | 0.170% | 9/27/13 | 37,000 | 36,995 |

| | Canada | 0.170% | 10/7/13 | 18,000 | 17,997 |

17

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 8 CPPIB Capital Inc. | 0.150% | 9/3/13 | 25,000 | 25,000 |

| 8 CPPIB Capital Inc. | 0.150% | 9/9/13 | 250,000 | 249,992 |

| 8 CPPIB Capital Inc. | 0.150% | 9/10/13 | 298,000 | 297,989 |

| 8 CPPIB Capital Inc. | 0.150% | 9/11/13 | 248,000 | 247,990 |

| 8 CPPIB Capital Inc. | 0.150% | 9/12/13 | 49,500 | 49,498 |

| 8 CPPIB Capital Inc. | 0.150% | 9/17/13 | 77,000 | 76,995 |

| 8 CPPIB Capital Inc. | 0.150% | 9/23/13 | 127,500 | 127,488 |

| 8 CPPIB Capital Inc. | 0.150% | 9/24/13 | 100,000 | 99,990 |

| 8 CPPIB Capital Inc. | 0.150% | 9/25/13 | 44,000 | 43,996 |

| 8 CPPIB Capital Inc. | 0.150% | 10/2/13 | 151,500 | 151,480 |

| 8 CPPIB Capital Inc. | 0.150% | 10/10/13 | 19,000 | 18,997 |

| 8 CPPIB Capital Inc. | 0.150%–0.190% | 10/11/13 | 82,000 | 81,985 |

| 8 CPPIB Capital Inc. | 0.150% | 10/16/13 | 20,000 | 19,996 |

| 8 CPPIB Capital Inc. | 0.150% | 10/21/13 | 15,750 | 15,747 |

| 8 CPPIB Capital Inc. | 0.180% | 10/22/13 | 29,000 | 28,993 |

| 8 CPPIB Capital Inc. | 0.190% | 11/1/13 | 107,000 | 106,966 |

| 8 CPPIB Capital Inc. | 0.190% | 11/7/13 | 148,000 | 147,948 |

| 8 CPPIB Capital Inc. | 0.190% | 11/8/13 | 36,000 | 35,987 |

| 8 CPPIB Capital Inc. | 0.150%–0.190% | 11/12/13 | 221,000 | 220,917 |

| 8 CPPIB Capital Inc. | 0.150% | 11/15/13 | 20,000 | 19,994 |

| 8 CPPIB Capital Inc. | 0.150% | 11/21/13 | 74,000 | 73,975 |

| 8 CPPIB Capital Inc. | 0.180% | 1/16/14 | 15,000 | 14,990 |

| 8 CPPIB Capital Inc. | 0.180% | 1/31/14 | 17,000 | 16,987 |

| Export Development Canada | 0.150% | 9/10/13 | 36,800 | 36,799 |

| Export Development Canada | 0.180% | 10/7/13 | 24,000 | 23,996 |

| Export Development Canada | 0.180%–0.190% | 10/8/13 | 94,000 | 93,982 |

| Export Development Canada | 0.140% | 11/1/13 | 196,000 | 195,954 |

| Export Development Canada | 0.140% | 11/5/13 | 100,000 | 99,975 |

| Export Development Canada | 0.140% | 11/12/13 | 200,000 | 199,944 |

| Export Development Canada | 0.170% | 11/15/13 | 197,000 | 196,930 |

| Export Development Canada | 0.160% | 11/18/13 | 25,000 | 24,991 |

| Export Development Canada | 0.160% | 11/19/13 | 99,000 | 98,965 |

| Export Development Canada | 0.160% | 11/22/13 | 198,000 | 197,928 |

| Export Development Canada | 0.160% | 12/2/13 | 149,000 | 148,939 |

| Export Development Canada | 0.155% | 12/9/13 | 200,000 | 199,915 |

| 5 Hydro-Quebec | 0.120% | 10/16/13 | 40,000 | 39,994 |

| 5 Hydro-Quebec | 0.100% | 11/15/13 | 20,000 | 19,996 |

| Province of British Columbia | 0.130% | 10/10/13 | 36,000 | 35,995 |

| Province of British Columbia | 0.140% | 10/22/13 | 33,000 | 32,993 |

| Province of British Columbia | 0.150% | 11/4/13 | 49,500 | 49,487 |

| Province of British Columbia | 0.145% | 11/12/13 | 9,775 | 9,772 |

| Province of British Columbia | 0.145% | 11/18/13 | 53,000 | 52,983 |

| Province of British Columbia | 0.150% | 11/22/13 | 50,000 | 49,983 |

| Province of British Columbia | 0.160% | 12/4/13 | 54,500 | 54,477 |

| Province of British Columbia | 0.160% | 12/11/13 | 99,000 | 98,956 |

| Province of Ontario | 0.135%–0.150% | 9/6/13 | 91,900 | 91,898 |

| Province of Ontario | 0.150% | 9/12/13 | 44,000 | 43,998 |

| Province of Ontario | 0.140% | 9/19/13 | 49,500 | 49,497 |

| Province of Ontario | 0.140% | 10/4/13 | 21,000 | 20,997 |

| Province of Ontario | 0.180% | 10/7/13 | 137,750 | 137,725 |

| Province of Ontario | 0.120% | 10/8/13 | 22,000 | 21,997 |

| Province of Ontario | 0.180% | 10/9/13 | 143,000 | 142,973 |

| Province of Ontario | 0.180% | 10/11/13 | 76,000 | 75,985 |

| Province of Ontario | 0.140%–0.170% | 10/15/13 | 150,000 | 149,971 |

| Province of Ontario | 0.140% | 10/16/13 | 12,000 | 11,998 |

18

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Province of Ontario | 0.110% | 10/29/13 | 20,000 | 19,996 |

| Province of Ontario | 0.150% | 11/1/13 | 28,000 | 27,993 |

| Province of Ontario | 0.140% | 11/5/13 | 49,500 | 49,487 |

| Province of Ontario | 0.120% | 11/6/13 | 49,000 | 48,989 |

| Province of Ontario | 0.130%–0.150% | 11/7/13 | 110,000 | 109,972 |

| Province of Ontario | 0.100%–0.160% | 11/18/13 | 75,000 | 74,977 |

| Province of Ontario | 0.160% | 11/22/13 | 24,500 | 24,491 |

| Province of Ontario | 0.100%–0.160% | 11/25/13 | 125,000 | 124,956 |

| Province of Ontario | 0.100% | 11/26/13 | 104,000 | 103,975 |

| Province of Ontario | 0.100% | 11/27/13 | 20,000 | 19,995 |

| Province of Ontario | 0.160% | 11/29/13 | 25,000 | 24,990 |

| Province of Ontario | 0.160% | 12/5/13 | 144,000 | 143,939 |

| Province of Ontario | 0.150% | 1/21/14 | 60,000 | 59,965 |

| 8 PSP Capital Inc. | 0.200% | 10/7/13 | 19,500 | 19,496 |

| 8 PSP Capital Inc. | 0.190% | 10/15/13 | 26,500 | 26,494 |

| 8 PSP Capital Inc. | 0.190% | 11/12/13 | 90,000 | 89,966 |

| 8 PSP Capital Inc. | 0.190% | 11/13/13 | 156,500 | 156,440 |

| 8 PSP Capital Inc. | 0.190% | 11/15/13 | 83,000 | 82,967 |

| 8 PSP Capital Inc. | 0.180% | 11/18/13 | 14,500 | 14,494 |

| 8 PSP Capital Inc. | 0.190% | 11/21/13 | 29,500 | 29,487 |

| 8 PSP Capital Inc. | 0.180% | 12/6/13 | 15,000 | 14,993 |

| 8 PSP Capital Inc. | 0.190% | 12/11/13 | 28,000 | 27,985 |

| 8 PSP Capital Inc. | 0.190% | 12/13/13 | 24,500 | 24,487 |

| 8 PSP Capital Inc. | 0.180% | 2/3/14 | 17,750 | 17,736 |

| 8 PSP Capital Inc. | 0.190% | 2/18/14 | 11,750 | 11,739 |

| 5 Quebec | 0.150% | 9/5/13 | 32,200 | 32,199 |

| 5 Quebec | 0.130% | 9/11/13 | 100,000 | 99,996 |

| 5 Quebec | 0.130%–0.150% | 9/12/13 | 245,000 | 244,990 |

| 5 Quebec | 0.150% | 9/13/13 | 36,000 | 35,998 |

| 5 Quebec | 0.110%–0.120% | 10/1/13 | 103,100 | 103,090 |

| 5 Quebec | 0.140% | 10/4/13 | 27,000 | 26,997 |

| 5 Quebec | 0.120% | 10/10/13 | 500,000 | 499,935 |

| 5 Quebec | 0.120%–0.130% | 10/17/13 | 468,000 | 467,927 |

| 5 Quebec | 0.130% | 10/24/13 | 100,000 | 99,981 |

| 5 Quebec | 0.120% | 11/1/13 | 22,500 | 22,495 |

| 5 Quebec | 0.120% | 11/6/13 | 32,500 | 32,493 |

| 5 Quebec | 0.100% | 11/19/13 | 49,500 | 49,489 |

| 5 Quebec | 0.100% | 11/20/13 | 503,500 | 503,388 |

| Queensland Treasury Corp. | 0.200% | 9/12/13 | 36,000 | 35,998 |

| Queensland Treasury Corp. | 0.240% | 10/15/13 | 150,000 | 149,956 |

| Queensland Treasury Corp. | 0.240% | 10/18/13 | 75,000 | 74,976 |

| Queensland Treasury Corp. | 0.130% | 10/24/13 | 25,000 | 24,995 |

| Queensland Treasury Corp. | 0.230%–0.240% | 10/29/13 | 151,000 | 150,943 |

| Queensland Treasury Corp. | 0.130% | 10/30/13 | 65,500 | 65,486 |

| Queensland Treasury Corp. | 0.140% | 11/6/13 | 99,000 | 98,975 |

| Queensland Treasury Corp. | 0.150% | 11/14/13 | 30,500 | 30,491 |

| | | | | 9,139,692 |

| Foreign Industrial (5.2%) | | | | |

| 5 BASF SE | 0.140% | 9/20/13 | 79,000 | 78,994 |

| 5 BASF SE | 0.150% | 9/25/13 | 200,000 | 199,980 |

| 5 BASF SE | 0.150% | 9/26/13 | 100,000 | 99,990 |

| 5 GlaxoSmithKline Finance plc | 0.150% | 9/3/13 | 63,000 | 62,999 |

| 5 GlaxoSmithKline Finance plc | 0.140% | 9/4/13 | 236,000 | 235,997 |

| 5 GlaxoSmithKline Finance plc | 0.100%–0.120% | 10/2/13 | 245,000 | 244,976 |

| 5 GlaxoSmithKline Finance plc | 0.150% | 10/9/13 | 123,500 | 123,480 |

19

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 5 Nestle Capital Corp. | 0.200% | 9/6/13 | 47,000 | 46,999 |

| 5 Nestle Capital Corp. | 0.250% | 9/17/13 | 10,000 | 9,999 |

| 5 Nestle Capital Corp. | 0.190% | 10/1/13 | 600,000 | 599,905 |

| 5 Nestle Capital Corp. | 0.140% | 10/7/13 | 396,000 | 395,945 |

| 5 Nestle Capital Corp. | 0.140% | 10/8/13 | 68,000 | 67,990 |

| 5 Nestle Capital Corp. | 0.150% | 11/13/13 | 368,000 | 367,888 |

| 5 Nestle Capital Corp. | 0.145% | 11/14/13 | 113,000 | 112,966 |

| 5 Nestle Capital Corp. | 0.120% | 11/18/13 | 214,000 | 213,944 |

| Nestle Finance International Ltd. | 0.150% | 9/24/13 | 230,000 | 229,978 |

| Nestle Finance International Ltd. | 0.150% | 9/26/13 | 115,000 | 114,988 |

| Nestle Finance International Ltd. | 0.200% | 10/3/13 | 235,000 | 234,958 |

| Nestle Finance International Ltd. | 0.200% | 10/15/13 | 45,000 | 44,989 |

| Nestle Finance International Ltd. | 0.200% | 10/16/13 | 98,000 | 97,976 |

| Nestle Finance International Ltd. | 0.140% | 11/1/13 | 228,000 | 227,946 |

| Nestle Finance International Ltd. | 0.140% | 11/5/13 | 53,000 | 52,987 |

| Nestle Finance International Ltd. | 0.125%–0.130% | 11/7/13 | 356,500 | 356,417 |

| Nestle Finance International Ltd. | 0.165% | 11/13/13 | 198,000 | 197,934 |

| Nestle Finance International Ltd. | 0.165% | 11/14/13 | 149,300 | 149,249 |

| 5 Reckitt Benckiser Treasury Services plc | 0.140% | 9/6/13 | 99,000 | 98,998 |

| 5 Reckitt Benckiser Treasury Services plc | 0.150% | 9/16/13 | 31,444 | 31,442 |

| 5 Reckitt Benckiser Treasury Services plc | 0.125% | 11/7/13 | 159,750 | 159,713 |

| 5 Roche Holdings Inc. | 0.110% | 9/10/13 | 49,500 | 49,499 |

| 5 Roche Holdings Inc. | 0.110%–0.120% | 9/12/13 | 97,000 | 96,997 |

| 5 Roche Holdings Inc. | 0.090% | 11/8/13 | 40,300 | 40,293 |

| 5 Sanofi | 0.140% | 9/19/13 | 224,000 | 223,984 |

| 5 Sanofi | 0.150% | 9/20/13 | 237,100 | 237,081 |

| 5 Sanofi | 0.150% | 9/25/13 | 335,000 | 334,967 |

| 5 Sanofi | 0.140% | 9/27/13 | 107,200 | 107,189 |

| 5 Siemens Capital Co. LLC | 0.120% | 9/10/13 | 200,000 | 199,994 |

| 5 Siemens Capital Co. LLC | 0.120% | 9/12/13 | 75,000 | 74,997 |

| 5 Total Capital Canada Ltd. | 0.160% | 1/13/14 | 200,000 | 199,881 |

| 5 Total Capital Canada Ltd. | 0.140% | 2/3/14 | 72,000 | 71,957 |

| Toyota Credit Canada Inc. | 0.260% | 9/17/13 | 48,500 | 48,494 |

| Toyota Credit Canada Inc. | 0.260% | 9/19/13 | 50,000 | 49,994 |

| Toyota Credit Canada Inc. | 0.220% | 10/21/13 | 19,000 | 18,994 |

| Toyota Credit Canada Inc. | 0.260% | 1/2/14 | 21,000 | 20,981 |

| Toyota Credit Canada Inc. | 0.250% | 1/6/14 | 20,000 | 19,982 |

| 5 Unilever Capital Corp. | 0.110% | 9/9/13 | 90,000 | 89,998 |

| | | | | 6,744,909 |

| Industrial (6.8%) | | | | |

| Caterpillar Financial Services Corp. | 0.110% | 9/3/13 | 75,000 | 75,000 |

| Caterpillar Financial Services Corp. | 0.110% | 9/4/13 | 58,600 | 58,600 |

| Caterpillar Financial Services Corp. | 0.150% | 9/23/13 | 231,000 | 230,979 |

| Caterpillar Financial Services Corp. | 0.170% | 9/26/13 | 141,000 | 140,983 |

| 5 Chevron Corp. | 0.090% | 9/3/13 | 65,000 | 65,000 |

| 5 Chevron Corp. | 0.090% | 9/4/13 | 200,000 | 199,999 |

| Exxon Mobil Corp. | 0.130% | 10/11/13 | 495,000 | 494,928 |

| Exxon Mobil Corp. | 0.090% | 10/25/13 | 200,000 | 199,973 |

| Exxon Mobil Corp. | 0.090% | 10/30/13 | 43,000 | 42,994 |

| Exxon Mobil Corp. | 0.090% | 10/31/13 | 300,000 | 299,955 |

| Exxon Mobil Corp. | 0.090% | 11/1/13 | 150,000 | 149,977 |

| General Electric Co. | 0.110% | 9/25/13 | 200,000 | 199,985 |

| General Electric Co. | 0.110% | 9/26/13 | 298,000 | 297,977 |

| General Electric Co. | 0.110% | 9/27/13 | 59,000 | 58,995 |

| 5 Google Inc. | 0.150% | 11/5/13 | 21,000 | 20,994 |

20

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 5 Google Inc. | 0.120% | 11/13/13 | 99,000 | 98,976 |

| 5 Google Inc. | 0.150% | 1/15/14 | 75,000 | 74,958 |

| 5 Google Inc. | 0.140% | 2/6/14 | 55,000 | 54,966 |

| 5 Honeywell International Inc. | 0.120% | 9/23/13 | 8,900 | 8,899 |

| 5 Honeywell International Inc. | 0.120% | 9/26/13 | 50,000 | 49,996 |

| 5 Procter & Gamble Co. | 0.110% | 10/16/13 | 24,500 | 24,497 |

| 5 Procter & Gamble Co. | 0.150% | 11/4/13 | 471,000 | 470,874 |

| 5 Procter & Gamble Co. | 0.100% | 11/6/13 | 75,750 | 75,736 |

| 5 Procter & Gamble Co. | 0.100% | 11/8/13 | 62,100 | 62,088 |

| 5 Procter & Gamble Co. | 0.090% | 11/15/13 | 75,000 | 74,986 |

| 5 Procter & Gamble Co. | 0.140% | 11/19/13 | 124,000 | 123,962 |

| 5 Procter & Gamble Co. | 0.090% | 11/26/13 | 204,500 | 204,456 |

| 5 Procter & Gamble Co. | 0.080% | 11/27/13 | 36,100 | 36,093 |

| 5 Procter & Gamble Co. | 0.080% | 12/2/13 | 40,300 | 40,292 |

| 5 Procter & Gamble Co. | 0.080% | 12/4/13 | 149,000 | 148,969 |

| 5 Syngenta Wilmington Inc. | 0.100% | 9/17/13 | 55,000 | 54,998 |

| 5 The Coca-Cola Co. | 0.200% | 9/3/13 | 163,000 | 162,998 |

| 5 The Coca-Cola Co. | 0.180% | 10/3/13 | 98,750 | 98,734 |

| 5 The Coca-Cola Co. | 0.180% | 10/7/13 | 208,550 | 208,512 |

| 5 The Coca-Cola Co. | 0.180% | 10/8/13 | 100,000 | 99,982 |

| 5 The Coca-Cola Co. | 0.180% | 10/9/13 | 100,000 | 99,981 |

| 5 The Coca-Cola Co. | 0.140% | 10/23/13 | 99,000 | 98,980 |

| 5 The Coca-Cola Co. | 0.140% | 10/24/13 | 100,000 | 99,979 |

| 5 The Coca-Cola Co. | 0.140% | 10/25/13 | 100,000 | 99,979 |

| 5 The Coca-Cola Co. | 0.190% | 11/4/13 | 187,000 | 186,937 |

| 5 The Coca-Cola Co. | 0.180%–0.190% | 11/5/13 | 326,000 | 325,891 |

| 5 The Coca-Cola Co. | 0.140%–0.170% | 11/6/13 | 257,500 | 257,426 |

| 5 The Coca-Cola Co. | 0.140% | 11/8/13 | 225,000 | 224,941 |

| 5 The Coca-Cola Co. | 0.140% | 11/12/13 | 200,000 | 199,944 |

| 5 The Coca-Cola Co. | 0.170% | 11/19/13 | 303,750 | 303,637 |

| 5 The Coca-Cola Co. | 0.170% | 11/20/13 | 131,000 | 130,951 |

| 5 The Coca-Cola Co. | 0.160% | 12/5/13 | 287,000 | 286,879 |

| 5 The Coca-Cola Co. | 0.160% | 12/6/13 | 173,000 | 172,926 |

| 5 The Coca-Cola Co. | 0.160% | 12/9/13 | 159,000 | 158,930 |

| 5 The Coca-Cola Co. | 0.160% | 12/10/13 | 17,000 | 16,992 |

| 5 The Coca-Cola Co. | 0.160% | 12/11/13 | 49,000 | 48,978 |

| 5 The Coca-Cola Co. | 0.190% | 12/19/13 | 74,000 | 73,957 |

| 5 The Coca-Cola Co. | 0.190% | 1/3/14 | 50,000 | 49,967 |

| 5 The Coca-Cola Co. | 0.190% | 1/7/14 | 38,000 | 37,974 |

| 5 The Coca-Cola Co. | 0.180% | 1/8/14 | 29,000 | 28,981 |

| 5 The Coca-Cola Co. | 0.170% | 2/10/14 | 27,000 | 26,979 |

| 5 The Coca-Cola Co. | 0.170% | 2/27/14 | 104,000 | 103,912 |

| 5 The Coca-Cola Co. | 0.170%–0.180% | 3/3/14 | 215,000 | 214,810 |

| 5 The Coca-Cola Co. | 0.170% | 3/4/14 | 125,000 | 124,891 |

| 5 The Coca-Cola Co. | 0.170% | 3/5/14 | 85,000 | 84,926 |

| 5 Wal-Mart Stores, Inc. | 0.100% | 10/16/13 | 49,500 | 49,494 |

| 5 Wal-Mart Stores, Inc. | 0.100%–0.110% | 10/17/13 | 59,250 | 59,242 |

| 5 Wal-Mart Stores, Inc. | 0.100% | 10/18/13 | 59,500 | 59,492 |

| 5 Wal-Mart Stores, Inc. | 0.100% | 10/21/13 | 29,750 | 29,746 |

| 5 Wal-Mart Stores, Inc. | 0.090% | 11/1/13 | 99,500 | 99,485 |

| 5 Wal-Mart Stores, Inc. | 0.100% | 11/4/13 | 198,500 | 198,465 |

| 5 Wal-Mart Stores, Inc. | 0.100% | 11/5/13 | 99,600 | 99,582 |

| | | | | 8,766,565 |

| Total Commercial Paper (Cost $36,176,080) | | | | 36,176,080 |

21

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Certificates of Deposit (19.4%) | | | | |

| Domestic Banks (4.0%) | | | | |

| JPMorgan Chase Bank NA | 0.160% | 10/1/13 | 730,000 | 730,000 |

| JPMorgan Chase Bank NA | 0.180% | 10/1/13 | 280,000 | 280,000 |

| JPMorgan Chase Bank NA | 0.180% | 10/1/13 | 88,000 | 88,000 |

| JPMorgan Chase Bank NA | 0.180% | 10/7/13 | 219,000 | 219,000 |

| 4 Wells Fargo Bank NA | 0.185% | 9/11/13 | 459,000 | 459,000 |

| 4 Wells Fargo Bank NA | 0.175% | 9/13/13 | 834,000 | 834,000 |

| 4 Wells Fargo Bank NA | 0.175% | 10/9/13 | 414,000 | 414,000 |

| 4 Wells Fargo Bank NA | 0.175% | 10/10/13 | 115,000 | 115,000 |

| 4 Wells Fargo Bank NA | 0.184% | 11/27/13 | 192,500 | 192,511 |

| 4 Wells Fargo Bank NA | 0.176% | 2/5/14 | 495,000 | 495,000 |

| Wells Fargo Bank NA | 0.220% | 2/12/14 | 500,000 | 500,000 |

| Wells Fargo Bank NA | 0.220% | 2/19/14 | 495,000 | 495,000 |

| 4 Wells Fargo Bank NA | 0.203% | 2/24/14 | 361,000 | 361,000 |

| | | | | 5,182,511 |

| Eurodollar Certificates of Deposit (6.7%) | | | | |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.200% | 10/11/13 | 432,000 | 432,000 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.204% | 10/17/13 | 170,000 | 170,000 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.204% | 10/24/13 | 432,000 | 432,000 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.207% | 11/1/13 | 646,000 | 646,000 |

| 4 Commonwealth Bank of Australia | 0.175% | 9/13/13 | 50,000 | 50,000 |

| 4 Commonwealth Bank of Australia | 0.175% | 10/8/13 | 840,000 | 840,000 |

| 4 Commonwealth Bank of Australia | 0.175% | 10/15/13 | 407,000 | 407,000 |

| 4 Commonwealth Bank of Australia | 0.174% | 11/20/13 | 126,000 | 126,000 |

| 4 Commonwealth Bank of Australia | 0.175% | 2/10/14 | 468,000 | 468,000 |

| 4 Commonwealth Bank of Australia | 0.174% | 2/19/14 | 522,000 | 522,000 |

| 4 Commonwealth Bank of Australia | 0.173% | 2/24/14 | 706,000 | 706,000 |

| 4 National Australia Bank Ltd. | 0.174% | 9/18/13 | 121,000 | 121,000 |

| 4 National Australia Bank Ltd. | 0.177% | 10/2/13 | 1,033,000 | 1,033,000 |

| 4 National Australia Bank Ltd. | 0.194% | 10/21/13 | 480,000 | 480,000 |

| 4 National Australia Bank Ltd. | 0.193% | 10/23/13 | 525,000 | 525,000 |

| 4 National Australia Bank Ltd. | 0.196% | 12/6/13 | 64,000 | 64,000 |

| 4 National Australia Bank Ltd. | 0.194% | 12/18/13 | 128,000 | 128,000 |

| 4 National Australia Bank Ltd. | 0.204% | 12/27/13 | 72,000 | 72,000 |

| 4 National Australia Bank Ltd. | 0.206% | 1/6/14 | 50,000 | 50,000 |

| 4 National Australia Bank Ltd. | 0.209% | 1/27/14 | 1,319,000 | 1,319,000 |

| 4 National Australia Bank Ltd. | 0.214% | 2/19/14 | 41,000 | 41,000 |

| 4 National Australia Bank Ltd. | 0.213% | 2/28/14 | 37,000 | 37,000 |

| | | | | 8,669,000 |

| Yankee Certificates of Deposit (8.7%) | | | | |

| 4 Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.176% | 12/5/13 | 50,000 | 50,000 |

| 4 Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.177% | 1/2/14 | 114,000 | 114,000 |

| Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.200% | 1/10/14 | 54,500 | 54,504 |

| Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.190% | 2/20/14 | 248,000 | 247,994 |

| Bank of Montreal (Chicago Branch) | 0.180% | 9/13/13 | 590,000 | 590,000 |

| Bank of Montreal (Chicago Branch) | 0.180% | 9/16/13 | 590,000 | 590,000 |

| Bank of Montreal (Chicago Branch) | 0.200% | 10/16/13 | 491,000 | 491,000 |

| Bank of Montreal (Chicago Branch) | 0.150% | 10/22/13 | 465,000 | 465,000 |

| Bank of Montreal (Chicago Branch) | 0.150% | 10/24/13 | 392,000 | 392,000 |

22

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Bank of Montreal (Chicago Branch) | 0.180% | 11/8/13 | 21,000 | 21,000 |

| Bank of Montreal (Chicago Branch) | 0.170% | 12/2/13 | 33,000 | 33,000 |

| Bank of Nova Scotia (Houston Branch) | 0.150% | 9/3/13 | 115,000 | 115,000 |

| Bank of Nova Scotia (Houston Branch) | 0.150% | 9/6/13 | 43,000 | 43,000 |

| Bank of Nova Scotia (Houston Branch) | 0.170% | 9/24/13 | 45,000 | 45,000 |

| Bank of Nova Scotia (Houston Branch) | 0.160% | 10/16/13 | 570,000 | 569,997 |

| Bank of Nova Scotia (Houston Branch) | 0.150% | 10/18/13 | 248,000 | 248,000 |

| Bank of Nova Scotia (Houston Branch) | 0.140% | 10/23/13 | 470,000 | 469,997 |

| Bank of Nova Scotia (Houston Branch) | 0.140% | 11/6/13 | 600,000 | 599,995 |

| Bank of Nova Scotia (Houston Branch) | 0.150% | 11/12/13 | 460,000 | 459,995 |

| Bank of Nova Scotia (Houston Branch) | 0.160% | 12/2/13 | 142,000 | 141,998 |

| Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 0.100% | 10/15/13 | 300,000 | 300,000 |

| Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 0.080% | 11/26/13 | 250,000 | 250,000 |

| Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 0.080% | 11/27/13 | 250,000 | 250,000 |

| 4 Commonwealth Bank of Australia | | | | |

| (New York Branch) | 0.186% | 9/6/13 | 127,000 | 127,000 |

| 4 Commonwealth Bank of Australia | | | | |

| (New York Branch) | 0.184% | 11/18/13 | 111,000 | 111,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.186% | 9/4/13 | 218,000 | 218,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.185% | 9/16/13 | 175,000 | 175,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.183% | 10/23/13 | 198,000 | 198,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.186% | 11/7/13 | 495,000 | 495,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.164% | 11/20/13 | 350,000 | 350,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 11/22/13 | 39,500 | 39,500 |

| 4 Toronto Dominion Bank (New York Branch) | 0.164% | 11/29/13 | 196,000 | 196,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.175% | 12/13/13 | 161,000 | 161,000 |

| 4 Toronto Dominion Bank (New York Branch) | 0.234% | 12/20/13 | 172,000 | 172,021 |

| 4 Toronto Dominion Bank (New York Branch) | 0.174% | 12/23/13 | 199,000 | 199,000 |

| Toronto Dominion Bank (New York Branch) | 0.200% | 1/15/14 | 230,000 | 230,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 2/3/14 | 400,000 | 400,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 2/3/14 | 95,000 | 95,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 2/5/14 | 185,000 | 185,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 2/13/14 | 175,000 | 175,000 |

| Toronto Dominion Bank (New York Branch) | 0.220% | 2/18/14 | 541,000 | 541,000 |

| Westpac Banking Corp. (New York Branch) | 0.190% | 9/30/13 | 50,000 | 50,000 |

| 4 Westpac Banking Corp. (New York Branch) | 0.184% | 10/24/13 | 73,000 | 73,000 |

| 4 Westpac Banking Corp. (New York Branch) | 0.186% | 11/4/13 | 360,000 | 360,000 |

| 4 Westpac Banking Corp. (New York Branch) | 0.182% | 12/30/13 | 106,000 | 106,000 |

| 4 Westpac Banking Corp. (New York Branch) | 0.184% | 12/30/13 | 50,000 | 50,000 |

| | | | | 11,248,001 |

| Total Certificates of Deposit (Cost $25,099,512) | | | | 25,099,512 |

| Repurchase Agreements (0.1%) | | | | |

| Bank of Nova Scotia | | | | |

| (Dated 8/30/13, Repurchase Value $20,000,000, | | | | |

| collateralized by U.S. Treasury Note/Bond | | | | |

| 2.000%, 1/15/14; with a value of $20,400,000) | 0.040% | 9/3/13 | 20,000 | 20,000 |

| RBC Capital Markets LLC | | | | |

| (Dated 8/30/13, Repurchase Value $40,091,000, | | | | |

| collateralized by U.S. Treasury Note/Bond | | | | |

| 2.000%, 2/15/22; with a value of $40,893,000) | 0.030% | 9/3/13 | 40,091 | 40,091 |

23

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| TD Securities (USA) LLC | | | | |

| (Dated 8/30/13, Repurchase Value $12,000,000, | | | | |

| collateralized by U.S. Treasury Note/Bond | | | | |

| 0.625%, 8/15/16, and U.S. Treasury Bill | | | | |

| 0.000%, 12/26/13; with a value of $12,240,000) | 0.030% | 9/3/13 | 12,000 | 12,000 |

| Total Repurchase Agreements (Cost $72,091) | | | | 72,091 |

| |

| | | | Shares | |

| Money Market Fund (1.3%) | | | | |

| 6 Vanguard Municipal Cash Management Fund | | | | |

| (Cost $1,678,903) | 0.079% | | 1,678,903,000 | 1,678,903 |

| |

| | | | Face | |

| | | | Amount | |

| | | | ($000) | |

| Tax-Exempt Municipal Bonds (1.5%) | | | | |

| 7 Apache County AZ Industrial Development | | | | |

| Authority Pollution Control Revenue | | | | |

| (Tucson Electric Power Co. Project) VRDO | 0.080% | 9/6/13 | 37,000 | 37,000 |

| 7 Arizona Health Facilities Authority Revenue | | | | |

| (Banner Health) VRDO | 0.080% | 9/6/13 | 35,000 | 35,000 |

| 7 Ascension Parish LA Industrial Development | | | | |

| Board Revenue (IMTT-Geismar Project) VRDO | 0.060% | 9/6/13 | 79,000 | 79,000 |

| 7 Burlington KS Environmental Improvement | | | | |

| Revenue (Kansas City Power & Light Co. | | | | |

| Project) VRDO | 0.070% | 9/6/13 | 29,000 | 29,000 |

| 7 Burlington KS Environmental Improvement | | | | |

| Revenue (Kansas City Power & Light Co. | | | | |

| Project) VRDO | 0.070% | 9/6/13 | 42,250 | 42,250 |

| 7 California Educational Facilities Authority | | | | |

| Revenue (University of San Francisco) VRDO | 0.060% | 9/6/13 | 8,800 | 8,800 |

| 7 California Educational Facilities Authority | | | | |

| Revenue (University of San Francisco) VRDO | 0.060% | 9/6/13 | 13,375 | 13,375 |

| 7 California Housing Finance Agency Multifamily | | | | |

| Housing Revenue VRDO | 0.050% | 9/6/13 | 20,180 | 20,180 |

| 7 California Statewide Communities Development | | | | |

| Authority Multifamily Housing Revenue | | | | |

| (Wilshire Court Project) VRDO | 0.050% | 9/6/13 | 11,900 | 11,900 |

| 7 Clackamas County OR Hospital Facility Authority | | | | |

| Revenue (Legacy Health System) VRDO | 0.050% | 9/6/13 | 9,700 | 9,700 |

| 7 Clark County NV Airport System Revenue VRDO | 0.070% | 9/6/13 | 12,200 | 12,200 |

| 7 Clark County NV Industrial Development | | | | |

| Revenue (Southwest Gas Corp. Project) VRDO | 0.080% | 9/6/13 | 14,300 | 14,300 |

| 7 Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (SPC Buildings 1 & 3 LLC) VRDO | 0.070% | 9/6/13 | 16,970 | 16,970 |

| 7 Colorado Health Facilities Authority Revenue | | | | |

| (Evangelical Lutheran Good Samaritan | | | | |

| Society Project) VRDO | 0.050% | 9/6/13 | 10,000 | 10,000 |

| 7 Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Oasbo Expanded Asset Program) | | | | |

| VRDO | 0.060% | 9/6/13 | 16,700 | 16,700 |

| 7 Contra Costa County CA Multifamily Housing | | | | |

| Revenue (Park Regency) VRDO | 0.040% | 9/6/13 | 46,700 | 46,700 |

24

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Curators of the University of Missouri System | | | | |

| Facilities Revenue VRDO | 0.050% | 9/6/13 | 61,940 | 61,940 |

| 7 District of Columbia Revenue | | | | |

| (World Wildlife Fund Inc.) VRDO | 0.080% | 9/6/13 | 19,500 | 19,500 |

| 7 Geneva NY Industrial Development Agency | | | | |

| Civic Facility Revenue (Colleges of the Seneca | | | | |

| Project) VRDO | 0.080% | 9/6/13 | 12,325 | 12,325 |

| 7 Glendale AZ Industrial Development Authority | | | | |

| Revenue (Midwestern University) VRDO | 0.080% | 9/6/13 | 33,975 | 33,975 |

| 7 Greenville County SC Hospital System Revenue | | | | |

| VRDO | 0.050% | 9/6/13 | 13,000 | 13,000 |

| 7 Gwinnett County GA Development Authority | | | | |

| Revenue (Nilhan Hospitality LLC) VRDO | 0.050% | 9/6/13 | 11,400 | 11,400 |

| 7 Hanover County VA Economic Development | | | | |

| Authority Revenue (Bon Secours Health | | | | |

| System Inc.) VRDO | 0.060% | 9/6/13 | 11,955 | 11,955 |

| 7 Idaho Housing & Finance Association | | | | |

| Single Family Mortgage Revenue VRDO | 0.070% | 9/6/13 | 18,200 | 18,200 |

| 7 Illinois Finance Authority Revenue | | | | |

| (Carle Foundation) VRDO | 0.060% | 9/6/13 | 18,225 | 18,225 |

| 7 Illinois Finance Authority Revenue (Little Co. of | | | | |

| Mary Hospital & Health Care Centers) VRDO | 0.070% | 9/6/13 | 15,620 | 15,620 |

| 7 Illinois Finance Authority Revenue (Northwest | | | | |

| Community Hospital) VRDO | 0.060% | 9/6/13 | 27,415 | 27,415 |

| 7 Illinois Finance Authority Revenue (Southern | | | | |

| Illinois Healthcare Enterprises Inc.) VRDO | 0.080% | 9/6/13 | 39,000 | 39,000 |

| 7 Johnson City TN Health & Educational Facilities | | | | |

| Board Hospital Revenue (STS Health Alliance) | | | | |

| VRDO | 0.050% | 9/6/13 | 32,140 | 32,140 |

| 7 Lee Memorial Health System Florida Hospital | | | | |

| Revenue VRDO | 0.060% | 9/6/13 | 6,425 | 6,425 |

| 7 Louisiana Public Facilities Authority Hospital | | | | |

| Revenue (Franciscan Missionaries | | | | |

| of Our Lady Health System Project) VRDO | 0.060% | 9/6/13 | 13,900 | 13,900 |

| 7 Maine Health & Higher Educational Facilities | | | | |

| Authority Revenue (Bowdoin College) VRDO | 0.060% | 9/6/13 | 14,600 | 14,600 |

| 7 Maine Health & Higher Educational Facilities | | | | |

| Authority Revenue VRDO | 0.070% | 9/6/13 | 55,430 | 55,430 |

| 7 Massachusetts Development Finance Agency | | | | |

| Revenue (Wentworth Institute of Technology) | | | | |

| VRDO | 0.070% | 9/6/13 | 4,000 | 4,000 |

| 7 Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Baystate Medical Center) | | | | |

| VRDO | 0.050% | 9/6/13 | 11,000 | 11,000 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) VRDO | 0.050% | 9/6/13 | 19,320 | 19,320 |

| Missouri Health & Educational Facilities | | | | |

| Authority Health Facilities Revenue | | | | |

| (BJC Health System) VRDO | 0.060% | 9/6/13 | 18,000 | 18,000 |

| 7 Missouri Health & Educational Facilities | | | | |

| Authority Health Facilities Revenue | | | | |

| (SSM Health System) VRDO | 0.070% | 9/6/13 | 77,535 | 77,535 |

| 7 New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (One Columbus Place Development) VRDO | 0.060% | 9/6/13 | 68,100 | 68,100 |

25

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 7 New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (Related-Sierra Development) VRDO | 0.060% | 9/6/13 | 32,500 | 32,500 |

| 7 New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (West End Towers) VRDO | 0.060% | 9/6/13 | 31,300 | 31,300 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (125 West 31st Street) VRDO | 0.080% | 9/6/13 | 42,300 | 42,300 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (20 River Terrace Housing) VRDO | 0.080% | 9/6/13 | 17,300 | 17,300 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (70 Battery Place) VRDO | 0.060% | 9/6/13 | 12,800 | 12,800 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (Clinton Green North) VRDO | 0.080% | 9/6/13 | 31,845 | 31,845 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (Clinton Green South) VRDO | 0.080% | 9/6/13 | 11,625 | 11,625 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (East 84th Street) VRDO | 0.060% | 9/6/13 | 24,500 | 24,500 |

| 7 New York State Housing Finance Agency Housing | | | | |

| Revenue (West 17th Street) VRDO | 0.060% | 9/6/13 | 11,710 | 11,710 |

| 7 North Carolina Medical Care Commission Health | | | | |

| Systems Revenue (Catholic Health East) VRDO | 0.070% | 9/6/13 | 6,910 | 6,910 |

| 7 Oakland University of Michigan Revenue VRDO | 0.090% | 9/6/13 | 16,120 | 16,120 |

| Ohio State University General Receipts Revenue | | | | |

| VRDO | 0.060% | 9/6/13 | 6,200 | 6,200 |

| 7 Piedmont SC Municipal Power Agency Revenue | | | | |

| VRDO | 0.060% | 9/6/13 | 16,000 | 16,000 |

| Posey County IN Economic Development | | | | |

| Revenue (Midwest Fertilizer Corp. Project) PUT | 0.750% | 10/17/13 | 306,500 | 306,500 |

| 7 Raleigh Durham NC Airport Authority Revenue | | | | |

| VRDO | 0.060% | 9/6/13 | 8,000 | 8,000 |

| 7 Rhode Island Health & Educational Building Corp. | | | | |

| Higher Education Facility Revenue | | | | |

| (Rogers Williams University) VRDO | 0.060% | 9/6/13 | 7,275 | 7,275 |

| 7 Salem OR Hospital Facility Authority Revenue | | | | |

| (Salem Hospital Project) VRDO | 0.060% | 9/6/13 | 16,500 | 16,500 |

| 7 San Francisco CA City & County | | | | |

| International Airport Revenue VRDO | 0.060% | 9/6/13 | 33,000 | 33,000 |

| 7 St. Charles County MO Public Water Supply | | | | |

| District No.2 Revenue VRDO | 0.060% | 9/6/13 | 13,000 | 13,000 |

| 7 St. Cloud MN Health Care Revenue | | | | |

| (Centracare Health System) VRDO | 0.060% | 9/6/13 | 21,995 | 21,995 |

| 7 Sunshine State Governmental Financing | | | | |

| Commission Florida Revenue | | | | |

| (Miami Dade County Program) VRDO | 0.070% | 9/6/13 | 13,800 | 13,800 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.070% | 9/6/13 | 42,400 | 42,400 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.070% | 9/6/13 | 34,620 | 34,620 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.070% | 9/6/13 | 28,900 | 28,900 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.090% | 9/6/13 | 16,445 | 16,445 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Mortgage Revenue VRDO | 0.090% | 9/6/13 | 51,990 | 51,990 |

26

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| 7 | University of Colorado Hospital Authority | | | | |

| | Revenue VRDO | 0.070% | 9/6/13 | 21,010 | 21,010 |

| 7 | West Virginia Hospital Finance Authority Hospital | | | | |

| | Revenue (Charleston Area Medical Center Inc.) | | | | |

| | VRDO | 0.070% | 9/6/13 | 29,555 | 29,555 |

| 7 | Wisconsin Health & Educational Facilities | | | | |

| | Authority Revenue (Gundersen Lutheran) VRDO | 0.080% | 9/6/13 | 11,000 | 11,000 |

| 7 | Wisconsin Health & Educational Facilities | | | | |

| | Authority Revenue (University of Wisconsin | | | | |

| | Medical Foundation) VRDO | 0.070% | 9/6/13 | 20,855 | 20,855 |

| 7 | Wyoming Student Loan Corp. Student | | | | |