UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2554

Name of Registrant: Vanguard Money Market Reserves

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: August 31

Date of reporting period: September 1, 2010 – August 31, 2011

Item 1: Reports to Shareholders

|

| Annual Report | August 31, 2011 |

| |

| Vanguard Money Market Funds |

| |

| Vanguard Prime Money Market Fund |

| Vanguard Federal Money Market Fund |

| Vanguard AdmiralTM Treasury Money Market Fund |

> For the 12 months ended August 31, 2011, the Vanguard Money Market Funds earned near-zero returns.

> Money market yields have remained negligible because of the Federal Reserve’s ongoing low-interest-rate policy.

> The three Vanguard funds posted slightly positive returns, while the average return of peer-group funds was 0%.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Prime Money Market Fund. | 9 |

| Federal Money Market Fund. | 32 |

| Admiral Treasury Money Market Fund. | 43 |

| About Your Fund’s Expenses. | 54 |

| Trustees Approve Advisory Arrangement. | 56 |

| Glossary. | 57 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

Fiscal Year Ended August 31, 2011

| | |

| | 7-Day SEC | Total |

| | Yields | Returns |

| Vanguard Prime Money Market Fund | | |

| Investor Shares | 0.03% | 0.06% |

| Institutional Shares | 0.11 | 0.17 |

| Money Market Funds Average | | 0.00 |

| Money Market Funds Average: Derived from data provided by Lipper Inc. |

| |

| Vanguard Federal Money Market Fund | 0.01% | 0.02% |

| Government Money Market Funds Average | | 0.00 |

| Government Money Market Funds Average: Derived from data provided by Lipper Inc. |

| |

| Vanguard Admiral Treasury Money Market Fund | 0.01% | 0.02% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | | 0.00 |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by iMoneyNet, Inc. |

The 7-day SEC yield of a money market fund more closely reflects the current earnings of the fund than its total return.

Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria.

1

Chairman’s Letter

Dear Shareholder,

Money market funds over the past 12 months have once again generated negligible returns. Yields of the Vanguard Money Market Funds continued to hover barely above zero as the Federal Reserve held short-term interest rates between 0% and 0.25%. Toward the end of the period, the Fed indicated that it expected to maintain this exceptionally low target at least through mid-2013.

Although it is small comfort, the funds’ advisor, Vanguard Fixed Income Group, has successfully navigated this challenging environment. Our funds’ returns, although tiny, were higher than the 0% average return of their peers.

Just as important, our money market funds followed their mandate to invest in very high-credit-quality securities, thus preserving our shareholders’ principal. Throughout the fiscal year, our three money market funds maintained a net asset value of $1 per share, as is expected but not guaranteed. On August 31, the Prime Money Market Fund’s 7-day SEC yield was 0.03% for Investor Shares, down from 0.07% six months earlier. As expected, the other funds’ yields were even lower.

As I mentioned in our last report to you, U.S. money market funds continue to implement changes required by the Securities and Exchange Commission (SEC) in reaction to the financial crisis of 2008. Besides shortening their average

2

maturity from 90 days to 60 days—which can reduce yields but enhance fund liquidity—money market funds are now posting their holdings five business days after the end of each month on their websites. In addition, the SEC is now posting funds’ “shadow net asset values” at month-end on its own site, with a 60-day delay. Shadow NAVs reflect the typically very minute differences between the amortized cost and the market prices of fund investments.

We have supported these enhancements to transparency and quality. As federal policymakers consider additional changes, Vanguard has been providing research and comments. These developments have not affected the high standards for credit quality and liquidity that we have always applied. We continue to believe that money market funds play an important role in our investors’ portfolios, as well as in the U.S. marketplace and economy.

Treasuries rallied as risk aversion returned

While the yields of money market instruments hovered near zero, bond yields rose (and prices declined) in the first half of the 12-month period as the prospect of improved economic growth and inflationary pressures set the bond market’s tone. Corporate bonds outperformed U.S. Treasury securities.

In the second half, risk aversion set the tone. Investors bid up Treasuries, trimming the yield of the 10-year Treasury note to barely 2%, and government bonds were

Market Barometer

| | | |

| | | Average Annual Total Returns |

| | | Periods Ended August 31, 2011 |

| | One | Three | Five |

| | Year | Years | Years |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 4.62% | 7.23% | 6.56% |

| Barclays Capital Municipal Bond Index (Broad tax-exempt | | | |

| market) | 2.66 | 6.00 | 4.94 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.12 | 0.24 | 1.69 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 19.06% | 0.84% | 1.11% |

| Russell 2000 Index (Small-caps) | 22.19 | 0.83 | 1.53 |

| Dow Jones U.S. Total Stock Market Index | 19.16 | 1.18 | 1.52 |

| MSCI All Country World Index ex USA (International) | 10.34 | -0.97 | 0.79 |

| |

| CPI | | | |

| Consumer Price Index | 3.77% | 1.12% | 2.13% |

3

among the market’s best performers. For the full year, the taxable investment-grade U.S. bond market returned 4.62%; the broad municipal bond market returned 2.66%.

Strong 12-month returns in a tale of two markets

Global stock markets delivered strong returns in a fiscal year marked by distinct periods of strength and then weakness. During the first six months, stock prices surged, with the broad U.S. stock market returning about 29%. As the slow, grinding economic recovery seemed to gather momentum, energy and industrial stocks, which are keenly sensitive to the rhythms of the business cycle, produced the best returns.

In the second six months, growth decelerated and stock market volatility spiked, amplified by Europe’s sovereign-debt drama, political wrangling over the U.S. debt ceiling, and Standard & Poor’s decision to downgrade the U.S. credit rating. (Vanguard’s confidence in the “full faith and credit” of the U.S. government remains unshaken.) Stock prices retreated, and those sectors that led the market in the first half lost ground in the second, displaced as leaders by defensive sectors such as utilities and consumer staples.

Maintaining high credit quality is a critical consideration

Since the Federal Reserve lowered short-term rates to historic lows nearly three years ago, money market fund

Expense Ratios

Your Fund Compared With Its Peer Group

| | | |

| | Investor | Institutional | Peer Group |

| | Shares | Shares | Average |

| Prime Money Market Fund | 0.23% | 0.09% | 0.40% |

| Federal Money Market Fund | 0.22 | — | 0.29 |

| Admiral Treasury Money Market Fund | 0.14 | — | 0.21 |

The fund expense ratios shown are from the prospectus dated December 23, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2011, the funds’ expense ratios were: for the Prime Money Market Fund, 0.20% for Investor Shares and 0.09% for Institutional Shares; for the Federal Money Market Fund, 0.19%; for the Admiral Treasury Money Market Fund, 0.11%. The expense ratios for the Federal Money Market Fund and the Admiral Treasury Money Market Fund reflect a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before the reduction, the expense ratios were: for the Federal Money Market Fund, 0.20%; for the Admiral Treasury Money Market Fund, 0.12%.

Peer groups are: for the Prime Money Market Fund, Money Market Funds; for the Federal Money Market Fund, Government Money Market Funds; for the Admiral Treasury Money Market Fund, U.S. Treasury Money Market Funds.

4

yields have fallen to almost nothing. Yields for our three money market funds were a hairsbreadth above zero for the 12 months ended August 31, 2011. Even so, the funds’ returns outpaced the 0% results of their benchmarks and peer-group averages.

At the end of the period, both the Admiral Treasury and Federal Money Market Funds posted a 7-day SEC yield of 0.01%. (These funds have been closed to new investors since 2009.) The Investor Shares of the Prime Money Market Fund yielded 0.03%, while the Institutional Shares, because of their lower expense ratio, yielded 0.11%. Returns for the 12 months were marginally higher.

In this environment, our advisor sought to produce as much income as possible consistent with the funds’ mandate of investing only in very high-quality instruments.

In fact, many investors these days are more concerned about credit quality than they are about the low returns produced by all money market funds—after all, fund advisors can’t control market interest rates, but they can control the nature of the securities the fund owns. Every potential holding—particularly for the Prime Money Market Fund, which invests in corporate and government securities—is thoroughly reviewed by a team of experienced credit analysts.

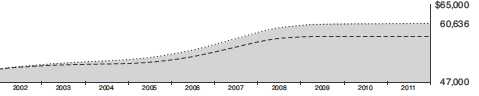

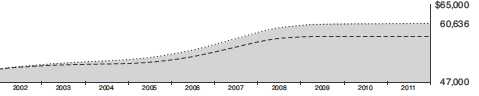

Total Returns

Ten Years Ended August 31, 2011

| |

| | Average |

| | Annual Return |

| Prime Money Market Fund Investor Shares | 2.09% |

| Money Market Funds Average | 1.59 |

| Money Market Funds Average: Derived from data provided by Lipper Inc. |

| Federal Money Market Fund | 2.02% |

| Government Money Market Funds Average | 1.57 |

| Government Money Market Funds Average: Derived from data provided by Lipper Inc. | |

| Admiral Treasury Money Market Fund | 1.95% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | 1.43 |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by iMoneyNet, Inc. |

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the funds. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in such a fund.

5

The advisor focused on securities issued by higher-rated sources

In recent months, the financial straits of some European governments have led to questions about the impact on money market funds that hold securities issued by banks and other borrowers in the regions. As of August 31, the Prime Money Market Fund had no direct exposure to instruments from issuers based in Greece, Ireland, Italy, Portugal, or Spain—Eurozone countries that, as the daily headlines proclaim, are under intense fiscal pressures. Indeed, the fund has had no such exposure for more than a year.

Most of the fund’s foreign investments are in securities issued by Australian banking institutions. Also represented are issuers from Canada, the United Kingdom, and non-euro countries in Scandinavia. The portfolio owns some securities from creditworthy banks in two Eurozone countries, Luxembourg and the Netherlands. It does not hold any securities from banks based in France or Germany, which have significant exposure to bonds of some of the most distressed Eurozone governments.

On August 31, about half of the Prime Money Market Fund’s assets were invested in U.S. Treasury bills and other U.S. government obligations.

About 24% of its assets were in dollar-denominated certificates of deposit issued mostly by Canadian, Australian, and non-euro European banks. A bit more than 20% of assets were invested in

Changes in Yields

| | |

| | | 7-Day SEC Yield |

| | August 31, | August 31, |

| | 2011 | 2010 |

| Prime Money Market Fund | | |

| Investor Shares | 0.03% | 0.13% |

| Institutional Shares | 0.11 | 0.26 |

| Federal Money Market Fund | 0.01 | 0.05 |

| Admiral Treasury Money Market Fund | 0.01 | 0.02 |

6

commercial paper issued by a wide range of industrial, financial, and governmental institutions across the globe. The portfolio also included a small allocation to U.S. municipal securities.

At the end of the fiscal year, the Admiral Treasury Money Market Fund was invested solely in U.S. Treasury securities, while the Federal Money Market Fund was invested mostly in obligations issued by agencies of the federal government, with the remainder of assets invested in U.S. Treasury bills.

A prudent approach for lean times

When will short-term interest rates emerge from the cellar? No one knows for sure. Predicting their future direction is always an uncertain enterprise, although the Federal Reserve foresees an extended period of rock-bottom rates for money market securities.

In the meantime, Vanguard will continue to manage its money market funds conservatively, with a constant focus on maintaining high credit quality. To that end, the credit analysts in Vanguard Fixed Income Group continually evaluate not only prospective investments but also securities that the portfolio already owns, and they recommend repositioning when warranted.

Balance and diversification for the short and long term

We’re confident that money market funds will remain a key part of the investment landscape, providing investors with a reliable source of stability and liquidity. Their utility is unquestioned, whether serving as a vehicle for investing short- term reserves or as part of a long-term investment plan.

We trust that your portfolio holds a diversified mix of assets, including money market funds, stocks, and bonds, in a steady allocation that fits your long-term needs and your tolerance for risk. Such a balanced, well-diversified portfolio can help put you on the road toward meeting your investment goals.

As always, thank you for your confidence in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

September 13, 2011

7

Advisor’s Report

Throughout the 12 months ended August 31, 2011, the United States continued to struggle under the weight of the deleveraging crisis that has affected everyone from homeowners to overly indebted nations. Consumers were saving more and spending less, leaving business leaders little incentive to hire in the face of sluggish demand.

The Federal Reserve has taken extraordinary measures designed to aid the U.S. economy, most recently by extending its guidance for low interest rates all the way out to 2013. Interest rates have fallen in response, and the Fed is prepared to do more if necessary.

Portfolio adjustments

In 2011, we made some adjustments to the Prime Money Market Fund portfolio. For more than a year, overindebtedness in the European periphery has been significantly affecting the short-term credit markets. In 2010, we stopped purchasing certificates of deposit and commercial paper from banks in Spain, Italy, France, and Germany. In 2011, as the situation became increasingly difficult, we continued to play defense and reduced our exposure throughout the rest of Europe.

The playbook isn’t very different from the one we followed during the depths of the financial crisis: Avoid credits that are under pressure. Invest in diverse, highly liquid assets. Adjust the portfolio’s position in U.S. Treasury and government securities to reflect current conditions.

We have significantly reduced our investment in bank certificates of deposit, most of which was in European credits. While some of those assets have been reallocated into additional Treasury and government securities, others have been diversified into commercial paper issued by names such as Coca-Cola, Pepsi, and Texas Instruments. We also added a number of high-quality asset-backed commercial paper programs, which provide an additional level of portfolio diversification.

The outlook

Demand for Treasuries remains strong amid investor concerns about market volatility and problems overseas. Treasury bill yields are hovering near 0%, with occasional dips into negative territory. With the Fed on hold for the next two years, these yields likely will remain exceptionally low.

Until the housing market begins to show signs of recovery, we expect the supply of agency securities to remain limited. We also expect agency yields to remain close to U.S. Treasury yields because of the agencies’ close ties to the U.S. government.

In the meantime, our approach will remain very conservative, with an emphasis on credit quality and price stability.

David R. Glocke, Principal

Vanguard Fixed Income Group

September 14, 2011

8

Prime Money Market Fund

Fund Profile

As of August 31, 2011

| | |

| Financial Attributes | | |

| | Investor | Institutional |

| | Shares | Shares |

| Ticker Symbol | VMMXX | VMRXX |

| Expense Ratio1 | 0.23% | 0.09% |

| 7-Day SEC Yield | 0.03% | 0.11% |

| Average Weighted | | |

| Maturity | 57 days | 57 days |

| |

| Sector Diversification (% of portfolio) | |

| Certificates of Deposit | | 0.9% |

| Repurchase Agreements | | 0.2 |

| U.S. Treasury Bills | | 20.3 |

| Yankee/Foreign | | 23.9 |

| Commercial Paper | | 20.2 |

| U.S. Government Agency Obligations | 30.1 |

| Other | | 4.4 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are not backed by the full faith and credit of the U.S. government.

| |

| Distribution by Credit Quality (% of portfolio) |

| First Tier | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. |

1 The expense ratios shown are from the prospectus dated December 23, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2011, the expense ratios were 0.20% for Investor Shares and 0.09% for Institutional Shares.

9

Prime Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

Cumulative Performance: August 31, 2001, Through August 31, 2011

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended August 31, 2011 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Prime Money Market Fund Investor | | | | |

| Shares | 0.06% | 2.04% | 2.09% | $12,294 |

| Citigroup Three-Month U.S. Treasury | | | | |

| Bill Index | 0.12 | 1.69 | 1.95 | 12,128 |

| |

| Money Market Funds Average | 0.00 | 1.63 | 1.59 | 11,705 |

Money Market Funds Average: Derived from data provided by Lipper Inc.

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $5,000,000 |

| | Year | Years | Years | Investment |

| Prime Money Market Fund Institutional | | | | |

| Shares | 0.17% | 2.18% | 2.26% | $6,255,143 |

| Citigroup Three-Month U.S. Treasury Bill | | | | |

| Index | 0.12 | 1.69 | 1.95 | 6,063,991 |

| Institutional Money Market Funds Average | 0.06 | 1.90 | 1.94 | 6,061,529 |

See Financial Highlights for dividend information.

10

Prime Money Market Fund

Fiscal-Year Total Returns (%): August 31, 2001, Through August 31, 2011

| | |

| | | Money |

| | | Market |

| | | Funds |

| | Investor Shares | Average |

| Fiscal Year | Total Returns | Total Returns |

| 2002 | 2.09% | 1.40% |

| 2003 | 1.12 | 0.60 |

| 2004 | 0.83 | 0.39 |

| 2005 | 2.31 | 1.68 |

| 2006 | 4.38 | 3.69 |

| 2007 | 5.23 | 4.55 |

| 2008 | 3.60 | 3.02 |

| 2009 | 1.31 | 0.62 |

| 2010 | 0.08 | 0.02 |

| 2011 | 0.06 | 0.00 |

| 7-day SEC yield (8/31/2011): 0.03% |

| Money Market Funds Average: Derived from data provided by Lipper Inc. |

Average Annual Total Returns: Periods Ended June 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 6/4/1975 | 0.08% | 2.21% | 2.15% |

| Institutional Shares | 10/3/1989 | 0.20 | 2.36 | 2.33 |

11

Prime Money Market Fund

Financial Statements

Statement of Net Assets

As of August 31, 2011

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| U.S. Government and Agency Obligations (50.8%) | | | |

| 2 | Fannie Mae Discount Notes | 0.065% | 9/12/11 | 812,000 | 811,984 |

| 2 | Fannie Mae Discount Notes | 0.150% | 9/13/11 | 71,600 | 71,596 |

| 2 | Fannie Mae Discount Notes | 0.085% | 9/14/11 | 30,000 | 29,999 |

| 2 | Fannie Mae Discount Notes | 0.050%–0.060% | 9/21/11 | 301,500 | 301,491 |

| 2 | Fannie Mae Discount Notes | 0.085% | 9/22/11 | 240,600 | 240,588 |

| 2 | Fannie Mae Discount Notes | 0.120% | 10/5/11 | 20,500 | 20,498 |

| 2 | Fannie Mae Discount Notes | 0.160% | 10/6/11 | 200,000 | 199,969 |

| 2 | Fannie Mae Discount Notes | 0.060%–0.160% | 10/12/11 | 572,809 | 572,732 |

| 2 | Fannie Mae Discount Notes | 0.075%–0.190% | 10/19/11 | 613,500 | 613,399 |

| 2 | Fannie Mae Discount Notes | 0.160% | 10/20/11 | 25,000 | 24,995 |

| 2 | Fannie Mae Discount Notes | 0.150% | 10/21/11 | 1,500,000 | 1,499,688 |

| 2 | Fannie Mae Discount Notes | 0.170% | 10/25/11 | 1,000,000 | 999,745 |

| 2 | Fannie Mae Discount Notes | 0.120%–0.170% | 10/26/11 | 588,507 | 588,364 |

| 2 | Fannie Mae Discount Notes | 0.150%–0.160% | 11/7/11 | 260,300 | 260,225 |

| 2 | Fannie Mae Discount Notes | 0.060%–0.080% | 11/9/11 | 95,186 | 95,173 |

| 2 | Fannie Mae Discount Notes | 0.070% | 11/16/11 | 84,667 | 84,654 |

| 2 | Federal Home Loan Bank Discount Notes | 0.050%–0.180% | 9/21/11 | 342,806 | 342,774 |

| 2 | Federal Home Loan Bank Discount Notes | 0.060% | 9/23/11 | 285,000 | 284,990 |

| 2 | Federal Home Loan Bank Discount Notes | 0.055%–0.140% | 9/28/11 | 1,778,600 | 1,778,464 |

| 2 | Federal Home Loan Bank Discount Notes | 0.070% | 9/30/11 | 101,238 | 101,232 |

| 2 | Federal Home Loan Bank Discount Notes | 0.055%–0.120% | 10/5/11 | 248,400 | 248,384 |

| 2 | Federal Home Loan Bank Discount Notes | 0.040%–0.150% | 10/14/11 | 1,513,890 | 1,513,735 |

| 2 | Federal Home Loan Bank Discount Notes | 0.075%–0.190% | 10/19/11 | 357,750 | 357,674 |

| 2 | Federal Home Loan Bank Discount Notes | 0.075%–0.190% | 10/21/11 | 1,230,915 | 1,230,746 |

| 2 | Federal Home Loan Bank Discount Notes | 0.120%–0.160% | 10/26/11 | 350,000 | 349,921 |

| 2 | Federal Home Loan Bank Discount Notes | 0.120%–0.145% | 11/2/11 | 200,000 | 199,952 |

| 2 | Federal Home Loan Bank Discount Notes | 0.060%–0.080% | 11/4/11 | 1,318,277 | 1,318,121 |

| 2 | Federal Home Loan Bank Discount Notes | 0.080% | 11/14/11 | 255,000 | 254,958 |

| 2,3 | Federal Home Loan Banks | 0.173% | 1/9/12 | 593,000 | 592,932 |

| 2,3 | Federal Home Loan Banks | 0.185% | 1/23/12 | 425,000 | 424,958 |

| 2,3 | Federal Home Loan Banks | 0.184% | 1/26/12 | 405,000 | 404,951 |

| 2,3 | Federal Home Loan Banks | 0.151% | 2/1/12 | 750,000 | 749,899 |

| 2,3 | Federal Home Loan Banks | 0.157% | 2/3/12 | 122,000 | 121,984 |

| 2,3 | Federal Home Loan Banks | 0.162% | 2/3/12 | 484,000 | 483,939 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.168% | 12/16/11 | 515,000 | 514,940 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.163% | 12/21/11 | 1,500,000 | 1,499,770 |

12

| | | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.168% | 2/16/12 | 470,400 | 470,309 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.157% | 8/24/12 | 2,515,000 | 2,513,818 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.151% | 2/4/13 | 1,000,000 | 999,272 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.173% | 3/21/13 | 907,000 | 906,288 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.155% | 5/6/13 | 980,000 | 979,208 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.142% | 6/3/13 | 950,000 | 949,326 |

| 2,3 | Federal Home Loan Mortgage Corp. | 0.160% | 6/17/13 | 83,000 | 82,925 |

| 2,3 | Federal National Mortgage Assn. | 0.235% | 8/23/12 | 1,455,500 | 1,455,068 |

| 2,3 | Federal National Mortgage Assn. | 0.240% | 9/17/12 | 988,000 | 987,791 |

| 2,3 | Federal National Mortgage Assn. | 0.235% | 11/23/12 | 1,772,795 | 1,772,134 |

| 2,3 | Federal National Mortgage Assn. | 0.243% | 12/20/12 | 494,500 | 494,369 |

| 2,3 | Federal National Mortgage Assn. | 0.251% | 12/28/12 | 219,000 | 218,941 |

| 2,3 | Federal National Mortgage Assn. | 0.197% | 8/12/13 | 1,000,000 | 999,408 |

| 2 | Freddie Mac Discount Notes | 0.150% | 9/14/11 | 79,360 | 79,356 |

| 2 | Freddie Mac Discount Notes | 0.070% | 9/30/11 | 41,762 | 41,760 |

| 2 | Freddie Mac Discount Notes | 0.120% | 10/5/11 | 27,000 | 26,997 |

| 2 | Freddie Mac Discount Notes | 0.050% | 10/6/11 | 50,100 | 50,098 |

| 2 | Freddie Mac Discount Notes | 0.040% | 10/12/11 | 150,000 | 149,993 |

| 2 | Freddie Mac Discount Notes | 0.130%–0.160% | 10/17/11 | 182,050 | 182,014 |

| 2 | Freddie Mac Discount Notes | 0.075%–0.170% | 10/24/11 | 539,300 | 539,184 |

| 2 | Freddie Mac Discount Notes | 0.170% | 10/31/11 | 489,584 | 489,445 |

| 2 | Freddie Mac Discount Notes | 0.160% | 11/1/11 | 30,725 | 30,717 |

| 2 | Freddie Mac Discount Notes | 0.080% | 11/2/11 | 62,300 | 62,291 |

| 2 | Freddie Mac Discount Notes | 0.070%–0.080% | 11/7/11 | 458,000 | 457,937 |

| 2 | Freddie Mac Discount Notes | 0.080%–0.150% | 11/9/11 | 331,500 | 331,439 |

| 2 | Freddie Mac Discount Notes | 0.120%–0.150% | 11/14/11 | 174,529 | 174,484 |

| | United States Treasury Bill | 0.170% | 9/1/11 | 253,120 | 253,120 |

| | United States Treasury Bill | 0.155% | 9/8/11 | 1,000,000 | 999,970 |

| | United States Treasury Bill | 0.135% | 9/15/11 | 600,000 | 599,969 |

| | United States Treasury Bill | 0.150% | 9/22/11 | 1,500,000 | 1,499,869 |

| | United States Treasury Bill | 0.170% | 9/29/11 | 1,500,000 | 1,499,802 |

| | United States Treasury Bill | 0.110% | 10/20/11 | 924,000 | 923,862 |

| | United States Treasury Bill | 0.115% | 10/27/11 | 1,000,000 | 999,821 |

| | United States Treasury Bill | 0.100%–0.115% | 11/3/11 | 3,347,671 | 3,347,006 |

| | United States Treasury Bill | 0.100% | 11/25/11 | 1,345,000 | 1,344,682 |

| | United States Treasury Bill | 0.015%–0.115% | 12/1/11 | 2,000,000 | 1,999,671 |

| | United States Treasury Bill | 0.105% | 12/8/11 | 1,000,000 | 999,714 |

| | United States Treasury Bill | 0.105% | 12/15/11 | 1,750,000 | 1,749,464 |

| | United States Treasury Bill | 0.100% | 12/22/11 | 1,250,000 | 1,249,611 |

| | United States Treasury Bill | 0.095%–0.106% | 12/29/11 | 2,150,000 | 2,149,288 |

| | United States Treasury Bill | 0.080% | 1/5/12 | 1,752,000 | 1,751,509 |

| | United States Treasury Bill | 0.100% | 1/26/12 | 1,500,000 | 1,499,388 |

| | United States Treasury Bill | 0.080% | 2/16/12 | 500,000 | 499,813 |

| Total U.S. Government and Agency Obligations (Cost $58,000,555) | | | 58,000,555 |

| Commercial Paper (20.3%) | | | | |

| Finance—Auto (1.5%) | | | | |

| | American Honda Finance Corp. | 0.150%–0.180% | 9/21/11 | 54,500 | 54,495 |

| | American Honda Finance Corp. | 0.170%–0.180% | 10/4/11 | 121,785 | 121,765 |

| | American Honda Finance Corp. | 0.170%–0.180% | 10/5/11 | 140,000 | 139,977 |

| | American Honda Finance Corp. | 0.190% | 10/18/11 | 27,500 | 27,493 |

| | American Honda Finance Corp. | 0.190% | 10/19/11 | 93,000 | 92,976 |

| | American Honda Finance Corp. | 0.190% | 10/20/11 | 124,000 | 123,968 |

| | American Honda Finance Corp. | 0.180% | 10/21/11 | 49,500 | 49,488 |

| | American Honda Finance Corp. | 0.180% | 10/24/11 | 28,000 | 27,993 |

13

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| American Honda Finance Corp. | 0.200% | 11/3/11 | 39,500 | 39,486 |

| American Honda Finance Corp. | 0.190%–0.220% | 11/14/11 | 117,100 | 117,051 |

| Toyota Motor Credit Corp. | 0.200% | 10/4/11 | 26,000 | 25,995 |

| Toyota Motor Credit Corp. | 0.280% | 11/10/11 | 12,750 | 12,743 |

| Toyota Motor Credit Corp. | 0.280% | 11/16/11 | 37,000 | 36,978 |

| Toyota Motor Credit Corp. | 0.270%–0.280% | 11/18/11 | 136,000 | 135,918 |

| Toyota Motor Credit Corp. | 0.280% | 11/21/11 | 99,000 | 98,938 |

| Toyota Motor Credit Corp. | 0.280% | 11/28/11 | 99,000 | 98,932 |

| Toyota Motor Credit Corp. | 0.280% | 11/29/11 | 109,000 | 108,925 |

| Toyota Motor Credit Corp. | 0.280% | 11/30/11 | 100,000 | 99,930 |

| Toyota Motor Credit Corp. | 0.341% | 1/19/12 | 116,000 | 115,847 |

| Toyota Motor Credit Corp. | 0.290% | 1/20/12 | 53,000 | 52,940 |

| Toyota Motor Credit Corp. | 0.401% | 2/22/12 | 38,000 | 37,926 |

| Toyota Motor Credit Corp. | 0.401% | 2/24/12 | 111,000 | 110,783 |

| | | | | 1,730,547 |

| Finance—Other (7.2%) | | | | |

| 4 Falcon Asset Securitization Co. LLC | 0.170% | 9/16/11 | 59,000 | 58,996 |

| 4 Falcon Asset Securitization Co. LLC | 0.170% | 9/20/11 | 60,000 | 59,995 |

| 4 Falcon Asset Securitization Co. LLC | 0.170% | 9/26/11 | 160,900 | 160,881 |

| General Electric Capital Corp. | 0.190% | 9/21/11 | 100,000 | 99,989 |

| General Electric Capital Corp. | 0.190% | 9/26/11 | 396,000 | 395,948 |

| General Electric Capital Corp. | 0.190% | 9/28/11 | 565,000 | 564,920 |

| General Electric Capital Corp. | 0.160% | 10/11/11 | 197,000 | 196,965 |

| General Electric Capital Corp. | 0.190% | 11/18/11 | 550,000 | 549,774 |

| General Electric Capital Corp. | 0.250% | 12/20/11 | 250,000 | 249,809 |

| General Electric Capital Corp. | 0.250% | 12/21/11 | 250,000 | 249,807 |

| General Electric Capital Services Inc. | 0.200% | 10/3/11 | 168,000 | 167,970 |

| General Electric Capital Services Inc. | 0.170% | 10/5/11 | 42,200 | 42,193 |

| General Electric Capital Services Inc. | 0.200% | 10/7/11 | 200,000 | 199,960 |

| General Electric Capital Services Inc. | 0.160% | 11/3/11 | 124,000 | 123,965 |

| 4 Govco LLC | 0.200% | 9/7/11 | 117,000 | 116,996 |

| 4 Govco LLC | 0.190% | 9/12/11 | 49,000 | 48,997 |

| 4 Govco LLC | 0.190%–0.200% | 9/13/11 | 197,000 | 196,987 |

| 4 Govco LLC | 0.190% | 9/15/11 | 198,000 | 197,985 |

| 4 Govco LLC | 0.190% | 9/19/11 | 118,000 | 117,989 |

| 4 Govco LLC | 0.190% | 9/21/11 | 157,250 | 157,233 |

| 4 Govco LLC | 0.190% | 9/23/11 | 50,000 | 49,994 |

| 4 Govco LLC | 0.190% | 9/26/11 | 78,500 | 78,490 |

| 4 Govco LLC | 0.260%–0.270% | 11/4/11 | 137,250 | 137,185 |

| 4 Govco LLC | 0.260%–0.330% | 11/14/11 | 213,600 | 213,481 |

| 4 Govco LLC | 0.330% | 11/15/11 | 109,250 | 109,175 |

| 4 Govco LLC | 0.335% | 11/22/11 | 92,000 | 91,930 |

| 4 Govco LLC | 0.335%–0.340% | 11/28/11 | 373,000 | 372,692 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 9/8/11 | 39,000 | 38,999 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 9/16/11 | 59,000 | 58,996 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 9/19/11 | 54,000 | 53,995 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 9/20/11 | 80,000 | 79,993 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 9/26/11 | 39,000 | 38,995 |

| 4 Jupiter Securitization Co. LLC | 0.170% | 10/3/11 | 59,000 | 58,991 |

| 4 Old Line Funding LLC | 0.180% | 9/6/11 | 398,500 | 398,490 |

| 4 Old Line Funding LLC | 0.180% | 9/7/11 | 29,000 | 28,999 |

| 4 Old Line Funding LLC | 0.170% | 9/8/11 | 99,000 | 98,997 |

| 4 Old Line Funding LLC | 0.180% | 9/9/11 | 43,000 | 42,998 |

| 4 Old Line Funding LLC | 0.170% | 9/12/11 | 191,017 | 191,007 |

| 4 Old Line Funding LLC | 0.170% | 9/19/11 | 30,000 | 29,997 |

14

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 4 Old Line Funding LLC | 0.170% | 9/20/11 | 160,000 | 159,986 |

| 4 Old Line Funding LLC | 0.170% | 10/3/11 | 39,000 | 38,994 |

| 4 Old Line Funding LLC | 0.170% | 10/4/11 | 82,500 | 82,487 |

| 4 Old Line Funding LLC | 0.170% | 10/6/11 | 55,308 | 55,299 |

| 4 Straight-A Funding LLC | 0.160% | 9/26/11 | 15,000 | 14,998 |

| 4 Straight-A Funding LLC | 0.160% | 9/26/11 | 98,000 | 97,989 |

| 4 Straight-A Funding LLC | 0.160% | 9/26/11 | 17,431 | 17,429 |

| 4 Straight-A Funding LLC | 0.160% | 9/26/11 | 70,887 | 70,879 |

| 4 Straight-A Funding LLC | 0.160% | 10/3/11 | 127,000 | 126,982 |

| 4 Straight-A Funding LLC | 0.160% | 10/4/11 | 40,000 | 39,994 |

| 4 Straight-A Funding LLC | 0.160% | 10/5/11 | 108,000 | 107,984 |

| 4 Straight-A Funding LLC | 0.160% | 10/11/11 | 50,000 | 49,991 |

| 4 Straight-A Funding LLC | 0.160% | 10/11/11 | 17,645 | 17,642 |

| 4 Straight-A Funding LLC | 0.160% | 10/11/11 | 85,000 | 84,985 |

| 4 Straight-A Funding LLC | 0.160% | 10/20/11 | 100,112 | 100,090 |

| 4 Straight-A Funding LLC | 0.190% | 11/7/11 | 100,000 | 99,965 |

| 4 Straight-A Funding LLC | 0.190% | 11/14/11 | 197,000 | 196,923 |

| 4 Straight-A Funding LLC | 0.190% | 11/14/11 | 260,000 | 259,899 |

| 4 Straight-A Funding LLC | 0.190% | 11/14/11 | 154,721 | 154,661 |

| 4 Straight-A Funding LLC | 0.190% | 11/15/11 | 172,554 | 172,486 |

| 4 Straight-A Funding LLC | 0.190% | 11/16/11 | 94,007 | 93,969 |

| | | | | 8,174,395 |

| Foreign Banks (5.9%) | | | | |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.311% | 10/3/11 | 297,000 | 296,918 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.280% | 10/6/11 | 150,000 | 149,959 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.250% | 11/8/11 | 96,105 | 96,060 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.250% | 11/9/11 | 120,000 | 119,943 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.230% | 12/2/11 | 183,000 | 182,892 |

| 4 Australia & New Zealand Banking Group, Ltd. | 0.351% | 2/16/12 | 247,000 | 246,597 |

| 4 Commonwealth Bank of Australia | 0.180% | 9/7/11 | 456,000 | 455,986 |

| 4 Commonwealth Bank of Australia | 0.331% | 9/14/11 | 500,000 | 499,940 |

| 4 Commonwealth Bank of Australia | 0.180% | 10/12/11 | 250,000 | 249,949 |

| 4 Commonwealth Bank of Australia | 0.265% | 11/21/11 | 450,000 | 449,732 |

| 4 Commonwealth Bank of Australia | 0.341% | 1/30/12 | 200,000 | 199,715 |

| 4 Commonwealth Bank of Australia | 0.346%–0.401% | 2/13/12 | 493,000 | 492,197 |

| Lloyds TSB Bank PLC | 0.218% | 9/7/11 | 440,000 | 439,984 |

| Rabobank USA Financial Corp. | 0.260% | 11/4/11 | 18,975 | 18,966 |

| 4 Westpac Banking Corp. | 0.190% | 9/6/11 | 114,100 | 114,097 |

| 4 Westpac Banking Corp. | 0.311% | 10/6/11 | 170,000 | 169,949 |

| 4 Westpac Banking Corp. | 0.290% | 10/21/11 | 517,000 | 516,792 |

| 4 Westpac Banking Corp. | 0.280% | 1/12/12 | 500,000 | 499,483 |

| 4 Westpac Banking Corp. | 0.351% | 1/30/12 | 47,450 | 47,380 |

| 4 Westpac Banking Corp. | 0.361% | 2/3/12 | 169,370 | 169,107 |

| 4 Westpac Banking Corp. | 0.351%–0.361% | 2/7/12 | 831,000 | 829,701 |

| 4 Westpac Banking Corp. | 0.371% | 2/16/12 | 499,000 | 498,138 |

| | | | | 6,743,485 |

| Foreign Governments (0.1%) | | | | |

| Banque et Caisse d’Epargne de L’Etat | 0.341% | 9/20/11 | 76,000 | 75,986 |

| Banque et Caisse d’Epargne de L’Etat | 0.260% | 12/5/11 | 75,000 | 74,949 |

| | | | | 150,935 |

| Foreign Industrial (2.5%) | | | | |

| 4 Nestle Capital Corp. | 0.200% | 9/1/11 | 365,000 | 365,000 |

| 4 Nestle Capital Corp. | 0.200% | 9/6/11 | 29,000 | 28,999 |

| 4 Nestle Capital Corp. | 0.120% | 10/11/11 | 400,375 | 400,321 |

15

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| 4 Nestle Capital Corp. | 0.150% | 11/10/11 | 106,000 | 105,969 |

| 4 Nestle Capital Corp. | 0.230% | 1/3/12 | 495,000 | 494,608 |

| Nestle Finance International Ltd. | 0.140% | 9/26/11 | 114,500 | 114,489 |

| Nestle Finance International Ltd. | 0.150% | 11/8/11 | 74,200 | 74,179 |

| Nestle Finance International Ltd. | 0.150% | 11/21/11 | 65,000 | 64,978 |

| Nestle Finance International Ltd. | 0.130% | 11/22/11 | 44,504 | 44,491 |

| Nestle Finance International Ltd. | 0.130% | 11/29/11 | 60,100 | 60,080 |

| Nestle Finance International Ltd. | 0.215% | 12/19/11 | 198,000 | 197,871 |

| 4 Novartis Finance Corp. | 0.290% | 9/12/11 | 36,774 | 36,771 |

| 4 Novartis Finance Corp. | 0.210%–0.250% | 10/11/11 | 31,650 | 31,642 |

| 4 Novartis Finance Corp. | 0.220% | 10/12/11 | 49,500 | 49,487 |

| 4 Novartis Securities Investment Ltd. | 0.140% | 9/9/11 | 74,400 | 74,398 |

| 4 Novartis Securities Investment Ltd. | 0.100% | 9/13/11 | 37,250 | 37,249 |

| 4 Novartis Securities Investment Ltd. | 0.180% | 10/11/11 | 46,000 | 45,991 |

| 4 Novartis Securities Investment Ltd. | 0.190% | 11/14/11 | 34,000 | 33,987 |

| 4 Novartis Securities Investment Ltd. | 0.190% | 11/18/11 | 61,000 | 60,975 |

| 4 Sanofi | 0.140% | 9/16/11 | 171,600 | 171,590 |

| 4 Siemens Capital Co. LLC | 0.100% | 9/19/11 | 19,230 | 19,229 |

| 4 Total Capital Canada, Ltd. | 0.311% | 9/16/11 | 40,500 | 40,495 |

| 4 Total Capital Canada, Ltd. | 0.080% | 9/23/11 | 168,100 | 168,092 |

| 4 Total Capital Canada, Ltd. | 0.195% | 2/29/12 | 99,000 | 98,903 |

| | | | | 2,819,794 |

| Industrial (3.1%) | | | | |

| 4 Abbott Laboratories | 0.090% | 9/19/11 | 49,250 | 49,248 |

| 4 Abbott Laboratories | 0.090% | 9/26/11 | 63,000 | 62,996 |

| General Electric Co. | 0.120% | 9/12/11 | 148,000 | 147,994 |

| 4 Johnson & Johnson | 0.160% | 2/28/12 | 50,000 | 49,960 |

| 4 Merck & Co Inc. | 0.110% | 9/7/11 | 73,800 | 73,799 |

| 4 PepsiCo Inc. | 0.080% | 9/6/11 | 27,500 | 27,500 |

| 4 PepsiCo Inc. | 0.080% | 9/12/11 | 118,740 | 118,737 |

| 4 PepsiCo Inc. | 0.100% | 10/3/11 | 49,500 | 49,496 |

| 4 Procter & Gamble Co. | 0.080% | 9/19/11 | 454,000 | 453,982 |

| 4 Procter & Gamble Co. | 0.100% | 10/5/11 | 7,750 | 7,749 |

| 4 Procter & Gamble Co. | 0.100% | 10/7/11 | 78,750 | 78,742 |

| 4 Procter & Gamble Co. | 0.120% | 10/12/11 | 78,000 | 77,989 |

| 4 Procter & Gamble Co. | 0.100%–0.110% | 10/14/11 | 90,995 | 90,984 |

| 4 Procter & Gamble Co. | 0.110% | 10/17/11 | 384,455 | 384,401 |

| 4 Texas Instruments Inc. | 0.120% | 10/7/11 | 117,000 | 116,986 |

| 4 The Coca-Cola Co. | 0.150% | 9/8/11 | 204,750 | 204,744 |

| 4 The Coca-Cola Co. | 0.150% | 9/22/11 | 141,500 | 141,488 |

| 4 The Coca-Cola Co. | 0.150% | 10/3/11 | 78,000 | 77,990 |

| 4 The Coca-Cola Co. | 0.130%–0.150% | 10/4/11 | 176,000 | 175,977 |

| 4 The Coca-Cola Co. | 0.120% | 10/12/11 | 72,225 | 72,215 |

| 4 The Coca-Cola Co. | 0.120% | 10/13/11 | 39,320 | 39,314 |

| 4 The Coca-Cola Co. | 0.150% | 11/1/11 | 98,950 | 98,925 |

| 4 The Coca-Cola Co. | 0.150% | 11/7/11 | 53,500 | 53,485 |

| 4 The Coca-Cola Co. | 0.150% | 11/8/11 | 53,000 | 52,985 |

| 4 The Coca-Cola Co. | 0.130% | 11/23/11 | 160,440 | 160,392 |

| 4 Wal-Mart Stores, Inc. | 0.190% | 9/13/11 | 265,000 | 264,983 |

| 4 Wal-Mart Stores, Inc. | 0.190% | 9/15/11 | 471,000 | 470,965 |

| | | | | 3,604,026 |

| Total Commercial Paper (Cost $23,223,182) | | | | 23,223,182 |

16

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Certificates of Deposit (25.0%) | | | | |

| Domestic Banks (0.9%) | | | | |

| Branch Banking & Trust Co. | 0.150% | 9/19/11 | 160,000 | 160,000 |

| Branch Banking & Trust Co. | 0.150% | 9/20/11 | 60,000 | 60,000 |

| Branch Banking & Trust Co. | 0.150% | 9/22/11 | 175,000 | 175,000 |

| Branch Banking & Trust Co. | 0.160% | 9/22/11 | 275,000 | 275,000 |

| Branch Banking & Trust Co. | 0.170% | 10/3/11 | 109,000 | 109,000 |

| Branch Banking & Trust Co. | 0.210% | 10/5/11 | 300,000 | 300,000 |

| | | | | 1,079,000 |

| Eurodollar Certificates of Deposit (9.2%) | | | | |

| Australia & New Zealand Banking Group, Ltd. | 0.320% | 10/5/11 | 495,000 | 495,000 |

| Australia & New Zealand Banking Group, Ltd. | 0.320% | 10/6/11 | 496,000 | 496,000 |

| Australia & New Zealand Banking Group, Ltd. | 0.310% | 10/18/11 | 300,000 | 300,008 |

| Australia & New Zealand Banking Group, Ltd. | 0.290% | 10/21/11 | 250,000 | 250,000 |

| Australia & New Zealand Banking Group, Ltd. | 0.280% | 11/4/11 | 247,000 | 247,000 |

| Australia & New Zealand Banking Group, Ltd. | 0.350% | 2/9/12 | 250,000 | 250,000 |

| Bank of Nova Scotia | 0.240% | 11/28/11 | 68,000 | 68,000 |

| Commonwealth Bank of Australia | 0.230% | 12/12/11 | 200,000 | 200,000 |

| Commonwealth Bank of Australia | 0.380% | 2/23/12 | 700,000 | 700,000 |

| DNB NOR Bank ASA (London Branch) | 0.195% | 10/12/11 | 1,200,000 | 1,200,007 |

| HSBC Bank PLC | 0.340% | 9/19/11 | 500,000 | 500,000 |

| HSBC Bank PLC | 0.330% | 10/3/11 | 450,000 | 450,000 |

| HSBC Bank PLC | 0.320% | 10/6/11 | 495,000 | 495,000 |

| HSBC Bank PLC | 0.300% | 10/11/11 | 500,000 | 500,000 |

| HSBC Bank PLC | 0.310% | 10/17/11 | 493,000 | 493,000 |

| HSBC Bank PLC | 0.285% | 11/9/11 | 349,000 | 349,003 |

| National Australia Bank Ltd. | 0.330% | 9/2/11 | 245,000 | 245,000 |

| National Australia Bank Ltd. | 0.275% | 12/2/11 | 780,000 | 780,000 |

| National Australia Bank Ltd. | 0.320% | 12/29/11 | 240,000 | 240,000 |

| National Australia Bank Ltd. | 0.320% | 1/12/12 | 1,000,000 | 1,000,000 |

| National Australia Bank Ltd. | 0.400% | 2/16/12 | 750,000 | 750,000 |

| National Australia Bank Ltd. | 0.400% | 2/17/12 | 445,000 | 445,000 |

| | | | | 10,453,018 |

| Yankee Certificates of Deposit (14.9%) | | | | |

| Abbey National Treasury Services PLC | | | | |

| (US Branch) | 0.420% | 9/7/11 | 360,000 | 360,000 |

| Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.250% | 11/17/11 | 99,000 | 99,000 |

| Australia & New Zealand Banking Group, Ltd. | | | | |

| (New York Branch) | 0.220% | 12/13/11 | 35,000 | 35,000 |

| Bank of Montreal (Chicago Branch) | 0.190% | 9/28/11 | 430,000 | 430,000 |

| Bank of Montreal (Chicago Branch) | 0.190% | 9/30/11 | 150,000 | 150,000 |

| Bank of Montreal (Chicago Branch) | 0.200% | 11/7/11 | 1,137,000 | 1,137,000 |

| Bank of Montreal (Chicago Branch) | 0.250% | 11/15/11 | 397,000 | 397,000 |

| Bank of Montreal (Chicago Branch) | 0.250% | 11/22/11 | 180,000 | 180,000 |

| Bank of Nova Scotia (Houston Branch) | 0.190% | 9/6/11 | 14,000 | 14,000 |

| Bank of Nova Scotia (Houston Branch) | 0.180% | 9/9/11 | 315,000 | 315,000 |

| Bank of Nova Scotia (Houston Branch) | 0.240% | 11/7/11 | 400,000 | 400,000 |

| Bank of Nova Scotia (Houston Branch) | 0.250% | 11/8/11 | 1,000,000 | 1,000,000 |

| Bank of Nova Scotia (Houston Branch) | 0.235% | 11/18/11 | 600,000 | 599,994 |

| Bank of Nova Scotia (Houston Branch) | 0.260% | 11/22/11 | 420,000 | 420,000 |

| Bank of Nova Scotia (Houston Branch) | 0.250% | 12/16/11 | 150,000 | 150,000 |

| Bank of Nova Scotia (Houston Branch) | 0.250% | 12/20/11 | 280,000 | 280,000 |

17

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Credit Suisse (New York Branch) | 0.260% | 10/26/11 | 200,000 | 200,000 |

| DNB NOR Bank ASA (New York Branch) | 0.300% | 11/28/11 | 500,000 | 500,000 |

| Lloyds TSB Bank PLC (New York Branch) | 0.300% | 11/28/11 | 330,000 | 330,000 |

| Lloyds TSB Bank PLC (New York Branch) | 0.300% | 11/30/11 | 500,000 | 500,000 |

| Nordea Bank Finland PLC (New York Branch) | 0.290% | 11/2/11 | 300,000 | 300,000 |

| Nordea Bank Finland PLC (New York Branch) | 0.310% | 11/30/11 | 500,000 | 500,000 |

| Nordea Bank Finland PLC (New York Branch) | 0.250% | 12/6/11 | 300,000 | 300,000 |

| Nordea Bank Finland PLC (New York Branch) | 0.240% | 12/9/11 | 44,000 | 44,000 |

| Nordea Bank Finland PLC (New York Branch) | 0.280% | 1/11/12 | 640,000 | 640,000 |

| Rabobank Nederland NV (New York Branch) | 0.350% | 9/1/11 | 645,000 | 645,000 |

| Rabobank Nederland NV (New York Branch) | 0.350% | 9/16/11 | 420,000 | 420,000 |

| Rabobank Nederland NV (New York Branch) | 0.340% | 10/6/11 | 175,000 | 175,000 |

| Rabobank Nederland NV (New York Branch) | 0.270% | 11/9/11 | 800,000 | 800,000 |

| Royal Bank of Canada (New York Branch) | 0.320% | 9/14/11 | 495,000 | 495,000 |

| Royal Bank of Canada (New York Branch) | 0.280% | 10/11/11 | 300,000 | 300,000 |

| Royal Bank of Canada (New York Branch) | 0.250% | 12/20/11 | 600,000 | 600,000 |

| Royal Bank of Canada (New York Branch) | 0.350% | 2/22/12 | 492,000 | 492,000 |

| Royal Bank of Scotland PLC (Connecticut Branch) | 0.240% | 10/3/11 | 200,000 | 200,000 |

| Svenska Handelsbanken (New York Branch) | 0.195% | 9/7/11 | 300,000 | 300,000 |

| Svenska Handelsbanken (New York Branch) | 0.300% | 11/1/11 | 250,000 | 250,000 |

| Svenska Handelsbanken (New York Branch) | 0.300% | 11/3/11 | 270,000 | 270,000 |

| Svenska Handelsbanken (New York Branch) | 0.310% | 11/30/11 | 500,000 | 500,000 |

| Toronto Dominion Bank (New York Branch) | 0.170% | 9/1/11 | 297,500 | 297,500 |

| Toronto Dominion Bank (New York Branch) | 0.330% | 9/6/11 | 197,000 | 197,000 |

| Toronto Dominion Bank (New York Branch) | 0.330% | 9/6/11 | 178,000 | 178,000 |

| Toronto Dominion Bank (New York Branch) | 0.330% | 9/9/11 | 75,000 | 75,000 |

| Toronto Dominion Bank (New York Branch) | 0.280% | 10/20/11 | 247,000 | 247,000 |

| Toronto Dominion Bank (New York Branch) | 0.240% | 12/1/11 | 297,500 | 297,500 |

| Toronto Dominion Bank (New York Branch) | 0.350% | 2/15/12 | 297,000 | 297,000 |

| Westpac Banking Corp. (New York Branch) | 0.230% | 12/7/11 | 200,000 | 200,000 |

| Westpac Banking Corp. (New York Branch) | 0.360% | 2/9/12 | 496,000 | 496,000 |

| | | | | 17,012,994 |

| Total Certificates of Deposit (Cost $28,545,012) | | | | 28,545,012 |

| Repurchase Agreements (0.2%) | | | | |

| Barclays Capital Inc. | | | | |

| (Dated 8/31/11, Repurchase Value | | | | |

| $10,000,000, collateralized by U.S. | | | | |

| Treasury Note/Bond 4.500%, 8/15/39) | 0.040% | 9/1/11 | 10,000 | 10,000 |

| Credit Suisse Securities (USA) LLC | | | | |

| (Dated 8/31/11, Repurchase Value | | | | |

| $50,000,000, collateralized by U.S. | | | | |

| Treasury Note/Bond 3.625%, 8/15/19) | 0.050% | 9/1/11 | 50,000 | 50,000 |

| RBC Capital Markets LLC | | | | |

| (Dated 8/31/11, Repurchase Value | | | | |

| $10,000,000, collateralized by U.S. | | | | |

| Treasury Note/Bond 0.500%, 8/15/14) | 0.050% | 9/1/11 | 10,000 | 10,000 |

| RBC Capital Markets LLC | | | | |

| (Dated 8/31/11, Repurchase Value | | | | |

| $71,640,000, collateralized by U.S. | | | | |

| Treasury Note/Bond 0.500%, 8/15/14) | 0.100% | 9/1/11 | 71,640 | 71,640 |

18

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| RBS Securities, Inc. | | | | |

| (Dated 8/31/11, Repurchase Value | | | | |

| $30,000,000, collateralized by U.S. | | | | |

| Treasury Note/Bond 0.625%, 6/30/12) | 0.060% | 9/1/11 | 30,000 | 30,000 |

| Total Repurchase Agreements (Cost $171,640) | | | | 171,640 |

| |

| | | | Shares | |

| Money Market Fund (1.3%) | | | | |

| 5 Vanguard Municipal Cash Management Fund | | | | |

| (Cost $1,460,019) | 0.170% | | 1,460,019,065 | 1,460,019 |

| |

| | | | Face | |

| | | | Amount | |

| | | | ($000) | |

| Tax-Exempt Municipal Bonds (3.1%) | | | | |

| Akron OH Bath & Copley Joint Township | | | | |

| Hospital District Revenue (Akron General | | | | |

| Health System) VRDO | 0.160% | 9/7/11 | 19,500 | 19,500 |

| Arizona Health Facilities Authority Revenue | | | | |

| (Banner Health) VRDO | 0.170% | 9/7/11 | 35,400 | 35,400 |

| Arizona Health Facilities Authority Revenue | | | | |

| (Banner Health) VRDO | 0.170% | 9/7/11 | 39,315 | 39,315 |

| Ascension Parish LA Industrial Development | | | | |

| Board Revenue (IMTT-Geismar Project) VRDO | 0.170% | 9/7/11 | 79,000 | 79,000 |

| Bi-State Development Agency of the | | | | |

| Missouri-Illinois Metropolitan District VRDO | 0.210% | 9/7/11 | 29,800 | 29,800 |

| Birmingham AL Public Educational Building | | | | |

| Student Housing Revenue (University of | | | | |

| Alabama at Birmingham Project) VRDO | 0.210% | 9/7/11 | 16,575 | 16,575 |

| Board of Regents of the University of Texas | | | | |

| System Revenue Financing System Revenue | | | | |

| VRDO | 0.090% | 9/7/11 | 17,425 | 17,425 |

| Board of Regents of the University of Texas | | | | |

| System Revenue Financing System Revenue | | | | |

| VRDO | 0.150% | 9/7/11 | 58,300 | 58,300 |

| Board of Regents of the University of Texas | | | | |

| System Revenue Financing System Revenue | | | | |

| VRDO | 0.150% | 9/7/11 | 95,000 | 95,000 |

| Boone County KY Pollution Control Revenue | | | | |

| (Duke Energy Kentucky Inc. Project) VRDO | 0.140% | 9/7/11 | 19,000 | 19,000 |

| California Housing Finance Agency | | | | |

| Home Mortgage Revenue VRDO | 0.150% | 9/7/11 | 24,520 | 24,520 |

| California Housing Finance Agency | | | | |

| Home Mortgage Revenue VRDO | 0.150% | 9/7/11 | 10,300 | 10,300 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Redlands Community | | | | |

| Hospital) VRDO | 0.150% | 9/7/11 | 22,100 | 22,100 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (SPC Buildings 1 & 3 LLC) VRDO | 0.170% | 9/7/11 | 24,000 | 24,000 |

| Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Oasbo Expanded Asset Program) | | | | |

| VRDO | 0.210% | 9/7/11 | 19,200 | 19,200 |

19

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Connecticut Health & Educational Facilities | | | | |

| Authority Revenue (Yale University) VRDO | 0.110% | 9/7/11 | 35,000 | 35,000 |

| Curators of the University of Missouri System | | | | |

| Facilities Revenue VRDO | 0.170% | 9/7/11 | 62,150 | 62,150 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.180% | 9/7/11 | 76,100 | 76,100 |

| District of Columbia Revenue | | | | |

| (George Washington University) VRDO | 0.170% | 9/7/11 | 27,560 | 27,560 |

| District of Columbia Revenue | | | | |

| (Georgetown University) VRDO | 0.170% | 9/7/11 | 17,200 | 17,200 |

| District of Columbia Revenue | | | | |

| (Georgetown University) VRDO | 0.170% | 9/7/11 | 7,575 | 7,575 |

| District of Columbia Revenue | | | | |

| (Washington Drama Society) VRDO | 0.200% | 9/7/11 | 20,375 | 20,375 |

| Fairfax County VA Economic Development | | | | |

| Authority Resource Recovery Revenue | | | | |

| (Lorton Arts Foundation Project) VRDO | 0.190% | 9/7/11 | 10,600 | 10,600 |

| Harris County TX Cultural Education Facilities | | | | |

| Finance Corp. Hospital Revenue (Memorial | | | | |

| Hermann Healthcare System) VRDO | 0.170% | 9/7/11 | 42,000 | 42,000 |

| Harris County TX Cultural Education Facilities | | | | |

| Finance Corp. Medical Facilities Revenue | | | | |

| (Baylor College of Medicine) VRDO | 0.160% | 9/7/11 | 42,500 | 42,500 |

| Idaho Housing & Finance Association | | | | |

| Single Family Mortgage Revenue VRDO | 0.170% | 9/7/11 | 16,800 | 16,800 |

| Idaho Housing & Finance Association | | | | |

| Single Family Mortgage Revenue VRDO | 0.190% | 9/7/11 | 29,205 | 29,205 |

| Illinois Development Finance Authority Revenue | | | | |

| (Chicago Horticultural Society) VRDO | 0.190% | 9/7/11 | 16,300 | 16,300 |

| Illinois Finance Authority Pollution Control | | | | |

| Revenue (Commonwealth Edison Co. Project) | | | | |

| VRDO | 0.160% | 9/7/11 | 29,400 | 29,400 |

| Illinois Finance Authority Revenue | | | | |

| (Carle Foundation) VRDO | 0.150% | 9/7/11 | 31,905 | 31,905 |

| Illinois Finance Authority Revenue | | | | |

| (Carle Healthcare System) VRDO | 0.100% | 9/7/11 | 44,665 | 44,665 |

| Illinois Finance Authority Revenue | | | | |

| (Ingalls Health System) VRDO | 0.150% | 9/7/11 | 43,000 | 43,000 |

| Illinois Finance Authority Revenue | | | | |

| (Little Co. of Mary Hospital & | | | | |

| Health Care Centers) VRDO | 0.200% | 9/7/11 | 17,815 | 17,815 |

| Illinois Finance Authority Revenue | | | | |

| (Museum of Science & Industry) VRDO | 0.210% | 9/7/11 | 13,000 | 13,000 |

| Indiana Development Finance Authority | | | | |

| Educational Facilities Revenue (Indianapolis | | | | |

| Museum of Art Inc. Project) VRDO | 0.160% | 9/7/11 | 14,400 | 14,400 |

| Indiana Educational Facilities Authority Revenue | | | | |

| (Wabash College) VRDO | 0.200% | 9/7/11 | 23,940 | 23,940 |

| Indiana Finance Authority Health System Revenue | | | | |

| (Sisters of St. Francis Health Services Inc. | | | | |

| Obligated Group) VRDO | 0.200% | 9/7/11 | 22,445 | 22,445 |

| Indiana Finance Authority Revenue | | | | |

| (Lease Appropriation) VRDO | 0.180% | 9/7/11 | 15,075 | 15,075 |

| Jacksonville FL Capital Project Revenue VRDO | 0.260% | 9/7/11 | 26,400 | 26,400 |

20

| | | | |

| Prime Money Market Fund | | | �� | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Kentucky Economic Development Finance | | | | |

| Authority Hospital Revenue (Baptist Healthcare | | | | |

| System Obligated Group) VRDO | 0.120% | 9/7/11 | 25,035 | 25,035 |

| Kentucky Higher Education Student Loan Corp. | | | | |

| Student Loan Revenue VRDO | 0.200% | 9/7/11 | 33,235 | 33,235 |

| Knox County TN Health Educational & | | | | |

| Housing Facilities Board Hospital Facilities | | | | |

| (Covenant Healthcare) VRDO | 0.170% | 9/7/11 | 15,690 | 15,690 |

| Los Angeles CA Wastewater System Revenue | | | | |

| VRDO | 0.140% | 9/7/11 | 37,300 | 37,300 |

| Los Angeles CA Wastewater System Revenue | | | | |

| VRDO | 0.160% | 9/7/11 | 20,400 | 20,400 |

| Los Angeles CA Wastewater System Revenue | | | | |

| VRDO | 0.240% | 9/7/11 | 23,200 | 23,200 |

| Los Angeles CA Wastewater System Revenue | | | | |

| VRDO | 0.240% | 9/7/11 | 27,595 | 27,595 |

| Loudoun County VA Industrial Development | | | | |

| Authority Revenue (Howard Hughes Medical | | | | |

| Institute) VRDO | 0.120% | 9/7/11 | 49,365 | 49,365 |

| Loudoun County VA Industrial Development | | | | |

| Authority Revenue (Howard Hughes Medical | | | | |

| Institute) VRDO | 0.130% | 9/7/11 | 18,855 | 18,855 |

| Louisiana Public Facilities Authority Hospital | | | | |

| Revenue (Franciscan Missionaries) VRDO | 0.180% | 9/7/11 | 11,650 | 11,650 |

| Maine Health & Higher Educational Facilities | | | | |

| Authority Revenue (Bowdoin College) VRDO | 0.200% | 9/7/11 | 15,130 | 15,130 |

| Maryland Health & Higher Educational Facilities | | | | |

| Authority Revenue (Johns Hopkins University) | | | | |

| VRDO | 0.130% | 9/7/11 | 30,635 | 30,635 |

| Maryland Health & Higher Educational Facilities | | | | |

| Authority Revenue (University of Maryland | | | | |

| Medical System) VRDO | 0.170% | 9/7/11 | 30,160 | 30,160 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Bentley College) VRDO | 0.150% | 9/7/11 | 21,900 | 21,900 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Dana Farber Cancer | | | | |

| Institute) VRDO | 0.180% | 9/7/11 | 9,015 | 9,015 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) VRDO | 0.150% | 9/7/11 | 19,320 | 19,320 |

| Metropolitan Atlanta GA Rapid Transportation | | | | |

| Authority Georgia Sales Tax Revenue VRDO | 0.150% | 9/7/11 | 43,100 | 43,100 |

| Miami-Dade County FL Special Obligation | | | | |

| Revenue (Juvenile Courthouse Project) VRDO | 0.140% | 9/7/11 | 25,350 | 25,350 |

| Michigan Higher Education Facilities Authority | | | | |

| Revenue (Albion College) VRDO | 0.220% | 9/7/11 | 13,000 | 13,000 |

| Michigan Hospital Finance Authority Revenue | | | | |

| (Henry Ford Health System) VRDO | 0.160% | 9/7/11 | 32,925 | 32,925 |

| Middletown OH Hospital Facilities Revenue | | | | |

| (Atrium Medical Center) VRDO | 0.170% | 9/7/11 | 22,000 | 22,000 |

| Minneapolis & St. Paul MN Housing & | | | | |

| Redevelopment Authority Health Care System | | | | |

| Revenue (Allina Health System) VRDO | 0.150% | 9/7/11 | 15,000 | 15,000 |

| Missouri Health & Educational Facilities Authority | | | | |

| Health Facilities Revenue (BJC Health System) | | | | |

| VRDO | 0.170% | 9/7/11 | 18,000 | 18,000 |

21

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| Missouri Health & Educational Facilities Authority | | | | |

| Health Facilities Revenue (SSM Health Care) | | | | |

| VRDO | 0.130% | 9/7/11 | 83,775 | 83,775 |

| New Jersey Health Care Facilities Financing | | | | |

| Authority Revenue (AHS Hospital Corp.) VRDO | 0.210% | 9/7/11 | 19,130 | 19,130 |

| New Jersey Health Care Facilities Financing | | | | |

| Authority Revenue (Hospital Capital Asset | | | | |

| Pooled Program) VRDO | 0.180% | 9/7/11 | 19,600 | 19,600 |

| New Jersey Transportation Trust Fund Authority | | | | |

| Transportation System Revenue VRDO | 0.140% | 9/7/11 | 32,800 | 32,800 |

| New York City NY GO VRDO | 0.140% | 9/7/11 | 58,550 | 58,550 |

| New York City NY GO VRDO | 0.150% | 9/7/11 | 29,800 | 29,800 |

| New York City NY GO VRDO | 0.160% | 9/7/11 | 11,775 | 11,775 |

| New York City NY GO VRDO | 0.160% | 9/7/11 | 9,825 | 9,825 |

| New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (Carnegie Park) VRDO | 0.130% | 9/7/11 | 39,505 | 39,505 |

| New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (Monterey) VRDO | 0.130% | 9/7/11 | 21,980 | 21,980 |

| New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (One Columbus Place Development) VRDO | 0.150% | 9/7/11 | 8,100 | 8,100 |

| New York City NY Housing Development Corp. | | | | |

| Multi-Family Rental Housing Revenue | | | | |

| (West End Towers) VRDO | 0.150% | 9/7/11 | 31,300 | 31,300 |

| New York City NY Industrial Development | | | | |

| Agency Civic Facility Revenue (New York | | | | |

| Law School) VRDO | 0.180% | 9/7/11 | 14,885 | 14,885 |

| New York State Dormitory Authority Revenue | | | | |

| (Fordham University) VRDO | 0.190% | 9/7/11 | 30,805 | 30,805 |

| New York State Dormitory Authority Revenue | | | | |

| (Fordham University) VRDO | 0.190% | 9/7/11 | 30,645 | 30,645 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (10 Liberty Street) VRDO | 0.140% | 9/7/11 | 20,500 | 20,500 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (125 West 31st Street) VRDO | 0.170% | 9/7/11 | 42,300 | 42,300 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (20 River Terrace Housing) | | | | |

| VRDO | 0.170% | 9/7/11 | 17,300 | 17,300 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (320 West 38th Street) VRDO | 0.140% | 9/7/11 | 31,500 | 31,500 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (330 West 39th Street) VRDO | 0.190% | 9/7/11 | 26,100 | 26,100 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (70 Battery Place) VRDO | 0.150% | 9/7/11 | 12,800 | 12,800 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (Clinton Green - South) VRDO | 0.170% | 9/7/11 | 11,625 | 11,625 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (Clinton Green North) VRDO | 0.170% | 9/7/11 | 31,845 | 31,845 |

| New York State Housing Finance Agency | | | | |

| Housing Revenue (East 84th Street) VRDO | 0.160% | 9/7/11 | 24,500 | 24,500 |

| New York State Urban Development Corp. | | | | |

| Revenue (Service Contract) VRDO | 0.170% | 9/7/11 | 10,375 | 10,375 |

22

| | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Yield1 | Date | ($000) | ($000) |

| North Texas Higher Education Authority | | | | |

| Student Loan Revenue VRDO | 0.230% | 9/7/11 | 29,900 | 29,900 |

| North Texas Tollway Authority System Revenue | | | | |

| VRDO | 0.170% | 9/7/11 | 35,100 | 35,100 |

| Oakland University of Michigan Revenue VRDO | 0.170% | 9/7/11 | 8,900 | 8,900 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Dayton Power & Light Co. Project) VRDO | 0.160% | 9/7/11 | 11,100 | 11,100 |

| Ohio GO VRDO | 0.130% | 9/7/11 | 23,515 | 23,515 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (University Hospitals Health | | | | |

| System Inc.) VRDO | 0.160% | 9/7/11 | 25,000 | 25,000 |

| Ohio State University General Receipts Revenue | | | | |

| VRDO | 0.130% | 9/7/11 | 115,300 | 115,300 |

| Ohio State University General Receipts Revenue | | | | |

| VRDO | 0.140% | 9/7/11 | 29,525 | 29,525 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (University of Pennsylvania | | | | |

| Health System) VRDO | 0.140% | 9/7/11 | 45,065 | 45,065 |

| Pittsburgh PA Water & Sewer Authority Revenue | | | | |

| VRDO | 0.310% | 9/7/11 | 57,850 | 57,850 |

| Salem OH Hospital Facilities Revenue | | | | |

| (Salem Community Hospital Project) VRDO | 0.170% | 9/7/11 | 13,400 | 13,400 |

| San Antonio TX Electric & Gas Systems Revenue | | | | |

| VRDO | 0.260% | 9/7/11 | 35,355 | 35,355 |

| Tarrant County TX Cultural Education Facilities | | | | |

| Finance Corp. Revenue (CHRISTUS Health) | | | | |

| VRDO | 0.170% | 9/7/11 | 18,400 | 18,400 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.170% | 9/7/11 | 28,900 | 28,900 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.170% | 9/7/11 | 42,400 | 42,400 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.200% | 9/7/11 | 23,035 | 23,035 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Family Revenue VRDO | 0.220% | 9/7/11 | 34,620 | 34,620 |

| Texas Department of Housing & Community | | | | |

| Affairs Single Mortgage Revenue VRDO | 0.200% | 9/7/11 | 69,085 | 69,085 |

| Torrance CA Hospital Revenue (Torrance | | | | |

| Memorial Medical Center) VRDO | 0.150% | 9/7/11 | 19,600 | 19,600 |

| University of Alabama Birmingham Hospital | | | | |

| Revenue VRDO | 0.250% | 9/7/11 | 24,100 | 24,100 |

| University of South Florida Financing Corp. | | | | |

| COP VRDO | 0.180% | 9/7/11 | 40,700 | 40,700 |

| University of Texas Permanent University Fund | | | | |

| Revenue VRDO | 0.110% | 9/7/11 | 66,305 | 66,305 |

| University of Texas Permanent University Fund | | | | |

| Revenue VRDO | 0.140% | 9/7/11 | 152,100 | 152,100 |

| Utah Housing Corp. Single Family Mortgage | | | | |

| Revenue VRDO | 0.170% | 9/7/11 | 19,250 | 19,250 |

| Utah Housing Corp. Single Family Mortgage | | | | |

| Revenue VRDO | 0.170% | 9/7/11 | 15,500 | 15,500 |

| Virginia Small Business Financing Authority | | | | |

| Health Facilities Revenue (Bon Secours Health | | | | |

| System Inc.) VRDO | 0.180% | 9/7/11 | 7,200 | 7,200 |

23

| | | | | |

| Prime Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Yield1 | Date | ($000) | ($000) |

| | Warren County KY Revenue (Western Kentucky | | | | |

| | University Student Life Foundation Inc. Project) | | | | |

| | VRDO | 0.200% | 9/7/11 | 19,500 | 19,500 |

| 6 | Washington County PA Authority Revenue | | | | |

| | (Girard Estate Project) VRDO | 0.200% | 9/7/11 | 11,040 | 11,040 |

| | Washington Health Care Facilities Authority | | | | |

| | Revenue (Multi Care Health System) VRDO | 0.170% | 9/7/11 | 24,975 | 24,975 |

| | Washington Health Care Facilities Authority | | | | |

| | Revenue (Swedish Health Services) VRDO | 0.130% | 9/7/11 | 20,500 | 20,500 |

| | West Virginia Hospital Finance Authority Hospital | | | | |

| | Revenue (Charleston Area Medical Center Inc.) | | | | |

| | VRDO | 0.150% | 9/7/11 | 30,045 | 30,045 |

| | Wisconsin Health & Educational Facilities | | | | |

| | Authority Revenue (Aurora Health Care Inc.) | | | | |

| | VRDO | 0.160% | 9/7/11 | 31,200 | 31,200 |

| 6 | Los Angeles CA Department of Water & | | | | |

| | Power Revenue TOB VRDO | 0.270% | 9/7/11 | 13,000 | 13,000 |

| Total Tax-Exempt Municipal Bonds (Cost $3,565,490) | | | | 3,565,490 |

| Taxable Municipal Bonds (0.0%) | | | | |

| 6 | Massachusetts State Transportation Fund | | | | |

| | Revenue TOB VRDO | 0.270% | 9/7/11 | 13,100 | 13,100 |

| 6 | Seattle WA Municipal Light & Power Revenue | | | | |

| | TOB VRDO | 0.270% | 9/7/11 | 6,400 | 6,400 |

| Total Taxable Municipal Bonds (Cost $19,500) | | | | 19,500 |

| Total Investments (100.7%) (Cost $114,985,398) | | | | 114,985,398 |

| Other Assets and Liabilities (-0.7%) | | | | |

| Other Assets | | | | 458,172 |

| Liabilities | | | | (1,300,646) |

| | | | | | (842,474) |

| Net Assets (100%) | | | | 114,142,924 |

24

Prime Money Market Fund

| |

| At August 31, 2011, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 114,134,618 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Gains | 8,306 |

| Net Assets | 114,142,924 |

| |

| Investor Shares—Net Assets | |

| Applicable to 92,387,498,956 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 92,403,666 |

| Net Asset Value Per Share—Investor Shares | $1.00 |

| |

| Institutional Shares—Net Assets | |

| Applicable to 21,736,467,632 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 21,739,258 |

| Net Asset Value Per Share—Institutional Shares | $1.00 |

See Note A in Notes to Financial Statements.

1 Represents annualized yield at date of purchase for discount securities, and coupon for coupon-bearing securities.

2 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

3 Adjustable-rate security.

4 Security exempt from registration under Section 4(2) of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration only to dealers in that program or other “accredited investors.” At August 31, 2011, the aggregate value of these securities was $17,337,368,000, representing 15.2% of net assets.

5 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

6 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At August 31, 2011, the aggregate value of these securities was $43,540,000.

GO—General Obligation Bond.

TOB—Tender Option Bond.

VRDO—Variable Rate Demand Obligation.

See accompanying Notes, which are an integral part of the Financial Statements.

25

Prime Money Market Fund

Statement of Operations

| |

| | Year Ended |

| | August 31, 2011 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest1 | 286,720 |

| Total Income | 286,720 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 5,208 |

| Management and Administrative—Investor Shares | 143,283 |

| Management and Administrative—Institutional Shares | 10,760 |

| Marketing and Distribution—Investor Shares | 28,095 |

| Marketing and Distribution—Institutional Shares | 6,317 |

| Custodian Fees | 1,586 |

| Auditing Fees | 28 |

| Shareholders’ Reports—Investor Shares | 683 |

| Shareholders’ Reports—Institutional Shares | 110 |

| Trustees’ Fees and Expenses | 137 |

| Total Expenses | 196,207 |

| Net Investment Income | 90,513 |

| Realized Net Gain (Loss) on Investment Securities Sold | 1,676 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 92,189 |

| 1 Interest income from an affiliated company of the fund was $2,577,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

26

Prime Money Market Fund

Statement of Changes in Net Assets

| | |

| | Year Ended August 31, |

| | 2011 | 2010 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 90,513 | 118,919 |

| Realized Net Gain (Loss) | 1,676 | 1,651 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 92,189 | 120,570 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (55,253) | (78,239) |

| Institutional Shares | (35,260) | (40,680) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| Institutional Shares | — | — |

| Total Distributions | (90,513) | (118,919) |

| Capital Share Transactions | | |

| Investor Shares | 3,718,120 | (7,395,143) |

| Institutional Shares | 2,631,581 | 784,242 |

| Net Increase (Decrease) from Capital Share Transactions | 6,349,701 | (6,610,901) |

| Total Increase (Decrease) | 6,351,377 | (6,609,250) |

| Net Assets | | |

| Beginning of Period | 107,791,547 | 114,400,797 |

| End of Period | 114,142,924 | 107,791,547 |

See accompanying Notes, which are an integral part of the Financial Statements.

27

Prime Money Market Fund

Financial Highlights

| | | | | |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | | | | Year Ended August 31, |

| Throughout Each Period | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | .001 | .001 | .013 | .035 | .051 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .001 | .001 | .013 | .035 | .051 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.001) | (.001) | (.013) | (.035) | (.051) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.001) | (.001) | (.013) | (.035) | (.051) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.06% | 0.08% | 1.31% | 3.60% | 5.23% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $92,404 | $88,684 | $96,078 | $92,483 | $84,052 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets | 0.20% | 0.23% | 0.28%2 | 0.23% | 0.24% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.06% | 0.08% | 1.25% | 3.49% | 5.10% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.