UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-09005 |

Name of Registrant: | Vanguard Massachusetts Tax-Exempt Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: November 30 | |

Date of reporting period: December 1, 2012 – November 30, 2013 |

Item 1: Reports to Shareholders | |

Annual Report | November 30, 2013

Vanguard Massachusetts Tax-Exempt Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 9 |

| Fund Profile. | 12 |

| Performance Summary. | 13 |

| Financial Statements. | 15 |

| About Your Fund’s Expenses. | 33 |

| Glossary. | 35 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas.

This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the

flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| | | | | |

| Fiscal Year Ended November 30, 2013 | | | | | |

| | | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield | Returns | Returns | Returns |

| Vanguard Massachusetts Tax-Exempt Fund | 2.94% | 5.48% | 3.02% | -7.73% | -4.71% |

| Barclays MA Municipal Bond Index | | | | | -3.52 |

| Massachusetts Municipal Debt Funds Average | | | | | -6.88 |

| Massachusetts Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 43.4% and

the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the

calculation.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2012, Through November 30, 2013 | | | | |

| |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Massachusetts Tax-Exempt Fund | $11.13 | $10.27 | $0.340 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

The 12 months ended November 30, 2013, marked a difficult period for the municipal bond market, mainly because of a slump from May through August. The Barclays Municipal Bond Index returned about –6% through that stretch before recovering somewhat, and it ended the fiscal year with a return of –3.51%.

Although Vanguard Massachusetts Tax-Exempt Fund felt the effects of the slump, it took steps to mitigate the damage. The fund returned –4.71% for the 12 months, trailing the –3.52% return of its benchmark, the Barclays Massachusetts Municipal Bond Index, but outpacing the –6.88% average return of competing Massachusetts tax-exempt funds. Its capital return of –7.73%, a result of rising interest rates, was partly offset by a 3.02% return in interest income.

Because bond yields and prices move in opposite directions, the fund’s 30-day SEC yield rose from 1.62% as of November 30, 2012, to 3.14% at the end of August before sliding to 2.94% as of November 30, 2013.

The fixed income markets, for both taxable and tax-exempt bonds, were roiled over the summer by investors’ concerns about whether the Federal Reserve would begin tapering its stimulative bond-buying

2

program. Detroit’s bankruptcy filing in July further rattled muni investors, even though the city’s long-standing financial challenges were widely known. Fresh coverage of Puerto Rico’s financial struggles added unease. As the fiscal year drew to a close, investors’ concerns about future Fed actions flared again, and municipal bond prices dipped.

Although state and local governments clearly still face financial challenges, they generally are tackling them head-on with restrained budgets. Postrecession tax revenues have risen at the state and, more recently, local levels. The situations in Detroit and Puerto Rico can be viewed as outliers to the trend. In Massachusetts, budgets are revised according to revenue collections, and the state has rebuilt healthy reserve levels to address future uncertainty.

Please note: The fund is permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). However, as of November 30, it owned none of these bonds.

On another matter, we announced in early November that Robert F. Auwaerter, principal and head of Vanguard Fixed Income Group, intends to retire in March 2014. Later in this letter, I’ll have more to say about Bob’s important contributions to Vanguard in his 32-year career, and I’ll introduce his successor, Gregory Davis.

| | | |

| Market Barometer | | | |

| | Average Annual Total Returns |

| | Periods Ended November 30, 2013 |

| | One | Three | Five |

| | Year | Years | Years |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | -1.61% | 3.09% | 5.33% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -3.51 | 4.23 | 6.26 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.07 | 0.10 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 30.96% | 17.78% | 18.33% |

| Russell 2000 Index (Small-caps) | 40.99 | 17.89 | 20.97 |

| Russell 3000 Index (Broad U.S. market) | 31.71 | 17.78 | 18.54 |

| MSCI All Country World Index ex USA (International) | 18.24 | 7.50 | 13.87 |

| |

| CPI | | | |

| Consumer Price Index | 1.24% | 2.13% | 1.87% |

3

Bond prices fell as yields rose over the period’s second half

Bonds held onto slight gains through the first five months of the fiscal year before retreating in May. For the full 12 months, the broad U.S. taxable bond market returned –1.61%. The yield of the 10-year Treasury note closed at 2.74%, up from 1.61% at the end of November 2012. Municipal bonds returned –3.51%.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –2.93%. Returns of money market funds and savings accounts continued to be restrained by the Fed’s 0%–0.25% target for short-term interest rates.

The bond market’s downturn, coupled with an upswing in stocks, provides an occasion for investors to review their portfolio’s asset allocation. In a powerful stock market rally, a portfolio’s mix of stocks and bonds can drift away from its target allocation, as Fran Kinniry, a principal in our Investment Strategy Group, recently reminded clients in an article on our website. “Buying stocks now may actually run counter to what many prudent investors should be doing,” he noted. “If you have an equity-heavy portfolio, you will most likely need to direct new cash flows to bond mutual funds, or sell stock mutual funds to maintain your target asset allocation.”

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Massachusetts Tax-Exempt Fund | 0.16% | 1.11% |

The fund expense ratio shown is from the prospectus dated March 28, 2013, and represents estimated costs for the current fiscal year. For

the fiscal year ended November 30, 2013, the fund’s expense ratio was 0.16%. The peer-group expense ratio is derived from data provided by

Lipper, a Thomson Reuters Company, and captures information through year-end 2012.

Peer group: Massachusetts Municipal Debt Funds.

4

Despite jolts, U.S. stocks notched an impressive 12-month gain

U.S. stocks powered to a return of about 32% for the 12 months ended November 30, despite a few bumps along the way. Uncertainty surrounding Fed policy contributed to market declines in June and August. But stocks bounced back in September, when, to the surprise of some investors, the Fed announced it had no immediate plans to scale back its stimulative bond-buying program. (In mid-December, the Fed ended several months of speculation by announcing that it would begin scaling back bond purchases in January 2014.) Corporate profit growth, though not robust, was generally solid.

International stocks returned about 18% in aggregate. While the developed markets of Europe and the Pacific region performed well, gains were modest for emerging-market stocks.

Advisor’s strategy helped dampen the impact of rising rates

Anticipating an eventual rise in yields and accompanying decline in prices after the extremely low interest rates of recent years, Vanguard Fixed Income Group, advisor to our national and state municipal bond funds, maintained shorter durations than peer funds, on average. Duration gauges the sensitivity of bond prices to rate changes, and shorter durations (measured in months and years) mitigate price declines when rates rise.

| |

| Total Returns | |

| Ten Years Ended November 30, 2013 | |

| | Average |

| | Annual Return |

| Massachusetts Tax-Exempt Fund | 3.93% |

| Barclays MA Municipal Bond Index | 4.43 |

| Massachusetts Municipal Debt Funds Average | 3.33 |

Massachusetts Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

|

| Munis’ yields exceed Treasury yields: What does it mean? |

| |

| At times over the 12 months ended November 30, 10-year municipal bonds nationwide yielded |

| substantially more than their Treasury counterparts, even before factoring in munis’ tax-favored |

| status. This reversal of what had been the historical relationship between Treasuries and munis |

| has occurred often in recent years. The turmoil started with the 2008–2009 financial crisis and |

| continued amid dire headlines about state and local finances. |

| |

| Through June, July, and August, a time when investor concerns mounted over Detroit’s |

| bankruptcy filing and the financial health of Puerto Rico, 10-year municipal yields averaged |

| 31 basis points, or about 12%, more than 10-year Treasuries. By the end of November, the |

| gap had closed significantly, but 10-year muni yields were still averaging about 8 basis points, |

| or 3%, more. Over the past decade, however, muni yields have averaged 5% less than their |

| Treasury equivalents. |

| |

| We believe investors shouldn’t be unduly swayed by this turnabout. Will it vanish if they chase |

| it? Or do investors now perceive muni bonds to be riskier? Rather than speculate, we believe |

| investors should carefully evaluate the role of tax-exempt bonds in a diversified portfolio. For |

| any investor, the proportion of muni holdings (if any) should be based on long-term goals, risk |

| tolerance, and tax considerations—not on what may be transient yield trends. |

6

The advisor also favored bonds whose other features made them less susceptible to the effects of rising rates. And compared with some previous periods, the funds maintained higher levels of reserves, consisting of high-quality bonds (as determined by independent credit-rating agencies) that could be sold easily to meet shareholder redemptions.

As I mentioned, the Massachusetts Tax-Exempt Fund surpassed the average return of its peers. Our competitors generally favored longer durations, and their operating costs, paid directly from returns, were noticeably higher, as you can see in the table on page 4. They also typically held fewer reserves and more bonds of lower liquidity, which can have higher yields but can be tough to sell during turbulent periods. Additionally, peer funds, on average, had significantly more exposure to Puerto Rico issuers, which dramatically underperformed the broader market over the period.

Over the last decade, the fund performed well versus its peers

For the ten years ended November 30, 2013, the Massachusetts Tax-Exempt Fund’s average annual return was 3.93%, lagging its benchmark return of 4.43% but surpassing the 3.33% peer fund average.

Although competitors generally have higher costs than Vanguard, benchmark indexes have none, which gives the benchmarks a built-in performance edge. Of course, we pay attention to such indexes, but our most important measure of a fund’s relative success is how it performs compared with its peers. The Massachusetts Tax-Exempt Fund’s strong results are primarily due to the skill of our portfolio managers, traders, and credit analysts. They also reflect the competitive advantage that Vanguard’s low-cost philosophy can create.

Bob Auwaerter’s retirement marks the end of a remarkable era

In mid-September 2008, about two weeks after I succeeded Jack Brennan as Vanguard’s chief executive officer, Lehman Brothers went bankrupt, igniting the nation’s worst financial crisis in 70 years. It was, to put it mildly, an extremely challenging time. Through it all, I was able to depend on Bob Auwaerter’s strong command of the Fixed Income Group, which persevered under these treacherous conditions. Although that was a difficult period for Vanguard and the industry, it was far from the only time I was grateful to have Bob at the helm of our bond group.

Bob, who joined Vanguard in 1981, was an original member of the three-person Fixed Income Group headed by Ian MacKinnon. Over the years, Bob held various leadership roles in the department, and he eventually succeeded Ian as its head in 2003. He earned a reputation at Vanguard and within the industry as an extremely dedicated, honest, and insightful decision-maker and leader.

7

The Fixed Income Group that Bob helped start began with total assets of about $1.3 billion in seven funds. He tracked his positions in the two funds he managed then on index cards stored in a small metal box. Thirty-two years later, the 120-person group oversees $750 billion, which represents nearly one-third of Vanguard’s assets under management.

On behalf of our clients, I thank Bob for more than three decades of exemplary service and wish him the best in his retirement.

We’re fortunate that Greg Davis will become the head of the Fixed Income Group. Greg currently serves as chief investment officer for the Asia Pacific region and as a director of Vanguard Investments Australia. He joined Vanguard in 1999 and had been head of bond

indexing and a senior portfolio manager in the Fixed Income Group. Greg is an eminently qualified successor and has a strong commitment to the Vanguard way of investing. I couldn’t be more confident in his ability to lead the Fixed Income Group and its deep and talented team.

As always, thank you for investing in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

December 12, 2013

8

Advisor’s Report

For the fiscal year ended November 30, 2013, Vanguard Massachusetts Tax-Exempt Fund returned –4.71%. The fund lagged its benchmark––the Barclays Massachusetts Municipal Bond Index, which returned –3.52%––but was ahead of the –6.88% average return of its peer funds.

The investment environment

Some uncertainty is natural in the financial markets, but during the fiscal year, conditions were more unsettled than usual, largely because of fiscal battles in Washington and apprehension over what the Federal Reserve might do.

The struggles in Washington included a debate over the debt ceiling and the partial government shutdown in October, both of which were resolved at least temporarily.

Although gross domestic product (the broadest measure of goods and services produced across the economy) increased at an annual rate of about 2% during the fiscal year, progress was uneven. Largely because of an earlier fiscal drama—the political showdown over scheduled tax increases and spending cuts known as the “fiscal cliff”—the rate of growth slowed during the first half of fiscal 2013, although it accelerated in the second half.

With the unemployment rate declining from 7.8% in November 2012 to 7.0% in November 2013, housing markets improving, and equity markets nearing all-time highs, the Federal Reserve openly contemplated reducing its aggressive bond-buying program.

| | |

| Yields of Tax-Exempt Municipal Securities | | |

| (AAA-Rated General-Obligation Issues) | | |

| | November 30, | November 30, |

| Maturity | 2012 | 2013 |

| 2 years | 0.30% | 0.33% |

| 5 years | 0.64 | 1.16 |

| 10 years | 1.47 | 2.65 |

| 30 years | 2.47 | 4.10 |

| Source: Vanguard. |

9

But the Fed’s suggestion in late May that it might “taper” its purchases surprised the bond markets, leading to a broad decline in bond prices over the summer as yields increased, especially for longer-term bonds. The Fed didn’t suggest any change in its target of 0% to 0.25% for short-term interest rates. As a result, the national municipal yield curve (the spread between shorter- and longer-term yields) steepened, as you can see in the table on page 9: While the short end of the yield curve remained anchored near 0.3%, the yield of 30-year munis increased more than 1.5 percentage points during the fiscal year.

Shortly after the close of the fiscal year, the Fed did announce that it planned to end its bond-buying program by the end of 2014, through small reductions, starting in January. It also made clear that it had no plans to change its stance on short-term rates.

Yields were also pushed higher during the fiscal year by a reduced supply of new issues of municipal bonds, reflecting the spending restraint of issuers as they continued to recover from the Great Recession. New issues in Massachusetts were expected to total about $8 billion in the 2013 calendar year, representing a drop of about 5% from a year earlier.

A bright spot is that Massachusetts state tax revenues (after accounting for inflation) have shown varying degrees of growth for six straight quarters, according to the most recent data available from the Nelson A. Rockefeller Institute of Government. The funding of future payments for pensions and other benefits, of course, remains an intermediate- to long-term challenge for most states and local governments.

The Massachusetts economy, which has generally fared better than the nation’s since the financial crisis, has been mixed over the last 12 months. Unemployment rose to 7.1% in November from 6.7% a year earlier. Health care and higher education provide a relatively stable labor base. However, initial federal budget cuts and the slowing global economy have contributed to weakness in the state’s economy.

Still, Massachusetts tax revenues during the state’s fiscal year, which ended June 30, 2013, increased about 5% from the previous year, according to data from the Rockefeller Institute. Some of the increase was tied to one-time payments on capital gains as residents sold profitable investments before fiscal cliff legislation permanently raised federal taxes on the gains for some taxpayers. Recent pension reform now requires Massachusetts to fund liabilities on a set schedule. The change was accompanied by a reduction in some retiree benefits and an increase in the retirement age for most state employees.

Massachusetts, which has one of the nation’s highest levels of debt per capita, also has one of the highest per capita personal income levels. The high debt per capita is largely a result of the state’s funding of major services, including education and transportation, that are funded at the local level in most other states.

10

Management of the funds

Funds with long-term maturities were affected most by the painful spring and summer, while those with shorter-term maturities weathered the volatility better. Yields rose more for bonds with maturities of 10 years or greater. This dynamic proved to be an advantage for the Massachusetts Tax-Exempt Fund when compared with its peer group, but not with its benchmark index.

The fund entered the period with a significant underweight to Puerto Rico bonds relative to its peers, and these bonds suffered notable declines. (State municipal funds can include Puerto Rico bonds; the state in the fund’s name refers to the home state of the investors for whom the fund’s income is tax-free.) The Massachusetts Tax-Exempt Fund also held fewer Puerto Rico bonds than its peers, while its benchmark held none; thus, the fund’s allocation to these bonds helped its results compared to peers but hurt them compared to the benchmark. By the period’s end, the fund had eliminated its modest exposure to Puerto Rico bonds.

While overall bond issuance was down in Massachusetts, we were able to purchase several new issues from the Massachusetts School Building Authority and the University of Massachusetts, as well as general obligation bonds.

A look ahead

We expect the U.S. economy to grow at a rate approaching 3% in 2014 and the unemployment rate to keep falling. But the federal fiscal uncertainties of 2013 will continue into 2014, and we wouldn’t be surprised if talk of tax reform, a subject that can include muni bonds, resurfaces after dying down during the past year.

The gradual reduction in the Federal Reserve’s bond-buying program that will begin in January should allow the Fed to bring the program to a close by the end of 2014. Of course, the market’s reaction to the Fed’s tapering is a big unknown. For short-term rates, we suspect that the Fed may announce that it will not change its policy until unemployment falls to 6%, and that this will delay any changes in this segment of the market.

As the Fed starts tapering, and if economic growth picks up, we expect that interest rates will move higher and lower-quality bonds will outperform. To defend against this, we plan to gradually upgrade the credit quality of the portfolio, as lower-quality bonds are likely to become overvalued. There is the risk of higher volatility, however, depending on how fast the economy grows and how the market reacts to the Fed’s reduction of its bond purchases.

Christopher W. Alwine, CFA, Principal,

Head of Municipal Bond Funds

Marlin G. Brown, Portfolio Manager

Vanguard Fixed Income Group

December 18, 2013

11

Massachusetts Tax-Exempt Fund

Fund Profile

As of November 30, 2013

| | | |

| Financial Attributes | | | |

| |

| | | Barclays | |

| | | MA | Barclays |

| | | Municipal | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 247 | 1,597 | 46,517 |

| Yield to Maturity | | | |

| (before expenses) | 3.1% | 2.6% | 3.1% |

| Average Coupon | 4.7% | 4.9% | 4.9% |

| Average Duration | 7.3 years | 8.0 years | 8.4 years |

| Average Effective | | | |

| Maturity | 7.8 years | 6.9 years | 7.1 years |

| Ticker Symbol | VMATX | — | — |

| Expense Ratio1 | 0.16% | — | — |

| 30-Day SEC Yield | 2.94% | — | — |

| Short-Term | | | |

| Reserves | 5.3% | — | — |

| | |

| Volatility Measures | | |

| | Barclays MA | Barclays |

| | Municipal | Municipal |

| | Bond Index | Bond Index |

| R-Squared | 0.99 | 0.98 |

| Beta | 1.10 | 1.11 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| |

| Distribution by Effective Maturity | |

| (% of portfolio) | |

| Under 1 Year | 4.8% |

| 1 - 3 Years | 12.4 |

| 3 - 5 Years | 18.2 |

| 5 - 10 Years | 49.3 |

| 10 - 20 Years | 9.7 |

| 20 - 30 Years | 5.1 |

| Over 30 Years | 0.5 |

| |

| Distribution by Credit Quality (% of portfolio) |

| AAA | 17.8% |

| AA | 58.7 |

| A | 16.4 |

| BBB | 6.9 |

| Not Rated | 0.2 |

| For information about these ratings, see the Glossary entry for Credit Quality. |

Investment Focus

1 The expense ratio shown is from the prospectus dated March 28, 2013, and represents estimated costs for the current fiscal year. For the

fiscal year ended November 30, 2013, the expense ratio was 0.16%.

12

Massachusetts Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

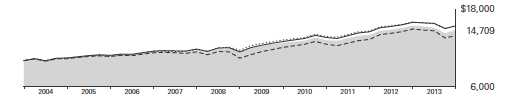

Cumulative Performance: November 30, 2003, Through November 30, 2013

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended November 30, 2013 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Massachusetts Tax-Exempt Fund | -4.71% | 5.38% | 3.93% | $14,709 |

| •••••••• | Barclays MA Municipal Bond Index | -3.52 | 5.84 | 4.43 | 15,432 |

| – – – – | Massachusetts Municipal Debt | | | | |

| | | -6.88 | 5.98 | 3.33 | 13,876 |

| | Barclays Funds Average Municipal Bond Index | -3.51 | 6.26 | 4.40 | 15,385 |

| Massachusetts Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

See Financial Highlights for dividend and capital gains information.

13

Massachusetts Tax-Exempt Fund

Fiscal-Year Total Returns (%): November 30, 2003, Through November 30, 2013

| | | | |

| | | | | Barclays MA |

| | | | | Municipal |

| | | | | Bond Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2004 | 4.13% | -0.88% | 3.25% | 3.82% |

| 2005 | 4.12 | -0.59 | 3.53 | 3.43 |

| 2006 | 4.38 | 2.16 | 6.54 | 6.13 |

| 2007 | 4.18 | -2.03 | 2.15 | 3.27 |

| 2008 | 4.00 | -6.72 | -2.72 | -1.30 |

| 2009 | 4.42 | 7.94 | 12.36 | 13.60 |

| 2010 | 3.80 | -0.39 | 3.41 | 3.96 |

| 2011 | 3.76 | 2.56 | 6.32 | 6.41 |

| 2012 | 3.49 | 6.92 | 10.41 | 9.57 |

| 2013 | 3.02 | -7.73 | -4.71 | -3.52 |

Average Annual Total Returns: Periods Ended September 30, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Massachusetts | | | | | | |

| Tax-Exempt Fund | 12/9/1998 | -3.28% | 5.26% | 3.94% | 0.01% | 3.95% |

14

Massachusetts Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.5%) | | | | |

| Massachusetts (100.1%) | | | | |

| Boston MA GO | 5.000% | 2/1/24 | 2,345 | 2,738 |

| Boston MA GO | 5.000% | 3/1/24 | 5,745 | 6,817 |

| Boston MA Housing Authority Revenue | 5.000% | 4/1/23 (4) | 2,000 | 2,125 |

| Boston MA Housing Authority Revenue | 5.000% | 4/1/25 (4) | 5,440 | 5,684 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/20 | 1,550 | 1,846 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/25 | 3,725 | 4,177 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/30 | 1,000 | 1,091 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/30 | 750 | 825 |

| Braintree MA GO | 5.000% | 5/15/27 | 4,000 | 4,481 |

| Cambridge MA GO | 5.000% | 1/1/23 | 850 | 996 |

| Holyoke MA GO | 5.000% | 9/1/30 | 1,690 | 1,803 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.000% | 7/1/22 | 5,500 | 6,531 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.250% | 7/1/31 | 2,285 | 2,621 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.250% | 7/1/34 | 14,500 | 15,786 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.000% | 7/1/41 | 5,000 | 5,260 |

| Massachusetts Bay Transportation Authority | | | | |

| General Transportation Revenue | 6.200% | 3/1/16 | 3,760 | 3,946 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.500% | 7/1/17 (ETM) | 75 | 88 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/22 | 3,500 | 4,223 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.500% | 7/1/22 | 5,285 | 6,479 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.000% | 7/1/23 | 4,000 | 4,754 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.000% | 7/1/24 | 1,325 | 1,574 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.500% | 7/1/24 | 3,020 | 3,738 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.500% | 7/1/26 (14) | 2,000 | 2,408 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 0.000% | 7/1/29 | 1,020 | 504 |

15

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/33 | 4,025 | 4,522 |

| 1 Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue TOB VRDO | 0.270% | 12/6/13 | 2,893 | 2,893 |

| Massachusetts Clean Energy Cooperative Corp. | | | | |

| Revenue (Municipal Lighting Plant) | 5.000% | 7/1/28 | 3,000 | 3,264 |

| Massachusetts Clean Energy Cooperative Corp. | | | | |

| Revenue (Municipal Lighting Plant) | 5.000% | 7/1/29 | 3,300 | 3,558 |

| Massachusetts Clean Energy Cooperative Corp. | | | | |

| Revenue (Municipal Lighting Plant) | 5.000% | 7/1/32 | 2,500 | 2,646 |

| Massachusetts College Building Authority | | | | |

| Revenue | 0.000% | 5/1/17 (10) | 3,340 | 3,201 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/25 | 1,100 | 1,248 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/29 | 1,500 | 1,677 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/30 | 1,500 | 1,639 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/30 | 1,075 | 1,163 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/36 | 6,360 | 6,681 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/41 | 3,000 | 3,121 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/43 | 3,285 | 3,429 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/20 | 3,500 | 4,069 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/32 | 5,620 | 5,798 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/35 | 2,350 | 2,449 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/37 | 3,000 | 3,066 |

| 2 Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue VRDO | 0.040% | 12/6/13 | 7,000 | 7,000 |

| 2 Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue VRDO | 0.040% | 12/6/13 | 3,600 | 3,600 |

| Massachusetts Development Finance Agency | | | | |

| Higher Education Revenue (Emerson College) | 5.000% | 1/1/18 | 2,000 | 2,173 |

| Massachusetts Development Finance Agency | | | | |

| Higher Education Revenue (Emerson College) | 5.000% | 1/1/20 | 3,105 | 3,322 |

| Massachusetts Development Finance Agency | | | | |

| Higher Education Revenue (Emerson College) | 5.000% | 1/1/22 | 1,985 | 2,094 |

| Massachusetts Development Finance Agency | | | | |

| Hospital Revenue (Cape Cod Healthcare | | | | |

| Obligated Group) | 5.250% | 11/15/36 | 5,130 | 5,189 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berklee College of Music) | 5.250% | 10/1/41 | 3,300 | 3,381 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/22 | 2,000 | 2,189 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/28 | 1,250 | 1,285 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/29 | 1,500 | 1,531 |

16

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/30 | 1,430 | 1,451 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/31 | 1,250 | 1,263 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/19 | 500 | 589 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/40 | 2,000 | 2,078 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/29 | 6,000 | 5,942 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 6.000% | 5/15/29 (2) | 1,400 | 1,628 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 10/1/35 (2) | 2,000 | 2,032 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.375% | 5/15/39 | 1,575 | 1,671 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 7/1/42 | 5,000 | 5,210 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 10/1/48 | 7,400 | 7,464 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 6.000% | 5/15/59 (10) | 5,575 | 6,190 |

| 3 Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) PUT | 0.630% | 3/30/17 | 5,000 | 4,989 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Broad Institute Inc.) | 5.250% | 4/1/37 | 4,000 | 4,145 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Carleton-Willard Village) | 5.250% | 12/1/25 | 600 | 622 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Carleton-Willard Village) | 5.625% | 12/1/30 | 550 | 567 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Commonwealth Contract Assistance) | 5.500% | 2/1/40 | 2,160 | 2,344 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Draper Laboratory) | 5.750% | 9/1/25 | 5,000 | 5,821 |

| 2 Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/40 | 5,160 | 5,028 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 10/15/28 | 1,000 | 1,132 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.250% | 2/1/34 | 6,000 | 6,565 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 10/15/40 | 7,000 | 7,565 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Loomis Obligated Group) | 6.000% | 1/1/33 | 4,000 | 3,885 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lowell General Hospital) | 5.000% | 7/1/37 | 2,800 | 2,648 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lowell General Hospital) | 5.000% | 7/1/44 | 5,000 | 4,597 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/19 | 175 | 203 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/21 | 300 | 346 |

17

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/23 | 250 | 286 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/26 | 1,380 | 1,534 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.000% | 7/1/32 | 3,370 | 3,263 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Mount Holyoke College) | 5.000% | 7/1/36 | 1,500 | 1,556 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 10/1/29 | 3,250 | 3,438 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 10/1/30 | 1,750 | 1,837 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Olin College) | 5.000% | 11/1/38 | 6,000 | 6,070 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/31 | 5,705 | 5,957 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/36 | 3,000 | 3,063 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/41 | 8,000 | 8,100 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.375% | 7/1/41 | 4,000 | 4,122 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.500% | 10/1/28 | 1,000 | 1,077 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.125% | 10/1/33 | 3,705 | 3,738 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.250% | 10/1/33 (10) | 1,500 | 1,537 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.250% | 10/1/39 | 3,000 | 3,007 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Southcoast Health System | | | | |

| Obligated Group) | 5.000% | 7/1/27 | 1,550 | 1,660 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Southcoast Health System | | | | |

| Obligated Group) | 5.000% | 7/1/37 | 2,700 | 2,696 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.000% | 7/1/30 | 3,000 | 3,002 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.125% | 7/1/40 | 3,000 | 2,917 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 7.250% | 1/1/32 | 2,500 | 2,874 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 6.875% | 1/1/41 | 2,000 | 2,228 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMASS Memorial Medical Center) | 5.125% | 7/1/26 | 2,750 | 2,871 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMASS Memorial Medical Center) | 5.500% | 7/1/31 | 4,750 | 4,916 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Wellesley College) | 5.000% | 7/1/42 | 2,000 | 2,098 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 5.000% | 1/1/36 (12) | 5,000 | 5,055 |

18

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/38 | 4,000 | 4,263 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/43 | 4,000 | 4,221 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Worcester Polytechnic Institute) | 5.000% | 9/1/50 | 2,650 | 2,659 |

| Massachusetts Educational Financing Authority | | | | |

| Education Loan Revenue | 5.500% | 1/1/17 | 3,000 | 3,344 |

| Massachusetts GO | 5.000% | 11/1/14 | 3,275 | 3,420 |

| Massachusetts GO | 5.000% | 9/1/15 (Prere.) | 10,000 | 10,821 |

| Massachusetts GO | 5.500% | 10/1/15 | 5,000 | 5,480 |

| 3 Massachusetts GO | 0.410% | 2/1/17 | 10,000 | 9,894 |

| Massachusetts GO | 5.000% | 10/1/17 | 4,000 | 4,634 |

| Massachusetts GO | 5.500% | 11/1/17 | 3,000 | 3,542 |

| 3 Massachusetts GO | 0.480% | 1/1/18 | 3,000 | 2,972 |

| Massachusetts GO | 5.500% | 8/1/19 | 5,000 | 6,064 |

| Massachusetts GO | 5.500% | 10/1/19 (2) | 2,000 | 2,431 |

| Massachusetts GO | 5.500% | 10/1/19 (12) | 1,000 | 1,216 |

| Massachusetts GO | 5.500% | 11/1/19 (4) | 5,550 | 6,754 |

| Massachusetts GO | 5.000% | 8/1/20 | 4,185 | 4,828 |

| Massachusetts GO | 5.000% | 8/1/21 | 5,000 | 5,956 |

| Massachusetts GO | 5.000% | 8/1/22 | 4,500 | 5,133 |

| Massachusetts GO | 5.250% | 8/1/22 | 5,260 | 6,351 |

| Massachusetts GO | 5.250% | 8/1/22 | 5,000 | 6,037 |

| Massachusetts GO | 5.250% | 8/1/23 | 1,000 | 1,204 |

| Massachusetts GO | 5.250% | 8/1/24 (4) | 1,500 | 1,708 |

| Massachusetts GO | 5.250% | 9/1/24 (4) | 7,800 | 9,408 |

| Massachusetts GO | 5.000% | 8/1/26 | 6,500 | 7,284 |

| Massachusetts GO | 5.000% | 8/1/28 | 4,535 | 4,945 |

| Massachusetts GO | 5.500% | 8/1/30 (2) | 9,000 | 10,964 |

| Massachusetts GO | 4.000% | 8/1/32 | 7,500 | 7,422 |

| Massachusetts GO | 5.000% | 8/1/33 | 3,000 | 3,211 |

| Massachusetts GO | 5.000% | 8/1/36 | 13,000 | 13,736 |

| Massachusetts GO | 5.000% | 8/1/40 | 10,000 | 10,479 |

| Massachusetts GO | 4.000% | 6/1/42 | 8,000 | 7,254 |

| Massachusetts GO | 4.000% | 6/1/43 | 8,000 | 7,134 |

| Massachusetts GO | 4.500% | 8/1/43 | 3,705 | 3,681 |

| 1 Massachusetts GO TOB VRDO | 0.060% | 12/2/13 | 2,200 | 2,200 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Berklee College of Music) | 5.000% | 10/1/26 | 1,755 | 1,875 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Boston Medical Center) | 5.000% | 7/1/28 | 3,000 | 3,011 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Caregroup) | 5.000% | 7/1/28 | 2,000 | 2,035 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Caregroup) | 5.125% | 7/1/33 | 3,015 | 3,057 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Caregroup) | 5.125% | 7/1/38 | 3,500 | 3,518 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Children’s Hospital) | 5.500% | 12/1/39 | 4,000 | 4,289 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Children’s Hospital) VRDO | 0.050% | 12/2/13 LOC | 9,600 | 9,600 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Dana-Farber Cancer Institute) | 5.000% | 12/1/37 | 5,000 | 5,046 |

19

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 6.250% | 4/1/20 | 3,000 | 3,798 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 5.000% | 12/15/21 | 2,000 | 2,404 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 5.500% | 11/15/36 | 9,945 | 11,047 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 5.000% | 10/1/38 | 3,000 | 3,163 |

| 1 Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | | | | |

| TOB VRDO | 0.060% | 12/2/13 | 5,875 | 5,875 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Isabella Stewart Gardner | | | | |

| Museum) | 5.000% | 5/1/27 | 1,650 | 1,791 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Isabella Stewart Gardner | | | | |

| Museum) | 5.000% | 5/1/28 | 2,080 | 2,228 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Lahey Clinic Medical Center) | 5.250% | 8/15/37 | 6,650 | 6,800 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.250% | 7/1/16 | 4,090 | 4,596 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.000% | 7/1/23 | 5,960 | 7,178 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.250% | 7/1/25 | 3,605 | 4,412 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.250% | 7/1/30 | 5,000 | 5,996 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) VRDO | 0.040% | 12/6/13 | 4,400 | 4,400 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Museum of Fine Arts) VRDO | 0.070% | 12/2/13 | 2,500 | 2,500 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/19 | 3,000 | 3,490 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/23 | 3,435 | 3,869 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/32 | 1,000 | 1,023 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/33 | 3,000 | 3,060 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | 5.250% | 7/1/29 | 5,000 | 5,305 |

| 1 Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | | | | |

| TOB VRDO | 0.060% | 12/6/13 | 600 | 600 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | | | | |

| VRDO | 0.040% | 12/2/13 | 1,900 | 1,900 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | | | | |

| VRDO | 0.040% | 12/6/13 | 5,000 | 5,000 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Simmons College) | 8.000% | 10/1/15 (Prere.) | 1,025 | 1,169 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Simmons College) | 8.000% | 10/1/39 | 1,475 | 1,619 |

20

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (South Coast Health System) | 5.000% | 7/1/39 | 6,000 | 5,974 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Sterling & Francine Clark) | 5.000% | 7/1/36 | 5,500 | 5,628 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Stonehill College) VRDO | 0.050% | 12/2/13 LOC | 8,090 | 8,090 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Tufts University) | 5.250% | 2/15/22 | 1,400 | 1,668 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Tufts University) | 5.250% | 2/15/26 | 1,880 | 2,200 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Williams College) | 5.000% | 7/1/31 | 385 | 408 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Winchester Hospital) | 5.250% | 7/1/38 | 1,840 | 1,865 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 2.650% | 12/1/41 | 6,510 | 6,597 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 2.750% | 12/1/41 | 1,955 | 2,021 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 4.000% | 12/1/43 | 4,000 | 4,293 |

| Massachusetts Port Authority Revenue | 5.500% | 7/1/16 (4) | 4,000 | 4,473 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/17 (4) | 9,600 | 10,867 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/25 | 1,230 | 1,386 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/30 | 2,000 | 2,152 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/31 | 1,800 | 1,923 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/33 | 4,650 | 4,916 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/15 (Prere.) | 16,125 | 17,417 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/15 (Prere.) | 8,000 | 8,641 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/15 (Prere.) | 645 | 697 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/15 (Prere.) | 15,000 | 16,202 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/15 (Prere.) | 10,000 | 10,801 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/22 | 5,000 | 5,916 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/27 | 10,000 | 11,153 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/28 | 7,250 | 8,016 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/29 | 10,000 | 10,976 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/30 | 8,000 | 8,712 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/30 (4) | 200 | 208 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 10/15/35 | 2,000 | 2,113 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.250% | 10/15/35 | 12,000 | 12,979 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/37 (2) | 2,860 | 2,973 |

21

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 10/15/41 | 4,000 | 4,169 |

| Massachusetts Special Obligation Dedicated | | | | |

| Tax Revenue | 5.500% | 1/1/27 (14) | 13,000 | 14,871 |

| Massachusetts Special Obligation Revenue | 5.000% | 12/15/13 (4) | 1,895 | 1,899 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/21 | 5,000 | 5,955 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/29 | 2,000 | 2,205 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/33 | 2,050 | 2,215 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 4.000% | 6/1/37 | 1,960 | 1,876 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/38 | 2,750 | 2,923 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/43 | 5,000 | 5,288 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/20 (14) | 3,000 | 2,580 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/25 (14) | 5,000 | 3,269 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/28 (14) | 7,000 | 3,849 |

| Massachusetts Water Pollution Abatement | | | | |

| Trust Revenue | 5.250% | 8/1/17 | 540 | 583 |

| Massachusetts Water Pollution Abatement | | | | |

| Trust Revenue | 5.000% | 8/1/20 | 1,180 | 1,409 |

| Massachusetts Water Pollution Abatement | | | | |

| Trust Revenue | 5.250% | 8/1/22 | 3,500 | 4,249 |

| Massachusetts Water Pollution Abatement | | | | |

| Trust Revenue | 5.250% | 8/1/29 | 1,520 | 1,755 |

| Massachusetts Water Pollution Abatement | | | | |

| Trust Revenue | 5.750% | 8/1/29 | 190 | 191 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/16 (Prere.) | 2,005 | 2,245 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.500% | 8/1/22 (4) | 1,490 | 1,820 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/31 | 2,230 | 2,433 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/31 (4) | 1,000 | 1,129 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/34 (14) | 8,000 | 8,601 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/35 (14) | 13,900 | 14,915 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/35 (4) | 1,310 | 1,455 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/36 | 1,700 | 1,783 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/36 | 1,000 | 1,059 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/36 (2) | 2,995 | 3,128 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/37 | 2,000 | 2,105 |

22

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/41 | 5,990 | 6,228 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/41 | 4,450 | 4,669 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/42 | 1,000 | 1,044 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/42 | 10,000 | 10,702 |

| Metropolitan Boston MA Transit Parking Corp. | | | | |

| Revenue | 5.000% | 7/1/31 | 1,000 | 1,048 |

| Metropolitan Boston MA Transit Parking Corp. | | | | |

| Revenue | 5.250% | 7/1/36 | 9,500 | 10,060 |

| Newton MA School District GO | 4.500% | 6/15/34 | 3,000 | 3,062 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 6.875% | 5/1/14 (ETM) | 355 | 360 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/19 | 2,000 | 2,366 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/21 (2) | 5,680 | 6,139 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/22 (2) | 2,695 | 2,904 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/23 (2) | 1,760 | 1,889 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/24 (2) | 1,980 | 2,123 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/25 (2) | 1,990 | 2,128 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 5/1/38 | 2,000 | 2,104 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/39 | 5,450 | 5,693 |

| Worcester MA GO | 5.500% | 8/15/14 (14) | 280 | 281 |

| Worcester MA GO | 5.500% | 8/15/15 (14) | 240 | 241 |

| |

| Worcester MA GO | 5.250% | 8/15/21 (14) | 315 | 316 |

| | | | | 1,002,445 |

| Guam (0.3%) | | | | |

| 2 Guam Government Waterworks Authority Water | | | | |

| & Waste Water System Revenue | 5.500% | 7/1/43 | 2,500 | 2,425 |

| |

| Virgin Islands (0.1%) | | | | |

| Virgin Islands Public Finance Authority Revenue | 5.250% | 10/1/14 (Prere.) | 1,000 | 1,042 |

| Total Tax-Exempt Municipal Bonds | | | | |

| (Cost $995,275) | | | | 1,005,912 |

| Other Assets and Liabilities (-0.5%) | | | | |

| Other Assets | | | | 13,803 |

| Liabilities | | | | (18,399) |

| | | | | (4,596) |

| Net Assets (100%) | | | | |

| Applicable to 97,462,371 outstanding $.001 par value shares of beneficial interest (unlimited authorization) |

| 1,001,316 |

| Net Asset Value Per Share | | | | $10.27 |

23

Massachusetts Tax-Exempt Fund

| |

| At November 30, 2013, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 991,150 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Losses | (471) |

| Unrealized Appreciation (Depreciation) | 10,637 |

| Net Assets | 1,001,316 |

See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from

registration, normally to qualified institutional buyers. At November 30, 2013, the aggregate value of these securities was $11,568,000,

representing 1.2% of net assets.

2 Security purchased on a when-issued or delayed-delivery basis for which the fund has not taken delivery as of November 30, 2013.

3 Adjustable-rate security.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Massachusetts Tax-Exempt Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corporation.

(13) Berkshire Hathaway Assurance Corporation.

(14) National Public Finance Guarantee Corporation.

(15) Build America Mutual Assurance Company.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

25

Massachusetts Tax-Exempt Fund

Statement of Operations

| |

| | Year Ended |

| | November 30, 2013 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 36,080 |

| Total Income | 36,080 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 82 |

| Management and Administrative | 1,358 |

| Marketing and Distribution | 220 |

| Custodian Fees | 18 |

| Auditing Fees | 29 |

| Shareholders’ Reports | 7 |

| Trustees’ Fees and Expenses | 1 |

| Total Expenses | 1,715 |

| Net Investment Income | 34,365 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 9,032 |

| Futures Contracts | (300) |

| Options on Futures Contracts | (5) |

| Realized Net Gain (Loss) | 8,727 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | (97,852) |

| Futures Contracts | 3 |

| Change in Unrealized Appreciation (Depreciation) | (97,849) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (54,757) |

See accompanying Notes, which are an integral part of the Financial Statements.

26

Massachusetts Tax-Exempt Fund

Statement of Changes in Net Assets

| | |

| | Year Ended November 30, |

| | 2013 | 2012 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 34,365 | 33,346 |

| Realized Net Gain (Loss) | 8,727 | 2,615 |

| Change in Unrealized Appreciation (Depreciation) | (97,849) | 65,815 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (54,757) | 101,776 |

| Distributions | | |

| Net Investment Income | (34,365) | (33,346) |

| Realized Capital Gain | — | — |

| Total Distributions | (34,365) | (33,346) |

| Capital Share Transactions | | |

| Issued | 206,683 | 219,253 |

| Issued in Lieu of Cash Distributions | 24,610 | 24,456 |

| Redeemed | (267,510) | (127,939) |

| Net Increase (Decrease) from Capital Share Transactions | (36,217) | 115,770 |

| Total Increase (Decrease) | (125,339) | 184,200 |

| Net Assets | | |

| Beginning of Period | 1,126,655 | 942,455 |

| End of Period | 1,001,316 | 1,126,655 |

See accompanying Notes, which are an integral part of the Financial Statements.

27

Massachusetts Tax-Exempt Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | Year Ended November 30, |

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $11.13 | $10.41 | $10.15 | $10.19 | $9.44 |

| Investment Operations | | | | | |

| Net Investment Income | . 340 | .349 | .366 | .386 | .401 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | (. 860) | .720 | . 260 | (.040) | .750 |

| Total from Investment Operations | (.520) | 1.069 | .626 | .346 | 1.151 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.340) | (. 349) | (. 366) | (. 386) | (.401) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.340) | (. 349) | (. 366) | (. 386) | (.401) |

| Net Asset Value, End of Period | $10.27 | $11.13 | $10.41 | $10.15 | $10.19 |

| |

| Total Return1 | -4.71% | 10.41% | 6.32% | 3.41% | 12.36% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $1,001 | $1,127 | $942 | $983 | $939 |

| Ratio of Total Expenses to Average Net Assets | 0.16% | 0.16% | 0.17% | 0.17% | 0.17% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 3.21% | 3.22% | 3.61% | 3.75% | 4.02% |

| Portfolio Turnover Rate | 36% | 13% | 13% | 18% | 15% |

| 1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

See accompanying Notes, which are an integral part of the Financial Statements.

28

Massachusetts Tax-Exempt Fund

Notes to Financial Statements

Vanguard Massachusetts Tax-Exempt Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Bonds, and temporary cash investments acquired over 60 days to maturity, are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value.

2. Futures and Options: The fund may use futures contracts and options on futures contracts to invest in fixed income asset classes with greater efficiency and lower cost than is possible through direct investment, to add value when these instruments are attractively priced, or to adjust sensitivity to changes in interest rates. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of bonds held by the fund and the prices of futures contracts, and the possibility of an illiquid market. The primary risk associated with purchasing options is that interest rates move in such a way that the option is out-of-the-money, the position is worthless at expiration, and the fund loses the premium paid. The primary risk associated with writing options is that interest rates move in such a way that the option is in-the-money, the counterparty exercises the option, and the fund loses an amount equal to the market value of the option written less the premium received. Counterparty risk involving futures and exchange-traded options is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures and options on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended November 30, 2013, the fund’s average investments in long and short futures contracts represented 1% and less than 1% of net assets, respectively, based on quarterly average aggregate settlement values. The fund had no open futures contracts at November 30, 2013.

Options on futures contracts are also valued at their quoted daily settlement prices. The premium paid for a purchased option is recorded as an asset that is subsequently adjusted daily to the current market value of the option purchased. The premium received for a written option is recorded as an asset with an equal liability that is subsequently adjusted daily to the current market value of the option written. Fluctuations in the value of the options are recorded as unrealized appreciation (depreciation) until expired, closed, or exercised, at which time realized gains (losses) are recognized.

29

Massachusetts Tax-Exempt Fund

During the year ended November 30, 2013, the fund’s average value of options purchased and options written represented less than 1% and 0% of net assets respectively, based on quarterly average market values. The fund had no open options on futures contracts at November 30, 2013.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2010–2013), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month. Annual distributions from realized capital gains, if any, are recorded on the ex-dividend date.

5. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At November 30, 2013, the fund had contributed capital of $115,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.05% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine

the fair value of investments). At November 30, 2013, 100% of the market value of the fund’s investments was determined based on Level 2 inputs.

D. Capital gain distributions are determined on a tax basis and may differ from realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when gains or losses are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future.

The fund used capital loss carryforwards of $7,948,000 to offset taxable capital gains realized during the year ended November 30, 2013, reducing the amount of capital gains that would otherwise be available to distribute to shareholders.

30

Massachusetts Tax-Exempt Fund

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from realized capital gains. Accordingly, the fund has reclassified $436,000 from accumulated net realized gains to paid-in capital. For tax purposes, at November 30, 2013, the fund had no capital gains available for distribution.

At November 30, 2013, the cost of investment securities for tax purposes was $995,746,000. Net unrealized appreciation of investment securities for tax purposes was $10,166,000, consisting of unrealized gains of $27,906,000 on securities that had risen in value since their purchase and $17,740,000 in unrealized losses on securities that had fallen in value since their purchase.

E. During the year ended November 30, 2013, the fund purchased $362,856,000 of investment securities and sold $361,098,000 of investment securities, other than temporary cash investments.

F. Capital shares issued and redeemed were:

| | |

| | Year Ended November 30, |

| | 2013 | 2012 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 19,417 | 20,273 |

| Issued in Lieu of Cash Distributions | 2,333 | 2,255 |

| Redeemed | (25,509) | (11,869) |

| Net Increase (Decrease) in Shares Outstanding | (3,759) | 10,659 |

G. Management has determined that no material events or transactions occurred subsequent to November 30, 2013, that would require recognition or disclosure in these financial statements.

31

Report of Independent Registered

Public Accounting Firm