UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: 811-09005 |

Name of Registrant: | Vanguard Massachusetts Tax-Exempt Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: November 30 | |

Date of reporting period: November 30, 2016 – May 31, 2017 |

Item 1: Reports to Shareholders | |

Semiannual Report | May 31, 2017

Vanguard Massachusetts Tax-Exempt Fund

A new format, unwavering commitment

As you begin reading this report, you’ll notice that we’ve made some improvements to the opening sections—based on feedback from you, our clients.

Page 1 starts with a new ”Your Fund’s Performance at a Glance,” a concise, handy summary of how your fund performed during the period.

In the renamed ”Chairman’s Perspective,” Bill McNabb will focus on enduring principles and investment insights.

We’ve modified some tables, and eliminated some redundancy, but we haven’t removed any information.

At Vanguard, we’re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 2 |

| Advisor’s Report. | 6 |

| Fund Profile. | 9 |

| Performance Summary. | 10 |

| Financial Statements. | 11 |

| About Your Fund’s Expenses. | 35 |

| Trustees Approve Advisory Arrangement. | 37 |

| Glossary. | 39 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary focus is on you, our clients. We conduct our business with integrity as a faithful steward of your assets. This message is shown translated into seven languages, reflecting our expanding global presence.

Your Fund’s Performance at a Glance

• For the six months ended May 31, 2017, Vanguard Massachusetts Tax-Exempt Fund returned 5.33%, as did its benchmark index. The average return of its peer funds was 3.82%.

• The fund’s capital return was 3.77% and its return from interest income was 1.56%.

• Municipal bond prices slumped in the wake of the U.S. presidential election but later regained some ground.

• Investor appetite for yield led to tighter overall credit spreads. As spreads narrowed, the fund received a boost from its overweight allocation to lower-rated investment-grade bonds.

• The fund also benefited from greater exposure to longer-dated bonds than the benchmark and peers.

| | | | | |

| Total Returns: Six Months Ended May 31, 2017 | | | | |

| | | Taxable- | | | |

| | 30-Day SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield | Return | Return | Returns |

| Vanguard Massachusetts Tax-Exempt Fund | 2.34% | 4.36% | 1.56% | 3.77% | 5.33% |

| Bloomberg Barclays MA Municipal Bond Index | | | | | 5.33 |

| Massachusetts Municipal Debt Funds Average | | | | | 3.82 |

| Massachusetts Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

| The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 43.4% and |

| the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the |

| calculation. | | | | | |

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Massachusetts Tax-Exempt Fund | 0.15% | 1.03% |

| The fund expense ratio shown is from the prospectus dated March 28, 2017, and represents estimated costs for the current fiscal year. For |

| the six months ended May 31, 2017, the fund’s annualized expense ratio was 0.15%. The peer-group expense ratio is derived from data |

| provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2016. | |

| |

| Peer group: Massachusetts Municipal Debt Funds. | | |

1

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

At the end of May, we completed the latest round of expense ratio changes for our U.S.-based funds. The estimated savings for our investors during the six-month period was more than $300 million across our fund lineup—another record for us.1

That’s a remarkable amount, but it’s also business as usual here at Vanguard. After all, we’ve been cutting costs for investors for more than 40 years. Indeed, we’ve become so synonymous with driving down costs that when other investment companies lower their fees, the financial press often refers to it as the “Vanguard effect.”

To be sure, high costs persist in some areas of the industry. But the good news is, our 40-year campaign to lower costs seems to be approaching its mathematical limits, with some fund expenses now near zero not just at Vanguard but at other investment companies as well.

What makes investors successful?

While we’ll continue our drive for cost efficiency, we’ll also keep vigorously promoting our three other linchpin investment principles:

• Goals. Create clear, appropriate investment goals.

• Balance. Develop a suitable asset allocation using broadly diversified funds.

1 This figure represents cumulative net savings from expense ratio changes for all Vanguard fund share classes announced from December 2016

through May 2017. The estimated savings is the difference between prior and current expense ratios multiplied by average assets under

management (AUM). Average AUM is based on averaging one month’s daily average assets over the 12 months of each fund’s fiscal year.

2

• Discipline. Maintain perspective and long-term discipline.

Today, these tenets are more relevant than ever. They’re essential elements of our Personal Advisor Services recommendations, the model portfolios we develop for financial advisors, and our target-date funds.

We’re convinced that as investors increasingly adopt low-cost portfolios, focusing on goals, balance, and discipline could make the difference between achieving financial objectives and falling short.

Of course, there’s nothing new about our philosophy. And it seems simple enough. But unfortunately, we all have built-in behavioral biases that can make it hard to stick to the plan. We might, for example, allow natural inertia to keep us from rebalancing our portfolios to control risk, or we may become too wedded to an opinion or approach.

Lessons from the last crisis

Although it can be difficult at times to follow proven investing principles, it’s not impossible, even under the most challenging circumstances.

During the financial crisis of 2008–2009, various media outlets asked me whether our investors were pulling out of the

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended May 31, 2017 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 10.55% | 17.48% | 15.37% |

| Russell 2000 Index (Small-caps) | 4.33 | 20.36 | 14.04 |

| Russell 3000 Index (Broad U.S. market) | 10.06 | 17.69 | 15.26 |

| FTSE All-World ex US Index (International) | 16.80 | 18.45 | 8.86 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 2.52% | 1.58% | 2.24% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 5.16 | 1.46 | 3.31 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.26 | 0.41 | 0.12 |

| |

| CPI | | | |

| Consumer Price Index | 1.40% | 1.87% | 1.27% |

3

market and running for the hills. In actuality, we didn’t see that at Vanguard. Our clients were certainly nervous, and they contacted us more often. But for the most part, they didn’t engage in the excessive, panicked trading that can be so destructive to building wealth. Those who relied on financial advisors who follow our philosophy were wisely counseled to stay the course.

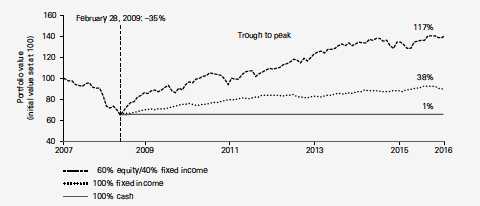

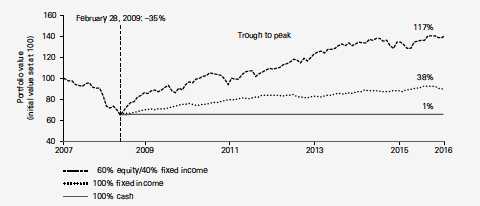

The accompanying chart shows the importance of patience and discipline. Investors who maintained a 60% stock/ 40% bond mix through the bear market were amply rewarded afterward, while those who fled stocks when they hit bottom were left far behind.

It’s not different this time

Today, nearly a decade after the global financial crisis, the world seems very different. Market indexes recently hit a series of all-time highs. With the wind at their backs and the increasing availability of low-cost funds, investors may be tempted to ask, “What could go wrong?” The answer is, “A lot.” Performance chasing and market-timing won’t be any more effective with low-cost funds than they are with high-cost funds.

| Reacting to volatility can hurt returns |

| Investors who kept a balanced portfolio through the 2008–2009 crash were rewarded |

| Notes: On October 31, 2007, close to the equity market’s peak, the value of a hypothetical 60/40 portfolio is set at 100. Subsequent returns |

| are calculated relative to this starting value of 100. It is assumed that all dividends and income are reinvested in the components of the |

| indexes. The initial allocation for the portfolios was 42% U.S. stocks, 18% international stocks, and 40% U.S. bonds. The rebalanced portfolio |

| is returned to this allocation every month-end. Returns for the U.S. stock allocation are based on the MSCI US Broad Market Index. Returns for |

| the international stock allocation are based on the MSCI All Country World Index ex USA. Returns for the bond allocation are based on the |

| Bloomberg Barclays U.S. Aggregate Bond Index. Returns for the cash allocation are based on the Citigroup 3-Month U.S. Treasury Bill Index. |

| Sources: Vanguard, using data provided by Thomson Reuters Datastream. |

4

Whether markets are sunny or stormy, investors need to stick to their investment plans, maintain balanced and diversified portfolios, and think long-term.

We strive to help investors follow the principles that lead to enduring success. I’d like to think that will be the real “Vanguard effect.”

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

June 14, 2017

5

Advisor’s Report

For the six months ended May 31, 2017, Vanguard Massachusetts Tax-Exempt Fund returned 5.33%, matching its benchmark, the Bloomberg Barclays Massachusetts Municipal Bond Index, and surpassing the 3.82% average return of its peer funds.

Both price appreciation and interest income contributed solidly to the results. The fund’s capital return was 3.77% and its return from interest income was 1.56%. Municipal bond yields crept a bit higher over the period. The fund’s 30-day SEC yield inched to 2.34% from 2.31% six months earlier.

Please note: The fund is permitted to invest in bonds whose income is subject to the alternative minimum tax (AMT). However, as of the end of the period, it did not own any AMT bonds.

The investment environment

During the period, the Federal Reserve increased interest rates twice; the second move, in March, put the federal funds rate at 0.75%–1.00% and marked just the third time the Fed had raised rates since the financial crisis. (After the period, in June, the Fed raised rates again.)

The Fed’s decisions signaled a normalization of monetary policy and came as the U.S. economy posted mostly positive results. In May, unemployment hit 4.3%, its lowest level since 2001. Wages ticked up and some commodities posted price increases, pushing inflation closer to the Fed’s 2% target.

In Massachusetts, the unemployment rate increased from 3.1% to 3.9% over the period but still remained below the national average. The commonwealth’s

| | |

| Yields of Municipal Securities | | |

| (AAA-Rated General Obligation Issues) | | |

| | November 30, | May 31, |

| Maturity | 2016 | 2017 |

| 2 years | 1.16% | 0.89% |

| 5 years | 1.85 | 1.22 |

| 10 years | 2.52 | 1.90 |

| 30 years | 3.26 | 2.74 |

| Source: Vanguard. | | |

6

economy over the period has lagged that of the United States as a whole, according to a gauge of current economic conditions published monthly by the Federal Reserve Bank of Philadelphia. The bank’s index for Massachusetts declined about 1% between November 2016 and April 2017, while at the national level it rose slightly more than 1%.

However, Massachusetts’ economy has outpaced the nation’s in the years since the financial crisis. From its low point in 2009 through April 2017, the bank’s index for Massachusetts climbed about 40%, compared with an increase of about 24% for the U.S. index. (Each state’s index incorporates data on nonfarm payroll employment, the jobless rate, average hours worked in manufacturing, and inflation-adjusted wage and salary payments.)

The Massachusetts economy remains fundamentally strong, and is bolstered by large education, health care, finance, and technology sectors. Massachusetts’ population has grown over 3% between 2010 and 2016. The population enjoys a highly educated workforce and wealth and income levels that are among the highest in the nation.

Despite the strong economy and year-over-year revenue growth of over 1% in the fiscal year through April 30, tax collections have underperformed estimates, a trend seen in many states nationwide. After mid-year budget cuts were implemented in December 2016 to balance the fiscal-year budget as a result of lower-than-expected revenues, revenues continued to underperform in the following months, leaving a projected gap of over $400 million on a $39 billion budget as of the end of May.

The state is reducing revenue projections for fiscal year 2018 based on results from fiscal 2017. While Governor Baker is generally opposed to tax increases, the legislature is expected to place a ballot initiative before voters in November 2018 to add language to the state constitution creating a surtax on incomes over $1 million. If implemented, the surtax is expected to generate an additional $2 billion in annual collections.

Massachusetts’ credit ratings from Moody’s, Fitch, and Standard & Poor’s remained unchanged during the fund’s reporting period ended May 31—Aa1 with a stable outlook from Moody’s, AA+ with a stable outlook from Fitch, and AA+ with a negative outlook from S&P. In June, however, S&P downgraded Massachusetts debt to AA.

Management of the fund

We strive to add value through a diversified mix of strategies that include duration, yield-curve positioning, credit-quality decisions, and security selection. Vanguard’s experienced team of credit analysts perform objective, independent analyses of bonds owned by the fund. Our investment process relies on robust risk management that monitors the positioning of the fund.

7

The fund’s A-rated and Baa-rated bonds and its bonds with maturities of 10–20 years and 20–30 years boosted its performance compared with its benchmark index.

Weaker results among general obligation state holdings were somewhat offset by our stronger university revenue and hospital revenue issues.

A look ahead

Absent an unexpected external shock, the U.S. economy looks set to continue its steady growth, with real GDP likely to be around 2% in 2017, or perhaps closer to 2.5% if implementation of the Trump administration’s agenda has a positive effect on the economy. While job growth may slow given the tightening we’ve seen in the labor market, competition for labor could increase the pace of annual wage increases. That should provide some support to inflation in the short term, but not so much that it would significantly overshoot the central bank’s 2% target. We’re encouraged by the Fed’s decision to continue normalizing rates, which have been near zero since 2009. By year end, the federal funds rate could increase to 1.25%–1.5% and we might see the Fed begin to reduce its balance sheet; in any case, we think the Fed will maintain its gradual, “dovish” policy approach given the structural anti-inflationary forces still at work in the global economy.

If growth and inflation remain modest, the cost of borrowing shouldn’t get out of hand, especially if yields in the United States remain attractive compared with those in other developed economies. International demand should help cap U.S. bond yields.

Although the pro-business, pro-growth agenda of the new administration could give the economy a boost, it remains to be seen what will get passed into law and what the financial markets’ reaction will be. Needless to say, we will closely monitor developments that could cloud the outlook for munis, such as changes to the marginal tax rates for individuals and corporations, a cap on the level of tax exemption for munis, and increased muni issuance if infrastructure spending ramps up significantly.

Although we may see more volatility in 2017, we expect munis to continue to offer relative stability and a steady stream of income. And whatever the markets may bring, our experienced team of portfolio managers, traders, and credit analysts will continue to seek opportunities to produce competitive returns.

Christopher W. Alwine, CFA, Principal,

Head of Municipal Group

Mathew M. Kiselak, Principal,

Portfolio Manager,

Head of Municipal Bond Desk

Vanguard Fixed Income Group

June 16, 2017

8

Massachusetts Tax-Exempt Fund

| | | |

| Fund Profile | | |

| As of May 31, 2017 | | |

|

| Financial Attributes | | |

| |

| | | Bloomberg | |

| | | Barclays | Bloomberg |

| | | MA | Barclays |

| | | Municipal | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 403 | 1,896 | 50,785 |

| Yield to Maturity | | | |

| (before expenses) | 2.3% | 2.0% | 2.1% |

| Average Coupon | 4.7% | 4.8% | 4.8% |

| Average Duration | 7.1 years | 6.6 years | 6.2 years |

| Average Stated | | | |

| Maturity | 16.8 years | 12.8 years | 12.9 years |

| Ticker Symbol | VMATX | — | — |

| Expense Ratio1 | 0.15% | — | — |

| 30-Day SEC Yield | 2.34% | — | — |

| Short-Term | | | |

| Reserves | 3.3% | — | — |

| | |

| Volatility Measures | | |

| | Bloomberg | Bloomberg |

| | Barclays MA | Barclays |

| | Municipal | Municipal |

| | Bond Index | Bond Index |

| R-Squared | 0.98 | 0.98 |

| Beta | 1.10 | 1.18 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| |

| Distribution by Stated Maturity | |

| (% of portfolio) | |

| Under 1 Year | 3.9% |

| 1 - 3 Years | 3.2 |

| 3 - 5 Years | 3.3 |

| 5 - 10 Years | 7.7 |

| 10 - 20 Years | 43.8 |

| 20 - 30 Years | 35.2 |

| Over 30 Years | 2.9 |

Distribution by Credit Quality (% of portfolio)

| |

| AAA | 15.8% |

| AA | 60.9 |

| A | 13.2 |

| BBB | 10.0 |

| Not Rated | 0.1 |

Credit-quality ratings are obtained from Moody's and S&P, and the

higher rating for each issue is shown. "Not Rated" is used to

classify securities for which a rating is not available. Not rated

securities include a fund's investment in Vanguard Market Liquidity

Fund or Vanguard Municipal Cash Management Fund, each of

which invests in high-quality money market instruments and may

serve as a cash management vehicle for the Vanguard funds,

trusts, and accounts. For more information about these ratings, see

the Glossary entry for Credit Quality.

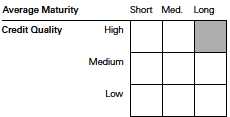

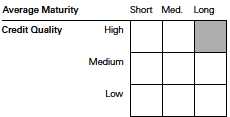

Investment Focus

1 The expense ratio shown is from the prospectus dated March 28, 2017, and represents estimated costs for the current fiscal year. For the six months ended May 31, 2017, the annualized expense ratio was 0.15%.

9

Massachusetts Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

| | | | |

| Fiscal-Year Total Returns (%): November 30, 2006, Through May 31, 2017 | |

| | | | | Bloomberg |

| | | | | Barclays MA |

| | | | | Municipal |

| | | | | Bond Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2007 | 4.18% | -2.03% | 2.15% | 3.27% |

| 2008 | 4.00 | -6.72 | -2.72 | -1.30 |

| 2009 | 4.42 | 7.94 | 12.36 | 13.60 |

| 2010 | 3.80 | -0.39 | 3.41 | 3.96 |

| 2011 | 3.76 | 2.56 | 6.32 | 6.41 |

| 2012 | 3.49 | 6.92 | 10.41 | 9.57 |

| 2013 | 3.02 | -7.73 | -4.71 | -3.52 |

| 2014 | 3.48 | 5.84 | 9.32 | 7.72 |

| 2015 | 3.15 | 0.62 | 3.77 | 3.14 |

| 2016 | 2.85 | -3.53 | -0.68 | -0.82 |

| 2017 | 1.56 | 3.77 | 5.33 | 5.33 |

| Note: For 2017, performance data reflect the six months ended May 31, 2017. | | |

Average Annual Total Returns: Periods Ended March 31, 2017

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Massachusetts | | | | | | |

| Tax-Exempt Fund | 12/9/1998 | -0.65% | 3.29% | 3.58% | 0.50% | 4.08% |

See Financial Highlights for dividend and capital gains information.

10

Massachusetts Tax-Exempt Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2017

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (99.2%) | | | | |

| Massachusetts (98.9%) | | | | |

| Boston MA GO | 5.000% | 2/1/24 | 2,345 | 2,733 |

| Boston MA GO | 5.000% | 3/1/24 | 3,000 | 3,608 |

| Boston MA GO | 5.000% | 4/1/28 | 1,940 | 2,359 |

| Boston MA Housing Authority Revenue | 5.000% | 4/1/23 (4) | 2,000 | 2,066 |

| Boston MA Housing Authority Revenue | 5.000% | 4/1/25 (4) | 5,440 | 5,617 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 5/1/19 (Prere.) | 3,725 | 4,010 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/19 (Prere.) | 1,000 | 1,095 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/20 | 1,550 | 1,757 |

| Boston MA Water & Sewer Commission Revenue | 5.000% | 11/1/30 | 750 | 876 |

| Cambridge MA GO | 5.000% | 1/1/23 | 850 | 990 |

| Cambridge MA GO | 4.000% | 1/1/26 | 1,600 | 1,856 |

| Cambridge MA GO | 4.000% | 1/1/27 | 1,000 | 1,149 |

| Essex MA North Shore Agricultural & Technical | | | | |

| School District GO | 4.000% | 6/1/39 | 2,810 | 2,953 |

| Holyoke MA GO | 5.000% | 9/1/30 | 1,690 | 1,927 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.250% | 7/1/31 | 2,285 | 2,961 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 4.000% | 7/1/37 | 5,000 | 5,248 |

| Massachusetts Bay Transportation Authority | | | | |

| Assessment Revenue | 5.000% | 7/1/41 | 7,430 | 8,487 |

| Massachusetts Bay Transportation Authority | | | | |

| General Transportation Revenue VRDO | 0.710% | 6/7/17 | 900 | 900 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 0.000% | 7/1/17 (Prere.) | 1,020 | 578 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.500% | 7/1/17 (ETM) | 75 | 75 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/22 | 3,500 | 4,179 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.000% | 7/1/23 | 4,000 | 4,825 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/23 | 2,825 | 3,451 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.000% | 7/1/27 | 5,950 | 7,449 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 4.000% | 7/1/32 | 2,870 | 3,100 |

11

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/32 | 2,900 | 3,769 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/33 | 2,000 | 2,607 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.250% | 7/1/33 | 10,000 | 13,033 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 4.000% | 7/1/35 | 1,980 | 2,107 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 4.000% | 7/1/35 | 3,000 | 3,192 |

| Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue | 5.000% | 7/1/35 | 2,145 | 2,359 |

| 1 Massachusetts Bay Transportation Authority | | | | |

| Sales Tax Revenue TOB VRDO | 0.880% | 6/7/17 | 2,879 | 2,879 |

| Massachusetts Clean Energy Cooperative | | | | |

| Corp. Revenue (Municipal Lighting Plant) | 5.000% | 7/1/26 | 2,875 | 3,384 |

| Massachusetts Clean Energy Cooperative | | | | |

| Corp. Revenue (Municipal Lighting Plant) | 5.000% | 7/1/29 | 2,000 | 2,313 |

| Massachusetts Clean Energy Cooperative | | | | |

| Corp. Revenue (Municipal Lighting Plant) | 5.000% | 7/1/32 | 2,500 | 2,857 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 2/1/28 | 3,000 | 3,583 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 8/1/28 | 4,485 | 5,747 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 2/1/29 | 405 | 498 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 8/1/29 | 3,545 | 4,555 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 2/1/30 | 405 | 494 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 2/1/35 | 3,000 | 3,474 |

| Massachusetts Clean Water Trust Revenue | 5.000% | 2/1/45 | 2,085 | 2,387 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/25 | 1,100 | 1,279 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/26 | 1,430 | 1,706 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/27 | 1,200 | 1,425 |

| Massachusetts College Building Authority | | | | |

| Revenue | 4.000% | 5/1/29 | 2,015 | 2,247 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/29 | 1,500 | 1,659 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/30 | 1,610 | 1,776 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/30 | 1,075 | 1,248 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/31 | 2,000 | 2,325 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/36 | 4,000 | 4,557 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/39 | 3,000 | 3,418 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/41 | 5,000 | 5,661 |

| Massachusetts College Building Authority | | | | |

| Revenue | 5.000% | 5/1/43 | 3,285 | 3,715 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/20 | 3,500 | 3,840 |

12

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/23 | 3,000 | 3,300 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/32 | 5,620 | 6,117 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/35 | 2,350 | 2,566 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue | 5.000% | 1/1/37 | 3,000 | 3,244 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue VRDO | 0.710% | 6/7/17 | 3,600 | 3,600 |

| Massachusetts Department of Transportation | | | | |

| Metropolitan Highway System Revenue VRDO | 0.740% | 6/7/17 | 3,900 | 3,900 |

| Massachusetts Development Finance Agency | | | | |

| Hospital Revenue (Cape Cod Healthcare | | | | |

| Obligated Group) | 5.250% | 11/15/36 | 5,130 | 5,841 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Baystate Medical Obligated Group) | 5.000% | 7/1/34 | 1,500 | 1,701 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Bentley University) | 5.000% | 7/1/40 | 5,750 | 6,594 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berklee College of Music) | 5.000% | 10/1/31 | 1,685 | 2,003 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berklee College of Music) | 5.250% | 10/1/41 | 3,300 | 3,738 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berklee College of Music) | 5.000% | 10/1/46 | 1,500 | 1,724 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/22 | 2,000 | 2,275 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/28 | 1,250 | 1,382 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/29 | 1,500 | 1,652 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/30 | 1,430 | 1,569 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Berkshire Health System) | 5.000% | 10/1/31 | 1,250 | 1,368 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/19 | 520 | 564 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/38 | 2,950 | 3,500 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/40 | 2,000 | 2,192 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston College) | 5.000% | 7/1/42 | 2,000 | 2,363 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/22 (Prere.) | 470 | 554 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/22 (Prere.) | 2,995 | 3,532 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/29 | 2,535 | 2,802 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/29 | 3,100 | 3,528 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/30 | 2,450 | 2,760 |

13

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/31 | 4,245 | 4,758 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/34 | 1,510 | 1,671 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/37 | 1,000 | 1,099 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston Medical Center) | 5.000% | 7/1/44 | 7,000 | 7,595 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 7/1/17 (Prere.) | 10,000 | 10,035 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 6.000% | 5/15/29 (2) | 1,400 | 1,756 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.375% | 5/15/39 | 1,575 | 1,964 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 4.000% | 10/1/46 | 3,000 | 3,123 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 10/1/46 | 3,000 | 3,448 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 5.000% | 10/1/48 | 5,000 | 5,625 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Boston University) | 6.000% | 5/15/59 (10) | 5,575 | 7,152 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Broad Institute Inc.) | 5.250% | 4/1/37 | 4,000 | 4,486 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (CareGroup Inc.) | 5.000% | 7/1/28 | 3,000 | 3,595 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (CareGroup Inc.) | 5.000% | 7/1/32 | 1,000 | 1,146 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (CareGroup Inc.) | 5.000% | 7/1/33 | 1,000 | 1,139 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (CareGroup Inc.) | 5.000% | 7/1/37 | 1,000 | 1,150 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (CareGroup Inc.) | 5.000% | 7/1/38 | 1,000 | 1,148 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Carleton-Willard Village) | 5.250% | 12/1/25 | 600 | 650 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Carleton-Willard Village) | 5.625% | 12/1/30 | 550 | 595 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Children’s Hospital) | 5.000% | 10/1/34 | 2,440 | 2,850 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Children’s Hospital) | 5.000% | 10/1/46 | 4,000 | 4,597 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Commonwealth Contract Assistance) | 5.000% | 5/1/35 | 5,210 | 5,999 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Commonwealth Contract Assistance) | 5.500% | 2/1/40 | 2,160 | 2,376 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Dana-Farber Cancer Institute) | 5.000% | 12/1/30 | 2,115 | 2,526 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Dana-Farber Cancer Institute) | 5.000% | 12/1/41 | 11,105 | 12,761 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Dana-Farber Cancer Institute) | 5.000% | 12/1/46 | 4,000 | 4,561 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Deerfield Academy) | 5.000% | 10/1/40 | 4,665 | 5,189 |

14

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/28 | 1,825 | 2,083 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/35 | 3,000 | 3,325 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/40 | 6,000 | 6,273 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/41 | 5,960 | 6,538 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.250% | 1/1/42 | 1,700 | 1,943 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emerson College) | 5.000% | 1/1/47 | 4,330 | 4,810 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Emmanuel College) | 5.000% | 10/1/43 | 4,000 | 4,447 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 10/15/20 (Prere.) | 9,790 | 11,076 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 10/15/20 (Prere.) | 740 | 837 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 10/15/20 (Prere.) | 260 | 294 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.250% | 2/1/21 (Prere.) | 11,000 | 12,657 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 7/15/33 | 5,340 | 6,476 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 7/15/34 | 5,000 | 6,037 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 4.000% | 7/15/36 | 3,500 | 3,848 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 7/15/36 | 9,340 | 12,219 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Harvard University) | 5.000% | 7/15/40 | 7,000 | 9,266 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lahey Clinic Obligated Group) | 5.000% | 8/15/28 | 750 | 838 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lahey Clinic Obligated Group) | 5.000% | 8/15/40 | 1,750 | 1,976 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lahey Clinic Obligated Group) | 5.000% | 8/15/45 | 9,000 | 10,119 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Loomis Obligated Group) | 6.000% | 1/1/33 | 4,000 | 4,452 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lowell General Hospital) | 5.000% | 7/1/37 | 4,800 | 5,156 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Lowell General Hospital) | 5.000% | 7/1/44 | 6,010 | 6,402 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/19 | 175 | 189 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/21 | 300 | 344 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/23 | 250 | 298 |

15

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Massachusetts College of Pharmacy | | | | |

| & Allied Health Sciences) | 5.000% | 7/1/26 | 1,380 | 1,594 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (MCPHS University) | 5.000% | 7/1/31 | 400 | 469 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (MCPHS University) | 5.000% | 7/1/32 | 300 | 350 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (MCPHS University) | 5.000% | 7/1/37 | 450 | 516 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.000% | 7/1/32 | 2,000 | 2,143 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.000% | 7/1/37 | 300 | 328 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.000% | 7/1/42 | 500 | 543 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.250% | 7/1/42 | 1,920 | 2,052 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.125% | 7/1/44 | 1,500 | 1,613 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Merrimack College) | 5.000% | 7/1/47 | 2,500 | 2,705 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Milford Regional Medical Center) | 5.625% | 7/15/36 | 1,000 | 1,124 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Milford Regional Medical Center) | 5.750% | 7/15/43 | 5,755 | 6,433 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Mount Holyoke College) | 5.000% | 7/1/18 (Prere.) | 1,500 | 1,567 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 10/1/29 | 3,250 | 3,711 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 10/1/30 | 1,750 | 1,992 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 3/1/32 | 950 | 1,081 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Northeastern University) | 5.000% | 3/1/39 | 3,500 | 3,918 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Olin College) | 5.000% | 11/1/38 | 6,000 | 6,815 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/28 | 2,000 | 2,304 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/29 | 6,000 | 7,193 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/30 | 1,500 | 1,709 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/31 | 5,705 | 6,406 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 4.000% | 7/1/32 | 8,000 | 8,573 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/36 | 4,000 | 4,467 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/40 | 3,000 | 3,386 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.375% | 7/1/41 | 4,000 | 4,400 |

16

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/45 | 3,775 | 4,241 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Partners Healthcare) | 5.000% | 7/1/47 | 5,000 | 5,653 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Phillips Academy) | 5.000% | 9/1/38 | 1,545 | 1,818 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Phillips Academy) | 5.000% | 9/1/43 | 8,295 | 9,718 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Seven Hills Foundation Obligated | | | | |

| Group) | 5.000% | 9/1/35 | 1,500 | 1,583 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.500% | 10/1/28 | 1,000 | 1,165 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.125% | 10/1/33 | 2,000 | 2,212 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.000% | 10/1/36 | 2,250 | 2,508 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Simmons College) | 5.250% | 10/1/39 | 3,000 | 3,341 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (South Shore Hospital Inc.) | 5.000% | 7/1/41 | 2,000 | 2,227 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Southcoast Health System Obligated | | | | |

| Group) | 5.000% | 7/1/27 | 1,550 | 1,783 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Sterling & Francine Clark Art Institute) | 5.000% | 7/1/34 | 1,000 | 1,167 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Sterling & Francine Clark Art Institute) | 5.000% | 7/1/35 | 2,000 | 2,324 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Sterling & Francine Clark Art Institute) | 4.000% | 7/1/41 | 6,130 | 6,403 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.000% | 7/1/30 | 3,000 | 3,184 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.000% | 7/1/35 | 1,000 | 1,137 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.000% | 7/1/36 | 1,000 | 1,133 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 4.000% | 7/1/39 | 6,975 | 7,120 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Suffolk University) | 5.125% | 7/1/40 | 3,000 | 3,160 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 6.250% | 1/1/27 | 3,545 | 4,056 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 7.250% | 1/1/32 | 4,500 | 5,284 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 6.750% | 1/1/36 | 850 | 975 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts Medical Center) | 6.875% | 1/1/41 | 2,000 | 2,298 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Tufts University) | 5.000% | 8/15/38 | 1,000 | 1,156 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Health Care | | | | |

| Obligated Group) | 5.000% | 7/1/31 | 1,000 | 1,142 |

17

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

|

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Health Care | | | | |

| Obligated Group) | 5.000% | 7/1/32 | 1,000 | 1,137 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Health Care | | | | |

| Obligated Group) | 5.000% | 7/1/38 | 3,000 | 3,379 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Medical Center) | 5.125% | 7/1/26 | 2,750 | 3,067 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Medical Center) | 5.000% | 7/1/31 | 1,000 | 1,136 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Medical Center) | 5.500% | 7/1/31 | 5,500 | 6,112 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Medical Center) | 5.000% | 7/1/41 | 700 | 771 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (UMass Memorial Medical Center) | 5.000% | 7/1/46 | 1,355 | 1,487 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Wellesley College) | 5.000% | 7/1/42 | 2,000 | 2,296 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Wentworth Institute | | | | |

| of Technology Inc.) | 5.000% | 10/1/46 | 4,250 | 4,714 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Western New England University) | 5.000% | 9/1/45 | 2,825 | 3,111 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 0.000% | 1/1/32 (12) | 1,620 | 970 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 0.000% | 1/1/33 (12) | 3,290 | 1,881 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 5.000% | 1/1/35 | 1,720 | 1,993 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 5.000% | 1/1/36 | 1,000 | 1,155 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (WGBH Educational Foundation) | 5.000% | 1/1/36 (12) | 2,650 | 2,703 |

| 2 Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/29 | 1,000 | 1,249 |

| 2 Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/30 | 1,000 | 1,241 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/33 | 5,600 | 6,676 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Williams College) | 5.000% | 7/1/38 | 4,000 | 4,616 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Worcester Polytechnic Institute) | 5.000% | 9/1/50 | 2,650 | 2,923 |

| Massachusetts Development Finance Agency | | | | |

| Revenue (Worcester Polytechnic Institute) | 5.000% | 9/1/52 | 10,095 | 11,375 |

| Massachusetts Development Finance Agency | | | | |

| Special Obligation Revenue | 5.000% | 5/1/34 | 1,295 | 1,483 |

| Massachusetts Development Finance Agency | | | | |

| Special Obligation Revenue | 5.000% | 5/1/39 | 6,470 | 7,363 |

| Massachusetts Development Finance Agency | | | | |

| Special Obligation Revenue | 5.000% | 5/1/39 | 1,000 | 1,138 |

| Massachusetts Federal Highway GAN | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/15/26 | 3,000 | 3,494 |

| Massachusetts Federal Highway Revenue | 5.000% | 6/15/27 | 6,000 | 7,213 |

18

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts GO | 5.000% | 8/1/17 (Prere.) | 1,250 | 1,259 |

| Massachusetts GO | 5.250% | 8/1/17 (Prere.) | 1,500 | 1,511 |

| Massachusetts GO | 5.000% | 7/1/19 (Prere.) | 780 | 845 |

| Massachusetts GO | 5.500% | 10/1/19 (2) | 2,025 | 2,238 |

| Massachusetts GO | 5.500% | 10/1/19 (12) | 1,000 | 1,105 |

| Massachusetts GO | 5.000% | 4/1/20 | 2,550 | 2,836 |

| Massachusetts GO | 5.250% | 8/1/20 | 4,740 | 5,364 |

| Massachusetts GO | 5.000% | 8/1/21 (Prere.) | 2,000 | 2,315 |

| Massachusetts GO | 5.000% | 8/1/21 (Prere.) | 6,500 | 7,510 |

| Massachusetts GO | 5.000% | 5/1/23 | 2,500 | 3,010 |

| Massachusetts GO | 5.250% | 8/1/23 | 1,000 | 1,226 |

| Massachusetts GO | 5.000% | 7/1/26 | 9,000 | 10,580 |

| Massachusetts GO | 5.000% | 7/1/27 | 5,000 | 6,338 |

| Massachusetts GO | 5.000% | 7/1/28 | 10,740 | 13,238 |

| Massachusetts GO | 5.000% | 7/1/28 | 2,570 | 3,285 |

| Massachusetts GO | 5.000% | 7/1/29 | 4,900 | 5,990 |

| Massachusetts GO | 5.000% | 7/1/30 | 560 | 680 |

| Massachusetts GO | 5.500% | 8/1/30 (2) | 7,000 | 9,259 |

| Massachusetts GO | 5.000% | 7/1/32 | 3,460 | 4,156 |

| Massachusetts GO | 4.000% | 8/1/32 | 5,000 | 5,326 |

| Massachusetts GO | 5.000% | 7/1/33 | 5,215 | 6,226 |

| Massachusetts GO | 4.500% | 7/1/34 | 11,170 | 12,518 |

| Massachusetts GO | 5.000% | 7/1/34 | 5,000 | 5,943 |

| Massachusetts GO | 5.000% | 12/1/34 | 13,000 | 15,551 |

| Massachusetts GO | 4.000% | 4/1/35 | 5,000 | 5,321 |

| Massachusetts GO | 4.000% | 5/1/35 | 5,000 | 5,264 |

| Massachusetts GO | 5.000% | 7/1/35 | 4,000 | 4,683 |

| Massachusetts GO | 5.000% | 7/1/35 | 5,000 | 5,916 |

| Massachusetts GO | 5.000% | 7/1/36 | 4,000 | 4,719 |

| Massachusetts GO | 5.000% | 8/1/36 | 9,000 | 10,228 |

| Massachusetts GO | 5.000% | 12/1/36 | 3,000 | 3,561 |

| Massachusetts GO | 5.000% | 7/1/37 | 500 | 582 |

| Massachusetts GO | 5.000% | 8/1/37 | 5,000 | 5,660 |

| Massachusetts GO | 4.000% | 4/1/38 | 4,000 | 4,223 |

| Massachusetts GO | 5.000% | 7/1/38 | 5,000 | 5,864 |

| Massachusetts GO | 5.000% | 12/1/38 | 2,500 | 2,949 |

| Massachusetts GO | 4.000% | 12/1/39 | 500 | 530 |

| Massachusetts GO | 5.000% | 7/1/40 | 8,000 | 9,278 |

| Massachusetts GO | 5.000% | 3/1/41 | 8,000 | 9,149 |

| Massachusetts GO | 4.000% | 9/1/41 | 3,000 | 3,159 |

| Massachusetts GO | 5.250% | 4/1/42 | 3,000 | 3,634 |

| Massachusetts GO | 4.000% | 9/1/42 | 6,900 | 7,265 |

| Massachusetts GO | 4.000% | 6/1/43 | 7,820 | 8,016 |

| Massachusetts GO | 4.500% | 8/1/43 | 3,705 | 4,016 |

| Massachusetts GO | 4.000% | 12/1/44 | 7,350 | 7,730 |

| Massachusetts GO | 4.000% | 5/1/45 | 10,000 | 10,390 |

| Massachusetts GO | 5.000% | 7/1/45 | 2,000 | 2,310 |

| Massachusetts GO | 4.000% | 12/1/45 | 5,000 | 5,254 |

| Massachusetts GO | 5.000% | 4/1/47 | 8,950 | 10,506 |

| Massachusetts GO | 5.250% | 4/1/47 | 7,000 | 8,438 |

| 1 Massachusetts GO TOB VRDO | 0.840% | 6/1/17 LOC | 12,010 | 12,010 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Baystate Medical | | | | |

| Center) VRDO | 0.780% | 6/1/17 LOC | 2,100 | 2,100 |

19

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Berklee College of | | | | |

| Music, Inc.) | 5.000% | 10/1/26 | 120 | 122 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Boston Medical Center) | 5.000% | 7/1/18 (Prere.) | 315 | 329 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Boston Medical Center) | 5.000% | 7/1/18 (Prere.) | 2,575 | 2,687 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (CareGroup) | 5.000% | 7/1/18 (Prere.) | 2,000 | 2,089 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (CareGroup) | 5.125% | 7/1/18 (Prere.) | 3,015 | 3,153 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (CareGroup) | 5.125% | 7/1/18 (Prere.) | 3,500 | 3,660 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Children’s Hospital) | 5.500% | 12/1/39 | 4,000 | 4,363 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Children’s Hospital) VRDO | 0.780% | 6/1/17 LOC | 5,400 | 5,400 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Dana-Farber Cancer | | | | |

| Institute) | 5.000% | 12/1/37 | 5,000 | 5,276 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 5.000% | 12/15/19 (Prere.) | 810 | 892 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 5.000% | 12/15/19 (Prere.) | 925 | 1,019 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Harvard University) | 6.250% | 4/1/20 | 3,000 | 3,441 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Isabella Stewart Gardner | | | | |

| Museum) | 5.000% | 5/1/19 (Prere.) | 1,650 | 1,776 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Isabella Stewart Gardner | | | | |

| Museum) | 5.000% | 5/1/19 (Prere.) | 2,080 | 2,239 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.500% | 7/1/18 (Prere.) | 1,000 | 1,051 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (MIT) | 5.250% | 7/1/30 | 3,000 | 3,951 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Museum of Fine Arts) | | | | |

| VRDO | 0.790% | 6/1/17 | 4,500 | 4,500 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Museum of Fine Arts) | | | | |

| VRDO | 0.790% | 6/1/17 | 1,100 | 1,100 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/19 | 3,000 | 3,260 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/23 | 3,435 | 3,612 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/32 | 1,000 | 1,126 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Northeastern University) | 5.000% | 10/1/33 | 3,000 | 3,143 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | 5.250% | 7/1/29 | 10,000 | 10,824 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare System) | 5.000% | 7/1/39 | 1,680 | 1,788 |

20

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare | | | | |

| System) TOB VRDO | 0.800% | 6/7/17 | 3,800 | 3,800 |

| 2 Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare | | | | |

| System) VRDO | 0.730% | 6/7/17 | 6,700 | 6,700 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Partners Healthcare | | | | |

| System) VRDO | 0.760% | 6/7/17 | 1,100 | 1,100 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (South Coast Health System) | 5.000% | 7/1/39 | 6,000 | 6,286 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Tufts University) | 5.250% | 2/15/22 | 1,400 | 1,654 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Tufts University) VRDO | 0.730% | 6/1/17 | 100 | 100 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (UMass Memorial Medical | | | | |

| Center) | 5.000% | 7/1/21 | 100 | 110 |

| Massachusetts Health & Educational Facilities | | | | |

| Authority Revenue (Winchester Hospital) | 5.250% | 7/1/38 | 2,840 | 3,086 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 2.650% | 12/1/41 | 2,935 | 2,979 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 2.750% | 12/1/41 | 865 | 876 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 3.500% | 6/1/42 | 990 | 1,047 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 4.000% | 12/1/43 | 2,560 | 2,641 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 4.000% | 12/1/44 | 2,530 | 2,659 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 4.000% | 6/1/45 | 1,360 | 1,443 |

| Massachusetts Housing Finance Agency Single | | | | |

| Family Housing Revenue | 4.050% | 12/1/52 | 4,490 | 4,557 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/25 | 1,230 | 1,434 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/30 | 2,000 | 2,304 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/31 | 1,800 | 2,064 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/33 | 4,650 | 5,297 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/34 | 3,845 | 4,468 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/35 | 1,500 | 1,756 |

| Massachusetts Port Authority Revenue | 5.000% | 7/1/40 | 6,850 | 7,944 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/17 (Prere.) | 20 | 20 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/22 | 5,000 | 5,920 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/25 | 3,110 | 3,657 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/26 | 5,000 | 5,872 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/27 | 10,000 | 11,733 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/28 | 7,250 | 8,490 |

21

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/29 | 11,450 | 13,384 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/29 | 2,400 | 2,941 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 8/15/30 | 8,000 | 9,241 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/30 | 4,700 | 5,733 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/31 | 7,855 | 9,522 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 4.000% | 8/15/32 | 4,000 | 4,334 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 10/15/32 | 2,400 | 2,741 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/34 | 2,000 | 2,359 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/34 | 7,000 | 8,361 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.250% | 10/15/35 | 10,000 | 11,503 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 4.000% | 8/15/36 | 5,000 | 5,316 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 4.000% | 1/15/37 | 3,000 | 3,159 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 11/15/37 | 5,000 | 5,823 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 5.000% | 5/15/38 | 2,660 | 3,045 |

| Massachusetts School Building Authority | | | | |

| Dedicated Sales Tax Revenue | 4.000% | 11/15/46 | 4,700 | 4,919 |

| Massachusetts Special Obligation Dedicated | | | | |

| Tax Revenue | 5.500% | 1/1/27 (14) | 10,000 | 12,797 |

| Massachusetts Special Obligation Dedicated | | | | |

| Tax Revenue | 5.500% | 1/1/28 (14) | 3,750 | 4,827 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/21 (Prere.) | 2,000 | 2,304 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/33 | 2,050 | 2,303 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 4.000% | 6/1/37 | 1,960 | 2,054 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/38 | 2,750 | 3,090 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/43 | 5,000 | 5,607 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 5.000% | 6/1/44 | 5,000 | 5,729 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 4.000% | 6/1/45 | 7,000 | 7,373 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Accelerated Bridge Program) | 4.000% | 6/1/46 | 10,000 | 10,525 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Rail Enhancement Program) | 5.000% | 6/1/40 | 5,000 | 5,819 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Rail Enhancement Program) | 5.000% | 6/1/41 | 7,000 | 8,212 |

22

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Transportation Fund Revenue | | | | |

| (Rail Enhancement Program) | 4.000% | 6/1/45 | 7,300 | 7,709 |

| Massachusetts Transportation Fund Revenue | | | | |

| (Rail Enhancement Program) | 5.000% | 6/1/45 | 5,640 | 6,537 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/20 (14) | 3,000 | 2,900 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/25 (14) | 5,000 | 4,287 |

| Massachusetts Turnpike Authority Revenue | | | | |

| (Metropolitan Highway System) | 0.000% | 1/1/28 (14) | 6,670 | 5,182 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.250% | 8/1/17 | 540 | 542 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.000% | 8/1/22 | 3,010 | 3,575 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.000% | 8/1/27 | 8,010 | 9,716 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.000% | 8/1/28 | 975 | 1,176 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.250% | 8/1/29 | 1,520 | 1,980 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.750% | 8/1/29 | 190 | 191 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.000% | 8/1/32 | 2,415 | 2,687 |

| Massachusetts Water Pollution Abatement Trust | | | | |

| Revenue | 5.000% | 8/1/32 | 5,685 | 6,141 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/17 (Prere.) | 500 | 503 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/17 (Prere.) | 875 | 881 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/19 (Prere.) | 2,950 | 3,204 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/20 (Prere.) | 2,775 | 3,119 |

| 3 Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/20 (Prere.) | 500 | 562 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.500% | 8/1/20 (4) | 1,000 | 1,141 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/21 (Prere.) | 180 | 208 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/21 (Prere.) | 820 | 948 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/22 (Prere.) | 2,400 | 2,842 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.500% | 8/1/22 (4) | 1,490 | 1,807 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/27 | 2,000 | 2,238 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/27 | 5,000 | 6,247 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/28 | 800 | 991 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/29 | 6,000 | 6,882 |

23

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/29 | 1,070 | 1,338 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/31 | 2,280 | 2,767 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/31 (4) | 1,000 | 1,289 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/32 | 5,020 | 6,061 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/33 | 3,300 | 4,027 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/34 (14) | 7,500 | 7,552 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/34 | 3,465 | 4,211 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/35 (14) | 13,025 | 13,116 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/35 (4) | 6,310 | 8,235 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 4.000% | 8/1/36 | 7,200 | 7,761 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/36 | 2,710 | 3,130 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/40 | 2,690 | 3,170 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/40 | 9,860 | 11,620 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/42 | 1,000 | 1,143 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.250% | 8/1/42 | 10,000 | 11,386 |

| Massachusetts Water Resources Authority | | | | |

| Revenue | 5.000% | 8/1/44 | 8,000 | 9,119 |

| Massachusetts Water Resources Authority | | | | |

| Revenue VRDO | 0.750% | 6/7/17 | 1,400 | 1,400 |

| Massachusetts Water Resources Authority | | | | |

| Revenue VRDO | 0.760% | 6/7/17 | 2,100 | 2,100 |

| Metropolitan Boston MA Transit Parking Corp. | | | | |

| Revenue | 5.000% | 7/1/31 | 1,000 | 1,130 |

| Metropolitan Boston MA Transit Parking Corp. | | | | |

| Revenue | 5.250% | 7/1/36 | 7,000 | 7,930 |

| Scituate MA GO | 4.000% | 9/15/39 | 3,000 | 3,159 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 5/1/18 (Prere.) | 1,615 | 1,676 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/31 | 2,500 | 2,986 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/32 | 4,060 | 4,802 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/35 | 5,460 | 6,566 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 5/1/38 | 2,000 | 2,276 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/38 | 4,615 | 5,499 |

24

| | | | |

| Massachusetts Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/39 | 3,000 | 3,437 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/39 | 6,695 | 7,656 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/40 | 3,000 | 3,487 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.000% | 11/1/44 | 3,365 | 3,843 |

| University of Massachusetts Building Authority | | | | |

| Revenue | 5.250% | 11/1/47 | 5,000 | 6,075 |

| Worcester MA GO | 5.250% | 8/15/21 (14) | 315 | 316 |

| | | | | 1,575,814 |

| Guam (0.3%) | | | | |

| Guam Government Business Privilege Tax | | | | |

| Revenue | 5.000% | 11/15/33 | 3,000 | 3,269 |

| Guam Government Waterworks Authority | | | | |

| Water & Waste Water System Revenue | 5.500% | 7/1/43 | 2,250 | 2,504 |

| | | | | 5,773 |

| Total Tax-Exempt Municipal Bonds (Cost $1,524,885) | | | 1,581,587 |

| |

| | | | | Amount |

| | | | | ($000) |

| Other Assets and Liabilities (0.8%) | | | | |

| Other Assets | | | | |

| Investment in Vanguard | | | | 105 |

| Receivables for Investment Securities Sold | | | | 1,365 |

| Receivables for Accrued Income | | | | 20,823 |

| Receivables for Capital Shares Issued | | | | 1,024 |

| Other Assets | | | | 135 |

| Total Other Assets | | | | 23,452 |

| Liabilities | | | | |

| Payables for Investment Securities Purchased | | | | (7,462) |

| Payables for Capital Shares Redeemed | | | | (1,588) |

| Payables for Distributions | | | | (956) |

| Payables to Vanguard | | | | (1,202) |

| Other Liabilities | | | | (70) |

| Total Liabilities | | | | (11,278) |

| Net Assets (100%) | | | | |

| Applicable to 147,482,661 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | | 1,593,761 |

| Net Asset Value Per Share | | | | $10.81 |

25

| |

| Massachusetts Tax-Exempt Fund | |

| |

| |

| |

| At May 31, 2017, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 1,536,857 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Gains | 238 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 56,702 |

| Futures Contracts | (36) |

| Net Assets | 1,593,761 |

• See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from

registration, normally to qualified institutional buyers. At May 31, 2017, the aggregate value of these securities was $18,689,000,

representing 1.2% of net assets.

2 Security purchased on a when-issued or delayed-delivery basis for which the fund has not taken delivery as of May 31, 2017.

3 Securities with a value of $534,000 have been segregated as initial margin for open futures contracts.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

26

Massachusetts Tax-Exempt Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PILOT—Payments in Lieu of Taxes.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.