UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: June 30, 2012

Date of reporting period: December 31, 2012

ITEM 1. REPORT TO SHAREHOLDERS

Wells Fargo Advantage

California Limited-Term Tax-Free Fund

Semi-Annual Report

December 31, 2012

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of December 31, 2012, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC, disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Wells Fargo investment history

| | |

| 1932 | | Keystone creates one of the first mutual fund families. |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first tactical asset allocation models in institutional separately managed accounts. |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM). |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| 1997 | | Wells Fargo launches the Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus and, if available, a summary prospectus, for Wells Fargo Advantage Funds, containing this and other information, visit wellsfargoadvantagefunds.com. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

“Dow Jones®” and “Dow Jones Target Date IndexesSM” are service marks of Dow Jones Trademark Holdings LLC (“Dow Jones”); have been licensed to CME Group Index Services LLC (“CME Indexes”); and have been sublicensed for use for certain purposes by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Wells Fargo Advantage Dow Jones Target Date FundsSM, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME Indexes, or their respective affiliates, and none of them makes any representation regarding the advisability of investing in such product(s).

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 110 mutual funds across a wide range of asset classes, representing over $217 billion in assets under management, as of December 31, 2012.

| | | | |

| Equity funds | | | | |

Asia Pacific Fund | | Enterprise Fund† | | Opportunity Fund† |

C&B Large Cap Value Fund | | Equity Value Fund | | Precious Metals Fund |

C&B Mid Cap Value Fund | | Global Opportunities Fund | | Premier Large Company Growth Fund |

Capital Growth Fund | | Growth Fund | | Small Cap Opportunities Fund |

Common Stock Fund | | Index Fund | | Small Cap Value Fund |

Disciplined U.S. Core Fund | | International Equity Fund | | Small Company Growth Fund |

Discovery Fund† | | International Value Fund | | Small Company Value Fund |

Diversified Equity Fund | | Intrinsic Small Cap Value Fund | | Small/Mid Cap Core Fund |

Diversified International Fund | | Intrinsic Value Fund | | Small/Mid Cap Value Fund |

Diversified Small Cap Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Emerging Growth Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Emerging Markets Equity Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Markets Equity Income Fund | | Large Company Value Fund | | Traditional Small Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Utility and Telecommunications Fund |

| Bond funds | | | | |

Adjustable Rate Government Fund | | High Yield Municipal Bond Fund | | Short Duration Government Bond Fund |

California Limited-Term Tax-Free Fund | | Income Plus Fund | | Short-Term Bond Fund |

California Tax-Free Fund | | Inflation-Protected Bond Fund | | Short-Term High Yield Bond Fund |

Colorado Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Short-Term Municipal Bond Fund |

Core Bond Fund | | International Bond Fund | | Strategic Income Fund |

Emerging Markets Local Bond Fund | | Minnesota Tax-Free Fund | | Strategic Municipal Bond Fund |

Government Securities Fund | | Municipal Bond Fund | | Ultra Short-Term Income Fund |

High Income Fund | | North Carolina Tax-Free Fund | | Ultra Short-Term Municipal Income Fund |

High Yield Bond Fund | | Pennsylvania Tax-Free Fund | | Wisconsin Tax-Free Fund |

| Asset allocation funds | | | | |

Absolute Return Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Asset Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Conservative Allocation Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Diversified Income Builder Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Growth Balanced Fund | | Target Today Fund† | | Target 2045 Fund† |

Index Asset Allocation Fund | | Target 2010 Fund† | | Target 2050 Fund† |

Moderate Balanced Fund | | Target 2015 Fund† | | Target 2055 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | | | |

| Money market funds | | | | |

100% Treasury Money Market Fund | | Heritage Money Market Fund† | | National Tax-Free Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | Prime Investment Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | Treasury Plus Money Market Fund |

Government Money Market Fund | | Municipal Money Market Fund | | |

| Variable trust funds1 | | | | |

VT Discovery Fund† | | VT Intrinsic Value Fund | | VT Small Cap Growth Fund |

VT Index Asset Allocation Fund | | VT Omega Growth Fund | | VT Small Cap Value Fund |

VT International Equity Fund | | VT Opportunity Fund† | | VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The variable trust funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

The past six months were marked by modest economic growth, continued accommodative monetary policy, and low interest rates. As a result, municipal bond yields declined, with longer-term maturities outperforming shorter-term maturities. In addition, lower-rated credits experienced stronger results than higher-rated bonds due to investor demand for yield.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage California Limited-Term Tax-Free Fund for the six-month period that ended December 31, 2012. The past six months were marked by modest economic growth, continued accommodative monetary policy, and low interest rates. As a result, municipal bond yields declined, with longer-term maturities outperforming shorter-term maturities. In addition, lower-rated credits experienced stronger results than higher-rated bonds due to investor demand for yield. The Barclays Municipal Bond Index1 the broadest measure for tracking investment-grade municipal bonds throughout the country, gained 3.01% for the period.

The economy experienced modest economic growth in the second half of 2012.

Economic growth continued at a modest pace in the second half of 2012 despite ongoing credit concerns in Europe and fiscal challenges domestically. The most recent measure of real gross domestic product (GDP), the broadest measure of U.S. economic activity, increased at an estimated annualized rate of 3.1% in the third quarter of 2012, primarily due to consumer spending, inventory buildup, government spending, residential fixed investment (housing), and exports, while constrained business spending held back growth. It is notable that the U.S. housing sector showed signs of improvement and helped the economy, despite many housing indicators remaining at depressed levels.

Labor markets continued to improve, but the total unemployment rate persisted at elevated levels. While nonfarm payrolls continued to increase, the labor-force participation rate declined to a 30-year low. Citing its dual mandate of fostering maximum employment and price stability, the Federal Reserve (Fed) reaffirmed its commitment to highly accommodative monetary policy. In addition, the Fed formally announced specific target ranges that could trigger a change to its highly accommodative monetary policy, noting thresholds for the unemployment rate at 6.5% and inflation projected to be half a percentage point above its 2.0% inflation target.

Municipal bond yields declined, the yield curve flattened, and credit spreads narrowed.

The last half of 2012 continued to see the municipal bond asset class provide positive total returns. The low-interest-rate policies of the Fed helped hold interest rates near record lows. Short-term yields were anchored near 20 basis points (bps; 100 bps equals 1.00%) as measured by a one-year municipal general obligation (GO) note, and longer-term GO bond yields declined 40 bps over the six months that ended December 31, 2012. As a result, the municipal yield curve flattened.

Meanwhile, lower-quality BBB-rated2 bonds outperformed higher-quality AAA-rated bonds as investors reached for yield. Credit spreads have narrowed from nearly a 400-bp difference between BBB- and AAA-rated yields in 2009 to a 165-bp yield advantage for BBB-rates bonds at year-end 2012. The credit quality of states has also continued to improve. One example of this improvement is that state tax revenues have grown for the past 10 consecutive quarters. In another example, states now have the smallest budget deficits on average since 2007, when the recession began.

| 1. | The Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 2. | The ratings indicated are from Standard & Poor’s. Credit-quality ratings apply to the underlying holdings of the Fund and not the Fund itself. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). We generally define higher-quality (investment grade) bonds as bonds having a rating above BBB/Baa and lower-quality bonds as bonds having a rating below BBB/Baa. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 3 | |

November election results also had implications for municipal creditworthiness. California passed Proposition 30, which was viewed as a positive for the state’s credit because it boosted tax revenues.

The final months of the year were marked by uncertainty regarding the so-called fiscal cliff negotiations. Market sentiment alternated between being positive when it seemed higher income-tax rates were imminent and negative when the municipal interest exemption appeared to be at risk of being eliminated. Throughout the political uncertainty, our portfolio managers emphasized the need to remain focused on the fundamentals of economic growth rates and the credit quality of individual securities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day,

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Throughout the political uncertainty, our portfolio managers emphasized the need to remain focused on the fundamentals of economic growth rates and the credit quality of individual securities.

Notice to shareholders

At its November 6-7, 2012 meeting, the Board of Trustees unanimously approved the following modifications to certain Class A sales load waiver privileges, with each change becoming effective on July 1, 2013:

| | n | | Annuity payments received under an annuity option or from death proceeds will no longer qualify for net asset value (NAV) repurchase privileges. | |

| | n | | The ability to reinvest redemption proceeds at NAV will be reduced from 120 days to 90 days. | |

| | n | | NAV purchase privileges for certain types of “grandfathered” shareholders will be modified to remove the ability to purchase Class A shares at NAV, unless those shares are held directly with the Fund. | |

Please contact your investment professional or call us directly at 1-800-222-8222 if you have any questions on this Notice to Shareholders.

| | | | |

| 4 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks current income exempt from federal income tax and California individual income tax, consistent with capital preservation.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Terry J. Goode

Adrian Van Poppel

Average annual total returns1 (%) as of December 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (SFCIX) | | 11-18-1992 | | | 1.34 | | | | 3.22 | | | | 2.85 | | | | 3.44 | | | | 3.63 | | | | 3.06 | | | | 0.85 | | | | 0.81 | |

| Class C (SFCCX) | | 8-30-2002 | | | 1.57 | | | | 2.84 | | | | 2.29 | | | | 2.57 | | | | 2.84 | | | | 2.29 | | | | 1.60 | | | | 1.56 | |

| Administrator Class (SCTIX) | | 9-6-1996 | | | – | | | | – | | | | – | | | | 3.57 | | | | 3.86 | | | | 3.32 | | | | 0.79 | | | | 0.61 | |

Barclays 1-5 Year Municipal Bond Index4 | | – | | | – | | | | – | | | | – | | | | 2.00 | | | | 3.91 | | | | 3.37 | | | | – | | | | – | |

| Barclays 1-5 Year California Municipal Bond Index5 | | – | | | – | | | | – | | | | – | | | | 2.06 | | | | 3.93 | | | | 3.38 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 2.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to California municipal securities risk, high-yield securities risk, and non-diversification risk. Consult the Fund’s prospectus for additional information on these and other risks. A portion of the Fund’s income may be subject to federal, state, and/or local income taxes or the alternative minimum tax (AMT). Any capital gains distributions may be taxable.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 5 | |

|

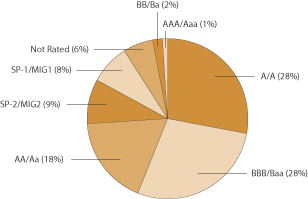

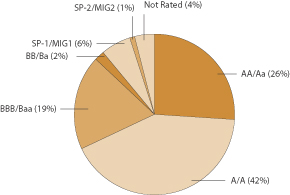

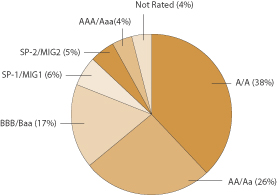

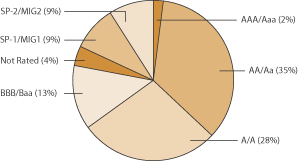

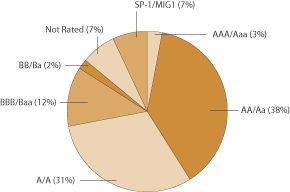

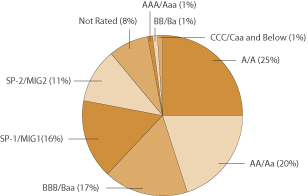

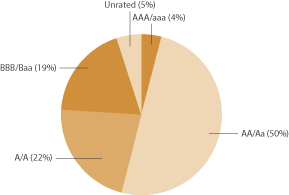

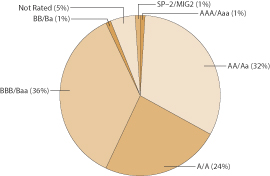

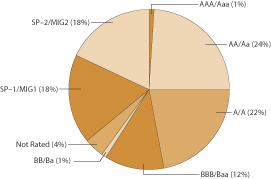

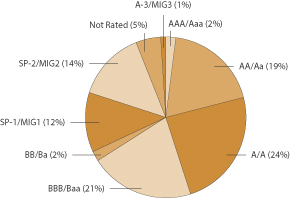

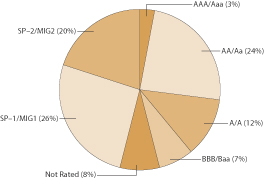

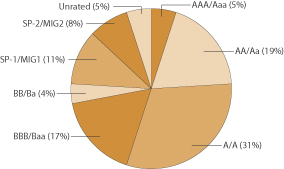

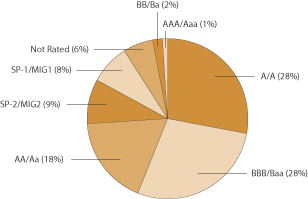

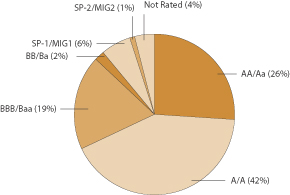

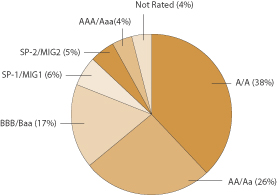

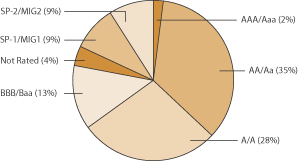

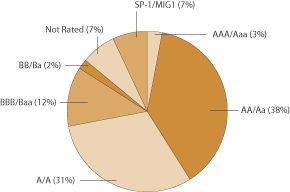

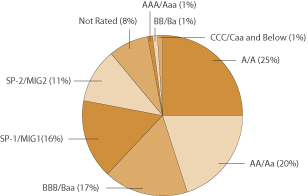

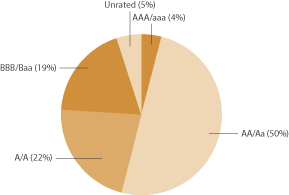

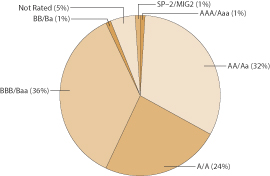

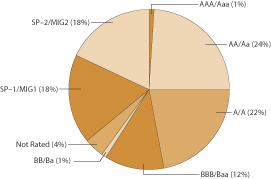

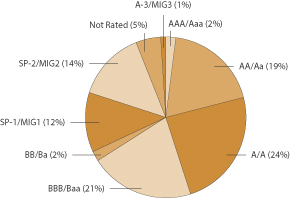

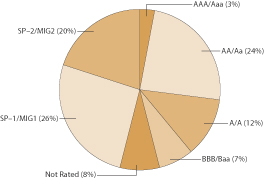

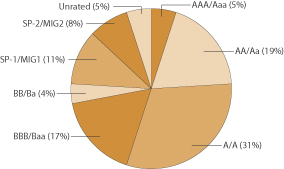

| Credit quality6 as of December 31, 2012 |

|

|

|

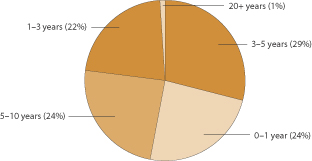

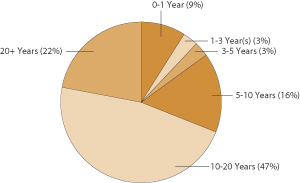

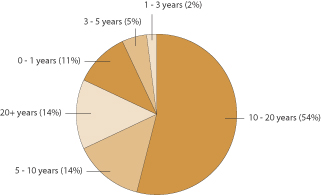

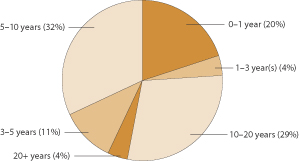

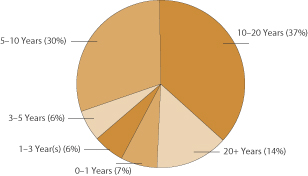

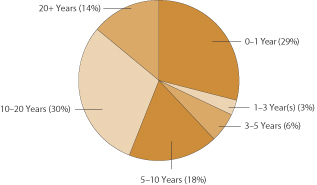

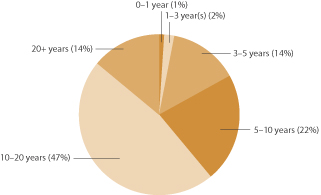

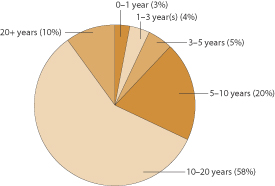

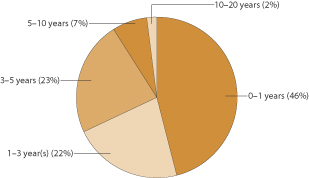

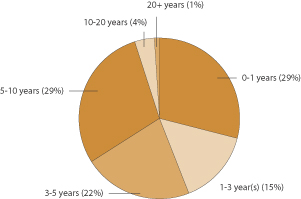

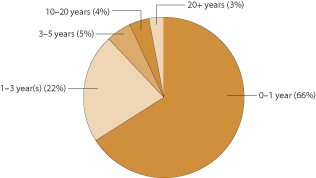

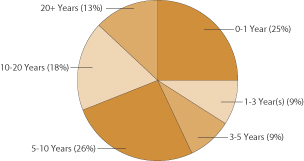

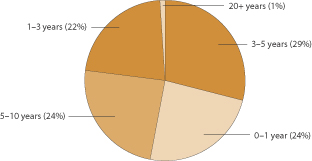

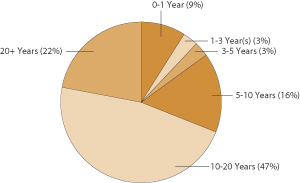

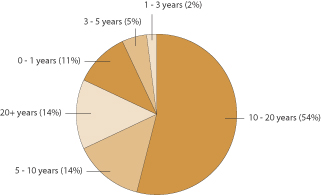

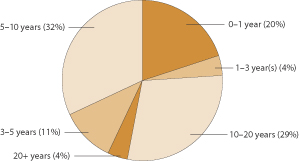

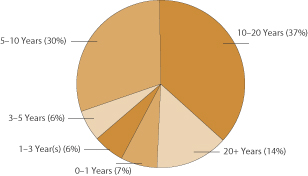

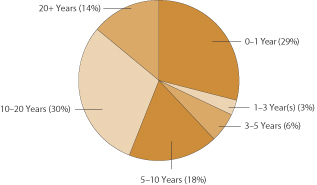

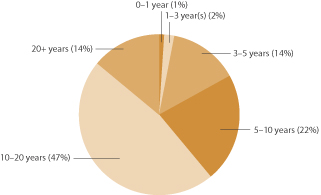

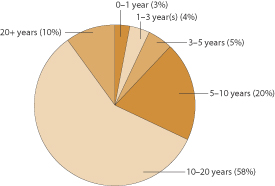

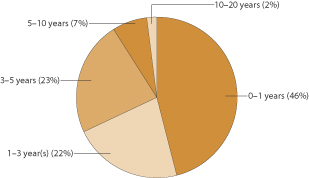

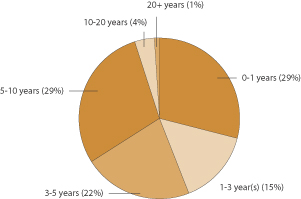

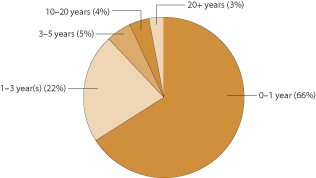

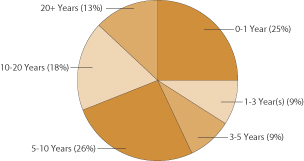

| Effective maturity distribution7 as of December 31, 2012 |

|

|

| 1. | Historical performance shown for Class C shares prior to their inception reflects the performance of Class A shares, adjusted to reflect the higher expenses applicable to Class C shares. |

| 2. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 3. | The Adviser has committed through October 31, 2013, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at 0.80% for Class A, 1.55% for Class C, and 0.60% for Administrator Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 4. | The Barclays 1-5 Year Municipal Blend Index is the 1-5 Year Blend Component of the Barclays Municipal Bond Index. You cannot invest directly in an index. |

| 5. | The Barclays 1-5 Year California Municipal Blend Index is the 1-5 Year Blend Component of the Barclays California Municipal Bond Index. You cannot invest directly in an index. |

| 6. | The ratings indicated are from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit Quality Ratings: Credit quality ratings apply to underlying holdings of the Fund and not the Fund itself. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (–) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Moody’s rates the creditworthiness of short-term securities from P-1 (highest) to P-3 (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of three rating agencies, the lower rating was utilized and if rated by one of the agencies that rating was utilized. Credit quality is subject to change and is calculated based on the total long-term investments of the Fund. We generally define higher-quality (investment grade) bonds as bonds having a rating above BBB/Baa and lower-quality bonds as bonds having a rating below BBB/Baa. |

| 7. | Effective maturity is calculated based on the total long-term investments of the Fund. It is subject to change and may have changed since the date specified. |

| | | | |

| 6 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2012 to December 31, 2012.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning account value 7-1-2012 | | | Ending account value

12-31-2012 | | | Expenses paid during the period1 | | | Net annual expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,014.93 | | | $ | 4.06 | | | | 0.80 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.17 | | | $ | 4.08 | | | | 0.80 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,010.16 | | | $ | 7.85 | | | | 1.55 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.39 | | | $ | 7.88 | | | | 1.55 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,016.03 | | | $ | 3.05 | | | | 0.60 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.06 | | | | 0.60 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—December 31, 2012 (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | |

Municipal Obligations: 102.70% | | | | | | | | | | | | | |

| | | | |

| California: 92.87% | | | | | | | | | | | | | | | | |

ABAG Financial Authority For Nonprofit Corporations Children’s Hospital (Health Revenue) | | | 4.25 | % | | | 12-1-2016 | | | $ | 305,000 | | | $ | 331,642 | |

ABAG Financial Authority For Nonprofit Corporations Episcopal Senior Community (Health Revenue) | | | 2.50 | | | | 7-1-2019 | | | | 2,250,000 | | | | 2,219,400 | |

ABAG Financial Authority For Nonprofit Corporations Episcopal Senior Community (Housing Revenue) | | | 4.00 | | | | 7-1-2014 | | | | 910,000 | | | | 944,999 | |

ABAG Financial Authority For Nonprofit Corporations Episcopal Senior Community (Housing Revenue) | | | 5.00 | | | | 7-1-2015 | | | | 995,000 | | | | 1,081,674 | |

ABAG Financial Authority For Nonprofit Corporations Episcopal Senior Community (Housing Revenue) | | | 5.00 | | | | 7-1-2016 | | | | 1,045,000 | | | | 1,156,439 | |

ABAG Financial Authority For Nonprofit Corporations Jackson Laboratory (Miscellaneous Revenue) | | | 5.00 | | | | 7-1-2019 | | | | 730,000 | | | | 865,568 | |

ABAG Financial Authority For Nonprofit Corporations Jackson Laboratory (Miscellaneous Revenue) | | | 5.00 | | | | 7-1-2020 | | | | 815,000 | | | | 976,044 | |

ABAG Financial Authority For Nonprofit Corporations Odd Fellows of California Series A (Health Revenue) | | | 5.00 | | | | 4-1-2018 | | | | 1,200,000 | | | | 1,387,452 | |

ABAG Financial Authority For Nonprofit Corporations Sharp Healthcare Series A (Health Revenue) | | | 5.00 | | | | 8-1-2019 | | | | 500,000 | | | | 593,755 | |

Adelanto CA School District CAB Series B (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | | | | 9-1-2018 | | | | 3,370,000 | | | | 2,535,184 | |

Alameda CA Corridor Transportation Authority CAB Sub Lien Series A (Transportation Revenue, AMBAC Insured) ¤ | | | 0.00 | | | | 10-1-2019 | | | | 3,000,000 | | | | 2,449,680 | |

Alameda County CA COP (Miscellaneous Revenue, AMBAC Insured) | | | 5.63 | | | | 12-1-2015 | | | | 550,000 | | | | 621,352 | |

Albany CA Limited Obligation Improvement Bonds Act 1915 (Miscellaneous Revenue, AMBAC Insured) | | | 4.75 | | | | 9-2-2019 | | | | 1,305,000 | | | | 1,311,851 | |

Alhambra CA Police Facilities (Miscellaneous Revenue, AMBAC Insured) | | | 6.75 | | | | 9-1-2023 | | | | 1,885,000 | | | | 2,191,953 | |

Alisal CA Unified School District 2006 Election Series A (GO, AGM Insured) | | | 5.50 | | | | 8-1-2013 | | | | 700,000 | | | | 720,006 | |

Alvord CA Unified School Election of 2007 Series B (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2016 | | | | 305,000 | | | | 288,933 | |

Alvord CA Unified School Election of 2007 Series B (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2017 | | | | 155,000 | | | | 146,343 | |

Alvord CA Unified School Election of 2007 Series B (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2018 | | | | 475,000 | | | | 460,940 | |

Alvord CA Unified School Election of 2007 Series B (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2020 | | | | 1,605,000 | | | | 1,612,094 | |

Alvord CA Unified School District BAN (GO) ¤ | | | 0.00 | | | | 5-1-2015 | | | | 5,000,000 | | | | 4,860,500 | |

Anaheim CA PFA Convention Center Project Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 8-1-2013 | | | | 1,600,000 | | | | 1,605,056 | |

Anaheim CA PFA Public Improvements Project Series C (Miscellaneous Revenue, AGM Insured) | | | 6.00 | | | | 9-1-2014 | | | | 500,000 | | | | 543,130 | |

Anaheim CA Redevelopment Agency Merged Project Area Series A (Tax Revenue, AGM Insured) | | | 4.50 | | | | 2-1-2018 | | | | 875,000 | | | | 961,135 | |

Antelope Valley CA Health Care District Series A (Health Revenue, AGM Insured) | | | 5.20 | | | | 1-1-2017 | | | | 530,000 | | | | 531,685 | |

Antelope Valley CA Health Care District Series A (Health Revenue, AGM Insured) ± | | | 5.25 | | | | 9-1-2017 | | | | 1,800,000 | | | | 1,838,106 | |

Baldwin Park CA Unified School District BAN (GO) ¤ | | | 0.00 | | | | 8-1-2014 | | | | 500,000 | | | | 490,975 | |

Bay Area Infrastructure Financing Authority of California State Payment Acceleration Notes (Transportation Revenue, NATL-RE/FGIC Insured) | | | 5.00 | | | | 8-1-2017 | | | | 390,000 | | | | 391,283 | |

Bay Area Infrastructure Financing Authority of California State Payment Acceleration Notes (Transportation Revenue, XLCA Insured) | | | 5.00 | | | | 8-1-2017 | | | | 100,000 | | | | 102,301 | |

Bay Area Infrastructure Financing Authority of California State Payment Acceleration Notes (Transportation Revenue, NATL-RE/FGIC Insured) | | | 5.00 | | | | 8-1-2017 | | | | 1,070,000 | | | | 1,137,742 | |

Bay Area Toll Authority San Francisco Bay Area Toll Bridge Series C (Transportation Revenue) ± | | | 1.04 | | | | 4-1-2045 | | | | 5,000,000 | | | | 5,006,450 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Portfolio of investments—December 31, 2012 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Brentwood CA Infrastructure Financing Authority Series A (Miscellaneous Revenue, AGM Insured) | | | 4.00 | % | | | 9-2-2017 | | | $ | 3,825,000 | | | $ | 4,143,508 | |

Cabrillo CA Unified School District CAB Series A (GO, AMBAC Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 1,500,000 | | | | 1,448,760 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 2.00 | | | | 6-1-2013 | | | | 290,000 | | | | 291,436 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 2.00 | | | | 6-1-2014 | | | | 350,000 | | | | 354,834 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 3.00 | | | | 6-1-2015 | | | | 360,000 | | | | 373,619 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 3.00 | | | | 6-1-2016 | | | | 370,000 | | | | 385,825 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 3.00 | | | | 6-1-2017 | | | | 380,000 | | | | 395,686 | |

California Communities Transportation Total Road Improvement COP Series B

(Tax Revenue) | | | 4.00 | | | | 6-1-2018 | | | | 390,000 | | | | 424,047 | |

California Community College Financing Authority Shasta-Tehama-Trinity Joint District Series A (Miscellaneous Revenue) | | | 2.00 | | | | 5-1-2013 | | | | 120,000 | | | | 120,499 | |

California Community College Financing Authority Shasta-Tehama-Trinity Joint District Series A (Miscellaneous Revenue) | | | 2.00 | | | | 5-1-2014 | | | | 225,000 | | | | 227,952 | |

California Community College Financing Authority Shasta-Tehama-Trinity Joint District Series A (Miscellaneous Revenue) | | | 2.00 | | | | 5-1-2015 | | | | 230,000 | | | | 234,062 | |

California Community College Financing Authority Shasta-Tehama-Trinity Joint District Series A (Miscellaneous Revenue) | | | 2.00 | | | | 5-1-2016 | | | | 420,000 | | | | 422,705 | |

California Community College Financing Authority Shasta-Tehama-Trinity Joint District Series A (Miscellaneous Revenue) | | | 2.25 | | | | 5-1-2017 | | | | 435,000 | | | | 438,354 | |

California Department of Transportation COP Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.25 | | | | 3-1-2016 | | | | 180,000 | | | | 180,733 | |

California HFA AMT Home Mortgage Series D (Housing Revenue, FGIC Insured) | | | 4.20 | | | | 2-1-2015 | | | | 2,000,000 | | | | 2,033,140 | |

California HFA AMT Home Mortgage Series E (Housing Revenue) | | | 4.65 | | | | 8-1-2022 | | | | 965,000 | | | | 978,211 | |

California HFA AMT Home Mortgage Series E (Housing Revenue) | | | 5.00 | | | | 2-1-2042 | | | | 440,000 | | | | 453,108 | |

California HFA AMT Home Mortgage Series G (Housing Revenue) | | | 5.50 | | | | 8-1-2042 | | | | 1,580,000 | | | | 1,646,992 | |

California HFA AMT Home Mortgage Series H (Housing Revenue, FGIC Insured) | | | 5.75 | | | | 8-1-2030 | | | | 875,000 | | | | 914,883 | |

California HFA AMT Home Mortgage Series J (Housing Revenue, FGIC Insured) | | | 4.05 | | | | 8-1-2013 | | | | 1,775,000 | | | | 1,789,378 | |

California HFA AMT Home Mortgage Series J (Housing Revenue) | | | 5.75 | | | | 8-1-2047 | | | | 535,000 | | | | 559,621 | |

California HFA AMT Home Mortgage Series L (Housing Revenue, FNMA Insured) | | | 3.95 | | | | 8-1-2015 | | | | 1,300,000 | | | | 1,345,500 | |

California HFA AMT Home Mortgage Series L (Housing Revenue, FGIC/FHA/VA Insured) | | | 4.00 | | | | 8-1-2013 | | | | 500,000 | | | | 501,770 | |

California HFA AMT Home Mortgage Series M (Housing Revenue) | | | 4.55 | | | | 8-1-2021 | | | | 280,000 | | | | 283,200 | |

California HFA CAB Home Mortgage Series B (Housing Revenue, FHA Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 5,000 | | | | 3,915 | |

California HFA Home Mortgage Series A (Housing Revenue, GNMA/FNMA Insured) | | | 3.75 | | | | 8-1-2020 | | | | 1,920,000 | | | | 2,087,712 | |

California HFFA Casa Colina Project (Health Revenue) | | | 5.50 | | | | 4-1-2013 | | | | 450,000 | | | | 451,161 | |

California HFFA Catholic Healthcare West Series A (Health Revenue) | | | 5.00 | | | | 3-1-2019 | | | | 700,000 | | | | 817,201 | |

California HFFA Catholic Healthcare West Series C (Health Revenue,

NATL-RE Insured) ±(m)(n) | | | 0.25 | | | | 7-1-2022 | | | | 5,300,000 | | | | 4,982,000 | |

California HFFA Catholic Healthcare West Series F (Health Revenue) ± | | | 5.00 | | | | 7-1-2027 | | | | 1,000,000 | | | | 1,055,710 | |

California HFFA Catholic Healthcare West Series I (Health Revenue) ± | | | 4.95 | | | | 7-1-2026 | | | | 1,790,000 | | | | 1,893,623 | |

California HFFA Catholic Healthcare West Series L (Health Revenue) | | | 5.13 | | | | 7-1-2022 | | | | 380,000 | | | | 415,150 | |

California HFFA Paradise Estate (Health Revenue) | | | 5.13 | | | | 1-1-2022 | | | | 3,000,000 | | | | 3,011,340 | |

California HFFA Revenue Home Mortgage Series D (Housing Revenue,

FGIC/FHA/VA Insured) | | | 4.10 | | | | 2-1-2015 | | | | 1,750,000 | | | | 1,789,673 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2012 (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 9 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

California HFFA Revenue Home Mortgage Series D (Housing Revenue, FGIC Insured) | | | 4.30 | % | | | 8-1-2015 | | | $ | 475,000 | | | $ | 488,908 | |

California PCFA (Resource Recovery Revenue) ± | | | 5.25 | | | | 6-1-2023 | | | | 3,245,000 | | | | 3,661,626 | |

California PCFA Solid Waste Disposal Waste Management Project Series A (Resource Recovery Revenue) ± | | | 5.13 | | | | 7-1-2031 | | | | 1,000,000 | | | | 1,059,300 | |

California State (GO, NATL-RE Insured) | | | 4.38 | | | | 2-1-2013 | | | | 200,000 | | | | 200,678 | |

California State (GO, AMBAC Insured) | | | 5.00 | | | | 10-1-2016 | | | | 10,000 | | | | 10,038 | |

California State Department of Veterans Affairs Home Purchase AMT Series A

(Housing Revenue) | | | 4.00 | | | | 12-1-2013 | | | | 1,995,000 | | | | 2,058,122 | |

California State DWR Central Valley Project Water System Series AM

(Water & Sewer Revenue) %% | | | 5.00 | | | | 12-1-2017 | | | | 6,595,000 | | | | 7,814,745 | |

California State Educational Facilities Authority California College of the Arts (Education Revenue) | | | 2.50 | | | | 6-1-2013 | | | | 235,000 | | | | 236,274 | |

California State Health Facilities Financing Chinese Hospital Associates (Health Revenue) | | | 5.00 | | | | 6-1-2019 | | | | 200,000 | | | | 234,526 | |

California State Health Facilities Financing City of Hope National Medical Center Series A (Health Revenue) | | | 5.00 | | | | 11-15-2019 | | | | 750,000 | | | | 899,580 | |

California State Public Works Board California Community Colleges Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.50 | | | | 4-1-2013 | | | | 100,000 | | | | 100,423 | |

California State Public Works Board California Community Colleges Series B (Miscellaneous Revenue, NATL-RE Insured) | | | 5.10 | | | | 9-1-2013 | | | | 1,930,000 | | | | 1,937,411 | |

California State Public Works Board California State University Trustees Series B (Miscellaneous Revenue) | | | 5.00 | | | | 9-1-2013 | | | | 365,000 | | | | 366,369 | |

California State Public Works Board Department of Corrections Series A

(Miscellaneous Revenue) | | | 6.50 | | | | 9-1-2017 | | | | 1,895,000 | | | | 2,097,519 | |

California State Public Works Board Department of Corrections Series C

(Miscellaneous Revenue) | | | 4.00 | | | | 6-1-2018 | | | | 1,625,000 | | | | 1,809,844 | |

California State Public Works Board Department of Corrections Series D

(Miscellaneous Revenue, AGM Insured) | | | 5.25 | | | | 6-1-2015 | | | | 935,000 | | | | 980,553 | |

California State Public Works Board Department of Corrections Series E

(Miscellaneous Revenue, XLCA Insured) | | | 5.00 | | | | 6-1-2015 | | | | 640,000 | | | | 681,638 | |

California State Public Works Board Department of Corrections Series E (Miscellaneous Revenue, NATL-RE/Bank of New York Insured) | | | 5.50 | | | | 6-1-2015 | | | | 535,000 | | | | 555,699 | |

California State Public Works Board Department of Corrections State Prisons Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 12-1-2013 | | | | 980,000 | | | | 1,022,483 | |

California State Public Works Board Department of General Services Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 12-1-2017 | | | | 2,000,000 | | | | 2,007,520 | |

California State Public Works Board Judicial Council Projects Series D

(Miscellaneous Revenue) | | | 5.00 | | | | 12-1-2019 | | | | 1,000,000 | | | | 1,179,940 | |

California State Public Works Board Trustees California State University Series A (Miscellaneous Revenue) | | | 5.25 | | | | 10-1-2013 | | | | 250,000 | | | | 250,990 | |

California State School Cash Reserve Program Authority Series L (Miscellaneous Revenue) | | | 2.00 | | | | 2-1-2013 | | | | 6,000,000 | | | | 6,005,040 | |

California State University Hayward Foundation Project (Education Revenue, NATL-RE/GO of Corporation Insured) | | | 5.25 | | | | 8-1-2025 | | | | 475,000 | | | | 475,694 | |

California State Veterans Bonds Series CA (GO) | | | 4.45 | | | | 12-1-2017 | | | | 1,000,000 | | | | 1,078,770 | |

California Statewide CDA (Tax Revenue) | | | 2.00 | | | | 9-2-2015 | | | | 2,000,000 | | | | 1,995,320 | |

California Statewide CDA (Health Revenue) | | | 4.00 | | | | 5-15-2017 | | | | 450,000 | | | | 486,644 | |

California Statewide CDA (Health Revenue) | | | 5.00 | | | | 5-15-2018 | | | | 610,000 | | | | 697,462 | |

California Statewide CDA (Miscellaneous Revenue) | | | 5.88 | | | | 7-1-2022 | | | | 2,595,000 | | | | 2,835,141 | |

California Statewide CDA American Baptist Homes West (Housing Revenue) | | | 4.25 | | | | 10-1-2015 | | | | 1,750,000 | | | | 1,808,590 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Portfolio of investments—December 31, 2012 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

California Statewide CDA COP (Health Revenue, American Capital Access Radian Insured) | | | 4.00 | % | | | 6-1-2015 | | | $ | 325,000 | | | $ | 348,114 | |

California Statewide CDA COP Health Facilities Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.50 | | | | 9-1-2014 | | | | 500,000 | | | | 526,935 | |

California Statewide CDA Eskaton Properties Incorporated Obligated Group (Health Revenue) | | | 4.00 | | | | 11-15-2014 | | | | 545,000 | | | | 563,012 | |

California Statewide CDA Eskaton Properties Incorporated Obligated Group (Health Revenue) | | | 4.00 | | | | 11-15-2015 | | | | 1,000,000 | | | | 1,044,340 | |

California Statewide CDA Eskaton Properties Incorporated Obligated Group (Health Revenue) | | | 4.00 | | | | 11-15-2016 | | | | 1,000,000 | | | | 1,045,780 | |

California Statewide CDA Health Facilities Catholic Series F (Health Revenue, AGM Insured) ±(m) | | | 0.43 | | | | 7-1-2040 | | | | 1,000,000 | | | | 1,000,000 | |

California Statewide CDA Henry Mayo Memorial Hospital Series B (Health Revenue, AMBAC Insured) | | | 4.00 | | | | 10-1-2014 | | | | 780,000 | | | | 796,762 | |

California Statewide CDA International School Peninsula Project (Education Revenue) | | | 4.60 | | | | 11-1-2013 | | | | 100,000 | | | | 100,564 | |

California Statewide CDA Kaiser Permanente Series B (Health Revenue) ± | | | 3.90 | | | | 8-1-2031 | | | | 750,000 | | | | 779,558 | |

California Statewide CDA Kaiser Permanente Series E (Health Revenue) ± | | | 5.00 | | | | 4-1-2044 | | | | 4,000,000 | | | | 4,639,360 | |

California Statewide CDA MFHR ROC RR-II-R-13104CE (Housing Revenue, Citibank NA LIQ) 144Aø | | | 0.63 | | | | 9-6-2035 | | | | 2,400,000 | | | | 2,400,000 | |

California Statewide CDA MFHR ROC RR-II-R-13105CE (Housing Revenue, Citibank NA LIQ) 144Aø | | | 0.63 | | | | 12-14-2016 | | | | 6,400,000 | | | | 6,400,000 | |

California Statewide CDA Monterey Community Hospital (Health Revenue) | | | 3.25 | | | | 6-1-2016 | | | | 415,000 | | | | 441,431 | |

California Statewide CDA Proposition 1A Receivables Program (Tax Revenue) | | | 4.00 | | | | 6-15-2013 | | | | 1,500,000 | | | | 1,525,605 | |

California Statewide CDA Proposition 1A Receivables Program (Tax Revenue) | | | 5.00 | | | | 6-15-2013 | | | | 4,000,000 | | | | 4,086,480 | |

California Statewide CDA Sherman Oaks Project Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.50 | | | | 8-1-2014 | | | | 800,000 | | | | 842,704 | |

California Statewide CDA St. Joseph Hospital (Health Revenue, AGM Insured) | | | 4.50 | | | | 7-1-2018 | | | | 1,060,000 | | | | 1,135,620 | |

California Statewide CDA University of California Irvine East Campus Apartments Phase I (Housing Revenue) | | | 5.00 | | | | 5-15-2017 | | | | 1,000,000 | | | | 1,129,450 | |

California Statewide CDA University of California Irvine East Campus Apartments Phase II (Education Revenue) | | | 5.00 | | | | 5-15-2015 | | | | 1,500,000 | | | | 1,624,080 | |

California Statewide CDA University of California Irvine East Campus Apartments Phase II (Education Revenue) | | | 5.00 | | | | 5-15-2016 | | | | 380,000 | | | | 420,956 | |

Centinela Valley CA Union High School District CAB Series A (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 375,000 | | | | 357,533 | |

Centralia CA School District (GO, AGM Insured) | | | 4.00 | | | | 8-1-2018 | | | | 375,000 | | | | 424,099 | |

Chula Vista CA COP (Miscellaneous Revenue, NATL-RE Insured) | | | 4.50 | | | | 8-1-2016 | | | | 430,000 | | | | 435,151 | |

Clovis CA PFA (Water & Sewer Revenue, AMBAC Insured) | | | 5.00 | | | | 8-1-2015 | | | | 375,000 | | | | 407,516 | |

Coalinga CA PFA Senior Lien Notes Series A (Miscellaneous Revenue, AMBAC Insured) | | | 5.85 | | | | 9-15-2013 | | | | 255,000 | | | | 261,237 | |

Colton CA PFA Series A (Utilities Revenue) | | | 4.00 | | | | 4-1-2019 | | | | 415,000 | | | | 465,742 | |

Compton CA Community College District (GO) | | | 5.00 | | | | 7-1-2017 | | | | 1,225,000 | | | | 1,367,590 | |

Compton CA Community RDA 2nd Lien (Tax Revenue) | | | 3.00 | | | | 8-1-2013 | | | | 855,000 | | | | 857,394 | |

Compton CA Community RDA 2nd Lien (Tax Revenue) | | | 3.50 | | | | 8-1-2014 | | | | 1,130,000 | | | | 1,139,695 | |

Compton CA Community RDA Project Series A (Tax Revenue, AMBAC Insured) | | | 5.00 | | | | 8-1-2013 | | | | 2,245,000 | | | | 2,284,063 | |

Compton CA Solid Waste Management Facilities (Resource Recovery Revenue) | | | 4.80 | | | | 8-1-2020 | | | | 175,000 | | | | 192,973 | |

Compton CA Unified School District Election of 2002 CAB Series D (GO, AMBAC Insured) ¤ | | | 0.00 | | | | 6-1-2017 | | | | 3,575,000 | | | | 3,157,512 | |

Contra Costa CA Transportation Authority (Tax Revenue) ± | | | 0.51 | | | | 3-1-2034 | | | | 2,000,000 | | | | 1,999,600 | |

Contra Costa County CA PFA Series B (Miscellaneous Revenue, NATL-RE Insured) | | | 4.00 | | | | 6-1-2013 | | | | 450,000 | | | | 451,211 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2012 (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Cudahy CA Community Development Commission Redevelopment Projects Series B (Tax Revenue) | | | 5.50 | % | | | 10-1-2015 | | | $ | 690,000 | | | $ | 741,985 | |

Cudahy CA Community Development Commission Redevelopment Projects Series B (Tax Revenue) | | | 6.00 | | | | 10-1-2016 | | | | 625,000 | | | | 693,575 | |

Cudahy CA Community Development Commission Redevelopment Projects Series B (Tax Revenue) | | | 6.00 | | | | 10-1-2017 | | | | 385,000 | | | | 434,122 | |

Cudahy CA Community Development Commission Redevelopment Projects Series B (Tax Revenue) | | | 6.38 | | | | 10-1-2018 | | | | 410,000 | | | | 474,817 | |

Culver City CA RDFA (Tax Revenue, AMBAC Insured) | | | 5.50 | | | | 11-1-2014 | | | | 675,000 | | | | 695,027 | |

Culver City CA Redevelopment Agency CAB Tax Allocation A (Tax Revenue) ¤ | | | 0.00 | | | | 11-1-2019 | | | | 2,575,000 | | | | 2,037,340 | |

Delano County CA Financing Authority Police Station Project Series A (Miscellaneous Revenue) | | | 4.00 | | | | 12-1-2016 | | | | 1,040,000 | | | | 1,130,906 | |

Dixon CA Unified School District (GO, AGM Insured) | | | 4.00 | | | | 8-1-2019 | | | | 805,000 | | | | 902,308 | |

Dixon CA Unified School District (GO, AGM Insured) | | | 5.00 | | | | 8-1-2020 | | | | 1,095,000 | | | | 1,298,451 | |

East Bay CA Municipal Utility District Series A (Water & Sewer Revenue) %% | | | 5.00 | | | | 6-1-2018 | | | | 2,000,000 | | | | 2,394,420 | |

El Centro CA Financing Authority Series A (Water & Sewer Revenue, AGM Insured) | | | 2.50 | | | | 10-1-2016 | | | | 460,000 | | | | 472,714 | |

El Centro CA Financing Authority Series A (Water & Sewer Revenue, AGM Insured) | | | 2.50 | | | | 10-1-2017 | | | | 475,000 | | | | 485,431 | |

El Centro CA Financing Authority Series A (Water & Sewer Revenue, AGM Insured) | | | 2.50 | | | | 10-1-2018 | | | | 485,000 | | | | 494,060 | |

El Dorado CA Community Facilities District #19-1 (Tax Revenue) | | | 4.00 | | | | 9-1-2018 | | | | 1,000,000 | | | | 1,090,920 | |

El Dorado CA Community Facilities District #92-1 (Tax Revenue) | | | 4.00 | | | | 9-1-2017 | | | | 1,135,000 | | | | 1,229,477 | |

El Dorado CA Irrigation District & Water Agency Series A (Miscellaneous Revenue, NATL-RE/FGIC Insured) | | | 5.00 | | | | 3-1-2017 | | | | 500,000 | | | | 525,465 | |

Emeryville CA PFA Emeryville Redevelopment Project Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.25 | | | | 9-1-2015 | | | | 1,265,000 | | | | 1,280,737 | |

Emeryville CA PFA Emeryville Redevelopment Project Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.25 | | | | 9-1-2017 | | | | 1,400,000 | | | | 1,416,870 | |

Encinitas CA Community Facilities District Ranch Public Improvements Project (Tax Revenue) | | | 4.00 | | | | 9-1-2017 | | | | 1,180,000 | | | | 1,286,448 | |

Folsom Cordova CA Unified School District School Facilities Improvement District #1 Series A (GO, NATL-RE Insured) | | | 5.50 | | | | 10-1-2015 | | | | 370,000 | | | | 371,347 | |

Fontana CA PFA (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 9-1-2017 | | | | 1,015,000 | | | | 1,092,495 | |

Fontana CA RDA Jurupa Hills Redevelopment Project Series A (Tax Revenue) | | | 5.50 | | | | 10-1-2017 | | | | 50,000 | | | | 50,326 | |

Fontana CA RDA Sierra Corridor Commercial Redevelopment Project (Tax Revenue, NATL-RE/FGIC Insured) | | | 4.50 | | | | 9-1-2015 | | | | 825,000 | | | | 872,611 | |

Fontana CA Unified School District (GO) | | | 4.00 | | | | 8-1-2020 | | | | 3,620,000 | | | | 4,104,320 | |

Foothill-Eastern CA Transportation Corridor Agency CAB (Transportation Revenue, NATL-RE Insured) ¤ | | | 0.00 | | | | 1-15-2017 | | | | 580,000 | | | | 463,646 | |

Fowler CA Unified School District School Facilities Improvement District #1 (GO, NATL-RE Insured) | | | 5.20 | | | | 7-1-2020 | | | | 1,730,000 | | | | 1,940,835 | |

Fresno CA Unified School District Series A (GO, NATL-RE Insured) | | | 6.55 | | | | 8-1-2020 | | | | 200,000 | | | | 207,054 | |

Fresno CA Unified School District Series C (GO, NATL-RE Insured) | | | 5.80 | | | | 2-1-2015 | | | | 475,000 | | | | 512,962 | |

Fresno County CA Financing Authority Lease Series A (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 8-1-2019 | | | | 970,000 | | | | 1,032,332 | |

Fullerton CA Community Facilities District (Tax Revenue) | | | 3.50 | | | | 9-1-2017 | | | | 565,000 | | | | 595,081 | |

Fullerton CA Community Facilities District (Tax Revenue) | | | 4.00 | | | | 9-1-2018 | | | | 610,000 | | | | 656,933 | |

Fullerton CA Community Facilities District (Tax Revenue) | | | 4.00 | | | | 9-1-2019 | | | | 665,000 | | | | 713,618 | |

Garden Grove CA Agency for Community Development (Tax Revenue, AMBAC Insured) | | | 5.25 | | | | 10-1-2016 | | | | 600,000 | | | | 612,114 | |

Gilroy CA PFFA BAN (Miscellaneous Revenue) | | | 3.00 | | | | 11-1-2013 | | | | 3,000,000 | | | | 3,006,720 | |

Golden State CA Tobacco Securitization Corporation Series 2003 A-1 (Tobacco Revenue) | | | 6.25 | | | | 6-1-2033 | | | | 2,275,000 | | | | 2,332,057 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Portfolio of investments—December 31, 2012 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Golden West CA Schools Financing Authority 1998 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) ¤ | | | 0.00 | % | | | 2-1-2014 | | | $ | 455,000 | | | $ | 446,387 | |

Golden West CA Schools Financing Authority 1998 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 6.60 | | | | 2-1-2016 | | | | 650,000 | | | | 691,847 | |

Golden West CA Schools Financing Authority 1999 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) ¤ | | | 0.00 | | | | 2-1-2013 | | | | 360,000 | | | | 359,669 | |

Golden West CA Schools Financing Authority 1999 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) ¤ | | | 0.00 | | | | 2-1-2014 | | | | 235,000 | | | | 230,551 | |

Golden West CA Schools Financing Authority 1999 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.75 | | | | 2-1-2015 | | | | 200,000 | | | | 216,940 | |

Golden West CA Schools Financing Authority 1999 CAB Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.75 | | | | 8-1-2015 | | | | 265,000 | | | | 292,335 | |

Hawthorne CA School District Election of 2008 Series A (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 100,000 | | | | 95,342 | |

Hawthorne CA School District Election of 2008 Series A (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2016 | | | | 155,000 | | | | 143,257 | |

Hawthorne CA School District Election of 2008 Series A (GO, AGM Insured) ¤ | | | 0.00 | | | | 8-1-2017 | | | | 165,000 | | | | 147,876 | |

Hayward CA Unified School District COP (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2016 | | | | 300,000 | | | | 315,813 | |

Hayward CA Unified School District COP (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2017 | | | | 705,000 | | | | 745,122 | |

Hayward CA Unified School District COP (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2018 | | | | 725,000 | | | | 767,268 | |

Hayward CA Unified School District COP (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2019 | | | | 750,000 | | | | 797,948 | |

Hemet CA Unified School District COP (Miscellaneous Revenue) ± | | | 1.13 | | | | 10-1-2036 | | | | 7,500,000 | | | | 7,556,700 | |

Hesperia CA Unified School District COP Interim School Facility Funding Program (Miscellaneous Revenue, AGM Insured, Dexia Bank SPA) ø | | | 1.50 | | | | 2-1-2028 | | | | 3,240,000 | | | | 3,240,000 | |

Hesperia CA Unified School District COP Interim School Facility Funding Program (Miscellaneous Revenue, AGM Insured, Dexia Bank SPA) ø | | | 1.50 | | | | 2-1-2038 | | | | 18,565,000 | | | | 18,565,000 | |

Horicon CA Elementary School District (GO, AMBAC Insured) | | | 4.00 | | | | 8-1-2013 | | | | 280,000 | | | | 284,071 | |

Horicon CA Elementary School District (GO, AMBAC Insured) | | | 4.00 | | | | 8-1-2014 | | | | 295,000 | | | | 305,422 | |

Imperial CA Community College TRAN (GO) | | | 2.00 | | | | 12-2-2013 | | | | 7,300,000 | | | | 7,358,546 | |

Imperial CA PFA Wastewater Facility (Water & Sewer Revenue) | | | 4.00 | | | | 10-15-2014 | | | | 490,000 | | | | 513,481 | |

Imperial CA PFA Wastewater Facility (Water & Sewer Revenue) | | | 4.00 | | | | 10-15-2016 | | | | 265,000 | | | | 285,198 | |

Industry CA Airport Revenue Refunding Senior Series B (Tax Revenue, NATL-RE Insured) | | | 4.00 | | | | 5-1-2018 | | | | 1,000,000 | | | | 1,008,310 | |

Inglewood CA RDA Sub Lien Merged Redevelopment Project (Tax Revenue, ACA Financial Guaranty Corporation Insured) ¤ | | | 0.00 | | | | 5-1-2013 | | | | 150,000 | | | | 147,900 | |

Inland Valley CA Development Agency Series B (Tax Revenue) ± | | | 4.25 | | | | 3-1-2041 | | | | 2,500,000 | | | | 2,603,475 | |

Inland Valley CA Development Agency Series C (Tax Revenue) ± | | | 4.50 | | | | 3-1-2041 | | | | 3,000,000 | | | | 3,180,240 | |

Irvine CA Limited Obligation Improvement Bonds Reassessment District #12-1 (Miscellaneous Revenue) | | | 4.00 | | | | 9-2-2018 | | | | 1,325,000 | | | | 1,483,417 | |

Irvine CA Public Facilities & Infrastructure Authority Series A (Miscellaneous Revenue) | | | 3.00 | | | | 9-2-2018 | | | | 1,200,000 | | | | 1,216,020 | |

Keyes CA Unified School District CAB (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | | | | 8-1-2013 | | | | 145,000 | | | | 143,140 | |

Keyes CA Unified School District CAB (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 150,000 | | | | 140,049 | |

Keyes CA Unified School District CAB (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | | | | 8-1-2016 | | | | 155,000 | | | | 140,148 | |

La Quinta CA Financing Authority Series A (Tax Revenue, AMBAC Insured) | | | 5.25 | | | | 9-1-2015 | | | | 940,000 | | | | 1,007,313 | |

Lake Elsinore CA PFFA (Tax Revenue, AMBAC Insured) | | | 4.00 | | | | 9-1-2016 | | | | 1,830,000 | | | | 1,915,736 | |

Lake Elsinore CA School Financing Authority (Tax Revenue) | | | 3.00 | | | | 9-1-2016 | | | | 1,420,000 | | | | 1,452,376 | |

Lancaster CA RDA Combined Redevelopment Project Areas (Tax Revenue) | | | 4.50 | | | | 8-1-2014 | | | | 750,000 | | | | 765,038 | |

Lancaster CA RDA Combined Redevelopment Project Areas (Tax Revenue) | | | 4.75 | | | | 8-1-2015 | | | | 585,000 | | | | 604,504 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2012 (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Lindsay CA Unified School District COP (Miscellaneous Revenue, AGM Insured) | | | 5.00 | % | | | 10-1-2014 | | | $ | 340,000 | | | $ | 359,060 | |

Loma Linda CA University Medical Center Project Series A (Housing Revenue,

AMBAC Insured) | | | 5.15 | | | | 12-1-2013 | | | | 500,000 | | | | 514,650 | |

Long Beach CA Bond Finance Authority Natural Gas Purchase Series A (Utilities Revenue) | | | 5.00 | | | | 11-15-2015 | | | | 1,250,000 | | | | 1,366,563 | |

Long Beach CA Bond Finance Authority Public Safety Facilities Project (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 11-1-2013 | | | | 1,080,000 | | | | 1,080,292 | |

Long Beach CA Harbor AMT Series A (Airport Revenue, NATL-RE Insured) | | | 5.00 | | | | 5-15-2016 | | | | 500,000 | | | | 545,920 | |

Long Beach CA Public Safety Facilities Project (Miscellaneous Revenue, AMBAC Insured) | | | 5.25 | | | | 11-1-2015 | | | | 250,000 | | | | 250,068 | |

Long Beach CA Senior Refunding Bonds Series B (Airport Revenue) | | | 4.00 | | | | 6-1-2014 | | | | 995,000 | | | | 1,025,805 | |

Los Alamitos CA Unified School District TRAN (GO) ¤ | | | 0.00 | | | | 9-1-2016 | | | | 1,000,000 | | | | 954,280 | |

Los Angeles CA CDA Earthquake Disaster Project Series D (Tax Revenue) | | | 5.00 | | | | 9-1-2014 | | | | 255,000 | | | | 271,040 | |

Los Angeles CA CDA Earthquake Disaster Project Series D (Tax Revenue) | | | 5.00 | | | | 9-1-2015 | | | | 375,000 | | | | 401,468 | |

Los Angeles CA Community Redevelopment Agency (Tax Revenue, AGM Insured) | | | 5.50 | | | | 12-1-2018 | | | | 2,225,000 | | | | 2,415,727 | |

Los Angeles CA COP Hollywood Presbyterian Medical Center (Miscellaneous Revenue) | | | 9.63 | | | | 7-1-2013 | | | | 85,000 | | | | 88,489 | |

Los Angeles CA Unified School District COP Multiple Properties Series A (Miscellaneous Revenue) | | | 5.00 | | | | 12-1-2015 | | | | 1,750,000 | | | | 1,942,150 | |

Los Angeles CA Unified School District Election of 2004 Series F (GO, FGIC Insured) | | | 5.00 | | | | 7-1-2020 | | | | 2,500,000 | | | | 2,841,350 | |

Los Angeles County CA Capital Asset Leasing Corporation Series B (Miscellaneous Revenue, AMBAC Insured) | | | 6.00 | | | | 12-1-2014 | | | | 200,000 | | | | 215,752 | |

Los Angeles County CA Capital Asset Leasing Corporation Series B (Miscellaneous Revenue, AMBAC Insured) | | | 6.00 | | | | 12-1-2015 | | | | 1,835,000 | | | | 2,042,465 | |

Los Angeles County CA Capital Asset Leasing Corporation Series B (Miscellaneous Revenue, AMBAC Insured) | | | 6.00 | | | | 12-1-2016 | | | | 3,285,000 | | | | 3,746,937 | |

Los Angeles County CA Community Facilities District #5 Rowland Heights Area (Tax Revenue, AGM Insured) | | | 5.00 | | | | 9-1-2019 | | | | 1,000,000 | | | | 1,007,100 | |

Los Angeles County CA COP CAB Disney Package Projects (Miscellaneous Revenue) ¤ | | | 0.00 | | | | 3-1-2014 | | | | 100,000 | | | | 98,909 | |

Los Angeles County CA COP CAB Disney Package Projects (Miscellaneous Revenue) ¤ | | | 0.00 | | | | 3-1-2017 | | | | 675,000 | | | | 615,263 | |

Los Angeles County CA Metropolitan Transportation Authority Series A (Tax Revenue) %% | | | 5.00 | | | | 7-1-2017 | | | | 7,880,000 | | | | 9,211,939 | |

Los Angeles County CA Public Works Financing Authority Master Project Series A (Miscellaneous Revenue, NATL-RE/FGIC Insured) | | | 5.00 | | | | 9-1-2014 | | | | 690,000 | | | | 733,484 | |

Los Angeles County CA Public Works Financing Authority Master Project Series A (Miscellaneous Revenue, NATL-RE Insured) | | | 5.00 | | | | 12-1-2016 | | | | 1,000,000 | | | | 1,106,890 | |

Los Angeles County CA Public Works Financing Authority Master Project Series B (Miscellaneous Revenue, NATL-RE/FGIC Insured) | | | 5.00 | | | | 9-1-2018 | | | | 400,000 | | | | 441,416 | |

Los Angeles County CA Public Works Multiple Capital Projects (Miscellaneous Revenue) | | | 5.00 | | | | 8-1-2020 | | | | 500,000 | | | | 596,670 | |

Los Angeles County CA Schools Regionalized Business Services Corporation Series A (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 9-1-2017 | | | | 595,000 | | | | 619,931 | |

Los Angeles County CA Schools Regionalized Business Services Corporation Series B (Miscellaneous Revenue, NATL-RE Insured) | | | 5.00 | | | | 6-1-2016 | | | | 1,000,000 | | | | 1,100,380 | |

Los Angeles County CA Schools Regionalized Business Services Corporation Series B (Miscellaneous Revenue, NATL-RE Insured) | | | 5.00 | | | | 6-1-2017 | | | | 1,010,000 | | | | 1,133,816 | |

Mendocino County CA COP Series A (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2015 | | | | 1,020,000 | | | | 1,062,667 | |

Mendocino County CA COP Series A (Miscellaneous Revenue, AGM Insured) | | | 3.00 | | | | 6-1-2017 | | | | 1,085,000 | | | | 1,122,812 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Portfolio of investments—December 31, 2012 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Merced CA Union High School CAB Series A (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | % | | | 8-1-2019 | | | $ | 2,190,000 | | | $ | 1,858,171 | |

Metropolitan Water District of Southern California Series A4 (Water & Sewer Revenue) ± | | | 0.28 | | | | 7-1-2036 | | | | 2,000,000 | | | | 2,000,160 | |

Modesto CA Irrigation District Electric Refunding Series A (Utilities Revenue) | | | 5.00 | | | | 7-1-2020 | | | | 500,000 | | | | 603,610 | |

Moreno Valley CA PFA (Miscellaneous Revenue, AMBAC Insured) | | | 5.00 | | | | 11-1-2013 | | | | 580,000 | | | | 599,059 | |

Moreno Valley CA Unified School District Financing Authority Series A (Tax Revenue, AGM Insured) | | | 5.00 | | | | 8-15-2014 | | | | 1,000,000 | | | | 1,005,460 | |

Mount Pleasant CA Elementary School District CAB Election of 1998 Series S (GO, AMBAC Insured) ¤ | | | 0.00 | | | | 9-1-2014 | | | | 1,070,000 | | | | 1,048,696 | |

Murrieta CA PFA (Tax Revenue) | | | 5.00 | | | | 9-1-2017 | | | | 870,000 | | | | 977,306 | |

Natomas CA Unified School District (GO, AGM Insured) | | | 3.00 | | | | 9-1-2017 | | | | 955,000 | | | | 1,000,659 | |

Natomas CA Unified School District (GO, AGM Insured) | | | 3.00 | | | | 9-1-2018 | | | | 1,025,000 | | | | 1,076,640 | |

Natomas CA Unified School District (GO, AGM Insured) | | | 3.00 | | | | 9-1-2019 | | | | 1,000,000 | | | | 1,048,060 | |

New Haven CA Unified School District Refunding (GO, AGM Insured) | | | 12.00 | | | | 8-1-2013 | | | | 905,000 | | | | 965,644 | |

Newhall CA School District BAN School Facilities Improvement (GO) ¤ | | | 0.00 | | | | 8-1-2017 | | | | 10,000,000 | | | | 9,412,500 | |

Norco CA RDA Refunding Redevelopment Project Area #1 (Tax Revenue) | | | 4.00 | | | | 3-1-2014 | | | | 100,000 | | | | 103,320 | |

North City CA West School Facilities Financing Authority Series C (Tax Revenue, AMBAC Insured) | | | 5.00 | | | | 9-1-2018 | | | | 1,125,000 | | | | 1,280,768 | |

Northern California Transmission California-Oregon Transportation Project Series A (Utilities Revenue, NATL-RE Insured) | | | 7.00 | | | | 5-1-2013 | | | | 955,000 | | | | 974,501 | |

Oakland CA Financing Authority Housing Set-Aside (Tax Revenue, AMBAC Insured) | | | 5.00 | | | | 9-1-2018 | | | | 2,000,000 | | | | 2,151,020 | |

Oakland CA Joint Powers Financing Authority Oakland Convention Centers (Miscellaneous Revenue, AMBAC Insured) | | | 5.50 | | | | 10-1-2013 | | | | 1,805,000 | | | | 1,854,944 | |

Oakland CA Joint Powers Financing Authority Oakland Convention Centers (Miscellaneous Revenue, AMBAC Insured) | | | 5.50 | | | | 10-1-2014 | | | | 580,000 | | | | 613,483 | |

Oakland CA Joint Powers Financing Authority Series A1 (Miscellaneous Revenue, AGM Insured) | | | 5.25 | | | | 1-1-2017 | | | | 1,885,000 | | | | 2,114,744 | |

Oakland CA RDA Sub Tax Allocation Centre Distribution (Tax Revenue, NATL-RE/FGIC Insured) | | | 5.50 | | | | 9-1-2015 | | | | 875,000 | | | | 880,670 | |

Oakland CA Redevelopment Agency Central District Project (Tax Revenue, NATL-RE/FGIC Insured) | | | 5.50 | | | | 9-1-2017 | | | | 800,000 | | | | 804,416 | |

Oakland CA Unified School District Alameda County Election of 2000 (GO, NATL-RE Insured) | | | 5.00 | | | | 8-1-2015 | | | | 500,000 | | | | 538,440 | |

Oakland CA Unified School District Alameda County Election of 2000 (GO, NATL-RE Insured) | | | 5.00 | | | | 8-1-2016 | | | | 530,000 | | | | 569,056 | |

Oakland CA Unified School District Alameda County Election of 2006 Series A (GO) | | | 3.00 | | | | 8-1-2013 | | | | 820,000 | | | | 829,676 | |

Oakland CA Unified School District Alameda County Election of 2006 Series A (GO) | | | 3.00 | | | | 8-1-2015 | | | | 640,000 | | | | 658,739 | |

Oakland CA Unified School District Alameda County Election of 2006 Series A (GO) | | | 3.00 | | | | 8-1-2016 | | | | 540,000 | | | | 554,990 | |

Oakland CA Unified School District Alameda County Election of 2006 Series A (GO) | | | 4.00 | | | | 8-1-2014 | | | | 435,000 | | | | 451,695 | |

Oakland-Alameda County CA Coliseum Authority Series A (Miscellaneous Revenue) | | | 5.00 | | | | 2-1-2019 | | | | 3,000,000 | | | | 3,507,390 | |

Orange County CA COP Civic Center Facilities (Miscellaneous Revenue, AMBAC Insured) ¤ | | | 0.00 | | | | 12-1-2018 | | | | 2,000,000 | | | | 1,590,680 | |

Orange Cove CA Irrigation District (Water & Sewer Revenue) | | | 3.15 | | | | 2-1-2019 | | | | 660,000 | | | | 670,349 | |

Oxnard CA Harbor District Series A (Airport Revenue) | | | 5.00 | | | | 8-1-2015 | | | | 1,960,000 | | | | 2,085,342 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2012 (unaudited) | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

| California (continued) | | | | | | | | | | | | | | | | |

Oxnard CA Harbor District Series A (Airport Revenue) | | | 5.00 | % | | | 8-1-2018 | | | $ | 2,275,000 | | | $ | 2,492,536 | |

Pacifica CA COP City of Pacifica Financing Authority (Miscellaneous Revenue, AMBAC Insured) | | | 4.50 | | | | 1-1-2016 | | | | 1,090,000 | | | | 1,163,706 | |

Palm Desert CA Financing Authority Housing Set-Aside (Tax Revenue, NATL-RE Insured) | | | 5.00 | | | | 10-1-2013 | | | | 1,200,000 | | | | 1,229,856 | |

Palm Springs CA Airport Sub Lien Palm Springs International Airport (Airport Revenue) | | | 5.20 | | | | 7-1-2013 | | | | 410,000 | | | | 412,107 | |

Palm Springs CA Airport Sub Lien Palm Springs International Airport (Airport Revenue) | | | 5.30 | | | | 7-1-2013 | | | | 45,000 | | | | 45,243 | |

Palm Springs CA Airport Sub Lien Palm Springs International Airport (Airport Revenue) | | | 5.30 | | | | 7-1-2014 | | | | 430,000 | | | | 436,493 | |

Palm Springs CA Financing Authority Convention Center Project Series A (Miscellaneous Revenue) | | | 3.00 | | | | 11-1-2017 | | | | 1,280,000 | | | | 1,328,858 | |

Palmdale CA Financing Authority Lease Refunding (Miscellaneous Revenue, AGM Insured) | | | 4.00 | | | | 9-1-2019 | | | | 545,000 | | | | 597,467 | |

Palo Alto CA Improvement Bond Act 1915 University Area Off-Street Parking Assessment District (Miscellaneous Revenue) | | | 2.50 | | | | 9-2-2015 | | | | 285,000 | | | | 290,623 | |

Palo Alto CA Improvement Bond Act 1915 University Area Off-Street Parking Assessment District (Miscellaneous Revenue) | | | 2.50 | | | | 9-2-2016 | | | | 330,000 | | | | 334,633 | |

Palo Alto CA Improvement Bond Act 1915 University Area Off-Street Parking Assessment District (Miscellaneous Revenue) | | | 3.00 | | | | 9-2-2018 | | | | 415,000 | | | | 427,226 | |

Palo Alto CA Improvement Bond Act 1915 University Area Off-Street Parking Assessment District (Miscellaneous Revenue) | | | 4.00 | | | | 9-2-2021 | | | | 450,000 | | | | 483,048 | |

Palo Verde CA Unified School District FlexFund Program (Lease Revenue) | | | 4.80 | | | | 9-1-2027 | | | | 891,668 | | | | 943,233 | |

Palomar CA Palomar County Election of 2006 Series B (GO) ¤ | | | 0.00 | | | | 8-1-2016 | | | | 250,000 | | | | 238,345 | |

Palomar CA Palomar County Election of 2006 Series B (GO) ¤ | | | 0.00 | | | | 8-1-2017 | | | | 880,000 | | | | 810,770 | |

Palomar Pomerado CA Health System CAB (GO, NATL-RE Insured) ¤ | | | 0.00 | | | | 8-1-2017 | | | | 2,000,000 | | | | 1,826,980 | |

Patterson CA Joint Unified School District CAB Series A (GO, NATL-RE/FGIC Insured) ¤ | | | 0.00 | | | | 8-1-2015 | | | | 140,000 | | | | 130,047 | |

Pioneers CA Memorial Healthcare District (GO) | | | 4.00 | | | | 10-1-2015 | | | | 400,000 | | | | 425,272 | |

Pioneers CA Memorial Healthcare District (GO) | | | 4.00 | | | | 10-1-2017 | | | | 810,000 | | | | 878,542 | |

Pomona CA PFA Redevelopment Project Series AD (Tax Revenue, NATL-RE Insured) | | | 4.75 | | | | 2-1-2013 | | | | 1,830,000 | | | | 1,834,081 | |

Poway CA Community Facilities District #88-1 Parkway Business (Tax Revenue) | | | 3.63 | | | | 8-15-2014 | | | | 1,100,000 | | | | 1,135,002 | |

Poway CA RDA Paguay Redevelopment Project Series A (Tax Revenue, NATL-RE Insured) | | | 4.50 | | | | 6-15-2014 | | | | 580,000 | | | | 588,787 | |

Poway CA Unified School District Community Facilities District #6 4S Ranch (Tax Revenue) | | | 4.00 | | | | 9-1-2017 | | | | 500,000 | | | | 543,090 | |

Poway CA Unified School District Community Facilities District #6 4S Ranch (Tax Revenue) | | | 4.00 | | | | 9-1-2018 | | | | 450,000 | | | | 492,417 | |

Poway CA Unified School District PFA Tranche Series B (Miscellaneous Revenue, AGM Insured, Dexia Credit Local SPA) ¤ | | | 0.00 | | | | 12-1-2042 | | | | 2,080,000 | | | | 2,031,016 | |

Rancho Cucamonga CA Redevelopment Agency Rancho Redevelopment Project (Tax Revenue, AGM Insured) | | | 5.00 | | | | 9-1-2013 | | | | 500,000 | | | | 501,895 | |

Rancho Santa Fe CA Community Services District Superior Lien Series A (Tax Revenue) | | | 3.00 | | | | 9-1-2013 | | | | 230,000 | | | | 232,811 | |

Rancho Santa Fe CA Community Services District Superior Lien Series A (Tax Revenue) | | | 3.00 | | | | 9-1-2014 | | | | 620,000 | | | | 633,491 | |

Rancho Santa Fe CA Community Services District Superior Lien Series A (Tax Revenue) | | | 3.13 | | | | 9-1-2015 | | | | 675,000 | | | | 694,879 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage California Limited-Term Tax-Free Fund | | Portfolio of investments—December 31, 2012 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |