UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 9 of its series, Wells Fargo Advantage Diversified Capital Builder Fund, Wells Fargo Advantage Diversified Income Builder Fund, Wells Fargo Advantage Index Asset Allocation Fund, Wells Fargo Advantage C&B Mid Cap Value Fund, Wells Fargo Advantage Common Stock Fund, Wells Fargo Advantage Discovery Fund, Wells Fargo Advantage Enterprise Fund, Wells Fargo Advantage Opportunity Fund, and Wells Fargo Advantage Special Mid Cap Value Fund. Each series had a September 30 fiscal year end.

Date of reporting period: March 31, 2014

ITEM 1. REPORT TO STOCKHOLDERS

Wells Fargo Advantage

Diversified Capital Builder Fund

Semi-Annual Report

March 31, 2014

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of March 31, 2014, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

The Federal Reserve (Fed) and other developed-country central banks continued to provide support to the economy with accommodative monetary policies.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Diversified Capital Builder Fund for the six-month period that ended March 31, 2014. The period was marked by continued accommodative monetary policy in developed countries, broader economic growth, low inflation, and equity market gains. That said, the final three months of the reporting period were marked by heightened equity market volatility as the U.S. and Europe confronted Russia over Ukraine.

Within equity markets over the six-month reporting period, U.S. stocks (measured by the S&P 500 Index1) had the best returns, followed by developed-country international equities (measured by the MSCI EAFE Index2) while emerging markets equities (measured by the MSCI Emerging Markets Index3) were up only slightly. Fixed-income results favored corporate bonds (measured by the Barclays U.S. Corporate Bond Index4) over U.S. Treasury bonds (measured by the Barclays U.S. Treasury Index5). Short-term interest rates remained ultra low.

Monetary policy remained accommodative and economic growth appeared sustainable.

The Federal Reserve (Fed) and other developed-country central banks continued to provide support to the economy with accommodative monetary policies. Throughout the reporting period, the Fed kept its key interest rate near zero. Entering the reporting period, the Fed had committed to purchase mortgage-backed securities to support the housing market and long-term U.S. Treasuries to keep interest rates low. In mid-December 2013, however, the Fed conveyed confidence in the strength of the economy by announcing it would begin tapering its bond-buying program by $10 billion in January 2014.

In November 2013, the European Central Bank (ECB) cut its key rate to a then-historic low of 0.25%. Its aggressive actions helped ease investor worries about a eurozone sovereign debt default. Given the substantial ties between the U.S. and Europe, the improved sentiment about the eurozone helped provide a tailwind for U.S. markets.

U.S. economic data was moderately positive, gaining strength as the period progressed. Data that was available at the end of the reporting period showed that U.S. real gross domestic product increased at a 2.6% annualized rate in the fourth quarter of 2013. The jobs picture continued to slowly improve as the unemployment rate declined to 6.7% as of February 2014. Meanwhile, inflation remained low. The eurozone exited a protracted recession and reported weak but positive economic activity during the last three quarters of 2013.

| 1. | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2. | The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia, and the Far East. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 3. | The Morgan Stanley Capital International (MSCI) Emerging Markets Index is a free float-adjusted market-capitalization-weighted index designed to measure the equity market performance in the global emerging markets. The index is currently composed of 21 emerging markets country indexes. You cannot invest directly in an index. |

| 4. | The Barclays U.S. Corporate Bond Index is an unmanaged market-value-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more. You cannot invest directly in an index. |

| 5. | The Barclays U.S. Treasury Index is an unmanaged index of prices of U.S. Treasury bonds with maturities of 1 to 30 years. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 3 | |

Returns by asset class were mixed, but generally positive.

The U.S. stock market outperformed foreign markets during the six-month period. The S&P 500 Index rose 12.51% and the MSCI EAFE Index rose 5.36%, while the MSCI Emerging Markets Index rose 1.49%. The U.S. was the fastest-growing developed country, which benefited U.S. companies. Emerging markets faced a number of challenges, including the spillover effect of slower growth in China as well as volatile currency movements that tempered investor demand for emerging markets equities.

Most bond sectors gained, particularly lower-credit-quality bonds, despite a renewed confidence in economic growth and higher interest rates across much of the yield curve. Interest rates drifted higher as investors tried to anticipate when the Fed would begin raising its key interest rate. Early in 2014, new Fed Chair Janet Yellen suggested that the time frame for the first increase in short-term interest rates might be as soon as the first half of 2015, sooner than most market participants had expected. Meanwhile, credit spreads narrowed, driving outperformance in credit-sensitive sectors as solid economic growth boosted company revenue and profits and kept default rates low. Investment-grade bonds (measured by the Barclays U.S. Aggregate Bond Index6) returned 1.70% and high-yield bonds (measured by the Barclays U.S. Corporate High Yield Index7) returned 6.67% during the six-month period.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Advantage Funds offers more than 100 mutual funds and other investments spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future.

| 6. | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. You cannot invest directly in an index. |

| 7. | The Barclays U.S. Corporate High Yield Index is an unmanaged, U.S. dollar-denominated, nonconvertible, non-investment-grade debt index. The index consists of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million. You cannot invest directly in an index. |

| | | | |

| 4 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Letter to shareholders (unaudited) |

Notice to shareholders

The Fund and Wells Fargo Funds Management, LLC (“Funds Management”) have received an exemptive order from the SEC that permits Funds Management, subject to the approval of the Board of Trustees of the Fund, to select or replace certain subadvisers to manage all or a portion of the Fund’s assets and enter into, amend or terminate a sub-advisory agreement with certain subadvisers without obtaining shareholder approval (“Multi-manager Structure”). The Multi-manager Structure applies to subadvisers that are not affiliated with Funds Management or the Fund, except to the extent that affiliation arises solely because such subadvisers provide sub-advisory services to the Fund (“Non-affiliated Subadvisers”), as well as subadvisers that are indirect or direct wholly-owned subsidiaries of Funds Management or of another company that, indirectly or directly, wholly owns Funds Management (“Wholly-owned Subadvisers”).

Pursuant to the SEC order, Funds Management, with the approval of the Board of Trustees, has the discretion to terminate any subadvisers and allocate and reallocate the Fund’s assets among any other Non-affiliated Subadvisers or Wholly-owned Subadvisers. Funds Management, subject to oversight and supervision by the Board of Trustees, has responsibility to continue to oversee any subadvisers to the Fund and to recommend, for approval by the Board of Trustees, the hiring, termination and replacement of subadvisers for the Fund. In the event that a new subadviser is hired pursuant to the Multi-manager Structure, the Fund is required to provide notice to shareholders within 90 days.

Please contact your investment professional or call us directly at 1-800-222-8222 if you have any questions on this Notice to Shareholders.

This page is intentionally left blank.

| | | | |

| 6 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term total return, consisting of capital appreciation and current income.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio manager

Margaret Patel

Average annual total returns1 (%) as of March 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (EKBAX) | | 1-20-1998 | | | 10.93 | | | | 17.21 | | | | 4.70 | | | | 17.65 | | | | 18.64 | | | | 5.33 | | | | 1.20 | | | | 1.20 | |

| Class B (EKBBX)* | | 9-11-1935 | | | 11.72 | | | | 17.64 | | | | 4.82 | | | | 16.72 | | | | 17.85 | | | | 4.82 | | | | 1.95 | | | | 1.95 | |

| Class C (EKBCX) | | 1-22-1998 | | | 15.75 | | | | 17.77 | | | | 4.56 | | | | 16.75 | | | | 17.77 | | | | 4.56 | | | | 1.95 | | | | 1.95 | |

| Administrator Class (EKBDX) | | 7-30-2010 | | | – | | | | – | | | | – | | | | 17.96 | | | | 18.87 | | | | 5.50 | | | | 1.04 | | | | 0.95 | |

| Institutional Class (EKBYX) | | 1-26-1998 | | | – | | | | – | | | | – | | | | 18.09 | | | | 19.07 | | | | 5.68 | | | | 0.77 | | | | 0.77 | |

| Diversified Capital Builder Blended Index4 | | – | | | – | | | | – | | | | – | | | | 18.58 | | | | 20.88 | | | | 8.07 | | | | – | | | | – | |

| BofA Merrill Lynch High Yield U.S. Corporates, Cash Pay Index5 | | – | | | – | | | | – | | | | – | | | | 7.51 | | | | 17.95 | | | | 8.46 | | | | – | | | | – | |

| Russell 1000® Index6 | | – | | | – | | | | – | | | | – | | | | 22.41 | | | | 21.73 | | | | 7.80 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, high-yield risk securities, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 7 | |

| | | | |

| Ten largest holdings7 (%) as of March 31, 2014 | |

CVS Caremark Corporation | | | 4.51 | |

LyondellBasell Industries Class A | | | 4.47 | |

Comcast Corporation Class A | | | 3.68 | |

Tronox Finance LLC, 6.38%, 8-15-2020 | | | 3.66 | |

FEI Company | | | 3.62 | |

Genuine Parts Company | | | 3.42 | |

Covidien plc | | | 3.33 | |

Becton Dickinson & Company | | | 2.55 | |

AbbVie Incorporated | | | 2.37 | |

Automatic Data Processing Incorporated | | | 2.33 | |

|

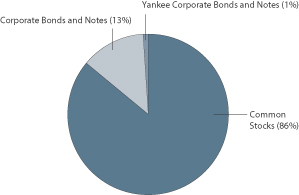

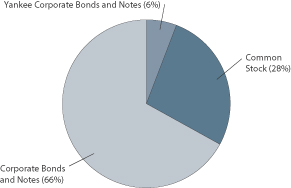

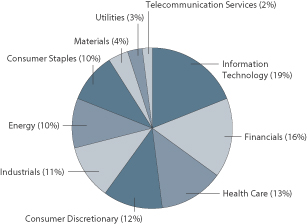

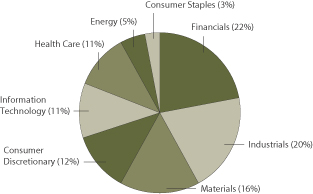

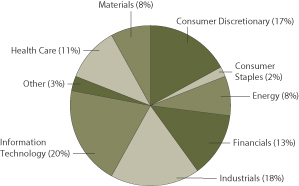

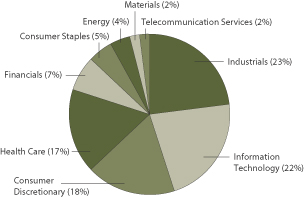

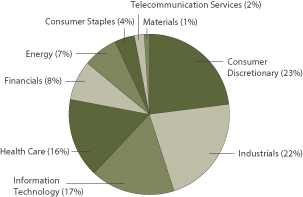

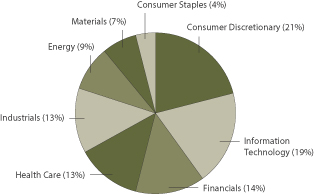

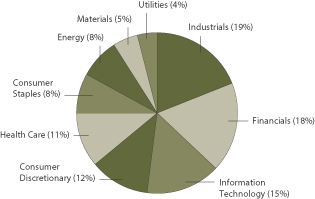

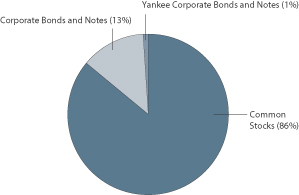

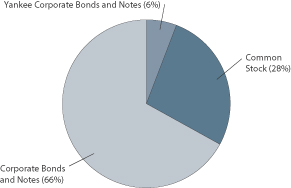

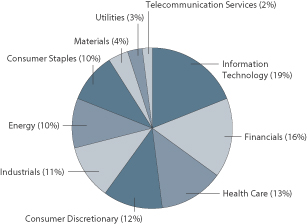

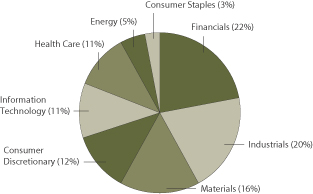

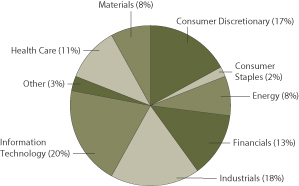

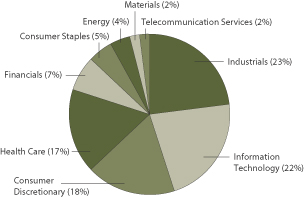

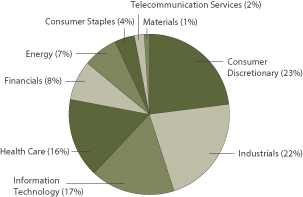

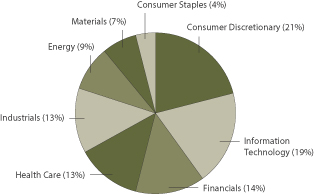

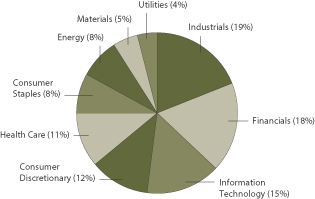

| Portfolio allocation8 as of March 31, 2014 |

|

|

| 1. | Historical performance shown for Administrator Class shares prior to their inception reflects the performance of Institutional Class shares and has been adjusted to reflect the higher expenses applicable to Administrator Class shares. Historical performance shown for all classes of the Fund prior to July 12, 2010, is based on the performance of the Fund’s predecessor, Evergreen Diversified Capital Builder Fund. |

| 2. | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3. | The Adviser has committed through January 31, 2015, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After FeeWaiver, excluding certain expenses, at 1.20% for Class A, 1.95% for Class B, 1.95% for Class C, 0.95% for Administrator class, and 0.78% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 4. | Source: Wells Fargo Funds Management, LLC. The Diversified Capital Builder Blended Index is composed of the following indexes: Russell 1000® Index (75%) and BofA Merrill Lynch High Yield U.S. Corporates, Cash Pay Index (25%). You cannot invest directly in an index. |

| 5. | The BofA Merrill Lynch High Yield U.S. Corporates, Cash Pay Index is an unmanaged market index that provides a broad-based performance measure of the non-investment grade U.S. domestic bond index. This index was previously named the BofA Merrill Lynch High Yield Master Index. You cannot invest directly in an index. |

| 6. | The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. You cannot invest directly in an index. |

| 7. | The ten largest holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 8. | Portfolio allocation is subject to change and is calculated based on the total long-term investments of the Fund. |

| | | | |

| 8 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from October 1, 2013 to March 31, 2014.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

10-1-2013 | | | Ending

account value

3-31-2014 | | | Expenses

paid during

the period1 | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,149.75 | | | $ | 6.43 | | | | 1.20 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.04 | | | | 1.20 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,144.11 | | | $ | 10.42 | | | | 1.95 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.21 | | | $ | 9.80 | | | | 1.95 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,145.35 | | | $ | 10.43 | | | | 1.95 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.21 | | | $ | 9.80 | | | | 1.95 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,151.13 | | | $ | 5.09 | | | | 0.95 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.19 | | | $ | 4.78 | | | | 0.95 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,151.47 | | | $ | 4.18 | | | | 0.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.04 | | | $ | 3.93 | | | | 0.78 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—March 31, 2014 (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 9 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 83.45% | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 10.51% | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.24% | | | | | | | | | | | | |

Johnson Controls Incorporated | | | | | | | 30,000 | | | $ | 1,419,600 | |

| | | | | | | | | | | | |

| | | | |

| Distributors: 3.42% | | | | | | | | | | | | |

Genuine Parts Company | | | | | | | 235,000 | | | | 20,409,750 | |

| | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 0.56% | | | | | | | | | | | | |

Marriott International Incorporated Class A | | | | | | | 60,000 | | | | 3,361,200 | |

| | | | | | | | | | | | |

| | | | |

| Household Durables: 2.30% | | | | | | | | | | | | |

Jarden Corporation † | | | | | | | 230,000 | | | | 13,760,900 | |

| | | | | | | | | | | | |

| | | | |

| Media: 3.99% | | | | | | | | | | | | |

Comcast Corporation Class A | | | | | | | 440,000 | | | | 22,008,800 | |

DISH Network Corporation † | | | | | | | 30,000 | | | | 1,866,300 | |

| | | | |

| | | | | | | | | | | 23,875,100 | |

| | | | | | | | | | | | |

| | | | |

Consumer Staples: 6.48% | | | | | | | | | | | | |

| | | | |

| Food & Staples Retailing: 4.51% | | | | | | | | | | | | |

CVS Caremark Corporation | | | | | | | 360,000 | | | | 26,949,600 | |

| | | | | | | | | | | | |

| | | | |

| Food Products: 0.15% | | | | | | | | | | | | |

Mondelez International Incorporated Class A | | | | | | | 25,000 | | | | 863,750 | |

| | | | | | | | | | | | |

| | | | |

| Household Products: 0.31% | | | | | | | | | | | | |

Colgate-Palmolive Company | | | | | | | 20,000 | | | | 1,297,400 | |

Kimberly-Clark Corporation | | | | | | | 5,000 | | | | 551,250 | |

| | | | |

| | | | | | | | | | | 1,848,650 | |

| | | | | | | | | | | | |

| | | | |

| Personal Products: 1.51% | | | | | | | | | | | | |

Estee Lauder Companies Incorporated Class A | | | | | | | 135,000 | | | | 9,028,800 | |

| | | | | | | | | | | | |

| | | | |

Energy: 7.26% | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.96% | | | | | | | | | | | | |

Bristow Group Incorporated | | | | | | | 50,000 | | | | 3,776,000 | |

Schlumberger Limited | | | | | | | 20,000 | | | | 1,950,000 | |

| | | | |

| | | | | | | | | | | 5,726,000 | |

| | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 6.30% | | | | | | | | | | | | |

ConocoPhillips Company | | | | | | | 70,000 | | | | 4,924,500 | |

Energy Transfer LP | | | | | | | 200,000 | | | | 9,350,000 | |

EOG Resources Incorporated | | | | | | | 30,000 | | | | 5,885,100 | |

Kinder Morgan Incorporated | | | | | | | 185,000 | | | | 6,010,650 | |

Marathon Oil Corporation | | | | | | | 60,000 | | | | 2,131,200 | |

Plains All American Pipeline LP | | | | | | | 170,000 | | | | 9,370,400 | |

| | | | |

| | | | | | | | | | | 37,671,850 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2014 (unaudited) |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | |

Financials: 2.08% | | | | | | | | | | | | |

| | | | |

| Banks: 1.26% | | | | | | | | | | | | |

PNC Financial Services Group Incorporated | | | | | | | 30,000 | | | $ | 2,610,000 | |

Regions Financial Corporation | | | | | | | 225,000 | | | | 2,499,750 | |

SunTrust Banks Incorporated | | | | | | | 60,000 | | | | 2,387,400 | |

| | | | |

| | | | | | | | | | | 7,497,150 | |

| | | | | | | | | | | | |

| | | | |

| Insurance: 0.82% | | | | | | | | | | | | |

Chubb Corporation | | | | | | | 55,000 | | | | 4,911,500 | |

| | | | | | | | | | | | |

| | | | |

Health Care: 16.33% | | | | | | | | | | | | |

| | | | |

| Biotechnology: 1.27% | | | | | | | | | | | | |

Amgen Incorporated | | | | | | | 20,000 | | | | 2,466,800 | |

Medivation Incorporated † | | | | | | | 80,000 | | | | 5,149,600 | |

| | | | |

| | | | | | | | | | | 7,616,400 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 6.62% | | | | | | | | | | | | |

Becton Dickinson & Company | | | | | | | 130,000 | | | | 15,220,400 | |

CareFusion Corporation † | | | | | | | 100,000 | | | | 4,022,000 | |

Covidien plc | | | | | | | 270,000 | | | | 19,888,200 | |

Meridian Diagnostics Incorporated | | | | | | | 20,000 | | | | 435,800 | |

| | | | |

| | | | | | | | | | | 39,566,400 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 1.38% | | | | | | | | | | | | |

DaVita HealthCare Partners Incorporated † | | | | | | | 40,000 | | | | 2,754,000 | |

McKesson Corporation | | | | | | | 25,000 | | | | 4,414,250 | |

Owens & Minor Incorporated | | | | | | | 30,000 | | | | 1,050,900 | |

| | | | |

| | | | | | | | | | | 8,219,150 | |

| | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 1.01% | | | | | | | | | | | | |

Thermo Fisher Scientific Incorporated | | | | | | | 50,000 | | | | 6,012,000 | |

| | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 6.05% | | | | | | | | | | | | |

AbbVie Incorporated | | | | | | | 275,000 | | | | 14,135,000 | |

Allergan Incorporated | | | | | | | 40,000 | | | | 4,964,000 | |

Eli Lilly & Company | | | | | | | 50,000 | | | | 2,943,000 | |

Forest Laboratories Incorporated † | | | | | | | 30,000 | | | | 2,768,100 | |

Mylan Laboratories Incorporated † | | | | | | | 190,000 | | | | 9,277,700 | |

Salix Pharmaceuticals Limited † | | | | | | | 20,000 | | | | 2,072,200 | |

| | | | |

| | | | | | | | | | | 36,160,000 | |

| | | | | | | | | | | | |

| | | | |

Industrials: 18.04% | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 4.90% | | | | | | | | | | | | |

General Dynamics Corporation | | | | | | | 70,000 | | | | 7,624,400 | |

Lockheed Martin Corporation | | | | | | | 85,000 | | | | 13,875,400 | |

Precision Castparts Corporation | | | | | | | 10,000 | | | | 2,527,600 | |

United Technologies Corporation | | | | | | | 45,000 | | | | 5,257,800 | |

| | | | |

| | | | | | | | | | | 29,285,200 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—March 31, 2014 (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 11 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | |

| Building Products: 2.14% | | | | | | | | | | | | |

Apogee Enterprises Incorporated | | | | | | | 125,000 | | | $ | 4,153,750 | |

Lennox International Incorporated | | | | | | | 95,000 | | | | 8,636,450 | |

| | | | |

| | | | | | | | | | | 12,790,200 | |

| | | | | | | | | | | | |

| | | | |

| Construction & Engineering: 0.54% | | | | | | | | | | | | |

Chicago Bridge & Iron Company NV | | | | | | | 30,000 | | | | 2,614,500 | |

Dycom Industries Incorporated † | | | | | | | 20,000 | | | | 632,200 | |

| | | | |

| | | | | | | | | | | 3,246,700 | |

| | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 4.84% | | | | | | | | | | | | |

AMETEK Incorporated | | | | | | | 155,000 | | | | 7,980,950 | |

Regal Beloit Corporation | | | | | | | 70,000 | | | | 5,089,700 | |

Rockwell Automation Incorporated | | | | | | | 45,000 | | | | 5,604,750 | |

Roper Industries Incorporated | | | | | | | 45,000 | | | | 6,007,950 | |

Sensata Technologies Holdings NV † | | | | | | | 100,000 | | | | 4,264,000 | |

| | | | |

| | | | | | | | | | | 28,947,350 | |

| | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 0.19% | | | | | | | | | | | | |

Danaher Corporation | | | | | | | 15,000 | | | | 1,125,000 | |

| | | | | | | | | | | | |

| | | | |

| Machinery: 4.09% | | | | | | | | | | | | |

Chart Industries Incorporated † | | | | | | | 5,000 | | | | 397,750 | |

Donaldson Company Incorporated | | | | | | | 40,000 | | | | 1,696,000 | |

Flowserve Corporation | | | | | | | 80,000 | | | | 6,267,200 | |

IDEX Corporation | | | | | | | 110,000 | | | | 8,017,900 | |

Pall Corporation | | | | | | | 90,000 | | | | 8,052,300 | |

| | | | |

| | | | | | | | | | | 24,431,150 | |

| | | | | | | | | | | | |

| | | | |

| Road & Rail: 1.34% | | | | | | | | | | | | |

Hertz Global Holdings Incorporated † | | | | | | | 300,000 | | | | 7,992,000 | |

| | | | | | | | | | | | |

| | | | |

Information Technology: 10.30% | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 5.92% | | | | | | | | | | | | |

Amphenol Corporation Class A | | | | | | | 150,000 | | | | 13,747,500 | |

FEI Company | | | | | | | 210,000 | | | | 21,634,200 | |

| | | | |

| | | | | | | | | | | 35,381,700 | |

| | | | | | | | | | | | |

| | | | |

| IT Services: 2.33% | | | | | | | | | | | | |

Automatic Data Processing Incorporated | | | | | | | 180,000 | | | | 13,906,800 | |

| | | | | | | | | | | | |

| | | | |

| Software: 0.17% | | | | | | | | | | | | |

Nuance Communications Incorporated Ǡ | | | | | | | 60,000 | | | | 1,030,200 | |

| | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.88% | | | | | | | | | | | | |

Seagate Technology plc | | | | | | | 200,000 | | | | 11,232,000 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2014 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Materials: 7.30% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 7.30% | | | | | | | | | | | | | | | | |

Eastman Chemical Company | | | | | | | | | | | 15,000 | | | $ | 1,293,150 | |

FMC Corporation | | | | | | | | | | | 60,000 | | | | 4,593,600 | |

LyondellBasell Industries Class A | | | | | | | | | | | 300,000 | | | | 26,682,000 | |

PPG Industries Incorporated | | | | | | | | | | | 10,000 | | | | 1,934,600 | |

Sigma-Aldrich Corporation | | | | | | | | | | | 25,000 | | | | 2,334,500 | |

Valspar Corporation | | | | | | | | | | | 30,000 | | | | 2,163,600 | |

Westlake Chemical Corporation | | | | | | | | | | | 70,000 | | | | 4,632,600 | |

| | | | |

| | | | | | | | | | | | | | | 43,634,050 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 5.15% | | | | | | | | | | | | | | | | |

| | | | |

| Electric Utilities: 3.88% | | | | | | | | | | | | | | | | |

American Electric Power Company Incorporated | | | | | | | | | | | 150,000 | | | | 7,599,000 | |

Edison International | | | | | | | | | | | 140,000 | | | | 7,925,400 | |

Pinnacle West Capital Corporation | | | | | | | | | | | 140,000 | | | | 7,652,400 | |

| | | | |

| | | | | | | | | | | | | | | 23,176,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities: 0.12% | | | | | | | | | | | | | | | | |

Atmos Energy Corporation | | | | | | | | | | | 15,000 | | | | 706,950 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 1.15% | | | | | | | | | | | | | | | | |

AES Corporation | | | | | | | | | | | 425,000 | | | | 6,069,000 | |

NRG Energy Incorporated | | | | | | | | | | | 25,000 | | | | 795,000 | |

| | | | |

| | | | | | | | | | | | | | | 6,864,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $400,673,877) | | | | | | | | | | | | | | | 498,647,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | | |

| | | | |

Corporate Bonds and Notes: 12.89% | | | | | | | | | | | | | | | | |

| | | | |

Energy: 1.14% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.70% | | | | | | | | | | | | | | | | |

Bristow Group Incorporated | | | 6.25 | % | | | 10-15-2022 | | | $ | 2,000,000 | | | | 2,120,000 | |

Hornbeck Offshore Services Incorporated | | | 5.88 | | | | 4-1-2020 | | | | 1,000,000 | | | | 1,045,000 | |

Regency Energy Partners LP | | | 5.88 | | | | 3-1-2022 | | | | 1,000,000 | | | | 1,037,500 | |

| | | | |

| | | | | | | | | | | | | | | 4,202,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 0.44% | | | | | | | | | | | | | | | | |

Atlas Pipeline Partners LP | | | 5.88 | | | | 8-1-2023 | | | | 650,000 | | | | 641,875 | |

Sabine Pass Liquefaction LLC | | | 5.63 | | | | 4-15-2023 | | | | 2,000,000 | | | | 1,990,000 | |

| | | | |

| | | | | | | | | | | | | | | 2,631,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 3.32% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 0.18% | | | | | | | | | | | | | | | | |

DaVita HealthCare Partners Incorporated | | | 5.75 | | | | 8-15-2022 | | | | 1,000,000 | | | | 1,065,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—March 31, 2014 (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Pharmaceuticals: 3.14% | | | | | | | | | | | | | | | | |

Salix Pharmaceuticals Incorporated 144A | | | 6.00 | % | | | 1-15-2021 | | | $ | 2,500,000 | | | $ | 2,668,750 | |

Valeant Pharmaceuticals International Incorporated 144A | | | 7.00 | | | | 10-1-2020 | | | | 11,253,000 | | | | 12,181,373 | |

Valeant Pharmaceuticals International Incorporated 144A | | | 7.25 | | | | 7-15-2022 | | | | 3,560,000 | | | | 3,933,800 | |

| | | | |

| | | | | | | | | | | | | | | 18,783,923 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 1.59% | | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.22% | | | | | | | | | | | | | | | | |

Dycom Investments Incorporated | | | 7.13 | | | | 1-15-2021 | | | | 1,200,000 | | | | 1,294,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.33% | | | | | | | | | | | | | | | | |

Iron Mountain Incorporated | | | 5.75 | | | | 8-15-2024 | | | | 2,000,000 | | | | 1,947,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.25% | | | | | | | | | | | | | | | | |

General Cable Corporation 144A | | | 6.50 | | | | 10-1-2022 | | | | 1,500,000 | | | | 1,522,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 0.79% | | | | | | | | | | | | | | | | |

Hertz Corporation | | | 6.25 | | | | 10-15-2022 | | | | 4,425,000 | | | | 4,734,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 4.15% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 4.15% | | | | | | | | | | | | | | | | |

Kraton Polymers LLC | | | 6.75 | | | | 3-1-2019 | | | | 1,770,000 | | | | 1,880,625 | |

Olin Corporation | | | 5.50 | | | | 8-15-2022 | | | | 1,000,000 | | | | 1,022,500 | |

Tronox Finance LLC « | | | 6.38 | | | | 8-15-2020 | | | | 21,288,000 | | | | 21,873,420 | |

| | | | |

| | | | | | | | | | | | | | | 24,776,545 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 2.69% | | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 2.69% | | | | | | | | | | | | | | | | |

AES Corporation | | | 5.50 | | | | 3-15-2024 | | | | 3,000,000 | | | | 2,977,500 | |

NRG Energy Incorporated | | | 6.63 | | | | 3-15-2023 | | | | 500,000 | | | | 518,750 | |

NRG Energy Incorporated | | | 7.88 | | | | 5-15-2021 | | | | 11,418,000 | | | | 12,559,800 | |

| | | | |

| | | | | | | | | | | | | | | 16,056,050 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes (Cost $73,524,264) | | | | | | | | | | | | | | | 77,015,143 | |

| | | | | | | | | | | | | | | | |

| | | | |

Yankee Corporate Bonds and Notes: 0.99% | | | | | | | | | | | | | | | | |

| | | | |

Industrials: 0.66% | | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.66% | | | | | | | | | | | | | | | | |

Sensata Technologies BV 144A | | | 4.88 | | | | 10-15-2023 | | | | 4,000,000 | | | | 3,930,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 0.33% | | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.33% | | | | | | | | | | | | | | | | |

Seagate HDD (Cayman) 144A | | | 4.75 | | | | 6-1-2023 | | | | 2,000,000 | | | | 1,975,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $5,873,166) | | | | | | | | | | | | | | | 5,905,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2014 (unaudited) |

| | | | | | | | | | | | | | |

| Security name | | Yield | | | | | Shares | | | Value | |

| | | | |

Short-Term Investments: 5.46% | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 5.46% | | | | | | | | | | | | | | |

Wells Fargo Advantage Cash Investment Money Market Fund, Select Class (l)(u) | | | 0.07 | % | | | | | 17,502,024 | | | $ | 17,502,024 | |

Wells Fargo Securities Lending Cash Investments, LLC (r)(v)(l)(u) | | | 0.09 | | | | | | 15,145,264 | | | | 15,145,264 | |

| | | | |

Total Short-Term Investments (Cost $32,647,288) | | | | | | | | | | | | | 32,647,288 | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities | | | | | | | | |

| (Cost $512,718,595) * | | | 102.79 | % | | | 614,215,331 | |

Other assets and liabilities, net | | | (2.79 | ) | | | (16,687,757 | ) |

| | | | | | | | |

Total net assets | | | 100.00 | % | | $ | 597,527,574 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| 144A | Security that may be resold to “qualified institutional buyers” under Rule 144A or security offered pursuant to Section 4(2) of the Securities Act of 1933, as amended. |

| (l) | Investment in an affiliate |

| (u) | Rate shown is the 7-day annualized yield at period end. |

| (r) | The investment company is exempt from registration under Section 3(c)(7) of the Investment Company Act of 1940, as amended. |

| (v) | Security represents investment of cash collateral received from securities on loan. |

| * | Cost for federal income tax purposes is $512,500,623 and unrealized appreciation (depreciation) consists of: |

| | | | |

Gross unrealized appreciation | | $ | 102,594,789 | |

Gross unrealized depreciation | | | (880,081 | ) |

| | | | |

Net unrealized appreciation | | $ | 101,714,708 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—March 31, 2014 (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 15 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments | | | | |

In unaffiliated securities (including securities on loan), at value (see cost below) | | $ | 581,568,043 | |

In affiliated securities, at value (see cost below) | | | 32,647,288 | |

| | | | |

Total investments, at value (see cost below) | | | 614,215,331 | |

Receivable for investments sold | | | 2,589,165 | |

Receivable for Fund shares sold | | | 126,391 | |

Receivable for dividends and interest | | | 2,065,893 | |

Receivable for securities lending income | | | 4,514 | |

Prepaid expenses and other assets | | | 133,473 | |

| | | | |

Total assets | | | 619,134,767 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 4,904,201 | |

Payable for Fund shares redeemed | | | 775,459 | |

Payable upon receipt of securities loaned | | | 15,145,264 | |

Advisory fee payable | | | 304,611 | |

Distribution fees payable | | | 31,989 | |

Due to other related parties | | | 142,669 | |

Accrued expenses and other liabilities | | | 303,000 | |

| | | | |

Total liabilities | | | 21,607,193 | |

| | | | |

Total net assets | | $ | 597,527,574 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 536,003,067 | |

Undistributed net investment income | | | 466,085 | |

Accumulated net realized losses on investments | | | (40,438,314 | ) |

Net unrealized gains on investments | | | 101,496,736 | |

| | | | |

Total net assets | | $ | 597,527,574 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE1 | | | | |

Net assets – Class A | | $ | 437,543,630 | |

Shares outstanding – Class A | | | 48,462,132 | |

Net asset value per share – Class A | | | $9.03 | |

Maximum offering price per share – Class A2 | | | $9.58 | |

Net assets – Class B | | $ | 6,100,916 | |

Shares outstanding – Class B | | | 670,856 | |

Net asset value per share – Class B | | | $9.09 | |

Net assets – Class C | | $ | 44,119,653 | |

Shares outstanding – Class C | | | 4,882,310 | |

Net asset value per share – Class C | | | $9.04 | |

Net assets – Administrator Class | | $ | 8,671,629 | |

Shares outstanding – Administrator Class | | | 959,692 | |

Net asset value per share – Administrator Class | | | $9.04 | |

Net assets – Institutional Class | | $ | 101,091,746 | |

Shares outstanding – Institutional Class | | | 11,255,425 | |

Net asset value per share – Institutional Class | | | $8.98 | |

| |

Investments in unaffiliated securities (including securities on loan), at cost | | $ | 480,071,307 | |

| | | | |

Investments in affiliated securities, at cost | | $ | 32,647,288 | |

| | | | |

Total investments, at cost | | $ | 512,718,595 | |

| | | | |

Securities on loan, at value | | $ | 14,822,723 | |

| | | | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Statement of operations—six months ended March 31, 2014 (unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends | | $ | 4,668,507 | |

Interest | | | 2,366,465 | |

Securities lending income, net | | | 22,677 | |

Income from affiliated securities | | | 2,267 | |

| | | | |

Total investment income | | | 7,059,916 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 1,830,679 | |

Administration fees | | | | |

Fund level | | | 155,093 | |

Class A | | | 546,292 | |

Class B | | | 8,267 | |

Class C | | | 54,821 | |

Administrator Class | | | 3,565 | |

Institutional Class | | | 57,795 | |

Shareholder servicing fees | | | | |

Class A | | | 525,281 | |

Class B | | | 7,949 | |

Class C | | | 52,713 | |

Administrator Class | | | 8,602 | |

Distribution fees | | | | |

Class B | | | 23,848 | |

Class C | | | 158,139 | |

Custody and accounting fees | | | 21,154 | |

Professional fees | | | 25,378 | |

Registration fees | | | 45,740 | |

Shareholder report expenses | | | 69,486 | |

Trustees’ fees and expenses | | | 6,608 | |

Other fees and expenses | | | 9,778 | |

| | | | |

Total expenses | | | 3,611,188 | |

Less: Fee waivers and/or expense reimbursements | | | (21,520 | ) |

| | | | |

Net expenses | | | 3,589,668 | |

| | | | |

Net investment income | | | 3,470,248 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 64,356,565 | |

Net change in unrealized gains (losses) on investments | | | 19,083,194 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 83,439,759 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 86,910,007 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 17 | |

| | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014

(unaudited) | | | Year ended

September 30, 2013 | |

| | | |

Operations | | | | | | | | | | | | |

Net investment income | | | | | | $ | 3,470,248 | | | | | | | $ | 10,337,226 | |

Net realized gains on investments | | | | | | | 64,356,565 | | | | | | | | 56,902,141 | |

Net change in unrealized gains (losses) on investments | | | | | | | 19,083,194 | | | | | | | | 20,604,806 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 86,910,007 | | | | | | | | 87,844,173 | |

| | | | |

| | | |

Distributions to shareholders from | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (1,943,969 | ) | | | | | | | (6,474,175 | ) |

Class B | | | | | | | (3,992 | ) | | | | | | | (62,222 | ) |

Class C | | | | | | | (38,422 | ) | | | | | | | (338,328 | ) |

Administrator Class | | | | | | | (47,574 | ) | | | | | | | (87,817 | ) |

Institutional Class | | | | | | | (820,838 | ) | | | | | | | (3,162,236 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (2,854,795 | ) | | | | | | | (10,124,778 | ) |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 372,105 | | | | 3,193,477 | | | | 988,049 | | | | 7,459,210 | |

Class B | | | 5,110 | | | | 43,143 | | | | 13,623 | | | | 102,631 | |

Class C | | | 197,077 | | | | 1,662,709 | | | | 456,565 | | | | 3,573,365 | |

Administrator Class | | | 304,071 | | | | 2,698,468 | | | | 680,652 | | | | 5,251,900 | |

Institutional Class | | | 1,056,136 | | | | 8,846,510 | | | | 5,136,491 | | | | 37,970,601 | |

| | | | |

| | | | | | | 16,444,307 | | | | | | | | 54,357,707 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 210,502 | | | | 1,823,008 | | | | 817,169 | | | | 6,011,822 | |

Class B | | | 415 | | | | 3,508 | | | | 7,691 | | | | 55,750 | |

Class C | | | 3,996 | | | | 33,960 | | | | 42,113 | | | | 305,059 | |

Administrator Class | | | 3,927 | | | | 34,291 | | | | 7,966 | | | | 59,321 | |

Institutional Class | | | 90,703 | | | | 776,154 | | | | 411,012 | | | | 3,018,578 | |

| | | | |

| | | | | | | 2,670,921 | | | | | | | | 9,450,530 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (2,748,350 | ) | | | (23,340,386 | ) | | | (7,524,370 | ) | | | (56,004,245 | ) |

Class B | | | (152,777 | ) | | | (1,299,838 | ) | | | (360,469 | ) | | | (2,709,323 | ) |

Class C | | | (351,982 | ) | | | (2,983,753 | ) | | | (981,014 | ) | | | (7,336,338 | ) |

Administrator Class | | | (213,891 | ) | | | (1,845,828 | ) | | | (257,295 | ) | | | (1,947,957 | ) |

Institutional Class | | | (8,970,863 | ) | | | (78,593,919 | ) | | | (7,089,654 | ) | | | (53,439,056 | ) |

| | | | |

| | | | | | | (108,063,724 | ) | | | | | | | (121,436,919 | ) |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | | | | | (88,948,496 | ) | | | | | | | (57,628,682 | ) |

| | | | |

Total increase (decrease) in net assets | | | | | | | (4,893,284 | ) | | | | | | | 20,090,713 | |

| | | | |

| | |

Net assets | | | | | | | | |

Beginning of period | | | | | | | 602,420,858 | | | | | | | | 582,330,145 | |

| | | | |

End of period | | | | | | $ | 597,527,574 | | | | | | | $ | 602,420,858 | |

| | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | 466,085 | | | | | | | $ | (149,368 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014 (unaudited) | | | Year ended September 30 | | | Year ended March 31 | |

| CLASS A | | | 2013 | | | 2012 | | | 2011 | | | 20101,2 | | | 20101 | | | 20091 | |

Net asset value, beginning of period | | $ | 7.89 | | | $ | 6.93 | | | $ | 5.65 | | | $ | 6.02 | | | $ | 6.02 | | | $ | 4.18 | | | $ | 8.28 | |

Net investment income | | | 0.04 | | | | 0.12 | | | | 0.15 | | | | 0.10 | | | | 0.07 | | | | 0.05 | | | | 0.11 | |

Net realized and unrealized gains (losses) on investments | | | 1.14 | | | | 0.96 | | | | 1.29 | | | | (0.36 | ) | | | 0.00 | 3 | | | 1.85 | | | | (3.33 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.18 | | | | 1.08 | | | | 1.44 | | | | (0.26 | ) | | | 0.07 | | | | 1.90 | | | | (3.22 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04 | ) | | | (0.12 | ) | | | (0.16 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.13 | ) |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.75 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.04 | ) | | | (0.12 | ) | | | (0.16 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.88 | ) |

Net asset value, end of period | | $ | 9.03 | | | $ | 7.89 | | | $ | 6.93 | | | $ | 5.65 | | | $ | 6.02 | | | $ | 6.02 | | | $ | 4.18 | |

Total return4 | | | 14.97 | % | | | 15.75 | % | | | 25.58 | % | | | (4.53 | )% | | | 1.21 | % | | | 45.51 | % | | | (38.57 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.21 | % | | | 1.20 | % | | | 1.21 | % | | | 1.21 | % | | | 1.17 | % | | | 1.14 | % | | | 1.06 | % |

Net expenses | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.15 | % | | | 1.14 | % | | | 1.04 | % |

Net investment income | | | 1.07 | % | | | 1.66 | % | | | 2.40 | % | | | 1.57 | % | | | 2.47 | % | | | 1.07 | % | | | 1.74 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 49 | % | | | 70 | % | | | 79 | % | | | 56 | % | | | 31 | % | | | 63 | % | | | 60 | % |

Net assets, end of period (000s omitted) | | | $437,544 | | | | $399,535 | | | | $390,705 | | | | $364,533 | | | | $435,454 | | | | $467,224 | | | | $366,237 | |

| 1. | After the close of business on July 9, 2010, the Fund acquired the net assets of Evergreen Diversified Capital Builder Fund which became the accounting and performance survivor in the transaction. The information for the periods prior to July 12, 2010 is that of Class A of Evergreen Diversified Capital Builder Fund. |

| 2. | For the six months ended September 30, 2010. The Fund changed its fiscal year end from March 31 to September 30, effective September 30, 2010. |

| 3. | Amount is less than $0.005. |

| 4. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014

(unaudited) | | | Year ended September 30 | | | Year ended March 31 | |

| CLASS B | | | 2013 | | | 2012 | | | 2011 | | | 20101,2 | | | 20101 | | | 20091 | |

Net asset value, beginning of period | | $ | 7.95 | | | $ | 6.98 | | | $ | 5.69 | | | $ | 6.05 | | | $ | 6.05 | | | $ | 4.19 | | | $ | 8.29 | |

Net investment income | | | 0.01 | 3 | | | 0.07 | 3 | | | 0.11 | 3 | | | 0.06 | 3 | | | 0.05 | 3 | | | 0.02 | 3 | | | 0.06 | 3 |

Net realized and unrealized gains (losses) on investments | | | 1.14 | | | | 0.96 | | | | 1.28 | | | | (0.37 | ) | | | 0.00 | 4 | | | 1.86 | | | | (3.33 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.15 | | | | 1.03 | | | | 1.39 | | | | (0.31 | ) | | | 0.05 | | | | 1.88 | | | | (3.27 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.02 | ) | | | (0.08 | ) |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.75 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.01 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.02 | ) | | | (0.83 | ) |

Net asset value, end of period | | $ | 9.09 | | | $ | 7.95 | | | $ | 6.98 | | | $ | 5.69 | | | $ | 6.05 | | | $ | 6.05 | | | $ | 4.19 | |

Total return5 | | | 14.41 | % | | | 14.87 | % | | | 24.62 | % | | | (5.20 | )% | | | 0.83 | % | | | 45.17 | % | | | (39.13 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.96 | % | | | 1.95 | % | | | 1.96 | % | | | 1.96 | % | | | 1.92 | % | | | 1.89 | % | | | 1.80 | % |

Net expenses | | | 1.95 | % | | | 1.95 | % | | | 1.95 | % | | | 1.95 | % | | | 1.89 | % | | | 1.89 | % | | | 1.78 | % |

Net investment income | | | 0.32 | % | | | 0.94 | % | | | 1.65 | % | | | 0.81 | % | | | 1.72 | % | | | 0.34 | % | | | 0.96 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 49 | % | | | 70 | % | | | 79 | % | | | 56 | % | | | 31 | % | | | 63 | % | | | 60 | % |

Net assets, end of period (000s omitted) | | | $6,101 | | | | $6,502 | | | | $8,077 | | | | $10,360 | | | | $16,329 | | | | $17,992 | | | | $18,115 | |

| 1. | After the close of business on July 9, 2010, the Fund acquired the net assets of Evergreen Diversified Capital Builder Fund which became the accounting and performance survivor in the transaction. The information for the periods prior to July 12, 2010 is that of Class B of Evergreen Diversified Capital Builder Fund. |

| 2. | For the six months ended September 30, 2010. The Fund changed its fiscal year end from March 31 to September 30, effective September 30, 2010. |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014 (unaudited) | | | Year ended September30 | | | Year ended March 31 | |

| CLASS C | | | 2013 | | | 2012 | | | 2011 | | | 20101,2 | | | 20101 | | | 20091 | |

Net asset value, beginning of period | | $ | 7.90 | | | $ | 6.94 | | | $ | 5.66 | | | $ | 6.02 | | | $ | 6.03 | | | $ | 4.18 | | | $ | 8.29 | |

Net investment income | | | 0.01 | | | | 0.07 | | | | 0.10 | | | | 0.05 | | | | 0.05 | | | | 0.02 | | | | 0.06 | |

Net realized and unrealized gains (losses) on investments | | | 1.14 | | | | 0.96 | | | | 1.29 | | | | (0.35 | ) | | | (0.01 | ) | | | 1.85 | | | | (3.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.15 | | | | 1.03 | | | | 1.39 | | | | (0.30 | ) | | | 0.04 | | | | 1.87 | | | | (3.28 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | (0.07 | ) | | | (0.11 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.02 | ) | | | (0.08 | ) |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.75 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.01 | ) | | | (0.07 | ) | | | (0.11 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.02 | ) | | | (0.83 | ) |

Net asset value, end of period | | $ | 9.04 | | | $ | 7.90 | | | $ | 6.94 | | | $ | 5.66 | | | $ | 6.02 | | | $ | 6.03 | | | $ | 4.18 | |

Total return3 | | | 14.54 | % | | | 14.86 | % | | | 24.63 | % | | | (5.14 | )% | | | 0.67 | % | | | 44.70 | % | | | (39.13 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.96 | % | | | 1.95 | % | | | 1.96 | % | | | 1.96 | % | | | 1.92 | % | | | 1.88 | % | | | 1.82 | % |

Net expenses | | | 1.95 | % | | | 1.95 | % | | | 1.95 | % | | | 1.95 | % | | | 1.90 | % | | | 1.88 | % | | | 1.80 | % |

Net investment income | | | 0.32 | % | | | 0.91 | % | | | 1.65 | % | | | 0.79 | % | | | 1.72 | % | | | 0.32 | % | | | 1.01 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 49 | % | | | 70 | % | | | 79 | % | | | 56 | % | | | 31 | % | | | 63 | % | | | 60 | % |

Net assets, end of period (000s omitted) | | | $44,120 | | | | $39,758 | | | | $38,279 | | | | $35,665 | | | | $40,197 | | | | $43,558 | | | | $33,077 | |

| 1. | After the close of business on July 9, 2010, the Fund acquired the net assets of Evergreen Diversified Capital Builder Fund which became the accounting and performance survivor in the transaction. The information for the periods prior to July 12, 2010 is that of Class C of Evergreen Diversified Capital Builder Fund. |

| 2. | For the six months ended September 30, 2010. The Fund changed its fiscal year end from March 31 to September 30, effective September 30, 2010. |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 21 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014 (unaudited) | | | Year ended September 30 | |

| ADMINISTRATOR CLASS | | | 2013 | | | 2012 | | | 2011 | | | 20101 | |

Net asset value, beginning of period | | $ | 7.90 | | | $ | 6.94 | | | $ | 5.66 | | | $ | 5.99 | | | $ | 5.79 | |

Net investment income | | | 0.06 | 2 | | | 0.14 | 2 | | | 0.17 | 2 | | | 0.13 | 2 | | | 0.02 | 2 |

Net realized and unrealized gains (losses) on investments | | | 1.13 | | | | 0.96 | | | | 1.28 | | | | (0.37 | ) | | | 0.22 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.19 | | | | 1.10 | | | | 1.45 | | | | (0.24 | ) | | | 0.24 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.14 | ) | | | (0.17 | ) | | | (0.09 | ) | | | (0.04 | ) |

Net asset value, end of period | | $ | 9.04 | | | $ | 7.90 | | | $ | 6.94 | | | $ | 5.66 | | | $ | 5.99 | |

Total return3 | | | 15.11 | % | | | 16.06 | % | | | 25.84 | % | | | (4.25 | )% | | | 4.08 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.04 | % | | | 1.04 | % | | | 1.03 | % | | | 1.04 | % | | | 1.14 | % |

Net expenses | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % | | | 0.99 | % |

Net investment income | | | 1.29 | % | | | 1.84 | % | | | 2.65 | % | | | 1.86 | % | | | 2.26 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 49 | % | | | 70 | % | | | 79 | % | | | 56 | % | | | 31 | % |

Net assets, end of period (000s omitted) | | | $8,672 | | | | $6,836 | | | | $3,015 | | | | $3,632 | | | | $10 | |

| 1. | For the period from July 30, 2010 (commencement of class operations) to September 30, 2010 |

| 2. | Calculated based upon average shares outstanding |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2014 (unaudited) | | | Year ended September 30 | | | Year ended March 31 | |

| INSTITUTIONAL CLASS | | | 2013 | | | 2012 | | | 2011 | | | 20101,2 | | | 20101 | | | 20091 | |

Net asset value, beginning of period | | $ | 7.85 | | | $ | 6.90 | | | $ | 5.62 | | | $ | 5.99 | | | $ | 5.99 | | | $ | 4.16 | | | $ | 8.25 | |

Net investment income | | | 0.06 | 3 | | | 0.15 | | | | 0.18 | 3 | | | 0.14 | 3 | | | 0.08 | | | | 0.06 | | | | 0.13 | |

Net realized and unrealized gains (losses) on investments | | | 1.13 | | | | 0.95 | | | | 1.28 | | | | (0.37 | ) | | | 0.00 | 4 | | | 1.84 | | | | (3.32 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.19 | | | | 1.10 | | | | 1.46 | | | | (0.23 | ) | | | 0.08 | | | | 1.90 | | | | (3.19 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.14 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.15 | ) |

Net realized gains | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.75 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.06 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.14 | ) | | | (0.08 | ) | | | (0.07 | ) | | | (0.90 | ) |

Net asset value, end of period | | $ | 8.98 | | | $ | 7.85 | | | $ | 6.90 | | | $ | 5.62 | | | $ | 5.99 | | | $ | 5.99 | | | $ | 4.16 | |

Total return5 | | | 15.15 | % | | | 16.17 | % | | | 26.23 | % | | | (4.08 | )% | | | 1.32 | % | | | 45.84 | % | | | (38.43 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.78 | % | | | 0.77 | % | | | 0.78 | % | | | 0.78 | % | | | 0.85 | % | | | 0.89 | % | | | 0.81 | % |

Net expenses | | | 0.78 | % | | | 0.77 | % | | | 0.78 | % | | | 0.77 | % | | | 0.83 | % | | | 0.89 | % | | | 0.79 | % |

Net investment income | | | 1.52 | % | | | 2.08 | % | | | 2.80 | % | | | 1.99 | % | | | 2.81 | % | | | 1.32 | % | | | 1.99 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 49 | % | | | 70 | % | | | 79 | % | | | 56 | % | | | 31 | % | | | 63 | % | | | 60 | % |

Net assets, end of period (000s omitted) | | | $101,092 | | | | $149,790 | | | | $142,256 | | | | $71,195 | | | | $86,592 | | | | $104,142 | | | | $84,042 | |

| 1. | After the close of business on July 9, 2010, the Fund acquired the net assets of Evergreen Diversified Capital Builder Fund which became the accounting and performance survivor in the transaction. The information for the periods prior to July 12, 2010 is that of Class I of Evergreen Diversified Capital Builder Fund. |

| 2. | For the six months ended September 30, 2010. The Fund changed its fiscal year end from March 31 to September 30, effective September 30, 2010. |

| 3. | Calculated based upon average shares outstanding |

| 4. | Amount is less than $0.005. |

| 5. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Diversified Capital Builder Fund | | | 23 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on the Wells Fargo Advantage Diversified Capital Builder Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the primary exchange or market for the security that day, the prior day’s price will be deemed “stale” and fair values will be determined in accordance with the Fund’s Valuation Procedures.

Fixed income securities acquired with maturities exceeding 60 days are valued based on evaluated bid prices provided by an independent pricing service which may utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. If prices are not available from the independent pricing service or prices received are deemed not representative of market value, prices will be obtained from an independent broker-dealer or otherwise determined based on the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Non-registered investment vehicles are fair valued at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy

| | | | |

| 24 | | Wells Fargo Advantage Diversified Capital Builder Fund | | Notes to financial statements (unaudited) |

by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Wells Fargo Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Securities Lending Fund is included in securities lending income on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily based on the effective interest method. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Distributions to shareholders