UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 10 of its series, Wells Fargo Advantage Capital Growth Fund, Wells Fargo Advantage Disciplined U.S. Core Fund, Wells Fargo Advantage Endeavor Select Fund, Wells Fargo Advantage Growth Fund, Wells Fargo Advantage Intrinsic Value Fund, Wells Fargo Advantage Large Cap Core Fund, Wells Fargo Advantage Large Cap Growth Fund, Wells Fargo Advantage Large Company Value Fund, Wells Fargo Advantage Omega Growth Fund, and Wells Fargo Advantage Premier Large Company Growth Fund. Each series had a July 31 fiscal year end.

Date of reporting period: January 31, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage Capital Growth Fund

Semi-Annual Report

January 31, 2014

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of January 31, 2014, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Advantage Capital Growth Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Major central banks continued to inject liquidity into the banks and the markets through various quantitative easing policies.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Capital Growth Fund for the six-month period that ended January 31, 2014. Much of the period was marked by monetary easing by global central banks. Entering the period, investors were concerned that the U.S. Federal Reserve (Fed) would end its bond-buying program, which initially led to higher interest rates and resulted in losses for bond indexes and volatility for global stock indexes. These fears dissipated in late September 2013 and ended altogether in mid-December 2013 when the Fed announced a tapering timeline that was far more moderate than some had feared. Growing confidence that the U.S. economy was staging a fragile recovery resulted in double-digit returns for domestic stock market indexes for the six-month reporting period.

Central banks continued to provide stimulus.

Major central banks continued to inject liquidity into the banks and the markets through various quantitative easing policies. Throughout the reporting period, the Federal Open Market Committee (FOMC)—the Fed’s monetary policymaking body—kept its key interest rate effectively near zero in order to support the economy and the financial system. Well before the reporting period began, the FOMC announced its intention to keep interest rates low for an extended period and to make open-ended purchases of $40 billion per month in mortgage-backed securities. The FOMC later added purchases of $45 billion per month in long-term U.S. Treasuries. Because the markets benefited from the FOMC’s liquidity, both stocks and bonds initially sold off after the FOMC indicated in May 2013 that it might reduce (or taper) its bond-buying program. However, in mid-December 2013, the FOMC announced that it would reduce its bond-buying program by $10 billion per month beginning in January 2014. The tapering was less aggressive than some investors had feared, and the markets ended 2013 strongly.

European markets continued to benefit from the European Central Bank’s (ECB’s) earlier announcement that it would purchase an unlimited amount of one- to three-year sovereign debt from countries that had formally applied for a bailout. In November 2013, the ECB cut its key rate to a historic low of 0.25%. The ECB’s aggressive actions helped ease investor worries about a eurozone sovereign debt default. Given the substantial ties between the U.S. and Europe, the improved sentiment about the eurozone helped provide a tailwind for U.S. markets.

U.S. stock markets gained on relatively good news.

For most of the period, U.S. economic data remained moderately positive. Reported gross domestic product (GDP) growth came in at a strong 4.1% annualized rate in the third quarter of 2013, and the advance annualized estimate for fourth-quarter GDP growth was 3.2%.

The most significant negative effect was the ongoing fight in Washington, D.C., over the federal budget and debt limit. The Budget Control Act of 2011, which was passed to resolve a previous fight over the federal debt ceiling, mandated budget sequestration that took effect on March 1, 2013, and was an overhang on economic growth throughout the reporting period. Most recently, Congress was unable to pass a resolution to continue to fund the federal government, and thus, the federal government underwent a partial shutdown from September 30, 2013, through October 16, 2013. The government reopened after the president and Congress reached a deal that funded the government through January 15, 2014, and raised the debt limit through February 7, 2014. In December 2013, Congress passed the Ryan-Murray budget agreement that funded the government through September 2015, lessening the near-term prospect of another shutdown.

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 3 | |

Despite political headwinds, the relatively positive outlook for the U.S. economy contributed to a strong domestic stock market for most of the reporting period. Economically sensitive sectors, such as industrials and materials, outperformed. Dividend-paying sectors such as utilities and telecommunication services lagged as higher interest rates dampened their relative performance. Judging by various Russell indexes, small-cap stocks moderately outperformed large-cap stocks, and growth stocks strongly outperformed value stocks.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Despite political headwinds, the relatively positive outlook for the U.S. economy contributed to a strong domestic stock market for most of the reporting period.

Notice to shareholders

The Fund and Wells Fargo Funds Management, LLC (“Funds Management”) have received an exemptive order from the SEC that permits Funds Management, subject to the approval of the Board of Trustees of the Fund, to select or replace certain subadvisers to manage all or a portion of the Fund’s assets and enter into, amend or terminate a sub-advisory agreement with certain subadvisers without obtaining shareholder approval (“Multi-manager Structure”). The Multi-manager Structure applies to subadvisers that are not affiliated with Funds Management or the Fund, except to the extent that affiliation arises solely because such subadvisers provide sub-advisory services to the Fund (“Non-affiliated Subadvisers”), as well as subadvisers that are indirect or direct wholly-owned subsidiaries of Funds Management or of another company that, indirectly or directly, wholly owns Funds Management (“Wholly-owned Subadvisers”).

Pursuant to the SEC order, Funds Management, with the approval of the Board of Trustees, has the discretion to terminate any subadvisers and allocate and reallocate the Fund’s assets among any other Non-affiliated Subadvisers or Wholly-owned Subadvisers. Funds Management, subject to oversight and supervision by the Board of Trustees, has responsibility to continue to oversee any subadvisers to the Fund and to recommend, for approval by the Board of Trustees, the hiring, termination and replacement of subadvisers for the Fund. In the event that a new subadviser is hired pursuant to the Multi-manager Structure, the Fund is required to provide notice to shareholders within 90 days.

Please contact your investment professional or call us directly at 1-800-222-8222 if you have any questions on this Notice to Shareholders.

| | | | |

| 4 | | Wells Fargo Advantage Capital Growth Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Thomas J. Pence, CFA

Michael T. Smith, CFA

Average annual total returns1 (%) as of January 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (WFCGX) | | 7-31-2007 | | | 21.24 | | | | 17.63 | | | | 6.21 | | | | 28.67 | | | | 19.03 | | | | 6.84 | | | | 1.25 | | | | 1.11 | |

| Class C (WFCCX) | | 7-31-2007 | | | 26.66 | | | | 18.15 | | | | 6.12 | | | | 27.66 | | | | 18.15 | | | | 6.12 | | | | 2.00 | | | | 1.86 | |

| Class R4 (WCGRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 29.16 | | | | 19.56 | | | | 7.38 | | | | 0.92 | | | | 0.75 | |

| Class R6 (WFCRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 29.33 | | | | 19.63 | | | | 7.41 | | | | 0.77 | | | | 0.60 | |

| Administrator Class (WFCDX) | | 6-30-2003 | | | – | | | | – | | | | – | | | | 28.93 | | | | 19.35 | | | | 7.21 | | | | 1.09 | | | | 0.90 | |

| Institutional Class (WWCIX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 29.25 | | | | 19.61 | | | | 7.41 | | | | 0.82 | | | | 0.65 | |

| Investor Class (SLGIX) | | 11-3-1997 | | | – | | | | – | | | | – | | | | 28.63 | | | | 18.97 | | | | 6.78 | | | | 1.31 | | | | 1.17 | |

| Russell 1000® Growth Index4 | | – | | | – | | | | – | | | | – | | | | 24.35 | | | | 20.88 | | | | 7.30 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R4, Class R6, Administrator Class, Institutional Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please keep in mind that high double-digit returns were primarily achieved during favorable market conditions. You should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for short time periods, should not be the sole factor in making your investment decision.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 5 | |

| | | | |

| Ten largest equity holdings5 (%) as of January 31, 2014 | |

Google Incorporated Class A | | | 4.70 | |

Amazon.com Incorporated | | | 2.98 | |

Facebook Incorporated Class A | | | 2.86 | |

Visa Incorporated Class A | | | 2.73 | |

Apple Incorporated | | | 2.72 | |

Constellation Brands Incorporated Class A | | | 2.58 | |

IntercontinentalExchange Group Incorporated | | | 2.51 | |

Gilead Sciences Incorporated | | | 2.40 | |

Alexion Pharmaceuticals Incorporated | | | 2.20 | |

Alliance Data Systems Corporation | | | 2.13 | |

| | |

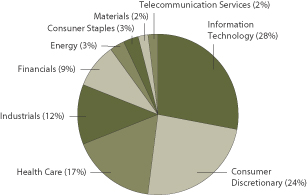

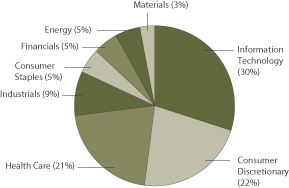

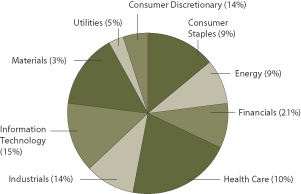

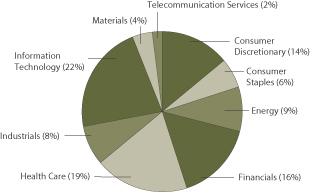

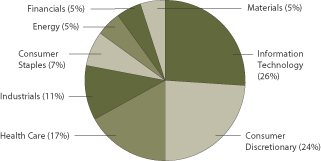

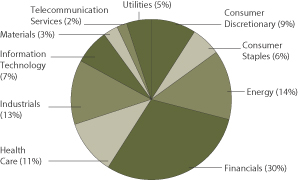

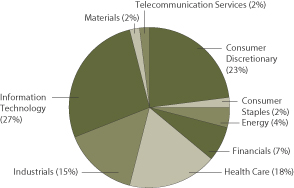

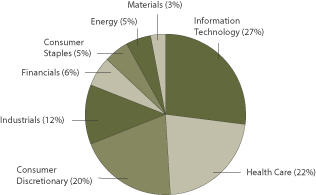

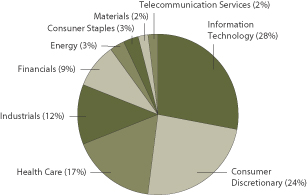

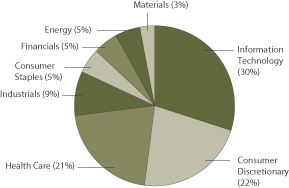

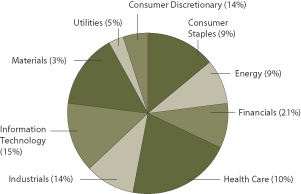

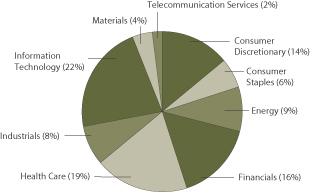

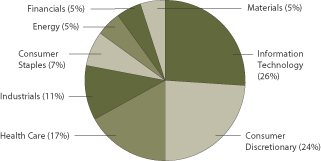

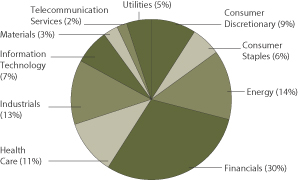

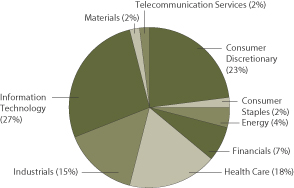

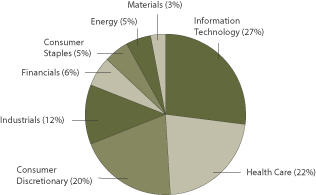

| Sector distribution6 as of January 31, 2014 |

|

|

| 1. | Historical performance shown for Class R4 shares prior to their inception reflects the performance of Institutional Class shares, adjusted to reflect the higher expenses applicable to Class R4 shares. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Institutional Class shares, and includes the higher expenses applicable to Institutional Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Class A shares prior to their inception reflects the performance of Investor Class shares, and includes the higher expenses applicable to Investor Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Class C shares prior to their inception reflects the performance of Investor Class shares, adjusted to reflect the higher expenses applicable to Class C shares. Historical performance shown for Institutional Class shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. If these expenses had not been included, returns would be higher. |

| 2. | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3. | The Adviser has committed through November 30, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 4. | The Russell 1000® Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 5. | The ten largest equity holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 6. | Sector distribution is subject to change and is calculated based on the total long-term investments of the Fund. |

| | | | |

| 6 | | Wells Fargo Advantage Capital Growth Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from August 1, 2013 to January 31, 2014.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

8-1-2013 | | | Ending

account value

1-31-2014 | | | Expenses

paid during

the period1 | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,142.26 | | | $ | 5.99 | | | | 1.11 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.65 | | | | 1.11 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,138.05 | | | $ | 10.02 | | | | 1.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.83 | | | $ | 9.45 | | | | 1.86 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,144.66 | | | $ | 4.05 | | | | 0.75 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.82 | | | | 0.75 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,145.66 | | | $ | 3.24 | | | | 0.60 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.06 | | | | 0.60 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,143.55 | | | $ | 4.86 | | | | 0.90 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,145.51 | | | $ | 3.52 | | | | 0.65 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.93 | | | $ | 3.31 | | | | 0.65 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,142.38 | | | $ | 6.32 | | | | 1.17 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.31 | | | $ | 5.96 | | | | 1.17 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—January 31, 2014 (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 7 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

Common Stocks: 97.99% | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 23.24% | | | | | | | | | | | | |

| | | | |

| Auto Components: 1.39% | | | | | | | | | | | | |

Delphi Automotive plc | | | | | | | 120,020 | | | $ | 7,308,018 | |

| | | | | | | | | | | | |

| | | | |

| Distributors: 0.90% | | | | | | | | | | | | |

LKQ Corporation † | | | | | | | 174,856 | | | | 4,733,352 | |

| | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 2.70% | | | | | | | | | | | | |

Las Vegas Sands Corporation | | | | | | | 72,550 | | | | 5,551,526 | |

Starbucks Corporation | | | | | | | 121,424 | | | | 8,635,675 | |

| | | | |

| | | | | | | | | | | 14,187,201 | |

| | | | | | | | | | | | |

| | | | |

| Household Durables: 1.25% | | | | | | | | | | | | |

Mohawk Industries Incorporated † | | | | | | | 46,150 | | | | 6,561,607 | |

| | | | | | | | | | | | |

| | | | |

| Internet & Catalog Retail: 6.65% | | | | | | | | | | | | |

Amazon.com Incorporated † | | | | | | | 43,580 | | | | 15,631,710 | |

Netflix Incorporated † | | | | | | | 20,430 | | | | 8,362,612 | |

priceline.com Incorporated † | | | | | | | 9,520 | | | | 10,899,353 | |

| | | | |

| | | | | | | | | | | 34,893,675 | |

| | | | | | | | | | | | |

| | | | |

| Media: 4.76% | | | | | | | | | | | | |

CBS Corporation Class B | | | | | | | 145,620 | | | | 8,550,806 | |

Liberty Global plc Class A † | | | | | | | 32,587 | | | | 2,604,679 | |

Liberty Global plc Class C † | | | | | | | 106,743 | | | | 8,467,922 | |

Twenty-First Century Fox Incorporated | | | | | | | 167,600 | | | | 5,333,032 | |

| | | | |

| | | | | | | | | | | 24,956,439 | |

| | | | | | | | | | | | |

| | | | |

| Specialty Retail: 3.45% | | | | | | | | | | | | |

Home Depot Incorporated | | | | | | | 127,690 | | | | 9,812,977 | |

TJX Companies Incorporated | | | | | | | 144,490 | | | | 8,287,946 | |

| | | | |

| | | | | | | | | | | 18,100,923 | |

| | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 2.14% | | | | | | | | | | | | |

Michael Kors Holdings Limited † | | | | | | | 44,975 | | | | 3,594,852 | |

Nike Incorporated Class B | | | | | | | 105,100 | | | | 7,656,535 | |

| | | | |

| | | | | | | | | | | 11,251,387 | |

| | | | | | | | | | | | |

| | | | |

Consumer Staples: 2.58% | | | | | | | | | | | | |

| | | | |

| Beverages: 2.58% | | | | | | | | | | | | |

Constellation Brands Incorporated Class A † | | | | | | | 176,730 | | | | 13,549,889 | |

| | | | | | | | | | | | |

| | | | |

Energy: 3.45% | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 3.45% | | | | | | | | | | | | |

Antero Resources Corporation † | | | | | | | 95,429 | | | | 5,605,499 | |

Marathon Petroleum Corporation | | | | | | | 45,050 | | | | 3,921,603 | |

Pioneer Natural Resources Company | | | | | | | 50,560 | | | | 8,560,819 | |

| | | | |

| | | | | | | | | | | 18,087,921 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Advantage Capital Growth Fund | | Portfolio of investments—January 31, 2014 (unaudited) |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

Financials: 8.70% | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.31% | | | | | | | | | | | | |

Affiliated Managers Group Incorporated † | | | | | | | 34,452 | | | $ | 6,864,216 | |

| | | | | | | | | | | | |

| | | | |

| Consumer Finance: 2.00% | | | | | | | | | | | | |

American Express Company | | | | | | | 123,500 | | | | 10,499,970 | |

| | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 3.70% | | | | | | | | | | | | |

IntercontinentalExchange Group Incorporated | | | | | | | 62,980 | | | | 13,149,594 | |

JPMorgan Chase & Company | | | | | | | 113,950 | | | | 6,308,272 | |

| | | | |

| | | | | | | | | | | 19,457,866 | |

| | | | | | | | | | | | |

| | | | |

| Insurance: 1.69% | | | | | | | | | | | | |

Aon plc | | | | | | | 110,100 | | | | 8,858,646 | |

| | | | | | | | | | | | |

| | | | |

Health Care: 16.79% | | | | | | | | | | | | |

| | | | |

| Biotechnology: 8.59% | | | | | | | | | | | | |

Alexion Pharmaceuticals Incorporated † | | | | | | | 72,800 | | | | 11,555,544 | |

Biogen Idec Incorporated † | | | | | | | 32,750 | | | | 10,238,960 | |

Celgene Corporation † | | | | | | | 70,270 | | | | 10,676,121 | |

Gilead Sciences Incorporated † | | | | | | | 156,220 | | | | 12,599,143 | |

| | | | |

| | | | | | | | | | | 45,069,768 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 1.41% | | | | | | | | | | | | |

Boston Scientific Corporation † | | | | | | | 545,950 | | | | 7,386,704 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 1.36% | | | | | | | | | | | | |

McKesson Corporation | | | | | | | 40,950 | | | | 7,142,090 | |

| | | | | | | | | | | | |

| | | | |

| Health Care Technology: 0.35% | | | | | | | | | | | | |

Cerner Corporation † | | | | | | | 32,830 | | | | 1,854,366 | |

| | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 5.08% | | | | | | | | | | | | |

AbbVie Incorporated | | | | | | | 118,500 | | | | 5,833,755 | |

Actavis plc † | | | | | | | 34,110 | | | | 6,446,108 | |

Bristol-Myers Squibb Company | | | | | | | 154,650 | | | | 7,727,861 | |

Shire plc ADR | | | | | | | 44,350 | | | | 6,635,647 | |

| | | | |

| | | | | | | | | | | 26,643,371 | |

| | | | | | | | | | | | |

| | | | |

Industrials: 11.88% | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 3.21% | | | | | | | | | | | | |

B/E Aerospace Incorporated † | | | | | | | 94,900 | | | | 7,541,703 | |

Precision Castparts Corporation | | | | | | | 36,481 | | | | 9,293,535 | |

| | | | |

| | | | | | | | | | | 16,835,238 | |

| | | | | | | | | | | | |

| | | | |

| Airlines: 2.31% | | | | | | | | | | | | |

American Airlines Group Incorporated † | | | | | | | 81,600 | | | | 2,737,680 | |

Delta Air Lines Incorporated | | | | | | | 306,830 | | | | 9,392,066 | |

| | | | |

| | | | | | | | | | | 12,129,746 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—January 31, 2014 (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 9 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | | | | | | | | | |

| | | | |

| Building Products: 1.15% | | | | | | | | | | | | |

Fortune Brands Home & Security Incorporated | | | | | | | 134,010 | | | $ | 6,038,491 | |

| | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.35% | | | | | | | | | | | | |

Eaton Corporation plc | | | | | | | 96,870 | | | | 7,080,228 | |

| | | | | | | | | | | | |

| | | | |

| Machinery: 0.97% | | | | | | | | | | | | |

Cummins Incorporated | | | | | | | 40,071 | | | | 5,088,216 | |

| | | | | | | | | | | | |

| | | | |

| Road & Rail: 1.40% | | | | | | | | | | | | |

Kansas City Southern | | | | | | | 69,580 | | | | 7,346,952 | |

| | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 1.49% | | | | | | | | | | | | |

United Rentals Incorporated † | | | | | | | 96,880 | | | | 7,841,467 | |

| | | | | | | | | | | | |

| | | | |

Information Technology: 27.80% | | | | | | | | | | | | |

| | | | |

| Computers & Peripherals: 2.72% | | | | | | | | | | | | |

Apple Incorporated | | | | | | | 28,525 | | | | 14,279,615 | |

| | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 10.11% | | | | | | | | | | | | |

Baidu Incorporated † | | | | | | | 34,300 | | | | 5,367,950 | |

Facebook Incorporated Class A † | | | | | | | 240,060 | | | | 15,020,554 | |

Google Incorporated Class A † | | | | | | | 20,880 | | | | 24,658,654 | |

LinkedIn Corporation Class A † | | | | | | | 36,370 | | | | 7,827,188 | |

Twitter Incorporated Ǡ | | | | | | | 3,187 | | | | 205,562 | |

| | | | |

| | | | | | | | | | | 53,079,908 | |

| | | | | | | | | | | | |

| | | | |

| IT Services: 8.14% | | | | | | | | | | | | |

Alliance Data Systems Corporation † | | | | | | | 46,650 | | | | 11,180,139 | |

MasterCard Incorporated Class A | | | | | | | 138,490 | | | | 10,480,923 | |

Vantiv Incorporated Class A † | | | | | | | 220,890 | | | | 6,701,803 | |

Visa Incorporated Class A | | | | | | | 66,620 | | | | 14,351,947 | |

| | | | |

| | | | | | | | | | | 42,714,812 | |

| | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 2.37% | | | | | | | | | | | | |

ARM Holdings plc | | | | | | | 157,170 | | | | 7,240,822 | |

ASML Holding NV | | | | | | | 61,450 | | | | 5,200,514 | |

| | | | |

| | | | | | | | | | | 12,441,336 | |

| | | | | | | | | | | | |

| | | | |

| Software: 4.46% | | | | | | | | | | | | |

Adobe Systems Incorporated † | | | | | | | 134,690 | | | | 7,972,301 | |

Salesforce.com Incorporated † | | | | | | | 139,480 | | | | 8,442,724 | |

ServiceNow Incorporated † | | | | | | | 109,730 | | | | 6,960,174 | |

| | | | |

| | | | | | | | | | | 23,375,199 | |

| | | | | | | | | | | | |

| | | | |

Materials: 2.06% | | | | | | | | | | | | |

| | | | |

| Chemicals: 2.06% | | | | | | | | | | | | |

Monsanto Company | | | | | | | 101,420 | | | | 10,806,301 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage Capital Growth Fund | | Portfolio of investments—January 31, 2014 (unaudited) |

| | | | | | | | | | | | | | |

| Security name | | | | | | | Shares | | | Value | |

| | | | | | | | | | | | | | |

| | | | |

Telecommunication Services: 1.49% | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services: 1.49% | | | | | | | | | | | | | | |

SBA Communications Corporation Class A † | | | | | | | | | 84,599 | | | $ | 7,846,648 | |

| | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $387,707,834) | | | | | | | | | | | | | 514,311,566 | |

| | | | | | | | | | | | | | |

| | | Yield | | | | | | | | | |

| | | | |

Short-Term Investments: 1.69% | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 1.69% | | | | | | | | | | | | | | |

Wells Fargo Advantage Cash Investment Money Market Fund, Select Class (l)(u) | | | 0.07 | % | | | | | 8,673,512 | | | | 8,673,512 | |

Wells Fargo Securities Lending Cash Investments, LLC (l)(r)(u)(v) | | | 0.08 | | | | | | 194,250 | | | | 194,250 | |

| | | | |

Total Short-Term Investments (Cost $8,867,762) | | | | | | | | | | | | | 8,867,762 | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities | | | | | | | | |

| (Cost $396,575,596) * | | | 99.68 | % | | | 523,179,328 | |

Other assets and liabilities, net | | | 0.32 | | | | 1,657,549 | |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 524,836,877 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | Investment in an affiliate |

| (u) | Rate shown is the 7-day annualized yield at period end. |

| (r) | The investment company is exempt from registration under Section 3(c)(7) of the Investment Company Act of 1940, as amended. |

| (v) | Security represents investment of cash collateral received from securities on loan. |

| * | Cost for federal income tax purposes is $396,962,923 and unrealized appreciation (depreciation) consists of: |

| | | | |

Gross unrealized appreciation | | $ | 129,879,277 | |

Gross unrealized depreciation | | | (3,662,872 | ) |

| | | | |

Net unrealized appreciation | | $ | 126,216,405 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—January 31, 2014 (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 11 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments | | | | |

In unaffiliated securities (including securities on loan), at value (see cost below) | | $ | 514,311,566 | |

In affiliated securities, at value (see cost below) | | | 8,867,762 | |

| | | | |

Total investments, at value (see cost below) | | | 523,179,328 | |

Receivable for investments sold | | | 9,084,195 | |

Receivable for Fund shares sold | | | 522,825 | |

Receivable for dividends | | | 170,551 | |

Receivable for securities lending income | | | 349 | |

Prepaid expenses and other assets | | | 56,334 | |

| | | | |

Total assets | | | 533,013,582 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 7,372,241 | |

Payable for Fund shares redeemed | | | 144,761 | |

Payable upon receipt of securities loaned | | | 194,250 | |

Advisory fee payable | | | 234,588 | |

Distribution fees payable | | | 3,438 | |

Due to other related parties | | | 85,761 | |

Accrued expenses and other liabilities | | | 141,666 | |

| | | | |

Total liabilities | | | 8,176,705 | |

| | | | |

Total net assets | | $ | 524,836,877 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 378,745,678 | |

Accumulated net investment loss | | | (408,616 | ) |

Accumulated net realized gains on investments | | | 19,896,083 | |

Net unrealized gains on investments | | | 126,603,732 | |

| | | | |

Total net assets | | $ | 524,836,877 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE1 | | | | |

Net assets – Class A | | $ | 19,247,067 | |

Shares outstanding – Class A | | | 941,458 | |

Net asset value per share – Class A | | | $20.44 | |

Maximum offering price per share – Class A2 | | | $21.69 | |

Net assets – Class C | | $ | 5,040,235 | |

Shares outstanding – Class C | | | 260,183 | |

Net asset value per share – Class C | | | $19.37 | |

Net assets – Class R4 | | $ | 13,370 | |

Share outstanding – Class R4 | | | 620 | |

Net asset value per share – Class R4 | | | $21.56 | |

Net assets – Class R6 | | $ | 66,799,196 | |

Share outstanding – Class R6 | | | 3,094,195 | |

Net asset value per share – Class R6 | | | $21.59 | |

Net assets – Administrator Class | | $ | 70,359,260 | |

Shares outstanding – Administrator Class | | | 3,304,361 | |

Net asset value per share – Administrator Class | | | $21.29 | |

Net assets – Institutional Class | | $ | 271,384,045 | |

Shares outstanding – Institutional Class | | | 12,588,991 | |

Net asset value per share – Institutional Class | | | $21.56 | |

Net assets – Investor Class | | $ | 91,993,704 | |

Shares outstanding – Investor Class | | | 4,530,251 | |

Net asset value per share – Investor Class | | | $20.31 | |

Investments in unaffiliated securities (including securities on loan), at cost | | $ | 387,707,834 | |

| | | | |

Investments in affiliated securities, at cost | | $ | 8,867,762 | |

| | | | |

Total investments, at cost | | $ | 396,575,596 | |

| | | | |

Securities on loan, at value | | $ | 190,410 | |

| | | | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Capital Growth Fund | | Statement of operations—six months ended January 31, 2014 (unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends | | $ | 1,709,981 | |

Securities lending income, net | | | 6,310 | |

Income from affiliated securities | | | 2,512 | |

| | | | |

Total investment income | | | 1,718,803 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 1,737,603 | |

Administration fees | | | | |

Fund level | | | 133,916 | |

Class A | | | 24,138 | |

Class C | | | 6,170 | |

Class R4 | | | 6 | |

Class R6 | | | 7,801 | |

Administrator Class | | | 35,048 | |

Institutional Class | | | 119,134 | |

Investor Class | | | 147,831 | |

Shareholder servicing fees | | | | |

Class A | | | 23,209 | |

Class C | | | 5,933 | |

Class R4 | | | 7 | |

Administrator Class | | | 86,599 | |

Investor Class | | | 115,493 | |

Distribution fees | | | | |

Class C | | | 17,798 | |

Custody and accounting fees | | | 19,851 | |

Professional fees | | | 24,878 | |

Registration fees | | | 38,234 | |

Shareholder report expenses | | | 18,905 | |

Trustees’ fees and expenses | | | 4,974 | |

Other fees and expenses | | | 13,617 | |

| | | | |

Total expenses | | | 2,581,145 | |

Less: Fee waivers and/or expense reimbursements | | | (453,971 | ) |

| | | | |

Net expenses | | | 2,127,174 | |

| | | | |

Net investment loss | | | (408,371 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 34,759,575 | |

Net change in unrealized gains (losses) on investments | | | 36,260,320 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 71,019,895 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 70,611,524 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Advantage Capital Growth Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31, 2013 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | | | $ | (408,371 | ) | | | | | | $ | 1,940,707 | |

Net realized gains on investments | | | | | | | 34,759,575 | | | | | | | | 81,731,695 | |

Net change in unrealized gains (losses) on investments | | | | | | | 36,260,320 | | | | | | | | 19,679,033 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 70,611,524 | | | | | | | | 103,351,435 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (22,340 | ) | | | | | | | 0 | |

Class R4 | | | | | | | (30 | ) | | | | | | | (48 | )1 |

Class R6 | | | | | | | (188,590 | ) | | | | | | | (246 | )1 |

Administrator Class | | | | | | | (150,185 | ) | | | | | | | 0 | |

Institutional Class | | | | | | | (1,022,514 | ) | | | | | | | (1,895,530 | ) |

Investor Class | | | | | | | (86,333 | ) | | | | | | | 0 | |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (1,873,636 | ) | | | | | | | (314,970 | ) |

Class C | | | | | | | (492,729 | ) | | | | | | | (99,514 | ) |

Class R4 | | | | | | | (1,251 | ) | | | | | | | (167 | )1 |

Class R6 | | | | | | | (6,224,341 | ) | | | | | | | (837 | )1 |

Administrator Class | | | | | | | (6,836,708 | ) | | | | | | | (1,194,743 | ) |

Institutional Class | | | | | | | (27,083,256 | ) | | | | | | | (6,263,868 | ) |

Investor Class | | | | | | | (9,335,586 | ) | | | | | | | (1,405,932 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (53,317,499 | ) | | | | | | | (11,175,855 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 81,252 | | | | 1,697,648 | | | | 143,319 | | | | 2,580,951 | |

Class C | | | 43,277 | | | | 856,543 | | | | 25,668 | | | | 440,857 | |

Class R4 | | | 0 | | | | 0 | | | | 549 | 1 | | | 10,000 | 1 |

Class R6 | | | 2,915,393 | | | | 63,090,467 | | | | 2,744 | 1 | | | 50,000 | 1 |

Administrator Class | | | 226,657 | | | | 4,963,945 | | | | 451,886 | | | | 8,385,890 | |

Institutional Class | | | 688,530 | | | | 15,192,089 | | | | 2,394,980 | | | | 44,709,816 | |

Investor Class | | | 249,313 | | | | 5,202,610 | | | | 314,463 | | | | 5,648,504 | |

| | | | |

| | | | | | | 91,003,302 | | | | | | | | 61,826,018 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 90,669 | | | | 1,852,251 | | | | 18,353 | | | | 308,704 | |

Class C | | | 21,836 | | | | 422,743 | | | | 4,726 | | | | 76,288 | |

Class R4 | | | 59 | | | | 1,281 | | | | 12 | 1 | | | 215 | 1 |

Class R6 | | | 297,090 | | | | 6,412,931 | | | | 61 | 1 | | | 1,083 | 1 |

Administrator Class | | | 313,298 | | | | 6,669,296 | | | | 64,170 | | | | 1,117,846 | |

Institutional Class | | | 1,194,493 | | | | 25,770,101 | | | | 433,529 | | | | 7,652,649 | |

Investor Class | | | 451,521 | | | | 9,160,992 | | | | 81,385 | | | | 1,360,759 | |

| | | | |

| | | | | | | 50,289,595 | | | | | | | | 10,517,544 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (55,390 | ) | | | (1,168,090 | ) | | | (399,052 | ) | | | (7,220,538 | ) |

Class C | | | (42,186 | ) | | | (830,488 | ) | | | (167,822 | ) | | | (2,892,076 | ) |

Class R6 | | | (121,093 | ) | | | (2,708,890 | ) | | | 0 | 1 | | | 0 | 1 |

Administrator Class | | | (330,870 | ) | | | (7,166,114 | ) | | | (1,724,968 | ) | | | (32,214,397 | ) |

Institutional Class | | | (5,190,727 | ) | | | (113,078,580 | ) | | | (17,915,534 | ) | | | (327,311,363 | ) |

Investor Class | | | (490,220 | ) | | | (10,162,306 | ) | | | (951,999 | ) | | | (17,003,561 | ) |

| | | | |

| | | | | | | (135,114,468 | ) | | | | | | | (386,641,935 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | 6,178,429 | | | | | | | | (314,298,373 | ) |

| | | | |

Total increase (decrease) in net assets | | | | | | | 23,472,454 | | | | | | | | (222,122,793 | ) |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 501,364,423 | | | | | | | | 723,487,216 | |

| | | | |

End of period | | | | | | $ | 524,836,877 | | | | | | | $ | 501,364,423 | |

| | | | |

Undistributed (accumulated) net investment income (loss) | | | | | | $ | (408,616 | ) | | | | | | $ | 1,469,747 | |

| | | | |

| 1. | For the period from November 30, 2012 (commencement of class operations) to July 31, 2013 |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Capital Growth Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31 | |

| CLASS A | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 19.87 | | | $ | 16.74 | | | $ | 16.25 | | | $ | 13.07 | | | $ | 11.83 | | | $ | 17.60 | |

Net investment income (loss) | | | (0.05 | )1 | | | 0.00 | 1,2 | | | (0.05 | )1 | | | (0.07 | )1 | | | (0.06 | )1 | | | (0.00 | )1,2 |

Net realized and unrealized gains (losses) on investments | | | 2.87 | | | | 3.43 | | | | 0.54 | | | | 3.25 | | | | 1.30 | | | | (5.26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.82 | | | | 3.43 | | | | 0.49 | | | | 3.18 | | | | 1.24 | | | | (5.26 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (2.25 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

Net asset value, end of period | | $ | 20.44 | | | $ | 19.87 | | | $ | 16.74 | | | $ | 16.25 | | | $ | 13.07 | | | $ | 11.83 | |

Total return3 | | | 14.23 | % | | | 20.85 | % | | | 3.02 | % | | | 24.43 | % | | | 10.40 | % | | | (29.23 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.25 | % | | | 1.26 | % | | | 1.21 | % | | | 1.21 | % | | | 1.27 | % | | | 1.31 | % |

Net expenses | | | 1.11 | % | | | 1.14 | % | | | 1.20 | % | | | 1.20 | % | | | 1.25 | % | | | 1.25 | % |

Net investment income (loss) | | | (0.48 | )% | | | 0.01 | % | | | (0.30 | )% | | | (0.48 | )% | | | (0.55 | )% | | | (0.01 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % | | | 116 | % | | | 116 | % | | | 128 | % | | | 172 | % |

Net assets, end of period (000s omitted) | | | $19,247 | | | | $16,390 | | | | $17,784 | | | | $20,693 | | | | $24,222 | | | | $21,064 | |

| 1. | Calculated based upon average shares outstanding |

| 2. | Amount is less than $0.005. |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Capital Growth Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31 | |

| CLASS C | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 18.98 | | | $ | 16.12 | | | $ | 15.77 | | | $ | 12.77 | | | $ | 11.65 | | | $ | 17.47 | |

Net investment loss | | | (0.12 | )1 | | | (0.13 | )1 | | | (0.16 | )1 | | | (0.19 | )1 | | | (0.17 | ) | | | (0.08 | )1 |

Net realized and unrealized gains (losses) on investments | | | 2.74 | | | | 3.29 | | | | 0.51 | | | | 3.19 | | | | 1.29 | | | | (5.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.62 | | | | 3.16 | | | | 0.35 | | | | 3.00 | | | | 1.12 | | | | (5.31 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

Net asset value, end of period | | $ | 19.37 | | | $ | 18.98 | | | $ | 16.12 | | | $ | 15.77 | | | $ | 12.77 | | | $ | 11.65 | |

Total return2 | | | 13.80 | % | | | 19.97 | % | | | 2.22 | % | | | 23.49 | % | | | 9.61 | % | | | (29.75 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.00 | % | | | 2.01 | % | | | 1.96 | % | | | 1.96 | % | | | 2.02 | % | | | 2.02 | % |

Net expenses | | | 1.86 | % | | | 1.89 | % | | | 1.95 | % | | | 1.95 | % | | | 2.00 | % | | | 1.96 | % |

Net investment loss | | | (1.22 | )% | | | (0.73 | )% | | | (1.05 | )% | | | (1.23 | )% | | | (1.31 | )% | | | (0.70 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % | | | 116 | % | | | 116 | % | | | 128 | % | | | 172 | % |

Net assets, end of period (000s omitted) | | | $5,040 | | | | $4,503 | | | | $6,042 | | | | $8,272 | | | | $7,127 | | | | $6,772 | |

| 1. | Calculated based upon average shares outstanding |

| 2. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Capital Growth Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | |

| CLASS R4 | | Six months ended January 31, 2014 (unaudited) | | | Year ended July 31, 20131 | |

Net asset value, beginning of period | | $ | 20.83 | | | $ | 18.22 | |

Net investment income (loss) | | | (0.01 | ) | | | 0.05 | |

Net realized and unrealized gains (losses) on investments | | | 3.02 | | | | 2.95 | |

| | | | | | | | |

Total from investment operations | | | 3.01 | | | | 3.00 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.09 | ) |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (2.28 | ) | | | (0.39 | ) |

Net asset value, end of period | | $ | 21.56 | | | $ | 20.83 | |

Total return2 | | | 14.47 | % | | | 16.86 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 0.91 | % | | | 0.90 | % |

Net expenses | | | 0.75 | % | | | 0.75 | % |

Net investment income (loss) | | | (0.12 | )% | | | 0.37 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % |

Net assets, end of period (000s omitted) | | | $13 | | | | $12 | |

| 1. | For the period from November 30, 2012 (commencement of class operations) to July 31, 2013 |

| 2. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Capital Growth Fund | | | 17 | |

(For a share outstanding throughout each period)

| | | | | | | | |

| CLASS R6 | | Six months ended January 31, 2014 (unaudited) | | | Year ended July 31, 20131 | |

Net asset value, beginning of period | | $ | 20.85 | | | $ | 18.22 | |

Net investment income (loss) | | | (0.01 | )2 | | | 0.07 | |

Net realized and unrealized gains (losses) on investments | | | 3.04 | | | | 2.95 | |

| | | | | | | | |

Total from investment operations | | | 3.03 | | | | 3.02 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.09 | ) |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (2.29 | ) | | | (0.39 | ) |

Net asset value, end of period | | $ | 21.59 | | | $ | 20.85 | |

Total return3 | | | 14.57 | % | | | 16.99 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 0.77 | % | | | 0.79 | % |

Net expenses | | | 0.60 | % | | | 0.60 | % |

Net investment income (loss) | | | (0.13 | )% | | | 0.52 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % |

Net assets, end of period (000s omitted) | | | $66,799 | | | | $58 | |

| 1. | For the period from November 30, 2012 (commencement of class operations) to July 31, 2013 |

| 2. | Calculated based upon average shares outstanding |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Advantage Capital Growth Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31 | |

| ADMINIATOR CLASS | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 20.61 | | | $ | 17.32 | | | $ | 16.77 | | | $ | 13.45 | | | $ | 12.17 | | | $ | 18.03 | |

Net investment income (loss) | | | (0.03 | )1 | | | 0.04 | 1 | | | (0.00 | )1,2 | | | (0.03 | )1 | | | (0.03 | )1 | | | 0.04 | 1 |

Net realized and unrealized gains (losses) on investments | | | 2.98 | | | | 3.55 | | | | 0.55 | | | | 3.35 | | | | 1.35 | | | | (5.39 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.95 | | | | 3.59 | | | | 0.55 | | | | 3.32 | | | | 1.32 | | | | (5.35 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.04 | ) | | | 0.00 | |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (2.27 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | (0.04 | ) | | | (0.51 | ) |

Net asset value, end of period | | $ | 21.29 | | | $ | 20.61 | | | $ | 17.32 | | | $ | 16.77 | | | $ | 13.45 | | | $ | 12.17 | |

Total return3 | | | 14.36 | % | | | 21.15 | % | | | 3.22 | % | | | 24.68 | % | | | 10.81 | % | | | (29.02 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.09 | % | | | 1.09 | % | | | 1.05 | % | | | 1.05 | % | | | 1.09 | % | | | 1.13 | % |

Net expenses | | | 0.90 | % | | | 0.91 | % | | | 0.94 | % | | | 0.94 | % | | | 0.94 | % | | | 0.94 | % |

Net investment income (loss) | | | (0.26 | )% | | | 0.24 | % | | | (0.01 | )% | | | (0.21 | )% | | | (0.25 | )% | | | 0.33 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % | | | 116 | % | | | 116 | % | | | 128 | % | | | 172 | % |

Net assets, end of period (000s omitted) | | | $70,359 | | | | $63,786 | | | | $74,529 | | | | $372,178 | | | | $684,207 | | | | $680,869 | |

| 1. | Calculated based upon average shares outstanding |

| 2. | Amount is less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Capital Growth Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31 | |

| INSTITUTIONAL CLASS | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 20.84 | | | $ | 17.56 | | | $ | 16.96 | | | $ | 13.57 | | | $ | 12.27 | | | $ | 18.14 | |

Net Investment income (loss) | | | 0.00 | 1,2 | | | 0.09 | 1 | | | 0.03 | 1 | | | 0.00 | 1,2 | | | (0.00 | )1,2 | | | 0.06 | 1 |

Net realized and unrealized gains (losses) on investments | | | 3.03 | | | | 3.58 | | | | 0.57 | | | | 3.39 | | | | 1.36 | | | | (5.42 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.03 | | | | 3.67 | | | | 0.60 | | | | 3.39 | | | | 1.36 | | | | (5.36 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.08 | ) | | | (0.09 | ) | | | 0.00 | | | | 0.00 | | | | (0.06 | ) | | | 0.00 | |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (2.31 | ) | | | (0.39 | ) | | | 0.00 | | | | 0.00 | | | | (0.06 | ) | | | (0.51 | ) |

Net asset value, end of period | | $ | 21.56 | | | $ | 20.84 | | | $ | 17.56 | | | $ | 16.96 | | | $ | 13.57 | | | $ | 12.27 | |

Total return3 | | | 14.55 | % | | | 21.42 | % | | | 3.48 | % | | | 25.07 | % | | | 10.97 | % | | | (28.90 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.82 | % | | | 0.82 | % | | | 0.78 | % | | | 0.78 | % | | | 0.82 | % | | | 0.86 | % |

Net expenses | | | 0.65 | % | | | 0.67 | % | | | 0.70 | % | | | 0.70 | % | | | 0.75 | % | | | 0.75 | % |

Net investment income (loss) | | | 0.02 | % | | | 0.46 | % | | | 0.21 | % | | | 0.00 | % | | | (0.06 | )% | | | 0.51 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % | | | 116 | % | | | 116 | % | | | 128 | % | | | 172 | % |

Net assets, end of period (000s omitted) | | | $271,384 | | | | $331,310 | | | | $543,933 | | | | $988,633 | | | | $473,777 | | | | $443,931 | |

| 1. | Calculated based upon average shares outstanding |

| 2. | Amount is less than $0.005. |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Advantage Capital Growth Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

January 31, 2014

(unaudited) | | | Year ended July 31 | |

| INVESTOR CLASS | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | $ | 19.75 | | | $ | 16.65 | | | $ | 16.18 | | | $ | 13.02 | | | $ | 11.79 | | | $ | 17.56 | |

Net investment loss | | | (0.06 | )1 | | | (0.01 | )1 | | | (0.06 | )1 | | | (0.08 | )1 | | | (0.08 | )1 | | | (0.01 | )1 |

Net realized and unrealized gains (losses) on investments | | | 2.87 | | | | 3.41 | | | | 0.53 | | | | 3.24 | | | | 1.31 | | | | (5.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.81 | | | | 3.40 | | | | 0.47 | | | | 3.16 | | | | 1.23 | | | | (5.26 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (2.23 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (2.25 | ) | | | (0.30 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.51 | ) |

Net asset value, end of period | | $ | 20.31 | | | $ | 19.75 | | | $ | 16.65 | | | $ | 16.18 | | | $ | 13.02 | | | $ | 11.79 | |

Total return2 | | | 14.24 | % | | | 20.78 | % | | | 2.90 | % | | | 24.37 | % | | | 10.35 | % | | | (29.30 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.31 | % | | | 1.32 | % | | | 1.28 | % | | | 1.28 | % | | | 1.36 | % | | | 1.41 | % |

Net expenses | | | 1.17 | % | | | 1.20 | % | | | 1.27 | % | | | 1.27 | % | | | 1.35 | % | | | 1.36 | % |

Net investment loss | | | (0.53 | )% | | | (0.06 | )% | | | (0.37 | )% | | | (0.55 | )% | | | (0.64 | )% | | | (0.12 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 50 | % | | | 107 | % | | | 116 | % | | | 116 | % | | | 128 | % | | | 172 | % |

Net assets, end of period (000s omitted) | | | $91,994 | | | | $85,306 | | | | $81,199 | | | | $96,941 | | | | $104,200 | | | | $220,008 | |

| 1. | Calculated based upon average shares outstanding |

| 2. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 21 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on the Wells Fargo Advantage Capital Growth Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time).

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the primary exchange or market for the security that day, the prior day’s price will be deemed “stale” and fair values will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Non-registered investment vehicles are fair valued at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Security loans

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

| | | | |

| 22 | | Wells Fargo Advantage Capital Growth Fund | | Notes to financial statements (unaudited) |

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Wells Fargo Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are fair valued based upon the amortized cost valuation technique. Income earned from investment in the Securities Lending Fund is included in securities lending income on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of July 31, 2013, the Fund had capital loss carryforwards available to offset future net realized capital gains in the amount of $3,375,420 expiring in 2016.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Shareholders of each class bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund, earn income from the portfolio, and are allocated any unrealized gains and losses pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gains and losses are allocated to each class pro rata based upon the net assets of each class on the date realized. Differences in per share dividend rates generally result from the relative weightings of pro rata income and realized gain allocations and from differences in separate class expenses, including distribution, shareholder servicing, and administration fees.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Capital Growth Fund | | | 23 | |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

As of January 31, 2014, the inputs used in valuing investments in securities were as follows:

| | | | | | | | | | | | | | | | |

| Investments in securities | | Quoted prices (Level 1) | | | Other significant

observable inputs (Level 2) | | | Significant unobservable inputs (Level 3) | | | Total | |

Equity securities | | | | | | | | | | | | | | | | |

Common stocks | | $ | 514,311,566 | | | $ | 0 | | | $ | 0 | | | $ | 514,311,566 | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 8,673,512 | | | | 194,250 | | | | 0 | | | | 8,867,762 | |

| | | $ | 522,985,078 | | | $ | 194,250 | | | $ | 0 | | | $ | 523,179,328 | |

Transfers in and transfers out are recognized at the end of the reporting period. For the six months ended January 31, 2014, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.65% and declining to 0.55% as the average daily net assets of the Fund increase. For the six months ended January 31, 2014, the advisory fee was equivalent to an annual rate of 0.65% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. WellsCap, an affiliate of Funds Management and an indirect, wholly owned subsidiary of Wells Fargo, is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.30% and declining to 0.20% as the average daily net assets of the Fund increase.

Administration and transfer agent fees

The Trust has entered into an administration agreement with Funds Management. Under this agreement, for providing administrative services, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual fund level administration fee starting at 0.05% and declining to 0.03% as the average daily net assets of the Fund increase and a class level administration fee which is calculated based on the average daily net assets of each class as follows:

| | | | |

| | | Class level

administration fee | |

Class A, Class C | | | 0.26 | % |

Class R4, Institutional Class | | | 0.08 | |

Class R6 | | | 0.03 | |

Administrator Class | | | 0.10 | |

Investor Class | | | 0.32 | |

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through November 30, 2014 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 1.11% for Class A shares, 1.86% for Class C shares, 0.75% for Class R4 shares, 0.60% for Class R6 shares, 0.90% for Administrator Class shares, 0.65% for Institutional Class shares, and 1.17% for Investor Class shares.

| | | | |

| 24 | | Wells Fargo Advantage Capital Growth Fund | | Notes to financial statements (unaudited) |

Distribution fees

The Trust has adopted a Distribution Plan for Class C shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares.

For the six months ended January 31, 2014, Wells Fargo Funds Distributor, LLC received $2,999 from the sale of Class A shares.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C, Administrator Class, and Investor Class of the Fund is charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class. Class R4 shares are charged a fee at an annual rate of 0.10% of its average daily net assets.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended January 31, 2014 were $260,872,083 and $309,925,643, respectively.

6. CAPITAL SHARES