UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: June 30

Registrant is making a filing for 16 of its series:

Wells Fargo Alternative Strategies Fund, Wells Fargo Global Long/Short Fund, Wells Fargo California Limited-Term Tax-Free Fund, Wells Fargo California Tax-Free Fund, Wells Fargo Colorado Tax-Free Fund, Wells Fargo High Yield Municipal Bond Fund, Wells Fargo Intermediate Tax/AMT-Free Fund, Wells Fargo Minnesota Tax-Free Fund, Wells Fargo Municipal Bond Fund, Wells Fargo North Carolina Tax-Free Fund, Wells Fargo Pennsylvania Tax-Free Fund, Wells Fargo Short-Term Municipal Bond Fund, Wells Fargo Small Cap Core Fund, Wells Fargo Strategic Municipal Bond Fund, Wells Fargo Ultra Short-Term Municipal Income Fund, and Wells Fargo Wisconsin Tax-Free Fund.

Date of reporting period: December 31, 2016

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

December 31, 2016

Wells Fargo Alternative Strategies Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of December 31, 2016, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Alternative Strategies Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Stocks drifted somewhat lower in the fall as the U.S. presidential campaign wore on toward the election.

Throughout the period, economic and business data, while sometimes uneven, appeared to be strengthening overall.

Dear Shareholder:

As the new president of Wells Fargo Funds now that Karla Rabusch is retiring from that position after nearly 14 years, I am pleased to offer you this semi-annual report for the Wells Fargo Alternative Strategies Fund for the six-month period that ended December 31, 2016. During much of the period, positive economic data influenced global stock, bond, and commodity markets. Late in the period, stocks in the U.S. moved higher while they drifted lower in most international markets in reaction to the U.S. presidential election, production-cut agreements among Organization of the Petroleum Exporting Countries (OPEC) members intended to support higher oil prices, and an interest-rate increase in December announced by the U.S. Federal Reserve (the Fed). As interest rates increased and sentiment for stock investments—particularly in the U.S.—improved, bond values globally fell.

The surprise Brexit vote rattled markets briefly before stocks rebounded.

A round of investment market volatility and losses followed the U.K. Brexit vote to leave the European Union (E.U.) at the end of June 2016. The equity sell-off proved temporary. During July 2016, better-than-expected corporate earnings, economic data, consumer confidence, and industrial output sent stocks higher.

Stocks drifted somewhat lower in the fall as the U.S. presidential campaign wore on toward the election. At the same time, political circumstances in countries outside of the U.S. challenged investor sentiment. In the U.K., a new prime minister took office following the Brexit vote and began setting the ground rules for the country’s exit from the E.U. In Brazil, the Senate removed the president from office, and the possibility of presidential impeachment emerged in South Korea due to a corruption scandal. The French president lost a primary election and endorsed his rival. An attempted coup in Turkey, continued escalation of conflicts in Syria and Iraq, and North Korea’s testing of nuclear weapons capabilities also caused uncertainty.

Investors sensed improving economic and business data as the period advanced.

Throughout the period, economic and business data, while sometimes uneven, appeared to be strengthening overall. After generating concern early in 2016, China’s economic growth demonstrated strength. The prime minister’s reelection in Japan offered the potential for new economic stimulus. India appointed a new central-bank governor who many expected would continue the outgoing governor’s policies, which were considered effective. OPEC members agreed to production cuts intended to support increased prices for oil, which could benefit commodities markets that are economically important to many international developed and emerging markets. In the U.S., the S&P 500 Index1 recorded a 7.8% return for the six-month period that ended December 31, 2016. Developed international markets, as measured by the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net),2 ended the period 5.6% higher. Stocks in emerging markets delivered a 4.5% gain for the period, as measured by the MSCI Emerging Markets Index (Net).3

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 3 | The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI EM Index (Net) consists of the following 23 emerging markets country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 3 | |

Fixed-income markets were volatile before the U.S. election and declined postelection.

Global fixed-income markets were volatile during the period, particularly following the U.S. election. Investors appeared to be anticipating U.S. interest-rate increases and waiting for clarity from central-bank policymakers outside of the U.S. When the Fed increased interest rates in December 2016, investors tended to favor equities and high-yield bonds, over investment-grade bonds.

Currency values in several European and Asian countries fell relative to the U.S. dollar during the period, restraining investor interest in foreign bond markets. While the Bloomberg Barclays U.S. Aggregate Bond Index4 lost 2.5% during the period, a 9.3% loss for the Bloomberg Barclays Global Aggregate ex U.S. Dollar Bond Index5 reflected relatively more difficult conditions for bonds outside of the U.S.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index (formerly known as Barclays U.S. Aggregate Bond Index) is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex U.S. Dollar Bond Index (formerly known as Barclays Global Aggregate ex U.S. Dollar Bond Index) tracks an international basket of government, corporate, agency, and mortgage-related bonds. You cannot invest directly in an index. |

| | | | |

| 4 | | Wells Fargo Alternative Strategies Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadvisers

The Rock Creek Group, LP

Chilton Investment Company, LLC

Ellington Global Asset Management Corporation

Mellon Capital Management Corporation

Passport Capital, LLC

Pine River Capital Management L.P.

River Canyon Fund Management LLC

Sirios Capital Management, L.P.

Wellington Management Company LLP

Portfolio managers

Joseph Bishop

John F. Brennan, Jr.

John Burbank

Richard L. Chilton, Jr.

Vassilis Dagioglu

George Jikovski

Robert Kinderman

Sudhir Krisnamurthi

Kenneth LaPlace

Soon Pho

Kent M. Stahl, CFA®

James Stavena

Gregg R. Thomas, CFA®

Ronald van der Wouden

Torrey Zaches

Aaron Zimmerman

Average annual total returns (%) as of December 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios1 (%) | |

| | | Inception date | | 1 year | | | Since inception | | | 1 year | | | Since inception | | | Gross | | | Net2 | |

| Class A (WALTX) | | 4-30-2014 | | | (8.29 | ) | | | (1.14 | ) | | | (2.73 | ) | | | 1.08 | | | | 3.46 | | | | 3.05 | |

| Class C (WACTX) | | 4-30-2014 | | | (4.46 | ) | | | 0.32 | | | | (3.46 | ) | | | 0.32 | | | | 4.21 | | | | 3.80 | |

| Administrator Class (WADTX) | | 4-30-2014 | | | – | | | | – | | | | (1.95 | ) | | | 1.45 | | | | 3.38 | | | | 2.90 | |

| Institutional Class (WAITX) | | 4-30-2014 | | | – | | | | – | | | | (2.43 | ) | | | 1.34 | | | | 3.13 | | | | 2.80 | |

| Bloomberg Barclays U.S. Aggregate Bond Index3 | | – | | | – | | | | – | | | | 2.65 | | | | 2.38 | | | | – | | | | – | |

| HFRI Fund of Funds Composite Index4 | | – | | | – | | | | – | | | | 0.48 | | | | 1.36 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

The Fund does not invest directly in hedge funds but pursues similar strategies to those typically used by hedge funds. The Fund invests using alternative investment strategies such as equity hedged, event driven, global macro, and relative value, which are speculative and entail a high degree of risk. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Borrowing money to purchase securities or cover short positions magnifies losses and incurs expenses. Short selling is generally considered speculative, has the potential for unlimited loss, and may involve leverage. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Securities issued by U.S. government agencies or government-sponsored entities may not be guaranteed by the U.S. Treasury. The Fund is exposed to high-yield securities risk, mortgage- and asset-backed securities risk, convertible securities risk, loan risk, regulatory risk, and smaller-company securities risk. Consult a Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 6.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 5 | |

| | | | |

| Top ten long positions (%) as of December 31, 20165 | |

AQR Managed Futures Strategy Fund Class I | | | 5.10 | |

The Sherwin-Williams Company | | | 1.81 | |

Halliburton Company | | | 1.36 | |

The Home Depot Incorporated | | | 1.25 | |

Microsoft Corporation | | | 1.20 | |

Yahoo! Incorporated | | | 1.13 | |

Credit-Based Asset Servicing and Securitization LLC Series 07-CB4 Class A1B, 0.71%, 4-25-2037 | | | 1.08 | |

Carrington Mortgage Loan Trust Series 06-NC4 Class A3, 0.75%, 10-25-2036 | | | 1.07 | |

HSBC Bank plc (Alinma AB) | | | 0.94 | |

Western Digital Corporation | | | 0.94 | |

| | | | |

| Top ten short positions (%) as of December 31, 20165 | |

SPDR S&P 500 ETF | | | (4.46) | |

Consumer Staples Select Sector SPDR Fund ETF | | | (1.21) | |

Schlumberger Limited | | | (0.91) | |

National Oilwell Varco Incorporated | | | (0.73) | |

iShares MSCI Emerging Markets ETF | | | (0.71) | |

Corning Incorporated | | | (0.67) | |

Infosys Limited ADR | | | (0.65) | |

Occidental Petroleum Corporation | | | (0.64) | |

Electronic Arts Incorporated | | | (0.62) | |

Toyota Motor Corporation ADR | | | (0.61) | |

| | | | | | | | |

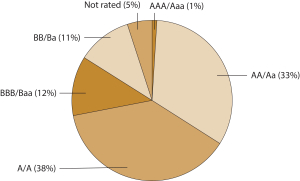

| Sector allocation as of December 31, 20166 | |

| | | Gross exposure(%) | | | Net exposure(%) | |

Consumer Discretionary | | | 13 | | | | 16 | |

Consumer Staples | | | 8 | | | | 10 | |

Energy | | | 8 | | | | 5 | |

Financials | | | 11 | | | | 15 | |

Health Care | | | 8 | | | | 11 | |

Industrials | | | 10 | | | | 9 | |

Information Technology | | | 15 | | | | 13 | |

Materials | | | 7 | | | | 10 | |

Real Estate | | | 1 | | | | 1 | |

Telecommunication Services | | | 2 | | | | 3 | |

Utilities | | | 1 | | | | 1 | |

Other | | | 16 | | | | 6 | |

| | | | 100 | | | | 100 | |

|

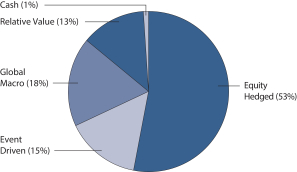

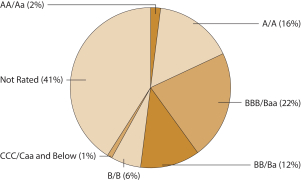

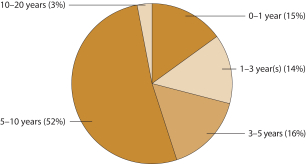

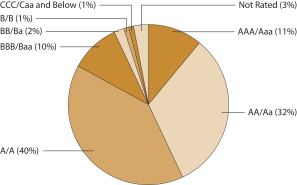

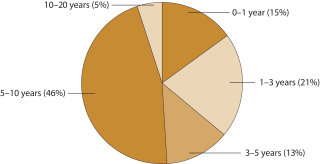

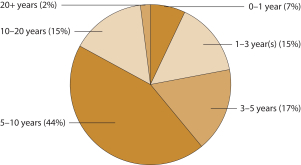

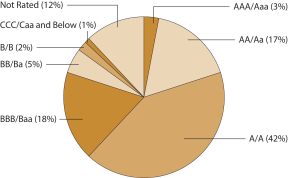

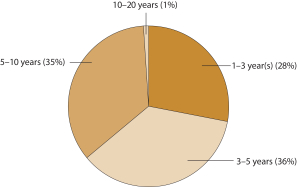

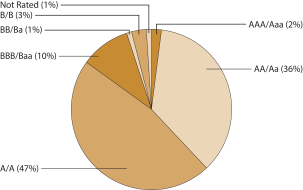

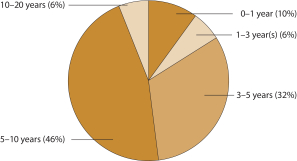

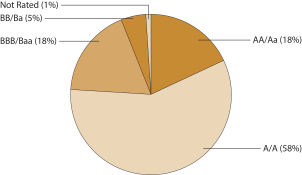

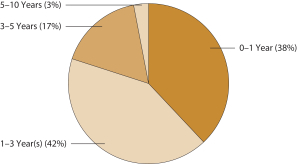

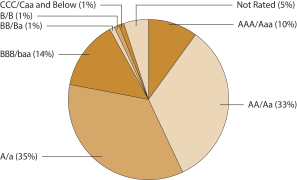

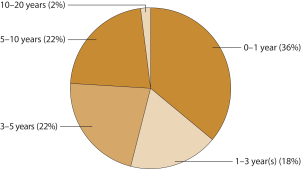

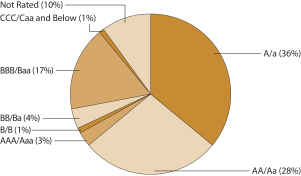

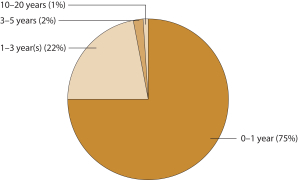

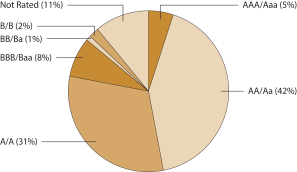

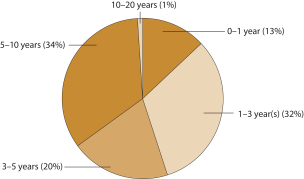

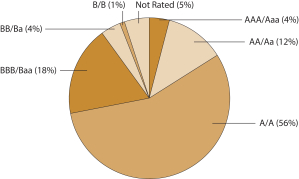

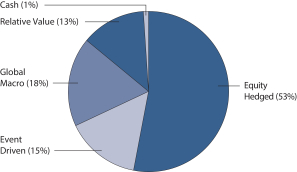

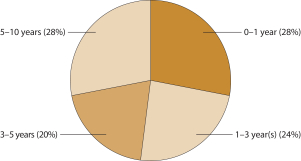

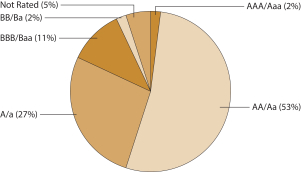

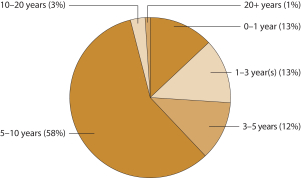

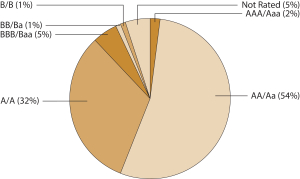

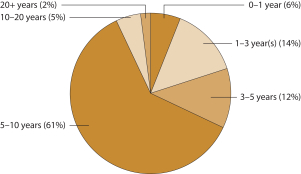

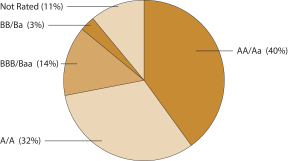

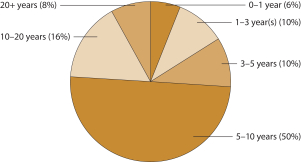

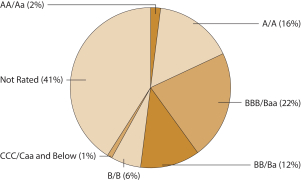

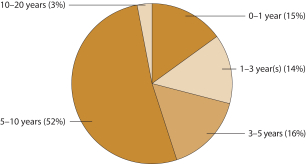

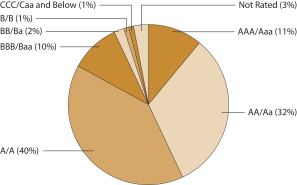

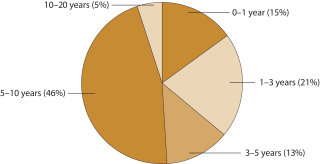

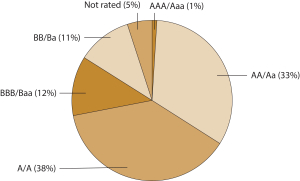

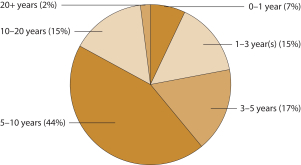

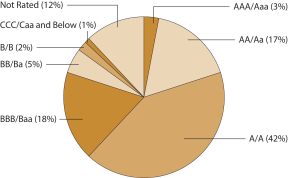

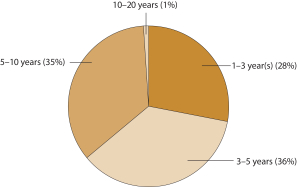

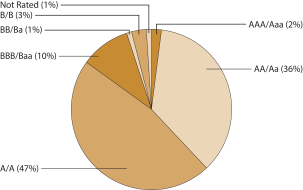

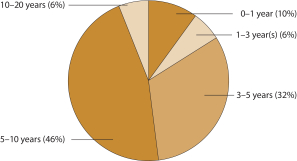

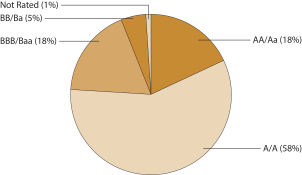

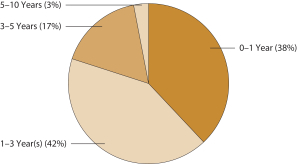

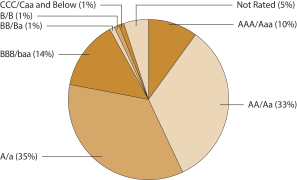

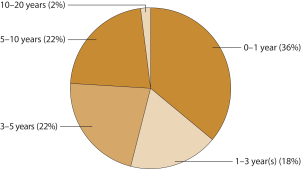

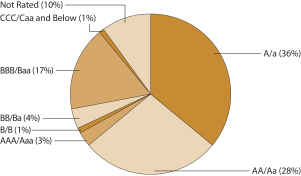

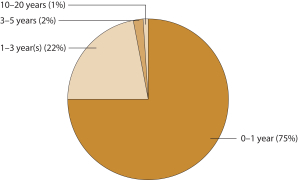

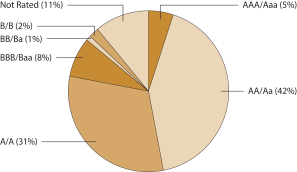

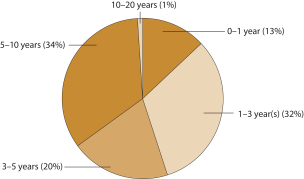

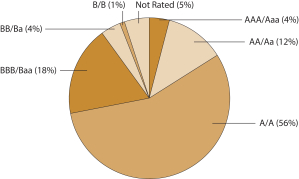

| Strategy allocation as of December 31, 20167 |

|

|

Please see footnotes on page 6.

| | | | |

| 6 | | Wells Fargo Alternative Strategies Fund | | Performance highlights (unaudited) |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.12% in acquired fund fees and expenses and 0.81% in dividend expense on securities sold short and prime broker fees. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 2 | The manager has contractually committed through October 31, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver at 2.22% for Class A, 2.97% for Class C, 2.07% for Administrator Class, and 1.97% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, prime broker fees, dividend and interest expenses on securities sold short, and extraordinary expenses are excluded from the expense cap. Acquired fund fees and expenses incurred by investments made by The Rock Creek Group, LP, a subadviser of the Fund, are included in the expense cap. Without this cap, the Fund’s returns would have been lower. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index (formerly known as Barclays U.S. Aggregate Bond Index) is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 4 | The Hedge Fund Research Incorporated (HFRI) Fund of Funds Composite Index is a global, equally-weighted index of hedge funds that invest with multiple managers in a broad range of strategies. You cannot invest directly in an index. |

| 5 | The ten largest long and short position holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 6 | The chart shows the percentage of Fund holdings within a particular sector that was held long (securities owned by the Fund) or sold short (sale of borrowed securities). Gross exposure is the absolute value of the long positions and short positions combined. Net exposure is the percentage of long positions minus the percentage of positions sold short. |

| 7 | Strategy allocation is calculated based on the market value of total investments. Cash shown is the sweep cash position of the Fund, and excludes any cash or cash equivalents that may be pledged as collateral for other investments of the Fund. Strategy allocation is subject to change and may have changed since the date specified. |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 7 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2016 to December 31, 2016.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

7-1-2016 | | | Ending

account value

12-31-2016 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.00 | | | $ | 14.56 | | | | 2.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,010.76 | | | $ | 14.46 | | | | 2.86 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,026.70 | | | $ | 18.34 | | | | 3.60 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,007.40 | | | $ | 18.16 | | | | 3.60 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,021.40 | | | $ | 13.36 | | | | 2.63 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,011.91 | | | $ | 13.30 | | | | 2.63 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,020.40 | | | $ | 13.36 | | | | 2.63 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,011.91 | | | $ | 13.30 | | | | 2.63 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | |

| 8 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 57.10% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 9.12% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.12% | | | | | | | | | | | | | | | | |

Bridgestone Corporation | | | | | | | | | | | 1,030 | | | $ | 37,137 | |

Delphi Automotive plc | | | | | | | | | | | 345 | | | | 23,236 | |

Nifco Incorporated | | | | | | | | | | | 282 | | | | 14,887 | |

Stanley Electric Company Limited | | | | | | | | | | | 739 | | | | 20,202 | |

Tokai Rika Company Limited | | | | | | | | | | | 1,190 | | | | 23,876 | |

Toyo Tire & Rubber Company Limited | | | | | | | | | | | 4,768 | | | | 59,358 | |

Toyota Boshoku Corporation | | | | | | | | | | | 433 | | | | 9,955 | |

Toyota Industries Corporation | | | | | | | | | | | 870 | | | | 41,462 | |

TS Tech Company Limited | | | | | | | | | | | 910 | | | | 23,436 | |

| | | | |

| | | | | | | | | | | | | | | 253,549 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Automobiles: 0.11% | | | | | | | | | | | | | | | | |

Chongqing Changchun Automobile Class B | | | | | | | | | | | 34,665 | | | | 49,576 | |

Fuji Heavy Industries Limited | | | | | | | | | | | 1,815 | | | | 74,106 | |

Isuzu Motors Limited | | | | | | | | | | | 2,535 | | | | 32,123 | |

Mazda Motor Corporation | | | | | | | | | | | 1,105 | | | | 18,077 | |

Renault SA | | | | | | | | | | | 365 | | | | 32,470 | |

Suzuki Motor Corporation | | | | | | | | | | | 700 | | | | 24,640 | |

| | | | |

| | | | | | | | | | | | | | | 230,992 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Distributors: 0.01% | | | | | | | | | | | | | | | | |

Paltac Corporation | | | | | | | | | | | 800 | | | | 18,906 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 0.13% | | | | | | | | | | | | | | | | |

Kroton Educacional SA | | | | | | | | | | | 15,148 | | | | 62,040 | |

New Oriental Education & Technology Group Incorporated † | | | | | | | | | | | 1,482 | | | | 62,392 | |

Service Corporation International | | | | | | | | | | | 5,452 | | | | 154,837 | |

| | | | |

| | | | | | | | | | | | | | | 279,269 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 1.72% | | | | | | | | | | | | | | | | |

Caesars Acquisition Company Class A † | | | | | | | | | | | 2,045 | | �� | | 27,608 | |

Caesars Entertainment Corporation † | | | | | | | | | | | 2,571 | | | | 21,854 | |

Chipotle Mexican Grill Incorporated † | | | | | | | | | | | 185 | | | | 69,804 | |

ClubCorp Holdings Incorporated | | | | | | | | | | | 5,171 | | | | 74,204 | |

Compass Group plc | | | | | | | | | | | 3,780 | | | | 69,924 | |

Domino’s Pizza Group plc | | | | | | | | | | | 7,758 | | | | 34,496 | |

Domino’s Pizza Incorporated | | | | | | | | | | | 2,914 | | | | 464,025 | |

Dunkin Brands Group Incorporated (b) | | | | | | | | | | | 9,074 | | | | 475,841 | |

Genting Singapore plc | | | | | | | | | | | 44,270 | | | | 27,666 | |

H.I.S. Company Limited | | | | | | | | | | | 1,816 | | | | 47,779 | |

Hilton Worldwide Holdings Incorporated | | | | | | | | | | | 2,687 | | | | 73,086 | |

Hyatt Hotels Corporation Class A † | | | | | | | | | | | 1,225 | | | | 67,694 | |

Ladbrokes Coral Group plc | | | | | | | | | | | 14,410 | | | | 20,600 | |

Las Vegas Sands Corporation | | | | | | | | | | | 2,006 | | | | 107,140 | |

Mandarin Oriental International Limited | | | | | | | | | | | 20,185 | | | | 25,736 | |

McDonald’s Corporation (b) | | | | | | | | | | | 5,790 | | | | 704,759 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 9 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Hotels, Restaurants & Leisure (continued) | | | | | | | | | | | | | | | | |

MGM Resorts International †(b) | | | | | | | | | | | 27,619 | | | $ | 796,256 | |

OPAP SA | | | | | | | | | | | 6,698 | | | | 59,225 | |

Panera Bread Company Class A † | | | | | | | | | | | 336 | | | | 68,910 | |

Sands China Limited | | | | | | | | | | | 5,870 | | | | 25,510 | |

Tosho Company Limited | | | | | | | | | | | 227 | | | | 10,449 | |

TUI AG | | | | | | | | | | | 4,085 | | | | 57,256 | |

Yum! Brands Incorporated | | | | | | | | | | | 6,790 | | | | 430,011 | |

| | | | |

| | | | | | | | | | | | | | | 3,759,833 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 0.38% | | | | | | | | | | | | | | | | |

Alpine Electronics Incorporated | | | | | | | | | | | 1,370 | | | | 17,852 | |

Cairn Homes plc † | | | | | | | | | | | 120,679 | | | | 171,494 | |

Casio Computer Company Limited | | | | | | | | | | | 1,280 | | | | 18,103 | |

Panahome Corporation | | | | | | | | | | | 2,625 | | | | 21,247 | |

Sekisui Chemical Company Limited | | | | | | | | | | | 2,187 | | | | 34,880 | |

Whirlpool Corporation | | | | | | | | | | | 3,063 | | | | 556,762 | |

| | | | |

| | | | | | | | | | | | | | | 820,338 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet & Direct Marketing Retail: 0.45% | | | | | | | | | | | | | | | | |

Amazon.com Incorporated † | | | | | | | | | | | 62 | | | | 46,492 | |

Netflix Incorporated † | | | | | | | | | | | 1,086 | | | | 134,447 | |

Qliro Group AB † | | | | | | | | | | | 11,366 | | | | 10,791 | |

Start Today Company Limited | | | | | | | | | | | 1,604 | | | | 27,709 | |

The Priceline Group Incorporated † | | | | | | | | | | | 49 | | | | 71,837 | |

Wayfair Incorporated Class A † | | | | | | | | | | | 19,457 | | | | 681,968 | |

| | | | |

| | | | | | | | | | | | | | | 973,244 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Leisure Products: 0.04% | | | | | | | | | | | | | | | | |

Bandai Namco Holdings Incorporated | | | | | | | | | | | 700 | | | | 19,316 | |

Sankyo Company Limited | | | | | | | | | | | 627 | | | | 20,252 | |

Sega Sammy Holdings Incorporated | | | | | | | | | | | 2,635 | | | | 39,207 | |

Yamaha Corporation | | | | | | | | | | | 629 | | | | 19,213 | |

| | | | |

| | | | | | | | | | | | | | | 97,988 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 2.83% | | | | | | | | | | | | | | | | |

Clear Channel Outdoor Holdings Incorporated Class A | | | | | | | | | | | 3,388 | | | | 17,109 | |

Comcast Corporation Class A (b) | | | | | | | | | | | 20,877 | | | | 1,441,557 | |

Discovery Communications Incorporated Class A †(b) | | | | | | | | | | | 14,318 | | | | 392,456 | |

DISH Network Corporation Class A †(b) | | | | | | | | | | | 15,428 | | | | 893,744 | |

Grupo Televisa SA | | | | | | | | | | | 6,950 | | | | 28,987 | |

M6 Metropole Television SA | | | | | | | | | | | 1,535 | | | | 28,552 | |

Nippon Television Network Corporation (b) | | | | | | | | | | | 4,395 | | | | 79,796 | |

Septeni Holdings Company Limited | | | | | | | | | | | 6,005 | | | | 20,552 | |

SES SA | | | | | | | | | | | 8,393 | | | | 184,870 | |

Societe Television Francaise 1 SA | | | | | | | | | | | 5,387 | | | | 53,593 | |

The Walt Disney Company | | | | | | | | | | | 10,664 | | | | 1,111,402 | |

Time Warner Incorporated (b) | | | | | | | | | | | 18,953 | | | | 1,829,533 | |

TV Asahi Corporation | | | | | | | | | | | 1,375 | | | | 27,165 | |

Wolters Kluwer NV | | | | | | | | | | | 1,580 | | | | 57,247 | |

| | | | |

| | | | | | | | | | | | | | | 6,166,563 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Multiline Retail: 0.02% | | | | | | | | | | | | | | | | |

Marks & Spencer Group plc | | | | | | | | | | | 9,356 | | | $ | 40,356 | |

Seria Company Limited | | | | | | | | | | | 235 | | | | 15,985 | |

| | | | |

| | | | | | | | | | | | | | | 56,341 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 3.07% | | | | | | | | | | | | | | | | |

Advance Auto Parts Incorporated | | | | | | | | | | | 639 | | | | 108,068 | |

Aoyama Trading Company Limited | | | | | | | | | | | 1,025 | | | | 35,694 | |

AutoNation Incorporated † | | | | | | | | | | | 28,343 | | | | 1,378,887 | |

AutoZone Incorporated † | | | | | | | | | | | 1,555 | | | | 1,228,123 | |

CarMax Incorporated †(b) | | | | | | | | | | | 6,043 | | | | 389,109 | |

Halfords Group plc | | | | | | | | | | | 2,081 | | | | 9,374 | |

Hikari Tsushin Incorporated | | | | | | | | | | | 292 | | | | 27,208 | |

Joyful Honda Company Limited | | | | | | | | | | | 798 | | | | 21,454 | |

Lowe’s Companies Incorporated | | | | | | | | | | | 9,348 | | | | 664,830 | |

Shimamura Company Limited | | | | | | | | | | | 266 | | | | 33,206 | |

The Home Depot Incorporated (b) | | | | | | | | | | | 20,388 | | | | 2,733,624 | |

The TJX Companies Incorporated | | | | | | | | | | | 1,015 | | | | 76,257 | |

| | | | |

| | | | | | | | | | | | | | | 6,705,834 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 0.24% | | | | | | | | | | | | | | | | |

Brunello Cucinelli SpA | | | | | | | | | | | 1,122 | | | | 24,023 | |

Crocs Incorporated † | | | | | | | | | | | 6,021 | | | | 41,304 | |

Deckers Outdoor Corporation † | | | | | | | | | | | 3,366 | | | | 186,443 | |

Geox SpA | | | | | | | | | | | 12,157 | | | | 28,282 | |

Global Brands Group Holding Limited † | | | | | | | | | | | 202,335 | | | | 26,875 | |

Nike Incorporated Class B | | | | | | | | | | | 3,234 | | | | 164,384 | |

Ralph Lauren Corporation | | | | | | | | | | | 280 | | | | 25,290 | |

VF Corporation | | | | | | | | | | | 685 | | | | 36,545 | |

| | | | |

| | | | | | | | | | | | | | | 533,146 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 5.63% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 2.43% | | | | | | | | | | | | | | | | |

Asahi Breweries Limited | | | | | | | | | | | 720 | | | | 22,732 | |

Brown-Forman Corporation Class B | | | | | | | | | | | 15,190 | | | | 682,335 | |

C&C Group plc | | | | | | | | | | | 11,345 | | | | 45,978 | |

Coca-Cola HBC AG | | | | | | | | | | | 1,453 | | | | 31,695 | |

Constellation Brands Incorporated Class A | | | | | | | | | | | 11,648 | | | | 1,785,755 | |

Davide Campari-Milano SpA | | | | | | | | | | | 59,951 | | | | 586,268 | |

Diageo plc | | | | | | | | | | | 3,780 | | | | 98,294 | |

Heineken NV | | | | | | | | | | | 5,187 | | | | 389,087 | |

Molson Coors Brewing Company Class B | | | | | | | | | | | 14,027 | | | | 1,364,967 | |

Monster Beverage Corporation † | | | | | | | | | | | 1,817 | | | | 80,566 | |

PepsiCo Incorporated | | | | | | | | | | | 671 | | | | 70,207 | |

The Coca-Cola Company | | | | | | | | | | | 2,243 | | | | 92,995 | |

Vina Concha y Toro SA | | | | | | | | | | | 10,435 | | | | 16,748 | |

Yantai Changyu Pioneer Wine Company Limited Class B | | | | | | | | | | | 12,800 | | | | 34,251 | |

| | | | |

| | | | | | | | | | | | | | | 5,301,878 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Food & Staples Retailing: 1.52% | | | | | | | | | | | | | | | | |

Casey’s General Stores Incorporated | | | | | | | | | | | 9,792 | | | $ | 1,164,073 | |

Costco Wholesale Corporation | | | | | | | | | | | 8,795 | | | | 1,408,167 | |

J Sainsbury plc | | | | | | | | | | | 25,442 | | | | 78,167 | |

Metro AG | | | | | | | | | | | 1,766 | | | | 58,716 | |

The Kroger Company (b) | | | | | | | | | | | 14,505 | | | | 500,568 | |

Walgreens Boots Alliance Incorporated | | | | | | | | | | | 880 | | | | 72,829 | |

Welcia Holdings Company | | | | | | | | | | | 393 | | | | 24,009 | |

| | | | |

| | | | | | | | | | | | | | | 3,306,529 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 1.25% | | | | | | | | | | | | | | | | |

Chocoladefabriken Lindt & Sprungli AG | | | | | | | | | | | 20 | | | | 1,215,752 | |

CJ Cheiljedang Corporation | | | | | | | | | | | 117 | | | | 34,631 | |

Mondelez International Incorporated Class A | | | | | | | | | | | 848 | | | | 37,592 | |

Morinaga & Company Limited | | | | | | | | | | | 725 | | | | 30,241 | |

Nestle SA | | | | | | | | | | | 12,395 | | | | 889,183 | |

The Hershey Company | | | | | | | | | | | 5,066 | | | | 523,976 | |

| | | | |

| | | | | | | | | | | | | | | 2,731,375 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Products: 0.12% | | | | | | | | | | | | | | | | |

Colgate-Palmolive Company | | | | | | | | | | | 1,893 | | | | 123,878 | |

Lion Corporation | | | | | | | | | | | 1,909 | | | | 31,361 | |

Reckitt Benckiser Group plc | | | | | | | | | | | 849 | | | | 72,049 | |

The Procter & Gamble Company | | | | | | | | | | | 503 | | | | 42,292 | |

| | | | |

| | | | | | | | | | | | | | | 269,580 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Personal Products: 0.08% | | | | | | | | | | | | | | | | |

Coty Incorporated Class A | | | | | | | | | | | 3,717 | | | | 68,058 | |

Unilever NV ADR | | | | | | | | | | | 2,338 | | | | 95,998 | |

| | | | |

| | | | | | | | | | | | | | | 164,056 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tobacco: 0.23% | | | | | | | | | | | | | | | | |

Altria Group Incorporated | | | | | | | | | | | 272 | | | | 18,393 | |

British American Tobacco plc | | | | | | | | | | | 1,079 | | | | 61,455 | |

Japan Tobacco Incorporated | | | | | | | | | | | 775 | | | | 25,490 | |

Reynolds American Incorporated (b) | | | | | | | | | | | 6,924 | | | | 388,021 | |

| | | | |

| | | | | | | | | | | | | | | 493,359 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 5.87% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 1.47% | | | | | | | | | | | | | | | | |

Baker Hughes Incorporated | | | | | | | | | | | 2,056 | | | | 133,578 | |

Ensco plc Class A | | | | | | | | | | | 2,631 | | | | 25,573 | |

Halliburton Company (b) | | | | | | | | | | | 54,746 | | | | 2,961,212 | |

Helmerich & Payne Incorporated | | | | | | | | | | | 348 | | | | 26,935 | |

Hilong Holding Limited | | | | | | | | | | | 93,995 | | | | 27,273 | |

Saipem SpA † | | | | | | | | | | | 38,534 | | | | 21,701 | |

Trican Well Service Limited † | | | | | | | | | | | 3,690 | | | | 12,642 | |

| | | | |

| | | | | | | | | | | | | | | 3,208,914 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Oil, Gas & Consumable Fuels: 4.40% | | | | | | | | | | | | | | | | |

Anadarko Petroleum Corporation | | | | | | | | | | | 19,826 | | | $ | 1,382,467 | |

BP plc | | | | | | | | | | | 25,879 | | | | 162,528 | |

Cabot Oil & Gas Corporation | | | | | | | | | | | 976 | | | | 22,799 | |

Canadian Natural Resources Limited | | | | | | | | | | | 8,891 | | | | 283,445 | |

Cobalt International Energy Incorporated † | | | | | | | | | | | 2,942 | | | | 3,589 | |

Concho Resources Incorporated †(b) | | | | | | | | | | | 8,483 | | | | 1,124,845 | |

Continental Resources Incorporated † | | | | | | | | | | | 11,645 | | | | 600,183 | |

Devon Energy Corporation (b) | | | | | | | | | | | 12,523 | | | | 571,925 | |

Diamondback Energy Incorporated † | | | | | | | | | | | 323 | | | | 32,642 | |

Eni SpA | | | | | | | | | | | 8,200 | | | | 133,533 | |

EOG Resources Incorporated | | | | | | | | | | | 858 | | | | 86,744 | |

Exxon Mobil Corporation | | | | | | | | | | | 6,520 | | | | 588,495 | |

Hess Corporation | | | | | | | | | | | 338 | | | | 21,054 | |

Imperial Oil Limited | | | | | | | | | | | 1,995 | | | | 69,405 | |

Japan Petroleum Exploration Company | | | | | | | | | | | 1,140 | | | | 25,351 | |

Kinder Morgan Incorporated | | | | | | | | | | | 78,138 | | | | 1,618,238 | |

Marathon Oil Corporation | | | | | | | | | | | 1,081 | | | | 18,712 | |

Newfield Exploration Company † | | | | | | | | | | | 364 | | | | 14,742 | |

Nippon Gas Company Limited | | | | | | | | | | | 580 | | | | 16,674 | |

Parsley Energy Incorporated Class A †(b) | | | | | | | | | | | 23,543 | | | | 829,655 | |

Petroleo Brasileiro SA ADR † | | | | | | | | | | | 3,200 | | | | 32,352 | |

Pioneer Natural Resources Company (b) | | | | | | | | | | | 7,585 | | | | 1,365,831 | |

Plains All American Pipeline LP | | | | | | | | | | | 8,143 | | | | 262,937 | |

Royal Dutch Shell plc Class B | | | | | | | | | | | 3,957 | | | | 114,795 | |

Southwestern Energy Company † | | | | | | | | | | | 1,547 | | | | 16,739 | |

Statoil ASA | | | | | | | | | | | 1,748 | | | | 32,064 | |

Total SA | | | | | | | | | | | 2,934 | | | | 150,471 | |

TransCanada Corporation | | | | | | | | | | | 185 | | | | 8,342 | |

| | | | |

| | | | | | | | | | | | | | | 9,590,557 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 6.26% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 3.44% | | | | | | | | | | | | | | | | |

Banca Popolare dell’Emilia Romagna Scarl | | | | | | | | | | | 10,071 | | | | 53,642 | |

Banco Popular Espanol SA | | | | | | | | | | | 39,508 | | | | 38,178 | |

Bank of America Corporation | | | | | | | | | | | 71,544 | | | | 1,581,122 | |

Bank of Ireland † | | | | | | | | | | | 164,800 | | | | 40,594 | |

Bank of Nova Scotia | | | | | | | | | | | 779 | | | | 43,375 | |

Bank of the Ozarks Incorporated (b) | | | | | | | | | | | 10,475 | | | | 550,880 | |

BNP Paribas SA | | | | | | | | | | | 3,658 | | | | 233,154 | |

CaixaBank SA | | | | | | | | | | | 30,420 | | | | 100,548 | |

Citigroup Incorporated | | | | | | | | | | | 4,015 | | | | 238,611 | |

Citizens Financial Group Incorporated | | | | | | | | | | | 1,272 | | | | 45,321 | |

DBS Group Holdings Limited | | | | | | | | | | | 1,235 | | | | 14,788 | |

Eurobank Ergasias SA † | | | | | | | | | | | 16,233 | | | | 11,022 | |

FinecoBank SpA | | | | | | | | | | | 10,494 | | | | 58,878 | |

HDFC Bank Limited ADR | | | | | | | | | | | 1,061 | | | | 64,381 | |

HSBC Holdings plc | | | | | | | | | | | 20,046 | | | | 162,285 | |

ICICI Bank Limited ADR | | | | | | | | | | | 8,448 | | | | 63,276 | |

ING Group NV | | | | | | | | | | | 5,612 | | | | 78,983 | |

JPMorgan Chase & Company (b) | | | | | | | | | | | 13,207 | | | | 1,139,632 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Banks (continued) | | | | | | | | | | | | | | | | |

Mitsubishi UFJ Financial Group Incorporated (b) | | | | | | | | | | | 20,258 | | | $ | 124,833 | |

PNC Financial Services Group Incorporated | | | | | | | | | | | 1,678 | | | | 196,259 | |

Regions Financial Corporation (b) | | | | | | | | | | | 57,239 | | | | 821,952 | |

Sberbank of Russia (a) | | | | | | | | | | | 18,058 | | | | 50,827 | |

Sberbank ADR | | | | | | | | | | | 5,100 | | | | 59,058 | |

Signature Bank †(b) | | | | | | | | | | | 4,753 | | | | 713,901 | |

Societe Generale SA | | | | | | | | | | | 2,092 | | | | 102,939 | |

Standard Chartered plc † | | | | | | | | | | | 8,499 | | | | 69,507 | |

SunTrust Banks Incorporated | | | | | | | | | | | 9,622 | | | | 527,767 | |

The San-in Godo Bank Limited | | | | | | | | | | | 2,580 | | | | 21,523 | |

Tokyo TY Financial Group Incorporated | | | | | | | | | | | 449 | | | | 15,655 | |

UniCredit SpA | | | | | | | | | | | 13,523 | | | | 38,918 | |

Western Alliance Bancorp † | | | | | | | | | | | 5,099 | | | | 248,372 | |

| | | | |

| | | | | | | | | | | | | | | 7,510,181 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.45% | | | | | | | | | | | | | | | | |

Affiliated Managers Group Incorporated † | | | | | | | | | | | 7,130 | | | | 1,035,989 | |

ANIMA Holding SpA 144A | | | | | | | | | | | 9,935 | | | | 53,964 | |

GAM Holding AG | | | | | | | | | | | 2,235 | | | | 25,899 | |

Hellenic Exchanges SA Holding | | | | | | | | | | | 6,177 | | | | 31,796 | |

Ichiyoshi Securities Company Limited | | | | | | | | | | | 4,100 | | | | 31,467 | |

Intercontinental Exchange Incorporated | | | | | | | | | | | 5,281 | | | | 297,954 | |

Japan Exchange Group Incorporated | | | | | | | | | | | 2,044 | | | | 29,206 | |

Julius Baer Group Limited | | | | | | | | | | | 2,039 | | | | 90,567 | |

Moody’s Corporation | | | | | | | | | | | 8,759 | | | | 825,711 | |

Nomura Holdings Incorporated | | | | | | | | | | | 3,645 | | | | 21,491 | |

OM Asset Management plc | | | | | | | | | | | 15,728 | | | | 228,056 | |

Raymond James Financial Incorporated | | | | | | | | | | | 397 | | | | 27,500 | |

SEI Investments Company | | | | | | | | | | | 4,982 | | | | 245,912 | |

UBS Group AG | | | | | | | | | | | 13,442 | | | | 210,547 | |

| | | | |

| | | | | | | | | | | | | | | 3,156,059 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Consumer Finance: 0.18% | | | | | | | | | | | | | | | | |

Ally Financial Incorporated | | | | | | | | | | | 12,337 | | | | 234,650 | |

Capital One Financial Corporation | | | | | | | | | | | 919 | | | | 80,174 | |

Santander Consumer USA Holdings Incorporated † | | | | | | | | | | | 5,460 | | | | 73,710 | |

| | | | |

| | | | | | | | | | | | | | | 388,534 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 0.07% | | | | | | | | | | | | | | | | |

Amundi SA | | | | | | | | | | | 1,603 | | | | 83,906 | |

Berkshire Hathaway Incorporated Class B † | | | | | | | | | | | 469 | | | | 76,438 | |

| | | | |

| | | | | | | | | | | | | | | 160,344 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance: 1.11% | | | | | | | | | | | | | | | | |

Ageas NV | | | | | | | | | | | 2,022 | | | | 80,051 | |

Ambac Financial Group Incorporated † | | | | | | | | | | | 295 | | | | 6,638 | |

American International Group Incorporated | | | | | | | | | | | 9,030 | | | | 589,750 | |

Assicurazioni Generali SpA | | | | | | | | | | | 8,825 | | | | 131,170 | |

Chubb Limited | | | | | | | | | | | 703 | | | | 92,880 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Insurance (continued) | | | | | | | | | | | | | | | | |

Coface SA | | | | | | | | | | | 5,448 | | | $ | 35,556 | |

Dai Ichi Mutual Life Insurance | | | | | | | | | | | 1,780 | | | | 29,637 | |

Delta Lloyd NV | | | | | | | | | | | 4,567 | | | | 25,561 | |

Japan Post Insurance Company Limited | | | | | | | | | | | 1,476 | | | | 31,610 | |

MetLife Incorporated | | | | | | | | | | | 1,539 | | | | 82,937 | |

MS&AD Insurance Group Holdings Incorporated | | | | | | | | | | | 1,720 | | | | 53,333 | |

Principal Financial Group Incorporated | | | | | | | | | | | 567 | | | | 32,807 | |

Prudential Financial Incorporated | | | | | | | | | | | 3,819 | | | | 397,405 | |

Saga plc | | | | | | | | | | | 19,508 | | | | 46,905 | |

Sony Financial Holdings Incorporated | | | | | | | | | | | 1,650 | | | | 25,751 | |

Storebrand ASA † | | | | | | | | | | | 9,779 | | | | 52,002 | |

T&D Holdings Incorporated | | | | | | | | | | | 3,059 | | | | 40,451 | |

Tokio Marine Holdings Incorporated | | | | | | | | | | | 1,691 | | | | 69,391 | |

Unum Group | | | | | | | | | | | 680 | | | | 29,872 | |

W.R. Berkley Corporation | | | | | | | | | | | 6,506 | | | | 432,714 | |

Willis Towers Watson plc | | | | | | | | | | | 613 | | | | 74,958 | |

Zurich Insurance Group AG | | | | | | | | | | | 218 | | | | 60,029 | |

| | | | |

| | | | | | | | | | | | | | | 2,421,408 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance: 0.01% | | | | | | | | | | | | | | | | |

Genworth Mortgage Insurance | | | | | | | | | | | 8,070 | | | | 19,044 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 5.19% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 0.21% | | | | | | | | | | | | | | | | |

Alder Biopharmaceuticals Incorporated † | | | | | | | | | | | 795 | | | | 16,536 | |

Biogen Incorporated † | | | | | | | | | | | 528 | | | | 149,731 | |

Incyte Corporation † | | | | | | | | | | | 1,480 | | | | 148,400 | |

Regeneron Pharmaceuticals Incorporated † | | | | | | | | | | | 143 | | | | 52,494 | |

Tesaro Incorporated † | | | | | | | | | | | 126 | | | | 16,944 | |

Vertex Pharmaceuticals Incorporated † | | | | | | | | | | | 800 | | | | 58,936 | |

| | | | |

| | | | | | | | | | | | | | | 443,041 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 2.02% | | | | | | | | | | | | | | | | |

Align Technology Incorporated † | | | | | | | | | | | 720 | | | | 69,214 | |

Becton Dickinson & Company | | | | | | | | | | | 11,333 | | | | 1,876,178 | |

Dentsply Sirona Incorporated | | | | | | | | | | | 7,200 | | | | 415,656 | |

IDEXX Laboratories Incorporated † | | | | | | | | | | | 4,245 | | | | 497,811 | |

Medtronic plc | | | | | | | | | | | 1,287 | | | | 91,673 | |

Shandong Weigao Group Medical Polymer Company Limited H Shares | | | | | | | | | | | 45,490 | | | | 30,387 | |

St. Jude Medical Incorporated | | | | | | | | | | | 17,812 | | | | 1,428,344 | |

| | | | |

| | | | | | | | | | | | | | | 4,409,263 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 1.57% | | | | | | | | | | | | | | | | |

Acadia Healthcare Company Incorporated † | | | | | | | | | | | 764 | | | | 25,288 | |

Aetna Incorporated | | | | | | | | | | | 4,936 | | | | 612,113 | |

Cardinal Health Incorporated | | | | | | | | | | | 1,299 | | | | 93,489 | |

Envision Healthcare Corporation † | | | | | | | | | | | 581 | | | | 36,771 | |

McKesson Corporation | | | | | | | | | | | 361 | | | | 50,702 | |

Medipal Holdings Corporation | | | | | | | | | | | 1,955 | | | | 30,828 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Health Care Providers & Services (continued) | | | | | | | | | | | | | | | | |

UnitedHealth Group Incorporated | | | | | | | | | | | 11,935 | | | $ | 1,910,078 | |

Universal Health Services Incorporated Class B (b) | | | | | | | | | | | 6,279 | | | | 667,960 | |

| | | | |

| | | | | | | | | | | | | | | 3,427,229 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 0.01% | | | | | | | | | | | | | | | | |

Agfa-Gevaert NV † | | | | | | | | | | | 6,396 | | | | 24,729 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 0.52% | | | | | | | | | | | | | | | | |

Mettler-Toledo International Incorporated † | | | | | | | | | | | 539 | | | | 225,604 | |

Thermo Fisher Scientific Incorporated | | | | | | | | | | | 6,430 | | | | 907,273 | |

| | | | |

| | | | | | | | | | | | | | | 1,132,877 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.86% | | | | | | | | | | | | | | | | |

Allergan plc † | | | | | | | | | | | 3,463 | | | | 727,265 | |

Almirall SA | | | | | | | | | | | 2,385 | | | | 37,056 | |

Astellas Pharma Incorporated | | | | | | | | | | | 2,839 | | | | 39,436 | |

AstraZeneca plc | | | | | | | | | | | 4,191 | | | | 229,196 | |

AstraZeneca plc ADR | | | | | | | | | | | 3,523 | | | | 96,248 | |

Bristol-Myers Squibb Company | | | | | | | | | | | 3,205 | | | | 187,300 | |

H. Lundbeck AS † | | | | | | | | | | | 813 | | | | 33,073 | |

Johnson & Johnson | | | | | | | | | | | 807 | | | | 92,974 | |

Kaken Pharmaceutical Company Limited | | | | | | | | | | | 496 | | | | 26,312 | |

Merck & Company Incorporated | | | | | | | | | | | 1,476 | | | | 86,892 | |

Mylan NV † | | | | | | | | | | | 1,635 | | | | 62,375 | |

Novartis AG | | | | | | | | | | | 1,587 | | | | 115,483 | |

Ono Pharmaceutical Company Limited | | | | | | | | | | | 2,521 | | | | 55,122 | |

Roche Holding AG | | | | | | | | | | | 210 | | | | 47,968 | |

Teva Pharmaceutical Industries Limited ADR | | | | | | | | | | | 503 | | | | 18,234 | |

UCB SA | | | | | | | | | | | 423 | | | | 27,121 | |

| | | | |

| | | | | | | | | | | | | | | 1,882,055 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 6.72% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 0.92% | | | | | | | | | | | | | | | | |

Airbus Group NV | | | | | | | | | | | 7,453 | | | | 493,005 | |

Cobham plc | | | | | | | | | | | 52,904 | | | | 106,731 | |

Leonardo-Finmeccanica SpA † | | | | | | | | | | | 6,886 | | | | 96,696 | |

Lockheed Martin Corporation (b) | | | | | | | | | | | 2,521 | | | | 630,099 | |

Qinetiq Group plc | | | | | | | | | | | 21,893 | | | | 70,906 | |

Raytheon Company | | | | | | | | | | | 3,356 | | | | 476,552 | |

Thales SA | | | | | | | | | | | 173 | | | | 16,778 | |

Ultra Electronics Holdings plc | | | | | | | | | | | 2,367 | | | | 56,621 | |

United Technologies Corporation | | | | | | | | | | | 512 | | | | 56,125 | |

| | | | |

| | | | | | | | | | | | | | | 2,003,513 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Air Freight & Logistics: 0.75% | | | | | | | | | | | | | | | | |

FedEx Corporation | | | | | | | | | | | 7,938 | | | | 1,478,056 | |

PostNL † | | | | | | | | | | | 17,383 | | | | 74,876 | |

United Parcel Service Incorporated Class B | | | | | | | | | | | 805 | | | | 92,285 | |

| | | | |

| | | | | | | | | | | | | | | 1,645,217 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Airlines: 0.09% | | | | | | | | | | | | | | | | |

Air France-KLM † | | | | | | | | | | | 9,989 | | | $ | 54,404 | |

Air New Zealand Limited | | | | | | | | | | | 18,110 | | | | 27,615 | |

Deutsche Lufthansa AG | | | | | | | | | | | 5,773 | | | | 74,564 | |

Japan Airlines Company Limited | | | | | | | | | | | 1,080 | | | | 31,557 | |

| | | | |

| | | | | | | | | | | | | | | 188,140 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.94% | | | | | | | | | | | | | | | | |

Compagnie de Saint-Gobain SA | | | | | | | | | | | 5,302 | | | | 246,994 | |

Fortune Brands Home & Security Incorporated | | | | | | | | | | | 4,491 | | | | 240,089 | |

Johnson Controls International plc (b) | | | | | | | | | | | 35,120 | | | | 1,446,593 | |

Owens Corning Incorporated | | | | | | | | | | | 402 | | | | 20,727 | |

Sanwa Holdings Corporation | | | | | | | | | | | 8,020 | | | | 76,512 | |

TOTO Limited | | | | | | | | | | | 252 | | | | 9,972 | |

| | | | |

| | | | | | | | | | | | | | | 2,040,887 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.06% | | | | | | | | | | | | | | | | |

Aeon Delight Company Limited | | | | | | | | | | | 963 | | | | 26,902 | |

Atento SA † | | | | | | | | | | | 2,705 | | | | 20,558 | |

Nippon Kanzai Company Limited | | | | | | | | | | | 1,960 | | | | 30,404 | |

Spotless Group Holdings Limited | | | | | | | | | | | 57,566 | | | | 41,127 | |

| | | | |

| | | | | | | | | | | | | | | 118,991 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction & Engineering: 0.11% | | | | | | | | | | | | | | | | |

Balfour Beatty plc | | | | | | | | | | | 10,182 | | | | 33,742 | |

Hazama Ando Corporation | | | | | | | | | | | 6,845 | | | | 45,155 | |

JGC Corporation | | | | | | | | | | | 1,206 | | | | 21,917 | |

Kandenko Company Limited | | | | | | | | | | | 1,393 | | | | 12,574 | |

Kinden Corporation | | | | | | | | | | | 2,385 | | | | 29,753 | |

Nippo Corporation | | | | | | | | | | | 1,281 | | | | 23,905 | |

Taisei Corporation | | | | | | | | | | | 3,090 | | | | 21,627 | |

Vinci SA | | | | | | | | | | | 841 | | | | 57,278 | |

| | | | |

| | | | | | | | | | | | | | | 245,951 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.81% | | | | | | | | | | | | | | | | |

Denyo Company Limited | | | | | | | | | | | 2,255 | | | | 30,562 | |

Eaton Corporation plc | | | | | | | | | | | 270 | | | | 18,114 | |

Legrand SA | | | | | | | | | | | 1,569 | | | | 89,104 | |

Mabuchi Motor Company Limited | | | | | | | | | | | 275 | | | | 14,353 | |

Mitsubishi Electric Corporation | | | | | | | | | | | 2,250 | | | | 31,370 | |

Rockwell Automation Incorporated | | | | | | | | | | | 10,930 | | | | 1,468,992 | |

Schneider Electric SE | | | | | | | | | | | 749 | | | | 52,123 | |

Ushio Incorporated | | | | | | | | | | | 1,340 | | | | 17,095 | |

Zumtobel Group AG | | | | | | | | | | | 2,471 | | | | 44,193 | |

| | | | |

| | | | | | | | | | | | | | | 1,765,906 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 0.13% | | | | | | | | | | | | | | | | |

Beijing Enterprises Holdings Limited | | | | | | | | | | | 6,110 | | | | 28,878 | |

Honeywell International Incorporated | | | | | | | | | | | 377 | | | | 43,675 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 17 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Industrial Conglomerates (continued) | | | | | | | | | | | | | | | | |

Koninklijke Philips NV | | | | | | | | | | | 1,476 | | | $ | 45,058 | |

Rheinmetall AG | | | | | | | | | | | 2,317 | | | | 155,852 | |

| | | | |

| | | | | | | | | | | | | | | 273,463 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 0.28% | | | | | | | | | | | | | | | | |

Alstom SA † | | | | | | | | | | | 5,899 | | | | 162,536 | |

Atlas Copco AB Class A | | | | | | | | | | | 1,281 | | | | 39,018 | |

Daifuku Company Limited | | | | | | | | | | | 1,500 | | | | 31,996 | |

Hino Motors Limited | | | | | | | | | | | 3,425 | | | | 34,873 | |

IHI Corporation † | | | | | | | | | | | 9,575 | | | | 24,905 | |

Kawasaki Heavy Industries Limited | | | | | | | | | | | 9,913 | | | | 31,128 | |

Makita Corporation | | | | | | | | | | | 486 | | | | 32,559 | |

Mitsubishi Heavy Industries Limited | | | | | | | | | | | 8,945 | | | | 40,762 | |

NGK Insulators Limited | | | | | | | | | | | 1,875 | | | | 36,369 | |

Shinmaywa Industries Limited | | | | | | | | | | | 1,131 | | | | 10,171 | |

SMC Corporation | | | | | | | | | | | 116 | | | | 27,696 | |

Takuma Company Limited | | | | | | | | | | | 3,195 | | | | 27,310 | |

The Middleby Corporation † | | | | | | | | | | | 737 | | | | 94,933 | |

Toshiba Machine Company Limited | | | | | | | | | | | 4,015 | | | | 16,112 | |

| | | | |

| | | | | | | | | | | | | | | 610,368 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Marine: 0.03% | | | | | | | | | | | | | | | | |

DS Norden AS † | | | | | | | | | | | 2,247 | | | | 35,157 | |

Kuehne & Nagel International AG | | | | | | | | | | | 268 | | | | 35,425 | |

| | | | |

| | | | | | | | | | | | | | | 70,582 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Professional Services: 0.77% | | | | | | | | | | | | | | | | |

Adecco SA | | | | | | | | | | | 765 | | | | 50,071 | |

Experian Group Limited | | | | | | | | | | | 4,089 | | | | 79,318 | |

Hays plc | | | | | | | | | | | 28,740 | | | | 52,845 | |

IHS Markit Limited † | | | | | | | | | | | 1,193 | | | | 42,244 | |

Nielsen Holdings plc | | | | | | | | | | | 24,656 | | | | 1,034,319 | |

Recruit Holdings Company Limited | | | | | | | | | | | 663 | | | | 26,605 | |

Robert Half International Incorporated | | | | | | | | | | | 7,593 | | | | 370,387 | |

SThree plc | | | | | | | | | | | 2,626 | | | | 10,037 | |

TechnoPro Holdings Incorporated | | | | | | | | | | | 606 | | | | 19,444 | |

| | | | |

| | | | | | | | | | | | | | | 1,685,270 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 1.70% | | | | | | | | | | | | | | | | |

Avis Budget Group Incorporated †(b) | | | | | | | | | | | 2,361 | | | | 86,601 | |

Canadian National Railway Company | | | | | | | | | | | 1,305 | | | | 87,826 | |

CSX Corporation (b) | | | | | | | | | | | 40,749 | | | | 1,464,112 | |

DSV AS | | | | | | | | | | | 1,494 | | | | 66,466 | |

Genesee & Wyoming Incorporated Class A † | | | | | | | | | | | 722 | | | | 50,114 | |

Hitachi Transport System Limited | | | | | | | | | | | 1,110 | | | | 22,537 | |

J.B. Hunt Transport Services Incorporated | | | | | | | | | | | 982 | | | | 95,323 | |

Kansas City Southern | | | | | | | | | | | 400 | | | | 33,940 | |

Knight Transportation Incorporated | | | | | | | | | | | 1,606 | | | | 53,078 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Road & Rail (continued) | | | | | | | | | | | | | | | | |

Old Dominion Freight Line Incorporated † | | | | | | | | | | | 4,813 | | | $ | 412,907 | |

Union Pacific Corporation (b) | | | | | | | | | | | 12,846 | | | | 1,331,873 | |

| | | | |

| | | | | | | | | | | | | | | 3,704,777 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 0.12% | | | | | | | | | | | | | | | | |

Fastenal Company | | | | | | | | | | | 1,449 | | | | 68,074 | |

Itochu Corporation | | | | | | | | | | | 3,618 | | | | 48,044 | |

Rexel SA | | | | | | | | | | | 6,810 | | | | 112,080 | |

SIG plc | | | | | | | | | | | 30,932 | | | | 39,340 | |

| | | | |

| | | | | | | | | | | | | | | 267,538 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Transportation Infrastructure: 0.01% | | | | | | | | | | | | | | | | |

Hamburger Hafen Und Logistik AG | | | | | | | | | | | 1,227 | | | | 22,861 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 11.04% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.40% | | | | | | | | | | | | | | | | |

ARRIS International plc † | | | | | | | | | | | 907 | | | | 27,328 | |

Cisco Systems Incorporated | | | | | | | | | | | 956 | | | | 28,890 | |

Juniper Networks Incorporated (b) | | | | | | | | | | | 17,399 | | | | 491,696 | |

Motorola Solutions Incorporated | | | | | | | | | | | 404 | | | | 33,488 | |

Nokia Oyj | | | | | | | | | | | 22,566 | | | | 108,984 | |

Radware Limited † | | | | | | | | | | | 7,277 | | | | 106,099 | |

Telefonaktiebolaget LM Ericsson Class B | | | | | | | | | | | 12,287 | | | | 72,153 | |

| | | | |

| | | | | | | | | | | | | | | 868,638 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 0.34% | | | | | | | | | | | | | | | | |

Alps Electric Company Limited | | | | | | | | | | | 1,442 | | | | 34,867 | |

Amano Corporation | | | | | | | | | | | 1,529 | | | | 26,858 | |

Flextronics International Limited †(b) | | | | | | | | | | | 38,616 | | | | 554,912 | |

Hosiden Corporation | | | | | | | | | | | 2,305 | | | | 18,657 | |

Largan Precision Company Limited | | | | | | | | | | | 380 | | | | 44,686 | |

Siix Corporation | | | | | | | | | | | 652 | | | | 22,008 | |

Spectris plc | | | | | | | | | | | 700 | | | | 19,954 | |

WPG Holdings Company Limited | | | | | | | | | | | 22,130 | | | | 26,093 | |

| | | | |

| | | | | | | | | | | | | | | 748,035 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 3.43% | | | | | | | | | | | | | | | | |

Alibaba Group Holding Limited ADR † | | | | | | | | | | | 1,500 | | | | 131,715 | |

Alphabet Incorporated Class A † | | | | | | | | | | | 1,515 | | | | 1,200,562 | |

Alphabet Incorporated Class C †(b) | | | | | | | | | | | 2,105 | | | | 1,624,681 | |

Baidu Incorporated ADR † | | | | | | | | | | | 687 | | | | 112,950 | |

Dena Company Limited | | | | | | | | | | | 1,831 | | | | 40,012 | |

Envestnet Incorporated † | | | | | | | | | | | 812 | | | | 28,623 | |

Facebook Incorporated Class A †(b) | | | | | | | | | | | 13,948 | | | | 1,604,718 | |

GMO Internet Incorporated | | | | | | | | | | | 749 | | | | 9,574 | |

Just Eat plc † | | | | | | | | | | | 8,319 | | | | 59,822 | |

Mimecast Limited † | | | | | | | | | | | 1,670 | | | | 29,893 | |

SMS Company Limited | | | | | | | | | | | 698 | | | | 15,474 | |

Tencent Holdings Limited | | | | | | | | | | | 2,123 | | | | 51,935 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 19 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Internet Software & Services (continued) | | | | | | | | | | | | | | | | |

Yahoo! Incorporated † | | | | | | | | | | | 63,560 | | | $ | 2,457,865 | |

Yandex NV Class A † | | | | | | | | | | | 5,902 | | | | 118,807 | |

| | | | |

| | | | | | | | | | | | | | | 7,486,631 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 1.00% | | | | | | | | | | | | | | | | |

Accenture plc Class A | | | | | | | | | | | 747 | | | | 87,496 | |

Alliance Data Systems Corporation | | | | | | | | | | | 316 | | | | 72,206 | |

Automatic Data Processing Incorporated | | | | | | | | | | | 741 | | | | 76,160 | |

Cerved Information Solutions SpA | | | | | | | | | | | 11,369 | | | | 94,424 | |

Cognizant Technology Solutions Corporation Class A †(b) | | | | | | | | | | | 11,600 | | | | 649,948 | |

CSRA Incorporated (b) | | | | | | | | | | | 10,005 | | | | 318,559 | |

MasterCard Incorporated Class A | | | | | | | | | | | 7,451 | | | | 769,316 | |

Sopra Steria Group | | | | | | | | | | | 394 | | | | 44,730 | |

Visa Incorporated Class A | | | | | | | | | | | 861 | | | | 67,175 | |

| | | | |

| | | | | | | | | | | | | | | 2,180,014 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 0.73% | | | | | | | | | | | | | | | | |

Intel Corporation | | | | | | | | | | | 5,114 | | | | 185,485 | |

Kontron AG † | | | | | | | | | | | 5,039 | | | | 15,117 | |

Marvell Technology Group Limited (b) | | | | | | | | | | | 76,185 | | | | 1,056,686 | |

Micron Technology Incorporated † | | | | | | | | | | | 3,139 | | | | 68,807 | |

Silicon Motion Technology Corporation | | | | | | | | | | | 440 | | | | 18,691 | |

Skyworks Solutions Incorporated | | | | | | | | | | | 725 | | | | 54,129 | |

STMicroelectronics NV | | | | | | | | | | | 6,734 | | | | 76,556 | |

Taiwan Semiconductor Manufacturing Company Limited | | | | | | | | | | | 6,400 | | | | 36,042 | |

Tokyo Electron Limited | | | | | | | | | | | 420 | | | | 39,691 | |

Tokyo Seimitsu Company Limited | | | | | | | | | | | 1,265 | | | | 37,504 | |

| | | | |

| | | | | | | | | | | | | | | 1,588,708 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 2.92% | | | | | | | | | | | | | | | | |

Dell Technologies Incorporated Class V † | | | | | | | | | | | 879 | | | | 48,319 | |

Microsoft Corporation (b) | | | | | | | | | | | 42,168 | | | | 2,620,320 | |

Nintendo Company Limited | | | | | | | | | | | 479 | | | | 100,575 | |

Nuance Communications Incorporated † | | | | | | | | | | | 12,382 | | | | 184,492 | |

Oracle Corporation (b) | | | | | | | | | | | 17,930 | | | | 689,409 | |

PTC Incorporated †(b) | | | | | | | | | | | 18,221 | | | | 843,086 | |

ServiceNow Incorporated † | | | | | | | | | | | 540 | | | | 40,144 | |

SS&C Technologies Holdings Incorporated | | | | | | | | | | | 742 | | | | 21,221 | |

Symantec Corporation (b) | | | | | | | | | | | 15,250 | | | | 364,323 | |

The Descartes Systems Group Incorporated † | | | | | | | | | | | 1,755 | | | | 37,423 | |

Verint Systems Incorporated †(b) | | | | | | | | | | | 19,623 | | | | 691,711 | |

VMware Incorporated Class A †(b) | | | | | | | | | | | 8,186 | | | | 644,484 | |

Workday Incorporated Class A † | | | | | | | | | | | 1,307 | | | | 86,380 | |

| | | | |

| | | | | | | | | | | | | | | 6,371,887 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 2.22% | | | | | | | | | | | | | | | | |

Apple Incorporated | | | | | | | | | | | 382 | | | | 44,243 | |

Catcher Technology Company Limited | | | | | | | | | | | 5,535 | | | | 38,470 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Alternative Strategies Fund | | Portfolio of investments—December 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Technology Hardware, Storage & Peripherals (continued) | | | | | | | | | | | | | | | | |

Hewlett Packard Enterprise Company | | | | | | | | | | | 10,461 | | | $ | 242,068 | |

HP Incorporated (b) | | | | | | | | | | | 87,849 | | | | 1,303,679 | |

NetApp Incorporated | | | | | | | | | | | 29,605 | | | | 1,044,168 | |

Samsung Electronics Company Limited | | | | | | | | | | | 68 | | | | 101,454 | |

Western Digital Corporation (b) | | | | | | | | | | | 30,216 | | | | 2,053,177 | |

| | | | |

| | | | | | | | | | | | | | | 4,827,259 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 4.86% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 2.56% | | | | | | | | | | | | | | | | |

Akzo Nobel NV | | | | | | | | | | | 1,215 | | | | 75,958 | |

Albemarle Corporation | | | | | | | | | | | 3,259 | | | | 280,535 | |

Celanese Corporation Series A | | | | | | | | | | | 661 | | | | 52,047 | |

CF Industries Holdings Incorporated | | | | | | | | | | | 1,087 | | | | 34,219 | |

Ingevity Corporation † | | | | | | | | | | | 10,375 | | | | 569,173 | |

JSR Corporation | | | | | | | | | | | 1,832 | | | | 28,889 | |

LG Chem Limited | | | | | | | | | | | 104 | | | | 22,474 | |

Mitsui Chemicals Incorporated | | | | | | | | | | | 3,128 | | | | 14,051 | |

Nissan Chemical Industries Limited | | | | | | | | | | | 737 | | | | 24,624 | |

Platform Specialty Products Corporation † | | | | | | | | | | | 7,058 | | | | 69,239 | |

Praxair Incorporated | | | | | | | | | | | 601 | | | | 70,431 | |

The Sherwin-Williams Company | | | | | | | | | | | 14,721 | | | | 3,956,122 | |

The Valspar Corporation | | | | | | | | | | | 1,857 | | | | 192,404 | |

Valvoline Incorporated | | | | | | | | | | | 9,037 | | | | 194,296 | |

| | | | |

| | | | | | | | | | | | | | | 5,584,462 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction Materials: 1.25% | | | | | | | | | | | | | | | | |

Boral Limited | | | | | | | | | | | 6,555 | | | | 25,592 | |

BRAAS Monier Building Group SA | | | | | | | | | | | 3,267 | | | | 86,577 | |

Buzzi Unicem SpA | | | | | | | | | | | 4,567 | | | | 108,216 | |

CRH plc | | | | | | | | | | | 2,412 | | | | 83,673 | |

CRH plc - London Exchange | | | | | | | | | | | 3,120 | | | | 108,816 | |

Ibstock plc 144A | | | | | | | | | | | 23,082 | | | | 52,995 | |

LafargeHolcim Limited - BATS Exchange | | | | | | | | | | | 4,976 | | | | 262,165 | |

Martin Marietta Materials Incorporated | | | | | | | | | | | 1,866 | | | | 413,375 | |

Sumitomo Osaka Cement Company | | | | | | | | | | | 8,910 | | | | 33,620 | |

Taiheiyo Cement Corporation | | | | | | | | | | | 9,085 | | | | 28,761 | |

Vicat SA | | | | | | | | | | | 607 | | | | 36,842 | |

Vulcan Materials Company (b) | | | | | | | | | | | 11,366 | | | | 1,422,455 | |

Wienerberger AG | | | | | | | | | | | 3,830 | | | | 66,502 | |

| | | | |

| | | | | | | | | | | | | | | 2,729,589 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.56% | | | | | | | | | | | | | | | | |

Ball Corporation | | | | | | | | | | | 8,929 | | | | 670,300 | |

Berry Plastics Group Incorporated †(b) | | | | | | | | | | | 6,709 | | | | 326,930 | |

International Paper Company | | | | | | | | | | | 1,380 | | | | 73,223 | |

Smurfit Kappa Group plc | | | | | | | | | | | 4,130 | | | | 94,753 | |

WestRock Company | | | | | | | | | | | 919 | | | | 46,658 | |

| | | | |

| | | | | | | | | | | | | | | 1,211,864 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 (unaudited) | | Wells Fargo Alternative Strategies Fund | | | 21 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Metals & Mining: 0.49% | | | | | | | | | | | | | | | | |

Anglo American plc † | | | | | | | | | | | 4,167 | | | $ | 59,571 | |

BHP Billiton Limited ADR | | | | | | | | | | | 638 | | | | 22,828 | |

Centerra Gold Incorporated | | | | | | | | | | | 700 | | | | 3,279 | |

Constellium NV Class A † | | | | | | | | | | | 1,751 | | | | 10,331 | |

Franco-Nevada Corporation | | | | | | | | | | | 197 | | | | 11,773 | |

Freeport-McMoRan Incorporated † | | | | | | | | | | | 18,047 | | | | 238,040 | |

Glencore International plc † | | | | | | | | | | | 25,469 | | | | 87,055 | |

Klondex Mines Limited † | | | | | | | | | | | 2,000 | | | | 9,310 | |

Lonmin plc † | | | | | | | | | | | 3,474 | | | | 6,058 | |

Randgold Resources Limited ADR | | | | | | | | | | | 315 | | | | 24,047 | |