UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: December 31

Registrant is making a filing for: Wells Fargo CoreBuilder Shares-Series M

Date of reporting period: December 31, 2016

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

December 31, 2016

Wells Fargo Managed Account

| ∎ | | Wells Fargo Managed Account CoreBuilder® Shares – Series M |

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of December 31, 2016, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Performance highlights (unaudited) |

Investment objective

The Fund seeks total return, consisting of current income and capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Lyle J. Fitterer, CFA®, CPA

Robert J. Miller

Average annual total returns (%) as of December 31, 2016

| | | | | | | | | | | | | | |

| | | Inception date | | 1 year | | | 5 year | | | Since inception | |

| Wells Fargo Managed Account CoreBuilder Shares – Series M | | 4-14-2008 | | | (0.75 | ) | | | 5.48 | | | | 7.29 | |

| Bloomberg Barclays Municipal Bond Index1 | | – | | | 0.25 | | | | 3.28 | | | | 4.35 | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available by calling 1-888-877-9275.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Fund and its share price can be sudden and unpredictable. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to high-yield securities risk and municipal securities risk. Consult the Fund’s prospectus for additional information on these and other risks. A portion of the Fund’s income may be subject to federal, state, and/or local income taxes or the Alternative Minimum Tax (AMT). Any capital gains distributions may be taxable.

CoreBuilder Shares are a series of investment options within the separately managed accounts advised or subadvised by Wells Fargo Funds Management, LLC. The shares are fee-waived mutual funds that enable certain separately managed account investors to achieve greater diversification than smaller managed accounts might otherwise achieve.

Please remember that shares of the Fund may be purchased only by or on behalf of separately managed account clients where Wells Fargo Funds Management, LLC has an agreement to serve as investment adviser or subadviser to the account with the separately managed account sponsor (typically a registered investment adviser or broker/dealer) or directly with the client.

Please see footnotes on page 3.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 3 | |

|

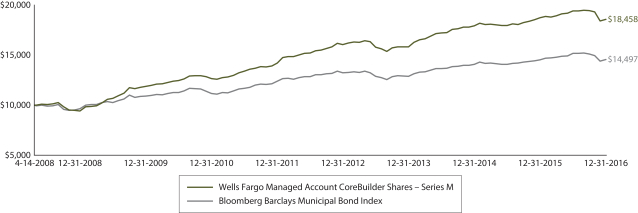

| Growth of $10,000 investment as of December 31, 20162 |

|

|

| 1 | The Bloomberg Barclays Municipal Bond Index (formerly known as Barclays Municipal Bond Index) is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 2 | The chart compares the performance of the Fund since inception with the Bloomberg Barclays Municipal Bond Index. The chart assumes a hypothetical $10,000 investment and reflects all operating expenses of the Fund. |

| 3 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

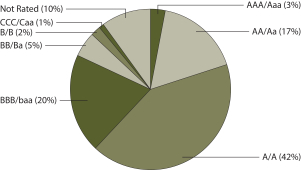

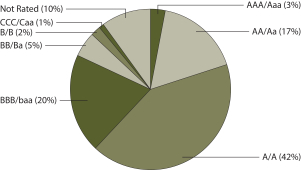

| 4 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the total market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

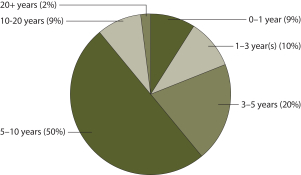

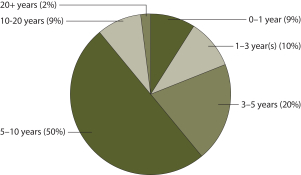

| 5 | Amounts are calculated based on the total investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| | | | |

| 4 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Performance highlights (unaudited) |

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund underperformed its benchmark, the Bloomberg Barclays Municipal Bond Index, for the 12-month period that ended December 31, 2016. |

| ∎ | | Duration and yield curve positioning were positive contributors to performance but were insufficient to offset individual security selection, a detractor to performance. |

| ∎ | | Use of the basis trade (that is, tactical short positions of U.S. Treasury futures) overall detracted from performance. |

Municipal bond returns were modestly positive and underperformed other fixed income asset classes and equities in 2016.

Municipal bonds, as measured by the Bloomberg Barclays Municipal Bond Index, returned 0.25% during 2016, underperforming fixed-income asset classes such as corporates; Treasuries; mortgages; and stock indexes, such as the S&P 500 Index.3 Municipals did well in the first half of the year, bolstered by rallies in credit and the intermediate and longer-end of the yield curve. Supply and demand technical factors, which had been supportive of the market, turned sharply negative in the third quarter. In the fourth quarter, municipal mutual fund flows turned negative (reversing a trend of 54 weeks of positive flows) and municipal bond supply increased. Deteriorating technicals, along with the expectation of an expansionary fiscal policy and lower tax rates under the new administration, drove market volatility; credit spreads widened and the yield curve steepened as municipal yields rose.

Credit and security selection were the key to Fund’s underperformance.

The Fund’s credit allocation to overweight lower-rated investment-grade bonds, which outperformed high-grade paper, was initially positive. However, the Fund’s BB-rated and nonrated categories underperformed in the second half of the year which more than offset the earlier positive position.

Security selection, often the largest contributor of performance, negatively affected performance in 2016. Rigorous credit analysis by our research team sought to identify credits that could benefit the Fund by recognizing opportunities and avoiding pitfalls. Relative-value trading also sought to enhance performance as we optimized buys and sells in certain issuers. Exposure to First Energy, Virgin Islands Public Finance Authority, Metropolitan Pier & Exposition Authority, and the Chicago Board of Education hurt performance. Our basis trade, used to hedge some longer-dated bonds and manage duration, was a net detractor from performance. The largest single contributor to performance was a trade executed in the first half of the year which exploited the disconnect between corporate high-yield and municipal high-yield bonds. Also contributing to performance were the following bonds: New York MTA; Wyandotte County, Kansas; Cleveland County, Oklahoma Education Facilities Authority; and Metropolitan Pier 0’s of 2030.

The Fund’s duration position aided performance. As the rally continued and credit spreads contracted in the first two quarters, we sold into strength and moved duration shorter than the benchmark. Treasury futures were used as a duration management tool to meet our duration target without foregoing the income associated with being more fully invested. During the market sell-off in the second half of the year, we were net buyers; this brought duration slightly long to the benchmark in anticipation of possible strong market technicals in early 2017. Meanwhile, the Fund’s yield-curve positioning was suboptimal in the first half of the year since it was underweight the long-end of the yield-curve, but this underweight aided performance later in the year.

We believe municipal market performance could be modest in 2017.

We believe municipal returns to be in the low single-digit area with income driving performance as interest rates rise. Tax reform and an expansionary fiscal policy may result in increased economic growth and higher inflation, though longer-term growth may be potentially muted by a more protectionist stance. We believe the Federal Reserve may raise the federal funds rate two or three times in 2017, and there is a low probability of any change to the tax preference of municipal bonds. Changes to individual tax rates are likely, but we do not anticipate any notable impact on municipal yields given historical precedent: municipal bond supply and general direction of interest rates are the key drivers of yields. Corporate tax reform may have some impact on our market since approximately 25% of all municipal bonds are held by banks and insurance companies. If corporate tax rates are lowered, there may be less appetite among companies to add exposure since the tax-adjusted yields would decrease.

Please see footnotes on page 3.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 5 | |

While improvements in the economy have been supportive of lower-rated municipal debt, we see fewer opportunities going forward. We continue to favor BBB-rated and A-rated credits, but rich valuations will temper the selection process. We expect that a higher degree of security selection will be necessary in the coming year, as compared to 2016.

In our view, opportunities in municipals remain solid. We will continue to manage interest-rate and credit risk, and position the Fund along the yield curve in a barbell manner that includes bonds with maturities in steeper parts of the yield curve, and tap our experienced research team to uncover municipal bonds with strong relative values from among the many municipal bond issuers.

|

| Credit quality as of December 31, 20164 |

|

|

|

| Effective maturity distribution as of December 31, 20165 |

|

|

Please see footnotes on page 3.

| | | | |

| 6 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur ongoing costs and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from July 1, 2016 to December 31, 2016.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

7-1-2016 | | | Ending

account value

12-31-2016 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Actual | | $ | 1,000.00 | | | $ | 957.99 | | | $ | 0.00 | * | | | 0.00 | %* |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,025.14 | | | $ | 0.00 | * | | | 0.00 | %* |

| 1 | Expenses paid is equal to the annualized net expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| * | Generally, no ordinary operating fees or expenses are charged to the Fund. Wells Fargo Funds Management, LLC has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other investment-related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent, interest, taxes, leverage expenses and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term. |

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Municipal Obligations: 99.51% | | | | | | | | | | | | | | | | |

| | | | |

| Alabama: 1.26% | | | | | | | | | | | | | | | | |

Alabama Federal Aid Highway Finance Authority Series A (Tax Revenue) | | | 5.00 | % | | | 9-1-2035 | | | $ | 3,250,000 | | | $ | 3,768,245 | |

Alabama State University General Tuition and Fee (Education Revenue, Syncora Guarantee Incorporated Insured) | | | 5.25 | | | | 8-1-2032 | | | | 1,500,000 | | | | 1,429,335 | |

Jefferson County AL CAB Series B (Water & Sewer Revenue, AGM Insured) ¤ | | | 0.00 | | | | 10-1-2026 | | | | 1,350,000 | | | | 915,786 | |

Jefferson County AL Series A (GO Revenue) | | | 4.90 | | | | 4-1-2021 | | | | 670,000 | | | | 697,798 | |

| |

| | | | 6,811,164 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Alaska: 0.41% | | | | | | | | | | | | | | | | |

Alaska International Airport Series B (Airport Revenue) | | | 5.00 | | | | 10-1-2035 | | | | 2,000,000 | | | | 2,211,680 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Arizona: 3.37% | | | | | | | | | | | | | | | | |

City of San Luis AZ Pledged Excise Tax Series A (Tax Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | | | | 7-1-2038 | | | | 1,200,000 | | | | 1,329,552 | |

Florence AZ IDA Legacy Traditional School Project Queen Creek & Casa Grande Campuses (Education Revenue) | | | 5.00 | | | | 7-1-2023 | | | | 650,000 | | | | 674,453 | |

Maricopa County AZ IDA Horizon Community Learning Center Project (Education Revenue) | | | 5.00 | | | | 7-1-2035 | | | | 3,000,000 | | | | 3,072,960 | |

Maricopa County AZ IDA Senior Living Facility Series 2016 (Health Revenue) 144A | | | 6.00 | | | | 1-1-2048 | | | | 2,000,000 | | | | 1,829,500 | |

Phoenix AZ IDA Education Great Hearts Academies-Veritas Project (Education Revenue) | | | 6.00 | | | | 7-1-2032 | | | | 500,000 | | | | 535,305 | |

Phoenix AZ IDA Education Great Hearts Academies-Veritas Project (Education Revenue) | | | 6.25 | | | | 7-1-2032 | | | | 315,000 | | | | 339,104 | |

Pima County AZ IDA Educational Facility Charter School Project Series R (Education Revenue) | | | 2.88 | | | | 7-1-2021 | | | | 1,000,000 | | | | 979,270 | |

Pima County AZ IDA Educational Facility Desert Heights Charter School (Education Revenue) | | | 7.00 | | | | 5-1-2034 | | | | 1,000,000 | | | | 1,072,620 | |

Pima County AZ IDA New Plan Learning Project Series A (Education Revenue) | | | 7.75 | | | | 7-1-2035 | | | | 1,000,000 | | | | 1,004,870 | |

Pima County AZ IDA Noah Webster Schools Project Series A (Education Revenue) | | | 6.75 | | | | 12-15-2033 | | | | 1,120,000 | | | | 1,218,885 | |

Pima County AZ IDA Paideia Academies Project (Education Revenue) 144A | | | 5.00 | | | | 7-1-2025 | | | | 830,000 | | | | 830,000 | |

Pima County AZ IDA Paideia Academies Project (Education Revenue) 144A | | | 6.00 | | | | 7-1-2035 | | | | 1,025,000 | | | | 1,031,099 | |

Pima County AZ IDA Paideia Academies Project (Education Revenue) 144A | | | 6.13 | | | | 7-1-2045 | | | | 1,000,000 | | | | 1,000,980 | |

Salt Verde Financial Corporation (Utilities Revenue, Citibank NA Guaranty Agreement) | | | 5.00 | | | | 12-1-2032 | | | | 2,055,000 | | | | 2,315,923 | |

Verrado AZ Community Facilities District #1 (GO Revenue) 144A | | | 5.00 | | | | 7-15-2022 | | | | 500,000 | | | | 522,625 | |

Yavapai County AZ IDA Business & Equine Center Project (Education Revenue) | | | 4.63 | | | | 3-1-2022 | | | | 390,000 | | | | 400,620 | |

| |

| | | | 18,157,766 | |

| | | | | | | | | | | | | | | | |

| | | | |

| California: 3.82% | | | | | | | | | | | | | | | | |

Anaheim CA PFA Convention Center Expansion Project Series A (Miscellaneous Revenue) | | | 5.00 | | | | 5-1-2046 | | | | 1,000,000 | | | | 1,094,230 | |

California Municipal Finance Authority Charter School Albert Einstein Academies Project Series A (Miscellaneous Revenue) | | | 7.13 | | | | 8-1-2043 | | | | 1,000,000 | | | | 1,096,800 | |

California PCFA Water Furnishing Poseidon Resources LP Desalination Project (Water & Sewer Revenue) 144A | | | 5.00 | | | | 7-1-2027 | | | | 1,000,000 | | | | 1,004,970 | |

California PFOTER Series DCL-011 (GO Revenue, Dexia Credit Local LOC, AGM Insured) 144Aø | | | 0.90 | | | | 8-1-2027 | | | | 5,965,000 | | | | 5,965,000 | |

California Public Works Board Department of General Services Buildings 8 & 9A (Miscellaneous Revenue) | | | 6.25 | | | | 4-1-2034 | | | | 250,000 | | | | 277,058 | |

California School Finance Authority View Park Elementary & Middle Schools Series A (Education Revenue) | | | 4.75 | | | | 10-1-2024 | | | | 425,000 | | | | 436,624 | |

California School Finance Authority View Park Elementary & Middle Schools Series A (Education Revenue) | | | 5.63 | | | | 10-1-2034 | | | | 575,000 | | | | 595,574 | |

California Statewide CDA Sutter Health Series A (Health Revenue) | | | 6.00 | | | | 8-15-2042 | | | | 100,000 | | | | 114,445 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| California (continued) | |

California Various Purposes (GO Revenue) | | | 6.00 | % | | | 4-1-2038 | | | $ | 200,000 | | | $ | 218,296 | |

Campbell CA Union High School District (Miscellaneous Revenue) | | | 5.00 | | | | 8-1-2022 | | | | 500,000 | | | | 510,950 | |

Campbell CA Union High School District (Miscellaneous Revenue) | | | 5.00 | | | | 8-1-2023 | | | | 500,000 | | | | 510,895 | |

Compton CA Community College District Election of 2002 CAB Series C (GO Revenue) ¤ | | | 0.00 | | | | 8-1-2029 | | | | 500,000 | | | | 298,255 | |

Gilroy CA Unified School District Prerefunded CAB Election of 2008 Series A (GO Revenue, AGC Insured) ¤ | | | 0.00 | | | | 8-1-2032 | | | | 130,000 | | | | 82,995 | |

Gilroy CA Unified School District Unrefunded CAB Election of 2008 Series A (GO Revenue, AGC Insured) ¤ | | | 0.00 | | | | 8-1-2032 | | | | 70,000 | | | | 37,758 | |

Golden State Tobacco Securitization California Tobacco Settlement CAB Series A (Tobacco Revenue, Ambac Insured) ¤ | | | 0.00 | | | | 6-1-2024 | | | | 4,985,000 | | | | 3,920,204 | |

Hawthorne CA School District CAB Series C (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 11-1-2025 | | | | 100,000 | | | | 74,075 | |

Los Angeles CA DW&P Series A (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2039 | | | | 500,000 | | | | 564,230 | |

Palo Alto CA Improvement Bond Act of 1915 (Miscellaneous Revenue) | | | 4.00 | | | | 9-2-2020 | | | | 240,000 | | | | 253,030 | |

Peralta CA Community College District Alameda County (GO Revenue) | | | 5.00 | | | | 8-1-2024 | | | | 450,000 | | | | 517,820 | |

San Buenaventura CA Community Mental Health System (Health Revenue) | | | 6.25 | | | | 12-1-2020 | | | | 150,000 | | | | 167,993 | |

San Diego CA Public Financing Authority Capital Improvement Project Series B (Miscellaneous Revenue) | | | 5.00 | | | | 10-15-2029 | | | | 500,000 | | | | 576,780 | |

University of California Regents Medical Center Series J (Health Revenue) | | | 5.25 | | | | 5-15-2038 | | | | 1,000,000 | | | | 1,145,870 | |

University of California Series AI (Education Revenue) | | | 5.00 | | | | 5-15-2038 | | | | 1,000,000 | | | | 1,125,730 | |

| |

| | | | 20,589,582 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Colorado: 2.19% | | | | | | | | | | | | | | | | |

Colorado ECFA Charter School American Academy Project (Education Revenue) | | | 7.13 | | | | 12-1-2033 | | | | 200,000 | | | | 225,548 | |

Colorado ECFA Charter School American Academy Project (Education Revenue) | | | 7.25 | | | | 12-1-2028 | | | | 250,000 | | | | 282,525 | |

Colorado ECFA Charter School American Academy Project (Education Revenue) | | | 7.63 | | | | 12-1-2040 | | | | 260,000 | | | | 295,667 | |

Colorado ECFA Charter School Banning Lewis Ranch Academy Project Series A (Education Revenue) | | | 6.00 | | | | 12-15-2037 | | | | 1,500,000 | | | | 1,366,920 | |

Colorado ECFA Charter School Community Leadership Academy Second Campus Project (Education Revenue) | | | 7.00 | | | | 8-1-2033 | | | | 500,000 | | | | 565,675 | |

Colorado ECFA Charter School Rocky Mountain Classical Academy Project Series A (Education Revenue) | | | 8.13 | | | | 9-1-2048 | | | | 1,000,000 | | | | 1,113,640 | |

Colorado Health Facilities Authority Catholic Health Initiative Series 2009A (Health Revenue) | | | 5.00 | | | | 7-1-2039 | | | | 4,000,000 | | | | 4,100,120 | |

Denver CO Convention Center Hotel Authority Senior Revenue Refunding Bonds Series 2016 (Industrial Development Revenue) | | | 5.00 | | | | 12-1-2033 | | | | 2,500,000 | | | | 2,705,100 | |

Regents of the University of Colorado Certificate of Participation Series 2013A (Education Revenue) | | | 5.00 | | | | 11-1-2028 | | | | 1,000,000 | | | | 1,139,410 | |

| |

| | | | 11,794,605 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Connecticut: 0.15% | | | | | | | | | | | | | | | | |

Hamden CT (GO Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | | | | 8-15-2024 | | | | 450,000 | | | | 519,134 | |

Hamden CT (GO Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | | | | 8-15-2025 | | | | 275,000 | | | | 314,402 | |

| |

| | | | 833,536 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Delaware: 0.28% | | | | | | | | | | | | | | | | |

Delaware EDA Odyssey Charter School Incorporated Project Series A (Education Revenue) 144A | | | 7.00 | | | | 9-1-2045 | | | | 1,500,000 | | | | 1,496,115 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 9 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| District of Columbia: 0.62% | | | | | | | | | | | | | | | | |

District of Columbia Association of American Medical Colleges Series A (Miscellaneous Revenue) | | | 5.00 | % | | | 10-1-2024 | | | $ | 270,000 | | | $ | 311,464 | |

District of Columbia Cesar Chavez Public Charter School (Education Revenue) | | | 6.50 | | | | 11-15-2021 | | | | 50,000 | | | | 53,517 | |

District of Columbia University Bonds Series 2009C (Education Revenue, Bank of Tokyo-Mitsubishi LOC) ø | | | 0.73 | | | | 4-1-2042 | | | | 3,000,000 | | | | 3,000,000 | |

| |

| | | | 3,364,981 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Florida: 2.05% | | | | | | | | | | | | | | | | |

CityPlace Florida Community Development District (Miscellaneous Revenue) | | | 5.00 | | | | 5-1-2022 | | | | 500,000 | | | | 544,925 | |

Florida Development Finance Corporation Educational Facilities Renaissance Charter School Project Series A (Education Revenue) | | | 8.50 | | | | 6-15-2044 | | | | 1,000,000 | | | | 1,144,840 | |

Holmes County FL Hospital Corporation Doctors Memorial Hospital Project (Health Revenue) | | | 6.00 | | | | 11-1-2038 | | | | 250,000 | | | | 247,575 | |

Miami-Dade County FL IDA Aspira Florida Project Series 2016A (Education Revenue) 144A | | | 5.75 | | | | 11-1-2036 | | | | 2,000,000 | | | | 1,960,440 | |

Miami-Dade County FL IDA Youth Co-Op Charter School Project Series 2015A (Education Revenue) 144A | | | 5.75 | | | | 9-15-2035 | | | | 1,500,000 | | | | 1,479,570 | |

Miami-Dade County FL School Board Certificate of Participation Series A (Miscellaneous Revenue) ± | | | 5.00 | | | | 5-1-2031 | | | | 3,000,000 | | | | 3,453,480 | |

Miami-Dade County FL Seaport AMT Series B (Airport Revenue) | | | 6.00 | | | | 10-1-2033 | | | | 1,000,000 | | | | 1,180,760 | |

Seminole Tribe of Florida Special Obligation Series A (Miscellaneous Revenue) 144A | | | 5.50 | | | | 10-1-2024 | | | | 1,000,000 | | | | 1,022,340 | |

| |

| | | | 11,033,930 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Georgia: 0.15% | | | | | | | | | | | | | | | | |

Atlanta GA Development Authority Tuff Yamacraw LLC Project Series A (Industrial Development Revenue, Ambac Insured) | | | 5.00 | | | | 1-1-2027 | | | | 50,000 | | | | 54,046 | |

Washington & Wilkes Counties GA Payroll Development Authority Sub Series C (Health Revenue) ¤ | | | 0.00 | | | | 12-1-2021 | | | | 815,000 | | | | 732,652 | |

| |

| | | | 786,698 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Guam: 1.07% | | | | | | | | | | | | | | | | |

Guam Government Business Privilege Tax Series A (Tax Revenue) | | | 5.00 | | | | 1-1-2031 | | | | 365,000 | | | | 387,860 | |

Guam Government Limited Obligation Section 30 Series A (Miscellaneous Revenue) | | | 5.38 | | | | 12-1-2024 | | | | 1,000,000 | | | | 1,105,420 | |

Guam Government Obligation Revenue Series A (Tax Revenue) | | | 5.00 | | | | 12-1-2020 | | | | 2,250,000 | | | | 2,461,793 | |

Guam Government Waterworks Authority Water & Wastewater System Project Series 2010 (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2019 | | | | 75,000 | | | | 80,333 | |

Guam Government Waterworks Authority Water & Wastewater System Project Series 2013 (Water & Sewer Revenue) | | | 5.25 | | | | 7-1-2021 | | | | 550,000 | | | | 607,613 | |

Guam Government Waterworks Authority Water & Wastewater System Project Series 2013 (Water & Sewer Revenue) | | | 5.25 | | | | 7-1-2022 | | | | 500,000 | | | | 558,160 | |

Guam Power Authority Series A (Utilities Revenue, AGM Insured) | | | 5.00 | | | | 10-1-2020 | | | | 500,000 | | | | 546,645 | |

| |

| | | | 5,747,824 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Idaho: 0.35% | | | | | | | | | | | | | | | | |

Boise-Kuna ID Irrigation District Arrowrock Hydroelectric Project (Utilities Revenue) | | | 7.38 | | | | 6-1-2040 | | | | 100,000 | | | | 108,646 | |

Idaho Housing & Finance Association Idaho Arts Charter School Series A (Education Revenue) 144A | | | 5.00 | | | | 12-1-2036 | | | | 1,000,000 | | | | 1,034,140 | |

Idaho Housing & Finance Association Legacy Public Charter School Incorporated Project Series A (Education Revenue) | | | 5.85 | | | | 5-1-2033 | | | | 500,000 | | | | 510,660 | |

Idaho Housing & Finance Association Liberty Charter School Series A (Education Revenue) | | | 6.00 | | | | 6-1-2038 | | | | 250,000 | | | | 255,573 | |

| |

| | | | 1,909,019 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Illinois: 20.31% | | | | | | | | | | | | | | | | |

Bureau County IL Township High School District #502 Series A (GO Revenue, Build America Mutual Assurance Company Insured) | | | 6.25 | % | | | 12-1-2033 | | | $ | 750,000 | | | $ | 914,355 | |

Chicago IL Board of Education CAB School Reform Series B-1 (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 12-1-2021 | | | | 4,380,000 | | | | 3,579,161 | |

Chicago IL Board of Education CAB School Reform Series B-1 (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 12-1-2022 | | | | 3,250,000 | | | | 2,524,860 | |

Chicago IL Board of Education Lease Certificates Refunding Bond Series A (Miscellaneous Revenue, National Insured) | | | 6.00 | | | | 1-1-2020 | | | | 195,000 | | | | 205,826 | |

Chicago IL Board of Education Series A (GO Revenue) | | | 5.00 | | | | 1-1-2020 | | | | 1,000,000 | | | | 998,400 | |

Chicago IL Board of Education Series A (GO Revenue, National Insured) | | | 5.25 | | | | 12-1-2017 | | | | 250,000 | | | | 255,058 | |

Chicago IL Board of Education Series A (GO Revenue, National Insured) | | | 5.25 | | | | 12-1-2021 | | | | 2,555,000 | | | | 2,738,679 | |

Chicago IL Board of Education Series C (GO Revenue) | | | 5.25 | | | | 12-1-2025 | | | | 1,000,000 | | | | 820,260 | |

Chicago IL Board of Education Series D (GO Revenue, AGM Insured) | | | 5.00 | | | | 12-1-2022 | | | | 375,000 | | | | 382,290 | |

Chicago IL CAB Series A (GO Revenue, National Insured) | | | 5.59 | | | | 1-1-2023 | | | | 950,000 | | | | 953,040 | |

Chicago IL City Colleges Capital Improvement Project CAB (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 1-1-2031 | | | | 800,000 | | | | 397,920 | |

Chicago IL Emergency Telephone System Project (GO Revenue, National Insured) | | | 5.50 | | | | 1-1-2023 | | | | 555,000 | | | | 594,361 | |

Chicago IL Library Project Series D (GO Revenue) | | | 5.00 | | | | 1-1-2021 | | | | 440,000 | | | | 438,926 | |

Chicago IL Modern Schools Across Chicago Program Series A (GO Revenue) | | | 4.00 | | | | 12-1-2018 | | | | 445,000 | | | | 443,696 | |

Chicago IL Motor Fuel Tax (Tax Revenue) | | | 5.00 | | | | 1-1-2019 | | | | 250,000 | | | | 258,958 | |

Chicago IL O’Hare International Airport (Airport Revenue) | | | 5.00 | | | | 1-1-2035 | | | | 2,350,000 | | | | 2,478,475 | |

Chicago IL O’Hare International Airport AMT Senior Lien Series C (Airport Revenue) | | | 5.50 | | | | 1-1-2044 | | | | 1,000,000 | | | | 1,101,180 | |

Chicago IL O’Hare International Airport Customer Facility Charge Senior Lien Series D (Airport Revenue) | | | 5.75 | | | | 1-1-2043 | | | | 1,500,000 | | | | 1,686,480 | |

Chicago IL O’Hare International Airport Senior Lien (Airport Revenue) | | | 5.25 | | | | 1-1-2032 | | | | 1,000,000 | | | | 1,107,700 | |

Chicago IL Park District Limited Tax Park Bonds Series 2016A (GO Revenue) | | | 5.00 | | | | 1-1-2030 | | | | 1,000,000 | | | | 1,103,600 | |

Chicago IL Park District Limited Tax Park Bonds Series 2016A (GO Revenue) | | | 5.00 | | | | 1-1-2031 | | | | 1,000,000 | | | | 1,099,570 | |

Chicago IL Park District Limited Tax Park Bonds Series 2016A (GO Revenue) | | | 5.00 | | | | 1-1-2032 | | | | 1,225,000 | | | | 1,341,081 | |

Chicago IL Park District Limited Tax Park Bonds Series 2016A (GO Revenue) | | | 5.00 | | | | 1-1-2035 | | | | 1,000,000 | | | | 1,079,690 | |

Chicago IL Park District Unlimited Tax Refunding Bonds Series 2016A (GO Revenue) | | | 5.00 | | | | 11-15-2028 | | | | 1,655,000 | | | | 1,855,934 | |

Chicago IL Park District Unlimited Tax Refunding Bonds Series 2016E (GO Revenue) | | | 5.00 | | | | 11-15-2029 | | | | 1,735,000 | | | | 1,936,260 | |

Chicago IL Sales Tax (Tax Revenue) | | | 5.00 | | | | 1-1-2031 | | | | 4,525,000 | | | | 4,743,784 | |

Chicago IL Sales Tax (Tax Revenue) | | | 5.00 | | | | 1-1-2032 | | | | 850,000 | | | | 888,174 | |

Chicago IL Sales Tax (Tax Revenue) | | | 5.00 | | | | 1-1-2033 | | | | 2,785,000 | | | | 2,898,600 | |

Chicago IL Sales Tax Refunding Bond (Tax Revenue) | | | 5.00 | | | | 1-1-2025 | | | | 1,775,000 | | | | 1,830,327 | |

Chicago IL Sales Tax Refunding Bond (Tax Revenue) | | | 5.00 | | | | 1-1-2030 | | | | 2,250,000 | | | | 2,371,275 | |

Chicago IL Series A (GO Revenue) | | | 4.00 | | | | 1-1-2020 | | | | 590,000 | | | | 576,943 | |

Chicago IL Series A (GO Revenue) | | | 5.25 | | | | 1-1-2021 | | | | 845,000 | | | | 842,955 | |

Chicago IL Series A (GO Revenue) | | | 5.25 | | | | 1-1-2026 | | | | 550,000 | | | | 547,272 | |

Chicago IL Series B (GO Revenue, AGM Insured) | | | 5.00 | | | | 1-1-2018 | | | | 735,000 | | | | 744,893 | |

Chicago IL Series B (GO Revenue) | | | 5.50 | | | | 1-1-2032 | | | | 1,300,000 | | | | 1,247,077 | |

Chicago IL Series C (GO Revenue) ¤ | | | 0.00 | | | | 1-1-2021 | | | | 610,000 | | | | 487,109 | |

Chicago IL Series C (GO Revenue) | | | 4.00 | | | | 1-1-2021 | | | | 750,000 | | | | 723,098 | |

Chicago IL Series C (GO Revenue, National Insured) | | | 5.00 | | | | 1-1-2029 | | | | 1,000,000 | | | | 1,027,920 | |

Chicago IL Wastewater Second Lien Transmission Revenue Project Bonds Series 2012 (Water & Sewer Revenue) | | | 5.00 | | | | 1-1-2027 | | | | 1,000,000 | | | | 1,078,760 | |

Chicago IL Wastewater Second Lien Transmission Revenue Project Bonds Series 2014 (Water & Sewer Revenue) | | | 5.00 | | | | 1-1-2025 | | | | 400,000 | | | | 444,056 | |

Chicago IL Waterworks Second Lien Revenue Bonds Series 2004 (Water & Sewer Revenue) | | | 5.00 | | | | 11-1-2027 | | | | 2,250,000 | | | | 2,516,760 | |

Chicago IL Waterworks Second Lien Revenue Bonds Series 2012 (Water & Sewer Revenue) | | | 4.00 | | | | 11-1-2020 | | | | 625,000 | | | | 654,931 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Illinois (continued) | | | | | | | | | | | | | | | | |

Chicago IL Waterworks Second Lien Revenue Bonds Series 2012 (Water & Sewer Revenue) | | | 5.00 | % | | | 11-1-2030 | | | $ | 1,000,000 | | | $ | 1,080,160 | |

Cook County IL School District #144 Prairie Hills CAB Refunding Bond Series C (GO Revenue, AGM Insured) ¤ | | | 0.00 | | | | 12-1-2025 | | | | 675,000 | | | | 455,645 | |

Cook County IL School District #159 CAB (GO Revenue, AGM Insured) ¤ | | | 0.00 | | | | 12-1-2023 | | | | 615,000 | | | | 457,726 | |

Cook County IL Series A (GO Revenue) | | | 5.00 | | | | 11-15-2020 | | | | 600,000 | | | | 654,480 | |

Cook County IL Series A (GO Revenue) | | | 5.25 | | | | 11-15-2022 | | | | 2,940,000 | | | | 3,214,126 | |

Illinois (GO Revenue) | | | 5.00 | | | | 2-1-2021 | | | | 3,000,000 | | | | 3,128,550 | |

Illinois (GO Revenue, AGM Insured) | | | 5.00 | | | | 1-1-2023 | | | | 300,000 | | | | 311,940 | |

Illinois (GO Revenue) | | | 5.00 | | | | 5-1-2025 | | | | 870,000 | | | | 891,794 | |

Illinois (GO Revenue, AGM Insured) | | | 5.00 | | | | 4-1-2026 | | | | 1,130,000 | | | | 1,203,405 | |

Illinois (Miscellaneous Revenue) | | | 5.50 | | | | 7-1-2025 | | | | 1,250,000 | | | | 1,311,913 | |

Illinois (Miscellaneous Revenue) | | | 5.50 | | | | 7-1-2038 | | | | 1,000,000 | | | | 1,018,580 | |

Illinois Finance Authority Charter Schools Series A (Education Revenue) | | | 7.13 | | | | 10-1-2041 | | | | 200,000 | | | | 218,644 | |

Illinois Finance Authority Medical District Commission Project A (Health Revenue, AGC Insured) | | | 4.13 | | | | 9-1-2018 | | | | 25,000 | | | | 25,048 | |

Illinois Finance Authority Rogers Park Montessori School (Miscellaneous Revenue) | | | 5.00 | | | | 2-1-2024 | | | | 505,000 | | | | 514,019 | |

Illinois Finance Authority The Art Institute of Chicago Series A (Miscellaneous Revenue) | | | 5.00 | | | | 3-1-2034 | | | | 500,000 | | | | 546,535 | |

Illinois Finance Authority The Art Institute of Chicago Series A (Miscellaneous Revenue) | | | 6.00 | | | | 3-1-2038 | | | | 400,000 | | | | 439,636 | |

Illinois Finance Authority Wesleyan University (Education Revenue) | | | 5.00 | | | | 9-1-2046 | | | | 1,000,000 | | | | 1,069,550 | |

Illinois Series A (GO Revenue) | | | 4.00 | | | | 9-1-2019 | | | | 600,000 | | | | 604,854 | |

Illinois Series A (Tax Revenue) | | | 4.00 | | | | 1-1-2029 | | | | 1,000,000 | | | | 903,830 | |

Illinois Series A (Tax Revenue) | | | 5.00 | | | | 6-1-2019 | | | | 465,000 | | | | 482,089 | |

Illinois Series A (GO Revenue, AGM Insured) | | | 5.00 | | | | 4-1-2024 | | | | 1,905,000 | | | | 2,035,988 | |

Illinois Series A (Tax Revenue) | | | 5.00 | | | | 1-1-2027 | | | | 2,000,000 | | | | 2,009,660 | |

Illinois Sports Facilities Authority State Tax Supported CAB (Tax Revenue, Ambac Insured) ¤ | | | 0.00 | | | | 6-15-2023 | | | | 1,285,000 | | | | 999,936 | |

Illinois Sports Facilities Authority State Tax Supported CAB (Tax Revenue, AGM Insured) | | | 5.25 | | | | 6-15-2031 | | | | 2,500,000 | | | | 2,753,925 | |

Illinois Sports Facilities Authority State Tax Supported Refunding Bonds (Tax Revenue, AGM Insured) | | | 5.00 | | | | 6-15-2028 | | | | 1,500,000 | | | | 1,643,175 | |

Illinois Toll Highway Authority Series B (Transportation Revenue) | | | 5.00 | | | | 1-1-2039 | | | | 1,000,000 | | | | 1,098,960 | |

Kane, Cook & DuPage Counties IL Series A (GO Revenue) | | | 5.00 | | | | 1-1-2034 | | | | 1,000,000 | | | | 1,077,640 | |

Kane, Cook & DuPage Counties IL Series D (GO Revenue) | | | 5.00 | | | | 1-1-2034 | | | | 1,700,000 | | | | 1,831,988 | |

Lake County IL School District #38 Big Hollow CAB (GO Revenue, Ambac Insured) ¤ | | | 0.00 | | | | 2-1-2019 | | | | 75,000 | | | | 70,555 | |

Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series A (Tax Revenue, National Insured) ¤ | | | 0.00 | | | | 12-15-2019 | | | | 1,135,000 | | | | 1,033,179 | |

Metropolitan Pier & Exposition Authority IIlinois CAB McCormick Place Expansion Project Series A (Tax Revenue, National Insured) ¤ | | | 0.00 | | | | 12-15-2030 | | | | 960,000 | | | | 505,373 | |

Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series A (Tax Revenue, National Insured) ¤ | | | 0.00 | | | | 6-15-2033 | | | | 3,440,000 | | | | 1,588,592 | |

Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series A (Tax Revenue, National Insured) ¤ | | | 0.00 | | | | 12-15-2033 | | | | 14,000,000 | | | | 6,315,101 | |

Metropolitan Pier & Exposition Authority IIlinois CAB McCormick Place Expansion Project Series A (Tax Revenue, National Insured) ¤ | | | 0.00 | | | | 12-15-2034 | | | | 2,200,000 | | | | 935,308 | |

Metropolitan Pier & Exposition Authority Illinois CAB McCormick Place Expansion Project Series B-1 (Tax Revenue, AGM Insured) ¤ | | | 0.00 | | | | 6-15-2027 | | | | 5,150,000 | | | | 3,284,516 | |

Southern Illinois State University (Education Revenue) | | | 4.00 | | | | 4-1-2017 | | | | 160,000 | | | | 160,309 | |

Springfield Sangamon County IL (GO Revenue) | | | 5.00 | | | | 12-1-2031 | | | | 850,000 | | | | 925,854 | |

Village Bolingbrook IL (GO Revenue, AGM Insured) | | | 5.00 | | | | 1-1-2031 | | | | 500,000 | | | | 552,320 | |

Will County IL Community High School District #210 Lincoln-Way Series 2009 (GO Revenue) | | | 4.00 | | | | 1-1-2017 | | | | 1,005,000 | | | | 1,005,010 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Illinois (continued) | | | | | | | | | | | | | | | | |

Will County IL Lincoln-Way Community High School District #210 Series A (GO Revenue, AGM Insured) | | | 5.00 | % | | | 1-1-2027 | | | $ | 4,000,000 | | | $ | 4,331,320 | |

Will County IL Lincoln-Way Community High School District #210 Series A (GO Revenue) | | | 5.00 | | | | 1-1-2030 | | | | 1,000,000 | | | | 959,370 | |

Will County IL Lincoln-Way Community High School District #210 Series B (GO Revenue) ¤ | | | 0.00 | | | | 1-1-2033 | | | | 1,590,000 | | | | 623,137 | |

Will County IL School District #14 Prerefunded CAB School Series (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 12-1-2017 | | | | 145,000 | | | | 143,285 | |

Will County IL School District #14 Prerefunded CAB School Series (GO Revenue, National Insured) ¤ | | | 0.00 | | | | 12-1-2017 | | | | 110,000 | | | | 108,350 | |

Winnebago County IL Series A (GO Revenue, AGM Insured) | | | 4.00 | | | | 12-30-2025 | | | | 1,000,000 | | | | 1,053,350 | |

| |

| | | | 109,498,419 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Indiana: 4.09% | | | | | | | | | | | | | | | | |

Indiana Finance Authority AMT-I-69 Development Partners LLC (Miscellaneous Revenue) | | | 5.25 | | | | 9-1-2034 | | | | 1,000,000 | | | | 997,760 | |

Indiana Finance Authority Environmental Facilities Series 2016A (Industrial Development Revenue) | | | 3.13 | | | | 12-1-2024 | | | | 3,125,000 | | | | 3,082,250 | |

Indiana Finance Authority Ohio River Bridges East End Crossing Project Series A (Industrial Development Revenue) | | | 5.00 | | | | 7-1-2035 | | | | 1,000,000 | | | | 1,023,950 | |

Indiana Finance Authority Series M (Miscellaneous Revenue) | | | 5.00 | | | | 7-1-2029 | | | | 605,000 | | | | 682,646 | |

Indiana Finance Authority Wastewater Utility Project Series A (Water & Sewer Revenue) | | | 5.25 | | | | 10-1-2031 | | | | 1,310,000 | | | | 1,473,095 | |

Indiana Health & Educational Facility Financing Authority Series 2006B (Health Revenue) ± | | | 1.75 | | | | 11-15-2031 | | | | 7,000,000 | | | | 6,791,890 | |

Indianapolis IN Local Public Improvement Series 2015E (Miscellaneous Revenue) | | | 5.00 | | | | 1-1-2035 | | | | 2,675,000 | | | | 3,044,578 | |

Whiting IN BP Products North America Incorporated Project (Resource Recovery Revenue) | | | 1.48 | | | | 12-1-2044 | | | | 5,000,000 | | | | 4,948,550 | |

| |

| | | | 22,044,719 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Iowa: 0.19% | | | | | | | | | | | | | | | | |

Coralville IA Certificate of Participation (Miscellaneous Revenue) | | | 4.00 | | | | 6-1-2020 | | | | 500,000 | | | | 522,555 | |

Coralville IA Certificate of Participation (Miscellaneous Revenue) | | | 4.00 | | | | 6-1-2021 | | | | 500,000 | | | | 523,565 | |

| |

| | | | 1,046,120 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Kansas: 1.15% | | | | | | | | | | | | | | | | |

Wyandotte County & Kansas City KS Sales Tax Special Obligation Vacation Village Project Area 4 - Major Multi-Sport Athletic Complex Project CAB Series 2015 (Tax Revenue) 144A¤ | | | 0.00 | | | | 9-1-2034 | | | | 19,680,000 | | | | 6,205,301 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Kentucky: 0.76% | | | | | | | | | | | | | | | | |

Kentucky EDFA Senior Revenue Bonds Next Generation Kentucky Information Highway Project Series A (Miscellaneous Revenue) | | | 5.00 | | | | 7-1-2037 | | | | 1,000,000 | | | | 1,043,090 | |

Kentucky Public Transportation Infrastructure Authority Downtown Crossing Project CAB Series B (Transportation Revenue) ¤ | | | 0.00 | | | | 7-1-2029 | | | | 1,400,000 | | | | 789,404 | |

Paducah KY Electric Plan (Utilities Revenue, AGM Insured) | | | 5.00 | | | | 10-1-2033 | | | | 2,000,000 | | | | 2,253,020 | |

| |

| | | | 4,085,514 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Louisiana: 1.30% | | | | | | | | | | | | | | | | |

Louisiana Series A (GO Revenue) | | | 5.00 | | | | 8-1-2026 | | | | 1,000,000 | | | | 1,161,340 | |

New Orleans LA Aviation Board Gulf Opportunity Zone Consolidated Rental Car Series A (Airport Revenue) | | | 6.50 | | | | 1-1-2040 | | | | 500,000 | | | | 539,035 | |

Shreveport LA Water & Sewer Series A (Water & Sewer Revenue, Build America Mutual Assurance Company Insured) | | | 4.00 | | | | 12-1-2018 | | | | 3,000,000 | | | | 3,132,510 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Louisiana (continued) | | | | | | | | | | | | | | | | |

Shreveport LA Water & Sewer Series A (Water & Sewer Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | % | | | 12-1-2019 | | | $ | 2,000,000 | | | $ | 2,173,440 | |

| |

| | | | 7,006,325 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Maine: 0.07% | | | | | | | | | | | | | | | | |

Portland ME General Airport (Airport Revenue) | | | 5.00 | | | | 7-1-2022 | | | | 150,000 | | | | 169,953 | |

Portland ME General Airport (Airport Revenue) | | | 5.00 | | | | 7-1-2023 | | | | 175,000 | | | | 200,828 | |

| |

| | | | 370,781 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Maryland: 0.49% | | | | | | | | | | | | | | | | |

Maryland Health & Higher Education Washington County Hospital Project (Health Revenue) | | | 5.00 | | | | 1-1-2019 | | | | 125,000 | | | | 129,771 | |

Prince George’s County MD Chesapeake Lighthouse Charter School Project Series 2016A (Education Revenue) | | | 5.75 | | | | 8-1-2033 | | | | 1,000,000 | | | | 1,012,760 | |

Prince George’s County MD Chesapeake Lighthouse Charter School Project Series 2016A (Education Revenue) | | | 7.00 | | | | 8-1-2046 | | | | 1,500,000 | | | | 1,518,045 | |

| |

| | | | 2,660,576 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Massachusetts: 0.34% | | | | | | | | | | | | | | | | |

Massachusetts Development Finance Agency Sabis International Charter Series A (Education Revenue) | | | 8.00 | | | | 4-15-2039 | | | | 100,000 | | | | 117,658 | |

Massachusetts School Building Authority Series A (Tax Revenue) | | | 5.00 | | | | 11-15-2034 | | | | 1,470,000 | | | | 1,702,510 | |

| |

| | | | 1,820,168 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Michigan: 5.28% | | | | | | | | | | | | | | | | |

Detroit MI Distributable State Aid Project (GO Revenue) | | | 4.25 | | | | 11-1-2021 | | | | 770,000 | | | | 797,243 | |

Detroit MI Water Supply System Second Lien Series B (Water & Sewer Revenue, AGM Insured) | | | 7.00 | | | | 7-1-2036 | | | | 715,000 | | | | 808,601 | |

Great Lakes Michigan Water Authority Sewage Disposal System Series 2016C (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2036 | | | | 3,560,000 | | | | 3,874,384 | |

Great Lakes Michigan Water Authority Water Supply System Series 2016D (Water & Sewer Revenue) | | | 4.00 | | | | 7-1-2032 | | | | 4,000,000 | | | | 4,025,200 | |

Great Lakes Michigan Water Authority Water Supply System Series 2016D (Water & Sewer Revenue, AGM Insured) | | | 4.00 | | | | 7-1-2033 | | | | 4,000,000 | | | | 4,031,520 | |

Michigan Finance Authority Local Government Loan Program Series D (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2030 | | | | 4,000,000 | | | | 4,437,440 | |

Michigan Finance Authority Local Government Loan Program Series D4 (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2029 | | | | 1,000,000 | | | | 1,114,640 | |

Michigan Public Educational Facilities Authority Bradford Academy Project (Education Revenue) (s) | | | 8.00 | | | | 9-1-2021 | | | | 115,000 | | | | 91,984 | |

Michigan Public Educational Facilities Authority Landmark Academy Project Series 2010 (Education Revenue) | | | 6.00 | | | | 6-1-2020 | | | | 390,000 | | | | 391,888 | |

Michigan Strategic Fund Limited Obligation Events Center Project Series A (Tax Revenue) ± | | | 4.13 | | | | 7-1-2045 | | | | 3,500,000 | | | | 3,543,750 | |

Oakland County MI Economic Development Corporation The Academy of The Sacred Heart Project Series A (Education Revenue) | | | 6.50 | | | | 12-15-2036 | | | | 500,000 | | | | 470,250 | |

Taylor MI Tax Increment Refunding Bond Series B (Tax Revenue, AGM Insured) | | | 4.00 | | | | 5-1-2020 | | | | 785,000 | | | | 786,507 | |

Taylor MI Tax Increment Refunding Bond Series B (Tax Revenue, AGM Insured) | | | 4.00 | | | | 5-1-2021 | | | | 870,000 | | | | 871,531 | |

Wayne County MI Airport Series A (Airport Revenue, AGM Insured) | | | 4.00 | | | | 12-1-2020 | | | | 1,715,000 | | | | 1,809,342 | |

Wayne County MI Building Improvement Series A (GO Revenue) | | | 6.75 | | | | 11-1-2039 | | | | 900,000 | | | | 930,177 | |

Western Michigan University (Education Revenue) | | | 5.25 | | | | 11-15-2031 | | | | 400,000 | | | | 455,524 | |

| |

| | | | 28,439,981 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Minnesota: 0.09% | | | | | | | | | | | | | | | | |

Independence MN Charter School Lease Series A (Education Revenue) | | | 4.25 | % | | | 7-1-2026 | | | $ | 500,000 | | | $ | 472,270 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Mississippi: 0.86% | | | | | | | | | | | | | | | | |

Mississippi Development Bank Special Obligation Convention Center Refunding Project Series A (Miscellaneous Revenue, Municipal Government Guaranty Insured) | | | 5.00 | | | | 3-1-2026 | | | | 3,050,000 | | | | 3,525,617 | |

Mississippi Development Bank Special Obligation Jackson Water & Sewer System Project Series A (Water & Sewer Revenue, AGM Insured) | | | 5.00 | | | | 9-1-2030 | | | | 1,000,000 | | | | 1,119,000 | |

| |

| | | | 4,644,617 | |

| | | | | | | | | | | | | | | | |

|

| Missouri: 0.47% | |

Missouri HEFA (Health Revenue) | | | 1.50 | | | | 2-1-2018 | | | | 450,000 | | | | 449,609 | |

Missouri HEFA (Health Revenue) | | | 5.00 | | | | 2-1-2021 | | | | 800,000 | | | | 878,072 | |

Missouri HEFA (Health Revenue) | | | 5.00 | | | | 2-1-2022 | | | | 220,000 | | | | 244,119 | |

Raymore MO Tax Increment Refunding & Improvement Raymore Galleria Project Series A (Tax Revenue) | | | 3.00 | | | | 5-1-2017 | | | | 190,000 | | | | 189,962 | |

Raymore MO Tax Increment Refunding & Improvement Raymore Galleria Project Series A (Tax Revenue) | | | 4.00 | | | | 5-1-2020 | | | | 750,000 | | | | 756,038 | |

| |

| | | | 2,517,800 | |

| | | | | | | | | | | | | | | | |

|

| New Hampshire: 0.83% | |

New Hampshire Business Authority Water Facility Pennichuck Water Works Incorporated Project Series A (Water & Sewer Revenue) | | | 5.00 | | | | 1-1-2026 | | | | 1,000,000 | | | | 1,129,210 | |

New Hampshire Business Authority Water Facility Pennichuck Water Works Incorporated Project Series A (Water & Sewer Revenue) | | | 5.00 | | | | 1-1-2027 | | | | 845,000 | | | | 937,333 | |

New Hampshire Business Authority Water Facility Pennichuck Water Works Incorporated Project Series A (Water & Sewer Revenue) | | | 5.00 | | | | 1-1-2028 | | | | 2,170,000 | | | | 2,418,696 | |

| |

| | | | 4,485,239 | |

| | | | | | | | | | | | | | | | |

|

| New Jersey: 7.44% | |

City of Bayonne NJ School District (GO Revenue, AGM Insured) | | | 5.00 | | | | 7-15-2021 | | | | 1,300,000 | | | | 1,443,065 | |

Essex County NJ Improvement Authority Lease Newark Project Series A (Miscellaneous Revenue) | | | 6.25 | | | | 11-1-2030 | | | | 1,490,000 | | | | 1,549,049 | |

New Jersey EDA Educational Facilities Series AB (Education Revenue) | | | 5.00 | | | | 6-1-2022 | | | | 1,875,000 | | | | 1,975,781 | |

New Jersey EDA Motor Vehicle Surcharges Series A (Miscellaneous Revenue, National Insured) | | | 5.25 | | | | 7-1-2026 | | | | 250,000 | | | | 281,238 | |

New Jersey EDA Police Barracks Project (Miscellaneous Revenue) | | | 5.00 | | | | 6-15-2020 | | | | 285,000 | | | | 300,880 | |

New Jersey EDA School Facilities Construction Project Series NN (Miscellaneous Revenue) | | | 5.00 | | | | 3-1-2027 | | | | 3,150,000 | | | | 3,223,395 | |

New Jersey EDA School Facilities Construction Project Series NN (Miscellaneous Revenue) | | | 5.00 | | | | 3-1-2028 | | | | 5,000,000 | | | | 5,096,200 | |

New Jersey EDA School Facilities Construction Project Series PP (Miscellaneous Revenue) | | | 5.00 | | | | 6-15-2019 | | | | 1,800,000 | | | | 1,883,430 | |

New Jersey EDA School Facilities Drew University Series C (Education Revenue, National Insured) | | | 5.25 | | | | 7-1-2020 | | | | 2,060,000 | | | | 2,256,833 | |

New Jersey EDA Student Loan Series 1 (Education Revenue) | | | 5.50 | | | | 12-1-2021 | | | | 2,900,000 | | | | 3,208,676 | |

New Jersey Educational Facilities Authority Series 2014 (Education Revenue) | | | 5.00 | | | | 6-15-2025 | | | | 1,000,000 | | | | 1,045,380 | |

New Jersey TTFA CAB Series A (Transportation Revenue) ¤ | | | 0.00 | | | | 12-15-2031 | | | | 2,500,000 | | | | 1,192,575 | |

New Jersey TTFA Series A (Miscellaneous Revenue) | | | 5.00 | | | | 6-15-2020 | | | | 1,600,000 | | | | 1,687,984 | |

New Jersey TTFA Series A (Transportation Revenue) | | | 5.00 | | | | 6-15-2029 | | | | 2,000,000 | | | | 2,140,220 | |

New Jersey TTFA Series A (Miscellaneous Revenue) | | | 5.25 | | | | 12-15-2022 | | | | 600,000 | | | | 642,528 | |

New Jersey TTFA Series AA (Miscellaneous Revenue) | | | 5.00 | | | | 6-15-2045 | | | | 1,500,000 | | | | 1,490,940 | |

New Jersey TTFA Series B (Miscellaneous Revenue, National Insured) | | | 5.50 | | | | 12-15-2021 | | | | 7,115,000 | | | | 7,896,583 | |

New Jersey TTFA Series B (Miscellaneous Revenue) | | | 5.50 | | | | 6-15-2031 | | | | 250,000 | | | | 262,058 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 15 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| New Jersey (continued) | |

Newark NJ Qualified General Improvement Series A (GO Revenue) | | | 5.00 | % | | | 7-15-2025 | | | $ | 2,355,000 | | | $ | 2,523,312 | |

| |

| | | | 40,100,127 | |

| | | | | | | | | | | | | | | | |

|

| New Mexico: 0.48% | |

New Mexico Municipal Energy Acquisition Authority Gas Supply Sub Series B (Utilities Revenue, Royal Bank of Canada SPA) ± | | | 1.16 | | | | 11-1-2039 | | | | 2,600,000 | | | | 2,584,088 | |

| | | | | | | | | | | | | | | | |

|

| New York: 7.51% | |

Glen Cove NY Local Economic Assistance Corporation CCAB Series B (Industrial Development Revenue) ¤ | | | 0.00 | | | | 1-1-2045 | | | | 3,250,000 | | | | 586,333 | |

Glen Cove NY Local Economic Assistance Corporation CCAB Series C (Industrial Development Revenue) ¤ | | | 0.00 | | | | 1-1-2055 | | | | 1,000,000 | | | | 683,580 | |

Hempstead Town NY Local Development Corporation The Academy Charter School Project Series A (Education Revenue) | | | 7.65 | | | | 2-1-2044 | | | | 500,000 | | | | 548,255 | |

Metropolitan Transportation Authority New York Series C (Transportation Revenue) | | | 5.25 | | | | 11-15-2031 | | | | 5,000,000 | | | | 5,849,450 | |

Monroe County NY IDAG Refunding Bond Monroe Community College Association (Education Revenue, AGM Insured) | | | 5.00 | | | | 1-15-2038 | | | | 500,000 | | | | 549,060 | |

Nassau County NY Series F (GO Revenue) | | | 5.00 | | | | 10-1-2020 | | | | 150,000 | | | | 162,494 | |

New York Dormitory Authority State University Educational Facilities Series A (Miscellaneous Revenue) | | | 5.50 | | | | 5-15-2019 | | | | 500,000 | | | | 534,565 | |

New York Local Government Assistance Corporation Series A-11V (Tax Revenue, AGM Insured) ±(m)(n) | | | 0.99 | | | | 4-1-2017 | | | | 25,000 | | | | 25,000 | |

New York NY Series F-1 (GO Revenue) | | | 5.00 | | | | 3-1-2032 | | | | 1,000,000 | | | | 1,136,560 | |

New York NY Sub Series H-5 (GO Revenue, Dexia Credit Local LOC) ø | | | 0.93 | | | | 3-1-2034 | | | | 6,500,000 | | | | 6,500,000 | |

New York Transportation Development Corporation American Airlines Incorporated John F. Kennedy International Airport Project Series 2016 (Airport Revenue) | | | 5.00 | | | | 8-1-2026 | | | | 3,000,000 | | | | 3,093,900 | |

New York Urban Development Corporation Certificate of Participation James A Farley Post Office Project (Miscellaneous Revenue) 144A | | | 4.20 | | | | 2-1-2017 | | | | 3,485,000 | | | | 3,483,606 | |

New York Urban Development Corporation Personal Income Tax Series A (Tax Revenue) | | | 5.00 | | | | 3-15-2020 | | | | 10,000,000 | | | | 11,059,500 | |

Onondaga NY Civic Development Corporation St. Joseph’s Hospital Health Center Project Series A (Health Revenue) | | | 4.63 | | | | 7-1-2022 | | | | 1,500,000 | | | | 1,617,795 | |

Onondaga NY Civic Development Corporation St. Joseph’s Hospital Health Center Project Series A (Health Revenue) | | | 5.00 | | | | 7-1-2019 | | | | 750,000 | | | | 798,953 | |

Oyster Bay NY BAN Series C (GO Revenue) | | | 4.00 | | | | 6-1-2018 | | | | 1,000,000 | | | | 1,003,370 | |

Oyster Bay NY Public Improvement (GO Revenue) | | | 3.00 | | | | 8-15-2019 | | | | 875,000 | | | | 856,581 | |

Suffolk NY Tobacco Asset Securitization Corporation (Tobacco Revenue) | | | 5.00 | | | | 6-1-2024 | | | | 500,000 | | | | 550,780 | |

Westchester County NY Local Development Pace University Series A (Education Revenue) | | | 5.00 | | | | 5-1-2034 | | | | 1,000,000 | | | | 1,017,130 | |

Western Nassau County NY Water Authority Series B (Water & Sewer Revenue) | | | 5.00 | | | | 4-1-2025 | | | | 340,000 | | | | 400,044 | |

| |

| | | | 40,456,956 | |

| | | | | | | | | | | | | | | | |

|

| North Carolina: 0.37% | |

Charlotte-Mecklenburg NC Hospital Authority Series B (Health Revenue, JPMorgan Chase & Company SPA) ø | | | 0.69 | | | | 1-15-2038 | | | | 1,980,000 | | | | 1,980,000 | |

| | | | | | | | | | | | | | | | |

|

| Ohio: 2.71% | |

Lancaster OH Port Authority (Utilities Revenue, Royal Bank of Canada SPA) ± | | | 1.13 | | | | 5-1-2038 | | | | 3,000,000 | | | | 2,973,720 | |

Maple Heights OH City School District Certificate of Participation (Miscellaneous Revenue) | | | 6.00 | | | | 11-1-2028 | | | | 620,000 | | | | 649,853 | |

Medina County OH Manor Apartments Project (Housing Revenue) ± | | | 1.00 | | | | 12-1-2017 | | | | 2,000,000 | | | | 1,998,340 | |

Ohio Air Quality Development Authority FirstEnergy Generation Series 2009-A (Utilities Revenue) | | | 5.70 | | | | 8-1-2020 | | | | 1,500,000 | | | | 626,985 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| Ohio (continued) | |

Ohio Air Quality Development Authority Series A (Utilities Revenue) ± | | | 3.75 | % | | | 12-1-2023 | | | $ | 3,000,000 | | | $ | 1,255,410 | |

Ohio Private Activity Bond AMT Portsmouth Bypass Project (Miscellaneous Revenue, AGM Insured) | | | 5.00 | | | | 12-31-2035 | | | | 2,000,000 | | | | 2,175,980 | |

Ohio Private Activity Bond Series A (Industrial Development Revenue, AGM Insured) | | | 5.00 | | | | 12-31-2029 | | | | 2,070,000 | | | | 2,303,020 | |

Ohio Water Development Authority Pollution Control Series A (Industrial Development Revenue) ± | | | 3.75 | | | | 7-1-2033 | | | | 6,000,000 | | | | 2,508,180 | |

Toledo OH Enterprise Bond Series 2-A (Industrial Development Revenue) | | | 5.50 | | | | 12-1-2019 | | | | 110,000 | | | | 114,520 | |

| |

| | | | 14,606,008 | |

| | | | | | | | | | | | | | | | |

|

| Oklahoma: 0.41% | |

Garfield County OK Educational Facilities Authority Enid Public Schools Project (Miscellaneous Revenue) | | | 5.00 | | | | 9-1-2027 | | | | 1,895,000 | | | | 2,197,177 | |

| | | | | | | | | | | | | | | | |

|

| Oregon: 0.14% | |

Deschutes County OR Hospital Facilities Authority Cascade Healthcare Community Incorporated Project (Health Revenue) | | | 8.25 | | | | 1-1-2038 | | | | 500,000 | | | | 565,600 | |

Oregon Facilities Authority Southern Oregon University Project (Education Revenue, AGM Insured) | | | 4.00 | | | | 7-1-2023 | | | | 185,000 | | | | 196,348 | |

| |

| | | | 761,948 | |

| | | | | | | | | | | | | | | | |

|

| Pennsylvania: 9.34% | |

Allegheny County PA IDA Propel Charter School Sunrise Project (Education Revenue) | | | 5.25 | | | | 7-15-2023 | | | | 540,000 | | | | 555,325 | |

Allegheny County PA Series C-72 (GO Revenue) | | | 5.25 | | | | 12-1-2032 | | | | 1,000,000 | | | | 1,152,440 | |

Beaver County PA IDA Pollution Control First Nuclear General Project Series A (Utilities Revenue) ± | | | 2.70 | | | | 4-1-2035 | | | | 1,500,000 | | | | 628,590 | |

Berks County PA Municipal Authority Reading Hospital & Medical Center Project Series B (Health Revenue) | | | 2.23 | | | | 11-1-2039 | | | | 2,000,000 | | | | 2,015,500 | |

Chester County PA IDA Avon Grove Charter School Project Series A (Education Revenue) | | | 6.25 | | | | 12-15-2027 | | | | 325,000 | | | | 333,778 | |

Commonwealth Financing Authority Pennsylvania Series B-1 (Miscellaneous Revenue, AGM Insured) | | | 5.00 | | | | 6-1-2025 | | | | 500,000 | | | | 578,275 | |

Delaware County PA IDA Resource Recovery Facility Series A (Resource Recovery Revenue) | | | 6.20 | | | | 7-1-2019 | | | | 35,000 | | | | 35,113 | |

Delaware Valley PA Regional Finance Authority Local Government Series A (Miscellaneous Revenue, Ambac Insured) | | | 5.50 | | | | 8-1-2028 | | | | 1,400,000 | | | | 1,661,100 | |

East Hempfield Township PA IDA Student Services Incorporated Student Housing Project Millersville University (Education Revenue) | | | 5.00 | | | | 7-1-2021 | | | | 660,000 | | | | 713,480 | |

East Hempfield Township PA IDA Student Services Incorporated Student Housing Project Millersville University (Education Revenue) | | | 5.00 | | | | 7-1-2023 | | | | 760,000 | | | | 829,016 | |

Pennsylvania EDFA Bridges Finco LP (Industrial Development Revenue) | | | 5.00 | | | | 12-31-2034 | | | | 5,000,000 | | | | 5,290,600 | |

Pennsylvania Turnpike Commission CCAB Sub Series E (Transportation Revenue) ± | | | 0.00 | | | | 12-1-2038 | | | | 1,000,000 | | | | 1,172,660 | |

Philadelphia PA Airport Bonds AMT Series A (Airport Revenue, AGM Insured) | | | 5.00 | | | | 6-15-2037 | | | | 2,000,000 | | | | 2,023,580 | |

Philadelphia PA IDA 1st Philadelphia Preparatory Charter School Project Series A (Education Revenue) | | | 7.00 | | | | 6-15-2033 | | | | 1,000,000 | | | | 1,129,180 | |

Philadelphia PA IDA Architecture & Design Charter School Project (Education Revenue) | | | 5.25 | | | | 3-15-2023 | | | | 265,000 | | | | 272,462 | |

Philadelphia PA IDA Cultural & Commercial Corridors Program Series A (Miscellaneous Revenue) | | | 5.00 | | | | 12-1-2025 | | | | 1,995,000 | | | | 2,281,382 | |

Philadelphia PA IDA Discovery Charter School Project (Education Revenue) | | | 4.00 | | | | 4-1-2017 | | | | 85,000 | | | | 84,992 | |

Philadelphia PA IDA Discovery Charter School Project (Education Revenue) | | | 5.00 | | | | 4-1-2022 | | | | 450,000 | | | | 450,995 | |

Philadelphia PA IDA Mariana Bracetti Academy Project (Education Revenue) | | | 6.25 | | | | 12-15-2021 | | | | 190,000 | | | | 200,908 | |

Philadelphia PA IDA National Board of Medical Examiners Project (Health Revenue) | | | 5.00 | | | | 5-1-2026 | | | | 1,420,000 | | | | 1,684,063 | |

Philadelphia PA IDA New Foundations Charter School Project (Education Revenue) | | | 6.00 | | | | 12-15-2027 | | | | 280,000 | | | | 301,731 | |

Philadelphia PA Refunding Bond Series A (GO Revenue) | | | 5.25 | | | | 7-15-2033 | | | | 1,000,000 | | | | 1,131,010 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—December 31, 2016 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | | 17 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| Pennsylvania (continued) | |

Philadelphia PA School District Series C (GO Revenue) | | | 5.00 | % | | | 9-1-2020 | | | $ | 250,000 | | | $ | 270,520 | |

Philadelphia PA School District Series E (GO Revenue) | | | 5.25 | | | | 9-1-2022 | | | | 1,350,000 | | | | 1,443,582 | |

Philadelphia Pa School District Series F (GO Revenue) | | | 5.00 | | | | 9-1-2030 | | | | 1,000,000 | | | | 1,091,220 | |

Philadelphia PA School District Series F (GO Revenue) | | | 5.00 | | | | 9-1-2036 | | | | 3,000,000 | | | | 3,188,940 | |

Philadelphia PA School District Series F (GO Revenue) | | | 5.00 | | | | 9-1-2037 | | | | 1,000,000 | | | | 1,058,900 | |

Philadelphia PA Series A (GO Revenue) | | | 5.00 | | | | 8-1-2025 | | | | 1,905,000 | | | | 2,210,505 | |

Philadelphia PA Water & Sewer Series B (Water & Sewer Revenue) | | | 5.00 | | | | 7-1-2032 | | | | 1,145,000 | | | | 1,293,724 | |

Reading PA Water Authority Series 2011 (Water & Sewer Revenue) | | | 5.25 | | | | 12-1-2036 | | | | 1,250,000 | | | | 1,400,013 | |

State Public School Building Authority Harrisburg School District Project Series A (Miscellaneous Revenue, AGM Insured) | | | 5.00 | | | | 12-1-2023 | | | | 1,710,000 | | | | 1,957,830 | |

State Public School Building Authority Series 2016A (Miscellaneous Revenue) | | | 5.00 | | | | 6-1-2036 | | | | 4,715,000 | | | | 4,998,654 | |

York County PA IDA Philadelphia Electric Company Project Series A (Industrial Development Revenue) ± | | | 2.55 | | | | 6-1-2036 | | | | 7,000,000 | | | | 6,926,360 | |

| |

| | | | 50,366,428 | |

| | | | | | | | | | | | | | | | |

|

| South Carolina: 0.84% | |

South Carolina Jobs EDA York Preparatory Academy Project Series A (Education Revenue) | | | 7.00 | | | | 11-1-2033 | | | | 1,000,000 | | | | 1,066,830 | |

South Carolina Public Service Authority Series C (Miscellaneous Revenue) | | | 5.00 | | | | 12-1-2030 | | | | 3,010,000 | | | | 3,437,059 | |

| |

| | | | 4,503,889 | |

| | | | | | | | | | | | | | | | |

|

| Tennessee: 1.21% | |

Bristol TN Industrial Development Board Sales Tax Pinnacle Project Series A (Tax Revenue) 144A | | | 5.13 | | | | 12-1-2042 | | | | 2,500,000 | | | | 2,231,175 | |

Bristol TN Industrial Development Board Sales Tax Series B CAB (Tax Revenue) 144A¤ | | | 0.00 | | | | 12-1-2031 | | | | 3,000,000 | | | | 1,195,980 | |

Metropolitan Government of Nashville & Davidson County TN Health & Educational Facilities Board Series 2001B-1 (Health Revenue) ± | | | 1.55 | | | | 11-15-2030 | | | | 3,000,000 | | | | 2,935,680 | |

Tennessee Energy Acquisition Corporation Series A (Utilities Revenue) | | | 5.25 | | | | 9-1-2018 | | | | 150,000 | | | | 158,367 | |

| |

| | | | 6,521,202 | |

| | | | | | | | | | | | | | | | |

|

| Texas: 8.12% | |

Arlington TX Higher Education Finance Corporation Universal Academy Project Series A (Education Revenue) | | | 7.13 | | | | 3-1-2044 | | | | 1,250,000 | | | | 1,261,813 | |

Arlington TX Permanent Import (GO Revenue) | | | 5.00 | | | | 8-15-2023 | | | | 2,940,000 | | | | 3,459,527 | |

Austin TX Airport System AMT (Airport Revenue) | | | 5.00 | | | | 11-15-2044 | | | | 2,500,000 | | | | 2,693,600 | |

Clifton TX Higher Educational Finance Corporation International Leadership Series A (Education Revenue) | | | 5.50 | | | | 8-15-2035 | | | | 2,000,000 | | | | 1,997,540 | |

Clifton TX Higher Educational Finance Corporation International Leadership Series A (Education Revenue) | | | 5.75 | | | | 8-15-2038 | | | | 1,000,000 | | | | 1,011,440 | |

Clifton TX Higher Educational Finance Corporation Uplift Education Project Series A (Education Revenue) | | | 3.10 | | | | 12-1-2022 | | | | 1,825,000 | | | | 1,771,966 | |

Houston TX Higher Education Finance Corporation Series A (Education Revenue) | | | 4.00 | | | | 2-15-2022 | | | | 175,000 | | | | 175,557 | |

La Vernia TX Higher Education Finance Corporation Series A (Education Revenue) | | | 6.25 | | | | 2-15-2017 | | | | 55,000 | | | | 55,366 | |

New Hope Cultural Educational Facilities Finance Corporation Series A (Education Revenue) 144A | | | 5.00 | | | | 8-15-2026 | | | | 500,000 | | | | 506,765 | |

North Texas Tollway Authority System Series A (Transportation Revenue) | | | 5.00 | | | | 1-1-2023 | | | | 3,500,000 | | | | 4,027,030 | |

North Texas Tollway Authority System Series B (Transportation Revenue) | | | 5.00 | | | | 1-1-2026 | | | | 350,000 | | | | 383,691 | |

Northside TX Independent School District Building Project (GO Revenue) ± | | | 2.00 | | | | 8-1-2044 | | | | 2,000,000 | | | | 2,017,020 | |

Port Houston TX Authority Series D-1 (GO Revenue) | | | 5.00 | | | | 10-1-2035 | | | | 2,190,000 | | | | 2,413,599 | |

San Antonio TX Independent School District (GO Revenue) ± | | | 2.00 | | | | 8-1-2044 | | | | 965,000 | | | | 969,005 | |

Tarrant County TX Cultural Education Facilities Finance Corporation Series 2974 (Health Revenue, Credit Suisse LIQ) 144Aø | | | 0.92 | | | | 11-15-2029 | | | | 5,605,000 | | | | 5,605,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Managed Account CoreBuilder Shares – Series M | | Portfolio of investments—December 31, 2016 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| Texas (continued) | |

Tender Option Bond Trust Receipts/Certificates Floaters Series 2015 (Transportation Revenue, Barclays Bank plc LIQ) 144Aø | | | 1.01 | % | | | 7-1-2021 | | | $ | 4,215,000 | | | $ | 4,215,000 | |

Texas Municipal Gas Acquisition & Supply Corporation Subordinated Lien Series C (Utilities Revenue) ± | | | 2.02 | | | | 12-15-2026 | | | | 5,000,000 | | | | 4,514,400 | |

Texas Private Activity Bond Surface Transportation Corporation LBJ Infrastructure Project (Transportation Revenue) | | | 7.50 | | | | 6-30-2033 | | | | 250,000 | | | | 290,858 | |

Texas Private Activity Bond Surface Transportation Corporation Project NTE Mobility Partners Segments LLC (Transportation Revenue) ## | | | 7.00 | | | | 12-31-2038 | | | | 1,300,000 | | | | 1,477,658 | |

Texas SA Energy Acquisition Public Facility Corporation Gas Supply (Utilities Revenue) | | | 5.50 | | | | 8-1-2019 | | | | 330,000 | | | | 357,918 | |

Texas Transportation Commission Highway (Miscellaneous Revenue) | | | 5.00 | | | | 4-1-2028 | | | | 2,605,000 | | | | 3,116,726 | |

Upper Trinity TX Regional Water District (Water & Sewer Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | | | | 8-1-2028 | | | | 750,000 | | | | 863,408 | |

Upper Trinity TX Regional Water District (Water & Sewer Revenue, Build America Mutual Assurance Company Insured) | | | 5.00 | | | | 8-1-2029 | | | | 500,000 | | | | 573,045 | |

| |

| | | | 43,757,932 | |

| | | | | | | | | | | | | | | | |

|

| Vermont: 0.77% | |

Burlington VT Airport (Airport Revenue, AGM Insured) | | | 5.00 | | | | 7-1-2018 | | | | 280,000 | | | | 293,353 | |

Burlington VT Airport (Airport Revenue, AGM Insured) | | | 5.00 | | | | 7-1-2019 | | | | 100,000 | | | | 107,212 | |

Vermont Student Assistance Corporation Series B Class A-2 (Education Revenue) ± | | | 3.94 | | | | 12-3-2035 | | | | 500,000 | | | | 526,930 | |

Vermont Student Assistance Corporation Series B Class B (Education Revenue) ± | | | 1.62 | | | | 6-2-2042 | | | | 3,266,204 | | | | 3,251,179 | |

| |

| | | | 4,178,674 | |

| | | | | | | | | | | | | | | | |

|

| Virgin Islands: 1.28% | |

Virgin Islands PFA Matching Fund Loan Note Senior Lien Series A (Tobacco Revenue) | | | 5.00 | | | | 10-1-2025 | | | | 2,500,000 | | | | 2,123,900 | |

Virgin Islands PFA Series A (Tax Revenue) 144A | | | 5.00 | | | | 10-1-2032 | | | | 5,750,000 | | | | 4,772,788 | |

| |

| | | | 6,896,688 | |

| | | | | | | | | | | | | | | | |

|

| Washington: 4.61% | |

King County WA Public Hospital District #1 Valley Medical Center Refunding Bond (GO Revenue) %% | | | 5.00 | | | | 12-1-2035 | | | | 5,500,000 | | | | 6,020,740 | |

King County WA Public Hospital District Series 2016 (GO Revenue) %% | | | 5.00 | | | | 12-1-2036 | | | | 1,475,000 | | | | 1,609,579 | |

Tacoma WA Solid Waste Series B (Resource Recovery Revenue) | | | 5.00 | | | | 12-1-2026 | | | | 1,135,000 | | | | 1,351,581 | |