UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 12 of its series:

Wells Fargo Diversified Capital Builder Fund, Wells Fargo Diversified Income Builder Fund, Wells Fargo Index Asset Allocation Fund, Wells Fargo International Bond Fund, Wells Fargo Strategic Income Fund, Wells Fargo Global Investment Grade Credit Fund, Wells Fargo C&B Mid Cap Value Fund, Wells Fargo Common Stock Fund, Wells Fargo Discovery Fund, Wells Fargo Enterprise Fund, Wells Fargo Opportunity Fund, and Wells Fargo Special Mid Cap Value Fund.

Date of reporting period: September 30, 2019

ITEM 1. REPORT TO STOCKHOLDERS

Annual Report

September 30, 2019

Wells Fargo

Diversified Capital Builder Fund

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling1-800-222-8222 or by enrolling at wellsfargo.com/advantagedelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-222-8222. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

|

|

|

Reduce clutter. Save trees. |

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/ advantagedelivery |

The views expressed and any forward-looking statements are as of September 30, 2019, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Diversified Capital Builder Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

“December’s S&P 500 Index performance was the worst since 1931.”

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Diversified Capital Builder Fund for the12-month period that ended September 30, 2019. After the first half of the period yielded eitherlow-single-digit or negative investment returns, U.S. stock and global bond investors generally saw markets recover during the second half amid intensifying market volatility, global economic growth concerns, international trade stare downs, and simmering geopolitical tensions.

Overall, fixed-income investors enjoyed a distinct advantage over stock investors. For the period, U.S. stocks, based on the S&P 500 Index,1 gained 4.25% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 fell 1.23%. The MSCI EM Index (Net)3 slipped 2.02%. Among fixed income investors, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 10.30%, the Bloomberg Barclays Global Aggregateex-USD Index5 added 5.34%, the Bloomberg Barclays Municipal Bond Index6 gained 8.55%, and the ICE BofAML U.S. High Yield Index7 added 6.30%.

Investors confronted unsettling events during the fourth quarter of 2018.

During the fourth quarter of 2018, investors grew concerned about the pace and sustainability of the global economic expansion. The U.S. Bureau of Economic Analysis reported third-quarter U.S. gross domestic product (GDP) was 3.4% on an annualized basis, which was down from the second-quarter rate. A partial U.S. government shutdown occurred, which extended into January 2019. Brexit efforts stalled, causing uncertainty for the eurozone. The value of the renminbi declined even as the People’s Bank of China cut reserve requirement ratios, accelerated infrastructure spending, and cut taxes in efforts to spur economic activity.

The combination of news in the U.S. and generally weak economic indicators outside of the U.S. caused investors to seek safe havens. December’s S&P 500 Index performance was the worst since 1931. Globally, fixed-income investments fared better than stocks during the last two months of the year. Even as indicators suggested growth was restrained, the U.S. Federal Reserve (Fed) increased the federal funds rate by 25 basis points (bps; 100 bps equal 1.00%) in December 2018 to a target range of between 2.25% and 2.50%. Many observers expressed concerns that higher rates could slow the economy further.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregateex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-termtax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Diversified Capital Builder Fund

Letter to shareholders (unaudited)

The market climbs a wall of worry.

Investment returns early in 2019 appeared to reaffirm the adage that markets climb a wall of worry as the new year began. The S&P 500 Index gained 8.01% for the month of January, the best monthly performance in 30 years. Returns for the MSCI ACWI ex USA Index (Net), the Bloomberg Barclays U.S. Aggregate Bond Index, and the Bloomberg Barclays Global Aggregateex-USD Index also were positive.

In February 2019, signs of slowing global growth grew more ominous. The Bureau of Economic Analysis announced fourth-quarter 2018 GDP grew at an annualized 2.2% rate, a slower rate than reported for the prior two quarters. In a February report, the Bank of England forecast the slowest growth for 2019 since the financial crisis. China and the U.S. continued to wrangle over trade issues. By the end of the first quarter of 2019, more accommodative Fed sentiment and steady, if not spectacular, U.S. economic and business metrics encouraged domestic investors.

Early second-quarter 2019 enthusiasm among investors faded.

During April 2019, favorable sentiment found additional support in reports of sustained low inflation, solid employment data, and first-quarter U.S. GDP of an annualized rate of 3.2%. During May, markets tumbled on mixed investment signals. In the U.S., partisan wrangling ramped up as Democrats and Republicans set their sights on 2020 presidential politics. The U.K.’s Brexit disagreements caused Prime Minister Theresa May to resign. Boris Johnson succeeded her only to exacerbate uncertainty about Brexit’s resolution ahead of an October 2019 deadline. The European Commission downgraded the 2019 growth forecast to 1.2%. The U.S. increased tariffs on products from China, China responded, and then talks broke down. President Donald Trump threatened to turn his foreign policy tariff tool to Mexico over immigration issues.

During the third quarter of 2019, investors regrouped. Just as the investment horizon appeared to darken, sentiment turned and U.S. equity markets gained during June and July. The gains, primarily driven by geopolitical and monetary policy events, pushed equity markets to new highs. European Central Bank President Mario Draghi said that if the outlook doesn’t improve, the bank would cut rates or buy more assets to prop up inflation. President Trump backed off of tariff threats against Mexico and China. In the U.S., the Fed implemented a 0.25% federal funds rate cut in July.

Later in July 2019, the U.S. reversed course and threatened to impose higher tariffs on China’s exports after talks failed. China responded with tariff threats of its own and devalued the renminbi, a move that roiled global markets. Major U.S. stock market indices closed July with the worst weekly results of the year. Bond prices gained as Treasury yields fell to levels not seen since November 2016 and the yield curve inverted at multiple points along the30-year arc.

In a microcosm, August 2019 encapsulated many of the unnerving events that plagued investors during the prior 11 months. The U.S.-China trade relationship swung from antagonistic to hopeful and back again with no evident compromise on the horizon. Evidence of a continued global economic slowdown mounted. Central banks in China, New Zealand, and Thailand cut interest rates. Industrial and manufacturing data declined in China, Canada, Japan, and Germany. Adding to the uncertain environment, Italy’s prime minister resigned, many feared a crackdown in Hong Kong as protesters sustained their calls for reform throughout the month, and Boris Johnson planned to suspend Parliament as Brexit’s deadline neared.

In the U.S., September saw the Fed join other central banks in cutting interest rates. Manufacturing data in the U.S., as reported by the Institute for Supply Management, disappointed investors. The U.S. Congress announced it would pursue an impeachment investigation of President Trump. Meanwhile, the Brexit impasse showed no signs of

“The S&P 500 Index gained 8.01% for the month of January, the best monthly performance in 30 years.”

Wells Fargo Diversified Capital Builder Fund | 3

Letter to shareholders (unaudited)

|

|

|

For further information about your Fund, contact your investment professional, visit our website at wfam.com, or call us directly at1-800-222-8222. |

resolution. Officials in China said that hitting the country’s economic growth goals for the year would be difficult considering the weight of tariffs and trade restrictions. So while the S&P 500 Index finished the third quarter withyear-to-date returns that were the best in more than 20 years, amid signs of equity investors taking money out of the stock market, concerns about future returns remained.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may potentially unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

4 | Wells Fargo Diversified Capital Builder Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Investment objective

The Fund seeks long-term total return, consisting of capital appreciation and current income.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Robert Junkin‡

Margaret Patel

Average annual total returns (%) as of September 30, 20191

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | | | | | | | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| | | | | | | | | | |

| Class A (EKBAX) | | 1-20-1998 | | | -0.44 | | | | 8.95 | | | | 11.05 | | | | 5.60 | | | | 10.26 | | | | 11.70 | | | | 1.12 | | | | 1.12 | |

| | | | | | | | | | |

| Class C (EKBCX) | | 1-22-1998 | | | 3.81 | | | | 9.43 | | | | 10.87 | | | | 4.81 | | | | 9.43 | | | | 10.87 | | | | 1.87 | | | | 1.87 | |

| | | | | | | | | | |

| Administrator Class (EKBDX)4 | | 7-30-2010 | | | – | | | | – | | | | – | | | | 5.67 | | | | 10.38 | | | | 11.89 | | | | 1.04 | | | | 1.04 | |

| | | | | | | | | | |

| Institutional Class (EKBYX) | | 1-26-1998 | | | – | | | | – | | | | – | | | | 5.98 | | | | 10.64 | | | | 12.13 | | | | 0.79 | | | | 0.78 | |

| | | | | | | | | | |

| Diversified Capital Builder Blended Index5 | | – | | | – | | | | – | | | | – | | | | 4.65 | | | | 9.36 | | | | 11.95 | | | | – | | | | – | |

| | | | | | | | | | |

| ICE BofAML U.S. Cash Pay High Yield Index6 | | – | | | – | | | | – | | | | – | | | | 6.34 | | | | 5.36 | | | | 7.82 | | | | – | | | | – | |

| | | | | | | | | | |

| Russell 1000® Index7 | | – | | | – | | | | – | | | | – | | | | 3.87 | | | | 10.62 | | | | 13.23 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Currentmonth-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximumfront-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without afront-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, high-yield securities risk, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

6 | Wells Fargo Diversified Capital Builder Fund

Performance highlights (unaudited)

|

|

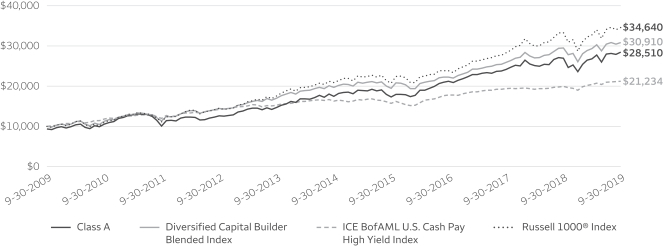

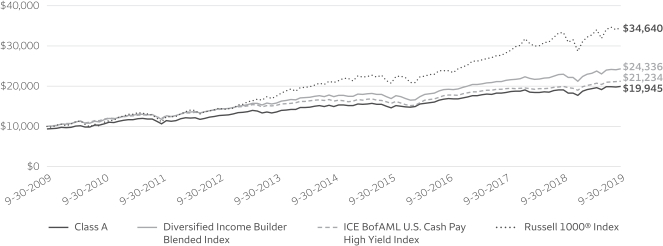

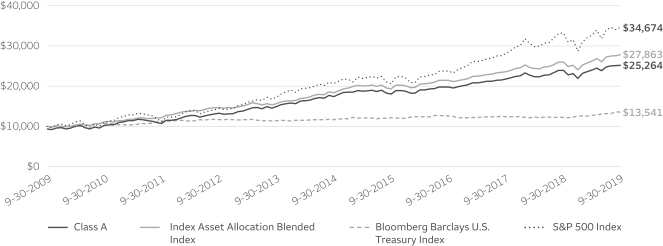

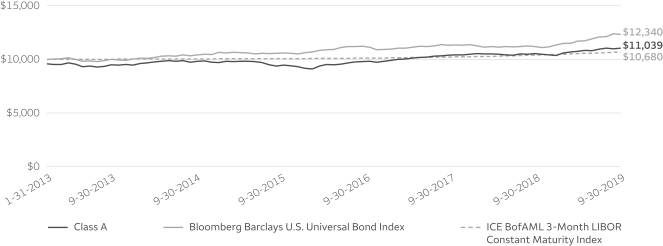

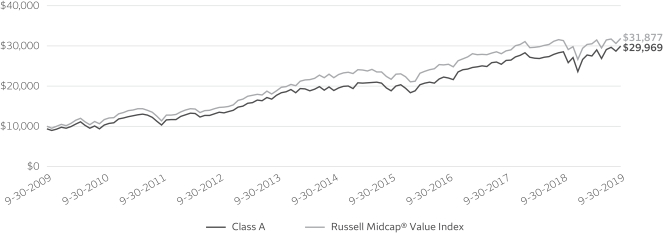

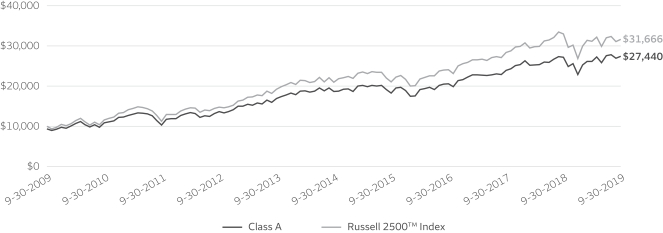

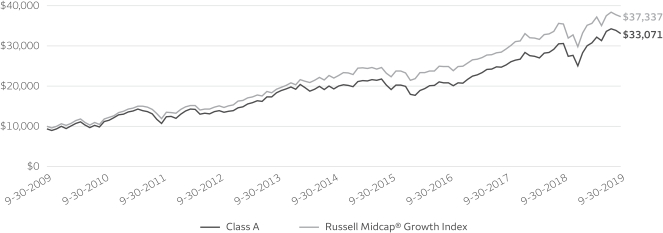

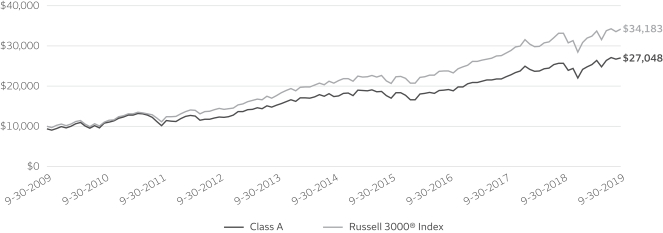

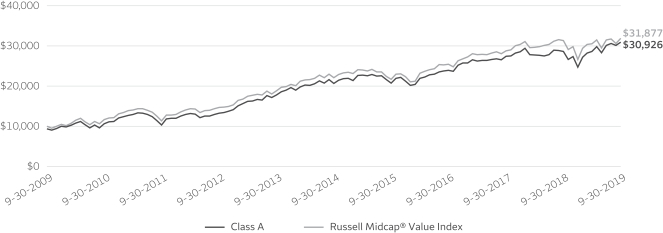

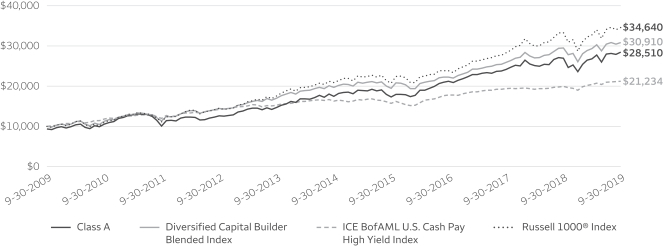

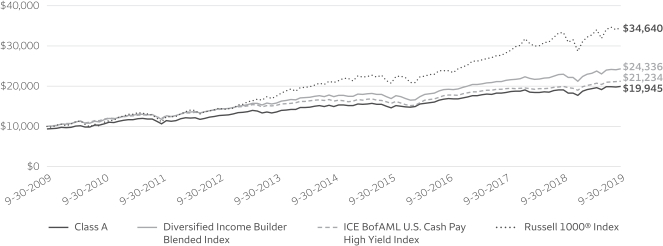

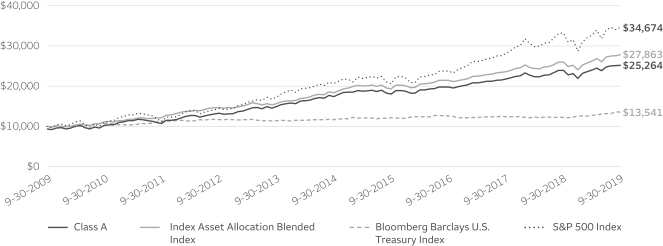

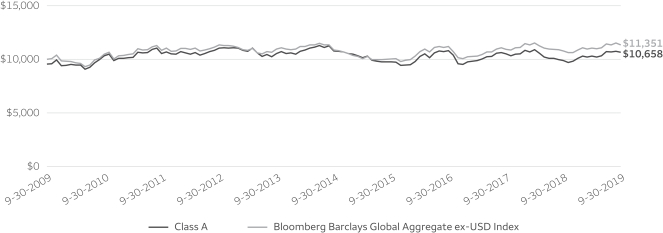

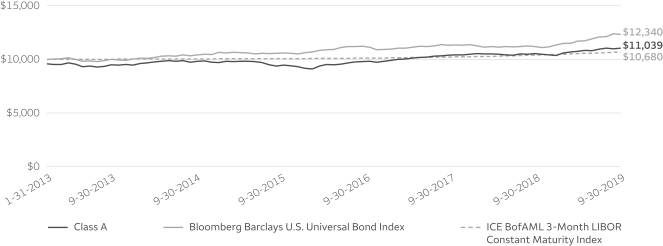

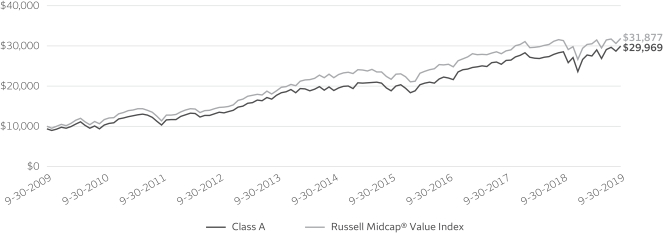

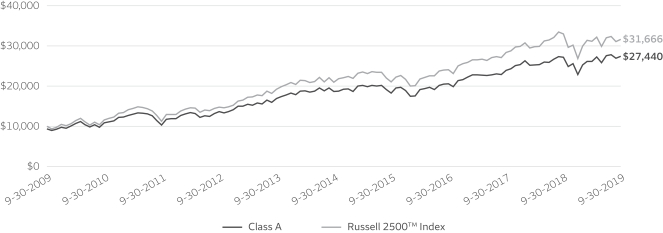

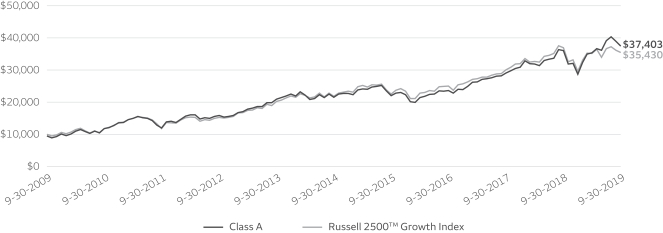

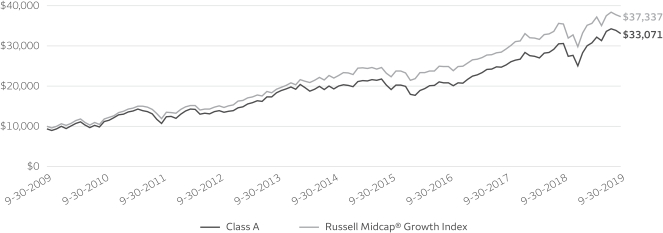

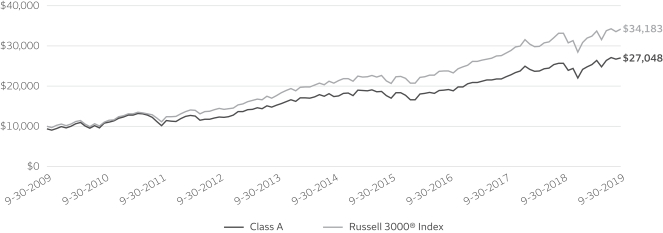

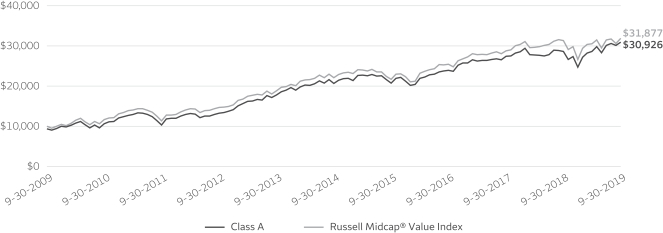

| Growth of $10,000 investment as of September 30, 20198 |

|

|

| ‡ | Mr. Junkin became a portfolio manager of the Fund on April 1, 2019. |

| 1 | Historical performance prior to July 12, 2010, is based on the performance of the Fund’s predecessor, Evergreen Diversified Capital Builder Fund. |

| 2 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3 | The manager has contractually committed through January 31, 2020, to waive fees and/or reimburse expenses to the extent necessary to cap the expenses of each class after fee waivers at 1.20% for Class A, 1.95% for Class C, 1.05% for Administrator Class, and 0.78% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 4 | Historical performance for Administrator Class shares prior to their inception reflects the performance of Institutional Class shares and has been adjusted to reflect the higher expenses applicable to Administrator Class shares. |

| 5 | Source: Wells Fargo Funds Management, LLC. The Diversified Capital Builder Blended Index is composed 75% of the Russell 1000® Index and 25% of the ICE BofAML U.S. Cash Pay High Yield Index. You cannot invest directly in an index. |

| 6 | The ICE BofAML U.S. Cash Pay High Yield Index is an unmanaged market index that provides a broad-based performance measure of thenon-investment grade U.S. domestic bond index. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

| 7 | The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| 8 | The chart compares the performance of Class A shares for the most recent ten years with the Diversified Capital Builder Blended Index, the ICE BofAML U.S. Cash Pay High Yield Index, and the Russell 1000® Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 9 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

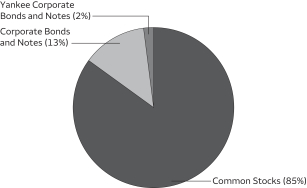

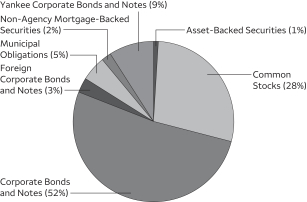

| 10 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

Wells Fargo Diversified Capital Builder Fund | 7

Performance highlights (unaudited)

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund outperformed its benchmark, the Diversified Capital Builder Blended Index, for the12-month period that ended September 30, 2019. |

| ∎ | | The Fund outperformed the benchmark because of outperformance in the consumer discretionary, industrials, and utilities sectors. |

| ∎ | | Information technology (IT) holdings also contributed. Although our holdings somewhat underperformed the sector’s performance in the Russell 1000® Index, IT outperformed other sectors of the market. |

| ∎ | | Our health care holdings had performance about equal to the index’s overall performance, but the performance of Fund holdings in the health care sector significantly outperformed the stocks in the index’s health care sector. |

| ∎ | | Underperforming sectors were the communication services and real estate sectors. |

| ∎ | | In the Fund’s bond portfolio, holdings moderately outperformed the ICE BofAML U.S. Cash Pay High Yield Index due to our above-average-quality holdings. Better-quality below-investment-grade bonds outperformed lower-quality high-yield issues. |

In the first quarter of the Fund’s fiscal year, which ended December 31, 2018, stock prices fell sharply as a result of the Federal Reserve’s (Fed’s) strategy of gradually raising short-term interest rates. The lower prices reflected market participants’ concern that higher rates, even from low levels, would tighten financial conditions and slow the economy, precipitating a recession. However, in January, the Fed reversed course, indicating a policy more sensitive to financial and market conditions in the formulation of future monetary policy. The stock market reacted positively and reached record levels in the fourth and final quarter of the Fund’s fiscal year that ended September 30, 2019.

Reflecting the change in outlook toward the Fed policy of gradually raising rates over the fiscal year, rates on intermediate-maturity Treasury bonds fell steadily during the period. Bond performance in the corporate market also was generally positive, with interest rates declining alongside the drops in Treasury yields, resulting in price increases for most corporate bonds.

| | | | |

|

| Ten largest holdings (%) as of September 30, 20199 | |

| | |

Broadcom Incorporated | | | 3.75 | |

| | |

Vistra Energy Corporation | | | 3.66 | |

| | |

American Electric Power Company Incorporated | | | 3.31 | |

| | |

Amphenol Corporation Class A | | | 3.24 | |

| | |

DTE Energy Company | | | 3.13 | |

| | |

CMS Energy Corporation | | | 3.07 | |

| | |

Atmos Energy Corporation | | | 2.99 | |

| | |

Adobe Systems Incorporated | | | 2.88 | |

| | |

Akamai Technologies Incorporated | | | 2.82 | |

| | |

Leidos Holdings Incorporated | | | 2.57 | |

Stocks gained in value during the period

After an initial setback in equity performance, most stocks gained in value during the fiscal year. Companies continued to report rising sales and profits. In addition, most companies maintained the historically high profit margins that have been characteristic of the market advance since the financial crisis in 2008. By the last quarter of the fiscal year, however, market levels flattened out as investors became concerned about slowing economic growth not only in the U.S. but also in the rest of the world, where economic conditions are not as robust as in the U.S. Additional concerns about tariffs and restrictions on international trade possibly causing slower growth globally also contributed to market caution at the end of the fiscal year.

Please see footnotes on page 7.

8 | Wells Fargo Diversified Capital Builder Fund

Performance highlights (unaudited)

|

|

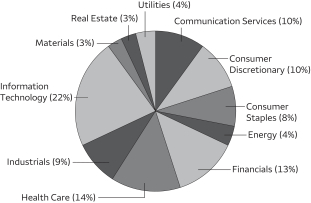

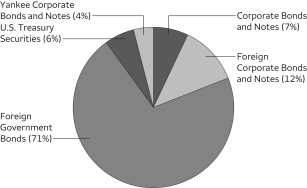

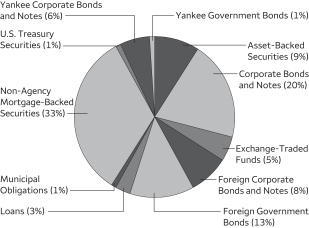

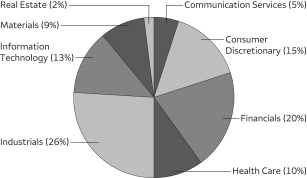

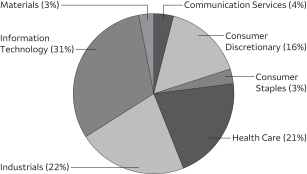

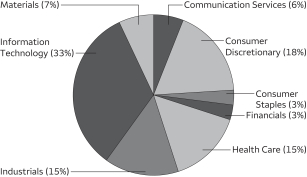

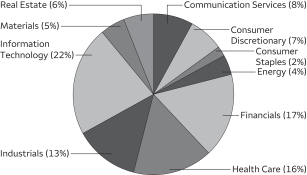

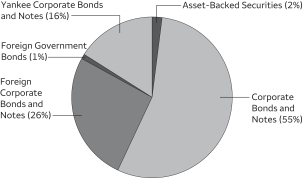

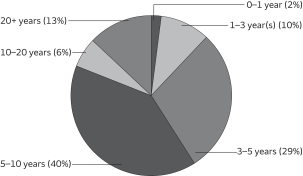

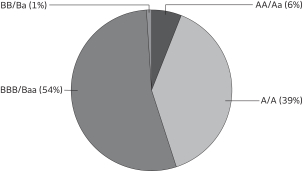

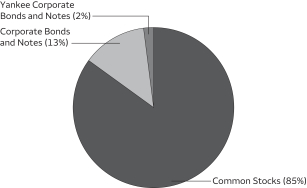

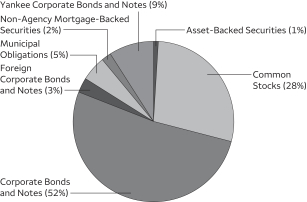

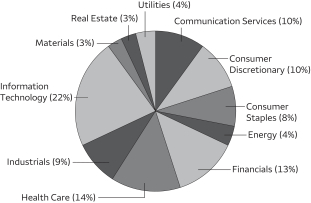

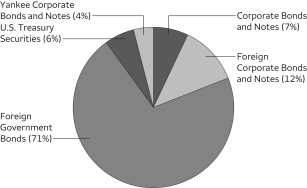

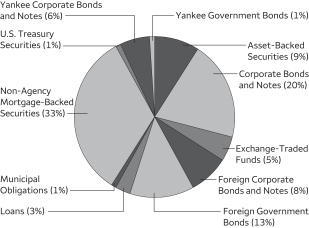

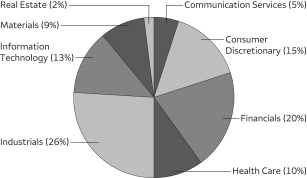

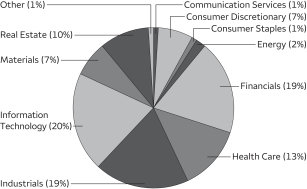

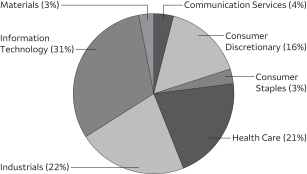

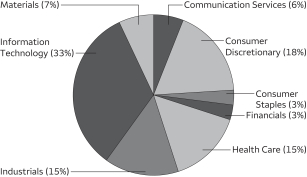

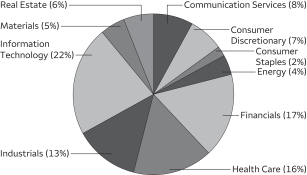

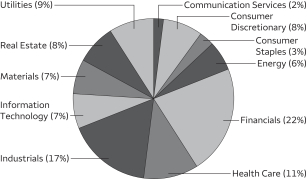

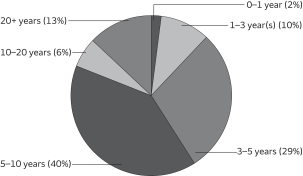

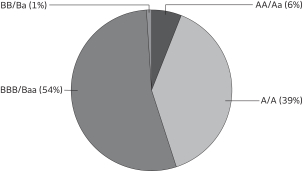

| Portfolio composition as of September 30, 201910 |

|

|

The Fund outperformed relative to its benchmark despite being overweight stocks, which trailed bonds over the12-month period. Within the equity portfolio, its holdings in the health care, utilities, industrials, and consumer discretionary sectors outperformed the return of the equity benchmark. In addition, the Fund’s IT sector holdings, while slightly lagging the sector return of the benchmark, substantially outpaced the average market gain and thus substantially added to incremental returns. Sectors detracting from performance were holdings in the communication services, real estate, materials, and consumer staples sectors.

Equity outperformers in health care included Danaher Corporation and Thermo Fisher Scientific Incorporated. In the utilities sector, American Electric Power Company, Incorporated; CMS Energy Corporation; and DTE Energy Company added to performance. In the IT sector, Akamai Technologies, Incorporated, added value, as did Cypress Semiconductor Corporation, which gained substantially in price after it accepted an acquisition offer from Infineon Technologies AG.

Detractors included energy sector holdings Andeavor Logistics LP* and Centennial Resource Development Incorporated*; materials sector holding Berry Global Group, Incorporated; and IT holdings Salesforce.com, Incorporated, and Corning Incorporated.

U.S. Treasury rates moved lower

In the bond market, interest rates for U.S. Treasury securities, after moving up in the first quarter of the fiscal year, steadily declined over the period’s last three quarters. To illustrate, Treasury issues maturing in 10 years fell from 3.06% at the beginning of the fiscal year to 1.67% bymonth-end September 2019.

High-yield bonds, which historically have been more sensitive to prospects of future economic growth than investment-grade bonds, had price trends that reflected both their equity-like and fixed-income characteristics. In the first quarter of the fiscal year, prices of high-yield bonds dropped, reflecting sharp price corrections in the equity market. However, as the Fed reversed course on monetary policy at the beginning of 2019, prices of high-yield bonds rose as Treasury rates fell. These fluctuations resulted in double-digit total returns for most high-yield bonds based on interest income combined with capital appreciation as yields fell. To illustrate, at the end of September 2018, the average yield to maturity of the index of high-yield bonds was 6.28%, with a yield advantage over similar-maturity U.S. Treasury bonds of 366 basis points (bps; 100 bps equal 1.00%). But at the end of the fiscal year that ended September 30, 2019, the yield to maturity had fallen to 5.87%, with a yield advantage over similar-maturity Treasuries of 420 bps.

In general, lower-quality high-yield bonds underperformed higher-quality high-yield bonds because investors became more concerned with the prospects of poor-credit-quality companies should future economic growth slow materially.

Relative outperformers in the bond portfolio included health care sector holdings AMN Healthcare Services, Incorporated, and DaVita HealthCare Partners Incorporated. In the industrials sector, Resideo Funding Incorporated and SPX FLOW, Incorporated, contributed to performance. Technology sector bonds of Gartner, Incorporated; Seagate Technology plc; and TTM Technologies, Incorporated, outperformed other holdings in the sector. Bond detractors included pharmaceutical company Mallinckrodt plc*; materials sector holding Rayonier Advanced Materials Incorporated; and industrials sector investment CommScope Holding Company, Incorporated.

Our outlook remains one of cautious optimism

The Fund’s positioning reflects our expectation for continued economic growth over the next year, although at levels probably around 1.5% to 2.0%, or somewhat lower than recent economic growth rates. We find stock prices reasonable compared with the earnings growth potential of many stocks. Thus, we are optimistic that equities may provide returns well above those available on the very low yields of risk-free alternatives. In addition, with yields of Treasuries likely to be at low levels for the foreseeable future, we feel stock dividend yields are attractive alternatives to yields offered on short-term fixed-income securities. Within the fixed-income assets of the Fund, virtually all of the bond holdings are of companies with U.S. public equity outstanding, which we think provides a more flexible capital structure and more transparent reporting of financial results. We expect these high-yield bonds to provide a competitive return to that available on lower-yielding, higher-rated bonds.

Please see footnotes on page 7.

Wells Fargo Diversified Capital Builder Fund | 9

Fund expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution(12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of thesix-month period and held for the entire period from April 1, 2019 to September 30, 2019.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

4-1-2019 | | | Ending

account value

9-30-2019 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

| | | | | |

Class A | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,062.68 | | | $ | 5.76 | | | | 1.11 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.49 | | | $ | 5.64 | | | | 1.11 | % |

| | | | | |

Class C | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,058.99 | | | $ | 9.63 | | | | 1.86 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.71 | | | $ | 9.43 | | | | 1.86 | % |

| | | | | |

Administrator Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,062.93 | | | $ | 5.35 | | | | 1.03 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.89 | | | $ | 5.23 | | | | 1.03 | % |

| | | | | |

Institutional Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,064.79 | | | $ | 4.05 | | | | 0.78 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.15 | | | $ | 3.96 | | | | 0.78 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect theone-half-year period). |

10 | Wells Fargo Diversified Capital Builder Fund

Portfolio of investments—September 30, 2019

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| Common Stocks: 84.04% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 1.35% | | | | | | | | | | | | | | | | |

| | | | |

| Media: 1.35% | | | | | | | | | | | | |

Comcast Corporation Class A | | | | | | | | | | | 330,000 | | | $ | 14,876,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 0.53% | | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 0.53% | | | | | | | | | | | | |

The Home Depot Incorporated | | | | | | | | | | | 25,000 | | | | 5,800,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.33% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.33% | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated | | | | | | | | | | | 50,001 | | | | 3,636,073 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 1.11% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 1.11% | | | | | | | | | | | | |

Kinder Morgan Incorporated | | | | | | | | | | | 10,000 | | | | 206,100 | |

ONEOK Incorporated | | | | | | | | | | | 160,000 | | | | 11,790,400 | |

Plains All American Pipeline LP | | | | | | | | | | | 15,000 | | | | 311,250 | |

| | | | |

| | | | | | | | | | | | | | | 12,307,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 1.30% | | | | | | | | | | | | | | | | |

| | | | |

| Insurance: 1.30% | | | | | | | | | | | | |

Chubb Limited | | | | | | | | | | | 35,000 | | | | 5,650,400 | |

The Allstate Corporation | | | | | | | | | | | 80,000 | | | | 8,694,400 | |

| | | | |

| | | | | | | | | | | | | | | 14,344,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 8.21% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 3.63% | | | | | | | | | | | | |

Abbott Laboratories | | | | | | | | | | | 100,000 | | | | 8,367,000 | |

Becton Dickinson & Company | | | | | | | | | | | 45,000 | | | | 11,383,200 | |

Danaher Corporation | | | | | | | | | | | 140,000 | | | | 20,220,200 | |

ElectroCore LLC Ǡ | | | | | | | | | | | 30,000 | | | | 65,700 | |

| | | | |

| | | | | | | | | | | | | | | 40,036,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 0.11% | | | | | | | | | | | | |

HCA Healthcare Incorporated | | | | | | | | | | | 10,000 | | | | 1,204,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 2.91% | | | | | | | | | | | | |

Agilent Technologies Incorporated | | | | | | | | | | | 80,000 | | | | 6,130,400 | |

Bio-Rad Laboratories Incorporated Class A † | | | | | | | | | | | 15,000 | | | | 4,991,100 | |

Illumina Incorporated † | | | | | | | | | | | 2,000 | | | | 608,440 | |

Thermo Fisher Scientific Incorporated | | | | | | | | | | | 70,000 | | | | 20,388,900 | |

| | | | |

| | | | | | | | | | | | | | | 32,118,840 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 1.56% | | | | | | | | | | | | |

Bristol-Myers Squibb Company | | | | | | | | | | | 110,000 | | | | 5,578,100 | |

Horizon Therapeutics plc † | | | | | | | | | | | 100,000 | | | | 2,723,000 | |

Merck KGaA ADR | | | | | | | | | | | 400,000 | | | | 8,992,000 | |

| | | | |

| | | | | | | | | | | | | | | 17,293,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 12.15% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 5.37% | | | | | | | | | | | | |

Curtiss-Wright Corporation | | | | | | | | | | | 165,000 | | | | 21,346,050 | |

Huntington Ingalls Industries Incorporated | | | | | | | | | | | 65,000 | | | | 13,766,350 | |

Wells Fargo Diversified Capital Builder Fund | 11

Portfolio of investments—September 30, 2019

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| | | | |

| Aerospace & Defense (continued) | | | | | | | | | | | | |

L3Harris Technologies Incorporated | | | | | | | | | | | 50,000 | | | $ | 10,432,000 | |

Lockheed Martin Corporation | | | | | | | | | | | 20,000 | | | | 7,801,200 | |

Raytheon Company | | | | | | | | | | | 30,000 | | | | 5,885,700 | |

| | | | |

| | | | | | | | | | | | | | | 59,231,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.21% | | | | | | | | | | | | |

Apogee Enterprises Incorporated | | | | | | | | | | | 60,000 | | | | 2,339,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.37% | | | | | | | | | | | | |

AMETEK Incorporated | | | | | | | | | | | 165,000 | | | | 15,150,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 0.65% | | | | | | | | | | | | |

Honeywell International Incorporated | | | | | | | | | | | 15,000 | | | | 2,538,000 | |

Roper Technologies Incorporated | | | | | | | | | | | 13,000 | | | | 4,635,800 | |

| | | | |

| | | | | | | | | | | | | | | 7,173,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 4.55% | | | | | | | | | | | | |

Crane Company | | | | | | | | | | | 100,000 | | | | 8,063,000 | |

IDEX Corporation | | | | | | | | | | | 120,000 | | | | 19,665,600 | |

John Bean Technologies Corporation | | | | | | | | | | | 180,000 | | | | 17,897,400 | |

Oshkosh Corporation | | | | | | | | | | | 60,000 | | | | 4,548,000 | |

| | | | |

| | | | | | | | | | | | | | | 50,174,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 30.97% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 1.26% | | | | | | | | | | | | |

Cisco Systems Incorporated | | | | | | | | | | | 280,000 | | | | 13,834,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 6.91% | | | | | | | | | | | | |

Amphenol Corporation Class A | | | | | | | | | | | 370,000 | | | | 35,705,000 | |

Corning Incorporated | | | | | | | | | | | 670,000 | | | | 19,108,400 | |

FLIR Systems Incorporated | | | | | | | | | | | 345,000 | | | | 18,143,550 | |

MTS Systems Corporation | | | | | | | | | | | 60,000 | | | | 3,315,000 | |

| | | | |

| | | | | | | | | | | | | | | 76,271,950 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 5.38% | | | | | | | | | | | | |

Akamai Technologies Incorporated † | | | | | | | | | | | 340,000 | | | | 31,069,200 | |

Leidos Holdings Incorporated | | | | | | | | | | | 330,000 | | | | 28,340,400 | |

| | | | |

| | | | | | | | | | | | | | | 59,409,600 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 8.90% | | | | | | | | | | | | |

Advanced Micro Devices Incorporated † | | | | | | | | | | | 610,000 | | | | 17,683,900 | |

Broadcom Incorporated | | | | | | | | | | | 150,000 | | | | 41,410,500 | |

Microchip Technology Incorporated | | | | | | | | | | | 235,000 | | | | 21,833,850 | |

Micron Technology Incorporated † | | | | | | | | | | | 35,000 | | | | 1,499,750 | |

Texas Instruments Incorporated | | | | | | | | | | | 70,000 | | | | 9,046,800 | |

Xilinx Incorporated | | | | | | | | | | | 70,000 | | | | 6,713,000 | |

| | | | |

| | | | | | | | | | | | | | | 98,187,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 7.71% | | | | | | | | | | | | |

Adobe Systems Incorporated † | | | | | | | | | | | 115,000 | | | | 31,768,750 | |

ANSYS Incorporated † | | | | | | | | | | | 45,000 | | | | 9,961,200 | |

Nutanix Incorporated Class A † | | | | | | | | | | | 50,000 | | | | 1,312,500 | |

Palo Alto Networks Incorporated † | | | | | | | | | | | 55,000 | | | | 11,210,650 | |

Salesforce.com Incorporated † | | | | | | | | | | | 80,000 | | | | 11,875,200 | |

12 | Wells Fargo Diversified Capital Builder Fund

Portfolio of investments—September 30, 2019

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| | | | |

| Software (continued) | | | | | | | | | | | | |

ServiceNow Incorporated † | | | | | | | | | | | 37,000 | | | $ | 9,392,450 | |

Synopsys Incorporated † | | | | | | | | | | | 70,000 | | | | 9,607,500 | |

| | | | |

| | | | | | | | | | | | | | | 85,128,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.81% | | | | | | | | | | | | |

Pure Storage Incorporated Class A † | | | | | | | | | | | 175,000 | | | | 2,964,500 | |

Western Digital Corporation | | | | | | | | | | | 100,000 | | | | 5,964,000 | |

| | | | |

| | | | | | | | | | | | | | | 8,928,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 7.99% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 6.26% | | | | | | | | | | | | |

Celanese Corporation Series A | | | | | | | | | | | 75,000 | | | | 9,171,750 | |

Eastman Chemical Company | | | | | | | | | | | 80,000 | | | | 5,906,400 | |

Huntsman Corporation | | | | | | | | | | | 630,000 | | | | 14,653,800 | |

LyondellBasell Industries NV Class A | | | | | | | | | | | 280,000 | | | | 25,051,600 | |

Olin Corporation | | | | | | | | | | | 60,000 | | | | 1,123,200 | |

The Sherwin-Williams Company | | | | | | | | | | | 17,000 | | | | 9,347,790 | |

Tronox Holdings plc Class A | | | | | | | | | | | 150,000 | | | | 1,245,000 | |

Westlake Chemical Corporation | | | | | | | | | | | 40,000 | | | | 2,620,800 | |

| | | | |

| | | | | | | | | | | | | | | 69,120,340 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 1.73% | | | | | | | | | | | | |

AptarGroup Incorporated | | | | | | | | | | | 81,500 | | | | 9,653,675 | |

Berry Global Group Incorporated † | | | | | | | | | | | 240,000 | | | | 9,424,800 | |

| | | | |

| | | | | | | | | | | | | | | 19,078,475 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 2.38% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 2.38% | | | | | | | | | | | | |

Crown Castle International Corporation | | | | | | | | | | | 150,000 | | | | 20,851,500 | |

Iron Mountain Incorporated | | | | | | | | | | | 50,000 | | | | 1,619,500 | |

Saul Centers Incorporated | | | | | | | | | | | 70,000 | | | | 3,815,700 | |

| | | | |

| | | | | | | | | | | | | | | 26,286,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 17.72% | | | | | | | | | | | | | | | | |

| | | | |

| Electric Utilities: 4.76% | | | | | | | | | | | | |

American Electric Power Company Incorporated | | | | | | | | | | | 390,000 | | | | 36,539,100 | |

Pinnacle West Capital Corporation | | | | | | | | | | | 165,000 | | | | 16,016,550 | |

| | | | |

| | | | | | | | | | | | | | | 52,555,650 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities: 2.99% | | | | | | | | | | | | |

Atmos Energy Corporation | | | | | | | | | | | 290,000 | | | | 33,028,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 3.66% | | | | | | | | | | | | |

Vistra Energy Corporation | | | | | | | | | | | 1,510,000 | | | | 40,362,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multi-Utilities: 6.31% | | | | | | | | | | | | |

CMS Energy Corporation | | | | | | | | | | | 530,000 | | | | 33,893,500 | |

DTE Energy Company | | | | | | | | | | | 260,000 | | | | 34,569,600 | |

NiSource Incorporated | | | | | | | | | | | 40,000 | | | | 1,196,800 | |

| | | | |

| | | | | | | | | | | | | | | 69,659,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $766,056,388) | | | | | | | | | | | | | | | 927,538,928 | |

| | | | | | | | | | | | | | | | |

Wells Fargo Diversified Capital Builder Fund | 13

Portfolio of investments—September 30, 2019

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Corporate Bonds and Notes: 13.17% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 0.23% | | | | | | | | | | | | | | | | |

| | | | |

| Media: 0.23% | | | | | | | | | | | | |

McGraw-Hill Global Education Holdings LLC 144A« | | | 7.88 | % | | | 5-15-2024 | | | $ | 3,000,000 | | | $ | 2,595,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 0.44% | | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 0.19% | | | | | | | | | | | | |

Speedway Motorsports Incorporated | | | 5.13 | | | | 2-1-2023 | | | | 2,000,000 | | | | 2,030,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 0.25% | | | | | | | | | | | | |

Installed Building Company 144A | | | 5.75 | | | | 2-1-2028 | | | | 2,700,000 | | | | 2,784,374 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.19% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.19% | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated 144A | | | 4.88 | | | | 11-1-2026 | | | | 2,000,000 | | | | 2,095,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 3.38% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 0.68% | | | | | | | | | | | | |

Teleflex Incorporated | | | 4.88 | | | | 6-1-2026 | | | | 7,175,000 | | | | 7,479,938 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.61% | | | | | | | | | | | | |

AMN Healthcare Incorporated 144A | | | 5.13 | | | | 10-1-2024 | | | | 13,512,000 | | | | 14,018,700 | |

DaVita Incorporated | | | 5.00 | | | | 5-1-2025 | | | | 7,000,000 | | | | 6,973,750 | |

DaVita Incorporated | | | 5.13 | | | | 7-15-2024 | | | | 1,000,000 | | | | 1,016,250 | |

West Street Merger Subordinate Bond Incorporated 144A | | | 6.38 | | | | 9-1-2025 | | | | 7,400,000 | | | | 6,808,000 | |

| | | | |

| | | | | | | | | | | | | | | 28,816,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.09% | | | | | | | | | | | | |

Catalent Pharma Solutions Incorporated 144A | | | 4.88 | | | | 1-15-2026 | | | | 1,000,000 | | | | 1,028,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 3.57% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 0.81% | | | | | | | | | | | | |

TransDigm Group Incorporated | | | 6.38 | | | | 6-15-2026 | | | | 7,000,000 | | | | 7,358,750 | |

TransDigm Group Incorporated | | | 6.50 | | | | 5-15-2025 | | | | 1,500,000 | | | | 1,556,250 | |

| | | | |

| | | | | | | | | | | | | | | 8,915,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.14% | | | | | | | | | | | | |

ACCO Brands Corporation 144A | | | 5.25 | | | | 12-15-2024 | | | | 1,500,000 | | | | 1,552,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.25% | | | | | | | | | | | | |

Resideo Funding Incorporated 144A | | | 6.13 | | | | 11-1-2026 | | | | 13,112,000 | | | | 13,833,160 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 1.00% | | | | | | | | | | | | |

SPX FLOW Incorporated 144A | | | 5.88 | | | | 8-15-2026 | | | | 10,500,000 | | | | 10,972,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 0.37% | | | | | | | | | | | | |

WESCO Distribution Incorporated | | | 5.38 | | | | 6-15-2024 | | | | 4,000,000 | | | | 4,130,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 3.41% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.51% | | | | | | | | | | | | |

CommScope Incorporated 144A | | | 5.50 | | | | 6-15-2024 | | | | 6,000,000 | | | | 5,638,080 | |

| | | | | | | | | | | | | | | | |

14 | Wells Fargo Diversified Capital Builder Fund

Portfolio of investments—September 30, 2019

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Electronic Equipment, Instruments & Components: 1.50% | | | | | | | | | | | | |

MTS Systems Corporation 144A | | | 5.75 | % | | | 8-15-2027 | | | $ | 3,000,000 | | | $ | 3,120,000 | |

TTM Technologies Incorporated 144A« | | | 5.63 | | | | 10-1-2025 | | | | 13,505,000 | | | | 13,505,000 | |

| | | | |

| | | | | | | | | | | | | | | 16,625,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 0.93% | | | | | | | | | | | | |

Gartner Incorporated 144A | | | 5.13 | | | | 4-1-2025 | | | | 9,779,000 | | | | 10,231,279 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 0.28% | | | | | | | | | | | | |

Nuance Communications Company | | | 6.00 | | | | 7-1-2024 | | | | 3,000,000 | | | | 3,135,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.19% | | | | | | | | | | | | |

Western Digital Corporation | | | 4.75 | | | | 2-15-2026 | | | | 2,000,000 | | | | 2,057,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 1.76% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 1.58% | | | | | | | | | | | | |

Koppers Incorporated 144A | | | 6.00 | | | | 2-15-2025 | | | | 8,190,000 | | | | 8,195,160 | |

Olin Corporation | | | 5.50 | | | | 8-15-2022 | | | | 1,000,000 | | | | 1,055,000 | |

Platform Specialty Products Corporation 144A | | | 5.88 | | | | 12-1-2025 | | | | 3,000,000 | | | | 3,139,800 | |

Rayonier Advanced Materials Products Incorporated 144A | | | 5.50 | | | | 6-1-2024 | | | | 4,130,000 | | | | 3,017,481 | |

Valvoline Incorporated | | | 4.38 | | | | 8-15-2025 | | | | 2,000,000 | | | | 2,035,000 | |

| | | | |

| | | | | | | | | | | | | | | 17,442,441 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.18% | | | | | | | | | | | | |

Berry Global Incorporated 144A | | | 4.50 | | | | 2-15-2026 | | | | 2,000,000 | | | | 1,972,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 0.19% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 0.19% | | | | | | | | | | | | |

Iron Mountain Incorporated 144A | | | 5.38 | | | | 6-1-2026 | | | | 2,000,000 | | | | 2,060,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes (Cost $143,012,081) | | | | | | | | | | | | | | | 145,394,722 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Yankee Corporate Bonds and Notes: 1.93% | | | | | | | | | | | | |

| | | | |

Financials: 0.43% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 0.43% | | | | | | | | | | | | |

Tronox Finance plc 144A | | | 5.75 | | | | 10-1-2025 | | | | 5,000,000 | | | | 4,728,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 1.50% | | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.50% | | | | | | | | | | | | |

Seagate HDD | | | 4.75 | | | | 6-1-2023 | | | | 9,500,000 | | | | 9,937,684 | |

Seagate HDD | | | 4.88 | | | | 6-1-2027 | | | | 6,396,000 | | | | 6,604,561 | |

| | | | |

| | | | | | | | | | | | | | | 16,542,245 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $20,013,880) | | | | | | | | | | | | | | | 21,270,995 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Yield | | | | | | Shares | | | | |

| Short-Term Investments: 1.04% | | | | | | | | | | | | |

| | | | |

| Investment Companies: 1.04% | | | | | | | | | | | | |

Securities Lending Cash Investments LLC (l)(r)(u) | | | 2.11 | | | | | | | | 5,714,900 | | | | 5,715,472 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 1.88 | | | | | | | | 5,712,610 | | | | 5,712,610 | |

| | | | |

Total Short-Term Investments (Cost $11,428,082) | | | | | | | | | | | | | | | 11,428,082 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $940,510,431) | | | 100.18 | % | | | 1,105,632,727 | |

| | |

Other assets and liabilities, net | | | (0.18 | ) | | | (2,003,789 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 1,103,628,938 | |

| | | | | | | | |

Wells Fargo Diversified Capital Builder Fund | 15

Portfolio of investments—September 30, 2019

| « | All or a portion of this security is on loan. |

| † | Non-income-earning security |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is anon-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the7-day annualized yield at period end. |

Abbreviations:

| ADR | American depositary receipt |

| REIT | Real estate investment trust |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end of

period | | | % of

net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investments LLC | | | 14,415,390 | | | | 146,589,697 | | | | 155,290,187 | | | | 5,714,900 | | | $ | (670 | ) | | $ | 0 | | | $ | 390,629 | # | | $ | 5,715,472 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 22,600,022 | | | | 416,436,441 | | | | 433,323,853 | | | | 5,712,610 | | | | 0 | | | | 0 | | | | 353,260 | | | | 5,712,610 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (670 | ) | | $ | 0 | | | $ | 743,889 | | | $ | 11,428,082 | | | | 1.04 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| # | Amount shown represents income before fees and rebates |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Diversified Capital Builder Fund

Statement of assets and liabilities—September 30, 2019

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities, (including $5,528,453 of securities on loan) at value (cost $929,082,349) | | $ | 1,094,204,645 | |

Investments in affiliated securities, at value (cost $11,428,082) | | | 11,428,082 | |

Receivable for Fund shares sold | | | 1,405,406 | |

Receivable for dividends and interest | | | 3,935,775 | |

Receivable for securities lending income, net | | | 3,434 | |

Prepaid expenses and other assets | | | 175,321 | |

| | | | |

Total assets | | | 1,111,152,663 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 5,716,509 | |

Payable for Fund shares redeemed | | | 829,750 | |

Management fee payable | | | 557,828 | |

Administration fees payable | | | 165,472 | |

Distribution fee payable | | | 72,181 | |

Trustees’ fees and expenses payable | | | 2,246 | |

Accrued expenses and other liabilities | | | 179,739 | |

| | | | |

Total liabilities | | | 7,523,725 | |

| | | | |

Total net assets | | $ | 1,103,628,938 | |

| | | | |

| |

Net assets consist of | | | | |

Paid-in capital | | $ | 890,051,184 | |

Total distributable earnings | | | 213,577,754 | |

| | | | |

Total net assets | | $ | 1,103,628,938 | |

| | | | |

| |

Computation of net asset value and offering price per share | | | | |

Net assets – Class A | | $ | 616,345,852 | |

Shares outstanding – Class A1 | | | 57,528,842 | |

Net asset value per share – Class A | | | $10.71 | |

Maximum offering price per share – Class A2 | | | $11.36 | |

Net assets – Class C | | $ | 118,296,693 | |

Shares outstanding – Class C1 | | | 11,066,066 | |

Net asset value per share – Class C | | | $10.69 | |

Net assets – Administrator Class | | $ | 9,707,918 | |

Shares outstanding – Administrator Class1 | | | 905,183 | |

Net asset value per share – Administrator Class | | | $10.72 | |

Net assets – Institutional Class | | $ | 359,278,475 | |

Shares outstanding – Institutional Class1 | | | 33,771,722 | |

Net asset value per share – Institutional Class | | | $10.64 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Diversified Capital Builder Fund | 17

Statement of operations—year ended September 30, 2019

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $15,223) | | $ | 14,061,326 | |

Interest | | | 11,364,415 | |

Income from affiliated securities | | | 405,545 | |

| | | | |

Total investment income | | | 25,831,286 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 6,415,796 | |

Administration fees | |

Class A | | | 1,203,693 | |

Class C | | | 241,778 | |

Administrator Class | | | 14,593 | |

Institutional Class | | | 431,848 | |

Shareholder servicing fees | |

Class A | | | 1,432,968 | |

Class C | | | 287,831 | |

Administrator Class | | | 28,063 | |

Distribution fee | |

Class C | | | 863,471 | |

Custody and accounting fees | | | 49,001 | |

Professional fees | | | 46,111 | |

Registration fees | | | 104,733 | |

Shareholder report expenses | | | 104,733 | |

Trustees’ fees and expenses | | | 21,652 | |

Other fees and expenses | | | 33,789 | |

| | | | |

Total expenses | | | 11,280,060 | |

Less: Fee waivers and/or expense reimbursements | | | | |

Administrator Class | | | (101 | ) |

Institutional Class | | | (23,260 | ) |

| | | | |

Net expenses | | | 11,256,699 | |

| | | | |

Net investment income | | | 14,574,587 | |

| | | | |

| |

Realized and unrealized gains (losses) on investments | | | | |

Net realized gains (losses) on | | | | |

Unaffiliated securities | | | 53,802,578 | |

Affiliated securities | | | (670 | ) |

| | | | |

Net realized gains on investments | | | 53,801,908 | |

Net change in unrealized gains (losses) on investments | | | (8,891,274 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 44,910,634 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 59,485,221 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Diversified Capital Builder Fund

Statement of changes in net assets

| | | | | | | | | | | | | | | | |

| | | Year ended

September 30, 2019 | | | Year ended

September 30, 2018 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 14,574,587 | | | | | | | $ | 9,550,632 | |

Net realized gains on investments | | | | | | | 53,801,908 | | | | | | | | 45,547,043 | |

Net change in unrealized gains (losses) on investments | | | | | | | (8,891,274 | ) | | | | | | | 53,496,076 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 59,485,221 | | | | | | | | 108,593,751 | |

| | | | |

| | | | |

Distributions to shareholders from net investment income and net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (36,253,338 | ) | | | | | | | (31,088,631 | ) |

Class C | | | | | | | (7,460,798 | ) | | | | | | | (5,826,986 | ) |

Administrator Class | | | | | | | (764,433 | ) | | | | | | | (638,260 | ) |

Institutional Class | | | | | | | (21,977,654 | ) | | | | | | | (16,658,344 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (66,456,223 | ) | | | | | | | (54,212,221 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 9,391,056 | | | | 93,260,195 | | | | 4,168,569 | | | | 43,865,273 | |

Class C | | | 4,595,019 | | | | 46,061,402 | | | | 3,054,283 | | | | 32,032,658 | |

Administrator Class | | | 227,726 | | | | 2,281,752 | | | | 507,748 | | | | 5,354,505 | |

Institutional Class | | | 15,448,752 | | | | 154,786,786 | | | | 10,093,186 | | | | 106,245,129 | |

| | | | |

| | | | | | | 296,390,135 | | | | | | | | 187,497,565 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 3,667,392 | | | | 34,796,863 | | | | 2,909,042 | | | | 29,709,824 | |

Class C | | | 774,676 | | | | 7,255,587 | | | | 555,563 | | | | 5,639,821 | |

Administrator Class | | | 79,989 | | | | 758,159 | | | | 60,161 | | | | 615,499 | |

Institutional Class | | | 2,124,090 | | | | 20,080,474 | | | | 1,566,794 | | | | 15,933,541 | |

| | | | |

| | | | | | | 62,891,083 | | | | | | | | 51,898,685 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (8,342,798 | ) | | | (83,876,599 | ) | | | (7,765,843 | ) | | | (81,546,998 | ) |

Class C | | | (6,420,901 | ) | | | (63,323,374 | ) | | | (2,906,268 | ) | | | (30,438,895 | ) |

Administrator Class | | | (671,418 | ) | | | (7,048,173 | ) | | | (290,129 | ) | | | (3,037,359 | ) |

Institutional Class | | | (13,982,283 | ) | | | (140,897,557 | ) | | | (7,121,216 | ) | | | (73,887,823 | ) |

| | | | |

| | | | | | | (295,145,703 | ) | | | | | | | (188,911,075 | ) |

| | | | |

Net increase in net assets resulting from capital share transactions | | | | | | | 64,135,515 | | | | | | | | 50,485,175 | |

| | | | |

Total increase in net assets | | | | | | | 57,164,513 | | | | | | | | 104,866,705 | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 1,046,464,425 | | | | | | | | 941,597,720 | |

| | | | |

End of period | | | | | | $ | 1,103,628,938 | | | | | | | $ | 1,046,464,425 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Diversified Capital Builder Fund | 19

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| CLASS A | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $10.88 | | | | $10.30 | | | | $9.96 | | | | $9.12 | | | | $9.31 | |

Net investment income | | | 0.14 | | | | 0.10 | | | | 0.14 | 1 | | | 0.17 | | | | 0.11 | |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 1.06 | | | | 1.12 | | | | 1.71 | | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.51 | | | | 1.16 | | | | 1.26 | | | | 1.88 | | | | (0.09 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.14 | ) | | | (0.09 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.10 | ) |

Net realized gains | | | (0.54 | ) | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.68 | ) | | | (0.58 | ) | | | (0.92 | ) | | | (1.04 | ) | | | (0.10 | ) |

Net asset value, end of period | | | $10.71 | | | | $10.88 | | | | $10.30 | | | | $9.96 | | | | $9.12 | |

Total return2 | | | 5.60 | % | | | 11.72 | % | | | 13.62 | % | | | 22.85 | % | | | (1.05 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.12 | % | | | 1.11 | % | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % |

Net expenses | | | 1.12 | % | | | 1.11 | % | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % |

Net investment income | | | 1.38 | % | | | 0.96 | % | | | 1.43 | % | | | 1.77 | % | | | 1.17 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 61 | % | | | 31 | % | | | 54 | % | | | 73 | % | | | 69 | % |

Net assets, end of period (000s omitted) | | | $616,346 | | | | $574,760 | | | | $551,272 | | | | $467,503 | | | | $402,303 | |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo Diversified Capital Builder Fund

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| CLASS C | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $10.86 | | | | $10.28 | | | | $9.96 | | | | $9.12 | | | | $9.32 | |

Net investment income | | | 0.06 | | | | 0.02 | | | | 0.08 | | | | 0.10 | | | | 0.05 | |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 1.06 | | | | 1.11 | | | | 1.72 | | | | (0.22 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.43 | | | | 1.08 | | | | 1.19 | | | | 1.82 | | | | (0.17 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.01 | ) | | | (0.09 | ) | | | (0.09 | ) | | | (0.03 | ) |

Net realized gains | | | (0.54 | ) | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.60 | ) | | | (0.50 | ) | | | (0.87 | ) | | | (0.98 | ) | | | (0.03 | ) |

Net asset value, end of period | | | $10.69 | | | | $10.86 | | | | $10.28 | | | | $9.96 | | | | $9.12 | |

Total return1 | | | 4.81 | % | | | 10.88 | % | | | 12.85 | % | | | 21.96 | % | | | (1.88 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.87 | % | | | 1.87 | % | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % |

Net expenses | | | 1.87 | % | | | 1.87 | % | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % |

Net investment income | | | 0.65 | % | | | 0.21 | % | | | 0.65 | % | | | 1.03 | % | | | 0.41 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 61 | % | | | 31 | % | | | 54 | % | | | 73 | % | | | 69 | % |

Net assets, end of period (000s omitted) | | | $118,297 | | | | $131,601 | | | | $117,346 | | | | $67,630 | | | | $53,373 | |

| 1 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Diversified Capital Builder Fund | 21

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| ADMINISTRATOR CLASS | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $10.89 | | | | $10.32 | | | | $9.97 | | | | $9.12 | | | | $9.32 | |

Net investment income | | | 0.15 | 1 | | | 0.11 | 1 | | | 0.16 | 1 | | | 0.18 | 1 | | | 0.14 | 1 |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 1.06 | | | | 1.12 | | | | 1.73 | | | | (0.22 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.52 | | | | 1.17 | | | | 1.28 | | | | 1.91 | | | | (0.08 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.15 | ) | | | (0.11 | ) | | | (0.15 | ) | | | (0.17 | ) | | | (0.12 | ) |

Net realized gains | | | (0.54 | ) | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.69 | ) | | | (0.60 | ) | | | (0.93 | ) | | | (1.06 | ) | | | (0.12 | ) |

Net asset value, end of period | | | $10.72 | | | | $10.89 | | | | $10.32 | | | | $9.97 | | | | $9.12 | |

Total return | | | 5.67 | % | | | 11.73 | % | | | 13.75 | % | | | 23.14 | % | | | (0.92 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.04 | % | | | 1.03 | % | | | 1.04 | % | | | 1.06 | % | | | 1.05 | % |

Net expenses | | | 1.04 | % | | | 1.03 | % | | | 1.04 | % | | | 1.03 | % | | | 0.95 | % |

Net investment income | | | 1.47 | % | | | 1.04 | % | | | 1.58 | % | | | 1.89 | % | | | 1.41 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 61 | % | | | 31 | % | | | 54 | % | | | 73 | % | | | 69 | % |

Net assets, end of period (000s omitted) | | | $9,708 | | | | $13,821 | | | | $10,225 | | | | $21,398 | | | | $7,898 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

22 | Wells Fargo Diversified Capital Builder Fund

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| INSTITUTIONAL CLASS | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $10.81 | | | | $10.25 | | | | $9.90 | | | | $9.07 | | | | $9.27 | |

Net investment income | | | 0.18 | | | | 0.14 | | | | 0.19 | | | | 0.20 | | | | 0.15 | |

Net realized and unrealized gains (losses) on investments | | | 0.36 | | | | 1.05 | | | | 1.11 | | | | 1.71 | | | | (0.21 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.54 | | | | 1.19 | | | | 1.30 | | | | 1.91 | | | | (0.06 | ) |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.17 | ) | | | (0.14 | ) | | | (0.17 | ) | | | (0.19 | ) | | | (0.14 | ) |

Net realized gains | | | (0.54 | ) | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.71 | ) | | | (0.63 | ) | | | (0.95 | ) | | | (1.08 | ) | | | (0.14 | ) |

Net asset value, end of period | | | $10.64 | | | | $10.81 | | | | $10.25 | | | | $9.90 | | | | $9.07 | |

Total return | | | 5.98 | % | | | 12.04 | % | | | 14.11 | % | | | 23.28 | % | | | (0.75 | )% |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.79 | % | | | 0.79 | % | | | 0.79 | % | | | 0.81 | % | | | 0.79 | % |

Net expenses | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.77 | % |

Net investment income | | | 1.73 | % | | | 1.30 | % | | | 1.71 | % | | | 2.14 | % | | | 1.58 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 61 | % | | | 31 | % | | | 54 | % | | | 73 | % | | | 69 | % |

Net assets, end of period (000s omitted) | | | $359,278 | | | | $326,283 | | | | $262,754 | | | | $122,769 | | | | $97,251 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Diversified Capital Builder Fund | 23

Notes to financial statements

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is anopen-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”)Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Diversified Capital Builder Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.