UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Alexander Kymn

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: July 31

Registrant is making a filing for 11 of its series:

Wells Fargo Capital Growth Fund, Wells Fargo Disciplined U.S. Core Fund, Wells Fargo Endeavor Select Fund, Wells Fargo Growth Fund, Wells Fargo Classic Value Fund, Wells Fargo Large Cap Core Fund, Wells Fargo Large Cap Growth Fund, Wells Fargo Large Company Value Fund, Wells Fargo Low Volatility U.S. Equity Fund, Wells Fargo Omega Growth Fund, and Wells Fargo Premier Large Company Growth Fund.

Date of reporting period: July 31, 2019

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

July 31, 2019

Wells Fargo Capital Growth Fund

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling1-800-222-8222 or by enrolling at wellsfargo.com/advantagedelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-222-8222. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

|

|

|

Reduce clutter. Save trees. |

Sign up for electronic delivery of prospectuses and shareholder reports atwellsfargo.com/advantagedelivery |

The views expressed and any forward-looking statements are as of July 31, 2019, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Capital Growth Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Capital Growth Fund for the 12-month period that ended July 31, 2019. After the first six months of the period yielded either low-single-digit or negative investment returns, U.S. stock and global bond investors generally enjoyed a recovery during the final six months amid continued concerns about global economic growth, international trade, geopolitical tensions, and bouts of market volatility. These concerns negatively influenced international equity markets.

For the period, U.S. stocks, based on the S&P 500 Index,1 gained 7.99% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 fell 2.27%. The MSCI EM Index (Net)3 slipped 2.18%. For bond investors, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 8.08%, the Bloomberg Barclays Global Aggregate ex-USD Index5 added 3.74%, the Bloomberg Barclays Municipal Bond Index6 gained 7.31%, and the ICE BofAML U.S. High Yield Index7 added 6.94%.

Entering the fourth quarter of 2018, economic data was encouraging.

Domestic equity investors entered the fourth quarter of 2018 with reasons to be optimistic. The U.S. Bureau of Economic Analysis reported second-quarter annualized gross domestic product (GDP) growth of 4.2%. Hiring improved. Unemployment declined. Consumer confidence and spending increased. Third-quarter corporate earnings reports were generally positive. U.S. trade negotiations with Mexico and Canada progressed. The U.S. Federal Reserve (Fed) raised the federal funds rate by 25 basis points (bps; 100 bps equal 1.00%) to a target range of between 2.00% and 2.25% in September 2018, one of four rate increases implemented during the calendar year, a sign of its confidence in the strength of the U.S. economy.

Investors in international markets were not as confident. Tensions between the U.S. and China increased. The U.S. imposed $200 billion in tariffs on Chinese goods. China reacted with $60 billion in tariffs on U.S. goods. Economic growth in China caused concern. In September 2018, international investors began to factor a number of disconcerting economic and business data points: lower July manufacturers’ and industrial orders in Germany; falling purchasing manager index numbers for August from the United Kingdom, China, and India; and declining household spending for August in Japan. Taken together, the data fed growing concerns over slowing global growth that unnerved investors.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Capital Growth Fund

Letter to shareholders (unaudited)

Global markets suffered during the fourth quarter of 2018.

November’s U.S. midterm elections shifted control of the House of Representatives from Republicans to Democrats, presaging partisan clashes that followed and caused uncertainty among investors. Third-quarter U.S. GDP was announced at an annualized 3.4% rate, lower than the second-quarter rate. Brexit efforts stalled ahead of the March 2019 deadline. The People’s Bank of China cut reserve requirement ratios, accelerated infrastructure spending, and cut taxes even as the value of the yuan declined to low levels last seen in 2008. A partial U.S. government shutdown driven by partisan policy disputes extended into January.

The combination of news in the U.S. and generally weak economic indicators outside of the U.S. caused investors to seek safe havens. December’s S&P 500 Index performance was the worst since 1931. Globally, fixed-income investments fared better than stocks during the last two months of the year. The Fed increased the federal funds rate by 25 bps in December to a target range of between 2.25% and 2.50%.

The market climbs a wall of worry.

Investors entered 2019 with reasons to be concerned. Investment returns appeared to reaffirm the adage that markets climb a wall of worry. The S&P 500 Index gained 8.01% for the month of January, the best monthly performance in 30 years. Returns for the MSCI ACWI ex USA Index (Net), the Bloomberg Barclays U.S. Aggregate Bond Index, and the Bloomberg Barclays Global Aggregate ex-USD Index also were positive.

In February 2019, signs of slowing global growth grew more ominous. The Bureau of Economic Analysis announced fourth-quarter 2018 GDP grew at an annualized 2.2% rate, down from the levels of the prior two quarters. In a February report, the Bank of England forecasted the slowest growth since the financial crisis for 2019. China and the U.S. continued to wrangle over trade issues.

By the end of March 2019, a combination of dovish Fed sentiment and steady, if not spectacular, U.S. economic and business metrics reinforced investors’ confidence. Monthly job creation data and corporate profits, while less consistent than during 2018, were solid. China announced a roughly $300 billion stimulus package through tax and fee cuts intended to reinvigorate economic growth. During April 2019, favorable sentiment found additional support in reports of sustained low inflation, solid employment data, and first-quarter U.S. GDP of an annualized rate of 3.2%.

During May 2019, markets tumbled on mixed investment signals. In the U.S., partisan wrangling ramped up as Democrats and Republicans set their sights on 2020 presidential politics. The U.K.’s Brexit caused Prime Minister Theresa May to resign. The European Commission downgraded the 2019 growth forecast to 1.2%. The U.S. increased tariffs on products from China, China responded, and then talks broke down. President Donald Trump threatened to turn his foreign policy tariff tool to Mexico over immigration issues.

As had been the case during most of 2019 to date, just as the investment horizon appeared to darken, sentiment turned and U.S. equity markets gained during June and July. The gains, primarily driven by geopolitical and monetary policy events, pushed equity markets to new highs.

President Mario Draghi of the European Central Bank said that if the outlook doesn’t improve, the bank will cut rates or buy more assets to prop up inflation. President Trump backed off of tariff threats against Mexico and China. In the U.S., the Fed implemented a 0.25% federal funds rate cut in July 2019.

“December’s S&P 500 Index performance was the worst since 1931.”

“The S&P 500 Index gained 8.01% for the month of January, the best monthly performance in 30 years.”

Wells Fargo Capital Growth Fund | 3

Letter to shareholders (unaudited)

Later in July 2019, the U.S. reversed course and threatened to impose higher tariffs on China’s exports after talks failed. China responded with tariff threats of its own and devalued the renminbi, a move that roiled global markets. Despite the accommodative approach of central banks, investors continued to have misgivings about the durability of economic growth globally and a pervasively cautious tone influenced the world’s equity and fixed-income markets.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

|

|

|

For further information about your Fund, contact your investment professional, visit our website at wfam.com, or call us directly at1-800-222-8222. |

4 | Wells Fargo Capital Growth Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Michael T. Smith, CFA®‡

Christopher J. Warner, CFA®‡

Average annual total returns (%) as of July 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios1 (%) | |

| | | | | | | | | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net2 | |

| | | | | | | | | | |

| Class A (WFCGX) | | 7-31-2007 | | | 7.92 | | | | 12.66 | | | | 13.97 | | | | 14.50 | | | | 14.00 | | | | 14.64 | | | | 1.27 | | | | 1.12 | |

| | | | | | | | | | |

| Class C (WFCCX) | | 7-31-2007 | | | 12.74 | | | | 13.17 | | | | 13.80 | | | | 13.74 | | | | 13.17 | | | | 13.80 | | | | 2.02 | | | | 1.87 | |

| | | | | | | | | | |

| Class R6 (WFCRX)3 | | 11-30-2012 | | | – | | | | – | | | | – | | | | 15.03 | | | | 14.50 | | | | 15.18 | | | | 0.84 | | | | 0.61 | |

| | | | | | | | | | |

| Administrator Class (WFCDX) | | 6-30-2003 | | | – | | | | – | | | | – | | | | 14.63 | | | | 14.17 | | | | 14.87 | | | | 1.19 | | | | 0.95 | |

| | | | | | | | | | |

| Institutional Class (WWCIX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 14.89 | | | | 14.43 | | | | 15.15 | | | | 0.94 | | | | 0.71 | |

| | | | | | | | | | |

| Russell 1000® Growth Index4 | | – | | | – | | | | – | | | | – | | | | 10.82 | | | | 14.25 | | | | 15.74 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Currentmonth-end performance is available on the Fund’s website, wfam.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximumfront-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class, and Institutional Class shares are sold without afront-end sales charge or contingent deferred sales charge.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

6 | Wells Fargo Capital Growth Fund

Performance highlights (unaudited)

|

|

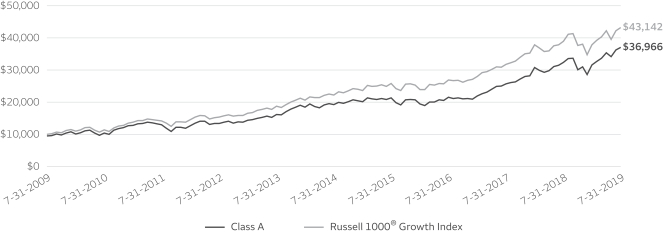

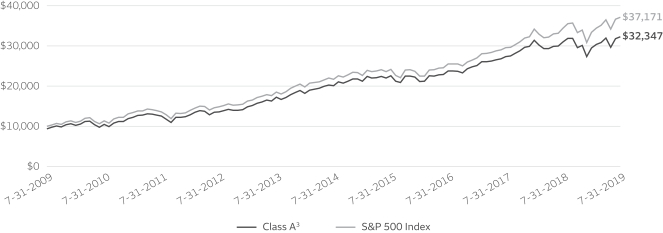

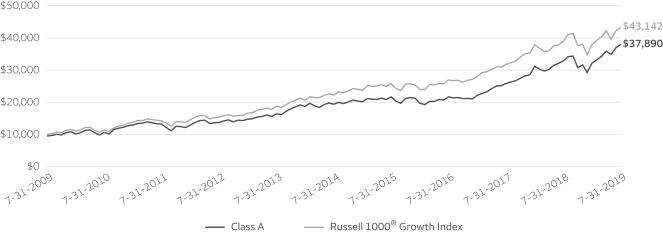

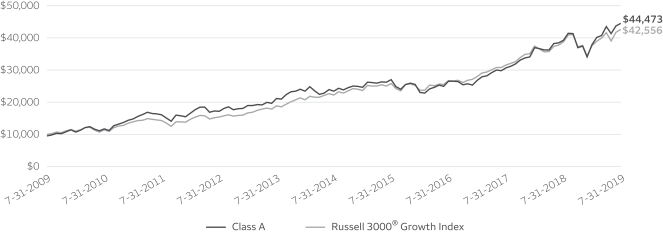

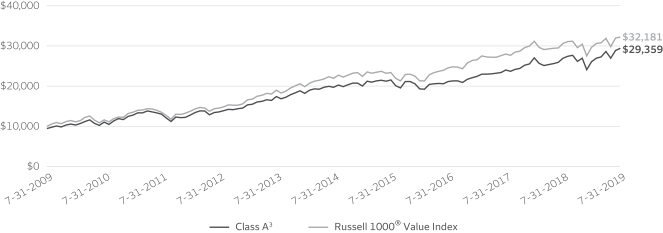

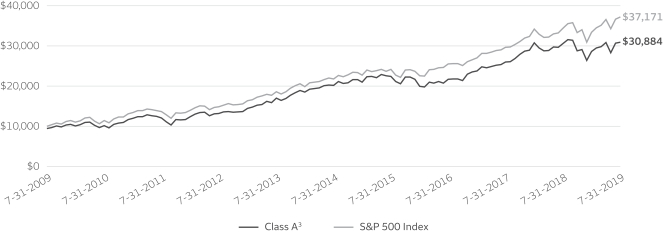

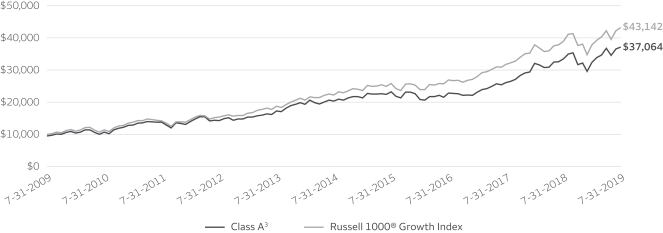

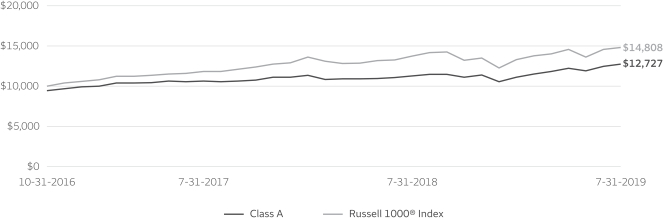

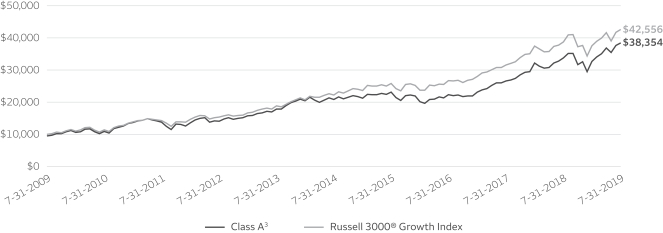

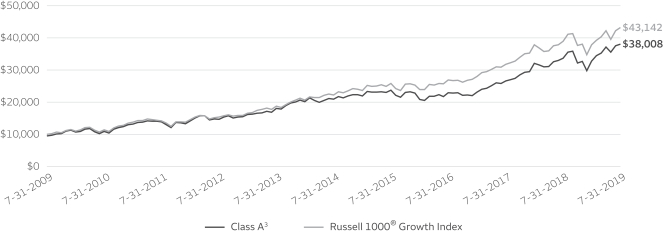

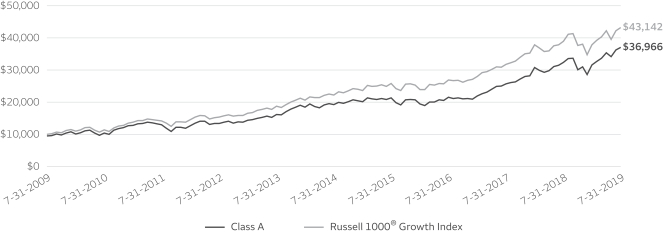

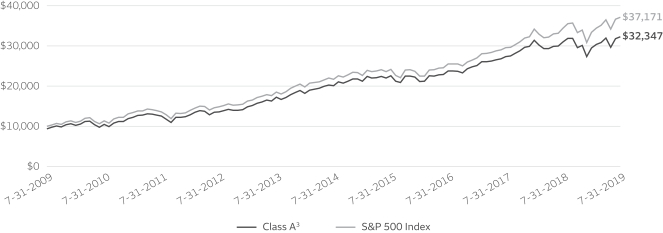

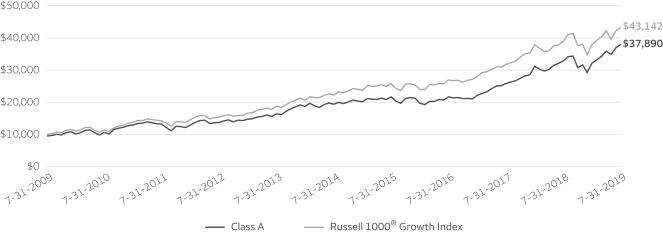

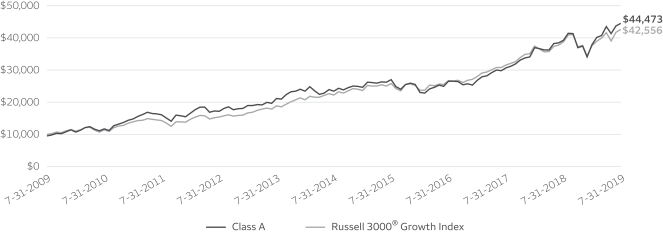

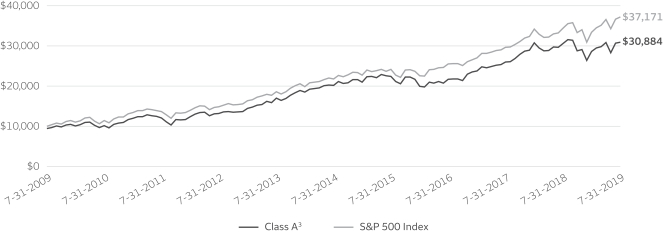

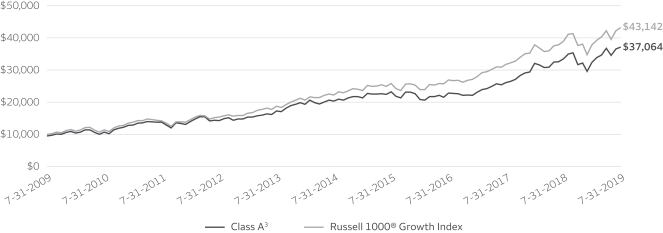

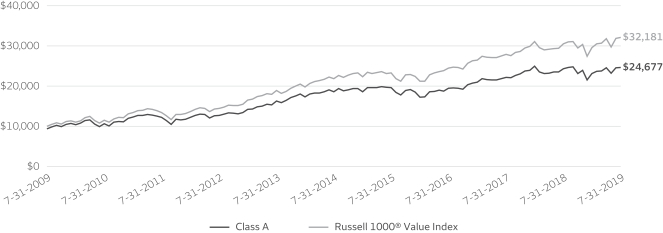

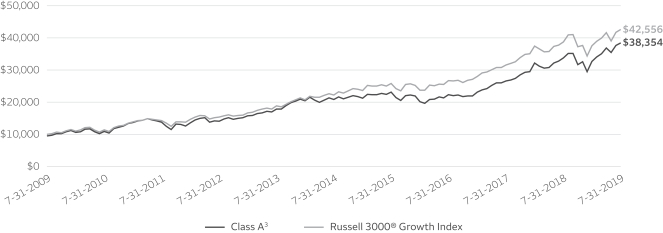

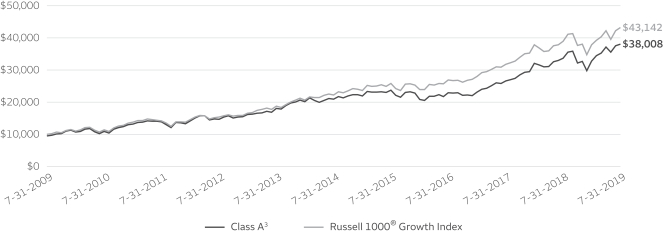

| Growth of $10,000 investment as of July 31, 20195 |

|

|

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through November 30, 2019, to waive fees and/or reimburse expenses to the extent necessary to cap the expenses of each class after fee waivers at 1.11% for Class A, 1.86% for Class C, 0.60% for Class R6, 0.94% for Administrator Class, and 0.70% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for Class R6 shares prior to their inception reflects the performance of Institutional Class shares, and includes the higher expenses applicable to Institutional Class shares. If these expenses had not been included, returns for Class R6 shares would be higher. |

| 4 | The Russell 1000®Growth Index measures the performance of those Russell 1000 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 5 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 1000®Growth Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 6 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

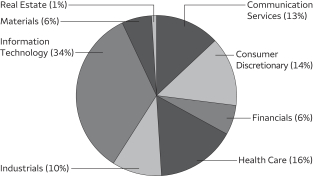

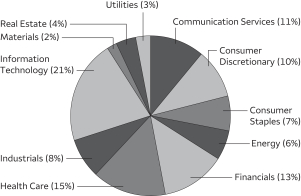

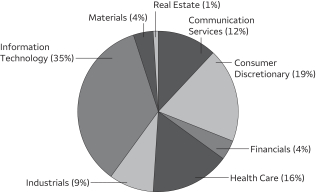

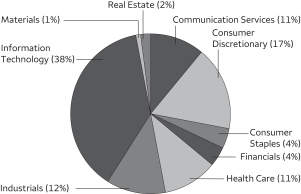

| 7 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

Wells Fargo Capital Growth Fund | 7

Performance highlights (unaudited)

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund outperformed its benchmark, the Russell 1000® Growth Index, for the12-month period that ended July 31, 2019. |

| ∎ | | Stock selection in information technology (IT) and select names within the consumer discretionary sector were key contributors to performance. |

| ∎ | | Stock selection within the communication services sector detracted from performance. |

Volatility reemerged during the middle of the12-month period.

While global stock markets posted positive returns during the12-month period, it was not an entirely smooth ride for investors. Optimism for synchronized global economic growth eventually evolved into a decidedlyrisk-off market driven by escalating uncertainty and investor fear. Mounting geopolitical concerns, rising domestic interest rates, concern over the stability of select emerging market economies, and escalating fears of a trade war between the U.S. and China contributed to market volatility. The Federal Reserve’s shift toward a neutral interest rate policy stance—and eventual easing—helped ease concerns and provided a tailwind for equities to reach new highs by the end of the period.

Despite increased uncertainty, we have not significantly repositioned the Fund. We continue to emphasize companies with a secular rather than a cyclical growth profile. The Fund remains positioned toward companies with high visibility of earnings growth and those positioned on the right side of change. We believe this strategy will prove beneficial should volatility levels remain elevated.

| | | | |

|

| Ten largest holdings(%) as of July 31, 20196 | |

| | |

Microsoft Corporation | | | 8.51 | |

| | |

Amazon.com Incorporated | | | 6.36 | |

| | |

Alphabet Incorporated Class A | | | 5.82 | |

| | |

Visa Incorporated Class A | | | 5.23 | |

| | |

UnitedHealth Group Incorporated | | | 3.96 | |

| | |

Union Pacific Corporation | | | 2.96 | |

| | |

The Home Depot Incorporated | | | 2.91 | |

| | |

Waste Connections Incorporated | | | 2.84 | |

| | |

Total System Services Incorporated | | | 2.46 | |

| | |

Fiserv Incorporated | | | 2.46 | |

The Fund’s IT and select consumer discretionary holdings contributed to relative performance.

Within the IT sector, the Fund’s position in Shopify Incorporated contributed to returns. Shopify, a provider ofe-commerce solutions fordirect-to-consumer brands such as Tesla Motors, Incorporated, traditionally focused on small andmedium-size businesses but is currently penetrating larger businesses via its Shopify Plus offering. Shopify benefits from its customers’ growth by processing payments for smaller customers and charging a fee on each transaction for larger customers. The company’s two vectors of growth—new customers and growth of existing customers—drove higher-than-expected sales and earnings.

Within consumer discretionary, MercadoLibre, Incorporated, was additive to returns. MercadoLibre is the dominant Latin Americane-commerce provider and owns MercadoPago, the leading online payment solution in Latin America. Increasede-commerce penetration in MercadoLibre’s key markets, such as Brazil and Argentina, drove higher sales growth. Customers’ use of MercadoPago both on and off MercadoLibre’se-commerce marketplace provided an additional avenue of growth for the company.

Please see footnotes on page 7.

8 | Wells Fargo Capital Growth Fund

Performance highlights (unaudited)

|

|

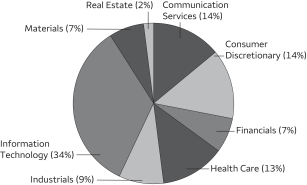

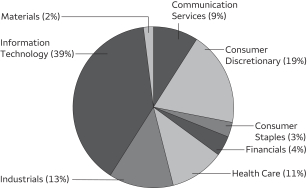

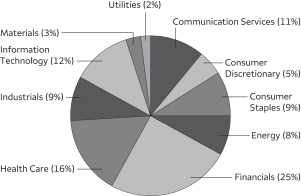

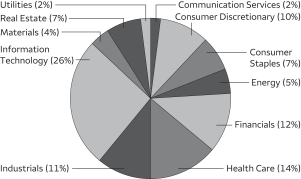

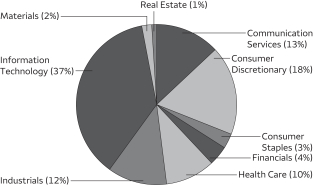

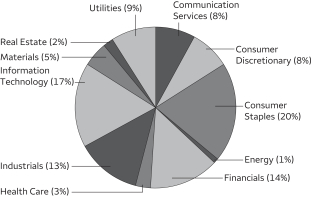

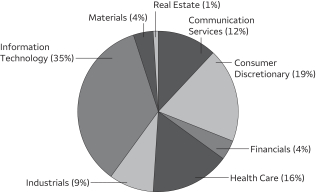

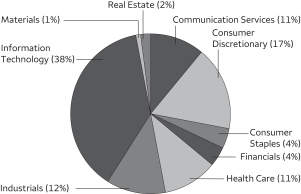

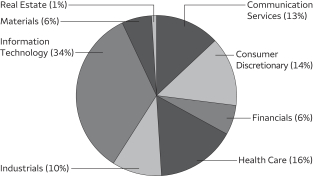

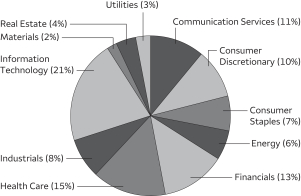

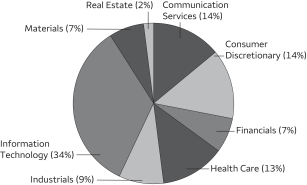

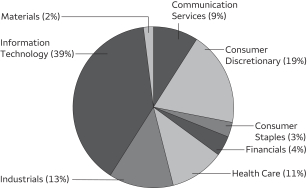

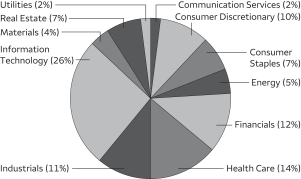

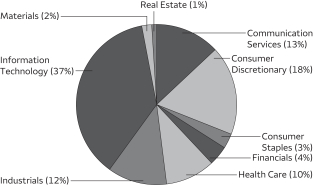

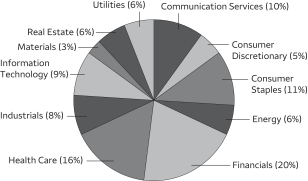

| Sector distribution as of July 31, 20197 |

|

|

Stock selection in the communication services sector detracted from performance.

Within the communication services sector, our position in Alphabet Incorporated detracted from the Fund’s performance. Alphabet is the parent company of Google and other services such as Android, Ads, and YouTube. Shares sold off after the company reported deceleration in revenue growth and other key metrics. Management stated the deceleration resulted from changes implemented at YouTube in 2018 to improve the user experience. These initiatives resulted in more difficult comparisons for 2019. We have continued to hold the position in Alphabet as it is the leader in online advertising and is positioned to potentially benefit from global growth in web usage.

Also within communication services, shares of Activision Blizzard, Incorporated, weighed on returns over the past year. Activision, like many video game software firms, is benefiting from rising digital downloads andin-game monetization opportunities. However, increased competition from both themega-hit “Fortnite,” as well as other publishers, pressured the shares. Activision’s “Call of Duty” franchise continues to perform extremely well, but the potential for greater competition to the company’s other titles caused the company to lower guidance for 2019.

The macro outlook is likely to remain muted, but opportunities abound to find companies on the right side of change.

As we look toward the remainder of 2019, we believe the U.S. economy is likely to avoid recessionary pressures and continue to expand, albeit at a slower rate. We believe, however, the collision of slowing economic growth caused partly by structural challenges such as demographics and elevated debt levels and accelerating change driven by technological innovation creates exciting investment opportunities.

Innovative companies on the right side of change have been benefiting from this environment in which true secular growth is becoming increasingly scarce. In our view,right-side-of-change companies may produce predictable earnings and cash flows into the future—characteristics hard to find in the current economy. In a world starved of growth, investors tend to seek out that which is more certain and reward these attributes with a scarcity premium.

However, we also believe the market will become even more selective regarding profitability. In our view, thescarcity-of-growth narrative is playing out, and valuations have expanded meaningfully for many companies levered to new technologies. We think it is essential to stay laser-focused on finding innovative companies on the right side of change while remaining vigilant about risk management.

Please see footnotes on page 7.

Wells Fargo Capital Growth Fund | 9

Fund expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution(12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of thesix-month period and held for the entire period from February 1, 2019 to July 31, 2019.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

2-1-2019 | | | Ending

account value

7-31-2019 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

| | | | | |

Class A | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,172.24 | | | $ | 5.71 | | | | 1.06 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.54 | | | $ | 5.31 | | | | 1.06 | % |

| | | | | |

Class C | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,168.19 | | | $ | 9.73 | | | | 1.81 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.82 | | | $ | 9.05 | | | | 1.81 | % |

| | | | | |

Class R6 | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,175.02 | | | $ | 3.24 | | | | 0.60 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.82 | | | $ | 3.01 | | | | 0.60 | % |

| | | | | |

Administrator Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,172.84 | | | $ | 5.06 | | | | 0.94 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.13 | | | $ | 4.71 | | | | 0.94 | % |

| | | | | |

Institutional Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,173.50 | | | $ | 3.77 | | | | 0.70 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | $ | 3.51 | | | | 0.70 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect theone-half-year period). |

10 | Wells Fargo Capital Growth Fund

Portfolio of investments—July 31, 2019

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| Common Stocks: 96.26% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 12.72% | | | | | | | | | | | | | | | | |

| | | | |

| Entertainment: 3.88% | | | | | | | | | | | | |

| | | | |

Activision Blizzard Incorporated | | | | | | | | | | | 20,000 | | | $ | 974,800 | |

| | | | |

Netflix Incorporated † | | | | | | | | | | | 5,200 | | | | 1,679,548 | |

| | | | |

Nintendo Company Limited ADR | | | | | | | | | | | 31,450 | | | | 1,452,676 | |

| | | | |

| | | | | | | | | | | | | | | 4,107,024 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Interactive Media & Services: 8.84% | | | | | | | | | | | | |

| | | | |

Alphabet Incorporated Class A † | | | | | | | | | | | 5,058 | | | | 6,161,656 | |

| | | | |

IAC Corporation † | | | | | | | | | | | 7,300 | | | | 1,745,065 | |

| | | | |

Tencent Holdings Limited ADR | | | | | | | | | | | 31,050 | | | | 1,443,825 | |

| | | | |

| | | | | | | | | | | | | | | 9,350,546 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 13.63% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 1.49% | | | | | | | | | | | | |

| | | | |

Aptiv plc | | | | | | | | | | | 18,050 | | | | 1,582,083 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Automobiles: 1.37% | | | | | | | | | | | | |

| | | | |

Ferrari NV | | | | | | | | | | | 9,000 | | | | 1,449,720 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet & Direct Marketing Retail: 7.86% | | | | | | | | | | | | |

| | | | |

Amazon.com Incorporated † | | | | | | | | | | | 3,605 | | | | 6,729,742 | |

| | | | |

MercadoLibre Incorporated † | | | | | | | | | | | 2,550 | | | | 1,584,621 | |

| | | | |

| | | | | | | | | | | | | | | 8,314,363 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 2.91% | | | | | | | | | | | | |

| | | | |

The Home Depot Incorporated | | | | | | | | | | | 14,433 | | | | 3,084,188 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 5.44% | | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 5.44% | | | | | | | | | | | | |

| | | | |

Intercontinental Exchange Incorporated | | | | | | | | | | | 26,375 | | | | 2,317,308 | |

| | | | |

Raymond James Financial Incorporated | | | | | | | | | | | 19,700 | | | | 1,589,199 | |

| | | | |

S&P Global Incorporated | | | | | | | | | | | 7,563 | | | | 1,852,557 | |

| | | | |

| | | | | | | | | | | | | | | 5,759,064 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 15.28% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 1.01% | | | | | | | | | | | | |

| | | | |

Exact Sciences Corporation † | | | | | | | | | | | 9,300 | | | | 1,070,523 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 9.09% | | | | | | | | | | | | |

| | | | |

Alcon Incorporated † | | | | | | | | | | | 22,000 | | | | 1,292,500 | |

| | | | |

Align Technology Incorporated † | | | | | | | | | | | 4,800 | | | | 1,003,584 | |

| | | | |

Boston Scientific Corporation † | | | | | | | | | | | 60,100 | | | | 2,551,846 | |

| | | | |

DexCom Incorporated † | | | | | | | | | | | 9,750 | | | | 1,529,483 | |

| | | | |

Edwards Lifesciences Corporation † | | | | | | | | | | | 8,300 | | | | 1,766,655 | |

| | | | |

Intuitive Surgical Incorporated † | | | | | | | | | | | 2,850 | | | | 1,480,604 | |

| | | | |

| | | | | | | | | | | | | | | 9,624,672 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 3.96% | | | | | | | | | | | | |

| | | | |

UnitedHealth Group Incorporated | | | | | | | | | | | 16,847 | | | | 4,195,071 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 11

Portfolio of investments—July 31, 2019

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| Life Sciences Tools & Services: 1.22% | | | | | | | | | | | | |

| | | | |

Illumina Incorporated † | | | | | | | | | | | 4,300 | | | $ | 1,287,334 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 9.16% | | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 5.17% | | | | | | | | | | | | |

| | | | |

Cintas Corporation | | | | | | | | | | | 9,500 | | | | 2,474,180 | |

| | | | |

Waste Connections Incorporated | | | | | | | | | | | 33,080 | | | | 3,001,018 | |

| | | | |

| | | | | | | | | | | | | | | 5,475,198 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.03% | | | | | | | | | | | | |

| | | | |

Rockwell Automation Incorporated | | | | | | | | | | | 6,800 | | | | 1,093,304 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 2.96% | | | | | | | | | | | | |

| | | | |

Union Pacific Corporation | | | | | | | | | | | 17,400 | | | | 3,131,130 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 32.72% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 1.87% | | | | | | | | | | | | |

| | | | |

Motorola Solutions Incorporated | | | | | | | | | | | 11,900 | | | | 1,974,924 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 16.97% | | | | | | | | | | | | |

| | | | |

Black Knight Incorporated † | | | | | | | | | | | 26,250 | | | | 1,662,150 | |

| | | | |

Fiserv Incorporated † | | | | | | | | | | | 24,664 | | | | 2,600,347 | |

| | | | |

FleetCor Technologies Incorporated † | | | | | | | | | | | 7,450 | | | | 2,117,067 | |

| | | | |

PayPal Holdings Incorporated † | | | | | | | | | | | 21,750 | | | | 2,401,200 | |

| | | | |

Shopify Incorporated Class A † | | | | | | | | | | | 3,300 | | | | 1,049,004 | |

| | | | |

Total System Services Incorporated | | | | | | | | | | | 19,200 | | | | 2,605,824 | |

| | | | |

Visa Incorporated Class A | | | | | | | | | | | 31,070 | | | | 5,530,460 | |

| | | | |

| | | | | | | | | | | | | | | 17,966,052 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 13.88% | | | | | | | | | | | | |

| | | | |

Autodesk Incorporated † | | | | | | | | | | | 10,900 | | | | 1,702,253 | |

| | | | |

Microsoft Corporation | | | | | | | | | | | 66,081 | | | | 9,004,853 | |

| | | | |

Salesforce.com Incorporated † | | | | | | | | | | | 13,430 | | | | 2,074,935 | |

| | | | |

ServiceNow Incorporated † | | | | | | | | | | | 6,880 | | | | 1,908,443 | |

| | | | |

| | | | | | | | | | | | | | | 14,690,484 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 6.22% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 4.73% | | | | | | | | | | | | |

| | | | |

Air Products & Chemicals Incorporated | | | | | | | | | | | 10,700 | | | | 2,442,489 | |

| | | | |

The Sherwin-Williams Company | | | | | | | | | | | 5,000 | | | | 2,565,200 | |

| | | | |

| | | | | | | | | | | | | | | 5,007,689 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction Materials: 1.49% | | | | | | | | | | | | |

| | | | |

Vulcan Materials Company | | | | | | | | | | | 11,350 | | | | 1,570,273 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 1.09% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 1.09% | | | | | | | | | | | | |

| | | | |

SBA Communications Corporation † | | | | | | | | | | | 4,700 | | | | 1,153,427 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $51,929,547) | | | | | | | | | | | | | | | 101,887,069 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Capital Growth Fund

Portfolio of investments—July 31, 2019

| | | | | | | | | | | | | | | | |

| | | Yield | | | | | | Shares | | | Value | |

| Short-Term Investments: 3.89% | | | | | | | | | | | | |

| | | | |

| Investment Companies: 3.89% | | | | | | | | | | | | |

| | | | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 2.26 | % | | | | | | | 4,112,350 | | | $ | 4,112,350 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Short-Term Investments (Cost $4,112,350) | | | | | | | | | | | | | | | 4,112,350 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $56,041,897) | | | 100.15 | % | | | 105,999,419 | |

| | |

Other assets and liabilities, net | | | (0.15 | ) | | | (154,294 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 105,845,125 | |

| | | | | | | | |

| † | Non-income-earning security |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (u) | The rate represents the7-day annualized yield at period end. |

Abbreviations:

| ADR | American depositary receipt |

| REIT | Real estate investment trust |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning

of period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end

of period | | | % of

net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investments LLC * | | | 1,332,367 | | | | 16,874,602 | | | | 18,206,969 | | | | 0 | | | $ | (1,030 | ) | | $ | 0 | | | $ | 10,122 | # | | $ | 0 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 922,555 | | | | 35,178,825 | | | | 31,989,030 | | | | 4,112,350 | | | | 0 | | | | 0 | | | | 32,866 | | | | 4,112,350 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (1,030 | ) | | $ | 0 | | | $ | 42,988 | | | $ | 4,112,350 | | | | 3.89 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | No longer held at the end of the period. |

| # | Amount shown represents income before fees and rebates. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 13

Statement of assets and liabilities—July 31, 2019

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities, at value (cost $51,929,547) | | $ | 101,887,069 | |

Investments in affiliated securities, at value (cost $4,112,350) | | | 4,112,350 | |

Receivable for investments sold | | | 83,593 | |

Receivable for Fund shares sold | | | 16,523 | |

Receivable for dividends | | | 26,892 | |

Prepaid expenses and other assets | | | 41,374 | |

| | | | |

Total assets | | | 106,167,801 | |

| | | | |

| |

Liabilities | | | | |

Payable for Fund shares redeemed | | | 177,487 | |

Management fee payable | | | 32,352 | |

Administration fees payable | | | 17,487 | |

Trustees’ fees and expenses payable | | | 4,308 | |

Distribution fee payable | | | 1,364 | |

Accrued expenses and other liabilities | | | 89,678 | |

| | | | |

Total liabilities | | | 322,676 | |

| | | | |

Total net assets | | $ | 105,845,125 | |

| | | | |

| |

Net assets consist of | | | | |

Paid-in capital | | $ | 44,802,993 | |

Total distributable earnings | | | 61,042,132 | |

| | | | |

Total net assets | | $ | 105,845,125 | |

| | | | |

| |

Computation of net asset value and offering price per share | | | | |

Net assets – Class A | | $ | 83,922,477 | |

Shares outstanding – Class A1 | | | 8,872,748 | |

Net asset value per share – Class A | | | $9.46 | |

Maximum offering price per share – Class A2 | | | $10.04 | |

Net assets – Class C | | $ | 2,131,304 | |

Shares outstanding – Class C1 | | | 333,771 | |

Net asset value per share – Class C | | | $6.39 | |

Net assets – Class R6 | | $ | 2,470,662 | |

Shares outstanding – Class R61 | | | 198,972 | |

Net asset value per share – Class R6 | | | $12.42 | |

Net assets – Administrator Class | | $ | 4,986,558 | |

Shares outstanding – Administrator Class1 | | | 437,453 | |

Net asset value per share – Administrator Class | | | $11.40 | |

Net assets – Institutional Class | | $ | 12,334,124 | |

Shares outstanding – Institutional Class1 | | | 1,001,694 | |

Net asset value per share – Institutional Class | | | $12.31 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Capital Growth Fund

Statement of operations—year ended July 31, 2019

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $8,987) | | $ | 812,167 | |

Income from affiliated securities | | | 34,286 | |

| | | | |

Total investment income | | | 846,453 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 745,417 | |

Administration fees | |

Class A | | | 167,756 | |

Class C | | | 5,413 | |

Class R6 | | | 1,389 | |

Administrator Class | | | 6,781 | |

Institutional Class | | | 18,434 | |

Shareholder servicing fees | |

Class A | | | 199,710 | |

Class C | | | 6,445 | |

Administrator Class | | | 13,041 | |

Distribution fee | |

Class C | | | 19,334 | |

Custody and accounting fees | | | 23,999 | |

Professional fees | | | 50,571 | |

Registration fees | | | 109,500 | |

Shareholder report expenses | | | 34,905 | |

Trustees’ fees and expenses | | | 22,017 | |

Other fees and expenses | | | 12,793 | |

| | | | |

Total expenses | | | 1,437,505 | |

Less: Fee waivers and/or expense reimbursements | | | (368,002 | ) |

| | | | |

Net expenses | | | 1,069,503 | |

| | | | |

Net investment loss | | | (223,050 | ) |

| | | | |

| |

Realized and unrealized gains (losses) on investments | | | | |

Net realized gains (losses) on | |

Unaffiliated securities | | | 14,965,496 | |

Affiliated securities | | | (1,030 | ) |

| | | | |

Net realized gains on investments | | | 14,964,466 | |

Net change in unrealized gains (losses) on investments | | | (2,615,121 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 12,349,345 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 12,126,295 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 15

Statement of changes in net assets

| | | | | | | | | | | | | | | | |

| | | Year ended

July 31, 2019 | | | Year ended

July 31, 20181 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment loss | | | | | | $ | (223,050 | ) | | | | | | $ | (105,891 | ) |

Net realized gains on investments | | | | | | | 14,964,466 | | | | | | | | 84,278,242 | |

Net change in unrealized gains (losses) on investments | | | | | | | (2,615,121 | ) | | | | | | | (34,428,399 | ) |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 12,126,295 | | | | | | | | 49,743,952 | |

| | | | |

| | | | |

Distributions to shareholders from net investment income and net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (45,016,507 | ) | | | | | | | (10,659,612 | ) |

Class C | | | | | | | (1,770,673 | ) | | | | | | | (475,651 | ) |

Class R4 | | | | | | | N/A | | | | | | | | (1,544 | )2 |

Class R6 | | | | | | | (4,194,378 | ) | | | | | | | (16,512,790 | ) |

Administrator Class | | | | | | | (2,839,109 | ) | | | | | | | (2,322,996 | ) |

Institutional Class | | | | | | | (7,429,012 | ) | | | | | | | (2,869,464 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (61,249,679 | ) | | | | | | | (32,842,057 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 572,554 | | | | 5,446,796 | | | | 324,772 | | | | 5,663,591 | |

Class C | | | 154,137 | | | | 905,087 | | | | 51,472 | | | | 773,137 | |

Class R6 | | | 29,622 | | | | 381,146 | | | | 429,937 | | | | 8,300,687 | |

Administrator Class | | | 30,341 | | | | 351,635 | | | | 98,501 | | | | 1,847,357 | |

Institutional Class | | | 165,425 | | | | 1,990,728 | | | | 180,220 | | | | 3,556,665 | |

| | | | |

| | | | | | | 9,075,392 | | | | | | | | 20,141,437 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 5,508,288 | | | | 44,139,774 | | | | 642,270 | | | | 10,449,869 | |

Class C | | | 301,972 | | | | 1,666,667 | | | | 30,860 | | | | 437,693 | |

Class R4 | | | N/A | | | | N/A | | | | 0 | 2 | | | 0 | 2 |

Class R6 | | | 89,812 | | | | 934,429 | | | | 905,002 | | | | 16,500,487 | |

Administrator Class | | | 291,982 | | | | 2,801,545 | | | | 131,868 | | | | 2,308,838 | |

Institutional Class | | | 716,926 | | | | 7,403,250 | | | | 155,432 | | | | 2,828,945 | |

| | | | |

| | | | | | | 56,945,665 | | | | | | | | 32,525,832 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (1,742,605 | ) | | | (17,335,658 | ) | | | (560,818 | ) | | | (9,909,912 | ) |

Class C | | | (327,409 | ) | | | (2,306,311 | ) | | | (62,592 | ) | | | (954,216 | ) |

Class R4 | | | N/A | | | | N/A | | | | (974 | )2 | | | (18,521 | )2 |

Class R6 | | | (401,198 | ) | | | (4,653,188 | ) | | | (8,922,240 | ) | | | (178,495,590 | ) |

Administrator Class | | | (172,162 | ) | | | (1,897,228 | ) | | | (1,169,379 | ) | | | (22,013,800 | ) |

Institutional Class | | | (822,709 | ) | | | (11,049,745 | ) | | | (661,462 | ) | | | (12,665,267 | ) |

| | | | |

| | | | | | | (37,242,130 | ) | | | | | | | (224,057,306 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | 28,778,927 | | | | | | | | (171,390,037 | ) |

| | | | |

Total decrease in net assets | | | | | | | (20,344,457 | ) | | | | | | | (154,488,142 | ) |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 126,189,582 | | | | | | | | 280,677,724 | |

| | | | |

End of period | | | | | | $ | 105,845,125 | | | | | | | $ | 126,189,582 | |

| | | | |

| 1 | Effective for all filings after November 4, 2018, the SEC prospectively eliminated the requirement to parenthetically disclose undistributed net investment income at the end of the period and permitted the aggregation of distributions, with the exception of tax basis returns of capital. Undistributed net investment income at July 31, 2018 was $0. The disaggregated distributions information for the year ended July 31, 2018 is included in Note 8,Distributions to Shareholders, in the notes to the financial statements. |

| 2 | For the period from August 1, 2017 to November 13, 2017. Effective at the close of business on November 13, 2017, Class R4 shares were liquidated and the class was subsequently closed. Class R4 shares are no longer offered by the Fund. |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Capital Growth Fund

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended July 31 | |

| CLASS A | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $19.03 | | | | $17.56 | | | | $15.12 | | | | $17.38 | | | | $21.31 | |

Net investment loss | | | (0.03 | )1 | | | (0.06 | )1 | | | (0.03 | )1 | | | (0.03 | )1 | | | (0.07 | )1 |

Net realized and unrealized gains (losses) on investments | | | 0.55 | | | | 4.06 | | | | 2.90 | | | | 0.04 | | | | 2.09 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.52 | | | | 4.00 | | | | 2.87 | | | | 0.01 | | | | 2.02 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | (0.02 | ) | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (10.09 | ) | | | (2.53 | ) | | | (0.41 | ) | | | (2.27 | ) | | | (5.95 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (10.09 | ) | | | (2.53 | ) | | | (0.43 | ) | | | (2.27 | ) | | | (5.95 | ) |

Net asset value, end of period | | | $9.46 | | | | $19.03 | | | | $17.56 | | | | $15.12 | | | | $17.38 | |

Total return2 | | | 14.50 | % | | | 25.83 | % | | | 19.52 | % | | | 0.75 | % | | | 11.00 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.40 | % | | | 1.26 | % | | | 1.24 | % | | | 1.24 | % | | | 1.27 | % |

Net expenses | | | 1.06 | % | | | 1.06 | % | | | 1.06 | % | | | 1.06 | % | | | 1.11 | % |

Net investment loss | | | (0.26 | )% | | | (0.32 | )% | | | (0.21 | )% | | | (0.18 | )% | | | (0.39 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 40 | % | | | 59 | % | | | 85 | % | | | 114 | % |

Net assets, end of period (000s omitted) | | | $83,922 | | | | $86,285 | | | | $72,511 | | | | $77,648 | | | | $17,126 | |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 17

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended July 31 | |

| CLASS C | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $16.41 | | | | $15.58 | | | | $13.54 | | | | $15.92 | | | | $20.12 | |

Net investment loss | | | (0.07 | )1 | | | (0.16 | )1 | | | (0.13 | )1 | | | (0.13 | )1 | | | (0.20 | )1 |

Net realized and unrealized gains (losses) on investments | | | 0.14 | | | | 3.52 | | | | 2.58 | | | | 0.02 | | | | 1.95 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.07 | | | | 3.36 | | | | 2.45 | | | | (0.11 | ) | | | 1.75 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (10.09 | ) | | | (2.53 | ) | | | (0.41 | ) | | | (2.27 | ) | | | (5.95 | ) |

Net asset value, end of period | | | $6.39 | | | | $16.41 | | | | $15.58 | | | | $13.54 | | | | $15.92 | |

Total return2 | | | 13.74 | % | | | 24.89 | % | | | 18.65 | % | | | 0.00 | % | | | 10.15 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.15 | % | | | 2.01 | % | | | 1.99 | % | | | 1.99 | % | | | 2.02 | % |

Net expenses | | | 1.81 | % | | | 1.81 | % | | | 1.81 | % | | | 1.81 | % | | | 1.86 | % |

Net investment loss | | | (1.03 | )% | | | (1.07 | )% | | | (0.95 | )% | | | (0.98 | )% | | | (1.14 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 40 | % | | | 59 | % | | | 85 | % | | | 114 | % |

Net assets, end of period (000s omitted) | | | $2,131 | | | | $3,365 | | | | $2,888 | | | | $3,415 | | | | $4,212 | |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Capital Growth Fund

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended July 31 | |

| CLASS R6 | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $21.55 | | | | $19.52 | | | | $16.70 | | | | $18.87 | | | | $22.56 | |

Net investment income | | | 0.03 | 1 | | | 0.04 | 1 | | | 0.04 | | | | 0.04 | 1 | | | 0.02 | |

Net realized and unrealized gains (losses) on investments | | | 0.93 | | | | 4.52 | | | | 3.24 | | | | 0.06 | | | | 2.24 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.96 | | | | 4.56 | | | | 3.28 | | | | 0.10 | | | | 2.26 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | (0.05 | ) | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (10.09 | ) | | | (2.53 | ) | | | (0.41 | ) | | | (2.27 | ) | | | (5.95 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (10.09 | ) | | | (2.53 | ) | | | (0.46 | ) | | | (2.27 | ) | | | (5.95 | ) |

Net asset value, end of period | | | $12.42 | | | | $21.55 | | | | $19.52 | | | | $16.70 | | | | $18.87 | |

Total return | | | 15.03 | % | | | 26.13 | % | | | 20.18 | % | | | 1.20 | % | | | 11.54 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.96 | % | | | 0.82 | % | | | 0.81 | % | | | 0.81 | % | | | 0.79 | % |

Net expenses | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % |

Net investment income | | | 0.19 | % | | | 0.19 | % | | | 0.23 | % | | | 0.23 | % | | | 0.11 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 40 | % | | | 59 | % | | | 85 | % | | | 114 | % |

Net assets, end of period (000s omitted) | | | $2,471 | | | | $10,360 | | | | $157,462 | | | | $140,581 | | | | $153,009 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 19

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended July 31 | |

| ADMINISTRATOR CLASS | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $20.71 | | | | $18.87 | | | | $16.20 | | | | $18.43 | | | | $22.22 | |

Net investment loss | | | (0.02 | )1 | | | (0.03 | )1 | | | (0.01 | )1 | | | (0.01 | )1 | | | (0.03 | )1 |

Net realized and unrealized gains (losses) on investments | | | 0.80 | | | | 4.40 | | | | 3.12 | | | | 0.05 | | | | 2.19 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.78 | | | | 4.37 | | | | 3.11 | | | | 0.04 | | | | 2.16 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | (0.03 | ) | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (10.09 | ) | | | (2.53 | ) | | | (0.41 | ) | | | (2.27 | ) | | | (5.95 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (10.09 | ) | | | (2.53 | ) | | | (0.44 | ) | | | (2.27 | ) | | | (5.95 | ) |

Net asset value, end of period | | | $11.40 | | | | $20.71 | | | | $18.87 | | | | $16.20 | | | | $18.43 | |

Total return | | | 14.63 | % | | | 26.01 | % | | | 19.68 | % | | | 0.88 | % | | | 11.22 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.32 | % | | | 1.17 | % | | | 1.16 | % | | | 1.16 | % | | | 1.11 | % |

Net expenses | | | 0.94 | % | | | 0.94 | % | | | 0.94 | % | | | 0.93 | % | | | 0.90 | % |

Net investment loss | | | (0.14 | )% | | | (0.18 | )% | | | (0.04 | )% | | | (0.09 | )% | | | (0.16 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 40 | % | | | 59 | % | | | 85 | % | | | 114 | % |

Net assets, end of period (000s omitted) | | | $4,987 | | | | $5,950 | | | | $23,144 | | | | $31,064 | | | | $34,886 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo Capital Growth Fund

Financial highlights

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended July 31 | |

| INSTITUTIONAL CLASS | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $21.47 | | | | $19.44 | | | | $16.65 | | | | $18.84 | | | | $22.54 | |

Net investment income | | | 0.01 | 1 | | | 0.01 | 1 | | | 0.02 | 1 | | | 0.03 | 1 | | | 0.02 | 1 |

Net realized and unrealized gains (losses) on investments | | | 0.92 | | | | 4.55 | | | | 3.22 | | | | 0.05 | | | | 2.23 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.93 | | | | 4.56 | | | | 3.24 | | | | 0.08 | | | | 2.25 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | (0.04 | ) | | | 0.00 | | | | 0.00 | |

Net realized gains | | | (10.09 | ) | | | (2.53 | ) | | | (0.41 | ) | | | (2.27 | ) | | | (5.95 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (10.09 | ) | | | (2.53 | ) | | | (0.45 | ) | | | (2.27 | ) | | | (5.95 | ) |

Net asset value, end of period | | | $12.31 | | | | $21.47 | | | | $19.44 | | | | $16.65 | | | | $18.84 | |

Total return | | | 14.89 | % | | | 26.25 | % | | | 20.00 | % | | | 1.09 | % | | | 11.50 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.06 | % | | | 0.93 | % | | | 0.91 | % | | | 0.91 | % | | | 0.84 | % |

Net expenses | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.68 | % | | | 0.65 | % |

Net investment income | | | 0.09 | % | | | 0.05 | % | | | 0.13 | % | | | 0.16 | % | | | 0.09 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 40 | % | | | 59 | % | | | 85 | % | | | 114 | % |

Net assets, end of period (000s omitted) | | | $12,334 | | | | $20,229 | | | | $24,653 | | | | $23,670 | | | | $22,578 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Capital Growth Fund | 21

Notes to financial statements

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is anopen-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”)Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Capital Growth Fund (the “Fund”) which is a diversified series of the Trust.

Effective at the close of business on November 13, 2017, Class R4 shares were liquidated and the class was subsequently closed. Class R4 shares are no longer offered by the Fund. Information for Class R4 shares reflected in the financial statements represents activity through November 13, 2017.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registeredopen-end investment companies are valued at net asset value. Interests innon-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. The values of other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Wells Fargo Asset Management Pricing Committee. Purchases and sales of securities, and income and expenses are converted at the rate of exchange on the respective dates of such transactions. Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting from changes in exchange rates. The changes in net assets arising from changes in exchange rates of securities and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are included in net realized and unrealized gains or losses from investments.

Securities lending

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. When securities are on loan, the Fund receives interest or dividends on those securities. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). Investments in Securities Lending Fund

22 | Wells Fargo Capital Growth Fund

Notes to financial statements

are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Fund (net of fees and rebates), if any, is included in income from affiliated securities on the Statement of Operations.

In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In such an event, the terms of the agreement allows the unaffiliated securities lending agent to use the collateral to purchase replacement securities on behalf of the Fund or pay the Fund the market value of the loaned securities. The Fund will bear the risk of loss with respect to depreciation of its investment of the cash collateral.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on theex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and any net realized gains are recorded on theex-dividend date and paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of July 31, 2019, the aggregate cost of all investments for federal income tax purposes was $56,136,293 and the unrealized gains (losses) consisted of:

| | | | |

| |

Gross unrealized gains | | $ | 49,938,919 | |

| |

Gross unrealized losses | | | (75,793 | ) |

| |

Net unrealized gains | | $ | 49,863,126 | |

Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under federal income tax regulations. U.S. generally accepted accounting principles require that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The primary permanent difference causing such reclassification is due to net operating losses. At July 31, 2019, as a result of permanentbook-to-tax differences, the following reclassification adjustments were made on the Statement of Assets and Liabilities:

| | |

| Paid-in capital | | Total distributable earnings |

| |

| $(62,640) | | $62,640 |

As of July 31, 2019, the Fund had a qualified late-year ordinary loss of $160,475 which will be recognized on the first day of the following fiscal year.

Wells Fargo Capital Growth Fund | 23

Notes to financial statements

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common fund-level expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ∎ | | Level 1 – quoted prices in active markets for identical securities |

| ∎ | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ∎ | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of July 31, 2019:

| | | | | | | | | | | | | | | | |

| | | | |

| | | Quoted prices (Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs (Level 3) | | | Total | |

| | | | |

Assets | | | | | | | | | | | | | | | | |

Investments in: | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

| | | | |

Communication services | | $ | 13,457,570 | | | $ | 0 | | | $ | 0 | | | $ | 13,457,570 | |

| | | | |

Consumer discretionary | | | 14,430,354 | | | | 0 | | | | 0 | | | | 14,430,354 | |

| | | | |

Financials | | | 5,759,064 | | | | 0 | | | | 0 | | | | 5,759,064 | |

| | | | |

Health care | | | 16,177,600 | | | | 0 | | | | 0 | | | | 16,177,600 | |

| | | | |

Industrials | | | 9,699,632 | | | | 0 | | | | 0 | | | | 9,699,632 | |

| | | | |

Information technology | | | 34,631,460 | | | | 0 | | | | 0 | | | | 34,631,460 | |

| | | | |

Materials | | | 6,577,962 | | | | 0 | | | | 0 | | | | 6,577,962 | |

| | | | |

Real estate | | | 1,153,427 | | | | 0 | | | | 0 | | | | 1,153,427 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

| | | | |

Investment companies | | | 4,112,350 | | | | 0 | | | | 0 | | | | 4,112,350 | |

| | | | |

Total assets | | $ | 105,999,419 | | | $ | 0 | | | $ | 0 | | | $ | 105,999,419 | |

Additional sector, industry or geographic detail is included in the Portfolio of Investments.

For the year ended July 31, 2019, the Fund did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”), is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser and providing fund-level administrative services in connection with the

24 | Wells Fargo Capital Growth Fund

Notes to financial statements

Fund’s operations. As compensation for its services under the investment management agreement, Funds Management is entitled to receive a management fee at the following annual rate based on the Fund’s average daily net assets:

| | | | |

| |

| Average daily net assets | | Management fee | |

| |

First $500 million | | | 0.700 | % |

| |

Next $500 million | | | 0.675 | |

| |

Next $1 billion | | | 0.650 | |

| |

Next $2 billion | | | 0.625 | |

| |

Next $1 billion | | | 0.600 | |

| |

Next $3 billion | | | 0.590 | |

| |

Next $2 billion | | | 0.565 | |

| |

Next $2 billion | | | 0.555 | |

| |

Next $4 billion | | | 0.530 | |

| |

Over $16 billion | | | 0.505 | |

For the year ended July 31, 2019, the management fee was equivalent to an annual rate of 0.70% of the Fund’s average daily net assets.