Exhibit (c)(2)

Discussion Materials – October 22, 2009

Disclaimer

This presentation and the information contained herein is confidential and has been prepared exclusively for the benefit and internal use of the Cowen client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”), in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not convey any right of publication or disclosure, in whole or in part, to any other party without the prior written consent of Cowen. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by Cowen.

The information in this presentation is based upon any management forecasts supplied to Cowen and reflects prevailing conditions and Cowen’s views as of this date, all of which are accordingly subject to change. Cowen’s estimates constitute Cowen’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, Cowen has with your consent, assumed and relied, without independent investigation, upon the accuracy and completeness of all financial and other information provided to us by the management of the Company or which is publicly available. Cowen’s analysis is not and does not purport to be appraisals of the assets, stock or business of the Company or any other entity. Cowen does not make representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. This presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind.

The information contained herein, as well as any other advice, services or other information provided to you by Cowen, is being provided in connection with an actual or potential mandate or engagement and may not be used or relied upon in any manner, nor are any duties or obligations created with respect thereto, except and to the extent specifically set forth in a written engagement letter or other agreement with Cowen. This presentation does not constitute a commitment by Cowen or any of its affiliates to underwrite, subscribe for or place any securities to extend or arrange credit or to provide any other service.

Cowen policy mandates that no Cowen employee may directly or indirectly offer a Company favorable research or threaten to change research as consideration or inducement for the receipt of business or compensation.

DISCUSSION MATERIALS

Table of Contents

Page I. Situation Overview 2

II. Restaurant Market Update 4 III. Rubio’s Overview 15 IV. Valuation Overview 33 V. Strategic Alternatives Overview 46

DISCUSSION MATERIALS

I. Situation Overview

Situation Overview

Cowen and Company, LLC is pleased to have been selected to assist and advise Rubio’s Special Committee of the Board of Directors

The Company has received two unsolicited acquisition proposals:

??A hostile, all cash offer at $8.00 per share from the Meruelo Group and Levine Leichtman

??A subsequent all cash expression of interest from Mill Road Capital for a $9.50 per share offer

Based upon our recent conversations, Cowen has been asked to address:

??Current market conditions within the restaurant sector

??Current state of the M&A markets and, specifically, recent restaurant M&A activity

??Whether Rubio’s should adopt a shareholder rights plan (poison pill)

??The Company’s options in light of the unsolicited proposals

??The appropriate timing and process should the Company determine it is appropriate to pursue a sale process

Cowen will also assist the Company with the development of a communications strategy to handle both internal and external inquiries

OVERVIEW SITUATION I .

DISCUSSION MATERIALS

II. Restaurant Market Update

Restaurant Operating Environment Summary

Weak revenue/same -store sales trends have continued

??Broader weakness now includes QSR/Fast -Casual segments

??Limited visibility to near term based upon economic data

New unit growth restrained and closures taking place

??Capacity growth is limited/few unit growth stories

??Large systems being rationalized and smaller, independents closing stores

Commodities and cost-cuts have provided margin relief

??The commodity “bubble” has burst for 2009, but 2010 looks uncertain

??Internal cost-cutting/”belt tightening” has allowed for improved profitability

Restaurant stocks have rebounded strongly in 2009

??After a brutal 2008, started the year at very depressed levels

??EPS “beats” have helped, but top-line needs to improve from here

??Anticipation of economic recovery already “baked in” or perhaps overdone

Expectations for 2010 are cloudy

??Sales improvement will likely lag economic recovery

??Stocks may move “sideways” for some time as valuations have returned to normalized levels

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS

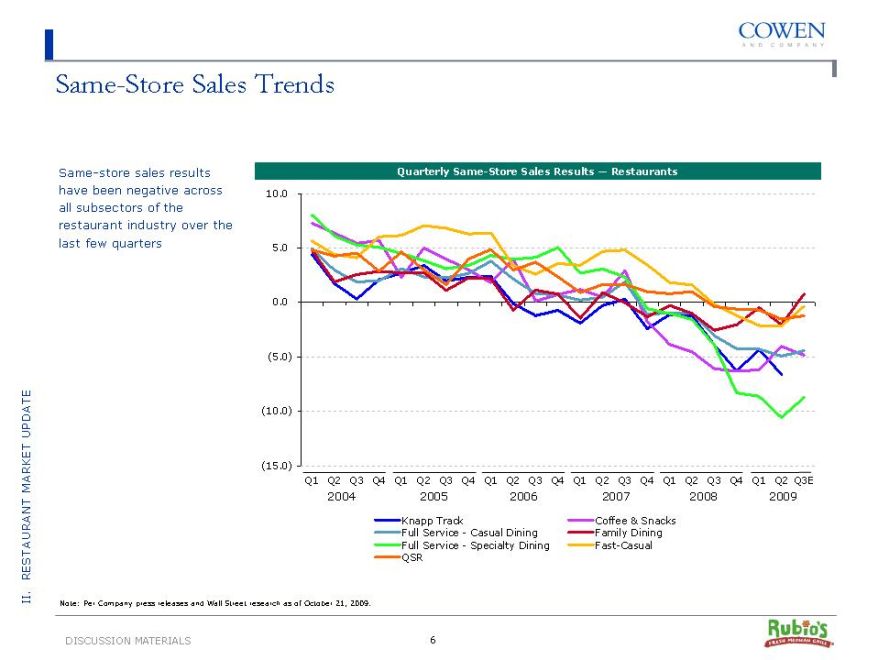

Same-Store Sales Trends

Same-store sales results have been negative across all subsectors of the restaurant industry over the last few quarters

Quarterly Same -Store Sales Results — Restaurants

10.0 5.0 0.0 (5.0) (10.0) (15.0)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3E 2004 2005 2006 2007 2008 2009

Knapp Track

Full Service—Casual Dining Full Service—Specialty Dining QSR

Coffee & Snacks Family Dining Fast-Casual

UPDATE MARKET RESTAURANT II .

Note: Per Company press releases and Wall Street research as of October 21, 2009.

DISCUSSION MATERIALS

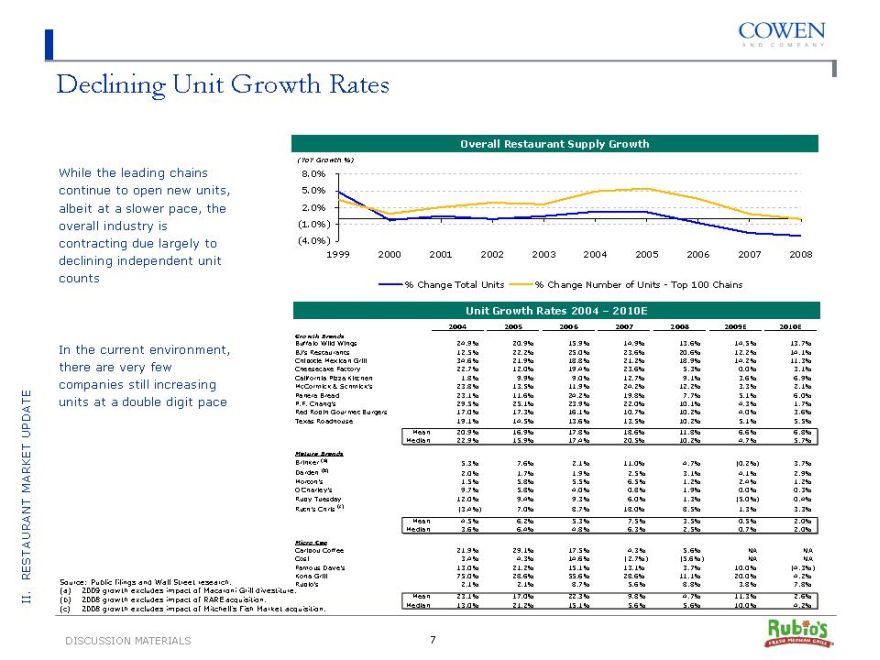

Declining Unit Growth Rates

While the leading chains continue to open new units, albeit at a slower pace, the overall industry is contracting due largely to declining independent unit counts

Overall Restaurant Supply Growth

(YoY Growth %)

8.0% 5.0% 2.0% (1.0%) (4.0%)

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

% Change Total Units

% Change Number of Units—Top 100 Chains

Unit Growth Rates 2004 – 2010E

In the current environment, there are very few companies still increasing units at a double digit pace

UPDATE MARKET RESTAURANT II .

Source: Public filings and Wall Street research.

(a) | | 2009 growth excludes impact of Macaroni Grill divestiture. |

(b) | | 2008 growth excludes impact of RARE acquisition. |

(c) | | 2008 growth excludes impact of Mitchell’s Fish Market acquisition. |

2004 2005 2006 2007 2008 2009E 2010E

Growth Brands

Buffalo Wild Wings 24.9% 20.9% 15.9% 14.9% 13.6% 14.5% 13.7% BJ’s Restaurants 12.5% 22.2% 25.0% 23.6% 20.6% 12.2% 14.1% Chipotle Mexican Grill 34.6% 21.9% 18.8% 21.2% 18.9% 14.2% 11.3% Cheesecake Factor y 22.7% 12.0% 19.4% 23.6% 5.3% 0.0% 3.1% California Pizza Kitchen 1.8% 9.9% 9.0% 12.7% 9.1% 3.6% 6.9% McCormick & Schmick’s 23.8% 13.5% 11.9% 24.2% 12.2% 3.3% 2.1% Panera Bread 23.1% 11.6% 24.2% 19.8% 7.7% 5.1% 6.0% P.F. Chang’s 29.5% 25.1% 23.9% 22.0% 10.1% 4.3% 1.7% Red Robin Gourmet Burgers 17.0% 17.3% 16.1% 10.7% 10.2% 4.0% 3.6% Texas Roadhouse 19.1% 14.5% 13.6% 13.5% 10.2% 5.1% 5.5% Mean 20.9% 16.9% 17.8% 18.6% 11.8% 6.6% 6.8% Median 22.9% 15.9% 17.4% 20.5% 10.2% 4.7% 5.7%

Mature Brands

Brinker (a) 5.3% 7.6% 2.1% 11.0% 4.7% (0.2%) 3.7% Darden (b) 2.0% 1.7% 1.9% 2.5% 3.1% 4.1% 2.9% Morton’s 1.5% 5.8% 5.5% 6.5% 1.2% 2.4% 1.2% O’Charle y’s 9.7% 5.8% 4.0% 0.8% 1.9% 0.0% 0.3% Ruby Tuesday 12.0% 9.4% 9.3% 6.0% 1.3% (5.0%) 0.4% Ruth’s Chris (c) (3.4%) 7.0% 8.7% 18.0% 8.5% 1.3% 3.3% Mean 4.5% 6.2% 5.3% 7.5% 3.5% 0.5% 2.0% Median 3.6% 6.4% 4.8% 6.3% 2.5% 0.7% 2.0%

Micro Cap

Caribou Coffee 21.9% 29.1% 17.5% 4.3% 5.6% NA NA Cosi 3.4% 4.3% 14.6% (2.7%) (5.6%) NA NA Famous Dave’s 13.0% 21.2% 15.1% 13.1% 3.7% 10.0% (4.3%) Kona Grill 75.0% 28.6% 55.6% 28.6% 11.1% 20.0% 4.2% Rubio’s 2.1% 2.1% 8.7% 5.6% 8.8% 3.8% 7.8%

Mean 23.1% 17.0% 22.3% 9.8% 4.7% 11.3% 2.6%

Median 13.0% 21.2% 15.1% 5.6% 5.6% 10.0% 4.2%

DISCUSSION MATERIALS

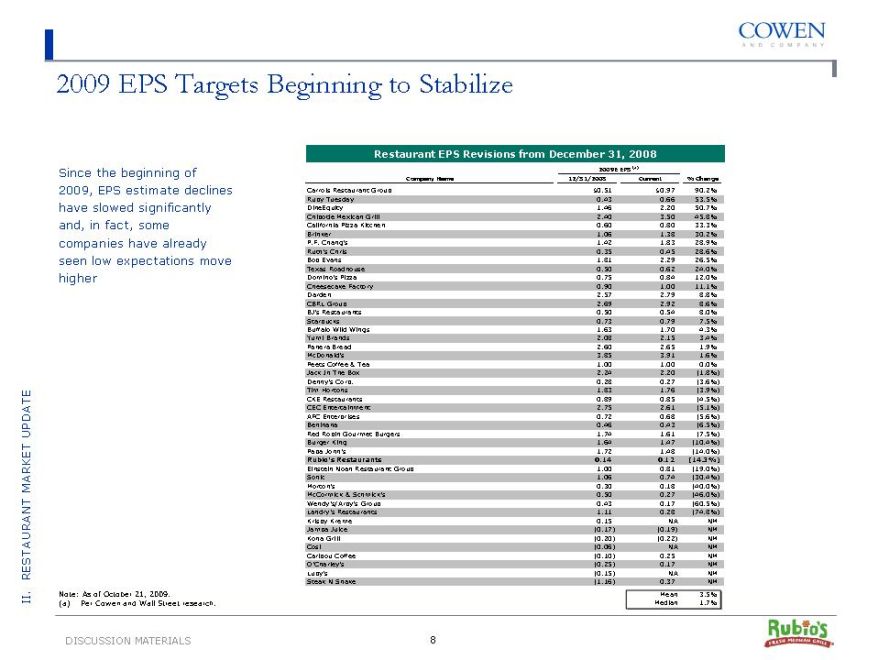

2009 EPS Targets Beginning to Stabilize

Since the beginning of 2009, EPS estimate declines have slowed significantly and, in fact, some companies have already seen low expectations move higher

Restaurant EPS Revisions from December 31, 2008

2009E EPS (a)

Company Name 12/31/2008 Current % Change

Carrols Restaurant Group $0.51 $0.97 90.2% Ruby Tuesday 0.43 0.66 53.5% DineEquity 1.46 2.20 50.7% Chipotle Mexican Grill 2.40 3.50 45.8% California Pizza Kitchen 0.60 0.80 33.3% Brinker 1.06 1.38 30.2% P.F. Chang’s 1.42 1.83 28.9% Ruth’s Chris 0.35 0.45 28.6% Bob Evans 1.81 2.29 26.5% Texas Roadhouse 0.50 0.62 24.0% Domino’s Pizza 0.75 0.84 12.0% Cheesecake Factor y 0.90 1.00 11.1% Darden 2.57 2.79 8.8% CBRL Group 2.69 2.92 8.6% BJ’s Restaurants 0.50 0.54 8.0% Starbucks 0.73 0.79 7.5% Buffalo Wild Wings 1.63 1.70 4.3% Yum! Brands 2.08 2.15 3.4% Panera Bread 2.60 2.65 1.9% McDonald’s 3.85 3.91 1.6% Peets Coffee & Tea 1.00 1.00 0.0% Jack In The Box 2.24 2.20 (1.8%) Denny’s Corp. 0.28 0.27 (3.6%) Tim Hortons 1.83 1.76 (3.9%) CKE Restaurants 0.89 0.85 (4.5%) CEC Entertainment 2.75 2.61 (5.1%) AFC Enterprises 0.72 0.68 (5.6%) Benihana 0.46 0.43 (6.5%) Red Robin Gourmet Burgers 1.74 1.61 (7.5%) Burger King 1.64 1.47 (10.4%) Papa John’s 1.72 1.48 (14.0%)

Rubio’s Restaurants 0.14 0.12 (14.3%)

Einstein Noah Restaurant Group 1.00 0.81 (19.0%) Sonic 1.06 0.74 (30.4%) Morton’s 0.30 0.18 (40.0%) McCormick & Schmick’s 0.50 0.27 (46.0%) Wendy’s/Arby’s Group 0.43 0.17 (60.5%) Landry’s Restaurants 1.11 0.28 (74.8%) Krispy Kreme 0.15 NA NM Jamba Juice (0.17) (0.19) NM Kona Grill (0.20) (0.22) NM Cosi (0.06) NA NM Caribou Coffee (0.10) 0.25 NM O’Charle y’s (0.25) 0.17 NM Luby’s (0.15) NA NM Steak N Shake (1.16) 0.37 NM Mean 3.5% Median 1.7%

Note: As of October 21, 2009.

(a) | | Per Cowen and Wall Street research. |

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS

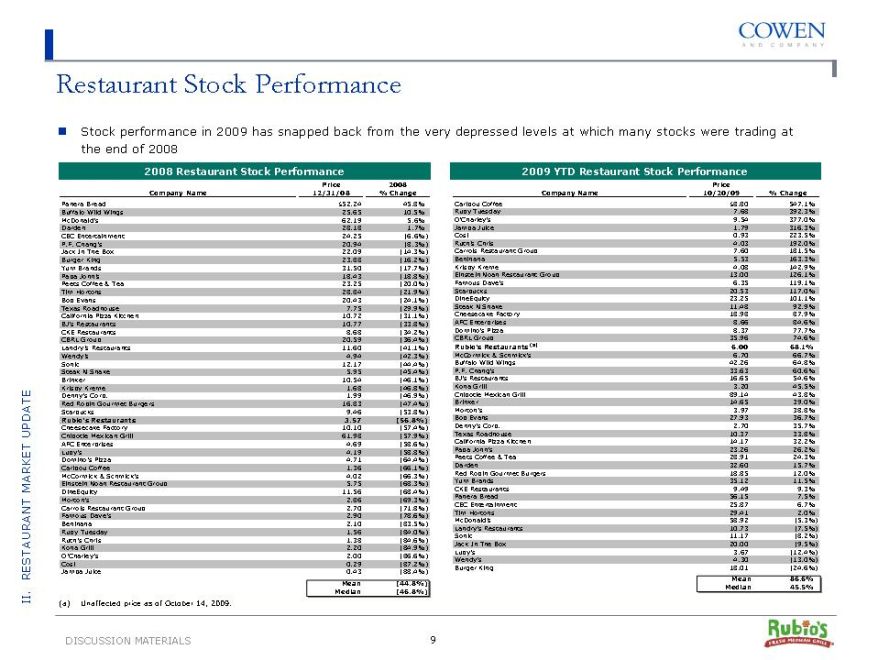

Restaurant Stock Performance

Stock performance in 2009 has snapped back from the very depressed levels at which many stocks were trading at the end of 2008

2008 Restaurant Stock Performance

Price 2008 Company Name 12/31/08 % Change

Panera Bread $52.24 45.8% Buffalo Wild Wings 25.65 10.5% McDonald’s 62.19 5.6% Darden 28.18 1.7% CEC Entertainment 24.25 (6.6%) P.F. Chang’s 20.94 (8.3%) Jack In The Box 22.09 (14.3%) Burger King 23.88 (16.2%) Yum Brands 31.50 (17.7%) Papa John’s 18.43 (18.8%) Peets Coffee & Tea 23.25 (20.0%) Tim Hortons 28.84 (21.9%) Bob Evans 20.43 (24.1%) Texas Roadhouse 7.75 (29.9%) California Pizza Kitchen 10.72 (31.1%) BJ’s Restaurants 10.77 (33.8%) CKE Restaurants 8.68 (34.2%) CBRL Group 20.59 (36.4%) Landry’s Restaurants 11.60 (41.1%) Wendy’s 4.94 (42.3%) Sonic 12.17 (44.4%) Steak N Shake 5.95 (45.4%) Brinker 10.54 (46.1%) Krispy Kreme 1.68 (46.8%) Denny’s Corp. 1.99 (46.9%) Red Robin Gourmet Burgers 16.83 (47.4%) Starbucks 9.46 (53.8%)

Rubio’s Restaurants 3.57 (56.8%)

Cheesecake Factory 10.10 (57.4%) Chipotle Mexican Grill 61.98 (57.9%) AFC Enterprises 4.69 (58.6%) Luby’s 4.19 (58.8%) Domino’s Pizza 4.71 (64.4%) Caribou Coffee 1.36 (66.1%) McCormick & Schmick’s 4.02 (66.3%) Einstein Noah Restaurant Group 5.75 (68.3%) DineEquity 11.56 (68.4%) Morton’s 2.86 (69.3%) Carrols Restaurant Group 2.70 (71.8%) Famous Dave’s 2.90 (78.6%) Benihana 2.10 (83.5%) Ruby Tuesday 1.56 (84.0%) Ruth’s Chris 1.38 (84.6%) Kona Grill 2.20 (84.9%) O’Charley’s 2.00 (86.6%) Cosi 0.29 (87.2%) Jamba Juice 0.43 (88.4%)

Mean (44.8%) Median (46.8%)

(a) | | Unaffected price as of October 14, 2009. |

2009 YTD Restaurant Stock Performance

Price

Company Name 10/20/09 % Change

Caribou Coffee $8.80 547.1% Ruby Tuesday 7.68 392.3% O’Charle y’s 9.54 377.0% Jamba Juice 1.79 316.3% Cosi 0.93 223.5% Ruth’s Chris 4.03 192.0% Carrols Restaurant Group 7.60 181.5% Benihana 5.53 163.3% Krispy Kreme 4.08 142.9% Einstein Noah Restaurant Group 13.00 126.1% Famous Dave’s 6.35 119.1% Starbucks 20.53 117.0% DineEquity 23.25 101.1% Steak N Shake 11.48 92.9% Cheesecake Factor y 18.98 87.9% AFC Enterprises 8.66 84.6% Domino’s Pizza 8.37 77.7% CBRL Group 35.96 74.6%

Rubio’s Restaurants (a) 6.00 68.1%

McCormick & Schmick’s 6.70 66.7% Buffalo Wild Wings 42.26 64.8% P.F. Chang’s 33.63 60.6% BJ’s Restaurants 16.65 54.6% Kona Grill 3.20 45.5% Chipotle Mexican Grill 89.14 43.8% Brinker 14.65 39.0% Morton’s 3.97 38.8% Bob Evans 27.93 36.7% Denny’s Corp. 2.70 35.7% Texas Roadhouse 10.37 33.8% California Pizza Kitchen 14.17 32.2% Papa John’s 23.26 26.2% Peets Coffee & Tea 28.91 24.3% Darden 32.60 15.7% Red Robin Gourmet Burgers 18.85 12.0% Yum Brands 35.12 11.5% CKE Restaurants 9.49 9.3% Panera Bread 56.15 7.5% CEC Entertainment 25.87 6.7% Tim Hortons 29.41 2.0% McDonald’s 58.92 (5.3%) Landry’s Restaurants 10.73 (7.5%) Sonic 11.17 (8.2%) Jack In The Box 20.00 (9.5%) Luby’s 3.67 (12.4%) Wendy’s 4.30 (13.0%) Burger King 18.01 (24.6%)

Mean 86.6% Median 45.5%

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS

9

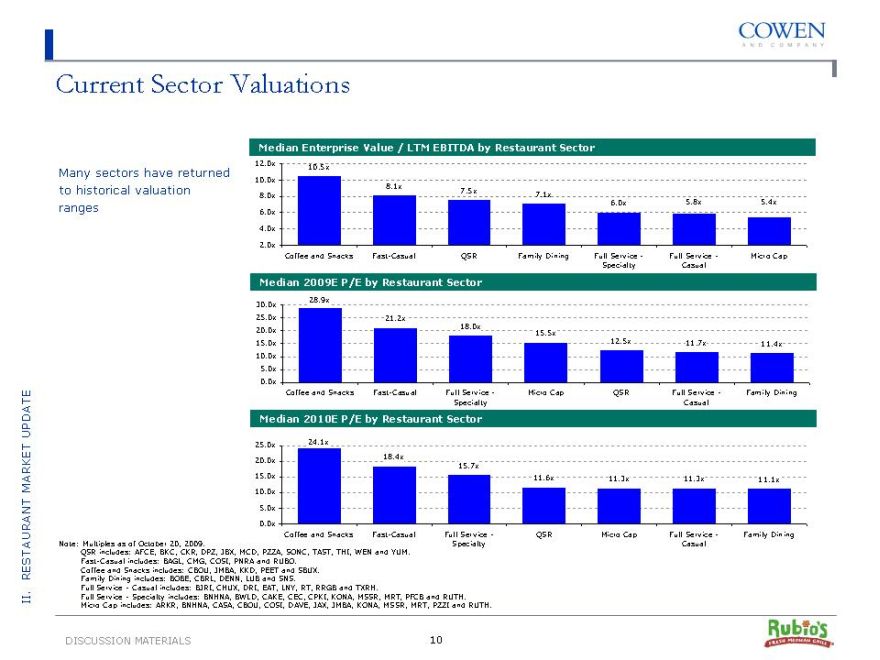

Current Sector Valuations

Many sectors have returned to historical valuation ranges

Median Enterprise Value / LTM EBITDA by Restaurant Sector

12.0x 10.0x 8.0x 6.0x 4.0x 2.0x

10.5x

8.1x

7.5x

7.1x

6.0x

5.8x

5.4x

Coffee and Snacks

Fast-Casual

QSR

Family Dining

Full Service -Specialty

Full Service -Casual

Micro Cap

Median 2009E P/E by Restaurant Sector

30.0x 25.0x 20.0x 15.0x 10.0x 5.0x 0.0x

28.9x

21.2x

18.0x

15.5x

12.5x

11.7x

11.4x

Coffee and Snacks

Fast-Casual

Full Service -Specialty

Micro Cap

QSR

Full Service -Casual

Family Dining

Median 2010E P/E by Restaurant Sector

25.0x 20.0x 15.0x 10.0x 5.0x 0.0x

24.1x

18.4x

15.7x

11.6x

11.3x

11.3x

11.1x

Coffee and Snacks

Fast-Casual

Full Service -Specialty

QSR

Micro Cap

Full Service -Casual

Family Dining

Note: Multiples as of October 20, 2009.

QSR includes: AFCE, BKC, CKR, DPZ, JBX, MCD, PZZA, SONC, TAST, THI, WEN and YUM. Fast-Casual includes: BAGL, CMG, COSI, PNRA and RUBO.

Coffee and Snacks includes: CBOU, JMBA, KKD, PEET and SBUX. Family Dining includes: BOBE, CBRL, DENN, LUB and SNS.

Full Service—Casual includes: BJRI, CHUX, DRI, EAT, LNY, RT, RRGB and TXRH.

Full Service—Specialty includes: BNHNA, BWLD, CAKE, CEC, CPKI, KONA, MSSR, MRT, PFCB and RUTH. Micro Cap includes: ARKR, BNHNA, CASA, CBOU, COSI, DAVE, JAX, JMBA, KONA, MSSR, MRT, PZZI and RUTH.

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS

10

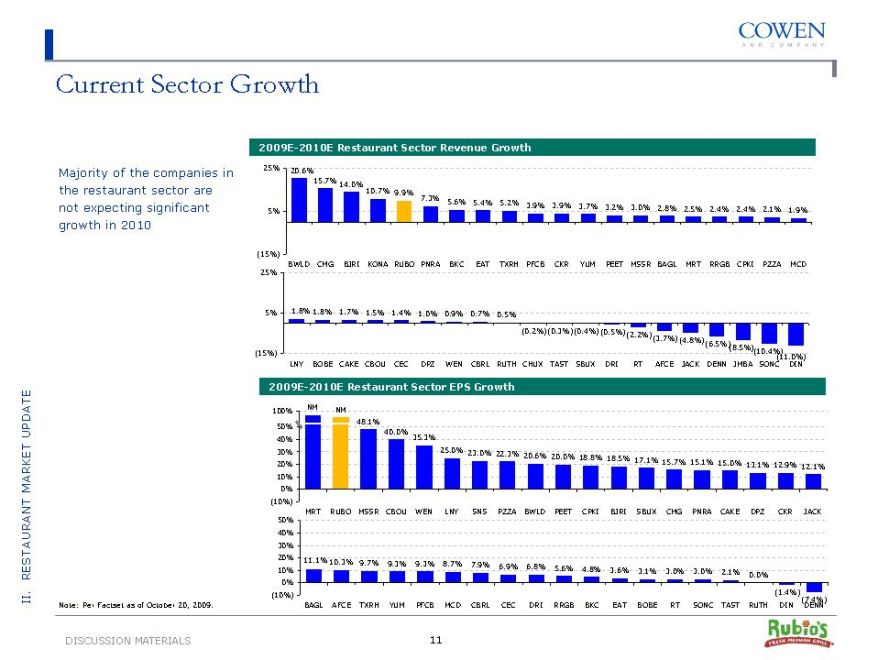

Current Sector Growth

Majority of the companies in the restaurant sector are not expecting significant growth in 2010

2009E -2010E Restaurant Sector Revenue Growth

25% 20.6% 15.7%

14.0% 10.7% 9.9%

7.3% 5.6%

5.4% 5.2% 3.9% 3.9%

3.7% 3.2% 3.0% 2.8% 2.5% 2.4% 2.4% 2.1%

5% 1.9%

(15%)

25% BWLD CMG BJRI KONA RUBO PNRA BKC EAT TXRH PFCB CKR YUM PEET MSSR BAGL MRT RRGB CPKI PZZA MCD

5% 1.8% 1.8% 1.7% 1.5% 1.4% 1.0% 0.9% 0.7% 0.5%

(0.2%) (0.3%) (0.4%) (0.5%)

(2.2%) (3.7%)

(4.8%) (6.5%) (8.5%) (15%) (10.4%) LNY BOBE CAKE CBOU CEC DPZ WEN CBRL RUTH CHUX TAST SBUX DRI RT AFCE JACK DENN JMBA SONC (11.0%) DIN

2009E -2010E Restaurant Sector EPS Growth

100% NM NM

48.1% 50% 40.0% 40% 35.3%

30% 25.0% 23.0% 22.3%

20.6% 20.0% 18.8% 18.5%

17.1% 15.7% 15.1% 15.0%

20% 13.1% 12.9% 12.1% 10% 0% (10%) 50% MRT RUBO MSSR CBOU WEN LNY SNS PZZA BWLD PEET CPKI BJRI SBUX CMG PNRA CAKE DPZ CKR JACK

40% 30%

20% 11.1%

10.3% 9.7% 9.3% 9.3% 8.7% 7.9%

6.9% 6.8% 5.6% 4.8%

10% 3.6% 3.1% 3.0% 3.0% 2.1% 0.0% 0%

(10%) (1.4%) (7.4%) BAGL AFCE TXRH YUM PFCB MCD CBRL CEC DRI RRGB BKC EAT BOBE RT SONC TAST RUTH DIN DENN

Note: Per Factset as of October 20, 2009.

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS 11

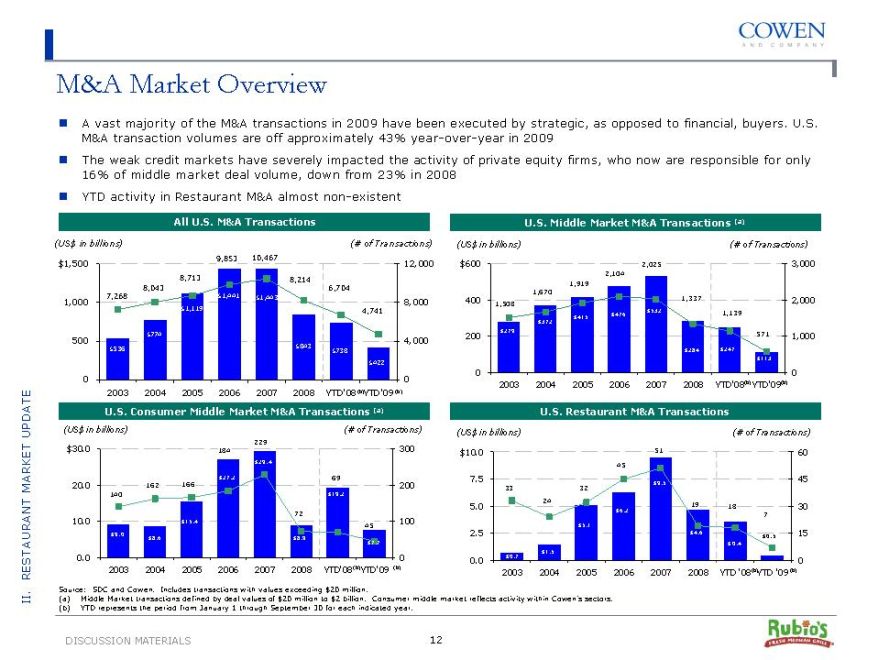

M&A Market Overview

A vast majority of the M&A transactions in 2009 have been executed by strategic, as opposed to financial, buyers. U.S. M&A transaction volumes are off approximately 43% year-over-year in 2009 The weak credit markets have severely impacted the activity of private equity firms, who now are responsible for only 16% of middle market deal volume, down from 23% in 2008 YTD activity in Restaurant M&A almost non-existent

All U.S. M&A Transactions U.S. Middle Market M&A Transactions (a)

(US$ in billions) (# of Transactions) (US$ in billions) (# of Transactions)

9,853 10,467

$1,500 12,000 $600 2,025 3,000 2,104 8,713 8,214 1,919 8,043 6,704 1,670 7,268 $1,441 $1,443 400 1,337 2,000 1,000 8,000 1,508 $1,119 4,741 $532 1,139 $476 $415 $372 $774 $279 571 200 1,000 500 4,000 $536 $843 $738 $284 $247 $113 $422

0 0

0 0

2003 2004 2005 2006 2007 2008 YTD’08 (b)YTD’09 (b) 2003 2004 2005 2006 2007 2008 YTD’08 (b)YTD’09 (b)

U.S. Consumer Middle Market M&A Transactions (a) U.S. Restaurant M&A Transactions

(US$ in billions) (# of Transactions) (US$ in billions) (# of Transactions)

229 $30.0 184 300 $10.0 51 60 $29.4 45 166 $27.2 69 7.5 $9.5 45 20.0 162 200 33 32 140 $19.2 24 5.0 $6.2 19 18 30 10.0 72 100 7 $15.4 45 $5.1 $9.0 2.5 $4.6 15 $8.6 $8.9 $7.7 $0.5 $0.4 $1.5 0.0 0 0.0 $0.7 0 2003 2004 2005 2006 2007 2008 YTD’08 (b)YTD’09 (b) 2003 2004 2005 2006 2007 2008 YTD ‘08(b)YTD ‘09 (b)

Source: SDC and Cowen. Includes transactions with values exceeding $20 million.

(a) Middle Market transactions defined by deal values of $20 million to $2 billion. Consumer middle market reflects activity within Cowen’s sectors. (b) YTD represents the period from January 1 through September 30 for each indicated year.

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS 12

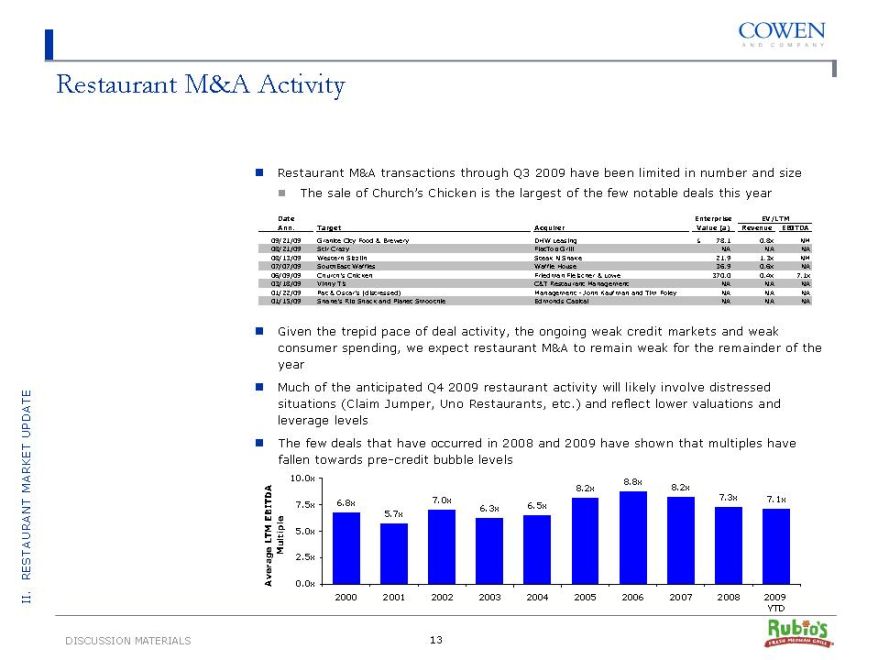

Restaurant M&A Activity

Restaurant M&A transactions through Q3 2009 have been limited in number and size

??The sale of Church’s Chicken is the largest of the few notable deals this year

Date Enterprise EV/LTM Ann. Target Acquirer Value (a) Revenue EBITDA

09/21/09 Granite City Food & Brewery DHW Leasing $ 78.1 0.8x NM 08/21/09 Stir Crazy FlatTop Grill NA NA NA 08/13/09 Western Sizzlin Steak N Shake 21.9 1.3x NM 07/07/09 SouthEast Waffles Waffle House 36.9 0.6x NA 06/09/09 Church’s Chicken Friedman Fleischer & Lowe 370.0 0.4x 7.1x 03/18/09 Vinny T’s C&T Restaurant Management NA NA NA 01/22/09 Pat & Oscar’s (distressed) Management—John Kaufman and Tim Foley NA NA NA 01/15/09 Shane’s Rib Shack and Planet Smoothie Edmonds Capital NA NA NA

Given the trepid pace of deal activity, the ongoing weak credit markets and weak consumer spending, we expect restaurant M&A to remain weak for the remainder of the year Much of the anticipated Q4 2009 restaurant activity will likely involve distressed situations (Claim Jumper, Uno Restaurants, etc.) and reflect lower valuations and leverage levels The few deals that have occurred in 2008 and 2009 have shown that multiples have fallen towards pre-credit bubble levels

10.0x 8.8x

8.2x 8.2x

7.0x 7.3x 7.1x 7.5x 6.8x 6.5x 6.3x

EBITDA 5.7x

LTM 5.0x

Multiple

2.5x

Average 0.0x

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 YTD

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS 13

Rumored Restaurant Deals in the Market

The number and quality of deals have declined meaningfully over the past 18 months, which could provide a timing advantage

Today

Carino’s

Claim Jumper (distressed) Hooters of America Kona Grill (distressed) Landry’s (distressed) Papa Gino’s Papa Murphy’s Uno Restaurants (debt restructuring) Wingstop

One Year Ago

American Restaurant (Black Angus) (restructured) Bertucci’s (restructured) Bubba Gump Dave & Buster’s Del Frisco’s Fatz Cafe Friendly’s Gordon Biersch Max & Erma’s (going private) Oregano’s Pizza Palm Restaurant Pat & Oscar’s (sold – distressed) Romano’s Macaroni Grill (sold –distressed) Smokey Bones (sold – distressed) Starr Restaurants Steak ‘n Shake Taco Bueno

UPDATE MARKET RESTAURANT II .

DISCUSSION MATERIALS 14

III. Rubio’s Overview

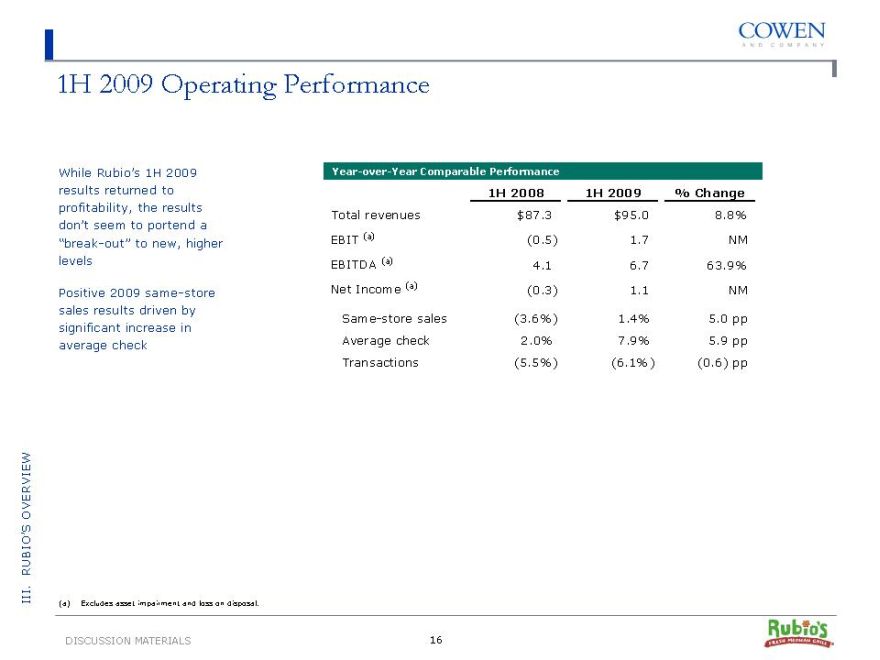

1H 2009 Operating Performance

While Rubio’s 1H 2009 results returned to profitability, the results don’t seem to portend a “break - -out” to new, higher levels

Positive 2009 same-store sales results driven by significant increase in average check

Year-over-Year Comparable Performance

1H 2008 1H 2009 % Change

Total revenues $87.3 $95.0 8.8% EBIT (a) (0.5) 1.7 NM EBITDA (a) 4.1 6.7 63.9% Net Income (a) (0.3) 1.1 NM Same-store sales (3.6%) 1.4% 5.0 pp Average check 2.0% 7.9% 5.9 pp Transactions (5.5%) (6.1%) (0.6) pp

OVERVIEW RUBIO’S III .

(a) | | Excludes asset impairment and loss on disposal. |

DISCUSSION MATERIALS 16

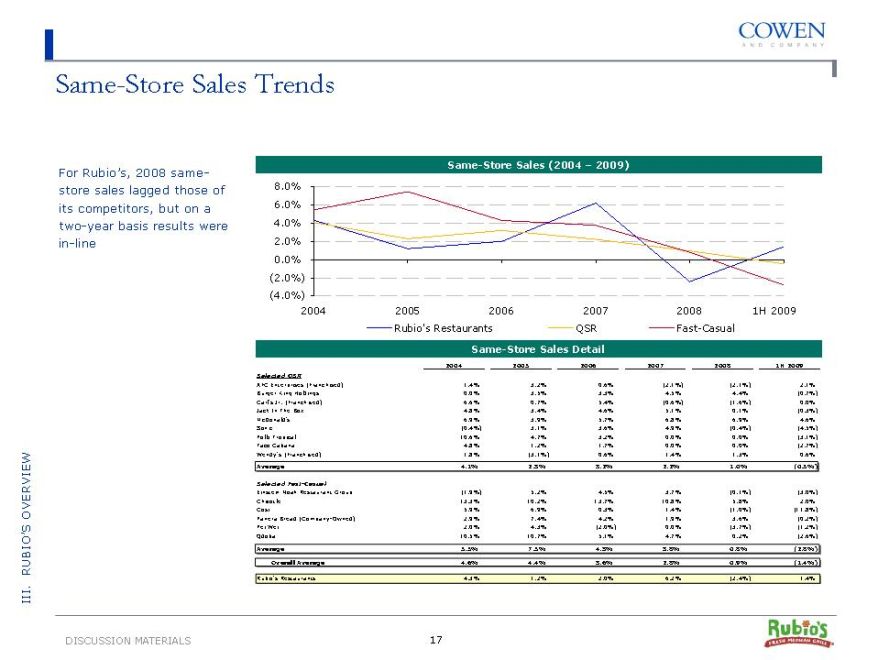

Same-Store Sales Trends

For Rubio’s, 2008 same-store sales lagged those of its competitors, but on a two-year basis results were in-line

Same -Store Sales (2004 – 2009)

8.0% 6.0% 4.0% 2.0% 0.0% (2.0%) (4.0%)

2004 2005 2006 2007 2008 1H 2009 Rubio’s Restaurants QSR Fast-Casual

Same -Store Sales Detail

2004 2005 2006 2007 2008 1H 2009

Selected QSR

AFC Enterprises (Franchised) 1.4% 3.2% 0.6% (2.1%) (2.1%) 2.1% Burger King Holdings 0.0% 3.5% 3.3% 4.5% 4.4% (0.7%) Carl’s Jr. (Franchised) 6.6% 0.7% 5.4% (0.6%) (1.6%) 0.0% Jack In The Box 4.8% 3.4% 4.6% 5.1% 0.1% (0.3%) McDonald’s 6.9% 3.9% 5.7% 6.8% 6.9% 4.6% Sonic (0.4%) 3.1% 3.6% 4.9% (0.4%) (4.5%) Pollo Tropical 10.6% 4.7% 3.2% 0.0% 0.0% (3.1%) Taco Cabana 4.8% 1.2% 1.7% 0.0% 0.0% (2.7%) Wendy’s (Franchised) 1.8% (3.1%) 0.6% 1.4% 1.3% 0.6%

Avera ge 4.1% 2.3% 3.2% 2.2% 1.0% (0.5%)

Selected Fast-Casual

Einstein Noah Restaurant Group (1.9%) 5.2% 4.5% 3.7% (0.1%) (3.0%) Chipotle 13.3% 10.2% 13.7% 10.8% 5.8% 2.0% Cosi 5.9% 6.9% 0.3% 1.4% (1.0%) (11.8%) Panera Bread (Company -Owned) 2.9% 7.4% 4.2% 1.9% 3.6% (0.2%) Pei Wei 2.0% 4.3% (2.0%) 0.0% (3.7%) (1.2%) Qdoba 10.5% 10.7% 5.1% 4.7% 0.2% (2.6%)

Average 5.5% 7.5% 4.3% 3.8% 0.8% (2.8%)

Overall Average 4.6% 4.4% 3.6% 2.8% 0.9% (1.4%)

Rubio’s Restaurants 4.3% 1.2% 2.0% 6.2% (2.4%) 1.4%

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 17

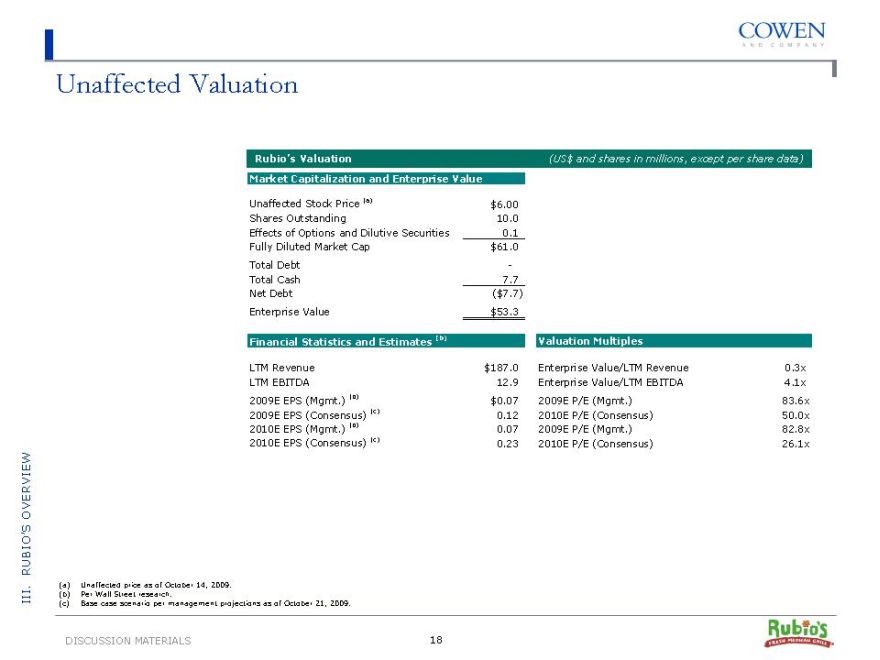

Unaffected Valuation

Rubio’s Valuation (US$ and shares in millions, except per share data)

Market Capitalization and Enterprise Value

Unaffected Stock Price (a) $6.00 Shares Outstanding 10.0 Effects of Options and Dilutive Securities 0.1 Fully Diluted Market Cap $61.0 Total Debt -Total Cash 7.7 Net Debt ($7.7) Enterprise Value $53.3

Financial Statistics and Estimates (b)

LTM Revenue $187.0 LTM EBITDA 12.9 2009E EPS (Mgmt. ) (b) $0.07 2009E EPS (Consensus) (c) 0.12 2010E EPS (Mgmt. ) (b) 0.07 2010E EPS (Consensus) (c) 0.23

Valuation Multiples

Enterprise Value/LTM Revenue 0.3x Enterprise Value/LTM EBITDA 4.1x 2009E P/E (Mgmt. ) 83.6x 2010E P/E (Consensus) 50.0x 2009E P/E (Mgmt. ) 82.8x 2010E P/E (Consensus) 26.1x

(a) | | Unaffected price as of October 14, 2009. (b) Per Wall Street research. |

(c) | | Base case scenario per management projections as of October 21, 2009. |

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 18

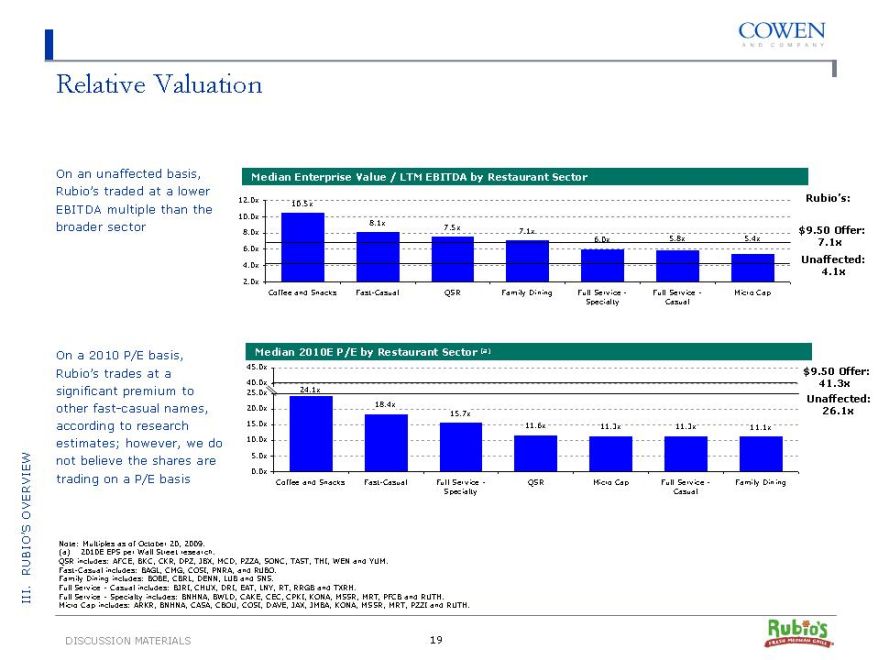

Relative Valuation

On an unaffected basis, Rubio’s traded at a lower EBITDA multiple than the broader sector

Median Enterprise Value / LTM EBITDA by Restaurant Sector

12.0x Rubio’s:

10.5x 10.0x

8.1x

7.5x 7.1x $9.50 Offer:

8.0x

6.0x 5.8x 5.4x 7.1x 6.0x

Unaffected:

4.0x

4.1x

2.0x

Coffee and Snacks Fast-Casual QSR Family Dining Full Service—Full Service—Micro Cap Specialty Casual

On a 2010 P/E basis, Rubio’s trades at a significant premium to other fast-casual names, according to research estimates; however, we do not believe the shares are trading on a P/E basis

Median 2010E P/E by Restaurant Sector (a)

45.0x $9.50 Offer:

40.0x 41.3x

25.0x 24.1x Unaffected:

20.0x 18.4x

15.7x 26.1x

15.0x 11.6x 11.3x 11.3x 11.1x 10.0x 5.0x 0.0x Coffee and Snacks Fast-Casual Full Service—QSR Micro Cap Full Service—Family Dining Specialty Casual

Note: Multiples as of October 20, 2009. (a) 2010E EPS per Wall Street research.

QSR includes: AFCE, BKC, CKR, DPZ, JBX, MCD, PZZA, SONC, TAST, THI, WEN and YUM. Fast-Casual includes: BAGL, CMG, COSI, PNRA, and RUBO.

Family Dining includes: BOBE, CBRL, DENN, LUB and SNS.

Full Service—Casual includes: BJRI, CHUX, DRI, EAT, LNY, RT, RRGB and TXRH.

Full Service—Specialty includes: BNHNA, BWLD, CAKE, CEC, CPKI, KONA, MSSR, MRT, PFCB and RUTH. Micro Cap includes: ARKR, BNHNA, CASA, CBOU, COSI, DAVE, JAX, JMBA, KONA, MSSR, MRT, PZZI and RUTH.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 19

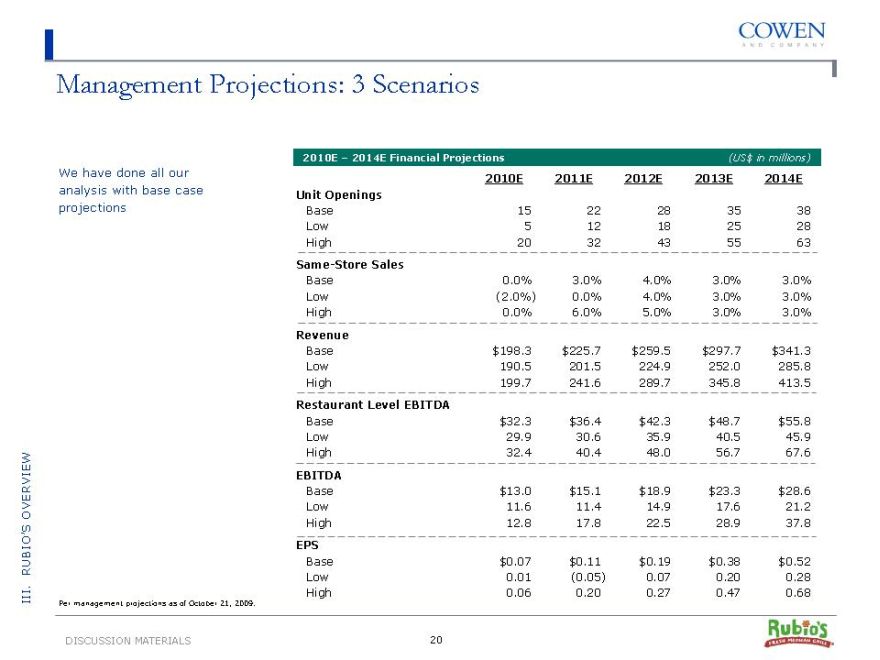

Management Projections: 3 Scenarios

We have done all our analysis with base case projections

2010E – 2014E Financial Projections (US$ in millions) 2010E 2011E 2012E 2013E 2014E Unit Openings

Base 15 22 28 35 38 Low 5 12 18 25 28 High 20 32 43 55 63

Same -Store Sales

Base 0.0% 3.0% 4.0% 3.0% 3.0% Low (2.0%) 0.0% 4.0% 3.0% 3.0% High 0.0% 6.0% 5.0% 3.0% 3.0%

Revenue

Base $198.3 $225.7 $259.5 $297.7 $341.3 Low 190.5 201.5 224.9 252.0 285.8 High 199.7 241.6 289.7 345.8 413.5

Restaurant Level EBITDA

Base $32.3 $36.4 $42.3 $48.7 $55.8 Low 29.9 30.6 35.9 40.5 45.9 High 32.4 40.4 48.0 56.7 67.6

EBITDA

Base $13.0 $15.1 $18.9 $23.3 $28.6 Low 11.6 11.4 14.9 17.6 21.2 High 12.8 17.8 22.5 28.9 37.8

EPS

Base $0.07 $0.11 $0.19 $0.38 $0.52 Low 0.01 (0.05) 0.07 0.20 0.28 High 0.06 0.20 0.27 0.47 0.68

Per management projections as of October 21, 2009.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 20

Historical and Projected Trend Lines

Although 2009 results have been encouraging so far, potential investors will look at historical trends to assess the likelihood of achieving future projections

Revenue Growth

20.0%

18.0% 18.0%

16.0% 15.0% 14.7% 13.9% 14.7% 14.0%

12.0% 11.5% 10.0% 9.9%

8.2% Historical Average: 8.0% 8.3% 5.9% 5.6% 6.0% 4.5% 5.3% 5.0% 4.0% 2.4% 2.0%

0.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Same -Store Sales

7.0 %

6.2% 6.0 %

5.0 %

4.3%

4.0 % 4.0%

3.0 % 3.0% 3.0% 3.0%

2.0% Historical 1.6% 1.8% Average: 2.0 % 1.8% 1.2% 1.0 % 0.0 % 0.0% (0.3%) (1.0%) (0.8%) (2.0%) (3.0%) (2.4%)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

EBITDA (a)

$35.0

30.0 $28.6

25.0 $23.3

20.0 $18.9

15.0 $15.1 $13.0 $12.1 $11.7 $10.9 $10.8 $11.0 $9.7 $10.3

10.0 Historical Average: $6.2 $9.5 $5.3 5.0

0.0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

New Company Units (Net Openings)

40 38

35 35

30 28

25 22 20

15 15 15 13

9 Historical

10 8 8

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Note: Base case scenario per management projections as of October 21, 2009.

(a) | | Projections include stock-based compensation expense, but exclude one-time costs. |

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 21

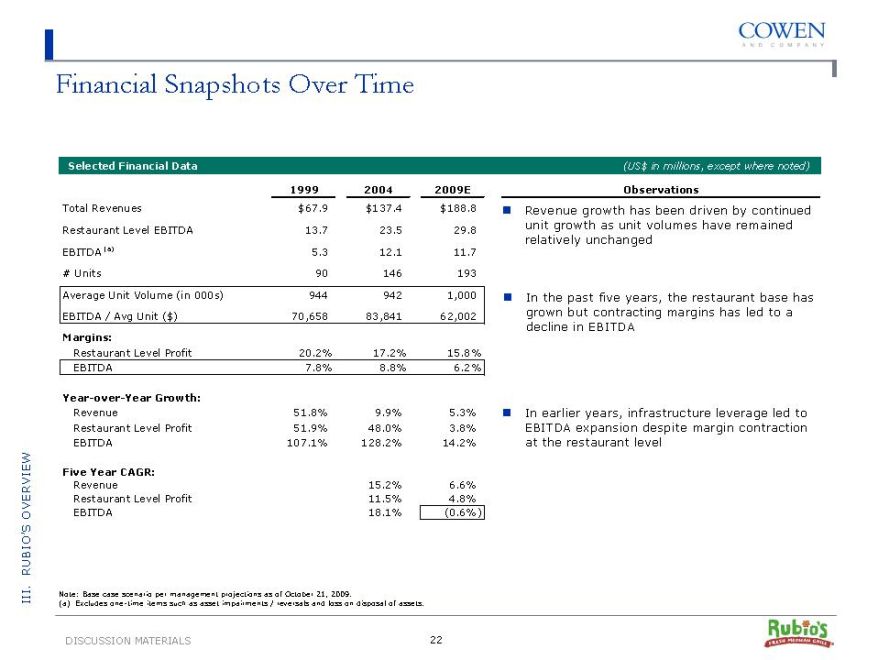

Financial Snapshots Over Time

Selected Financial Data

1999 2004 2009E

Total Revenues $67.9 $137.4 $188.8 Restaurant Level EBITDA 13.7 23.5 29.8 EBITDA (a) 5.3 12.1 11.7 # Units 90 146 193 Average Unit Volume (in 000s) 944 942 1,000 EBITDA / Avg Unit ($) 70,658 83,841 62,002

Margins:

Restaurant Level Profit 20.2% 17.2% 15.8% EBITDA 7.8% 8.8% 6.2%

Year-over-Year Growth:

Revenue 51.8% 9.9% 5.3% Restaurant Level Profit 51.9% 48.0% 3.8% EBITDA 107.1% 128.2% 14.2%

Five Year CAGR:

Revenue 15.2% 6.6% Restaurant Level Profit 11.5% 4.8% EBITDA 18.1% (0.6%)

Note: Base case scenario per management projections as of October 21, 2009.

(a) | | Excludes one-time items such as asset impairments / reversals and loss on disposal of assets. |

Observations

Revenue growth has been driven by continued unit growth as unit volumes have remained relatively unchanged

In the past five years, the restaurant base has grown but contracting margins has led to a decline in EBITDA

In earlier years, infrastructure leverage led to EBITDA expansion despite margin contraction at the restaurant level

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 22

Projections Relative to Recent Trends

The projections suggest an acceleration of unit growth, revenue growth and margin expansion when compared to historical trends

Revenue Growth

$350.0 $341.3

CAGR = 7.6% CAGR = 14.5%

300.0 $297.7 $259.5 250.0 $225.7 $198.3 200.0 $188.8 $179.3 $169.7 $152.3 150.0 $140.8

100.0

50.0

0.0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

EBITDA Growth

$35.0

CAGR = 1.8% CAGR = 21.8%

30.0 $28.6

25.0 $23.3

20.0 $18.9

$15.1 15.0 $13.0 $11.7 $10.9 $10.8 $11.0 $10.3 10.0

5.0

0.0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Total Units

350.0 331

CAGR = 6.7% CAGR = 12.3%

293 300.0 258 250.0 230 208 193 200.0 186 171 149 162 150.0

100.0

50.0

0.0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Average New Units/Year

40.0 Average = 9 Average = 28 38

35

30.0 28

22

20.0

15 15 13

10.0 9

0.0

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Note: Base case scenario per management projections as of October 21, 2009.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 23

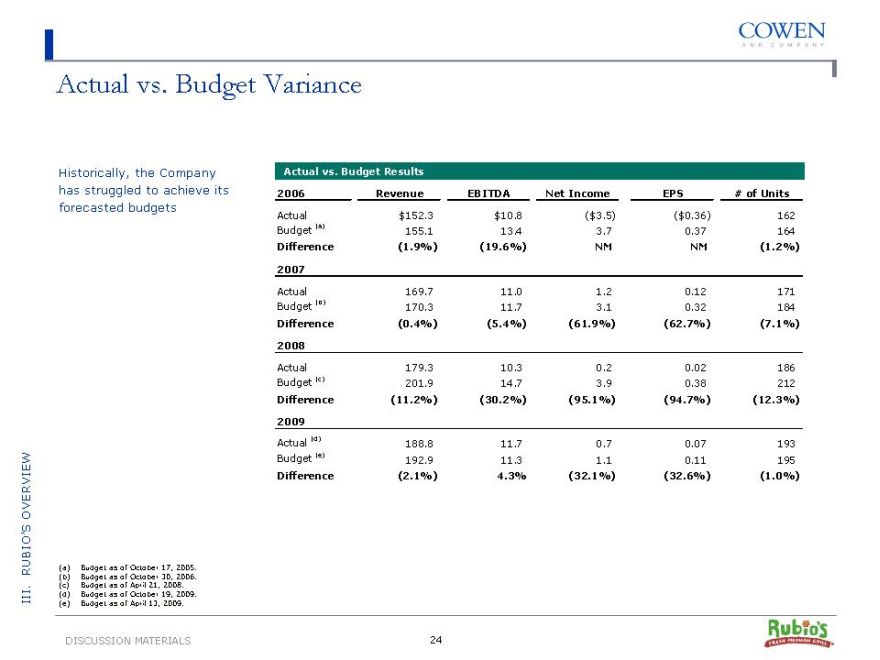

Actual vs. Budget Variance

Historically, the Company has struggled to achieve its forecasted budgets

Actual vs. Budget Results

2006 Revenue EBITDA Net Income EPS # of Units

Actual $152.3 $10.8 ($3.5) ($0.36) 162 Budget (a) 155.1 13.4 3.7 0.37 164

Difference (1.9%) (19.6%) NM NM (1.2%)

2007

Actual 169.7 11.0 1.2 0.12 171 Budget (b) 170.3 11.7 3.1 0.32 184

Difference (0.4%) (5.4%) (61.9%) (62.7%) (7.1%)

2008

Actual 179.3 10.3 0.2 0.02 186 Budget (c) 201.9 14.7 3.9 0.38 212

Difference (11.2%) (30.2%) (95.1%) (94.7%) (12.3%)

2009

Actual (d) 188.8 11.7 0.7 0.07 193 Budget (e) 192.9 11.3 1.1 0.11 195

Difference (2.1%) 4.3% (32.1%) (32.6%) (1.0%)

(a) Budget as of October 17, 2005. (b) Budget as of October 30, 2006. (c) Budget as of April 21, 2008. (d) Budget as of October 19, 2009. (e) Budget as of April 13, 2009.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 24

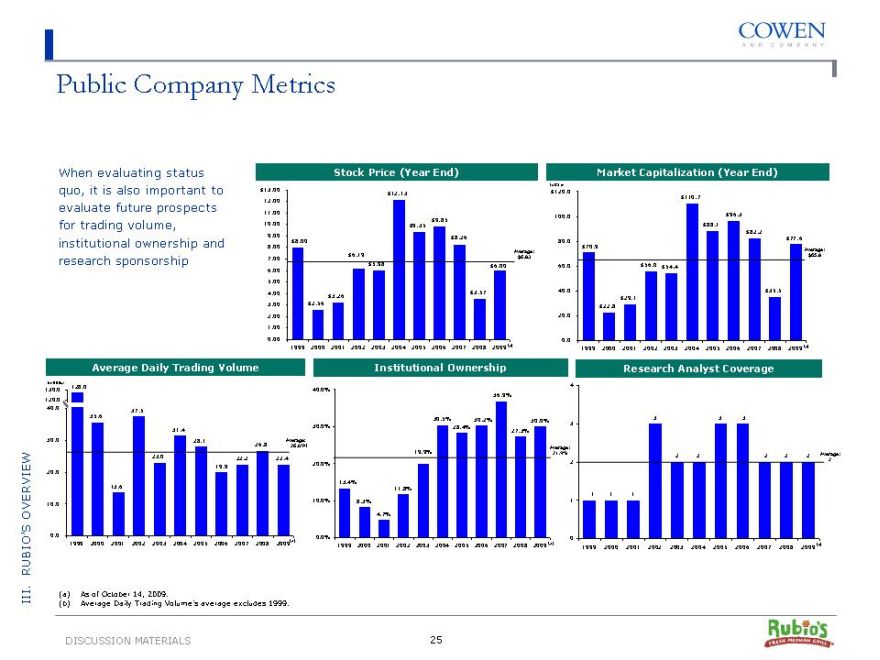

Public Company Metrics

When evaluating status quo, it is also important to evaluate future prospects for trading volume, institutional ownership and research sponsorship

Stock Price (Year End)

$13.00 $12.13 12.00 11.00 $9.85 10.00 $9.35 9.00 $8.00 $8.26 8.00

Average: $6.19 $6.83 7.00 $5.98 $6.00 6.00 5.00 4.00 $3.57 $3.26 3.00 $2.56 2.00 1.00 0.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009(a)

Market Capitalization (Year End)

(US$ in $120.0 $110.7

100.0 $96.3 $88.1 $82.2 $77.6 80.0 $70.9 Average: $65.8 60.0 $56.0 $54.4

40.0 $35.5 $29.1 $22.8 20.0

0.0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009(a)

Average Daily Trading Volume

(in 000s)

128.0 130.0 120.0

40.0 37.5 35.6

31.4

30.0 28.1 Average: 26.8 26.0 (b) 23.0 22.2 22.4 20.0 19.9 13.6

10.0

0.0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009(a)

Institutional Ownership

40.0% 36.9%

30.5% 30.2% 30.0% 30.0% 28.4% 27.3%

Average: 19.9% 21.9% 20.0%

13.4% 11.8% 10.0% 8.3%

4.7%

0.0%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 (a)

Research Analyst Coverage

0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 (a)

(a) | | As of October 14, 2009. |

(b) | | Average Daily Trading Volume’s average excludes 1999. |

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 25

Challenges of a Micro-Cap Stock

Given the current economic and market environment, Rubio’s will likely continue to experience:

??Lack of meaningful research coverage

??Limited trading volume

??A sub-$100 million market capitalization

??Difficulty in expanding its institutional shareholder base

??Volatility in stock price performance

??Meaningful costs and risks associated with its public-company status

Without a material “break -out” in EBITDA growth to levels more in line with forward projections, the challenges of overcoming micro-cap status seem significant

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 26

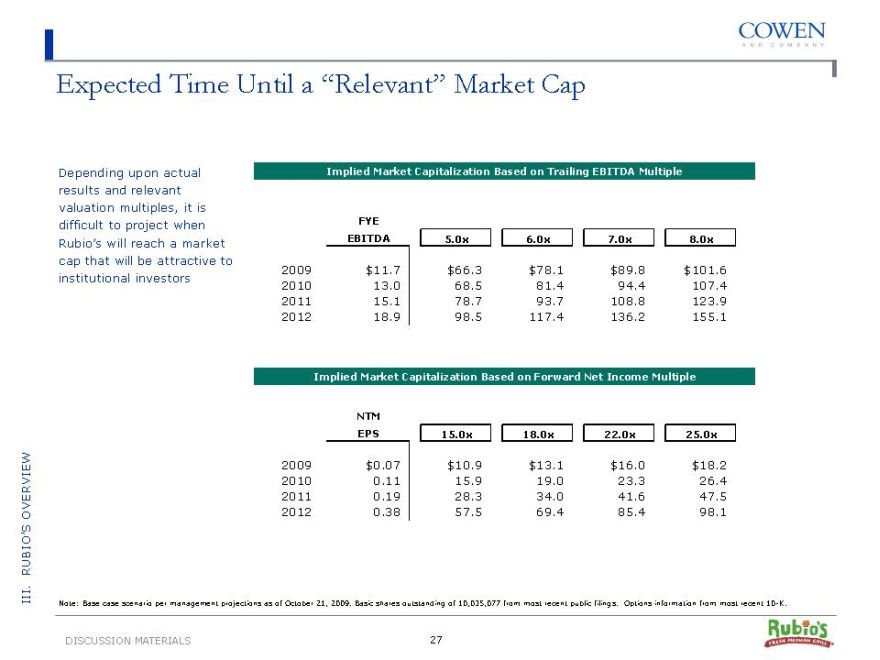

Expected Time Until a “Relevant” Market Cap

Depending upon actual results and relevant valuation multiples, it is difficult to project when Rubio’s will reach a market cap that will be attractive to institutional investors

Implied Market Capitalization Based on Trailing EBITDA Multiple

FYE

EBITDA 5.0x 6.0x 7.0x 8.0x

2009 $11.7 $66.3 $78.1 $89.8 $101.6 2010 13.0 68.5 81.4 94.4 107.4 2011 15.1 78.7 93.7 108.8 123.9 2012 18.9 98.5 117.4 136.2 155.1

Implied Market Capitalization Based on Forward Net Income Multiple

NTM

EPS 15.0x 18.0x 22.0x 25.0x

2009 $0.07 $10.9 $13.1 $16.0 $18.2 2010 0.11 15.9 19.0 23.3 26.4 2011 0.19 28.3 34.0 41.6 47.5 2012 0.38 57.5 69.4 85.4 98.1

Note: Base case scenario per management projections as of October 21, 2009. Basic shares outstanding of 10,035,077 from most recent public filings. Options information from most recent 10-K.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 27

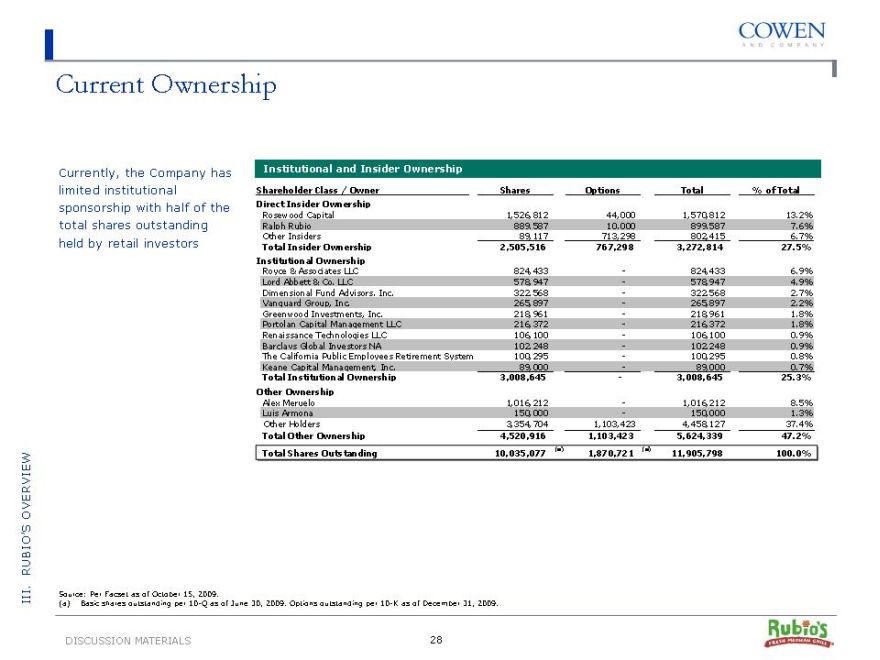

Current Ownership

Currently, the Company has limited institutional sponsorship with half of the total shares outstanding held by retail investors

Institutional and Insider Ownership

Shareholder Class / Owner Shares Options Total % of Total Direct Insider Ownership

Rosewood Capital 1,526,812 44,000 1,570,812 13.2% Ralph Rubio 889,587 10,000 899,587 7.6% Other Insiders 89,117 713,298 802,415 6.7%

Total Insider Ownership 2,505,516 767,298 3,272,814 27.5% Institutional Ownership

Royce & Associates LLC 824,433—824,433 6.9% Lord Abbett & Co. LLC 578,947—578,947 4.9% Dimensional Fund Advisors, Inc. 322,568—322,568 2.7% Vanguard Group, Inc. 265,897—265,897 2.2% Greenwood Investments, Inc. 218,961—218,961 1.8% Portolan Capital Management LLC 216,372—216,372 1.8% Renaissance Technologies LLC 106,100—106,100 0.9% Barclays Global Investors NA 102,248—102,248 0.9% The California Public Employees Retirement System 100,295—100,295 0.8% Keane Capital Management, Inc. 89,000—89,000 0.7%

Total Institutional Ownership 3,008,645—3,008,645 25.3% Other Ownership

Alex Meruelo 1,016,212—1,016,212 8.5% Luis Armona 150,000—150,000 1.3% Other Holders 3,354,704 1,103,423 4,458,127 37.4%

Total Other Ownership 4,520,916 1,103,423 5,624,339 47.2% Total Shares Outstanding 10,035,077 (a) 1,870,721 (a) 11,905,798 100.0%

Source: Per Facset as of October 15, 2009.

(a) | | Basic shares outstanding per 10-Q as of June 30, 2009. Options outstanding per 10-K as of December 31, 2009. |

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 28

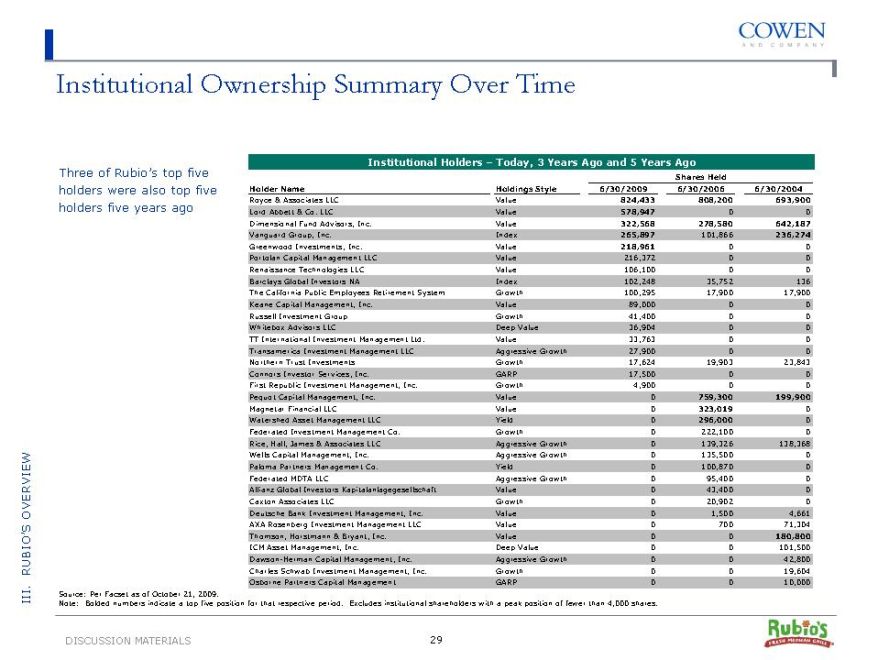

Institutional Ownership Summary Over Time

Three of Rubio’s top five holders were also top five holders five years ago

Institutional Holders – Today, 3 Years Ago and 5 Years Ago Shares Held Holder Name Holdings Style 6/30/2009 6/30/2006 6/30/2004

Royce & Associates LLC Value 824,433 808,200 693,900 Lord Abbett & Co. LLC Value 578,947 0 0 Dimensional Fund Advisors, Inc. Value 322,568 278,580 642,187 Vanguard Group, Inc. Index 265,897 101,866 236,274 Greenwood Investments, Inc. Value 218,961 0 0 Portolan Capital Management LLC Value 216,372 0 0 Renaissance Technologies LLC Value 106,100 0 0 Barclays Global Investors NA Index 102,248 35,752 136 The California Public Employees Retirement System Growth 100,295 17,900 17,900 Keane Capital Management, Inc. Value 89,000 0 0 Russell Investment Group Growth 41,400 0 0 Whitebox Advisors LLC Deep Value 36,904 0 0 TT International Investment Management Ltd. Value 33,763 0 0 Transamerica Investment Management LLC Aggressive Growth 27,900 0 0 Northern Trust Investments Growth 17,624 19,903 23,843 Connors Investor Services, Inc. GARP 17,500 0 0 First Republic Investment Management, Inc. Growth 4,900 0 0 Pequot Capital Management, Inc. Value 0 759,300 199,900 Magnetar Financial LLC Value 0 323,019 0 Watershed Asset Management LLC Yield 0 296,000 0 Federated Investment Management Co. Growth 0 222,100 0 Rice, Hall, James & Associates LLC Aggressive Growth 0 139,326 138,368 Wells Capital Management, Inc. Aggressive Growth 0 135,500 0 Paloma Partners Management Co. Yield 0 100,870 0 Federated MDTA LLC Aggressive Growth 0 95,400 0 Allianz Global Investors Kapitalanlagegesellschaft Value 0 43,400 0 Caxton Associates LLC Growth 0 20,902 0 Deutsche Bank Investment Management, Inc. Value 0 1,500 4,661 AXA Rosenberg Investment Management LLC Value 0 700 71,304 Thomson, Horstmann & Bryant, Inc. Value 0 0 180,800 ICM Asset Management, Inc. Deep Value 0 0 101,500 Dawson -Herman Capital Management, Inc. Aggressive Growth 0 0 42,800 Charles Schwab Investment Management, Inc. Growth 0 0 19,604 Osborne Partners Capital Management GARP 0 0 10,000

Source: Per Facset as of October 21, 2009.

Note: Bolded numbers indicate a top five position for that respective period. Excludes institutional shareholders with a peak position of fewer than 4,000 shares.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 29

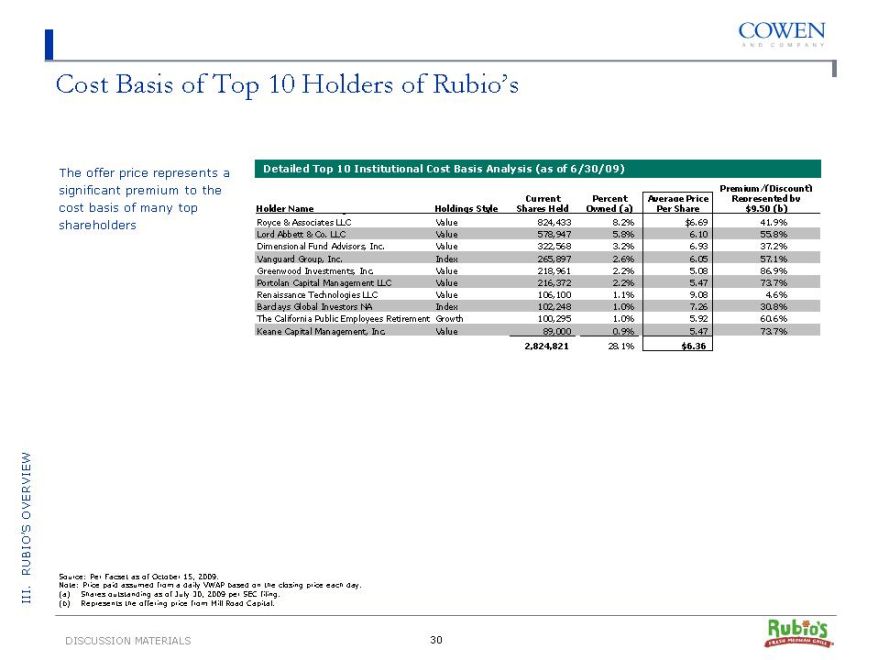

Cost Basis of Top 10 Holders of Rubio’s

The offer price represents a significant premium to the cost basis of many top shareholders

Detailed Top 10 Institutional Cost Basis Analysis (as of 6/30/09)

Premium/(Discount)

Current Percent Average Price Represented by Holder Name Holdings Style Shares Held Owned (a) Per Share $9.50 (b)

Royce & Associates LLC Value 824,433 8.2% $6.69 41.9% Lord Abbett & Co. LLC Value 578,947 5.8% 6.10 55.8% Dimensional Fund Advisors, Inc. Value 322,568 3.2% 6.93 37.2% Vanguard Group, Inc. Index 265,897 2.6% 6.05 57.1% Greenwood Investments, Inc. Value 218,961 2.2% 5.08 86.9% Portolan Capital Management LLC Value 216,372 2.2% 5.47 73.7% Renaissance Technologies LLC Value 106,100 1.1% 9.08 4.6% Barclays Global Investors NA Index 102,248 1.0% 7.26 30.8% The California Public Employees Retirement SGrowth 100,295 1.0% 5.92 60.6% Keane Capital Management, Inc. Value 89,000 0.9% 5.47 73.7%

2,824,821 28.1% $6.36

Source: Per Facset as of October 15, 2009.

Note: Price paid assumed from a daily VWAP based on the closing price each day. (a) Shares outstanding as of July 30, 2009 per SEC filing. (b) Represents the offering price from Mill Road Capital.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 30

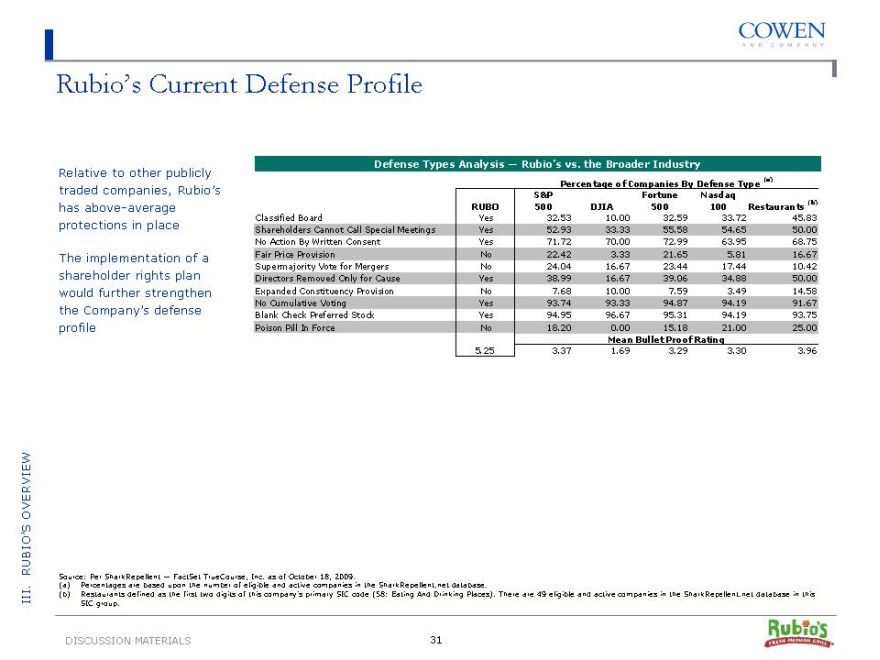

Rubio’s Current Defense Profile

Relative to other publicly traded companies, Rubio’s has above-average protections in place

The implementation of a shareholder rights plan would further strengthen the Company’s defense profile

Defense Types Analysis — Rubio’s vs. the Broader Industry

Percentage of Companies By Defense Type (a) S&P Fortune Nasdaq

RUBO 500 DJIA 500 100 Restaurants (b)

Classified Board Yes 32.53 10.00 32.59 33.72 45.83 Shareholders Cannot Call Special Meetings Yes 52.93 33.33 55.58 54.65 50.00 No Action By Written Consent Yes 71.72 70.00 72.99 63.95 68.75 Fair Price Provision No 22.42 3.33 21.65 5.81 16.67 Supermajority Vote for Mergers No 24.04 16.67 23.44 17.44 10.42 Directors Removed Only for Cause Yes 38.99 16.67 39.06 34.88 50.00 Expanded Constituency Provision No 7.68 10.00 7.59 3.49 14.58 No Cumulative Voting Yes 93.74 93.33 94.87 94.19 91.67 Blank Check Preferred Stock Yes 94.95 96.67 95.31 94.19 93.75 Poison Pill In Force No 18.20 0.00 15.18 21.00 25.00

Mean Bullet Proof Rating

5.25 3.37 1.69 3.29 3.30 3.96

Source: Per SharkRepellent — FactSet TrueCourse, Inc. as of October 18, 2009.

(a) | | Percentages are based upon the number of eligible and active companies in the SharkRepellent. net database. |

(b) Restaurants defined as the first two digits of this company’s primary SIC code (58: Eating And Drinking Places) . There are 49 eligible and active companies in the SharkRepellent. net database in this SIC group.

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 31

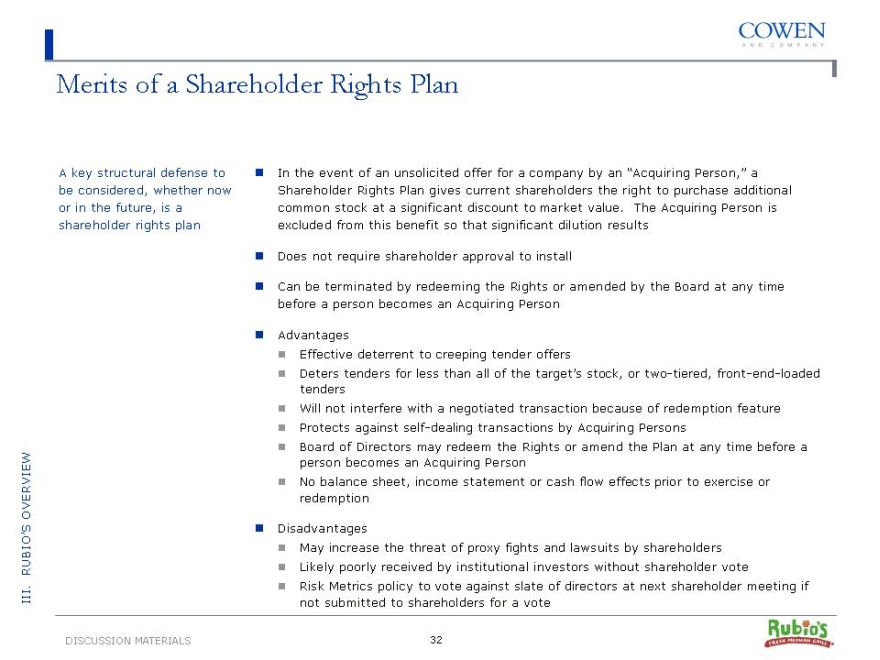

Merits of a Shareholder Rights Plan

A key structural defense to be considered, whether now or in the future, is a shareholder rights plan

In the event of an unsolicited offer for a company by an “Acquiring Person,” a Shareholder Rights Plan gives current shareholders the right to purchase additional common stock at a significant discount to market value. The Acquiring Person is excluded from this benefit so that significant dilution results

Does not require shareholder approval to install

Can be terminated by redeeming the Rights or amended by the Board at any time before a person becomes an Acquiring Person

Advantages

??Effective deterrent to creeping tender offers

??Deters tenders for less than all of the target’s stock, or two-tiered, front-end-loaded tenders

??Will not interfere with a negotiated transaction because of redemption feature

??Protects against self-dealing transactions by Acquiring Persons

??Board of Directors may redeem the Rights or amend the Plan at any time before a person becomes an Acquiring Person

??No balance sheet, income statement or cash flow effects prior to exercise or redemption

Disadvantages

??May increase the threat of proxy fights and lawsuits by shareholders

??Likely poorly received by institutional investors without shareholder vote

??Risk Metrics policy to vote against slate of directors at next shareholder meeting if not submitted to shareholders for a vote

OVERVIEW RUBIO’S III .

DISCUSSION MATERIALS 32

IV. Valuation Overview

Overview of Offers

The Company has received two unsolicited acquisition proposals

Summary of Unsolicited Proposals

Offer 1 Offer 2

Potential Acquirers Meruelo Enterprises and Mill Road Capital Levine Leichtman

Current Ownership 1,166,212 shares <5.0% Offer Price $8.00 $9.50 Consideration Cash Cash

Sources of Funds $13.3 m cash from Meruelo Claims to be fully financed 3.9 m cash from LLCP 52.5 m debt from LLCP 5.1 m Company cash on hand 9.3 m in existing ownership

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 34

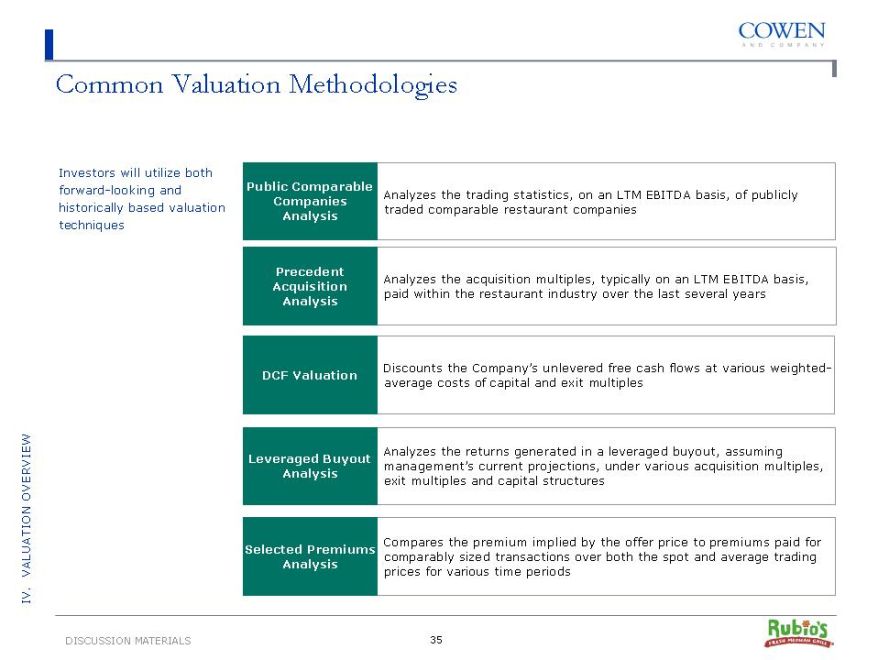

Common Valuation Methodologies

Investors will utilize both forward -looking and historically based valuation techniques

Public Comparable

Analyzes the trading statistics, on an LTM EBITDA basis, of publicly

Companies traded comparable restaurant companies

Analysis

Precedent

Analyzes the acquisition multiples, typically on an LTM EBITDA basis,

Acquisition paid within the restaurant industry over the last several years

Analysis

Discounts the Company’s unlevered free cash flows at various weighted -

DCF Valuation average costs of capital and exit multiples

Analyzes the returns generated in a leveraged buyout, assuming

Leveraged Buyout management’s current projections, under various acquisition multiples,

Analysis exit multiples and capital structures

Compares the premium implied by the offer price to premiums paid for

Selected Premiums comparably sized transactions over both the spot and average trading

Analysis prices for various time periods

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 35

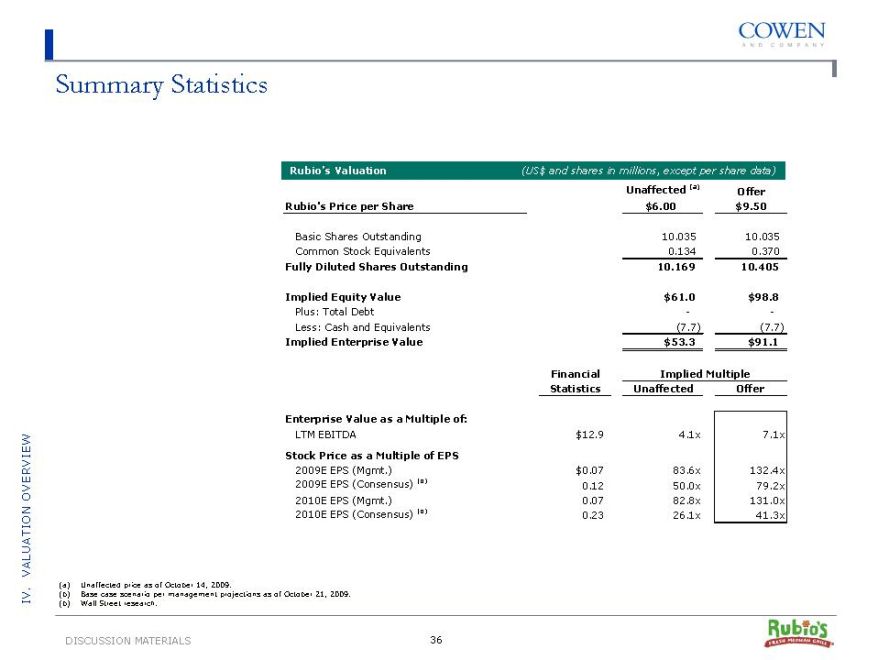

Summary Statistics

Rubio’s Valuation (US$ and shares in millions, except per share data)

Unaffected (a) Offer Rubio’s Price per Share $6.00 $9.50

Basic Shares Outstanding 10.035 10.035 Common Stock Equivalents 0.134 0.370

Fully Diluted Shares Outstanding 10.169 10.405

Implied Equity Value $61.0 $98.8

Plus: Total Debt—-Less: Cash and Equivalents (7.7) (7.7)

Implied Enterprise Value $53.3 $91.1

Financial Implied Multiple

Statistics Unaffected Offer

Enterprise Value as a Multiple of:

LTM EBITDA $12.9 4.1x 7.1x

Stock Price as a Multiple of EPS

2009E EPS (Mgmt. ) $0.07 83.6x 132.4x 2009E EPS (Consensus) (b) 0.12 50.0x 79.2x 2010E EPS (Mgmt. ) 0.07 82.8x 131.0x 2010E EPS (Consensus) (b) 0.23 26.1x 41.3x

(a) | | Unaffected price as of October 14, 2009. |

(b) | | Base case scenario per management projections as of October 21, 2009. (b) Wall Street research. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 36

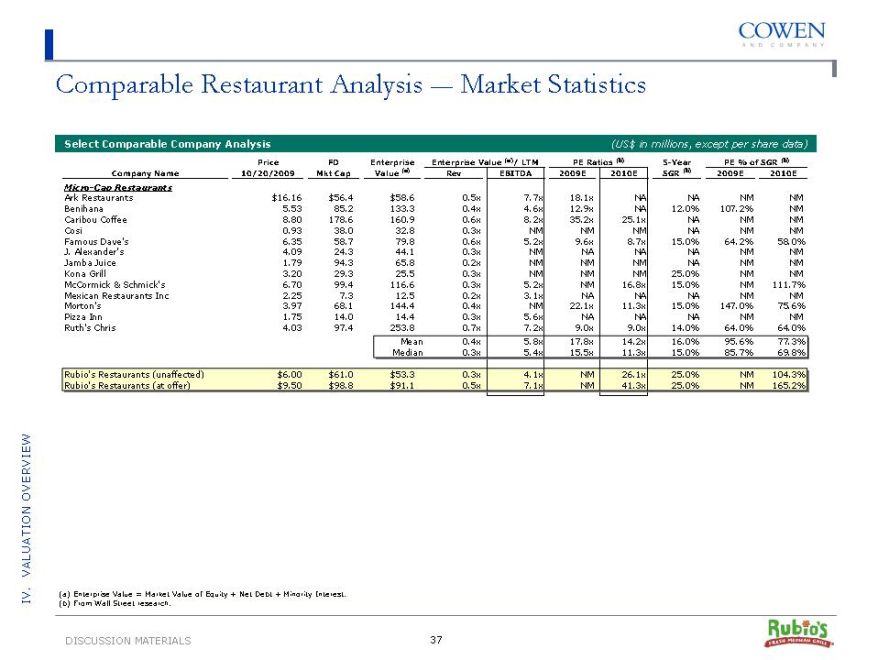

Comparable Restaurant Analysis —Market Statistics

Select Comparable Company Analysis (US$ in millions, except per share data)

Price FD Enterprise Enterprise Value (a)/ LTM PE Ratios (b) 5-Year PE % of SGR (b) Company Name 10/20/2009 Mkt Cap Value (a) Rev EBITDA 2009E 2010E SGR (b) 2009E 2010E

Micro -Cap Restaurants

Ark Restaurants $16.16 $56.4 $58.6 0.5x 7.7x 18.1x NA NA NM NM Benihana 5.53 85.2 133.3 0.4x 4.6x 12.9x NA 12.0% 107.2% NM Caribou Coffee 8.80 178.6 160.9 0.6x 8.2x 35.2x 25.1x NA NM NM Cosi 0.93 38.0 32.8 0.3x NM NM NM NA NM NM Famous Dave’s 6.35 58.7 79.8 0.6x 5.2x 9.6x 8.7x 15.0% 64.2% 58.0% J. Alexander’s 4.09 24.3 44.1 0.3x NM NA NA NA NM NM Jamba Juice 1.79 94.3 65.8 0.2x NM NM NM NA NM NM Kona Grill 3.20 29.3 25.5 0.3x NM NM NM 25.0% NM NM McCormick & Schmick’s 6.70 99.4 116.6 0.3x 5.2x NM 16.8x 15.0% NM 111.7% Mexican Restaurants Inc 2.25 7.3 12.5 0.2x 3.1x NA NA NA NM NM Morton’s 3.97 68.1 144.4 0.4x NM 22.1x 11.3x 15.0% 147.0% 75.6% Pizza Inn 1.75 14.0 14.4 0.3x 5.6x NA NA NA NM NM Ruth’s Chris 4.03 97.4 253.8 0.7x 7.2x 9.0x 9.0x 14.0% 64.0% 64.0% Mean 0.4x 5.8x 17.8x 14.2x 16.0% 95.6% 77.3% Median 0.3x 5.4x 15.5x 11.3x 15.0% 85.7% 69.8%

Rubio’s Restaurants (unaffected) $6.00 $61.0 $53.3 0.3x 4.1x NM 26.1x 25.0% NM 104.3% Rubio’s Restaurants (at offer) $9.50 $98.8 $91.1 0.5x 7.1x NM 41.3x 25.0% NM 165.2%

(a) | | Enterprise Value = Market Value of Equity + Net Debt + Minority Interest. (b) From Wall Street research. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 37

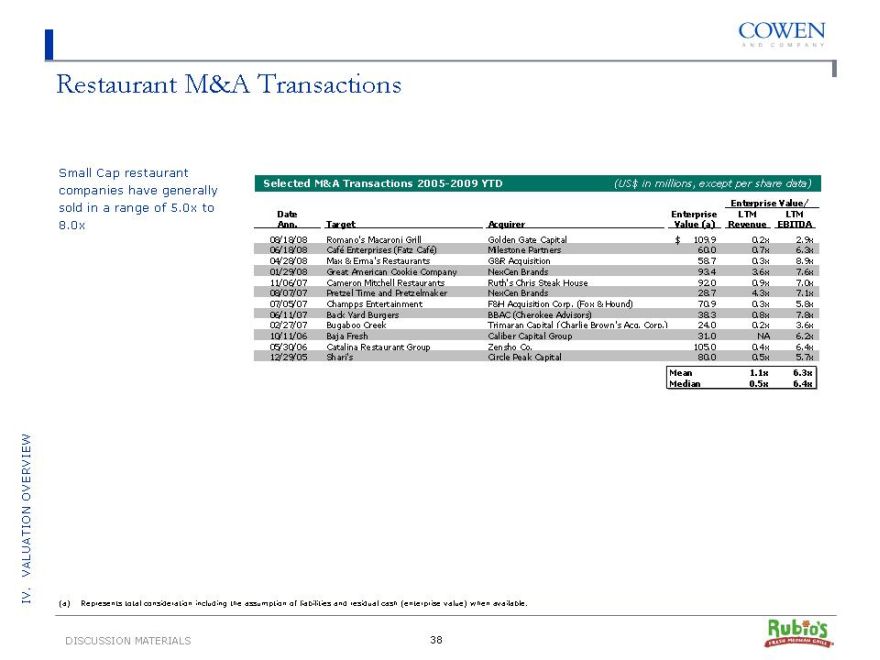

Restaurant M&A Transactions

Small Cap restaurant companies have generally sold in a range of 5.0x to 8.0x

Selected M&A Transactions 2005 -2009 YTD (US$ in millions, except per share data) Enterprise Value/ Date Enterprise LTM LTM

Ann. Target Acquirer Value (a) Revenue EBITDA

08/18/08 Romano’s Macaroni Grill Golden Gate Capital $ 109.9 0.2x 2.9x 06/18/08 Café Enterprises (Fatz Café) Milestone Partners 60.0 0.7x 6.3x 04/28/08 Max & Erma’s Restaurants G&R Acquisition 58.7 0.3x 8.9x 01/29/08 Great American Cookie Company NexCen Brands 93.4 3.6x 7.6x 11/06/07 Cameron Mitchell Restaurants Ruth’s Chris Steak House 92.0 0.9x 7.0x 08/07/07 Pretzel Time and Pretzelmaker NexCen Brands 28.7 4.3x 7.1x 07/05/07 Champps Entertainment F&H Acquisition Corp. (Fox & Hound) 70.9 0.3x 5.8x 06/11/07 Back Yard Burgers BBAC (Cherokee Advisors) 38.3 0.8x 7.8x 02/27/07 Bugaboo Creek Trimaran Capital (Charlie Brown’s Acq. Corp.) 24.0 0.2x 3.6x 10/11/06 Baja Fresh Caliber Capital Group 31.0 NA 6.2x 05/30/06 Catalina Restaurant Group Zensho Co. 105.0 0.4x 6.4x 12/29/05 Shari’s Circle Peak Capital 80.0 0.5x 5.7x

Mean 1.1x 6.3x Median 0.5x 6.4x

(a) Represents total consideration including the assumption of liabilities and residual cash (enterprise value) when available.

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 38

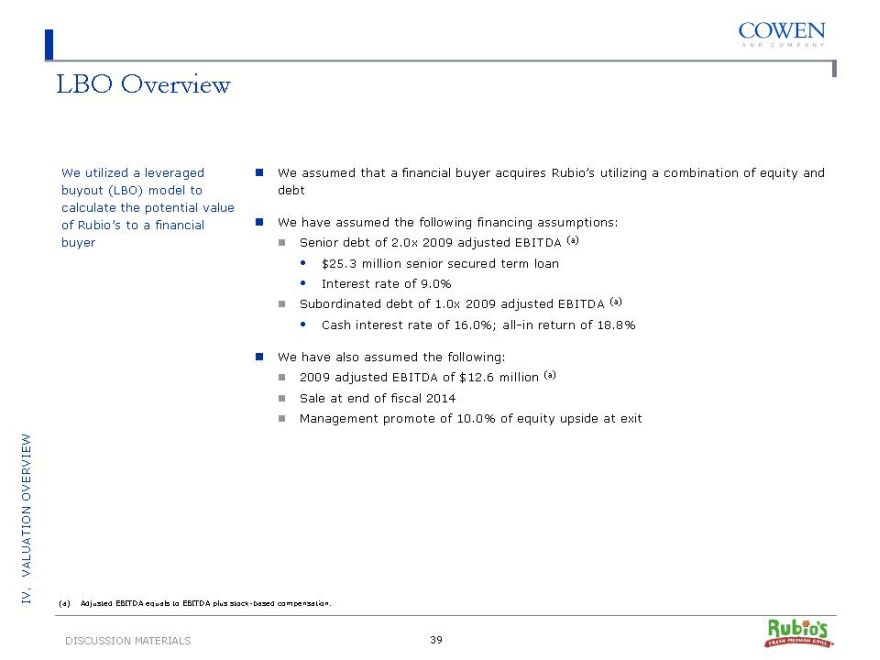

LBO Overview

We utilized a leveraged buyout (LBO) model to calculate the potential value of Rubio’s to a financial buyer

We assumed that a financial buyer acquires Rubio’s utilizing a combination of equity and debt

We have assumed the following financing assumptions:

??Senior debt of 2.0x 2009 adjusted EBITDA (a) • $25.3 million senior secured term loan

• Interest rate of 9.0%

??Subordinated debt of 1.0x 2009 adjusted EBITDA (a)

• Cash interest rate of 16.0%; all-in return of 18.8%

We have also assumed the following:

??2009 adjusted EBITDA of $12.6 million (a)

??Sale at end of fiscal 2014

??Management promote of 10.0% of equity upside at exit

(a) | | Adjusted EBITDA equals to EBITDA plus stock-based compensation. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 39

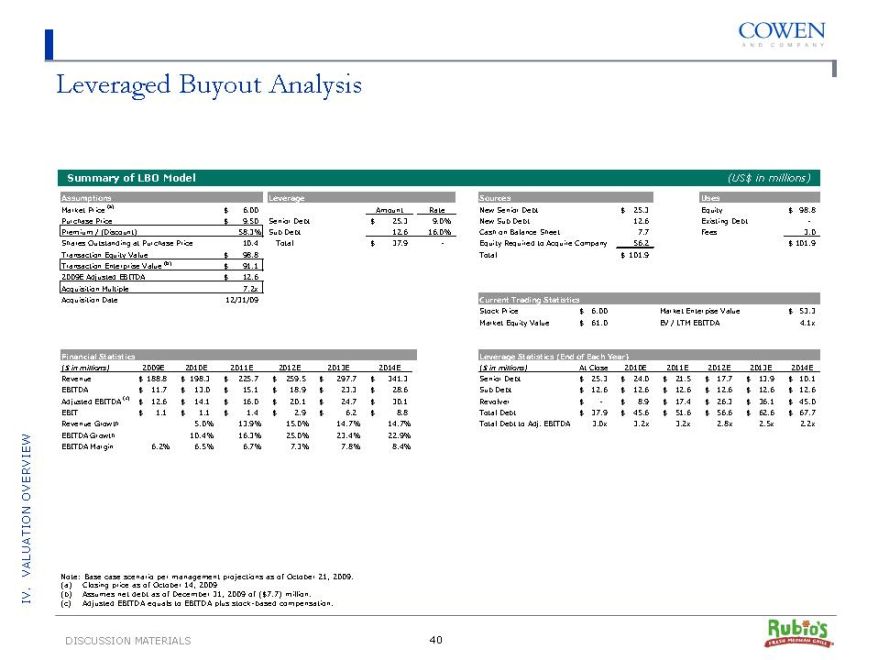

Leveraged Buyout Analysis

Summary of LBO Model

Assumptions

Market Price (a) $ 6.00 Purchase Price $ 9.50 Premium / (Discount) 58.3% Shares Outstanding at Purchase Price 10.4 Transaction Equity Value $ 98.8 Transaction Enterprise Value (b) $ 91.1 2009E Adjusted EBITDA $ 12.6 Acquisition Multiple 7.2x Acquisition Date 12/31/09

Leverage

Amount Rate Senior Debt $ 25.3 9.0% Sub Debt 12.6 16.0% Total $ 37.9 -

Sources

New Senior Debt $ 25.3 New Sub Debt 12.6 Cash on Balance Sheet 7.7 Equity Required to Acquire Company 56.2 Total $ 101.9

[Graphic Appears Here]

Current Trading Statistics

Stock Price $ 6.00 Market Enterpise Value $ 53.3 Market Equity Value $ 61.0 EV / LTM EBITDA 4.1x

Financial Statistics

($ in millions) 2009E 2010E 2011E 2012E 2013E 2014E Revenue $ 188.8 $ 198.3 $ 225.7 $ 259.5 $ 297.7 $ 341.3 EBITDA $ 11.7 $ 13.0 $ 15.1 $ 18.9 $ 23.3 $ 28.6 Adjusted EBITDA (c) $ 12.6 $ 14.1 $ 16.0 $ 20.1 $ 24.7 $ 30.1 EBIT $ 1.1 $ 1.1 $ 1.4 $ 2.9 $ 6.2 $ 8.8 Revenue Growth 5.0% 13.9% 15.0% 14.7% 14.7% EBITDA Growth 10.4% 16.3% 25.0% 23.4% 22.9% EBITDA Margin 6.2% 6.5% 6.7% 7.3% 7.8% 8.4%

Leverage Statistics (End of Each Year)

($ in millions) At Close 2010E 2011E 2012E 2013E 2014E Senior Debt $ 25.3 $ 24.0 $ 21.5 $ 17.7 $ 13.9 $ 10.1 Sub Debt $ 12.6 $ 12.6 $ 12.6 $ 12.6 $ 12.6 $ 12.6 Revolver $—$ 8.9 $ 17.4 $ 26.3 $ 36.1 $ 45.0 Total Debt $ 37.9 $ 45.6 $ 51.6 $ 56.6 $ 62.6 $ 67.7 Total Debt to Adj. EBITDA 3.0x 3.2x 3.2x 2.8x 2.5x 2.2x

Note: Base case scenario per management projections as of October 21, 2009. (a) Closing price as of October 14, 2009 (b) Assumes net debt as of December 31, 2009 of ($7.7) million.

(c) | | Adjusted EBITDA equals to EBITDA plus stock-based compensation. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 40

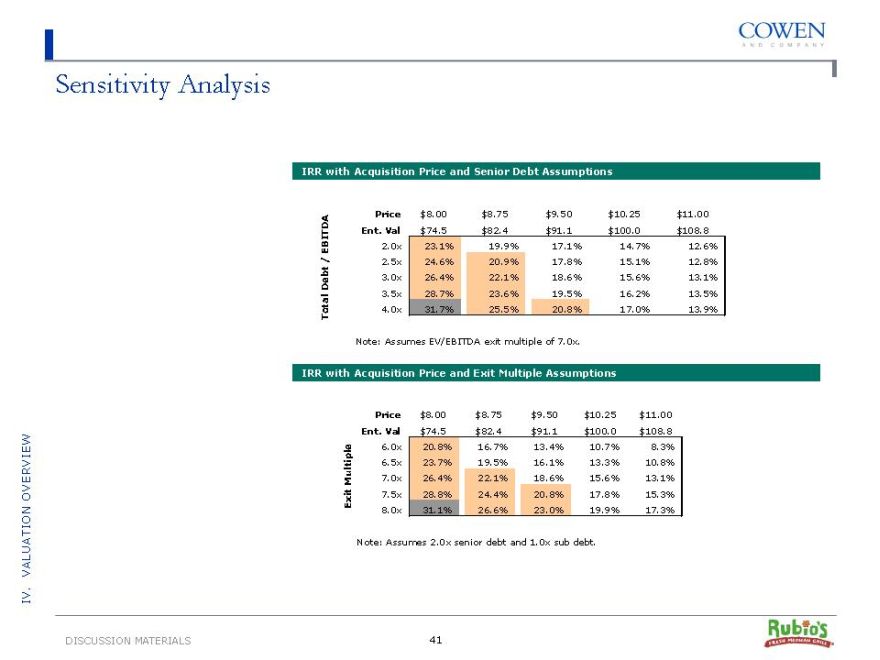

Sensitivity Analysis

IRR with Acquisition Price and Senior Debt Assumptions

EBITDA / Debt Total

Price $8.00 $8.75 $9.50 $10.25 $11.00 Ent. Val $74.5 $82.4 $91.1 $100.0 $108.8 2.0x 23.1% 19.9% 17.1% 14.7% 12.6% 2.5x 24.6% 20.9% 17.8% 15.1% 12.8% 3.0x 26.4% 22.1% 18.6% 15.6% 13.1% 3.5x 28.7% 23.6% 19.5% 16.2% 13.5% 4.0x 31.7% 25.5% 20.8% 17.0% 13.9%

Note: Assumes EV/EBITDA exit multiple of 7.0x.

IRR with Acquisition Price and Exit Multiple Assumptions

Multiple Exit

Price $8.00 $8.75 $9.50 $10.25 $11.00 Ent. Val $74.5 $82.4 $91.1 $100.0 $108.8 6.0x 20.8% 16.7% 13.4% 10.7% 8.3% 6.5x 23.7% 19.5% 16.1% 13.3% 10.8% 7.0x 26.4% 22.1% 18.6% 15.6% 13.1% 7.5x 28.8% 24.4% 20.8% 17.8% 15.3% 8.0x 31.1% 26.6% 23.0% 19.9% 17.3%

Note: Assumes 2.0x senior debt and 1.0x sub debt.

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 41

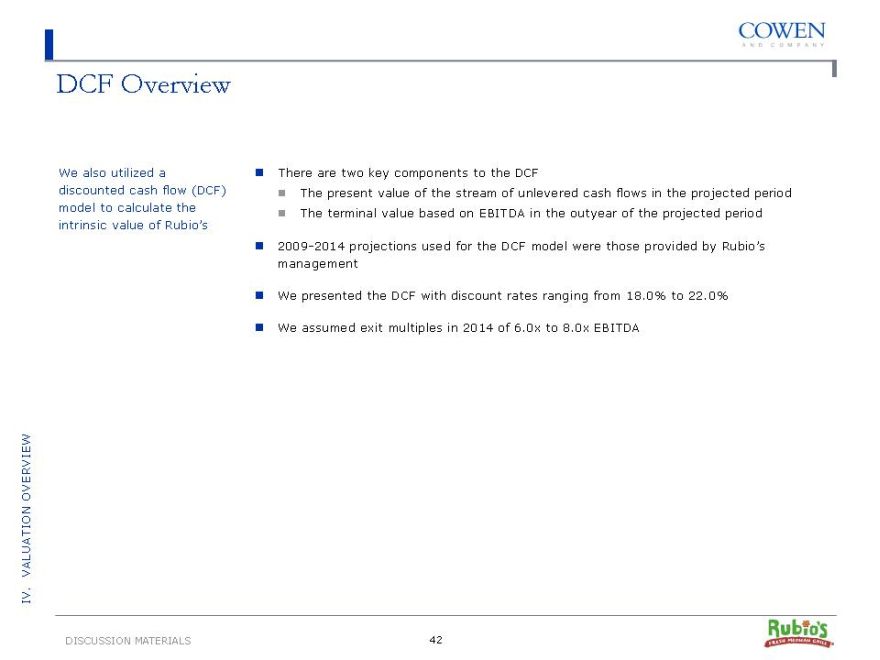

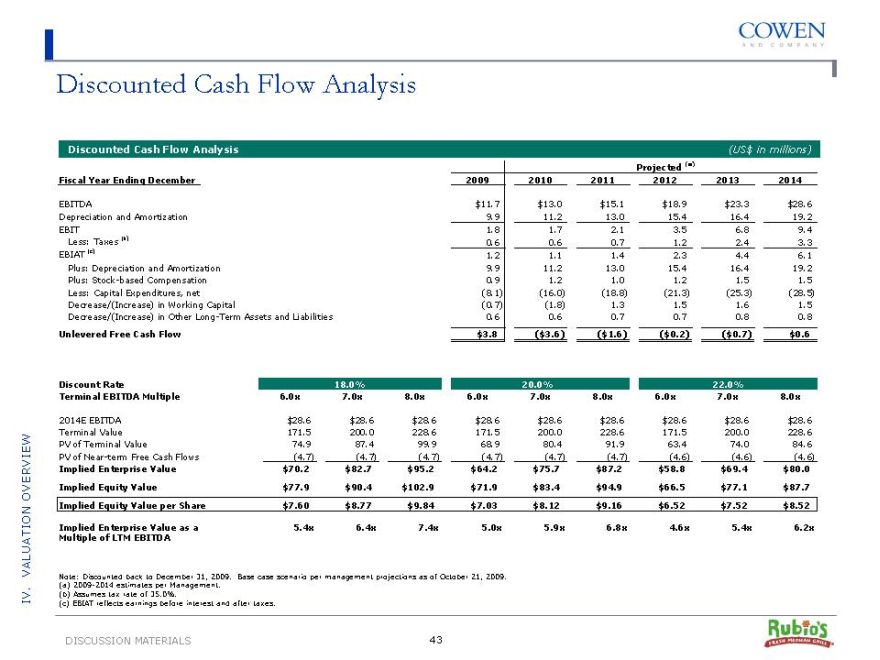

DCF Overview

We also utilized a discounted cash flow (DCF) model to calculate the intrinsic value of Rubio’s

There are two key components to the DCF

??The present value of the stream of unlevered cash flows in the projected period

??The terminal value based on EBITDA in the outyear of the projected period

2009-2014 projections used for the DCF model were those provided by Rubio’s management

We presented the DCF with discount rates ranging from 18.0% to 22.0%

We assumed exit multiples in 2014 of 6.0x to 8.0x EBITDA

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 42

Discounted Cash Flow Analysis

Discounted Cash Flow Analysis (US$ in millions) Projected (a) Fiscal Year Ending December 2009 2010 2011 2012 2013 2014

EBITDA $11.7 $13.0 $15.1 $18.9 $23.3 $28.6 Depreciation and Amortization 9.9 11.2 13.0 15.4 16.4 19.2 EBIT 1.8 1.7 2.1 3.5 6.8 9.4 Less: Taxes (b) 0.6 0.6 0.7 1.2 2.4 3.3 EBIAT (c) 1.2 1.1 1.4 2.3 4.4 6.1 Plus: Depreciation and Amortization 9.9 11.2 13.0 15.4 16.4 19.2 Plus: Stock-based Compensation 0.9 1.2 1.0 1.2 1.5 1.5 Less: Capital Expenditures, net (8.1) (16.0) (18.8) (21.3) (25.3) (28.5) Decrease/(Increase) in Working Capital (0.7) (1.8) 1.3 1.5 1.6 1.5 Decrease/(Increase) in Other Long-Term Assets and Liabilities 0.6 0.6 0.7 0.7 0.8 0.8

Unlevered Free Cash Flow $3.8 ($3.6) ($1.6) ($0.2) ($0.7) $0.6

Discount Rate 18.0% 20.0% 22.0%

Terminal EBITDA Multiple 6.0x 7.0x 8.0x 6.0x 7.0x 8.0x 6.0x 7.0x 8.0x

2014E EBITDA $28.6 $28.6 $28.6 $28.6 $28.6 $28.6 $28.6 $28.6 $28.6 Terminal Value 171.5 200.0 228.6 171.5 200.0 228.6 171.5 200.0 228.6 PV of Terminal Value 74.9 87.4 99.9 68.9 80.4 91.9 63.4 74.0 84.6 PV of Near-term Free Cash Flows (4.7) (4.7) (4.7) (4.7) (4.7) (4.7) (4.6) (4.6) (4.6)

Implied Enterprise Value $70.2 $82.7 $95.2 $64.2 $75.7 $87.2 $58.8 $69.4 $80.0 Implied Equity Value $77.9 $90.4 $102.9 $71.9 $83.4 $94.9 $66.5 $77.1 $87.7 Implied Equity Value per Share $7.60 $8.77 $9.84 $7.03 $8.12 $9.16 $6.52 $7.52 $8.52

Implied Enterprise Value as a 5.4x 6.4x 7.4x 5.0x 5.9x 6.8x 4.6x 5.4x 6.2x Multiple of LTM EBITDA

Note: Discounted back to December 31, 2009. Base case scenario per management projections as of October 21, 2009. (a) 2009-2014 estimates per Management.

(b) | | Assumes tax rate of 35.0% . |

(c) | | EBIAT reflects earnings before interest and after taxes. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 43

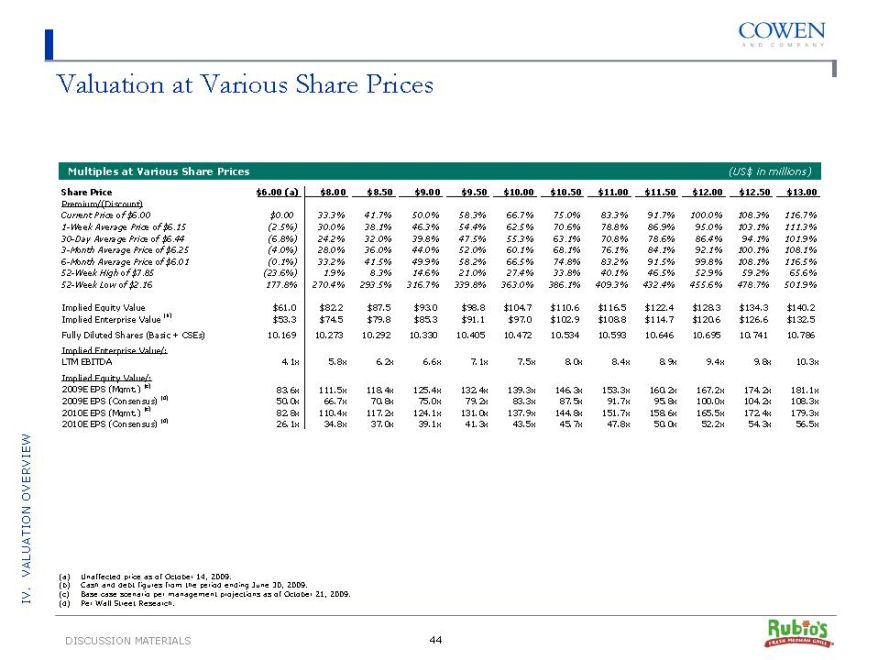

Valuation at Various Share Prices

Multiples at Various Share Prices (US$ in millions)

Share Price $6.00 (a) $8.00 $8.50 $9.00 $9.50 $10.00 $10.50 $11.00 $11.50 $12.00 $12.50 $13.00

Premium/(Discount)

Current Price of $6.00 $0.00 33.3% 41.7% 50.0% 58.3% 66.7% 75.0% 83.3% 91.7% 100.0% 108.3% 116.7% 1-Week Average Price of $6.15 (2.5%) 30.0% 38.1% 46.3% 54.4% 62.5% 70.6% 78.8% 86.9% 95.0% 103.1% 111.3% 30-Day Average Price of $6.44 (6.8%) 24.2% 32.0% 39.8% 47.5% 55.3% 63.1% 70.8% 78.6% 86.4% 94.1% 101.9%

3-Month Average Price of $6.25 (4.0%) 28.0% 36.0% 44.0% 52.0% 60.1% 68.1% 76.1% 84.1% 92.1% 100.1% 108.1%

6-Month Average Price of $6.01 (0.1%) 33.2% 41.5% 49.9% 58.2% 66.5% 74.8% 83.2% 91.5% 99.8% 108.1% 116.5% 52-Week High of $7.85 (23.6%) 1.9% 8.3% 14.6% 21.0% 27.4% 33.8% 40.1% 46.5% 52.9% 59.2% 65.6% 52-Week Low of $2.16 177.8% 270.4% 293.5% 316.7% 339.8% 363.0% 386.1% 409.3% 432.4% 455.6% 478.7% 501.9%

Implied Equity Value $61.0 $82.2 $87.5 $93.0 $98.8 $104.7 $110.6 $116.5 $122.4 $128.3 $134.3 $140.2 Implied Enterprise Value (b) $53.3 $74.5 $79.8 $85.3 $91.1 $97.0 $102.9 $108.8 $114.7 $120.6 $126.6 $132.5 Fully Diluted Shares (Basic + CSEs) 10.169 10.273 10.292 10.330 10.405 10.472 10.534 10.593 10.646 10.695 10.741 10.786 Implied Enterprise Value/: LTM EBITDA 4.1x 5.8x 6.2x 6.6x 7.1x 7.5x 8.0x 8.4x 8.9x 9.4x 9.8x 10.3x Implied Equity Value/: 2009E EPS (Mgmt. ) (c) 83.6x 111.5x 118.4x 125.4x 132.4x 139.3x 146.3x 153.3x 160.2x 167.2x 174.2x 181.1x 2009E EPS (Consensus) (d) 50.0x 66.7x 70.8x 75.0x 79.2x 83.3x 87.5x 91.7x 95.8x 100.0x 104.2x 108.3x 2010E EPS (Mgmt. ) (c) 82.8x 110.4x 117.2x 124.1x 131.0x 137.9x 144.8x 151.7x 158.6x 165.5x 172.4x 179.3x 2010E EPS (Consensus) (d) 26.1x 34.8x 37.0x 39.1x 41.3x 43.5x 45.7x 47.8x 50.0x 52.2x 54.3x 56.5x

(a) | | Unaffected price as of October 14, 2009. |

(b) | | Cash and debt figures from the period ending June 30, 2009. |

(c) | | Base case scenario per management projections as of October 21, 2009. (d) Per Wall Street Research. |

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 44

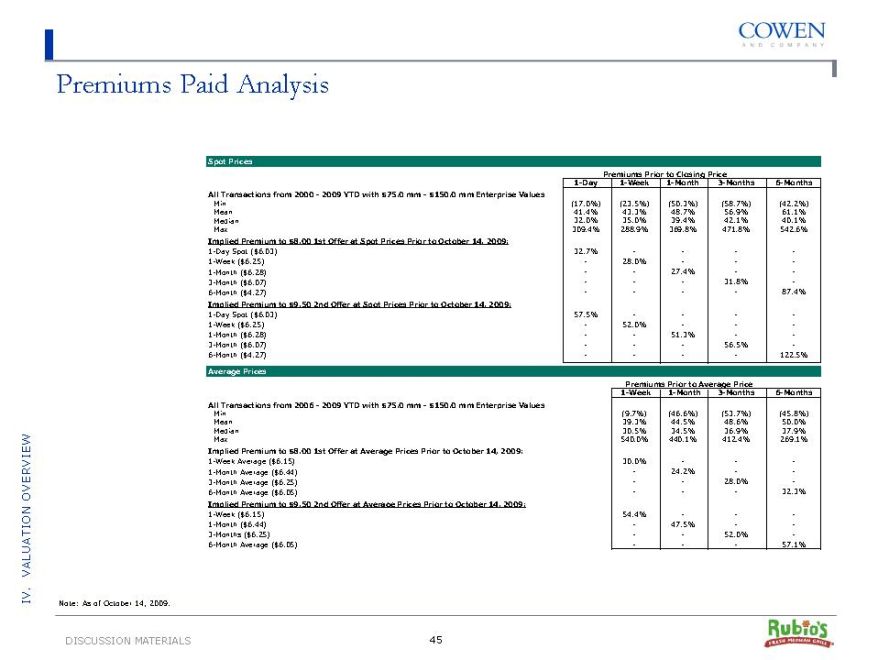

Premiums Paid Analysis

Spot Prices

Premiums Prior to Closing Price 1-Day 1-Week 1-Month 3-Months 6-Months All Transactions from 2000—2009 YTD with $75.0 mm—$150.0 mm Enterprise Values

Min (17.0%) (23.5%) (50.3%) (58.7%) (42.2%) Mean 41.4% 43.3% 48.7% 56.9% 61.1% Median 32.0% 35.0% 39.4% 42.1% 40.1% Max 309.4% 288.9% 369.8% 471.8% 542.6%

Implied Premium to $8.00 1st Offer at Spot Prices Prior to October 14, 2009:

1-Day Spot ($6.03) 32.7%———1-Week ($6.25)—28.0%——

1-Month ($6.28)—- 27.4%—-

3-Month ($6.07)—— 31.8%—

6-Month ($4.27)———87.4%

Implied Premium to $9.50 2nd Offer at Spot Prices Prior to October 14, 2009:

1-Day Spot ($6.03) 57.5%———1-Week ($6.25)—52.0%——

1-Month ($6.28)—- 51.3%—-

3-Month ($6.07)—— 56.5%—

6-Month ($4.27)———122.5%

Average Prices

Premiums Prior to Average Price

1-Week 1-Month 3-Months 6-Months All Transactions from 2006—2009 YTD with $75.0 mm—$150.0 mm Enterprise Values

Min (9.7%) (46.6%) (53.7%) (45.8%) Mean 39.3% 44.5% 48.6% 50.0% Median 30.5% 34.5% 36.9% 37.9% Max 540.0% 440.1% 412.4% 269.1%

Implied Premium to $8.00 1st Offer at Average Prices Prior to October 14, 2009:

1-Week Average ($6.15) 30.0%——

1-Month Average ($6.44)—24.2%—-

3-Month Average ($6.25)—- 28.0%—

6-Month Average ($6.05)—— 32.3%

Implied Premium to $9.50 2nd Offer at Average Prices Prior to October 14, 2009:

1-Week ($6.15) 54.4%——

1-Month ($6.44)—47.5%—-

3-Months ($6.25)—- 52.0%—

6-Month Average ($6.05)—— 57.1%

Note: As of October 14, 2009.

OVERVIEW VALUATION IV .

DISCUSSION MATERIALS 45

V. Strategic Alternatives Overview

Strategic Alternatives Overview

Rubio’s is currently considering two primary alternatives

Status Quo

Sale

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 47

Status Quo

Status quo remains a viable alternative to drive shareholder value

Under status quo, the Company would:

??Continue to operate as a public company

??Execute current growth plan

??Consider other growth avenues such as franchising and joint ventures

Advantages of Status Quo

Opportunity to demonstrate positive performance and momentum

Opportunity for share-price appreciation if Company proves growth strategy over next couple of years

Maintains control of Company’s direction and culture

Leverages current infrastructure and management team

Status Quo Issues to Consider

Costs and risks of being a “micro -cap” stock

Business execution risk (increasing competition, difficult consumer environment, risk of executing growth plan)

Costs and risks of being a public company

Stock price pressure from reduced growth and illiquidity

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 48

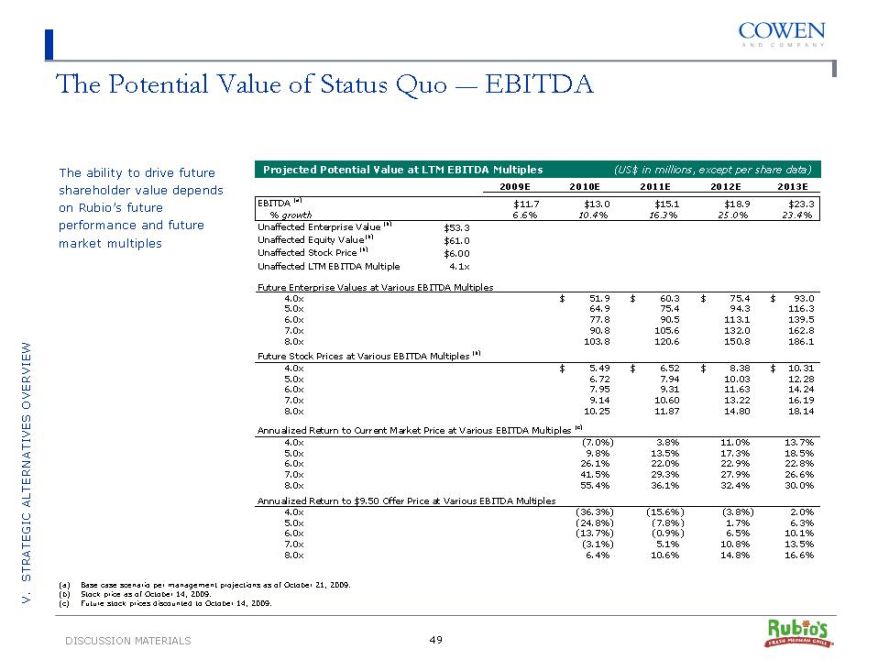

The Potential Value of Status Quo —EBITDA

The ability to drive future shareholder value depends on Rubio’s future performance and future market multiples

Projected Potential Value at LTM EBITDA Multiples (US$ in millions, except per share data) 2009E 2010E 2011E 2012E 2013E

EBITDA (a) $11.7 $13.0 $15.1 $18.9 $23.3

% growth 6.6% 10.4% 16.3% 25.0% 23.4%

Unaffected Enterprise Value (b) $53.3 Unaffected Equity Value (b) $61.0 Unaffected Stock Price (b) $6.00 Unaffected LTM EBITDA Multiple 4.1x

Future Enterprise Values at Various EBITDA Multiples

4.0x $ 51.9 $ 60.3 $ 75.4 $ 93.0 5.0x 64.9 75.4 94.3 116.3 6.0x 77.8 90.5 113.1 139.5 7.0x 90.8 105.6 132.0 162.8 8.0x 103.8 120.6 150.8 186.1 Future Stock Prices at Various EBITDA Multiples (b) 4.0x $ 5.49 $ 6.52 $ 8.38 $ 10.31 5.0x 6.72 7.94 10.03 12.28 6.0x 7.95 9.31 11.63 14.24 7.0x 9.14 10.60 13.22 16.19 8.0x 10.25 11.87 14.80 18.14 Annualized Return to Current Market Price at Various EBITDA Multiples (c) 4.0x (7.0%) 3.8% 11.0% 13.7% 5.0x 9.8% 13.5% 17.3% 18.5% 6.0x 26.1% 22.0% 22.9% 22.8% 7.0x 41.5% 29.3% 27.9% 26.6% 8.0x 55.4% 36.1% 32.4% 30.0% Annualized Return to $9.50 Offer Price at Various EBITDA Multiples 4.0x (36.3%) (15.6%) (3.8%) 2.0% 5.0x (24.8%) (7.8%) 1.7% 6.3% 6.0x (13.7%) (0.9%) 6.5% 10.1% 7.0x (3.1%) 5.1% 10.8% 13.5% 8.0x 6.4% 10.6% 14.8% 16.6%

(a) | | Base case scenario per management projections as of October 21, 2009. (b) Stock price as of October 14, 2009. |

(c) | | Future stock prices discounted to October 14, 2009. |

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 49

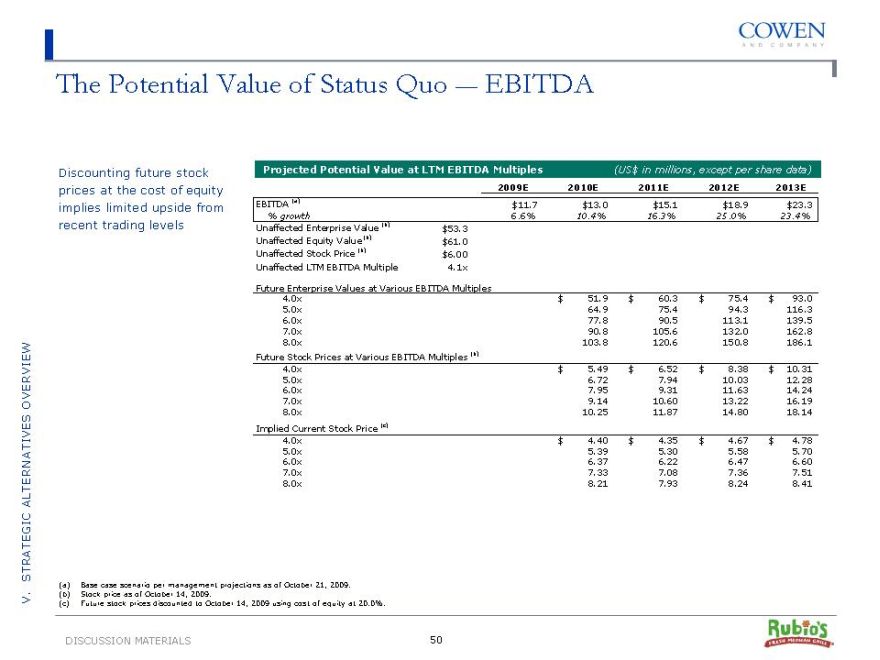

The Potential Value of Status Quo —EBITDA

Discounting future stock prices at the cost of equity implies limited upside from recent trading levels

Projected Potential Value at LTM EBITDA Multiples (US$ in millions, except per share data) 2009E 2010E 2011E 2012E 2013E

EBITDA (a) $11.7 $13.0 $15.1 $18.9 $23.3

% growth 6.6% 10.4% 16.3% 25.0% 23.4%

Unaffected Enterprise Value (b) $53.3 Unaffected Equity Value (b) $61.0 Unaffected Stock Price (b) $6.00 Unaffected LTM EBITDA Multiple 4.1x

Future Enterprise Values at Various EBITDA Multiples

4.0x $ 51.9 $ 60.3 $ 75.4 $ 93.0 5.0x 64.9 75.4 94.3 116.3 6.0x 77.8 90.5 113.1 139.5 7.0x 90.8 105.6 132.0 162.8 8.0x 103.8 120.6 150.8 186.1 Future Stock Prices at Various EBITDA Multiples (b) 4.0x $ 5.49 $ 6.52 $ 8.38 $ 10.31 5.0x 6.72 7.94 10.03 12.28 6.0x 7.95 9.31 11.63 14.24 7.0x 9.14 10.60 13.22 16.19 8.0x 10.25 11.87 14.80 18.14 Implied Current Stock Price (c) 4.0x $ 4.40 $ 4.35 $ 4.67 $ 4.78 5.0x 5.39 5.30 5.58 5.70 6.0x 6.37 6.22 6.47 6.60 7.0x 7.33 7.08 7.36 7.51 8.0x 8.21 7.93 8.24 8.41

OVERVIEW ALTERNATIVES STRATEGIC V .

(a) | | Base case scenario per management projections as of October 21, 2009. (b) Stock price as of October 14, 2009. |

(c) | | Future stock prices discounted to October 14, 2009 using cost of equity at 20.0% . |

DISCUSSION MATERIALS 50

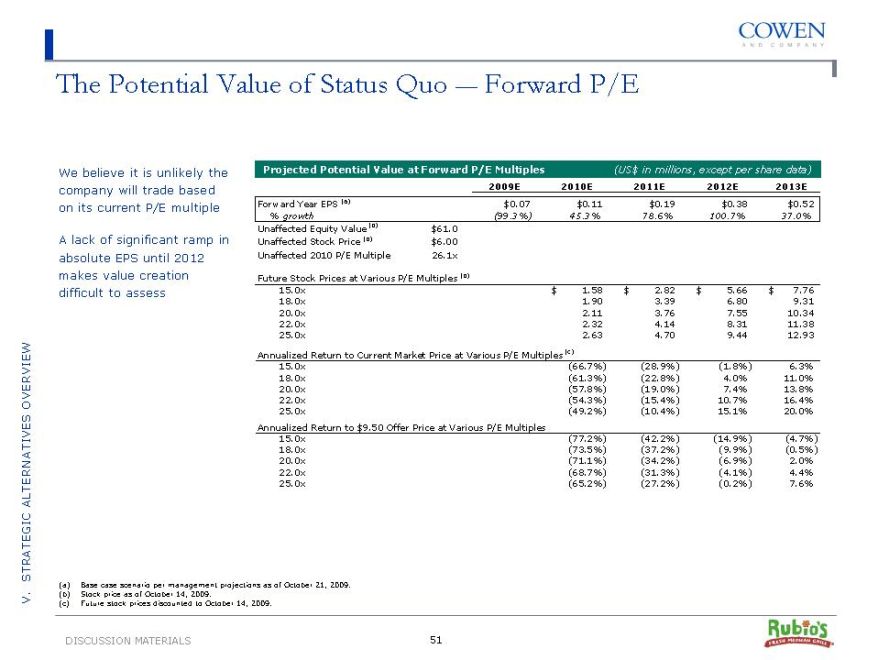

The Potential Value of Status Quo —Forward P/E

We believe it is unlikely the company will trade based on its current P/E multiple

A lack of significant ramp in absolute EPS until 2012 makes value creation difficult to assess

Projected Potential Value at Forward P/E Multiples (US$ in millions, except per share data) 2009E 2010E 2011E 2012E 2013E

Forward Year EPS (a) $0.07 $0.11 $0.19 $0.38 $0.52

% growth (99.3%) 45.3% 78.6% 100.7% 37.0%

Unaffected Equity Value (b) $61.0 Unaffected Stock Price (b) $6.00 Unaffected 2010 P/E Multiple 26.1x

Future Stock Prices at Various P/E Multiples (b)

15.0x $ 1.58 $ 2.82 $ 5.66 $ 7.76 18.0x 1.90 3.39 6.80 9.31 20.0x 2.11 3.76 7.55 10.34 22.0x 2.32 4.14 8.31 11.38 25.0x 2.63 4.70 9.44 12.93 Annualized Return to Current Market Price at Various P/E Multiples (c) 15.0x (66.7%) (28.9%) (1.8%) 6.3% 18.0x (61.3%) (22.8%) 4.0% 11.0% 20.0x (57.8%) (19.0%) 7.4% 13.8% 22.0x (54.3%) (15.4%) 10.7% 16.4% 25.0x (49.2%) (10.4%) 15.1% 20.0% Annualized Return to $9.50 Offer Price at Various P/E Multiples 15.0x (77.2%) (42.2%) (14.9%) (4.7%) 18.0x (73.5%) (37.2%) (9.9%) (0.5%) 20.0x (71.1%) (34.2%) (6.9%) 2.0% 22.0x (68.7%) (31.3%) (4.1%) 4.4% 25.0x (65.2%) (27.2%) (0.2%) 7.6%

(a) | | Base case scenario per management projections as of October 21, 2009. (b) Stock price as of October 14, 2009. |

(c) | | Future stock prices discounted to October 14, 2009. |

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 51

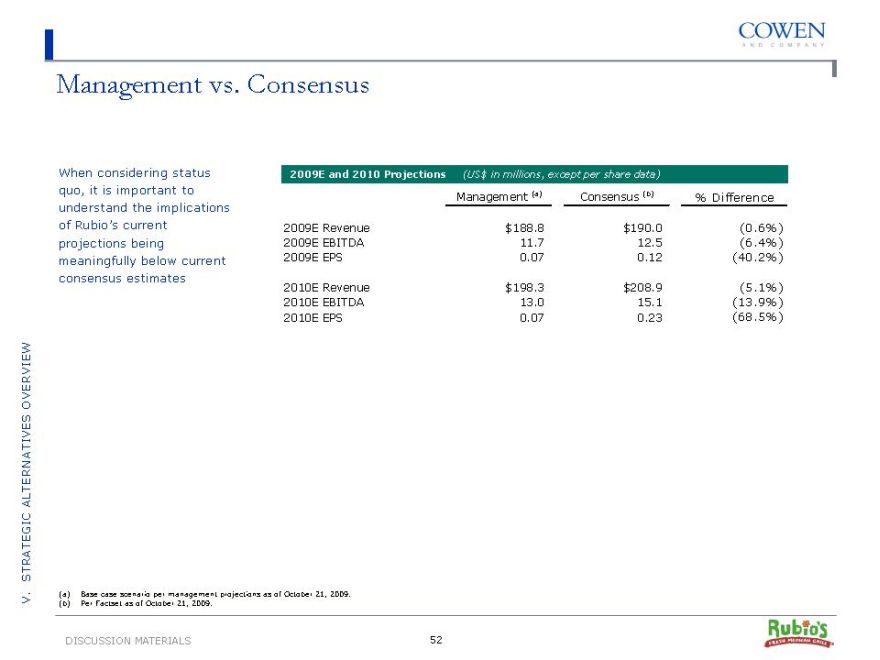

Management vs. Consensus

When considering status quo, it is important to understand the implications of Rubio’s current projections being meaningfully below current consensus estimates

2009E and 2010 Projections (US$ in millions, except per share data)

Management (a) Consensus (b) % Difference

2009E Revenue $188.8 $190.0 (0.6%) 2009E EBITDA 11.7 12.5 (6.4%) 2009E EPS 0.07 0.12 (40.2%)

2010E Revenue $198.3 $208.9 (5.1%) 2010E EBITDA 13.0 15.1 (13.9%) 2010E EPS 0.07 0.23 (68.5%)

(a) | | Base case scenario per management projections as of October 21, 2009. (b) Per Factset as of October 21, 2009. |

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 52

Sale of the Company

The Special Committee could also pursue a sale of the Company in order to maximize near-term shareholder value

In the event the Special Committee elects to pursue a sale of the Company, it will need to explore the various process options

Advantages

Provides investors a premium to current stock price

Provides investors a guaranteed return, regardless of future execution risk

Provides immediate liquidity to shareholders

Removes Company from public scrutiny

Eliminates public-company costs and risks

Issues to Consider

May be challenging to maximize valuation given current macroeconomic environment

The Company is trading at a relatively low EBITDA valuation

Difficult financing markets have materially reduced M&A activity

Sacrifices potential upside for investors

Management and Board distraction

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 53

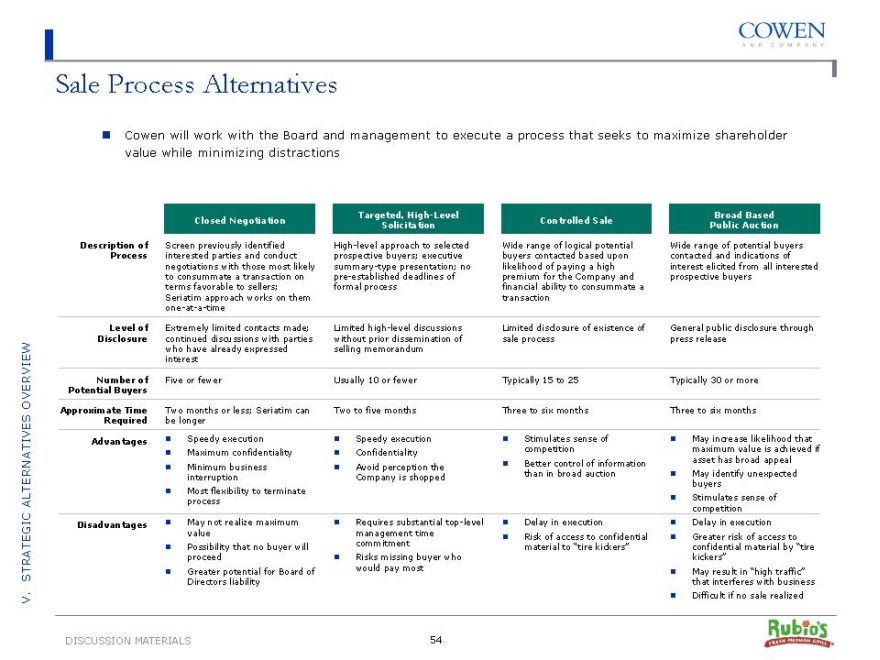

Sale Process Alternatives

Cowen will work with the Board and management to execute a process that seeks to maximize shareholder value while minimizing distractions

Description of Process

Level of Disclosure

Number of Potential Buyers

Approximate Time Required

Advantages

Disadvantages

Closed Negotiation

Screen previously identified interested parties and conduct negotiations with those most likely to consummate a transaction on terms favorable to sellers; Seriatim approach works on them one-at-a-time

Extremely limited contacts made; continued discussions with parties who have already expressed interest

Five or fewer

Two months or less; Seriatim can be longer

? Speedy execution

? Maximum confidentiality

? Minimum business interruption

? Most flexibility to terminate process

? May not realize maximum value

? Possibility that no buyer will proceed

? Greater potential for Board of Directors liability

Targeted, High-Level Solicitation

High-level approach to selected prospective buyers; executive summary -type presentation; no pre-established deadlines of formal process

Limited high-level discussions without prior dissemination of selling memorandum

Usually 10 or fewer

Two to five months

? Speedy execution

? Confidentiality

? Avoid perception the Company is shopped

? Requires substantial top-level management time commitment

? Risks missing buyer who would pay most

Controlled Sale

Wide range of logical potential buyers contacted based upon likelihood of paying a high premium for the Company and financial ability to consummate a transaction

Limited disclosure of existence of sale process

Typically 15 to 25

Three to six months

? Stimulates sense of competition

? Better control of information than in broad auction

? Delay in execution

? Risk of access to confidential material to “tire kickers”

Broad Based Public Auction

Wide range of potential buyers contacted and indications of interest elicited from all interested prospective buyers

General public disclosure through press release

Typically 30 or more

Three to six months

? May increase likelihood that maximum value is achieved if asset has broad appeal

? May identify unexpected buyers

? Stimulates sense of competition

? Delay in execution

? Greater risk of access to confidential material by “tire kickers”

? May result in “high traffic” that interferes with business

? Difficult if no sale realized

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 54

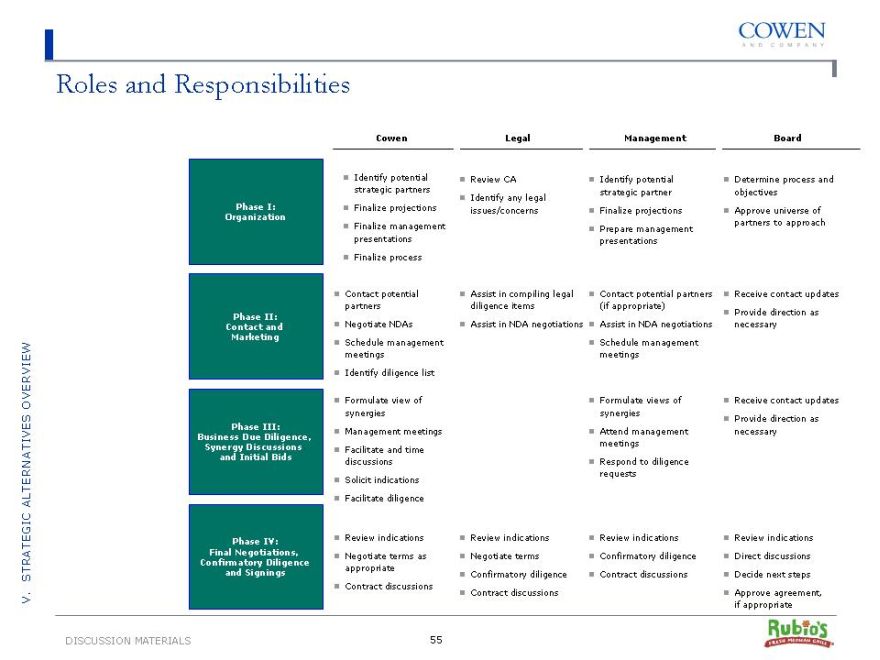

Roles and Responsibilities

Phase I: Organization

Phase II: Contact and Marketing

Phase III: Business Due Diligence, Synergy Discussions and Initial Bids

Phase IV: Final Negotiations, Confirmatory Diligence and Signings

Cowen

??Identify potential strategic partners

??Finalize projections

??Finalize management presentations

??Finalize process

??Contact potential partners

??Negotiate NDAs

??Schedule management meetings

??Identify diligence list

??Formulate view of synergies

??Management meetings

??Facilitate and time discussions

??Solicit indications

??Facilitate diligence

??Review indications

??Negotiate terms as appropriate

??Contract discussions

Legal

Review CA Identify any legal issues/concerns

Assist in compiling legal diligence items Assist in NDA negotiations

Review indications Negotiate terms Confirmatory diligence Contract discussions

Management

??Identify potential strategic partner

??Finalize projections

??Prepare management presentations

??Contact potential partners (if appropriate)

??Assist in NDA negotiations

??Schedule management meetings

??Formulate views of synergies

??Attend management meetings

??Respond to diligence requests

??Review indications

??Confirmatory diligence

??Contract discussions

Board

Determine process and objectives Approve universe of partners to approach

Receive contact updates Provide direction as necessary

Receive contact updates Provide direction as necessary

Review indications Direct discussions Decide next steps Approve agreement, if appropriate

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 55

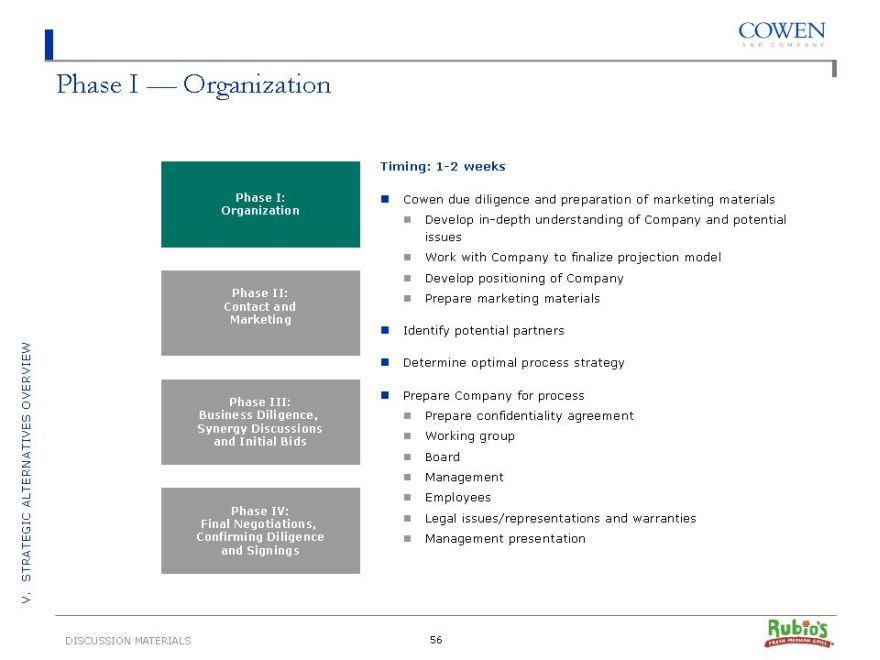

Phase I — Organization

Phase I: Organization

Phase II: Contact and Marketing

Phase III: Business Diligence, Synergy Discussions and Initial Bids

Phase IV: Final Negotiations, Confirming Diligence and Signings

Timing: 1-2 weeks

Cowen due diligence and preparation of marketing materials

Develop in-depth understanding of Company and potential issues Work with Company to finalize projection model Develop positioning of Company Prepare marketing materials

Identify potential partners

Determine optimal process strategy

Prepare Company for process

Prepare confidentiality agreement Working group Board Management Employees

Legal issues/representations and warranties Management presentation

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 56

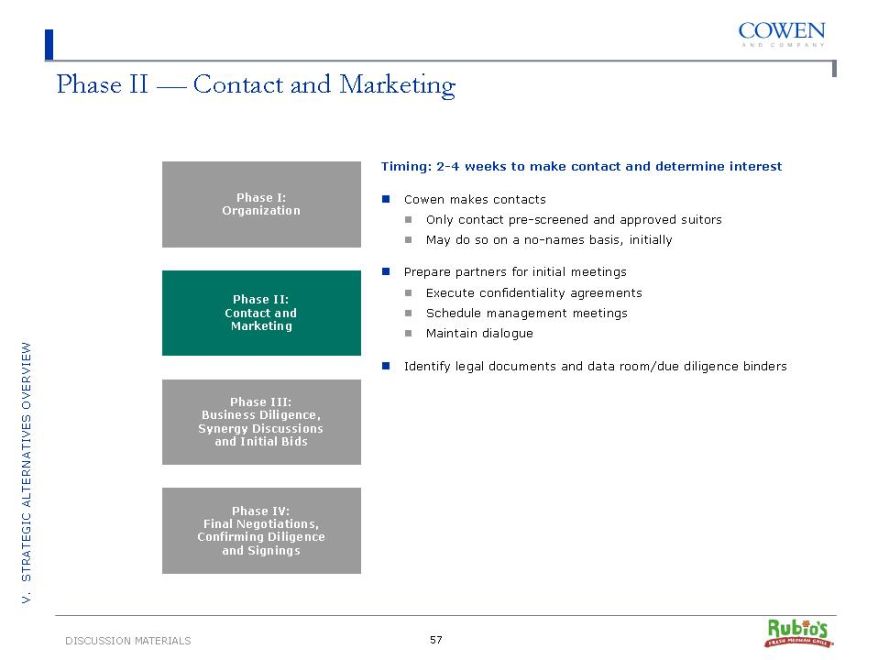

Phase II — Contact and Marketing

Phase I: Organization

Phase II: Contact and Marketing

Phase III: Business Diligence, Synergy Discussions and Initial Bids

Phase IV: Final Negotiations, Confirming Diligence and Signings

Timing: 2-4 weeks to make contact and determine interest

Cowen makes contacts

Only contact pre-screened and approved suitors May do so on a no-names basis, initially

Prepare partners for initial meetings

Execute confidentiality agreements Schedule management meetings Maintain dialogue

Identify legal documents and data room/due diligence binders

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 57

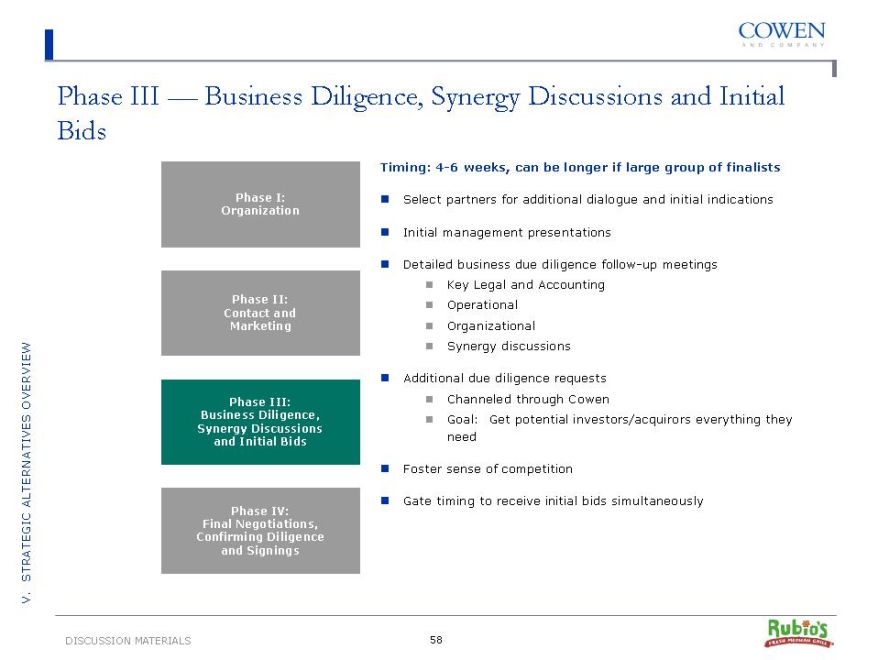

Phase III — Business Diligence, Synergy Discussions and Initial Bids

Phase I: Organization

Phase II: Contact and Marketing

Phase III: Business Diligence, Synergy Discussions and Initial Bids

Phase IV: Final Negotiations, Confirming Diligence and Signings

Timing: 4-6 weeks, can be longer if large group of finalists

Select partners for additional dialogue and initial indications Initial management presentations Detailed business due diligence follow-up meetings

Key Legal and Accounting Operational Organizational Synergy discussions

Additional due diligence requests

Channeled through Cowen

Goal: Get potential investors/acquirors everything they need

Foster sense of competition

Gate timing to receive initial bids simultaneously

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 58

Phase IV — Final Negotiations, Confirming Diligence and Signings

Phase I: Organization

Phase II: Contact and Marketing

Phase III: Business Diligence, Synergy Discussions and Initial Bids

Phase IV: Final Negotiations, Confirming Diligence and Signings

Timing: 3-4 weeks to signing, approximately 1-4 months to closing

Final confirmatory due diligence

Negotiation dynamics

Go face-to-face or exclusive at appropriate moment Leverage competing bids Measure price and terms vs. certainty of closure

Enter bidding agreement with board approval Announce transaction to employees and public File Hart-Scott-Rodino, if necessary Shareholders’ meetings and closing

OVERVIEW ALTERNATIVES STRATEGIC V .

DISCUSSION MATERIALS 59