|

Exhibit (c)(5)

|

CONFIDENTIAL

Discussion Materials – March 29, 2010

CONFIDENTIAL

Disclaimer

This presentation and the information contained herein is confidential and has been prepared exclusively for the benefit and internal use of the Special Committee of the Board of Directors of Rubio’s Restaurants, Inc. (the “Company”), in order to assist the Special Committee in evaluating, on a preliminary basis, a possible transaction or transactions and does not convey any right of publication or disclosure, in whole or in part, to any other party without the prior written consent of Cowen. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by Cowen to the Special Committee.

The information in this presentation is based upon management forecasts supplied to Cowen and reflects prevailing conditions and Cowen’s views as of this date, all of which are accordingly subject to change. Cowen’s estimates constitute Cowen’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, Cowen has with your consent, assumed and relied, without independent investigation, upon the accuracy and completeness of all financial and other information provided to us by the management of the Company or which is publicly available or was otherwise reviewed by Cowen. Cowen’s analysis is not and does not purport to be appraisals of the assets, stock or business of the Company or any other entity. Cowen does not make representations as to the actual value which may be received in connection with a transaction or as to the price at which the Company’s securities may trade at any time. Cowen does not address any legal, tax or accounting effects of consummating a transaction or any other alternative. The information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. This presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind. Cowen does not have any obligation to update, revise or reaffirm this presentation.

The information contained herein, as well as any other advice, services or other information provided to you by Cowen, is being provided pursuant to and subject to the terms of our engagement letter with the Board and may not be used or relied upon in any manner, nor are any duties or obligations created with respect thereto. This presentation does not constitute a commitment by Cowen or any of its affiliates to underwrite, subscribe for or place any securities to extend or arrange credit or to provide any other service.

Cowen policy mandates that no Cowen employee may directly or indirectly offer a company favorable research or threaten to change research as consideration or inducement for the receipt of business or compensation.

DISCUSSION MATERIALS

CONFIDENTIAL

Table of Contents

Page

I. Process Update & Bid Summary 2

II. Restaurant Market Update 9

III. Rubio’s Overview 17

IV. Valuation Overview 31

V. Discussions and Q&A 60

DISCUSSION MATERIALS 1

CONFIDENTIAL

I. Process Update & Bid Summary

CONFIDENTIAL

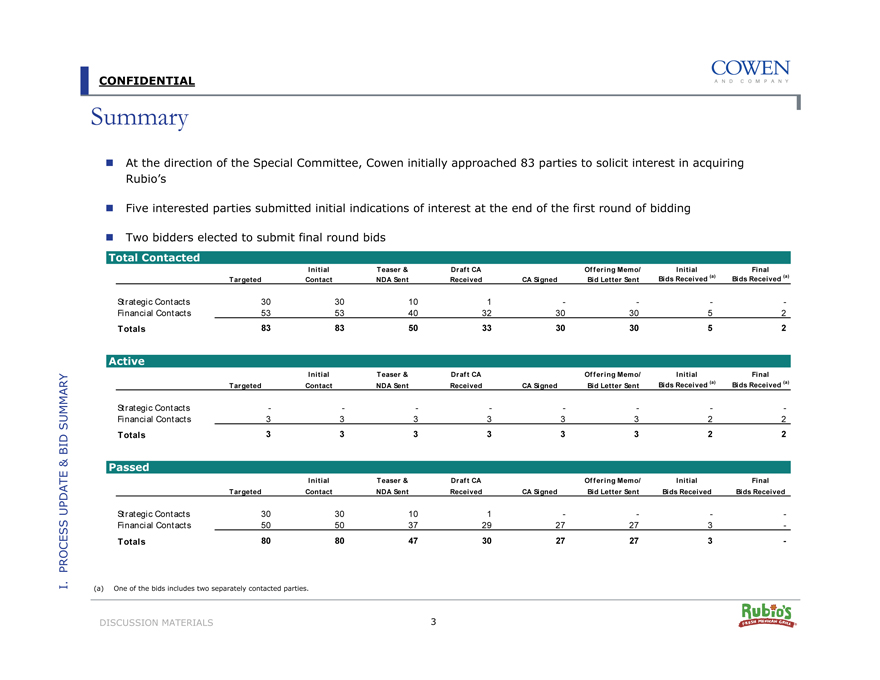

Summary

At the direction of the Special Committee, Cowen initially approached 83 parties to solicit interest in acquiring Rubio’s

Five interested parties submitted initial indications of interest at the end of the first round of bidding

Two bidders elected to submit final round bids

Total Contacted

Initial Teaser & Draft CA Offering Memo/ Initial Final

Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received (a) Bids Received (a)

Strategic Contacts 30 30 10 1- - - -

Financial Contacts 53 53 40 32 30 30 5 2

Totals 83 83 50 33 30 30 5 2

Active

Initial Teaser & Draft CA Offering Memo/ Initial Final

Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received (a) Bids Received (a)

Strategic Contacts - - - - - - - -

Financial Contacts 3 3 3 3 3 3 2 2

Totals 3 3 3 3 3 3 2 2

Passed

Initial Teaser & Draft CA Offering Memo/ Initial Final

Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received Bids Received

Strategic Contacts 30 30 10 1 - - - -

Financial Contacts 50 50 37 29 27 27 3 -

Totals 80 80 47 30 27 27 3 -

I. PROCESS UPDATE & BID SUMMARY

(a) One of the bids includes two separately contacted parties.

DISCUSSION MATERIALS 3

CONFIDENTIAL

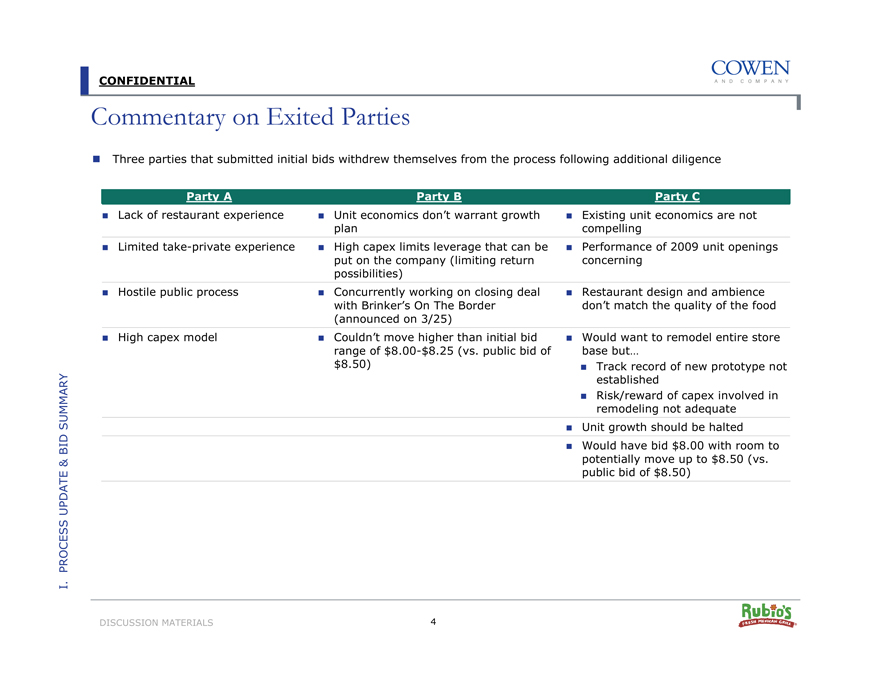

Commentary on Exited Parties

Three parties that submitted initial bids withdrew themselves from the process following additional diligence

Party A Party B Party C

Lack of restaurant experience Unit economics don’t warrant growth Existing unit economics are not

plan compelling

Limited take-private experience High capex limits leverage that can be Performance of 2009 unit openings

put on the company (limiting return concerning

possibilities)

Hostile public process Concurrently working on closing deal Restaurant design and ambience

with Brinker’s On The Border don’t match the quality of the food

(announced on 3/25)

High capex model Couldn’t move higher than initial bid Would want to remodel entire store

range of $8.00-$8.25 (vs. public bid of base but…

$8.50) ? Track record of new prototype not

established

Risk/reward of capex involved in

remodeling not adequate

Unit growth should be halted

Would have bid $8.00 with room to

potentially move up to $8.50 (vs.

public bid of $8.50)

I. PROCESS UPDATE BID& SUMMARY

DISCUSSION MATERIALS 4

CONFIDENTIAL

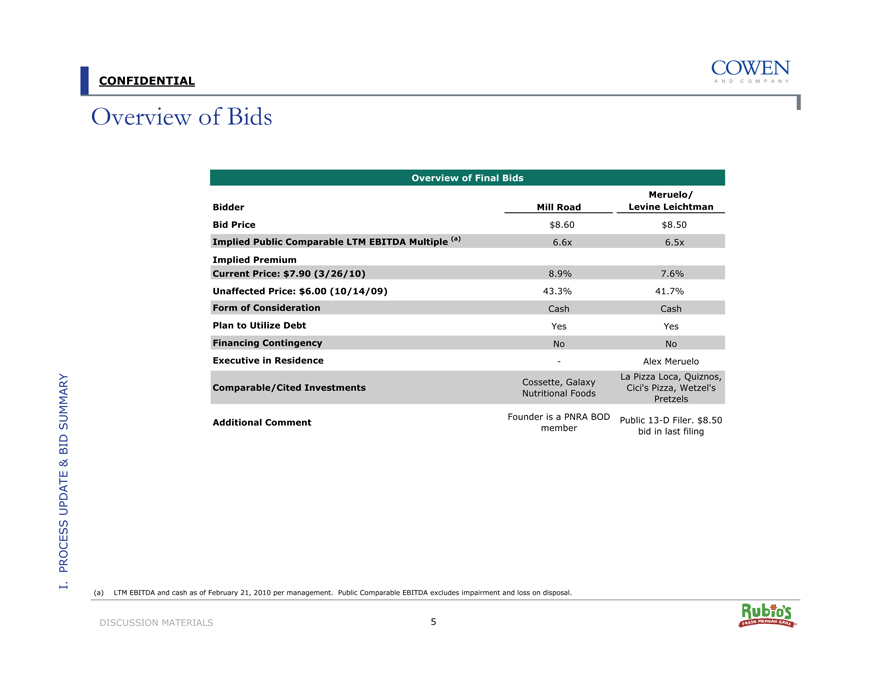

Overview of Bids

Overview of Final Bids

Meruelo/

Bidder Mill Road Levine Leichtman

Bid Price $8.60 $8.50

Implied Public Comparable LTM EBITDA Multiple (a) 6.6x 6.5x

Implied Premium

Current Price: $7.90 (3/26/10) 8.9% 7.6%

Unaffected Price: $6.00 (10/14/09) 43.3% 41.7%

Form of Consideration Cash Cash

Plan to Utilize Debt Yes Yes

Financing Contingency No No

Executive in Residence—Alex Meruelo

Cossette, Galaxy La Pizza Loca, Quiznos,

Comparable/Cited Investments Cici’s Pizza, Wetzel’s

Nutritional Foods Pretzels

Additional Comment Founder is a PNRA BOD Public 13-D Filer. $8.50

member bid in last filing

I. PROCESS UPDATE BID& SUMMARY

(a) LTM EBITDA and cash as of February 21, 2010 per management. Public Comparable EBITDA excludes impairment and loss on disposal.

DISCUSSION MATERIALS 5

CONFIDENTIAL

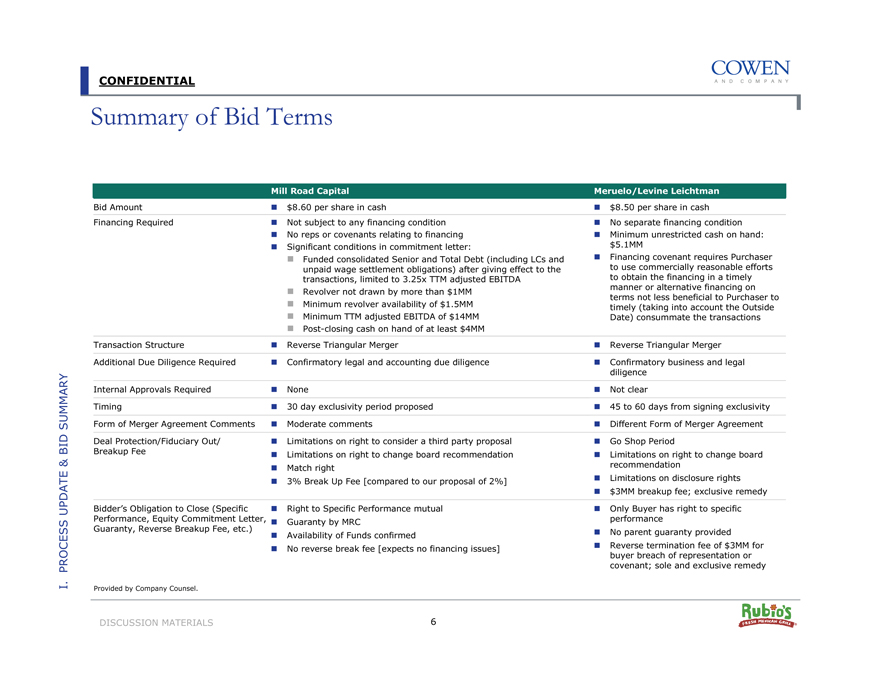

Summary of Bid Terms

Mill Road Capital Meruelo/Levine Leichtman

Bid Amount

$8.60 per share in cash

$8.50 per share in cash

Financing Required

Not subject to any financing condition

No separate financing condition

No reps or covenants relating to financing

Minimum unrestricted cash on hand:

Significant conditions in commitment letter:

$5.1MM

Funded consolidated Senior and Total Debt (including LCs and

Financing covenant requires Purchaser

unpaid wage settlement obligations) after giving effect to the

to use commercially reasonable efforts

transactions, limited to 3.25x TTM adjusted EBITDA

to obtain the financing in a timely

Revolver not drawn by more than $1MM

manner or alternative financing on

terms not less beneficial to Purchaser to

Minimum revolver availability of $1.5MM

timely (taking into account the Outside

Minimum TTM adjusted EBITDA of $14MM

Date) consummate the transactions

Post-closing cash on hand of at least $4MM

Transaction Structure

Reverse Triangular Merger

Reverse Triangular Merger

Additional Due Diligence Required

Confirmatory legal and accounting due diligence

Confirmatory business and legal

diligence

Internal Approvals Required

None

Not clear

Timing

30 day exclusivity period proposed

45 to 60 days from signing exclusivity

Form of Merger Agreement Comments

Moderate comments

Different Form of Merger Agreement

Deal Protection/Fiduciary Out/

Limitations on right to consider a third party proposal

Go Shop Period

Breakup Fee

Limitations on right to change board recommendation

Limitations on right to change board

Match right

recommendation

3% Break Up Fee [compared to our proposal of 2%]

Limitations on disclosure rights

$3MM breakup fee; exclusive remedy

Bidder’s Obligation to Close (Specific

Right to Specific Performance mutual

Only Buyer has right to specific

Performance, Equity Commitment Letter,

Guaranty by MRC

performance

Guaranty, Reverse Breakup Fee, etc.)

Availability of Funds confirmed

No parent guaranty provided

No reverse break fee [expects no financing issues]

Reverse termination fee of $3MM for

buyer breach of representation or

covenant; sole and exclusive remedy

I. PROCESS UPDATE BID& SUMMARY

DISCUSSION MATERIALS 6

CONFIDENTIAL

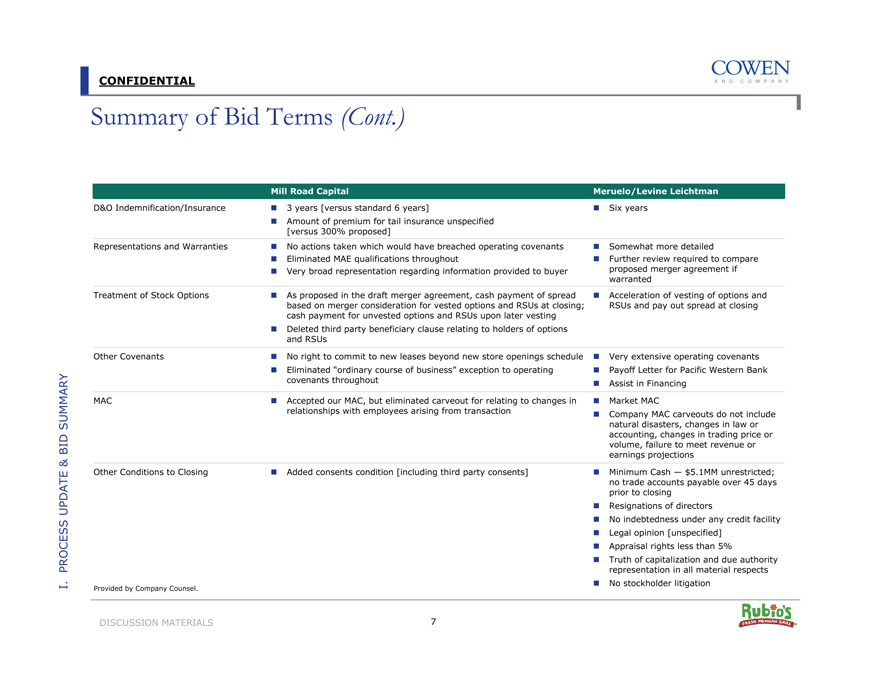

Summary of Bid Terms (Cont.)

Mill Road Capital Meruelo/Levine Leichtman

D&O Indemnification/Insurance

3 years [versus standard 6 years]

Six years

Amount of premium for tail insurance unspecified

[versus 300% proposed]

Representations and Warranties

No actions taken which would have breached operating covenants

Somewhat more detailed

Eliminated MAE qualifications throughout

Further review required to compare

Very broad representation regarding information provided to buyer

proposed merger agreement if

warranted

Treatment of Stock Options

As proposed in the draft merger agreement, cash payment of spread

Acceleration of vesting of options and

based on merger consideration for vested options and RSUs at closing;

RSUs and pay out spread at closing

cash payment for unvested options and RSUs upon later vesting

Deleted third party beneficiary clause relating to holders of options

and RSUs

Other Covenants

No right to commit to new leases beyond new store openings schedule

Very extensive operating covenants

Eliminated “ordinary course of business” exception to operating

Payoff Letter for Pacific Western Bank

covenants throughout

Assist in Financing

MAC

Accepted our MAC, but eliminated carveout for relating to changes in

Market MAC

relationships with employees arising from transaction

Company MAC carveouts do not include

natural disasters, changes in law or

accounting, changes in trading price or

volume, failure to meet revenue or

earnings projections

Other Conditions to Closing

Added consents condition [including third party consents]

Minimum Cash — $5.1MM unrestricted;

no trade accounts payable over 45 days

prior to closing

Resignations of directors

No indebtedness under any credit facility

Legal opinion [unspecified]

Appraisal rights less than 5%

Truth of capitalization and due authority

representation in all material respects

Provided by Company Counsel.

No stockholder litigation

I. PROCESS UPDATE BID& SUMMARY

DISCUSSION MATERIALS 7

CONFIDENTIAL

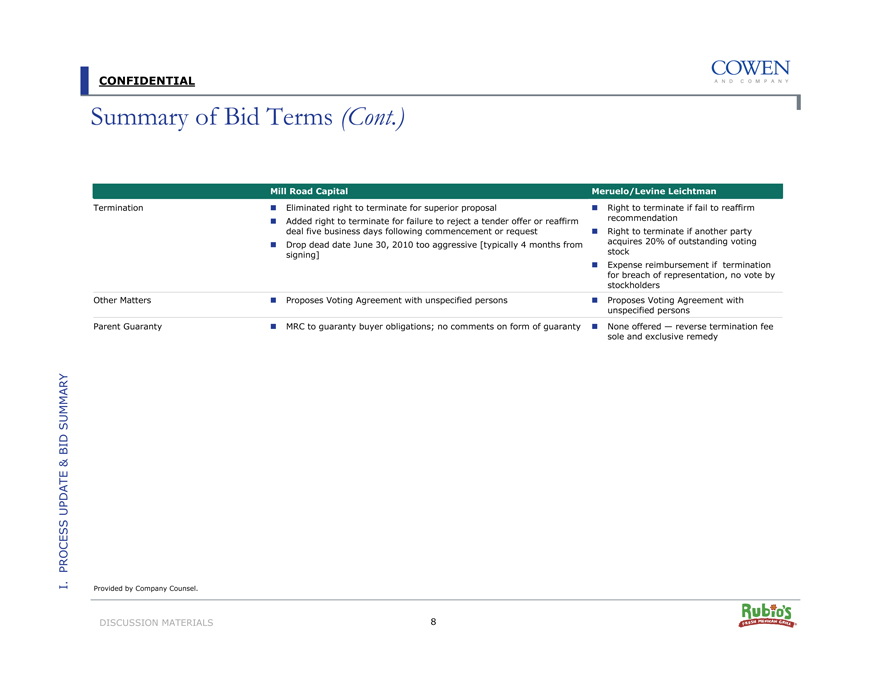

Summary of Bid Terms (Cont.)

Mill Road Capital Meruelo/Levine Leichtman

Termination

Eliminated right to terminate for superior proposal

Right to terminate if fail to reaffirm

Added right to terminate for failure to reject a tender offer or reaffirm

recommendation

deal five business days following commencement or request

Right to terminate if another party

Drop dead date June 30, 2010 too aggressive [typically 4 months from

acquires 20% of outstanding voting

signing]

stock

Expense reimbursement if termination

for breach of representation, no vote by

stockholders

Other Matters

Proposes Voting Agreement with unspecified persons

Proposes Voting Agreement with

unspecified persons

Parent Guaranty

MRC to guaranty buyer obligations; no comments on form of guaranty

None offered — reverse termination fee

sole and exclusive remedy

I. PROCESS UPDATE & BID SUMMARY

Provided by Company Counsel.

DISCUSSION MATERIALS 8

CONFIDENTIAL

II. Restaurant Market Update

CONFIDENTIAL

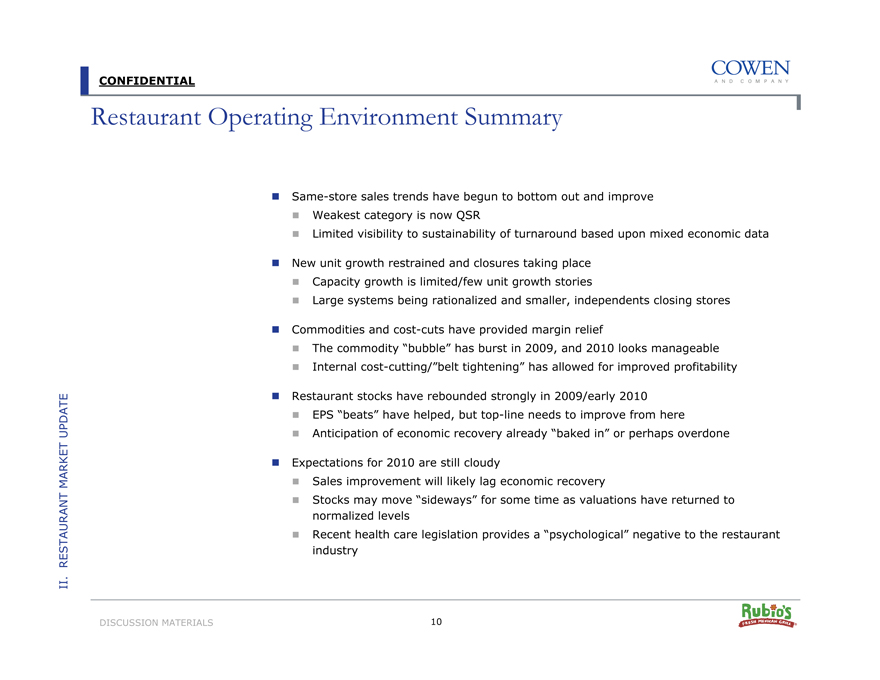

Restaurant Operating Environment Summary

Same-store sales trends have begun to bottom out and improve

Weakest category is now QSR

Limited visibility to sustainability of turnaround based upon mixed economic data

New unit growth restrained and closures taking place

Capacity growth is limited/few unit growth stories

Large systems being rationalized and smaller, independents closing stores

Commodities and cost-cuts have provided margin relief

The commodity “bubble” has burst in 2009, and 2010 looks manageable

Internal cost-cutting/“belt tightening” has allowed for improved profitability

Restaurant stocks have rebounded strongly in 2009/early 2010

EPS “beats” have helped, but top-line needs to improve from here

Anticipation of economic recovery already “baked in” or perhaps overdone

Expectations for 2010 are still cloudy

Sales improvement will likely lag economic recovery

Stocks may move “sideways” for some time as valuations have returned to normalized levels

Recent health care legislation provides a “psychological” negative to the restaurant industry

II. RESTAURANT MARKET UPDATE

DISCUSSION MATERIALS 10

CONFIDENTIAL

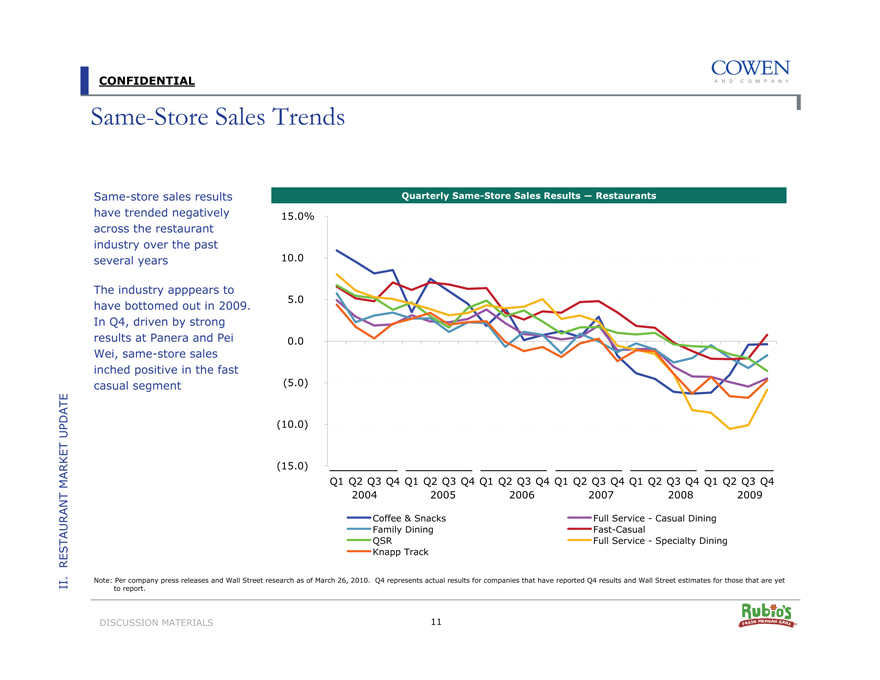

Same-Store Sales Trends

Same-store sales results have trended negatively across the restaurant industry over the past several years

The industry apppears to have bottomed out in 2009. In Q4, driven by strong results at Panera and Pei Wei, same-store sales inched positive in the fast casual segment

Quarterly Same-Store Sales Results — Restaurants

15.0% 10.0 5.0 0.0 (5.0) (10.0) (15.0)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2004 2005 2006 2007 2008 2009

Coffee & Snacks Full Service—Casual Dining Family Dining Fast-Casual QSR Full Service—Specialty Dining Knapp Track

II. RESTAURANT MARKET UPDATE

Note: Per company press releases and Wall Street research as of March 26, 2010. Q4 represents actual results for companies that have reported Q4 results and Wall Street estimates for those that are yet to report.

DISCUSSION MATERIALS 11

CONFIDENTIAL

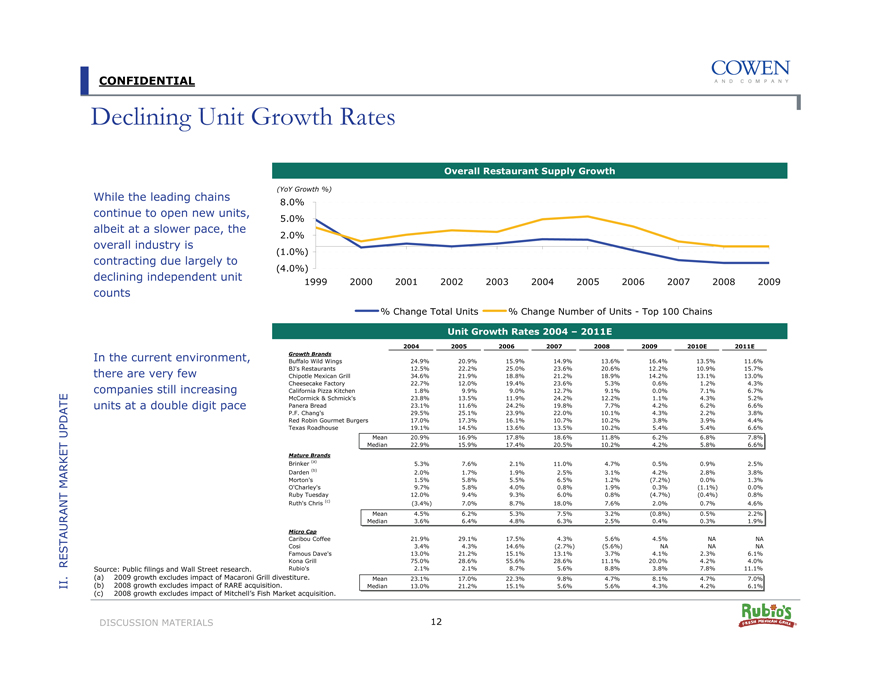

Declining Unit Growth Rates

While the leading chains continue to open new units, albeit at a slower pace, the overall industry is contracting due largely to declining independent unit counts

Overall Restaurant Supply Growth

(YoY Growth %)

8.0% 5.0% 2.0% (1.0%) (4.0%)

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

% Change Total Units % Change Number of Units—Top 100 Chains

In the current environment, there are very few companies still increasing units at a double digit pace

II. RESTAURANT MARKET UPDATE

Unit Growth Rates 2004 – 2011E

2004

2005

2006

2007

2008

2009

2010E

2011E

Growth Brands

Buffalo Wild Wings

24.9%

20.9%

15.9%

14.9%

13.6%

16.4%

13.5%

11.6%

BJ’s Restaurants

12.5%

22.2%

25.0%

23.6%

20.6%

12.2%

10.9%

15.7%

Chipotle Mexican Grill

34.6%

21.9%

18.8%

21.2%

18.9%

14.2%

13.1%

13.0%

Cheesecake Factory

22.7%

12.0%

19.4%

23.6%

5.3%

0.6%

1.2%

4.3%

California Pizza Kitchen

1.8%

9.9%

9.0%

12.7%

9.1%

0.0%

7.1%

6.7%

McCormick & Schmick’s

23.8%

13.5%

11.9%

24.2%

12.2%

1.1%

4.3%

5.2%

Panera Bread

23.1%

11.6%

24.2%

19.8%

7.7%

4.2%

6.2%

6.6%

P.F. Chang’s

29.5%

25.1%

23.9%

22.0%

10.1%

4.3%

2.2%

3.8%

Red Robin Gourmet Burgers

17.0%

17.3%

16.1%

10.7%

10.2%

3.8%

3.9%

4.4%

Texas Roadhouse

19.1%

14.5%

13.6%

13.5%

10.2%

5.4%

5.4%

6.6%

Mean

20.9%

16.9%

17.8%

18.6%

11.8%

6.2%

6.8%

7.8%

Median

22.9%

15.9%

17.4%

20.5%

10.2%

4.2%

5.8%

6.6%

Mature Brands

Brinker (a)

5.3%

7.6%

2.1%

11.0%

4.7%

0.5%

0.9%

2.5%

Darden (b)

2.0%

1.7%

1.9%

2.5%

3.1%

4.2%

2.8%

3.8%

Morton’s

1.5%

5.8%

5.5%

6.5%

1.2%

(7.2%)

0.0%

1.3%

O’Charley’s

9.7%

5.8%

4.0%

0.8%

1.9%

0.3%

(1.1%)

0.0%

Ruby Tuesday

12.0%

9.4%

9.3%

6.0%

0.8%

(4.7%)

(0.4%)

0.8%

Ruth’s Chris (c)

(3.4%)

7.0%

8.7%

18.0%

7.6%

2.0%

0.7%

4.6%

Mean

4.5%

6.2%

5.3%

7.5%

3.2%

(0.8%)

0.5%

2.2%

Median

3.6%

6.4%

4.8%

6.3%

2.5%

0.4%

0.3%

1.9%

Micro Cap

Caribou Coffee

Source: Public filings and Wall Street research.

(a) 2009 growth excludes impact of Macaroni Grill divestiture. (b) 2008 growth excludes impact of RARE acquisition. (c) 2008 growth excludes impact of Mitchell’s Fish Market acquisition.

DISCUSSION MATERIALS 12

CONFIDENTIAL

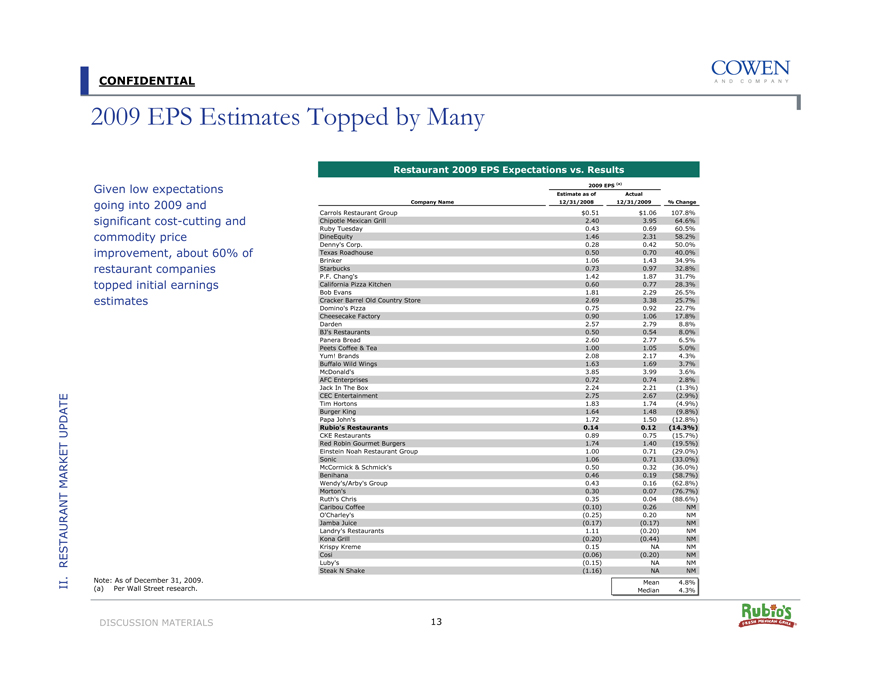

2009 EPS Estimates Topped by Many

Given low expectations going into 2009 and significant cost-cutting and commodity price improvement, about 60% of restaurant companies topped initial earnings estimates

Restaurant 2009 EPS Expectations vs. Results

2009 EPS (a)

Estimate as of

Actual

Company Name

12/31/2008

12/31/2009

% Change

Carrols Restaurant Group

$0.51

$1.06

107.8%

Chipotle Mexican Grill

2.40

3.95

64.6%

Ruby Tuesday

0.43

0.69

60.5%

DineEquity

1.46

2.31

58.2%

Denny’s Corp.

0.28

0.42

50.0%

Texas Roadhouse

0.50

0.70

40.0%

Brinker

1.06

1.43

34.9%

Starbucks

0.73

0.97

32.8%

P.F. Chang’s

1.42

1.87

31.7%

California Pizza Kitchen

0.60

0.77

28.3%

Bob Evans

1.81

2.29

26.5%

Cracker Barrel Old Country Store

2.69

3.38

25.7%

Domino’s Pizza

0.75

0.92

22.7%

Cheesecake Factory

0.90

1.06

17.8%

Darden

2.57

2.79

8.8%

BJ’s Restaurants

0.50

0.54

8.0%

Panera Bread

2.60

2.77

6.5%

Peets Coffee & Tea

1.00

1.05

5.0%

Yum! Brands

2.08

2.17

4.3%

Buffalo Wild Wings

1.63

1.69

3.7%

McDonald’s

3.85

3.99

3.6%

AFC Enterprises

0.72

0.74

2.8%

Jack In The Box

2.24

2.21

(1.3%)

CEC Entertainment

2.75

2.67

(2.9%)

Tim Hortons

1.83

1.74

(4.9%)

Burger King

1.64

1.48

(9.8%)

Papa John’s

1.72

1.50

(12.8%)

Rubio’s Restaurants

0.14

0.12

(14.3%)

CKE Restaurants

0.89

0.75

(15.7%)

Red Robin Gourmet Burgers

1.74

1.40

(19.5%)

Einstein Noah Restaurant Group

1.00

0.71

(29.0%)

Sonic

1.06

0.71

(33.0%)

McCormick & Schmick’s

0.50

0.32

(36.0%)

Benihana

0.46

0.19

(58.7%)

Wendy’s/Arby’s Group

0.43

0.16

(62.8%)

Morton’s

0.30

0.07

(76.7%)

Ruth’s Chris

0.35

0.04

(88.6%)

Caribou Coffee

(0.10)

0.26

NM

O’Charley’s

(0.25)

0.20

NM

Jamba Juice

(0.17)

(0.17)

NM

Landry’s Restaurants

1.11

(0.20)

NM

Kona Grill

(0.20)

(0.44)

NM

Krispy Kreme

0.15

NA

NM

Cosi

(0.06)

(0.20)

NM

Luby’s

(0.15)

NA

NM

Steak N Shake

(1.16)

NA

NM

Mean

4.8%

Median

4.3%

II. RESTAURANT MARKET UPDATE

Note: As of December 31, 2009. (a) Per Wall Street research.

DISCUSSION MATERIALS 13

CONFIDENTIAL

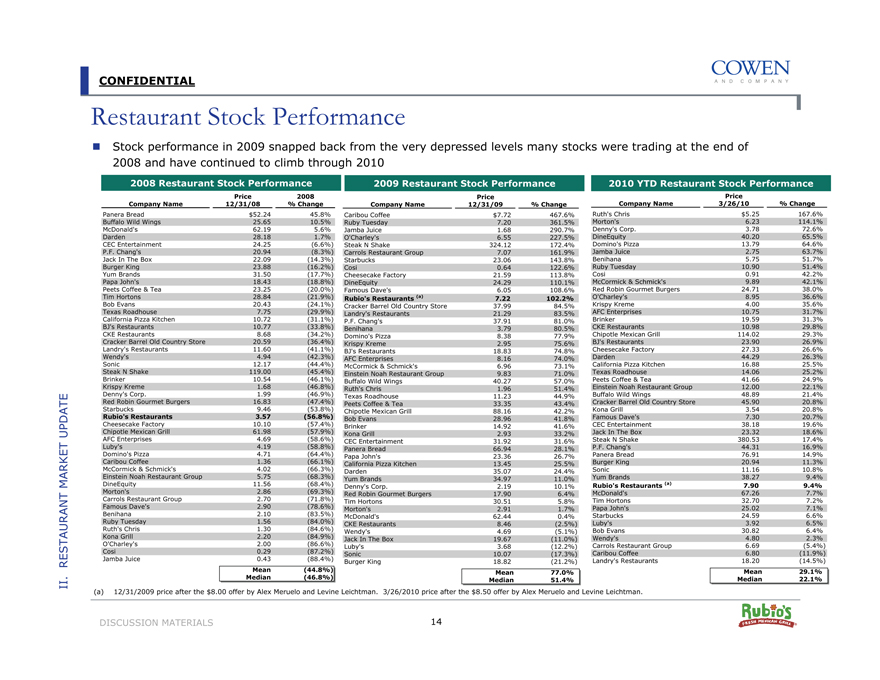

Restaurant Stock Performance

Stock performance in 2009 snapped back from the very depressed levels many stocks were trading at the end of 2008 and have continued to climb through 2010

2008 Restaurant Stock Performance

Price

2008

Company Name

12/31/08

% Change

Panera Bread

$52.24

45.8%

Buffalo Wild Wings

25.65

10.5%

McDonald’s

62.19

5.6%

Darden

28.18

1.7%

CEC Entertainment

24.25

(6.6%)

P.F. Chang’s

20.94

(8.3%)

Jack In The Box

22.09

(14.3%)

Burger King

23.88

(16.2%)

Yum Brands

31.50

(17.7%)

Papa John’s

18.43

(18.8%)

Peets Coffee & Tea

23.25

(20.0%)

Tim Hortons

28.84

(21.9%)

Bob Evans

20.43

(24.1%)

Texas Roadhouse

7.75

(29.9%)

California Pizza Kitchen

10.72

(31.1%)

BJ’s Restaurants

10.77

(33.8%)

CKE Restaurants

8.68

(34.2%)

Cracker Barrel Old Country Store

20.59

(36.4%)

Landry’s Restaurants

11.60

(41.1%)

Wendy’s

4.94

(42.3%)

Sonic

12.17

(44.4%)

Steak N Shake

119.00

(45.4%)

Brinker

10.54

(46.1%)

Krispy Kreme

1.68

(46.8%)

Denny’s Corp.

1.99

(46.9%)

Red Robin Gourmet Burgers

16.83

(47.4%)

Starbucks

9.46

(53.8%)

Rubio’s Restaurants

3.57

(56.8%)

Cheesecake Factory

10.10

(57.4%)

Chipotle Mexican Grill

61.98

(57.9%)

AFC Enterprises

4.69

(58.6%)

Luby’s

4.19

(58.8%)

Domino’s Pizza

4.71

(64.4%)

Caribou Coffee

1.36

(66.1%)

McCormick & Schmick’s

4.02

(66.3%)

Einstein Noah Restaurant Group

5.75

(68.3%)

DineEquity

11.56

(68.4%)

Morton’s

2.86

(69.3%)

Carrols Restaurant Group

2.70

(71.8%)

Famous Dave’s

2.90

(78.6%)

Benihana

2.10

(83.5%)

Ruby Tuesday

1.56

(84.0%)

Ruth’s Chris

1.30

(84.6%)

Kona Grill

2.20

(84.9%)

O’Charley’s

2.00

(86.6%)

Cosi

0.29

(87.2%)

Jamba Juice

0.43

(88.4%)

Mean

(44.8%)

Median

(46.8%)

2009 Restaurant Stock Performance

Price

Company Name

12/31/09

% Change

Caribou Coffee

$7.72

467.6%

Ruby Tuesday

7.20

361.5%

Jamba Juice

1.68

290.7%

O’Charley’s

6.55

227.5%

Steak N Shake

324.12

172.4%

Carrols Restaurant Group

7.07

161.9%

Starbucks

23.06

143.8%

Cosi

0.64

122.6%

Cheesecake Factory

21.59

113.8%

DineEquity

24.29

110.1%

Famous Dave’s

6.05

108.6%

Rubio’s Restaurants (a)

7.22

102.2%

Cracker Barrel Old Country Store

37.99

84.5%

Landry’s Restaurants

21.29

83.5%

P.F. Chang’s

37.91

81.0%

Benihana

3.79

80.5%

Domino’s Pizza

8.38

77.9%

Krispy Kreme

2.95

75.6%

BJ’s Restaurants

18.83

74.8%

AFC Enterprises

8.16

74.0%

McCormick & Schmick’s

6.96

73.1%

Einstein Noah Restaurant Group

9.83

71.0%

Buffalo Wild Wings

40.27

57.0%

Ruth’s Chris

1.96

51.4%

Texas Roadhouse

11.23

44.9%

Peets Coffee & Tea

33.35

43.4%

Chipotle Mexican Grill

88.16

42.2%

Bob Evans

28.96

41.8%

Brinker

14.92

41.6%

Kona Grill

2.93

33.2%

CEC Entertainment

31.92

31.6%

Panera Bread

66.94

28.1%

Papa John’s

23.36

26.7%

California Pizza Kitchen

13.45

25.5%

Darden

35.07

24.4%

Yum Brands

34.97

11.0%

Denny’s Corp.

2.19

10.1%

Red Robin Gourmet Burgers

17.90

6.4%

Tim Hortons

30.51

5.8%

Morton’s

2.91

1.7%

McDonald’s

62.44

0.4%

CKE Restaurants

8.46

(2.5%)

Wendy’s

4.69

(5.1%)

Jack In The Box

19.67

(11.0%)

Luby’s

3.68

(12.2%)

Sonic

10.07

(17.3%)

Burger King

18.82

(21.2%)

Mean

77.0%

Median

51.4%

2010 YTD Restaurant Stock Performance

Price

Company Name

3/26/10

% Change

Ruth’s Chris

$5.25

167.6%

Morton’s

6.23

114.1%

Denny’s Corp.

3.78

72.6%

DineEquity

40.20

65.5%

Domino’s Pizza

13.79

64.6%

Jamba Juice

2.75

63.7%

Benihana

5.75

51.7%

Ruby Tuesday

10.90

51.4%

Cosi

0.91

42.2%

McCormick & Schmick’s

9.89

42.1%

Red Robin Gourmet Burgers

24.71

38.0%

O’Charley’s

8.95

36.6%

Krispy Kreme

4.00

35.6%

AFC Enterprises

10.75

31.7%

Brinker

19.59

31.3%

CKE Restaurants

10.98

29.8%

Chipotle Mexican Grill

114.02

29.3%

BJ’s Restaurants

23.90

26.9%

Cheesecake Factory

27.33

26.6%

Darden

44.29

26.3%

California Pizza Kitchen

16.88

25.5%

Texas Roadhouse

14.06

25.2%

Peets Coffee & Tea

41.66

24.9%

Einstein Noah Restaurant Group

12.00

22.1%

Buffalo Wild Wings

48.89

21.4%

Cracker Barrel Old Country Store

45.90

20.8%

Kona Grill

3.54

20.8%

Famous Dave’s

7.30

20.7%

CEC Entertainment

38.18

19.6%

Jack In The Box

23.32

18.6%

Steak N Shake

380.53

17.4%

P.F. Chang’s

44.31

16.9%

Panera Bread

76.91

14.9%

Burger King

20.94

11.3%

Sonic

11.16

10.8%

Yum Brands

38.27

9.4%

Rubio’s Restaurants (a)

7.90

9.4%

McDonald’s

67.26

7.7%

Tim Hortons

32.70

7.2%

Papa John’s

25.02

7.1%

Starbucks

24.59

6.6%

Luby’s

3.92

6.5%

Bob Evans

30.82

6.4%

Wendy’s

4.80

2.3%

Carrols Restaurant Group

6.69

(5.4%)

Caribou Coffee

6.80

(11.9%)

Landry’s Restaurants

18.20

(14.5%)

Mean

29.1%

Median

22.1%

(a) 12/31/2009 price after the $8.00 offer by Alex Meruelo and Levine Leichtman. 3/26/2010 price after the $8.50 offer by Alex Meruelo and Levine Leichtman.

II. RESTAURANT MARKET UPDATE

DISCUSSION MATERIALS 14

CONFIDENTIAL

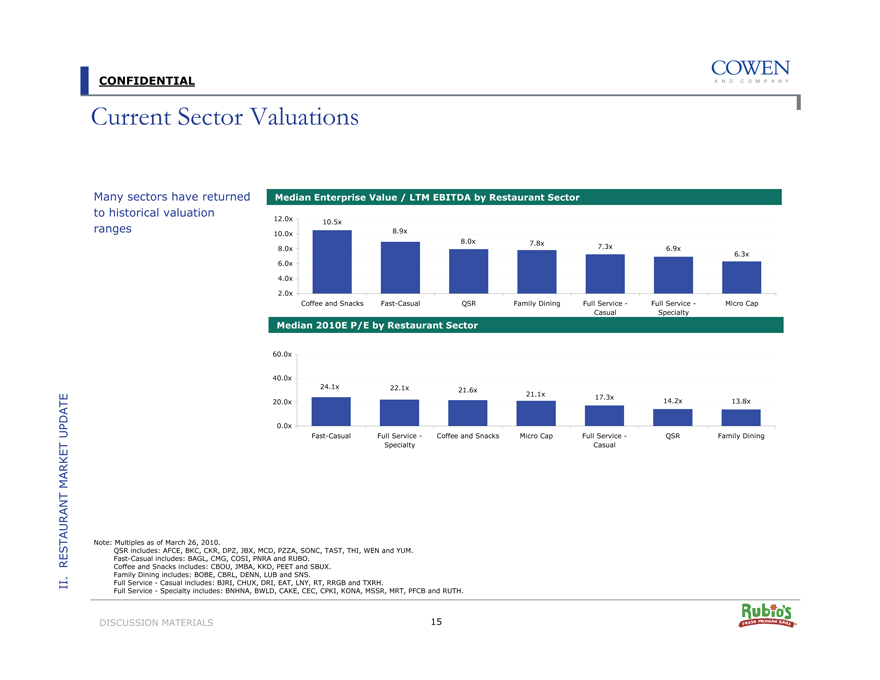

Current Sector Valuations

Many sectors have returned to historical valuation ranges

Median Enterprise Value / LTM EBITDA by Restaurant Sector

12.0x 10.5x

10.0x 8.9x

8.0x 7.8x

8.0x 7.3x 6.9x

6.3x

6.0x

4.0x

2.0x

Coffee and Snacks Fast-Casual QSR Family Dining Full Service—Full Service—Micro Cap Casual Specialty

Casual Specialty

Median 2010E P/E by Restaurant Sector

60.0x

40.0x

24.1x 22.1x 21.6x

21.1x 17.3x 14.2x 13.8x

20.0x

0.0x

Fast-Casual Full Service—Coffee and Snacks Micro Cap Full Service—QSR Family Dining Specialty Casual

II. RESTAURANT MARKET UPDATE

Note: Multiples as of March 26, 2010.

QSR includes: AFCE, BKC, CKR, DPZ, JBX, MCD, PZZA, SONC, TAST, THI, WEN and YUM. Fast-Casual includes: BAGL, CMG, COSI, PNRA and RUBO.

Coffee and Snacks includes: CBOU, JMBA, KKD, PEET and SBUX. Family Dining includes: BOBE, CBRL, DENN, LUB and SNS.

Full Service—Casual includes: BJRI, CHUX, DRI, EAT, LNY, RT, RRGB and TXRH.

Full Service—Specialty includes: BNHNA, BWLD, CAKE, CEC, CPKI, KONA, MSSR, MRT, PFCB and RUTH.

DISCUSSION MATERIALS 15

CONFIDENTIAL

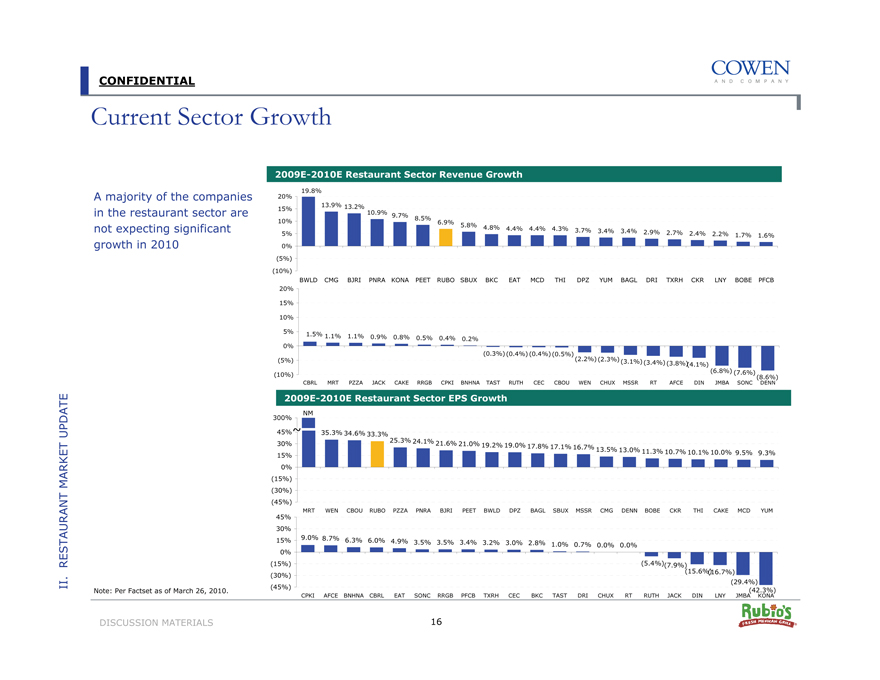

Current Sector Growth

A majority of the companies in the restaurant sector are not expecting significant growth in 2010

2009E-2010E Restaurant Sector Revenue Growth

20% 15% 10% 5% 0% (5%) (10%)

19.8%

13.9% 13.2%

10.9% 9.7% 8.5%

6.9% 5.8%

4.8% 4.4% 4.4% 4.3% 3.7%

3.4% 3.4% 2.9% 2.7% 2.4% 2.2%

1.7% 1.6%

BWLD CMG BJRI PNRA KONA PEET RUBO SBUX BKC EAT MCD THI DPZ YUM BAGL DRI TXRH CKR LNY BOBE PFCB

20% 15% 10% 5% 0% (5%) (10%)

1.5% 1.1% 1.1% 0.9% 0.8%

0.5% 0.4% 0.2%

(0.3%) (0.4%) (0.4%) (0.5%)

(2.2%) (2.3%) (3.1%)

(3.4%) (3.8%) (4.1%)

(6.8%) (7.6%) (8.6%)

CBRL MRT PZZA JACK CAKE RRGB CPKI BNHNA TAST RUTH CEC CBOU WEN CHUX MSSR RT AFCE DIN JMBA SONC DENN

2009E-2010E Restaurant Sector EPS Growth

NM

300% 45% 30% 15% 0% (15%) (30%) (45%)

45% 30% 15% 0% (15%) (30%) (45%)

35.3% 34.6% 33.3%

25.3% 24.1% 21.6%

21.0% 19.2% 19.0% 17.8% 17.1%

16.7% 13.5% 13.0%

11.3% 10.7% 10.1% 10.0% 9.5% 9.3%

MRT WEN CBOU RUBO PZZA PNRA BJRI PEET BWLD DPZ BAGL SBUX MSSR CMG DENN BOBE CKR THI CAKE MCD YUM

9.0% 8.7% 6.3% 6.0%

4.9% 3.5% 3.5% 3.4% 3.2% 3.0% 2.8% 1.0%

0.7% 0.0% 0.0%

(5.4%) (7.9%)

(15.6%) (16.7%) (29.4%) (42.3%)

CPKI AFCE BNHNA CBRL EAT SONC RRGB PFCB TXRH CEC BKC TAST DRI CHUX RT RUTH JACK DIN LNY JMBA KONA

II. RESTAURANT MARKET UPDATE

Note: Per Factset as of March 26, 2010.

DISCUSSION MATERIALS 16

CONFIDENTIAL

III. Rubio’s Overview

CONFIDENTIAL

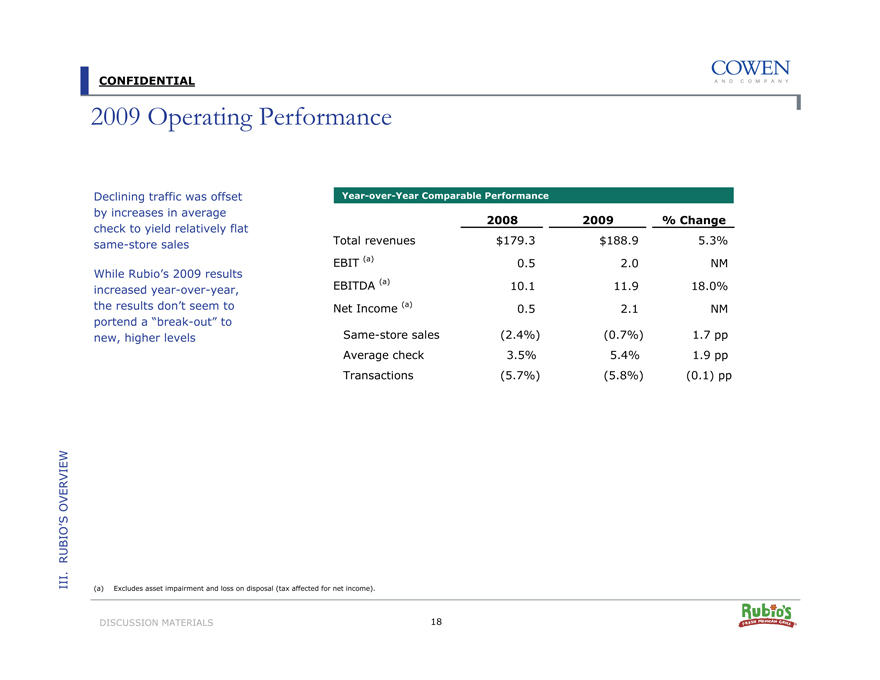

2009 Operating Performance

Declining traffic was offset by increases in average check to yield relatively flat same-store sales

While Rubio’s 2009 results increased year-over-year, the results don’t seem to portend a “break-out” to new, higher levels

Year-over-Year Comparable Performance

2008

2009

% Change

Total revenues

$179.3

$188.9

5.3%

EBIT (a)

0.5

2.0

NM

EBITDA (a)

10.1

11.9

18.0%

Net Income (a)

0.5

2.1

NM

Same-store sales

(2.4%)

(0.7%)

1.7 pp

Average check

3.5%

5.4%

1.9 pp

Transactions

(5.7%)

(5.8%)

(0.1) pp

III. RUBIO’S OVERVIEW

(a) Excludes asset impairment and loss on disposal (tax affected for net income).

DISCUSSION MATERIALS 18

CONFIDENTIAL

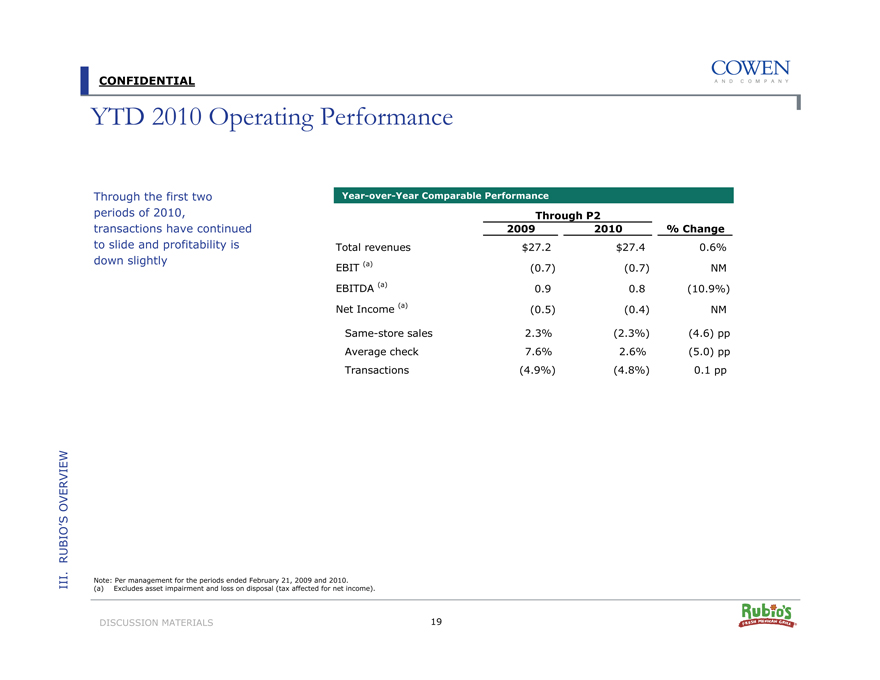

YTD 2010 Operating Performance

Through the first two periods of 2010, transactions have continued to slide and profitability is down slightly

Year-over-Year Comparable Performance

Through P2

2009

2010

% Change

Total revenues

$27.2

$27.4

0.6%

EBIT (a)

(0.7)

(0.7)

NM

EBITDA (a)

0.9

0.8

(10.9%)

Net Income (a)

(0.5)

(0.4)

NM

Same-store sales

2.3%

(2.3%)

(4.6) pp

Average check

7.6%

2.6%

(5.0) pp

Transactions

(4.9%)

(4.8%)

0.1 pp

III. RUBIO’S OVERVIEW

Note: Per management for the periods ended February 21, 2009 and 2010.

(a) Excludes asset impairment and loss on disposal (tax affected for net income).

DISCUSSION MATERIALS 19

CONFIDENTIAL

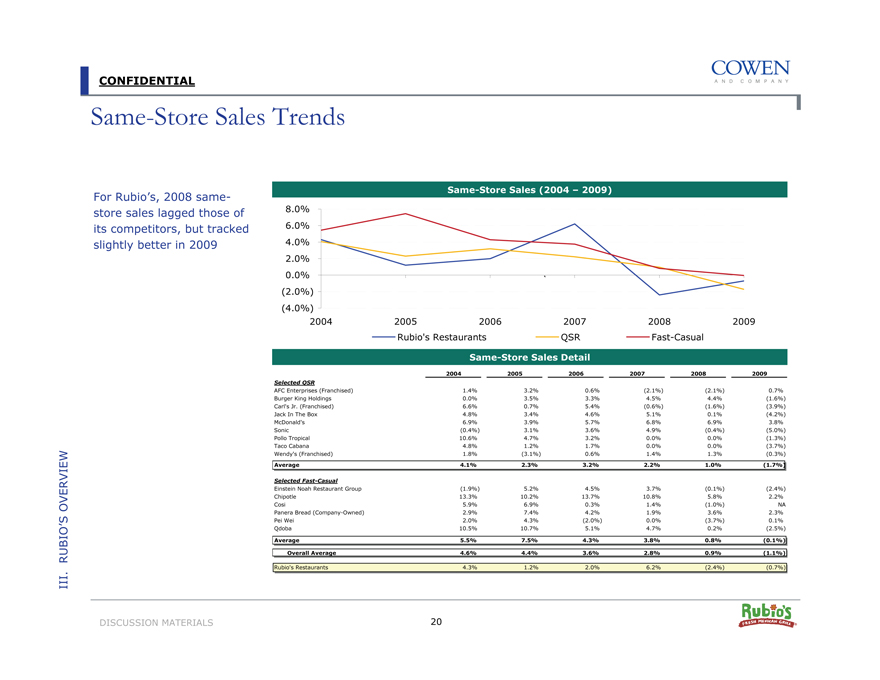

Same-Store Sales Trends

For Rubio’s, 2008 same-store sales lagged those of its competitors, but tracked slightly better in 2009

Same-Store Sales (2004 – 2009)

8.0% 6.0% 4.0% 2.0% 0.0% (2.0%) (4.0%)

2004 2005 2006 2007 2008 2009 Rubio’s Restaurants QSR Fast-Casual

Same-Store Sales Detail

2004

2005

2006

2007

2008

2009

Selected QSR

AFC Enterprises (Franchised)

1.4%

3.2%

0.6%

(2.1%)

(2.1%)

0.7%

Burger King Holdings

0.0%

3.5%

3.3%

4.5%

4.4%

(1.6%)

Carl’s Jr. (Franchised)

6.6%

0.7%

5.4%

(0.6%)

(1.6%)

(3.9%)

Jack In The Box

4.8%

3.4%

4.6%

5.1%

0.1%

(4.2%)

McDonald’s

6.9%

3.9%

5.7%

6.8%

6.9%

3.8%

Sonic

(0.4%)

3.1%

3.6%

4.9%

(0.4%)

(5.0%)

Pollo Tropical

10.6%

4.7%

3.2%

0.0%

0.0%

(1.3%)

Taco Cabana

4.8%

1.2%

1.7%

0.0%

0.0%

(3.7%)

Wendy’s (Franchised)

1.8%

(3.1%)

0.6%

1.4%

1.3%

(0.3%)

Average

4.1%

2.3%

3.2%

2.2%

1.0%

(1.7%)

Selected Fast-Casual

Einstein Noah Restaurant Group

(1.9%)

5.2%

4.5%

3.7%

(0.1%)

(2.4%)

Chipotle

13.3%

10.2%

13.7%

10.8%

5.8%

2.2%

Cosi

5.9%

6.9%

0.3%

1.4%

(1.0%)

NA

Panera Bread (Company-Owned)

2.9%

7.4%

4.2%

1.9%

3.6%

2.3%

Pei Wei

2.0%

4.3%

(2.0%)

0.0%

(3.7%)

0.1%

Qdoba

10.5%

10.7%

5.1%

4.7%

0.2%

(2.5%)

Average

5.5%

7.5%

4.3%

3.8%

0.8%

(0.1%)

Overall Average

4.6%

4.4%

3.6%

2.8%

0.9%

(1.1%)

Rubio’s Restaurants

4.3%

1.2%

2.0%

6.2%

(2.4%)

(0.7%)

III. RUBIO’S OVERVIEW

DISCUSSION MATERIALS 20

CONFIDENTIAL

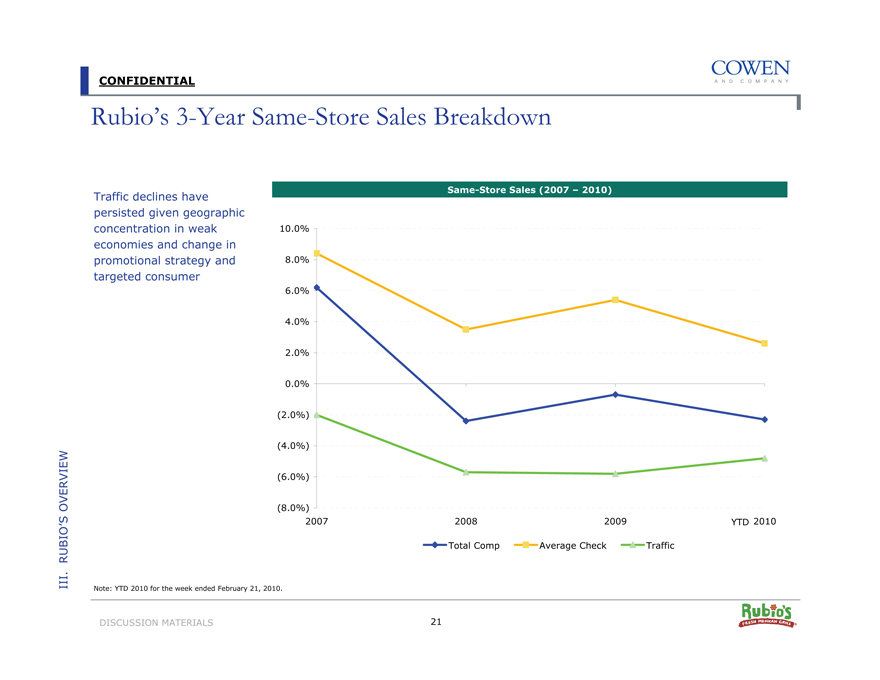

Rubio’s 3-Year Same-Store Sales Breakdown

Traffic declines have persisted given geographic concentration in weak economies and change in promotional strategy and targeted consumer

Same-Store Sales (2007 – 2010)

10.0% 8.0% 6.0% 4.0% 2.0% 0.0% (2.0%) (4.0%) (6.0%) (8.0%)

2007 2008 2009 YTD 2010

Total Comp Average Check Traffic

III. RUBIO’S OVERVIEW

Note: YTD 2010 for the week ended February 21, 2010.

DISCUSSION MATERIALS 21

CONFIDENTIAL

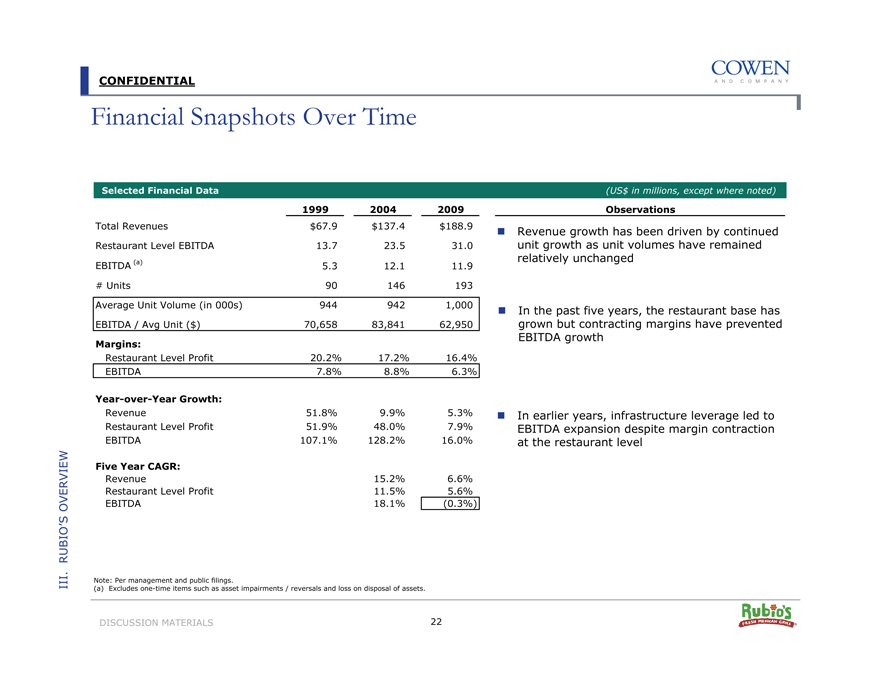

Financial Snapshots Over Time

Selected Financial Data

1999

2004

2009

Total Revenues

$67.9

$137.4

$188.9

Restaurant Level EBITDA

13.7

23.5

31.0

EBITDA (a)

5.3

12.1

11.9

# Units

90

146

193

Average Unit Volume (in 000s)

944

942

1,000

EBITDA / Avg Unit ($)

70,658

83,841

62,950

Margins:

Restaurant Level Profit

20.2%

17.2%

16.4%

EBITDA

7.8%

8.8%

6.3%

Year-over-Year Growth:

Revenue

51.8%

9.9%

5.3%

Restaurant Level Profit

51.9%

48.0%

7.9%

EBITDA

107.1%

128.2%

16.0%

Five Year CAGR:

Revenue

15.2%

6.6%

Restaurant Level Profit

11.5%

5.6%

EBITDA

18.1%

(0.3%)

(US$ in millions, except where noted)

Observations

Revenue growth has been driven by continued unit growth as unit volumes have remained relatively unchanged

In the past five years, the restaurant base has grown but contracting margins have prevented EBITDA growth

In earlier years, infrastructure leverage led to EBITDA expansion despite margin contraction at the restaurant level

III. RUBIO’S OVERVIEW

Note: Per management and public filings.

(a) Excludes one-time items such as asset impairments / reversals and loss on disposal of assets.

DISCUSSION MATERIALS 22

CONFIDENTIAL

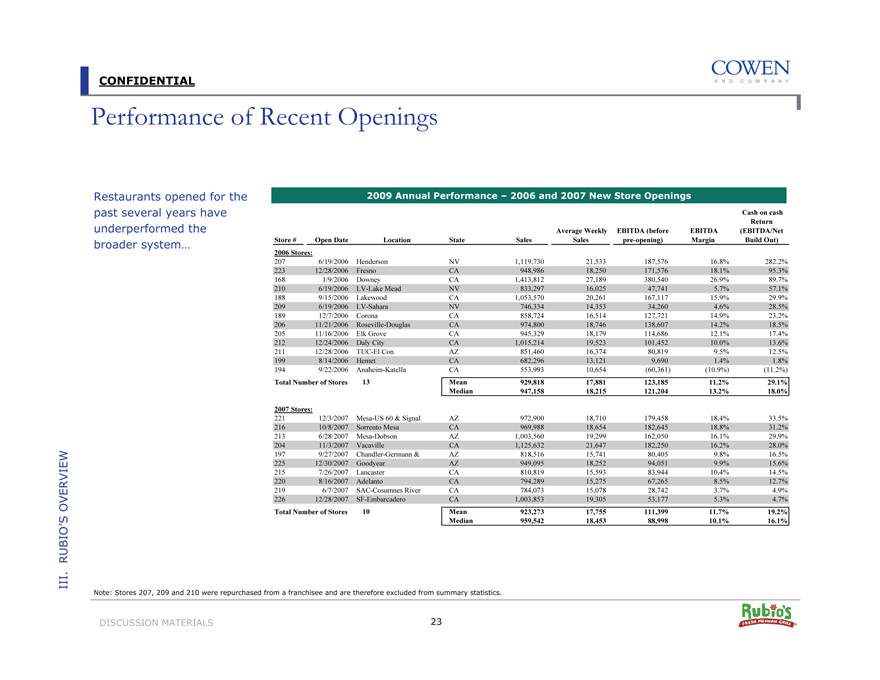

Performance of Recent Openings

Restaurants opened for the past several years have underperformed the broader system…

2009 Annual Performance – 2006 and 2007 New Store Openings

Cash on cash

Return

Average Weekly EBITDA (before

EBITDA

(EBITDA/Net

Store #

Open Date

Location

State

Sales

Sales

pre-opening)

Margin

Build Out)

2006 Stores:

207

6/19/2006

Henderson

NV

1,119,730

21,533

187,576

16.8%

282.2%

223

12/28/2006

Fresno

CA

948,986

18,250

171,576

18.1%

95.3%

168

1/9/2006

Downey

CA

1,413,812

27,189

380,540

26.9%

89.7%

210

6/19/2006

LV-Lake Mead

NV

833,297

16,025

47,741

5.7%

57.1%

188

9/15/2006

Lakewood

CA

1,053,570

20,261

167,117

15.9%

29.9%

209

6/19/2006

LV-Sahara

NV

746,334

14,353

34,260

4.6%

28.5%

189

12/7/2006

Corona

CA

858,724

16,514

127,721

14.9%

23.2%

206

11/21/2006

Roseville-Douglas

CA

974,800

18,746

138,607

14.2%

18.5%

205

11/16/2006

Elk Grove

CA

945,329

18,179

114,686

12.1%

17.4%

212

12/24/2006

Daly City

CA

1,015,214

19,523

101,452

10.0%

13.6%

211

12/28/2006

TUC-El Con

AZ

851,460

16,374

80,819

9.5%

12.5%

199

8/14/2006

Hemet

CA

682,296

13,121

9,690

1.4%

1.8%

194

9/22/2006

Anaheim-Katella

CA

553,993

10,654

(60,361)

(10.9%)

(11.2%)

Total Number of Stores

13

Mean

929,818

17,881

123,185

11.2%

29.1%

Median

947,158

18,215

121,204

13.2%

18.0%

2007 Stores:

221

12/3/2007

Mesa-US 60 & Signal

AZ

972,900

18,710

179,458

18.4%

33.5%

216

10/8/2007

Sorrento Mesa

CA

969,988

18,654

182,645

18.8%

31.2%

213

6/28/2007

Mesa-Dobson

AZ

1,003,560

19,299

162,050

16.1%

29.9%

204

11/3/2007

Vacaville

CA

1,125,632

21,647

182,250

16.2%

28.0%

197

9/27/2007

Chandler-Germann &

AZ

818,516

15,741

80,405

9.8%

16.5%

225

12/30/2007

Goodyear

AZ

949,095

18,252

94,051

9.9%

15.6%

215

7/26/2007

Lancaster

CA

810,819

15,593

83,944

10.4%

14.5%

220

8/16/2007

Adelanto

CA

794,289

15,275

67,265

8.5%

12.7%

219

6/7/2007

SAC-Cosumnes River

CA

784,073

15,078

28,742

3.7%

4.9%

226

12/28/2007

SF-Embarcadero

CA

1,003,853

19,305

53,177

5.3%

4.7%

Total Number of Stores

10

Mean

923,273

17,755

111,399

11.7%

19.2%

Median

959,542

18,453

88,998

10.1%

16.1%

III. RUBIO’S OVERVIEW

Note: Stores 207, 209 and 210 were repurchased from a franchisee and are therefore excluded from summary statistics.

DISCUSSION MATERIALS 237

CONFIDENTIAL

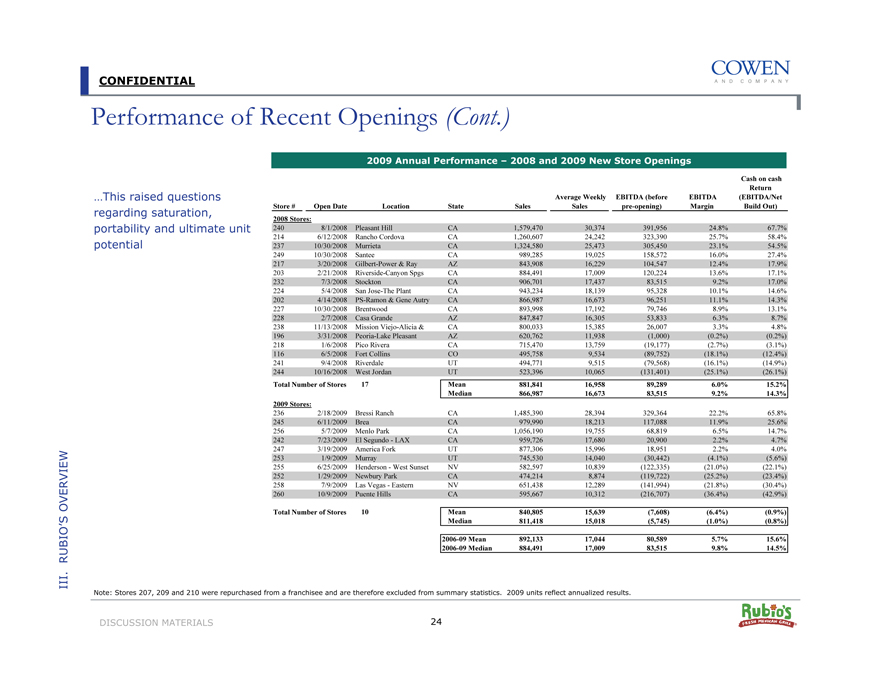

Performance of Recent Openings (Cont.)

2009 Annual Performance – 2008 and 2009 New Store Openings

…This raised questions regarding saturation, portability and ultimate unit potential

Store #

Open Date

Location

State

Sales

Average Weekly EBITDA (before Sales

pre-opening)

EBITDA Margin

Cash on cash Return (EBITDA/Net Build Out)

2008 Stores:

240

8/1/2008

Pleasant Hill

CA

1,579,470

30,374

391,956

24.8%

67.7%

214

6/12/2008

Rancho Cordova

CA

1,260,607

24,242

323,390

25.7%

58.4%

237

10/30/2008

Murrieta

CA

1,324,580

25,473

305,450

23.1%

54.5%

249

10/30/2008

Santee

CA

989,285

19,025

158,572

16.0%

27.4%

217

3/20/2008

Gilbert-Power & Ray

AZ

843,908

16,229

104,547

12.4%

17.9%

203

2/21/2008

Riverside-Canyon Spgs

CA

884,491

17,009

120,224

13.6%

17.1%

232

7/3/2008

Stockton

CA

906,701

17,437

83,515

9.2%

17.0%

224

5/4/2008

San Jose-The Plant

CA

943,234

18,139

95,328

10.1%

14.6%

202

4/14/2008

PS-Ramon & Gene Autry

CA

866,987

16,673

96,251

11.1%

14.3%

227

10/30/2008

Brentwood

CA

893,998

17,192

79,746

8.9%

13.1%

228

2/7/2008

Casa Grande

AZ

847,847

16,305

53,833

6.3%

8.7%

238

11/13/2008

Mission Viejo-Alicia &

CA

800,033

15,385

26,007

3.3%

4.8%

196

3/31/2008

Peoria-Lake Pleasant

AZ

620,762

11,938

(1,000)

(0.2%)

(0.2%)

218

1/6/2008

Pico Rivera

CA

715,470

13,759

(19,177)

(2.7%)

(3.1%)

116

6/5/2008

Fort Collins

CO

495,758

9,534

(89,752)

(18.1%)

(12.4%)

241

9/4/2008

Riverdale

UT

494,771

9,515

(79,568)

(16.1%)

(14.9%)

244

10/16/2008

West Jordan

UT

523,396

10,065

(131,401)

(25.1%)

(26.1%)

Total Number of Stores

17

Mean

881,841

16,958

89,289

6.0%

15.2%

Median

866,987

16,673

83,515

9.2%

14.3%

2009 Stores:

236

2/18/2009

Bressi Ranch

CA

1,485,390

28,394

329,364

22.2%

65.8%

245

6/11/2009

Brea

CA

979,990

18,213

117,088

11.9%

25.6%

256

5/7/2009

Menlo Park

CA

1,056,190

19,755

68,819

6.5%

14.7%

242

7/23/2009

El Segundo - LAX

CA

959,726

17,680

20,900

2.2%

4.7%

247

3/19/2009

America Fork

UT

877,306

15,996

18,951

2.2%

4.0%

253

1/9/2009

Murray

UT

745,530

14,040

(30,442)

(4.1%)

(5.6%)

255

6/25/2009

Henderson - West Sunset

NV

582,597

10,839

(122,335)

(21.0%)

(22.1%)

252

1/29/2009

Newbury Park

CA

474,214

8,874

(119,722)

(25.2%)

(23.4%)

258

7/9/2009

Las Vegas - Eastern

NV

651,438

12,289

(141,994)

(21.8%)

(30.4%)

260

10/9/2009

Puente Hills

CA

595,667

10,312

(216,707)

(36.4%)

(42.9%)

Total Number of Stores

10

Mean

840,805

15,639

(7,608)

(6.4%)

(0.9%)

Median

811,418

15,018

(5,745)

(1.0%)

(0.8%)

2006-09 Mean

892,133

17,044

80,589

5.7%

15.6%

2006-09 Median

884,491

17,009

83,515

9.8%

14.5%

III. RUBIO’S OVERVIEW

Note: Stores 207, 209 and 210 were repurchased from a franchisee and are therefore excluded from summary statistics. 2009 units reflect annualized results.

DISCUSSION MATERIALS 24

CONFIDENTIAL

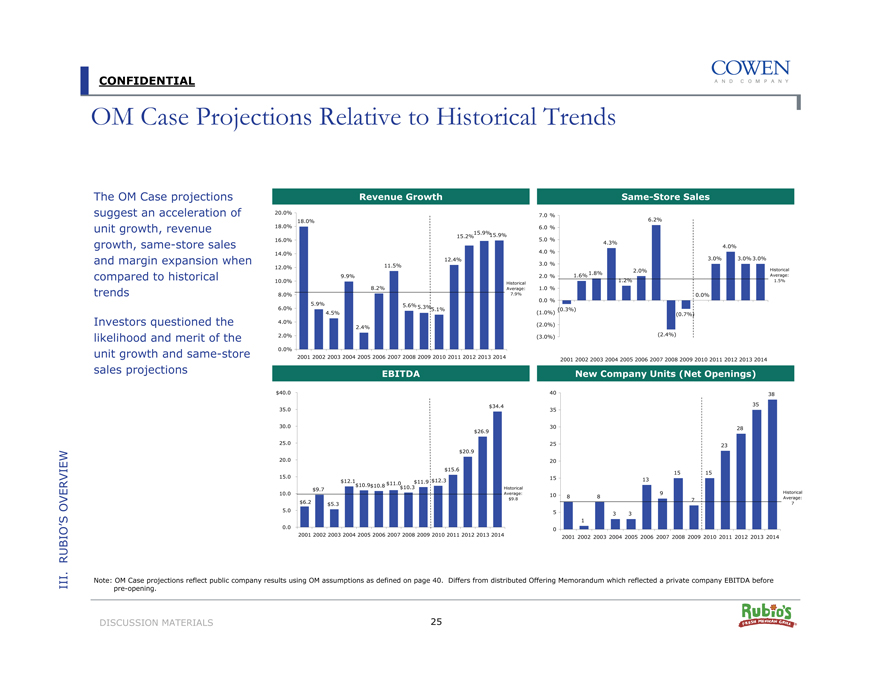

OM Case Projections Relative to Historical Trends

The OM Case projections suggest an acceleration of unit growth, revenue growth, same-store sales and margin expansion when compared to historical trends

Investors questioned the likelihood and merit of the unit growth and same-store sales projections

Revenue Growth

20.0%

18.0% 18.0%

15.9%15.9%

15.2%

16.0%

14.0%

12.4%

12.0% 11.5%

10.0% 9.9%

8.2% Historical Average:

8.0% 7.9%

5.9% 5.6%

6.0% 5.3%5.1%

4.5%

4.0% 2.4%

2.0%

0.0%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Same-Store Sales

7.0 %

6.2%

6.0 %

5.0 %

4.3%

4.0 % 4.0%

3.0 % 3.0% 3.0% 3.0%

2.0% Historical

1.6% 1.8% Average:

2.0 % 1.5%

1.2%

1.0 %

0.0 % 0.0%

(0.3%)

(1.0%) (0.7%)

(2.0%)

(3.0%) (2.4%)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

EBITDA

$40.0

$34.4

35.0

30.0 $26.9

25.0

$20.9

20.0

$15.6

15.0

$12.1 $11.9 $12.3

$10.9$10.8 $11.0

$9.7 $10.3 Historical

10.0 Average:

$9.8

$6.2 $5.3

5.0

0.0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

New Company Units (Net Openings)

40 38

35 35

30 28

25 23 20

15 15 15 13

9 Historical

10 8 8

7 Average: 7

5 3 3 1 0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

III. RUBIO’S OVERVIEW

Note: OM Case projections reflect public company results using OM assumptions as defined on page 40. Differs from distributed Offering Memorandum which reflected a private company EBITDA before pre-opening.

DISCUSSION MATERIALS 25

CONFIDENTIAL

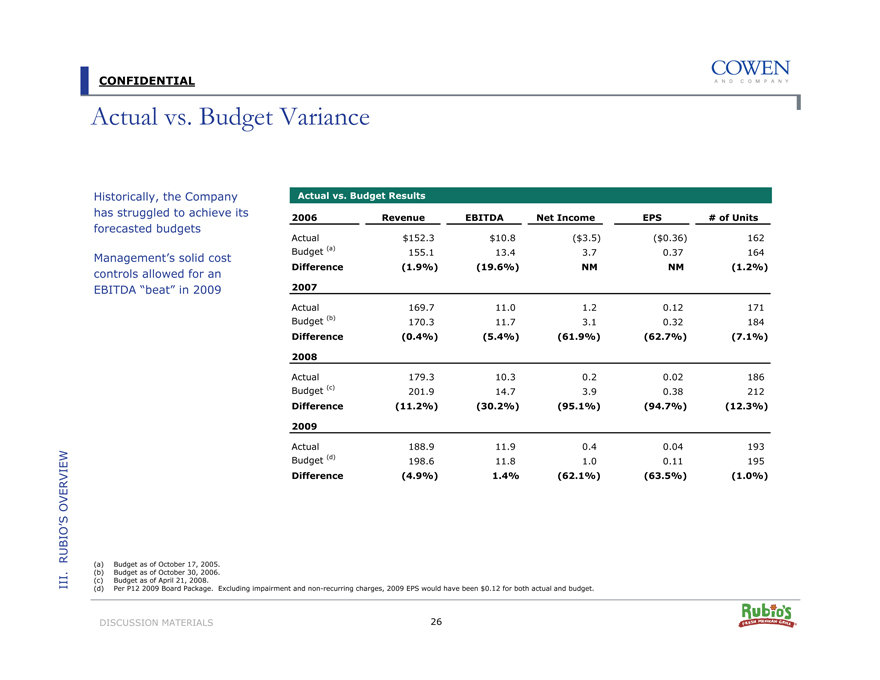

Actual vs. Budget Variance

Historically, the Company has struggled to achieve its forecasted budgets

Management’s solid cost controls allowed for an EBITDA “beat” in 2009

Actual vs. Budget Results

2006

Revenue

EBITDA

Net Income

EPS

# of Units

Actual

$152.3

$10.8

($3.5)

($0.36)

162

Budget (a)

155.1

13.4

3.7

0.37

164

Difference

(1.9%)

(19.6%)

NM

NM

(1.2%)

2007

Actual

169.7

11.0

1.2

0.12

171

Budget (b)

170.3

11.7

3.1

0.32

184

Difference

(0.4%)

(5.4%)

(61.9%)

(62.7%)

(7.1%)

2008

Actual

179.3

10.3

0.2

0.02

186

Budget (c)

201.9

14.7

3.9

0.38

212

Difference

(11.2%)

(30.2%)

(95.1%)

(94.7%)

(12.3%)

2009

Actual

188.9

11.9

0.4

0.04

193

Budget (d)

198.6

11.8

1.0

0.11

195

Difference

(4.9%)

1.4%

(62.1%)

(63.5%)

(1.0%)

III. RUBIO’S OVERVIEW

(a) | | Budget as of October 17, 2005. (b) Budget as of October 30, 2006. (c) Budget as of April 21, 2008. |

(d) Per P12 2009 Board Package. Excluding impairment and non-recurring charges, 2009 EPS would have been $0.12 for both actual and budget.

DISCUSSION MATERIALS 26

CONFIDENTIAL

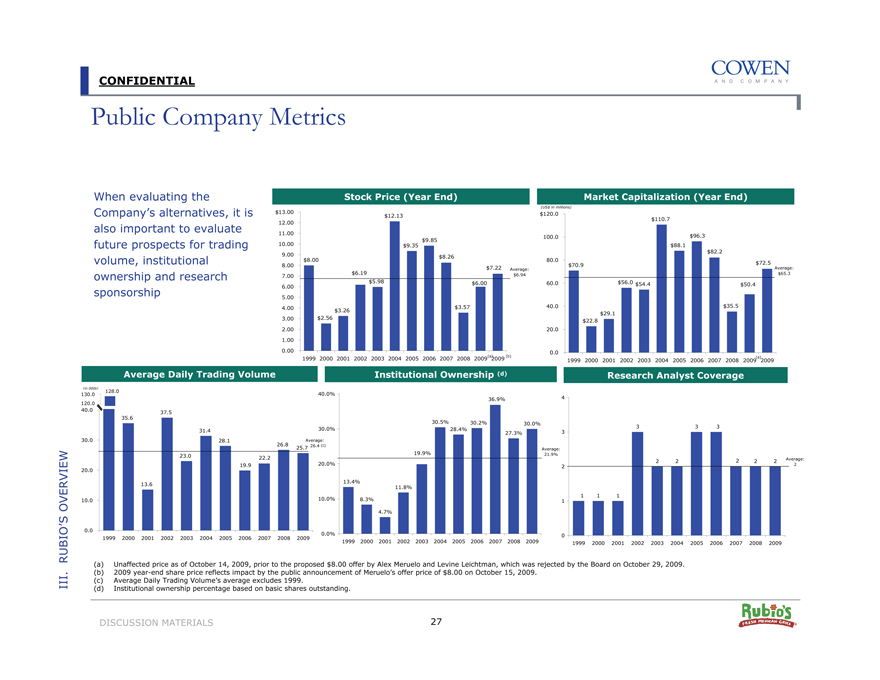

Public Company Metrics

When evaluating the Company’s alternatives, it is also important to evaluate future prospects for trading volume, institutional ownership and research sponsorship

Stock Price (Year End)

$13.00

$12.13

12.00

11.00

$9.85

10.00 $9.35

9.00 $8.00 $8.26

8.00 $7.22

Average:

$6.19 $6.94

7.00 $5.98

$6.00

6.00

5.00

4.00 $3.57

$3.26

3.00 $2.56

2.00

1.00

0.00

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009(a) 2009 (b)

Market Capitalization (Year End)

(US$ in millions) $120.0 $110.7

100.0 $96.3

$88.1

$82.2

80.0

$70.9 $72.5 Average:

$65.3

60.0 $56.0 $54.4 $50.4

40.0 $35.5

$29.1

$22.8

20.0

0.0 (a) 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2009

Average Daily Trading Volume

(in 000s)

128.0 130.0 120.0

40.0 37.5

35.6

31.4

30.0 28.1

26.8

25.7

23.0 22.2

20.0 19.9

13.6

10.0

0.0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Institutional Ownership (d)

Average:

.7 26.4 (c)

40.0%

30.0%

20.0% 10.0% 0.0%

36.9%

30.5% 30.2% 30.0%

28.4%

27.3%

Average:

19.9% 21.9%

13.4% 11.8%

8.3%

4.7%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Research Analyst Coverage

4

3 3 3 3

2 2 2 2 2 Average:

2 2

1 1 1 1

0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

III. RUBIO’S OVERVIEW

(a) Unaffected price as of October 14, 2009, prior to the proposed $8.00 offer by Alex Meruelo and Levine Leichtman, which was rejected by the Board on October 29, 2009. (b) 2009 year-end share price reflects impact by the public announcement of Meruelo’s offer price of $8.00 on October 15, 2009.

(c) Average Daily Trading Volume’s average excludes 1999.

(d) Institutional ownership percentage based on basic shares outstanding.

DISCUSSION MATERIALS 27

CONFIDENTIAL

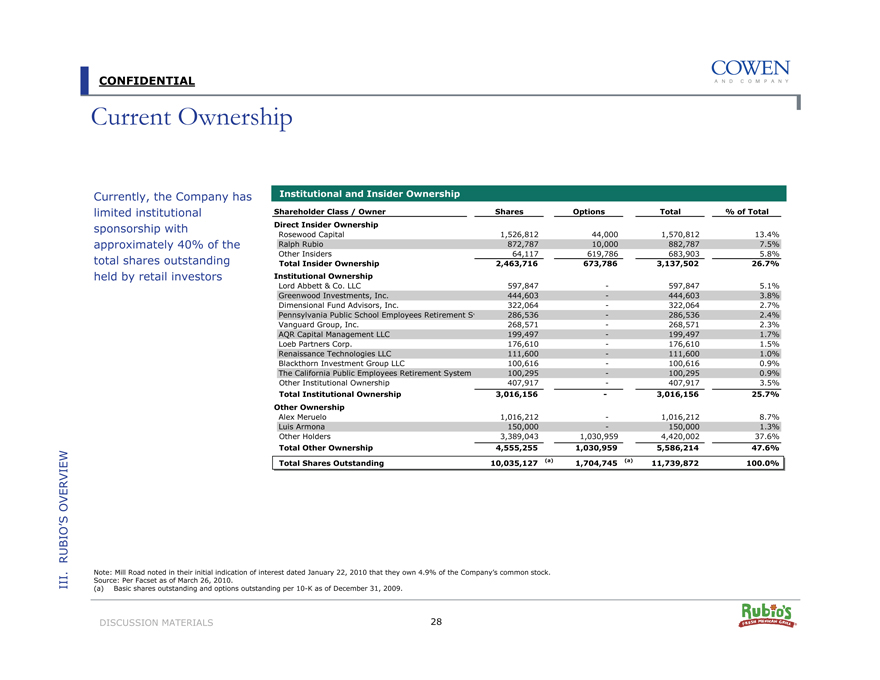

Current Ownership

Currently, the Company has limited institutional sponsorship with approximately 40% of the total shares outstanding held by retail investors

Institutional and Insider Ownership

Shareholder Class / Owner

Shares

Options

Total

% of Total

Direct Insider Ownership

Rosewood Capital

1,526,812

44,000

1,570,812

13.4%

Ralph Rubio

872,787

10,000

882,787

7.5%

Other Insiders

64,117

619,786

683,903

5.8%

Total Insider Ownership

2,463,716

673,786

3,137,502

26.7%

Institutional Ownership

Lord Abbett & Co. LLC

597,847

—

597,847

5.1%

Greenwood Investments, Inc.

444,603

—

444,603

3.8%

Dimensional Fund Advisors, Inc.

322,064

—

322,064

2.7%

Pennsylvania Public School Employees Retirement Sy

286,536

—

286,536

2.4%

Vanguard Group, Inc.

268,571

—

268,571

2.3%

AQR Capital Management LLC

199,497

—

199,497

1.7%

Loeb Partners Corp.

176,610

—

176,610

1.5%

Renaissance Technologies LLC

111,600

—

111,600

1.0%

Blackthorn Investment Group LLC

100,616

—

100,616

0.9%

The California Public Employees Retirement System

100,295

—

100,295

0.9%

Other Institutional Ownership

407,917

—

407,917

3.5%

Total Institutional Ownership

3,016,156

—

3,016,156

25.7%

Other Ownership

Alex Meruelo

1,016,212

—

1,016,212

8.7%

Luis Armona

150,000

—

150,000

1.3%

Other Holders

3,389,043

1,030,959

4,420,002

37.6%

Total Other Ownership

4,555,255

1,030,959

5,586,214

47.6%

Total Shares Outstanding

10,035,127 (a)

1,704,745 (a)

11,739,872

100.0%

III. RUBIO’S OVERVIEW

Note: Mill Road noted in their initial indication of interest dated January 22, 2010 that they own 4.9% of the Company’s common stock. Source: Per Facset as of March 26, 2010.

(a) | | Basic shares outstanding and options outstanding per 10-K as of December 31, 2009. |

DISCUSSION MATERIALS 28

CONFIDENTIAL

Institutional Ownership Summary Over Time

Two of Rubio’s top five holders were also top five holders five years ago

Of note, Royce Associates, previously the largest institutional shareholder of the company, liquidated its position during the second half of 2009 when the stock passed its average cost basis of $6.69

Institutional Holders – Today, 1 Year Ago, 3 Years Ago and 5 Years Ago

Shares Held

Holder Name

Holdings Style

12/31/2009

12/31/2008

12/31/2006

12/31/2004

Lord Abbett & Co. LLC

Value

597,847

504,547

0

0

Dimensional Fund Advisors, Inc.

Deep Value

322,064

341,404

291,505

525,187

Pennsylvania Public School Employees Retirement System

GARP

286,536

0

0

0

Vanguard Group, Inc.

Index

268,571

262,665

102,516

222,272

AQR Capital Management LLC

Value

199,497

0

0

0

Loeb Partners Corp.

Value

176,610

0

0

0

Renaissance Technologies LLC

Value

111,600

93,100

0

0

Blackthorn Investment Group LLC

Value

100,616

0

0

0

The California Public Employees Retirement System

GARP

100,295

100,295

17,900

17,900

Kennedy Capital Management, Inc.

Deep Value

87,182

0

0

0

Portolan Capital Management LLC

Value

75,600

0

0

0

Keane Capital Management, Inc.

Value

66,800

0

0

0

Russell Investment Group

Value

38,100

41,400

0

0

CNH Partners LLC

GARP

36,279

0

0

0

Discovery Group I LLC

Value

31,881

0

0

0

Northern Trust Investments

GARP

22,618

24,165

19,903

26,752

BlackRock Global Investors

Index

18,264

99,105

36,469

4,734

Credit Agricole Structured Asset Management Advisers LLC

Value

11,725

0

0

0

Connors Investor Services, Inc.

GARP

11,300

17,500

0

0

Royce & Associates LLC

Value

0

870,330

858,200

557,500

Pequot Capital Management, Inc.

Deep Value

0

150,000

360,400

493,900

Wells Capital Management, Inc.

Growth

0

135,500

135,500

0

Spark LP

Value

0

15,200

0

0

Roxbury Capital Management LLC

Growth

0

7,783

0

0

AXA Rosenberg Investment Management LLC

Value

0

2,123

19,704

88,522

Watershed Asset Management LLC

GARP

0

0

296,000

0

Magnetar Financial LLC

Value

0

0

241,173

0

Federated Investment Management Co.

Growth

0

0

222,100

0

Rice, Hall, James & Associates LLC

GARP

0

0

129,705

152,008

Paloma Partners Management Co.

Value

0

0

116,058

0

AXA Investment Managers (Paris) SA

Value

0

0

700

700

Nicholas-Applegate Capital Management

Value

0

0

0

183,700

Morgan Stanley & Co., Inc.

GARP

0

0

0

0

Thomson, Horstmann & Bryant, Inc.

Value

0

0

0

138,700

Numeric Investors LP

Value

0

0

0

129,500

Driehaus Capital Management LLC

Growth

0

0

0

85,912

Calamos Advisors LLC

Growth

0

0

0

67,000

Charles Schwab Investment Management, Inc.

GARP

0

0

0

30,522

Dawson-Herman Capital Management, Inc.

Growth

0

0

0

25,200

Osborne Partners Capital Management

GARP

0

0

0

10,000

Source: Per Facset as of December 31, 2009.

Note: Bolded numbers indicate a top five position for that respective period. Excludes institutional shareholders with a peak position of fewer than 4,000 shares.

III. RUBIO’S OVERVIEW

DISCUSSION MATERIALS 29

CONFIDENTIAL

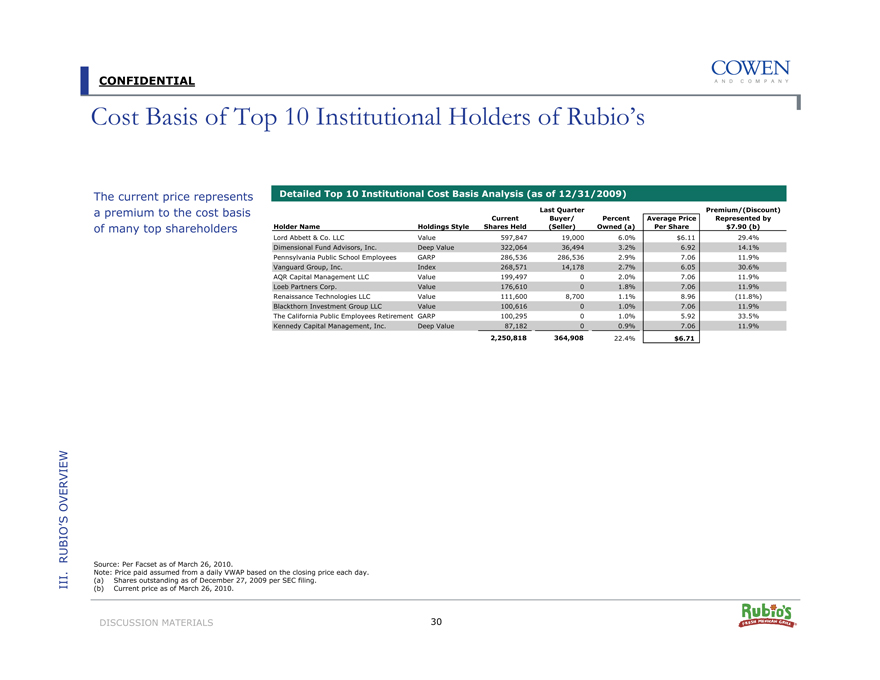

Cost Basis of Top 10 Institutional Holders of Rubio’s

The current price represents a premium to the cost basis of many top shareholders

Detailed Top 10 Institutional Cost Basis Analysis (as of 12/31/2009)

Last Quarter

Premium/(Discount)

Current

Buyer/

Percent Average Price

Represented by

Holder Name

Holdings Style

Shares Held

(Seller)

Owned (a)

Per Share

$7.90 (b)

Lord Abbett & Co. LLC

Value

597,847

19,000

6.0%

$6.11

29.4%

Dimensional Fund Advisors, Inc.

Deep Value

322,064

36,494

3.2%

6.92

14.1%

Pennsylvania Public School Employees

GARP

286,536

286,536

2.9%

7.06

11.9%

Vanguard Group, Inc.

Index

268,571

14,178

2.7%

6.05

30.6%

AQR Capital Management LLC

Value

199,497

0

2.0%

7.06

11.9%

Loeb Partners Corp.

Value

176,610

0

1.8%

7.06

11.9%

Renaissance Technologies LLC

Value

111,600

8,700

1.1%

8.96

(11.8%)

Blackthorn Investment Group LLC

Value

100,616

0

1.0%

7.06

11.9%

The California Public Employees Retirement GARP

100,295

0

1.0%

5.92

33.5%

Kennedy Capital Management, Inc.

Deep Value

87,182

0

0.9%

7.06

11.9%

2,250,818

364,908

22.4%

$6.71

III. RUBIO’S OVERVIEW

Source: Per Facset as of March 26, 2010.

Note: Price paid assumed from a daily VWAP based on the closing price each day. (a) Shares outstanding as of December 27, 2009 per SEC filing.

(b) | | Current price as of March 26, 2010. |

DISCUSSION MATERIALS 30

CONFIDENTIAL

IV. Valuation Overview

CONFIDENTIAL

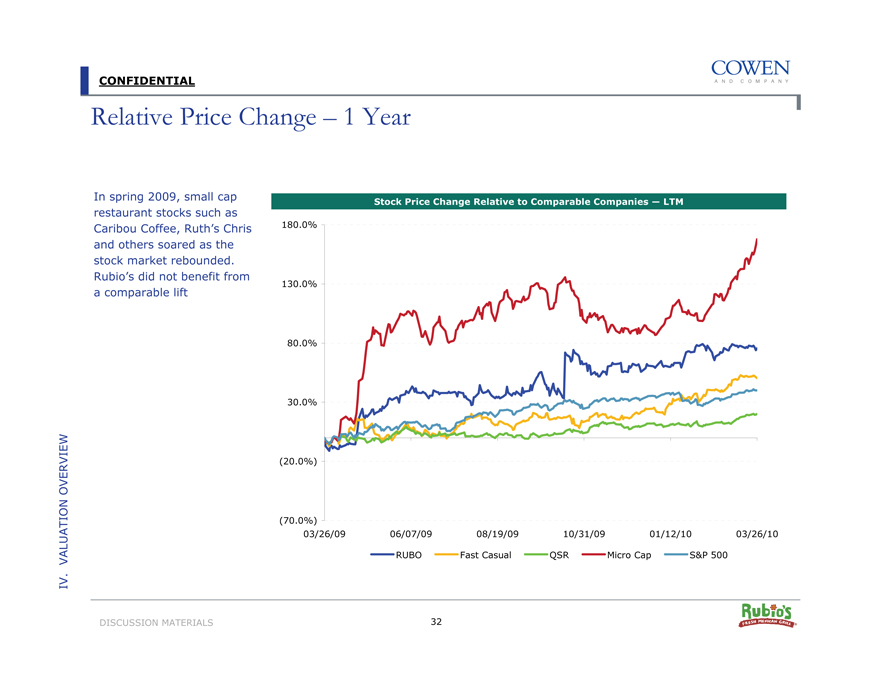

Relative Price Change – 1 Year

In spring 2009, small cap restaurant stocks such as Caribou Coffee, Ruth’s Chris and others soared as the stock market rebounded. Rubio’s did not benefit from a comparable lift

Stock Price Change Relative to Comparable Companies — LTM

180.0% 130.0% 80.0% 30.0% (20.0%) (70.0%)

03/26/09 06/07/09 08/19/09 10/31/09 01/12/10 03/26/10

RUBO Fast Casual QSR Micro Cap S&P 500

IV VALUATION. OVERVIEW

DISCUSSION MATERIALS 32

CONFIDENTIAL

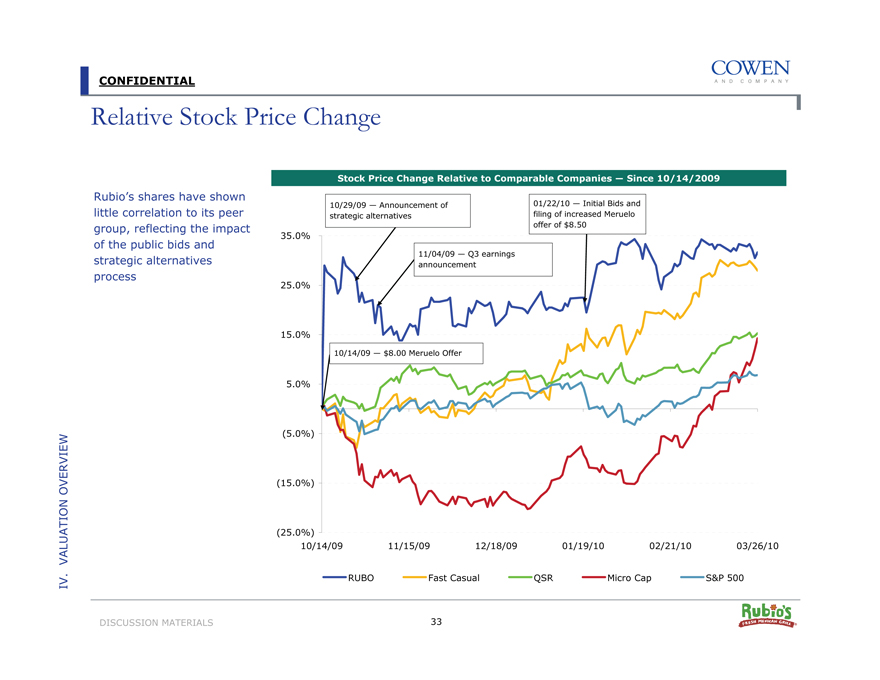

Relative Stock Price Change

Rubio’s shares have shown little correlation to its peer group, reflecting the impact of the public bids and strategic alternatives process

Stock Price Change Relative to Comparable Companies — Since 10/14/2009

10/29/09 — Announcement of strategic alternatives

01/22/10 — Initial Bids and filing of increased Meruelo offer of $8.50

35.0% 25.0% 15.0% 5.0% (5.0%) (15.0%) (25.0%)

10/14/09 11/15/09 12/18/09 01/19/10 02/21/10 03/26/10

RUBO Fast Casual QSR Micro Cap S&P 500

IV VALUATION. OVERVIEW

DISCUSSION MATERIALS 33

CONFIDENTIAL

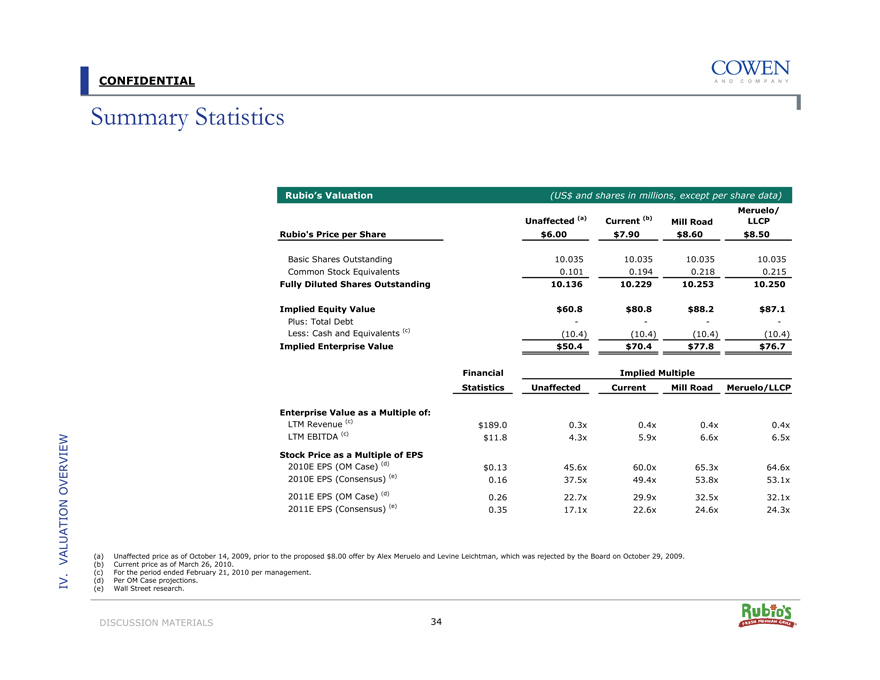

Summary Statistics

Rubio’s Valuation

(US$ and shares in millions, except per share data)

Meruelo/

Unaffected (a)

Current (b)

Mill Road

LLCP

Rubio’s Price per Share

$6.00

$7.90

$8.60

$8.50

Basic Shares Outstanding

10.035

10.035

10.035

10.035

Common Stock Equivalents

0.101

0.194

0.218

0.215

Fully Diluted Shares Outstanding

10.136

10.229

10.253

10.250

Implied Equity Value

$60.8

$80.8

$88.2

$87.1

Plus: Total Debt

—

—

—

—

Less: Cash and Equivalents (c)

(10.4)

(10.4)

(10.4)

(10.4)

Implied Enterprise Value

$50.4

$70.4

$77.8

$76.7

Financial

Implied Multiple

Statistics

Unaffected

Current

Mill Road

Meruelo/LLCP

Enterprise Value as a Multiple of:

LTM Revenue (c)

$189.0

0.3x

0.4x

0.4x

0.4x

LTM EBITDA (c)

$11.8

4.3x

5.9x

6.6x

6.5x

Stock Price as a Multiple of EPS

2010E EPS (OM Case) (d)

$0.13

45.6x

60.0x

65.3x

64.6x

2010E EPS (Consensus) (e)

0.16

37.5x

49.4x

53.8x

53.1x

2011E EPS (OM Case) (d)

0.26

22.7x

29.9x

32.5x

32.1x

2011E EPS (Consensus) (e)

0.35

17.1x

22.6x

24.6x

24.3x

IV VALUATION. OVERVIEW

(a) Unaffected price as of October 14, 2009, prior to the proposed $8.00 offer by Alex Meruelo and Levine Leichtman, which was rejected by the Board on October 29, 2009. (b) Current price as of March 26, 2010.

(c) | | For the period ended February 21, 2010 per management. (d) Per OM Case projections. |

(e) | | Wall Street research. |

DISCUSSION MATERIALS 34

CONFIDENTIAL

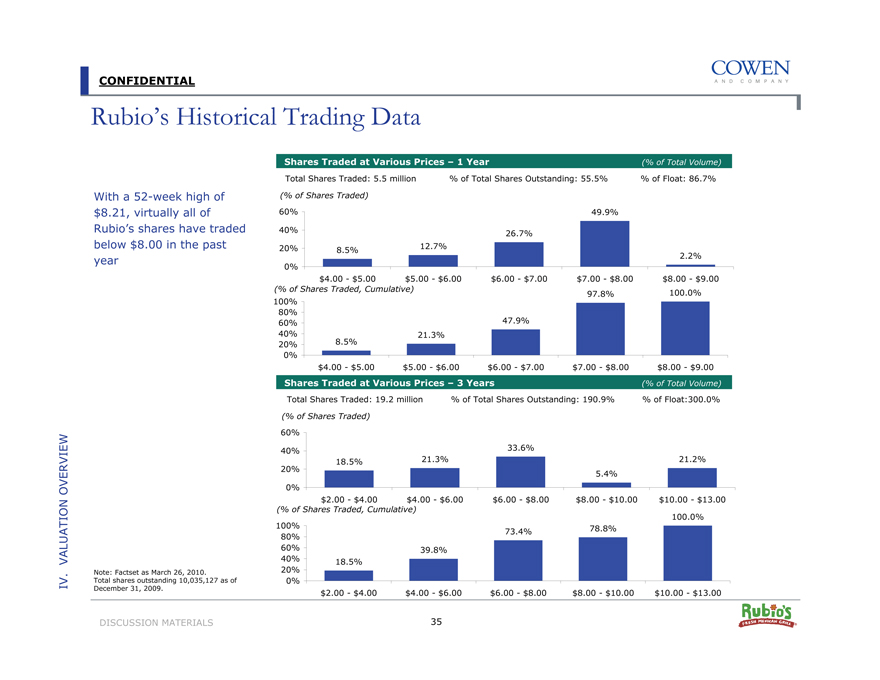

Rubio’s Historical Trading Data

With a 52-week high of $8.21, virtually all of Rubio’s shares have traded below $8.00 in the past year

Shares Traded at Various Prices – 1 Year (% of Total Volume)

Total Shares Traded: 5.5 million % of Total Shares Outstanding: 55.5% % of Float: 86.7%

(% of Shares Traded)

60% 40% 20% 0%

49.9%

26.7%

8.5% 12.7%

2.2%

$4.00 - $5.00 $5.00 - $6.00 $6.00 - $7.00 $7.00 - $8.00 $8.00 - $9.00

(% of Shares Traded, Cumulative)

100% 80% 60% 40% 20% 0%

47.9%

21.3%

8.5%

97.8% 100.0%

$4.00 - $5.00 $5.00 - $6.00 $6.00 - $7.00 $7.00 - $8.00 $8.00 - $9.00

Shares Traded at Various Prices – 3 Years (% of Total Volume)

Total Shares Traded: 19.2 million % of Total Shares Outstanding: 190.9% % of Float:300.0%

(% of Shares Traded)

60% 40% 20% 0%

33.6%

18.5% 21.3% 21.2%

5.4%

$2.00 - $4.00 $4.00 - $6.00 $6.00 - $8.00 $8.00 - $10.00 $10.00 - $13.00

(% of Shares Traded, Cumulative)

100% 80% 60% 40% 20% 0%

39.8%

18.5%

100.0% 73.4% 78.8%

$2.00 - $4.00 $4.00 - $6.00 $6.00 - $8.00 $8.00 - $10.00 $10.00 - $13.00

IV VALUATION. OVERVIEW

Note: Factset as March 26, 2010.

Total shares outstanding 10,035,127 as of December 31, 2009.

DISCUSSION MATERIALS 35

CONFIDENTIAL

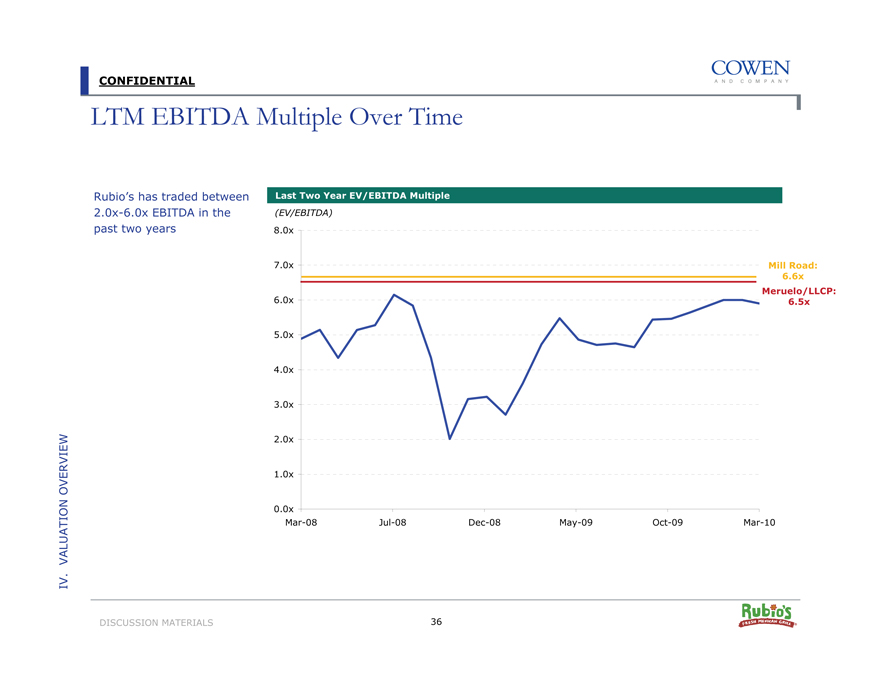

LTM EBITDA Multiple Over Time

Rubio’s has traded between 2.0x-6.0x EBITDA in the past two years

Last Two Year EV/EBITDA Multiple

(EV/EBITDA)

8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x

Mar-08 Jul-08 Dec-08 May-09 Oct-09 Mar-10

Mill Road: 6.6x Meruelo/LLCP: 6.5x

IV VALUATION. OVERVIEW

DISCUSSION MATERIALS

36

CONFIDENTIAL

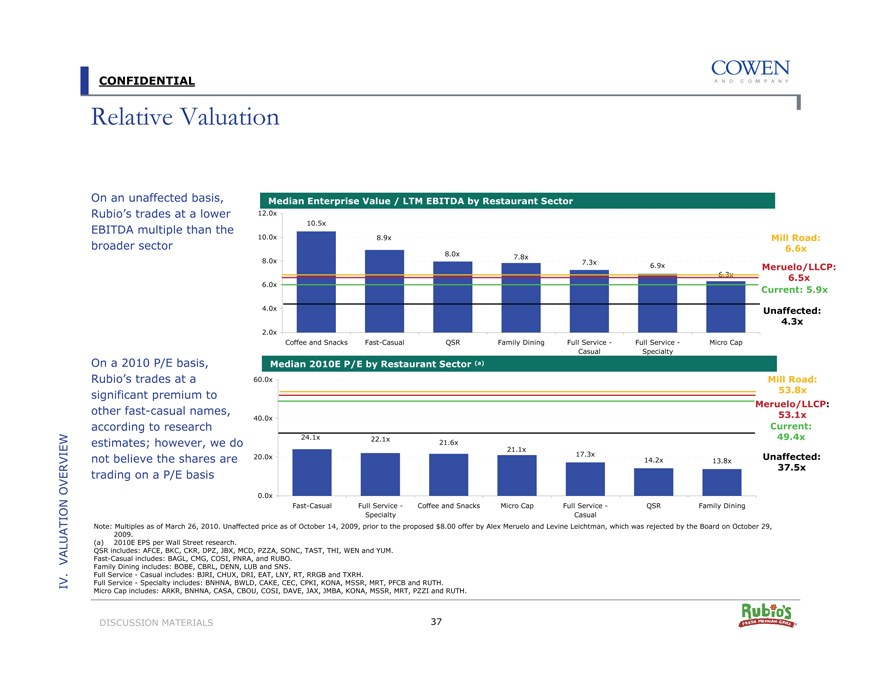

Relative Valuation

On an unaffected basis, Rubio’s trades at a lower EBITDA multiple than the broader sector

Median Enterprise Value / LTM EBITDA by Restaurant Sector

12.0x 10.0x 8.0x 6.0x 4.0x 2.0x

10.5x

8.9x

8.0x 7.8x

7.3x 6.9x

6.3x

Coffee and Snacks Fast-Casual QSR Family Dining Full Service—Full Service—Micro Cap Casual Specialty

Mill Road: 6.6x Meruelo/LLCP: 6.5x Current: 5.9x

Unaffected: 4.3x

Median 2010E P/E by Restaurant Sector (a)

On a 2010 P/E basis, Rubio’s trades at a significant premium to other fast-casual names, according to research estimates; however, we do not believe the shares are trading on a P/E basis

60.0x 40.0x 20.0x 0.0x

24.1x 22.1x

21.6x 21.1x

17.3x

14.2x 13.8x

Fast-Casual Full Service—Coffee and Snacks Micro Cap Full Service—QSR Family Dining Specialty Casual

Mill Road: 53.8x Meruelo/LLCP: 53.1x Current: 49.4x Unaffected: 37.5x

Note: Multiples as of March 26, 2010. Unaffected price as of October 14, 2009, prior to the proposed $8.00 offer by Alex Meruelo and Levine Leichtman, which was rejected by the Board on October 29, 2009.

(a) 2010E EPS per Wall Street research.

QSR includes: AFCE, BKC, CKR, DPZ, JBX, MCD, PZZA, SONC, TAST, THI, WEN and YUM. Fast-Casual includes: BAGL, CMG, COSI, PNRA, and RUBO.

Family Dining includes: BOBE, CBRL, DENN, LUB and SNS.

Full Service—Casual includes: BJRI, CHUX, DRI, EAT, LNY, RT, RRGB and TXRH.

Full Service—Specialty includes: BNHNA, BWLD, CAKE, CEC, CPKI, KONA, MSSR, MRT, PFCB and RUTH. Micro Cap includes: ARKR, BNHNA, CASA, CBOU, COSI, DAVE, JAX, JMBA, KONA, MSSR, MRT, PZZI and RUTH.

IV VALUATION. OVERVIEW

DISCUSSION MATERIALS

37

CONFIDENTIAL

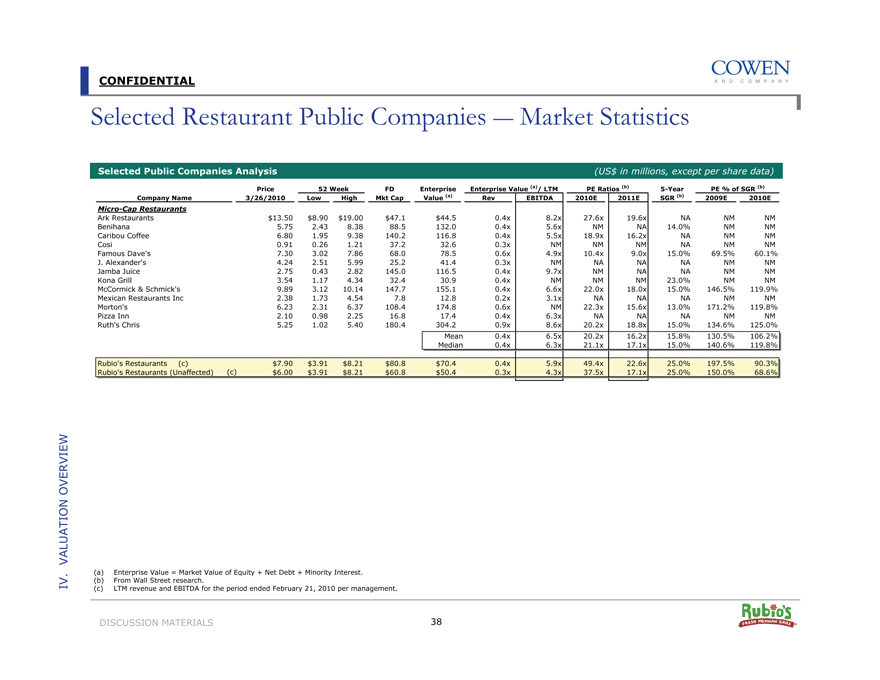

Selected Restaurant Public Companies —Market Statistics

Selected Public Companies Analysis

(US$ in millions, except per share data)

Price

52 Week

FD

Enterprise

Enterprise Value (a)/ LTM

PE Ratios (b)

5-Year

PE % of SGR (b)

Company Name

3/26/2010

Low

High

Mkt Cap

Value (a)

Rev

EBITDA

2010E

2011E

SGR (b)

2009E

2010E

Micro-Cap Restaurants

Ark Restaurants

$13.50

$8.90

$19.00

$47.1

$44.5

0.4x

8.2x

27.6x

19.6x

NA

NM

NM

Benihana

5.75

2.43

8.38

88.5

132.0

0.4x

5.6x

NM

NA

14.0%

NM

NM

Caribou Coffee

6.80

1.95

9.38

140.2

116.8

0.4x

5.5x

18.9x

16.2x

NA

NM

NM

Cosi

0.91

0.26

1.21

37.2

32.6

0.3x

NM

NM

NM

NA

NM

NM

Famous Dave’s

7.30

3.02

7.86

68.0

78.5

0.6x

4.9x

10.4x

9.0x

15.0%

69.5%

60.1%

J. Alexander’s

4.24

2.51

5.99

25.2

41.4

0.3x

NM

NA

NA

NA

NM

NM

Jamba Juice

2.75

0.43

2.82

145.0

116.5

0.4x

9.7x

NM

NA

NA

NM

NM

Kona Grill

3.54

1.17

4.34

32.4

30.9

0.4x

NM

NM

NM

23.0%

NM

NM

McCormick & Schmick’s

9.89

3.12

10.14

147.7

155.1

0.4x

6.6x

22.0x

18.0x

15.0%

146.5%

119.9%

Mexican Restaurants Inc

2.38

1.73

4.54

7.8

12.8

0.2x

3.1x

NA

NA

NA

NM

NM

Morton’s

6.23

2.31

6.37

108.4

174.8

0.6x

NM

22.3x

15.6x

13.0%

171.2%

119.8%

Pizza Inn

2.10

0.98

2.25

16.8

17.4

0.4x

6.3x

NA

NA

NA

NM

NM

Ruth’s Chris

5.25

1.02

5.40

180.4

304.2

0.9x

8.6x

20.2x

18.8x

15.0%

134.6%

125.0%

Mean

0.4x

6.5x

20.2x

16.2x

15.8%

130.5%

106.2%

Median

0.4x

6.3x

21.1x

17.1x

15.0%

140.6%

119.8%

Rubio’s Restaurants (c)

$7.90

$3.91

$8.21

$80.8

$70.4

0.4x

5.9x

49.4x

22.6x

25.0%

197.5%

90.3%

Rubio’s Restaurants (Unaffected) (c)

$6.00

$3.91

$8.21

$60.8

$50.4

0.3x

4.3x

37.5x

17.1x

25.0%

150.0%

68.6%

(a) | | Enterprise Value = Market Value of Equity + Net Debt + Minority Interest. (b) From Wall Street research. |

(c) | | LTM revenue and EBITDA for the period ended February 21, 2010 per management. |

DISCUSSION MATERIALS

IV VALUATION. OVERVIEW

38

CONFIDENTIAL

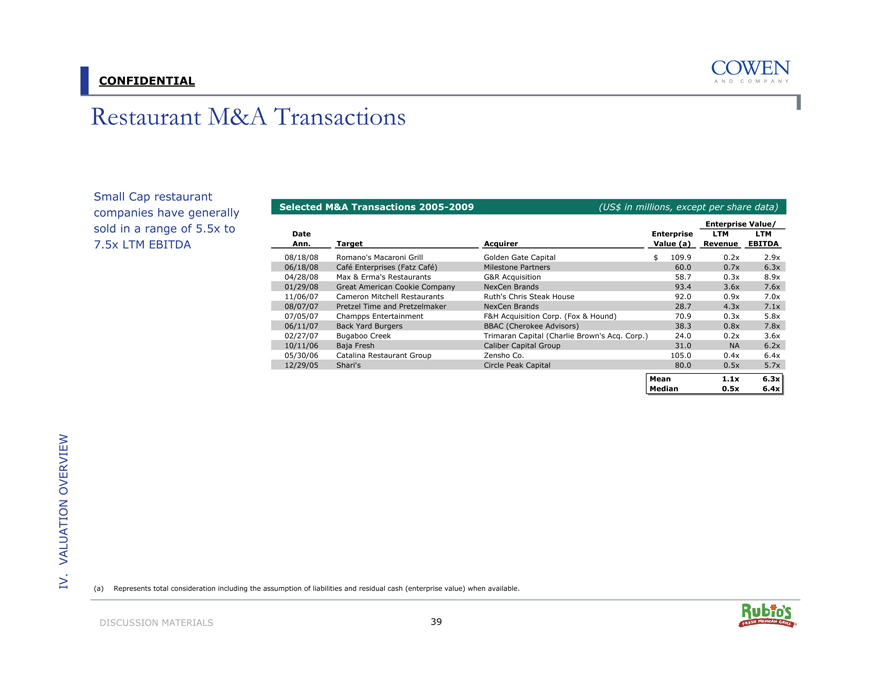

Restaurant M&A Transactions

Small Cap restaurant companies have generally sold in a range of 5.5x to 7.5x LTM EBITDA

Selected M&A Transactions 2005-2009 (US$ in millions, except per share data)

Enterprise Value/

Date

Enterprise

LTM

LTM

Ann.

Target

Acquirer

Value (a) Revenue EBITDA

08/18/08

Romano’s Macaroni Grill

Golden Gate Capital

$109.9

0.2x

2.9x

06/18/08

Café Enterprises (Fatz Café)

Milestone Partners

60.0

0.7x

6.3x

04/28/08

Max & Erma’s Restaurants

G&R Acquisition

58.7

0.3x

8.9x

01/29/08

Great American Cookie Company

NexCen Brands

93.4

3.6x

7.6x

11/06/07

Cameron Mitchell Restaurants

Ruth’s Chris Steak House

92.0

0.9x

7.0x

08/07/07

Pretzel Time and Pretzelmaker

NexCen Brands

28.7

4.3x

7.1x

07/05/07

Champps Entertainment

F&H Acquisition Corp. (Fox & Hound)

70.9

0.3x

5.8x

06/11/07

Back Yard Burgers

BBAC (Cherokee Advisors)

38.3

0.8x

7.8x

02/27/07

Bugaboo Creek

Trimaran Capital (Charlie Brown’s Acq. Corp.)

24.0

0.2x

3.6x

10/11/06

Baja Fresh

Caliber Capital Group

31.0

NA

6.2x

05/30/06

Catalina Restaurant Group

Zensho Co.

105.0

0.4x

6.4x

12/29/05

Shari’s

Circle Peak Capital

80.0

0.5x

5.7x

Mean

1.1x

6.3x

Median

0.5x

6.4x

(a) Represents total consideration including the assumption of liabilities and residual cash (enterprise value) when available.

DISCUSSION MATERIALS 39

IV. VALUATION OVERVIEW

CONFIDENTIAL

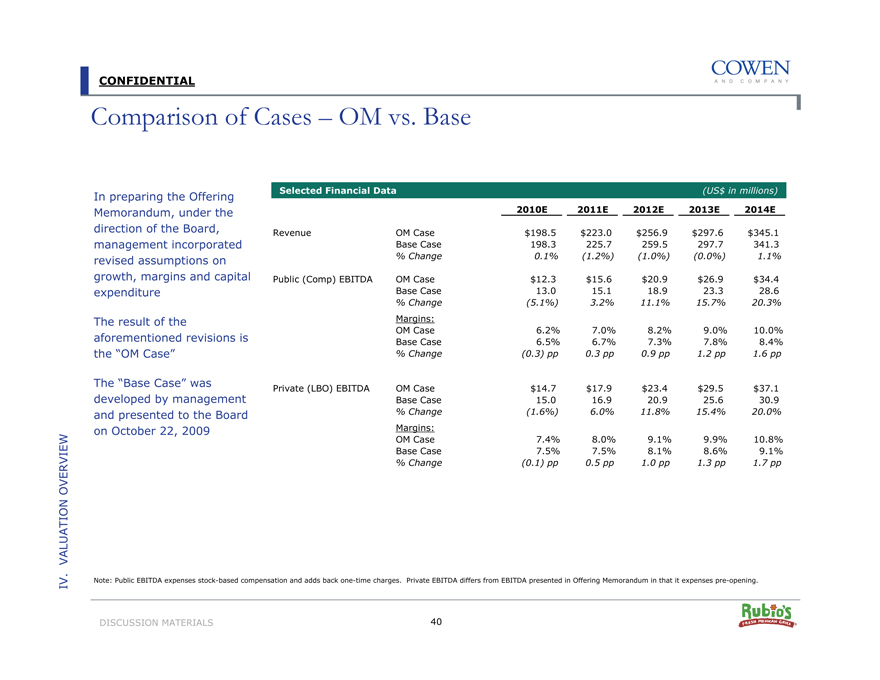

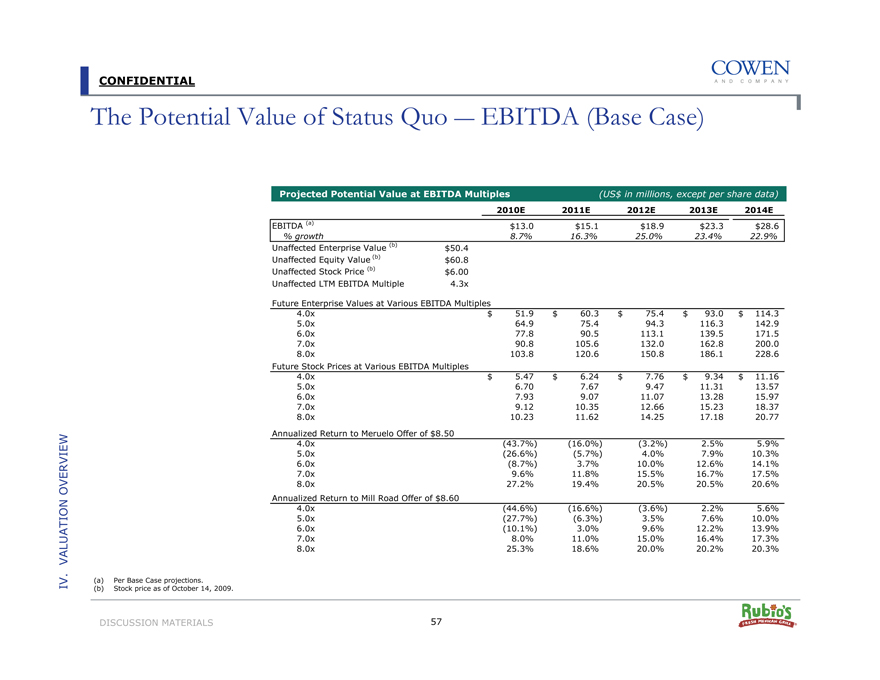

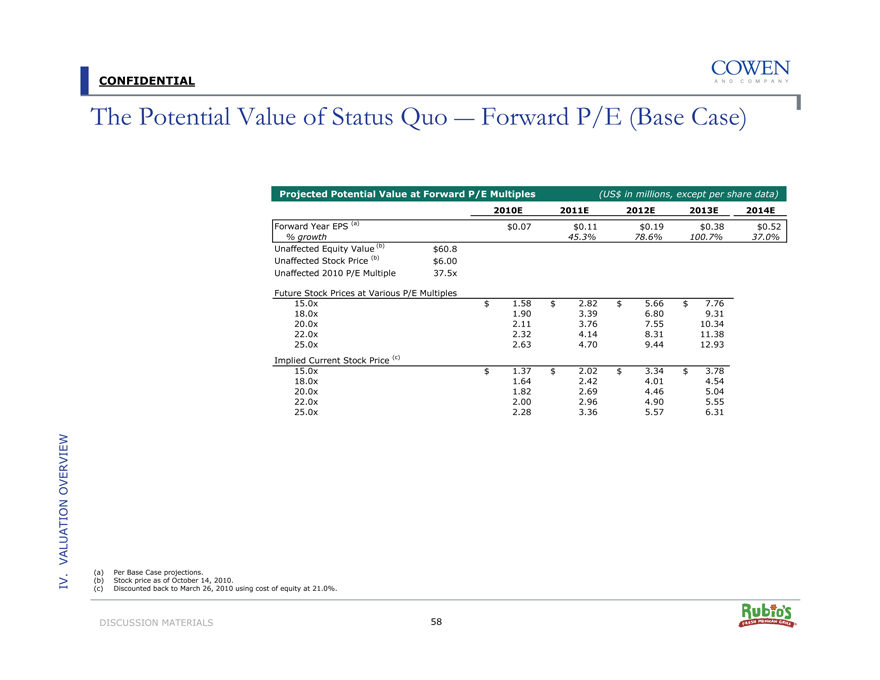

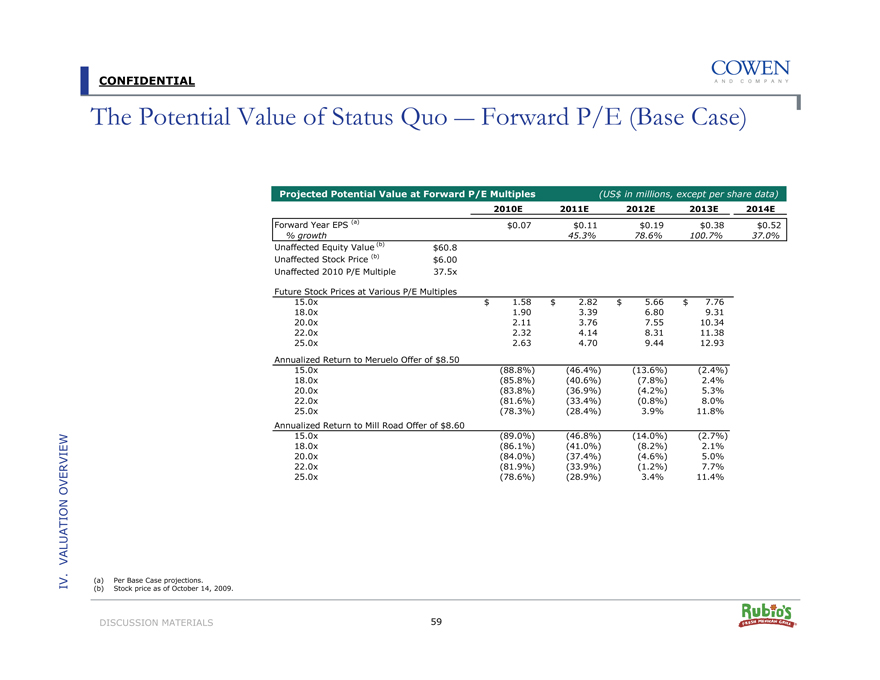

Comparison of Cases – OM vs. Base

In preparing the Offering

Selected Financial Data

(US$ in millions)

Memorandum, under the

2010E

2011E

2012E

2013E

2014E

direction of the Board,

Revenue

OM Case

$198.5

$223.0

$256.9

$297.6

$345.1

management incorporated

Base Case

198.3

225.7

259.5

297.7

341.3

revised assumptions on

% Change

0.1%

(1.2%)

(1.0%)

(0.0%)

1.1%

growth, margins and capital

Public (Comp) EBITDA

OM Case

$12.3

$15.6

$20.9

$26.9

$34.4

expenditure

Base Case

13.0

15.1

18.9

23.3

28.6

% Change

(5.1%)

3.2%

11.1%

15.7%

20.3%

The result of the

Margins:

OM Case

6.2%

7.0%

8.2%

9.0%

10.0%

aforementioned revisions is

Base Case

6.5%

6.7%

7.3%

7.8%

8.4%

the “OM Case”

% Change

(0.3) pp

0.3 pp

0.9 pp

1.2 pp

1.6 pp

The “Base Case” was

Private (LBO) EBITDA

OM Case

$14.7

$17.9

$23.4

$29.5

$37.1

developed by management

Base Case

15.0

16.9

20.9

25.6

30.9

and presented to the Board

% Change

(1.6%)

6.0%

11.8%

15.4%

20.0%

on October 22, 2009

Margins:

OM Case

7.4%

8.0%

9.1%

9.9%

10.8%

Base Case

7.5%

7.5%

8.1%

8.6%

9.1%

% Change

(0.1) pp

0.5 pp

1.0 pp

1.3 pp

1.7 pp

IV. VALUATION OVERVIEW

Note: Public EBITDA expenses stock-based compensation and adds back one-time charges. Private EBITDA differs from EBITDA presented in Offering Memorandum in that it expenses pre-opening.

DISCUSSION MATERIALS

40

CONFIDENTIAL

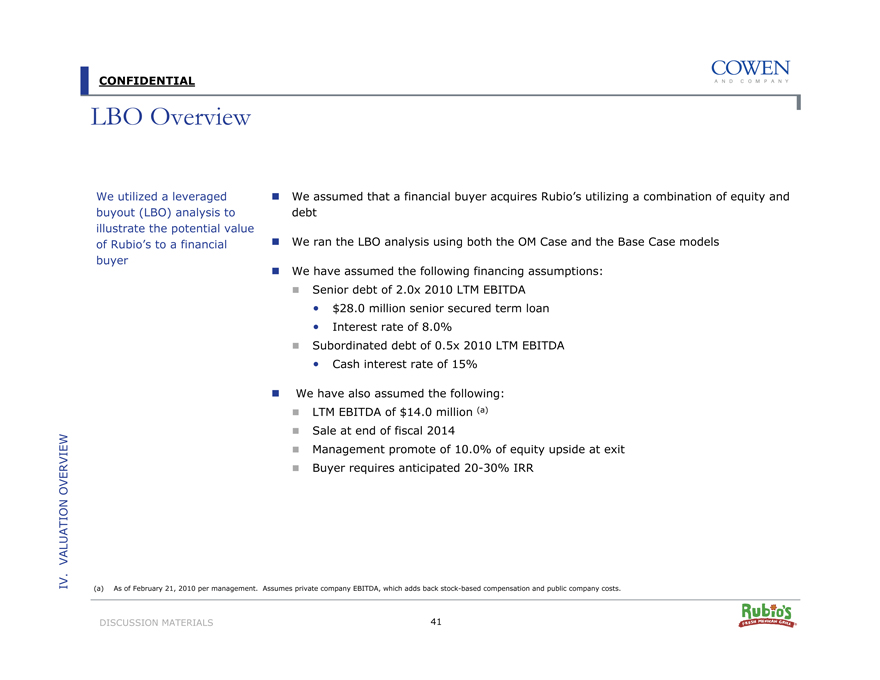

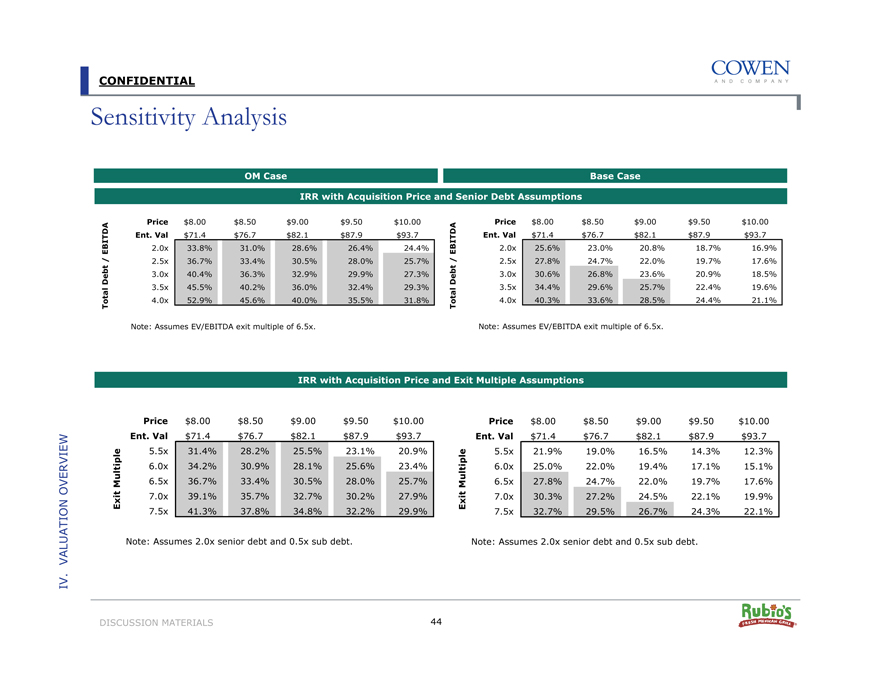

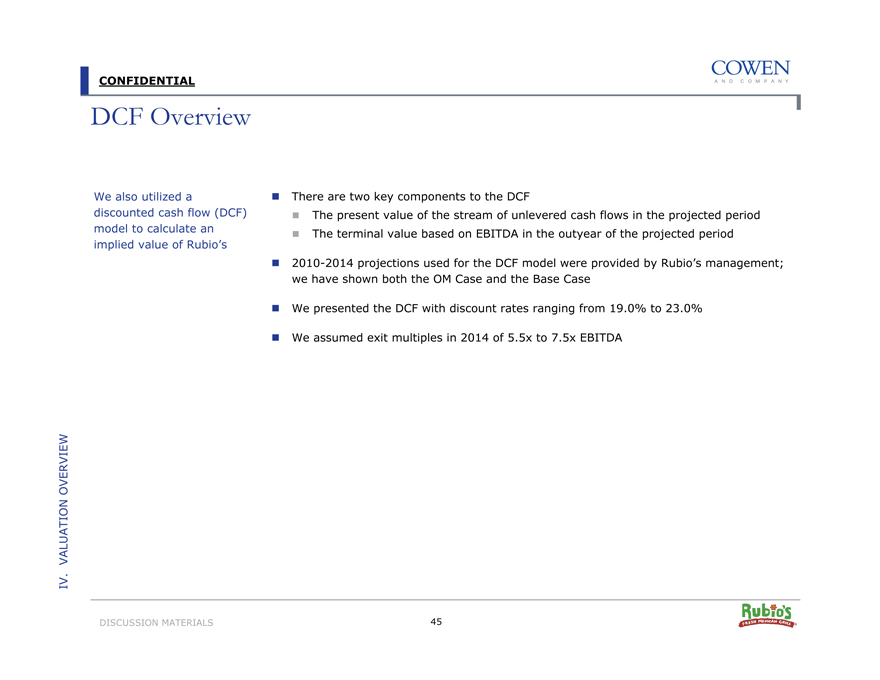

LBO Overview

We utilized a leveraged buyout (LBO) analysis to illustrate the potential value of Rubio’s to a financial buyer

We assumed that a financial buyer acquires Rubio’s utilizing a combination of equity and debt

We ran the LBO analysis using both the OM Case and the Base Case models

We have assumed the following financing assumptions:

Senior debt of 2.0x 2010 LTM EBITDA

• $28.0 million senior secured term loan

• Interest rate of 8.0%

Subordinated debt of 0.5x 2010 LTM EBITDA

• Cash interest rate of 15%

We have also assumed the following:

LTM EBITDA of $14.0 million (a)

Sale at end of fiscal 2014

Management promote of 10.0% of equity upside at exit

Buyer requires anticipated 20-30% IRR

IV. VALUATION OVERVIEW

(a) As of February 21, 2010 per management. Assumes private company EBITDA, which adds back stock-based compensation and public company costs.

DISCUSSION MATERIALS

41

CONFIDENTIAL

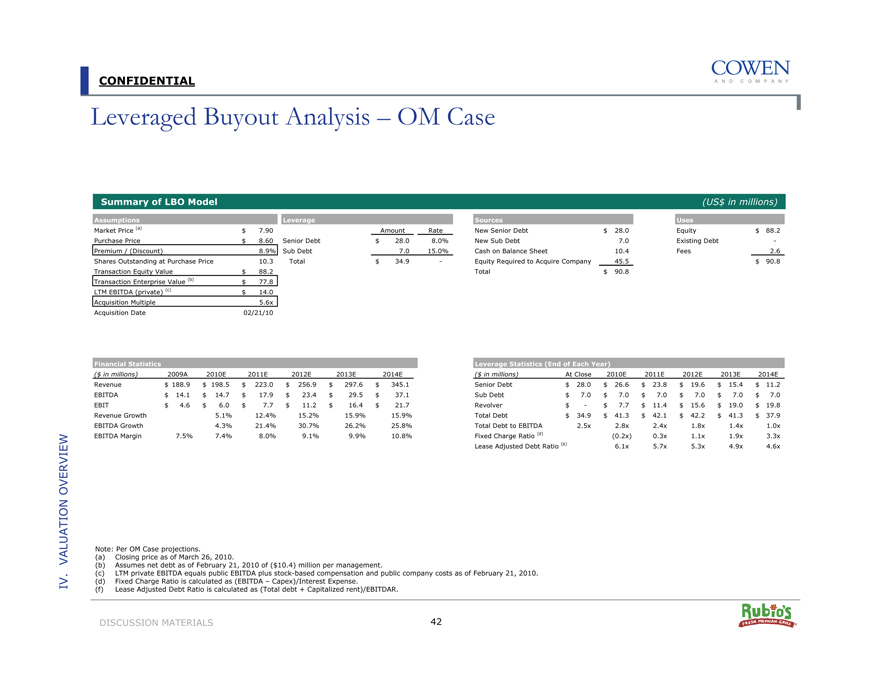

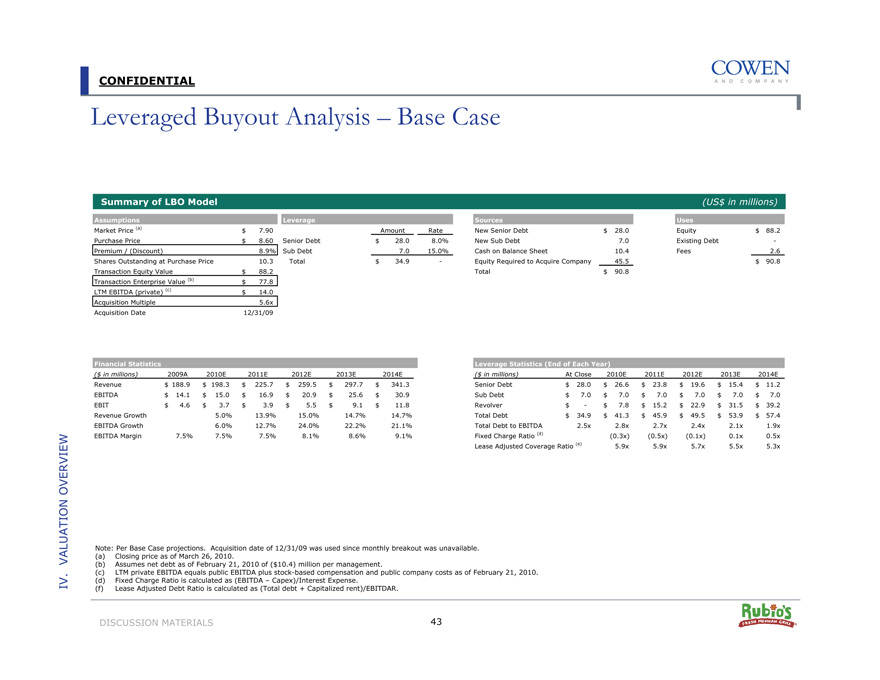

Leveraged Buyout Analysis – OM Case

Summary of LBO Model (US$ in millions)

Assumptions

Market Price (a)

$7.90

Purchase Price

$8.60

Premium / (Discount)

8.9%

Shares Outstanding at Purchase Price

10.3

Transaction Equity Value

$88.2

Transaction Enterprise Value (b)

$77.8

LTM EBITDA (private) (c)

$14.0

Acquisition Multiple

5.6x

Acquisition Date

02/21/10

Leverage

Amount

Rate

Senior Debt

$28.0

8.0%

Sub Debt

7.0

15.0%

Total

$34.9

—

Sources

New Senior Debt

$28.0

New Sub Debt

7.0

Cash on Balance Sheet

10.4

Equity Required to Acquire Company

45.5

Total

$90.8

Uses

Equity

$88.2

Existing Debt

—

Fees

2.6

$90.8

Financial Statistics

($ in millions)

2009A

2010E

2011E

2012E

2013E

2014E

Revenue

$188.9

$198.5

$223.0

$256.9

$297.6

$345.1

EBITDA

$14.1

$14.7

$17.9

$23.4

$29.5

$37.1

EBIT

$4.6

$6.0

$7.7

$11.2

$16.4

$21.7

Revenue Growth

5.1%

12.4%

15.2%

15.9%

15.9%

EBITDA Growth

4.3%

21.4%

30.7%

26.2%

25.8%

EBITDA Margin

7.5%

7.4%

8.0%

9.1%

9.9%

10.8%

Leverage Statistics (End of Each Year)

($ in millions)

At Close

2010E

2011E

2012E

2013E

2014E

Senior Debt

$28.0

$26.6

$23.8

$19.6

$15.4

$11.2

Sub Debt

$7.0

$7.0

$7.0

$7.0

$7.0

$7.0

Revolver

$—

$7.7