UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

��

Matthew Prasse

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: February 28

Registrant is making a filing for 11 of its series:

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio, Wells Fargo Emerging Markets Bond Portfolio, Wells Fargo Factor Enhanced Emerging Markets Equity Portfolio, Wells Fargo Factor Enhanced International Equity Portfolio, Wells Fargo Factor Enhanced U.S. Large Cap Equity Portfolio, Wells Fargo Factor Enhanced U.S. Small Cap Equity Portfolio, Wells Fargo Factor Enhanced U.S. Low Volatility Equity Portfolio, Wells Fargo High Yield Corporate Bond Portfolio, Wells Fargo Investment Grade Corporate Bond Portfolio, Wells Fargo Strategic Retirement Bond Portfolio and Wells Fargo U.S. REIT Portfolio.

Date of reporting period: August 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS |

Semi-Annual Report

August 31, 2021

Wells Fargo Bloomberg Barclays

US Aggregate ex-Corporate Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED ■ NO BANK GUARANTEE ■ MAY LOSE VALUE

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 1

Portfolio information (unaudited)

| Investment objective | The Portfolio seeks to replicate the total return of the Bloomberg U.S. Aggregate ex-Corporate Index, before fees and expenses. |

| Adviser | Wells Fargo Funds Management, LLC |

| Subadviser | Wells Capital Management, LLC |

| Portfolio managers | Manjunath Boraiah, Christopher Y. Kauffman, CFA®‡, Janet S. Rilling, CFA®‡, CPA, Michal Stanczyk |

| Ten largest holdings (%) as of August 31, 20211 |

| FNMA, 2.00%, 9-14-2051 | 6.51 |

| FNMA, 2.50%, 9-14-2051 | 3.54 |

| U.S. Treasury Bond, 3.00%, 5-15-2047 | 2.83 |

| FHLMC, 3.00%, 2-1-2047 | 1.48 |

| GNMA, 2.00%, 9-21-2051 | 1.35 |

| GNMA, 2.50%, 9-21-2051 | 1.30 |

| FHLMC, 3.50%, 2-1-2044 | 1.29 |

| FNMA, 2.00%, 9-16-2036 | 1.21 |

| GNMA, 3.50%, 2-20-2045 | 1.18 |

| U.S. Treasury Note, 1.63%, 2-15-2026 | 1.10 |

| 1 | Figures represent the percentage of the Portfolio's net assets. Holdings are subject to change and may have changed since the date specified. |

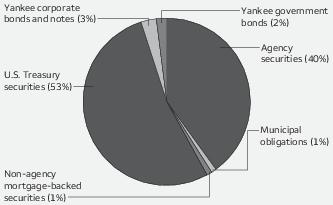

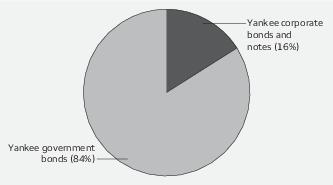

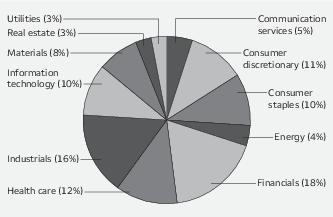

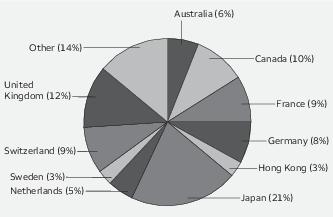

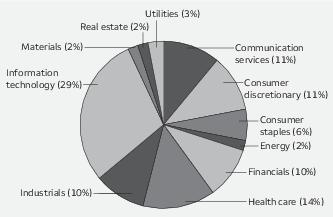

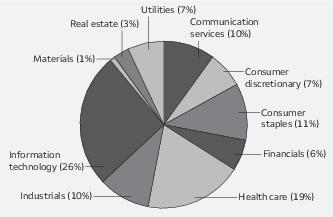

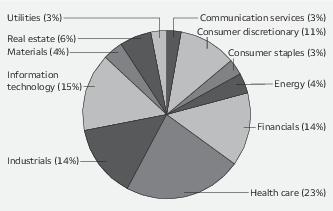

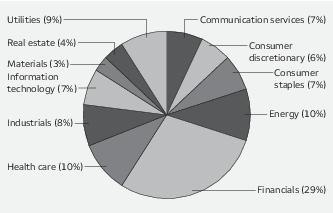

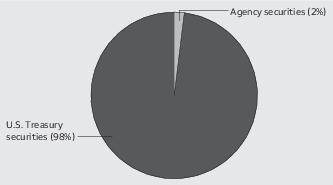

| Portfolio composition as of August 31, 20211 |

| 1 | Figures represent the percentage of the Portfolio's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

2 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Agency securities: 39.45% | | | | | | |

| FFCB | | 0.17% | 11-30-2022 | $ | 20,000 | $ 19,991 |

| FFCB | | 0.30 | 3-28-2024 | | 100,000 | 99,804 |

| FFCB | | 0.48 | 9-3-2024 | | 70,000 | 69,860 |

| FFCB | | 0.57 | 7-2-2024 | | 180,000 | 180,008 |

| FFCB | | 1.55 | 7-26-2030 | | 700,000 | 698,289 |

| FHLB | | 1.50 | 8-15-2024 | | 10,000 | 10,331 |

| FHLB | | 2.13 | 3-10-2023 | | 980,000 | 1,009,139 |

| FHLB | | 2.13 | 6-9-2023 | | 70,000 | 72,412 |

| FHLB | | 2.75 | 12-13-2024 | | 10,000 | 10,748 |

| FHLB | | 2.88 | 6-14-2024 | | 430,000 | 459,389 |

| FHLB | | 2.88 | 9-13-2024 | | 60,000 | 64,470 |

| FHLB | | 3.00 | 3-10-2028 | | 10,000 | 11,180 |

| FHLB | | 3.38 | 9-8-2023 | | 30,000 | 31,891 |

| FHLB | | 5.38 | 8-15-2024 | | 420,000 | 480,853 |

| FHLB | | 5.63 | 3-14-2036 | | 10,000 | 14,907 |

| FHLMC | | 0.25 | 11-6-2023 | | 990,000 | 990,030 |

| FHLMC | | 0.32 | 11-24-2023 | | 50,000 | 49,998 |

| FHLMC | | 0.62 | 12-1-2025 | | 900,000 | 896,437 |

| FHLMC | | 1.50 | 11-1-2035 | | 962,055 | 978,135 |

| FHLMC | | 2.50 | 3-1-2032 | | 2,098,874 | 2,204,764 |

| FHLMC | | 2.50 | 2-1-2035 | | 814,025 | 852,304 |

| FHLMC | | 2.75 | 6-19-2023 | | 220,000 | 230,030 |

| FHLMC | | 3.00 | 2-1-2047 | | 8,184,338 | 8,695,116 |

| FHLMC | | 3.00 | 3-1-2048 | | 62,752 | 65,807 |

| FHLMC | | 3.00 | 6-1-2050 | | 1,455,781 | 1,533,732 |

| FHLMC | | 3.00 | 7-1-2050 | | 2,845,680 | 3,005,154 |

| FHLMC | | 3.00 | 8-1-2050 | | 1,375,846 | 1,455,535 |

| FHLMC | | 3.50 | 2-1-2044 | | 6,956,908 | 7,574,035 |

| FHLMC | | 3.50 | 4-1-2045 | | 284,792 | 308,584 |

| FHLMC | | 3.50 | 8-1-2047 | | 2,622,768 | 2,787,597 |

| FHLMC | | 5.50 | 7-15-2036 | | 220,000 | 328,401 |

| FHLMC | | 6.00 | 7-1-2040 | | 1,575,901 | 1,865,220 |

| FHLMC | | 6.75 | 3-15-2031 | | 330,000 | 488,387 |

| FHLMC Series K029 Class A2 ±± | | 3.32 | 2-25-2023 | | 545,000 | 565,864 |

| FHLMC Series K030 Class A2 ±± | | 3.25 | 4-25-2023 | | 305,000 | 317,085 |

| FHLMC Series K032 Class A2 ±± | | 3.31 | 5-25-2023 | | 50,000 | 52,305 |

| FHLMC Series K034 Class A2 ±± | | 3.53 | 7-25-2023 | | 60,000 | 63,140 |

| FHLMC Series K035 Class A2 ±± | | 3.46 | 8-25-2023 | | 55,000 | 57,962 |

| FHLMC Series K048 Class A2 ±± | | 3.28 | 6-25-2025 | | 215,000 | 233,958 |

| FHLMC Series K062 Class A2 | | 3.41 | 12-25-2026 | | 750,000 | 838,477 |

| FHLMC Series K063 Class A2 ±± | | 3.43 | 1-25-2027 | | 45,000 | 50,360 |

| FHLMC Series K070 Class A2 ±± | | 3.30 | 11-25-2027 | | 425,000 | 477,433 |

| FHLMC Series K152 Class A1 | | 2.83 | 5-25-2030 | | 299,284 | 325,423 |

| FHLMC Series K152 Class A2 | | 3.08 | 1-25-2031 | | 125,000 | 141,124 |

| FHLMC Series K153 Class A3 ±± | | 3.12 | 10-25-2031 | | 70,000 | 79,614 |

| FHLMC Series K155 Class A3 | | 3.75 | 4-25-2033 | | 40,000 | 47,753 |

| FNMA | | 0.25 | 5-22-2023 | | 330,000 | 330,478 |

| FNMA | | 0.25 | 7-10-2023 | | 390,000 | 390,373 |

| FNMA | | 0.35 | 8-18-2023 | | 310,000 | 310,501 |

| FNMA | | 0.38 | 7-21-2025 | | 400,000 | 396,594 |

| FNMA | | 0.50 | 11-7-2025 | | 280,000 | 278,246 |

| FNMA | | 0.63 | 4-22-2025 | | 650,000 | 651,745 |

| FNMA %% | | 1.50 | 9-16-2036 | | 2,115,000 | 2,148,844 |

| FNMA %% | | 1.50 | 9-14-2051 | | 6,490,000 | 6,378,200 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 3

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Agency securities (continued) | | | | | | |

| FNMA %% | | 2.00% | 9-16-2036 | $ | 6,910,000 | $ 7,150,135 |

| FNMA | | 2.00 | 1-1-2041 | | 933,988 | 957,096 |

| FNMA %% | | 2.00 | 9-14-2051 | | 37,860,000 | 38,379,096 |

| FNMA | | 2.13 | 4-24-2026 | | 180,000 | 191,333 |

| FNMA | | 2.50 | 12-1-2027 | | 404,275 | 424,288 |

| FNMA | | 2.50 | 9-1-2031 | | 1,430,009 | 1,501,740 |

| FNMA | | 2.50 | 2-1-2035 | | 1,080,764 | 1,131,216 |

| FNMA | | 2.50 | 11-1-2050 | | 4,339,965 | 4,534,459 |

| FNMA %% | | 2.50 | 9-14-2051 | | 20,115,000 | 20,891,313 |

| FNMA | | 3.00 | 12-1-2026 | | 1,569,249 | 1,655,179 |

| FNMA | | 3.00 | 12-1-2030 | | 304,696 | 323,330 |

| FNMA | | 3.00 | 7-1-2032 | | 1,673,558 | 1,773,232 |

| FNMA | | 3.00 | 1-1-2034 | | 233,413 | 246,615 |

| FNMA | | 3.00 | 8-1-2036 | | 106,957 | 112,777 |

| FNMA | | 3.00 | 2-1-2037 | | 2,118,293 | 2,234,363 |

| FNMA | | 3.00 | 8-1-2043 | | 1,504,723 | 1,605,026 |

| FNMA | | 3.00 | 11-1-2046 | | 1,596,215 | 1,701,361 |

| FNMA | | 3.00 | 12-1-2047 | | 865,896 | 909,274 |

| FNMA | | 3.00 | 9-1-2050 | | 5,154,874 | 5,450,630 |

| FNMA | | 3.50 | 4-1-2034 | | 2,146,997 | 2,300,190 |

| FNMA | | 3.50 | 1-1-2035 | | 108,563 | 117,448 |

| FNMA | | 3.50 | 3-1-2036 | | 1,154,570 | 1,242,181 |

| FNMA | | 3.50 | 4-1-2037 | | 533,048 | 568,670 |

| FNMA | | 3.50 | 6-1-2042 | | 316,343 | 344,432 |

| FNMA | | 3.50 | 7-1-2042 | | 466,538 | 505,070 |

| FNMA | | 3.50 | 9-1-2043 | | 1,065,673 | 1,153,178 |

| FNMA | | 3.50 | 3-1-2048 | | 349,822 | 371,417 |

| FNMA | | 3.50 | 10-1-2050 | | 4,954,165 | 5,240,921 |

| FNMA | | 4.00 | 6-1-2042 | | 5,422,640 | 5,960,060 |

| FNMA | | 4.00 | 6-1-2042 | | 424,395 | 464,996 |

| FNMA | | 4.00 | 8-1-2043 | | 2,462,732 | 2,697,641 |

| FNMA | | 4.00 | 12-1-2047 | | 1,672,160 | 1,798,959 |

| FNMA | | 4.00 | 2-1-2048 | | 1,756,792 | 1,968,881 |

| FNMA | | 4.00 | 6-1-2048 | | 395,222 | 423,699 |

| FNMA | | 4.00 | 8-1-2048 | | 270,858 | 290,240 |

| FNMA | | 4.00 | 2-1-2050 | | 761,375 | 816,050 |

| FNMA | | 4.50 | 5-1-2040 | | 218,466 | 244,027 |

| FNMA | | 4.50 | 9-1-2040 | | 4,614,400 | 5,116,766 |

| FNMA | | 4.50 | 2-1-2047 | | 1,754,287 | 1,921,016 |

| FNMA | | 4.50 | 4-1-2048 | | 507,467 | 552,187 |

| FNMA | | 4.50 | 8-1-2048 | | 32,191 | 34,801 |

| FNMA | | 5.00 | 1-1-2042 | | 189,582 | 218,507 |

| FNMA | | 5.00 | 6-1-2045 | | 827,769 | 947,022 |

| FNMA | | 5.00 | 7-1-2045 | | 1,177,158 | 1,338,215 |

| FNMA | | 5.50 | 9-1-2040 | | 1,623,036 | 1,888,194 |

| FNMA | | 6.00 | 5-1-2041 | | 92,003 | 109,294 |

| FNMA | | 6.21 | 8-6-2038 | | 60,000 | 97,961 |

| FNMA | | 6.25 | 5-15-2029 | | 100,000 | 136,773 |

| FNMA | | 7.13 | 1-15-2030 | | 250,000 | 365,238 |

| FNMA | | 7.25 | 5-15-2030 | | 380,000 | 564,837 |

| FNMA Series 2016-M5 Class A2 | | 2.47 | 4-25-2026 | | 220,000 | 232,889 |

| FNMA Series 2016-M7 Class A2 | | 2.50 | 9-25-2026 | | 151,816 | 158,622 |

| FNMA Series 2017-M1 Class A2 ±± | | 2.50 | 10-25-2026 | | 245,488 | 260,700 |

| FNMA Series 2017-M11 Class A2 | | 2.98 | 8-25-2029 | | 1,370,000 | 1,530,530 |

| FNMA Series 2017-M5 Class A2 ±± | | 3.23 | 4-25-2029 | | 66,047 | 74,057 |

The accompanying notes are an integral part of these financial statements.

4 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Agency securities (continued) | | | | | | |

| FNMA Series 2018-M1 Class A2 ±± | | 3.08% | 12-25-2027 | $ | 758,807 | $ 833,548 |

| FNMA Series 2018-M13 Class A2 ±± | | 3.82 | 9-25-2030 | | 90,000 | 106,355 |

| FNMA Series 2019-M4 Class A2 | | 3.61 | 2-25-2031 | | 1,770,000 | 2,079,598 |

| FNMA Series 2019-M7 Class A2 | | 3.14 | 4-25-2029 | | 225,000 | 250,281 |

| FNMA Series 2020 M1 Class A2 | | 2.44 | 10-25-2029 | | 1,100,000 | 1,183,158 |

| GNMA %% | | 2.00 | 9-21-2051 | | 7,815,000 | 7,977,100 |

| GNMA %% | | 2.50 | 9-21-2051 | | 7,390,000 | 7,663,661 |

| GNMA | | 3.00 | 4-20-2045 | | 3,131,597 | 3,319,074 |

| GNMA | | 3.00 | 11-20-2045 | | 249,619 | 264,323 |

| GNMA | | 3.00 | 3-20-2046 | | 546,534 | 579,203 |

| GNMA | | 3.00 | 12-20-2049 | | 1,141,519 | 1,194,205 |

| GNMA | | 3.00 | 10-20-2050 | | 5,929,290 | 6,202,943 |

| GNMA | | 3.50 | 2-20-2045 | | 6,480,804 | 6,955,066 |

| GNMA | | 3.50 | 6-20-2045 | | 1,037,274 | 1,110,458 |

| GNMA | | 3.50 | 11-20-2045 | | 1,202,066 | 1,287,351 |

| GNMA | | 3.50 | 7-20-2047 | | 280,643 | 297,983 |

| GNMA | | 3.50 | 5-20-2048 | | 78,747 | 83,467 |

| GNMA | | 4.00 | 7-20-2044 | | 1,327,382 | 1,451,368 |

| GNMA | | 4.00 | 8-20-2044 | | 657,609 | 718,994 |

| GNMA | | 4.00 | 9-20-2044 | | 1,340,621 | 1,465,289 |

| GNMA | | 4.00 | 12-20-2047 | | 1,779,760 | 1,895,892 |

| TVA | | 2.88 | 2-1-2027 | | 35,000 | 38,599 |

| TVA | | 4.63 | 9-15-2060 | | 55,000 | 83,394 |

| TVA | | 5.38 | 4-1-2056 | | 140,000 | 233,282 |

| TVA | | 5.50 | 6-15-2038 | | 30,000 | 43,976 |

| TVA | | 5.88 | 4-1-2036 | | 80,000 | 119,404 |

| TVA | | 6.75 | 11-1-2025 | | 120,000 | 150,003 |

| Total Agency securities (Cost $228,328,115) | | | | | | 232,494,124 |

| Asset-backed securities: 0.40% | | | | | | |

| Capital One Multi Asset Execution Trust Series 2017-A3 Class A3 | | 2.43 | 1-15-2025 | | 110,000 | 111,349 |

| CarMax Auto Owner Trust Series 2017-3 Class A4 | | 2.22 | 11-15-2022 | | 24,284 | 24,302 |

| CarMax Auto Owner Trust Series 2018-3 Class D | | 3.91 | 1-15-2025 | | 80,000 | 82,366 |

| CenterPoint Energy Transition Restoration Bond Company LLC | | 4.24 | 8-15-2023 | | 32,156 | 33,039 |

| Chase Issuance Trust Series 2012-A7 Class A7 | | 2.16 | 9-15-2024 | | 205,000 | 209,284 |

| Citibank Credit Card Issuance Trust Series 2018-A3 Class A3 | | 3.29 | 5-23-2025 | | 180,000 | 189,354 |

| Citibank Credit Card Issuance Trust Series 2018-A7 Class A7 | | 3.96 | 10-13-2030 | | 130,000 | 152,940 |

| Discover Card Execution Note Trust Series 2017-A2 Class A2 | | 2.39 | 7-15-2024 | | 335,000 | 337,815 |

| Ford Credit Floorplan Master Owner Trust Series 2017-3 Class A | | 2.48 | 9-15-2024 | | 50,000 | 51,153 |

| Ford Credit Floorplan Master Owner Trust Series 2018-2 Class A | | 3.17 | 3-15-2025 | | 100,000 | 104,397 |

| Ford Credit Floorplan Master Owner Trust Series 2018-3 Class A1 | | 3.52 | 10-15-2023 | | 105,000 | 105,431 |

| Ford Credit Floorplan Master Owner Trust Series 2019-2 Class A | | 3.06 | 4-15-2026 | | 65,000 | 69,146 |

| Nissan Auto Receivables Owner Trust Series 2017-C Class A4 | | 2.28 | 2-15-2024 | | 50,284 | 50,507 |

| Nissan Auto Receivables Owner Trust Series 2018-B Class A4 | | 3.16 | 12-16-2024 | | 195,000 | 199,418 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 5

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Asset-backed securities (continued) | | | | | | |

| Nissan Auto Receivables Owner Trust Series 2018-C Class A4 | | 3.27% | 6-16-2025 | $ | 155,000 | $ 159,505 |

| Santander Drive Auto Receivables Trust Series 2019-1 Class C | | 3.42 | 4-15-2025 | | 59,177 | 59,483 |

| Synchrony Credit Card Master Note Trust Series 2018-2 Class A | | 3.47 | 5-15-2026 | | 105,000 | 110,699 |

| Toyota Auto Receivables Owner Trust Series 2017-D Class A4 | | 2.12 | 2-15-2023 | | 63,199 | 63,323 |

| World Omni Auto Receivables Trust Series 2017-B Class A4 | | 2.25 | 10-16-2023 | | 205,000 | 205,871 |

| World Omni Auto Receivables Trust Series 2018-D Class A4 | | 3.44 | 12-16-2024 | | 28,000 | 28,907 |

| Total Asset-backed securities (Cost $2,298,542) | | | | | | 2,348,289 |

| Municipal obligations: 0.86% | | | | | | |

| California: 0.31% | | | | | | |

| Education revenue: 0.02% | | | | | | |

| California Series B | | 3.90 | 11-1-2047 | | 15,000 | 17,797 |

| University of California Series AD | | 4.86 | 5-15-2112 | | 70,000 | 104,445 |

| | | | | | | 122,242 |

| GO revenue: 0.18% | | | | | | |

| California Build America Bonds Taxable Various Purpose | | 1.75 | 11-1-2030 | | 110,000 | 110,705 |

| California Build America Bonds Taxable Various Purpose | | 7.35 | 11-1-2039 | | 70,000 | 114,018 |

| California Build America Bonds Taxable Various Purpose | | 7.50 | 4-1-2034 | | 100,000 | 157,825 |

| California Build America Bonds Taxable Various Purpose | | 7.55 | 4-1-2039 | | 170,000 | 292,324 |

| California Build America Bonds Taxable Various Purpose | | 7.60 | 11-1-2040 | | 15,000 | 26,600 |

| Los Angeles CA Community College District Build America Bonds | | 6.75 | 8-1-2049 | | 5,000 | 8,728 |

| Los Angeles CA Unified School District Build America Bonds | | 5.75 | 7-1-2034 | | 15,000 | 20,227 |

| Los Angeles CA Unified School District Build America Bonds | | 5.76 | 7-1-2029 | | 60,000 | 75,037 |

| Los Angeles CA Unified School District Build America Bonds | | 6.76 | 7-1-2034 | | 160,000 | 230,705 |

| | | | | | | 1,036,169 |

| Transportation revenue: 0.07% | | | | | | |

| Bay Area CA Toll Authority Series 1 | | 6.26 | 4-1-2049 | | 100,000 | 164,073 |

| Bay Area CA Toll Authority Series 1 | | 6.92 | 4-1-2040 | | 15,000 | 23,112 |

| Bay Area CA Toll Authority Series 1 | | 7.04 | 4-1-2050 | | 140,000 | 252,594 |

| | | | | | | 439,779 |

| Utilities revenue: 0.04% | | | | | | |

| Los Angeles CA Department of Water & Power Build America Bonds Series A | | 5.72 | 7-1-2039 | | 100,000 | 143,625 |

| Los Angeles CA Department of Water & Power Build America Bonds Series D | | 6.57 | 7-1-2045 | | 55,000 | 91,060 |

| | | | | | | 234,685 |

| Florida: 0.03% | | | | | | |

| Miscellaneous revenue: 0.03% | | | | | | |

| Florida Board of Administrative Finance | | 2.15 | 7-1-2030 | | 200,000 | 205,189 |

The accompanying notes are an integral part of these financial statements.

6 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Georgia: 0.00% | | | | | | |

| Utilities revenue: 0.00% | | | | | | |

| Municipal Electric Authority of Georgia Build America Bonds | | 7.06% | 4-1-2057 | $ | 10,000 | $ 15,025 |

| Illinois: 0.08% | | | | | | |

| GO revenue: 0.02% | | | | | | |

| Chicago IL Series B | | 6.31 | 1-1-2044 | | 50,000 | 67,556 |

| Illinois Taxable Pension | | 5.10 | 6-1-2033 | | 50,000 | 59,392 |

| | | | | | | 126,948 |

| Miscellaneous revenue: 0.01% | | | | | | |

| Illinois Build America Bonds Series 3 | | 6.73 | 4-1-2035 | | 45,000 | 57,127 |

| Tax revenue: 0.05% | | | | | | |

| Chicago IL Transit Authority Series B | | 6.90 | 12-1-2040 | | 210,000 | 303,822 |

| Kansas: 0.00% | | | | | | |

| Miscellaneous revenue: 0.00% | | | | | | |

| Kansas Development Finance Authority Series H | | 4.93 | 4-15-2045 | | 5,000 | 6,698 |

| Massachusetts: 0.03% | | | | | | |

| GO revenue: 0.03% | | | | | | |

| Massachusetts Build America Bonds Series A | | 4.91 | 5-1-2029 | | 130,000 | 160,880 |

| Massachusetts Build America Bonds Series D | | 4.50 | 8-1-2031 | | 5,000 | 6,195 |

| | | | | | | 167,075 |

| New Jersey: 0.06% | | | | | | |

| Miscellaneous revenue: 0.02% | | | | | | |

| New Jersey EDA Series A (NPFGC Insured) | | 7.43 | 2-15-2029 | | 95,000 | 123,289 |

| Transportation revenue: 0.04% | | | | | | |

| New Jersey Transportation Trust | | 6.56 | 12-15-2040 | | 60,000 | 90,063 |

| New Jersey Turnpike Authority Build America Bonds Series A | | 7.10 | 1-1-2041 | | 70,000 | 113,302 |

| | | | | | | 203,365 |

| New York: 0.17% | | | | | | |

| Airport revenue: 0.08% | | | | | | |

| Port Authority of New York & New Jersey Consolidated Bonds Series 174 | | 4.46 | 10-1-2062 | | 190,000 | 261,130 |

| Port Authority of New York & New Jersey Consolidated Bonds Series 201 | | 4.23 | 10-15-2057 | | 100,000 | 130,738 |

| Port Authority of New York & New Jersey Consolidated Bonds Series 210 | | 4.03 | 9-1-2048 | | 50,000 | 61,757 |

| | | | | | | 453,625 |

| Tax revenue: 0.09% | | | | | | |

| New York Metropolitan Transportation Authority Dedicated Tax Fund Build America Bonds | | 7.34 | 11-15-2039 | | 140,000 | 230,785 |

| New York NY Transitional Finance Authority Build America Bonds Subseries B-1 | | 5.57 | 11-1-2038 | | 130,000 | 174,404 |

| New York NY Transitional Finance Authority Build America Bonds Subseries C-2 | | 5.77 | 8-1-2036 | | 100,000 | 129,081 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 7

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Tax revenue (continued) | | | | | | |

| | | | | | | 534,270 |

| Water & sewer revenue: 0.00% | | | | | | |

| New York NY Municipal Water Finance Authority Series AA | | 5.44% | 6-15-2043 | $ | 10,000 | $ 14,906 |

| Ohio: 0.04% | | | | | | |

| Education revenue: 0.00% | | | | | | |

| Ohio State University Build America Bonds | | 4.91 | 6-1-2040 | | 5,000 | 6,776 |

| Utilities revenue: 0.04% | | | | | | |

| American Municipal Power Ohio Incorporated Build America Bonds | | 5.94 | 2-15-2047 | | 150,000 | 229,357 |

| Oregon: 0.03% | | | | | | |

| Tax revenue: 0.03% | | | | | | |

| Oregon Department of Transportation Build America Bonds Series A | | 5.83 | 11-15-2034 | | 50,000 | 70,654 |

| Oregon Taxable Pension | | 5.76 | 6-1-2023 | | 75,549 | 80,928 |

| | | | | | | 151,582 |

| Pennsylvania: 0.00% | | | | | | |

| Transportation revenue: 0.00% | | | | | | |

| Pennsylvania Turnpike Commission Series B | | 5.51 | 12-1-2045 | | 5,000 | 7,262 |

| Texas: 0.10% | | | | | | |

| GO revenue: 0.02% | | | | | | |

| Texas Transportation Commission | | 2.56 | 4-1-2042 | | 90,000 | 91,228 |

| Transportation revenue: 0.06% | | | | | | |

| Grand Parkway Transportation Corporation Series 2013E | | 5.18 | 10-1-2042 | | 50,000 | 68,654 |

| Northern Texas Tollway Authority | | 3.01 | 1-1-2043 | | 200,000 | 207,029 |

| Texas Private Activity Bond North Tarrant Express Managed Lanes Project Series B | | 3.92 | 12-31-2049 | | 50,000 | 57,359 |

| | | | | | | 333,042 |

| Utilities revenue: 0.02% | | | | | | |

| San Antonio TX Electric and Gas Revenue | | 4.43 | 2-1-2042 | | 110,000 | 138,441 |

| Wisconsin: 0.01% | | | | | | |

| Tax revenue: 0.01% | | | | | | |

| Wisconsin General Fund Annual Appropriations Series C | | 3.15 | 5-1-2027 | | 80,000 | 88,776 |

| Total Municipal obligations (Cost $4,555,862) | | | | | | 5,090,678 |

| Non-agency mortgage-backed securities: 1.07% | | | | | | |

| Benchmark Mortgage Trust Series 2018-B1 Class A4 | | 3.40 | 1-15-2051 | | 25,000 | 27,391 |

| Benchmark Mortgage Trust Series 2018-B6 Class A4 | | 4.26 | 10-10-2051 | | 135,000 | 157,266 |

| CFCRE Commercial Mortgage Trust Series 2016-C7 Class A3 | | 3.84 | 12-10-2054 | | 20,000 | 22,257 |

| Citigroup Commercial Mortgage Trust Series 2015-GC27 Class A5 | | 3.14 | 2-10-2048 | | 55,000 | 58,697 |

| Citigroup Commercial Mortgage Trust Series 2016 GC37 Class B | | 4.23 | 4-10-2049 | | 110,000 | 117,810 |

| Citigroup Commercial Mortgage Trust Series 2016-GC36 Class B ±± | | 4.91 | 2-10-2049 | | 40,000 | 44,105 |

The accompanying notes are an integral part of these financial statements.

8 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Non-agency mortgage-backed securities (continued) | | | | | | |

| Citigroup Commercial Mortgage Trust Series 2016-GC36 Class C ±± | | 4.91% | 2-10-2049 | $ | 95,000 | $ 100,143 |

| Citigroup Commercial Mortgage Trust Series 2016-P4 Class A4 | | 2.90 | 7-10-2049 | | 135,000 | 144,825 |

| Citigroup Commercial Mortgage Trust Series 2017-P8 Class AS ±± | | 3.79 | 9-15-2050 | | 300,000 | 333,799 |

| Citigroup Commercial Mortgage Trust Series 2018-C6 Class A4 | | 4.41 | 11-10-2051 | | 520,000 | 610,621 |

| Commercial Mortgage Trust Series 2013-CR6 Class A4 | | 3.10 | 3-10-2046 | | 60,000 | 61,415 |

| Commercial Mortgage Trust Series 2014 UBS5 Class C ±± | | 4.75 | 9-10-2047 | | 195,000 | 203,813 |

| Commercial Mortgage Trust Series 2014-UBS6 Class C ±± | | 4.59 | 12-10-2047 | | 60,000 | 62,819 |

| Commercial Mortgage Trust Series 2015-CR23 Class A3 | | 3.23 | 5-10-2048 | | 60,000 | 63,748 |

| Commercial Mortgage Trust Series 2016-COR1 Class C ±± | | 4.51 | 10-10-2049 | | 65,000 | 70,296 |

| Commercial Mortgage Trust Series 2016-CR28 Class A4 | | 3.76 | 2-10-2049 | | 215,000 | 237,626 |

| Goldman Sachs Mortgage Securities Trust Series 2012-GCJ9 Class AS | | 3.12 | 11-10-2045 | | 40,000 | 40,930 |

| Goldman Sachs Mortgage Securities Trust Series 2013-GC14 Class A5 | | 4.24 | 8-10-2046 | | 265,000 | 281,210 |

| Goldman Sachs Mortgage Securities Trust Series 2014-GC18 Class B ±± | | 4.89 | 1-10-2047 | | 80,000 | 79,249 |

| Goldman Sachs Mortgage Securities Trust Series 2014-GC26 Class A5 | | 3.63 | 11-10-2047 | | 340,000 | 367,551 |

| Goldman Sachs Mortgage Securities Trust Series 2018-GS10 Class AAB ±± | | 4.11 | 7-10-2051 | | 180,000 | 201,623 |

| Goldman Sachs Mortgage Securities Trust Series 2018-GS9 Class A4 ±± | | 3.99 | 3-10-2051 | | 140,000 | 159,979 |

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2013-C15 Class A4 | | 4.10 | 11-15-2045 | | 12,037 | 12,693 |

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2015-C29 Class A4 | | 3.61 | 5-15-2048 | | 200,000 | 216,895 |

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2015-C31 Class A3 | | 3.80 | 8-15-2048 | | 195,000 | 212,723 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2013-C11 Class AS ±± | | 4.50 | 8-15-2046 | | 360,000 | 354,817 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2013-C8 Class A4 | | 3.13 | 12-15-2048 | | 50,000 | 51,311 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2015-C22 Class A4 | | 3.31 | 4-15-2048 | | 60,000 | 64,428 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2015-C22 Class ASB | | 3.04 | 4-15-2048 | | 754,348 | 785,233 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2015-C22 Class B ±± | | 3.88 | 4-15-2048 | | 285,000 | 299,326 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2015-C24 Class A4 | | 3.73 | 5-15-2048 | | 400,000 | 438,594 |

| Morgan Stanley Bank of America Merrill Lynch Trust Series 2016-C30 Class B ±± | | 3.31 | 9-15-2049 | | 425,000 | 437,510 |

| Total Non-agency mortgage-backed securities (Cost $6,076,747) | | | | | | 6,320,703 |

| U.S. Treasury securities: 52.49% | | | | | | |

| U.S. Treasury Bond | | 1.13 | 5-15-2040 | | 1,595,000 | 1,420,921 |

| U.S. Treasury Bond | | 1.13 | 8-15-2040 | | 1,885,000 | 1,673,379 |

| U.S. Treasury Bond | | 1.25 | 5-15-2050 | | 3,330,000 | 2,822,955 |

| U.S. Treasury Bond | | 1.38 | 11-15-2040 | | 1,350,000 | 1,249,594 |

| U.S. Treasury Bond | | 1.38 | 8-15-2050 | | 2,030,000 | 1,775,616 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 9

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| U.S. Treasury securities (continued) | | | | | | |

| U.S. Treasury Bond | | 1.63% | 11-15-2050 | $ | 2,390,000 | $ 2,223,727 |

| U.S. Treasury Bond | | 1.75 | 8-15-2041 | | 3,105,000 | 3,055,999 |

| U.S. Treasury Bond | | 1.88 | 2-15-2051 | | 2,065,000 | 2,038,542 |

| U.S. Treasury Bond | | 2.00 | 2-15-2050 | | 2,515,000 | 2,555,476 |

| U.S. Treasury Bond | | 2.25 | 8-15-2049 | | 1,725,000 | 1,846,896 |

| U.S. Treasury Bond | | 2.38 | 11-15-2049 | | 1,660,000 | 1,825,546 |

| U.S. Treasury Bond | | 2.50 | 2-15-2046 | | 100,000 | 111,676 |

| U.S. Treasury Bond | | 2.50 | 5-15-2046 | | 200,000 | 223,492 |

| U.S. Treasury Bond | | 2.75 | 8-15-2042 | | 3,085,000 | 3,569,441 |

| U.S. Treasury Bond | | 2.75 | 11-15-2042 | | 2,665,000 | 3,083,592 |

| U.S. Treasury Bond | | 2.88 | 5-15-2043 | | 605,000 | 714,160 |

| U.S. Treasury Bond | | 2.88 | 5-15-2049 | | 2,040,000 | 2,463,539 |

| U.S. Treasury Bond | | 3.00 | 5-15-2042 | | 145,000 | 174,255 |

| U.S. Treasury Bond | | 3.00 | 5-15-2045 | | 105,000 | 127,362 |

| U.S. Treasury Bond | | 3.00 | 11-15-2045 | | 35,000 | 42,573 |

| U.S. Treasury Bond | | 3.00 | 2-15-2047 | | 310,000 | 379,181 |

| U.S. Treasury Bond | | 3.00 | 5-15-2047 | | 13,601,000 | 16,660,162 |

| U.S. Treasury Bond | | 3.00 | 2-15-2048 | | 435,000 | 534,149 |

| U.S. Treasury Bond | | 3.00 | 8-15-2048 | | 10,000 | 12,302 |

| U.S. Treasury Bond | | 3.13 | 11-15-2041 | | 1,090,000 | 1,333,164 |

| U.S. Treasury Bond | | 3.13 | 2-15-2042 | | 370,000 | 453,467 |

| U.S. Treasury Bond | | 3.13 | 2-15-2043 | | 475,000 | 582,061 |

| U.S. Treasury Bond | | 3.13 | 8-15-2044 | | 110,000 | 135,579 |

| U.S. Treasury Bond | | 3.38 | 5-15-2044 | | 20,000 | 25,585 |

| U.S. Treasury Bond | | 3.50 | 2-15-2039 | | 15,000 | 19,211 |

| U.S. Treasury Bond | | 3.63 | 8-15-2043 | | 110,000 | 145,183 |

| U.S. Treasury Bond | | 3.63 | 2-15-2044 | | 35,000 | 46,375 |

| U.S. Treasury Bond | | 3.75 | 8-15-2041 | | 35,000 | 46,595 |

| U.S. Treasury Bond | | 3.75 | 11-15-2043 | | 350,000 | 471,010 |

| U.S. Treasury Bond | | 3.88 | 8-15-2040 | | 1,040,000 | 1,400,384 |

| U.S. Treasury Bond | | 4.25 | 11-15-2040 | | 480,000 | 677,531 |

| U.S. Treasury Bond | | 4.38 | 5-15-2040 | | 800,000 | 1,143,063 |

| U.S. Treasury Bond | | 4.38 | 5-15-2041 | | 1,905,000 | 2,739,182 |

| U.S. Treasury Bond | | 4.50 | 8-15-2039 | | 550,000 | 792,838 |

| U.S. Treasury Bond | | 4.75 | 2-15-2041 | | 120,000 | 180,216 |

| U.S. Treasury Bond | | 5.00 | 5-15-2037 | | 1,574,000 | 2,337,083 |

| U.S. Treasury Bond | | 5.38 | 2-15-2031 | | 1,592,000 | 2,183,652 |

| U.S. Treasury Bond | | 5.50 | 8-15-2028 | | 1,760,000 | 2,287,244 |

| U.S. Treasury Bond | | 6.13 | 11-15-2027 | | 245,000 | 321,687 |

| U.S. Treasury Bond | | 6.38 | 8-15-2027 | | 50,000 | 65,885 |

| U.S. Treasury Bond | | 6.88 | 8-15-2025 | | 335,000 | 417,284 |

| U.S. Treasury Note | | 0.13 | 9-30-2022 | | 3,065,000 | 3,066,197 |

| U.S. Treasury Note | | 0.13 | 10-31-2022 | | 3,110,000 | 3,110,486 |

| U.S. Treasury Note | | 0.13 | 11-30-2022 | | 2,790,000 | 2,790,654 |

| U.S. Treasury Note | | 0.13 | 5-15-2023 | | 2,815,000 | 2,812,801 |

| U.S. Treasury Note | | 0.13 | 7-15-2023 | | 545,000 | 544,383 |

| U.S. Treasury Note | | 0.13 | 8-15-2023 | | 3,190,000 | 3,185,389 |

| U.S. Treasury Note | | 0.13 | 9-15-2023 | | 2,855,000 | 2,849,201 |

| U.S. Treasury Note | | 0.13 | 12-15-2023 | | 2,445,000 | 2,436,977 |

| U.S. Treasury Note | | 0.13 | 1-15-2024 | | 3,080,000 | 3,068,209 |

| U.S. Treasury Note | | 0.13 | 2-15-2024 | | 3,070,000 | 3,057,408 |

| U.S. Treasury Note | | 0.25 | 4-15-2023 | | 1,475,000 | 1,477,189 |

| U.S. Treasury Note | | 0.25 | 6-15-2023 | | 2,925,000 | 2,928,085 |

| U.S. Treasury Note | | 0.25 | 11-15-2023 | | 3,105,000 | 3,105,121 |

| U.S. Treasury Note | | 0.25 | 6-15-2024 | | 2,360,000 | 2,352,625 |

The accompanying notes are an integral part of these financial statements.

10 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| U.S. Treasury securities (continued) | | | | | | |

| U.S. Treasury Note | | 0.25% | 5-31-2025 | $ | 1,790,000 | $ 1,768,184 |

| U.S. Treasury Note | | 0.25 | 6-30-2025 | | 1,295,000 | 1,278,408 |

| U.S. Treasury Note | | 0.25 | 7-31-2025 | | 3,000,000 | 2,958,867 |

| U.S. Treasury Note | | 0.25 | 8-31-2025 | | 3,060,000 | 3,014,698 |

| U.S. Treasury Note | | 0.25 | 9-30-2025 | | 2,925,000 | 2,879,183 |

| U.S. Treasury Note | | 0.25 | 10-31-2025 | | 1,905,000 | 1,873,225 |

| U.S. Treasury Note | | 0.38 | 12-31-2025 | | 2,315,000 | 2,284,525 |

| U.S. Treasury Note | | 0.38 | 7-31-2027 | | 1,860,000 | 1,801,730 |

| U.S. Treasury Note | | 0.38 | 9-30-2027 | | 2,000,000 | 1,931,719 |

| U.S. Treasury Note | | 0.50 | 3-15-2023 | | 2,915,000 | 2,931,169 |

| U.S. Treasury Note | | 0.50 | 3-31-2025 | | 1,675,000 | 1,673,037 |

| U.S. Treasury Note | | 0.50 | 4-30-2027 | | 220,000 | 215,351 |

| U.S. Treasury Note | | 0.50 | 5-31-2027 | | 1,645,000 | 1,607,923 |

| U.S. Treasury Note | | 0.50 | 6-30-2027 | | 2,225,000 | 2,173,460 |

| U.S. Treasury Note | | 0.50 | 8-31-2027 | | 2,015,000 | 1,963,444 |

| U.S. Treasury Note | | 0.63 | 7-31-2026 | | 3,145,000 | 3,123,378 |

| U.S. Treasury Note | | 0.63 | 3-31-2027 | | 205,000 | 202,317 |

| U.S. Treasury Note | | 0.63 | 11-30-2027 | | 2,840,000 | 2,778,652 |

| U.S. Treasury Note | | 0.63 | 12-31-2027 | | 2,145,000 | 2,096,570 |

| U.S. Treasury Note | | 0.63 | 5-15-2030 | | 2,675,000 | 2,540,519 |

| U.S. Treasury Note | | 0.63 | 8-15-2030 | | 3,160,000 | 2,992,742 |

| U.S. Treasury Note | | 0.75 | 3-31-2026 | | 2,535,000 | 2,538,169 |

| U.S. Treasury Note | | 0.75 | 4-30-2026 | | 2,060,000 | 2,061,609 |

| U.S. Treasury Note | | 0.75 | 5-31-2026 | | 2,860,000 | 2,860,782 |

| U.S. Treasury Note | | 0.75 | 1-31-2028 | | 1,615,000 | 1,589,198 |

| U.S. Treasury Note | | 0.88 | 6-30-2026 | | 1,925,000 | 1,935,678 |

| U.S. Treasury Note | | 0.88 | 11-15-2030 | | 3,240,000 | 3,130,903 |

| U.S. Treasury Note | | 1.13 | 2-28-2025 | | 1,855,000 | 1,894,129 |

| U.S. Treasury Note | | 1.13 | 2-29-2028 | | 2,495,000 | 2,512,835 |

| U.S. Treasury Note | | 1.13 | 8-31-2028 | | 1,840,000 | 1,844,888 |

| U.S. Treasury Note | | 1.13 | 2-15-2031 | | 3,135,000 | 3,092,873 |

| U.S. Treasury Note | | 1.25 | 7-31-2023 | | 630,000 | 642,748 |

| U.S. Treasury Note | | 1.25 | 8-31-2024 | | 1,610,000 | 1,650,690 |

| U.S. Treasury Note | | 1.25 | 3-31-2028 | | 3,080,000 | 3,123,553 |

| U.S. Treasury Note | | 1.25 | 6-30-2028 | | 3,025,000 | 3,062,340 |

| U.S. Treasury Note | | 1.25 | 8-15-2031 | | 1,275,000 | 1,268,426 |

| U.S. Treasury Note | | 1.38 | 6-30-2023 | | 4,245,000 | 4,337,694 |

| U.S. Treasury Note | | 1.38 | 8-31-2023 | | 725,000 | 741,766 |

| U.S. Treasury Note | | 1.38 | 9-30-2023 | | 6,135,000 | 6,281,186 |

| U.S. Treasury Note | | 1.38 | 8-31-2026 | | 2,175,000 | 2,238,891 |

| U.S. Treasury Note | | 1.50 | 1-15-2023 | | 1,695,000 | 1,726,914 |

| U.S. Treasury Note | | 1.50 | 2-28-2023 | | 3,560,000 | 3,632,313 |

| U.S. Treasury Note | | 1.50 | 3-31-2023 | | 1,755,000 | 1,792,431 |

| U.S. Treasury Note | | 1.50 | 9-30-2024 | | 3,215,000 | 3,321,622 |

| U.S. Treasury Note | | 1.50 | 10-31-2024 | | 225,000 | 232,567 |

| U.S. Treasury Note | | 1.50 | 8-15-2026 | | 545,000 | 564,181 |

| U.S. Treasury Note | | 1.50 | 1-31-2027 | | 1,350,000 | 1,397,303 |

| U.S. Treasury Note | | 1.50 | 2-15-2030 | | 2,090,000 | 2,139,393 |

| U.S. Treasury Note | | 1.63 | 4-30-2023 | | 280,000 | 286,825 |

| U.S. Treasury Note | | 1.63 | 5-31-2023 | | 3,090,000 | 3,168,578 |

| U.S. Treasury Note | | 1.63 | 10-31-2023 | | 2,540,000 | 2,615,902 |

| U.S. Treasury Note | | 1.63 | 2-15-2026 | | 6,240,000 | 6,492,525 |

| U.S. Treasury Note | | 1.63 | 5-15-2026 | | 2,720,000 | 2,830,819 |

| U.S. Treasury Note | | 1.63 | 9-30-2026 | | 1,395,000 | 1,452,762 |

| U.S. Treasury Note | | 1.63 | 10-31-2026 | | 915,000 | 952,958 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 11

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| U.S. Treasury securities (continued) | | | | | | |

| U.S. Treasury Note | | 1.63% | 8-15-2029 | $ | 2,005,000 | $ 2,076,037 |

| U.S. Treasury Note | | 1.63 | 5-15-2031 | | 3,040,000 | 3,134,525 |

| U.S. Treasury Note | | 1.75 | 9-30-2022 | | 10,000 | 10,177 |

| U.S. Treasury Note | | 1.75 | 5-15-2023 | | 410,000 | 420,939 |

| U.S. Treasury Note | | 1.75 | 6-30-2024 | | 3,510,000 | 3,646,972 |

| U.S. Treasury Note | | 1.75 | 12-31-2026 | | 2,720,000 | 2,850,900 |

| U.S. Treasury Note | | 1.75 | 11-15-2029 | | 830,000 | 867,350 |

| U.S. Treasury Note | | 1.88 | 10-31-2022 | | 2,775,000 | 2,832,234 |

| U.S. Treasury Note | | 1.88 | 8-31-2024 | | 3,290,000 | 3,434,966 |

| U.S. Treasury Note | | 2.00 | 10-31-2022 | | 1,990,000 | 2,033,687 |

| U.S. Treasury Note | | 2.00 | 11-30-2022 | | 1,300,000 | 1,330,570 |

| U.S. Treasury Note | | 2.00 | 2-15-2023 | | 30,000 | 30,816 |

| U.S. Treasury Note | | 2.00 | 6-30-2024 | | 4,751,000 | 4,969,063 |

| U.S. Treasury Note | | 2.00 | 2-15-2025 | | 340,000 | 357,385 |

| U.S. Treasury Note | | 2.00 | 8-15-2025 | | 1,200,000 | 1,265,391 |

| U.S. Treasury Note | | 2.13 | 12-31-2022 | | 1,700,000 | 1,745,090 |

| U.S. Treasury Note | | 2.13 | 11-30-2023 | | 750,000 | 781,348 |

| U.S. Treasury Note | | 2.13 | 7-31-2024 | | 10,000 | 10,506 |

| U.S. Treasury Note | | 2.13 | 9-30-2024 | | 3,270,000 | 3,440,653 |

| U.S. Treasury Note | | 2.13 | 11-30-2024 | | 995,000 | 1,048,248 |

| U.S. Treasury Note | | 2.13 | 5-15-2025 | | 880,000 | 930,291 |

| U.S. Treasury Note | | 2.25 | 12-31-2023 | | 15,000 | 15,688 |

| U.S. Treasury Note | | 2.25 | 4-30-2024 | | 605,000 | 635,628 |

| U.S. Treasury Note | | 2.25 | 10-31-2024 | | 2,035,000 | 2,150,979 |

| U.S. Treasury Note | | 2.25 | 11-15-2024 | | 640,000 | 676,850 |

| U.S. Treasury Note | | 2.25 | 12-31-2024 | | 1,485,000 | 1,572,186 |

| U.S. Treasury Note | | 2.25 | 11-15-2025 | | 1,805,000 | 1,924,793 |

| U.S. Treasury Note | | 2.25 | 11-15-2027 | | 20,000 | 21,556 |

| U.S. Treasury Note | | 2.38 | 8-15-2024 | | 490,000 | 518,654 |

| U.S. Treasury Note | | 2.38 | 5-15-2027 | | 2,493,000 | 2,699,549 |

| U.S. Treasury Note | | 2.38 | 5-15-2029 | | 100,000 | 109,086 |

| U.S. Treasury Note | | 2.38 | 5-15-2051 | | 1,920,000 | 2,120,400 |

| U.S. Treasury Note | | 2.50 | 8-15-2023 | | 270,000 | 282,076 |

| U.S. Treasury Note | | 2.50 | 1-31-2024 | | 895,000 | 942,512 |

| U.S. Treasury Note | | 2.50 | 5-15-2024 | | 1,150,000 | 1,216,844 |

| U.S. Treasury Note | | 2.50 | 1-31-2025 | | 1,670,000 | 1,783,312 |

| U.S. Treasury Note | | 2.50 | 2-28-2026 | | 800,000 | 863,844 |

| U.S. Treasury Note | | 2.63 | 12-31-2025 | | 2,015,000 | 2,182,497 |

| U.S. Treasury Note | | 2.63 | 2-15-2029 | | 3,060,000 | 3,390,384 |

| U.S. Treasury Note | | 2.75 | 11-15-2023 | | 2,040,000 | 2,151,722 |

| U.S. Treasury Note | | 2.75 | 2-28-2025 | | 90,000 | 96,993 |

| U.S. Treasury Note | | 2.75 | 6-30-2025 | | 1,270,000 | 1,374,130 |

| U.S. Treasury Note | | 2.75 | 2-15-2028 | | 2,685,000 | 2,979,301 |

| U.S. Treasury Note | | 2.88 | 11-30-2023 | | 2,400,000 | 2,541,000 |

| U.S. Treasury Note | | 2.88 | 11-30-2025 | | 1,145,000 | 1,251,226 |

| U.S. Treasury Note | | 2.88 | 5-15-2028 | | 2,295,000 | 2,569,324 |

| U.S. Treasury Note | | 2.88 | 8-15-2028 | | 2,510,000 | 2,814,730 |

| U.S. Treasury Note | | 3.13 | 11-15-2028 | | 1,910,000 | 2,179,788 |

| U.S. Treasury Note | | 6.00 | 2-15-2026 | | 450,000 | 555,258 |

| U.S. Treasury Note | | 6.50 | 11-15-2026 | | 745,000 | 961,719 |

| U.S. Treasury Note | | 7.50 | 11-15-2024 | | 695,000 | 852,298 |

| Total U.S. Treasury securities (Cost $301,052,237) | | | | | | 309,329,566 |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Yankee corporate bonds and notes: 2.64% | | | | | | |

| Energy: 0.13% | | | | | | |

| Oil, gas & consumable fuels: 0.13% | | | | | | |

| Equinor ASA | | 1.75% | 1-22-2026 | $ | 370,000 | $ 380,890 |

| Equinor ASA | | 3.00 | 4-6-2027 | | 150,000 | 162,810 |

| Equinor ASA | | 3.63 | 4-6-2040 | | 40,000 | 45,666 |

| Equinor ASA | | 4.25 | 11-23-2041 | | 130,000 | 159,384 |

| | | | | | | 748,750 |

| Financials: 2.51% | | | | | | |

| Banks: 2.51% | | | | | | |

| African Development Bank | | 0.75 | 4-3-2023 | | 410,000 | 413,493 |

| Asian Development Bank | | 0.25 | 7-14-2023 | | 160,000 | 159,964 |

| Asian Development Bank | | 0.38 | 9-3-2025 | | 600,000 | 592,929 |

| Asian Development Bank | | 1.50 | 10-18-2024 | | 360,000 | 371,187 |

| Asian Development Bank | | 1.75 | 9-19-2029 | | 160,000 | 166,323 |

| Asian Development Bank | | 1.88 | 1-24-2030 | | 110,000 | 115,274 |

| Asian Development Bank | | 2.00 | 4-24-2026 | | 60,000 | 63,359 |

| Asian Development Bank | | 2.13 | 3-19-2025 | | 260,000 | 274,202 |

| Asian Development Bank | | 2.63 | 1-12-2027 | | 180,000 | 196,210 |

| Asian Development Bank | | 5.82 | 6-16-2028 | | 10,000 | 13,087 |

| Asian Development Bank | | 6.22 | 8-15-2027 | | 80,000 | 102,267 |

| Asian Infrastructure Investment Bank | | 0.50 | 5-28-2025 | | 350,000 | 348,367 |

| European Bank for Reconstruction & Development | | 0.50 | 5-19-2025 | | 430,000 | 428,094 |

| European Investment Bank | | 0.25 | 9-15-2023 | | 470,000 | 470,009 |

| European Investment Bank | | 0.63 | 7-25-2025 | | 160,000 | 159,949 |

| European Investment Bank | | 0.88 | 5-17-2030 | | 50,000 | 48,364 |

| European Investment Bank | | 1.25 | 2-14-2031 | | 440,000 | 436,303 |

| European Investment Bank | | 1.88 | 2-10-2025 | | 110,000 | 114,990 |

| European Investment Bank | | 2.00 | 12-15-2022 | | 100,000 | 102,383 |

| European Investment Bank | | 2.25 | 6-24-2024 | | 640,000 | 672,783 |

| European Investment Bank | | 2.50 | 3-15-2023 | | 200,000 | 207,134 |

| European Investment Bank | | 3.25 | 1-29-2024 | | 20,000 | 21,392 |

| Inter-American Development Bank | | 0.88 | 4-20-2026 | | 470,000 | 471,985 |

| Inter-American Development Bank | | 1.75 | 9-14-2022 | | 250,000 | 254,201 |

| Inter-American Development Bank | | 1.75 | 3-14-2025 | | 170,000 | 176,919 |

| Inter-American Development Bank | | 2.00 | 6-2-2026 | | 260,000 | 274,564 |

| Inter-American Development Bank | | 2.13 | 1-15-2025 | | 150,000 | 157,844 |

| Inter-American Development Bank | | 2.38 | 7-7-2027 | | 30,000 | 32,373 |

| Inter-American Development Bank | | 3.13 | 9-18-2028 | | 250,000 | 283,389 |

| Inter-American Development Bank | | 4.38 | 1-24-2044 | | 60,000 | 84,418 |

| Inter-American Development Bank | | 7.00 | 6-15-2025 | | 50,000 | 62,151 |

| International Bank for Reconstruction & Development | | 0.38 | 7-28-2025 | | 220,000 | 217,752 |

| International Bank for Reconstruction & Development | | 0.50 | 10-28-2025 | | 410,000 | 406,952 |

| International Bank for Reconstruction & Development | | 0.75 | 8-26-2030 | | 130,000 | 123,975 |

| International Bank for Reconstruction & Development | | 1.50 | 8-28-2024 | | 30,000 | 30,930 |

| International Bank for Reconstruction & Development | | 1.88 | 10-7-2022 | | 320,000 | 326,179 |

| International Bank for Reconstruction & Development | | 1.88 | 6-19-2023 | | 470,000 | 484,058 |

| International Bank for Reconstruction & Development | | 2.50 | 3-19-2024 | | 260,000 | 274,040 |

| International Bank for Reconstruction & Development | | 2.50 | 7-29-2025 | | 570,000 | 610,644 |

| International Bank for Reconstruction & Development | | 2.50 | 11-22-2027 | | 370,000 | 403,093 |

| International Finance Corporation | | 1.38 | 10-16-2024 | | 100,000 | 102,688 |

| International Finance Corporation | | 2.13 | 4-7-2026 | | 100,000 | 106,102 |

| KfW ¤ | | 0.00 | 4-18-2036 | | 80,000 | 62,386 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 13

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Banks (continued) | | | | | | |

| KfW ¤ | | 0.00% | 6-29-2037 | $ | 50,000 | $ 38,075 |

| KfW | | 0.50 | 9-20-2024 | | 540,000 | 540,421 |

| KfW | | 0.75 | 9-30-2030 | | 260,000 | 247,676 |

| KfW | | 2.00 | 5-2-2025 | | 40,000 | 42,037 |

| KfW | | 2.13 | 1-17-2023 | | 870,000 | 893,383 |

| KfW | | 2.88 | 4-3-2028 | | 410,000 | 457,084 |

| Korea Development Bank | | 3.38 | 9-16-2025 | | 410,000 | 449,732 |

| Landwirtschaftliche Rentenbank | | 1.75 | 7-27-2026 | | 10,000 | 10,444 |

| Landwirtschaftliche Rentenbank | | 2.00 | 1-13-2025 | | 150,000 | 157,167 |

| Landwirtschaftliche Rentenbank | | 3.13 | 11-14-2023 | | 350,000 | 371,441 |

| Nordic Investment Bank | | 0.38 | 9-11-2025 | | 370,000 | 365,118 |

| Oesterreichische Kontrollbank AG | | 2.88 | 3-13-2023 | | 260,000 | 270,663 |

| Swedish Export Credit ¤ | | 0.00 | 5-11-2037 | | 65,000 | 44,494 |

| Swedish Export Credit | | 0.50 | 8-26-2025 | | 510,000 | 505,150 |

| | | | | | | 14,817,591 |

| Total Yankee corporate bonds and notes (Cost $15,361,779) | | | | | | 15,566,341 |

| Yankee government bonds: 2.09% | | | | | | |

| Canada Government | | 1.63 | 1-22-2025 | | 235,000 | 243,679 |

| Canada Government | | 2.00 | 11-15-2022 | | 10,000 | 10,229 |

| Export Development Canada | | 2.63 | 2-21-2024 | | 320,000 | 337,463 |

| Export-Import Bank of Korea | | 2.88 | 1-21-2025 | | 400,000 | 426,413 |

| Japan Bank for International Cooperation | | 0.38 | 9-15-2023 | | 560,000 | 560,123 |

| Japan Bank for International Cooperation | | 2.38 | 4-20-2026 | | 320,000 | 341,131 |

| Japan Bank for International Cooperation | | 2.75 | 11-16-2027 | | 360,000 | 393,498 |

| Japan Bank for International Cooperation | | 3.38 | 10-31-2023 | | 270,000 | 287,256 |

| Oriental Republic of Uruguay | | 4.38 | 1-23-2031 | | 75,000 | 87,978 |

| Oriental Republic of Uruguay | | 4.98 | 4-20-2055 | | 200,000 | 262,342 |

| Oriental Republic of Uruguay | | 5.10 | 6-18-2050 | | 35,000 | 46,618 |

| Province of Alberta | | 1.30 | 7-22-2030 | | 210,000 | 204,482 |

| Province of Alberta | | 1.88 | 11-13-2024 | | 210,000 | 218,574 |

| Province of British Columbia | | 2.00 | 10-23-2022 | | 15,000 | 15,311 |

| Province of British Columbia | | 7.25 | 9-1-2036 | | 100,000 | 167,047 |

| Province of Manitoba | | 2.10 | 9-6-2022 | | 120,000 | 122,370 |

| Province of Manitoba | | 3.05 | 5-14-2024 | | 150,000 | 160,364 |

| Province of Ontario | | 2.00 | 10-2-2029 | | 90,000 | 94,302 |

| Province of Ontario | | 2.20 | 10-3-2022 | | 120,000 | 122,689 |

| Province of Ontario | | 2.30 | 6-15-2026 | | 70,000 | 74,536 |

| Province of Ontario | | 2.50 | 4-27-2026 | | 70,000 | 75,136 |

| Province of Ontario | | 3.20 | 5-16-2024 | | 5,000 | 5,364 |

| Province of Ontario | | 3.40 | 10-17-2023 | | 110,000 | 117,148 |

| Province of Quebec | | 1.35 | 5-28-2030 | | 100,000 | 99,073 |

| Province of Quebec | | 2.50 | 4-9-2024 | | 70,000 | 73,767 |

| Province of Quebec | | 2.50 | 4-20-2026 | | 75,000 | 80,700 |

| Province of Quebec | | 2.63 | 2-13-2023 | | 260,000 | 269,087 |

| Province of Quebec | | 7.13 | 2-9-2024 | | 110,000 | 127,436 |

| Province of Quebec | | 7.50 | 7-15-2023 | | 80,000 | 90,494 |

| Republic of Chile | | 2.25 | 10-30-2022 | | 155,000 | 158,129 |

| Republic of Chile | | 3.63 | 10-30-2042 | | 365,000 | 394,123 |

| Republic of Hungary | | 5.38 | 3-25-2024 | | 19,000 | 21,259 |

| Republic of Hungary | | 7.63 | 3-29-2041 | | 112,000 | 190,421 |

| Republic of Indonesia | | 3.50 | 1-11-2028 | | 200,000 | 220,180 |

| Republic of Indonesia | | 4.10 | 4-24-2028 | | 225,000 | 255,858 |

| Republic of Indonesia | | 4.35 | 1-11-2048 | | 205,000 | 237,653 |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Portfolio of investments—August 31, 2021 (unaudited)

| | | Interest

rate | Maturity

date | Principal | Value |

| Yankee government bonds (continued) | | | | | | |

| Republic of Italy | | 2.88% | 10-17-2029 | $ | 415,000 | $ 437,517 |

| Republic of Italy | | 5.38 | 6-15-2033 | | 60,000 | 76,579 |

| Republic of Korea | | 3.88 | 9-11-2023 | | 210,000 | 224,583 |

| Republic of Panama | | 2.25 | 9-29-2032 | | 200,000 | 195,084 |

| Republic of Panama | | 3.87 | 7-23-2060 | | 200,000 | 206,830 |

| Republic of Panama | | 8.88 | 9-30-2027 | | 175,000 | 241,770 |

| Republic of Panama | | 9.38 | 4-1-2029 | | 105,000 | 155,626 |

| Republic of Peru | | 2.78 | 1-23-2031 | | 200,000 | 204,318 |

| Republic of Peru | | 2.84 | 6-20-2030 | | 180,000 | 185,873 |

| Republic of Peru | | 3.23 | 7-28-2121 | | 75,000 | 65,711 |

| Republic of Peru | | 5.63 | 11-18-2050 | | 105,000 | 145,766 |

| Republic of Philippines | | 1.65 | 6-10-2031 | | 200,000 | 196,632 |

| Republic of Philippines | | 2.65 | 12-10-2045 | | 200,000 | 193,056 |

| Republic of Philippines | | 3.70 | 2-2-2042 | | 215,000 | 237,838 |

| Republic of Philippines | | 5.50 | 3-30-2026 | | 210,000 | 251,419 |

| Republic of Philippines | | 9.50 | 2-2-2030 | | 55,000 | 87,041 |

| Republic of Poland | | 3.00 | 3-17-2023 | | 215,000 | 223,880 |

| Republic of Poland | | 3.25 | 4-6-2026 | | 10,000 | 11,020 |

| State of Israel | | 3.38 | 1-15-2050 | | 350,000 | 381,290 |

| State of Israel | | 5.50 | 12-4-2023 | | 120,000 | 133,940 |

| State of Israel | | 5.50 | 9-18-2033 | | 6,000 | 8,554 |

| United Mexican States | | 3.60 | 1-30-2025 | | 200,000 | 218,836 |

| United Mexican States | | 4.00 | 10-2-2023 | | 72,000 | 77,353 |

| United Mexican States | | 4.15 | 3-28-2027 | | 205,000 | 233,962 |

| United Mexican States | | 4.35 | 1-15-2047 | | 225,000 | 239,531 |

| United Mexican States | | 4.50 | 1-31-2050 | | 260,000 | 282,571 |

| United Mexican States | | 4.75 | 3-8-2044 | | 54,000 | 60,776 |

| United Mexican States | | 5.55 | 1-21-2045 | | 255,000 | 313,931 |

| United Mexican States | | 5.75 | 10-12-2110 | | 103,000 | 125,631 |

| United Mexican States | | 6.05 | 1-11-2040 | | 40,000 | 51,000 |

| United Mexican States | | 7.50 | 4-8-2033 | | 110,000 | 156,614 |

| United Mexican States | | 8.30 | 8-15-2031 | | 60,000 | 89,280 |

| Total Yankee government bonds (Cost $11,920,573) | | | | | | 12,306,045 |

| | | Yield | | Shares | |

| Short-term investments: 16.25% | | | | | | |

| Investment companies: 16.25% | | | | | | |

| Wells Fargo Government Money Market Fund Select Class ♠∞## | | 0.03 | | | 95,742,605 | 95,742,605 |

| Total Short-term investments (Cost $95,742,605) | | | | | | 95,742,605 |

| Total investments in securities (Cost $665,336,460) | 115.25% | | | | | 679,198,351 |

| Other assets and liabilities, net | (15.25) | | | | | (89,848,165) |

| Total net assets | 100.00% | | | | | $589,350,186 |

| ±± | The coupon of the security is adjusted based on the principal and interest payments received from the underlying pool of mortgages as well as the credit quality and the actual prepayment speed of the underlying mortgages. The rate shown is the rate in effect at period end. |

| ¤ | The security is issued in zero coupon form with no periodic interest payments. |

| ## | All or a portion of this security is segregated for when-issued securities. |

| ♠ | The issuer of the security is an affiliated person of the Portfolio as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| %% | The security is purchased on a when-issued basis. |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 15

Portfolio of investments—August 31, 2021 (unaudited)

| Abbreviations: |

| EDA | Economic Development Authority |

| FFCB | Federal Farm Credit Banks |

| FHLB | Federal Home Loan Bank |

| FHLMC | Federal Home Loan Mortgage Corporation |

| FNMA | Federal National Mortgage Association |

| GNMA | Government National Mortgage Association |

| GO | General obligation |

| NPFGC | National Public Finance Guarantee Corporation |

| TVA | Tennessee Valley Authority |

Investments in affiliates

An affiliated investment is an investment in which the Portfolio owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Portfolio and the issuer having the same adviser or investment manager. Transactions with issuers that were either affiliates of the Portfolio at the beginning of the period or the end of the period were as follows:

| | Value,

beginning of

period | Purchases | Sales

proceeds | Net

realized

gains

(losses) | Net

change in

unrealized

gains

(losses) | Value,

end of

period | Shares,

end

of period | Income

from

affiliated

securities |

| Short-term investments | | | | | | | |

| Wells Fargo Government Money Market Fund Select Class | $57,676,698 | $81,948,195 | $(43,882,288) | $0 | $0 | $95,742,605 | 95,742,605 | $10,937 |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Statement of assets and liabilities—August 31, 2021 (unaudited)

| | |

| Assets | |

Investments in unaffiliated securities, at value (cost $569,593,855)

| $ 583,455,746 |

Investments in affiliated securites, at value (cost $95,742,605)

| 95,742,605 |

Receivable for investments sold

| 13,191,626 |

Receivable for interest

| 1,693,563 |

Total assets

| 694,083,540 |

| Liabilities | |

Payable for when-issued transactions

| 90,796,640 |

Payable for investments purchased

| 13,328,324 |

Overdraft due to custodian bank

| 548,461 |

Advisory fee payable

| 14,572 |

Accrued expenses and other liabilities

| 45,357 |

Total liabilities

| 104,733,354 |

Total net assets

| $589,350,186 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 17

Statement of operations—six months ended August 31, 2021 (unaudited)

| | |

| Investment income | |

Interest

| $ 3,626,776 |

Income from affiliated securities

| 10,937 |

Total investment income

| 3,637,713 |

| Expenses | |

Advisory fee

| 148,016 |

Custody and accounting fees

| 15,891 |

Professional fees

| 27,137 |

Interest holder report expenses

| 5,186 |

Trustees’ fees and expenses

| 9,771 |

Other fees and expenses

| 6,770 |

Total expenses

| 212,771 |

Less: Fee waivers and/or expense reimbursements

| (58,834) |

Net expenses

| 153,937 |

Net investment income

| 3,483,776 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments

| 2,188,647 |

Net change in unrealized gains (losses) on investments

| (142,503) |

Net realized and unrealized gains (losses) on investments

| 2,046,144 |

Net increase in net assets resulting from operations

| $5,529,920 |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Statement of changes in net assets

| | | |

| | Six months ended

August 31, 2021

(unaudited) | Year ended

February 28, 2021 |

| Operations | | |

Net investment income

| $ 3,483,776 | $ 8,895,120 |

Net realized gains on investments

| 2,188,647 | 13,824,150 |

Net change in unrealized gains (losses) on investments

| (142,503) | (20,010,769) |

Net increase in net assets resulting from operations

| 5,529,920 | 2,708,501 |

| Capital transactions | | |

| Transactions in investors’ beneficial interests | | |

Contributions

| 43,529,772 | 200,389,400 |

Withdrawals

| (46,871,847) | (281,370,896) |

Net decrease in net assets resulting from capital transactions

| (3,342,075) | (80,981,496) |

Total increase (decrease) in net assets

| 2,187,845 | (78,272,995) |

| Net assets | | |

Beginning of period

| 587,162,341 | 665,435,336 |

End of period

| $589,350,186 | $ 587,162,341 |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 19

| | | Year ended February 28 |

| | Six months ended

August 31, 2021

(unaudited) | 2021 | 2020 1 | 2019 | 2018 2 |

Total return3

| 0.94% | 0.52% | 10.34% | 3.23% | (1.39)% |

| Ratios to average net assets (annualized) | | | | | |

Gross expenses

| 0.07% | 0.07% | 0.07% | 0.08% | 0.08% |

Net expenses

| 0.05% * | 0.05% * | 0.06% | 0.07% | 0.07% |

Net investment income

| 1.18% | 1.57% | 2.32% | 2.38% | 2.03% |

| Supplemental data | | | | | |

Portfolio turnover rate

| 94% | 114% | 46% | 72% | 221% |

| * | Ratios reflect expenses which were voluntarily waived by the adviser. Without these voluntary waivers, the net expense ratios would be increased by the following amounts: |

| Six months ended August 31, 2021 (unaudited) | 0.02% |

| Year ended February 28, 2021 | 0.02% |

| 1 | Year ended February 29 |

| 2 | For the period from May 23, 2017 (commencement of operations) to February 28, 2018 |

| 3 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Notes to financial statements (unaudited)

1. ORGANIZATION

Wells Fargo Master Trust (the "Trust"), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio (the "Portfolio") which is a diversified series of the Trust.

Interests in the Portfolio are available solely through private placement transactions that do not involve any "public offering" within the meaning of Section 4(2) of the Investment Company Act of 1933.

On February 23, 2021, Wells Fargo & Company announced that it has entered into a definitive agreement to sell Wells Fargo Asset Management ("WFAM") to GTCR LLC and Reverence Capital Partners, L.P. WFAM is the trade name used by the asset management businesses of Wells Fargo & Company and includes Wells Fargo Funds Management, LLC, the adviser to the Portfolio, Wells Capital Management, LLC and Wells Fargo Asset Management (International) Limited, both registered investment advisers providing subadvisory services to certain funds, and Wells Fargo Funds Distributor, LLC, the Portfolio's principal underwriter. As part of the transaction, Wells Fargo & Company will own a 9.9% equity interest and will continue to serve as an important client and distribution partner.

Consummation of the transaction will result in the automatic termination of the Portfolio’s investment advisory agreement and subadvisory agreements. The Portfolio’s Board of Trustees approved a new investment advisory agreement and a new subadvisory agreement which were subsequently approved on behalf of the feeder funds that were investors in the Portfolio at the close of business on May 28, 2021. The new agreements will take effect upon the closing of the transaction. The transaction is expected to close in the second half of 2021, subject to customary closing conditions.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Portfolio, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Portfolio may deviate from this calculation time under unusual or unexpected circumstances.

Debt securities are valued at the evaluated bid price provided by an independent pricing service (e.g. taking into account various factors, including yields, maturities, or credit ratings) or, if a reliable price is not available, the quoted bid price from an independent broker-dealer.

Investments in registered open-end investment companies are valued at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC ("Funds Management"). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

When-issued transactions

The Portfolio may purchase securities on a forward commitment or when-issued basis. The Portfolio records a when-issued transaction on the trade date and will segregate assets in an amount at least equal in value to the Portfolio's commitment to purchase when-issued securities. Securities purchased on a when-issued basis are marked-to-market daily and the Portfolio begins earning interest on the settlement date. Losses may arise due to changes in the market value of the underlying securities or if the counterparty does not perform under the contract.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 21

Notes to financial statements (unaudited)

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has been determined to be doubtful based on consistently applied procedures and the fair value has decreased. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status. Paydown gains and losses are included in interest income.

Federal and other taxes

The Portfolio is not required to pay federal income taxes on its net investment income and net capital gains as it is treated as a partnership for federal income tax purposes. All income, gains and losses of the Portfolio are deemed to have been “passed through” to the interest holders in proportion to their holdings of the Portfolio regardless of whether income and gains have been distributed by the Portfolio.

The Portfolio’s income tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal revenue authority. Management has analyzed the Portfolio’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of August 31, 2021, the aggregate cost of all investments for federal income tax purposes was $665,184,197 and the unrealized gains (losses) consisted of:

| Gross unrealized gains | $16,993,230 |

| Gross unrealized losses | (2,979,076) |

| Net unrealized gains | $14,014,154 |

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Portfolio’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Portfolio’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

22 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Notes to financial statements (unaudited)

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities as of August 31, 2021:

| | Quoted prices

(Level 1) | Other significant

observable inputs

(Level 2) | Significant

unobservable inputs

(Level 3) | Total |

| Assets | | | | |

| Investments in: | | | | |

| Agency securities | $ 0 | $ 232,494,124 | $0 | $ 232,494,124 |

| Asset-backed securities | 0 | 2,348,289 | 0 | 2,348,289 |

| Municipal obligations | 0 | 5,090,678 | 0 | 5,090,678 |

| Non-agency mortgage-backed securities | 0 | 6,320,703 | 0 | 6,320,703 |

| U.S. Treasury securities | 309,329,566 | 0 | 0 | 309,329,566 |

| Yankee corporate bonds and notes | 0 | 15,566,341 | 0 | 15,566,341 |

| Yankee government bonds | 0 | 12,306,045 | 0 | 12,306,045 |

| Short-term investments | | | | |

| Investment companies | 95,742,605 | 0 | 0 | 95,742,605 |

| Total assets | $405,072,171 | $274,126,180 | $0 | $679,198,351 |

Additional sector, industry or geographic detail, if any, is included in the Portfolio of Investments.

For the six months ended August 31, 2021, the Portfolio did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company ("Wells Fargo"). The adviser is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Portfolio. Pursuant to the contract, Funds Management is entitled to receive an advisory fee at the following annual rate based on the Portfolio’s average daily net assets:

| Average daily net assets | Advisory fee |

| First $5 billion | 0.050% |

| Next $5 billion | 0.040 |

| Over $10 billion | 0.030 |

For the six months ended August 31, 2021, the advisory fee was equivalent to an annual rate of 0.05% of the Portfolio’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Portfolio. The fee for subadvisory services is borne by Funds Management. Wells Capital Management, LLC, an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo, is the subadviser to the Portfolio and is entitled to receive a fee from Funds Management at an annual rate starting at 0.04% and declining to 0.03% as the average daily net assets of the Portfolio increase.

Funds Management has voluntarily waived and/or reimbursed advisory fees to reduce the net operating expense ratio of the Portfolio. These voluntary waivers may be discontinued at any time.

Interfund transactions

The Portfolio may purchase or sell portfolio investment securities to certain other Wells Fargo affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 23

Notes to financial statements (unaudited)

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding short-term securities, for the six months ended August 31, 2021 were as follows:

| Purchases at cost | | Sales proceeds |

U.S.

government | Non-U.S.

government | | U.S.

government | Non-U.S.

government |

| $569,767,573 | $9,270,701 | | $535,235,024 | $11,267,367 |

6. BANK BORROWINGS

The Trust, along with Wells Fargo Variable Trust and Wells Fargo Funds Trust (excluding the money market funds), are parties to a $350,000,000 revolving credit agreement whereby the Portfolio is permitted to use bank borrowings for temporary or emergency purposes, such as to fund interest holders withdrawal requests. Interest under the credit agreement is charged to the Portfolio based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight bank funding rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.25% of the unused balance is allocated to each participating fund.

For the six months ended August 31, 2021, there were no borrowings by the Portfolio under the agreement.

7. INDEMNIFICATION

Under the Portfolio's organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Portfolio. The Portfolio has entered into a separate agreement with each Trustee that converts indemnification rights currently existing under the Portfolio’s organizational documents into contractual rights that cannot be changed in the future without the consent of the Trustee. Additionally, in the normal course of business, the Portfolio may enter into contracts with service providers that contain a variety of indemnification clauses. The Portfolio’s maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolio and, therefore, cannot be estimated.

8. CORONAVIRUS (COVID-19) PANDEMIC

On March 11, 2020, the World Health Organization announced that it had made the assessment that coronavirus disease 2019 (“COVID-19”) is a pandemic. The impacts of COVID-19 are affecting the entire global economy, individual companies and investment products, the funds, and the market in general. There is significant uncertainty around the extent and duration of business disruptions related to COVID-19 and the impacts may last for an extended period of time. COVID-19 has led to significant uncertainty and volatility in the financial markets.

9. SUBSEQUENT EVENTS

Wells Fargo Asset Management ("WFAM") announced that it will be changing its company name to Allspring Global Investments upon the closing of the previously announced sale transaction of WFAM by Wells Fargo & Company to GTCR LLC and Reverence Capital Partners, L.P. The new corporate name is expected to go into effect on the closing date of the transaction, which is anticipated to occur in the second half of 2021, subject to customary closing conditions.

The Board of Trustees of the Wells Fargo Funds approved a change in the Portfolio's name to remove “Wells Fargo” from the Portfolio's name and replace with “Allspring” on December 6, 2021.

Following the closing of the transaction, Wells Fargo Funds Management, LLC, the Portfolio's adviser, Wells Capital Management, LLC and Wells Fargo Asset Management (International) Limited, each subadvisers to certain funds, and Wells Fargo Funds Distributor, LLC will each be rebranded as Allspring.

24 | Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio

Other information (unaudited)

PROXY VOTING INFORMATION

A description of the policies and procedures used to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our website at wfam.com, or visiting the SEC website at sec.gov. Information regarding how the proxies related to portfolio securities were voted during the most recent 12-month period ended June 30 is available on the website at wfam.com or by visiting the SEC website at sec.gov.

QUARTERLY PORTFOLIO HOLDINGS INFORMATION

The Portfolio files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Interest holders may view the filed Form N-PORT by visiting the SEC website at sec.gov.

Wells Fargo Bloomberg Barclays US Aggregate ex-Corporate Portfolio | 25

Other information (unaudited)

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers listed in the table below acts in identical capacities for each fund in the Wells Fargo family of funds, which consists of 139 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information1. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

Name and

year of birth | Position held and

length of service* | Principal occupations during past five years or longer | Current other

public company or

investment

company

directorships |

William R. Ebsworth

(Born 1957) | Trustee,

since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

Jane A. Freeman

(Born 1953) | Trustee,

since 2015;

Chair Liaison,

since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Isaiah Harris, Jr.

(Born 1952) | Trustee,

since 2009; Audit

Committee

Chair,