S&P500 was up about 9 per cent from the beginning of the year.Over approximately the same period, the value of the US dollar fell, reaching US$1.36 to the euro by the end of December.

InCanada, annualised GDP growth slowed to 2.7 per cent in the first quarter of 2004 from 3.3 per cent in the final quarter of 2003, largely because of a fall in stockbuilding. Consumer spending and investment growth began the year strongly. However, the Bank of Canada (‘BoC’) cut interest rates three times in the first half of 2004 in response to low inflation and currency appreciation. With the global economy recovering and Canadian GDP growth having rebounded to 3.9 per cent in the second quarter, the BoC started to reverse its policy, raising rates by 25 basis points in both September and October. Growth remained robust in the second half of the year with consumer spending accelerating. Import growth was significant, partly reflecting a very large build-up of inventory in the third quarter, much of it related to the auto sector. Although inflation picked up a little, the BoC kept rates on hold in November and December, because of concerns about the impact of a stronger Canadian dollar. This left the overnight rate at 2.5 per cent, still below the rate at which it started the year.

Mexico’s macro-economic fundamentals remained strong in 2004, with year-on-year GDP growth of 4.4 per cent in line with that of the US. At year-end, the fiscal accounts were showing relatively low deficits helped by the windfall of high oil prices. Driven by oil receipts and an unprecedented level of workers´ remittances, the current account deficit shrank to a figure below the level of reinvested earnings from existing foreign direct investment. Inflation increased from 4.0 per cent at the end of 2003 to 5.2 per cent in 2004, as a result of increases in external energy and food prices, but remained manageable. HSBC anticipates that inflation will be reduced in 2005 due to a restrictive monetary policy, and that moderate to strong GDP growth will continue with a mildly appreciating currency.

On 1 July 2004, HSBC Bank USA, Inc. consolidated its banking operations under a single national charter, following approval from the Office of Comptroller of Currency. This enabled the newly formed HSBC Bank USA to serve its customers more efficiently and effectively across the US and provide an expanded range of products. It also put HSBC Bank USA on the same footing as other major US banks.

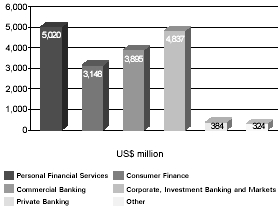

HSBC’s operations in North America reported a pre-tax profit of US$5,419 million, compared with US$3,613 million in 2003. Excluding goodwill

amortisation, pre-tax profit was US$6,180 million, compared with US$4,257 million in 2003, and represented 32 per cent of HSBC’s total pre-tax profit on this basis.

Within these figures HSBC Finance reported a pre-tax profit, before goodwill amortisation, of US$3,576 million in 2004, an increase of US$1,524 million, of which US$1,084 million was an additional quarter’s contribution. Profit was 21 per cent higher than for the comparable period in the prior year.

Bank of Bermuda, acquired in February 2004, contributed US$73 million to pre-tax profit, before goodwill amortisation, in the North American segment.

At constant exchange rates, and on an underlying basis, HSBC’s pre-tax profit, before goodwill amortisation, was 17 per cent higher than in 2003.

The detailed customer group commentary that follows is based on constant exchange rates.

Excluding Consumer Finance,Personal Financial Services generated a pre-tax profit, before goodwill amortisation, of US$1,164 million, 35 per cent higher than in 2003. Approximately 22 per cent of this growth arose from the acquisition of Bank of Bermuda and certain insurance interests in Mexico.

Growth in net interest income was 19 per cent. This was driven mainly by a 34 per cent increase in Mexico, where growth in low cost deposits and consumer loans, and higher interest income from the insurance business, contributed to the rise. Acquisitions in Mexico accounted for 17 per cent of the overall improvement. HSBC attracted 359,000 net new deposit customers in Mexico during the year, and this contributed to the US$1.6 billion rise in average deposit balances. Despite an increasingly competitive marketplace, market share in deposits rose to 14.4 per cent, driven by the bank’s extensive branch and ATM network. Consumer loan growth was robust in the second half of the year, particularly in pre-approved payroll loans offered through the ATM network, and residential mortgages.

Net interest income in the US grew by 10 per cent, reflecting a US$10.9 billion, or 58 per cent, increase in average residential mortgage balances and the widening of spreads on savings and deposits, as interest rates rose. Sales of residential mortgages remained strong following an expansion of the sales force and the development of the correspondent network, competitive pricing and increased marketing. In 2004, customers generally favoured variable rate products over fixed. Several new

Back to Contents

H S B C H O L D I N G S P L C

Financial Review(continued)

products, including a range of adjustable rate mortgages, were launched during the year contributing to an overall increase in gross new lending of 3 per cent to US$32.6 billion. The income benefit of this growth, however, was partly offset by pressure on spreads. Competitive pricing in a contracting market forced a general downward trend in mortgage yields in 2004 compared with the levels seen in 2003.

Other operating income rose by US$164 million or 20 per cent to US$979 million, of which US$82 million came from acquisitions. Growth was largely attributable to the strong performance in Mexico, where expansion of the pension funds business, acquired in the last quarter of 2003, complemented higher fee income from credit cards, deposit-related services and international remittances. Sales of pension and bancassurance products grew strongly, attracting some 270,000 new customers, following an expansion of the sales force. An enhanced customer relationship management system and the employment of WHIRL helped the number of credit cards in circulation in Mexico to rise by 29 per cent to 568,000. Fee income from credit cards rose by 20 per cent compared with 2003. Operations in Canada benefited from a rise in retail broking volumes, as market activity revived. In the US, a revised fee structure and improved collection processes produced a 9 per cent increase in fee income from cards and deposit-related services.

The US mortgage banking business contributed a pre-tax profit of US$270 million, in line with 2003, despite a fall in other operating income. Lower origination and sales-related income in the secondary market was only partly offset by a reduction in net servicing expenses. There was a net loss of US$4 million from sale of mortgage loans in 2004 compared with a net gain of US$117 million in 2003. This was mainly driven by lower gains on sales of mortgages, as narrower spreads combined with a fall in the volume of loans originated for sale. As interest rates increased in 2004 from the historically low levels experienced in 2003, prepayments of residential mortgages, mostly in the form of loan refinancing, reduced significantly and residential mortgages originated for sale declined by 64 per cent compared with 2003, despite an overall increase in mortgage lending. Loan refinancing activity represented 50 per cent of the total loan originations, compared with 74 per cent in 2003. Pricing also fell from the unusually high levels seen in 2003 and, as a result, HSBC earned lower returns on loans sold.

The net cost of servicing mortgages fell, improved primarily as a result of lower amortisation

expenses on mortgage servicing rights (‘MSR’) and increased income associated with the derivatives used to offset the changes in the economic value of the MSRs. The reduction in amortisation expenses was also partly affected by lower MSR balances in 2004. The cost reduction was partly offset by higher temporary impairment reserves.

Operating expenses, excluding goodwill amortisation, were 16 per cent higher than in 2003. This was due mainly to a 15 per cent increase in costs in Mexico, where the expansion of the pension funds business and the inclusion of the insurance business acquired in the last quarter of 2003 contributed to generally higher salaries and performance-related bonuses. Staff numbers increased in the Mexican branch network to support growth in business volumes, improve customer service, and support the rollout of HSBCPremier. The introduction of the WHIRL credit card system in Mexico and the US, at a cost of US$23 million, was completed by the end of October. In the US, expansion in the mortgage sales force and higher performance-related bonuses led to higher staff costs, while the launch of advertising campaigns for mortgages and deposits added to marketing costs. Additional staff were recruited in the branch network to support business expansion and to improve customer service. Costs in Canada increased by 4 per cent, principally due to higher performance-related staff costs in the brokerage business and restructuring expenses arising from the integration of Intesa Bank Canada, acquired in May.

The net bad debts charge fell by 29 per cent to US$99 million. Recoveries of amounts previously written-off in Mexico more than offset the US$11 million increase in new specific provisions in the US, predominantly for the credit cards portfolio within HSBC Bank USA. There was also a US$28 million release of general provisions in Mexico following a review of historical loss experience, reflecting a general improvement in the credit quality of consumer loan portfolios, and the improved market environment.

Consumer Finance contributed a pre-tax profit, before goodwill amortisation, of US$3,576 million in 2004, an increase of US$1,508 million of which US$1,097 million was an additional quarter’s contribution. On an underlying basis, pre-tax profit, before goodwill amortisation, grew by 20 per cent to US$2,479 million.

The integration of HSBC Finance Corporation into HSBC continued to deliver funding benefits in line with those anticipated. Since December 2003, HSBC Finance Corporation has sold US$3.7 billion

96

Back to Contents

of residential mortgages and US$15.6 billion of its domestic private label assets to HSBC Bank USA, the latter in December 2004. Under various service level agreements, HSBC Finance Corporation will continue to maintain the related customer account relationships for the assets transferred. By the end of 2004, HSBC had provided a total of US$35.6 billion in direct and client funding to HSBC Finance Corporation, and cash savings realised in 2004 were in excess of US$400 million.

Following receipt of regulatory approval for the sale of the private label portfolio, and prior to the sale, HSBC Finance Corporation adopted charge-off and account management policies in accordance with the Uniform Retail Credit Classification and Account Management Policy issued by the Federal Financial Institutions Examination Council (‘FFIEC policies’), for its domestic private label, MasterCard and Visa credit card portfolios. The main effect of this was on the private label credit card portfolio, where the FFIEC policies resulted in accounts being charged-off earlier. Certain pools of accounts were already following FFIEC policies, and so their adoption improved conformity across all relevant portfolios. The FFIEC account management practices change the delinquency and roll rates applicable to these portfolios, and resulted in a one-off charge to pre-tax profit, before goodwill amortisation, of US$154 million, which is expected to be offset by future funding benefits in the region of US$47 million per annum.

Net interest income of US$10,541 million was US$2,690 million higher than in 2003, although on an underlying basis adjusting for the additional quarter in 2004, it was only marginally higher. Average customer loan balances increased by 11 per cent to US$120.6 billion. Lower funding costs gave HSBC Finance Corporation the opportunity to expand its prime and near-prime customer base, particularly in the mortgage business. Average mortgage balances grew by 23 per cent to US$54.1 billion. Some US$3.9 billion of gross new lending balances were originated from a single correspondent relationship, while balances of US$1.6 billion were originated following the launch in 2003 of the ‘Secured Plus’ mortgage product.

Organic growth of 16 per cent to US$9.6 billion in vehicle finance loans was primarily achieved through a network of 5,200 motor dealers, extensive alliance relationships and direct sales channels.

Loans in the MasterCardand Visa credit card portfolios grew by 3 per cent to US$18 billion, driven largely by growth in the sub-prime portfolio. Spreads widened reflecting the change in product

mix towards the sub-prime market. The private label business also achieved growth in average loan balances, 5 per cent higher than in 2003, through new and existing merchant agreements.

The benefit of strong growth in loan balances was reduced significantly by lower yields. A greater than normal run-off of older, higher-yielding loans, product expansion into near-prime customer segments, and competitive pricing pressures from excess capacity, particularly in the mortgage market, contributed to an overall decline in loan yields. The decline was only partly offset by increased pricing of variable-rate products in line with interest rate movements, and continued growth in sub-prime credit cards. Also, the adoption of the FFIEC policies reduced net interest income by US$57 million.

Other operating income rose by US$895 million, or 52 per cent, to US$2,602 million, largely reflecting the additional quarter’s income. On an underlying basis, and excluding the effect of adopting the FFIEC policies, the increase was 10 per cent, predominantly reflecting strong growth in fee income from credit cards, and increased revenue from sales of value added products.

Operating expenses, excluding goodwill amortisation, of US$4,470 million were 44 per cent higher than in 2003. On an underlying basis, operating expenses, excluding goodwill amortisation, increased by 10 per cent to US$3,422 million due mainly to increased staff costs and higher IT and marketing expenditure. Additional staff were recruited in the branch network and in the mortgage services business to support growth in volumes and to improve customer service. Increased business volumes also led to higher performance-related bonuses and higher IT costs. Marketing costs increased, largely due to changes in contractual obligations associated with the General Motors co-branded credit card portfolio, but were partly offset by lower account origination costs. Marketing expenses were also incurred in support of income growth initiatives in the sub-prime market. In September 2004, HSBC rebranded a number of its Consumer Finance businesses at a cost of US$8 million.

The charge for bad and doubtful debts rose by 17 per cent to US$5,136 million. On an underlying basis and excluding the effect of adopting the FFIEC policies, the charge fell by 12 per cent. This reflected a marked improvement in credit quality, driven by the economic upturn, improved origination, growth in the proportion of secured lending, improved

97

Back to Contents

H S B C H O L D I N G S P L C

FinancialReview(continued)

collections, and the move into prime and near-prime markets. Improvements in delinquency were seen across most products and in a number of key indicators, including early stage delinquency, charge-offs and year-on-year bankruptcy filings. The rate of improvement declined in the second half of the year reflecting seasonality, a slowdown in employment growth and rising energy prices.

Commercial Banking reported pre-tax profits, before amortisation of goodwill, of US$845 million for 2004, an improvement of 41 per cent over 2003.

Net interest income increased by 8 per cent, of which 3 per cent was attributable to the acquisition of Bank of Bermuda. Adjusting for the loss of net interest income following the disposal of the US equipment-leasing portfolio last year, underlying growth was 7 per cent.

In the US, the recruitment of 50 additional relationship managers, focusing on the SME market, contributed to a 12 per cent rise in lending balances and a 17 per cent increase in commercial deposits. Improved economic conditions and stronger consumer confidence also led to increased demand for credit, but spreads suffered in the competitive marketplace. Commercial real estate lending increased by 11 per cent, largely as a result of expansion into the US West Coast and Miami.

In Canada, net interest income increased by 16 per cent. Growth in lending reflected stronger demand for credit in the low interest rate environment, improved market conditions and additional income following the integration of Intesa Bank. In Mexico, competitors displaying a greater appetite for risk enabled HSBC to selectively reduce loan balances. This, together with the effect of lower interest rates on deposit spreads and a restructuring of prices, which emphasised fees at the expense of margin, led to an 11 per cent reduction in Mexican net interest income.

Other operating income was US$13 million or 3 per cent higher than in 2003. Excluding the disposal of the US factoring and equipment leasing businesses, which in 2003 contributed other operating income of US$109 million, the underlying growth was 25 per cent. The impact of acquisitions during 2004 was not material.

In Mexico, fees and commissions grew by US$10 million or 11 per cent. Fees earned from payments and cash management and electronic banking both increased. The Mexican authorities changed the tax regulations to require all companies to make tax payments via electronic banking channels from January 2004. HSBC seized the

opportunities presented by this change to increase both the number of clients using electronic banking, and the number of transactions and income per client. Earnings from new trade services products and increased loan fees (from the price restructuring) also contributed.

Operating expenses declined by 6 per cent compared with 2003 as a result of the disposal of the factoring and equipment leasing businesses in the US. Adjusting for this, there was a 3 per cent rise in expenses reflecting additional costs from the restructuring and integration of Intesa Bank, the inclusion of Bank of Bermuda, and the effect of increased transaction volumes and business flows between Mexico and the US.

The charge for bad and doubtful debts fell by 90 per cent to US$13 million, reflecting an improved economic environment and falling corporate default rates. In 2003, the charge included US$33 million in the US factoring and leasing businesses which were sold during that year.

Corporate, Investment Banking and Marketsreported pre-tax profit, before amortisation of goodwill, of US$750 million, 11 per cent lower than in 2003.

Net interest income was 11 per cent lower than in 2003, notwithstanding the first contribution from Bank of Bermuda, which added US$31 million, or 4 per cent to the total. In part this reflected the cost of funding trading strategies where the offsetting income arises within dealing revenues. The return on investments held for liquidity fell and the yield on loans dropped as re-financing reached record levels following the reductions in interest rates in the latter part of 2003 and early 2004. The lower interest rates resulted in large early redemptions of mortgage-backed securities. Reinvestment opportunities, however, failed to match the yields given up on these redemptions. In Canada, a combination of interest rate cuts in the early part of 2004 and lower corporate loan balances reduced net interest income. However, in Mexico, investment portfolios profited from having locked into higher long-term interest rate str uctures.

Other operating income improved by 15 per cent, of which 7 per cent was attributable to Bank of Bermuda, which improved its market share in funds administration following its acquisition. A 23 per cent increase in fees and commissions in the US was driven by increased underwriting fees from debt issues and syndication, coupled with higher deal execution revenues. Increased revenues from customers reflected improved client coverage. The growing use of electronic trading by clients resulted

98

Back to Contents

in increased commissions from futures transactions, while structured finance and HSBC Amanah benefited from higher transaction fees and new deals. In Global Transaction Banking, higher payment and cash management revenues reflected an increase in volumes. Dealing profits benefited from a reduced level of losses in respect of mortgage hedging activities transacted on behalf of other HSBC customer groups. These transactions resulted in an offsetting reduction in other income. Although credit spread volatility was relatively low, movements in individual corporate spreads, primarily in the industrials sector, adversely affected corporate bond trading revenues. Global Markets continued to benefit from the previous year’s expansion of derivatives capabilities and higher profits from improved marketing and delivery of structured solutions. Proprietary trading revenues increased, mainly through profits on long futures positions and foreign exchang e gains which arose from successful positioning against the weakening US dollar. Foreign exchange also benefited from a higher volume of customer transactions.

In Mexico, earnings from debt trading fell as interest rates rose during the year, while in Canada, higher fees from securities sales and corporate finance reflected improved market sentiment in local equity markets. Foreign exchange income in Canada grew by 10 per cent in response to the continued volatility of the Canadian and US dollars.

Operating expenses, before goodwill amortisation, of US$1,014 million rose by 31 per cent, of which 12 per cent related to costs in Bank of Bermuda. In New York, the significant expansion of the Corporate Investment Banking and Markets’ business resulted in an increase of some 300 in headcount and a corresponding rise in salary costs. Incentive compensation also rose, largely due to the costs of recruiting and retaining the high quality staff needed to deliver the business strategy. Key hires within the expanded complement included the establishment of a mergers and acquisitions and advisory group, and product teams to develop asset-backed and mortgage-backed securitisation and trading. Non-staff costs grew correspondingly and included investment in technology to support the new business streams and the related control environment.

A net release of provisions for bad and doubtful debts reflected a significant improvement in credit quality as corporate restructuring and refinancing was facilitated by the better economic conditions. This resulted in releases and recoveries across a number of sectors.

Private Banking contributed a pre-tax profit, before goodwill amortisation, of US$66 million, an increase of 6 per cent on the result achieved in 2003. Good progress was made in the integration of Bank of Bermuda’s Private Client Services business, which added an onshore banking capability in Bermuda, and complementary offshore and trust products and services to HSBC’s North American operations. In aggregate, Bank of Bermuda’s North American Private Banking operations added US$2 million to pre-tax profits, before goodwill amortisation, in 2004.

Net interest income increased by 37 per cent, due largely to balance sheet growth. Strong growth in customer loans, which were 50 per cent higher than in 2003, reflected the success of the insurance premium financing business, an expanded customer base, and growth in secured borrowing by clients to invest in higher-yielding assets or funds. The larger customer base resulted from an expansion of Private Banking’s geographical presence, and cross-referrals generated through the alignment of Private Banking’s operations with other customer groups. This contributed to an increase in average customer deposits.

Other operating income was 4 per cent below that achieved in 2003 but was 23 per cent lower excluding the Bank of Bermuda. The fall in other operating income was mainly driven by client anticipation of interest rate rises, which reduced demand for interest-rate-linked structured products, and sales of fixed interest bonds. WTAS increased revenue despite subdued demand for tax planning services. As a consequence of restrictions placed on the personal tax practices in the major accounting firms engaged in providing audit services, WTAS increased both its customer base and the number of fee-generating staff. Cross-referrals also grew.

Operating expenses, before goodwill amortisation and excluding Bank of Bermuda, were broadly flat compared with 2003. Savings were generated from the continuing alignment of international and domestic client servicing units and from operational efficiencies in WTAS.

The gain on disposal of investments and tangible fixed assets reflected the sale of seed capital holdings.

99

Back to Contents

H S B C H O L D I N G S P L C

Financial Review(continued)

Year ended 31 December 2003 compared with year ended 31 December 2002

Fuelled by fiscal stimuli and a further interest rate reduction, the US economy steadily gained momentum in 2003. GDP expanded at an annualised rate of 8.2 per cent in the third quarter, the strongest rate since 1984. A strong revival in profits growth boosted investment spending while consumer spending remained strong, supported by tax cuts, a buoyant housing market, and equity releases from refinancing mortgages at record low interest rates. By the end of the year there was some evidence of the long-awaited recovery in the labour market, with the economy adding jobs, albeit modestly. In June the Federal Reserve cut its Fed Funds rate by 25 basis points to 1 per cent. Subsequently, 10-year bond yields rose by 100 basis points from their mid-June low of 3.1 per cent. Equity markets recovered strongly following the end of the Iraq war: by the end of December the S&P 500 had risen by 39 per cent from its March low and was at its highest level since July 2002. This supported consumer confidence. However, with the US current account deficit continuing to deteriorate, the US dollar remained under downward pressure, falling to US$1.26 against the euro by the end of the year.

Canada’s central bank was the first of the G7 countries to embark on a policy of raising interest rates in 2003. In response to inflationary pressures in the early part of the year, overnight lending rates were raised on two occasions, by a total of 50 basis points. However, with the Canadian dollar strengthening against the US dollar, inflation worries easing, and concerns about subdued GDP growth, the Central Bank reversed the earlier interest rate rises to take the overnight rate back down to 2.75 per cent in September. Many of the reasons for the disappointing growth were temporary, such as SARS, BSE, forest fires and the Ontario power blackout, and their immediate impact abated. Consumer spending growth remained robust all year, but the ongoing impact of the strong Canadian dollar appeared set to continue, restraining export growth.

The Mexican economy continued to lag behind the US recovery, largely because, apart from technology, the US manufacturing sector remained subdued. However, the impact of stronger US growth is expected to benefit Mexico in the near term, boosting exports and growth. Meanwhile, political conflicts delayed the passage of critical reform legislation, threatening approval of the 2004 budget. This notwithstanding, a solid macroeconomic foundation had been established and was expected to be maintained.

On 28 March 2003, HSBC completed its acquisition of HSBC Finance Corporation for a consideration of US$14.8 billion, expanding significantly its existing North American business. The addition of HSBC Finance Corporation’s substantial consumer lending portfolio increased the proportion of HSBC’s assets in North America from 19 per cent to 28 per cent of the total Group.

The results of HSBC Finance Corporation’s consumer finance business for the period from 29 March to 31 December 2003 are tabulated separately under Consumer Finance in order to highlight their significance to HSBC’s overall performance in North America. HSBC’s results at the pre-tax level and before amortising goodwill also benefited from a US$534 million contribution from HSBC Mexico in its first full year. The integration of both HSBC Finance Corporation and HSBC Mexico progressed well, with synergy benefits and business opportunities generally meeting or exceeding expectations.

The following discussion of HSBC’s North American performance highlights the impact of the additions of HSBC Finance Corporation and HSBC Mexico. The phrase ‘on an underlying basis’ is used to describe performance excluding these acquisitions.

HSBC’s operations in North America contributed US$3,613 million to HSBC’s profit before tax, an increase of US$2,375 million, compared with 2002. Excluding goodwill amortisation, pre-tax profit was US$4,257 million, compared with US$1,384 million in 2002, which was equivalent to 30 per cent of HSBC’s total pre-tax profit on this basis. On an underlying basis, HSBC’s pre-tax profit, before goodwill amortisation, of US$1,672 million was US$320 million, or 24 per cent, higher than in 2002. Goodwill amortisation was US$644 million in 2003, compared with US$146 million last year, predominantly reflecting the acquisition of HSBC Finance Corporation and, to a lesser extent, HSBC Mexico.

The commentaries that follow are based on constant exchange rates.

Personal Financial Services, excluding Consumer Finance, generated pre-tax profit, before goodwill amortisation, of US$870 million in 2003, 40 per cent higher than last year. HSBC Mexico contributed US$350 million to pre-tax profit for the year. On an underlying basis, pre-tax profit, before goodwill amortisation, was 13 per cent lower than in 2002 mainly due to lower earnings from mortgage servicing and higher staff costs.

100

Back to Contents

Net interest income increased by 53 per cent to US$2,116 million mainly as a result of the inclusion of HSBC Mexico. The first full year’s result for HSBC Mexico was strong and ahead of expectations. Growth in Mexico from a relatively weak performance in 2002 reflected an improvement in net interest income driven by a greater level of low cost deposits and an expanding consumer loan portfolio. Interest spreads benefited from a change in asset mix, with over 25 per cent growth in higher yielding assets, including motor vehicle finance, credit cards and payroll loans.

On an underlying basis, growth in net interest income of 7 per cent was mainly driven by growth of US$2.5 billion in residential mortgage balances in the US and Canada. In both countries, the low interest rate environment proved attractive to new homebuyers and encouraged existing homeowners to refinance their mortgages. In the US, net interest income further benefited from improved spreads on mortgages and an improved mix of loans and savings deposits.

Other operating income of US$825 million was 62 per cent higher than in 2002. Operations in Mexico contributed US$461 million to other operating income in the year. Transaction volumes on core banking related products, such as credit cards, deposit-related services and ATMs, grew significantly. HSBC Mexico led the market with a 34 per cent share in domestic interbank ATM transactions across Mexico, delivering fee revenue of US$92 million. In addition, a growing level of fee income was generated from bancassurance sales and international remittances.

On an underlying basis, other operating income fell by 23 per cent. This was primarily caused by a fall in mortgage banking-related income in the US. Total servicing-related income decreased by US$210 million compared with 2002. This decrease was driven by accelerated amortisation and large write-downs of mortgage servicing rights (‘MSRs’) as many customers refinanced mortgages in order to take advantage of the low interest rate environment. MSR income also declined as a result of significant losses on derivative instruments used to protect the economic value of MSRs.

In addition, the June/July time period was one of the more difficult periods related to derivative activity. Specifically, in June, positions were taken in derivative instruments to further reduce HSBC’s exposure to these losses as mortgage rates continued to fall. However, in July extreme interest rate volatility ensued and there was a significant rise in interest rates resulting in a substantial loss in the

value of the derivative instruments. These losses were only partly offset by subsequent falls in interest rates, and gains from the sale of certain mortgage-backed securities available-for-sale that were used as on-balance sheet economic hedges of the MSRs.

While the value of MSRs generally declines in a falling interest rate environment as mortgages are repaid, the effect of this decline is often mitigated by income from refinancing mortgage loans and subsequent sales to mortgage agencies. Total loan volumes sold in 2003 were US$20.1 billion compared with US$12.4 billion in 2002. Market conditions during 2003 permitted favourable pricing which allowed HSBC to earn higher gains on loans sold as well as a higher spread on refinanced loans. As a result, sales-related income for 2003 increased by US$82 million compared with 2002.

Overall, the US mortgage banking business contributed US$210 million to pre-tax profit in 2003, compared with US$251 million in 2002. In the US, HSBC generated increases in deposit-related service charges and in card fees, though sales of investment products fell reflecting a lack of confidence in the equity markets. Increased fees in Canada reflected higher insurance sales and increased commissions from retail broking activities as the equity markets rebounded in 2003.

Growth in operating expenses, excluding goodwill amortisation, of 65 per cent to US$1,965 million was substantially attributable to the addition of HSBC Mexico, which contributed US$758 million to the overall cost base in 2003. In Mexico, savings in operating expenses were achieved from merging HSBC Mexico with HSBC’s existing operations in the country. These savings funded investment to improve technology support for HSBC Mexico’s branch network.

On an underlying basis, operating expenses, excluding goodwill amortisation, increased by 7 per cent. Pension costs rose due to falls in the long-term rates of return on assets, and higher profitability drove increased staff incentive payments. Following the integration with HSBC Finance Corporation, long-term restructuring programmes, including the rationalisation of staff functions, were initiated, adding US$20 million of costs in the year.

Operations in Mexico contributed US$67 million to the overall net charge for bad and doubtful debts of US$142 million. On an underlying basis, credit provisions in Personal Financial Services were broadly in line with the prior year, a good performance in view of strong growth in personal lending. Overall credit quality improved, reflecting the improved economic environment.

101

Back to Contents

H S B C H O L D I N G S P L C

Financial Review (continued)

Consumer Finance contributedUS$2,068 million to pre-tax profit, before goodwill amortisation, in the nine months since HSBC Finance Corporation became a member of HSBC. The integration of HSBC Finance Corporation into HSBC delivered anticipated benefits in improved funding costs, and technology and administrative cost savings. Significant progress has been made in exporting HSBC Finance Corporation’s core skills, particularly in the areas of credit risk management, sales-focused organisation and customer-centred technology, to other parts of the Group. Further synergies are planned in card processing, IT contingency rationalisation, purchasing, call-centre operations and the shared use of HSBC’s Group Service Centres. HSBC Finance Corporation’s business model is being taken to selected markets overseas and established alongside existing HSBC operations to meet the growing global demand for consumer finance.

Net interest margin benefited by US$531 million from purchase accounting adjustments relating to the acquisition of HSBC Finance Corporation in the nine months in which HSBC Finance Corporation was part of the HSBC Group. This comprised of a US$946 million benefit in respect of debt funding, offset by the amortisation of purchase accounting adjustments relating to loans and advances to customers totalling US$415 million. Purchase accounting adjustments restated the book value of debt to fair value at that date and, therefore, reflected the improvement in spread already in the market as well as falling interest rates. They are being amortised in line with the residual maturity of the debt. Assuming credit spreads remain consistent, savings on future debt issues will replace the fair value adjustments relating to credit spreads. Since acquisition, HSBC Finance Corporation’s funding costs on new issues have, in fact , fallen as the credit spreads sought by the market decreased, reflecting the improvement in HSBC Finance Corporation’s credit rating on joining the HSBC Group. During 2003, net interest income benefited by US$124 million as a result of such savings.

All consumer portfolios grew during the year, except for personal unsecured loans, with the strongest growth in the real estate secured and private label portfolios. The secured real estate portfolio growth was driven by the correspondent business while the private label portfolio benefited from a number of new relationships added during the year. Growth in MasterCard and Visa loans benefited from portfolio acquisitions made during the year in advantageous circumstances and growth in the General Motors portfolio. The motor vehicle finance

business also benefited from new originations from strategic alliances during the year.

Included within operating expenses were one-off retention payments arising on the change of control amounting to US$52 million. Headcount increased to support business expansion, particularly in the consumer lending and mortgage services businesses.

The charge for bad and doubtful debts in 2003 reflected growth in receivables, increases in personal bankruptcy filings and the weak US economy. However, in the second half of the year credit quality stabilised and improvement was seen in a number of key indicators, including early stage delinquency, charge-offs, bankruptcy filings and collection activities. The improvement reflected resumed domestic economic growth which is forecast to continue into 2004.

Commercial Banking in North America reported pre-tax profit, before goodwill amortisation, of US$595 million, an increase of 32 per cent, compared with 2002. On an underlying basis, HSBC generated pre-tax profit, before goodwill amortisation, of US$498 million, 12 per cent higher than last year.

Net interest income on an underlying basis was marginally lower than 2002. In Canada, income growth was generated from increased balances on loans and deposits. There were increases in commercial real estate lending where growth in market share was concentrated primarily in New York. Service delivered to SMEs was enhanced as part of the strategy to focus on that market. Notably, the credit application process was re-engineered to make it easier for customers and the number of relationship managers doubled. As a result, lending to SMEs increased by 17 per cent. Net interest income further benefited from steady growth in deposit balances and lower funding costs. Offsetting this was the impact of business disposals as HSBC disposed of its equipment leasing portfolio in the first half of 2003 following a re-evaluation of its core businesses.

On an underlying basis, other operating income rose by 20 per cent, reflecting income on the sale of the factoring business and increases in fees related to commercial real estate lending, deposit taking and trade.

The inclusion of HSBC Finance Corporation’s commercial portfolio reduced other operating income by US$17 million. These losses were more than offset by tax credits, resulting in an overall benefit to post tax profits of US$40 million.

102

Back to Contents

HSBC Mexico contributed US$325 million to total operating income in the Commercial Banking segment in North America, reflecting a strong position in customer deposits. In addition, a growing level of fee income was generated from payments and cash management, loan and credit card fees.

Of the total increase in operating expenses, US$163 million was attributable to HSBC Mexico. Underlying operating expenses, excluding goodwill amortisation, increased by 9 per cent to US$614 million. This was driven by higher pension and incentive compensation expenses. In Canada, staff costs increased, primarily due to increased variable incentive payments.

Credit quality remained satisfactory. On an underlying basis, provisions for bad and doubtful debts fell by 40 per cent to US$88 million, reflecting the improved credit environment in North America in 2003. Low interest rates, declining credit spreads and positive economic sentiment all contributed to this improvement.

Corporate, Investment Banking and Marketsreported pre-tax profit, before amortisation of goodwill, of US$837 million, an increase of 70 per cent, compared with 2002. On an underlying basis, the Corporate, Investment Banking and Markets business generated pre-tax profit, before amortisation of goodwill, of US$772 million, 58 per cent higher than in 2002. In generally favourable trading conditions, Global Markets achieved higher customer sales from structured finance and hedging products as institutional and corporate borrowers took advantage of low interest rates to raise finance or fix the cost of existing facilities.

HSBC’s North American securities trading and debt capital markets business was substantially restructured and refocused towards the end of 2002 and this was reflected positively in its 2003 financial performance. Government and agency securities arbitrage activities were wound down. Corporate bond trading returned to profitability, contrasting with the heavy losses suffered in 2002 as a result of widening credit spreads, particularly in the telecommunications and auto sectors. The turnaround in performance added US$67 million to profit before tax. Investment in relationship management generated new business from major institutional and corporate clients. Global Markets also expanded its structured credit derivatives trading in response to the evolving requirements of its institutional customer base, allowing these clients to risk manage their portfolios more actively, thereby generating fees and trading revenues for HSBC.

Underlying net interest income ofUS$685 million, increased by 28 per cent, compared with 2002. This was partly attributable to the restructuring initiatives in the securities trading and debt capital markets business. As part of this restructuring, large arbitrage trading portfolios, which had historically contributed dealing profits but incurred significant funding costs, were eliminated. Net interest income further benefited from good balance sheet management and effective interest rate positioning in the US and Canada.

Underlying total other operating income, at US$738 million improved by 32 per cent. Strong foreign exchange and domestic dollar book trading activity contributed to increased revenues, driven by historically low interest rates and volatile currency markets. Derivatives trading revenues increased, reflecting the growth in demand for the structuring of tailored products for corporate and institutional customers.

HSBC Mexico generated other operating income of US$90 million, of which US$64 million was accounted for by dealing profits. Volatility in the Mexican markets enabled the Group to increase trading volumes and capitalise on favourable market movements. These positive market conditions led to increased profits from foreign exchange and fixed income.

Underlying operating expenses, before goodwill amortisation, of US$706 million, increased by 9 per cent. Investment in the core business added to the expenditure but was partly funded by lower costs in the securities trading and debt capital markets business, elements of which were wound down.

Credit experience on major corporate customers in the US was better in 2003. Many accounts which were potentially problematic at the end of 2002 were successfully refinanced and restructured in the strong debt market at the start of 2003. Elsewhere, credit quality remained satisfactory and consequently, on an underlying basis, there was a net release of US$7 million for bad and doubtful debts.

Profits on disposal of investments, on an underlying basis, were US$57 million, a decline of 53 per cent compared with 2002, which included a higher level of securities disposals arising from the restructuring of investment portfolios.

HSBC’sPrivate Banking operations in North America contributed US$63 million to pre-tax profits, before goodwill amortisation, an increase of 11 per cent compared with 2002.

During the year the North American business continued its evolution from a deposit-based

103

Back to Contents

H S B C H O L D I N G S P L C

Financial Review (continued)

business to broader wealth advisory service, with a resulting shift from net interest income to fees and commissions. Despite this, net interest income was 3 per cent higher than 2002, reflecting an improved funding environment in 2003.

An increase in net fees and commissions and other income of US$52 million, or 37 per cent, mainly reflected the benefit from increased investment activity by clients and a greater emphasis on fee-based non-discretionary advisory and structured products. In addition, WTAS (HSBC’s tax

advisory service for high net-worth clients), in its first full year of operation, contributed to this increase.

The inclusion of WTAS was the principal contributor to the US$48 million increase in operating expenses, before goodwill amortisation. Cost savings from the alignment of international and domestic client servicing units offset higher staff and restructuring costs. Excluding this operating expenses were essentially flat year-on-year.

104

Back to Contents

Profit/(loss) excluding goodwill amortisation by customer group

| | Year ended 31 December 2004 | |

| |

| |

| | | | | | Total | | | | Corporate, | | | | | | | | | |

| | Personal | | | | Personal | | | | Investment | | | | | | Inter- | | | |

| | Financial | | Consumer | | Financial | | Commercial | | Banking & | | Private | | | | segment | | | |

| | Services | | Finance | 4 | Services | | Banking | | Markets | | Banking | | Other | | elimination | | Total | |

| North America | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | |

| | | | | | | | | | | | | | | | | | | |

| Net interest | | | | | | | | | | | | | | | | | | |

| income/(expense) | 2,498 | | 10,541 | | 13,039 | | 1,146 | | 664 | | 166 | | (102 | ) | – | | 14,913 | |

| Dividend income | 4 | | 9 | | 13 | | – | | 19 | | – | | – | | – | | 32 | |

| Net fees and commissions | 829 | | 1,828 | | 2,657 | | 302 | | 492 | | 176 | | (92) | | – | | 3,535 | |

| Dealing profits | 54 | | – | | 54 | | 15 | | 364 | | 6 | | – | | – | | 439 | |

| Other income | 92 | | 765 | | 857 | | 159 | | 82 | | 4 | | 1,067 | | (1,011) | | 1,158 | |

| Other operating income | 979 | | 2,602 | | 3,581 | | 476 | | 957 | | 186 | | 975 | | (1,011 | ) | 5,164 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income | 3,477 | | 13,143 | | 16,620 | | 1,622 | | 1,621 | | 352 | | 873 | | (1,011 | ) | 20,077 | |

| | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | | | |

| excluding goodwill | | | | | | | | | | | | | | | | | | |

| amortisation1 | (2,270 | ) | (4,470 | ) | (6,740 | ) | (749 | ) | (1,014 | ) | (294 | ) | (1,101 | ) | 1,011 | | (8,887 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss) | | | | | | | | | | | | | | | | | | |

| before provisions1 | 1,207 | | 8,673 | | 9,880 | | 873 | | 607 | | 58 | | (228 | ) | – | | 11,190 | |

| | | | | | | | | | | | | | | | | | | |

| Provisions for bad and | | | | | | | | | | | | | | | | | | |

| doubtful debts | (99 | ) | (5,136 | ) | (5,235 | ) | (13 | ) | 60 | | 2 | | – | | – | | (5,186 | ) |

| Provisions for contingent | | | | | | | | | | | | | | | | | | |

| liabilities and | | | | | | | | | | | | | | | | | | |

| commitments | (13 | ) | – | | (13 | ) | (20 | ) | (8 | ) | – | | (1 | ) | – | | (42 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss)1 | 1,095 | | 3,537 | | 4,632 | | 840 | | 659 | | 60 | | (229 | ) | – | | 5,962 | |

| | | | | | | | | | | | | | | | | | | |

| Share of operating | | | | | | | | | | | | | | | | | | |

| profit/(loss) | | | | | | | | | | | | | | | | | | |

| in associates2 | – | | – | | – | | – | | (16 | ) | – | | 8 | | – | | (8 | ) |

| Gains on disposal of | | | | | | | | | | | | | | | | | | |

| investments and tangible | | | | | | | | | | | | | | | | | | |

| fixed assets | 69 | | 39 | | 108 | | 5 | | 107 | | 6 | | – | | – | | 226 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Profit/(loss) on ordinary | | | | | | | | | | | | | | | | | | |

| activities before tax3 | 1,164 | | 3,576 | | 4,740 | | 845 | | 750 | | 66 | | (221 | ) | – | | 6,180 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | % | | % | | % | | % | | % | | % | | % | | | | % | |

| Share of HSBC’s pre-tax | | | | | | | | | | | | | | | | | | |

| profits3 | 6.0 | | 18.4 | | 24.4 | | 4.3 | | 3.9 | | 0.3 | | (1.1 | ) | | | 31.8 | |

| Cost:income ratio1 | 65.3 | | 34.0 | | 40.6 | | 46.2 | | 62.6 | | 83.5 | | 126.1 | | | | 44.3 | |

| | | | | | | | | | | | | | | | | | | |

| | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | | | US$m | |

| Selected balance sheet | | | | | | | | | | | | | | | | | | |

| data5 | | | | | | | | | | | | | | | | | | |

| Loans and advances to | | | | | | | | | | | | | | | | | | |

| customers (net) | 65,850 | | 126,543 | | 192,393 | | 26,844 | | 26,142 | | 3,871 | | 1 | | | | 249,251 | |

| Total assets | 77,054 | | 150,633 | | 227,687 | | 31,426 | | 106,785 | | 4,548 | | 31 | | | | 370,477 | |

| Customer accounts | 50,659 | | 506 | | 51,165 | | 27,167 | | 46,745 | | 7,822 | | 1 | | | | 132,900 | |

| The following assets and | | | | | | | | | | | | | | | | | | |

| liabilities were also | | | | | | | | | | | | | | | | | | |

| significant to the customer | | | | | | | | | | | | | | | | | | |

| groups noted: | | | | | | | | | | | | | | | | | | |

| Loans and advances to | | | | | | | | | | | | | | | | | | |

| banks (net) | | | | | | | | | 23,814 | | | | | | | | | |

| Debt securities, treasury | | | | | | | | | | | | | | | | | | |

| bills and other eligible | | | | | | | | | | | | | | | | | | |

| bills | | | | | | | | | 45,688 | | | | | | | | | |

| Deposits by banks | | | | | | | | | 14,887 | | | | | | | | | |

| Debt securities in issue | | | 113,729 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Goodwill amortisation excluded: | | | | | | | | | | | | | | | | | | |

| 1 | from (1) above | 125 | | 475 | | 600 | | 79 | | 57 | | 25 | | – | | | | 761 | |

| 2 | from (2) above | – | | – | | – | | – | | – | | – | | – | | | | – | |

| 3 | from (3) above | 125 | | 475 | | 600 | | 79 | | 57 | | 25 | | – | | | | 761 | |

| 4 | Comprises HSBC Finance Corporation’s consumer finance business and the US residential mortgages and credit card portfolios acquired by HSBC Bank USA from HSBC Finance Corporation and its correspondents since December 2003. |

| 5 | Third party only. |

105

Back to Contents

H S B C H O L D I N G S P L C

Financial Review(continued)

Profit/(loss) excluding goodwill amortisation by customer group(continued)

| | Year ended 31 December 2003 | |

| |

| |

| | | | | | Total | | | | Corporate, | | | | | | | | | |

| | Personal | | | | Personal | | | | Investment | | | | | | Inter- | | | |

| | Financial | | Consumer | | Financial | | Commercial | | Banking & | | Private | | | | segment | | | |

| | Services | | Finance5 | | Services | | Banking | | Markets | | Banking | | Other | | elimination | | Total | |

| North America | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | |

| | | | | | | | | | | | | | | | | | | |

| Net interest | | | | | | | | | | | | | | | | | | |

| income/(expense) | 2,116 | | 7,851 | | 9,967 | | 1,046 | | 743 | | 121 | | (100 | ) | – | | 11,777 | |

| | | | | | | | | | | | | | | | | | | |

| Dividend income | – | | 12 | | 12 | | – | | 20 | | 1 | | 1 | | – | | 34 | |

| Net fees and commissions | 720 | | 1,170 | | 1,890 | | 292 | | 351 | | 155 | | (12) | | – | | 2,676 | |

| Dealing profits | 19 | | – | | 19 | | 18 | | 301 | | 2 | | – | | – | | 340 | |

| Other income | 86 | | 525 | | 611 | | 152 | | 156 | | 36 | | 33 | | (56) | | 932 | |

| Other operating income | 825 | | 1,707 | | 2,532 | | 462 | | 828 | | 194 | | 22 | | (56 | ) | 3,982 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income | 2,941 | | 9,558 | | 12,499 | | 1,508 | | 1,571 | | 315 | | (78 | ) | (56 | ) | 15,759 | |

| | | | | | | | | | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | | | |

| excluding goodwill | | | | | | | | | | | | | | | | | | |

| amortisation1 | (1,965 | ) | (3,098 | ) | (5,063 | ) | (786 | ) | (777 | ) | (254 | ) | (123 | ) | 56 | | (6,947 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss) | | | | | | | | | | | | | | | | | | |

| before provisions1 | 976 | | 6,460 | | 7,436 | | 722 | | 794 | | 61 | | (201 | ) | – | | 8,812 | |

| | | | | | | | | | | | | | | | | | | | |

| Provisions for bad and | | | | | | | | | | | | | | | | | | |

| doubtful debts | (142 | ) | (4,395 | ) | (4,537 | ) | (133 | ) | (6 | ) | 1 | | (1 | ) | – | | (4,676 | ) |

| Provisions for contingent | | | | | | | | | | | | | | | | | | |

| liabilities and | | | | | | | | | | | | | | | | | | |

| commitments | – | | – | | – | | 4 | | – | | – | | (1 | ) | – | | 3 | |

| Amounts written off fixed | | | | | | | | | | | | | | | | | | |

| asset investments | – | | – | | – | | – | | (9 | ) | – | | – | | – | | (9 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss)1 | 834 | | 2,065 | | 2,899 | | 593 | | 779 | | 62 | | (203 | ) | – | | 4,130 | |

| | | | | | | | | | | | | | | | | | | | |

| Share of operating profit | | | | | | | | | | | | | | | | | | |

| in joint ventures | 11 | | – | | 11 | | – | | – | | – | | – | | – | | 11 | |

| Share of operating profit | | | | | | | | | | | | | | | | | | |

| in associates2 | – | | – | | – | | – | | – | | – | | 7 | | – | | 7 | |

| Gains on disposal of | | | | | | | | | | | | | | | | | | |

| investments and | | | | | | | | | | | | | | | | | | |

| tangible fixed assets | 25 | | 3 | | 28 | | 2 | | 58 | | 1 | | 20 | | – | | 109 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Profit/(loss) on ordinary | | | | | | | | | | | | | | | | | | |

| activities before tax3 | 870 | | 2,068 | | 2,938 | | 595 | | 837 | | 63 | | (176 | ) | – | | 4,257 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | % | | % | | % | | % | | % | | % | | % | | | | % | |

| Share of HSBC’s pre-tax | | | | | | | | | | | | | | | | | | |

| profits3 | 6.0 | | 14.4 | | 20.4 | | 4.1 | | 5.8 | | 0.4 | | (1.1 | ) | | | 29.6 | |

| Cost:income ratio1 | 66.8 | | 32.4 | | 40.5 | | 52.1 | | 49.5 | | 80.6 | | (157.7 | ) | | | 44.1 | |

| | | | | | | | | | | | | | | | | | | | |

| | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | | | US$m | |

| Selected balance sheet data5 | | | | | | | | | | | | | | | | | | |

| Loans and advances to | | | | | | | | | | | | | | | | | | |

| customers (net) | 43,608 | | 107,957 | | 151,565 | | 23,553 | | 13,758 | | 2,574 | | – | | | | 191,450 | |

| Total assets | 53,082 | | 134,857 | | 187,939 | | 27,444 | | 70,223 | | 3,108 | | 1,086 | | | | 289,800 | |

| Customer accounts | 48,576 | | 1 | | 48,577 | | 20,032 | | 17,239 | | 8,148 | | – | | | | 93,996 | |

| The following assets and | | | | | | | | | | | | | | | | | | |

| liabilities were also | | | | | | | | | | | | | | | | | | |

| significant to the customer | | | | | | | | | | | | | | | | | | |

| groups noted: | | | | | | | | | | | | | | | | | | |

| Loans and advances to | | | | | | | | | | | | | | | | | | |

| banks (net) | | | | | | | | | 11,577 | | | | | | | | | |

| Debt securities, treasury | | | | | | | | | | | | | | | | | | |

| bills and other eligible | | | | | | | | | | | | | | | | | | |

| bills | | | | | | | | | 36,026 | | | | | | | | | |

| Deposits by banks | | | | | | | | | 9,958 | | | | | | | | | |

| Debt securities in issue | | | 107,673 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Goodwill amortisation | | | | | | | | | | | | | | | | | | |

| | excluded: | | | | | | | | | | | | | | | | | | |

| 1 | from (1) above | 117 | | 356 | | 473 | | 100 | | 45 | | 25 | | – | | | | 643 | |

| 2 | from (2) above | 1 | | – | | 1 | | – | | – | | – | | – | | | | 1 | |

| 3 | from (3) above | 118 | | 356 | | 474 | | 100 | | 45 | | 25 | | – | | | | 644 | |

| 4 | Comprises HSBC Finance Corporation’s consumer finance business and the US residential mortgages acquired by HSBC Bank USA from HSBC Finance Corporation and its correspondents in December 2003. |

| 5 | Third party only. |

106

Back to Contents

| | Year ended 31 December 2002 | |

| |

| |

| | | | | | Corporate, | | | | | | | | | |

| | Personal | | | | Investment | | | | | | Inter- | | | |

| | Financial | | Commercial | | Banking & | | Private | | | | segment | | | |

| | Services | | Banking | | Markets | | Banking | | Other | | elimination | | Total | |

| North America | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | | US$m | |

| Net interest income/(expense) | 1,352 | | 844 | | 539 | | 117 | | (120 | ) | – | | 2,732 | |

| | | | | | | | | | | | | | | |

| Dividend income | – | | – | | 24 | | – | | – | | – | | 24 | |

| Net fees and commissions | 437 | | 222 | | 268 | | 61 | | (4) | | – | | 984 | |

| Dealing profits/(losses) | (63) | | 18 | | 204 | | 9 | | (7) | | – | | 161 | |

| Other income | 126 | | 61 | | 61 | | 78 | | 29 | | (22) | | 333 | |

| Other operating income | 500 | | 301 | | 557 | | 148 | | 18 | | (22 | ) | 1,502 | |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income | 1,852 | | 1,145 | | 1,096 | | 265 | | (102 | ) | (22 | ) | 4,234 | |

| | | | | | | | | | | | | | | |

| Operating expenses excluding | | | | | | | | | | | | | | |

| goodwill amortisation1 | (1,172 | ) | (567 | ) | (649 | ) | (206 | ) | (103 | ) | 22 | | (2,675 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss) before | | | | | | | | | | | | | | |

| provisions1 | 680 | | 578 | | 447 | | 59 | | (205 | ) | – | | 1,559 | |

| | | | | | | | | | | | | | | |

| Provisions for bad and doubtful | | | | | | | | | | | | | | |

| debts | (76 | ) | (150 | ) | (66 | ) | (2 | ) | (6 | ) | – | | (300 | ) |

| Provisions for contingent liabilities | | | | | | | | | | | | | | |

| and commitments | – | | 2 | | 2 | | – | | (1 | ) | – | | 3 | |

| Amounts written off fixed asset | | | | | | | | | | | | | | |

| investments | – | | – | | (9 | ) | – | | – | | – | | (9 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating profit/(loss)1 | 604 | | 430 | | 374 | | 57 | | (212 | ) | – | | 1,253 | |

| | | | | | | | | | | | | | | |

| Share of operating loss in joint | | | | | | | | | | | | | | |

| ventures2 | (1 | ) | – | | – | | (1 | ) | – | | – | | (2 | ) |

| Share of operating profit in | | | | | | | | | | | | | | |

| associates2 | 2 | | – | | – | | – | | 6 | | – | | 8 | |

| Gains/(losses) on disposal of | | | | | | | | | | | | | | |

| investments and tangible fixed | | | | | | | | | | | | | | |

| assets | – | | 5 | | 120 | | 1 | | (1 | ) | – | | 125 | |

| |

| |

| |

| |

| |

| |

| |

| |

| Profit/(loss) on ordinary activities | | | | | | | | | | | | | | |

| before tax3 | 605 | | 435 | | 494 | | 57 | | (207 | ) | – | | 1,384 | |

| |

| |

| |

| |

| |

| |

| |

| |

| | % | | % | | % | | % | | % | | | | % | |

| Share of HSBC’s pre-tax profits3 | 5.8 | | 4.1 | | 4.7 | | 0.5 | | (1.9 | ) | | | 13.2 | |

| Cost:income ratio1 | 63.3 | | 49.5 | | 59.2 | | 77.7 | | (101.0 | ) | | | 63.2 | |

| | | | | | | | | | | | | | | |

| | US$m | | US$m | | US$m | | US$m | | US$m | | | | US$m | |

| Selected balance sheet data4 | | | | | | | | | | | | | | |

| Loans and advances to | | | | | | | | | | | | | | |

| customers (net) | 37,922 | | 25,361 | | 12,604 | | 1,701 | | 1 | | | | 77,589 | |

| Total assets | 46,777 | | 29,166 | | 63,161 | | 2,707 | | 221 | | | | 142,032 | |

| Customer accounts | 46,002 | | 17,717 | | 19,396 | | 6,969 | | 53 | | | | 90,137 | |

| The following assets and liabilities | | | | | | | | | | | | | | |

| were also significant to Corporate, | | | | | | | | | | | | | | |

| Investment Banking and Markets: | | | | | | | | | | | | | | |

| Loans and advances to banks (net) . | | | | | 9,948 | | | | | | | | | |

| Debt securities, treasury bills and | | | | | | | | | | | | | | |

| other eligible bills | | | | | 34,926 | | | | | | | | | |

| Deposits by banks | | | | | 9,545 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Goodwill amortisation excluded: | | | | | | | | | | | | | | |

| 1 | from (1) above | 55 | | 32 | | 34 | | 25 | | – | | | | 146 | |

| 2 | from (2) above | – | | – | | – | | – | | – | | | | – | |

| 3 | from (3) above | 55 | | 32 | | 34 | | 25 | | – | | | | 146 | |

| 4 | Third party only. | | | | | | | | | | | | | | |

107

Back to Contents

H S B C H O L D I N G S P L C

Financial Review (continued)

| South America | | | | | | |

| | | | | | | |

| Profit/(loss) before tax excluding goodwill amortisation | | | | | | |

| | Year ended 31 December | |

| |

| |

| | 2004 | | 2003 | | 2002 | |

| | US$m | | US$m | | US$m | |

| | | | | | | |

| Personal Financial Services | 47 | | (27 | ) | (33 | ) |

| Brazil | 51 | | (31) | | 11 | |

| Argentina | (4) | | 3 | | (45) | |

| Other | – | | 1 | | 1 | |

| | | | | | | |

| Commercial Banking | 165 | | 99 | | 79 | |

| Brazil | 113 | | 65 | | 54 | |

| Argentina | 51 | | 34 | | 27 | |

| Other | 1 | | – | | (2 | ) |

| | | | | | | |

| Corporate, Investment Banking and Markets | 150 | | (24 | ) | 32 | |

| Brazil | 134 | | 49 | | 125 | |

| Argentina | 8 | | (72 | ) | (101 | ) |

| Other | 8 | | (1 | ) | 8 | |

| | | | | | | |

| Private Banking | 1 | | (2 | ) | (12 | ) |

| Brazil | 1 | | (1 | ) | (1 | ) |

| Other | – | | (1 | ) | (11 | ) |

| | | | | | | |

| Other | 81 | | 80 | | (100 | ) |

| Brazil | (18 | ) | 1 | | (62 | ) |

| Argentina | 101 | | 83 | | (91 | ) |

| Other | (2 | ) | (4 | ) | 53 | |

| |

| |

| |

| |

| | | | | | | |

| Total1 | 444 | | 126 | | (34 | ) |

| Brazil | 281 | | 83 | | 127 | |

| Argentina | 156 | | 48 | | (210 | ) |

| Other | 7 | | (5 | ) | 49 | |

| | | | | | | |

| 1Goodwill amortisation arising on subsidiaries excluded | 29 | | 11 | | 24 | |

108

Profit/(loss) before tax

| | Year ended 31 December | |

| |

| |

| | | | | | | |

| | 2004 | | 2003 | | 2002 | |

| South America | US$m | | US$m | | US$m | |

| | | | | | | |

| Net interest income | 1,355 | | 640 | | 645 | |

| | | | | | | |

| Dividend income | 2 | | 3 | | 15 | |

| Net fees and commissions | 480 | | 338 | | 324 | |

| Dealing profits | 50 | | 136 | | 147 | |

| Other income | 207 | | 201 | | 110 | |

| | | | | | | |

| Other operating income | 739 | | 678 | | 596 | |

| |

| |

| |

| |

| Total operating income | 2,094 | | 1,318 | | 1,241 | |

| |

| |

| |

| |

| | | | | | | |

| Staff costs | (660 | ) | (584 | ) | (572 | ) |

| Premises and equipment | (174 | ) | (124 | ) | (113 | ) |

| Other | (549 | ) | (327 | ) | (330 | ) |

| Depreciation and intangible asset amortisation | (61 | ) | (40 | ) | (45 | ) |

| |

| |

| |

| |

| | (1,444 | ) | (1,075 | ) | (1,060 | ) |

| | | | | | | |

| Goodwill amortisation | (29 | ) | (11 | ) | (24 | ) |

| |

| |

| |

| |

| Operating expenses | (1,473 | ) | (1,086 | ) | (1,084 | ) |

| |

| |

| |

| |

| | | | | | | |

| Operating profit before provisions | 621 | | 232 | | 157 | |

| | | | | | | |

| Provisions for bad and doubtful debts | (269 | ) | (58 | ) | (117 | ) |

| Provisions for contingent liabilities and commitments | 30 | | 2 | | (31 | ) |

| Loss from foreign currency redenomination in Argentina | – | | (9 | ) | (68 | ) |

| Amounts written off fixed asset investments | (6 | ) | (62 | ) | (36 | ) |

| |

| |

| |

| |

| Operating profit/(loss) | 376 | | 105 | | (95 | ) |

| | | | | | | |

| Share of operating profit in associated undertakings | 1 | | 1 | | – | |

| Gains on disposal of investments and tangible fixed assets | 38 | | 9 | | 37 | |

| |

| |

| |

| |

| Profit/(loss) on ordinary activities before tax | 415 | | 115 | | (58 | ) |

| |

| |

| |

| |

| | | | | | | |

| | % | | % | | % | |

| Share of HSBC’s pre-tax profits (excluding goodwill amortisation) | 2.3 | | 0.9 | | (0.3 | ) |

| Share of HSBC’s pre-tax profits | 2.4 | | 0.9 | | (0.6 | ) |

| Cost:income ratio (excluding goodwill amortisation) | 69.0 | | 81.6 | | 85.4 | |

| | | | | | | |

| Period-end staff numbers (full-time equivalent) | 32,108 | | 28,292 | | 25,522 | |

| | | | | | | |

| | | | | | | |

| | US$m | | US$m | | US$m | |

| Selected balance sheet data1 | | | | | | |

| Loans and advances to customers (net) | 6,933 | | 4,982 | | 3,028 | |

| Loans and advances to banks (net) | 2,597 | | 1,922 | | 1,665 | |

| Debt securities, treasury bills and other eligible bills | 3,742 | | 2,151 | | 1,450 | |

| Total assets | 17,397 | | 12,549 | | 8,491 | |

| Deposits by banks | 680 | | 828 | | 661 | |

| Customer accounts | 10,957 | | 6,945 | | 4,863 | |

| | | | | | | |

| 1 Third party only. | | | | | | |

Year ended 31 December 2004 compared with year ended 31 December 2003

Reaping the rewards of measures taken in 2003 and helped by a buoyant external environment,Brazilenjoyed an outstanding economic performance in 2004. Annualised GDP growth topped 4 per cent in each of the first three quarters of 2004 and, for the year as a whole, HSBC expects growth to exceed 5

per cent, driven by external demand. The 2004 trade surplus reached US$34 billion and the current account surplus US$12 billion. Employment and real wages both expanded in 2004. Faster than anticipated growth and some unexpected consequences of tax changes pushed fiscal revenues to record highs allowing the public sector to produce a consolidated primary surplus in excess of 4 per

109

Back to Contents

H S B C H O L D I N G S P L C

Financial Review (continued)

cent of GDP in 2004. This, together with the growth in the economy and an appreciating currency, reduced the ratio of debt to GDP, ushering in a virtuous circle of declining risk spreads, growing confidence and a return of investment. This was despite the rekindling of inflationary pressures from rising commodity prices early in 2004, adjustments in administered prices and a very rapidly narrowing output gap. Core inflation remained in excess of 7 per cent throughout the year, and the Central Bank raised interest rates and tightened monetary policy in an attempt to avert higher inflation in 2005. The combined effect of the global slowdown and local policy restrictions is slowing the Brazilian economy. Nevertheless, the short-term outlook remains encouragingly positive.

InArgentina, the recovery from the crisis of 2001 continued in 2004, helped by the favourable external environment and the absence of effective pressure to improve the exchange offer on defaulted debt. Year-on-year GDP growth was 8.8 per cent. Employment in the formal economy in October was up by 6.8 per cent on the year before, continuing the trend of the past two years. By the end of 2004, the stock market index had surpassed the levels last achieved in August 2001, and stood almost 12 per cent above the minimum reached in September 2002, when the economy began its current expansionary phase. Inflation appeared to be under control and the government, buoyed by revenues from exports, was able to post large fiscal surpluses, with a primary surplus in excess of 5 per cent of GDP. By contrast, the progress on debt restructuring was slow. Though the rate of investment returned to the pre-crisis level of 20 per cent of GDP – arguably, too low to sustain growth in excess of 3 to 4 per cent per annum – it is likely that the re-investment cycle will falter without a workable solution to the debt crisis. To that extent, the outlook for Argentina remains uncertain.

HSBC’s operations in South America reported a pre-tax profit of US$415 million, substantially ahead of the US$115 million achieved in 2003. Excluding goodwill amortisation, pre-tax profit was US$444 million compared with US$126 million in 2003, and represented 2 per cent of HSBC’s total pre-tax profit on this basis. The 2004 results include the first full year’s contribution from the Brazilian consumer finance company, Losango, acquired in December 2003, along with contributions from CreditMatone S.A., acquired in November 2004, and Valeu Promotora de Vendas, the consumer finance operations of Indusval Multistock Group, acquired in August 2004. Together, these three businesses contributed US$72 million to pre tax profits before goodwill amortisation, representing 23 per cent of

the growth. There were no significant exchange rate impacts in 2004.

The commentary that follows is based on constant exchange rates.

Personal Financial Services’ pre-tax profit, before goodwill amortisation, of US$47 million predominantly reflected the Losango consumer finance business acquired in December 2003, which contributed US$72 million. It was pleasing to note that, in its first full year in HSBC, Losango’s full-year profitability doubled compared with 2003. Excluding Losango at constant exchange rates, the pre-tax loss before goodwill amortisation improved by 50 per cent on the previous year.

The integration of Losango progressed extremely well. There was strong growth across the product portfolios during the period, notably in store loans and personal lending products. Good progress was made in delivering anticipated operational synergies. Plans to embed Losango branches within the HSBC Brazil network are well advanced. In the second half of the year, Losango benefited from the acquisition of the two consumer finance portfolios noted above.

Excluding the impact of the acquired businesses, net interest income grew by 15 per cent, reflecting good asset growth in Brazil, partly offset by reduced spreads on credit cards in Argentina.

Auto finance loans in Brazil grew by 69 per cent, reflecting the success of a number of initiatives taken to enhance the distribution channels in the branch network, and effective marketing promotions and incentive campaigns. Market share increased from 3.1 per cent to 4.1 per cent. The income benefit arising from the increase in balances was only partly offset by narrower spreads.

Competitive pricing was used to grow the cards business to take advantage of strong growth in consumer spending: this generated an 11 per cent increase in balances. Growth in demand deposits was augmented by a widening of spreads. However, the benefit was partly offset by narrower spreads on savings accounts, where rates are set by the Brazilian Government, and on time deposits.

Other operating income rose by 32 per cent, of which 17 per cent came from Losango and its consumer lending acquisitions. The remaining 15 per cent arose principally from growth in fee income in Brazil driven by increased lending activity and higher revenues from the life insurance business in Argentina.

110

Back to Contents

Excluding Losango, credit-related fee income grew by 44 per cent in Brazil, as a result of growth in customer lending and the introduction of a new pricing structure. Greater use of a new automated collection service and revised fee charging led to a 19 per cent increase in account service fees. Strong growth in the cards business, where cards in circulation rose by 30 per cent, generated a significant increase in fee income of 27 per cent. Higher consumer lending also contributed to an overall increase in brokerage fees from insurance operations.

Operating expenses, excluding goodwill amortisation, increased by 38 per cent, of which 25 per cent was attributable to Losango and its acquisitions. Marketing expenditure increased by 58 per cent as HSBC sought to build and reinforce brand awareness in Brazil. Transactional taxes increased by 26 per cent in line with operating income growth. Prices also increased on the renewal of a number of service contracts. Costs in Argentina were 21 per cent higher, largely from increased staff costs, notably pensions and labour claims, together with higher marketing expenditure and regulatory fees.

The provision for bad and doubtful debts increased by 88 per cent or US$126 million, of which US$107 million or 75 per cent arose in Losango. The remaining increase was driven by the growth in unsecured lending in Brazil. Credit quality in both Brazil and Argentina was relatively stable throughout 2004 as unemployment and inflation rates declined and domestic economic growth strengthened.

Commercial Banking reported pre-tax profits, before goodwill amortisation, of US$165 million, an increase of 62 per cent over 2003, due largely to higher net interest income in Brazil.

Net interest income of US$234 million was US$59 million or 34 per cent higher than in 2003. In Brazil, overdraft balances increased by 44 per cent as a result of strong growth in the demand for credit and the introduction of a new pricing structure for SME customers. This led to a 22 per cent increase in income despite a marginal fall in spreads and this, together with strong growth inGiro fácil, a combined loan and overdraft product, contributed US$26 million of additional income. Total commercial lending balances increased by 58 per cent to US$1.4 billion and, following product development expenditure in 2003, lending backed by discounted receivables increased by 81 per cent. Spreads on deposit balances benefited from a reduction in the compulsory deposit rate and lower

rural loans, while deposit balances increased by 29 per cent, contributing further to the increase in net interest income. In Argentina, net interest income declined as the low interest rate environment led to reduced spreads on deposits.

Other operating income increased by 14 per cent to US$136 million. In Brazil, the growth in lending balances resulted in higher arrangement fee income, while current account fees rose by 15 per cent following the introduction of the new SME pricing structure. Income in Argentina was in line with 2003.

Operating expenses of US$203 million were 12 per cent higher than in 2003. In Brazil, growth in staff numbers in support of business expansion and increased transactional tax costs contributed to a 17 per cent rise in costs. Marketing expenses also increased reflecting the SME initiatives taken during the year. In Argentina, cost control initiatives resulted in a 7 per cent reduction in operating expenses.

Provisions for bad and doubtful debts were 82 per cent lower than in 2003. Recoveries and releases in Argentina reflected the improved economic conditions. These were partly offset by higher specific provisions raised in Brazil, in line with growth in the small business portfolio.

Corporate, Investment Banking and Marketsreported pre-tax profit, before amortisation of goodwill, of US$150 million, compared with a small loss in 2003.