| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | October 31, 2006 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .19.3 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-9477 |

|

ING Variable Insurance Trust |

(Exact name of registrant as specified in charter) |

|

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

|

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-992-0180 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2006 to June 30, 2006 | |

| | | | | | | | | |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Funds

Semi-Annual Report

June 30, 2006

ING VP Global Equity Dividend Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolio uses to determine how to vote proxies related to portfolio securities is available (1) without charge, upon request, by calling Shareholder Services toll-free at 1-800-992-0180; (2) on the ING Fund’s website at www.ingfunds.com; and (3) on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information regarding how the Portfolio voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Fund’s website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Registrant files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Registrant’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Registrant’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330; and is available upon request from the Registrant by calling Shareholder Services toll-free at 1-800-992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

JAMES M. HENNESSY

Dear Shareholder,

As you may recall, in my last letter I described the enthusiasm that we were experiencing here at ING Funds as we worked to bring more of the world’s investment opportunities to you, the investor.

I am happy to report that enthusiasm is continuing to thrive. Since the beginning of the year, we have launched a series of new international mutual funds, each created to bring more of the world’s opportunities to you.

Meanwhile, we have also heard you loud and clear. Our research tells us that many investors report that they find investing an intimidating and overly-complex endeavor. That is why ING is committed to helping investors across the country cut through the confusion and clutter. “Your future. Made easier.SM” is more than words; they represent our promise to you.

Those two objectives — bringing you more of the world’s opportunities and doing it in a way that is easier for you — are behind the development of the new portfolios.

According to a recent finding, 58 percent of the world market capitalization now lies outside of the United States1. In other words, the majority of investments are now beyond our borders and we think that the ING VP Index Plus International Portfolio — a broad-based international portfolio — is an easy, single-step method to gain exposure to international investment opportunities.

Meanwhile, the ING VP Global Real Estate Portfolio was developed as an easy way to bring global — international and domestic — real estate opportunities to the variable portfolio investor. Real Estate Investment Trusts (REITs) are becoming more and more popular around the world, and this new portfolio seeks to capitalize on that popularity. But again, we’ve made it easy. With just one investment, investors bring the diversification of global real estate to their investment strategy.

One of our goals at ING Funds is to find tomorrow’s opportunities today, and we believe these two portfolios are just the latest examples of that plan in action.

On behalf of everyone at ING Funds, I thank you for your continued support and loyalty. We look forward to serving you in the future.

Sincerely,

James M. Hennessy

President

ING Funds

August 11, 2006

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic. Investments in issuers that are principally engaged in real estate, including REITs, may subject the Fund to risks similar to those associated with the direct ownership of real estate, including terrorist attacks, war or other acts that destroy real property (in addition to market risks). These companies are sensitive to factors such as changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and creditworthiness of the issuer. REITs may also be affected by tax and regulatory requirements.

1 MSCI December, 2005

1

MARKET PERSPECTIVE: SIX MONTHS ENDED JUNE 30, 2006 |

|

Global equities markets as a whole started 2006 with their best first quarter since 1998. Much of the buying interest swelled from the busiest quarter for merger and acquisition activity since 2000. However, by mid way through the second quarter, reality set in as investors were gripped by fears that zealous, inflation fighting central bankers would raise interest rates by more than enough to choke off the global growth enjoyed in recent years. For the first six months of 2006, the Morgan Stanley Capital International (“MSCI”) World® Index(1) in dollars, including net reinvested dividends, gained 6.1%, but more than half of this was due to U.S. dollar weakness. An initially slow retreat gathered pace, spurred by communication from the G7 Finance Ministers and Central Bank of Governors that seemed to sanction a lower dollar. The currency slid 7.4%, 6.8% and 2.8%, respectively, against the euro, pound and yen for the six months ended June 30, 2006.

Alan Greenspan may have retired in January 2006, after 18 years as Chairman of the Federal Reserve Board (“Fed”), but the issue didn’t change for most investors, not just those in U.S. fixed income securities: when would the Federal Open Market Committee (“FOMC”) stop raising interest rates? By April 2006, Greenspan’s successor, Ben Bernanke seemed to be hinting that after a sixteenth increase on May 10, The FOMC might pause. Stock markets took heart, but with commodities prices making new records, the combination of inflationary pressures and a Fed apparently about to go on hold led commentators to wonder if Mr. Bernanke was just a little bit soft on inflation. In fact, he had never meant to signal a pause. The respected academic who espoused plain-speaking openness to make policy clear had instead succeeded in achieving the opposite. He needed to re-establish his inflation fighting credentials by going on the offensive.

Over the next few weeks, every one of his FOMC colleagues would stress publicly that inflation was the prime concern. By June 13, the yield curve inverted for the second time this year, investors fearing that the FOMC had tough-talked themselves into protracted rate increases, even as the economy was obviously cooling. This was evidenced by a shockingly weak employment report on June 2 and a slumping housing market that had been the source of much of the consumer spending in the last few years. So the seventeenth interest rate increase to 5.25% on June 29 surprised no one, but at least it was couched in balanced language that raised hopes the FOMC might at last be done. Then again, the quarter ended with every yield on the Treasury curve lower than the federal funds rate: the market’s vote that the FOMC had already gone too far. For the half-year, the 10-year U.S. Treasury yield rose by 74 basis points to 5.14%, the three-month U.S. Treasury rate by 88 basis points to 4.86%, while the Lehman Brothers Aggregate Bond Index(2) of investment grade bonds lost 72 basis points for the six months ended June 30, 2006.

U.S. equities in the form of the Standard & Poor’s 500® Composite Stock Price (“S&P 500®”) Index(3), rose 2.7% including dividends, in the first half of 2006 and traded at a price-to-earnings (“P/E”) ratio of 14.8 for the current fiscal year. Stocks had actually become cheaper in the last 12 months as prices had only reflected about half of the increase in corporate profits in that time. Indeed, first quarter profits registered double-digit year-over-year growth for the eleventh straight quarter. Nevertheless, investors seemed only to have eyes for interest rates. After the best first quarter for the market since 1999, investors were encouraged through early May 2006 as the events described above suggested an imminent end to the tightening cycle. The S&P 500® Index even reached a five-year high at its best level on May 5, 2006. In spite of this, these hopes were soon dashed by the hawkish rhetoric from the FOMC and from there stocks fell nearly 4% to the end of the quarter. Only the less uncompromising language in the FOMC’s June 29, 2006 statement prevented the loss from being 2% worse.

In international markets, the pattern of results resembled that of the U.S.: strong through early May 2006, a sharp drop to mid-June 2006, partially reversed in the last two weeks. Because of significant currency movements, returns are based on MSCI indices in local currencies including net dividends. Japan continued where it left off in 2005 and by May 8, 2006 the market was up 8.9% on bullish news about rising wages, an end to deflation and an evidently sustainable gross domestic product (“GDP”) growth path. Unfortunately, over the next month stocks plunged 15.3% as U.S. interest rate fears combined with signals from the Bank of Japan that local interest rates were about to rise for the first time in six years. The market closed the six months ended June 30, 2006 down 1.3% based on the MSCI Japan® Index(4) after a late rebound. European ex UK markets were initially supported by widespread merger and acquisition activity amid clear signs of improving growth, business confidence and falling

2

MARKET PERSPECTIVE: SIX MONTHS ENDED JUNE 30, 2006 |

|

unemployment, and despite a 25 basis point rate increase in March. At their May 9, 2006 high, stocks had returned 12.2% for the year. But events in the U.S. and another 25 basis points increase in euro interest rates, as inflation remained stubbornly above the 2% target, sent stocks into negative territory by mid-June, before recovering to a 4.8% gain for the half year based on MSCI Europe ex UK® Index(5). By May 9, 2006, UK equities were up 9.8% boosted by acquisition-prone financials and the large energy and materials sectors, as commodity prices surged. The reversal in these prices and interest rate concerns dragged the market down 9.3% by mid-June. Rebounding energy prices and improved economic data allowed more than half of this loss to be retraced and stocks closed the six months ended June 30, 2006 ahead by 5.5% based on the MSCI UK® Index(6).

(1) The MSCI World® Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Standard & Poor’s 500® Composite Stock Price Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(4) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(5) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(6) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Funds’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of the ING Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

SHAREHOLDER EXPENSE EXAMPLE (UNAUDITED) |

|

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b–1) fees; and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2006 to June 30, 2006.

Actual Expenses

The first section of the table shown, “Actual Fund Return”, provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical 5% Return”, provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

ING VP Global Equity Dividend Portfolio | | Beginning

Account

Value

January 1, 2006 | | Ending

Account

Value

June 30, 2006 | | Expenses Paid

During the

Six Months Ended

June 30, 2006* | |

Actual Fund Return | | $1,000.00 | | $1,090.60 | | $5.96 | |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.09 | | $5.76 | |

* Expenses are equal to the Portfolio’s annualized expense ratios of 1.15%; multiplied by the average account value over the period, multiplied by 181/365 to reflect the most recent fiscal half year.

4

STATEMENT OF ASSETS AND LIABILITIES AS OF JUNE 30, 2006 (UNAUDITED) |

|

ASSETS: | | | |

Investments in securities at value+* | | $ | 59,721,078 | |

Short-term investments at amortized cost | | 5,188,158 | |

Cash | | 67,277 | |

Foreign currencies at value** | | 17,698 | |

Dividends and interest receivable | | 219,903 | |

Prepaid expenses | | 557 | |

Total assets | | 65,214,671 | |

LIABILITIES: | | | |

Payable for fund shares redeemed | | 211,434 | |

Payable upon receipt of securities loaned | | 5,188,158 | |

Payable to affiliates | | 51,043 | |

Payable for trustee fees | | 9,879 | |

Other accrued expenses and liabilities | | 45,893 | |

Total liabilities | | 5,506,407 | |

NET ASSETS (equivalent to $8.28 per share on 7,208,565 shares outstanding) | | $ | 59,708,264 | |

| | | |

NET ASSETS WERE COMPRISED OF: | | | |

Paid-in capital — shares of beneficial interest at $0.001 par value (unlimited shares authorized) | | $ | 52,048,796 | |

Undistributed net investment income | | 914,960 | |

Accumulated net realized gain on investments and foreign currency related transactions | | 2,316,725 | |

Net unrealized appreciation on investments and foreign currency related transactions | | 4,427,783 | |

NET ASSETS | | $ | 59,708,264 | |

+ | | Including securities loaned at value | | $ | 5,035,399 | |

* | | Cost of investments in securities | | $ | 55,295,283 | |

** | | Cost of foreign currencies | | $ | 17,568 | |

See Accompanying Notes to Financial Statements

5

STATEMENT OF OPERATIONS FOR THE SIX MONTHS ENDED JUNE 30, 2006 (UNAUDITED) |

|

INVESTMENT INCOME: | | | |

Dividends, net of foreign taxes withheld* | | $ | 1,670,844 | |

Interest | | 33,478 | |

Total investment income | | 1,704,322 | |

| | | |

EXPENSES: | | | |

Investment management fees | | 310,795 | |

Transfer agent fees | | 91 | |

Shareholder reporting expense | | 13,554 | |

Registration fees | | 733 | |

Professional fees | | 11,902 | |

Custody and accounting expense | | 18,515 | |

Trustee fees | | 2,426 | |

Insurance expense | | 686 | |

Interest expense | | 1,033 | |

Miscellaneous expense | | 2,634 | |

Total expenses | | 362,369 | |

Net waived and reimbursed fees | | (4,766 | ) |

Net expenses | | 357,603 | |

Net investment income | | 1,346,719 | |

| | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY RELATED TRANSACTIONS: | | | |

Net realized gain (loss) on: | | | |

Investments | | 2,502,177 | |

Foreign currency related transactions | | (12,532 | ) |

Net realized gain on investments and foreign currency related transactions | | 2,489,645 | |

Net change in unrealized appreciation or depreciation on: | | | |

Investments | | 1,644,801 | |

Foreign currency related transactions | | 3,857 | |

Net change in unrealized appreciation or depreciation on investments and foreign currency related transactions | | 1,648,658 | |

Net realized and unrealized gain on investments and foreign currency related transactions | | 4,138,303 | |

Increase in net assets resulting from operations | | $ | 5,485,022 | |

| | | |

|

* Foreign taxes withheld | | $ | 149,368 | |

See Accompanying Notes to Financial Statements

6

STATEMENTS OF CHANGES IN NET ASSETS (UNAUDITED) |

|

| | Six Months

Ended June 30,

2006 | | Year Ended

December 31,

2005 | |

FROM OPERATIONS: | | | | | |

Net investment income | | $ | 1,346,719 | | $ | 1,661,048 | |

Net realized gain on investments and foreign currency related transactions | | 2,489,645 | | 4,152,745 | |

Net change in unrealized appreciation or depreciation on investments and foreign currency related transactions | | 1,648,658 | | (3,304,540 | ) |

Net increase in net assets resulting from operations | | 5,485,022 | | 2,509,253 | |

| | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | |

Net investment income | | (477,264 | ) | (1,790,754 | ) |

Total distributions | | (477,264 | ) | (1,790,754 | ) |

| | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | |

Net proceeds from sale of shares | | 928,596 | | 11,392,929 | |

Dividends reinvested | | 477,264 | | 1,790,754 | |

| | 1,405,860 | | 13,183,683 | |

Cost of shares redeemed | | (7,681,248 | ) | (9,867,641 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | (6,275,388 | ) | 3,316,042 | |

Net increase (decrease) in net assets | | (1,267,630 | ) | 4,034,541 | |

| | | | | |

NET ASSETS: | | | | | |

Beginning of period | | 60,975,894 | | 56,941,353 | |

End of period | | $ | 59,708,264 | | $ | 60,975,894 | |

Undistributed net investment income at end of period | | $ | 914,960 | | $ | 45,505 | |

See Accompanying Notes to Financial Statements

7

ING VP GLOBAL EQUITY DIVIDEND PORTFOLIO(UNAUDITED) | FINANCIAL HIGHLIGHTS |

|

Selected data for a share of beneficial interest outstanding throughout each period.

| | Six Months

Ended

June 30, | | Year Ended December 31, | |

| | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

Per Share Operating Performance: | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 7.65 | | 7.56 | | 6.96 | | 5.39 | | 7.18 | | 8.81 | |

Income (loss) from investment operations: | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 0.16 | | 0.21 | | 0.04 | | 0.01 | | 0.00 | * | (0.01 | ) |

Net realized and unrealized gain (loss) on investments and foreign currencies | | $ | 0.53 | | 0.11 | | 0.61 | | 1.56 | | (1.79 | ) | (1.62 | ) |

Total from investment operations | | $ | 0.69 | | 0.32 | | 0.65 | | 1.57 | | (1.79 | ) | (1.63 | ) |

Less distributions from: | | | | | | | | | | | | | |

Net investment income | | $ | 0.06 | | 0.23 | | 0.05 | | — | | 0.00 | * | — | |

Total distributions | | $ | 0.06 | | 0.23 | | 0.05 | | — | | 0.00 | * | — | |

Net asset value, end of the period | | $ | 8.28 | | 7.65 | | 7.56 | | 6.96 | | 5.39 | | 7.18 | |

Total Return(1) | | % | 9.06 | | 4.39 | | 9.44 | | 29.13 | | (24.92 | ) | (18.50 | ) |

Ratios and Supplemental Data: | | | | | | | | | | | | | |

Net assets, end of the period (000s) | | $ | 59,708 | | 60,976 | | 56,941 | | 50,752 | | 27,745 | | 23,983 | |

Ratios to average net assets: | | | | | | | | | | | | | |

Net expenses after expense reimbursement/recoupment and brokerage commission recapture(2)(3) | | % | 1.15 | | 1.16 | | 1.23 | | 1.23 | | 1.23 | | 1.23 | |

Net expenses after expense reimbursement/recoupment prior to brokerage commission recapture(2)(3) | | % | 1.15 | | 1.16 | | 1.23 | | 1.23 | | 1.23 | | 1.23 | |

Gross expenses prior to expense reimbursement/recoupment and brokerage commission recapture(3) | | % | 1.17 | | 1.24 | | 1.20 | | 1.75 | | 2.07 | | 2.97 | |

Net investment income (loss) after expense reimbursement/recoupment and brokerage commission

recapture(2)(3) | | % | 4.33 | | 2.91 | | 0.62 | | 0.23 | | (0.01 | ) | (0.15 | ) |

Portfolio turnover rate | | % | 15 | | 183 | | 122 | | 111 | | 279 | | 252 | |

(1) Total return is calculated assuming reinvestment of all dividends and capital gain distributions at net asset value and does not reflect the effect of insurance contract charges.

(2) The Investment Manager has agreed to limit expenses, (excluding interest, taxes, brokerage and extraordinary expenses) subject to possible recoupment by ING Investment, LLC within three years of being incurred.

(3) Annualized for periods less than one year.

* Per share amount is less than $0.005.

See Accompanying Notes to Financial Statements.

8

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) |

|

NOTE 1 — ORGANIZATION

Organization. The ING Variable Insurance Trust (the “Trust”) was organized as a Delaware statutory trust on July 15, 1999 and is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as amended, as an open-end management investment company. There are fifteen separate investment series which comprise the Trust. This report is for the ING VP Global Equity Dividend Portfolio (the “Portfolio”), a diversified series of the Trust. The investment objective of the Portfolio is to seek growth of capital with dividend income as a secondary consideration.

Shares of the Portfolio may be offered to segregated asset accounts of insurance companies as investment options under variable annuity contracts and variable life insurance policies. Shares may also be offered to qualified pension and retirement plans and to certain investment advisers and their affiliates.

Participating insurance companies and other designated organizations are authorized to receive purchase orders on the Portfolio’s behalf.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies are consistently followed by the Portfolio in the preparation of its financial statements, and such policies are in conformity with U.S. generally accepted accounting principles for investment companies.

A. Security Valuation. Investments in equity securities traded on a national securities exchange are valued at the last reported sale price. Securities reported by NASDAQ are valued at the NASDAQ official closing prices. Securities traded on an exchange or NASDAQ for which there has been no sale and equity securities traded in the over-the-counter-market are valued at the mean between the last reported bid and asked prices. All investments quoted in foreign currencies will be valued daily in U.S. dollars on the basis of the foreign currency exchange rates prevailing at that time. Debt securities are valued at prices obtained from independent services or from one or more dealers making markets in the securities and may be adjusted based on the Portfolio’s valuation procedures. U.S. government obligations are valued by using market quotations or independent pricing services which use prices provided by market-makers or estimates of market values obtained from yield data relating to instruments or securities with similar characteristics.

Securities and assets for which market quotations are not readily available (which may include certain restricted securities which are subject to limitations as to their sale) or deemed unreliable are valued at their fair values as determined in good faith by or under the supervision of the Portfolio’s Board of Trustees (“Board”), in accordance with methods that are specifically authorized by the Board. Securities traded on exchanges, including foreign exchanges, which close earlier than the time that the Portfolio calculates its net asset value (“NAV”) may also be valued at their fair values as determined in good faith by or under the supervision of the Portfolio’s Board, in accordance with methods that are specifically authorized by the Board. The valuation techniques applied in any specific instance are likely to vary from case to case. With respect to a restricted security, for example, consideration is generally given to the cost of the investment, the market value of any unrestricted securities of the same class at the time of valuation, the potential expiration of restrictions on the security, the existence of any registration rights, the costs to the Portfolio related to registration of the security, as well as factors relevant to the issuer itself. Consideration may also be given to the price and extent of any public trading in similar securities of the issuer or comparable companies’ securities.

The value of a foreign security traded on an exchange outside the United States is generally based on the price of a foreign security on the principal foreign exchange where it trades as of the time a Portfolio determines its NAV or if the foreign exchange closes prior to the time the Portfolio determines its NAV, the most recent closing price of the foreign security on its principal exchange. Trading in certain non-U.S. securities may not take place on all days on which the New York Stock Exchange (“NYSE”) is open. Further, trading takes place in various foreign markets on days on which the NYSE is not open. Consequently, the calculation of the Portfolio’s NAV may not take place contemporaneously with the determination of the prices of securities held by the Portfolio in foreign securities markets. Further, the value of the Portfolio’s assets may be significantly affected by foreign trading on days when a shareholder cannot purchase or redeem shares of the Portfolio. In calculating the Portfolio’s NAV, foreign securities in foreign currency are converted to U.S. dollar equivalents.

9

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

If an event occurs after the time at which the market for foreign securities held by the Portfolio closes but before the time that the Portfolio’s NAV is calculated, such event may cause the closing price on the foreign exchange to not represent a readily available reliable market value quotation for such securities at the time the Portfolio determines its NAV. In such a case, the Portfolio will use the fair value of such securities as determined under the Portfolio’s valuation procedures. Events after the close of trading on a foreign market that could require the Portfolio to fair value some or all of its foreign securities include, among others, securities trading in the U.S. and other markets, corporate announcements, natural and other disasters, and political and other events. Among other elements of analysis in the determination of a security’s fair value, the Board has authorized the use of one or more independent research services to assist with such determinations. An independent research service may use statistical analyses and quantitative models to help determine fair value as of the time the Portfolio calculates its NAV. There can be no assurance that such models accurately reflect the behavior of the applicable markets or the effect of the behavior of such markets on the fair value of securities, or that such markets will continue to behave in a fashion that is consistent with such models. Unlike the closing price of a security on an exchange, fair value determinations employ elements of judgment. Consequently, the fair value assigned to a security may not represent the actual value that the Portfolio could obtain if it were to sell the security at the time of the close of the NYSE. Pursuant to procedures adopted by the Board, the Portfolio is not obligated to use the fair valuations suggested by any research service, and valuation recommendations provided by such research services may be overridden if other events have occurred or if other fair valuations are determined in good faith to be more accurate. Unless an event is such that it causes the Portfolio to determine that the closing prices for one or more securities do not represent readily available reliable market value quotations at the time the Portfolio determines its NAV, events that occur between the time of the close of the foreign market on which they are traded and the close of regular trading on the NYSE will not be reflected in the Portfolio’s NAV. Investments in securities maturing in 60 days or less are valued at amortized cost, which, when combined with accrued interest, approximates market value.

B. Security Transactions and Revenue Recognition. Security transactions are recorded on the trade date. Realized gains or losses on sales of investments are calculated on the identified cost basis. Interest income is recorded on the accrual basis. Premium amortization and discount accretion are determined using the effective yield method. Dividend income is recorded on the

ex-dividend date or when notified for foreign securities.

C. Foreign Currency Translation. The books and records of the Portfolio are maintained in U.S. dollars. Any foreign currency amounts are translated into U.S. dollars on the following basis:

(1) Market value of investment securities, other assets and liabilities — at the exchange rates prevailing at the end of the day.

(2) Purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets and the market values are presented at the foreign exchange rates at the end of the day, the Portfolio does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses from investments. For securities which are subject to foreign withholding tax upon disposition, liabilities are recorded on the Statement of Assets and Liabilities for the estimated tax withholding based on the securities current market value. Upon disposition, realized gains or losses on such securities are recorded net of foreign withholding tax.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Portfolio’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at period end, resulting from changes in

10

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

the exchange rate. Foreign security and currency transactions may involve certain considerations and risks not typically associated with investing in U.S. companies and U.S. government securities. These risks include, but are not limited to, revaluation of currencies and future adverse political and economic developments which could cause securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies and U.S. government securities.

D. Forward Foreign Currency Contracts. The Portfolio may enter into forward foreign currency contracts primarily to hedge against foreign currency exchange rate risks on their non-U.S. dollar denominated investment securities. When entering into a currency forward contract, the Portfolio agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. These contracts are valued daily and the Portfolio’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is included in the Statement of Assets and Liabilities. Realized and unrealized gains and losses are included on the Statement of Operations. These instruments involve market and/or credit risk in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet in terms of their contracts and from movement in currency and securities values and interest rates.

E. Distributions to Shareholders. Dividends from net investment income and net realized gains, if any are declared and paid quarterly by the Portfolio. Distributions are determined annually in accordance with federal tax principles which may differ from U.S. generally accepted accounting principles for investment companies. The Portfolio may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code. Distributions are recorded on the

ex-dividend date.

F. Federal Income Taxes. It is the policy of the Portfolio to comply with subchapter M of the Internal Revenue Code and related excise tax provisions applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized capital gains to its shareholders. Therefore, no federal income tax provision is required. No capital gain distributions shall be made until any capital loss carryforwards have been fully utilized or expired.

G. Use of Estimates. Management of the Portfolio has made certain estimates and assumptions relating to the reporting of assets, liabilities, income, and expenses to prepare these financial statements in conformity with U.S. generally accepted accounting principles for investment companies. Actual results could differ from these estimates.

H. Repurchase Agreements. The Portfolio may invest in repurchase agreements only with government securities dealers recognized by the Board of Governors of the Federal Reserve System. Under such agreements, the seller of the security agrees to repurchase it at a mutually agreed upon time and price. The resale price is in excess of the purchase price and reflects an agreed upon interest rate for the period of time the agreement is outstanding. The period of the repurchase agreements is usually short, from overnight to one week, while the underlying securities generally have longer maturities. The Portfolio will receive as collateral securities acceptable to it whose market value is equal to at least 100% of the carrying amount of the repurchase agreements, plus accrued interest, being invested by the Portfolio. The underlying collateral is valued daily on a mark to market basis to assure that the value, including accrued interest, is at least equal to the repurchase price. There would be potential loss to the Portfolio in the event the Portfolio is delayed or prevented from exercising its right to dispose of the collateral and it might incur disposition costs in liquidating the collateral.

I. Securities Lending. The Portfolio has the option to temporarily loan up to 331/3% of its total assets to brokers, dealers or other financial institutions in exchange for a negotiated lender’s fee. The borrower is required to fully collateralize the loans with cash or U.S. government securities. Generally, in the event of counterparty default, the Portfolio has the right to use collateral to offset losses incurred. There would be potential loss to the Portfolio in the event the Portfolio is delayed or prevented from exercising its right to dispose of the collateral. The Portfolio bears the risk of loss with respect to the investment of collateral. Engaging in securities lending could have a leveraging effect, which may intensify the credit, market and other risks associated with investing in the Portfolio.

11

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 3 — INVESTMENT MANAGEMENT FEE

ING Investments, LLC (the “Investment Manager”) is the Investment Manager of the Portfolio. The Portfolio pays the Investment Manager for its services under the Management Agreement, a fee, payable monthly, based on an annual rate of 1.00% of the average daily net assets of the Portfolio.

The Investment Manager has entered into an Expense Limitation Agreement with the Portfolio, under which it will limit expenses of the Portfolio to the extent of 1.23% of the value of the Portfolio’s average daily net assets, excluding interest, taxes, brokerage and extraordinary expenses. Fee waivers and/or reimbursements by the Investment Manager may vary in order to achieve such contractually obligated expense limit.

The Expense Limitation Agreement is contractual and shall renew automatically for one-year terms unless ING Investments provides written notice of the termination of the Expense Limitation Agreement within 90 days of the end of the then current term.

The Investment Manager may at a later date recoup from the Portfolio management fees waived and other expenses assumed by the Investment Manager during the previous 36 months, but only if, after such reimbursement, the Portfolio’s expense ratio does not exceed the percentage described above. Waived and reimbursed fees net of any recoupment by the Investment Manager of such waived and reimbursed fees, are reflected on the accompanying Statement of Operations.

Effective January 1, 2006, pursuant to a side agreement, the Investment Manager has lowered the expense limit for the Portfolio to 1.15% through December 31, 2006. There is no guarantee that this side agreement will continue after that date. If after December 31, 2006, the Investment Manager elects not to renew the side agreement, the expense limit will revert to the limitation under the Portfolio’s expense limitation agreement of 1.23%. The Portfolio waived $4,766 pursuant to the side agreement during the six months ended June 30, 2006. Any fees waived pursuant to the side agreement shall not be eligible for recoupment.

As of June 30, 2006, the amounts of waived and reimbursed fees that are subject to possible recoupment by the Investment Manager are $95,727 which expire December 31, 2006.

Effective April 29, 2005, ING Investment Management Advisors B.V. (“IIMA”) began serving as sub-adviser to the Portfolio. Prior to April 29, 2005, the Portfolio was sub-advised by ING Investment Management Co.

ING Funds Services, LLC (the “Administrator”) serves as Administrator to the Portfolio. There is no fee paid to the Administrator.

The Investment Manager, IIMA, and the Administrator are indirect, wholly-owned subsidiaries of ING Groep N.V. (“ING Groep”). ING Groep is one of the largest financial services organizations in the world, and offers an array of banking, insurance and asset management services to both individuals and institutional investors.

NOTE 4 — OTHER TRANSACTIONS WITH AFFILIATED AND RELATED PARTIES

The Investment Manager may direct the Portfolio’s portfolio managers to use their best efforts (subject to obtaining best execution of each transaction) to allocate the Portfolio’s equity security transactions through certain designated broker-dealers. The designated broker-dealer, in turn, will reimburse a portion of the brokerage commissions to pay certain expenses of the Portfolio. There was no brokerage commission recapture during the six months ended June 30, 2006.

At June 30, 2006, the Portfolio had $51,043 recorded in payable to affiliates on the accompanying Statement of Assets and Liabilities for accrued investment management fees.

The Portfolio has adopted a Retirement Policy covering all Independent Trustees of the Portfolio who will have served as an Independent Trustee for at least five years at the time of retirement. Benefits under this plan are based on an annual rate as defined in the plan agreement.

At June 30, 2006, the following indirect, wholly-owned subsidiary of ING Groep owned more than 5% of the following Portfolio:

ING USA Annuity and Life Insurance Company (99.45%).

At June 30, 2006, the Portfolio had no payables included in Other Accrued Expenses and Liabilities that exceeded 5% of total liabilities on the Statement of Assets and Liabilities.

NOTE 6 — PURCHASES AND SALES OF INVESTMENT SECURITIES

The cost of purchases and proceeds from sales of investments for the six months ended June 30, 2006, excluding short-term securities, were $9,355,300 and $12,804,800, respectively.

NOTE 7 — LINE OF CREDIT

The Portfolio, in addition to certain other funds managed by the Investment Manager, has entered into an unsecured committed revolving line of credit agreement (the “Credit Agreement”) with The Bank of New York for an aggregate amount of $125,000,000. The proceeds may be used to: (1) temporarily finance the purchase and sale of securities; (2) finance the redemption

12

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

of shares of an investor in the funds; and (3) enable the funds to meet other emergency expenses as defined in the Credit Agreement. The funds to which the line of credit is available pay a commitment fee equal to 0.09% per annum on the daily unused portion of the committed line amount payable quarterly in arrears. The Portfolio utilized the line of credit for fifteen days with an approximate average daily balance of $458,000 at an approximate weighted average interest rate of 5.49% during the six months ended June 30, 2006.

NOTE 8 — CAPITAL SHARE TRANSACTIONS

Transactions in capital shares and dollars, were as follows:

| | Six Months

Ended

June 30,

2006 | | Year

Ended

December 31,

2005 | |

VP Global Equity Dividend (Number of Shares) | | | | | |

Shares sold | | 114,335 | | 1,543,589 | |

Dividends reinvested | | 57,991 | | 242,178 | |

Shares redeemed | | (936,195 | ) | (1,343,870 | ) |

Net increase (decrease) in shares outstanding | | (763,869 | ) | 441,897 | |

VP Global Equity Dividend ($) | | | | | |

Shares sold | | $ | 928,596 | | $ | 11,392,929 | |

Dividends reinvested | | 477,264 | | 1,790,754 | |

Shares redeemed | | (7,681,248 | ) | (9,867,641 | ) |

Net increase (decrease) | | $ | (6,275,388 | ) | $ | 3,316,042 | |

NOTE 9 — CONCENTRATION OF INVESTMENT RISKS

Foreign Securities. The Portfolio makes significant investments in foreign securities. Investments in foreign securities may entail risks not present in domestic investments. Since investments in securities are denominated in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Portfolio. Foreign investments may also subject the Portfolio to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, as well as from movements in currency, security value and interest rate, all of which could affect the market and/or credit risk of the investments.

Diversification. The Portfolio is “diversified” within the meaning of the 1940 Act. In order to qualify as diversified, the Portfolio must diversify its holdings so that at all times at least 75% of the value of its total assets is represented by cash and cash items (including receivables), securities issued or guaranteed as to principal or interest by the United States or its agencies or instrumentalities, securities of other investment companies, and other securities (for this purpose other securities of any one issuer are limited to an amount not greater than 5% of the value of the total assets of the Portfolio and to not more than 10% of the outstanding voting securities of the issuer).

NOTE 10 — SECURITIES LENDING

Under an agreement with The Bank of New York (“BNY”), the Portfolio can lend its securities to approved brokers, dealers and other financial institutions. Loans are collateralized by cash and U.S. government securities. The collateral must be in an amount equal to at least 105% of the market value of non-U.S. securities loaned and 102% of the market value of U.S. securities loaned. The cash collateral received is invested in approved investments as defined in the Securities Lending Agreement with BNY (the “Agreement”). The securities purchased with cash collateral received are reflected in the Portfolio of Investments. Generally, in the event of counterparty default, the Portfolio has the right to use the collateral to offset losses incurred. The Agreement contains certain guarantees by BNY in the event of counterparty default and/or a borrower’s failure to return a loaned security, however there would be a potential loss to the Portfolio in the event the Portfolio is delayed or prevented from exercising its right to dispose of the collateral. The Portfolio bears the risk of loss with respect to the investment of collateral. Engaging in securities lending could have a leveraging effect, which may intensify the credit, market and other risks associated with investing in the Portfolio. At June 30, 2006, the Portfolio had securities on loan valued at $5,035,399 with collateral valued at $5,188,158.

NOTE 11 — FEDERAL INCOME TAXES

The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles for investment companies. These book/tax differences may be either temporary or permanent. Permanent differences are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences are not reclassified. Key differences include the treatment of short-term capital gains, foreign currency transactions and wash sale deferrals. Distributions in excess of net investment income and/or net realized capital gains for tax purposes are reported as distributions of paid-in capital.

Dividends paid by the Portfolio from net investment income and distributions of net realized short-term capital gains are, for federal income tax purposes, taxable as ordinary income to shareholders.

13

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 11 — FEDERAL INCOME TAXES (continued)

The tax composition of dividends and distributions to shareholders was as follows:

Six Months Ended | | Year Ended | |

| June 30, 2006 | | | | December 31, 2005 | | |

| Ordinary

Income | | | | Ordinary

Income | | |

$477,264 | | $1,790,754 | |

| | | | | | | | | | | |

The tax-basis components of distributable earnings and the expiration dates of the capital loss carryforwards which may be used to offset future realized capital gains for federal income tax purposes as of December 31, 2005 were:

Undistributed | | Unrealized | | Post-October Currency | | Capital Loss | | | |

| Ordinary Income | | | | Appreciation/Depreciation | | | | Losses Deferred | | | | Carryforwards | | | | Expiration Dates | | |

$59,070 | | $2,701,163 | | $(23,538) | | $(84,985) | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation 48 (FIN 48), “Accounting for Uncertainty in Income Taxes.” This standard defines the threshold for recognizing the benefits of tax-return positions in the financial statements as “more-likely-than-not” to be sustained by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion, based on the largest benefit that is more than 50 percent likely to be realized. FIN 48 is effective as of the beginning of the first fiscal year beginning after December 15, 2006, with early application permitted if no interim financial statements have been issued. At adoption, companies must adjust their financial statements to reflect only those tax positions that are more likely- than-not to be sustained as of the adoption date. As of June 30, 2006, the Funds are currently assessing the impact, if any, that will result from adopting FIN 48.

NOTE 12 — INFORMATION REGARDING TRADING OF ING’S U.S. MUTUAL FUNDS

In 2004 ING Investments reported to the Boards of Trustees (the “Boards”) of the ING Funds that, like many U.S. financial services companies, ING Investments and certain of its U.S. affiliates have received informal and formal requests for information since September 2003 from various governmental and self-regulatory agencies in connection with investigations related to mutual funds and variable insurance products. ING Investments has advised the Boards that it and its affiliates have cooperated fully with each request.

In addition to responding to regulatory and governmental requests, ING Investments reported that management of U.S. affiliates of ING Groep N.V., including ING Investments (collectively, “ING”), on their own initiative, have conducted, through independent special counsel and a national accounting firm, an extensive internal review of trading in ING insurance, retirement, and mutual fund products. The goal of this review was to identify any instances of inappropriate trading in those products by third parties or by ING investment professionals and other ING personnel. ING’s internal review related to mutual fund trading is now substantially completed. ING has reported that, of the millions of customer relationships that ING maintains, the internal review identified several isolated arrangements allowing third parties to engage in frequent trading of mutual funds within ING’s variable insurance and mutual fund products, and identified other circumstances where frequent trading occurred, despite measures taken by ING intended to combat market timing. ING further reported that each of these arrangements has been terminated and fully disclosed to regulators. The results of the internal review were also reported to the independent members of the Board.

ING Investments has advised the Board that most of the identified arrangements were initiated prior to ING’s acquisition of the businesses in question in the U.S. ING Investments further reported that the companies in question did not receive special benefits in return for any of these arrangements, which have all been terminated.

Based on the internal review, ING Investments has advised the Board that the identified arrangements do not represent a systemic problem in any of the companies that were involved.

In September 2005, ING Funds Distributor, LLC (“IFD”), the distributor of certain ING Funds, settled an administrative proceeding with the NASD regarding three arrangements, dating from 1995, 1996 and

14

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 12 — INFORMATION REGARDING TRADING OF ING’S U.S. MUTUAL FUNDS (continued)

1998, under which the administrator to the then-Pilgrim Funds, which subsequently became part of the ING Funds, entered into formal and informal arrangements that permitted frequent trading. Under the terms of the Letter of Acceptance, Waiver and Consent (“AWC”) with the NASD, under which IFD neither admitted nor denied the allegations or findings, IFD consented to the following sanctions: (i) a censure; (ii) a fine of $1.5 million; (iii) restitution of approximately $1.44 million to certain ING Funds for losses attributable to excessive trading described in the AWC; and (iv) agreement to make certification to NASD regarding the review and establishment of certain procedures.

In addition to the arrangements discussed above, in 2004 ING Investments reported to the Board that, at that time, these instances include the following, in addition to the arrangements subject to the AWC discussed above:

• Aeltus Investment Management, Inc. (a predecessor entity to ING Investment Management Co.) has identified two investment professionals who engaged in extensive frequent trading in certain ING Funds. One was subsequently terminated for cause and incurred substantial financial penalties in connection with this conduct and the second has been disciplined.

• ReliaStar Life Insurance Company (“ReliaStar”) entered into agreements seven years ago permitting the owner of policies issued by the insurer to engage in frequent trading and to submit orders until 4pm Central Time. In 2001 ReliaStar also entered into a selling agreement with a broker-dealer that engaged in frequent trading. Employees of ING affiliates were terminated and/or disciplined in connection with these matters.

• In 1998, Golden American Life Insurance Company entered into arrangements permitting a broker-dealer to frequently trade up to certain specific limits in a fund available in an ING variable annuity product. No employee responsible for this arrangement remains at the company.

For additional information regarding these matters, you may consult the Form 8-K and Form 8-K/A for each of four life insurance companies, ING USA Annuity and Life Insurance Company, ING Life Insurance and Annuity Company, ING Insurance Company of America, and ReliaStar Life Insurance Company of New York, each filed with the Securities and Exchange Commission (the “SEC”) on October 29, 2004 and September 8, 2004. These Forms 8-K and Forms 8-K/A can be accessed through the SEC’s Web site at http://www.sec.gov. Despite the extensive internal review conducted through independent special counsel and a national accounting firm, there can be no assurance that the instances of inappropriate trading reported to the Board are the only instances of such trading respecting the ING Funds.

ING Investments reported to the Board that ING is committed to conducting its business with the highest standards of ethical conduct with zero tolerance for noncompliance. Accordingly, ING Investments advised the Board that ING management was disappointed that its voluntary internal review identified these situations. Viewed in the context of the breadth and magnitude of its U.S. business as a whole, ING management does not believe that ING’s acquired companies had systemic ethical or compliance issues in these areas. Nonetheless, ING Investments reported that given ING’s refusal to tolerate any lapses, it has taken the steps noted below, and will continue to seek opportunities to further strengthen the internal controls of its affiliates.

• ING has agreed with the ING Funds to indemnify and hold harmless the ING Funds from all damages resulting from wrongful conduct by ING or its employees or from ING’s internal investigation, any investigations conducted by any governmental or self-regulatory agencies, litigation or other formal proceedings, including any proceedings by the Securities and Exchange Commission. ING Investments reported to the Board that ING management believes that the total amount of any indemnification obligations will not be material to ING or its U.S. business.

• ING updated its Code of Conduct for employees reinforcing its employees’ obligation to conduct personal trading activity consistent with the law, disclosed limits, and other requirements.

• The ING Funds, upon a recommendation from ING, updated their respective Codes of Ethics applicable to investment professionals with ING entities and certain other fund personnel, requiring such personnel to pre-clear any purchases or sales of ING Funds that are not systematic in nature (i.e., dividend reinvestment), and imposing minimum holding periods for shares of ING Funds.

• ING instituted excessive trading policies for all customers in its variable insurance and retirement products and for shareholders of the ING Funds sold to the public through financial intermediaries. ING does not make exceptions to these policies.

• ING reorganized and expanded its U.S. Compliance Department, and created an Enterprise Compliance team to enhance controls and consistency in regulatory compliance.

15

NOTES TO FINANCIAL STATEMENTS AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

NOTE 12 — INFORMATION REGARDING TRADING OF ING’S U.S. MUTUAL FUNDS (continued)

The New York Attorney General and other federal and state regulators are also conducting broad inquiries and investigations involving the insurance industry. These initiatives currently focus on, among other things, compensation and other sales incentives; potential conflicts of interest; potential anti-competitive activity; reinsurance; marketing practices (including suitability); specific product types (including group annuities and indexed annuities); fund selection for investment products and brokerage sales; and disclosure. It is likely that the scope of these industry investigations will further broaden before they conclude. ING has received formal and informal requests in connection with such investigations, and is cooperating fully with each request. In connection with one such investigation, affiliates of Investments have been named in a petition for relief and cease and desist order filed by the New Hampshire Bureau of Securities Regulation concerning ING’s administration of the New Hampshire state employees deferred compensation plan. ING is cooperating with this regulator to resolve the matter. Other federal and state regulators could initiate similar actions in this or other areas of ING’s businesses.

These regulatory initiatives may result in new legislation and regulation that could significantly affect the financial services industry, including businesses in which ING is engaged.

In light of these and other developments, ING continuously reviews whether modifications to its business practices are appropriate.

At this time, in light of the current regulatory factors, ING U.S. is actively engaged in reviewing whether any modifications in our practices are appropriate for the future.

There can be no assurance that these matters, or the adverse publicity associated with them, will not result in increased fund redemptions, reduced sale of fund shares, or other adverse consequences to ING Funds.

NOTE 13 — SUBSEQUENT EVENT

Dividends: Subsequent to June 30, 2006, the Portfolio declared dividends and distributions of $0.1281 per share from net investment income payable July 6, 2006 and recorded June 30, 2006.

16

ING VP GLOBAL EQUITY DIVIDEND PORTFOLIO | PORTFOLIO OF INVESTMENTS

AS OF JUNE 30, 2006 (UNAUDITED) |

|

Shares | | | | | | Value | |

COMMON STOCK: 97.9% | | | |

| | | | Australia: 8.6% | | | |

30,301 | | | | Australia & New Zealand Banking Group Ltd. | | $ | 599,084 | |

61,576 | | | | Coca-Cola Amatil Ltd. | | 324,329 | |

144,553 | | | | Foster’s Group Ltd. | | 586,887 | |

25,985 | | | | Publishing & Broadcasting Ltd. | | 351,296 | |

41,754 | | | | Santos Ltd. | | 375,756 | |

29,613 | | | | St. George Bank Ltd. | | 644,768 | |

61,730 | | | | Stockland | | 322,000 | |

27,430 | | | | SunCorp.-Metway Ltd. | | 393,518 | |

31,018 | | | | TABCorp. Holdings Ltd. | | 350,135 | |

22,595 | | | | Wesfarmers Ltd. | | 592,945 | |

46,613 | | | | Westfield Group | | 600,110 | |

| | | | | | 5,140,828 | |

| | | | Belgium: 2.1% | | | |

19,544 | | | | Belgacom SA | | 648,191 | |

17,848 | | | | Fortis | | 608,623 | |

| | | | | | 1,256,814 | |

| | | | Brazil: 2.3% | | | |

10,724 | | | | Cia Siderurgica Nacional SA ADR | | 345,313 | |

7,117 | | | | Petroleo Brasileiro SA ADR | | 568,221 | |

38,650 | | | | Tele Norte Leste Participacoes SA ADR | | 492,788 | |

| | | | | | 1,406,322 | |

| | | | | | | |

| | | | Canada: 6.7% | | | |

39,124 | | L | | BCE Inc | | 924,564 | |

8,597 | | | | Canadian Imperial Bank of Commerce | | 575,367 | |

6,136 | | | | Enerplus Resources Fund | | $ | 345,089 | |

16,137 | | | | Fording Canadian Coal Trust | | 511,543 | |

11,080 | | | | Penn West Energy Trust | | 445,662 | |

17,051 | | | | Precision Drilling Corp. | | 566,686 | |

21,563 | | | | TransCanada Corp. | | 615,230 | |

| | | | | | 3,984,141 | |

| | | | China: 1.1% | | | |

606,000 | | | | PetroChina Co., Ltd. | | 654,047 | |

| | | | | | 654,047 | |

| | | | Denmark: 1.1% | | | |

17,048 | | | | Danske Bank A/S | | 647,395 | |

| | | | | | 647,395 | |

| | | | France: 3.1% | | | |

26,985 | | | | France Telecom SA | | 575,780 | |

4,234 | | | | Societe Generale | | 621,662 | |

18,369 | | | | Vivendi Universal SA | | 641,678 | |

| | | | | | 1,839,120 | |

| | | | Germany: 2.0% | | | |

35,916 | | | | Deutsche Telekom AG | | 576,429 | |

5,575 | | | | EON AG | | 640,709 | |

| | | | | | 1,217,138 | |

| | | | Greece: 1.0% | | | |

16,542 | | | | OPAP SA | | 601,168 | |

| | | | | | 601,168 | |

| | | | Hong Kong: 1.0% | | | |

103,000 | | | | Citic Pacific Ltd. | | 303,911 | |

52,000 | | | | CLP Holdings Ltd. | | 304,273 | |

| | | | | | 608,184 | |

| | | | Ireland: 1.1% | | | |

26,841 | | | | Allied Irish Banks PLC | | 645,082 | |

| | | | | | 645,082 | |

| | | | Israel: 0.6% | | | |

84,687 | | | | Bank Hapoalim Ltd. | | 370,211 | |

| | | | | | 370,211 | |

| | | | Italy: 8.0% | | | |

105,232 | | L | | Banca Intesa S.p.A. | | 613,998 | |

83,798 | | | | Enel S.p.A. | | 720,921 | |

31,065 | | | | ENI-Ente Nazionale Idrocarburi S.p.A. | | 912,472 | |

53,339 | | | | Mediaset S.p.A. | | 628,424 | |

144,604 | | | | Snam Rete Gas S.p.A. | | 635,393 | |

240,435 | | | | Telecom Italia S.p.A. | | 620,537 | |

83,247 | | | | UniCredito Italiano S.p.A. | | 651,082 | |

| | | | | | 4,782,827 | |

| | | | Mexico: 0.4% | | | |

90,194 | | | | Grupo Mexico SA de CV | | 257,669 | |

| | | | | | 257,669 | |

| | | | Netherlands: 3.5% | | | |

20,749 | | | | ABN Amro Holding NV | | 568,230 | |

3,134 | | | | Rodamco Europe NV | | 307,118 | |

18,007 | | | | Royal Dutch Shell PLC | | 605,030 | |

56,377 | | | | Royal KPN NV | | 633,563 | |

| | | | | | 2,113,941 | |

See Accompanying Notes to Financial Statements

17

ING VP GLOBAL EQUITY DIVIDEND PORTFOLIO | PORTFOLIO OF INVESTMENTS

AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

Shares | | | | | | Value | |

| | | | New Zealand: 0.8% | | | |

190,903 | | | | Telecom Corp. of New Zealand Ltd. | | $ | 470,377 | |

| | | | | | 470,377 | |

| | | | Norway: 1.0% | | | |

49,185 | | | | DNB Holding ASA | | 611,361 | |

| | | | | | 611,361 | |

| | | | Portugal: 1.5% | | | |

26,689 | | | | Brisa-Auto Estradas de Portugal SA | | 278,095 | |

51,638 | | | | Portugal Telecom SGPS SA | | 623,186 | |

| | | | | | 901,281 | |

| | | | Singapore: 1.1% | | | |

66,000 | | | | United Overseas Bank Ltd. | | 649,803 | |

| | | | | | 649,803 | |

| | | | South Africa: 1.6% | | | |

52,217 | | | | Edgars Consolidated Stores Ltd. | | 210,443 | |

23,919 | | | | Standard Bank Group Ltd. | | 255,643 | |

25,386 | | @ | | Telkom SA Ltd. | | 466,164 | |

| | | | | | 932,250 | |

| | | | South Korea: 1.2% | | | |

15,070 | | | | KT Corp. ADR | | 323,252 | |

5,390 | | | | S-Oil Corp. | | 380,854 | |

| | | | | | 704,106 | |

| | | | Spain: 0.5% | | | |

27,770 | | | | Telefonica Publicidad e Informacion SA | | 300,432 | |

| | | | | | 300,432 | |

| | | | Sweden: 2.9% | | | |

7,369 | | | | Scania AB | | 334,672 | |

14,600 | | | | Svenska Cellulosa AB | | 602,773 | |

15,900 | | | | Volvo AB | | 781,315 | |

| | | | | | 1,718,760 | |

| | | | Thailand: 0.8% | | | |

94,600 | | | | Advanced Info Service PLC | | 223,925 | |

39,200 | | L | | Siam Cement PCL | | 236,815 | |

| | | | | | 460,740 | |

| | | | United Kingdom: 10.6% | | | |

53,883 | | | | Barclays PLC | | 610,835 | |

64,423 | | | | BBA Group PLC | | 316,068 | |

37,259 | | | | Diageo PLC | | 625,814 | |

168,903 | | | | Dixons Group PLC | | 595,884 | |

20,959 | | | | GlaxoSmithKline PLC | | 584,907 | |

33,069 | | | | GUS PLC | | 590,284 | |

20,899 | | | | Imperial Tobacco Group PLC | | 644,578 | |

255,160 | | | | Legal & General Group PLC | | 603,960 | |

25,894 | | | | Provident Financial PLC | | 293,976 | |

27,378 | | | | Royal Bank of Scotland Group PLC | | 898,686 | |

26,850 | | | | Severn Trent PLC | | 580,534 | |

| | | | | | 6,345,526 | |

| | | | United States: 33.3% | | | |

8,431 | | | | AGL Resources, Inc. | | 321,390 | |

12,625 | | | | Altria Group, Inc. | | 927,054 | |

12,426 | | L | | Ameren Corp. | | 627,513 | |

17,810 | | | | American Capital Strategies Ltd. | | $ | 596,279 | |

11,203 | | | | Arthur J Gallagher & Co. | | 283,884 | |

20,502 | | L | | AT&T, Inc. | | 571,801 | |

19,006 | | | | Bank of America Corp. | | 914,185 | |

18,467 | | | | Citigroup, Inc. | | 890,848 | |

35,299 | | | | Citizens Communications Co. | | 460,652 | |

27,264 | | | | ConAgra Foods, Inc. | | 602,807 | |

13,872 | | | | Consolidated Edison, Inc. | | 616,472 | |

5,723 | | | | Developers Diversified Realty Corp. | | 298,626 | |

20,344 | | | | Duke Energy Corp. | | 597,503 | |

6,646 | | L | | Duke Realty Corp. | | 233,607 | |

13,031 | | | | EI Du Pont de Nemours & Co. | | 542,090 | |

12,752 | | | | Energy East Corp. | | 305,155 | |

15,514 | | | | First Horizon National Corp. | | 623,663 | |

5,693 | | | | Hospitality Properties Trust | | 250,037 | |

6,603 | | | | iStar Financial, Inc. | | 249,263 | |

17,017 | | | | Keycorp | | 607,167 | |

8,449 | | | | Kinder Morgan Energy Partners LP | | 388,316 | |

6,049 | | | | Kinder Morgan, Inc. | | 604,235 | |

5,303 | | | | Liberty Property Trust | | 234,393 | |

15,493 | | | | Merck & Co., Inc. | | 564,410 | |

13,385 | | | | Oneok, Inc. | | 455,625 | |

24,682 | | | | Pfizer, Inc. | | 579,287 | |

9,244 | | | | Public Service Enterprise Group, Inc. | | 611,213 | |

7,395 | | | | Rayonier, Inc. | | 280,344 | |

25,400 | | L | | Regal Entertainment Group | | 516,128 | |

5,328 | | L | | Reynolds America, Inc. | | 614,318 | |

35,141 | | | | Sara Lee Corp. | | 562,959 | |

2,957 | | | | Simon Property Group LP | | 245,254 | |

19,177 | | | | Southern Co. | | 614,623 | |

11,173 | | L | | Thornburg Mortgage, Inc. | | 311,392 | |

10,995 | | | | United Dominion Realty Trust, Inc. | | 307,970 | |

17,444 | | | | US BanCorp. | | 538,671 | |

19,239 | | | | UST, Inc. | | 869,410 | |

7,604 | | | | Ventas, Inc. | | 257,624 | |

17,446 | | | | Washington Mutual, Inc. | | 795,188 | |

| | | | | | 19,871,356 | |

| | | | Total Common Stock

(Cost $54,222,671) | | 58,490,879 | |

| | | | | | | |

WARRANTS: 2.1% | |

| | | | India: 0.5% | | | |

172,000 | | @ | | Steel Authority of India Ltd, expires 04/21/09 | | 302,720 | |

| | | | | | 302,720 | |

| | | | Luxembourg: 0.6% | | | |

222,000 | | @ | | Lite-On Technology Corp., expires 01/20/10 | | 328,560 | |

| | | | | | 328,560 | |

| | | | Taiwan: 1.0% | | | |

177,960 | | @ | | Formosa Chemicals & Fibre Corp., expires 10/26/10 | | 274,058 | |

439,000 | | # | | Mega Financial Holdings Co. Ltd., expires 01/26/07 | | 324,861 | |

| | | | | | 598,919 | |

| | | | Total Warrants

(Cost $1,072,612) | | 1,230,199 | |

| | | | Total Long-Term Investments

(Cost $55,295,283) | | 59,721,078 | |

See Accompanying Notes to Financial Statements

18

ING VP GLOBAL EQUITY DIVIDEND PORTFOLIO | PORTFOLIO OF INVESTMENTS

AS OF JUNE 30, 2006 (UNAUDITED) (CONTINUED) |

|

Principal

Amount | | | | | | Value | |

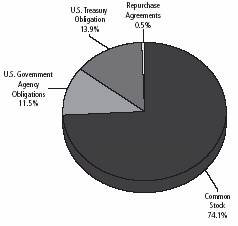

SHORT-TERM INVESTMENTS: 8.7% | | | |

Securities Lending Collateralcc: 8.7% | | | | | |

$ | 5,188,158 | | | | The Bank of New York Institutional Cash Reserves Fund | | | | $ | 5,188,158 | |

| | | | Total Short-Term Investments

(Cost $5,188,158) | | | | 5,188,158 | |

| | | | Total Investments in Securities

(Cost $60,483,441)* | | 108.7 | % | $ | 64,909,236 | |

| | | | Other Assets and Liabilities-Net | | (8.7 | ) | (5,200,972 | ) |

| | | | Net Assets | | 100.0 | % | $ | 59,708,264 | |

| | | | | | | | | | | |

@ | Non-income producing security |

ADR | American Depositary Receipt |

# | Securities with purchases pursuant to Rule 144A, under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. These securities have been determined to be liquid under the guidelines established by the Funds’ Board of Directors/Trustees. |

cc | Securities purchased with cash collateral for securities loaned. |

L | Loaned security, a portion or all of the security is on loan at June 30, 2006. |

* | Cost for federal income tax purposes is $60,500,886. |

| Net unrealized appreciation consists of: |

| Gross Unrealized Appreciation | | $ | 5,819,813 | |

| Gross Unrealized Depreciation | | (1,411,463 | ) |

| Net Unrealized Appreciation | | $ | 4,408,350 | |

| | | | | | |

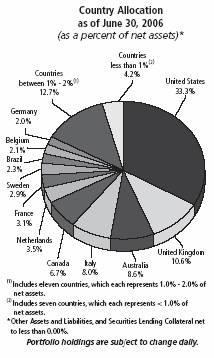

Industry | | Percentage of

Net Assets | |

Advertising | | 0.5 | % |

Agriculture | | 5.1 | |

Auto Manufacturers | | 1.9 | |

Banks | | 21.7 | |

Beverages | | 2.6 | |

Building Materials | | 0.4 | |

Chemicals | | 1.4 | |

Coal | | 0.9 | |

Commercial Services | | 0.5 | |

Computers | | 0.5 | |

Diversified Financial Services | | 2.5 | |

Electric | | 8.4 | |

Entertainment | | 2.5 | |

Food | | 2.0 | |

Forest Products & Paper | | 1.5 | |

Gas | | 2.4 | |

Holding Companies - Diversified | | 0.5 | |

Insurance | | 1.5 | |

Investment Companies | | 1.0 | |

Iron/Steel | | 1.1 | |

Media | | 2.7 | |

Mining | | 0.4 | |

Miscellaneous Manufacturing | | 1.5 | |

Oil & Gas | | 8.1 | |

Pharmaceuticals | | 2.9 | |

Pipelines | | 2.7 | |

Real Estate | | 1.5 | |

Real Estate Investment Trust | | 4.0 | |

Retail | | 2.3 | |

Savings & Loans | | 1.3 | |

Telecommunications | | 12.7 | |

Water | | 1.0 | |

Securities Lending Collateral | | 8.7 | |

Other Assets and Liabilities | | (8.7 | ) |

Total Net Assets | | 100.0 | % |

See Accompanying Notes to Financial Statements

19

Investment Manager

ING Investments, LLC

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258

Administrator

ING Funds Services, LLC

7337 East Doubletree Ranch Road

Scottsdale, Arizona 85258

Transfer Agent

DST Systems, Inc.

P.O. Box 419368

Kansas City, Missouri 64141

Custodian

The Bank of New York

100 Colonial Center Parkway, Suite 300

Lake Mary, Florida 32746

Legal Counsel

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Before investing, carefully consider the investment objectives, risks, charges and expenses of the variable annuity contract and the underlying variable investment options. This and other information is contained in the prospectus for the variable annuity contract and the underlying variable investment options. Obtain these prospectuses from your agent/registered representative and read them carefully before investing.

Funds

Semi-Annual Report

June 30, 2006

ING GET U.S. Core Portfolio

• Series 1

• Series 2

• Series 3

• Series 4

• Series 5

• Series 6

• Series 7

• Series 8

• Series 9

• Series 10

• Series 11

• Series 12

• Series 13

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. | |

|

TABLE OF CONTENTS

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available (1) without charge, upon request, by calling Shareholder Services toll-free at 800-992-0180; (2) on the ING Fund’s website at www.ingfunds.com and (3) on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended December 31 is available without charge on the ING Fund’s website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Registrant files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Registrant’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Registrant’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330; and is available upon request from the Registrant by calling Shareholder Services toll-free at 800-992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

PRESIDENT’S LETTER

JAMES M. HENNESSY

Dear Shareholder,

As you may recall, in my last letter I described the enthusiasm that we were experiencing here at ING Funds as we worked to bring more of the world’s investment opportunities to you, the investor.