UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09561

Century Capital Management Trust

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09561

Century Capital Management Trust

(Exact name of registrant as specified in charter)

c/o Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

c/o Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Maureen Kane

Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

Maureen Kane

Century Capital Management, LLC

100 Federal Street, Boston, Massachusetts 02110

Registrant's telephone number, including area code: (617) 482-3060

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Item 1. Report to Stockholders.

TABLE OF CONTENTS | |

Page | |

Letter to Shareholders | 1 |

Fund Summaries | |

Century Small Cap Select Fund | 3 |

Century Shares Trust | 6 |

Century Growth Opportunities Fund | 9 |

Portfolio of Investments and Financial Statements | |

Century Small Cap Select Fund | 12 |

Century Shares Trust | 20 |

Century Growth Opportunities Fund | 26 |

Notes to the Financial Statements | 32 |

Shareholder Expense Example | 38 |

Approval of Investment Advisory Agreements | 40 |

Privacy Policy | 44 |

This report is submitted for the general information of the shareholders of Century Small Cap Select Fund, Century Shares Trust, and Century Growth Opportunities Fund (each a “Fund” and collectively, the “Funds”). It is not authorized for distribution to prospective investors in a Fund unless it is preceded by or accompanied by the Fund’s current prospectus. The prospectus includes important information about the Fund’s objective, risks, charges and expenses, experience of its management, and other information. Please read the prospectus carefully before you invest.

The views expressed in this report are those of the Funds’ Portfolio Managers as of April 30, 2012, the end of the reporting period. Any such views are subject to change at any time and may not reflect the Portfolio Managers’ views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice. There is no assurance that the Funds will continue to invest in the securities mentioned in this report.

CENTURY FUNDS

DEAR FELLOW SHAREHOLDERS,

The equity markets rewarded investors over the first half of the Funds’ fiscal year, amidst ongoing economic and political uncertainty. The S&P 500 returned 12.7% during the November 2011 to April 2012 time period, and the rally during the first quarter of 2012 was its best opening quarter since 1998. This rally was book ended by periods of volatility. The one constant during this period was reduced trading volumes, as many investors remained on the sidelines.

There is a sense of déjà vu as I compose this letter. In the 2011 semi-annual report I wrote about issues that were clouding the investment landscape. Many of those issues are relevant still today: the European debt crisis, the upcoming U.S. elections, the impact of the Chinese economic slowdown. While Greece’s exit from the European Union appears to be almost inevitable, the ECB’s handling of Spain’s issues could have a more significant effect on the global economy and investors.

Surprisingly, countries representing 50% of the world’s GDP are holding presidential elections this year, and there are key questions for the many victors to quickly decide how to handle the “fiscal cliffs” they will inherit. The U.S. election rhetoric is in full swing, and the potential massive changes to spending and tax policies are restraining many companies from making new investments in people and plants until there is more fiscal clarity in 2013. Finally, the Chinese economy will remain solid, even at lowered growth rates.

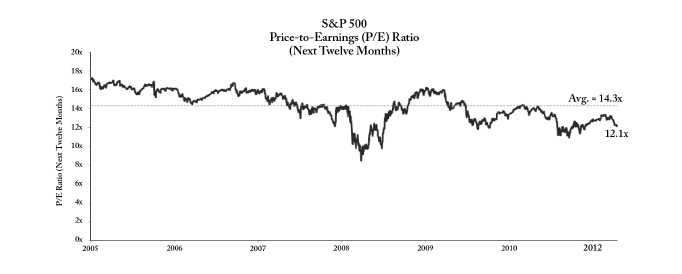

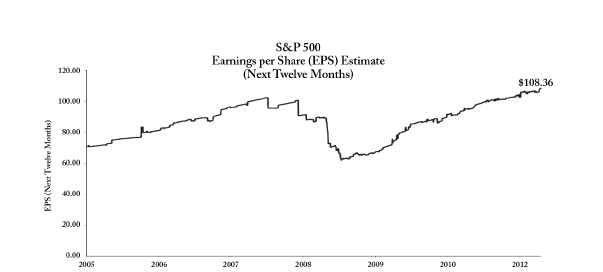

Despite these concerns, we see several reasons for investor optimism. The U.S. domestic economy continues to be a safe haven and grow at a slow, steady pace. Portfolio company earnings are solid on average, and management outlooks are encouraging, due to the positive unemployment trends and housing market improvements. Recent drops in energy and commodity prices are also very encouraging signs for consumer spending and inflation. Stock valuations remain reasonable, particularly among higher quality companies.

CENTURY FUNDS

1

Source: FactSet

We have been focused on companies that are more domestically-oriented. We’ve attempted to limit, or at least fully understand the extent and impact of, European exposure in our portfolio companies. In a slow growth environment we believe it is essential to emphasize franchise-quality firms that have the market share that allows them to maintain pricing power and to take business from competitors. We believe current equity markets provide compelling risk-adjusted returns for patient investors.

Retail investors do not seem to share our optimism in equity markets. Investors have clearly chosen bond funds over domestic equity funds since the financial crisis of 2008. They have done so even as yields have fallen to historical lows and short-term real yields have turned negative.

We understand that investors have been given reasons to mistrust equity markets. However, we believe that equities are an important component in investors’ long-term financial plans. Creeping inflation and low real yields can destroy purchasing power.

We value the trust that you place in us through your investment in the Century Funds. We will continue to seek long-term, risk-adjusted returns through our fundamental research approach. Together we will work to help meet your financial goals.

Respectfully submitted,

Alexander L. Thorndike

Chairman of the Century Funds

2

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND COMMENTARY

How did the portfolio perform?

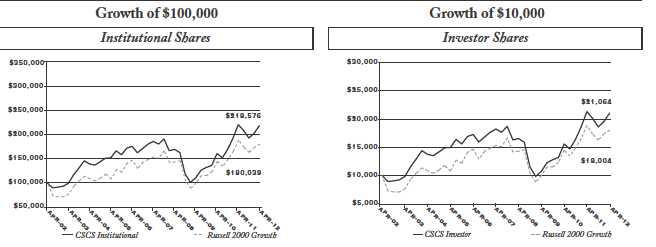

For the six-month period ended April 30, 2012, Century Small Cap Select Fund’s Institutional Shares returned 13.43% and the Investor Shares returned 13.25%, significantly outperforming the Russell 2000 Growth Index’s return of 10.58%.

What were the main drivers of the fund’s performance?

The strong absolute performance over the past six months is due to an improving economy, attractive valuations and the expectation that the European Sovereign Debt Crisis would be resolved. The U.S. unemployment situation has improved, consumer confidence has increased, retail sales remain strong and manufacturing activity has rebounded. In terms of valuation, the R2000 Growth Index was valued attractively on both a Price-to-Earnings and Price-to-Sales basis relative to its 5 year history. Although there were high hopes for resolving European crisis, recent developments have unfortunately increased investor concerns.

Strong stock selection was the driver of the Fund’s outperformance relative to its benchmark. Significant contributions from SolarWinds (enterprise software company), SXC Health Solutions (pharmacy benefit manager), Liquidity Services (auction marketplace), and Beacon Roofing (roofing distributor) more than offset relative weakness from J2 Global (internet software company), Pioneer Drilling (exploration & production) and Silicon Laboratories (semiconductor manufacturer). The sectors where stock picking was strongest include Industrials, Financials, Consumer Staples and Consumer Discretionary. Only one sector, Materials, was a drag on relative performance.

Describe portfolio positioning at period-end

The Fund continues to invest in high quality growth companies that we believe will outperform over the long term. The Fund remains well diversified, with exposure in almost every sector. While the Fund owns some higher growth, higher P/E companies, we primarily invest in companies whose growth prospects are underappreciated by the market. In doing so, we believe that we create a portfolio that has an attractive risk-reward profile. We think the Fund is well positioned and are optimistic regarding the outlook for the U.S. economy.

CENTURY FUNDS

3

CENTURY SMALL CAP SELECT FUND COMMENTARY (CONTINUED)

Risks: The Fund concentrates its investments in the financial services and health care group of industries. Concentration in a particular industry subjects the Fund to the risks associated with that industry and, as a result, the Fund may be subject to greater price volatility than funds with less concentrated portfolios. In addition, the Fund invests in smaller companies which pose greater risks than those associated with larger, more established companies. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | Portfolio Composition* | |||

J2 GLOBAL COMMUNICATIONS, INC. | 3.26% | Information Technology | 24.9% | |

Electronic communications | Health Care | 19.0% | ||

CAI INTERNATIONAL, INC. | 3.08% | Industrials | 17.3% | |

Marine cargo container leasing | Consumer Discretionary | 10.9% | ||

BEACON ROOFING SUPPLY, INC. | 2.91% | Financials | 10.2% | |

Distributer of roofing materials | Energy | 5.9% | ||

SOLARWINDS, INC. | 2.64% | Materials | 3.2% | |

IT management software | Consumer Staples | 2.6% | ||

THE HAIN CELESTIAL GROUP, INC. | 2.58% | Telecommunication Services | 1.8% | |

Retailer of organic products | Short-term Investment | |||

HFF, INC. CLASS A | 2.54% | plus net other assets | 4.2% | |

Real estate service provider | ||||

DSW, INC. CLASS A | 2.43% | |||

Footwear retailer | ||||

LIQUIDITY SERVICES, INC. | 2.29% | |||

Wholesale goods service provider | ||||

RADWARE LTD. | 2.29% | |||

Manufacturer of network security solutions | ||||

SIGNATURE BANK | 2.26% | |||

Full service commercial bank |

* Based on the Fund’s net assets at April 30, 2012 and subject to change. | |||

4

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND Performance Summary – Institutional Shares and Investor Shares

The returns shown below represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Current performance may be significantly lower or higher than the Fund’s past performance. Please call (800) 303-1928 for the Fund’s most recent month-end performance. As stated in the Fund’s current prospectus, the total (gross) annual operating expenses are 1.48% for the Investor Shares and 1.11% for the Institutional Shares. Returns would have been lower during certain periods if certain fees had not been waived or expenses reimbursed. The recent growth rate in the global equity markets has helped to produce short-term returns for some sectors/asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

| Average Annual Total Returns as of 4/30/12 (%) | ||||

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Small Cap Select Institutional Shares | -0.84 | 25.53 | 3.31 | 8.13 |

| Russell 2000 Growth Index | -4.42 | 21.83 | 3.27 | 6.06 |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Small Cap Select Investor Shares | -1.16 | 25.10 | 2.94 | 7.73 |

| Russell 2000 Growth Index | -4.42 | 21.83 | 3.27 | 6.06 |

| Sources: Century Capital Management, LLC and Russell |

The graphs and table reflect the change in value of a hypothetical investment in the Fund, including reinvest of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

CENTURY FUNDS

5

CENTURY SHARES TRUST COMMENTARY

How did the portfolio perform?

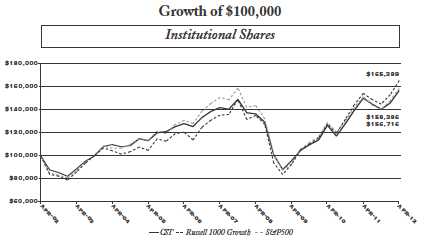

For the six-month period ended April 30, 2012, Century Shares Trust’s Institutional Shares returned 11.65%, underperforming both the Russell 1000 Growth Index, 14.13%, and the S&P 500 Index, 12.77%.

What were the main drivers of the fund’s performance?

The Fund’s total return of 11.65% over the past six months is due to an improving economy. The unemployment rate declined from 8.9% in Oct-2011 to 8.1% in Apr-2012. Consumer confidence has increased meaningfully while retail sales have remained healthy. In terms of manufacturing, industrial production grew by at least 3.6% year-over-year in each month while capacity utilization increased from 77.7% in Nov-11 to 79.2% in Apr-12. The improvement helped propel CST and the overall stock market higher.

CST performed well during the first half of the period, but underperformed in the second half due primarily to a shift in investor sentiment and two underperforming stocks. During the first half of the period, economically sensitive sectors such as Industrials and Materials performed well, leading the market higher. CST was positioned to benefit from a gradually improving economy. However, investor sentiment shifted to become risk averse, leading defensive sectors such as Healthcare, Consumer Staples and Utilities to outperform in the second half of the period. In contrast to the first half, CST fell behind in the second half as concerns increased regarding growth, the crisis in Europe and the threat of a “fiscal cliff” in the U.S. in 2013.

The two stocks that disappointed were Tiffany & Co. (jewelry retailer) and Tempur-Pedic International (mattress manufacturer). In early January, Tiffany & Co. reported disappointing sales for the holiday season and lowered guidance. The two principal issues were macro pressures in Europe and the weak outlook for Wall Street compensation. The stock fell more than 10% on the news. Tempur-Pedic declined about 20% when earnings results fell short of bullish expectations. Management also cited an increasingly competitive environment with more aggressive pricing and promotion incentives. While the specialty bedding segment remains healthy, the competitive pressures led Tempur-Pedic to lose market share. These two stocks were the Fund’s best performers in 2011.

In terms of relative performance, the drag from these two stocks plus Western Union (payment services) and Oracle (enterprise software) more than offset strong performance by Alexion Pharmaceuticals (biotech-nology), LyondellBasell (chemicals) and CBS Corporation (mass media). Similarly, contributions by the Materials and Industrials sectors were offset by weakness in Consumer Discretionary and Technology.

6

CENTURY FUNDS

CENTURY SHARES TRUST COMMENTARY (CONTINUED)

Describe portfolio positioning at period-end

The Fund continues to invest in high quality growth companies that we believe will outperform over the long term. While growth and profitability remain key variables in our company analysis, we are more sensitive to valuation given the uncertain outlook both in the U.S. and abroad. The U.S. economy remains solid, but we are concerned that the European Sovereign Debt Crisis and the slowing of growth in China may negatively impact global growth. We believe this valuation sensitivity will provide down-side protection should growth slow or come in below expectations.

Risks: The Fund may invest a significant portion of assets in a limited number of companies or in companies within the same market sector. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies or sectors and therefore may experience greater price volatility than funds with more diversified portfolios. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | Portfolio Composition* | |||

APPLE, INC | 7.65% | Information Technology | 30.5% | |

Worldwide technology company | Consumer Discretionary | 14.0% | ||

ALEXION PHARMACEUTICALS, INC | 4.44% | Industrials | 12.9% | |

Biopharmaceutical company | Health Care | 11.6% | ||

CBS CORP. CLASS B | 4.40% | Consumer Staples | 10.4% | |

Mass media company | Energy | 9.8% | ||

MARRIOTT INTERNATIONAL, INC. | 3.87% | Financials | 4.4% | |

Worldwide operator and franchisor of hotels | Materials | 3.2% | ||

F5 NETWORKS, INC. | 3.86% | Short-term Investment | ||

Network equipment manufacturer | plus net other liabilities | 3.2% | ||

QUALCOMM, INC. | 3.82% | |||

Manufacturer of communication systems | ||||

O’REILLY AUTOMOTIVE, INC. | 3.76% | |||

Retailer of automotive equipment | ||||

GREEN MOUNTAIN COFFEE | ||||

ROASTERS, INC. | 3.62% | |||

Retailer of specialty coffee products | ||||

CHICAGO BRIDGE & IRON CO. NV | 3.61% | |||

Designer of steel plate structures | ||||

EXPRESS SCRIPTS HOLDING CO. | 3.56% | |||

Pharmacy benefit management company |

* Based on the Fund’s net assets at April 30, 2012 and subject to change. | ||||

CENTURY FUNDS

7

CENTURY SHARES TRUST

Performance Summary – Institutional Shares

The returns shown below represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Current performance may be significantly lower or higher than the Fund’s past performance. Please call (800) 303-1928 for the Fund’s most recent month-end performance. As stated in the Fund’s current prospectus, the total (gross) annual operating expenses for the Institutional Shares are 1.13%. On May 27, 2011, all of the Fund’s issued and outstanding Investor Shares were converted to Institutional Shares and the Investor Shares class was closed. Institutional Shares performance shown does not include fees or the higher expense ratios applicable to the former Investor Shares. Otherwise, returns shown would have been lower. The recent growth rate in the global equity markets has helped to produce short-term returns for some sectors/asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

Effective October 31, 2011, the Russell 1000® Growth Index replaced the S&P 500® Index as the comparative index for the Fund. The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 Index is a broad based unmanaged index representing the performance of 500 widely held common stocks. The Fund’s Adviser believes that the Russell 1000 Growth Index is a more appropriate benchmark because the Fund’s sector weightings and other portfolio characteristics are more comparable to those of the Russell 1000 Growth Index.

| Average Annual Total Returns as of 4/30/12 (%) | ||||

| 1 Year | 3 Years | 5 Years | 10 Years | |

| CST Institutional Shares | 4.42 | 17.90 | 2.01 | 4.60 |

| Russell 1000 Growth Index | 7.26 | 21.44 | 4.11 | 5.16 |

| S&P 500 Index | 4.76 | 19.46 | 1.01 | 4.71 |

| Sources: Century Capital Management, LLC, S&P and Russell |

The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvest of dividends and distributions, compared with the listed indices.

Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

8

CENTURY FUNDS

CENTURY GROWTH OPPORTUNITIES FUND COMMENTARY

How did the portfolio perform?

For the six-month period ended April 30, 2012, Century Growth Opportunities Fund returned 7.78% trailing the Russell 2500 Growth Index, which gained 11.72%.

What were the main drivers of the fund’s performance?

As equity markets climbed higher, investors shifted to more domestically focused equities. Investors shied away from companies with exposure to Europe and its ongoing financial crisis, and from the decelerating Chinese economy, which had been a multi-year, global growth catalyst. U.S. economic news – from improved housing statistics to lower jobless claims to decent retail sales – all were more than enough to buffer companies with large U.S. exposure. Meanwhile, economic data points from outside the U.S. were less than inspiring.

Within the Fund, Telecommunication Services and Consumer Discretionary were the leading contributors to performance. Outperformance in Telecommunication Services was largely tied to the acquisition of portfolio holding, AboveNet (fiber-optic infrastructure), by Zayo Group LLC. Consumer Discretionary benefited from strong stock selection, especially in Specialty Retail, where Pier 1 Imports, Inc. (decorative home furnishings) and Sally Beauty Holdings Inc. (professional beauty supplies) helped drive returns.

Several Information Technology holdings weighed on the Fund’s performance during the period. IPG Photonics Corporation (fiber laser developer and manufacturer) struggled as investors worried about the company’s exposure to China and trimmed their 2012 earnings estimates accordingly. Acme Packet, Inc. (session delivery network solutions) declined on concerns over telecommunication service providers’ spending concerns and delays in the roll out of 4th generation wireless delivery by providers. Also hurting performance was Riverbed Technology, Inc. (WAN optimization network equipment provider), which sold off significantly in April after company management lowered 2012 guidance citing slower trends in the purchasing of its equipment.

The Fund underperformed its benchmark, the Russell 2500 Growth Index, throughout the period. Health Care and Information Technology were the weakest sectors in terms of performance, driven mostly by individual stock selection. Within Health Care, Biotechnology was the leading contributor to the sector’s overall performance. Some of the Health Care underperformance can be traced to industry underweights relative to Index. The Fund is typically underweight this area, because of our concern over its high risk profile as well as its high valuations.

Describe portfolio positioning at period-end

The Fund has increased exposure to more defensive sectors given the slow, but steady progression of U.S. economy, which has been buoyed by improved housing and employment data while enjoying the advantage of cheap, domestic natural gas. We increased allocations to Health Care and Consumer Discretionary as well as Consumer Staples, while we reduced holdings in Technology, Energy, and Materials. We expect to remain biased towards U.S. oriented companies until we have confidence that there is some resolution to the ongoing European debt issues and that we see stabilization within emerging market economies, including China, Brazil, and India.

CENTURY FUNDS

9

CENTURY GROWTH OPPORTUNITIES FUND COMMENTARY (CONTINUED)

Risks: The Fund invests mainly in small-cap and mid-cap companies, which, historically, have been more volatile in price than the stocks of large-cap companies. The Fund may invest in foreign companies, which involves risks not associated with investing solely in U.S. companies, such as currency fluctuations, unfavorable political developments, or economic instability. These risks are magnified in emerging markets. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | Portfolio Composition* | ||

THE COOPER COS., INC | 2.71% | Information Technology | 27.1% |

Manufacturer of healthcare products | Consumer Discretionary | 19.4% | |

SOLARWINDS, INC. | 2.46% | Industrials | 16.7% |

IT management software | Health Care | 14.6% | |

QUESTCOR PHARMACEUTICALS, INC. | 2.40% | Financials | 6.3% |

Biopharmaceutical company | Energy | 5.0% | |

DSW, INC. CLASS A | 2.36% | Materials | 4.5% |

Footwear retailer | Consumer Staples | 4.2% | |

ANSYS, Inc. | 2.32% | Short-term Investment | |

Software developer | plus net other liabilities | 2.2% | |

CYBERONICS, INC. | 2.27% | ||

Developer of medical devices | |||

DICK’S SPORTING GOODS, INC. | 2.26% | ||

Sporting goods retailer | |||

HERBALIFE LTD. | 2.24% | ||

Direct marketer of health products | |||

MOODY’S CORP. | 2.23% | ||

Financial analysis and credit rating provider | |||

KANSAS CITY SOUTHERN | 2.23% | ||

Freight rail transportation |

* Based on the Fund’s net assets at April 30, 2012 and subject to change. | |||

10

CENTURY FUNDS

CENTURY GROWTH OPPORTUNITIES FUND Performance Summary – Institutional Shares

The returns shown below represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Current performance may be significantly lower or higher than the Fund’s past performance. Please call (800) 303-1928 for the Fund’s most recent month-end performance. As stated in the Fund’s current prospectus, the total (gross) annual operating expenses are 3.62% for the Institutional Shares. The Adviser has agreed contractually to limit the operating expenses for the Fund’s Institutional Shares to 1.10% through February 28, 2013. Returns would have been lower during relevant periods if certain fees had not been waived or expenses reimbursed. The recent growth rate in the global equity markets has helped to produce short-term returns for some sectors/asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

| Total Returns as of 4/30/12 (%) | ||

| Since | ||

| 1-Year | Inception* | |

| Century Growth Opportunities Fund Institutional Shares | -1.54 | 10.09 |

| Russell 2500 Growth Index | -1.61 | 15.75 |

| *11/17/2010 (annualized) | ||

| Sources: Century Capital Management, LLC and Russell |

The Russell 2500 Growth® Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

CENTURY FUNDS

11

CENTURY SMALL CAP SELECT FUND |

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) |

| Shares | Value | ||

| COMMON STOCK - 95.8% | |||

| Consumer Discretionary - 10.9% | |||

Auto Components - 0.1% | |||

97,567 | China Zenix Auto International | ||

Ltd. ADR | $ 361,974 | ||

Specialty Retail - 10.8% | |||

179,550 | DSW, Inc. Class A | 10,101,483 | |

348,250 | Express, Inc.* | 8,225,665 | |

38,425 | Monro Muffler Brake, Inc. | 1,585,416 | |

197,800 | Sally Beauty Holdings, Inc.* | 5,261,480 | |

246,550 | Select Comfort Corp.* | 7,120,364 | |

211,450 | The Men’s Wearhouse, Inc. | 7,832,108 | |

420,450 | West Marine, Inc.* | 4,923,469 | |

45,049,985 | |||

45,411,959 | |||

| Consumer Staples - 2.6% | |||

Food Products - 2.6% | |||

226,850 | The Hain Celestial Group, Inc.* | 10,730,005 | |

| Energy - 5.9% | |||

Energy Equipment & Services - 2.9% | |||

383,300 | Matrix Service Co* | 5,232,045 | |

857,700 | Pioneer Drilling Co.* | 6,758,676 | |

11,990,721 | |||

Oil, Gas & Consumable Fuels - 3.0% | |||

129,950 | Berry Petroleum Co. Class A | 5,919,223 | |

240,900 | Carrizo Oil & Gas, Inc.* | 6,754,836 | |

12,674,059 | |||

24,664,780 | |||

| Financials - 10.2% | |||

Capital Markets - 6.7% | |||

123,058 | Cohen & Steers, Inc. | 4,336,564 | |

204,800 | Evercore Partners, Inc. Class A | 5,412,864 | |

646,600 | HFF, Inc. Class A* | 10,565,444 | |

232,150 | Waddell & Reed Financial, Inc. | ||

Class A | 7,424,157 | ||

27,739,029 | |||

Commercial Banks - 3.5% | |||

143,350 | Signature Bank* | 9,416,661 | |

146,700 | Wintrust Financial Corp. | 5,300,271 | |

14,716,932 | |||

42,455,961 | |||

| Shares | Value | ||

| Health Care - 19.0% | |||

Biotechnology - 1.8% | |||

1,045,600 | NPS Pharmaceuticals, Inc.* | $ 7,486,496 | |

Health Care Providers & Services - 6.0% | |||

381,800 | Acadia Healthcare Co, Inc.* | 6,093,528 | |

47,100 | Air Methods Corp.* | 3,961,581 | |

440,700 | Brookdale Senior Living, Inc.* | 8,377,707 | |

167,500 | IPC The Hospitalist Co., Inc.* | 6,433,675 | |

24,866,491 | |||

Health Care Technology - 3.4% | |||

152,700 | Quality Systems, Inc. | 5,710,980 | |

92,350 | SXC Health Solutions Corp.* | 8,365,063 | |

14,076,043 | |||

Life Sciences Tools & Services - 3.7% | |||

609,350 | Bruker Corp.* | 9,158,530 | |

446,850 | WuXi PharmaTech (Cayman), | ||

Inc. ADR* | 6,425,703 | ||

15,584,233 | |||

Pharmaceuticals - 4.1% | |||

158,400 | Jazz Pharmaceuticals PLC* | 8,083,152 | |

199,750 | Questcor Pharmaceuticals, Inc.* | 8,968,775 | |

17,051,927 | |||

79,065,190 | |||

| Industrials - 17.3% | |||

Aerospace & Defense - 1.8% | |||

120,450 | Triumph Group, Inc. | 7,566,669 | |

Air Freight & Logistics - 2.3% | |||

123,600 | Atlas Air Worldwide Holdings, Inc.* | 5,691,780 | |

223,650 | Echo Global Logistics, Inc.* | 3,808,760 | |

9,500,540 | |||

Commercial Services & Supplies - 0.2% | |||

40,000 | Heritage-Crystal Clean, Inc.* | 846,000 | |

Electrical Equipment - 1.2% | |||

77,500 | General Cable Corp.* | 2,281,600 | |

130,200 | II-VI, Inc.* | 2,657,382 | |

4,938,982 | |||

See notes to financial statements.

12

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND (CONTINUED) |

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) |

| Shares | Value | ||

| Industrials (Continued) | |||

Machinery - 5.8% | |||

55,100 | Chart Industries, Inc.* | $ 4,211,293 | |

107,850 | Graco, Inc. | 5,749,484 | |

261,950 | Titan International, Inc. | 7,567,735 | |

163,850 | Woodward, Inc. | 6,814,522 | |

24,343,034 | |||

Trading Companies & Distributors - 6.0% | |||

454,250 | Beacon Roofing Supply, Inc.* | 12,123,932 | |

620,000 | CAI International, Inc.* | 12,809,200 | |

24,933,132 | |||

72,128,357 | |||

| Information Technology - 24.9% | |||

Communications Equipment - 3.2% | |||

187,950 | Aruba Networks, Inc.* | 3,969,504 | |

247,500 | Radware Ltd.* | 9,523,800 | |

13,493,304 | |||

Internet Software & Services - 9.0% | |||

525,300 | j2 Global, Inc. | 13,568,499 | |

178,950 | Liquidity Services, Inc.* | 9,543,403 | |

264,250 | LivePerson, Inc.* | 4,196,290 | |

136,750 | LogMeIn, Inc.* | 4,924,368 | |

187,100 | Stamps.com, Inc.* | 5,431,513 | |

37,664,073 | |||

IT Services - 2.3% | |||

793,200 | Online Resources Corp.* | 2,244,756 | |

605,550 | Sapient Corp. | 7,248,434 | |

9,493,190 | |||

Semiconductors & Semiconductor Equipment - 4.3% | |||

67,450 | Hittite Microwave Corp.* | 3,611,273 | |

210,600 | Power Integrations, Inc. | 7,977,528 | |

180,150 | Silicon Laboratories, Inc.* | 6,393,523 | |

17,982,324 | |||

Software - 6.1% | |||

80,700 | CommVault Systems, Inc.* | 4,202,049 | |

291,400 | NetScout Systems, Inc.* | 6,029,066 | |

137,200 | QLIK Technologies, Inc.* | 3,952,732 | |

| Information Technology (Continued) | |||

Software (Continued) | |||

234,500 | Solarwinds, Inc.* | $ 11,000,395 | |

25,184,242 | |||

103,817,133 | |||

| Materials - 3.2% | |||

Chemicals - 1.9% | |||

113,200 | Intrepid Potash, Inc.* | 2,813,020 | |

119,300 | TPC Group, Inc.* | 5,008,214 | |

7,821,234 | |||

Metals & Mining - 1.3% | |||

513,250 | Noranda Aluminum | ||

Holding Corp. | 5,450,715 | ||

13,271,949 | |||

| Telecommunication Services - 1.8% | |||

Diversified Telecommunication Services - 1.8% | |||

394,200 | Cogent Communications | ||

Group, Inc.* | 7,383,366 | ||

| Total Investment in Common Stocks - 95.8% | |||

(Identified cost, $327,270,176) | 398,928,700 | ||

| Short-Term Investment - 3.6% | |||

15,197,339 | State Street Institutional U.S. | ||

Government Money | |||

Market Fund | |||

(Identified cost, $15,197,339) | 15,197,339 | ||

| Total Investments - 99.4% | |||

(Identified cost, $342,467,515) | 414,126,039 | ||

| Other Assets in Excess | |||

of Liabilities - 0.6% | 2,378,973 | ||

| Net Assets - 100% | $416,505,012 | ||

* | Non-income producing security | ||

ADR | American Depositary Receipt | ||

See notes to financial statements.

13

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND | ||||

STATEMENT OF ASSETS AND LIABILITIES - APRIL 30, 2012 (UNAUDITED) | ||||

| Assets: | ||||

Investments, at value (Note 1A) (Identified cost of $342,467,515) | $ | 414,126,039 | ||

Dividends receivable | 77,933 | |||

Receivable for investments sold | 7,791,792 | |||

Receivable for Fund shares sold | 811,079 | |||

Prepaid expenses | 24,672 | |||

Total Assets | 422,831,515 | |||

| Liabilities: | ||||

Payable to Affiliates: | ||||

Investment adviser fee (Note 4) | 318,665 | |||

Distribution and service fees (Note 6) | 26,554 | |||

Accrued expenses and other liabilities | 123,579 | |||

Payable for investments purchased | 5,157,479 | |||

Payable for Fund shares repurchased | 700,226 | |||

Total Liabilities | 6,326,503 | |||

| Net Assets | $ | 416,505,012 | ||

At April 30, 2012, net assets consisted of: | ||||

Paid-in capital | $ | 392,241,141 | ||

Accumulated net investment loss | (1,091,960 | ) | ||

Accumulated net realized loss on investments | (46,302,693 | ) | ||

Unrealized appreciation in value of investments | 71,658,524 | |||

Net assets applicable to outstanding capital stock | $ | 416,505,012 | ||

Net Assets consist of: | ||||

Institutional shares | $ | 293,688,695 | ||

Investor shares | $ | 122,816,317 | ||

Shares Outstanding consist of (Note 2): | ||||

Institutional shares | 10,828,530 | |||

Investor shares | 4,664,863 | |||

| Net Asset Value Per Share | ||||

(Represents both the offering and redemption price*) | ||||

Institutional shares | $ | 27.12 | ||

Investor shares | $ | 26.33 | ||

| * | In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by each share class of the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital. |

See notes to financial statements.

14

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND | ||||

STATEMENT OF OPERATIONS - FOR THE SIX MONTHS ENDED APRIL 30, 2012 (UNAUDITED) | ||||

| Investment Income: | ||||

Dividends | $ | 1,248,732 | ||

Other Income | 26,301 | |||

Total investment income | 1,275,033 | |||

| Expenses: | ||||

Investment adviser fee (Notes 4 and 7) | 1,847,662 | |||

Non-interested trustees’ remuneration | 65,470 | |||

Transfer agent | ||||

Institutional Shares | 30,432 | |||

Investor Shares | 106,905 | |||

Custodian | 50,668 | |||

Insurance | 15,907 | |||

Professional fees | 34,890 | |||

Registration | 41,098 | |||

Distribution and service fees (Note 6) | 113,164 | |||

Printing and other expenses | 60,797 | |||

Total expenses | 2,366,993 | |||

Net investment loss | (1,091,960 | ) | ||

Realized and unrealized gain/(loss) on investments: | ||||

Net realized gain on investments | 31,034,323 | |||

Increase in unrealized appreciation on investments | 19,618,881 | |||

Net realized and unrealized gain on investments | 50,653,204 | |||

Net increase in net assets resulting from operations | $ | 49,561,244 | ||

See notes to financial statements.

CENTURY FUNDS

15

CENTURY SMALL CAP SELECT FUND | ||||||||

STATEMENT OF CHANGES IN NET ASSETS | ||||||||

| Six Months Ended | ||||||||

INCREASE (DECREASE) | April 30, 2012 | Year Ended | ||||||

IN NET ASSETS: | (Unaudited) | October 31, 2011 | ||||||

Operations: | ||||||||

Net investment loss | $ | (1,091,960 | ) | $ | (1,865,136 | ) | ||

Net realized gain on investments | 31,034,323 | 79,336,385 | ||||||

Change in net unrealized appreciation | 19,618,881 | (29,175,691 | ) | |||||

Net increase in net assets resulting from operations | 49,561,244 | 48,295,558 | ||||||

Capital share transactions - net (Note 2) | (4,461,551 | ) | (18,974,857 | ) | ||||

Redemption fees | 3,876 | 32,775 | ||||||

Total increase | 45,103,569 | 29,353,476 | ||||||

| Net Assets: | ||||||||

Beginning of period | 371,401,443 | 342,047,967 | ||||||

End of period | $ | 416,505,012 | $ | 371,401,443 | ||||

Accumulated net investment loss | $ | (1,091,960 | ) | $ | — | |||

See notes to financial statements.

16

CENTURY FUNDS

CENTURY SMALL CAP SELECT FUND | ||||||||||||||||||||||||

FINANCIAL HIGHLIGHTS - INSTITUTIONAL SHARES | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| April 30, 2012 | Year Ended October 31, | |||||||||||||||||||||||

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

Net Asset Value, beginning of period | $ | 23.91 | $ | 20.99 | $ | 16.34 | $ | 14.62 | $ | 26.13 | $ | 25.74 | ||||||||||||

Income/(loss) from Investment Operations: | ||||||||||||||||||||||||

Net investment income/(loss)(a) | (0.06 | ) | (0.09 | ) | (0.05 | ) | (0.01 | ) | (0.12 | ) | 0.00 | † | ||||||||||||

Net realized and unrealized gain/(loss) | ||||||||||||||||||||||||

on investments | 3.27 | 3.01 | 4.70 | 1.73 | (9.00 | ) | 2.75 | |||||||||||||||||

Total income/(loss) from investment | ||||||||||||||||||||||||

operations | 3.21 | 2.92 | 4.65 | 1.72 | (9.12 | ) | 2.75 | |||||||||||||||||

Less Distributions From: | ||||||||||||||||||||||||

Net investment income | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.10 | ) | (0.35 | ) | ||||||||||||

Tax return of capital | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.19 | ) | (0.00 | ) | ||||||||||||

Net realized gain on investment transactions | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (2.10 | ) | (2.01 | ) | ||||||||||||

Total distributions | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (2.39 | ) | (2.36 | ) | ||||||||||||

Redemption fees | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | ||||||||||||

Net Asset Value, end of period | $ | 27.12 | $ | 23.91 | $ | 20.99 | $ | 16.34 | $ | 14.62 | $ | 26.13 | ||||||||||||

Total Return | 13.43 | %** | 13.86 | % | 28.52 | % | 11.69 | % | (38.24 | )% | 11.61 | % | ||||||||||||

Ratios and supplemental data | ||||||||||||||||||||||||

Net assets, end of period (000 omitted) | $ | 293,689 | $ | 254,724 | $ | 249,429 | $ | 216,295 | $ | 262,793 | $ | 575,027 | ||||||||||||

Ratio of expenses to average net assets | 1.11 | %* | 1.11 | % | 1.13 | % | 1.14 | % | 1.11 | % | 1.08 | % | ||||||||||||

Ratio of net investment income/(loss) to | ||||||||||||||||||||||||

average net assets | (0.45 | )%* | (0.37 | )% | (0.25 | )% | (0.08 | )% | (0.57 | )% | 0.02 | % | ||||||||||||

Portfolio Turnover Rate | 23 | %** | 75 | % | 85 | % | 133 | % | 104 | % | 100 | % | ||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| † | Amount represents less than $0.005 per share. |

| ** | Not annualized |

| * | Annualized |

See notes to financial statements.

CENTURY FUNDS

17

CENTURY SMALL CAP SELECT FUND | ||||||||||||||||||||||||

FINANCIAL HIGHLIGHTS - INVESTOR SHARES | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| April 30, 2012 | Year Ended October 31, | |||||||||||||||||||||||

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

Net Asset Value, beginning of period | $ | 23.25 | $ | 20.49 | $ | 16.00 | $ | 14.37 | $ | 25.72 | $ | 25.40 | ||||||||||||

Income/(loss) from Investment Operations: | ||||||||||||||||||||||||

Net investment loss(a) | (0.10 | ) | (0.17 | ) | (0.11 | ) | (0.07 | ) | (0.20 | ) | (0.06 | ) | ||||||||||||

Net realized and unrealized gain/(loss) | ||||||||||||||||||||||||

on investments | 3.18 | 2.92 | 4.60 | 1.70 | (8.86 | ) | 2.71 | |||||||||||||||||

Total income/(loss) from investment operations | 3.08 | 2.75 | 4.49 | 1.63 | (9.06 | ) | 2.65 | |||||||||||||||||

Less Distributions From: | ||||||||||||||||||||||||

Net investment income | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.32 | ) | ||||||||||||

Tax return of capital | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.19 | ) | (0.00 | ) | ||||||||||||

Net realized gain on investment transactions | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (2.10 | ) | (2.01 | ) | ||||||||||||

Total distributions | (0.00 | ) | (0.00 | ) | (0.00 | ) | (0.00 | ) | (2.29 | ) | (2.33 | ) | ||||||||||||

Redemption fees | 0.00 | † | 0.01 | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | |||||||||||||

Net Asset Value, end of period | $ | 26.33 | $ | 23.25 | $ | 20.49 | $ | 16.00 | $ | 14.37 | $ | 25.72 | ||||||||||||

Total Return | 13.25 | %** | 13.47 | % | 28.06 | % | 11.27 | % | (38.49 | )% | 11.34 | % | ||||||||||||

Ratios and supplemental data | ||||||||||||||||||||||||

Net assets, end of period (000 omitted) | $ | 122,816 | $ | 116,678 | $ | 92,618 | $ | 91,809 | $ | 102,252 | $ | 257,750 | ||||||||||||

Ratio of expenses to average net assets | 1.46 | %* | 1.48 | % | 1.50 | % | 1.53 | % | 1.50 | % | 1.36 | % | ||||||||||||

Ratio of net investment loss to | ||||||||||||||||||||||||

average net assets | (0.81 | )%* | (0.71 | )% | (0.61 | )% | (0.47 | )% | (0.96 | )% | (0.24 | )% | ||||||||||||

Portfolio turnover rate | 23 | %** | 75 | % | 85 | % | 133 | % | 104 | % | 100 | % | ||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| † | Amount represents less than $0.005 per share. |

| ** | Not annualized |

| * | Annualized |

See notes to financial statements.

18

CENTURY FUNDS

This Page Intentionally Left Blank.

19

CENTURY SHARES TRUST |

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) |

| Shares | Value | ||

| COMMON STOCK - 96.8% | |||

| Consumer Discretionary - 14.0% | |||

Hotels, Restaurants & Leisure - 3.9% | |||

188,050 | Marriott International, Inc. | ||

Class A | $ 7,350,875 | ||

Media - 4.4% | |||

250,750 | CBS Corp. Class B | 8,362,512 | |

Multiline Retail - 2.0% | |||

92,900 | Macy’s, Inc. | 3,810,758 | |

Specialty Retail - 3.7% | |||

67,650 | O’Reilly Automotive, Inc.* | 7,134,369 | |

26,658,514 | |||

| Consumer Staples - 10.4% | |||

Food & Staples Retailing - 3.3% | |||

70,550 | Costco Wholesale Corp. | 6,220,393 | |

Food Products - 7.1% | |||

140,900 | Green Mountain Coffee | ||

Roasters, Inc.* | 6,868,875 | ||

118,400 | McCormick & Co. Inc. | 6,619,744 | |

13,488,619 | |||

19,709,012 | |||

| Energy - 9.8% | |||

Energy Equipment & Services - 3.3% | |||

78,800 | Oil States International, Inc.* | 6,270,904 | |

Oil, Gas & Consumable Fuels - 6.5% | |||

60,850 | Apache Corp. | 5,837,949 | |

89,650 | ConocoPhillips | 6,421,630 | |

12,259,579 | |||

18,530,483 | |||

| Financials - 4.4% | |||

Commercial Banks - 1.4% | |||

68,450 | CIT Group, Inc.* | 2,590,833 | |

Insurance - 3.0% | |||

| 4 | Berkshire Hathaway, Inc. Class A* | 483,200 | |

87,650 | Prudential Financial, Inc. | 5,306,331 | |

5,789,531 | |||

8,380,364 | |||

| Shares | Value | ||

| Health Care - 11.6% | |||

Biotechnology - 4.4% | |||

93,350 | Alexion Pharmaceuticals, Inc.* | $ 8,431,372 | |

Health Care Providers & Services - 3.6% | |||

121,150 | Express Scripts Holding Co* | 6,758,958 | |

Pharmaceuticals - 3.6% | |||

108,750 | Abbott Laboratories | 6,749,025 | |

21,939,355 | |||

| Industrials - 12.9% | |||

Aerospace & Defense - 3.1% | |||

123,550 | BE Aerospace, Inc.* | 5,810,556 | |

Construction & Engineering - 3.6% | |||

154,350 | Chicago Bridge & Iron Co. NV | 6,856,227 | |

Electrical Equipment - 2.8% | |||

68,000 | Rockwell Automation, Inc. | 5,259,120 | |

Machinery - 3.4% | |||

115,300 | Timken Co. | 6,515,603 | |

24,441,506 | |||

| Information Technology - 30.5% | |||

Communications Equipment - 7.7% | |||

54,750 | F5 Networks, Inc.* | 7,332,668 | |

113,550 | QUALCOMM, Inc. | 7,249,032 | |

14,581,700 | |||

Computers & Peripherals - 10.7% | |||

24,850 | Apple, Inc.* | 14,518,364 | |

206,350 | EMC Corp.* | 5,821,133 | |

20,339,497 | |||

Internet Software & Services - 3.1% | |||

9,900 | Google, Inc. Class A* | 5,991,777 | |

IT Services - 2.6% | |||

68,300 | Cognizant Technology Solutions | ||

Corp. Class A* | 5,007,756 | ||

See notes to financial statements.

20

CENTURY FUNDS

CENTURY SHARES TRUST (CONTINUED) | |||

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) | |||

| Shares | Value | ||

| Information Technology (Continued) | |||

Software - 6.4% | |||

181,350 | Adobe Systems, Inc.* | $ 6,086,106 | |

204,000 | Oracle Corp. | 5,995,560 | |

12,081,666 | |||

58,002,396 | |||

| Materials - 3.2% | |||

Chemicals - 3.2% | |||

146,700 | LyondellBasell Industries | ||

NV Class A | 6,129,127 | ||

| Total Investment in Common Stocks - 96.8% | |||

(Identified cost, $138,269,328) | 183,790,757 | ||

| Short-Term Investment - 5.6% | |||

10,566,343 | State Street Institutional U.S. | ||

Government Money | |||

Market Fund | |||

(Identified cost, $10,566,343) | 10,566,343 | ||

| Total Investments - 102.4% | |||

(Identified cost, $148,835,671) | 194,357,100 | ||

| Liabilities in Excess of | |||

Other Assets - (2.4)% | (4,491,696) | ||

| Net Assets - 100% | $189,865,404 | ||

| * | Non-income producing security |

See notes to financial statements.

CENTURY FUNDS

21

CENTURY SHARES TRUST | ||||

STATEMENT OF ASSETS AND LIABILITIES - APRIL 30, 2012 (UNAUDITED) | ||||

| Assets: | ||||

Investments, at value (Note 1A) (Identified cost of $148,835,671) | $ | 194,357,100 | ||

Dividends receivable | 78,102 | |||

Receivable for Fund shares sold | 4,114 | |||

Prepaid expenses | 10,651 | |||

Total Assets | 194,449,967 | |||

| Liabilities: | ||||

Payable to Affiliates: | ||||

Investment adviser fee (Note 4) | 125,009 | |||

Administration fees (Note 5) | 15,626 | |||

Accrued expenses and other liabilities | 67,800 | |||

Payable for investments purchased | 4,317,947 | |||

Payable for Fund shares repurchased | 58,181 | |||

Total Liabilities | 4,584,563 | |||

| Net Assets | $ | 189,865,404 | ||

At April 30, 2012, net assets consisted of: | ||||

Paid-in capital | $ | 131,164,024 | ||

Distributions in excess of net investment income | (113,719 | ) | ||

Accumulated undistributed net realized gains on investments | 13,293,670 | |||

Unrealized appreciation in value of investments | 45,521,429 | |||

Net assets applicable to outstanding capital stock | $ | 189,865,404 | ||

Net Assets consist of: | ||||

Institutional shares | $ | 189,865,404 | ||

Shares Outstanding consist of (Note 2): | ||||

Institutional shares | 9,236,634 | |||

| Net Asset Value Per Share | ||||

(Represents both the offering and redemption price*) | ||||

Institutional shares | $ | 20.56 | ||

| * | In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital. |

See notes to financial statements.

22

CENTURY FUNDS

CENTURY SHARES TRUST | ||||

STATEMENT OF OPERATIONS - FOR THE SIX MONTHS ENDED APRIL 30, 2012 (UNAUDITED) | ||||

| Investment Income: | ||||

Dividends (net of foreign withholding tax of $112,340) | $ | 1,445,737 | ||

Total investment income | 1,445,737 | |||

| Expenses: | ||||

Investment adviser fee (Notes 4 and 7) | 723,688 | |||

Non-interested trustees’ remuneration | 31,368 | |||

Transfer agent | 58,049 | |||

Custodian | 23,275 | |||

Administration fees (Note 5) | 90,461 | |||

Insurance | 7,335 | |||

Professional fees | 27,892 | |||

Registration | 12,470 | |||

Printing and other expenses | 29,932 | |||

Total expenses | 1,004,470 | |||

Net investment income | 441,267 | |||

Realized and unrealized gain/(loss) on investments: | ||||

Net realized gain on investments | 13,293,641 | |||

Increase in unrealized appreciation on investments | 6,218,004 | |||

Net realized and unrealized gain on investments | 19,511,645 | |||

Net increase in net assets resulting from operations | $ | 19,952,912 | ||

See notes to financial statements.

CENTURY FUNDS

23

CENTURY SHARES TRUST | ||||||||

STATEMENT OF CHANGES IN NET ASSETS | ||||||||

| Six Months Ended | ||||||||

INCREASE (DECREASE) | April 30, 2012 | Year Ended | ||||||

IN NET ASSETS: | (Unaudited) | October 31, 2011 | ||||||

Operations: | ||||||||

Net investment income/(loss) | $ | 441,267 | $ | (186,914 | ) | |||

Net realized gain on investments | 13,293,641 | 18,620,958 | ||||||

Change in net unrealized appreciation | 6,218,004 | (1,153,307 | ) | |||||

Net increase in net assets resulting from operations | 19,952,912 | 17,280,737 | ||||||

Distributions to shareholders from: | ||||||||

Net investment income | ||||||||

Institutional shares | (554,986 | ) | (51,630 | ) | ||||

Net realized gain from investment transactions | ||||||||

Institutional shares | (18,171,512 | ) | (7,888,685 | ) | ||||

Investor shares | — | (73,860 | ) | |||||

Capital share transactions - net (Note 2) | 10,430,081 | (9,736,363 | ) | |||||

Redemption fees | 7,862 | 424 | ||||||

Total increase/(decrease) | 11,664,357 | (469,377 | ) | |||||

Net Assets: | ||||||||

Beginning of period | 178,201,047 | 178,670,424 | ||||||

End of period | $ | 189,865,404 | $ | 178,201,047 | ||||

Distributions in excess of net investment income | $ | (113,719 | ) | $ | — | |||

See notes to financial statements.

24

CENTURY FUNDS

CENTURY SHARES TRUST | ||||||||||||||||||||||||

FINANCIAL HIGHLIGHTS - INSTITUTIONAL SHARES | ||||||||||||||||||||||||

| Six Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| April 30, 2012 | Year Ended October 31, | |||||||||||||||||||||||

| (Unaudited) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

Net Asset Value, beginning of period | $ | 20.66 | $ | 19.65 | $ | 16.84 | $ | 15.51 | $ | 29.52 | $ | 35.69 | ||||||||||||

Income/(loss) from Investment Operations: | ||||||||||||||||||||||||

Net investment income/(loss)(a) | 0.05 | (0.02 | ) | (0.01 | ) | 0.00 | † | (0.01 | ) | 0.16 | ||||||||||||||

Net realized and unrealized gain/(loss) | ||||||||||||||||||||||||

on investments | 2.03 | 1.93 | 2.82 | 1.36 | (7.44 | ) | 2.95 | |||||||||||||||||

Total income/(loss) from | ||||||||||||||||||||||||

investment operations | 2.08 | 1.91 | 2.81 | 1.36 | (7.45 | ) | 3.11 | |||||||||||||||||

Less Distributions From: | ||||||||||||||||||||||||

Net investment income | (0.06 | ) | (0.01 | ) | (0.00 | )† | (0.03 | ) | (0.30 | ) | (0.43 | ) | ||||||||||||

Net realized gain on investment transactions | (2.12 | ) | (0.89 | ) | (0.00 | ) | (0.00 | ) | (6.26 | ) | (8.85 | ) | ||||||||||||

Total distributions | (2.18 | ) | (0.90 | ) | (0.00 | )† | (0.03 | ) | (6.56 | ) | (9.28 | ) | ||||||||||||

Redemption fees | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | 0.00 | † | ||||||||||||

Net Asset Value, end of period | $ | 20.56 | $ | 20.66 | $ | 19.65 | $ | 16.84 | $ | 15.51 | $ | 29.52 | ||||||||||||

Total Return | 11.65 | %** | 9.79 | % | 16.72 | % | 8.59 | % | (32.31 | )% | 11.86 | % | ||||||||||||

Ratios and supplemental data | ||||||||||||||||||||||||

Net assets, end of period (000 omitted) | $ | 189,865 | $ | 178,201 | $ | 177,042 | $ | 166,574 | $ | 168,199 | $ | 287,670 | ||||||||||||

Ratio of expenses to average net assets | 1.11 | %* | 1.13 | % | 1.15 | % | 1.20 | % | 1.17 | % | 1.10 | % | ||||||||||||

Ratio of net investment income/(loss) to | ||||||||||||||||||||||||

average net assets | 0.49 | %* | (0.10 | )% | (0.05 | )% | 0.03 | % | (0.02 | )% | 0.56 | % | ||||||||||||

Portfolio Turnover Rate | 34 | %** | 72 | % | 67 | % | 79 | % | 91 | % | 38 | % | ||||||||||||

| (a) | Calculated based on average shares outstanding during the period. |

| † | Amount represents less than $0.005 per share. |

| ** | Not annualized |

| * | Annualized |

See notes to financial statements.

CENTURY FUNDS

25

CENTURY GROWTH OPPORTUNITIES FUND |

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) |

| Shares | Value | ||

| COMMON STOCK - 97.8% | |||

| Consumer Discretionary - 19.4% | |||

Diversified Consumer Services - 0.6% | |||

6,350 | Strayer Education, Inc. | $ 626,618 | |

Hotels, Restaurants & Leisure - 2.0% | |||

23,350 | Buffalo Wild Wings, Inc.* | 1,957,897 | |

Household Durables - 2.1% | |||

125,100 | DR Horton, Inc. | 2,045,385 | |

Media - 1.9% | |||

60,250 | Lamar Advertising Co. Class A* | 1,917,155 | |

Specialty Retail - 11.9% | |||

96,450 | Ascena Retail Group, Inc.* | 1,975,296 | |

44,200 | Dick’s Sporting Goods, Inc. | 2,236,520 | |

41,550 | DSW, Inc. Class A | 2,337,603 | |

11,550 | O’Reilly Automotive, Inc.* | 1,218,063 | |

105,300 | Pier 1 Imports, Inc. | 1,809,054 | |

83,000 | Sally Beauty Holdings, Inc.* | 2,207,800 | |

11,784,336 | |||

Textiles, Apparel & Luxury Goods - 0.9% | |||

45,000 | Crocs, Inc.* | 909,000 | |

19,240,391 | |||

| Consumer Staples - 4.2% | |||

Food Products - 2.0% | |||

40,050 | Green Mountain Coffee | ||

Roasters, Inc.* | 1,952,438 | ||

Personal Products - 2.2% | |||

31,600 | Herbalife Ltd. | 2,222,112 | |

4,174,550 | |||

| Energy - 5.0% | |||

Energy Equipment & Services - 2.0% | |||

15,300 | Dril-Quip, Inc.* | 1,031,067 | |

12,450 | Lufkin Industries, Inc. | 956,658 | |

1,987,725 | |||

| Shares | Value | ||

| Energy (Continued) | |||

Oil, Gas & Consumable Fuels - 3.0% | |||

20,200 | Berry Petroleum Co. Class A | $ 920,110 | |

35,750 | Whiting Petroleum Corp.* | 2,044,900 | |

2,965,010 | |||

4,952,735 | |||

| Financials - 6.3% | |||

Capital Markets - 2.1% | |||

63,600 | Waddell & Reed Financial, | ||

Inc. Class A | 2,033,928 | ||

Commercial Banks - 2.0% | |||

150,600 | Associated Banc-Corp | 2,007,498 | |

Diversified Financial Services - 2.2% | |||

54,050 | Moody’s Corp. | 2,213,347 | |

6,254,773 | |||

| Health Care - 14.6% | |||

Health Care Equipment & Supplies - 5.0% | |||

58,600 | Cyberonics, Inc.* | 2,244,380 | |

30,400 | The Cooper Cos., Inc. | 2,680,368 | |

4,924,748 | |||

Health Care Providers & Services - 3.2% | |||

14,050 | MWI Veterinary Supply, Inc.* | 1,326,320 | |

30,000 | WellCare Health Plans, Inc.* | 1,835,400 | |

3,161,720 | |||

Pharmaceuticals - 6.4% | |||

35,500 | Jazz Pharmaceuticals PLC* | 1,811,565 | |

52,950 | Questcor Pharmaceuticals, Inc.* | 2,377,455 | |

39,300 | Salix Pharmaceuticals Ltd.* | 1,941,420 | |

8,850 | VIVUS, Inc.* | 214,347 | |

6,344,787 | |||

14,431,255 | |||

| Industrials - 16.7% | |||

Aerospace & Defense - 2.1% | |||

44,700 | BE Aerospace, Inc.* | 2,102,241 | |

Construction & Engineering - 1.9% | |||

56,100 | KBR, Inc. | 1,899,546 | |

See notes to financial statements.

26

CENTURY FUNDS

CENTURY GROWTH OPPORTUNITIES FUND (CONTINUED) |

PORTFOLIO OF INVESTMENTS – AS OF APRIL 30, 2012 (UNAUDITED) |

| Shares | Value | ||

| Industrials (Continued) | |||

Electrical Equipment - 2.1% | |||

20,500 | Roper Industries, Inc. | $ 2,088,950 | |

Machinery - 7.4% | |||

42,700 | AGCO Corp.* | 1,988,539 | |

48,750 | Kennametal, Inc. | 2,058,712 | |

27,050 | Nordson Corp. | 1,457,995 | |

57,400 | Rexnord Corp.* | 1,267,392 | |

20,150 | Xylem, Inc. | 561,782 | |

7,334,420 | |||

Road & Rail - 2.2% | |||

28,700 | Kansas City Southern | 2,210,474 | |

Trading Companies & Distributors - 1.0% | |||

12,550 | MSC Industrial Direct Co., | ||

Inc. Class A | 925,061 | ||

16,560,692 | |||

| Information Technology - 27.1% | |||

Communications Equipment - 2.1% | |||

15,800 | F5 Networks, Inc.* | 2,116,094 | |

Electronic Equipment, Instruments | |||

& Components - 1.9% | |||

38,050 | IPG Photonics Corp.* | 1,841,620 | |

Internet Software & Services - 3.7% | |||

60,900 | Akamai Technologies, Inc.* | 1,985,340 | |

36,600 | OpenTable, Inc.* | 1,637,118 | |

3,622,458 | |||

IT Services - 4.0% | |||

76,800 | Cardtronics, Inc.* | 2,024,448 | |

40,450 | VeriFone Systems, Inc.* | 1,927,038 | |

3,951,486 | |||

Semiconductors & Semiconductor Equipment - 5.5% | |||

84,750 | NXP Semiconductor NV* | 2,190,787 | |

55,000 | Power Integrations, Inc. | 2,083,400 | |

34,650 | Volterra Semiconductor Corp.* | 1,139,639 | |

5,413,826 | |||

| Shares | Value | ||

| Information Technology (Continued) | |||

Software - 9.9% | |||

34,250 | ANSYS, Inc.* | $ 2,297,147 | |

34,050 | BroadSoft, Inc.* | 1,457,681 | |

57,200 | Fortinet, Inc.* | 1,494,064 | |

48,050 | NetScout Systems, Inc.* | 994,155 | |

40,900 | QLIK Technologies, Inc.* | 1,178,329 | |

51,950 | Solarwinds, Inc.* | 2,436,974 | |

9,858,350 | |||

26,803,834 | |||

| Materials - 4.5% | |||

Chemicals - 2.9% | |||

38,500 | Intrepid Potash, Inc.* | 956,725 | |

72,500 | Kraton Performance | ||

Polymers, Inc.* | 1,885,000 | ||

2,841,725 | |||

Metals & Mining - 1.6% | |||

151,100 | Stillwater Mining Co.* | 1,621,303 | |

4,463,028 | |||

| Total Investment in Common Stocks - 97.8% | |||

(Identified cost, $92,902,180) | 96,881,258 | ||

| Short-Term Investment - 4.3% | |||

4,240,453 | State Street Institutional U.S. | ||

Government Money | |||

Market Fund | |||

(Identified cost, $4,240,453) | 4,240,453 | ||

| Total Investments - 102.1% | |||

(Identified cost, $97,142,633) | 101,121,711 | ||

| Liabilities in Excess of | |||

Other Assets - (2.1)% | (2,046,452) | ||

| Net Assets - 100% | $ 99,075,259 | ||

* Non-income producing security | |||

See notes to financial statements.

CENTURY FUNDS

27

CENTURY GROWTH OPPORTUNITIES FUND | ||||

STATEMENT OF ASSETS AND LIABILITIES -APRIL30, 2012 (UNAUDITED) | ||||

| Assets: | ||||

Investments, at value (Note 1A) (Identified cost of $97,142,633) | $ | 101,121,711 | ||

Dividends receivable | 11,856 | |||

Receivable for investments sold | 234,478 | |||

Receivable for Fund shares sold | 484,667 | |||

Receivable from investment advisor | 28,338 | |||

Prepaid expenses | 1,875 | |||

Total Assets | 101,882,925 | |||

| Liabilities: | ||||

Payable to Affiliates: | ||||

Investment adviser fee (Note 4) | 64,732 | |||

Administration fees (Note 5) | 8,092 | |||

Accrued expenses and other liabilities | 50,758 | |||

Payable for investments purchased | 2,670,216 | |||

Payable for Fund shares repurchased | 13,868 | |||

Total Liabilities | 2,807,666 | |||

| Net Assets | $ | 99,075,259 | ||

At April 30, 2012, net assets consisted of: | ||||

Paid-in capital | $ | 97,055,437 | ||

Accumulated net investment loss | (185,186 | ) | ||

Accumulated net realized loss on investments | (1,774,070 | ) | ||

Unrealized appreciation in value of investments | 3,979,078 | |||

Net assets applicable to outstanding capital stock | $ | 99,075,259 | ||

Net Assets consist of: | ||||

Institutional shares | $ | 99,075,259 | ||

Shares Outstanding consist of (Note 2): | ||||

Institutional shares | 8,613,980 | |||

| Net Assets Value Per Share | ||||

(Represents both the offering and redemption price*) | ||||

Institutional shares | $ | 11.50 | ||

| * | In general, shares of the Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by the Fund for the benefit of remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital. |

See notes to financial statements.

28

CENTURY FUNDS

CENTURY GROWTH OPPORTUNITIES FUND | ||||

STATEMENT OF OPERATIONS - FOR THE SIX MONTHS ENDED APRIL 30, 2012 (UNAUDITED) | ||||

| Investment Income: | ||||

Dividends | $ | 89,897 | ||

Total investment income | 89,897 | |||

| Expenses: | ||||

Investment adviser fee (Notes 4 and 7) | 200,060 | |||

Non-interested trustees’ remuneration | 15,269 | |||

Transfer agent | 10,054 | |||

Custodian | 37,020 | |||

Administration fees (Note 5) | 25,008 | |||

Insurance | 141 | |||

Professional fees | 24,569 | |||

Registration | 12,093 | |||

Printing and other expenses | 5,153 | |||

Total expenses | 329,367 | |||

Adviser reimbursements (Note 7) | (54,284 | ) | ||

Net expenses | 275,083 | |||

Net investment loss | (185,186 | ) | ||

Realized and unrealized gain/(loss) on investments: | ||||

Net realized loss on investments | (1,236,621 | ) | ||

Increase in unrealized appreciation on investments | 3,625,960 | |||

Net realized and unrealized gain on investments | 2,389,339 | |||

Net increase in net assets resulting from operations | $ | 2,204,153 | ||

See notes to financial statements.

CENTURY FUNDS

29

CENTURY GROWTH OPPORTUNITIES FUND | ||||||||

STATEMENT OF CHANGES IN NET ASSETS | ||||||||

| Six Months Ended | For the | |||||||

INCREASE (DECREASE) | April 30, 2012 | Period Ended | ||||||

IN NET ASSETS: | (Unaudited) | October 31, 2011(a) | ||||||

Operations: | ||||||||

Net investment loss | $ | (185,186 | ) | $ | (30,402 | ) | ||

Net realized loss on investments | (1,236,621 | ) | (537,714 | ) | ||||

Change in net unrealized appreciation | 3,625,960 | 353,118 | ||||||

Net increase/(decrease) in net assets resulting from operations | 2,204,153 | (214,998 | ) | |||||

Capital share transactions - net (Note 2) | 89,547,048 | 7,538,090 | ||||||

Redemption fees | 610 | 356 | ||||||

Total increase | 91,751,811 | 7,323,448 | ||||||

Net Assets: | ||||||||

Beginning of period | 7,323,448 | 0 | ||||||

End of period | $ | 99,075,259 | $ | 7,323,448 | ||||

Accumulated net investment loss | $ | (185,186 | ) | $ | — | |||

(a) For the period from the Fund’s inception, November 17, 2010, to October 31, 2011. |

See notes to financial statements.

30

CENTURY FUNDS

CENTURY GROWTH OPPORTUNITIES FUND | ||||||||

FINANCIAL HIGHLIGHTS - INSTITUTIONAL SHARES | ||||||||

| Six Months | For the | |||||||

| Ended | Period | |||||||

| April 30, | Ended | |||||||

| 2012 | October 31, | |||||||

| (Unaudited) | 2011(a) | |||||||

Net Asset Value, beginning of period | $ | 10.67 | $ | 10.00 | ||||

Income/(loss) from Investment Operations: | ||||||||

Net investment loss(b) | (0.04 | ) | (0.07 | ) | ||||

Net realized and unrealized gain on investments | 0.87 | 0.74 | ||||||

Total income from investment operations | 0.83 | 0.67 | ||||||

Redemption fees | 0.00 | † | 0.00 | † | ||||

Net Asset Value, end of period | $ | 11.50 | $ | 10.67 | ||||

Total Return | 7.78 | %** | 6.70 | %** | ||||

Ratios and supplemental data | ||||||||

Net assets, end of period (000 omitted) | $ | 99,075 | $ | 7,323 | ||||

Ratio of expenses to average net assets | 1.10 | %* | 1.10 | %* | ||||

Ratio of expenses to average net assets without | ||||||||

giving effect to contractual expense agreement | 1.32 | %* | 3.62 | %* | ||||

Ratio of net investment loss to average net assets | (0.74 | )%* | (0.64 | )%* | ||||

Portfolio Turnover Rate | 56 | %** | 119 | %** | ||||

| (a) | For the period from the Fund’s inception, November 17, 2010, to October 31, 2011. |

| (b) | Calculated based on average shares outstanding during the period. |

| † | Amount represents less than $0.005 per share. |

| ** | Not annualized |

| * | Annualized |

See notes to financial statements.

CENTURY FUNDS

31

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

(1) SIGNIFICANT ACCOUNTING POLICIES –– Century Capital Management Trust (the “Trust”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as an open-end management investment company organized as a Massachusetts business trust. Century Shares Trust, Century Small Cap Select Fund and Century Growth Opportunities Fund (each a “Fund” and, collectively, the “Funds”) are diversified series of the Trust. The following are significant accounting policies consistently followed by the Funds and are in conformity with accounting principles generally accepted in the United States (GAAP).

A. Security Valuations –– Equity securities are valued at the last reported sale price or official closing price on the primary exchange or market on which they are traded, as reported by an independent pricing service. If no sale price or official closing price is reported, market value is generally determined based on quotes or closing prices obtained from a quotation reporting system, established market maker, or reputable pricing service. For unlisted securities and for exchange-listed securities for which there are no reported sales or official closing prices, fair value is generally determined using closing bid prices. Short-term obligations, maturing in 60 days or less, are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at their closing net asset value each business day.

Under GAAP for fair value measurements, a three tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value.

| · | Level 1 – quoted prices in active markets for identical investments |

| · | Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of April 30, 2012 in valuing the Funds’ investments carried at fair value:

| Quoted Prices | Significant | ||||||||||||||

| In Active | Other | Significant | |||||||||||||

| Markets for | Observable | Unobservable | |||||||||||||

| Identical Assets | Inputs | Inputs | |||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||||

| Century Shares Trust | |||||||||||||||

Common Stock* | $ | 183,790,757 | $ | — | $ | — | $ | 183,790,757 | |||||||

Money Market Funds | 10,566,343 | — | — | 10,566,343 | |||||||||||

Total Investments | $ | 194,357,100 | $ | — | $ | — | $ | 194,357,100 | |||||||

| Century Small Cap Select Fund | |||||||||||||||

Common Stock* | $ | 398,928,700 | $ | — | $ | — | $ | 398,928,700 | |||||||

Money Market Funds | 15,197,339 | — | — | 15,197,339 | |||||||||||

Total Investments | $ | 414,126,039 | $ | — | $ | — | $ | 414,126,039 | |||||||

32

CENTURY FUNDS

| Quoted Prices | Significant | ||||||||||||||

| In Active | Other | Significant | |||||||||||||

| Market for | Observable | Unobservable | |||||||||||||

| Identical Assets | Inputs | Inputs | |||||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||||

| Century Growth Opportunities Fund | |||||||||||||||

Common Stock* | $ | 96,881,258 | $ | — | $ | — | $ | 96,881,258 | |||||||

Money Market Funds | 4,240,453 | — | — | 4,240,453 | |||||||||||

Total Investments | $ | 101,121,711 | $ | — | $ | — | $ | 101,121,711 | |||||||

* At April 30, 2012 the Funds held investments in common stocks classified as Level 1, with corresponding major categories as shown on each Fund’s Portfolio of Investments. |

B. Security Transactions –– Security transactions are recorded on a trade date basis. Gain or loss on sales is determined by the use of a specific identification method, for both financial reporting and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Payments received from certain investments held by the Funds may be comprised of dividends, capital gains and return of capital. The Funds originally estimate the expected classification of such payments. The amounts may subsequently be reclassified upon receipt of information from the issuer. The Funds may invest in equity securities issued or guaranteed by companies organized and based in countries outside of the United States. These securities may be traded on foreign securities exchanges or in foreign over-the-counter markets. Foreign dividend income is recorded on ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Foreign income and capital gain on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded daily on an accrual basis.

C. Use of Estimates –– The preparation of these financial statements in accordance with GAAP incorporates estimates made by management in determining the reported amounts of assets, liabilities, income and expenses of the Funds. Actual results could differ from those estimates.

D. Risks and Uncertainty — Century Small Cap Select Fund concentrates its investments in certain industries detailed in the Portfolio of Investments, which subjects the Fund to the risks associated with those industries and may result in greater fluctuation in share value than is experienced in more diversified portfolios. In addition, the Fund invests in smaller companies, which generally involves greater risk than investing in larger, more established companies.

Century Shares Trust may invest a significant portion of assets in a limited number of companies. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies and therefore may experience greater price volatility than funds with more diversified portfolios.

Century Growth Opportunities Fund invests mainly in small-cap and mid-cap companies, which, historically, have been more volatile in price than the stocks of large-cap companies.

Foreign investing involves certain risks and increased volatility not associated with investing solely in the U.S. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments.

At any given time, a significant portion of the assets of each Fund may be invested in securities of companies within the same market sector of the economy. Companies within the same sector often face similar issues and, consequently, may react similarly to changes in market conditions. If a Fund has a significant weighting in one or more sectors, it may be subject to more risk and price volatility.

E. Multiple Classes of Shares –– Century Small Cap Select Fund offers two classes of shares, which differ in their respective distribution and service fees. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Certain expense reductions may differ by class. Because transfer agent fees include a per account fee, each class differs with respect to transfer agent fees incurred.

CENTURY FUNDS

33

Prior to May 27, 2011, Century Shares Trust offered two classes of shares; however, effective as of that date, all 61,614 of the Fund’s issued and outstanding Investors Shares were converted to Institutional Shares and the Investors Shares class was closed.

F. Redemption Fees –– In general, shares of each Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by each share class of each Fund for the benefit of the Fund’s remaining shareholders. The redemption fee is accounted for as an addition to paid-in-capital.

G. Income Tax Information and Distributions to Shareholders –– Each year, each Fund intends to qualify as a regulated investment company by distributing all of its taxable income and sufficient net investment income and net realized gains, if any, under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on each Fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Income dividends and capital gain distributions are declared separately for each class. Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Capital accounts within the financial statements are adjusted for permanent book and tax differences. Generally accepted accounting principles require that any distributions in excess of tax basis earnings and profits be reported in the financial statements as a tax return of capital.

The federal income tax cost of investments and gross unrealized appreciation and depreciation as of April 30, 2012 were as follows:

| Century Shares Trust | ||||