UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-09561 | ||

| (Investment Company Act File Number) | ||

Century Capital Management Trust | ||

| (Exact Name of Registrant as Specified in Charter) | ||

| c/o Century Capital Management, LLC | ||

| 100 Federal Street, Boston, MA 02110 | ||

| (Address of Principal Executive Offices) | ||

Jennifer Mortimer Century Capital Management, LLC | ||

100 Federal Street, Boston, MA 02110 | ||

| (Name and Address of Agent for Service) | ||

(617) 482-3060 | ||

| (Registrant’s Telephone Number) | ||

Date of Fiscal Year End: October 31

Date of Reporting Period: October 31, 2015

| Item 1. | Reports to Shareholders. |

Table of Contents

| Page | |

| Letter to Shareholders | 1 |

| Fund Summaries | |

| Century Shares Trust | 5 |

| Century Small Cap Select Fund | 8 |

| Century Growth Opportunities Fund | 11 |

| Portfolio of Investments | |

| Century Shares Trust | 14 |

| Century Small Cap Select Fund | 16 |

| Century Growth Opportunities Fund | 18 |

| Statements of Assets and Liabilities | 20 |

| Statements of Operations | 21 |

| Statements of Changes in Net Assets | 22 |

| Financial Highlights | |

| Century Shares Trust | 24 |

| Century Small Cap Select Fund | 25 |

| Century Growth Opportunities Fund | 27 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered Public Accounting Firm | 37 |

| Shareholder Meeting Results | 38 |

| Disclosure of Fund Expenses | 39 |

| Tax Information | 40 |

| Approval of Investment Management Agreements | 41 |

| Trustees and Officers | 46 |

This report is submitted for the general information of the shareholders of Century Shares Trust, Century Small Cap Select Fund, and Century Growth Opportunities Fund (each a “Fund” and collectively, the “Funds”). It is not authorized for distribution to prospective investors in a Fund unless it is preceded by or accompanied by the Fund’s current prospectus. The prospectus includes important information about the Fund’s objective, risks, charges and expenses, experience of its management, and other information. Please read the prospectus carefully before you invest.

The views expressed in this report are those of the Funds’ Portfolio Managers as of October 31, 2015, the end of the reporting period. Any such views are subject to change at any time and may not reflect the Portfolio Managers’ views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice. There is no assurance that the Funds will continue to invest in the securities mentioned in this report.

| Letter to Shareholders |

October 31, 2015 (Unaudited)

Dear Fellow Shareholders,

The year 2015 has been a continuation of favorable domestic trends amidst global challenges. After five years of a fairly steady economic recovery, shouldn’t investors and consumers feel better about low inflation and low unemployment? At the time of writing, the S&P 500 Index is up 3.01% for the calendar year through November 30, 2015, and the index is up 95.84% for the five years through November 30, 2015, compounding at an impressive 14.38% annual return. This sustained recovery seems unloved, despite these strong results.

We suggest there are a few primary reasons for this cautious market: 1) the pace of economic growth has been slower than prior recoveries 2) rising interest rate risks are unknown and 3) the recovery benefits have not been evenly distributed across the population. We believe the economy will benefit as wage increases spread to lower income households over the next year. The upcoming 2016 Presidential election is already highlighting populist economic themes as a major campaign issue.

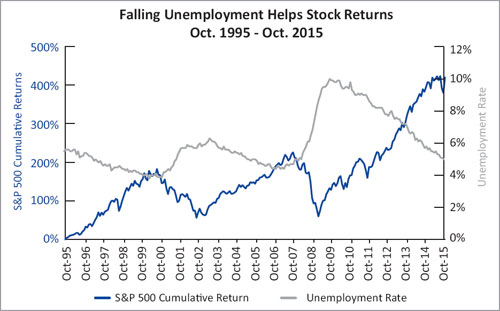

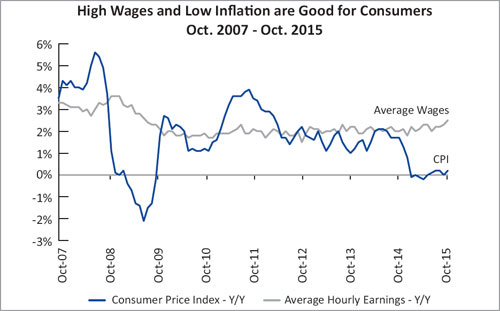

The U.S. economy has remained on firmer footing than other global powers. U.S. inflation has been running below the Federal Reserve’s (“Fed”) 2% target. Companies have consistently added jobs, and the unemployment rate has dropped to 5.0%, well below its long term average. We find it interesting that wage pressures are emerging, despite the price of goods (represented by CPI in the nearby chart) not growing. Perhaps, we are finally seeing a shift in the balance of power from capital toward labor, which would be a reversal of recent trends. Oil prices have declined over 40% in the last year - the equivalent of a tax cut for consumers. Interest rates are at record lows, although the Federal Reserve is widely expected to raise rates over the coming months. In summary, Americans are in an enviable position. Most other nations have been trying to stimulate spending and have kept interest rates low to avoid slipping into another recession.

Source: Bloomberg (Data as of 10/30/2015; Date range 10/31/1995 through 10/30/2015)

Source: Bloomberg (Data as of 10/31/2015; Date range 10/31/2007 through 10/31/2015)

Past performance is not indicative of future results.

| Annual Report | October 31, 2015 | 1 |

| Letter to Shareholders |

October 31, 2015 (Unaudited)

After several years of rising profit margins, we expect U.S. corporate earnings to remain flat this year, due to weakening global trade and a strengthening U.S. dollar, which hurts exports. S&P 500 earnings are estimated to return to 8%-9% growth in 2016. Companies have been generating significant free cash flow, and Gross Domestic Product (“GDP”) has continued to expand at a moderate 2% rate. Looking out our office window, several construction cranes pierce the skyline, reaffirming our belief that the slow and plodding domestic recovery keeps gaining altitude, despite few signs of ‘irrational exuberance.’ These are encouraging indicators, even if investor optimism is currently missing.

Domestic Economy Looks Steady

The U.S. economy has remained in an expansionary phase. GDP growth has been steady, the unemployment rate has been cut in half (from 10% in 2009 to 5% in 2015), and consumer confidence has been registering levels not seen since 2007. Elevated home prices, lower energy prices and higher wages have put more money in consumers’ pockets. Discretionary spending has remained strong for automobile and household improvement items, but we have been surprised to see consumers show spending restraint at the retail mall and redeploy the proceeds into savings and paying down debts. This frugal trend is worth monitoring.

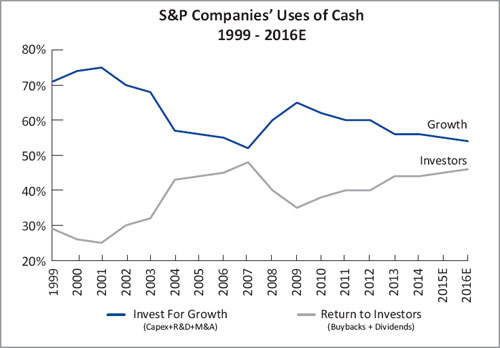

Domestic corporations have generally been healthy with high profit margins and large amounts of net cash on their balance sheets. Free cash flow can be invested for growth (research and development (“R&D”), mergers and acquisitions (“M&A”), and capital expenditures for new equipment) or returned to shareholders (stock buybacks and dividends). Currently, many firms seem hesitant to increase investment in new products or services and more willing to return cash to shareholders. Amid a slower GDP growth environment, CEOs increasingly turn to acquisitions to boost organic revenues. As a result, the mergers and acquisitions cycle has accelerated.

The 2016 Presidential election cycle is already in full swing, which means that any hope for legislative policy initiatives and bipartisanship must wait until 2017. We believe that the political rhetoric and campaign vitriol will dominate the headlines from now until Election Day.

Source: Compustat and Goldman Sachs Global Investment Research Report. (Data as of 11/5/2015; Date range 01/1/1999 through 12/31/2014; 2015 & 2016 are estimates.)

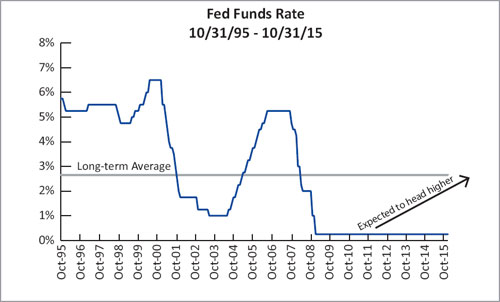

Since the financial crisis of 2008, central banks across the U.S., Europe and Asia have been using innovative monetary policies to spur economic growth. The U.S. recovery is mostly complete, and we believe that the Fed is on the cusp of reversing course and raising rates. Globally, the results are more uncertain. The Fed’s decoupling from other nations’ central banks is another issue to monitor over the next year.

Past performance is not indicative of future results.

| 2 | centuryfunds.com |

| Letter to Shareholders |

October 31, 2015 (Unaudited)

Global Growth Uneven

The Eurozone has been awash in quantitative easing programs, and growth has been erratic. While the latest round of stimulus initiatives have stabilized the Eurozone for now, GDP growth has remained anemic across the continent. More recently, the Paris terrorist attacks and Syrian migrant news headlines have raised concerns about European border and immigration controls.

Asia has continued to face significant economic headwinds. China has also engaged in stimulus measures and recently stumbled as the government intervened to curb market volatility. This interference cast further doubts on the true health of the Chinese economy. Japan has remained stymied by decades of stagnation. Latin America has also suffered from the Asian slowdown and severe commodity recession.

Perhaps, the biggest geopolitical surprise of the last year was the rising belligerence of Russian President Vladimir Putin in Crimea, Ukraine, Syria and Turkey. Russia’s economy has shrunk from the severe drop in oil prices, and Putin’s remedy seems to have been challenging the NATO Alliance countries as the cause of Russia’s problems and the possible return of Russian greatness.

Interest Rate Normalization Takes a Decade

After the Lehman Brothers bankruptcy in 2008, the Federal Reserve undertook an extraordinary program to stimulate growth. Fast forward seven years and most investors are now expecting the Fed to raise rates at their December meeting. The Fed has a dual mandate from Congress to achieve full employment and price stability. The last time the Fed raised interest rates was back on June 29, 2006, nearly a decade ago! It is difficult to forecast how investors will adjust to analyzing markets or companies in a gradually rising interest rate environment, but the capital markets have had several months to adjust their expectations and the fear of inflation appears to be receding for now.

Source Bloomberg (Data as of 10/31/2015; Date range 10/31/1995 through 10/31/2015)

Each Cycle is Slightly Different

Seven years removed from a financial disaster, economic indicators have been improving, and corporations and consumers are arguably in better shape than in other economic recoveries. It surprises us that companies aren’t investing more aggressively in new people, products and plants. With jobs plentiful and rates low, why aren’t consumers spending more of their gas savings? Perhaps it’s the hangover effect of the financial crisis. Caution derived from vivid memory of recent pain is a healthy motivator of behavior. Unfortunately, this painful lesson tends to fade over time as the memory recedes.

Past performance is not indicative of future results.

| Annual Report | October 31, 2015 | 3 |

| Letter to Shareholders |

October 31, 2015 (Unaudited)

Capital markets have been anxiously waiting three years for the Fed to begin raising rates – never have so many waited so long for so little. If the recovery had been stronger and faster, we likely would have battled much steeper wage and commodity inflation, which would have led to more uncertainty and earlier interest rate increases, as well as shortened the expansion. This leaves us feeling that investors should probably be more excited about our ‘tortoise-like’ current economic position than the current investor malaise toward the market.

The stock market tends to climb a wall of worry, and we certainly worry about terrorism, geopolitical crises, inflation, student loan default, global recession, the 2016 election and current valuation levels. However, we remain optimistic that the competitive outlook for American quality growth companies looks favorable versus other countries. While our corporate tax rates and regulatory burden are higher than other nations, the U.S. enjoys many structural advantages in our corporate governance, our diverse and innovative culture, unified laws and strong belief in democratic capitalism. We remain optimistic about researching innovative leaders and investing in well-run companies.

Business Update

We hosted a Special Meeting of Shareholders of the Century Funds on October 1 to seek approval from you, our shareholders, related to our pending change of control, among other proposals. We are excited to announce that all the proposals passed successfully. We will continue to be a 100% employee owned investment boutique. We remain committed to investing in high-quality companies that we believe will deliver solid results in normal and nervous markets and provide an attractive return profile over a full market cycle. We hope to help you reach your investment goals, so please contact us if we can be helpful to you.

We truly appreciate your business, and we are grateful for the trust you place in us.

Respectfully submitted,

Alexander L. Thorndike

Chairman of the Century Funds

| 4 | centuryfunds.com |

| Fund Commentary |

| CENTURY SHARES TRUST | October 31, 2015 (Unaudited) |

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2015, Century Shares Trust’s Institutional shares (CENSX) returned +11.76%, outperforming the Russell 1000 Growth Index (R1000G), the Fund’s benchmark, which returned +9.18%.

WHAT FACTORS INFLUENCED PERFORMANCE?

The top contributors to relative performance on a sector basis were Information Technology, Consumer Discretionary and Financials, resulting mainly from stock selection. The top performing stocks included Amazon.com, Inc. (e-commerce), Equinix, Inc. (data center services), Alphabet, Inc. (internet search and advertising), Starbucks Corp. (coffee retailing) and Allergan PLC (specialty drug manufacturing). Amazon delivered better than expected earnings results despite a negative foreign exchange impact. Equinix lifted on solid earnings results with better than expected revenues. Alphabet, commonly known as Google, benefited from solid earnings results including accelerating growth and lower than expected operating expenses from its U.S. business. Starbucks rose on strong same store sales results. Allergan performed well due to its strong sales and earnings growth.

The top detractors from relative performance on a sector basis were Consumer Staples, Industrials and Energy, resulting mainly from stock selection. The worst performing stocks included Harley-Davidson, Inc. (recreational vehicles), QUALCOMM, Inc. (communication equipment), Fluor Corp. (construction services), FMC Technologies, Inc. (oil and gas services) and Union Pacific Corp. (railroads). Harley-Davidson traded down as a slower than anticipated recovery in the U.S. economy and macro risks led to a lower earnings forecast. QUALCOMM fell on concerns regarding chipset pricing (in the non-iPhone market) and increased competition. Fluor declined due to continued weak capital spending in the oil & gas and mining sectors. FMC underperformed due to the expected impact of lower oil prices. Union Pacific sold off on lowered earnings forecasts due to weaker than anticipated volume growth in coal, crude by rail and sand used in hydraulic fracturing.

HOW WAS THE PORTFOLIO POSITIONED AT PERIOD END?

The portfolio is diversified across almost every sector while maintaining its largest overweight positions in the Financials and Telecommunication Services sectors. Conversely, the portfolio holds its largest underweight positions in the Consumer Staples and Consumer Discretionary sectors.

We believe the domestic economy has remained stable. GDP growth has continued to be positive, consumer confidence has remained high and unemployment levels have dropped to pre-crisis levels. Inflation has remained low which prompted the Fed to delay raising interest rates during its most recent meeting. Given the strong performance of U.S. equities since the recession in 2008, in our view, stocks appear to be reasonably valued.

Europe, following in the U.S.’s footsteps, has continued its quantitative easing program in hopes of jump starting economic growth. The Eurozone has seen modest progress including mild GDP growth, but the true effectiveness of the stimulus effort has yet to be seen.

Further east, China has continued to experience economic problems. Most recently, disappointing economic data led to a slide in the Chinese stock market which required government intervention to stabilize the situation. These events increased suspicion that China’s economy is slowing faster than expected and has more issues than its government is willing to admit.

With these thoughts in mind, we remain focused on investing in high quality U.S. based companies. Should we see an increase in market volatility, we will look for opportunities to enhance our portfolio holdings.

Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted.

| Annual Report | October 31, 2015 | 5 |

| Fund Commentary |

| CENTURY SHARES TRUST | October 31, 2015 (Unaudited) |

Risks: The Fund may invest a significant portion of assets in a limited number of companies or in companies within the same market sector. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies or sectors and therefore may experience greater price volatility than funds with more diversified portfolios. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | ||

| ALPHABET, INC. Internet Software & Services | 6.08% | |

| AMAZON.COM, INC. Internet & Catalog Retail | 5.60% | |

| APPLE, INC. Technology Hardware, Storage & Peripherals | 4.83% | |

| AMERICAN TOWER CORP. Real Estate Investment Trust (REITs) | 4.36% | |

| EQUINIX, INC. Real Estate Investment Trust (REITs) | 4.19% | |

| PEPSICO, INC. Beverages | 4.05% | |

| WESTERN UNION CO. IT Services | 3.99% | |

| VISA, INC., CLASS A IT Services | 3.92% | |

| ALLERGAN PLC Pharmaceuticals | 3.91% | |

| UNITED PARCEL SERVICE, INC., CLASS B Air Freight & Logistics | 3.80% |

| Sector Allocation* | ||

| Information Technology | 26.3% | |

| Consumer Discretionary | 17.8% | |

| Health Care | 14.7% | |

| Financials | 12.1% | |

| Industrials | 9.8% | |

| Consumer Staples | 7.7% | |

| Materials | 3.0% | |

| Telecommunication Services | 2.9% | |

| Cash, Cash Equivalents, & Other Net Assets | 5.7% |

| * | Based on the Fund’s net assets at October 31, 2015 and subject to change. |

| 6 | centuryfunds.com |

| Performance Summary |

| CENTURY SHARES TRUST | October 31, 2015 (Unaudited) |

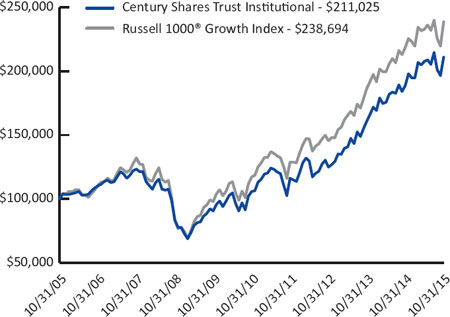

Institutional Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month‐end performance, please call 800‐303‐1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.09% for the Institutional Shares. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

| Average Annual Total Returns October 31, 2015 | ||||

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Shares Trust - Institutional Shares (CENSX) | 11.76% | 19.09% | 14.82% | 7.75% |

Russell 1000® Growth Index | 9.18% | 17.94% | 15.30% | 9.09% |

Growth of $100,000 for the period ended October 31, 2015

The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvestment of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 1000®Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000®companies with higher price-to-book ratios and higher forecasted growth values.

| Annual Report | October 31, 2015 | 7 |

| Fund Commentary |

| CENTURY SMALL CAP SELECT FUND | October 31, 2015 (Unaudited) |

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2015, Century Small Cap Select Fund Institutional Shares (CSMCX) returned +2.48% and the Investor Shares (CSMVX) returned +2.14%, underperforming the Russell 2000 Growth Index (R2000G), the Fund’s benchmark, which returned +3.52%.

For the one-year period ended October 31, 2015, Century Small Cap Select Fund Institutional Shares (CSMCX) returned +2.48% and the Investor Shares (CSMVX) returned +2.14%, underperforming the Russell 2000 Growth Index (R2000G), the Fund’s benchmark, which returned +3.52%.

WHAT FACTORS INFLUENCED PERFORMANCE?

The top contributors to relative performance on a sector basis were Health Care (stock selection), Materials (allocation) and Consumer Discretionary (stock selection). The top performing stocks included Anacor Pharmaceuticals, Inc. (biotechnology), Cambrex Corp. (biotechnology), AMN Healthcare Services, Inc. (healthcare services), j2 Global, Inc. (software) and Eagle Bancorp, Inc. (banking). Anacor appreciated from favorable Phase 3 trial results for the company’s second product, Crisaborole. Cambrex delivered better than expected earnings results and added additional manufacturing capacity to meet rising demand for its product. AMN Healthcare Services traded up on better than expected earnings results and raised guidance. j2 Global lifted on better than expected earnings results. Eagle Bancorp executed well on a recent accretive acquisition and delivered faster than expected growth.

The top detractors from relative performance on a sector basis were Industrials (stock selection), Energy (allocation) and Consumer Staples (stock selection). The worst performing stocks included Basic Energy Services, Inc. (oil and gas services), Saia, Inc. (trucking), NCI Building Systems, Inc. (building materials), Greenbrier Companies, Inc. (railroads) and CAI International, Inc. (transportation rental and leasing). Basic Energy, Saia, NCI and Greenbrier all underperformed due to general weakness in the energy sector. CAI lagged due to underlying weakness in global trade expectations.

HOW WAS THE PORTFOLIO POSITIONED AT PERIOD END?

The portfolio currently maintains its largest overweight positions in the Energy, Consumer Discretionary and Information Technology sectors. The Fund is most underweight the Materials, Industrials and Telecommunication Services sectors.

We continue to believe that the domestic economy is sound, despite the recent increase in equity market volatility. Investors were rattled during the third quarter by weak economic data coming from China, prompting government intervention to stabilize a slide in their stock market. The broader global economy has also generally remained dependent on central bank actions. Europe is a few steps behind the U.S. and has continued its quantitative easing program to jump start economic growth.

On the positive side, equity markets rebounded in October supported by decent U.S. GDP growth, adequate consumer confidence levels, and an unemployment rate that recently dropped to 5.0%. In general, corporations have remained well capitalized and have continued to grow their earnings without the typical inflationary pressures that usually appear at this stage of a recovery. Investors hope the impending rise in interest rates will be slower and less disruptive than prior cycles. We believe a rate increase might benefit higher quality growth businesses, rather than more speculative industries, such as biotechnology. As always, we remain focused on finding high quality growth enterprises that we believe are trading at reasonable valuations.

Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted.

| 8 | centuryfunds.com |

| Fund Commentary |

| CENTURY SMALL CAP SELECT FUND | October 31, 2015 (Unaudited) |

Risks:The Fund invests in smaller companies which pose greater risks than those associated with larger, more established companies. The Fund may invest a significant portion of assets in securities of companies within the same market sector. If the Fund’s portfolio is over weighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not over weighted in that sector. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | ||

J2 GLOBAL, INC. Internet Software & Services | 3.14% | |

EAGLE BANCORP, INC. Banks | 3.09% | |

PHARMERICA CORP. Health Care Providers & Services | 2.96% | |

ON ASSIGNMENT, INC. Professional Services | 2.89% | |

ICON PLC Life Sciences Tools & Services | 2.62% | |

INFINERA CORP. Communications Equipment | 2.39% | |

INTEGRATED DEVICE TECHNOLOGY, INC. Semiconductors & Semiconductor Equipment | 2.30% | |

AMN HEALTHCARE SERVICES, INC. Health Care Providers & Services | 2.23% | |

INPHI CORP. Semiconductors & Semiconductor Equipment | 2.23% | |

COHEN & STEERS, INC. Capital Markets | 2.22% |

| Sector Allocation* | ||

| Health Care | 24.9% | |

| Information Technology | 24.7% | |

| Consumer Discretionary | 19.2% | |

| Industrials | 11.1% | |

| Financials | 7.6% | |

| Energy | 4.1% | |

| Consumer Staples | 3.3% | |

| Materials | 2.1% | |

| Cash, Cash Equivalents, & Other Net Assets | 3.0% |

* | Based on the Fund’s net assets at October 31, 2015 and subject to change. |

| Annual Report | October 31, 2015 | 9 |

| Performance Summary |

| CENTURY SMALL CAP SELECT FUND | October 31, 2015 (Unaudited) |

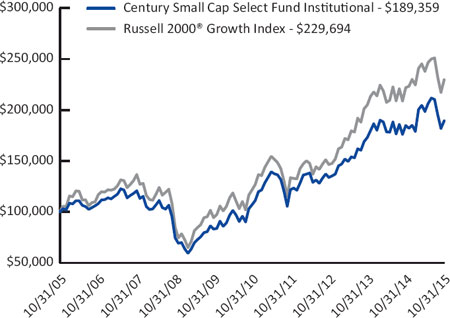

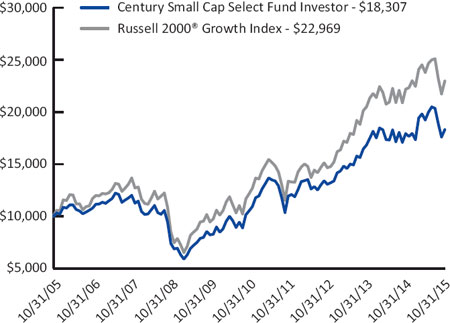

Institutional Shares and Investor Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.11% for the Institutional Shares and 1.40% for the Investor Shares. Returns would have been lower during the 10 year period if certain fees had not been waived or expenses reimbursed. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

Average Annual Total Returns October 31, 2015

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Small Cap Select Fund - Institutional Shares (CSMCX) | 2.48% | 12.24% | 12.08% | 6.59% |

| Century Small Cap Select Fund - Investor Shares (CSMVX) | 2.14% | 11.89% | 11.71% | 6.23% |

Russell 2000® Growth Index | 3.52% | 16.16% | 13.56% | 8.67% |

Growth of $100,000 for the period ended October 31, 2015

Institutional Shares

Growth of $10,000 for the period ended October 31, 2015

Investor Shares

The graphs and table reflect the change in value of a hypothetical investment in the Fund, including reinvestment of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

| 10 | centuryfunds.com |

| Fund Commentary |

| CENTURY GROWTH OPPORTUNITIES FUND | October 31, 2015 (Unaudited) |

HOW DID THE PORTFOLIO PERFORM?

For the one-year period ended October 31, 2015, Century Growth Opportunities Fund Institutional Shares (CGOIX) returned +1.13%, underperforming the Russell 2500 Growth Index (R2500G), which returned +4.17%.

WHAT FACTORS INFLUENCED PERFORMANCE?

The top contributors to relative performance on a sector basis were Health Care, Energy and Financials, resulting mainly from stock selection. Top performing stocks on an absolute basis included Anacor Pharmaceuticals, Inc. (biotechnology), Cambrex Corp. (biotechnology), Alkermes PLC (biotechnology), Integrated Device Technology, Inc. (semiconductors) and Dyax Corp. (biotechnology). Anacor appreciated as results for its Phase 3 trial for the company’s second product, Crisaborole, were positive. Cambrex delivered better than expected earnings results and raised guidance. Alkermes provided positive updates on its drug development pipeline. Integrated Device Technology traded up as new management streamlined operations and improved margins. Dyax appreciated after the drug received fast track designation from the FDA.

The top detractors from relative performance on a sector basis were Industrials, Consumer Discretionary and Consumer Staples, resulting mainly from stock selection. The worst performing stocks on an absolute basis included Greenbrier Companies, Inc. (railroads), United Rentals, Inc. (rental and leasing services), Boot Barn Holdings, Inc. (specialty retail), Fairmount Santrol Holdings, Inc. (metals and mining) and Ubiquiti Networks, Inc. (communication equipment). Greenbrier underperformed as energy price weakness caused uncertainty for future tank car orders along with concerns over the impact of increased railcar safety regulations. United Rentals traded down as weakness in the energy sector adversely affected their revenue. Boot Barn underperformed on concerns regarding the integration of recently acquired Sheplers, Inc. Fairmount Santrol declined on general oil price weakness. Ubiquiti experienced a deceleration in growth due to its exposure to Eastern European and Middle Eastern economies, which have been impacted by various conflicts in addition to slow European economic growth.

HOW WAS THE PORTFOLIO POSITIONED AT PERIOD END?

The portfolio currently maintains its largest overweight positions in the Information Technology, Consumer Staples and Energy sectors. The portfolio is most underweight the Materials, Financials and Industrials sectors.

The domestic economy has continued to grow at a moderate pace and recent economic data has been encouraging. However, the economic outlook in Europe has decelerated as has growth in most emerging markets. The Chinese economy has continued to grow but at slower rates than had been anticipated at the beginning of the year. This has caused the U.S. Dollar to appreciate against most major currencies. The market seems concerned that slower growth overseas will eventually slow growth domestically. With these factors in mind, we continue to search for companies with sustainable secular growth drivers that we believe are trading at reasonable valuations. On the margin, we favor companies with limited exposure to the European economies and currencies.

Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted.

| Annual Report | October 31, 2015 | 11 |

| Fund Commentary |

| CENTURY GROWTH OPPORTUNITIES FUND | October 31, 2015 (Unaudited) |

Risks: The Fund invests mainly in small-cap and mid-cap companies, which, historically, have been more volatile in price than the stocks of large-cap companies. The Fund may invest in foreign companies, which involves risks not associated with investing solely in U.S. companies, such as currency fluctuations, unfavorable political developments, or economic instability. These risks are magnified in emerging markets. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | ||

INTEGRATED DEVICE TECHNOLOGY, INC. Semiconductors & Semiconductor Equipment | 2.40% | |

LAMAR ADVERTISING CO., CLASS A Real Estate Investment Trusts (REITs) | 2.28% | |

HANESBRANDS, INC. Textiles, Apparel & Luxury Goods | 2.26% | |

INFINERA CORP. Communications Equipment | 2.25% | |

MAXIMUS, INC. IT Services | 2.24% | |

CARDTRONICS, INC. IT Services | 2.22% | |

STERIS CORP. Health Care Equipment & Supplies | 2.18% | |

HEADWATERS, INC. Construction Materials | 2.18% | |

SNAP-ON, INC. Machinery | 2.17% | |

SERVICEMASTER GLOBAL HOLDINGS, INC. Diversified Consumer Services | 2.16% |

| Sector Allocation* | ||

| Information Technology | 28.9% | |

| Health Care | 20.4% | |

| Consumer Discretionary | 18.4% | |

| Industrials | 13.0% | |

| Financials | 7.3% | |

| Consumer Staples | 5.2% | |

| Materials | 2.2% | |

| Energy | 2.0% | |

| Telecommunication Services | 1.2% | |

| Cash, Cash Equivalents, & Other Net Assets | 1.4% |

| * | Based on the Fund’s net assets at October 31, 2015 and subject to change. |

| 12 | centuryfunds.com |

| Performance Summary |

| CENTURY GROWTH OPPORTUNITIES FUND | October 31, 2015 (Unaudited) |

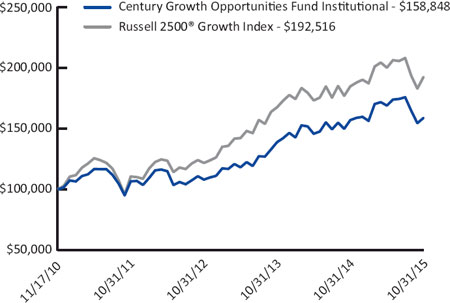

Institutional Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.10%. The Adviser has agreed contractually to limit the operating expenses for the Fund’s Institutional Shares to 0.99% through February 28, 2017. Returns would have been lower during all periods if certain fees had not been waived or expenses reimbursed. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

Average Annual Total Returns October 31, 2015

| 1 Year | 3 Years | Since Inception* | |

| Century Growth Opportunities Fund - Institutional Shares (CGOIX) | 1.13% | 13.69% | 9.79% |

Russell 2500® Growth Index | 4.17% | 16.48% | 14.14% |

| * | Fund inception date of November 17, 2010. |

Growth of $100,000 for the period ended October 31, 2015

The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvestment of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 2500® Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

| Annual Report | October 31, 2015 | 13 |

| Portfolio of Investments |

| CENTURY SHARES TRUST | October 31, 2015 |

| Shares | Value | |||||

| COMMON STOCKS - 94.3% | ||||||

| Consumer Discretionary - 17.8% | ||||||

| Automobiles - 3.6% | ||||||

| 162,397 | Harley-Davidson, Inc. | $ | 8,030,532 | |||

| Hotels, Restaurants & Leisure - 4.5% | ||||||

| 19,171 | Panera Bread Co., Class A(a) | 3,400,360 | ||||

| 109,846 | Starbucks Corp. | 6,873,064 | ||||

| 10,273,424 | ||||||

| Internet & Catalog Retail - 5.6% | ||||||

| 20,180 | Amazon.com, Inc.(a) | 12,630,662 | ||||

| Multiline Retail - 1.8% | ||||||

| 60,753 | Dollar Tree, Inc.(a) | 3,978,714 | ||||

| Specialty Retail - 2.3% | ||||||

| 41,995 | Home Depot, Inc. | 5,192,262 | ||||

| Total Consumer Discretionary | 40,105,594 | |||||

| Consumer Staples - 7.7% | ||||||

| Beverages - 4.1% | ||||||

| 89,371 | PepsiCo, Inc. | 9,132,823 | ||||

| Food & Staples Retailing - 1.6% | ||||||

| 37,212 | CVS Health Corp. | 3,675,801 | ||||

| Household Products - 2.0% | ||||||

| 66,355 | Colgate-Palmolive Co. | 4,402,654 | ||||

| Total Consumer Staples | 17,211,278 | |||||

| Financials - 12.1% | ||||||

| Diversified Financial Services - 3.6% | ||||||

| 4 | Berkshire Hathaway, Inc., Class A(a) | 818,384 | ||||

| 75,358 | Moody’s Corp. | 7,246,425 | ||||

| 8,064,809 | ||||||

| Real Estate Investment Trust (REITs) - 8.5% | ||||||

| 96,088 | American Tower Corp. | 9,823,076 | ||||

| 31,836 | Equinix, Inc. | 9,445,105 | ||||

| 19,268,181 | ||||||

| Total Financials | 27,332,990 | |||||

| Shares | Value | |||||

| Health Care - 14.7% | ||||||

| Biotechnology - 4.3% | ||||||

| 20,801 | Alexion Pharmaceuticals, Inc.(a) | $ | 3,660,976 | |||

| 49,875 | Celgene Corp.(a) | 6,120,161 | ||||

| 9,781,137 | ||||||

| Health Care Providers & Services - 2.8% | ||||||

| 72,662 | Express Scripts Holding Co.(a) | 6,276,544 | ||||

| Health Care Technology - 3.7% | ||||||

| 124,469 | Cerner Corp.(a) | 8,251,050 | ||||

| Pharmaceuticals - 3.9% | ||||||

| 28,578 | Allergan PLC(a) | 8,815,456 | ||||

| Total Health Care | 33,124,187 | |||||

| Industrials - 9.8% | ||||||

| Aerospace & Defense - 2.6% | ||||||

| 38,665 | Boeing Co. | 5,725,127 | ||||

| Air Freight & Logistics - 3.8% | ||||||

| 83,218 | United Parcel Service, Inc., Class B | 8,573,118 | ||||

| Professional Services - 3.4% | ||||||

| 107,988 | Verisk Analytics, Inc.(a) | 7,733,021 | ||||

| Total Industrials | 22,031,266 | |||||

| Information Technology - 26.3% | ||||||

| Internet Software & Services - 6.1% | ||||||

| 8,952 | Alphabet, Inc., Class A(a) | 6,601,116 | ||||

| 9,983 | Alphabet, Inc., Class C(a) | 7,096,016 | ||||

| 13,697,132 | ||||||

| IT Services - 7.9% | ||||||

| 113,940 | Visa, Inc., Class A | 8,839,465 | ||||

| 466,595 | Western Union Co. | 8,981,954 | ||||

| 17,821,419 | ||||||

| Software - 7.5% | ||||||

| 54,872 | Adobe Systems, Inc.(a) | 4,864,952 | ||||

| 62,681 | Citrix Systems, Inc.(a) | 5,146,110 | ||||

| 131,194 | Microsoft Corp. | 6,906,052 | ||||

| 16,917,114 | ||||||

| Technology Hardware, Storage & Peripherals - 4.8% | ||||||

| 91,015 | Apple, Inc. | 10,876,292 | ||||

| Total Information Technology | 59,311,957 | |||||

| See Notes to Financial Statements |

| 14 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY SHARES TRUST | October 31, 2015 |

| Shares | Value | |||||

| Materials - 3.0% | ||||||

| Chemicals - 3.0% | ||||||

| 73,386 | LyondellBasell Industries NV, Class A | $ | 6,818,293 | |||

| Telecommunication Services - 2.9% | ||||||

| Diversified Telecommunication Services - 2.9% | ||||||

| 195,273 | AT&T, Inc. | 6,543,598 | ||||

TOTAL COMMON STOCKS (Cost $149,630,192) | 212,479,163 | |||||

| SHORT-TERM INVESTMENTS - 5.6% | ||||||

| Money Market Mutual Funds - 5.6% | ||||||

| 12,705,932 | State Street Institutional U.S. Government Money Market Fund - Investment Class (0.00% 7 Day Yield) | 12,705,932 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $12,705,932) | 12,705,932 | |||||

TOTAL INVESTMENTS - 99.9% (Cost, $162,336,124) | 225,185,095 | |||||

| Other Assets in Excess of Liabilities - 0.1% | 174,672 | |||||

| NET ASSETS - 100.0% | $ | 225,359,767 | ||||

| (a) | Non-income producing security. |

| Abbreviations: | ||

| NV | - | Naamloze Vennootschap (Dutch: Limited Liability Company) |

| PLC | - | Public Limited Company |

| See Notes to Financial Statements |

| Annual Report | October 31, 2015 | 15 |

| Portfolio of Investments |

| CENTURY SMALL CAP SELECT FUND | October 31, 2015 |

| Shares | Value | |||||

| COMMON STOCKS - 97.0% | ||||||

| Consumer Discretionary - 19.2% | ||||||

| Auto Components - 3.2% | ||||||

| 65,965 | Gentherm, Inc.(a) | $ | 3,242,839 | |||

| 235,922 | Metaldyne Performance Group, Inc. | 5,147,818 | ||||

| 8,390,657 | ||||||

| Diversified Consumer Services - 4.1% | ||||||

| 123,739 | Grand Canyon Education, Inc.(a) | 5,142,593 | ||||

| 169,305 | Sotheby’s | 5,866,418 | ||||

| 11,009,011 | ||||||

| Hotels, Restaurants & Leisure - 5.2% | ||||||

| 136,443 | La Quinta Holdings, Inc.(a) | 2,067,112 | ||||

| 77,630 | Papa John’s International, Inc. | 5,447,297 | ||||

| 144,876 | Ruth’s Hospitality Group, Inc. | 2,247,027 | ||||

| 144,860 | Sonic Corp. | 4,134,304 | ||||

| 13,895,740 | ||||||

| Household Durables - 2.1% | ||||||

| 145,620 | CalAtlantic Group, Inc.(a) | 5,546,666 | ||||

| Multiline Retail - 1.4% | ||||||

| 78,460 | Burlington Stores, Inc.(a) | 3,772,357 | ||||

| Specialty Retail - 1.3% | ||||||

| 136,161 | DSW, Inc., Class A | 3,395,855 | ||||

| Textiles, Apparel & Luxury Goods - 1.9% | ||||||

| 89,742 | Columbia Sportswear Co. | 4,922,349 | ||||

| Total Consumer Discretionary | 50,932,635 | |||||

| Consumer Staples - 3.3% | ||||||

| Food & Staples Retailing - 2.0% | ||||||

| 49,824 | Casey’s General Stores, Inc. | 5,292,305 | ||||

| Food Products - 1.3% | ||||||

| 97,439 | Snyder’s-Lance, Inc. | 3,462,982 | ||||

| Total Consumer Staples | 8,755,287 | |||||

| Energy - 4.1% | ||||||

| Energy Equipment & Services - 0.4% | ||||||

| 331,714 | Basic Energy Services, Inc.(a) | 1,230,659 | ||||

| Oil, Gas & Consumable Fuels - 3.7% | ||||||

| 184,596 | Matador Resources Co.(a) | 4,745,963 | ||||

| 547,052 | Scorpio Tankers, Inc. | 4,989,114 | ||||

| 9,735,077 | ||||||

| Total Energy | 10,965,736 | |||||

| Shares | Value | |||||

| Financials - 7.6% | ||||||

| Banks - 3.1% | ||||||

| 172,048 | Eagle Bancorp, Inc.(a) | $ | 8,189,485 | |||

| Capital Markets - 2.2% | ||||||

| 191,973 | Cohen & Steers, Inc. | 5,872,454 | ||||

| Diversified Financial Services - 1.0% | ||||||

| 152,827 | Marlin Business Services Corp. | 2,698,925 | ||||

| Real Estate Investment Trusts (REITs) - 1.3% | ||||||

| 149,400 | Terreno Realty Corp. | 3,343,572 | ||||

| Total Financials | 20,104,436 | |||||

| Health Care - 24.9% | ||||||

| Biotechnology - 3.3% | ||||||

| 44,223 | Anacor Pharmaceuticals, Inc.(a) | 4,971,107 | ||||

| 56,806 | Dyax Corp.(a) | 1,563,869 | ||||

| 17,626 | Eagle Pharmaceuticals, Inc.(a) | 1,122,953 | ||||

| 69,031 | ProQR Therapeutics NV(a) | 1,005,782 | ||||

| 8,663,711 | ||||||

| Health Care Equipment & Supplies - 4.2% | ||||||

| 118,388 | Globus Medical, Inc., Class A(a) | 2,645,972 | ||||

| 61,102 | Greatbatch, Inc.(a) | 3,265,902 | ||||

| 91,164 | Masimo Corp.(a) | 3,617,387 | ||||

| 25,766 | West Pharmaceutical Services, Inc. | 1,546,218 | ||||

| 11,075,479 | ||||||

| Health Care Providers & Services - 10.9% | ||||||

| 83,577 | Acadia Healthcare Co., Inc.(a) | 5,132,464 | ||||

| 102,106 | Almost Family, Inc.(a) | 4,225,146 | ||||

| 208,566 | AMN Healthcare Services, Inc.(a) | 5,917,017 | ||||

| 151,608 | Brookdale Senior Living, Inc.(a) | 3,170,123 | ||||

| 191,901 | Cross Country Healthcare, Inc.(a) | 2,590,664 | ||||

| 274,808 | PharMerica Corp.(a) | 7,851,265 | ||||

| 28,886,679 | ||||||

| Health Care Technology - 0.9% | ||||||

| 87,522 | Omnicell, Inc.(a) | 2,380,598 | ||||

| Life Sciences Tools & Services - 4.1% | ||||||

| 87,028 | Cambrex Corp.(a) | 4,000,677 | ||||

| 108,612 | ICON PLC(a) | 6,937,048 | ||||

| 10,937,725 | ||||||

| See Notes to Financial Statements |

| 16 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY SMALL CAP SELECT FUND | October 31, 2015 |

| Shares | Value | |||||

| Pharmaceuticals - 1.5% | ||||||

| 96,933 | ANI Pharmaceuticals, Inc.(a) | $ | 4,055,677 | |||

| Total Health Care | 65,999,869 | |||||

| Industrials - 11.1% | ||||||

| Air Freight & Logistics - 0.5% | ||||||

| 29,354 | Forward Air Corp. | 1,331,498 | ||||

| Building Products - 1.2% | ||||||

| 308,550 | NCI Building Systems, Inc.(a) | 3,227,433 | ||||

| Commercial Services & Supplies - 2.2% | ||||||

| 178,106 | Herman Miller, Inc. | 5,651,303 | ||||

| Machinery - 2.1% | ||||||

| 147,968 | Greenbrier Companies, Inc. | 5,628,703 | ||||

| Professional Services - 2.9% | ||||||

| 169,912 | On Assignment, Inc.(a) | 7,664,730 | ||||

| Road & Rail - 1.1% | ||||||

| 123,766 | Saia, Inc.(a) | 2,922,115 | ||||

| Trading Companies & Distributors - 1.1% | ||||||

| 248,445 | CAI International, Inc.(a) | 2,886,931 | ||||

| Total Industrials | 29,312,713 | |||||

| Information Technology - 24.7% | ||||||

| Communications Equipment - 3.4% | ||||||

| 319,932 | Infinera Corp.(a) | 6,321,856 | ||||

| 16,794 | Palo Alto Networks, Inc.(a) | 2,703,834 | ||||

| 9,025,690 | ||||||

| Internet Software & Services - 7.1% | ||||||

| 93,030 | comScore, Inc.(a) | 3,979,823 | ||||

| 75,730 | Constant Contact, Inc.(a) | 1,976,553 | ||||

| 78,548 | Demandware, Inc.(a) | 4,453,672 | ||||

| 107,105 | j2 Global, Inc. | 8,305,993 | ||||

| 18,716,041 | ||||||

| Semiconductors & Semiconductor Equipment - 7.9% | ||||||

| 51,507 | Cavium, Inc.(a) | 3,654,422 | ||||

| 198,145 | Inphi Corp.(a) | 5,898,777 | ||||

| 239,231 | Integrated Device Technology, Inc.(a) | 6,100,390 | ||||

| 156,232 | M/A-COM Technology Solutions Holdings, Inc.(a) | 5,271,268 | ||||

| 20,924,857 | ||||||

| Software - 5.4% | ||||||

| 92,683 | CyberArk Software Ltd.(a) | 4,600,784 | ||||

| 134,950 | Paycom Software, Inc.(a) | 5,129,449 | ||||

| Shares | Value | |||||

| 242,661 | VASCO Data Security International, Inc.(a) | $ | 4,612,986 | |||

| 14,343,219 | ||||||

| Technology Hardware Storage & Peripherals - 0.9% | ||||||

| 83,089 | Super Micro Computer, Inc.(a) | 2,343,941 | ||||

| Total Information Technology | 65,353,748 | |||||

| Materials - 2.1% | ||||||

| Chemicals - 2.1% | ||||||

| 52,565 | Balchem Corp. | 3,590,189 | ||||

| 60,956 | PolyOne Corp. | 2,038,369 | ||||

| 5,628,558 | ||||||

TOTAL COMMON STOCKS (Cost $230,411,787) | 257,052,982 | |||||

| SHORT-TERM INVESTMENTS - 2.5% | ||||||

| Money Market Mutual Funds - 2.5% | ||||||

| 6,566,813 | State Street Institutional U.S. Government Money Market Fund - Investment Class (0.00% 7 Day Yield) | 6,566,813 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $6,566,813) | 6,566,813 | |||||

TOTAL INVESTMENTS - 99.5% (Cost, $236,978,600) | 263,619,795 | |||||

| Other Assets in Excess of Liabilities - 0.5% | 1,241,144 | |||||

| NET ASSETS - 100.0% | $ | 264,860,939 | ||||

(a) | Non-income producing security. |

| Abbreviations: | ||

| Ltd. | - | Limited |

| NV | - | Naamloze Vennootschap (Dutch: Limited Liability Company) |

| PLC | - | Public Limited Company |

| See Notes to Financial Statements |

| Annual Report | October 31, 2015 | 17 |

| Portfolio of Investments |

| CENTURY GROWTH OPPORTUNITIES FUND | October 31, 2015 |

| Shares | Value | |||||

| COMMON STOCKS - 98.6% | ||||||

| Consumer Discretionary - 18.4% | ||||||

| Diversified Consumer Services - 4.3% | ||||||

| 43,923 | Grand Canyon Education, Inc.(a) | $ | 1,825,440 | |||

| 51,586 | ServiceMaster Global Holdings, Inc.(a) | 1,839,041 | ||||

| 3,664,481 | ||||||

| Hotels, Restaurants & Leisure - 2.0% | ||||||

| 11,075 | Buffalo Wild Wings, Inc.(a) | 1,708,540 | ||||

| Household Durables - 3.8% | ||||||

| 42,421 | CalAtlantic Group, Inc.(a) | 1,615,816 | ||||

| 35,380 | Jarden Corp.(a) | 1,585,024 | ||||

| 3,200,840 | ||||||

| Specialty Retail - 2.3% | ||||||

| 21,963 | Boot Barn Holdings, Inc.(a) | 329,445 | ||||

| 9,073 | Ulta Salon, Cosmetics & Fragrance, Inc.(a) | 1,578,339 | ||||

| 1,907,784 | ||||||

| Textiles, Apparel & Luxury Goods - 6.0% | ||||||

| 60,154 | Hanesbrands, Inc. | 1,921,319 | ||||

| 30,728 | lululemon athletica, Inc.(a) | 1,510,896 | ||||

| 23,377 | Oxford Industries, Inc. | 1,702,313 | ||||

| 5,134,528 | ||||||

| Total Consumer Discretionary | 15,616,173 | |||||

| Consumer Staples - 5.2% | ||||||

| Food & Staples Retailing - 2.2% | ||||||

| 36,102 | United Natural Foods, Inc.(a) | 1,821,346 | ||||

| Food Products - 3.0% | ||||||

| 49,481 | Snyder’s-Lance, Inc. | 1,758,555 | ||||

| 19,723 | WhiteWave Foods Co.(a) | 808,248 | ||||

| 2,566,803 | ||||||

| Total Consumer Staples | 4,388,149 | |||||

| Energy - 2.0% | ||||||

| Oil, Gas & Consumable Fuels - 2.0% | ||||||

| 65,882 | Matador Resources Co.(a) | 1,693,826 | ||||

| Financials - 7.3% | ||||||

| Banks - 1.7% | ||||||

| 34,373 | PrivateBancorp, Inc. | 1,437,823 | ||||

| Consumer Finance - 1.5% | ||||||

| 23,551 | PRA Group, Inc.(a) | 1,290,595 | ||||

| Shares | Value | |||||

| Real Estate Investment Trusts (REITs) - 4.1% | ||||||

| 39,626 | Apartment Investment & Management Co., Class A | $ | 1,552,943 | |||

| 34,292 | Lamar Advertising Co., Class A | 1,935,097 | ||||

| 3,488,040 | ||||||

| Total Financials | 6,216,458 | |||||

| Health Care - 20.4% | ||||||

| Biotechnology - 4.5% | ||||||

| 21,594 | Alkermes PLC(a) | 1,553,040 | ||||

| 10,480 | Anacor Pharmaceuticals, Inc.(a) | 1,178,057 | ||||

| 17,551 | Eagle Pharmaceuticals, Inc.(a) | 1,118,174 | ||||

| 3,849,271 | ||||||

| Health Care Equipment & Supplies - 8.9% | ||||||

| 5,990 | Cooper Companies, Inc. | 912,636 | ||||

| 78,941 | Globus Medical, Inc., Class A(a) | 1,764,331 | ||||

| 23,250 | Greatbatch, Inc.(a) | 1,242,713 | ||||

| 43,725 | Masimo Corp.(a) | 1,735,008 | ||||

| 24,762 | STERIS Corp. | 1,855,912 | ||||

| 7,510,600 | ||||||

| Health Care Providers & Services - 5.9% | ||||||

| 43,065 | Almost Family, Inc.(a) | 1,782,030 | ||||

| 57,469 | PharMerica Corp.(a) | 1,641,889 | ||||

| 13,130 | Universal Health Services, Inc., Class B | 1,603,042 | ||||

| 5,026,961 | ||||||

| Life Sciences Tools & Services - 1.1% | ||||||

| 20,474 | Cambrex Corp.(a) | 941,190 | ||||

| Total Health Care | 17,328,022 | |||||

| Industrials - 13.0% | ||||||

| Building Products - 3.2% | ||||||

| 19,774 | Allegion PLC | 1,288,671 | ||||

| 115,782 | PGT, Inc.(a) | 1,396,331 | ||||

| 2,685,002 | ||||||

| Commercial Services & Supplies - 3.7% | ||||||

| 25,867 | G&K Services, Inc., Class A | 1,702,566 | ||||

| 36,843 | U.S. Ecology, Inc. | 1,444,614 | ||||

| 3,147,180 | ||||||

| See Notes to Financial Statements |

| 18 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY GROWTH OPPORTUNITIES FUND | October 31, 2015 |

| Shares | Value | |||||

| Machinery - 4.2% | ||||||

| 26,925 | Proto Labs, Inc.(a) | $ | 1,745,817 | |||

| 11,104 | Snap-on, Inc. | 1,842,043 | ||||

| 3,587,860 | ||||||

| Road & Rail - 1.9% | ||||||

| 26,798 | Old Dominion Freight Line, Inc.(a) | 1,659,868 | ||||

| Total Industrials | 11,079,910 | |||||

| Information Technology - 28.9% | ||||||

| Communications Equipment - 5.7% | ||||||

| 6,839 | Arista Networks, Inc.(a) | 441,184 | ||||

| 14,908 | F5 Networks, Inc.(a) | 1,642,862 | ||||

| 96,956 | Infinera Corp.(a) | 1,915,850 | ||||

| 5,340 | Palo Alto Networks, Inc.(a) | 859,740 | ||||

| 4,859,636 | ||||||

| Electronic Equipment, Instruments & Components - 1.0% | ||||||

| 10,108 | IPG Photonics Corp.(a) | 835,123 | ||||

| Internet Software & Services - 1.2% | ||||||

| 18,103 | Demandware, Inc.(a) | 1,026,440 | ||||

| IT Services - 5.6% | ||||||

| 54,769 | Cardtronics, Inc.(a) | 1,889,530 | ||||

| 12,532 | EPAM Systems, Inc.(a) | 969,350 | ||||

| 27,904 | MAXIMUS, Inc. | 1,903,053 | ||||

| 4,761,933 | ||||||

| Semiconductors & Semiconductor Equipment - 4.8% | ||||||

| 13,179 | Cavium, Inc.(a) | 935,050 | ||||

| 36,413 | Inphi Corp.(a) | 1,084,015 | ||||

| 79,855 | Integrated Device Technology, Inc.(a) | 2,036,303 | ||||

| 4,055,368 | ||||||

| Software - 8.9% | ||||||

| 57,258 | BroadSoft, Inc.(a) | 1,830,538 | ||||

| 22,357 | CyberArk Software Ltd.(a) | 1,109,801 | ||||

| 31,672 | Fleetmatics Group PLC(a) | 1,762,864 | ||||

| 41,230 | Paycom Software, Inc.(a) | 1,567,152 | ||||

| 70,972 | VASCO Data Security International, Inc.(a) | 1,349,178 | ||||

| 7,619,533 | ||||||

| Technology Hardware Storage & Peripherals - 1.7% | ||||||

| 50,457 | Super Micro Computer, Inc.(a) | 1,423,392 | ||||

| Total Information Technology | 24,581,425 | |||||

| Shares | Value | |||||

| Materials - 2.2% | ||||||

| Construction Materials - 2.2% | ||||||

| 90,094 | Headwaters, Inc.(a) | $ | 1,851,432 | |||

| Telecommunication Services - 1.2% | ||||||

| Diversified Telecommunication Services - 1.2% | ||||||

| 33,927 | Cogent Communications Holdings, Inc. | 1,042,237 | ||||

TOTAL COMMON STOCKS (Cost $76,255,396) | 83,797,632 | |||||

| SHORT-TERM INVESTMENTS - 2.0% | ||||||

| Money Market Mutual Funds - 2.0% | ||||||

| 1,707,287 | State Street Institutional U.S. Government Money Market Fund - Investment Class (0.00% 7 Day Yield) | 1,707,287 | ||||

TOTAL SHORT-TERM INVESTMENTS (Cost $1,707,287) | 1,707,287 | |||||

TOTAL INVESTMENTS - 100.6% (Cost, $77,962,683) | 85,504,919 | |||||

| Liabilities in Excess of Other Assets - (0.6%) | (535,244 | ) | ||||

| NET ASSETS - 100.0% | $ | 84,969,675 | ||||

(a) | Non-income producing security. |

| Abbreviations: | ||

| Ltd. | - | Limited |

| PLC | - | Public Limited Company |

| See Notes to Financial Statements |

| Annual Report | October 31, 2015 | 19 |

| Statements of Assets and Liabilities |

October 31, 2015

Century Shares Trust | Century Small Cap Select Fund | Century Growth Opportunities Fund | ||||||||||

| ASSETS: | ||||||||||||

| Investments, at value (Note 1) (cost - see below) | $ | 225,185,095 | $ | 263,619,795 | $ | 85,504,919 | ||||||

| Receivable for investments sold | – | 2,418,279 | 1,443,033 | |||||||||

| Receivable for fund shares subscribed | 1,748 | 412,608 | 81,008 | |||||||||

| Dividends receivable | 469,381 | 17,558 | 6,191 | |||||||||

| Prepaid expenses | 4,888 | 7,363 | 1,874 | |||||||||

| Total Assets | 225,661,112 | 266,475,603 | 87,037,025 | |||||||||

| LIABILITIES: | ||||||||||||

| Payable to Affiliates: | ||||||||||||

| Investment adviser fees (Note 4) | 149,683 | 216,696 | 49,846 | |||||||||

| Administration fees (Note 5) | 18,710 | – | 7,223 | |||||||||

| Distribution and service fees (Note 6) | – | 31,553 | – | |||||||||

| Payable for investments purchased | – | 1,009,397 | 1,923,484 | |||||||||

| Payable for shares redeemed | 624 | 207,109 | – | |||||||||

| Payable to trustees | 22,048 | 29,042 | 9,001 | |||||||||

| Payable for professional fees | 59,506 | 63,367 | 52,303 | |||||||||

| Accrued expenses and other liabilities | 50,774 | 57,500 | 25,493 | |||||||||

| Total Liabilities | 301,345 | 1,614,664 | 2,067,350 | |||||||||

| NET ASSETS | $ | 225,359,767 | $ | 264,860,939 | $ | 84,969,675 | ||||||

| NET ASSETS CONSIST OF: | ||||||||||||

| Paid-in capital | $ | 154,863,325 | $ | 183,891,763 | $ | 70,924,363 | ||||||

| Accumulated net investment income/(loss) | 295,420 | (973,396 | ) | – | ||||||||

| Accumulated net realized gain on investments | 7,352,051 | 55,301,377 | 6,503,076 | |||||||||

| Unrealized appreciation in value of investments | 62,848,971 | 26,641,195 | 7,542,236 | |||||||||

| NET ASSETS | $ | 225,359,767 | $ | 264,860,939 | $ | 84,969,675 | ||||||

| Net Assets: | ||||||||||||

| Institutional Shares | $ | 225,359,767 | $ | 164,140,658 | $ | 84,969,675 | ||||||

| Investor Shares | N/A | $ | 100,720,281 | N/A | ||||||||

| Shares Outstanding (Note 2): | ||||||||||||

| Institutional Shares | 10,662,600 | 5,471,509 | 6,797,100 | |||||||||

| Investor Shares | N/A | 3,529,969 | N/A | |||||||||

| Net Asset Value Per Share | ||||||||||||

(Represents both the offering and redemption price)(a) | ||||||||||||

| Institutional Shares | $ | 21.14 | $ | 30.00 | $ | 12.50 | ||||||

| Investor Shares | N/A | $ | 28.53 | N/A | ||||||||

| Cost of investments | $ | 162,336,124 | $ | 236,978,600 | $ | 77,962,683 | ||||||

| (a) | A redemption fee may be assessed for shares redeemed within 90 days after purchase. (Note 1) |

See Notes to Financial Statements

| 20 | centuryfunds.com |

| Statements of Operations |

For the Year Ended October 31, 2015

Century Shares Trust | Century Small Cap Select Fund | Century Growth Opportunities Fund | ||||||||||

| INVESTMENT INCOME: | ||||||||||||

| Dividends | $ | 2,746,647 | $ | 1,809,936 | $ | 335,921 | ||||||

| Total Investment Income | 2,746,647 | 1,809,936 | 335,921 | |||||||||

| EXPENSES: | ||||||||||||

| Investment adviser fees (Notes 4 and 7) | 1,798,228 | 2,905,463 | 711,718 | |||||||||

| Distribution and service fees (Note 6): | ||||||||||||

| Investor Shares | – | 240,902 | – | |||||||||

| Administrative fees | 224,779 | – | 88,965 | |||||||||

| Transfer agency fees | 132,369 | 241,194 | 12,849 | |||||||||

| Fund accounting fees | 29,741 | 40,304 | 14,667 | |||||||||

| Custodian fees | 20,392 | 28,133 | 27,094 | |||||||||

| Insurance fees | 18,651 | 30,319 | 7,373 | |||||||||

| Professional fees | 86,235 | 98,057 | 63,765 | |||||||||

| Registration fees | 36,269 | 36,074 | 22,951 | |||||||||

| Trustee fees | 97,704 | 120,866 | 37,578 | |||||||||

| Printing fees | 28,510 | 14,391 | 1,446 | |||||||||

| Other expenses | 11,220 | 25,863 | 7,666 | |||||||||

| Total Expenses | 2,484,098 | 3,781,566 | 996,072 | |||||||||

| Adviser waivers/reimbursements (Note 7) | – | – | (25,507 | ) | ||||||||

| Net Expenses | 2,484,098 | 3,781,566 | 970,565 | |||||||||

| NET INVESTMENT INCOME/(LOSS) | 262,549 | (1,971,630 | ) | (634,644 | ) | |||||||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||||||||||

| Net realized gain on investments | 7,397,854 | 57,511,187 | 8,678,417 | |||||||||

| Net change in unrealized appreciation/(depreciation) of investments | 17,286,786 | (49,085,133 | ) | (7,291,195 | ) | |||||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 24,684,640 | 8,426,054 | 1,387,222 | |||||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 24,947,189 | $ | 6,454,424 | $ | 752,578 | ||||||

See Notes to Financial Statements

| Annual Report | October 31, 2015 | 21 |

| Century Shares Trust | ||||||||

| For the Year Ended October 31, | ||||||||

| 2015 | 2014 | |||||||

| OPERATIONS: | ||||||||

| Net investment income/(loss) | $ | 262,549 | $ | (139,136 | ) | |||

| Net realized gain on investments | 7,397,854 | 53,680,617 | ||||||

| Long-term capital gains from other investment companies | – | 36,899 | ||||||

| Change in net unrealized appreciation/(depreciation) | 17,286,786 | (19,688,444 | ) | |||||

| Net increase in net assets resulting from operations | 24,947,189 | 33,889,936 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| Institutional Shares | ||||||||

| From net realized gains on investments | (53,335,537 | ) | (11,893,456 | ) | ||||

| Investor Shares | ||||||||

| From net realized gains on investments | – | – | ||||||

| Total distributions | (53,335,537 | ) | (11,893,456 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Increase/(decrease) in net assets from capital share transactions (Note 2) | 31,196,795 | (716,312 | ) | |||||

| Redemption fees | 188 | 33 | ||||||

| Net increase/(decrease) from share transactions | 31,196,983 | (716,279 | ) | |||||

| Total increase | 2,808,635 | 21,280,201 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 222,551,132 | 201,270,931 | ||||||

| End of year* | $ | 225,359,767 | $ | 222,551,132 | ||||

| *Including accumulated net investment income/(loss) | $ | 295,420 | $ | – | ||||

See Notes to Financial Statements

| 22 | centuryfunds.com |

Statements of Changes in Net Assets

| Century Small Cap Select Fund | Century Growth Opportunities Fund | |||||||||||||

| For the Year Ended October 31, | For the Year Ended October 31, | |||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||

| $ | (1,971,630 | ) | $ | (3,286,711 | ) | $ | (634,644 | ) | $ | (691,768 | ) | |||

| 57,511,187 | 57,842,711 | 8,678,417 | 18,260,490 | |||||||||||

| – | – | – | – | |||||||||||

| (49,085,133 | ) | (27,150,382 | ) | (7,291,195 | ) | (6,570,681 | ) | |||||||

| 6,454,424 | 27,405,618 | 752,578 | 10,998,041 | |||||||||||

| (33,970,609 | ) | (14,887,988 | ) | (17,660,595 | ) | (987,358 | ) | |||||||

| (18,018,773 | ) | (6,555,307 | ) | – | – | |||||||||

| (51,989,382 | ) | (21,443,295 | ) | (17,660,595 | ) | (987,358 | ) | |||||||

| (73,851,491 | ) | (50,603,727 | ) | 14,457,587 | (16,003,874 | ) | ||||||||

| 22,054 | 4,834 | – | 372 | |||||||||||

| (73,829,437 | ) | (50,598,893 | ) | 14,457,587 | (16,003,502 | ) | ||||||||

| (119,364,395 | ) | (44,636,570 | ) | (2,450,430 | ) | (5,992,819 | ) | |||||||

| 384,225,334 | 428,861,904 | 87,420,105 | 93,412,924 | |||||||||||

| $ | 264,860,939 | $ | 384,225,334 | $ | 84,969,675 | $ | 87,420,105 | |||||||

| $ | (973,396 | ) | $ | – | $ | – | $ | (596,361 | ) | |||||

| Annual Report | October 31, 2015 | 23 |

| Financial Highlights |

| CENTURY SHARES TRUST | For a share outstanding throughout the periods presented |

| INSTITUTIONAL SHARES |

| For the Year Ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 24.78 | $ | 22.41 | $ | 19.81 | $ | 20.66 | $ | 19.65 | ||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||

Net investment income/(loss)(a) | 0.02 | (0.02 | ) | 0.03 | 0.05 | (0.02 | ) | |||||||||||||

| Net realized and unrealized gain on investments | 2.39 | 3.72 | 5.09 | 1.28 | 1.93 | |||||||||||||||

| Total income from investment operations | 2.41 | 3.70 | 5.12 | 1.33 | 1.91 | |||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||

| Net investment income | – | – | (0.05 | ) | (0.06 | ) | (0.01 | ) | ||||||||||||

| Net realized gain on investment transactions | (6.05 | ) | (1.33 | ) | (2.47 | ) | (2.12 | ) | (0.89 | ) | ||||||||||

| Total distributions | (6.05 | ) | (1.33 | ) | (2.52 | ) | (2.18 | ) | (0.90 | ) | ||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 21.14 | $ | 24.78 | $ | 22.41 | $ | 19.81 | $ | 20.66 | ||||||||||

| Total Return | 11.76 | % | 17.29 | % | 28.85 | % | 7.63 | % | 9.79 | % | ||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of period (000's) | $ | 225,360 | $ | 222,551 | $ | 201,271 | $ | 174,534 | $ | 178,201 | ||||||||||

| Ratio of expenses to average net assets | 1.11 | % | 1.09 | % | 1.11 | % | 1.12 | % | 1.13 | % | ||||||||||

| Ratio of net investment income/(loss) to average net assets | 0.12 | % | (0.06 | %) | 0.16 | % | 0.24 | % | (0.10 | %) | ||||||||||

| Portfolio Turnover Rate | 46 | % | 126 | % | 39 | % | 79 | % | 72 | % | ||||||||||

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

See Notes to Financial Statements

| 24 | centuryfunds.com |

| Financial Highlights |

| CENTURY SMALL CAP SELECT FUND | For a share outstanding throughout the periods presented |

| INSTITUTIONAL SHARES |

| For the Year Ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 34.46 | $ | 33.94 | $ | 26.27 | $ | 23.91 | $ | 20.99 | ||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||

Net investment loss(a) | (0.17 | ) | (0.24 | ) | (0.04 | ) | (0.12 | ) | (0.09 | ) | ||||||||||

| Net realized and unrealized gain on investments | 0.87 | 2.48 | 7.71 | 2.48 | 3.01 | |||||||||||||||

| Total income from investment operations | 0.70 | 2.24 | 7.67 | 2.36 | 2.92 | |||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||

| Net realized gain on investment transactions | (5.16 | ) | (1.72 | ) | – | – | – | |||||||||||||

| Total distributions | (5.16 | ) | (1.72 | ) | – | – | – | |||||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 30.00 | $ | 34.46 | $ | 33.94 | $ | 26.27 | $ | 23.91 | ||||||||||

| Total Return | 2.48 | % | 6.79 | % | 29.20 | % | 9.87 | % | 13.86 | % | ||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of period (000's) | $ | 164,141 | $ | 266,045 | $ | 300,833 | $ | 281,480 | $ | 254,724 | ||||||||||

| Ratio of expenses to average net assets | 1.13 | % | 1.11 | % | 1.12 | % | 1.10 | % | 1.11 | % | ||||||||||

| Ratio of net investment loss to average net assets | (0.52 | %) | (0.71 | %) | (0.14 | %) | (0.48 | %) | (0.37 | %) | ||||||||||

| Portfolio Turnover Rate | 69 | % | 97 | % | 91 | % | 53 | % | 75 | % | ||||||||||

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

See Notes to Financial Statements

| Annual Report | October 31, 2015 | 25 |

| Financial Highlights |

| CENTURY SMALL CAP SELECT FUND | For a share outstanding throughout the periods presented |

| INVESTOR SHARES |

| For the Year Ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 33.12 | $ | 32.78 | $ | 25.45 | $ | 23.25 | $ | 20.49 | ||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||

Net investment loss(a) | (0.26 | ) | (0.33 | ) | (0.13 | ) | (0.21 | ) | (0.17 | ) | ||||||||||

| Net realized and unrealized gain on investments | 0.83 | 2.39 | 7.46 | 2.41 | 2.92 | |||||||||||||||

| Total income from investment operations | 0.57 | 2.06 | 7.33 | 2.20 | 2.75 | |||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||

| Net realized gain on investment transactions | (5.16 | ) | (1.72 | ) | – | – | – | |||||||||||||

| Total distributions | (5.16 | ) | (1.72 | ) | – | – | – | |||||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.01 | |||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 28.53 | $ | 33.12 | $ | 32.78 | $ | 25.45 | $ | 23.25 | ||||||||||

| Total Return | 2.14 | % | 6.47 | % | 28.80 | % | 9.46 | % | 13.47 | % | ||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of period (000's) | $ | 100,720 | $ | 118,181 | $ | 128,029 | $ | 111,965 | $ | 116,678 | ||||||||||

| Ratio of expenses to average net assets | 1.42 | % | 1.40 | % | 1.41 | % | 1.47 | % | 1.48 | % | ||||||||||

| Ratio of net investment loss to average net assets | (0.85 | %) | (1.00 | %) | (0.44 | %) | (0.84 | %) | (0.71 | %) | ||||||||||

| PORTFOLIO TURNOVER RATE | 69 | % | 97 | % | 91 | % | 53 | % | 75 | % | ||||||||||

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

See Notes to Financial Statements

| 26 | centuryfunds.com |

| Financial Highlights |

| CENTURY GROWTH OPPORTUNITIES FUND | For a share outstanding throughout the periods presented |

| INSTITUTIONAL SHARES |

For the Year Ended October 31, | For the Period November 17, 2010 (Inception) to October 31, 2011 | |||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | |||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 15.51 | $ | 13.87 | $ | 10.81 | $ | 10.67 | $ | 10.00 | ||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||

Net investment loss(a) | (0.10 | ) | (0.11 | ) | (0.03 | ) | (0.02 | ) | (0.07 | ) | ||||||||||

| Net realized and unrealized gain on investments | 0.30 | 1.90 | 3.11 | 0.16 | 0.74 | |||||||||||||||

| Total income from investment operations | 0.20 | 1.79 | 3.08 | 0.14 | 0.67 | |||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||

| Net investment income | – | – | (0.02 | ) | – | – | ||||||||||||||

| Net realized gain on investment transactions | (3.21 | ) | (0.15 | ) | – | – | – | |||||||||||||

| Total distributions | (3.21 | ) | (0.15 | ) | (0.02 | ) | – | – | ||||||||||||

| REDEMPTION FEES | – | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | |||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 12.50 | $ | 15.51 | $ | 13.87 | $ | 10.81 | $ | 10.67 | ||||||||||

| Total Return | 1.13 | % | 13.04 | % | 28.54 | % | 1.31 | % | 6.70 | %(c) | ||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of period (000's) | $ | 84,970 | $ | 87,420 | $ | 93,413 | $ | 94,285 | $ | 7,323 | ||||||||||

| Ratio of expenses to average net assets without giving effect to contractual expense agreement | 1.12 | % | 1.10 | % | 1.12 | % | 1.20 | % | 3.62 | %(d) | ||||||||||

| Ratio of expenses to average net assets | 1.09 | %(e) | 1.10 | % | 1.10 | % | 1.10 | % | 1.10 | %(d) | ||||||||||

| Ratio of net investment loss to average net assets | (0.71 | %) | (0.77 | %) | (0.27 | %) | (0.18 | %) | (0.64 | %)(d) | ||||||||||

| Portfolio Turnover Rate | 141 | % | 165 | % | 155 | % | 148 | % | 119 | %(c) | ||||||||||

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Contractual expense limitation change from 1.10% to 0.99% effective October 1, 2015. |

See Notes to Financial Statements

| Annual Report | October 31, 2015 | 27 |

| Notes to Financial Statements |

October 31, 2015

1. SIGNIFICANT ACCOUNTING POLICIES

Century Capital Management Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”) as an open-end management investment company organized as a Massachusetts business trust. Century Shares Trust, Century Small Cap Select Fund, and Century Growth Opportunities Fund (each a “Fund” and, collectively, the “Funds”) are diversified series of the Trust. The following are significant accounting policies consistently followed by the Funds and are in conformity with accounting principles generally accepted in the United States (“GAAP”). Each Fund is considered an investment company for financial reporting purposes under GAAP.

The investment objective of each of Century Shares Trust, Century Small Cap Select Fund and Century Growth Opportunities Fund is to seek long-term capital growth.

A. Security Valuations —Equity securities are valued at the last reported sale price or official closing price on the primary exchange or market on which they are traded, as reported by an independent pricing service. If no sale price or official closing price is reported, market value is generally determined based on quotes or closing prices obtained from a quotation reporting system, established market maker, or reputable pricing service. For unlisted securities and for exchange-listed securities for which there are no reported sales or official closing prices, fair value is generally determined using closing bid prices. In the absence of readily available market quotes, securities and other assets will be valued at fair value, as determined in good faith under procedures established by and under the general supervision of the Funds’ Board of Trustees. Short-term obligations, maturing in 60 days or less, are valued at amortized cost, which approximates fair value unless particular circumstances dictate otherwise (for example, if the issuer’s creditworthiness has become impaired). Investments in open-end mutual funds are valued at their closing net asset value each business day.

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; | |

| Level 2 — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; | |

| Level 3 — | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| 28 | centuryfunds.com |

| Notes to Financial Statements |

October 31, 2015

The following is a summary of the inputs used as of October 31, 2015 in valuing the Funds’ investments carried at fair value:

| Century Shares Trust | ||||||||||||||||

| Investments in Securities at Value* | Level 1 - Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks | $ | 212,479,163 | $ | – | $ | – | $ | 212,479,163 | ||||||||

| Short-Term Investments | 12,705,932 | – | – | 12,705,932 | ||||||||||||

| TOTAL | $ | 225,185,095 | $ | – | $ | – | $ | 225,185,095 | ||||||||

| Century Small Cap Select Fund | ||||||||||||||||

| Investments in Securities at Value* | Level 1 - Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks | $ | 257,052,982 | $ | – | $ | – | $ | 257,052,982 | ||||||||

| Short-Term Investments | 6,566,813 | – | – | 6,566,813 | ||||||||||||

| TOTAL | $ | 263,619,795 | $ | – | $ | – | $ | 263,619,795 | ||||||||

| Century Growth Opportunities Fund | ||||||||||||||||