UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-09561

(Investment Company Act File Number)

Century Capital Management Trust

(Exact Name of Registrant as Specified in Charter)

c/o Century Capital Management, LLC

100 Federal Street, Boston, MA 02110

(Address of Principal Executive Offices)

Julie Smith

Century Capital Management, LLC

100 Federal Street, Boston, MA 02110

(Name and Address of Agent for Service)

(617) 482-3060

(Registrant’s Telephone Number)

Date of Fiscal Year End: October 31

Date of Reporting Period: November 1, 2016 - April 30, 2017

| Item 1. | Reports to Shareholders. |

Table of Contents

| Page | |

| Letter to Shareholders | 2 |

| Fund Summaries | |

| Century Shares Trust | 5 |

| Century Small Cap Select Fund | 8 |

| Portfolio of Investments | |

| Century Shares Trust | 11 |

| Century Small Cap Select Fund | 13 |

| Statements of Assets and Liabilities | 16 |

| Statements of Operations | 17 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | |

| Century Shares Trust | 19 |

| Century Small Cap Select Fund | 20 |

| Notes to Financial Statements | 22 |

| Disclosure of Fund Expenses | 30 |

| Privacy Policy | 31 |

This report is submitted for the general information of the shareholders of Century Shares Trust and Century Small Cap Select Fund (each a “Fund” and collectively, the “Funds”). It is not authorized for distribution to prospective investors in a Fund unless it is preceded by or accompanied by the Fund’s current prospectus. The prospectus includes important information about the Fund’s objective, risks, charges and expenses, experience of its management, and other information. Please read the prospectus carefully before you invest.

The views expressed in this report are those of the Funds’ Portfolio Managers as of April 30, 2017, the end of the reporting period. Any such views are subject to change at any time and may not reflect the Portfolio Managers’ views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments, do not constitute investment advice, and are not intended to predict the performance of any investment. There is no assurance that the Funds will continue to invest in the securities mentioned in this report.

| Semi‐Annual Report | April 30, 2017 | 1 |

| Letter to Shareholders |

April 30, 2017 (Unaudited)

Dear Fellow Shareholders,

Stocks continue their winning streak

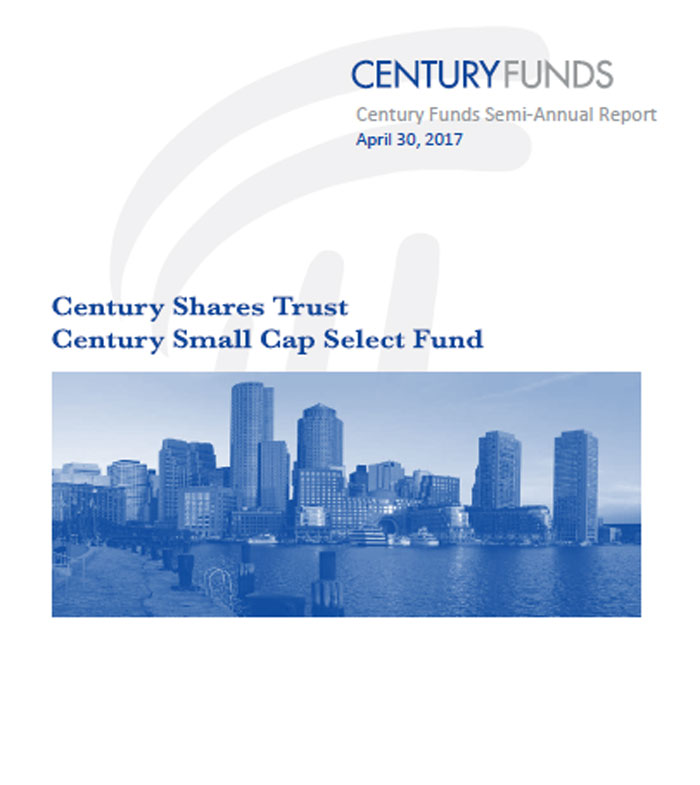

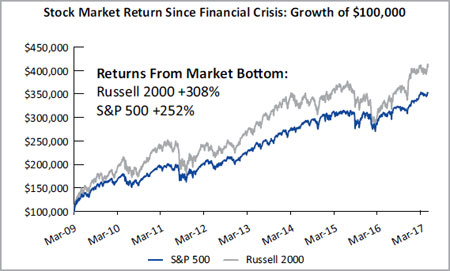

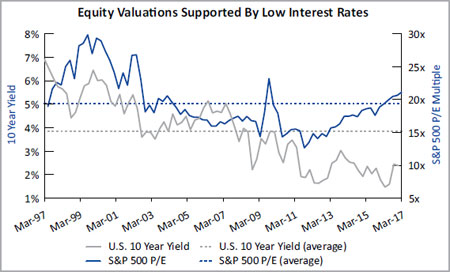

As we head into the summer of 2017, the domestic economy continues to perform well. Over the past six months, the S&P 500 and the Russell 2000 have gained an impressive 12% and 18%, respectively. In addition, the U.S. economy has entered its ninth year of economic expansion and recently reached a new milestone: the second longest bull market in history. Accordingly, stock performance since the market bottom on March 9th, 2009 has been very strong. While stock valuations appear extended on an absolute basis, interest rates are still low by historical standards and corporate earnings growth continues to strengthen.

An expectation for faster growth

Domestic GDP for the first quarter of 2017 was recently revised up to 1.2% growth and is expected to increase above 2.0% growth for the remainder of the year as businesses and households increase spending. The energy sector may have bottomed ahead of the recent OPEC agreement to restrict oil production for another nine months. Additionally, corporate cash flows are positive and strong balance sheets are being deployed for strategic expenditures and acquisitions.

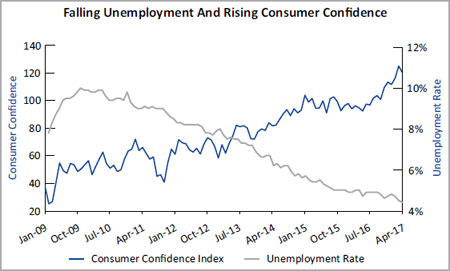

Source: Bloomberg data as of 4/30/2017;

Date range: 3/09/2009-4/30/2017

In addition to strengthening corporate fundamentals, U.S. consumers are also in sound financial condition. Household net worth has increased considerably since the financial crisis and aggregate consumer debt service is at the lowest levels since the 1980s. Accordingly, consumer confidence remains high and the economy is operating at full employment. Assuming GDP continues to grow, the current low levels of unemployment should contribute to faster wage growth.

Inflation is rising slowly. This gradual increase should allow the Federal Reserve to continue raising interest rates. In March, the Fed raised its benchmark interest rate to 0.75-1.00% and indicated that further rate increases are expected. Meanwhile, President Trump continues to champion his pro-growth agenda, but Congressional momentum has been slowed by recent investigations. While the market has reacted positively to plans for lower taxes, infrastructure spending and health care reform, the path to accomplishing these initiatives is uncertain.

Outside the U.S., growth also seems to be accelerating. The Eurozone posted annualized GDP growth of 2.0% in the first quarter of 2017. Despite the negative headlines associated with the historic 2016 Brexit vote, its long term ramifications remain unknown. Additionally, the election of French President, Emmanuel Marcon, bodes well for European unity. Further east, China continues to grow annual GDP at a rate close to 7%, but the risks of excess capacity and bad debt linger. Japan has also continued to muddle along despite an ultra-accommodative monetary policy.

Source: Bloomberg data as of 3/31/2017;

Date range: 3/31/1997-3/31/2017

Past performance is not indicative of future results.

| 2 | centuryfunds.com |

| Letter to Shareholders |

April 30, 2017 (Unaudited)

While Geopolitical risks remain, stocks climb a wall of worry

Global growth appears to be accelerating, but continuing terrorism and other geopolitical risks have the ability to hinder economic progress. The Trump administration has continued to battle allegations of Russian interference during the 2016 presidential election. Emmanuel Marcon, the newly elected French President, is a positive development for European unity, but the full effects of the historic Brexit vote have yet to be felt. In the Middle East, Syria continues to be embattled in a civil war with no end in sight. The Korean peninsula is an increasing concern as North Korea aggression and recent South Korean elections complicate the possibility of peaceful resolution to regional tensions.

Despite these risks, we are encouraged by the resurgence of global growth. While GDP growth has been relatively slow during this recovery, it has proven to be stable and resilient. However, we are mindful that we are in the ninth year of an economic expansion. Accordingly, overall valuation levels appear stretched and are dependent on favorable economic trends continuing beyond 2017. While extended valuations alone don’t lead to bear markets, they can create a fragile environment for stock volatility. As a result, we are keeping a close eye on risk factors such as increasing geopolitical tensions or slowing economic growth.

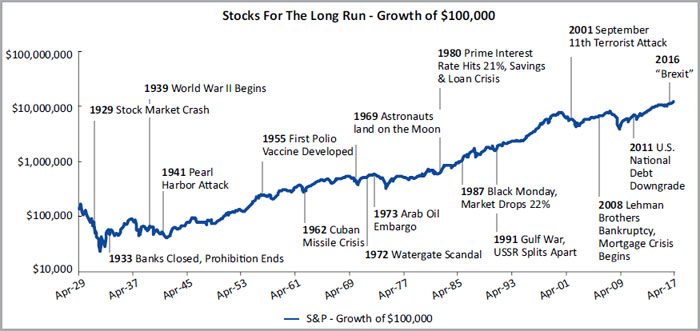

Source: FactSet data as of 3/31/2017;

Date range: 3/31/2014-3/31/2017

While these tensions are significant, stocks tend to climb a wall of worry. Historically, investors have faced several crises over Century Shares Trust’s 89 years, ranging from the Great Depression and World War II, through the Cuban Missile Crisis and Watergate scandal to the savings and loan crisis, the September 11 terrorist attacks and the downgrade of the U.S. national debt among others (see chart on following page). Throughout these difficult situations, patient investors have been rewarded. Should we see a similar period of volatility, we will use it as an opportunity to improve our portfolio positioning.

Source: Bloomberg data as of 4/30/2017;

Date range: 1/31/2009-4/30/2017

Century Funds Update

As you know, Century Capital Management, LLC manages the Century Funds on behalf of you, our fellow shareholders. We are excited to announce that Century Capital Management has entered an agreement to be acquired by Congress Asset Management, LLP (“Congress”), a registered investment adviser with approximately $8.7 billion in assets under management (as of 3/31/17). We believe this merger will benefit the funds and our shareholders.

Past performance is not indicative of future results.

| Semi‐Annual Report | April 30, 2017 | 3 |

| Letter to Shareholders |

April 30, 2017 (Unaudited)

Source: Bloomberg data as of 4/30/2017; date range: 4/30/1928-4/30/2017

Alexander Thorndike, a current portfolio manager for both the Century Small Cap Select Fund and Century Shares Trust, will continue to serve as a portfolio manager of each successor fund managed by Congress. The transaction with Congress is subject to a number of closing conditions, including approval by shareholders of each Century Fund to reorganize with and into a corresponding mutual fund managed by Congress. We will mail further information to you during the summer.

As always, we thank you for your continued support of our stewardship and wish you a wonderful summer.

Sincerely,

Alexander L. Thorndike

Chairman of the Century Funds

Past performance is not indicative of future results.

Shareholders of each Century Fund are urged to read carefully the Prospectus/Proxy Statement and other documents to be filed with the Securities and Exchange Commission (“SEC”) regarding the Century Fund reorganizations when they become available, because these documents will contain important information related to the transactions described above.

Shareholders may obtain free copies of the Prospectus/Proxy Statement and other documents (when they become available) filed with the SEC at the SEC’s web site at www.sec.gov, or by calling 1-800-303-1928. Shareholders should consult their own financial and legal advisors before investing in a Century Fund.

| 4 | centuryfunds.com |

| Fund Commentary |

CENTURY SHARES TRUST | April 30, 2017 (Unaudited) |

HOW DID THE PORTFOLIO PERFORM?

For the six-month period ended April 30, 2017, Century Shares Trust’s shares returned +14.05%, underperforming the Russell 1000 Growth Index (R1000G), the Fund’s benchmark, which returned +15.23%.

WHAT FACTORS INFLUENCED PERFORMANCE?

The top contributors to relative performance on a sector basis were Information Technology (stock selection), Real Estate (stock selection) and Consumer Staples (sector allocation). The top performing stocks included Apple, Inc. (consumer electronics), Western Digital Corporation (data storage), CBRE Group, Inc. (real estate services), Alphabet, Inc. (internet search) and Skyworks Solutions, Inc. (semiconductors). Apple appreciated on positive expectations for the iPhone 8 “supercycle,” strong services growth and the possibilities of augmented reality products and services. Western Digital benefited from acquisition cost synergies and healthy market share gains. CBRE rose due to a positive outlook for real estate and related services. Alphabet reported strong operating results and Skyworks benefited from rising RF content in cell phones.

The top detractors from relative performance on a sector basis were Industrials, Health Care and Consumer Discretionary, resulting mainly from stock selection. The worst performing stocks included Cerner Corporation (health care technology), AutoZone, Inc. (retailer), Abbott Laboratories (pharmaceuticals), Dollar Tree, Inc. (discount stores) and LKQ Corporation (distributor). Cerner declined due to disappointing operating results. AutoZone lagged as it fell short of delivering double digit earnings growth for the first time in over ten years. Abbott continued to be hurt by the turnaround of its Chinese Pediatric Nutritionals business and the integration of the St. Jude Medical acquisition. Dollar Tree reported a weak operating outlook and LKQ was hurt by slower growth, a leadership change and European exposure.

HOW WAS THE PORTFOLIO POSITIONED AT PERIOD END?

The portfolio is diversified across almost every sector while maintaining its largest overweight positions in the Real Estate and Information Technology sectors. Conversely, the portfolio holds its largest underweight positions in the Consumer Staples and Consumer Discretionary sectors.

We believe the domestic economy has continued to make headway. Economic tailwinds include growing consumer and business optimism, solid homebuilding activity and a gradual improvement in business investment. Additionally, energy prices remain stable, U.S. dollar strength has been muted and inventories are more balanced relative to a year ago.

In the Eurozone, growth and inflation data have improved buoyed by accommodative policy, easy financial and credit conditions and little, if any, fiscal drag. The French election of pro-EU centrist, Emmanuel Macron, was seen as a positive development for stability within the region. However, political risks remain and a calm policy environment is needed to foster more robust and sustained economic growth.

Further East, China’s real GDP growth has slowed but is expected to be over 6% for the next few years. However, excess capacity and growing debt remain a serious concern. Japan continued to muddle along as GDP growth remained anemic despite an ultra accommodative monetary policy.

While we continue to monitor risks to global economic growth, we are encouraged that the domestic economy continues to post solid growth. As always, we remain focused on investing in high quality, U.S. based companies. Should we see an increase in market volatility, we will approach it as an opportunity to further enhance our portfolio holdings.

Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted.

| Semi-Annual Report | April 30, 2017 | 5 |

| Fund Commentary |

| CENTURY SHARES TRUST | April 30, 2017 (Unaudited) |

Risks: The Fund may invest a significant portion of assets in a limited number of companies or in companies within the same market sector. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies or sectors and therefore may experience greater price volatility than funds with more diversified portfolios. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | |

| ALPHABET, INC. | 7.16% |

| Internet Software & Services | |

| APPLE, INC. | 5.84% |

| Technology Hardware, Storage & Peripherals | |

| AMAZON.COM, INC. | 4.79% |

| Internet & Direct Marketing Retail | |

| VISA, INC., CLASS A | 4.65% |

| IT Services | |

| MICROSOFT CORP. | 4.56% |

| Software | |

| AMERICAN TOWER CORP. | 3.93% |

| Equity Real Estate Investment Trusts (REITs) | |

| CELGENE CORP. | 3.61% |

| Biotechnology | |

| MOODY'S CORP. | 3.59% |

| Capital Markets | |

| SKYWORKS SOLUTIONS, INC. | 3.58% |

| Semiconductors & Semiconductor Equipment | |

| BORGWARNER, INC. | 3.44% |

| Consumer Discretionary |

| Sector Allocation* | |

| Information Technology | 37.9% |

| Consumer Discretionary | 16.4% |

| Health Care | 13.6% |

| Real Estate | 9.2% |

| Financials | 7.3% |

| Industrials | 6.4% |

| Consumer Staples | 3.2% |

| Materials | 3.0% |

| Telecommunication Services | 2.0% |

| Cash, Cash Equivalents, & Other Net Assets | 1.0% |

| * | Based on the Fund’s net assets at April 30, 2017 and subject to change. |

| 6 | centuryfunds.com |

| Performance Summary |

| CENTURY SHARES TRUST | April 30, 2017 (Unaudited) |

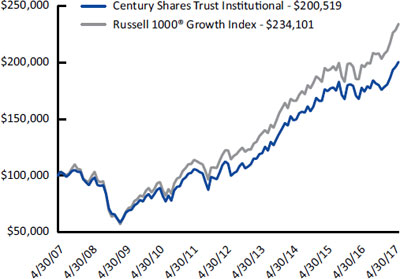

Institutional Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 1-800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.13% for the Institutional Shares. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

Average Annual Total Returns April 30, 2017

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Shares Trust - Institutional Shares (CENSX) | 15.09% | 10.22% | 12.66% | 7.21% |

Russell 1000® Growth Index | 19.50% | 12.11% | 13.87% | 8.88% |

| Growth of $100,000 for the 10 year period ended April 30, 2017 | |

| The graph and table reflect the change in value of a hypothetical investment in the Fund, including reinvestment of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000. The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. |

| Semi-Annual Report | April 30, 2017 | 7 |

| Fund Commentary |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

HOW DID THE PORTFOLIO PERFORM?

For the six-month period ended April 30, 2017, Century Small Cap Select Fund Institutional Shares returned +19.17% and the Investor Shares returned +18.95%, outperforming the Russell 2000 Growth Index (R2000G), the Fund’s benchmark, which returned +18.48%.

WHAT FACTORS INFLUENCED PERFORMANCE?

The top contributors to relative performance on a sector basis were Consumer Discretionary, Health Care and Consumer Staples, resulting mainly from stock selection. The top performing stocks included Grand Canyon Education, Inc. (education services), VCA, Inc. (animal health care), Children’s Place, Inc. (retailer), iRobot Corporation (consumer robotics) and Merit Medical Systems, Inc. (medical devices). Grand Canyon performed well due to a strong fourth quarter report and solid guidance. VCA agreed to be purchased by Mars, Inc. for a substantial valuation premium. Children’s Place reported strong sales, margins and a positive outlook. iRobot announced strong quarterly earnings results and Merit Medical reported operating results which beat expectations.

The top detractors from relative performance on a sector basis were Materials, Financials and Information Technology, resulting mainly from stock selection. The worst performing stocks included Gigamon, Inc. (software), Adeptus Health, Inc. (health care), HMS Holdings Corp. (health care payments), American Eagle Outfitters, Inc. (retailer) and Echo Global Logistics, Inc. (logistics). Gigamon missed earnings estimates and lowered guidance. Adeptus announced weaker patient volume in some of its markets. HMS depreciated as federal legislation proposals cast doubts over Medicaid funding. American Eagle reported weaker same store sales and declining mall traffic, and Echo delivered weaker than expected operating results.

HOW WAS THE PORTFOLIO POSITIONED AT PERIOD END?

The portfolio is diversified across almost every sector while currently maintaining its largest overweight positions in the Financials and Consumer Discretionary sectors. Conversely, the portfolio is most underweight the Information Technology and Real Estate sectors.

We believe that the U.S. economy is well positioned to continue its expansion as corporate fundamentals are strong and consumer and business optimism remains high. Additionally, the economy has continued to benefit from stable energy prices, muted U.S. dollar strength and more balanced business inventories. However, investors are still adapting to the new administration’s shifts in policies and priorities.

In the Eurozone, growth and inflation appeared to be on a path toward stabilization and normalization. The French election of a centrist, Emanuel Macron, has relieved concerns that EU unity might dissolve. Policy remained accommodative, and there was little fiscal drag. However, geopolitical risks exist and global trade developments need to remain supportive to foster a return to healthy growth.

To the East, China is expected to grow real GDP over 6% but excess capacity and growing debt remain a key concern. Japan continued to battle anemic growth and maintained a 0% interest rate target for its 10-year government bonds. We also remain concerned by continuing friction on the Korean peninsula.

While we continue to monitor risks to global economic growth, we are optimistic that the U.S. economy will continue to make progress. However, we remain sensitive to the relatively high valuations of the current equity markets. As always, we remain focused on investing in high quality, U.S. based companies. Should we see an increase in market volatility, we will approach it as an opportunity to further enhance our portfolio holdings.

Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted.

| 8 | centuryfunds.com |

| Fund Commentary |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

Risks: The Fund invests in smaller companies which pose greater risks than those associated with larger, more established companies. The Fund may invest a significant portion of assets in securities of companies within the same market sector. If the Fund’s portfolio is over weighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not over weighted in that sector. Please read the Fund’s prospectus for details regarding the Fund’s risk profile.

| Ten Largest Holdings* | |

| J2 GLOBAL, INC. | 3.50% |

| Internet Software & Services | |

| GRAND CANYON EDUCATION, INC. | 3.36% |

| Diversified Consumer Services | |

| LCI INDUSTRIES | 3.02% |

| Auto Components | |

| PAYCOM SOFTWARE, INC. | 2.94% |

| Software | |

| ON ASSIGNMENT, INC. | 2.90% |

| Professional Services | |

| WASHINGTON FEDERAL, INC. | 2.85% |

| Thrifts & Mortgage Finance | |

| BMC STOCK HOLDINGS, INC. | 2.82% |

| Trading Companies & Distributors | |

| MERIT MEDICAL SYSTEMS, INC. | 2.80% |

| Health Care Equipment & Supplies | |

| INTER PARFUMS, INC. | 2.79% |

| Personal Products | |

| BRIGHT HORIZONS FAMILY SOLUTIONS, INC. | 2.76% |

| Diversified Consumer Services |

| Sector Allocation* | |

| Health Care | 24.3% |

| Information Technology | 24.3% |

| Consumer Discretionary | 20.9% |

| Industrials | 18.3% |

| Financials | 10.3% |

| Materials | 5.2% |

| Consumer Staples | 4.4% |

| Energy | 3.4% |

| Telecommunication Services | 2.1% |

| Real Estate | 2.0% |

| Cash, Cash Equivalents, & Other Net Assets | -15.2% |

| * | Based on the Fund’s net assets at April 30, 2017 and subject to change. |

| Semi-Annual Report | April 30, 2017 | 9 |

| Performance Summary |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

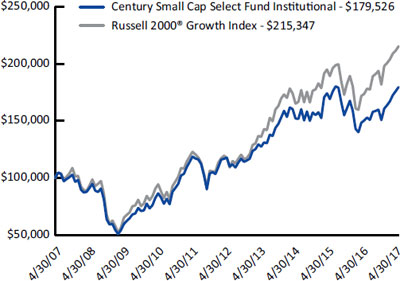

Institutional Shares and Investor Shares

The returns shown below represent past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the Fund’s past performance. For the most recent month-end performance, please call 1-800-303-1928.

As stated in the Fund’s current prospectus, the total (gross) operating expenses are 1.16% for the Institutional Shares and 1.46% for the Investor Shares. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted to reflect the deduction of taxes that a shareholder would pay on these distributions or the redemption of Fund shares. Shares held less than 90 days may be subject to a 1% redemption fee.

Average Annual Total Returns April 30, 2017

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Century Small Cap Select Fund - Institutional Shares (CSMCX) | 19.44% | 5.70% | 8.81% | 6.03% |

| Century Small Cap Select Fund - Investor Shares (CSMVX) | 19.06% | 5.37% | 8.47% | 5.67% |

Russell 2000® Growth Index | 24.06% | 9.27% | 12.89% | 7.97% |

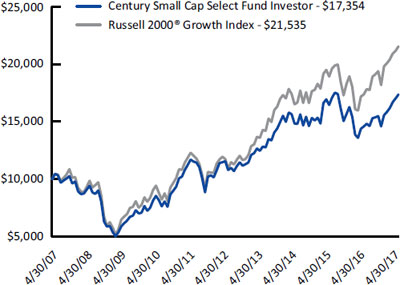

| Growth of $100,000 for the 10 year period ended April 30, 2017 | Growth of $10,000 for the 10 year period ended April 30, 2017 |

Institutional Shares | Investor Shares |

|  |

The graphs and table reflect the change in value of a hypothetical investment in the Fund, including reinvestment of dividends and distributions, compared with the index. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly in an index. Minimum initial investment for Institutional Shares is $100,000.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. Index returns assume reinvestment of dividends but, unlike Fund returns, do not reflect fees or expenses. One cannot invest directly in an index.

| 10 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY SHARES TRUST | April 30, 2017 (Unaudited) |

| Shares | Value | ||||||

| COMMON STOCKS ‐ 99.0% | |||||||

| Consumer Discretionary ‐ 16.4% | |||||||

| Auto Components ‐ 3.4% | |||||||

| 182,091 | BorgWarner, Inc. | $ | 7,698,807 | ||||

| Distributors ‐ 1.0% | |||||||

| 69,288 | LKQ Corp.(a) | 2,164,557 | |||||

| Diversified Consumer Services ‐ 2.2% | |||||||

| 198,050 | H&R Block, Inc. | 4,909,660 | |||||

| Hotels, Restaurants & Leisure ‐ 2.1% | |||||||

| 78,515 | Starbucks Corp. | 4,715,611 | |||||

| Internet & Direct Marketing Retail ‐ 4.8% | |||||||

| 11,579 | Amazon.com, Inc.(a) | 10,710,459 | |||||

| Specialty Retail ‐ 2.9% | |||||||

| 41,995 | Home Depot, Inc. | 6,555,420 | |||||

| Total Consumer Discretionary | 36,754,514 | ||||||

| Consumer Staples ‐ 3.2% | |||||||

| Beverages ‐ 3.2% | |||||||

| 63,109 | PepsiCo, Inc. | 7,148,988 | |||||

| Financials ‐ 7.3% | |||||||

| Capital Markets ‐ 6.9% | |||||||

| 189,346 | Charles Schwab Corp. | 7,356,092 | |||||

| 67,916 | Moody’s Corp. | 8,035,821 | |||||

| 15,391,913 | |||||||

| Diversified Financial Services ‐ 0.4% | |||||||

| 4 | Berkshire Hathaway, Inc., Class A(a) | 991,120 | |||||

| Total Financials | 16,383,033 | ||||||

| Health Care ‐ 13.6% | |||||||

| Biotechnology ‐ 6.1% | |||||||

| 82,712 | AbbVie, Inc. | 5,454,029 | |||||

| 65,146 | Celgene Corp.(a) | 8,081,361 | |||||

| 13,535,390 | |||||||

| Health Care Equipment & Supplies ‐ 1.9% | |||||||

| 97,556 | Abbott Laboratories | 4,257,344 | |||||

| Health Care Providers & Services ‐ 2.6% | |||||||

| 71,633 | AmerisourceBergen Corp. | 5,877,488 | |||||

| Shares | Value | ||||||

| Health Care (continued) | |||||||

| Pharmaceuticals ‐ 3.0% | |||||||

| 27,291 | Allergan PLC | $ | 6,655,183 | ||||

| Total Health Care | 30,325,405 | ||||||

| Industrials ‐ 6.4% | |||||||

| Aerospace & Defense ‐ 1.4% | |||||||

| 12,990 | TransDigm Group, Inc. | 3,205,023 | |||||

| Electrical Equipment ‐ 1.6% | |||||||

| 61,770 | AMETEK, Inc. | 3,533,244 | |||||

| Professional Services ‐ 3.4% | |||||||

| 91,840 | Verisk Analytics, Inc.(a) | 7,605,270 | |||||

| Total Industrials | 14,343,537 | ||||||

| Information Technology ‐ 37.9% | |||||||

| Internet Software & Services ‐ 7.5% | |||||||

| 8,952 | Alphabet, Inc., Class A(a) | 8,276,303 | |||||

| 8,547 | Alphabet, Inc., Class C(a) | 7,743,240 | |||||

| 6,151 | LogMeIn, Inc. | 695,063 | |||||

| 16,714,606 | |||||||

| IT Services ‐ 9.3% | |||||||

| 123,560 | Cognizant Technology Solutions Corp., Class A(a) | 7,442,019 | |||||

| 113,940 | Visa, Inc., Class A | 10,393,607 | |||||

| 154,063 | Western Union Co. | 3,059,691 | |||||

| 20,895,317 | |||||||

| Semiconductors & Semiconductor Equipment ‐ 3.6% | |||||||

| 80,205 | Skyworks Solutions, Inc. | 7,999,647 | |||||

| Software ‐ 8.8% | |||||||

| 54,872 | Adobe Systems, Inc.(a) | 7,338,581 | |||||

| 26,439 | Citrix Systems, Inc.(a) | 2,139,973 | |||||

| 149,155 | Microsoft Corp. | 10,211,151 | |||||

| 19,689,705 | |||||||

| Technology Hardware, Storage & Peripherals ‐ 8.7% | |||||||

| 91,015 | Apple, Inc. | 13,074,305 | |||||

| 71,867 | Western Digital Corp. | 6,401,193 | |||||

| 19,475,498 | |||||||

| Total Information Technology | 84,774,773 | ||||||

See Notes to Financial Statements

| Semi‐Annual Report | April 30, 2017 | 11 |

| Portfolio of Investments |

| CENTURY SHARES TRUST | April 30, 2017 (Unaudited) |

| Shares | Value | ||||||

| Materials ‐ 3.0% | |||||||

| Chemicals ‐ 3.0% | |||||||

| 78,438 | LyondellBasell Industries NV, Class A | $ | 6,648,405 | ||||

| Real Estate ‐ 9.2% | |||||||

| Equity Real Estate Investment Trusts (REITs) ‐ 6.2% | |||||||

| 69,819 | American Tower Corp. | 8,793,005 | |||||

| 12,142 | Equinix, Inc. | 5,071,713 | |||||

| 13,864,718 | |||||||

| Real Estate Management & Development ‐ 3.0% | |||||||

| 190,413 | CBRE Group, Inc., Class A(a) | 6,818,690 | |||||

| Total Real Estate | 20,683,408 | ||||||

| Telecommunication Services ‐ 2.0% | |||||||

| Diversified Telecommunication Services ‐ 2.0% | |||||||

| 112,616 | AT&T, Inc. | 4,462,972 | |||||

| TOTAL COMMON STOCKS (Cost $142,708,873) | 221,525,035 | ||||||

| SHORT‐TERM INVESTMENTS ‐ 1.1% | |||||||

| Money Market Fund ‐ 1.1% | |||||||

| 2,365,012 | State Street Institutional U.S. Government Money Market Fund ‐ Investment Class (0.68% 7 Day Yield) | 2,365,012 | |||||

| TOTAL SHORT‐TERM INVESTMENTS (Cost $2,365,012) | 2,365,012 | ||||||

| TOTAL INVESTMENTS ‐ 100.1% (Cost $145,073,885) | 223,890,047 | ||||||

| Liabilities in Excess of Other Assets ‐ (0.1%) | (188,669 | ) | |||||

| NET ASSETS ‐ 100.0% | $ | 223,701,378 | |||||

| (a) | Non-income producing security. |

Abbreviations:

| NV | - | Naamloze Vennootschap (Dutch: Limited Liability Company) |

| PLC | - | Public Limited Company |

See Notes to Financial Statements

| 12 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

| Shares | Value | ||||||

| COMMON STOCKS ‐ 115.2% | |||||||

| Consumer Discretionary ‐ 20.9% | |||||||

| Auto Components ‐ 3.0% | |||||||

| 24,081 | LCI Industries | $ | 2,435,793 | ||||

| Diversified Consumer Services ‐ 6.1% | |||||||

| 29,272 | Bright Horizons Family Solutions, Inc.(a) | 2,228,185 | |||||

| 36,064 | Grand Canyon Education, Inc.(a) | 2,710,570 | |||||

| 4,938,755 | |||||||

| Hotels, Restaurants & Leisure ‐ 3.9% | |||||||

| 20,241 | Choice Hotels International, Inc. | 1,269,111 | |||||

| 9,426 | Vail Resorts, Inc. | 1,863,143 | |||||

| 3,132,254 | |||||||

| Household Durables ‐ 2.7% | |||||||

| 27,218 | iRobot Corp.(a) | 2,170,363 | |||||

| Multiline Retail ‐ 2.5% | |||||||

| 40,250 | Big Lots, Inc. | 2,032,223 | |||||

| Specialty Retail ‐ 2.7% | |||||||

| 18,651 | Children’s Place, Inc. | 2,141,135 | |||||

| Total Consumer Discretionary | 16,850,523 | ||||||

| Consumer Staples ‐ 4.4% | |||||||

| Household Products ‐ 1.6% | |||||||

| 22,346 | Energizer Holdings, Inc. | 1,323,554 | |||||

| Personal Products ‐ 2.8% | |||||||

| 59,216 | Inter Parfums, Inc. | 2,247,247 | |||||

| Total Consumer Staples | 3,570,801 | ||||||

| Energy ‐ 3.4% | |||||||

| Energy Equipment & Services ‐ 0.8% | |||||||

| 15,846 | U.S. Silica Holdings, Inc. | 657,609 | |||||

| Oil, Gas & Consumable Fuels ‐ 2.6% | |||||||

| 53,125 | Matador Resources Co.(a) | 1,151,750 | |||||

| 118,560 | Sanchez Energy Corp.(a) | 917,654 | |||||

| 2,069,404 | |||||||

| Total Energy | 2,727,013 | ||||||

| Shares | Value | ||||||

| Financials ‐ 10.3% | |||||||

| Banks ‐ 5.7% | |||||||

| 45,595 | Berkshire Hills Bancorp, Inc. | $ | 1,709,812 | ||||

| 21,873 | Eagle Bancorp, Inc.(a) | 1,310,193 | |||||

| 53,485 | Hanmi Financial Corp. | 1,553,739 | |||||

| 4,573,744 | |||||||

| Capital Markets ‐ 1.8% | |||||||

| 35,992 | Cohen & Steers, Inc. | 1,436,081 | |||||

| Thrifts & Mortgage Finance ‐ 2.8% | |||||||

| 68,234 | Washington Federal, Inc. | 2,299,486 | |||||

| Total Financials | 8,309,311 | ||||||

| Health Care ‐ 24.3% | |||||||

| Biotechnology ‐ 3.6% | |||||||

| 23,857 | Acceleron Pharma, Inc.(a) | 787,758 | |||||

| 26,438 | Global Blood Therapeutics, Inc.(a) | 765,380 | |||||

| 27,956 | Ironwood Pharmaceuticals, Inc.(a) | 456,242 | |||||

| 6,051 | TESARO, Inc.(a) | 893,067 | |||||

| 2,902,447 | |||||||

| Health Care Equipment & Supplies ‐ 5.3% | |||||||

| 24,434 | Inogen, Inc.(a) | 2,025,334 | |||||

| 67,072 | Merit Medical Systems, Inc.(a) | 2,260,327 | |||||

| 4,285,661 | |||||||

| Health Care Providers & Services ‐ 5.0% | |||||||

| 43,237 | Acadia Healthcare Co., Inc.(a) | 1,884,268 | |||||

| 29,730 | AMN Healthcare Services, Inc.(a) | 1,214,471 | |||||

| 56,275 | Surgery Partners, Inc.(a) | 967,930 | |||||

| 4,066,669 | |||||||

| Health Care Technology ‐ 1.2% | |||||||

| 46,935 | HMS Holdings Corp.(a) | 960,759 | |||||

| Life Sciences Tools & Services ‐ 8.2% | |||||||

| 25,497 | Cambrex Corp.(a) | 1,513,247 | |||||

| 24,131 | Charles River Laboratories International, Inc.(a) | 2,164,551 | |||||

| 108,345 | NeoGenomics, Inc.(a) | 818,005 | |||||

| 33,471 | PRA Health Sciences, Inc.(a) | 2,140,805 | |||||

| 6,636,608 | |||||||

See Notes to Financial Statements

| Semi‐Annual Report | April 30, 2017 | 13 |

| Portfolio of Investments |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

| Shares | Value | ||||||

| Health Care (continued) | |||||||

| Pharmaceuticals ‐ 1.0% | |||||||

| 22,941 | Dermira, Inc.(a) | $ | 781,370 | ||||

| Total Health Care | 19,633,514 | ||||||

| Industrials ‐ 18.3% | |||||||

| Airlines ‐ 1.9% | |||||||

| 27,281 | Spirit Airlines, Inc.(a) | 1,562,383 | |||||

| Building Products ‐ 2.5% | |||||||

| 22,835 | Simpson Manufacturing Co., Inc. | 952,448 | |||||

| 14,887 | Trex Co., Inc(a) | 1,089,579 | |||||

| 2,042,027 | |||||||

| Commercial Services & Supplies ‐ 0.6% | |||||||

| 45,934 | InnerWorkings, Inc.(a) | 486,441 | |||||

| Construction & Engineering ‐ 4.6% | |||||||

| 19,299 | Dycom Industries, Inc.(a) | 2,039,132 | |||||

| 31,308 | Granite Construction, Inc. | 1,650,245 | |||||

| 3,689,377 | |||||||

| Machinery ‐ 2.0% | |||||||

| 18,084 | John Bean Technologies Corp. | 1,603,147 | |||||

| Professional Services ‐ 2.9% | |||||||

| 45,195 | On Assignment, Inc.(a) | 2,339,745 | |||||

| Road & Rail ‐ 1.0% | |||||||

| 16,092 | Saia, Inc.(a) | 774,830 | |||||

| Trading Companies & Distributors ‐ 2.8% | |||||||

| 97,541 | BMC Stock Holdings, Inc.(a) | 2,272,705 | |||||

| Total Industrials | 14,770,655 | ||||||

| Information Technology ‐ 24.3% | |||||||

| Communications Equipment ‐ 0.9% | |||||||

| 4,968 | Arista Networks, Inc.(a) | 693,732 | |||||

| Electronic Equipment Instruments & Components ‐ 1.2% | |||||||

| 6,202 | Littelfuse, Inc. | 956,038 | |||||

| Internet Software & Services ‐ 4.4% | |||||||

| 13,465 | Criteo SA, Sponsored ADR(a) | 732,361 | |||||

| 31,295 | j2 Global, Inc. | 2,824,061 | |||||

| 3,556,422 | |||||||

| Shares | Value | ||||||

| Information Technology (continued) | |||||||

| IT Services ‐ 1.8% | |||||||

| 45,341 | WNS Holdings Ltd., Sponsored ADR(a) | $ | 1,451,819 | ||||

| Semiconductors & Semiconductor Equipment ‐ 5.8% | |||||||

| 27,901 | Cavium, Inc.(a) | 1,920,984 | |||||

| 31,771 | Inphi Corp.(a) | 1,315,955 | |||||

| 60,216 | Integrated Device Technology, Inc.(a) | 1,444,582 | |||||

| 4,681,521 | |||||||

| Software ‐ 10.2% | |||||||

| 34,195 | CyberArk Software Ltd.(a) | 1,809,257 | |||||

| 25,305 | Gigamon, Inc.(a) | 802,169 | |||||

| 25,715 | Manhattan Associates, Inc.(a) | 1,200,633 | |||||

| 39,411 | Paycom Software, Inc.(a) | 2,374,513 | |||||

| 63,891 | RingCentral, Inc., Class A(a) | 2,041,317 | |||||

| 8,227,889 | |||||||

| Total Information Technology | 19,567,421 | ||||||

| Materials ‐ 5.2% | |||||||

| Chemicals ‐ 5.2% | |||||||

| 26,181 | Balchem Corp. | 2,124,850 | |||||

| 21,245 | Scotts Miracle‐Gro Co., Class A | 2,052,267 | |||||

| 4,177,117 | |||||||

| Real Estate ‐ 2.0% | |||||||

| Equity Real Estate Investment Trusts (REITs) ‐ 2.0% | |||||||

| 29,408 | QTS Realty Trust, Inc., Class A | 1,571,564 | |||||

| Telecommunication Services ‐ 2.1% | |||||||

| Wireless Telecommunication Services ‐ 2.1% | |||||||

| 53,614 | Shenandoah Telecommunications Co. | 1,715,648 | |||||

| TOTAL COMMON STOCKS (Cost $68,008,820) | $ | 92,893,567 | |||||

See Notes to Financial Statements

| 14 | centuryfunds.com |

| Portfolio of Investments |

| CENTURY SMALL CAP SELECT FUND | April 30, 2017 (Unaudited) |

| Shares | Value | ||||||

| SHORT‐TERM INVESTMENTS ‐ 5.8% | |||||||

| Money Market Fund ‐ 5.8% | |||||||

| 4,708,853 | State Street Institutional U.S. Government Money Market Fund ‐ Investment Class (0.68% 7 Day Yield) | 4,708,853 | |||||

| TOTAL SHORT‐TERM INVESTMENTS (Cost $4,708,853) | 4,708,853 | ||||||

| TOTAL INVESTMENTS ‐ 121.0% (Cost $72,717,673) | 97,602,420 | ||||||

| Liabilities in Excess of Other Assets ‐ (21.0%) | (16,939,925) | ||||||

| NET ASSETS ‐ 100.0% | $ | 80,662,495 | |||||

| (a) | Non-income producing security. |

Abbreviations:

| ADR | - | American Depositary Receipt |

| Ltd. | - | Limited |

See Notes to Financial Statements

| Semi‐Annual Report | April 30, 2017 | 15 |

| Statements of Assets and Liabilities |

April 30, 2017 (Unaudited)

Century Shares Trust | Century Small Cap Select Fund | |||||||

| ASSETS: | ||||||||

| Investments, at value (Note 1) (cost - see below) | $ | 223,890,047 | $ | 97,602,420 | ||||

| Cash | – | 721 | ||||||

| Receivable for investments sold | – | 716,906 | ||||||

| Receivable for fund shares subscribed | 6,583 | 7,355 | ||||||

| Dividends receivable | 135,395 | 9,882 | ||||||

| Prepaid expenses | 18,605 | 12,550 | ||||||

| Total Assets | 224,050,630 | 98,349,834 | ||||||

| LIABILITIES: | ||||||||

| Payable to Affiliates: | ||||||||

| Investment adviser fees (Note 4) | 143,929 | 73,717 | ||||||

| Administration fees (Note 5) | 17,991 | – | ||||||

| Distribution and service fees (Note 6) | – | 11,035 | ||||||

| Payable for investments purchased | – | 440,106 | ||||||

| Payable for shares redeemed | 92,780 | 17,073,347 | ||||||

| Payable to trustees | 28,558 | 24,277 | ||||||

| Payable for professional fees | 28,767 | 29,109 | ||||||

| Accrued expenses and other liabilities | 37,227 | 35,748 | ||||||

| Total Liabilities | 349,252 | 17,687,339 | ||||||

| NET ASSETS | $ | 223,701,378 | $ | 80,662,495 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid-in capital | $ | 144,747,812 | $ | 46,730,373 | ||||

| Accumulated net investment income/(loss) | 4,965 | (1,487,674 | ) | |||||

| Accumulated net realized gain on investments | 132,439 | 10,535,049 | ||||||

| Unrealized appreciation in value of investments | 78,816,162 | 24,884,747 | ||||||

| NET ASSETS | $ | 223,701,378 | $ | 80,662,495 | ||||

| Net Assets: | ||||||||

| Institutional Shares | $ | 223,701,378 | $ | 29,763,887 | ||||

| Investor Shares | N/A | $ | 50,898,608 | |||||

| Shares Outstanding (Note 2): | ||||||||

| Institutional Shares | 10,181,084 | 1,137,396 | ||||||

| Investor Shares | N/A | 2,084,175 | ||||||

| Net Asset Value Per Share | ||||||||

(Represents both the offering and redemption price)(a) | ||||||||

| Institutional Shares | $ | 21.97 | $ | 26.17 | ||||

| Investor Shares | N/A | $ | 24.42 | |||||

| Cost of investments | $ | 145,073,885 | $ | 72,717,673 | ||||

(a) | A redemption fee may be assessed for shares redeemed within 90 days after purchase. (Note 1) |

See Notes to Financial Statements

| 16 | centuryfunds.com |

| Statements of Operations |

For the Six Months Ended April 30, 2017 (Unaudited)

Century Shares Trust | Century Small Cap Select Fund | |||||||

| INVESTMENT INCOME: | ||||||||

| Dividends | $ | 1,476,907 | $ | 556,588 | ||||

| Total Investment Income | 1,476,907 | 556,588 | ||||||

| EXPENSES: | ||||||||

| Investment adviser fees (Note 4) | 848,706 | 662,497 | ||||||

| Distribution and service fees (Note 6): | ||||||||

| Investor Shares | – | 65,510 | ||||||

| Administrative fees | 106,088 | – | ||||||

| Transfer agency fees | 73,518 | 64,111 | ||||||

| Trustee fees | 73,256 | 55,017 | ||||||

| Professional fees | 54,329 | 47,727 | ||||||

| Fund accounting fees | 17,064 | 12,535 | ||||||

| Registration fees | 12,596 | 17,267 | ||||||

| Printing fees | 12,594 | 8,402 | ||||||

| Insurance fees | 10,844 | 10,909 | ||||||

| Custodian fees | 9,231 | 12,096 | ||||||

| Other expenses | – | 3,419 | ||||||

| Total Expenses | 1,218,226 | 959,490 | ||||||

| NET INVESTMENT INCOME/(LOSS) | 258,681 | (402,902 | ) | |||||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||||||

| Net realized gain on investments | 256,186 | 15,333,741 | ||||||

| Net change in unrealized appreciation of investments | 27,702,500 | 10,028,985 | ||||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 27,958,686 | 25,362,726 | ||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 28,217,367 | $ | 24,959,824 | ||||

See Notes to Financial Statements

| Semi-Annual Report | April 30, 2017 | 17 |

| Statements of Changes in Net Assets |

| Century Shares Trust | Century Small Cap Select Fund | |||||||||||||||

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, 2016 | For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, 2016 | |||||||||||||

| OPERATIONS: | ||||||||||||||||

| Net investment income/(loss) | $ | 258,681 | $ | 279,726 | $ | (402,902 | ) | $ | (1,148,690 | ) | ||||||

| Net realized gain/(loss) on investments | 256,186 | 6,600,965 | 15,333,741 | (4,285,311 | ) | |||||||||||

| Change in net unrealized appreciation/(depreciation) | 27,702,500 | (11,735,309 | ) | 10,028,985 | (11,785,433 | ) | ||||||||||

| Net increase/(decrease) in net assets resulting from operations | 28,217,367 | (4,854,618 | ) | 24,959,824 | (17,219,434 | ) | ||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||||||||||

| Institutional Shares | ||||||||||||||||

| From net investment income | (360,357 | ) | (468,505 | ) | – | – | ||||||||||

| From net realized gains on investments | (6,723,561 | ) | (7,353,202 | ) | – | (34,271,035 | ) | |||||||||

| Investor Shares | ||||||||||||||||

| From net realized gains on investments | – | – | – | (21,543,723 | ) | |||||||||||

| Total distributions | (7,083,918 | ) | (7,821,707 | ) | – | (55,814,758 | ) | |||||||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||||||||||

| Decrease in net assets from capital share transactions (see Note 2) | (3,066,061 | ) | (7,049,692 | ) | (98,585,529 | ) | (37,558,710 | ) | ||||||||

| Redemption fees | 116 | 124 | 3,774 | 16,389 | ||||||||||||

| Net decrease from share transactions | (3,065,945 | ) | (7,049,568 | ) | (98,581,755 | ) | (37,542,321 | ) | ||||||||

| Total increase/(decrease) | 18,067,504 | (19,725,893 | ) | (73,621,931 | ) | (110,576,513 | ) | |||||||||

| NET ASSETS: | ||||||||||||||||

| Beginning of period | 205,633,874 | 225,359,767 | 154,284,426 | 264,860,939 | ||||||||||||

| End of period* | $ | 223,701,378 | $ | 205,633,874 | $ | 80,662,495 | $ | 154,284,426 | ||||||||

| *Including accumulated net investment income/(loss) | $ | 4,965 | $ | 106,641 | $ | (1,487,674 | ) | $ | (1,084,772 | ) | ||||||

See Notes to Financial Statements

| 18 | centuryfunds.com |

| Financial Highlights |

| CENTURY SHARES TRUST | For a share outstanding throughout the periods presented |

| INSTITUTIONAL SHARES |

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 19.93 | $ | 21.14 | $ | 24.78 | $ | 22.41 | $ | 19.81 | $ | 20.66 | ||||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||||||

Net investment income/(loss)(a) | 0.03 | 0.03 | 0.02 | (0.02 | ) | 0.03 | 0.05 | |||||||||||||||||

| Net realized and unrealized gain/(loss) on investments | 2.70 | (0.50 | ) | 2.39 | 3.72 | 5.09 | 1.28 | |||||||||||||||||

| Total income/(loss) from investment operations | 2.73 | (0.47 | ) | 2.41 | 3.70 | 5.12 | 1.33 | |||||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||||||

| Net investment income | (0.03 | ) | (0.04 | ) | – | – | (0.05 | ) | (0.06 | ) | ||||||||||||||

| Net realized gain on investment transactions | (0.66 | ) | (0.70 | ) | (6.05 | ) | (1.33 | ) | (2.47 | ) | (2.12 | ) | ||||||||||||

| Total distributions | (0.69 | ) | (0.74 | ) | (6.05 | ) | (1.33 | ) | (2.52 | ) | (2.18 | ) | ||||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 21.97 | $ | 19.93 | $ | 21.14 | $ | 24.78 | $ | 22.41 | $ | 19.81 | ||||||||||||

| Total Return | 14.05 | %(c) | (2.24 | %) | 11.76 | % | 17.29 | % | 28.85 | % | 7.63 | % | ||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||||||

| Net assets, end of period (000's) | $ | 223,701 | $ | 205,634 | $ | 225,360 | $ | 222,551 | $ | 201,271 | $ | 174,534 | ||||||||||||

| Ratio of expenses to average net assets | 1.15 | %(d) | 1.13 | % | 1.11 | % | 1.09 | % | 1.11 | % | 1.12 | % | ||||||||||||

| Ratio of net investment – to average net assets | 0.24 | %(d) | 0.13 | % | 0.12 | % | (0.06 | %) | 0.16 | % | 0.24 | % | ||||||||||||

| Portfolio Turnover Rate | 14 | %(c) | 44 | % | 46 | % | 126 | % | 39 | % | 79 | % | ||||||||||||

(a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share. |

(c) | Not annualized. |

(d) | Annualized. |

See Notes to Financial Statements

| Semi-Annual Report | April 30, 2017 | 19 |

| Financial Highlights |

| CENTURY SMALL CAP SELECT FUND | For a share outstanding throughout the periods presented |

| INSTITUTIONAL SHARES |

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 21.96 | $ | 30.00 | $ | 34.46 | $ | 33.94 | $ | 26.27 | $ | 23.91 | ||||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||||||

Net investment loss(a) | (0.05 | ) | (0.11 | ) | (0.17 | ) | (0.24 | ) | (0.04 | ) | (0.12 | ) | ||||||||||||

| Net realized and unrealized gain/(loss) on investments | 4.26 | (1.58 | ) | 0.87 | 2.48 | 7.71 | 2.48 | |||||||||||||||||

| Total income/(loss) from investment operations | 4.21 | (1.69 | ) | 0.70 | 2.24 | 7.67 | 2.36 | |||||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||||||

| Net realized gain on investment transactions | – | (6.35 | ) | (5.16 | ) | (1.72 | ) | – | – | |||||||||||||||

| Total distributions | – | (6.35 | ) | (5.16 | ) | (1.72 | ) | – | – | |||||||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 26.17 | $ | 21.96 | $ | 30.00 | $ | 34.46 | $ | 33.94 | $ | 26.27 | ||||||||||||

| Total Return | 19.17 | %(c) | (6.53 | %) | 2.48 | % | 6.79 | % | 29.20 | % | 9.87 | % | ||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||||||

| Net assets, end of period (000's) | $ | 29,764 | $ | 88,182 | $ | 164,141 | $ | 266,045 | $ | 300,833 | $ | 281,480 | ||||||||||||

| Ratio of expenses to average net assets | 1.24 | %(d) | 1.16 | % | 1.13 | % | 1.11 | % | 1.12 | % | 1.10 | % | ||||||||||||

| Ratio of net investment – to average net assets | (0.41 | %)(d) | (0.47 | %) | (0.52 | %) | (0.71 | %) | (0.14 | %) | (0.48 | %) | ||||||||||||

| Portfolio Turnover Rate | 27 | %(c) | 82 | % | 69 | % | 97 | % | 91 | % | 53 | % | ||||||||||||

(a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share. |

(c) | Not annualized. |

(d) | Annualized. |

See Notes to Financial Statements

| 20 | centuryfunds.com |

| Financial Highlights |

| CENTURY SMALL CAP SELECT FUND | For a share outstanding throughout the periods presented |

| INVESTOR SHARES |

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF PERIOD | $ | 20.53 | $ | 28.53 | $ | 33.12 | $ | 32.78 | $ | 25.45 | $ | 23.25 | ||||||||||||

| INCOME/(LOSS) FROM OPERATIONS: | ||||||||||||||||||||||||

Net investment loss(a) | (0.09 | ) | (0.17 | ) | (0.26 | ) | (0.33 | ) | (0.13 | ) | (0.21 | ) | ||||||||||||

| Net realized and unrealized gain/(loss) on investments | 3.98 | (1.48 | ) | 0.83 | 2.39 | 7.46 | 2.41 | |||||||||||||||||

| Total income/(loss) from investment operations | 3.89 | (1.65 | ) | 0.57 | 2.06 | 7.33 | 2.20 | |||||||||||||||||

| LESS DISTRIBUTIONS FROM: | ||||||||||||||||||||||||

| Net realized gain on investment transactions | – | (6.35 | ) | (5.16 | ) | (1.72 | ) | – | – | |||||||||||||||

| Total distributions | – | (6.35 | ) | (5.16 | ) | (1.72 | ) | – | – | |||||||||||||||

| REDEMPTION FEES | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) | ||||||||||||

| NET ASSET VALUE, END OF PERIOD | $ | 24.42 | $ | 20.53 | $ | 28.53 | $ | 33.12 | $ | 32.78 | $ | 25.45 | ||||||||||||

| Total Return | 18.95 | %(c) | (6.77 | %) | 2.14 | % | 6.47 | % | 28.80 | % | 9.46 | % | ||||||||||||

| RATIOS AND SUPPLEMENTAL DATA | ||||||||||||||||||||||||

| Net assets, end of period (000's) | $ | 50,899 | $ | 66,102 | $ | 100,720 | $ | 118,181 | $ | 128,029 | $ | 111,965 | ||||||||||||

| Ratio of expenses to average net assets | 1.53 | %(d) | 1.46 | % | 1.42 | % | 1.40 | % | 1.41 | % | 1.47 | % | ||||||||||||

| Ratio of net investment – to average net assets | (0.76 | %)(d) | (0.78 | %) | (0.85 | %) | (1.00 | %) | (0.44 | %) | (0.84 | %) | ||||||||||||

| Portfolio Turnover Rate | 27 | %(c) | 82 | % | 69 | % | 97 | % | 91 | % | 53 | % | ||||||||||||

(a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share. |

(c) | Not annualized. |

(d) | Annualized. |

See Notes to Financial Statements

| Semi-Annual Report | April 30, 2017 | 21 |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

1. SIGNIFICANT ACCOUNTING POLICIES

Century Capital Management Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”) as an open‐end management investment company organized as a Massachusetts business trust. Century Shares Trust and Century Small Cap Select Fund, (each a “Fund” and, collectively, the “Funds”) are diversified series of the Trust. The following are significant accounting policies consistently followed by the Funds and are in conformity with accounting principles generally accepted in the United States (“GAAP”). Each Fund is considered an investment company for financial reporting purposes under GAAP.

The investment objective of Century Shares Trust and Century Small Cap Select Fund is to seek long‐term capital growth.

A. Security Valuations — Equity securities are valued at the last reported sale price or official closing price on the primary exchange or market on which they are traded, as reported by an independent pricing service. If no sale price or official closing price is reported, market value is generally determined based on quotes or closing prices obtained from a quotation reporting system, established market maker, or reputable pricing service. For unlisted securities and for exchange‐listed securities for which there are no reported sales or official closing prices, fair value is generally determined using closing bid prices. In the absence of readily available market quotes, securities and other assets will be valued at fair value, as determined in good faith under procedures established by and under the general supervision of the Funds’ Board of Trustees. Short‐term obligations, maturing in 60 days or less, are valued at amortized cost, which approximates fair value unless particular circumstances dictate otherwise (for example, if the issuer’s creditworthiness has become impaired). Investments in open‐end mutual funds are valued at their closing net asset value each business day.

A three‐tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| Level 2 — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; |

| Level 3 — | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| 22 | centuryfunds.com |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

The following is a summary of the inputs used as of April 30, 2017 in valuing the Funds’ investments carried at fair value:

Century Shares Trust

| Investments in Securities at Value* | Level 1 ‐ Quoted Prices | Level 2 ‐ Other Significant Observable Inputs | Level 3 ‐ Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks | $ | 221,525,035 | $ | – | $ | – | $ | 221,525,035 | ||||||||

Short‐Term Investments | 2,365,012 | – | – | 2,365,012 | ||||||||||||

| TOTAL | $ | 223,890,047 | $ | – | $ | – | $ | 223,890,047 | ||||||||

Century Small Cap Select Fund

| Investments in Securities at Value* | Level 1 ‐ Quoted Prices | Level 2 ‐ Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks | $ | 92,893,567 | $ | – | $ | – | $ | 92,893,567 | ||||||||

Short‐Term Investments | 4,708,853 | – | – | 4,708,853 | ||||||||||||

| TOTAL | $ | 97,602,420 | $ | – | $ | – | $ | 97,602,420 | ||||||||

| * | At April 30, 2017 the Funds held investments in common stocks classified as Level 1, with corresponding major categories as shown on each Fund’s Portfolio of Investments. |

The Funds recognize transfers into and out of all levels at the end of the reporting period. There were no transfers into or out of Levels 1 and 2 during the period.

There were no securities classified as Level 3 securities during the period, thus, a reconciliation of assets in which significant unobservable inputs (Level 3) were used is not applicable for these Funds.

B. Security Transactions — Security transactions are recorded on a trade date basis. Gain or loss on sales is determined by the use of the highest cost‐method, for both financial reporting and federal income tax purposes. Dividend income is recorded on the ex‐dividend date. Payments received from certain investments held by the Funds may be comprised of dividends, capital gains and return of capital. The Funds originally estimate the expected classification of such payments. The amounts may subsequently be reclassified upon receipt of information from the issuer. The Funds may invest in equity securities issued or guaranteed by companies organized and based in countries outside of the United States. These securities may be traded on foreign securities exchanges or in foreign over‐the‐counter markets. Foreign dividend income is recorded on ex‐dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Foreign income and capital gain on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded daily on an accrual basis.

Semi‐Annual Report | April 30, 2017 | 23 |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

C. Use of Estimates — The preparation of these financial statements in accordance with GAAP incorporates estimates made by management in determining the reported amounts of assets, liabilities, income and expenses of the Funds. Actual results could differ from those estimates.

D. Risks and Uncertainty — Century Shares Trust may invest a significant portion of assets in a limited number of companies. As a result, the Fund may be more susceptible to financial, market and economic events affecting particular companies and therefore may experience greater price volatility than funds with more diversified portfolios.

Century Small Cap Select Fund invests in smaller companies, which generally involves greater risk than investing in larger, more established companies.

Foreign investing involves certain risks and increased volatility not associated with investing solely in the U.S. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments.

At any given time, a significant portion of the assets of each Fund may be invested in securities of companies within the same market sector of the economy. Companies within the same sector often face similar issues and, consequently, may react similarly to changes in market conditions. If a Fund has a significant weighting in one or more sectors, it may be subject to more risk and price volatility.

E. Multiple Classes of Shares — Century Small Cap Select Fund offers two classes of shares, which differ in their respective distribution and service fees. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund‐level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Certain expense reductions may differ by class. Because transfer agent fees include a per account fee, each class differs with respect to transfer agent fees incurred.

F. Redemption Fees — In general, shares of each Fund may be redeemed at net asset value. However, upon the redemption of shares held less than 90 days, a redemption fee of 1% of the current net asset value of the shares may be assessed and retained by each share class of each Fund for the benefit of the Fund’s remaining shareholders. The redemption fee is accounted for as an addition to paid‐in‐capital and amounts are shown on the Statement of Changes in Net Assets.

G. Income Tax Information and Distributions to Shareholders — Each year, each Fund intends to qualify as a regulated investment company by distributing all of its taxable income and sufficient net investment income and net realized gains, if any, under Subchapter M of the Internal Revenue Code of 1986 (“Code”), as amended. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on each Fund’s understanding of the tax rules and rates class. Distributions are recorded on the ex‐dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Capital accounts within the financial statements are adjusted for permanent book and tax differences. Generally accepted accounting principles require that any distributions in excess of tax basis earnings and profits be reported in the financial statements as a tax return of capital.

| 24 | centuryfunds.com |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

The net unrealized appreciation/depreciation of investments based on federal tax cost as of April 30, 2016 was as follows:

Century Shares Trust | Century Small Cap Select Fund | |||||||

| Gross appreciation on investments (excess of value over tax cost) | $ | 79,690,749 | $ | 25,166,633 | ||||

| Gross depreciation on investments (excess of tax cost over value) | (998,284 | ) | (838,212 | ) | ||||

| Net unrealized appreciation | $ | 78,692,465 | $ | 24,328,421 | ||||

| Cost of investments for federal income tax purposes | $ | 145,197,582 | $ | 73,273,999 | ||||

The tax character of distributions paid by the Funds during the year ended October 31, 2016, were as follows:

| Distributions Paid From: | Century Shares Trust | Century Small Cap Select Fund | ||||||

| Ordinary income | $ | 1,520,204 | $ | – | ||||

Long‐term capital gains | 6,301,503 | 55,814,758 | ||||||

| Total | $ | 7,821,707 | $ | 55,814,758 | ||||

The tax character of distributions paid by the Funds during the period ended April 30, 2017, will be determined at the Funds’ fiscal year end October 31, 2017.

As of October 31, 2016, Century Small Cap Select Fund had short term capital losses deferred to the next tax year of $4,185,589.

Century Small Cap Select Fund elects to defer to the period ending October 31, 2017, late year ordinary losses in the amount of $1,084,772.

As of April 30, 2017, the Funds had no uncertain tax positions that would require financial statement recognition or disclosure. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of a tax return, but may extend to four years in certain jurisdictions. Tax returns for open years have incorporated no uncertain positions that require a provision for income taxes.

H. Indemnifications — In the normal course of business, the Funds enter into agreements with service providers that may contain indemnification clauses. The Funds maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred.

Semi‐Annual Report | April 30, 2017 | 25 |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

2. TRANSACTIONS IN SHARES

Century Shares Trust — The number of authorized shares is unlimited. Transactions in Institutional Class shares were as follows:

| Institutional | ||||||||||||||||

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, 2016 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold | 24,376 | $ | 499,861 | 98,033 | $ | 1,952,190 | ||||||||||

| Issued to shareholders in reinvestment of distributions | 319,511 | 6,406,200 | 355,390 | 7,146,898 | ||||||||||||

| 343,887 | 6,906,061 | 453,423 | 9,099,088 | |||||||||||||

| Repurchased | (480,644 | ) | (9,972,122 | ) | (798,182 | ) | (16,148,780 | ) | ||||||||

| Net Decrease | (136,757 | ) | $ | (3,066,061 | ) | (344,759 | ) | $ | (7,049,692 | ) | ||||||

Century Small Cap Select Fund — The number of authorized shares is unlimited. Transactions in each class of shares were as follows:

| Institutional | ||||||||||||||||

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, 2016 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold | 329,115 | $ | 8,109,093 | 547,654 | $ | 12,738,016 | ||||||||||

| Issued to shareholders in reinvestment of distributions | – | – | 1,444,718 | 33,112,940 | ||||||||||||

| 329,115 | 8,109,093 | 1,992,372 | 45,850,956 | |||||||||||||

| Repurchased | (3,206,836 | ) | (79,745,599 | ) | (3,448,764 | ) | (76,500,718 | ) | ||||||||

| Net Decrease | (2,877,721 | ) | $ | (71,636,506 | ) | (1,456,392 | ) | $ | (30,649,762 | ) | ||||||

| 26 | centuryfunds.com |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

Century Small Cap Select Fund (continued)

| Investor | ||||||||||||||||

For the Six Months Ended April 30, 2017 (Unaudited) | For the Year Ended October 31, 2016 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Sold | 68,396 | $ | 1,572,894 | 236,525 | $ | 5,033,490 | ||||||||||

| Issued to shareholders in reinvestment of distributions | – | – | 994,743 | 21,357,127 | ||||||||||||

| 68,396 | 1,572,894 | 1,231,268 | 26,390,617 | |||||||||||||

| Repurchased | (1,204,767 | ) | (28,521,917 | ) | (1,540,691 | ) | (33,299,565 | ) | ||||||||

| Net Decrease | (1,136,371 | ) | $ | (26,949,023 | ) | (309,423 | ) | $ | (6,908,948 | ) | ||||||

3. INVESTMENT SECURITIES TRANSACTIONS

Century Shares Trust purchases and sales of investment securities (excluding short-term securities and U.S. Government obligations) aggregated $28,779,965 and $28,610,805, respectively, during the six months ended April 30, 2017.

Century Small Cap Select Fund purchases and sales of investment securities (excluding short-term securities, in-kind transactions and U.S. Government obligations) aggregated $36,546,613 and $64,605,667 respectively, during the six months ended April 30, 2017.

During the six months ended April 30, 2017 Century Small Cap Select Fund had sales of in-kind transactions in the amount of $53,622,400. The in-kind net realized gains were $9,630,782.

4. INVESTMENT ADVISER FEE

Century Shares Trust: The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with Century Capital Management, LLC (“CCM”) pursuant to which CCM provides an investment program for Century Shares Trust. Under the Agreement, the Fund pays a monthly management fee based on the Fund’s average daily net assets computed at the following annual rates: 0.80% of the first $500 million and 0.70% of the amounts exceeding $500 million.

Century Small Cap Select Fund: The Trust has entered into an Investment Advisory and Management Services Agreement (the “Agreement”) with CCM pursuant to which CCM provides investment advisory, management and administrative services to Century Small Cap Select Fund. Under the Agreement, the Fund pays a monthly management fee at the annual rate of 0.95% of the Fund’s average daily net assets.

5. ADMINISTRATION FEES

Century Shares Trust: The Trust has entered into an Administration Agreement with CCM pursuant to which CCM provides certain administrative services to Century Shares Trust. Under the agreement, the Fund pays a monthly administration fee at the annual rate of 0.10% of the Fund’s average daily net assets.

| Semi-Annual Report | April 30, 2017 | 27 |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

Century Small Cap Select Fund: Per the Investment Advisory and Management Services Agreement between the Trust and CCM, Century Small Cap Select Fund may reimburse CCM for expenses associated with having the adviser’s personnel perform shareholder service functions and certain financial, accounting, administrative and clerical services. No reimbursements were paid to CCM during the six months ended April 30, 2017.

CCM has entered into a Sub-Administration Agreement with ALPS Fund Services, Inc. (“ALPS”) pursuant to which ALPS provides certain administrative services to each Fund on behalf of CCM. CCM pays ALPS a sub-administration fee for sub-administration services provided to each Fund.

6. DISTRIBUTION FEES AND OTHER PAYMENTS TO FINANCIAL INTERMEDIARIES

The Trust has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act on behalf of Century Small Cap Select Fund. The Plan authorizes the Fund to pay up to 0.25% of the average daily net assets of the Fund’s Investor Shares class for distribution and shareholder services. The Plan may be terminated at any time by the vote of a majority of the independent Trustees or by the vote of the holders of a majority of the outstanding shares of the Investor Shares.

The Trust has entered into agreements with financial intermediaries to provide recordkeeping, processing, shareholder communications and other services to customers of the intermediaries and has agreed to compensate the intermediaries for providing such services. Certain services would be provided by the Funds if the shares of each customer were registered directly with the Funds’ transfer agent.

7. TRUSTEE AND OFFICER FEES

As of April 30, 2017, there were seven Trustees, six of whom are not “interested persons” (within the meaning of the 1940 Act) of the Trust (the “Independent Trustees”). Each Independent Trustee receives a retainer of $4,000 per calendar quarter from the Trust for his or her services. The chairperson of the Audit Committee receives an additional retainer of $1,125 per calendar quarter; the Lead Independent Trustee receives an additional retainer of $750 per calendar quarter; and the Chairpersons of the Oversight and Governance Committee and Nominating Committee each receive an additional retainer of $375 per calendar quarter. In addition, each Independent Trustee is paid a fee of $5,500 for each meeting of the Board of Trustees attended or participated in, as the case may be. The Independent Trustees are not paid an additional fee from the Trust for attendance at and/or participation in meetings of the various committees of the Board. The Independent Trustees are also reimbursed for meeting-related expenses. Officers of the Trust and Trustees who are interested persons of the Trust receive no salary or fees from the Trust.

8. SUBSEQUENT EVENT

CCM has entered into an agreement to be acquired by Congress Asset Management, LLP (“Congress”), a Boston based registered investment adviser. On May 18, 2017 the Board of Trustees approved plans of reorganization (the “Reorganization(s)”) to merge Century Shares Trust into Congress Large Cap Growth Fund and to merge Century Small Cap Select Fund into a newly organized fund to be managed by Congress. Proxy statements will be sent to shareholders that provide detailed information about the Reorganizations. If shareholders of each Fund approve each such Reorganization, and all other closing conditions are satisfied or waived, the transaction between CCM and Congress is expected to close in second half of 2017.

| 28 | centuryfunds.com |

| Notes to Financial Statements |

April 30, 2017 (Unaudited)

9. RECENT ACCOUNTING PRONOUNCEMENT

In December 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-19, “Technical Corrections and Improvements.” It includes an update to Accounting Standards Codification Topic 820 (“Topic 820”), Fair Value Measurement. The update to Topic 820 clarifies the difference between a valuation approach and a valuation technique. It also requires disclosure when there has been a change in either or both a valuation approach and/or a valuation technique. The changes related to Topic 820 are effective for annual reporting periods, including interim periods within those annual periods, beginning after December 15, 2016. Management is currently evaluating the impact of the ASU to the financial statements.

| Semi-Annual Report | April 30, 2017 | 29 |

| Disclosure of Fund Expenses |

April 30, 2017 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: direct costs, such as short-term redemption fees and wire fees, and indirect costs, including management fees, and other fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

Beginning Account Value November 1, 2016 | Ending Account Value April 30, 2017 | Expense Ratio(a) | Expenses Paid During period November 1, 2016 to April 30, 2017(b) | |

| Century Shares Trust | ||||

| Institutional Shares | ||||

| Actual | $1,000.00 | $1,140.50 | 1.15% | $6.10 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.09 | 1.15% | $5.76 |

| Century Small Cap Select Fund | ||||

| Institutional Shares | ||||

| Actual | $1,000.00 | $1,191.70 | 1.24% | $6.74 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.65 | 1.24% | $6.21 |

| Investor Shares | ||||

| Actual | $1,000.00 | $1,189.50 | 1.53% | $8.31 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.21 | 1.53% | $7.65 |

(a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half year expenses. |