UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

(This FormN-CSR relates solely to the Registrant’s: PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund.)

| | |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 1/31/2019 |

| |

| Date of reporting period: | | 1/31/2019 |

Item 1 – Reports to Stockholders

PGIM CORE SHORT-TERM BOND FUND

PGIM CORE ULTRA SHORT BOND FUND

PGIM INSTITUTIONAL MONEY MARKET FUND

(Formerly known as Prudential Core Short-Term Bond Fund, Prudential Core Ultra Short Bond Fund and Prudential Institutional Money Market Fund)

ANNUAL REPORT

JANUARY 31, 2019

|

PGIM Core Short-Term Bond Fund—Objective:Income consistent with relative

stability of principal PGIM Core Ultra Short Bond Fund—Objective:Current income consistent with

the preservation of capital and the maintenance of liquidity PGIM Institutional Money Market Fund—Objective:Current income consistent

with the preservation of capital and the maintenance of liquidity |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The information about the Funds’ portfolio holdings is for the period covered by this report and is subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PGIM is a Prudential Financial company.© 2019 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Table of Contents

| | | | |

| Prudential Investment Portfolios 2 | | | 3 | |

This Page Intentionally Left Blank

PGIM Core Short-Term Bond Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | | | |

| |

| | | Average Annual Total Returns as of 1/31/19 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| PGIM Core Short-Term Bond Fund |

| | 2.42 | | 1.77 | | 3.99 |

| Lipper Ultra Short Obligations Funds Average |

| | 1.70 | | 0.98 | | 1.28 |

| 3 Month LIBOR IX |

| | | 2.32 | | 0.97 | | 0.70 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

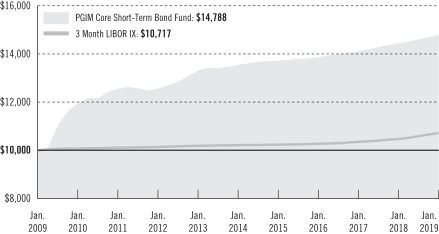

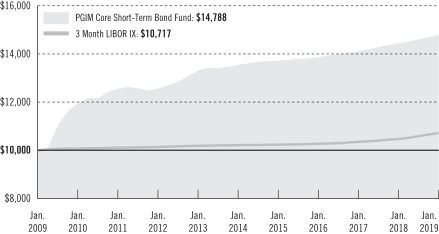

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund with a similar investment in the 3 Month LIBOR IX by portraying the initial account values at the beginning of the10-year period (January 31, 2009) and the account values at the end of the current fiscal year (January 31, 2019), as measured on a quarterly basis. For purposes of the graph, and unless

| | | | |

| Prudential Investment Portfolios 2 | | | 5 | |

PGIM Core Short-Term Bond Fund

Your Fund’s Performance(continued)

otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Bloomberg

Benchmark Definitions

Lipper Ultra Short Obligations Funds Average—The Lipper Ultra Short Obligation Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Ultra Short Obligation Funds universe for the periods noted. Funds in the Lipper Average primarily invest in investment-grade debt issues or better and maintain a portfolio dollar-weighted average maturity between 91 days and 365 days.

3 Month LIBOR IX—The 3 Month London InterBank Offered Rate Index is the average rate at which a panel of leading banks borrowed US dollar funds from one another with a maturity of three months during the periods noted. LIBOR is the most widely used “benchmark” or reference rate for short term interest rates.

Investors cannot invest directly in an index. The returns for the 3 Month LIBOR IX would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | | | |

|

| Distributions and Yields as of 1/31/19 |

| | Total Distributions

Paid for

12 Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| PGIM Core Short-Term Bond Fund | | 0.28 | | 3.12 | | 3.12 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | |

| 6 | | Visit our website at pgiminvestments.com |

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 1/31/19 (%) | |

| AAA | | | 27.9 | |

| AA | | | 18.6 | |

| A | | | 24.9 | |

| BBB | | | 10.2 | |

| BB | | | 1.5 | |

| B | | | 0.2 | |

| CCC | | | 0.3 | |

| Not Rated | | | 0.2 | |

| Cash/Equivalents | | | 16.2 | |

| Total Investments | | | 100.0 | |

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent, and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

| | | | |

| Prudential Investment Portfolios 2 | | | 7 | |

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | | | |

| |

| | | Average Annual Total Returns as of 1/31/19 |

| | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| PGIM Core Ultra Short Bond Fund |

| | 2.17 | | 0.87 | | 0.56 |

| iMoneyNet Prime Institutional Funds Average |

| | | 1.89 | | 0.64 | | 0.37 |

Source: PGIM Investments LLC and iMoneyNet Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

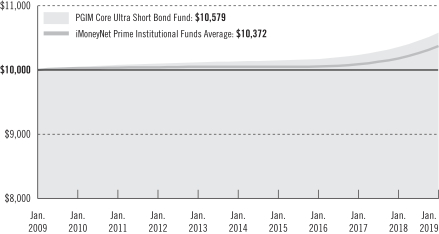

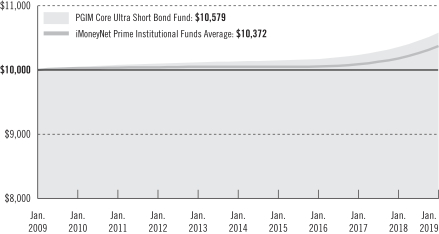

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund with a similar investment in the iMoneyNet Prime Institutional Funds Average by portraying the initial account values at the beginning of the 10-year period (January 31, 2009) and the account values at the end of the current fiscal year (January 31, 2019), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring

| | |

| 8 | | Visit our website at pgiminvestments.com |

fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Benchmark Definition

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | | | | | |

|

| Distributions and Yields as of 1/31/19 |

| | Total Distributions

Paid for

12 Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| PGIM Core Ultra Short Bond Fund | | 0.02 | | 2.62 | | 2.62 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 1/31/19 (%) | |

| A-1+/P-1 | | | 76.2 | |

| A-1/P-1 | | | 23.8 | |

| Total Investments | | | 100.0 | |

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by an NRSRO such as Moody’s, S&P and Fitch. Moody’s Investor Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent, and are widely used. Credit ratings are subject to change.

| | | | |

| Prudential Investment Portfolios 2 | | | 9 | |

PGIM Institutional Money Market Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | |

| |

| | | Average Annual Total Returns as of 1/31/19 |

| | | One Year (%) | | Since Inception (%) |

| PGIM Institutional Money Market Fund |

| | 2.16 | | 1.44 (7/19/16) |

| iMoneyNet Prime Institutional Funds Average |

| | | 1.89 | | 1.20 |

Source: PGIM Investments LLC and iMoneyNet Inc.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns for the Average are measured from the closest month-end to the Fund’s inception date.

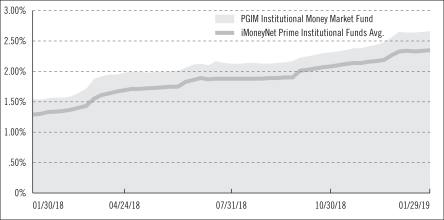

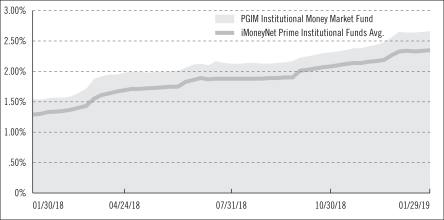

Institutional Money Market Fund Yield Comparison

| | |

| 10 | | Visit our website at pgiminvestments.com |

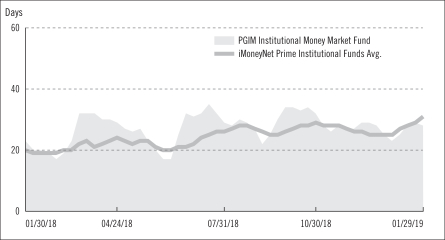

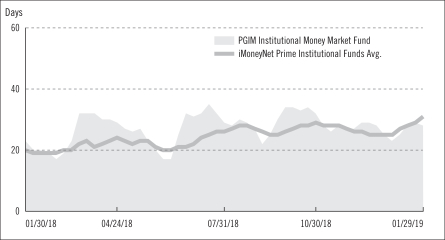

Weighted Average Maturity* (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for PGIM Institutional Money Market Fund and the iMoneyNet Prime Institutional Funds Average every Tuesday from January 30, 2018 to January 29, 2019, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund’s performance table as of January 31, 2019.

* Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

Benchmark Definition

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | | | |

| Prudential Investment Portfolios 2 | | | 11 | |

PGIM Core Short-Term Bond Fund

Strategy and Performance Overview(unaudited)

How did the Fund perform?

During the reporting period that ended January 31, 2019, thePGIM Core Short-Term Bond Fund’s net asset value (NAV) experienced minimal volatility while posting a total return of 2.42%. Over the same period, the 3 Month LIBOR IX (the Index) returned 2.32%, and the Lipper Ultra Short Obligations Funds Average returned 1.70%.

What were market conditions?

In the face of escalating financial market volatility and trade tensions, the global economic expansion moderated during the reporting period from “very strong” to just “solid.” While perhaps disappointing relative to robust expectations from a year ago, the current pace of growth, if sustained, would hardly be distressing for the global economy. Against this backdrop, the Federal Reserve (the Fed) led other central banks in the “punch-bowl snatching” by reducing the size of its balance sheet and increasing interest rates. In 2018, the Fed hiked rates four times, bringing the federal funds target rate to a range of2.25%-2.50%. Meanwhile, the European Central Bank ended its bond purchase program, and the Bank of Japan continued to reduce its bond purchases after widening the target range on the 10-year Japanese government bond yield. Other central banks (e.g., the Bank of Canada and Bank of England) hiked rates as well.

The sharp downward adjustment in financial markets late in 2018 was driven in large measure by concerns of further Fed rate hikes and balance sheet adjustment. But partially in response to the tightening of financial conditions, the Fed has lurched to a more dovish stance. While in December the Fed foresaw “some further gradual” rate hikes, the late January statement removed any bias toward increases, emphasizing only that the Fed would be “patient” in determining what “adjustments” to its policy rate might be “appropriate.” Chairman Jerome Powell went even further during the press conference, indicating that the Federal Open Markets Committee (FOMC) had no “strong prior” mandate regarding the direction of its next move. This was a remarkable assessment, in PGIM Fixed Income’s view, given that the committee’s December “dot plot” had envisioned two rate hikes this year and one more in 2020. The Fed’s dot plot displays projections of the 12 members of the FOMC. Each dot represents a member’s view on where the federal funds rate should be at the end of the various calendar years shown, as well as in the long run.

Turning to the fixed income markets, in early 2018 bonds suffered from a tough starting point: a combination of low government yields and tight credit spreads (yield differentials) that left little room for error. Over the course of the year, the market was buffeted alternately—and at times jointly—by rising government yields and widening spreads. Some of the initial spread widening could easily have been chalked up to normalizing (i.e., spreads may have gotten ahead of fundamentals and were too tight early in 2018). But investor anxiety soon rose, driving spreads wider across virtually all fixed income sectors. As

| | |

| 12 | | Visit our website at pgiminvestments.com |

a result, for all but the most defensive bond market segments, total returns and excess returns relative to US Treasuries were generally low or negative for the period.

Within the short end of the yield curve, a key theme for the reporting period was spread tightening among credit securities versus government securities. Based on Bloomberg Barclays indices, 1-3 year government bonds posted a 2.16% return for the period. Other “spread” sectors fared better. The 1-3 year segment of the Bloomberg Barclays US Aggregate Bond Index, which includes non-government sectors, posted a 2.28% return for the period, while 1-3 year investment-grade corporate debt posted a 2.53% return.

What strategies or holdings affected the Fund’s performance?

The Fund emphasized spread assets, with over 80% of assets allocated to the aforementioned non-Treasury sectors, including short-term investment-grade corporates, commercial mortgage-backed securities, and asset-backed securities (non-agency residential mortgages, credit card receivables, etc.). This positioning helped the Fund outpace its LIBOR (London Inter-Bank Offered Rate) benchmark during the reporting period.

Did the Fund use derivatives and how did they affect performance?

During the reporting period, the Fund used swap agreements for hedging interest rate risk and to add value versus cash securities. The use of these derivatives had a negligible effect on the performance of the Fund.

Current outlook

Looking ahead, PGIM Fixed Income continues to believe that the combination of a more dovish Fed, attenuating headwinds from the trade war, a still strong US labor market, and (particularly) mounting stimulus in China will be sufficient to deliver “lukewarm” global growth and a generally favorable macro backdrop for markets. Nevertheless, the weakening momentum in the global economy is concerning, and PGIM Fixed Income is monitoring the incoming data and policy developments closely. The Fund will continue to emphasize well-researched short-term credit sectors, including short-term corporate debt, commercial mortgage-backed securities, and asset-backed securities as PGIM Fixed Income expects these assets to offer the most value from a total return perspective.

| | | | |

| Prudential Investment Portfolios 2 | | | 13 | |

PGIM Core Ultra Short Bond Fund

Strategy and Performance Overview(unaudited)

What were market conditions?

In the face of escalating financial market volatility and trade tensions, the global economic expansion moderated during the reporting period from “very strong” to just “solid.” While perhaps disappointing relative to robust expectations from a year ago, the current pace of growth, if sustained, would hardly be distressing for the global economy. Against this backdrop, the Federal Reserve (the Fed) led other central banks in the “punch-bowl snatching” by reducing the size of its balance sheet and increasing interest rates. In 2018, the Fed hiked rates four times, bringing the federal funds target rate to a range of2.25%-2.50%. Meanwhile, the European Central Bank ended its bond purchase program, and the Bank of Japan continued to reduce its bond purchases after widening the target range on the 10-year Japanese government bond yield. Other central banks (e.g., the Bank of Canada and Bank of England) hiked rates as well.

The sharp downward adjustment in financial markets late in 2018 was driven in large measure by concerns of further Fed rate hikes and balance sheet adjustment. But partially in response to the tightening of financial conditions, the Fed has lurched to a more dovish stance. While in December the Fed foresaw “some further gradual” rate hikes, the late January statement removed any bias toward increases, emphasizing only that the Fed would be “patient” in determining what “adjustments” to its policy rate might be “appropriate.” Chairman Jerome Powell went even further during the press conference, indicating that the Federal Open Markets Committee (FOMC) had no “strong prior” mandate regarding the direction of its next move. This was a remarkable assessment, in PGIM Fixed Income’s view, given that the committee’s December “dot plot” had envisioned two rate hikes this year and one more in 2020. The Fed’s dot plot displays projections of the 12 members of the FOMC. Each dot represents a member’s view on where the federal funds rate should be at the end of the various calendar years shown, as well as in the long run.

For most of 2018, the money markets and cash alternatives segment of the market was fairly stable. Consistent with increases in the federal funds rate, other measures including 3 Month LIBOR and Treasury bill rates rose to levels last seen in 2008. 3 Month LIBOR rose from 1.8% at the beginning of the period to 2.7% at the end of it. Commercial paper held fairly steady until December when the spread between LIBOR and the overnight index swap widened, making corporates more attractive approaching the last Fed meeting of the year.

What strategies or holdings affected the Fund’s performance?

The Fund continued to emphasize spread assets over Treasury and agency paper to capture additional yield. Throughout the period, with the Fed’s rate hikes generally anticipated and broadcasted, the Fund’s managers shortened the Fund’s weighted average maturity (WAM) and weighted average life (WAL) ahead of the hikes, thus allowing these proceeds to be reinvested post-hike at higher levels in longer maturities.

| | |

| 14 | | Visit our website at pgiminvestments.com |

At different times throughout the year, the managers also took advantage of wider floating rate spreads and increased positions in LIBOR floaters. Additionally, the Fund’s position in agency discount notes versus corporates, repurchase agreements, and Treasuries shifted tactically based on relative value between the sectors throughout the period.

Current outlook

Looking ahead, PGIM Fixed Income continues to believe that the combination of a more dovish Fed, attenuating headwinds from the trade war, a still strong US labor market, and (particularly) mounting stimulus in China will be sufficient to deliver “lukewarm” global growth and a generally favorable macro backdrop for markets. Nevertheless, the weakening momentum in the global economy is concerning, and PGIM Fixed Income is monitoring the incoming data and policy developments closely. The portfolio management team will continue to focus on corporate assets, with an emphasis on financials, over other money market sectors including Treasuries and agencies. As relative value between floating rate and fixed rate assets fluctuates, the team will seek to rotate into more attractively priced holdings. The Fund’s WAM will also be tactically adjusted, in anticipation of Fed policy expectations, to position the Fund to capture the best available yields post-Fed action.

| | | | |

| Prudential Investment Portfolios 2 | | | 15 | |

PGIM Institutional Money Market Fund

Strategy and Performance Overview(unaudited)

What were market conditions?

In the face of escalating financial market volatility and trade tensions, the global economic expansion moderated during the reporting period from “very strong” to just “solid.” While perhaps disappointing relative to robust expectations from a year ago, the current pace of growth, if sustained, would hardly be distressing for the global economy. Against this backdrop, the Federal Reserve (the Fed) led other central banks in the “punch-bowl snatching” by reducing the size of its balance sheet and increasing interest rates. In 2018, the Fed hiked rates four times, bringing the federal funds target rate to a range of2.25%-2.50%. Meanwhile, the European Central Bank ended its bond purchase program, and the Bank of Japan continued to reduce its bond purchases after widening the target range on the 10-year Japanese government bond yield. Other central banks (e.g., the Bank of Canada and Bank of England) hiked rates as well.

The sharp downward adjustment in financial markets late in 2018 was driven in large measure by concerns of further Fed rate hikes and balance sheet adjustment. But partially in response to the tightening of financial conditions, the Fed has lurched to a more dovish stance. While in December the Fed foresaw “some further gradual” rate hikes, the late January statement removed any bias toward increases, emphasizing only that the Fed would be “patient” in determining what “adjustments” to its policy rate might be “appropriate.” Chairman Jerome Powell went even further during the press conference, indicating that the Federal Open Markets Committee (FOMC) had no “strong prior” mandate regarding the direction of its next move. This was a remarkable assessment, in PGIM Fixed Income’s view, given that the committee’s December “dot plot” had envisioned two rate hikes this year and one more in 2020. The Fed’s dot plot displays projections of the 12 members of the FOMC. Each dot represents a member’s view on where the federal funds rate should be at the end of the various calendar years shown, as well as in the long run.

For most of 2018, the money markets and cash alternatives segment of the market was fairly stable. Consistent with increases in the federal funds rate, other measures including 3 Month LIBOR and Treasury bill rates rose to levels last seen in 2008. 3 Month LIBOR rose from 1.8% at the beginning of the period to 2.7% at the end of it. Commercial paper held fairly steady until December when the spread between LIBOR and the overnight index swap widened, making corporates more attractive approaching the last Fed meeting of the year.

What strategies or holdings affected the Fund’s performance?

The Fund continued to emphasize spread assets over Treasury and agency paper to capture additional yield. Throughout the period, with the Fed’s rate hikes generally anticipated and broadcasted, the Fund’s managers shortened the Fund’s weighted average maturity (WAM) and weighted average life (WAL) ahead of the hikes, thus allowing these proceeds to be reinvested post-hike at higher levels in longer maturities.

| | |

| 16 | | Visit our website at pgiminvestments.com |

At different times throughout the year, the managers also took advantage of wider floating rate spreads and increased positions in LIBOR floaters. This allocation consisted mainly of foreign bank positions, as the floating rate paper is attractive for the Fund’s mandate. Additionally, the Fund’s position in agency discount notes versus corporates, repurchase agreements, and Treasuries shifted tactically based on relative value between the sectors throughout the period.

Current outlook

Looking ahead, PGIM Fixed Income continues to believe that the combination of a more dovish Fed, attenuating headwinds from the trade war, a still strong US labor market, and (particularly) mounting stimulus in China will be sufficient to deliver “lukewarm” global growth and a generally favorable macro backdrop for markets. Nevertheless, the weakening momentum in the global economy is concerning, and PGIM Fixed Income is monitoring the incoming data and policy developments closely. The portfolio management team will continue to focus on corporate assets, with an emphasis on financials, over other money market sectors including Treasuries and agencies. As relative value between floating rate and fixed rate assets fluctuates, the team will seek to rotate into more attractively priced holdings. The Fund’s WAM will also be tactically adjusted, in anticipation of Fed policy expectations, to position the Fund to capture the best available yields post-Fed action.

| | | | |

| Prudential Investment Portfolios 2 | | | 17 | |

Fees and Expenses(unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended January 31, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 18 | | Visit our website at pgiminvestments.com |

| | | | | | | | | | | | | | | | |

| | | | | |

PGIM Core

Short-Term

Bond Fund | | Beginning Account

Value

August 1, 2018 | | | Ending Account

Value

January 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Actual | | $ | 1,000.00 | | | $ | 1,012.40 | | | | 0.03 | % | | $ | 0.15 | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,025.05 | | | | 0.03 | % | | $ | 0.15 | |

| | | | | | | | | | | | | | | | |

| | | | |

PGIM Core

Ultra Short Bond Fund | | Beginning Account

Value

August 1, 2018 | | | Ending Account

Value

January 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Actual | | $ | 1,000.00 | | | $ | 1,012.00 | | | | 0.01 | % | | $ | 0.05 | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,025.16 | | | | 0.01 | % | | $ | 0.05 | |

| | | | | | | | | | | | | | | | |

| | | | | |

PGIM

Institutional Money

Market Fund | | Beginning Account

Value

August 1, 2018 | | | Ending Account

Value

January 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Actual | | $ | 1,000.00 | | | $ | 1,012.00 | | | | 0.07 | % | | $ | 0.35 | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,024.85 | | | | 0.07 | % | | $ | 0.36 | |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended January 31, 2019, and divided by the 365 days in each Fund’s fiscal year ended January 31, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which each Fund may invest.

| | | | |

| Prudential Investment Portfolios 2 | | | 19 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 83.9% | | | | | | | | | | | | | | | | |

| | | | |

ASSET-BACKED SECURITIES 19.1% | | | | | | | | | | | | | | | | |

| | | | |

Automobiles 8.2% | | | | | | | | | | | | | | | | |

Ally Auto Receivables Trust,

Series 2018-03, Class A3 | | | 3.000 | % | | | 01/17/23 | | | | 15,000 | | | $ | 15,037,464 | |

Ally Master Owner Trust, | | | | | | | | | | | | | | | | |

Series 2017-03, Class A1, 1 Month LIBOR + 0.430% | | | 2.939 | (c) | | | 06/15/22 | | | | 6,600 | | | | 6,612,869 | |

Series 2018-02, Class A | | | 3.290 | | | | 05/15/23 | | | | 9,100 | | | | 9,154,323 | |

Series 2018-04, Class A | | | 3.300 | | | | 07/17/23 | | | | 10,000 | | | | 10,055,170 | |

Bank of The West Auto Trust, | | | | | | | | | | | | | | | | |

Series 2017-01, Class A2, 144A | | | 1.780 | | | | 02/15/21 | | | | 475 | | | | 473,422 | |

Series 2017-01, Class A3, 144A | | | 2.110 | | | | 01/15/23 | | | | 1,000 | | | | 986,381 | |

BMW Floorplan Master Owner Trust,

Series 2018-01, Class A1, 144A | | | 3.150 | | | | 05/15/23 | | | | 5,000 | | | | 5,018,252 | |

CarMax Auto Owner Trust, | | | | | | | | | | | | | | | | |

Series 2017-04, Class A3 | | | 2.110 | | | | 10/17/22 | | | | 2,300 | | | | 2,272,465 | |

Series 2018-01, Class A3 | | | 2.480 | | | | 11/15/22 | | | | 2,900 | | | | 2,880,276 | |

Series 2018-02, Class A3 | | | 2.980 | | | | 01/17/23 | | | | 4,800 | | | | 4,831,276 | |

Series 2018-03, Class A3 | | | 3.130 | | | | 06/15/23 | | | | 9,100 | | | | 9,148,710 | |

Series 2018-04, Class A3 | | | 3.360 | | | | 09/15/23 | | | | 9,500 | | | | 9,595,921 | |

Series 2019-01, Class A2A | | | 3.020 | | | | 07/15/22 | | | | 4,800 | | | | 4,805,368 | |

Ford Credit Auto Lease Trust,

Series 2018-A, Class A2A | | | 2.710 | | | | 12/15/20 | | | | 7,998 | | | | 7,986,117 | |

Ford Credit Auto Owner Trust, | | | | | | | | | | | | | | | | |

Series 2014-02, Class A, 144A | | | 2.310 | | | | 04/15/26 | | | | 7,900 | | | | 7,865,312 | |

Series 2015-02, Class A, 144A | | | 2.440 | | | | 01/15/27 | | | | 3,600 | | | | 3,568,060 | |

Series 2016-01, Class A, 144A | | | 2.310 | | | | 08/15/27 | | | | 3,250 | | | | 3,206,283 | |

Ford Credit Floorplan Master Owner Trust A, | | | | | | | | | | | | | | | | |

Series 2016-05, Class A1 | | | 1.950 | | | | 11/15/21 | | | | 4,500 | | | | 4,462,534 | |

Series 2016-05, Class A2, 1 Month LIBOR + 0.460% | | | 2.969 | (c) | | | 11/15/21 | | | | 3,915 | | | | 3,919,894 | |

Series 2017-02, Class A2, 1 Month LIBOR + 0.350% | | | 2.859 | (c) | | | 09/15/22 | | | | 7,500 | | | | 7,495,522 | |

GM Financial Automobile Leasing Trust, | | | | | | | | | | | | | | | | |

Series 2017-02, Class A2B, 1 Month LIBOR + 0.300% | | | 2.806 | (c) | | | 01/21/20 | | | | 661 | | | | 660,483 | |

Series 2017-03, Class A2B, 1 Month LIBOR + 0.240% | | | 2.746 | (c) | | | 01/21/20 | | | | 1,047 | | | | 1,047,632 | |

Series 2018-02, Class A2A | | | 2.830 | | | | 07/20/20 | | | | 10,308 | | | | 10,304,843 | |

GM Financial Consumer Automobile Receivables Trust, | | | | | | | | | | | | | | | | |

Series 2018-03, Class A3 | | | 3.020 | | | | 05/16/23 | | | | 4,100 | | | | 4,117,988 | |

Series 2018-04, Class A3 | | | 3.210 | | | | 10/16/23 | | | | 5,900 | | | | 5,949,845 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 21 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Automobiles (cont’d.) | | | | | | | | | | | | | | | | |

GMF Floorplan Owner Revolving Trust, | | | | | | | | | | | | | | | | |

Series 2017-02, Class A2, 144A, 1 Month LIBOR + 0.430% | | | 2.939 | %(c) | | | 07/15/22 | | | | 9,000 | | | $ | 8,998,636 | |

Series 2018-04, Class A1, 144A | | | 3.500 | | | | 09/15/23 | | | | 13,100 | | | | 13,267,210 | |

Honda Auto Receivables Owner Trust,

Series 2018-02, Class A3 | | | 3.010 | | | | 05/18/22 | | | | 4,800 | | | | 4,810,789 | |

Mercedes-Benz Auto Receivables Trust,

Series 2018-01, Class A3 | | | 3.030 | | | | 01/17/23 | | | | 4,510 | | | | 4,521,787 | |

Nissan Auto Lease Trust, | | | | | | | | | | | | | | | | |

Series 2017-A, Class A2B, 1 Month LIBOR + 0.200% | | | 2.709 | (c) | | | 09/16/19 | | | | 1,201 | | | | 1,201,524 | |

Series 2017-B, Class A2B, 1 Month LIBOR + 0.210% | | | 2.719 | (c) | | | 12/16/19 | | | | 3,013 | | | | 3,012,784 | |

Nissan Auto Receivables Owner Trust,

Series 2018-B, Class A3 | | | 3.060 | | | | 03/15/23 | | | | 4,300 | | | | 4,320,047 | |

Nissan Master Owner Trust Receivables,

Series 2017-B, Class A, 1 Month LIBOR + 0.430% | | | 2.939 | (c) | | | 04/18/22 | | | | 20,000 | | | | 20,024,110 | |

Santander Retail Auto Lease Trust, | | | | | | | | | | | | | | | | |

Series 2017-A, Class A2A, 144A | | | 2.020 | | | | 03/20/20 | | | | 2,482 | | | | 2,476,769 | |

Series 2018-A, Class A2A, 144A | | | 2.710 | | | | 10/20/20 | | | | 7,494 | | | | 7,483,712 | |

Toyota Auto Receivables Owner Trust,

Series 2018-C, Class A3 | | | 3.020 | | | | 12/15/22 | | | | 2,800 | | | | 2,809,726 | |

World Omni Auto Receivables Trust, | | | | | | | | | | | | | | | | |

Series 2018-C, Class A3 | | | 3.130 | | | | 11/15/23 | | | | 8,100 | | | | 8,152,847 | |

Series 2018-D, Class A3 | | | 3.330 | | | | 04/15/24 | | | | 8,400 | | | | 8,503,743 | |

Series 2019-A, Class A3 | | | 3.040 | | | | 05/15/24 | | | | 1,800 | | | | 1,805,954 | |

World Omni Automobile Lease Securitization Trust,

Series 2018-A, Class A2 | | | 2.590 | | | | 11/16/20 | | | | 7,119 | | | | 7,102,877 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 239,948,925 | |

| | | | |

Credit Cards 3.6% | | | | | | | | | | | | | | | | |

American Express Credit Account Master Trust, | | | | | | | | | | | | | | | | |

Series 2014-01, Class A, 1 Month LIBOR + 0.370% | | | 2.879 | (c) | | | 12/15/21 | | | | 10,000 | | | | 10,007,999 | |

Series 2018-06, Class A | | | 3.060 | | | | 02/15/24 | | | | 7,700 | | | | 7,762,681 | |

Series 2018-08, Class A | | | 3.180 | | | | 04/15/24 | | | | 7,700 | | | | 7,778,656 | |

BA Credit Card Trust, | | | | | | | | | | | | | | | | |

Series 2016-A01, Class A, 1 Month LIBOR + 0.390% | | | 2.899 | (c) | | | 10/15/21 | | | | 14,400 | | | | 14,407,537 | |

Series 2018-A03, Class A3 | | | 3.100 | | | | 12/15/23 | | | | 4,500 | | | | 4,533,476 | |

Chase Issuance Trust,

Series 2017-A01, Class A, 1 Month LIBOR + 0.300% | | | 2.809 | (c) | | | 01/15/22 | | | | 13,400 | | | | 13,411,955 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Credit Cards (cont’d.) | | | | | | | | | | | | | | | | |

Discover Card Execution Note Trust, | | | | | | | | | | | | | | | | |

Series 2014-A04, Class A4 | | | 2.120 | % | | | 12/15/21 | | | | 17,400 | | | $ | 17,358,190 | |

Series 2016-A02, Class A2, 1 Month LIBOR + 0.540% | | | 3.049 | (c) | | | 09/15/21 | | | | 1,700 | | | | 1,700,807 | |

Series 2018-A04, Class A4 | | | 3.110 | | | | 01/16/24 | | | | 7,400 | | | | 7,458,547 | |

Series 2018-A05, Class A5 | | | 3.320 | | | | 03/15/24 | | | | 10,100 | | | | 10,236,351 | |

Series 2019-A01, Class A1 | | | 3.040 | | | | 07/15/24 | | | | 1,000 | | | | 1,002,994 | |

MBNA Credit Card Master Note Trust,

Series 2004-A03, Class A3, 1 Month LIBOR + 0.260% | | | 2.769 | (c) | | | 08/16/21 | | | | 9,000 | | | | 9,000,840 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 104,660,033 | |

| | | | |

Home Equity Loans 5.1% | | | | | | | | | | | | | | | | |

ABFC Trust, | | | | | | | | | | | | | | | | |

Series 2003-AHL01, Class A1 | | | 4.184 | | | | 03/25/33 | | | | 248 | | | | 246,651 | |

Series 2003-OPT01, Class A3, 1 Month LIBOR + 0.680% | | | 3.190 | (c) | | | 04/25/33 | | | | 766 | | | | 751,896 | |

Series 2004-HE01, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 03/25/34 | | | | 710 | | | | 704,571 | |

Series 2004-OPT05, Class A4, 1 Month LIBOR + 1.250% | | | 3.760 | (c) | | | 06/25/34 | | | | 5,124 | | | | 5,109,502 | |

Accredited Mortgage Loan Trust,

Series 2004-04, Class A2D, 1 Month LIBOR + 0.700% | | | 3.210 | (c) | | | 01/25/35 | | | | 1,238 | | | | 1,228,518 | |

ACE Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-HE01, Class M2, 1 Month LIBOR + 2.550% | | | 5.060 | (c) | | | 11/25/33 | | | | 48 | | | | 51,824 | |

Series 2003-OP01, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 12/25/33 | | | | 1,650 | | | | 1,630,476 | |

Series 2004-OP01, Class M1, 1 Month LIBOR + 0.780% | | | 3.290 | (c) | | | 04/25/34 | | | | 3,198 | | | | 3,131,517 | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series 2003-01, Class M1, 1 Month LIBOR + 1.350% | | | 3.860 | (c) | | | 02/25/33 | | | | 5,076 | | | | 5,066,531 | |

Series 2003-08, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 10/25/33 | | | | 1,766 | | | | 1,728,502 | |

Series 2003-09, Class AV2, 1 Month LIBOR + 0.680% | | | 3.190 | (c) | | | 09/25/33 | | | | 184 | | | | 181,703 | |

Series 2003-11, Class AV2, 1 Month LIBOR + 0.740% | | | 3.250 | (c) | | | 12/25/33 | | | | 259 | | | | 254,455 | |

Series 2003-12, Class M1, 1 Month LIBOR + 1.125% | | | 3.635 | (c) | | | 01/25/34 | | | | 276 | | | | 274,259 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 23 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Equity Loans (cont’d.) | | | | | | | | | | | | | | | | |

Argent Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series 2003-W02, Class M4, 1 Month LIBOR + 5.625% | | | 4.011 | %(c) | | | 09/25/33 | | | | 883 | | | $ | 836,329 | |

Series 2003-W03, Class M2, 1 Month LIBOR + 2.700% | | | 4.433 | (c) | | | 09/25/33 | | | | 8,827 | | | | 8,825,696 | |

Series 2003-W04, Class M1, 1 Month LIBOR + 1.200% | | | 3.710 | (c) | | | 10/25/33 | | | | 2,451 | | | | 2,405,057 | |

Series 2003-W05, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 10/25/33 | | | | 22 | | | | 21,584 | |

Series 2004-W05, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 04/25/34 | | | | 134 | | | | 132,974 | |

Series 2004-W06, Class AV2, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 05/25/34 | | | | 353 | | | | 349,547 | |

Series 2004-W06, Class M1, 1 Month LIBOR + 0.825% | | | 3.335 | (c) | | | 05/25/34 | | | | 309 | | | | 306,140 | |

Series 2004-W07, Class M1, 1 Month LIBOR + 0.825% | | | 3.335 | (c) | | | 05/25/34 | | | | 12,051 | | | | 11,906,524 | |

Series 2004-W08, Class A2, 1 Month LIBOR + 0.960% | | | 3.470 | (c) | | | 05/25/34 | | | | 50 | | | | 50,004 | |

Asset-Backed Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-HE06, Class A2, 1 Month LIBOR + 0.680% | | | 3.190 | (c) | | | 11/25/33 | | | | 193 | | | | 187,756 | |

Series 2004-HE03, Class M1, 1 Month LIBOR + 0.810% | | | 3.320 | (c) | | | 06/25/34 | | | | 247 | | | | 242,924 | |

Bear Stearns Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.230% | | | 3.740 | (c) | | | 06/25/43 | | | | 622 | | | | 603,259 | |

Series 2004-HE02, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 03/25/34 | | | | 3,289 | | | | 3,277,534 | |

Series 2004-HE07, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 08/25/34 | | | | 4,012 | | | | 3,992,025 | |

Series 2004-HE10, Class M1, 1 Month LIBOR + 0.975% | | | 3.485 | (c) | | | 12/25/34 | | | | 1,216 | | | | 1,215,528 | |

CDC Mortgage Capital Trust, | | | | | | | | | | | | | | | | |

Series 2003-HE03, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 11/25/33 | | | | 1,953 | | | | 1,930,954 | |

Series 2003-HE04, Class M1, 1 Month LIBOR + 0.975% | | | 3.485 | (c) | | | 03/25/34 | | | | 692 | | | | 680,865 | |

Equifirst Mortgage Loan Trust,

Series 2003-01, Class M2, 1 Month LIBOR + 2.850% | | | 5.360 | (c) | | | 12/25/32 | | | | 75 | | | | 75,526 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Equity Loans (cont’d.) | | | | | | | | | | | | | | | | |

Home Equity Asset Trust, | | | | | | | | | | | | | | | | |

Series 2002-03, Class M1, 1 Month LIBOR + 1.350% | | | 3.860 | %(c) | | | 02/25/33 | | | | 583 | | | $ | 577,408 | |

Series 2002-04, Class M1, 1 Month LIBOR + 1.500% | | | 4.010 | (c) | | | 03/25/33 | | | | 417 | | | | 414,854 | |

Series 2003-02, Class M1, 1 Month LIBOR + 1.320% | | | 3.830 | (c) | | | 08/25/33 | | | | 1,013 | | | | 1,003,744 | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.290% | | | 3.800 | (c) | | | 08/25/33 | | | | 1,063 | | | | 1,059,566 | |

Series 2003-04, Class M1, 1 Month LIBOR + 1.200% | | | 3.710 | (c) | | | 10/25/33 | | | | 5,396 | | | | 5,340,352 | |

Series 2003-08, Class M1, 1 Month LIBOR + 1.080% | | | 3.590 | (c) | | | 04/25/34 | | | | 393 | | | | 393,391 | |

MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | |

Series 2004-OPT02, Class A1, 1 Month LIBOR + 0.700% | | | 3.210 | (c) | | | 09/25/34 | | | | 743 | | | | 719,350 | |

Series 2004-OPT02, Class A2, 1 Month LIBOR + 0.700% | | | 3.210 | (c) | | | 09/25/34 | | | | 166 | | | | 158,411 | |

Series 2004-WMC03, Class M1, 1 Month LIBOR + 0.825% | | | 3.335 | (c) | | | 10/25/34 | | | | 1,588 | | | | 1,587,611 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | | | |

Series 2004-HE02, Class A1A, 1 Month LIBOR + 0.800% | | | 3.310 | (c) | | | 08/25/35 | | | | 51 | | | | 48,160 | |

Series 2004-HE02, Class M1, 1 Month LIBOR + 1.200% | | | 3.710 | (c) | | | 08/25/35 | | | | 444 | | | | 445,458 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | | | |

Series 2002-NC06, Class M1, 1 Month LIBOR + 1.500% | | | 4.010 | (c) | | | 11/25/32 | | | | 296 | | | | 293,949 | |

Series 2003-HE01, Class M1, 1 Month LIBOR + 1.200% | | | 3.710 | (c) | | | 05/25/33 | | | | 1,146 | | | | 1,136,309 | |

Series 2003-NC05, Class M1, 1 Month LIBOR + 1.275% | | | 3.785 | (c) | | | 04/25/33 | | | | 1,879 | | | | 1,874,314 | |

Series 2003-NC05, Class M3, 1 Month LIBOR + 3.450% | | | 5.960 | (c) | | | 04/25/33 | | | | 88 | | | | 85,239 | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 09/25/33 | | | | 1,168 | | | | 1,158,334 | |

Series 2003-NC08, Class M2, 1 Month LIBOR + 2.625% | | | 5.135 | (c) | | | 09/25/33 | | | | 45 | | | | 42,921 | |

Series 2003-NC10, Class M1, 1 Month LIBOR + 1.020% | | | 3.530 | (c) | | | 10/25/33 | | | | 208 | | | | 205,018 | |

Series 2004-HE01, Class A4, 1 Month LIBOR + 0.740% | | | 3.250 | (c) | | | 01/25/34 | | | | 1,253 | | | | 1,243,382 | |

Series 2004-HE05, Class M1, 1 Month LIBOR + 0.945% | | | 3.455 | (c) | | | 06/25/34 | | | | 747 | | | | 742,875 | |

Series 2004-HE07, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 08/25/34 | | | | 3,392 | | | | 3,375,097 | |

See Notes to Financial Statements.

��

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 25 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Equity Loans (cont’d.) | | | | | | | | | | | | | | | | |

Morgan Stanley ABS Capital I, Inc. Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2004-HE08, Class M1, 1 Month LIBOR + 0.960% | | | 3.470 | %(c) | | | 09/25/34 | | | | 17,082 | | | $ | 17,000,445 | |

Morgan Stanley Dean Witter Capital I, Inc.,

Series 2003-NC03, Class M1, 1 Month LIBOR + 1.350% | | | 3.860 | (c) | | | 03/25/33 | | | | 462 | | | | 461,212 | |

Morgan Stanley Dean Witter Capital I, Inc. Trust, | | | | | | | | | | | | | | | | |

Series 2002-NC05, Class M1, 1 Month LIBOR + 1.410% | | | 3.920 | (c) | | | 10/25/32 | | | | 412 | | | | 410,156 | |

Series 2002-NC05, Class M2, 1 Month LIBOR + 2.400% | | | 4.910 | (c) | | | 10/25/32 | | | | 51 | | | | 51,023 | |

New Century Home Equity Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-04, Class M1, 1 Month LIBOR + 1.125% | | | 3.635 | (c) | | | 10/25/33 | | | | 3,266 | | | | 3,264,134 | |

Series 2003-06, Class M1, 1 Month LIBOR + 1.080% | | | 3.590 | (c) | | | 01/25/34 | | | | 5,303 | | | | 5,294,224 | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.885% | | | 3.395 | (c) | | | 05/25/34 | | | | 3,803 | | | | 3,757,277 | |

Series 2004-03, Class M1, 1 Month LIBOR + 0.930% | | | 3.440 | (c) | | | 11/25/34 | | | | 12,059 | | | | 12,023,992 | |

Series 2004-04, Class M1, 1 Month LIBOR + 0.765% | | | 3.275 | (c) | | | 02/25/35 | | | | 10,687 | | | | 10,560,142 | |

Option One Mortgage Loan Trust,

Series 2004-01, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 01/25/34 | | | | 1,274 | | | | 1,258,326 | |

Renaissance Home Equity Loan Trust,

Series 2003-01, Class A, 1 Month LIBOR + 0.860% | | | 3.370 | (c) | | | 06/25/33 | | | | 283 | | | | 275,314 | |

Residential Asset Securities Trust, | | | | | | | | | | | | | | | | |

Series 2004-KS01, Class AI5 | | | 5.721 | (cc) | | | 02/25/34 | | | | 2,130 | | | | 2,163,101 | |

Series 2004-KS05, Class AI5 | | | 4.824 | (cc) | | | 06/25/34 | | | | 7,078 | | | | 7,154,175 | |

Saxon Asset Securities Trust, | | | | | | | | | | | | | | | | |

Series 2001-03, Class M1, 1 Month LIBOR + 1.170% | | | 3.680 | (c) | | | 07/25/31 | | | | 38 | | | | 37,524 | |

Series 2003-03, Class M2, 1 Month LIBOR + 2.400% | | | 4.413 | (c) | | | 12/25/33 | | | | 59 | | | | 53,807 | |

Securitized Asset-Backed Receivables LLC Trust,

Series 2004-NC01, Class M1, 1 Month LIBOR + 0.780% | | | 3.290 | (c) | | | 02/25/34 | | | | 2,961 | | | | 2,956,012 | |

Specialty Underwriting & Residential Finance Trust,

Series 2004-BC01, Class M1, 1 Month LIBOR + 0.765% | | | 3.275 | (c) | | | 02/25/35 | | | | 1,736 | | | | 1,728,806 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 147,756,044 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Residential Mortgage-Backed Securities 1.8% | | | | | | | | | | | | | | | | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series 2004-R05, Class M1, 1 Month LIBOR + 0.870% | | | 3.380 | %(c) | | | 07/25/34 | | | | 565 | | | $ | 564,270 | |

Series 2005-R09, Class AF5 | | | 5.818 | (cc) | | | 11/25/35 | | | | 678 | | | | 680,204 | |

Amortizing Residential Collateral Trust,

Series 2002-BC05, Class M2, 1 Month LIBOR + 1.800% | | | 4.310 | (c) | | | 07/25/32 | | | | 80 | | | | 78,966 | |

Chase Funding Trust, | | | | | | | | | | | | | | | | |

Series 2002-02, Class 2A1, 1 Month LIBOR + 0.500% | | | 3.010 | (c) | | | 05/25/32 | | | | 404 | | | | 393,119 | |

Series 2003-01, Class 2A2, 1 Month LIBOR + 0.660% | | | 3.170 | (c) | | | 11/25/32 | | | | 450 | | | | 445,535 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 07/25/33 | | | | 195 | | | | 193,876 | |

Series 2004-ECC01, Class M1, 1 Month LIBOR + 0.945% | | | 3.455 | (c) | | | 11/25/34 | | | | 2,581 | | | | 2,530,529 | |

Credit-Based Asset Servicing & Securitization LLC,

Series 2003-CB05, Class M1, 1 Month LIBOR + 1.020% | | | 3.530 | (c) | | | 11/25/33 | | | | 679 | | | | 661,475 | |

CWABS, Inc., Asset-Backed Certificates,

Series 2004-01, Class M1, 1 Month LIBOR + 0.750% | | | 3.260 | (c) | | | 03/25/34 | | | | 442 | | | | 443,098 | |

Equity One Mortgage Pass-Through Trust,

Series 2003-01, Class M1 | | | 4.860 | (cc) | | | 08/25/33 | | | | 85 | | | | 85,912 | |

Finance America Mortgage Loan Trust,

Series 2004-03, Class M1, 1 Month LIBOR + 0.870% | | | 3.380 | (c) | | | 11/25/34 | | | | 7,524 | | | | 7,473,456 | |

First Franklin Mortgage Loan Trust,

Series 2004-FF05, Class A1, 1 Month LIBOR + 0.720% | | | 3.230 | (c) | | | 08/25/34 | | | | 219 | | | | 213,369 | |

Fremont Home Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-B, Class M1, 1 Month LIBOR + 1.050% | | | 3.560 | (c) | | | 12/25/33 | | | | 355 | | | | 347,374 | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.675% | | | 3.185 | (c) | | | 02/25/34 | | | | 1,633 | | | | 1,601,210 | |

Series 2004-02, Class M1, 1 Month LIBOR + 0.855% | | | 3.365 | (c) | | | 07/25/34 | | | | 853 | | | | 847,178 | |

Series 2004-B, Class M1, 1 Month LIBOR + 0.870% | | | 3.380 | (c) | | | 05/25/34 | | | | 4,143 | | | | 4,080,436 | |

Series 2004-C, Class M1, 1 Month LIBOR + 0.975% | | | 3.485 | (c) | | | 08/25/34 | | | | 3,769 | | | | 3,742,818 | |

GSAMP Trust, | | | | | | | | | | | | | | | | |

Series 2003-FM01, Class M2, 1 Month LIBOR + 2.775% | | | 5.281 | (c) | | | 03/20/33 | | | | 64 | | | | 64,345 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 27 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Residential Mortgage-Backed Securities (cont’d.) | | | | | | | | | | | | | | | | |

GSAMP Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2004-FM01, Class M2, 1 Month LIBOR + 2.100% | | | 4.610 | %(c) | | | 11/25/33 | | | | 3 | | | $ | 2,879 | |

HSI Asset Securitization Corp. Trust,

Series 2006-OPT04, Class 2A4, 1 Month LIBOR + 0.250% | | | 2.760 | (c) | | | 03/25/36 | | | | 1,400 | | | | 1,331,469 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.125% | | | 3.635 | (c) | | | 07/25/33 | | | | 1,019 | | | | 1,018,126 | |

Series 2003-04, Class M1, 1 Month LIBOR + 1.020% | | | 3.530 | (c) | | | 08/25/33 | | | | 730 | | | | 725,068 | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.750% | | | 3.260 | (c) | | | 02/25/34 | | | | 10,694 | | | | 10,571,581 | |

Series 2004-02, Class M1, 1 Month LIBOR + 0.795% | | | 3.305 | (c) | | | 06/25/34 | | | | 2,803 | | | | 2,756,819 | |

Series 2004-03, Class M1, 1 Month LIBOR + 0.855% | | | 3.365 | (c) | | | 07/25/34 | | | | 2,991 | | | | 2,967,526 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | | | |

Series 2003-WMC02, Class M2, 1 Month LIBOR + 2.850% | | | 5.360 | (c) | | | 02/25/34 | | | | 227 | | | | 224,316 | |

Series 2004-WMC01, Class M2, 1 Month LIBOR + 1.650% | | | 4.160 | (c) | | | 10/25/34 | | | | 985 | | | | 971,549 | |

Morgan Stanley ABS Capital I, Inc. Trust,

Series 2004-NC05, Class M1, 1 Month LIBOR + 0.900% | | | 3.410 | (c) | | | 05/25/34 | | | | 493 | | | | 486,113 | |

Popular ABS Mortgage Pass-Through Trust,

Series 2004-04, Class M1 | | | 4.313 | (cc) | | | 09/25/34 | | | | 812 | | | | 821,137 | |

Saxon Asset Securities Trust,

Series 2004-02, Class AF3 | | | 4.054 | (cc) | | | 08/25/35 | | | | 740 | | | | 744,100 | |

Specialty Underwriting & Residential Finance Trust, | | | | | | | | | | | | | | | | |

Series 2003-BC01, Class M1, 1 Month LIBOR + 1.200% | | | 3.710 | (c) | | | 01/25/34 | | | | 106 | | | | 105,887 | |

Series 2003-BC03, Class M1, 1 Month LIBOR + 0.975% | | | 3.485 | (c) | | | 08/25/34 | | | | 3,675 | | | | 3,560,499 | |

Series 2004-BC04, Class A1B, 1 Month LIBOR + 0.800% | | | 3.310 | (c) | | | 10/25/35 | | | | 618 | | | | 600,570 | |

Structured Asset Investment Loan Trust,

Series 2003-BC01, Class A2, 1 Month LIBOR + 0.680% | | | 3.190 | (c) | | | 01/25/33 | | | | 122 | | | | 120,255 | |

Structured Asset Securities Corp. Mortgage Loan Trust,

Series 2006-OW01, Class A4, 144A, 1 Month LIBOR + 0.400% | | | 2.910 | (c) | | | 12/25/35 | | | | 34 | | | | 34,045 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 51,489,109 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Student Loans 0.4% | | | | | | | | | | | | | | | | |

Navient Student Loan Trust, | | | | | | | | | | | | | | | | |

Series 2016-06A, Class A1, 144A, 1 Month LIBOR + 0.480% | | | 2.990 | %(c) | | | 03/25/66 | | | | 4 | | | $ | 3,795 | |

Series 2018-03A, Class A1, 144A, 1 Month LIBOR + 0.270% | | | 2.780 | (c) | | | 03/25/67 | | | | 5,177 | | | | 5,173,588 | |

Series 2018-04A, Class A1, 144A, 1 Month LIBOR + 0.250% | | | 2.760 | (c) | | | 06/27/67 | | | | 3,930 | | | | 3,923,784 | |

Series 2019-01A, Class A1, 144A, 1 Month LIBOR + 0.330% | | | 2.838 | (c) | | | 12/27/67 | | | | 4,200 | | | | 4,200,000 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 13,301,167 | |

| | | | | | | | | | | | | | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $526,915,071) | | | | | | | | | | | | | | | 557,155,278 | |

| | | | | | | | | | | | | | | | |

| | | | |

CERTIFICATES OF DEPOSIT 0.7% | | | | | | | | | | | | | | | | |

Nordea Bank Abp, 3 Month LIBOR + 0.300% | | | 3.051 | (c) | | | 06/05/20 | | | | 9,500 | | | | 9,509,822 | |

Nordea Bank Abp, 3 Month LIBOR + 0.300% | | | 3.076 | (c) | | | 06/12/20 | | | | 10,000 | | | | 9,999,994 | |

| | | | | | | | | | | | | | | | |

TOTAL CERTIFICATES OF DEPOSIT

(cost $19,500,000) | | | | | | | | | | | | | | | 19,509,816 | |

| | | | | | | | | | | | | | | | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 15.3% | | | | | | | | | | | | | | | | |

BANK,

Series 2017-BNK05, Class A1 | | | 1.909 | | | | 06/15/60 | | | | 1,625 | | | | 1,598,290 | |

BX Commercial Mortgage Trust,

Series 2018-BIOA, Class A, 144A, 1 Month LIBOR + 0.671% | | | 3.180 | (c) | | | 03/15/37 | | | | 35,000 | | | | 34,495,461 | |

CAMB Commercial Mortgage Trust,

Series 2019-LIFE, Class A, 144A, 1 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | | 3.570 | (c) | | | 12/15/37 | | | | 9,500 | | | | 9,503,865 | |

CD Mortgage Trust,

Series 2017-CD06, Class A1 | | | 2.168 | | | | 11/13/50 | | | | 3,485 | | | | 3,441,113 | |

CGDBB Commercial Mortgage Trust,

Series 2017-BIOC, Class A, 144A, 1 Month LIBOR + 0.790% (Cap N/A, Floor 0.750%) | | | 3.299 | (c) | | | 07/15/32 | | | | 5,000 | | | | 4,971,762 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2015-GC27, Class A1 | | | 1.353 | | | | 02/10/48 | | | | 577 | | | | 575,357 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 29 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

Citigroup Commercial Mortgage Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2016-P04, Class A2 | | | 2.450 | % | | | 07/10/49 | | | | 20,000 | | | $ | 19,766,648 | |

Cold Storage Trust,

Series 2017-ICE03, Class A, 144A, 1 Month LIBOR + 1.000% | | | 3.509 | (c) | | | 04/15/36 | | | | 45,000 | | | | 44,815,563 | |

Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2014-CR15, Class A2 | | | 2.928 | | | | 02/10/47 | | | | 1,735 | | | | 1,733,270 | |

Series 2014-UBS02, Class A2 | | | 2.820 | | | | 03/10/47 | | | | 5,395 | | | | 5,389,888 | |

Series 2014-UBS03, Class A2 | | | 2.844 | | | | 06/10/47 | | | | 2,141 | | | | 2,138,171 | |

Series 2014-UBS05, Class A2 | | | 3.031 | | | | 09/10/47 | | | | 4,891 | | | | 4,887,001 | |

Series 2015-CR25, Class A2 | | | 3.104 | | | | 08/10/48 | | | | 8,561 | | | | 8,567,420 | |

Series 2018-HCLV, Class A, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | | 3.509 | (c) | | | 09/15/33 | | | | 31,508 | | | | 31,402,518 | |

CSAIL Commercial Mortgage Trust,

Series 2015-C01, Class A1 | | | 1.684 | | | | 04/15/50 | | | | 3,431 | | | | 3,409,845 | |

CSWF,

Series 2018-TOP, Class A, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | | 3.509 | (c) | | | 08/15/35 | | | | 20,000 | | | | 19,918,384 | |

DBJPM Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-C01, Class A1 | | | 1.676 | | | | 05/10/49 | | | | 1,353 | | | | 1,333,959 | |

Series 2016-C03, Class A1 | | | 1.502 | | | | 08/10/49 | | | | 775 | | | | 760,289 | |

GE Business Loan Trust,

Series 2006-02A, Class A, 144A, 1 Month LIBOR + 0.180% | | | 2.689 | (c) | | | 11/15/34 | | | | 1,676 | | | | 1,646,633 | |

GS Mortgage Securities Trust,

Series 2018-HART, Class A, 144A, 1 Month LIBOR + 1.090% (Cap N/A, Floor 1.090%) | | | 3.599 | (c) | | | 10/15/31 | | | | 23,300 | | | | 23,306,060 | |

JP Morgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2014-C20, Class A2 | | | 2.872 | | | | 07/15/47 | | | | 8,509 | | | | 8,494,376 | |

Series 2014-C20, Class A3A2, 144A | | | 3.472 | | | | 07/15/47 | | | | 25,000 | | | | 24,976,842 | |

Series 2017-FL11, Class A, 144A, 1 Month LIBOR + 0.850% | | | 3.359 | (c) | | | 10/15/32 | | | | 9,977 | | | | 9,975,636 | |

Series 2018-WPT, Class AFL, 144A, 1 Month LIBOR + 0.950% | | | 3.463 | (c) | | | 07/05/33 | | | | 20,000 | | | | 19,924,460 | |

JPMBB Commercial Mortgage Securities Trust,

Series 2013-C15, Class ASB | | | 3.659 | | | | 11/15/45 | | | | 1,196 | | | | 1,211,011 | |

LSTAR Commercial Mortgage Trust,

Series 2017-05, Class A1, 144A | | | 2.417 | | | | 03/10/50 | | | | 3,875 | | | | 3,836,456 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | | | |

Series 2013-C07, Class A3 | | | 2.655 | | | | 02/15/46 | | | | 7,044 | | | | 6,919,964 | |

Series 2014-C17, Class A2 | | | 3.119 | | | | 08/15/47 | | | | 5,074 | | | | 5,069,235 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

Morgan Stanley Bank of America Merrill Lynch Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2014-C19, Class A1 | | | 1.573 | % | | | 12/15/47 | | | | 1,468 | | | $ | 1,462,257 | |

Series 2014-C19, Class A2 | | | 3.101 | | | | 12/15/47 | | | | 5,000 | | | | 4,998,279 | |

Series 2015-C20, Class A1 | | | 1.405 | | | | 02/15/48 | | | | 814 | | | | 811,294 | |

Series 2015-C24, Class A2 | | | 3.088 | | | | 05/15/48 | | | | 5,000 | | | | 4,999,921 | |

Morgan Stanley Capital I Trust,

Series 2012-C04, Class A4 | | | 3.244 | | | | 03/15/45 | | | | 3,450 | | | | 3,448,351 | |

RETL,

Series 2018-RVP, Class A, 144A, 1 Month LIBOR + 1.100% | | | 3.609 | (c) | | | 03/15/33 | | | | 33,300 | | | | 33,006,693 | |

Starwood Retail Property Trust,

Series 2014-STAR, Class A, 144A, 1 Month LIBOR + 1.220% | | | 3.729 | (c) | | | 11/15/27 | | | | 22,467 | | | | 22,256,673 | |

UBS Commercial Mortgage Trust,

Series 2017-C01, Class A1 | | | 1.887 | | | | 06/15/50 | | | | 2,208 | | | | 2,172,963 | |

UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2012-C02, Class A4 | | | 3.525 | | | | 05/10/63 | | | | 43,642 | | | | 44,200,682 | |

Series 2012-C03, Class A3 | | | 2.728 | | | | 08/10/49 | | | | 526 | | | | 524,657 | |

Series 2012-C04, Class A3 | | | 2.533 | | | | 12/10/45 | | | | 17,836 | | | | 17,709,558 | |

Wells Fargo Commercial Mortgage Trust,

Series 2017-RC01, Class A1 | | | 2.012 | | | | 01/15/60 | | | | 1,799 | | | | 1,775,423 | |

WFRBS Commercial Mortgage Trust,

Series 2014-LC14, Class A3FL, 144A, 1 Month LIBOR + 0.750% | | | 3.258 | (c) | | | 03/15/47 | | | | 3,000 | | | | 3,004,394 | |

| | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $448,369,254) | | | | | | | | 444,440,622 | |

| | | | | | | | | | | | | | | | |

| | | | |

CORPORATE BONDS 48.8% | | | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense 0.6% | | | | | | | | | | | | | | | | |

General Dynamics Corp.,

Gtd. Notes, 3 Month LIBOR + 0.290% | | | 2.908 | (c) | | | 05/11/20 | | | | 4,000 | | | | 4,007,227 | |

Raytheon Co.,

Sr. Unsec’d. Notes | | | 4.400 | | | | 02/15/20 | | | | 13,640 | | | | 13,866,481 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 17,873,708 | |

| | | | |

Agriculture 0.0% | | | | | | | | | | | | | | | | |

Philip Morris International, Inc.,

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.420% | | | 3.066 | (c) | | | 02/21/20 | | | | 356 | | | | 355,998 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 31 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Auto Manufacturers 6.1% | | | | | | | | | | | | | | | | |

American Honda Finance Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.150% | | | 2.768 | %(c) | | | 11/13/19 | | | | 5,000 | | | $ | 4,999,606 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.340% | | | 2.954 | (c) | | | 02/14/20 | | | | 26,000 | | | | 26,039,464 | |

BMW US Capital LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 1.500 | | | | 04/11/19 | | | | 24,000 | | | | 23,945,430 | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.370% | | | 2.984 | (c) | | | 08/14/20 | | | | 5,000 | | | | 4,977,958 | |

Daimler Finance North America LLC (Germany), | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.530% | | | 3.112 | (c) | | | 05/05/20 | | | | 15,000 | | | | 14,956,290 | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.630% | | | 3.425 | (c) | | | 01/06/20 | | | | 9,300 | | | | 9,297,864 | |

Ford Motor Credit Co. LLC,

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.830% | | | 3.606 | (c) | | | 03/12/19 | | | | 4,735 | | | | 4,735,805 | |

Harley-Davidson Financial Services, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.500% | | | 3.146 | (c) | | | 05/21/20 | | | | 9,750 | | | | 9,750,780 | |

Gtd. Notes, 144A, MTN | | | 2.400 | | | | 09/15/19 | | | | 6,520 | | | | 6,475,267 | |

Nissan Motor Acceptance Corp.,

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.390% | | | 3.187 | (c) | | | 07/13/20 | | | | 2,400 | | | | 2,389,671 | |

Toyota Motor Credit Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.060% | | | 2.676 | (c) | | | 05/15/19 | | | | 10,000 | | | | 9,999,973 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.280% | | | 3.077 | (c) | | | 04/13/21 | | | | 10,000 | | | | 9,991,872 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.820% | | | 3.460 | (c) | | | 02/19/19 | | | | 20,000 | | | | 20,007,415 | |

Volkswagen Group of America Finance LLC (Germany),

Gtd. Notes, 144A, 3 Month LIBOR + 0.770% | | | 3.388 | (c) | | | 11/13/20 | | | | 30,000 | | | | 29,989,320 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 177,556,715 | |

| | | | |

Banks 15.3% | | | | | | | | | | | | | | | | |

Australia & New Zealand Banking Group Ltd.

(Australia), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.320% | | | 2.921 | (c) | | | 11/09/20 | | | | 600 | | | | 599,632 | |

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.320% | | | 3.117 | (c) | | | 07/02/20 | | | | 25,000 | | | | 25,053,906 | |

Bank of Montreal (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.250% | | | 3.021 | (c) | | | 09/11/19 | | | | 25,000 | | | | 25,013,250 | |

Sr. Unsec’d. Notes, Series D, MTN, 3 Month LIBOR + 0.460% | | | 3.257 | (c) | | | 04/13/21 | | | | 7,500 | | | | 7,511,175 | |

Branch Banking & Trust Co.,

Sr. Unsec’d. Notes | | | 1.450 | | | | 05/10/19 | | | | 26,000 | | | | 25,915,182 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | | | | | |

Capital One NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | | 1.850 | % | | | 09/13/19 | | | | 24,500 | | | $ | 24,347,557 | |

Sr. Unsec’d. Notes | | | 2.350 | | | | 01/31/20 | | | | 5,905 | | | | 5,867,503 | |

Citibank NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.320% | | | 3.056 | (c) | | | 05/01/20 | | | | 20,000 | | | | 19,995,113 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.260% | | | 3.061 | (c) | | | 09/18/19 | | | | 699 | | | | 699,934 | |

Citigroup, Inc., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.790% | | | 3.573 | (c) | | | 01/10/20 | | | | 2,259 | | | | 2,270,228 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.930% | | | 3.696 | (c) | | | 06/07/19 | | | | 10,000 | | | | 10,029,108 | |

Commonwealth Bank of Australia (Australia),

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.320% | | | 3.142 | (c) | | | 06/25/20 | | | | 16,000 | | | | 16,008,548 | |

Goldman Sachs Group, Inc. (The),

Sr. Unsec’d. Notes, 3 Month LIBOR + 1.040% | | | 3.811 | (c) | | | 04/25/19 | | | | 25,000 | | | | 25,030,313 | |

Morgan Stanley, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, GMTN | | | 2.375 | | | | 07/23/19 | | | | 10,000 | | | | 9,982,336 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.740% | | | 3.512 | (c) | | | 07/23/19 | | | | 1,900 | | | | 1,904,610 | |

Sr. Unsec’d. Notes, MTN | | | 5.625 | | | | 09/23/19 | | | | 24,500 | | | | 24,922,952 | |

National Australia Bank Ltd. (Australia),

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.510% | | | 3.187 | (c) | | | 05/22/20 | | | | 40,000 | | | | 40,153,600 | |

PNC Bank NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.360% | | | 3.000 | (c) | | | 05/19/20 | | | | 25,000 | | | | 25,031,522 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.250% | | | 3.011 | (c) | | | 01/22/21 | | | | 5,540 | | | | 5,513,568 | |

Royal Bank of Canada (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, GMTN, 3 Month LIBOR + 0.380% | | | 3.118 | (c) | | | 03/02/20 | | | | 30,000 | | | | 30,063,093 | |

Sr. Unsec’d. Notes, GMTN, 3 Month LIBOR + 0.390% | | | 3.141 | (c) | | | 04/30/21 | | | | 10,000 | | | | 10,003,040 | |

Santander UK PLC (United Kingdom), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.660% | | | 3.276 | (c) | | | 11/15/21 | | | | 29,000 | | | | 28,831,827 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 1.480% | | | 4.258 | (c) | | | 03/14/19 | | | | 25,000 | | | | 25,032,135 | |

Skandinaviska Enskilda Banken AB (Sweden),

Sr. Unsec’d. Notes | | | 1.500 | | | | 09/13/19 | | | | 10,500 | | | | 10,411,482 | |

Toronto-Dominion Bank (The) (Canada),

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.280% | | | 3.051 | (c) | | | 06/11/20 | | | | 20,000 | | | | 19,979,873 | |

US Bank NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.250% | | | 3.029 | (c) | | | 07/24/20 | | | | 12,000 | | | | 12,005,244 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.320% | | | 3.085 | (c) | | | 04/26/21 | | | | 13,000 | | | | 12,997,387 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 445,174,118 | |

See Notes to Financial Statements.

| | | | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | | 33 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (continued)

as of January 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |