UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

|

| (This FormN-CSR relates solely to the Registrant’s: PGIM JennisonSmall-Cap Core Equity Fund, PGIM Core Conservative Bond Fund, PGIM TIPS Fund, PGIM QMA Commodity Strategies Fund, PGIM QMAMid-Cap Core Equity Fund and PGIM QMA US Broad Market Index Fund.) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French 655 Broad Street, 17th Floor Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 7/31/2019 |

| |

| Date of reporting period: | | 7/31/2019 |

Item 1 – Reports to Stockholders

PGIM Jennison Small-Cap Core Equity Fund

PGIM Core Conservative Bond Fund

PGIM TIPS Fund

PGIM QMA Commodity Strategies Fund

PGIM QMA Mid-Cap Core Equity Fund

PGIM QMA US Broad Market Index Fund

ANNUAL REPORT

JULY 31, 2019

|

PGIM Jennison Small-Cap Core Equity Fund—Objective:To outperform the

Russell 2000 Index PGIM Core Conservative Bond Fund—Objective:To outperform the Bloomberg

Barclays US Aggregate Bond Index over full market cycles PGIM TIPS Fund—Objective:To seek to outperform the Bloomberg Barclays

US Treasury Inflation-Protected Securities (TIPS) Index PGIM QMA Commodity Strategies Fund—Objective:To generate returns over

time in excess of the Bloomberg Commodity Index PGIM QMA Mid-Cap Core Equity Fund—Objective:To outperform the

S&P MidCap 400 Index PGIM QMA US Broad Market Index Fund—Objective:To seek to provide investment

results that approximate the performance of the S&P Composite 1500 Index |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. Jennison Associates LLC is a registered investment adviser. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. QMA is the primary business name of QMA LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company.© 2019 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

PGIM Day One Underlying Funds

TABLE OF CONTENTS

| | | | |

| PGIM Day One Underlying Funds | | | 3 | |

This Page Intentionally Left Blank

PGIM Jennison Small-Cap Core Equity Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | –3.26 | | 9.73 (11/15/16) |

| Russell 2000 Index | | | | |

| | –4.42 | | 8.20 |

| Lipper Small Cap Core Funds Average |

| | | –4.41 | | 6.31 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

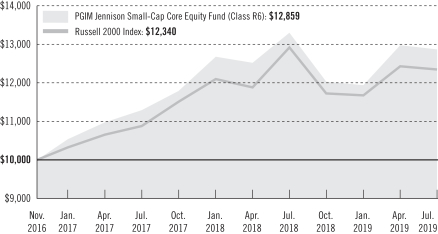

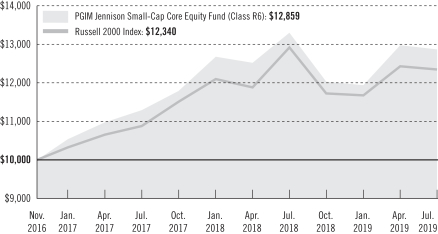

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Russell 2000 Index by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the

| | | | |

| PGIM Day One Underlying Funds | | | 5 | |

PGIM Jennison Small-Cap Core Equity Fund

Your Fund’s Performance(continued)

current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

Russell 2000 Index—The Russell 2000 Index is an unmanaged index of the 2,000 smallest US companies included in the Russell 3000 Index. It gives an indication of how stock prices of smaller companies have performed.

Lipper Small Cap Core Funds Average—Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 6 | | Visit our website at pgiminvestments.com |

Presentation of Fund Holdings

| | | | |

| PGIM Jennison Small-Cap Core Equity Fund |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

| Performance Food Group Co. | | Food & Staples Retailing | | 2.0% |

| Planet Fitness, Inc. (Class A Stock) | | Hotels, Restaurants & Leisure | | 1.9% |

| HubSpot, Inc. | | Software | | 1.8% |

| Pinnacle Financial Partners, Inc. | | Banks | | 1.6% |

| CyberArk Software Ltd. (Israel) | | Software | | 1.6% |

| East West Bancorp, Inc. | | Banks | | 1.5% |

| InterXion Holding NV (Netherlands) | | IT Services | | 1.5% |

| Mobile Mini, Inc. | | Commercial Services & Supplies | | 1.5% |

| Rexnord Corp. | | Machinery | | 1.4% |

| BankUnited, Inc. | | Banks | | 1.4% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term Investments. The Lines of Business are subject to change.

| | | | |

| PGIM Day One Underlying Funds | | | 7 | |

PGIM Core Conservative Bond Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | 7.74 | | 2.94 (11/15/16) |

| Bloomberg Barclays US Aggregate Bond Index |

| | 8.08 | | 3.74 |

| Lipper Core Bond Funds Average |

| | | 7.52 | | 3.59 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

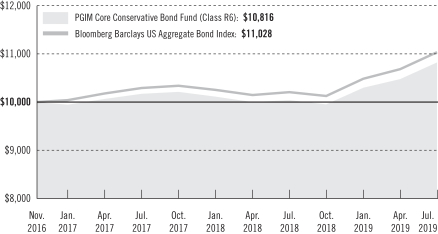

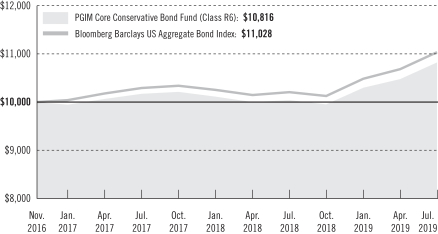

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg Barclays US Aggregate Bond Index by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the

| | |

| 8 | | Visit our website at pgiminvestments.com |

Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Averages are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is unmanaged and represents securities that are SEC registered, taxable, and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Lipper Core Bond Funds Average—Funds that invest at least 85% in domestic investment-grade debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high yield, global and emerging markets debt. These funds maintain dollar-weighted average maturities of five to ten years.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 7/31/19 (%) | |

| AAA | | | 72.7 | |

| AA | | | 5.1 | |

| A | | | 14.1 | |

| BBB | | | 7.2 | |

| Cash/Cash Equivalents | | | 0.9 | |

| Total Investments | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. Credit ratings are subject to change.

| | | | |

| PGIM Day One Underlying Funds | | | 9 | |

PGIM TIPS Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | 5.38 | | 2.42 (11/15/16) |

| Bloomberg Barclays US Treasury Inflation-Protected Securities (TIPS) Index |

| | 5.72 | | 3.01 |

| Lipper Inflation Protected Bond Funds Average |

| | | 4.42 | | 2.49 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

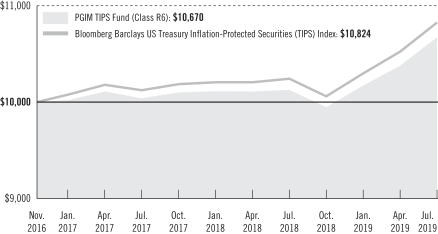

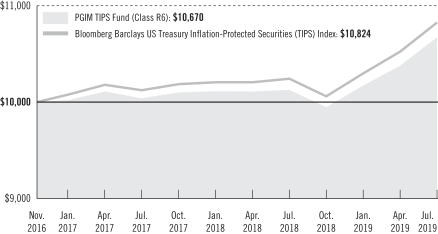

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg Barclays US Treasury Inflation-Protected Securities (TIPS) Index by portraying the initial account values at the commencement of operations of

| | |

| 10 | | Visit our website at pgiminvestments.com |

Class R6 shares and the account values at the end of the current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

Bloomberg Barclays US Treasury Inflation-Protected Securities (TIPS) Index—The Bloomberg Barclays US Treasury Inflation-Protected Securities (TIPS) Index is an unmanaged index that consists of inflation-protected securities issued by the US Treasury.

Lipper Inflation Protected Bond Funds Average—Funds that invest primarily in inflation-indexed fixed income securities. Inflation-linked bonds are fixed income securities structured to provide protection against inflation.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 7/31/19 (%) | |

| AAA | | | 99.7 | |

| Cash/Cash Equivalents | | | 0.3 | |

| Total Investments | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. Credit ratings are subject to change.

| | | | |

| PGIM Day One Underlying Funds | | | 11 | |

PGIM QMA Commodity Strategies Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | –5.69 | | –0.53 (11/15/16) |

| Bloomberg Commodity Index |

| | –5.36 | | –1.56 |

| Lipper Commodities General Funds Average |

| | | –6.49 | | –0.68 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

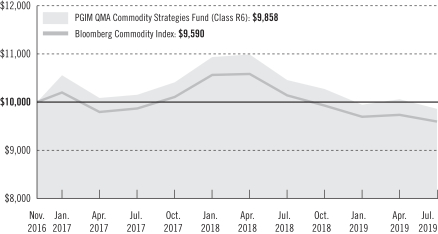

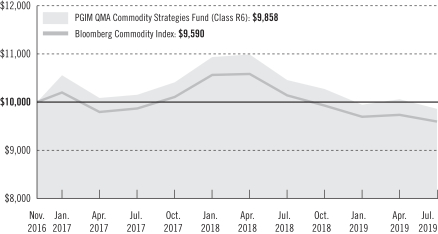

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the Bloomberg Commodity Index by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of

| | |

| 12 | | Visit our website at pgiminvestments.com |

the current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 15, 2016, while the Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

Bloomberg Commodity Index—The Bloomberg Commodity Index is a diversified benchmark for the commodity futures market. It is composed of futures contracts on 19 physical commodities traded on US exchanges, with the exception of aluminum, nickel, and zinc, which trade on the London Metal Exchange (LME).

Lipper Commodities General Funds Average—Funds that invest primarily in a blended basket of commodity-linked derivative instruments or physicals.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

| PGIM Day One Underlying Funds | | | 13 | |

PGIM QMA Commodity Strategies Fund

Your Fund’s Performance(continued)

Presentation of Fund Holdings

| | |

| PGIM QMA Commodity Strategies Fund |

| Ten Largest Commodities Future Exposure Holdings | | % of Net Assets |

| Gold 100 OZ | | 11.6% |

| WTI Crude | | 9.4% |

| Copper | | 8.5% |

| Brent Crude | | 7.6% |

| Corn | | 6.0% |

| Natural Gas | | 5.3% |

| Live Cattle | | 4.9% |

| LME Zinc | | 4.4% |

| LME PRI Aluminum | | 4.2% |

| Soybean | | 3.8% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings/Issues/Industries/Sectors are subject to change.

| | |

| 14 | | Visit our website at pgiminvestments.com |

PGIM QMA Mid-Cap Core Equity Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | –4.08 | | 6.76 (11/17/16) |

| S&P MidCap 400 Index |

| | 0.79 | | 9.08 |

| Lipper Mid-Cap Core Funds Average |

| | | 1.99 | | 8.32 |

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

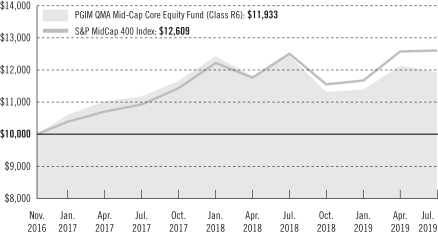

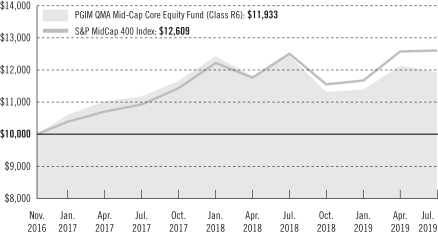

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the S&P MidCap 400 Index by portraying the initial account values at the commencement of operations of Class R6 shares and the account values at the end of the

| | | | |

| PGIM Day One Underlying Funds | | | 15 | |

PGIM QMA Mid-Cap Core Equity Fund

Your Fund’s Performance(continued)

current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 17, 2016, while the Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

S&P MidCap 400 Index—The S&P MidCap 400 Index is designed to measure the performance of 400 mid-sized companies in the US.

Lipper Mid-Cap Core Funds Average—Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE large-cap floor.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 16 | | Visit our website at pgiminvestments.com |

Presentation of Fund Holdings

| | | | |

| PGIM QMA Mid-Cap Core Equity Fund |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

| iShares Core S&P Mid-Cap ETF | | Exchange-Traded Fund | | 2.0% |

| STERIS PLC | | Health Care Equipment | | 1.3% |

| Leidos Holdings, Inc. | | IT Consulting & Other Services | | 1.3% |

| Universal Display Corp. | | Electronic Components | | 1.2% |

| Teradyne, Inc. | | Semiconductor Equipment | | 1.1% |

| West Pharmaceutical Services, Inc. | | Health Care Supplies | | 1.1% |

| Camden Property Trust, REIT | | Residential REITs | | 1.1% |

| Manhattan Associates, Inc. | | Application Software | | 1.1% |

| Reinsurance Group of America, Inc. | | Reinsurance | | 1.1% |

| Masimo Corp. | | Health Care Equipment | | 1.0% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term Investments. The Lines of Business are subject to change.

| | | | |

| PGIM Day One Underlying Funds | | | 17 | |

PGIM QMA US Broad Market Index Fund

Your Fund’s Performance(unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | |

| |

| | | Average Annual Total Returns as of 7/31/19 |

| | | One Year (%) | | Since Inception (%) |

| Fund | | 6.95 | | 13.65 (11/17/16) |

| S&P Composite 1500 Index |

| | 7.04 | | 13.75 |

| Lipper Multi-Cap Core Funds Average* |

| | 4.44 | | 11.59 |

| Lipper Large-Cap Core Funds Average* |

| | | 6.78 | | 13.02 |

*The Fund is compared to the Lipper Multi-Cap Core Funds Universe, although Lipper classifies the Fund in the Lipper Large-Cap Core Funds Universe. The Lipper Multi-Cap Core Funds Universe is utilized because the Fund’s manager believes that the funds included in the universe provide a more appropriate basis for Fund performance comparisons.

Source: PGIM Investments LLC and Lipper Inc.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

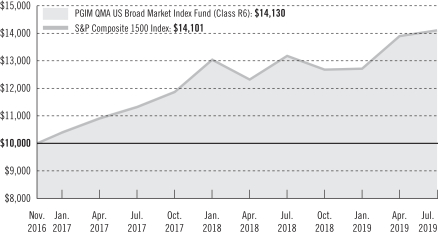

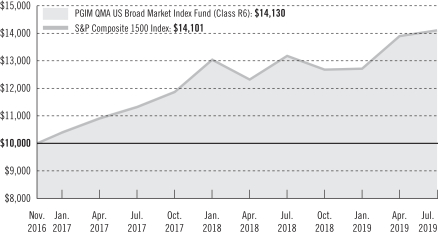

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class R6 shares with a similar investment in the S&P Composite 1500 Index by portraying the initial account values at the

| | |

| 18 | | Visit our website at pgiminvestments.com |

commencement of operations of Class R6 shares and the account values at the end of the current fiscal year (July 31, 2019), as measured on a quarterly basis. The R6 share class assumes an initial investment on November 17, 2016, while the Custom Benchmark and the Index assume that the initial investment occurred on November 30, 2016. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index and the Lipper Averages are measured from the closest month-end to the Fund’s inception date.

Benchmark Definitions

S&P Composite 1500 Index—The S&P Composite 1500® Index is an unmanaged index of stocks of 1,500 US companies, with market capitalizations ranging from small to large. The SP Composite 1500 Index is a combination of three leading US stock indices: The S&P 500 Index (which measures the performance of US Large Cap stocks), the S&P MidCap 400 Index (which measures the performance of Mid Cap stocks) and the S&P 600 Index (which measures the performance of US Small Cap stocks) and gives an indication of how the broad US stock market has performed. Index returns do not include the effect of any sales charges, mutual fund operating expenses or taxes. These returns would be lower if they included the effect of these expenses.

Lipper Multi-Cap Core Funds Average—Funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time.

Lipper Large-Cap Core Funds Average—Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large cap floor.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

| PGIM Day One Underlying Funds | | | 19 | |

PGIM QMA US Broad Market Index Fund

Your Fund’s Performance(continued)

Presentation of Fund Holdings

| | | | |

| PGIM QMA US Broad Market Index Fund |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

| Microsoft Corp. | | Software | | 3.7% |

| Apple, Inc. | | Technology Hardware, Storage & Peripherals | | 3.3% |

| Amazon.com, Inc. | | Internet & Direct Marketing Retail | | 2.7% |

| SPDR S&P 500 ETF Trust | | Exchange-Traded Funds | | 2.0% |

| Facebook, Inc. (Class A Stock) | | Interactive Media & Services | | 1.6% |

| Berkshire Hathaway, Inc. (Class B Stock) | | Diversified Financial Services | | 1.4% |

| JPMorgan Chase & Co. | | Banks | | 1.3% |

| Alphabet, Inc. (Class C Stock) | | Interactive Media & Services | | 1.3% |

| Alphabet, Inc. (Class A Stock) | | Interactive Media & Services | | 1.3% |

| Johnson & Johnson | | Pharmaceuticals | | 1.2% |

For a complete list of holdings, please refer to the Schedule of Investments section of this report. Holdings reflect only long-term Investments. The Lines of Business are subject to change.

| | |

| 20 | | Visit our website at pgiminvestments.com |

PGIM Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM Jennison Small-Cap Core Equity Fund’s shares returned –3.26% in the12-month reporting period that ended July 31, 2019, outperforming the –4.42% return of the Russell 2000 Index (the Index).

What was the market environment?

| • | | Equity markets were volatile in the period. At the outset (in August 2018), global gross domestic product (GDP) growth was accelerating, the US labor market was strengthening, and lower US corporate tax rates were helping boost wages and capital spending. Given the constructive macroeconomic landscape, investors largely overlooked uncertainty created by White House trade and other policy initiatives. |

| • | | An abrupt equity market sell-off in the fourth quarter of 2018 reflected mounting investor concerns about the rising risk of a major trade war with China, the state of US trade alliances with other major trading partners, the pace of US economic growth, decelerating expansion in non-US economies, US interest rate increases, and discord and uncertainty about domestic policy. |

| • | | US equity markets subsequently rebounded early in 2019 as the Federal Reserve (the Fed) signaled a pause in its federal funds rate hikes, corporate earnings reports generally indicated continued strength, and sentiment grew that trade friction would be resolved. |

| • | | Markets declined again late in the period as trade discord between the US and China (the world’s two largest economies) escalated. |

| • | | In the index, there was signficant disparity among sector returns over the period. Utilities and information technology performed the best, while energy and materials declined sharply. |

What worked?

| • | | Information technology contributed strongly to the Fund’s relative performance, led by several positions in software companies: |

| | • | | CyberArk Software Ltd., which develops, markets, and sells software-based security solutions that protect organizations from cyberattacks, reported very strong financial results across all measures. Past investments in globalizing the sales force and simplifying pricing have paid off, and Jennison has confidence in the firm’s management. Jennison expects continued success from CyberArk as Privilege Access Management software gains popularity in the cybersecurity market. |

| | • | | The Trade Desk, Inc. provides a self-service, omni-channel software platform that enables clients to purchase and manage data-driven digital advertising campaigns. Jennison remains impressed with the company’s growth potential. Its new trading platform, launched in 2018, achieved 75% adoption in its first eight months and is |

| | | | |

| PGIM Day One Underlying Funds | | | 21 | |

PGIM Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview(continued)

| | helping the company reach deeper into existing accounts to improve accuracy of reach and marketing returns on investments. In Jennison’s view, The Trade Desk is making smart investments in international markets. Jennison expects continued growth as the firm expands. |

| | • | | Everbridge, Inc. offers an end-to-end “critical event management (CEM) and threat assessment platform” to manage the full lifecycle of a critical event. The company has gained a number of new CEM customers with multi-year, annual, recurring-revenue contracts. Jennison believes this will continue to drive and accelerate earnings growth. |

| | • | | HubSpot, Inc. provides a cloud-based marketing and sales software platform for businesses. Jennison views HubSpot’s competitive position as very favorable and sees its multi-product strategy gaining momentum. The company is enjoying good customer growth, which indicates significant up-sell and cross-sell opportunities in Jennison’s view. |

| • | | A large underweight to energy, the Index’s worst-performing sector, added value to the Fund’s performance over the period. Holdings in consumer discretionary, communication services, and consumer staples were the other notable sources of relative gains. |

| • | | Planet Fitness, Inc., a fitness club operator, was a standout in the consumer discretionary sector as earnings beat expectations. Several factors that Jennison believes bode well for continued growth include an increasing average royalty rate, increasing the price of the Black Card for new members, continuing improvement to real estate site selection, and upgrading technology and equipment to enhance the member experience, which Jennison believes could lead to further customer acquisition. |

What didn’t work?

| • | | With respect to sectors, industrials, financials, and materials detracted from relative performance. However, individual detractors were found in several different sectors: |

| | • | | La Jolla Pharmaceutical Co. has developed Giapreza, a proprietary formulation of one of the body’s central regulators of blood pressure in adults who experience septic or other distributive shock. Giapreza’s cost has been an issue for some investors, who believe hospitals will opt to use less-expensive (although significantly less-efficacious, in Jennison’s view) alternatives. Disappointing fourth-quarter sales of the drug and La Jolla’s guidance for full-year Giapreza sales suggest the cost is inhibiting its adoption. Jennison eliminated the position in January 2019. |

| | • | | WPX Energy, Inc. is an independent oil and natural gas exploration and production company that is focused on developing its oil positions in the Williston Basin in North Dakota, and the Permian and San Juan Basins in the southwestern US. The performance of the company’s shares was weak over the period due to poor sentiment surrounding the sector as a whole, as well as falling oil and gas prices. Jennison thinks |

| | |

| 22 | | Visit our website at pgiminvestments.com |

| | WPX offers one of the best growth rates among crude oil producers, top-tier margin expansion, and incremental visibility toward 2020 production growth. |

| | • | | Party City reported weaker-than-expected fourth-quarter results and a lackluster 2019 outlook due mostly to inflated helium prices. Jennison continues to see several tailwinds that could drive an inflection in top-line growth, including a stronger licensed product calendar, Party Planner initiative, and expanding Amazon assortment. |

| | • | | Evoqua Water Technologies Corp. provides a range of water and wastewater treatment systems and technologies, as well as mobile and emergency water supply solutions and services. Financial results were disappointing over the period. Jennison eliminated the position in October 2018 as it did not believe Evoqua’s management had a sound strategy for fixing problems with the business. |

| | • | | NN, Inc. is a diversified industrial manufacturer of high-precision solutions, components, and assemblies. Its suite of auto products includes fuel delivery, motor, steering and braking systems. It also makes components and devices for the life sciences, electrical, industrial, aerospace, and defense markets. The company’s share price was hampered by poor quarterly financial results and lowered guidance. Still, Jennison continues to find the company attractively valued and likes its position as a key component supplier. |

The percentages shown in the tables below identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| |

| Top Contributors (%) | | Top Detractors (%) |

| CyberArk Software | | 1.37 | | La Jolla Pharmaceutical | | –0.78 |

| Planet Fitness | | 0.91 | | WPX Energy | | –0.73 |

| The Trade Desk | | 0.83 | | Evoqua Water Technologies | | –0.57 |

| Everbridge | | 0.72 | | NN | | –0.54 |

| HubSpot | | 0.66 | | Party City | | –0.52 |

Current outlook

| • | | The end of 2018 was marked by rising interest rates, global trade uncertainty, and a general increase in market volatility. While some of these concerns may have tapered, some have persisted. |

| • | | The Fed has withdrawn its tightening stance from last year as it cut interest rates on the last day of the reporting period in an attempt to extend US economic growth. |

| | | | |

| PGIM Day One Underlying Funds | | | 23 | |

PGIM Jennison Small-Cap Core Equity Fund

Strategy and Performance Overview(continued)

| • | | Global trade disagreements between the US and China continue to grab market attention and create volatility. Although negotiations continue, albeit punctuated with periodic bouts of brinkmanship, the talks have been going on for nearly a year. The longer they take, the greater the likelihood this uncertainty will have a negative economic impact, in Jennison’s view. |

| • | | Earnings growth is likely to decelerate as 2019 progresses, and it’s not clear to what degree and how much of this sentiment is built into expectations in a market that had risen significantly by the end of the period. On the positive side, unemployment remains low, inflation is under control, and global monetary easing should support economic growth. However, negative data points such as lower capital spending in 2019 (following a very robust 2018), higher wage inflation, and potential supply chain disruptions from trade disputes may cause downward earnings revisions. |

| • | | If we are entering a more modest earnings-growth environment, Jennison believes that identifying companies that can outperform market averages will be key to Fund performance in 2019, as the market should increasingly reward fundamentals. Jennison thinks this trend favors its bottom-up investment approach that focuses on identifying companies with above-average growth and reasonable valuations. |

| • | | The economic outlook, particularly for cyclical companies, is still uncertain and necessitates close monitoring. Current portfolio positioning is biased toward strong secular growth stories, even at valuations that are generally above long-term ranges. The Fund is most bullish on technology and consumer stocks and is selective in areas like healthcare and industrials. |

| | |

| 24 | | Visit our website at pgiminvestments.com |

PGIM Core Conservative Bond Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM Core Conservative Bond Fund’s Class R6 shares returned 7.74% in the12-month reporting period that ended July 31, 2019, underperforming the 8.08% return of the Bloomberg Barclays US Aggregate Bond Index (the Index).

What were market conditions?

| • | | 2018 was an inhospitable year for financial markets. Most bond market returns were low or negative, and stock returns were negative as well. The only rising trend seemed to be the level of market volatility. Over the course of the year, the bond market was buffeted alternately—and at times jointly—by rising government yields and widening credit spreads. Some of the initial spread widening could easily be chalked up to normalizing (i.e., In early 2018, spreads may have gotten ahead of fundamentals and were generally too tight.). But investor anxiety soon rose, taking spreads wider across virtually all fixed income sectors. As a result, for all but the most defensive bond market segments, total returns and excess returns relative to US Treasuries were generally low or negative for the year. |

| • | | After the tumult of the fourth quarter of 2018, investors deserved a less challenging first quarter of 2019, and they got it. The trend of falling interest rates and rising economic concerns from the fourth quarter continued. But risk assets, such as stocks and non-government fixed income spread products, pulled out of their nose dives with strong performances. Although most central bankers thought they’d be well on their way toward normalizing policy (i.e., ending quantitative easing and raising short-term interest rates) by now, the global economy had other plans. Instead, central bankers ran into the reality of slowing growth and stubborn or chronic levels of below-target inflation. The good news—and presumably the difference between fourth-quarter 2018 risk-off sentiment and first-quarter 2019 risk-on sentiment—was that the central banks had recognized the need to either stop tightening (the Federal Reserve), introduce lending programs (the European Central Bank), or at least let the markets know they’re thinking about easing even though they really had no good options (the Bank of Japan). The rallies in G10 bond markets were spectacular, as much for their magnitude as for their incredibly low yields. (The G10, or Group of Ten, are actually 11 industrialized nations that include Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the UK, and the US.) The US 10-year Treasury rallied, with its yield dropping down to the federal funds rate, completely flattening the yield curve. The bond rally was hardly limited to the Group of 3 (Japan, Germany, and the US). Its breadth also included the vast majority of developed markets and many emerging market rate complexes. And yet, despite the low-rate environment, economic growth in many, if not most, of these countries remained subpar; and inflation generally remained solidly contained, often at below-target levels. |

| • | | While record highs on major equity indices made for good headlines, several fixed income sectors posted year-to-date returns through the second quarter of 2019 that were impressive in their own right. Fueled by a collapse in developed market interest rates in the second quarter, long-maturity US corporate bonds, emerging markets hard-currency debt, long-maturity US Treasuries, and US high yield corporate bonds generated double-digit gains in the first half of 2019. While US-China trade tensions led to a pronounced hiccup in |

| | | | |

| PGIM Day One Underlying Funds | | | 25 | |

PGIM Core Conservative Bond Fund

Strategy and Performance Overview(continued)

| | the risk markets in May, they recovered by quarter end, leaving returns for equities and riskier fixed income sectors in positive territory and even stronger year-to-date performance, thanks to a banner first quarter. These strong returns certainly belied what many observers considered to be low levels of yields and spreads at the beginning of the year. |

| • | | Financial markets continued to post solid gains in July 2019, in large part buoyed by anticipated further global monetary easing. However, the third quarter started off on a weak note, especially as trade and manufacturing continued to slide as the persistent trade-war uncertainties took their toll. In July, Treasury yields rose and the curve flattened as markets shifted toward expectations for a 25 basis point (bp) cut in the federal funds rate at the July Federal Open Market Committee (FOMC) meeting. (One basis point equals 0.01%.) Mixed messages from Fed members about the potential for a 50 bp cut contributed to volatility in front-end interest rates during the month. The 2-year and10-year Treasuries rose 12 bps and 1 bp, respectively. The Fed subsequently cut interest rates by 25 bps at its July 31 meeting, the first cut in 10 years. Fed Chairman Jerome Powell’s post-FOMC press conference comments highlighting the cut as a “mid-cycle adjustment” rather than the start of an easing cycle contributed to the flattening in the Treasury yield curve. |

| • | | The fixed income markets, as represented by the Index, over the reporting period posted a strong return of 8.08%. |

| • | | For the period, the corporate fixed income markets, as represented by the Bloomberg Barclays US Credit Bond Index, posted a return of 10.12%, resulting in an excess return to US Treasuries of 160 bps. Within this Index, utilities outpaced industrials and financials over the period, albeit with all posting strong total returns. Gaming, telecom, and “other finance” were among the strongest sectors over the period while energy, tobacco, and electric utilities were among the largest underperformers. |

| • | | In July 2019, the Bloomberg Barclays Agency MBS Index posted its best month since 2015 as multi-year wide option-adjusted spread (OAS) levels, contained interest rate volatility, central bank easing expectations, and the beginning of the new quarter attracted broad-based demand. The 30-year mortgage rate has remained sticky recently, with primary mortgage rates ending July at 3.875%. |

What worked?

| • | | An overweight to commercial mortgage-backed securities (CMBS) added value to the Fund’s performance during the reporting period. |

| • | | Strong security selection was highlighted by positioning in investment-grade corporates, CMBS, and mortgage-backed securities (MBS). |

| • | | Within corporates, security selection in the banking, media & entertainment, and health care & pharmaceutical sectors was positive. |

| | |

| 26 | | Visit our website at pgiminvestments.com |

| • | | In individual security selection, the Fund benefited from overweights to media & entertainment issuersTwenty-First Century Fox Inc. andAT&T Inc., and to banking companyCitigroup Inc. |

| • | | The Fund’s yield curve positioning was a modest contributor to performance for the period. |

What didn’t work?

| • | | Underweights in investment-grade corporates and emerging markets detracted from performance. |

| • | | Security selection in emerging markets limited results. |

| • | | The Fund’s positioning in the capital goods, foreign noncorporate, and midstream energy sectors detracted from performance. |

| • | | In individual security selection, the Fund’s overweight positions inPacific Gas and Electric Co. (electric utilities) andTWDC Enterprises 18 Corp. (media & entertainment) hurt performance for the period. An underweight toGE Co. (finance) was also negative. |

Current outlook

| • | | PGIM Fixed Income continues to favor being long duration in US Treasuries. Duration measures the sensitivity of the price (the value of principal) of a bond to a change in interest rates. |

| • | | Within investment-grade corporates, corporate leverage has stabilized while interest coverage remains solid. However, PGIM Fixed Income expects margins to come under some pressure in 2019. As we enter the later stage of the credit cycle, PGIM Fixed Income continues to favor high-quality financials and electric utilities over industrials. Within industrials, PGIM Fixed Income is focusing on select non-cyclical issuers. Potential risks to the investment-grade market include trade tension with China and Mexico, slowing global growth, potential hawkish rhetoric from the Fed, merger-and-acquisition activity, and increased new issue supply. |

| • | | In MBS, PGIM Fixed Income has moved closer to neutral short term, but remains positive longer term on the mortgage basis and the London Inter-Bank Offered Rate (LIBOR) OAS following the significant tightening. |

| • | | Looking at CMBS, PGIM Fixed Income continues to expect supply to remain manageable for the market and to find value in high-quality securities of new issue conduit deals. |

| | | | |

| PGIM Day One Underlying Funds | | | 27 | |

PGIM TIPS Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM TIPS Fund’s Class R6 shares returned 5.38% in the 12-month reporting period that ended July 31, 2019, underperforming the 5.72% return of the Bloomberg Barclays US Treasury Inflation-Protected Securities (TIPS) Index (the Index).

What were market conditions?

| • | | The US economy continued to accelerate at a roughly 3% pace at the beginning of the reporting period. Both households and businesses were participating in the growth, bolstered by tax cuts and fundamental strength in the private sector. Average monthly job gains reaccelerated to 207,000 through September 2018 from an already-strong 182,000 in 2017. Business investment also picked up, growing at a robust 10% annualized in the first half of 2018, and was on track for further solid gains in the second half of the year given surging profits and business confidence. While trade policy was dominating headlines, the aggregate economic effects on the US economy were minimal. |

| • | | Despite financial market volatility and concerns about US-China trade tensions, economic growth continued largely as expected, tracking at a strong 2.5% to 3.0% pace for the fourth quarter of 2018 and 2.9% for 2018 as a whole. Consumer spending remained the main engine of growth, with household purchasing power boosted by tax cuts early in 2018. Companies were still hiring at a strong pace, while real wage growth inched higher. Business investment, however, slowed to a low single-digit growth rate during the fourth quarter, following a robust 10% pace in the first half of 2018. Inflation trends also appeared to soften. |

| • | | While US economic growth was solid in 2018, momentum slowed into 2019. Downside risks emerged amid the broader global growth slowdown, the escalating trade policy uncertainty, the government shutdown, and the usual volatile winter weather. All of this was reinforced by a sharp tightening of financial conditions, particularly following the Federal Reserve’s (the Fed’s) December Federal Open Markets Committee (FOMC) meeting, where the Fed was seen as still in tightening mode. But economic data since then firmed, albeit not quickly enough to prevent a possible sub-2% reading for growth in the first quarter of 2019. Core durable goods orders and shipments suggested that demand for investment equipment remained solid. Both the manufacturing and services Institute for Supply Management (ISM) surveys remained in expansionary territory. Housing activity, although volatile, suggested some stabilization after last year’s downtrend, and wage gains were at cycle highs. |

| • | | Amid the re-acceleration of domestic demand in the second quarter of 2019, core inflation staged a moderate pickup from weakness earlier in 2019—weakness that Fed Chairman Jerome Powell described at the time as likely “transitory.” Nonetheless, core personal consumption expenditures (PCE) inflation still ran at only 1.6% year over year, below the Fed’s 2% target, and the recent pickup in real activity occurred against a backdrop of |

| | |

| 28 | | Visit our website at pgiminvestments.com |

| | now-lower market interest rates and generally looser financial conditions, all of which suggested the Fed may have over-tightened a bit last year. Additionally, the trade war and other global challenges have been hitting a number of industries, necessitating many companies to rethink their supply chains and capital expenditure plans. |

| • | | In July 2019, US Treasury yields rose and the curve flattened as markets shifted toward expectations for a 25 basis point (bp) cut in the federal funds rate at the July FOMC meeting. (One basis point equals 0.01%.) Mixed messages from Fed members about the potential for a 50 bp cut contributed to volatility in front-end interest rates during the month. The 2-year and 10-year US Treasuries rose 12 bps and 1 bp, respectively. The Fed subsequently cut interest rates by 25 bps at its July 31 meeting, the first cut in 10 years. Chairman Powell’s post-FOMC press conference comments highlighting the cut as a “mid-cycle adjustment” rather than the start of an easing cycle contributed to the flattening in the US Treasury yield curve. |

What worked?

| • | | Security selection added to the Fund’s performance for the reporting period. |

| • | | The duration of the Fund was closely matched to the Index for the period. Duration measures the sensitivity of the price (the value of principal) of a bond to a change in interest rates. Duration positioning added to performance, and the Fund ended the period with a modest duration overweight position to the Index. |

What didn’t work?

Transaction costs related to inflows experienced during the period detracted from performance.

Current outlook

| • | | Financial markets continued to post solid gains in July 2019, in large part buoyed by anticipated further global monetary easing. However, the third quarter started off on a weak note, especially as trade and manufacturing continued to slide as persistent trade-war uncertainties took their toll. As a result, in PGIM’s view, there are more signs of softness in demand for investment goods and consumer durables. |

| • | | This broad-based weakness was reflected in some of the gross domestic product (GDP) data for the second quarter. Eurozone growth slowed in the quarter to 0.8% annualized, held down in large part by Italy and Germany. Meanwhile, US GDP growth slowed to 2.0%, with robust contributions from household and government spending offsetting weakness in business investment and other components. |

| • | | In addition to cutting the federal funds rate to a target range of 2.0%-2.25% at its July policy meeting, the Fed kept its easing message consistent by also announcing that it would pull the end date of its balance sheet run-off forward by two months to August |

| | | | |

| PGIM Day One Underlying Funds | | | 29 | |

PGIM TIPS Fund

Strategy and Performance Overview(continued)

| | 2019. As expected, the Fed’s statement left the door open for further easing, noting that it will continue to monitor incoming data and act “as appropriate” to sustain the economic expansion. |

| • | | Fed officials have been somewhat divided over whether a rate cut was necessary at this point in the cycle. Indeed, two FOMC voters dissented, preferring to keep the federal funds rate unchanged. On one hand, household spending has rebounded sharply from weakness earlier this year, and housing market activity has shown signs of stabilizing after declining throughout much of last year. On the other hand, business investment recorded an outright modest decline in the second quarter of 2019, and the global economic backdrop remains weak enough that many other G10 central banks are signaling a need to ease. (The G10, or Group of Ten, actually consists of 11 industrialized nations that include Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the UK, and the US.) US inflation continues to undershoot the Fed’s 2% target, with the PCE and core PCE deflators up just 1.4% and 1.6%, respectively, year over year as of June 2019. It was the global backdrop and inflation undershoot that the Fed cited as reasons for the rate cut. |

| • | | PGIM Fixed Income believes rates seem more likely to remain range-bound around current, or even lower, levels over the long term. While that idea may seem crazy, the factors covered in PGIM’s whitepapers since 2003 that have supported expectations for lower yields—aging demographics, high debt levels, and rising inequality—appear to warrant interest rates at current levels or lower. After all, despite the low level of rates, growth has continued to moderate and inflation has remained below target, suggesting that, if anything, rates may not yet be low enough to stabilize the economic trajectory, in PGIM Fixed Income’s view. |

| | |

| 30 | | Visit our website at pgiminvestments.com |

PGIM QMA Commodity Strategies Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM QMA Commodity Strategies Fund’s Class R6 shares returned –5.69% in the12-month reporting period that ended July 31, 2019, underperforming the –5.36% return of the Bloomberg Commodity Index (the Index).

What were the market conditions?

For the reporting period, the energy sector experienced a sell-off amid global-slowdown fears, which drove the negative results generated by the Index. Most of the other sectors in the Index posted negative results as well, led by declines in the grains, soft commodities, and industrial metals sectors.

What worked?

The Fund’s overweight position in the petroleum sector contributed to performance in the third quarter of 2018. For much of 2019 through July 31, this overweight position in the petroleum sector also added value, as that sector of the commodities market rallied. The Fund’s positioning in the livestock sector also benefited performance in the first half of 2019.

What didn’t work?

An overweight position in the petroleum complex detracted from returns in the fourth quarter of 2018. The Fund’s positioning in sugar and natural gas detracted from performance for most of the reporting period.

Did the Fund hold derivatives and, if so, how did they affect performance?

The Fund primarily trades in listed exchange-traded commodities futures contracts. These futures are a form of derivatives based on the underlying price of a specific commodity. Since the Fund is invested primarily in these derivatives, its performance during the reporting period (see above) is explained by the derivatives.

Current outlook

As of the end of the reporting period, the Fund was positioned with overweights in the petroleum complex and industrial metals sectors and held underweight positions in the grains, precious metals, and soft commodities sectors. Within livestock, the Fund was overweight live cattle while underweight lean hogs.

| | | | |

| PGIM Day One Underlying Funds | | | 31 | |

PGIM QMA Mid-Cap Core Equity Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM QMA Mid-Cap Core Equity Fund’s Class R6 shares returned –4.08% in the12-month reporting period that ended July 31, 2019, underperforming the 0.79% return of the S&P MidCap 400 Index (the Index).

What were the market conditions?

| • | | US equity markets rose but were volatile during the period; 2018 ended with a sharp drawdown but was followed by strong, broad market gains in 2019. |

| • | | The period was characterized by macro concerns, trade uncertainty, slowing growth, and central banks getting dovish (i.e., moderating their stance on interest rate hikes), but US equity markets performed well. |

| • | | Trade wars and slowing global growth were a hurdle, but dovish US Federal Reserve (Fed) monetary policy helped advance US equity prices. |

What worked?

| • | | The Fund is comprised of a diversified portfolio of stocks that QMA identifies as attractive using a proprietary quantitative model. The model evaluates stocks based on quality, earnings expectations, and relative value metrics. The emphasis on these factors varies based on the growth rate of the company under evaluation. |

| • | | Underweighting companies with deteriorating growth prospects helped drive the Fund’s performance over the reporting period. |

| • | | The Fund’s sector weights are established from bottom-up stock selection, and limits are placed on how much these weights can differ from the Index’s weights. Modestly underweighting the energy sector, which performed quite poorly over the period, helped the Fund’s performance. |

What didn’t work?

| • | | For slower-growing firms, QMA favors stocks that are inexpensive relative to their industry peers. Over the period, value factors produced negative excess returns. Value’s struggles were evident in markets around the globe in a slowing-growth environment where investors were favoring growth stocks, often at the expense of solid fundamentals. |

| • | | Stock selection in the financials and information technology sectors detracted from the Fund’s performance relative to the Index. In these two sectors, the gap between the performance of inexpensive stocks, which QMA favors, and expensive stocks, which QMA avoids, was quite wide and hurt performance. |

| | |

| 32 | | Visit our website at pgiminvestments.com |

Did the Fund hold derivatives and, if so, how did they affect performance?

The Fund did not hold derivatives over the period but did hold exchange-traded funds that track the Index. QMA uses these instruments primarily to manage daily cash flows and provide liquidity, not as a means of adding to performance. Their effect on performance was minimal.

The percentages shown in the tables below identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| |

| Top Contributors (%) | | Top Detractors (%) |

| Manhattan Associates, Inc. | | 0.31 | | Superior Energy Services, Inc. | | –0.50 |

| Exelixis, Inc. | | 0.28 | | Michaels Companies Inc. | | –0.45 |

| Versum Materials, Inc. | | 0.27 | | MarketAxess Holdings Inc. | | –0.25 |

| Masimo Corporation | | 0.27 | | MEDNAX, Inc. | | –0.25 |

| Teradyne, Inc. | | 0.23 | | Senior Housing Properties Trust | | –0.24 |

Current outlook

Factor performance was negative over the reporting period, led by QMA’s value factors. Value factors faced a series of headwinds over the period, including slowing global growth and a series of macro risks. Growth and quality factors have not compensated for value’s underperformance as they have historically. However, QMA continues to see value in inexpensive stocks and believes the Fund is well positioned to take advantage of a potential payoff to value factors in the future.

| | | | |

| PGIM Day One Underlying Funds | | | 33 | |

PGIM QMA US Broad Market Index Fund

Strategy and Performance Overview

How did the Fund perform?

ThePGIM QMA US Broad Market Index Fund’s Class R6 shares returned 6.95% for the 12-month reporting period that ended July 31, 2019, underperforming the 7.04% return of the S&P 1500 Composite Index (the Index).

What were the market conditions?

| • | | US equity markets rose but were volatile during the period; 2018 ended with a sharp drawdown but was followed by strong, broad market gains in 2019. |

| • | | The period was characterized by macro concerns, trade uncertainty, slowing growth, and central banks getting dovish (i.e., moderating their stance on interest rate hikes), but US equity markets performed well. |

| • | | Trade wars and slowing global growth were a hurdle, but dovish US Federal Reserve (Fed) monetary policy helped advance US equity prices. |

What worked?

| • | | The Fund closely tracked the performance of the Index over the reporting period. |

| • | | The Fund held all stocks included in the Index in approximately the same proportions. |

Did the Fund hold derivatives and, if so, how did they affect performance?

The Fund held S&P 500, S&P MidCap 400 and Russell 2000 E-Mini stock index futures, a form of derivatives, to maintain exposure to equities and provide portfolio liquidity. These futures had minimal impact on performance over the period.

| | |

| 34 | | Visit our website at pgiminvestments.com |

Fees and Expenses(unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended July 31, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM Jennison

Small-Cap Core

Equity Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 1,077.60 | | | | 0.95 | % | | $ | 4.89 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.08 | | | | 0.95 | % | | $ | 4.76 | |

| | | | |

| PGIM Day One Underlying Funds | | | 35 | |

Fees and Expenses(continued)

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM Core

Conservative Bond Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 1,050.60 | | | | 0.50 | % | | $ | 2.54 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.32 | | | | 0.50 | % | | $ | 2.51 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM

TIPS Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 1,049.20 | | | | 0.40 | % | | $ | 2.03 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.81 | | | | 0.40 | % | | $ | 2.01 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM QMA Commodity

Strategies Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 991.60 | | | | 0.89 | % | | $ | 4.39 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.38 | | | | 0.89 | % | | $ | 4.46 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM QMA

Mid-Cap Core Equity Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 1,047.30 | | | | 0.85 | % | | $ | 4.31 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.58 | | | | 0.85 | % | | $ | 4.26 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM QMA

US Broad Market

Index Fund | | Beginning Account

Value

February 1, 2019 | | | Ending Account

Value

July 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | Actual | | $ | 1,000.00 | | | $ | 1,108.40 | | | | 0.20 | % | | $ | 1.05 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,023.80 | | | | 0.20 | % | | $ | 1.00 | |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2019, and divided by the 365 days in each Fund’s fiscal year ended July 31, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which each Fund may invest.

| | |

| 36 | | Visit our website at pgiminvestments.com |

Glossary

The following abbreviations are used in the Funds’ descriptions:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

Aces—Alternative Credit Enhancements Securities

ADR—American Depositary Receipt

BABs—Build America Bonds

CVR—Contingent Value Rights

ETF—Exchange-Traded Fund

FHLMC—Federal Home Loan Mortgage Corporation

GMTN—Global Medium Term Note

LME—London Metal Exchange

MTN—Medium Term Note

PRI—Primary Rate Interface

RBOB—Reformulated Gasoline Blendstock for Oxygen Blending

REITs—Real Estate Investment Trust

S&P—Standard & Poor’s

SPDR—Standard & Poor’s Depositary Receipts

TIPS—Treasury Inflation-Protected Securities

ULSD—Ultra-Low Sulfur Diesel

WTI—West Texas Intermediate

XNGS—London Stock Exchange

PGIM JennisonSmall-Cap Core Equity Fund

Schedule of Investments

as of July 31, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

LONG-TERM INVESTMENTS 97.5% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Banks 11.8% | | | | | | | | |

Ameris Bancorp | | | 3,756 | | | $ | 149,376 | |

Atlantic Union Bankshares Corp. | | | 3,754 | | | | 142,765 | |

BankUnited, Inc. | | | 7,255 | | | | 249,644 | |

Brookline Bancorp, Inc. | | | 5,401 | | | | 80,097 | |

Byline Bancorp, Inc.* | | | 5,959 | | | | 113,876 | |

East West Bancorp, Inc. | | | 5,588 | | | | 268,280 | |

First Bancorp/Southern Pines NC | | | 4,454 | | | | 164,531 | |

First Foundation, Inc. | | | 2,367 | | | | 35,600 | |

Heritage Financial Corp. | | | 2,527 | | | | 72,070 | |

Pinnacle Financial Partners, Inc. | | | 4,559 | | | | 276,914 | |

Renasant Corp. | | | 4,104 | | | | 147,293 | |

Seacoast Banking Corp. of Florida* | | | 4,985 | | | | 134,794 | |

Wintrust Financial Corp. | | | 3,069 | | | | 219,556 | |

| | | | | | | | |

| | | | | | | 2,054,796 | |

| | |

Beverages 0.7% | | | | | | | | |

MGP Ingredients, Inc. | | | 2,457 | | | | 122,825 | |

| | |

Biotechnology 3.8% | | | | | | | | |

Amicus Therapeutics, Inc.* | | | 11,135 | | | | 138,074 | |

Audentes Therapeutics, Inc.* | | | 2,015 | | | | 78,424 | |

Emergent BioSolutions, Inc.* | | | 2,136 | | | | 94,283 | |

Ligand Pharmaceuticals, Inc.* | | | 658 | | | | 60,214 | |

Madrigal Pharmaceuticals, Inc.* | | | 416 | | | | 36,313 | |

Mirati Therapeutics, Inc.* | | | 1,315 | | | | 139,127 | |

Natera, Inc.* | | | 4,401 | | | | 121,379 | |

| | | | | �� | | | |

| | | | | | | 667,814 | |

| | |

Building Products 2.0% | | | | | | | | |

Armstrong World Industries, Inc. | | | 307 | | | | 29,997 | |

JELD-WEN Holding, Inc.* | | | 5,733 | | | | 125,610 | |

PGT Innovations, Inc.* | | | 7,723 | | | | 124,495 | |

Trex Co., Inc.* | | | 736 | | | | 60,168 | |

| | | | | | | | |

| | | | | | | 340,270 | |

| | |

Capital Markets 2.6% | | | | | | | | |

Assetmark Financial Holdings, Inc.* | | | 729 | | | | 20,624 | |

Brightsphere Investment Group, Inc. | | | 12,589 | | | | 134,702 | |

Focus Financial Partners, Inc. (Class A Stock)* | | | 1,874 | | | | 52,303 | |

See Notes to Financial Statements.

PGIM JennisonSmall-Cap Core Equity Fund

Schedule of Investments (continued)

as of July 31, 2019

| | | | | | | | |

| Description | | Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Capital Markets (cont’d.) | | | | | | | | |

Houlihan Lokey, Inc. | | | 2,506 | | | $ | 115,276 | |

Moelis & Co. (Class A Stock) | | | 3,595 | | | | 131,002 | |

| | | | | | | | |

| | | | | | | 453,907 | |

| | |

Chemicals 1.3% | | | | | | | | |

Ferro Corp.* | | | 7,658 | | | | 112,802 | |

PolyOne Corp. | | | 3,301 | | | | 108,174 | |

| | | | | | | | |

| | | | | | | 220,976 | |

| | |

Commercial Services & Supplies 2.4% | | | | | | | | |